Document

Herc Holdings Reports Third Quarter 2025 Results and

Reaffirms 2025 Full Year Guidance

Third Quarter 2025 Highlights

–H&E technology integration completed

–Equipment rental revenue of $1,122 million increased 30%

–Total revenues of $1,304 million increased 35%

–Net income of $30 million, or $0.90 per diluted share, and adjusted net income of $74 million, or $2.22 per diluted share

–Adjusted EBITDA of $551 million increased 24% with adjusted EBITDA margin of 42%

–Successfully completed the sale of Cinelease studio entertainment business on July 31, 2025

Bonita Springs, Fla., October 28, 2025 -- Herc Holdings Inc. (NYSE: HRI) ("Herc Holdings" or the "Company") today reported financial results for the quarter ended September 30, 2025.

“As we continue to execute on our strategic priorities, the third quarter marked a pivotal step in unlocking the value of our acquisition of H&E Equipment Services,” said Larry Silber, president and chief executive officer. “From day one, our focus has been on bringing together the strengths of both companies through a seamless integration, and we’re very pleased with the pace and success of those efforts to date.

“In the third quarter, we achieved a major milestone by completing the full IT integration—successfully migrating all of the acquired branches onto Herc’s systems and network infrastructure within a best-in-class timeline. Our combined team now operates from a single, unified dashboard that spans ERP, fleet management, pricing, CRM, logistics, business intelligence, human capital management and our industry-leading, customer-facing technology platform, ProControl by Herc RentalsTM. This alignment is poised to drive efficiencies and position us for long term market-share expansion.

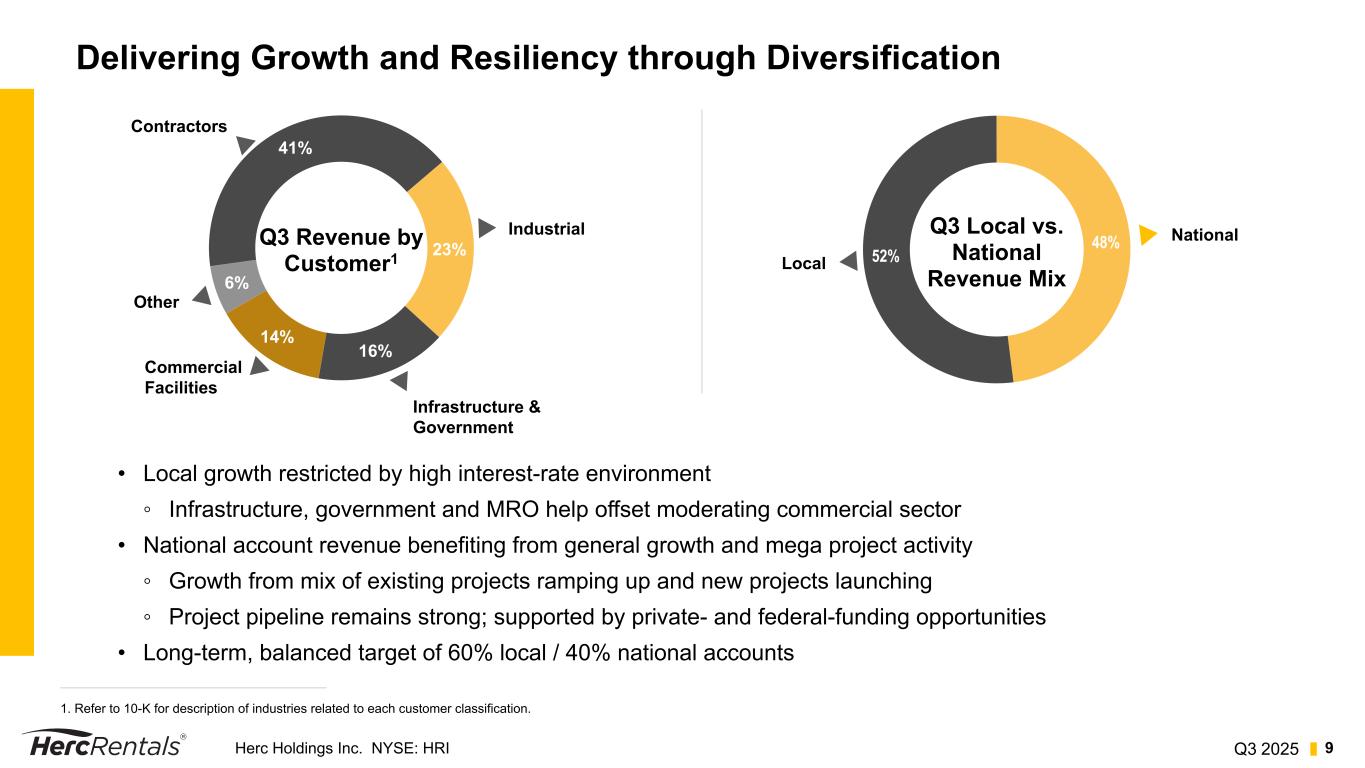

“As we continue integration efforts for fleet and branch network optimization, the operating environment remains stable despite broader macroeconomic uncertainties. While local market growth is tempered by prolonged high interest rates, our national accounts and specialty products and solutions delivered another strong quarter. Our scale and diversified footprint—across geographies, end markets, and product lines—continue to be key strengths, enabling us to navigate this bifurcated landscape with resilience and agility,” said Silber.

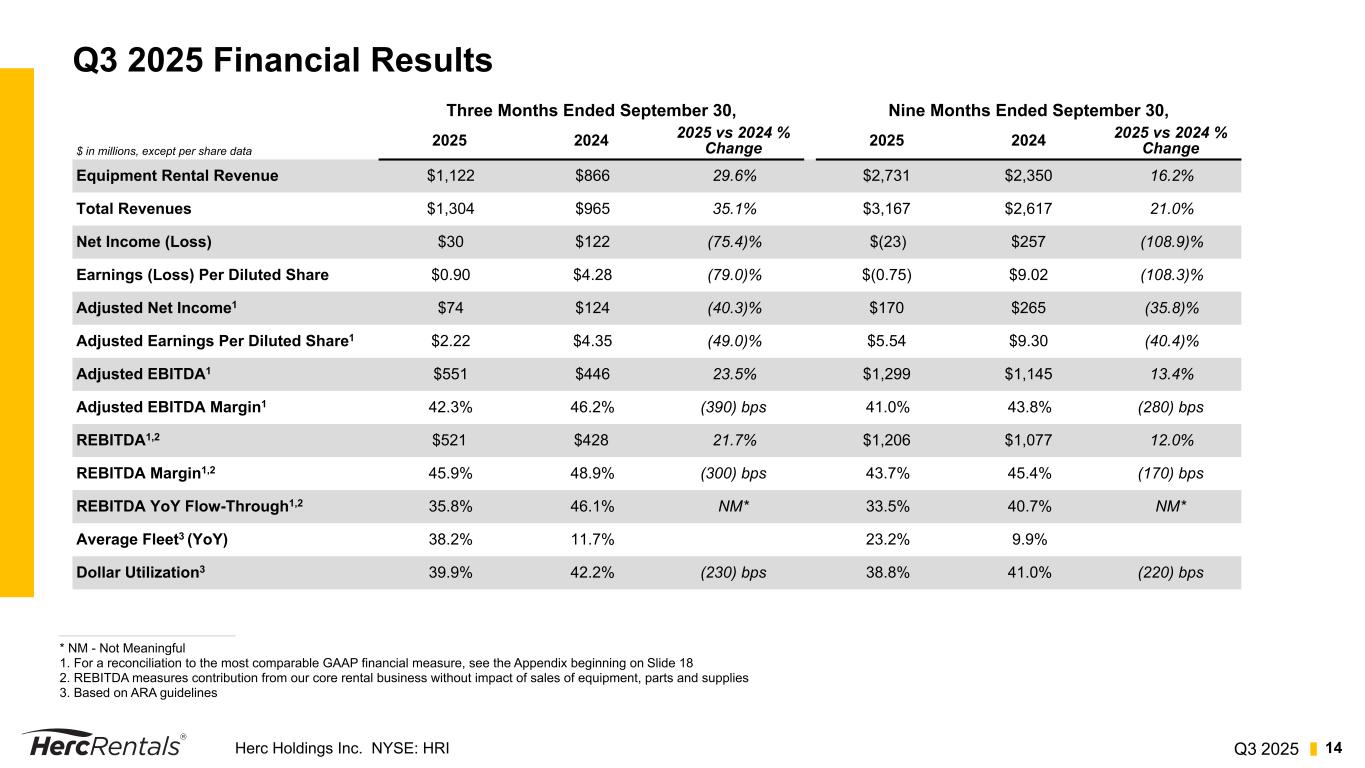

2025 Third Quarter Financial Results

•Total revenues increased 35% to $1,304 million compared to $965 million in the prior-year period. This year-over-year increase was driven by a 30% increase in equipment rental revenue. Sales of rental equipment increased by $70 million during the period as acquisition fleet was sold to improve mix and utilization.

•Dollar utilization was 39.9% in the third quarter compared to 42.2% in the prior-year period, primarily due to lower utilization of the acquired fleet ahead of fleet optimization initiatives.

•Direct operating expenses were $467 million, or 41.6% of equipment rental revenue, compared to $334 million, or 38.6% in the prior-year period. Operating expenses as a percent of equipment rental revenue were elevated during the period due to lower fixed cost absorption as a result of the ongoing moderation in certain local markets and acquisition-related redundancies, preceding the full impact of cost synergies and IT integration.

•Depreciation of rental equipment increased 41% to $246 million due to higher year-over-year average fleet size primarily as a result of the H&E acquisition. Non-rental depreciation and amortization increased 112% to $70 million primarily due to amortization of the H&E customer relationship intangible asset and an increase in non-rental asset depreciation resulting from the growth of the business.

•Selling, general and administrative expenses were $166 million, or 14.8% of equipment rental revenue compared to $120 million, or 13.9% of equipment rental revenue in the prior-year period. The increase as a percent of equipment rental revenue primarily was related to an increase in stock-based compensation expense including stock awards granted to certain H&E employees as part of the merger related agreements.

•Transaction expenses were $38 million compared to $3 million in the prior-year period. The increase is related to costs incurred for the H&E acquisition, primarily fleet retitling costs, consulting and professional fees.

•Interest expense was $134 million compared with $69 million in the prior-year period, reflecting the new debt facilities issued in June 2025 to fund the H&E acquisition.

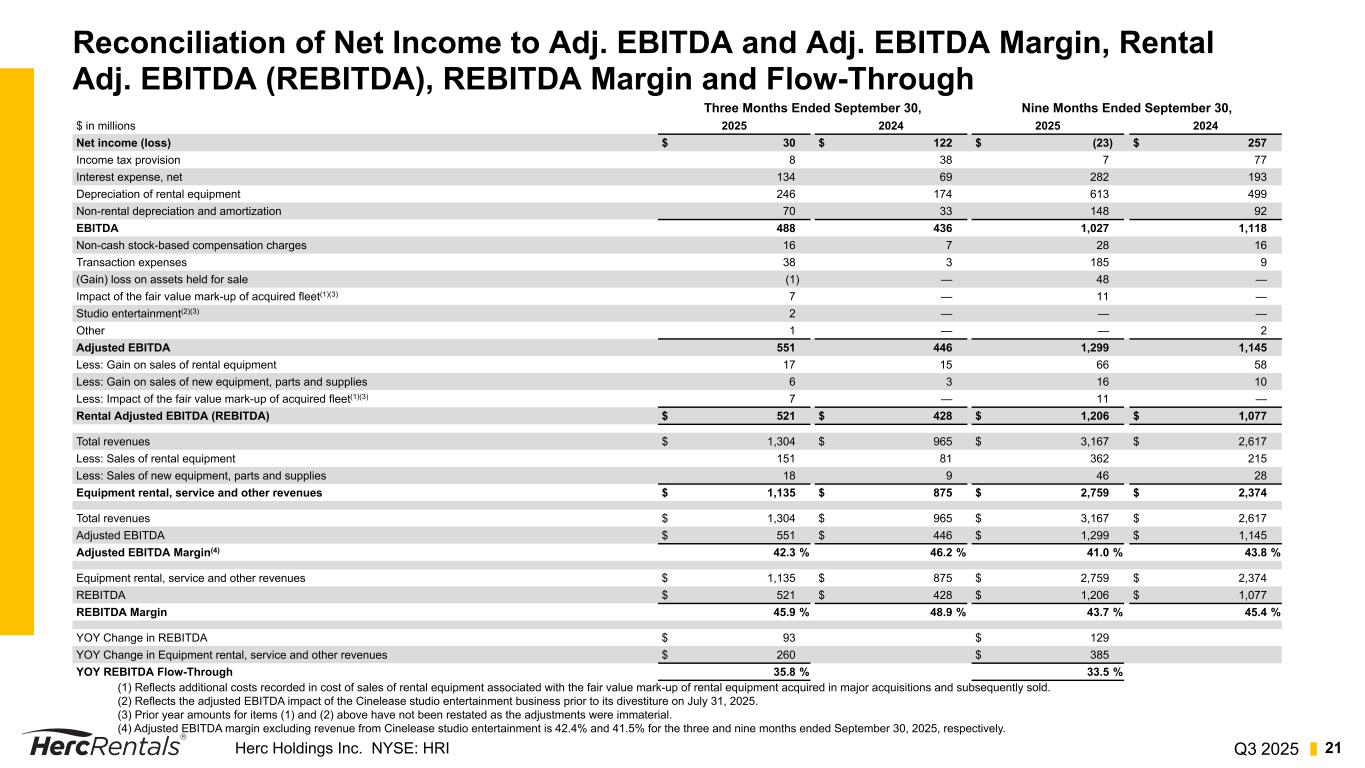

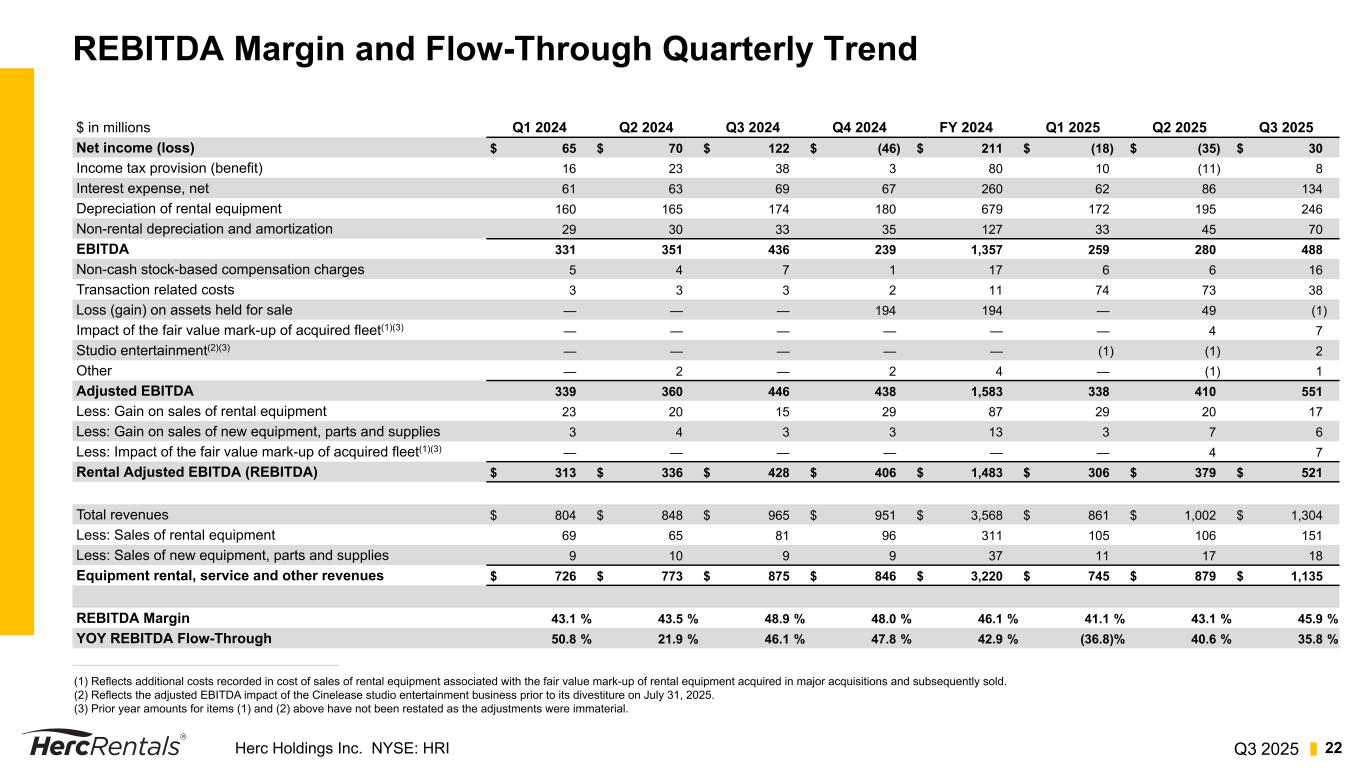

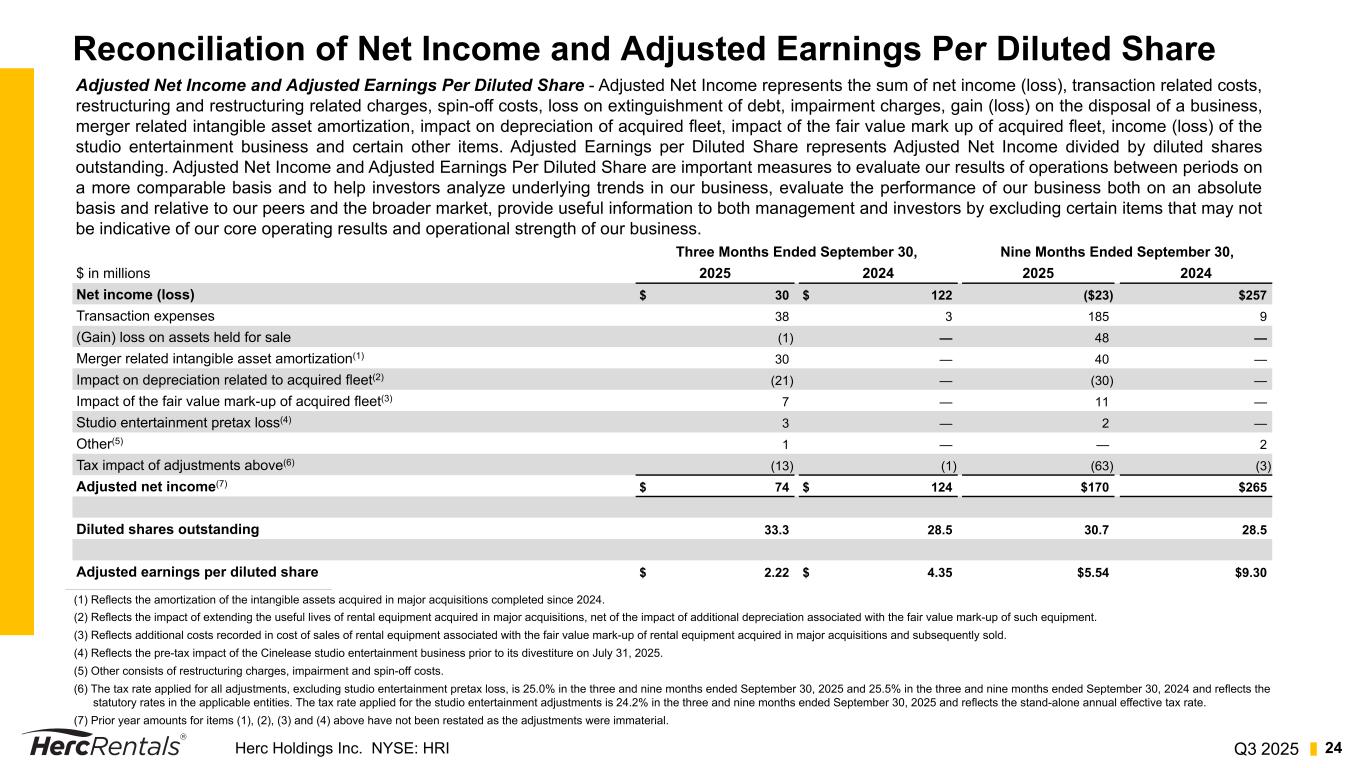

•Net income was $30 million compared to $122 million in the prior-year period. Adjusted net income decreased 40% to $74 million, or $2.22 per diluted share, compared to $124 million, or $4.35 per diluted share, in the prior-year period.

•Adjusted EBITDA increased 24% to $551 million compared to $446 million in the prior-year period and adjusted EBITDA margin was 42.3% compared to 46.2% in the prior-year period. The decrease in margin was primarily due to the impact of acquisition-related redundant costs preceding integration and a larger proportion of overall volume of used equipment sales through the lower margin auction channel to begin rightsizing acquired fleet. Margin on sales of rental equipment was 11% in the current year compared to 19% in the prior-year period.

2025 Nine Months Financial Results

•Total revenues increased 21% to $3,167 million compared to $2,617 million in the prior-year period. The year-over-year increase was driven by a 16% increase in equipment rental revenue. Sales of rental equipment increased by $147 million during the period as acquisition fleet was sold to improve mix and utilization.

•Dollar utilization was 38.8% compared to 41.0% in the prior-year period, primarily due to lower utilization of the acquired fleet ahead of fleet optimization initiatives.

•Direct operating expenses were $1,173 million, or 43.0% of equipment rental revenue, compared to $967 million, or 41.1%, in the prior-year period. Operating expenses as a percent of equipment rental revenue were elevated during the period due to lower fixed cost absorption as a result of the ongoing moderation in certain local markets and acquisition-related redundancies, preceding the full impact of cost synergies and IT integration.

•Depreciation of rental equipment increased 23% to $613 million due to higher year-over-year average fleet size, primarily as a result of the H&E acquisition. Non-rental depreciation and amortization increased 61% to $148 million, primarily due to amortization of intangible assets related to the H&E and Otay acquisitions and an increase in non-rental asset depreciation resulting from the growth of the business.

•Selling, general and administrative expenses were $411 million, or 15.0% of equipment rental revenue, compared to $349 million, or 14.9% of equipment rental revenue, in the prior-year period. The increase as a percent of equipment rental revenue primarily was related to an increase in stock-based compensation expense including stock awards granted to certain H&E employees as part of the merger related agreements, partially offset by initial acquisition cost synergies obtained as well as overall cost control measures introduced to mitigate the impact of moderation in certain local markets.

•Transaction expenses were $185 million compared to $9 million in the prior-year period. The increase related to costs incurred for the H&E acquisition, primarily a $64 million termination fee paid on behalf of H&E, advisory fees of $27 million, commitment fees related to the bridge facility of $21 million and various other consulting, professional and legal fees.

•Interest expense was $282 million compared with $193 million in the prior-year period, reflecting new debt facilities issued in June 2025 to fund the H&E acquisition.

•Loss on assets held for sale was $48 million during the current year to adjust the carrying value of Cinelease net assets to its fair value less estimated costs to sell prior to its divestiture on July 31, 2025.

•Net loss was $23 million compared to net income of $257 million in the prior-year period. Adjusted net income was $170 million, or $5.54 per diluted share, compared to $265 million, or $9.30 per diluted share, in the prior-year period.

•Adjusted EBITDA increased 13% to $1,299 million compared to $1,145 million in the prior-year period and adjusted EBITDA margin was 41.0% compared to 43.8% in the prior-year period. The decrease in margin was primarily due to the impact of acquisition-related redundant costs preceding integration and a larger proportion of overall volume of used equipment sales through the lower margin auction channel to begin rightsizing acquired fleet. Margin on sales of rental equipment was 18% in the current year compared to 27% in the prior-year period.

Rental Fleet

•Net rental equipment capital expenditures were as follows (in millions):

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

2025 |

|

2024 |

| Rental equipment expenditures |

$ |

835 |

|

|

$ |

753 |

|

| Proceeds from disposal of rental equipment |

(306) |

|

|

(198) |

|

| Net rental equipment capital expenditures |

$ |

529 |

|

|

$ |

555 |

|

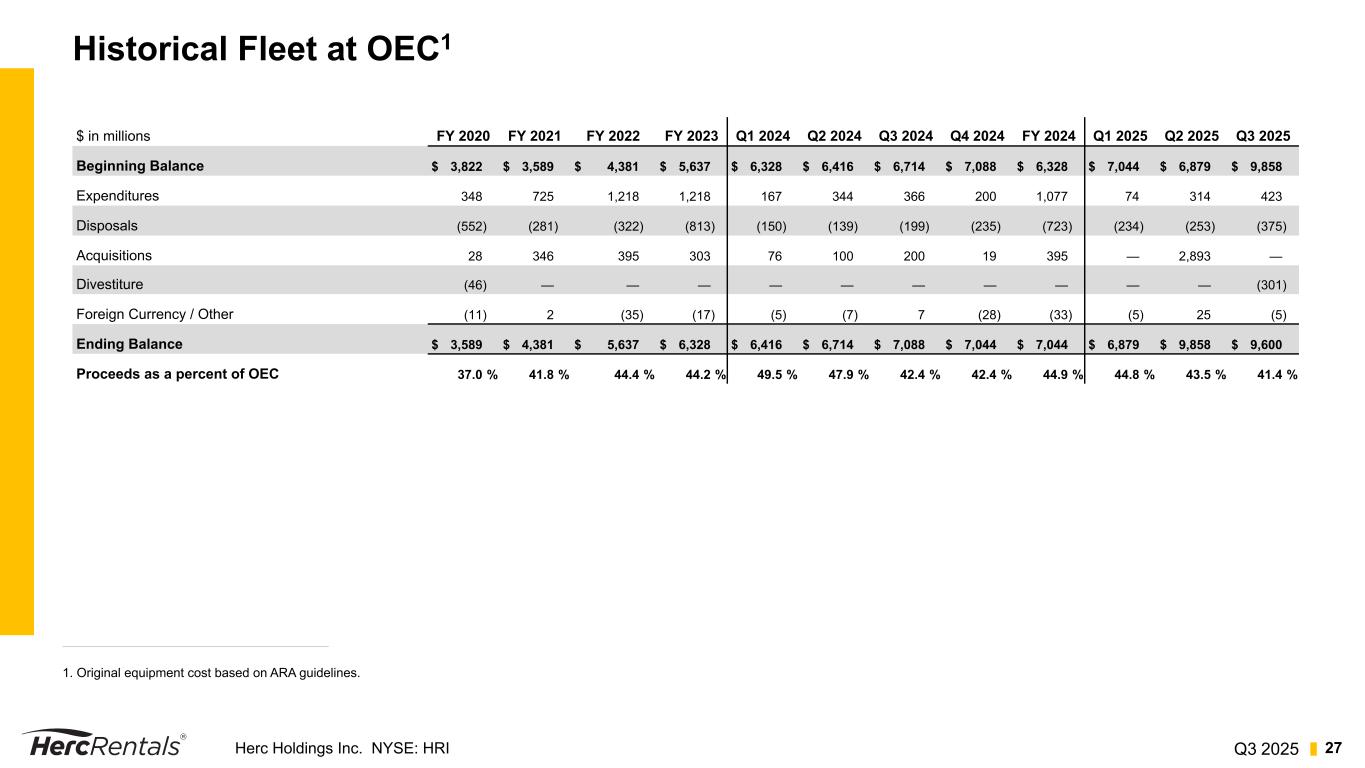

•As of September 30, 2025, the Company's total fleet was approximately $9.6 billion at OEC.

•Average fleet at OEC in the third quarter increased 38% compared to the prior-year period.

•Average fleet age was 45 months and 46 months at September 30, 2025 and 2024, respectively.

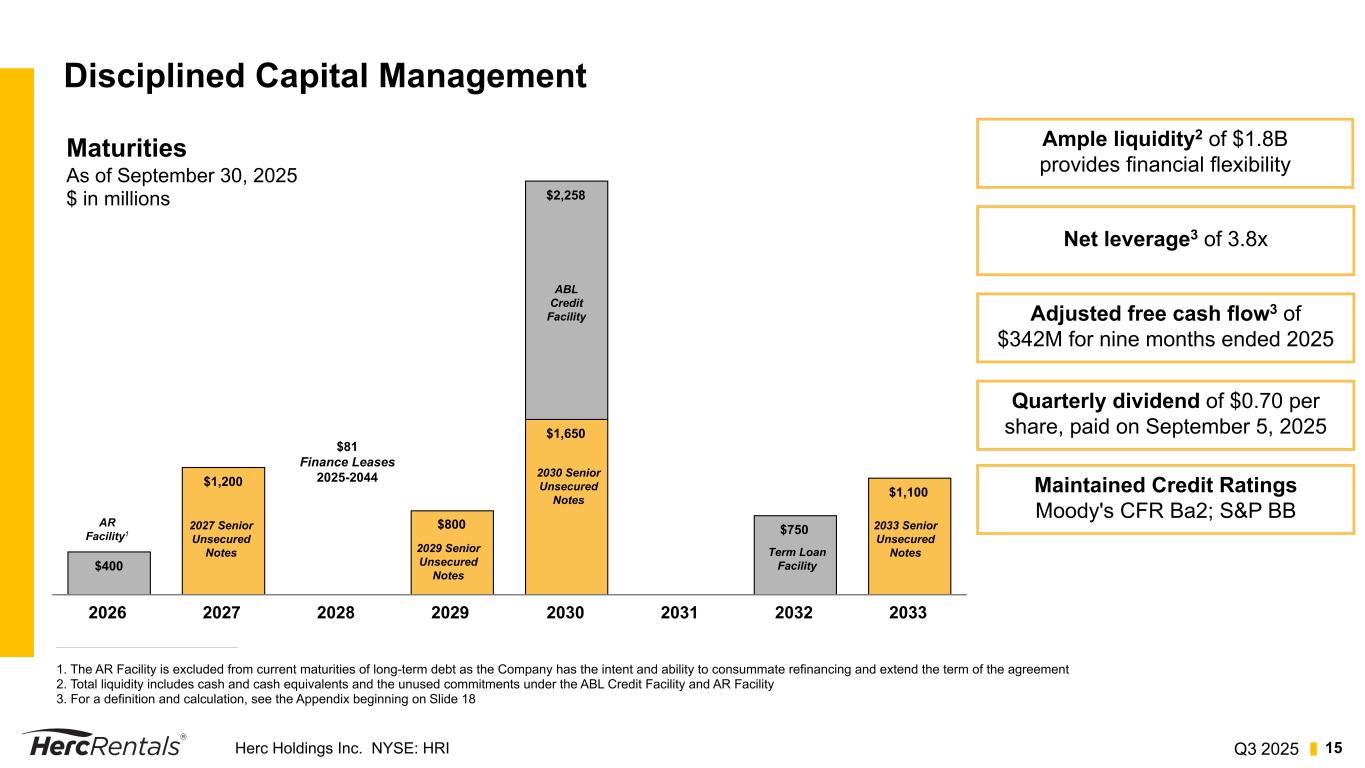

Disciplined Capital Management

•The Company opened 17 greenfield locations during the nine months ended September 30, 2025.

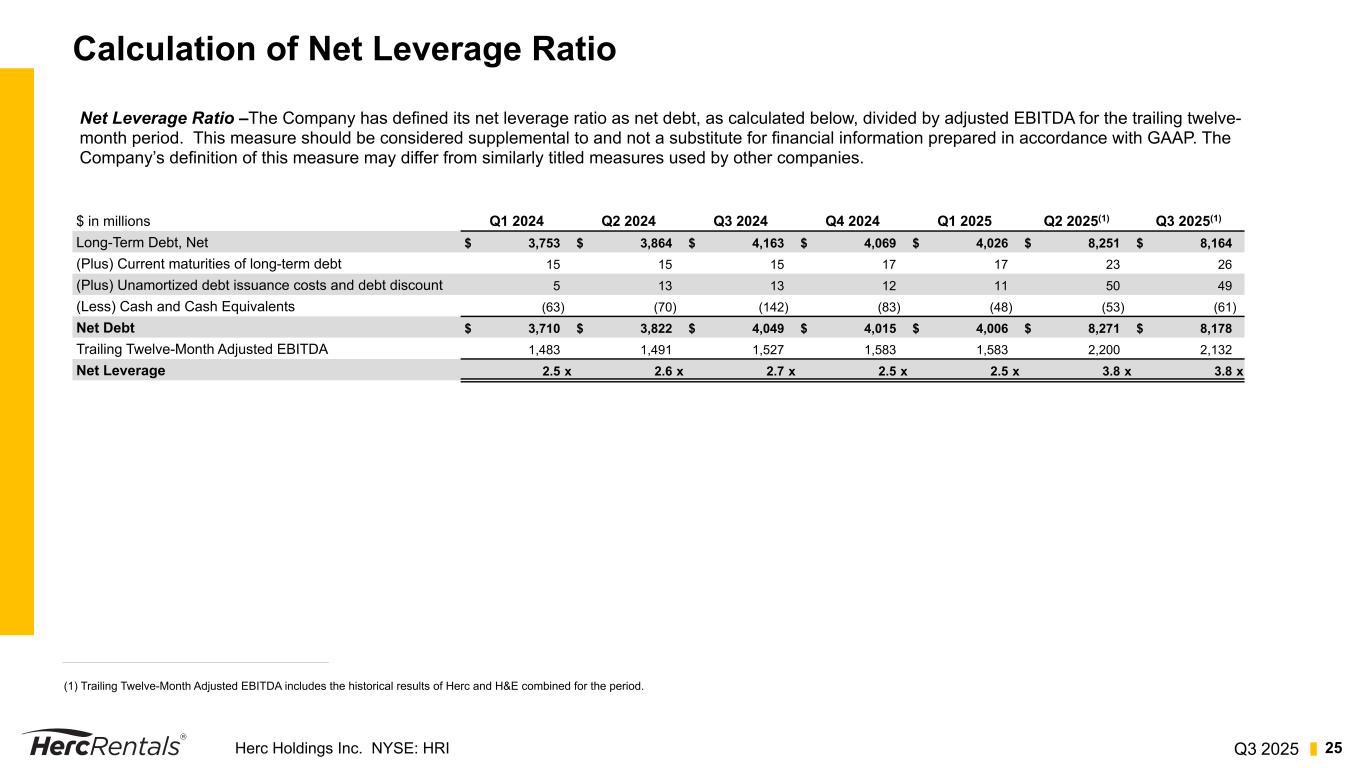

•Net debt was $8.2 billion as of September 30, 2025, with net leverage of 3.8x1 compared to 2.7x in the same prior-year period. Cash and cash equivalents and unused commitments under the ABL Credit Facility contributed to approximately $1.8 billion of liquidity as of September 30, 2025.

•The Company declared its quarterly dividend of $0.70 paid to shareholders of record as of August 22, 2025 on September 5, 2025.

(1) Current period net leverage is calculated using pro forma trailing twelve month adjusted EBITDA including the standalone, pre-acquisition results of H&E.

Cinelease Divestiture

On July 31, 2025, the Company completed the divestiture of the Cinelease studio entertainment business for initial cash consideration of $100 million, subject to customary post-closing adjustments, and agreed upon earn outs pursuant to the purchase and sale agreement. The Company used the net proceeds from the sale of Cinelease to repay a portion of the New ABL Credit Facility.

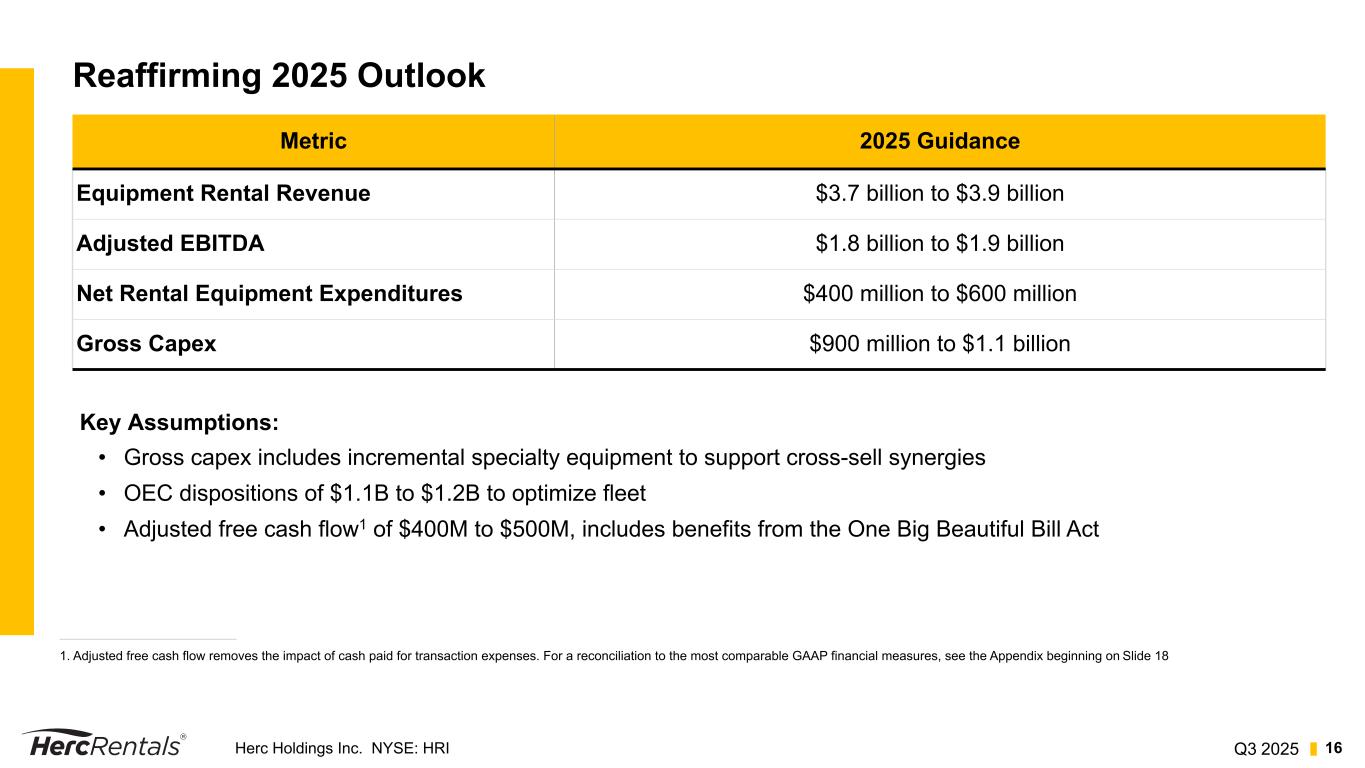

2025 Outlook—Excluding Cinelease

The Company is reaffirming its full year 2025 equipment rental revenue, adjusted EBITDA, and gross and net rental capital expenditures guidance ranges, excluding Cinelease studio entertainment and lighting and grip equipment rental business.

|

|

|

|

|

|

|

| Equipment rental revenue: |

|

$3.7 billion to $3.9 billion |

| Adjusted EBITDA: |

|

$1.8 billion to $1.9 billion |

| Net rental equipment capital expenditures: |

|

$400 million to $600 million |

| Gross capex: |

|

$900 million to $1.1 billion |

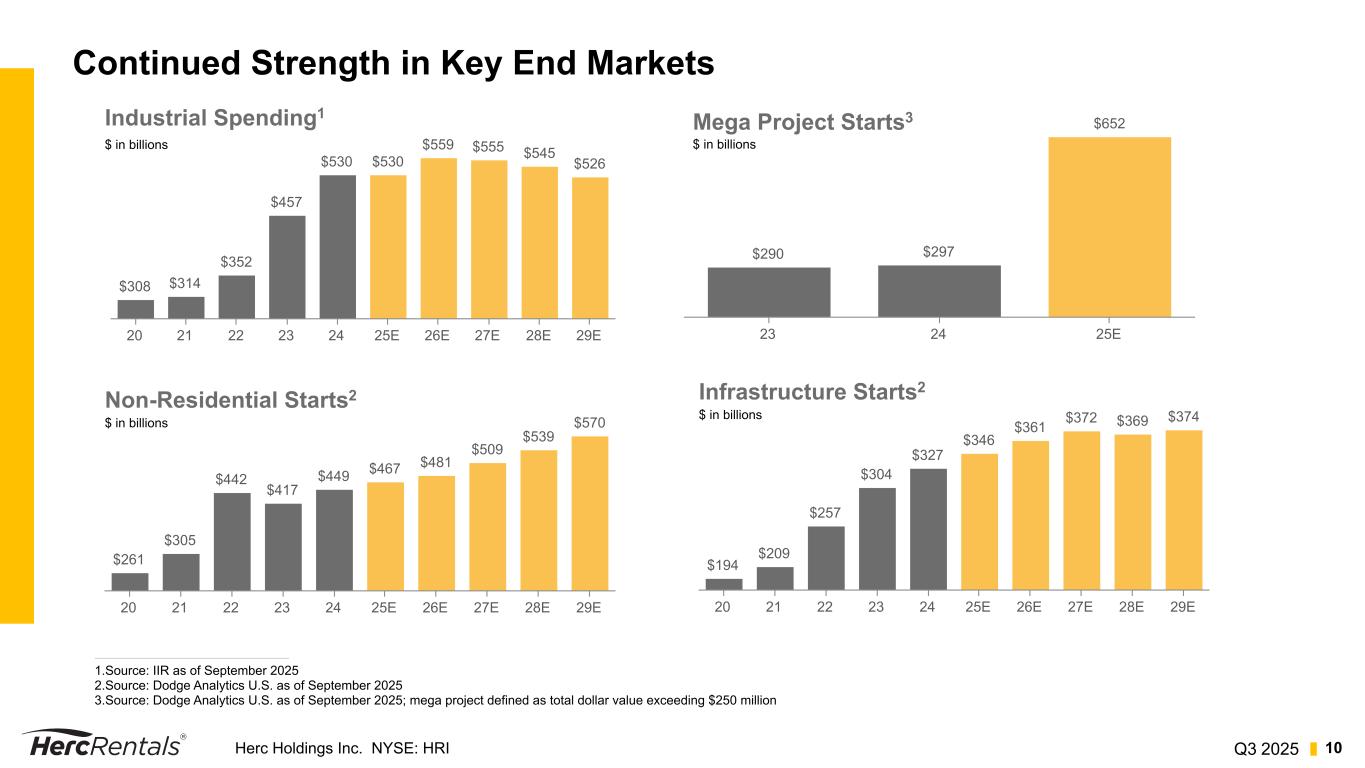

As a leader in an industry where scale matters, the Company expects to continue to gain share by capturing an outsized position of the forecasted higher construction spending in 2025 by investing in its fleet, optimizing its existing fleet, capitalizing on recent acquisitions and greenfield opportunities, and cross-selling a diversified product portfolio.

Earnings Call and Webcast Information

Herc Holdings' third quarter 2025 earnings webcast will be held today at 8:30 a.m. U.S. Eastern Time. Interested U.S. parties may call +1-800-715-9871 and international participants should call the country specific dial in numbers listed at https://registrations.events/directory/international/itfs.html, using the access code: 9128891. Please dial in at least 10 minutes before the call start time to ensure that you are connected to the call and to register your name and company.

Those who wish to listen to the live conference call and view the accompanying presentation slides should visit the Events and Presentations tab of the Investor Relations section of the Company's website at IR.HercRentals.com. The press release and presentation slides for the call will be posted to this section of the website prior to the call.

A replay of the conference call will be available via webcast on the Company website at IR.HercRentals.com, where it will be archived for 12 months after the call.

About Herc Holdings Inc.

Founded in 1965, Herc Holdings Inc., which operates through its Herc Rentals Inc. subsidiary, is a full-line rental supplier and, with the recent acquisition of H&E Equipment Services, we have 612 locations across North America and 2024 pro forma total revenues were approximately $5.1 billion. We offer products and services aimed at helping customers work more efficiently, effectively, and safely. Our classic fleet includes aerial, earthmoving, material handling, trucks and trailers, air compressors, compaction, and lighting equipment. Our ProSolutions® offering includes industry-specific, solutions-based services in tandem with power generation, climate control, remediation and restoration, pumps, and trench shorting equipment as well as our ProContractor professional grade tools. We employ approximately 9,900 employees, who equip our customers and communities to build a brighter future. Learn more at www.HercRentals.com and follow us on Instagram, Facebook and LinkedIn.

Certain Additional Information

In this release we refer to the following operating measures:

•Dollar utilization: calculated by dividing rental revenue (excluding re-rent, delivery, pick-up and other ancillary revenue) by the average OEC of the equipment fleet for the relevant time period, based on the guidelines of the American Rental Association (ARA).

•OEC: original equipment cost based on the guidelines of the ARA, which is calculated as the cost of the asset at the time it was first purchased plus additional capitalized refurbishment costs (with the basis of refurbished assets reset at the refurbishment date).

Forward-Looking Statements

This press release includes forward-looking statements within the meaning of Section 21E of the Securities Exchange Act, as amended, and the Private Securities Litigation Reform Act of 1995. Forward looking statements are generally identified by the words "estimates," "expects," "anticipates," "projects," "plans," "intends," "believes," "forecasts," "looks," and future or conditional verbs, such as "will," "should," "could" or "may," as well as variations of such words or similar expressions. All forward-looking statements are based upon our current expectations and various assumptions and there can be no assurance that our current expectations will be achieved. You should not place undue reliance on the forward-looking statements. They are subject to future events, risks and uncertainties - many of which are beyond our control - as well as potentially inaccurate assumptions, that could cause actual results to differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those projected include, but are not limited to, the following: (1) the cyclical nature of our industry and our dependence on the levels of capital investment and maintenance expenditures by our customers; (2) the competitiveness of our industry, including the potential downward pricing pressures or the inability to increase prices; (3) our dependence on relationships with key suppliers; (4) our heavy reliance on communication networks, centralized information technology systems and third party technology and services and our ability to maintain, upgrade or replace our information technology systems; (5) our ability to respond adequately to changes in technology and customer demands; (6) our ability to attract and retain key management, sales and trades talent; (7) our rental fleet is subject to residual value risk upon disposition; (8) the impact of climate change and the legal and regulatory responses to such change; (9) our ability to execute our strategy to grow through strategic transactions; (10) our significant indebtedness; and (11) our ability to integrate the acquisition of H&E Equipment Services, Inc. into our business and our ability to realize all the anticipated benefits of the transaction. Further information on the risks that may affect our business is included in filings we make with the Securities and Exchange Commission from time to time, including our most recent annual report on Form 10-K, subsequent quarterly reports on Form 10-Q, and in our other SEC filings. We undertake no obligation to update or revise forward-looking statements that have been made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events.

Information Regarding Non-GAAP Financial Measures

In addition to results calculated according to accounting principles generally accepted in the United States (“GAAP”), the Company has provided certain information in this release that is not calculated according to GAAP (“non-GAAP”), such as EBITDA, adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted earnings per diluted common share, free cash flow and adjusted free cash flow. Management uses these non-GAAP measures to evaluate operating performance and period-over-period performance of our core business without regard to potential distortions, and believes that investors will likewise find these non-GAAP measures useful in evaluating the Company’s performance. These measures are frequently used by security analysts, institutional investors and other interested parties in the evaluation of companies in our industry. Non-GAAP measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and, as calculated, may not be comparable to similarly titled measures of other companies. For the definitions of these terms, further information about management’s use of these measures as well as a reconciliation of these non-GAAP measures to the most comparable GAAP financial measures, please see the supplemental schedules that accompany this release.

Contact:

Leslie Hunziker

Senior Vice President,

Investor Relations, Communications & Sustainability

Leslie.hunziker@hercrentals.com

239-301-1675

(See Accompanying Tables)

HERC HOLDINGS INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

Unaudited

(In millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2025 |

|

2024 |

|

2025 |

|

2024 |

| Revenues: |

|

|

|

|

|

|

|

| Equipment rental |

$ |

1,122 |

|

|

$ |

866 |

|

|

$ |

2,731 |

|

|

$ |

2,350 |

|

| Sales of rental equipment |

151 |

|

|

81 |

|

|

362 |

|

|

215 |

|

| Sales of new equipment, parts and supplies |

18 |

|

|

9 |

|

|

46 |

|

|

28 |

|

| Service and other revenue |

13 |

|

|

9 |

|

|

28 |

|

|

24 |

|

| Total revenues |

1,304 |

|

|

965 |

|

|

3,167 |

|

|

2,617 |

|

| Expenses: |

|

|

|

|

|

|

|

| Direct operating |

467 |

|

|

334 |

|

|

1,173 |

|

|

967 |

|

| Depreciation of rental equipment |

246 |

|

|

174 |

|

|

613 |

|

|

499 |

|

| Cost of sales of rental equipment |

134 |

|

|

66 |

|

|

296 |

|

|

157 |

|

| Cost of sales of new equipment, parts and supplies |

12 |

|

|

6 |

|

|

30 |

|

|

18 |

|

| Selling, general and administrative |

166 |

|

|

120 |

|

|

411 |

|

|

349 |

|

| Transaction expenses |

38 |

|

|

3 |

|

|

185 |

|

|

9 |

|

| Non-rental depreciation and amortization |

70 |

|

|

33 |

|

|

148 |

|

|

92 |

|

|

|

|

|

|

|

|

|

| Interest expense, net |

134 |

|

|

69 |

|

|

282 |

|

|

193 |

|

| (Gain) loss on assets held for sale |

(1) |

|

|

— |

|

|

48 |

|

|

— |

|

| Other income, net |

— |

|

|

— |

|

|

(3) |

|

|

(1) |

|

| Total expenses |

1,266 |

|

|

805 |

|

|

3,183 |

|

|

2,283 |

|

| Income (loss) before income taxes |

38 |

|

|

160 |

|

|

(16) |

|

|

334 |

|

| Income tax provision |

(8) |

|

|

(38) |

|

|

(7) |

|

|

(77) |

|

| Net income (loss) |

$ |

30 |

|

|

$ |

122 |

|

|

$ |

(23) |

|

|

$ |

257 |

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding: |

|

|

|

|

|

|

|

| Basic |

33.2 |

|

|

28.4 |

|

|

30.6 |

|

|

28.4 |

|

| Diluted |

33.3 |

|

|

28.5 |

|

|

30.6 |

|

|

28.5 |

|

| Earnings (loss) per share: |

|

|

|

|

|

|

|

| Basic |

$ |

0.90 |

|

|

$ |

4.30 |

|

|

$ |

(0.75) |

|

|

$ |

9.05 |

|

| Diluted |

$ |

0.90 |

|

|

$ |

4.28 |

|

|

$ |

(0.75) |

|

|

$ |

9.02 |

|

HERC HOLDINGS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2025 |

|

December 31, 2024 |

| ASSETS |

(unaudited) |

|

|

| Cash and cash equivalents |

$ |

61 |

|

|

$ |

83 |

|

| Receivables, net of allowances |

810 |

|

|

589 |

|

| Prepaid expenses |

77 |

|

|

47 |

|

| Other current assets |

26 |

|

|

40 |

|

| Current assets held for sale |

— |

|

|

17 |

|

| Total current assets |

974 |

|

|

776 |

|

| Rental equipment, net |

6,020 |

|

|

4,225 |

|

| Property and equipment, net |

873 |

|

|

554 |

|

| Right-of-use lease assets |

1,456 |

|

|

852 |

|

| Intangible assets, net |

1,626 |

|

|

572 |

|

| Goodwill |

2,931 |

|

|

670 |

|

| Other long-term assets |

47 |

|

|

8 |

|

| Long-term assets held for sale |

— |

|

|

220 |

|

| Total assets |

$ |

13,927 |

|

|

$ |

7,877 |

|

|

|

|

|

| LIABILITIES AND EQUITY |

|

|

|

| Current maturities of long-term debt and financing obligations |

$ |

31 |

|

|

$ |

21 |

|

| Current maturities of operating lease liabilities |

55 |

|

|

39 |

|

| Accounts payable |

355 |

|

|

248 |

|

| Accrued liabilities |

360 |

|

|

239 |

|

| Current liabilities held for sale |

— |

|

|

15 |

|

| Total current liabilities |

801 |

|

|

562 |

|

| Long-term debt, net |

8,164 |

|

|

4,069 |

|

| Financing obligations, net |

97 |

|

|

101 |

|

| Operating lease liabilities |

1,437 |

|

|

842 |

|

| Deferred tax liabilities |

1,431 |

|

|

800 |

|

| Other long-term liabilities |

68 |

|

|

47 |

|

| Long-term liabilities held for sale |

— |

|

|

60 |

|

| Total liabilities |

11,998 |

|

|

6,481 |

|

| Total equity |

1,929 |

|

|

1,396 |

|

| Total liabilities and equity |

$ |

13,927 |

|

|

$ |

7,877 |

|

HERC HOLDINGS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

Unaudited

(In millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

| |

2025 |

|

2024 |

| Cash flows from operating activities: |

|

|

|

| Net income (loss) |

$ |

(23) |

|

|

$ |

257 |

|

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: |

|

|

|

| Depreciation of rental equipment |

613 |

|

|

499 |

|

| Depreciation of property and equipment |

77 |

|

|

60 |

|

| Amortization of intangible assets |

71 |

|

|

32 |

|

| Amortization of deferred debt and financing obligations costs |

6 |

|

|

3 |

|

| Stock-based compensation charges |

28 |

|

|

16 |

|

|

|

|

|

| Provision for receivables allowances |

58 |

|

|

48 |

|

| Loss on assets held for sale |

48 |

|

|

— |

|

| Deferred taxes |

2 |

|

|

57 |

|

| Gain on sale of rental equipment |

(66) |

|

|

(58) |

|

| Other |

11 |

|

|

10 |

|

| Changes in assets and liabilities, net of effects from acquisitions: |

|

|

|

| Receivables |

(59) |

|

|

(76) |

|

| Other assets |

(19) |

|

|

(5) |

|

| Accounts payable |

10 |

|

|

17 |

|

| Accrued liabilities and other long-term liabilities |

13 |

|

|

34 |

|

| Net cash provided by operating activities |

770 |

|

|

894 |

|

| Cash flows from investing activities: |

|

|

|

| Rental equipment expenditures |

(835) |

|

|

(753) |

|

| Proceeds from disposal of rental equipment |

306 |

|

|

198 |

|

| Non-rental capital expenditures |

(123) |

|

|

(127) |

|

| Proceeds from disposal of property and equipment |

15 |

|

|

6 |

|

| Acquisitions, net of cash acquired |

(4,256) |

|

|

(567) |

|

| Proceeds from disposal of business, net |

99 |

|

|

— |

|

|

|

|

|

| Net cash used in investing activities |

(4,794) |

|

|

(1,243) |

|

| Cash flows from financing activities: |

|

|

|

| Proceeds from issuance of long-term debt |

3,467 |

|

|

800 |

|

| Proceeds from revolving lines of credit and securitization |

3,928 |

|

|

1,530 |

|

| Repayments on revolving lines of credit and securitization |

(3,299) |

|

|

(1,821) |

|

| Principal payments under finance lease and financing obligations |

(16) |

|

|

(15) |

|

| Dividends paid |

(64) |

|

|

(58) |

|

|

|

|

|

| Other financing activities, net |

(14) |

|

|

(16) |

|

| Net cash provided by financing activities |

4,002 |

|

|

420 |

|

| Effect of foreign exchange rate changes on cash and cash equivalents |

— |

|

|

— |

|

| Net change in cash and cash equivalents during the period |

(22) |

|

|

71 |

|

| Cash and cash equivalents at beginning of period |

83 |

|

|

71 |

|

| Cash and cash equivalents at end of period |

$ |

61 |

|

|

$ |

142 |

|

HERC HOLDINGS INC. AND SUBSIDIARIES

SUPPLEMENTAL SCHEDULES

EBITDA AND ADJUSTED EBITDA RECONCILIATIONS

Unaudited

(In millions)

EBITDA and adjusted EBITDA - EBITDA represents the sum of net income (loss), provision (benefit) for income taxes, interest expense, net, depreciation of rental equipment and non-rental depreciation and amortization. Adjusted EBITDA represents EBITDA plus the sum of transaction related costs, restructuring and restructuring related charges, spin-off costs, non-cash stock-based compensation charges, loss on extinguishment of debt (which is included in interest expense, net), impairment charges, gain (loss) on the disposal of a business, impact of the fair value mark-up of acquired fleet, impact of the studio entertainment business and certain other items. EBITDA and adjusted EBITDA do not purport to be alternatives to net income as an indicator of operating performance. Additionally, neither measure purports to be an alternative to cash flows from operating activities as a measure of liquidity, as they do not consider certain cash requirements such as interest payments and tax payments.

Adjusted EBITDA Margin - Adjusted EBITDA Margin, calculated by dividing Adjusted EBITDA by Total Revenues, is a commonly used profitability ratio.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Net income (loss) |

$ |

30 |

|

$ |

122 |

|

$ |

(23) |

|

$ |

257 |

| Income tax provision |

8 |

|

38 |

|

7 |

|

77 |

| Interest expense, net |

134 |

|

69 |

|

282 |

|

193 |

| Depreciation of rental equipment |

246 |

|

174 |

|

613 |

|

499 |

| Non-rental depreciation and amortization |

70 |

|

33 |

|

148 |

|

92 |

| EBITDA |

488 |

|

436 |

|

1,027 |

|

1,118 |

| Non-cash stock-based compensation charges |

16 |

|

7 |

|

28 |

|

16 |

|

|

|

|

|

|

|

|

| Transaction related costs |

38 |

|

3 |

|

185 |

|

9 |

| (Gain) loss on assets held for sale |

(1) |

|

— |

|

48 |

|

— |

Impact of the fair value mark-up of acquired fleet(1)(3) |

7 |

|

— |

|

11 |

|

— |

Studio entertainment(2)(3) |

2 |

|

— |

|

— |

|

— |

Other(4) |

1 |

|

— |

|

— |

|

2 |

| Adjusted EBITDA |

$ |

551 |

|

$ |

446 |

|

$ |

1,299 |

|

$ |

1,145 |

|

|

|

|

|

|

|

|

| Total revenues |

$ |

1,304 |

|

$ |

965 |

|

$ |

3,167 |

|

$ |

2,617 |

| Adjusted EBITDA |

$ |

551 |

|

$ |

446 |

|

$ |

1,299 |

|

$ |

1,145 |

Adjusted EBITDA margin(5) |

42.3 |

% |

|

46.2 |

% |

|

41.0 |

% |

|

43.8 |

% |

(1) Reflects additional costs recorded in cost of sales of rental equipment associated with the fair value mark-up of rental equipment acquired in major acquisitions and subsequently sold.

(2) Reflects the adjusted EBITDA impact of the Cinelease studio entertainment business prior to its divestiture on July 31, 2025.

(3) Prior year amounts for items (1) and (2) above have not been restated as the adjustments were immaterial.

(4) Other consists of restructuring charges, impairment and spin-off costs.

(5) Adjusted EBITDA margin excluding revenue from Cinelease studio entertainment is 42.4% and 41.5% for the three and nine months ended September 30, 2025, respectively.

HERC HOLDINGS INC. AND SUBSIDIARIES

SUPPLEMENTAL SCHEDULES

ADJUSTED NET INCOME AND ADJUSTED EARNINGS PER DILUTED SHARE

Unaudited

(In millions)

Adjusted Net Income and Adjusted Earnings Per Diluted Share - Adjusted Net Income represents the sum of net income (loss), restructuring and restructuring related charges, spin-off costs, loss on extinguishment of debt, impairment charges, transaction related costs, gain (loss) on the disposal of a business, merger related intangible asset amortization, impact on depreciation of acquired fleet, impact of the fair value mark up of acquired fleet, income (loss) of the studio entertainment business, and certain other items. Adjusted Earnings per Diluted Share represents Adjusted Net Income divided by diluted shares outstanding. Adjusted Net Income and Adjusted Earnings Per Diluted Share are important measures to evaluate our results of operations between periods on a more comparable basis and to help investors analyze underlying trends in our business, evaluate the performance of our business both on an absolute basis and relative to our peers and the broader market, provide useful information to both management and investors by excluding certain items that may not be indicative of our core operating results and operational strength of our business.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Net income (loss) |

$ |

30 |

|

|

$ |

122 |

|

|

$ |

(23) |

|

|

$ |

257 |

|

|

|

|

|

|

|

|

|

| Transaction related costs |

38 |

|

|

3 |

|

|

185 |

|

|

9 |

|

| Loss (gain) on assets held for sale |

(1) |

|

|

— |

|

|

48 |

|

|

— |

|

Merger related intangible asset amortization(1) |

30 |

|

|

— |

|

|

40 |

|

|

— |

|

Impact on depreciation related to acquired fleet(2) |

(21) |

|

|

— |

|

|

(30) |

|

|

— |

|

Impact of the fair value mark-up of acquired fleet(3) |

7 |

|

|

— |

|

|

11 |

|

|

— |

|

Studio entertainment pretax loss(4) |

3 |

|

|

— |

|

|

2 |

|

|

— |

|

Other(5) |

1 |

|

|

— |

|

|

— |

|

|

2 |

|

Tax impact of adjustments above(6) |

(13) |

|

|

(1) |

|

|

(63) |

|

|

(3) |

|

Adjusted net income(7) |

$ |

74 |

|

|

$ |

124 |

|

|

$ |

170 |

|

|

$ |

265 |

|

|

|

|

|

|

|

|

|

| Diluted shares outstanding |

33.3 |

|

|

28.5 |

|

|

30.7 |

|

|

28.5 |

|

|

|

|

|

|

|

|

|

| Adjusted earnings per diluted share |

$ |

2.22 |

|

|

$ |

4.35 |

|

|

$ |

5.54 |

|

|

$ |

9.30 |

|

(1) Reflects the amortization of the intangible assets acquired in major acquisitions completed since 2024.

(2) Reflects the impact of extending the useful lives of rental equipment acquired in major acquisitions, net of the impact of additional depreciation associated with the fair value mark-up of such equipment.

(3) Reflects additional costs recorded in cost of sales of rental equipment associated with the fair value mark-up of rental equipment acquired in major acquisitions and subsequently sold.

(4) Reflects the pre-tax impact of the Cinelease studio entertainment business prior to its divestiture on July 31, 2025.

(5) Other consists of restructuring charges, impairment and spin-off costs.

(6) The tax rate applied for all adjustments, excluding studio entertainment pretax loss, is 25.0% in the three and nine months ended September 30, 2025 and 25.5% in the three and nine months ended September 30, 2024 and reflects the statutory rates in the applicable entities. The tax rate applied for the studio entertainment adjustments is 24.2% in the three and nine months ended September 30, 2025 and reflects the stand-alone annual effective tax rate.

(7) Prior year amounts for items (1), (2), (3) and (4) above have not been restated as the adjustments were immaterial.

HERC HOLDINGS INC. AND SUBSIDIARIES

SUPPLEMENTAL SCHEDULES

FREE CASH FLOW

Unaudited

(In millions)

Free cash flow represents net cash provided by (used in) operating activities less rental equipment expenditures and non-rental capital expenditures, plus proceeds from disposal of rental equipment, proceeds from disposal of property and equipment, and other investing activities. Free cash flow is used by management in analyzing the Company’s ability to service and repay its debt, fund potential acquisitions and to forecast future periods. However, this measure does not represent funds available for investment or other discretionary uses since it does not deduct cash used to service debt or for other non-discretionary expenditures.

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

2025 |

|

2024 |

| Net cash provided by operating activities |

$ |

770 |

|

|

$ |

894 |

|

|

|

|

|

| Rental equipment expenditures |

(835) |

|

|

(753) |

|

| Proceeds from disposal of rental equipment |

306 |

|

|

198 |

|

| Net rental equipment expenditures |

(529) |

|

|

(555) |

|

|

|

|

|

| Non-rental capital expenditures |

(123) |

|

|

(127) |

|

| Proceeds from disposal of property and equipment |

15 |

|

|

6 |

|

|

|

|

|

| Free cash flow |

$ |

133 |

|

|

$ |

218 |

|

|

|

|

|

| Acquisitions, net of cash acquired |

(4,256) |

|

|

(567) |

|

| Proceeds from disposal of business, net |

99 |

|

|

— |

|

| Increase in net debt, excluding financing activities |

$ |

(4,024) |

|

|

$ |

(349) |

|