Document

FORM 6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of May 2023

Commission File Number: 001-38757

TAKEDA PHARMACEUTICAL COMPANY LIMITED

(Translation of registrant’s name into English)

1-1, Nihonbashi-Honcho 2-Chome

Chuo-ku, Tokyo 103-8668

Japan

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Information furnished on this form:

EXHIBIT

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TAKEDA PHARMACEUTICAL COMPANY LIMITED |

|

|

|

|

| Date: May 30, 2023 |

|

By: |

/s/ Norimasa Takeda |

|

|

|

Norimasa Takeda

Chief Accounting Officer and Corporate Controller

|

TAKEDA’S EXECUTIVE COMPENSATION OVERVIEW

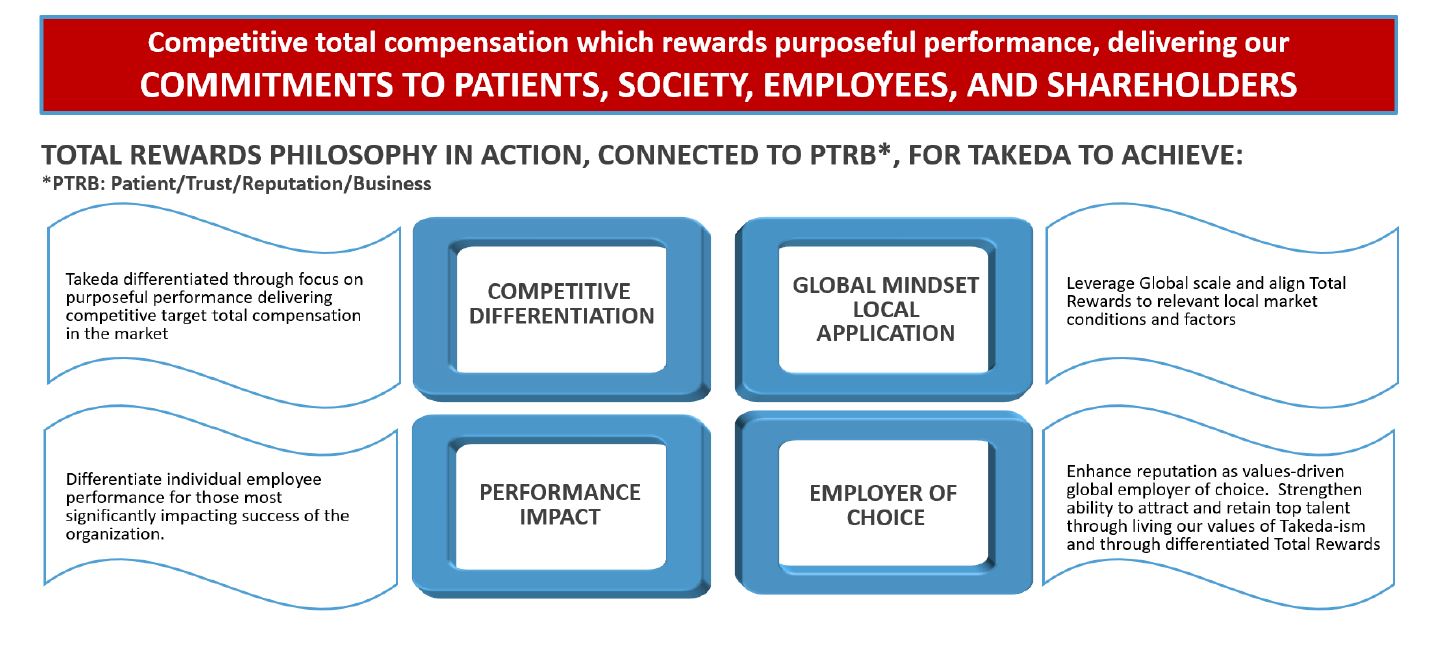

Takeda’s executive compensation structure reflects our position as a patient-focused, values-based, R&D-driven global biopharmaceutical company. We have an experienced and diverse Takeda Executive Team (the “TET”) representing nine nationalities and located in three countries, which includes four members of our Board of Directors (the “Internal Directors”). Our executive compensation programs are designed to be globally competitive and performance-oriented, while also considering local market factors.

COMPENSATION PAY FOR PERFORMANCE PHILOSOPHY AND OBJECTIVES

Our executive compensation strategy is designed to closely link pay with performance and long-term shareholder value creation while minimizing excessive risk-taking. To help us accomplish these important objectives, we have adopted the following policies and practices over time:

|

|

|

What We Do |

| We conduct competitive benchmarking to ensure executive compensation is aligned with market practices and standards |

| We align short- and long-term incentives with company performance |

| We tie the majority of the TET compensation to long-term performance |

| We utilize a total shareholder return metric in the long-term incentive compensation to further align with long-term stock performance and shareholder interests |

| We include caps on short-term incentive and Performance Share Unit awards payouts |

| We have adopted share retention policies |

| We have adopted a robust incentive recoupment (i.e., clawback) policy, further enhancing our compensation governance standards |

| We engage independent compensation consultants |

| We actively engage with our shareholders |

| What We Don’t Do |

| We do not have automatic or guaranteed annual salary increases |

| We do not have guaranteed bonuses or long-term incentive awards |

TAKEDA’S EXECUTIVE COMPENSATION OVERVIEW

Takeda’s Total Rewards Philosophy:

COMPONENTS OF THE COMPENSATION PROGRAM

We achieve these objectives through a combination of the following three primary components of our executive compensation structure:

Base Salary: A fixed cash compensation amount that is competitive within the markets in which we compete for talent. The Company provides appropriate levels of base salary to ensure that Takeda can attract and retain a global leadership team that will continue to meet our commitments to customers and patients and sustain long-term profitable growth for our shareholders and lead and grow the scale, size, and complexity of the business. Base salary is established for each of the TET members relative to his or her market benchmarking based on their respective performance (including ESG individual objectives), experience, unique skills, internal equity with others at Takeda, and the Company’s operating budget.

Short-Term Incentive (“STI”): An annual cash bonus opportunity with payout levels based on degree of achievement of pre-established annual performance goals. The STI plan is designed to focus the entire team on shared annual company performance goals and specific group goals. The STI program was structured in this manner so that program participants have a clear line of sight to both company and division results, aligned with Takeda’s annual operating goals, in order to create value for our shareholders. STI target amounts for participants are set as a percentage of base salary. It is important to note that the STI plan extends beyond the TET to over 30,000 employees globally, uniting leaders and plan participants with a common vision of delivering therapies for patients and value to shareholders.

Long-Term Incentives (“LTI”): The greatest emphasis among the three components is placed on longer-term incentives, in order to focus and align our TET on the achievement of long-term shareholder value creation. LTI compensation takes two forms: Performance Share Unit awards (subject to performance based vesting requirements) (“PSU” awards) and Restricted Stock Unit awards (subject to service-based vesting requirements) (“RSU” awards). In Fiscal Year 2022, 60% of the LTI program is delivered in PSU awards and 40% in RSU awards.

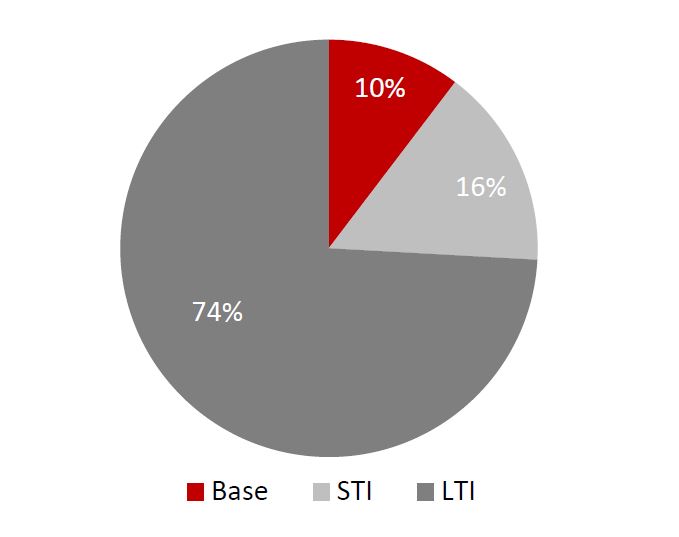

The mix of compensation for our TET reflects Takeda’s desire to link executive compensation with individual, group, and company performance. A substantial portion of the target pay for executives is performance-based. The STI and LTI PSU awards payouts are contingent upon company performance, with the STI factoring in performance over a one-year period, and LTI PSU awards compensation factoring in performance over a three-year period (as described below).

TAKEDA’S EXECUTIVE COMPENSATION OVERVIEW

FY 2022 CEO Pay Mix:

The chart below depicts the annualized mix of target compensation for Takeda’s CEO:

CEO Contractual Agreements

Effective September 2020, Takeda updated the contractual arrangements for Christophe Weber to appropriately reflect his approximate work allocation between the Company’s offices in Japan and the United States. As it was anticipated that Mr. Weber will continue to spend considerable time in the United States with the Company’s global team presence in the Boston area, the Company entered into two separate agreements with Mr. Weber.

The first agreement, representing 70% (updated from 75% to 70% in 2022 to align closer to his work allocation between the Company’s offices in Japan and the United States) of Mr. Weber’s work allocation in Japan, is a Mandate Agreement made between Takeda Pharmaceutical Company Limited and Mr. Weber, that describes the terms and compensation arrangements for his role as Representative Director and Chief Executive Officer of the Company. Under this Mandate agreement, 70% of Mr. Weber’s base salary and short-term incentives are payable from Takeda Pharmaceutical Company Limited. Currently 100% of his long-term incentives are granted from Takeda Pharmaceutical Company Limited.

The second agreement, representing 30% (updated from 25% to 30% in 2022 to align closer to his work allocation between the Company’s offices in Japan and the United States) of Mr. Weber’s work allocation in the United States, is an Employment Agreement made between Takeda Pharmaceutical U.S.A. Inc. (“TPUSA”) and Mr. Weber, that describes the terms and compensation arrangements for his role as Head of Global Business of TPUSA. Under this employment agreement, 30% of Mr. Weber’s base salary and short-term incentives are payable from TPUSA. Currently none of his LTI is granted from TPUSA.

These agreements were designed to split the compensation for Mr. Weber according to his work allocation and were not intended to increase any portion of his compensation. Accordingly, the total amount of compensation paid to Mr. Weber from the Company and Takeda group companies did not increase due to his concurrent duties of Head of Global Business of TPUSA, and the Compensation Committee reviewed and confirmed the entire amount provided under both agreements. The total amount of each Individual Director’s compensation is disclosed in the Company’s Annual Securities Report submitted after its General Meeting of Shareholders.

TAKEDA’S EXECUTIVE COMPENSATION OVERVIEW

COMPENSATION PROGRAM OVERSIGHT

Role of the Compensation Committee

The Board of Directors (the “Board”) has delegated to the Compensation Committee (the “Committee”) (an advisory committee of the Board) the authority to determine compensation for Internal Directors. The Committee consists of four independent External Directors. For Fiscal Year 2022, the Committee continued to utilize Semler Brossy as its primary compensation consultant. Semler Brossy, which is retained directly by the Committee and does not have any other engagements with the Company, attended select meetings at the invitation of the Committee, assisted the Committee with analyzing competitive peer company market data and relevant information relating to the Company’s compensation programs, and reported to the Committee regarding market trends and technical developments. In addition, members of our management team keep abreast of developments in compensation matters and participate in the gathering and presentation of data related to these matters as requested by the Committee. In order to enhance transparency of the Company’s corporate governance, the Company has externally disclosed the Compensation Committee Charter, which defines the Committee’s roles and responsibilities, as a part of the Company’s corporate governance documents.

Compensation Determination

The level and the mix of compensation for Internal Directors are reviewed and established each year by the Committee. The process begins with consideration of compensation levels, and compensation mix, for comparable executives at companies in Takeda’s Fiscal Year Peer Group (see below). After this benchmark review, the Committee establishes Internal Director compensation – base salary adjustments, annual short-term incentive, and long-term incentive awards – relative to the peer median. Awards can be differentiated from peer compensation levels based on each Internal Director’s individual performance, experience, leadership, and contributions to Takeda’s business and strategic performance. The remaining TET members participate in the same compensation programs as the Internal Directors, and their compensation level and mix are set by our CEO in a manner that is generally consistent with the framework established by the Compensation Committee for Internal Directors.

Comparative Framework

Individual compensation levels and opportunities are compared to a peer group of global pharmaceutical companies approved by the Committee and the Board to ensure our compensation programs and levels are competitive to attract and retain key talent in the global pharmaceutical market. Although the Committee considers the compensation practices of peer companies, it does not make any determinations or changes in compensation in reaction to the market data alone. The Fiscal Year 2022 Takeda Peer Group included the following companies:

|

|

|

|

|

|

| Fiscal Year 2022 Takeda Peer Group |

| AbbVie (United States) |

Amgen (United States) |

| Astellas (Japan) |

AstraZeneca (United Kingdom) |

| Bristol Myers Squibb (United States) |

Eli Lilly (United States) |

| Gilead Sciences (United States) |

GlaxoSmithKline (United Kingdom) |

| Merck & Co (United States) |

Merck Group (Germany) |

| Novartis (Switzerland) |

Pfizer (United States) |

| Roche (Switzerland) |

Sanofi (France) |

The Takeda Fiscal Year 2023 Peer Group will remain the same as the Takeda Fiscal Year 2022 Peer Group.

TAKEDA’S EXECUTIVE COMPENSATION OVERVIEW

Key Performance Indicator Determination

Each year, the Committee and the Board review and establish the annual Key Performance Indicators (“KPI”) used for the STI plan and for the LTI PSU awards. The KPIs included in the STI and LTI PSU awards were carefully evaluated by the Committee before being approved by the Board. Each KPI has been set in order to align the short- and long-term strategies with shareholder returns, while also promoting the retention of critical global executive talent. Takeda believes these KPIs enable the organization to focus on growth, profitability, pipeline performance, expense management and shareholder value creation.

Furthermore, consistent with Takeda’s peer group practices, the Committee and the Board may select KPIs based on certain financial measures that are adjusted from Takeda’s reported, IFRS financial measures to focus on Takeda’s core business strategies and operations. Additional information about Takeda’s non-IFRS measures, including Core financial measures, is set forth in the financial appendix at the end of Takeda's fourth quarter FY2022 investor presentation (available on Takeda’s website at: https://www.takeda.com/investors/financial-results/quarterly-results/).

The Committee and the Board reference Takeda’s annual operating plan to establish performance targets and to assess the relative weighting for each KPI.

Both the STI and the LTI plans are designed in a way that allows participants to be rewarded for delivering strong results for shareholders if Takeda exceeds the plan targets. Conversely, if Takeda does not achieve targets, participants will receive a below target payout. If performance is below threshold, participants receive a 0% payout for that KPI. The maximum payout participants can receive under the plans is 200% of target payout.

The Committee has authority to adjust KPI results upon which incentive compensation payouts are determined to eliminate the distorting effect of unusual income or expense items. The adjustments are intended to:

•align award payments with the underlying performance of the core business;

•avoid volatile, artificial inflation or deflation of awards due to unusual items in the award year, and, where relevant, the previous (comparator) year;

•eliminate certain counterproductive short-term incentives; and

•facilitate comparisons with peer companies.

The Committee reviews and approves adjustments, including but not limited to, the impact of significant acquisitions or divestitures, the impact of share repurchases that differ significantly from business plan, and large swings in foreign exchange rates. Amounts listed below for “Target” and “Results” incorporate these adjustments, to the extent applicable, with adjustments having a significant impact on results separately identified.

FY2022 SHORT- AND LONG-TERM INCENTIVE COMPENSATION

Short-Term Incentive Plan

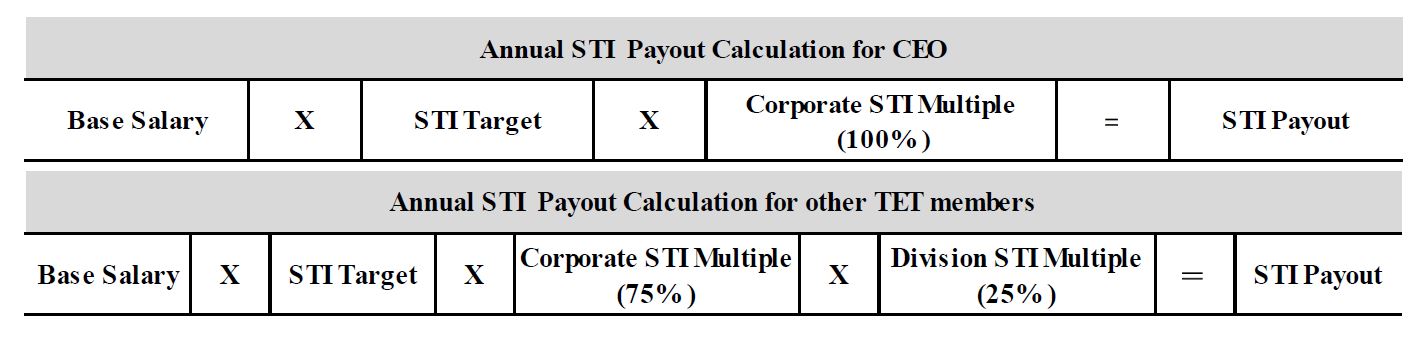

Takeda’s STI framework aligns cash rewards with key measures of success over a one-year period. For the CEO, Fiscal Year 2022 performance was based 100% on corporate KPIs. The STI for other TET members, was based on 75% corporate KPIs and 25% division KPIs.

The annual STI cash payout is calculated as follows:

TAKEDA’S EXECUTIVE COMPENSATION OVERVIEW

Fiscal Year 2022 Short-Term Incentive Results

The chart below summarizes the Fiscal Year 2022 KPIs and performance ranges approved by the Committee and the Board for the STI plan:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| KPI |

Rationale |

Weight |

Measurement |

Threshold |

Target |

Maximum |

| Total Core Revenue |

•Key indicator of growth, including pipeline delivery

•Important measure of success within the industry

|

45% |

Performance Goal as a % of Target |

97% |

100% |

105% |

| STI Payout as a % of Target |

40% |

100% |

200% |

| Global Growth Products + New Product Incremental Core Revenue |

•Global Growth Products: Emphasis on subset of revenue that is the key driver of future revenue growth

•New Product Revenue: Key indicator of driving pipeline growth and commercial revenue success

|

15% |

Performance Goal as a % of Target |

80% |

100% |

120% |

| STI Payout as a % of Target |

40% |

100% |

200% |

| Total Core Operating Profit |

•Measure of margin achievement while ensuring expense discipline

•Reflects synergy capture

•Communicated to shareholders as a key measure of Takeda success post Shire acquisition

|

40% |

Performance Goal as a % of Target |

95% |

100% |

115% |

| STI Payout as a % of Target |

50% |

100% |

200% |

The Committee approved a Corporate STI Multiple for Fiscal Year 2022 of 95.1% for the TET members as shown in the following chart which details target performance levels, performance outcomes, and performance outcome scores:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

KPI1 |

Weight |

Target |

Result |

Performance |

Score |

Weighted

Score

|

| Total Core Revenue |

45% |

3,557.8

billion

JPY

|

3,550.5

billion

JPY

|

99.8% |

95.6% |

43.0% |

| Global Growth Products + New Product Incremental Core Revenue |

15% |

248.7

billion JPY

|

238.8 billion

JPY

|

96.1% |

88.2% |

13.2% |

| Total Core Operating Profit |

40% |

1,050.4

billion

JPY

|

1,047.4

billion

JPY

|

99.7% |

97.0% |

38.8% |

| Corporate STI Multiple |

95.1% |

1 KPI metrics for STI purposes are based on FX rates used for internal budgetary planning to neutralize currency exchange rate fluctuations.

TAKEDA’S EXECUTIVE COMPENSATION OVERVIEW

In the Notice of Convocation of the 147th Ordinary Meeting of Shareholders, Takeda proposes to pay bonuses up to 400 million JPY (excluding bonuses paid to the relevant Directors for their work as employees) to Christophe Weber, Costa Saroukos, and Masato Iwasaki based upon the STI plan performance summarized above. At the previous 146th Ordinary Meeting of Shareholders, the amount of bonuses of up to 500 million JPY was approved by shareholders.

Long-Term Incentive Plan

The LTI framework aligns the TET with the long-term strategy and shareholder returns while promoting the retention of critical global executive talent. In Fiscal Year 2022, as in Fiscal Year 2021, 60% of the LTI program is delivered in PSU awards and 40% in RSU awards.

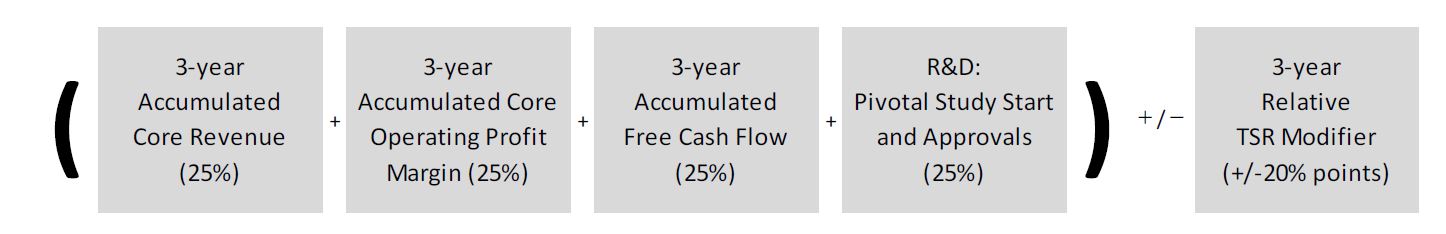

Fiscal Year 2022-2024 PSU Awards

PSU awards will be earned based on financial performance, strategic pipeline objectives and stock price performance relative to peers. For Fiscal Year 2022, the Committee and Board approved the following KPIs for the Fiscal Year 2022-2024 PSU awards:

|

|

|

|

|

|

|

|

|

| KPI |

Weight |

Rationale |

3-year Accumulated Core Revenue |

25% |

•Aligns with investor expectations

•Focuses participants on continued growth and pipeline delivery

•Important measure of success within the industry

|

| 3-year Accumulated Core Operating Profit Margin |

25% |

•Measures quality of the earnings over the performance period

•High shareholder expectation for strong earnings growth

|

| 3-year Accumulated Free Cash Flow |

25% |

•Focuses participants on cash generation and paying down debt following the Shire acquisition |

| R&D: Pivotal Study Start & Approvals |

25% |

•Reflects future strength of Takeda’s overall performance through delivery of innovative research and development programs.

•Underscores our commitment to patients.

•Reflects our objective of driving commercial revenue success, driving innovation and ultimate replenishment of pipeline.

•Ultimately drives revenue growth from new products.

|

| 3-year Relative TSR |

Modifier +/-20% points |

•Aligns payout from our Performance Share Unit awards with the shareholder experience

•Only applies if absolute TSR is positive

|

From the Fiscal Year 2021-2023 PSU awards, the R&D KPIs were updated from Pivotal Study Starts only to include both Pivotal Study Starts and Approvals in order to align management’s performance to not only starting pivotal studies but also achieving approvals, as approvals link more closely to new product launches and therefore future cash generation.

After measuring performance under the financial and non-financial metrics outlined above, Takeda will assess the 3-Year Total Shareholder Return (“TSR”) performance relative to our Fiscal Year 2022 Takeda Peer Group.

Relative TSR can modify the final LTI PSU awards payout (up or down) by 20 percentage points. If absolute TSR performance is negative but Takeda outperforms our peers, a positive adjustment would not be made to the PSU awards payout factor. The chart below is the TSR goal for the Fiscal Year 2022-2024 performance cycle:

TAKEDA’S EXECUTIVE COMPENSATION OVERVIEW

|

|

|

|

|

|

| Percentile Rank |

Modifier |

80th and Above |

+20% points |

60th to 79th |

+10% points |

40th to 59th (median) |

No adjustment |

20th to 39th |

-10% points |

19th and Below |

-20% points |

Fiscal Year 2020-2022 PSU Awards Targets and Outcomes/Results

The chart below summarizes Takeda’s KPIs, weightings, and performance ranges for the Fiscal Year 2020-2022 PSU awards. The originally approved R&D KPI included Pivotal Study Starts only. However, in order to align with Takeda’s PSU awards KPIs from Fiscal Year 2021 and to reflect our performance on approvals as well, the R&D KPI was updated and approved by the Committee and the Board to include both Pivotal Study Starts and Approvals. This is because approvals link more closely to new product launches and therefore future cash generation for shareholders.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| KPI |

Weight |

Measurement |

Threshold |

Target |

Maximum |

| 3-year Accumulated Underlying Revenue |

25% |

Performance Goal as a % of Target |

96% |

100% |

105% |

| PSU awards Payout as a % of Target |

50% |

100% |

200% |

| Point in Time Core Operating Margin (at end of performance period) |

25% |

Performance Goal as a % of Target |

93% |

100% |

107% |

| PSU awards Payout as a % of Target |

50% |

100% |

200% |

| 3-year Accumulated Free Cash Flow |

25% |

Performance Goal as a % of Target |

90% |

100% |

115% |

| PSU awards Payout as a % of Target |

50% |

100% |

200% |

| R&D: Pivotal Study Start & Approvals |

25% |

PSU awards Payout as a % of Target |

50% |

100% |

200% |

| 3-year Relative TSR |

Modifier

+/-20% points

|

|

|

|

|

The number of units earned by the participant is calculated as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Target Number of Units

(Standard Points)

|

× |

PSU Multiple

(Payout rate based on performance)

|

= |

PSUs earned |

The Committee approved a PSU Multiple for Fiscal Year 2020-2022 PSU awards of 120.1% for the TET members as shown in the following chart which details target performance levels, performance outcomes, and performance outcome scores:

TAKEDA’S EXECUTIVE COMPENSATION OVERVIEW

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| KPI |

Weight |

Target |

Result |

Performance |

Score |

Weighted

Score

|

3-year Accumulated Underlying Revenue |

25% |

9,810.1

billion

JPY

|

10,124.5

billion

JPY

|

103.2% |

164.1% |

41.0% |

| Point in Time Core Operating Margin (at end of performance period) |

25% |

32.4% |

29.5% |

90.9% |

0.0% |

0.0% |

3-year Accumulated Free Cash Flow1 |

25% |

2,373.0

billion

JPY

|

3,018.6

billion

JPY

|

127.2% |

200.0% |

50.0% |

R&D: Pivotal Study Start & Approvals2 |

25% |

- |

- |

77.9% |

76.2% |

19.1% |

| PSU Multiple (Before 3-Year Relative TSR Modifier) |

110.1% |

3-Year Relative TSR Modifier3 |

+10% points |

| Payout (PSU Score) |

120.1% |

1 Free cash flow excluding upfront payment related to the acquisition of TAK-279 was used for FY2022 to exclude the impact of a significant one-time event which was not predicted in the initial target from a consistent performance evaluation standpoint.

2 R&D KPIs were changed from Pivotal Study Start to Pivotal Study Start and Approvals in order to align management’s performance to not only starting pivotal study but also final approvals, because approvals link more closely to new product launches and therefore future cash generation for shareholders.

3 Takeda’s 3-year relative TSR ranked at the 60th percentile of the peer group, resulting in +10% points modifier to the total results.

FISCAL YEAR 2023 SHORT-TERM INCENTIVE AND LONG-TERM INCENTIVE COMPENSATION PLANS

In Fiscal Year 2022, the Committee, in consultation with its consultants, conducted a review of Takeda’s KPIs in light of the company’s business strategy and incentive plan practices among the peer group companies. As a result of this review, the Committee and the Board reviewed and approved the following STI and PSU awards) KPIs for Fiscal Year 2023:

The Fiscal Year 2023 STI KPIs and respective weightings are as follows:

•Total Core Revenue (45%)

•Growth and Launch Product Incremental Core Revenue (15%)

•Total Core Operating Profit (40%)

The Fiscal Year 2023-2025 PSU awards KPIs and respective weightings are as follows:

•3-year Accumulated Core Revenue (30%)

•3-year Accumulated Core Operating Profit (30%)

•R&D: Pivotal Study Start and Approvals (40%)

•3-year Relative TSR Modifier (+/-30% points)

TAKEDA’S EXECUTIVE COMPENSATION OVERVIEW

SHAREHOLDING REQUIREMENT

Takeda’s shareholding requirement is designed to further promote sustained shareholder return and to ensure the company's senior executives remain focused on both short- and long-term objectives. Beginning with LTI grants in 2019 and continuing in subsequent years, PSU awards (not including the one-time Special Integration PSU awards) and RSU awards granted to the TET are subject to a two-year holding period after vesting.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LTI Vesting Schedule and Holding Requirement |

| Grant Year |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

| RSU awards |

1/3 vest after 1-year |

Required to hold the shares for 2 years after vesting |

|

|

|

1/3 vest after 2-years |

Required to hold the shares for 2 years after vesting |

|

|

|

1/3 vest after 3-years |

Required to hold the shares for 2 years after vesting |

| PSU awards |

Vest at the end of 3-year performance period based on achievement of KPI targets |

Required to hold the shares for 2 years after vesting |

One-time special PSU awards1 |

Vest after 1-year based on achievement of KPI targets |

Vest after 2-years based on achievement of KPI targets |

Vest after 3-year based on achievement of KPI targets |

No holding requirement |

1 One-time special PSU awards have not been granted since FY2020.

RECOUPMENT POLICY

The Committee and the Board adopted a clawback policy in 2020 which provides that in the event of a significant restatement of financial results or/and significant misconduct, the independent External Directors may require Takeda to recoup incentive compensation. This would include all or a portion of the incentive compensation received by any Internal Director, any other member of the TET, and any other individual designated by the independent External Directors within the fiscal year, and the three (3) prior fiscal years, where the need for a significant restatement of financial results or significant misconduct was discovered.

The policy became effective on April 1, 2020 and applies to short-term incentive compensation beginning with the Fiscal Year 2020 performance year and long-term incentives granted in Fiscal Year 2020, and continues to apply for all subsequent periods.

SHAREHOLDER ENGAGEMENT

Takeda is committed to regular, ongoing engagement with shareholders to make sure that we continue to understand shareholder feedback and deepen shareholders’ understanding about topics including the company’s management policy, corporate governance, compensation, measures addressing environmental and social issues, strategies and current business status. In FY2022, as in previous years, Takeda held many meetings with shareholders, investors and analysts. Their feedback helped inform the Compensation Committee’s continuous assessment of the compensation program design and ongoing discussions with shareholders.