00013736702023FYFALSE00013736702023-01-012023-12-310001373670us-gaap:CommonStockMember2023-01-012023-12-310001373670us-gaap:SeriesAPreferredStockMember2023-01-012023-12-3100013736702023-06-30iso4217:USD00013736702024-02-23xbrli:shares00013736702023-12-31grbk:employee0001373670us-gaap:CommonStockMember2023-12-3100013736702022-12-31iso4217:USDxbrli:shares0001373670us-gaap:ResidentialRealEstateMember2023-01-012023-12-310001373670us-gaap:ResidentialRealEstateMember2022-01-012022-12-310001373670us-gaap:ResidentialRealEstateMember2021-01-012021-12-310001373670us-gaap:RealEstateOtherMember2023-01-012023-12-310001373670us-gaap:RealEstateOtherMember2022-01-012022-12-310001373670us-gaap:RealEstateOtherMember2021-01-012021-12-3100013736702022-01-012022-12-3100013736702021-01-012021-12-310001373670us-gaap:CommonStockMember2020-12-310001373670us-gaap:TreasuryStockCommonMember2020-12-310001373670us-gaap:AdditionalPaidInCapitalMember2020-12-310001373670us-gaap:RetainedEarningsMember2020-12-310001373670us-gaap:ParentMember2020-12-310001373670us-gaap:NoncontrollingInterestMember2020-12-3100013736702020-12-310001373670us-gaap:CommonStockMember2021-01-012021-12-310001373670us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001373670us-gaap:ParentMember2021-01-012021-12-310001373670grbk:PreferredStockGRBKPRAMember2021-12-310001373670us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001373670us-gaap:RetainedEarningsMember2021-01-012021-12-310001373670us-gaap:CommonStockMember2021-12-3100013736702021-12-310001373670us-gaap:TreasuryStockCommonMember2021-12-310001373670us-gaap:AdditionalPaidInCapitalMember2021-12-310001373670us-gaap:RetainedEarningsMember2021-12-310001373670us-gaap:ParentMember2021-12-310001373670us-gaap:NoncontrollingInterestMember2021-12-310001373670us-gaap:CommonStockMember2022-01-012022-12-310001373670us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001373670us-gaap:ParentMember2022-01-012022-12-310001373670grbk:PreferredStockGRBKPRAMember2022-01-012022-12-310001373670us-gaap:TreasuryStockCommonMember2022-01-012022-12-310001373670us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001373670us-gaap:RetainedEarningsMember2022-01-012022-12-310001373670us-gaap:CommonStockMember2022-12-310001373670us-gaap:TreasuryStockCommonMember2022-12-310001373670us-gaap:AdditionalPaidInCapitalMember2022-12-310001373670us-gaap:RetainedEarningsMember2022-12-310001373670us-gaap:ParentMember2022-12-310001373670us-gaap:NoncontrollingInterestMember2022-12-310001373670us-gaap:CommonStockMember2023-01-012023-12-310001373670us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001373670us-gaap:ParentMember2023-01-012023-12-310001373670us-gaap:RetainedEarningsMember2023-01-012023-12-310001373670us-gaap:TreasuryStockCommonMember2023-01-012023-12-310001373670grbk:PreferredStockGRBKPRAMember2023-01-012023-12-310001373670us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001373670us-gaap:TreasuryStockCommonMember2023-12-310001373670us-gaap:AdditionalPaidInCapitalMember2023-12-310001373670us-gaap:RetainedEarningsMember2023-12-310001373670us-gaap:ParentMember2023-12-310001373670us-gaap:NoncontrollingInterestMember2023-12-310001373670us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-01-012023-12-31xbrli:pure0001373670us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310001373670srt:MinimumMember2023-01-012023-12-310001373670srt:MaximumMember2023-01-012023-12-310001373670srt:MinimumMember2023-12-310001373670srt:MaximumMember2023-12-310001373670us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-12-310001373670us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310001373670us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-12-3100013736702018-04-260001373670grbk:TPGMember2023-12-310001373670grbk:TPGMember2022-12-310001373670grbk:ChallengerMember2023-12-310001373670grbk:ChallengerMember2022-12-310001373670grbk:GBTMSenderaMember2023-12-310001373670grbk:GBTMSenderaMember2022-12-310001373670grbk:EJBRiverHoldingsLLCMember2023-12-310001373670grbk:EJBRiverHoldingsLLCMember2022-12-310001373670grbk:GreenBrickMortgageLLCMember2023-12-310001373670grbk:GreenBrickMortgageLLCMember2022-12-310001373670grbk:BHomeMortgageMember2023-12-310001373670grbk:BHomeMortgageMember2022-12-310001373670grbk:ChallengerMember2017-08-150001373670grbk:ChallengerMember2023-01-012023-12-310001373670grbk:ChallengerMember2022-01-012022-12-310001373670grbk:ChallengerMember2021-01-012021-12-310001373670grbk:GBTMSenderaMember2023-01-012023-12-310001373670grbk:GBTMSenderaMember2022-01-012022-12-310001373670grbk:GBTMSenderaMember2023-12-310001373670grbk:EJBRiverHoldingsLLCMember2023-12-310001373670us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOtherMember2023-12-310001373670us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOtherMember2022-12-310001373670us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOtherMember2023-01-012023-12-310001373670us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOtherMember2022-01-012022-12-310001373670us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOtherMember2021-01-012021-12-310001373670grbk:EJBRiverHoldingsLLCMember2023-01-012023-12-310001373670grbk:EJBRiverHoldingsLLCMember2022-01-012022-12-310001373670grbk:EJBRiverHoldingsLLCMember2021-01-012021-12-310001373670grbk:BHomeMortgageMember2023-01-012023-12-310001373670grbk:BHomeMortgageMember2022-01-012022-12-310001373670grbk:BHomeMortgageMember2021-01-012021-12-310001373670grbk:GreenBrickMortgageLLCMember2023-01-012023-12-310001373670grbk:GreenBrickMortgageLLCMember2022-01-012022-12-310001373670grbk:GreenBrickMortgageLLCMember2021-01-012021-12-310001373670grbk:ModelHomeFurnishingsMember2023-12-310001373670grbk:ModelHomeFurnishingsMember2022-12-310001373670us-gaap:FurnitureAndFixturesMember2023-12-310001373670us-gaap:FurnitureAndFixturesMember2022-12-310001373670us-gaap:LeaseholdImprovementsMember2023-12-310001373670us-gaap:LeaseholdImprovementsMember2022-12-310001373670us-gaap:ComputerEquipmentMember2023-12-310001373670us-gaap:ComputerEquipmentMember2022-12-310001373670us-gaap:VehiclesMember2023-12-310001373670us-gaap:VehiclesMember2022-12-310001373670us-gaap:ConstructionMember2023-12-310001373670us-gaap:ConstructionMember2022-12-310001373670us-gaap:AccruedLiabilitiesMember2023-12-310001373670us-gaap:AccruedLiabilitiesMember2022-12-310001373670us-gaap:DeferredBonusMember2023-12-310001373670us-gaap:DeferredBonusMember2022-12-310001373670us-gaap:AccruedLiabilitiesMember2021-12-310001373670us-gaap:AccruedLiabilitiesMember2023-01-012023-12-310001373670us-gaap:AccruedLiabilitiesMember2022-01-012022-12-310001373670grbk:SecuredRevolvingLineOfCreditMember2023-12-310001373670grbk:SecuredRevolvingLineOfCreditMember2022-12-310001373670us-gaap:UnsecuredDebtMember2023-12-310001373670us-gaap:UnsecuredDebtMember2022-12-310001373670grbk:SecuredRevolvingLineOfCreditMember2023-01-012023-12-310001373670srt:MinimumMemberus-gaap:RevolvingCreditFacilityMembersrt:SubsidiaryIssuerMember2023-12-310001373670srt:MaximumMemberus-gaap:RevolvingCreditFacilityMembersrt:SubsidiaryIssuerMember2023-12-310001373670us-gaap:RevolvingCreditFacilityMember2023-12-310001373670us-gaap:RevolvingCreditFacilityMember2023-01-012023-12-310001373670grbk:UnsecuredRevolvingCreditFacilityMember2023-12-310001373670grbk:UnsecuredRevolvingCreditFacilityMember2023-01-012023-12-310001373670grbk:BaseRateAdvancesMember2023-01-012023-12-310001373670us-gaap:UnsecuredDebtMember2023-01-012023-12-310001373670us-gaap:UnsecuredDebtMember2015-12-150001373670us-gaap:UnsecuredDebtMember2022-01-012022-12-310001373670us-gaap:UnsecuredDebtMember2021-01-012021-12-310001373670grbk:A2026NotesMember2019-08-0800013736702019-08-080001373670grbk:A2026NotesMember2019-08-082019-08-080001373670srt:ScenarioForecastMember2024-08-080001373670srt:ScenarioForecastMember2025-08-080001373670srt:ScenarioForecastMember2026-08-0800013736702020-08-2600013736702020-08-080001373670grbk:A2027NotesMember2020-08-262020-08-260001373670grbk:A2027NotesMember2022-01-012022-12-310001373670grbk:A2028NotesMember2021-02-2500013736702021-02-250001373670grbk:A2028NotesMember2023-01-012023-12-310001373670grbk:A2027NotesMember2023-01-012023-12-310001373670grbk:A2029NotesMember2021-12-2800013736702021-12-280001373670grbk:A2029NotesMember2023-01-012023-12-310001373670us-gaap:NotesPayableOtherPayablesMember2023-12-310001373670us-gaap:NotesPayableOtherPayablesMember2023-01-012023-12-3100013736702021-12-2300013736702021-12-232021-12-2300013736702021-03-030001373670grbk:A2021ShareRepurchaseProgramMember2022-01-012022-12-3100013736702022-04-270001373670grbk:A2022ShareRepurchaseProgramMember2023-01-012023-12-310001373670grbk:A2022ShareRepurchaseProgramMember2022-01-012022-12-310001373670grbk:A2022ShareRepurchaseProgramMember2023-12-3100013736702023-04-270001373670grbk:A2023ShareRepurchasePlanMember2023-12-3100013736702014-10-270001373670srt:DirectorMember2021-01-012021-12-31grbk:non-employee0001373670srt:OfficerMemberus-gaap:RestrictedStockMember2021-01-012021-12-3100013736702014-10-272014-10-270001373670us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001373670us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001373670us-gaap:RestrictedStockMember2023-12-310001373670us-gaap:RestrictedStockMember2023-01-012023-12-310001373670us-gaap:ResidentialRealEstateMembergrbk:CentralMember2023-01-012023-12-310001373670us-gaap:RealEstateOtherMembergrbk:CentralMember2023-01-012023-12-310001373670us-gaap:ResidentialRealEstateMembergrbk:CentralMember2022-01-012022-12-310001373670us-gaap:RealEstateOtherMembergrbk:CentralMember2022-01-012022-12-310001373670us-gaap:ResidentialRealEstateMembergrbk:CentralMember2021-01-012021-12-310001373670us-gaap:RealEstateOtherMembergrbk:CentralMember2021-01-012021-12-310001373670us-gaap:ResidentialRealEstateMembergrbk:SoutheastMember2023-01-012023-12-310001373670us-gaap:RealEstateOtherMembergrbk:SoutheastMember2023-01-012023-12-310001373670us-gaap:ResidentialRealEstateMembergrbk:SoutheastMember2022-01-012022-12-310001373670us-gaap:RealEstateOtherMembergrbk:SoutheastMember2022-01-012022-12-310001373670us-gaap:ResidentialRealEstateMembergrbk:SoutheastMember2021-01-012021-12-310001373670us-gaap:RealEstateOtherMembergrbk:SoutheastMember2021-01-012021-12-310001373670grbk:HomebuyersMemberus-gaap:ResidentialRealEstateMember2023-01-012023-12-310001373670grbk:HomebuyersMemberus-gaap:RealEstateOtherMember2023-01-012023-12-310001373670grbk:HomebuyersMemberus-gaap:ResidentialRealEstateMember2022-01-012022-12-310001373670grbk:HomebuyersMemberus-gaap:RealEstateOtherMember2022-01-012022-12-310001373670grbk:HomebuyersMemberus-gaap:ResidentialRealEstateMember2021-01-012021-12-310001373670grbk:HomebuyersMemberus-gaap:RealEstateOtherMember2021-01-012021-12-310001373670grbk:HomebuildersMemberus-gaap:ResidentialRealEstateMember2023-01-012023-12-310001373670grbk:HomebuildersMemberus-gaap:RealEstateOtherMember2023-01-012023-12-310001373670grbk:HomebuildersMemberus-gaap:ResidentialRealEstateMember2022-01-012022-12-310001373670grbk:HomebuildersMemberus-gaap:RealEstateOtherMember2022-01-012022-12-310001373670grbk:HomebuildersMemberus-gaap:ResidentialRealEstateMember2021-01-012021-12-310001373670grbk:HomebuildersMemberus-gaap:RealEstateOtherMember2021-01-012021-12-310001373670grbk:LandSubdividersAndDevelopersNoCemeteriesMemberus-gaap:ResidentialRealEstateMember2023-01-012023-12-310001373670grbk:LandSubdividersAndDevelopersNoCemeteriesMemberus-gaap:ResidentialRealEstateMember2022-01-012022-12-310001373670grbk:LandSubdividersAndDevelopersNoCemeteriesMemberus-gaap:ResidentialRealEstateMember2021-01-012021-12-310001373670grbk:LandandLotsMembergrbk:UsGaap_HomeBuildingMemberMember2023-01-012023-12-310001373670grbk:LandandLotsMembergrbk:UsGaap_HomeBuildingMemberMember2022-01-012022-12-310001373670grbk:LandandLotsMembergrbk:UsGaap_HomeBuildingMemberMember2021-01-012021-12-310001373670us-gaap:ResidentialRealEstateMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310001373670us-gaap:RealEstateOtherMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310001373670us-gaap:ResidentialRealEstateMemberus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001373670us-gaap:RealEstateOtherMemberus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001373670us-gaap:ResidentialRealEstateMemberus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001373670us-gaap:RealEstateOtherMemberus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001373670us-gaap:TransferredOverTimeMemberus-gaap:ResidentialRealEstateMember2023-01-012023-12-310001373670us-gaap:TransferredOverTimeMemberus-gaap:RealEstateOtherMember2023-01-012023-12-310001373670us-gaap:TransferredOverTimeMemberus-gaap:ResidentialRealEstateMember2022-01-012022-12-310001373670us-gaap:TransferredOverTimeMemberus-gaap:RealEstateOtherMember2022-01-012022-12-310001373670us-gaap:TransferredOverTimeMemberus-gaap:ResidentialRealEstateMember2021-01-012021-12-310001373670us-gaap:TransferredOverTimeMemberus-gaap:RealEstateOtherMember2021-01-012021-12-310001373670grbk:UsGaap_HomeBuildingMemberMembergrbk:CentralMember2023-01-012023-12-310001373670grbk:UsGaap_HomeBuildingMemberMembergrbk:CentralMember2022-01-012022-12-310001373670grbk:UsGaap_HomeBuildingMemberMembergrbk:CentralMember2021-01-012021-12-310001373670grbk:UsGaap_HomeBuildingMemberMembergrbk:SoutheastMember2023-01-012023-12-310001373670grbk:UsGaap_HomeBuildingMemberMembergrbk:SoutheastMember2022-01-012022-12-310001373670grbk:UsGaap_HomeBuildingMemberMembergrbk:SoutheastMember2021-01-012021-12-310001373670grbk:UsGaap_HomeBuildingMemberMember2023-01-012023-12-310001373670grbk:UsGaap_HomeBuildingMemberMember2022-01-012022-12-310001373670grbk:UsGaap_HomeBuildingMemberMember2021-01-012021-12-310001373670grbk:LandSubdividersAndDevelopersNoCemeteriesMember2023-01-012023-12-310001373670grbk:LandSubdividersAndDevelopersNoCemeteriesMember2022-01-012022-12-310001373670grbk:LandSubdividersAndDevelopersNoCemeteriesMember2021-01-012021-12-310001373670us-gaap:CorporateAndOtherMember2023-01-012023-12-310001373670us-gaap:CorporateAndOtherMember2022-01-012022-12-310001373670us-gaap:CorporateAndOtherMember2021-01-012021-12-310001373670grbk:HomebuildersMembergrbk:CentralMember2023-01-012023-12-310001373670grbk:HomebuildersMembergrbk:CentralMember2022-01-012022-12-310001373670grbk:HomebuildersMembergrbk:CentralMember2021-01-012021-12-310001373670grbk:HomebuildersMembergrbk:SoutheastMember2023-01-012023-12-310001373670grbk:HomebuildersMembergrbk:SoutheastMember2022-01-012022-12-310001373670grbk:HomebuildersMembergrbk:SoutheastMember2021-01-012021-12-310001373670grbk:HomebuildersMember2023-01-012023-12-310001373670grbk:HomebuildersMember2022-01-012022-12-310001373670grbk:HomebuildersMember2021-01-012021-12-310001373670grbk:UsGaap_HomeBuildingMemberMembergrbk:CentralMember2023-12-310001373670grbk:UsGaap_HomeBuildingMemberMembergrbk:CentralMember2022-12-310001373670grbk:UsGaap_HomeBuildingMemberMembergrbk:SoutheastMember2023-12-310001373670grbk:UsGaap_HomeBuildingMemberMembergrbk:SoutheastMember2022-12-310001373670grbk:UsGaap_HomeBuildingMemberMember2023-12-310001373670grbk:UsGaap_HomeBuildingMemberMember2022-12-310001373670grbk:LandSubdividersAndDevelopersNoCemeteriesMember2023-12-310001373670grbk:LandSubdividersAndDevelopersNoCemeteriesMember2022-12-310001373670us-gaap:CorporateAndOtherMember2023-12-310001373670us-gaap:CorporateAndOtherMember2022-12-310001373670grbk:UsGaap_HomeBuildingMemberMemberus-gaap:RealEstateOtherMember2023-01-012023-12-310001373670grbk:UsGaap_HomeBuildingMemberMemberus-gaap:RealEstateOtherMember2022-01-012022-12-310001373670grbk:UsGaap_HomeBuildingMemberMemberus-gaap:RealEstateOtherMember2021-01-012021-12-310001373670grbk:CentreLivingMembergrbk:GreenBrickPartnersInc.Member2021-12-310001373670grbk:CentreLivingMembergrbk:TrevorBrickmanMember2023-12-310001373670grbk:CentreLivingMembergrbk:GreenBrickPartnersInc.Member2023-12-310001373670srt:AffiliatedEntityMembergrbk:GHOHomesMembergrbk:OfficeSpaceLeaseAgreementsMember2023-01-012023-12-310001373670srt:AffiliatedEntityMembergrbk:GHOHomesMembergrbk:OfficeSpaceLeaseAgreementsMember2022-01-012022-12-310001373670srt:AffiliatedEntityMembergrbk:GHOHomesMembergrbk:OfficeSpaceLeaseAgreementsMember2021-01-012021-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

|

|

|

|

|

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

or

|

|

|

|

|

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from — to —

Commission file number: 001-33530

|

|

|

Green Brick Partners, Inc. |

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Delaware |

|

20-5952523 |

| (State or other jurisdiction of incorporation) |

|

(IRS Employer Identification Number) |

| 5501 Headquarters Drive, Suite 300W |

|

|

|

| Plano |

, |

TX |

75024 |

|

(469) |

573-6755 |

| (Address of principal executive offices, including Zip Code) |

|

(Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

GRBK |

The New York Stock Exchange |

Depositary Shares (each representing a 1/1000th interest in a share of 5.75% Series A Cumulative Perpetual Preferred Stock, par value $0.01 per share) |

GRBK PRA |

The New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☒ |

|

Non-accelerated filer |

☐ |

|

Smaller reporting company |

☐ |

|

|

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ☐ No ☒

The aggregate market value of voting stock held by non-affiliates of the Registrant was $1,451,010,187 as of June 30, 2023 (based upon the closing sale price on The New York Stock Exchange for such date). For this purpose, all shares held by directors, executive officers and stockholders beneficially owning ten percent or more of the registrant’s common stock have been treated as held by affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares of the Registrant’s common stock outstanding as of February 23, 2024 was 44,971,005.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive Proxy Statement for its 2024 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 1. |

|

|

|

Item 1A. |

|

|

|

Item 1B. |

|

|

|

Item 1C. |

|

|

|

Item 2. |

|

|

|

Item 3. |

|

|

|

Item 4. |

|

|

|

|

|

|

Item 5. |

|

|

|

Item 6. |

|

|

|

Item 7. |

|

|

|

Item 7A. |

|

|

|

Item 8. |

|

|

|

Item 9. |

|

|

|

Item 9A. |

|

|

|

Item 9B. |

|

|

|

|

|

|

Item 10. |

|

|

|

Item 11. |

|

|

|

Item 12. |

|

|

|

Item 13. |

|

|

|

Item 14. |

|

|

|

|

|

|

Item 15. |

|

|

|

Item 16. |

|

|

|

|

|

|

PART I

ITEM 1. BUSINESS

Green Brick Partners, Inc. and its subsidiaries (“Green Brick”, “the Company”, “we” or “us”) is a diversified homebuilding and land development company. We acquire and develop land and build homes through our seven brands of builders in four major markets. Our core markets are in the high growth U.S. metropolitan areas of Dallas-Fort Worth (“DFW”) and Austin, Texas, and Atlanta, Georgia, as well as the Treasure Coast, Florida area. We are engaged in all aspects of the homebuilding process, including land acquisition and development, entitlements, design, construction, title and mortgage services, marketing and sales and the creation of brand images at our residential neighborhoods and master planned communities. We previously owned a noncontrolling interest in a builder in Colorado Springs, Colorado, which was sold on February 1, 2024.

We believe we offer higher quality homes with more distinctive designs and floor plans than those built by our competitors at comparable prices. Many of our communities are located in premium locations and we seek to enhance homebuyer satisfaction by utilizing high-quality materials, and building well-crafted homes. We seek to maximize value over the long term and operate our business to mitigate risks in the event of a downturn by controlling costs and quickly reacting to regional and local market trends.

We are a leading lot developer in our markets and believe that our strict operating discipline provides us with a competitive advantage in seeking to maximize returns while minimizing risk. As of December 31, 2023, we owned or controlled approximately 28,700 home sites in high-growth submarkets throughout the DFW, Austin, and Atlanta metropolitan areas and the Treasure Coast, Florida market. We provide finished lots to our subsidiary builders or option lots from third-party developers for our builders’ homebuilding operations and provide them with construction funding and strategic planning. Our Atlanta and Florida builders provide us with their local knowledge and relationships.

We are a Delaware corporation, incorporated in 2006. We commenced operations as a publicly held homebuilding company in 2014. Our principal executive offices are located at 5501 Headquarters Drive, Ste 300W, Plano, TX 75024.

Business Strategy

We believe we are well-positioned for growth through the disciplined execution of the following elements of our strategy:

•Consistent Land Acquisition Program with Disciplined Underwriting. We believe our ability to identify, acquire and develop land in desirable locations and on favorable terms is critical to our success. We evaluate land opportunities based on how we expect such opportunities will contribute to overall profitability and returns. Through our rigorous national underwriting program, we seek to identify attractive properties that are typically located in prime neighborhood locations or in preferred growth corridors. We focus on the development of entitled parcels in communities where we can generally sell all homes within 24 to 72 months from the start of sales. Notwithstanding, we will also invest in longer-term land investments if our return criteria is generated.

•Focus on Markets with a Favorable Growth Outlook and Strong Demand Fundamentals. We have chosen to focus our operations on sunbelt and sunbelt-adjacent states because we believe these markets offer attractive residential real estate investment characteristics, such as growing economies, improving levels of employment, population growth relative to national averages, favorable migration patterns, general housing affordability, and desirable lifestyle and weather characteristics. We currently generate income from home sales in Texas, Florida, and Georgia. In 2023, Texas, Florida and Georgia were ranked first, second and fourth, respectively, in terms of population growth according to the U.S. Census Bureau.

•Strategically Increase Market Positions in our Existing Markets. We believe there are significant opportunities to profitably expand in our core markets. As of December 31, 2023, we believe our extensive land and lot inventory will allow us to maximize our profitability and return on capital. In DFW, Austin, and Atlanta, we seek to acquire land with convenient access to metropolitan areas which have diverse economic and employment bases and demographics that we believe will support long-term growth. In the Treasure Coast market, we seek land in highly desirable, but limited, coastal regions that attract relocating homebuyers. We continuously review the allocation of our investments in these markets taking into account demographic trends and the likely impact on our operating results and will reallocate our investments when necessary.

•Deliver Superior Designs, Broad Product Ranges and Enhanced Homebuying Experience. We partner our expertise with that of our builders to design attractive neighborhoods and homes to appeal to a wide variety of potential homebuyers. Our homebuilding projects include single family homes, townhomes, luxury homes, and patio homes. We believe we can adapt quickly to changing market conditions and optimize performance and returns while strategically reducing portfolio risk because of our diversified product strategy. One of our core operating philosophies is to create a culture that provides a positive, memorable experience for our homebuyers. In consultation with nationally and locally recognized architecture firms, interior and exterior consultants, and homeowner focus groups, we research and design a diversified range of products for various levels and price points.

•Disciplined Investment Strategy Combined with the Prudent Use of Leverage. We seek to maximize value over the long-term and operate our business to mitigate risks in the event of a downturn by controlling costs and focusing on regional and local market trends. We believe our strict operating discipline combined with our prudent use of financial leverage to continue to invest in our land acquisition, development and homebuilding businesses provides us with a competitive advantage in seeking to maximize returns while minimizing risk. We target a debt to total capitalization ratio of approximately 30%, which we expect will continue to provide us with significant additional growth capital. As of December 31, 2023, our debt to total capitalization ratio was 21.1%.

•Targeted Expansion into Adjacent Markets. We currently intend to pursue targeted expansion of our entry-level builder, Trophy Signature Homes, into markets within our current states. We believe Trophy’s more affordable product and quicker inventory turns make its platform uniquely scalable to expand outside of the DFW metroplex. We plan to expand Trophy into markets compatible with our existing markets that demonstrate strong trends in demographics, employment, and in-migration by leveraging existing relationships with land developers and homebuilders. In this regard, in 2023 we continued our expansion into the Austin, TX market, which began in 2022. In addition, we have traditionally, and may in the future, grow through the acquisition of homebuilders in our current markets or other markets that meet our demographic and economic growth criteria.

Our Builders and Homes

The following table presents general information about each of our builders, including the types of homes they build and their price ranges as of December 31, 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Builder* |

|

Ownership |

|

Market |

|

Products Offered |

|

Price Range |

| Trophy Signature Homes LLC (“Trophy”) |

|

100% |

|

DFW and Austin |

|

Single family |

|

$260,000 to $1,100,000 |

| CB JENI Homes DFW LLC (“CB JENI”) |

|

100% |

|

DFW |

|

Townhomes |

|

$270,000 to $640,000 |

| Normandy Homes (“Normandy”) |

|

100% |

|

DFW |

|

Single family |

|

$460,000 to $910,000 |

| SGHDAL LLC (“Southgate”) |

|

100% |

|

DFW |

|

Luxury homes |

|

$790,000 to $1,880,000 |

| CLH20 LLC (“Centre Living”) |

|

90% |

|

DFW |

|

Townhomes and Single Family |

|

$340,000 to $710,000 |

| The Providence Group of Georgia LLC (“TPG”) |

|

50% |

|

Atlanta |

|

Townhomes, Condominiums and Single Family |

|

$390,000 to $1,260,000 |

| GRBK GHO Homes LLC (“GRBK GHO”) |

|

80% |

|

Treasure Coast |

|

Patio homes and Single Family |

|

$370,000 to $2,100,000 |

*The Company sold its 49.9% ownership interest in GB Challenger, LLC (“Challenger”) effective February 1, 2024.

Our backlog reflects the number and value of homes for which we have entered into sales contracts with customers but we have not yet delivered the home. With the exception of a normal cancellation rate, we expect all of the backlog as of December 31, 2023 to be delivered during 2024. The following table sets forth the information about selling communities and backlog of our builders.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, 2023 |

|

December 31, 2023 |

|

December 31, 2022 |

| Builder |

|

Average Selling Communities |

|

Selling Communities |

|

Backlog, Units |

|

Backlog, in thousands |

|

Selling Communities |

|

Backlog, Units |

|

Backlog, in thousands |

| Trophy |

|

28 |

|

|

30 |

|

|

124 |

|

|

$ |

56,929 |

|

|

28 |

|

|

143 |

|

|

$ |

78,840 |

|

CB JENI (1) |

|

17 |

|

|

20 |

|

|

264 |

|

|

169,773 |

|

|

16 |

|

|

121 |

|

|

72,395 |

|

| Southgate |

|

3 |

|

|

4 |

|

|

70 |

|

|

77,529 |

|

|

4 |

|

|

38 |

|

|

44,045 |

|

| Centre Living |

|

4 |

|

|

5 |

|

|

61 |

|

|

32,587 |

|

|

3 |

|

|

22 |

|

|

12,352 |

|

| TPG |

|

21 |

|

|

20 |

|

|

142 |

|

|

112,675 |

|

|

20 |

|

|

111 |

|

|

77,431 |

|

| GRBK GHO |

|

12 |

|

|

12 |

|

|

109 |

|

|

105,707 |

|

|

9 |

|

|

102 |

|

|

84,032 |

|

Total (2) |

|

85 |

|

|

91 |

|

|

770 |

|

|

$ |

555,200 |

|

|

80 |

|

|

537 |

|

|

$ |

369,095 |

|

(1)Includes Normandy Homes.

(2)GB Challenger is not included in the table above as Green Brick does not have a controlling financial interest in Challenger. Prior to the sale of our interest in Challenger on February1, 2024, our investment in Challenger was treated as an unconsolidated investment under the equity method of accounting and was included in investments in unconsolidated entities in our consolidated balance sheets.

In response to our customers’ expressed desire for an expedited and transparent sales process, we offer a selection of homes with simplified, all-upgrades-included options. Our Trophy Signature Homes and CB JENI X lines have been at the forefront of creating a straightforward sales experience that offers simplified solutions with top-of-the-line finishes regardless of a homebuyer’s price range. We believe this streamlined process and focus on operational efficiency has enabled us to adapt to changes in our homebuyers’ lifestyles. As a result, we have launched updated plans with a focus on dedicated office spaces, home integrations with the newest technology, and the latest in energy-efficient solutions, including tankless water heaters, high-efficiency LED lighting, ENERGY STAR rated appliances, and low flow bathroom fixtures.

We are focused on creating environmentally sustainable products, and our purchasing power enables us to include green features in our homes. Each new home we build is healthier and more energy efficient, and has less impact on the environment than prior generations of homes as a result of features like:

•Low-VOC paint that reduces pollution;

•WaterSense® faucets that reduce water flow without sacrificing performance;

• Low-E windows that reduce infrared and ultraviolet light coming into the home; and

•Energy Star® appliances that reduce energy consumption.

Land Policy

Our land inventory strategy provides us with a multi-year supply of lots for each of our brands for future homebuilding while limiting excess supply that would be subject to market cycle risk. With certain exceptions, we focus on the development of entitled parcels in communities where we can generally sell all lots and homes within 24 to 72 months from the start of sales. This focus allows us to limit exposure to land development and land risks while pursuing favorable returns on our investments. We seek to minimize our exposure to land risk through disciplined management of entitlements, the use of land and lot options, and other flexible land acquisition arrangements. We are actively involved in every step of the land entitlement, home design, and construction processes with our builders.

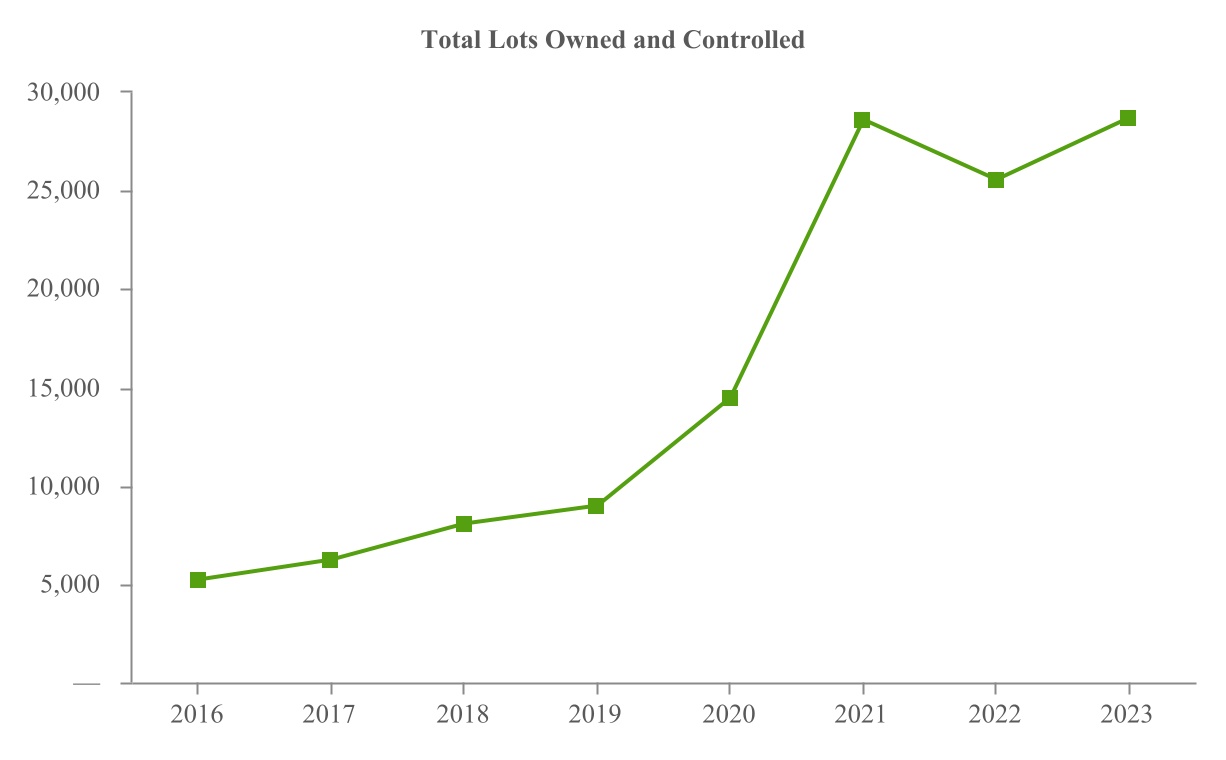

Our land teams focus on acquiring well located land that will position us to deliver future earnings growth in 2024 and beyond. As of December 31, 2023, we had 28,681 lots owned and controlled. When excluding land held for future development, as of December 31, 2023, we had 20,315 lots owned and controlled.

Marketing and Sales Process

We sell our homes primarily from models we have designed and constructed. We employ community sales managers who are paid primarily via commissions to conduct on-site sales of our homes. Our in-house sales force typically works from sales offices located in model homes in or near each community. Community sales managers assist potential buyers by providing them with floor plans, price information, development and construction timetables, virtual and in-person tours of model homes, and upgrade options. Community sales managers are trained by us and generally have had prior experience selling new homes in the local market. Our personnel, along with subcontracted marketing and design consultants, carefully design the exterior and interior of each home to appeal to the lifestyles of targeted homebuyers. We also sell homes through independent realtors.

We offer a preferred lender referral program, including through our mortgage joint venture, to provide lending options to homebuyers in need of financing. We also offer homeowners a comprehensive warranty on each home. Homes are generally covered by a six to ten-year warranty for structural concerns, one year for workmanship issues and products used, and two years for electrical, plumbing, heating, ventilation, and air conditioning systems.

Our marketing strategies utilize traditional and digital channels, which include third-party real estate listing sites, billboards, USPS mailers, ads in publications, paid search ads, remarketing, display ads, social media posts, and e-mail and text campaigns, all of which drive traffic to our builders’ websites. This has allowed us to attract more qualified and knowledgeable homebuyers and has helped us reduce our selling, general and administrative expenses as a percentage of home sales revenues.We also advertise through more traditional media on a limited basis, including newspapers, radio, other local and regional publications, and billboards where appropriate. We tailor our marketing strategy and message based on the community being advertised and the customers being targeted.

Financial Services

In addition to independently branded subsidiary homebuilders, Green Brick Partners retains 100% ownership in Green Brick Title and 49% ownership in BHome Mortgage. Our financial service platforms help our customers bring their homebuying dreams into reality by providing mortgage and title services, allowing for a one-stop-shop solution. Through BHome Mortgage, we endeavor to have our buyers receive personal attention from their first meeting through the closing of their new home regarding their financing options. As part of the Green Brick Partners family, Green Brick Title’s access to resources beyond those of a traditional title company enables us to stay one step ahead of our competition and bring buyers unmatched customer service.

Raw Materials

Typically, all the raw materials and most of the components used in our business are readily available in the United States. Most are standard items carried by major suppliers. However, a rapid increase in the number of homes started could cause shortages in the availability of such materials or in the price of services, thereby leading to delays in the delivery of homes. We continue to monitor the supply markets to achieve the best prices available. See “Risk Factors - Labor and raw material shortages and price fluctuations could delay or increase the cost of land development and home construction, which could materially and adversely affect our business.”

Seasonality

The homebuilding industry experiences seasonal fluctuations in quarterly operating results and capital requirements. We typically experience the highest new home order activity in spring and summer, although this activity is also highly dependent on the number of active selling communities, timing of new community openings, and other market factors. Since it typically has taken four to nine months to construct a new home, we have historically delivered more homes in the second half of the year as spring and summer home orders are delivered. Because of this seasonality, home starts, construction costs and related cash outflows have historically been highest in the second and third quarters, and the majority of cash receipts from home deliveries occur during the third and fourth quarters. We expect this seasonal pattern to continue over the long-term, although it may be affected by volatility in the homebuilding industry. Due to the significant increase in home demand and the more limited supply of both existing homes and speculative home inventory from all builders in recent years, such seasonal patterns have been less pronounced in our business operations.

Competition

Competition in the homebuilding industry is intense and there are relatively low barriers to entry. Homebuilders compete for, among other things, homebuyers, desirable land parcels, financing, raw materials, and skilled labor. Increased competition could hurt our business, as it could prevent us from acquiring attractive land parcels on which to build homes or make such acquisitions more expensive, hinder our market share expansion, and lead to pricing pressures on our homes that may adversely impact our revenues and margins. Our competitors may independently develop land and construct housing units that are superior or substantially similar to our products. Furthermore, a number of our primary competitors are significantly larger, have a longer operating history, and may have greater resources or lower cost of capital; accordingly, they may be able to compete more effectively in one or more of the markets in which we operate. Many of these competitors also have longstanding relationships with subcontractors, suppliers, and developers in the markets in which we operate. We also compete for sales with existing home resales and with available rental housing.

Human Capital Resources

Attracting, retaining, and building talent is critical in our business. We continue to recruit talented team members that exhibit superior emotional intelligence. This focus on a staff that places a strong emphasis on communication and navigating a fast-paced environment empathetically, strategically, and judiciously enables us to operate effectively and efficiently each day. We seek to establish a supportive culture that fosters a strong sense of ownership and a continuous drive to excel. Our goal is to not just empower our team members with the tools needed to succeed but to create a community that focuses on taking ownership of one’s work. Our culture celebrates individual success, primes our employees for growth, and is critical in maintaining our competitive edge over our peers.

At December 31, 2023, we had approximately 600 full-time employees, including approximately 550 who were involved in our homebuilding operations, with locations in Dallas-Ft. Worth and Austin, Texas, Atlanta, Georgia, and Treasure Coast, Florida, and approximately 50 in management and administration. Our operations are carried out through both local and centralized management. Our centralized management sets our strategy and leads decisions related to our land acquisition, national purchasing, marketing analytics, risk management, finance, cash management, capital allocation, human resources management, and IT support for our builders. Our homebuilder operations consist of our division employees, led by management with significant homebuilding experience and who possess a depth of knowledge in their particular markets, and include employees responsible for the design, construction oversight, marketing, and sales of our homes. We act solely as a general contractor, and all construction operations are coordinated by our project managers and field superintendents who schedule and monitor the progress of third-party independent subcontractors. Our ability to deliver our homes is dependent on the availability and quality of the subcontractors, such as electricians, plumbers, drywall installers, and bricklayers with whom we partner to build our homes. We do not have collective bargaining agreements relating to any of our employees. We offer our employees a compensation package with a broad range of company-paid benefits, including medical, dental, life insurance, a 401(k) plan, and other health and welfare plans we believe are competitive.

We believe having a diverse and inclusive work environment, where everyone has a sense of belonging, not only drives engagement but fosters innovation, which is critical to driving growth. Our management teams are expected to exhibit and promote honest, ethical and respectful conduct in the workplace. All of our employees must adhere to a code of conduct that sets standards for appropriate behavior and includes required internal training on preventing, identifying, reporting and stopping any type of discrimination. Furthermore, our management team supports a culture of developing future leaders from our existing workforce, enabling us to promote from within for many leadership positions. We believe this provides long-term focus and continuity to our operations while also providing opportunities for the growth and advancement of our employees.

Governmental Regulations and Environmental Regulation

Homebuilding Related Regulations. We are subject to various local, state, and federal statutes, ordinances, rules, and regulations concerning zoning, building design, construction, and similar matters, including local regulations that impose restrictive zoning and density requirements. In addition, local and state governments have broad discretion regarding the imposition of development fees for projects under their jurisdictions. Governing agencies may also require concessions or may require the developer to commit to providing roads and other offsite infrastructure, the costs of which can be substantial, and may require them to be in place prior to the commencement of new home construction. In addition, governing agencies may impose construction moratoriums that could subject us to delays or may preclude us entirely from developing communities due to building moratoriums, “no growth” or “slow growth” initiatives or building permit allocation ordinances, which could be implemented in the future. In addition, we are subject to various licensing, registration, and filing requirements in connection with the construction, advertisement, and sale of homes in our communities. Also, some states are attempting to make homebuilders responsible for violations of wage and other labor laws by their subcontractors.

Environmental Regulations. We are subject to a variety of local, state, and federal statutes, ordinances, rules and regulations concerning the protection of the environment. The particular environmental laws that apply to any given homebuilding site vary according to multiple factors, including the site’s location, its environmental conditions, and the present and former uses of the site and adjoining properties. In some markets, we are subject to environmentally-focused land ordinances that mandate open space areas with public elements in housing developments, and prevent development on hillsides, wetlands and other protected areas. We must also comply with open space restrictions, flood plain restrictions, desert wash area restrictions, native plant regulations, endangered species acts, and view restrictions. In those cases where an endangered or threatened species is involved, environmental rules and regulations can result in the restriction or elimination of development in identified environmentally sensitive areas. From time to time, the United States Environmental Protection Agency and similar federal or state agencies review homebuilders’ compliance with environmental laws and may levy fines and penalties for failure to comply strictly with applicable environmental laws or impose additional requirements for future compliance as a result of past failures. Any such actions taken may increase our costs. Further, we expect that increasingly stringent requirements will be imposed on homebuilders and land developers in the future.

Energy and Climate Change Related Regulations. There is constantly a variety of new legislation being enacted, or considered for enactment at the federal, state and local levels relating to energy and climate change. Some of this legislation relates to items such as carbon dioxide emissions and building codes that impose energy efficiency standards. New building code requirements that impose stricter energy efficiency standards could significantly increase the cost to construct homes, although our energy-efficiency technologies and offerings meet, and in many instances exceed, current energy efficiency thresholds. As climate change concerns continue to grow, legislation and regulations of this nature are expected to continue and may result in increased costs and longer approval and development timelines. Similarly, energy and environment-related initiatives affect a wide variety of companies throughout the United States and the world, and because our operations are heavily dependent on significant amounts of raw materials, such as lumber, steel, and concrete, such initiatives could have an indirect adverse impact on our operations and profitability to the extent the manufacturers and suppliers of our materials are burdened with expensive carbon dioxide emissions controls and reporting requirements and other environmental and energy-related regulations.

Available Information

Our website address is www.greenbrickpartners.com. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13 or 15(d) of the Exchange Act are available free of charge through our website as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission (the “SEC”). Our website and the information contained or incorporated therein are not intended to be incorporated into this Annual Report on Form 10-K.

ITEM 1A. RISK FACTORS

Set forth below are the risks that we believe are material to our investors. Any of these risks could significantly and adversely affect our business, financial condition and results of operations. You should carefully consider the risks described below, together with the other information included in this Annual Report on Form 10-K, including the information contained under the caption “Forward-Looking Statements”.

Risks Related to our Business and Industry

The homebuilding industry is cyclical. A severe downturn in the industry could adversely affect our business, results of operations and stockholders’ equity.

The residential homebuilding industry is cyclical and is highly sensitive to changes in general economic conditions such as levels of employment, consumer confidence and income, availability of financing for acquisitions, construction and permanent mortgages, interest rate levels, inflation and demand for housing. The U.S. housing market could be negatively impacted by declining consumer confidence, restrictive mortgage standards and large supplies of foreclosures, resales and new homes, among other factors. These conditions, combined with a prolonged economic downturn, high unemployment levels, increases in the rate of inflation and uncertainty in the U.S. economy, could contribute to higher cancellation rates, decreased demand for housing, increased market inventory of new homes, reduced sales prices and increased pricing pressure. Lower demand for our homes, combined with lower sales prices or the offering of other incentives or concessions would also have an adverse impact on our margins. If demand for housing stalls or declines, we could experience declines in the market value of our inventory and demand for our lots, homes, and construction loans, which could have a material adverse effect on our business, liquidity, financial condition and results of operations.

Our operating performance is subject to risks associated with the real estate industry.

Real estate investments are susceptible to various risks, fluctuations and cycles in value and demand, many of which are beyond our control. Certain events may decrease cash available for operations and the value of our real estate assets. These events include, but are not limited to:

•adverse changes in international, national or local economic and demographic conditions;

•adverse changes in financial conditions of buyers and sellers of properties, particularly residential homes and land suitable for development of residential homes;

•competition from other real estate investors with significant capital, including other real estate operating companies and developers and institutional investment funds;

•fluctuations in interest rates, which could adversely affect the ability of homebuyers to obtain financing on favorable terms or their willingness to obtain financing at all;

•unanticipated increases in expenses, including, without limitation, insurance costs, development costs, real estate assessments and other taxes and costs of compliance with laws, regulations and governmental policies; and

•changes in enforcement of laws, regulations and governmental policies, including, without limitation, health, safety, environmental, zoning and tax laws.

Adverse changes in macroeconomic conditions in and around the markets we operate in, and where prospective purchasers of our homes live, could reduce the demand and adversely affect our business, results of operations, and financial condition.

Adverse changes in economic conditions in markets where we conduct our operations and where prospective purchasers of our homes live have had and may in the future have a negative impact on our business. Adverse changes in employment and median income levels, job growth, consumer confidence, interest rates, perceptions regarding the strength of the housing market, and population growth, or an oversupply of homes for sale may reduce demand or depress prices for our homes and cause home buyers to cancel their agreements to purchase our homes. This, in turn, could adversely affect our results of operations and financial condition.

In addition, periods of economic slowdown or recession, rising or high interest rates or declining demand for real estate, or the public perception that any of these events may occur, could result in a general decline in the purchases of homes or an increased incidence of home order cancellations. If we cannot successfully implement our business strategy, our business, liquidity, financial condition and results of operations will be adversely affected.

Our business and financial results could be adversely affected by significant inflation or deflation.

Inflation can adversely affect our homebuilding operations by increasing costs of land, financing, materials, labor and construction. While we attempt to pass on cost increases to homebuyers by increasing prices, we may not be able to offset cost increases with higher selling prices in a weak housing market. In addition, significant inflation is often accompanied by higher interest rates, which have a negative impact on housing demand. In a highly inflationary environment, depending on industry and other economic conditions, we may be precluded from raising home prices enough to keep up with the rate of inflation or may have to discount prices that could reduce our profit margins. Moreover, with inflation, the costs of capital increase and the purchasing power of our cash resources could decline. The current and continued economic conditions of high inflation

and high interest rates, especially increased mortgage rates, could lead to a decrease in demand for new homes. Current or future efforts by the government to stimulate the economy may increase the risk of significant inflation and its adverse impact on our business or financial results.

Alternatively, a significant period of deflation could cause a decrease in overall spending and borrowing levels. This could lead to a deterioration in economic conditions, including an increase in the rate of unemployment. Deflation could cause the value of our inventory to decline or reduce the value of existing homes below the related mortgage loan balance, which could potentially increase the supply of existing homes and have a negative impact on our results of operations.

We depend on the availability and satisfactory performance of subcontractors. Our business could be negatively affected if our subcontractors are not able to perform.

We conduct our land development and homebuilding operations primarily as a general contractor. Our unaffiliated third-party subcontractors perform virtually all of our land development and constructions. Consequently, the timing and quality of the development of our land and the construction of our homes depends on the availability and skill of our subcontractors. There may not be sufficient availability of and satisfactory performance by these unaffiliated third-party subcontractors in the markets in which we operate. If there are inadequate subcontractor resources, our ability to meet customer demands, both timing and quality, could be adversely affected, which could have a material adverse effect on our reputation, our future growth and our profitability.

Labor and raw material shortages and price fluctuations could delay or increase the cost of land development and home construction, which could materially and adversely affect our business.

The residential construction industry experiences labor and raw material shortages from time to time, including shortages in qualified tradespeople and in supplies such as insulation, drywall, cement, steel and lumber. These labor and raw material shortages can be more severe during periods of strong demand for housing or when a region in which we operate experiences a natural disaster that has a significant impact on existing residential and commercial structures. Significant increases in the demand for new homes result in extended lead times, supply shortages and price increases because of the heightened demand for raw materials, products and appliances. For example, we have previously, and may in the future experience price increases, shortages and extensions to our lead time for the delivery of materials such as lumber, appliances and windows. This has and may continue to result in longer construction periods, delays in home closings and margin compression if we are unable to increase our sales prices accordingly.

The cost of labor and raw materials may also be adversely affected during periods of shortage or high inflation. Shortages and price increases could cause delays in, and increase our costs of, land development and home construction, which we may not be able to offset by raising home prices due to market demand and because the price for each home is typically set prior to its delivery pursuant to the agreement of sale with the homebuyer. In addition, the federal government has at various times in recent years imposed tariffs on a variety of imports from foreign countries and may impose additional tariffs in the future. Significant tariffs or other restrictions that are placed on raw materials that we use in our homebuilding operation, such as lumber or steel, could cause the cost of home construction to increase, which we may not be able to offset by raising home prices or which could slow our absorption due to constraints on market demand. As a result, shortages or increased costs of labor and raw materials could have a material adverse effect on our business, prospects, financial condition and results of operations.

Failure to recruit, retain and develop highly skilled, competent employees may have a material adverse effect on our business and results of operations.

Our success depends on the continued performance of key employees, including management team members at both the corporate and homebuilder subsidiary levels. Our results of operations could suffer if any of the management team members decided to terminate their employment with us. Our ability to retain our management team or to attract suitable replacements should any members of our management team leave is dependent on the competitive nature of the employment market. The loss of services from key management team members or a limitation in their availability could materially and adversely impact our business, liquidity, financial condition and results of operations.

Such a loss could also be negatively perceived in the capital markets. We do not maintain key person insurance with respect to any member of our named executive officers.

Furthermore, key employees working in the land development, homebuilding and construction industries are highly sought after. Experienced employees in the homebuilding, land acquisition, and construction industries are fundamental to our ability to generate, obtain and manage opportunities. In particular, local knowledge and relationships are critical to our ability to source attractive land acquisition opportunities. Failure to attract and retain such personnel or to ensure that their experience and knowledge is retained by the company when they leave the business through retirement, redundancy or otherwise may adversely affect the standards of our service and may have an adverse impact on our business, financial conditions and results of operations.

We may be unable to achieve our objectives because of our inability to execute on our business strategies.

Our business objectives include expanding into new markets and becoming a more capital and operationally efficient home builder. We cannot guarantee that our strategies to meet these objectives will be successful or that they will result in growth and increased earnings or returns within our desired time frame. We cannot guarantee that we will achieve positive operational or financial results in the future or results that are equal to or better than those attained in the past. We also cannot provide any assurance that we will be able to maintain our strategies in the future. Due to unexpectedly favorable or unfavorable market conditions or other factors, we may determine that we need to adjust, refine or abandon all or portions of our strategies, and any related initiatives or actions. We cannot guarantee that any such adjustments will be successful. The failure of any one or more of our present strategies, or any related initiatives or actions, or the failure of any adjustments that we may pursue or implement, could have an adverse effect on our ability to increase the value and profitability of our business, our ability to operate our business in the ordinary course, our overall liquidity, and our consolidated financial statements. The effect in each case could be material.

Our long-term success depends on our ability to acquire undeveloped land, partially finished developed lots and finished lots suitable for residential homebuilding at reasonable prices and in accordance with our land investment criteria.

The homebuilding industry is highly competitive for suitable land and the risk inherent in purchasing and developing land is directly impacted by changes in consumer demand for housing. The availability of finished and partially finished developed lots and undeveloped land for purchase that meet our investment criteria depends on a number of factors outside our control, including land availability, competition with other homebuilders and land buyers, inflation in land prices, zoning, allowable housing density, the ability to obtain building permits and other regulatory requirements. Should suitable land or lots become more difficult to locate or obtain, the number of lots we may be able to develop and sell could decrease, the number of homes we may be able to build and sell could decrease and the cost of land could increase substantially, which could adversely impact our results of operations.

As competition for suitable land increases, the cost of acquiring both finished and undeveloped lots and the cost of developing owned land could rise and the availability of suitable land at acceptable prices may decline, which could adversely impact our financial results. The availability of suitable land assets could also affect the success of our land acquisition strategy, which may impact our ability to maintain or increase the number of active selling communities, grow our revenues and margins, and to achieve or maintain profitability.

Our results of operations could be adversely affected if we are unable to develop communities successfully or within expected timeframes.

Before a community generates any revenue, time and material expenditures are required to acquire and develop land, entitle and finish lots, obtain development approvals, pay taxes and construct significant portions of project infrastructure, amenities, model homes and sales facilities. It can take several years from the time that we acquire control of a property to the time that we make our first home sale on the site. Delays in the development of communities expose us to the risk of changes in market conditions for homes. A decline in our ability to develop and market our communities successfully and to generate positive cash flow from these operations in a timely manner could have a material adverse effect on our business and results of operations and on our ability to service our debt and meet our working capital requirements.

Real estate investments are relatively illiquid. As a result, our ability to promptly sell one or more properties in response to changing economic, financial and investment conditions may be limited, and we may be forced to hold non-income producing assets for an extended period of time. We cannot predict whether we will be able to sell any property for the price or on the terms that we set or whether any price or other terms offered by a prospective purchaser would be acceptable to us. We also cannot predict the length of time needed to find a willing purchaser and to close the sale of a property.

Our future growth may include additional strategic investments, joint ventures, partnerships and/or acquisitions of companies that may not be as successful as we anticipate and could disrupt our ongoing businesses and adversely affect our operations.

Our investments in our homebuilding subsidiaries have contributed to our historical growth and similar investments may be a component of our growth strategy in the future. We may make additional strategic investments, enter into new joint ventures or partnership arrangements or acquire businesses, or initiate new, related business opportunities, some of which may be significant. These endeavors may involve significant risks and uncertainties, including distraction of management from current operations, significant start-up costs, insufficient revenues to offset expenses associated with these new investments and inadequate return on capital in these investments, any of which may adversely affect our financial condition and results of operations. Our failure to successfully identify and manage future investments, joint ventures, partnerships or acquisitions could harm our results of operations.

Our geographic concentration could materially and adversely affect us if the homebuilding industry in our current markets decline.

In the DFW metropolitan area, we primarily operate in the counties of Dallas, Collin, Denton, Ellis, Rockwall, Tarrant, Kaufman, Hunt, and Johnson. In Austin, we primarily operate in the counties of Bastrop and Travis. In Atlanta, we primarily operate in the counties of Fulton, Gwinnett, Forsyth, and Cherokee. In Florida, we primarily operate in the counties of Indian River and St. Lucie. We may not realize our favorable growth outlook if housing demand and population growth stagnate or decrease in our core markets. Furthermore, we may be unable to compete effectively with the resale home market in our core markets. Because our operations are concentrated in these areas, a prolonged economic downturn in one or more of these areas could have a material adverse effect on our business, liquidity, financial condition and results of operations, and a disproportionately greater impact on us than other homebuilders with more diversified operations. Further, slower rates of population growth or population declines in the DFW, Austin, Atlanta or Treasure Coast markets, especially as compared to the high population growth rates in prior years, could affect the demand for housing, causing home prices in these markets to decline and adversely affect our business, financial condition and results of operations.

Our developments are subject to government regulations, which could cause us to incur significant liabilities or restrict our business activities.

Our developments are subject to numerous local, state, federal and other statutes, ordinances, rules and regulations concerning zoning, development, building design, construction and similar matters that impose restrictive zoning and density requirements, which impose limitations on the number and type of homes that can be built within the boundaries of a particular area. Projects that are not yet entitled may be subjected to periodic delays, changes in use, less robust development or elimination of development in certain specific areas due to government regulations. We may also be subject to periodic delays or may be precluded entirely from developing in certain communities due to building moratoriums or “slow-growth” or “no-growth” initiatives that could be implemented in the future. Local governments also have broad discretion regarding the imposition of development and service fees for projects in their jurisdiction. Projects for which we have received land use and development entitlements or approvals may still require a variety of other governmental approvals and permits during the development process and can also be impacted adversely by unforeseen health, safety and welfare issues, which can further delay these projects or prevent their development. As a result, lot and home sales could decline and costs could increase, which could have a material adverse effect on our current results of operations and our long-term growth prospects.

Changes in global or regional environmental conditions and governmental actions in response to such changes may adversely affect us by increasing the costs of or restricting our planned or future growth activities.

There is growing concern from many members of the scientific community and the general public that an increase in global average temperatures due to emissions of greenhouse gases and other human activities have caused, or will cause, significant changes in weather patterns and increase the frequency and severity of natural disasters. Government mandates, standards or regulations intended to reduce greenhouse gas emissions or projected climate change impacts have resulted, and are likely to continue to result, in restrictions on land development in certain areas and increased energy, transportation and raw material costs. Governmental requirements directed at reducing effects on climate could cause us to incur expenses that we cannot recover or that will require us to increase the price of homes we sell to the point that it affects demand for those homes.

Our financial condition and results of operations may be adversely affected by a decrease in the value of our land or homes and the associated carrying costs.

We continuously acquire land for replacement of land inventory and expansion within our current markets and may in the future acquire land for expansion into new markets. However, the market value of land, building lots and housing inventories can fluctuate significantly due to changing market conditions. The measures we employ to manage inventory risk may not be adequate to insulate our operations from a severe drop in inventory values.

If housing demand decreases below what we anticipated when we acquired our inventory, we may not be able to generate profits consistent with those we have generated in the past and we may not be able to recover our costs when we sell lots and homes. When market conditions are such that land values are not appreciating, option arrangements previously entered into may become less desirable, at which time we may elect to forgo deposits and pre-acquisition costs and terminate such arrangements. During adverse market conditions, we may have substantially higher inventory carrying costs, may have to write down our inventory as a result of impairment and/or may have to sell land or homes at a loss. Any material write-downs of assets, or sales at a loss, could have a material adverse effect on our financial condition and results of operations.

Demand for our homes and lots is dependent on the cost and availability of mortgage financing.

Our business depends on the ability of our homebuyers, as well as the ability of those who buy homes from the third-party homebuilding entities to which we sell lots (our “homebuilding customers”), to obtain financing for the purchase of their homes. Many of these homebuyers must sell their existing homes in order to buy a home from us or our homebuilding customers. Increased interest rates, decreased availability of mortgage financing or of certain mortgage programs, higher down payment requirements or increased monthly mortgage costs may lead to reduced demand for our homes and lots. Higher interest rates can also hinder our ability to realize our backlog because certain of our home purchase contracts provide homebuyers with a financing contingency. Financing contingencies allow homebuyers to cancel their home purchase contracts in the event that they cannot arrange for adequate financing within a certain time period after the execution of the home purchase contracts. As a result, higher interest rates can decrease our home sales and mortgage originations. Any of these factors could have a material adverse effect on our business, liquidity, financial condition and results of operations.

In addition, the federal government has a significant role in supporting mortgage lending through its conservatorship of Federal National Mortgage Association (“Fannie Mae”) and Federal Home Loan Mortgage Corporation (“Freddie Mac”), both of which purchase home mortgages and mortgage-backed securities originated by mortgage lenders, and its insurance of mortgages originated by lenders through the Federal Housing Administration (the “FHA”) and the Veterans Administration (“VA”). The availability and affordability of mortgage loans, including consumer interest rates for such loans, could be adversely affected by a curtailment or cessation of the federal government’s mortgage-related programs or policies. The FHA may continue to impose stricter loan qualification standards, raise minimum down payment requirements, impose higher mortgage insurance premiums and other costs and/or limit the number of mortgages it insures. Due to growing federal budget deficits, the U.S. Treasury may not be able to continue supporting the mortgage-related activities of Fannie Mae, Freddie Mac, the FHA and the VA at present levels, or it may significantly revise the federal government’s participation in and support of the residential mortgage market. Because the availability of Fannie Mae, Freddie Mac, FHA- and VA-backed mortgage financing is an important factor in marketing and selling many of our homes, any limitations, restrictions or changes in the availability of such government-backed financing could reduce our home sales, which could have a material adverse effect on our business, liquidity, financial condition and results of operations.

High cancellation rates may negatively impact our business.

Our backlog reflects the number and value of homes for which we have entered into sales contracts with homebuyers but not yet delivered. Although these sales contracts require a cash deposit, a homebuyer may in certain circumstances cancel the contract and receive a complete or partial refund of the deposit in certain circumstances, including due to state or local laws and our contract provisions. If home prices decline, the national or local homebuilding environment or general economy weakens, our neighboring competitors reduce their sales prices (or increase their sales incentives), interest rates increase or the availability of mortgage financing tightens, homebuyers may have an incentive to cancel their contracts with us, even where they might be entitled to no refund or only a partial refund. Significant cancellations could have a material adverse effect on our business as a result of lost sales revenue and the accumulation of unsold housing inventory.

Any increase in unemployment or underemployment may lead to an increase in the number of loan delinquencies and property repossessions, which would have an adverse impact on our business.