Document

EMERGENT BIOSOLUTIONS REPORTS THIRD QUARTER 2024 FINANCIAL RESULTS

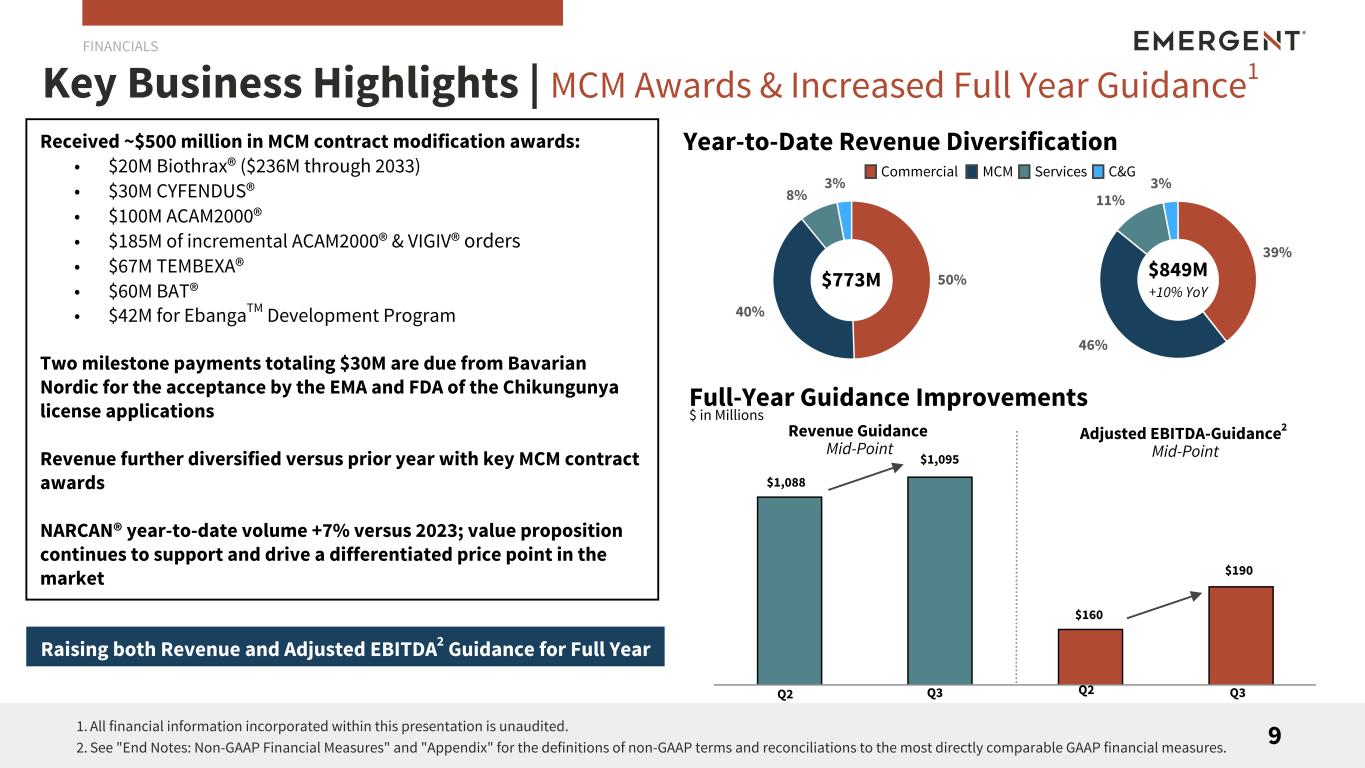

•Third Quarter 2024 Total Revenues of $293.8 million, increase of 9% versus prior year

•Third Quarter 2024 Net Income of $114.8 million, increase of 144% versus prior year

•Third Quarter 2024 Adjusted EBITDA of $105.3 million, increase of 432% versus prior year

•Raises FY 2024 guidance

GAITHERSBURG, Md., November 6, 2024—Emergent BioSolutions Inc. (NYSE: EBS) today reported financial results for the third quarter ended September 30, 2024.

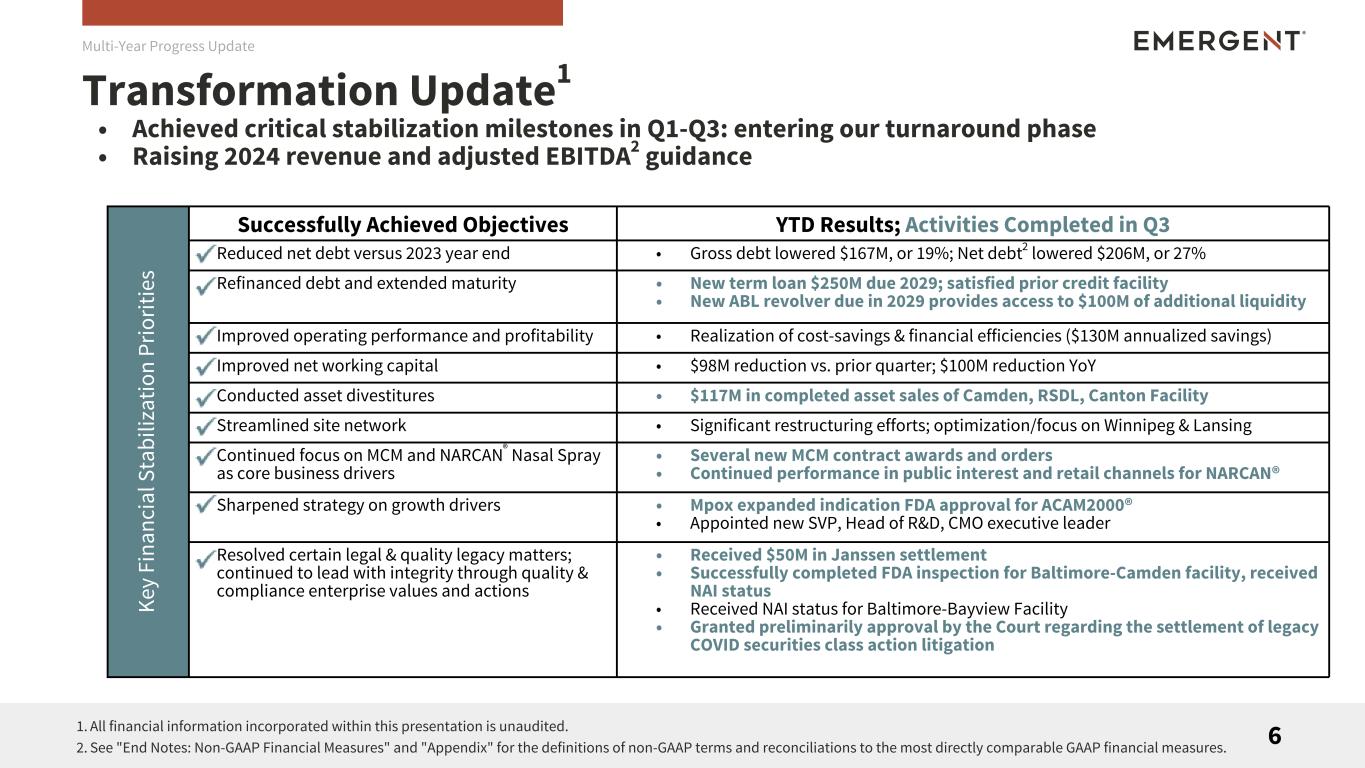

"Through disciplined execution and steady, measurable progress, Emergent's financial position is the strongest it has been since 2021 as evidenced by our favorable third-quarter results," said CEO Joe Papa. "We have successfully improved efficiencies and refocused our operations related to customer demand, generated value in our core medical countermeasures and NARCAN® Nasal Spray businesses and refinanced our debt leading to increased revenue and cash flow."

Papa continued, "Based on the success of our efforts since the beginning of this year, we are officially entering the turnaround phase of our multi-year transformation plan, and we will be focused on profitable growth, continued operational improvements and the generation of sustainable value for shareholders. We believe ongoing public health crises like the opioid overdose epidemic and mpox outbreak underscore the need for Emergent's capabilities and expertise. It is not if, but when, the next public health threat emerges, and we believe we are uniquely qualified to help respond to protect, enhance and save lives."

FINANCIAL HIGHLIGHTS(1)

Q3 2024 vs. Q3 2023

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in millions, except per share amounts) |

Q3 2024 |

Q3 2023 |

% Change |

| Total Revenues |

$ |

293.8 |

|

$ |

270.5 |

|

9 |

% |

| Net Income (Loss) |

$ |

114.8 |

|

$ |

(263.4) |

|

144 |

% |

| Net Income (Loss) per Diluted Share |

$ |

2.06 |

|

$ |

(5.08) |

|

141 |

% |

Adjusted Net Income (Loss)(2) |

$ |

76.2 |

|

$ |

(56.2) |

|

236 |

% |

Adjusted Net Income (Loss) per Diluted Share(2) |

$ |

1.37 |

|

$ |

(1.09) |

|

226 |

% |

Adjusted EBITDA(2) |

$ |

105.3 |

|

$ |

19.8 |

|

432 |

% |

Total Segment Gross Margin %(2) |

57 |

% |

33 |

% |

|

Total Segment Adjusted Gross Margin %(2) |

59 |

% |

38 |

% |

|

|

|

|

|

|

|

|

|

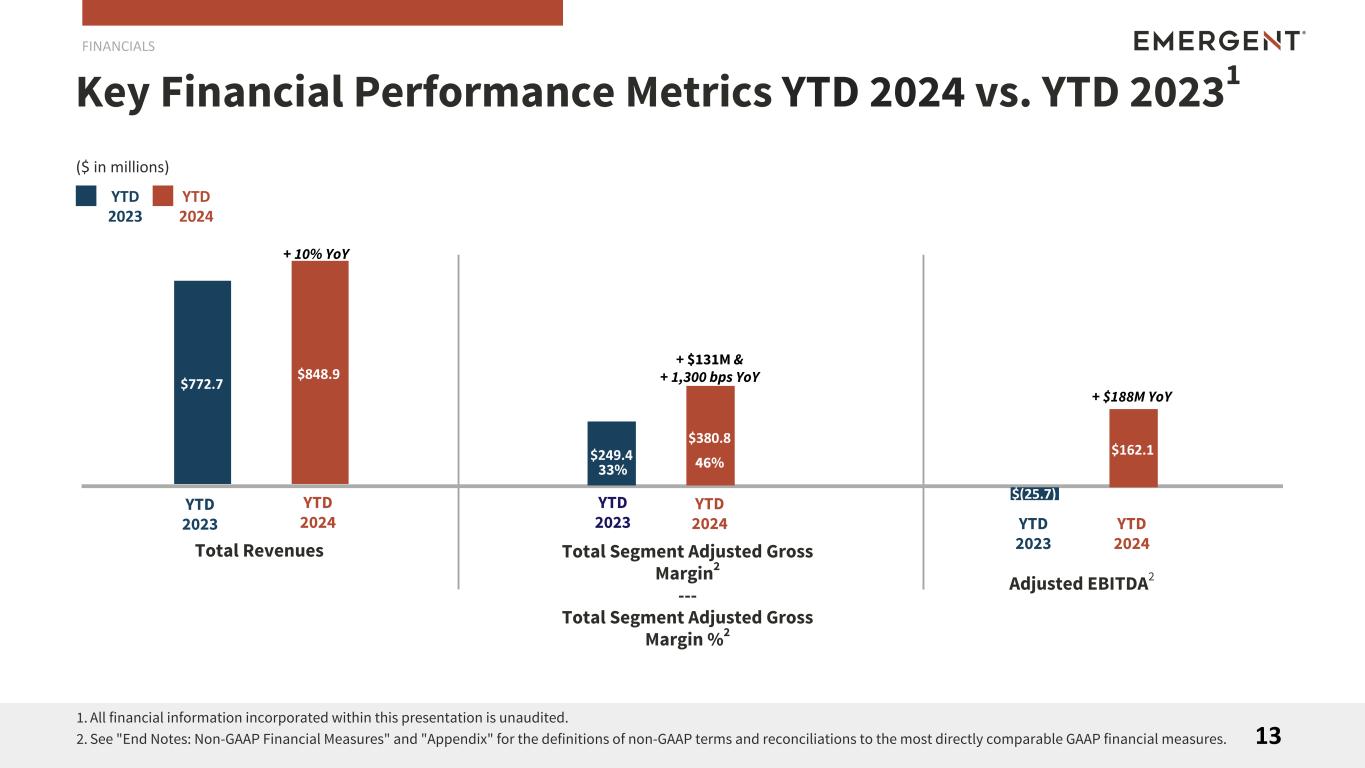

Year to Date (“YTD”) 2024 vs. YTD 2023

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in millions, except per share amounts) |

YTD 2024 |

YTD 2023 |

% Change |

| Total Revenues |

$ |

848.9 |

|

$ |

772.7 |

|

10 |

% |

| Net Loss |

$ |

(159.3) |

|

$ |

(711.0) |

|

78 |

% |

| Net Loss per Diluted Share |

$ |

(3.03) |

|

$ |

(13.97) |

|

78 |

% |

Adjusted Net Loss(2) |

$ |

(14.7) |

|

$ |

(273.0) |

|

95 |

% |

Adjusted Net Loss per Diluted Share(2) |

$ |

(0.28) |

|

$ |

(5.36) |

|

95 |

% |

Adjusted EBITDA(2) |

$ |

162.1 |

|

$ |

(25.7) |

|

731 |

% |

Total Segment Gross Margin %(2) |

32 |

% |

31 |

% |

|

Total Segment Adjusted Gross Margin %(2) |

46 |

% |

33 |

% |

|

|

|

|

|

|

|

|

|

SELECT Q3 2024 BUSINESS UPDATES

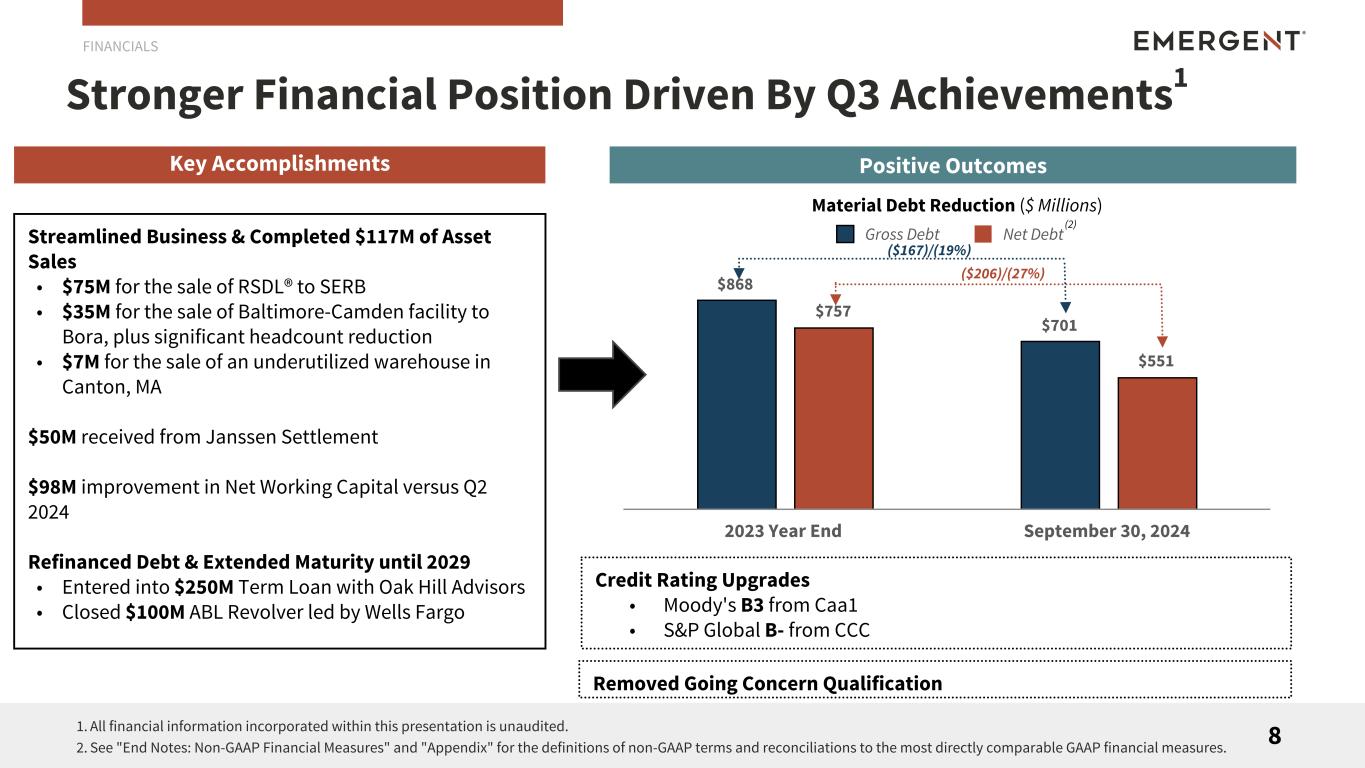

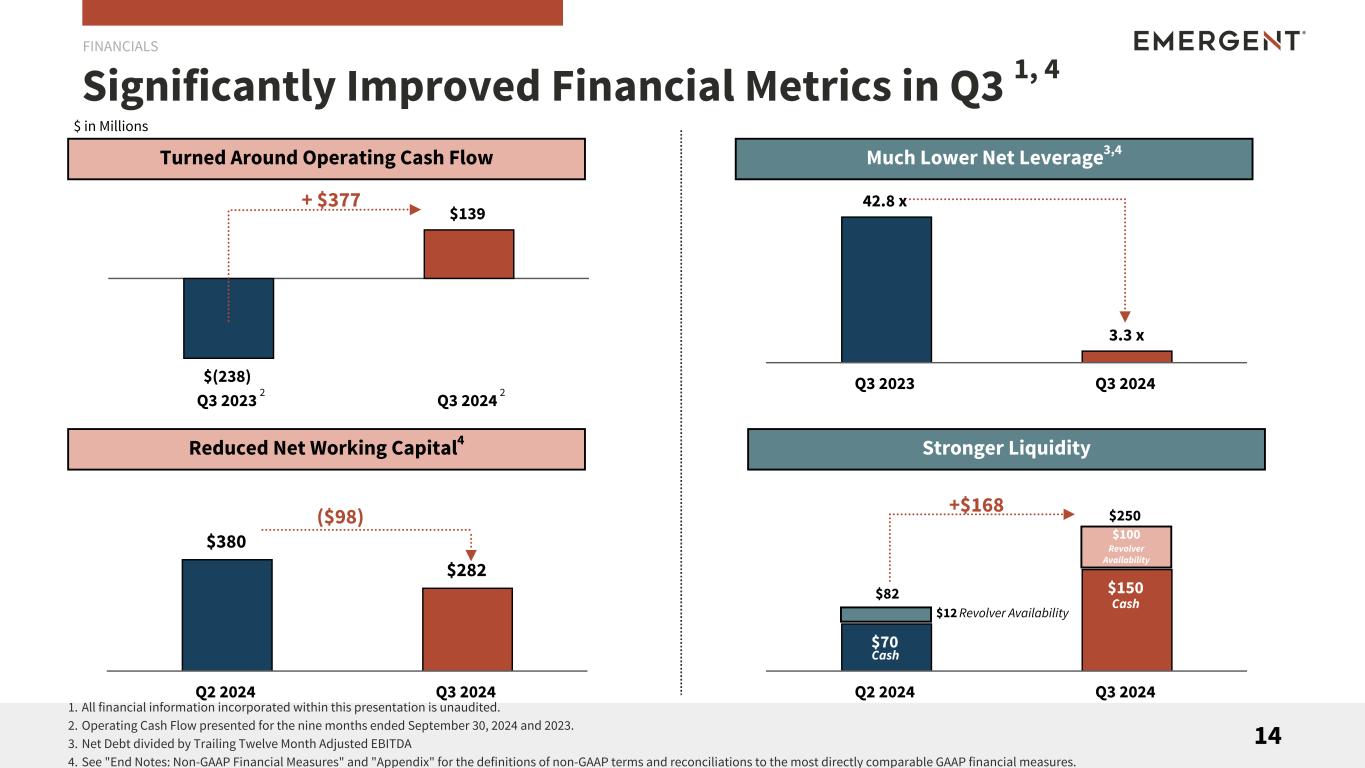

•Secured a new Term Loan for $250 million with OHA Agency, LLC as administrative agent.

•Closed on a new asset backed loan facility for $100 million with Wells Fargo Bank, National Association.

•Received $75 million for the sale of our RSDL® (Reactive Skin Decontamination Lotion) product to a subsidiary of SERB Pharmaceuticals ("SERB"), subject to customary adjustments based on inventory value at closing

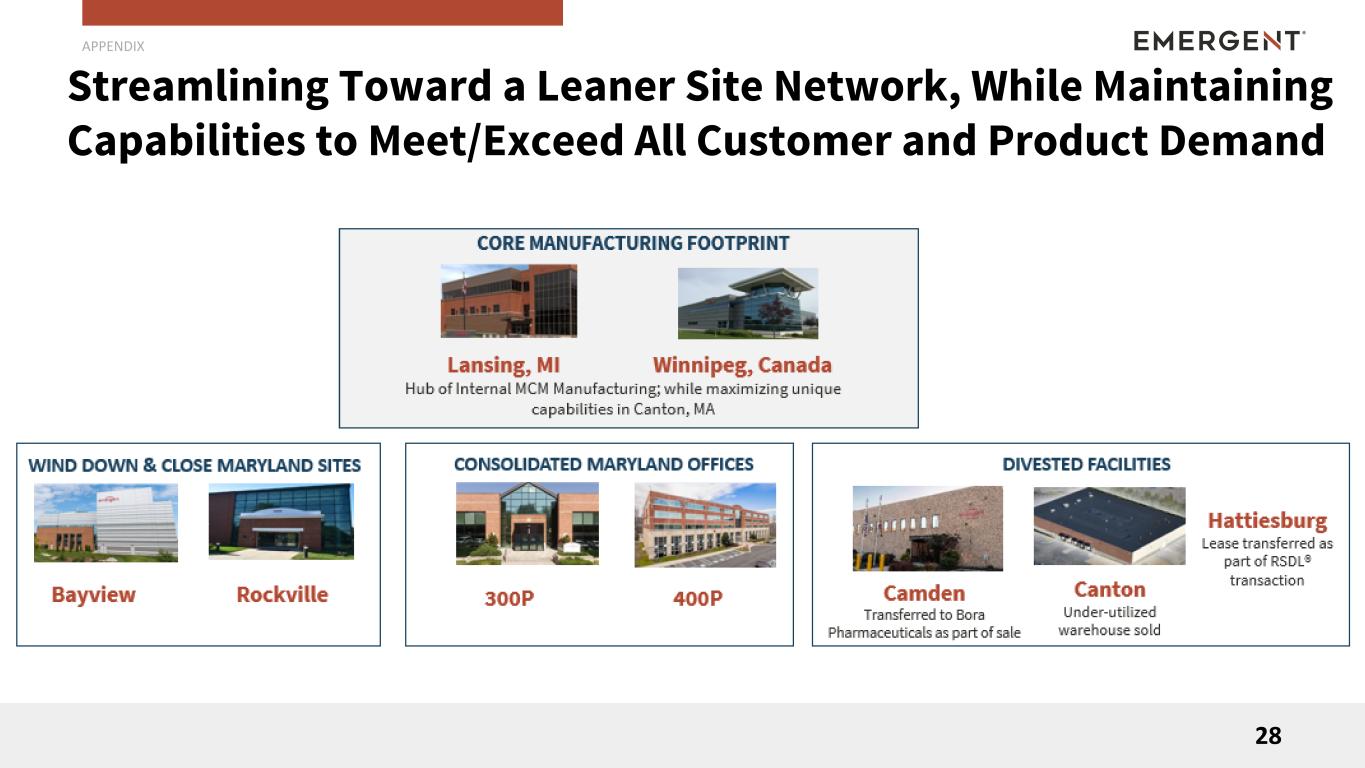

•Completed the sale of the Baltimore-Camden manufacturing site for $35 million, including customary post-closing adjustments

•Sold an underutilized warehouse at our Canton, MA facility for $7 million

•Received $50 million in the third quarter related to the resolution of the contractual dispute with Janssen Pharmaceuticals, Inc.

•Earned $30 million development milestone payments from Bavarian Nordic as part of the sale of the Travel Health Business

THIRD QUARTER 2024 FINANCIAL PERFORMANCE(1)

Revenues

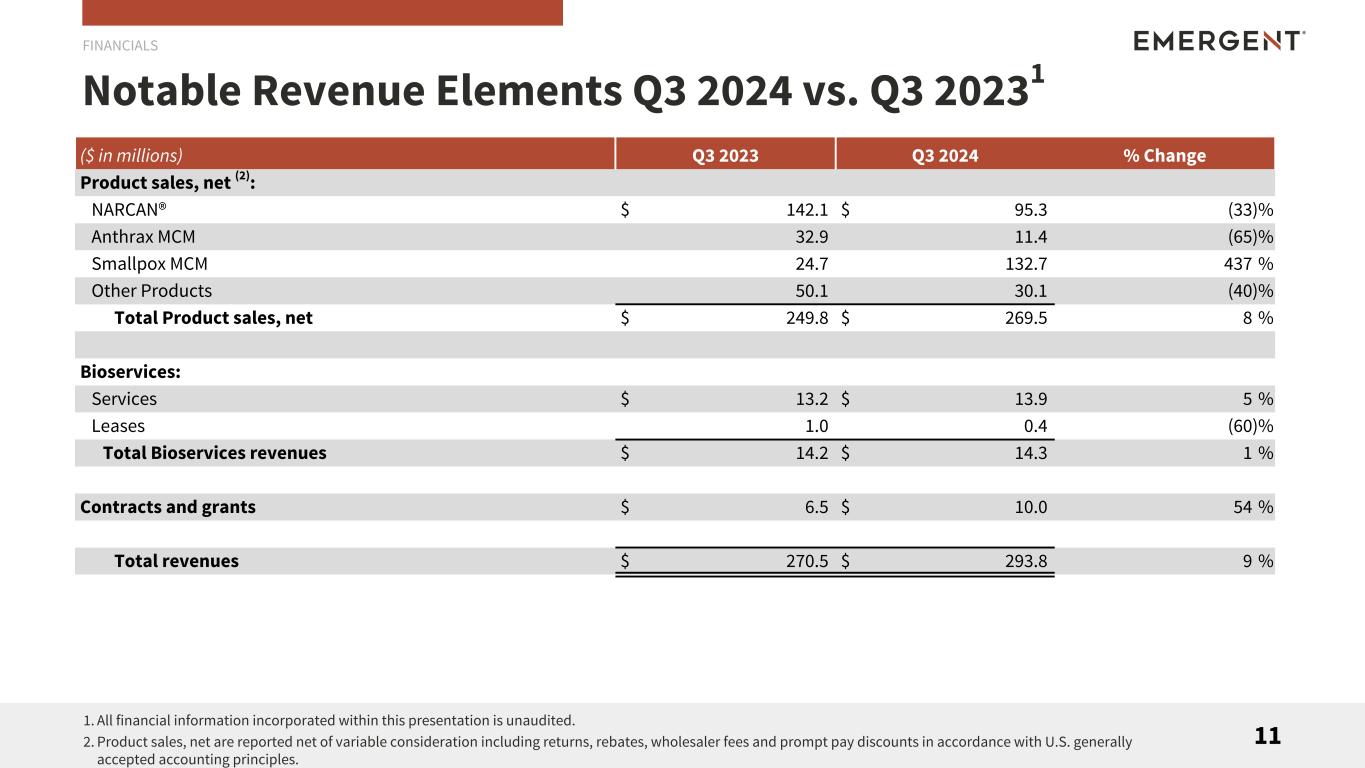

The Company uses the following categories in discussing product/service level revenues:

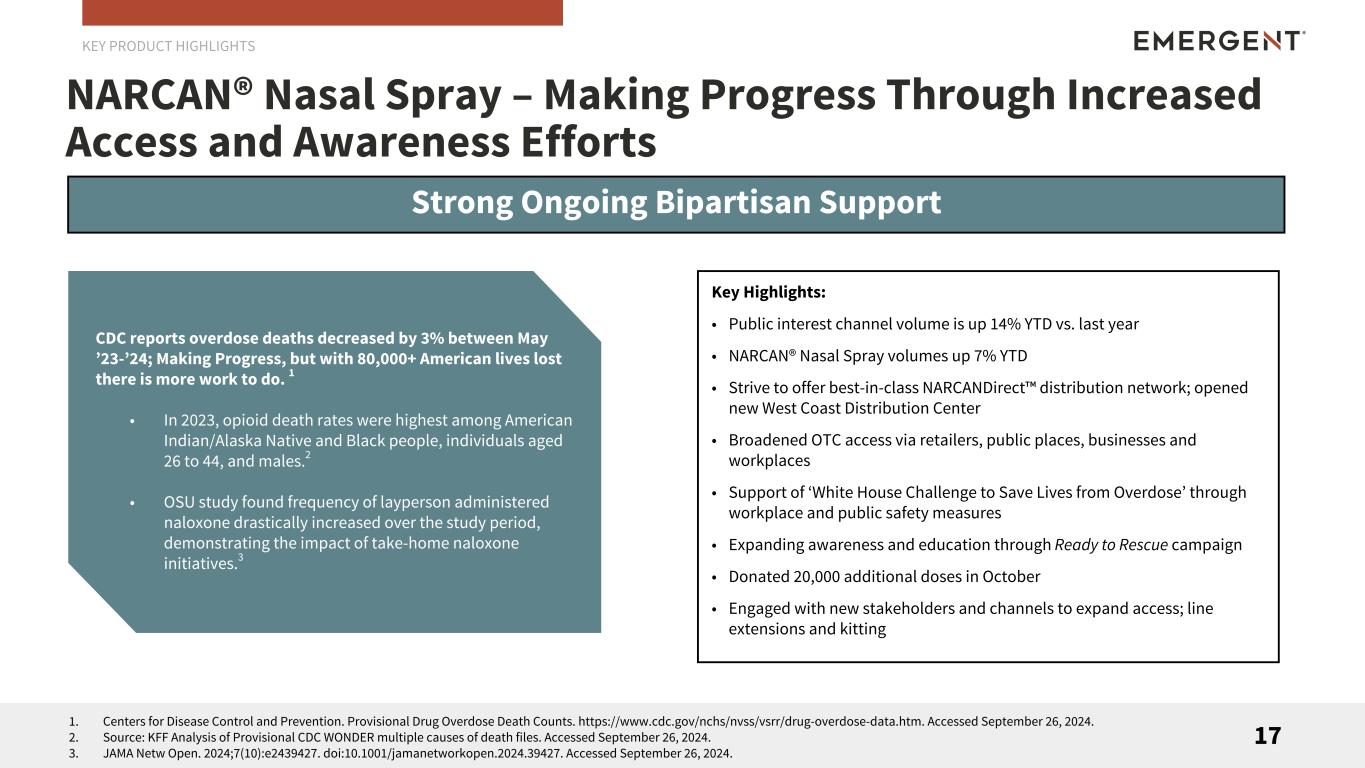

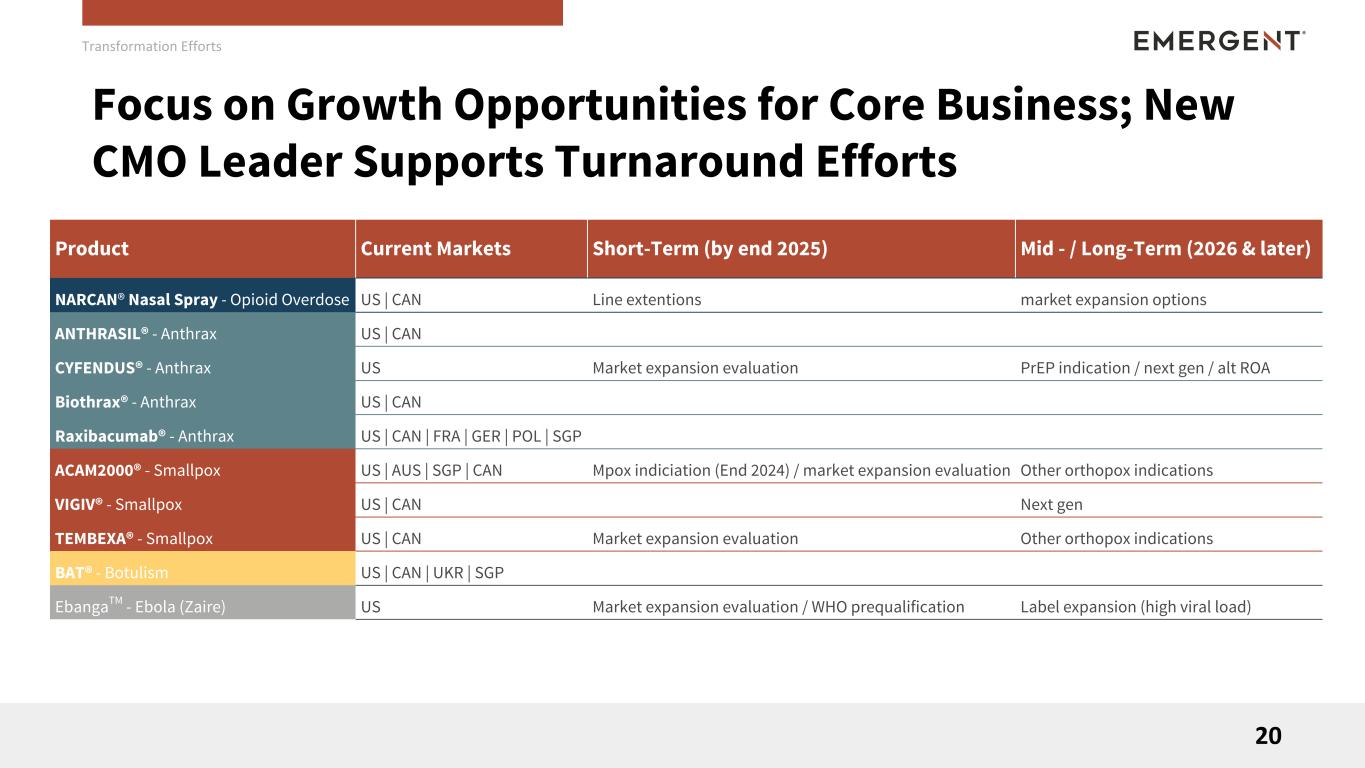

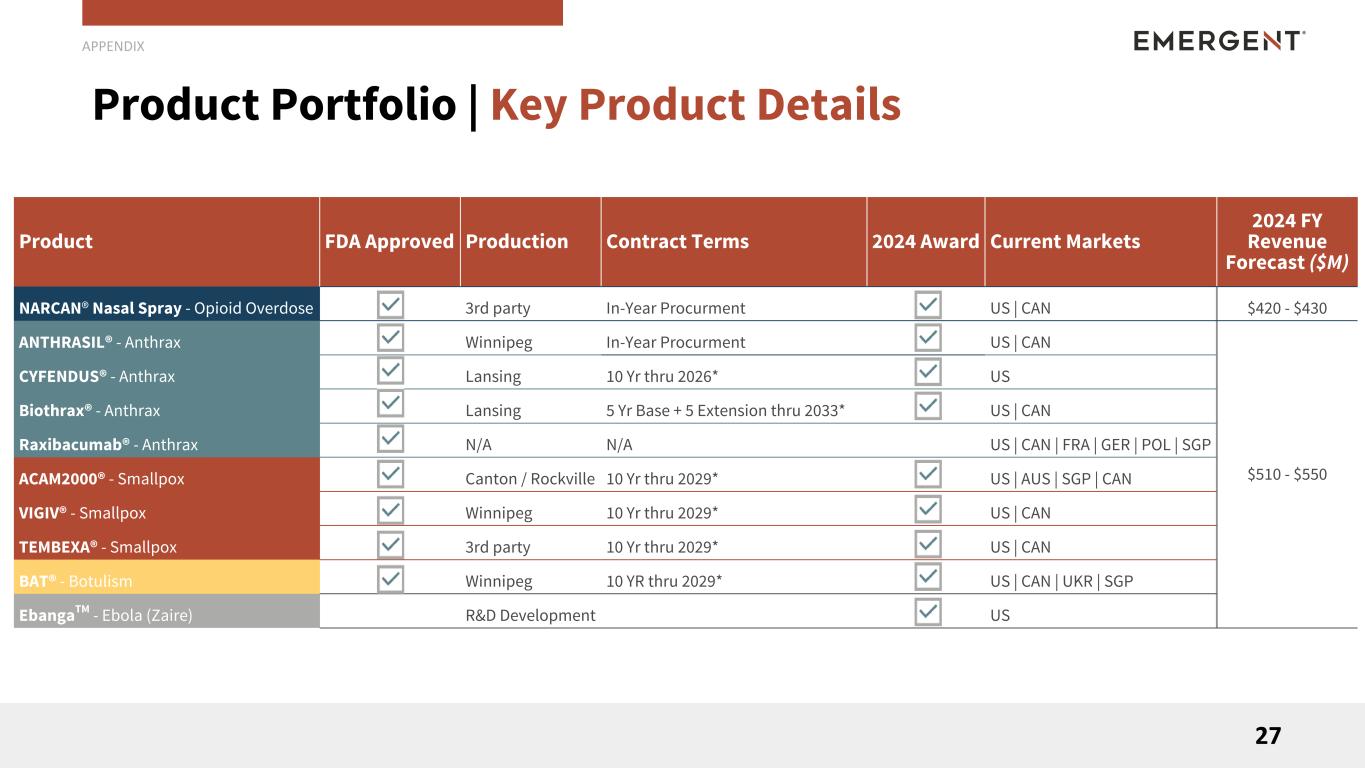

•NARCAN® — comprises contributions from NARCAN® Nasal Spray

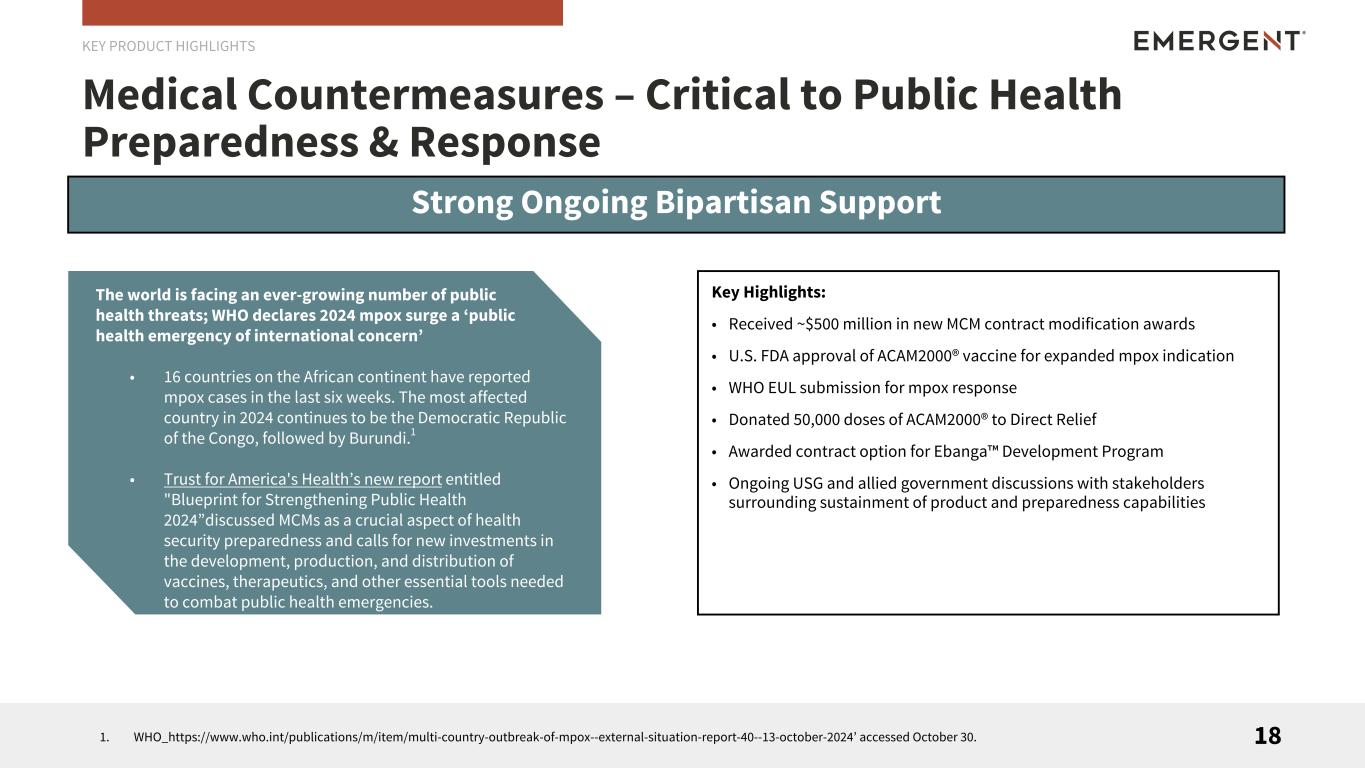

•Anthrax MCM — comprises contributions from CYFENDUS®, previously known as AV7909, BioThrax®, Anthrasil® and Raxibacumab

•Smallpox MCM — comprises contributions from ACAM2000®, VIGIV and TEMBEXA®

•Other Products — comprises contributions from BAT® and RSDL®

•Bioservices — comprises service and lease revenues from the Bioservices business

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in millions) |

Q3 2024 |

Q3 2023 |

% Change |

Product sales, net:(3) |

|

|

|

NARCAN® |

$ |

95.3 |

|

$ |

142.1 |

|

(33) |

% |

|

|

|

|

| Anthrax MCM |

11.4 |

|

32.9 |

|

(65) |

% |

| Smallpox MCM |

132.7 |

|

24.7 |

|

437 |

% |

| Other Products |

30.1 |

|

50.1 |

|

(40) |

% |

| Total Product sales, net |

$ |

269.5 |

|

$ |

249.8 |

|

8 |

% |

|

|

|

|

| Bioservices: |

|

|

|

| Services |

$ |

13.9 |

|

$ |

13.2 |

|

5 |

% |

| Leases |

0.4 |

|

1.0 |

|

(60) |

% |

| Total Bioservices revenues |

$ |

14.3 |

|

$ |

14.2 |

|

1 |

% |

|

|

|

|

| Contracts and grants |

$ |

10.0 |

|

$ |

6.5 |

|

54 |

% |

|

|

|

|

| Total revenues |

$ |

293.8 |

|

$ |

270.5 |

|

9 |

% |

|

|

|

|

|

|

|

|

|

Products Sales, net

NARCAN®

For Q3 2024, revenues from NARCAN® (naloxone HCl) Nasal Spray decreased $46.8 million, or 33%, as compared with Q3 2023. The decrease was primarily driven by the discontinuation of prescription NARCAN® due to the launch of over-the-counter (“OTC”) NARCAN® in the third quarter of 2023 and lower Canadian retail sales, partially offset by higher sales of OTC NARCAN®.

Anthrax MCM

For Q3 2024, revenues from Anthrax MCM products decreased $21.5 million, or 65%, as compared with Q3 2023. The decrease reflects the impact of timing of sales related to CYFENDUS® and Anthrasil®, partially offset by an increase in BioThrax® sales, due to timing. Anthrax vaccine product sales are primarily made under annual purchase options exercised by the U.S. government (the “USG”). Fluctuations in revenues result from the timing of the exercise of annual purchase options, the timing of USG purchases, the availability of governmental funding and the Company’s delivery of orders that follow.

Smallpox MCM

For Q3 2024, revenues from Smallpox MCM products increased $108.0 million, or 437%, as compared with Q3 2023. The increase was primarily due to timing of USG purchases of ACAM2000® and VIGIV. Fluctuations in revenues from Smallpox MCM result from the timing of the exercise of annual purchase options in the existing procurement contracts, the timing of USG purchases, the availability of governmental funding and Company delivery of orders that follow.

Other Products

For Q3 2024, revenues from Other Product sales decreased $20.0 million, or 40%, as compared with Q3 2023. The decrease was due to lower product sales of BAT®, due to timing of deliveries, and lower product sales of RSDL®, which was sold to SERB during the third quarter of 2024.

Bioservices Revenues

Services

For Q3 2024, revenues from Bioservices services increased $0.7 million, or 5%, as compared with Q3 2023. The increase was primarily attributable to an increase in production at the Company’s Camden facility, prior to the sale of the facility to Bora, partially offset by lower production at the Company’s Canton and Winnipeg facilities.

Leases

For Q3 2024, revenues from Bioservices leases decreased $0.6 million, or 60%, as compared with Q3 2023. The decrease was related to the completion of a lease for a Bioservices customer at our Canton facility, partially offset by new lease revenue associated with SERB at our Winnipeg facility.

Contracts and Grants

For Q3 2024, revenues from contracts and grants increased $3.5 million, or 54%, as compared with Q3 2023. The increase was primarily due to timing of funding as well as an increase related to work under the EbangaTM program.

Operating Expenses

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in millions) |

Q3 2024 |

Q3 2023 |

% Change |

| Cost of Commercial product sales |

$ |

47.2 |

|

$ |

60.0 |

|

(21) |

% |

Cost of MCM product sales |

54.0 |

|

72.5 |

|

(26) |

% |

| Cost of Bioservices |

21.4 |

|

44.3 |

|

(52) |

% |

| Research and development (“R&D”) |

13.8 |

|

15.3 |

|

(10) |

% |

| Selling, general and administrative (“SG&A”) |

76.6 |

|

86.0 |

|

(11) |

% |

| Amortization of intangible assets |

16.3 |

|

16.3 |

|

— |

% |

| Goodwill impairment |

— |

|

218.2 |

|

(100) |

% |

|

|

|

|

| Total operating expenses |

$ |

229.3 |

|

$ |

512.6 |

|

(55) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

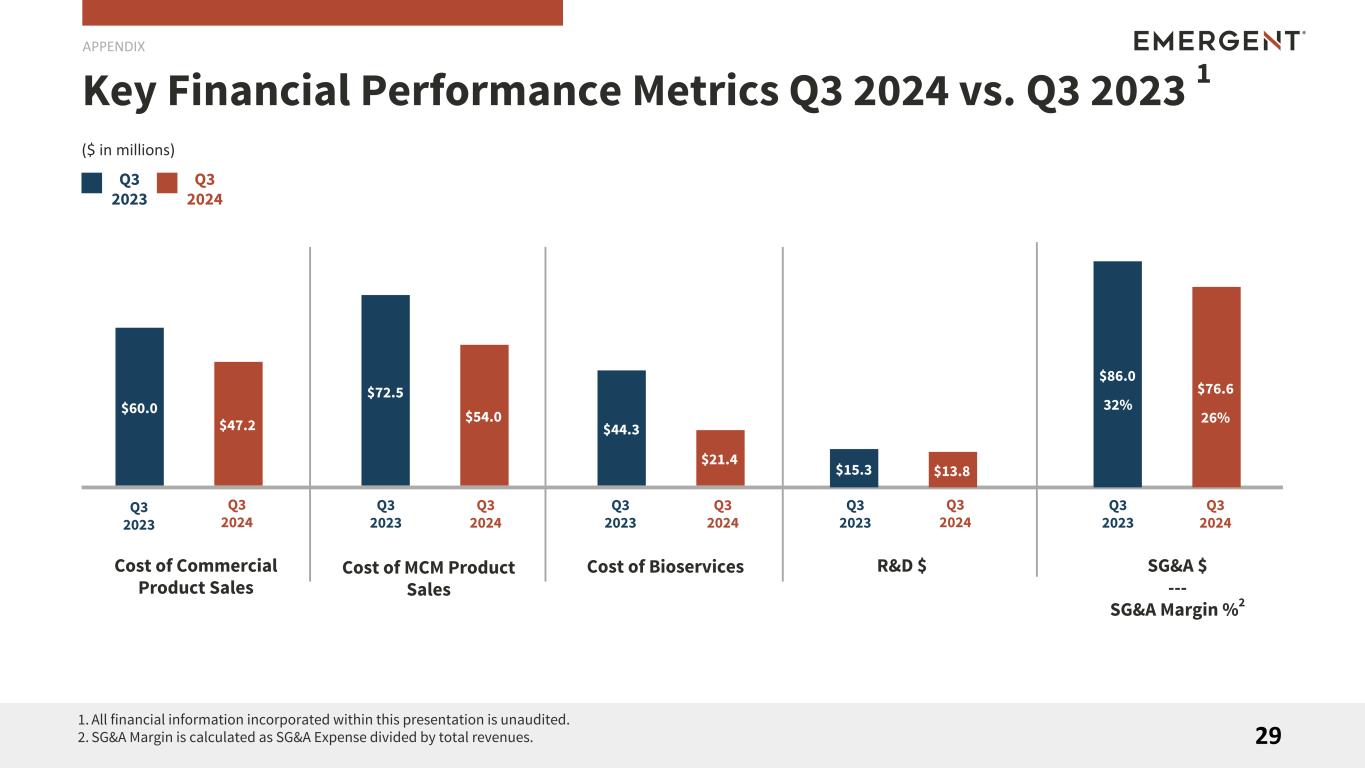

Cost of Commercial Product Sales

For Q3 2024, cost of Commercial Product sales decreased $12.8 million, or 21%, as compared with Q3 2023. The decrease was primarily due to lower prescription NARCAN® unit volume, partially offset by higher OTC NARCAN® unit volume.

Cost of MCM Product Sales

For Q3 2024, cost of MCM Product sales decreased $18.5 million, or 26%, as compared with Q3 2023. The decrease was primarily due to lower sales of BAT® and CYFENDUS®, coupled with lower allocations to Cost of MCM Product sales at our Bayview facility. This decrease was partially offset by higher sales of BioThrax® and ACAM2000®.

Cost of Bioservices

For Q3 2024, cost of Bioservices decreased $22.9 million, or 52%, as compared with Q3 2023. The decrease was primarily due to lower overhead and remediation costs related to the sale of the Camden facility, coupled with a decrease in overhead costs at our other Maryland facilities as a result of the announced shutdowns and lower costs at our Canton facility. The decrease was partially offset by an increase in production at our Winnipeg facility.

Research and Development Expenses

For Q3 2024, R&D expenses decreased $1.5 million, or 10%, as compared with Q3 2023. The decrease was driven by a reduction in spend for certain funded and unfunded projects, excluding EbangaTM. The decrease was partially offset by an increase in funded R&D related to EbangaTM.

Selling, General and Administrative Expenses

For Q3 2024, SG&A expenses decreased $9.4 million, or 11%, as compared with Q3 2023. The decrease was primarily due to lower employee related expenses and compensation as a result of restructuring initiatives during 2023 and 2024, coupled with a decrease in legal services fees for disputes and other corporate initiatives. This decrease was partially offset by the settlement charge related to the stockholder litigation matter, net of expected insurance proceeds.

Goodwill Impairment

For Q3 2024, Goodwill impairment decreased $218.2 million as compared with Q3 2023. The decrease was due to the Q3 2023 non-cash impairment charge to Goodwill in the MCM Products reporting unit, which reduced the reporting unit’s goodwill balance to zero.

ADDITIONAL FINANCIAL INFORMATION(1)

Capital Expenditures

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in millions) |

Q3 2024 |

Q3 2023 |

% Change |

| Capital expenditures |

$ |

5.8 |

|

$ |

12.6 |

|

(54) |

% |

|

|

|

|

|

|

|

|

| Capital expenditures as a % of total revenues |

2 |

% |

5 |

% |

|

|

|

|

|

|

|

|

|

|

For Q3 2024, capital expenditures decreased largely due to lower product development activities across the Company’s facilities.

SEGMENT INFORMATION

The Company manages the business with a focus on three reportable segments: (1) the Commercial Products segment consisting of our NARCAN® and other commercial products that were sold as part of our travel health business in the second quarter of 2023; (2) the MCM Products segment consisting of the Anthrax - MCM, Smallpox - MCM and Other products and (3) the services segment (“Services”) consisting of our Bioservices business. The Company evaluates the performance of these reportable segments based on revenues and segment adjusted gross margin, which is a non-GAAP financial measure. Segment revenue includes external customer sales, but does not include inter-segment services. The Company does not allocate contracts and grants revenue, R&D, SG&A, amortization of intangible assets, interest and other income (expense) or taxes to its evaluation of the performance of these segments.

THIRD QUARTER 2024 SEGMENT RESULTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in millions) |

Commercial Products |

| Quarter Ended September 30, |

| 2024 |

2023 |

$ Change |

% Change |

| Revenues |

$ |

95.3 |

|

$ |

142.1 |

|

$ |

(46.8) |

|

(33) |

% |

| Cost of sales |

47.2 |

|

60.0 |

|

(12.8) |

|

(21) |

% |

Gross margin** |

$ |

48.1 |

|

$ |

82.1 |

|

$ |

(34.0) |

|

(41) |

% |

Gross margin %** |

50 |

% |

58 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Segment adjusted gross margin(2) |

$ |

48.1 |

|

$ |

82.1 |

|

$ |

(34.0) |

|

(41) |

% |

Segment adjusted gross margin %(2) |

50 |

% |

58 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| ** Gross margin is calculated as revenues less cost of sales. Gross margin % is calculated as gross margin divided by revenues. |

|

|

Commercial Products gross margin decreased $34.0 million, or 41%, to $48.1 million in the quarter, as compared with $82.1 million in the prior year quarter. Commercial Products gross margin percentage decreased seven percentage points to 50% for the quarter ended September 30, 2024. The decrease was largely due to an unfavorable price and volume mix in 2024 for NARCAN® products. Commercial Products segment adjusted gross margin is consistent with gross margin.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in millions) |

MCM Products |

| Quarter Ended September 30, |

| 2024 |

2023 |

$ Change |

% Change |

| Revenues |

$ |

174.2 |

|

$ |

107.7 |

|

$ |

66.5 |

|

62 |

% |

| Cost of sales |

54.0 |

|

72.5 |

|

(18.5) |

|

(26) |

% |

Gross margin** |

$ |

120.2 |

|

$ |

35.2 |

|

$ |

85.0 |

|

241 |

% |

Gross margin %** |

69 |

% |

33 |

% |

|

|

| Add back: |

|

|

|

|

| Changes in fair value of financial instruments |

$ |

— |

|

$ |

(1.1) |

|

$ |

1.1 |

|

100 |

% |

| Restructuring costs |

4.9 |

|

5.0 |

|

(0.1) |

|

(2) |

% |

| Inventory step-up provision |

1.2 |

|

— |

|

1.2 |

|

NM |

Segment adjusted gross margin(2) |

$ |

126.3 |

|

$ |

39.1 |

|

$ |

87.2 |

|

223 |

% |

Segment adjusted gross margin %(2) |

73 |

% |

36 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| ** Gross margin is calculated as revenues less cost of sales. Gross margin % is calculated as gross margin divided by revenues. |

|

| NM - Not Meaningful |

MCM Products gross margin increased $85.0 million, or 241%, to $120.2 million in the quarter, as compared with $35.2 million in the prior year quarter. MCM Products gross margin percentage increased 36 percentage points to 69% for the quarter ended September 30, 2024. The increase was largely due to overall higher sales volumes with a favorable product mix weighted more heavily to higher margin products coupled with lower allocations to cost of MCM Product sales at our Bayview facility and overall lower shutdown and overhead costs across our facilities. MCM Product segment adjusted gross margin in the current year period excludes the impact of non-cash items related to the impact of restructuring costs of $4.9 million and inventory step-up provision of $1.2 million.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in millions) |

Services |

| Quarter Ended September 30, |

| 2024 |

2023 |

$ Change |

% Change |

| Revenues |

$ |

14.3 |

|

$ |

14.2 |

|

$ |

0.1 |

|

1 |

% |

| Cost of services |

21.4 |

|

44.3 |

|

(22.9) |

|

(52) |

% |

Gross margin** |

$ |

(7.1) |

|

$ |

(30.1) |

|

$ |

23.0 |

|

76 |

% |

Gross margin %** |

(50) |

% |

(212) |

% |

|

|

| Add back: |

|

|

|

|

|

|

|

|

|

| Restructuring costs |

0.1 |

|

8.1 |

|

(8.0) |

|

(99) |

% |

|

|

|

|

|

Segment adjusted gross margin(2) |

$ |

(7.0) |

|

$ |

(22.0) |

|

$ |

15.0 |

|

68 |

% |

Segment adjusted gross margin %(2) |

(49) |

% |

(155) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| ** Gross margin is calculated as revenues less cost of services. Gross margin % is calculated as gross margin divided by revenues. |

|

|

|

|

|

|

Services gross margin increased $23.0 million, or 76%, to $(7.1) million in the quarter, as compared with $(30.1) million in the prior year quarter. Services gross margin percentage increased 162 percentage points to (50)% for the quarter ended September 30, 2024. The increase was primarily due to lower overhead and remediation costs related to the sale of the Camden facility coupled with lower costs at our Bayview facility. Services segment adjusted gross margin in the current year period excludes the impact of restructuring costs of $0.1 million.

YTD 2024 SEGMENT RESULTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in millions) |

Commercial Products |

| Nine Months Ended September 30, |

| 2024 |

2023 |

$ Change |

% Change |

| Revenues |

$ |

333.8 |

|

$ |

386.2 |

|

$ |

(52.4) |

|

(14) |

% |

| Cost of sales |

152.7 |

|

160.2 |

|

(7.5) |

|

(5) |

% |

Gross margin** |

$ |

181.1 |

|

$ |

226.0 |

|

$ |

(44.9) |

|

(20) |

% |

Gross margin %** |

54 |

% |

59 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Segment adjusted gross margin(2) |

$ |

181.1 |

|

$ |

226.0 |

|

$ |

(44.9) |

|

(20) |

% |

Segment adjusted gross margin %(2) |

54 |

% |

59 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| ** Gross margin is calculated as revenues less cost of sales. Gross margin % is calculated as gross margin divided by revenues. |

|

|

Commercial Products gross margin decreased $44.9 million, or 20%, to $181.1 million for the nine months ended September 30, 2024, as compared with $226.0 million for the nine months ended September 30, 2023. Commercial Products gross margin percentage decreased five percentage points to 54% in 2024. The decrease was largely due to an unfavorable price and volume mix in 2024 for NARCAN® products, partially offset by the sale of the products associated with our travel health business to Bavarian Nordic. Commercial Products segment adjusted gross margin is consistent with gross margin.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in millions) |

MCM Products |

| Nine Months Ended September 30, |

| 2024 |

2023 |

$ Change |

% Change |

| Revenues |

$ |

393.0 |

|

$ |

309.2 |

|

$ |

83.8 |

|

27 |

% |

| Cost of sales |

147.3 |

|

208.4 |

|

(61.1) |

|

(29) |

% |

Gross margin** |

$ |

245.7 |

|

$ |

100.8 |

|

$ |

144.9 |

|

144 |

% |

Gross margin %** |

63 |

% |

33 |

% |

|

|

| Add back: |

|

|

|

|

| Changes in fair value of financial instruments |

$ |

0.6 |

|

$ |

(0.4) |

|

$ |

1.0 |

|

250 |

% |

| Inventory step-up provision |

1.2 |

|

1.9 |

|

(0.7) |

|

(37) |

% |

| Restructuring costs |

7.5 |

|

7.0 |

|

0.5 |

|

7 |

% |

Segment adjusted gross margin(2) |

$ |

255.0 |

|

$ |

109.3 |

|

$ |

145.7 |

|

133 |

% |

Segment adjusted gross margin %(2) |

65 |

% |

35 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| ** Gross margin is calculated as revenues less cost of sales. Gross margin % is calculated as gross margin divided by revenues. |

|

| NM - Not Meaningful |

MCM Products gross margin increased $144.9 million, or 144%, to $245.7 million for the nine months ended September 30, 2024, as compared with $100.8 million for the nine months ended September 30, 2023. MCM Products gross margin percentage increased 29 percentage points to 63% for the nine months ended September 30, 2024. The increase was largely due to overall higher sales volumes with a favorable product mix weighted more heavily to higher margin products coupled with lower allocations to Cost of MCM Product sales at our Bayview facility and lower shutdown related costs, a reduction in Trobigard® related costs, due to the Trobigard® revocation, and realization of previously adjusted inventory values. MCM Product segment adjusted gross margin excludes the impact of restructuring costs of $7.5 million, inventory step-up provision of $1.2 million and changes in fair value of financial instruments of $0.6 million.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in millions) |

Services |

| Nine Months Ended September 30, |

| 2024 |

2023 |

$ Change |

% Change |

| Revenues |

$ |

97.5 |

|

$ |

57.7 |

|

$ |

39.8 |

|

69 |

% |

| Cost of services |

263.3 |

|

151.7 |

|

111.6 |

|

74 |

% |

Gross margin** |

$ |

(165.8) |

|

$ |

(94.0) |

|

$ |

(71.8) |

|

(76) |

% |

Gross margin %** |

(170) |

% |

(163) |

% |

|

|

| Add back: |

|

|

|

|

| Settlement charges, net |

$ |

110.2 |

|

$ |

— |

|

$ |

110.2 |

|

NM |

| Restructuring costs |

0.3 |

|

8.1 |

|

(7.8) |

|

(96) |

% |

|

|

|

|

|

Segment adjusted gross margin(2) |

$ |

(55.3) |

|

$ |

(85.9) |

|

$ |

30.6 |

|

36 |

% |

Segment adjusted gross margin %(2) |

(57) |

% |

(149) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| ** Gross margin is calculated as revenues less cost of sales. Gross margin % is calculated as gross margin divided by revenues. |

|

| NM - Not Meaningful |

|

|

|

|

Services gross margin decreased $71.8 million, or 76%, to $(165.8) million for the nine months ended September 30, 2024, as compared with $(94.0) million for the nine months ended September 30, 2023. Services gross margin percentage decreased 7 percentage points to (170)% for the nine months ended September 30, 2024. The decrease was primarily due to the Settlement Agreement with Janssen and resulting revenue and write-down of related assets to net realizable value, coupled with lower production at the Company's Canton facility. This decrease was partially offset by an increase in production at the Camden facility prior to the sale of the facility to Bora and a decrease in overhead costs at our other Maryland facilities. Services segment adjusted gross margin in the current year period excludes the impact of segment settlement charge, net of $110.2 million and restructuring costs of $0.3 million.

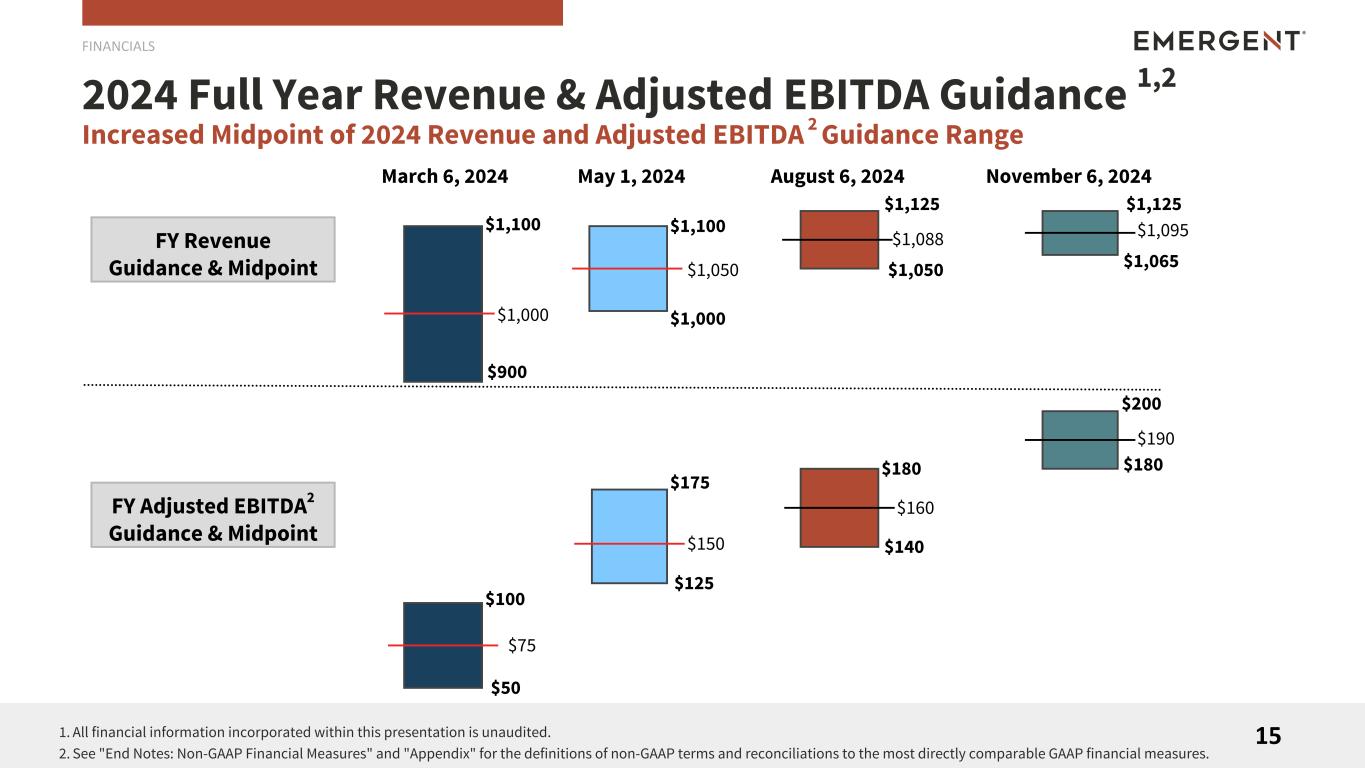

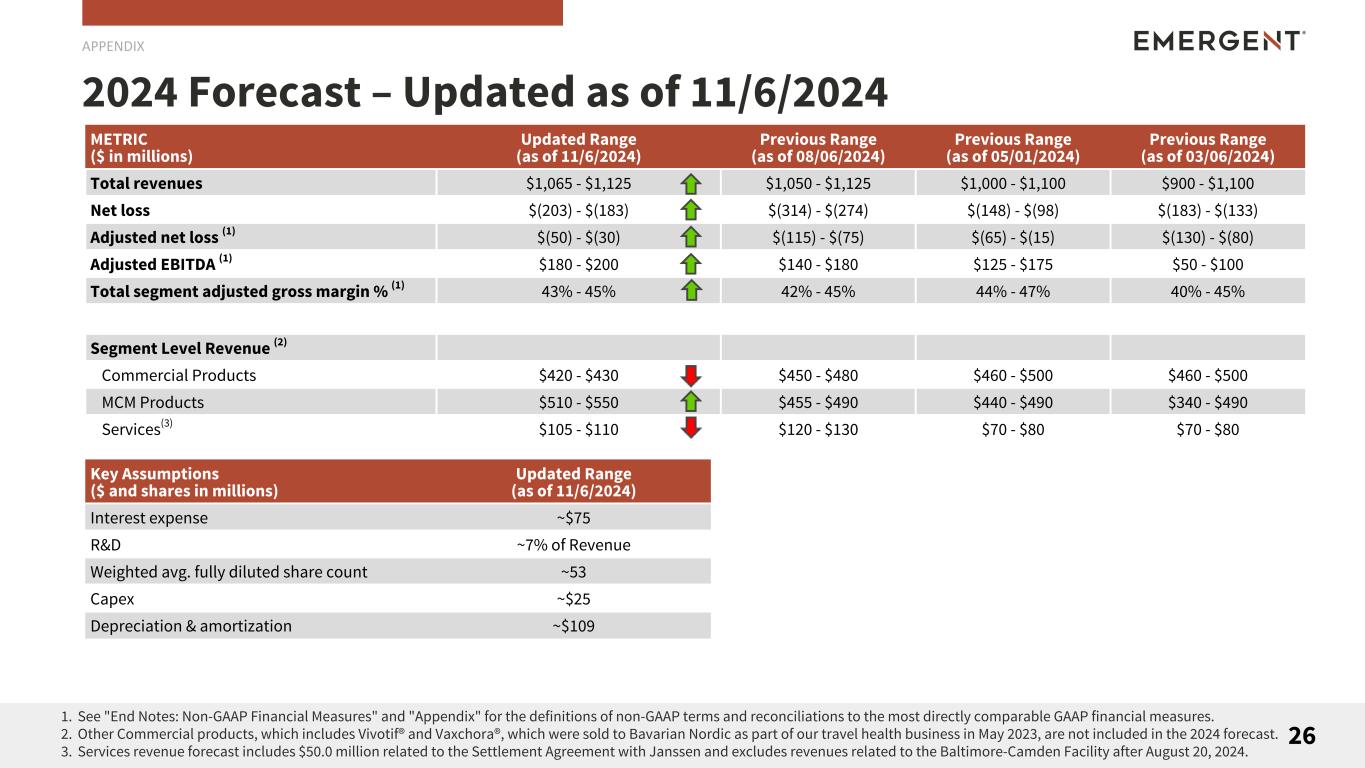

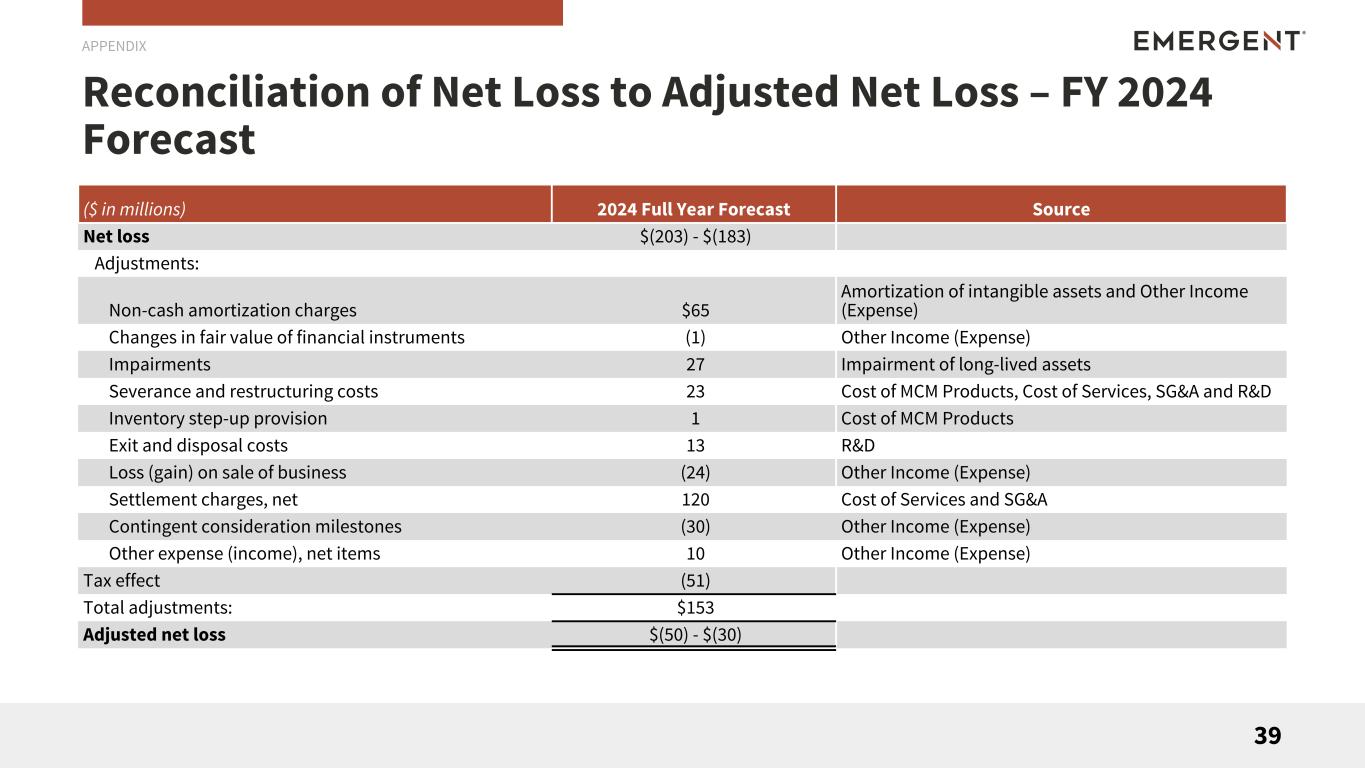

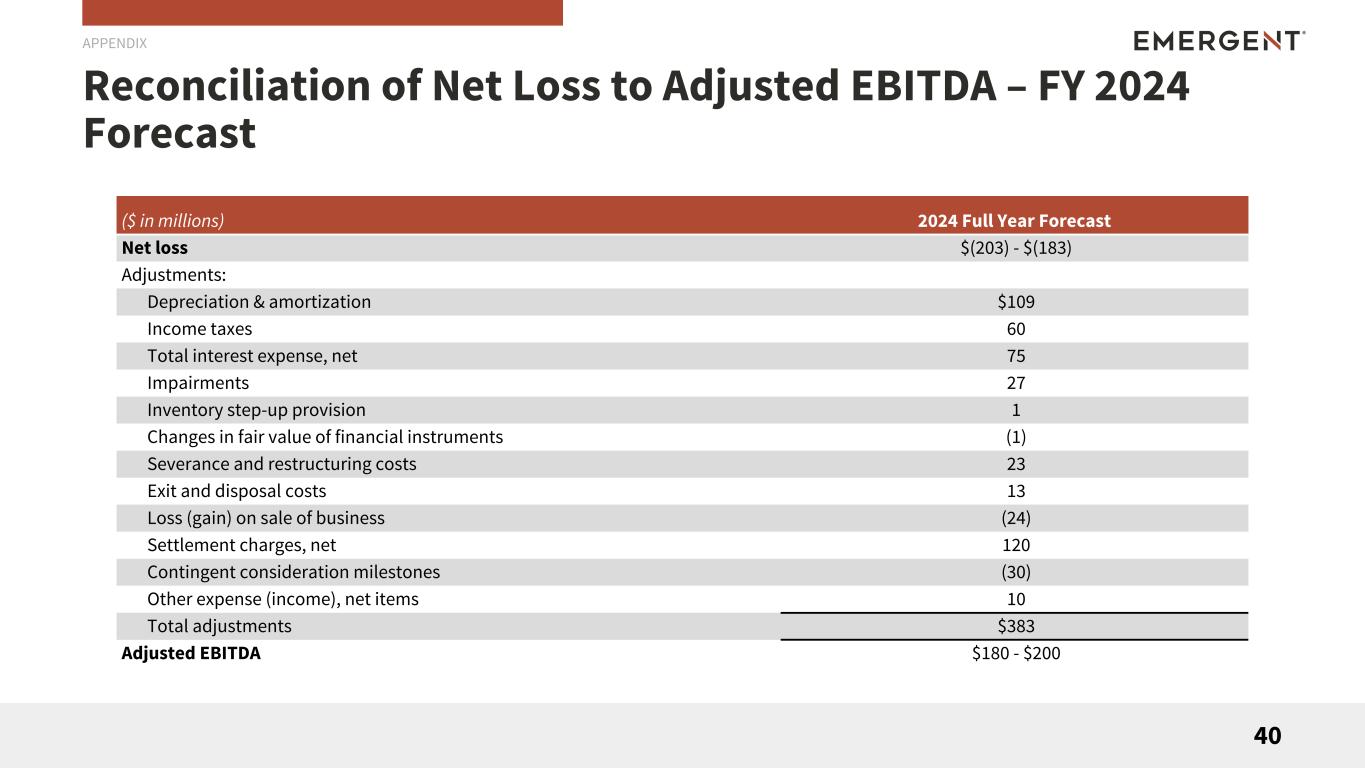

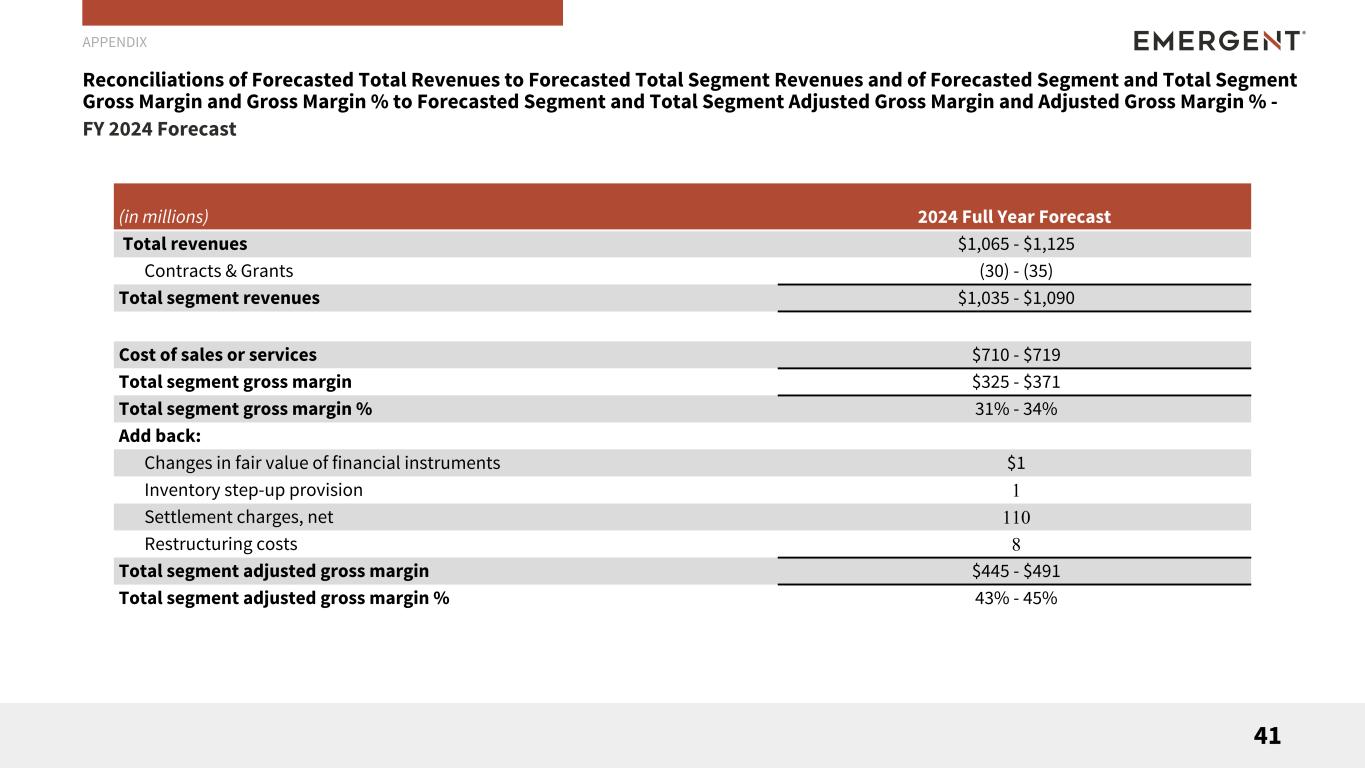

2024 FINANCIAL FORECAST

The Company provides the following updated financial forecast for full year 2024, reflecting management's expectations based on the most current information available.

Full Year 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

METRIC

($ in millions)

|

Updated Range

(as of 11/6/2024) |

Previous Range

(as of 08/06/2024) |

Previous Range

(as of 05/01/2024) |

Previous Range

(as of 03/06/2024) |

| Total revenues |

$1,065 - $1,125 |

$1,050 - $1,125 |

$1,000 - $1,100 |

$900 - $1,100 |

| Net loss |

$(203) - $(183) |

$(314) - $(274) |

$(148) - $(98) |

$(183) - $(133) |

Adjusted net loss(2) |

$(50) - $(30) |

$(115) - $(75) |

$(65) - $(15) |

$(130) - $(80) |

Adjusted EBITDA(2) |

$180 - $200 |

$140 - $180 |

$125 - $175 |

$50 - $100 |

Total segment adjusted gross margin %(2) |

43% - 45% |

42% - 45% |

44% - 47% |

40% - 45% |

|

|

|

|

|

Segment Level Revenue(4) |

|

|

|

|

| Commercial Products |

$420 - $430 |

$450 - $480 |

$460 - $500 |

$460 - $500 |

| MCM Products |

$510 - $550 |

$455 - $490 |

$440 - $490 |

$340 - $490 |

Services(5) |

$105 - $110 |

$120 - $130 |

$70 - $80 |

$70 - $80 |

|

|

|

|

|

|

|

Key Assumptions

($ and shares in millions)

|

Updated Range

(as of 11/6/2024) |

| Interest expense |

~$75 |

| R&D |

~7% of Revenue |

| Weighted avg. fully diluted share count |

~53 |

| Capex |

~$25 |

| Depreciation & amortization |

~$109 |

FOOTNOTES

(1) All financial information included in this release is unaudited.

(2) See “Non-GAAP Financial Measures” and the "Reconciliation of Non-GAAP Financial Measures" tables for the definitions and reconciliations of these non-GAAP financial measures to the most closely related GAAP financial measures.

(3) Product sales, net are reported net of variable consideration including returns, rebates, wholesaler fees and prompt pay discounts in accordance with U.S. generally accepted accounting principles.

(4) Our Commercial Products forecast consists solely of NARCAN® Nasal Spray, as our Other Commercial Products, including Vivotif® and Vaxchora®, were sold to Bavarian Nordic as part of our travel health business in May 2023.

(5) Our Services revenue forecast includes $50.0 million related to the Settlement Agreement with Janssen and excludes revenues related to the Baltimore-Camden Facility after August 20, 2024.

CONFERENCE CALL, PRESENTATION SUPPLEMENT AND WEBCAST INFORMATION

Company management will host a conference call at 5:00 pm eastern time today, November 6, 2024, to discuss these financial results. The conference call and presentation supplement can be accessed from the Company's website or through the following:

By phone

To join via telephone, please use the following dial-in details:

U.S. / New York: +1-646-968-2525

U.S. & Canada (Toll Free): +1-888-596-4144

Conference ID: 5259189

By webcast

Visit https://edge.media-server.com/mmc/p/nm3oj8g9

A replay of the call can be accessed from the Emergent website.

ABOUT EMERGENT BIOSOLUTIONS INC.

At Emergent, our mission is to protect and enhance life. We develop, manufacture, and deliver protections against public health threats through a pipeline of innovative vaccines and therapeutics. For over 25 years, we have been at work defending people from things we hope will never happen—so that we are prepared just in case they ever do. We do what we do because we see the opportunity to create a better, more secure world. One where preparedness empowers protection from the threats we face. And peace of mind prevails. In working together, we envision protecting or enhancing 1 billion lives by 2030. For more information, visit our website and follow us on LinkedIn, Twitter, and Instagram.

NON-GAAP FINANCIAL MEASURES

In the accompanying analysis of financial information, we sometimes use information derived from consolidated and segment financial information that may not be presented in our financial statements or prepared in accordance with generally accepted accounting principles in the United States (“GAAP”). Certain of these financial measures are considered not in conformity with GAAP (“non-GAAP financial measures”) under the United States Securities and Exchange Commission (“SEC”) rules. Specifically, we have referred to the following non-GAAP financial measures:

•Adjusted Net Income (Loss)

•Adjusted Net Income (Loss) per Diluted Share

•Adjusted EBITDA

•Total Segment Revenues

•Total Segment Gross Margin

•Total Segment Gross Margin %

•Total Segment Adjusted Gross Margin

•Total Segment Adjusted Gross Margin %

•Segment Adjusted Gross Margin

•Segment Adjusted Gross Margin %

We define Adjusted Net Income (Loss) and Adjusted Net Income (Loss) per Diluted Share, which are non-GAAP financial measures, as net income (loss) and net income (loss) per diluted share, respectively, excluding the impact of changes in fair value of financial instruments, acquisition and divestiture-related costs, severance and restructuring costs, settlement charges, net, exit and disposal costs, impairment charges, gain (loss) on sale of business, non-cash amortization charges, contingent consideration milestones, and other income (expense) items. We use Adjusted Net Income (Loss) for the purpose of calculating Adjusted Net Income (Loss) per Diluted Share. Management uses Adjusted Net Income (Loss) per Diluted Share to assess total Company operating performance on a consistent basis. We believe that these non-GAAP financial measures, when considered together with our GAAP financial results and GAAP financial measures, provide management and investors with an additional understanding of our business operating results, including underlying trends.

We define Adjusted EBITDA, which is a non-GAAP financial measure, as consolidated net income (loss) before income tax provision (benefit), interest expense, net, depreciation, amortization of intangible assets, excluding the impact of changes in fair value of financial instruments, acquisition and divestiture-related costs, severance and restructuring costs, settlement charges, net, exit and disposal costs, impairment charges, gain (loss) on sale of business, non-cash amortization charges, contingent consideration milestones and other income (expense) items. We believe that this non-GAAP financial measure, when considered together with our GAAP financial results and GAAP financial measures, provides management and investors with a more complete understanding of our operating results, including underlying trends.

In addition, EBITDA is a common alternative measure of operating performance used by many of our competitors. It is used by investors, financial analysts, rating agencies and others to value and compare the financial performance of companies in our industry, although it may be defined differently by different companies. Therefore, we also believe that this non-GAAP financial measure, considered along with corresponding GAAP financial measures, provides management and investors with additional information for comparison of our operating results with the operating results of other companies.

We have included the definitions of Segment Gross Margin and Segment Gross Margin %, which are GAAP financial measures, below in order to more fully define the components of certain non-GAAP financial measures presented in this press release. We define Segment Gross Margin, as a segment's revenues, less a segment's cost of sales or services. We define Segment Gross Margin %, as Segment Gross Margin as a percentage of a segments revenues. We define Segment Adjusted Gross Margin, which is a non-GAAP financial measure as Segment Gross Margin excluding the impact of restructuring costs, changes in the fair value of financial instruments, settlement charges, net and inventory step-up provision. We define Segment Adjusted Gross Margin %, which is a non-GAAP financial measure, as Segment Adjusted Gross Margin as a percentage of a segment's revenues.

We define Total Segment Revenues, which is a non-GAAP financial measure, as our Total Revenues, less contracts and grants revenue, which is also equal to the sum of the revenues of our reportable operating segments. We define Total Segment Gross Margin, which is a non-GAAP financial measure, as Total Segment Revenues less our aggregate cost of sales or services. We define Total Segment Gross Margin %, which is a non-GAAP financial measure, as Total Segment Gross Margin as a percentage of Total Segment Revenues. We define Total Segment Adjusted Gross Margin, which is a non-GAAP financial measure, as Total Segment Gross Margin, excluding the impact of restructuring costs, settlement charges, net, changes in the fair value of financial instruments and inventory step-up provision. We define Total Segment Adjusted Gross Margin %, which is a non-GAAP financial measure, as Total Segment Adjusted Gross Margin as a percentage of Total Segment Revenues.

Non-GAAP financial measures are not defined in the same manner by all companies and may not be comparable with other similarly titled measures of other companies. The determination of the amounts that are excluded from these non-GAAP financial measures are a matter of management judgment and depend upon, among other factors, the nature of the underlying expense or income amounts. Non-GAAP financial measures should be considered in addition to, but not as a substitute for or superior to, the information contained in our Consolidated Statements of Operations and Consolidated Statements of Cash Flows. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the financial tables accompanying this press release.

SAFE HARBOR STATEMENT

This press release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, including statements regarding the future performance of the Company or any of our businesses, our business strategy, future operations, future financial position, future revenues and earnings, our ability to achieve the objectives of our restructuring initiatives and divestitures, including our future results, projected costs, prospects, plans and objectives of management, are forward-looking statements. We generally identify forward-looking statements by using words like “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “future,” “goal,” “intend,” “may,” “plan,” “position,” “possible,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would,” and similar expressions or variations thereof, or the negative thereof, but these terms are not the exclusive means of identifying such statements. Forward-looking statements are based on our current intentions, beliefs, assumptions and expectations regarding future events based on information that is currently available. Readers should realize that if underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could differ materially from our expectations. Readers are, therefore, cautioned not to place undue reliance on any forward-looking statement contained herein. Any such forward-looking statement speaks only as of the date of this press release, and, except as required by law, we do not undertake any obligation to update any forward-looking statement to reflect new information, events or circumstances.

There are a number of important factors that could cause our actual results to differ materially from those indicated by such forward-looking statements, including, among others, the availability of USG funding for contracts related to procurement of our medical countermeasure ("MCM") products, including CYFENDUS® (Anthrax Vaccine Adsorbed (AVA) Adjuvanted), previously known as AV7909, BioThrax® (Anthrax Vaccine Adsorbed), and ACAM2000® (Smallpox (Vaccinia) Vaccine, Live) among others, as well as contracts related to development of medical countermeasures; the availability of government funding for our other commercialized products, including EbangaTM (ansuvimab-zykl) and BAT® (Botulism Antitoxin Heptavalent (A,B,C,D,E,F,G)-(Equine)); our ability to meet our commitments to quality and compliance in all of our manufacturing operations; our ability to negotiate additional USG procurement or follow-on contracts for our MCM products that have expired or will be expiring; the commercial availability and acceptance of over-the-counter NARCAN® (naloxone HCl) Nasal Spray; the impact of a generic and competitive marketplace on NARCAN® Nasal Spray and future NARCAN® Nasal Spray sales; our ability to perform under our contracts with the USG, including the timing of and specifications relating to deliveries; our ability to provide Bioservices (as defined below) for the development and/or manufacture of product and/or product candidates of our customers at required levels and on required timelines; the ability of our contractors and suppliers to maintain compliance with current good manufacturing practices and other regulatory obligations; our ability to negotiate further commitments related to the collaboration and deployment of capacity toward future commercial manufacturing under our existing Bioservices contracts; our ability to collect reimbursement for raw materials and payment of service fees from our Bioservices customers; the results of pending government investigations and their potential impact on our business; our ability to obtain final court approval of the proposed settlement agreement relating to the stockholder litigation, including our ability to satisfy the conditions of the proposed settlement, and the source of funds to be used to resolve the litigation, and the potential impact of the settlement agreement, if approved, on our business; our ability to comply with the operating and financial covenants required by our term loan facility under a credit agreement, dated August 30, 2024, our revolving credit facility under a credit agreement, dated September 30, 2024, and our 3.875% Senior Unsecured Notes due 2028; our ability to maintain adequate internal control over financial reporting and to prepare accurate financial statements in a timely manner; our ability to successfully manage our liquidity in order to continue as a going concern; the procurement of our product candidates by USG entities under regulatory authorities that permit government procurement of certain medical products prior to FDA marketing authorization, and corresponding procurement by government entities outside the United States; our ability to realize the expected benefits of the sale of our travel health business to Bavarian Nordic, the sale of RSDL® to SERB Pharmaceuticals and the sale of our drug product facility in Baltimore-Camden to Bora Pharmaceuticals Injectables Inc.; the impact of the organizational changes we announced in January 2023, August 2023, May 2024 and August 2024; our ability to identify and acquire companies, businesses, products or product candidates that satisfy our selection criteria; the impact of cyber security incidents, including the risks from the unauthorized access, interruption, failure or compromise of our information systems or those of our business partners, collaborators or other third parties; the success of our commercialization, marketing and manufacturing capabilities and strategy; and the accuracy of our estimates regarding future revenues, expenses, capital requirements and need for additional financing. The foregoing sets forth many, but not all, of the factors that could cause actual results to differ from our expectations in any forward-looking statement. Readers should consider this cautionary statement, as well as the risks identified in our periodic reports filed with the Securities and Exchange Commission, when evaluating our forward-looking statements.

Trademarks

Emergent®, BioThrax®, BaciThrax®, BAT®, Trobigard®, Anthrasil®, CNJ-016®, ACAM2000®, NARCAN®, CYFENDUS®, TEMBEXA® and any and all Emergent BioSolutions Inc. brands, products, services and feature names, logos and slogans are trademarks or registered trademarks of Emergent BioSolutions Inc. or its subsidiaries in the United States or other countries. All other brands, products, services and feature names or trademarks are the property of their respective owners, including RSDL® (Reactive Skin Decontamination Lotion), which was acquired by SERB on July 31, 2024.

|

|

|

|

|

|

|

Investor Contact

Rich Lindahl

Executive Vice President, Chief Financial Officer

lindahlr@ebsi.com

|

Media Contact

Assal Hellmer

Vice President, Communications

mediarelations@ebsi.com

|

Emergent BioSolutions Inc.

Consolidated Balance Sheets

(unaudited, in millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

December 31, |

| 2024 |

|

2023 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

149.9 |

|

|

$ |

111.7 |

|

| Restricted cash |

6.5 |

|

|

— |

|

| Accounts receivable, net |

121.3 |

|

|

191.0 |

|

| Inventories, net |

322.7 |

|

|

328.9 |

|

| Prepaid expenses and other current assets |

61.0 |

|

|

47.9 |

|

|

|

|

|

| Total current assets |

661.4 |

|

|

679.5 |

|

|

|

|

|

| Property, plant and equipment, net |

278.1 |

|

|

382.8 |

|

| Intangible assets, net |

517.8 |

|

|

566.6 |

|

|

|

|

|

| Other assets |

20.5 |

|

|

194.3 |

|

| Total assets |

$ |

1,477.8 |

|

|

$ |

1,823.2 |

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

82.1 |

|

|

$ |

112.2 |

|

| Accrued expenses |

16.1 |

|

|

18.6 |

|

| Accrued compensation |

63.3 |

|

|

74.1 |

|

| Debt, current portion |

0.8 |

|

|

413.7 |

|

| Other current liabilities |

67.6 |

|

|

32.7 |

|

|

|

|

|

| Total current liabilities |

229.9 |

|

|

651.3 |

|

|

|

|

|

| Debt, net of current portion |

661.8 |

|

|

446.5 |

|

| Deferred tax liability |

41.9 |

|

|

47.2 |

|

| Other liabilities |

35.8 |

|

|

28.9 |

|

| Total liabilities |

$ |

969.4 |

|

|

$ |

1,173.9 |

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

Preferred stock, $0.001 par value per share; 15.0 shares authorized, no shares issued and outstanding |

— |

|

|

— |

|

Common stock, $0.001 par value per share; 200.0 shares authorized, 59.7 and 57.8 shares issued; 54.1 and 52.2 shares outstanding, respectively. |

0.1 |

|

|

0.1 |

|

Treasury stock, at cost, 5.6 and 5.6 common shares, respectively |

(227.7) |

|

|

(227.7) |

|

| Additional paid-in capital |

924.4 |

|

|

904.4 |

|

| Accumulated other comprehensive loss, net |

(7.3) |

|

|

(5.7) |

|

| Accumulated deficit |

(181.1) |

|

|

(21.8) |

|

| Total stockholders’ equity |

$ |

508.4 |

|

|

$ |

649.3 |

|

| Total liabilities and stockholders’ equity |

$ |

1,477.8 |

|

|

$ |

1,823.2 |

|

Emergent BioSolutions Inc.

Consolidated Statements of Operations

(unaudited, in millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| 2024 |

|

2023 |

|

2024 |

|

2023 |

| Revenues: |

|

|

|

|

|

|

|

| Commercial Product sales |

$ |

95.3 |

|

|

$ |

142.1 |

|

|

$ |

333.8 |

|

|

$ |

386.2 |

|

| MCM Product sales |

174.2 |

|

|

107.7 |

|

|

393.0 |

|

|

309.2 |

|

| Total Product sales, net |

269.5 |

|

|

249.8 |

|

|

726.8 |

|

|

695.4 |

|

| Bioservices: |

|

|

|

|

|

|

|

| Services |

13.9 |

|

|

13.2 |

|

|

96.7 |

|

|

52.2 |

|

| Leases |

0.4 |

|

|

1.0 |

|

|

0.8 |

|

|

5.5 |

|

| Total Bioservices revenues |

14.3 |

|

|

14.2 |

|

|

97.5 |

|

|

57.7 |

|

| Contracts and grants |

10.0 |

|

|

6.5 |

|

|

24.6 |

|

|

19.6 |

|

| Total revenues |

293.8 |

|

|

270.5 |

|

|

848.9 |

|

|

772.7 |

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

| Cost of Commercial Product sales |

47.2 |

|

|

60.0 |

|

|

152.7 |

|

|

160.2 |

|

| Cost of MCM Product sales |

54.0 |

|

|

72.5 |

|

|

147.3 |

|

|

208.4 |

|

| Cost of Bioservices |

21.4 |

|

|

44.3 |

|

|

263.3 |

|

|

151.7 |

|

| Research and development |

13.8 |

|

|

15.3 |

|

|

61.6 |

|

|

82.0 |

|

| Selling, general and administrative |

76.6 |

|

|

86.0 |

|

|

247.2 |

|

|

278.7 |

|

| Amortization of intangible assets |

16.3 |

|

|

16.3 |

|

|

48.8 |

|

|

49.4 |

|

| Goodwill impairment |

— |

|

|

218.2 |

|

|

— |

|

|

218.2 |

|

| Impairment of long-lived assets |

— |

|

|

— |

|

|

27.2 |

|

|

306.7 |

|

| Total operating expenses |

229.3 |

|

|

512.6 |

|

|

948.1 |

|

|

1,455.3 |

|

|

|

|

|

|

|

|

|

| Income (loss) from operations |

64.5 |

|

(242.1) |

|

(99.2) |

|

(682.6) |

|

|

|

|

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

|

| Interest expense |

(8.3) |

|

|

(19.7) |

|

|

(56.2) |

|

|

(66.2) |

|

| Gain (loss) on sale of business |

64.3 |

|

|

(0.7) |

|

|

24.3 |

|

|

74.2 |

|

| Other, net |

21.9 |

|

|

(3.4) |

|

|

15.8 |

|

|

(2.1) |

|

| Total other income (expense), net |

77.9 |

|

|

(23.8) |

|

|

(16.1) |

|

|

5.9 |

|

|

|

|

|

|

|

|

|

| Income (loss) before income taxes |

142.4 |

|

|

(265.9) |

|

|

(115.3) |

|

|

(676.7) |

|

| Income tax provision (benefit) |

27.6 |

|

|

(2.5) |

|

|

44.0 |

|

|

34.3 |

|

| Net income (loss) |

$ |

114.8 |

|

|

$ |

(263.4) |

|

|

$ |

(159.3) |

|

|

$ |

(711.0) |

|

|

|

|

|

|

|

|

|

| Earnings (loss) per common share |

|

|

|

|

|

|

|

| Basic |

$ |

2.16 |

|

|

$ |

(5.08) |

|

|

$ |

(3.03) |

|

|

$ |

(13.97) |

|

| Diluted |

$ |

2.06 |

|

|

$ |

(5.08) |

|

|

$ |

(3.03) |

|

|

$ |

(13.97) |

|

|

|

|

|

|

|

|

|

| Shares used in computing earnings (loss) per common share |

|

|

|

|

|

|

|

| Basic |

53.1 |

|

51.8 |

|

52.6 |

|

50.9 |

| Diluted |

55.6 |

|

51.8 |

|

52.6 |

|

50.9 |

|

|

|

|

|

|

|

|

Emergent BioSolutions Inc.

Consolidated Statements of Cash Flows

(unaudited, in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

| 2024 |

|

2023 |

| Operating Activities |

|

|

|

| Net loss |

$ |

(159.3) |

|

|

$ |

(711.0) |

|

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: |

|

|

|

| Share-based compensation expense |

13.7 |

|

|

19.1 |

|

|

|

|

|

| Depreciation and amortization |

82.8 |

|

|

95.5 |

|

| Change in fair value of contingent obligations, net |

0.6 |

|

|

(0.4) |

|

| Amortization of deferred financing costs |

5.2 |

|

|

15.6 |

|

| Deferred income taxes |

(5.1) |

|

|

(3.7) |

|

| Noncash gain on sale of business |

(32.2) |

|

|

(74.2) |

|

| Change in fair value of warrant and forward liabilities |

(1.1) |

|

|

— |

|

| Goodwill impairment |

— |

|

|

218.2 |

|

|

|

|

|

| Impairment of long-lived assets |

27.2 |

|

|

306.7 |

|

| Loss on disposal of assets |

28.9 |

|

|

13.9 |

|

| Other |

3.9 |

|

|

(5.0) |

|

| Changes in operating assets and liabilities: |

|

|

|

| Accounts receivable |

52.7 |

|

|

(58.5) |

|

| Inventories |

(35.5) |

|

|

(25.0) |

|

| Prepaid expenses and other assets |

146.3 |

|

|

(18.3) |

|

| Accounts payable |

(22.8) |

|

|

17.7 |

|

| Accrued expenses and other liabilities |

32.9 |

|

|

(30.2) |

|

| Long-term incentive plan accrual |

2.5 |

|

|

3.7 |

|

| Accrued compensation |

(9.9) |

|

|

(0.8) |

|

| Income taxes receivable and payable, net |

26.6 |

|

|

(3.5) |

|

| Contract liabilities |

(18.8) |

|

|

1.8 |

|

| Net cash provided by (used in) operating activities |

138.6 |

|

|

(238.4) |

|

| Investing Activities |

|

|

|

| Purchases of property, plant and equipment |

(21.2) |

|

|

(40.2) |

|

| Proceeds from sale of property, plant and equipment |

7.6 |

|

|

— |

|

|

|

|

|

| Milestone payment from prior asset acquisition |

— |

|

|

(6.3) |

|

|

|

|

|

| Proceeds from sale of business |

110.2 |

|

|

270.2 |

|

| Net cash provided by investing activities |

96.6 |

|

|

223.7 |

|

| Financing Activities |

|

|

|

|

|

|

|

| Proceeds from the issuance of debt, net of lender fees |

219.0 |

|

|

— |

|

| Proceeds allocated to warrants issued in conjunction with debt |

13.4 |

|

|

— |

|

| Proceeds allocated to common stock issued in conjunction with debt |

9.3 |

|

|

— |

|

| Principal payments on term loan facility |

(198.2) |

|

|

(160.7) |

|

| Proceeds from revolving credit facility |

65.0 |

|

|

— |

|

| Principal payments on revolving credit facility |

(284.2) |

|

|

(386.8) |

|

|

|

|

|

|

|

|

|

| Debt issuance costs |

(14.6) |

|

|

— |

|

| Proceeds from share-based compensation activity |

0.7 |

|

|

1.3 |

|

| Taxes paid for share-based compensation activity |

(0.9) |

|

|

(2.4) |

|

|

|

|

|

| Proceeds from at-the-market sale of stock, net of commissions and expenses |

— |

|

|

8.2 |

|

| Net cash used in financing activities: |

(190.5) |

|

|

(540.4) |

|

| Effect of exchange rate changes on cash, cash equivalents and restricted cash |

— |

|

|

0.3 |

|

| Net change in cash, cash equivalents and restricted cash |

44.7 |

|

|

(554.8) |

|

|

|

|

|

| Cash, cash equivalents and restricted cash, beginning of period |

111.7 |

|

|

642.6 |

|

| Cash, cash equivalents and restricted cash, end of period |

$ |

156.4 |

|

|

$ |

87.8 |

|

Emergent BioSolutions Inc.

Consolidated Statements of Cash Flows Continued

(unaudited, in millions)

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental cash flow disclosures: |

|

|

|

| Cash paid for interest |

$ |

55.8 |

|

|

$ |

56.5 |

|

| Cash paid for income taxes |

$ |

35.5 |

|

|

$ |

38.3 |

|

| Non-cash investing and financing activities: |

|

|

|

| Purchases of property, plant and equipment unpaid at period end |

$ |

1.6 |

|

|

$ |

9.2 |

|

|

|

|

|

| Gain on extinguishments of debt |

$ |

0.6 |

|

|

$ |

— |

|

| Issuance of common stock in conjunction with debt |

7.7 |

|

|

— |

|

| Reconciliation of cash and cash equivalents and restricted cash: |

|

|

|

| Cash and cash equivalents |

$ |

149.9 |

|

|

$ |

87.8 |

|

|

|

|

|

| Restricted cash |

6.5 |

|

|

— |

|

| Total |

$ |

156.4 |

|

|

$ |

87.8 |

|

Emergent BioSolutions, Inc.

Reconciliation of Non-GAAP Financial Measures

Reconciliation of Net Income (Loss) and Net Income (Loss) per Diluted Share to Adjusted Net Income (Loss) and Adjusted Net Income (Loss) per Diluted Share(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in millions, except per share data) |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

| 2024 |

2023 |

|

2024 |

2023 |

Source |

| Net income (loss) |

$ |

114.8 |

|

$ |

(263.4) |

|

|

$ |

(159.3) |

|

$ |

(711.0) |

|

|

| Adjustments: |

|

|

|

|

|

|

| Non-cash amortization charges |

$ |

9.7 |

|

$ |

21.9 |

|

|

$ |

54.0 |

|

$ |

65.0 |

|

Amortization of intangible assets (IA), Other Income |

| Impairments |

— |

|

218.2 |

|

|

27.2 |

|

524.9 |

|

Impairment of long-lived assets and goodwill |

| Severance and restructuring costs |

6.3 |

|

20.6 |

|

|

22.9 |

|

34.5 |

|

Cost of MCM Products, Cost of Services, SG&A and R&D |

| Inventory step-up provision |

1.2 |

|

— |

|

|

1.2 |

|

1.9 |

|

Cost of MCM Products |

| Acquisition and divestiture costs |

— |

|

— |

|

|

— |

|

2.8 |

|

SG&A |

| Exit and disposal costs |

— |

|

— |

|

|

13.3 |

|

6.1 |

|

R&D |

| Loss (gain) on sale of business |

(64.3) |

|

0.7 |

|

|

(24.3) |

|

(74.2) |

|

Other Income (Expense) |

| Settlement charges, net |

10.0 |

|

— |

|

|

120.2 |

|

— |

|

Cost of Services and SG&A |

| Contingent consideration milestones |

(30.0) |

|

— |

|

|

(30.0) |

|

— |

|

Other Income (Expense) |

| Changes in fair value of financial instruments |

(1.1) |

|

(1.1) |

|

|

(0.5) |

|

(0.4) |

|

Cost of MCM Products and Other Income (Expense) |

| Other expense (income), net items |

6.7 |

|

— |

|

|

9.8 |

|

— |

|

Other Income (Expense) |

| Tax effect |

22.9 |

|

(53.1) |

|

|

(49.2) |

|

(122.6) |

|

|

| Total adjustments: |

$ |

(38.6) |

|

$ |

207.2 |

|

|

$ |

144.6 |

|

$ |

438.0 |

|

|

| Adjusted net income (loss) |

$ |

76.2 |

|

$ |

(56.2) |

|

|

$ |

(14.7) |

|

$ |

(273.0) |

|

|

| Net income (loss) per diluted share |

$ |

2.06 |

|

$ |

(5.08) |

|

|

$ |

(3.03) |

|

$ |

(13.97) |

|

|

| Adjustments: |

|

|

|

|

|

|

| Non-cash amortization charges |

$ |

0.17 |

|

$ |

0.42 |

|

|

$ |

1.03 |

|

$ |

1.28 |

|

Amortization of IA, Other Income (Expense) |

| Impairments |

— |

|

4.21 |

|

|

0.52 |

|

10.31 |

|

Impairment of long-lived assets |

| Severance and restructuring costs |

0.12 |

|

0.40 |

|

|

0.44 |

|

0.68 |

|

Cost of MCM Products, Cost of Services, SG&A and R&D |

| Inventory step-up provision |

0.02 |

|

— |

|

|

0.02 |

|

0.04 |

|

Cost of MCM Products |

| Acquisition and divestiture costs |

— |

|

— |

|

|

— |

|

0.06 |

|

SG&A |

| Exit and disposal costs |

— |

|

— |

|

|

0.25 |

|

0.12 |

|

R&D |

| Loss (gain) on sale of business |

(1.16) |

|

0.01 |

|

|

(0.46) |

|

(1.46) |

|

Other Income (Expense) |

| Settlement charges, net |

0.18 |

|

— |

|

|

2.29 |

|

— |

|

Cost of Services and SG&A |

| Contingent consideration milestones |

(0.54) |

|

— |

|

|

(0.57) |

|

— |

|

Other Income (Expense) |

| Changes in fair value of financial instruments |

(0.02) |

|

(0.02) |

|

|

(0.01) |

|

(0.01) |

|

Cost of MCM Products and Other Income (Expense) |

| Other expense (income), net items |

0.12 |

|

— |

|

|

0.19 |

|

— |

|

Other Income (Expense) |

| Tax effect |

0.42 |

|

(1.03) |

|

|

(0.95) |

|

(2.41) |

|

|

| Total adjustments: |

$ |

(0.69) |

|

$ |

3.99 |

|

|

$ |

2.75 |

|

$ |

8.61 |

|

|

| Adjusted net income (loss) per diluted share |

$ |

1.37 |

|

$ |

(1.09) |

|

|

$ |

(0.28) |

|

$ |

(5.36) |

|

|

| Diluted shares used in computing Adjusted net income (loss) per diluted share |

55.6 |

|

51.8 |

|

|

52.6 |

|

50.9 |

|

|

Emergent BioSolutions, Inc.

Reconciliation of Net Income (Loss) to Adjusted EBITDA(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in millions) |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| 2024 |

2023 |

|

2024 |

2023 |

| Net income (loss) |

$ |

114.8 |

|

$ |

(263.4) |

|

|

$ |

(159.3) |

|

$ |

(711.0) |

|

| Adjustments: |

|

|

|

|

|

| Depreciation & amortization |

$ |

26.4 |

|

$ |

27.9 |

|

|

$ |

82.8 |

|

$ |

95.5 |

|

| Income taxes |

27.6 |

|

(2.5) |

|

|

44.0 |

|

34.3 |

|

| Total interest expense, net |

7.7 |

|

19.4 |

|

|

54.8 |

|

59.9 |

|

| Impairments |

— |

|

218.2 |

|

|

27.2 |

|

524.9 |

|

| Inventory step-up provision |

1.2 |

|

— |

|

|

1.2 |

|

1.9 |

|

| Changes in fair value of financial instruments |

(1.1) |

|

(1.1) |

|

|

(0.5) |

|

(0.4) |

|

| Severance and restructuring costs |

6.3 |

|

20.6 |

|

|

22.9 |

|

34.5 |

|

| Exit and disposal costs |

— |

|

— |

|

|

13.3 |

|

6.1 |

|

| Acquisition and divestiture costs |

— |

|

— |

|

|

— |

|

2.8 |

|

| Loss (gain) on sale of business |

(64.3) |

|

0.7 |

|

|

(24.3) |

|

(74.2) |

|

| Settlement charges, net |

10.0 |

|

— |

|

|

120.2 |

|

— |

|

| Contingent consideration milestones |

(30.0) |

|

— |

|

|

(30.0) |

|

— |

|

| Other expense (income), net items |

6.7 |

|

— |

|

|

9.8 |

|

— |

|

| Total adjustments |

$ |

(9.5) |

|

$ |

283.2 |

|

|

$ |

321.4 |

|

$ |

685.3 |

|

| Adjusted EBITDA |

$ |

105.3 |

|

$ |

19.8 |

|

|

$ |

162.1 |

|

$ |

(25.7) |

|

Emergent BioSolutions, Inc.

Reconciliations of Total Revenues to Total Segment Revenues and of Segment and Total Segment Gross Margin and Gross Margin %

to Segment and Total Segment Adjusted Gross Margin and Adjusted Gross Margin %(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, 2024

(unaudited, in millions)

|

Commercial Products |

MCM Products |

Services |

|

Total Segment |

Contracts & Grants |

Total Revenues |

| Revenues |

$ |

95.3 |

|

$ |

174.2 |

|

$ |

14.3 |

|

|

$ |

283.8 |

|

$ |

10.0 |

|

$ |

293.8 |

|

|

|

|

|

|

|

|

|

| Cost of sales or services |

47.2 |

|

54.0 |

|

21.4 |

|

|

122.6 |

|

|

|

|

|

|

|

|

|

|

|

| Gross margin |

$ |

48.1 |

|

$ |

120.2 |

|

$ |

(7.1) |

|

|

$ |

161.2 |

|

|

|

| Gross margin % |

50 |

% |

69 |

% |

(50) |

% |

|

57 |

% |

|

|

|

|

|

|

|

|

|

|

| Add back: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Inventory step-up provision |

$ |

— |

|

$ |

1.2 |

|

$ |

— |

|

|

$ |

1.2 |

|

|

|

|

|

|

|

|

|

|

|

| Restructuring costs |

— |

|

4.9 |

|

0.1 |

|

|

5.0 |

|

|

|

|

|

|

|

|

|

|

|

| Adjusted gross margin |

$ |

48.1 |

|

$ |

126.3 |

|

$ |

(7.0) |

|

|

$ |

167.4 |

|

|

|

| Adjusted gross margin % |

50 |

% |

73 |

% |

(49) |

% |

|

59 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, 2023

(unaudited, in millions)

|

Commercial Products |

MCM Products |

Services |

|

Total Segment |

Contracts & Grants |

Total Revenues |

| Revenues |

$ |

142.1 |

|

$ |

107.7 |

|

$ |

14.2 |

|

|

$ |

264.0 |

|

$ |

6.5 |

|

$ |

270.5 |

|

|

|

|

|

|

|

|

|

| Cost of sales or services |

60.0 |

|

72.5 |

|

44.3 |

|

|

176.8 |

|

|

|

|

|

|

|

|

|

|

|

| Gross margin |

$ |

82.1 |

|

$ |

35.2 |

|

$ |

(30.1) |

|

|

$ |

87.2 |

|

|

|

| Gross margin % |

58 |

% |

33 |

% |

(212) |

% |

|

33 |

% |

|

|

|

|

|

|

|

|

|

|

| Add back: |

|

|

|

|

|

|

|

| Changes in fair value of financial instruments |

$ |

— |

|

$ |

(1.1) |

|

$ |

— |

|

|

$ |

(1.1) |

|

|

|

|

|

|

|

|

|

|

|

| Restructuring costs |

— |

|

5.0 |

|

8.1 |

|

|

13.1 |

|

|

|

|

|

|

|

|

|

|

|

| Adjusted gross margin |

$ |

82.1 |

|

$ |

39.1 |

|

$ |

(22.0) |

|

|

$ |

99.2 |

|

|

|

| Adjusted gross margin % |

58 |

% |

36 |

% |

(155) |

% |

|

38 |

% |

|

|

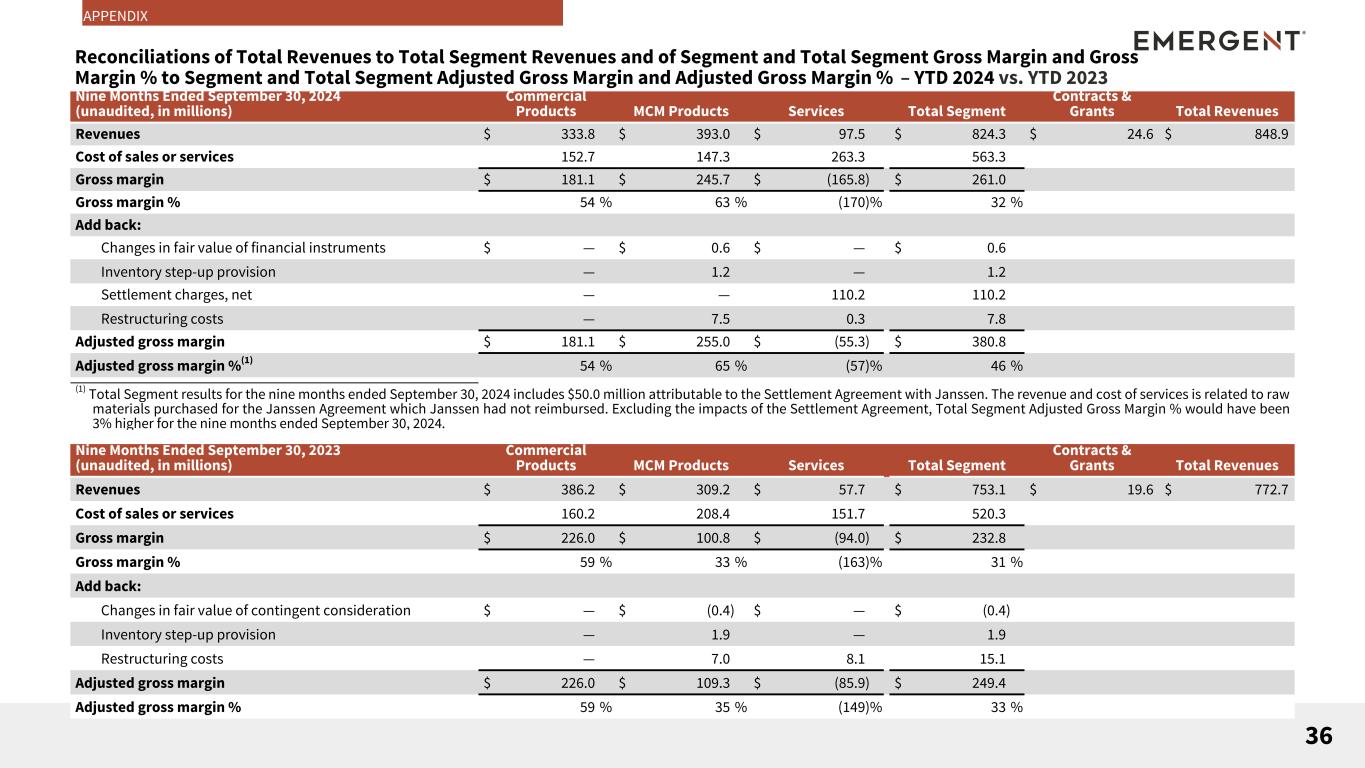

Emergent BioSolutions, Inc.

Reconciliations of Total Revenues to Total Segment Revenues and of Segment and Total Segment Gross Margin and Gross Margin % to Segment and Total Segment Adjusted Gross Margin and Adjusted Gross Margin %(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, 2024

(unaudited, in millions)

|

Commercial Products |

MCM Products |

Services1 |

|

Total Segment |

Contracts & Grants |

Total Revenues |

| Revenues |

$ |

333.8 |

|

$ |

393.0 |

|

$ |

97.5 |

|

|

$ |

824.3 |

|

$ |

24.6 |

|

$ |

848.9 |

|

|

|

|

|

|

|

|

|

| Cost of sales or services |

152.7 |

|

147.3 |

|

263.3 |

|

|

563.3 |

|

|

|

|

|

|

|

|

|

|

|

| Gross margin |

$ |

181.1 |

|

$ |

245.7 |

|

$ |

(165.8) |

|

|

$ |

261.0 |

|

|

|

| Gross margin % |

54 |

% |

63 |

% |

(170) |

% |

|

32 |

% |

|

|

|

|

|

|

|

|

|

|

| Add back: |

|

|

|

|

|

|

|

| Changes in fair value of financial instruments |

$ |

— |

|

$ |

0.6 |

|

$ |

— |

|

|

$ |

0.6 |

|

|

|

| Inventory step-up provision |

— |

|

1.2 |