| Delaware | 001-35651 | 13-2614959 | ||||||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

||||||

|

Title of each class |

Trading symbol(s) |

Name of each exchange on which registered |

||||||

| Common Stock, $0.01 par value | BK | New York Stock Exchange | ||||||

| 6.244% Fixed-to-Floating Rate Normal Preferred Capital Securities of Mellon Capital IV | BK/P | New York Stock Exchange | ||||||

| (fully and unconditionally guaranteed by The Bank of New York Mellon Corporation) | ||||||||

| Depositary Shares, each representing a 1/4,000th interest in a share of Series K Noncumulative | BK PRK | New York Stock Exchange | ||||||

| Perpetual Preferred Stock | ||||||||

| Exhibit | ||||||||

| Number | Description | |||||||

| 99.1 | ||||||||

| The quotation in Exhibit 99.1 (the “Excluded Section”) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (“Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of BNY under the Securities Act of 1933 or the Exchange Act. The information included in Exhibit 99.1, other than in the Excluded Section, shall be deemed “filed” for purposes of the Exchange Act. | ||||||||

| 99.2 | ||||||||

| The information included in Exhibit 99.2 shall be deemed “filed” for purposes of the Exchange Act. | ||||||||

| 99.3 | ||||||||

| The information included in Exhibit 99.3 shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of BNY under the Securities Act of 1933 or the Exchange Act. | ||||||||

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. | |||||||

|

The Bank of New York Mellon Corporation

(Registrant)

|

|||||||||||

| Date: January 13, 2026 | By: | /s/ Jean Weng | |||||||||

| Name: Title: |

Jean Weng Secretary |

||||||||||

|

4Q25 |

FINANCIALRESULTS |

||||||||||||

| CEO COMMENTARY | ||||||||

|

2025 was another successful year for BNY. We delivered record net income of $5.3 billion on record revenue of $20.1 billion and generated an ROTCE of 26%. On the back of eight consecutive quarters of positive operating leverage, we grew earnings per share by 28% year-over-year and returned $5.0 billion of capital to our shareholders. | |||||||

| Three years ago, we embarked on a multi-year transformation of BNY. Two years ago, we communicated our strategic roadmap and a set of medium-term financial targets for what we viewed as the first, foundation-setting phase of that work. The pace of progress and our results to date demonstrate that the strategy is working. | ||||||||

| Today, we are raising the bar. With the foundations in place, we expect to realize greater scale and growth opportunities across our platforms. Our new medium-term financial targets represent the next milestones on our path to unlocking BNY’s full potential over the long-term. | ||||||||

| I want to thank our teams around the world for their dedication to our clients and their commitment to reimagining BNY. We are entering 2026 with positive momentum and excited for the work ahead of us to deliver increased value for our clients and shareholders. |  |

|||||||

– Robin Vince, Chief Executive Officer | ||||||||

| EPS | Adj. EPS | Pre-tax margin | ROE | ROTCE | |||||||||||||||||||||||||

| 4Q25 | $2.02 |

$2.08 (a) |

36% |

14.5% |

26.6% (a) |

||||||||||||||||||||||||

| FY25 | $7.40 |

$7.50 (a) |

35% |

13.9% |

26.1% (a) |

||||||||||||||||||||||||

| 4Q25 KEY FINANCIAL INFORMATION | |||||||||||

| (dollars in millions, except per share amounts and unless otherwise noted) | 4Q25 vs. | ||||||||||

| 4Q25 | 3Q25 | 4Q24 | |||||||||

| Selected income statement data: | |||||||||||

| Total fee revenue | $ | 3,698 | 2 | % | 5 | % | |||||

| Investment and other revenue | 135 | N/M | N/M | ||||||||

| Net interest income | 1,346 | 9 | % | 13 | % | ||||||

| Total revenue | $ | 5,179 | 2 | % | 7 | % | |||||

| Provision for credit losses | (26) | N/M | N/M | ||||||||

| Noninterest expense | $ | 3,360 | 4 | % | — | % | |||||

| Net income applicable to common shareholders | $ | 1,427 | 7 | % | 26 | % | |||||

| Diluted EPS | $ | 2.02 | 7 | % | 31 | % | |||||

| Selected metrics: | |||||||||||

AUC/A (in trillions) |

$ | 59.3 | 3 | % | 14 | % | |||||

AUM (in trillions) |

$ | 2.2 | 2 | % | 7 | % | |||||

| Financial ratios: | 4Q25 | 3Q25 | 4Q24 | ||||||||

| Pre-tax operating margin | 36 | % | 36 | % | 30 | % | |||||

| ROE | 14.5 | % | 13.7 | % | 12.2 | % | |||||

ROTCE (a) |

26.6 | % | 25.6 | % | 23.3 | % | |||||

| Capital ratios: | |||||||||||

| Tier 1 leverage ratio | 6.0 | % | 6.1 | % | 5.7 | % | |||||

| CET1 ratio | 11.9 | % | 11.7 | % | 11.2 | % | |||||

| 4Q25 HIGHLIGHTS | ||

(a) For information on the Non-GAAP measures, see “Explanation of GAAP and Non-GAAP financial measures” beginning on page 11. | |||||

| Note: Above comparisons are 4Q25 vs. 4Q24, unless otherwise noted. | |||||

Media: Anneliese Diedrichs + 1 646 468 6026 |

Investors: Marius Merz +1 212 298 1480 |

||||

BNY 4Q25 Financial Results | ||

| (dollars in millions, except per share amounts and unless otherwise noted; not meaningful - N/M) |

4Q25 vs. | ||||||||||||||||

| 4Q25 | 3Q25 | 4Q24 | 3Q25 | 4Q24 | |||||||||||||

| Fee revenue | $ | 3,698 | $ | 3,637 | $ | 3,513 | 2 | % | 5 | % | |||||||

| Investment and other revenue | 135 | 208 | 140 | N/M | N/M | ||||||||||||

| Total fee and other revenue | 3,833 | 3,845 | 3,653 | — | 5 | ||||||||||||

| Net interest income | 1,346 | 1,236 | 1,194 | 9 | 13 | ||||||||||||

| Total revenue | 5,179 | 5,081 | 4,847 | 2 | 7 | ||||||||||||

| Provision for credit losses | (26) | (7) | 20 | N/M | N/M | ||||||||||||

| Noninterest expense | 3,360 | 3,236 | 3,355 | 4 | — | ||||||||||||

| Income before taxes | 1,845 | 1,852 | 1,472 | — | 25 | ||||||||||||

| Provision for income taxes | 376 | 395 | 315 | (5) | 19 | ||||||||||||

| Net income | $ | 1,469 | $ | 1,457 | $ | 1,157 | 1 | % | 27 | % | |||||||

| Net income applicable to common shareholders of The Bank of New York Mellon Corporation | $ | 1,427 | $ | 1,339 | $ | 1,130 | 7 | % | 26 | % | |||||||

Operating leverage (a) |

(190) | bps | 670 | bps | |||||||||||||

| Diluted earnings per common share | $ | 2.02 | $ | 1.88 | $ | 1.54 | 7 | % | 31 | % | |||||||

Average common shares and equivalents outstanding - diluted (in thousands) |

705,140 | 712,854 | 733,720 | ||||||||||||||

| Pre-tax operating margin | 36 | % | 36 | % | 30 | % | |||||||||||

| Metrics: | |||||||||||||||||

| Average loans | $ | 76,678 | $ | 72,692 | $ | 69,211 | 5 | % | 11 | % | |||||||

| Average deposits | 310,482 | 299,326 | 286,488 | 4 | 8 | ||||||||||||

AUC/A at period end (in trillions) (current period is preliminary) |

59.3 | 57.8 | 52.1 | 3 | 14 | ||||||||||||

AUM at period end (in trillions) (current period is preliminary) |

2.2 | 2.1 | 2.0 | 2 | 7 | ||||||||||||

Non-GAAP measures, excluding notable items: (b) |

|||||||||||||||||

| Adjusted total revenue | $ | 5,179 | $ | 5,069 | $ | 4,847 | 2 | % | 7 | % | |||||||

| Adjusted noninterest expense | 3,309 | 3,197 | 3,190 | 4 | 4 | ||||||||||||

Adjusted operating leverage (a) |

(133) | bps | 312 | bps | |||||||||||||

| Adjusted diluted earnings per common share | $ | 2.08 | $ | 1.91 | $ | 1.72 | 9 | % | 21 | % | |||||||

| Adjusted pre-tax operating margin | 37 | % | 37 | % | 34 | % | |||||||||||

2 | ||

BNY 4Q25 Financial Results | ||

| (dollars in millions, except per share amounts; not meaningful - N/M) | 2025 vs. | ||||||||||

| 2025 | 2024 | 2024 | |||||||||

| Fee revenue | $ | 14,379 | $ | 13,620 | 6 | % | |||||

| Investment and other revenue | 757 | 687 | N/M | ||||||||

| Total fee and other revenue | 15,136 | 14,307 | 6 | ||||||||

| Net interest income | 4,944 | 4,312 | 15 | ||||||||

| Total revenue | 20,080 | 18,619 | 8 | ||||||||

| Provision for credit losses | (32) | 70 | N/M | ||||||||

| Noninterest expense | 13,054 | 12,701 | 3 | ||||||||

| Income before taxes | 7,058 | 5,848 | 21 | ||||||||

| Provision for income taxes | 1,475 | 1,305 | 13 | ||||||||

| Net income | $ | 5,583 | $ | 4,543 | 23 | % | |||||

| Net income applicable to common shareholders of The Bank of New York Mellon Corporation | $ | 5,306 | $ | 4,336 | 22 | % | |||||

Operating leverage (a) |

507 | bps | |||||||||

| Diluted earnings per common share | $ | 7.40 | $ | 5.80 | 28 | % | |||||

Average common shares and equivalents outstanding - diluted (in thousands) |

716,718 | 748,101 | |||||||||

| Pre-tax operating margin | 35 | % | 31 | % | |||||||

Non-GAAP measures, excluding notable items: (b) |

|||||||||||

| Adjusted total revenue | $ | 20,028 | $ | 18,619 | 8 | % | |||||

| Adjusted noninterest expense | $ | 12,912 | $ | 12,480 | 3 | % | |||||

Adjusted operating leverage (a) |

411 | bps | |||||||||

| Adjusted diluted earnings per common share | $ | 7.50 | $ | 6.03 | 24 | % | |||||

| Adjusted pre-tax operating margin | 36 | % | 33 | % | |||||||

3 | ||

BNY 4Q25 Financial Results | ||

| (dollars in millions, unless otherwise noted; not meaningful - N/M) | 4Q25 vs. | ||||||||||||||||

| 4Q25 | 3Q25 | 4Q24 | 3Q25 | 4Q24 | |||||||||||||

| Investment services fees: | |||||||||||||||||

| Asset Servicing | $ | 1,159 | $ | 1,141 | $ | 1,042 | 2 | % | 11 | % | |||||||

| Issuer Services | 331 | 313 | 295 | 6 | 12 | ||||||||||||

| Total investment services fees | 1,490 | 1,454 | 1,337 | 2 | 11 | ||||||||||||

| Foreign exchange revenue | 142 | 143 | 147 | (1) | (3) | ||||||||||||

Other fees (a) |

68 | 73 | 62 | (7) | 10 | ||||||||||||

| Total fee revenue | 1,700 | 1,670 | 1,546 | 2 | 10 | ||||||||||||

| Investment and other revenue | 62 | 119 | 97 | N/M | N/M | ||||||||||||

| Total fee and other revenue | 1,762 | 1,789 | 1,643 | (2) | 7 | ||||||||||||

| Net interest income | 735 | 670 | 681 | 10 | 8 | ||||||||||||

| Total revenue | 2,497 | 2,459 | 2,324 | 2 | 7 | ||||||||||||

| Provision for credit losses | (13) | (3) | 15 | N/M | N/M | ||||||||||||

| Noninterest expense | 1,672 | 1,656 | 1,666 | 1 | — | ||||||||||||

| Income before taxes | $ | 838 | $ | 806 | $ | 643 | 4 | % | 30 | % | |||||||

| Total revenue by line of business: | |||||||||||||||||

| Asset Servicing | $ | 1,945 | $ | 1,915 | $ | 1,797 | 2 | % | 8 | % | |||||||

| Issuer Services | 552 | 544 | 527 | 1 | 5 | ||||||||||||

| Total revenue by line of business | $ | 2,497 | $ | 2,459 | $ | 2,324 | 2 | % | 7 | % | |||||||

| Pre-tax operating margin | 34 | % | 33 | % | 28 | % | |||||||||||

Securities lending revenue (b) |

$ | 69 | $ | 62 | $ | 52 | 11 | % | 33 | % | |||||||

| Metrics: | |||||||||||||||||

| Average loans | $ | 11,439 | $ | 10,706 | $ | 11,553 | 7 | % | (1) | % | |||||||

| Average deposits | $ | 192,796 | $ | 183,081 | $ | 180,843 | 5 | % | 7 | % | |||||||

AUC/A at period end (in trillions) (current period is preliminary) (c) |

$ | 43.0 | $ | 41.7 | $ | 37.7 | 3 | % | 14 | % | |||||||

Market value of securities on loan at period end (in billions) (d) |

$ | 604 | $ | 554 | $ | 488 | 9 | % | 24 | % | |||||||

4 | ||

BNY 4Q25 Financial Results | ||

| (dollars in millions, unless otherwise noted; not meaningful - N/M) | 4Q25 vs. | ||||||||||||||||

| 4Q25 | 3Q25 | 4Q24 | 3Q25 | 4Q24 | |||||||||||||

| Investment services fees: | |||||||||||||||||

| Pershing | $ | 505 | $ | 508 | $ | 516 | (1) | % | (2) | % | |||||||

Payments and Trade (a) |

212 | 214 | 206 | (1) | 3 | ||||||||||||

| Clearance and Collateral Management | 417 | 398 | 364 | 5 | 15 | ||||||||||||

| Total investment services fees | 1,134 | 1,120 | 1,086 | 1 | 4 | ||||||||||||

| Foreign exchange revenue | 28 | 31 | 27 | (10) | 4 | ||||||||||||

Other fees (b) |

65 | 70 | 61 | (7) | 7 | ||||||||||||

| Total fee revenue | 1,227 | 1,221 | 1,174 | — | 5 | ||||||||||||

| Investment and other revenue | 9 | 22 | 19 | N/M | N/M | ||||||||||||

| Total fee and other revenue | 1,236 | 1,243 | 1,193 | (1) | 4 | ||||||||||||

| Net interest income | 569 | 524 | 474 | 9 | 20 | ||||||||||||

| Total revenue | 1,805 | 1,767 | 1,667 | 2 | 8 | ||||||||||||

| Provision for credit losses | (7) | (3) | 9 | N/M | N/M | ||||||||||||

| Noninterest expense | 930 | 895 | 852 | 4 | 9 | ||||||||||||

| Income before taxes | $ | 882 | $ | 875 | $ | 806 | 1 | % | 9 | % | |||||||

| Total revenue by line of business: | |||||||||||||||||

| Pershing | $ | 741 | $ | 729 | $ | 705 | 2 | % | 5 | % | |||||||

Payments and Trade (a) |

524 | 510 | 471 | 3 | 11 | ||||||||||||

| Clearance and Collateral Management | 540 | 528 | 491 | 2 | 10 | ||||||||||||

| Total revenue by line of business | $ | 1,805 | $ | 1,767 | $ | 1,667 | 2 | % | 8 | % | |||||||

| Pre-tax operating margin | 49 | % | 50 | % | 48 | % | |||||||||||

| Metrics: | |||||||||||||||||

| Average loans | $ | 49,613 | $ | 46,278 | $ | 42,217 | 7 | % | 18 | % | |||||||

| Average deposits | $ | 101,751 | $ | 97,497 | $ | 90,980 | 4 | % | 12 | % | |||||||

AUC/A at period end (in trillions) (current period is preliminary) (c) |

$ | 15.9 | $ | 15.8 | $ | 14.1 | 1 | % | 13 | % | |||||||

5 | ||

BNY 4Q25 Financial Results | ||

| (dollars in millions, unless otherwise noted; not meaningful - N/M) | 4Q25 vs. | ||||||||||||||||||||||

| 4Q25 | 3Q25 | 4Q24 | (a) | 3Q25 | 4Q24 | (a) | |||||||||||||||||

Investment management fees (a) |

$ | 793 | $ | 776 | $ | 789 | 2 | % | 1 | % | |||||||||||||

| Performance fees | 14 | 6 | 20 | N/M | N/M | ||||||||||||||||||

| Investment management and performance fees | 807 | 782 | 809 | 3 | — | ||||||||||||||||||

| Distribution and servicing fees | 69 | 69 | 68 | — | 1 | ||||||||||||||||||

Other fees (b) |

(84) | (78) | (64) | N/M | N/M | ||||||||||||||||||

| Total fee revenue | 792 | 773 | 813 | 2 | (3) | ||||||||||||||||||

Investment and other revenue (c) |

11 | 10 | 13 | N/M | N/M | ||||||||||||||||||

Total fee and other revenue (c) |

803 | 783 | 826 | 3 | (3) | ||||||||||||||||||

| Net interest income | 51 | 41 | 47 | 24 | 9 | ||||||||||||||||||

| Total revenue | 854 | 824 | 873 | 4 | (2) | ||||||||||||||||||

| Provision for credit losses | 3 | — | — | N/M | N/M | ||||||||||||||||||

Noninterest expense (a) |

703 | 640 | 700 | 10 | — | ||||||||||||||||||

| Income before taxes | $ | 148 | $ | 184 | $ | 173 | (20) | % | (14) | % | |||||||||||||

| Total revenue by line of business: | |||||||||||||||||||||||

Investment Management (a)(d) |

$ | 577 | $ | 559 | $ | 598 | 3 | % | (4) | % | |||||||||||||

Wealth Management (d) |

277 | 265 | 275 | 5 | 1 | ||||||||||||||||||

| Total revenue by line of business | $ | 854 | $ | 824 | $ | 873 | 4 | % | (2) | % | |||||||||||||

| Pre-tax operating margin | 17 | % | 22 | % | 20 | % | |||||||||||||||||

Adjusted pre-tax operating margin – Non-GAAP (e) |

19 | % | 24 | % | 22 | % | |||||||||||||||||

| Metrics: | |||||||||||||||||||||||

| Average loans | $ | 13,931 | $ | 14,143 | $ | 13,718 | (1) | % | 2 | % | |||||||||||||

| Average deposits | $ | 9,453 | $ | 9,201 | $ | 9,967 | 3 | % | (5) | % | |||||||||||||

AUM (in billions) (current period is preliminary) (f) |

$ | 2,178 | $ | 2,142 | $ | 2,029 | 2 | % | 7 | % | |||||||||||||

|

Wealth Management client assets (in billions) (current period

is preliminary) (g)

|

$ | 350 | $ | 348 | $ | 327 | 1 | % | 7 | % | |||||||||||||

6 | ||

BNY 4Q25 Financial Results | ||

| (dollars in millions) | 4Q25 | 3Q25 | 4Q24 | ||||||||

| Fee revenue | $ | (21) | $ | (27) | $ | (20) | |||||

| Investment and other revenue | 45 | 45 | 9 | ||||||||

| Total fee and other revenue | 24 | 18 | (11) | ||||||||

| Net interest (expense) income | (9) | 1 | (8) | ||||||||

| Total revenue | 15 | 19 | (19) | ||||||||

| Provision for credit losses | (9) | (1) | (4) | ||||||||

| Noninterest expense | 55 | 45 | 137 | ||||||||

| (Loss) before taxes | $ | (31) | $ | (25) | $ | (152) | |||||

7 | ||

BNY 4Q25 Financial Results | ||

Notable items by business segment (a) |

4Q25 | 4Q24 | |||||||||||||||||||||||||||||||||

| (dollars in millions) | Securities Services |

Market and Wealth Services | Investment and Wealth Management | Other | Total | Securities Services |

Market and Wealth Services | Investment and Wealth Management | Other | Total | |||||||||||||||||||||||||

| Fee and other revenue | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | |||||||||||||||

| Noninterest expense | 24 | 27 | 17 | (17) | 51 | 50 | 15 | 16 | 84 | 165 | |||||||||||||||||||||||||

| (Loss) income before taxes | $ | (24) | $ | (27) | $ | (17) | $ | 17 | $ | (51) | $ | (50) | $ | (15) | $ | (16) | $ | (84) | $ | (165) | |||||||||||||||

Notable items by business segment (a) |

3Q25 | |||||||||||||||||||

| (dollars in millions) | Securities Services |

Market and Wealth Services | Investment and Wealth Management | Other | Total | |||||||||||||||

| Fee and other revenue | $ | 12 | $ | — | $ | — | $ | — | $ | 12 | ||||||||||

| Noninterest expense | 38 | 8 | 2 | (9) | 39 | |||||||||||||||

| (Loss) income before taxes | $ | (26) | $ | (8) | $ | (2) | $ | 9 | $ | (27) | ||||||||||

Notable items by business segment (a) |

2025 | 2024 | |||||||||||||||||||||||||||||||||

| (dollars in millions) | Securities Services |

Market and Wealth Services | Investment and Wealth Management | Other | Total | Securities Services |

Market and Wealth Services | Investment and Wealth Management | Other | Total | |||||||||||||||||||||||||

| Fee and other revenue | $ | 52 | $ | — | $ | — | $ | — | $ | 52 | $ | — | $ | — | $ | — | $ | — | $ | — | |||||||||||||||

| Noninterest expense | 63 | 58 | 33 | (12) | 142 | 66 | 20 | 20 | 115 | 221 | |||||||||||||||||||||||||

| (Loss) income before taxes | $ | (11) | $ | (58) | $ | (33) | $ | 12 | $ | (90) | $ | (66) | $ | (20) | $ | (20) | $ | (115) | $ | (221) | |||||||||||||||

8 | ||

BNY 4Q25 Financial Results | ||

| Capital and liquidity ratios | Dec. 31, 2025 | Sept. 30, 2025 | Dec. 31, 2024 | ||||||||

Consolidated regulatory capital ratios: (a) |

|||||||||||

| CET1 ratio | 11.9 | % | 11.7 | % | 11.2 | % | |||||

| Tier 1 capital ratio | 14.6 | 14.4 | 13.7 | ||||||||

| Total capital ratio | 15.4 | 15.3 | 14.8 | ||||||||

Tier 1 leverage ratio (a) |

6.0 | 6.1 | 5.7 | ||||||||

Supplementary leverage ratio (a) |

6.7 | 6.7 | 6.5 | ||||||||

| BNY shareholders’ equity to total assets ratio | 9.4 | % | 9.6 | % | 9.9 | % | |||||

| BNY common shareholders’ equity to total assets ratio | 8.4 | % | 8.6 | % | 8.9 | % | |||||

Average LCR (a) |

112 | % | 112 | % | 115 | % | |||||

Average NSFR (a) |

130 | % | 130 | % | 132 | % | |||||

| Book value per common share | $ | 57.36 | $ | 55.99 | $ | 51.52 | |||||

Tangible book value per common share – Non-GAAP (b) |

$ | 31.64 | $ | 30.60 | $ | 27.05 | |||||

Common shares outstanding (in thousands) |

688,236 | 697,349 | 717,680 | ||||||||

| Net interest income | 4Q25 vs. | ||||||||||||||||

| (dollars in millions; not meaningful - N/M) | 4Q25 | 3Q25 | 4Q24 | 3Q25 | 4Q24 | ||||||||||||

| Net interest income | $ | 1,346 | $ | 1,236 | $ | 1,194 | 9% | 13% | |||||||||

| Add: Tax equivalent adjustment | — | — | 1 | N/M | N/M | ||||||||||||

Net interest income, on a fully taxable equivalent (“FTE”) basis – Non-GAAP (a) |

$ | 1,346 | $ | 1,236 | $ | 1,195 | 9% | 13% | |||||||||

| Average interest-earning assets | $ | 387,289 | $ | 374,493 | $ | 357,768 | 3% | 8% | |||||||||

| Net interest margin | 1.38 | % | 1.31 | % | 1.32 | % | 7 | bps | 6 | bps | |||||||

Net interest margin (FTE) – Non-GAAP (a) |

1.38 | % | 1.31 | % | 1.32 | % | 7 | bps | 6 | bps | |||||||

9 | ||

BNY 4Q25 Financial Results | ||

| (dollars in millions) | Quarter ended | Year ended | ||||||||||||||||||

| Dec. 31, 2025 | Sept. 30, 2025 | Dec. 31, 2024 | Dec. 31, 2025 | Dec. 31, 2024 | ||||||||||||||||

| Fee and other revenue | ||||||||||||||||||||

| Investment services fees | $ | 2,632 | $ | 2,585 | $ | 2,438 | $ | 10,211 | $ | 9,419 | ||||||||||

| Investment management and performance fees | 806 | 782 | 808 | 3,085 | 3,139 | |||||||||||||||

| Foreign exchange revenue | 171 | 166 | 177 | 706 | 688 | |||||||||||||||

| Financing-related fees | 53 | 67 | 53 | 231 | 216 | |||||||||||||||

| Distribution and servicing fees | 36 | 37 | 37 | 146 | 158 | |||||||||||||||

| Total fee revenue | 3,698 | 3,637 | 3,513 | 14,379 | 13,620 | |||||||||||||||

| Investment and other revenue | 135 | 208 | 140 | 757 | 687 | |||||||||||||||

| Total fee and other revenue | 3,833 | 3,845 | 3,653 | 15,136 | 14,307 | |||||||||||||||

| Net interest income | ||||||||||||||||||||

| Interest income | 6,307 | 6,594 | 6,467 | 25,626 | 25,607 | |||||||||||||||

| Interest expense | 4,961 | 5,358 | 5,273 | 20,682 | 21,295 | |||||||||||||||

| Net interest income | 1,346 | 1,236 | 1,194 | 4,944 | 4,312 | |||||||||||||||

| Total revenue | 5,179 | 5,081 | 4,847 | 20,080 | 18,619 | |||||||||||||||

| Provision for credit losses | (26) | (7) | 20 | (32) | 70 | |||||||||||||||

| Noninterest expense | ||||||||||||||||||||

| Staff | 1,812 | 1,745 | 1,817 | 7,159 | 7,130 | |||||||||||||||

| Software and equipment | 565 | 542 | 520 | 2,147 | 1,962 | |||||||||||||||

| Professional, legal and other purchased services | 429 | 404 | 410 | 1,587 | 1,503 | |||||||||||||||

| Sub-custodian and clearing | 139 | 141 | 128 | 561 | 498 | |||||||||||||||

| Net occupancy | 143 | 140 | 149 | 551 | 537 | |||||||||||||||

| Distribution and servicing | 73 | 68 | 87 | 269 | 361 | |||||||||||||||

| Business development | 71 | 45 | 54 | 217 | 188 | |||||||||||||||

| Bank assessment charges | (22) | 6 | 16 | 44 | 36 | |||||||||||||||

| Amortization of intangible assets | 11 | 12 | 13 | 45 | 50 | |||||||||||||||

| Other | 139 | 133 | 161 | 474 | 436 | |||||||||||||||

| Total noninterest expense | 3,360 | 3,236 | 3,355 | 13,054 | 12,701 | |||||||||||||||

| Income | ||||||||||||||||||||

| Income before taxes | 1,845 | 1,852 | 1,472 | 7,058 | 5,848 | |||||||||||||||

| Provision for income taxes | 376 | 395 | 315 | 1,475 | 1,305 | |||||||||||||||

| Net income | 1,469 | 1,457 | 1,157 | 5,583 | 4,543 | |||||||||||||||

| Net (income) attributable to noncontrolling interests related to consolidated investment management funds | (8) | (12) | (2) | (34) | (13) | |||||||||||||||

| Net income applicable to shareholders of The Bank of New York Mellon Corporation | 1,461 | 1,445 | 1,155 | 5,549 | 4,530 | |||||||||||||||

| Preferred stock dividends | (34) | (106) | (25) | (243) | (194) | |||||||||||||||

| Net income applicable to common shareholders of The Bank of New York Mellon Corporation | $ | 1,427 | $ | 1,339 | $ | 1,130 | $ | 5,306 | $ | 4,336 | ||||||||||

| Earnings per share applicable to the common shareholders of The Bank of New York Mellon Corporation | Quarter ended | Year ended | ||||||||||||||||||

| Dec. 31, 2025 | Sept. 30, 2025 | Dec. 31, 2024 | Dec. 31, 2025 | Dec. 31, 2024 | ||||||||||||||||

| (in dollars) | ||||||||||||||||||||

| Basic | $ | 2.04 | $ | 1.90 | $ | 1.56 | $ | 7.47 | $ | 5.84 | ||||||||||

| Diluted | $ | 2.02 | $ | 1.88 | $ | 1.54 | $ | 7.40 | $ | 5.80 | ||||||||||

10 | ||

BNY 4Q25 Financial Results | ||

| Reconciliation of Non-GAAP measures, excluding notable items | 4Q25 vs. | |||||||||||||||||||||||||

| (dollars in millions, except per share amounts) | 4Q25 | 3Q25 | 4Q24 | 3Q25 | 4Q24 | |||||||||||||||||||||

| Total revenue – GAAP | $ | 5,179 | $ | 5,081 | $ | 4,847 | 2 | % | 7 | % | ||||||||||||||||

Less: Disposal gain (a) |

— | 12 | — | |||||||||||||||||||||||

| Adjusted total revenue – Non-GAAP | $ | 5,179 | $ | 5,069 | $ | 4,847 | 2 | % | 7 | % | ||||||||||||||||

| Total noninterest expense – GAAP | $ | 3,360 | $ | 3,236 | $ | 3,355 | 4 | % | — | % | ||||||||||||||||

Less: Severance expense (b) |

98 | 50 | 135 | |||||||||||||||||||||||

Litigation reserves (b) |

3 | 3 | 38 | |||||||||||||||||||||||

FDIC special assessment (b) |

(50) | (14) | (8) | |||||||||||||||||||||||

| Adjusted total noninterest expense – Non-GAAP | $ | 3,309 | $ | 3,197 | $ | 3,190 | 4 | % | 4 | % | ||||||||||||||||

| Net income applicable to common shareholders of The Bank of New York Mellon Corporation – GAAP | $ | 1,427 | $ | 1,339 | $ | 1,130 | 7 | % | 26 | % | ||||||||||||||||

Less: Disposal gain (a) |

— | 9 | — | |||||||||||||||||||||||

Severance expense (b) |

(74) | (39) | (103) | |||||||||||||||||||||||

Litigation reserves (b) |

(6) | (2) | (37) | |||||||||||||||||||||||

FDIC special assessment (b) |

37 | 11 | 6 | |||||||||||||||||||||||

| Adjusted net income applicable to common shareholders of The Bank of New York Mellon Corporation – Non-GAAP | $ | 1,470 | $ | 1,360 | $ | 1,264 | 8 | % | 16 | % | ||||||||||||||||

| Diluted earnings per common share – GAAP | $ | 2.02 | $ | 1.88 | $ | 1.54 | 7 | % | 31 | % | ||||||||||||||||

Less: Disposal gain (a) |

— | 0.01 | — | |||||||||||||||||||||||

Severance expense (b) |

(0.11) | (0.05) | (0.14) | |||||||||||||||||||||||

Litigation reserves (b) |

(0.01) | — | (0.05) | |||||||||||||||||||||||

FDIC special assessment (b) |

0.05 | 0.01 | 0.01 | |||||||||||||||||||||||

| Total diluted earnings per common share impact of notable items | (0.06) | (c) | (0.03) | (0.18) | ||||||||||||||||||||||

| Adjusted diluted earnings per common share – Non-GAAP | $ | 2.08 | $ | 1.91 | $ | 1.72 | 9 | % | 21 | % | ||||||||||||||||

Operating leverage – GAAP (d) |

(190) | bps | 670 | bps | ||||||||||||||||||||||

Adjusted operating leverage – Non-GAAP (d) |

(133) | bps | 312 | bps | ||||||||||||||||||||||

11 | ||

BNY 4Q25 Financial Results | ||

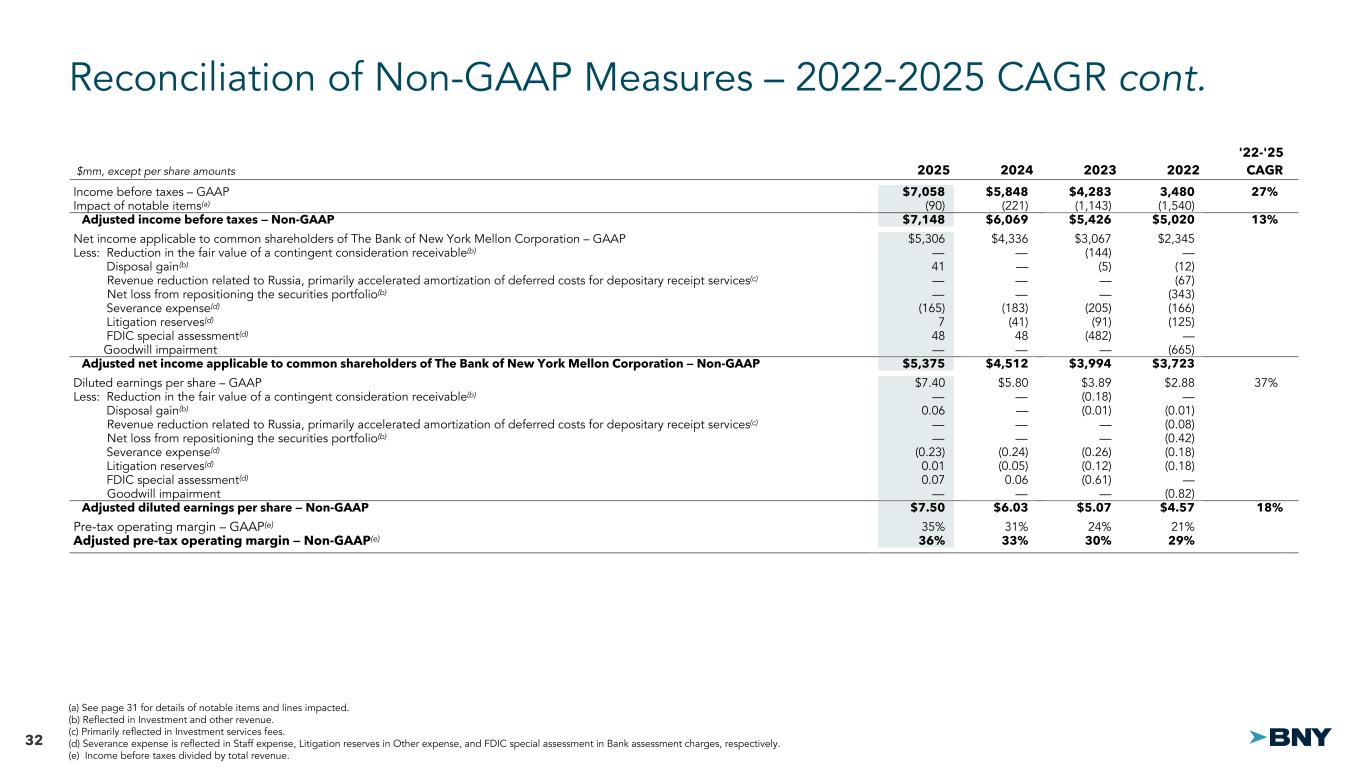

| Reconciliation of Non-GAAP measures, excluding notable items | 2025 vs. | ||||||||||||||||

| (dollars in millions, except per share amounts) | 2025 | 2024 | 2024 | ||||||||||||||

| Total revenue – GAAP | $ | 20,080 | $ | 18,619 | 8 | % | |||||||||||

Less: Disposal gain (a) |

52 | — | |||||||||||||||

| Adjusted total revenue – Non-GAAP | $ | 20,028 | $ | 18,619 | 8 | % | |||||||||||

| Total noninterest expense – GAAP | $ | 13,054 | $ | 12,701 | 3 | % | |||||||||||

Less: Severance expense (b) |

214 | 240 | |||||||||||||||

Litigation reserves (b) |

(8) | 44 | |||||||||||||||

FDIC special assessment (b) |

(64) | (63) | |||||||||||||||

| Adjusted total noninterest expense – Non-GAAP | $ | 12,912 | $ | 12,480 | 3 | % | |||||||||||

| Net income applicable to common shareholders of The Bank of New York Mellon Corporation – GAAP |

$ | 5,306 | $ | 4,336 | 22 | % | |||||||||||

Less: Disposal gain (a) |

41 | — | |||||||||||||||

Severance expense (b) |

(165) | (183) | |||||||||||||||

Litigation reserves (b) |

7 | (41) | |||||||||||||||

FDIC special assessment (b) |

48 | 48 | |||||||||||||||

| Adjusted net income applicable to common shareholders of The Bank of New York Mellon Corporation – Non-GAAP | $ | 5,375 | $ | 4,512 | 19 | % | |||||||||||

| Diluted earnings per share – GAAP | $ | 7.40 | $ | 5.80 | 28 | % | |||||||||||

Less: Disposal gain (a) |

0.06 | — | |||||||||||||||

Severance expense (b) |

(0.23) | (0.24) | |||||||||||||||

Litigation reserves (b) |

0.01 | (0.05) | |||||||||||||||

FDIC special assessment (b) |

0.07 | 0.06 | |||||||||||||||

| Total diluted earnings per common share impact of notable items | $ | (0.10) | (c) | $ | (0.23) | ||||||||||||

| Adjusted diluted earnings per common share – Non-GAAP | $ | 7.50 | $ | 6.03 | 24 | % | |||||||||||

Operating leverage – GAAP (d) |

507 | bps | |||||||||||||||

Adjusted operating leverage – Non-GAAP (d) |

411 | bps | |||||||||||||||

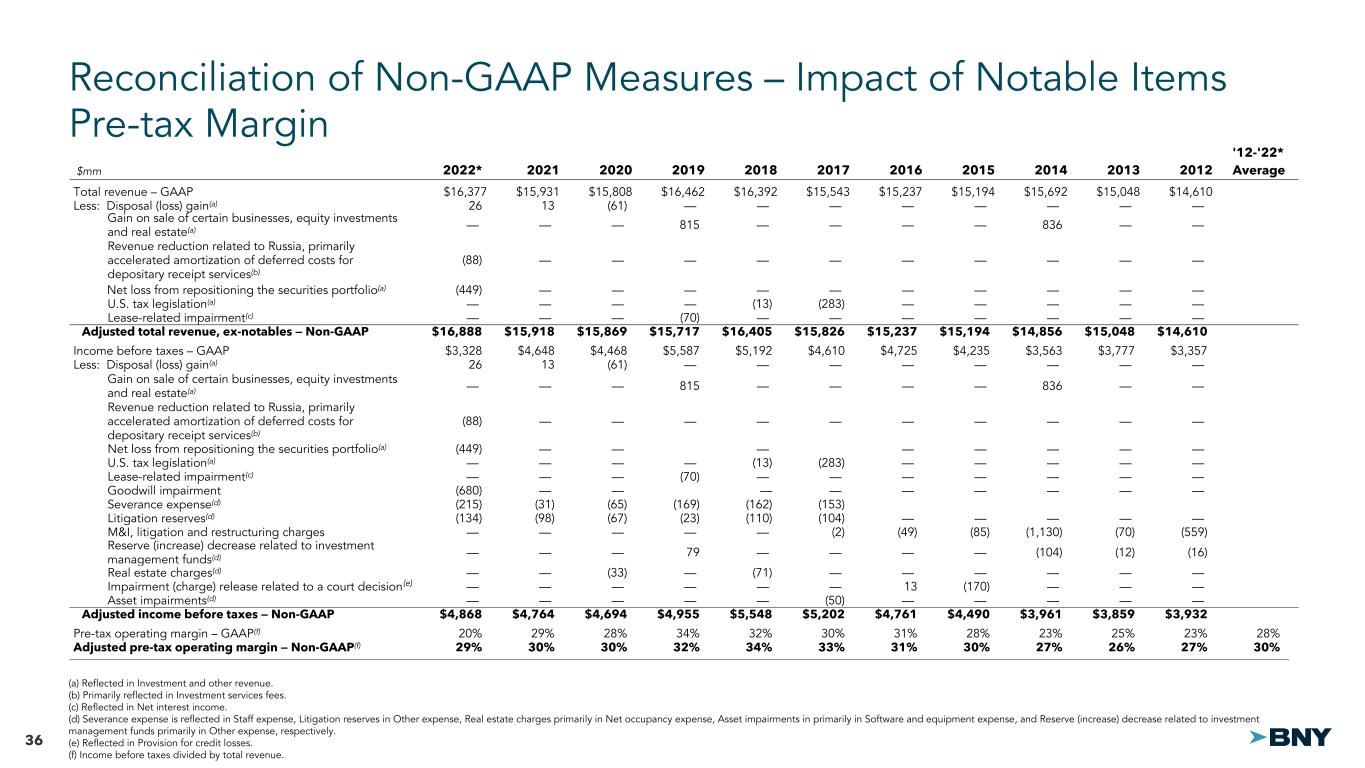

| Pre-tax operating margin reconciliation | ||||||||||||||||||||

| (dollars in millions) | 4Q25 | 3Q25 | 4Q24 | 2025 | 2024 | |||||||||||||||

| Income before taxes – GAAP | $ | 1,845 | $ | 1,852 | $ | 1,472 | $ | 7,058 | $ | 5,848 | ||||||||||

Impact of notable items (a) |

(51) | (27) | (165) | (90) | (221) | |||||||||||||||

| Adjusted income before taxes, excluding notable items – Non-GAAP | $ | 1,896 | $ | 1,879 | $ | 1,637 | $ | 7,148 | $ | 6,069 | ||||||||||

| Total revenue – GAAP | $ | 5,179 | $ | 5,081 | $ | 4,847 | $ | 20,080 | $ | 18,619 | ||||||||||

Impact of notable items (a) |

— | 12 | — | 52 | — | |||||||||||||||

| Adjusted total revenue, excluding notable items – Non-GAAP | $ | 5,179 | $ | 5,069 | $ | 4,847 | $ | 20,028 | $ | 18,619 | ||||||||||

Pre-tax operating margin – GAAP (b) |

36 | % | 36 | % | 30 | % | 35 | % | 31 | % | ||||||||||

Adjusted pre-tax operating margin – Non-GAAP (b) |

37 | % | 37 | % | 34 | % | 36 | % | 33 | % | ||||||||||

12 | ||

BNY 4Q25 Financial Results | ||

| Return on common equity and return on tangible common equity reconciliation | ||||||||||||||||||||

| (dollars in millions) | 4Q25 | 3Q25 | 4Q24 | 2025 | 2024 | |||||||||||||||

| Net income applicable to common shareholders of The Bank of New York Mellon Corporation – GAAP | $ | 1,427 | $ | 1,339 | $ | 1,130 | $ | 5,306 | $ | 4,336 | ||||||||||

| Add: Amortization of intangible assets | 11 | 12 | 13 | 45 | 50 | |||||||||||||||

| Less: Tax impact of amortization of intangible assets | 3 | 3 | 3 | 11 | 12 | |||||||||||||||

| Adjusted net income applicable to common shareholders of The Bank of New York Mellon Corporation, excluding amortization of intangible assets – Non-GAAP | $ | 1,435 | $ | 1,348 | $ | 1,140 | $ | 5,340 | $ | 4,374 | ||||||||||

Impact of notable items (a) |

(43) | (21) | (134) | (69) | (176) | |||||||||||||||

| Adjusted net income applicable to common shareholders of The Bank of New York Mellon Corporation, excluding amortization of intangible assets and notable items – Non-GAAP | $ | 1,478 | $ | 1,369 | $ | 1,274 | $ | 5,409 | $ | 4,550 | ||||||||||

| Average common shareholders’ equity | $ | 39,142 | $ | 38,626 | $ | 36,923 | $ | 38,167 | $ | 36,413 | ||||||||||

| Less: Average goodwill | 16,777 | 16,787 | 16,515 | 16,733 | 16,316 | |||||||||||||||

| Average intangible assets | 2,827 | 2,842 | 2,846 | 2,842 | 2,839 | |||||||||||||||

| Add: Deferred tax liability – tax deductible goodwill | 1,227 | 1,236 | 1,221 | 1,227 | 1,221 | |||||||||||||||

| Deferred tax liability – intangible assets | 662 | 665 | 665 | 662 | 665 | |||||||||||||||

| Average tangible common shareholders’ equity – Non-GAAP | $ | 21,427 | $ | 20,898 | $ | 19,448 | $ | 20,481 | $ | 19,144 | ||||||||||

Return on common equity – GAAP (b) |

14.5 | % | 13.7 | % | 12.2 | % | 13.9 | % | 11.9 | % | ||||||||||

Adjusted return on common equity – Non-GAAP (b) |

14.9 | % | 14.0 | % | 13.6 | % | 14.1 | % | 12.4 | % | ||||||||||

Return on tangible common equity – Non-GAAP (b) |

26.6 | % | 25.6 | % | 23.3 | % | 26.1 | % | 22.8 | % | ||||||||||

Adjusted return on tangible common equity – Non-GAAP (b) |

27.4 | % | 26.0 | % | 26.1 | % | 26.4 | % | 23.8 | % | ||||||||||

13 | ||

BNY 4Q25 Financial Results | ||

14 | ||

| The Bank of New York Mellon Corporation | ||

| Financial Supplement | ||

| Fourth Quarter 2025 | ||

| Table of Contents |  |

|||||||

| Consolidated Results | Page | |||||||

| Consolidated Financial Highlights | ||||||||

| Condensed Consolidated Income Statement | ||||||||

| Condensed Consolidated Balance Sheet | ||||||||

| Fee and Other Revenue | ||||||||

| Average Balances and Interest Rates | ||||||||

| Capital and Liquidity | ||||||||

| Business Segment Results | ||||||||

| Securities Services Business Segment | ||||||||

| Market and Wealth Services Business Segment | ||||||||

| Investment and Wealth Management Business Segment | ||||||||

| AUM by Product Type, Changes in AUM and Wealth Management Client Assets | ||||||||

| Other Segment | ||||||||

| Other | ||||||||

| Securities Portfolio | ||||||||

| Allowance for Credit Losses and Nonperforming Assets | ||||||||

| Supplemental Information | ||||||||

| Explanation of GAAP and Non-GAAP Financial Measures | ||||||||

| THE BANK OF NEW YORK MELLON CORPORATION |  |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in millions, except per common share amounts, or unless otherwise noted) | 4Q25 vs. | FY25 vs. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q25 | 3Q25 | 2Q25 | 1Q25 | 4Q24 | 3Q25 | 4Q24 | FY25 | FY24 | FY24 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Selected income statement data | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fee and other revenue | $ | 3,833 | $ | 3,845 | $ | 3,825 | $ | 3,633 | $ | 3,653 | — | % | 5 | % | $ | 15,136 | $ | 14,307 | 6 | % | ||||||||||||||||||||||||||||||||||||||||||

| Net interest income | 1,346 | 1,236 | 1,203 | 1,159 | 1,194 | 9 | 13 | 4,944 | 4,312 | 15 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | 5,179 | 5,081 | 5,028 | 4,792 | 4,847 | 2 | 7 | 20,080 | 18,619 | 8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | (26) | (7) | (17) | 18 | 20 | N/M | N/M | (32) | 70 | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense | 3,360 | 3,236 | 3,206 | 3,252 | 3,355 | 4 | — | 13,054 | 12,701 | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income before income taxes | 1,845 | 1,852 | 1,839 | 1,522 | 1,472 | — | 25 | 7,058 | 5,848 | 21 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for income taxes | 376 | 395 | 404 | 300 | 315 | (5) | 19 | 1,475 | 1,305 | 13 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | $ | 1,469 | $ | 1,457 | $ | 1,435 | $ | 1,222 | $ | 1,157 | 1 | % | 27 | % | $ | 5,583 | $ | 4,543 | 23 | % | ||||||||||||||||||||||||||||||||||||||||||

| Net income applicable to common shareholders of The Bank of New York Mellon Corporation | $ | 1,427 | $ | 1,339 | $ | 1,391 | $ | 1,149 | $ | 1,130 | 7 | % | 26 | % | $ | 5,306 | $ | 4,336 | 22 | % | ||||||||||||||||||||||||||||||||||||||||||

| Diluted earnings per common share | $ | 2.02 | $ | 1.88 | $ | 1.93 | $ | 1.58 | $ | 1.54 | 7 | % | 31 | % | $ | 7.40 | $ | 5.80 | 28 | % | ||||||||||||||||||||||||||||||||||||||||||

Average common shares and equivalents outstanding – diluted (in thousands) |

705,140 | 712,854 | 720,007 | 727,398 | 733,720 | (1) | % | (4) | % | 716,718 | 748,101 | (4) | % | |||||||||||||||||||||||||||||||||||||||||||||||||

Financial ratios (Quarterly returns are annualized) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pre-tax operating margin | 36 | % | 36 | % | 37 | % | 32 | % | 30 | % | 35 | % | 31 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Return on common equity | 14.5 | % | 13.7 | % | 14.7 | % | 12.6 | % | 12.2 | % | 13.9 | % | 11.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

Return on tangible common equity – Non-GAAP (a) |

26.6 | % | 25.6 | % | 27.8 | % | 24.2 | % | 23.3 | % | 26.1 | % | 22.8 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Non-U.S. revenue as a percentage of total revenue | 36 | % | 35 | % | 36 | % | 33 | % | 35 | % | 35 | % | 35 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Period end | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Assets under custody and/or administration (“AUC/A”) (in trillions) (b) |

$ | 59.3 | $ | 57.8 | $ | 55.8 | $ | 53.1 | $ | 52.1 | 3 | % | 14 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

Assets under management (“AUM”) (in trillions) |

$ | 2.2 | $ | 2.1 | $ | 2.1 | $ | 2.0 | $ | 2.0 | 2 | % | 7 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Full-time employees | 48,100 | 49,200 | 49,900 | 51,000 | 51,800 | (2) | % | (7) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Book value per common share | $ | 57.36 | $ | 55.99 | $ | 54.76 | $ | 52.82 | $ | 51.52 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Tangible book value per common share – Non-GAAP (a) |

$ | 31.64 | $ | 30.60 | $ | 29.57 | $ | 28.20 | $ | 27.05 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash dividends per common share | $ | 0.53 | $ | 0.53 | $ | 0.47 | $ | 0.47 | $ | 0.47 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common dividend payout ratio | 26 | % | 28 | % | 25 | % | 30 | % | 31 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Closing stock price per common share | $ | 116.09 | $ | 108.96 | $ | 91.11 | $ | 83.87 | $ | 76.83 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Market capitalization | $ | 79,897 | $ | 75,983 | $ | 64,254 | $ | 60,003 | $ | 55,139 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Common shares outstanding (in thousands) |

688,236 | 697,349 | 705,241 | 715,434 | 717,680 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Capital ratios at period end (c) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common Equity Tier 1 (“CET1”) ratio | 11.9 | % | 11.7 | % | 11.5 | % | 11.5 | % | 11.2 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tier 1 capital ratio | 14.6 | % | 14.4 | % | 14.5 | % | 14.6 | % | 13.7 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total capital ratio | 15.4 | % | 15.3 | % | 15.5 | % | 15.7 | % | 14.8 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tier 1 leverage ratio | 6.0 | % | 6.1 | % | 6.1 | % | 6.2 | % | 5.7 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Supplementary leverage ratio (“SLR”) | 6.7 | % | 6.7 | % | 6.9 | % | 6.9 | % | 6.5 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) Non-GAAP information, for all periods presented, excludes goodwill and intangible assets, net of deferred tax liabilities. See “Explanation of GAAP and Non-GAAP Financial Measures” beginning on page 18 for the reconciliation of Non-GAAP measures. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) Includes the AUC/A of CIBC Mellon Trust Company (“CIBC Mellon”), a joint venture with the Canadian Imperial Bank of Commerce, of $2.2 trillion at Dec. 31, 2025, $2.1 trillion at Sept. 30, 2025, $2.0 trillion at June 30, 2025, $1.9 trillion at March 31, 2025 and $1.8 trillion at Dec. 31, 2024. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(c) Regulatory capital ratios for Dec. 31, 2025 are preliminary. For our CET1, Tier 1 capital and Total capital ratios, our effective capital ratios under the U.S. capital rules are the lower of the ratios as calculated under the Standardized and Advanced Approaches, which for the periods presented, was the Standardized Approach. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| N/M – Not meaningful. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| THE BANK OF NEW YORK MELLON CORPORATION |  |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CONDENSED CONSOLIDATED INCOME STATEMENT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in millions, except per share amounts; common shares in thousands) | 4Q25 vs. | FY25 vs. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q25 | 3Q25 | 2Q25 | 1Q25 | 4Q24 | 3Q25 | 4Q24 | FY25 | FY24 | FY24 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revenue | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment services fees | $ | 2,632 | $ | 2,585 | $ | 2,583 | $ | 2,411 | $ | 2,438 | 2 | % | 8 | % | $ | 10,211 | $ | 9,419 | 8 | % | ||||||||||||||||||||||||||||||||||||||||||

| Investment management and performance fees | 806 | 782 | 758 | 739 | 808 | 3 | — | 3,085 | 3,139 | (2) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign exchange revenue | 171 | 166 | 213 | 156 | 177 | 3 | (3) | 706 | 688 | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financing-related fees | 53 | 67 | 51 | 60 | 53 | (21) | — | 231 | 216 | 7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Distribution and servicing fees | 36 | 37 | 36 | 37 | 37 | (3) | (3) | 146 | 158 | (8) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total fee revenue | 3,698 | 3,637 | 3,641 | 3,403 | 3,513 | 2 | 5 | 14,379 | 13,620 | 6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment and other revenue | 135 | 208 | 184 | 230 | 140 | N/M | N/M | 757 | 687 | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total fee and other revenue | 3,833 | 3,845 | 3,825 | 3,633 | 3,653 | — | 5 | 15,136 | 14,307 | 6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | 1,346 | 1,236 | 1,203 | 1,159 | 1,194 | 9 | 13 | 4,944 | 4,312 | 15 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | 5,179 | 5,081 | 5,028 | 4,792 | 4,847 | 2 | 7 | 20,080 | 18,619 | 8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | (26) | (7) | (17) | 18 | 20 | N/M | N/M | (32) | 70 | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Staff | 1,812 | 1,745 | 1,768 | 1,834 | 1,817 | 4 | — | 7,159 | 7,130 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Software and equipment | 565 | 542 | 527 | 513 | 520 | 4 | 9 | 2,147 | 1,962 | 9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Professional, legal and other purchased services | 429 | 404 | 388 | 366 | 410 | 6 | 5 | 1,587 | 1,503 | 6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sub-custodian and clearing | 139 | 141 | 150 | 131 | 128 | (1) | 9 | 561 | 498 | 13 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net occupancy | 143 | 140 | 132 | 136 | 149 | 2 | (4) | 551 | 537 | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Distribution and servicing | 73 | 68 | 63 | 65 | 87 | 7 | (16) | 269 | 361 | (25) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Business development | 71 | 45 | 53 | 48 | 54 | 58 | 31 | 217 | 188 | 15 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bank assessment charges | (22) | 6 | 22 | 38 | 16 | N/M | N/M | 44 | 36 | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of intangible assets | 11 | 12 | 11 | 11 | 13 | (8) | (15) | 45 | 50 | (10) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 139 | 133 | 92 | 110 | 161 | 5 | (14) | 474 | 436 | 9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total noninterest expense | 3,360 | 3,236 | 3,206 | 3,252 | 3,355 | 4 | — | 13,054 | 12,701 | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income before income taxes | 1,845 | 1,852 | 1,839 | 1,522 | 1,472 | — | 25 | 7,058 | 5,848 | 21 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for income taxes | 376 | 395 | 404 | 300 | 315 | (5) | 19 | 1,475 | 1,305 | 13 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | 1,469 | 1,457 | 1,435 | 1,222 | 1,157 | 1 | 27 | 5,583 | 4,543 | 23 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net (income) attributable to noncontrolling interests | (8) | (12) | (12) | (2) | (2) | N/M | N/M | (34) | (13) | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Preferred stock dividends | (34) | (106) | (32) | (71) | (25) | N/M | N/M | (243) | (194) | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income applicable to common shareholders of The Bank of New York Mellon Corporation | $ | 1,427 | $ | 1,339 | $ | 1,391 | $ | 1,149 | $ | 1,130 | 7 | % | 26 | % | $ | 5,306 | $ | 4,336 | 22 | % | ||||||||||||||||||||||||||||||||||||||||||

| Average common shares and equivalents outstanding: Basic | 697,540 | 705,873 | 714,799 | 720,951 | 726,568 | (1) | % | (4) | % | 710,177 | 742,588 | (4) | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Diluted | 705,140 | 712,854 | 720,007 | 727,398 | 733,720 | (1) | % | (4) | % | 716,718 | 748,101 | (4) | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Earnings per common share: Basic | $ | 2.04 | $ | 1.90 | $ | 1.95 | $ | 1.59 | $ | 1.56 | 7 | % | 31 | % | $ | 7.47 | $ | 5.84 | 28 | % | ||||||||||||||||||||||||||||||||||||||||||

| Diluted | $ | 2.02 | $ | 1.88 | $ | 1.93 | $ | 1.58 | $ | 1.54 | 7 | % | 31 | % | $ | 7.40 | $ | 5.80 | 28 | % | ||||||||||||||||||||||||||||||||||||||||||

| N/M – Not meaningful. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| THE BANK OF NEW YORK MELLON CORPORATION |  |

|||||||||||||||||||||||||||||||

| CONDENSED CONSOLIDATED BALANCE SHEET | ||||||||||||||||||||||||||||||||

| 2025 | 2024 | |||||||||||||||||||||||||||||||

| (dollars in millions) | Dec. 31 | Sept. 30 | June 30 | March 31 | Dec. 31 | |||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||

| Cash and due from banks | $ | 5,111 | $ | 5,055 | $ | 5,699 | $ | 5,354 | $ | 4,178 | ||||||||||||||||||||||

| Interest-bearing deposits with the Federal Reserve and other central banks | 116,009 | 106,368 | 135,602 | 102,303 | 89,546 | |||||||||||||||||||||||||||

| Interest-bearing deposits with banks | 10,397 | 11,027 | 12,069 | 11,945 | 9,612 | |||||||||||||||||||||||||||

| Federal funds sold and securities purchased under resale agreements | 44,892 | 41,863 | 45,547 | 41,316 | 41,146 | |||||||||||||||||||||||||||

| Securities | 150,200 | 149,528 | 147,068 | 145,385 | 136,627 | |||||||||||||||||||||||||||

| Trading assets | 14,276 | 13,625 | 12,610 | 11,978 | 13,981 | |||||||||||||||||||||||||||

| Loans | 80,615 | 75,195 | 73,096 | 71,404 | 71,570 | |||||||||||||||||||||||||||

| Allowance for loan losses | (245) | (272) | (275) | (295) | (294) | |||||||||||||||||||||||||||

Net loans |

80,370 | 74,923 | 72,821 | 71,109 | 71,276 | |||||||||||||||||||||||||||

| Premises and equipment | 3,581 | 3,549 | 3,289 | 3,257 | 3,266 | |||||||||||||||||||||||||||

| Accrued interest receivable | 1,435 | 1,426 | 1,348 | 1,302 | 1,293 | |||||||||||||||||||||||||||

| Goodwill | 16,767 | 16,773 | 16,823 | 16,661 | 16,598 | |||||||||||||||||||||||||||

| Intangible assets | 2,822 | 2,834 | 2,849 | 2,846 | 2,851 | |||||||||||||||||||||||||||

| Other assets | 26,440 | 28,341 | 30,056 | 27,235 | 25,690 | |||||||||||||||||||||||||||

Total assets |

$ | 472,300 | $ | 455,312 | $ | 485,781 | $ | 440,691 | $ | 416,064 | ||||||||||||||||||||||

| Liabilities | ||||||||||||||||||||||||||||||||

| Deposits | $ | 331,894 | $ | 314,697 | $ | 346,393 | $ | 308,644 | $ | 289,524 | ||||||||||||||||||||||

| Federal funds purchased and securities sold under repurchase agreements | 18,992 | 16,585 | 15,492 | 15,663 | 14,064 | |||||||||||||||||||||||||||

| Trading liabilities | 6,135 | 3,499 | 6,134 | 4,580 | 4,865 | |||||||||||||||||||||||||||

| Payables to customers and broker-dealers | 21,872 | 23,638 | 21,273 | 22,244 | 20,073 | |||||||||||||||||||||||||||

| Commercial paper | 2,003 | 2,364 | 2,361 | 1,662 | 301 | |||||||||||||||||||||||||||

| Other borrowed funds | 422 | 283 | 293 | 212 | 225 | |||||||||||||||||||||||||||

| Accrued taxes and other expenses | 5,544 | 4,920 | 4,634 | 4,438 | 5,270 | |||||||||||||||||||||||||||

| Other liabilities | 8,757 | 12,678 | 11,233 | 8,756 | 9,124 | |||||||||||||||||||||||||||

| Long-term debt | 31,873 | 32,287 | 33,429 | 30,869 | 30,854 | |||||||||||||||||||||||||||

Total liabilities |

427,492 | 410,951 | 441,242 | 397,068 | 374,300 | |||||||||||||||||||||||||||

| Temporary equity | ||||||||||||||||||||||||||||||||

| Redeemable noncontrolling interests | 87 | 111 | 111 | 94 | 87 | |||||||||||||||||||||||||||

| Permanent equity | ||||||||||||||||||||||||||||||||

| Preferred stock | 4,836 | 4,836 | 5,331 | 5,331 | 4,343 | |||||||||||||||||||||||||||

| Common stock | 14 | 14 | 14 | 14 | 14 | |||||||||||||||||||||||||||

| Additional paid-in capital | 29,907 | 29,795 | 29,659 | 29,535 | 29,321 | |||||||||||||||||||||||||||

| Retained earnings | 46,396 | 45,346 | 44,388 | 43,343 | 42,537 | |||||||||||||||||||||||||||

| Accumulated other comprehensive loss, net of tax | (3,035) | (3,362) | (3,549) | (4,115) | (4,656) | |||||||||||||||||||||||||||

Less: Treasury stock, at cost |

(33,805) | (32,750) | (31,893) | (30,989) | (30,241) | |||||||||||||||||||||||||||

| Total The Bank of New York Mellon Corporation shareholders’ equity | 44,313 | 43,879 | 43,950 | 43,119 | 41,318 | |||||||||||||||||||||||||||

Nonredeemable noncontrolling interests of consolidated investment management funds |

408 | 371 | 478 | 410 | 359 | |||||||||||||||||||||||||||

Total permanent equity |

44,721 | 44,250 | 44,428 | 43,529 | 41,677 | |||||||||||||||||||||||||||

Total liabilities, temporary equity and permanent equity |

$ | 472,300 | $ | 455,312 | $ | 485,781 | $ | 440,691 | $ | 416,064 | ||||||||||||||||||||||

| THE BANK OF NEW YORK MELLON CORPORATION |  |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FEE AND OTHER REVENUE | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q25 vs. | FY25 vs. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in millions) | 4Q25 | 3Q25 | 2Q25 | 1Q25 | 4Q24 | 3Q25 | 4Q24 | FY25 | FY24 | FY24 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment services fees | $ | 2,632 | $ | 2,585 | $ | 2,583 | $ | 2,411 | $ | 2,438 | 2 | % | 8 | % | $ | 10,211 | $ | 9,419 | 8 | % | ||||||||||||||||||||||||||||||||||||||||||

| Investment management and performance fees: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Investment management fees (a) |

792 | 776 | 748 | 734 | 788 | 2 | 1 | 3,050 | 3,088 | (1) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Performance fees | 14 | 6 | 10 | 5 | 20 | N/M | N/M | 35 | 51 | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Total investment management and performance fees (b) |

806 | 782 | 758 | 739 | 808 | 3 | — | 3,085 | 3,139 | (2) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign exchange revenue | 171 | 166 | 213 | 156 | 177 | 3 | (3) | 706 | 688 | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financing-related fees | 53 | 67 | 51 | 60 | 53 | (21) | — | 231 | 216 | 7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Distribution and servicing fees | 36 | 37 | 36 | 37 | 37 | (3) | (3) | 146 | 158 | (8) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total fee revenue | 3,698 | 3,637 | 3,641 | 3,403 | 3,513 | 2 | 5 | 14,379 | 13,620 | 6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment and other revenue: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income (loss) from consolidated investment management funds | 19 | 23 | 35 | 6 | (5) | N/M | N/M | 83 | 46 | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Seed capital gains (losses) (c) |

4 | 8 | 8 | (6) | 3 | N/M | N/M | 14 | 20 | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other trading revenue | 76 | 73 | 59 | 71 | 89 | N/M | N/M | 279 | 314 | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Renewable energy investment gains | 6 | 19 | 15 | 15 | 5 | N/M | N/M | 55 | 25 | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate/bank-owned life insurance | 51 | 41 | 35 | 38 | 47 | N/M | N/M | 165 | 137 | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Other investments (losses) gains (d) |

(43) | 7 | 26 | 24 | 8 | N/M | N/M | 14 | 67 | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Disposal gains | — | 12 | — | 40 | — | N/M | N/M | 52 | — | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Expense reimbursements from joint venture | 35 | 36 | 34 | 31 | 29 | N/M | N/M | 136 | 118 | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other income | 2 | 19 | 7 | 11 | 14 | N/M | N/M | 39 | 45 | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net securities (losses) | (15) | (30) | (35) | — | (50) | N/M | N/M | (80) | (85) | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total investment and other revenue | 135 | 208 | 184 | 230 | 140 | N/M | N/M | 757 | 687 | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total fee and other revenue | $ | 3,833 | $ | 3,845 | $ | 3,825 | $ | 3,633 | $ | 3,653 | — | % | 5 | % | $ | 15,136 | $ | 14,307 | 6 | % | ||||||||||||||||||||||||||||||||||||||||||

(a) Excludes seed capital gains (losses) related to consolidated investment management funds. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) On a constant currency basis, investment management and performance fees decreased 1% (Non-GAAP) compared with 4Q24. See “Explanation of GAAP and Non-GAAP Financial Measures” beginning on page 18 for the reconciliation of this Non-GAAP measure. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (c) Includes gains (losses) on investments in BNY funds which hedge deferred incentive awards. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (d) Includes strategic equity, private equity and other investments. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| N/M – Not meaningful. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| THE BANK OF NEW YORK MELLON CORPORATION |  |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AVERAGE BALANCES AND INTEREST RATES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q25 | 3Q25 | 2Q25 | 1Q25 | 4Q24 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average balance | Average rate | Average balance | Average rate | Average balance | Average rate | Average balance | Average rate | Average balance | Average rate | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in millions; average rates are annualized) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits with the Federal Reserve and other central banks | $ | 97,489 | 3.38 | % | $ | 94,533 | 3.69 | % | $ | 99,426 | 3.73 | % | $ | 86,038 | 3.84 | % | $ | 94,337 | 4.18 | % | ||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits with banks | 11,440 | 2.53 | 10,980 | 2.97 | 11,199 | 3.10 | 10,083 | 3.39 | 10,479 | 3.54 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Federal funds sold and securities purchased under resale agreements | 43,363 | 26.99 | (a) | 40,885 | 30.66 | (a) | 39,522 | 32.23 | (a) | 41,166 | 28.79 | (a) | 37,939 | 31.22 | (a) | |||||||||||||||||||||||||||||||||||||||||||||||

| Loans | 76,678 | 5.46 | 72,692 | 5.80 | 71,265 | 5.81 | 69,670 | 5.80 | 69,211 | 6.17 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Securities: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. government obligations | 33,726 | 3.49 | 31,754 | 3.59 | 29,279 | 3.63 | 26,614 | 3.49 | 27,223 | 3.47 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. government agency obligations | 61,578 | 3.29 | 61,174 | 3.40 | 62,874 | 3.36 | 63,514 | 3.27 | 63,166 | 3.31 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other securities | 55,119 | 3.54 | 54,986 | 3.61 | 54,610 | 3.58 | 51,403 | 3.62 | 49,675 | 3.76 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total investment securities | 150,423 | 3.43 | 147,914 | 3.52 | 146,763 | 3.49 | 141,531 | 3.44 | 140,064 | 3.50 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Trading securities (b) |

7,896 | 4.82 | 7,489 | 5.02 | 7,367 | 4.84 | 6,199 | 5.29 | 5,738 | 6.13 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Total securities (b) |

158,319 | 3.50 | 155,403 | 3.59 | 154,130 | 3.56 | 147,730 | 3.52 | 145,802 | 3.61 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Total interest-earning assets (b) |

$ | 387,289 | 6.46 | % | $ | 374,493 | 6.98 | % | $ | 375,542 | 7.03 | % | $ | 354,687 | 6.97 | % | $ | 357,768 | 7.18 | % | ||||||||||||||||||||||||||||||||||||||||||

| Noninterest-earning assets | 63,924 | 62,998 | 63,066 | 61,157 | 62,576 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 451,213 | $ | 437,491 | $ | 438,608 | $ | 415,844 | $ | 420,344 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities and equity | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits | $ | 258,640 | 2.58 | % | $ | 248,016 | 2.90 | % | $ | 250,688 | 2.95 | % | $ | 234,394 | 2.98 | % | $ | 235,281 | 3.27 | % | ||||||||||||||||||||||||||||||||||||||||||

| Federal funds purchased and securities sold under repurchase agreements | 18,105 | 57.66 | (a) | 16,242 | 69.11 | (a) | 17,485 | 65.95 | (a) | 17,566 | 60.25 | (a) | 17,599 | 60.52 | (a) | |||||||||||||||||||||||||||||||||||||||||||||||

| Trading liabilities | 2,839 | 4.03 | 3,333 | 4.40 | 2,821 | 4.94 | 2,063 | 4.56 | 1,887 | 4.61 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other borrowed funds | 339 | 4.57 | 243 | 4.63 | 432 | 5.06 | 288 | 5.93 | 484 | 2.32 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial paper | 2,310 | 4.32 | 3,268 | 4.63 | 2,511 | 4.56 | 1,279 | 4.51 | 2,336 | 4.83 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Payables to customers and broker-dealers | 16,764 | 4.02 | 16,434 | 4.34 | 15,494 | 4.19 | 15,142 | 4.21 | 13,672 | 4.77 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Long-term debt | 32,135 | 5.09 | 32,503 | 5.53 | 31,805 | 5.64 | 31,216 | 5.57 | 31,506 | 5.58 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | $ | 331,132 | 5.94 | % | $ | 320,039 | 6.64 | % | $ | 321,236 | 6.74 | % | $ | 301,948 | 6.66 | % | $ | 302,765 | 6.92 | % | ||||||||||||||||||||||||||||||||||||||||||

| Total noninterest-bearing deposits | 51,842 | 51,310 | 49,610 | 48,141 | 51,207 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other noninterest-bearing liabilities | 23,858 | 21,674 | 24,073 | 23,808 | 24,790 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total The Bank of New York Mellon Corporation shareholders’ equity | 43,978 | 43,974 | 43,223 | 41,542 | 41,266 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noncontrolling interests | 403 | 494 | 466 | 405 | 316 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and equity | $ | 451,213 | $ | 437,491 | $ | 438,608 | $ | 415,844 | $ | 420,344 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest margin | 1.38 | % | 1.31 | % | 1.27 | % | 1.30 | % | 1.32 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Net interest margin (FTE) – Non-GAAP (c) |

1.38 | % | 1.31 | % | 1.27 | % | 1.30 | % | 1.32 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) Includes the average impact of offsetting under enforceable netting agreements of approximately $242 billion for 4Q25, $241 billion for 3Q25, $247 billion for 2Q25, $224 billion for 1Q25 and $208 billion for 4Q24. On a Non-GAAP basis, excluding the impact of offsetting, the yield on federal funds sold and securities purchased under resale agreements would have been 4.11% for 4Q25, 4.45% for 3Q25, 4.45% for 2Q25, 4.46% for 1Q25 and 4.82% for 4Q24. On a Non-GAAP basis, excluding the impact of offsetting, the rate on federal funds purchased and securities sold under repurchase agreements would have been 4.02% for 4Q25, 4.36% for 3Q25, 4.36% for 2Q25, 4.37% for 1Q25 and 4.73% for 4Q24. We believe providing the rates excluding the impact of netting is useful to investors as it is more reflective of the actual rates earned and paid. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (b) Average rates were calculated on an FTE basis, at tax rates of approximately 21%. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(c) See “Explanation of GAAP and Non-GAAP Financial Measures” beginning on page 18 for the reconciliation of this Non-GAAP measure. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| THE BANK OF NEW YORK MELLON CORPORATION |  |

|||||||||||||||||||||||||||||||

| CAPITAL AND LIQUIDITY | ||||||||||||||||||||||||||||||||

| 2025 | 2024 | |||||||||||||||||||||||||||||||

| (dollars in millions) | Dec. 31 | Sept. 30 | June 30 | March 31 | Dec. 31 | |||||||||||||||||||||||||||

Consolidated regulatory capital ratios: (a) |

||||||||||||||||||||||||||||||||

| Standardized Approach: | ||||||||||||||||||||||||||||||||

| CET1 capital | $ | 21,087 | $ | 20,645 | $ | 20,149 | $ | 19,505 | $ | 18,759 | ||||||||||||||||||||||

| Tier 1 capital | 25,910 | 25,471 | 25,472 | 24,783 | 23,039 | |||||||||||||||||||||||||||

| Total capital | 27,391 | 27,079 | 27,243 | 26,581 | 24,818 | |||||||||||||||||||||||||||

| Risk-weighted assets | 177,588 | 176,432 | 175,668 | 169,262 | 167,786 | |||||||||||||||||||||||||||

| CET1 ratio | 11.9 | % | 11.7 | % | 11.5 | % | 11.5 | % | 11.2 | % | ||||||||||||||||||||||

| Tier 1 capital ratio | 14.6 | 14.4 | 14.5 | 14.6 | 13.7 | |||||||||||||||||||||||||||

| Total capital ratio | 15.4 | 15.3 | 15.5 | 15.7 | 14.8 | |||||||||||||||||||||||||||

| Advanced Approaches: | ||||||||||||||||||||||||||||||||

| CET1 capital | $ | 21,087 | $ | 20,645 | $ | 20,149 | $ | 19,505 | $ | 18,759 | ||||||||||||||||||||||

| Tier 1 capital | 25,910 | 25,471 | 25,472 | 24,783 | 23,039 | |||||||||||||||||||||||||||

| Total capital | 27,047 | 26,734 | 26,897 | 26,246 | 24,535 | |||||||||||||||||||||||||||

| Risk-weighted assets | 162,959 | 168,841 | 168,748 | 162,234 | 160,472 | |||||||||||||||||||||||||||

| CET1 ratio | 12.9 | % | 12.2 | % | 11.9 | % | 12.0 | % | 11.7 | % | ||||||||||||||||||||||

| Tier 1 capital ratio | 15.9 | 15.1 | 15.1 | 15.3 | 14.4 | |||||||||||||||||||||||||||

| Total capital ratio | 16.6 | 15.8 | 15.9 | 16.2 | 15.3 | |||||||||||||||||||||||||||

Tier 1 leverage ratio: (a) |

||||||||||||||||||||||||||||||||

| Average assets for Tier 1 leverage ratio | $ | 432,804 | $ | 419,077 | $ | 420,131 | $ | 397,513 | $ | 402,069 | ||||||||||||||||||||||

| Tier 1 leverage ratio | 6.0 | % | 6.1 | % | 6.1 | % | 6.2 | % | 5.7 | % | ||||||||||||||||||||||

SLR: (a) |

||||||||||||||||||||||||||||||||

| Leverage exposure | $ | 388,733 | $ | 377,728 | $ | 369,838 | $ | 359,666 | $ | 353,523 | ||||||||||||||||||||||

| SLR | 6.7 | % | 6.7 | % | 6.9 | % | 6.9 | % | 6.5 | % | ||||||||||||||||||||||

Average liquidity coverage ratio (a) |

112 | % | 112 | % | 112 | % | 116 | % | 115 | % | ||||||||||||||||||||||

Average net stable funding ratio (a) |

130 | % | 130 | % | 131 | % | 132 | % | 132 | % | ||||||||||||||||||||||

(a) Regulatory capital and liquidity ratios for Dec. 31, 2025 are preliminary. For our CET1, Tier 1 capital and Total capital ratios, our effective capital ratios under the U.S. capital rules are the lower of the ratios as calculated under the Standardized and Advanced Approaches, which for the periods presented, was the Standardized Approach. | ||||||||||||||||||||||||||||||||

| THE BANK OF NEW YORK MELLON CORPORATION |  |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

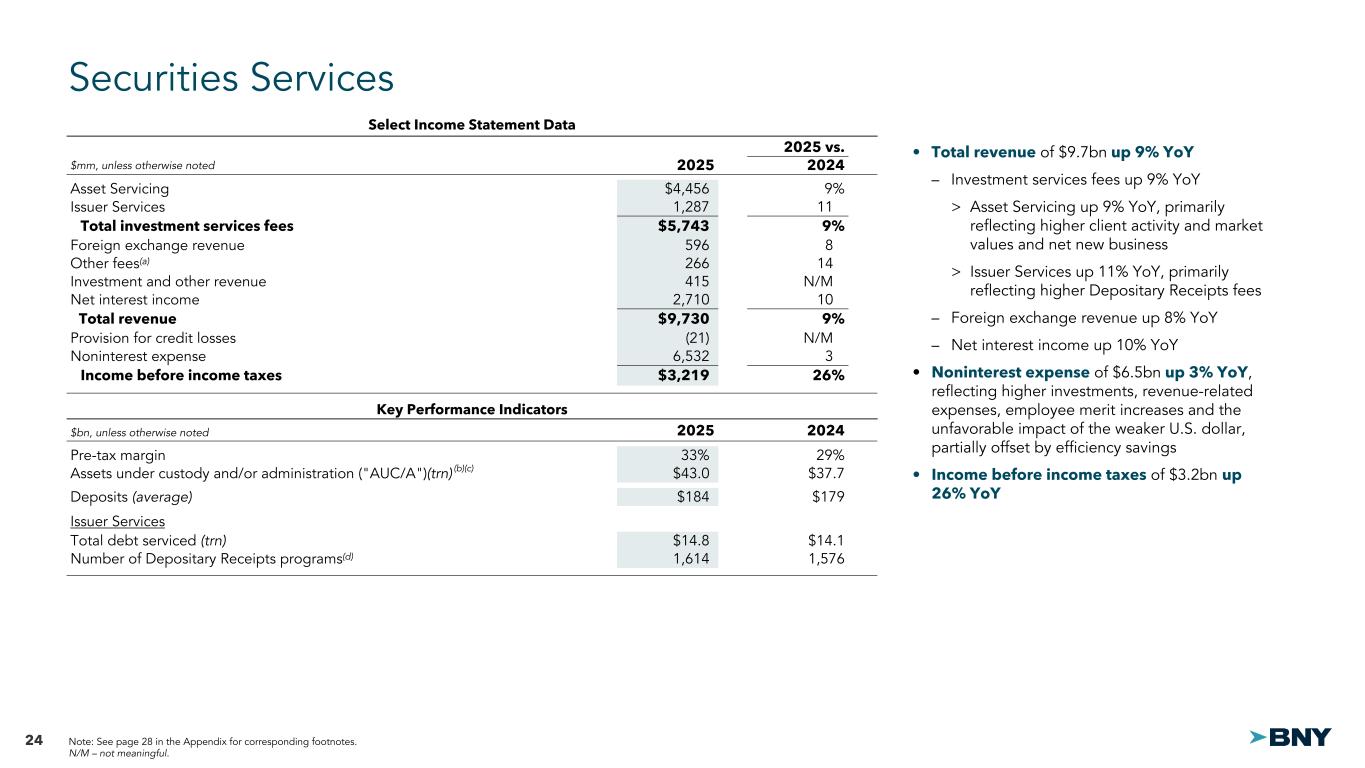

| SECURITIES SERVICES BUSINESS SEGMENT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q25 vs. | FY25 vs. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in millions) | 4Q25 | 3Q25 | 2Q25 | 1Q25 | 4Q24 | 3Q25 | 4Q24 | FY25 | FY24 | FY24 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revenue: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment services fees: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Asset Servicing | $ | 1,159 | $ | 1,141 | $ | 1,094 | $ | 1,062 | $ | 1,042 | 2 | % | 11 | % | $ | 4,456 | $ | 4,094 | 9 | % | ||||||||||||||||||||||||||||||||||||||||||

| Issuer Services | 331 | 313 | 376 | 267 | 295 | 6 | 12 | 1,287 | 1,163 | 11 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total investment services fees | 1,490 | 1,454 | 1,470 | 1,329 | 1,337 | 2 | 11 | 5,743 | 5,257 | 9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign exchange revenue | 142 | 143 | 175 | 136 | 147 | (1) | (3) | 596 | 552 | 8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Other fees (a) |

68 | 73 | 60 | 65 | 62 | (7) | 10 | 266 | 234 | 14 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total fee revenue | 1,700 | 1,670 | 1,705 | 1,530 | 1,546 | 2 | 10 | 6,605 | 6,043 | 9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment and other revenue | 62 | 119 | 94 | 140 | 97 | N/M | N/M | 415 | 405 | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total fee and other revenue | 1,762 | 1,789 | 1,799 | 1,670 | 1,643 | (2) | 7 | 7,020 | 6,448 | 9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | 735 | 670 | 675 | 630 | 681 | 10 | 8 | 2,710 | 2,468 | 10 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | 2,497 | 2,459 | 2,474 | 2,300 | 2,324 | 2 | 7 | 9,730 | 8,916 | 9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | (13) | (3) | (13) | 8 | 15 | N/M | N/M | (21) | 38 | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense (ex. amortization of intangible assets) | 1,665 | 1,649 | 1,613 | 1,578 | 1,659 | 1 | — | 6,505 | 6,286 | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of intangible assets | 7 | 7 | 7 | 6 | 7 | — | — | 27 | 28 | (4) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total noninterest expense | 1,672 | 1,656 | 1,620 | 1,584 | 1,666 | 1 | — | 6,532 | 6,314 | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income before income taxes | $ | 838 | $ | 806 | $ | 867 | $ | 708 | $ | 643 | 4 | % | 30 | % | $ | 3,219 | $ | 2,564 | 26 | % | ||||||||||||||||||||||||||||||||||||||||||

| Total revenue by line of business: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Asset Servicing | $ | 1,945 | $ | 1,915 | $ | 1,870 | $ | 1,786 | $ | 1,797 | 2 | % | 8 | % | $ | 7,516 | $ | 6,872 | 9 | % | ||||||||||||||||||||||||||||||||||||||||||

| Issuer Services | 552 | 544 | 604 | 514 | 527 | 1 | 5 | 2,214 | 2,044 | 8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue by line of business | $ | 2,497 | $ | 2,459 | $ | 2,474 | $ | 2,300 | $ | 2,324 | 2 | % | 7 | % | $ | 9,730 | $ | 8,916 | 9 | % | ||||||||||||||||||||||||||||||||||||||||||

| Financial ratios: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pre-tax operating margin | 34 | % | 33 | % | 35 | % | 31 | % | 28 | % | 33 | % | 29 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

Memo: Securities lending revenue (b) |

$ | 69 | $ | 62 | $ | 56 | $ | 52 | $ | 52 | 11 | % | 33 | % | $ | 239 | $ | 191 | 25 | % | ||||||||||||||||||||||||||||||||||||||||||

| (a) Other fees primarily include financing-related fees. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (b) Included in investment services fees reported in the Asset Servicing line of business. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| N/M – Not meaningful. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| THE BANK OF NEW YORK MELLON CORPORATION |  |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SECURITIES SERVICES BUSINESS SEGMENT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q25 vs. | FY25 vs. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in millions, unless otherwise noted) | 4Q25 | 3Q25 | 2Q25 | 1Q25 | 4Q24 | 3Q25 | 4Q24 | FY25 | FY24 | FY24 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Selected balance sheet data: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average loans | $ | 11,439 | $ | 10,706 | $ | 11,327 | $ | 11,347 | $ | 11,553 | 7 | % | (1) | % | $ | 11,204 | $ | 11,235 | — | % | ||||||||||||||||||||||||||||||||||||||||||

Average assets (a) |

$ | 212,227 | $ | 202,454 | $ | 206,552 | $ | 194,901 | $ | 200,277 | 5 | % | 6 | % | $ | 204,077 | $ | 196,740 | 4 | % | ||||||||||||||||||||||||||||||||||||||||||

| Average deposits | $ | 192,796 | $ | 183,081 | $ | 185,831 | $ | 175,854 | $ | 180,843 | 5 | % | 7 | % | $ | 184,433 | $ | 178,643 | 3 | % | ||||||||||||||||||||||||||||||||||||||||||

| Selected metrics: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

AUC/A at period end (in trillions) (b)(c) |

$ | 43.0 | $ | 41.7 | $ | 40.1 | $ | 38.1 | $ | 37.7 | 3 | % | 14 | % | $ | 43.0 | $ | 37.7 | 14 | % | ||||||||||||||||||||||||||||||||||||||||||

Market value of securities on loan at period end (in billions) (d) |

$ | 604 | $ | 554 | $ | 516 | $ | 504 | $ | 488 | 9 | % | 24 | % | $ | 604 | $ | 488 | 24 | % | ||||||||||||||||||||||||||||||||||||||||||

| Issuer Services | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Total debt serviced at period end (in trillions) |

$ | 14.8 | $ | 14.5 | $ | 14.3 | $ | 13.9 | $ | 14.1 | 2 | % | 5 | % | $ | 14.8 | $ | 14.1 | 5 | % | ||||||||||||||||||||||||||||||||||||||||||

Number of Depositary Receipts programs at period end (e) |

1,614 | 1,601 | 1,568 | 1,576 | 1,576 | 1 | % | 2 | % | 1,614 | 1,576 | 2 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) In business segments where average deposits are greater than average loans, average assets include an allocation of investment securities equal to the difference. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) Dec. 31, 2025 information is preliminary. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(c) Consists of AUC/A primarily from the Asset Servicing line of business and, to a lesser extent, the Issuer Services line of business. Includes the AUC/A of CIBC Mellon of $2.2 trillion at Dec. 31, 2025, $2.1 trillion at Sept. 30, 2025, $2.0 trillion at June 30, 2025, $1.9 trillion at March 31, 2025 and $1.8 trillion at Dec. 31, 2024. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(d) Represents the total amount of securities on loan in our agency securities lending program. Excludes securities for which BNY acts as agent on behalf of CIBC Mellon clients, which totaled $74 billion at Dec. 31, 2025, $81 billion at Sept. 30, 2025, $68 billion at June 30, 2025, $62 billion at March 31, 2025 and $60 billion at Dec. 31, 2024. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (e) Beginning in 4Q25, the previously reported metric for the Issuer Services line of business, Number of sponsored Depositary Receipts programs, has been replaced with a new metric, Number of Depositary Receipts programs. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| THE BANK OF NEW YORK MELLON CORPORATION |  |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MARKET AND WEALTH SERVICES BUSINESS SEGMENT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q25 vs. | FY25 vs. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in millions) | 4Q25 | 3Q25 | 2Q25 | 1Q25 | 4Q24 | 3Q25 | 4Q24 | FY25 | FY24 | FY24 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revenue: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment services fees: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pershing | $ | 505 | $ | 508 | $ | 513 | $ | 503 | $ | 516 | (1) | % | (2) | % | $ | 2,029 | $ | 1,947 | 4 | % | ||||||||||||||||||||||||||||||||||||||||||

Payments and Trade (a) |

212 | 214 | 209 | 209 | 206 | (1) | 3 | 844 | 792 | 7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Clearance and Collateral Management | 417 | 398 | 385 | 362 | 364 | 5 | 15 | 1,562 | 1,385 | 13 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total investment services fees | 1,134 | 1,120 | 1,107 | 1,074 | 1,086 | 1 | 4 | 4,435 | 4,124 | 8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign exchange revenue | 28 | 31 | 30 | 29 | 27 | (10) | 4 | 118 | 97 | 22 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Other fees (b) |

65 | 70 | 63 | 65 | 61 | (7) | 7 | 263 | 235 | 12 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total fee revenue | 1,227 | 1,221 | 1,200 | 1,168 | 1,174 | — | 5 | 4,816 | 4,456 | 8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment and other revenue | 9 | 22 | 36 | 21 | 19 | N/M | N/M | 88 | 79 | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total fee and other revenue | 1,236 | 1,243 | 1,236 | 1,189 | 1,193 | (1) | 4 | 4,904 | 4,535 | 8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | 569 | 524 | 506 | 497 | 474 | 9 | 20 | 2,096 | 1,729 | 21 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | 1,805 | 1,767 | 1,742 | 1,686 | 1,667 | 2 | 8 | 7,000 | 6,264 | 12 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | (7) | (3) | (6) | 4 | 9 | N/M | N/M | (12) | 19 | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense (ex. amortization of intangible assets) | 929 | 894 | 897 | 865 | 851 | 4 | 9 | 3,585 | 3,349 | 7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of intangible assets | 1 | 1 | — | 1 | 1 | — | — | 3 | 4 | (25) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total noninterest expense | 930 | 895 | 897 | 866 | 852 | 4 | 9 | 3,588 | 3,353 | 7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income before income taxes | $ | 882 | $ | 875 | $ | 851 | $ | 816 | $ | 806 | 1 | % | 9 | % | $ | 3,424 | $ | 2,892 | 18 | % | ||||||||||||||||||||||||||||||||||||||||||

| Total revenue by line of business: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pershing | $ | 741 | $ | 729 | $ | 739 | $ | 719 | $ | 705 | 2 | % | 5 | % | $ | 2,928 | $ | 2,687 | 9 | % | ||||||||||||||||||||||||||||||||||||||||||

Payments and Trade (a) |

524 | 510 | 490 | 477 | 471 | 3 | 11 | 2,001 | 1,737 | 15 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Clearance and Collateral Management | 540 | 528 | 513 | 490 | 491 | 2 | 10 | 2,071 | 1,840 | 13 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue by line of business | $ | 1,805 | $ | 1,767 | $ | 1,742 | $ | 1,686 | $ | 1,667 | 2 | % | 8 | % | $ | 7,000 | $ | 6,264 | 12 | % | ||||||||||||||||||||||||||||||||||||||||||

| Financial ratios: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pre-tax operating margin | 49 | % | 50 | % | 49 | % | 48 | % | 48 | % | 49 | % | 46 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| (a) Formerly Treasury Services. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (b) Other fees primarily include financing-related fees. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| N/M – Not meaningful. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| THE BANK OF NEW YORK MELLON CORPORATION |  |