0001367644false00013676442023-05-252023-05-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 25, 2023

EMERGENT BIOSOLUTIONS INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Delaware |

|

001-33137 |

|

14-1902018 |

| (State or other jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

| of incorporation) |

|

|

|

Identification No.) |

400 Professional Drive, Suite 400,

Gaithersburg, Maryland 20879

(Address of principal executive offices, including zip code)

(240) 631-3200

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, Par Value $0.001 per share |

EBS |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Amendment to Stock Incentive Plan

On May 25, 2023, Emergent BioSolutions Inc. (the “Company”) held its 2023 annual meeting of stockholders (the “Annual Meeting”). At the Annual Meeting, the Company’s stockholders approved the Emergent BioSolutions Inc. Amended and Restated Stock Incentive Plan (the “Amended SIP”).

The Board of Directors previously adopted the Amended SIP on March 23, 2023, subject to stockholder approval.

The Amended SIP:

•increases the number of shares of the Company’s common stock available for issuance under the plan by 3,675,000 shares, subject to adjustment in the event of stock splits and other similar events;

•updates the ratio by which shares of common stock subject to a full-value award granted on or subsequent to May 25, 2023 are counted against the maximum aggregate number of shares available for issuance under the Amended SIP to 1.6;

•confirms that awards granted to non-employee directors will be subject to a minimum vesting period of 50 weeks following the date of grant and that awards granted to participants other than non-employee directors shall not vest before the first anniversary of the date of grant;

•clarifies that no dividends or dividend equivalent rights are payable with respect to options or stock appreciation rights; and

•clarifies the treatment of awards in the event of a change in control.

A summary of the terms and conditions of the Amended Plan is set forth in Amendment No. 1 to the Company’s definitive proxy statement on revised Schedule 14A related to the Annual Meeting, filed on April 24, 2023 (the “Proxy Statement”), which summary is incorporated herein by reference. This summary does not purport to be complete and is qualified in its entirety by, and should be read in conjunction with, the Amended SIP, a blacklined copy of which is attached as Appendix B to the Proxy Statement.

Amendment to Employee Stock Purchase Plan

At the Annual Meeting, the Company’s stockholders also approved an amendment (the “ESPP Amendment”) to the Emergent BioSolutions Inc. Employee Stock Purchase Plan (the “ESPP”).

The Board of Directors previously adopted the ESPP Amendment on March 23, 2023, subject to stockholder approval.

The ESPP Amendment increases the number of shares of the Company’s common stock available for issuance under the plan by 2,000,000 shares.

A summary of the terms and conditions of the ESPP and the ESPP Amendment is set forth in the Proxy Statement.

Item 5.07 Submission of Matters to a Vote of Security Holders.

As noted above, the Annual Meeting was held on May 25, 2023. A total of 43,714,218 shares of the Company’s common stock were present or represented by proxy, which represented approximately 86.7% of the Company’s 50,398,410 shares of common stock that were outstanding and entitled to vote at the Annual Meeting as of the record date of March 30, 2023. Stockholders considered the six proposals outlined below, each of which is described in more detail in the Proxy Statement.

Proposal 1. To elect three Class II directors to hold office for a term expiring at our 2026 annual meeting of stockholders, each to serve until their respective successors are duly elected and qualified. All director nominees were elected and qualified. The voting results were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

| Director Nominee |

For |

Withhold |

Broker Non-Votes |

| Zsolt Harsanyi, Ph.D. |

35,447,738 |

|

3,334,217 |

|

4,932,263 |

|

| Sujata Dayal |

38,560,258 |

|

221,697 |

|

4,932,263 |

|

| Louis Sullivan, M.D. |

29,546,015 |

|

9,235,940 |

|

4,932,263 |

|

Proposal 2. To ratify the appointment by the Audit and Finance Committee of Ernst & Young LLP as our Independent Registered Public Accounting Firm for the fiscal year ending December 31, 2023. Proposal 2 was approved. The voting results were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

| For |

Against |

Abstentions |

Broker Non-Votes |

| 43,371,082 |

|

310,370 |

|

32,766 |

|

— |

|

Proposal 3. To approve, on an advisory basis, the 2022 compensation of our named executive officers. Proposal 3 was approved. The voting results were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

| For |

Against |

Abstentions |

Broker Non-Votes |

| 33,224,006 |

|

5,533,397 |

|

24,552 |

|

4,932,263 |

|

Proposal 4. To vote, on an advisory basis, on the frequency of future stockholder advisory votes on the compensation of our named executive officers. Stockholders voted, on a non-binding, advisory basis, to hold advisory votes on the compensation of our named executive officers every year. The voting results were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

| Every year |

Every two years |

Every three years |

Abstentions |

| 36,907,390 |

|

36,805 |

|

1,802,055 |

|

35,705 |

|

Consistent with the recommendation of our board of directors and the vote of our stockholders reflected above, we will hold advisory stockholder votes on the compensation of our named executive officers annually until the next vote on the frequency of stockholder votes on the compensation of our named executive officers.

Proposal 5. To approve the Amended SIP. Proposal 5 was approved. The voting results were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

| For |

Against |

Abstentions |

Broker Non-Votes |

| 35,382,763 |

|

3,374,483 |

|

24,709 |

|

4,932,263 |

|

Proposal 6. To approve the ESPP Amendment. Proposal 6 was approved. The voting results were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

| For |

Against |

Abstentions |

Broker Non-Votes |

| 38,578,091 |

|

184,700 |

|

19,164 |

|

4,932,263 |

|

Item 7.01 Regulation FD Disclosure.

On May 25, 2023, Company management delivered a presentation at the Annual Meeting. A copy of the presentation is furnished as Exhibit 99.1 hereto.

The information contained in this Item 7.01 shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing, under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

|

|

|

|

|

|

|

|

|

| Exhibit No. |

|

Description |

| 99.1 |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

EMERGENT BIOSOLUTIONS INC. |

| |

|

|

| Dated: May 31, 2023 |

By: |

/s/ RICHARD S. LINDAHL |

|

|

Name: Richard S. Lindahl

Title: Executive Vice President, Chief Financial

Officer and Treasurer |

|

|

|

EX-99.1

2

ebsvasm2023-slidesxfinal.htm

EX-99.1

ebsvasm2023-slidesxfinal

Emergent BioSolutions Inc. 2023 Annual Meeting of Stockholders May 25, 2023

Agenda 22023 Virtual Annual Meeting of Stockholders INTRODUCTION 1. Call to Order; Rules and Procedure 2. Introductions 3. Procedural Matters; Declaration of Quorum 4. Presentation of the proposals to be considered and voted on by the stockholders as set forth in the proxy statement: • Proposal No. 1: Election of Class II Directors • Proposal No. 2: Ratification of Independent Registered Accounting Firm • Proposal No. 3: Advisory Vote to Approve the 2022 Compensation of NEOs • Proposal No. 4: Advisory Vote on Frequency of Future Stockholder Advisory Votes on Compensation of NEOs • Proposal No. 5: Amendment to Company’s Stock Incentive Plan • Proposal No. 6: Amendment to Company’s Employee Stock Purchase Plan 5. Report of Voting Results by Inspector of Election 6. Adjournment of the Formal Meeting 7. Presentation: State of the Company 8. General Q&A Session Robert G. Kramer President and Chief Executive Officer Richard S. Lindahl Executive Vice President, Chief Financial Officer and Treasurer Jennifer Fox Executive Vice President, External Affairs, General Counsel and Corporate Secretary Zsolt Harsanyi, Ph.D. Chairman of the Board of Directors

PROPRIETARY AND CONFIDENTIAL 32023 Virtual Annual Meeting of Stockholders State of the Company Bob Kramer President and Chief Executive Officer

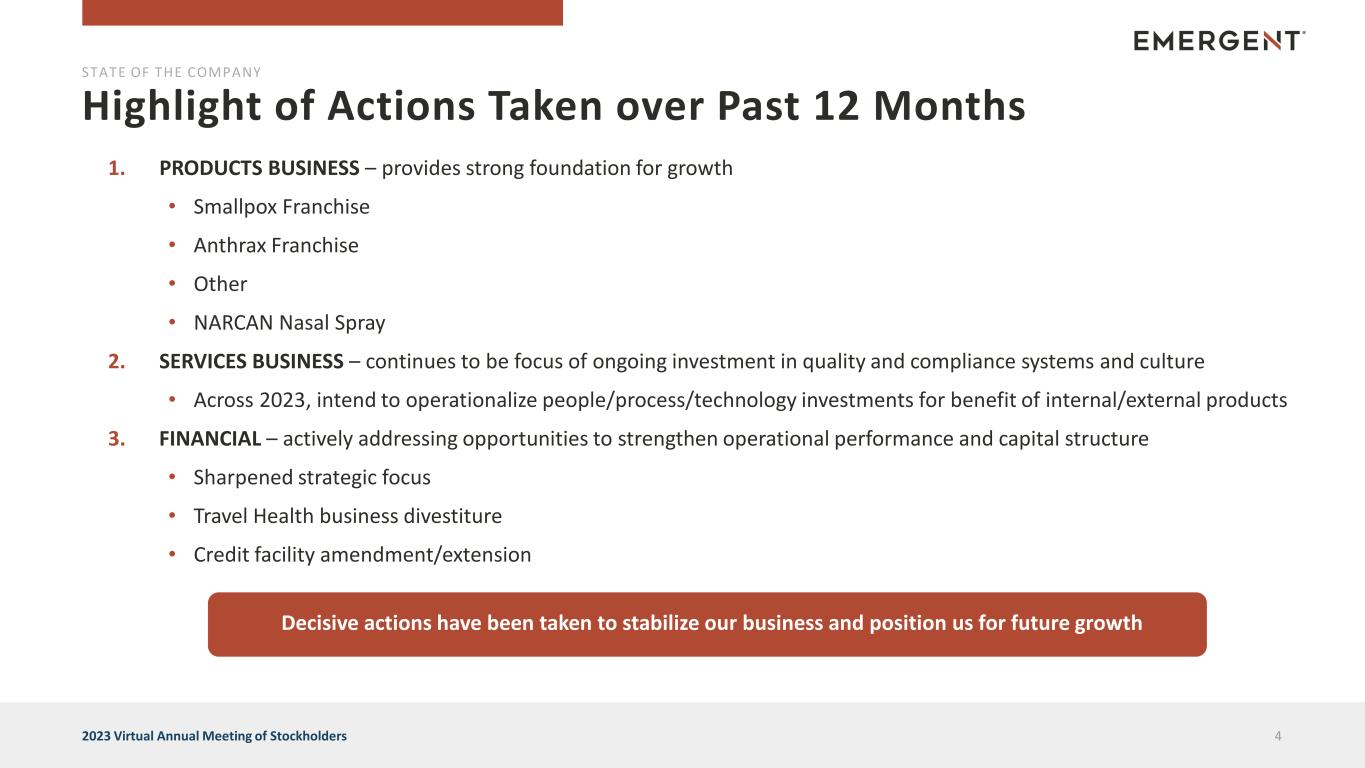

Highlight of Actions Taken over Past 12 Months 42023 Virtual Annual Meeting of Stockholders STATE OF THE COMPANY 1. PRODUCTS BUSINESS – provides strong foundation for growth • Smallpox Franchise • Anthrax Franchise • Other • NARCAN Nasal Spray 2. SERVICES BUSINESS – continues to be focus of ongoing investment in quality and compliance systems and culture • Across 2023, intend to operationalize people/process/technology investments for benefit of internal/external products 3. FINANCIAL – actively addressing opportunities to strengthen operational performance and capital structure • Sharpened strategic focus • Travel Health business divestiture • Credit facility amendment/extension Decisive actions have been taken to stabilize our business and position us for future growth

PROPRIETARY AND CONFIDENTIAL 52023 Virtual Annual Meeting of Stockholders Q&A

Safe Harbor Statement/Trademarks 62023 Virtual Annual Meeting of Stockholders This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, including statements regarding the future performance of the Company or our business strategy, future operations, future financial position, future revenues and earnings, projected costs, prospects, plans and objectives of management and the ongoing impact of the COVID-19 pandemic, are forward-looking statements. We generally identify forward-looking statements by using words like “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “plan,” should,” “will,” “would,” and similar expressions or variations thereof, or the negative thereof, but these terms are not the exclusive means of identifying such statements. Forward-looking statements are based on our current intentions, beliefs and expectations regarding future events. We cannot guarantee that any forward-looking statement will be accurate. You should realize that if underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could differ materially from our expectations. You are, therefore, cautioned not to place undue reliance on any forward-looking statement. Any forward-looking statement speaks only as of the date on which such statement is made, and, except as required by law we do not undertake to update any forward-looking statement to reflect new information, events or circumstances. There are a number of important factors that could cause our actual results to differ materially from those indicated by such forward-looking statements, including, among others, the availability of USG funding for contracts related to procurement of our medical countermeasures, including AV7909 (Anthrax Vaccine Adsorbed (AVA), Adjuvanted), BioThrax® (Anthrax Vaccine Adsorbed) and ACAM2000®, (Smallpox (Vaccinia) Vaccine, Live), among others, as well as contracts related to development of medical countermeasures; our ability to meet our commitments to quality and compliance in all of our manufacturing operations; our ability to negotiate additional USG procurement or follow-on contracts for our medical countermeasures products that have expired or will be expiring; the commercial availability, including the timing of availability, of over-the-counter NARCAN® (naloxone HCI) Nasal Spray; the impact of the generic marketplace on NARCAN® (naloxone HCI) Nasal Spray and future NARCAN sales; our ability to perform under our contracts with the USG, including the timing of and specifications relating to deliveries; our ability to provide CDMO services for the development and/or manufacture of product and/or product candidates of our customers at required levels and on required timelines; the ability of our contractors and suppliers to maintain compliance with current good manufacturing practices and other regulatory obligations; our ability to negotiate new CDMO contracts and the negotiation of further commitments related to the collaboration and deployment of capacity toward future commercial manufacturing under our existing CDMO contracts; our ability to collect reimbursement for raw materials and payment of services fees from our CDMO customers; the results of pending shareholder litigation and government investigations and their potential impact on our business; our ability to comply with the operating and financial covenants required by our senior secured credit facilities and the amended and restated credit agreement relating to such facilities, and our 3.875% Senior Unsecured Notes due 2028; our ability to refinance our senior secured credit facilities prior to their maturity in October 2023; the procurement of our product candidates by USG entities under regulatory authorities that permit government procurement of certain medical products prior to U.S. Food and Drug Administration marketing authorization, and corresponding procurement by government entities outside of the United States; the full impact of the COVID-19 pandemic on our markets, operations and employees as well as those of our customers and suppliers; the impact on our revenues from and duration of declines in sales of our vaccine products that target travelers due to the reduction of international travel caused by the COVID-19 pandemic; the ability of the Company and Bavarian Nordic to consummate the transactions contemplated under the agreement pursuant to which we agreed to sell our travel health business, to meet expectations regarding the conditions, timing and completion of the transactions, and to realize the potential benefits of the transactions; the impact of the organizational changes we announced in January 2023 on our business; our ability to identify and acquire companies, businesses, products or product candidates that satisfy our selection criteria; the impact of cyber security incidents, including the risks from the interruption, failure or compromise of our information systems or those of our business partners, collaborators or other third parties; the success of our commercialization, marketing and manufacturing capabilities and strategy; and the accuracy of our estimates regarding future revenues, expenses, capital requirements and needs for additional financing. The foregoing sets forth many, but not all, of the factors that could cause actual results to differ from our expectations in any forward-looking statement. When evaluating our forward-looking statements, you should consider this cautionary statement along with the risks identified in our reports filed with the SEC. New factors emerge from time to time and it is not possible for management to predict all such factors, nor can it assess the impact of any such factor on the business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Trademarks Emergent,® BioThrax® (Anthrax Vaccine Adsorbed), RSDL® (Reactive Skin Decontamination Lotion Kit), BAT® (Botulism Antitoxin Heptavalent (A,B,C,D,E,F and G)-(Equine)), Anthrasil® (Anthrax Immune Globulin Intravenous (Human)), VIGIV (Vaccinia Immune Globulin Intravenous (Human)), Trobigard® (atropine sulfate, obidoxime chloride), ACAM2000® (Smallpox (Vaccinia) Vaccine, Live), NARCAN® (naloxone HCI) Nasal Spray, TEMBEXA® (brincidofovir) and any and all Emergent BioSolutions Inc. brands, products, services and feature names, logos and slogans are trademarks or registered trademarks of Emergent BioSolutions Inc. or its subsidiaries in the United States or other countries. All other brands, products, services and feature names or trademarks are the property of their respective owners.

Emergent BioSolutions Inc. 2023 Annual Meeting of Stockholders May 25, 2023