Investor Presentation November 2025

Forward-Looking Statements This presentation contains forward-looking statements (“FLS”) which are protected as FLS under the PSLRA, and which are based on management’s current expectations and beliefs, as well as a number of assumptions concerning future events. The assumptions and estimates underlying FLS are inherently uncertain and are subject to a wide variety of significant business and economic uncertainties and competitive risks that could cause actual results to differ materially from those contained in the prospective information. Accordingly, there can be no assurance CVR Energy, Inc. (together with its subsidiaries, “CVI”, “CVR Energy”, “we”, “us” or the Company”) will achieve the future results we expect or that actual results will not differ materially from expectations. Statements concerning current estimates, expectations and projections about future results, performance, prospects, opportunities, plans, actions and events and other statements, concerns, or matters that are not historical facts are FLS and include, but are not limited to, statements regarding future: safe and reliable operations; compliance with regulations; ability to minimize environmental impacts and create value; economic and social impacts of donations and contributions; financial performance and forecasts; profitable growth; strategic value of our locations and ability to capitalize thereon; crude oil capacities and throughputs and factors impacting same; access to crude oil and condensate fields with price advantages or at all; exposure to Brent-WTI; liquid volume yields; renewable diesel capacity and production; benefits of our renewable feed pre-treater; renewable feedstock composition, cost and yield impact; conversion of the RDU back to hydrocarbon processing in December or at all; ability to return the RDU to renewable diesel service; percentage ownership of CVR Partners common units and its general partner; our controlling shareholder’s intention regarding ownership of our common stock and CVR Partners common units and potential strategic transactions involving us or CVR Partners; fertilizer segment feedstock diversity, costs, and utilization rates; strategic priorities including our ability to operate safely, improve EH&S performance, preserve cash, refocus capital spending, cut costs, preserve and strengthen our balance sheet and liquidity, navigate market conditions, achieve our deleveraging strategy, deliver high value neat crude oils to our refineries, optimize refinery configuration, maximize netbacks, leverage logistics systems, improve margin capture through feedstock and yield optimizations, secure SREs, maximize distillate and premium gasoline production, , improve reliability and optimize feedstocks at our fertilizer plants; ability to achieve capital allocation strategy, create long term value, optimize assets, invest in high return projects, and improve feedstock supply; capture rates and product placement; liquidity at appropriate levels or at all; cost of capital including reduction thereof; ability to optimize capital structure and provide above average cash returns; capex allocations and levels; asset utilization, including ability to reduce downtime exposure; turnaround timing, impacts, schedules (including optimization thereof) and investment levels; investments to diversify and enhance core assets; IRR targets; merger and acquisition opportunities; investment profile; generation and return of cash; divestiture of non-core assets; return of debt levels and capital structure to target levels or in line with or better than peers; timing and amount of our dividends/distributions, if any; ; optionality of our crude oil sourcing and/or marketing network; storage capacity; use of, access to (on a contracted basis or otherwise), space on and direction of pipelines we utilize; power supply outages; unplanned downtime; adverse weather events; blending and participation in renewable fuel blending economics; RIN and LCFS generation, capture, pricing, purchasing and availability; rack access; product sales outlets; quality of our refining assets; feedstock optionality; utilization rates; ; production mix; liquid volume, gasoline and distillate yields; the macro environment; gasoline and diesel supply and demand; product inventories; crack spreads; crude oil differentials (including our exposure thereto); ; renewable feedstock CI; availability, sufficiency or impact of government credit programs, including the BTC and PTC; renewables projects;; capital and turnaround expenses and timing therefor; benefits of our margin capture investments; ; increasing overall throughput volumes during turnarounds; fertilizer segment service areas; ability to minimize distribution costs and maximize fertilizer net back pricing; fertilizer logistics optionality and storage; sustainability of production; feedstock diversification and optimization at our Coffeyville fertilizer facility, including the economics thereof; our and third party nitrogen fertilizer plant capacity, production, yields, pricing, feedstocks (including types and costs thereof), inventories, utilization rates, sales, distribution methods (including rail) and revenue; global and domestic nitrogen fertilizer production, curtailments, supply, capacity, demand and consumption; farmer economics and cost structure; market capacity absorption; ; imports and exports including restrictions and actual and potential tariffs thereupon;; corn and grain demand, stocks, pricing, uses, pricing, cost, consumption, production, planting and yield, including the drivers thereof; ethanol demand; domestic nitrogen fertilizer market conditions; natural gas pricing, including impacts thereof on fertilizer production; corn planted acre levels; nitrogen fertilizer application rates; harvest timing; carryout inventories; corn futures pricing; weather and soil conditions and impacts thereof on application and pricing; trade disputes, geopolitical impacts and global fertilizer plant disruptions on fertilizer supply and pricing; prepay levels; fertilizer segment maintenance, growth and turnaround spending, timing and benefits; reserve levels; distributions (if any) from our 45Q JV; EBITDA and adjusted EBITDA; projected maintenance and growth expenditures in our segments; impact of RFS including but not limited to renewable volume obligations and potential reallocation thereof including challenges thereto, RIN pricing and availability, small refinery exemptions (SREs) or other hardship relief to WRC or others, WRC’s full or partial grant or denial of hardship relief including the impact of EPA rulings and past, current or potential challenges thereto and the impact thereof on our financial position, operations and cash flow;; and other matters. Please do not put undue reliance on FLS (including forecasts and projections regarding our future performance) because actual results may vary materially from those expressed or implied as a result of various factors, including, but not limited to those set forth under “Risk Factors” in the Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and any other filings with the Securities and Exchange Commission (“SEC”) by CVR Energy, Inc. (“CVI”) or CVR Partners, LP (“UAN”). These FLS are made only as of the date hereof. Neither CVI nor UAN assume any obligation to, and they expressly disclaim any obligation to, update or revise any FLS, whether as a result of new information, future events or otherwise, except as required by law. Non-GAAP Financial Measures Certain financial information in this presentation (including EBITDA and Adjusted EBITDA) are not presentations made in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”) and use of such terms varies from others in the same industry. Non-GAAP financial measures should not be considered as alternatives to income from continuing operations, income from operations or any other performance measures derived in accordance with GAAP. Non-GAAP financial measures have important limitations as analytical tools, and you should not consider them in isolation or as substitutes for results as reported under GAAP. This presentation includes a reconciliation of certain non-GAAP financial measures to the most directly comparable financial measures calculated in accordance with GAAP. Market and Industry Data The market and industry data included in this presentation is based on a variety of sources, including industry publications, government publications and other published sources, information from customers, distributors, suppliers, trade and business organizations and publicly available information (including reports and other information others file with the SEC, which we did not participate in preparing and as to which we make no representation), as well as our good faith estimates, which have been derived from management’s knowledge and experience. Estimates of market size and relative positions in a market are difficult to develop and inherently uncertain. Accordingly, investors should not place undue weight on the industry and market share data presented in or discussed during this presentation. 1

Mission and Values Safety - We always put safety first. The protection of our employees, contractors and communities is paramount. We have an unwavering commitment to safety above all else. If it’s not safe, then we don’t do it. Environment - We care for our environment. Complying with all regulations and minimizing any environmental impact from our operations is essential. We understand our obligation to the environment and that it’s our duty to protect it. Integrity - We require high business ethics. We comply with the law and practice sound corporate governance. We only conduct business one way – the right way with integrity. Corporate Citizenship - We are proud members of the communities where we operate. We are good neighbors and know that it’s a privilege we can’t take for granted. We seek to make a positive economic and social impact through our financial donations and contributions of time, knowledge and talent of our employees to the places where we live and work. Continuous Improvement - We foster accountability under a performance-driven culture. We believe in both individual and team success. We foster accountability under a performance-driven culture that supports creative thinking, teamwork, diversity and personal development so that employees can realize their maximum potential. We use defined work practices for consistency, efficiency and to create value across the organization. Our core values are driven by our people, inform the way we do business each and every day and enhance our ability to accomplish our mission and related strategic objectives. Our mission is to be a top tier North American renewable fuels, petroleum refining, and nitrogen-based fertilizer company as measured by safe and reliable operations, superior financial performance and profitable growth. 2

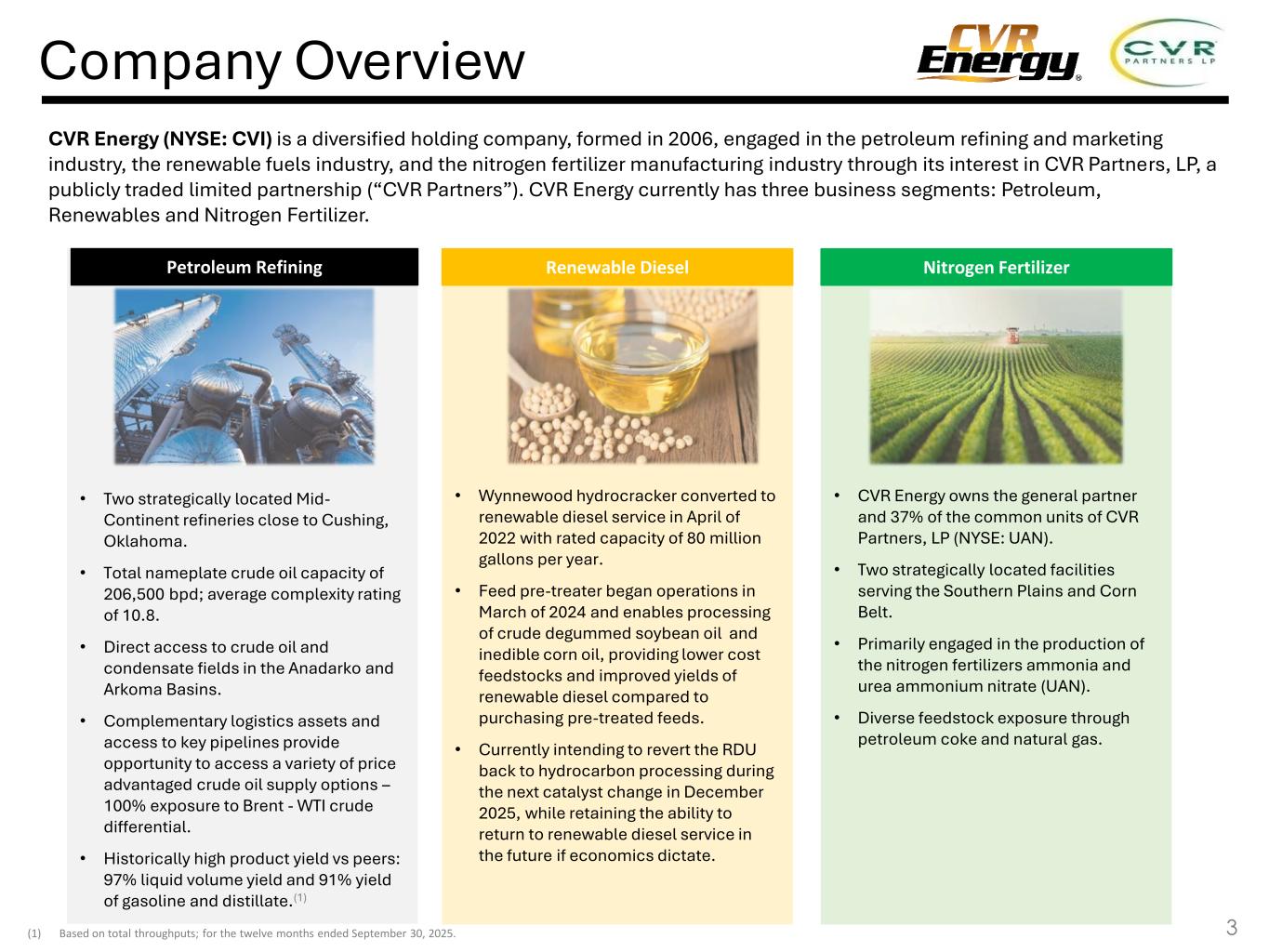

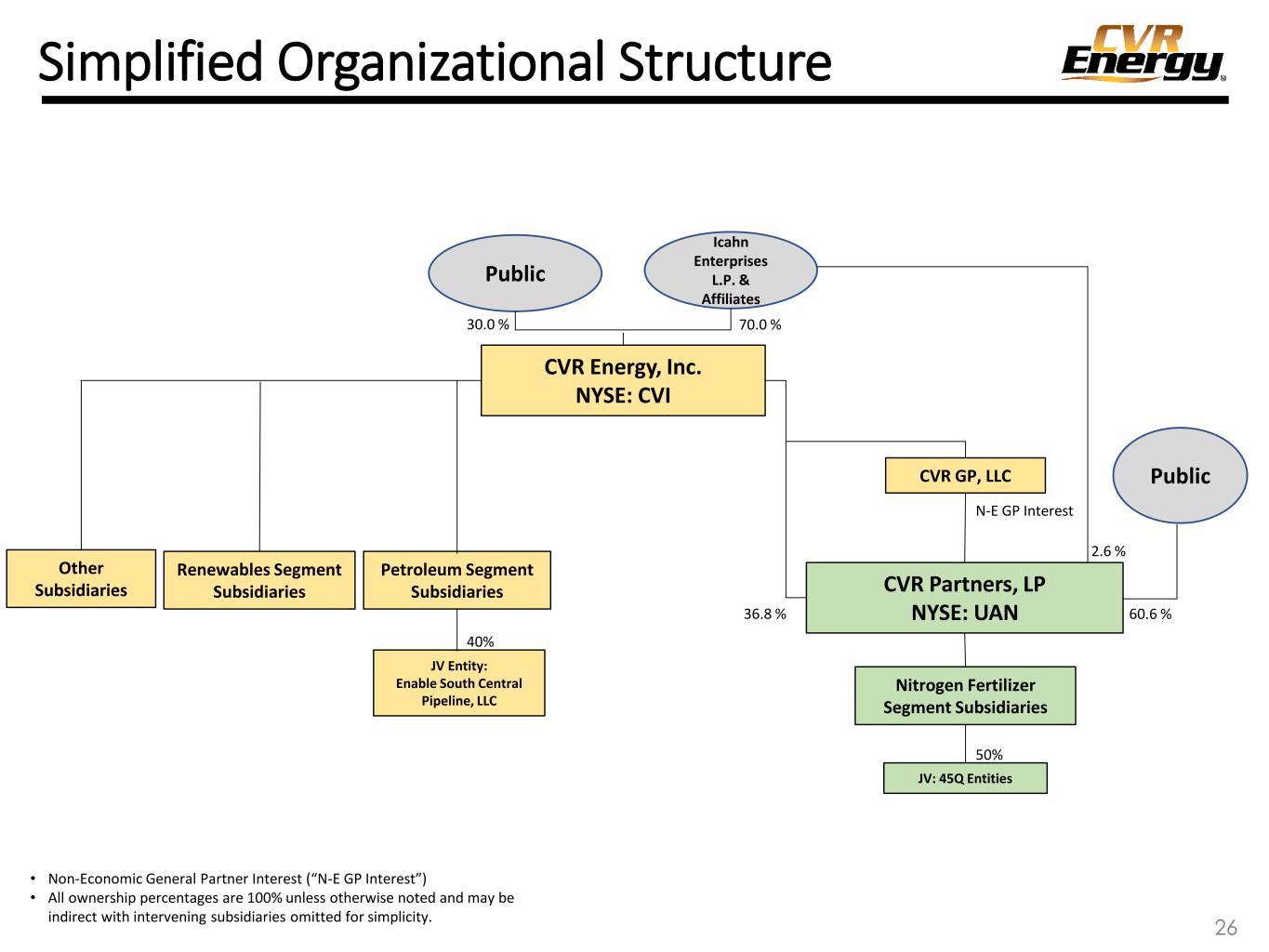

• CVR Energy owns the general partner and 37% of the common units of CVR Partners, LP (NYSE: UAN). • Two strategically located facilities serving the Southern Plains and Corn Belt. • Primarily engaged in the production of the nitrogen fertilizers ammonia and urea ammonium nitrate (UAN). • Diverse feedstock exposure through petroleum coke and natural gas. • Wynnewood hydrocracker converted to renewable diesel service in April of 2022 with rated capacity of 80 million gallons per year. • Feed pre-treater began operations in March of 2024 and enables processing of crude degummed soybean oil and inedible corn oil, providing lower cost feedstocks and improved yields of renewable diesel compared to purchasing pre-treated feeds. • Currently intending to revert the RDU back to hydrocarbon processing during the next catalyst change in December 2025, while retaining the ability to return to renewable diesel service in the future if economics dictate. • Two strategically located Mid- Continent refineries close to Cushing, Oklahoma. • Total nameplate crude oil capacity of 206,500 bpd; average complexity rating of 10.8. • Direct access to crude oil and condensate fields in the Anadarko and Arkoma Basins. • Complementary logistics assets and access to key pipelines provide opportunity to access a variety of price advantaged crude oil supply options – 100% exposure to Brent - WTI crude differential. • Historically high product yield vs peers: 97% liquid volume yield and 91% yield of gasoline and distillate.(1) CVR Energy (NYSE: CVI) is a diversified holding company, formed in 2006, engaged in the petroleum refining and marketing industry, the renewable fuels industry, and the nitrogen fertilizer manufacturing industry through its interest in CVR Partners, LP, a publicly traded limited partnership (“CVR Partners”). CVR Energy currently has three business segments: Petroleum, Renewables and Nitrogen Fertilizer. (1) Based on total throughputs; for the twelve months ended September 30, 2025. Company Overview Petroleum Refining Renewable Diesel Nitrogen Fertilizer 3

Strategic Priorities Focus on EH&S Performance Preserve Cash Flow Maintain Balance Sheet & Liquidity Focus on Crude Oil Quality & Differentials Improve Margin Capture Focusing on improvements in Environmental, Health and Safety Matters – Safety is Job #1 Consolidated Total Recordable Incident Rate (“TRIR”) declined approximately 20% in 2024 compared to 2023, including declines of approximately 18% in the Petroleum Segment and approximately 29% in the Nitrogen Fertilizer Segment. Safe, reliable operations in an environmentally responsible manner are the best ways to improve EH&S performance. Refocusing capital spending on projects that are in flight and those critical to safe, reliable operations while also working on internal cost cutting initiatives Focusing capital spending on planned turnaround activities and projects supportive of safe, reliable operations as we seek to preserve liquidity. Also working on internal cost cutting initiatives, including limited hiring and eliminating waste wherever possible. Positioning to strengthen the balance sheet to navigate current market conditions Preserving our balance sheet with total liquidity position of approximately $830 million, excluding CVR Partners, at the end of 3Q 2025. Total liquidity comprised of $514 million of cash and availability under the CVR Energy ABL of $316 million. Progressing deleveraging strategy with a combined $90 million repayment on the Term Loan in June and July 2025, representing a 28% reduction and a remaining balance of $232 million. Leveraging our strategic location and proprietary gathering system to deliver high value neat crude oils to our refineries Focusing on optimal refinery configurations to maximize the netbacks for the crude oils available in our operating regions. Leveraging our gathering systems, trucking operations and pipelines to create the greatest value over time. Exploring opportunities to improve margin capture across all businesses through feedstock and yield optimizations In the Petroleum Segment, we will aggressively pursue Small Refinery Exemptions at Wynnewood Refining Company, LLC while focusing on maximizing production of distillate (diesel and jet fuel) and premium gasoline at both refineries. We believe there could be additional opportunities to increase margin capture following the reversion of the RDU at Wynnewood back to hydrocarbon processing. In the Fertilizer Segment, we are investing to improve reliability at both facilities and optimizing feedstocks at Coffeyville. 4

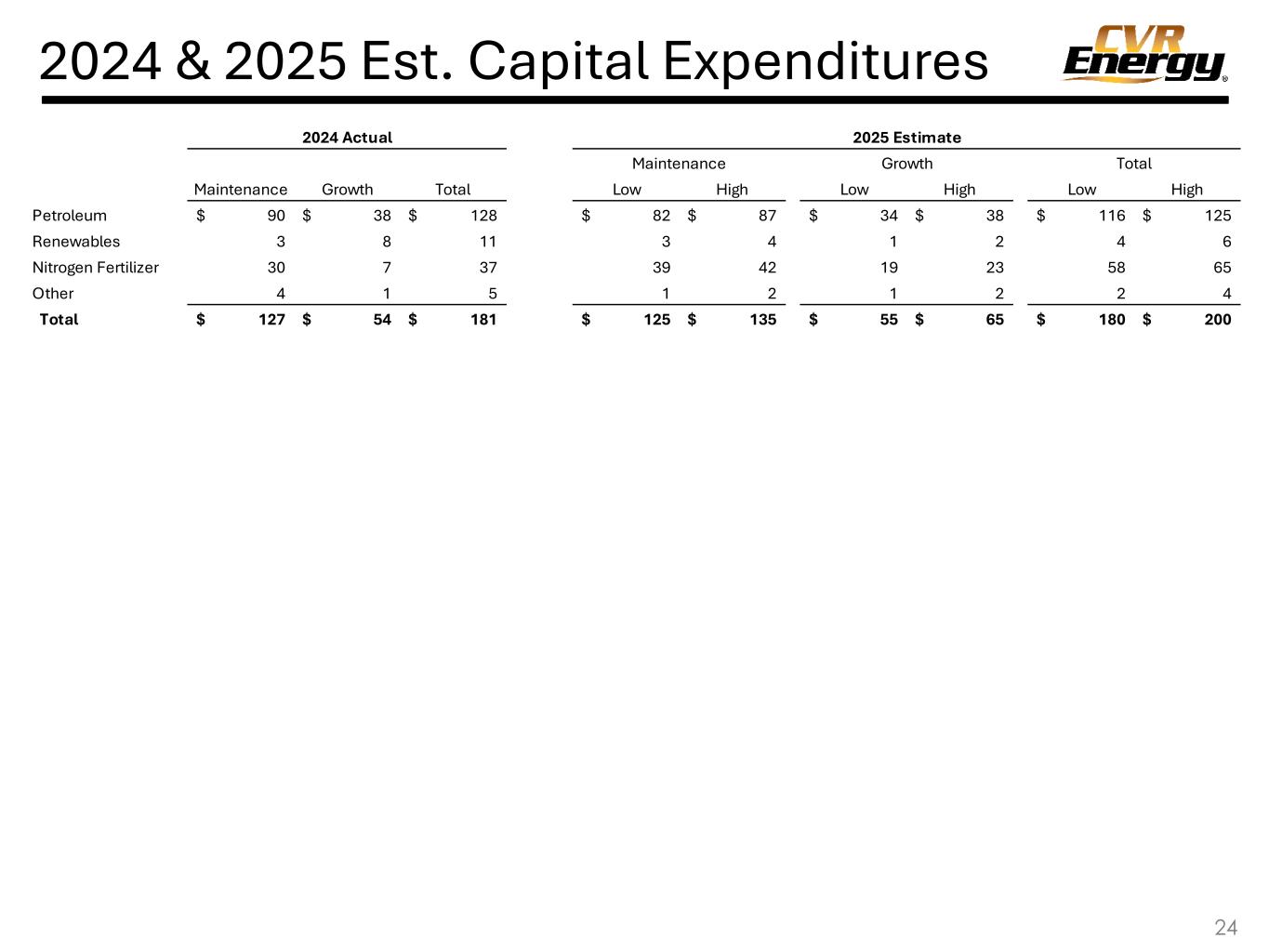

Capital Allocation Strategy Safety, reliability and environmental compliance are core to CVR’s management philosophy ▪ Approximately $100MM in annual sustaining and regulatory capex, allocated to assets through a continuous assessment process. ▪ Run-rate annual refining turnaround investment of $75MM over a five-year cycle to maximize asset utilization and reduce downtime exposure. ▪ Optimizing significant turnaround operations to be scheduled around periods with lower opportunity cost. Strategically invest in asset development and businesses that diversify and enhance core assets ▪ 30% target IRR for traditional refining organic projects. ▪ 20% target IRR for renewables- focused investments as these assets typically garner higher multiples. ▪ Evaluate merger and acquisition activity as opportunities arise that diversify market exposure or offer significant synergy. Maintain an attractive investment profile by focusing on free cash flow generation and maintaining an appropriately strong balance sheet ▪ Explore potential divestiture of non-core assets. ▪ Support adequate liquidity to operate the business while returning or investing excess cash. ▪ Seek to return debt levels and capital structure profile to be in line with or better than peer group. ▪ Continually re-evaluate the Company’s dividend policy. ▪ Create long-term value through safe, reliable operations and continuously optimizing core refining, renewables, fertilizer and associated logistics assets; ▪ Invest in high return projects that are complimentary to existing assets and improve feedstock supply, capture rate and product placement; ▪ Protect the balance sheet by maintaining appropriate liquidity, reducing cost of capital and optimizing capital structure; and ▪ Provide above average cash returns to investors through dividends/distributions when supported by market conditions and deemed appropriate by our Boards of Directors. 5 In the near term we will continue to prioritize efforts to reduce debt and restore our balance sheet to targeted levels as soon as we can, subject to market and other conditions. Key Priorities: Non-Discretionary Asset Continuity Discretionary Investment Financial Discipline & Investor Returns

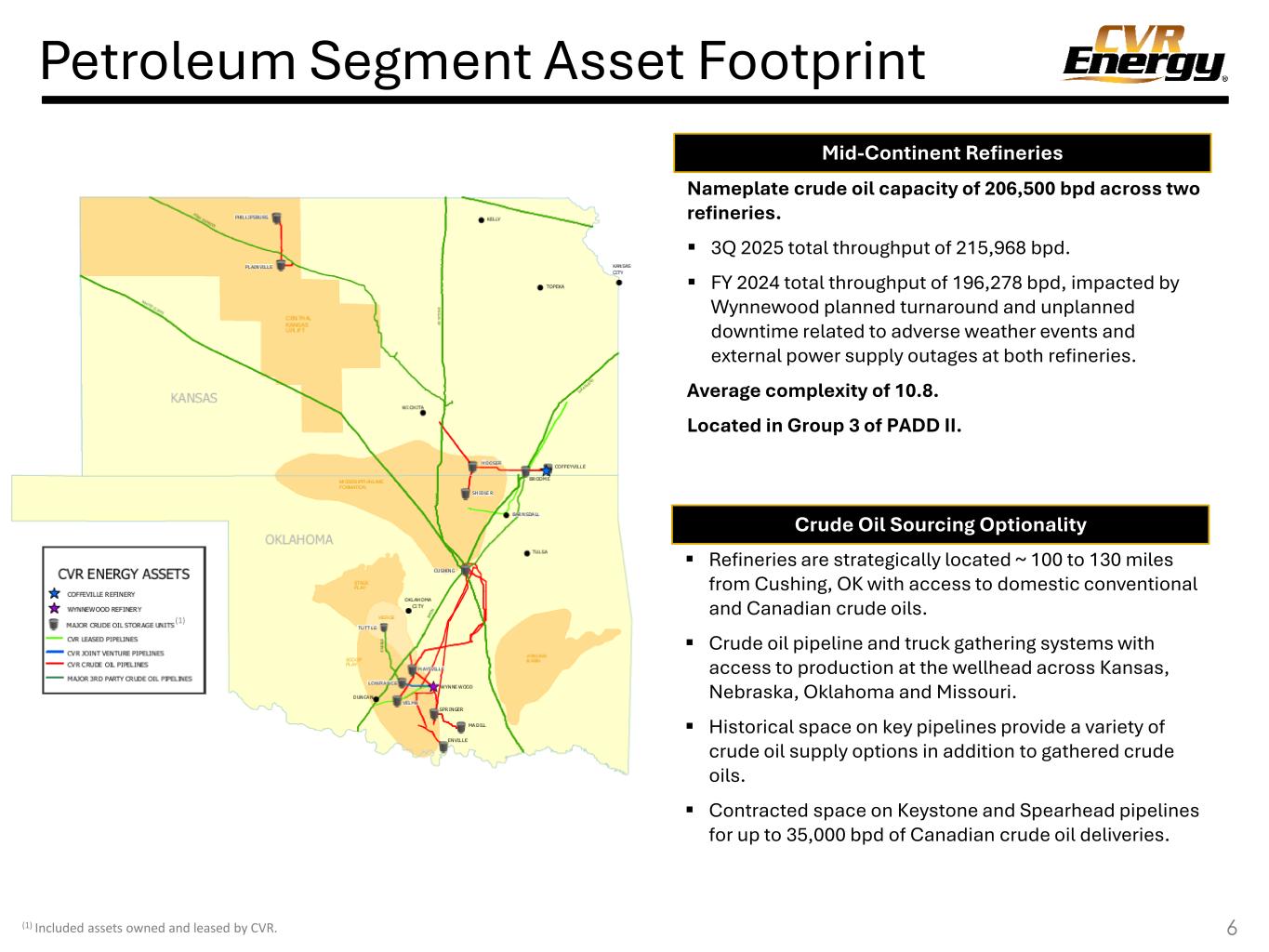

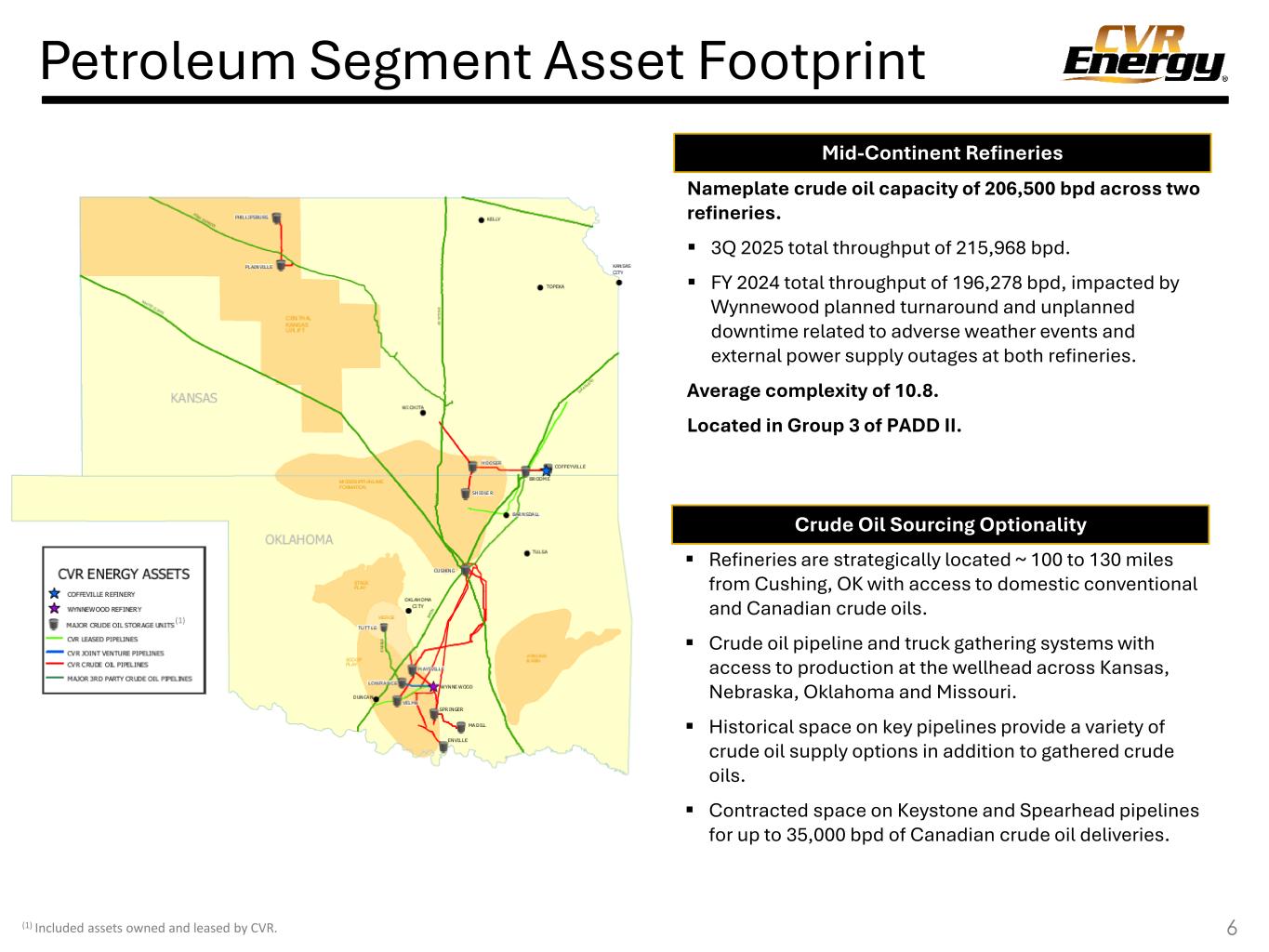

Petroleum Segment Asset Footprint 6 Nameplate crude oil capacity of 206,500 bpd across two refineries. ▪ 3Q 2025 total throughput of 215,968 bpd. ▪ FY 2024 total throughput of 196,278 bpd, impacted by Wynnewood planned turnaround and unplanned downtime related to adverse weather events and external power supply outages at both refineries. Average complexity of 10.8. Located in Group 3 of PADD II. ▪ Refineries are strategically located ~ 100 to 130 miles from Cushing, OK with access to domestic conventional and Canadian crude oils. ▪ Crude oil pipeline and truck gathering systems with access to production at the wellhead across Kansas, Nebraska, Oklahoma and Missouri. ▪ Historical space on key pipelines provide a variety of crude oil supply options in addition to gathered crude oils. ▪ Contracted space on Keystone and Spearhead pipelines for up to 35,000 bpd of Canadian crude oil deliveries. Mid-Continent Refineries Crude Oil Sourcing Optionality (1) Included assets owned and leased by CVR. (1)

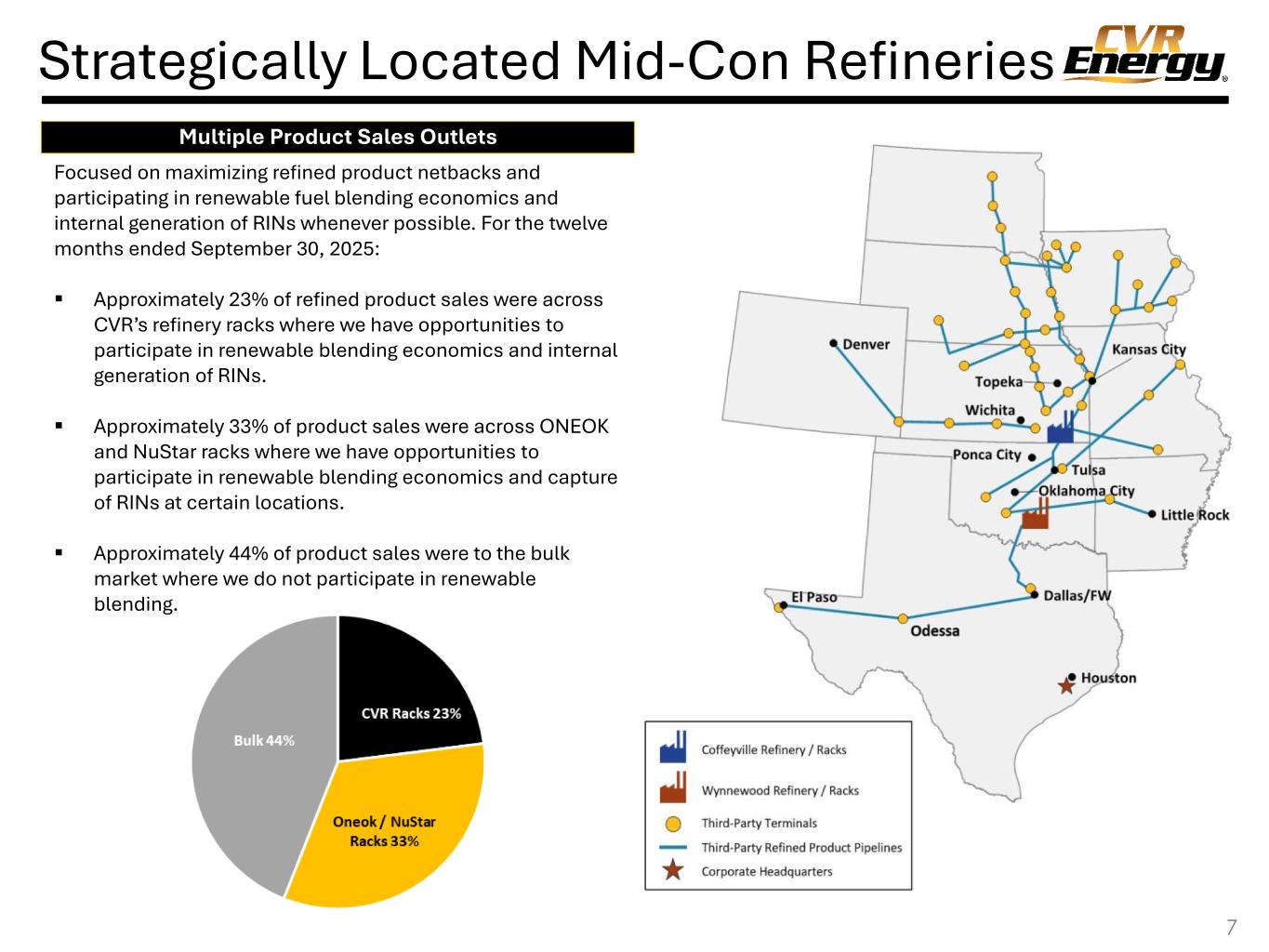

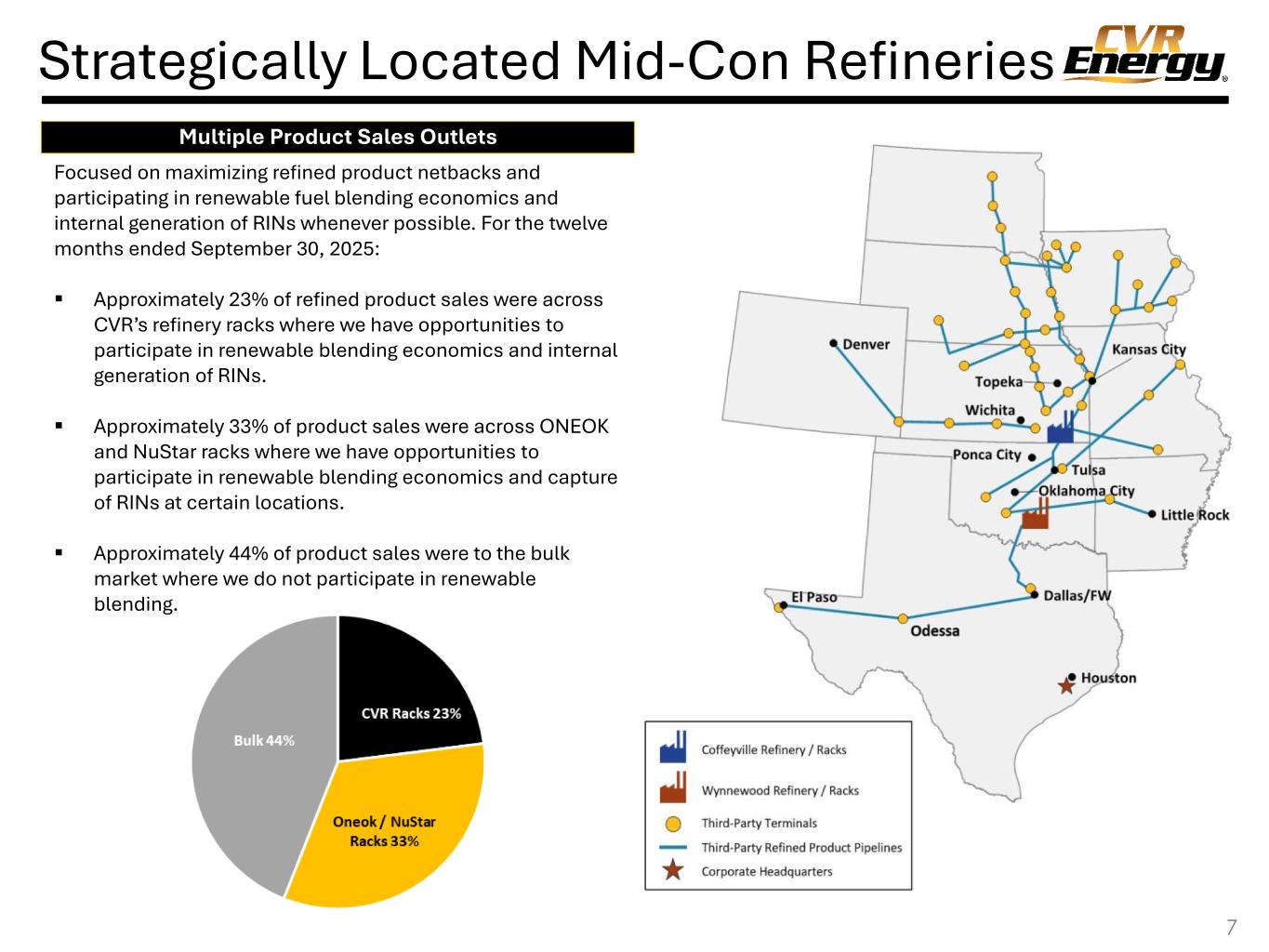

Strategically Located Mid-Con Refineries Multiple Product Sales Outlets Focused on maximizing refined product netbacks and participating in renewable fuel blending economics and internal generation of RINs whenever possible. For the twelve months ended September 30, 2025: ▪ Approximately 23% of refined product sales were across CVR’s refinery racks where we have opportunities to participate in renewable blending economics and internal generation of RINs. ▪ Approximately 33% of product sales were across ONEOK and NuStar racks where we have opportunities to participate in renewable blending economics and capture of RINs at certain locations. ▪ Approximately 44% of product sales were to the bulk market where we do not participate in renewable blending. 7

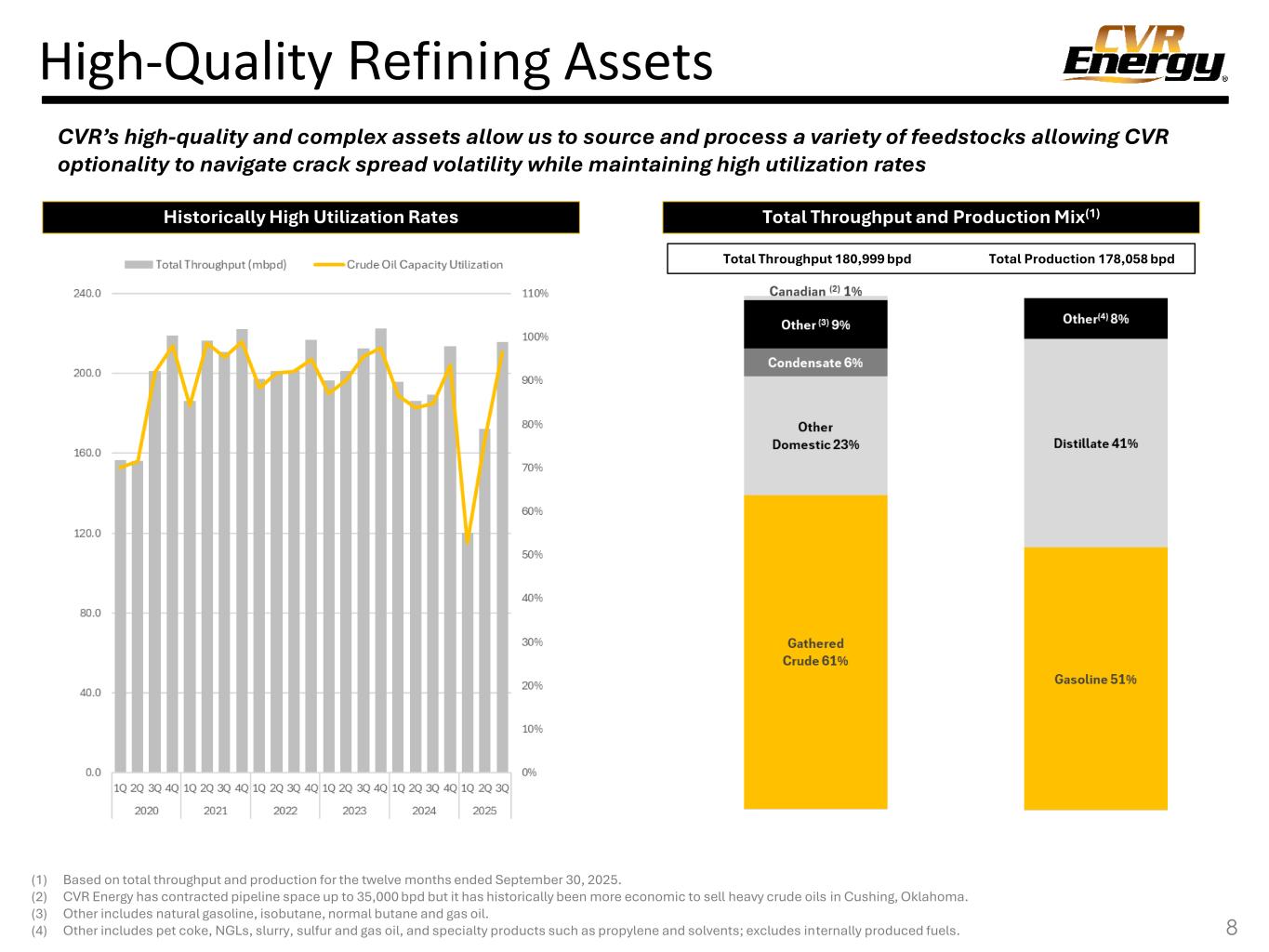

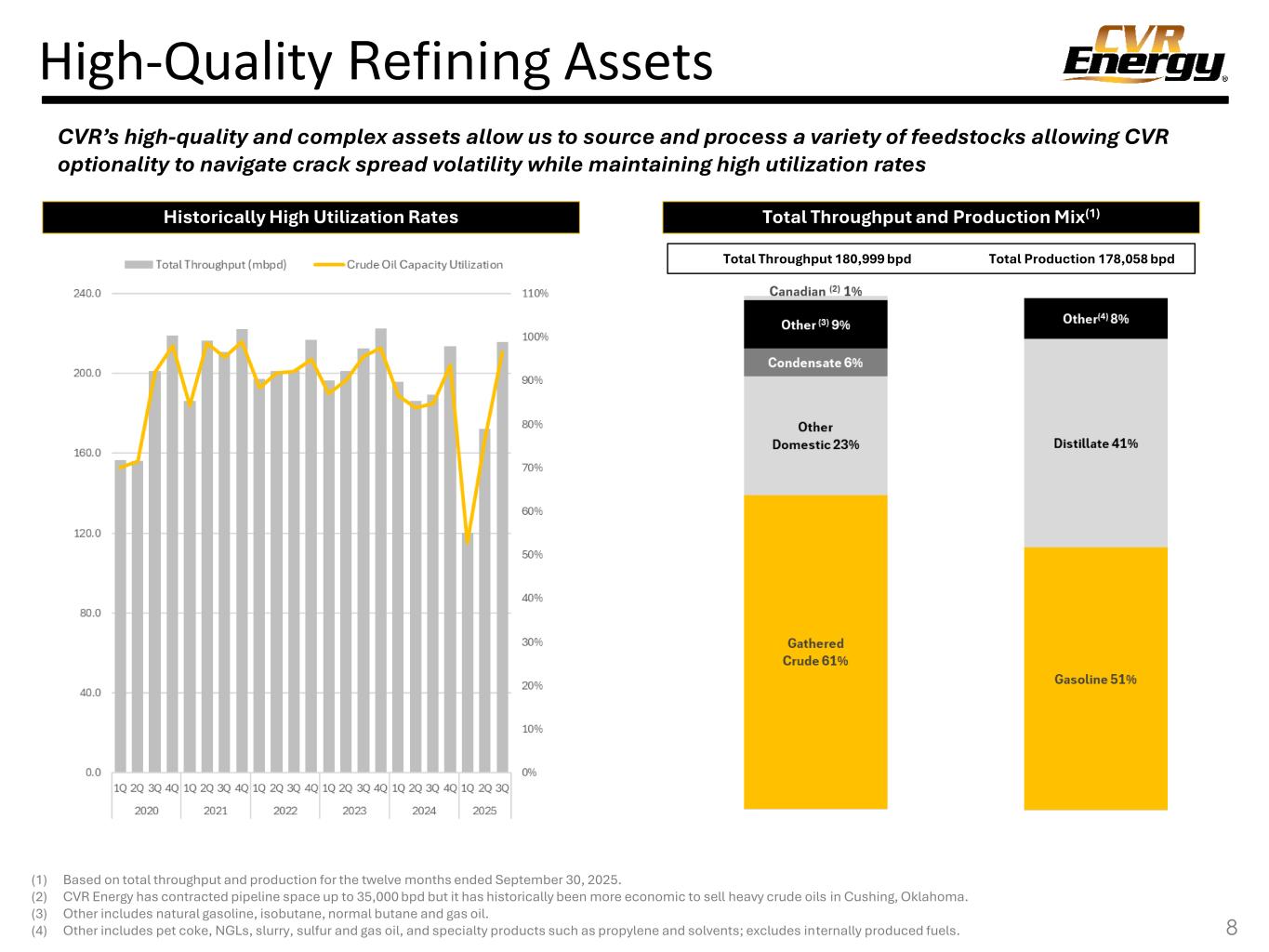

High-Quality Refining Assets Historically High Utilization Rates Total Throughput and Production Mix(1) (1) Based on total throughput and production for the twelve months ended September 30, 2025. (2) CVR Energy has contracted pipeline space up to 35,000 bpd but it has historically been more economic to sell heavy crude oils in Cushing, Oklahoma. (3) Other includes natural gasoline, isobutane, normal butane and gas oil. (4) Other includes pet coke, NGLs, slurry, sulfur and gas oil, and specialty products such as propylene and solvents; excludes internally produced fuels. Total Throughput 180,999 bpd Total Production 178,058 bpd 8 CVR’s high-quality and complex assets allow us to source and process a variety of feedstocks allowing CVR optionality to navigate crack spread volatility while maintaining high utilization rates

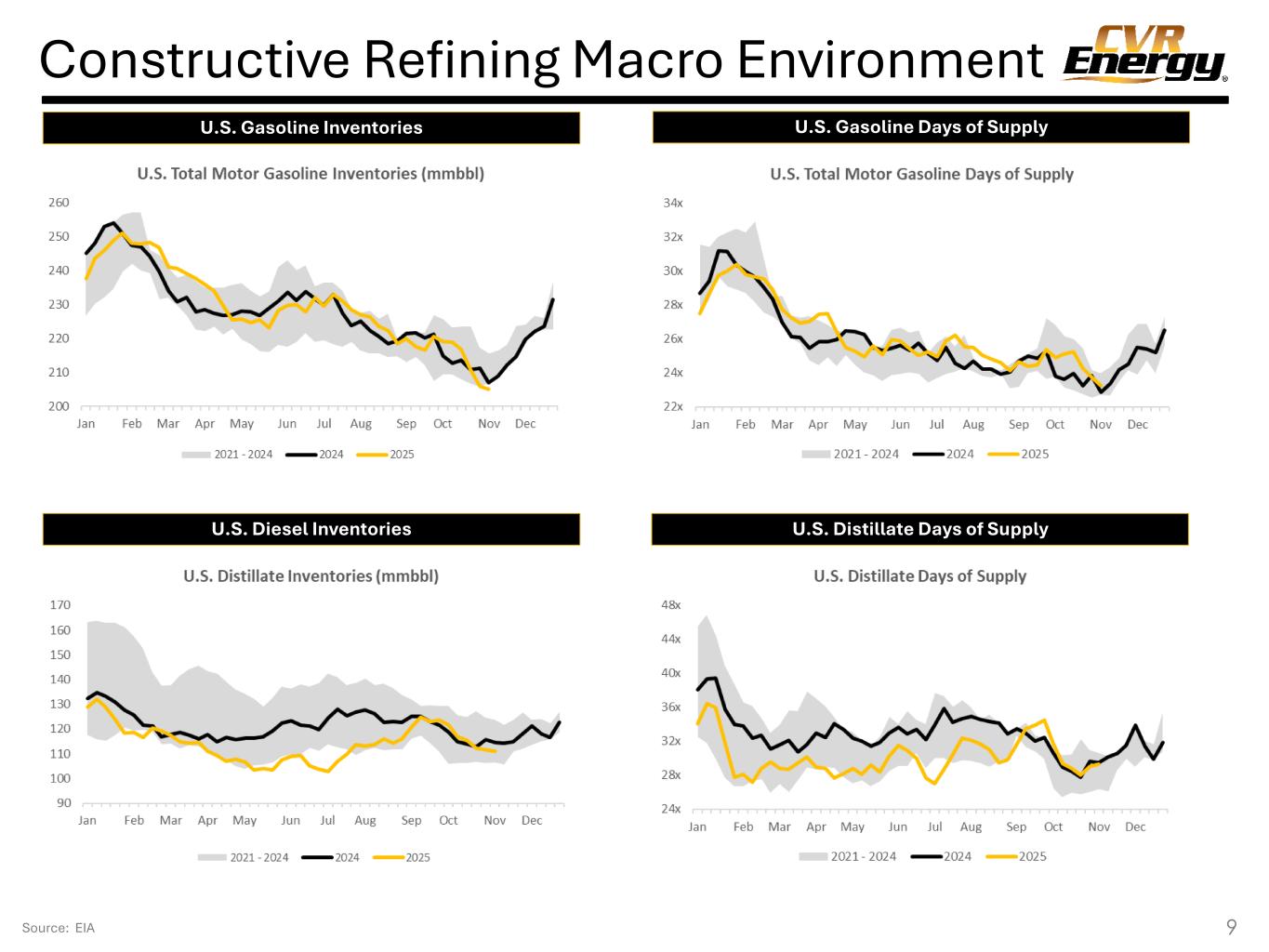

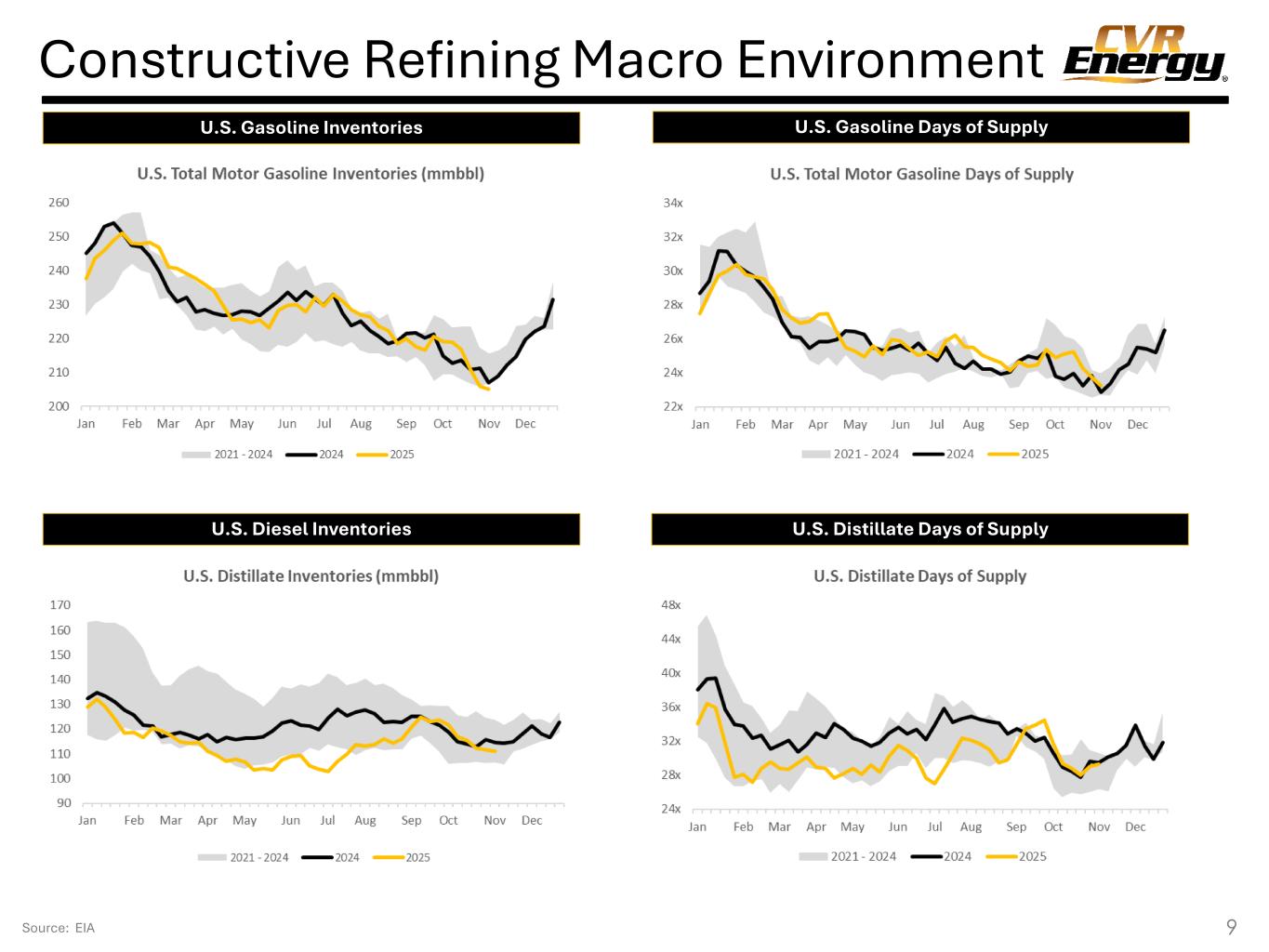

Constructive Refining Macro Environment 9Source: EIA U.S. Gasoline Inventories U.S. Gasoline Days of Supply U.S. Diesel Inventories U.S. Distillate Days of Supply

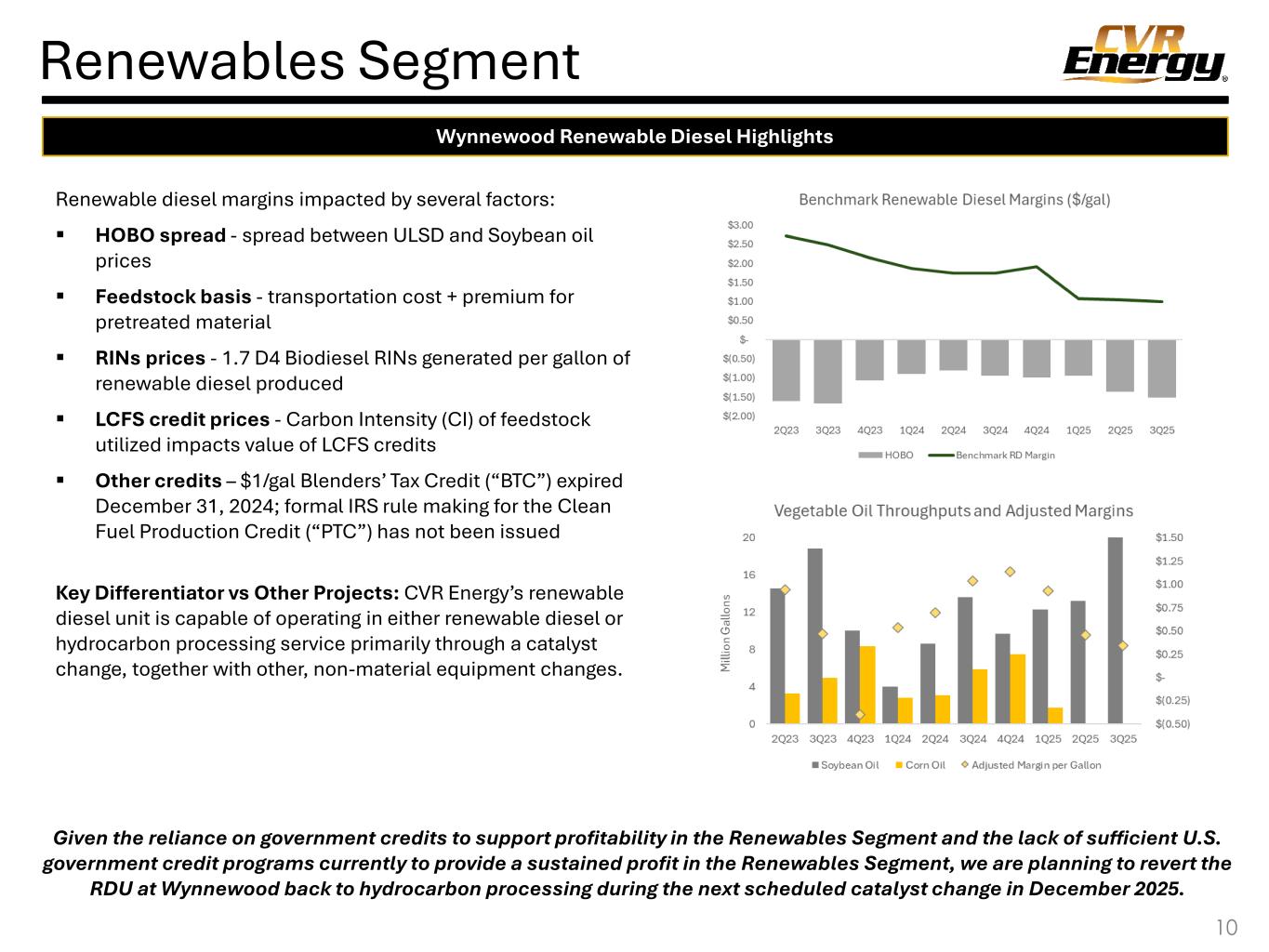

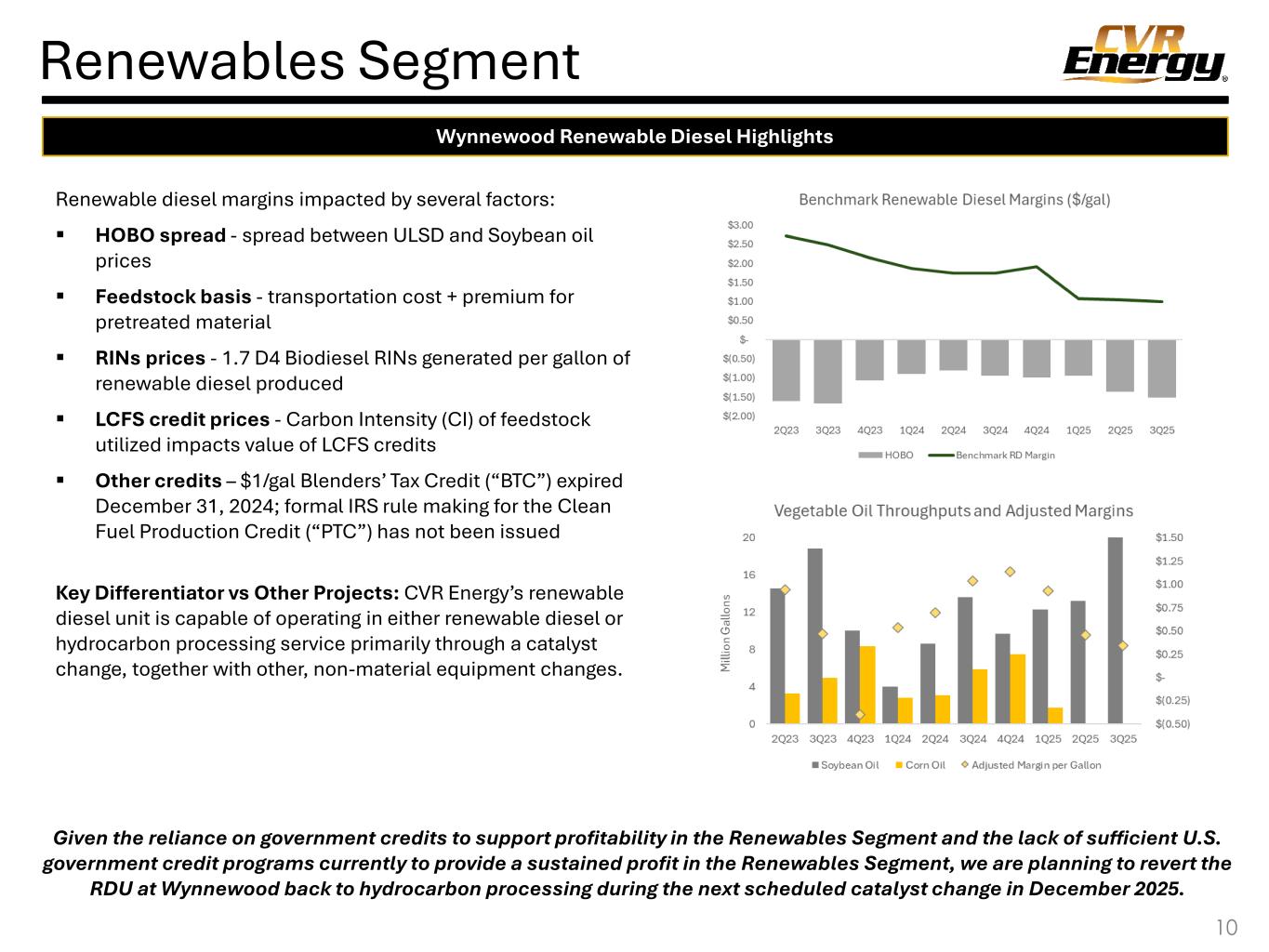

Renewables Segment 10 KSAAT Project at Wynnewood Renewable diesel margins impacted by several factors: ▪ HOBO spread - spread between ULSD and Soybean oil prices ▪ Feedstock basis - transportation cost + premium for pretreated material ▪ RINs prices - 1.7 D4 Biodiesel RINs generated per gallon of renewable diesel produced ▪ LCFS credit prices - Carbon Intensity (CI) of feedstock utilized impacts value of LCFS credits ▪ Other credits – $1/gal Blenders’ Tax Credit (“BTC”) expired December 31, 2024; formal IRS rule making for the Clean Fuel Production Credit (“PTC”) has not been issued Key Differentiator vs Other Projects: CVR Energy’s renewable diesel unit is capable of operating in either renewable diesel or hydrocarbon processing service primarily through a catalyst change, together with other, non-material equipment changes. Wynnewood Renewable Diesel Highlights Given the reliance on government credits to support profitability in the Renewables Segment and the lack of sufficient U.S. government credit programs currently to provide a sustained profit in the Renewables Segment, we are planning to revert the RDU at Wynnewood back to hydrocarbon processing during the next scheduled catalyst change in December 2025.

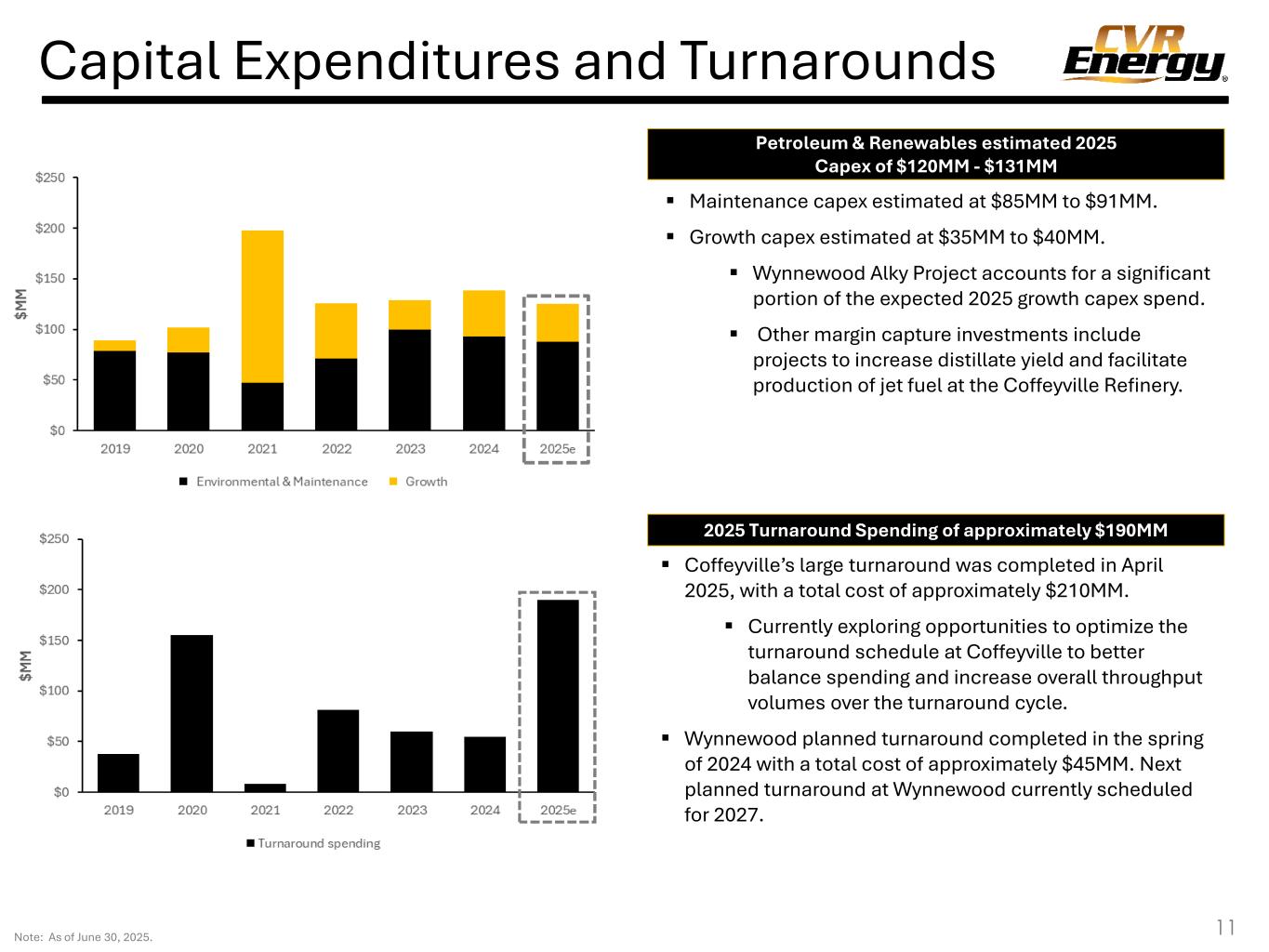

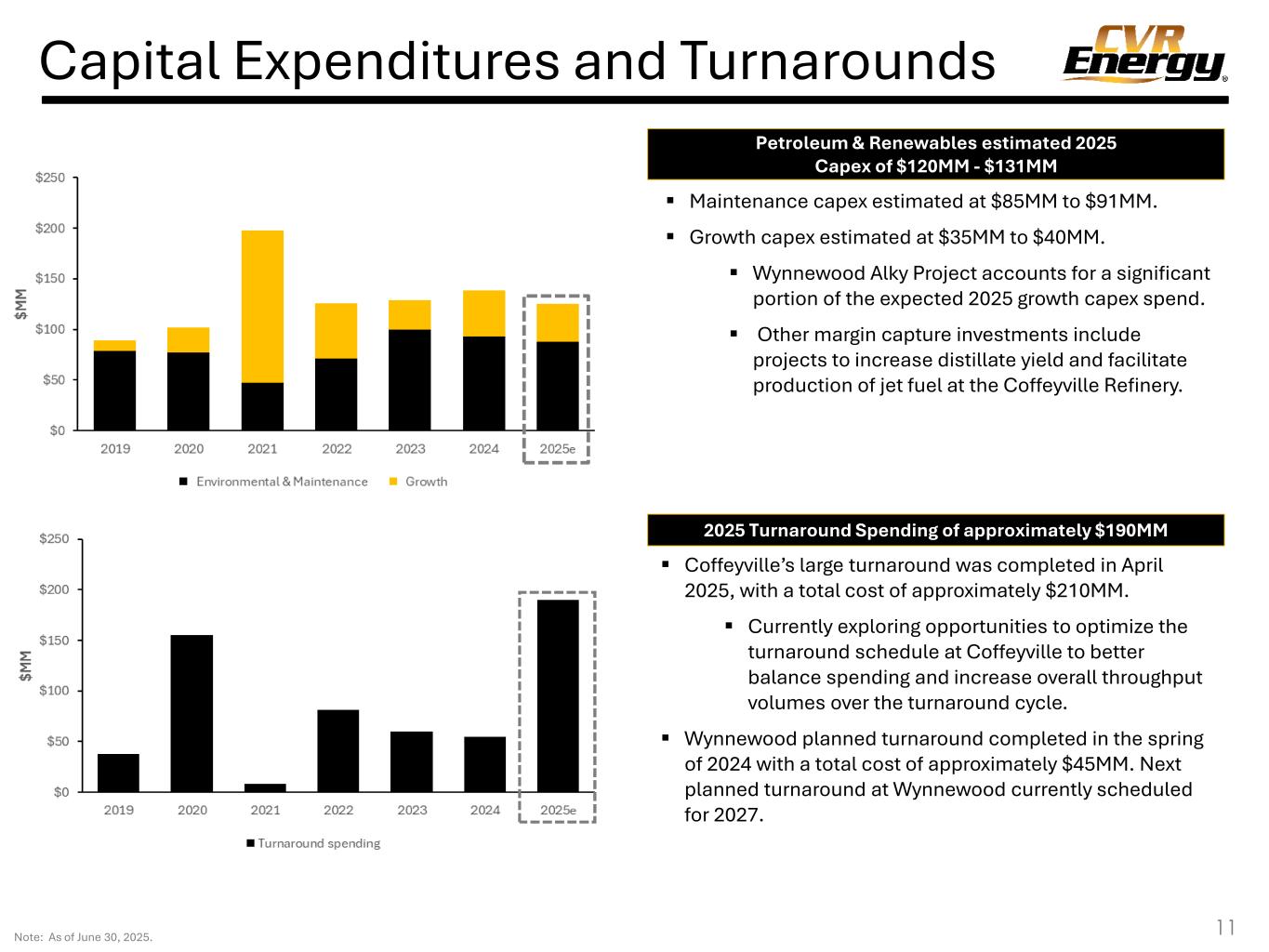

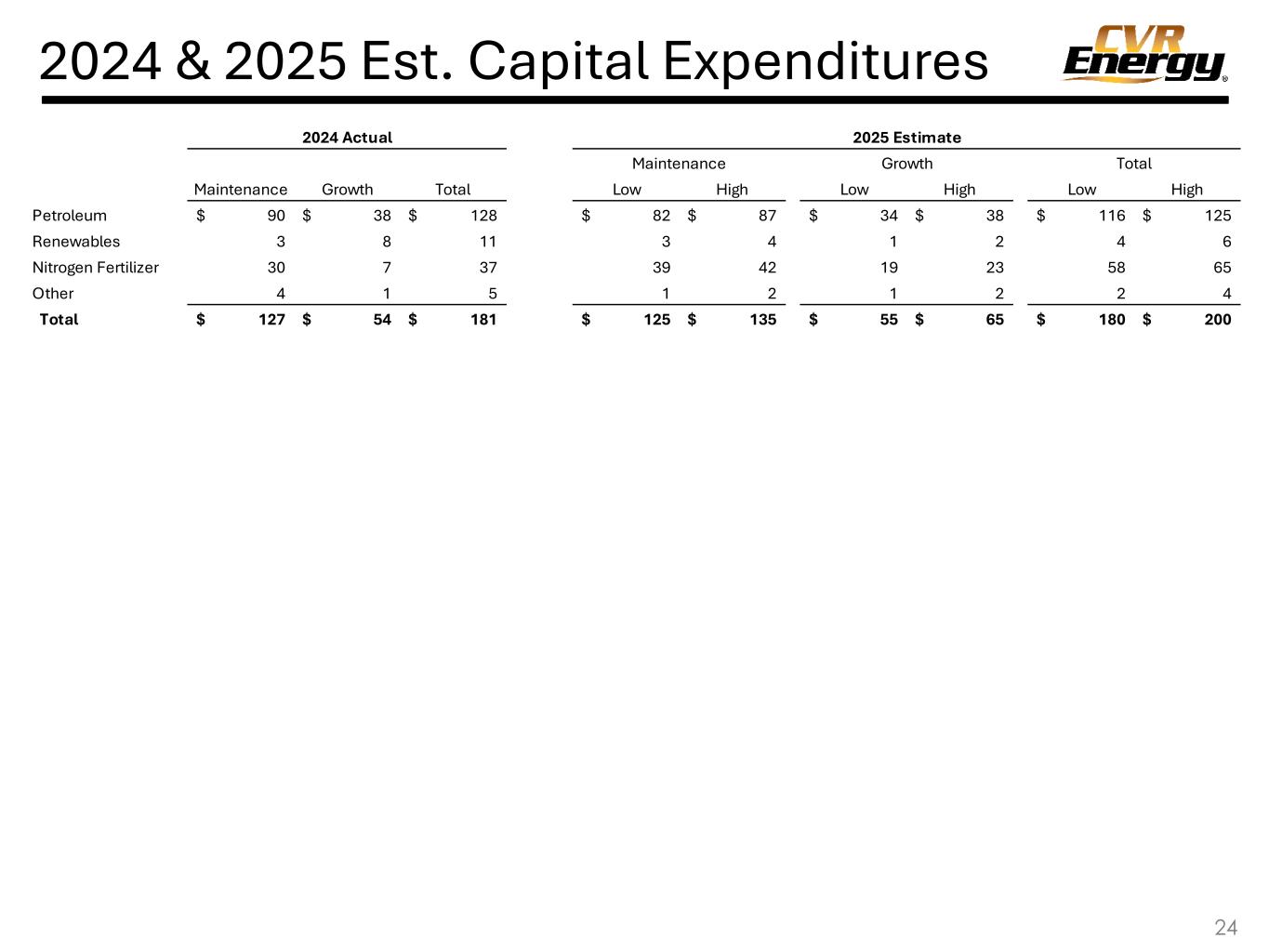

Capital Expenditures and Turnarounds 11Note: As of June 30, 2025. ▪ Maintenance capex estimated at $85MM to $91MM. ▪ Growth capex estimated at $35MM to $40MM. ▪ Wynnewood Alky Project accounts for a significant portion of the expected 2025 growth capex spend. ▪ Other margin capture investments include projects to increase distillate yield and facilitate production of jet fuel at the Coffeyville Refinery. ▪ Coffeyville’s large turnaround was completed in April 2025, with a total cost of approximately $210MM. ▪ Currently exploring opportunities to optimize the turnaround schedule at Coffeyville to better balance spending and increase overall throughput volumes over the turnaround cycle. ▪ Wynnewood planned turnaround completed in the spring of 2024 with a total cost of approximately $45MM. Next planned turnaround at Wynnewood currently scheduled for 2027. Petroleum & Renewables estimated 2025 Capex of $120MM - $131MM 2025 Turnaround Spending of approximately $190MM

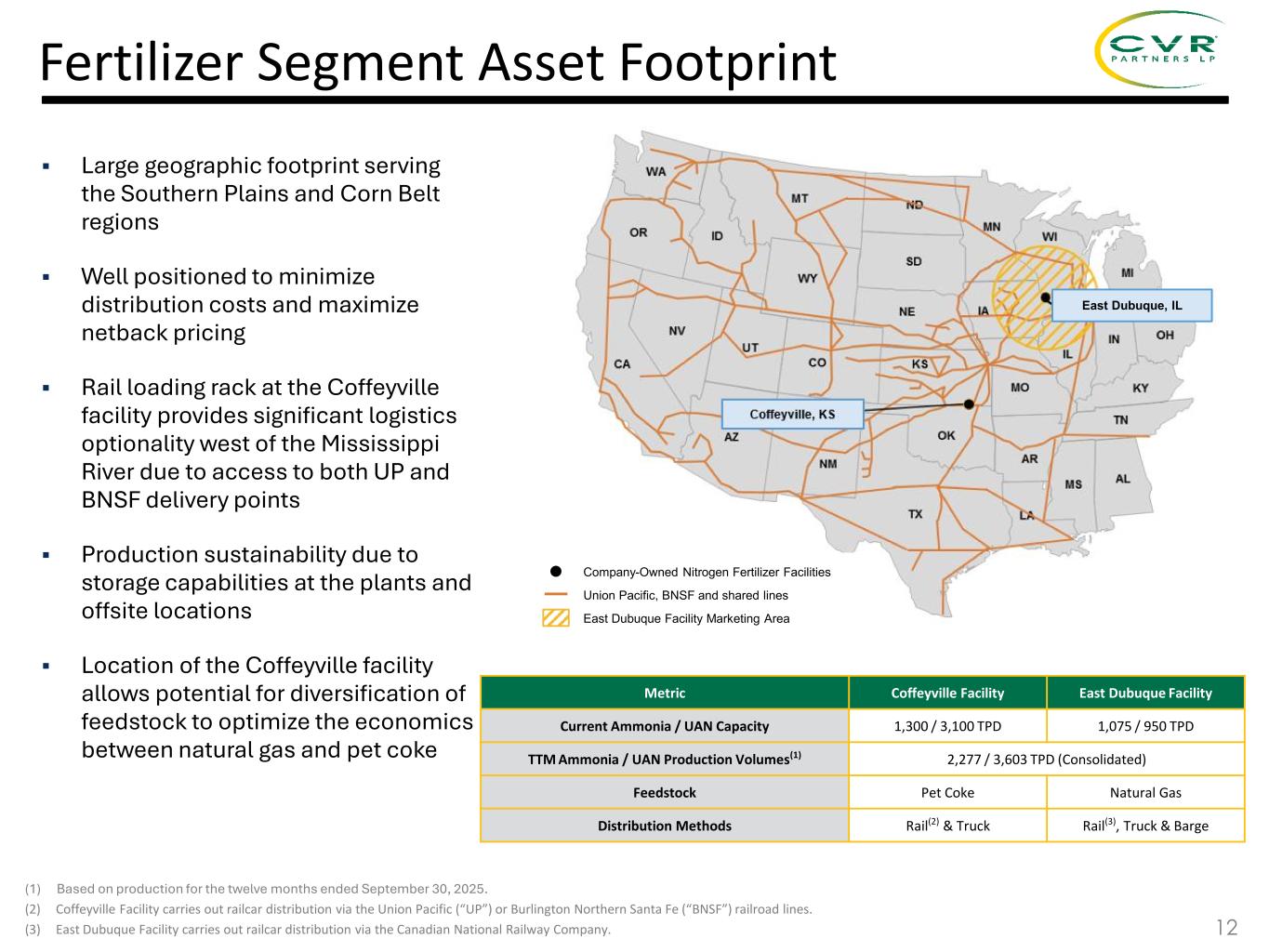

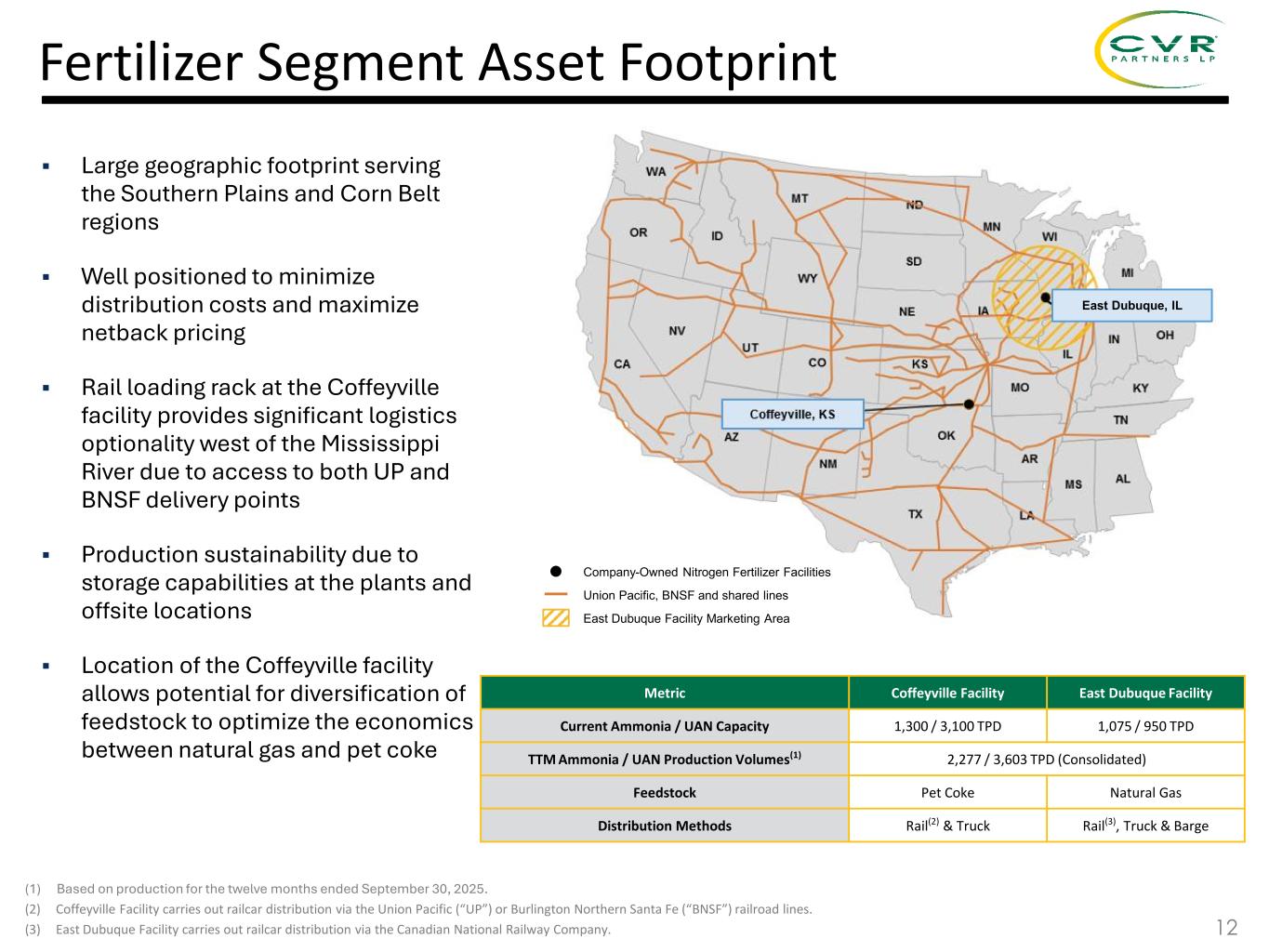

▪ Large geographic footprint serving the Southern Plains and Corn Belt regions ▪ Well positioned to minimize distribution costs and maximize netback pricing ▪ Rail loading rack at the Coffeyville facility provides significant logistics optionality west of the Mississippi River due to access to both UP and BNSF delivery points ▪ Production sustainability due to storage capabilities at the plants and offsite locations ▪ Location of the Coffeyville facility allows potential for diversification of feedstock to optimize the economics between natural gas and pet coke (1) Based on production for the twelve months ended September 30, 2025. (2) Coffeyville Facility carries out railcar distribution via the Union Pacific (“UP”) or Burlington Northern Santa Fe (“BNSF”) railroad lines. (3) East Dubuque Facility carries out railcar distribution via the Canadian National Railway Company. Union Pacific, BNSF and shared lines Company-Owned Nitrogen Fertilizer Facilities East Dubuque Facility Marketing Area Metric Coffeyville Facility East Dubuque Facility Current Ammonia / UAN Capacity 1,300 / 3,100 TPD 1,075 / 950 TPD TTM Ammonia / UAN Production Volumes(1) 2,277 / 3,603 TPD (Consolidated) Feedstock Pet Coke Natural Gas Distribution Methods Rail(2) & Truck Rail(3), Truck & Barge Fertilizer Segment Asset Footprint 12 East Dubuque, IL

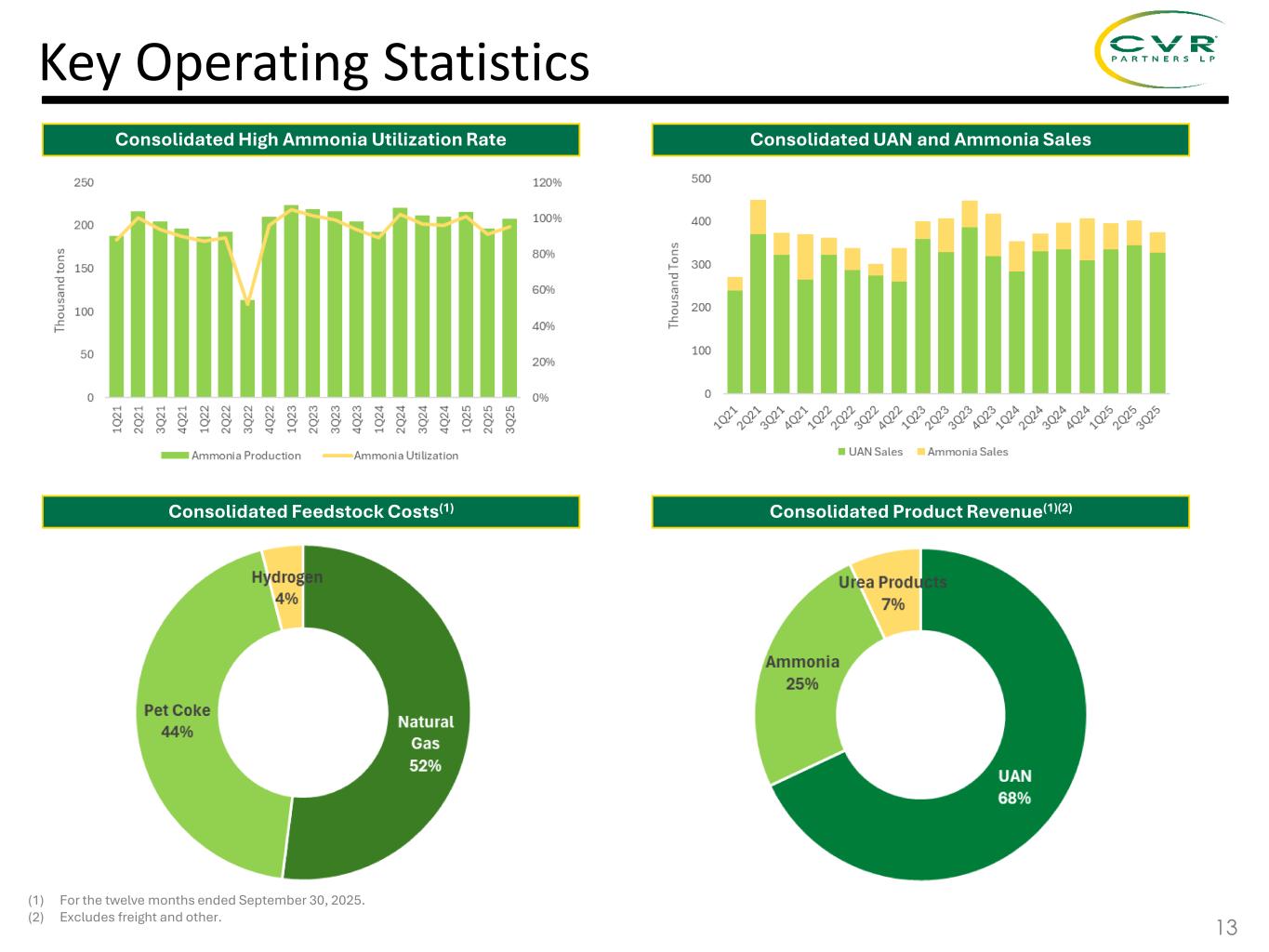

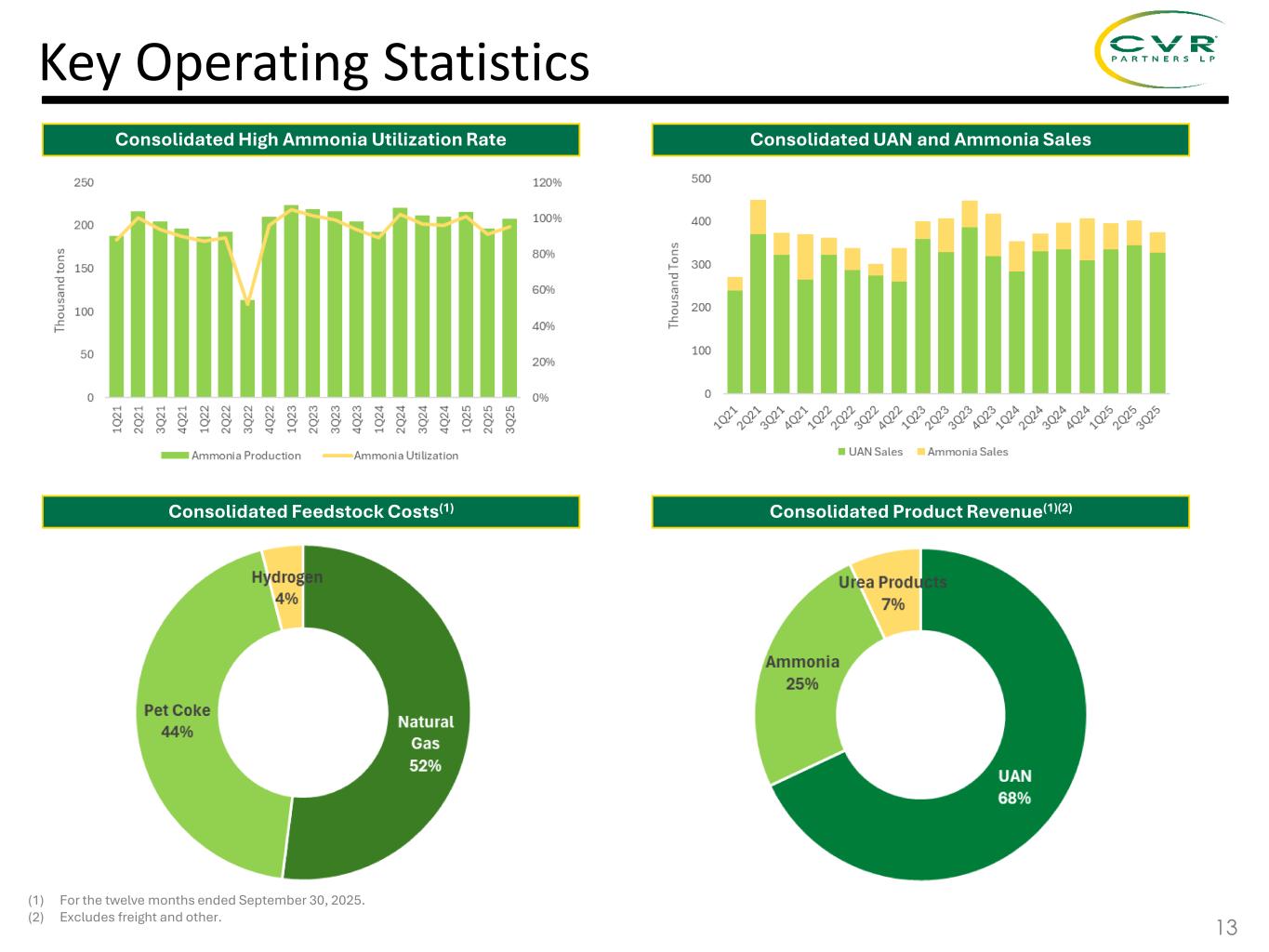

Consolidated High Ammonia Utilization Rate Consolidated UAN and Ammonia Sales Consolidated Feedstock Costs(1) (1) For the twelve months ended September 30, 2025. (2) Excludes freight and other. Key Operating Statistics Consolidated Product Revenue(1)(2) 13

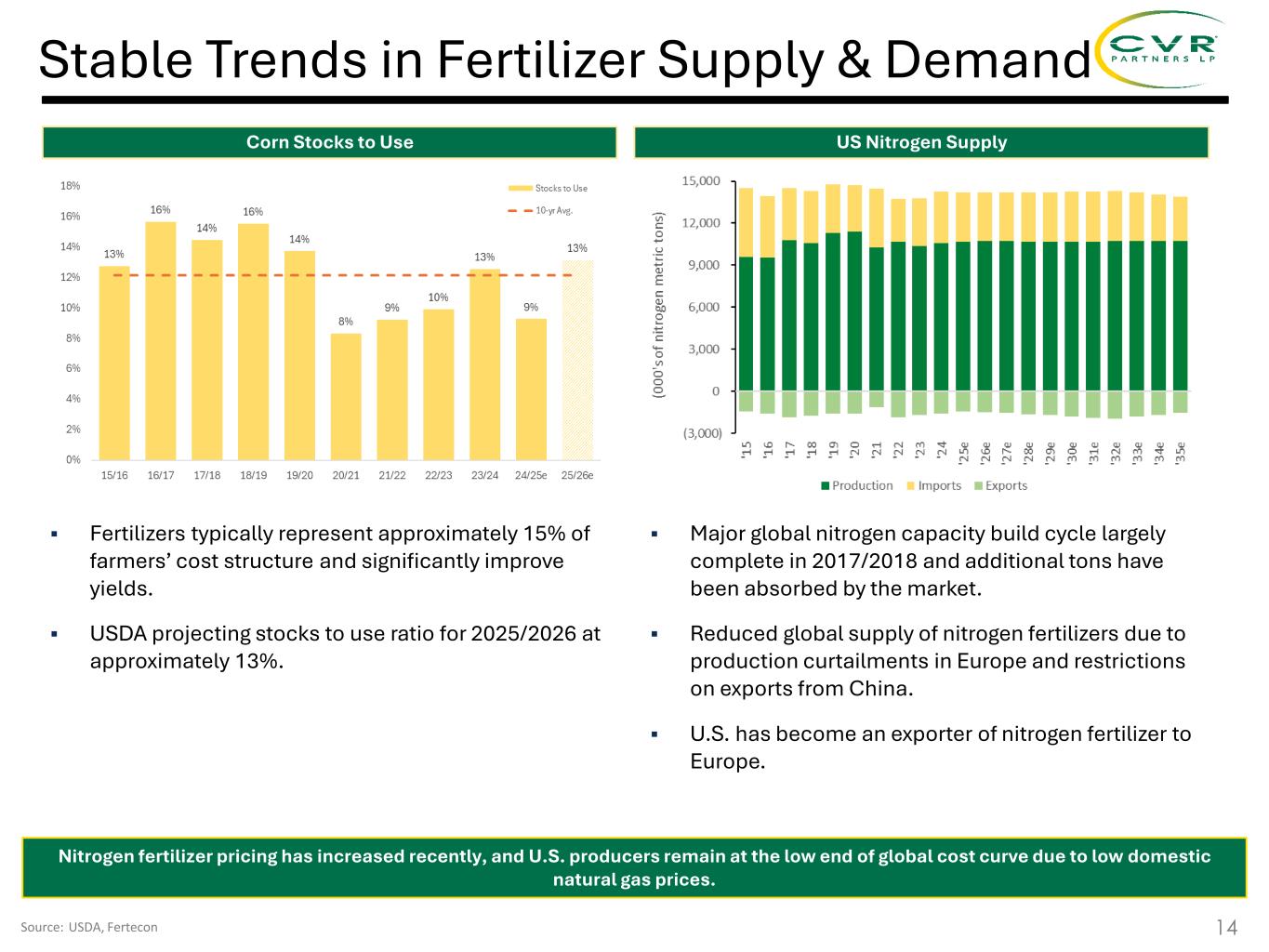

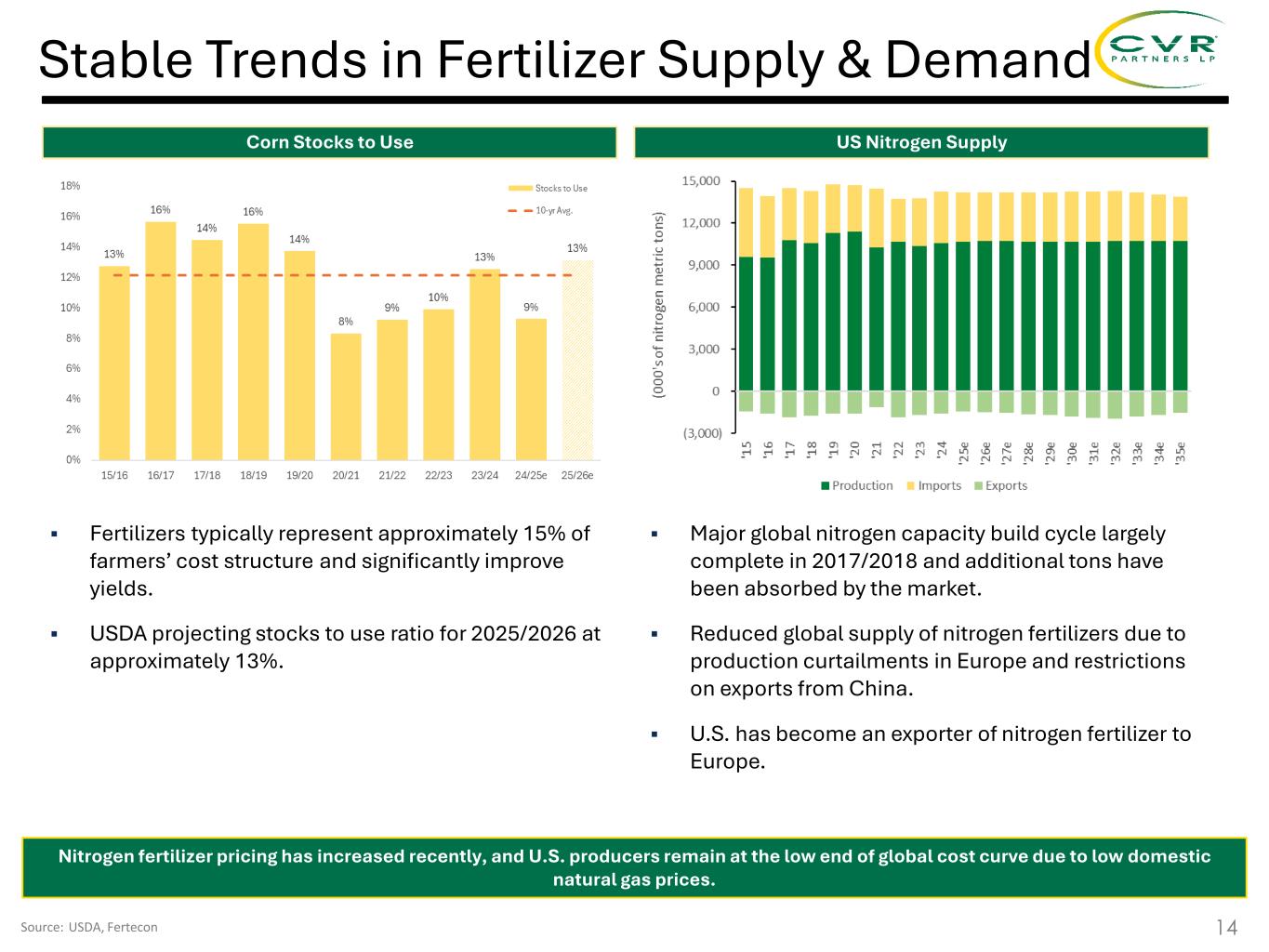

14 Stable Trends in Fertilizer Supply & Demand Source: USDA, Fertecon US Nitrogen SupplyCorn Stocks to Use ▪ Fertilizers typically represent approximately 15% of farmers’ cost structure and significantly improve yields. ▪ USDA projecting stocks to use ratio for 2025/2026 at approximately 13%. Nitrogen fertilizer pricing has increased recently, and U.S. producers remain at the low end of global cost curve due to low domestic natural gas prices. ▪ Major global nitrogen capacity build cycle largely complete in 2017/2018 and additional tons have been absorbed by the market. ▪ Reduced global supply of nitrogen fertilizers due to production curtailments in Europe and restrictions on exports from China. ▪ U.S. has become an exporter of nitrogen fertilizer to Europe.

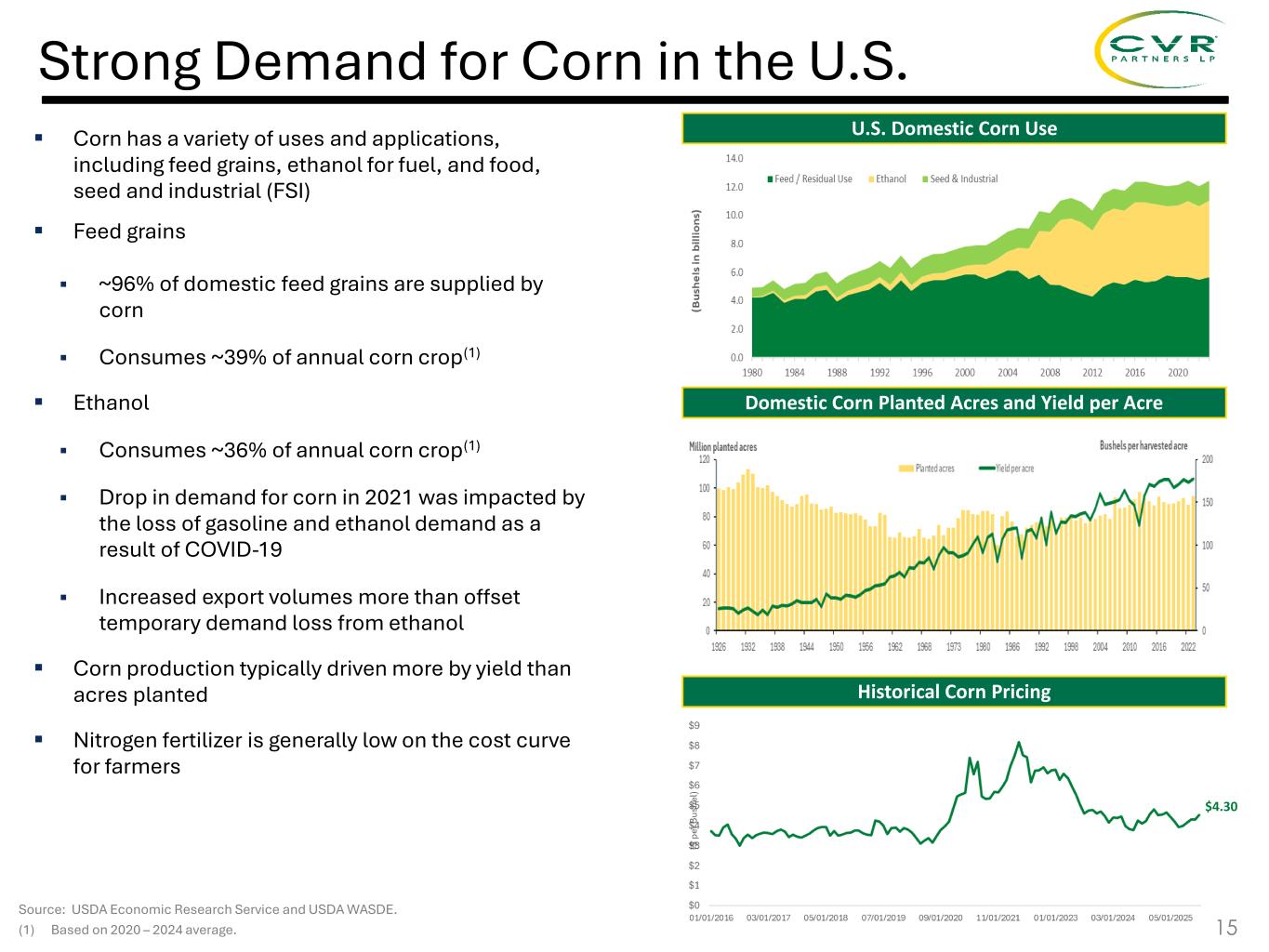

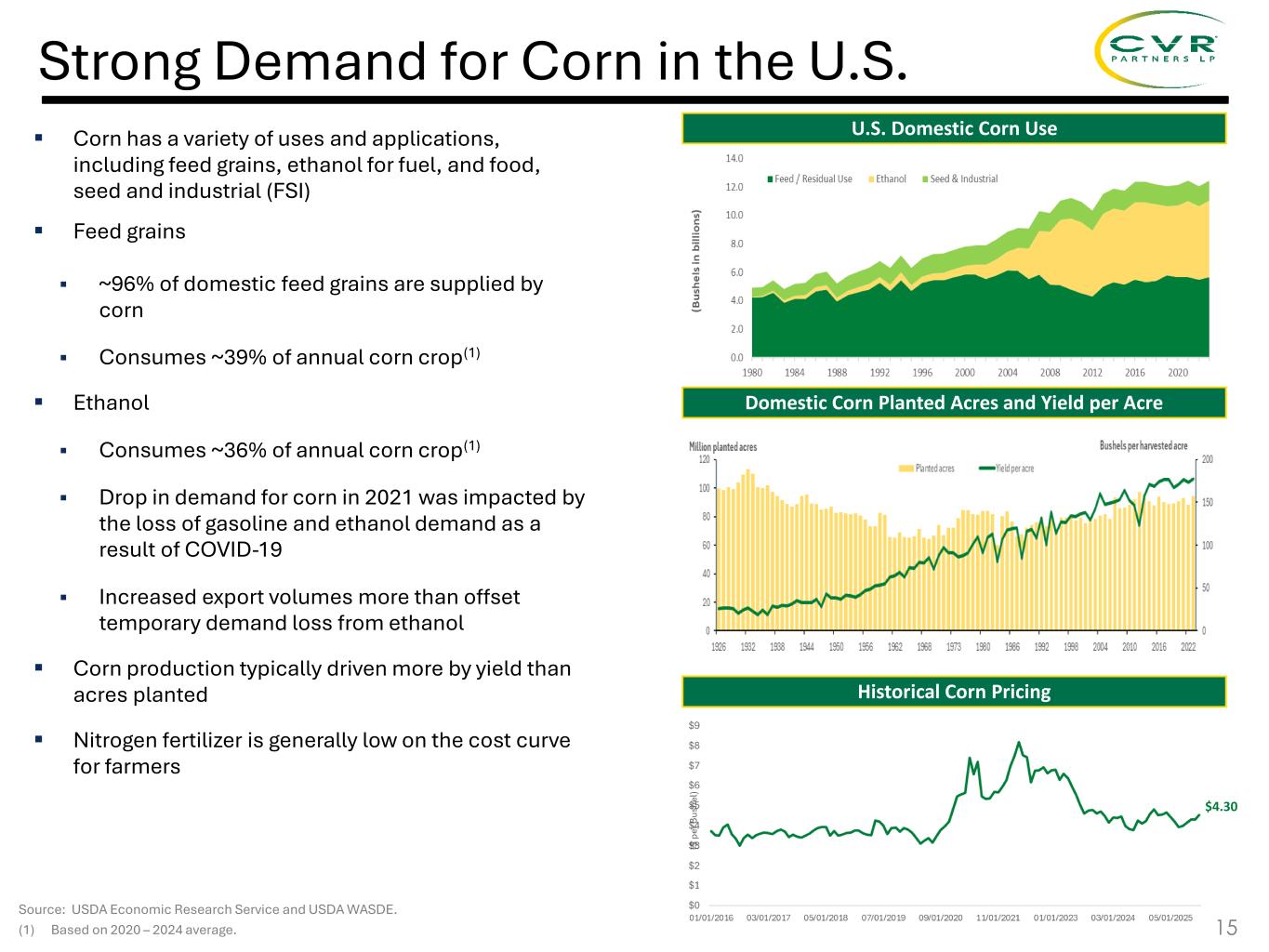

Strong Demand for Corn in the U.S. Source: USDA Economic Research Service and USDA WASDE. (1) Based on 2020 – 2024 average. 15 ▪ Corn has a variety of uses and applications, including feed grains, ethanol for fuel, and food, seed and industrial (FSI) ▪ Feed grains ▪ ~96% of domestic feed grains are supplied by corn ▪ Consumes ~39% of annual corn crop(1) ▪ Ethanol ▪ Consumes ~36% of annual corn crop(1) ▪ Drop in demand for corn in 2021 was impacted by the loss of gasoline and ethanol demand as a result of COVID-19 ▪ Increased export volumes more than offset temporary demand loss from ethanol ▪ Corn production typically driven more by yield than acres planted ▪ Nitrogen fertilizer is generally low on the cost curve for farmers U.S. Domestic Corn Use Domestic Corn Planted Acres and Yield per Acre Historical Corn Pricing $4.30

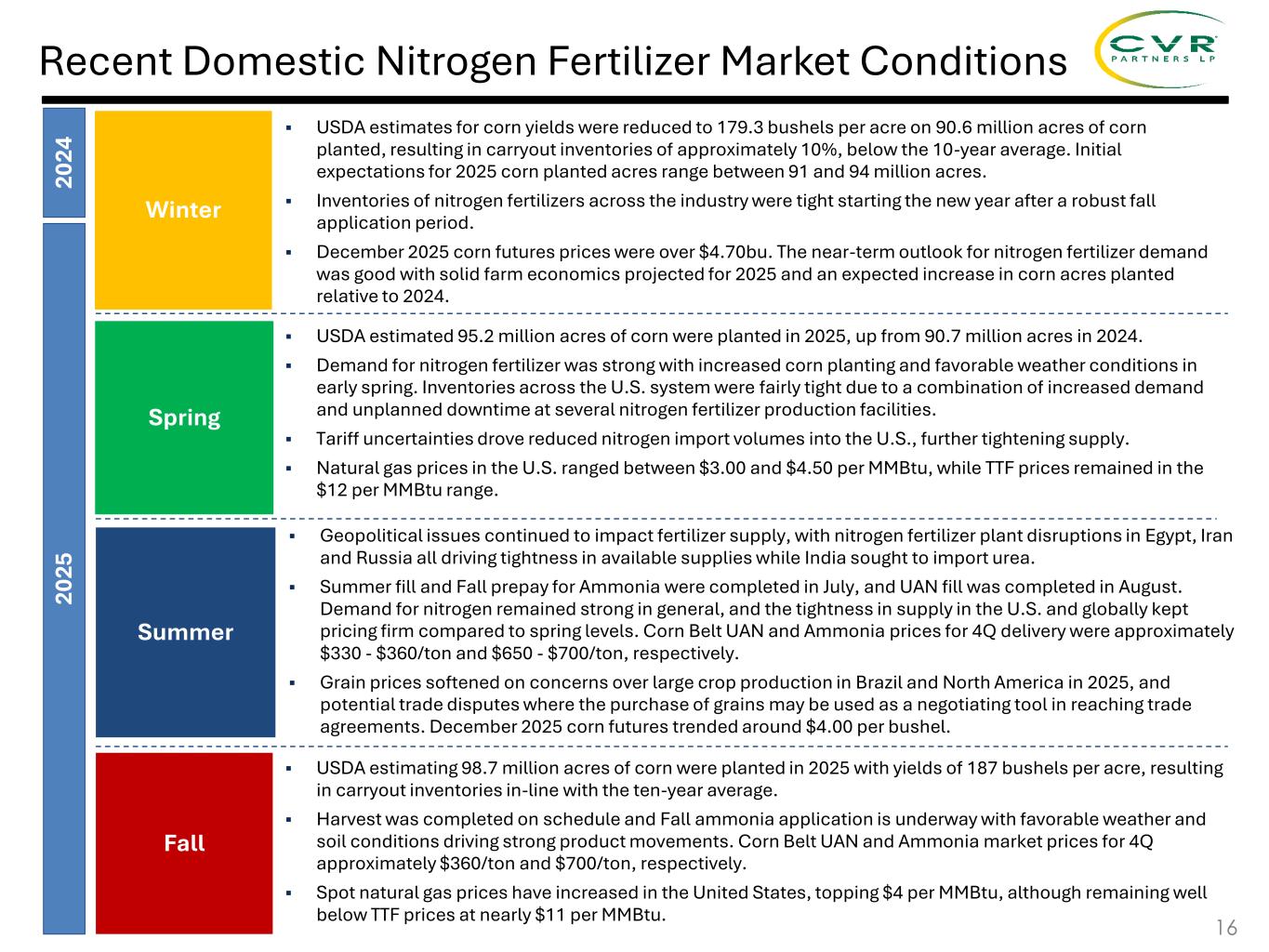

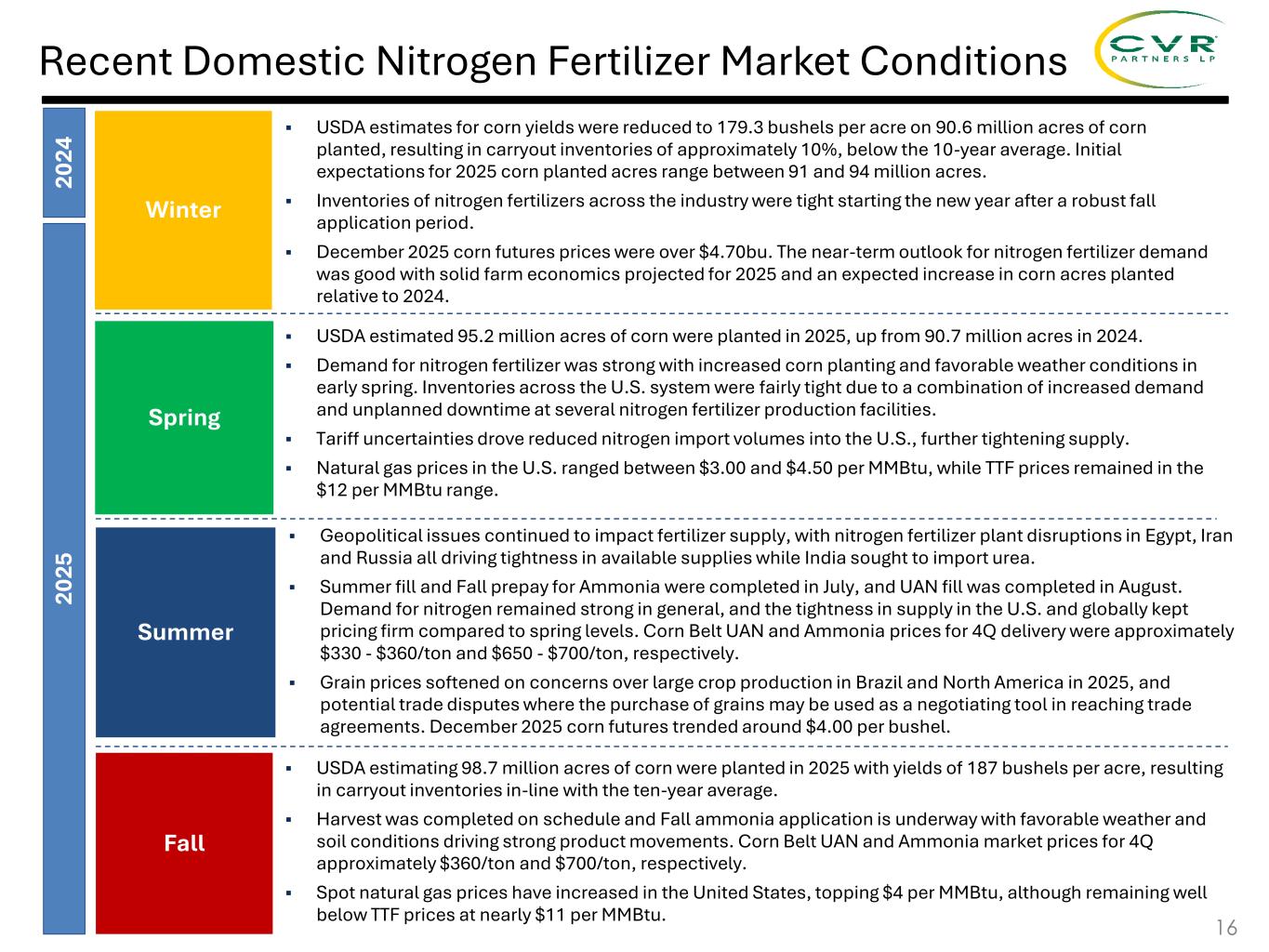

▪ USDA estimated 95.2 million acres of corn were planted in 2025, up from 90.7 million acres in 2024. ▪ Demand for nitrogen fertilizer was strong with increased corn planting and favorable weather conditions in early spring. Inventories across the U.S. system were fairly tight due to a combination of increased demand and unplanned downtime at several nitrogen fertilizer production facilities. ▪ Tariff uncertainties drove reduced nitrogen import volumes into the U.S., further tightening supply. ▪ Natural gas prices in the U.S. ranged between $3.00 and $4.50 per MMBtu, while TTF prices remained in the $12 per MMBtu range. ▪ USDA estimating 98.7 million acres of corn were planted in 2025 with yields of 187 bushels per acre, resulting in carryout inventories in-line with the ten-year average. ▪ Harvest was completed on schedule and Fall ammonia application is underway with favorable weather and soil conditions driving strong product movements. Corn Belt UAN and Ammonia market prices for 4Q approximately $360/ton and $700/ton, respectively. ▪ Spot natural gas prices have increased in the United States, topping $4 per MMBtu, although remaining well below TTF prices at nearly $11 per MMBtu. ▪ USDA estimates for corn yields were reduced to 179.3 bushels per acre on 90.6 million acres of corn planted, resulting in carryout inventories of approximately 10%, below the 10-year average. Initial expectations for 2025 corn planted acres range between 91 and 94 million acres. ▪ Inventories of nitrogen fertilizers across the industry were tight starting the new year after a robust fall application period. ▪ December 2025 corn futures prices were over $4.70bu. The near-term outlook for nitrogen fertilizer demand was good with solid farm economics projected for 2025 and an expected increase in corn acres planted relative to 2024. ▪ Geopolitical issues continued to impact fertilizer supply, with nitrogen fertilizer plant disruptions in Egypt, Iran and Russia all driving tightness in available supplies while India sought to import urea. ▪ Summer fill and Fall prepay for Ammonia were completed in July, and UAN fill was completed in August. Demand for nitrogen remained strong in general, and the tightness in supply in the U.S. and globally kept pricing firm compared to spring levels. Corn Belt UAN and Ammonia prices for 4Q delivery were approximately $330 - $360/ton and $650 - $700/ton, respectively. ▪ Grain prices softened on concerns over large crop production in Brazil and North America in 2025, and potential trade disputes where the purchase of grains may be used as a negotiating tool in reaching trade agreements. December 2025 corn futures trended around $4.00 per bushel. 20 25 Recent Domestic Nitrogen Fertilizer Market Conditions 20 24 Summer Spring 16 Winter Fall

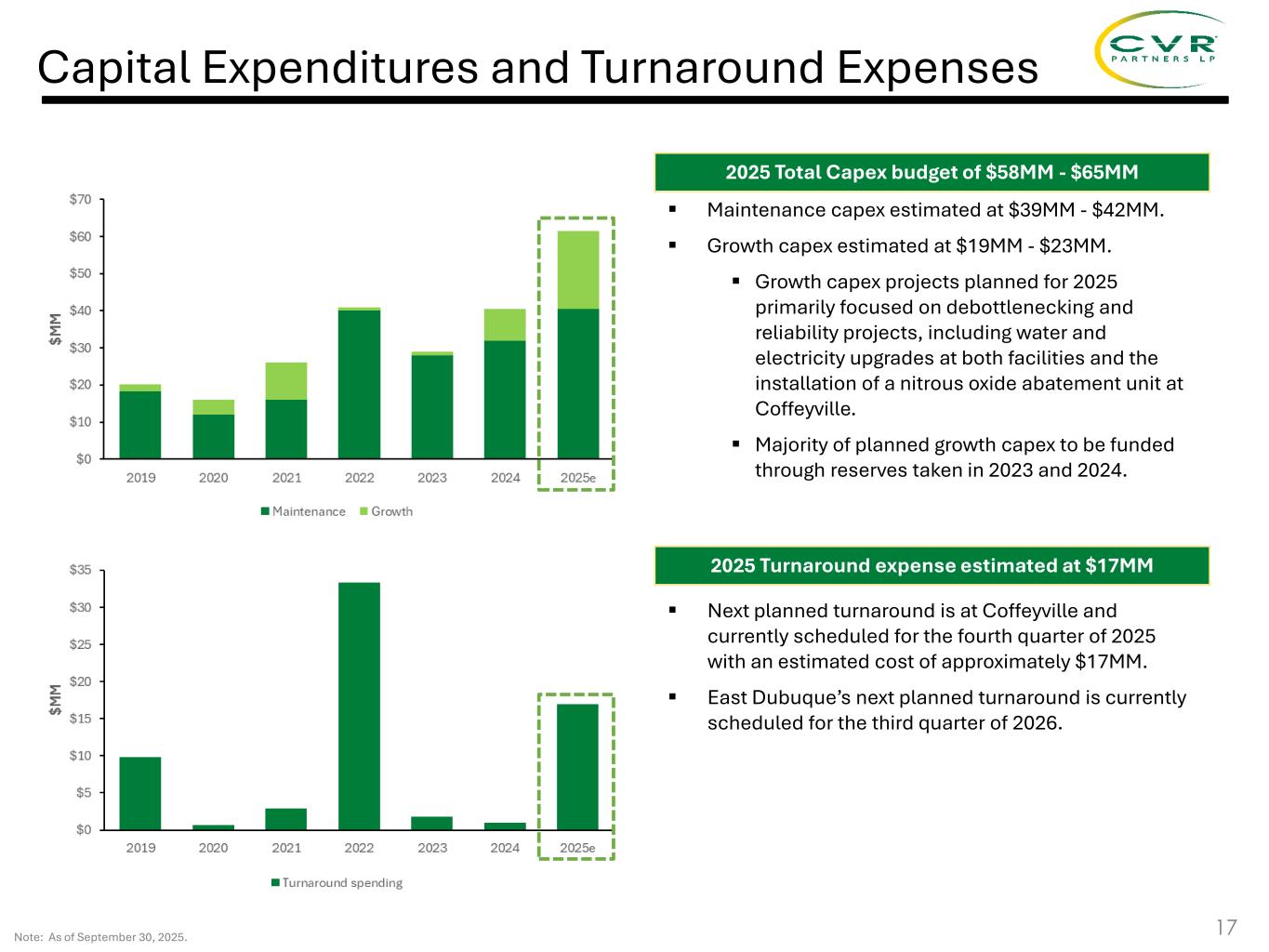

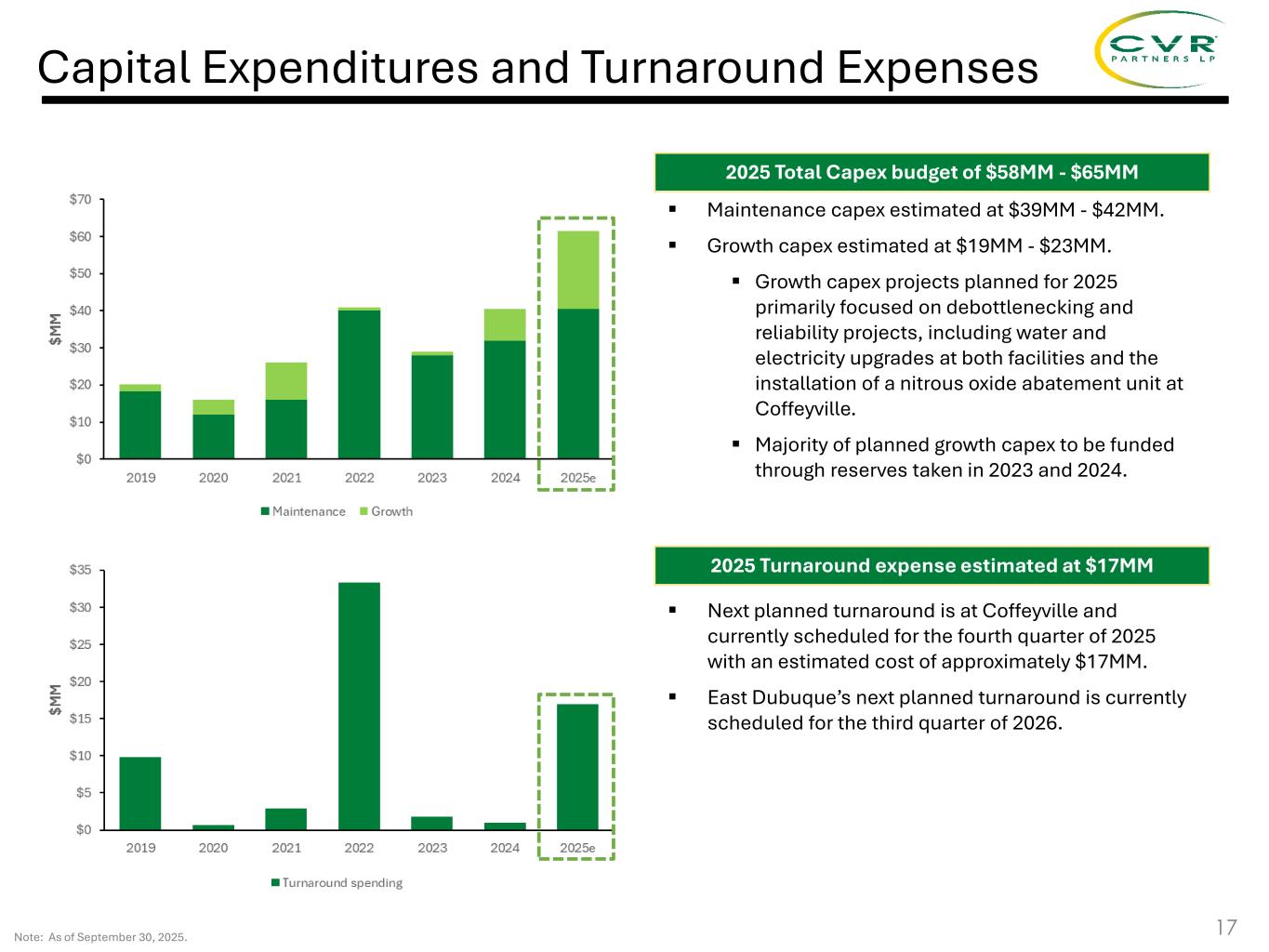

Capital Expenditures and Turnaround Expenses 17 ▪ Maintenance capex estimated at $39MM - $42MM. ▪ Growth capex estimated at $19MM - $23MM. ▪ Growth capex projects planned for 2025 primarily focused on debottlenecking and reliability projects, including water and electricity upgrades at both facilities and the installation of a nitrous oxide abatement unit at Coffeyville. ▪ Majority of planned growth capex to be funded through reserves taken in 2023 and 2024. ▪ Next planned turnaround is at Coffeyville and currently scheduled for the fourth quarter of 2025 with an estimated cost of approximately $17MM. ▪ East Dubuque’s next planned turnaround is currently scheduled for the third quarter of 2026. 2025 Total Capex budget of $58MM - $65MM 2025 Turnaround expense estimated at $17MM Note: As of September 30, 2025.

APPENDIX

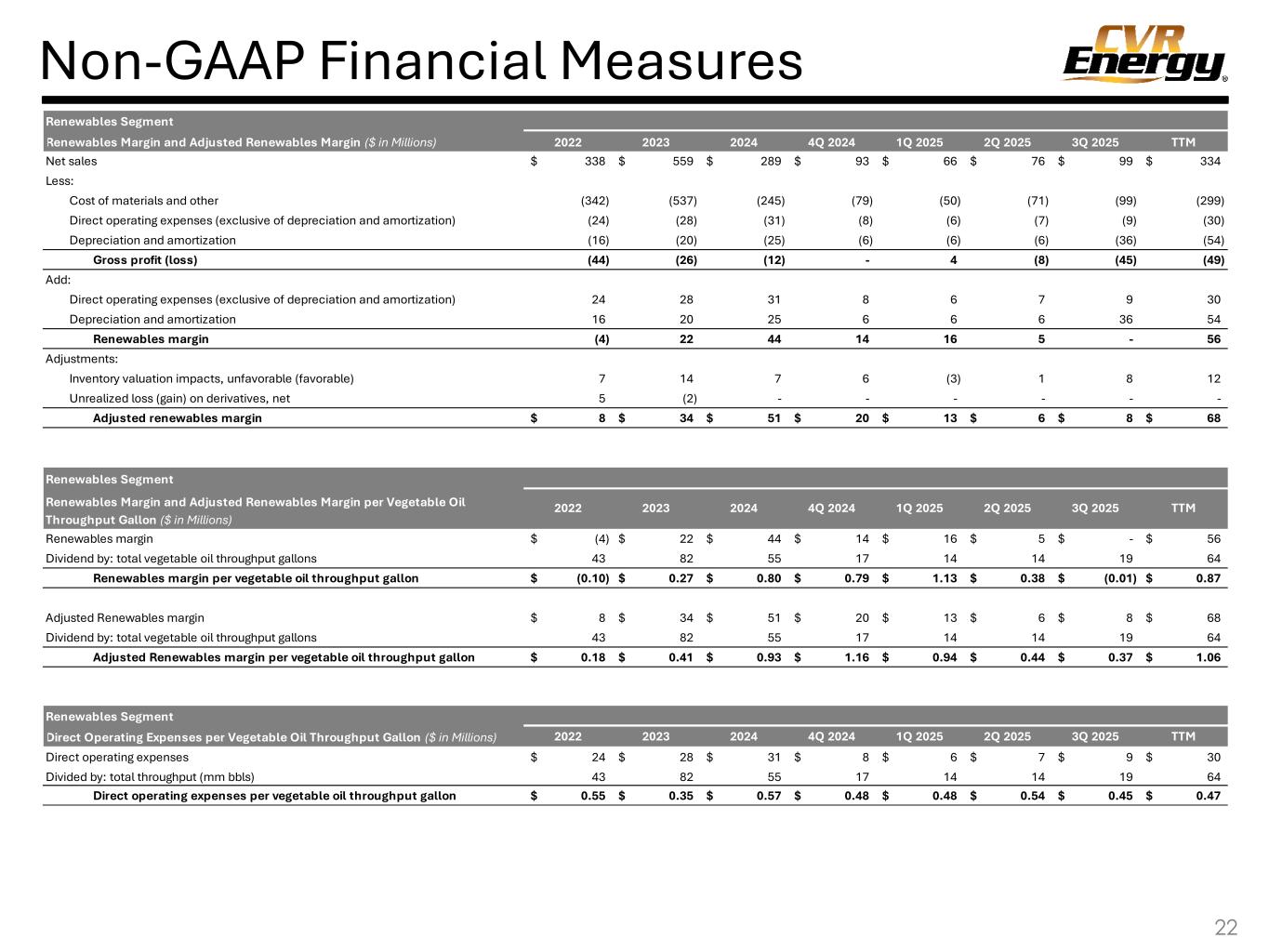

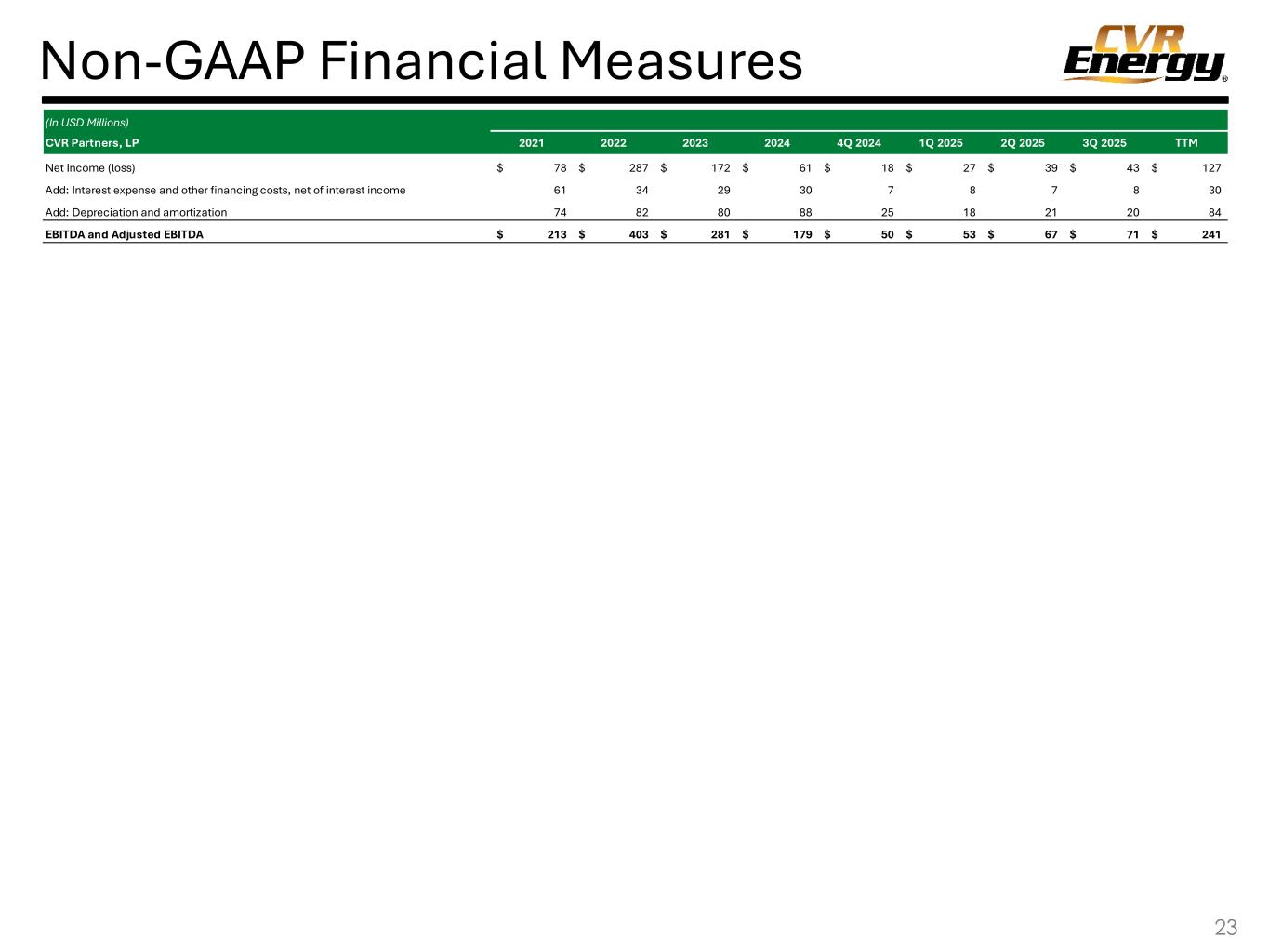

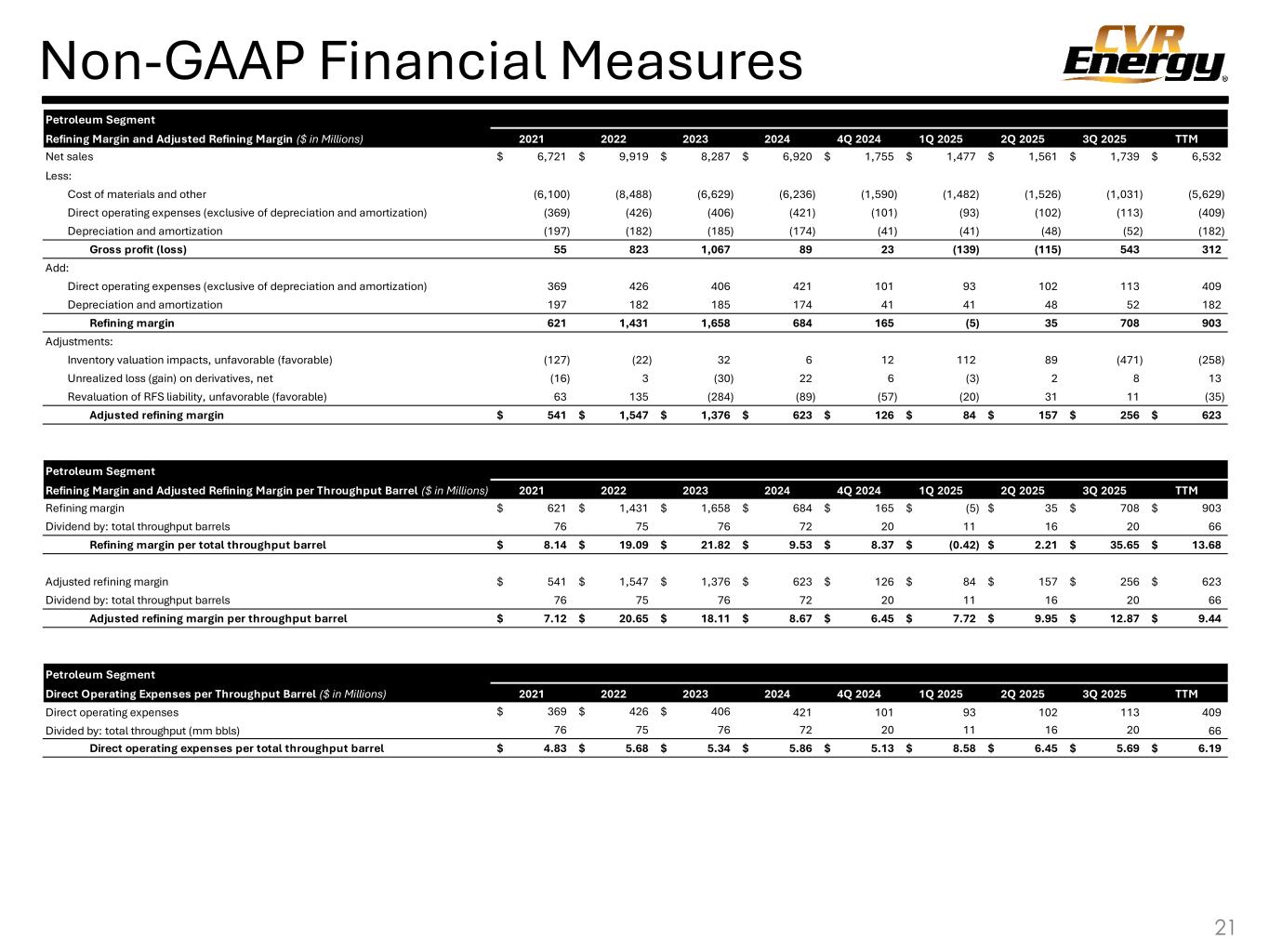

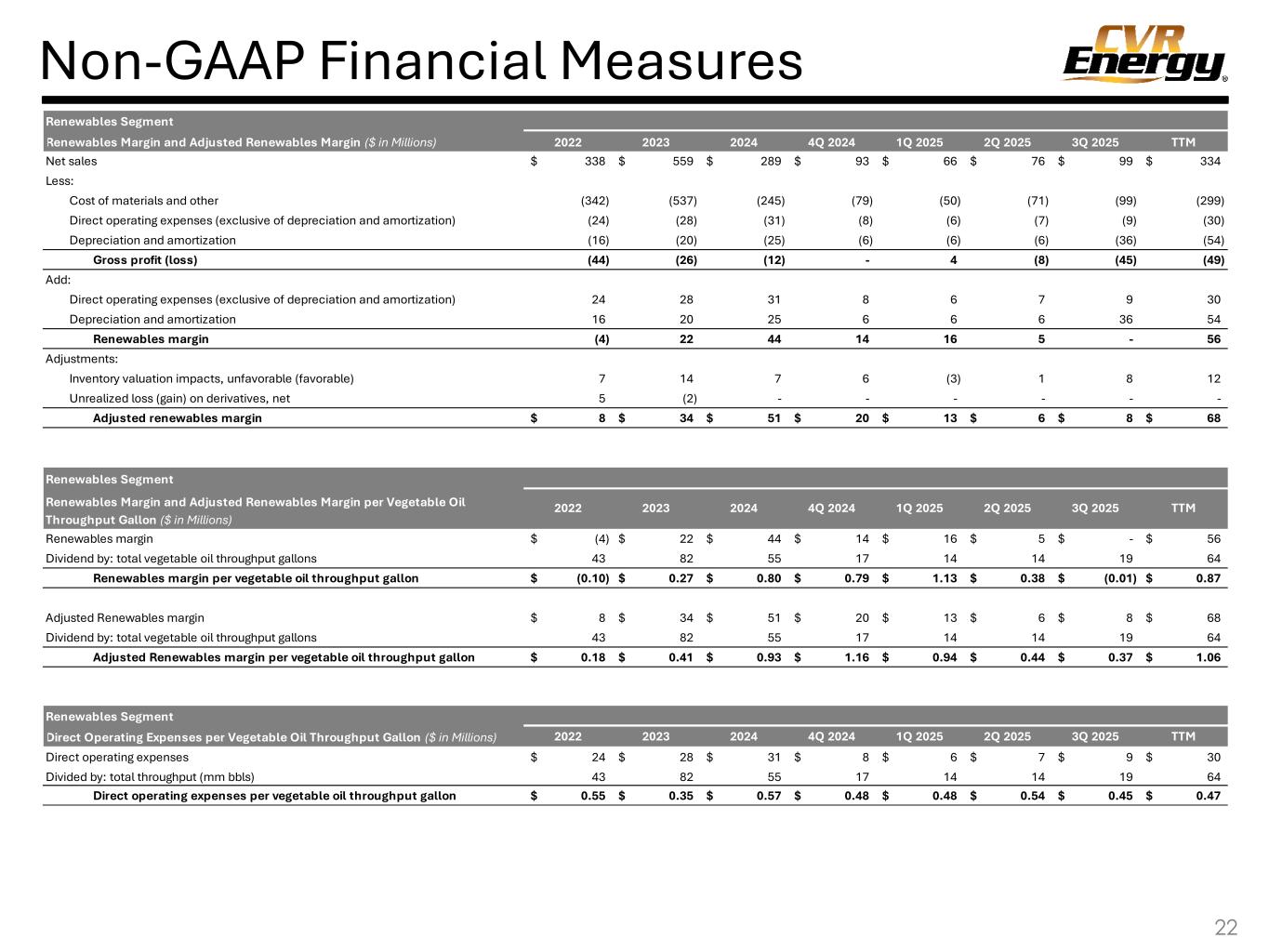

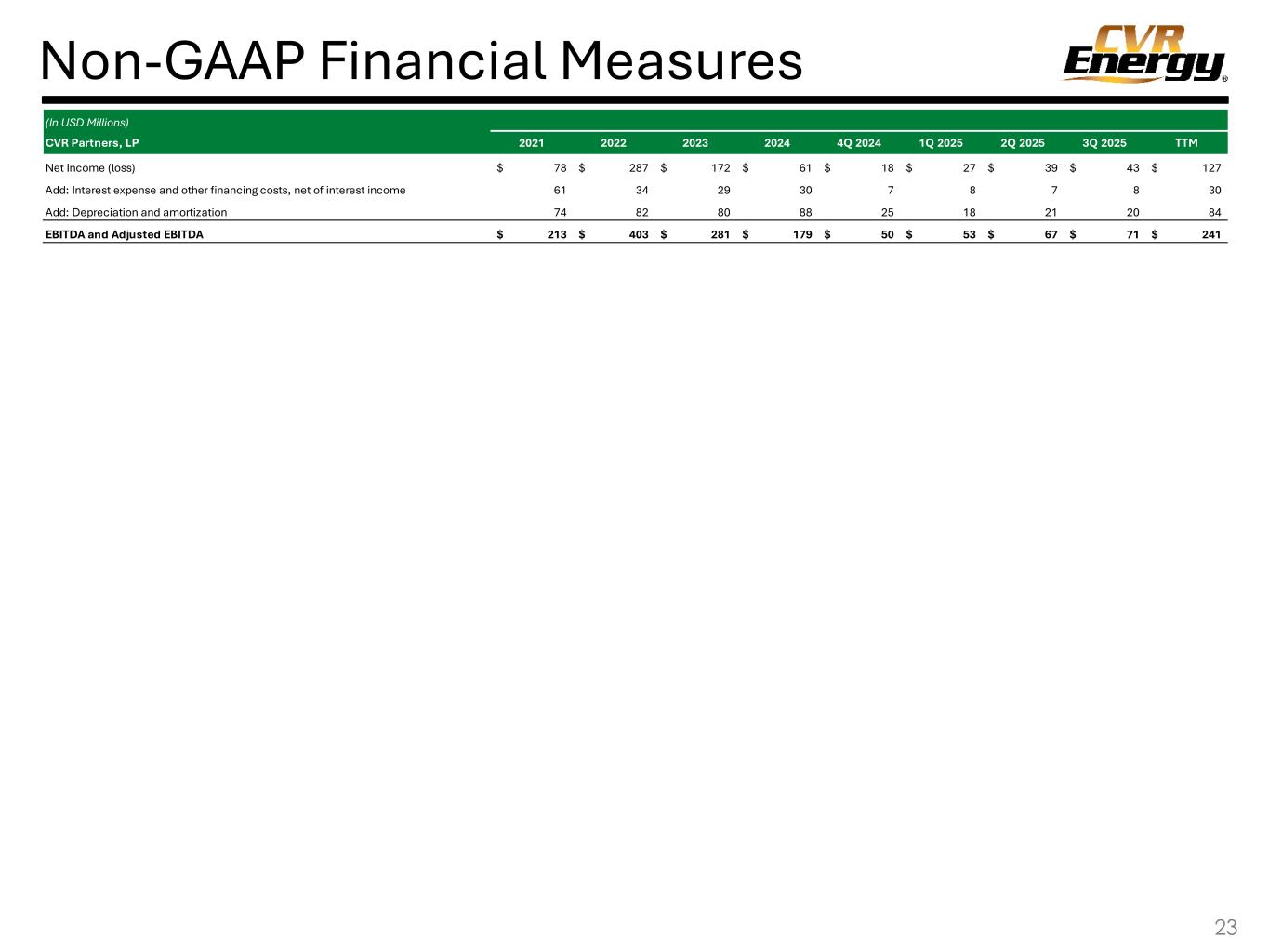

19 Adjusted EBITDA represents EBITDA adjusted for certain significant noncash items and items that management believes are not attributable to or indicative of our on-going operations or that may obscure our underlying results and trends. Adjusted Refining Margin and Adjusted Renewables Margin represents Refining Margin and Renewables Margin adjusted for certain significant non- cash items and items that management believes are not attributable to or indicative of our underlying operational results of the period or that may obscure results and trends we deem useful. Direct Operating Expenses per Throughput Barrel represents direct operating expenses for the Company’s Petroleum segment divided by total throughput barrels for the period, which is calculated as total throughput barrels per day times the number of days in the period. Direct Operating Expenses per Vegetable Oil Throughput Gallon represents direct operating expenses for the Company’s Renewables segment divided by total vegetable oil throughput gallons for the period, which is calculated as total vegetable oil throughput gallons per day times the number of days in the period. EBITDA represents net income (loss) before (i) interest expense, net, (ii) income tax expense (benefit) and (iii) depreciation and amortization expense. Refining Margin represents the difference between the Company’s Petroleum segment net sales and cost of materials and other. Refining Margin and Adjusted Refining Margin per Throughput Barrel represents Refining Margin and Adjusted Refining Margin divided by the total throughput barrels for the period, which is calculated as total throughput barrels per day times the number of days in the period. Renewables Margin represents the difference between the Company’s Renewables segment net sales and cost of materials and other. Renewables Margin and Adjusted Renewables Margin per Vegetable Oil Throughput Gallon represents Renewables Margin and Adjusted Renewables Margin divided by the total vegetable oil throughput gallons for the period, which is calculated as total vegetable oil throughput gallons per day times the number of days in the period. Note: Due to rounding, numbers presented within this section may not add or equal to numbers or totals presented elsewhere within this document. Non-GAAP Financial Measures

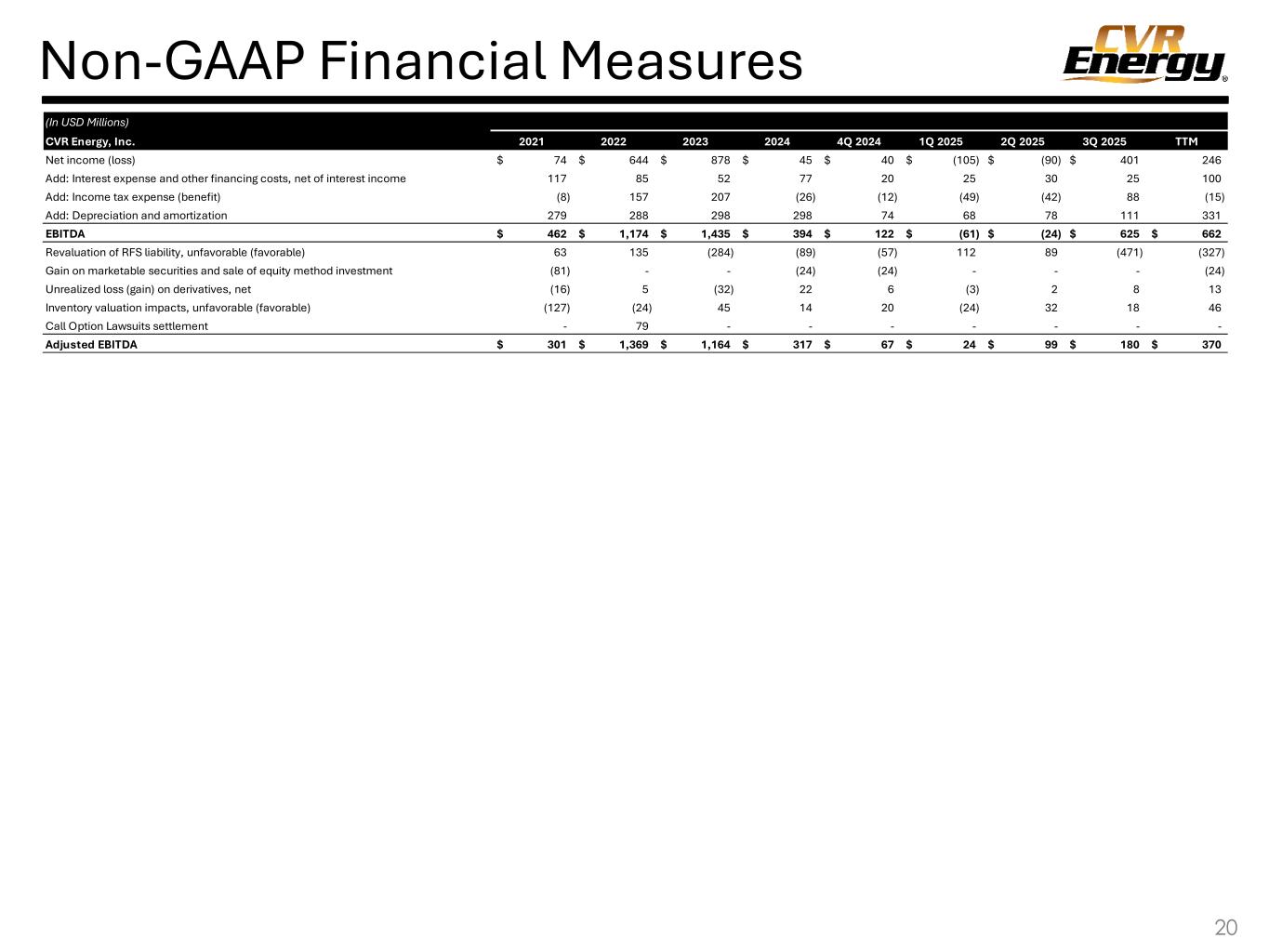

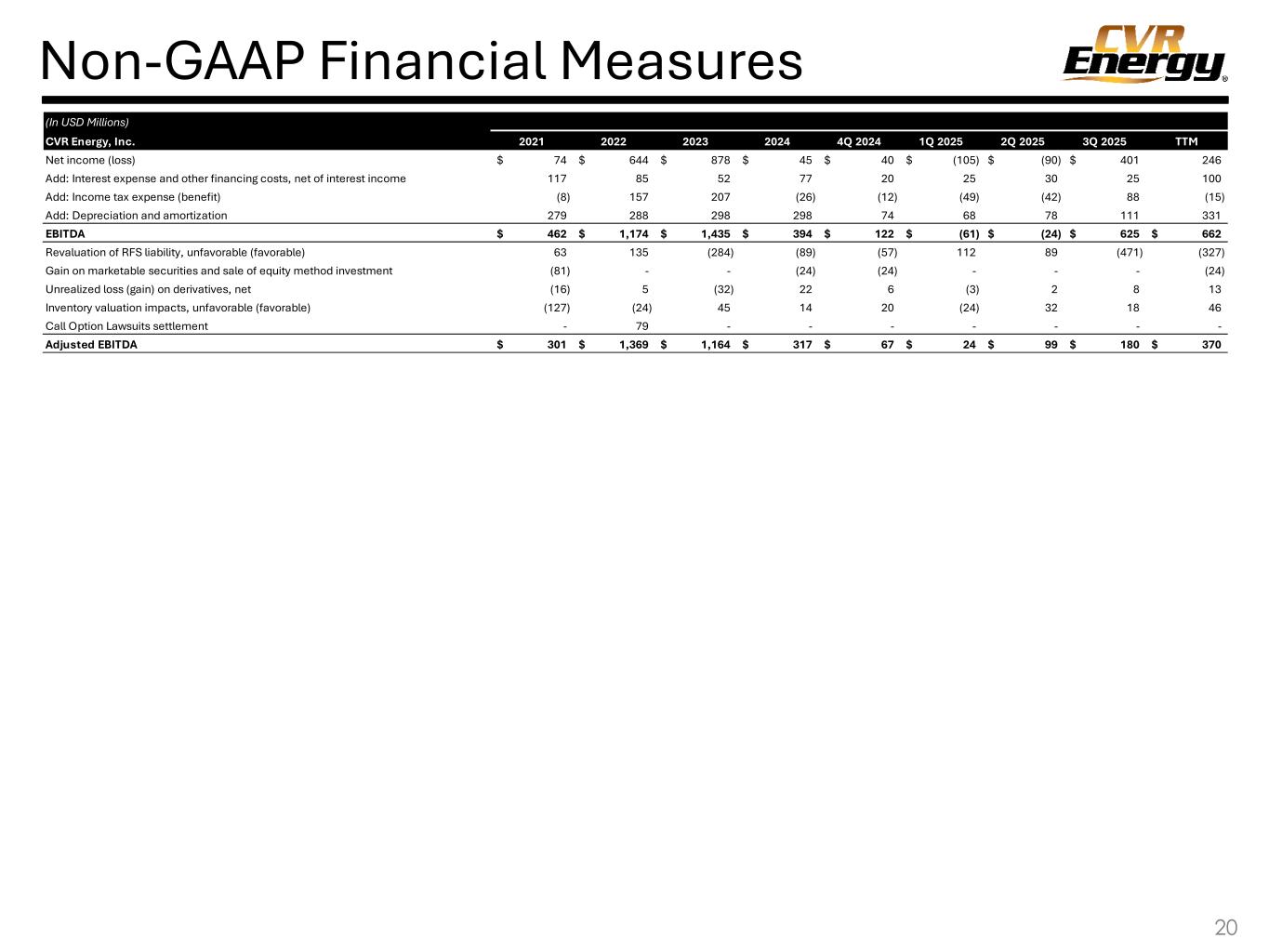

Non-GAAP Financial Measures 20 (In USD Millions) CVR Energy, Inc. 2021 2022 2023 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 TTM Net income (loss) 74$ 644$ 878$ 45$ 40$ (105)$ (90)$ 401$ 246 Add: Interest expense and other financing costs, net of interest income 117 85 52 77 20 25 30 25 100 Add: Income tax expense (benefit) (8) 157 207 (26) (12) (49) (42) 88 (15) Add: Depreciation and amortization 279 288 298 298 74 68 78 111 331 EBITDA 462$ 1,174$ 1,435$ 394$ 122$ (61)$ (24)$ 625$ 662$ Revaluation of RFS liability, unfavorable (favorable) 63 135 (284) (89) (57) 112 89 (471) (327) Gain on marketable securities and sale of equity method investment (81) - - (24) (24) - - - (24) Unrealized loss (gain) on derivatives, net (16) 5 (32) 22 6 (3) 2 8 13 Inventory valuation impacts, unfavorable (favorable) (127) (24) 45 14 20 (24) 32 18 46 Call Option Lawsuits settlement - 79 - - - - - - - Adjusted EBITDA 301$ 1,369$ 1,164$ 317$ 67$ 24$ 99$ 180$ 370$

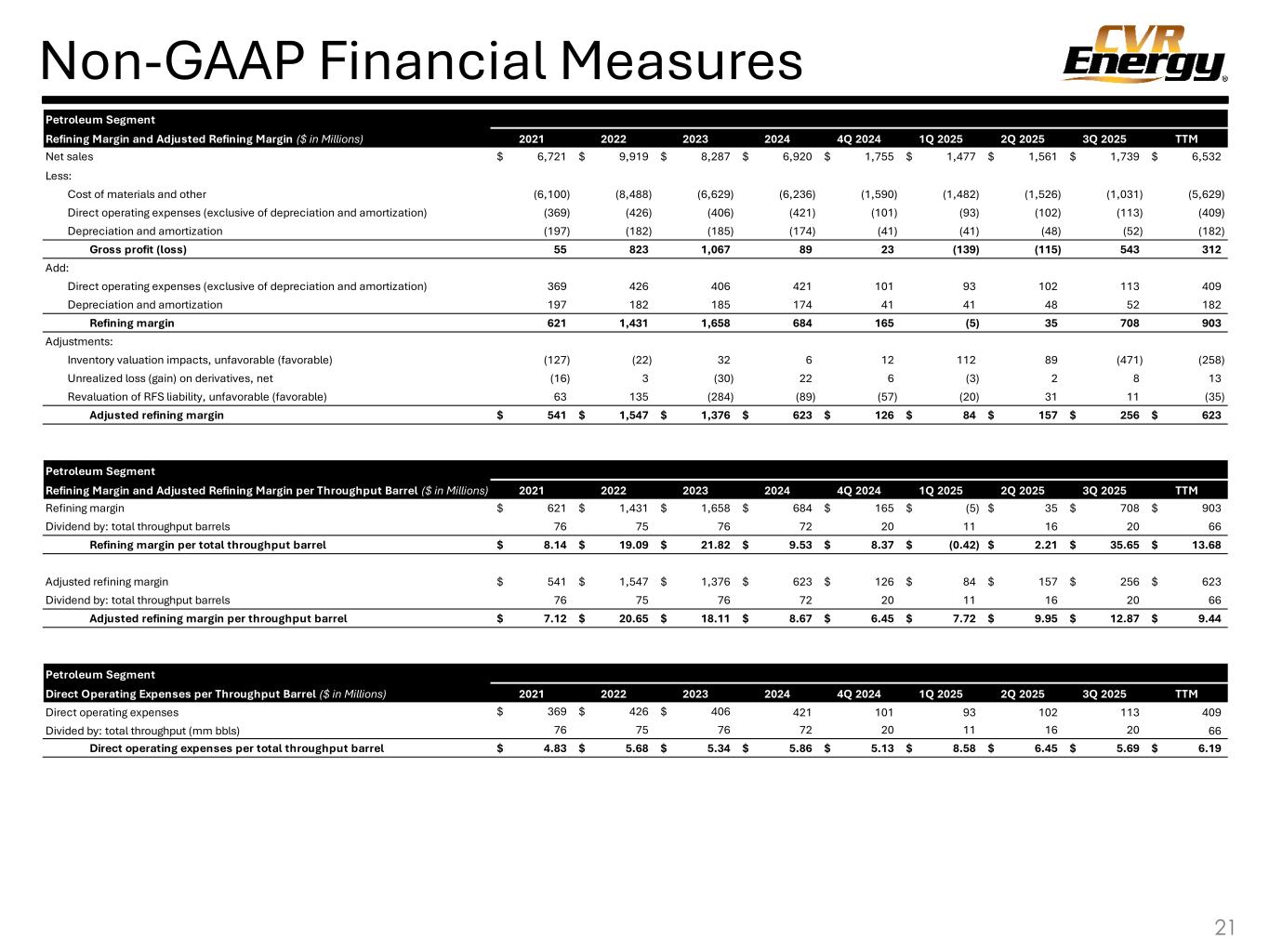

Non-GAAP Financial Measures 21 Petroleum Segment Refining Margin and Adjusted Refining Margin ($ in Millions) 2021 2022 2023 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 TTM Net sales 6,721$ 9,919$ 8,287$ 6,920$ 1,755$ 1,477$ 1,561$ 1,739$ 6,532$ Less: Cost of materials and other (6,100) (8,488) (6,629) (6,236) (1,590) (1,482) (1,526) (1,031) (5,629) Direct operating expenses (exclusive of depreciation and amortization) (369) (426) (406) (421) (101) (93) (102) (113) (409) Depreciation and amortization (197) (182) (185) (174) (41) (41) (48) (52) (182) Gross profit (loss) 55 823 1,067 89 23 (139) (115) 543 312 Add: Direct operating expenses (exclusive of depreciation and amortization) 369 426 406 421 101 93 102 113 409 Depreciation and amortization 197 182 185 174 41 41 48 52 182 Refining margin 621 1,431 1,658 684 165 (5) 35 708 903 Adjustments: Inventory valuation impacts, unfavorable (favorable) (127) (22) 32 6 12 112 89 (471) (258) Unrealized loss (gain) on derivatives, net (16) 3 (30) 22 6 (3) 2 8 13 Revaluation of RFS liability, unfavorable (favorable) 63 135 (284) (89) (57) (20) 31 11 (35) Adjusted refining margin 541$ 1,547$ 1,376$ 623$ 126$ 84$ 157$ 256$ 623$ Petroleum Segment Refining Margin and Adjusted Refining Margin per Throughput Barrel ($ in Millions) 2021 2022 2023 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 TTM Refining margin 621$ 1,431$ 1,658$ 684$ 165$ (5)$ 35$ 708$ 903$ Dividend by: total throughput barrels 76 75 76 72 20 11 16 20 66 Refining margin per total throughput barrel 8.14$ 19.09$ 21.82$ 9.53$ 8.37$ (0.42)$ 2.21$ 35.65$ 13.68$ Adjusted refining margin 541$ 1,547$ 1,376$ 623$ 126$ 84$ 157$ 256$ 623$ Dividend by: total throughput barrels 76 75 76 72 20 11 16 20 66 Adjusted refining margin per throughput barrel 7.12$ 20.65$ 18.11$ 8.67$ 6.45$ 7.72$ 9.95$ 12.87$ 9.44$ Petroleum Segment Direct Operating Expenses per Throughput Barrel ($ in Millions) 2021 2022 2023 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 TTM Direct operating expenses 369$ 426$ 406$ 421 101 93 102 113 409 Divided by: total throughput (mm bbls) 76 75 76 72 20 11 16 20 66 Direct operating expenses per total throughput barrel 4.83$ 5.68$ 5.34$ 5.86$ 5.13$ 8.58$ 6.45$ 5.69$ 6.19$

Non-GAAP Financial Measures 22 Renewables Segment Renewables Margin and Adjusted Renewables Margin ($ in Millions) 2022 2023 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 TTM Net sales 338$ 559$ 289$ 93$ 66$ 76$ 99$ 334$ Less: Cost of materials and other (342) (537) (245) (79) (50) (71) (99) (299) Direct operating expenses (exclusive of depreciation and amortization) (24) (28) (31) (8) (6) (7) (9) (30) Depreciation and amortization (16) (20) (25) (6) (6) (6) (36) (54) Gross profit (loss) (44) (26) (12) - 4 (8) (45) (49) Add: Direct operating expenses (exclusive of depreciation and amortization) 24 28 31 8 6 7 9 30 Depreciation and amortization 16 20 25 6 6 6 36 54 Renewables margin (4) 22 44 14 16 5 - 56 Adjustments: Inventory valuation impacts, unfavorable (favorable) 7 14 7 6 (3) 1 8 12 Unrealized loss (gain) on derivatives, net 5 (2) - - - - - - Adjusted renewables margin 8$ 34$ 51$ 20$ 13$ 6$ 8$ 68$ Renewables Segment Renewables margin (4)$ 22$ 44$ 14$ 16$ 5$ -$ 56$ Dividend by: total vegetable oil throughput gallons 43 82 55 17 14 14 19 64 Renewables margin per vegetable oil throughput gallon (0.10)$ 0.27$ 0.80$ 0.79$ 1.13$ 0.38$ (0.01)$ 0.87$ Adjusted Renewables margin 8$ 34$ 51$ 20$ 13$ 6$ 8$ 68$ Dividend by: total vegetable oil throughput gallons 43 82 55 17 14 14 19 64 Adjusted Renewables margin per vegetable oil throughput gallon 0.18$ 0.41$ 0.93$ 1.16$ 0.94$ 0.44$ 0.37$ 1.06$ Renewables Segment Direct Operating Expenses per Vegetable Oil Throughput Gallon ($ in Millions) 2022 2023 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 TTM Direct operating expenses 24$ 28$ 31$ 8$ 6$ 7$ 9$ 30$ Divided by: total throughput (mm bbls) 43 82 55 17 14 14 19 64 Direct operating expenses per vegetable oil throughput gallon 0.55$ 0.35$ 0.57$ 0.48$ 0.48$ 0.54$ 0.45$ 0.47$ TTM3Q 20252024Renewables Margin and Adjusted Renewables Margin per Vegetable Oil Throughput Gallon ($ in Millions) 2022 2023 4Q 2024 1Q 2025 2Q 2025

Non-GAAP Financial Measures 23 (In USD Millions) CVR Partners, LP 2021 2022 2023 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 TTM Net Income (loss) 78$ 287$ 172$ 61$ 18$ 27$ 39$ 43$ 127$ Add: Interest expense and other financing costs, net of interest income 61 34 29 30 7 8 7 8 30 Add: Depreciation and amortization 74 82 80 88 25 18 21 20 84 EBITDA and Adjusted EBITDA 213$ 403$ 281$ 179$ 50$ 53$ 67$ 71$ 241$

2024 & 2025 Est. Capital Expenditures 24 Growth Total Low High Low High Low High Petroleum 90$ 38$ 128$ 82$ 87$ 34$ 38$ 116$ 125$ Renewables 3 8 11 3 4 1 2 4 6 Nitrogen Fertilizer 30 7 37 39 42 19 23 58 65 Other 4 1 5 1 2 1 2 2 4 Total 127$ 54$ 181$ 125$ 135$ 55$ 65$ 180$ 200$ 2024 Actual 2025 Estimate Maintenance Maintenance Growth Total

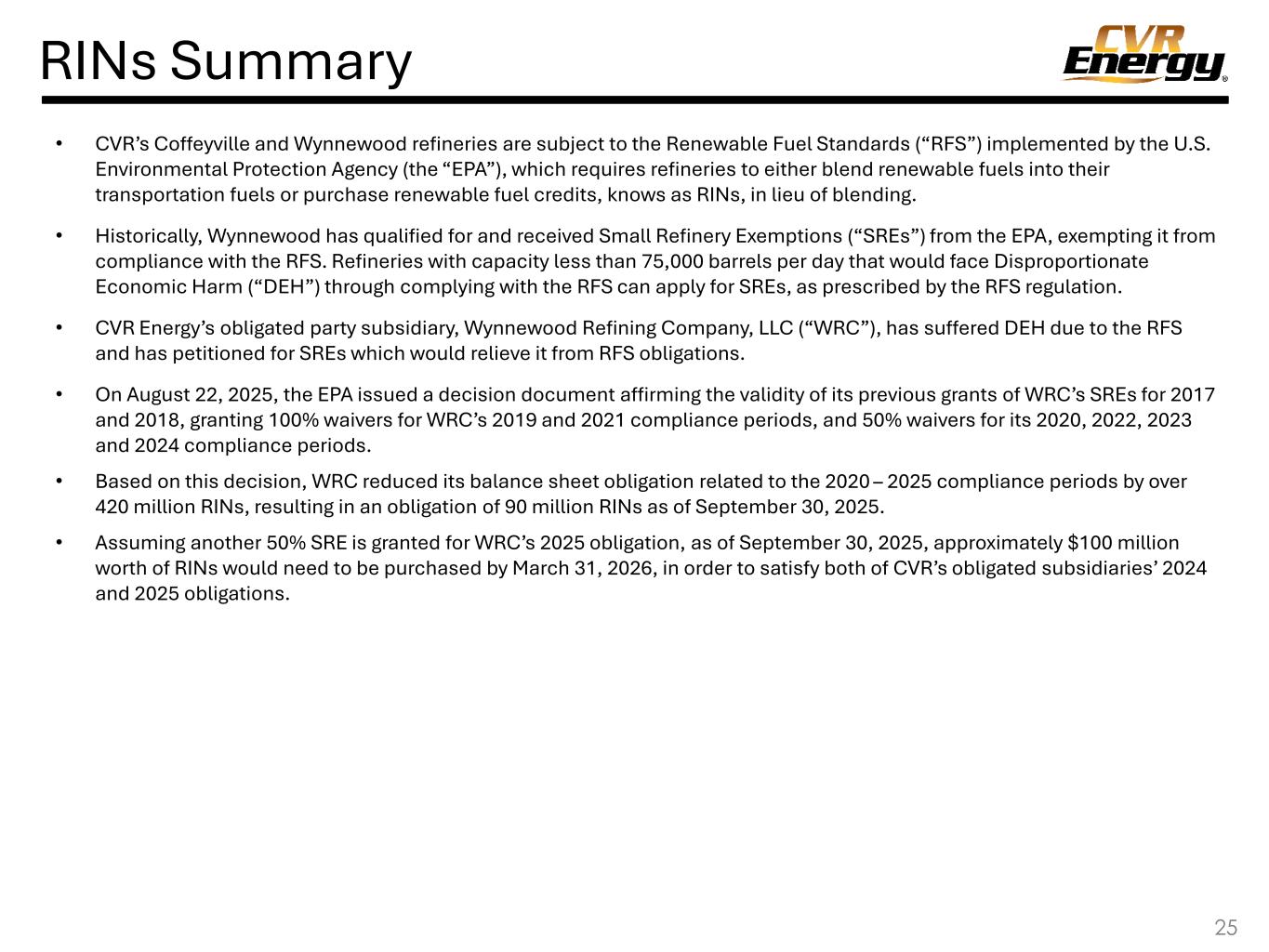

RINs Summary 25 • CVR’s Coffeyville and Wynnewood refineries are subject to the Renewable Fuel Standards (“RFS”) implemented by the U.S. Environmental Protection Agency (the “EPA”), which requires refineries to either blend renewable fuels into their transportation fuels or purchase renewable fuel credits, knows as RINs, in lieu of blending. • Historically, Wynnewood has qualified for and received Small Refinery Exemptions (“SREs”) from the EPA, exempting it from compliance with the RFS. Refineries with capacity less than 75,000 barrels per day that would face Disproportionate Economic Harm (“DEH”) through complying with the RFS can apply for SREs, as prescribed by the RFS regulation. • CVR Energy’s obligated party subsidiary, Wynnewood Refining Company, LLC (“WRC”), has suffered DEH due to the RFS and has petitioned for SREs which would relieve it from RFS obligations. • On August 22, 2025, the EPA issued a decision document affirming the validity of its previous grants of WRC’s SREs for 2017 and 2018, granting 100% waivers for WRC’s 2019 and 2021 compliance periods, and 50% waivers for its 2020, 2022, 2023 and 2024 compliance periods. • Based on this decision, WRC reduced its balance sheet obligation related to the 2020 – 2025 compliance periods by over 420 million RINs, resulting in an obligation of 90 million RINs as of September 30, 2025. • Assuming another 50% SRE is granted for WRC’s 2025 obligation, as of September 30, 2025, approximately $100 million worth of RINs would need to be purchased by March 31, 2026, in order to satisfy both of CVR’s obligated subsidiaries’ 2024 and 2025 obligations.

CVR Energy, Inc. NYSE: CVI Icahn Enterprises L.P. & Affiliates Public CVR GP, LLC CVR Partners, LP NYSE: UAN Nitrogen Fertilizer Segment Subsidiaries Petroleum Segment Subsidiaries Public 60.6 % N-E GP Interest • Non-Economic General Partner Interest (“N-E GP Interest”) • All ownership percentages are 100% unless otherwise noted and may be indirect with intervening subsidiaries omitted for simplicity. 30.0 % 70.0 % 36.8 % JV: 45Q Entities Other Subsidiaries JV Entity: Enable South Central Pipeline, LLC 40% 50% 2.6 % Renewables Segment Subsidiaries Simplified Organizational Structure 26