Document

Broadridge Reports Fourth Quarter and Fiscal 2024 Results

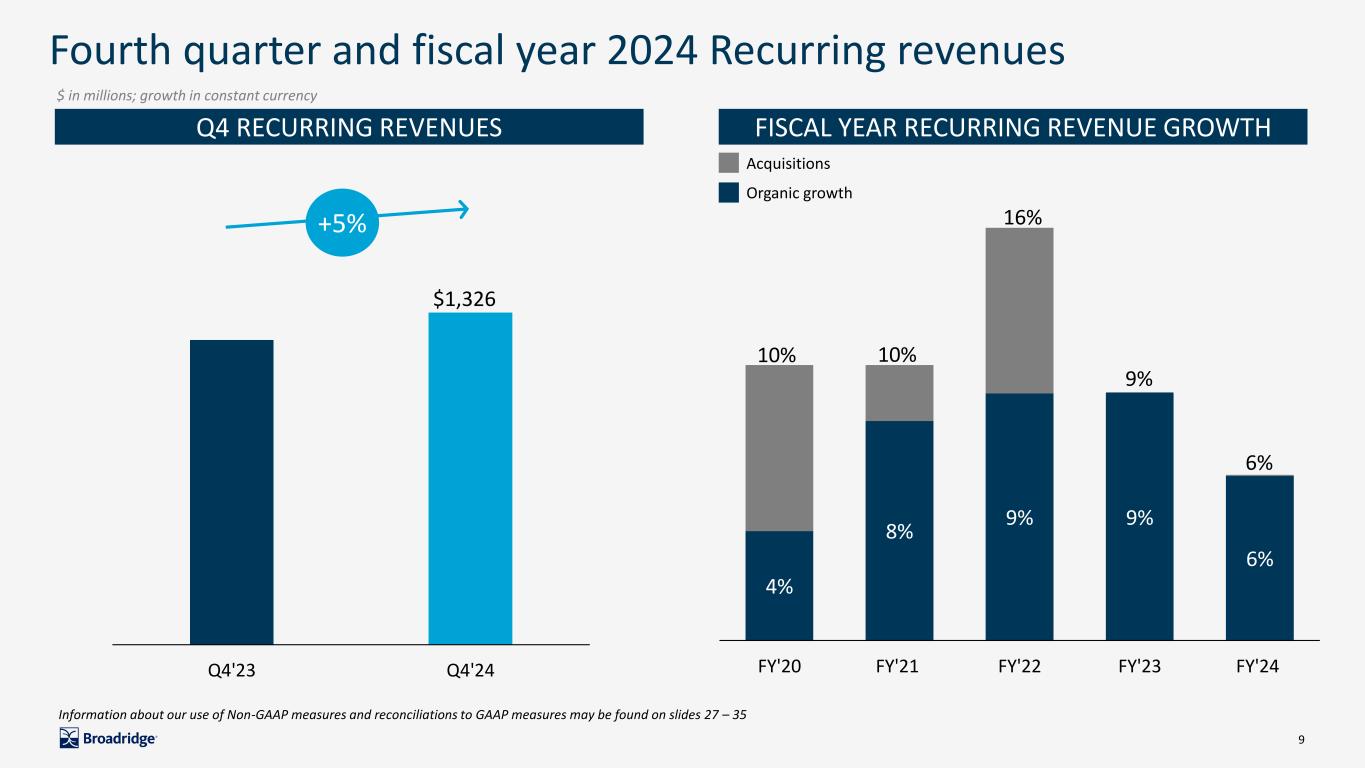

Fiscal Year 2024 Recurring revenues grew 6% on a reported and constant currency basis

Diluted EPS grew 11% and Adjusted EPS grew 10% to $7.73

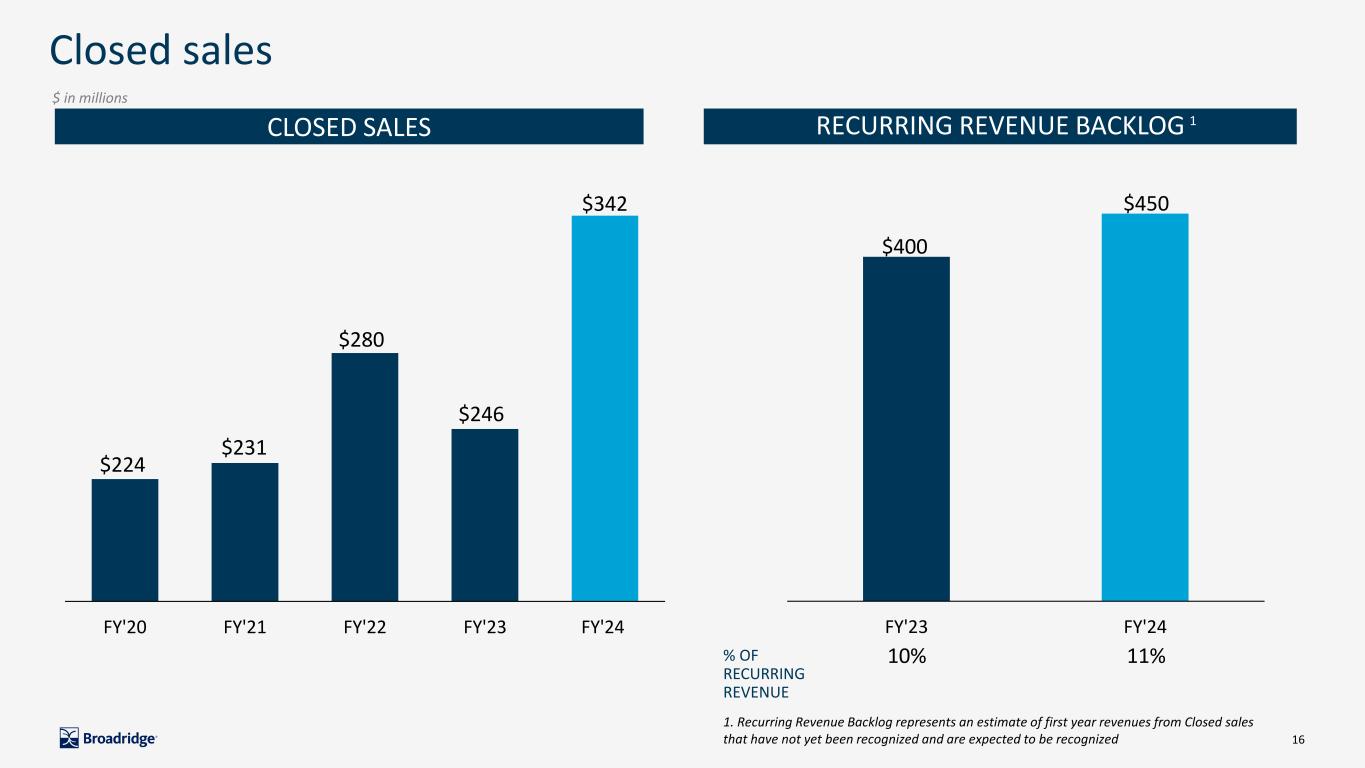

Closed sales rose 39% to a record $342 million

18th consecutive annual dividend increase, up 10% to $3.52 per share

Fiscal year 2025 guidance of 5-7% Recurring revenue growth constant currency

and 8-12% Adjusted EPS growth

NEW YORK, N.Y., August 6, 2024 - Broadridge Financial Solutions, Inc. (NYSE:BR) today reported financial results for the fourth quarter and fiscal year 2024. Results compared with the same period last year were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Summary Financial Results |

|

Fourth Quarter |

|

Fiscal Year |

|

|

Dollars in millions, except per share data

|

|

2024 |

2023 |

Change |

2024 |

2023 |

Change |

|

|

|

|

|

|

|

|

|

| Recurring revenues |

|

$1,326 |

$1,259 |

5 |

% |

$4,223 |

$3,987 |

6 |

% |

|

Constant currency growth - Non-GAAP |

|

|

|

5 |

% |

|

|

6 |

% |

| Total revenues |

|

$1,944 |

$1,839 |

6 |

% |

$6,507 |

$6,061 |

7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

$441 |

$454 |

(3 |

%) |

$1,017 |

$936 |

9 |

% |

|

Margin |

|

22.7 |

% |

24.7 |

% |

|

15.6 |

% |

15.4 |

% |

|

|

|

|

|

|

|

|

|

|

| Adjusted Operating income - Non-GAAP |

|

$559 |

$531 |

5 |

% |

$1,303 |

$1,199 |

9 |

% |

|

Margin |

|

28.8 |

% |

28.9 |

% |

|

20.0 |

% |

19.8 |

% |

|

|

|

|

|

|

|

|

|

|

| Diluted EPS |

|

$2.72 |

$2.72 |

— |

% |

$5.86 |

$5.30 |

11 |

% |

| Adjusted EPS - Non-GAAP |

|

$3.50 |

$3.21 |

9 |

% |

$7.73 |

$7.01 |

10 |

% |

|

|

|

|

|

|

|

|

|

| Closed sales |

|

$157 |

$90 |

74 |

% |

$342 |

$246 |

39 |

% |

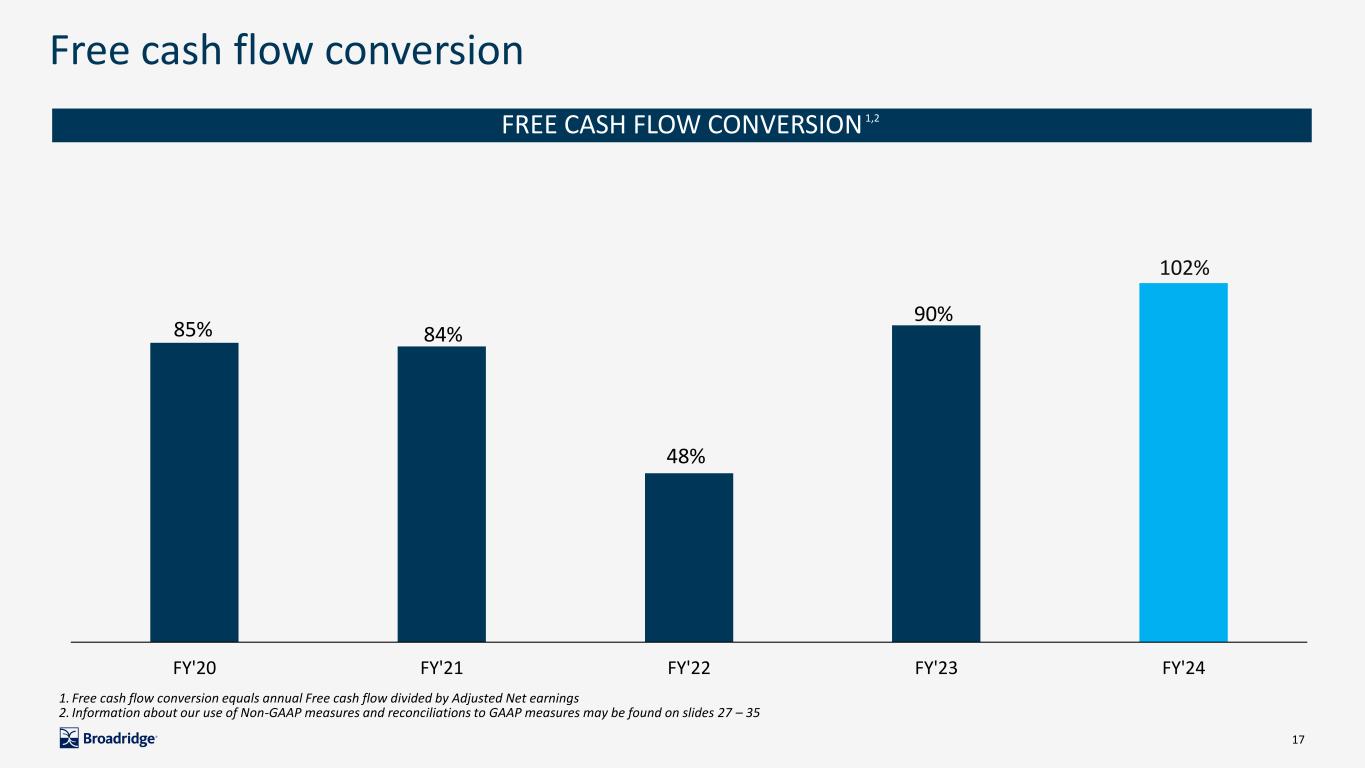

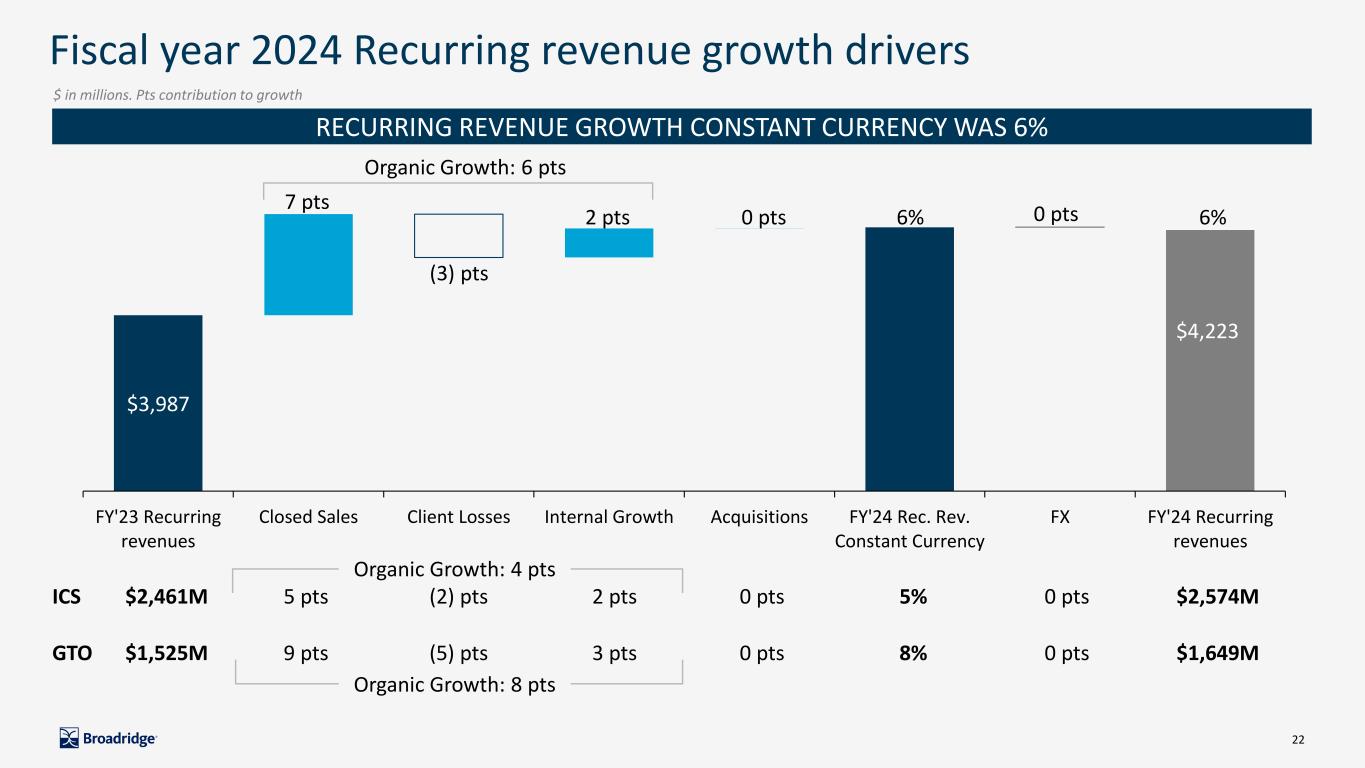

“As we close fiscal year 2024, Broadridge is executing on its strategy to democratize and digitize Governance, simplify and innovate trading in Capital Markets, and modernize Wealth Management,” said Tim Gokey, Broadridge CEO. “Closed sales for the year rose 39% to $342 million as we helped our clients adapt to regulatory change and modernize their technology and operations. That sales performance capped a strong year with 6% Recurring revenue growth, 10% Adjusted EPS growth, and Free cash flow conversion of 102%.

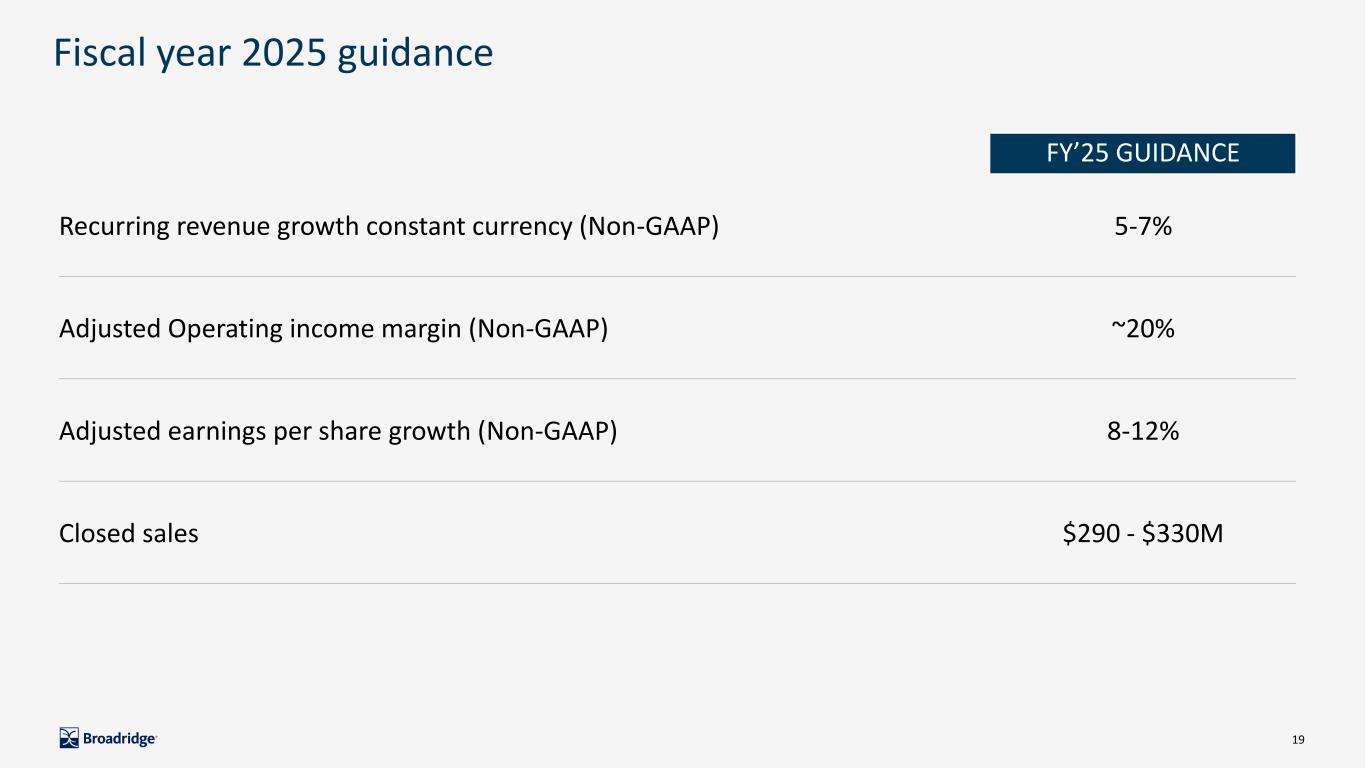

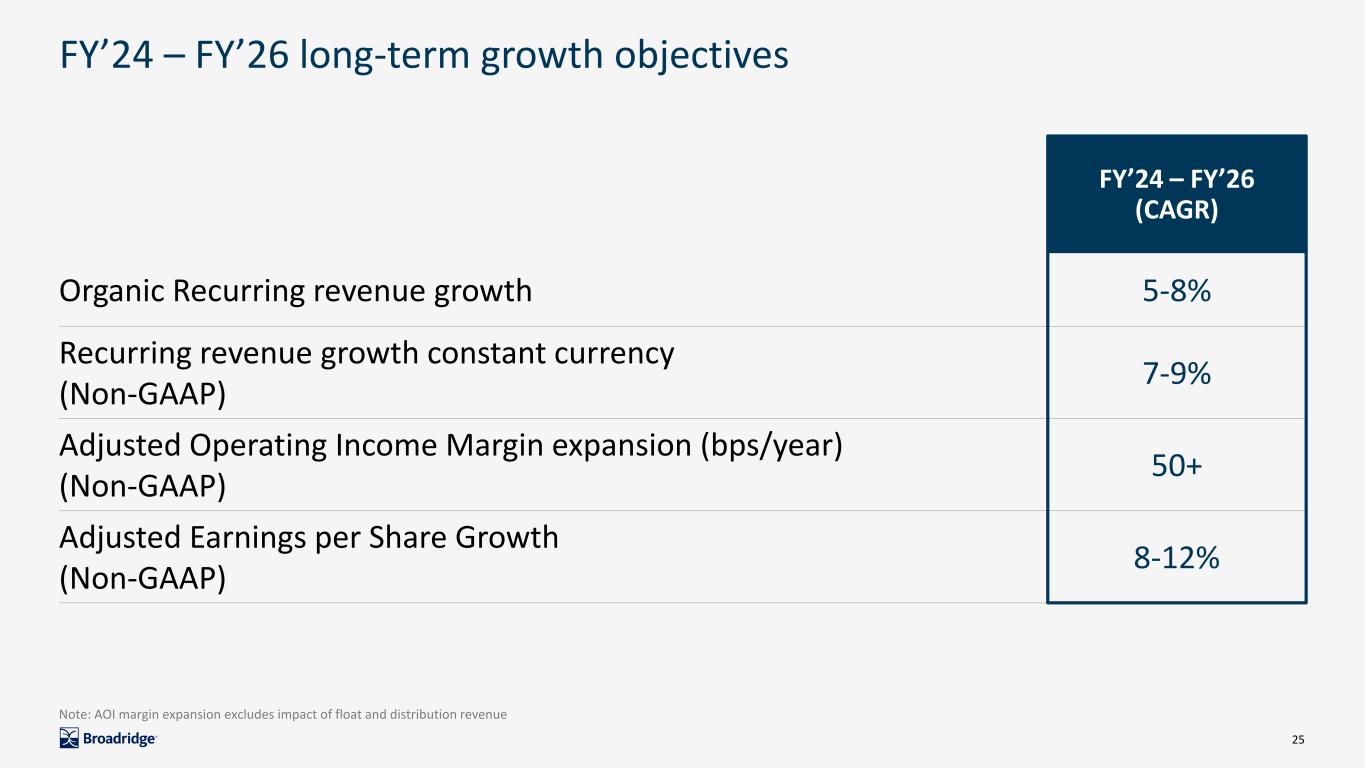

“Broadridge is well-positioned for continued growth. Our fiscal year 2025 guidance calls for another year of strong and sustainable growth, including 5-7% Recurring revenue constant currency and 8-12% Adjusted EPS growth,” Mr. Gokey added. “The combination of our strong fiscal year 2024 results and fiscal year 2025 guidance has Broadridge well on-track to deliver again on our three-year financial objectives.

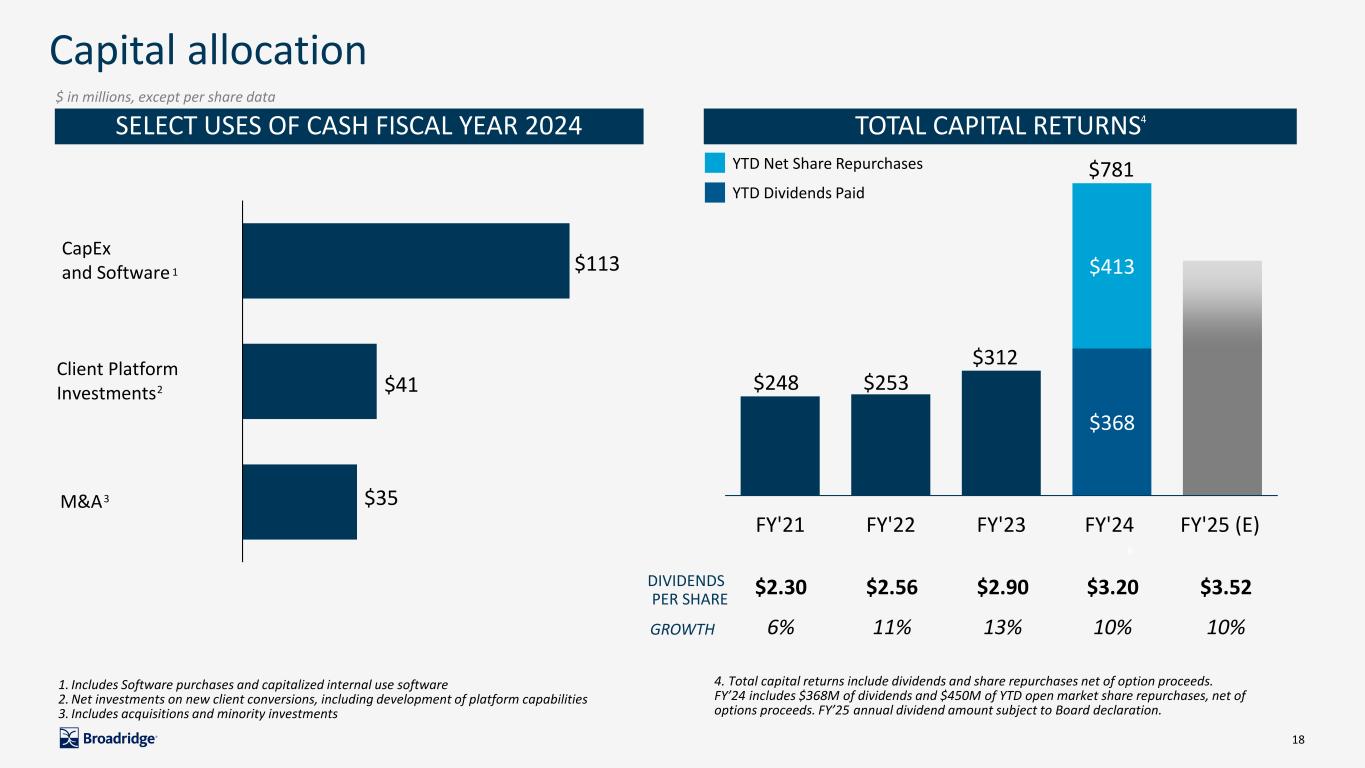

“We remain committed to a balanced approach to capital allocation. In fiscal year 2024, we repurchased $450 million of our shares and announced three tuck-in acquisitions. I am also pleased to report that our Board has approved a 10% increase in our annual dividend to $3.52, marking the 12th double-digit increase in the past thirteen years,” Mr. Gokey concluded.

Fiscal Year 2025 Financial Guidance

|

|

|

|

|

|

|

|

|

| Recurring revenue growth constant currency - Non-GAAP |

|

5 - 7% |

| Adjusted Operating income margin - Non-GAAP |

|

~20% |

| Adjusted Earnings per share growth - Non-GAAP |

|

8 - 12% |

| Closed sales |

|

$290 - $330 million |

Financial Results for Fourth Quarter Fiscal Year 2024 compared to Fourth Quarter Fiscal Year 2023

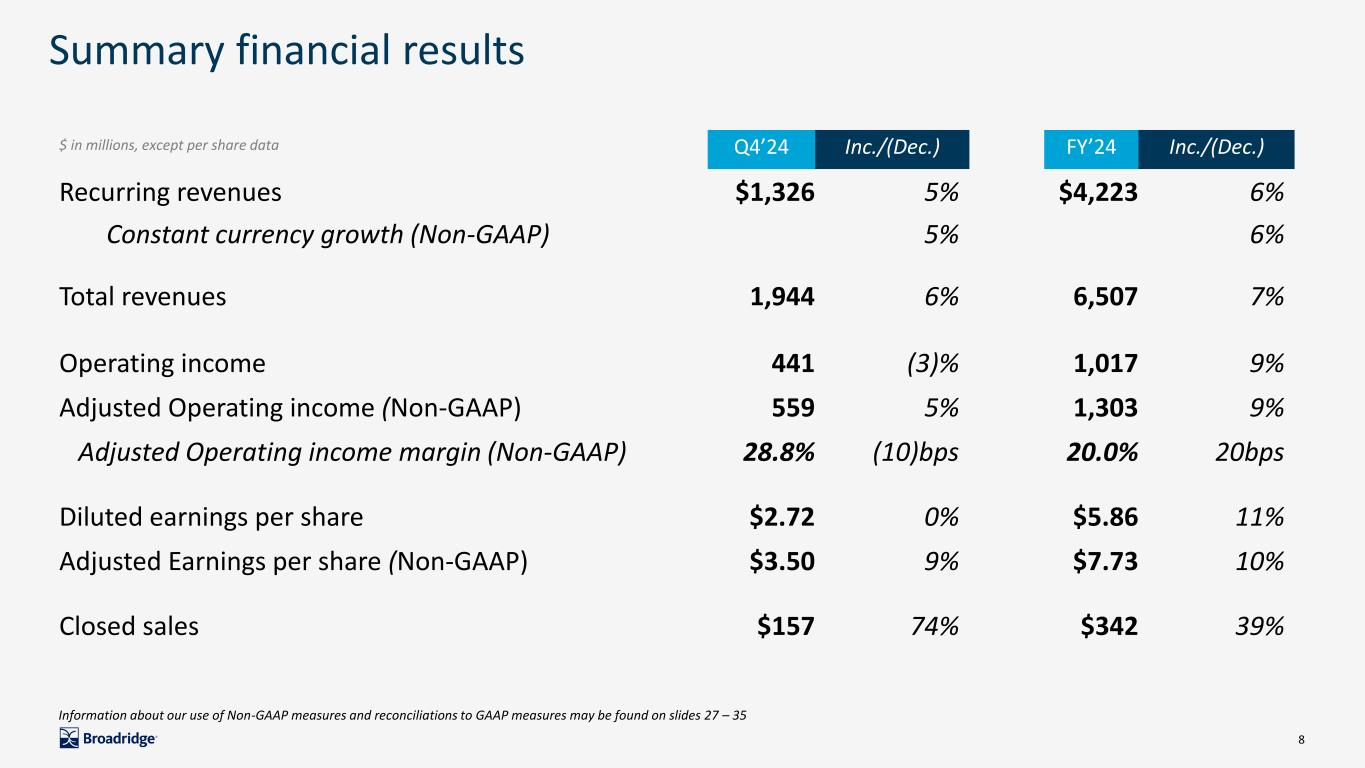

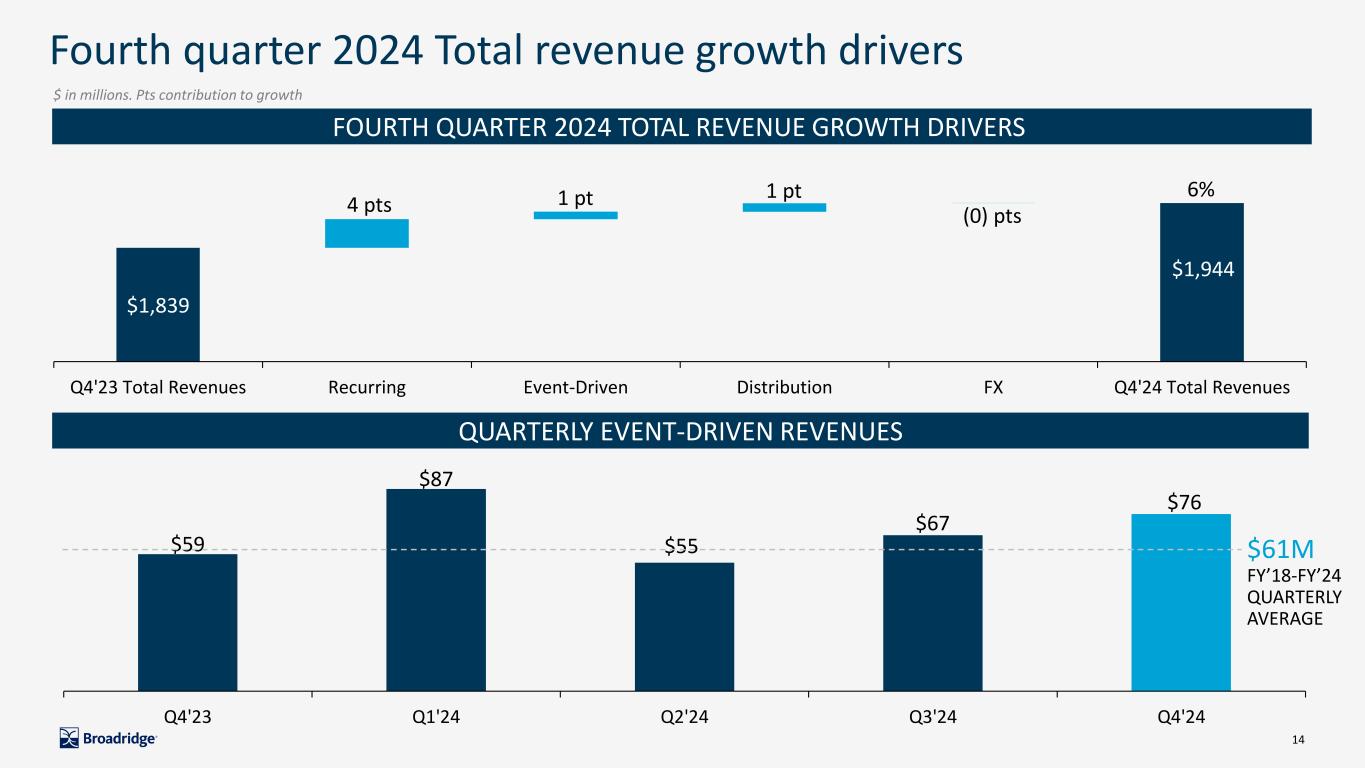

•Total revenues increased 6% to $1,944 million from $1,839 million in the prior year period.

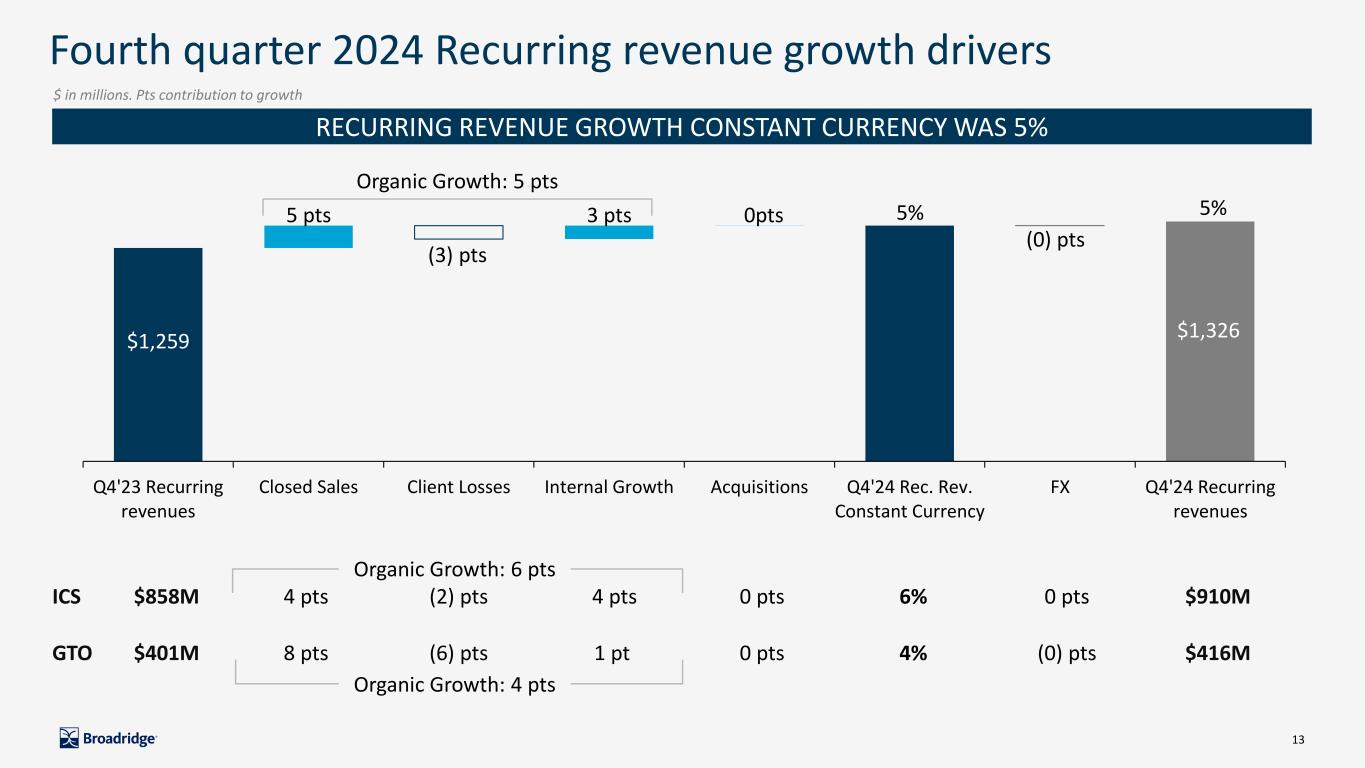

◦Recurring revenues increased 5% to $1,326 million from $1,259 million. Recurring revenue growth constant currency (Non-GAAP) was 5%, driven by Internal Growth and Net New Business.

◦Event-driven revenues increased by $17 million, or 29%, to $76 million, primarily due to higher equity proxy contests and higher volume of mutual fund proxy communications.

◦Distribution revenues increased $20 million, or 4%, to $542 million, driven by the impact of postage rate increases of approximately $28 million, partially offset by lower print revenues.

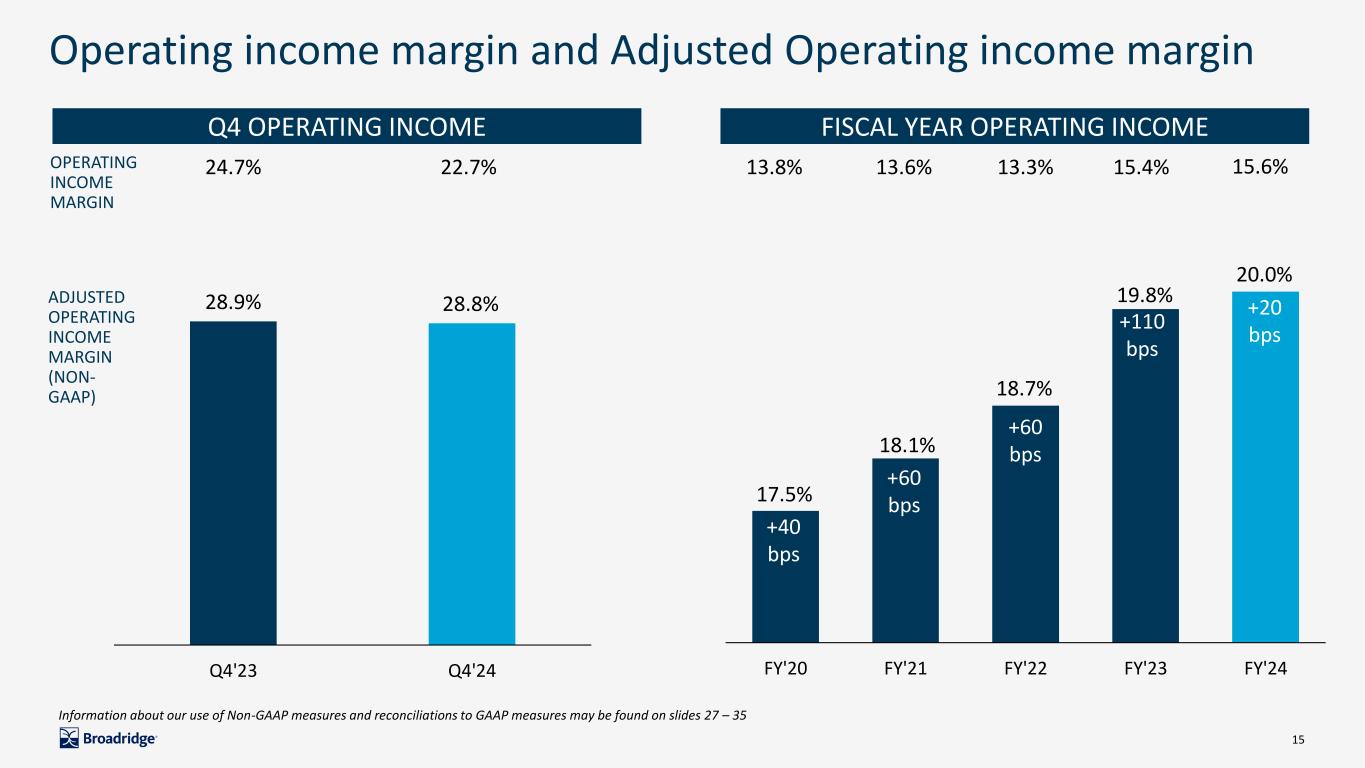

•Operating income was $441 million, a decrease of $13 million, or 3%. Operating income margin decreased to 22.7%, compared to 24.7% for the prior year period, due to increased operating expenses, including higher Restructuring and Other Related Costs and Litigation Settlement Charges (as defined below), more than offsetting the growth in Recurring revenues and event-driven revenues.

Adjusted Operating income was $559 million, an increase of $28 million, or 5%. The increase was driven by higher Recurring revenues. Adjusted Operating income margin decreased to 28.8%, compared to 28.9% for the prior year period. The combination of higher distribution revenue and float income had an offsetting impact on margins.

•Interest expense, net was $33 million, a decrease of $3 million, primarily due to a decrease in average borrowings.

•The effective tax rate was 21.2% compared to 22.4% in the prior year period. The decrease was driven by an increase in discrete tax benefits. The higher excess tax benefit related to equity compensation contributed to the increase in total discrete tax benefits.

•Net earnings were essentially unchanged at $323 million and Adjusted Net earnings increased 9% to $415 million.

◦Diluted earnings per share were flat at $2.72.

◦Adjusted earnings per share increased 9% to $3.50.

Segment and Other Results for Fourth Quarter Fiscal Year 2024 compared to Fourth Quarter Fiscal Year 2023

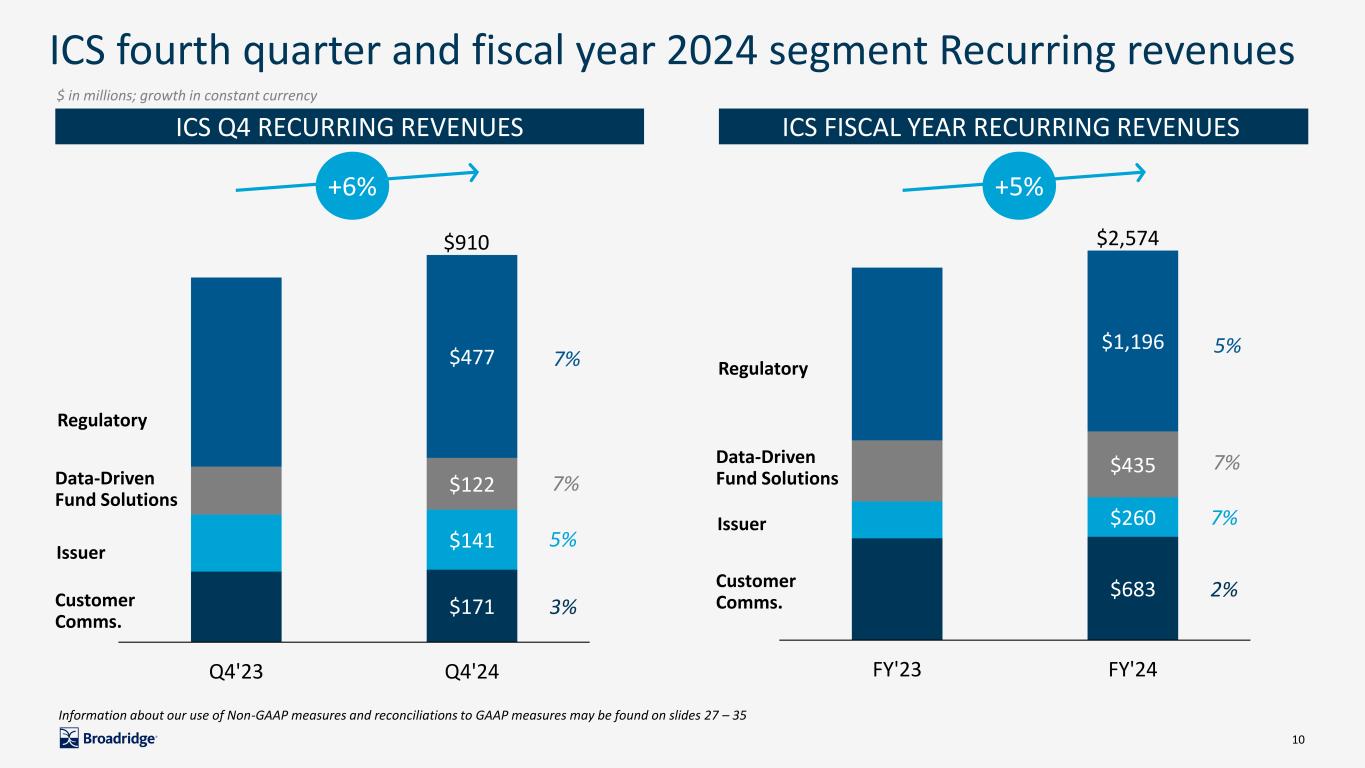

Investor Communication Solutions (“ICS”)

•ICS total Revenues were $1,528 million, an increase of $90 million, or 6%.

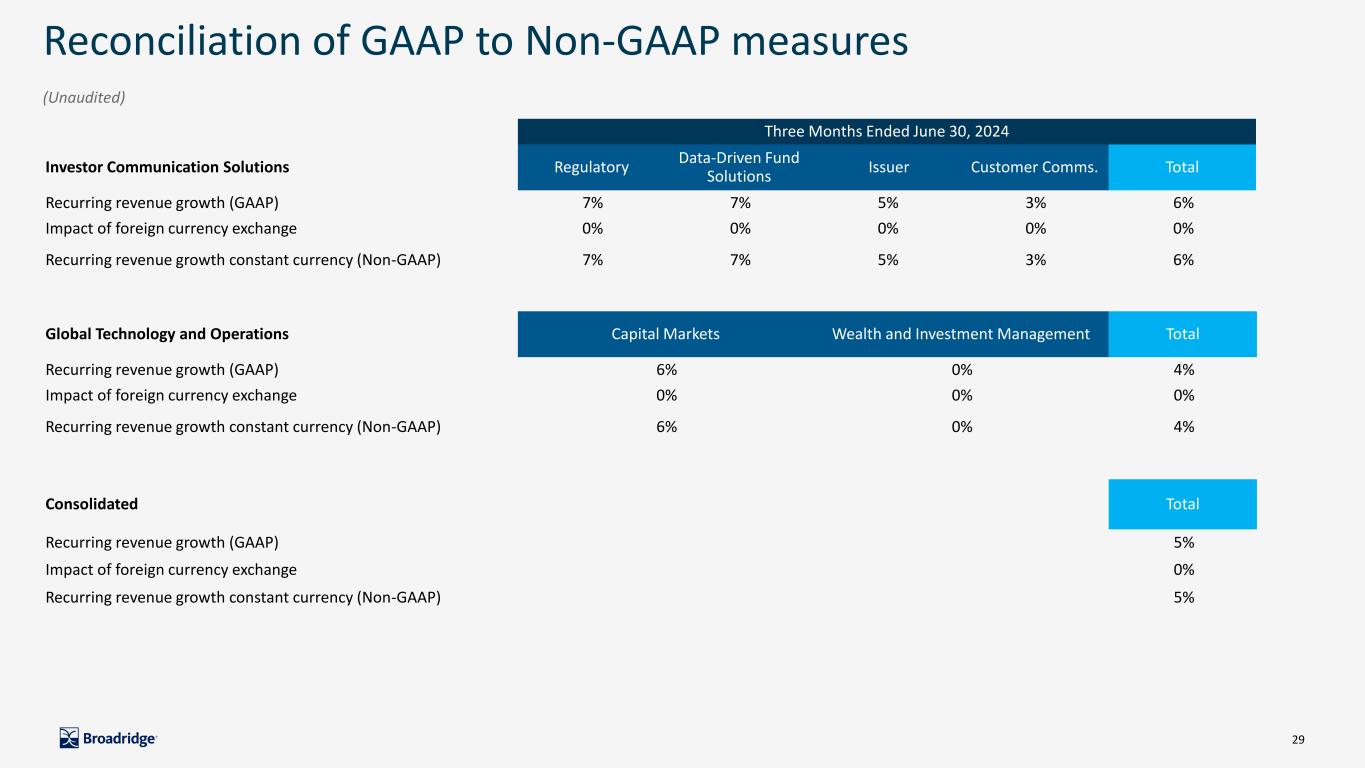

◦Recurring revenues increased $53 million, or 6%, to $910 million. Recurring revenue growth constant currency (Non-GAAP) was 6%, driven by Internal Growth and Net New Business.

◦By product line, Recurring revenue growth and Recurring revenue growth constant currency (Non-GAAP) were as follows:

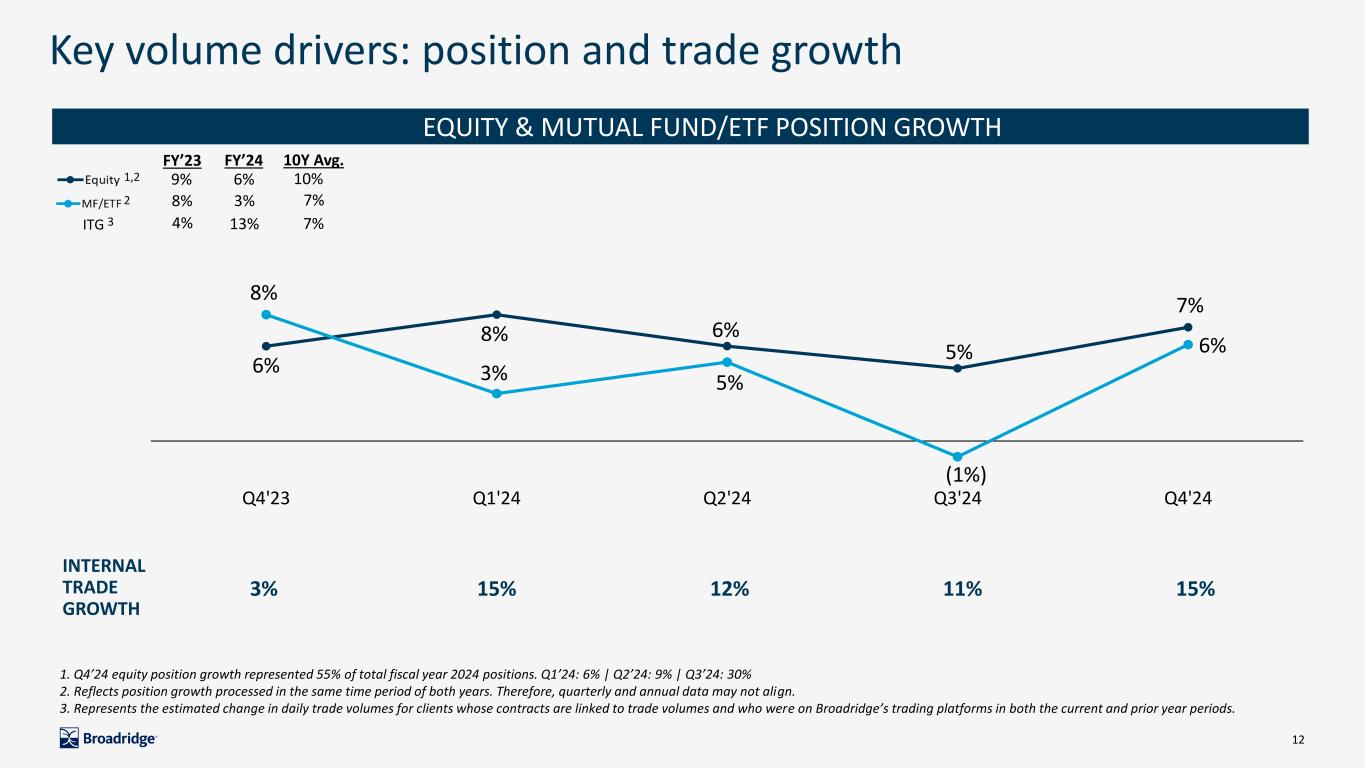

▪Regulatory rose 7% and 7%, respectively, driven by equity position growth of 7% and mutual fund/ETF position growth of 6%. Revenues also benefited from the delay in timing of a portion of proxy communications from the fiscal third quarter into fiscal fourth quarter.

▪Data-driven fund solutions rose 7% and 7%, respectively, driven by growth in our retirement and workplace products, as well as data and analytics solutions.

▪Issuer rose 5% and 5%, respectively, driven by growth in our registered shareholder solutions; and

▪Customer communications rose 3% and 3%, respectively, driven by growth in digital communications, partially offset by slower growth in print revenues.

◦Event-driven revenues increased $17 million, or 29%, to $76 million, primarily due to higher equity proxy contests and higher volume of mutual fund proxy communications.

◦Distribution revenues increased $20 million, or 4%, to $542 million, driven by the impact of postage rate increases of approximately $32 million, partially offset by lower print volumes.

•Earnings before income taxes were $469 million, an increase of $38 million, or 9%, primarily from higher Recurring revenue. Operating expenses rose 5%, or $52 million, to $1,059 million, driven by higher distribution and other segment expenses. Pre-tax margins increased to 30.7% from 30.0%.

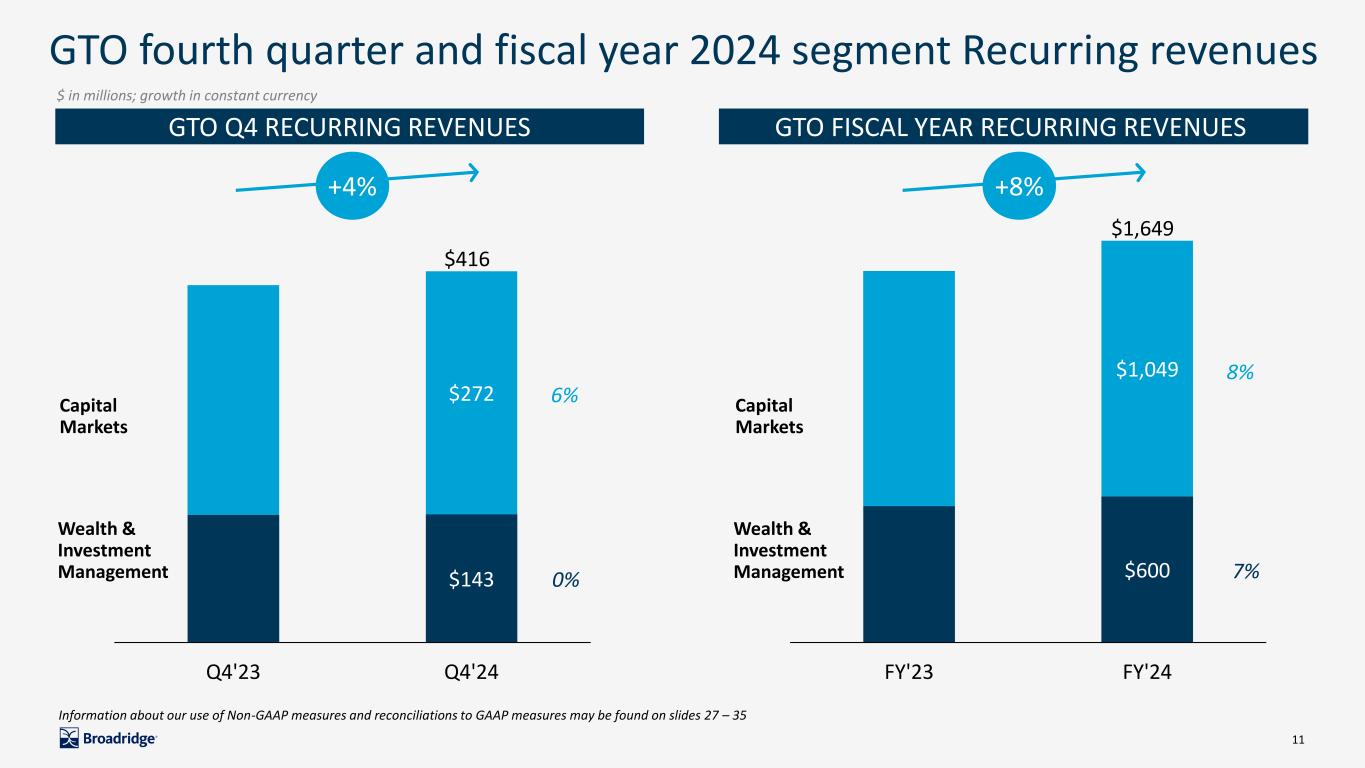

Global Technology and Operations (“GTO”)

•GTO Recurring revenues were $416 million, an increase of $15 million, or 4%. Recurring revenue growth constant currency (Non-GAAP) was 4%, all organic, driven by Net New Business and Internal Growth.

•By product line, Recurring revenue growth and Recurring revenue growth constant currency (Non-GAAP) were as follows:

◦Capital markets rose 6% and 6%, respectively, driven by Net New Business and Internal Growth, which benefited from higher trading volumes.

◦Wealth and investment management was essentially flat as revenue from new sales was offset by client losses.

•Earnings before income taxes were $47 million, a decrease of $5 million, or 9%. Pre-tax margins decreased to 11.3% from 13.0% as higher revenues were more than offset by higher expenses, including an increase in amortization and depreciation expenses of $17 million.

Other

•Other Loss before income tax was $106 million compared to a loss of $66 million in the prior year period primarily due to the impact of $36 million of higher Restructuring and Other Related Costs and a Litigation Settlement Charge of $10 million, partially offset by lower interest expense, net of $3 million.

Financial Results for Fiscal Year 2024 compared to Fiscal Year 2023

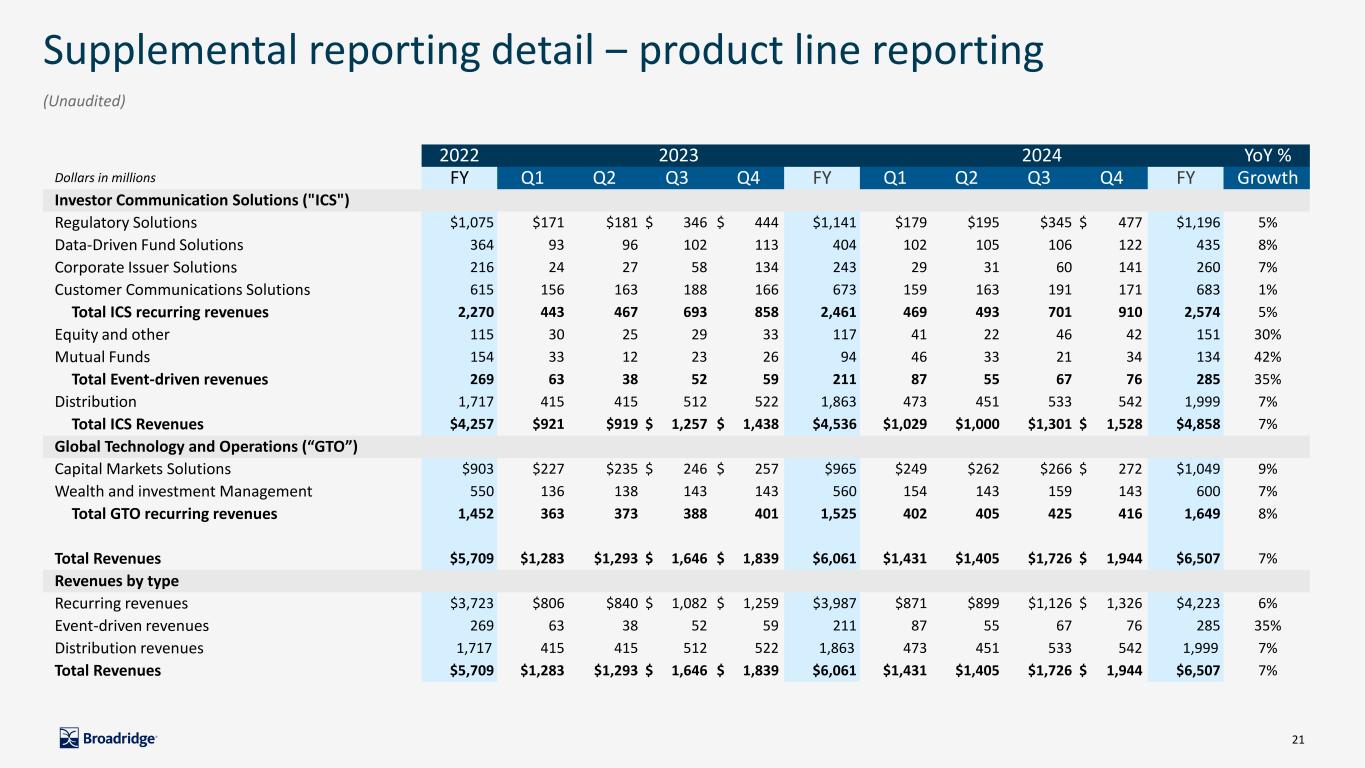

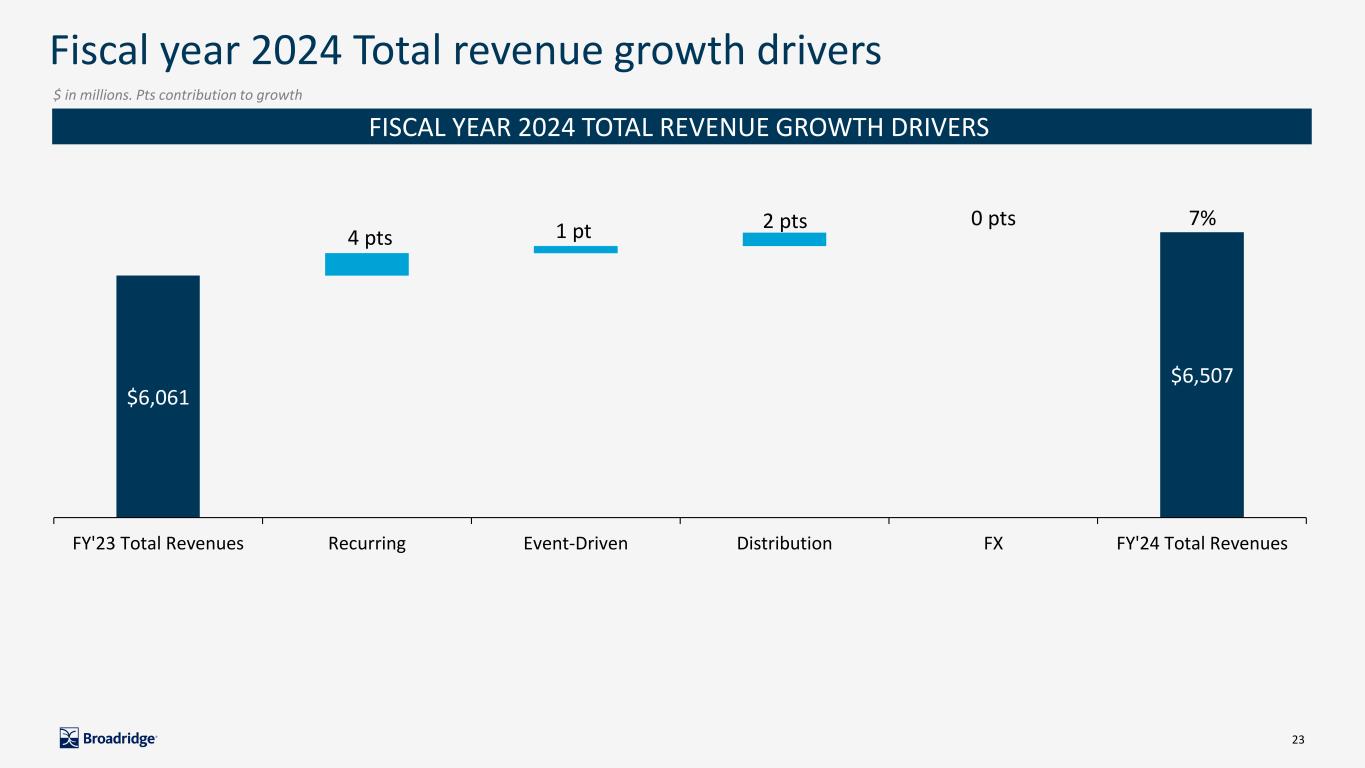

•Total revenues increased 7% to $6,507 million from $6,061 million in the prior year period.

◦Recurring revenues increased 6% to $4,223 million from $3,987 million. Recurring revenue growth constant currency (Non-GAAP) was 6%, driven by Net New Business and Internal Growth.

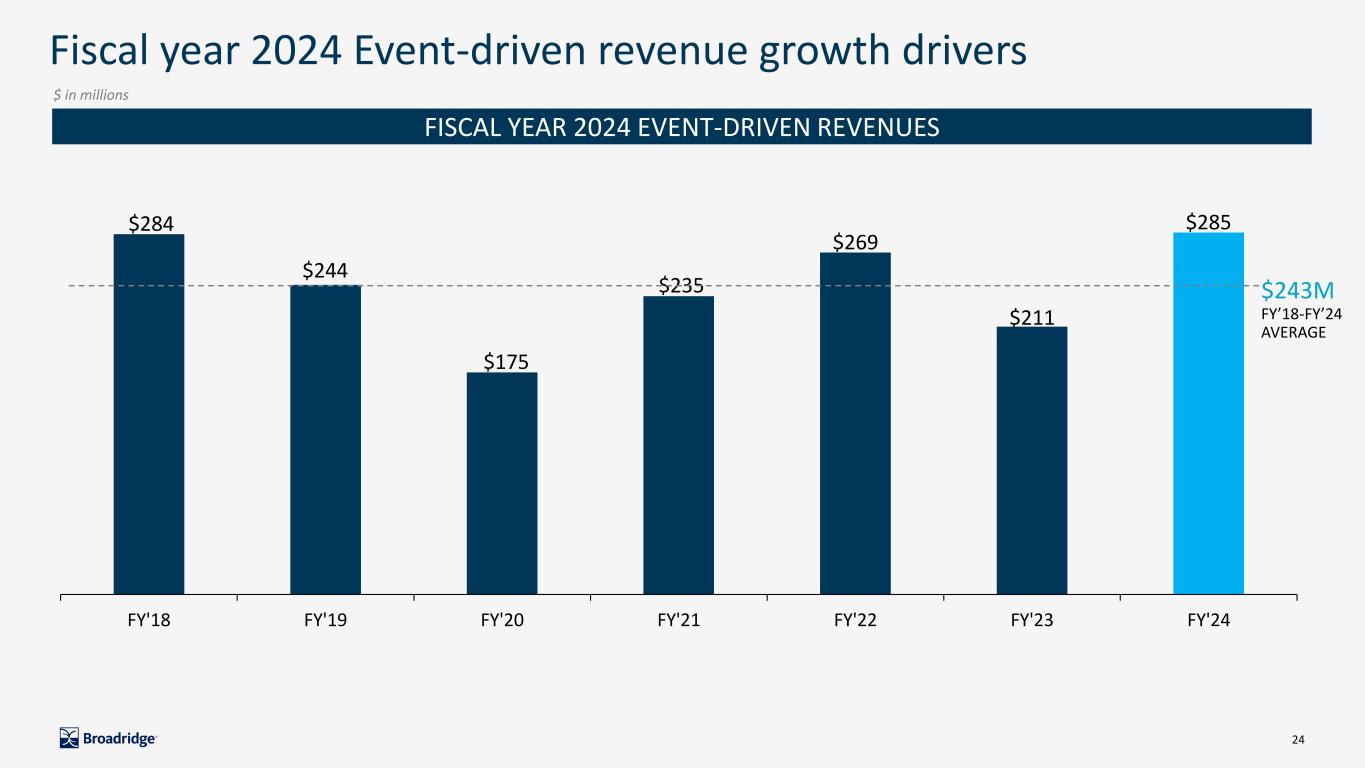

◦Event-driven revenues increased $74 million, or 35%, to $285 million, driven by higher mutual fund proxy, equity proxy contests, and corporate action activity.

◦Distribution revenues increased $136 million, or 7%, to $1,999 million, driven by the impact of postage rate increases of approximately $116 million, as well as higher event-driven mailings.

•Operating income was $1,017 million, an increase of $81 million, or 9%. Operating income margin increased to 15.6% from 15.4% due to the growth in Recurring revenues and higher event-driven revenues.

Adjusted Operating income was $1,303 million, an increase of $104 million, or 9%. The increase was primarily driven by higher Recurring revenues and higher event-driven revenues, partially offset by growth investments and other spending. Adjusted Operating income margin increased to 20.0%, compared to 19.8% for the prior year period. The combination of higher distribution revenue and higher float income had a net benefit of approximately 30 basis points.

•Interest expense, net was $138 million, an increase of $3 million, as the impact of higher interest rates was partially offset by a decrease in average borrowings.

•The effective tax rate was 20.4% compared to 20.7% in the prior year period. The decrease in the effective tax rate was driven by an increase in discrete tax benefits relative to pre-tax income. The higher excess tax benefit related to equity compensation contributed to the increase in total discrete tax benefits.

•Net earnings increased 11% to $698 million and Adjusted Net earnings increased 10% to $921 million.

◦Diluted Earnings per share increased 11% to $5.86.

◦Adjusted Earnings per share increased 10% to $7.73.

Segment and Other Results for Fiscal Year 2024 compared to Fiscal Year 2023

ICS

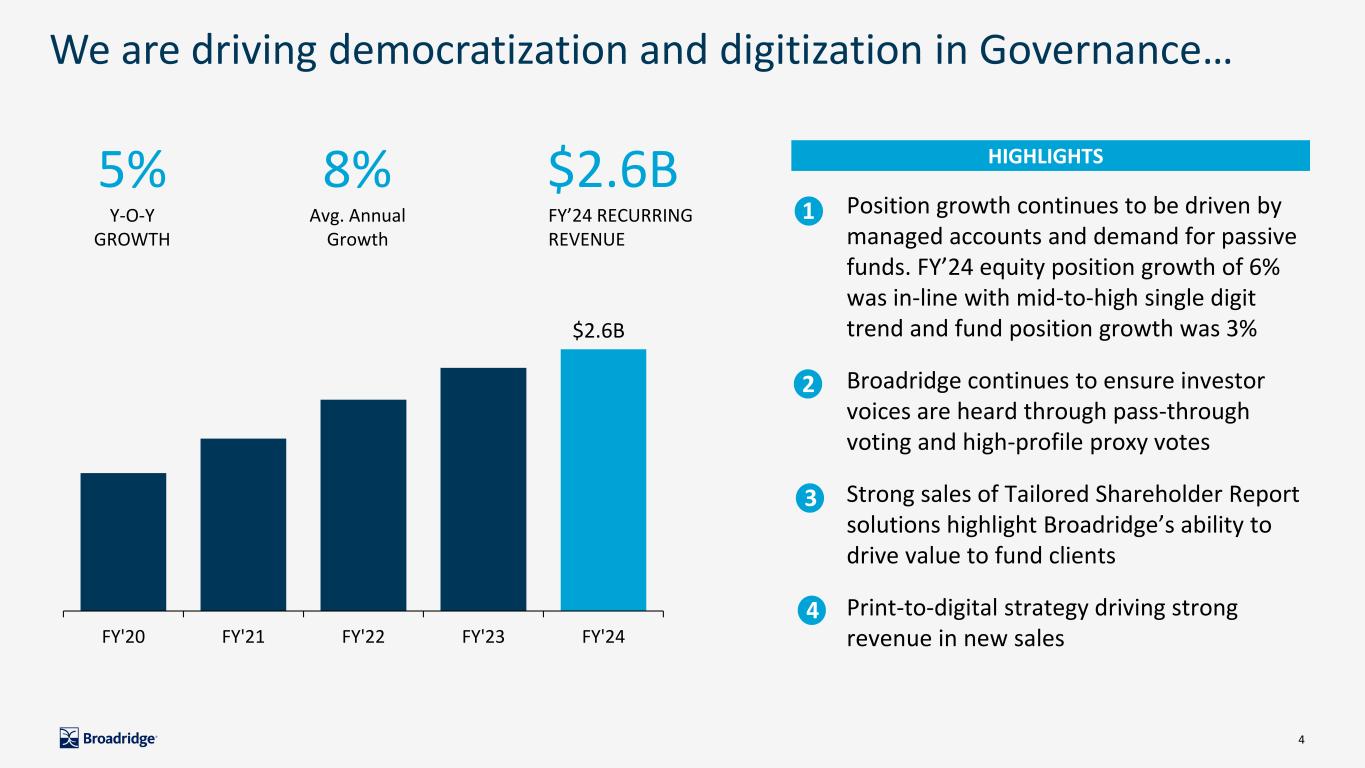

•ICS total Revenues were $4,858 million, an increase of $322 million, or 7%.

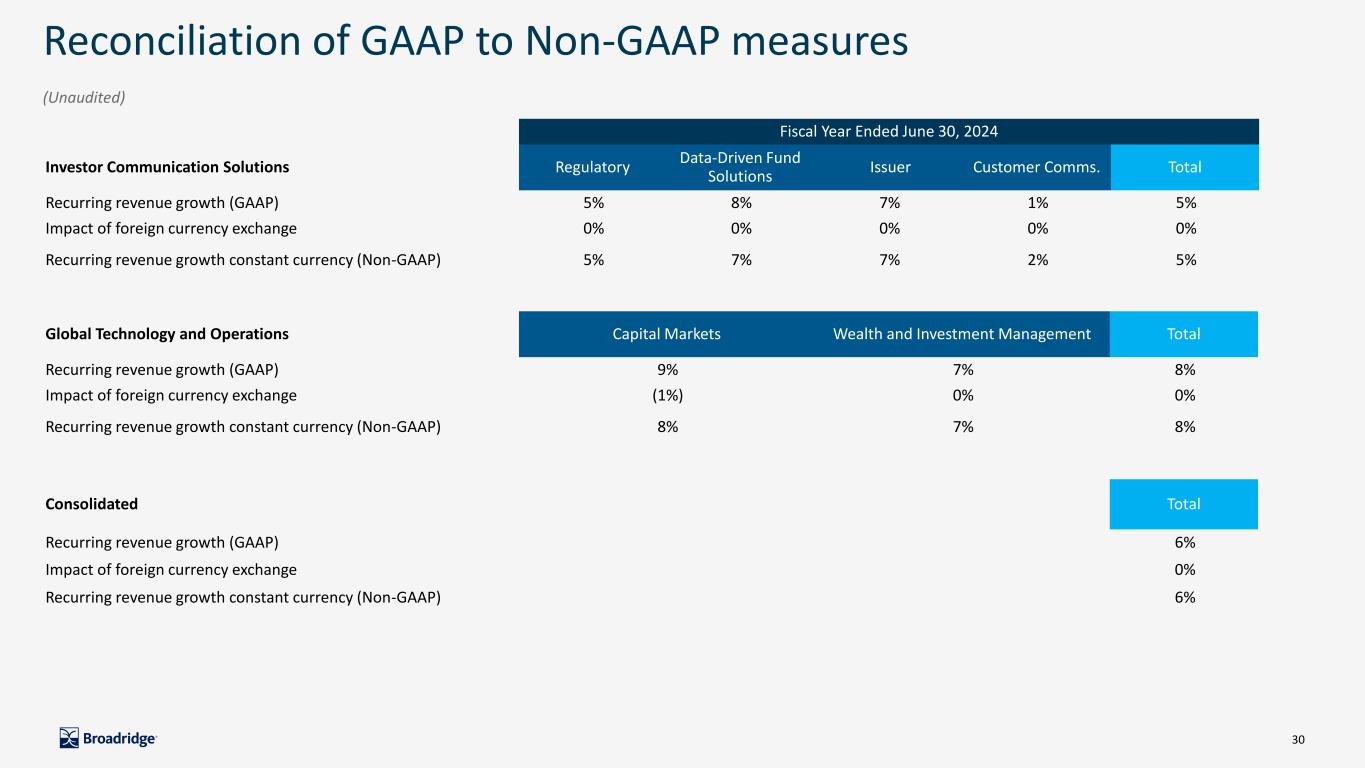

◦Recurring revenues increased $112 million, or 5%, to $2,574 million. Recurring revenue growth constant currency (Non-GAAP) was 5%, driven by Net New Business and Internal Growth.

◦By product line, Recurring revenue growth and Recurring revenue growth constant currency (Non-GAAP) were as follows:

▪Regulatory rose 5% and 5%, respectively, driven by equity position growth of 6% and mutual fund/ETF position growth of 3%.

▪Data-driven fund solutions rose 8% and 7%, respectively, driven by growth in our retirement and workplace products, as well as data and analytics solutions.

▪Issuer rose 7% and 7%, respectively, driven by growth in our registered shareholder solutions and disclosure solutions.

▪Customer communications rose 1% and 2%, respectively, driven by growth in digital communications, partially offset by flat growth in print revenues.

◦Event-driven revenues increased $74 million, or 35%, to $285 million, driven by mutual fund proxy, equity proxy contests, and corporate action communications.

◦Distribution revenues increased $136 million, or 7%, to $1,999 million, driven by postage rate increases of approximately $116 million, as well as higher event-driven mailings.

•Earnings before income taxes were $950 million, an increase of $139 million, or 17%. The earnings benefit resulted from higher Recurring revenue and higher event-driven revenue. Operating expenses rose 5%, or $183 million, to $3,907 million, primarily driven by higher distribution expenses, as well as higher technology and selling expenses. Pre-tax margins increased to 19.6% from 17.9%.

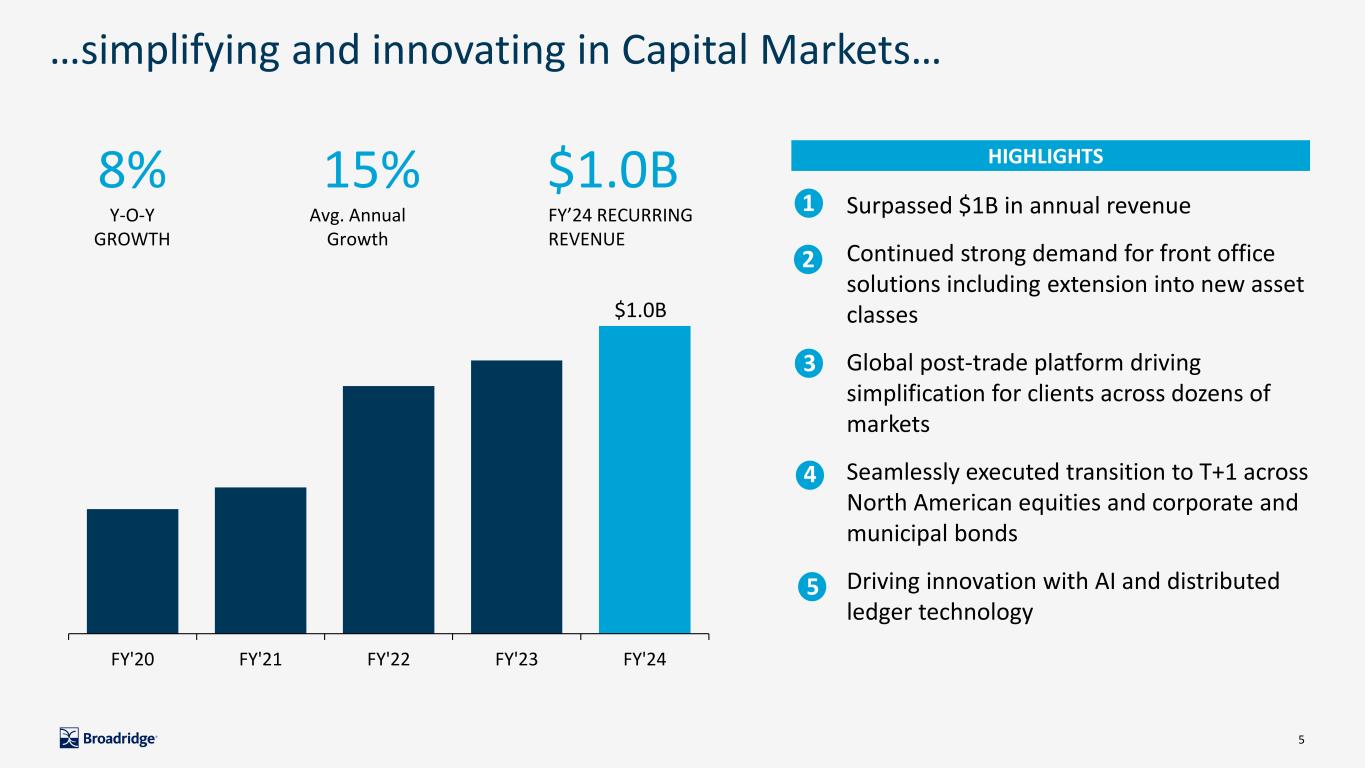

GTO

•GTO Recurring revenues were $1,649 million, an increase of $124 million, or 8%. Recurring revenue growth constant currency (Non-GAAP) was 8%, all organic, driven by Net New Business and Internal Growth.

•By product line, Recurring revenue growth and Recurring revenue growth constant currency (Non-GAAP) were as follows:

◦Capital markets rose 9% and 8%, respectively, driven by Net New Business and Internal Growth, which benefited from higher trading volumes.

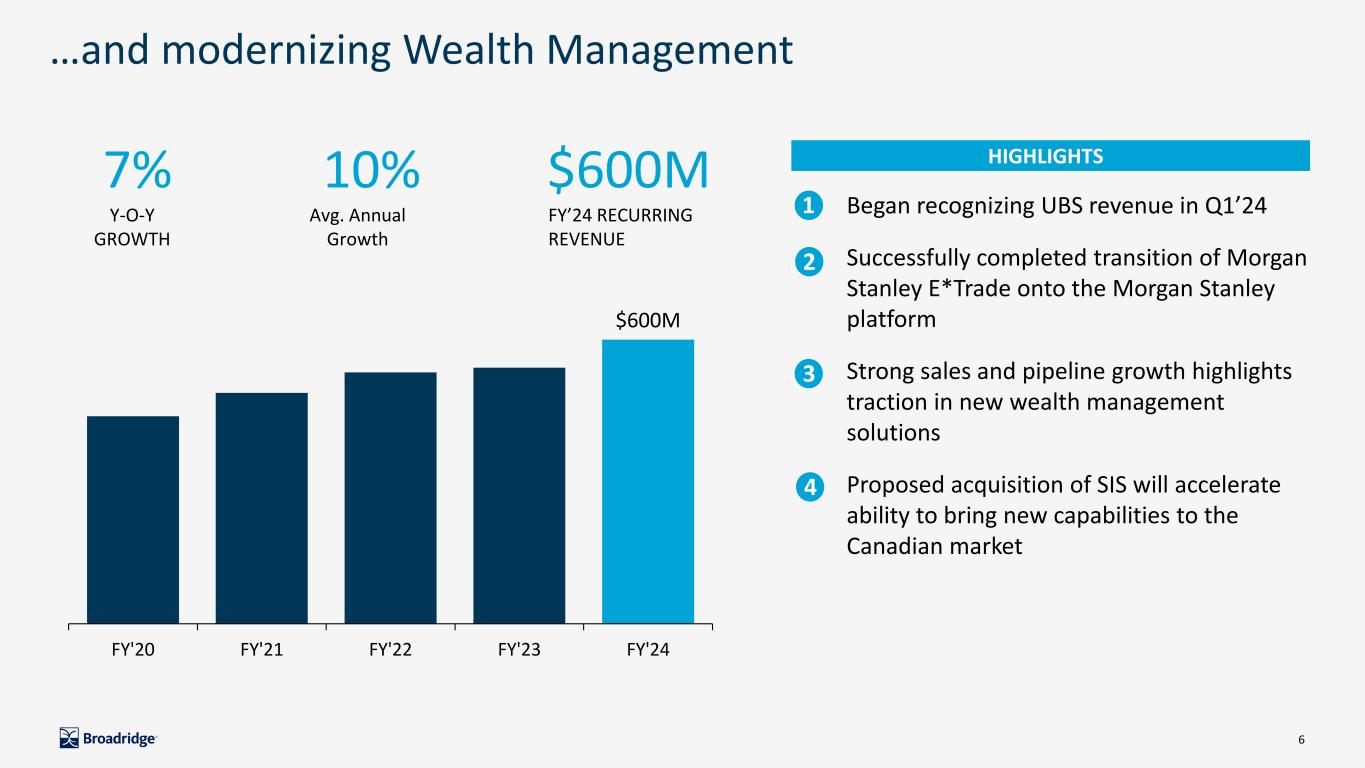

◦Wealth and investment management rose 7% and 7%, respectively driven by Net New Business and Internal Growth.

•Earnings before income taxes were $173 million, a decrease of $11 million, or 6%, as higher revenues were more than offset by higher expenses, including an increase in amortization and depreciation expenses of $63 million. Pre-tax margins decreased to 10.5% from 12.1%.

Other

•Other Loss before income tax was $246 million compared to a loss of $201 million in the prior year period. The increased loss before income taxes was primarily due to $43 million of higher Restructuring and Other Related Costs related to the Corporate Restructuring Initiative and Litigation Settlement Charges of $18 million, partially offset by the absence of Russia-Related Exit Costs (as defined below) of $11 million.

Fourth Quarter 2024 Announced Acquisitions

During and following the fourth quarter of fiscal year 2024, Broadridge announced three acquisitions:

Kyndryl Securities Industry Services (“Kyndryl SIS”): On May 13, 2024, Broadridge announced the proposed acquisition of Kyndryl’s Securities Industry Services (SIS) business to provide wealth management, capital markets, and information technology solutions to the Canadian financial services industry, expanding our product offerings in our GTO reportable segment. The total purchase price is approximately $200 million. The acquisition is subject to closing conditions, including regulatory approvals. Upon closing, Kyndryl SIS is expected to contribute $80 to $85 million in annual revenue. It is not expected to have a significant impact on Broadridge’s margins and Adjusted EPS during the first year of Broadridge ownership.

AdvisorTarget (“AdvisorTarget”): On May 30, 2024, Broadridge announced its acquisition of AdvisorTarget, a market leader in providing asset management and wealth management firms with data products to help power digital marketing, sales and engagement programs targeting financial advisors. The acquisition closed on June 1, 2024, for $35 million plus contingent consideration. AdvisorTarget is included in the Company’s ICS reportable segment.

CompSci Resources (“CompSci”): On July 1, 2024, Broadridge announced its acquisition of CompSci, a provider of cloud-based financial technology software for the preparation and processing of SEC filings for public companies and funds. The transaction is not expected to have a material impact on Broadridge's financial results. CompSci is included in the Company’s ICS reportable segment.

Dividend Declaration and Increase

On August 5, 2024, Broadridge's Board of Directors (the “Board”) declared a quarterly dividend of $0.88 per share payable on October 3, 2024 to stockholders of record on September 12, 2024. This declaration reflects the Board's approval of a 10% increase in the annual dividend from $3.20 to $3.52 per share, subject to the discretion of the Board to declare quarterly dividends. With this increase, the Company's annual dividend has increased for the 18th consecutive year since becoming a public company in 2007.

Earnings Conference Call

An analyst conference call will be held today, August 6, 2024 at 8:00 a.m. ET. A live webcast of the call will be available to the public on a listen-only basis. To listen to the live event and access the slide presentation, visit Broadridge’s Investor Relations website at www.broadridge-ir.com prior to the start of the webcast. To listen to the call, investors may also dial 1-877-328-2502 within the United States and international callers may dial 1-412-317-5419.

A replay of the webcast will be available and can be accessed in the same manner as the live webcast at the Broadridge Investor Relations site. Through August 13, 2024, the recording will also be available by dialing 1-877-344-7529 within the United States or 1-412-317-0088 for international callers, using passcode 2725998 for either dial-in number.

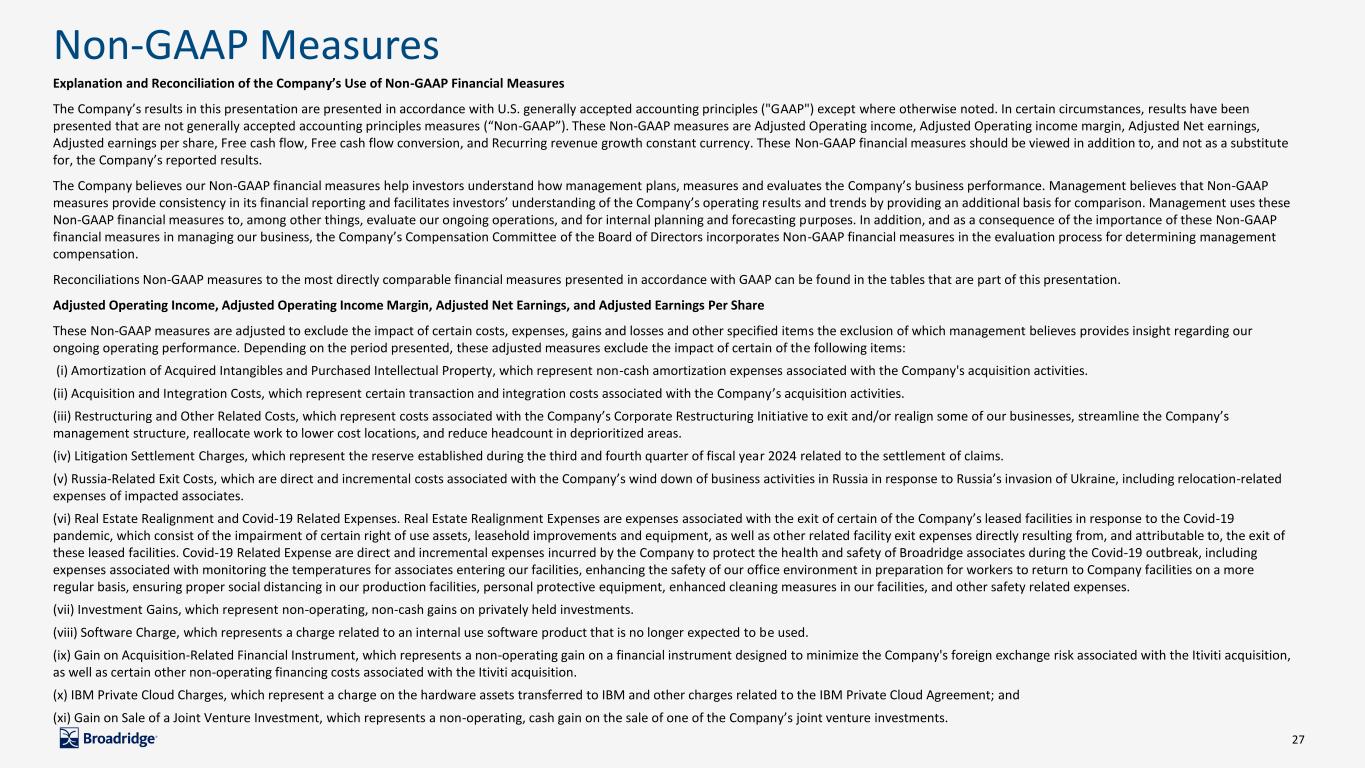

Explanation and Reconciliation of the Company’s Use of Non-GAAP Financial Measures

The Company’s results in this press release are presented in accordance with U.S. GAAP except where otherwise noted.

In certain circumstances, results have been presented that are not generally accepted accounting principles measures (“Non-GAAP”). These Non-GAAP measures are Adjusted Operating income, Adjusted Operating income margin, Adjusted Net earnings, Adjusted earnings per share, Free cash flow, Free cash flow conversion and Recurring revenue growth constant currency. These Non-GAAP financial measures should be viewed in addition to, and not as a substitute for, the Company’s reported results.

The Company believes our Non-GAAP financial measures help investors understand how management plans, measures and evaluates the Company’s business performance. Management believes that Non-GAAP measures provide consistency in its financial reporting and facilitates investors’ understanding of the Company’s operating results and trends by providing an additional basis for comparison. Management uses these Non-GAAP financial measures to, among other things, evaluate our ongoing operations, and for internal planning and forecasting purposes. In addition, and as a consequence of the importance of these Non-GAAP financial measures in managing our business, the Company’s Compensation Committee of the Board of Directors incorporates Non-GAAP financial measures in the evaluation process for determining management compensation.

Adjusted Operating Income, Adjusted Operating Income Margin, Adjusted Net Earnings and Adjusted Earnings Per Share

These Non-GAAP measures reflect Operating income, Operating income margin, Net earnings, and Diluted earnings per share, as adjusted to exclude the impact of certain costs, expenses, gains and losses and other specified items the exclusion of which management believes provides insight regarding our ongoing operating performance. Depending on the period presented, these adjusted measures exclude the impact of certain of the following items:

(i) Amortization of Acquired Intangibles and Purchased Intellectual Property, which represent non-cash amortization expenses associated with the Company’s acquisition activities.

(ii) Acquisition and Integration Costs, which represent certain transaction and integration costs associated with the Company’s acquisition activities.

(iii) Restructuring and Other Related Costs, which represent costs associated with the Company’s Corporate Restructuring Initiative to exit and/or realign some of our businesses, streamline the Company’s management structure, reallocate work to lower cost locations, and reduce headcount in deprioritized areas.

(iv) Litigation Settlement Charges, which represent reserves established during the third and fourth quarter of 2024 related to the settlement of claims.

(v) Russia-Related Exit Costs, which are direct and incremental costs associated with the Company’s wind down of business activities in Russia in response to Russia’s invasion of Ukraine, including relocation-related expenses of impacted associates.

We exclude Acquisition and Integration Costs, Restructuring and Other Related Costs, Litigation Settlement Charges, and Russia-Related Exit Costs from our Adjusted Operating income (as applicable) and other adjusted earnings measures because excluding such information provides us with an understanding of the results from the primary operations of our business and enhances comparability across fiscal reporting periods, as these items are not reflective of our underlying operations or performance.

We also exclude the impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, as these non-cash amounts are significantly impacted by the timing and size of individual acquisitions and do not factor into the Company's capital allocation decisions, management compensation metrics or multi-year objectives. Furthermore, management believes that this adjustment enables better comparison of our results as Amortization of Acquired Intangibles and Purchased Intellectual Property will not recur in future periods once such intangible assets have been fully amortized. Although we exclude Amortization of Acquired Intangibles and Purchased Intellectual Property from our adjusted earnings measures, our management believes that it is important for investors to understand that these intangible assets contribute to revenue generation. Amortization of intangible assets that relate to past acquisitions will recur in future periods until such intangible assets have been fully amortized. Any future acquisitions may result in the amortization of additional intangible assets.

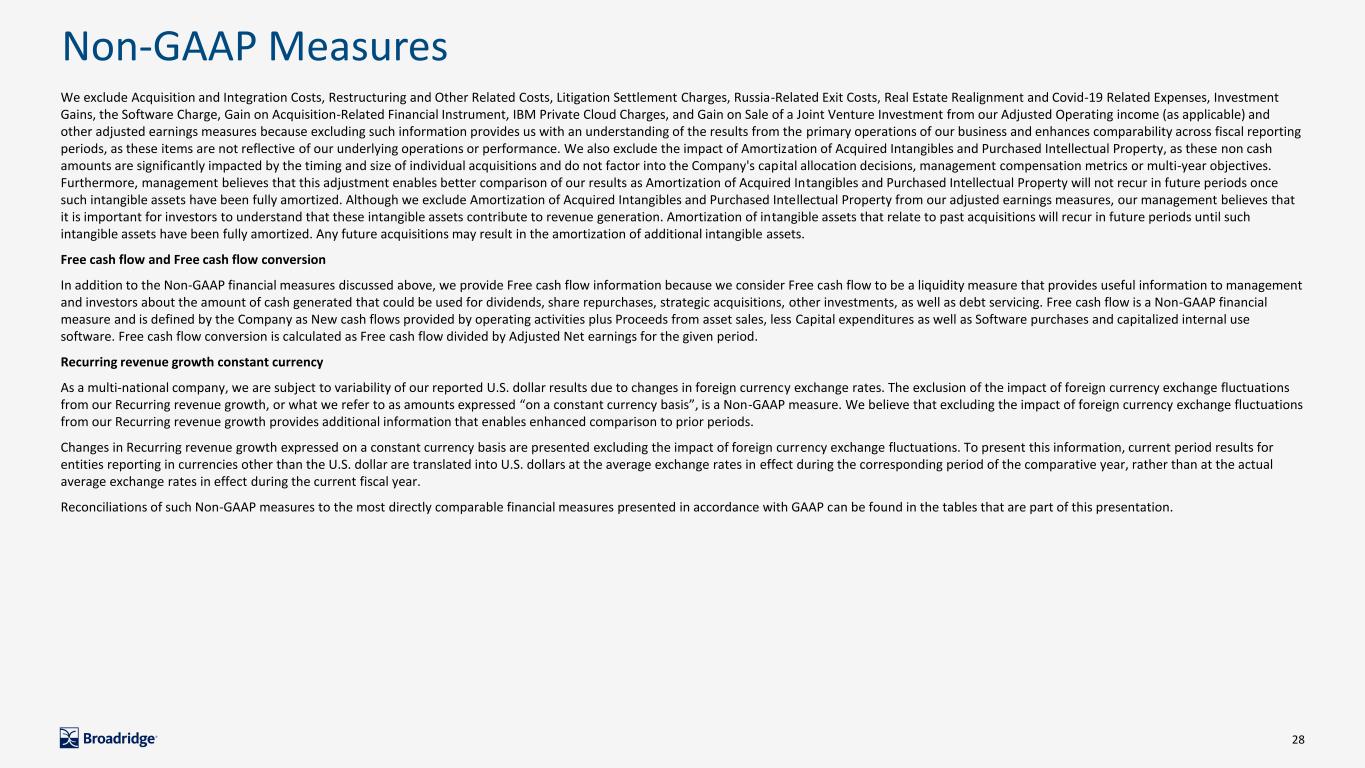

Free Cash Flow and Free Cash Flow Conversion

In addition to the Non-GAAP financial measures discussed above, we provide Free cash flow information because we consider Free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated that could be used for dividends, share repurchases, strategic acquisitions, other investments, as well as debt servicing. Free cash flow is a Non-GAAP financial measure and is defined by the Company as Net cash flows provided by operating activities less Capital expenditures as well as Software purchases and capitalized internal use software. Free cash flow conversion is calculated as Free cash flow divided by Adjusted Net earnings for the given period.

Recurring revenue growth constant currency

As a multi-national company, we are subject to variability of our reported U.S. dollar results due to changes in foreign currency exchange rates. The exclusion of the impact of foreign currency exchange fluctuations from our Recurring revenue growth, or what we refer to as amounts expressed “on a constant currency basis,” is a Non-GAAP measure. We believe that excluding the impact of foreign currency exchange fluctuations from our Recurring revenue growth provides additional information that enables enhanced comparison to prior periods.

Changes in Recurring revenue growth expressed on a constant currency basis are presented excluding the impact of foreign currency exchange fluctuations. To present this information, current period results for entities reporting in currencies other than the U.S. dollar are translated into U.S. dollars at the average exchange rates in effect during the corresponding period of the comparative year, rather than at the actual average exchange rates in effect during the current fiscal year.

Reconciliations of such Non-GAAP measures to the most directly comparable financial measures presented in accordance with GAAP can be found in the tables that are part of this press release.

Forward-Looking Statements

This press release and other written or oral statements made from time to time by representatives of Broadridge may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical in nature, and which may be identified by the use of words such as “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could be,” “on track” and other words of similar meaning, are forward-looking statements. In particular, information appearing in the “Fiscal Year 2025 Financial Guidance” section and statements about our three-year objectives are forward-looking statements.

These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed. These risks and uncertainties include those risk factors described and discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the year ended June 30, 2024 (the “2024 Annual Report”), as they may be updated in any future reports filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date of this press release and are expressly qualified in their entirety by reference to the factors discussed in the 2024 Annual Report.

These risks include:

•changes in laws and regulations affecting Broadridge’s clients or the services provided by Broadridge;

•Broadridge’s reliance on a relatively small number of clients, the continued financial health of those clients, and the continued use by such clients of Broadridge’s services with favorable pricing terms;

•a material security breach or cybersecurity attack affecting the information of Broadridge’s clients;

•declines in participation and activity in the securities markets;

•the failure of Broadridge’s key service providers to provide the anticipated levels of service;

•a disaster or other significant slowdown or failure of Broadridge’s systems or error in the performance of Broadridge’s services;

•overall market, economic and geopolitical conditions and their impact on the securities markets;

•the success of Broadridge in retaining and selling additional services to its existing clients and in obtaining new clients;

•Broadridge’s failure to keep pace with changes in technology and the demands of its clients;

•competitive conditions;

•Broadridge’s ability to attract and retain key personnel; and

•the impact of new acquisitions and divestitures.

Broadridge disclaims any obligation to update or revise forward-looking statements that may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by law.

About Broadridge

Broadridge Financial Solutions (NYSE: BR), a global Fintech leader with over $6 billion in revenues, provides the critical infrastructure that powers investing, corporate governance and communications to enable better financial lives. We deliver technology-driven solutions to banks, broker-dealers, asset and wealth managers and public companies. Broadridge's infrastructure serves as a global communications hub enabling corporate governance by linking thousands of public companies and mutual funds to tens of millions of individual and institutional investors around the world. In addition, Broadridge's technology and operations platforms underpin the daily trading of on average more than U.S. $10 trillion of equities, fixed income and other securities globally. A certified Great Place to Work®, Broadridge is a part of the S&P 500® Index, employing over 14,000 associates in 21 countries. For more information about Broadridge, please visit www.broadridge.com.

Contact Information

Investors: broadridgeir@broadridge.com

Media: Gregg.rosenberg@broadridge.com

Condensed Consolidated Statements of Earnings

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| In millions, except per share amounts |

|

|

Three Months Ended

June 30, |

|

Fiscal Year Ended

June 30, |

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Revenues |

|

|

$ |

1,944.3 |

|

|

$ |

1,839.0 |

|

|

$ |

6,506.8 |

|

|

$ |

6,060.9 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

| Cost of revenues |

|

|

1,253.0 |

|

|

1,159.1 |

|

|

4,572.9 |

|

|

4,275.5 |

|

| Selling, general and administrative expenses |

|

|

249.8 |

|

|

225.7 |

|

|

916.8 |

|

|

849.0 |

|

| Total operating expenses |

|

|

1,502.9 |

|

|

1,384.8 |

|

|

5,489.7 |

|

|

5,124.5 |

|

| Operating income |

|

|

441.4 |

|

|

454.2 |

|

|

1,017.1 |

|

|

936.4 |

|

| Interest expense, net |

|

|

(33.0) |

|

|

(36.0) |

|

|

(138.1) |

|

|

(135.5) |

|

| Other non-operating income (expenses), net |

|

|

1.8 |

|

|

(0.7) |

|

|

(1.7) |

|

|

(6.0) |

|

| Earnings before income taxes |

|

|

410.2 |

|

|

417.5 |

|

|

877.4 |

|

|

794.9 |

|

| Provision for income taxes |

|

|

87.0 |

|

|

93.4 |

|

|

179.3 |

|

|

164.3 |

|

| Net earnings |

|

|

$ |

323.2 |

|

|

$ |

324.1 |

|

|

$ |

698.1 |

|

|

$ |

630.6 |

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per share |

|

|

$ |

2.75 |

|

|

$ |

2.75 |

|

|

$ |

5.93 |

|

|

$ |

5.36 |

|

| Diluted earnings per share |

|

|

$ |

2.72 |

|

|

$ |

2.72 |

|

|

$ |

5.86 |

|

|

$ |

5.30 |

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average shares outstanding: |

|

|

|

|

|

|

|

|

|

| Basic |

|

|

117.5 |

|

|

118.0 |

|

|

117.7 |

|

|

117.7 |

|

| Diluted |

|

|

118.7 |

|

|

119.1 |

|

|

119.1 |

|

|

119.0 |

|

|

|

|

|

|

|

|

|

|

|

Amounts may not sum due to rounding.

Condensed Consolidated Balance Sheets

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| In millions, except per share amounts |

|

|

June 30,

2024 |

|

June 30,

2023 |

| Assets |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

| Cash and cash equivalents |

|

|

$ |

304.4 |

|

|

$ |

252.3 |

|

Accounts receivable, net of allowance for doubtful accounts of $9.7 and $7.2, respectively |

|

|

1,065.6 |

|

|

974.0 |

|

| Other current assets |

|

|

170.9 |

|

|

166.2 |

|

| Total current assets |

|

|

1,540.9 |

|

|

1,392.5 |

|

| Property, plant and equipment, net |

|

|

162.2 |

|

|

145.7 |

|

| Goodwill |

|

|

3,469.4 |

|

|

3,461.6 |

|

| Intangible assets, net |

|

|

1,307.2 |

|

|

1,467.2 |

|

| Deferred client conversion and start-up costs |

|

|

892.1 |

|

|

937.0 |

|

| Other non-current assets |

|

|

870.6 |

|

|

829.2 |

|

| Total assets |

|

|

$ |

8,242.4 |

|

|

$ |

8,233.2 |

|

| Liabilities and Stockholders’ Equity |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

| Current portion of long-term debt |

|

|

$ |

— |

|

|

$ |

1,178.5 |

|

| Payables and accrued expenses |

|

|

1,194.4 |

|

|

1,019.5 |

|

| Contract liabilities |

|

|

227.4 |

|

|

199.8 |

|

| Total current liabilities |

|

|

1,421.8 |

|

|

2,397.8 |

|

| Long-term debt |

|

|

3,355.1 |

|

|

2,234.7 |

|

| Deferred taxes |

|

|

277.3 |

|

|

391.3 |

|

| Contract liabilities |

|

|

469.2 |

|

|

492.8 |

|

| Other non-current liabilities |

|

|

550.9 |

|

|

476.0 |

|

| Total liabilities |

|

|

6,074.2 |

|

|

5,992.6 |

|

| Commitments and contingencies |

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

| Preferred stock: Authorized, 25.0 shares; issued and outstanding, none |

|

|

— |

|

|

— |

|

Common stock, $0.01 par value: Authorized, 650.0 shares; issued, 154.5 and 154.5 shares, respectively; outstanding, 116.7 and 118.1 shares, respectively |

|

|

1.6 |

|

|

1.6 |

|

| Additional paid-in capital |

|

|

1,552.5 |

|

|

1,436.8 |

|

| Retained earnings |

|

|

3,435.1 |

|

|

3,113.0 |

|

Treasury stock, at cost: 37.8 and 36.4 shares, respectively |

|

|

(2,489.2) |

|

|

(2,026.1) |

|

| Accumulated other comprehensive income (loss) |

|

|

(331.7) |

|

|

(284.7) |

|

| Total stockholders’ equity |

|

|

2,168.2 |

|

|

2,240.6 |

|

| Total liabilities and stockholders’ equity |

|

|

$ |

8,242.4 |

|

|

$ |

8,233.2 |

|

Amounts may not sum due to rounding.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

| In millions |

Fiscal Year |

|

2024 |

|

2023 |

| Cash Flows From Operating Activities |

|

|

|

| Net earnings |

$ |

698.1 |

|

|

$ |

630.6 |

|

| Adjustments to reconcile net earnings to net cash flows from operating activities: |

|

|

|

| Depreciation and amortization |

119.8 |

|

|

84.4 |

|

| Amortization of acquired intangibles and purchased intellectual property |

200.3 |

|

|

214.4 |

|

| Amortization of other assets |

157.8 |

|

|

126.2 |

|

| Write-down of long-lived assets |

18.2 |

|

|

2.5 |

|

| Stock-based compensation expense |

70.6 |

|

|

73.1 |

|

| Deferred income taxes |

(119.7) |

|

|

(50.8) |

|

| Other |

(57.7) |

|

|

(27.4) |

|

| Changes in operating assets and liabilities, net of assets and liabilities acquired: |

|

|

|

| Current assets and liabilities: |

|

|

|

| Accounts receivable, net |

(37.4) |

|

|

19.6 |

|

| Other current assets |

(2.8) |

|

|

(10.0) |

|

| Payables and accrued expenses |

136.5 |

|

|

(104.5) |

|

| Contract liabilities |

80.6 |

|

|

328.5 |

|

| Non-current assets and liabilities: |

|

|

|

| Other non-current assets |

(232.4) |

|

|

(472.4) |

|

| Other non-current liabilities |

24.3 |

|

|

9.1 |

|

| Net cash flows from operating activities |

1,056.2 |

|

|

823.3 |

|

| Cash Flows From Investing Activities |

|

|

|

| Capital expenditures |

(57.4) |

|

|

(38.4) |

|

| Software purchases and capitalized internal use software |

(55.6) |

|

|

(36.8) |

|

| Acquisitions, net of cash acquired |

(34.3) |

|

|

— |

|

| Other investing activities |

(0.8) |

|

|

(5.3) |

|

| Net cash flows from investing activities |

(148.0) |

|

|

(80.4) |

|

| Cash Flows From Financing Activities |

|

|

|

| Debt proceeds |

1,022.7 |

|

|

990.0 |

|

| Debt repayments |

(1,082.7) |

|

|

(1,375.0) |

|

| Dividends paid |

(368.2) |

|

|

(331.0) |

|

| Purchases of Treasury stock |

(485.4) |

|

|

(24.3) |

|

| Proceeds from exercise of stock options |

72.4 |

|

|

43.1 |

|

| Other financing activities |

(14.3) |

|

|

(17.5) |

|

| Net cash flows from financing activities |

(855.5) |

|

|

(714.7) |

|

| Effect of exchange rate changes on Cash and cash equivalents |

(0.6) |

|

|

(0.6) |

|

| Net change in Cash and cash equivalents |

52.1 |

|

|

27.6 |

|

| Cash and cash equivalents, beginning of fiscal year |

252.3 |

|

|

224.7 |

|

| Cash and cash equivalents, end of fiscal year |

$ |

304.4 |

|

|

$ |

252.3 |

|

|

|

|

|

Amounts may not sum due to rounding

Segment Results

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| In millions |

Three Months Ended

June 30, |

|

Fiscal Year Ended

June 30, |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Revenues |

|

|

|

|

|

| Investor Communication Solutions |

$ |

1,528.3 |

|

|

$ |

1,438.4 |

|

|

$ |

4,857.9 |

|

|

$ |

4,535.6 |

|

| Global Technology and Operations |

415.9 |

|

|

400.6 |

|

|

1,648.9 |

|

|

1,525.2 |

|

| Total |

$ |

1,944.3 |

|

|

$ |

1,839.0 |

|

|

$ |

6,506.8 |

|

|

$ |

6,060.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings Before Income Taxes |

|

|

|

|

|

| Investor Communication Solutions |

$ |

469.0 |

|

$ |

431.1 |

|

$ |

950.4 |

|

$ |

811.4 |

| Global Technology and Operations |

47.1 |

|

52.0 |

|

173.3 |

|

183.9 |

| Other |

(105.9) |

|

(65.6) |

|

(246.3) |

|

(200.5) |

| Total |

$ |

410.2 |

|

$ |

417.5 |

|

$ |

877.4 |

|

$ |

794.9 |

|

|

|

|

|

|

|

|

| Pre-tax margins: |

|

|

|

|

|

|

|

| Investor Communication Solutions |

30.7 |

% |

|

30.0 |

% |

|

19.6 |

% |

|

17.9 |

% |

| Global Technology and Operations |

11.3 |

% |

|

13.0 |

% |

|

10.5 |

% |

|

12.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization of acquired intangibles and purchased intellectual property |

| Investor Communication Solutions |

$ |

11.2 |

|

|

$ |

11.8 |

|

|

$ |

45.4 |

|

|

$ |

55.5 |

|

| Global Technology and Operations |

37.7 |

|

|

39.8 |

|

|

154.9 |

|

|

158.9 |

|

| Total |

$ |

48.9 |

|

|

$ |

51.6 |

|

|

$ |

200.3 |

|

|

$ |

214.4 |

|

|

|

|

|

|

|

|

|

Amounts may not sum due to rounding.

Supplemental Reporting Detail - Additional Product Line Reporting

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| In millions |

Three Months Ended

June 30, |

|

Fiscal Year Ended

June 30, |

|

2024 |

|

2023 |

|

Change |

|

2024 |

|

2023 |

|

Change |

| Investor Communication Solutions |

|

|

|

|

|

|

|

|

|

|

|

Regulatory |

$ |

476.9 |

|

|

$ |

444.3 |

|

|

7 |

% |

|

$ |

1,195.6 |

|

|

$ |

1,141.4 |

|

|

5 |

% |

Data-driven fund solutions |

121.8 |

|

|

113.4 |

|

|

7 |

% |

|

435.2 |

|

|

404.3 |

|

|

8 |

% |

Issuer |

141.0 |

|

|

134.4 |

|

|

5 |

% |

|

259.8 |

|

|

242.6 |

|

|

7 |

% |

Customer communications |

170.6 |

|

|

165.8 |

|

|

3 |

% |

|

683.1 |

|

|

673.1 |

|

|

1 |

% |

| Total ICS Recurring revenues |

910.4 |

|

|

857.9 |

|

|

6 |

% |

|

2,573.6 |

|

|

2,461.4 |

|

|

5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Equity and other |

42.1 |

|

|

32.7 |

|

|

29 |

% |

|

151.0 |

|

|

116.5 |

|

|

30 |

% |

| Mutual funds |

34.0 |

|

|

26.3 |

|

|

29 |

% |

|

134.2 |

|

|

94.5 |

|

|

42 |

% |

| Total ICS Event-driven revenues |

76.1 |

|

|

58.9 |

|

|

29 |

% |

|

285.2 |

|

|

211.0 |

|

|

35 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Distribution revenues |

541.9 |

|

|

521.5 |

|

|

4 |

% |

|

1,999.0 |

|

|

1,863.1 |

|

|

7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Total ICS Revenues |

$ |

1,528.3 |

|

|

$ |

1,438.4 |

|

|

6 |

% |

|

$ |

4,857.9 |

|

|

$ |

4,535.6 |

|

|

7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Global Technology and Operations |

|

|

|

|

|

|

|

|

|

|

|

Capital markets |

$ |

272.5 |

|

|

$ |

257.4 |

|

|

6 |

% |

|

$ |

1,049.2 |

|

|

$ |

965.2 |

|

|

9 |

% |

Wealth and investment management |

143.5 |

|

|

143.2 |

|

|

0 |

% |

|

599.7 |

|

|

560.1 |

|

|

7 |

% |

| Total GTO Recurring revenues |

415.9 |

|

|

400.6 |

|

|

4 |

% |

|

1,648.9 |

|

|

1,525.2 |

|

|

8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Total Revenues |

$ |

1,944.3 |

|

|

$ |

1,839.0 |

|

|

6 |

% |

|

$ |

6,506.8 |

|

|

$ |

6,060.9 |

|

|

7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues by Type |

|

|

|

|

|

|

|

|

|

|

|

| Recurring revenues |

$ |

1,326.4 |

|

|

$ |

1,258.5 |

|

|

5 |

% |

|

$ |

4,222.6 |

|

|

$ |

3,986.7 |

|

|

6 |

% |

| Event-driven revenues |

76.1 |

|

|

58.9 |

|

|

29 |

% |

|

285.2 |

|

|

211.0 |

|

|

35 |

% |

| Distribution revenues |

541.9 |

|

|

521.5 |

|

|

4 |

% |

|

1,999.0 |

|

|

1,863.1 |

|

|

7 |

% |

| Total Revenues |

$ |

1,944.3 |

|

|

$ |

1,839.0 |

|

|

6 |

% |

|

$ |

6,506.8 |

|

|

$ |

6,060.9 |

|

|

7 |

% |

Amounts may not sum due to rounding.

Select Operating Metrics

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| In millions |

Three Months Ended

June 30, |

|

|

|

Fiscal Year Ended June 30, |

|

|

|

2024 |

|

2023 |

|

Change |

|

2024 |

|

2023 |

|

Change |

|

|

|

|

|

|

|

|

|

|

|

|

Closed sales1 |

$ |

156.6 |

|

$ |

89.8 |

|

74 |

% |

|

$ |

341.8 |

|

$ |

245.8 |

|

39 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Record Growth2 |

|

|

|

|

|

|

|

|

|

|

|

| Equity positions (Stock records) |

7 |

% |

|

6 |

% |

|

|

|

6 |

% |

|

9 |

% |

|

|

| Mutual fund/ETF positions (Interim records) |

6 |

% |

|

8 |

% |

|

|

|

3 |

% |

|

8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Internal Trade Growth3 |

15 |

% |

|

3 |

% |

|

|

|

13 |

% |

|

4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amounts may not sum due to rounding |

|

|

|

|

|

|

|

|

|

|

|

1. Refer to the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of Broadridge’s 2024 Annual Report for a description of Closed sales and its calculation. |

2. Record Growth is comprised of stock record growth and interim record growth. Stock record growth (also referred to as “SRG” or “equity position growth”) measures the estimated annual change in positions eligible for equity proxy materials. Interim record growth (also referred to as “IRG” or “mutual fund/ETF position growth”) measures the estimated change in mutual fund and exchange traded fund positions eligible for interim communications. These metrics are calculated from equity proxy and mutual fund/ETF position data reported to Broadridge for the same issuers or funds in both the current and prior year periods. |

3. Represents the estimated change in daily average trade volumes for clients whose contracts are linked to trade volumes and who were on Broadridge’s trading platforms in both the current and prior year periods. |

|

|

|

|

|

|

|

|

|

|

|

|

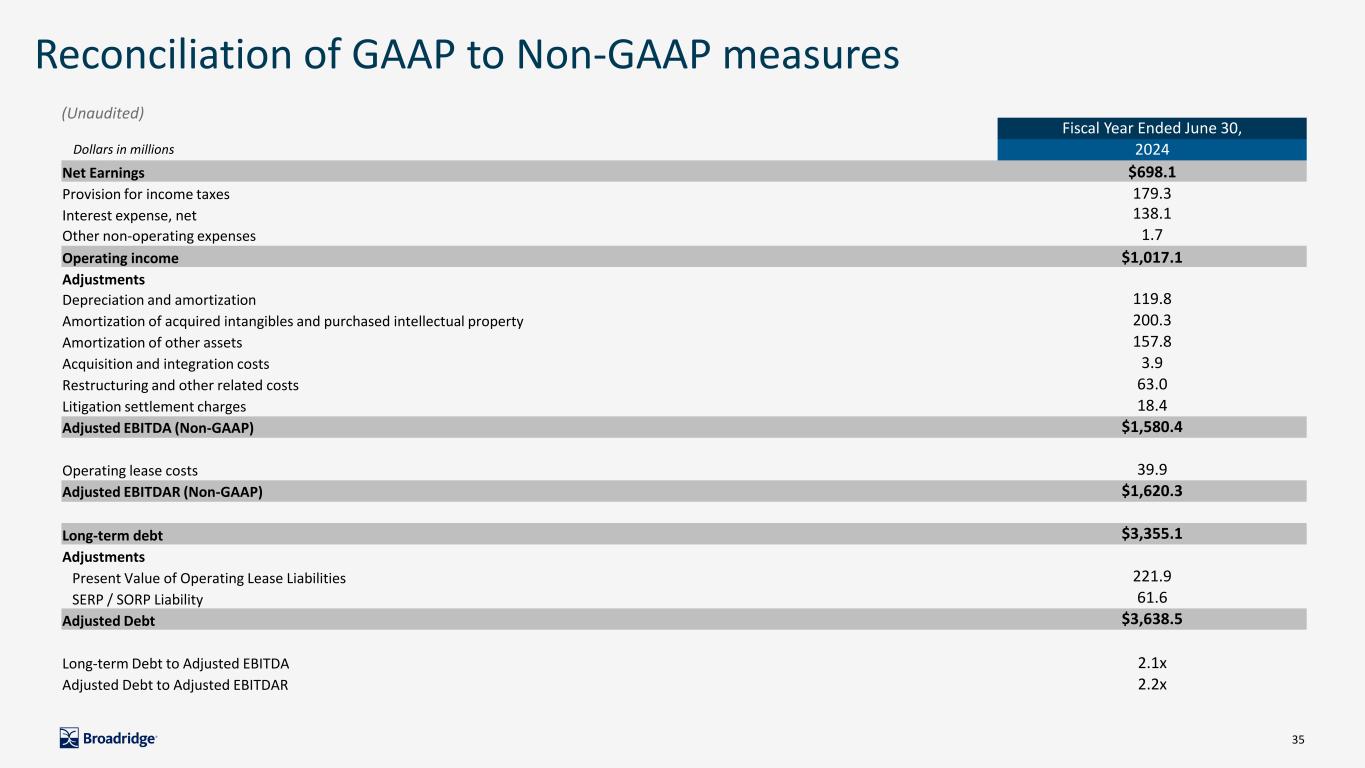

Reconciliation of Non-GAAP to GAAP Measures

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| In millions, except per share amounts |

Three Months Ended

June 30, |

|

Fiscal Year Ended

June 30, |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Reconciliation of Adjusted Operating Income |

|

| Operating income (GAAP) |

$ |

441.4 |

|

$ |

454.2 |

|

$ |

1,017.1 |

|

$ |

936.4 |

| Adjustments: |

|

|

|

|

|

|

|

| Amortization of Acquired Intangibles and Purchased Intellectual Property |

48.9 |

|

51.6 |

|

200.3 |

|

214.4 |

| Acquisition and Integration Costs |

2.9 |

|

4.8 |

|

3.9 |

|

15.8 |

| Restructuring and Other Related Costs (a) |

56.0 |

|

20.4 |

|

63.0 |

|

20.4 |

| Litigation Settlement Charges |

10.3 |

|

— |

|

18.4 |

|

— |

| Russia-Related Exit Costs (b) |

— |

|

0.1 |

|

— |

|

12.1 |

| Adjusted Operating income (Non-GAAP) |

$ |

559.5 |

|

$ |

531.2 |

|

$ |

1,302.8 |

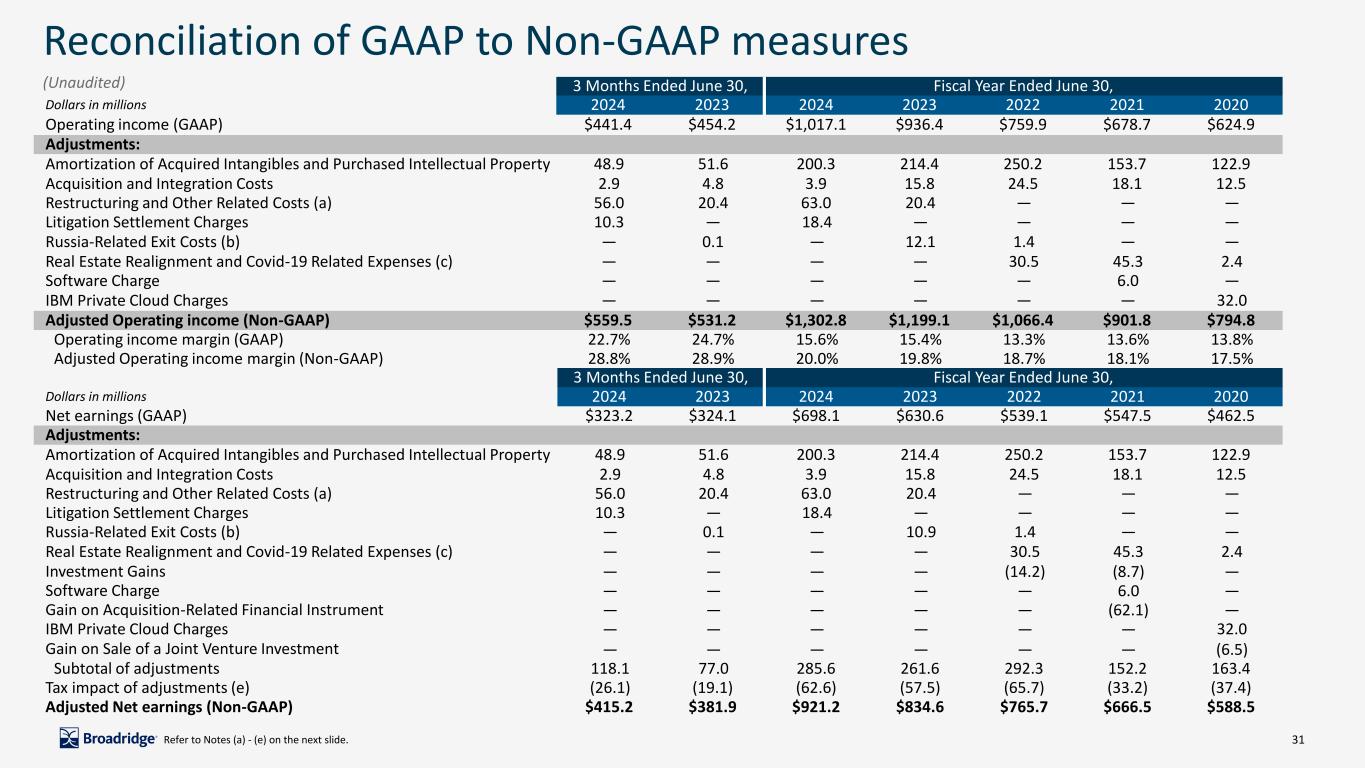

|

$ |

1,199.1 |

| Operating income margin (GAAP) |

22.7 |

% |

|

24.7 |

% |

|

15.6 |

% |

|

15.4 |

% |

| Adjusted Operating income margin (Non-GAAP) |

28.8 |

% |

|

28.9 |

% |

|

20.0 |

% |

|

19.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of Adjusted Net earnings |

|

| Net earnings (GAAP) |

$ |

323.2 |

|

|

$ |

324.1 |

|

|

$ |

698.1 |

|

|

$ |

630.6 |

|

| Adjustments: |

|

|

|

|

|

|

|

| Amortization of Acquired Intangibles and Purchased Intellectual Property |

48.9 |

|

|

51.6 |

|

|

200.3 |

|

|

214.4 |

|

| Acquisition and Integration Costs |

2.9 |

|

|

4.8 |

|

|

3.9 |

|

|

15.8 |

|

| Restructuring and Other Related Costs (a) |

56.0 |

|

|

20.4 |

|

|

63.0 |

|

|

20.4 |

|

Litigation Settlement Charges |

10.3 |

|

|

— |

|

|

18.4 |

|

|

— |

|

| Russia-Related Exit Costs (b) |

— |

|

|

0.1 |

|

|

— |

|

|

10.9 |

|

| Subtotal of adjustments |

118.1 |

|

|

77.0 |

|

|

285.6 |

|

|

261.6 |

|

| Tax impact of adjustments (c) |

(26.1) |

|

|

(19.1) |

|

|

(62.6) |

|

|

(57.5) |

|

| Adjusted Net earnings (Non-GAAP) |

$ |

415.2 |

|

|

$ |

381.9 |

|

|

$ |

921.2 |

|

|

$ |

834.6 |

|

|

|

|

|

|

|

|

|

Amounts may not sum due to rounding. Refer to notes (a) - (c) on the next page.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| In millions, except per share amounts |

Three Months Ended

June 30, |

|

Fiscal Year Ended

June 30, |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

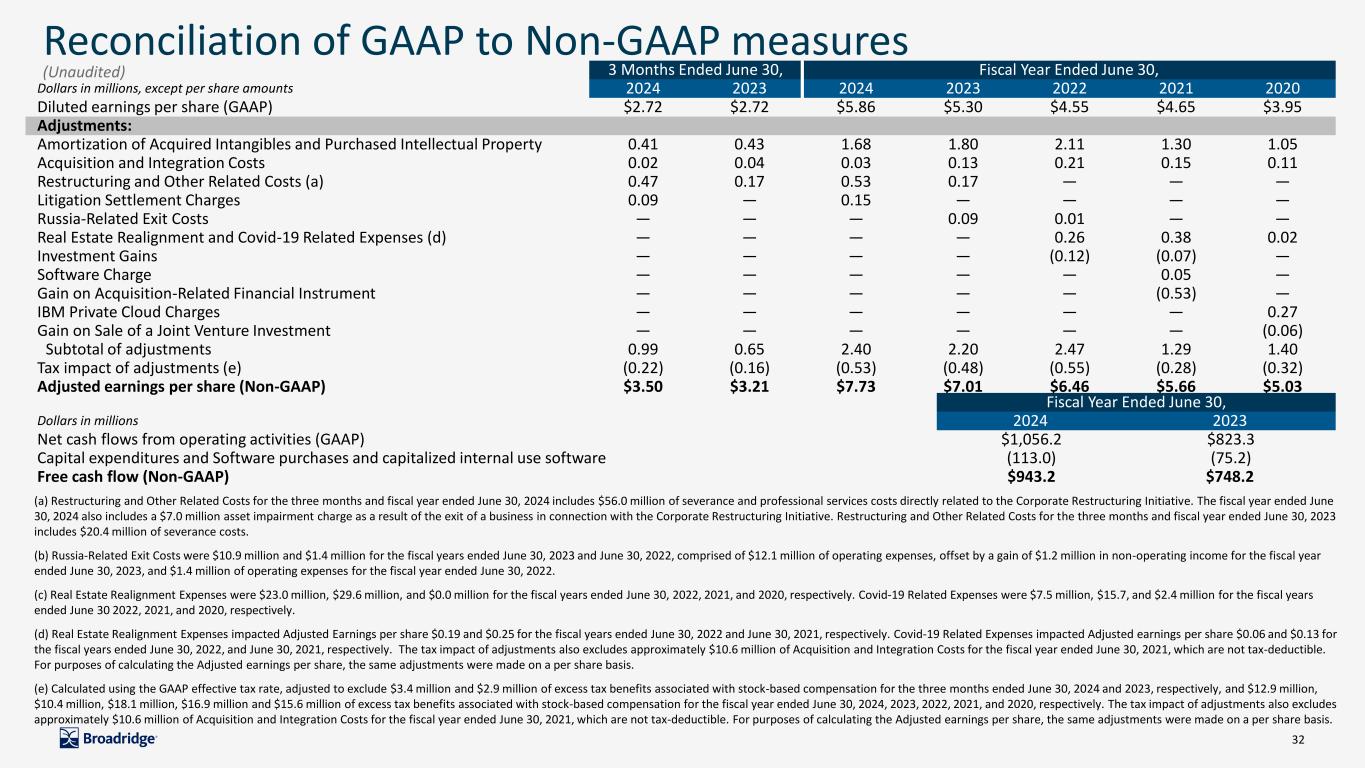

| Reconciliation of Adjusted EPS |

|

|

|

|

|

|

|

| Diluted earnings per share (GAAP) |

$ |

2.72 |

|

|

$ |

2.72 |

|

|

$ |

5.86 |

|

|

$ |

5.30 |

|

| Adjustments: |

|

|

|

|

|

|

|

| Amortization of Acquired Intangibles and Purchased Intellectual Property |

0.41 |

|

|

0.43 |

|

|

1.68 |

|

|

1.80 |

|

| Acquisition and Integration Costs |

0.02 |

|

|

0.04 |

|

|

0.03 |

|

|

0.13 |

|

| Restructuring and Other Related Costs (a) |

0.47 |

|

|

0.17 |

|

|

0.53 |

|

|

0.17 |

|

Litigation Settlement Charges |

0.09 |

|

|

— |

|

|

0.15 |

|

|

— |

|

| Russia-Related Exit Costs |

— |

|

|

— |

|

|

— |

|

|

0.09 |

|

| Subtotal of adjustments |

0.99 |

|

|

0.65 |

|

|

2.40 |

|

|

2.20 |

|

| Tax impact of adjustments (c) |

(0.22) |

|

|

(0.16) |

|

|

(0.53) |

|

|

(0.48) |

|

| Adjusted earnings per share (Non-GAAP) |

$ |

3.50 |

|

|

$ |

3.21 |

|

|

$ |

7.73 |

|

|

$ |

7.01 |

|

(a) Restructuring and Other Related Costs for the three months and fiscal year ended June 30, 2024 includes $56.0 million of severance and professional services costs directly related to the Corporate Restructuring Initiative. The fiscal year ended June 30, 2024 also includes a $7.0 million asset impairment charge as a result of the exit of a business in connection with the Corporate Restructuring Initiative. Restructuring and Other Related Costs for the three months and fiscal year ended June 30, 2023 includes $20.4 million of severance costs.

(b) Total Russia-Related Exit costs were $0.1 million for the three months ended June 30, 2023. Total Russia-Related Exit costs were $10.9 million for the fiscal year ended June 30, 2023, comprised of $12.1 million of operating expenses, offset by a gain of $1.2 million in non-operating income.

(c) Calculated using the GAAP effective tax rate, adjusted to exclude excess tax benefits associated with stock-based compensation of $3.4 million and $12.9 million for the three months and fiscal year ended June 30, 2024, and $2.9 million and $10.4 million for the three months and fiscal year ended June 30, 2023, respectively. For purposes of calculating the Adjusted earnings per share, the same adjustments were made on a per share basis.

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year Ended

June 30, |

|

2024 |

|

2023 |

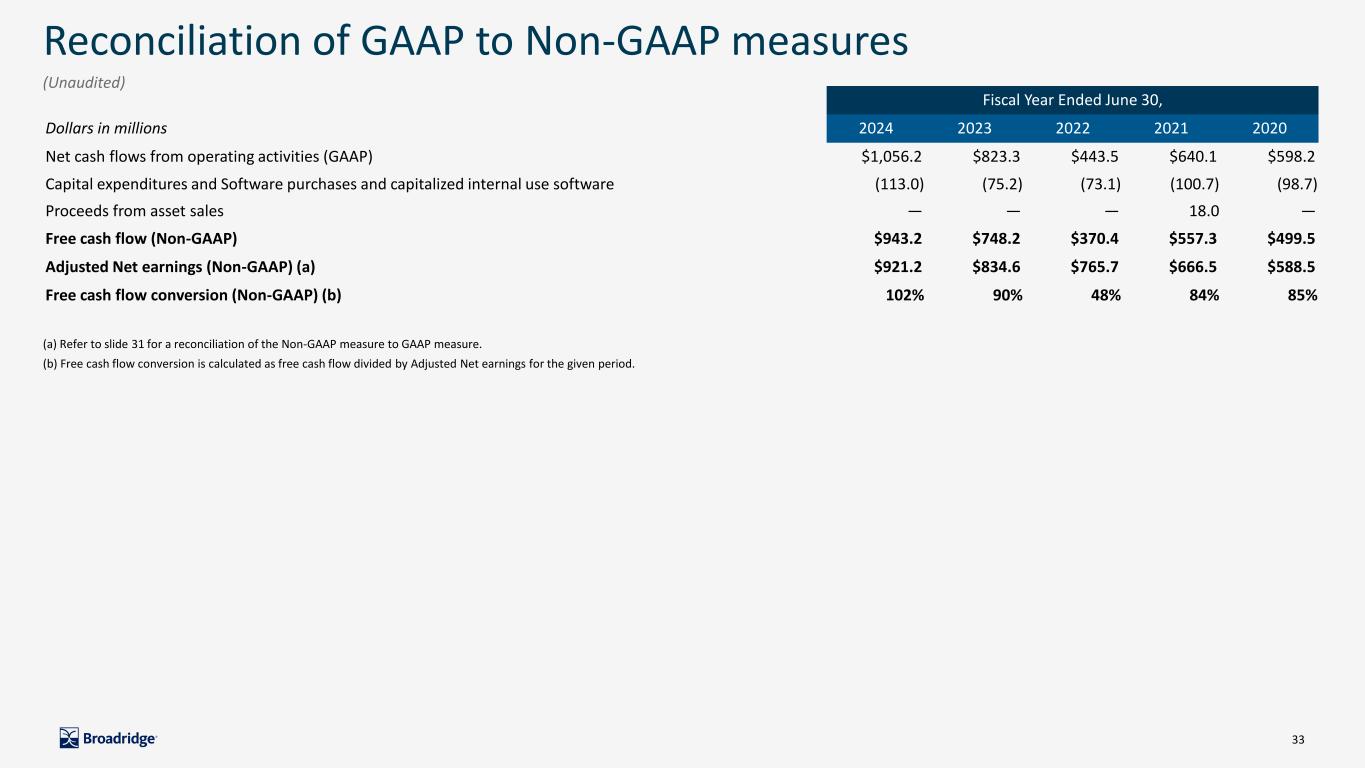

| Reconciliation of Free cash flow |

|

| Net cash flows from operating activities (GAAP) |

$ |

1,056.2 |

|

$ |

823.3 |

| Capital expenditures and Software purchases and capitalized internal use software |

(113.0) |

|

(75.2) |

| Free cash flow (Non-GAAP) |

$ |

943.2 |

|

$ |

748.2 |

|

|

|

|

| Adjusted Net earnings (Non-GAAP) |

$ |

921.2 |

|

$ |

834.6 |

|

|

|

|

| Free cash flow conversion (Non-GAAP) |

102 |

% |

|

90 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of Recurring Revenue Growth Constant Currency |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, 2024 |

| Investor Communication Solutions |

Regulatory |

|

Data-Driven Fund Solutions |

|

Issuer |

|

Customer Comm. |

|

Total |

| Recurring revenue growth (GAAP) |

7 |

% |

|

7 |

% |

|

5 |

% |

|

3 |

% |

|

6 |

% |

| Impact of foreign currency exchange |

0 |

% |

|

0 |

% |

|

0 |

% |

|

0 |

% |

|

0 |

% |

| Recurring revenue growth constant currency (Non-GAAP) |

7 |

% |

|

7 |

% |

|

5 |

% |

|

3 |

% |

|

6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year Ended June 30, 2024 |

| Investor Communication Solutions |

Regulatory |

|

Data-Driven Fund Solutions |

|

Issuer |

|

Customer Comm. |

|

Total |

| Recurring revenue growth (GAAP) |

5 |

% |

|

8 |

% |

|

7 |

% |

|

1 |

% |

|

5 |

% |

| Impact of foreign currency exchange |

0 |

% |

|

0 |

% |

|

0 |

% |

|

0 |

% |

|

0 |

% |

| Recurring revenue growth constant currency (Non-GAAP) |

5 |

% |

|

7 |

% |

|

7 |

% |

|

2 |

% |

|

5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, 2024 |

| Global Technology and Operations |

Capital Markets |

|

Wealth and Investment Management |

|

Total |

| Recurring revenue growth (GAAP) |

6 |

% |

|

0 |

% |

|

4 |

% |

| Impact of foreign currency exchange |

0 |

% |

|

0 |

% |

|

0 |

% |

| Recurring revenue growth constant currency (Non-GAAP) |

6 |

% |

|

0 |

% |

|

4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year Ended June 30, 2024 |

| Global Technology and Operations |

Capital Markets |

|

Wealth and Investment Management |

|

Total |

| Recurring revenue growth (GAAP) |

9 |

% |

|

7 |

% |

|

8 |

% |

| Impact of foreign currency exchange |

(1 |

%) |

|

0 |

% |

|

0 |

% |

| Recurring revenue growth constant currency (Non-GAAP) |

8 |

% |

|

7 |

% |

|

8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, 2024 |

|

Fiscal Year Ended June 30, 2024 |

| Consolidated |

Total |

|

Total |

| Recurring revenue growth (GAAP) |

5 |

% |

|

6 |

% |

| Impact of foreign currency exchange |

0 |

% |

|

0 |

% |

| Recurring revenue growth constant currency (Non-GAAP) |

5 |

% |

|

6 |

% |

Amounts may not sum due to rounding.

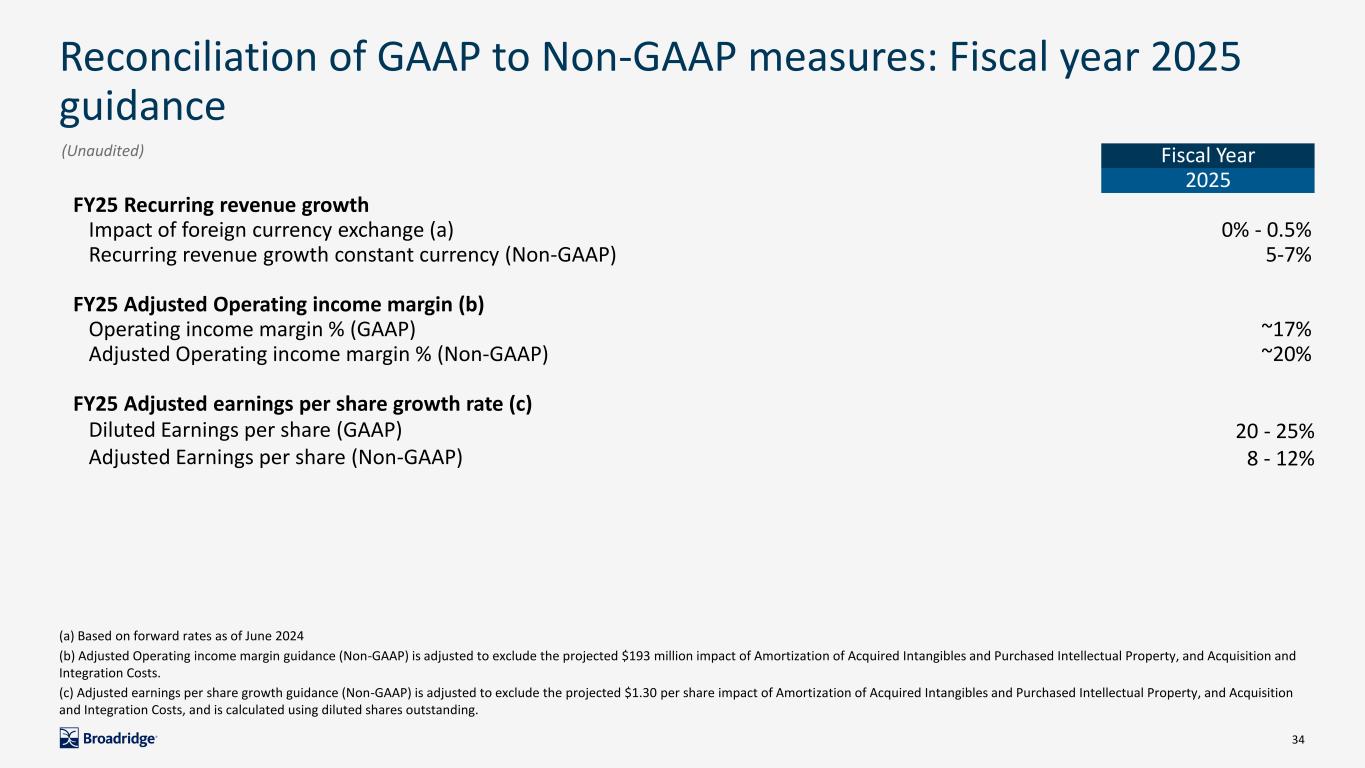

Fiscal Year 2025 Guidance

Reconciliation of Non-GAAP to GAAP Measures

Adjusted Earnings Per Share Growth and Adjusted Operating Income Margin

(Unaudited)

|

|

|

|

|

|

|

|

|

|

| FY25 Recurring revenue growth |

|

|

|

| Impact of foreign currency exchange (a) |

|

0 - 0.5% |

|

| Recurring revenue growth constant currency - Non-GAAP |

|

5 - 7% |

|

|

|

|

|

| FY25 Adjusted Operating income margin (b) |

|

|

|

| Operating income margin % - GAAP |

|

~17% |

|

| Adjusted Operating income margin % - Non-GAAP |

|

~20% |

|

|

|

|

| FY25 Adjusted earnings per share growth rate (c) |

|

|

|

| Diluted earnings per share - GAAP |

|

20 - 25% growth |

|

| Adjusted earnings per share - Non-GAAP |

|

8 - 12% growth |

|

|

|

|

|

|

|

|

|

|

(a) Based on forward rates as of July 2024.

(b) Adjusted Operating income margin guidance (Non-GAAP) is adjusted to exclude the projected $193 million impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, and Acquisition and Integration Costs.

(c) Adjusted earnings per share growth guidance (Non-GAAP) is adjusted to exclude the projected $1.30 per share impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, and Acquisition and Integration Costs, and is calculated using diluted shares outstanding.