| Delaware | 36-2517428 | |||||||

| (State or other jurisdiction of incorporation) |

(IRS Employer Identification No.) |

|||||||

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Securities registered pursuant to Section 12(b) of the Act | ||||||||

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||||||

| Common Stock, par value $0.01 per share | DFS | New York Stock Exchange | ||||||

| Exhibit No. | Description | |||||||

| Press Release of the Company dated October 16, 2024 containing financial information for the quarter ended September 30, 2024 | ||||||||

| Financial Data Supplement of the Company for the quarter and the Nine Months Ended September 30, 2024 | ||||||||

| Financial Results Presentation of the Company for the quarter ended September 30, 2024 | ||||||||

| 104 | Cover Page Interactive Data File — the cover page from this Current Report on Form 8-K, formatted as Inline XBRL (included as Exhibit 101) | |||||||

| DISCOVER FINANCIAL SERVICES | ||||||||||||||

| Dated: October 16, 2024 | By: | /s/ Hope D. Mehlman |

||||||||||||

Name: Hope D. Mehlman |

||||||||||||||

| Title: Executive Vice President, Chief Legal Officer, General Counsel and Corporate Secretary | ||||||||||||||

Third Quarter 2024 Results | |||||||||||

2024(1) |

2023 | YOY Change | |||||||||

| Total loans, end of period (in billions) | $127.0 | $122.7 | 4% | ||||||||

| Total revenue net of interest expense (in millions) | $4,453 | $4,044 | 10% | ||||||||

| Total net charge-off rate | 4.86% | 3.52% | 134 bps | ||||||||

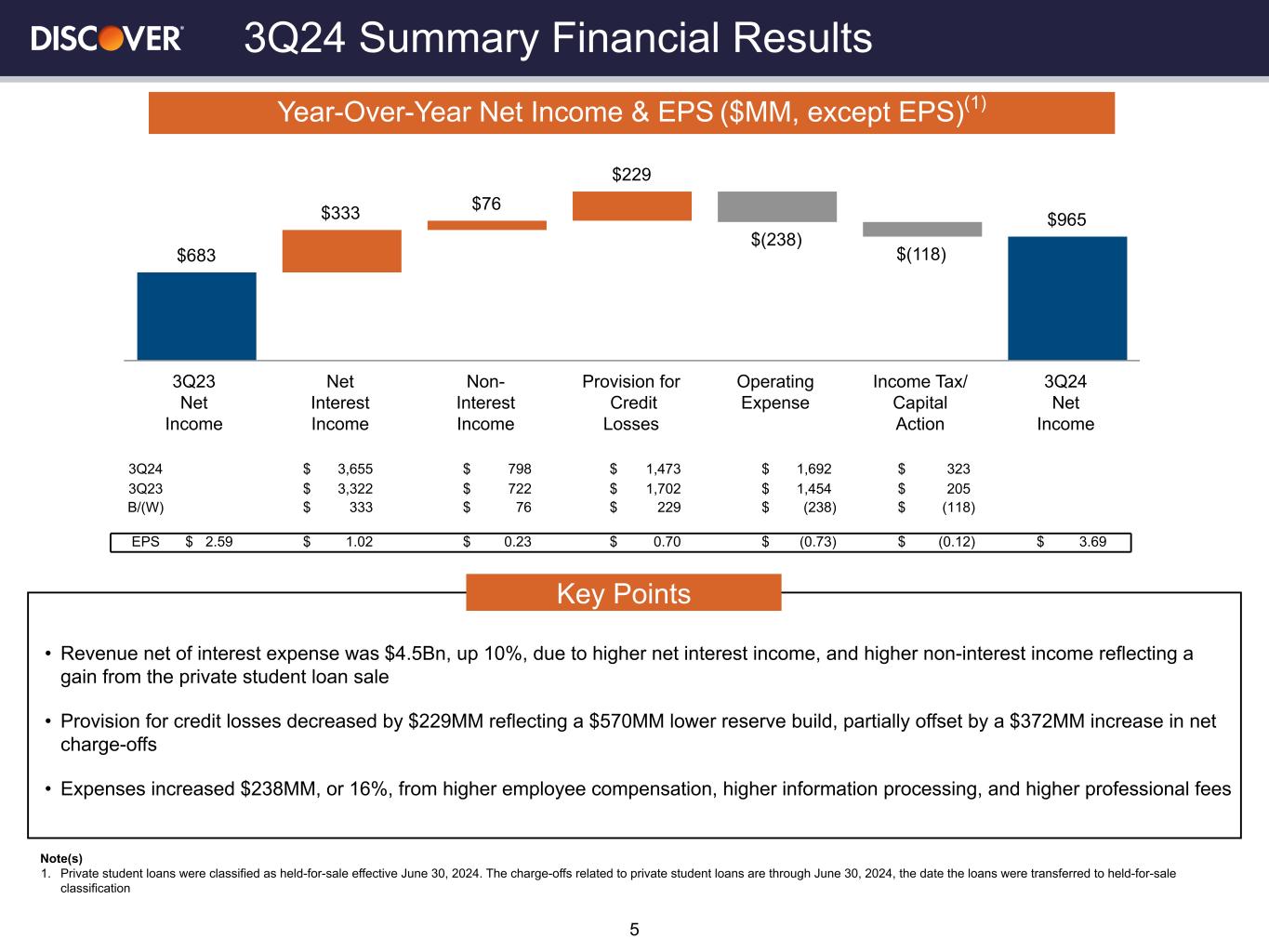

| Net income (in millions) | $965 | $683 | 41% | ||||||||

| Diluted EPS | $3.69 | $2.59 | 42% | ||||||||

| Discover Financial Services | Capital One Financial Corporation | |||||||

| 2500 Lake Cook Road | 1680 Capital One Drive | |||||||

| Riverwoods, IL 60015 | McLean, VA 22102 | |||||||

| Attention: Investor Relations | Attention: Investor Relations | |||||||

| investorrelations@discover.com (224) 405-4555 |

investorrelations@capitalone.com (703) 720-1000 |

|||||||

| DISCOVER FINANCIAL SERVICES | Exhibit 99.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EARNINGS SUMMARY | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, in millions, except per share statistics) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | Nine Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sep 30, 2024 | Jun 30, 2024 | Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | Sep 30, 2024 vs. Sep 30, 2023 |

Sep 30, 2024 | Sep 30, 2023 | 2024 vs. 2023 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EARNINGS SUMMARY | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest Income | $5,112 | $4,971 | $4,948 | $4,868 | $4,610 | $502 | 11 | % | $15,031 | $12,977 | $2,054 | 16 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Interest Expense | 1,457 | 1,447 | 1,461 | 1,400 | 1,288 | 169 | 13 | % | 4,365 | 3,346 | 1,019 | 30 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

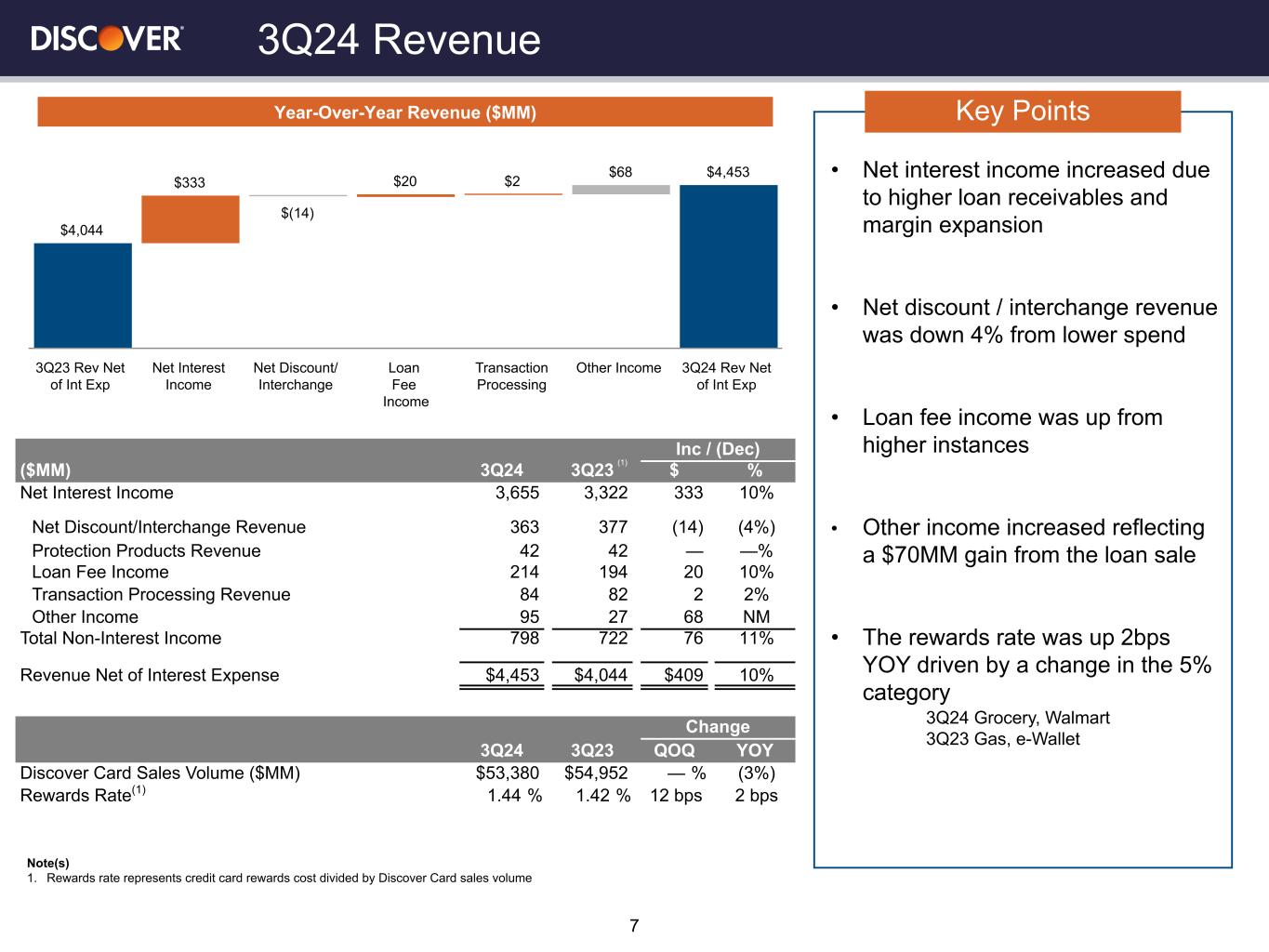

| Net Interest Income | 3,655 | 3,524 | 3,487 | 3,468 | 3,322 | 333 | 10 | % | 10,666 | 9,631 | 1,035 | 11 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Discount/Interchange Revenue | 1,142 | 1,153 | 1,074 | 1,158 | 1,164 | (22) | (2 | %) | 3,369 | 3,368 | 1 | — | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Rewards Cost | 779 | 716 | 703 | 788 | 787 | (8) | (1 | %) | 2,198 | 2,291 | (93) | (4 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Discount and Interchange Revenue, net | 363 | 437 | 371 | 370 | 377 | (14) | (4 | %) | 1,171 | 1,077 | 94 | 9 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Protection Products Revenue | 42 | 42 | 42 | 43 | 42 | — | — | % | 126 | 129 | (3) | (2 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Loan Fee Income | 214 | 205 | 200 | 217 | 194 | 20 | 10 | % | 619 | 546 | 73 | 13 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Transaction Processing Revenue | 84 | 91 | 87 | 82 | 82 | 2 | 2 | % | 262 | 221 | 41 | 19 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other Income | 95 | 239 | 23 | 16 | 27 | 68 | NM | 357 | 60 | 297 | NM | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Non-Interest Income | 798 | 1,014 | 723 | 728 | 722 | 76 | 11 | % | 2,535 | 2,033 | 502 | 25 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Revenue Net of Interest Expense | 4,453 | 4,538 | 4,210 | 4,196 | 4,044 | 409 | 10 | % | 13,201 | 11,664 | 1,537 | 13 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for Credit Losses | 1,473 | 739 | 1,497 | 1,909 | 1,702 | (229) | (13 | %) | 3,709 | 4,109 | (400) | (10 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||

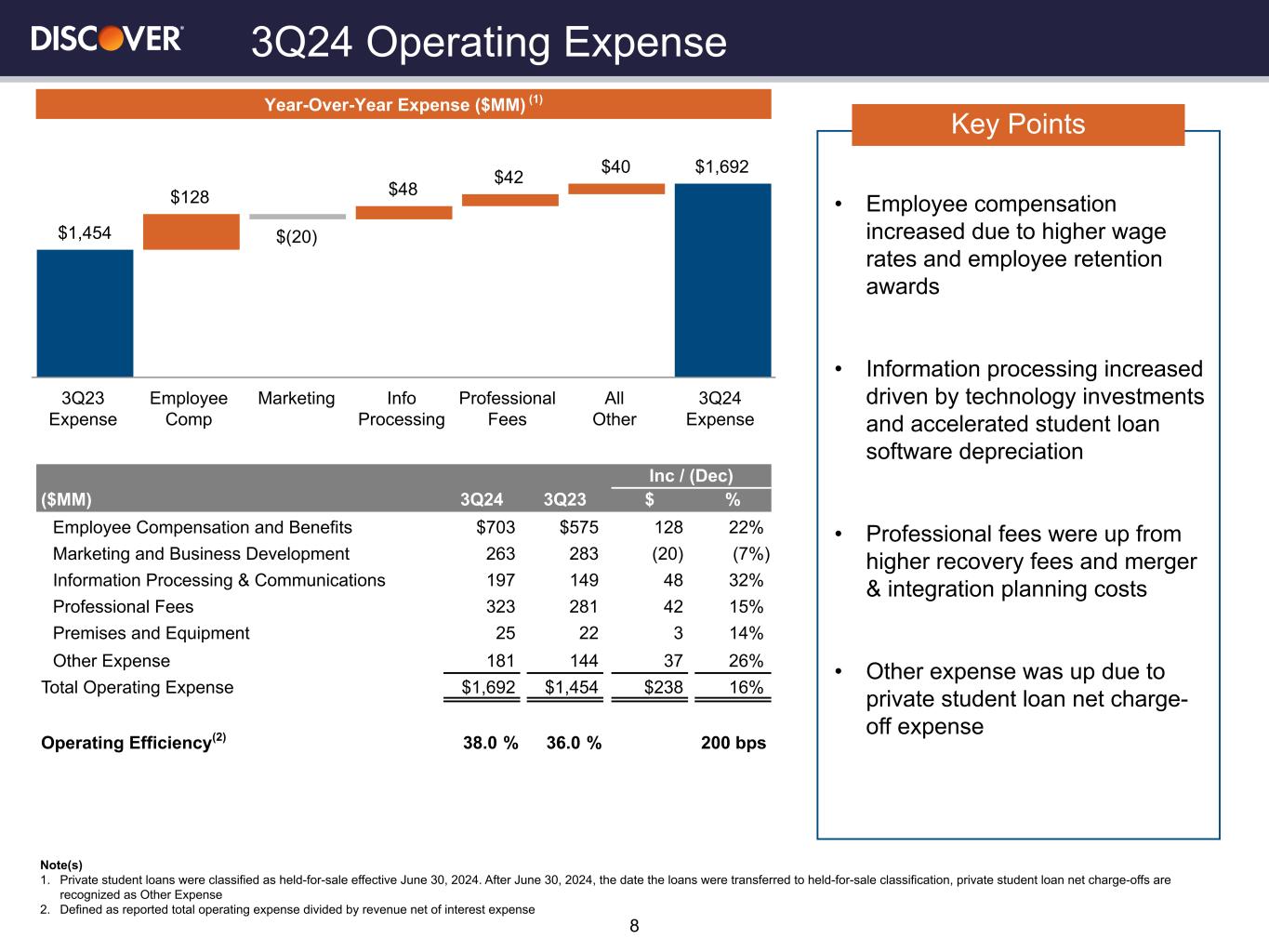

| Employee Compensation and Benefits | 703 | 658 | 671 | 646 | 575 | 128 | 22 | % | 2,032 | 1,788 | 244 | 14 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Marketing and Business Development | 263 | 258 | 250 | 372 | 283 | (20) | (7 | %) | 771 | 792 | (21) | (3 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Information Processing & Communications | 197 | 167 | 163 | 170 | 149 | 48 | 32 | % | 527 | 438 | 89 | 20 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Professional Fees | 323 | 296 | 292 | 312 | 281 | 42 | 15 | % | 911 | 729 | 182 | 25 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Premises and Equipment | 25 | 23 | 20 | 25 | 22 | 3 | 14 | % | 68 | 64 | 4 | 6 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other Expense | 181 | 327 | 913 | 250 | 144 | 37 | 26 | % | 1,421 | 430 | 991 | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||

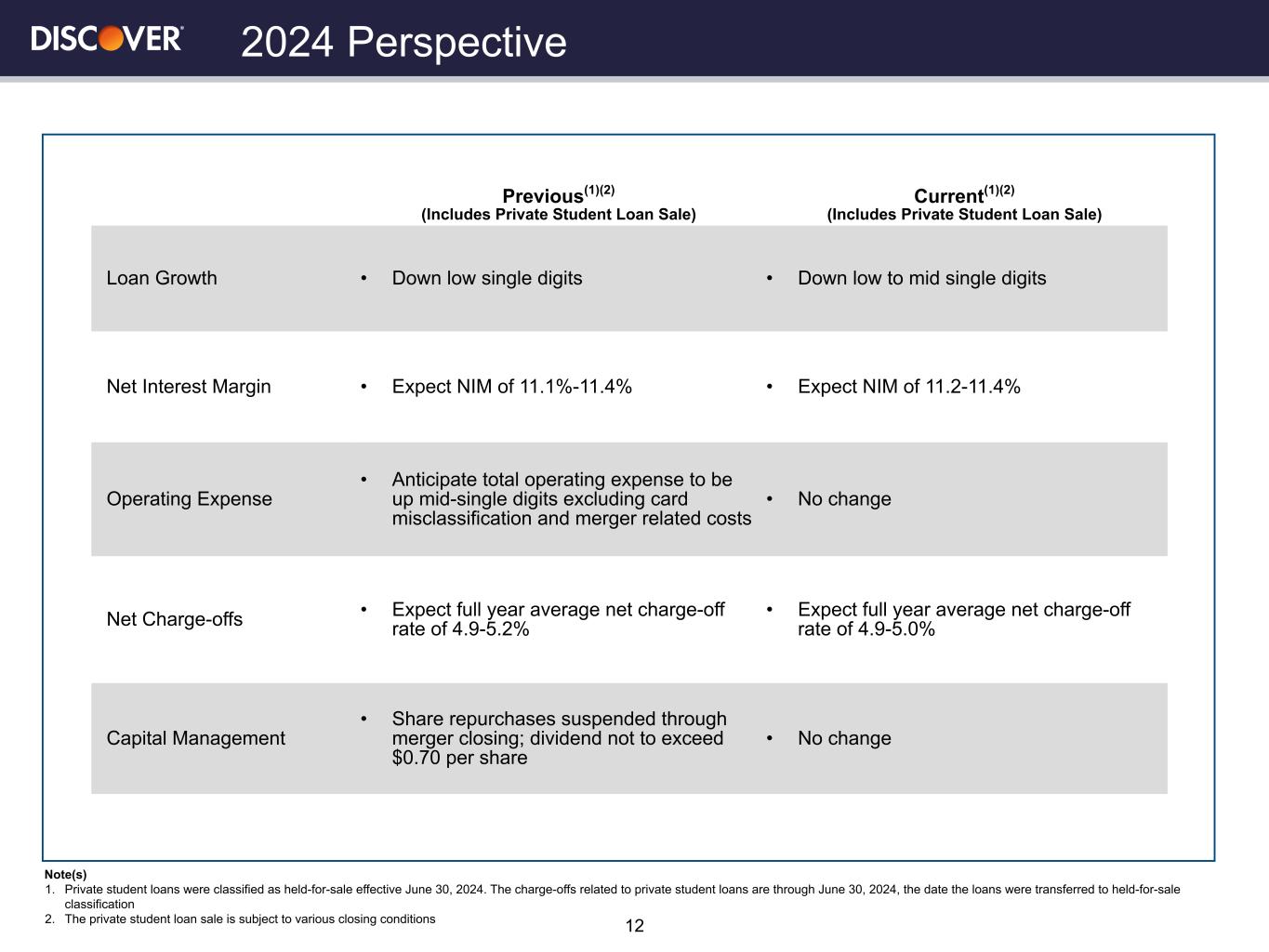

| Total Operating Expense | 1,692 | 1,729 | 2,309 | 1,775 | 1,454 | 238 | 16 | % | 5,730 | 4,241 | 1,489 | 35 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Income/ (Loss) Before Income Taxes | 1,288 | 2,070 | 404 | 512 | 888 | 400 | 45 | % | 3,762 | 3,314 | 448 | 14 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Tax Expense | 323 | 540 | 96 | 124 | 205 | 118 | 58 | % | 959 | 762 | 197 | 26 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net Income/ (Loss) | $965 | $1,530 | $308 | $388 | $683 | $282 | 41 | % | $2,803 | $2,552 | $251 | 10 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net Income/ (Loss) Allocated to Common Stockholders | $928 | $1,521 | $274 | $386 | $647 | $281 | 43 | % | $2,723 | $2,473 | $250 | 10 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Effective Tax Rate | 25.1 | % | 26.1 | % | 23.7 | % | 24.0 | % | 23.1 | % | 25.5 | % | 23.0 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

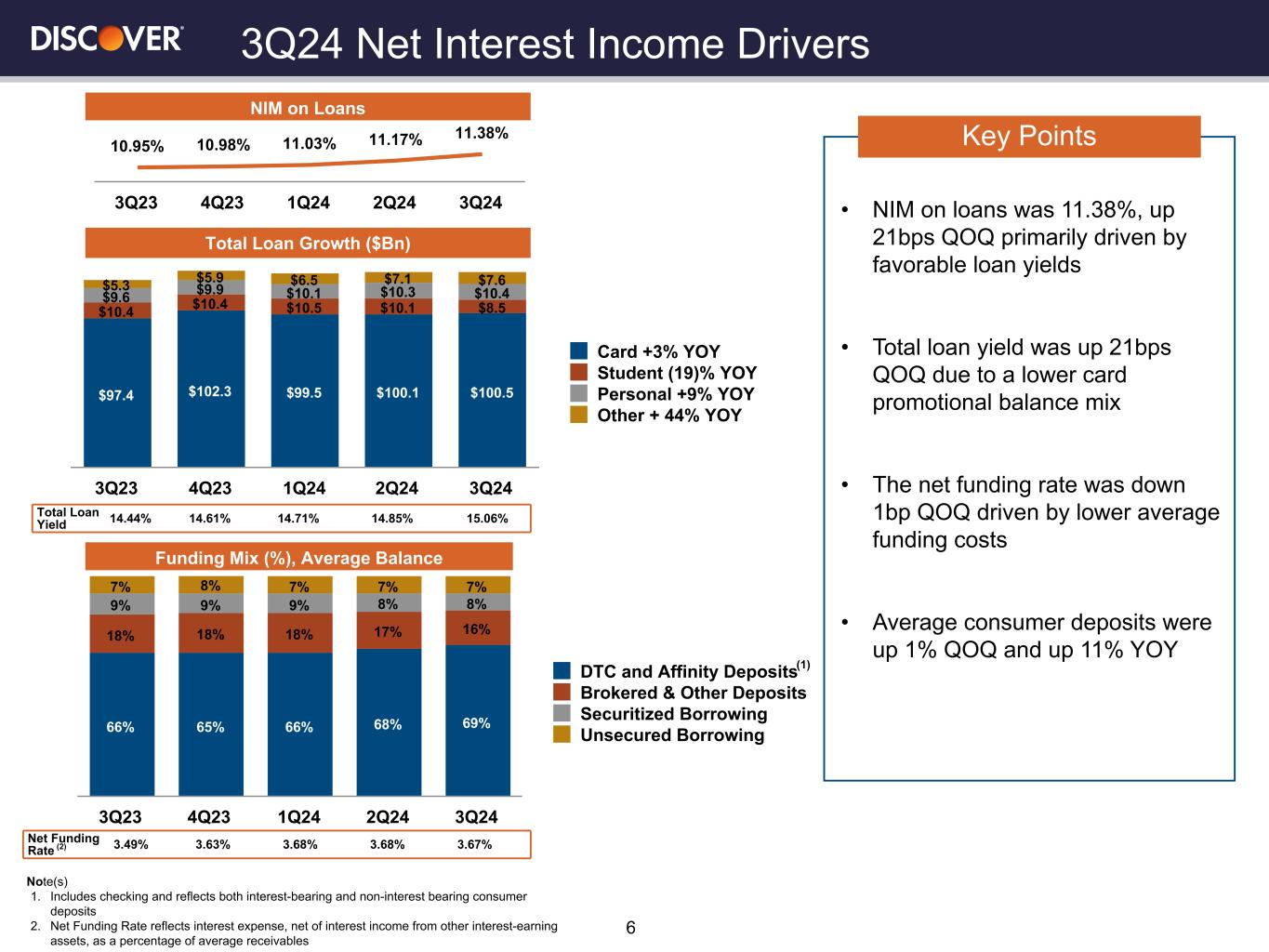

| Net Interest Margin | 11.38 | % | 11.17 | % | 11.03 | % | 10.98 | % | 10.95 | % | 43 | bps | 11.19 | % | 11.11 | % | 8 | bps | ||||||||||||||||||||||||||||||||||||||||||||

| Operating Efficiency | 38.0 | % | 38.1 | % | 54.9 | % | 42.3 | % | 36.0 | % | 200 | bps | 43.4 | % | 36.4 | % | 700 | bps | ||||||||||||||||||||||||||||||||||||||||||||

| ROE | 23 | % | 40 | % | 8 | % | 11 | % | 19 | % | 24 | % | 24 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| ROCE | 23 | % | 43 | % | 8 | % | 11 | % | 20 | % | 25 | % | 25 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

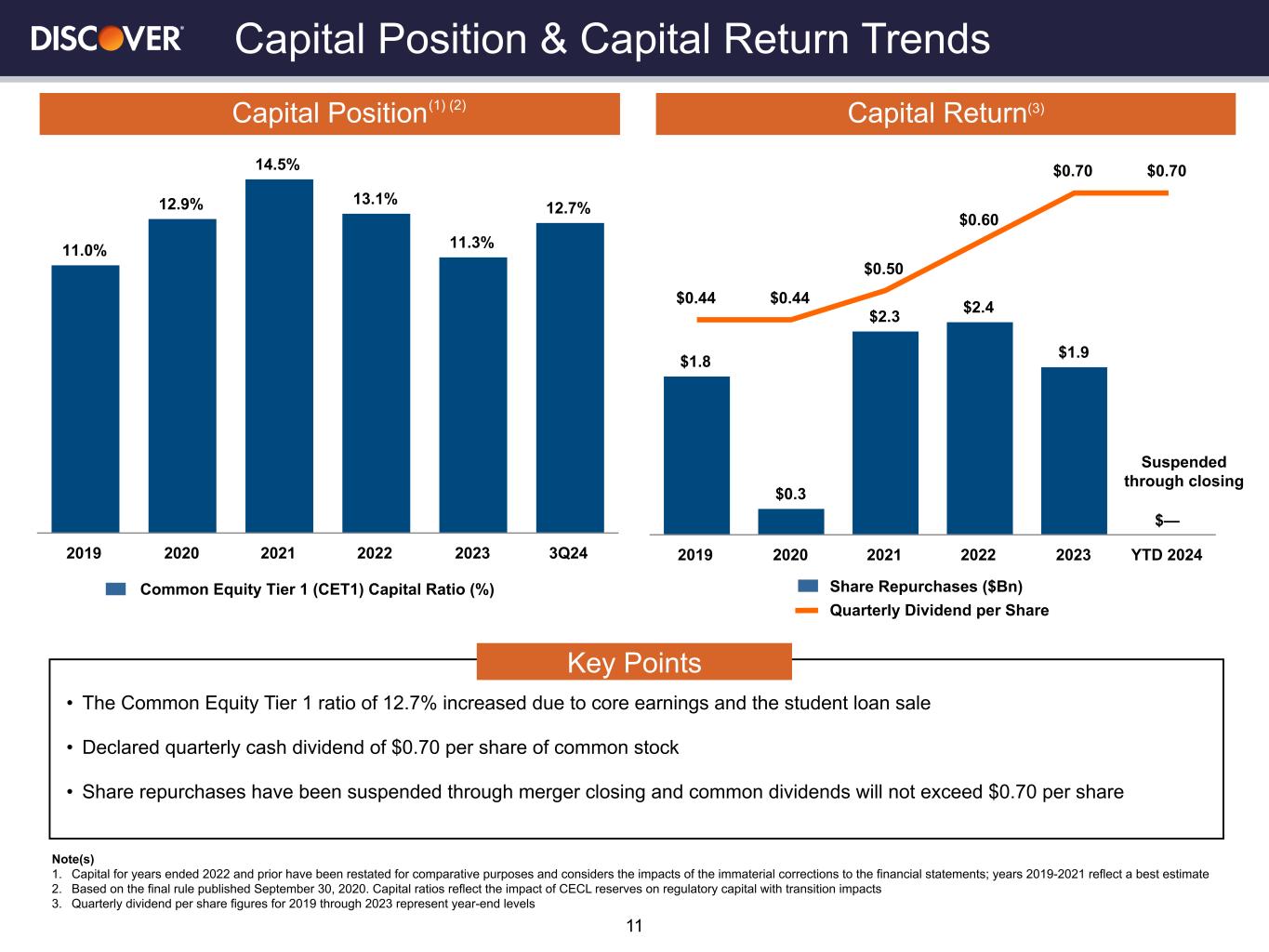

| Capital Returned to Common Stockholders | $155 | $178 | $180 | $144 | $169 | ($14) | (8 | %) | $513 | $2,397 | ($1,884) | (79 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Payout Ratio | 17 | % | 12 | % | 66 | % | 37 | % | 26 | % | 19 | % | 97 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Ending Common Shares Outstanding | 251 | 251 | 251 | 250 | 250 | 1 | — | % | 251 | 250 | 1 | — | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Weighted Average Common Shares Outstanding | 251 | 251 | 250 | 250 | 250 | 1 | — | % | 251 | 255 | (4) | (2 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Weighted Average Common Shares Outstanding (fully diluted) | 251 | 251 | 250 | 250 | 250 | 1 | — | % | 251 | 255 | (4) | (2 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||

| PER SHARE STATISTICS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Basic EPS | $3.69 | $6.06 | $1.10 | $1.54 | $2.59 | $1.10 | 42 | % | $10.86 | $9.70 | $1.16 | 12 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Diluted EPS | $3.69 | $6.06 | $1.10 | $1.54 | $2.59 | $1.10 | 42 | % | $10.85 | $9.69 | $1.16 | 12 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Common Dividends Declared Per Share | $0.70 | $0.70 | $0.70 | $0.70 | $0.70 | $— | — | % | $2.10 | $2.00 | $0.10 | 5 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Common Stock Price (period end) | $140.29 | $130.81 | $131.09 | $112.40 | $86.63 | $53.66 | 62 | % | $140.29 | $86.63 | $53.66 | 62 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Book Value per share | $68.71 | $63.99 | $58.74 | $59.29 | $56.93 | $11.78 | 21 | % | $68.71 | $56.93 | $11.78 | 21 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Note: See Glossary of Financial Terms for definitions of financial terms | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DISCOVER FINANCIAL SERVICES | ||||||||||||||||||||||||||||||||||||||||||||

| BALANCE SHEET SUMMARY | ||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, in millions) | ||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | ||||||||||||||||||||||||||||||||||||||||||||

| Sep 30, 2024 | Jun 30, 2024 | Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | Sep 30, 2024 vs. Sep 30, 2023 |

|||||||||||||||||||||||||||||||||||||||

| BALANCE SHEET SUMMARY | ||||||||||||||||||||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||||||||||||||

| Cash and Investment Securities | $26,423 | $24,405 | $27,965 | $25,383 | $22,569 | $3,854 | 17 | % | ||||||||||||||||||||||||||||||||||||

| Loans Held-for-Sale | 8,484 | 10,145 | — | — | — | 8,484 | NM | |||||||||||||||||||||||||||||||||||||

| Loan Portfolio | 118,509 | 117,504 | 126,555 | 128,409 | 122,676 | (4,167) | (3 | %) | ||||||||||||||||||||||||||||||||||||

| Total Loan Receivables | 126,993 | 127,649 | 126,555 | 128,409 | 122,676 | 4,317 | 4 | % | ||||||||||||||||||||||||||||||||||||

| Allowance for Credit Losses | (8,512) | (8,481) | (9,258) | (9,283) | (8,665) | 153 | 2 | % | ||||||||||||||||||||||||||||||||||||

| Net Loan Receivables | 118,481 | 119,168 | 117,297 | 119,126 | 114,011 | 4,470 | 4 | % | ||||||||||||||||||||||||||||||||||||

| Premises and Equipment, net | 1,085 | 1,087 | 1,107 | 1,091 | 1,084 | 1 | 0 | % | ||||||||||||||||||||||||||||||||||||

| Goodwill and Intangible Assets, net | 255 | 255 | 255 | 255 | 255 | — | — | % | ||||||||||||||||||||||||||||||||||||

| Other Assets | 5,349 | 5,952 | 6,065 | 5,667 | 5,513 | (164) | (3 | %) | ||||||||||||||||||||||||||||||||||||

| Total Assets | $151,593 | $150,867 | $152,689 | $151,522 | $143,432 | $8,161 | 6 | % | ||||||||||||||||||||||||||||||||||||

| Liabilities & Stockholders' Equity | ||||||||||||||||||||||||||||||||||||||||||||

Certificates of Deposits 1 |

30,296 | 25,881 | 25,921 | 24,151 | 21,755 | 8,541 | 39 | % | ||||||||||||||||||||||||||||||||||||

Savings, Money Market, and Other Deposits 1, 2 |

60,013 | 61,414 | 61,412 | 59,882 | 59,501 | 512 | 1 | % | ||||||||||||||||||||||||||||||||||||

Total Direct to Consumer Deposits 1, 2 |

90,309 | 87,295 | 87,333 | 84,033 | 81,256 | 9,053 | 11 | % | ||||||||||||||||||||||||||||||||||||

| Brokered Deposits and Other Deposits | 19,543 | 21,055 | 23,097 | 24,898 | 22,763 | (3,220) | (14 | %) | ||||||||||||||||||||||||||||||||||||

| Deposits | 109,852 | 108,350 | 110,430 | 108,931 | 104,019 | 5,833 | 6 | % | ||||||||||||||||||||||||||||||||||||

Securitized Borrowings 3 |

9,307 | 9,608 | 10,933 | 11,743 | 10,889 | (1,582) | (15 | %) | ||||||||||||||||||||||||||||||||||||

Other Borrowings 3 |

8,870 | 9,533 | 9,542 | 9,588 | 8,578 | 292 | 3 | % | ||||||||||||||||||||||||||||||||||||

| Borrowings | 18,177 | 19,141 | 20,475 | 21,331 | 19,467 | (1,290) | (7 | %) | ||||||||||||||||||||||||||||||||||||

| Accrued Expenses and Other Liabilities | 6,304 | 7,309 | 7,064 | 6,432 | 5,710 | 594 | 10 | % | ||||||||||||||||||||||||||||||||||||

| Total Liabilities | 134,333 | 134,800 | 137,969 | 136,694 | 129,196 | 5,137 | 4 | % | ||||||||||||||||||||||||||||||||||||

| Total Equity | 17,260 | 16,067 | 14,720 | 14,828 | 14,236 | 3,024 | 21 | % | ||||||||||||||||||||||||||||||||||||

| Total Liabilities and Stockholders' Equity | $151,593 | $150,867 | $152,689 | $151,522 | $143,432 | $8,161 | 6 | % | ||||||||||||||||||||||||||||||||||||

| LIQUIDITY | ||||||||||||||||||||||||||||||||||||||||||||

| Liquidity Portfolio | $24,804 | $22,371 | $25,739 | $23,254 | $21,186 | $3,618 | 17 | % | ||||||||||||||||||||||||||||||||||||

| Private Asset-backed Securitization Capacity | 2,750 | 3,500 | 3,500 | 2,750 | 3,500 | (750) | (21 | %) | ||||||||||||||||||||||||||||||||||||

| Federal Home Loan Bank Borrowing Capacity | 3,853 | 3,383 | 3,087 | 2,551 | 2,202 | 1,651 | 75 | % | ||||||||||||||||||||||||||||||||||||

Federal Reserve Discount Window 4 |

46,118 | 39,569 | 41,710 | 41,199 | 48,658 | (2,540) | (5 | %) | ||||||||||||||||||||||||||||||||||||

Undrawn Credit Facilities 4 |

52,721 | 46,452 | 48,297 | 46,500 | 54,360 | (1,639) | (3 | %) | ||||||||||||||||||||||||||||||||||||

| Total Liquidity | $77,525 | $68,823 | $74,036 | $69,754 | $75,546 | $1,979 | 3 | % | ||||||||||||||||||||||||||||||||||||

1 Includes Affinity relationships |

||||||||||||||||||||||||||||||||||||||||||||

2 Savings, Money Market, and Other Deposits and reflects both interest-bearing and non-interest bearing direct to consumer deposits |

||||||||||||||||||||||||||||||||||||||||||||

3 Includes short-term and long-term borrowings |

||||||||||||||||||||||||||||||||||||||||||||

4 Excludes investments pledged to the Federal Reserve, which is included within the liquidity portfolio |

||||||||||||||||||||||||||||||||||||||||||||

| Note: See Glossary of Financial Terms for definitions of financial terms | ||||||||||||||||||||||||||||||||||||||||||||

| DISCOVER FINANCIAL SERVICES | ||||||||||||||||||||||||||||||||||||||||||||

| BALANCE SHEET STATISTICS | ||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, in millions) | ||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | ||||||||||||||||||||||||||||||||||||||||||||

| Sep 30, 2024 | Jun 30, 2024 | Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | Sep 30, 2024 vs. Sep 30, 2023 |

|||||||||||||||||||||||||||||||||||||||

| BALANCE SHEET STATISTICS | ||||||||||||||||||||||||||||||||||||||||||||

| Total Common Equity | $16,204 | $15,011 | $13,664 | $13,772 | $13,180 | $3,024 | 23 | % | ||||||||||||||||||||||||||||||||||||

| Total Common Equity/Total Assets | 10.7 | % | 9.9 | % | 8.9 | % | 9.1 | % | 9.2 | % | ||||||||||||||||||||||||||||||||||

| Total Common Equity/Net Loans | 13.7 | % | 12.6 | % | 11.6 | % | 11.6 | % | 11.6 | % | ||||||||||||||||||||||||||||||||||

| Tangible Assets | $151,338 | $150,612 | $152,434 | $151,267 | $143,177 | $8,161 | 6 | % | ||||||||||||||||||||||||||||||||||||

Tangible Common Equity 1 |

$15,949 | $14,756 | $13,409 | $13,517 | $12,925 | $3,024 | 23 | % | ||||||||||||||||||||||||||||||||||||

Tangible Common Equity/Tangible Assets 1 |

10.5 | % | 9.8 | % | 8.8 | % | 8.9 | % | 9.0 | % | ||||||||||||||||||||||||||||||||||

Tangible Common Equity/Net Loans 1 |

13.5 | % | 12.4 | % | 11.4 | % | 11.3 | % | 11.3 | % | ||||||||||||||||||||||||||||||||||

Tangible Common Equity per share 1 |

$63.49 | $58.76 | $53.51 | $54.04 | $51.69 | $11.80 | 23 | % | ||||||||||||||||||||||||||||||||||||

| Basel III | ||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | ||||||||||||||||||||||||||||||||||||||||||||

REGULATORY CAPITAL RATIOS 2 |

Sep 30, 2024 | Jun 30, 2024 | Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | |||||||||||||||||||||||||||||||||||||||

| Total Risk Based Capital Ratio | 15.0 | % | 14.3 | % | 13.3 | % | 13.7 | % | 14.1 | % | ||||||||||||||||||||||||||||||||||

| Tier 1 Risk Based Capital Ratio | 13.5 | % | 12.7 | % | 11.7 | % | 12.1 | % | 12.5 | % | ||||||||||||||||||||||||||||||||||

| Tier 1 Leverage Ratio | 11.5 | % | 11.1 | % | 10.1 | % | 10.7 | % | 11.0 | % | ||||||||||||||||||||||||||||||||||

| Common Equity Tier 1 Capital Ratio | 12.7 | % | 11.9 | % | 10.9 | % | 11.3 | % | 11.6 | % | ||||||||||||||||||||||||||||||||||

1 Tangible Common Equity ("TCE") is a non-GAAP measure. The Company believes TCE is a more meaningful measure to investors of the net asset value of the Company. For corresponding reconciliation of TCE to a GAAP financial measure see Reconciliation of GAAP to non-GAAP Data schedule |

||||||||||||||||||||||||||||||||||||||||||||

2 Based on the final rule published September 30, 2020. Capital ratios reflect the impact of CECL reserves on regulatory capital with transition impacts |

||||||||||||||||||||||||||||||||||||||||||||

| Note: See Glossary of Financial Terms for definitions of financial terms | ||||||||||||||||||||||||||||||||||||||||||||

| DISCOVER FINANCIAL SERVICES | |||||||||||||||||||||||||||||||||||||||||

| AVERAGE BALANCE SHEET | |||||||||||||||||||||||||||||||||||||||||

| (unaudited, in millions) | |||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | |||||||||||||||||||||||||||||||||||||||||

| Sep 30, 2024 | Jun 30, 2024 | Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | Sep 30, 2024 vs. Sep 30, 2023 |

||||||||||||||||||||||||||||||||||||

| AVERAGE BALANCES | |||||||||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||

| Cash and Investment Securities | $24,023 | $24,193 | $25,662 | $22,448 | $21,210 | $2,813 | 13 | % | |||||||||||||||||||||||||||||||||

| Restricted Cash | 641 | 590 | 558 | 104 | 238 | 403 | 169 | % | |||||||||||||||||||||||||||||||||

| Credit Card Loans | 100,290 | 99,584 | 100,310 | 99,610 | 95,796 | 4,494 | 5 | % | |||||||||||||||||||||||||||||||||

Private Student Loans 1 |

9,631 | 10,304 | 10,577 | 10,369 | 10,274 | (643) | (6 | %) | |||||||||||||||||||||||||||||||||

| Personal Loans | 10,428 | 10,266 | 10,004 | 9,754 | 9,368 | 1,060 | 11 | % | |||||||||||||||||||||||||||||||||

| Other Loans | 7,358 | 6,829 | 6,235 | 5,654 | 4,942 | 2,416 | 49 | % | |||||||||||||||||||||||||||||||||

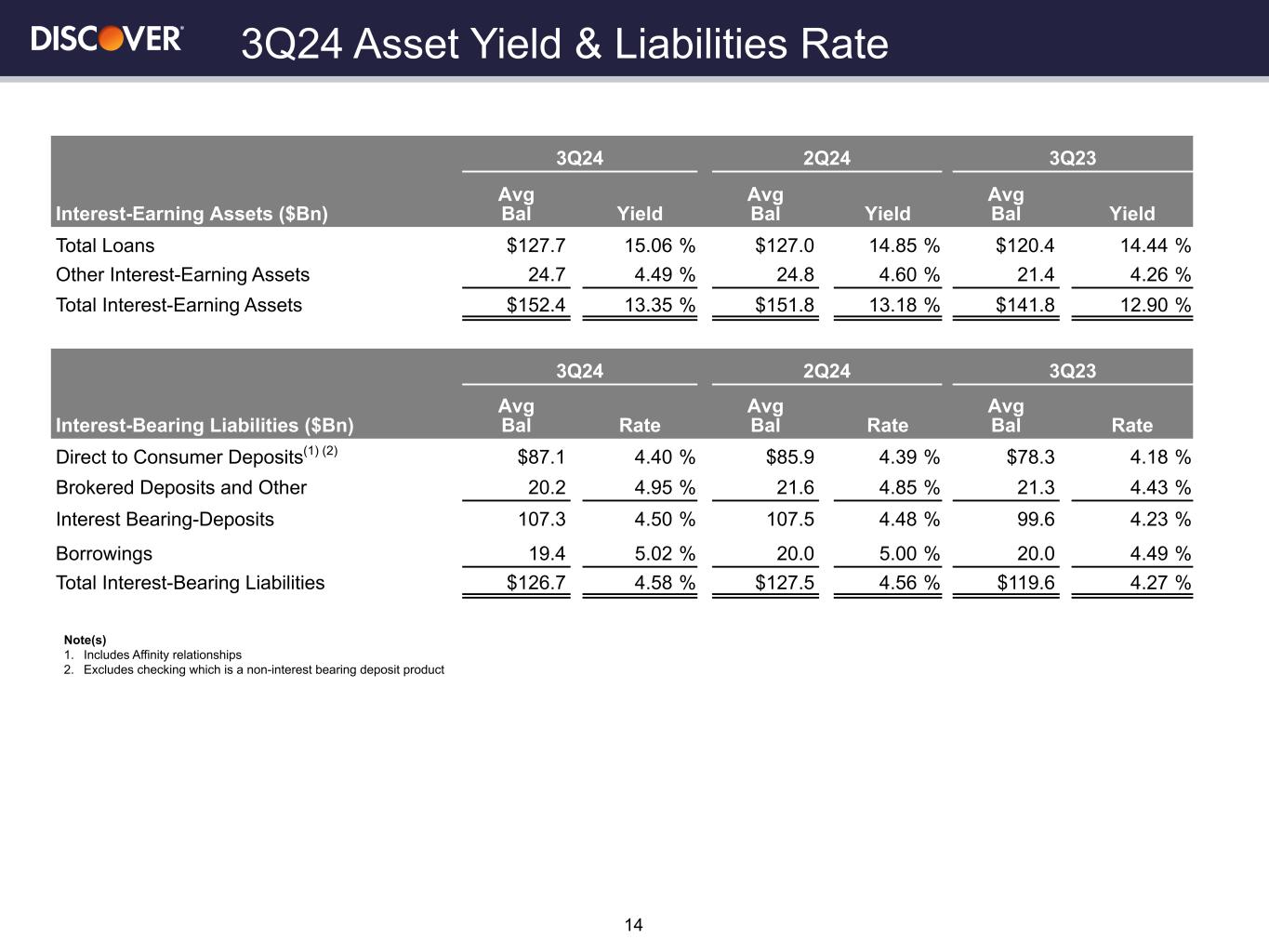

| Total Loans | 127,707 | 126,983 | 127,126 | 125,387 | 120,380 | 7,327 | 6 | % | |||||||||||||||||||||||||||||||||

| Total Interest Earning Assets | 152,371 | 151,766 | 153,346 | 147,939 | 141,828 | 10,543 | 7 | % | |||||||||||||||||||||||||||||||||

| Allowance for Credit Losses | (8,480) | (9,245) | (9,279) | (8,668) | (8,063) | (417) | (5 | %) | |||||||||||||||||||||||||||||||||

| Other Assets | 7,756 | 7,953 | 7,709 | 7,462 | 7,116 | 640 | 9 | % | |||||||||||||||||||||||||||||||||

| Total Assets | $151,647 | $150,474 | $151,776 | $146,733 | $140,881 | $10,766 | 8 | % | |||||||||||||||||||||||||||||||||

| Liabilities and Stockholders' Equity | |||||||||||||||||||||||||||||||||||||||||

Non-Interest-bearing Direct to Consumer Deposits 2 |

$1,063 | $1,071 | $1,037 | $987 | $961 | $102 | 11 | % | |||||||||||||||||||||||||||||||||

Certificates of Deposits 2 |

27,839 | 25,906 | 25,625 | 22,496 | 21,473 | 6,366 | 30 | % | |||||||||||||||||||||||||||||||||

Savings, Money Market, and Other Deposits 2 |

59,258 | 59,973 | 59,212 | 58,766 | 56,797 | 2,461 | 4 | % | |||||||||||||||||||||||||||||||||

Interest-bearing Direct to Consumer Deposits 2 |

87,097 | 85,879 | 84,837 | 81,262 | 78,270 | 8,827 | 11 | % | |||||||||||||||||||||||||||||||||

| Brokered Deposits and Other Deposits | 20,189 | 21,631 | 23,792 | 23,271 | 21,336 | (1,147) | (5 | %) | |||||||||||||||||||||||||||||||||

| Total Interest-bearing Deposits | 107,286 | 107,510 | 108,629 | 104,533 | 99,606 | 7,680 | 8 | % | |||||||||||||||||||||||||||||||||

Securitized Borrowings 3 |

9,971 | 10,432 | 11,340 | 11,045 | 11,161 | (1,190) | (11 | %) | |||||||||||||||||||||||||||||||||

Other Borrowings 3 |

9,416 | 9,521 | 9,572 | 9,228 | 8,873 | 543 | 6 | % | |||||||||||||||||||||||||||||||||

| Total Interest-bearing Liabilities | 126,673 | 127,463 | 129,541 | 124,806 | 119,640 | 7,033 | 6 | % | |||||||||||||||||||||||||||||||||

| Other Liabilities & Stockholders' Equity | 23,911 | 21,940 | 21,198 | 20,940 | 20,280 | 3,631 | 18 | % | |||||||||||||||||||||||||||||||||

| Total Liabilities and Stockholders' Equity | $151,647 | $150,474 | $151,776 | $146,733 | $140,881 | $10,766 | 8 | % | |||||||||||||||||||||||||||||||||

| AVERAGE YIELD | |||||||||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||

| Cash and Investment Securities | 4.46 | % | 4.51 | % | 4.51 | % | 4.36 | % | 4.19 | % | 27 | bps | |||||||||||||||||||||||||||||

| Restricted Cash | 5.73 | % | 8.33 | % | 7.03 | % | 16.71 | % | 10.65 | % | (492) | bps | |||||||||||||||||||||||||||||

| Credit Card Loans | 16.23 | % | 15.99 | % | 15.79 | % | 15.63 | % | 15.43 | % | 80 | bps | |||||||||||||||||||||||||||||

Private Student Loans 1 |

10.08 | % | 9.97 | % | 10.04 | % | 10.16 | % | 10.11 | % | (3) | bps | |||||||||||||||||||||||||||||

| Personal Loans | 13.72 | % | 13.60 | % | 13.40 | % | 13.20 | % | 12.94 | % | 78 | bps | |||||||||||||||||||||||||||||

| Other Loans | 7.45 | % | 7.45 | % | 7.39 | % | 7.14 | % | 6.95 | % | 50 | bps | |||||||||||||||||||||||||||||

| Total Loans | 15.06 | % | 14.85 | % | 14.71 | % | 14.61 | % | 14.44 | % | 62 | bps | |||||||||||||||||||||||||||||

| Total Interest Earning Assets | 13.35 | % | 13.18 | % | 12.98 | % | 13.05 | % | 12.90 | % | 45 | bps | |||||||||||||||||||||||||||||

| AVERAGE RATES | |||||||||||||||||||||||||||||||||||||||||

| Liabilities and Stockholders' Equity | |||||||||||||||||||||||||||||||||||||||||

Certificates of Deposits 2 |

4.67 | % | 4.62 | % | 4.53 | % | 4.24 | % | 3.84 | % | 83 | bps | |||||||||||||||||||||||||||||

Savings, Money Market, and Other Deposits 2 |

4.27 | % | 4.29 | % | 4.35 | % | 4.39 | % | 4.30 | % | (3) | bps | |||||||||||||||||||||||||||||

Interest-bearing Direct to Consumer Deposits 2 |

4.40 | % | 4.39 | % | 4.41 | % | 4.35 | % | 4.18 | % | 22 | bps | |||||||||||||||||||||||||||||

| Brokered Deposits and Other Deposits | 4.95 | % | 4.85 | % | 4.75 | % | 4.64 | % | 4.43 | % | 52 | bps | |||||||||||||||||||||||||||||

| Total Interest-bearing Deposits | 4.50 | % | 4.48 | % | 4.48 | % | 4.41 | % | 4.23 | % | 27 | bps | |||||||||||||||||||||||||||||

Securitized Borrowings 3 |

4.81 | % | 4.89 | % | 4.71 | % | 4.68 | % | 4.60 | % | 21 | bps | |||||||||||||||||||||||||||||

Other Borrowings 3 |

5.23 | % | 5.12 | % | 4.94 | % | 4.55 | % | 4.32 | % | 91 | bps | |||||||||||||||||||||||||||||

| Total Interest-bearing Liabilities | 4.58 | % | 4.56 | % | 4.54 | % | 4.45 | % | 4.27 | % | 31 | bps | |||||||||||||||||||||||||||||

| Net Interest Margin | 11.38 | % | 11.17 | % | 11.03 | % | 10.98 | % | 10.95 | % | 43 | bps | |||||||||||||||||||||||||||||

| Net Yield on Interest-earning Assets | 9.54 | % | 9.34 | % | 9.15 | % | 9.30 | % | 9.29 | % | 25 | bps | |||||||||||||||||||||||||||||

1 Private student loans were classified as held-for-sale effective June 30, 2024 | |||||||||||||||||||||||||||||||||||||||||

2 Includes Affinity relationships | |||||||||||||||||||||||||||||||||||||||||

3 Includes short-term and long-term borrowings | |||||||||||||||||||||||||||||||||||||||||

| Note: See Glossary of Financial Terms for definitions of financial terms | |||||||||||||||||||||||||||||||||||||||||

| DISCOVER FINANCIAL SERVICES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LOAN STATISTICS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, in millions) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | Nine Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sep 30, 2024 | Jun 30, 2024 | Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | Sep 30, 2024 vs. Sep 30, 2023 |

Sep 30, 2024 | Sep 30, 2023 | 2024 vs. 2023 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL LOAN RECEIVABLES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

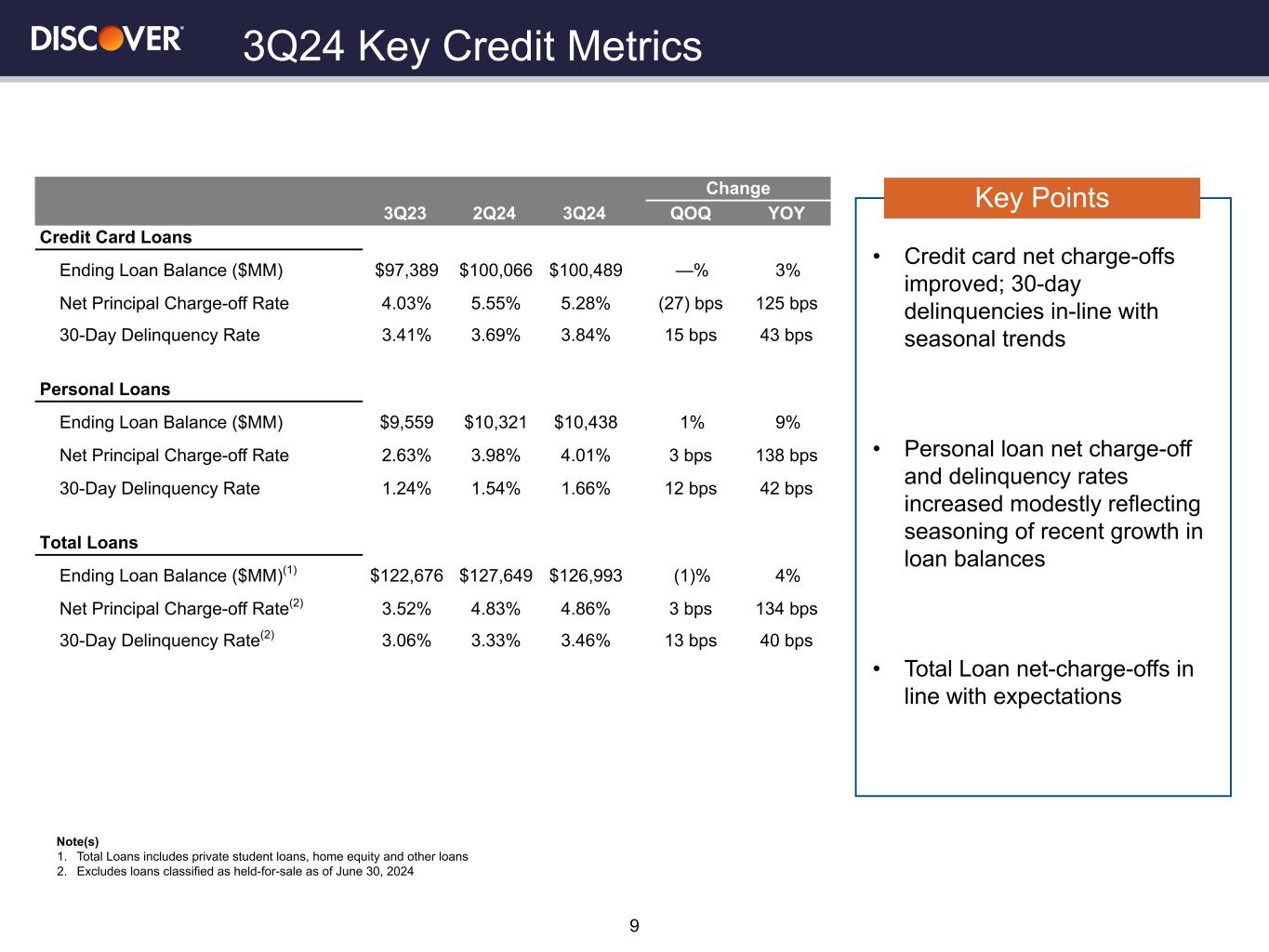

Ending Loans 1 |

$126,993 | $127,649 | $126,555 | $128,409 | $122,676 | $4,317 | 4 | % | $126,993 | $122,676 | $4,317 | 4 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Average Loans 1 |

$127,707 | $126,983 | $127,126 | $125,387 | $120,380 | $7,327 | 6 | % | $127,273 | $115,926 | $11,347 | 10 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Interest Yield 1 |

15.06 | % | 14.85 | % | 14.71 | % | 14.61 | % | 14.44 | % | 62 | bps | 14.87 | % | 14.23 | % | 64 | bps | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Gross Principal Charge-off Rate 2 |

5.91 | % | 5.77 | % | 5.74 | % | 4.82 | % | 4.24 | % | 167 | bps | 5.80 | % | 3.93 | % | 187 | bps | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

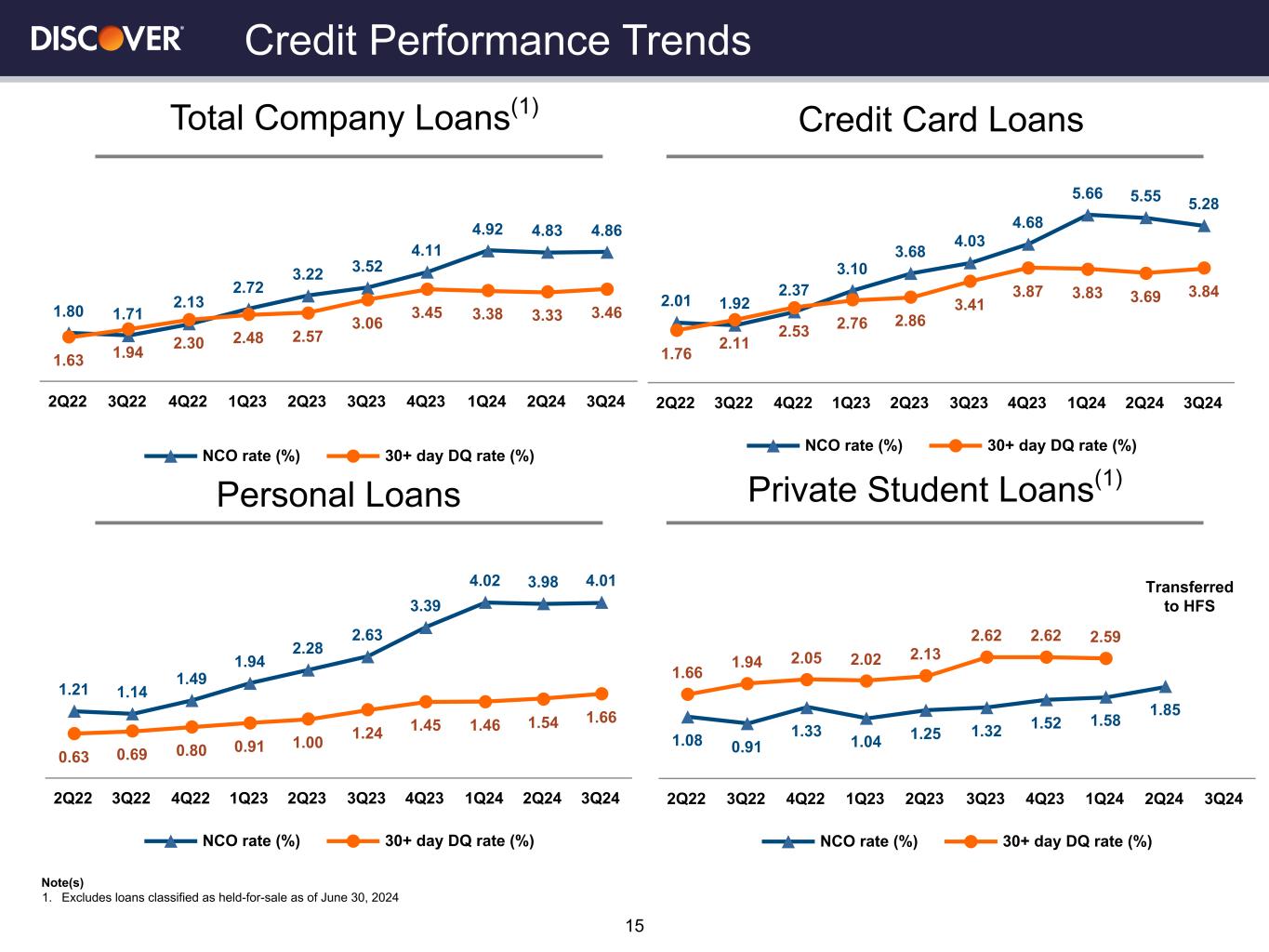

Net Principal Charge-off Rate 2 |

4.86 | % | 4.83 | % | 4.92 | % | 4.11 | % | 3.52 | % | 134 | bps | 4.87 | % | 3.16 | % | 171 | bps | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Delinquency Rate (30 or more days) 2 |

3.46 | % | 3.33 | % | 3.38 | % | 3.45 | % | 3.06 | % | 40 | bps | 3.46 | % | 3.06 | % | 40 | bps | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Delinquency Rate (90 or more days) 2 |

1.65 | % | 1.62 | % | 1.64 | % | 1.59 | % | 1.34 | % | 31 | bps | 1.65 | % | 1.34 | % | 31 | bps | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Gross Principal Charge-off Dollars 2 |

$1,756 | $1,820 | $1,812 | $1,521 | $1,287 | $469 | 36 | % | $5,388 | $3,406 | $1,982 | 58 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net Principal Charge-off Dollars 2 |

$1,442 | $1,522 | $1,556 | $1,298 | $1,070 | $372 | 35 | % | $4,520 | $2,744 | $1,776 | 65 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net Interest and Fee Charge-off Dollars 2 |

$335 | $344 | $348 | $279 | $223 | $112 | 50 | % | $1,027 | $594 | $433 | 73 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Loans Delinquent 30 or more days 2 |

$4,105 | $3,917 | $4,282 | $4,427 | $3,756 | $349 | 9 | % | $4,105 | $3,756 | $349 | 9 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Loans Delinquent 90 or more days 2 |

$1,960 | $1,903 | $2,079 | $2,045 | $1,637 | $323 | 20 | % | $1,960 | $1,637 | $323 | 20 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

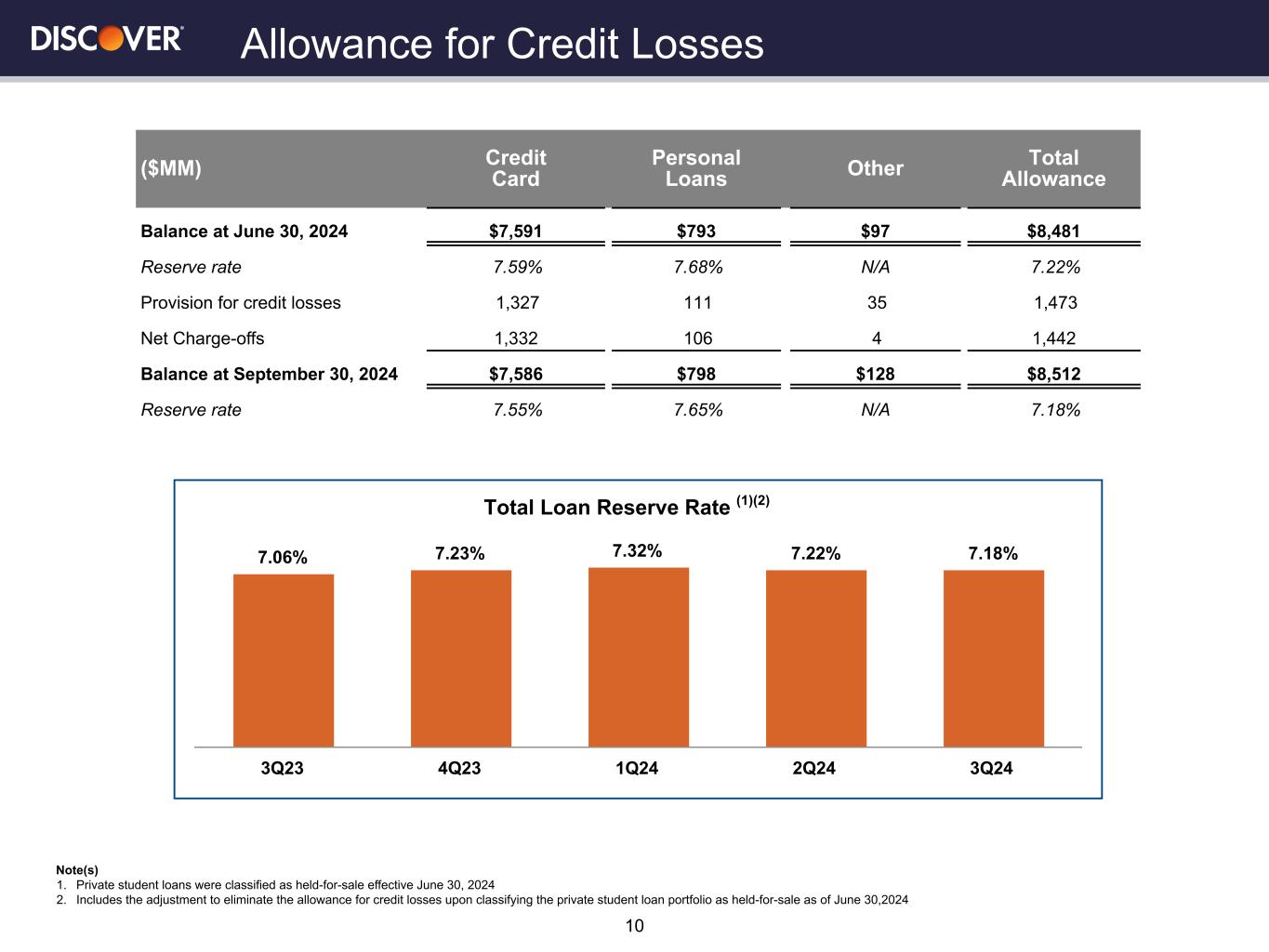

| Allowance for Credit Losses (period end) | $8,512 | $8,481 | $9,258 | $9,283 | $8,665 | ($153) | (2 | %) | $8,512 | $8,665 | ($153) | (2 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Reserve Change Build/ (Release) 3, 4 |

$31 | ($777) | ($25) | $618 | $601 | ($570) | ($771) | $1,359 | ($2,130) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Reserve Rate 2 |

7.18 | % | 7.22 | % | 7.32 | % | 7.23 | % | 7.06 | % | 12 | bps | 7.18 | % | 7.06 | % | 12 | bps | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CREDIT CARD LOANS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ending Loans | $100,489 | $100,066 | $99,475 | $102,259 | $97,389 | $3,100 | 3 | % | $100,489 | $97,389 | $3,100 | 3 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Loans | $100,290 | $99,584 | $100,310 | $99,610 | $95,796 | $4,494 | 5 | % | $100,062 | $92,383 | $7,679 | 8 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest Yield | 16.23 | % | 15.99 | % | 15.79 | % | 15.63 | % | 15.43 | % | 80 | bps | 16.01 | % | 15.21 | % | 80 | bps | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gross Principal Charge-off Rate | 6.46 | % | 6.66 | % | 6.61 | % | 5.50 | % | 4.85 | % | 161 | bps | 6.58 | % | 4.49 | % | 209 | bps | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Principal Charge-off Rate | 5.28 | % | 5.55 | % | 5.66 | % | 4.68 | % | 4.03 | % | 125 | bps | 5.50 | % | 3.62 | % | 188 | bps | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Delinquency Rate (30 or more days) | 3.84 | % | 3.69 | % | 3.83 | % | 3.87 | % | 3.41 | % | 43 | bps | 3.84 | % | 3.41 | % | 43 | bps | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Delinquency Rate (90 or more days) | 1.87 | % | 1.83 | % | 1.95 | % | 1.87 | % | 1.57 | % | 30 | bps | 1.87 | % | 1.57 | % | 30 | bps | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gross Principal Charge-off Dollars | $1,629 | $1,648 | $1,649 | $1,380 | $1,171 | $458 | 39 | % | $4,926 | $3,101 | $1,825 | 59 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Principal Charge-off Dollars | $1,332 | $1,373 | $1,411 | $1,175 | $973 | $359 | 37 | % | $4,116 | $2,499 | $1,617 | 65 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans Delinquent 30 or more days | $3,857 | $3,697 | $3,810 | $3,955 | $3,324 | $533 | 16 | % | $3,857 | $3,324 | $533 | 16 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans Delinquent 90 or more days | $1,883 | $1,834 | $1,941 | $1,917 | $1,527 | $356 | 23 | % | $1,883 | $1,527 | $356 | 23 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Allowance for Credit Losses (period end) | $7,586 | $7,591 | $7,541 | $7,619 | $7,070 | $516 | 7 | % | $7,586 | $7,070 | $516 | 7 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Reserve Change Build/ (Release) 4 |

($5) | $50 | ($78) | $549 | $545 | ($550) | ($33) | $1,253 | ($1,286) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reserve Rate | 7.55 | % | 7.59 | % | 7.58 | % | 7.45 | % | 7.26 | % | 29 | bps | 7.55 | % | 7.26 | % | 29 | bps | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

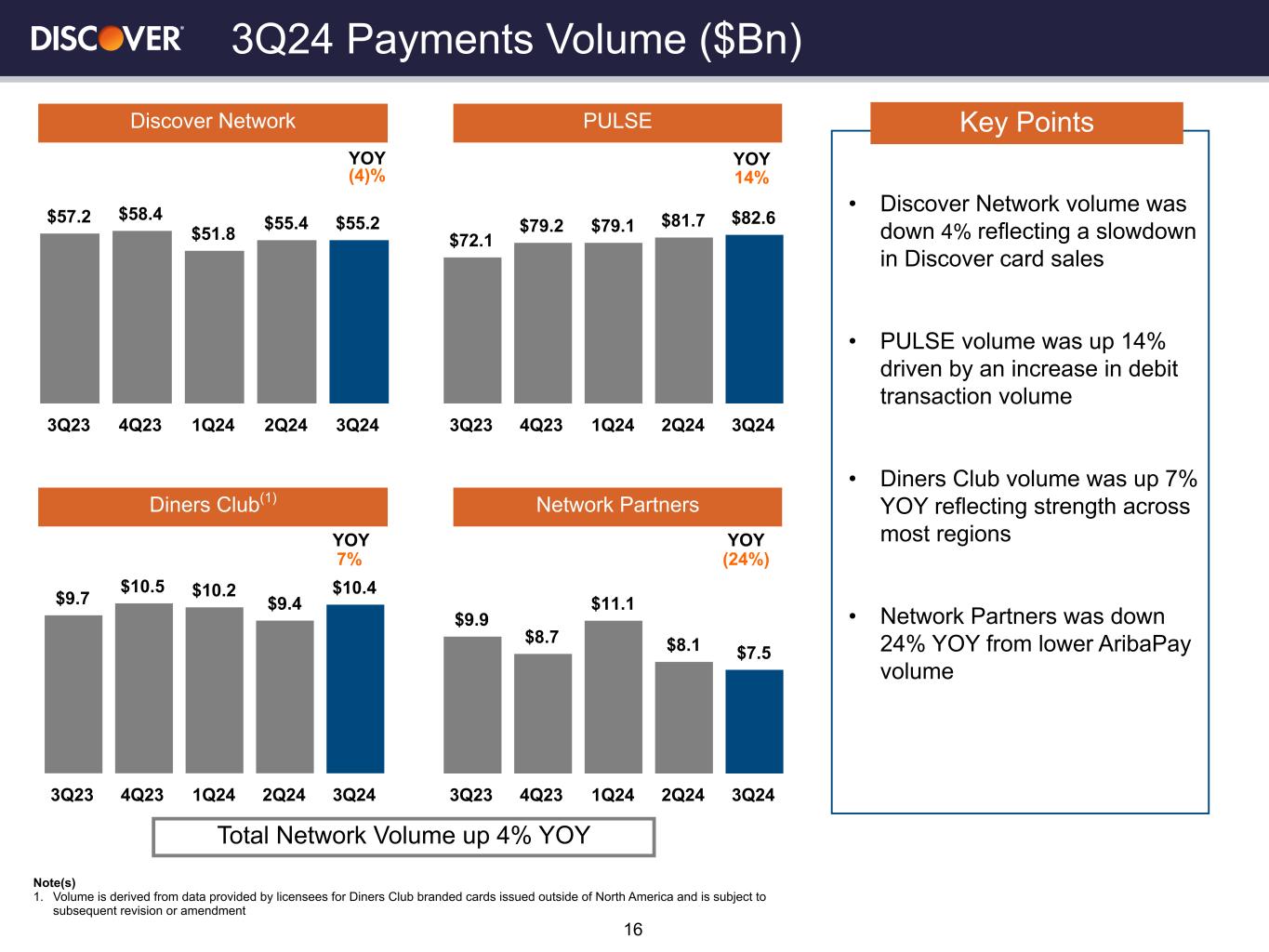

| Total Discover Card Volume | $56,593 | $56,441 | $53,239 | $60,917 | $58,965 | ($2,372) | (4 | %) | $166,273 | $171,868 | ($5,595) | (3 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Discover Card Sales Volume | $53,380 | $53,482 | $50,137 | $57,145 | $54,952 | ($1,572) | (3 | %) | $156,999 | $160,769 | ($3,770) | (2 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rewards Rate | 1.44 | % | 1.32 | % | 1.39 | % | 1.37 | % | 1.42 | % | 2 | bps | 1.38 | % | 1.42 | % | (4) | bps | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

1 Total Loans includes private student loans, home equity and other loans |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2 Excludes loans classified as held-for-sale as of June 30, 2024 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

3 Includes the adjustment to eliminate the allowance for credit losses upon classifying the private student loan portfolio as held-for-sale as of June 30, 2024 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

4 Excludes any build/release of the liability for expected credit losses on unfunded commitments as the offset is recorded in accrued expenses and other liabilities in the Company's condensed consolidated statements of financial condition |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Note: See Glossary of Financial Terms for definitions of financial terms | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DISCOVER FINANCIAL SERVICES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LOAN STATISTICS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, in millions) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | Nine Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sep 30, 2024 | Jun 30, 2024 | Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | Sep 30, 2024 vs. Sep 30, 2023 |

Sep 30, 2024 | Sep 30, 2023 | 2024 vs. 2023 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

PRIVATE STUDENT LOANS 1 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Organic Student Loans | $8,101 | $9,740 | $10,050 | $9,894 | $9,963 | ($1,862) | (19 | %) | $8,101 | $9,963 | ($1,862) | (19 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Purchased Student Loans | 383 | 405 | 430 | 458 | 485 | (102) | (21 | %) | 383 | 485 | (102) | (21 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total Private Student Loans | $8,484 | $10,145 | $10,480 | $10,352 | $10,448 | ($1,964) | (19 | %) | $8,484 | $10,448 | ($1,964) | (19 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Interest Yield | 10.08 | % | 9.97 | % | 10.04 | % | 10.16 | % | 10.11 | % | (3) | bps | 10.03 | % | 9.88 | % | 15 | bps | ||||||||||||||||||||||||||||||||||||||||||||

Net Principal Charge-off Rate 2 |

N/A | 1.85 | % | 1.58 | % | 1.52 | % | 1.32 | % | 1.72 | % | 1.21 | % | 51 | bps | |||||||||||||||||||||||||||||||||||||||||||||||

Delinquency Rate (30 or more days) 2 |

N/A | N/A | 2.59 | % | 2.62 | % | 2.62 | % | N/A | 2.62 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

Reserve Rate 3 |

N/A | N/A | 8.29 | % | 8.29 | % | 8.29 | % | N/A | 8.29 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| PERSONAL LOANS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ending Loans | $10,438 | $10,321 | $10,107 | $9,852 | $9,559 | $879 | 9 | % | $10,438 | $9,559 | $879 | 9 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Interest Yield | 13.72 | % | 13.60 | % | 13.40 | % | 13.20 | % | 12.94 | % | 78 | bps | 13.58 | % | 12.69 | % | 89 | bps | ||||||||||||||||||||||||||||||||||||||||||||

| Net Principal Charge-off Rate | 4.01 | % | 3.98 | % | 4.02 | % | 3.39 | % | 2.63 | % | 138 | bps | 4.00 | % | 2.30 | % | 170 | bps | ||||||||||||||||||||||||||||||||||||||||||||

| Delinquency Rate (30 or more days) | 1.66 | % | 1.54 | % | 1.46 | % | 1.45 | % | 1.24 | % | 42 | bps | 1.66 | % | 1.24 | % | 42 | bps | ||||||||||||||||||||||||||||||||||||||||||||

| Reserve Rate | 7.65 | % | 7.68 | % | 7.48 | % | 7.33 | % | 6.83 | % | 82 | bps | 7.65 | % | 6.83 | % | 82 | bps | ||||||||||||||||||||||||||||||||||||||||||||

1 Private student loans were classified as held-for-sale effective June 30, 2024 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2 Excludes loans classified as held-for-sale as of June 30, 2024 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

3 The allowance for credit losses was reversed upon classifying the private student loan portfolio as held-for-sale | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Note: See Glossary of Financial Terms for definitions of financial terms | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DISCOVER FINANCIAL SERVICES | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SEGMENT RESULTS AND VOLUME STATISTICS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, in millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | Nine Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sep 30, 2024 | Jun 30, 2024 | Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | Sep 30, 2024 vs. Sep 30, 2023 |

Sep 30, 2024 | Sep 30, 2023 | 2024 vs. 2023 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DIGITAL BANKING | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest Income | $5,112 | $4,971 | $4,948 | $4,868 | $4,610 | $502 | 11 | % | $15,031 | $12,977 | $2,054 | 16 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest Expense | 1,457 | 1,447 | 1,461 | 1,400 | 1,288 | 169 | 13 | % | 4,365 | 3,346 | 1,019 | 30 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Interest Income | 3,655 | 3,524 | 3,487 | 3,468 | 3,322 | 333 | 10 | % | 10,666 | 9,631 | 1,035 | 11 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-Interest Income | 669 | 691 | 591 | 611 | 592 | 77 | 13 | % | 1,951 | 1,700 | 251 | 15 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revenue Net of Interest Expense | 4,324 | 4,215 | 4,078 | 4,079 | 3,914 | 410 | 10 | % | 12,617 | 11,331 | 1,286 | 11 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for Credit Losses | 1,473 | 739 | 1,497 | 1,909 | 1,702 | (229) | (13 | %) | 3,709 | 4,109 | (400) | (10 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Operating Expense | 1,647 | 1,683 | 2,259 | 1,712 | 1,409 | 238 | 17 | % | 5,589 | 4,110 | 1,479 | 36 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income/ (Loss) Before Income Taxes | $1,204 | $1,793 | $322 | $458 | $803 | $401 | 50 | % | $3,319 | $3,112 | $207 | 7 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Interest Margin | 11.38 | % | 11.17 | % | 11.03 | % | 10.98 | % | 10.95 | % | 43 | bps | 11.19 | % | 11.11 | % | 8 | bps | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pretax Return on Loan Receivables | 3.75 | % | 5.68 | % | 1.02 | % | 1.45 | % | 2.65 | % | 110 | bps | 3.48 | % | 3.59 | % | (11) | bps | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Allowance for Credit Losses (period end) | $8,512 | $8,481 | $9,258 | $9,283 | $8,665 | ($153) | (2 | %) | $8,512 | $8,665 | ($153) | (2 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reserve Change Build/ (Release) | $31 | ($777) | ($25) | $618 | $601 | ($570) | ($771) | $1,359 | ($2,130) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PAYMENT SERVICES | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest Income | $— | $— | $— | $— | $— | $— | NM | $— | $— | $— | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest Expense | — | — | — | — | — | — | NM | — | — | — | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Interest Income | — | — | — | — | — | — | NM | — | — | — | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-Interest Income (Loss) | 129 | 323 | 132 | 117 | 130 | (1) | (1 | %) | 584 | 333 | 251 | 75 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revenue Net of Interest Expense | 129 | 323 | 132 | 117 | 130 | (1) | (1 | %) | 584 | 333 | 251 | 75 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for Credit Losses | — | — | — | — | — | — | NM | — | — | — | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Operating Expense | 45 | 46 | 50 | 63 | 45 | — | — | % | 141 | 131 | 10 | 8 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income/ (Loss) Before Income Taxes | $84 | $277 | $82 | $54 | $85 | ($1) | NM | $443 | $202 | $241 | 119 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TRANSACTIONS PROCESSED ON NETWORKS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Discover Network | 954 | 936 | 883 | 974 | 964 | (10) | (1) | % | 2,773 | 2,754 | 19 | 1 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PULSE Network | 2,421 | 2,413 | 2,312 | 2,308 | 2,011 | 410 | 20 | % | 7,146 | 5,397 | 1,749 | 32 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | 3,375 | 3,349 | 3,195 | 3,282 | 2,975 | 400 | 13 | % | 9,919 | 8,151 | 1,768 | 22 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NETWORK VOLUME | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PULSE Network | $82,573 | $81,749 | $79,073 | $79,194 | $72,146 | $10,427 | 14 | % | $243,395 | $206,422 | $36,973 | 18 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Network Partners | 7,512 | 8,111 | 11,070 | 8,736 | 9,899 | (2,387) | (24 | %) | 26,693 | 30,935 | (4,242) | (14 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Diners Club International 1 |

10,388 | 9,421 | 10,181 | 10,468 | 9,723 | 665 | 7 | % | 29,990 | 28,831 | 1,159 | 4 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Payment Services | 100,473 | 99,281 | 100,324 | 98,398 | 91,768 | 8,705 | 9 | % | 300,078 | 266,188 | 33,890 | 13 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Discover Network - Proprietary | 55,184 | 55,351 | 51,764 | 58,419 | 57,228 | (2,044) | (4) | % | 162,299 | 166,153 | (3,854) | (2) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | $155,657 | $154,632 | $152,088 | $156,817 | $148,996 | $6,661 | 4 | % | $462,377 | $432,341 | $30,036 | 7 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

1 Volume is derived from data provided by licencees for Diners Club branded cards issued outside of North America and is subject to subsequent revision or amendment |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Note: See Glossary of Financial Terms for definitions of financial terms | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DISCOVER FINANCIAL SERVICES - GLOSSARY OF FINANCIAL TERMS | |||||||||||

| Balance Sheet & Regulatory Capital Terms | |||||||||||

Liquidity Portfolio represents cash and cash equivalents (excluding cash-in-process) and other investments | |||||||||||

Regulatory Capital Ratios are preliminary | |||||||||||

| • | Total Risk Based Capital Ratio represents total capital divided by risk-weighted assets |

||||||||||

| • | Tier 1 Capital Ratio represents tier 1 capital divided by risk-weighted assets |

||||||||||

| • | Tier 1 Leverage Ratio represents tier 1 capital divided by average total assets |

||||||||||

| • | Common Equity Tier 1 Capital Ratio represents common equity tier 1 capital divided by risk weighted assets |

||||||||||

Tangible Assets represents total assets less goodwill and intangibles | |||||||||||

Tangible Common Equity ("TCE"), a non-GAAP financial measure, represents total common equity less goodwill and intangibles. The Company believes TCE is a meaningful measure to investors of the net asset value of the Company. For corresponding reconciliation of TCE to a GAAP financial measure, see Reconciliation of GAAP to Non-GAAP Data | |||||||||||

Tangible Common Equity/Net Loans, a non-GAAP measure, represents TCE divided by total loans less the allowance for credit losses (period end) | |||||||||||

Tangible Common Equity per Share, a non-GAAP measure, represents TCE divided by ending common shares outstanding | |||||||||||

Tangible Common Equity/Tangible Assets, a non-GAAP measure, represents TCE divided by total assets less goodwill and intangibles | |||||||||||

Undrawn Credit Facilities represents asset-backed conduit funding facilities and Federal Reserve discount window (excluding investments pledged to the Federal Reserve, which are included within the liquidity investment portfolio) | |||||||||||

| Credit Related Terms | |||||||||||

Delinquency Rate (30 or more days) represents loans delinquent thirty days or more divided by ending loans (total or respective product loans, as appropriate) | |||||||||||

Delinquency Rate (90 or more days) represents loans delinquent ninety days or more divided by ending loans (total or respective product loans, as appropriate) | |||||||||||

Gross Principal Charge-off Rate represents gross principal charge-off dollars (annualized) divided by average loans for the reporting period (total or respective product loans, as appropriate) | |||||||||||

Net Principal Charge-off Rate represents net principal charge-off dollars (annualized) divided by average loans for the reporting period (total or respective product loans, as appropriate) | |||||||||||

Reserve Rate represents the allowance for credit losses divided by total loans (total or respective product loans, as appropriate) | |||||||||||

| Earnings and Shareholder Return Terms | |||||||||||

Book Value per share represents total equity divided by ending common shares outstanding | |||||||||||

Capital Returned to Common Stockholders represents common stock dividends declared and treasury share repurchases, excluding common stock issued under employee benefit plans and stock based compensation | |||||||||||

Earnings Per Share represents net income allocated to common stockholders divided by the weighted average common shares outstanding | |||||||||||

Interest Yield represents interest income on loan receivables (annualized) divided by average loans for the reporting period (total or respective product loans, as appropriate) | |||||||||||

Net Income Allocated to Common Stockholders represents net income less preferred stock dividends and income allocated to participating securities | |||||||||||

Net Interest Margin represents net interest income (annualized) divided by average total loans for the period | |||||||||||

Net Yield on Interest Earning Assets represents net interest income (annualized) divided by average total interest earning assets for the period | |||||||||||

Operating Efficiency represents total operating expense divided by revenue net of interest expense | |||||||||||

Pretax Return on Loan Receivables represents income before income taxes (annualized) divided by total average loans for the period | |||||||||||

Payout Ratio represents capital returned to common stockholders divided by net income allocated to common stockholders | |||||||||||

Return on Common Equity represents net income available for common stockholders (annualized) divided by average total common equity for the reporting period | |||||||||||

Return on Equity represents net income (annualized) divided by average total equity for the reporting period | |||||||||||

Rewards Rate represents Credit Card rewards cost divided by Discover Card sales volume | |||||||||||

| Volume Terms | |||||||||||

Discover Card Sales Volume represents Discover card activity related to sales net of returns | |||||||||||

Discover Card Volume represents Discover card activity related to sales net of returns, balance transfers, cash advances and other activity | |||||||||||

Discover Network Proprietary Volume represents gross Discover Card sales volume on the Discover Network | |||||||||||

| DISCOVER FINANCIAL SERVICES | |||||||||||||||||||||||||||||

| RECONCILIATION OF GAAP TO NON-GAAP DATA | |||||||||||||||||||||||||||||

| (unaudited, in millions) | |||||||||||||||||||||||||||||

| Quarter Ended | |||||||||||||||||||||||||||||

| Sep 30, 2024 | Jun 30, 2024 | Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | |||||||||||||||||||||||||

| GAAP Total Common Equity | $16,204 | $15,011 | $13,664 | $13,772 | $13,180 | ||||||||||||||||||||||||

| Less: Goodwill | (255) | (255) | (255) | (255) | (255) | ||||||||||||||||||||||||

| Less: Intangibles | — | — | — | — | — | ||||||||||||||||||||||||

Tangible Common Equity 1 |

$15,949 | $14,756 | $13,409 | $13,517 | $12,925 | ||||||||||||||||||||||||

| GAAP Book Value Per Share | $68.71 | $63.99 | $58.74 | $59.29 | $56.93 | ||||||||||||||||||||||||

| Less: Goodwill | (1.02) | (1.02) | (1.02) | (1.03) | (1.02) | ||||||||||||||||||||||||

| Less: Intangibles | — | — | — | — | — | ||||||||||||||||||||||||

| Less: Preferred Stock | (4.20) | (4.21) | (4.21) | (4.22) | (4.22) | ||||||||||||||||||||||||

| Tangible Common Equity Per Share | $63.49 | $58.76 | $53.51 | $54.04 | $51.69 | ||||||||||||||||||||||||

1 Tangible Common Equity ("TCE"), a non-GAAP financial measure, represents common equity less goodwill and intangibles. A reconciliation of TCE to common equity, a GAAP financial measure, is shown above. Other financial services companies may also use TCE and definitions may vary, so users of this information are advised to exercise caution in comparing TCE of different companies. TCE is included because management believes that common equity excluding goodwill and intangibles is a more meaningful measure to investors of the true net asset value of the Company | |||||||||||||||||||||||||||||

| Note: See Glossary of Financial Terms for definitions of financial terms | |||||||||||||||||||||||||||||