Investor Presentation – Fourth Quarter 2024 February 2025 Financial Information for the three and twelve months ended December 31, 2024 EXHIBIT 99.2

1 Disclaimers LIMITATIONS ON THE USE OF INFORMATION This presentation has been prepared by Tiptree Inc. and its consolidated subsidiaries (“Tiptree", "the Company" or "we”) solely for informational purposes, and not for the purpose of updating any information or forecast with respect to Tiptree, its subsidiaries or any of its affiliates or any other purpose. Tiptree reports a non-controlling interest in certain operating subsidiaries that are not wholly owned. Unless otherwise noted, all information is of Tiptree on a consolidated basis before non-controlling interest. Neither Tiptree nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and no such party shall have any liability for such information. These materials and any related oral statements are not all-inclusive and shall not be construed as legal, tax, investment or any other advice. You should consult your own counsel, accountant or business advisors. Performance information is historical and is not indicative of, nor does it guarantee future results. There can be no assurance that similar performance may be experienced in the future. SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS This document contains "forward-looking statements" which involve risks, uncertainties and contingencies, many of which are beyond Tiptree's control, which may cause actual results, performance, or achievements to differ materially from anticipated results, performance, or achievements. All statements contained herein that are not clearly historical in nature are forward-looking, and the words "anticipate," "believe," "estimate," "expect,“ “intend,” “may,” “might,” "plan," “project,” “should,” "target,“ “will,” "view," “confident,” or similar expressions are intended to identify forward-looking statements. Such forward-looking statements include, but are not limited to, statements about Tiptree's plans, objectives, expectations and intentions. The forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, many of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecast in the forward-looking statements. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including, but not limited to those described in the section entitled “Risk Factors” in Tiptree’s Annual Report on Form 10-K, and as described in the Tiptree’s other filings with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as to the date of this release. The factors described therein are not necessarily all of the important factors that could cause actual results or developments to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors also could affect our forward-looking statements. Consequently, our actual performance could be materially different from the results described or anticipated by our forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Except as required by the federal securities laws, we undertake no obligation to update any forward- looking statements. MARKET AND INDUSTRY DATA Certain market data and industry data used in this presentation were obtained from reports of governmental agencies and industry publications and surveys. We believe the data from third-party sources to be reliable based upon our management’s knowledge of the industry, but have not independently verified such data and as such, make no guarantees as to its accuracy, completeness or timeliness. NOT AN OFFER OR A SOLICIATION This document does not constitute an offer or invitation for the sale or purchase of securities or to engage in any other transaction with Tiptree, its subsidiaries or its affiliates. The information in this document is not targeted at the residents of any particular country or jurisdiction and is not intended for distribution to, or use by, any person in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. NON-GAAP MEASURES In this document, we sometimes use financial measures derived from consolidated financial data but not presented in our financial statements prepared in accordance with U.S. generally accepted accounting principles ("GAAP"). Certain of these data are considered “non-GAAP financial measures” under the SEC rules. These non-GAAP financial measures supplement our GAAP disclosures and should not be considered an alternative to the GAAP measure. Management's reasons for using these non-GAAP financial measures and the reconciliations to their most directly comparable GAAP financial measures are posted in the Appendix.

2 2024 Highlights Revenue $2.043 billion 23.9% vs. prior year Adjusted Net Income1 $100.1 million 61.6% vs. prior year Book Value per share1,3 $12.29 12.6% vs. 12/31/23 Net Income $53.4 million vs. prior year net income of $14.0 million Overall Revenues of $2.043bn, an increase of 23.9% from 2023, driven by growth at Fortegra. Net income of $53mm. Adj. net income1 of $100mm, and 22.9% annualized adj. ROAE1, driven by growth in insurance operations. Insurance $3.1bn of gross written premiums and premium equivalents (GWPPE), 12% increase from prior year, driven primarily by specialty E&S insurance lines. Net written premiums of $1.4bn, 9% increase from 2023, driven by organic growth. Combined ratio of 90.0%, improved 0.3% from consistent underwriting performance and operating scale. Adj. net income1,2 of $157mm, up 36% from prior year driven by revenue growth and improved combined ratio. Annualized Adj. ROAE1,2 of 29%, flat to prior year. $40mm investment in Fortegra in March and April 2024 (existing shareholders) to support continued growth. Tiptree Capital Pre-tax income of $4.6mm driven by improved performance in our mortgage business. ($ in millions, except per share information) 1 For a reconciliation of Non-GAAP metrics adjusted net income, adjusted return on average equity and book value per share to GAAP financials, see the Appendix. 2 Adjusted net income and adjusted return on average equity for insurance is presented before the impacts of non-controlling interests. 3 Annual total return defined as cumulative dividends paid of $0.49 per share plus change in book value per share as of December 31, 2024.

Financial Highlights 31 For a reconciliation of Non-GAAP metrics adjusted net income, adjusted return on average equity (annualized) and book value per share to GAAP financials, see the Appendix. 2 Adjusted net income for Fortegra is presented before the impacts of non-controlling interests. ($ in millions, except per share information) $23.9 $32.6 $42.5 $(0.8) $(0.4) $(0.3) $(8.6) $(11.7) $(6.1) $14.6 $20.5 $36.1 Q4'22 Q4'23 Q4'24 Corporate Fortegra2 Tiptree Capital Key Highlights – Q4’24 Adjusted Net Income by business Revenues increased 13% • Growth in net earned premiums and net investment income • Improvement in investment portfolio book yield to 4.0%, from 3.3% prior year Net income of $19.6mm • Growth in insurance operations while maintaining consistent margins • Impacted by Fortegra tax deconsolidation of $6.8mm in Q4‘24 vs $8.9mm in Q4‘23 Adj. net income1 of $27.2mm, increased by 96.6% versus prior year • Continued revenue growth and consistent combined ratio at Fortegra Annualized Adj. ROAE1 of 22.9%, improvement of 7.7% versus prior year 12.6% growth in book value per share from Q4’23 (incl. dividends paid) • Earnings growth partially offset by unrealized losses on fixed income portfolio (AFS securities & currency movements) $27.2$9.7 $13.9 Adjusted Net Income (after NCI) Q4'23 Q4'24 FY’23 FY’24 Total Revenues $446.4 $503.6 $1,649.0 $2,042.9 Net income (loss) $6.9 $19.6 $14.0 $53.4 Diluted EPS $0.15 $0.47 $0.33 $1.30 Adjusted net income1 $13.9 $27.2 $61.9 $100.1 Adjusted ROAE1 13.6% 23.7% 15.2% 22.9% Total shares outstanding 36.8 37.3 Book Value per share1 $11.34 $12.29 $83.8 $115.7 $157.0 $9.0 $1.8 $(29.4) $(29.9) $(26.2) $63.4 $85.7 $132.7 2022 2023 2024 $100.1$53.0 $61.9

Specialty Insurance Performance Highlights Q4’24

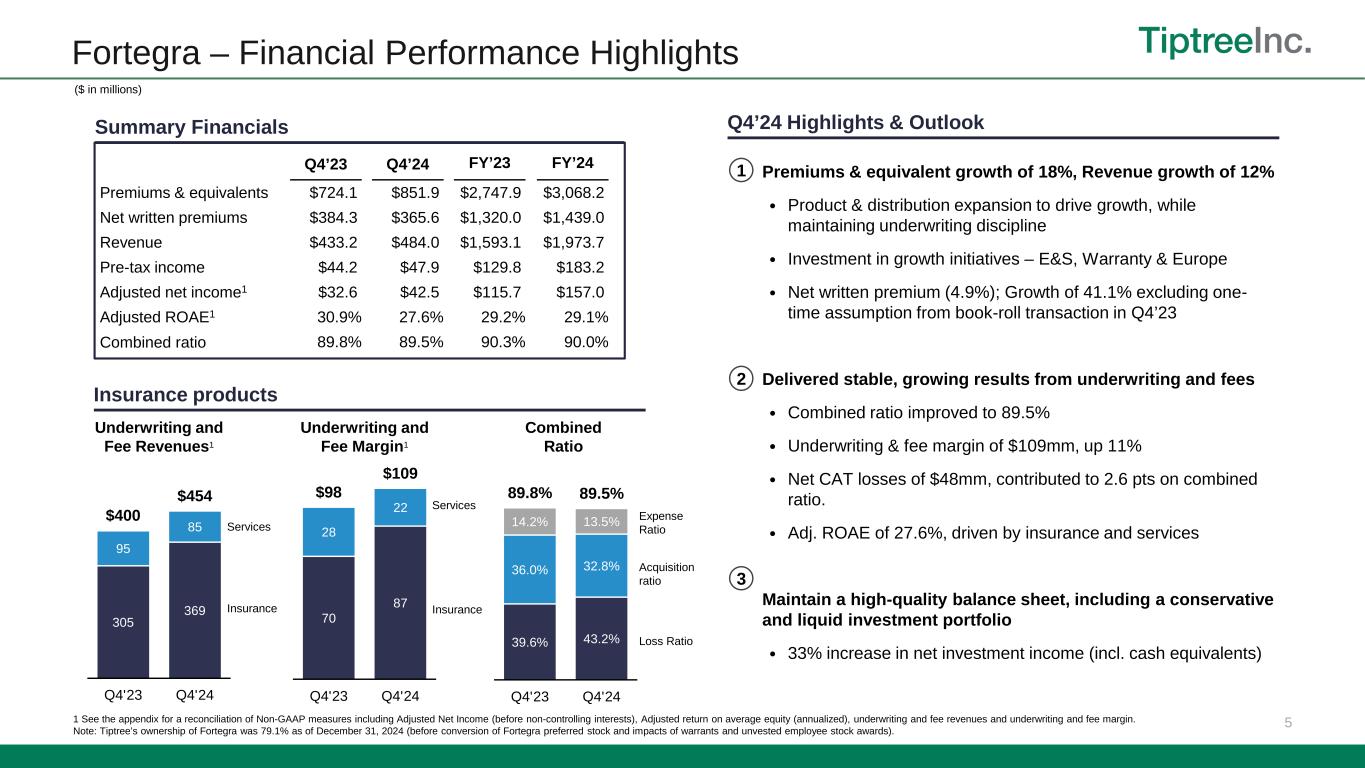

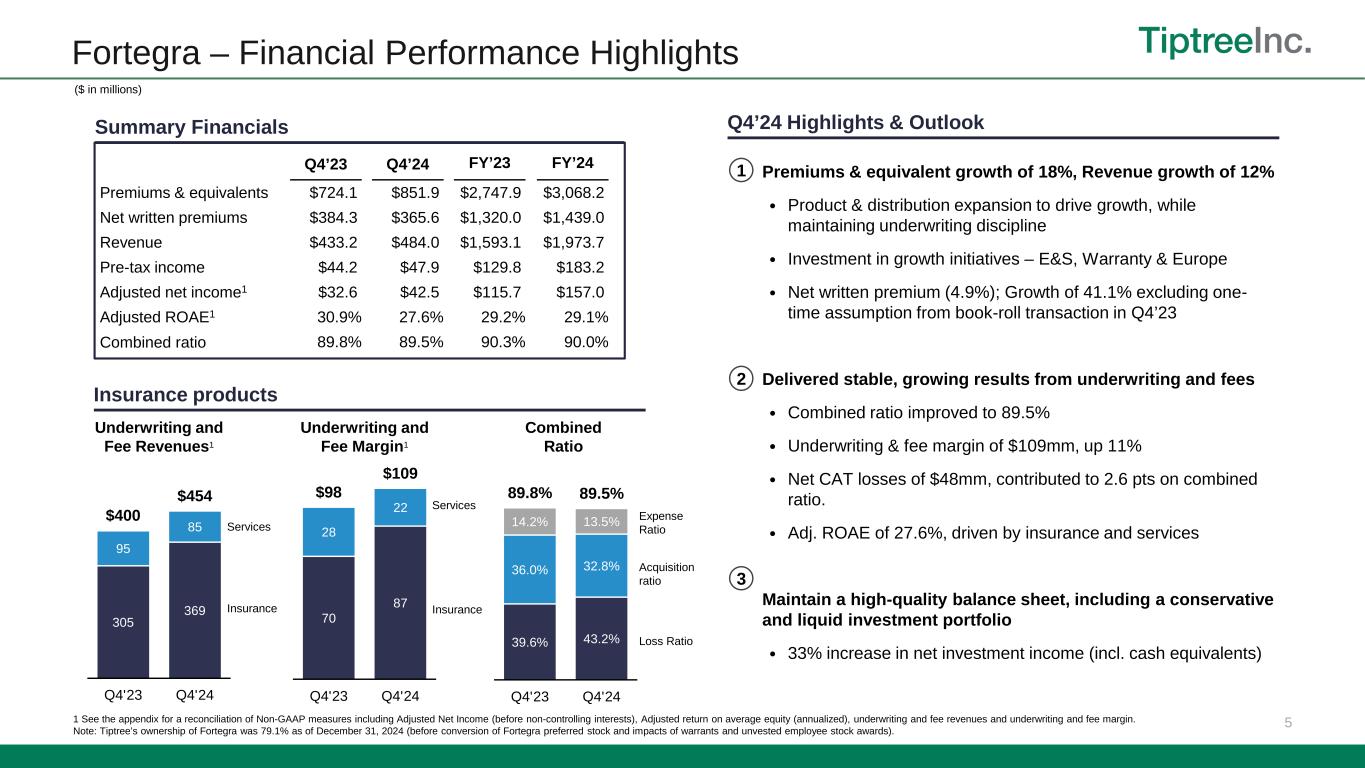

5 Fortegra – Financial Performance Highlights Premiums & equivalent growth of 18%, Revenue growth of 12% • Product & distribution expansion to drive growth, while maintaining underwriting discipline • Investment in growth initiatives – E&S, Warranty & Europe • Net written premium (4.9%); Growth of 41.1% excluding one- time assumption from book-roll transaction in Q4’23 Delivered stable, growing results from underwriting and fees • Combined ratio improved to 89.5% • Underwriting & fee margin of $109mm, up 11% • Net CAT losses of $48mm, contributed to 2.6 pts on combined ratio. • Adj. ROAE of 27.6%, driven by insurance and services Maintain a high-quality balance sheet, including a conservative and liquid investment portfolio • 33% increase in net investment income (incl. cash equivalents) Underwriting and Fee Margin1 Underwriting and Fee Revenues1 Combined Ratio 1 2 3 Summary Financials Insurance products Q4’24 Highlights & Outlook ($ in millions) Expense Ratio Loss Ratio Services Insurance 1 See the appendix for a reconciliation of Non-GAAP measures including Adjusted Net Income (before non-controlling interests), Adjusted return on average equity (annualized), underwriting and fee revenues and underwriting and fee margin. Note: Tiptree’s ownership of Fortegra was 79.1% as of December 31, 2024 (before conversion of Fortegra preferred stock and impacts of warrants and unvested employee stock awards). Services Insurance 305 369 95 85 $400 $454 Q4'23 Q4'24 70 87 28 22 $98 $109 Q4'23 Q4'24 39.6% 43.2% 36.0% 32.8% 14.2% 13.5% 89.8% 89.5% Q4'23 Q4'24 Acquisition ratio Q4’23 Q4’24 FY’23 FY’24 Premiums & equivalents $724.1 $851.9 $2,747.9 $3,068.2 Net written premiums $384.3 $365.6 $1,320.0 $1,439.0 Revenue $433.2 $484.0 $1,593.1 $1,973.7 Pre-tax income $44.2 $47.9 $129.8 $183.2 Adjusted net income1 $32.6 $42.5 $115.7 $157.0 Adjusted ROAE1 30.9% 27.6% 29.2% 29.1% Combined ratio 89.8% 89.5% 90.3% 90.0%

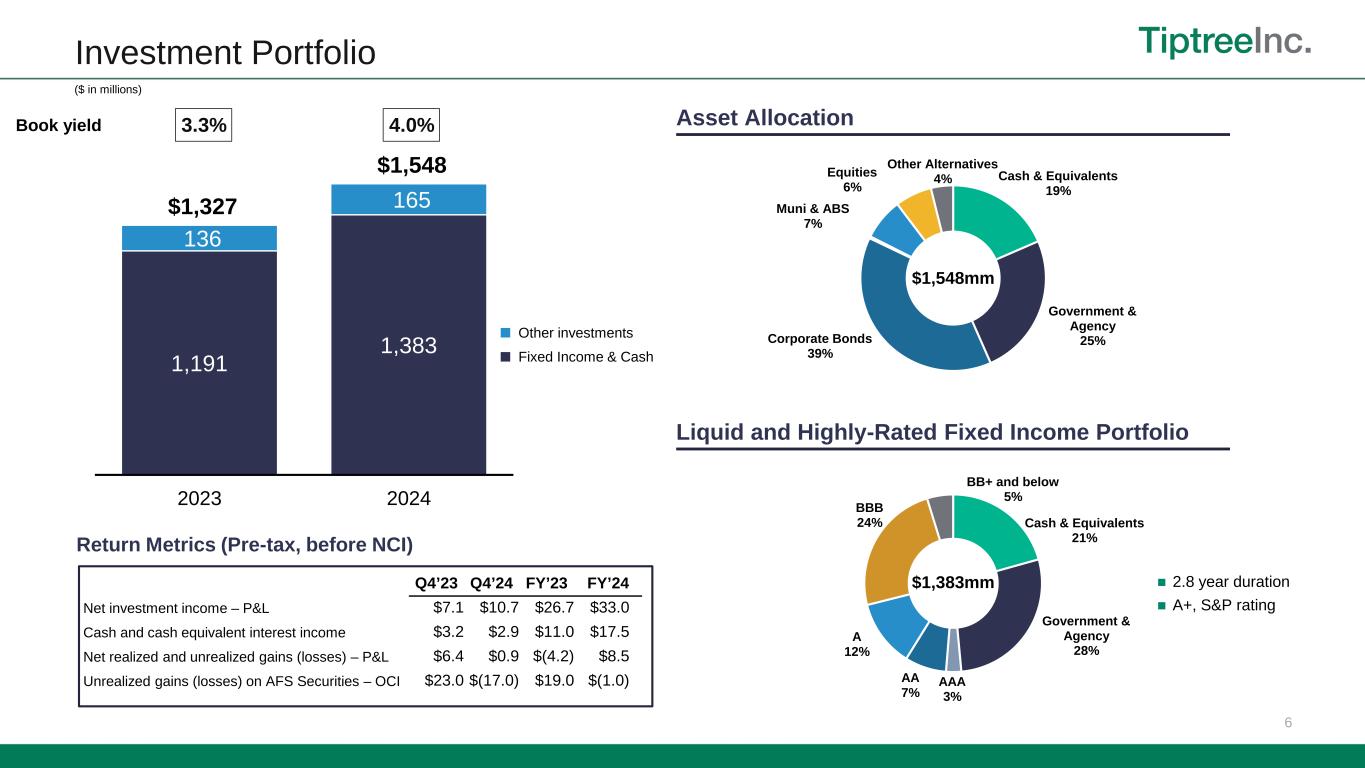

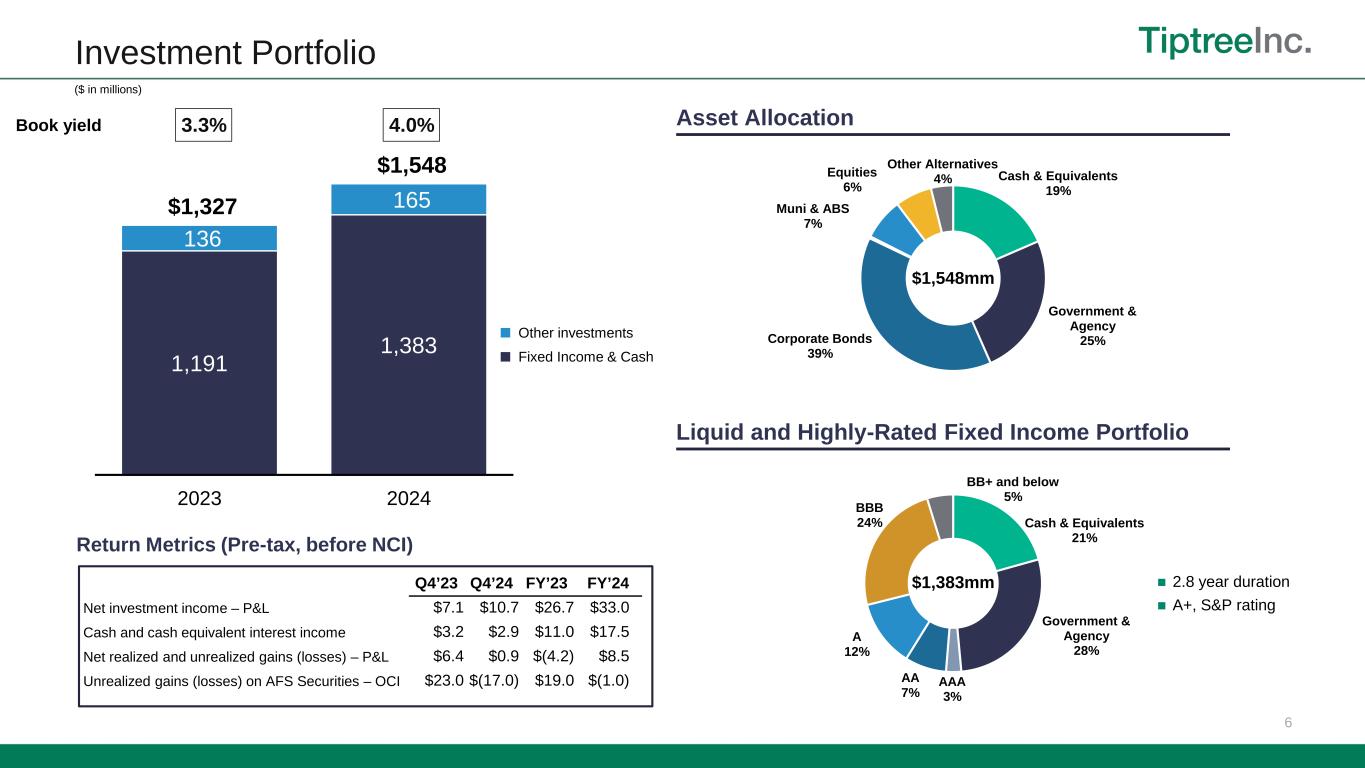

Investment Portfolio Cash & Equivalents 19% Government & Agency 25%Corporate Bonds 39% Muni & ABS 7% Equities 6% Other Alternatives 4% Cash & Equivalents 21% Government & Agency 28% AAA 3% AA 7% A 12% BBB 24% BB+ and below 5% $1,383mm 6 Asset Allocation Liquid and Highly-Rated Fixed Income Portfolio ($ in millions) 1,191 1,383 136 165 $1,327 $1,548 2023 2024 Other investments Fixed Income & Cash $1,548mm ◼ 2.8 year duration ◼ A+, S&P rating 4.0%3.3%Book yield Q4’23 Q4’24 FY’23 FY’24 Net investment income – P&L $7.1 $10.7 $26.7 $33.0 Cash and cash equivalent interest income $3.2 $2.9 $11.0 $17.5 Net realized and unrealized gains (losses) – P&L $6.4 $0.9 $(4.2) $8.5 Unrealized gains (losses) on AFS Securities – OCI $23.0 $(17.0) $19.0 $(1.0) Return Metrics (Pre-tax, before NCI)

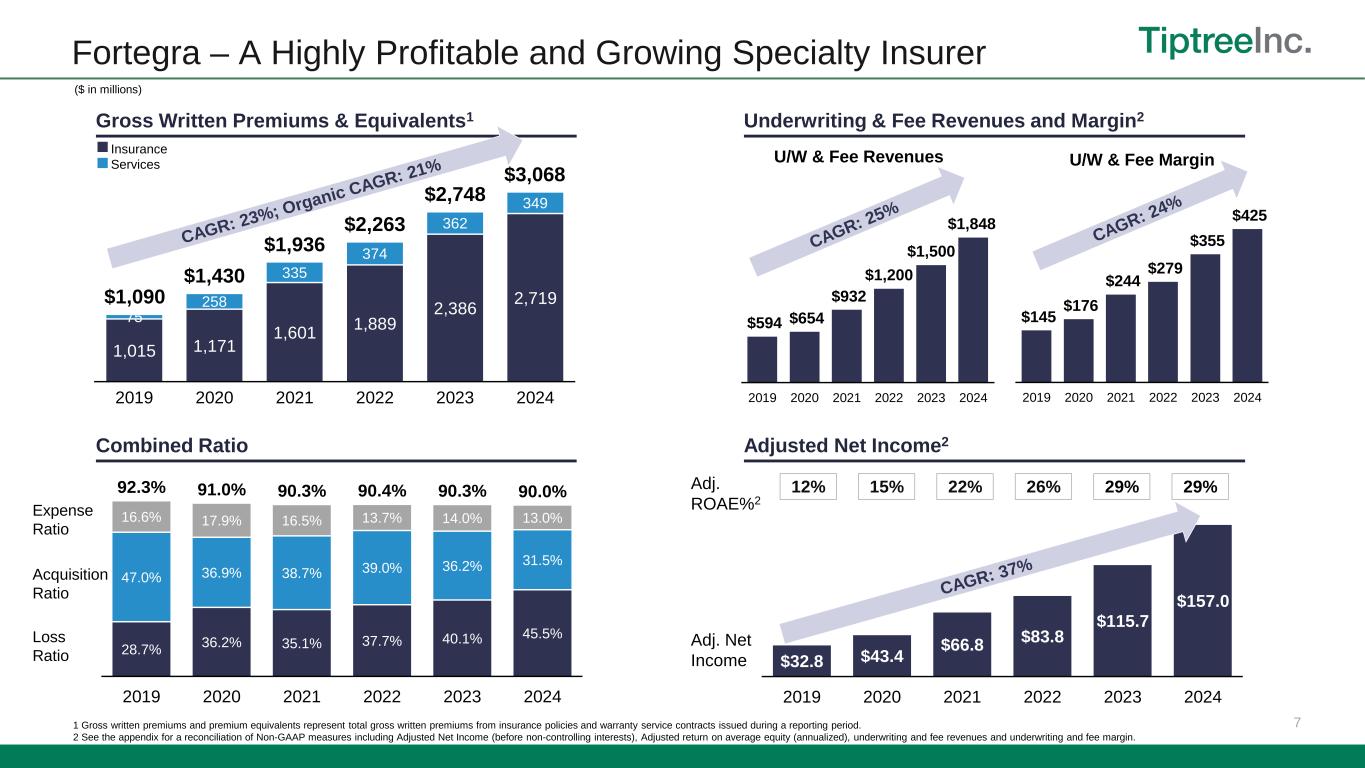

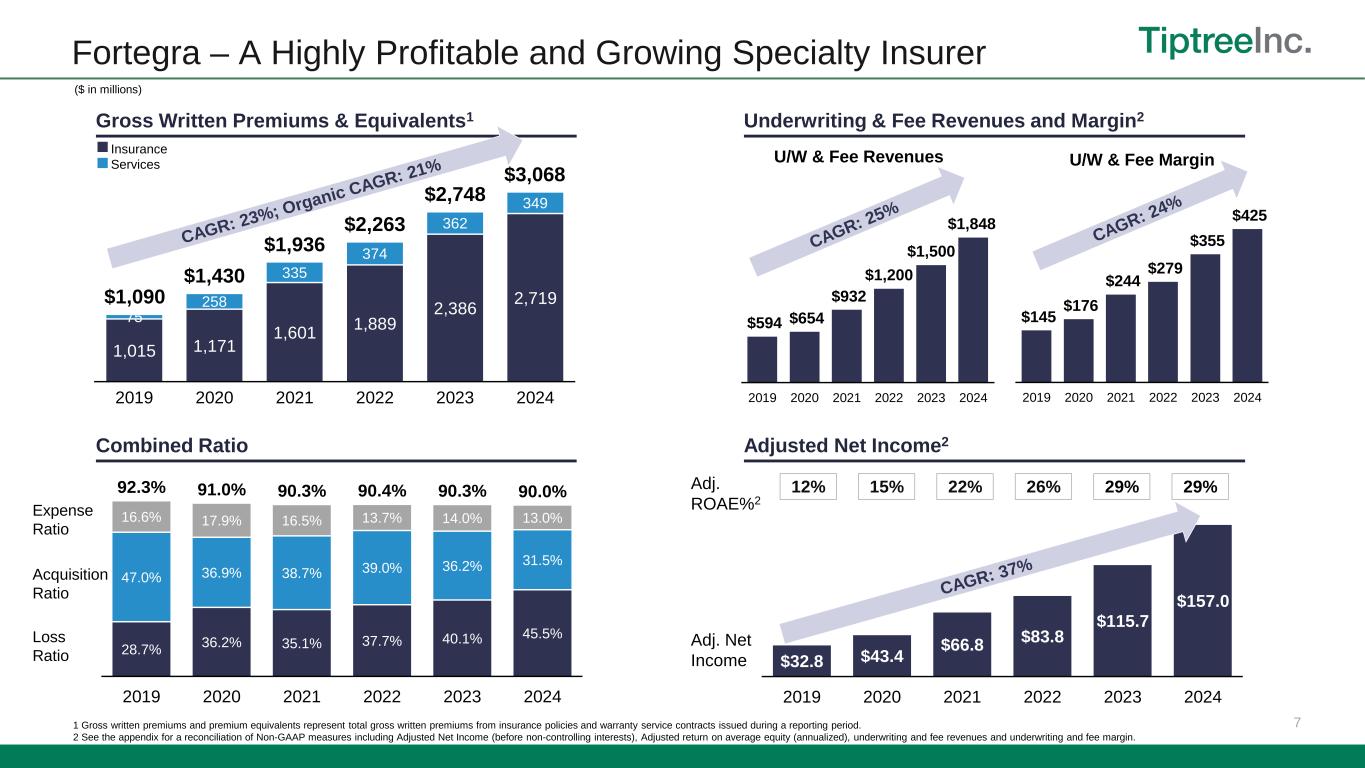

Fortegra – A Highly Profitable and Growing Specialty Insurer $32.8 $43.4 $66.8 $83.8 $115.7 $157.0 2019 2020 2021 2022 2023 2024 7 ($ in millions) Gross Written Premiums & Equivalents1 Underwriting & Fee Revenues and Margin2 Adjusted Net Income2 1,015 1,171 1,601 1,889 2,386 2,719 75 258 335 374 362 349 $1,090 $1,430 $1,936 $2,263 $2,748 $3,068 2019 2020 2021 2022 2023 2024 Combined Ratio Adj. ROAE%2 Adj. Net Income Loss Ratio Expense Ratio Insurance Services 1 Gross written premiums and premium equivalents represent total gross written premiums from insurance policies and warranty service contracts issued during a reporting period. 2 See the appendix for a reconciliation of Non-GAAP measures including Adjusted Net Income (before non-controlling interests), Adjusted return on average equity (annualized), underwriting and fee revenues and underwriting and fee margin. 12% U/W & Fee Revenues 26% U/W & Fee Margin 29%22%15% $145 $176 $244 $279 $355 $425 2019 2020 2021 2022 2023 2024 $594 $654 $932 $1,200 $1,500 $1,848 2019 2020 2021 2022 2023 2024 28.7% 36.2% 35.1% 37.7% 40.1% 45.5% 47.0% 36.9% 38.7% 39.0% 36.2% 31.5% 16.6% 17.9% 16.5% 13.7% 14.0% 13.0% 92.3% 91.0% 90.3% 90.4% 90.3% 90.0% 2019 2020 2021 2022 2023 2024 Acquisition Ratio 29%

Performance Highlights Q4’24

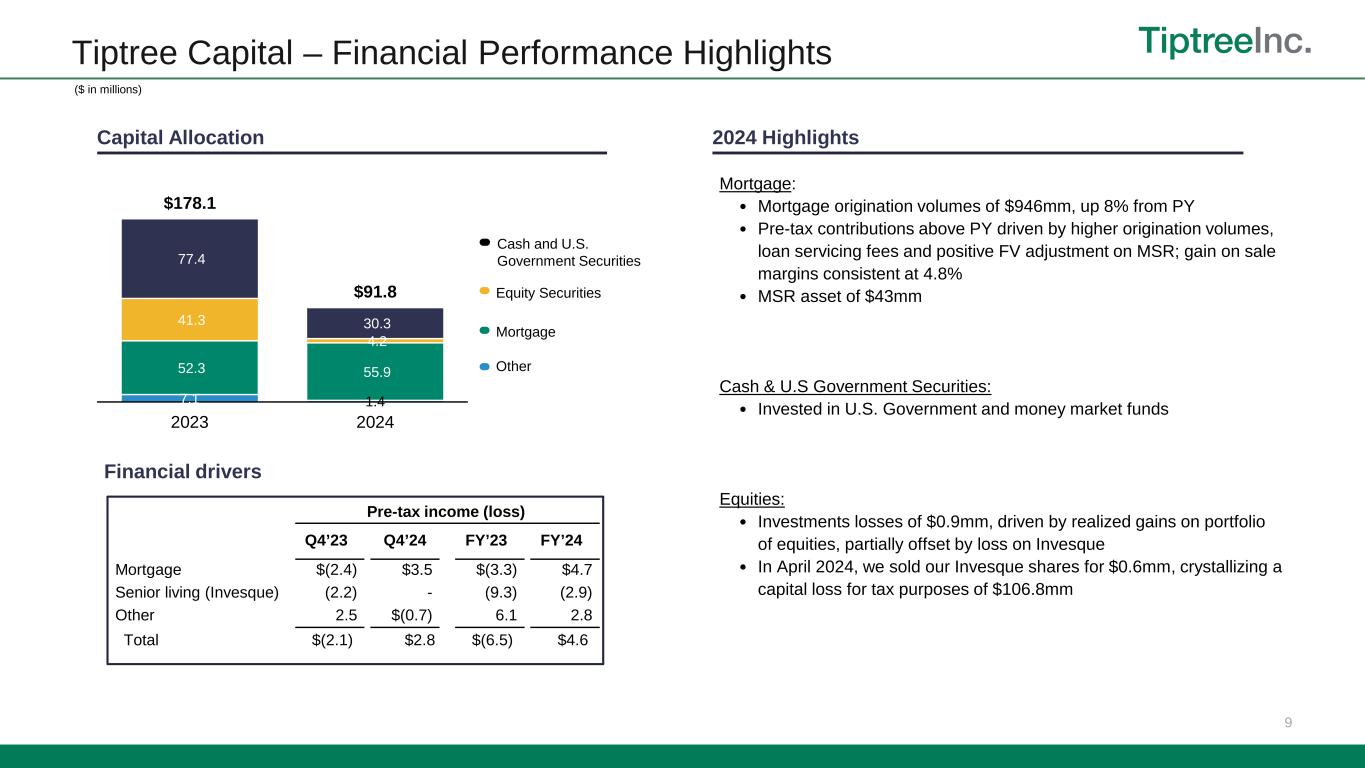

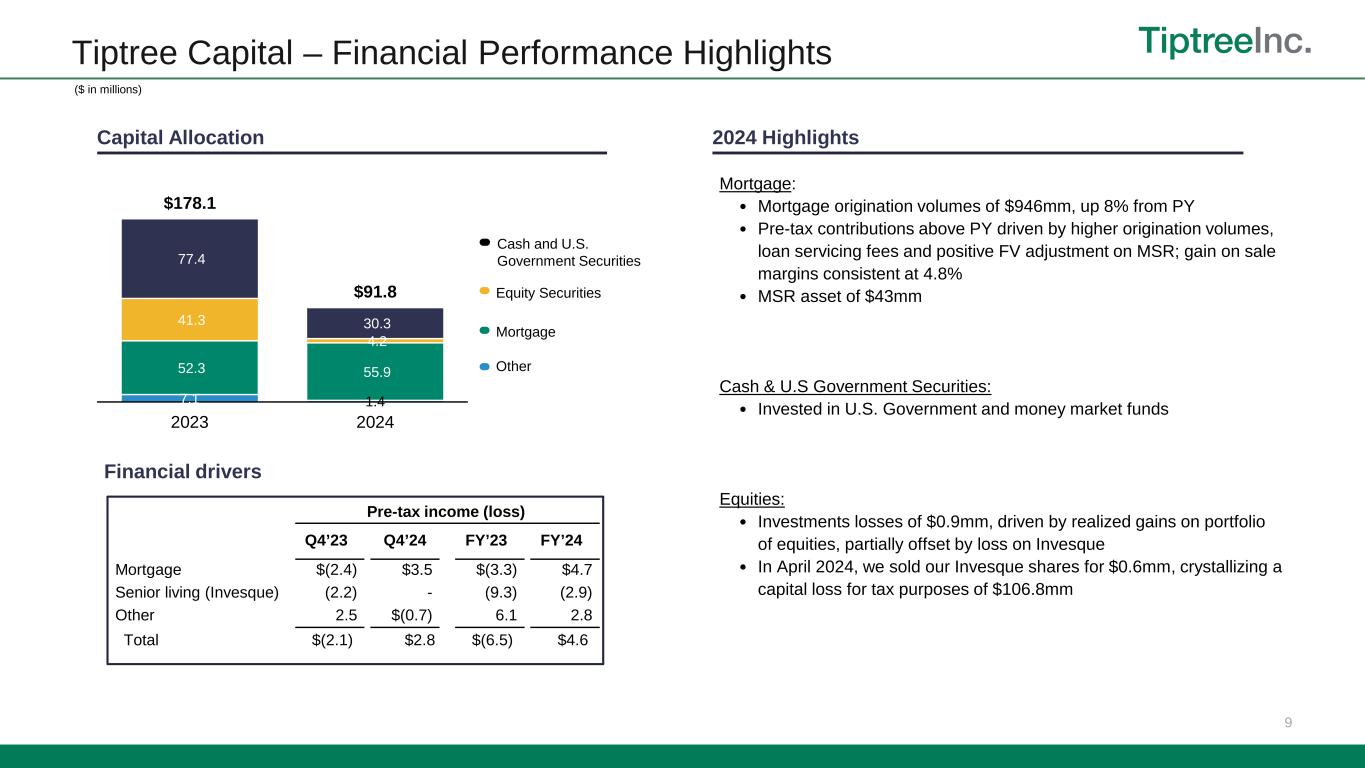

7.1 1.4 52.3 55.9 41.3 4.2 77.4 30.3 $178.1 $91.8 2023 2024 Financial drivers 9 Tiptree Capital – Financial Performance Highlights Mortgage: • Mortgage origination volumes of $946mm, up 8% from PY • Pre-tax contributions above PY driven by higher origination volumes, loan servicing fees and positive FV adjustment on MSR; gain on sale margins consistent at 4.8% • MSR asset of $43mm Cash & U.S Government Securities: • Invested in U.S. Government and money market funds Equities: • Investments losses of $0.9mm, driven by realized gains on portfolio of equities, partially offset by loss on Invesque • In April 2024, we sold our Invesque shares for $0.6mm, crystallizing a capital loss for tax purposes of $106.8mm Capital Allocation 2024 Highlights ($ in millions) Mortgage Other Equity Securities Cash and U.S. Government Securities Pre-tax income (loss) Q4’23 Q4’24 FY’23 FY’24 Mortgage $(2.4) $3.5 $(3.3) $4.7 Senior living (Invesque) (2.2) - (9.3) (2.9) Other 2.5 $(0.7) 6.1 2.8 Total $(2.1) $2.8 $(6.5) $4.6

01 Summary & Outlook

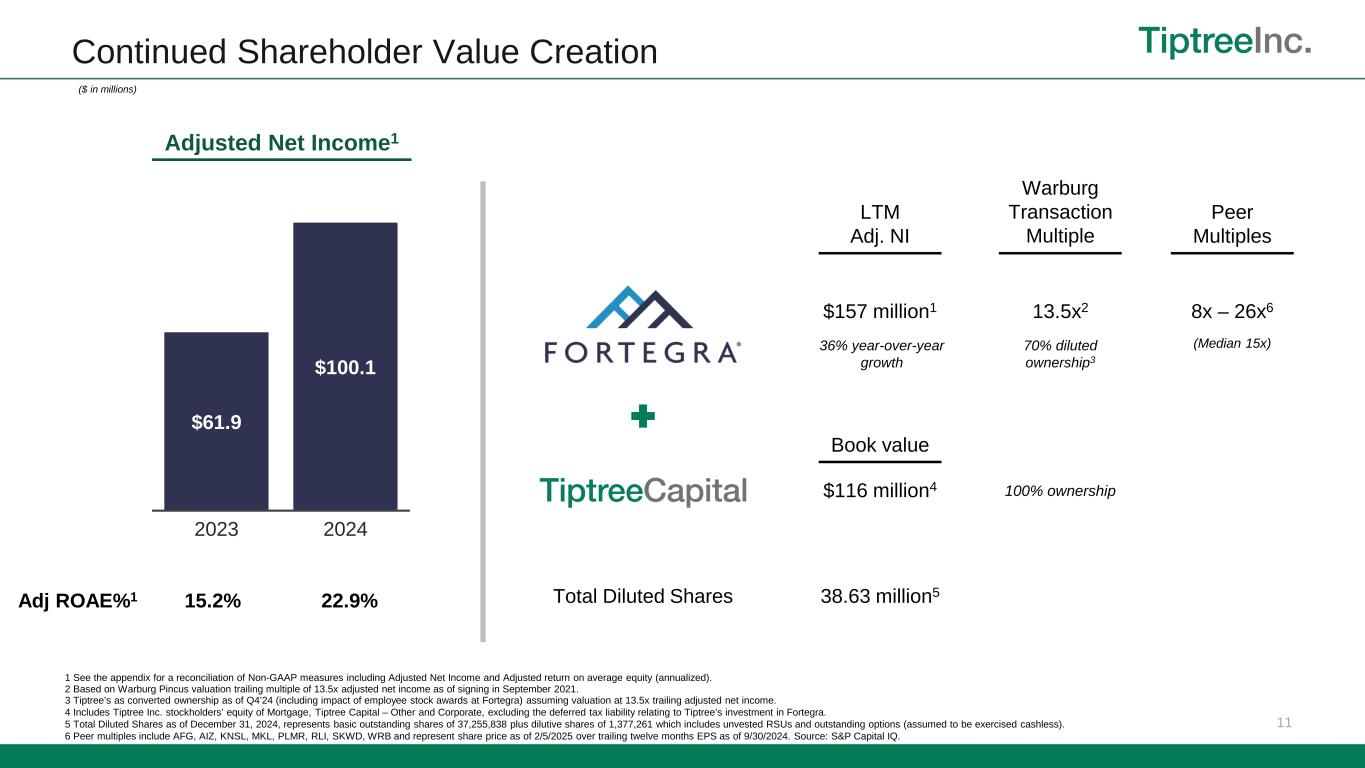

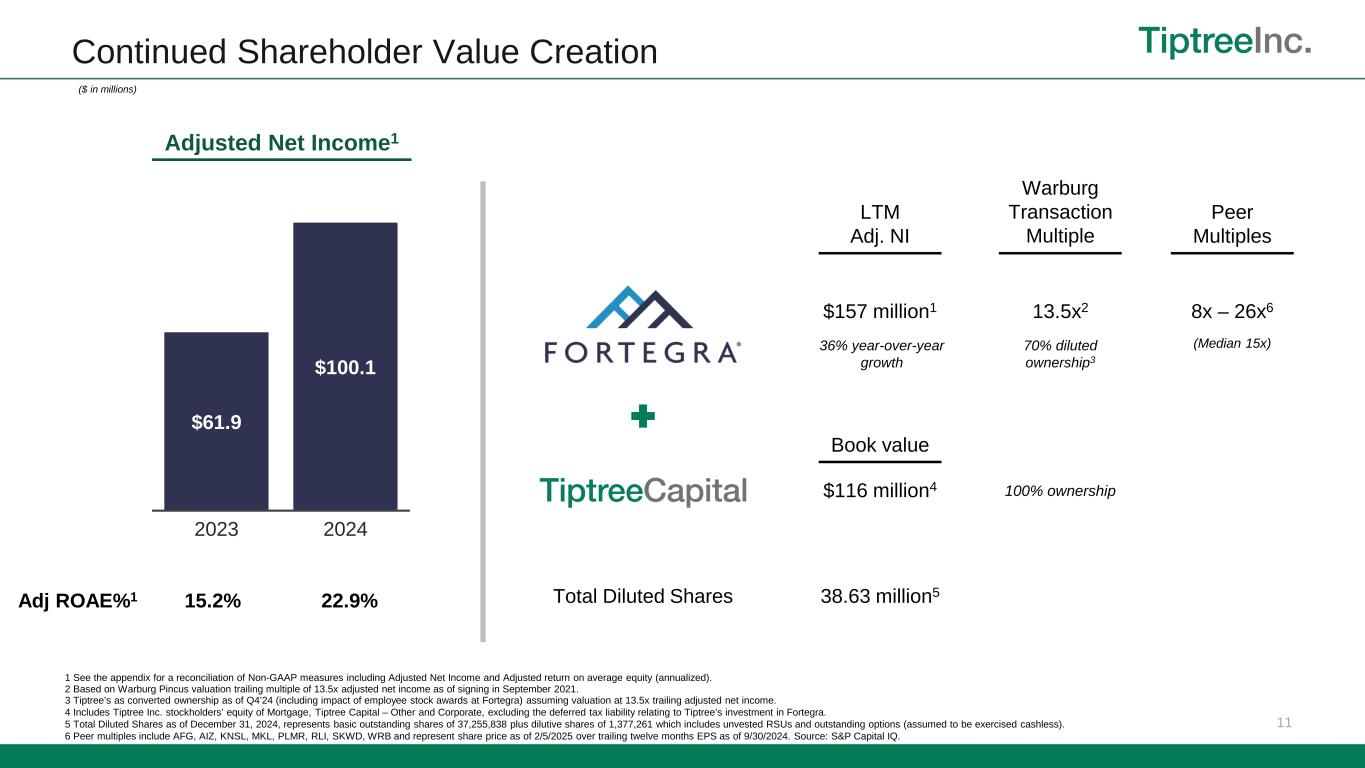

Continued Shareholder Value Creation 11 ($ in millions) Adjusted Net Income1 Adj ROAE%1 15.2% 22.9% $61.9 $100.1 2023 2024 $157 million1 $116 million4 8x – 26x6 (Median 15x) Peer Multiples LTM Adj. NI Warburg Transaction Multiple Total Diluted Shares 38.63 million5 13.5x2 1 See the appendix for a reconciliation of Non-GAAP measures including Adjusted Net Income and Adjusted return on average equity (annualized). 2 Based on Warburg Pincus valuation trailing multiple of 13.5x adjusted net income as of signing in September 2021. 3 Tiptree’s as converted ownership as of Q4’24 (including impact of employee stock awards at Fortegra) assuming valuation at 13.5x trailing adjusted net income. 4 Includes Tiptree Inc. stockholders’ equity of Mortgage, Tiptree Capital – Other and Corporate, excluding the deferred tax liability relating to Tiptree’s investment in Fortegra. 5 Total Diluted Shares as of December 31, 2024, represents basic outstanding shares of 37,255,838 plus dilutive shares of 1,377,261 which includes unvested RSUs and outstanding options (assumed to be exercised cashless). 6 Peer multiples include AFG, AIZ, KNSL, MKL, PLMR, RLI, SKWD, WRB and represent share price as of 2/5/2025 over trailing twelve months EPS as of 9/30/2024. Source: S&P Capital IQ. 70% diluted ownership3 100% ownership Book value 36% year-over-year growth

12 ❑ Maintain consistent top-line growth and sustained underwriting profitability over the long-term in our insurance business ❑ Continue to look for opportunities to allocate capital for long-term value creation Summary & Outlook ($ in millions) ✓ Strong operating performance from our businesses – Fortegra continues to deliver record financial and operating performance – Increasing yields on investment portfolio – Mortgage business profitable 2024 Highlights Looking Ahead

Appendix Non-GAAP Reconciliations • Insurance underwriting and fee revenue • Insurance underwriting and fee margin • Book Value per share • Adjusted net income

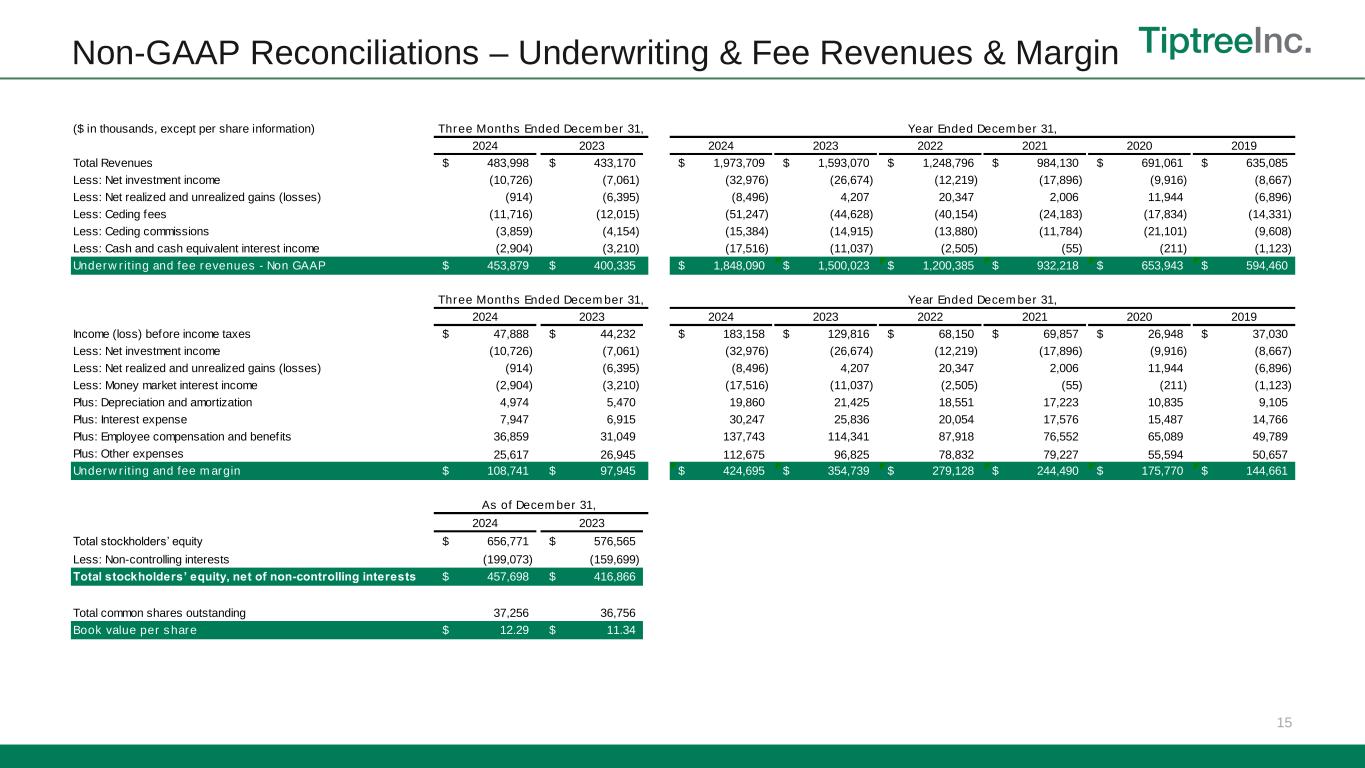

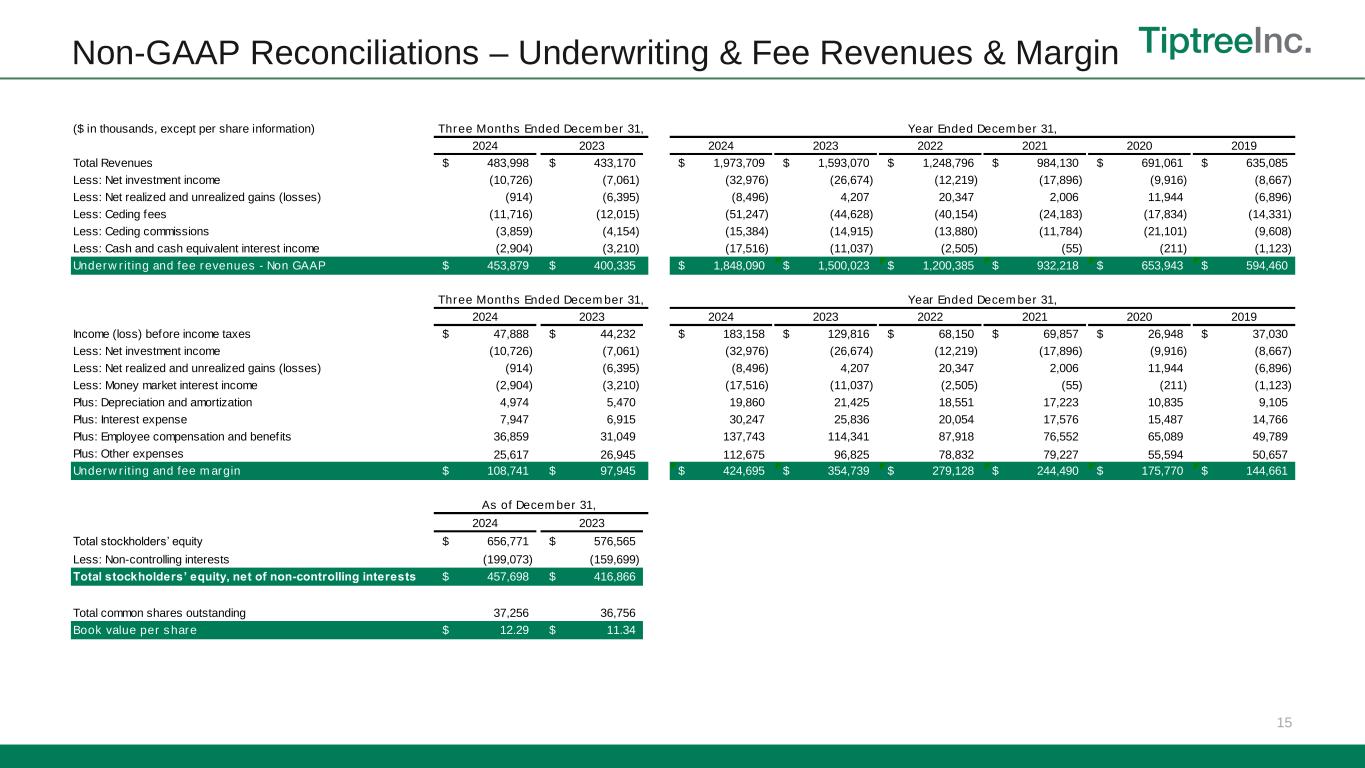

Non-GAAP Reconciliations 14 Adjusted Net Income We define adjusted net income as income before taxes, less provision (benefit) for income taxes, and excluding the after-tax impact of various expenses that we consider to be unique and non-recurring in nature, including merger and acquisition related expenses, stock-based compensation, net realized and unrealized gains (losses) and intangibles amortization associated with purchase accounting, all of which is reduced for non- controlling interests. The calculation of adjusted net income excludes net realized and unrealized gains (losses) that relate to investments or assets rather than business operations. Adjusted net income should not be viewed as a substitute for income before taxes calculated in accordance with GAAP, and other companies may define adjusted net income differently. Adjusted net income (before NCI) is presented before the impacts of non-controlling interests. We present adjustments for amortization associated with acquired intangible assets. The intangible assets were recorded as part of purchase accounting in connection with Tiptree’s acquisition of Fortegra Financial in 2014, Defend in 2019, and Smart AutoCare and Sky Auto in 2020, ITC in 2022 and Premia in 2023. The intangible assets acquired contribute to overall revenue generation, and the respective purchase accounting adjustments will continue to occur in future periods until such intangible assets are fully amortized in accordance with the respective amortization periods required by GAAP. We define adjusted return on average equity as adjusted net income expressed on an annualized basis as a percentage of average beginning and ending stockholder’s equity during the period. We use adjusted return on average equity as an internal performance measure in the management of our operations because we believe it gives our management and other users of our financial information useful insight into our results of operations and our underlying business performance. Adjusted return on average equity should not be viewed as a substitute for return on average equity calculated in accordance with GAAP, and other companies may define adjusted return on average equity differently. Book value per share Management believes the use of book value per share provides supplemental information useful to investors as it is frequently used by the financial community to analyze company growth on a relative per share basis. Insurance – Underwriting and Fee Revenues We generally manage our exposure to the underwriting risk we assume using both reinsurance (e.g., quota share and excess of loss) and retrospective commission agreements with our partners (e.g., commissions paid are adjusted based on the actual underlying losses incurred), which mitigate our risk. Period-over-period comparisons of revenues and expenses are often impacted by the Producer Owned Reinsurance Company (PORCs) and distribution partners’ choice as to whether to retain risk, specifically service and administration fees and ceding commissions, both components of revenue, and policy and contract benefits and commissions paid to our partners and reinsurers. Generally, when losses are incurred, the risk which is retained by our partners and reinsurers is reflected in a reduction in commissions paid. In order to better explain to investors the underwriting performance of the Company’s programs and the respective retentions between the Company and its agents and reinsurance partners, we use non-GAAP metrics of underwriting and fee revenues and underwriting and fee margin. We define underwriting and fee revenues as total revenues excluding net investment income, net realized gains (losses) and net unrealized gains (losses), ceding fees, ceding commissions and cash and cash equivalent interest income as reported in other income. Underwriting and fee revenues represents revenues generated by our underwriting and fee-based operations and allows us to evaluate our underwriting performance without regard to investment income. We use this metric as we believe it gives our management and other users of our financial information useful insight into our underlying business performance. Underwriting and fee revenues should not be viewed as a substitute for total revenues calculated in accordance with GAAP, and other companies may define underwriting and fee revenues differently. Insurance - Underwriting and Fee Margin We define underwriting and fee margin as income before taxes, excluding net investment income, net realized gains (losses), net unrealized gains (losses), cash and cash equivalent interest income, employee compensation and benefits, other expenses, interest expense and depreciation and amortization. Underwriting and fee margin represents the underwriting performance of our underwriting and fee-based programs. As such, underwriting and fee margin excludes general administrative expenses, interest expense, depreciation and amortization and other corporate expenses as those expenses support the vertically integrated business model and not any individual component of our business mix. We use this metric as we believe it gives our management and other users of our financial information useful insight into the specific performance of our underlying underwriting and fee programs. Underwriting and fee income should not be viewed as a substitute for income before taxes calculated in accordance with GAAP, and other companies may define underwriting and fee margin differently.

15 Non-GAAP Reconciliations – Underwriting & Fee Revenues & Margin ($ in thousands, except per share information) 2024 2023 2024 2023 2022 2021 2020 2019 Total Revenues 483,998$ 433,170$ 1,973,709$ 1,593,070$ 1,248,796$ 984,130$ 691,061$ 635,085$ Less: Net investment income (10,726) (7,061) (32,976) (26,674) (12,219) (17,896) (9,916) (8,667) Less: Net realized and unrealized gains (losses) (914) (6,395) (8,496) 4,207 20,347 2,006 11,944 (6,896) Less: Ceding fees (11,716) (12,015) (51,247) (44,628) (40,154) (24,183) (17,834) (14,331) Less: Ceding commissions (3,859) (4,154) (15,384) (14,915) (13,880) (11,784) (21,101) (9,608) Less: Cash and cash equivalent interest income (2,904) (3,210) (17,516) (11,037) (2,505) (55) (211) (1,123) Underwriting and fee revenues - Non GAAP 453,879$ 400,335$ 1,848,090$ 1,500,023$ 1,200,385$ 932,218$ 653,943$ 594,460$ 2024 2023 2024 2023 2022 2021 2020 2019 Income (loss) before income taxes 47,888$ 44,232$ 183,158$ 129,816$ 68,150$ 69,857$ 26,948$ 37,030$ Less: Net investment income (10,726) (7,061) (32,976) (26,674) (12,219) (17,896) (9,916) (8,667) Less: Net realized and unrealized gains (losses) (914) (6,395) (8,496) 4,207 20,347 2,006 11,944 (6,896) Less: Money market interest income (2,904) (3,210) (17,516) (11,037) (2,505) (55) (211) (1,123) Plus: Depreciation and amortization 4,974 5,470 19,860 21,425 18,551 17,223 10,835 9,105 Plus: Interest expense 7,947 6,915 30,247 25,836 20,054 17,576 15,487 14,766 Plus: Employee compensation and benefits 36,859 31,049 137,743 114,341 87,918 76,552 65,089 49,789 Plus: Other expenses 25,617 26,945 112,675 96,825 78,832 79,227 55,594 50,657 Underwriting and fee margin 108,741$ 97,945$ 424,695$ 354,739$ 279,128$ 244,490$ 175,770$ 144,661$ 2024 2023 Total stockholders’ equity 656,771$ 576,565$ Less: Non-controlling interests (199,073) (159,699) Total stockholders’ equity, net of non-controlling interests 457,698$ 416,866$ Total common shares outstanding 37,256 36,756 Book value per share 12.29$ 11.34$ Three Months Ended December 31, Three Months Ended December 31, As of December 31, Year Ended December 31, Year Ended December 31,

16 Non-GAAP Reconciliations – Adjusted Net Income The footnotes below correspond to the tables above, under “—Adjusted Net Income - Non-GAAP” and “—Adjusted Return on Average Equity - Non-GAAP”. 1 Net realized and unrealized gains (losses) added back in Adjusted net income excludes net realized and unrealized gains (losses) from the mortgage segment and unrealized gains (losses) on mortgage servicing rights. 2 Specifically associated with acquisition purchase accounting. See Note (9) Goodwill and Intangible Assets, net. 3 For the three months ended December 31, 2024, 2023, and 2022 included in other expenses were expenses related to legal and other expenses associated with preparation of the registration statement for the withdrawn Fortegra initial public offering in 2024 and acquisitions of services businesses in 2023 and 2022, respectively. 4 For the three months ended December 31, 2024, 2023 and 2022, non-cash fair-value adjustments represent a change in fair value of the Fortegra Additional Warrant liability. 5 For the three months ended December 31, 2024, 2023 and 2022, included in the adjustment is an add-back of $6.8 million, $8.9 million, and $9.0 million, respectively, related to deferred tax expense from the WP Transaction. 6 Tax on adjustments represents the tax applied to the total non-GAAP adjustments and includes adjustments for non-recurring or discrete tax impacts. 7 Total Adjusted return on average equity after non-controlling interests was 23.7%, 13.6%, and 9.9% for the three months ended December 31, 2024, 2023, and 2022 respectively, based on $27.2 million, $13.9 million, and $9.7 million of Adjusted net income over $459.8 million, $406.5 million, and $392.3 million of average Tiptree Inc. stockholders’ equity. ($ in thousands) Insurance Mortgage Other Corporate Total Insurance Mortgage Other Corporate Total Insurance Mortgage Other Corporate Total Income (loss) before taxes 47,888$ 3,533$ (764)$ (8,463)$ 42,194$ 44,232$ (2,391)$ 333$ (12,109)$ 30,065$ 29,093$ (2,476)$ 10,935$ (12,521)$ 25,031$ Less: Income tax (benefit) expense (7,656) (847) 164 (4,514) (12,853) (5,288) 606 (266) (8,989) (13,937) (10,152) 511 (2,076) (7,196) (18,913) Less: Net realized and unrealized gains (losses) 1 (914) (3,139) 179 - (3,874) (6,395) 2,794 (596) - (4,197) (2,804) 973 (10,495) - (12,326) Plus: Intangibles amortization 2 3,856 - - - 3,856 4,252 - - - 4,252 4,083 - - - 4,083 Plus: Stock-based compensation expense 2,999 - - 1,492 4,491 780 - - 1,219 1,999 47 - (98) 1,656 1,605 Plus: Non-recurring expenses 3 - - - - - 348 - - - 348 1,813 - 140 - 1,953 Plus: Non-cash fair value adjustments 4 1,418 - - - 1,418 842 - - - 842 (939) - 1 - (938) Plus: Impact of tax deconsolidation of Fortegra 5 - - - 6,766 6,766 - - - 8,891 8,891 - - - 9,029 9,029 Less: Tax on adjustments 6 (5,051) 753 (159) (1,416) (5,873) (6,167) (702) (185) (671) (7,725) 2,798 (150) 1,948 448 5,044 Adjusted net income (before NCI) 42,540$ 300$ (580)$ (6,135)$ 36,125$ 32,604$ 307$ (714)$ (11,659)$ 20,538$ 23,939$ (1,142)$ 355$ (8,584)$ 14,568$ Less: Impact of non-controlling interests (8,891) - - - (8,891) (6,684) - - - (6,684) (4,884) - - - (4,884) Adjusted net income 33,649$ 300$ (580)$ (6,135)$ 27,234$ 25,920$ 307$ (714)$ (11,659)$ 13,854$ 19,055$ (1,142)$ 355$ (8,584)$ 9,684$ Adjusted net income (before NCI) 42,540$ 300$ (580)$ (6,135)$ 36,125$ 32,604$ 307$ (714)$ (11,659)$ 20,538$ 23,939$ (1,142)$ 355$ (8,584)$ 14,568$ Average stockholders’ equity 615,922$ 54,586$ 46,299$ (60,322)$ 656,485$ 422,327$ 53,188$ 128,827$ (44,272)$ 560,070$ 326,431$ 55,726$ 70,628$ 73,789$ 526,574$ Adjusted return on average equity 7 27.6% 2.2% (5.0)% NM% 22.0% 30.9% 2.3% (2.2)% NM% 14.7% 29.3% (8.2)% 2.0% NM% 11.1% Three Month Ended December 31, 2022 Tiptree CapitalTiptree Capital Three Months Ended December 31, 2024 Tiptree Capital Three Months Ended December 31, 2023

17 Non-GAAP Reconciliations – Adjusted Net Income The footnotes below correspond to the tables above, under “—Adjusted Net Income - Non-GAAP” and “—Adjusted Return on Average Equity - Non-GAAP”. 1 Net realized and unrealized gains (losses) added back in Adjusted net income excludes net realized and unrealized gains (losses) from the mortgage segment and unrealized gains (losses) on mortgage servicing rights. 2 Specifically associated with acquisition purchase accounting. See Note (9) Goodwill and Intangible Assets, net. 3 For the years ended December 31, 2024, 2023, and 2022 included in other expenses were expenses related to legal and other expenses associated with preparation of the registration statement for the withdrawn Fortegra initial public offering in 2024 and acquisitions of services businesses in 2023 and 2022, respectively. 4 For the years ended December 31, 2024, 2023 and 2022, non-cash fair-value adjustments represent a change in fair value of the Fortegra Additional Warrant liability. 5 For the years ended December 31, 2024, 2023 and 2022, included in the adjustment is an add-back of $23.5 million, $19.1 million, and $31.6 million, respectively, related to deferred tax expense from the WP Transaction. 6 Tax on adjustments represents the tax applied to the total non-GAAP adjustments and includes adjustments for non-recurring or discrete tax impacts. 7 Total Adjusted return on average equity after non-controlling interests was 22.9%, 15.2%, and 13.6% for the years ended December 31, 2024, 2023, and 2022 respectively, based on $100.1 million, $61.9 million, and $53.0 million of Adjusted net income over $437.3 million, $407.1 million, and $390.2 million of average Tiptree Inc. stockholders’ equity. ($ in thousands) Insurance Mortgage Other Corporate Total Insurance Mortgage Other Corporate Total Insurance Mortgage Other Corporate Total Income (loss) before taxes 183,158$ 4,725$ (163)$ (38,401)$ 149,319$ 129,816$ (3,285)$ (3,264)$ (40,214)$ 83,053$ 68,150$ 874$ 31,403$ (46,416)$ 54,011$ Less: Income tax (benefit) expense (43,260) (1,091) (540) (16,761) (61,652) (28,224) 837 153 (15,822) (43,056) (21,251) (363) (5,545) (23,291) (50,450) Less: Net realized and unrealized gains (losses) 1 (8,496) (2,711) 905 - (10,302) 4,207 1,861 5,289 - 11,357 20,347 (7,003) (18,788) - (5,444) Plus: Intangibles amortization 2 15,413 - - - 15,413 16,919 - - - 16,919 16,229 - - - 16,229 Plus: Stock-based compensation expense 8,998 - - 8,682 17,680 2,018 - - 6,251 8,269 2,423 - - 7,093 9,516 Plus: Non-recurring expenses 3 3,455 - - - 3,455 2,824 - - - 2,824 3,374 - (729) 2,108 4,753 Plus: Non-cash fair value adjustments 4 7,436 - - - 7,436 (1,769) - - - (1,769) (939) - 3,555 - 2,616 Plus: Impact of tax deconsolidation of Fortegra 5 - - - 23,495 23,495 - - - 19,101 19,101 1,560 - - 31,573 33,133 Less: Tax on adjustments 6 (9,673) 608 87 (3,168) (12,146) (10,086) (495) (1,255) 797 (11,039) (6,061) 1,834 3,731 (467) (963) Adjusted net income (before NCI) 157,031$ 1,531$ 289$ (26,153)$ 132,698$ 115,705$ (1,082)$ 923$ (29,887)$ 85,659$ 83,832$ (4,658)$ 13,627$ (29,400)$ 63,401$ Less: Impact of non-controlling interests (32,638) - - - (32,638) (23,742) - - - (23,742) (10,367) - - - (10,367) Adjusted net income 124,393$ 1,531$ 289$ (26,153)$ 100,060$ 91,963$ (1,082)$ 923$ (29,887)$ 61,917$ 73,465$ (4,658)$ 13,627$ (29,400)$ 53,034$ Adjusted net income (before NCI) 157,031$ 1,531$ 289$ (26,153)$ 132,698$ 115,705$ (1,082)$ 923$ (29,887)$ 85,659$ 83,832$ (4,658)$ 13,627$ (29,400)$ 63,401$ Average stockholders’ equity 539,049$ 54,113$ 80,857$ (57,350)$ 616,669$ 395,661$ 53,520$ 100,325$ 5,564$ 555,070$ 321,320$ 57,575$ 98,373$ (10,390)$ 466,878$ Adjusted return on average equity 7 29.1% 2.8% 0.4% NM% 21.5% 29.2% (2.0)% 0.9% NM% 15.4% 26.1% (8.1)% 13.9% NM% 13.6% Tiptree Capital Tiptree Capital Tiptree Capital Year ended December 31, 2024 Year ended December 31, 2023 Year ended December 31, 2022

TiptreeInc. ir@tiptreeinc.com