0001376139FALSE--12-312025Q2http://fasb.org/us-gaap/2025#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2025#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2025#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2025#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2025#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2025#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2025#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2025#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2025#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2025#LongTermDebtAndCapitalLeaseObligationsP6MP1YP1Yxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pureutr:bblcvi:renewalcvi:segment00013761392025-01-012025-06-3000013761392025-07-250001376139us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2025-06-300001376139us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-12-3100013761392025-06-3000013761392024-12-3100013761392025-04-012025-06-3000013761392024-04-012024-06-3000013761392024-01-012024-06-3000013761392025-03-310001376139us-gaap:CommonStockMember2024-12-310001376139us-gaap:AdditionalPaidInCapitalMember2024-12-310001376139us-gaap:RetainedEarningsMember2024-12-310001376139us-gaap:TreasuryStockCommonMember2024-12-310001376139us-gaap:ParentMember2024-12-310001376139us-gaap:NoncontrollingInterestMember2024-12-310001376139us-gaap:RetainedEarningsMember2025-01-012025-03-310001376139us-gaap:ParentMember2025-01-012025-03-310001376139us-gaap:NoncontrollingInterestMember2025-01-012025-03-3100013761392025-01-012025-03-310001376139us-gaap:CommonStockMember2025-03-310001376139us-gaap:AdditionalPaidInCapitalMember2025-03-310001376139us-gaap:RetainedEarningsMember2025-03-310001376139us-gaap:TreasuryStockCommonMember2025-03-310001376139us-gaap:ParentMember2025-03-310001376139us-gaap:NoncontrollingInterestMember2025-03-310001376139us-gaap:RetainedEarningsMember2025-04-012025-06-300001376139us-gaap:ParentMember2025-04-012025-06-300001376139us-gaap:NoncontrollingInterestMember2025-04-012025-06-300001376139us-gaap:CommonStockMember2025-06-300001376139us-gaap:AdditionalPaidInCapitalMember2025-06-300001376139us-gaap:RetainedEarningsMember2025-06-300001376139us-gaap:TreasuryStockCommonMember2025-06-300001376139us-gaap:ParentMember2025-06-300001376139us-gaap:NoncontrollingInterestMember2025-06-3000013761392024-06-3000013761392024-03-310001376139us-gaap:CommonStockMember2023-12-310001376139us-gaap:AdditionalPaidInCapitalMember2023-12-310001376139us-gaap:RetainedEarningsMember2023-12-310001376139us-gaap:TreasuryStockCommonMember2023-12-310001376139us-gaap:ParentMember2023-12-310001376139us-gaap:NoncontrollingInterestMember2023-12-3100013761392023-12-310001376139us-gaap:RetainedEarningsMember2024-01-012024-03-310001376139us-gaap:ParentMember2024-01-012024-03-310001376139us-gaap:NoncontrollingInterestMember2024-01-012024-03-3100013761392024-01-012024-03-310001376139us-gaap:CommonStockMember2024-03-310001376139us-gaap:AdditionalPaidInCapitalMember2024-03-310001376139us-gaap:RetainedEarningsMember2024-03-310001376139us-gaap:TreasuryStockCommonMember2024-03-310001376139us-gaap:ParentMember2024-03-310001376139us-gaap:NoncontrollingInterestMember2024-03-310001376139us-gaap:RetainedEarningsMember2024-04-012024-06-300001376139us-gaap:ParentMember2024-04-012024-06-300001376139us-gaap:NoncontrollingInterestMember2024-04-012024-06-300001376139us-gaap:CommonStockMember2024-06-300001376139us-gaap:AdditionalPaidInCapitalMember2024-06-300001376139us-gaap:RetainedEarningsMember2024-06-300001376139us-gaap:TreasuryStockCommonMember2024-06-300001376139us-gaap:ParentMember2024-06-300001376139us-gaap:NoncontrollingInterestMember2024-06-300001376139cvi:CVREnergyMembercvi:IcahnEnterprisesL.P.AndAffiliatesIEPMember2025-01-012025-06-300001376139cvi:CVRPartnersLPMember2025-01-012025-06-300001376139cvi:CVRPartnersLPMember2025-01-012025-06-300001376139cvi:CVRGPLLCMember2025-01-012025-06-300001376139cvi:CVRPartnersLPMembercvi:IcahnEnterprisesL.P.AndAffiliatesIEPMember2025-01-012025-06-300001376139us-gaap:MachineryAndEquipmentMember2025-06-300001376139us-gaap:MachineryAndEquipmentMember2024-12-310001376139us-gaap:BuildingAndBuildingImprovementsMember2025-06-300001376139us-gaap:BuildingAndBuildingImprovementsMember2024-12-310001376139us-gaap:LandAndLandImprovementsMember2025-06-300001376139us-gaap:LandAndLandImprovementsMember2024-12-310001376139us-gaap:FurnitureAndFixturesMember2025-06-300001376139us-gaap:FurnitureAndFixturesMember2024-12-310001376139us-gaap:ConstructionInProgressMember2025-06-300001376139us-gaap:ConstructionInProgressMember2024-12-310001376139us-gaap:PropertyPlantAndEquipmentOtherTypesMember2025-06-300001376139us-gaap:PropertyPlantAndEquipmentOtherTypesMember2024-12-310001376139us-gaap:PropertyPlantAndEquipmentMember2025-04-012025-06-300001376139us-gaap:PropertyPlantAndEquipmentMember2025-01-012025-06-300001376139us-gaap:PropertyPlantAndEquipmentMember2024-04-012024-06-300001376139us-gaap:PropertyPlantAndEquipmentMember2024-01-012024-06-300001376139cvi:EquipmentRealEstateAndOtherMember2025-06-300001376139cvi:EquipmentRealEstateAndOtherMember2024-12-310001376139cvi:PipelinesAndStorageTanksMember2025-06-300001376139cvi:PipelinesAndStorageTanksMember2024-12-310001376139cvi:RailcarsMember2025-06-300001376139cvi:RailcarsMember2024-12-310001376139srt:ParentCompanyMembercvi:EightPointFiveZeroPercentNotesDue2029Memberus-gaap:SeniorNotesMember2025-06-300001376139srt:ParentCompanyMembercvi:EightPointFiveZeroPercentNotesDue2029Memberus-gaap:SeniorNotesMember2024-12-310001376139srt:ParentCompanyMembercvi:FivePointSevenFivePercentNotesDue2028Memberus-gaap:SeniorNotesMember2025-06-300001376139srt:ParentCompanyMembercvi:FivePointSevenFivePercentNotesDue2028Memberus-gaap:SeniorNotesMember2024-12-310001376139srt:ParentCompanyMember2025-06-300001376139srt:ParentCompanyMember2024-12-310001376139cvi:TermLoanMembercvi:PetroleumSegmentMember2025-06-300001376139cvi:TermLoanMembercvi:PetroleumSegmentMember2024-12-310001376139cvi:PetroleumSegmentMember2024-12-310001376139cvi:PetroleumSegmentMember2025-06-300001376139cvi:SixPointOneTwoFivePercentNotesDueJune2028Memberus-gaap:SeniorNotesMembercvi:NitrogenFertilizerSegmentMember2025-06-300001376139cvi:SixPointOneTwoFivePercentNotesDueJune2028Memberus-gaap:SeniorNotesMembercvi:NitrogenFertilizerSegmentMember2024-12-310001376139cvi:NitrogenFertilizerSegmentMember2024-12-310001376139cvi:NitrogenFertilizerSegmentMember2025-06-300001376139us-gaap:RevolvingCreditFacilityMembercvi:AmendedAndRestatedAssetBasedCreditAgreementMemberus-gaap:LineOfCreditMembercvi:PetroleumSegmentMember2025-06-300001376139us-gaap:RevolvingCreditFacilityMembercvi:AssetBasedCreditAgreementMemberus-gaap:LineOfCreditMembercvi:NitrogenFertilizerSegmentMember2025-06-300001376139cvi:TermLoanMembercvi:PetroleumSegmentMember2025-06-302025-06-300001376139cvi:TermLoanMembercvi:PetroleumSegmentMember2025-04-012025-06-300001376139cvi:TermLoanMembercvi:PetroleumSegmentMemberus-gaap:SubsequentEventMember2025-07-252025-07-250001376139us-gaap:OperatingSegmentsMembercvi:ProductGasolineMembercvi:PetroleumSegmentMember2025-04-012025-06-300001376139us-gaap:OperatingSegmentsMembercvi:ProductGasolineMembercvi:PetroleumSegmentMember2024-04-012024-06-300001376139us-gaap:OperatingSegmentsMembercvi:ProductGasolineMembercvi:PetroleumSegmentMember2025-01-012025-06-300001376139us-gaap:OperatingSegmentsMembercvi:ProductGasolineMembercvi:PetroleumSegmentMember2024-01-012024-06-300001376139us-gaap:OperatingSegmentsMembercvi:ProductDistillatesMembercvi:PetroleumSegmentMember2025-04-012025-06-300001376139us-gaap:OperatingSegmentsMembercvi:ProductDistillatesMembercvi:PetroleumSegmentMember2024-04-012024-06-300001376139us-gaap:OperatingSegmentsMembercvi:ProductDistillatesMembercvi:PetroleumSegmentMember2025-01-012025-06-300001376139us-gaap:OperatingSegmentsMembercvi:ProductDistillatesMembercvi:PetroleumSegmentMember2024-01-012024-06-300001376139us-gaap:OperatingSegmentsMembercvi:ServiceCrudeOilSalesMembercvi:PetroleumSegmentMember2025-04-012025-06-300001376139us-gaap:OperatingSegmentsMembercvi:ServiceCrudeOilSalesMembercvi:PetroleumSegmentMember2024-04-012024-06-300001376139us-gaap:OperatingSegmentsMembercvi:ServiceCrudeOilSalesMembercvi:PetroleumSegmentMember2025-01-012025-06-300001376139us-gaap:OperatingSegmentsMembercvi:ServiceCrudeOilSalesMembercvi:PetroleumSegmentMember2024-01-012024-06-300001376139us-gaap:OperatingSegmentsMembercvi:PetroleumSegmentMember2025-04-012025-06-300001376139us-gaap:OperatingSegmentsMembercvi:PetroleumSegmentMember2024-04-012024-06-300001376139us-gaap:OperatingSegmentsMembercvi:PetroleumSegmentMember2025-01-012025-06-300001376139us-gaap:OperatingSegmentsMembercvi:PetroleumSegmentMember2024-01-012024-06-300001376139cvi:PetroleumSegmentMember2025-04-012025-06-300001376139cvi:PetroleumSegmentMember2024-04-012024-06-300001376139cvi:PetroleumSegmentMember2025-01-012025-06-300001376139cvi:PetroleumSegmentMember2024-01-012024-06-300001376139us-gaap:OperatingSegmentsMembercvi:RenewablesDieselMembercvi:RenewablesSegmentMember2025-04-012025-06-300001376139us-gaap:OperatingSegmentsMembercvi:RenewablesDieselMembercvi:RenewablesSegmentMember2024-04-012024-06-300001376139us-gaap:OperatingSegmentsMembercvi:RenewablesDieselMembercvi:RenewablesSegmentMember2025-01-012025-06-300001376139us-gaap:OperatingSegmentsMembercvi:RenewablesDieselMembercvi:RenewablesSegmentMember2024-01-012024-06-300001376139us-gaap:OperatingSegmentsMembercvi:RenewableFuelCreditsMembercvi:RenewablesSegmentMember2025-04-012025-06-300001376139us-gaap:OperatingSegmentsMembercvi:RenewableFuelCreditsMembercvi:RenewablesSegmentMember2024-04-012024-06-300001376139us-gaap:OperatingSegmentsMembercvi:RenewableFuelCreditsMembercvi:RenewablesSegmentMember2025-01-012025-06-300001376139us-gaap:OperatingSegmentsMembercvi:RenewableFuelCreditsMembercvi:RenewablesSegmentMember2024-01-012024-06-300001376139cvi:RenewablesSegmentMember2025-04-012025-06-300001376139cvi:RenewablesSegmentMember2024-04-012024-06-300001376139cvi:RenewablesSegmentMember2025-01-012025-06-300001376139cvi:RenewablesSegmentMember2024-01-012024-06-300001376139us-gaap:OperatingSegmentsMembercvi:ProductAmmoniaMembercvi:NitrogenFertilizerSegmentMember2025-04-012025-06-300001376139us-gaap:OperatingSegmentsMembercvi:ProductAmmoniaMembercvi:NitrogenFertilizerSegmentMember2024-04-012024-06-300001376139us-gaap:OperatingSegmentsMembercvi:ProductAmmoniaMembercvi:NitrogenFertilizerSegmentMember2025-01-012025-06-300001376139us-gaap:OperatingSegmentsMembercvi:ProductAmmoniaMembercvi:NitrogenFertilizerSegmentMember2024-01-012024-06-300001376139us-gaap:OperatingSegmentsMembercvi:ProductUANMembercvi:NitrogenFertilizerSegmentMember2025-04-012025-06-300001376139us-gaap:OperatingSegmentsMembercvi:ProductUANMembercvi:NitrogenFertilizerSegmentMember2024-04-012024-06-300001376139us-gaap:OperatingSegmentsMembercvi:ProductUANMembercvi:NitrogenFertilizerSegmentMember2025-01-012025-06-300001376139us-gaap:OperatingSegmentsMembercvi:ProductUANMembercvi:NitrogenFertilizerSegmentMember2024-01-012024-06-300001376139us-gaap:OperatingSegmentsMembercvi:ProductUreaProductsMembercvi:NitrogenFertilizerSegmentMember2025-04-012025-06-300001376139us-gaap:OperatingSegmentsMembercvi:ProductUreaProductsMembercvi:NitrogenFertilizerSegmentMember2024-04-012024-06-300001376139us-gaap:OperatingSegmentsMembercvi:ProductUreaProductsMembercvi:NitrogenFertilizerSegmentMember2025-01-012025-06-300001376139us-gaap:OperatingSegmentsMembercvi:ProductUreaProductsMembercvi:NitrogenFertilizerSegmentMember2024-01-012024-06-300001376139us-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMember2025-04-012025-06-300001376139us-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMember2024-04-012024-06-300001376139us-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMember2025-01-012025-06-300001376139us-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMember2024-01-012024-06-300001376139cvi:NitrogenFertilizerSegmentMember2025-04-012025-06-300001376139cvi:NitrogenFertilizerSegmentMember2024-04-012024-06-300001376139cvi:NitrogenFertilizerSegmentMember2025-01-012025-06-300001376139cvi:NitrogenFertilizerSegmentMember2024-01-012024-06-3000013761392025-07-012025-06-300001376139cvi:NitrogenFertilizerSegmentMember2025-07-012025-06-300001376139cvi:NitrogenFertilizerSegmentMember2026-01-012025-06-300001376139us-gaap:OtherCurrentLiabilitiesMember2025-06-300001376139us-gaap:OtherCurrentLiabilitiesMember2024-12-310001376139us-gaap:OtherNoncurrentLiabilitiesMember2025-06-300001376139us-gaap:OtherNoncurrentLiabilitiesMember2024-12-310001376139cvi:NitrogenFertilizerSegmentMember2027-01-012025-06-300001376139us-gaap:ForwardContractsMembersrt:CrudeOilMemberus-gaap:LongMember2025-06-300001376139us-gaap:ForwardContractsMembersrt:CrudeOilMemberus-gaap:ShortMember2024-12-310001376139us-gaap:InterestRateSwapMembercvi:NYMEXDieselCracksMemberus-gaap:ShortMember2025-06-300001376139us-gaap:InterestRateSwapMembercvi:NYMEXDieselCracksMemberus-gaap:ShortMember2024-12-310001376139us-gaap:FutureMembercvi:UltraLowSulfurDieselMemberus-gaap:ShortMember2025-06-300001376139us-gaap:FutureMembercvi:UltraLowSulfurDieselMemberus-gaap:ShortMember2024-12-310001376139us-gaap:FutureMembercvi:SoybeanMemberus-gaap:ShortMember2025-06-300001376139us-gaap:FutureMembercvi:SoybeanMemberus-gaap:LongMember2024-12-310001376139cvi:NYMEXDieselCracksMember2025-06-300001376139us-gaap:OtherCurrentAssetsMember2025-06-300001376139us-gaap:OtherCurrentAssetsMember2024-12-310001376139us-gaap:CommodityContractMember2025-04-012025-06-300001376139us-gaap:CommodityContractMember2024-04-012024-06-300001376139us-gaap:CommodityContractMember2025-01-012025-06-300001376139us-gaap:CommodityContractMember2024-01-012024-06-300001376139us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2025-06-300001376139us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2025-06-300001376139us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2025-06-300001376139us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2025-06-300001376139cvi:RFSMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2025-06-300001376139cvi:RFSMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2025-06-300001376139cvi:RFSMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2025-06-300001376139cvi:RFSMemberus-gaap:FairValueMeasurementsRecurringMember2025-06-300001376139us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2024-12-310001376139us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2024-12-310001376139us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2024-12-310001376139us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001376139cvi:RFSMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2024-12-310001376139cvi:RFSMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2024-12-310001376139cvi:RFSMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2024-12-310001376139cvi:RFSMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001376139us-gaap:FairValueMeasurementsRecurringMember2025-06-300001376139us-gaap:FairValueMeasurementsRecurringMember2024-12-310001376139us-gaap:FairValueInputsLevel1Member2025-06-300001376139us-gaap:FairValueInputsLevel1Member2024-12-310001376139us-gaap:FairValueInputsLevel2Member2025-06-300001376139us-gaap:FairValueInputsLevel2Member2024-12-310001376139cvi:PhantomStockUnitsMembercvi:CVRPartnersLongTermIncentivePlanMembercvi:CVRPartnersLPMember2025-04-012025-06-300001376139cvi:PhantomStockUnitsMembercvi:CVRPartnersLongTermIncentivePlanMembercvi:CVRPartnersLPMember2024-04-012024-06-300001376139cvi:PhantomStockUnitsMembercvi:CVRPartnersLongTermIncentivePlanMembercvi:CVRPartnersLPMember2025-01-012025-06-300001376139cvi:PhantomStockUnitsMembercvi:CVRPartnersLongTermIncentivePlanMembercvi:CVRPartnersLPMember2024-01-012024-06-300001376139cvi:IncentiveUnitAwardMember2025-04-012025-06-300001376139cvi:IncentiveUnitAwardMember2024-04-012024-06-300001376139cvi:IncentiveUnitAwardMember2025-01-012025-06-300001376139cvi:IncentiveUnitAwardMember2024-01-012024-06-300001376139cvi:GunvorCrudeOilSupplyAgreementMemberus-gaap:SupplierConcentrationRiskMembercvi:ContractedVolumeMembercvi:PetroleumSegmentMember2025-04-012025-06-300001376139cvi:GunvorCrudeOilSupplyAgreementMemberus-gaap:SupplierConcentrationRiskMembercvi:ContractedVolumeMembercvi:PetroleumSegmentMember2024-04-012024-06-300001376139cvi:GunvorCrudeOilSupplyAgreementMemberus-gaap:SupplierConcentrationRiskMembercvi:ContractedVolumeMembercvi:PetroleumSegmentMember2025-01-012025-06-300001376139cvi:GunvorCrudeOilSupplyAgreementMemberus-gaap:SupplierConcentrationRiskMembercvi:ContractedVolumeMembercvi:PetroleumSegmentMember2024-01-012024-06-300001376139cvi:GunvorCrudeOilSupplyAgreementMemberus-gaap:SubsequentEventMember2025-07-292025-07-290001376139us-gaap:CollaborativeArrangementTransactionWithPartyToCollaborativeArrangementAndThirdPartyMembercvi:CVRCapturePointParentLLCCVRPJVMembercvi:CRNFMember2025-01-012025-06-300001376139us-gaap:CollaborativeArrangementTransactionWithPartyToCollaborativeArrangementAndThirdPartyMembercvi:CVRCapturePointParentLLCCVRPJVMembercvi:CRNFMember2025-06-300001376139cvi:EnvironmentalHealthAndSafetyMattersMembercvi:PetroleumSegmentMember2025-04-012025-06-300001376139cvi:EnvironmentalHealthAndSafetyMattersMembercvi:PetroleumSegmentMember2024-04-012024-06-300001376139cvi:EnvironmentalHealthAndSafetyMattersMembercvi:PetroleumSegmentMember2025-01-012025-06-300001376139cvi:EnvironmentalHealthAndSafetyMattersMembercvi:PetroleumSegmentMember2024-01-012024-06-300001376139cvi:EnvironmentalHealthAndSafetyMattersMembercvi:PetroleumSegmentMember2025-06-300001376139cvi:EnvironmentalHealthAndSafetyMattersMembercvi:PetroleumSegmentMember2024-12-310001376139us-gaap:CorporateNonSegmentMember2025-04-012025-06-300001376139us-gaap:IntersegmentEliminationMembercvi:PetroleumSegmentMember2025-04-012025-06-300001376139us-gaap:IntersegmentEliminationMembercvi:RenewablesSegmentMember2025-04-012025-06-300001376139us-gaap:IntersegmentEliminationMembercvi:NitrogenFertilizerSegmentMember2025-04-012025-06-300001376139us-gaap:IntersegmentEliminationMember2025-04-012025-06-300001376139us-gaap:OperatingSegmentsMembercvi:RenewablesSegmentMember2025-04-012025-06-300001376139cvi:CorporateAndEliminationsMember2025-04-012025-06-300001376139us-gaap:CorporateNonSegmentMember2024-04-012024-06-300001376139us-gaap:IntersegmentEliminationMembercvi:PetroleumSegmentMember2024-04-012024-06-300001376139us-gaap:IntersegmentEliminationMembercvi:RenewablesSegmentMember2024-04-012024-06-300001376139us-gaap:IntersegmentEliminationMembercvi:NitrogenFertilizerSegmentMember2024-04-012024-06-300001376139us-gaap:IntersegmentEliminationMember2024-04-012024-06-300001376139us-gaap:OperatingSegmentsMembercvi:RenewablesSegmentMember2024-04-012024-06-300001376139cvi:CorporateAndEliminationsMember2024-04-012024-06-300001376139us-gaap:CorporateNonSegmentMember2025-01-012025-06-300001376139us-gaap:IntersegmentEliminationMembercvi:PetroleumSegmentMember2025-01-012025-06-300001376139us-gaap:IntersegmentEliminationMembercvi:RenewablesSegmentMember2025-01-012025-06-300001376139us-gaap:IntersegmentEliminationMembercvi:NitrogenFertilizerSegmentMember2025-01-012025-06-300001376139us-gaap:IntersegmentEliminationMember2025-01-012025-06-300001376139us-gaap:OperatingSegmentsMembercvi:RenewablesSegmentMember2025-01-012025-06-300001376139cvi:CorporateAndEliminationsMember2025-01-012025-06-300001376139us-gaap:CorporateNonSegmentMember2024-01-012024-06-300001376139us-gaap:IntersegmentEliminationMembercvi:PetroleumSegmentMember2024-01-012024-06-300001376139us-gaap:IntersegmentEliminationMembercvi:RenewablesSegmentMember2024-01-012024-06-300001376139us-gaap:IntersegmentEliminationMembercvi:NitrogenFertilizerSegmentMember2024-01-012024-06-300001376139us-gaap:IntersegmentEliminationMember2024-01-012024-06-300001376139us-gaap:OperatingSegmentsMembercvi:RenewablesSegmentMember2024-01-012024-06-300001376139cvi:CorporateAndEliminationsMember2024-01-012024-06-300001376139us-gaap:OperatingSegmentsMembercvi:PetroleumSegmentMember2025-06-300001376139us-gaap:OperatingSegmentsMembercvi:PetroleumSegmentMember2024-12-310001376139us-gaap:OperatingSegmentsMembercvi:RenewablesSegmentMember2025-06-300001376139us-gaap:OperatingSegmentsMembercvi:RenewablesSegmentMember2024-12-310001376139us-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMember2025-06-300001376139us-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMember2024-12-310001376139cvi:CorporateAndEliminationsMember2025-06-300001376139cvi:CorporateAndEliminationsMember2024-12-310001376139cvi:CVRPJVCOContractMemberus-gaap:RelatedPartyMember2025-04-012025-06-300001376139cvi:CVRPJVCOContractMemberus-gaap:RelatedPartyMember2024-04-012024-06-300001376139cvi:CVRPJVCOContractMemberus-gaap:RelatedPartyMember2025-01-012025-06-300001376139cvi:CVRPJVCOContractMemberus-gaap:RelatedPartyMember2024-01-012024-06-300001376139cvi:EnableJointVentureTransportationAgreementMemberus-gaap:RelatedPartyMember2025-04-012025-06-300001376139cvi:EnableJointVentureTransportationAgreementMemberus-gaap:RelatedPartyMember2024-04-012024-06-300001376139cvi:EnableJointVentureTransportationAgreementMemberus-gaap:RelatedPartyMember2025-01-012025-06-300001376139cvi:EnableJointVentureTransportationAgreementMemberus-gaap:RelatedPartyMember2024-01-012024-06-300001376139cvi:MidwayJointVentureAgreementMemberus-gaap:RelatedPartyMember2025-04-012025-06-300001376139cvi:MidwayJointVentureAgreementMemberus-gaap:RelatedPartyMember2024-04-012024-06-300001376139cvi:MidwayJointVentureAgreementMemberus-gaap:RelatedPartyMember2025-01-012025-06-300001376139cvi:MidwayJointVentureAgreementMemberus-gaap:RelatedPartyMember2024-01-012024-06-300001376139us-gaap:MajorityShareholderMember2025-04-012025-06-300001376139us-gaap:MajorityShareholderMember2024-04-012024-06-300001376139us-gaap:MajorityShareholderMember2025-01-012025-06-300001376139us-gaap:MajorityShareholderMember2024-01-012024-06-300001376139cvi:MidwayPipelineLLCMidwayJVMember2024-12-230001376139cvi:O2024Q1DividendsMember2024-01-012024-03-310001376139cvi:PublicStockholdersMembercvi:O2024Q1DividendsMember2024-01-012024-03-310001376139cvi:IEPEnergyLLCMembercvi:O2024Q1DividendsMember2024-01-012024-03-310001376139cvi:O2024Q2DividendsMember2024-04-012024-06-300001376139cvi:PublicStockholdersMembercvi:O2024Q2DividendsMember2024-04-012024-06-300001376139cvi:IEPEnergyLLCMembercvi:O2024Q2DividendsMember2024-04-012024-06-300001376139cvi:O2024Q3DividendsMember2024-07-012024-09-300001376139cvi:PublicStockholdersMembercvi:O2024Q3DividendsMember2024-07-012024-09-300001376139cvi:IEPEnergyLLCMembercvi:O2024Q3DividendsMember2024-07-012024-09-300001376139cvi:O2024ADividendsMember2024-01-012024-12-310001376139cvi:PublicStockholdersMembercvi:O2024ADividendsMember2024-01-012024-12-310001376139cvi:IEPEnergyLLCMembercvi:O2024ADividendsMember2024-01-012024-12-310001376139cvi:CVRPartnersLPMember2025-01-012025-03-310001376139cvi:CommonUnitholdersMembercvi:CVRPartnersLPMember2025-01-012025-03-310001376139cvi:IEPEnergyLLCMembercvi:CVRPartnersLPMember2025-01-012025-03-310001376139cvi:CVRPartnersLPMembersrt:ParentCompanyMember2025-01-012025-03-310001376139cvi:CVRPartnersLPMember2025-04-012025-06-300001376139cvi:CommonUnitholdersMembercvi:CVRPartnersLPMember2025-04-012025-06-300001376139cvi:IEPEnergyLLCMembercvi:CVRPartnersLPMember2025-04-012025-06-300001376139cvi:CVRPartnersLPMembersrt:ParentCompanyMember2025-04-012025-06-300001376139cvi:CommonUnitholdersMembercvi:CVRPartnersLPMember2025-01-012025-06-300001376139cvi:IEPEnergyLLCMembercvi:CVRPartnersLPMember2025-01-012025-06-300001376139cvi:CVRPartnersLPMembersrt:ParentCompanyMember2025-01-012025-06-300001376139cvi:CVRPartnersLPMember2024-01-012024-03-310001376139cvi:CommonUnitholdersMembercvi:CVRPartnersLPMember2024-01-012024-03-310001376139cvi:IEPEnergyLLCMembercvi:CVRPartnersLPMember2024-01-012024-03-310001376139cvi:CVRPartnersLPMembersrt:ParentCompanyMember2024-01-012024-03-310001376139cvi:CVRPartnersLPMember2024-04-012024-06-300001376139cvi:CommonUnitholdersMembercvi:CVRPartnersLPMember2024-04-012024-06-300001376139cvi:IEPEnergyLLCMembercvi:CVRPartnersLPMember2024-04-012024-06-300001376139cvi:CVRPartnersLPMembersrt:ParentCompanyMember2024-04-012024-06-300001376139cvi:CVRPartnersLPMember2024-07-012024-09-300001376139cvi:CommonUnitholdersMembercvi:CVRPartnersLPMember2024-07-012024-09-300001376139cvi:IEPEnergyLLCMembercvi:CVRPartnersLPMember2024-07-012024-09-300001376139cvi:CVRPartnersLPMembersrt:ParentCompanyMember2024-07-012024-09-300001376139cvi:CVRPartnersLPMember2024-10-012024-12-310001376139cvi:CommonUnitholdersMembercvi:CVRPartnersLPMember2024-10-012024-12-310001376139cvi:IEPEnergyLLCMembercvi:CVRPartnersLPMember2024-10-012024-12-310001376139cvi:CVRPartnersLPMembersrt:ParentCompanyMember2024-10-012024-12-310001376139cvi:CVRPartnersLPMember2024-01-012024-12-310001376139cvi:CommonUnitholdersMembercvi:CVRPartnersLPMember2024-01-012024-12-310001376139cvi:IEPEnergyLLCMembercvi:CVRPartnersLPMember2024-01-012024-12-310001376139cvi:CVRPartnersLPMembersrt:ParentCompanyMember2024-01-012024-12-310001376139cvi:CVRPartnersLPMemberus-gaap:SubsequentEventMember2025-07-302025-07-300001376139cvi:CVREnergyMemberus-gaap:SubsequentEventMember2025-08-182025-08-180001376139cvi:IEPEnergyLLCMemberus-gaap:SubsequentEventMember2025-08-182025-08-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

|

|

|

|

|

|

|

|

|

(Mark One) |

| ☑ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

For the quarterly period ended |

June 30, 2025 |

|

|

|

| OR |

|

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

For the transition period from to |

Commission file number: 001-33492

CVR ENERGY, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Delaware |

|

|

|

61-1512186 |

|

(State or other jurisdiction of

incorporation or organization)

|

|

|

(I.R.S. Employer

Identification No.) |

2277 Plaza Drive, Suite 500, Sugar Land, Texas 77479

(Address of principal executive offices) (Zip Code)

(281) 207-3200

(Registrant’s telephone number, including area code)

_____________________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.01 par value per share |

CVI |

The New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☑ |

Accelerated filer |

☐ |

Non-accelerated filer |

☐ |

| Smaller reporting company |

☐ |

Emerging growth company |

☐ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

There were 100,530,599 shares of the registrant’s common stock outstanding at July 25, 2025.

TABLE OF CONTENTS

CVR Energy, Inc. - Quarterly Report on Form 10-Q

June 30, 2025

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PART I. Financial Information |

|

|

PART II. Other Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This Quarterly Report on Form 10-Q (including documents incorporated by reference herein) contains statements with respect to our expectations or beliefs as to future events. These types of statements are “forward-looking” and subject to uncertainties. See “Important Information Regarding Forward-Looking Statements” section of this filing.

Important Information Regarding Forward-Looking Statements

This Quarterly Report on Form 10-Q (this “Report”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including, but not limited to, those under Part I, Item 2, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Report. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control. All statements other than statements of historical fact, including without limitation, statements regarding future operations, financial position, estimated revenues and losses, growth, capital projects, stock or unit repurchases, impacts of legal proceedings, projected costs, prospects, plans and objectives of management are forward looking statements. The words “could”, “believe”, “anticipate”, “intend”, “estimate”, “expect”, “may”, “continue”, “predict”, “potential”, “project”, and similar terms and phrases are intended to identify forward-looking statements.

Although we believe our assumptions concerning future events are reasonable, a number of risks, uncertainties, and other factors could cause actual results and trends to differ materially from those projected or forward looking. Forward looking statements, as well as certain risks, contingencies or uncertainties that may impact our forward-looking statements, include but are not limited to the following:

•volatile margins in the refining industry and exposure to the risks associated with volatile crude oil, refined product and feedstock prices;

•the availability of adequate cash and other sources of liquidity for the capital, operating and other needs of our businesses;

•the effects of the Russia-Ukraine war and the tensions and conflict in the Middle East and any spread or expansion thereof, including with respect to impacts to commodity prices and other markets;

•the effects of changes in market conditions; market volatility; crude oil and other commodity prices; demand for those commodities, storage and transportation capacities and costs, inflation, and the impact of such changes on our operating results and financial condition;

•the ability to forecast our future financial condition, results of operations, revenues and expenses accurately or at all;

•the effects of transactions involving derivative instruments;

•political uncertainty and impacts to the oil and gas industry and the United States and global economies generally as a result of actions taken by the current administration or others in response thereto, including the imposition of tariffs and reactions thereto and changes in climate or other energy laws, rules, regulations, or policies;

•interruption in pipelines supplying feedstocks or distributing the petroleum business’ products;

•competition in the petroleum and nitrogen fertilizer businesses, including potential impacts of domestic and global supply and demand or domestic or international duties, tariffs, or similar costs;

•capital expenditures;

•changes in our or our segments’ credit profiles and impacts thereof on cash needs or otherwise;

•the cyclical and seasonal nature of the petroleum and nitrogen fertilizer businesses;

•the supply, availability and price levels of raw materials and feedstocks and the effects of inflation thereupon;

•existing and future laws, regulations, rules, policies, or rulings, including changes, amendments, reinterpretations or amplification thereof and the actions of the current administration or future administrations relating thereto, and including but not limited to those relating to the environment and climate change; crude oil, refined products, other hydrocarbons or renewable feedstocks or products; renewable or alternative energy or fuel sources; electric vehicles; emissions and impacts thereof; safety and security; or the export, transportation, storage, sale or production of hazardous chemicals, materials or substances including potential liabilities or capital requirements arising from such laws, regulations, rules, policies, or rulings and the impacts thereof on macroeconomic factors, consumer activity or otherwise;

•our production levels, including the risk of a material decline thereof, as well as potential operating hazards, downtime, and damage to our or our counterparties’ facilities and other assets from accidents, fires, severe weather, tornadoes, floods, wildfires, or other natural disasters, accidents or other unscheduled shutdowns or interruptions affecting our facilities, machinery, people, or equipment, or those of our suppliers or customers;

•the impact of weather on commodity supply or pricing and on the nitrogen fertilizer business including our ability to produce, market or sell fertilizer products profitability or at all;

•rulings, judgments or settlements in litigation, tax or other legal or regulatory matters;

•the dependence of the nitrogen fertilizer business on customers and distributors including to transport goods and equipment and providers of feedstocks;

•the reliance on, or the ability to procure economically or at all, petroleum coke (“pet coke”) that our nitrogen fertilizer business purchases from our subsidiaries and third-party suppliers or the natural gas, electricity, oxygen, nitrogen, sulfur processing and compressed dry air and other products purchased from third parties by the nitrogen fertilizer and petroleum businesses and the facility operating risks associated with these third parties;

•risks of terrorism, cybersecurity attacks, and the security of chemical manufacturing facilities and other matters beyond our control;

•our lack of diversification of assets or operating and supply areas;

•the petroleum business’ and nitrogen fertilizer business’ dependence on significant customers and the creditworthiness and performance by counterparties;

•the potential loss of the nitrogen fertilizer business’ transportation cost advantage over its competitors;

•the potential inability to successfully implement our business strategies at all or on time and within budget, including significant capital programs or projects, turnarounds or other initiatives, and other projects;

•our ability to continue to license the technology used for our operations;

•the impact of refined product demand and declining inventories on refined product prices and crack spreads;

•Organization of Petroleum Exporting Countries’ (“OPEC”) and its allies’ production levels and pricing;

•the impact of renewable fuel credits, known as renewable identification numbers (“RINs”), pricing, our blending and purchasing activities, our ability to purchase RINs on a timely and cost effective basis or at all, and governmental actions, including by the U.S. Environmental Protection Agency (the “EPA”) on our RIN obligation, open RINs positions, small refinery exemptions, and our cost to comply with our Renewable Fuel Standard (“RFS”) obligations;

•our accounting policies and treatment, including of our RFS obligations;

•operational upsets or changes in laws that could impact the amount and receipt of credits (if any) under Section 45Q of the Internal Revenue Code of 1986, as amended, or any similar law, rule, or regulation;

•our ability to meet certain carbon capture and sequestration milestones;

•our businesses’ ability to obtain, retain or renew environmental and other governmental permits, licenses or authorizations necessary for the operation of its business;

•impact of potential runoff of water containing nitrogen based fertilizer into waterways and regulatory or legal actions in response thereto;

•our ability to issue securities, obtain financing or sell assets on terms favorable to us or at all;

•bank failures or other events affecting financial institutions;

•existing and future regulations related to the end-use of our products or the application of fertilizers;

•refinery and nitrogen fertilizer facilities’ operating hazards and interruptions, including unscheduled maintenance or downtime and the availability of adequate insurance coverage;

•risks related to services provided by or competition among our subsidiaries, including conflicts of interests and control of the general partner of CVR Partners, LP (“CVR Partners”), and control of CVR Energy, Inc. (“CVR Energy”) by its controlling shareholder;

•risks related to potential strategic transactions involving CVR Energy including, but not limited to, those in which its controlling shareholder or others may participate or direct and potential strategic transactions involving CVR Partners in which CVR Energy or its controlling shareholder or others may participate, including in each case the process of exploring any such transaction and potentially completing any such transaction, including the costs thereof and the risk that any such transaction may not achieve any or all of any anticipated benefits or be completed at all;

•instability and volatility in the capital and credit markets;

•restrictions in our debt agreements and our ability to refinance our debt on acceptable terms or at all;

•asset impairments and impacts thereof;

•our controlling shareholder’s intentions regarding ownership of our common stock or the common units of CVR Partners, including any acquisitions, dispositions or transactions relating thereto;

•the impact of any pandemic or breakout of infectious disease, and of businesses’ and governments’ responses thereto on our operations, personnel, commercial activity, and supply and demand across our and our customers’ and suppliers’ business;

•the variable nature of CVR Partners’ distributions, including the ability of its general partner to modify or revoke its distribution policy, or to cease making cash distributions on its common units;

•changes in tax and other laws, regulations and policies, including, without limitation, the One Big Beautiful Bill Act and actions of the past, current or future administrations that impact conventional fuel operations or favor renewable energy projects in the United States;

•changes in CVR Partners’ treatment as a partnership for U.S. federal income or state tax purposes;

•our ability to procure or recover under our insurance policies for damages or losses in full or at all;

•labor supply shortages, labor difficulties, labor disputes or strikes;

•impacts of any decision to return a unit back to hydrocarbon processing following renewable conversion; and

•the factors described in greater detail under “Risk Factors” in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2024 and our other filings with the U.S. Securities and Exchange Commission (“SEC”).

All forward-looking statements contained in this Report only speak as of the date of this Report. We undertake no obligation to publicly update or revise any forward-looking statements to reflect events or circumstances that occur after the date of this Report, or to reflect the occurrence of unanticipated events, except to the extent required by law.

Information About Us

Investors should note that we make available, free of charge on our website at www.CVREnergy.com, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. We also post announcements, updates, events, investor information and presentations on our website in addition to copies of all recent news releases. We may use the Investor Relations section of our website to communicate with investors. It is possible that the financial and other information posted there could be deemed to be material information. Documents and information on our website are not incorporated by reference herein.

The SEC maintains a website at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers, including us, that file electronically with the SEC.

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

CVR ENERGY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

June 30, 2025 |

|

December 31, 2024 |

| ASSETS |

| Current assets: |

|

|

|

Cash and cash equivalents (including $114 and $91, respectively, of consolidated variable interest entity (“VIE”)) |

$ |

596 |

|

|

$ |

987 |

|

|

|

|

|

Accounts receivable, net (including $50 and $65, respectively, of VIE) |

245 |

|

|

295 |

|

|

|

|

|

Inventories (including $74 and $76, respectively, of VIE) |

503 |

|

|

502 |

|

Prepaid expenses (including $2 and $1, respectively, of VIE) |

25 |

|

|

16 |

|

Other current assets (including $1 and $1, respectively, of VIE) |

23 |

|

|

24 |

|

|

|

|

|

|

|

|

|

| Total current assets |

1,392 |

|

|

1,824 |

|

Property, plant, and equipment, net (including $713 and $736, respectively, of VIE) |

2,155 |

|

|

2,176 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other long-term assets (including $43 and $50, respectively, of VIE) |

437 |

|

|

263 |

|

| Total assets |

$ |

3,984 |

|

|

$ |

4,263 |

|

|

|

|

|

LIABILITIES AND EQUITY |

| Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

Accounts payable (including $38 and $37, respectively, of VIE) |

$ |

462 |

|

|

$ |

538 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other current liabilities (including $32 and $75, respectively, of VIE) |

729 |

|

|

560 |

|

| Total current liabilities |

1,191 |

|

|

1,098 |

|

| Long-term liabilities: |

|

|

|

Long-term debt and finance lease obligations, net of current portion (including $569 and $568, respectively, of VIE) |

1,849 |

|

|

1,907 |

|

|

|

|

|

| Deferred income taxes |

186 |

|

|

277 |

|

Other long-term liabilities (including $42 and $46, respectively, of VIE) |

92 |

|

|

93 |

|

| Total long-term liabilities |

2,127 |

|

|

2,277 |

|

|

|

|

|

| CVR Energy stockholders’ equity: |

|

|

|

Common stock, $0.01 par value per share; 350,000,000 shares authorized; 100,629,209 and 100,629,209 shares issued as of June 30, 2025 and December 31, 2024, respectively |

1 |

|

|

1 |

|

| Additional paid-in-capital |

1,508 |

|

|

1,508 |

|

| Accumulated deficit |

(1,041) |

|

|

(804) |

|

Treasury stock, 98,610 shares at cost |

(2) |

|

|

(2) |

|

|

|

|

|

Total CVR stockholders’ equity |

466 |

|

|

703 |

|

| Noncontrolling interest |

200 |

|

|

185 |

|

| Total equity |

666 |

|

|

888 |

|

| Total liabilities and equity |

$ |

3,984 |

|

|

$ |

4,263 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

CVR ENERGY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

Six Months Ended

June 30, |

| (in millions, except per share data) |

2025 |

|

2024 |

|

2025 |

|

2024 |

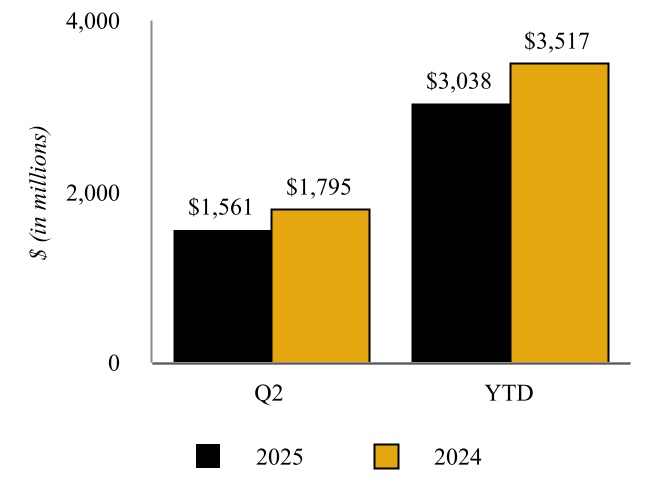

Net sales |

$ |

1,761 |

|

|

$ |

1,967 |

|

|

$ |

3,407 |

|

|

$ |

3,829 |

|

| Operating costs and expenses: |

|

|

|

|

|

|

|

Cost of materials and other |

1,582 |

|

|

1,667 |

|

|

3,099 |

|

|

3,130 |

|

Direct operating expenses (exclusive of depreciation and amortization) |

169 |

|

|

173 |

|

|

324 |

|

|

337 |

|

Depreciation and amortization |

76 |

|

|

70 |

|

|

142 |

|

|

145 |

|

Cost of sales |

1,827 |

|

|

1,910 |

|

|

3,565 |

|

|

3,612 |

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses (exclusive of depreciation and amortization) |

36 |

|

|

28 |

|

|

73 |

|

|

63 |

|

Depreciation and amortization |

2 |

|

|

2 |

|

|

4 |

|

|

4 |

|

| (Gain) loss on asset disposal |

(1) |

|

|

— |

|

|

— |

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

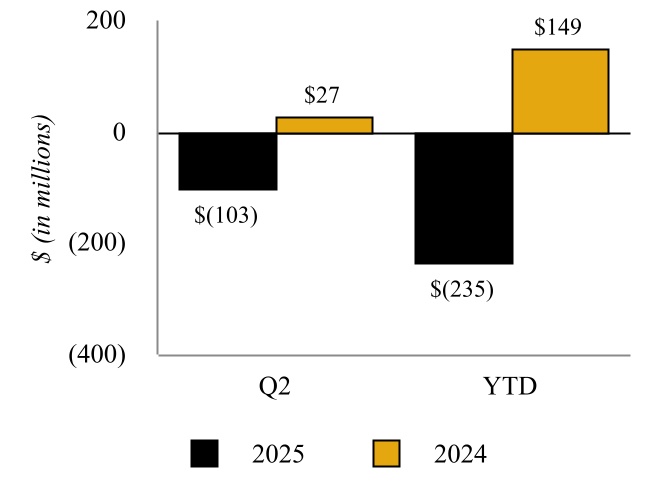

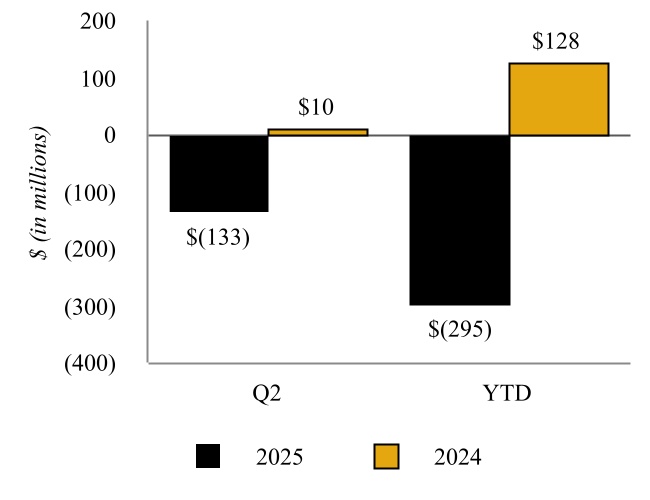

| Operating (loss) income |

(103) |

|

|

27 |

|

|

(235) |

|

|

149 |

|

Other (expense) income: |

|

|

|

|

|

|

|

Interest expense, net |

(30) |

|

|

(19) |

|

|

(55) |

|

|

(39) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income, net |

1 |

|

|

4 |

|

|

4 |

|

|

8 |

|

|

|

|

|

|

|

|

|

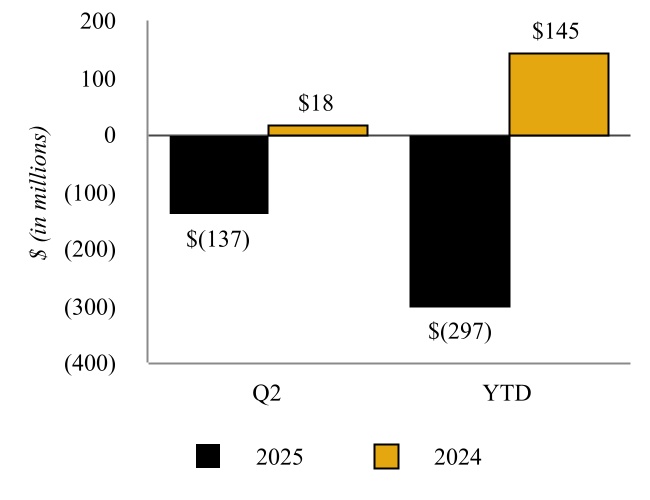

| (Loss) income before income tax benefit |

(132) |

|

|

12 |

|

|

(286) |

|

|

118 |

|

| Income tax benefit |

(42) |

|

|

(26) |

|

|

(91) |

|

|

(10) |

|

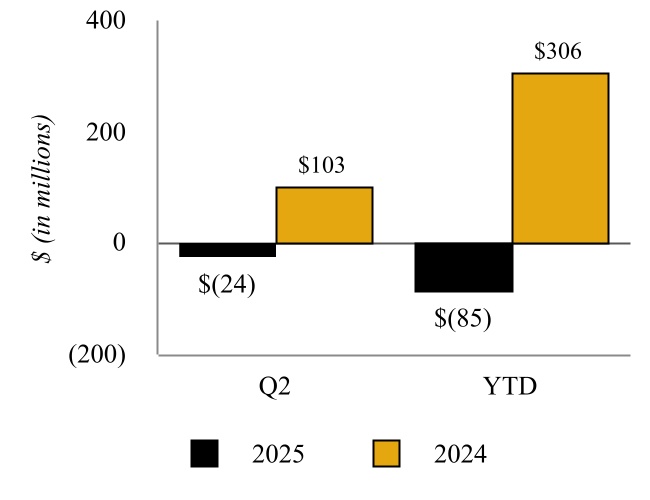

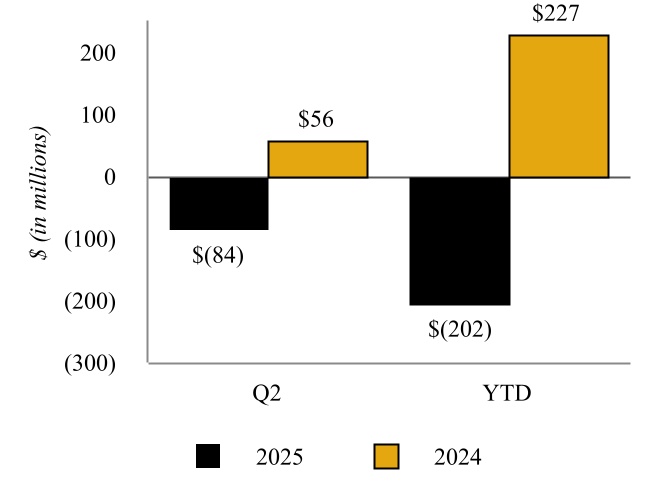

| Net (loss) income |

(90) |

|

|

38 |

|

|

(195) |

|

|

128 |

|

| Less: Net income attributable to noncontrolling interest |

24 |

|

|

17 |

|

|

42 |

|

|

25 |

|

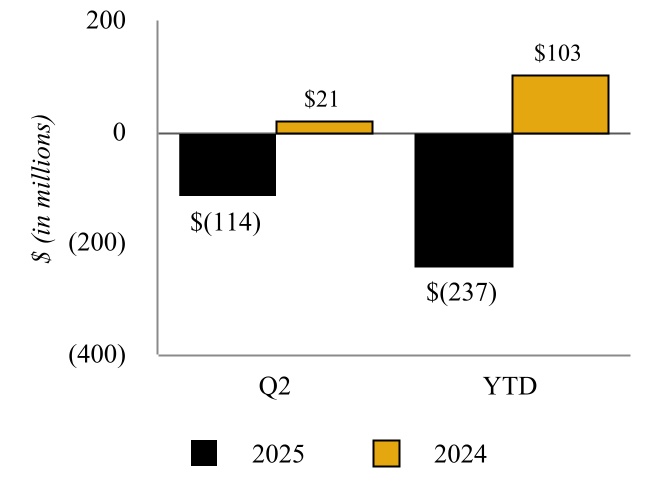

| Net (loss) income attributable to CVR Energy stockholders |

$ |

(114) |

|

|

$ |

21 |

|

|

$ |

(237) |

|

|

$ |

103 |

|

|

|

|

|

|

|

|

|

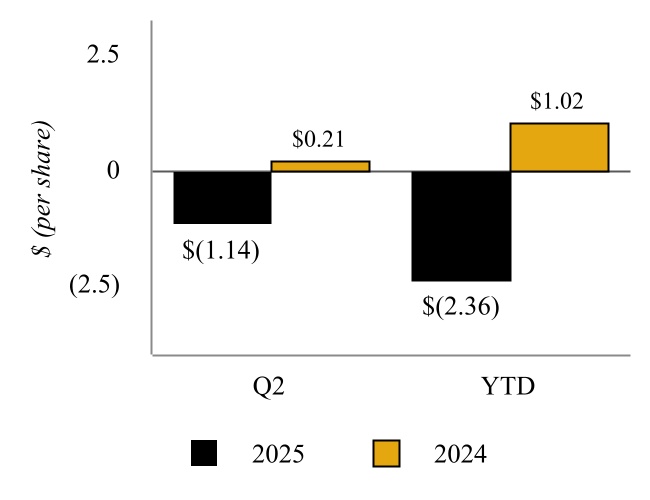

| Basic and diluted (loss) earnings per share |

$ |

(1.14) |

|

|

$ |

0.21 |

|

|

$ |

(2.36) |

|

|

$ |

1.02 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

| Basic and diluted |

100.5 |

|

|

100.5 |

|

|

100.5 |

|

|

100.5 |

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

CVR ENERGY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stockholders |

|

|

|

|

| (in millions, except share data) |

Shares

Issued |

|

$0.01 Par

Value

Common

Stock

|

|

Additional

Paid-In

Capital |

|

Accumulated Deficit |

|

Treasury

Stock |

|

|

|

Total CVR

Stockholders’

Equity |

|

Noncontrolling

Interest |

|

Total

Equity |

| Balance at December 31, 2024 |

100,629,209 |

|

|

$ |

1 |

|

|

$ |

1,508 |

|

|

$ |

(804) |

|

|

$ |

(2) |

|

|

|

|

$ |

703 |

|

|

$ |

185 |

|

|

$ |

888 |

|

| Net (loss) income |

— |

|

|

— |

|

|

— |

|

|

(123) |

|

|

— |

|

|

|

|

(123) |

|

|

18 |

|

|

(105) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Distributions from CVR Partners to its public unitholders and IEP |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

(12) |

|

|

(12) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at March 31, 2025 |

100,629,209 |

|

|

1 |

|

|

1,508 |

|

|

(927) |

|

|

(2) |

|

|

|

|

580 |

|

|

191 |

|

|

771 |

|

| Net income |

— |

|

|

— |

|

|

— |

|

|

(114) |

|

|

— |

|

|

|

|

(114) |

|

|

24 |

|

|

(90) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Distributions from CVR Partners to its public unitholders and IEP |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

(15) |

|

|

(15) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at June 30, 2025 |

100,629,209 |

|

|

$ |

1 |

|

|

$ |

1,508 |

|

|

$ |

(1,041) |

|

|

$ |

(2) |

|

|

|

|

$ |

466 |

|

|

$ |

200 |

|

|

$ |

666 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stockholders |

|

|

|

|

| (in millions, except share data) |

Shares

Issued |

|

$0.01 Par

Value

Common

Stock

|

|

Additional

Paid-In

Capital |

|

Accumulated Deficit |

|

Treasury

Stock |

|

|

|

Total CVR

Stockholders’

Equity |

|

Noncontrolling

Interest |

|

Total

Equity |

| Balance at December 31, 2023 |

100,629,209 |

|

|

$ |

1 |

|

|

$ |

1,508 |

|

|

$ |

(660) |

|

|

$ |

(2) |

|

|

|

|

$ |

847 |

|

|

$ |

191 |

|

|

$ |

1,038 |

|

| Net income |

— |

|

|

— |

|

|

— |

|

|

82 |

|

|

— |

|

|

|

|

82 |

|

|

8 |

|

|

90 |

|

| Dividends to CVR Energy stockholders |

— |

|

|

— |

|

|

— |

|

|

(50) |

|

|

— |

|

|

|

|

(50) |

|

|

— |

|

|

(50) |

|

| Distributions from CVR Partners to its public unitholders |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

(11) |

|

|

(11) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at March 31, 2024 |

100,629,209 |

|

|

1 |

|

|

1,508 |

|

|

(628) |

|

|

(2) |

|

|

|

|

879 |

|

|

188 |

|

|

1,067 |

|

| Net income |

— |

|

|

— |

|

|

— |

|

|

21 |

|

|

— |

|

|

|

|

21 |

|

|

17 |

|

|

38 |

|

| Dividends to CVR Energy stockholders |

— |

|

|

— |

|

|

— |

|

|

(50) |

|

|

— |

|

|

|

|

(50) |

|

|

— |

|

|

(50) |

|

| Distributions from CVR Partners to its public unitholders |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

(13) |

|

|

(13) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other |

— |

|

|

— |

|

|

— |

|

|

(1) |

|

|

— |

|

|

|

|

(1) |

|

|

— |

|

|

(1) |

|

| Balance at June 30, 2024 |

100,629,209 |

|

|

$ |

1 |

|

|

$ |

1,508 |

|

|

$ |

(658) |

|

|

$ |

(2) |

|

|

|

|

$ |

849 |

|

|

$ |

192 |

|

|

$ |

1,041 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

CVR ENERGY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, |

| (in millions) |

2025 |

|

2024 |

| Cash flows from operating activities: |

|

|

|

| Net (loss) income |

$ |

(195) |

|

|

$ |

128 |

|

Adjustments to reconcile net (loss) income to net cash (used in) provided by operating activities: |

|

|

|

| Depreciation and amortization |

146 |

|

|

149 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deferred income taxes and unrecognized tax benefits |

(91) |

|

|

(48) |

|

|

|

|

|

|

|

|

|

| Share-based compensation |

18 |

|

|

10 |

|

| Unrealized loss (gain) on derivatives, net |

(1) |

|

|

7 |

|

Income from equity method investments |

(2) |

|

|

(7) |

|

| Return from equity method investment earnings |

2 |

|

|

7 |

|

| Other items |

8 |

|

|

3 |

|

| Changes in working capital: |

|

|

|

|

|

|

|

| Accounts receivables |

50 |

|

|

(19) |

|

| Inventories |

(10) |

|

|

64 |

|

| Income tax receivable |

1 |

|

|

(3) |

|

| Prepaid expenses and other current assets |

(8) |

|

|

30 |

|

|

|

|

|

|

|

|

|

| Accounts payable |

(91) |

|

|

(7) |

|

| Accrued income taxes |

— |

|

|

(18) |

|

| Deferred revenue |

(45) |

|

|

(5) |

|

| Other current liabilities |

199 |

|

|

(33) |

|

|

|

|

|

|

|

|

|

| Net cash (used in) provided by operating activities |

(19) |

|

|

258 |

|

| Cash flows from investing activities: |

|

|

|

| Capital expenditures |

(92) |

|

|

(90) |

|

| Turnaround expenditures |

(191) |

|

|

(44) |

|

| Proceeds from sale of assets |

9 |

|

|

1 |

|

|

|

|

|

| Insurance proceeds related to asset damages |

2 |

|

|

— |

|

| Return of equity method investment |

5 |

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

(267) |

|

|

(129) |

|

| Cash flows from financing activities: |

|

|

|

| Principal payments of long-term debt |

(72) |

|

|

— |

|

|

|

|

|

| Principal payments on senior secured notes |

— |

|

|

(600) |

|

|

|

|

|

|

|

|

|

| Dividends to CVR Energy stockholders |

— |

|

|

(101) |

|

| Distributions to CVR Partners noncontrolling interest holders |

(27) |

|

|

(24) |

|

| Other financing activities |

(6) |

|

|

(4) |

|

| Net cash used in financing activities |

(105) |

|

|

(729) |

|

| Net decrease in cash, cash equivalents |

(391) |

|

|

(600) |

|

Cash, cash equivalents, reserved funds, and restricted cash, beginning of period (1) |

987 |

|

|

1,186 |

|

| Cash and cash equivalents, end of period |

$ |

596 |

|

|

$ |

586 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)As of December 31, 2023, consisted of $581 million of cash and cash equivalents, $598 million of reserved funds, and $7 million of restricted cash. The reserved funds and restricted cash were released in the first quarter of 2024.

The accompanying notes are an integral part of these condensed consolidated financial statements.

CVR ENERGY, INC. AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

(1) Organization and Nature of Business

Organization

CVR Energy, Inc. (“CVR Energy”, “CVR”, “we”, “us”, “our”, or the “Company”) is a diversified holding company primarily engaged in the petroleum refining and marketing industry (the “Petroleum Segment”), the renewable fuels industry (the “Renewables Segment”), and the nitrogen fertilizer manufacturing industry through its interest in CVR Partners, LP, a publicly traded limited partnership (the “Nitrogen Fertilizer Segment” or “CVR Partners”). The Petroleum Segment refines and markets high value transportation fuels which consist of gasoline, diesel, jet fuel, and distillates, as well as activities related to crude oil gathering and logistics that support refinery operations. The Renewables Segment refines renewable feedstocks, such as soybean oil, corn oil, and other renewable feedstocks, into renewable diesel and markets renewables products. CVR Partners produces and markets nitrogen fertilizer products primarily in the form of ammonia and urea ammonium nitrate (“UAN”) for the farming industry. CVR’s common stock is listed on the New York Stock Exchange (“NYSE”) under the symbol “CVI”. As of June 30, 2025, Icahn Enterprises L.P. and its affiliates, including Mr. Carl C. Icahn (“IEP”), owned approximately 70% of the Company’s outstanding common stock.

CVR Partners, LP

As of June 30, 2025, public common unitholders held approximately 60% of CVR Partners’ outstanding common units; CVR Energy, through its subsidiaries, held approximately 37% of CVR Partners’ outstanding common units and 100% of CVR Partners’ general partner interests, while IEP held approximately 3% of CVR Partners’ outstanding common units. The noncontrolling interest reflected on the Condensed Consolidated Balance Sheets of CVR is only impacted by the results of and distributions from CVR Partners.

Subsequent Events

The Company evaluated subsequent events, if any, that would require an adjustment to the Company’s condensed consolidated financial statements or require disclosure in the notes to the condensed consolidated financial statements through the date of issuance of the condensed consolidated financial statements. Where applicable, the notes to these condensed consolidated financial statements have been updated to reflect all significant subsequent events which have occurred.

On July 4, 2025, the One Big Beautiful Bill Act was signed into law, making significant amendments to federal tax law including permanently extending several provisions of the 2017 Tax Cuts and Jobs Act (“TCJA”). The legislation did not affect the Company’s income tax balances as of June 30, 2025. The Company is currently assessing its impact on future income tax balances and related disclosures and anticipates that it will benefit from the permanent extension of certain TCJA provisions.

(2) Basis of Presentation

The accompanying condensed consolidated financial statements, prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and in accordance with the rules and regulations of the Securities and Exchange Commission (“SEC”), include the accounts of the Company and its majority-owned direct and indirect subsidiaries. All intercompany accounts and transactions have been eliminated. Certain notes and other information have been condensed or omitted from the condensed consolidated financial statements. Therefore, these condensed consolidated financial statements should be read in conjunction with the December 31, 2024 audited consolidated financial statements and notes thereto included in CVR Energy’s Annual Report on Form 10-K for the year ended December 31, 2024 (the “2024 Form 10-K”).

Our condensed consolidated financial statements include the consolidated results of CVR Partners, which is defined as a variable interest entity (“VIE”). As the 100% owner of the general partner of CVR Partners, the Company has the sole ability to direct the activities that most significantly impact the economic performance of CVR Partners and is considered the primary beneficiary.

In the opinion of the Company’s management, the accompanying condensed consolidated financial statements reflect all adjustments that are necessary for fair presentation of the financial position and results of operations of the Company for the periods presented. Such adjustments are of a normal recurring nature, unless otherwise disclosed.

CVR ENERGY, INC. AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

The condensed consolidated financial statements are prepared in conformity with GAAP, which requires management to make certain estimates and assumptions that affect the reported amounts and disclosure of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Results of operations and cash flows for the interim periods presented are not necessarily indicative of the results that will be realized for the year ending December 31, 2025 or any other interim or annual period.

Reclassifications

Effective beginning with the 2024 Form 10-K and due to the prominence of the renewables business relative to the Company’s overall 2024 performance, the Company has revised its reportable segments to reflect a new reportable segment: Renewables. The Renewables Segment includes the operations of the renewable diesel unit and renewable feedstock pretreater at the refinery located in Wynnewood, Oklahoma (the “Wynnewood Refinery”). Results of the Renewables Segment were not previously included within our reportable segments, rather included within “Other.” Prior period segment information has been retrospectively adjusted to reflect the current segment presentation. Refer to Note 13 (“Business Segments”) for segment disclosures.

In addition, certain other immaterial reclassifications have been made within the consolidated financial statements for prior periods to conform with current presentation.

Recent Accounting Pronouncements - Accounting Standards Issued But Not Yet Implemented

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740) - Improvements to Income Tax Disclosures, which requires enhanced income tax disclosures that reflect how operations and related tax risks, as well as how tax planning and operational opportunities, affect the tax rate and prospects for future cash flows. This standard is effective for the Company’s annual reporting beginning January 1, 2025 with early adoption permitted. The adoption of this standard update will not have a material impact on the Company’s consolidated financial statements but additional disclosures will be included for our Annual Report on Form 10-K for the year ending December 31, 2025. The Company does not intend to early adopt this ASU.

In November 2024, the FASB issued ASU 2024-03, Income Statement - Reporting Comprehensive Income - Expense Disaggregation Disclosures (Subtopic 220-40), which requires additional disclosures in the footnotes that disaggregate certain expenses presented on the face of the income statement. This standard is effective for the Company’s annual reporting period beginning January 1, 2027 and interim reporting periods beginning January 1, 2028. Retrospective application to comparative periods is optional, and early adoption is permitted. The Company continues to evaluate and assess potential impacts of adopting this new accounting guidance.

(3) Inventories

Inventories consisted of the following:

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

June 30, 2025 |

|

December 31, 2024 |

| Finished goods |

$ |

217 |

|

|

$ |

221 |

|

| Raw materials |

145 |

|

|

146 |

|

| In-process inventories |

31 |

|

|

28 |

|

| Parts, supplies and other |

110 |

|

|

107 |

|

| Total inventories |

$ |

503 |

|

|

$ |

502 |

|

At June 30, 2025, the Renewables Segment had inventories with carrying amounts exceeding their net realizable value, which is estimated using indicative market pricing available at the time the estimate was made. As a result, we recognized a loss of $2 million in Cost of materials and other in the Company’s Condensed Consolidated Statements of Operations for the three months ended June 30, 2025 to reflect the net realizable value of such inventories. No adjustment was necessary for the three months ended March 31, 2025 or the three and six months ended June 30, 2024.

CVR ENERGY, INC. AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

(4) Long-Term Assets

Property, Plant, and Equipment

Property, plant, and equipment, net consisted of the following:

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

June 30, 2025 |

|

December 31, 2024 |

| Machinery and equipment |

$ |

4,464 |

|

|

$ |

4,403 |

|

| Buildings and improvements |

148 |

|

|

148 |

|

| ROU finance leases |

121 |

|

|

106 |

|

| Land and improvements |

74 |

|

|

74 |

|

| Furniture and fixtures |

31 |

|

|

32 |

|

| Construction in progress |

168 |

|

|

171 |

|

| Other |

16 |

|

|

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,022 |

|

|

4,950 |

|

| Less: Accumulated depreciation and amortization |

(2,867) |

|

|

(2,774) |

|

| Total property, plant, and equipment, net |

$ |

2,155 |

|

|

$ |

2,176 |

|

For the three and six months ended June 30, 2025, depreciation and amortization expense related to property, plant, and equipment was $59 million and $115 million, respectively, compared to $58 million and $114 million for the three and six months ended June 30, 2024, respectively. For the three and six months ended June 30, 2025, capitalized interest was $2 million and $5 million, respectively, compared to $2 million and $3 million for the three and six months ended June 30, 2024, respectively.

Other Long-Term Assets

As of June 30, 2025 and December 31, 2024, Other long-term assets included turnaround assets, net of accumulated amortization of $289 million and $124 million, respectively.

(5) Leases