EXECUTION VERSION TERM LOAN AND SECURITY AGREEMENT APOLLO ADMINISTRATIVE AGENCY LLC (AS ADMINISTRATIVE AGENT) WITH REDFIN CORPORATION (AS BORROWER), EACH GUARANTOR FROM TIME TO TIME PARTY HERETO, THE LENDERS FROM TIME TO TIME PARTY HERETO, AND APOLLO GLOBAL FUNDING, LLC (AS SOLE LEAD ARRANGER) October 20, 2023

- i- TABLE OF CONTENTS Page I. DEFINITIONS ....................................................................................................................... 1 1.1 Accounting Terms ...................................................................................................... 1 1.2 General Terms ............................................................................................................ 2 1.3 Uniform Commercial Code Terms ........................................................................... 42 1.4 Certain Matters of Construction ............................................................................... 43 1.5 Divisions ................................................................................................................... 43 II. ADVANCES, PAYMENTS ................................................................................................. 44 2.1 [Reserved] ................................................................................................................. 44 2.2 Procedures for Selection of Applicable Interest Rates for All Advances; Breakage 44 2.3 Term Loans ............................................................................................................... 46 2.4 Currencies ................................................................................................................. 48 2.5 Disbursement of Advance Proceeds ......................................................................... 48 2.6 Making and Settlement of Advances ........................................................................ 48 2.7 Termination of Commitments .................................................................................. 48 2.8 Manner and Repayment of Advances ....................................................................... 49 2.9 Repayment of Excess Advances ............................................................................... 50 2.10 Statement of Account ............................................................................................... 50 2.11 [Reserved]. ................................................................................................................ 50 2.12 [Reserved] ................................................................................................................. 50 2.13 [Reserved] ................................................................................................................. 50 2.14 [Reserved] ................................................................................................................. 50 2.15 [Reserved] ................................................................................................................. 50 2.16 [Reserved] ................................................................................................................. 50 2.17 [Reserved] ................................................................................................................. 50 2.18 [Reserved] ................................................................................................................. 50 2.19 [Reserved] ................................................................................................................. 50 2.20 Mandatory Prepayments; Prepayment Premium. ..................................................... 50 2.21 Use of Proceeds ........................................................................................................ 52 2.22 Defaulting Lender ..................................................................................................... 52 2.23 [Reserved] ................................................................................................................. 54 2.24 [Reserved] ................................................................................................................. 54 III. INTEREST AND FEES ....................................................................................................... 54 3.1 Interest ...................................................................................................................... 54 3.2 Delayed Draw Term Loan Commitment Fee ........................................................... 55 3.3 [Reserved] ................................................................................................................. 55 3.4 Fee Letter .................................................................................................................. 55 3.5 Computation of Interest and Fees ............................................................................. 55 3.6 Maximum Charges ................................................................................................... 55 3.7 Increased Costs ......................................................................................................... 56 3.9 Capital Adequacy ..................................................................................................... 56 3.10 Taxes ......................................................................................................................... 57

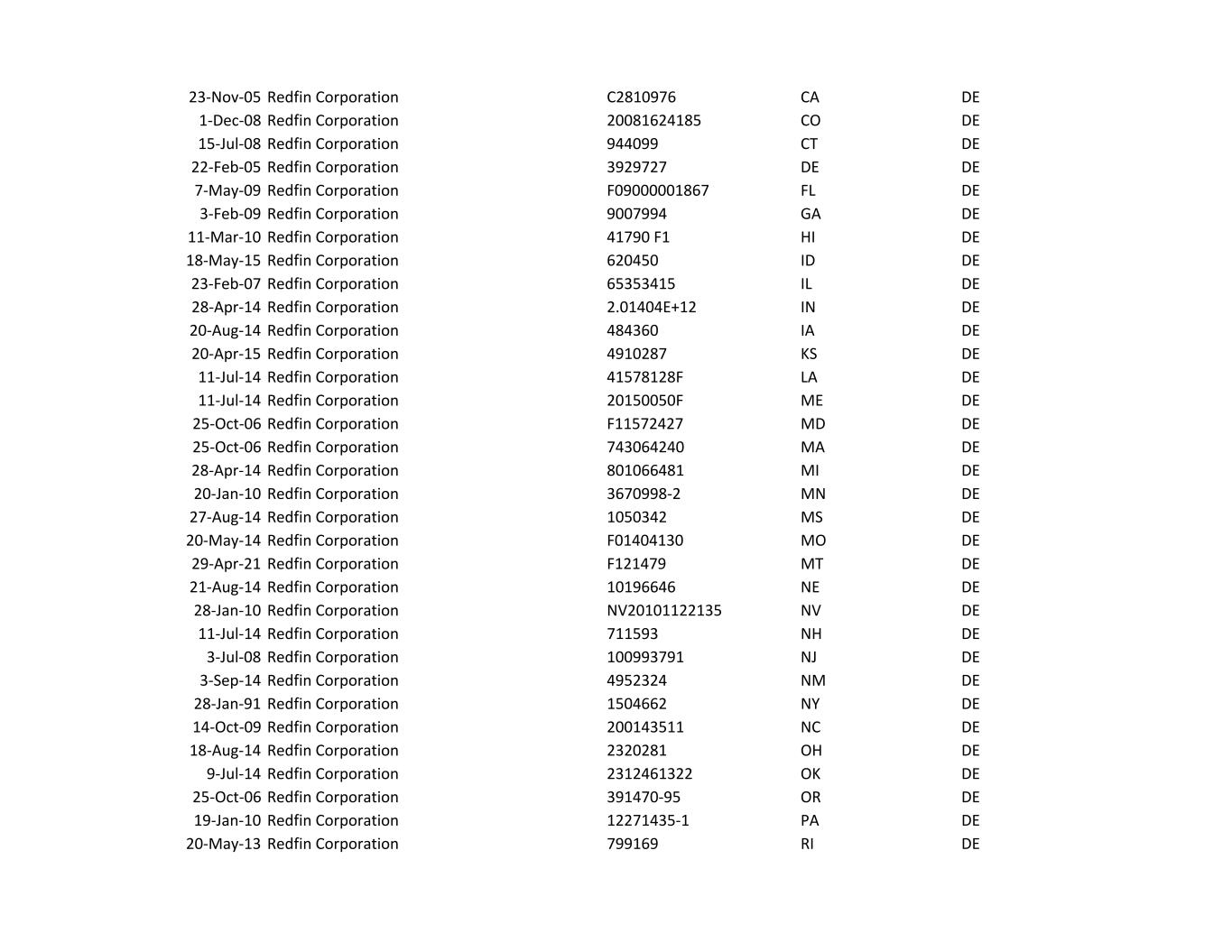

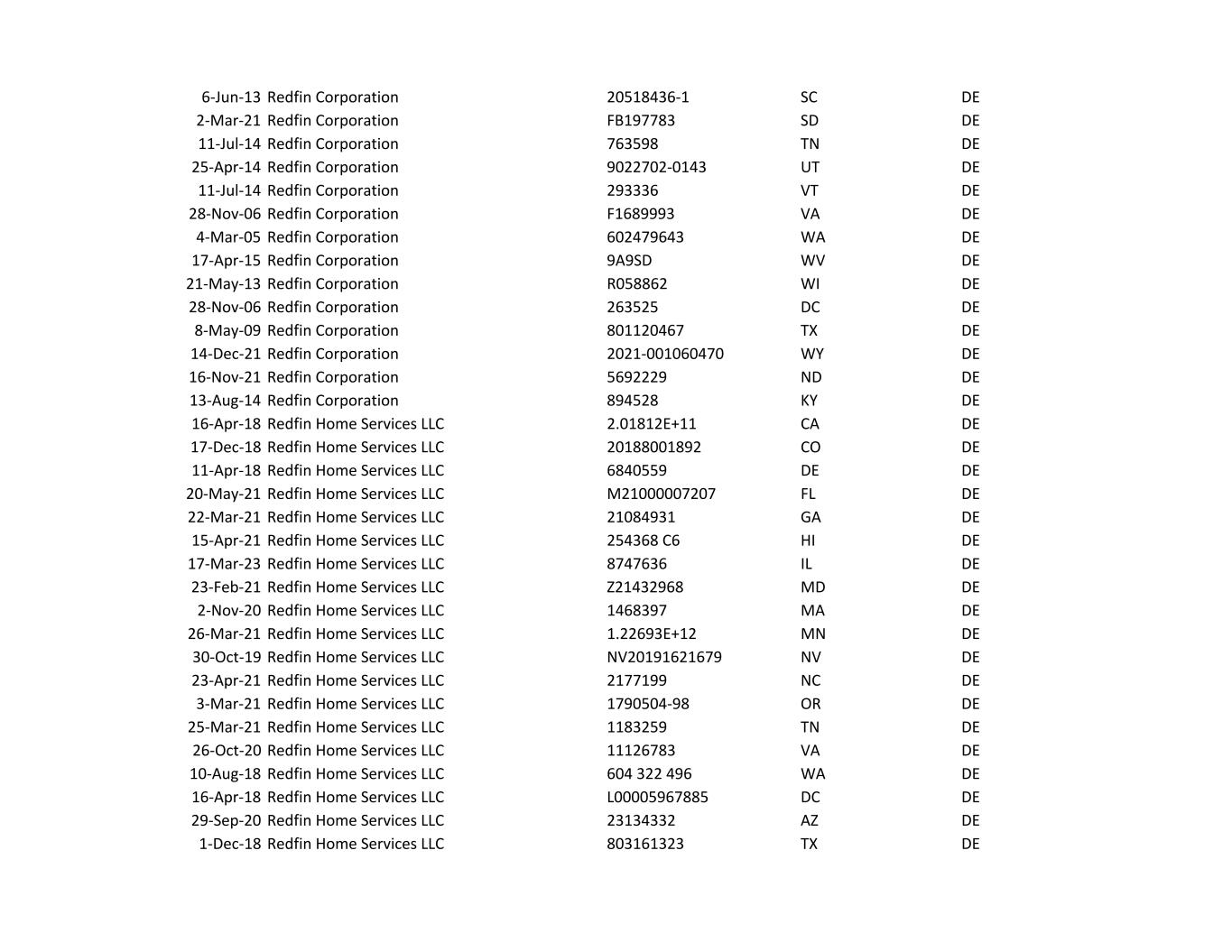

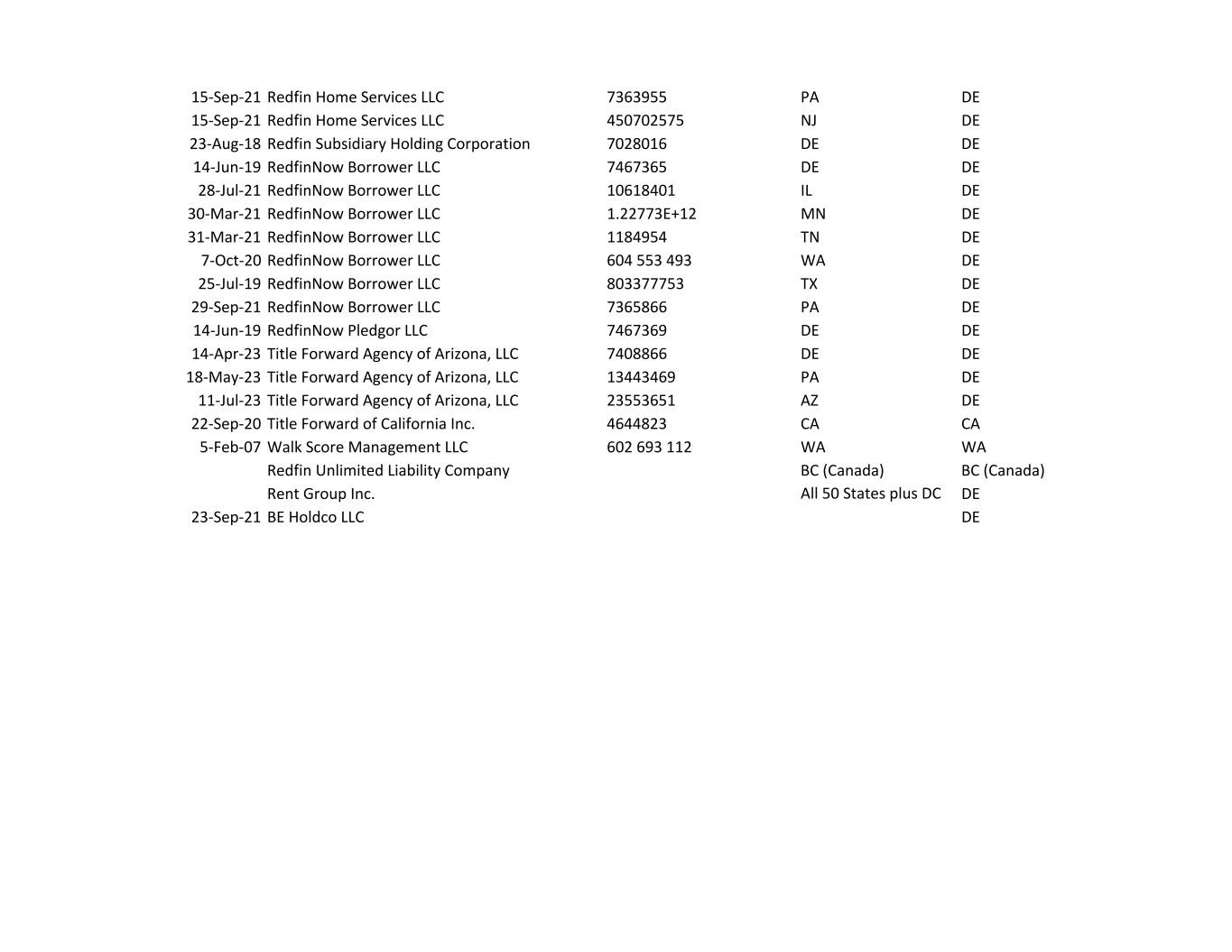

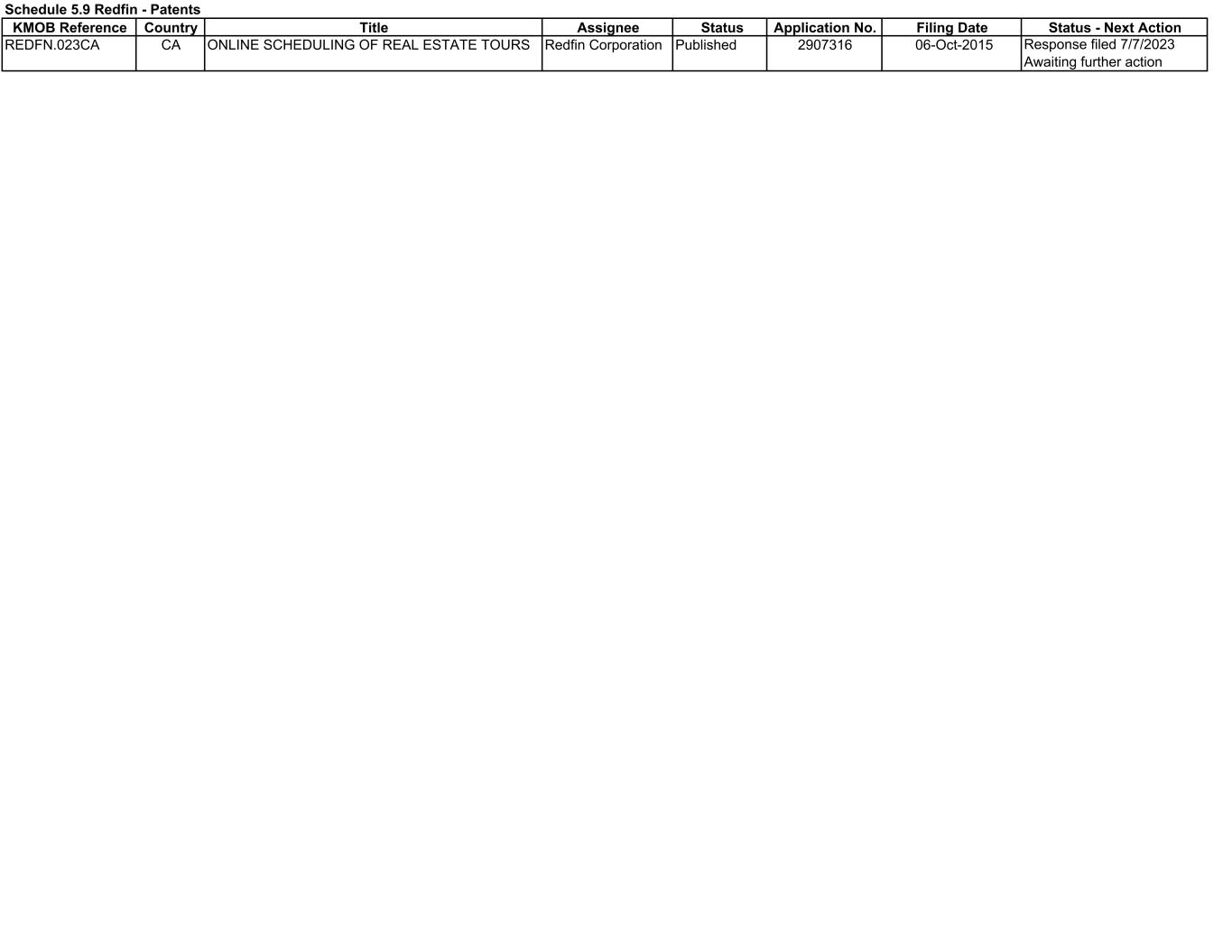

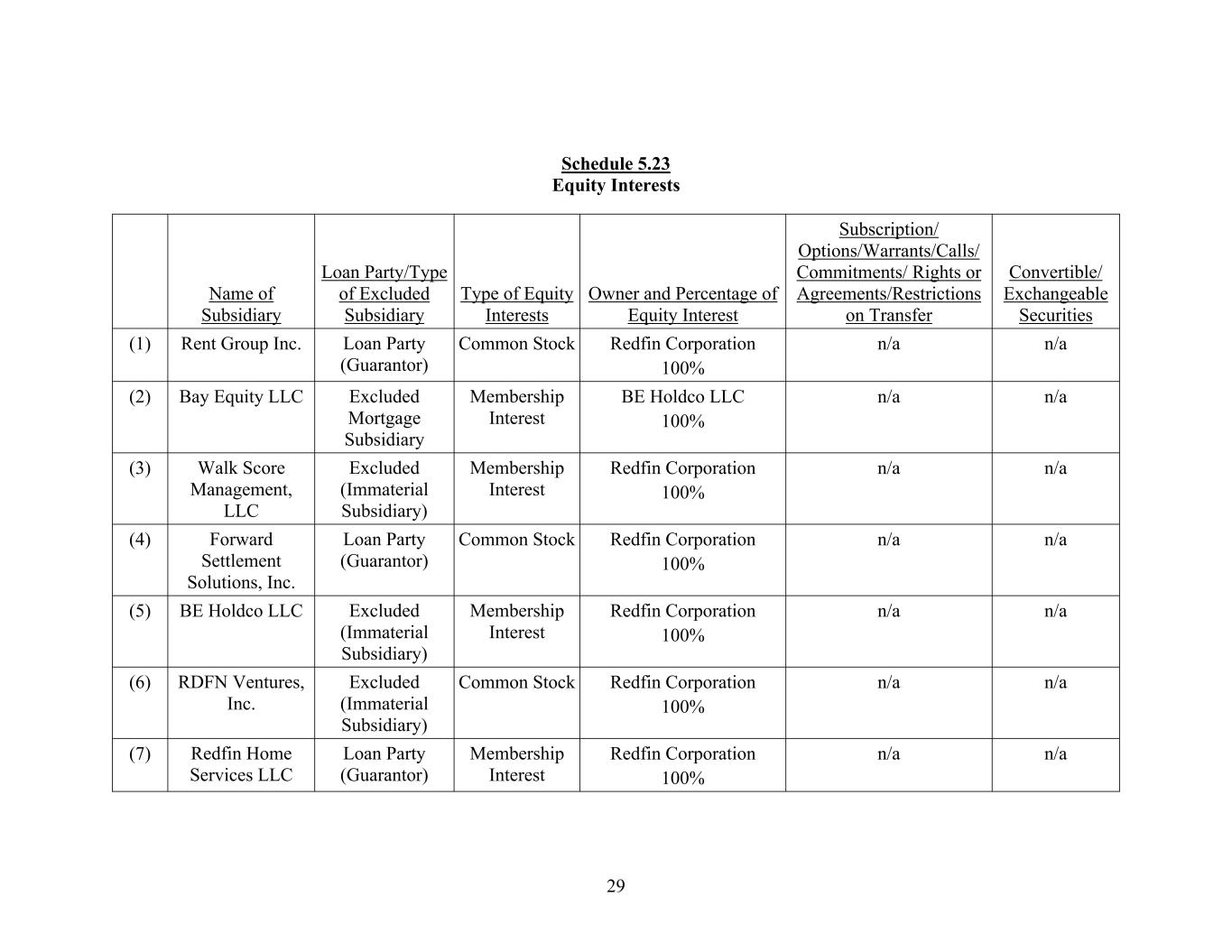

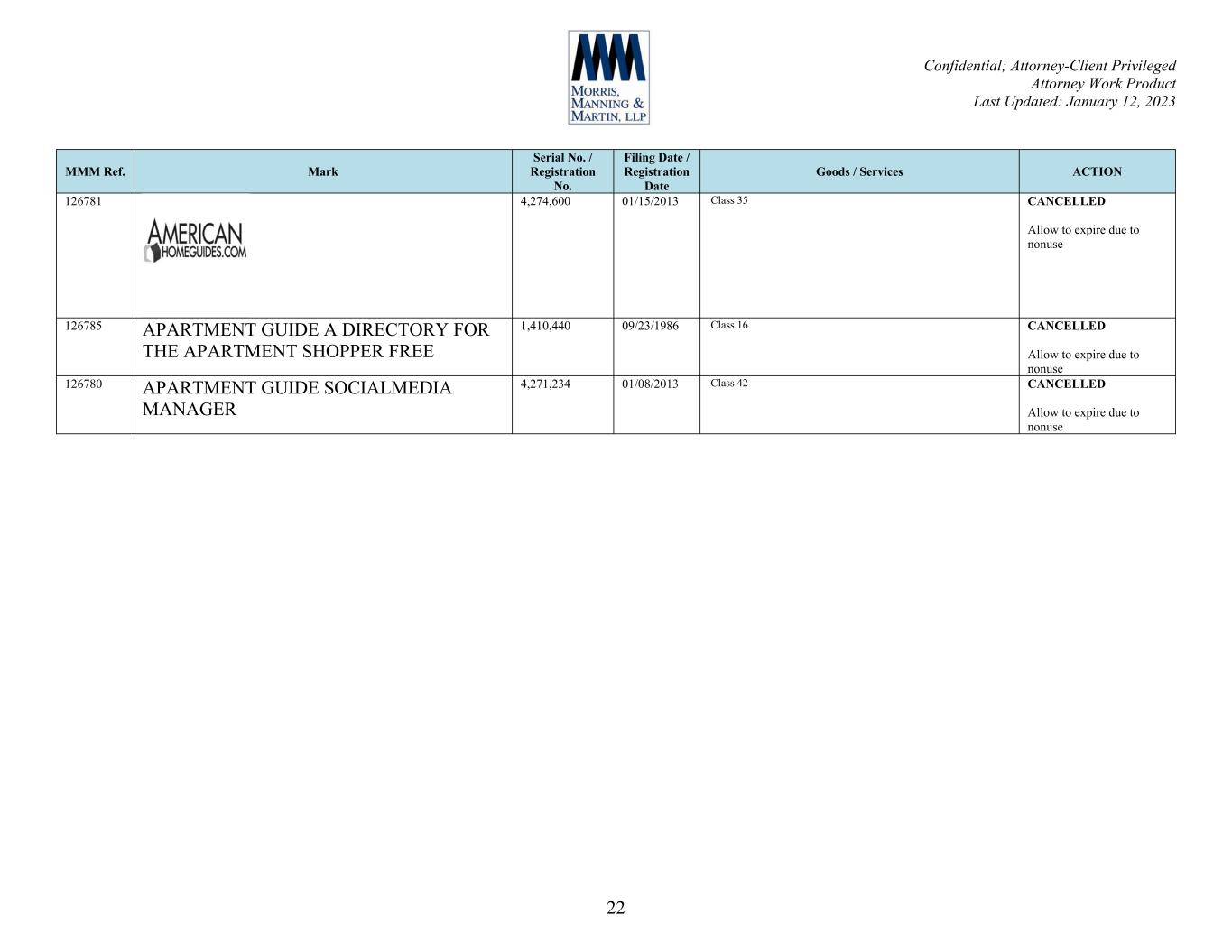

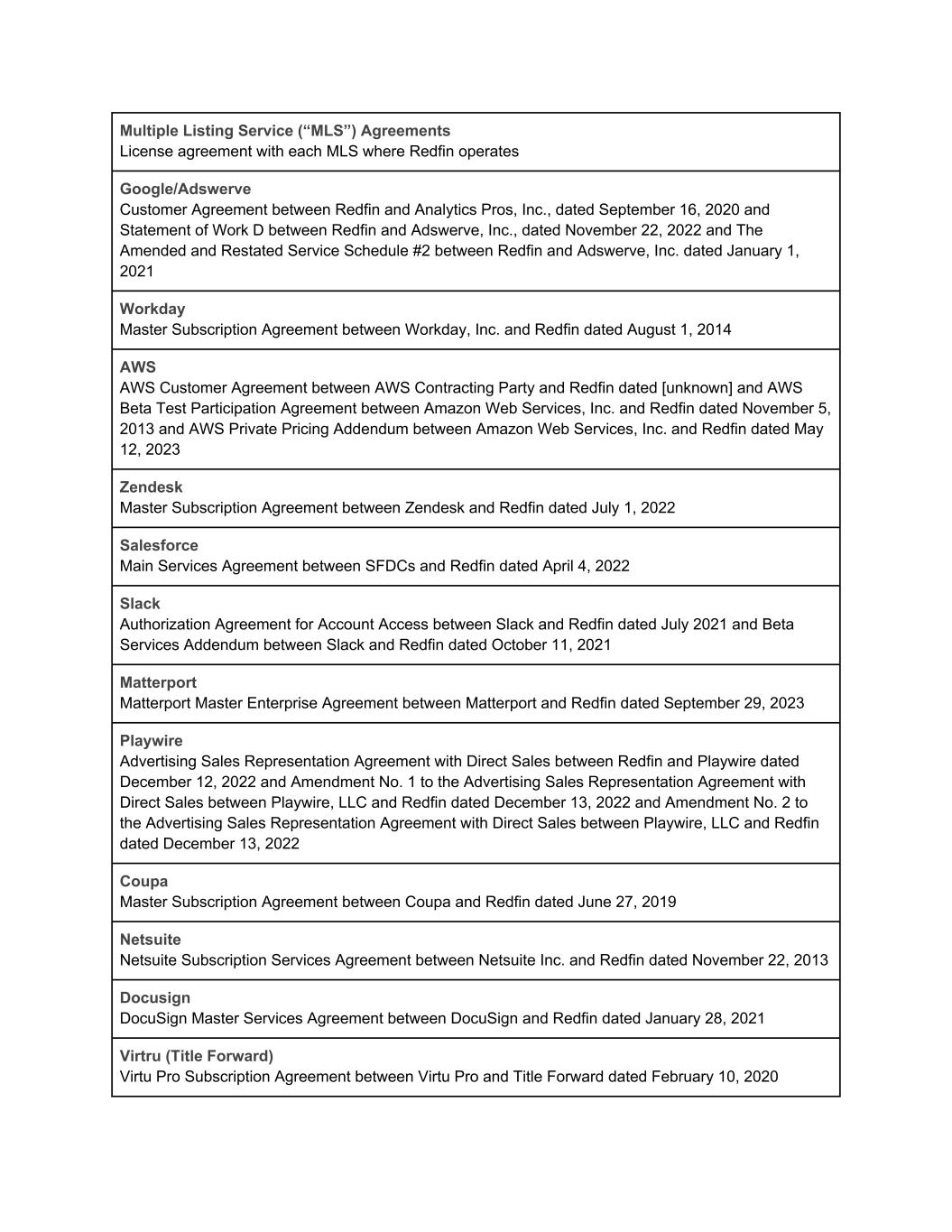

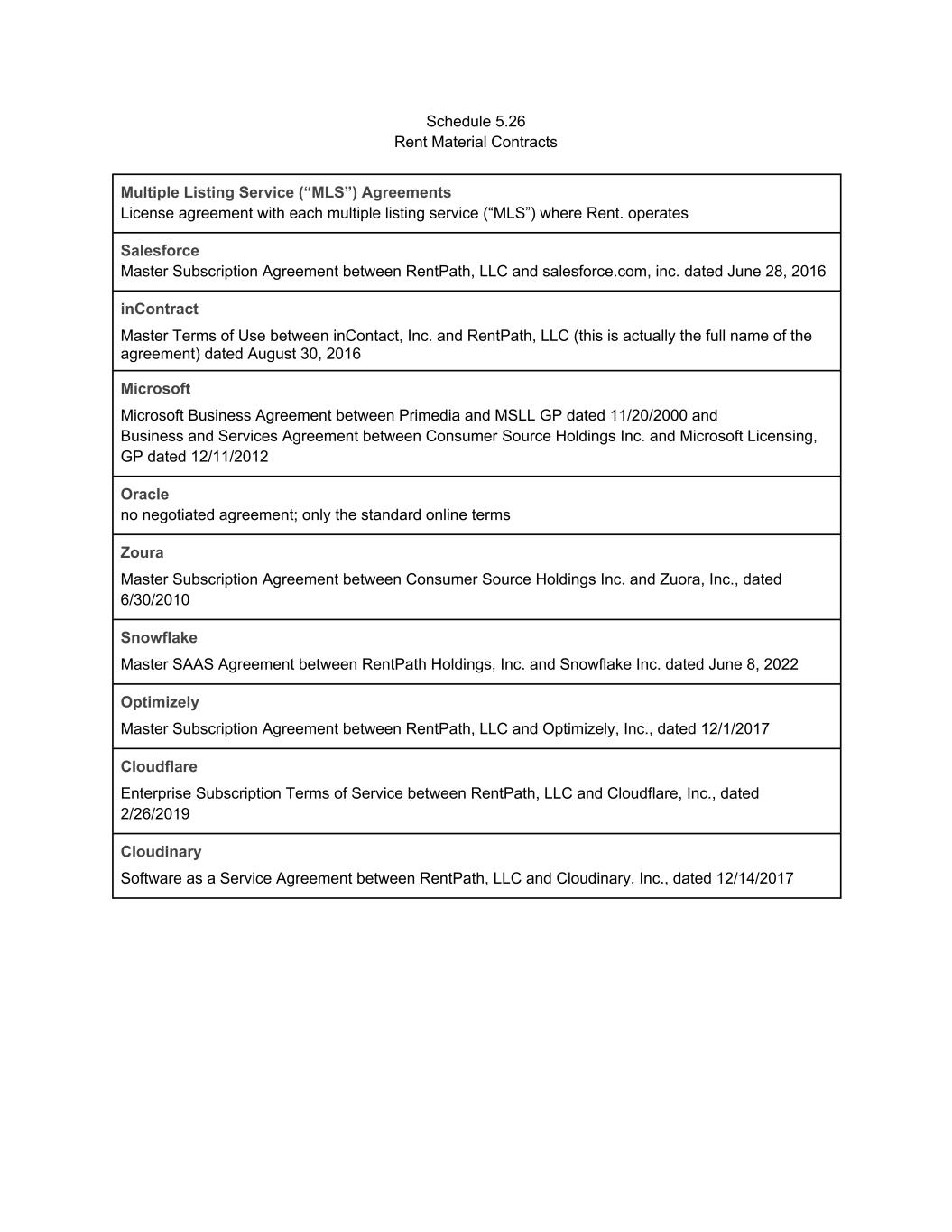

- ii- 3.11 Replacement of Lenders ........................................................................................... 60 3.12 Alternate Rate of Interest. ......................................................................................... 61 IV. COLLATERAL: GENERAL TERMS ................................................................................. 63 4.1 Security Interest in the Collateral ............................................................................. 63 4.2 Perfection of Security Interest; Intellectual Property Collateral .............................. 63 4.3 Preservation of Collateral ......................................................................................... 65 4.4 Ownership and Location of Collateral ..................................................................... 65 4.5 Defense of Administrative Agent’s and Lenders’ Interests ..................................... 66 4.6 Inspection Rights ...................................................................................................... 66 4.7 Real Property ............................................................................................................ 67 4.8 Receivables; Deposit Accounts and Securities Accounts ........................................ 67 4.9 Inventory ................................................................................................................... 68 4.10 Maintenance of Equipment ....................................................................................... 68 4.11 Exculpation of Liability ............................................................................................ 69 4.12 Financing Statements ................................................................................................ 69 4.13 Investment Property and Pledged Debt Collateral ................................................... 69 4.14 Provisions Regarding Certain Investment Property Collateral ................................ 70 V. REPRESENTATIONS AND WARRANTIES .................................................................... 71 5.1 Authority ................................................................................................................... 71 5.2 Formation and Qualification ..................................................................................... 71 5.3 Survival of Representations and Warranties ............................................................ 72 5.4 Tax Returns .............................................................................................................. 72 5.5 Financial Statements ................................................................................................. 72 5.6 Entity Names ............................................................................................................ 72 5.7 O.S.H.A. Environmental Compliance; Flood Insurance .......................................... 73 5.8 Solvency; No Litigation, Violation, Indebtedness or Default; ERISA Compliance 73 5.9 Patents, Trademarks, Copyrights and Licenses ........................................................ 75 5.10 Licenses and Permits ................................................................................................ 75 5.11 [Reserved] ................................................................................................................. 75 5.12 No Default ................................................................................................................ 75 5.13 No Burdensome Restrictions .................................................................................... 75 5.14 No Labor Disputes .................................................................................................... 75 5.15 Margin Regulations .................................................................................................. 76 5.16 Investment Company Act ......................................................................................... 76 5.17 Disclosure ................................................................................................................. 76 5.18 [Reserved] ................................................................................................................. 76 5.19 [Reserved] ................................................................................................................. 76 5.20 Business and Property of Loan Parties ..................................................................... 76 5.21 [Reserved] ................................................................................................................. 76 5.22 [Reserved] ................................................................................................................. 76 5.23 Equity Interests ......................................................................................................... 76 5.24 Commercial Tort Claims .......................................................................................... 77 5.25 Letter of Credit Rights .............................................................................................. 77 5.26 Material Contracts .................................................................................................... 77 5.27 Investment Property Collateral ................................................................................. 77

- iii- VI. AFFIRMATIVE COVENANTS .......................................................................................... 77 6.1 Compliance with Laws ............................................................................................. 77 6.2 Conduct of Business and Maintenance of Existence and Assets ............................. 77 6.3 Books and Records ................................................................................................... 78 6.4 Payment of Taxes ..................................................................................................... 78 6.5 Financial Covenant ................................................................................................... 78 6.6 Insurance ................................................................................................................... 78 6.7 Payment of Contractual Obligations ........................................................................ 79 6.8 Environmental Matters ............................................................................................. 79 6.9 Standards of Financial Statements ............................................................................ 79 6.10 [Reserved] ................................................................................................................. 79 6.11 Further Assurances .................................................... Error! Bookmark not defined. 6.12 [Reserved] ................................................................................................................. 80 6.13 [Reserved]. ................................................................................................................ 80 6.14 [Reserved]. ................................................................................................................ 80 6.15 Post-Closing Covenants. ........................................................................................... 80 VII. NEGATIVE COVENANTS ................................................................................................. 80 7.1 Merger, Consolidation, Acquisition and Sale of Assets ........................................... 80 7.2 Creation of Liens ...................................................................................................... 81 7.3 Guarantees ................................................................................................................ 81 7.4 Investments ............................................................................................................... 82 7.5 Loans ........................................................................................................................ 82 7.6 [Reserved] ................................................................................................................. 82 7.7 Restricted Payments ................................................................................................. 82 7.8 Indebtedness ............................................................................................................. 83 7.9 [Reserved] ................................................................................................................. 83 7.10 Transactions with Affiliates ..................................................................................... 83 7.11 [Reserved]. ................................................................................................................ 83 7.12 Subsidiaries ............................................................................................................... 83 7.13 Fiscal Year; Accounting Changes; Tax Reporting ................................................... 83 7.14 Burdensome Agreements .......................................................................................... 83 7.15 Amendment of Organizational Documents .............................................................. 84 7.16 Compliance with ERISA .......................................................................................... 84 7.17 Prepayment of Indebtedness ..................................................................................... 85 7.18 Membership/Partnership Interests ............................................................................ 85 7.19 [Reserved] ................................................................................................................. 85 7.20 Negative Pledge of Equity Interests of Specified Loan Parties ................................ 85 VIII. CONDITIONS PRECEDENT .............................................................................................. 85 8.1 Conditions to Closing Date ...................................................................................... 85 8.2 Conditions to Each Advance .................................................................................... 88 IX. INFORMATION AS TO LOAN PARTIES AND SUBSIDIARIES ................................... 89 9.1 Disclosure of Material Matters ................................................................................. 89 9.2 [Reserved] ................................................................................................................. 89 9.3 Environmental Reports ............................................................................................. 89

- iv- 9.4 [Reserved]. ................................................................................................................ 89 9.5 Material Occurrences ................................................................................................ 89 9.6 [Reserved] ................................................................................................................. 90 9.7 Annual Financial Statements .................................................................................... 90 9.8 Quarterly Financial Statements ................................................................................ 90 9.9 [Reserved] ................................................................................................................. 91 9.10 Lender Calls .............................................................................................................. 91 9.11 Additional Information ............................................................................................. 91 9.12 Projections ................................................................................................................ 91 9.13 Regulatory Matters ................................................................................................... 91 9.14 Notice of Litigation, Etc ........................................................................................... 91 9.15 ERISA Notices and Requests ................................................................................... 91 9.16 Additional Documents .............................................................................................. 92 9.17 Updates to Certain Schedules; Collateral Information Certificate ........................... 92 X. EVENTS OF DEFAULT ..................................................................................................... 92 10.1 Nonpayment ............................................................................................................. 92 10.2 Breach of Representation ......................................................................................... 93 10.3 Financial Information ............................................................................................... 93 10.4 Judicial Actions ........................................................................................................ 93 10.5 Noncompliance ......................................................................................................... 93 10.6 Judgments ................................................................................................................. 93 10.7 Bankruptcy ............................................................................................................... 93 10.8 Lien Priority .............................................................................................................. 94 10.9 Cross Default. ........................................................................................................... 94 10.10 Breach of Guaranty, Guarantor Security Agreement or Other Document ............... 94 10.11 Change of Control. ................................................................................................... 94 10.12 Invalidity ................................................................................................................... 94 10.13 [Reserved] ................................................................................................................. 94 10.14 [Reserved] ................................................................................................................. 94 10.15 Plans; ERISA ............................................................................................................ 94 10.16 Anti-Money Laundering/International Trade Law Compliance ............................... 94 XI. LENDERS’ RIGHTS AND REMEDIES AFTER DEFAULT ............................................ 94 11.1 Rights and Remedies ................................................................................................ 94 11.2 Administrative Agent’s Discretion ........................................................................... 98 11.3 Setoff ........................................................................................................................ 98 11.4 Rights and Remedies not Exclusive ......................................................................... 98 11.5 Allocation of Payments After Event of Default ....................................................... 98 XII. WAIVERS AND JUDICIAL PROCEEDINGS ................................................................... 99 12.1 Waiver of Notice ...................................................................................................... 99 12.2 Delay ......................................................................................................................... 99 12.3 Jury Waiver .............................................................................................................. 99 XIII. EFFECTIVE DATE AND TERMINATION ..................................................................... 100 13.1 Term ....................................................................................................................... 100 13.2 Termination ............................................................................................................ 100

- v- XIV. REGARDING ADMINISTRATIVE AGENT AND ARRANGER .................................. 100 14.1 Appointment ........................................................................................................... 100 14.2 Nature of Duties ..................................................................................................... 101 14.3 Lack of Reliance on Administrative Agent and Arranger ...................................... 101 14.4 Resignation/Removal of Administrative Agent; Successor Administrative Agent 102 14.5 Certain Rights of Administrative Agent ................................................................. 102 14.6 Reliance .................................................................................................................. 103 14.7 Notice of Default .................................................................................................... 103 14.8 Indemnification ....................................................................................................... 103 14.9 Administrative Agent in Its Individual Capacity .................................................... 103 14.10 Delivery of Documents ........................................................................................... 103 14.11 Loan Parties Undertaking to Administrative Agent ............................................... 104 14.12 No Reliance on Administrative Agent’s Customer Identification Program ........... 104 14.13 Other Agreements ................................................................................................... 104 14.14 Erroneous Payments. .............................................................................................. 104 14.15 Collateral and Guaranty Matters ............................................................................ 107 14.16 Status of Administrative Agent .............................................................................. 107 XV. BORROWER AGENCY .................................................................................................... 108 15.1 Borrower Agency Provisions ................................................................................. 108 15.2 Waiver of Subrogation ........................................................................................... 109 XVI. MISCELLANEOUS ........................................................................................................... 109 16.1 Governing Law ....................................................................................................... 109 16.2 Entire Understanding; Amendments, etc ................................................................ 110 16.3 Successors and Assigns; Participations; New Lenders .......................................... 111 16.4 Application of Payments ........................................................................................ 114 16.5 Indemnity ................................................................................................................ 114 16.6 Notice ..................................................................................................................... 115 16.7 Survival ................................................................................................................... 117 16.8 Severability ............................................................................................................. 117 16.9 Expenses ................................................................................................................. 117 16.10 Injunctive Relief ..................................................................................................... 118 16.11 Consequential Damages ......................................................................................... 118 16.12 Captions .................................................................................................................. 118 16.13 Counterparts; Facsimile Signatures; Electronic Execution .................................... 118 16.14 Construction ........................................................................................................... 118 16.15 Confidentiality; Sharing Information ..................................................................... 118 16.16 Publicity .................................................................................................................. 119 16.17 Certifications From Banks and Participants; USA PATRIOT Act ........................ 119 16.18 Anti-Terrorism Laws; Beneficial Ownership Regulation ...................................... 120 16.19 Acknowledgment and Consent to Bail-In of EEA Financial Institutions .............. 121 16.20 Acknowledgment Regarding Any Supported QFCs .............................................. 121 XVII. GUARANTY .......................................................................................................... 123 17.1 Guaranty ................................................................................................................. 123 17.2 Waivers ................................................................................................................... 123

- vi- 17.3 No Defense ............................................................................................................. 123 17.4 Guaranty of Payment .............................................................................................. 123 17.5 Liabilities Absolute ................................................................................................ 124 17.6 Waiver of Notice .................................................................................................... 124 17.7 Administrative Agent’s Discretion ......................................................................... 125 17.8 Reinstatement ......................................................................................................... 125

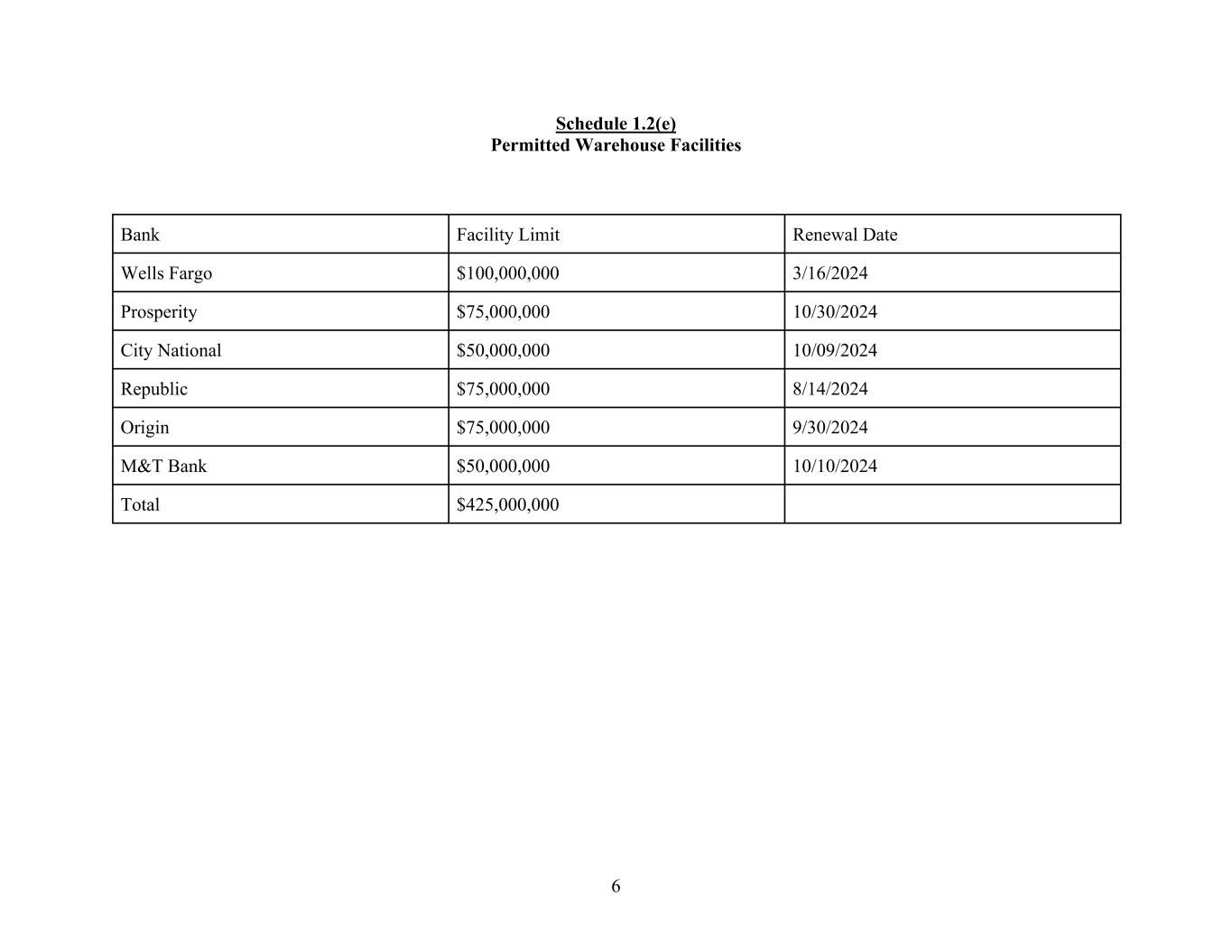

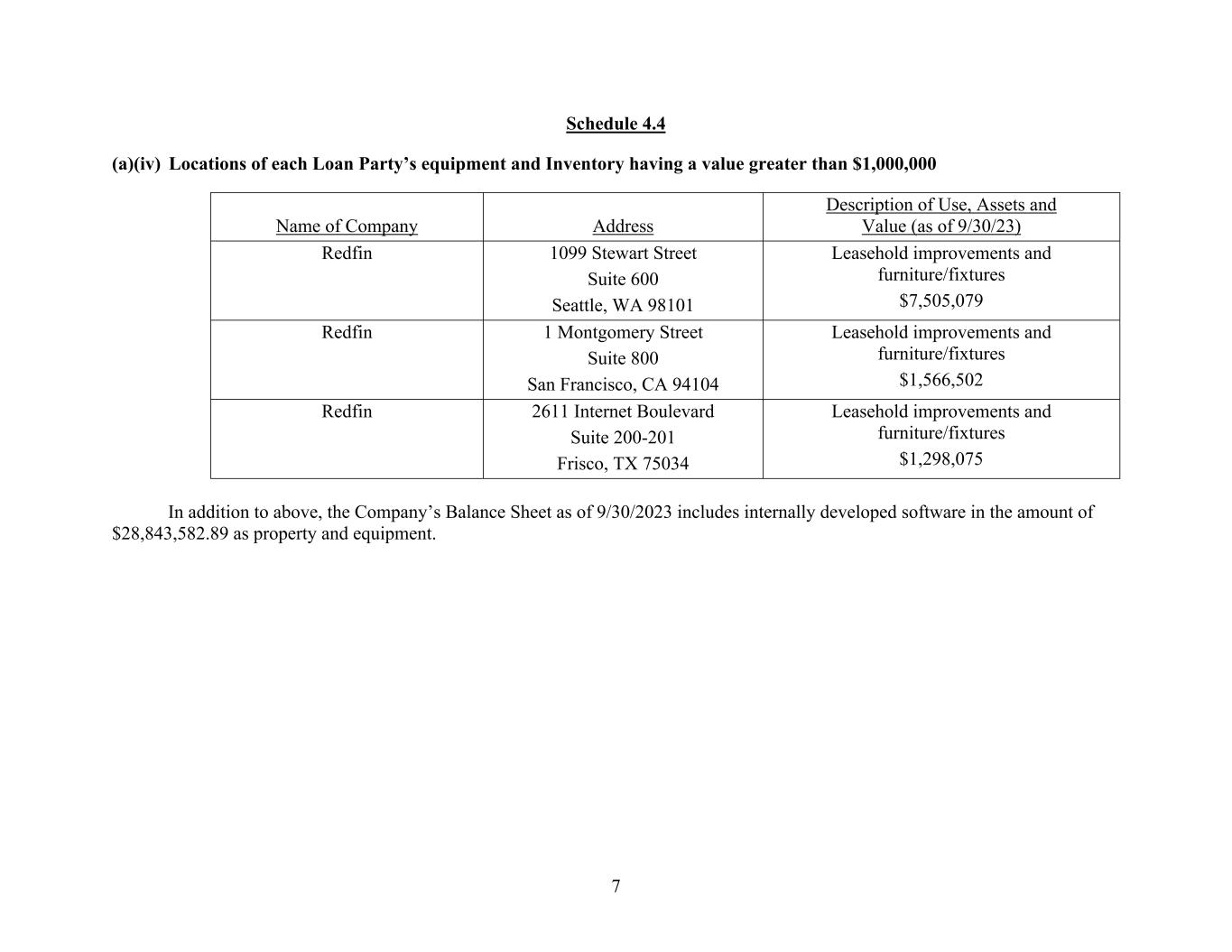

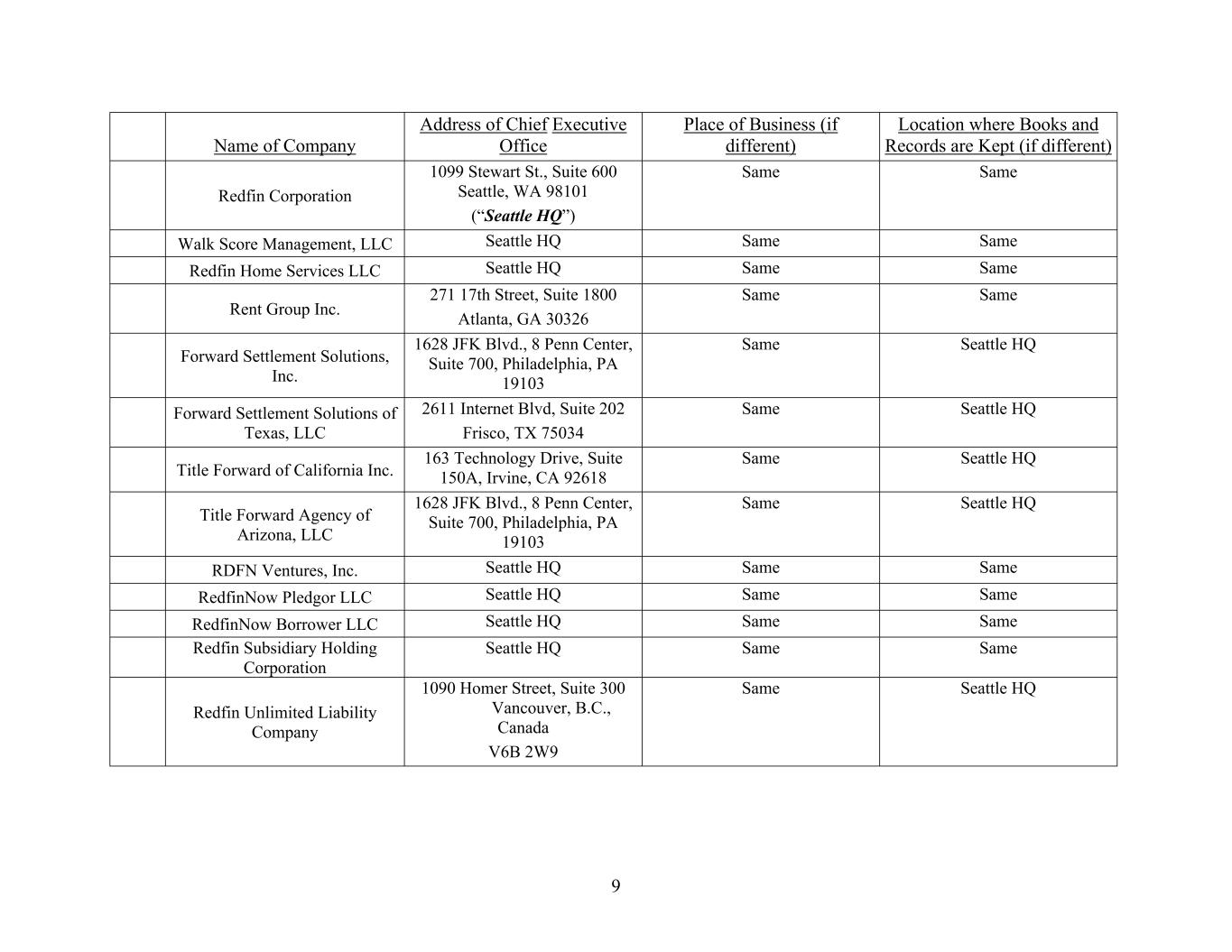

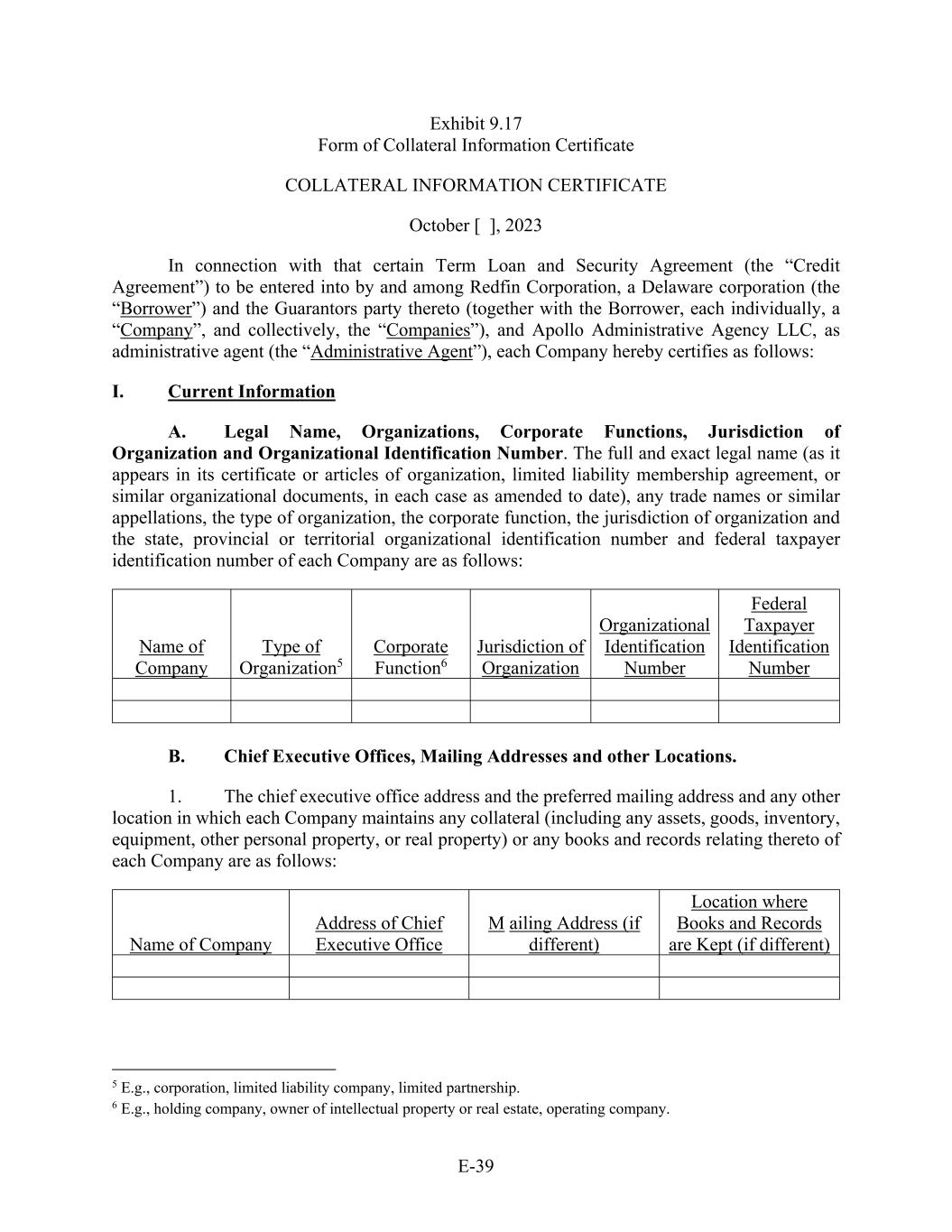

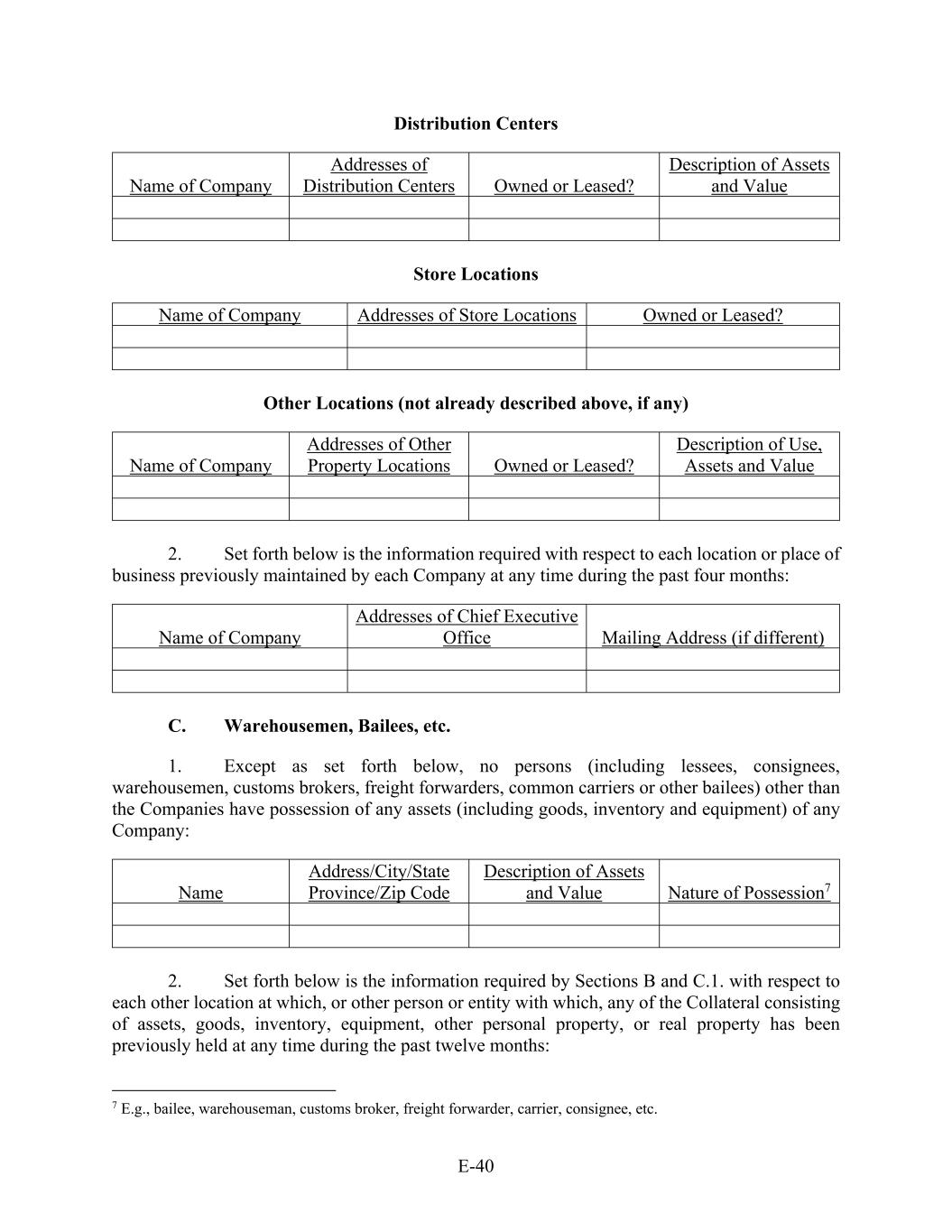

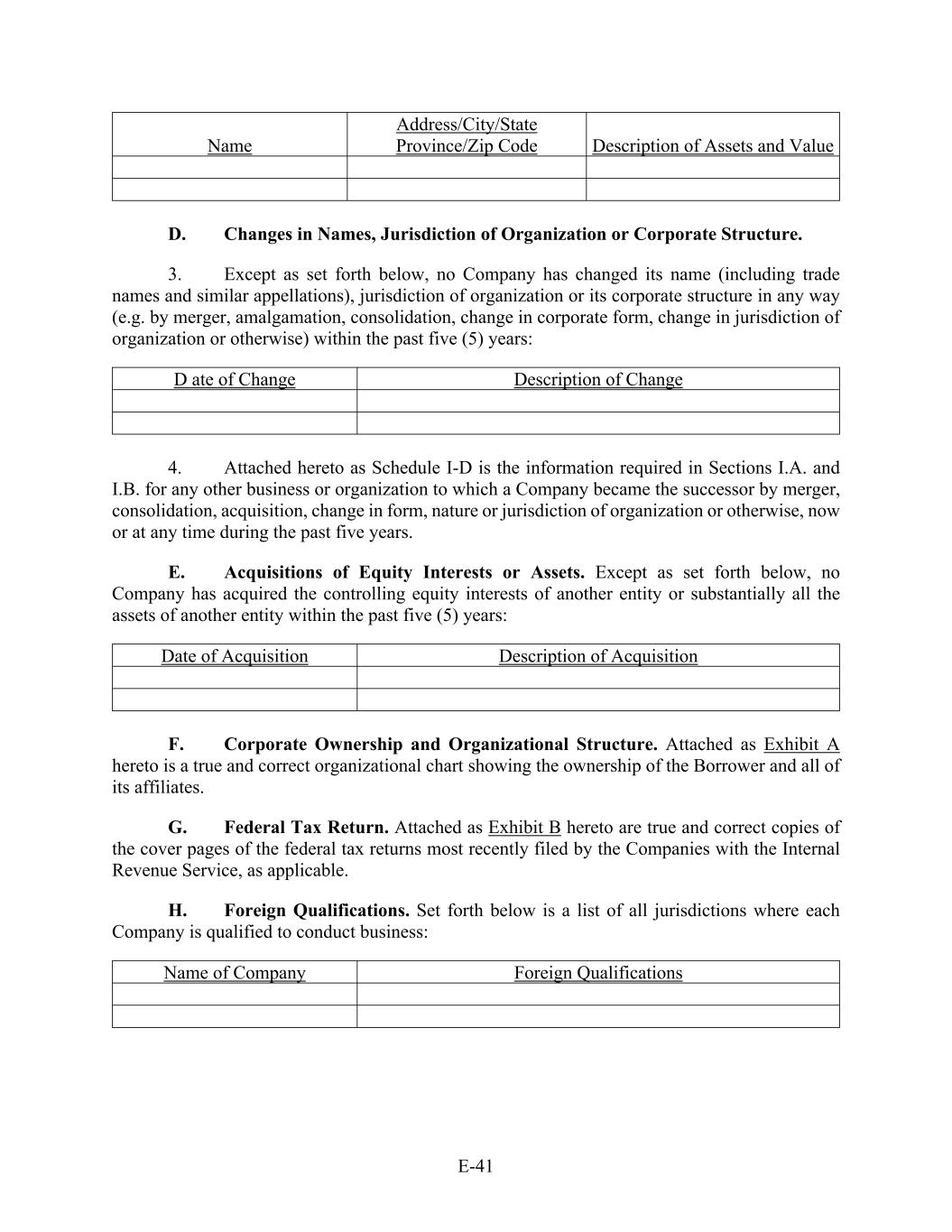

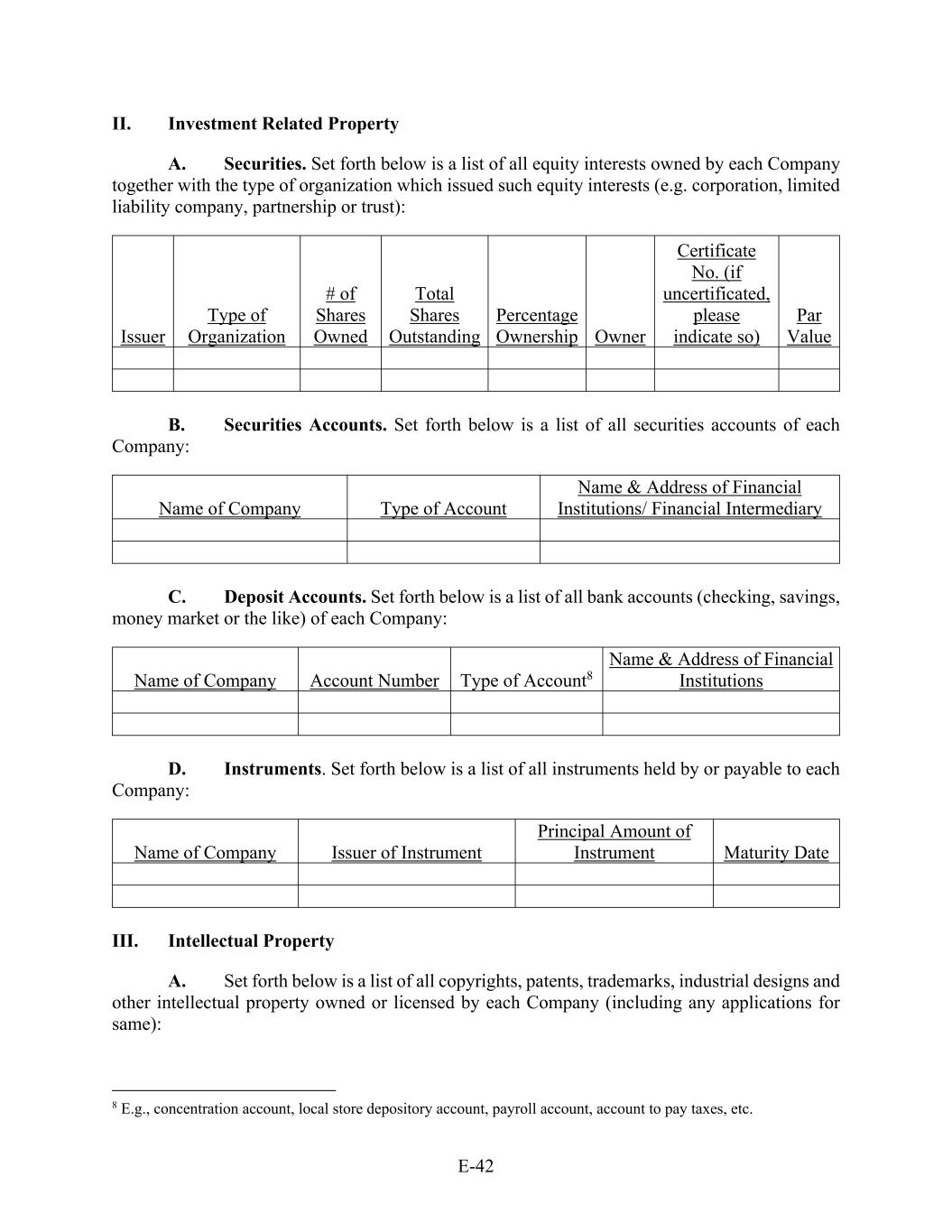

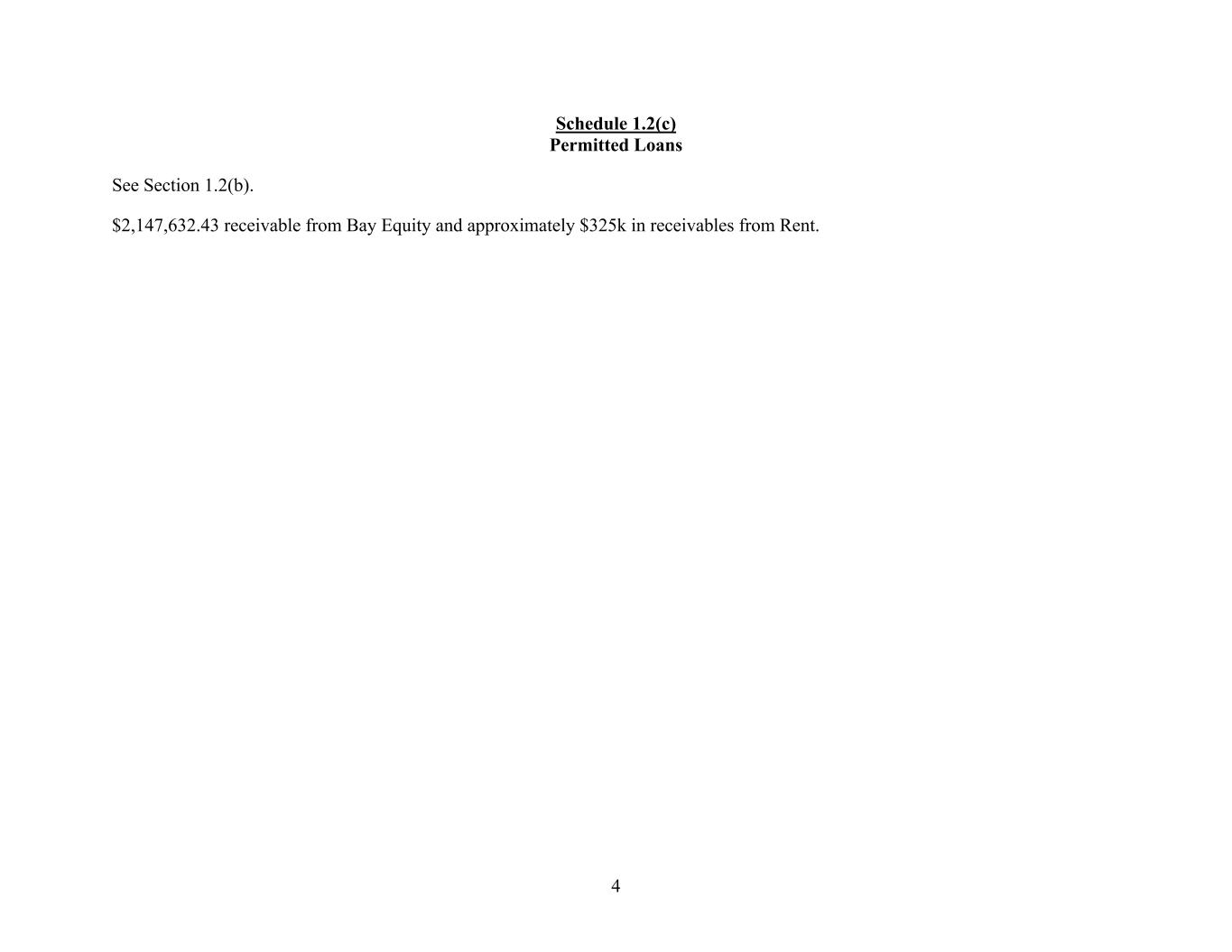

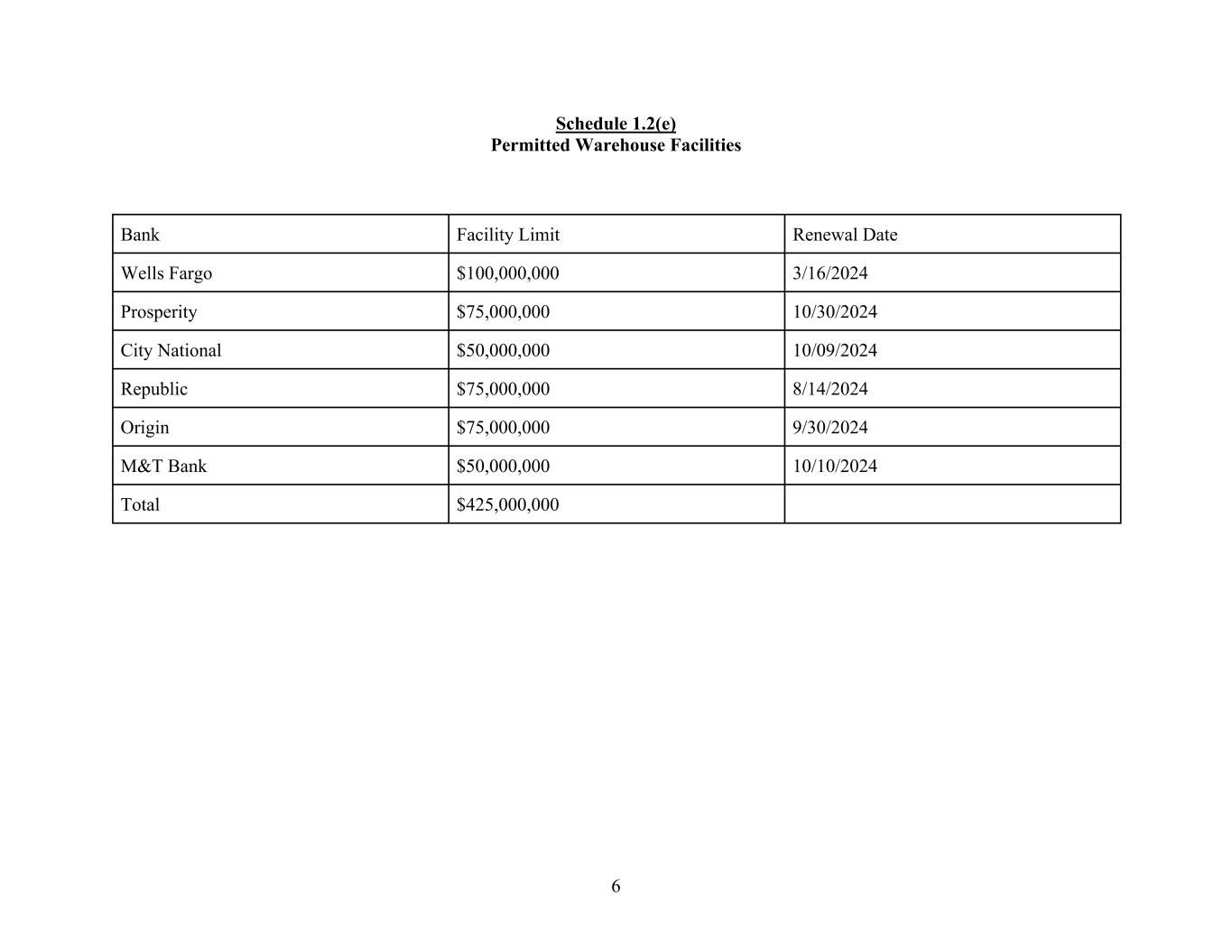

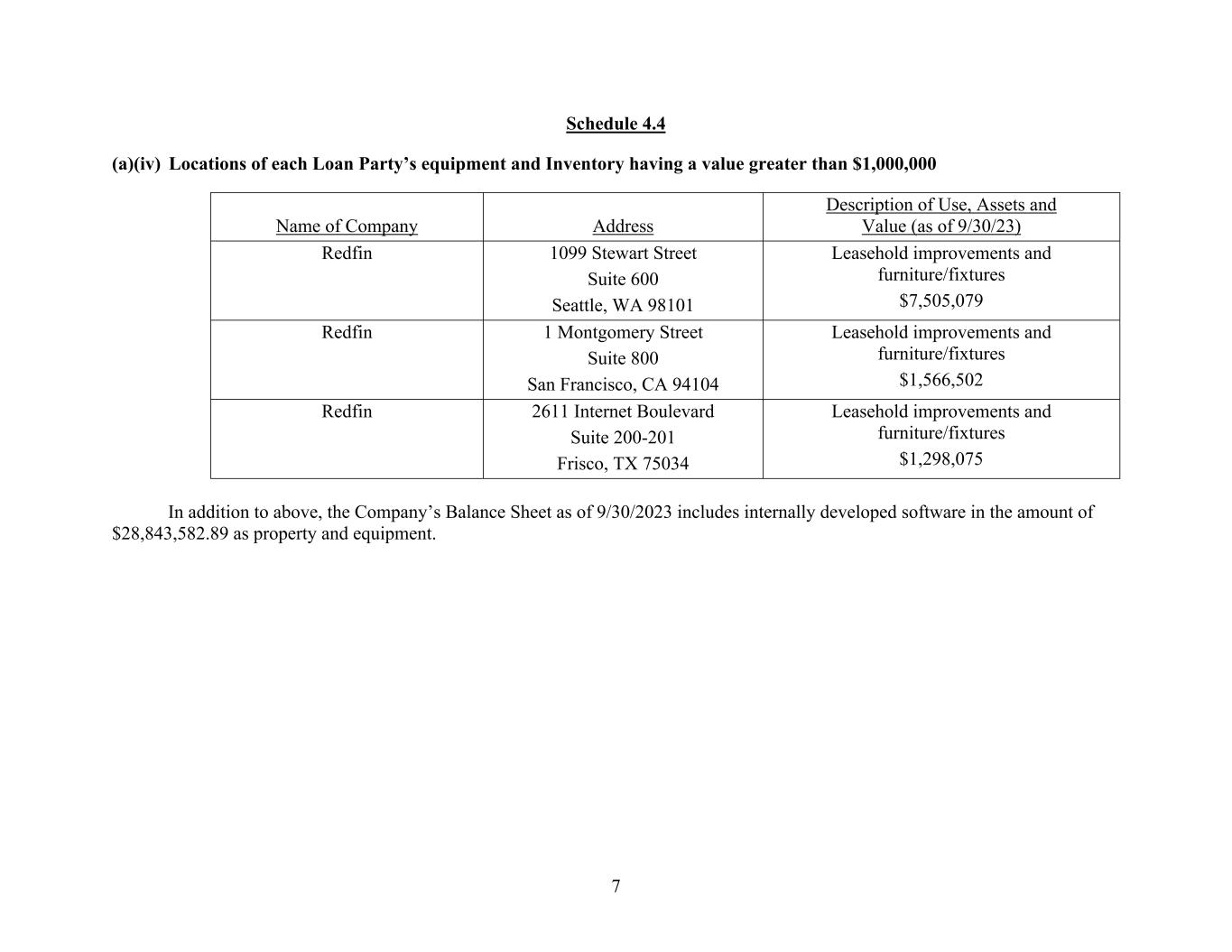

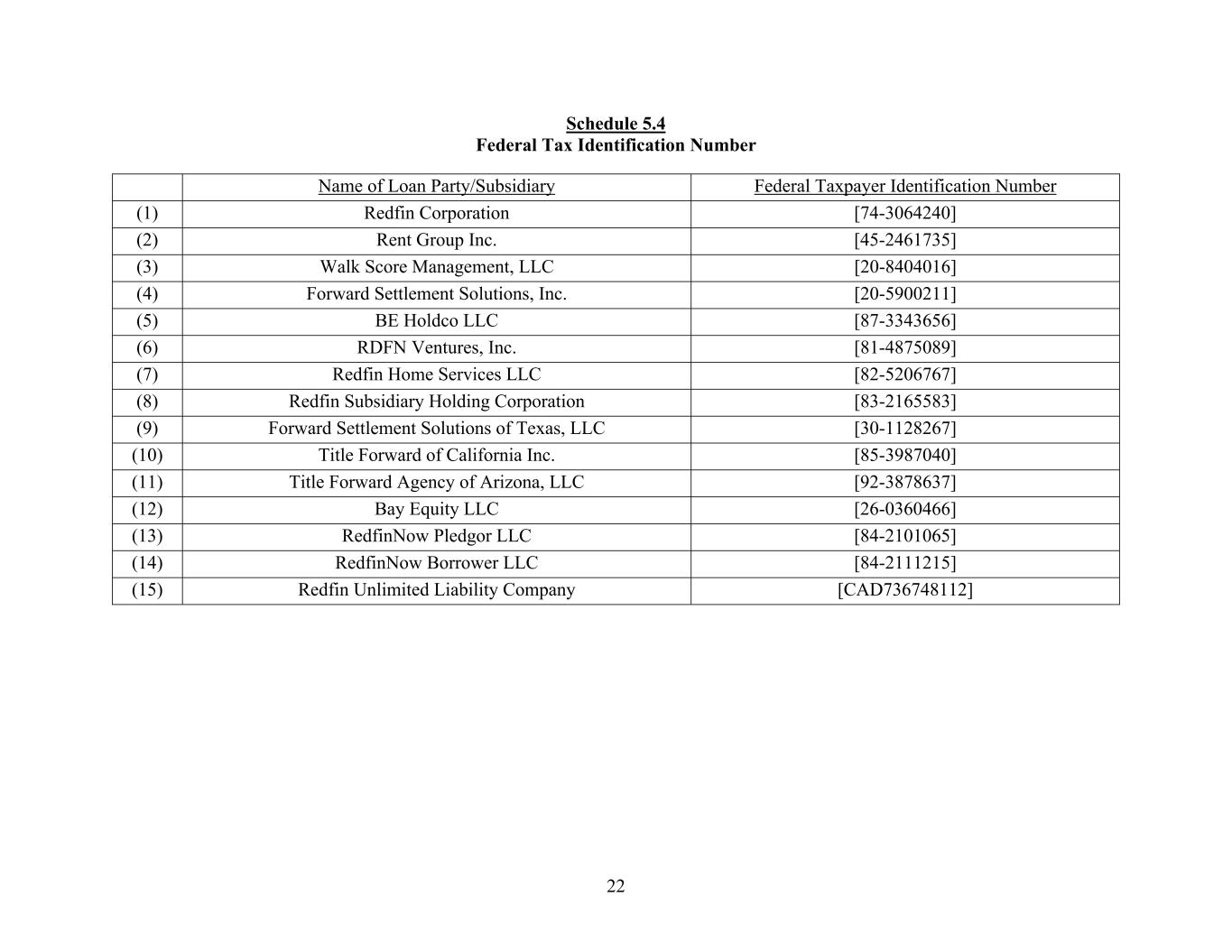

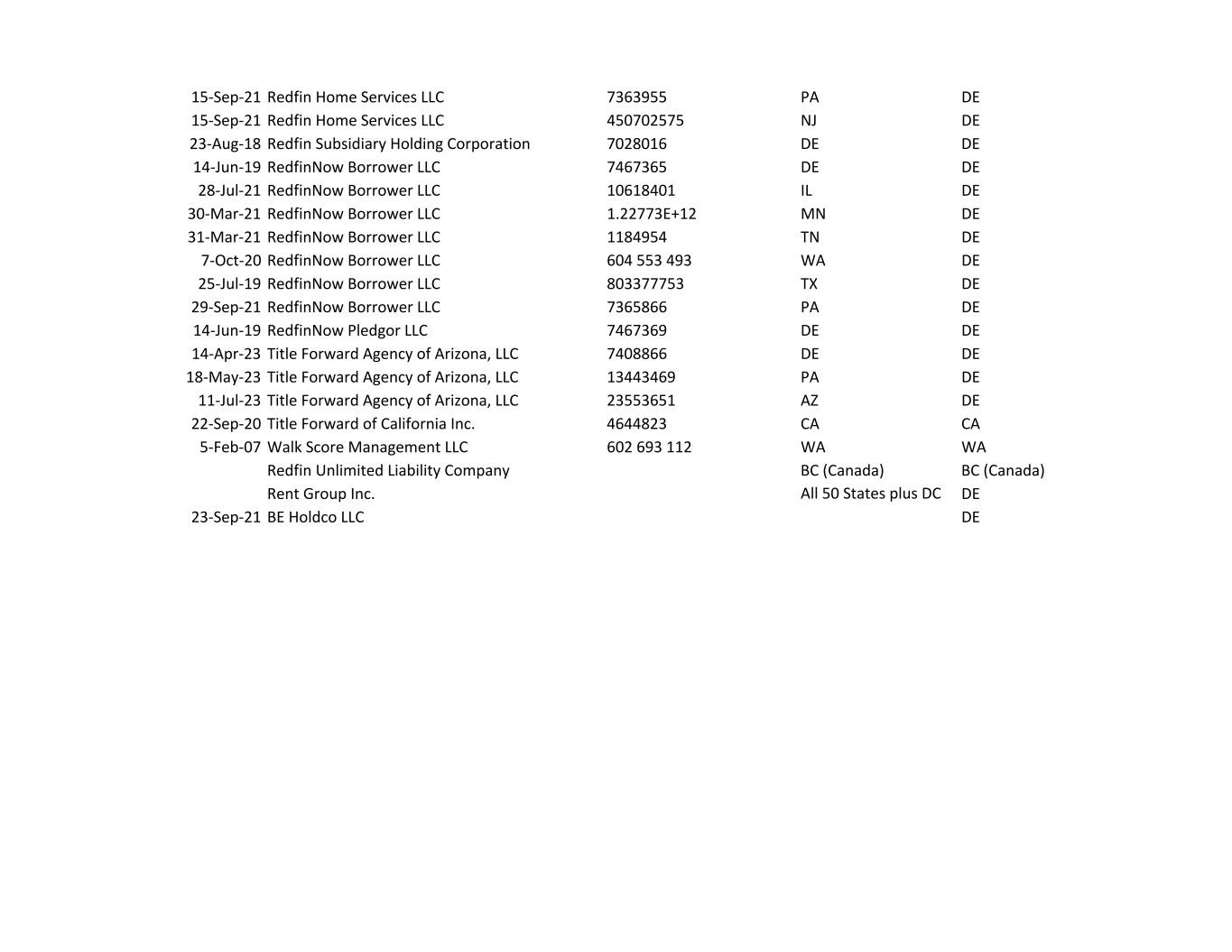

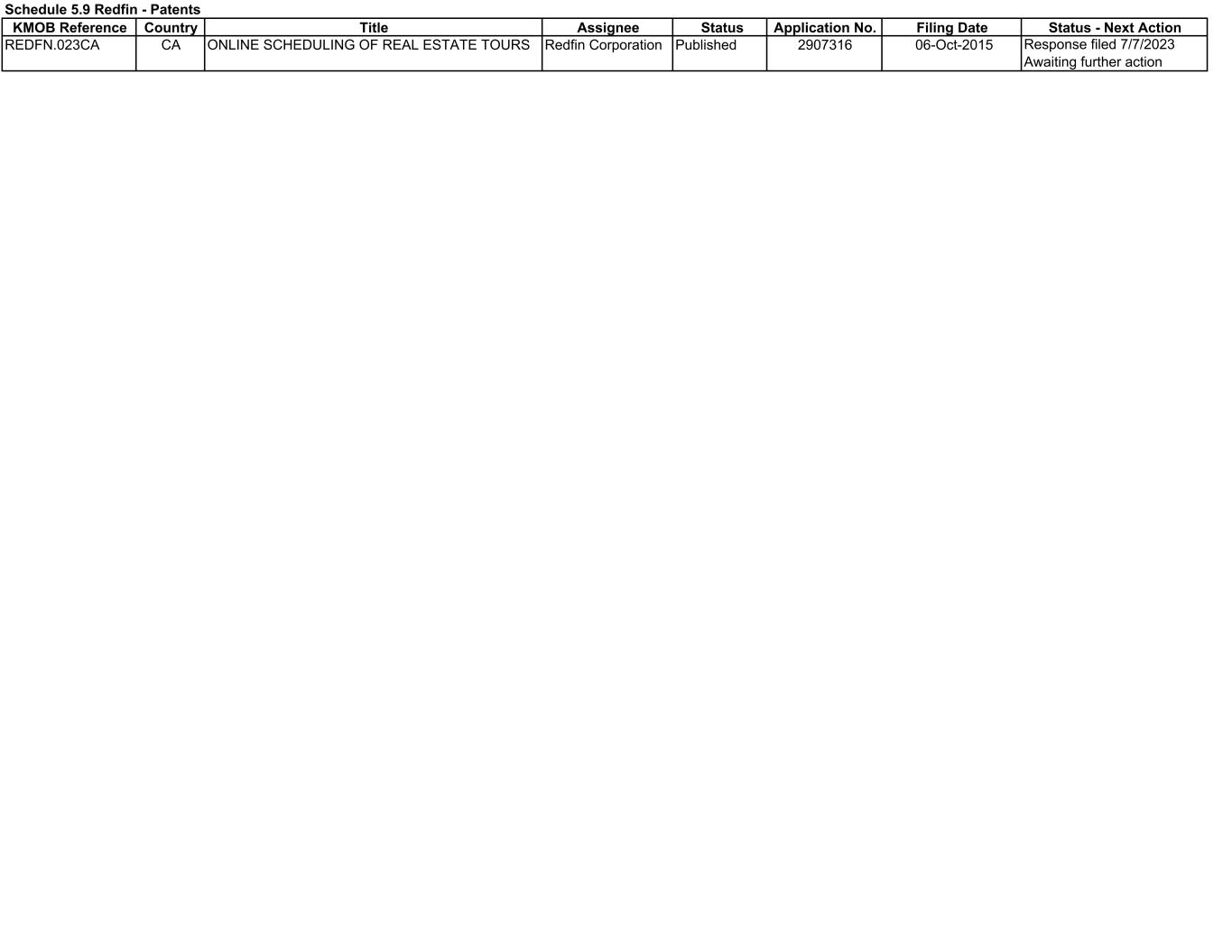

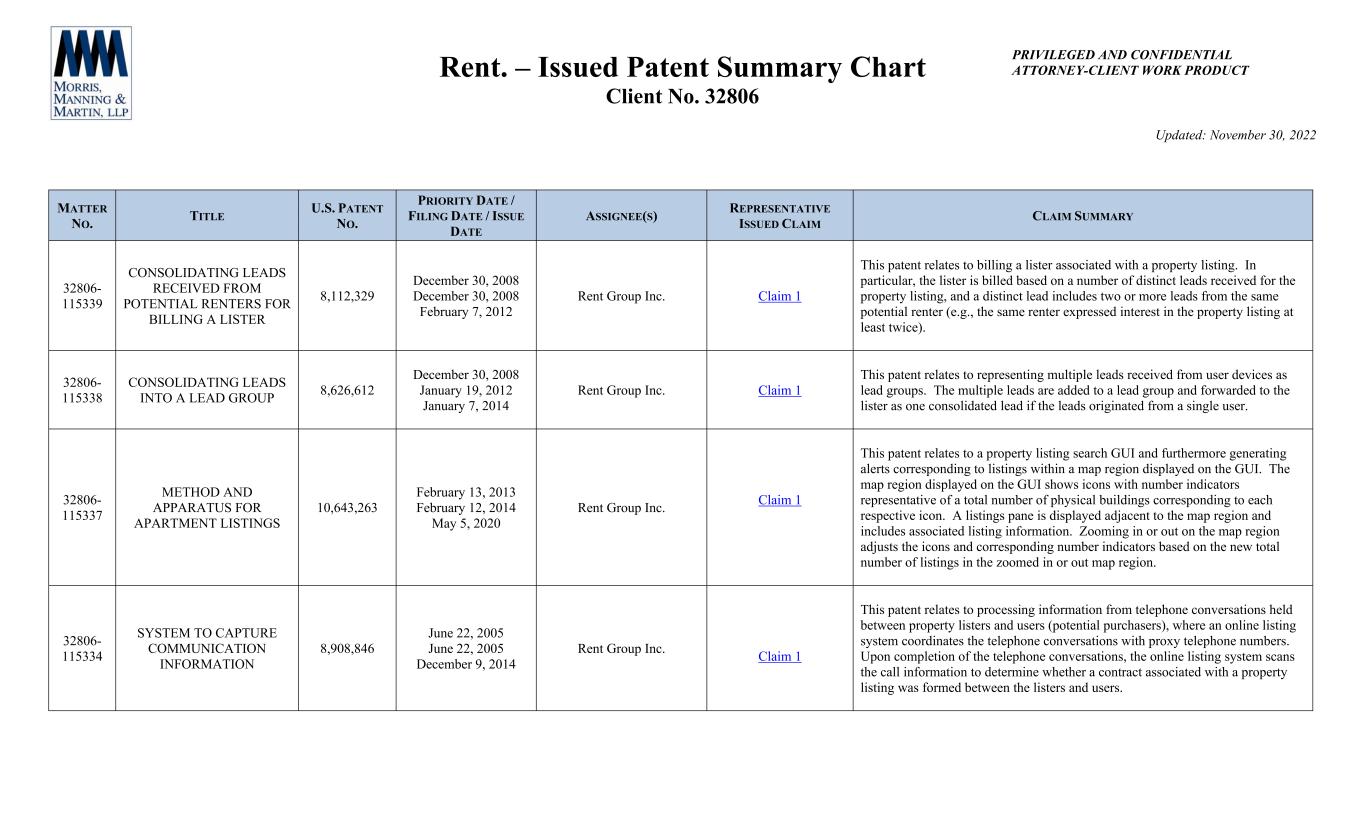

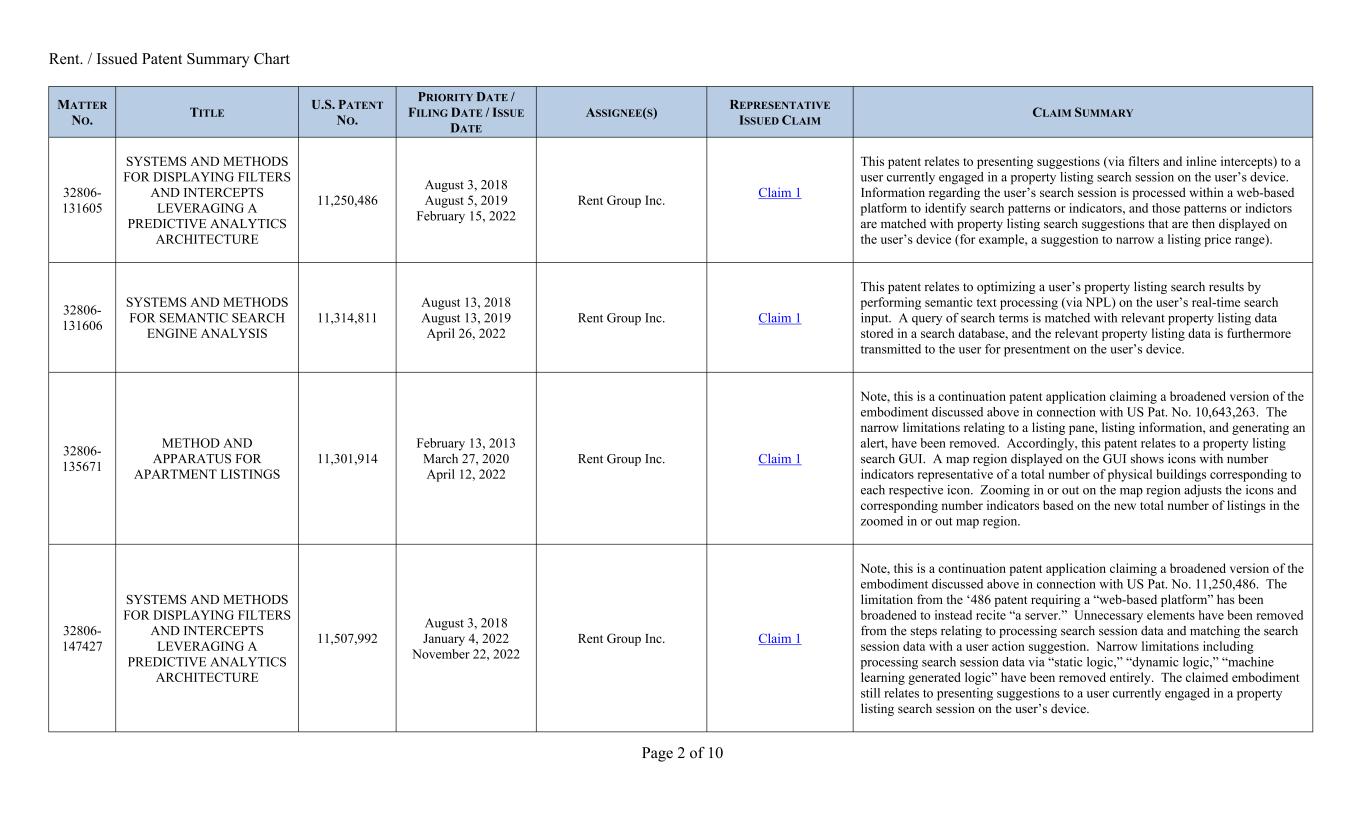

- vii- LIST OF EXHIBITS AND SCHEDULES Exhibits Exhibit 1.2(b) Form of Compliance Certificate Exhibit 2.3-1 Form of Initial Term Loan Note Exhibit 2.3-2 Form of Delayed Draw Term Loan Note Exhibit 3.10(g)-1 Form of U.S. Tax Compliance Certificate (For Foreign Lenders That Are Not Partnerships For U.S. Federal Income Tax Purposes) Exhibit 3.10(g)-2 Form of U.S. Tax Compliance Certificate (For Foreign Participants That Are Not Partnerships For U.S. Federal Income Tax Purposes) Exhibit 3.10(g)-3 Form of U.S. Tax Compliance Certificate (For Foreign Participants That Are Partnerships For U.S. Federal Income Tax Purposes) Exhibit 3.10(g)-4 Form of U.S. Tax Compliance Certificate (For Foreign Lenders That Are Partnerships For U.S. Federal Income Tax Purposes) Exhibit 4.2(d)(1) Form of IP Security Agreement Exhibit 4.2(d)(2) Form of IP Security Agreement Supplement Exhibit 7.12 Form of Joinder Agreement Exhibit 9.17 Form of Collateral Information Certificate and Supplemental Collateral Information Certificate Exhibit 16.3 Form of Commitment Transfer Supplement Schedules Schedule 1.1 Commitments Schedule 1.2(a) Permitted Encumbrances Schedule 1.2(b) Permitted Indebtedness Schedule 1.2(c) Permitted Loans Schedule 1.2(d) Existing Leases Schedule 1.2(e) Permitted Warehouse Facilities Schedule 4.4 Equipment and Inventory Locations; Place of Business, Chief Executive Office, Real Property Schedule 4.8(f) Deposit and Investment Accounts Schedule 5.1 Consents Schedule 5.2(a) States of Qualification and Good Standing Schedule 5.2(b) Subsidiaries Schedule 5.4 Federal Tax Identification Number Schedule 5.6 Prior Names Schedule 5.8(b)(i) Litigation Schedule 5.8(c) Plans Schedule 5.9 Intellectual Property; Intellectual Property Collateral Schedule 5.10 Licenses and Permits Schedule 5.14 Labor Disputes Schedule 5.23 Equity Interests Schedule 5.26 Material Contracts Schedule 7.10 Transactions with Affiliates

- 1- TERM LOAN AND SECURITY AGREEMENT Term Loan and Security Agreement, dated as of October 20, 2023, by and among REDFIN CORPORATION, a corporation formed under the laws of the State of Delaware (the “Borrower”), the guarantors party hereto from time to time (each, a “Guarantor” and collectively, the “Guarantors”), the financial institutions which are now or which hereafter become a party hereto (collectively, the “Lenders” and each individually a “Lender”), and APOLLO ADMINISTRATIVE AGENCY LLC, as agent for Lenders (in such capacity, together with its successors and assigns, the “Administrative Agent”). PRELIMINARY STATEMENTS WHEREAS, Borrower has requested that (i) the Initial Term Loan Lenders extend credit to Borrower in the form of Initial Term Loans on the Closing Date in an aggregate principal amount of $125,000,000 pursuant to this Agreement and (ii) from time to time after the Closing Date, the Delayed Draw Term Loan Lenders extend credit to Borrower in the form of Delayed Draw Term Loans in accordance with their Delayed Draw Term Loan Commitments in an aggregate principal amount of up to $125,000,000 pursuant to this Agreement; WHEREAS, on the Closing Date, the proceeds of the Initial Term Loans made on such date will be used in part to consummate the Transactions (as hereinafter defined); WHEREAS, the Lenders have indicated their willingness to extend credit on the terms and subject to the conditions set forth herein; and IN CONSIDERATION of the mutual covenants and undertakings herein contained, Loan Parties, Lenders and Administrative Agent hereby agree as follows: I. DEFINITIONS. 1.1 Accounting Terms. As used in this Agreement, the Other Documents or any certificate, report or other document made or delivered pursuant to this Agreement, accounting terms not defined in Section 1.2 hereof or elsewhere in this Agreement and accounting terms partly defined in Section 1.2 hereof to the extent not defined shall have the respective meanings given to them under GAAP; provided, however, that, whenever such accounting terms are used for the purposes of determining compliance with financial covenants in this Agreement, such accounting terms shall be defined in accordance with GAAP as applied in preparation of the audited financial statements of the Borrower for the fiscal year ended December 31, 2022, except for the application of ASU No. 2016-2, Leases (Topic 842), which was adopted effective January 1, 2022 (“Topic 842”). If after the Closing Date any change in GAAP occurs that affects in any respect the calculation of any covenant contained in this Agreement or the definition of any term defined under GAAP used in such calculations, Administrative Agent, Lenders and Loan Parties shall negotiate in good faith to amend the provisions of this Agreement that relate to the calculation of such covenants with the intent of having the respective positions of Administrative Agent, Lenders and Loan Parties after such change in GAAP conform as nearly as possible to their respective positions as of the Closing Date; provided, that, until any such amendments have been agreed upon, the covenants in this Agreement shall be calculated as if no such change in GAAP had occurred and Loan Parties shall provide additional financial statements or supplements thereto, attachments to Compliance Certificates and/or calculations regarding financial covenants as Administrative Agent may reasonably require in order to provide the appropriate financial information required hereunder with respect to Loan Parties both reflecting any applicable changes

- 2- in GAAP and as necessary to demonstrate compliance with the financial covenants before giving effect to the applicable changes in GAAP. 1.2 General Terms. For purposes of this Agreement the following terms shall have the following meanings: “Accountants” shall have the meaning set forth in Section 9.7 hereof. “Administrative Agent” shall have the meaning set forth in the preamble to this Agreement. “Advances” shall mean and include the Term Loans (including Delayed Draw Term Loans). “Affected Lender” shall have the meaning set forth in Section 3.11 hereof. “Affiliate” of any Person shall mean any Person which, directly or indirectly, is in control of, is controlled by, or is under common control with such Person and any Persons with the same investment manager or whose investment manager is directly or indirectly controlling, controlled by, or under common control with another Person’s investment manager. “After-Acquired Intellectual Property” shall have the meaning set forth in Section 4.2(d) hereof. “Agent Parties” shall mean, collectively, the Administrative Agent, the Arranger and each of their respective officers, directors, partners, members, managers, Affiliates, attorneys, employees and agents. “Agreement” shall mean this Term Loan and Security Agreement, as the same may be amended, restated, supplemented or otherwise modified from time to time. “Alternate Base Rate” shall mean, for any day, a rate per annum equal to the highest of (a) the Base Rate in effect on such day, (b) the sum of the Overnight Bank Funding Rate in effect on such day plus one half of one percent (0.5%), (c) the sum of Daily Simple SOFR in effect on such day plus one percent (1.0%), so long as Daily Simple SOFR is offered, ascertainable and not unlawful, and (d) two and one half of one percent (2.5%). Any change in the Alternate Base Rate (or any component thereof) shall take effect at the opening of business on the day such change has occurred. “Alternate Source” shall have the meaning set forth in the definition of “Overnight Bank Funding Rate”. “Anti-Corruption Laws” shall mean the Foreign Corrupt Practices Act of 1977, as amended, and the rules and regulations thereunder, the U.K. Bribery Act of 2010, as amended, and all other Applicable Laws and regulations or ordinances concerning or relating to bribery or corruption in any jurisdiction in which any Loan Party or any Subsidiary of any of the foregoing, is located or is doing business. “Anti-Money Laundering Laws” shall mean the Applicable Laws or regulations in any jurisdiction in which any Loan Party or any Subsidiary of any of the foregoing, is located or is doing business that relates to money laundering, any predicate crime to money laundering, or any financial record keeping and reporting requirements related thereto. “Anti-Terrorism Laws” shall mean any Laws relating to terrorism, trade sanctions programs and embargoes, import/export licensing, money laundering or bribery, and any regulation, order, or directive promulgated, issued or enforced pursuant to such Laws, all as amended, supplemented or replaced from time to time, and including, without limitation, Anti-Corruption Laws and Anti-Money Laundering Laws.

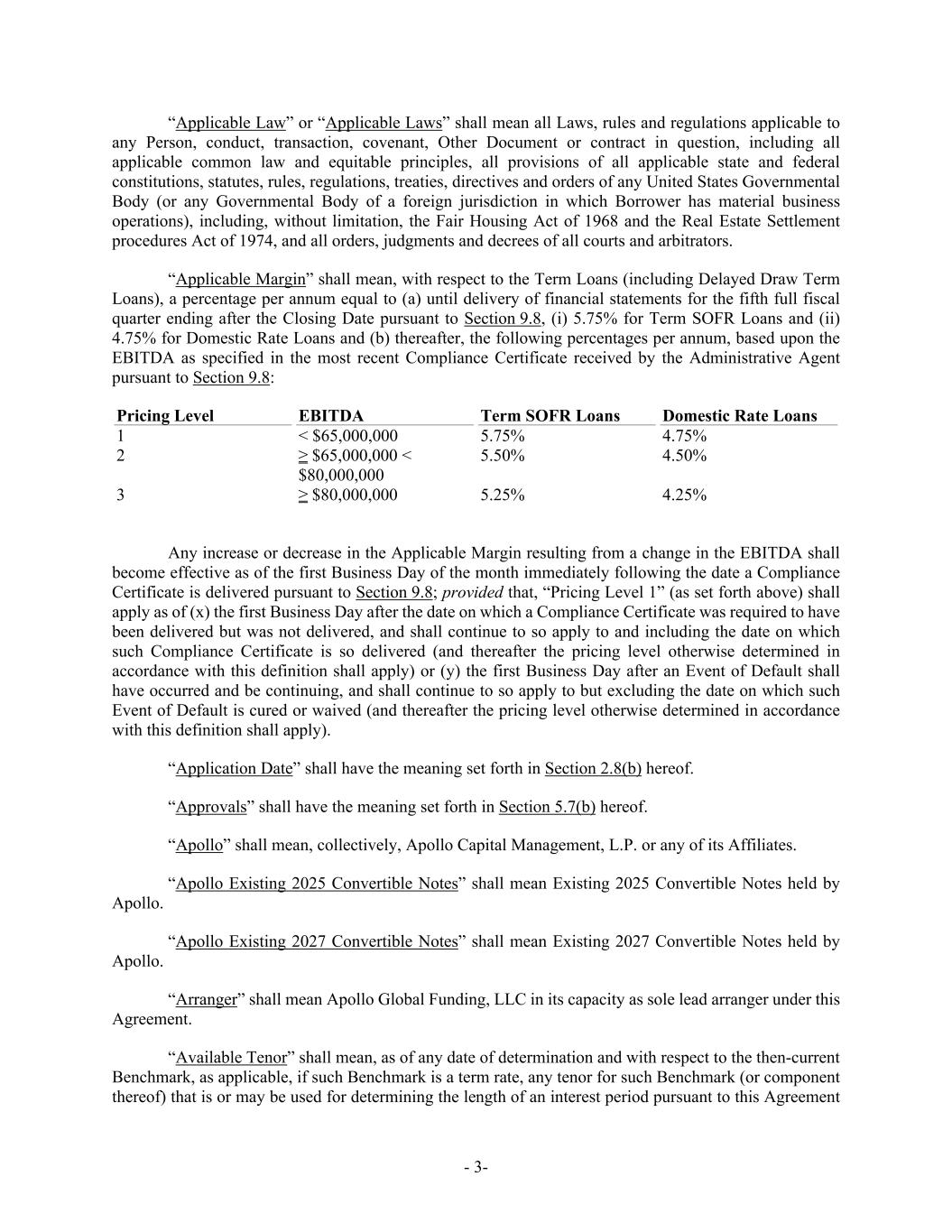

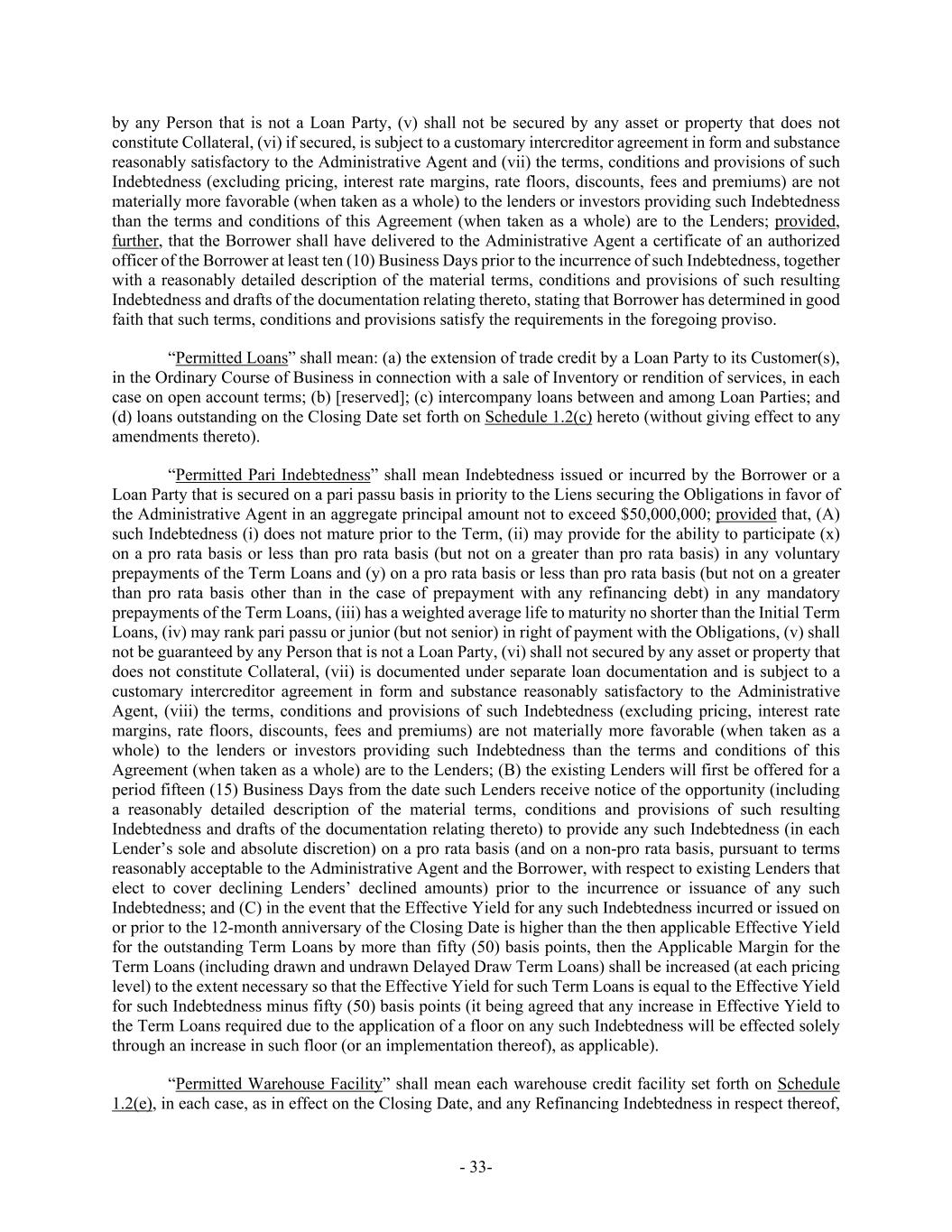

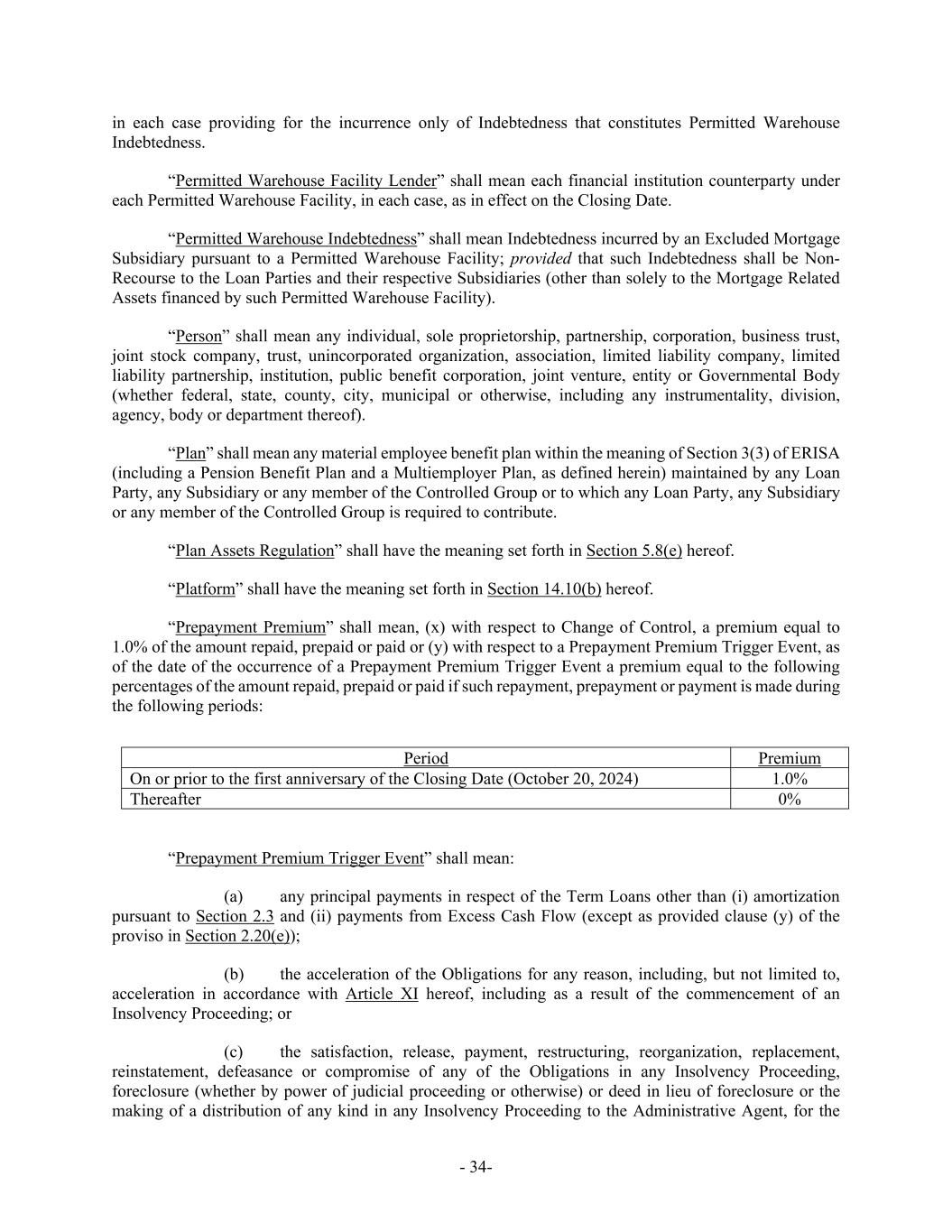

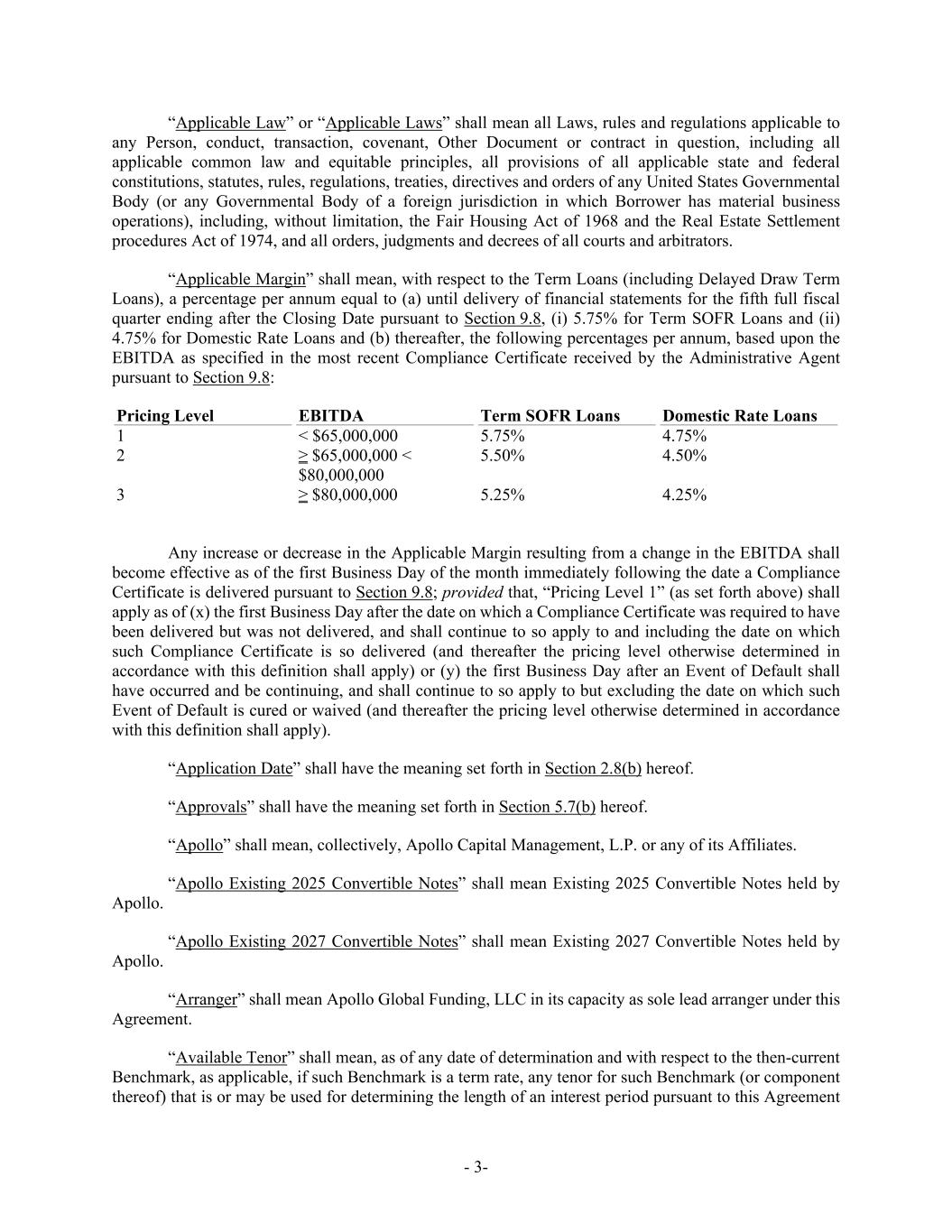

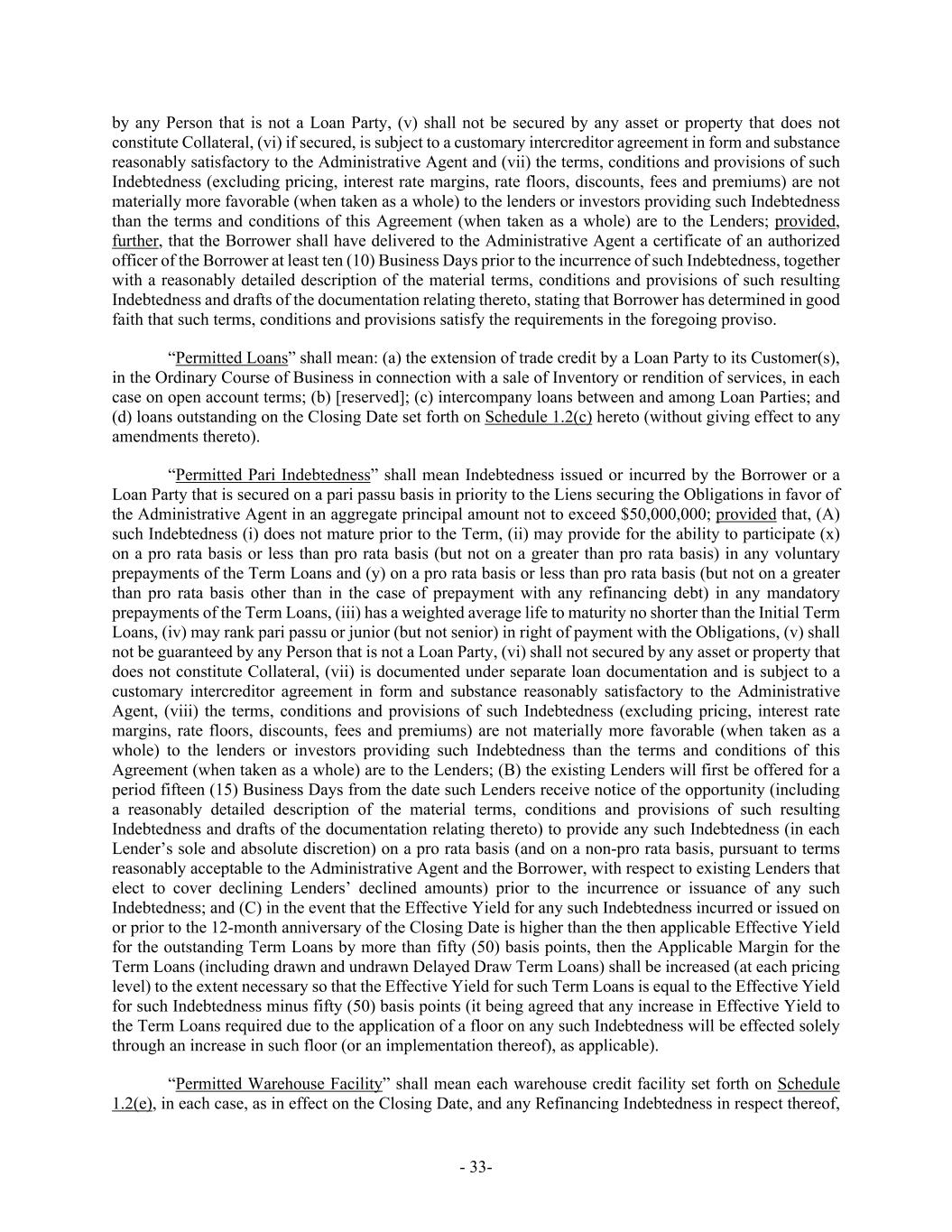

- 3- “Applicable Law” or “Applicable Laws” shall mean all Laws, rules and regulations applicable to any Person, conduct, transaction, covenant, Other Document or contract in question, including all applicable common law and equitable principles, all provisions of all applicable state and federal constitutions, statutes, rules, regulations, treaties, directives and orders of any United States Governmental Body (or any Governmental Body of a foreign jurisdiction in which Borrower has material business operations), including, without limitation, the Fair Housing Act of 1968 and the Real Estate Settlement procedures Act of 1974, and all orders, judgments and decrees of all courts and arbitrators. “Applicable Margin” shall mean, with respect to the Term Loans (including Delayed Draw Term Loans), a percentage per annum equal to (a) until delivery of financial statements for the fifth full fiscal quarter ending after the Closing Date pursuant to Section 9.8, (i) 5.75% for Term SOFR Loans and (ii) 4.75% for Domestic Rate Loans and (b) thereafter, the following percentages per annum, based upon the EBITDA as specified in the most recent Compliance Certificate received by the Administrative Agent pursuant to Section 9.8: Pricing Level EBITDA Term SOFR Loans Domestic Rate Loans 1 < $65,000,000 5.75% 4.75% 2 ≥ $65,000,000 < $80,000,000 5.50% 4.50% 3 ≥ $80,000,000 5.25% 4.25% Any increase or decrease in the Applicable Margin resulting from a change in the EBITDA shall become effective as of the first Business Day of the month immediately following the date a Compliance Certificate is delivered pursuant to Section 9.8; provided that, “Pricing Level 1” (as set forth above) shall apply as of (x) the first Business Day after the date on which a Compliance Certificate was required to have been delivered but was not delivered, and shall continue to so apply to and including the date on which such Compliance Certificate is so delivered (and thereafter the pricing level otherwise determined in accordance with this definition shall apply) or (y) the first Business Day after an Event of Default shall have occurred and be continuing, and shall continue to so apply to but excluding the date on which such Event of Default is cured or waived (and thereafter the pricing level otherwise determined in accordance with this definition shall apply). “Application Date” shall have the meaning set forth in Section 2.8(b) hereof. “Approvals” shall have the meaning set forth in Section 5.7(b) hereof. “Apollo” shall mean, collectively, Apollo Capital Management, L.P. or any of its Affiliates. “Apollo Existing 2025 Convertible Notes” shall mean Existing 2025 Convertible Notes held by Apollo. “Apollo Existing 2027 Convertible Notes” shall mean Existing 2027 Convertible Notes held by Apollo. “Arranger” shall mean Apollo Global Funding, LLC in its capacity as sole lead arranger under this Agreement. “Available Tenor” shall mean, as of any date of determination and with respect to the then-current Benchmark, as applicable, if such Benchmark is a term rate, any tenor for such Benchmark (or component thereof) that is or may be used for determining the length of an interest period pursuant to this Agreement

- 4- as of such date and not including, for the avoidance of doubt, any tenor for such Benchmark that is then- removed from the definition of “Interest Period” pursuant to Section 3.12.3. “Bail-In Action” shall mean the exercise of any Write-Down and Conversion Powers by the applicable EEA Resolution Authority in respect of any liability of an EEA Financial Institution. “Bail-In Legislation” shall mean, with respect to any EEA Member Country implementing Article 55 of Directive 2014/59/EU of the European Parliament and of the Council of the European Union, the implementing law for such EEA Member Country from time to time which is described in the Bail-In Legislation Schedule. “Bail-In Legislation Schedule” shall mean the EU Bail-In Legislation Schedule published by the Loan Market Association (or any successor person), as in effect from time to time. “Bankruptcy Code” shall mean Title 11 of the United States Code entitled “Bankruptcy”, as amended, and other Applicable Laws regarding bankruptcy, insolvency or similar proceedings. “Base Rate” shall mean the rate of interest last quoted by The Wall Street Journal as the “Prime Rate” in the U.S. or, if The Wall Street Journal ceases to quote such rate, the higher per annum interest rate published by the Federal Reserve Board in Federal Reserve Statistical Release H.5 (519) (Selected Interest Rates) as the “bank prime loan” rate, or if such rate is no longer quoted therein, any similar rate quoted therein (as determined by the Administrative Agent) or any similar release by the Federal Reserve Board (as determined by the Administrative Agent), in each case to be adjusted automatically, without notice, on the effective date of any change in such rate. “Benchmark” means, initially, the Term SOFR Reference Rate; provided that if a Benchmark Transition Event has occurred with respect to the Term SOFR Reference Rate or the then-current Benchmark, then “Benchmark” means the applicable Benchmark Replacement to the extent that such Benchmark Replacement has replaced such prior benchmark rate pursuant to Section 3.12.3. “Benchmark Replacement” shall mean, with respect to any Benchmark Transition Event, the first alternative set forth in the order below that can be determined by the Administrative Agent for the applicable Benchmark Replacement Date: (a) Daily Simple SOFR; or (b) the sum of: (i) the alternate benchmark rate that has been selected by the Administrative Agent and the Borrower giving due consideration to (A) any selection or recommendation of a replacement benchmark rate or the mechanism for determining such a rate by the Relevant Governmental Body or (B) any evolving or then-prevailing market convention for determining a benchmark rate as a replacement to the then-current Benchmark for Dollar-denominated syndicated credit facilities and (ii) the related Benchmark Replacement Adjustment. If the Benchmark Replacement as determined pursuant to clause (a) or (b) above would be less than the SOFR Floor, the Benchmark Replacement will be deemed to be the SOFR Floor for the purposes of this Agreement and the Other Documents. “Benchmark Replacement Adjustment” means, with respect to any replacement of the then-current Benchmark with an Unadjusted Benchmark Replacement, the spread adjustment, or method for calculating or determining such spread adjustment, (which may be a positive or negative value or zero) that has been selected by the Administrative Agent and the Borrower giving due consideration to (a) any selection or

- 5- recommendation of a spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of such Benchmark with the applicable Unadjusted Benchmark Replacement by the Relevant Governmental Body or (b) any evolving or then-prevailing market convention for determining a spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of such Benchmark with the applicable Unadjusted Benchmark Replacement for Dollar-denominated syndicated credit facilities at such time. “Benchmark Replacement Date” shall mean a date and time determined by the Administrative Agent, which date shall be no later than the earliest to occur of the following events with respect to the then-current Benchmark: (a) in the case of clause (a) or (b) of the definition of “Benchmark Transition Event,” the later of (i) the date of the public statement or publication of information referenced therein and (ii) the date on which the administrator of such Benchmark (or the published component used in the calculation thereof) permanently or indefinitely ceases to provide such Benchmark (or such component thereof) or, if such Benchmark is a term rate, all Available Tenors of such Benchmark (or such component thereof); or (b) in the case of clause (c) of the definition of “Benchmark Transition Event,” the first date on which all Available Tenors of such Benchmark (or the published component used in the calculation thereof) has been or, if such Benchmark is a term rate, all Available Tenors of such Benchmark (or such component thereof) have been determined and announced by the regulatory supervisor for the administrator of such Benchmark (or such component thereof) to be non-representative; provided that such non-representativeness will be determined by reference to the most recent statement or publication referenced in such clause (c) and even if such Benchmark (or such component thereof) or, if such Benchmark is a term rate, any Available Tenor of such Benchmark (or such component thereof) continues to be provided on such date. For the avoidance of doubt, if such Benchmark is a term rate, the “Benchmark Replacement Date” will be deemed to have occurred in the case of clause (a) or (b) with respect to any Benchmark upon the occurrence of the applicable event or events set forth therein with respect to all then-current Available Tenors of such Benchmark (or the published component used in the calculation thereof). “Benchmark Transition Event” means the occurrence of one or more of the following events with respect to the then-current Benchmark: (a) a public statement or publication of information by or on behalf of the administrator of such Benchmark (or the published component used in the calculation thereof) announcing that such administrator has ceased or will cease to provide such Benchmark (or such component thereof) or, if such Benchmark is a term rate, all Available Tenors of such Benchmark (or such component thereof), permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide such Benchmark (or such component thereof) or, if such Benchmark is a term rate, any Available Tenor of such Benchmark (or such component thereof); (b) a public statement or publication of information by the regulatory supervisor for the administrator of such Benchmark (or the published component used in the calculation thereof), the Federal Reserve Board, the Federal Reserve Bank of New York, an insolvency official with jurisdiction over the administrator for such Benchmark (or such component), a resolution authority with jurisdiction over the administrator for such Benchmark (or such component) or a court or an entity with similar insolvency or resolution authority over the administrator for such Benchmark (or such

- 6- component), which states that the administrator of such Benchmark (or such component) has ceased or will cease to provide such Benchmark (or such component thereof) or, if such Benchmark is a term rate, all Available Tenors of such Benchmark (or such component thereof) permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide such Benchmark (or such component thereof) or, if such Benchmark is a term rate, any Available Tenor of such Benchmark (or such component thereof); or (c) a public statement or publication of information by the regulatory supervisor for the administrator of such Benchmark (or the published component used in the calculation thereof) announcing that such Benchmark (or such component thereof) or, if such Benchmark is a term rate, all Available Tenors of such Benchmark (or such component thereof) are not, or as of a specified future date will not be, representative. For the avoidance of doubt, if such Benchmark is a term rate, a “Benchmark Transition Event” will be deemed to have occurred with respect to any Benchmark if a public statement or publication of information set forth above has occurred with respect to each then-current Available Tenor of such Benchmark (or the published component used in the calculation thereof). “Benchmark Unavailability Period” means the period (if any) (a) beginning at the time that a Benchmark Replacement Date has occurred if, at such time, no Benchmark Replacement has replaced the then-current Benchmark for all purposes hereunder and under any Other Document in accordance with Section 3.12.3 and (b) ending at the time that a Benchmark Replacement has replaced the then-current Benchmark for all purposes hereunder and under any Other Document in accordance with Section 3.12.3. “Beneficial Owner” shall mean, for each Loan Party, each of the following: (a) each individual, if any, who, directly or indirectly, owns 25% or more of such Loan Party’s Equity Interests; and (b) a single individual with significant responsibility to control, manage, or direct such Loan Party. “Beneficial Ownership Regulations” shall mean 31 C.F.R. § 1010.230. “Benefited Lender” shall have the meaning set forth in Section 2.6(e) hereof. “Boards of Directors” shall have the meaning set forth in Section 6.14 hereof. “Borrower” shall have the meaning set forth in the preamble to this Agreement. “Borrower’s Account” shall have the meaning set forth in Section 2.10 hereof. “Borrower Materials” shall have the meaning set forth in Section 14.10(a) hereof. “Business Day” shall mean any day other than Saturday or Sunday or a legal holiday on which commercial banks are authorized or required by law to be closed for business in Seattle, Washington or New York, New York; provided that when used in connection with an amount that bears interest at a rate based on SOFR or any direct or indirect calculation or determination of SOFR, “Business Day” shall mean any such day that is also a U.S. Government Securities Business Day. “Capital Costs and Expenditures” shall mean expenditures made or liabilities incurred for (i) the acquisition of any fixed assets or improvements (or of any replacements or substitutions thereof or additions thereto) which have a useful life of more than one year and which, in accordance with GAAP, would be classified as Capital Costs and Expenditures or as “purchases of property and equipment” or similar items

- 7- reflected in the statement of cash flows; or (ii) purchased software or internally developed software and software enhancements which, in accordance with GAAP, would be classified as capitalized costs. Capital Costs and Expenditures for any period shall include the principal portion of Finance Leases paid in such period to the extent not included in rent, lease or interest expense. “Cash Dominion Period” shall mean each period (a) beginning upon the occurrence of an Event of Default (after giving effect to any applicable grace period), and (b) ending on the date that such Event of Default shall have been cured or waived or is no longer continuing. “CEA” shall mean the Commodity Exchange Act (7 U.S.C.§1 et seq.), as amended from time to time, and any successor statute. “CERCLA” shall mean the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended, 42 U.S.C. §§9601 et seq. “Certificate of Beneficial Ownership” shall mean a certificate in form and substance acceptable to Administrative Agent (as amended or modified by Administrative Agent from time to time in its sole discretion), certifying, among other things, the Beneficial Owner of each Loan Party and its Subsidiaries. “CFTC” shall mean the Commodity Futures Trading Commission. “Change in Law” shall mean the occurrence, after the Closing Date, of any of the following: (a) the adoption or taking effect of any Applicable Law; (b) any change in any Applicable Law or in the administration, implementation, interpretation or application thereof by any Governmental Body; or (c) the making or issuance of any request, rule, guideline or directive (whether or not having the force of law) by any Governmental Body; provided that notwithstanding anything herein to the contrary, (x) the Dodd-Frank Wall Street Reform and Consumer Protection Act and all requests, rules, regulations, guidelines, interpretations or directives thereunder or issued in connection therewith and (y) all requests, rules, regulations, guidelines, interpretations or directives promulgated by the Bank for International Settlements, the Basel Committee on Banking Supervision (or any successor or similar authority) or the United States or foreign regulatory authorities, in each case pursuant to Basel III, shall in each case be deemed to be a Change in Law regardless of the date enacted, adopted, issued, promulgated or implemented. “Change of Control” shall mean: (a) a “person” or “group” within the meaning of Section 13(d) of the Exchange Act, other than the Borrower, its Wholly-Owned Subsidiaries and the employee benefit plans of the Borrower and its Wholly-Owned Subsidiaries, files a Schedule TO (or any successor schedule, form or report) or any schedule, form or report under the Exchange Act disclosing that such person has become the direct or indirect “beneficial owner,” as defined in Rule 13d-3 under the Exchange Act, of (i) the Borrower’s Common Equity representing more than 50% of the voting power of the Borrower’s Common Equity or (ii) more than 50% of the then outstanding Common Stock; or (b) the consummation of (A) any recapitalization, reclassification or change of the Common Stock as a result of which the Common Stock would be converted into, or exchanged for, stock of any Person other than the Borrower, other securities, other property or assets; (B) any share exchange, consolidation or merger of the Borrower pursuant to which the Common Stock will be converted into cash, securities (other than securities of the Borrower) or other property or assets; or (C) any sale, lease or other transfer in one transaction or a series of transactions of all or substantially all of the consolidated assets of the Borrower and its Subsidiaries, taken as a whole, to any Person other than one or more of the Borrower’s Wholly-Owned Subsidiaries;

- 8- (c) the stockholders of the Borrower approve any plan or proposal for the liquidation or dissolution of the Borrower; or (d) the Common Stock (or other Common Equity of the Borrower) ceases to be listed or quoted on any of The New York Stock Exchange, The Nasdaq Global Select Market or The Nasdaq Global Market (or any of their respective successors). “CIP Regulations” shall have the meaning set forth in Section 14.12 hereof. “Claims” shall have the meaning set forth in Section 16.5 hereof. “Closing Date” shall mean the date of this Agreement. “Closing Date Repurchase” shall have the meaning set forth in Section 8.1(c) hereof. “Code” shall mean the Internal Revenue Code of 1986, as the same may be amended or supplemented from time to time, and any successor statute of similar import, and the rules and regulations thereunder, as from time to time in effect. “Collateral” shall mean and include all right, title and interest of each Loan Party in all of the following property and assets of such Loan Party, in each case whether now existing or hereafter arising or created and whether now owned or hereafter acquired and wherever located: (a) all accounts, Receivables and all supporting obligations relating thereto; (b) all equipment and fixtures; (c) all general intangibles (including all payment intangibles and all software and all Intellectual Property Collateral) and all supporting obligations related thereto; (d) all Goods and Inventory; (e) all Subsidiary Stock, securities, Investment Property, and financial assets; (f) all Real Property; (g) all contract rights, rights of payment which have been earned under a contract rights, chattel paper (including electronic chattel paper and tangible chattel paper), commercial tort claims (whether now existing or hereafter arising, including those described from time to time in the Collateral Information Certificate); documents (including all warehouse receipts and bills of lading), deposit accounts, goods, indebtedness owed to such Loan Party, instruments and promissory notes (all such indebtedness, instruments and notes owing to or in favor of any Loan Party, “Pledged Debt”), letters of credit (whether or not the respective letter of credit is evidenced by a writing) and letter-of-credit rights, cash, cash equivalents, certificates of deposit, insurance proceeds (including hazard, flood and credit insurance), security agreements, eminent domain proceeds, condemnation proceeds, tort claim proceeds and all supporting obligations; (h) all ledger sheets, ledger cards, files, correspondence, records, books of account, business papers, computers, computer software (owned by any Loan Party or in which it has an interest), computer programs, tapes, disks and documents, including all of such property relating to the property described in clauses (a) through and including (g) of this definition; and

- 9- (i) all proceeds and products of the property described in clauses (a) through and including (h) of this definition, in whatever form. It is the intention of the parties that if Administrative Agent shall fail to have a perfected Lien in any particular property or assets of any Loan Party for any reason whatsoever, but the provisions of this Agreement and/or of the Other Documents, together with all financing statements and other public filings relating to Liens filed or recorded by Administrative Agent against Loan Parties, would be sufficient to create a perfected Lien in any property or assets that such Loan Party may receive upon the sale, lease, license, exchange, transfer or disposition of such particular property or assets, then all such “proceeds” of such particular property or assets shall be included in the Collateral as original collateral that is the subject of a direct and original grant of a security interest as provided for herein and in the Other Documents (and not merely as proceeds (as defined in Article 9 of the Uniform Commercial Code) in which a security interest is created or arises solely pursuant to Section 9-315 of the Uniform Commercial Code). Notwithstanding the foregoing, “Collateral” shall not include Excluded Property. “Collateral Information Certificate” shall mean the document in the form of Exhibit 9.17 hereto, properly completed by the Loan Parties and otherwise in form and substance satisfactory to Administrative Agent, as supplemented from time to time. “Commitment Transfer Supplement” shall mean a document in the form of Exhibit 16.3 hereto, properly completed and otherwise in form and substance satisfactory to Administrative Agent by which the Purchasing Lender purchases and assumes a portion of the obligation of Lenders to make Advances under this Agreement. “Common Equity” of any Person means Equity Interests of such Person that is generally entitled (a) to vote in the election of directors of such Person or (b) if such Person is not a corporation, to vote or otherwise participate in the selection of the governing body, partners, managers or others that will control the management or policies of such Person. “Common Stock” means the common stock of the Borrower, par value $0.001 per share as of the Closing Date. “Compliance Certificate” shall mean a compliance certificate substantially in the form of Exhibit 1.2(b) hereto to be signed by the President, Chief Financial Officer, Head of Finance, or Controller of Borrower, or another authorized officer of the Borrower. “Conforming Changes” shall mean, with respect to either the use or administration of Term SOFR Rate or the use, administration, adoption or implementation of any Benchmark Replacement, any technical, administrative or operational changes (including changes to the definitions of “Alternate Base Rate”, “Business Day”, “Interest Period”, “U.S. Government Securities Business Day”, or any similar or analogous definition (or the addition of a concept of “interest period”), the timing and frequency of determining rates and making payments of interest, timing of borrowing requests or prepayment, conversion or continuation notices, the applicability and length of lookback periods, the applicability of breakage provisions, and other technical, administrative or operational matters) that the Administrative Agent decides may be appropriate to reflect the adoption and implementation of any such rate or to permit the use and administration thereof by the Administrative Agent in a manner substantially consistent with market practice (or, if the Administrative Agent decides that adoption of any portion of such market practice is not administratively feasible or if the Administrative Agent determines that no market practice for the administration of any such rate exists, in such other manner of administration as the Administrative Agent decides is reasonably necessary in connection with the administration of this Agreement and the Other Documents).

- 10- “Connection Income Taxes” shall mean Other Connection Taxes that are imposed on or measured by net income (however denominated) or that are franchise Taxes or branch profits Taxes. “Consents” shall mean all filings and all licenses, permits, consents, approvals, authorizations, qualifications and orders of Governmental Bodies and other third parties, domestic or foreign, necessary to carry on any Loan Party’s business or necessary (including to avoid a conflict or breach under any agreement, instrument, other document, license, permit or other authorization) for the execution, delivery or performance of this Agreement or the Other Documents, including any Consents required under all applicable federal, state or other Applicable Law. “Consolidated Basis” shall mean, (a) with respect to the Borrower, the consolidation of the accounts or other items of the Borrower and its Subsidiaries in accordance with GAAP, and (b) with respect to the Loan Parties, the consolidation of the accounts or other items of the Loan Parties in accordance with GAAP and excluding Subsidiaries that are not Loan Parties. “Consolidated Interest Expense” shall mean with respect to any Person for any period, the total consolidated cash interest expense (excluding that portion attributable to Finance Leases and amortization of right of use assets) of such Person and its consolidated Subsidiaries for such period (calculated without regard to any limitations on the payment thereof and including commitment fees, letter-of-credit fees, and net amounts payable under any interest rate protection agreements but, for the avoidance of doubt, excluding any original issue discount or revolving facility closing fee, and any interest income earned by such Person) determined in accordance with GAAP. “Contract Rate” shall have the meaning set forth in Section 3.1 hereof. “Controlled Account Bank” shall mean (a) Wells Fargo Bank, N.A., (b) PNC Bank, N.A. and (c) such other bank acceptable to Administrative Agent in its reasonable discretion. “Controlled Accounts” shall have the meaning set forth in Section 4.8 hereof. “Controlled Group” shall mean, at any time, each Loan Party, each Subsidiary of a Loan Party and all members of a controlled group of corporations and all trades or businesses (whether or not incorporated) under common control and all other entities which, together with any Loan Party or any Subsidiary of a Loan Party, are (A) treated as a single employer under Section 414 of the Code or (B) under common control within the meaning of 4001(a)(14) of ERISA. “Copyrights” shall have the meaning set forth in the definition of “Intellectual Property”. “Covered Entity” shall mean (a) each Loan Party, each Subsidiary of each Loan Party, all Guarantors and all pledgors of Collateral and (b) each Person that, directly or indirectly, is in control of a Person described in clause (a) above. For purposes of this definition, control of a Person shall mean the direct or indirect (x) ownership of, or power to vote, 25% or more of the issued and outstanding equity interests having ordinary voting power for the election of directors of such Person or other Persons performing similar functions for such Person, or (y) power to direct or cause the direction of the management and policies of such Person whether by ownership of equity interests, contract or otherwise. “Customer” shall mean and include the account debtor with respect to any Receivable with respect to any contract or contract right, and/or any party who enters into any contract or other arrangement with any Loan Party, pursuant to which such Loan Party is to deliver any personal property or perform any services.

- 11- “Customs” shall have the meaning set forth in Section 2.13(b) hereof. “Daily Simple SOFR” shall mean, for any day, SOFR, with the conventions for this rate (which will include a lookback) being established by the Administrative Agent in accordance with the conventions for this rate selected or recommended by the Relevant Governmental Body for determining “Daily Simple SOFR” for syndicated business loans; provided that if the Administrative Agent decides that any such convention is not administratively feasible for the Administrative Agent, then the Administrative Agent may establish another convention in its reasonable discretion. “Debt Payments” shall mean for any period, in each case, all cash actually expended by the Loan Parties and their Subsidiaries to make: (a) interest payments on any Advances hereunder, plus (b) scheduled principal payments on the Term Loans plus (c) payments for all fees, commissions and charges set forth herein, plus (d) payments with respect to any other Permitted Indebtedness for borrowed money (other than the Obligations) at the scheduled maturity thereof. “Declined Proceeds” shall have the meaning set forth in Section 2.20(i) hereof. “Default” shall mean an event, circumstance or condition which, with the giving of notice or passage of time or both, would constitute an Event of Default. “Default Rate” shall have the meaning set forth in Section 3.1 hereof. “Defaulting Lender” shall mean any Lender that: (a) has failed, within two (2) Business Days of the date required to be funded or paid, to (i) fund any portion of its Term Loan Commitment Percentage of Advances, (ii) [reserved] or (iii) pay over to Administrative Agent or any Lender any other amount required to be paid by it hereunder, unless, in the case of clause (i) above, such Lender notifies Administrative Agent in writing prior to the making of the applicable Term Loan that such failure is the result of such Lender’s good faith determination that a condition precedent to funding (specifically identified and including a particular Default or Event of Default, if any) has not been satisfied; (b) has notified Loan Parties or Administrative Agent in writing, or has made a public statement to the effect, that it does not intend or expect to comply with any of its funding obligations under this Agreement (unless such writing or public statement indicates that such position is based on such Lender’s good faith determination that a condition precedent (specifically identified and including a particular Default or Event of Default, if any) to funding an Advance under this Agreement cannot be satisfied) or generally under other agreements in which it commits to extend credit; (c) has failed, within two (2) Business Days after request by Administrative Agent, acting in good faith, to provide a certification in writing from an authorized officer of such Lender that it will comply with its obligations (and is financially able to meet such obligations) to fund prospective Advances, provided that such Lender shall cease to be a Defaulting Lender pursuant to this clause (c) upon Administrative Agent’s receipt of such certification in form and substance satisfactory to Administrative Agent and Borrower; (d) has become the subject of an Insolvency Event and/or a Bail-In Action; or (e) has failed at any time to comply with the provisions of Section 2.6(e) hereof with respect to purchasing participations from the other Lenders, whereby such Lender’s share of any payment received, whether by setoff or otherwise, is in excess of its pro rata share of such payments due and payable to all of the Lenders. “Delayed Draw Term Loans” shall mean the Delayed Draw Term Loans borrowed by the Borrower pursuant to Section 2.3(b). “Delayed Draw Term Loan Commitment” shall mean, as to any Delayed Draw Term Loan Lender, the obligation of such Delayed Draw Term Loan Lender (if applicable), to fund Delayed Draw Term Loans pursuant to Section 2.3(b), in an aggregate principal amount equal to the Delayed Draw Term Loan Commitment Amount (if any) of such Delayed Draw Term Loan Lender.

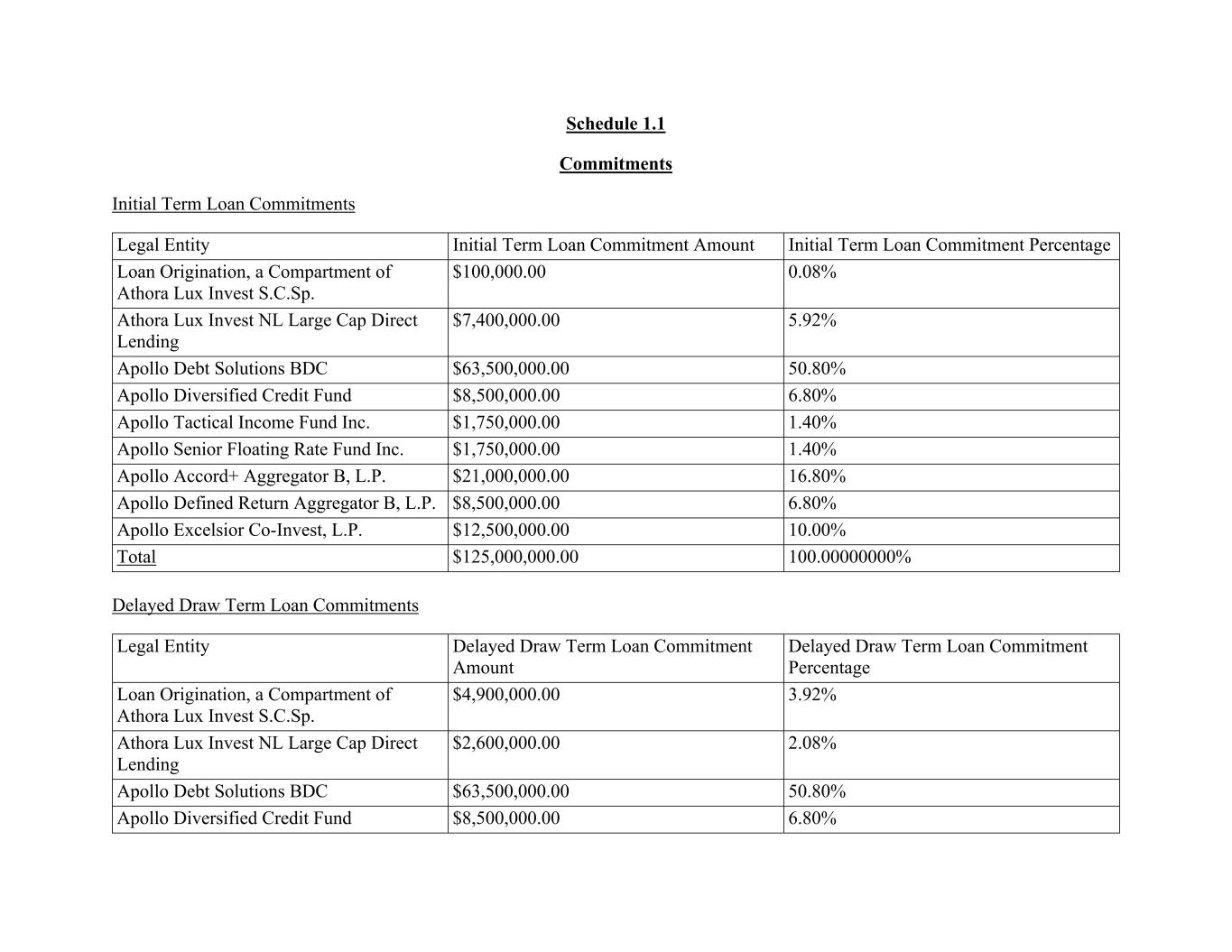

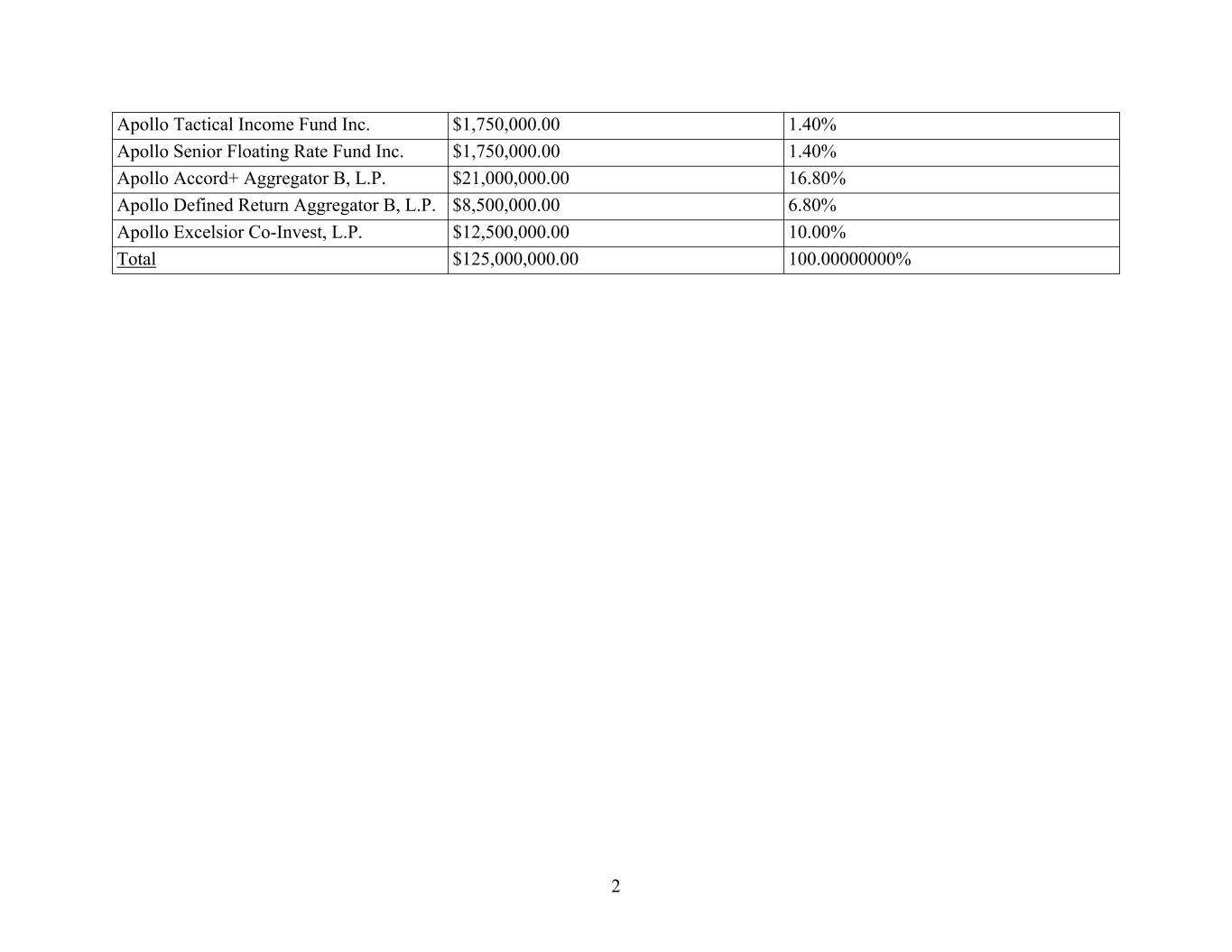

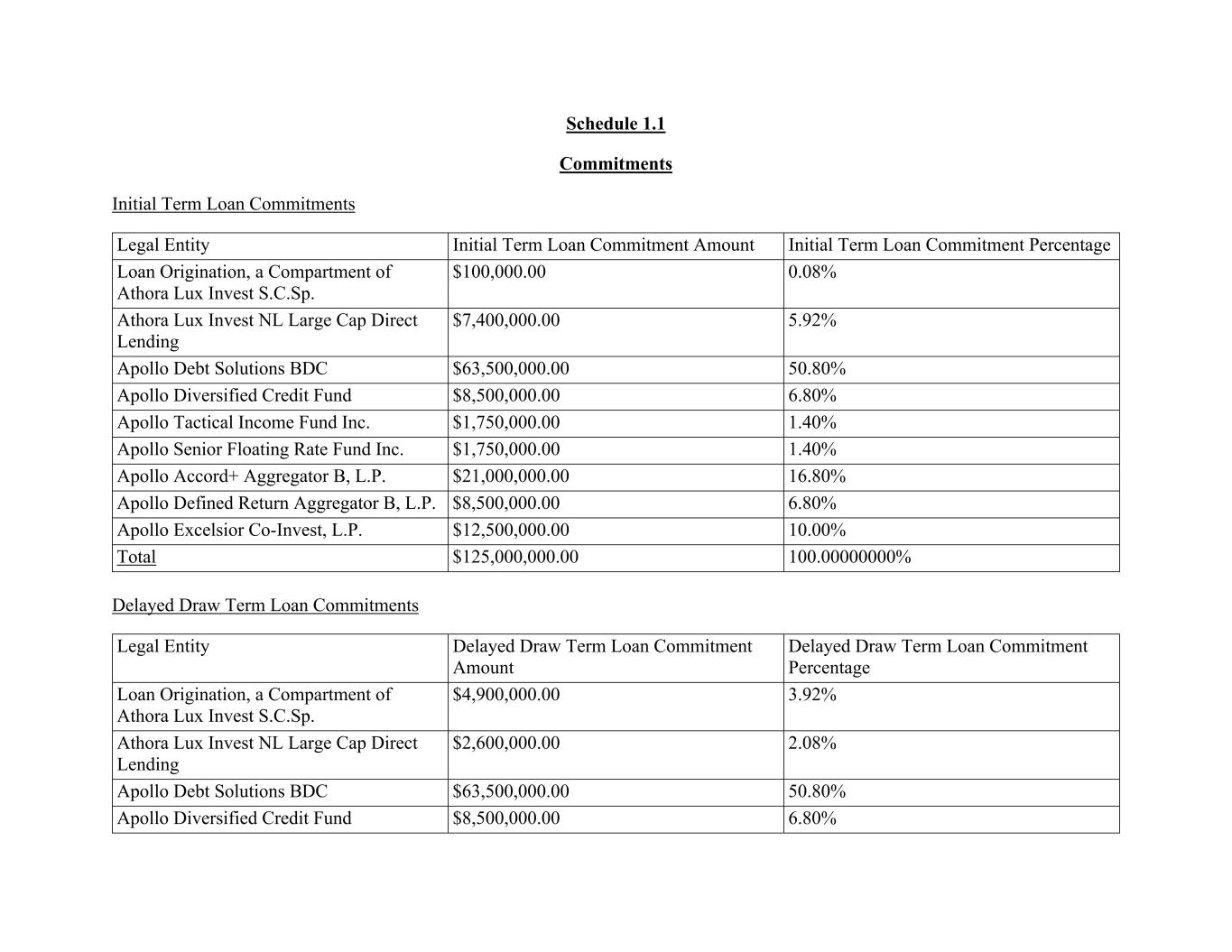

- 12- “Delayed Draw Term Loan Commitment Amount” shall mean, as to any Delayed Draw Term Loan Lender, the Delayed Draw Term Loan Commitment Amount of such Delayed Draw Term Loan Lender set forth on Schedule 1.1 hereto (or, in the case of any Lender that becomes party to this Agreement after the Closing Date pursuant to Section 16.3(c) or (d) hereof, the Delayed Draw Term Loan Commitment Amount of such Delayed Draw Term Loan Lender as set forth in the applicable Commitment Transfer Supplement). The aggregate Delayed Draw Term Loan Commitment Amount of all Delayed Draw Term Loan Lenders as of the Closing Date is $125,000,000. “Delayed Draw Term Loan Commitment Expiration Date” means the earlier of (a) the date on which the Delayed Draw Term Loan Commitments have been reduced to zero and (y) October 20, 2024. “Delayed Draw Term Loan Commitment Percentage” shall mean, as to any Delayed Draw Term Loan Lender, the Delayed Draw Term Loan Commitment Percentage of such Delayed Draw Term Loan Lender set forth on Schedule 1.1 hereto (or, in the case of any Lender that becomes party to this Agreement after the Closing Date pursuant to Section 16.3(c) or (d) hereof, the Delayed Draw Term Loan Commitment Percentage (if any) of such Delayed Draw Term Loan Lender as set forth in the applicable Commitment Transfer Supplement). “Delayed Draw Term Loan Commitment Period” means in respect of the Delayed Draw Term Loan Commitments, the period after the Closing Date to, but excluding, the Delayed Draw Term Loan Commitment Expiration Date. “Delayed Draw Term Loan Funding Date” means any date on which Delayed Draw Term Loans are made by a Delayed Draw Term Loan Lender. “Delayed Draw Term Loan Lender” shall mean a Lender holding a Delayed Draw Term Loan Commitment, a Delayed Draw Term Loan Commitment Amount, and/or any Delayed Draw Term Loans. “Disqualified Equity Interests” shall mean any Equity Interest that, by its terms (or by the terms of any security or other Equity Interests into which it is convertible or for which it is exchangeable), or upon the happening of any event or condition (a) matures or is mandatorily redeemable (other than solely for Qualified Equity Interests), pursuant to a sinking fund obligation or otherwise (except as a result of a change of control or asset sale so long as any rights of the holders thereof upon the occurrence of a change of control or asset sale event shall be subject to the prior repayment in full of the Loans and all other Obligations that are accrued and payable and the termination of the Term Loan Commitments), (b) is redeemable at the option of the holder thereof (other than solely for Qualified Equity Interests), in whole or in part, (c) provides for the scheduled payments of dividends in cash or (d) is or becomes convertible into or exchangeable for Indebtedness or any other Equity Interests that would constitute Disqualified Equity Interests, in each case, prior to the date that is 91 days after the Term, provided, that only the portion of the Equity Interests that so mature or are mandatorily redeemable, are so convertible or exchangeable or are so redeemable at the option of the holder thereof prior to such date, shall be deemed to be Disqualified Equity Interests. "Disqualified Lender” means (a) any Person that has been identified in writing to the Administrative Agent prior to the Closing Date; (b) any Person that is a competitor of the Borrower or any of its Subsidiaries that has been identified in writing to the Administrative Agent from time to time by the Borrower (which list of competitors may be supplemented by the Borrower after the Closing Date by means of a written notice to the Administrative Agent, but which supplementation shall not apply retroactively to disqualify any previously acquired assignment or participation in any Loan); and (c) any Affiliate (other than a bona fide debt fund affiliate) of any Person described in clauses (a) and (b) above that is (x) identified

- 13- in writing to the Administrative Agent, (y) a known Affiliate of such Person in the marketplace, or (z) readily identifiable on the basis of such Affiliate’s name. “Document” shall have the meaning given to the term “document” in the Uniform Commercial Code. “Dollar” and the sign “$” shall mean lawful money of the United States of America. “Domestic Rate Loan” shall mean any Advance that bears interest based upon the Alternate Base Rate. “Earn-Outs” shall mean obligations of the Loan Parties consisting of earn-outs related to an entity, business or assets acquired in connection with a Permitted Acquisition or other investment permitted hereunder, calculated at any time of determination as the amount thereof required to be reflecting as a balance sheet liability at such time in accordance with GAAP. “EBITDA” shall mean for any period with respect to Loan Parties on a Consolidated Basis, the result of: (a) Net Income for such period, plus (b) the sum of the following for such period, in each case only to the extent (and in the same proportion) deducted in determining Net Income, without duplication: (i) Consolidated Interest Expense; (ii) provision for income or franchise Taxes; (iii) depreciation; (iv) amortization (including amortization of deferred fees and the accretion of original issue discount); (v) any expenses or charges in connection with the impairment of any assets; (vi) any other non-cash charges; provided, that for purposes of this subclause (v) of this clause (a), any non-cash charges or losses shall be treated as cash charges or losses in any subsequent period during which cash disbursements attributable thereto are made (but excluding, for the avoidance of doubt, amortization of a prepaid cash item that was paid in a prior period); (vii) any expenses or charges (other than depreciation or amortization expenses as described in the preceding subclauses (iii) and (iv)) related to any repurchase or issuance of Equity Interests or Indebtedness, investment (including any Permitted Investments), acquisition (including any Permitted Acquisition), disposition, recapitalization or the incurrence, modification, redemption, retirement or repayment of Permitted Indebtedness (including any refinancing thereof) (whether or not completed or successful), including (x) such fees, expenses or charges related to this Agreement (and, in each case, any refinancing of such

- 14- Permitted Indebtedness), and (y) any amendment or other modification of the Obligations or other Indebtedness; (viii) (A) any expenses or charges resulting from non-cash stock-based compensation (including expenses or charges relating to stock options, restricted stock units and the Borrower’s employee stock purchase plan, and the employer portion of any payroll taxes thereon; (ix) Loss on extinguishment, repayment or repurchase of indebtedness; (x) extraordinary, unusual or other onetime charges or expenses; (xi) any losses on disposition of assets; minus (c) the sum of (without duplication and to the extent the amounts described in this clause (c) increased such Net Income for such period) non-cash items increasing Net Income of the Loan Parties on a Consolidated Basis for such period (but excluding any such items (A) in respect of which cash was received in a prior period or will be received in a future period or (B) which represent the reversal of any accrual of, or cash reserve for, anticipated cash charges that reduced EBITDA in any prior period). “ECF Minimum Payment” shall have the meaning set forth in Section 2.20(e) hereof. “ECF Period” shall mean (a) the period commencing on January 1, 2024 and ending on December 31, 2024, and (b) each twelve month period ending on December 31 of each fiscal year thereafter. “ECF Retained Amount” shall mean the amount of Excess Cash Flow in excess of the ECF Minimum Payment which is not applied to prepay the Term Loans in accordance with Section 2.20(e) hereof. “EEA Financial Institution” shall mean (a) any institution established in any EEA Member Country which is subject to the supervision of an EEA Resolution Authority, (b) any entity established in an EEA Member Country which is a parent of an institution described in clause (a) of this definition, or (c) any institution established in an EEA Member Country which is a subsidiary of an institution described in clauses (a) or (b) of this definition and is subject to consolidated supervision with its parent. “EEA Member Country” shall mean any of the member states of the European Union, Iceland, Liechtenstein and Norway. “EEA Resolution Authority” shall mean any public administrative authority or any person entrusted with public administrative authority of any EEA Member Country (including any delegee) having responsibility for the resolution of any EEA Financial Institution. “Effective Date” shall mean the date indicated in a document or agreement to be the date on which such document or agreement becomes effective, or, if there is no such indication, the date of execution of such document or agreement. “Effective Yield” means, as to any Indebtedness as of any date of determination, the effective yield on such Indebtedness in the reasonable determination of the Administrative Agent and consistent with generally accepted financial practices, taking into account the applicable interest rate margins, any interest rate floors (the effect of which floors shall be determined in a manner set forth in the proviso below) or