Document

TIPTREE REPORTS FOURTH QUARTER AND 2022 RESULTS

Greenwich, Connecticut - March 8, 2023 - Tiptree Inc. (NASDAQ:TIPT) (“Tiptree” or the “Company”), today announced its financial results for the quarter and year ended December 31, 2022.

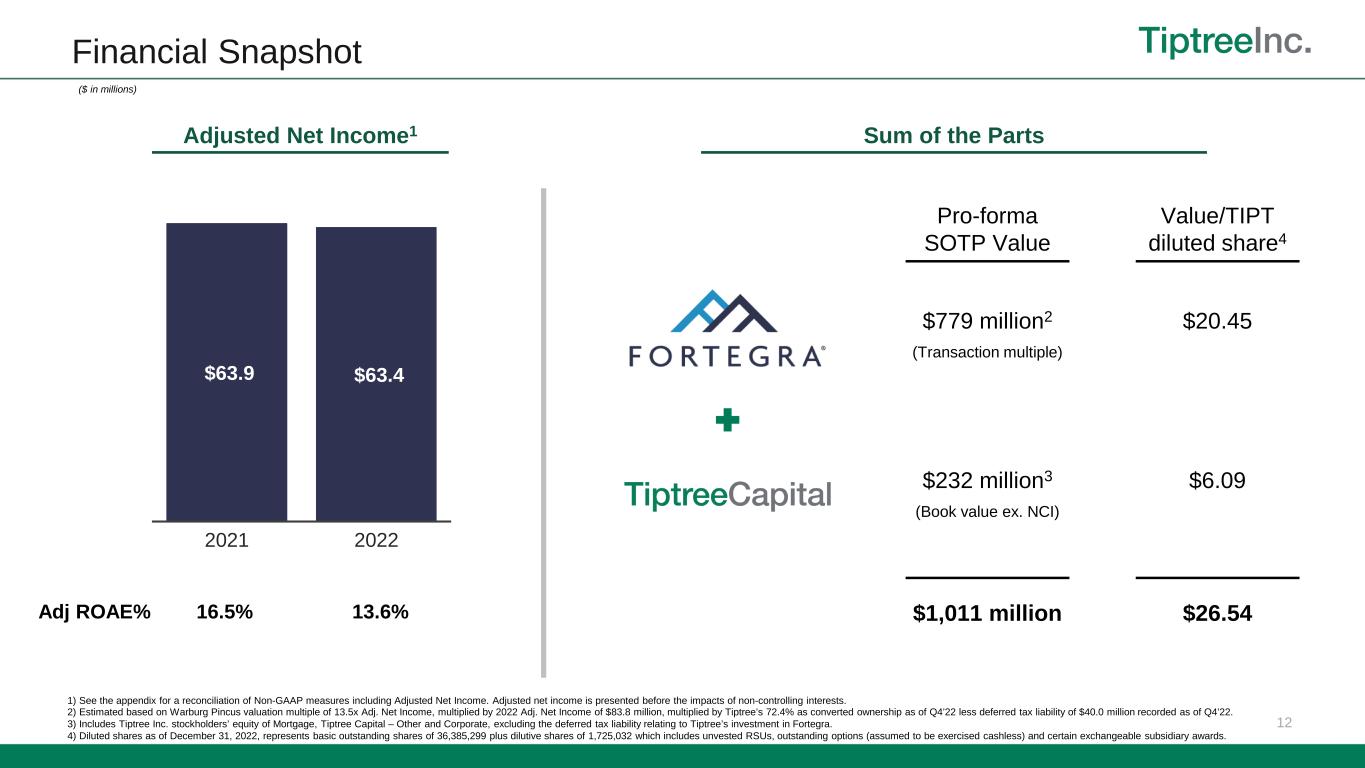

“2022 was a strong year for Tiptree, with our operating businesses performing well. Revenues for the year increased to a record $1.4 billion, while contributing an adjusted return on equity of 13.6%. As we look forward, we see significant opportunities to grow our businesses and are confident in the long-term outlook for the company”, said Tiptree’s Executive Chairman, Michael Barnes.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fourth Quarter |

|

Year Ended |

|

| ($ in thousands, except per share information) |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

| Total revenues |

$ |

369,528 |

|

|

$ |

319,534 |

|

|

$ |

1,397,752 |

|

|

$ |

1,200,514 |

|

|

| Net income (loss) attributable to common stockholders |

$ |

871 |

|

|

$ |

(426) |

|

|

$ |

(8,274) |

|

|

$ |

38,132 |

|

|

| Diluted earnings per share |

$ |

0.02 |

|

|

$ |

(0.01) |

|

|

$ |

(0.23) |

|

|

$ |

1.09 |

|

|

| Cash dividends paid per common share |

$ |

0.04 |

|

|

$ |

0.04 |

|

|

$ |

0.16 |

|

|

$ |

0.16 |

|

|

| Return on average equity |

0.9 |

% |

|

(0.4) |

% |

|

(2.1) |

% |

|

11.4 |

% |

|

|

|

|

|

|

|

|

|

|

Non-GAAP: (1) |

|

|

|

|

|

|

|

|

Adjusted net income |

$ |

14,568 |

|

|

$ |

16,859 |

|

|

$ |

63,401 |

|

|

$ |

63,869 |

|

|

| Adjusted return on average equity |

11.1 |

% |

|

16.8 |

% |

|

13.6 |

% |

|

16.5 |

% |

|

| Book value per share |

$ |

10.92 |

|

|

$ |

11.22 |

|

|

$ |

10.92 |

|

|

$ |

11.22 |

|

|

(1) See “—Non-GAAP Reconciliations” for a discussion of non-GAAP financial measures. Adjusted net income is presented before the impacts of non-controlling interests.

Fourth Quarter 2022 Summary

•Revenues for the quarter of $369.5 million, an increase of 15.6% from Q4'21, driven by growth in Fortegra’s specialty insurance lines and the gain on sale of two product tankers. Excluding investment gains and losses, revenues were up 11.5%.

•Net income of $0.9 million compared to net loss of $0.4 million in Q4'21, driven by the gain on sale of two product tankers and growth in our insurance business, partially offset by unrealized losses on Invesque shares and declines in our mortgage business.

•Adjusted net income of $14.6 million decreased by 13.6% from $16.9 million in Q4'21, driven by declines in our mortgage business. Adjusted return on average equity was 11.1% for the quarter.

•Completed the sale of two remaining product tankers for $49.0 million, representing a gain of $13.6 million, or 44% as compared to Q3’22 book value. Total proceeds from dry-bulk vessel and product tanker sales in 2022 were $116.7 million, or a net gain of $34.8 million.

•Declared a dividend of $0.05 per share (an increase of 25%) to stockholders of record on March 20, 2023 with a payment date of March 27, 2023.

Full-Year 2022 Summary

•In June 2022, Tiptree closed the previously announced $200 million strategic investment in Fortegra by Warburg Pincus. As part of the closing, $113 million of Tiptree’s corporate debt was repaid in full. In the year ended December 31, 2022, Tiptree recognized a $63.2 million pre-tax gain in stockholders’ equity from the investment in Fortegra, which was partially offset by an increase in deferred tax liability associated with the tax deconsolidation of Fortegra. Of the total deferred tax liability of $44.8 million, $33.1 million impacted net income with the remainder impacting stockholders’ equity directly.

•Revenues of $1.4 billion, an increase of 16.4% from 2021, driven by growth in our insurance business, increases in charter rates and the gain on sale of five vessels in our maritime operations, and increased revenues from our mortgage servicing portfolio, partially offset by lower mortgage volume and margins and investment losses in 2022 compared to gains in 2021. Excluding investment gains and losses, revenues were up 17.2%.

•Net loss of $8.3 million compared to net income of $38.1 million in 2021, driven primarily by the deferred tax liability associated with the tax deconsolidation of Fortegra and unrealized losses on investments, partially offset by gain on sale of five vessels and growth in insurance operations.

•Adjusted net income of $63.4 million decreased by 0.7% from prior year, driven by growth in specialty insurance and shipping operations, more than offset by declines in mortgage volumes and margins. Adjusted return on average equity was 13.6%.

•The Company repurchased 165,040 shares for the year ended December 31, 2022 at an average price of $10.44 per share.

Segment Financial Highlights - Fourth Quarter 2022 and Total Year 2022

Insurance (The Fortegra Group):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fourth Quarter |

|

Year Ended |

|

| ($ in thousands) |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

| Gross written premiums and premium equivalents |

$ |

723,773 |

|

|

$ |

575,948 |

|

|

$ |

2,680,771 |

|

|

$ |

2,194,024 |

|

|

| Revenues |

$ |

345,408 |

|

|

$ |

262,606 |

|

|

$ |

1,248,796 |

|

|

$ |

984,130 |

|

|

| Income before taxes |

$ |

29,093 |

|

|

$ |

20,288 |

|

|

$ |

68,150 |

|

|

$ |

69,857 |

|

|

| Return on average equity |

23.2 |

% |

|

17.4 |

% |

|

14.6 |

% |

|

17.1 |

% |

|

| Combined ratio |

89.8 |

% |

|

89.4 |

% |

|

90.7 |

% |

|

90.6 |

% |

|

|

|

|

|

|

|

|

|

|

Non-GAAP: (1) |

|

|

|

|

|

|

|

|

| Adjusted net income |

$ |

23,939 |

|

|

$ |

20,382 |

|

|

$ |

83,832 |

|

|

$ |

66,782 |

|

|

| Adjusted return on average equity |

29.3 |

% |

|

27.2 |

% |

|

26.1 |

% |

|

22.2 |

% |

|

(1) See “—Non-GAAP Reconciliations” for a discussion of non-GAAP financial measures. Adjusted net income is presented before the impacts of non-controlling interests.

•Fortegra’s gross written premiums and premium equivalents increased 25.7% for the quarter and 22.2% for the year driven by growth in U.S. specialty insurance lines and service contract businesses in U.S. and Europe. As a function of Fortegra’s premium growth, the combination of unearned premiums and deferred revenues on the balance sheet grew to $2.0 billion, up $348 million, or 21.0%, from December 31, 2021.

•Revenues increased 31.5% for the quarter and 26.9% for the year driven by premium growth in specialty admitted and E&S lines, and service contract businesses in U.S. and Europe. Excluding the impact of investment gains and losses, revenues increased by 27.1% for the quarter and 28.7% for the year.

•The combined ratio for the quarter was 89.8%, compared to 89.4% in Q4'21 driven by consistent underwriting performance and scalability of the operating platform. Total year 2022 combined ratio of 90.7%, consistent with prior year.

•Income before taxes for the quarter was $29.1 million. Total year 2022 income before taxes of $68.2 million compared to $69.9 million in the prior year. Return on equity for 2022 was 14.6%, as compared to 17.1% in 2021, impacted by unrealized investment losses.

•Adjusted net income for the quarter was $23.9 million, up 17.4% from Q4'21. Adjusted net income for 2022 was $83.8 million, up 25.5% from prior year driven by revenue growth and consistent combined ratio. The adjusted return on average equity was 26.1% for 2022, as compared to 22.2% in 2021, with the improvement driven by strong underwriting and fee income.

•In April 2022, Fortegra acquired ITC Compliance GRP Limited for net cash consideration of $15.0 million, which further establishes Fortegra's footprint in Europe and provides a wholly vertical compliance solution for the U.K. automotive market.

•In February 2023, Fortegra acquired Premia Solutions Limited, one of the largest providers of automotive protection products in the United Kingdom, for net cash consideration of approximately $20.8 million.

Tiptree Capital:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fourth Quarter |

|

Year Ended |

|

| ($ in thousands) |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

| Revenues |

$ |

24,120 |

|

|

$ |

56,928 |

|

|

$ |

148,956 |

|

|

$ |

216,384 |

|

|

| Income before taxes |

$ |

8,459 |

|

|

$ |

7,584 |

|

|

$ |

32,277 |

|

|

$ |

45,617 |

|

|

| Return on average equity |

21.8 |

% |

|

14.4 |

% |

|

16.9 |

% |

|

22.2 |

% |

|

|

|

|

|

|

|

|

|

|

Non-GAAP: (1) |

|

|

|

|

|

|

|

|

| Adjusted net income |

$ |

(787) |

|

|

$ |

4,559 |

|

|

$ |

8,969 |

|

|

$ |

28,197 |

|

|

| Adjusted return on average equity |

(2.5) |

% |

|

10.1 |

% |

|

5.8 |

% |

|

16.2 |

% |

|

(1) See “—Non-GAAP Reconciliations” for a discussion of non-GAAP financial measures. Adjusted net income is presented before the impacts of non-controlling interests.

•Tiptree Capital income before taxes for the quarter was $8.5 million compared to $7.6 million in the prior year driven by the gain on sale of two tankers.

•Tiptree Capital Income before taxes for the year was $32.3 million, down from the prior year as contributions from our maritime transportation business were more than offset by declines in origination volumes and gain on sale margins in our mortgage business.

•Maritime transportation income before taxes was $49.8 million in 2022, as compared to $11.6 million in 2021, with the increase driven by the gain on sale of five vessels and cyclically high dry-bulk and product tanker charter rates.

•Mortgage income before taxes was $0.9 million in 2022, as compared to $28.4 million in 2021, with the decrease driven by a decline in gain on sale margins, partially offset by higher servicing fees and positive fair value adjustments on the mortgage servicing portfolio.

Corporate:

Corporate includes expenses of the holding company for interest expense, employee compensation and benefits, audit and professional fees, and public company and other expenses. For the quarter, corporate expenses were $12.5 million compared to $17.0 million in Q4'21 and for the year were $46.4 million compared to $50.1 million. The decrease for each respective period was driven by lower incentive compensation expense and interest expense as we repaid our corporate holding company borrowings in June 2022.

Non-GAAP

Management uses Adjusted net income and Adjusted return on average equity as measurements of operating performance. Management believes these measures provide supplemental information useful to investors as they are frequently used by the financial community to analyze financial performance and comparison among companies. Management uses Adjusted net income and adjusted return on average equity as part of its capital allocation process and to assess comparative returns on invested capital. Adjusted net income represents income before taxes, less provision (benefit) for income taxes, and excluding the after-tax impact of various expenses that we consider to be unique and non-recurring in nature, stock-based compensation, net realized and unrealized gains (losses), and intangibles amortization associated with purchase accounting. Adjusted net income and Adjusted return on average equity are presented before the impacts of non-controlling interests. Adjusted net income and Adjusted return on average equity are not measurements of financial performance or liquidity under GAAP and should not be considered as an alternative or substitute for GAAP net income. See “Non-GAAP Reconciliations” for a reconciliation of these measures to their GAAP equivalents.

Earnings Conference Call

Tiptree will host a conference call on Thursday, March 9, 2023 at 9:00 a.m. Eastern Time to discuss its Q4 and full year 2022 financial results. A copy of our investor presentation, to be used during the conference call, as well as this press release, will be available in the Investor Relations section of the Company’s website, located at www.tiptreeinc.com.

The conference call will be available via live or archived webcast at http://www.investors.tiptreeinc.com. To listen to a live broadcast, go to the site at least 15 minutes prior to the scheduled start time in order to register, download and install any necessary audio software. To participate in the telephone conference call, please dial 1-877-407-4018 (domestic) or 1-201-689-8471 (international). Please dial in at least five minutes prior to the start time.

A replay of the call will be available from Thursday, March 9, 2023 at 12:00 p.m. Eastern Time, until midnight Eastern on Thursday, March 16, 2023. To listen to the replay, please dial 1-844-512-2921 (domestic) or 1-412-317-6671 (international), Passcode: 13734675.

About Tiptree

Tiptree Inc. (NASDAQ: TIPT) allocates capital to select small and middle market companies with the mission of building long-term value. Established in 2007, we have a significant track record investing in the insurance sector and across a variety of other industries, including mortgage origination, specialty finance and shipping. With proprietary access and a flexible capital base, we seek to uncover compelling investment opportunities and support management teams in unlocking the full value potential of their businesses. For more information, please visit tiptreeinc.com and follow us on LinkedIn.

Forward-Looking Statements

This release contains “forward-looking statements” which involve risks, uncertainties and contingencies, many of which are beyond the Company’s control, which may cause actual results, performance, or achievements to differ materially from anticipated results, performance, or achievements. All statements contained in this release that are not clearly historical in nature are forward-looking, and the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “project,” “should,” “target,” “will,” or similar expressions are intended to identify forward-looking statements. Such forward-looking statements include, but are not limited to, statements about the Company’s plans, objectives, expectations for our businesses and intentions. The forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, many of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecast in the forward-looking statements. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including, but not limited to those described in the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K, and as described in the Company’s other filings with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as to the date of this release. The factors described therein are not necessarily all of the important factors that could cause actual results or developments to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors also could affect our forward-looking statements. Consequently, our actual performance could be materially different from the results described or anticipated by our forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Except as required by the federal securities laws, we undertake no obligation to update any forward-looking statements.

Tiptree Inc.

Condensed Consolidated Balance Sheets

($ in thousands, except share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

As of |

|

December 31,

2022 |

|

December 31,

2021 |

|

|

|

|

|

|

| Assets: |

|

|

|

| Investments: |

|

|

|

| Available for sale securities, at fair value, net of allowance for credit losses |

$ |

611,980 |

|

|

$ |

577,448 |

|

| Loans, at fair value |

64,843 |

|

|

105,583 |

|

| Equity securities |

85,776 |

|

|

138,483 |

|

| Other investments |

73,025 |

|

|

168,656 |

|

| Total investments |

835,624 |

|

|

990,170 |

|

| Cash and cash equivalents |

538,065 |

|

|

175,718 |

|

| Restricted cash |

12,782 |

|

|

19,368 |

|

| Notes and accounts receivable, net |

502,311 |

|

|

454,369 |

|

| Reinsurance receivables |

1,176,090 |

|

|

880,836 |

|

| Deferred acquisition costs |

498,925 |

|

|

379,373 |

|

| Goodwill |

186,608 |

|

|

179,103 |

|

| Intangible assets, net |

117,015 |

|

|

122,758 |

|

| Other assets |

172,143 |

|

|

146,844 |

|

| Assets held for sale |

— |

|

|

250,608 |

|

| Total assets |

$ |

4,039,563 |

|

|

$ |

3,599,147 |

|

|

|

|

|

| Liabilities and Stockholders’ Equity |

|

|

|

| Liabilities: |

|

|

|

| Debt, net |

$ |

259,366 |

|

|

$ |

393,349 |

|

| Unearned premiums |

1,357,436 |

|

|

1,123,952 |

|

| Policy liabilities and unpaid claims |

567,193 |

|

|

331,703 |

|

| Deferred revenue |

649,150 |

|

|

534,863 |

|

| Reinsurance payable |

305,097 |

|

|

265,569 |

|

| Other liabilities and accrued expenses |

367,748 |

|

|

306,536 |

|

| Liabilities held for sale |

— |

|

|

242,994 |

|

| Total liabilities |

$ |

3,505,990 |

|

|

$ |

3,198,966 |

|

|

|

|

|

| Stockholders’ Equity: |

|

|

|

| Preferred stock: $0.001 par value, 100,000,000 shares authorized, none issued or outstanding |

$ |

— |

|

|

$ |

— |

|

| Common stock: $0.001 par value, 200,000,000 shares authorized, 36,385,299 and 34,124,153 shares issued and outstanding, respectively |

36 |

|

|

34 |

|

| Additional paid-in capital |

382,645 |

|

|

317,459 |

|

| Accumulated other comprehensive income (loss), net of tax |

(39,429) |

|

|

(2,685) |

|

| Retained earnings |

54,113 |

|

|

68,146 |

|

| Total Tiptree Inc. stockholders’ equity |

397,365 |

|

|

382,954 |

|

| Non-controlling interests: |

|

|

|

| Fortegra preferred interests |

77,679 |

|

|

— |

|

| Common interests |

58,529 |

|

|

17,227 |

|

| Total non-controlling interests |

136,208 |

|

|

17,227 |

|

| Total stockholders’ equity |

533,573 |

|

|

400,181 |

|

| Total liabilities and stockholders’ equity |

$ |

4,039,563 |

|

|

$ |

3,599,147 |

|

Tiptree Inc.

Condensed Consolidated Statements of Operations

($ in thousands, except share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

Year Ended

December 31, |

|

2022 |

|

2021 |

|

2022 |

|

2021 |

| Revenues: |

|

|

|

|

|

|

|

| Earned premiums, net |

$ |

242,531 |

|

|

$ |

186,649 |

|

|

$ |

904,765 |

|

|

$ |

685,552 |

|

| Service and administrative fees |

87,837 |

|

|

69,111 |

|

|

320,720 |

|

|

260,525 |

|

| Ceding commissions |

3,994 |

|

|

2,957 |

|

|

13,880 |

|

|

11,784 |

|

| Net investment income |

2,055 |

|

|

8,565 |

|

|

12,219 |

|

|

17,896 |

|

| Net realized and unrealized gains (losses) |

19,933 |

|

|

31,082 |

|

|

69,983 |

|

|

151,350 |

|

| Other revenue |

13,178 |

|

|

21,170 |

|

|

76,185 |

|

|

73,407 |

|

| Total revenues |

369,528 |

|

|

319,534 |

|

|

1,397,752 |

|

|

1,200,514 |

|

| Expenses: |

|

|

|

|

|

|

|

| Policy and contract benefits |

122,252 |

|

|

89,814 |

|

|

452,605 |

|

|

327,012 |

|

| Commission expense |

140,251 |

|

|

104,103 |

|

|

522,686 |

|

|

396,683 |

|

| Employee compensation and benefits |

39,730 |

|

|

60,062 |

|

|

182,657 |

|

|

207,322 |

|

| Interest expense |

5,403 |

|

|

10,784 |

|

|

30,240 |

|

|

37,674 |

|

| Depreciation and amortization |

5,259 |

|

|

6,176 |

|

|

22,973 |

|

|

24,437 |

|

| Other expenses |

31,602 |

|

|

37,704 |

|

|

132,580 |

|

|

142,044 |

|

| Total expenses |

344,497 |

|

|

308,643 |

|

|

1,343,741 |

|

|

1,135,172 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) before taxes |

25,031 |

|

|

10,891 |

|

|

54,011 |

|

|

65,342 |

|

| Less: provision (benefit) for income taxes |

18,913 |

|

|

9,875 |

|

|

50,450 |

|

|

21,291 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

6,118 |

|

|

1,016 |

|

|

3,561 |

|

|

44,051 |

|

|

|

|

|

|

|

|

|

| Less: net income (loss) attributable to non-controlling interests |

5,247 |

|

|

1,442 |

|

|

11,835 |

|

|

5,919 |

|

| Net income (loss) attributable to common stockholders |

$ |

871 |

|

|

$ |

(426) |

|

|

$ |

(8,274) |

|

|

$ |

38,132 |

|

|

|

|

|

|

|

|

|

| Net income (loss) per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per share |

$ |

0.02 |

|

|

$ |

(0.01) |

|

|

$ |

(0.23) |

|

|

$ |

1.13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per share |

$ |

0.02 |

|

|

$ |

(0.01) |

|

|

$ |

(0.23) |

|

|

$ |

1.09 |

|

|

|

|

|

|

|

|

|

| Weighted average number of common shares: |

|

|

|

|

|

|

|

| Basic |

36,330,653 |

|

|

33,996,324 |

|

|

35,531,149 |

|

|

33,223,792 |

|

| Diluted |

37,161,862 |

|

|

33,996,324 |

|

|

35,531,149 |

|

|

33,688,256 |

|

|

|

|

|

|

|

|

|

| Dividends declared per common share |

$ |

0.04 |

|

|

$ |

0.04 |

|

|

$ |

0.16 |

|

|

$ |

0.16 |

|

Tiptree Inc.

Non-GAAP Reconciliations (Unaudited)

Non-GAAP Financial Measures — Adjusted net income and Adjusted return on average equity

The Company defines Adjusted net income as income before taxes, less provision (benefit) for income taxes, and excluding the after-tax impact of various expenses that we consider to be unique and non-recurring in nature, including merger and acquisition related expenses, stock-based compensation, net realized and unrealized gains (losses) and intangibles amortization associated with purchase accounting. We use adjusted net income as an internal operating performance measure in the management of business as part of our capital allocation process. We believe adjusted net income provides useful supplemental information to investors as it is frequently used by the financial community to analyze financial performance between periods and for comparison among companies. Adjusted net income should not be viewed as a substitute for income before taxes calculated in accordance with GAAP, and other companies may define adjusted net income differently. Adjusted net income is presented before the impacts of non-controlling interests.

We define Adjusted return on average equity as Adjusted net income expressed on an annualized basis as a percentage of average beginning and ending stockholder’s equity during the period. We use Adjusted return on average equity as an internal performance measure in the management of our operations because we believe it gives our management and other users of our financial information useful insight into our results of operations and our underlying business performance. Adjusted return on average equity should not be viewed as a substitute for return on average equity calculated in accordance with GAAP, and other companies may define adjusted return on average equity differently.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, 2022 |

|

|

|

Tiptree Capital |

|

|

|

|

| ($ in thousands) |

Insurance |

|

Mortgage |

|

Other |

|

Corporate |

|

Total |

| Income (loss) before taxes |

$ |

29,093 |

|

|

$ |

(2,476) |

|

|

$ |

10,935 |

|

|

$ |

(12,521) |

|

|

$ |

25,031 |

|

| Less: Income tax (benefit) expense |

(10,152) |

|

|

511 |

|

|

(2,076) |

|

|

(7,196) |

|

|

(18,913) |

|

| Less: Net realized and unrealized gains (losses) |

(2,804) |

|

|

973 |

|

|

(10,495) |

|

|

— |

|

|

(12,326) |

|

Plus: Intangibles amortization (1) |

4,083 |

|

|

— |

|

|

— |

|

|

— |

|

|

4,083 |

|

| Plus: Stock-based compensation expense |

47 |

|

|

— |

|

|

(98) |

|

|

1,656 |

|

|

1,605 |

|

| Plus: Non-recurring expenses |

1,813 |

|

|

— |

|

|

140 |

|

|

— |

|

|

1,953 |

|

| Plus: Non-cash fair value adjustments |

(939) |

|

|

— |

|

|

1 |

|

|

— |

|

|

(938) |

|

Less: Tax on adjustments (2) |

2,798 |

|

|

(150) |

|

|

1,948 |

|

|

9,477 |

|

|

14,073 |

|

| Adjusted net income |

$ |

23,939 |

|

|

$ |

(1,142) |

|

|

$ |

355 |

|

|

$ |

(8,584) |

|

|

$ |

14,568 |

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net income |

$ |

23,939 |

|

|

$ |

(1,142) |

|

|

$ |

355 |

|

|

$ |

(8,584) |

|

|

$ |

14,568 |

|

| Average stockholders’ equity |

$ |

326,431 |

|

|

$ |

55,726 |

|

|

$ |

70,628 |

|

|

$ |

73,789 |

|

|

$ |

526,574 |

|

| Adjusted return on average equity |

29.3 |

% |

|

(8.2) |

% |

|

2.0 |

% |

|

NM% |

|

11.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, 2021 |

|

|

|

Tiptree Capital |

|

|

|

|

| ($ in thousands) |

Insurance |

|

Mortgage |

|

Other |

|

Corporate |

|

Total |

| Income (loss) before taxes |

$ |

20,288 |

|

|

$ |

3,288 |

|

|

$ |

4,296 |

|

|

$ |

(16,981) |

|

|

$ |

10,891 |

|

| Less: Income tax (benefit) expense |

(7,281) |

|

|

(434) |

|

|

(642) |

|

|

(1,518) |

|

|

(9,875) |

|

| Less: Net realized and unrealized gains (losses) |

1,272 |

|

|

(723) |

|

|

421 |

|

|

— |

|

|

970 |

|

Plus: Intangibles amortization (1) |

3,830 |

|

|

— |

|

|

— |

|

|

— |

|

|

3,830 |

|

| Plus: Stock-based compensation expense |

659 |

|

|

— |

|

|

4 |

|

|

6,750 |

|

|

7,413 |

|

| Plus: Non-recurring expenses |

82 |

|

|

— |

|

|

209 |

|

|

— |

|

|

291 |

|

| Plus: Non-cash fair value adjustments |

— |

|

|

— |

|

|

(1,003) |

|

|

— |

|

|

(1,003) |

|

Less: Tax on adjustments (2) |

1,532 |

|

|

(182) |

|

|

(675) |

|

|

3,667 |

|

|

4,342 |

|

| Adjusted net income |

$ |

20,382 |

|

|

$ |

1,949 |

|

|

$ |

2,610 |

|

|

$ |

(8,082) |

|

|

$ |

16,859 |

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net income |

$ |

20,382 |

|

|

$ |

1,949 |

|

|

$ |

2,610 |

|

|

$ |

(8,082) |

|

|

$ |

16,859 |

|

| Average stockholders’ equity |

$ |

299,236 |

|

|

$ |

62,065 |

|

|

$ |

119,016 |

|

|

$ |

(79,155) |

|

|

$ |

401,162 |

|

| Adjusted return on average equity |

27.2 |

% |

|

12.6 |

% |

|

8.8 |

% |

|

NM% |

|

16.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, 2022 |

|

|

|

|

|

|

Tiptree Capital |

|

|

|

|

|

|

|

| ($ in thousands) |

Insurance |

|

Mortgage |

|

Other |

|

Corporate |

|

Total |

|

|

|

| Income (loss) before taxes |

$ |

68,150 |

|

|

$ |

874 |

|

|

$ |

31,403 |

|

|

$ |

(46,416) |

|

|

$ |

54,011 |

|

|

|

|

| Less: Income tax (benefit) expense |

(21,251) |

|

|

(363) |

|

|

(5,545) |

|

|

(23,291) |

|

|

(50,450) |

|

|

|

|

| Less: Net realized and unrealized gains (losses) |

20,347 |

|

|

(7,003) |

|

|

(18,788) |

|

|

— |

|

|

(5,444) |

|

|

|

|

Plus: Intangibles amortization (1) |

16,229 |

|

|

— |

|

|

— |

|

|

— |

|

|

16,229 |

|

|

|

|

| Plus: Stock-based compensation expense |

2,423 |

|

|

— |

|

|

— |

|

|

7,093 |

|

|

9,516 |

|

|

|

|

| Plus: Non-recurring expenses |

3,374 |

|

|

— |

|

|

(729) |

|

|

2,108 |

|

|

4,753 |

|

|

|

|

| Plus: Non-cash fair value adjustments |

(939) |

|

|

— |

|

|

3,555 |

|

|

— |

|

|

2,616 |

|

|

|

|

Less: Tax on adjustments (2) |

(4,501) |

|

|

1,834 |

|

|

3,731 |

|

|

31,106 |

|

|

32,170 |

|

|

|

|

| Adjusted net income |

$ |

83,832 |

|

|

$ |

(4,658) |

|

|

$ |

13,627 |

|

|

$ |

(29,400) |

|

|

$ |

63,401 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net income |

$ |

83,832 |

|

|

$ |

(4,658) |

|

|

$ |

13,627 |

|

|

$ |

(29,400) |

|

|

$ |

63,401 |

|

|

|

|

| Average stockholders’ equity |

$ |

321,320 |

|

|

$ |

57,575 |

|

|

$ |

98,373 |

|

|

$ |

(10,390) |

|

|

$ |

466,878 |

|

|

|

|

| Adjusted return on average equity |

26.1 |

% |

|

(8.1) |

% |

|

13.9 |

% |

|

NM % |

|

13.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, 2021 |

|

|

|

Tiptree Capital |

|

|

|

|

| ($ in thousands) |

Insurance |

|

Mortgage |

|

Other |

|

Corporate |

|

Total |

| Income (loss) before taxes |

$ |

69,857 |

|

|

$ |

28,407 |

|

|

$ |

17,210 |

|

|

$ |

(50,132) |

|

|

$ |

65,342 |

|

| Less: Income tax (benefit) expense |

(18,438) |

|

|

(4,882) |

|

|

(1,992) |

|

|

4,021 |

|

|

(21,291) |

|

| Less: Net realized and unrealized gains (losses) |

(3,732) |

|

|

(5,798) |

|

|

(3,091) |

|

|

— |

|

|

(12,621) |

|

Plus: Intangibles amortization (1) |

15,329 |

|

|

— |

|

|

— |

|

|

— |

|

|

15,329 |

|

| Plus: Stock-based compensation expense |

2,006 |

|

|

331 |

|

|

213 |

|

|

8,581 |

|

|

11,131 |

|

| Plus: Non-recurring expenses |

2,158 |

|

|

— |

|

|

938 |

|

|

2,171 |

|

|

5,267 |

|

| Plus: Non-cash fair value adjustments |

— |

|

|

— |

|

|

(3,170) |

|

|

— |

|

|

(3,170) |

|

Less: Tax on adjustments (2) |

(398) |

|

|

(624) |

|

|

655 |

|

|

4,249 |

|

|

3,882 |

|

| Adjusted net income |

$ |

66,782 |

|

|

$ |

17,434 |

|

|

$ |

10,763 |

|

|

$ |

(31,110) |

|

|

$ |

63,869 |

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net income |

$ |

66,782 |

|

|

$ |

17,434 |

|

|

$ |

10,763 |

|

|

$ |

(31,110) |

|

|

$ |

63,869 |

|

| Average stockholders’ equity |

$ |

300,820 |

|

|

$ |

60,433 |

|

|

$ |

113,717 |

|

|

$ |

(88,111) |

|

|

$ |

386,859 |

|

| Adjusted return on average equity |

22.2 |

% |

|

28.8 |

% |

|

9.5 |

% |

|

NM% |

|

16.5 |

% |

|

|

|

|

|

|

| Notes |

|

|

| (1) |

Specifically associated with acquisition purchase accounting. See Note (9) Goodwill and Intangible Assets, net, of the Company’s Form 10-K for the period ended December 31, 2022. |

| (2) |

Tax on adjustments represents the tax applied to the total non-GAAP adjustments and includes adjustments for non-recurring or discrete tax impacts. For the three months and year ended December 31, 2022, included in the adjustment is an add-back of $9.0 million and $33.1 million, respectively, related to deferred tax expense from the WP Transaction. |

Non-GAAP Financial Measures — Book value per share

Management believes the use of this financial measure provides supplemental information useful to investors as book value is frequently used by the financial community to analyze company growth on a relative per share basis. The following table provides a reconciliation between total stockholders’ equity and total shares outstanding, net of treasury shares.

|

|

|

|

|

|

|

|

|

|

|

|

($ in thousands, except per share information) |

As of December 31, |

|

2022 |

|

2021 |

| Total stockholders’ equity |

$ |

533,573 |

|

|

$ |

400,181 |

|

| Less: Non-controlling interests |

136,208 |

|

|

17,227 |

|

| Total stockholders’ equity, net of non-controlling interests |

$ |

397,365 |

|

|

$ |

382,954 |

|

|

|

|

|

| Total common shares outstanding |

36,385 |

|

|

34,124 |

|

|

|

|

|

| Book value per share |

$ |

10.92 |

|

|

$ |

11.22 |

|