Document

Effective Date March 31, 2025

Table of Contents

WESTPORT FUEL SYSTEMS INC. 2024 ANNUAL INFORMATION FORM

Reference and Forward-Looking Information

In this Annual Information Form (“AIF”) references to "Westport Fuel Systems,” "Westport,” "the Company,” "we,” "us" and "our" refer to Westport Fuel Systems Inc. and its subsidiaries, collectively, unless the context otherwise requires. All dollar amounts outlined in this AIF are in U.S. dollars unless specifically stated otherwise. Except where otherwise indicated, all information presented is as of December 31, 2024.

Some of the historical data, statistics, and certain other industry information contained in this AIF are derived by the Company from industry consultants or from recognized industry reports regularly published by independent consulting and data compilation organizations. Industry consultants and publications generally state the information provided was obtained from reliable sources. We have not independently verified any of the data from third party sources nor have we ascertained the underlying economic assumptions relied upon in these reports.

Certain statements contained in this AIF and in certain documents incorporated by reference in this AIF, constitute "forward-looking statements". When used in this document, the words "may,” "would,” "could,” "will,” "intend,” "plan,” "anticipate,” "believe,” "estimate,” "expect,” "project" and similar expressions, as they relate to us or our management, are intended to identify forward-looking statements. Such statements are subject to certain risks and uncertainties and are based on several assumptions, all of which are outlined in Schedule "A": Forward Looking Information. While the Company has a reasonable basis for such forward-looking statements, readers are cautioned that actual results may vary materially from the forward-looking statements in this AIF.

Corporate Structure

Our governing corporate statute is the Business Corporations Act (Alberta). Our head office and principal place of business is at 1691 West 75th Avenue, Vancouver, British Columbia V6P 6P2. Our registered office is 4500, 855 2nd Street SW, Calgary, Alberta T2P 4K7. In 2016, we amended our articles to change our name from Westport Innovations Inc. to Westport Fuel Systems Inc. following a merger with Fuel Systems Solutions Inc. on June 1, 2016.

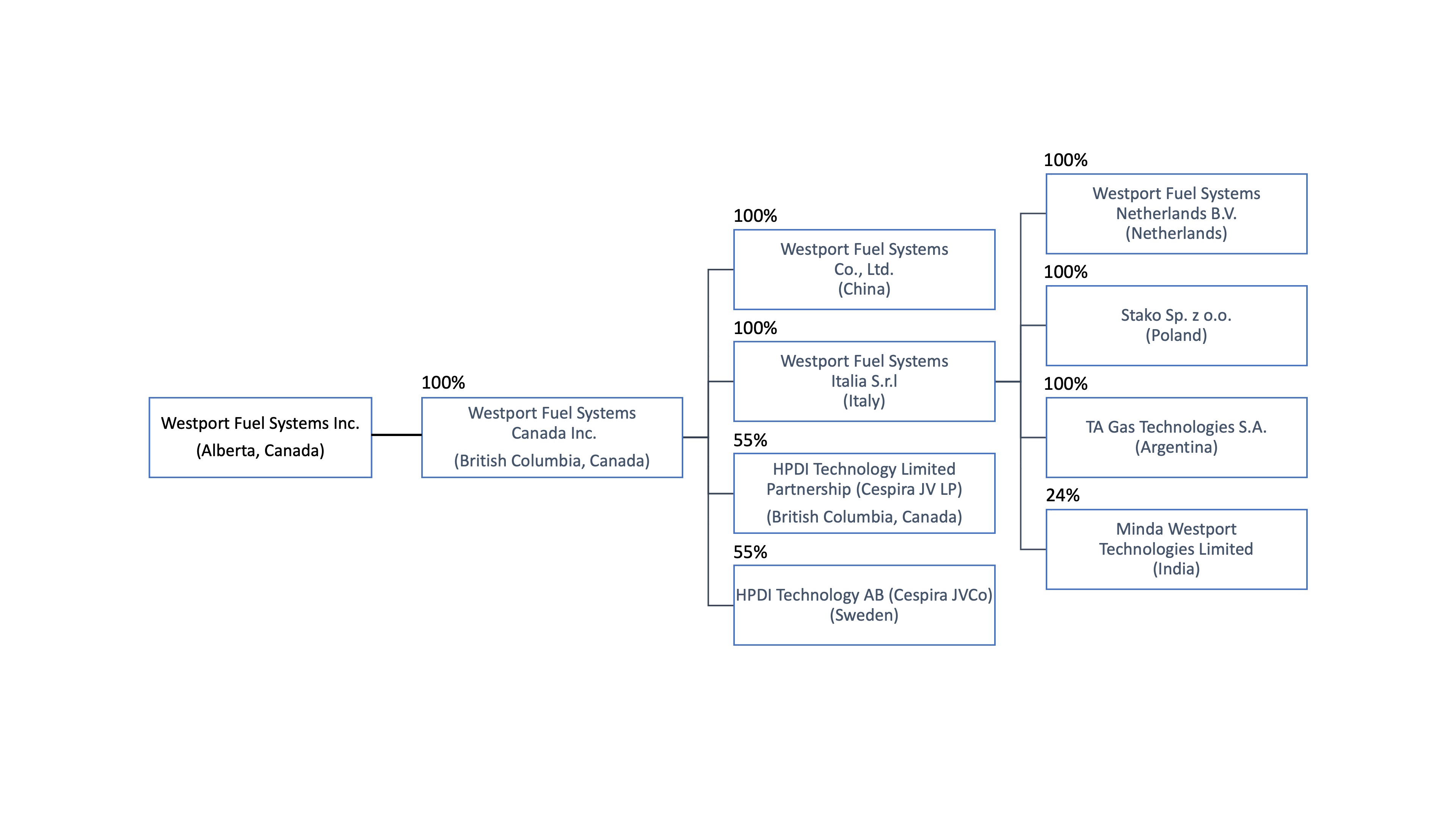

The following chart includes our principal operating subsidiaries as of March 28, 2025, and, for each subsidiary, its place of organization and our percentage of voting interests beneficially owned or over which we exercise control or direction. The structure is not necessarily indicative of our operational structure.

WESTPORT FUEL SYSTEMS INC. 2024 ANNUAL INFORMATION FORM

About Westport Fuel Systems

Business Overview

Headquartered in Vancouver, British Columbia, Canada, with operations in Europe, Asia, North America, and South America, Westport serves customers in approximately 70 countries with leading global transportation brands through a network of distributors, service providers for the aftermarket and direct to Original Equipment Manufacturers (“OEMs”) and Tier 1 and Tier 2 OEM suppliers.

With a focus on engineering, manufacturing, and supplying alternative fuel systems and components for transportation applications, Westport’s diverse product offerings, sold under a wide range of established global brands, enable the use of a number of alternative fuels in the transportation sector that provide environmental and/or economic advantages as compared to diesel, gasoline, or battery powered electric vehicles.

Westport designs, manufactures, develops, validates, certifies, and sells alternative fuel (including alternative fuels such as hydrogen (“H2”), liquefied natural gas (“LNG”), biogas, biomethane, and renewable natural gas (collectively “RNG”), compressed natural gas (“CNG”), and liquefied petroleum gas (“LPG”) components and systems for passenger cars and light-, medium- and heavy-duty commercial vehicles and off-highway applications.

Our portfolio of products includes pressure regulators, injectors, electronic control units, valves and filters, complete bi-fuel, mono-fuel and dual-fuel LPG and natural gas conversion kits and high-pressure hydrogen components. Cespira, our 55% owned joint venture (“JV”) with the Volvo Group ("Volvo"), launched in 2024, is advancing the development and commercialization of the HPDITM fuel system, a fully OEM-integrated solution that enables heavy-duty trucks to operate on natural gas, RNG, hydrogen and other alternative fuels.

WESTPORT FUEL SYSTEMS INC. 2024 ANNUAL INFORMATION FORM

Business Segments

Our diverse portfolio of technologies, products, and services are sold under a wide range of established brands. They provide the foundation for sustainable growth in existing markets and guide our expansion into new and emerging markets worldwide. Our business is operated under the following four segments:

Cespira

In June 2024, Westport and Volvo entered into a series of joint venture agreements (collectively, the "JV Agreement"), establishing Cespira to promote, develop, and commercialize the HPDI fuel system technology (see Material Contracts – Joint Venture Governance Agreements). The JV will prioritize scaling the HPDI fuel system and supporting the global transition to carbon-neutral fuel systems, particularly in heavy-duty, long-haul trucking, where multiple technologies are required to achieve substantial decarbonization. Under the terms of the agreement, Westport owns a 55% equity interest in Cespira, while Volvo owns 45%. Cespira's business operations involve supplying systems, engineering services and components, including LNG HPDI fuel system products, to engine manufacturers and commercial vehicle OEMs. The fully integrated LNG HPDI fuel systems enable diesel engines to operate predominantly on alternative fuels while delivering equivalent power, torque, and fuel efficiency as conventional compression ignition engines. The system can be a cost-effective way to reduce greenhouse gas emissions using renewable fuels such as RNG. Furthermore, the JV is engaged in adapting HPDI fuel systems for hydrogen and other alternative fuel applications in internal combustion engines.

Light-Duty

The Light-Duty segment specializes in LPG and CNG solutions, catering to OEM, delayed OEM (“DOEM”), and independent aftermarket (“IAM”) markets. Customers can choose from Westport IAM conversions, DOEM solutions, or OEM-manufactured monofuel and bi-fuel vehicles. The segment offers industry-leading direct injection engine technology that complies with EURO 7 and EPA 24 standards, along with lightweight, high-quality fuel storage solutions.

The Light-Duty business serves three distinct markets:

1. OEM: Systems are integrated into production lines by vehicle manufacturers.

2. DOEM: Conversions are performed at 0 km in specialized centers operated by Westport or its partners.

3. IAM: Aftermarket products, including conversion kits, support post-sale conversions through an extensive dealer and installer network operating in approximately 70 countries worldwide.

Westport works to distinguish itself as a global company that integrates and manufactures mechanical components, electronics, and fuel storage systems, providing a seamless and efficient solution for our customers.

High-Pressure Controls and Systems

Our High-Pressure Controls and Systems segment is at the forefront of the clean energy revolution, designing, developing, and producing high-demand components for transportation and industrial applications. We partner with the world's leading fuel cell, hydrogen engine and alternative fuel engine manufacturers and companies committed to decarbonizing transport, offering versatile solutions that serve a variety of fuel types. While we believe hydrogen is key to the future decarbonization of transport, our components and solutions are already powering emission-reducing innovation today across a range of alternative fuels. While we are a small enterprise, our strategic position and innovative capabilities position us for significant growth, as the go-to choice for those shaping the future of clean energy, today and tomorrow.

WESTPORT FUEL SYSTEMS INC. 2024 ANNUAL INFORMATION FORM

Heavy-Duty OEM

Our Heavy-Duty OEM business represents historical results from our heavy-duty business for the period January 1, 2024, until the formation of the Cespira joint venture which occurred on June 3, 2024. Going forward, the Heavy-Duty OEM segment will reflect revenue earned from a transitional services agreement in place with Cespira, intended to support the JV in the short-term as the organization establishes its operations.

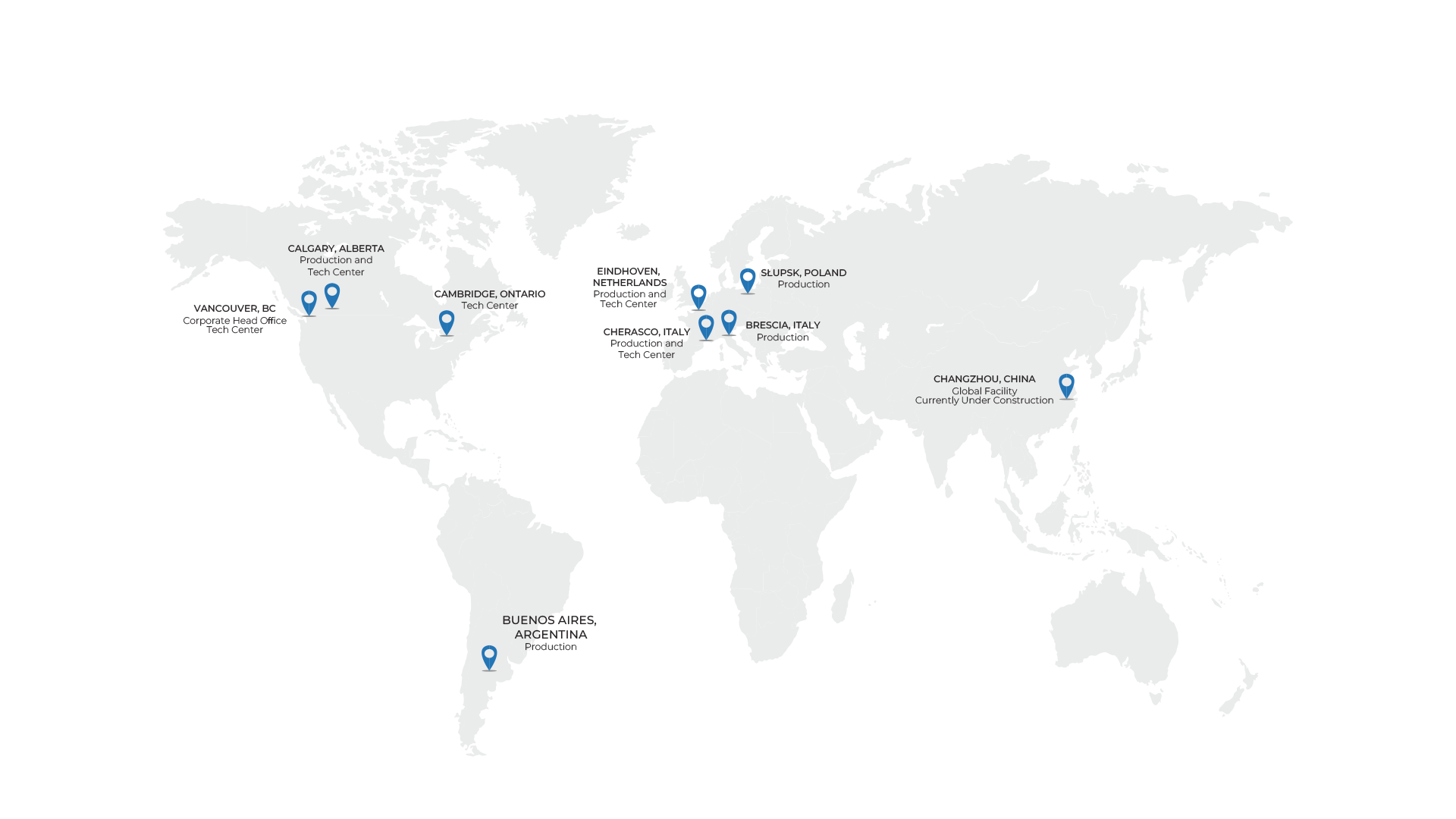

Production and Operations

The majority of our manufacturing operations are localized to respond quickly and efficiently to customer and market demands and to assure a high level of service and support.

Europe

Manufacturing activities are carried out in several plants located in Italy (Cherasco, Brescia), Netherlands (Eindhoven) and Poland (Slupsk). Our facilities contain automated assembly lines, sophisticated lathes, milling and cutting equipment, robots to perform machining, assembly of critical electronic components, automated test lines, and robotic welding machinery. Our Italian plants are certified to ISO 9001, IATF 16949 and ISO 14001 standards. In the Netherlands, products are assembled and packaged in NEN-EN-ISO-9001:2015 certified facilities. In Poland, the plant is IATF 16949 certified.

Our Brescia plant supplies components for major OEM customers in the passenger car and medium duty segment. At our plant in Cherasco, LPG components and systems are assembled for the aftermarket, DOEM and OEM customers, LPG alternative fuel systems are installed on cars owned by customer automakers, and electronic boards are produced for the automotive market. At our plant in Slupsk, tanks for the OEM and aftermarket segments are produced and distributed through an extensive global dealer network.

Asia

Please see the Long- Term Investments--Minda Westport Technologies section.

South America

In Buenos Aires, CNG reducers, valves and injectors are manufactured by TA Gas Technology and distributed in Argentina, Brazil, Perú, Colombia, Bolivia and Mexico.

Our Brands

WESTPORT FUEL SYSTEMS INC. 2024 ANNUAL INFORMATION FORM

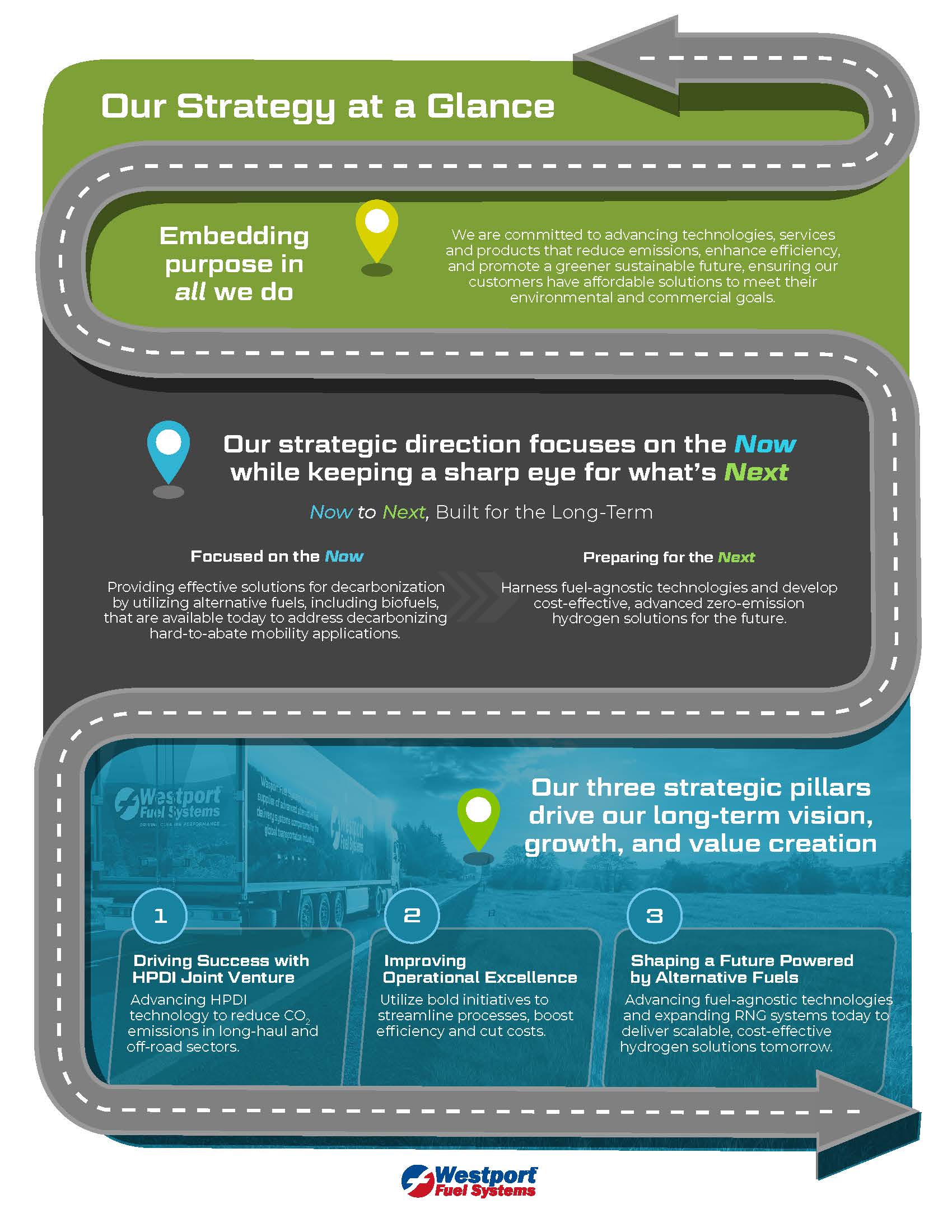

Business Strategy: Now to Next, Built for the Long-Term

Anchored in Westport’s purpose and commitment to advance technology services and products that reduce emissions, enhance efficiency, and promote a sustainable future, the Company’s strategic plan represents a transformative journey focused on today’s tangible opportunities while preparing the business for future growth. Below is an overview of the plan highlights, objectives, and the three pillars that will guide the business forward.

WESTPORT FUEL SYSTEMS INC. 2024 ANNUAL INFORMATION FORM

WESTPORT FUEL SYSTEMS INC. 2024 ANNUAL INFORMATION FORM

The strategic pillars are the core focus areas. They represent Westport’s, high-level, long-term priorities and serve as the foundation of the strategy, guiding and supporting our decision-making and resource allocation over time. The strategic actions which are outlined below are specific, measurable actions that are designed to contribute to and positively impact the long-term vision.

Strategic Actions:

1. Increase financial flexibility and establish the foundation required to enable Westport to achieve its strategic pillars through enhanced financial performance.

a. Commitment to building transportation solutions that improve the environment and add prosperity to communities. Some of these priorities include: 1) realign cost structure including mitigating inflationary pressures; 2) focus on site-specific margin improvements; and 3) optimize current production portfolio.

2. Streamline operations to enhance agility, while building a world-class manufacturing system that boosts global competitiveness.

a. Unlock new and emerging markets through the delivery of cleaner, affordable transportation solutions.

b. Satisfy the demand for clean, affordable, low emissions transportation with our diverse portfolio of technology solutions for low-carbon gaseous fuels in Europe, North America, South America, Asia, and India.

c. Drive operational excellence and reputation as a Tier 1 supplier with superior quality and reliability.

3. Seek and prioritize investments that align with our strategy to drive growth.

a. Invest in opportunities that address global trends impacting the evolution and diversification of sustainable transportation fuel alternatives.

b. Complement our growth and scale efficiencies through strategic mergers and acquisitions and corporate development activities.

Our Business History - Three Year Look back

Over the past three years, we have focused on expanding the business and making strategic long-term investments to ready the operations for future opportunities. The significant developments in our business over the past three years are set out below.

WESTPORT FUEL SYSTEMS INC. 2024 ANNUAL INFORMATION FORM

2025

Westport Announces Proposed Sale of Westport Fuel Systems Italia S.r.l.

On March 31, Westport announced a proposal to divest Westport Fuel Systems Italia S.r.l., which includes the Light-Duty segment, including the light-duty OEM, delayed OEM, and independent aftermarket businesses, to a wholly-owned investment vehicle of Heliaca Investments Coöperatief U.A., a Netherlands based investment firm supported by Ramphastos Investment Management B.V. a prominent Dutch venture capital and private equity firm.

Cespira Appoints Carlos Gonzalez as President and CEO

On January 22, Cespira announced that it had appointed Carlos Gonzalez as President and CEO, effective April 1, 2025. Carlos succeeds Dan Sceli, CEO of Westport, who held the position on an interim basis since the closing of the JV transaction in June 2024 and will continue to sit on Cespira’s board.

Westport Announces Director Retirement

On January 13, Westport announced that Brenda Eprile retired from Westport’s Board of Directors effective January 6, 2025.

2024

Westport and Volvo Sign and Close a Joint Venture called Cespira

On July 5, we officially launched the Cespira JV between Westport and Volvo, a joint venture focused on promoting, developing, and further accelerating the commercialization of the HPDI technology. Leading up to the announcement, on June 3, it was announced that Westport and Volvo had closed the JV transaction; and on March 11, Westport announced the signing of a definitive agreement with Volvo to establish the JV to accelerate the commercialization and global adoption of Westport's HPDI fuel system technology for long-haul and off-road applications.

Westport Announces At-the-Market Equity Offering Program (the “ATM Program”)

On September 13, we announced an ATM Program that allows the Company to issue and sell up to $35,000,000 (or its Canadian dollar equivalent) of common shares of the Company (the “Common Shares”) from treasury to the public, from time to time, at the Company’s discretion.

Westport Fuel Systems Publishes 2023 ESG Report

On June 25, we published our 2023 ESG Report, which outlined the Company's accomplishments within its primary areas of focus that include reduced emissions and energy consumption, operational health and safety, diversity, equity and inclusion, responsible sourcing, human rights, and ESG governance.

Westport Responds to Strengthened European Decarbonization Targets for Heavy-Duty Vehicles

On April 11, we welcomed the agreement between European legislators regarding the lowering of CO2 emissions in the European Union's (EU) heavy-duty road transport sector. The new standards reflect ambitious decarbonization targets that Westport believes can be achieved by utilizing a blend of new and current vehicle and fuel system technologies such as those in Westport's portfolio while also clearing a path to encourage future investment in the best and most affordable solutions to decarbonize heavy-duty transport.

Westport Announces Methanol HPDI Project with a Leading Global Supplier of Power Solutions for Marine Applications

On February 26, we announced a proof-of-concept project with a global OEM that supplies power solutions for marine applications to test the HPDI fuel system utilizing methanol for marine applications (the "Marine Project").

WESTPORT FUEL SYSTEMS INC. 2024 ANNUAL INFORMATION FORM

Leadership Transition at Westport

On January 16, 2024, we announced Daniel Sceli as the Company's new Chief Executive Officer and a member of Westport’s Board of Directors (the "Board").

2023

Westport Awarded U.S. $33 Million Development Program by Global Heavy Truck Manufacturer

On December 19, we announced that we had been awarded a development program by a global heavy truck manufacturer to adapt the Next Generation LNG HPDI fuel system to meet the Euro 7 emissions requirements for heavy-duty vehicle applications. The value of the development program is estimated to be $33 million and will be funded by the OEM.

Westport Announces Successful Demonstrations

On December 12, we announced the successful completion of a heavy transport demonstration with KAJ Inrikes and others, utilizing a H2 HPDI fuel system-equipped prototype truck hauling a trailer filled with IKEA home-furnishing products in Älmhult, Sweden. On October 10, we announced the successful completion of a heavy transport demonstration with our H2 HPDI fuel system equipped prototype truck hauling a refrigerated trailer in Madrid, Spain. The demo marked the first of its kind in Spain, representing an important step forward in the decarbonization of heavy transport for the country. On May 2, we announced that we would be displaying our HPDI fuel system on commercial vehicles during the Advanced Clean Transportation (ACT) Expo 2023 in Anaheim, California.

Westport Announces New Agreements and Collaborations

On November 6, we announced an agreement with a leading global provider of locomotives and related equipment for the freight and transit rail industries, to adapt our hydrogen HPDI fuel system for use with the locomotive OEM engine design. On July 19, we announced that we entered a non-binding letter of intent with Volvo to establish the Cespira JV to accelerate the commercialization and global adoption of Westport's HPDI fuel system technology for long-haul and off-road applications. On March 6, we announced a collaboration with a global OEM to evaluate the performance, efficiency and emissions of the OEM’s engine equipped with the H2 HPDI fuel system. This collaboration marked Westport’s third major OEM engagement evaluating its H2 HPDI fuel system. On February 27, we announced plans to invest up to $10 million in a global manufacturing facility in Changzhou Hydrogen Valley, China.

2022 ESG Report is Published

On June 29, we released our 2022 ESG report.

Westport Announces Leadership Transitions

On August 22, we announced that David Johnson, Chief Executive Officer, stepped down as Chief Executive Officer and resigned from the Board. Tony Guglielmin, who served on the Westport Board and as Chair of the Audit Committee, was appointed interim CEO. On May 1, we announced the appointment of our new Executive Vice President of Product Development and Chief Technology Officer, Fabien G. Redon.

Westport Provides Updates on Compliance Regulatory Requirements

On June 21, we announced that we received a compliance letter from the Nasdaq Stock Market LLC ("Nasdaq"), notifying Westport that it had regained compliance with the minimum bid price requirements under Nasdaq listing rules.

On May 18, we filed a short form base shelf prospectus with Canadian securities regulatory authorities pursuant to which the Company may, from time to time, offer and issue up to an aggregate amount of $200 million of common shares, preferred shares, debt securities, warrants, subscription receipts, units, or any combination thereof, during the 25-month period that the base shelf prospectus is effective.

WESTPORT FUEL SYSTEMS INC. 2024 ANNUAL INFORMATION FORM

On April 26, we announced our intention to consolidate the Common Shares of Westport on a 10-1 basis to restore compliance with the minimum bid price requirements under Nasdaq listing rules. The consolidation became effective on June 6, 2023.

2022

Westport Provides Updates on Awards and Advances Regarding Hydrogen and Alternative Fuel Technologies

On December 13, we announced a collaboration with Johnson Matthey, a global leader in sustainable technologies, to develop an emissions after treatment system tailored to Westport’s proprietary H2 HPDI fuel system, with the goal of reducing or eliminating emissions. On October 26, the Company and Scania AB ("Scania"), a world-leading provider of transport solutions, announced impressive engine test results of Westport’s H2 HPDI fuel system for heavy-duty vehicle applications. On September 28, we unveiled in Brussels to an audience of policy makers and industry representatives, our new H2 HPDI fuel system for heavy-duty vehicles that is expected to reduce CO2 emissions in alignment with EU decarbonization goals. On May 3, we announced our H2 HPDI fuel system in a demonstrator truck enabled heavy-duty trucks to operate on biomethane (renewable natural gas) and natural gas with the same power, torque, efficiency, and performance as diesel engines, and with better results running on hydrogen, all while meeting global emissions regulations.

On February 7, we announced that Cummins Inc. ("Cummins") and Westport had. agreed to a share purchase agreement for the sale of Westport's stake in the Cummins Westport Inc. ("CWI") joint venture, for proceeds of approximately $22 million. Westport also sold certain of its rights in the intellectual property of CWI for additional proceeds of $20 million. Cummins and Westport also agreed to conduct an initial technical assessment of Westport's HPDI fuel system for potential use on Cummins' hydrogen applications, an application designed to directly inject a fuel into the combustion chamber of an internal combustion engine ("ICE").

On January 27, we announced that we had joined the internationally recognized Hydrogen Council (www.hydrogencouncil.com) as a supporting member. The Hydrogen Council is a global CEO-level advisory body providing a long-term vision for the vital role of hydrogen technologies in an energy transition for cleaner transportation solutions.

Westport Shares Business Growth and New Contract Announcements

On December 7, we announced that we were awarded a program to develop and supply LPG systems to a global OEM to accommodate some of its Euro 7 vehicle platforms, which is forecasted to generate €40 million in annual revenue with production expected to begin in Q1 2025. On July 11, we announced that we were awarded a program to develop and supply LPG systems for several vehicle applications for a global OEM, which was forecasted to provide €38 million in revenue through the end of 2025, with production expected to begin in Q4 2023. Under the program, we will provide fuel systems solutions for the Euro 6 applications to this OEM, supplying the entire LPG system from the fuel tank to the fuel injectors. In parallel, we announced that we were developing fuel systems to respond to future regulations including the proposed Euro 7 standards.

On November 29, we announced we would provide a strategic update and deep dive into the H2 HPDI fuel system at our 2022 Capital Markets Day on December 8, 2022, in Toronto, Canada.

2021 ESG Report is Released

On August 29, we released our 2021 ESG report outlining the Company's accomplishments within the core ESG areas of carbon footprint, operational health and safety, diversity, equity and inclusion, responsible sourcing, human rights, and ESG governance.

WESTPORT FUEL SYSTEMS INC. 2024 ANNUAL INFORMATION FORM

Westport Provides Updates on Compliance Regulatory Requirements

On November 7, the Company announced that on November 3, 2022, it received written notice (“Notification”) from the Nasdaq notifying it that it was not in compliance with the minimum bid price requirement set forth under Nasdaq Listing Rule 5550(a)(2) (“Nasdaq Listing Rule”). In accordance with applicable Nasdaq procedures, the Company had 180 calendar days, or until May 2, 2023, to regain compliance with the Nasdaq Listing Rule.

Westport Announces Leadership Transitions

On September 30, we announced the resignation of Chief Financial Officer (“CFO”) Richard Orazietti and the appointment of William Larkin as successor CFO. On January 25, we announced the appointment of Philip B. Hodge to the Westport Board.

Human Resources and Related Policies

We employ a highly educated and experienced team of professionals focused on the development and commercialization of a portfolio of products and technologies. We actively recruit skilled individuals with diverse backgrounds and provide them with specific training relating to our product and technology portfolios and retain consultants and contract workers with specific expertise when appropriate. Employees must certify to having read, understood, and agree to abide by our Code of Conduct. Online training is also conducted to ensure, our global and diverse workforce is empowered to do the right thing, for the right reason, and in the right way.

As of December 31, 2024, our global workforce was approximately 1,509 individuals, a slight decrease from the previous year as some employees transitioned to join Cespira following the closing of the JV in June 2024. The total count of individuals includes direct employees, and individuals contracted directly for twelve months or longer. Our workforce includes, but is not limited to, a mix of engineers, manufacturing technicians, and commercial professionals who have experience with alternative fuel systems, combustion technologies, controls and engine management, and fuel storage and delivery systems, including cryogenics and high-pressure storage and delivery systems. Our direct employees are represented by labour unions in Italy and Argentina.

We are committed to a workplace free of discrimination and harassment. Our expectations for individual integrity and ethical, moral, and legal conduct are outlined in the Code of Conduct which applies to everyone within the organization, including directors, officers, employees, contractors, agents, and consultants who act on behalf of Westport in any business dealings. An anonymous ethics hotline is made available as an avenue for employees to raise concerns about corporate conduct. Our whistleblower policy includes the reassurance that individuals will be protected from reprisals or victimization for "whistle blowing" in good faith.

Environmental and Social Policies

At Westport, we encourage every member of our organization to make a daily commitment toward creating transportation solutions that enhance the well-being of people and the environment while contributing to the sustainability of our communities. To help fulfill our commitments, Westport aims to accelerate the impact of the energy transition by bringing innovative products to market while attracting, engaging, and retaining top-tier talent by fostering a creative and inclusive culture. Westport's commitment to health and safety remains paramount, and we leverage robust governance practices to facilitate prudent decision-making in the face of risks, ultimately maximizing value creation.

Throughout 2024, we successfully implemented our Corporate Environmental Policy, which underscores our awareness of the necessity for ongoing initiatives and projects dedicated to minimizing the environmental footprint of our organizational activities. The policy is one way Westport is committed to helping shape the practices of our suppliers, customers, and other stakeholders, aligning with our dedication to sustainability and responsible corporate citizenship. We continued our collaboration with Ecovadis Sustainability Rating that was first initiated in 2023, with a view to enhancing the engagement of Westport's suppliers while fostering a deeper comprehension of how, collaboratively, we can contribute to environmental betterment.

WESTPORT FUEL SYSTEMS INC. 2024 ANNUAL INFORMATION FORM

Westport's Human Rights Policy and Diversity Policy guides our daily operations. Some notable achievements for 2024 include the following:

• The Italian facility confirmed its UNI PdR 125:2022 certification which is awarded to companies showcasing a dedication to implementing policies and practices that promote gender equality in the workplace.

• Italy also maintained its ISO 14001:2015 certification after a maintenance assessment in 2024.

• In furtherance of the assessment our Italian facilities underwent with the external certification body RINA in 2023, we had a further assessment in June of 2024 resulting in an increase in score.

• In Poland, we successfully implemented the ISO 14001 certification in 2024, which has resulted in improvements to our waste management practices. Moreover, it has provided a solid foundation for analyzing and identifying potential circular economy initiatives.

• A newly installed solar panel system at our facilities in Poland resulted in the generation of 450 MWh yielding more than 1000 GJ of green energy.

• Westport’s climate-related disclosures are available in the Carbon Disclosure Project (CDP) and ESG Reports, all available on our website https://wfsinc.com/ in the "Sustainability at Westport" section.

Operational Procurement

We organize operational planning into different models to adapt to our diverse customer base and expectations. We operate to optimize our inventories based on customer deliveries, or in a traditional manufacturing planning technique that directly undertakes operational procurement activities. Our procurement is divided into three general categories depending on the type of goods: raw materials, commercial off-the-shelf parts, and custom-made-to-order parts.

• Raw materials are typically sourced from large-scale trading partners and are purchased at a fair market value when benefit can be gained. When practical, we will sign long-term agreements on commodity pricing to access lower market prices.

• Commercial off-the-shelf parts are typically sourced in local regions and can be shared across the organization to ensure a consistent supply where it is needed and to leverage our purchasing power.

• Custom made-to-order parts are sourced from strategic suppliers, or jointly developed with partners, to ensure the best combination of price, quality and delivery. Our supply base is subject to our general terms and conditions or unique long-term supply agreements and is subject to reviewing key performance indicators to ensure we are getting optimal performance and value.

Innovation, Research and Development

Intellectual Property

Our intellectual property strategy is to capture, protect, and utilize our intellectual property in coordination with our business and technology plans and enable the successful commercialization of our proprietary products. Our intellectual property strategy is designed to be adaptive to our target markets in supporting the commercial launch of new products while maintaining Westport’s long-term competitive advantage.

WESTPORT FUEL SYSTEMS INC. 2024 ANNUAL INFORMATION FORM

As a result, we rely on a combination of patents, trade secrets, trademarks, copyrights and contracts to protect our proprietary technology.

We use patents as the primary means of protecting our technological advances and innovations. They include proprietary claims to novel concepts embodied in our components, materials, operating techniques, and systems. We have a proactive approach to identifying, evaluating, and choosing strategic inventions to protect through the timely filing and prosecution of patent applications. Patent applications are filed in various jurisdictions internationally, which are carefully chosen based on the likely value and enforceability of intellectual property rights, and to strategically protect anticipated major commercial markets.

Research and Development

With the closing of the JV, Cespira is responsible for all research and development work undertaken to advance the HPDI fuel system technology. Westport continues to improve the products for Westport’s Light-Duty and High-Pressure Controls and Systems business segments, as we continue to make strategic investments that drive innovation, strengthen our competitive edge, and position us for long-term success.

Long-Term Investments

Cespira

Westport’s JV with Volvo Group, also known as Cespira became effective on June 3, 2024. Westport owns a 55% equity interest in Cespira and Volvo Group owns the remaining 45%.

Cespira enables Westport to remain focused on its long-term strategic priorities. Through Cespira, we aim to accelerate the global commercialization of HPDI, expand our customer base, drive innovation, and strengthen Westport’s financial position by leveraging combined resources and expertise.

Cespira is committed to accelerating the commercialization and global adoption of the HPDI fuel system technology for long-haul and off-road applications. Westport, by way of a transitional services agreement in place with Cespira, is providing as-needed support to Cespira in the short-term as the organization establishes its operations.

Weichai Westport Inc. (WWI)

WWI was our joint venture in China with Weichai Holdings Group Co., Ltd. The Company, indirectly through its wholly owned subsidiary, Westport Innovations (Hong Kong) Limited (“Westport HK”), was the registered holder of a 23.33% equity interest in WWI. In April 2016, we sold a derivative economic interest to Cartesian granting it the right to receive an amount of future income received by Westport HK from WWI equivalent to having an 18.78% equity interest in WWI and concurrently granted Cartesian an option to acquire all the equity securities of Westport HK for a nominal amount. We retained the right to transfer any equity interest held by Westport HK in WWI that was more than an 18.78% interest if such option was exercised. In December 2023, the Company, through its wholly owned subsidiary, Westport HK, signed an equity transfer agreement with WWI for the 4.55% economic interest, with the registration of this transfer being completed on July 29, 2024.

Minda Westport Technologies

Beginning in 2009, Westport Fuel Systems Italia S.r.l. (“WFS Italia”) and Uno Minda Limited (“Uno Minda”) operated Minda Westport Technologies Limited (“MWTL”) as 50/50 joint venture partners. On September 28, 2023, as part of a restructuring initiative of the business of the WFS Group in India, WFS Italia and Uno Minda entered into an Amended and Restated Joint Venture Agreement, along with a Share Purchase Agreement for the purchase by Uno Minda of an additional 26% of the shares of MWTL with a purchase price of approximately $1.75 million (with closing adjustments) (the “SPA”) and an Asset Purchase Agreement whereby MWTL agreed to purchase the majority of the fixed assets and existing inventory of Rohan BRC Gas Equipment Private Limited (“RBRC”) for approximately $1.59 million (with closing adjustments) (the “APA”).

WESTPORT FUEL SYSTEMS INC. 2024 ANNUAL INFORMATION FORM

The transactions described in the SPA and the APA have both closed leaving WFS Italia with a minority stake of 24% in MWTL while commencing a strategic business relationship with MWTL to supply products and provide technical services.

Industry Summary

Overview of the Market

The transportation sector is undergoing a transformation, shaped by evolving regulatory frameworks and groundbreaking technological advancements. This shift is primarily fueled by increasingly stringent emissions standards and the global momentum toward decarbonization. Below is an overview of the most recent trends shaping this dynamic landscape:

Current Trends in Transportation

1. Continuing Focus on Reducing Vehicle Energy Consumption and CO2 Emissions

Regulatory bodies globally continue to refine and adapt emissions standards, with a growing focus on CO2 reduction. As the regulatory landscape evolves, there is increasing momentum toward the adoption of zero-emission and low-carbon technologies, while allowing for a range of approaches to meet sustainability goals.

2. Emerging Role of Alternative Fuels

Hydrogen and RNG are gaining traction as key solutions to reduce well-to-wheel emissions. They are poised to complement electric and fuel-cell technologies in decarbonizing the heavy-duty transport and off-road sectors.

Hydrogen and RNG powered ICE technologies, such as Cespira's HPDI fuel system, are viable and affordable alternatives to electric and fuel cell vehicles, offering a viable route to achieving zero carbon-emission classifications and net zero carbon results without the need for complete vehicle redesigns.

3. Expansion of Infrastructure

Both Europe and North America are making substantial investments in refueling and recharging infrastructure. Regulations in Europe now mandate the establishment of hydrogen refueling stations every 200 km and LNG refueling stations every 400 km along key transportation corridors to support the growth of alternative fuel-powered fleets.1,2 China continues to lead in the development of hydrogen infrastructure, with over 400 hydrogen refueling stations in operation.3 This extensive network highlights the country's strategic focus on hydrogen mobility and its potential to drive industry-wide adoption of clean fuel solutions.

1 https://www.consilium.europa.eu/en/press/press-releases/2023/07/25/alternative-fuels-infrastructure-council-adopts-new-law-for-more-recharging-and-refuelling-stations-across-europe/

2 https://www.lngeurope.org/about-lng/availability-of-lng/#:~:text=There%20is%20no%20consistent%20network%20of%20LNG%20fueling,distance%20between%20each%20other%20on%20all%20TEN_T%20corridors.

WESTPORT FUEL SYSTEMS INC. 2024 ANNUAL INFORMATION FORM

4. Increasing OEM Collaboration

The industry is increasingly embracing joint platform development, cost-sharing, and collaborative purchasing to drive efficiency and innovation. Partnerships are extending beyond OEMs to include fleets, fuel providers, and other stakeholders, reflecting a growing trend toward ecosystem-wide collaboration to address shared challenges and opportunities.

Market Size

The world is growing and the amount of goods that need transport is increasing as well. The transportation industry aspires to get more goods to more people in a cleaner, more efficient, and affordable way.4

Heavy-Duty Truck Market

The global Class 8 truck market saw a notable recovery in 2024, driven by a strong economic rebound and a significant surge in e-commerce activity. The broader Class 4-8 truck segment is projected to continue its growth trajectory through 2025, supported by robust consumer spending and favorable economic conditions, including reduced interest rates which are expected to further stimulate demand for commercial vehicles.5,6

The global market for LNG and RNG powered trucks is experiencing significant growth, driven by increased infrastructure availability, lower fuel costs in some geographies, and growing regulatory pressures to adopt cleaner energy solutions. As the transportation sector continues to transition toward alternative fuels, LNG, RNG and hydrogen are emerging as key enablers of this shift, particularly in the heavy-duty truck segment.7 Major fleets increasingly incorporate RNG into their transportation strategies to meet their emission reduction goals.8 By leveraging RNG, these fleets can significantly lower their carbon footprint while benefiting from a readily available and cost-effective fuel source.

North American Market Performance

•Class 8 Orders: North America recorded approximately 280,000 Class 8 truck orders for the full-year 2024,9 marking a strong recovery as demand continues to be fueled by improving economic conditions and ongoing shifts in supply chain logistics, including e-commerce expansion.

•Political and Regulatory Landscape: The political and regulatory environment in North America is expected to further influence demand for alternatively fueled Class 4-8 trucks, with regulatory frameworks guiding Original Equipment Manufacturer (“OEM”) commitments to sustainability and emissions standards.

3 https://hydrogen-central.com/china-tops-world-hydrogen-stations-fueling-clean-energy-future/#google_vignette

4 Race to Zero: European Heavy Duty Vehicle Market Development Quarterly (January – June 2024) - International Council on Clean Transportation

5 https://www.globenewswire.com/en/news-release/2024/08/28/2936842/0/en/Class-8-truck-Market-to-be-worth-432-6-Bn-by-2032-Says-Global-Market-Insights-Inc.html

6 https://www.spglobal.com/mobility/en/research-analysis/us-medium-heavy-commercial-vehicle-forecast.html

7 Nikola Corporation DHL Supply Chain and Diageo North America Power Up Sustainability Partnership with Deployment of Hydrogen Fuel Cell Trucks -

8 https://s3.eu-central-1.amazonaws.com/hexagonassets/HEX-Q3-2024-Presentation.pdf

9 https://www.ccjdigital.com/economic-trends/article/15711395/class-8-net-orders-saw-23-yearoveryear-increase-exceeding-seasonal-expectations

WESTPORT FUEL SYSTEMS INC. 2024 ANNUAL INFORMATION FORM

•Evolving emission standards, such as the U.S. EPA 27 regulations, are expected to drive increased demand for sustainable Class 4-8 trucks ahead of their implementation. Similarly, regulatory changes like California's Advanced Clean Trucks mandate require truck OEMs to sell more zero-emission vehicles, accelerating the industry's transition toward cleaner technologies. These factors are anticipated to increase the share of alternative fuel options in the truck market in the coming years as both public and private sectors align with decarbonization goals.10

•Class 8 Truck Fleet Transition: Diesel trucks currently dominate the North American Class 8 market, comprising 97% of new truck registrations. This concentration of diesel vehicles presents a substantial opportunity for conversion to cleaner energy solutions, driven by regulatory pressures and the growing availability of alternative fuel infrastructure. Competitive fuel pricing for natural gas and in the future hydrogen, along with advancements in fuel efficiency, will be key drivers of this shift.

•Hydrogen Adoption: While hydrogen use in U.S. heavy-duty trucking is still in its nascent stages, major fleets are beginning to integrate hydrogen technologies into their portfolios. This early-stage adoption, signals increasing interest in hydrogen as a viable solution for decarbonizing the sector, especially as infrastructure develops and hydrogen production becomes more scalable.

European Market Insights

•Truck Registrations: In the first three quarters of 2024, over 250,000 heavy-duty vehicles were sold in the EU-27, showing a slight year-over-year decline. Despite this minor setback, the EU heavy-duty truck market is expected to see growth over the next five years, driven by regulatory incentives, increased infrastructure investments, and the ongoing transition to alternative fuel solutions.11

•LNG Truck Registrations: Natural gas trucks now account for over 2% of all new truck registrations in the region, signaling a steady adoption trajectory in line with Europe’s push to reduce emissions and diversify fuel sources in the transportation sector.12

•Hydrogen Truck Registrations: The hydrogen-powered truck market is emerging and expanding at a steady pace. Recent developments indicate a surge in interest and investment in hydrogen technologies, driven by supportive government policies and the broader push for decarbonization. This momentum underscores the growing role of hydrogen in the future of sustainable transportation.

Chinese Market Dynamics

•Sales Growth: China’s domestic sales and exports of heavy-duty trucks totaled over 900,000 units in 2024, reflecting strong demand in the wake of recovering economic activity and government support for infrastructure and industrial growth.13 Through 2030, a 4% per annum growth rate is anticipated for the Chinese heavy-duty truck market, supported by continued industrial expansion, urbanization, and increasin g adoption of alternative fuel technologies.14

10 https://www.spglobal.com/mobility/en/research-analysis/us-medium-heavy-commercial-vehicle-forecast.html

11 https://theicct.org/publication/r2z-eu-hdv-market-development-quarterly-jan-sept-2024-dec24/

12 https://alternative-fuels-observatory.ec.europa.eu/transport-mode/road/european-union-eu27/vehicles-and-fleet

13 https://www.chinatrucks.org/statistics/2025/0206/article_10991.html

WESTPORT FUEL SYSTEMS INC. 2024 ANNUAL INFORMATION FORM

•LNG Demand Growth: In China, the demand for LNG-powered heavy-duty trucks is growing rapidly, supported by competitive LNG prices and expanding fueling infrastructure. In the first half of 2024, sales of LNG trucks rose 127% year-over-year, reaching over 92,000 units, and accounted for 21% of total heavy-duty truck sales. This surge is expected to continue as additional LNG supply comes online and the government maintains supportive policies for cleaner energy solutions in the transport sector.15

•

•Hydrogen Vehicle Sales: China’s hydrogen-powered commercial vehicle market saw significant growth in 2024, with sales surpassing 5,000 units in the first three quarters. This represents record growth, fueled by strong government incentives and rising demand for zero-emission vehicles across various industries.

Light-Duty Passenger Car Market:

The global market for vehicles powered by LPG continues to expand, with over 28 million vehicles currently in operation worldwide. In Europe, LPG is commonly referred to as Autogas, and the market for Autogas has experienced steady growth.16 In 2023, the Autogas market grew by 6%, primarily driven by demand from key markets such as Turkey and Algeria.

Key Markets and Growth Trends17

•Europe: Turkey, Poland, and Italy are the largest markets for light-duty LPG vehicles in Europe, with a combined total of nearly 11.5 million vehicles. These countries have seen consistent growth in LPG vehicle adoption in recent years. Turkey, Poland, and Ukraine remain some of the largest LPG vehicle markets, with sales concentrated in these regions.

•Emerging Markets: LPG consumption and production are experiencing robust growth in emerging markets across South America, Africa, and Asia. This growth is being fueled by several factors, including favorable fuel pricing, expanding LPG infrastructure, and government incentives aimed at promoting cleaner fuel alternatives.

Renewable LPG and Decarbonization

•Sustainable Solutions: Renewable LPG, derived from renewable sources such as biomass and waste, is gaining momentum as a sustainable solution to support global decarbonization efforts. Its growing adoption is in alignment with regulatory targets aimed at reducing carbon emissions in the transportation sector.

14 https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/a-new-era-trends-shaping-chinas-heavy-duty-trucking-industry

15 https://www.spglobal.com/commodity-insights/en/news-research/latest-news/lng/062624-china-nears-peak-gasoil-demand-as-lng-fueled-heavy-duty-truck-sales-surge

16 Source: EUROPEAN LIQUID GAS CONGRESS, Argus Media

17 Source: EUROPEAN LIQUID GAS CONGRESS, Argus Media

WESTPORT FUEL SYSTEMS INC. 2024 ANNUAL INFORMATION FORM

Fuel Availability

Alternative fueling infrastructure is growing rapidly, a direct result of tighter global emissions standards. The creation of a fueling station network is essential to meeting the targets and demand predictions for 2030 and beyond. Renewables specifically have grown significantly over the past decade, making them both more scalable and widely available. Greater fuel availability for RNG and hydrogen drives faster adoption and is crucial for reaching decarbonization targets.

RNG is making a positive, substantial impact currently and has the capability to make a much larger impact. The use of RNG as a transport fuel bolsters the environmental case for gas-based vehicles and can fully replace natural gas as a source of fuel without any changes required to the engine. The case for using RNG for transport is strongest in transport segments, such as long-haul road freight and shipping where electrification is more challenging. These areas are currently experiencing the greatest adoption, due to climate benefits and availability. RNG is a well-to-wheel climate reduction solution that is available today. Key developments in alternative fuels include:

1. Infrastructure Expansion

a. Regulations are shaping future fueling networks and providing clear guidance for industry stakeholders while the development of fueling infrastructure for RNG and hydrogen is accelerating due to urgent emissions reduction targets and expected demand beyond 2030.

b. Policies requiring hydrogen refueling stations every 200 km in Europe demonstrate global commitment to alternative fuel adoption.

c. Heavy-duty transport is projected to drive significant hydrogen demand in Europe, necessitating refueling infrastructure along key routes by 2030. The European Automobile Manufacturers’ Association estimates that 700 hydrogen refueling stations for trucks will be needed in Europe to achieve a 45% CO2 reduction by 2030.18

2. Alternative Fuels Growth

a. Over the past decade, renewable energy sources have become increasingly scalable and accessible, strengthening their position as long-term solutions for decarbonizing the transportation sector.

b. RNG has emerged as a proven, sustainable alternative to conventional natural gas, with the added benefit of seamless integration into existing gas-based vehicle systems, offering an immediate pathway to reduce emissions in the sector.

c. Hydrogen continues to gain traction as a key enabler of future mobility, with expanding infrastructure facilitating its adoption, particularly in heavy-duty and industrial transport segments.

The transition to zero-emission propulsion systems will be a multi-decade process influenced by market dynamics, cost structures, and technology readiness. Emerging markets may adopt technologies at different rates due to varied infrastructure and economic factors. However, the confluence of government policies, corporate sustainability commitments, and advancing technologies signals a steady move toward decarbonization. This evolving landscape presents both challenges and opportunities, with collaboration among stakeholders being critical to achieving global decarbonization goals.

18 https://www.acea.auto/press-release/truck-and-bus-co2-standards-ambition-levels-for-all-stakeholders-must-be-aligned/

WESTPORT FUEL SYSTEMS INC. 2024 ANNUAL INFORMATION FORM

As regulatory pressures intensify and infrastructure continues to expand, the transportation industry is poised for a sustainable, low-carbon future.

Near-Term Industry Challenges

Inflationary Pressures and Impact on LPG Market and Production Costs

Global inflation trends remain inconsistent, with inflationary pressures easing in many developed countries, while continuing to impact certain emerging and developed markets, including Turkey, Brazil, and India. In key LPG markets such as Poland, Turkey, and Italy, LPG prices have experienced upward pressure. This has been driven by a combination of factors, including inflation in crude oil prices, production disruptions, adverse weather conditions, rising freight costs, and geopolitical conflicts. Ongoing geopolitical risks and climate-related challenges present the potential for further inflationary pressures, particularly on production input costs and energy prices. Such increases could impact the demand for clean energy products, as higher costs may make alternative fuels less competitive relative to conventional energy sources.

Westport sources its components from global suppliers and continues to face inflationary pressure on production input costs. Specifically, the cost of semiconductors, raw materials, and parts has increased, along with higher labor costs, all of which are contributing to margin compression.

Increased Interest Rates

In response to inflationary pressures, central banks in major markets has raised interest rates to multi-decade highs. While some regions, including Canada, the United States, and the Euro Area, have begun reducing rates, current levels remain restrictive and are having a significant impact on both the automotive and clean energy sectors.

Automotive manufacturers and OEMs are facing challenges as higher interest rates are compressing profit margins. This environment is leading to delays and cancellations of clean energy investments as companies prioritize cost-cutting measures. Additionally, elevated interest rates have contributed to a slowdown in global economic growth, particularly in emerging markets such as India and Brazil. These markets, where economic conditions are already volatile, are facing heightened financial pressures, which could further dampen demand for clean energy solutions.19

Hydrogen Eco-System Uncertainty

The hydrogen industry is currently facing economic challenges associated with limited load of available hydrogen which has resulted in high operational costs across the value chain. This has led to delays and cancellations of projects.20 Key cost factors, such as rising renewable electricity prices and increased electrolyzer costs, are having a significant impact on the economics of renewable (green) hydrogen projects. These higher costs, coupled with uncertainties surrounding fuel supply and infrastructure development, make it challenging to predict when hydrogen technology for transport will become a viable decarbonization solution.21 While market adoption of hydrogen technologies may take time, we are positioned to leverage the fuel flexibility of this technology.

19 https://www.iea.org/reports/world-energy-outlook-2024

20 https://www.hydrogenfuelnews.com/neste-hydrogen-project-cancelled/8567862/

21 https://hydrogencouncil.com/wp-content/uploads/2024/09/Hydrogen-Insights-2024.pdf

WESTPORT FUEL SYSTEMS INC. 2024 ANNUAL INFORMATION FORM

This flexibility enables us to capitalize on the growing demand for RNG as a near-term solution, bridging the transition to hydrogen in the future.

Industry Growth Drivers

Aligning industry and economies with the targets laid out in the Paris Agreement—limiting global warming to well below 2°C, continues to drive the replacement of legacy systems powered by fossil fuels with low carbon energy sources such as renewables. While natural barriers to investment exist such as substantial increases in costs and the evolving regulatory environments, particularly when it comes to decarbonizing hard-to-abate sectors such as transportation, there have been significant advances leading to steady growth opportunities. Steady change will be critical regarding fuels used to achieve the CO2 reductions needed to meet various countries' requirements and industries are now turning to both RNG and hydrogen.

Depressed Natural Gas Market Prices

Europe

European natural gas prices, although elevated recently, are still significantly below the record highs of 2022. Lower demand, influenced by reduced economic activity and previous mild weather, has contributed to price moderation. Additionally, the diversification of gas imports continues to be a key focus of European energy policy. Long-term forecasts suggest that natural gas prices will remain well below 2022 peaks. This outlook reinforces the fuel’s cost-effectiveness and its role in advancing the transition to natural gas-powered vehicles.22

North America

In 2024, North American natural gas prices reached pandemic-era lows, driven by oversupply and an exceptionally warm winter. In the U.S., prices are expected to rebound from extreme lows as natural gas rigs are decommissioned and producers delay new projects in response to weak pricing. Additionally, several new export facilities are set to come online, potentially boosting demand. Despite this, storage levels remain well above the five-year average, and mild weather forecasts continue to exert downward pressure on price expectations. U.S. natural gas prices have recently diverged from European markets, staying significantly lower. This favourable pricing environment supports North America's adoption and growth of natural gas-powered vehicles.

In Canada, natural gas prices have also been under pressure due to similar factors as in the U.S. While Canadian producers have adapted operations to manage low prices, production cuts have been less pronounced than in the U.S. Prices are projected to rise toward 2023 levels, though recent forecasts suggest a more moderate increase than initially expected.23

China

China is the world’s largest LNG importer with significant growth projected to 2040. While prices have risen due to greater demand from Europe, China, a price sensitive market, has been reducing imports of LNG with increasing prices and already has a large store of LNG, mitigating some of the impact of rising LNG prices.24

22 European Gas Prices Post Biggest Weekly Decline Since January – BNN Bloomberg

23 Deloitte Sept 2024 NG Price Forecast

24 China’s Gas Demand Surges with Urban Growth and LNG Boom | OilPrice.com

WESTPORT FUEL SYSTEMS INC. 2024 ANNUAL INFORMATION FORM

Government Funding and Policy Support

Hydrogen

In North America, hydrogen development was gaining significant momentum due to robust government support. The Biden-Harris administration introduced several policy measures, including production tax credits and multi-billion-dollar funding initiatives across the hydrogen value chain. Similarly, the Canadian government launched various incentive programs, such as the Clean Hydrogen Investment Tax Credit, aimed at encouraging hydrogen production. Additional funding mechanisms, including the Strategic Innovation Fund and the $15 billion Canada Growth Fund, further bolster clean energy advancements, with hydrogen as a key focus.

A potential shift in U.S. federal policy under a Trump presidency introduces uncertainty for hydrogen development, particularly around key incentives such as the 45V tax credit. Tax credits for hydrogen production and carbon capture, along with funding for hydrogen hubs, have demonstrated significant economic benefits, earning backing from Republican-led states and the oil and gas sector.25

Looking ahead, projections indicate that eligibility criteria for hydrogen tax credits may be eased, potentially increasing support for blue hydrogen. Furthermore, enhanced federal support for natural gas could indirectly benefit hydrogen produced from natural gas. Despite potential federal-level changes, state-led initiatives and ongoing industry expansion are expected to sustain momentum in hydrogen development across the U.S.26

In Europe, hydrogen policy is anchored by a comprehensive framework built on the EU’s hydrogen strategy, which outlines binding targets to accelerate hydrogen adoption. Funding initiatives such as the ‘Important Projects of Common European Interest’ ("IPCEIs") play a crucial role in fostering cross-border collaboration and driving large-scale hydrogen projects.

Globally, hydrogen continues to be expected to play a crucial role in decarbonizing the transportation industry—enabling a clean and resilient energy system.

RNG

The US and Canada have in place policies that provide subsidies to the RNG industry, such as the U.S. Environmental Protection Agency’s (“EPA”) Renewable Fuel Standard (“RFS”) program and Canada’s Clean Fuel Standard. Canada’s $1.5 billion Clean Fuels Fund, launched in 2021, was extended in 2024 for another 5 years to provide support for low-carbon fuels, including RNG. Within the EU, several clean energy funding programs also include support for the RNG industry, such as the European Fund for Strategic Investments ("EFSI") and Horizon 2020 Program.

Competitive Conditions and Advantages

Tier 1 Suppliers

The competitive conditions on the journey toward zero emissions continue to intensify. The rapid rise of electrification, disruptive technologies, CO2 regulations, managing supply chain interruptions, and workforce talent management are all areas of intense competition.

For many Tier 1 suppliers, the formula for success during this sustainable transportation transition has shifted significantly from creating competitive advantage through operational efficiencies in the short term to a longer-term strategy of leveraging existing assets and building new competencies.

25 https://www.hydrogenfuelnews.com/hydrogen-energy-incentives-trump/8568035/

26 https://www.hydrogeninsight.com/policy/analysts-split-on-what-trump-s-re-election-might-mean-for-the-us-clean-hydrogen-sector/2-1-1736348

WESTPORT FUEL SYSTEMS INC. 2024 ANNUAL INFORMATION FORM

The world market for LPG/CNG conversion kits is estimated to be more than one million units per year, and Westport is recognized as a leader, with roughly 25% market share globally.

As a Tier 1 supplier, we have the unique opportunity to position our organization as a global supplier with innovative technology products and systems. We are tackling climate change head-on. We are dedicated to driving cleaner performance for transportation with affordable fuel system solutions - across audiences, across global regions, across fuels, and across applications that meet existing and future emissions regulations.

Powertrains – No One Size Fits All

We recognize there will be a diversity of powertrains used throughout the world. Our competitive advantage is the ability to adapt and deliver today with existing manufacturing and fueling infrastructures. Our products and related technologies compete with:

Manufacturers of on-engine and off-engine components and systems for alternative fuels

These companies produce components, manufacture, and assemble complete systems, and may also manufacture or assemble conversion kits used to convert vehicles fueled by diesel or gasoline to an alternative fuel.

Conversion specialists

These companies convert vehicles to run on alternative fuels by installing alternative fuel components or systems on vehicles or by installing aftermarket components and conversion kits that were originally fueled by diesel or gasoline.

Conventional spark-ignited or direct injection combustion technology

These incumbent technologies such as engines powered by diesel or gasoline produced by global manufacturers, hold a large market share in our target applications. Although we compete with these systems, our business is based on the conversion of these platforms to alternative fuels.

Hydrogen-powered engines: H2ICE and Fuel Cell Electric Vehicles ("FCEVs") system suppliers

In the hydrogen economy there are two technologies: FCEVs and hydrogen internal combustion engines (H2ICE). FCEVs generate electricity from hydrogen in a fuel cell used to power the electric motor, whereas H2ICE burns hydrogen in an internal combustion engine.

Regulatory

In response to growing concerns over climate change, and air quality and health impacts, government regulation and social pressure are driving accelerated global demand for and adoption of reduced emission vehicles. More stringent emissions standards and accelerated timelines towards bans on the sale of internal combustion engine vehicles within the passenger car market have drawn much of the political, industry and media focus. Meanwhile, emissions standards continue to tighten and are also forcing changes in the heavy-duty vehicle segment.

In the long-term, fossil fuels are anticipated to be replaced by low/zero emission propulsion systems for transportation. The transition will be a multi-decade process and regulation will vary across developed and emerging markets, shaping the adoption of various technologies. Feasibility, cost, development time, and the structural readiness of supply chains are all factors in creating a true zero emissions solution, which is compelling, but not practical today for all vehicle platforms.

WESTPORT FUEL SYSTEMS INC. 2024 ANNUAL INFORMATION FORM

However, alternative fuels such as natural gas, hydrogen and RNG are proven to deliver significant well-to-wheel reductions in carbon emissions, and our expertise in these alternative fuels positions Westport to play a significant role in the decarbonization of the transportation industry.27

Carbon neutrality objectives, carbon dioxide ("CO2") emissions, and fuel efficiency standards for vehicles are all critical considerations in future regulatory requirements as governments worldwide are targeting lower fuel consumption and lower CO2 emissions beginning in 2025. The increasing levels of supportive government policy combined with rising corporate adherence to emission reduction goals are creating growth catalysts for Westport in its key markets.

Europe:

The European Union ("EU") is an important jurisdiction that has historically supported the adoption of alternative fuel for lower emissions.

The EU is currently targeting a quicker transition to lessen its reliance on Russian fossil fuels which has driven both the expansion of RNG plants and revised hydrogen production targets.

• In 2023, the EU finalized the revision of its regulations on the deployment of alternative fuel infrastructure which is expected to play a crucial role in driving the growth of the alternative fuel vehicle market. The new legislation sets mandatory national targets for recharging points at least every 60 km on main roads by the end of 2025 and hydrogen refueling infrastructure at least every 200 km on main roads by the end of 2030. This hydrogen refueling infrastructure must be designed for a minimum cumulative capacity of one ton per day and equipped with at least a 700-bar dispenser, making it suitable to refuel both light and heavy-duty vehicles. These new requirements come on top of the existing regulations for a minimum LNG refueling infrastructure to be in place by 2025, which represents an indicative distance of approximately 400 km between stations on the roads linking major cities and nodes.28

• In October 2024, the EU Parliament adopted new measures to strengthen CO2 emission reduction targets for new heavy-duty vehicles. The targets include a 45% reduction in 2030, 65% in 2035 and 90% in 2040 as compared to a 2019 baseline. Industry projections show the path to decarbonization will require the use of a variety of low/zero carbon solutions including RNG and hydrogen.29

• The European Zero Emission Vehicle ("ZEV") definition for heavy duty vehicles was set in October 2024 with a new threshold of 3g CO2/t-km, enabling hydrogen internal combustion engine vehicles, including those using pilot ignition technologies such as Cespira’s HPDI fuel system, to classify under this label alongside battery electric and fuel cell vehicles.30,31

• New car and van fleets must reduce average CO2 emissions by 15% in 2025, 55% by 2030 for cars (50% for vans) and 100% by 2035 relative to 2021 baseline levels. The European Commission is expected to make a proposal for registering vehicles exclusively using CO2 neutral fuels after 2035. It is also expected to develop a common EU methodology, by 2025, for assessing the full life cycle of CO2 emissions of cars and vans placed on the EU market, as well as for the fuels and energy consumed by these vehicles.32 In January 2024, the UK government turned its zero-emission vehicle mandate into law, mandating that 80% of new cars and 70% of new vans be zero emission vehicles by 2030.33

27 Allied Market Research (December 2022): Heavy-Duty Truck Market, Forecast and Size

28 Alternative Fuels Infrastructure - European Commission (europa.eu); Directive - 2014/94 - EN - EUR-Lex (europa.eu);

29 https://www.europarl.europa.eu/news/en/press-room/20240408IPR20305/meps-adopt-stricter-co2-emissions-targets-for-trucks-and-buses

30 https://www.europarl.europa.eu/news/en/press-room/20240408IPR20305/meps-adopt-stricter-co2-emissions-targets-for-trucks-and-buses

31 https://climate.ec.europa.eu/eu-action/transport/road-transport-reducing-co2-emissions-vehicles/reducing-co2-emissions-heavy-duty-vehicles_en

32 https://www.twobirds.com/en/insights/2024/belgium/the-new-european-vehicle-co2emissions-targets?utm

33 https://www.gov.uk/government/news/pathway-for-zero-emission-vehicle-transition-by-2035-becomes-law

WESTPORT FUEL SYSTEMS INC. 2024 ANNUAL INFORMATION FORM

• The REPowerEU package adopted in 2023 aims to rapidly reduce dependence on Russian fossil fuels and fast forward the green transition, in which RNG and hydrogen are expected to play a key role.34 REPowerEU has set a target of 35 billion cubic meters (bcm), additional RNG production per year by 2030, and 20 million tons (Mt) of renewable hydrogen supply by 2030.

• In April 2024, the EU Council adopted the Euro 7 regulation, which sets more stringent emission limits for cars, vans, and trucks. This regulation introduces requirements for vehicle type-approval, including emission limits, durability requirements, and compliance verification methods. Set for implementation by mid-2026 for passenger cars and 2028 for heavy-duty vehicles, these new standards introduce stringent lifetime requirements and new testing measures, including emissions from brakes and tires. 35

North America:

Government agencies in both the United States (U.S.) and Canada have committed to continue cutting emissions from cars, trucks and transport vehicles while focusing on increasing emissions standards.

• In December 2022, the EPA adopted a final rule, “Control of Air Pollution from New Motor Vehicles: Heavy-Duty Engine and Vehicle Standards,” that sets stronger emissions standards to further reduce air pollution. This includes pollutants that create ozone and particulate matter, from new heavy-duty vehicles and engines starting in the 2027 model year.36

• In June 2023, the EPA adopted the Renewable Fuel Standards (“RFS”) program for 2023-2025, establishing the applicable volumes and percentage standards for cellulosic biofuel, biomass-based diesel, advanced biofuel, and total renewable fuel. This rule includes steady growth of biofuels for use in the nation’s fuel supply until 2025.

• In December 2023, the Government of Canada published its final Electric Vehicle Availability Standard. These regulations set ZEV sales targets for manufacturers and importers of new passenger cars, sport utility vehicles, and pickup trucks. The regulations require that at least 20% of new vehicles sold in Canada will be zero emission by 2026, at least 60% by 2030, and 100% by 2035. 37

• In March 2024, the EPA finalized new, more protective Multi-Pollutant Emissions Standards for light-duty and medium-duty vehicles, starting with the 2027 model year. These standards aim to reduce both greenhouse gases (“GHGs”) and criteria pollutants, thereby improving air quality and public health.38

• Beginning with the 2024 model year, the EPA implemented more stringent NOx emission standards for heavy-duty vehicles. These standards will become progressively stricter with the 2027 and subsequent model years, aiming to significantly curb NOx emissions, a major contributor to air pollution.

• In April 2024, the EPA announced new GHG emissions standards for heavy-duty highway vehicles, applicable from model year 2027 onwards. This initiative is part of the Phase 3 program, targeting substantial reductions in GHG emissions from the heavy-duty sector. 39

• An increasing number of U.S. states are adopting similar ZEV regulations for new light-duty passenger vehicles. California requires that 100% of new vehicles be ZEVs by 2035. As of 2024, 11 other states have adopted similar standards: Colorado, Connecticut, Delaware, Maine, Maryland, Massachusetts, Minnesota, New Mexico, New York, New Jersey, Oregon, Rhode Island, Vermont, Virginia, and Washington.

34 The European Commission (https://commission.europa.eu): Priorities; The European Green Deal; REPowerEU: affordable, secure and sustainable energy for Europe Additional states have adopted California’s current ZEV regulations, and altogether over 40% of the North American vehicle market could have similar ZEV requirements by 2027.

35 https://www.consilium.europa.eu/en/press/press-releases/2024/04/12/euro-7-council-adopts-new-rules-on-emission-limits-for-cars-vans-and-trucks/

36 https://www.epa.gov/regulations-emissions-vehicles-and-engines/final-rule-and-related-materials-control-air-pollution

37 https://tc.canada.ca/en/road-transportation/innovative-technologies/zero-emission-vehicles/canada-s-zero-emission-vehicle-sales-targets

38 https://www.federalregister.gov/documents/2024/04/18/2024-06214/multi-pollutant-emissions-standards-for-model-years-2027-and-later-light-duty-and-medium-duty

39 https://www.federalregister.gov/documents/2024/04/22/2024-06809/greenhouse-gas-emissions-standards-for-heavy-duty-vehicles-phase-3?utm_source=chatgpt.com

WESTPORT FUEL SYSTEMS INC. 2024 ANNUAL INFORMATION FORM

• For medium and heavy-duty vehicles, the California Air Resources Board (“CARB”) requires all new medium- and heavy-duty vehicles sold in California to be a ZEV by 2045 as part of the Advanced Clean Trucks regulation. Zero-emission technologies are defined as battery electric and fuel cell electric vehicles. Beginning in 2024, manufacturers seeking certification for Class 2b through Class 8 chassis or complete vehicles with combustion engines were required to sell zero-emission trucks as an increasing percentage of their annual California sales. In addition, CARB’s Advanced Clean Fleets Regulation approved in April 2023 requires fleets above 50 trucks to purchase minimum ZEV percentages from 2024, reaching 100% between 2035 and 2042 depending on the vehicle categories. In November 2023, the CARB held a workshop on hydrogen internal combustion engines and their use in California’s trucks. However, CARB has no current plan to make a regulatory change on this topic until the agency sees some data and results of ongoing test programs.

• The U.S. Inflation Reduction Act (“IRA”) of 2022 supports investment in clean fuel production, refueling infrastructure and vehicles including RNG and hydrogen and represents the single largest investment in climate and energy in American history. The IRA actively promotes hydrogen and RNG by introducing a new clean fuel production credit and reinstalling expired alternative fuel credits until 2024; making “energy storage technologies” (including hydrogen storage) eligible for the investment tax credit; revising the clean vehicle credit for passenger vehicles and introducing a substantial credit for clean commercial vehicles, a key use case for hydrogen; and reviving and expanding the alternative fuel station credit which will foster more alternative fuel fueling stations.

• Canada’s Hydrogen Strategy is aimed at positioning hydrogen as a key component of the country’s transition to a low-carbon economy, including hydrogen playing a significant role in Canada’s energy mix by 2030. The strategy outlines Canada’s approach to developing hydrogen as a clean energy source, emphasizing its role in decarbonizing various sectors, including transportation, industry, and electricity generation.

China:

China’s VI standards are more stringent than their European counterparts in some respects. China VI called for application of Euro VI standards for all new heavy-duty vehicles starting in mid-2021. China VI-b, implemented in July 2023, introduces slightly more stringent testing requirements and aims to significantly reduce vehicle emissions, including nitrogen oxides and particulate matter. China VII standards remain under development and are focused on tightening regulations for both light-duty and heavy-duty vehicles. New standards would likely be implemented from 2030, requiring stricter limits on nitrogen oxides ("NOx"), new cold start requirements, as well as improved on-board diagnostics ("OBD") and remote monitoring systems. China is advancing efforts to enhance fuel efficiency and reduce emissions from diesel and LNG heavy-duty vehicles with the implementation of the national “fourth stage” of fuel consumption standard that mandates a reduction in fuel consumption by approximately 12% - 16% across various heavy-duty vehicle categories. The standards will be mandatory for all newly manufactured vehicles beginning in August 2027.

Annually, China emits more CO2 than the entire developed world combined and will likely face tremendous challenges to meet its 2030 peak carbon emissions and 2060 carbon neutrality targets, particularly in the class 8 truck transportation industry. To meet these targets, China has implemented aggressive goals and policies to transform the transportation sector including for new energy vehicles to reach 25% of total auto sales by 2025 from about 5% in 202040, with primary focus on electrical vehicles, plug-in hybrid electric vehicles, and fuel cell electric

40 New energy vehicles to make up 20% of China's new car sales by 2025 | Reuters vehicles. China has also been at the forefront of natural gas vehicle adoption globally and includes one of the world’s most extensive network of refueling stations.

WESTPORT FUEL SYSTEMS INC. 2024 ANNUAL INFORMATION FORM

• By October 2024, the annual sales of LNG and CNG heavy-duty trucks reached over 185,000 units. Adoption of natural gas trucks has been on the rise, mainly due to the widening price difference between diesel and natural gas.

• China is the largest hydrogen producer in the world. Hydrogen mobility is seen as crucial to decarbonize China’s transport sector. The country has set a target of having a fleet of 50,000 hydrogen vehicles by the end of 2025, focused primarily on medium- and heavy-duty trucks.

Capital Structure