SHARE PURCHASE AGREEMENT – CAUTIONARY NOTE FOR READERS The attached Share Purchase Agreement has been filed with certain securities regulatory authorities in Canada pursuant to National Instrument 51-102 – Continuous Disclosure Obligations, which requires Westport Fuel Systems Inc. ("Westport") to file certain material contracts to which it (or any subsidiary) is a party. Unlike certain other documents filed on behalf of Westport, the attached Share Purchase Agreement has not been prepared as a disclosure document and was not drafted with the intention of providing factual information about Westport (or any affiliate) for the benefit of investors. The attached Share Purchase Agreement contains representations and warranties made by Westport and certain of its affiliates to various counterparties for risk allocation purposes, and solely for the benefit of those counterparties. National Instrument 51-102 allows reporting issuers to omit certain provisions of material contracts and readers are cautioned that statements made by Westport (and its affiliates) in the attached Share Purchase Agreement may be qualified (in whole or in part) by information redacted from the attached copy of the Share Purchase Agreement, which information is not otherwise available to the public. Moreover, information concerning Westport, its affiliates or the subject matter of statements made in the attached Share Purchase Agreement concerning Westport or certain of its affiliates may change after the date of the attached Share Purchase Agreement, and subsequent information may or may not be fully reflected in Westport's public disclosures. Accordingly, investors should not rely on statements in the attached Share Purchase Agreement concerning Westport (or any of its affiliates) as accurate statements of fact.

Westport Fuel Systems Italy S.r.l. (as Seller) and Green Day Holding B.V. (as Purchaser) SALE AND PURCHASE AGREEMENT in respect of the entire corporate capital of Westport Fuel Systems Italia S.r.l.

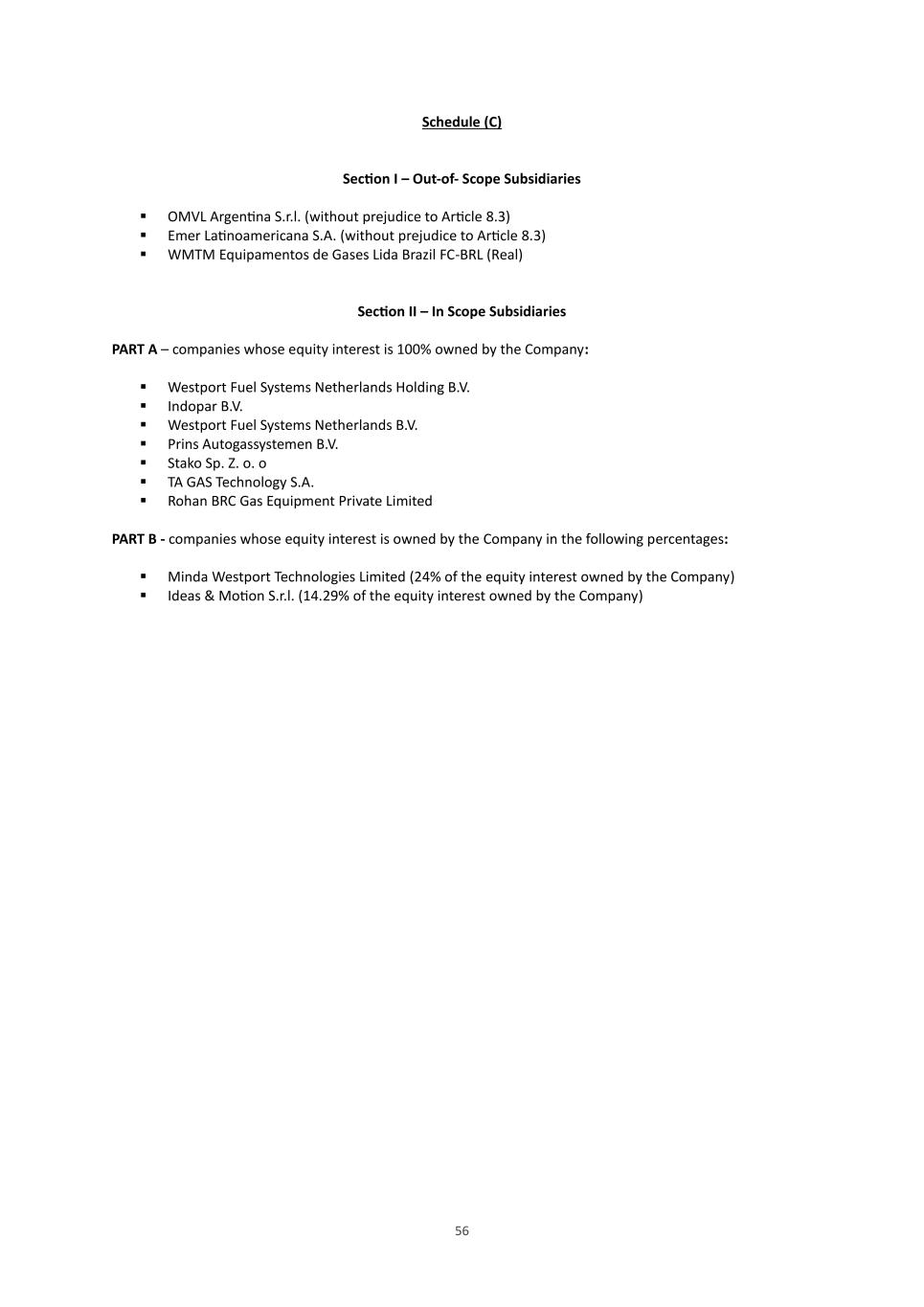

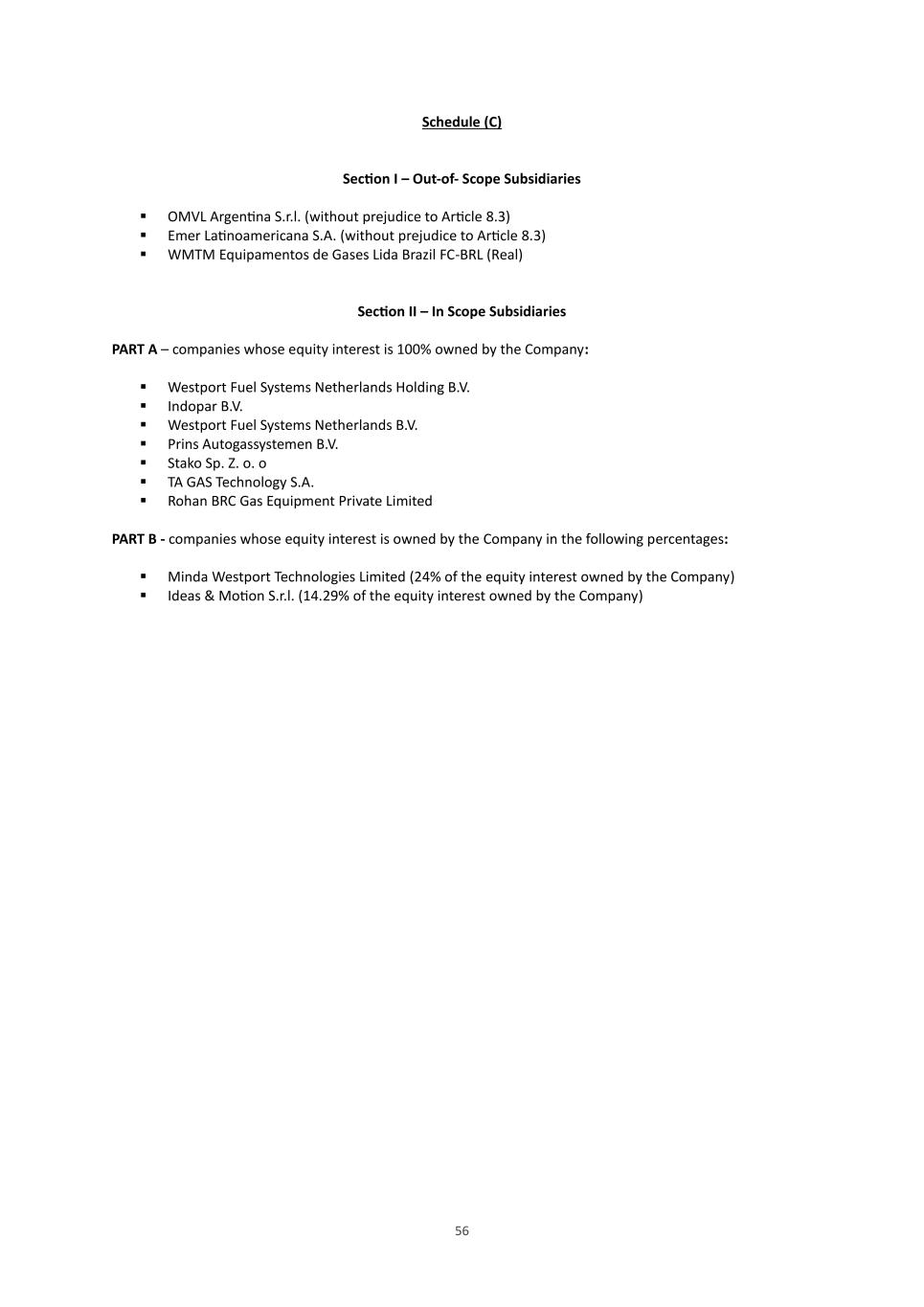

3 SALE AND PURCHASE AGREEMENT This sale and purchase agreement (the “Agreement”) is entered into on March 30, 2025, by and among: (1) Westport Fuel Systems Italy S.r.l., a limited liability company (Società a responsabilità limitata) established and existing under the laws of Italy, having its registered office in Via La Morra no. 1, 12062 Cherasco (CN), Italy, with tax code, VAT and registration number with the Companies’ Register of Cuneo no. 03812680043, REA no. CN – 318200 (“WFS Italy” or “Seller”) - on the one side - and (2) Green Day Holding B.V., a limited liability company (Besloten Vennootschap) established and existing under the laws of the Netherlands, having its registered office in Amsterdam, at Concertgebouwplein 5, registered with KVK (Kamer van Koophandel) with number 96767537 (“Green Day Holding” or the “Purchaser”, as the context may require), ultimately controlled by Heliaca Investments Coöperatief U.A.a cooperative (Coöperatie) established and existing under the laws of the Netherlands, having its registered office in Amsterdam, at Concertgebouwplein 5, 1071LL Amsterdam, registered with KVK (Kamer van Koophandel) with number 96762314 - on the other side - (the Seller and the Purchaser are herein collectively referred to also as the “Parties”, and each, individually, as a “Party”) and (3) Westport Fuel Systems Inc., a company existing under the laws of the Province of Alberta, having its registered office in 1691 West 75th Ave, Vancouver, British Columbia, Canada V6P 6P2, listed in NASDAQ: WPRT (“WFS Canada” or “Guarantor”). WHEREAS: (A) the Seller owns the entire corporate capital of Westport Fuel Systems Italia S.r.l., a limited liability company (Società a responsabilità limitata) established and existing under the laws of Italy, having its registered office in Via La Morra no. 1, 12062 Cherasco (CN), Italy, with tax code, VAT and registration number with the Companies’ Register of Cuneo no. 00525960043, REA no. CN – 107283 (“WFS Italia” or the “Company”); (B) WFS Italia is a company active in the business of advanced fuel delivery components and systems for clean, low-carbon fuels like LPG (Liquefied Petroleum Gas / Propane / Autogas), CNG (Compressed Natural Gas), RNG (Renewable Natural Gas), and hydrogen, serving the global light and medium duty transportation markets; (C) as of the date hereof, the Company owns, directly and indirectly, the equity interests in the companies listed under sections I and II of Schedule (C), in the percentages set forth therein.; (D) from January 28, 2025 until 18:00 CET of 28 March 2025, (i) the Purchaser was given access to a virtual data room accessible on the web site [Redacted – Commercially Sensitive Information] (the “VDR”) and was provided with the opportunity to request additional information and attend meetings with the Company and (ii) in this context, the Purchaser, directly and/or through its advisors, has conducted a comprehensive investigation on the Group Companies and the due diligence review (including on financial, accounting, commercial, legal, technical, permitting, environmental, labor and tax matters) of the due diligence materials (the “Due Diligence”);

4 (E) in connection with the transaction contemplated herein, the Seller and the Purchaser agree that prior to or at the Completion Date, the Company shall complete the Carve-Out (as detailed in Article 6.3 below); (F) the Guarantor has agreed to guarantee the payment obligations of the Seller on the terms and subject to the conditions of this Agreement (as detailed in Article 14.1 below); (G) this Agreement sets forth the terms and conditions upon which the Parties agree to carry out the transactions contemplated herein (collectively, the “Transaction”) consisting, inter alia, of (i) implementing the Carve-Out and (ii) the sale and transfer by the Seller to the Purchaser, and the purchase by the Purchaser from the Seller, of a quota corresponding to 100% (one hundred per cent) of the outstanding corporate capital of the Company (the “Participation”). NOW THEREFORE, on the basis of the Whereas above, which, together with the Annexes and Schedules hereto, are an integral and essential part of this Agreement, the Parties agree as follows. 1. DEFINITIONS AND INTERPRETATION 1.1. Definitions The following terms shall have the meanings set forth below for the purposes of this Agreement. i. “32024 S.r.l.” means 32024 S.r.l., with registered office in Brescia (BS), zona industrial S. Eufemia, Via Giovanni Bormioli n. 19, registered with the Companies’ Register of Brescia with fiscal code and VAT no. 04571140989. ii. “A-Series Licensing Agreement” [Redacted – Commercially Sensitive Information]. iii. “A-Series TSA” [Redacted – Commercially Sensitive Information]. iv. “Accounting Principles” means (i) in respect of the Company, the accounting principles set forth in the Italian Civil Code approved by the Consiglio Nazionale dei Dottori Commercialisti e degli Esperti Contabili, as amended by the Organismo Italiano di Contabilità (O.I.C.) applied consistently and in accordance with previous standards (Italian GAAP) or, in their absence, the accounting principles prepared by the Financial Accounting Standards Board (FASB) (US GAAP) and (ii) in respect of the In- Scope Subsidiaries, the equivalent accounting principles applicable in the relevant jurisdiction, as in effect at the relevant time, in each case applied consistently with past practice, as applied in the past 3 (three) financial years. v. “Actual Adjusted EBITDA” has the meaning set forth in Article 4.3(b). vi. “Actual Intra-Group Payables” has the meaning set forth in Article 4.3(b). vii. “Actual Intra-Group Receivables” has the meaning set forth in Article 4.3(b). viii. “Actual Locked Box Net Debt” has the meaning set forth in Article 4.3(b). ix. “Actual Net Cash Flow Adjustment” has the meaning set forth in Article 4.3(b). x. “Adjusted EBITDA” means EBITDA taking into account the effects of the following matters, which shall be taken into account when calculating the EBITDA. The effects of the following matters shall be excluded in calculating the Adjusted EBITDA, except where any of such items constitute a Leakage (provided that the following shall be applied without double counting any income or expense): a) [Redacted – Commercially Sensitive Information]. xi. “Advantek Commercial Agreement” [Redacted – Commercially Sensitive Information].

5 xii. “Affiliate” means, with respect to (i) any legal entity, any Person directly or indirectly controlling, controlled by, or under common control with, such Person, provided that, with respect to the Seller, “Affiliate” shall include WFS Canada and Westport Fuel Systems Canada and, from the effective date of the Carve-Out, the Out-of-Scope Subsidiaries and, with respect to the, Purchaser, “Affiliate” shall exclude its subsidiaries, any investment fund and/or managed accounts managed thereby and any portfolio company (as such term is used in the context of private equity business) in which such investment fund or managed account is invested and (ii) a Person that is an individual: (a) the spouse of such Person or of any of the individuals under (b) hereafter; (b) any relative (parente) of, or person related by affinity (affine) to, such Person or any of the individuals under (a) above, in each case within the second degree (including step-children and adopted children); and (c) any legal entity directly or indirectly controlled by such Person, any of the individuals under (a) or (b) above, or those Persons collectively. It is being understood that, for the purpose of this definition, the HPDI Technology Limited Partnership, HPDI Technology AB, 1464244 B.C. Ltd. and 32024 S.R.L. and their relevant affiliates shall not be considered as “Affiliates” of the Seller and of the Company. xiii. “AFS Business” means the business related to the design, prototype, manufacture and program engine control units including their own A-series controller developed for and sold in the Indian market . xiv. “Ancillary Agreements” means, jointly, the SQT Commercial Agreement, the Advantek Commercial Agreement, and the Tata Development Agreement. xv. “Anti-Bribery Laws” means in each case to the extent that they have been applicable to a group Company at any time prior to the date of this Agreement: (i) the Legislative Decree no. 231 of 8 June 2001 and the Legislative Decree no. 231 of 31 November 2007, (ii) the UK Bribery Act 2010; (iii) any applicable Law, rule, or regulation promulgated to implement the OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions, signed on 17 December 1997; and (iv) any other applicable Laws of similar purpose and scope in any jurisdiction, including books and records offences relating directly or indirectly to a bribe. xvi. “Antitrust Authority(ies)” means any antitrust Authority(ies) - if any - having jurisdiction to scrutinize and approve the Transaction contemplated hereunder. xvii. “Antitrust Clearance” means (i) a decision, in whatever form by the Antitrust Authority, declining jurisdiction over the Transaction or granting unconditional clearance, (ii) a mere filing or notification, if the Completion can take place, pursuant to applicable Law, without a decision, (iii) the expiry or termination of the applicable waiting period pursuant to applicable Law, as the case may be, or (iv) the decision of the Antitrust Authority authorizing the Transaction subject to conditions, obligations, undertakings, prescriptions and/or commitments (as the case may be) unless any such conditions, obligations, undertakings, prescriptions and/or commitments are not satisfactory to the Purchaser, it being agreed that the Purchaser shall act reasonably and in good faith in the relevant evaluation. xviii. “Authority” means any Italian, foreign, international, supranational, European, state, municipal or local governmental, regulatory, judicial, legislative, tax or administrative body or authority or any subdivision, agency, registry, commission, court or office thereof, or any arbitrator or arbitration panel in each case having jurisdiction over any of the transactions contemplated hereunder or the parties thereto. xix. “Base Purchase Price” has the meaning set forth in Article 4.1(a)(i). xx. “Basket” has the meaning set forth in Article 11.2(c). xxi. “Books and Records” means all books and records relating to the Company or its business, including books of account, financial and accounting information and records, personnel records, tax records, sales and purchase records, customer and supplier lists, production reports and records, equipment logs, business reports, marketing and advertising materials (whether in written, printed, electronic or computer printout form, or stored on computer discs or other data and software storage and media devices).

6 xxii. “Brescia Lease Agreement” means the lease agreement entered into on March 2021 between the Company, as tenant, and [Redacted – Confidential Information] as lessor, in relation to the property located [Redacted – Commercially Sensitive Information]. xxiii. “Brescia Sublease Agreement” means the sublease agreement entered into on June 1, 2024, between the Company, as sub-lessor, and 32024 S.r.l., as sub-tenant, in relation to the same property that is the subject matter of the Brescia Lease Agreement. xxiv. “Business Day” means any calendar day other than a Saturday or a Sunday or any other day in which banks are required or authorized to close in Milan (Italy) and Amsterdam (The Netherlands). xxv. “Business IP” means the Owned IP and all other registered and material unregistered Intellectual Property Rights used by the Group Companies. xxvi. “Businesses” means the Going Concern, the AFS Business and the activities of the Company relating to the Cespira Business. xxvii. “Business Plan” means the business plan of the Group Companies for the period January–December 2025, agreed between the Parties prior to the date hereof and attached hereto under Schedule xxvii. xxviii. “Business Warranties” has the meaning set forth in Article 9(a). xxix. “Cap” has the meaning set forth in Article 11.2(c). xxx. “Capex” means the capital expenditures of the Group Companies determined in a manner consistent with Accounting Principles. xxxi. “Carve-Out” means, collectively, any and all the actions and transactions that the Seller is required to carry out (or that it shall cause to be carried out by the relevant Group Company and/or Westport Fuel Systems Canada and/or WFS Canada), pursuant to the Carve-Out Plan and Article 6.3. xxxii. “Carve Out Cash” means in relation to the Going Concern (and the Out-of-Scope Subsidiaries) cash at banks, cash in transit or credited to the account of or held in any account on behalf of the Going Concern (or the Out-of-Scope Subsidiaries) with any bank, financial, credit, lending or similar institution (together with accrued interest), marketable securities, any amounts or expenses prepaid and security deposits made by the Going Concern, any loans granted by the Going Concern (and the Out-of-Scope Subsidiaries) and any amounts to be received by the Going Concern (and the Out-of-Scope Subsidiaries) upon the termination of any derivative and/or hedging instrument contracts (taking into account their market value, margin, prepayment fees and penalties related to or arising as a result of the termination, if any) as at the Locked Box Date. xxxiii. “Cash” means in relation to the Group Companies (i) cash or cash equivalents in hand or credited to the account of or held in any account on behalf of the Group Companies as at the Locked Box Date, (ii) less restricted cash which is not freely available excluding Carve Out Cash. xxxiv. “Carve-Out CP” has the meaning set forth in Article 5.1. xxxv. “Carve-Out Plan” means the carve-out plan as agreed between the Parties and attached hereto under Schedule xxxv. xxxvi. “Carved-Out Employees” means the Transferred Carved Out Employees and the Remaining Carved-Out Employees. xxxvii. “Cespira Business” has the meaning set forth in Article 1.1xxxix. xxxviii. “Cespira Employees” has the meaning set forth in Article 6.4(c).

7 xxxix. “Cespira Transfer Agreement” means the agreement governing the transfer of a branch of business as a going concern (consisting, inter alia, of certain machinery and equipment, contracts, employees, inventory, intellectual property, authorizations and registers, through which the Company carries out the manufacture, assembly and repackaging, sales and aftermarket support service of the components and systems that comprise injection systems which use HPDI technology, for use by OEMs – all as better detailed under the Cespira Transfer Agreement, the “Cespira Business”) entered into on 31 May 2024 between the Company, as transferor, and 32024 S.r.l., as transferee. xl. “Claim” has the meaning set forth in Article 13.1(a). xli. “CoC CP” has the meaning set forth in Article 5.1. xlii. “Company” (or “WFS Italia”) has the meaning set forth in Recital (A). xliii. “Completion” means the execution, delivery and exchange of all documents and the performance and consummation of all obligations and actions respectively required to be executed, exchanged, performed and/or consummated on the Completion Date pursuant to this Agreement and applicable Laws. xliv. “Completion Date” means the date falling no. 10 (ten) Business Day following the satisfaction (or waiver) of the latest of the Conditions Precedent or such other date as the Parties may agree in writing. xlv. “Completion Leakage Amount” has the meaning set forth in Article 4.4(b). xlvi. “Completion Outstanding Balance” has the meaning set forth in Article 4.2(c). xlvii. “Completion Purchase Price” has the meaning set forth in Article 4.1(b). xlviii. “Conciliation Period” has the meaning set forth in Article 4.3(b). xlix. “Conditions Precedent” has the meaning set forth in Article 5.1. l. “De Minimis” has the meaning set forth in Article 11.2(c). li. “Debt” has the meaning set forth in Schedule li. lii. “Debt Assumption Agreement” has the meaning set forth in Article 4.2(c)(ii). liii. “Deed of Transfer of the Going Concern” means the notarial deed of transfer of the Going Concern, whose terms shall be discussed in good faith between the Parties during the Interim Period, which (a) shall be legally sufficient, in form and substance, to transfer to Westport Fuel Systems Canada, good and marketable title to the Going Concern, (b) shall not have either the purpose nor the effect of amending, substituting or novating (novare) the applicable provisions of this Agreement, which shall therefore remain in full force and effect. It is agreed and understood that the Company shall not be required to give any representation, warranty or indemnity, covenant and/or guarantee in relation to such transfer, other than warranties related to title to and existence of the Going Concern, good standing, powers and capacity to sell and absence of any Encumbrances on such Going Concern. liv. “Deeds of Transfer of the Out-of-Scope Subsidiaries” means the deeds of transfer of the Out-of-Scope Subsidiaries which shall be legally sufficient (according to the applicable Laws), in form and substance, to transfer to Westport Fuel Systems Canada and/or its Affiliates, good and marketable title to the equity interest in the Out-of-Scope Subsidiaries. lv. “Designated Company” has the meaning set forth in Article 2.1. lvi. “Disagreement Notice” has the meaning set forth in Article 4.4(d).

8 lvii. “Dismissed Manager” means [Redacted – Private Information]. lviii. “Dissolving Entities” has the meaning set forth in Article 8.3. lix. “Due Diligence” has the meaning set forth in Recital (D). lx. “Dutch CP” has the meaning set forth in Article 5.1. lxi. “Earn-Outs” has the meaning set forth in Article 4.6(c). lxii. “EBITDA” means, without any duplication, in respect of the Group Companies and the AFS Business (excluding the Going Concern and the Cespira Business), the net earnings for the period October 1, 2024 up to and including May 31, 2025, before taxation, net financial expense, amortisation, depreciation, impairment losses and share in the result of participation of the Group Companies, calculated on the basis of the management accounts. lxiii. “Employees” means the employees of the Group Companies as of the Signing Date as listed in Annex L Part 1. lxiv. “Employees Settlements” means (i) the individual settlement and novation agreements to be entered between the Company, the Seller and the Transferred Carved Out Employees, whereby each of the Transferred Carved Out Employees accepts, pursuant to article 2113, paragraph IV of the Italian Civil Code the transfer of the employment relationship to WFS Italy, whether pursuant to article 1408 or 2112 of the Italian Civil Code, and irrevocably and unconditionally waives any possible right, action, demand or claim against the Company (the “Employees Settlement for the Transferred Carved Out Employees”), and (ii) the delivery to the Remaining Carved Out Employees of a communication from the Company, to be countersigned to acknowledge relevant receipt by each Remaining Carved-Out Employee, that states that the Remaining Carved-Out Employees shall not be transferred to Westport Fuel System Canada with the Going Concern, being re-allocated to other activities within the Company (“Employees Settlement for the Remaining Carved Out Employees”). The Seller shall consult in good faith with the Purchaser on the texts of each Employees Settlement for the Transferred Carved Out Employees and on the relevant activities and decisions. lxv. “Encumbrance” means any passive security interest, lien, pledge, mortgage, charge or other encumbrance, usufruct or right in rem, right to acquire or subscribe, right of conversion, right of first refusal or restriction on transfer, including any agreement, option, written or oral undertaking, or other right of a third party which may lawfully affect the right or title of the Person having an interest in the asset subject thereto, or other agreement or obligation (including any conditional obligation) to create one or more of the foregoing rights. lxvi. “Environment” means (i) all or any of the following media, namely air (including the air within buildings or other natural or man-made structures above or below ground), water (including surface or ground water, water in pipes, drainage or sewerage systems) and/or land (including soil, subsoil, and/or soil beneath any body of water) and (ii) any living organisms (including human beings) or systems supported by all or any of those media. lxvii. “Environmental Consents” means any permit, licence, authorisation, approval, registration and/or consent, however named, required under or in relation to Environmental Laws. lxviii. “Environmental Laws” means all or any international, European Union, national, state, federal, regional or local Laws (including common law, statute law, civil, criminal and administrative law), including Legislative Decree no. 152 of 2006, together with all subordinate legislation, codes of practice, guidance notes, circulars, decisions, decrees, ordinances, regulations, orders, by-laws and judgments relating to Environmental Matters, together with any judicial or administrative interpretation of each of the foregoing.

9 lxix. “Environmental Matters” means all or any matters relating to the pollution or protection of the Environment, the use, storage, handling or disposal of Hazardous Substances, human health and safety (including health and safety of employees, occupiers and invitees, and fire safety) and matters relating to the construction, demolition, alteration or use of buildings or land to the extent that they relate to any of the foregoing. lxx. “Escrow Agent” means the escrow agent to be designated by the Purchaser in a timely manner before the Completion, to be chosen among Italian primary providers of such kind of services. lxxi. “Escrow Agreement” means the agreement with the Escrow Agent in the form to be agreed upon in good faith between the Seller, the Purchaser and the Escrow Agent in due course following to the Signing Date, whose main terms and conditions are set forth in Schedule lxxi. lxxii. “Escrow Amount” means the aggregate amount of [Redacted – Commercially Sensitive Information] to be deposited with the Escrow Agent in accordance with the terms of this Agreement and the Escrow Agreement and to be held and released pursuant to the terms and subject to the conditions set forth in this Agreement and the Escrow Agreement, whose purpose is to guarantee the Purchaser against any payment obligation of the Seller under this Agreement, including – without limitation – the payment of any indemnity obligations pursuant to Article 11 below. lxxiii. “Estimated Completion Statement” has the meaning set forth in Article 4.2(a). lxxiv. “Estimated Locked Box Date Net Debt” means the Net Debt as of the Locked Box Date, as estimated by the Seller pursuant to Article 4.2. lxxv. “Estimated Net Cash Flow Adjustment” means the Net Cash Flow Adjustment as estimated by the Seller pursuant to Article 4.2. lxxvi. “Final Intra-Group Payables Amount” has the meaning set forth in Article 4.3(c). lxxvii. “Final Intra-Group Receivables Amount” has the meaning set forth in Article 4.3(c). lxxviii. “Financial Statements” means the stand-alone audited financial statements of the Group Companies as of December 31 in respect of the relevant financial year (or any other reference date of the approved financial statements of the In-Scope Subsidiaries) approved by the competent corporate bodies of the relevant Group Companies. lxxix. “Fundamental Warranties” has the meaning set forth in Article 9(a). lxxx. “GFI H2 Manufacturing TSA” [Redacted – Commercially Sensitive Information]. lxxxi. “Going Concern” means the line of business as a going concern (ramo d’azienda) of the Company related to GFI hydrogen business, through which, as at the date hereof, the Company carries out the supply of components for hydrogen-powered motors and which consists of all assets, rights, contracts, liabilities, debts and legal relationships of any nature whatsoever, pertaining to the GFI hydrogen business as conducted by the Company as of the Signing Date, whose perimeter shall be better detailed in the Deed of Transfer of the Going Concern. lxxxii. “Going Concern Consideration” means the cash consideration owed by Westport Fuel Systems Canada to the Company for the transfer of the Going Concern (that will result from the Deed of Transfer of the Going Concern), that the Parties agree being equal to [Redacted – Commercially Sensitive Information], or the different amount agreed in good faith between the Parties taking into account the composition of the Going Concern as of the Going Concern Transfer Effective Date. lxxxiii. “Going Concern Transfer Effective Date” has the meaning set forth in Article 6.3(a).

10 lxxxiv. “Golden Power Clearance” means, in relation to the Transaction contemplated under this Agreement, the obtainment of the clearances, approvals and consents required to be obtained under the applicable foreign investment control Law from the Italian Presidency of the Council of Ministries (Presidenza del Consiglio dei Ministri), including (i) any declaration of lack of jurisdiction or a decision considering that the acquisition is not included in the scope of application of the applicable Law, (ii) the expiry of the applicable waiting period (or any extension thereof), as applicable, if this has the same effect of an explicit clearance, approval or consent, or (iii) the decision declaring that the Transaction is conditional or contingent upon any recommendations, undertakings, prescriptions and/or commitments (as the case may be) from the Purchaser and/or the Group Companies, unless any such recommendations, undertakings, prescriptions and/or commitments are substantially detrimental to the Transaction, provided that in the event that the Italian Presidency of the Council of Ministries (Presidenza del Consiglio dei Ministri) imposes any recommendations, undertakings, prescriptions and/or commitments (“Prescriptions”), the Parties shall nevertheless enter into a good faith discussion in order to assess by mutual agreement whether (a) to accept the Prescription indicated in the measure of the Authority and to negotiate in good faith the appropriate solutions to implement the content of the said measure clarifying that the Prescription are acceptable prescriptions, and to the effect (b) to consider the Golden Power CP as fulfilled notwithstanding the presence of the Prescriptions. lxxxv. “Golden Power CP” has the meaning set forth in Article 5.1. lxxxvi. “Group” (and “Group Companies” accordingly) means the Company and the In-Scope Subsidiaries listed under Section II of Schedule (C) it being understood that in any case: 1. for the purposes of the Schedule 9(a) “Group” and “Group Companies” refer exclusively to the Company; Westport Fuel Systems Netherlands Holding B.V.; Indopar B.V.; Westport Fuel Systems Netherlands B.V.; Prins Autogassystemen B.V.; Stako Sp. Z. o. o.; and, in the circumstances under Article 8.3, the Dissolving Entities, and any definition used in Schedule 9(a) that includes a reference to a Group Company shall be construed and interpreted as referring exclusively to such companies; 2. for the purposes of (x) the definition of “Leakage”, “Permitted Leakage” “Intra-Group Payables”, Intra-Group Receivables”, and (y) Article 6.1 (Interim Management), Article 6.2 (Interim Actions), Article 7.1(b)vii, Article 7.1(b)viii, Article 7.1(b)xiv, Article 7.1(b)xv “Group” and “Group Companies” refer exclusively to the Company and the In-Scope Subsidiaries listed under Section II Part A of Schedule (C), and any definition used in such terms and Articles that includes a reference to Group Companies shall be construed and interpreted as referring exclusively to the Company and such In-Scope Subsidiaries listed under Section II Part A of Schedule (C). lxxxvii. “Guarantor” (or “WFS Canada”) has the meaning set forth in the Preamble. lxxxviii. “Hazardous Substances” means any natural or artificial substance, chemical, waste and/or thing (including, but not limited to, asbestos, polychlorinated biphenyls, petroleum, greenhouse gases, and fluorinated gases), whether in the form of a solid, liquid, gas, vapour and/or any other form, which, alone or in combination with other substances, causes or may cause harm or damage to the Environment or detriment to the health and safety of any person, such as controlled, special, hazardous, polluting, toxic, and/or dangerous substances, waste, radiation, electricity, and/or heat. lxxxix. [Redacted – Commercially Sensitive Information] xc. [Redacted – Commercially Sensitive Information] xci. [Redacted – Commercially Sensitive Information] xcii. “Indemnified Party” has the meaning set forth in Article 13.1(a). xciii. “Indemnifying Party” has the meaning set forth in Article 13.1(a).

11 xciv. “Indemnity Agreements”: means the indemnity agreements entered into between and WFS Canada, as indemnifying party, and [Redacted – Private Information] as indemnified parties, respectively on [Redacted – Confidential Information]. xcv. “Independent Expert” means: 1. any of the Selected Auditing Firms any other professional expert depending on the matter submitted to its assessment under this Agreement, jointly agreed by the Parties, in each case provided that (i) it is independent from the Parties and their Affiliates, and (ii) it is based in Italy, or has a branch in Italy and acts through such branch, in any case as the Parties may agree in writing; or 2. if the Independent Expert agreed under number (1) above is unwilling or unable to accept the engagement (including by reason of conflict) or fails to perform its assignment for any reason whatsoever, any other Selected Auditing Firms or any other professional expert depending on the matter submitted to its assessment under this Agreement, as the Parties may agree in writing; or 3. if the Parties fail to reach an agreement within 10 (ten) Business Days from the date on which either Party requests to the other the appointment of an Independent Expert under this Agreement or, in the event contemplated under number (2) above, from the refusal (even tacit) of said elected Independent Expert to be engaged, any other Independent Expert as designated by the President of the Milan Arbitration Chamber upon request of either Party. xcvi. “In-Scope Subsidiaries” means the subsidiaries of the Company listed under Section II of Schedule (C). xcvii. “Intellectual Property Rights” means patents and patent applications for invention, supplementary protection certificates, and all proprietary rights associated with patents, trademarks, internet domain names, copyright (including rights in computer software) and other rights associated therewith, including related rights and sui generis database rights, semi-conductor topography rights, utility models, rights in designs, rights in get up, rights in inventions, rights in know-how, technology, trade secrets, know-how documented or evidenced in writing or in other form (including drawings, technical data, formulae, manufacturing processes, proprietary information, customers and suppliers lists), and rights protecting confidential information and other intellectual and/or industrial property rights, in each case whether registered or unregistered, and all rights or forms of protection having equivalent or similar effect anywhere in the world and “registered” and including also all rights to apply for and be granted, renewals or extensions thereof. xcviii. “Interim Action” has the meaning set forth in Article 6.2. xcix. “Interim Period” means period starting from (but excluding) the Signing Date and ending on the Completion Date. c. “Intra-Group Payables” means all amounts owed by the Company to the Seller (and/or its Affiliates) (including, but not limited to, those amounts owed in the ordinary course of trading for purchase of goods or services, including in respect of the purchase of goods or services or the payment of salaries or other Employee benefits, VAT, insurance, pension or retirement benefit payments, management training, intellectual property and IT licences, IT costs, internal control activities for SOCS requirements, legal and HR support, R&D for the Going Concern, management fees and other corporate allocations), plus any properly accrued and outstanding interest thereon (where applicable)). ci. “Intra-Group Receivables” means all amounts owed by the Seller (and/or its Affiliates) to the Company (including, but not limited to, any amounts lent by the Company to WFS Canada (at any title) from time to time and those amounts owed in the ordinary course of trading for purchase of goods or services, including in respect of the purchase of goods or services or the payment of salaries or other Employee benefits, VAT, insurance, pension or retirement benefit payments, management training, intellectual

12 property and IT licences), with the exclusion of the Going Concern Consideration, plus any properly accrued and outstanding interest thereon (where applicable)), and excluding the WMTM Receivables. cii. “Italian Civil Code” means the Italian civil code, as approved by the Royal Decree dated 16 March 1942, No. 262, as subsequently amended. ciii. “IT Systems” means the information and communications technologies used by the Group Companies, including hardware, proprietary and third-party software, services, networks, peripherals and associated documentation. civ. “JV Agreement” [Redacted – Commercially Sensitive Agreement]. cv. “JV Products” means components and systems to enable the use of alternative fuels (e.g. CNG, LNG, LPG, Hydrogen) for automotive, industrial and/or any other application. cvi. “JV Supply Agreement” [Redacted – Commercially Sensitive Agreement]. cvii. “Law” means all legislation applicable to the Company and/or the Group Companies and/or the Parties, as the case may be, including law, regulations, judgments, decisions, decrees, orders and other legislative measures or decisions having the force of law, from time to time. cviii. “Leakage” means, to the extent occurring in the Locked Box Period, and without double counting, exclusively: 1. any and all dividends and other distributions, whether of capital income or profit and whether by way of share redemption, repurchase, share capital reduction or otherwise or any other payment or repayment in respect of any share capital, loan capital, bonds or other securities of any Group Company, in each case whether in cash, stock, in specie or kind, authorized, declared, paid or made, by any Group Company to, or for the benefit of, the Seller or its Affiliates; 2. any (i) charges paid (with the exception of Ordinary Course of Business charges) and (ii) payment (including any payment of interest or fees) made or costs, expenses, or liabilities incurred to, or for the benefit of, the Seller and/or its Affiliates; 3. the value of any asset, right or other benefit transferred by any Group Company or any agreement in relation thereto, to the extent transferred for no consideration, at an overvalued consideration or a consideration which is not at arm’s length to, or for the benefit of, the Seller or its Affiliates; 4. the value of any forgiveness, release, deferral, discount, discharge or waiver (whether in whole or in part) by any Group Company of any amount, right, benefit, obligation, indebtedness, liability or claim incurred by, in favor of, or due from, or for the benefit of the Seller or its Affiliates, except for the WMTM Receivables; 5. the entry into by any Group Company of any guarantee, security, or indemnity of any kind relating to obligations of the Seller or its Affiliates, the creation of any Encumbrance over any assets or securities of any Group Company in favor or for the benefit of the Seller or its Affiliates or the accrual, assumption, incurrence, indemnification, the increase or discharge by any Group Company of any indebtedness or liability (actual or contingent) of, or for the benefit of, any of the Seller or its Affiliates; 6. any payment or agreement to pay by a Group Company of any bonuses, incentive, brokerage, finder fee, commission, compensation or severance payment (in cash or kind) in connection with the Transaction to any director, executive (dirigente), member of a corporate body, employee, consultant or independent contractor of a Group Company, in each case in connection with the execution of this Agreement and/or the consummation of the Transaction contemplated hereunder, or in connection with services rendered by advisors, data room providers or any third

13 party in relation to the Transaction, or any premium for any run-off directors and officers insurance policy purchased in the context of the Transaction; 7. any consultant, advisory, management, monitoring, service, shareholder, board or other fees of a similar nature paid, or any salary, paid by a Group entity to or for the benefit of any of the Seller or its Affiliates. For the avoidance of doubt this list expressly excludes any amount under no. 4 of “Permitted Leakage”; 8. any employer’s payroll, social security payable by a Group Company in connection with any amounts described in numbers 6 and 7 above; 9. any costs borne by the Group Companies for external advisors, consultants, independent contractor, in connection with the negotiation, preparation, execution and implementation of the Horse Agreement; 10. any Tax payable or suffered by any Group Company and any VAT as a consequence of the foregoing (such Tax being “Tax on Leakage”), the Carve-Out and the actions and transactions contemplated in Article 6.4; 11. any and all Debts incurred or agreed to be incurred by any Group Company during the Locked Box Period except for those (i) incurred in the Ordinary Course of Business, or (ii) whose value does not exceed [Redacted – Commercially Sensitive Information] individually and [Redacted – Commercially Sensitive Information]in the aggregate; 12. any agreement or obligation assumed by any Group Company prior to or after the Completion to do any of the foregoing, but excluding any Permitted Leakage, any amount that has been reimbursed to the Group Companies by the Seller or its Affiliates (excluding the Group Companies) prior to Completion and any amount in respect of VAT that is actually recoverable, as input Tax, by a Group Company; and is, in each case, net of the amount of Tax saved by the utilization of any Relief that arises in connection with 1 to 10 above by a Group Company to the extent such saving has given rise or is reasonably expected to give rise to an actual cash saving for a Group Company. cix. “Locked Box Accounts” means the unaudited consolidated management accounts of the Group as of the Locked Box Date, which are attached hereto under Schedule cix. cx. “Locked Box Date” means 30 September 2024. cxi. “Locked Box Period” means the period from (but excluding) the Locked Box Date to (and including) the Completion Date. cxii. “Long Stop Date” means September 1, 2025. cxiii. “Loss” means any damages under Article 1223 et seq. of the Italian Civil Code (including the loss of profit (lucro cessante) and Taxes) and any related costs (including reasonable legal costs). cxiv. “MAC CP” has the meaning set forth in Article 5.1. cxv. “Material Adverse Change” means any state of facts, change, development, circumstance, condition, effect, event or occurrence, unknown as of the date of this Agreement, that, individually or in the aggregate with other states of facts, changes, developments, circumstances, conditions, effects, events or occurrences, has had, or could objectively have a material adverse effect on the assets, liabilities, results of operations or financial condition of the Group Companies, taken as a whole. For purposes of this Agreement, “Material Adverse Change” shall exclude any effects to the extent resulting from (i) changes in the economy or other economies of the territories in which the Group Companies have material operations, (ii) changes or prospective changes in the applicable Accounting Principles or in

14 any applicable Law, including those concerning Taxes or applicable accounting regulations or principles or interpretations thereof, (iii) changes or conditions in or affecting industries in which the Group Companies operate, (iv) conditions generally affecting financial, banking or securities markets (including any disruption thereof), (v) conditions from acts of God, calamities, earthquakes, hurricanes, floods, tornadoes, storms, weather conditions, fires, power outages, epidemics, pandemics (including Covid- 19) or other natural disasters or the worsening thereof, cyber-attacks or data breaches beyond Seller’s reasonable control, (vi) political, regulatory, legislative or social conditions (including any outbreak or escalation of hostilities, acts of war or terrorism or the escalation thereof, whether or not pursuant to the declaration of a national emergency or war, or the occurrence of any military or terrorist attack or otherwise) (and including for the avoidance of doubt, the worsening or escalation of the military actions currently occurring in Ukraine), (vii) the execution, delivery or announcement of the execution of this Agreement or any other Transaction Document and the consummation of the transactions contemplated under this Agreement, and (viii) the exit of any nation from the European Union. cxvi. “Net Cash Flow Adjustment” means, earnings (loss) before interest expense, income taxes, depreciation and amortization, minus interest expense plus/minus estimated income tax (expense) benefit, plus any decrease in the net working capital and less any increase in the net working capital, consisting of trade accounts receivables, inventory and trade accounts payables, minus cash paid for capital expenditures related to the Businesses for the period from October 1, 2024 through the Completion Date (the “Net Cash Flow Adjustment Reference Period”). By way of examples and for illustration purposes only, numerical examples of the calculation of the Net Cash Flow Adjustment are set out in Schedule cxvi. cxvii. “Net Cash Flow Adjustment Reference Period” has the meaning set forth in Article 1.1cxvi. cxviii. “Net Debt” means the Debt minus the Cash. cxix. “Notarial Deed” has the meaning set forth in Article 7.1(b)ix. cxx. “Notary” means the notary public designated by the Purchaser and notified to the Seller in accordance with this Agreement at least 7 (seven) Business Days before the Completion Date. cxxi. “Notice of Claim” has the meaning set forth in Article 13.1(b). cxxii. “Notice of Designation” has the meaning set forth in Article 2.2. cxxiii. “Notice of Objection” has the meaning set forth in Article 4.3(b). cxxiv. “Ordinary Course of Business” an action taken by a Person will be deemed to have been taken in the Ordinary Course of Business only if that action: (a) is taken in the ordinary course of the normal, day-to- day, operations of such Person acting reasonably, in a prudent and responsible manner and in any case in compliance with applicable Laws and consistently with the past practice; and (b) does not require authorisation by the quotaholders/shareholders of such Person (or by any Person or group of Persons exercising similar authority). cxxv. “Out-of-Scope Subsidiaries” means the subsidiaries of the Company listed under Section I of Schedule (C). cxxvi. “Outstanding Leakages” has the meaning set forth in Article 4.4(d). cxxvii. “Outstanding Leakages Claim” has the meaning set forth in Article 4.4(d). cxxviii. “Owned IP” means the registered and material unregistered Intellectual Property Rights owned by the Group Companies. The registered Owned IP is listed in Schedule cxxviii. cxxix. “Participation” has the meaning set forth in Recital (G).

15 cxxx. “Permitted Leakage” means, without duplication, any of the following: 1. any payment made or agreed to be made, or liability incurred or agreed to be incurred, in respect of any matter (i) expressly contemplated in the Locked Box Accounts or (ii) undertaken by or on behalf of any Group Company at the written request of the Purchaser or on the basis of a written agreement with the Purchaser, but only to the extent expressly stated and agreed by the Purchaser to be treated as a Permitted Leakage; and 2. any payment made or agreed to be made, or liability incurred or agreed to be incurred, in respect of the execution of the Carve-Out Plan (excluding any payments in relation to Taxes); 3. any payments made or agreed to be made, or liability incurred or agreed to be incurred, in respect of the Cespira Business or the Going Concern, in any case in the Ordinary Course of Business; and 4. any amount owed by the Company to Westport Fuel Systems Canada for corporate allocations, including, without limitation, the payment made by the Company to Westport Fuel Systems Canada on January 23, 2025 for corporate allocations in the amount of [Redacted – Commercially Sensitive Information], in any case in line with past practice. cxxxi. “Person” means any natural person (persona fisica) or legal person (persona giuridica), even if not recognised (persona giuridica non riconosciuta), including any corporation, company, partnership, trust, unincorporated organisation, association or other entity, or any administrative or judicial authority. cxxxii. “Preliminary Statement” has the meaning set forth in Article 4.4. cxxxiii. “Post-Completion Statement” has the meaning set forth in Article 4.3(a). cxxxiv. “Post-Completion Outstanding Balance” has the meaning set forth in Article 4.3(c). cxxxv. “Purchase Price” has the meaning set forth in Article 4.1(a). cxxxvi. “Purchaser” (or “Green Day Holding”) has the meaning set forth in the Preamble. cxxxvii. “Purchaser’s Bank Account” means the bank account of the Purchaser, which will be communicated in writing to the Seller within 5 (five) Business Days prior to Completion Date. cxxxviii. “Purchaser Calculated Adjusted EBITDA” has the meaning set forth in Article 4.3(a). cxxxix. “Purchaser’s Indemnification Obligations” has the meaning set forth in Article 12(a). cxl. “Purchaser Re-Calculated Intra-Group Payables” has the meaning set forth in Article 4.3(a). cxli. “Purchaser Re-Calculated Intra-Group Receivables” has the meaning set forth in Article 4.3(a). cxlii. “Purchaser Re-Calculated Locked Box Net Debt” has the meaning set forth in Article 4.3(a). cxliii. “Purchaser’s Warranties” has the meaning set forth in Article 10. cxliv. “Redundancy Payment” means the amount of [Redacted – Commercially Sensitive Agreement] agreed between the Parties in connection with costs and liabilities related to the termination and/or the management of the agreements of employees [Redacted – Private Information] (the “Redundant Employees”). cxlv. “Rejection Notice” has the meaning set forth in Article 13.1(d).

16 cxlvi. “Relief” means any loss, relief, allowance, deduction, exemption, set-off or credit in respect of Tax or relevant to the computation of any income, profits, gains for the purposes of Tax or any right to or actual repayment or refund of or saving of Tax. cxlvii. “Remaining Carved Out Employees” means the Carved-Out Employees listed under Schedule cxlvii. cxlviii. “Representative” means the directors, officers, employees, attorneys-in-fact, investment bankers, consultants, attorneys, accountants and other advisors and representatives of a Person. cxlix. “Requisite Approval” means the irrevocable and unconditional approval for the WFS Canada Transaction Resolution of 66⅔% of the votes cast on the WFS Canada Transaction Resolution by the WFS Canada Shareholders present, either virtually or by proxy, at the WFS Canada Meeting. cl. “Resigning Auditors” has the meaning set forth in Article 7.1(b)vii. cli. “Resigning Directors” has the meaning set forth in Article 7.1(b)vii. clii. “Sanctioned Country” means any country or territory which is the subject or target of any comprehensive territorial Sanctions imposed by a Sanctions Authority (as of the date of this Agreement, Russia, Belarus, Crimea and Sevastopol, Cuba, Iran, North Korea, Donetsk, Luhansk, Zaporizhzhia and Kherson regions of Ukraine and Syria). cliii. “Sanctioned Person” means (i) any Person that is, or is (directly or indirectly) controlled by one or more Persons that are, listed in any Sanctions-related list of designated persons maintained by OFAC (or any successor thereto) or the U.S. Department of State, the United Nations Security Council, the European Union, or the United Kingdom Government (including His Majesty’s Treasury of the UK), (ii) any Person located, organized or resident in a Sanctioned Country, or (iii) any other person with whom engaging in trade, business, dealings or other activities is prohibited by Sanctions. cliv. “Sanctions” means all applicable economic or financial sanctions, trade embargoes or export controls imposed or enforced on the basis of Law, regulations, executive order, restrictive measures or other related rules imposed or publicly notified by: (i) the United Nations Security Council, (ii) the European Union, (iii) the US Government (including the Office of Foreign Assets Control (“OFAC”) of the US Department of the Treasury, the Bureau of Industry and Security of the U.S. Department of Commerce and the Department of State) and (iv) the UK Government, including His Majesty’s Treasury of the United Kingdom. clv. “Selected Auditing Firm” means any of the following auditing firms: KPMG, Deloitte, PWC, and EY. clvi. “Selected IP Rights” means all Intellectual Property Rights, including patents, trademarks, copyrights, trade secrets, know-how, designs, technical data, and other proprietary information owned or licensed by the Group Companies, relating to liquefied propane gas fuel systems and components, including but not limited to vessel storage, gaseous fuel injectors, rails, valves, electronic control units (ECUs), tanks, pump drive units, fluid storage, and delivery systems or any processes, methods, compositions, formulations, or applications associated with the production, distribution, use, or performance of same. clvii. “Seller” (or “WFS Italy”) has the meaning set forth in the Preamble. clviii. “Seller’s Bank Account” means the bank account of the Seller, which will be communicated in writing to the Purchaser within 5 (five) Business Days prior to Completion Date. clix. “Seller’s Indemnification Obligations” has the meaning set forth in Article 11.1(a). clx. “Seller’s Knowledge” means the constructive knowledge of the Seller having made due enquiries of the appropriate Persons within the Group Companies. clxi. “Seller’s Warranties” has the meaning set forth in Article 9(a).

17 clxii. “Senior Managers” means any director, officer, executive or Employee of the Group Companies whose annual gross remuneration exceeds [Redacted – Commercially Sensitive Information]. clxiii. “Signing Date” means the date of execution of this Agreement. clxiv. “Special Indemnities” has the meaning set forth in Article 11.3(a). clxv. “SQT Commercial Agreement” means [Redacted – Commercially Sensitive Agreement]. clxvi. “Stako” means Stako z.o.o., a limited company established and existing under the Laws of Poland, registered with the Register of entrepreneurs of the National Court Register with number 0000078261, NIP (tax ID) 8392766131, being an In-Scope Subsidiary. clxvii. “Stako Demerger” means the demerger from Stako to Worthington Industries Poland sp. z o.o. of the CNG business by way of demerger by separation executed on March 1, 2021 according to polish Law. clxviii. “Stako Earn-Out” has the meaning set forth in Article 4.6(c). clxix. “Stako Real Estate Property” means the property owned by Stako located in [Redacted – Confidential Information], used as primarily as a manufacturing facility for tanks. clxx. “Target EBITDA” means the amount of the EBITDA of the Group Companies for the period comprised between October 1, 2024 and May 31, 2025 and equal to [Redacted – Commercially Sensitive Agreement]. clxxi. “Tata Development Agreements” [Redacted – Confidential Information]. clxxii. “Tax” means any supranational, national, regional, municipal or local tax, direct or indirect, primary or secondary, duty, or other charge or withholding of a similar nature, including any tax on income, any national and regional tax on corporate income and business activities (such as IRES and IRAP for Italy), value added tax (VAT), municipal tax on real property, substitute tax, stamp duty, mortgage tax, cadastral tax, tax on exchanges, consumer tax, transfer tax, excise, employment tax (including social security, assistance contributions and insurance charge to any national social security or employee social security scheme) final and/or on account of withholding taxes, excise taxes, custom duties, registration taxes and any form of taxation, levy, duty, charge, contribution or impost that is at any time due, levied, withheld or withdrawn, collected or assessed by, or payable to, any Authority also on a joint liability basis together with all interest, sanctions and penalties. clxxiii. “Tax Certificate” has the meaning set forth in Article 6.3. clxxiv. “Technology Assistance and Engineering Services Agreement”:[Redacted – Commercially Sensitive Information]. clxxv. “Third Party Claim” has the meaning set forth in Article 13.2(a). clxxvi. “Trademarks to be Transferred” means all trademarks listed in Schedule clxxvi. clxxvii. “Transaction” has the meaning set forth in Recital (G). clxxviii. “Transaction Documents” means this Agreement (including its Schedules) and each document required entered into or to be entered into on or before the Completion pursuant to the terms of this Agreement (including the WFS Canada Guarantee, the GFI H2 Manufacturing TSA and the A-Series TSA). clxxix. “Transferred Carved Out Employees” means the Carved-Out Employees listed under Schedule clxxix.

18 clxxx. “VAT” means any tax imposed in compliance with the Council Directive of November 28, 2006, on the common system of value added tax (EC Directive 2006/112) or any other Tax on the sale and/or supply of goods and/or services of a similar nature, wherever imposed. clxxxi. “VDR” has the meaning set forth in Recital (D). clxxxii. “Westport Fuel Systems Canada”, means Westport Fuel Systems Canada Inc., a company incorporated under the laws of the Province of British Columbia, having its registered office at Suite 2500 Park Place, 666 Burrard Street, Vancouver, BC V6C 2X8, Canada. clxxxiii. "WFS Canada Approval CP" has the meaning set forth in Article 5.1. clxxxiv. "WFS Canada Circular" means the notice of the WFS Canada Meeting and the accompanying management information circular of WFS Canada, including all schedules, appendices and exhibits thereto and enclosures therewith, as amended, supplemented or otherwise modified from time to time, to be sent to the WFS Canada Shareholders, and each other Person required by applicable Laws, in connection with the WFS Canada Meeting. clxxxv. “WFS Canada Guarantee” means the unlimited guarantee to be signed by WFS Canada pursuant to which WFS Canada shall irrevocably and unconditionally guarantee all amounts owing by the Seller to the Purchaser on a continuing basis, under and arising out of this Agreement, the Transaction Documents and all Transactions contemplated thereby, which WFS Canada Guarantee shall be to the laws of the Province of British Columbia, in the form to be agreed upon between the Parties, acting reasonably and in good faith, after Signing Date and before Completion. clxxxvi. “WFS IP Amendment License Agreement” means the amendment agreement to the license agreement to be entered into between Westport Fuel Systems Canada, as licensor, and the Company, as licensee, in relation to the license to manufacture and sell certain GFI products – to be entered into prior to Completion Date between the Company and Westport Fuel Systems Canada, the final form of which will be agreed upon in good faith by the Parties between Signing Date and Completion Date. clxxxvii. “WFS Canada Meeting” means the annual general and special meeting of WFS Canada Shareholders, including any adjournment or postponement thereof, to consider, among other things the WFS Canada Transaction Resolution. clxxxviii. “WFS Canada Shareholders” means the registered and/or beneficial owners of the WFS Canada Shares, as the context requires. clxxxix. “WFS Canada Shares” means the WFS Canada Common shares. cxc. “WFS Canada Transaction Resolution” means the special resolution of WFS Canada Shareholders to approve the Transaction, which is to be considered at the WFS Canada Meeting. cxci. “WMTM” [Redacted – Confidential Information]. cxcii. “WMTM Receivables” [Redacted – Confidential Information]. 1.1. Interpretation In this Agreement, unless otherwise specified: (i) references to schedules, whereas and articles are to the Schedules, Whereas, and Articles of this Agreement. The Schedules and the Whereas form an integral part of this Agreement. The division of this Agreement into Articles and other subdivisions and the insertion of headings are for convenience of reference only and shall not affect the interpretation of this Agreement;

19 (ii) references to any applicable Law shall be construed as references to such applicable Law as it has been, or may from time to time be, amended, modified or re-enacted and to any subordinate legislation from time to time made under the relevant applicable Law (as so amended, modified or re-enacted), it being however understood that any representation under this Agreement shall be construed according to the Law applicable at the relevant reference time of such representation; (iii) references to the singular include the plural and vice versa; (iv) references to the words “include” and “including” are illustrative, do not limit the sense of the words preceding them and shall be deemed to include the expression “without limitation”; (v) references to “shall cause”, “shall procure” and/or “cause” or “procure” with reference to the fact and/or act of any other Person, means “shall cause”, “shall procure” and/or “cause” or “procure” pursuant to article 1381 (promessa dell’obbligazione o del fatto del terzo) of the Italian Civil Code. Save as otherwise set forth herein, the obligation of a Party to use reasonable or best efforts to accomplish an objective shall be construed as an “obbligazione di mezzi” and not as an “obbligazione di risultato”, meaning that there is no obligation to ensure that the specific objective will, in fact, be reached; (vi) “control”, “to control”, “controlling”, “controlled”, “common control” and similar expressions shall be construed in accordance with article 2359, paragraph 1, no. 1 and no. 2, of the Italian Civil Code; (vii) any reference in this Agreement to a “day” or number of “days”, without the explicit qualification of Business Day(s), will be interpreted as a reference to a calendar day or number of calendar days. When calculating the period of days before which, by which or following which any act is to be done or any step is to be taken under this Agreement, the day that is the reference date in calculating such term will be excluded. If the last day of the relevant term is not a Business Day, the relevant term will end on the next following Business Day. Unless otherwise expressly provided for, any period of time expressed in months will be calculated in accordance with article 2963 of the Italian Civil Code; (viii) the language throughout this Agreement shall in all cases be construed as a whole, in accordance with fair meaning and without any presumption that the terms hereof shall be more strictly construed against one Party than the other by reason of the rule that a document is to be construed more strictly against the Party who has prepared it, it being acknowledged that both Parties have participated in the drafting and negotiation of this Agreement; (ix) the words such as “herein,” “hereinafter,” “hereof,” and “hereunder” refer to this Agreement as a whole (including the Whereas and the Schedules) and not merely to a subdivision in which such words appear; (x) where in this Agreement an Italian term is given after an English term, the meaning of the Italian term shall prevail. 2. RIGHT TO DESIGNATE 2.1. Green Day Holding’s right to designate a wholly-owned Italian subsidiary Pursuant to articles 1401 et seq. of the Italian Civil Code, Green Day Holding may assign all (but not less than all) of its rights and delegate all (but not less than all) of the Purchaser’s obligations under this Agreement to a wholly-owned, direct or indirect subsidiary of Green Day Holding incorporated under the laws of the Italian Republic (the “Designated Company”). 2.2. Term and form of designation

20 Pursuant to articles 1402 and 1403 of the Italian Civil Code, Green Day Holding may exercise its right under Article 2.1 by delivering to the Seller a written notice (the “Notice of Designation”) within 40 (forty) Business Days from the Signing Date. The Notice of Designation will not have any effect unless it is executed also by the Designated Company for full and unconditional acceptance of its designation and adherence to this Agreement. 2.3. Effects of designation Pursuant to article 1404 of the Italian Civil Code, the Designated Company will acquire all rights and assume all obligations of the Purchaser hereunder effective as of the Signing Date, it being understood that the Purchaser shall be jointly and severally liable with the Designated Company in respect of the payment of the Purchase Price including the Earn-Outs. 2.4. Effects of non-designation Pursuant to article 1405 of the Italian Civil Code, if the Notice of Designation is not delivered to the Seller within the term and in the form specified in Article 2.2, this Agreement will be finally and definitively effective between Green Day Holding and the Seller. 3. SALE AND PURCHASE OF THE PARTICIPATION 3.1. Scope of the Agreement (a) Upon the terms and subject to the conditions set forth in this Agreement, on the Completion Date, the Seller shall sell and transfer to the Purchaser – and the Purchaser shall purchase and acquire from the Seller – the Participation, free and clear from any Encumbrances. (b) The Participation shall be transferred to the Purchaser with all rights and entitlements thereto as from the Completion Date, upon execution by the Parties of the Notarial Deed, which shall include only the mandatory representations required for the validity of the Notarial Deed and shall not supersede nor novate (in whole or in part) any term, provision, covenant, undertaking and obligation under this Agreement. 4. PURCHASE PRICE 4.1. Purchase Price (a) The aggregate purchase price for the Participation (the “Purchase Price”) payable to the Seller shall be equal to: (i) Euro 67,700,000.00 (sixty seven million seven hundred thousand/00), as base purchase price for the transfer of the Participation (the “Base Purchase Price”); minus (ii) the Redundancy Payment minus (iii) the Completion Leakage Amount (if and to the extent due) indicated by the Seller to the Purchaser pursuant to Article 4.4(b) below and any Outstanding Leakages; plus or minus (iv) the Actual Locked Box Net Debt; minus

21 (i) the difference between the Actual Adjusted EBITDA and the Target EBITDA as determined pursuant to Article 4.3(c)(2) (if any); plus or minus (ii) the amount of any Completion Outstanding Balance (as determined pursuant to Article 4.2(c)(i), if any) – to be, as applicable, set-off against the Base Price (in the circumstance under Article 4.2(c)(i)A or paid by the Company to the Seller (in the circumstance under 4.2(c)(i)B) (plus or minus the amount of any Post-Completion Outstanding Balance (as determined pursuant to Article 4.3(c), if any); plus (iii) the Earn-Outs amounts set out under Article 4.6, if and to the extent due in accordance with such Article; plus or minus (iv) the Actual Net Cash Flow Adjustment. (b) In consideration for the Participation, at Completion, the Purchaser shall pay: (i) to the Seller (without prejudice to Articles 4.2(c)(i)A, 4.2(c)(i)B and 4.2(c)(ii) below), i. the Base Purchase Price, minus ii. the Redundancy Payment; minus iii. the Completion Leakage Amount (if and to the extent due) indicated by the Seller to the Purchaser pursuant to Article 4.4(b) below, minus iv. the Estimated Locked Box Date Net Debt; plus or minus v. the Estimated Net Cash Flow Adjustment; minus vi. the Escrow Amount; (the aggregate amount determined pursuant to this Article 4.1(b) the “Completion Purchase Price”); and (ii) to the Escrow Agent, the Escrow Amount. (c) The Completion Purchase Price shall be paid at Completion in immediately available funds via wire transfer on the Seller’s Bank Account. 4.2. Estimated Completion Statement (a) Not later than 3 (three) Business Days and not earlier than 10 (ten) Business Days prior to the Completion Date, the Seller shall prepare in good faith and deliver to the Purchaser a statement (prepared in accordance with the Accounting Principles (and US GAAP) setting forth in reasonable detail the Seller’s calculation of: (i) the Intra-Group Payables and Intra-Group Receivables as of the Completion Date; (ii) the Estimated Locked Box Net Debt; (iii) the Estimated Net Cash Flow Adjustment;

22 (iv) the Completion Purchase Price, (which shall also reflect and capture, inter alia, the Completion Leakage Amount set forth in the Preliminary Statement pursuant to Article 4.4 below) (the “Estimated Completion Statement”). (b) Without prejudice to Article 4.4, the Completion Purchase Price shall be subject to a post- Completion verification procedure in accordance with the provisions set out in Article 4.3 below, it being understood that on the Completion Date the Purchaser shall pay to the Seller an overall cash amount equal to the Completion Purchase Price, as determined by the Seller in the Estimated Completion Statement. (c) In particular, for the purposes of the calculation of the Base Purchase Price: (i) the amount of the Intra-Group Payables owed by the Company (as set forth in the Estimated Completion Statement) shall be set-off (in accordance with Article 1243 and Articles 1252 et seq. of the Italian Civil Code) against the amount of the Intra-Group Receivables owed by the Seller (and/or its Affiliates) (as set forth in the Estimated Completion Statement), and vice versa, to the maximum extent permitted by applicable Law. Any remaining balance following such set-off (the “Completion Outstanding Balance”) shall be settled as set forth below: A. if, after the set-off, the difference between the amount of the Intra-Group Payables and of the Intra-Group Receivables (as determined in the Estimated Completion Statement), results in a net amount payable to the Company, such Completion Outstanding Balance shall be set-off against the Base Purchase Price (it being understood that, upon the set-off of such amount (x) the Seller shall be irrevocably and unconditionally released and discharged from any and all liabilities or obligations towards the Company in respect of such amounts, (y) the Purchaser and the Company shall have no further claims, rights, actions or entitlements against the Seller in respect thereto and (z) the Purchaser shall assume and take over the corresponding payment obligation towards the Company); or B. if, after the set-off, the difference between the amount of the Intra-Group Payables and of the Intra-Group Receivables (as determined in the Estimated Completion Statement), results in a net amount payable by the Company, the Seller shall cause the Company to pay such Completion Outstanding Balance in immediately available funds, at Completion, via wire transfer on the Seller’s Bank Account (it being understood that, upon payment of such amount (i) the Company shall be irrevocably and unconditionally released and discharged from any and all liabilities or obligations towards the Seller in respect of such amounts, and (ii) the Seller shall have no further claims, rights, actions or entitlements against the Company in respect thereto); (ii) the Parties acknowledge and agree that: i. (x) the Going Concern Consideration shall not be paid by Westport Fuel Systems Canada to the Company, thereby creating a corresponding debt of Westport Fuel Systems Canada vis-à-vis the Company in the amount of the Going Concern Consideration, (y) such debt shall be taken over from Westport Fuel Systems Canada by the Purchaser pursuant to a debt assumption agreement under Article 1273 of the Italian Civil Code, to be entered into among the Company, Westport Fuel Systems Canada and the Purchaser on Completion Date (the “Debt Assumption Agreement”) and (z) such debt assumption has been taken into consideration by the Parties for the purposes of determining the Purchase Price

23 and reflected as a pricing item in Article 4.1, and such debt shall not be deemed as an Intra Group Receivable or as a Leakage; ii. (x) the consideration due by the Company to Westport Fuel Systems Canada for the services to be rendered by the latter in connection with the AFS Business (the “AFS Consideration”) shall not be paid by the Company to Westport Fuel Systems Canada, thereby creating a corresponding receivable of Westport Fuel Systems Canada vis-à-vis the Company in the amount of the AFS Consideration, (y) such (future) receivable shall be transferred by Westport Fuel Systems Canada to the Purchaser pursuant to a credit transfer agreement under Article 1260 et. seq. of the Italian Civil Code, to be entered into among the Company, Westport Fuel Systems Canada and the Purchaser on Completion Date (the “Credit Transfer Agreement”) and (z) such credit transfer has been taken into consideration by the Parties for the purposes of determining the Purchase Price and reflected as a pricing item in Article 4.1, and such receivable shall not be deemed as an Intra Group Payable; (iii) the Parties further acknowledge and agree that (i) after Completion Date, the Purchaser shall use its best efforts to cause the Company to collect all trade receivables and discharge all trade payables related to the Cespira Business (as of the Completion Date), ensuring payment to the respective creditors and collection from the respective debtors; and (ii) on a monthly basis, following the payment of the relevant outstanding payables and the collection of the relevant receivables due as of each end-month date (i.e. 30/31 as the case may be), the Purchaser shall procure that the balance of any amount resulting after the set-off of any collected receivables and paid payables, if any, is paid by the Purchaser and/or the Company (at discretion of the Purchaser) to Westport Fuel Systems Canada within 10 (ten) Business Days. 4.3. Post-Completion Adjustments (a) Post-Completion Statement (i) Within 60 (sixty) Business Days after Completion Date, the Purchaser shall prepare in good faith and deliver to the Seller a statement prepared in accordance with Schedule 4.3 (the “Post-Completion Statement”) setting forth in reasonable detail the draft re- calculation/calculation of: A. the Intra-Group Payables and Intra-Group Receivables as of Completion Date; B. the Adjusted EBITDA of the Group Companies for the period comprised between October 1, 2024 and May 31, 2025 (the “EBITDA Reference Period”); C. the Net Debt of the Group Companies as of the Locked Box Date; D. the Net Cash Flow Adjustment; and E. the Completion Purchase Price, accordingly (ii) (the Intra-Group Payables, the Intra-Group Receivables, the Adjusted EBITDA, the Net Debt of the Group Companies and the Net Cash Flow Adjustment so re- calculated/calculated, respectively, the “Purchaser Re-Calculated Intra-Group Payables”, the “Purchaser Re-Calculated Intra-Group Receivables”, the “Purchaser Calculated Adjusted EBITDA”, the “Purchaser Re-Calculated Locked Box Net Debt” and the “Purchaser Re-Calculated Net Cash Flow Adjustment”). Following Completion Date, the Seller shall be permitted to access and review the Books and Records of the Group Companies that are reasonably related to the calculations of each items under the Post- Completion Statement, and the Purchaser shall cause the Group Companies to

24 reasonably cooperate with the Seller in connection with such review, including by providing access to such Books and Records, in each case, upon reasonable notice and during normal business hours. (iii) The Parties agree that the Redundancy Payment shall not be deemed as a Leakage, Debt or Loss and the Purchaser hereby waives any claim, action and request pursuant to this Agreement or applicable Law against the Seller in relation to any Loss arising out of, or in connection with, the termination and/or the management of the employment agreement with the Redundant Employees. (b) Reconciliation of the Post-Completion Statement. (i) If the Seller disagrees with the draft Post-Completion Statement, it shall notify so to the Purchaser in writing, no later than 20 (twenty) Business Days after the Seller’s receipt of the draft Post-Completion Statement, by serving a notice (the “Notice of Objection”) which shall reasonably describe the items objected and the basis for any such disagreements. (ii) If no Notice of Objection is delivered to the Purchaser within such 20 (twenty) Business Days period, then the amount of the Purchaser Re-Calculated Intra-Group Payables, the Purchaser Re-Calculated Intra-Group Receivables, the Purchaser Calculated Adjusted EBITDA, the Purchaser Re-Calculated Locked Box Net Debt and the Purchaser Re- Calculated Net Cash Flow Adjustment (and so the re-calculation of the Completion Purchase Price under the draft Post-Completion Statement) shall become final and binding among the Parties. (iii) In the event that the Seller delivers a Notice of Objection, the following provisions shall apply: A. during the 20 (twenty) Business Days immediately following the delivery of a Notice of Objection (the “Conciliation Period”), the Seller and Purchaser shall seek in good faith to resolve any differences that they may have with respect to the items identified in the Notice of Objection, with the aim of executing a written settlement agreement; B. if, at the end of the Conciliation Period, the Seller and Purchaser have been unable to resolve any differences that they may have with respect to any of the items identified in the Notice of Objection (and, therefore, to execute the aforesaid written settlement agreement), the Seller and the Purchaser shall submit all such remaining disputed items to the Independent Expert, to be jointly appointed by the Seller and Purchaser, in accordance with the procedure under Article 4.4(d) below, as initiated by the most diligent Party. (iv) The amount of the Purchaser Re-Calculated Intra-Group Payables, the Purchaser Re- Calculated Intra-Group Receivables, the Purchaser Calculated Adjusted EBITDA, the Purchaser Re-Calculated Locked Box Net Debt and the Purchaser Re-Calculated Net Cash Flow Adjustment, as finally determined in agreement between the Parties pursuant to Article 4.3(b)(ii), or according to Article 4.3(b)(iii)A or through the action of the Independent Expert pursuant to Article 4.3(b)(iii)B, shall be deemed to be final and binding among the Parties (respectively, the “Actual Intra-Group Payables” the “Actual Intra-Group Receivables”, the “Actual Adjusted EBITDA”, the “Actual Locked Box Net Debt” and the “Actual Net Cash Flow Adjustment”). (c) Post-Completion Adjustments [Redacted – Commercially Sensitive Information].