Document

Executive Summary

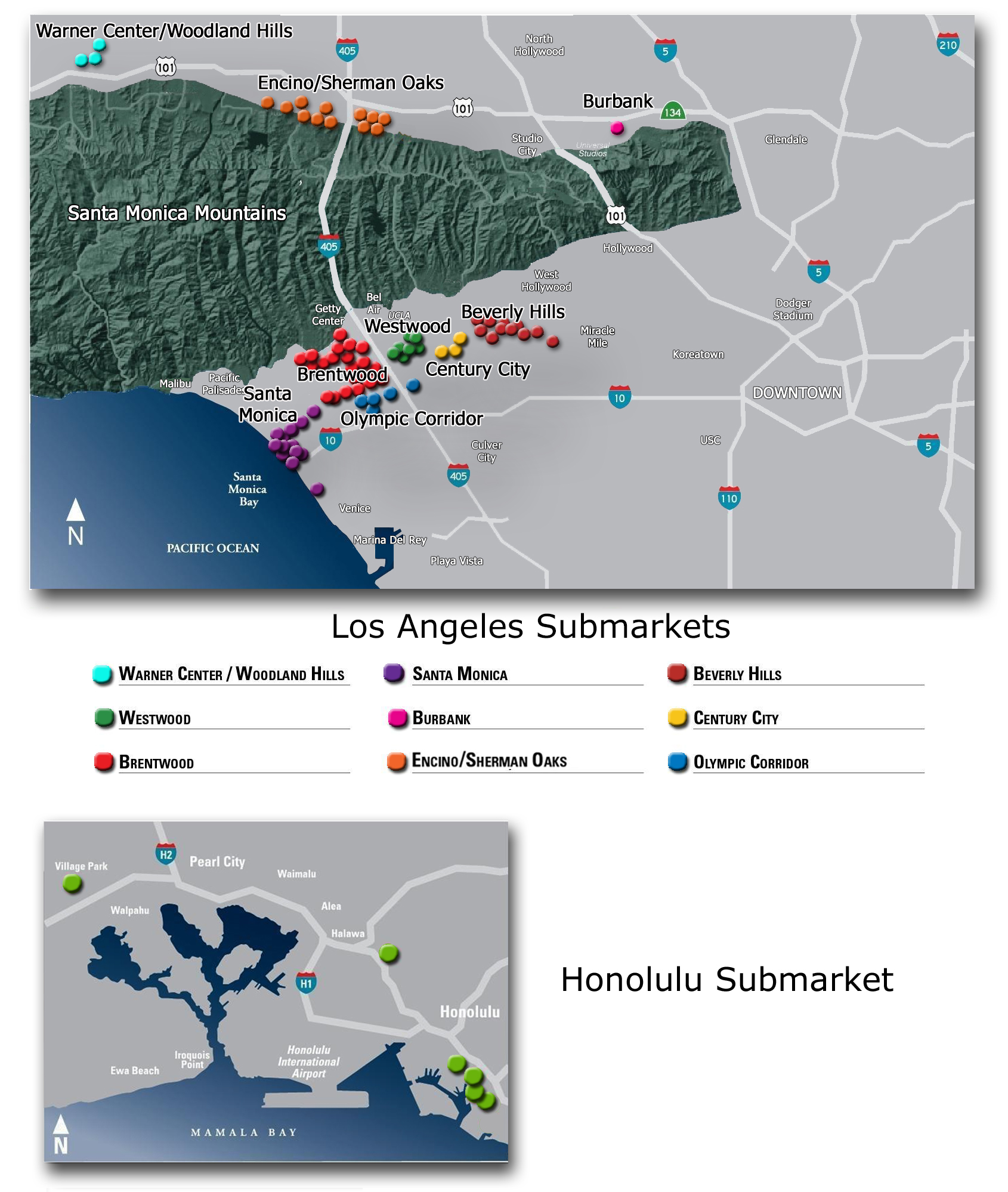

We own and operate 18.0 million square feet of Class A office properties and 4,528 apartment units (excluding our residential development pipeline and the vacated Barrington Plaza units) in the premier coastal submarkets of Los Angeles and Honolulu.

Quarterly Results: For the quarter ended March 31, 2024 compared to the quarter ended March 31, 2023:

•Our revenues decreased by 2.9% to $245.0 million, as increased revenue from new residential units, higher in-place office rents and increased parking revenue were more than offset by lower office occupancy, lower tenant recoveries, and the removal of Barrington Plaza apartments from the rental market.

•Our net income attributable to common stockholders decreased by 51.5% to net income of $8.9 million, or net income of $0.05 per diluted share, primarily due to higher interest expense and lower revenues, partially offset by lower operating expenses.

•Our FFO decreased by 8.7% to $90.1 million, or $0.45 per fully diluted share, primarily due to higher interest expense and lower revenues, partially offset by lower operating expenses.

•Our AFFO decreased by 8.2% to $74.7 million.

•Our same property Cash NOI increased by 0.7% to $146.1 million, reflecting lower expenses including some property tax refunds.

Leasing: During the first quarter, we signed 214 office leases covering 1.2 million square feet, including 202,000 square feet of new leases and 987,000 square feet of renewal leases. Renewals included a 250,000 square foot lease in Beverly Hills, extending the term for ten years through 2037. Comparing the office leases we signed during the first quarter to the expiring leases for the same space, straight-line rents increased by 23.8% and cash rents increased by 1.9%. Our multifamily portfolio remains essentially fully leased at 98.9%.

Balance sheet: At quarter end, we had cash and cash equivalents of $556.7 million. We have strong cash flow after dividends, no corporate level debt, and almost half of our office properties remain unencumbered.

Dividends: On April 16, 2024, we paid a quarterly cash dividend of $0.19 per common share, or $0.76 per common share on an annualized basis.

Guidance: First quarter FFO per share was above expectations due to lower operating expenses, and we expect straight-line revenue to be higher during the balance of the year. Nevertheless, we have left FFO guidance for the year unchanged, because we expect the operating expense savings and higher straight-line revenue to be offset by higher interest expense. As a result, we still expect Net Income Per Common Share - Diluted to be between $0.04 and $0.10, and our FFO per fully diluted share to be between $1.64 and $1.70. Our guidance does not include the impact of future property acquisitions or dispositions, stock sales or repurchases, financings, property damage insurance recoveries, impairment charges or other possible capital markets activities. See page

22.

NOTE: See the non-GAAP reconciliations for FFO & AFFO on page

8 and same property NOI on page

10.

See the "Definitions" section for definitions of certain terms used in this Earnings Package.

Table of Contents

|

|

|

|

|

|

| COMPANY OVERVIEW |

|

|

|

|

|

|

|

|

| |

|

| FINANCIAL RESULTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

| PORTFOLIO DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GUIDANCE |

| |

|

|

|

|

|

|

|

|

|

Forward Looking Statements (FLS)

This First Quarter 2024 Earnings Results and Operating Information, which we refer to as our Earnings Package (EP), supplements the information provided in our reports filed with the Securities and Exchange Commission (SEC). It contains FLS within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and we claim the protection of the safe harbor contained in the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements related to the expectations regarding the performance of our business, financial results, liquidity and capital resources and other non-historical statements. In some cases, these FLS can be identified by the use of words such as “expect,” "potential,” “continue,” “may,” “will,” “should,” “could,” “seek,” “project,” “intend,” “plan,” “estimate,” "anticipate,” or the negative version of these words or other similar words which are predictions of or indicate future events or trends and which do not relate solely to historical matters. FLS presented in this EP, and those that we may make orally or in writing from time to time, are based on our beliefs and assumptions. Our actual results will be affected by known and unknown risks, trends, uncertainties and factors, some of which are beyond our control or ability to predict, including, but not limited to: adverse economic, political or real estate developments affecting Southern California or Honolulu, Hawaii; competition from other real estate investors in our markets; decreased rental rates or increased tenant incentives and vacancy rates; reduced demand for office space, including as a result of remote work and flexible working arrangements that allow work from remote locations other than the employer’s office premises; defaults on, early terminations of, or non-renewal of leases by tenants; increases in interest rates and operating costs, including due to inflation; insufficient cash flows to service our debt or pay rent on ground leases; difficulties in raising capital; inability to liquidate real estate or other investments quickly; difficulties in acquiring properties; failure to successfully operate properties; failure to maintain our REIT status; adverse changes in rent control laws and regulations; environmental uncertainties; natural disasters; fire and other property damage; insufficient insurance or increases in insurance costs; inability to successfully expand into new markets or submarkets; risks associated with property development; conflicts of interest with our officers; reliance on key personnel; changes in zoning and other land use laws; adverse changes to tax laws, including those related to property taxes; possible terrorist attacks or wars; and other risks and uncertainties detailed in our Annual Report on Form 10-K for 2023, and other documents filed with the SEC. Although we believe that our assumptions underlying our FLS are reasonable, they are not guarantees of future performance and some will inevitably prove to be incorrect. As a result, our actual future results can be expected to differ from our expectations, and those differences could be material. Accordingly, please use caution in relying on any FLS in this EP to anticipate future results or trends. This EP and all subsequent written and oral FLS attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We do not undertake any obligation to release publicly any revisions to our FLS.

Corporate Data

as of March 31, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Office Portfolio |

|

|

|

|

|

|

|

|

|

Consolidated |

|

Total |

|

|

Properties |

68 |

|

|

70 |

|

|

|

Rentable square feet (in thousands) |

17,595 |

|

17,981 |

|

|

Leased rate |

82.5 |

% |

|

82.6 |

% |

|

|

Occupancy rate |

80.8 |

% |

|

80.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Multifamily Portfolio(1) |

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

Properties |

|

|

14 |

|

|

|

Units |

|

|

4,528 |

|

|

Leased rate |

|

|

98.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Market Capitalization (in thousands, except price per share) |

|

|

|

|

|

|

|

Fully Diluted Shares outstanding as of March 31, 2024 |

|

201,874 |

|

|

|

Common stock closing price per share (NYSE:DEI) |

|

$ |

13.87 |

|

|

|

Equity Capitalization |

|

$ |

2,799,992 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Debt (in thousands) |

|

|

|

|

|

|

|

|

|

Consolidated |

|

Our Share |

|

|

|

|

|

|

|

|

Debt principal(2) |

$ |

5,569,819 |

|

|

$ |

4,641,149 |

|

|

|

Less: cash and cash equivalents and loan collateral deposits(3) |

(570,217) |

|

|

(444,937) |

|

|

|

Net Debt |

$ |

4,999,602 |

|

|

$ |

4,196,212 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leverage Ratio (in thousands, except percentage) |

|

|

|

|

|

|

|

Pro Forma Enterprise Value |

|

$ |

6,996,204 |

|

|

|

Our Share of Net Debt to Pro Forma Enterprise Value |

|

60 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AFFO Payout Ratio(4) |

|

|

|

|

|

|

|

Three months ended March 31, 2024 |

|

51.6 |

% |

|

|

|

|

|

|

_______________________________________________

(1) Unit totals exclude units vacated as part of removing Barrington Plaza from the rental market. Leased rate excludes the impact of Barrington Plaza.

(2) See page

12 for a reconciliation of consolidated debt principal and our share of debt principal to consolidated debt on the balance sheet.

(3) The consolidated balance of $570.2 million includes our consolidated cash and cash equivalents of $556.7 million and a loan collateral deposit of $13.5 million deposited with a lender. Our share is calculated by starting with the consolidated balance of $570.2 million, then deducting the other owners' share of our JVs' cash and cash equivalents of $140.9 million and then adding our share of our unconsolidated Fund's cash and cash equivalents of $15.6 million. See note 4 to the debt table on page

12 regarding the loan collateral deposit.

(4) Payout ratio based on $0.19 cent dividend payable to shareholders of record as of March 28, 2024.

NOTE: See the "Definitions" section for definitions of certain terms used in this Earnings Package.

Property Map

as of March 31, 2024

Board of Directors and Executive Officers

as of March 31, 2024

BOARD OF DIRECTORS

__________________________________________________________________________________________________________________________________

|

|

|

|

|

|

| Dan A. Emmett |

Our Chairman of the Board |

| Jordan L. Kaplan |

Our Chief Executive Officer and President |

| Kenneth M. Panzer |

Our Chief Operating Officer |

| Leslie E. Bider |

Retired Executive and Investor |

| Dorene C. Dominguez |

Chairwoman and CEO of Vanir Group of Companies |

| Dr. David T. Feinberg |

Chairman, Oracle Health |

| Ray C. Leonard |

President, Sugar Ray Leonard Foundation |

| Virginia A. McFerran |

Technology and Data Science Advisor |

| Thomas E. O’Hern |

Former CEO of The Macerich Company |

| William E. Simon, Jr. |

Partner Emeritus, Simon Quick Advisors |

| Shirley Wang |

Founder and CEO, Plastpro Inc. |

EXECUTIVE OFFICERS

__________________________________________________________________________________________________________________________________

|

|

|

|

|

|

| Jordan L. Kaplan |

Chief Executive Officer and President |

| Kenneth M. Panzer |

Chief Operating Officer |

| Peter D. Seymour |

Chief Financial Officer |

| Kevin A. Crummy |

Chief Investment Officer |

| Michele L. Aronson |

Executive Vice President, General Counsel and Secretary |

CORPORATE OFFICE

1299 Ocean Avenue, Suite 1000, Santa Monica, California 90401

Phone: (310) 255-7700

For more information, please visit our website at www.douglasemmett.com or contact:

Stuart McElhinney, Vice President, Investor Relations

(310) 255-7751

smcelhinney@douglasemmett.com

Consolidated Balance Sheets

(Unaudited; In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

| |

March 31, 2024 |

|

December 31, 2023 |

|

|

|

|

| Assets |

|

|

|

| Investment in real estate, gross |

$ |

12,432,301 |

|

|

$ |

12,405,814 |

|

| Less: accumulated depreciation and amortization |

(3,721,673) |

|

|

(3,652,630) |

|

| Investment in real estate, net |

8,710,628 |

|

|

8,753,184 |

|

|

|

|

|

| Ground lease right-of-use asset |

7,445 |

|

|

7,447 |

|

| Cash and cash equivalents |

556,677 |

|

|

523,082 |

|

| Tenant receivables |

5,783 |

|

|

6,096 |

|

| Deferred rent receivables |

115,120 |

|

|

115,321 |

|

| Acquired lease intangible assets, net |

2,848 |

|

|

2,971 |

|

| Interest rate contract assets |

170,607 |

|

|

170,880 |

|

| Investment in unconsolidated Fund |

24,996 |

|

|

15,977 |

|

| Other assets |

42,963 |

|

|

49,260 |

|

| Total assets |

$ |

9,637,067 |

|

|

$ |

9,644,218 |

|

|

|

|

|

| Liabilities |

|

|

|

| Secured notes payable, net |

$ |

5,544,517 |

|

|

$ |

5,543,171 |

|

| Ground lease liability |

10,832 |

|

|

10,836 |

|

| Interest payable, accounts payable and deferred revenue |

153,235 |

|

|

131,237 |

|

| Security deposits |

62,428 |

|

|

61,958 |

|

| Acquired lease intangible liabilities, net |

17,373 |

|

|

19,838 |

|

|

|

|

|

| Dividends payable |

31,812 |

|

|

31,781 |

|

| Total liabilities |

5,820,197 |

|

|

5,798,821 |

|

|

|

|

|

| Equity |

|

|

|

| Douglas Emmett, Inc. stockholders' equity: |

|

|

|

| Common stock |

1,674 |

|

|

1,672 |

|

| Additional paid-in capital |

3,395,499 |

|

|

3,392,955 |

|

| Accumulated other comprehensive income |

118,999 |

|

|

115,917 |

|

| Accumulated deficit |

(1,313,573) |

|

|

(1,290,682) |

|

| Total Douglas Emmett, Inc. stockholders' equity |

2,202,599 |

|

|

2,219,862 |

|

| Noncontrolling interests |

1,614,271 |

|

|

1,625,535 |

|

| Total equity |

3,816,870 |

|

|

3,845,397 |

|

| Total liabilities and equity |

$ |

9,637,067 |

|

|

$ |

9,644,218 |

|

NOTE: See the "Definitions" section for definitions of certain terms used in this Earnings Package.

Consolidated Operating Results

(Unaudited; In thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months Ended March 31, |

|

|

|

|

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

| Revenues |

|

|

|

|

|

|

|

| Office rental |

|

|

|

|

|

|

|

Rental revenues and tenant recoveries(1) |

|

|

|

|

$ |

169,726 |

|

|

$ |

176,345 |

|

| Parking and other income |

|

|

|

|

28,211 |

|

|

27,013 |

|

| Total office revenues |

|

|

|

|

197,937 |

|

|

203,358 |

|

|

|

|

|

|

|

|

|

| Multifamily rental |

|

|

|

|

|

|

|

| Rental revenues |

|

|

|

|

43,220 |

|

|

43,973 |

|

| Parking and other income |

|

|

|

|

3,812 |

|

|

5,062 |

|

| Total multifamily revenues |

|

|

|

|

47,032 |

|

|

49,035 |

|

|

|

|

|

|

|

|

|

| Total revenues |

|

|

|

|

244,969 |

|

|

252,393 |

|

|

|

|

|

|

|

|

|

| Operating Expenses |

|

|

|

|

|

|

|

| Office expenses |

|

|

|

|

67,220 |

|

|

72,768 |

|

| Multifamily expenses |

|

|

|

|

15,850 |

|

|

16,888 |

|

| General and administrative expenses |

|

|

|

|

11,571 |

|

|

10,940 |

|

| Depreciation and amortization |

|

|

|

|

95,769 |

|

|

93,176 |

|

| Total operating expenses |

|

|

|

|

190,410 |

|

|

193,772 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income |

|

|

|

|

7,044 |

|

|

3,283 |

|

| Other expenses |

|

|

|

|

(114) |

|

|

(520) |

|

| (Loss) income from unconsolidated Fund |

|

|

|

|

(26) |

|

|

289 |

|

| Interest expense |

|

|

|

|

(55,332) |

|

|

(45,511) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

|

|

6,131 |

|

|

16,162 |

|

| Net loss attributable to noncontrolling interests |

|

|

|

|

2,778 |

|

|

2,211 |

|

| Net income attributable to common stockholders |

|

|

|

|

$ |

8,909 |

|

|

$ |

18,373 |

|

|

|

|

|

|

|

|

|

| Net income per common share - basic and diluted |

|

|

|

|

$ |

0.05 |

|

|

$ |

0.10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends declared per common share |

|

|

|

|

$ |

0.19 |

|

|

$ |

0.19 |

|

|

|

|

|

|

|

|

|

| Weighted average shares of common stock outstanding - basic and diluted |

|

|

|

|

167,326 |

|

175,765 |

|

|

|

|

|

|

|

|

_______________________________________________________________________

(1)Rental revenues and tenant recoveries include tenant recoveries of $9.1 million and $13.1 million for the three months ended March 31, 2024 and 2023, respectively.

NOTE: See the "Definitions" section for definitions of certain terms used in this Earnings Package.

Funds From Operations & Adjusted Funds From Operations(1)

(Unaudited; in thousands, except per share data)

The table below presents a reconciliation of Net income attributable to common stockholders to Funds from Operations (FFO) and Adjusted Funds from Operations (AFFO):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months Ended March 31, |

| |

|

|

|

|

2024 |

|

2023 |

| Funds From Operations (FFO) |

|

|

|

|

|

|

|

| Net income attributable to common stockholders |

|

|

|

|

$ |

8,909 |

|

|

$ |

18,373 |

|

| Depreciation and amortization of real estate assets |

|

|

|

|

95,769 |

|

|

93,176 |

|

| Net loss attributable to noncontrolling interests |

|

|

|

|

(2,778) |

|

|

(2,211) |

|

Adjustments attributable to unconsolidated Fund(2) |

|

|

|

|

1,011 |

|

|

745 |

|

Adjustments attributable to consolidated JVs(2) |

|

|

|

|

(12,855) |

|

|

(11,471) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FFO |

|

|

|

|

$ |

90,056 |

|

|

$ |

98,612 |

|

|

|

|

|

|

|

|

|

| Adjusted Funds From Operations (AFFO) |

|

|

|

|

|

|

|

| FFO |

|

|

|

|

$ |

90,056 |

|

|

$ |

98,612 |

|

| Straight-line rent |

|

|

|

|

202 |

|

|

126 |

|

| Net accretion of acquired above- and below-market leases |

|

|

|

|

(2,343) |

|

|

(3,037) |

|

| Loan costs, loan premium amortization and swap amortization |

|

|

|

|

2,286 |

|

|

2,034 |

|

Recurring capital expenditures, tenant improvements and capitalized leasing expenses(3) |

|

|

|

|

(23,657) |

|

|

(27,249) |

|

| Non-cash compensation expense |

|

|

|

|

5,427 |

|

|

5,473 |

|

Adjustments attributable to unconsolidated Fund(2) |

|

|

|

|

175 |

|

|

(97) |

|

Adjustments attributable to consolidated JVs(2) |

|

|

|

|

2,570 |

|

|

5,540 |

|

| AFFO |

|

|

|

|

$ |

74,716 |

|

|

$ |

81,402 |

|

|

|

|

|

|

|

|

|

| Weighted average shares of common stock outstanding - diluted |

|

|

|

|

167,326 |

|

|

175,765 |

|

| Weighted average units in our operating partnership outstanding |

|

|

|

|

34,423 |

|

|

32,924 |

|

| Weighted average fully diluted shares outstanding |

|

|

|

|

201,749 |

|

|

208,689 |

|

|

|

|

|

|

|

|

|

| Net income per common share - basic and diluted |

|

|

|

|

$ |

0.05 |

|

|

$ |

0.10 |

|

| FFO per share - fully diluted |

|

|

|

|

$ |

0.45 |

|

|

$ |

0.47 |

|

Dividends paid per share(4) |

|

|

|

|

$ |

0.19 |

|

|

$ |

0.19 |

|

__________________________________________________________

(1)Presents the FFO and AFFO attributable to our common stockholders and noncontrolling interests in our Operating Partnership, including our share of our consolidated JVs and our unconsolidated Fund.

(2)Adjusts for the portion of each other listed adjustment item on our share of the results of our unconsolidated Fund and for each other listed adjustment item that is attributed to the noncontrolling interests in our consolidated JVs.

(3)Under the GAAP lease accounting rules, we expense non-incremental leasing expenses (leasing expenses not directly related to the signing of a lease) and capitalize incremental leasing expenses. Since non-incremental leasing expenses are included in the calculation of net income attributable to common stockholders and FFO, the capitalized leasing expenses adjustment to AFFO only includes incremental leasing expenses.

(4)Reflects dividends paid within the respective periods.

NOTE: See the "Definitions" section for definitions of certain terms used in this Earnings Package.

Same Property Statistics & Net Operating Income (NOI)(1)

(Unaudited; in thousands, except statistics)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of March 31, |

|

|

|

2024 |

|

2023 |

|

|

Office Statistics |

|

|

|

|

|

Number of properties |

66 |

|

|

66 |

|

|

|

Rentable square feet (in thousands) |

17,105 |

|

|

17,105 |

|

|

|

Ending % leased |

82.1 |

% |

|

85.2 |

% |

|

|

Ending % occupied |

80.3 |

% |

|

83.0 |

% |

|

|

Quarterly average % occupied |

80.4 |

% |

|

83.1 |

% |

|

|

|

|

|

|

|

|

Multifamily Statistics |

|

|

|

|

|

Number of properties |

11 |

|

|

11 |

|

|

|

Number of units |

3,569 |

|

|

3,569 |

|

|

|

Ending % leased |

98.9 |

% |

|

99.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

% Favorable |

|

|

|

2024 |

|

2023 |

|

(Unfavorable) |

|

|

Net Operating Income (NOI) |

|

|

|

|

|

|

|

Office revenues |

$ |

190,438 |

|

|

$ |

196,148 |

|

|

(2.9) |

% |

|

|

Office expenses |

(66,383) |

|

|

(71,946) |

|

|

7.7 |

% |

|

|

Office NOI |

124,055 |

|

|

124,202 |

|

|

(0.1) |

% |

|

|

|

|

|

|

|

|

|

|

Multifamily revenues |

35,672 |

|

|

35,672 |

|

|

— |

% |

|

|

Multifamily expenses |

(10,816) |

|

|

(11,421) |

|

|

5.3 |

% |

|

|

Multifamily NOI |

24,856 |

|

|

24,251 |

|

|

2.5 |

% |

|

|

|

|

|

|

|

|

|

|

Total NOI |

$ |

148,911 |

|

|

$ |

148,453 |

|

|

0.3 |

% |

|

|

|

|

|

|

|

|

|

|

Cash Net Operating Income (NOI) |

|

|

|

|

|

|

|

Office cash revenues |

$ |

189,011 |

|

|

$ |

194,591 |

|

|

(2.9) |

% |

|

|

Office cash expenses |

(66,383) |

|

|

(71,946) |

|

|

7.7 |

% |

|

|

Office cash NOI |

122,628 |

|

|

122,645 |

|

|

— |

% |

|

|

|

|

|

|

|

|

|

|

Multifamily cash revenues |

34,278 |

|

|

33,858 |

|

|

1.2 |

% |

|

|

Multifamily cash expenses |

(10,816) |

|

|

(11,421) |

|

|

5.3 |

% |

|

|

Multifamily cash NOI |

23,462 |

|

|

22,437 |

|

|

4.6 |

% |

|

|

|

|

|

|

|

|

|

|

Total Cash NOI |

$ |

146,090 |

|

|

$ |

145,082 |

|

|

0.7 |

% |

|

|

|

|

|

|

|

|

|

_________________________________________________

(1) The amounts presented include 100% (not our pro-rata share). See page

10 for a reconciliation of net income attributable to common stockholders to these non-GAAP measures.

NOTE: See the "Definitions" section for definitions of certain terms used in this Earnings Package.

Same Property NOI Reconciliation

(Unaudited and in thousands)

The tables below present a reconciliation of Net income attributable to common stockholders to Same Property NOI:

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended March 31, |

| |

2024 |

|

2023 |

|

|

|

|

| Net income attributable to common stockholders |

$ |

8,909 |

|

|

$ |

18,373 |

|

| Net loss attributable to noncontrolling interests |

(2,778) |

|

|

(2,211) |

|

| Net income |

6,131 |

|

|

16,162 |

|

| General and administrative expenses |

11,571 |

|

|

10,940 |

|

| Depreciation and amortization |

95,769 |

|

|

93,176 |

|

| Other income |

(7,044) |

|

|

(3,283) |

|

| Other expenses |

114 |

|

|

520 |

|

| Loss (income) from unconsolidated Fund |

26 |

|

|

(289) |

|

| Interest expense |

55,332 |

|

|

45,511 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| NOI |

$ |

161,899 |

|

|

$ |

162,737 |

|

|

|

|

|

| Same Property NOI by Segment |

|

|

|

|

|

|

|

| Same property office cash revenues |

$ |

189,011 |

|

|

$ |

194,591 |

|

| Non-cash adjustments per definition of NOI |

1,427 |

|

|

1,557 |

|

| Same property office revenues |

190,438 |

|

|

196,148 |

|

|

|

|

|

| Same property office cash expenses |

(66,383) |

|

|

(71,946) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Same Property Office NOI |

124,055 |

|

|

124,202 |

|

|

|

|

|

| Same property multifamily cash revenues |

34,278 |

|

|

33,858 |

|

| Non-cash adjustments per definition of NOI |

1,394 |

|

|

1,814 |

|

| Same property multifamily revenues |

35,672 |

|

|

35,672 |

|

|

|

|

|

| Same property multifamily cash expenses |

(10,816) |

|

|

(11,421) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Same Property Multifamily NOI |

24,856 |

|

|

24,251 |

|

|

|

|

|

| Same Property NOI |

148,911 |

|

|

148,453 |

|

| Non-comparable office revenues |

7,499 |

|

|

7,210 |

|

| Non-comparable office expenses |

(837) |

|

|

(822) |

|

| Non-comparable multifamily revenues |

11,360 |

|

|

13,363 |

|

| Non-comparable multifamily expenses |

(5,034) |

|

|

(5,467) |

|

| NOI |

$ |

161,899 |

|

|

$ |

162,737 |

|

NOTE: See the "Definitions" section for definitions of certain terms used in this Earnings Package.

Financial Data for JVs & Fund

(Unaudited, in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, 2024 |

|

|

|

|

|

|

|

Wholly-Owned Properties |

|

Consolidated JVs(1) |

|

Unconsolidated Fund(2) |

|

|

|

|

|

|

| Revenues |

$ |

185,372 |

|

|

$ |

59,597 |

|

|

$ |

3,823 |

|

| Office and multifamily operating expenses |

$ |

64,895 |

|

|

$ |

18,175 |

|

|

$ |

1,643 |

|

| Straight-line rent |

$ |

366 |

|

|

$ |

(568) |

|

|

$ |

(773) |

|

| Above/below-market lease revenue |

$ |

207 |

|

|

$ |

2,136 |

|

|

$ |

— |

|

Cash NOI attributable to outside interests(3) |

$ |

— |

|

|

$ |

20,531 |

|

|

$ |

1,028 |

|

Our share of cash NOI(4) |

$ |

119,904 |

|

|

$ |

19,323 |

|

|

$ |

1,925 |

|

______________________________________________________

(1) Represents stand-alone financial data (with property management fees excluded from operating expenses as a consolidating entry) for four consolidated JVs that we manage. We own a weighted average interest of approximately 46% (based on square footage) in the four JVs, which owned a combined sixteen Class A office properties totaling 4.2 million square feet and two residential properties with 470 apartments in our submarkets. We are entitled to (i) distributions based on invested capital, (ii) fees for property management and other services, (iii) reimbursement of certain acquisition-related expenses and certain other costs and (iv) additional distributions based on Cash NOI.

(2) Represents stand-alone financial data (with property management fees excluded from operating expenses as a consolidating entry) for one unconsolidated Fund that we manage. We owned an interest of approximately 54% during January and February of 2024. We purchased an additional 20% interest on February 29, 2024 which increased our ownership interest in the Fund to 74%. The Fund owns two Class A office properties totaling 0.4 million square feet in our submarkets. We are entitled to (i) priority distributions, (ii) distributions based on invested capital, (iii) a carried interest if the investors’ distributions exceed a hurdle rate, (iv) fees for property management and other services and (v) reimbursement of certain costs.

(3) Represents the share of Cash NOI allocable under the applicable agreements to interests other than our Fully Diluted Shares.

(4) Represents the share of Cash NOI allocable to our Fully Diluted Shares.

NOTE: See the "Definitions" section for definitions of certain terms used in this Earnings Package.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans

(As of March 31 2024, unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maturity Date(1) |

|

Principal Balance

(In Thousands) |

|

Our Share(2)

(In Thousands)

|

|

Effective

Rate(3)

|

|

Swap Maturity Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Wholly-Owned Subsidiaries |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3/3/2025 |

|

$ |

335,000 |

|

|

$ |

335,000 |

|

|

SOFR + 1.41% |

|

N/A |

|

|

|

4/1/2025 |

|

102,400 |

|

|

102,400 |

|

|

SOFR + 1.36% |

|

N/A |

|

|

|

8/15/2026 |

|

415,000 |

|

|

415,000 |

|

|

3.07% |

|

8/1/2025 |

|

|

|

9/19/2026 |

|

400,000 |

|

|

400,000 |

|

|

2.44% |

|

9/1/2024 |

|

|

|

9/26/2026 |

|

200,000 |

|

|

200,000 |

|

|

2.36% |

|

10/1/2024 |

|

|

|

11/1/2026 |

|

400,000 |

|

|

400,000 |

|

|

2.31% |

|

10/1/2024 |

|

|

|

6/1/2027 |

(4) |

550,000 |

|

|

550,000 |

|

|

SOFR + 1.48% |

|

N/A |

|

|

|

5/18/2028 |

|

300,000 |

|

|

300,000 |

|

|

2.21% |

|

6/1/2026 |

|

|

|

1/1/2029 |

|

300,000 |

|

|

300,000 |

|

|

2.66% |

|

1/1/2027 |

|

|

|

6/1/2029 |

|

255,000 |

|

|

255,000 |

|

|

3.26% |

|

6/1/2027 |

|

|

|

6/1/2029 |

|

125,000 |

|

|

125,000 |

|

|

3.25% |

|

6/1/2027 |

|

|

|

8/1/2033 |

|

350,000 |

|

|

350,000 |

|

|

SOFR + 1.37% |

|

N/A |

|

|

|

6/1/2038 |

(5) |

27,419 |

|

|

27,419 |

|

|

4.55% |

|

N/A |

|

|

|

Subtotal |

|

3,759,819 |

|

|

3,759,819 |

|

|

|

|

|

|

|

Consolidated JVs |

|

|

|

12/19/2024 |

|

400,000 |

|

|

80,000 |

|

|

SOFR + 1.40% |

|

N/A |

|

|

|

5/15/2027 |

|

450,000 |

|

|

400,500 |

|

|

2.26% |

|

4/1/2025 |

|

|

|

8/19/2028 |

|

625,000 |

|

|

187,500 |

|

|

2.12% |

|

6/1/2025 |

|

|

|

4/26/2029 |

(6) |

175,000 |

|

|

96,250 |

|

|

3.90% |

|

5/1/2026 |

|

|

|

6/1/2029 |

|

160,000 |

|

|

32,000 |

|

|

3.25% |

|

7/1/2027 |

|

|

Total Consolidated Loans |

(7) |

$ |

5,569,819 |

|

|

$ |

4,556,069 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unconsolidated Fund |

|

|

|

9/14/2028 |

|

$ |

115,000 |

|

|

$ |

85,080 |

|

|

2.19% |

|

10/1/2026 |

|

|

Total Loans |

|

|

|

$ |

4,641,149 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Except as noted below, our loans: (i) are non-recourse, (ii) are secured by separate collateral pools consisting of one or more properties, (iii) require interest-only monthly payments with the outstanding principal due at maturity, and (iv) contain certain financial covenants which could require us to deposit excess cash flow with the lender under certain circumstances unless we (at our option) either provide a guarantee or additional collateral or pay down the loan within certain parameters set forth in the loan documents. Certain loans with maturity date extension options require us to meet minimum financial thresholds in order to exercise those extension options.

(1)Maturity dates include the effect of extension options.

(2)"Our Share" is calculated by multiplying the principal balance by our share of the borrowing entity's equity, and is used to calculate the non-GAAP measure "Our Share of Net Debt" - see Corporate Data on page

3.

(3)Effective rate as of March 31, 2024. Includes the effect of interest rate swaps and excludes the effect of prepaid loan costs.

(4)The loan is secured by four residential properties. For the portion secured by Barrington Plaza, in connection with the removal of that property from the rental market during 2023, we deposited $13.3 million of cash into an interest bearing collateral account with the lender. The lender will return the deposit at the earlier of August 2026 or when the loan is paid in full. The lender is treating the loan as a construction loan and we signed a construction completion guarantee.

(5)The loan requires monthly payments of principal and interest based upon a 30-year principal amortization schedule.

(6)A portion of this loan is guaranteed.

(7)Our consolidated debt on the balance sheet (see page

6) of $5.54 billion is calculated by adding $3.0 million of unamortized loan premium and deducting $28.3 million of unamortized deferred loan costs from our total consolidated loans of $5.57 billion.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statistics for consolidated loans with interest fixed under the terms of the loan or a swap |

|

|

|

|

|

|

Principal balance (in billions) |

$3.83 |

|

|

Weighted average remaining life (including extension options) |

3.8 years |

|

|

Weighted average remaining fixed interest period |

1.6 years |

|

|

Weighted average annual interest rate |

2.66% |

|

|

|

|

|

NOTE: See the "Definitions" section for definitions of certain terms used in this Earnings Package.

Office Portfolio Summary

Total Office Portfolio as of March 31, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Region |

|

Number of Properties |

|

Our Rentable Square Feet |

|

Region Rentable Square Feet(1) |

|

Our Average Market Share(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Los Angeles |

|

|

|

|

|

|

|

|

|

|

Westside(3) |

|

52 |

|

|

9,999,051 |

|

|

40,523,615 |

|

34.4 |

% |

|

|

Valley |

|

16 |

|

|

6,790,777 |

|

|

22,485,019 |

|

44.4 |

|

|

|

Honolulu(3) |

|

2 |

|

|

1,190,835 |

|

|

5,311,332 |

|

22.4 |

|

|

|

Total / Average |

|

70 |

|

|

17,980,663 |

|

|

68,319,966 |

|

37.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

_________________________________________________

(1) The rentable square feet in each region is based on the Rentable Square Feet as reported in the 2024 first quarter CBRE Marketview report for our submarkets in that region.

(2) Our market share is calculated by dividing our Rentable Square Feet by the applicable Region's Rentable Square Feet, weighted in the case of averages based on the square feet of exposure in our total portfolio to each submarket as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Region |

|

Submarket |

|

Number of Properties |

|

Our Rentable Square Feet |

|

Our Market Share(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Westside |

|

Brentwood |

|

15 |

|

|

2,085,745 |

|

|

60.3 |

% |

|

|

|

Westwood |

|

7 |

|

|

2,191,711 |

|

|

43.6 |

|

|

|

|

Olympic Corridor |

|

5 |

|

|

1,142,885 |

|

|

28.1 |

|

|

|

|

Beverly Hills(3) |

|

11 |

|

|

2,196,067 |

|

|

27.6 |

|

|

|

|

Santa Monica |

|

11 |

|

|

1,425,374 |

|

|

14.1 |

|

|

|

|

Century City |

|

3 |

|

|

957,269 |

|

|

9.0 |

|

|

|

Valley |

|

Sherman Oaks/Encino |

|

12 |

|

|

3,488,995 |

|

|

55.1 |

|

|

|

|

Warner Center/Woodland Hills |

|

3 |

|

|

2,845,577 |

|

|

37.4 |

|

|

|

|

Burbank |

|

1 |

|

|

456,205 |

|

|

5.3 |

|

|

|

Honolulu |

|

Honolulu(3) |

|

2 |

|

|

1,190,835 |

|

|

22.4 |

|

|

|

|

|

Total / Weighted Average |

|

70 |

|

|

17,980,663 |

|

|

37.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

_______________________________________________

(3) In calculating market share, we adjusted the rentable square footage by: (i) removing a 218,000 square foot property located just outside the Beverly Hills city limits from both the numerator and the denominator, and (ii) removing 77,000 rentable square feet for an office building in Honolulu that we are converting to residential apartments from both our rentable square footage and that of the submarket.

NOTE: See the "Definitions" section for definitions of certain terms used in this Earnings Package.

Office Percentage Leased and In-Place Rents

Total Office Portfolio as of March 31, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Region(1) |

|

Percent Leased |

|

Annualized Rent(2) |

|

Annualized Rent Per Leased Square Foot(2) |

|

Monthly Rent Per Leased Square Foot(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Los Angeles |

|

|

|

|

|

|

|

|

|

|

Westside |

|

82.0 |

% |

|

$ |

451,747,729 |

|

|

$ |

57.19 |

|

|

$ |

4.77 |

|

|

|

Valley |

|

82.1 |

|

|

196,895,262 |

|

|

36.22 |

|

|

3.02 |

|

|

|

Honolulu |

|

90.7 |

|

|

37,286,249 |

|

|

36.16 |

|

|

3.01 |

|

|

|

Total / Weighted Average |

|

82.6 |

% |

|

$ |

685,929,240 |

|

|

$ |

47.74 |

|

|

$ |

3.98 |

|

|

|

|

|

|

|

|

|

|

|

|

|

_______________________________________________________________

(1)Regional data reflects the following underlying submarket data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Region |

|

Submarket |

|

Percent Leased |

|

|

|

|

|

Monthly Rent Per Leased Square Foot(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Westside |

|

Beverly Hills |

|

85.3 |

% |

|

|

|

|

|

$ |

4.98 |

|

|

|

|

Brentwood |

|

79.7 |

|

|

|

|

|

|

4.02 |

|

|

|

|

Century City |

|

88.0 |

|

|

|

|

|

|

4.73 |

|

|

|

|

Olympic Corridor |

|

75.7 |

|

|

|

|

|

|

3.33 |

|

|

|

|

Santa Monica |

|

81.2 |

|

|

|

|

|

|

6.99 |

|

|

|

|

Westwood |

|

81.9 |

|

|

|

|

|

|

4.48 |

|

|

|

Valley |

|

Burbank |

|

100.0 |

|

|

|

|

|

|

5.08 |

|

|

|

|

Sherman Oaks/Encino |

|

84.9 |

|

|

|

|

|

|

3.01 |

|

|

|

|

Warner Center/Woodland Hills |

|

75.7 |

|

|

|

|

|

|

2.58 |

|

|

|

Honolulu |

|

Honolulu |

|

90.7 |

|

|

|

|

|

|

3.01 |

|

|

|

|

|

Weighted Average |

|

82.6 |

% |

|

|

|

|

|

$ |

3.98 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) Does not include signed leases not yet commenced, which are included in percent leased but excluded from annualized rent.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Recurring Office Capital Expenditures per Rentable Square Foot |

|

|

|

|

|

|

|

Three months ended March 31, 2024 |

$ |

0.06 |

|

|

|

|

|

|

NOTE: See the "Definitions" section for definitions of certain terms used in this Earnings Package.

Office Lease Diversification

Total Office Portfolio as of March 31, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Portfolio Tenant Size |

|

|

|

Median |

|

Average |

|

|

|

|

|

|

|

|

Square feet |

2,500 |

|

5,300 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Office Leases |

|

Rentable Square Feet |

|

Annualized Rent |

|

|

Square Feet Under Lease |

|

Number |

|

Percent |

|

Amount |

|

Percent |

|

Amount |

|

Percent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,500 or less |

|

1,359 |

|

|

50.5 |

% |

|

1,952,990 |

|

|

13.6 |

% |

|

$ |

86,458,274 |

|

|

12.6 |

% |

|

|

2,501-10,000 |

|

1,011 |

|

|

37.5 |

|

|

4,936,772 |

|

|

34.4 |

|

|

228,646,054 |

|

|

33.3 |

|

|

|

10,001-20,000 |

|

207 |

|

|

7.7 |

|

|

2,845,983 |

|

|

19.8 |

|

|

137,985,346 |

|

|

20.1 |

|

|

|

20,001-40,000 |

|

85 |

|

|

3.2 |

|

|

2,301,067 |

|

|

16.0 |

|

|

106,092,387 |

|

|

15.5 |

|

|

|

40,001-100,000 |

|

28 |

|

|

1.0 |

|

|

1,625,762 |

|

|

11.3 |

|

|

82,767,718 |

|

|

12.1 |

|

|

|

Greater than 100,000 |

|

2 |

|

|

0.1 |

|

|

703,973 |

|

|

4.9 |

|

|

43,979,461 |

|

|

6.4 |

|

|

|

Total for all leases |

|

2,692 |

|

|

100.0 |

% |

|

14,366,547 |

|

|

100.0 |

% |

|

$ |

685,929,240 |

|

|

100.0 |

% |

|

|

|

|

|

|

|

NOTE: See the "Definitions" section for definitions of certain terms used in this Earnings Package.

Largest Office Tenants

Total Office Portfolio as of March 31, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tenants paying 1% or more of our aggregate Annualized Rent: |

|

|

|

|

|

Tenant |

|

Number of Leases |

|

Number of Properties |

|

Lease Expiration(1) |

|

Total Leased Square Feet |

|

Percent of Rentable Square Feet |

|

Annualized Rent |

|

Percent of Annualized Rent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Warner Bros. Discovery |

|

1 |

|

1 |

|

2024 |

|

456,205 |

|

2.5 |

% |

|

$ |

27,787,941 |

|

|

4.0 |

% |

|

|

William Morris Endeavor(2) |

|

1 |

|

1 |

|

2037 |

|

247,768 |

|

|

1.4 |

|

|

16,191,520 |

|

|

2.4 |

|

|

|

UCLA(3) |

|

15 |

|

8 |

|

2024-2033 |

|

227,071 |

|

1.3 |

|

|

12,989,596 |

|

|

1.9 |

|

|

|

Morgan Stanley(4) |

|

5 |

|

5 |

|

2025-2028 |

|

144,688 |

|

|

0.8 |

|

|

10,921,995 |

|

|

1.6 |

|

|

|

Equinox Fitness(5) |

|

6 |

|

5 |

|

2028-2038 |

|

185,236 |

|

1.0 |

|

|

10,407,103 |

|

|

1.5 |

|

|

|

Total |

|

28 |

|

20 |

|

|

|

1,260,968 |

|

7.0 |

% |

|

$ |

78,298,155 |

|

|

11.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

______________________________________________________

(1) Expiration dates are per lease (expiration dates do not reflect storage and similar leases).

(2) Tenant has the option to terminate in 2033.

(3) Square footage (rounded) expires as follows: 2 lease totaling 33,000 square feet in 2024; 4 leases totaling 89,000 square feet in 2025; 5 leases totaling 32,000 square feet in 2026; 1 leases totaling 51,000 square feet in 2027; 1 lease totaling 8,000 square feet in 2028; and 2 leases totaling 14,000 square feet in 2033. Tenant has options to terminate 51,000 square feet in 2025.

(4) Square footage (rounded) expires as follows: 26,000 square feet in 2025; 89,000 square feet in 2027 and 30,000 square feet in 2028.

(5) Square footage (rounded) expires as follows: 34,000 square feet in 2029; 46,000 square feet in 2035; 31,000 square feet in 2037 and 74,000 square feet in 2038.

NOTE: See the "Definitions" section for definitions of certain terms used in this Earnings Package.

Office Industry Diversification

Total Office Portfolio as of March 31, 2024

Percentage of Annualized Rent by Tenant Industry

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Industry |

|

Number of Leases |

|

Annualized Rent as a Percent of Total |

|

|

|

|

|

|

|

|

|

Legal |

|

573 |

|

|

18.3 |

% |

|

|

Financial Services |

|

366 |

|

|

15.6 |

|

|

|

Entertainment |

|

145 |

|

|

14.0 |

|

|

|

Real Estate |

|

316 |

|

|

12.8 |

|

|

|

Health Services |

|

392 |

|

|

9.3 |

|

|

|

Accounting & Consulting |

|

298 |

|

|

8.6 |

|

|

|

Retail |

|

158 |

|

|

5.0 |

|

|

|

Technology |

|

97 |

|

|

4.7 |

|

|

|

Insurance |

|

90 |

|

|

3.2 |

|

|

|

Educational Services |

|

42 |

|

|

2.8 |

|

|

|

Public Administration |

|

72 |

|

|

2.3 |

|

|

|

Manufacturing & Distribution |

|

54 |

|

|

1.3 |

|

|

|

Advertising |

|

33 |

|

|

0.9 |

|

|

|

Other |

|

56 |

|

|

1.2 |

|

|

|

Total |

|

2,692 |

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

NOTE: See the "Definitions" section for definitions of certain terms used in this Earnings Package.

Office Lease Expirations

Total Office Portfolio as of March 31, 2024

(1) Average of the percentage of leases expiring at March 31, 2021, 2022, and 2023 with the same remaining duration as the leases for the labeled year had at March 31, 2024. Acquisitions are included in the comparable average commencing in the quarter after the acquisition.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year of Lease Expiration |

|

Number of Leases |

|

Rentable Square Feet |

|

Expiring Square Feet as a Percent of Total |

|

Annualized Rent at March 31, 2024 |

|

Annualized Rent as a Percent of Total |

|

Annualized Rent Per Leased Square Foot(1) |

|

Annualized Rent Per Leased Square Foot at Expiration(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short Term Leases |

|

71 |

|

|

294,219 |

|

|

1.6 |

% |

|

$ |

12,476,152 |

|

|

1.8 |

% |

|

$ |

42.40 |

|

|

$ |

42.60 |

|

|

|

2024 |

|

432 |

|

|

2,023,444 |

|

|

11.2 |

|

|

98,845,265 |

|

|

14.4 |

|

|

48.85 |

|

|

49.16 |

|

|

|

2025 |

|

602 |

|

|

2,543,090 |

|

|

14.1 |

|

|

119,850,661 |

|

|

17.4 |

|

|

47.13 |

|

|

48.96 |

|

|

|

2026 |

|

485 |

|

|

2,209,781 |

|

|

12.3 |

|

|

101,529,213 |

|

|

14.8 |

|

|

45.95 |

|

|

49.07 |

|

|

|

2027 |

|

358 |

|

|

1,856,023 |

|

|

10.3 |

|

|

90,168,166 |

|

|

13.2 |

|

|

48.58 |

|

|

54.02 |

|

|

|

2028 |

|

277 |

|

|

1,476,842 |

|

|

8.2 |

|

|

68,462,687 |

|

|

10.0 |

|

|

46.36 |

|

|

53.09 |

|

|

|

2029 |

|

177 |

|

|

1,020,338 |

|

|

5.7 |

|

|

46,779,002 |

|

|

6.8 |

|

|

45.85 |

|

|

52.49 |

|

|

|

2030 |

|

89 |

|

|

805,054 |

|

|

4.5 |

|

|

40,914,841 |

|

|

5.9 |

|

|

50.82 |

|

|

60.75 |

|

|

|

2031 |

|

69 |

|

|

467,364 |

|

|

2.6 |

|

|

22,574,235 |

|

|

3.3 |

|

|

48.30 |

|

|

59.62 |

|

|

|

2032 |

|

37 |

|

|

407,837 |

|

|

2.3 |

|

|

19,669,305 |

|

|

2.9 |

|

|

48.23 |

|

|

61.18 |

|

|

|

2033 |

|

52 |

|

|

354,678 |

|

|

2.0 |

|

|

17,700,322 |

|

|

2.6 |

|

|

49.91 |

|

|

68.06 |

|

|

|

Thereafter |

|

43 |

|

|

907,877 |

|

|

5.1 |

|

|

46,959,391 |

|

|

6.9 |

|

|

51.72 |

|

|

75.57 |

|

|

|

Subtotal/weighted average |

|

2,692 |

|

|

14,366,547 |

|

|

79.9 |

% |

|

$ |

685,929,240 |

|

|

100.0 |

% |

|

$ |

47.74 |

|

|

$ |

53.71 |

|

|

|

Signed leases not commenced |

|

305,565 |

|

|

1.7 |

|

|

|

|

|

|

|

|

|

|

|

Available |

|

3,131,578 |

|

|

17.4 |

|

|

|

|

|

|

|

|

|

|

|

Building management use |

|

106,798 |

|

|

0.6 |

|

|

|

|

|

|

|

|

|

|

|

BOMA adjustment(3) |

|

|

|

70,175 |

|

|

0.4 |

|

|

|

|

|

|

|

|

|

|

|

Total/weighted average |

|

2,692 |

|

|

17,980,663 |

|

|

100.0 |

% |

|

$ |

685,929,240 |

|

|

100.0 |

% |

|

$ |

47.74 |

|

|

$ |

53.71 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

___________________________________________________

(1)Represents annualized rent at March 31, 2024 divided by leased square feet.

(2)Represents annualized rent at expiration divided by leased square feet.

(3)Represents the square footage adjustments for leases that do not reflect BOMA remeasurement.

NOTE: See the "Definitions" section for definitions of certain terms used in this Earnings Package.

Office Lease Expirations - Next Four Quarters

Total Office Portfolio as of March 31, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q2 2024 |

|

Q3 2024 |

|

Q4 2024 |

|

Q1 2025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Los Angeles |

|

|

|

|

|

|

|

|

|

|

Westside |

|

289,009 |

|

231,962 |

|

353,625 |

|

358,734 |

|

|

Valley |

|

174,672 |

|

639,278 |

|

232,517 |

|

262,523 |

|

|

Honolulu |

|

10,475 |

|

49,356 |

|

42,550 |

|

26,659 |

|

|

Expiring Square Feet(1) |

|

474,156 |

|

920,596 |

|

628,692 |

|

647,916 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage of Portfolio |

|

2.6 |

% |

|

5.1 |

% |

|

3.5 |

% |

|

3.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Los Angeles |

|

|

|

|

|

|

|

|

|

|

Westside |

|

$56.73 |

|

$55.77 |

|

$54.88 |

|

$57.63 |

|

|

Valley |

|

$32.89 |

|

$53.22 |

|

$32.02 |

|

$34.17 |

|

|

Honolulu |

|

$29.13 |

|

$37.12 |

|

$32.57 |

|

$35.88 |

|

|

Expiring Rent per Square Foot(2) |

|

$47.34 |

|

$53.00 |

|

$44.92 |

|

$47.23 |

|

|

|

|

|

|

|

|

|

|

|

|

________________________________________________________

(1)Includes leases with an expiration date in the applicable period where the space had not been re-leased as of March 31, 2024, other than 294,219 square feet of Short-Term Leases.

(2)Fluctuations in this number primarily reflect the mix of buildings/submarkets involved, as well as the varying terms and square footage of the individual leases expiring. As a result, the data in this table should only be extrapolated with caution. While the following table sets forth data for our underlying submarkets, that data is even more influenced by such issues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Next Four Quarters |

|

|

|

|

|

|

|

|

|

|

|

Region |

|

Submarket |

|

Expiring SF |

|

Expiring Rent per SF |

|

|

|

|

|

|

|

|

|

|

|

Westside |

|

Beverly Hills |

|

209,054 |

|

|

$61.61 |

|

|

|

Brentwood |

|

295,567 |

|

|

$49.60 |

|

|

|

Century City |

|

136,993 |

|

|

$58.43 |

|

|

|

Olympic Corridor |

|

180,220 |

|

|

$43.55 |

|

|

|