0001372299--12-312025Q3falseP1YP2YP4YP4Yxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pureocgn:leaseocgn:dayocgn:vaccine_doseocgn:equity_compensation_planocgn:lawsuitocgn:plaintiffocgn:segment00013722992025-01-012025-09-3000013722992025-10-3100013722992025-09-3000013722992024-12-310001372299us-gaap:CollaborativeArrangementMember2025-07-012025-09-300001372299us-gaap:CollaborativeArrangementMember2024-07-012024-09-300001372299us-gaap:CollaborativeArrangementMember2025-01-012025-09-300001372299us-gaap:CollaborativeArrangementMember2024-01-012024-09-3000013722992025-07-012025-09-3000013722992024-07-012024-09-3000013722992024-01-012024-09-300001372299us-gaap:CommonStockMember2025-07-012025-09-300001372299us-gaap:CommonStockMember2024-07-012024-09-300001372299us-gaap:CommonStockMember2025-01-012025-09-300001372299us-gaap:CommonStockMember2024-01-012024-09-300001372299us-gaap:SeriesBPreferredStockMember2025-07-012025-09-300001372299us-gaap:SeriesBPreferredStockMember2024-07-012024-09-300001372299us-gaap:SeriesBPreferredStockMember2025-01-012025-09-300001372299us-gaap:SeriesBPreferredStockMember2024-01-012024-09-300001372299us-gaap:PreferredStockMember2024-12-310001372299us-gaap:CommonStockMember2024-12-310001372299us-gaap:TreasuryStockCommonMember2024-12-310001372299us-gaap:AdditionalPaidInCapitalMember2024-12-310001372299us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310001372299us-gaap:RetainedEarningsMember2024-12-310001372299us-gaap:AdditionalPaidInCapitalMember2025-01-012025-03-3100013722992025-01-012025-03-310001372299us-gaap:CommonStockMember2025-01-012025-03-310001372299us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-01-012025-03-310001372299us-gaap:RetainedEarningsMember2025-01-012025-03-310001372299us-gaap:PreferredStockMember2025-03-310001372299us-gaap:CommonStockMember2025-03-310001372299us-gaap:TreasuryStockCommonMember2025-03-310001372299us-gaap:AdditionalPaidInCapitalMember2025-03-310001372299us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-03-310001372299us-gaap:RetainedEarningsMember2025-03-3100013722992025-03-310001372299us-gaap:AdditionalPaidInCapitalMember2025-04-012025-06-3000013722992025-04-012025-06-300001372299us-gaap:CommonStockMember2025-04-012025-06-300001372299us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-04-012025-06-300001372299us-gaap:RetainedEarningsMember2025-04-012025-06-300001372299us-gaap:PreferredStockMember2025-06-300001372299us-gaap:CommonStockMember2025-06-300001372299us-gaap:TreasuryStockCommonMember2025-06-300001372299us-gaap:AdditionalPaidInCapitalMember2025-06-300001372299us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-06-300001372299us-gaap:RetainedEarningsMember2025-06-3000013722992025-06-300001372299us-gaap:AdditionalPaidInCapitalMember2025-07-012025-09-300001372299us-gaap:CommonStockMember2025-07-012025-09-300001372299us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-07-012025-09-300001372299us-gaap:RetainedEarningsMember2025-07-012025-09-300001372299us-gaap:PreferredStockMember2025-09-300001372299us-gaap:CommonStockMember2025-09-300001372299us-gaap:TreasuryStockCommonMember2025-09-300001372299us-gaap:AdditionalPaidInCapitalMember2025-09-300001372299us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-09-300001372299us-gaap:RetainedEarningsMember2025-09-300001372299us-gaap:PreferredStockMember2023-12-310001372299us-gaap:CommonStockMember2023-12-310001372299us-gaap:TreasuryStockCommonMember2023-12-310001372299us-gaap:AdditionalPaidInCapitalMember2023-12-310001372299us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001372299us-gaap:RetainedEarningsMember2023-12-3100013722992023-12-310001372299us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-3100013722992024-01-012024-03-310001372299us-gaap:CommonStockMember2024-01-012024-03-310001372299us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001372299us-gaap:RetainedEarningsMember2024-01-012024-03-310001372299us-gaap:PreferredStockMember2024-03-310001372299us-gaap:CommonStockMember2024-03-310001372299us-gaap:TreasuryStockCommonMember2024-03-310001372299us-gaap:AdditionalPaidInCapitalMember2024-03-310001372299us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001372299us-gaap:RetainedEarningsMember2024-03-3100013722992024-03-310001372299us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-3000013722992024-04-012024-06-300001372299us-gaap:CommonStockMember2024-04-012024-06-300001372299us-gaap:PreferredStockMember2024-04-012024-06-300001372299us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001372299us-gaap:RetainedEarningsMember2024-04-012024-06-300001372299us-gaap:PreferredStockMember2024-06-300001372299us-gaap:CommonStockMember2024-06-300001372299us-gaap:TreasuryStockCommonMember2024-06-300001372299us-gaap:AdditionalPaidInCapitalMember2024-06-300001372299us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001372299us-gaap:RetainedEarningsMember2024-06-3000013722992024-06-300001372299us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300001372299us-gaap:CommonStockMember2024-07-012024-09-300001372299us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-300001372299us-gaap:RetainedEarningsMember2024-07-012024-09-300001372299us-gaap:PreferredStockMember2024-09-300001372299us-gaap:CommonStockMember2024-09-300001372299us-gaap:TreasuryStockCommonMember2024-09-300001372299us-gaap:AdditionalPaidInCapitalMember2024-09-300001372299us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300001372299us-gaap:RetainedEarningsMember2024-09-3000013722992024-09-3000013722992025-09-162025-09-160001372299srt:MinimumMember2025-01-012025-09-300001372299srt:MaximumMember2025-01-012025-09-300001372299us-gaap:EmployeeStockOptionMember2025-01-012025-09-300001372299us-gaap:CollaborativeArrangementMember2025-09-300001372299us-gaap:CollaborativeArrangementMember2024-09-300001372299us-gaap:FurnitureAndFixturesMember2025-09-300001372299us-gaap:FurnitureAndFixturesMember2024-12-310001372299us-gaap:MachineryAndEquipmentMember2025-09-300001372299us-gaap:MachineryAndEquipmentMember2024-12-310001372299us-gaap:LeaseholdImprovementsMember2025-09-300001372299us-gaap:LeaseholdImprovementsMember2024-12-310001372299ocgn:CorporateHeadquartersMember2025-09-300001372299ocgn:GMPFacilityMember2025-09-300001372299ocgn:GeneralUseFacilitiesMember2025-09-300001372299ocgn:GeneralUseFacilitiesMembersrt:MinimumMember2025-09-300001372299ocgn:GeneralUseFacilitiesMembersrt:MaximumMember2025-09-300001372299country:CAsrt:MinimumMember2025-09-300001372299country:INsrt:MinimumMember2025-09-300001372299country:CAsrt:MaximumMember2025-09-300001372299country:INsrt:MaximumMember2025-09-300001372299us-gaap:CollaborativeArrangementMember2024-12-310001372299ocgn:EB5LoanAgreementMemberus-gaap:LoansPayableMember2016-09-300001372299ocgn:EB5LoanAgreementMemberus-gaap:LoansPayableMember2016-09-012016-09-300001372299ocgn:EB5LoanAgreementMemberus-gaap:LoansPayableMember2016-01-012016-12-310001372299ocgn:EB5LoanAgreementMemberus-gaap:LoansPayableMember2020-01-012020-12-310001372299ocgn:EB5LoanAgreementMemberus-gaap:LoansPayableMember2022-09-012022-09-300001372299ocgn:EB5LoanAgreementMemberus-gaap:LoansPayableMember2023-05-012023-05-310001372299ocgn:EB5LoanAgreementMemberus-gaap:LoansPayableMember2022-03-012022-03-310001372299ocgn:EB5LoanAgreementMemberus-gaap:LoansPayableMember2023-05-310001372299ocgn:EB5LoanAgreementMemberus-gaap:LoansPayableMember2025-09-300001372299ocgn:EB5LoanAgreementMemberus-gaap:LoansPayableMember2024-12-310001372299ocgn:DebtFinancingTransactionMember2024-11-012024-11-300001372299ocgn:DebtFinancingTransactionMember2024-11-300001372299us-gaap:CommonStockMemberus-gaap:PrivatePlacementMember2024-11-062024-11-060001372299ocgn:DebtFinancingTransactionMember2025-09-300001372299ocgn:DebtFinancingTransactionMember2024-12-310001372299ocgn:PublicStockOfferingMember2024-07-012024-07-310001372299ocgn:PublicStockOfferingMember2024-07-310001372299us-gaap:OverAllotmentOptionMember2024-07-012024-07-310001372299us-gaap:OverAllotmentOptionMember2024-08-012024-08-310001372299us-gaap:PrivatePlacementMember2025-08-012025-08-310001372299ocgn:RegisteredDirectOfferingWarrantMemberus-gaap:PrivatePlacementMember2025-08-310001372299us-gaap:PrivatePlacementMember2025-08-310001372299ocgn:RegisteredDirectOfferingWarrantMemberus-gaap:PrivatePlacementMember2025-08-012025-08-3100013722992024-07-310001372299ocgn:COVAXINPreferredStockPurchaseAgreementMember2021-03-010001372299ocgn:COVAXINPreferredStockPurchaseAgreementMember2021-03-182021-03-180001372299ocgn:COVAXINPreferredStockPurchaseAgreementMember2021-03-180001372299us-gaap:GeneralAndAdministrativeExpenseMember2025-07-012025-09-300001372299us-gaap:GeneralAndAdministrativeExpenseMember2024-07-012024-09-300001372299us-gaap:GeneralAndAdministrativeExpenseMember2025-01-012025-09-300001372299us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-09-300001372299us-gaap:ResearchAndDevelopmentExpenseMember2025-07-012025-09-300001372299us-gaap:ResearchAndDevelopmentExpenseMember2024-07-012024-09-300001372299us-gaap:ResearchAndDevelopmentExpenseMember2025-01-012025-09-300001372299us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-09-300001372299ocgn:OcugenInc2019EquityIncentivePlanMember2025-01-012025-09-300001372299ocgn:A2014OcugenOpCoIncStockOptionPlanMember2025-09-300001372299ocgn:OcugenInc2019EquityIncentivePlanMember2025-09-3000013722992024-01-012024-12-310001372299us-gaap:RestrictedStockUnitsRSUMember2024-12-310001372299us-gaap:RestrictedStockUnitsRSUMember2025-01-012025-09-300001372299us-gaap:RestrictedStockUnitsRSUMember2025-09-300001372299ocgn:OcugenInc2019EquityIncentivePlanMemberus-gaap:PerformanceSharesMember2024-01-022024-01-020001372299ocgn:OcugenInc2019EquityIncentivePlanMemberus-gaap:PerformanceSharesMember2024-04-162024-04-160001372299ocgn:OcugenInc2019EquityIncentivePlanMemberus-gaap:PerformanceSharesMember2025-01-022025-01-020001372299us-gaap:PerformanceSharesMembersrt:MinimumMemberocgn:OcugenInc2019EquityIncentivePlanMember2023-12-012023-12-310001372299us-gaap:PerformanceSharesMembersrt:MaximumMemberocgn:OcugenInc2019EquityIncentivePlanMember2023-12-012023-12-310001372299us-gaap:PerformanceSharesMember2024-12-310001372299us-gaap:PerformanceSharesMember2025-01-012025-09-300001372299us-gaap:PerformanceSharesMember2025-09-300001372299us-gaap:StockOptionMember2025-01-012025-09-300001372299us-gaap:StockOptionMember2024-01-012024-09-300001372299us-gaap:RestrictedStockUnitsRSUMember2025-01-012025-09-300001372299us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-09-300001372299us-gaap:PerformanceSharesMember2025-01-012025-09-300001372299us-gaap:PerformanceSharesMember2024-01-012024-09-300001372299us-gaap:WarrantMember2025-01-012025-09-300001372299us-gaap:WarrantMember2024-01-012024-09-300001372299ocgn:StockholderDerivativeLawsuitMember2024-07-012024-09-300001372299ocgn:StockholderDerivativeLawsuitMember2025-03-310001372299ocgn:StockholderDerivativeLawsuitMember2025-06-012025-06-300001372299us-gaap:CollaborativeArrangementMemberocgn:ReportableSegmentMember2025-07-012025-09-300001372299us-gaap:CollaborativeArrangementMemberocgn:ReportableSegmentMember2024-07-012024-09-300001372299us-gaap:CollaborativeArrangementMemberocgn:ReportableSegmentMember2025-01-012025-09-300001372299us-gaap:CollaborativeArrangementMemberocgn:ReportableSegmentMember2024-01-012024-09-300001372299ocgn:TechnologyPipelineOCU400Memberocgn:ReportableSegmentMember2025-07-012025-09-300001372299ocgn:TechnologyPipelineOCU400Memberocgn:ReportableSegmentMember2024-07-012024-09-300001372299ocgn:TechnologyPipelineOCU400Memberocgn:ReportableSegmentMember2025-01-012025-09-300001372299ocgn:TechnologyPipelineOCU400Memberocgn:ReportableSegmentMember2024-01-012024-09-300001372299ocgn:TechnologyPipelineOCU410AndOCU410STMemberocgn:ReportableSegmentMember2025-07-012025-09-300001372299ocgn:TechnologyPipelineOCU410AndOCU410STMemberocgn:ReportableSegmentMember2024-07-012024-09-300001372299ocgn:TechnologyPipelineOCU410AndOCU410STMemberocgn:ReportableSegmentMember2025-01-012025-09-300001372299ocgn:TechnologyPipelineOCU410AndOCU410STMemberocgn:ReportableSegmentMember2024-01-012024-09-300001372299ocgn:TechnologyPipelineNeoCarMemberocgn:ReportableSegmentMember2025-07-012025-09-300001372299ocgn:TechnologyPipelineNeoCarMemberocgn:ReportableSegmentMember2024-07-012024-09-300001372299ocgn:TechnologyPipelineNeoCarMemberocgn:ReportableSegmentMember2025-01-012025-09-300001372299ocgn:TechnologyPipelineNeoCarMemberocgn:ReportableSegmentMember2024-01-012024-09-300001372299ocgn:TechnologyPipelineCOVAXINMemberocgn:ReportableSegmentMember2025-07-012025-09-300001372299ocgn:TechnologyPipelineCOVAXINMemberocgn:ReportableSegmentMember2024-07-012024-09-300001372299ocgn:TechnologyPipelineCOVAXINMemberocgn:ReportableSegmentMember2025-01-012025-09-300001372299ocgn:TechnologyPipelineCOVAXINMemberocgn:ReportableSegmentMember2024-01-012024-09-300001372299ocgn:TechnologyPipelineInhaledMucosalVaccinePlatformMemberocgn:ReportableSegmentMember2025-07-012025-09-300001372299ocgn:TechnologyPipelineInhaledMucosalVaccinePlatformMemberocgn:ReportableSegmentMember2024-07-012024-09-300001372299ocgn:TechnologyPipelineInhaledMucosalVaccinePlatformMemberocgn:ReportableSegmentMember2025-01-012025-09-300001372299ocgn:TechnologyPipelineInhaledMucosalVaccinePlatformMemberocgn:ReportableSegmentMember2024-01-012024-09-300001372299ocgn:TechnologyPipelineOCU200Memberocgn:ReportableSegmentMember2025-07-012025-09-300001372299ocgn:TechnologyPipelineOCU200Memberocgn:ReportableSegmentMember2024-07-012024-09-300001372299ocgn:TechnologyPipelineOCU200Memberocgn:ReportableSegmentMember2025-01-012025-09-300001372299ocgn:TechnologyPipelineOCU200Memberocgn:ReportableSegmentMember2024-01-012024-09-300001372299ocgn:ReportableSegmentMember2025-07-012025-09-300001372299ocgn:ReportableSegmentMember2024-07-012024-09-300001372299ocgn:ReportableSegmentMember2025-01-012025-09-300001372299ocgn:ReportableSegmentMember2024-01-012024-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________________________

FORM 10-Q

___________________________________________________________

(Mark One)

|

|

|

|

|

|

| ☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2025

or

|

|

|

|

|

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-36751

___________________________________________________________

OCUGEN, INC.

(Exact name of registrant as specified in its charter)

___________________________________________________________

|

|

|

|

|

|

| Delaware |

04-3522315 |

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

11 Great Valley Parkway

Malvern, Pennsylvania 19355

(Address of principal executive offices, including zip code)

(484) 328-4701

(Registrant's telephone number, including area code)

___________________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, par value $0.01 per share |

|

OCGN |

|

The Nasdaq Stock Market LLC

(The Nasdaq Capital Market)

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of October 31, 2025 there were 312,320,112 outstanding shares of the registrant's common stock, $0.01 par value per share.

OCUGEN, INC.

QUARTERLY REPORT ON FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED JUNE 30, 2025

Unless the context otherwise requires, references to the "Company," "we," "our," or "us" in this report refer to Ocugen, Inc. and its subsidiaries.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements that involve substantial risks and uncertainties. All statements, other than statements of historical facts contained in this Quarterly Report on Form 10-Q regarding our strategy, future operations, future financial position, future revenues, projected costs, prospects, plans, and objectives of management are forward-looking statements. These statements involve known and unknown risks, uncertainties, and other important factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. The words "anticipate," "believe," "estimate," "expect," "intend," "may," "plan," "predict," "project," "will," "would," or the negative of such terms and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Such statements are based on assumptions and expectations that may not be realized and are inherently subject to risks, uncertainties, and other factors, many of which cannot be predicted with accuracy and some of which might not even be anticipated.

The forward-looking statements in this Quarterly Report on Form 10-Q and those contained in (i) our Annual Report on Form 10-K filed with the United States Securities and Exchange Commission ("SEC") on March 5, 2025 (the "2024 Annual Report") and (ii) our Quarterly Report on Form 10-Q for the quarter ended March 31, 2025, and June 30, 2025 filed with the SEC on May 09, 2025 and August 4, 2025, respectively (together with this Quarterly Report on Form 10-Q, the "2025 Quarterly Reports") include, among other things, statements about:

•our estimates regarding expenses, future revenues, and capital requirements, as well as the timing, availability of, and the need for, additional financing to continue to advance our product candidates;

•our activities with respect to OCU400, OCU410 and OCU410ST, including the results from our ongoing Phase 1/2 trials, our ability to continue dosing patients for our Phase 3 trial for OCU400 for the treatment of retinitis pigmentosa ("RP"), our ability to continue dosing patients for our Phase 2/3 pivotal confirmatory trial for OCU410ST for the treatment of Stargardt disease (“ST”), and our ability to complete pivotal trials;

•our ability to obtain additional funding from government agencies in the United States and/or other countries to continue the development of our inhaled mucosal vaccine platform;

•the uncertainties associated with the clinical development and regulatory approval of our product candidates including potential delays in the initiation, enrollment, and completion of current and future clinical trials;

•our ability to realize any value from our product candidates and preclinical programs being developed and anticipated to be developed, in light of inherent risks and difficulties involved in successfully commercializing products and the risk that our products, if approved, may not achieve broad market acceptance;

•our ability to comply with regulatory schemes and other regulatory developments applicable to our business in the United States and other countries;

•the performance of third-parties upon which we depend, including contract development and manufacturing organizations, suppliers, manufacturers, group purchasing organizations, distributors, and logistics providers;

•the pricing and reimbursement of our product candidates, if commercialized;

•the size and growth potential of the markets for our product candidates, and our ability to serve those markets;

•developments relating to our competitors and our industry;

•our ability to obtain and maintain patent protection, or obtain licenses to intellectual property and defend our intellectual property rights against third-parties;

•our ability to maintain our relationships and contracts with our key collaborators and commercial partners and our ability to establish additional collaborations and partnerships;

•our ability to recruit and retain key scientific, technical, commercial, and management personnel and to retain our executive officers;

•our ability to comply with stringent United States and applicable foreign government regulations with respect to the manufacturing of pharmaceutical products, including compliance with current Good Manufacturing Practice regulations, and other relevant regulatory authorities;

•the extent to which health epidemics and other outbreaks of communicable diseases, geopolitical turmoil, macroeconomic conditions, tariff policies, social unrest, political instability, terrorism, or acts of war could disrupt our business and operations, including impacts on our development programs, global supply chain, and collaborators and manufacturers; and

•other matters discussed under the heading "Risk Factors" contained in the 2024 Annual Report, the 2025 Quarterly Reports, and in any other documents we have filed with the SEC.

We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions, and expectations disclosed in the forward-looking statements we make. We have included important factors in the cautionary statements included in our 2024 Annual Report and in our 2025 Quarterly Reports, particularly under the section titled "Risk Factors," that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, collaborations, investments, or other significant transactions we may make.

You should read this Quarterly Report on Form 10-Q and the documents we have filed as exhibits to this Quarterly Report on Form 10-Q completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we do not assume any obligation to update any forward-looking statements.

In addition, statements that "we believe" and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Quarterly Report on Form 10-Q, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements. We qualify all of our forward-looking statements by these cautionary statements. In addition, with respect to all of our forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Solely for convenience, tradenames and trademarks referred to in this Quarterly Report on Form 10-Q appear without the ® or ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owners will not assert their rights, to these tradenames or trademarks, as applicable. All tradenames, trademarks, and service marks included or incorporated by reference in this Quarterly Report on Form 10-Q are the property of their respective owners. The name NeoCart has not been evaluated or cleared by the FDA.

PART I — FINANCIAL INFORMATION

Item 1. Financial Statements

OCUGEN, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2025 |

|

December 31, 2024 |

| Assets |

|

|

|

| Current assets |

|

|

|

| Cash |

$ |

32,565 |

|

|

$ |

58,514 |

|

| Prepaid expenses and other current assets |

5,074 |

|

|

3,168 |

|

| Total current assets |

37,639 |

|

|

61,682 |

|

| Property and equipment, net |

14,946 |

|

|

16,554 |

|

| Restricted cash |

314 |

|

|

307 |

|

| Other assets |

4,697 |

|

|

3,899 |

|

| Total assets |

$ |

57,596 |

|

|

82,442 |

|

| Liabilities and stockholders' equity |

|

|

|

| Current liabilities |

|

|

|

| Accounts payable |

$ |

4,574 |

|

|

$ |

4,243 |

|

| Accrued expenses and other current liabilities |

14,932 |

|

|

15,500 |

|

| Operating lease obligations |

855 |

|

|

519 |

|

| Current portion of long term debt |

— |

|

|

1,326 |

|

| Total current liabilities |

20,361 |

|

|

21,588 |

|

| Non-current liabilities |

|

|

|

| Operating lease obligations, less current portion |

3,709 |

|

|

3,313 |

|

| Long term debt, net |

28,400 |

|

|

27,345 |

|

| Other non-current liabilities |

1,593 |

|

|

564 |

|

| Total non-current liabilities |

33,702 |

|

|

31,222 |

|

| Total liabilities |

54,063 |

|

|

52,810 |

|

Commitments and contingencies (Note 13) |

|

|

|

| Stockholders' equity |

|

|

|

Preferred stock; $0.01 par value; 10,000,000 shares authorized at September 30, 2025 and December 31, 2024 |

|

|

|

|

|

|

|

Common stock; $0.01 par value; 390,000,000 shares authorized, 312,441,123 and 291,489,058 shares issued, and 312,319,623 and 291,367,558 shares outstanding at September 30, 2025 and December 31, 2024, respectively |

3,125 |

|

|

2,915 |

|

Treasury stock, at cost, 121,500 shares at September 30, 2025 and December 31, 2024 |

(48) |

|

|

(48) |

|

| Additional paid-in capital |

390,759 |

|

|

366,938 |

|

| Accumulated other comprehensive income |

58 |

|

|

48 |

|

| Accumulated deficit |

(390,361) |

|

|

(340,221) |

|

| Total stockholders' equity |

3,533 |

|

|

29,632 |

|

| Total liabilities and stockholders' equity |

$ |

57,596 |

|

|

$ |

82,442 |

|

See accompanying notes to condensed consolidated financial statements.

OCUGEN, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(in thousands, except share and per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Collaborative arrangement revenue |

$ |

1,752 |

|

|

$ |

1,136 |

|

|

$ |

4,606 |

|

|

$ |

3,291 |

|

| Total revenue |

1,752 |

|

|

1,136 |

|

|

4,606 |

|

|

3,291 |

|

| Operating expenses |

|

|

|

|

|

|

|

| Research and development |

11,149 |

|

|

8,108 |

|

|

29,081 |

|

|

23,836 |

|

| General and administrative |

8,228 |

|

|

6,280 |

|

|

21,446 |

|

|

20,372 |

|

| Total operating expenses |

19,377 |

|

|

14,388 |

|

|

50,527 |

|

|

44,208 |

|

| Loss from operations |

(17,625) |

|

|

(13,252) |

|

|

(45,921) |

|

|

(40,917) |

|

| Other (expense) income : |

|

|

|

|

|

|

|

| Interest expense |

(1,314) |

|

|

(29) |

|

|

(3,856) |

|

|

(87) |

|

| Interest income |

207 |

|

|

310 |

|

|

778 |

|

|

843 |

|

| Other (expense) income, net |

(1,319) |

|

|

1 |

|

|

(1,141) |

|

|

(13) |

|

| Total other (expense) income |

(2,426) |

|

|

282 |

|

|

(4,219) |

|

|

743 |

|

| Net loss |

$ |

(20,051) |

|

|

$ |

(12,970) |

|

|

$ |

(50,140) |

|

|

$ |

(40,174) |

|

| Other comprehensive income (loss) |

|

|

|

|

|

|

|

| Foreign currency translation adjustment |

46 |

|

|

(5) |

|

|

10 |

|

|

3 |

|

| Comprehensive loss |

$ |

(20,005) |

|

|

$ |

(12,975) |

|

|

$ |

(50,130) |

|

|

$ |

(40,171) |

|

|

|

|

|

|

|

|

|

| Net loss attributable to common shareholders — basic and diluted |

(20,051) |

|

|

(12,970) |

|

|

(50,140) |

|

|

(40,128) |

|

| Weighted shares used in calculating net loss per common share — basic and diluted |

304,003,247 |

|

|

278,171,593 |

|

|

296,066,314 |

|

|

264,303,494 |

|

| Net loss per share attributable to common shareholders — basic and diluted |

$ |

(0.07) |

|

|

$ |

(0.05) |

|

|

$ |

(0.17) |

|

|

$ |

(0.15) |

|

|

|

|

|

|

|

|

|

| Net loss attributable to Series B Convertible Preferred shareholders — basic and diluted |

— |

|

|

— |

|

|

— |

|

|

(46) |

|

| Weighted shares used in calculating net loss per Series B Convertible Preferred Stock — basic and diluted |

— |

|

|

— |

|

|

— |

|

|

54,745 |

|

| Net loss per share attributable to Series B Convertible Preferred shareholders — basic and diluted |

— |

|

|

— |

|

|

— |

|

|

(0.84) |

|

See accompanying notes to condensed consolidated financial statements.

OCUGEN, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

(in thousands, except share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series B Convertible Preferred Stock |

|

Common Stock |

|

Treasury Stock |

|

Additional

Paid-in Capital |

|

Accumulated Other Comprehensive Income |

|

Accumulated

Deficit |

|

Total |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

|

| Balance at December 31, 2024 |

— |

|

|

$ |

— |

|

|

291,489,058 |

|

$ |

2,915 |

|

|

$ |

(48) |

|

|

$ |

366,938 |

|

|

$ |

48 |

|

|

$ |

(340,221) |

|

|

$ |

29,632 |

|

| Stock-based compensation expense |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1,885 |

|

|

— |

|

|

— |

|

|

1,885 |

|

| Issuance of common stock for stock option exercises and restricted stock unit vesting, net |

— |

|

|

— |

|

|

660,917 |

|

|

7 |

|

|

— |

|

|

(252) |

|

|

— |

|

|

— |

|

|

(245) |

|

| Other comprehensive loss |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(8) |

|

|

— |

|

|

(8) |

|

| Net loss |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(15,350) |

|

|

(15,350) |

|

| Balance at March 31, 2025 |

— |

|

|

$ |

— |

|

|

292,149,975 |

|

|

$ |

2,922 |

|

|

$ |

(48) |

|

|

$ |

368,571 |

|

|

$ |

40 |

|

|

$ |

(355,571) |

|

|

$ |

15,914 |

|

| Stock-based compensation expense |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1,844 |

|

|

— |

|

|

— |

|

|

1,844 |

|

| Issuance of common stock for stock option exercises and restricted stock unit vesting, net |

— |

|

|

— |

|

|

163,586 |

|

|

2 |

|

|

— |

|

|

59 |

|

|

— |

|

|

— |

|

|

61 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive loss |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(28) |

|

|

— |

|

|

(28) |

|

| Net loss |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(14,739) |

|

|

(14,739) |

|

| Balance at June 30, 2025 |

— |

|

|

— |

|

|

292,313,561 |

|

|

2,924 |

|

|

(48) |

|

|

370,474 |

|

|

12 |

|

|

(370,310) |

|

|

3,052 |

|

| Stock-based compensation expense |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1,976 |

|

|

— |

|

|

— |

|

|

1,976 |

|

| Issuance of common stock for stock option exercises and restricted stock unit vesting, net |

— |

|

|

— |

|

|

127,562 |

|

|

1 |

|

|

— |

|

|

55 |

|

|

— |

|

|

— |

|

|

56 |

|

| Issuance of common stock & warrants for capital raises, net of issuance costs |

— |

|

|

— |

|

|

20,000,000 |

|

|

200 |

|

|

— |

|

|

18,254 |

|

|

— |

|

|

— |

|

|

18,454 |

|

| Other comprehensive income (loss) |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

46 |

|

|

— |

|

|

46 |

|

| Net loss |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(20,051) |

|

|

(20,051) |

|

| Balance at September 30, 2025 |

— |

|

|

— |

|

|

312,441,123 |

|

|

$ |

3,125 |

|

|

$ |

(48) |

|

|

390,759 |

|

|

$ |

58 |

|

|

$ |

(390,361) |

|

|

3,533 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OCUGEN, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (CONTINUED)

(in thousands, except share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series B Convertible Preferred Stock |

|

Common Stock |

|

Treasury Stock |

|

Additional

Paid-in Capital |

|

Accumulated Other Comprehensive Income |

|

Accumulated

Deficit |

|

Total |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

|

| Balance at December 31, 2023 |

54,745 |

|

|

$ |

1 |

|

|

256,688,304 |

|

$ |

2,567 |

|

|

$ |

(48) |

|

|

$ |

324,191 |

|

|

$ |

20 |

|

|

$ |

(286,167) |

|

|

$ |

40,564 |

|

| Stock-based compensation expense |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1,761 |

|

|

— |

|

|

— |

|

|

1,761 |

|

| Issuance of common stock for stock option exercises and restricted stock unit vesting, net |

— |

|

|

— |

|

|

758,460 |

|

|

8 |

|

|

— |

|

|

(153) |

|

|

— |

|

|

— |

|

|

(145) |

|

| Other comprehensive income (loss) |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

5 |

|

|

— |

|

|

5 |

|

| Net loss |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(11,924) |

|

|

(11,924) |

|

| Balance at March 31, 2024 |

54,745 |

|

|

$ |

1 |

|

|

257,446,764 |

|

|

$ |

2,575 |

|

|

$ |

(48) |

|

|

$ |

325,799 |

|

|

$ |

25 |

|

|

$ |

(298,091) |

|

|

$ |

30,261 |

|

| Stock-based compensation expense |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1,898 |

|

|

— |

|

|

— |

|

|

1,898 |

|

| Issuance of common stock for stock option exercises and restricted stock unit vesting, net |

— |

|

|

— |

|

|

95,860 |

|

|

1 |

|

|

— |

|

|

44 |

|

|

— |

|

|

— |

|

|

45 |

|

| Series B convertible preferred stock reacquisition |

(54,745) |

|

|

(1) |

|

|

— |

|

|

— |

|

|

— |

|

|

1 |

|

|

— |

|

|

— |

|

|

— |

|

| Other comprehensive income (loss) |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

3 |

|

|

— |

|

|

3 |

|

| Net loss |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(15,280) |

|

|

(15,280) |

|

| Balance at June 30, 2024 |

— |

|

|

$ |

— |

|

|

257,542,624 |

|

|

$ |

2,576 |

|

|

$ |

(48) |

|

|

$ |

327,742 |

|

|

$ |

28 |

|

|

$ |

(313,371) |

|

|

$ |

16,927 |

|

| Stock-based compensation expense |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1,892 |

|

|

— |

|

|

— |

|

|

1,892 |

|

| Issuance of common stock for stock option exercises and restricted stock unit vesting, net |

— |

|

|

— |

|

|

124,237 |

|

1 |

|

|

— |

|

|

48 |

|

|

— |

|

|

— |

|

|

49 |

|

| Issuance of common stock for capital raises, net of issuance costs |

|

|

|

|

32,717,391 |

|

|

327 |

|

|

— |

|

|

34,410 |

|

|

|

|

|

|

34,737 |

|

| Other comprehensive income (loss) |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(5) |

|

|

— |

|

|

(5) |

|

| Net loss |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(12,970) |

|

|

(12,970) |

|

| Balance at September 30, 2024 |

— |

|

|

$ |

— |

|

|

290,384,252 |

|

|

$ |

2,904 |

|

|

$ |

(48) |

|

|

$ |

364,092 |

|

|

$ |

23 |

|

|

$ |

(326,341) |

|

|

$ |

40,630 |

|

See accompanying notes to condensed consolidated financial statements.

OCUGEN, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine months ended September 30, |

|

2025 |

|

2024 |

| Cash flows from operating activities |

|

|

|

| Net loss |

$ |

(50,140) |

|

|

$ |

(40,174) |

|

| Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

| Depreciation and amortization expense |

2,786 |

|

|

1,370 |

|

| Non-cash interest expense |

75 |

|

|

87 |

|

| Non-cash lease expense |

944 |

|

|

634 |

|

| Non-cash (income) expense from collaborative arrangements, net |

(2,684) |

|

|

(2,406) |

|

| Stock-based compensation expense |

5,705 |

|

|

5,551 |

|

| Other |

29 |

|

|

28 |

|

| Changes in assets and liabilities: |

|

|

|

| Prepaid expenses and other current assets |

(1,913) |

|

|

1,701 |

|

| Accounts payable and accrued expenses |

2,105 |

|

|

2,048 |

|

| Other non-current liabilities |

90 |

|

|

(617) |

|

| Net cash used in operating activities |

(43,003) |

|

|

(31,778) |

|

| Cash flows from investing activities |

|

|

|

| Purchases of property and equipment |

(150) |

|

|

(3,372) |

|

| Payment of security deposits |

(126) |

|

|

— |

|

| Net cash used in investing activities |

(276) |

|

|

(3,372) |

|

| Cash flows from financing activities |

|

|

|

| Issuance of common stock and warrants, net |

18,326 |

|

|

37,575 |

|

| Payment of EB-5 Loan |

(1,000) |

|

|

(2,889) |

|

| Net cash provided by financing activities |

17,326 |

|

|

34,686 |

|

| Effect of changes in exchange rate on cash and restricted cash |

10 |

|

|

3 |

|

| Net decrease in cash and restricted cash |

(25,943) |

|

|

(461) |

|

| Cash and restricted cash at beginning of period |

58,821 |

|

|

39,462 |

|

| Cash and restricted cash at end of period |

$ |

32,879 |

|

|

$ |

39,001 |

|

| Supplemental disclosure of non-cash investing and financing transactions: |

|

|

|

| Purchases of property and equipment |

$ |

19 |

|

|

$ |

— |

|

| Series B Convertible Preferred Stock reacquisition |

$ |

— |

|

|

$ |

1 |

|

| Right-of-use asset related to operating leases |

$ |

1,316 |

|

|

$ |

103 |

|

|

|

|

|

See accompanying notes to condensed consolidated financial statements.

OCUGEN, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Nature of Business

Ocugen, Inc., together with its wholly owned subsidiaries ("Ocugen" or the "Company"), is a biotechnology company focused on discovering, developing, and commercializing novel gene therapies that improve health and offer hope for patients across the globe. The Company is headquartered in Malvern, Pennsylvania, and manages its business as one operating segment.

Going Concern

The Company has incurred recurring net losses since inception and has funded its operations to date through the sale of common stock, warrants to purchase common stock, the issuance of convertible notes and debt, and grant proceeds. The Company incurred net losses of approximately $50.1 million and $40.2 million for the Nine months ended September 30, 2025 and 2024, respectively. As of September 30, 2025, the Company had an accumulated deficit of $390.4 million and cash totaling $32.6 million. This amount will not be sufficient to fund the Company's operations over the next 12 months after the date that the condensed consolidated financial statements are issued. Due to the inherent uncertainty involved in making estimates and the risks associated with the research, development, and commercialization of biotechnology products, the Company may have based this estimate on assumptions that may prove to be different than actuals, and the Company's operating plan may change as a result of many factors currently unknown to the Company.

The Company is subject to risks and uncertainties frequently encountered by companies in its industry, and while the Company intends to continue its research, development, and commercialization efforts for its product candidates, the Company will require significant additional funding. If the Company is unable to obtain additional funding in the future and/or its research, development, and commercialization efforts require higher than anticipated capital, there will be a negative impact on the financial viability of the Company. The Company will continue to explore options to fund its operations through public and private placements of equity and/or debt, payments from potential strategic research and development arrangements, sales of assets, licensing and/or collaboration arrangements with pharmaceutical companies or other institutions, funding from the government, particularly for the development of the Company's novel inhaled mucosal vaccine platform, or funding from other third parties. Such financing and funding may not be available at all, or on terms that are favorable to the Company. While Company management believes that it has a plan to fund operations, its plan may not be successfully implemented. If we cannot obtain the necessary funding, we will need to delay, scale back, or eliminate some or all of our research and development programs and commercialization efforts; consider other various strategic alternatives, including a merger or sale; or cease operations. If we cannot expand our operations or otherwise capitalize on our business opportunities because we lack sufficient capital, our business, financial condition, and results of operations could be materially adversely affected.

As a result of these factors, together with the anticipated continued spending that will be necessary to continue to research, develop, and commercialize the Company's product candidates, there is substantial doubt about the Company's ability to continue as a going concern within one year after the date that these condensed consolidated financial statements are issued. The condensed consolidated financial statements do not contain any adjustments that might result from the resolution of any of the above uncertainties.

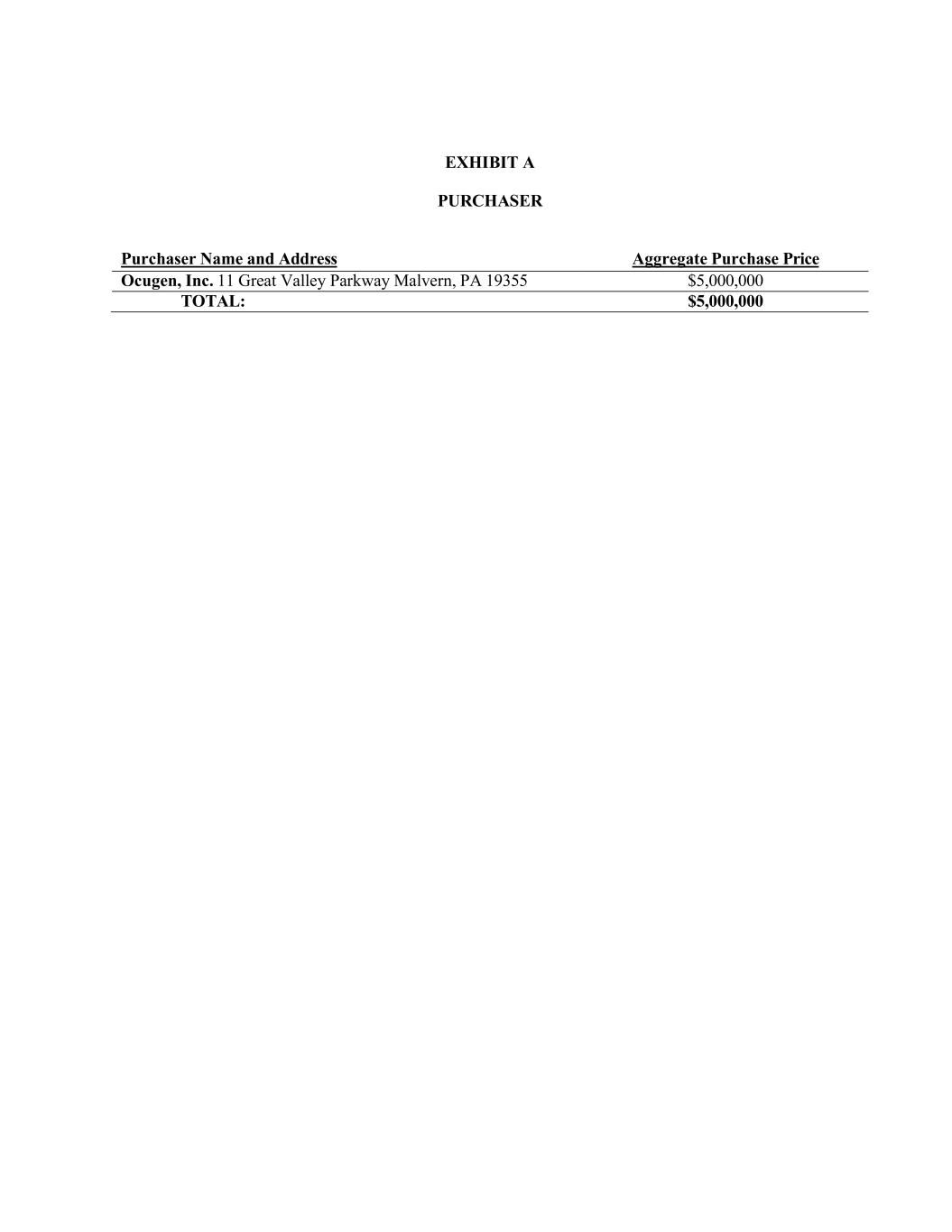

Update on NeoCart Business Merger: Agreement and Subsequent Termination

On June 22, 2025, we and OrthoCellix, Inc., a Delaware corporation and our wholly-owned subsidiary to which we have contributed the assets related to our NeoCart product candidate (“OrthoCellix”), entered into an Agreement and Plan of Merger (the “Merger Agreement”), by and among Ocugen, OrthoCellix, Carisma Therapeutics Inc., a Delaware corporation (“Carisma”) and Azalea Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Carisma (“Merger Sub”).

On September 16, 2025, Carisma Therapeutics, Inc. delivered a termination notice to Ocugen, providing for the termination of the Merger Agreement as a result of Ocugen having obtained less than $25.0 million in commitments for the Concurrent Investment (as defined in the Merger Agreement) sufficiently in advance of Carisma’s pending Nasdaq compliance deadline of October 7, 2025. Ocugen continue to pursue new strategic partnerships and investment opportunities that align with the Company's long-term growth objectives.

2. Summary of Significant Accounting Policies

Basis of Presentation and Consolidation

The accompanying unaudited condensed consolidated financial statements included herein have been prepared in conformity with GAAP and under the rules and regulations of the United States Securities and Exchange Commission ("SEC") for interim reporting. The accompanying unaudited condensed consolidated financial statements include all adjustments, consisting of normal recurring adjustments, necessary for a fair statement of the Company's financial position, results of operations, and cash flows. The condensed consolidated results of operations are not necessarily indicative of the results that may occur for the full fiscal year. Certain information and footnote disclosures of the Company normally included in the financial statements prepared in accordance with GAAP have been condensed or omitted under the SEC's rules and regulations. These condensed consolidated financial statements should be read in conjunction with the audited financial statements and accompanying notes thereto for the year ended December 31, 2024, included in the Company's Annual Report on Form 10-K filed with the SEC on March 5, 2025 (the "2024 Annual Report"). The condensed consolidated financial statements include the accounts of Ocugen and its wholly owned subsidiaries. All intercompany balances and transactions have been eliminated in consolidation.

Certain prior period amounts have been reclassified to conform to the current year presentation of our condensed consolidated interim financial statements. These reclassifications had no effect on the reported results of operations and ending shareholders’ equity.

The accounting policies of the Company, as applied in the condensed consolidated financial statements presented herein, are substantially the same as presented in the Company’s 2024 Form 10-K filed on March 5, 2025, except as may be indicated below.

Use of Estimates

In preparing the condensed consolidated financial statements in conformity with GAAP, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of expenses during the reporting period. Due to the inherent uncertainty involved in making estimates, actual results reported in future periods may be affected by changes in these estimates. On an ongoing basis, the Company evaluates its estimates and assumptions. These estimates and assumptions include those used in the accounting for research and development contracts, including clinical trial accruals, determination of the collaborative arrangements' transaction price, calculating the progress towards the satisfaction of the performance obligations under the collaborative arrangements, and determining the value of the non-cash consideration received under collaborative arrangements.

Cash, Cash Equivalents, and Restricted Cash

The Company considers all highly liquid investments that have maturities of three months or less when acquired to be cash equivalents. Cash equivalents may include bank demand deposits and money market funds that invest primarily in certificates of deposit, commercial paper, and U.S. government agency securities and treasuries. The Company records interest income received on its cash and cash equivalents to interest (expense) income, net in the condensed consolidated statements of operations and comprehensive loss. The Company recorded $0.2 million and $0.8 million as interest income for the three and nine months ended September 30, 2025, respectively. The Company recorded $0.3 million and $0.8 million as interest income for the three and nine months ended September 30, 2024, respectively. The Company's restricted cash balance as of September 30, 2025 consisted of cash held to collateralize a corporate credit card account and a line of credit related to an operating lease in the event of a payment default.

The following table provides a reconciliation of cash and restricted cash from the condensed consolidated balance sheets to the total amount shown in the condensed consolidated statements of cash flows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

As of September 30, |

|

2025 |

|

2024 |

| Cash |

$ |

32,565 |

|

|

$ |

38,696 |

|

| Restricted cash |

314 |

|

|

305 |

|

| Total cash and restricted cash |

$ |

32,879 |

|

|

$ |

39,001 |

|

Fair Value Measurements

The Company follows the provisions of Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") Topic 820, Fair Value Measurements ("ASC 820"), which defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. ASC 820 also establishes a fair value hierarchy, which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. ASC 820 describes three levels of inputs that may be used to measure fair value:

Level 1 — quoted prices in active markets for identical assets or liabilities

Level 2 — quoted prices for similar assets and liabilities in active markets or inputs that are observable

Level 3 — inputs that are unobservable (for example, cash flow modeling inputs based on assumptions)

The carrying value of certain financial instruments, including cash, accounts payable, and accrued expenses, approximates their fair value due to the short-term nature of these instruments.

Concentration of Credit Risk

Financial instruments that potentially subject the Company to significant concentrations of credit risk consist of cash and restricted cash. The Company's cash and restricted cash are held in accounts at financial institutions that may exceed federally insured limits. The Company has not experienced any credit losses in such accounts and does not believe it is exposed to significant credit risk beyond the standard credit risk associated with commercial banking relationships.

Leases

The Company determines if an arrangement is or contains a lease at inception. This determination generally depends on whether the arrangement conveys to the Company the right to control the use of an explicitly or implicitly identified fixed asset for a period of time in exchange for consideration. Control of an underlying asset is conveyed to the Company, if the Company obtains the rights to direct the use of and to obtain substantially all of the economic benefits from using the underlying asset. The Company's lease agreements include lease and non-lease components, which the Company has elected not to account for separately for all classes of underlying assets. Lease expense for variable lease components is recognized when incurred.

The Company currently leases real estate classified as operating leases. Operating right of use assets are included in other assets and operating lease obligations in the Company's consolidated balance sheets. At lease commencement, the Company records a lease liability based on the present value of the lease payments over the expected lease term including any options to extend the lease that the Company is reasonably certain to exercise and records a corresponding right-of-use lease asset based on the lease liability, adjusted for any lease incentives received and any initial direct costs paid to the lessor prior to the lease commencement date. Lease expense is recognized on a straight-line basis over the lease term and recognized as research and development expense or general and administrative expense based on the underlying nature of the expense. FASB ASC Topic 842, Leases ("ASC 842") requires a lessee to discount its unpaid lease payments using the interest rate implicit in the lease or, if that rate cannot be readily determined, its incremental borrowing rate. The implicit interest rates were not readily determinable in the Company's current operating leases. As such, the incremental borrowing rates were used based on the information available at the commencement dates in determining the present value of lease payments.

The lease term for the Company's leases includes the non-cancellable period of the lease plus any additional periods covered by either an option to extend (or not to terminate) the lease that the Company is reasonably certain to exercise, or an option to extend (or not to terminate) the lease controlled by the lessor.

Lease payments included in the measurement of the lease liability are comprised of fixed payments, variable payments that depend on an index or rate, and amounts probable to be payable under the exercise of an option to purchase the underlying asset if reasonably certain.

Variable payments not dependent on an index or rate associated with the Company's leases are recognized when incurred. Variable payments include the Company's proportionate share of certain utilities and other operating expenses and are presented as operating expenses in the Company's condensed consolidated statements of operations and comprehensive loss in the same line item as expense arising from fixed lease payments.

Impairment of Assets

The Company reviews its assets, including property and equipment, for impairment whenever changes in circumstances or events may indicate that the carrying amounts are not recoverable. These indicators include, but are not limited to, a significant change in the extent or manner in which an asset is used or its physical condition, a significant decrease in the market price of an asset, or a significant adverse change in the business or the industry that could affect the value of an asset. An asset is tested for impairment by comparing the net carrying value of the asset to the undiscounted net cash flows to be generated from the use and eventual disposition of the asset.

Stock-Based Compensation

The Company accounts for its stock-based compensation awards in accordance with FASB ASC Topic 718, Compensation—Stock Compensation ("ASC 718"). The Company has issued stock-based compensation awards including stock options, restricted stock units ("RSUs"), and market-condition based restricted stock units ("PSUs"), and also accounts for certain issuances of preferred stock and warrants in accordance with ASC 718. ASC 718 requires all stock-based payments, including grants of stock options, RSUs, and PSUs, to be recognized in the condensed consolidated statements of operations and comprehensive loss based on their grant date fair values. The Company uses the Black-Scholes option-pricing model to determine the fair value of stock options granted. For RSUs, the fair value of the RSU is determined by the market price of a share of the Company's common stock on the grant date. For PSUs, the Company determines fair value by using a Monte Carlo simulation technique. The Company recognizes forfeitures as they occur.

Expense related to stock-based compensation awards granted with service-based vesting conditions is recognized on a straight-line basis based on the grant date fair value over the associated service period of the award, which is generally the vesting term. Stock-based compensation awards generally vest over a one to three year requisite service period. Stock options have a contractual term of 10 years. Expense for stock-based compensation awards with performance-based vesting conditions is only recognized when the performance-based vesting condition is deemed probable to occur. Expense for stock-based compensation awards with market-based and service-based vesting conditions is recognized ratably over the grantee's requisite service period. Compensation cost is not adjusted based on the actual achievement of the market-based performance goals. Expense related to stock-based compensation awards are recorded to research and development expense or general and administrative expense based on the underlying function of the individual that was granted the stock-based compensation award. Shares issued upon stock option exercise, PSU and RSU vesting are newly-issued common shares.

Estimating the fair value of stock options requires the input of subjective assumptions, including the expected term of the stock option, stock price volatility, the risk-free interest rate, and expected dividends. Estimating the fair value of PSUs requires the input of subjective assumptions, including stock price volatility, total shareholder return ("TSR") ranking, the risk-free rate, and expected dividends. The assumptions used in the Company's Black-Scholes option-pricing model and Monte Carlo simulation technique represent management's best estimates and involve a number of variables, uncertainties, assumptions, and the application of management's judgment, as they are inherently subjective. If any assumptions change, the Company's stock-based compensation expense could be materially different in the future.

The assumptions used in Ocugen's Black-Scholes option-pricing model for stock options and in Ocugen's Monte Carlo simulation technique for PSUs are as follows, unless noted otherwise:

Expected Term. As Ocugen does not have sufficient historical exercise data to provide a reasonable basis upon which to estimate expected term, the expected term of employee stock options subject to service-based vesting conditions is determined using the "simplified" method, as prescribed in SEC's Staff Accounting Bulletin No. 107, whereby the expected term equals the arithmetic average of the vesting term and the original contractual term of the stock option.

This expected term assumption is not an assumption used in the Company's Monte Carlo simulation technique for PSUs. The expected term of the PSUs is equal to the performance period of the PSUs.

Expected Volatility. The expected volatility is based on historical volatilities of Ocugen and similar entities within Ocugen's industry for periods commensurate with the assumed expected term.

Risk-Free Interest Rate. The risk-free interest rate is based on the interest rate payable on U.S. Treasury securities in effect at the time of grant for a period that is commensurate with the assumed expected term.

Expected Dividends. The expected dividend yield is 0% because Ocugen has not historically paid, and does not expect for the foreseeable future to pay, a dividend on its common stock.

TSR ranking. The Company's TSR, over a three-year period, is relative to the TSR, for that same period, as related to other companies within the Nasdaq Biotechnology index. This assumption is only used for the market-based PSUs.

Collaborative Arrangements and Revenue Recognition

The Company analyzes its collaborative arrangements to assess whether they are within the scope of ASC 808, Collaborative Arrangements ("ASC 808") to determine whether such arrangements involve joint operating activities performed by parties that are both active participants in the activities and exposed to significant risks and rewards. This assessment is performed throughout the life of the arrangements based on changes to the arrangements. For collaborative arrangements within the scope of ASC 808 the Company may analogize to ASC 606 for certain elements.

The Company identifies the goods or services promised within each collaborative arrangement and assesses whether each promised good or service is distinct for the purpose of identifying the performance obligations in the contract. This assessment involves subjective determinations and requires management to make judgments about the individual promised goods or services and whether such are separable from the other aspects of the contractual relationship. Promised goods and services are considered distinct provided that: (i) the customer can benefit from the good or service either on its own or together with other resources that are readily available to the customer and (ii) the entity's promise to transfer the good or service to the customer is separately identifiable from other promises in the contract.

The allocation of the transaction price to the performance obligations in proportion to their standalone selling prices is determined at contract inception. If the consideration promised in a contract includes a variable amount, the Company estimates the amount of consideration to which it will be entitled in exchange for transferring the promised goods or services to a customer. The Company determines the amount of variable consideration by using the expected value method or the most likely amount method. The Company includes the unconstrained amount of estimated variable consideration in the transaction price. The amount included in the transaction price is the amount for which it is probable that a significant reversal of cumulative revenue recognized will not occur. At the end of each subsequent reporting period, the Company re-evaluates the estimated variable consideration included in the transaction price and any related constraint, and if necessary, adjusts its estimate of the overall transaction price. Any such adjustments are recorded on a cumulative catch-up basis in the period of adjustment.

In determining the transaction price, the Company adjusts consideration for the effects of the time value of money if the timing of payments provides the Company with a significant benefit of financing. The Company does not assess whether a contract has a significant financing component if the expectation at contract inception is such that the period between payment by the counterparty and the transfer of the promised goods or services to the counterparty will be one year or less. The Company assessed its collaboration arrangements in order to determine whether a significant financing component exists and concluded that a significant financing component does not exist in any of its arrangements.

The Company recognizes as collaboration revenue the amount of the transaction price that is allocated to the respective performance obligation as each performance obligation is satisfied over time, with progress toward completion measured based on actual costs incurred relative to total estimated costs to be incurred over the life of the arrangement. Significant management judgment is required in determining the level of effort required under an arrangement and the period over which the Company is expected to complete their performance obligations under the arrangements. The Company evaluates the measure of progress each reporting period and, if necessary, adjusts the measure of performance and related revenue recognition. Adjustments to original estimates will be required as work progresses and additional information becomes known, even though the scope of the work required under the contract may not change. Any adjustment as a result of a change in estimates is made when facts develop, events become known, or an adjustment is otherwise warranted.

Under the Company's collaborative arrangements, the timing of revenue recognition and receipt of consideration may differ, and result in assets and liabilities. Assets represent revenues recognized in excess of the consideration received under collaborative arrangement.

Liabilities represent the consideration received in excess of revenues recognized under collaborative arrangement.

Recently Adopted Accounting Standards

In November 2023, the FASB issued ASU 2023-07 “Segment Reporting: Improvements to Reportable Segment Disclosures”. This guidance expands public entities’ segment disclosures primarily by requiring disclosure of significant segment expenses that are regularly provided to the chief operating decision maker and included within each reported measure of segment profit or loss, an amount and description of its composition for other segment items, and interim disclosures of a reportable segment’s profit or loss and assets. The guidance is effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024, with early adoption permitted. The amendments are required to be applied retrospectively to all prior periods presented in an entity’s financial statements. The Company adopted the guidance in the fiscal year beginning January 1, 2024. There was no impact on the Company's reportable segments identified and additional required disclosures have been included in Note 14.

Recent Accounting Pronouncements

In December 2023, the FASB issued ASU 2023-09 “Income Taxes (Topic 740): Improvements to Income Tax Disclosures”. This guidance is intended to enhance the transparency and decision-usefulness of income tax disclosures. The amendments in ASU 2023-09 address investor requests for enhanced income tax information primarily through changes to disclosure regarding rate reconciliation and income taxes paid both in the U.S. and in foreign jurisdictions. ASU 2023-09 is effective for fiscal years beginning after December 15, 2024 on a prospective basis, with the option to apply the standard retrospectively. The adoption of ASU 2023-09 is not expected to have a material impact on the Company’s consolidated financial statements, but will require additional income tax disclosures when adopted in the Company’s Annual Report on Form 10-K for the year ending December 31, 2025 and annual periods thereafter.

In November 2024, the FASB issued ASU No. 2024-03, Income Statement—Reporting Comprehensive Income—Expense Disaggregation Disclosures (Subtopic 220-40): Disaggregation of Income Statement Expenses (ASU 2024-03). The new guidance requires disaggregated information about certain income statement expense line items on an annual and interim basis. This guidance will be effective for annual periods beginning the year ended December 31, 2027 and for interim periods thereafter. The new standard permits early adoption and can be applied prospectively or retrospectively. We are evaluating the effect that this guidance will have on our consolidated financial statements and related disclosures.

In November 2024, the FASB issued ASU 2024-04, Debt with Conversion and Other Options (Subtopic 470-20): Induced Conversions of Convertible Debt Instruments, which clarifies the requirements for determining whether certain settlements of convertible debt instruments should be accounted for as induced conversions rather than as debt extinguishments. This update is effective for annual periods beginning after December 15, 2025, including interim periods within those fiscal years, though early adoption is permitted. We are evaluating the effect that this guidance will have on our consolidated financial statements and related disclosures.

3. License and Development Agreements

Co-Development and Commercialization Agreement with CanSino Biologics, Inc.