00013706372024FYFALSEP3Yhttp://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2024#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortization0.00405180.00500070.011404481iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesiso4217:USDetsy:itemxbrli:pureetsy:segmentetsy:dayetsy:position00013706372024-01-012024-12-3100013706372024-06-3000013706372025-02-1400013706372024-12-3100013706372023-12-3100013706372023-01-012023-12-3100013706372022-01-012022-12-310001370637us-gaap:CommonStockMember2021-12-310001370637us-gaap:AdditionalPaidInCapitalMember2021-12-310001370637us-gaap:RetainedEarningsMember2021-12-310001370637us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-3100013706372021-12-310001370637us-gaap:CommonStockMember2022-01-012022-12-310001370637us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001370637us-gaap:RetainedEarningsMember2022-01-012022-12-310001370637us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001370637us-gaap:CommonStockMember2022-12-310001370637us-gaap:AdditionalPaidInCapitalMember2022-12-310001370637us-gaap:RetainedEarningsMember2022-12-310001370637us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-3100013706372022-12-310001370637us-gaap:CommonStockMember2023-01-012023-12-310001370637us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001370637us-gaap:RetainedEarningsMember2023-01-012023-12-310001370637us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001370637us-gaap:CommonStockMember2023-12-310001370637us-gaap:AdditionalPaidInCapitalMember2023-12-310001370637us-gaap:RetainedEarningsMember2023-12-310001370637us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001370637us-gaap:CommonStockMember2024-01-012024-12-310001370637us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310001370637us-gaap:RetainedEarningsMember2024-01-012024-12-310001370637us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310001370637us-gaap:CommonStockMember2024-12-310001370637us-gaap:AdditionalPaidInCapitalMember2024-12-310001370637us-gaap:RetainedEarningsMember2024-12-310001370637us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310001370637etsy:MarketplaceRevenueMember2024-01-012024-12-310001370637etsy:MarketplaceRevenueMember2022-04-112022-12-310001370637etsy:MarketplaceRevenueMember2022-01-012022-04-100001370637etsy:OffsiteAdvertisingMembersrt:MinimumMember2024-01-012024-12-310001370637etsy:OffsiteAdvertisingMembersrt:MaximumMember2024-01-012024-12-310001370637etsy:EtsyPaymentsProcessingFeesMembersrt:MinimumMember2024-01-012024-12-310001370637etsy:EtsyPaymentsProcessingFeesMembersrt:MaximumMember2024-01-012024-12-310001370637etsy:ReverbMemberetsy:MarketplaceRevenueMember2024-01-012024-12-310001370637etsy:DepopMemberetsy:MarketplaceRevenueMember2024-01-012024-12-310001370637etsy:DepopMemberetsy:MarketplaceRevenueMember2023-01-012023-12-310001370637us-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedPaymentArrangementEmployeeMember2024-01-012024-12-310001370637us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedPaymentArrangementEmployeeMember2024-01-012024-12-310001370637etsy:ConvertibleSeniorNotesDue2028Memberus-gaap:ConvertibleDebtMember2021-06-300001370637etsy:ConvertibleSeniorNotesDue2027Memberus-gaap:ConvertibleDebtMember2020-08-310001370637etsy:ConvertibleSeniorNotesDue2026Memberus-gaap:ConvertibleDebtMember2019-09-300001370637srt:MinimumMemberus-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-12-310001370637srt:MaximumMemberus-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-12-310001370637etsy:MarketplaceRevenueMember2023-01-012023-12-310001370637etsy:MarketplaceRevenueMember2022-01-012022-12-310001370637etsy:ServicesRevenueMember2024-01-012024-12-310001370637etsy:ServicesRevenueMember2023-01-012023-12-310001370637etsy:ServicesRevenueMember2022-01-012022-12-310001370637us-gaap:DomesticCountryMember2024-12-310001370637us-gaap:StateAndLocalJurisdictionMember2024-12-310001370637us-gaap:ForeignCountryMember2024-12-310001370637us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-12-310001370637us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-12-310001370637us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-12-310001370637us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2024-01-012024-12-310001370637us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-01-012023-12-310001370637us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-01-012022-12-310001370637us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2024-12-310001370637us-gaap:ConvertibleDebtSecuritiesMember2024-01-012024-12-310001370637us-gaap:ConvertibleDebtSecuritiesMember2023-01-012023-12-310001370637us-gaap:ConvertibleDebtSecuritiesMember2022-01-012022-12-310001370637us-gaap:StockCompensationPlanMember2024-01-012024-12-310001370637us-gaap:StockCompensationPlanMember2023-01-012023-12-310001370637us-gaap:StockCompensationPlanMember2022-01-012022-12-310001370637us-gaap:ConvertibleDebtSecuritiesMember2024-01-012024-12-310001370637us-gaap:ConvertibleDebtSecuritiesMember2023-01-012023-12-310001370637us-gaap:ConvertibleDebtSecuritiesMember2022-01-012022-12-310001370637etsy:Elo7Member2023-01-012023-12-310001370637etsy:EtsyMember2024-01-012024-12-310001370637etsy:ReverbMember2024-01-012024-12-310001370637etsy:ReverbMember2023-01-012023-12-310001370637etsy:EtsyMember2023-01-012023-12-310001370637etsy:DepopMember2022-07-012022-09-300001370637etsy:Elo7Member2022-07-012022-09-300001370637us-gaap:TrademarksMember2024-12-310001370637us-gaap:CustomerRelationshipsMember2024-12-310001370637us-gaap:CustomerRelatedIntangibleAssetsMember2024-12-310001370637us-gaap:PatentedTechnologyMember2024-12-310001370637us-gaap:TrademarksMember2023-12-310001370637us-gaap:CustomerRelationshipsMember2023-12-310001370637us-gaap:CustomerRelatedIntangibleAssetsMember2023-12-310001370637us-gaap:PatentedTechnologyMember2023-12-310001370637etsy:Elo7Member2023-04-012023-06-300001370637etsy:ReportableSegmentMember2024-01-012024-12-310001370637etsy:ReportableSegmentMember2023-01-012023-12-310001370637etsy:ReportableSegmentMember2022-01-012022-12-310001370637country:US2024-01-012024-12-310001370637country:US2023-01-012023-12-310001370637country:US2022-01-012022-12-310001370637country:GB2024-01-012024-12-310001370637country:GB2023-01-012023-12-310001370637country:GB2022-01-012022-12-310001370637etsy:NonUSAndUnitedKingdomMember2024-01-012024-12-310001370637etsy:NonUSAndUnitedKingdomMember2023-01-012023-12-310001370637etsy:NonUSAndUnitedKingdomMember2022-01-012022-12-310001370637country:US2024-12-310001370637country:US2023-12-310001370637us-gaap:NonUsMember2024-12-310001370637us-gaap:NonUsMember2023-12-310001370637us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2024-12-310001370637us-gaap:FairValueInputsLevel1Memberus-gaap:USGovernmentDebtSecuritiesMember2024-12-310001370637us-gaap:FairValueInputsLevel1Member2024-12-310001370637us-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMember2024-12-310001370637us-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMember2024-12-310001370637us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateBondSecuritiesMember2024-12-310001370637us-gaap:FairValueInputsLevel2Member2024-12-310001370637us-gaap:FairValueInputsLevel3Memberetsy:LoansReceivableHeldForInvestmentsMember2024-12-310001370637us-gaap:FairValueInputsLevel3Member2024-12-310001370637us-gaap:FairValueInputsLevel12And3Member2024-12-310001370637us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberetsy:ThirdPartyManagedFundsMember2024-12-310001370637us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2023-12-310001370637us-gaap:FairValueInputsLevel1Memberus-gaap:USGovernmentDebtSecuritiesMember2023-12-310001370637us-gaap:FairValueInputsLevel1Member2023-12-310001370637us-gaap:FairValueInputsLevel2Memberus-gaap:AgencySecuritiesMember2023-12-310001370637us-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMember2023-12-310001370637us-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMember2023-12-310001370637us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateBondSecuritiesMember2023-12-310001370637us-gaap:FairValueInputsLevel2Member2023-12-310001370637us-gaap:FairValueInputsLevel3Memberetsy:LoansReceivableHeldForInvestmentsMember2023-12-310001370637us-gaap:FairValueInputsLevel3Member2023-12-310001370637us-gaap:FairValueInputsLevel12And3Member2023-12-310001370637us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberetsy:ThirdPartyManagedFundsMember2023-12-310001370637us-gaap:USGovernmentDebtSecuritiesMember2024-12-310001370637us-gaap:CertificatesOfDepositMember2024-12-310001370637us-gaap:CommercialPaperMember2024-12-310001370637us-gaap:CorporateBondSecuritiesMember2024-12-310001370637us-gaap:USGovernmentDebtSecuritiesMember2023-12-310001370637us-gaap:AgencySecuritiesMember2023-12-310001370637us-gaap:CertificatesOfDepositMember2023-12-310001370637us-gaap:CommercialPaperMember2023-12-310001370637us-gaap:CorporateBondSecuritiesMember2023-12-310001370637srt:MaximumMember2024-12-310001370637srt:MinimumMember2024-12-310001370637us-gaap:FairValueInputsLevel2Memberetsy:ConvertibleSeniorNotesDue2028Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:ConvertibleDebtMember2024-12-310001370637us-gaap:FairValueInputsLevel2Memberetsy:ConvertibleSeniorNotesDue2028Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:ConvertibleDebtMember2024-12-310001370637us-gaap:FairValueInputsLevel2Memberetsy:ConvertibleSeniorNotesDue2028Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:ConvertibleDebtMember2023-12-310001370637us-gaap:FairValueInputsLevel2Memberetsy:ConvertibleSeniorNotesDue2028Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:ConvertibleDebtMember2023-12-310001370637us-gaap:FairValueInputsLevel2Memberetsy:ConvertibleSeniorNotesDue2027Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:ConvertibleDebtMember2024-12-310001370637us-gaap:FairValueInputsLevel2Memberetsy:ConvertibleSeniorNotesDue2027Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:ConvertibleDebtMember2024-12-310001370637us-gaap:FairValueInputsLevel2Memberetsy:ConvertibleSeniorNotesDue2027Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:ConvertibleDebtMember2023-12-310001370637us-gaap:FairValueInputsLevel2Memberetsy:ConvertibleSeniorNotesDue2027Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:ConvertibleDebtMember2023-12-310001370637us-gaap:FairValueInputsLevel2Memberetsy:ConvertibleSeniorNotesDue2026Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:ConvertibleDebtMember2024-12-310001370637us-gaap:FairValueInputsLevel2Memberetsy:ConvertibleSeniorNotesDue2026Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:ConvertibleDebtMember2024-12-310001370637us-gaap:FairValueInputsLevel2Memberetsy:ConvertibleSeniorNotesDue2026Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:ConvertibleDebtMember2023-12-310001370637us-gaap:FairValueInputsLevel2Memberetsy:ConvertibleSeniorNotesDue2026Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:ConvertibleDebtMember2023-12-310001370637us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:ConvertibleDebtMember2024-12-310001370637us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:ConvertibleDebtMember2024-12-310001370637us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:ConvertibleDebtMember2023-12-310001370637us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:ConvertibleDebtMember2023-12-310001370637us-gaap:ComputerEquipmentMember2024-12-310001370637us-gaap:ComputerEquipmentMember2023-12-310001370637srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2024-12-310001370637srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2024-12-310001370637us-gaap:FurnitureAndFixturesMember2024-12-310001370637us-gaap:FurnitureAndFixturesMember2023-12-310001370637us-gaap:LeaseholdImprovementsMember2024-12-310001370637us-gaap:LeaseholdImprovementsMember2023-12-310001370637us-gaap:ConstructionInProgressMember2024-12-310001370637us-gaap:ConstructionInProgressMember2023-12-310001370637us-gaap:BuildingMember2024-12-310001370637us-gaap:BuildingMember2023-12-310001370637us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-12-310001370637us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-12-310001370637us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-01-012024-12-310001370637us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-01-012023-12-310001370637us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2022-01-012022-12-310001370637etsy:ConvertibleSeniorNotesDue2028Memberus-gaap:ConvertibleDebtMember2024-12-310001370637etsy:ConvertibleSeniorNotesDue2027Memberus-gaap:ConvertibleDebtMember2024-12-310001370637etsy:ConvertibleSeniorNotesDue2026Memberus-gaap:ConvertibleDebtMember2024-12-310001370637us-gaap:ConvertibleDebtMember2024-12-310001370637etsy:ConvertibleSeniorNotesDue2028Memberus-gaap:ConvertibleDebtMember2023-12-310001370637etsy:ConvertibleSeniorNotesDue2027Memberus-gaap:ConvertibleDebtMember2023-12-310001370637etsy:ConvertibleSeniorNotesDue2026Memberus-gaap:ConvertibleDebtMember2023-12-310001370637us-gaap:ConvertibleDebtMember2023-12-310001370637us-gaap:DebtInstrumentRedemptionPeriodOneMemberus-gaap:ConvertibleDebtMember2024-01-012024-12-310001370637etsy:ConvertibleSeniorNotesDue2027Memberus-gaap:ConvertibleDebtMemberus-gaap:DebtInstrumentRedemptionPeriodTwoMember2020-08-012020-08-310001370637etsy:ConvertibleSeniorNotesDue2028Memberus-gaap:ConvertibleDebtMember2021-06-012021-06-300001370637etsy:A2021CappedCallTransactionsMemberus-gaap:ConvertibleDebtMember2021-06-082021-06-080001370637etsy:ConvertibleSeniorNotesDue2028Memberus-gaap:ConvertibleDebtMemberus-gaap:DebtInstrumentRedemptionPeriodOneMember2021-06-012021-06-300001370637etsy:ConvertibleSeniorNotesDue2028Memberus-gaap:ConvertibleDebtMemberus-gaap:DebtInstrumentRedemptionPeriodThreeMember2021-06-012021-06-300001370637etsy:ConvertibleSeniorNotesDue2027Memberus-gaap:ConvertibleDebtMember2020-08-012020-08-310001370637etsy:A2020CappedCallTransactionsMemberus-gaap:ConvertibleDebtMember2020-08-012020-08-310001370637etsy:ConvertibleSeniorNotesDue2026Memberus-gaap:ConvertibleDebtMember2019-09-012019-09-300001370637etsy:A2019CappedCallTransactionsMemberus-gaap:ConvertibleDebtMember2019-09-012019-09-300001370637us-gaap:ConvertibleDebtMember2024-01-012024-12-310001370637us-gaap:ConvertibleDebtMember2022-01-012022-12-310001370637us-gaap:ConvertibleDebtMember2023-01-012023-12-310001370637etsy:A2021CappedCallTransactionsMemberus-gaap:ConvertibleDebtMember2021-06-080001370637etsy:A2020CappedCallTransactionsMemberus-gaap:ConvertibleDebtMember2020-08-310001370637etsy:A2020CappedCallTransactionsMemberus-gaap:ConvertibleDebtMember2020-08-192020-08-190001370637etsy:A2019CappedCallTransactionsMemberus-gaap:ConvertibleDebtMember2019-09-300001370637etsy:A2019CappedCallTransactionsMemberus-gaap:ConvertibleDebtMember2019-09-182019-09-180001370637etsy:A2018CappedCallTransactionsMemberus-gaap:ConvertibleDebtMember2018-03-310001370637etsy:A2018CappedCallTransactionsMemberus-gaap:ConvertibleDebtMember2018-03-082018-03-080001370637etsy:ConvertibleSeniorNotesDue2023Memberus-gaap:ConvertibleDebtMember2018-03-310001370637etsy:A2018CappedCallTransactionsMember2023-03-012023-03-010001370637etsy:CreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2023-03-240001370637etsy:CreditAgreementMemberus-gaap:LetterOfCreditMember2023-03-240001370637etsy:CreditAgreementMemberus-gaap:BridgeLoanMember2023-03-240001370637etsy:CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:FederalFundsEffectiveSwapRateMember2023-03-242023-03-240001370637etsy:CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberetsy:OneMonthAdjustedTermSOFRMember2023-03-242023-03-240001370637etsy:CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberetsy:OneMonthAdjustedTermSOFRPlus1Membersrt:MinimumMember2023-03-242023-03-240001370637etsy:CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberetsy:OneMonthAdjustedTermSOFRPlus1Membersrt:MaximumMember2023-03-242023-03-240001370637etsy:CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberetsy:AdjustedTermSOFRAdjustedMembersrt:MinimumMember2023-03-242023-03-240001370637etsy:CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberetsy:AdjustedTermSOFRAdjustedMembersrt:MaximumMember2023-03-242023-03-240001370637etsy:CreditAgreementMemberus-gaap:RevolvingCreditFacilityMembersrt:MinimumMember2023-03-242023-03-240001370637etsy:CreditAgreementMemberus-gaap:RevolvingCreditFacilityMembersrt:MaximumMember2023-03-242023-03-240001370637etsy:CreditAgreementMember2023-03-242023-03-240001370637etsy:CreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2023-12-310001370637etsy:CreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2024-12-310001370637etsy:NonIncomeTaxObligationsMember2024-12-310001370637etsy:NonIncomeTaxObligationsMember2023-12-310001370637etsy:DepopMemberetsy:NonIncomeTaxObligationsMember2024-12-310001370637etsy:ReverbMemberetsy:NonIncomeTaxObligationsMember2023-12-3100013706372024-10-3000013706372023-06-3000013706372022-05-3100013706372020-12-310001370637etsy:TwoThousandTwentyFourEquityIncentivePlanMember2024-12-310001370637etsy:A2024InducementPlanMember2024-12-310001370637us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-12-310001370637etsy:FinancialPerformanceBasedRestrictedStockUnitsRSUsMembersrt:MinimumMember2024-01-012024-12-310001370637etsy:FinancialPerformanceBasedRestrictedStockUnitsRSUsMembersrt:MaximumMember2024-01-012024-12-310001370637etsy:TotalShareholderReturnPerformanceBasedRestrictedStockUnitsRSUsMember2024-01-012024-12-310001370637us-gaap:RestrictedStockUnitsRSUMember2021-12-310001370637us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001370637us-gaap:RestrictedStockUnitsRSUMember2022-12-310001370637us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001370637us-gaap:RestrictedStockUnitsRSUMember2023-12-310001370637us-gaap:RestrictedStockUnitsRSUMember2024-12-310001370637etsy:DepopMemberus-gaap:CommonStockMember2021-07-120001370637etsy:DepopMember2021-07-122021-07-1200013706372021-01-012021-12-310001370637etsy:CostOfRevenueMember2024-01-012024-12-310001370637etsy:CostOfRevenueMember2023-01-012023-12-310001370637etsy:CostOfRevenueMember2022-01-012022-12-310001370637us-gaap:SellingAndMarketingExpenseMember2024-01-012024-12-310001370637us-gaap:SellingAndMarketingExpenseMember2023-01-012023-12-310001370637us-gaap:SellingAndMarketingExpenseMember2022-01-012022-12-310001370637us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-12-310001370637us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-12-310001370637us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-12-310001370637us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-12-310001370637us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-12-310001370637us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-3100013706372023-12-1200013706372023-12-122023-12-1200013706372023-10-012023-12-3100013706372024-10-012024-12-310001370637etsy:JoshSilvermanMember2024-01-012024-12-310001370637etsy:JoshSilvermanMember2024-10-012024-12-310001370637etsy:JoshSilvermanMember2024-12-310001370637etsy:RainaMoskowitzMember2024-01-012024-12-310001370637etsy:RainaMoskowitzMember2024-10-012024-12-310001370637etsy:RainaMoskowitzTradingArrangementCommonStockMemberetsy:RainaMoskowitzMember2024-12-310001370637etsy:RainaMoskowitzTradingArrangementStockOptionsMemberetsy:RainaMoskowitzMember2024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 10-K

__________________________

|

|

|

|

|

|

|

|

|

| ☒ |

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

|

For the fiscal year ended |

December 31, 2024 |

|

|

|

| OR |

|

|

|

| ☐ |

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from to |

Commission File Number 001-36911

_________________________

ETSY, INC.

(Exact name of registrant as specified in its charter)

_________________________

|

|

|

|

|

|

|

|

|

|

|

|

Delaware |

|

|

20-4898921 |

| (State or other jurisdiction of incorporation or organization) |

|

|

(I.R.S. Employer Identification No.) |

|

|

|

|

| 117 Adams Street |

Brooklyn, |

NY |

11201 |

| (Address of principal executive offices) |

|

|

(Zip code) |

(718) 880-3660

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, $0.001 par value per share |

ETSY |

The Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☒ |

|

Accelerated filer |

☐ |

| Non-accelerated filer |

☐ |

|

Smaller reporting company |

☐ |

|

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2024 (the last business day of the registrant’s most recently completed second fiscal quarter), was approximately $6.7 billion.

The number of shares of common stock outstanding as of February 14, 2025 was 107,072,348.

Documents Incorporated By Reference

Portions of the registrant’s Proxy Statement for its 2025 Annual Meeting of Stockholders, to be filed with the Securities and Exchange Commission no later than 120 days after December 31, 2024, are incorporated by reference in Part III of this Annual Report.

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

|

| Note Regarding Forward-Looking Statements |

| Summary Risk Factors |

|

|

|

|

|

|

|

|

|

| Part I - Financial Information |

|

Item 1. |

Business |

|

Item 1A. |

Risk Factors |

|

Item 1B. |

Unresolved Staff Comments |

|

Item 1C. |

Cybersecurity |

|

Item 2. |

Properties |

|

Item 3. |

Legal Proceedings |

|

Item 4. |

Mine Safety Disclosures |

|

|

|

|

|

|

|

|

|

| Part II - Other Information |

|

Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

|

Item 6. |

[Reserved] |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk |

|

Item 8. |

Financial Statements and Supplementary Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

Item 9A. |

Controls and Procedures |

|

Item 9B. |

Other Information |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

|

|

|

|

|

|

|

|

|

| Part III |

|

Item 10. |

Directors, Executive Officers and Corporate Governance |

|

Item 11. |

Executive Compensation |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

|

Item 14. |

Principal Accounting Fees and Services |

|

|

|

|

|

|

|

|

|

| Part IV |

|

Item 15. |

Exhibits and Financial Statement Schedules |

|

|

|

|

Item 16. |

Form 10-K Summary |

|

|

Signatures |

Unless the context otherwise requires, we use the terms “Etsy,” the “Company,” “we,” “us” and “our” in this Annual Report on Form 10-K (“Annual Report”) to refer to Etsy, Inc. and, where appropriate, our consolidated subsidiaries.

Unless otherwise noted, references to a particular year are to our fiscal year, which corresponds to the calendar year ended or ending on December 31 of the same year. For example, a reference to “2024” is a reference to the year ended December 31, 2024.

See Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Operating and Financial Metrics” for the definitions of the following terms used in this Annual Report: “active buyer,” “active seller,” “Adjusted EBITDA,” “Adjusted EBITDA margin,” “GMS,” “GMS ex-U.S. Domestic,” “U.S. Buyer GMS,” and “currency-neutral GMS growth.”

Etsy has used, and intends to continue using, its investor relations website and the Etsy News Blog (etsy.com/news) to disclose material non-public information and to comply with its disclosure obligations under Regulation FD. Accordingly, you should monitor our investor relations website and the Etsy News Blog in addition to following our press releases, SEC filings, and public conference calls and webcasts.

Note Regarding Forward-Looking Statements

This Annual Report contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements include statements relating to our mission, our opportunity and potential to grow; the impact of our “Right to Win” and other growth strategies, including marketing and product initiatives, investments, and other levers for growth, on our business and operating results, including future gross merchandise sales (“GMS”) and revenue growth; our ability to attract, engage, and retain buyers and sellers; strategic investments or acquisitions, product and marketing investments, and the potential benefits thereof; our impact goals, strategy, and intended progress; the impact of global macroeconomic, domestic and geopolitical uncertainty and volatility may have on our business, strategy, operating results, key metrics, financial condition, profitability, and cash flows; the effects on consumer behavior from cultural, weather, and political events; our ability to expand beyond our top geographies; and uncertainty regarding and changes in overall levels of consumer spending and e-commerce generally. Forward-looking statements include all statements that are not historical facts. In some cases, forward-looking statements can be identified by terms such as “aim,” “anticipate,” “believe,” “could,” “enable,” “estimate,” “expect,” “goal,” “intend,” “may,” “plan,” “potential,” “project,” “seek,” “should,” “target,” “will,” “would,” or similar expressions and derivative forms and/or negatives of those terms.

Forward-looking statements are not guarantees of performance and involve known and unknown risks and uncertainties. Other factors may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. Those risks include those described in Part I, Item 1A, “Risk Factors” and elsewhere in this Annual Report. Given these uncertainties, you should read this Annual Report in its entirety and not place undue reliance on any forward-looking statements in this Annual Report.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Annual Report and, although we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely upon these statements.

Moreover, we operate in a competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements made in this Annual Report. In light of these risks, uncertainties, and assumptions, the future events and trends discussed in this Annual Report may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. In addition, the global economic climate and general market, political, economic, and business conditions may amplify many of these risks.

Forward-looking statements represent our beliefs and assumptions only as of the date of this Annual Report. We disclaim any obligation to update forward-looking statements.

Summary Risk Factors

Our business is subject to numerous risks. The following summary highlights some of the risks we are exposed to in the normal course of our business activities. This summary is not complete and the risks summarized below are not the only risks we face. You should review and consider carefully the risks and uncertainties described in more detail in Part I, Item 1A, “Risk Factors,” which includes a more complete discussion of the risks summarized below as well as a discussion of other risks related to our business and an investment in our common stock.

Financial Performance and Operational Risks Related to Our Business

•Our quarterly operating results have and may continue to fluctuate for a variety of reasons, many of which are beyond our control, which can cause significant stock price fluctuations.

•We may fail to meet our publicly announced guidance or other expectations about our business and future operating results, which could cause our stock price to decline.

•The trustworthiness of our marketplaces and the connections within our communities are important to our success. Our business, financial performance, and growth depend on our ability to attract and retain active and engaged communities of buyers and sellers. If we are unable to retain our existing buyers and sellers and activate new ones, our financial performance could decline.

•We track certain operational metrics with internal systems and tools or manual processes, and do not independently verify such metrics. Certain of these metrics are subject to inherent challenges in measurement, and any real or perceived inaccuracies may adversely affect our business and reputation.

•If we experience a technology disruption that results in a loss of information, if personal data or sensitive information about members of our communities or employees is misused or disclosed, or if we or our third-party providers are unable to protect against software and hardware vulnerabilities, service interruptions, cyber-related events, ransomware, security incidents, or other security breaches, then members of our communities may curtail use of our platforms, we may be exposed to liability or incur additional expenses, and our reputation might suffer.

•Our business depends on continued use of and unimpeded access to third-party technology, services, platforms, and infrastructure that we rely upon to maintain and scale our platform. If the widely adopted mobile, social, search, and/or advertising solutions that we, our sellers, and our buyers rely on as part of our key offering are no longer available or effective, or if access to these major platforms is limited, the use of our marketplaces could decline.

•Our payments systems have both operational and compliance risks, including in-house execution risk, dependency on third-party providers, and a complex landscape of evolving laws, regulations, rules, and standards.

•Our ability to recruit and retain a talented and broadly diverse group of employees and retain key employees is important to our success. Significant attrition or turnover could impact our ability to grow our business.

Strategic Risks Related to Our Business and Industry

•We face intense competition and may not be able to compete effectively.

•Enforcement of our marketplace policies may negatively impact our brands, reputation, and/or our financial performance.

•If we are not able to keep pace with technological changes, and enhance our current offerings and develop new offerings to respond to the changing needs of sellers and buyers, our business, financial performance, and growth may be harmed.

•Continuing to expand our operations outside of the United States is part of our strategy, and our business could be harmed if our expansion efforts do not succeed.

•We have incurred impairment charges for our goodwill and other long-lived tangible and intangible assets, and may incur further impairment charges in the future, which would negatively impact our operating results.

•We may engage in acquisitions, dispositions, or strategic partnerships which may divert management’s attention and/or prove to be unsuccessful.

•We are subject to risks related to our environmental, social, and governance activities and disclosures.

•We have a significant amount of convertible debt and may incur additional debt in the future.

Regulatory, Compliance, and Legal Risks

•Failure to deal effectively with fraud or other illegal activity could harm our business.

•Compliance with evolving global legal and regulatory requirements and/or available safe harbors, including privacy and data protection laws, tax laws, product liability laws, laws regulating speech and platform monitoring or moderation, antitrust laws, intellectual property and counterfeiting regulations, may materially impact our time, resources, and ability to grow our business.

•We are regularly involved in litigation, arbitration, and regulatory matters that are expensive and time consuming and that may require changes to our strategy, the features of our marketplaces and/or how our business operates.

•We may be subject to intellectual property or other claims, which, even if meritless, could be extremely costly to defend, damage our brands, require us to pay significant damages, and limit our ability to use certain technologies or business strategies in the future.

Other Risks

•Future sales and issuances of our common stock or rights to purchase common stock, including upon conversion of our convertible notes, could result in additional dilution to our stockholders and could cause the price of our common stock to decline.

PART I - Financial Information

Item 1. Business.

Overview

Our Mission

Etsy’s mission to “Keep Commerce Human” is rooted in our belief that, although automation and commoditization are parts of modern life, human creativity cannot be automated and human connection cannot be commoditized. We believe consumers increasingly expect more from the businesses they support, and companies that prioritize people, the planet, and profit will be best positioned to succeed over the long term. We are committed to sustainable growth by aligning our mission with our business strategy, fostering economic impact through entrepreneurship. You can read more about Etsy’s Impact and environmental, social, and governance (“ESG”) strategies beginning on page

20, where we report on metrics aligned with both our self-identified Impact priorities and widely accepted third-party frameworks.

About our Company

Etsy operates two-sided online marketplaces that connect millions of passionate and creative buyers and sellers around the world. These marketplaces — which collectively create a “House of Brands” — share our mission, common levers for growth, similar business models, and a strong commitment to use business and technology to strengthen communities and empower people.

Our primary Etsy marketplace is the global destination for unique, creative goods from independent sellers. It connects artisans and entrepreneurs with thoughtful consumers seeking items that reflect their tastes and values. We aim to create a virtuous cycle that benefits all of our stakeholders. Ultimately, our success is tied to our sellers; we make money when they do. In addition to providing them with access to tens of millions of buyers, we offer tools and services to help sellers grow. For buyers, we surface quality listings that offer great value and provide a reliable shopping experience. When buyers are satisfied, it fuels this cycle.

In addition to our core Etsy marketplace, our “House of Brands” consists of Reverb Holdings, Inc. (“Reverb”), our musical instrument marketplace acquired in 2019, and Depop Limited (“Depop”), our fashion resale marketplace acquired in 2021. Each Etsy, Inc. marketplace primarily operates independently, while benefiting from shared expertise in product development, marketing, technology, and customer support. On August 10, 2023, Etsy completed the sale of Elo7 Serviços de Informática S.A. (“Elo7”), a Brazil-based marketplace for handmade and unique items. The results of Elo7 are included in all financial and other metrics discussed in this report, unless otherwise noted, from the date of acquisition on July 2, 2021 until August 10, 2023.

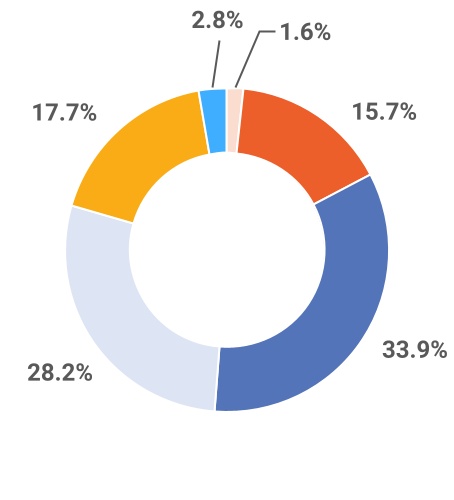

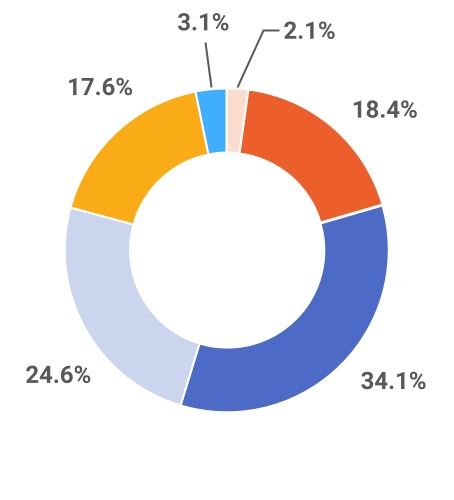

Our sellers generated $12.6 billion of Gross Merchandise Sales (“GMS”) in 2024. Of this, Etsy marketplace GMS was $10.9 billion or 86.4% of the total and the Reverb and Depop marketplaces generated approximately $917.9 million (7.3% of the total) and $788.9 million (6.3% of the total) of GMS, respectively. We anticipate that the Etsy marketplace will continue to be the primary driver of our overall financial performance for the foreseeable future.

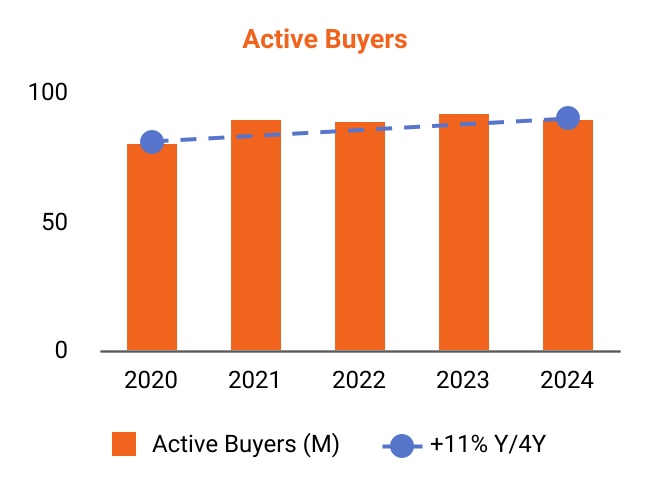

Our marketplaces collectively connected a total of 8.1 million active sellers to 95.5 million active buyers as of December 31, 2024.

Our top six retail categories on the Etsy marketplace in 2024 were homewares and home furnishings, jewelry and personal accessories, apparel, craft supplies, paper and party supplies, and toys and games. These categories represented approximately $9 billion, or 87% of 2024 GMS. Reverb provides a significant presence in the market for musical instruments, and Depop enhances our apparel offering in the resale space.

Our Strategy

As illustrated below, our strategy is focused around:

•Building a sustainable competitive advantage for the Etsy marketplace — our “Right to Win;”

•Growing the Etsy marketplace in our core geographies and globally; and

•Leveraging our marketplace playbook across our “House of Brands.”

Building a sustainable competitive advantage — our “Right to Win”

Our “Right to Win” is centered on four key elements that we believe make the Etsy marketplace a better place to shop and sell and, which, in turn, will bring more buyers, lead to increased frequency and size of purchases, and build long-term loyalty. We believe that when executed effectively, these elements can create a multiplier effect that will drive future growth.

Our sellers’ unique items: The foundation of the Etsy marketplace’s competitive advantage is our sellers’ millions of unique items. We have created a community that attracts, supports, and retains some of the world’s most talented makers, and sellers choose to list on our marketplace because they believe that we are a great place to start and grow a creative business. As of December 31, 2024, there were over 100 million items listed on the Etsy marketplace, and approximately 30% of our 2024 GMS was from custom or made-to-order merchandise. The unique nature of our sellers’ items requires that we invest in the other three elements of our strategy: search and discovery; human connections; and a trusted brand in order to deliver a best-in-class marketplace experience.

Best-in-class search and discovery: We aim to enhance the search and discovery experience by showcasing the highest quality listings, unlocking the value of Etsy’s unique items. Since the items listed on the Etsy marketplace do not map to a catalog or a stock keeping unit (“SKU”), delivering world-class search and discovery technology is essential for connecting each buyer with the right product at the right time, driving satisfaction and sales. We use a combination of artificial intelligence (“AI”), generative artificial intelligence (“Gen AI”), machine learning (“ML”), and human curation to help organize, personalize, and streamline search, making it easier for buyers to browse, filter, and find what they want. Beyond assisting current searches, we are also investing in understanding buyers’ tastes and preferences to anticipate and inspire future purchases.

The power of human connections: Our mission to “Keep Commerce Human” is a vital part of our strategy. We continue to emphasize the role that humans play in every aspect of our business. As of December 31, 2024, 89.6 million buyers and 5.6 million sellers were active on the Etsy marketplace. What sets the Etsy marketplace apart isn’t just the unique items, but the stories behind them, created by real people. Etsy buyers can collaborate with sellers to personalize items, fostering genuine connections. We believe that strengthening these human connections will enable us to drive buyer engagement, loyalty, and purchase frequency, distinguishing the Etsy marketplace from other shopping destinations.

A trusted brand: We remain focused on being a reliable brand that inspires trust throughout the buyer and seller journeys — from discovery to delivery. Since Etsy marketplace sellers largely offer unbranded items, we aim to make the Etsy brand synonymous with an excellent end-to-end experience. Building a trusted brand requires two key elements: standing for something buyers understand and delivering a safe, efficient purchasing experience. Our goal is to bolster trust in the Etsy brand, our sellers, their items, and in the overall Etsy experience. We also aim to support sellers with services that help them comply with our policies and transact confidently on the Etsy marketplace.

Growing the Etsy marketplace in our core geographies and globally

We are expanding our focus beyond growing the Etsy marketplace in our historical core geographies of the United States, the United Kingdom, Germany, Canada, Australia, and France. We remain focused on driving frequency and retention in these markets and also see significant opportunity to increase non-U.S. buyer GMS by improving the customer experience for cross-border transactions, particularly in Western Europe. We also make strategic investments in other select geographies where we perceive growth opportunities.

In 2024, 74% of Etsy, Inc. and Etsy marketplace’s GMS came from U.S. buyers and 26% came from buyers outside of the United States. Note that for 2024 we have changed our presentation of U.S. versus non-U.S. GMS disclosure to focus on “buyer GMS,” which we believe provides a more useful view of our success attracting buyers and driving GMS from buyers outside the United States than our prior disclosure of GMS U.S. domestic versus GMS ex-U.S. domestic. See Part II, Item 7,“Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Operating and Financial Metrics” for a discussion of how each of these metrics is calculated.

Leveraging our marketplace playbook across our “House of Brands”

Our “House of Brands” includes Etsy, Reverb, and Depop— two-sided marketplaces which share values of creativity, community, and making a positive impact. We believe our marketplaces share key elements central to success, including:

•analytical frameworks, product experiment and measurement approaches, and operating rhythms that prioritize resource allocation towards the most impactful outcomes;

•sophisticated search and discovery technology;

•compelling on-site customer experiences;

•efficient payment platforms;

•value-added seller services, such as advertising platforms and effective shipping options;

•strong brand and performance marketing capabilities; and

•a commitment to investments that protect the marketplace.

Capital Allocation Strategy

Etsy’s overall capital allocation strategy is focused in three areas: core investments in organic growth, which includes investments in our “House of Brands;” selectively pursuing acquisitions of businesses or technologies that complement our marketplaces or align with our overall growth strategy; and mitigating dilution to our stockholders through stock repurchase programs that have and may continue to be authorized by our Board of Directors.

In addition, in both 2023 and 2024, we increased investment in share repurchases beyond the amount required to offset the dilution created by the equity we grant to our employees as a form of compensation, and expect to continue to seek opportunities to do so as conditions warrant. To that end, in October 2024, Etsy’s Board of Directors approved a new $1 billion stock repurchase program.

How We Make Money

We see our business model as a virtuous circle: we connect sellers and buyers, enable their transactions, receive fees for our services, and reinvest in enhancing customer experiences to drive growth for Etsy and our sellers. We generate revenue primarily from marketplace activities, including transaction (inclusive of offsite advertising), payments processing, and listing fees, as well as from optional seller services, which include on-site advertising and shipping labels. For more information, see Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations— Components of Our Results of Operations—Revenue.”

|

|

|

| Marketplace Revenue |

| (Required fees) |

|

•Transaction Fee (inclusive of Offsite Advertising Fee)

•Payments Processing Fee

•Listing Fee

•Other

|

|

| Services Revenue |

| (Optional value-added services) |

|

•On-site Advertising

•Shipping Labels

•Other

|

|

Our “House of Brands” Marketplaces

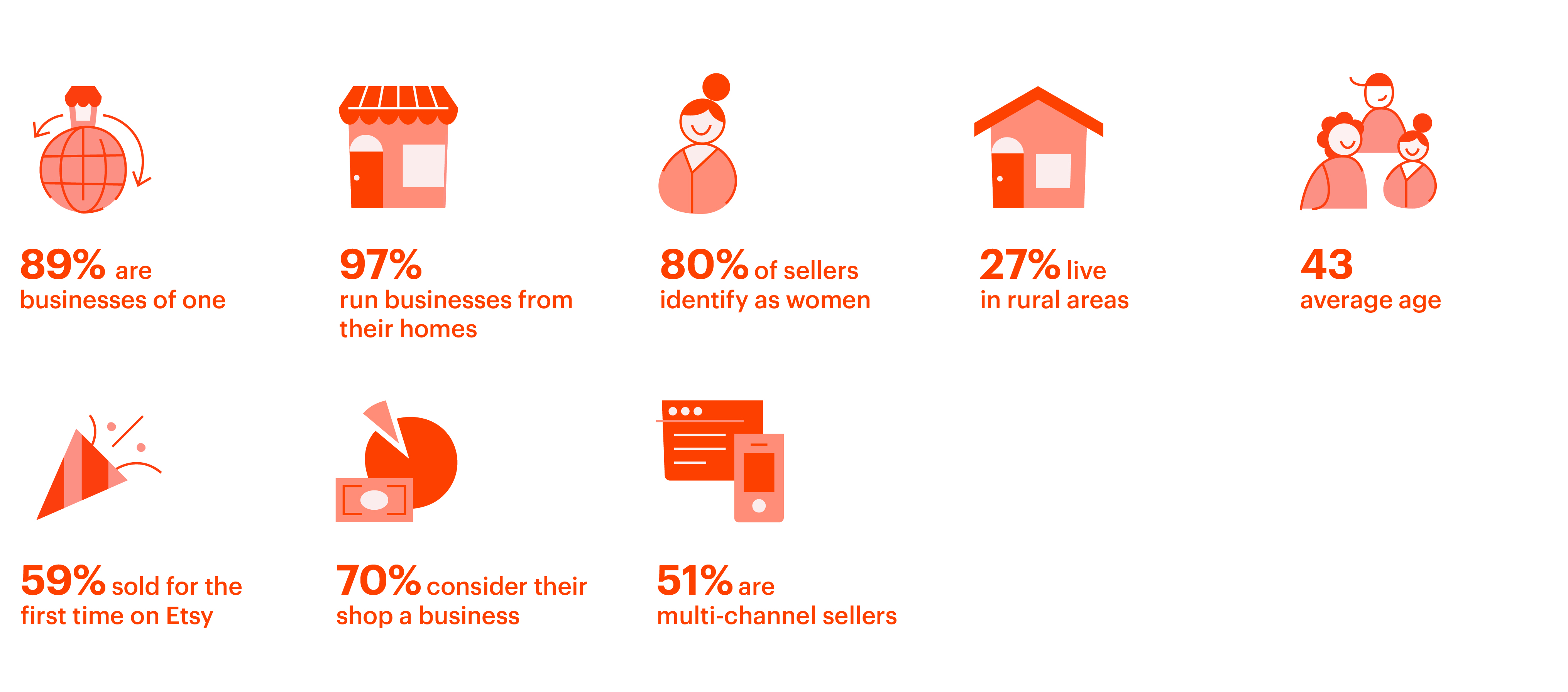

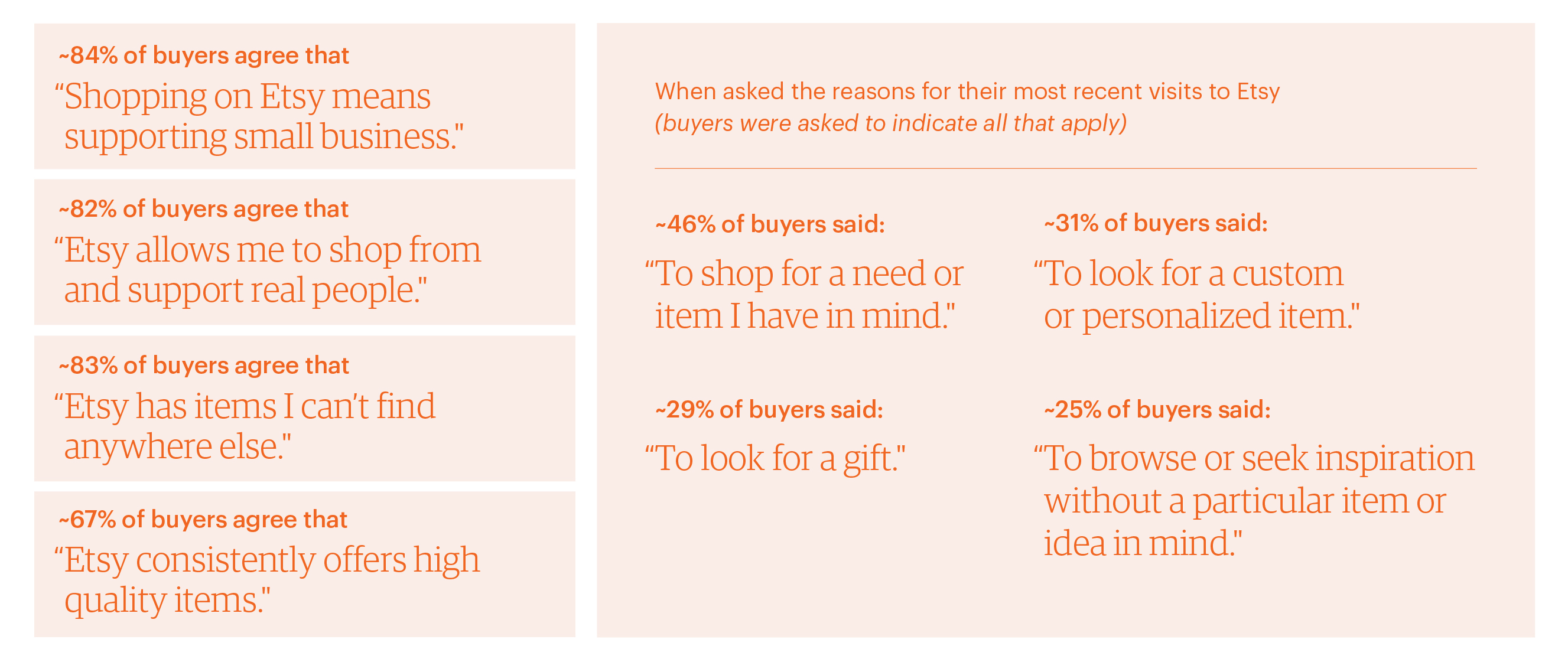

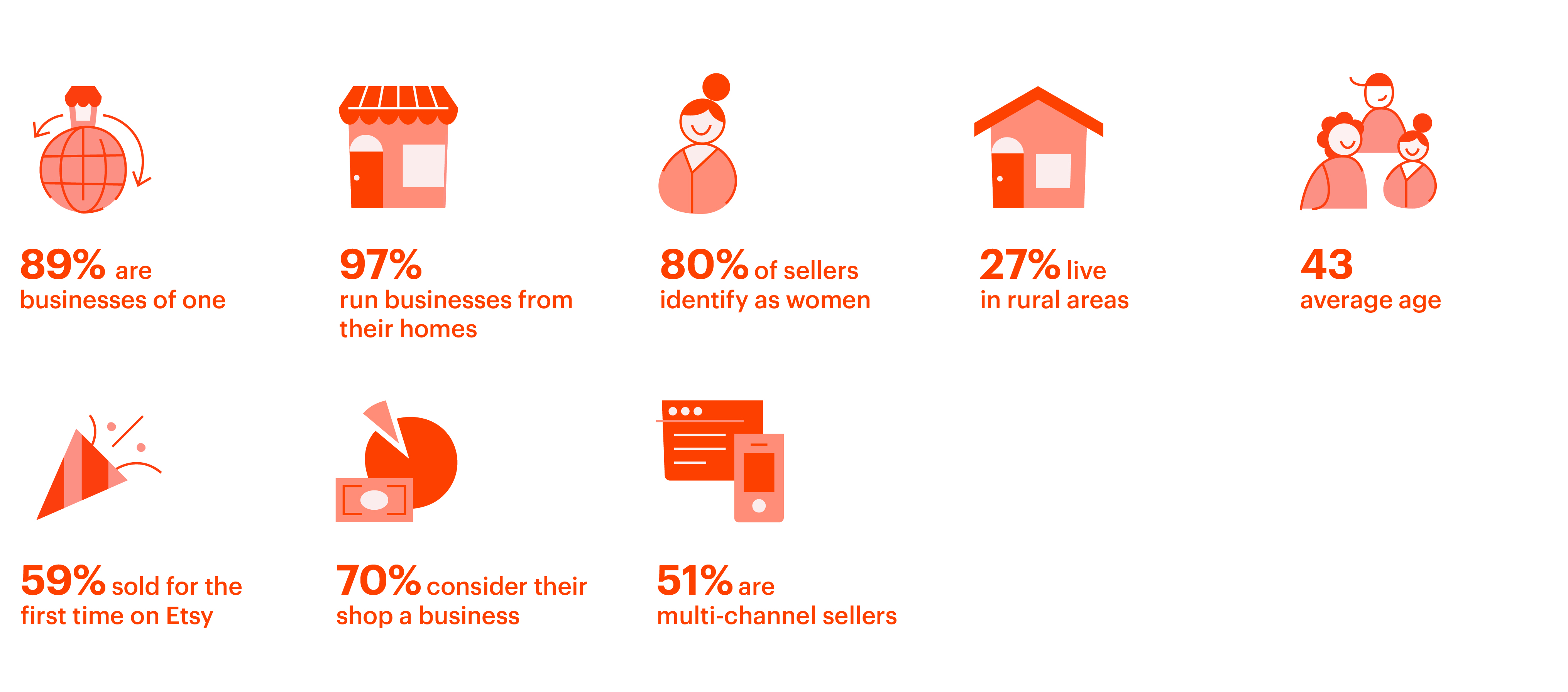

Buyers come to the Etsy marketplace for meaningful, one-of-a-kind items handcrafted, handpicked, designed and sourced by our creative entrepreneurs. Etsy buyer surveys* indicate:

*Above data reflects averages from monthly Etsy marketplace buyer surveys completed in 2024.

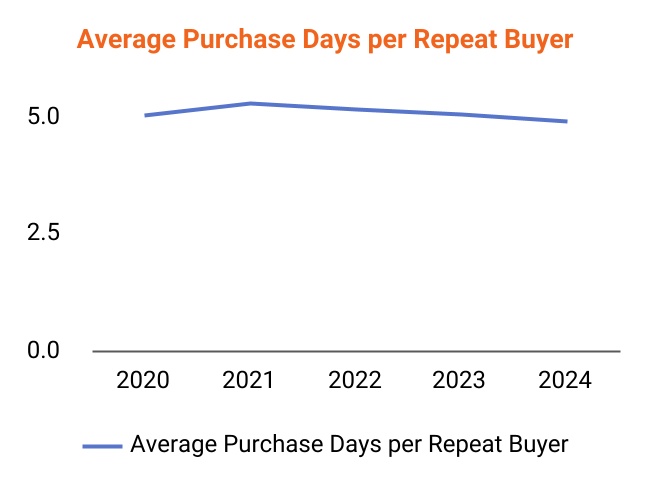

Building buyer consideration by knocking down barriers and focusing on purchase occasions:

Our 2024 survey data shows that, while the majority of consumers in the United States are aware of Etsy and say the brand is relevant to them and our aided brand awareness is high in key markets, there are still large gaps in unaided awareness, even for some of our top categories and occasions. Currently, the average number of purchase days for Etsy’s active buyers is three days per year: about half have one purchase day on Etsy per year, and the other half have approximately five purchase days per year. We believe that our sellers’ broad array of unique merchandise presents a strong opportunity to drive purchase frequency among both existing and potential buyers. By positioning Etsy as a destination for a wider range of purchase occasions, including those with higher stakes, we aim to drive long-term growth and market share gains. To that end, in 2024, we continued to focus on driving buyer consideration by highlighting our sellers’ quality listings, at great value, that we believe our sellers can deliver in a way that is both reliable and dependable. You can read more about these specific initiatives on page

8 in the Product Development section.

We believe the Etsy marketplace is characterized by several unique qualities, including:

•Our Right to Win: As noted on page

2, the Etsy marketplace is focused on strengthening the power of our sellers’ unique items, our ability to develop best-in-class search and discovery, the power of human connection, and being a trusted brand.

•A brand that stands for “Conscious Shopping:” In a world of increasing automation and commoditization, Etsy is a marketplace where creativity lives and thrives because it’s powered by people. We help our community of sellers turn their ideas into successful businesses. Our platform connects them with millions of buyers looking for an alternative—something special that expresses their taste and values, providing a destination for conscious shopping that supports small business.

•Global reach: Etsy enables cross-border transactions, allowing buyers and sellers to easily connect despite language and currency differences. Using advanced ML, we translate listings, reviews, ads, and messages. By investing in localization—such as browse features, local payment methods, and fulfillment partnerships in key non-U.S. markets—we work to foster a tailored experience to drive both domestic and international sales.

•Organic traffic base: The unique nature of our sellers’ inventory and power of our brand have enabled us to organically build a loyal, global base of Etsy buyers on the platform. In 2024, the percentage of our GMS attributed to performance marketing (paid GMS) was 21%, meaning that the vast majority of our GMS comes to us organically through awareness of our brand, as well as from non-paid channels such as search, social, email, and push notifications.

•Connected experience across all devices: We want to engage Etsy buyers wherever they are and provide an enjoyable and accessible shopping experience regardless of the device used. Our desktop and mobile web experiences, as well as the Buy on Etsy (“BOE”) consumer shopping app, include search and discovery, curation, personalization, augmented reality, and social shopping features. We have made product investments designed to drive buyers to our app, which is beneficial to our conversion rate, as our mobile app has the highest conversion rate among platforms. In addition, we offer similar desktop, mobile web, and mobile app experiences to help sellers manage their shops and successfully serve buyers on Etsy.

High Level Performance Recap:

GMS for the Etsy marketplace declined 6% in 2024 to $10.9 billion compared to the e-commerce sector at large, which experienced growth. We attribute this underperformance to the following factors: 1) consumers spent less on discretionary categories, including the types of items we primarily sell; 2) the fact that we are not known for or do not sell certain ‘essentials’ such as groceries, staples, and consumer electronics where a significant amount of e-commerce growth was concentrated; 3) pressure on certain categories, such as home and living, which represent a sizeable part of our GMS; and 4) while Etsy sellers do offer items on sale, our brand is not known for “cheap” or “inexpensive” goods, in the same way that certain major commoditized marketplaces or competitors are. These types of goods and the companies who sell them had better performance in 2024 when compared to others in e-commerce.

Despite this pressure on GMS, we continued to grow our revenue through technology advancements in our Etsy Ads product line that enabled us to utilize more of our sellers’ advertising budgets, key investments to expand coverage of our payments platform as well as growth in international markets where transactions yield higher payments fees, the introduction of a new seller onboarding fee, and other initiatives. We believe these activities are indicative of our ability to drive value for our sellers and improve buyer experiences, while also delivering more revenue for Etsy.

Etsy Marketplace Opportunity

We believe the e-commerce industry continues to have significant tailwinds in terms of its long-term growth opportunity, and that this overall growth bodes well for Etsy. Global e-commerce revenue in our core markets is estimated to grow by a compounded annual growth rate of 8% through 20281, and we believe Etsy has significant potential to grow within this context. As commerce evolves, more consumers are shopping online and many are seeking unique, personalized alternatives to mass-produced goods. We believe Etsy stands out globally with its creative, handcrafted merchandise.

Our future success depends on effectively showcasing this differentiation—helping buyers understand why and when to choose Etsy, the quality of our listings, and the stories behind our sellers’ items. By emphasizing our mission to “Keep Commerce Human,” we aim to deepen our connection with global consumers. By focusing on the growth strategies outlined in the Primary Business Drivers section beginning on page

8, our goal is to bring more buyers to the marketplace, and drive frequency of purchasing and the amount of spend on the Etsy marketplace. Below are several important growth opportunities for the Etsy marketplace.

Capturing more of our total available market

We estimate that the online market size across all relevant retail categories for the Etsy marketplace within our historical core geographic markets represents an approximately $550 billion market opportunity, and an approximately $2 trillion market opportunity when offline sales are included2. The “relevant retail categories” included in our estimate of total market size are apparel and footwear, personal accessories, beauty and personal care, home and garden, toys and games, pet care, craft supplies, paper and party, and art and collectibles. We believe that since our 2024 Etsy marketplace GMS represented approximately 2% of that online only portion, we have significant opportunity to gain further e-commerce market share. Since our estimated opportunity is focused on our core geographies and retail categories, additional upside to this opportunity could come from further geographic and/or category expansion for the Etsy marketplace.

Driving purchase frequency

As outlined above, about half of our active buyer base shops on Etsy one purchase day per year, with the other half purchasing approximately five purchase days per year. Given our broad array of quality listings, we believe Etsy should be able to drive existing and potential buyers to think of us more often for more purchase occasions, driving long-term growth and market share gains.

1 According to Euromonitor International Ltd; Passport: Retail 2024 edition, accessed January 15th, 2025; retail selling price (“RSP”) excluding value added tax (“VAT”), USD year-over-year exchange rates, current terms

2 Estimate based on the Company's own calculations and assumptions based on data from Euromonitor and other sources, without any representation or warranty from Euromonitor.

Connected to our efforts to increase purchase frequency, in 2024, Etsy focused on tapping into opportunities within the Gifting category. Given the special and unique nature of items on Etsy, we see significant opportunity to expand in the Gifting market, which we estimate represents a $200 billion3 relevant opportunity, online and offline, in the United States alone, and where we believe the Etsy marketplace has approximately 1%1,4 of that market. During the year, we launched significant new features and improvements to allow buyers (and their gift recipients) to shop for gifts and experience gifting on Etsy. We believe a focus on gifting can better connect our global buyers to the millions of unique gift items offered by our sellers and drive more frequent purchasing among buyers.

Another key way we are looking to drive frequency is through investing in our BOE app, which has historically been the channel to generate the highest level of buyer lifetime value (“LTV”) on Etsy. In 2024, approximately 42% of Etsy marketplace GMS came from purchases completed on BOE.

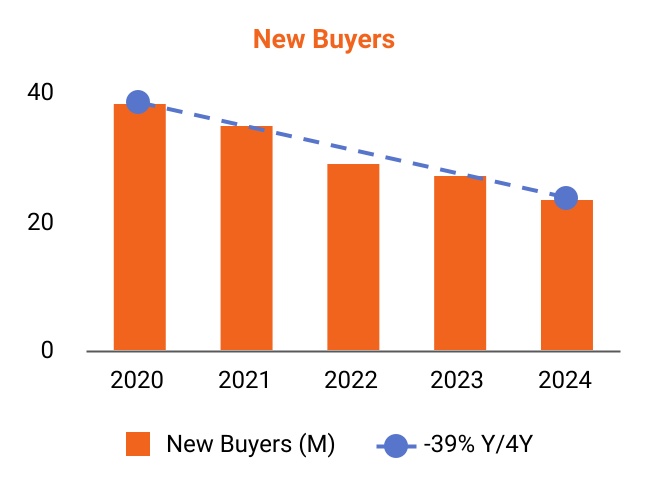

Continuing to expand beyond our top geographies

While Etsy nearly doubled the number of active buyers on our marketplace from 2019, we continue to believe that there are millions of additional consumers globally who would be interested in unique and creative goods made by independent sellers. We estimate that approximately 30% of adults who identify as women in the United States and the United Kingdom shopped Etsy at least once in 2024, so there are many more millions of women who did not shop on Etsy during that time frame. We estimate our penetration with consumers who identify as men is much lower, with only about 10% of adult men in the United States and United Kingdom having shopped on Etsy at least once in 2024. Furthermore, when looking at the next 15 largest markets beyond the United States and United Kingdom, our penetration rate of consumers shopping on Etsy is approximately only one fifth as high as it is within the United States and United Kingdom. Etsy added a total of nearly 24 million new buyers in 2024 - which we believe is indicative of the size of the new buyer opportunity over the long term.

Continuing to retain and reactivate lapsed buyers

We continue to have a very large pool of over 100 million lapsed buyers to reactivate, and we expect that for the foreseeable future there will continue to be millions of buyers for us to reactivate each year. In fact, we reactivated nearly 29 million lapsed buyers in 2024. We also have a long history of healthy buyer retention and believe this trend can continue. See “The Etsy Marketplace: Our Passionate and Engaged Community” on page

12 for additional details.

Lastly, there are many millions of visits to the Etsy marketplace each month that do not result in a purchase. We believe that continued improvements in search and discovery, and other components of our “Right to Win” strategy, can help us better convert visitors into buyers and infrequent buyers into loyal customers.

Reverb, headquartered in Chicago, is a two-sided marketplace launched in 2013 with a mission to make the world more musical by making it easy to buy and sell musical instruments online. Reverb enables a thriving circular economy for music gear, connecting the music-making community with millions of used, like-new, and new musical instruments. With nearly 80% of Reverb’s GMS coming from the sale of used musical instruments, Reverb helps musicians access a wide variety of music gear that fits within their budgets. In 2024, 56% of Reverb’s active sellers were also buyers and this cohort spent 2.5 times more than those who only bought music gear.

Reverb’s buyers and sellers include musicians, local music stores, and the largest music gear brands. As of December 31, 2024, our Reverb marketplace had 785 thousand active buyers and 221 thousand active sellers. We believe that Reverb is the largest online marketplace dedicated to music gear. 86% of 2024 GMS came from U.S. buyers and 14% came from non-U.S. buyers.

Reverb offers one of the largest databases of historical pricing data for music gear in the world, helping buyers and sellers better understand the value of their gear. Similar to Etsy, more than 80% of Reverb’s traffic is unpaid, evidencing the strength of the Reverb brand and its large, passionate community of music makers. Over 40% of Reverb’s GMS comes from its mobile app.

High Level Performance Recap:

In 2024, Reverb’s GMS was $918 million, down 2.6% from 2023, as macroeconomic factors weighed on consumer discretionary spending. Despite these headwinds, Reverb performed slightly better than the musical instrument industry overall. Given the continued pressure on GMS, Reverb completed an approximately 18% reduction in force in September 2024. Reverb’s leaner, more agile team is focused on strategic initiatives to bring more used music gear into the circular economy and make used music gear musicians’ first choice. Reverb improved its profitability in 2024, driven by increased paid marketing efficiency, a leaner overall cost structure, improved payment margins, and higher shipping-label adoption.

3 Based upon Etsy estimates and external sources. Online and offline categories included: clothing, jewelry and accessories, home and living, toys, personal care and beauty, gift cards, books and other media, candy, food, among others.

4 Estimated based on 2024 active buyers who marked a purchase as a gift, purchased a listing with “gift” in the title or entered “gift” in a search query during the trailing twelve month period.

In 2024, Reverb provided musicians with more options and better value by introducing the Reverb Outlet and launching a Certified Pre-Owned program with Fender, one of the world’s leading guitar manufacturers. Reverb also better highlighted affordable used and like-new gear throughout the marketplace to boost conversion. In 2024, Reverb also optimized its search algorithms to make price comparisons easier, enhanced seller tools, and drove awareness through video-first integrated marketing campaigns.

Reverb Marketplace Opportunity

The total available market opportunity for musical instruments is approximately $24 billion5, with Reverb having a less than 5% market share. We remain optimistic about Reverb’s opportunity for future market share gains within its industry, given its broad and deep range of supply, large and loyal community, and value offered on the marketplace — particularly for used music gear sales, which have continued to grow even as overall music gear sales have remained challenged.

Depop, headquartered in London, is on a mission to “Make Fashion Circular.” Since its founding in 2011, Depop has been a people-powered fashion marketplace where anyone can buy, sell, explore, and discover incredible secondhand fashion. Depop had approximately 43.5 million registered users, 5.1 million active buyers, and 2.3 million active sellers at December 31, 2024. Approximately 57% of Depop sellers who made a sale in 2024 also made at least one purchase in 2024, which we believe shows the strong engagement of Depop’s user base. Nearly 94% of Depop’s GMS is in the apparel category. 64% of Depop’s GMS came from U.S. buyers and 36% came from non-U.S. buyers.

Depop is a place for anyone to discover and share their style by selling items directly from their closets and buying secondhand garments from others whose style they admire. Depop’s circular ecosystem extends the life of millions of garments every year, providing a more sustainable way to enjoy fashion.

High Level Performance Recap:

In 2024, Depop’s GMS was $789 million, providing a tailwind to our consolidated GMS results. Depop grew GMS by 31.6% year-over-year, with growth accelerating throughout the year on a sequential basis. We believe that, in the challenging macroeconomic environment, Depop’s inventory of low-cost, fashionable, resold merchandise remained highly relevant to the increasingly value-conscious consumer.

This year, Depop evolved its U.K. and U.S. selling fee structure, removing the selling fee on users, and introducing a buyer marketplace fee. We believe this change has made Depop more attractive to sellers, driving a meaningful acceleration in listings in each market, since being launched. We believe that this change should drive more choice and variety for buyers, fueling a dynamic marketplace with greater power to make fashion more circular and less wasteful. Among other factors, Depop’s removal of seller fees, in conjunction with product enhancements and a step-up in marketing investments, drove an approximately 61% increase in U.S. buyer GMS, making Depop the fastest-growing U.S. online apparel marketplace.

Etsy believes Depop is a highly relevant and authentic re-commerce brand that is still early in its growth lifecycle and plans to continue to invest accordingly. Depop continues to prioritize improving customer experiences, streamlining the listing process this year with the launch of a new Gen-AI powered tool that improves price guidance, pre-populates listing attributes using image recognition, and simplifies its "Repop" feature for easy relisting of previously purchased items.

Depop Marketplace Opportunity:

The global secondhand apparel market (including resale and thrifting) is forecasted to grow approximately three times faster on average than the broader global apparel market through 2028, reaching an estimated $350 billion6. We believe the growth opportunity for Depop is meaningful due to its: 1) differentiated position in the fast-growing resale space; 2) passionate and highly engaged community of buyers and sellers that advocate for the brand; 3) strong affinity with the Generation Z (“Gen Z”) and Millennial consumer demographics, who are adopting resale shopping faster than other demographics; and 4) significant market share opportunity in the United States (where the resale market is forecasted to grow more than six times faster than the broader retail clothing sector and reach about $44 billion by 20286) and the United Kingdom where Depop has meaningful brand awareness.

5 Music Trades Global Market for Music Products Report (As of December 31, 2023)

6 2024 ThredUp Annual Resale Report

Primary Business Drivers

We leverage technology to connect people around the world through commerce. Among other things, we invest in our technology infrastructure, product development, marketing, trust and safety, member support, helping sellers grow, and fostering engaged and impactful teams as we strive to continuously improve our marketplaces. While the discussion below focuses on each of these primary drivers of the Etsy marketplace, there are similar business drivers present for our subsidiary marketplaces.

Technology Infrastructure

Our engineering team has built a sophisticated platform that enables millions of sellers and buyers to smoothly transact across borders, languages, and devices. This team writes, deploys, and operates the software and services that drive our business, including both web and mobile products for external and internal use. They also maintain our cloud environment, local office networks, and more. Etsy makes significant investments in areas such as foundational, data, and cybersecurity infrastructure, our payments, experimentation, advertising, machine learning and recommendations platforms, internal information technology, system architecture, and inventory, fulfillment, and search systems.

We collect and analyze large volumes of data to enhance the performance of our platform, personalize search and discovery, improve our search experience, bolster trust and safety capabilities, and test features on our website. We apply a combination of proprietary and non-proprietary AI, Gen AI, and ML algorithms, as well as human curation, to personalize the search and discovery experiences and enable buyers to more easily browse, filter, and buy that perfect item, even when they may not have something specific in mind.

For Search, specifically, we leverage: 1) lexical search, which matches results with the literal representation of words and phrases from a query; 2) relational search engines, which understand interactions between buyers, listings, and shops; and 3) neural information retrieval, which interprets what a buyer means even if they don’t know how to describe the item. In 2024, we re-trained our search algorithms to better highlight higher-quality listings, and increase the diversity of merchandise shown, aiming to reduce the cognitive load for buyers when search results show too many similar items. We also began to focus more engineering resources toward making the BOE app the center of our customer experience.

We expect to continue investing in innovative ways to leverage advanced AI, Gen AI, and ML technologies to enhance customer experiences across our platform—improving both seller and buyer experiences while strengthening our infrastructure.

In addition, we maintain an agile technology infrastructure, leveraging our operations in Google Cloud to dynamically flex computing power in sync with traffic. This infrastructure aids operational efficiencies, allowing a greater portion of our engineers to spend time working on customer-facing initiatives and less time on infrastructure activities.

In 2024, we continued to invest in initiatives to democratize ML across the Etsy platform, with the goal to streamline and automate ML modeling in order to allow more Etsy engineers to deploy these models in significantly less time. We deployed coding assistant technology to improve the efficiency and effectiveness of our software engineers along with a Gen AI assistant for workplace productivity, and improved other work streams across our platform.

Our other marketplaces Reverb and Depop also operate their marketplaces in the cloud and make similar technical development investments with Amazon Web Services (“AWS”). In 2024, both Reverb and Depop continued to improve their deployment of ML and tools that allow for more rapid development and experimentation.

Product Development

Etsy’s product development and engineering organization is built around the core belief that we can create connections between our sellers and buyers that are personal and fundamentally different from other platforms where you can shop or sell. Our teams are organized around a collection of initiatives that support a common strategy aligned with our “Right to Win,” with cross-functional teams focused on delivering engaging customer experiences that we measure by a set of objectives and key results, all meant to solve key customer friction points and elevate overall Etsy shopping missions.

Historically, Etsy’s product development strategies often focused on product launches which are intended primarily to drive in-period conversion and incremental GMS wins, with product development squads often working in silos with short-term performance targets. In 2024, we evolved some of our investment strategies and the way we manage our teams to also identify ways to holistically look at overall customer experiences and to create more integrated product launches that we believe could, over time, drive buyer engagement and better overall consideration for Etsy.

In 2024, significant product launches included:

•Expanded diversity of merchandise in search results, incorporating high-quality listing indicators into our search algorithms;

•The Etsy Search Visibility Page to provide sellers more insights into how they appear in search;

•Revamped Etsy homepage, to index more heavily on inspiration; and

•Significant product improvements to the “Gifting” shopping experience and expanded marketing for this purchase occasion.

Etsy also shares aspects of its product development culture and strategies with our other marketplaces. In 2024, Reverb and Depop focused on new ways to improve the customer experience and drive incremental GMS. For example, Reverb launched The Reverb Outlet and Fender’s first-ever Certified Pre-Owned program, making it easier for musicians to access budget-friendly used and like-new instruments, and Depop streamlined its selling process, with a continued focus on experimentation, search and discovery, and pricing.

Marketing

We continue to refine our marketing strategy to reinforce our brand promise with Etsy buyers and optimize our investments through a full-funnel approach. Our two primary types of marketing investments, performance and brand - where we spent approximately $546 million and $172 million, respectively on a consolidated basis in 2024 - are discussed below.

Performance marketing

In 2024, the percentage of GMS attributed to performance marketing (“paid GMS”) for the Etsy marketplace was 21%, meaning that the vast majority of our GMS comes to us organically through awareness of our brand. Our investments in performance marketing, which we define as paid media spend related to the digital acquisition and re-engagement of buyers (for example, Google Product Listing Ads, or “PLAs”), adjusts according to demand and scale based on incremental return. We do not set fixed budgets for our marketing team. Our investment philosophy for performance marketing is to invest until the marginal return on investment (“ROI”) on the next dollar spent is below our target minimum ROI. Increases in buyer LTV, driven by visits, conversion rate, incremental revenue, and frequency, shift the return curve higher, enabling us to spend more in marketing. The vast majority of return comes in-period, although some does fall into subsequent quarters. We continue to test the effectiveness of our performance marketing and expand into new channels and geographies, and utilize new tactics.

For example, in 2024, the Etsy marketplace increased investments in paid social marketing — which we define as paid media spend to promote Etsy content on social media platforms such as Meta, Pinterest, and TikTok — to 22% as a percentage of our performance marketing spend, up from 17% in the prior year. This allowed us to expand beyond buyers' specific queries and meet them where they are spending their time and finding inspiration for shopping, which aligns with our broader goal of enhancing discovery and inspiration for our buyers. Within our paid social, we have increased the percentage of spend in ‘mid funnel’ video marketing. We also have a growing affiliate-based creator program, Creator Collective, through which influencers, buyers, and sellers are incentivized to develop Etsy content designed to drive engagement and sales, which also acts as a content engine to fuel our channels’ creative strategy. In 2024, we transitioned our paid-search investment, which encompasses our PLA and search engine marketing channels, in-house. We now manage all of Etsy’s paid-search campaigns with an internal team of subject-matter experts enabling us to reallocate the significant external costs of managing these campaigns directly back into the campaigns themselves.

Offsite Ads. Offsite Ads is an innovative advertising program for Etsy marketplace sellers, where Etsy’s marketing spend funds the upfront costs to promote Etsy sellers’ listings on multiple internet platforms and takes a ‘success fee’ when a sale is made. The program works as follows: when a shopper clicks on an offsite ad featuring a seller’s listing and purchases from the seller’s shop within 30 days of that click, the seller pays Etsy an additional transaction fee on that sale. We believe our Offsite Ads program is a win-win for Etsy and our sellers since: 1) the seller only pays a transaction fee when a sale is made; and 2) the additional fee expands Etsy’s LTV, as outlined above, enabling us to spend deeper for performance marketing to drive more visits to our marketplace. In 2024, revenue from the Offsite Ads program offset approximately 31% of the Etsy marketplace’s performance marketing spend.

Customer Relationship Management (“CRM”). In 2024, the Etsy marketplace continued to enhance its sophisticated CRM capabilities that enable us to segment and target our buyers for engagement on and off Etsy. We believe our CRM and mobile app push notifications are efficient tools to drive engagement with our active and lapsed buyers, as well as meaningful drivers of our strong buyer reactivation levels (which are detailed on page