00013874676/302026Q1false343274295xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pureiso4217:CNYiso4217:EUR00013874672025-07-012025-09-3000013874672025-10-3100013874672025-09-3000013874672025-06-300001387467us-gaap:NonrelatedPartyMember2025-09-300001387467us-gaap:NonrelatedPartyMember2025-06-300001387467us-gaap:RelatedPartyMember2025-09-300001387467us-gaap:RelatedPartyMember2025-06-3000013874672024-07-012024-09-300001387467us-gaap:CommonStockMember2024-06-300001387467us-gaap:TreasuryStockCommonMember2024-06-300001387467us-gaap:AdditionalPaidInCapitalMember2024-06-300001387467us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001387467us-gaap:RetainedEarningsMember2024-06-300001387467us-gaap:ParentMember2024-06-300001387467us-gaap:CommonStockMember2024-07-012024-09-300001387467us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300001387467us-gaap:ParentMember2024-07-012024-09-300001387467us-gaap:RetainedEarningsMember2024-07-012024-09-300001387467us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-300001387467us-gaap:CommonStockMember2024-09-300001387467us-gaap:TreasuryStockCommonMember2024-09-300001387467us-gaap:AdditionalPaidInCapitalMember2024-09-300001387467us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300001387467us-gaap:RetainedEarningsMember2024-09-300001387467us-gaap:ParentMember2024-09-300001387467us-gaap:CommonStockMember2025-06-300001387467us-gaap:TreasuryStockCommonMember2025-06-300001387467us-gaap:AdditionalPaidInCapitalMember2025-06-300001387467us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-06-300001387467us-gaap:RetainedEarningsMember2025-06-300001387467us-gaap:ParentMember2025-06-300001387467us-gaap:CommonStockMember2025-07-012025-09-300001387467us-gaap:AdditionalPaidInCapitalMember2025-07-012025-09-300001387467us-gaap:ParentMember2025-07-012025-09-300001387467us-gaap:RetainedEarningsMember2025-07-012025-09-300001387467us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-07-012025-09-300001387467us-gaap:CommonStockMember2025-09-300001387467us-gaap:TreasuryStockCommonMember2025-09-300001387467us-gaap:AdditionalPaidInCapitalMember2025-09-300001387467us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-09-300001387467us-gaap:RetainedEarningsMember2025-09-300001387467us-gaap:ParentMember2025-09-3000013874672024-06-3000013874672024-09-300001387467aosl:JVCompanyMemberus-gaap:ScenarioPlanMember2025-07-142025-07-140001387467aosl:JVCompanyMember2025-08-290001387467aosl:JVCompanyMember2025-08-292025-08-2900013874672025-08-290001387467aosl:JVCompanyMember2024-07-012024-09-300001387467us-gaap:CorporateJointVentureMember2025-07-012025-09-300001387467us-gaap:CorporateJointVentureMemberaosl:ReimbursementsMember2025-07-012025-09-300001387467us-gaap:CorporateJointVentureMemberaosl:ReimbursementsMember2024-07-012024-09-300001387467us-gaap:CorporateJointVentureMember2024-07-012024-09-300001387467us-gaap:CorporateJointVentureMemberaosl:OtherServicesMember2025-07-012025-09-300001387467aosl:StockOptionsAndRestrictedStockUnitsRsusMember2025-07-012025-09-300001387467aosl:StockOptionsAndRestrictedStockUnitsRsusMember2024-07-012024-09-300001387467us-gaap:EmployeeStockMember2025-07-012025-09-300001387467us-gaap:EmployeeStockMember2024-07-012024-09-300001387467srt:MinimumMember2025-07-012025-09-300001387467srt:MaximumMember2025-07-012025-09-300001387467aosl:CustomerMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2025-07-012025-09-300001387467aosl:CustomerMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-07-012024-09-300001387467aosl:CustomerBMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2025-07-012025-09-300001387467aosl:CustomerBMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-07-012024-09-300001387467aosl:CustomerMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2024-07-012025-06-300001387467aosl:CustomerBMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2025-09-302025-09-300001387467aosl:CustomerBMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2024-07-012025-06-300001387467us-gaap:LandMember2025-09-300001387467us-gaap:LandMember2025-06-300001387467us-gaap:BuildingMember2025-09-300001387467us-gaap:BuildingMember2025-06-300001387467us-gaap:MachineryAndEquipmentMember2025-09-300001387467us-gaap:MachineryAndEquipmentMember2025-06-300001387467aosl:EquipmentAndToolingMember2025-09-300001387467aosl:EquipmentAndToolingMember2025-06-300001387467us-gaap:ComputerEquipmentMember2025-09-300001387467us-gaap:ComputerEquipmentMember2025-06-300001387467us-gaap:FurnitureAndFixturesMember2025-09-300001387467us-gaap:FurnitureAndFixturesMember2025-06-300001387467us-gaap:LeaseholdImprovementsMember2025-09-300001387467us-gaap:LeaseholdImprovementsMember2025-06-300001387467aosl:PatentsAndPatentedTechnologyMember2025-09-300001387467aosl:PatentsAndPatentedTechnologyMember2025-06-300001387467us-gaap:LicensingAgreementsMember2025-09-300001387467us-gaap:LicensingAgreementsMember2025-06-300001387467us-gaap:TradeNamesMember2025-09-300001387467us-gaap:TradeNamesMember2025-06-300001387467us-gaap:CustomerRelationshipsMember2025-09-300001387467us-gaap:CustomerRelationshipsMember2025-06-300001387467aosl:CustomerMember2025-09-300001387467aosl:CustomerBMember2025-09-300001387467us-gaap:OtherCustomerMember2025-09-300001387467aosl:CustomerMember2025-06-300001387467aosl:CustomerBMember2025-06-300001387467us-gaap:OtherCustomerMember2025-06-300001387467aosl:OtherCustomersMember2025-09-300001387467aosl:OtherCustomersMember2025-06-300001387467aosl:AccountsReceivableFactoringAgreementAugustNinthTwoThousandNineteenMemberus-gaap:SecuredDebtMember2019-08-090001387467aosl:HongkongAndShanghaiBankingCorporationLimitedMemberaosl:AccountsReceivableFactoringAgreementAugustNinthTwoThousandNineteenMemberus-gaap:SecuredDebtMember2019-08-092019-08-090001387467aosl:AccountsReceivableFactoringAgreementAugustNinthTwoThousandNineteenMemberus-gaap:SecuredDebtMember2021-08-110001387467aosl:SalesLeaseBackTransactionWithJirehSemiconductorIncorporatedMemberaosl:JirehSemiconductorIncorporatedMember2025-07-012025-09-300001387467aosl:SalesLeaseBackTransactionWithJirehSemiconductorIncorporatedMemberaosl:JirehSemiconductorIncorporatedMember2025-09-300001387467aosl:SalesLeaseBackTransactionWithJirehSemiconductorIncorporatedMemberaosl:JirehSemiconductorIncorporatedMember2021-04-300001387467aosl:SalesLeaseBackTransactionWithJirehSemiconductorIncorporatedMemberaosl:JirehSemiconductorIncorporatedMember2024-06-300001387467aosl:SalesLeaseBackTransactionWithJirehSemiconductorIncorporatedMemberaosl:JirehSemiconductorIncorporatedMember2022-09-300001387467aosl:SalesLeaseBackTransactionWithJirehSemiconductorIncorporatedMemberaosl:JirehSemiconductorIncorporatedMember2022-09-012022-09-300001387467aosl:SalesLeaseBackTransactionWithJirehSemiconductorIncorporatedMemberaosl:JirehSemiconductorIncorporatedMemberus-gaap:MachineryAndEquipmentMember2025-09-300001387467aosl:JirehMemberus-gaap:SecuredDebtMember2021-08-180001387467aosl:JirehMemberus-gaap:SecuredDebtMember2021-08-182021-08-180001387467aosl:JirehMemberus-gaap:SecuredDebtMember2022-02-162022-02-160001387467aosl:JirehMemberus-gaap:SecuredDebtMember2025-06-300001387467aosl:TimebasedRestrictedStockUnitsTRSUMember2025-06-300001387467aosl:TimebasedRestrictedStockUnitsTRSUMember2025-06-302025-06-300001387467aosl:TimebasedRestrictedStockUnitsTRSUMember2025-07-012025-09-300001387467aosl:TimebasedRestrictedStockUnitsTRSUMember2025-09-300001387467aosl:A2021MarketBasedRestrictedStockUnitsMember2021-12-012021-12-310001387467aosl:MarketbasedRestrictedStockUnitsMSUMemberus-gaap:ScenarioAdjustmentMember2023-09-012023-09-300001387467aosl:MarketbasedRestrictedStockUnitsMSUMemberus-gaap:ScenarioAdjustmentMember2024-04-012024-06-300001387467aosl:MarketBasedRestrictedStockUnitsMSUPreModificationMember2024-08-082024-08-080001387467aosl:A2021MarketBasedRestrictedStockUnitsMember2025-07-012025-09-300001387467aosl:A2021MarketBasedRestrictedStockUnitsMember2024-07-012024-09-300001387467aosl:A2018MarketBasedRestrictedStockUnitsMSUMember2018-07-012018-09-300001387467aosl:A2018MarketBasedRestrictedStockUnitsMSUMember2025-07-012025-09-300001387467aosl:A2018MarketBasedRestrictedStockUnitsMSUMember2024-07-012024-09-300001387467aosl:MarketbasedRestrictedStockUnitsMSUMember2025-06-300001387467aosl:MarketbasedRestrictedStockUnitsMSUMember2025-06-302025-06-300001387467aosl:MarketbasedRestrictedStockUnitsMSUMember2025-07-012025-09-300001387467aosl:MarketbasedRestrictedStockUnitsMSUMember2025-09-300001387467aosl:MarketbasedRestrictedStockUnitsMSUMember2025-09-302025-09-300001387467aosl:PerformanceBasedRestrictedStockUnitsPRSUsMemberMember2025-07-012025-09-300001387467aosl:PerformanceBasedRestrictedStockUnitsPRSUsMemberMember2024-07-012024-09-300001387467aosl:PerformanceBasedRestrictedStockUnitsPRSUsMemberMember2025-06-300001387467aosl:PerformanceBasedRestrictedStockUnitsPRSUsMemberMember2025-06-302025-06-300001387467aosl:PerformanceBasedRestrictedStockUnitsPRSUsMemberMember2025-09-300001387467aosl:PerformanceBasedRestrictedStockUnitsPRSUsMemberMember2025-09-302025-09-300001387467us-gaap:EmployeeStockMember2025-07-012025-09-300001387467us-gaap:CostOfSalesMember2025-07-012025-09-300001387467us-gaap:CostOfSalesMember2024-07-012024-09-300001387467us-gaap:ResearchAndDevelopmentExpenseMember2025-07-012025-09-300001387467us-gaap:ResearchAndDevelopmentExpenseMember2024-07-012024-09-300001387467us-gaap:SellingGeneralAndAdministrativeExpensesMember2025-07-012025-09-300001387467us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-07-012024-09-300001387467aosl:JVCompanyMember2025-07-012025-09-300001387467country:HK2025-07-012025-09-300001387467country:HK2024-07-012024-09-300001387467country:CN2025-07-012025-09-300001387467country:CN2024-07-012024-09-300001387467country:KR2025-07-012025-09-300001387467country:KR2024-07-012024-09-300001387467country:US2025-07-012025-09-300001387467country:US2024-07-012024-09-300001387467aosl:OtherCountriesMember2025-07-012025-09-300001387467aosl:OtherCountriesMember2024-07-012024-09-300001387467aosl:PowerDiscreteMember2025-07-012025-09-300001387467aosl:PowerDiscreteMember2024-07-012024-09-300001387467aosl:PowerIcMember2025-07-012025-09-300001387467aosl:PowerIcMember2024-07-012024-09-300001387467aosl:PackagingAndTestingServicesMember2025-07-012025-09-300001387467aosl:PackagingAndTestingServicesMember2024-07-012024-09-300001387467aosl:LicenseAndDevelopmentServicesMember2025-07-012025-09-300001387467aosl:LicenseAndDevelopmentServicesMember2024-07-012024-09-300001387467country:CN2025-09-300001387467country:CN2025-06-300001387467country:US2025-09-300001387467country:US2025-06-300001387467aosl:OtherCountriesMember2025-09-300001387467aosl:OtherCountriesMember2025-06-300001387467aosl:InventoriesAndServicesMember2025-09-300001387467us-gaap:CapitalAdditionsMember2025-09-300001387467us-gaap:IndemnificationGuaranteeMember2025-09-300001387467us-gaap:IndemnificationGuaranteeMember2025-06-300001387467aosl:BingXueMember2025-07-012025-09-300001387467aosl:BingXueMember2025-09-300001387467aosl:YifanLiangMember2025-07-012025-09-300001387467aosl:YifanLiangMember2025-09-300001387467aosl:StephenC.ChangMember2025-07-012025-09-300001387467aosl:StephenC.ChangMember2025-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________

FORM 10-Q

_________________________________

(MARK ONE)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2025

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM TO

Commission file number 001-34717

__________________________

Alpha and Omega Semiconductor Limited

(Exact name of Registrant as Specified in its Charter)

|

|

|

|

|

|

| Bermuda |

77-0553536 |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification Number) |

Clarendon House, 2 Church Street

Hamilton HM 11, Bermuda

(Address of Principal Registered

Offices including Zip Code)

(408) 830-9742

(Registrant's Telephone Number, Including Area Code)

__________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☒ |

Accelerated filer |

☐ |

Non-accelerated filer |

☐ |

| |

|

|

|

(Do not check if a smaller reporting company) |

|

| Smaller reporting company |

☐ |

Emerging growth company |

☐ |

|

|

|

|

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Shares |

AOSL |

The NASDAQ Global Select Market |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Number of common shares outstanding as of October 31, 2025: 30,061,450

Alpha and Omega Semiconductor Limited

Form 10-Q

Fiscal First Quarter Ended September 30, 2025

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

| |

|

Page |

| Part I. |

|

|

| Item 1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Item 2. |

|

|

| Item 3. |

|

|

| Item 4. |

|

|

| Part II. |

|

|

| Item 1. |

|

|

| Item 1A. |

|

|

| Item 2. |

|

|

| Item 3. |

|

|

| Item 4. |

|

|

| Item 5. |

|

|

| Item 6. |

|

|

|

|

|

PART I. FINANCIAL INFORMATION

ITEM 1. Financial Statements

|

|

|

|

|

|

|

|

|

|

|

|

| ALPHA AND OMEGA SEMICONDUCTOR LIMITED |

| CONDENSED CONSOLIDATED BALANCE SHEETS |

| (Unaudited, in thousands except par value per share) |

| |

September 30,

2025 |

|

June 30,

2025 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

223,509 |

|

|

$ |

153,079 |

|

| Restricted cash |

421 |

|

|

419 |

|

| Accounts receivable, net |

37,099 |

|

|

34,772 |

|

|

|

|

|

| Receivable from sale of equity interest in the JV Company |

56,410 |

|

|

— |

|

| Inventories |

196,156 |

|

|

189,677 |

|

|

|

|

|

| Other current assets |

17,689 |

|

|

18,215 |

|

| Total current assets |

531,284 |

|

|

396,162 |

|

| Property, plant and equipment, net |

309,677 |

|

|

314,097 |

|

| Operating lease right-of-use assets |

24,212 |

|

|

21,288 |

|

| Intangible assets, net |

1,380 |

|

|

269 |

|

|

|

|

|

| Equity method investment |

140,825 |

|

|

279,122 |

|

| Deferred income tax assets |

7,981 |

|

|

599 |

|

|

|

|

|

| Other long-term assets |

22,190 |

|

|

22,766 |

|

| Total assets |

$ |

1,037,549 |

|

|

$ |

1,034,303 |

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

49,136 |

|

|

$ |

60,044 |

|

| Accrued liabilities |

68,176 |

|

|

59,027 |

|

| Payable related to equity investee, net |

21,157 |

|

|

15,809 |

|

| Income taxes payable |

13,115 |

|

|

1,790 |

|

| Short-term debt |

2,925 |

|

|

11,852 |

|

|

|

|

|

| Finance lease liabilities |

1,026 |

|

|

1,007 |

|

| Operating lease liabilities |

5,782 |

|

|

4,978 |

|

| Total current liabilities |

161,317 |

|

|

154,507 |

|

| Long-term debt |

2,879 |

|

|

14,872 |

|

| Income taxes payable - long-term |

4,276 |

|

|

4,201 |

|

| Deferred income tax liabilities |

12,309 |

|

|

13,192 |

|

| Finance lease liabilities - long-term |

1,011 |

|

|

1,274 |

|

| Operating lease liabilities - long-term |

19,149 |

|

|

16,925 |

|

| Other long-term liabilities |

2,504 |

|

|

7,000 |

|

| Total liabilities |

203,445 |

|

|

211,971 |

|

| Commitments and contingencies (Note 12) |

|

|

|

| Shareholders' Equity: |

|

|

|

Preferred shares, par value $0.002 per share: |

|

|

|

Authorized: 10,000 shares; issued and outstanding: none at September 30, 2025 and June 30, 2025 |

— |

|

|

— |

|

Common shares, par value $0.002 per share: |

|

|

|

Authorized: 100,000 shares; issued and outstanding: 37,171 shares and 30,053 shares, respectively at September 30, 2025 and 37,127 shares and 30,009 shares, respectively at June 30, 2025 |

74 |

|

|

74 |

|

Treasury shares at cost: 7,118 shares at September 30, 2025 and 7,118 shares at June 30, 2025 |

(79,058) |

|

|

(79,058) |

|

| Additional paid-in capital |

386,470 |

|

|

379,779 |

|

| Accumulated other comprehensive loss |

(5,187) |

|

|

(12,390) |

|

| Retained earnings |

531,805 |

|

|

533,927 |

|

|

|

|

|

|

|

|

|

| Total shareholders' equity |

834,104 |

|

|

822,332 |

|

| Total liabilities and shareholders' equity |

$ |

1,037,549 |

|

|

$ |

1,034,303 |

|

|

|

|

|

See accompanying notes to these condensed consolidated financial statements.

ALPHA AND OMEGA SEMICONDUCTOR LIMITED

CONDENSED CONSOLIDATED STATEMENTS OF LOSS

(Unaudited, in thousands except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

| |

2025 |

|

2024 |

|

|

|

|

| Revenue |

$ |

182,501 |

|

|

$ |

181,887 |

|

|

|

|

|

Cost of goods sold 1 |

139,656 |

|

|

137,361 |

|

|

|

|

|

| Gross profit |

42,845 |

|

|

44,526 |

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

| Research and development |

24,145 |

|

|

22,478 |

|

|

|

|

|

| Selling, general and administrative |

23,284 |

|

|

22,300 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

47,429 |

|

|

44,778 |

|

|

|

|

|

| Operating loss |

(4,584) |

|

|

(252) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (loss), net 1 |

2,468 |

|

|

(650) |

|

|

|

|

|

| Interest income |

892 |

|

|

1,265 |

|

|

|

|

|

| Interest expenses |

(360) |

|

|

(812) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss before income taxes and equity method investment income (loss) |

(1,584) |

|

|

(449) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax expense |

1,927 |

|

|

1,040 |

|

|

|

|

|

| Net loss before equity method investment income (loss) |

(3,511) |

|

|

(1,489) |

|

|

|

|

|

| Equity method investment income (loss) |

1,389 |

|

|

(1,007) |

|

|

|

|

|

| Net loss |

$ |

(2,122) |

|

|

$ |

(2,496) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per common share |

|

|

|

|

|

|

|

| Basic |

$ |

(0.07) |

|

|

$ |

(0.09) |

|

|

|

|

|

| Diluted |

$ |

(0.07) |

|

|

$ |

(0.09) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of common shares used to compute net loss per share |

|

|

|

|

|

|

|

| Basic |

30,036 |

|

|

29,004 |

|

|

|

|

|

| Diluted |

30,036 |

|

|

29,004 |

|

|

|

|

|

(1) - Amounts include related party transactions. Refer to Note 3, Related Party Transaction.

See accompanying notes to these condensed consolidated financial statements.

ALPHA AND OMEGA SEMICONDUCTOR LIMITED

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(Unaudited, in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

|

2025 |

|

2024 |

|

|

|

|

| Net loss |

$ |

(2,122) |

|

|

$ |

(2,496) |

|

|

|

|

|

| Other comprehensive income (loss), net of tax |

|

|

|

|

|

|

|

Foreign currency translation adjustments, net of $(476) and $103 tax in each of the three months ended September 30, 2025 and 2024, respectively |

(789) |

|

|

(159) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cumulative translation adjustment release from sale of equity interest in the JV Company, net of tax $(1,209) |

7,992 |

|

|

— |

|

|

|

|

|

Comprehensive income (loss) |

$ |

5,081 |

|

|

$ |

(2,655) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to these condensed consolidated financial statements.

ALPHA AND OMEGA SEMICONDUCTOR LIMITED

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY

(Unaudited, in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares |

|

Treasury Shares |

|

Additional Paid-In Capital |

|

Accumulated Other Comprehensive Loss |

|

Retained Earnings |

|

Total Shareholders' Equity |

|

|

|

|

|

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

|

|

|

|

|

|

|

| Balance, June 30, 2024 |

|

36,107 |

|

|

$ |

72 |

|

|

(7,138) |

|

|

$ |

(79,213) |

|

|

$ |

353,109 |

|

|

$ |

(13,419) |

|

|

$ |

631,058 |

|

|

$ |

891,607 |

|

|

|

|

|

| Exercise of common stock options and release of restricted stock units |

|

73 |

|

|

— |

|

|

— |

|

|

— |

|

|

91 |

|

|

— |

|

|

— |

|

|

91 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Withholding tax on restricted stock units |

|

(18) |

|

|

— |

|

|

— |

|

|

— |

|

|

(673) |

|

|

— |

|

|

— |

|

|

(673) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share-based compensation |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

6,902 |

|

|

— |

|

|

— |

|

|

6,902 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(2,496) |

|

|

(2,496) |

|

|

|

|

|

| Foreign currency translation adjustment, net of tax |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(159) |

|

|

— |

|

|

(159) |

|

|

|

|

|

| Balance, September 30, 2024 |

|

36,162 |

|

|

$ |

72 |

|

|

(7,138) |

|

|

$ |

(79,213) |

|

|

$ |

359,429 |

|

|

$ |

(13,578) |

|

|

$ |

628,562 |

|

|

$ |

895,272 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares |

|

Treasury Shares |

|

Additional Paid-In Capital |

|

Accumulated Other Comprehensive Income (Loss) |

|

Retained Earnings |

|

Total Shareholders' Equity |

|

|

|

|

|

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

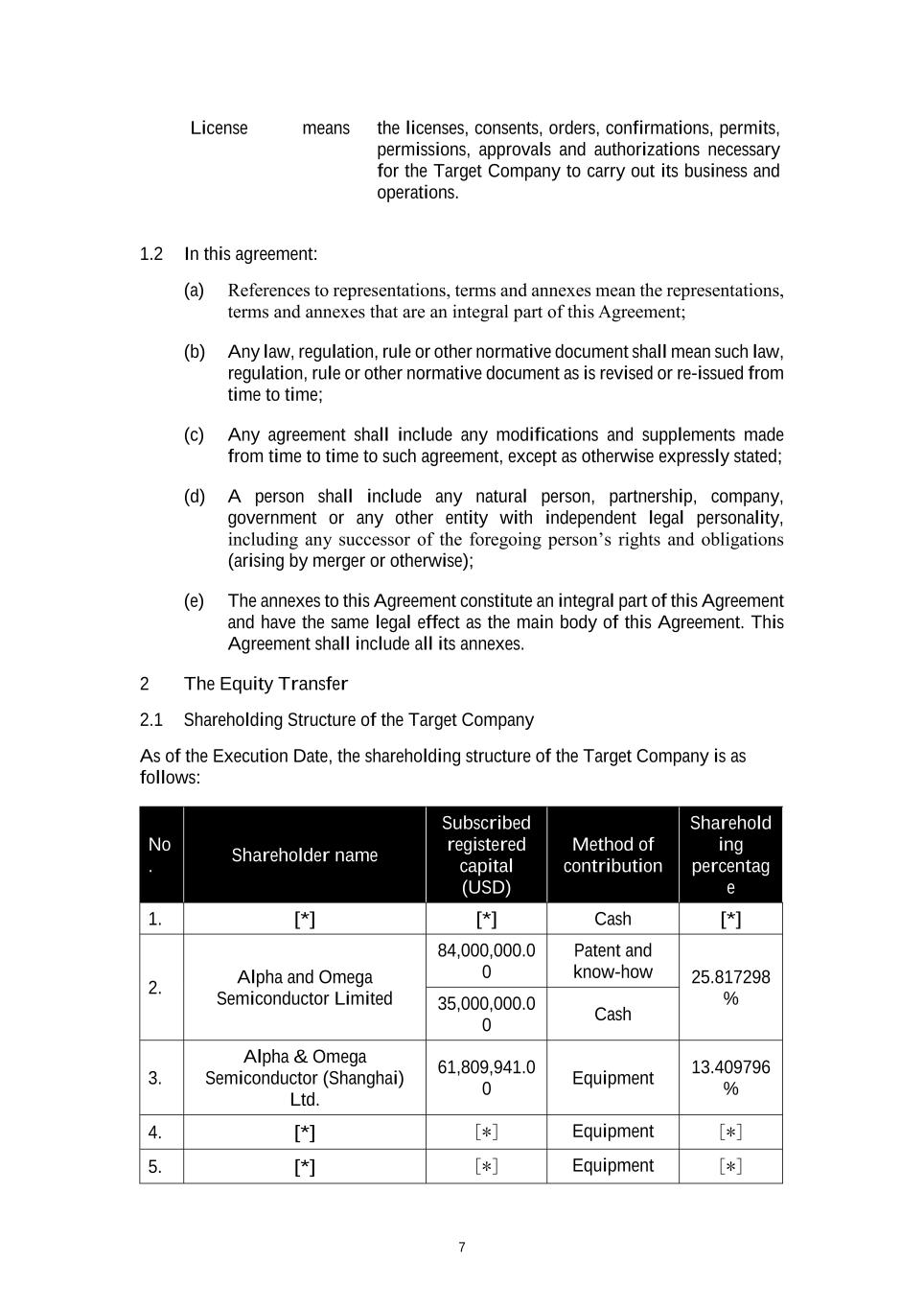

Balance, June 30, 2025 |

|

37,127 |

|

|

$ |

74 |

|

|

(7,118) |

|

|

$ |

(79,058) |

|

|

$ |

379,779 |

|

|

$ |

(12,390) |

|

|

$ |

533,927 |

|

|

$ |

822,332 |

|

|

|

|

|

Release of restricted stock units |

|

60 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Withholding tax on restricted stock units |

|

(16) |

|

|

— |

|

|

— |

|

|

— |

|

|

(441) |

|

|

— |

|

|

— |

|

|

(441) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share-based compensation |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

7,132 |

|

|

— |

|

|

— |

|

|

7,132 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(2,122) |

|

|

(2,122) |

|

|

|

|

|

| Foreign currency translation adjustment, net of tax |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

7,203 |

|

|

— |

|

|

7,203 |

|

|

|

|

|

Balance, September 30, 2025 |

|

37,171 |

|

|

$ |

74 |

|

|

(7,118) |

|

|

$ |

(79,058) |

|

|

$ |

386,470 |

|

|

$ |

(5,187) |

|

|

$ |

531,805 |

|

|

$ |

834,104 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to these condensed consolidated financial statements.

ALPHA AND OMEGA SEMICONDUCTOR LIMITED

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

2025 |

|

2024 |

| Cash flows from operating activities |

|

|

|

| Net loss |

$ |

(2,122) |

|

|

$ |

(2,496) |

|

| Adjustments to reconcile net loss to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

14,341 |

|

|

14,562 |

|

| Equity method investment (gain) loss |

(1,389) |

|

|

1,007 |

|

|

|

|

|

| Share-based compensation expense |

7,132 |

|

|

6,902 |

|

| Deferred income taxes, net |

(8,265) |

|

|

(221) |

|

| Loss on disposal of property and equipment |

— |

|

|

15 |

|

| Impairment of property and equipment |

7 |

|

|

— |

|

| Impairment of privately-held investment |

— |

|

|

100 |

|

| Changes in operating assets and liabilities |

|

|

|

| Accounts receivable |

(2,327) |

|

|

(12,045) |

|

| Inventories |

(6,480) |

|

|

10,782 |

|

| Contract assets |

— |

|

|

(3,050) |

|

| Other current and long-term assets |

840 |

|

|

137 |

|

| Accounts payable |

(9,182) |

|

|

(1,519) |

|

| Net payable, equity investee |

5,348 |

|

|

3,513 |

|

| Income taxes payable |

11,400 |

|

|

641 |

|

|

|

|

|

| Deferred revenue |

— |

|

|

(2,591) |

|

| Accrued and other liabilities |

884 |

|

|

(4,716) |

|

| Net cash provided by operating activities |

10,187 |

|

|

11,021 |

|

| Cash flows from investing activities |

|

|

|

| Proceeds from sale of equity interest in the JV Company |

92,100 |

|

|

— |

|

|

|

|

|

| Purchases of property and equipment |

(9,767) |

|

|

(6,918) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchase of intangible assets |

(388) |

|

|

— |

|

|

|

|

|

|

|

|

|

| Government grant related to equipment |

— |

|

|

180 |

|

| Net cash provided by (used in) investing activities |

81,945 |

|

|

(6,738) |

|

| Cash flows from financing activities |

|

|

|

| Withholding tax on restricted stock units |

(441) |

|

|

(673) |

|

| Proceeds from exercise of stock options |

— |

|

|

91 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Repayments of borrowings |

(20,948) |

|

|

(2,897) |

|

| Principal payments on finance leases |

(245) |

|

|

(227) |

|

| Net cash used in financing activities |

(21,634) |

|

|

(3,706) |

|

| Effect of exchange rate changes on cash, cash equivalents and restricted cash |

(66) |

|

|

105 |

|

| Net increase in cash, cash equivalents and restricted cash |

70,432 |

|

|

682 |

|

| Cash, cash equivalents and restricted cash at beginning of period |

153,498 |

|

|

175,540 |

|

| Cash, cash equivalents and restricted cash at end of period |

$ |

223,930 |

|

|

$ |

176,222 |

|

|

|

|

|

| Supplemental disclosures of non-cash investing and financing information: |

|

|

|

| Property and equipment purchased but not yet paid |

$ |

4,738 |

|

|

$ |

2,507 |

|

|

|

|

|

|

|

|

|

| Reconciliation of cash, cash equivalents, and restricted cash: |

|

|

|

| Cash and cash equivalents |

$ |

223,509 |

|

|

$ |

176,008 |

|

| Restricted cash |

421 |

|

|

214 |

|

|

|

|

|

| Total cash, cash equivalents, and restricted cash |

$ |

223,930 |

|

|

$ |

176,222 |

|

See accompanying notes to these condensed consolidated financial statements.

ALPHA AND OMEGA SEMICONDUCTOR LIMITED

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. The Company and Significant Accounting Policies

The Company

Alpha and Omega Semiconductor Limited and its subsidiaries (the “Company”, “AOS”, “we” or “us”) design, develop and supply a broad range of power semiconductors. The Company's portfolio of products targets high-volume applications, including personal computers, graphic cards, game consoles, home appliances, power tools, smart phones, battery packs, consumer and industrial motor controls and power supplies for computers, servers and telecommunications equipment. The Company conducts its operations primarily in the United States, Hong Kong, China, and South Korea.

Basis of Preparation

The accompanying unaudited Condensed Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) for interim financial information and with the instructions to Article 10 of Securities and Exchange Commission Regulation S-X, as amended. They do not include all information and footnotes necessary for a fair presentation of financial position, results of operations and cash flows in conformity with U.S. GAAP for complete financial statements. These Condensed Consolidated Financial Statements should be read in conjunction with the consolidated financial statements and related notes contained in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2025. For a complete discussion of the Company's accounting policies, refer to Part II, Item 8, Note 1 — Significant Accounting Policies in our 2025 Form 10-K. All significant intercompany balances and transactions have been eliminated in consolidation. In the opinion of management, all adjustments (consisting of normal recurring adjustments and accruals) considered necessary for a fair presentation of the results of operations for the periods presented have been included in the interim periods. Operating results for the three months ended September 30, 2025 are not necessarily indicative of the results that may be expected for the fiscal year ending June 30, 2026 or any other interim period. The consolidated balance sheet at June 30, 2025 is derived from the audited financial statements included in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2025.

Use of Estimates

The preparation of the consolidated financial statements in conformity with U.S. GAAP requires the Company to make estimates, judgments and assumptions that affect the reported amounts of assets, liabilities, revenue and expenses. To the extent there are material differences between these estimates and actual results, the Company's consolidated financial statements will be affected. On an ongoing basis, the Company evaluates the estimates, judgments and assumptions including those related to reserve of stock rotation returns, allowance for price adjustments, allowance for expected credit loss, inventory reserves, warranty accrual, income taxes, leases, share-based compensation, and recoverability of and useful lives for property, plant and equipment.

Recent Accounting Pronouncements

Recently Adopted Accounting Standards

In December 2023, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2023-09, “Income Taxes (Topic 740) – Improvements to Income Tax Disclosures”, which enhances the transparency, effectiveness and comparability of income tax disclosures by requiring consistent categories and greater disaggregation of information related to income tax rate reconciliations and the jurisdictions in which income taxes are paid. This will impact only the Company's disclosures for the annual reporting period ending June 30, 2026, with no impacts to its financial condition or results of operations.

Recently Issued Accounting Standards not yet adopted

In November 2024, the FASB issued ASU No. 2024-03, “Income Statement – Reporting Comprehensive Income – Expense Disaggregation Disclosures”, which improves disclosure requirements and provides more detailed information about an entity’s expenses, specifically amounts related to purchases of inventory, employee compensation, depreciation, intangible asset amortization, and selling expenses, along with qualitative descriptions of certain other types of expenses. This guidance is effective for fiscal years beginning after December 15, 2026, and interim periods within fiscal years beginning after December 15, 2027, with early adoption permitted.

ALPHA AND OMEGA SEMICONDUCTOR LIMITED

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

The Company is currently evaluating the impact of the ASU on its consolidated financial statements.

In July 2025, the FASB issued ASU No. 2025-05, “Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses for Accounts Receivable and Contract Assets”, which provides an optional practical expedient for estimating future credit losses based on current conditions as of the balance sheet date and assuming those conditions do not change over the remaining life of the accounts receivable. The guidance will be effective for annual reporting periods beginning after December 15, 2025, and interim reporting periods within those annual reporting periods, with early adoption permitted. The Company does not expect this ASU to have a material impact on its consolidated financial statements.

In September 2025, the FASB issued ASU No. 2025-06, “Intangibles - Goodwill and Other - Internal-Use Software (Subtopic 350-40): Targeted Improvements to the Accounting for Internal-Use Software”. The ASU removes references to prescriptive software development stages and includes an updated framework for capitalizing internal software costs. The guidance will be effective for annual reporting periods beginning after December 15, 2027, and interim reporting periods within those annual reporting periods, with early adoption permitted. The Company is currently evaluating the impact of the ASU on its consolidated financial statements.

ALPHA AND OMEGA SEMICONDUCTOR LIMITED

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

2. Equity Method Investment in Equity Investee

The Company has accounted for its investment in the JV Company using the equity method of accounting. For details of its equity method investment, please refer to Part II, Item 8, Note 2 — Equity Method Investment in Equity Investee in its 2025 Form 10-K.

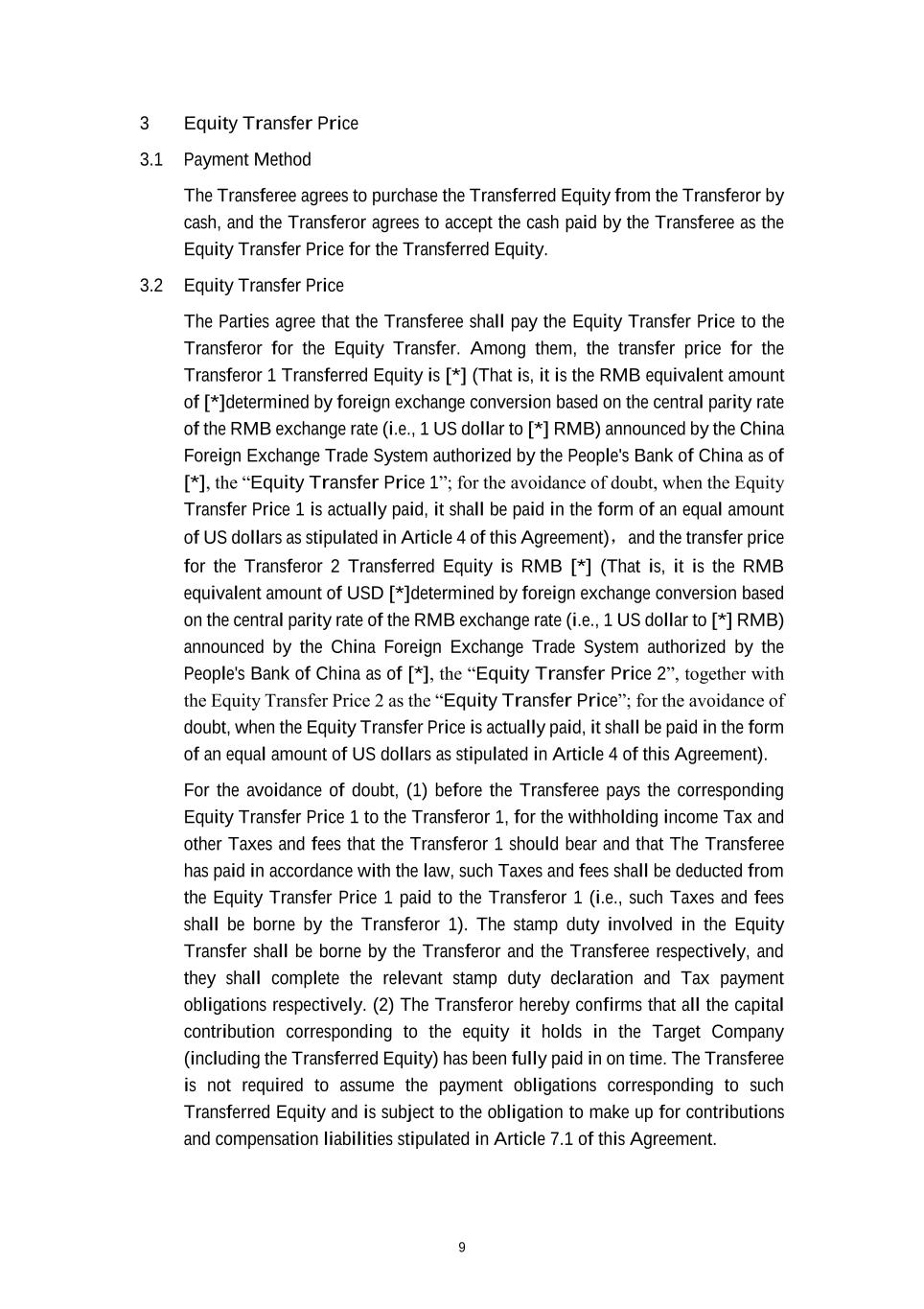

On July 14, 2025, the Company entered into an equity transfer agreement to sell approximately 20.3% of outstanding equity interest in the JV Company for an aggregate cash consideration of $150 million. On August 29, 2025, the amended shareholders’ agreement for the JV Company was signed, which reduced the Company’s equity interest in the JV Company by 20.3% to an ownership percentage of 18.9%. As a result, the Company received its first installment of RMB 676 million (or $94.5 million based on the currency exchange rate between RMB and U.S. Dollar on August 29, 2025), and paid transaction costs related to this sale of approximately $2.4 million. In addition, the Company recorded a receivable of $56.4 million for the remaining installments, which is included in the receivable from sale of equity interest in the JV Company line on the Condensed Consolidated Balance Sheets. The remaining installments will be received subject to satisfaction of certain conditions, which require the Company's continuing involvement, including voting in shareholder meetings to complete the transaction in accordance with the equity transfer agreement, plus other administrative actions. As a result of the sales transaction, the Company evaluated the factors that indicate the ability to exercise its significant influence to the JV Company, including but not limited to representation on the board, material intra-entity transactions, and participation in policy making process. The Company concluded that it continues to have the ability to exercise significant influence over the operating and financial policies of the JV Company and accordingly accounts for the investment using the equity method of accounting.

The Company reports its equity in earnings or loss of the JV Company on a three-month lag due to an inability to timely obtain financial information of the JV Company. During the three months ended September 30, 2025 and 2024, the Company recorded a $1.4 million gain, including the $1.1 million on the related sale of a portion of its interest in the equity method investment and $1.0 million loss of its equity share of the JV Company, respectively, using lag reporting.

ALPHA AND OMEGA SEMICONDUCTOR LIMITED

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

3. Related Party Transactions

As of September 30, 2025, the Company owned approximately 18.9% equity interest in the JV Company, which, by definition, is a related party to the Company. The JV Company supplies 12-inch wafers and provides assembly and testing services to AOS. The JV Company reimbursed AOS for purchases made on its behalf of $0.1 million and $2.2 million for the three months ended September 30, 2025 and 2024, respectively. The purchases by AOS for the three months ended September 30, 2025 and 2024 were $30.4 million and $28.3 million, respectively. Due to the right of offset of receivables and payables with the JV Company, as of September 30, 2025 and June 30, 2025, AOS recorded the net amount of $21.2 million and $15.8 million, respectively, as a payable related to equity investee, net, on the Condensed Consolidated Balance Sheet. During the three months ended September 30, 2025, the Company also recorded approximately $1.9 million other income for certain service the Company provided to the JV Company.

ALPHA AND OMEGA SEMICONDUCTOR LIMITED

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

4. Net Loss Per Common Share

The following table presents the calculation of basic and diluted net loss per share attributable to common shareholders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

|

| |

2025 |

|

2024 |

|

|

|

|

|

(in thousands, except per share data) |

| Numerator: |

|

|

|

|

|

|

|

| Net loss |

$ |

(2,122) |

|

|

$ |

(2,496) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Denominator: |

|

|

|

|

|

|

|

| Basic: |

|

|

|

|

|

|

|

| Weighted average number of common shares used to compute basic net loss per share |

30,036 |

|

|

29,004 |

|

|

|

|

|

| Diluted: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of common shares used to compute diluted net loss per share |

30,036 |

|

|

29,004 |

|

|

|

|

|

| Net loss per common share: |

|

|

|

|

|

|

|

| Basic |

$ |

(0.07) |

|

|

$ |

(0.09) |

|

|

|

|

|

| Diluted |

$ |

(0.07) |

|

|

$ |

(0.09) |

|

|

|

|

|

The following potential dilutive securities were excluded from the computation of diluted net loss per common share as their effect would have been anti-dilutive:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

|

| |

2025 |

|

2024 |

|

|

|

|

|

(in thousands) |

|

|

| Employee stock options and RSUs |

2,420 |

|

|

2,583 |

|

|

|

|

|

| ESPP |

327 |

|

|

704 |

|

|

|

|

|

| Total potential dilutive securities |

2,747 |

|

|

3,287 |

|

|

|

|

|

ALPHA AND OMEGA SEMICONDUCTOR LIMITED

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

5. Concentration of Credit Risk and Significant Customers

The Company manages its credit risk associated with exposure to distributors and direct customers on outstanding accounts receivable through the application and review of credit approvals, credit ratings and other monitoring procedures. In some instances, the Company also obtains letters of credit from certain customers.

Credit sales, which are mainly on credit terms of 30 to 60 days, are only made to customers who meet the Company’s credit requirements, while sales to new customers or customers with low credit ratings are usually made on an advance payment basis. The Company considers its trade accounts receivable to be of good credit quality because its key distributors and direct customers have long-standing business relationships with the Company and the Company has not experienced any significant bad debt write-offs of accounts receivable in the past. The Company closely monitors the aging of accounts receivable from its distributors and direct customers, and regularly reviews their financial positions, where available.

Summarized below are individual customers whose revenue or accounts receivable balances were 10% or higher than the respective total consolidated amounts:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

| Percentage of revenue |

2025 |

|

2024 |

|

|

|

|

| Customer A |

21.8 |

% |

|

22.5 |

% |

|

|

|

|

| Customer B |

53.8 |

% |

|

51.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

September 30,

2025 |

|

June 30,

2025 |

| Percentage of accounts receivable |

|

| Customer A |

* |

|

14.9 |

% |

| Customer B |

72.9 |

% |

|

52.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Less than 10%

ALPHA AND OMEGA SEMICONDUCTOR LIMITED

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

6. Balance Sheet Components

Accounts receivable, net:

|

|

|

|

|

|

|

|

|

|

|

|

| |

September 30,

2025 |

|

June 30,

2025 |

|

(in thousands) |

| Accounts receivable |

$ |

75,851 |

|

|

$ |

75,604 |

|

| Less: Allowance for price adjustments |

(38,722) |

|

|

(40,802) |

|

| Less: Allowance for credit losses |

(30) |

|

|

(30) |

|

| Accounts receivable, net |

$ |

37,099 |

|

|

$ |

34,772 |

|

Inventories:

|

|

|

|

|

|

|

|

|

|

|

|

| |

September 30,

2025 |

|

June 30,

2025 |

|

(in thousands) |

| Raw materials |

$ |

80,522 |

|

|

$ |

81,341 |

|

| Work-in-process |

96,373 |

|

|

91,591 |

|

| Finished goods |

19,261 |

|

|

16,745 |

|

| |

$ |

196,156 |

|

|

$ |

189,677 |

|

Other current assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

2025 |

|

June 30,

2025 |

|

(in thousands) |

| Value-added tax receivable |

$ |

454 |

|

|

$ |

339 |

|

| Other prepaid expenses |

2,154 |

|

|

2,383 |

|

| Prepaid insurance |

3,992 |

|

|

3,669 |

|

| Prepaid maintenance |

1,904 |

|

|

1,990 |

|

| Deposit with supplier |

5,521 |

|

|

7,073 |

|

| Prepaid income tax |

826 |

|

|

336 |

|

| Interest receivable |

234 |

|

|

191 |

|

| Short term deposit |

971 |

|

|

534 |

|

|

|

|

|

| Other receivables |

1,633 |

|

|

1,700 |

|

|

|

|

|

|

$ |

17,689 |

|

|

$ |

18,215 |

|

ALPHA AND OMEGA SEMICONDUCTOR LIMITED

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Property, plant and equipment, net:

|

|

|

|

|

|

|

|

|

|

|

|

| |

September 30,

2025 |

|

June 30,

2025 |

|

(in thousands) |

| Land |

$ |

4,877 |

|

|

$ |

4,877 |

|

|

|

|

|

| Building and building improvements |

72,029 |

|

|

71,961 |

|

| Manufacturing machinery and equipment |

451,443 |

|

|

442,462 |

|

| Equipment and tooling |

38,551 |

|

|

37,918 |

|

| Computer equipment and software |

53,528 |

|

|

53,509 |

|

| Office furniture and equipment |

3,255 |

|

|

3,267 |

|

| Leasehold improvements |

43,857 |

|

|

43,901 |

|

|

|

|

|

| |

667,540 |

|

|

657,895 |

|

| Less: accumulated depreciation and amortization |

(384,135) |

|

|

(371,836) |

|

| |

283,405 |

|

|

286,059 |

|

| Equipment and construction in progress |

26,272 |

|

|

28,038 |

|

| Property, plant and equipment, net |

$ |

309,677 |

|

|

$ |

314,097 |

|

Intangible assets, net:

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

2025 |

|

June 30,

2025 |

|

(in thousands) |

| Patents and technology rights |

$ |

18,037 |

|

|

$ |

18,037 |

|

| Software license |

1,181 |

|

|

— |

|

| Trade name |

268 |

|

|

268 |

|

| Customer relationships |

1,150 |

|

|

1,150 |

|

|

20,636 |

|

|

19,455 |

|

| Less: accumulated amortization |

(19,525) |

|

|

(19,455) |

|

|

1,111 |

|

|

— |

|

| Goodwill |

269 |

|

|

269 |

|

| Intangible assets, net |

$ |

1,380 |

|

|

$ |

269 |

|

Future amortization expense of intangible assets is as follows (in thousands):

|

|

|

|

|

|

| Year ending June 30, |

|

| 2026 (Remaining) |

$ |

295 |

|

| 2027 |

406 |

|

| 2028 |

406 |

|

| 2029 |

4 |

|

|

|

|

|

$ |

1,111 |

|

|

|

|

|

|

|

|

|

|

|

|

|

ALPHA AND OMEGA SEMICONDUCTOR LIMITED

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Other long-term assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

2025 |

|

June 30,

2025 |

|

(in thousands) |

| Prepayments for property and equipment |

$ |

1,844 |

|

|

$ |

1,973 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Customs deposit |

824 |

|

|

814 |

|

| Deposit with supplier |

18,080 |

|

|

18,080 |

|

|

|

|

|

| Office leases deposits |

971 |

|

|

1,358 |

|

| Other |

471 |

|

|

541 |

|

| |

$ |

22,190 |

|

|

$ |

22,766 |

|

Accrued liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

2025 |

|

June 30,

2025 |

|

(in thousands) |

| Accrued compensation and benefits |

$ |

22,999 |

|

|

$ |

17,766 |

|

|

|

|

|

|

|

|

|

| Warranty accrual |

2,082 |

|

|

2,118 |

|

| Stock rotation accrual |

5,659 |

|

|

6,184 |

|

| Accrued professional fees |

3,315 |

|

|

3,399 |

|

|

|

|

|

|

|

|

|

| Accrued inventory |

465 |

|

|

1,465 |

|

| Accrued facilities related expenses |

2,793 |

|

|

2,184 |

|

|

|

|

|

| Accrued property, plant and equipment |

2,839 |

|

|

2,704 |

|

| Other accrued expenses |

4,871 |

|

|

4,755 |

|

| Customer deposits |

19,625 |

|

|

17,030 |

|

| ESPP payable |

3,528 |

|

|

1,422 |

|

| |

$ |

68,176 |

|

|

$ |

59,027 |

|

Short-term customer deposits are payments received from customers for securing future product shipments. As of September 30, 2025, $7.0 million for such deposits were from Customer A, $2.0 million were from Customer B, and $10.6 million were from other customers. As of June 30, 2025, $7.0 million were from Customer A, $2.0 million were from Customer B, and $8.0 million were from other customers.

The activities in the warranty accrual, included in accrued liabilities, are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

2025 |

|

2024 |

|

|

(in thousands) |

|

| Beginning balance |

$ |

2,118 |

|

|

$ |

2,407 |

|

|

| Additions |

163 |

|

|

341 |

|

|

| Released |

— |

|

|

(700) |

|

|

| Utilization |

(199) |

|

|

(200) |

|

|

| Ending balance |

$ |

2,082 |

|

|

$ |

1,848 |

|

|

ALPHA AND OMEGA SEMICONDUCTOR LIMITED

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

The activities in the stock rotation accrual, included in accrued liabilities, are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

2025 |

|

2024 |

|

(in thousands) |

| Beginning balance |

$ |

6,184 |

|

|

$ |

4,660 |

|

| Additions |

3,598 |

|

|

2,251 |

|

| Utilization |

(4,123) |

|

|

(2,459) |

|

| Ending balance |

$ |

5,659 |

|

|

$ |

4,452 |

|

Other long-term liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

| |

September 30,

2025 |

|

June 30,

2025 |

|

(in thousands) |

|

|

|

|

| Customer deposits |

$ |

2,000 |

|

|

$ |

7,000 |

|

| Other |

504 |

|

|

— |

|

| Other long-term liabilities |

$ |

2,504 |

|

|

$ |

7,000 |

|

Customer deposits are payments received from customers for securing future product shipments. As of September 30, 2025, $1.0 million for such deposits were from Customer A, and $1.0 million were from other customers. As of June 30, 2025, $5.0 million were from Customer A and $2.0 million were from other customers.

ALPHA AND OMEGA SEMICONDUCTOR LIMITED

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

7. Bank Borrowings

Accounts Receivable Factoring Agreement

On August 9, 2019, one of the Company's wholly-owned subsidiaries (the "Borrower") entered into a factoring agreement with the Hongkong and Shanghai Banking Corporation Limited (“HSBC”), whereby the Borrower assigns certain of its accounts receivable with recourse. This factoring agreement allows the Borrower to borrow up to 70% of the net amount of its eligible accounts receivable of the Borrower with a maximum amount of $30.0 million. The interest rate is based on the Secured Overnight Financing Rate ("SOFR)", plus 2.01% per annum. The Company is the guarantor for this agreement. The Company is accounting for this transaction as a secured borrowing under the Transfers and Servicing of Financial Assets guidance. In addition, any cash held in the restricted bank account controlled by HSBC has a legal right of offset against the borrowing. This agreement, with certain financial covenants required, has no expiration date. On August 11, 2021, the Borrower signed an agreement with HSBC to decrease the borrowing maximum amount to $8.0 million with certain financial covenants required. Other terms remain the same. In August 2025, this factoring agreement was terminated with no outstanding balance.

Debt financing