00013505939/302022FYFALSEP6YP6YP3YP3Y00013505932022-10-012023-09-3000013505932022-11-10xbrli:shares00013505932023-03-31iso4217:USD00013505932023-09-30xbrli:pure00013505932022-09-30iso4217:USDxbrli:shares00013505932021-10-012022-09-3000013505932020-10-012021-09-300001350593us-gaap:RetainedEarningsMember2021-10-012022-09-300001350593us-gaap:CommonStockMember2020-09-300001350593us-gaap:AdditionalPaidInCapitalMember2020-09-300001350593us-gaap:RetainedEarningsMember2020-09-300001350593us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-09-3000013505932020-09-300001350593us-gaap:RetainedEarningsMember2020-10-012021-09-300001350593srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2020-09-300001350593srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2020-09-300001350593us-gaap:AdditionalPaidInCapitalMember2020-10-012021-09-300001350593us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-10-012021-09-300001350593us-gaap:CommonStockMember2021-09-300001350593us-gaap:AdditionalPaidInCapitalMember2021-09-300001350593us-gaap:RetainedEarningsMember2021-09-300001350593us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-09-3000013505932021-09-300001350593us-gaap:AdditionalPaidInCapitalMember2021-10-012022-09-300001350593us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-10-012022-09-300001350593us-gaap:CommonStockMember2022-09-300001350593us-gaap:AdditionalPaidInCapitalMember2022-09-300001350593us-gaap:RetainedEarningsMember2022-09-300001350593us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-300001350593us-gaap:RetainedEarningsMember2022-10-012023-09-300001350593us-gaap:AdditionalPaidInCapitalMember2022-10-012023-09-300001350593mwa:StockbasedCompensationRelatedMember2022-10-012023-09-300001350593us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-012023-09-300001350593us-gaap:CommonStockMember2023-09-300001350593us-gaap:AdditionalPaidInCapitalMember2023-09-300001350593us-gaap:RetainedEarningsMember2023-09-300001350593us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-30mwa:business_segmentsmwa:employee0001350593srt:MinimumMember2021-10-012022-09-300001350593srt:MaximumMember2021-10-012022-09-300001350593us-gaap:LandImprovementsMembersrt:MinimumMember2023-09-300001350593us-gaap:LandImprovementsMembersrt:MaximumMember2023-09-300001350593us-gaap:BuildingMembersrt:MinimumMember2023-09-300001350593us-gaap:BuildingMembersrt:MaximumMember2023-09-300001350593srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2023-09-300001350593srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2023-09-300001350593us-gaap:SoftwareAndSoftwareDevelopmentCostsMembersrt:MaximumMember2023-09-300001350593mwa:UsPipeMembersrt:MaximumMember2023-09-300001350593mwa:UsPipeMembersrt:MaximumMember2022-09-300001350593us-gaap:RevolvingCreditFacilityMember2023-09-300001350593us-gaap:DebtMember2023-09-300001350593us-gaap:UnsecuredDebtMember2023-09-300001350593us-gaap:TransferredAtPointInTimeMember2022-10-012023-09-300001350593us-gaap:TransferredOverTimeMember2022-10-012023-09-300001350593us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-09-300001350593us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2022-10-012023-09-300001350593us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2021-10-012022-09-300001350593us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2021-07-012021-09-300001350593us-gaap:CustomerRelationshipsMember2023-09-300001350593us-gaap:TechnologyBasedIntangibleAssetsMember2023-09-300001350593mwa:BusinessCombinationRelatedIdentifiableIntangibleMember2022-10-012023-09-300001350593mwa:BusinessCombinationRelatedIdentifiableIntangibleMember2021-10-012022-09-300001350593mwa:BusinessCombinationRelatedIdentifiableIntangibleMember2020-10-012021-09-300001350593mwa:BusinessCombinationRelatedIdentifiableIntangibleMember2023-09-300001350593us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2022-09-300001350593us-gaap:TechnologyBasedIntangibleAssetsMember2022-09-300001350593us-gaap:CustomerRelationshipsMember2022-09-300001350593us-gaap:TrademarksAndTradeNamesMember2023-09-300001350593us-gaap:TrademarksAndTradeNamesMember2022-09-300001350593mwa:BusinessCombinationRelatedIdentifiableIntangibleMember2023-09-300001350593mwa:BusinessCombinationRelatedIdentifiableIntangibleMember2022-09-300001350593us-gaap:UnsecuredDebtMember2022-09-300001350593us-gaap:OtherDebtSecuritiesMember2023-09-300001350593us-gaap:OtherDebtSecuritiesMember2022-09-300001350593mwa:SwingLineLoansMember2023-09-300001350593us-gaap:LetterOfCreditMember2023-09-300001350593us-gaap:DomesticLineOfCreditMember2022-10-012023-09-300001350593mwa:SecuredOvernightFinancingRateMemberus-gaap:DomesticLineOfCreditMember2023-07-012023-09-300001350593srt:MinimumMemberus-gaap:DomesticLineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-10-012023-09-300001350593us-gaap:DomesticLineOfCreditMembersrt:MaximumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-10-012023-09-300001350593us-gaap:RevolvingCreditFacilityMembersrt:MinimumMemberus-gaap:BaseRateMember2022-10-012023-09-300001350593us-gaap:RevolvingCreditFacilityMembersrt:MaximumMemberus-gaap:BaseRateMember2022-10-012023-09-300001350593us-gaap:DomesticLineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-09-300001350593us-gaap:DomesticLineOfCreditMemberus-gaap:BaseRateMember2023-09-300001350593us-gaap:DomesticLineOfCreditMember2023-09-300001350593srt:MinimumMemberus-gaap:DomesticLineOfCreditMember2022-10-012023-09-300001350593us-gaap:RevolvingCreditFacilityMember2022-10-012023-09-300001350593us-gaap:BondsMember2023-09-300001350593us-gaap:UnsecuredDebtMember2021-07-012021-09-300001350593us-gaap:UnsecuredDebt2023-09-300001350593us-gaap:UnsecuredDebtMembermwa:A55SeniorNotesMember2021-09-300001350593us-gaap:BondsMember2021-09-300001350593us-gaap:PensionPlansDefinedBenefitMember2022-09-300001350593us-gaap:PensionPlansDefinedBenefitMember2021-09-300001350593us-gaap:PensionPlansDefinedBenefitMember2022-10-012023-09-300001350593us-gaap:PensionPlansDefinedBenefitMember2021-10-012022-09-300001350593us-gaap:PensionPlansDefinedBenefitMember2023-09-300001350593srt:ScenarioForecastMember2023-10-012024-09-300001350593us-gaap:FixedIncomeSecuritiesMember2023-09-300001350593srt:MinimumMemberus-gaap:FixedIncomeFundsMember2023-09-300001350593srt:MaximumMemberus-gaap:FixedIncomeFundsMember2023-09-300001350593us-gaap:FixedIncomeFundsMember2023-09-300001350593us-gaap:FixedIncomeFundsMember2022-09-300001350593us-gaap:FixedIncomeFundsMember2021-09-300001350593us-gaap:EquitySecuritiesMember2023-09-300001350593us-gaap:EquitySecuritiesMembersrt:MinimumMember2023-09-300001350593us-gaap:EquitySecuritiesMembersrt:MaximumMember2023-09-300001350593us-gaap:EquitySecuritiesMember2022-09-300001350593us-gaap:EquitySecuritiesMember2021-09-300001350593us-gaap:CashAndCashEquivalentsMember2023-09-300001350593srt:MinimumMemberus-gaap:CashAndCashEquivalentsMember2023-09-300001350593srt:MaximumMemberus-gaap:CashAndCashEquivalentsMember2023-09-300001350593us-gaap:CashAndCashEquivalentsMember2022-09-300001350593us-gaap:CashAndCashEquivalentsMember2021-09-300001350593us-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeFundsMember2023-09-300001350593us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel2Member2023-09-300001350593us-gaap:FairValueInputsLevel1Membermwa:LargeCapIndexFundsMemberMember2023-09-300001350593mwa:LargeCapIndexFundsMemberMemberus-gaap:FairValueInputsLevel2Member2023-09-300001350593mwa:LargeCapIndexFundsMemberMember2023-09-300001350593mwa:InternationalStocksMemberus-gaap:FairValueInputsLevel1Member2023-09-300001350593mwa:InternationalStocksMemberus-gaap:FairValueInputsLevel2Member2023-09-300001350593mwa:InternationalStocksMember2023-09-300001350593us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-09-300001350593us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-09-300001350593us-gaap:FairValueInputsLevel1Memberus-gaap:CashAndCashEquivalentsMember2023-09-300001350593us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel2Member2023-09-300001350593us-gaap:FairValueInputsLevel1Member2023-09-300001350593us-gaap:FairValueInputsLevel2Member2023-09-300001350593us-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeFundsMember2022-09-300001350593us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel2Member2022-09-300001350593us-gaap:FairValueInputsLevel1Membermwa:LargeCapGrowthFundsMember2022-09-300001350593mwa:LargeCapGrowthFundsMemberus-gaap:FairValueInputsLevel2Member2022-09-300001350593mwa:LargeCapGrowthFundsMember2022-09-300001350593mwa:InternationalStocksMemberus-gaap:FairValueInputsLevel1Member2022-09-300001350593mwa:InternationalStocksMemberus-gaap:FairValueInputsLevel2Member2022-09-300001350593mwa:InternationalStocksMember2022-09-300001350593us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel1Member2022-09-300001350593us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-09-300001350593us-gaap:FairValueInputsLevel1Memberus-gaap:CashAndCashEquivalentsMember2022-09-300001350593us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel2Member2022-09-300001350593us-gaap:FairValueInputsLevel1Member2022-09-300001350593us-gaap:FairValueInputsLevel2Member2022-09-300001350593us-gaap:PerformanceSharesMember2021-10-012022-09-300001350593us-gaap:PerformanceSharesMember2022-10-012023-09-3000013505932011-12-140001350593us-gaap:RestrictedStockUnitsRSUMember2022-10-012023-09-300001350593us-gaap:RestrictedStockUnitsRSUMember2020-09-300001350593us-gaap:RestrictedStockUnitsRSUMember2019-10-012020-09-300001350593us-gaap:RestrictedStockUnitsRSUMember2020-10-012021-09-300001350593us-gaap:RestrictedStockUnitsRSUMember2021-09-300001350593us-gaap:RestrictedStockUnitsRSUMember2021-10-012022-09-300001350593us-gaap:RestrictedStockUnitsRSUMember2022-09-300001350593us-gaap:RestrictedStockUnitsRSUMember2023-09-300001350593srt:MinimumMemberus-gaap:PerformanceSharesMember2022-10-012023-09-300001350593us-gaap:PerformanceSharesMembersrt:MaximumMember2022-10-012023-09-300001350593us-gaap:PerformanceSharesMember2020-10-012021-09-300001350593mwa:A2017memberMember2018-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheOneMembermwa:A2017memberMembermwa:PRSUbaseunitsMember2018-10-012018-12-310001350593us-gaap:ShareBasedCompensationAwardTrancheOneMembermwa:A2017memberMembermwa:PRSUbaseunitsMember2018-10-012019-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheOneMembermwa:A2017memberMembermwa:PRSUbaseunitsMember2019-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheOneMembermwa:A2017memberMember2017-10-012018-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheOneMembermwa:A2017memberMember2021-10-012022-09-300001350593mwa:A2017memberMember2019-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheTwoMembermwa:A2017memberMembermwa:PRSUbaseunitsMember2018-10-012018-12-310001350593us-gaap:ShareBasedCompensationAwardTrancheTwoMembermwa:A2017memberMembermwa:PRSUbaseunitsMember2019-10-012020-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheTwoMembermwa:A2017memberMembermwa:PRSUbaseunitsMember2020-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheTwoMembermwa:A2017memberMember2018-10-012019-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheTwoMembermwa:A2017memberMember2021-10-012022-09-300001350593mwa:A2017memberMember2020-09-300001350593mwa:A2017memberMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMembermwa:PRSUbaseunitsMember2018-10-012018-12-310001350593mwa:A2017memberMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMembermwa:PRSUbaseunitsMember2020-10-012021-09-300001350593mwa:A2017memberMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMembermwa:PRSUbaseunitsMember2021-09-300001350593mwa:A2017memberMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2019-10-012020-09-300001350593mwa:A2017memberMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2021-10-012022-09-300001350593mwa:January232017Member2018-09-300001350593mwa:January232017Memberus-gaap:ShareBasedCompensationAwardTrancheOneMembermwa:PRSUbaseunitsMember2019-01-012019-03-310001350593mwa:January232017Memberus-gaap:ShareBasedCompensationAwardTrancheOneMembermwa:PRSUbaseunitsMember2018-10-012019-09-300001350593mwa:January232017Memberus-gaap:ShareBasedCompensationAwardTrancheOneMembermwa:PRSUbaseunitsMember2019-09-300001350593mwa:January232017Memberus-gaap:ShareBasedCompensationAwardTrancheOneMember2017-10-012018-09-300001350593mwa:January232017Memberus-gaap:ShareBasedCompensationAwardTrancheOneMember2021-10-012022-09-300001350593mwa:January232017Memberus-gaap:ShareBasedCompensationAwardTrancheTwoMembermwa:PRSUbaseunitsMember2019-01-012019-03-310001350593mwa:January232017Memberus-gaap:ShareBasedCompensationAwardTrancheTwoMembermwa:PRSUbaseunitsMember2019-10-012020-09-300001350593mwa:January232017Memberus-gaap:ShareBasedCompensationAwardTrancheTwoMembermwa:PRSUbaseunitsMember2020-09-300001350593mwa:January232017Memberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2018-10-012019-09-300001350593mwa:January232017Memberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2021-10-012022-09-300001350593mwa:January232017Memberus-gaap:ShareBasedCompensationAwardTrancheThreeMembermwa:PRSUbaseunitsMember2019-01-012019-03-310001350593mwa:January232017Memberus-gaap:ShareBasedCompensationAwardTrancheTwoMembermwa:PRSUbaseunitsMember2020-10-012021-09-300001350593mwa:January232017Memberus-gaap:ShareBasedCompensationAwardTrancheTwoMembermwa:PRSUbaseunitsMember2021-09-300001350593mwa:January232017Memberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2019-10-012020-09-300001350593mwa:January232017Memberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2021-10-012022-09-300001350593mwa:November282017Member2019-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheOneMembermwa:PRSUbaseunitsMember2019-10-012019-12-310001350593us-gaap:ShareBasedCompensationAwardTrancheOneMembermwa:November282017Membermwa:PRSUbaseunitsMember2019-10-012020-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheOneMembermwa:November282017Membermwa:PRSUbaseunitsMember2020-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheOneMembermwa:November282017Member2018-10-012019-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheOneMembersrt:ScenarioForecastMembermwa:November282017Member2022-10-012023-09-300001350593mwa:November282017Member2020-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheTwoMembermwa:November282017Membermwa:PRSUbaseunitsMember2019-10-012019-12-310001350593us-gaap:ShareBasedCompensationAwardTrancheTwoMembermwa:November282017Membermwa:PRSUbaseunitsMember2020-10-012021-09-300001350593mwa:November282017Member2021-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheTwoMembermwa:November282017Member2019-10-012020-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheTwoMembersrt:ScenarioForecastMembermwa:November282017Member2022-10-012023-09-300001350593mwa:November282017Memberus-gaap:ShareBasedCompensationAwardTrancheThreeMembermwa:PRSUbaseunitsMember2019-10-012019-12-310001350593mwa:November282017Memberus-gaap:ShareBasedCompensationAwardTrancheThreeMembermwa:PRSUbaseunitsMember2021-10-012022-09-300001350593mwa:November282017Member2022-09-300001350593mwa:November282017Memberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2020-10-012021-09-300001350593srt:ScenarioForecastMembermwa:November282017Memberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2022-10-012023-09-300001350593mwa:November272018Member2020-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheOneMembermwa:November272018Membermwa:PRSUbaseunitsMember2020-10-012020-12-310001350593us-gaap:ShareBasedCompensationAwardTrancheOneMembermwa:November272018Membermwa:PRSUbaseunitsMember2020-10-012021-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheOneMembermwa:November272018Member2021-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheOneMembermwa:November272018Member2019-10-012020-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheOneMembersrt:ScenarioForecastMembermwa:November272018Member2022-10-012023-09-300001350593mwa:November272018Member2021-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheTwoMembermwa:November272018Membermwa:PRSUbaseunitsMember2020-10-012020-12-310001350593us-gaap:ShareBasedCompensationAwardTrancheTwoMembermwa:November272018Membermwa:PRSUbaseunitsMember2021-10-012022-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheTwoMembermwa:November272018Member2022-09-300001350593mwa:November272018Memberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2020-10-012021-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheTwoMembersrt:ScenarioForecastMembermwa:November272018Member2022-10-012023-09-300001350593mwa:November272018Member2022-09-300001350593mwa:November272018Memberus-gaap:ShareBasedCompensationAwardTrancheThreeMembermwa:PRSUbaseunitsMember2020-10-012020-12-310001350593mwa:November272018Memberus-gaap:ShareBasedCompensationAwardTrancheThreeMembermwa:PRSUbaseunitsMember2021-10-012022-09-300001350593mwa:November272018Memberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2022-09-300001350593mwa:November272018Memberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2021-10-012022-09-300001350593srt:ScenarioForecastMembermwa:November272018Memberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2022-10-012023-09-300001350593mwa:December32019Member2020-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheOneMembermwa:December32019Membermwa:PRSUbaseunitsMember2021-10-012021-12-310001350593us-gaap:ShareBasedCompensationAwardTrancheOneMembermwa:December32019Membermwa:PRSUbaseunitsMember2021-10-012022-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheOneMembermwa:December32019Member2022-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheOneMembermwa:December32019Member2020-10-012021-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheOneMembersrt:ScenarioForecastMembermwa:December32019Member2023-10-012024-09-300001350593mwa:December32019Member2021-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheTwoMembermwa:December32019Membermwa:PRSUbaseunitsMember2021-10-012021-12-310001350593us-gaap:ShareBasedCompensationAwardTrancheTwoMembersrt:ScenarioForecastMembermwa:December32019Membermwa:PRSUbaseunitsMember2022-10-012023-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheTwoMembermwa:December32019Member2022-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheTwoMembermwa:December32019Member2021-10-012022-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheTwoMembersrt:ScenarioForecastMembermwa:December32019Member2023-10-012024-09-300001350593mwa:December32019Member2022-09-300001350593mwa:December32019Memberus-gaap:ShareBasedCompensationAwardTrancheThreeMembermwa:PRSUbaseunitsMember2021-10-012021-12-310001350593srt:ScenarioForecastMembermwa:December32019Memberus-gaap:ShareBasedCompensationAwardTrancheThreeMembermwa:PRSUbaseunitsMember2022-10-012023-09-300001350593mwa:December32019Memberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2022-09-300001350593mwa:December32019Memberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2021-10-012022-09-300001350593srt:ScenarioForecastMembermwa:December32019Memberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2023-10-012024-09-300001350593mwa:November292022Member2025-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheThreeMembermwa:PRSUbaseunitsMembermwa:November292022Member2024-10-012025-09-300001350593srt:ScenarioForecastMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMembermwa:PRSUbaseunitsMembermwa:November292022Member2025-10-012026-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheThreeMembermwa:November292022Member2025-09-300001350593us-gaap:ShareBasedCompensationAwardTrancheThreeMembermwa:November292022Member2024-10-012025-09-300001350593srt:ScenarioForecastMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMembermwa:November292022Member2026-10-012027-09-300001350593srt:MinimumMembermwa:MarketBasedAwardsMember2022-10-012023-09-300001350593srt:MaximumMembermwa:MarketBasedAwardsMember2022-10-012023-09-300001350593mwa:MarketBasedPerformanceSharesMemberMember2022-11-292022-11-290001350593mwa:MarketBasedPerformanceSharesMemberMember2021-11-302021-11-300001350593mwa:MarketBasedPerformanceSharesMemberMember2021-01-272021-01-270001350593mwa:MarketBasedPerformanceSharesMemberMember2020-12-022020-12-020001350593us-gaap:StockOptionMember2022-11-292022-11-290001350593mwa:A2006PlanMember2020-09-300001350593mwa:A2006PlanMember2019-10-012020-09-300001350593mwa:A2006PlanMember2020-10-012021-09-300001350593mwa:A2006PlanMember2021-09-300001350593mwa:A2006PlanMember2021-10-012022-09-300001350593mwa:A2006PlanMember2022-09-300001350593mwa:A2006PlanMember2022-10-012023-09-300001350593mwa:A2006PlanMember2023-09-300001350593srt:MinimumMembermwa:ExercisePriceRange2Member2022-10-012023-09-300001350593srt:MaximumMembermwa:ExercisePriceRange2Member2022-10-012023-09-300001350593mwa:ExercisePriceRange2Member2023-09-300001350593mwa:ExercisePriceRange2Member2022-10-012023-09-300001350593srt:MinimumMembermwa:ExercisePriceRange3Member2022-10-012023-09-300001350593srt:MaximumMembermwa:ExercisePriceRange3Member2022-10-012023-09-300001350593mwa:ExercisePriceRange3Member2023-09-300001350593mwa:ExercisePriceRange3Member2022-10-012023-09-300001350593us-gaap:EmployeeStockMember2020-09-300001350593us-gaap:EmployeeStockMember2022-10-012023-09-300001350593us-gaap:EmployeeStockMember2023-09-300001350593us-gaap:PhantomShareUnitsPSUsMember2022-10-012023-09-300001350593us-gaap:PhantomShareUnitsPSUsMember2023-09-300001350593us-gaap:PhantomShareUnitsPSUsMember2020-09-300001350593us-gaap:PhantomShareUnitsPSUsMember2019-10-012020-09-300001350593us-gaap:PhantomShareUnitsPSUsMember2020-10-012021-09-300001350593us-gaap:PhantomShareUnitsPSUsMember2021-09-300001350593us-gaap:PhantomShareUnitsPSUsMember2021-10-012022-09-300001350593us-gaap:PhantomShareUnitsPSUsMember2022-09-300001350593mwa:AuroraSurreyMember2022-10-012023-09-300001350593mwa:A55SeniorNotesMember2022-10-012023-09-300001350593mwa:A55SeniorNotesMember2021-10-012022-09-300001350593mwa:A55SeniorNotesMember2020-10-012021-09-300001350593mwa:A40SeniorNotesMember2022-10-012023-09-300001350593mwa:A40SeniorNotesMember2021-10-012022-09-300001350593mwa:A40SeniorNotesMember2020-10-012021-09-300001350593mwa:AblAgreementMember2022-10-012023-09-300001350593mwa:AblAgreementMember2021-10-012022-09-300001350593mwa:AblAgreementMember2020-10-012021-09-300001350593mwa:SalesRevenueGoodsGrossMemberus-gaap:CustomerConcentrationRiskMembermwa:CoreMainIncMember2022-10-012023-09-300001350593mwa:SalesRevenueGoodsGrossMemberus-gaap:CustomerConcentrationRiskMembermwa:CoreMainIncMember2021-10-012022-09-300001350593mwa:SalesRevenueGoodsGrossMemberus-gaap:CustomerConcentrationRiskMembermwa:CoreMainIncMember2020-10-012021-09-300001350593us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembermwa:CoreMainIncMember2023-09-300001350593us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembermwa:CoreMainIncMember2021-09-300001350593mwa:FergusonEnterprisesIncMembermwa:SalesRevenueGoodsGrossMemberus-gaap:CustomerConcentrationRiskMember2022-10-012023-09-300001350593mwa:FergusonEnterprisesIncMembermwa:SalesRevenueGoodsGrossMemberus-gaap:CustomerConcentrationRiskMember2021-10-012022-09-300001350593mwa:FergusonEnterprisesIncMembermwa:SalesRevenueGoodsGrossMemberus-gaap:CustomerConcentrationRiskMember2020-10-012021-09-300001350593us-gaap:AccountsReceivableMembermwa:FergusonEnterprisesIncMemberus-gaap:CustomerConcentrationRiskMember2023-09-300001350593us-gaap:AccountsReceivableMembermwa:FergusonEnterprisesIncMemberus-gaap:CustomerConcentrationRiskMember2022-09-300001350593country:US2023-09-300001350593country:IL2023-09-300001350593mwa:RestOfWorldMember2023-09-300001350593country:US2022-09-300001350593country:IL2022-09-300001350593mwa:RestOfWorldMember2022-09-300001350593mwa:CentralRegionMembermwa:MuellerCoMember2022-10-012023-09-300001350593mwa:CentralRegionMembermwa:MuellerCoMember2021-10-012022-09-300001350593mwa:CentralRegionMembermwa:MuellerCoMember2020-10-012021-09-300001350593mwa:NortheastRegionMemberMembermwa:MuellerCoMember2022-10-012023-09-300001350593mwa:NortheastRegionMemberMembermwa:MuellerCoMember2021-10-012022-09-300001350593mwa:NortheastRegionMemberMembermwa:MuellerCoMember2020-10-012021-09-300001350593us-gaap:SoutheastRegionMembermwa:MuellerCoMember2022-10-012023-09-300001350593us-gaap:SoutheastRegionMembermwa:MuellerCoMember2021-10-012022-09-300001350593us-gaap:SoutheastRegionMembermwa:MuellerCoMember2020-10-012021-09-300001350593mwa:WesternRegionMembermwa:MuellerCoMember2022-10-012023-09-300001350593mwa:WesternRegionMembermwa:MuellerCoMember2021-10-012022-09-300001350593mwa:WesternRegionMembermwa:MuellerCoMember2020-10-012021-09-300001350593country:USmwa:MuellerCoMember2022-10-012023-09-300001350593country:USmwa:MuellerCoMember2021-10-012022-09-300001350593country:USmwa:MuellerCoMember2020-10-012021-09-300001350593country:CAmwa:MuellerCoMember2022-10-012023-09-300001350593country:CAmwa:MuellerCoMember2021-10-012022-09-300001350593country:CAmwa:MuellerCoMember2020-10-012021-09-300001350593mwa:OtherInternationalLocationsMembermwa:MuellerCoMember2022-10-012023-09-300001350593mwa:OtherInternationalLocationsMembermwa:MuellerCoMember2021-10-012022-09-300001350593mwa:OtherInternationalLocationsMembermwa:MuellerCoMember2020-10-012021-09-300001350593mwa:MuellerCoMember2022-10-012023-09-300001350593mwa:MuellerCoMember2021-10-012022-09-300001350593mwa:MuellerCoMember2020-10-012021-09-300001350593mwa:CentralRegionMembermwa:MuellerTechnologiesMember2022-10-012023-09-300001350593mwa:CentralRegionMembermwa:MuellerTechnologiesMember2021-10-012022-09-300001350593mwa:CentralRegionMembermwa:MuellerTechnologiesMember2020-10-012021-09-300001350593mwa:MuellerTechnologiesMembermwa:NortheastRegionMemberMember2022-10-012023-09-300001350593mwa:MuellerTechnologiesMembermwa:NortheastRegionMemberMember2021-10-012022-09-300001350593mwa:MuellerTechnologiesMembermwa:NortheastRegionMemberMember2020-10-012021-09-300001350593us-gaap:SoutheastRegionMembermwa:MuellerTechnologiesMember2022-10-012023-09-300001350593us-gaap:SoutheastRegionMembermwa:MuellerTechnologiesMember2021-10-012022-09-300001350593us-gaap:SoutheastRegionMembermwa:MuellerTechnologiesMember2020-10-012021-09-300001350593mwa:MuellerTechnologiesMembermwa:WesternRegionMember2022-10-012023-09-300001350593mwa:MuellerTechnologiesMembermwa:WesternRegionMember2021-10-012022-09-300001350593mwa:MuellerTechnologiesMembermwa:WesternRegionMember2020-10-012021-09-300001350593mwa:MuellerTechnologiesMembercountry:US2022-10-012023-09-300001350593mwa:MuellerTechnologiesMembercountry:US2021-10-012022-09-300001350593mwa:MuellerTechnologiesMembercountry:US2020-10-012021-09-300001350593mwa:MuellerTechnologiesMembercountry:CA2022-10-012023-09-300001350593mwa:MuellerTechnologiesMembercountry:CA2021-10-012022-09-300001350593mwa:MuellerTechnologiesMembercountry:CA2020-10-012021-09-300001350593mwa:OtherInternationalLocationsMembermwa:MuellerTechnologiesMember2022-10-012023-09-300001350593mwa:OtherInternationalLocationsMembermwa:MuellerTechnologiesMember2021-10-012022-09-300001350593mwa:OtherInternationalLocationsMembermwa:MuellerTechnologiesMember2020-10-012021-09-300001350593mwa:MuellerTechnologiesMember2022-10-012023-09-300001350593mwa:MuellerTechnologiesMember2021-10-012022-09-300001350593mwa:MuellerTechnologiesMember2020-10-012021-09-300001350593us-gaap:CorporateMember2022-10-012023-09-300001350593us-gaap:CorporateMember2021-10-012022-09-300001350593us-gaap:CorporateMember2020-10-012021-09-300001350593mwa:MuellerCoMember2023-09-300001350593mwa:MuellerTechnologiesMember2023-09-300001350593us-gaap:CorporateMember2023-09-300001350593mwa:MuellerCoMember2022-09-300001350593mwa:MuellerTechnologiesMember2022-09-300001350593us-gaap:CorporateMember2022-09-300001350593us-gaap:SubsequentEventMember2023-10-242023-10-240001350593us-gaap:SubsequentEventMember2023-11-202023-11-200001350593us-gaap:SubsequentEventMember2023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 001-32892

MUELLER WATER PRODUCTS, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

|

|

| Delaware |

|

20-3547095 |

| (State or Other Jurisdiction of Incorporation or Organization) |

|

(I.R.S. Employer Identification Number) |

1200 Abernathy Road N.E.

Suite 1200

Atlanta, GA 30328

(Address of Principal Executive Offices)

Registrant’s telephone number: (770) 206-4200

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 |

MWA |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ Yes ☐ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulations S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files.) ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one): ☒ Large accelerated filer ☐ Accelerated filer ☐ Non-accelerated filer ☐ Smaller reporting company ☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant had filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☒ No

There were 156,112,060 shares of common stock of the registrant outstanding at December 11, 2023. At March 31, 2023, the aggregate market value of the voting and non-voting common stock held by non-affiliates (assuming only for purposes of this computation that directors and executive officers may be affiliates) was $2,149.2 million based on the closing price per share as reported on the New York Stock Exchange.

DOCUMENTS INCORPORATED BY REFERENCE

Applicable portions of the Proxy Statement for our upcoming 2024 Annual Meeting of Stockholders of the Company are incorporated by reference into Part III of this Form 10-K.

Introductory Note

In this Annual Report on Form 10-K (“Annual Report”), (1) the “Company,” “we,” “us” or “our” refers to Mueller Water Products, Inc. and its subsidiaries; (2) “Water Flow Solutions” refers to our Water Flow Solutions segment; (3) “Water Management Solutions” refers to our Water Management Solutions segment; (4) “Anvil” refers to our former Anvil segment, which we sold on January 6, 2017; and (5) “U.S. Pipe” refers to our former U.S. Pipe segment, which we sold on April 1, 2012. With regard to the Company’s segments, “we,” “us” or “our” may also refer to the segment being discussed.

Certain of the titles and logos of our products referenced in this Annual Report are part of our intellectual property. Each trade name, trademark or service mark of any other company appearing in this Annual Report is the property of its owner.

Unless the context indicates otherwise, whenever we refer in this Annual Report to a particular year, we mean our fiscal year ended or ending September 30 in that particular calendar year. We manage our business and report operations through two business segments, Water Flow Solutions and Water Management Solutions, based largely on the products they sell and the customers they serve.

Industry and Market Data

In this Annual Report, we rely on and refer to information and statistics from third-party sources regarding economic conditions and trends, the demand for our water infrastructure, flow control, technology products, other products and services and the competitive conditions we face in serving our customers and end users. We believe these sources of information and statistics are reasonably accurate, but we have not independently verified them.

Most of our primary competitors are not publicly traded companies. Only limited current public information is available with respect to the size of our end markets and our relative competitive position. Our statements in this Annual Report regarding our end markets and competitive positions are based on our beliefs, studies and judgments concerning industry trends.

Forward-Looking Statements

This report contains certain statements that may be deemed “forward-looking statements” within the meaning of the federal securities laws. All statements that address activities, events or developments that the Company intends, expects, plans, projects, believes or anticipates will or may occur in the future are forward-looking statements including, without limitation, statements regarding outlooks, projections, forecasts, expectations, commitments, trend descriptions and the ability to capitalize on trends, value creation, Board of Directors and committee composition plans, long-term strategies and the execution or acceleration thereof, operational improvements, inventory positions, the benefits of capital investments, financial or operating performance including improving sales growth and driving increased margins, capital allocation and growth strategy plans, the Company’s product portfolio positioning and the demand for the Company’s products. Forward-looking statements are based on certain assumptions and assessments made by the Company in light of the Company’s experience and perception of historical trends, current conditions and expected future developments.

Actual results and the timing of events may differ materially from those contemplated by the forward-looking statements due to a number of factors, including, without limitation, the ongoing assessment and remediation of the cybersecurity incident announced on October 28, 2023, including legal, reputational, audit and financial risks resulting therefrom and the effectiveness of the Company’s business continuity plans related thereto, as well as the Company’s ability to recover under its cybersecurity insurance policies; logistical challenges and supply chain disruptions, geopolitical conditions, including the Israel-Hamas war, public health crises, or other events; inventory and in-stock positions of our distributors and end customers; an inability to realize the anticipated benefits from our operational initiatives, including our large capital investments in Chattanooga and Kimball, Tennessee and Decatur, Illinois, plant closures, and reorganization and related strategic realignment activities; an inability to attract or retain a skilled and diverse workforce, including executive officers, increased competition related to the workforce and labor markets; an inability to protect the Company’s information systems against further service interruption, misappropriation of data or breaches of security; failure to comply with personal data protection and privacy laws; cyclical and changing demand in core markets such as municipal spending, residential construction, and natural gas distribution; government monetary or fiscal policies; the impact of adverse weather conditions; the impact of manufacturing and product performance; the impact of wage, commodity and materials price inflation; foreign exchange rate fluctuations; the impact of warranty charges and claims, and related accommodations; the strength of our brands and reputation; an inability to successfully resolve significant legal proceedings or government investigations; compliance with environmental, trade and anti-corruption laws and regulations; climate change and legal or regulatory responses thereto; changing regulatory, trade and tariff conditions; the failure to integrate and/or realize any of the anticipated benefits of acquisitions or divestitures; an inability to achieve some or all of our Environmental, Social and Governance goals; and other factors that are described in the section entitled “RISK FACTORS” in Item 1A of this Annual Report.

Forward-looking statements do not guarantee future performance and are only as of the date they are made. The Company undertakes no duty to update its forward-looking statements except as required by law. Undue reliance should not be placed on any forward-looking statements. You are advised to review any further disclosures the Company makes on related subjects in subsequent Forms 10-K, 10-Q, 8-K and other reports filed with the U.S. Securities and Exchange Commission.

|

|

|

|

|

|

|

|

|

| TABLE OF CONTENTS |

|

|

Page |

|

|

|

| Item 1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Item 1A. |

|

|

Item 1C. |

|

|

| Item 2. |

|

|

| Item 3. |

|

|

|

|

|

|

|

|

| Item 5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Item 6. |

|

|

| Item 7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Item 7A. |

|

|

| Item 8. |

|

|

| Item 9A. |

|

|

| Item 9B. |

|

|

| Item 9C. |

|

|

|

|

|

|

|

|

| Item 10* |

|

|

| Item 11* |

|

|

| Item 12* |

|

|

| Item 13* |

|

|

| Item 14* |

|

|

|

|

|

|

|

|

| Item 15 |

|

|

|

|

|

| * |

All or a portion of the referenced section is incorporated by reference from our definitive proxy statement that will be issued in connection with our upcoming 2024 Annual Meeting of Stockholders. |

PART I

Item 1.BUSINESS

Our Company

Mueller Water Products, Inc. (“Mueller,” “we,” “our,” or the “Company”) is a leading manufacturer and marketer of products and services used in the transmission, distribution and measurement of water in North America. Our products and services are used by municipalities and the residential and non-residential construction industries. Some of our products have leading positions as a result of their strong brand recognition and reputation for quality, service and innovation. We believe we have one of the largest installed bases of iron gate valves and fire hydrants in the United States. Our iron gate valve or fire hydrant products are specified for use in the largest 100 metropolitan areas in the United States. Our large installed base, broad product range and well-known brands have led to long-standing relationships with the key distributors and end users of our products. Our consolidated net sales were $1,275.7 million in 2023.

Organization Updates

Effective October 1, 2021, we implemented a new management structure designed to increase revenue growth, drive operational excellence, accelerate new product development and enhance profitability. Our two operating segments, Water Flow Solutions and Water Management Solutions, align with this management structure.

Effective August 21, 2023, the Company’s Chief Executive Officer (“CEO”) left his role and Marietta Edmunds Zakas, the Company’s Chief Financial Officer (“CFO”) was named President and CEO. Steven S. Heinrichs, the Company’s Chief Legal and Compliance Officer, was named CFO, and continues to serve as Chief Legal and Compliance Officer. In addition, certain other management changes occurred. As a result, the Company incurred transition and retention expense which has been recorded to Strategic reorganization and other charges in our consolidated statements of operations.

Water Flow Solutions

The Water Flow Solutions product portfolio includes iron gate valves, specialty valves and service brass products. Net sales of products in the Water Flow Solutions business unit were approximately 50% of fiscal 2023 consolidated net sales.

Water Management Solutions

The Water Management Solutions product and service portfolio includes fire hydrants, repair and installation, natural gas, metering, leak detection, and pressure management and control products and solutions. Net sales of products and services in the Water Management Solutions business unit were approximately 50% of fiscal 2023 consolidated net sales.

Business Strategy

Our business strategy is to capitalize on the large, attractive and growing water infrastructure markets worldwide. Key elements of this strategy are as follows:

Drive operational improvements and deliver benefits from capital investments.

We seek to bring best practices focused on Lean manufacturing and Six Sigma business process improvement methodologies, with an investment mindset to deliver manufacturing productivity improvements. We expect these efforts will drive sales growth, improve product margins, and facilitate innovation and new product development. Productivity improvements within our facilities should allow us to lower costs, which can help fund additional manufacturing initiatives and continued investment in product development.

Over the past five years, we have prioritized capital investments to modernize our manufacturing facilities and processes, expand capacity and capabilities for domestic manufacturing and accelerate new product development. We believe these investments will drive margin expansion by lowering costs, expand our product portfolio, and improve product quality. We have completed our large valve manufacturing expansion in Chattanooga, Tennessee and our new facility in Kimball, Tennessee, which included consolidating multiple facilities.

We expect these investments to support our domestic manufacturing capabilities for specialty and large valves and to capitalize on the growing need for highly engineered valves required for water infrastructure projects. During 2023, we started initial production at a new brass foundry in Decatur, Illinois, which will eventually replace our original brass foundry built there in the early 1900s. These three projects accounted for a significant portion of our capital expenditures over the past five years. They are expected to drive operational efficiencies, expand capabilities for American-made products, advance our sustainability environmental initiatives, and help accelerate product development.

Accelerate product development and innovation.

We plan to continue to invest in our product development capabilities, including expanding our research and development staff, to develop and market new products and services. We expect to add new products to our portfolio and offer new products in different end markets. We continue to enhance our software platform, Sentryx™, which provides data intelligence to help water utilities make strategic and operational decisions. This data includes leak detection, pressure monitoring, advanced metering and water quality metrics, which are aggregated and consolidated within the Sentryx™ platform, providing utilities with critical information to monitor and control their water networks. As our customers seek to use real-time data and analytics to manage and repair their aging pipe networks more efficiently, we believe we are well-positioned to provide solutions given our expertise and the large installed base of our products.

Execute sales initiatives and channel strategies to enhance customer service and increase growth.

While our distribution network covers all of the major locations for our principal products in the United States and Canada, we want to continue to invest in process improvements to support our objective of being the preferred partner for our customers. Expanding the capabilities of our systems and employees will allow us to improve our customers’ experiences. We continue to invest time and resources to deepen our channel partnerships and end customer relationships to increase our presence in the fastest growing markets. Additionally, we seek to attract and retain customers through product training and engineering resources to ascertain, educate and understand project requirements.

Continue to seek, acquire, and invest in businesses and technologies that expand our existing portfolio or allow us to enter new markets.

We will continue to evaluate the acquisition of strategic businesses, technologies and product lines that have the potential to strengthen our competitive position, enhance or expand our existing product and service offerings, expand our technological capabilities, leverage our manufacturing capabilities, provide synergistic opportunities, enhance our customer relationships or allow us to enter new markets. As part of this strategy, we may pursue international opportunities, including acquisitions, joint ventures and partnerships.

Description of Products and Services

We offer a broad line of water infrastructure, flow control, metering and leak detection products and services primarily in the United States and Canada. Water Flow Solutions sells iron gate and specialty valves, and service brass products. Water Management Solutions sells fire hydrants, repair and installation, natural gas, metering, leak detection and pressure management and control products and solutions. Our products are designed, manufactured and tested in compliance with relevant industry standards. Our water distribution products are manufactured to meet or exceed American Water Works Association (“AWWA”) standards and, where applicable, certified to National Science Foundation (“NSF”)/American National Standards Institute (“ANSI”) Standard 61 for potable water conveyance. Underwriters Laboratory (“UL”) and FM Approvals (“FM”) have approved many of these products. Additionally, our products are typically specified by a water utility for use in its infrastructure system.

, leak detection and pressure control products

Water Flow Solutions

Water Flow Solutions’ product portfolio includes iron gate valves, specialty valves and service brass products. We recognized $634.4 million, $714.1 million and $617.8 million of net sales in our 2023, 2022 and 2021 fiscal years, respectively, for Water Flow Solutions products and solutions.

Water Valves and Related Products. Water Flow Solutions manufactures valves for water systems, including iron gate, butterfly, tapping, check, knife, plug, and ball valves, and sells these products under a variety of brand names, including Mueller®, Pratt®, and U.S. Pipe Valve and Hydrant. These valve products are used to control distribution and transmission of potable water and non-potable water. Water valve products typically range in size from ¾ inch to 36 inches in diameter. Water Flow Solutions also manufactures significantly larger valves as custom orders through some of its product lines. Most of these valves are used in water transmission or distribution, water treatment facilities or industrial applications.

Water Management Solutions

Water Management Solutions’ portfolio includes fire hydrants, repair and installation, natural gas, metering, leak detection and pressure management and control products and solutions. We recognized $641.3 million, $533.3 million and $493.2 million of net sales in our 2023, 2022, and 2021 fiscal years respectively, for Water Management Solutions products and solutions.

Fire Hydrants. Water Management Solutions manufactures dry-barrel and wet-barrel fire hydrants. Water Management Solutions sells fire hydrants for new water infrastructure development, fire protection systems and water infrastructure repair and replacement projects.

Our fire hydrants consist of an upper barrel and nozzle section and a lower barrel and valve section that connects to a water main. In dry-barrel fire hydrants, the valve connecting the barrel of the hydrant to the water main is located below ground at or below the frost line, which keeps the upper barrel dry. Water Management Solutions sells dry-barrel fire hydrants under the Mueller and U.S. Pipe Valve and Hydrant brand names in the United States and Mueller and the Canada Valve™ brand names in Canada. Water Management Solutions also makes wet-barrel fire hydrants, where the valves are located in the hydrant nozzles and the barrel contains water at all times. Wet-barrel fire hydrants are made for warm weather climates, such as in California and Hawaii, and are sold under the Jones® brand name.

Most municipalities have approved a limited number of fire hydrant brands for installation as a result of their desire to use the same tools and operating instructions across their systems and to minimize inventories of spare parts. We believe the large installed base of Mueller fire hydrants throughout the United States and Canada, reputation for superior quality and performance as well as specified position have contributed to the leading market position of our fire hydrants. This large installed base also leads to recurring sales of replacement fire hydrants and hydrant parts.

Repair Products and Services. Water Management Solutions also sells pipe repair products, such as couplings, grips and clamps used to repair leaks, under the HYMAX®, Mueller® and Krausz® brand names.

Water Metering Products and Systems. Water Management Solutions manufactures and sources a variety of water technology products under the Mueller® brand name that are designed to help water providers accurately measure and control water usage. Water Management Solutions offers a complete line of residential, fire protection and commercial metering solutions. Residential and commercial water meters are generally classified as either manually read meters or remotely read meters via radio technology. A manually read meter consists of a water meter and a register that gives a visual meter reading display. Meters equipped with radio transmitters (endpoints) use encoder registers to convert the measurement data from the meter (mechanical or static) into an encrypted digital format which is then transmitted via radio frequency to a receiver that collects and formats the data appropriately for water utility billing systems. These remotely or electronically read systems are either automatic meter reading (“AMR”) systems or fixed network advanced metering infrastructure (“AMI”) systems. With an AMR system, utility personnel with mobile equipment, including a radio receiver, computer and reading software, collect the data from utilities’ meters. With an AMI system, a network of permanent data collectors or gateway receivers that are always active or listening for the radio transmission from the utilities’ meters gather the data. AMI systems eliminate the need for utility personnel to travel through service territories to collect meter reading data. These systems provide the utilities with more frequent and diverse data at specified intervals from the utilities’ meters and allow for two-way communication. Water Management Solutions sells both AMR and AMI systems and related products. Our remote disconnect water meter enables the water flow to be stopped and started remotely via handheld devices or from a central operating facility.

Water Leak Detection and Pipe Condition Assessment Products and Services. Water Management Solutions develops technologies and offers products and services under the Echologics® brand name that can non-invasively (i.e., without disrupting service or introducing a foreign object into the water system) detect underground leaks and assess the condition of water mains comprised of a variety of materials. We leverage our proprietary acoustic technology to offer leak detection and condition assessment surveys. We also offer fixed leak detection systems that allow customers to continuously monitor and detect leaks on water distribution and transmission mains. We believe Water Management Solutions’ ability to offer non-invasive leak detection and pipe condition assessment services is a key competitive advantage.

Additionally, Water Management Solutions produces machines and tools for tapping, drilling, extracting, installing and stopping-off, which are designed to work with its water and gas fittings and valves as an integrated system. We also provide gas valve products primarily for use in gas distribution systems. With our Singer Valve and i2O products, we provide a range of intelligent water solutions including pressure control valves, advanced pressure management, network analytics, event management and data logging.

Manufacturing

See “Item 2. PROPERTIES” for a description of our principal manufacturing facilities.

We will continue to expand the use of Lean manufacturing and Six Sigma business process improvement methodologies where appropriate to safely capture higher levels of quality, service and operational efficiency in our manufacturing facilities in both segments.

Mueller Water Products operates ten manufacturing facilities located in the United States, Israel and China. These manufacturing operations include foundry, machining, fabrication, assembly, testing and painting operations. Not all facilities perform each of these operations. Our existing manufacturing capacity is sufficient for anticipated near-term requirements. In order to meet longer-term capacity requirements and modernize some production facilities, we have expanded the large valve casting capabilities at the facility located in Chattanooga, Tennessee, and added a new facility nearby in Kimball, Tennessee to expand domestic manufacturing capabilities for specialty large valves. Additionally, our new brass foundry in Decatur, Illinois, is nearly complete and will replace our existing brass foundry there. Our foundries use both lost foam and green sand casting techniques. We use the lost foam technique for fire hydrant production in our Albertville, Alabama facility and for iron gate valve production in our Chattanooga, Tennessee facility. The lost foam technique has several advantages over the green sand technique, especially for high-volume products, including a reduction in the number of manual finishing operations, lower scrap levels and the ability to reuse some of the materials.

Additionally, we design, manufacture, and assemble water metering products in Cleveland, North Carolina. In Atlanta, Georgia, we design and support AMR and AMI systems in our research and development center of excellence for software and electronics. Our research and development center in Toronto, Ontario, Canada, designs and supports leak detection and pipe condition assessment products and solutions. Product design and support for our intelligent water solutions products and services for pressure management are in Southampton, United Kingdom.

Purchased Components and Raw Materials

Our products are made using various purchased components and several basic raw materials that include brass ingot, scrap steel, sand and resin. Purchased parts and raw materials represented approximately 45% and 11%, respectively, of Cost of sales in 2023.

Patents, Licenses and Trademarks

We have active patents relating to the design of our products and trademarks for our brands and products. We have filed and continue to file when appropriate, patent applications used in connection with our business and products. Many of the patents for technology underlying the majority of our products have been in the public domain for many years, and we do not believe third-party patents individually or in the aggregate are material to our business. However, we consider the pool of proprietary information, consisting of expertise and trade secrets relating to the design, manufacture and operation of our products to be particularly important and valuable. We generally own the rights to the products that we manufacture and sell, and we are not dependent in any material way upon any third-party license or franchise to operate. See “Item 1A. RISK FACTORS-Any inability to protect our intellectual property or our failure to effectively defend against intellectual property infringement claims could adversely affect our competitive position.”

Our brand names include:

|

|

|

|

|

|

|

|

|

Canada Valve™ |

|

Centurion® |

Echologics® |

|

Echoshore® |

ePulse® |

|

Ez-Max® |

Hersey®™ |

|

Hydro Gate® |

Hydro-Guard® |

|

HYMAX® |

HYMAX VERSA® |

|

Jones® |

Krausz® |

|

LeakFinderRT® |

LeakFinderST™ |

|

LeakListener® |

LeakTuner® |

|

Milliken™® |

Mueller® |

|

Mueller Systems® |

Pratt® |

|

Pratt Industrial® |

Repaflex® |

|

Repamax® |

Sentryx™ |

|

Singer™® |

| U.S. Pipe Valve and Hydrant |

|

|

Seasonality

Parts of our business depend upon construction activity, which is seasonal in many areas as a result of the impact of cold weather conditions on construction. Net sales and operating income have historically been lowest in the quarters ending December 31 and March 31 when the northern United States and most of Canada generally face weather conditions that restrict significant construction and other field crew activity. See “Item 1A. RISK FACTORS-Seasonal demand for certain of our products and services may adversely affect our financial results.”

Sales, Marketing and Distribution

We primarily sell to national and regional waterworks distributors in the U.S. and Canada. Our distributor relationships are generally non-exclusive, but we attempt to align ourselves with key distributors in the principal markets we serve. We believe “Mueller” is the most recognized brand in the United States water infrastructure industry. Our extensive installed base, broad product range and well-known brands have led to many long-standing relationships with the key distributors in the principal markets we serve. Our distribution network covers all of the major locations for our principal products in the United States and Canada. Although we have long-standing relationships with most of our key distributors, we typically do not have long-term contracts with them, including our two largest distributors, which together accounted for approximately 35%, 40% and 39% of our gross sales in 2023, 2022 and 2021 fiscal years, respectively. See “Item 1A. RISK FACTORS-Our business depends on a small group of key customers for a significant portion of our sales.”

Water Flow Solutions

Water Flow Solutions sells its products primarily through waterworks distributors to a wide variety of end user customers, including water and wastewater utilities, and fire protection and construction contractors. Sales of the products are heavily influenced by the specifications for the underlying projects. Approximately 6% of Water Flow Solutions’ net sales were to Canadian customers in our fiscal year 2023, 8% in fiscal year 2022 and 7% in fiscal year 2021.

Water Management Solutions

Water Management Solutions sells its products primarily through waterworks distributors to a wide variety of end user customers, including water and wastewater utilities, gas utilities, integrated suppliers, as well as fire protection and construction contractors. Sales of our products are heavily influenced by the specifications for the underlying projects. Water Management Solutions also sells its water metering, leak detection, including pipe condition assessment, and pressure management and control products and solutions directly to municipalities and to waterworks distributors. Approximately 6% of Water Management Solutions’ net sales were to Canadian customers in fiscal year 2023, 7% in fiscal year 2022 and 8% in fiscal year 2021.

Backlog

We consider backlog to represent orders placed by customers for which goods or services have yet to be shipped. Backlog is a meaningful indicator for many of our product lines. The delivery lead time for certain product lines such as specialty valves can be longer than one year, and we expect approximately 22% of Water Flow Solutions’ backlog at the end of 2023 will not be shipped until beyond 2024. Water Management Solutions manufactures or sources water meter systems that are sometimes ordered in large quantities with delivery dates over several years. We expect approximately 2% of Water Management Solutions’ backlog at the end of 2023 will not be shipped until beyond 2024. Due to higher demand levels in 2022, we experienced record levels of short-cycle backlog, primarily for our iron gate valves, service brass products and fire hydrants. Backlog for Water Management Solutions and Water Flow Solutions are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

| |

September 30, |

|

2023 |

|

2022 |

|

(in millions) |

| Water Flow Solutions |

$ |

232.0 |

|

|

$ |

419.1 |

|

| Water Management Solutions |

93.5 |

|

|

309.8 |

|

| Total backlog |

$ |

325.5 |

|

|

$ |

728.9 |

|

Sales cycles for metering systems can span several years, and it is common for customers to place orders throughout the contract period. Although we believe we have a common understanding with our customer as to the total value of a contract when it is awarded, we do not include customer orders in our backlog until the customer order is received.

Competition

The United States and Canadian markets for water infrastructure and flow control products are very competitive. See “Item 1A. RISK FACTORS-Strong competition could adversely affect prices and demand for our products and services, which would adversely affect our operating results and financial condition.” There are only a few competitors for most of our product and service offerings. Many of our competitors are well-established companies with products that have strong brand recognition. We consider our installed base, product quality, customer service level, brand recognition, innovation, distribution and technical support to be competitive strengths.

The competitive environment for most of Water Flow Solutions’ valve products is mature and many end users are slow to transition to brands other than their historically preferred brands making it difficult to increase market share in this environment. We believe our valves enjoy strong competitive positions based primarily on the extent of their installed base, product quality, specified position and brand recognition. Our principal competitors for iron gate valves are McWane, Inc. and American Cast Iron Pipe Company. The primary competitors for our service brass products are The Ford Meter Box Company, Inc. and A.Y. McDonald Mfg. Co. Many service brass valves are interchangeable among different manufacturers. For our specialty valve products such as butterfly, plug, and check valves, our principal competitors are DeZURIK, Val-Matic and McWane, Inc.

The markets for products and services sold by Water Management Solutions are very competitive, with some mature products, and many end users are slow to transition to brands other than their historically preferred brands. We believe that our fire hydrants enjoy a strong competitive position primarily based on the extent of their installed base, product quality, specified position and brand recognition. Our principal competitors for fire hydrants are McWane, Inc. and American Cast Iron Pipe Company. We believe the markets for many of our repair products are open to product innovation. For our pipe repair products, we believe our brand names, including Krausz® and HYMAX®, are generally associated with premium products as a result of our patented technology and superior features. Our current marketing strategy is primarily focused on repair, joining and restraining of water infrastructure piping systems, which consists of cast iron, ductile iron and plastic pipe. Our repair solutions work well with all of these. Our primary competitors in the repair market are Romac Industries, Smith Blair, Viking Johnson, AVK Group, JCM Industries, and Georg Fisher Ltd.

Water Management Solutions sells water metering products and systems, primarily in the United States. We believe a substantial portion of this market is in the process of transitioning from manually read meters to electronically read meters; however, we expect this transition to be relatively slow and that many end users will be reluctant to adopt brands other than their historically preferred brand. Although Water Management Solutions’ market position is relatively small, we believe our electronically read meters and associated technology are positioned to gain a greater share of these markets.

Our principal competitors are Sensus, Neptune Technology Group Inc., Badger Meter, Inc., Itron, Inc., and Master Meter, Inc. We also sell pressure control valves and pressure loggers through our Singer Valve and i2O products. The primary competitors for these products are Cla-Val, Watts, OCV, Ross Valve, Bermad and Halma. Water Management Solutions also sells water leak detection and pipe condition assessment products and services in North America, the United Kingdom and select countries in Europe, Asia and the Middle East, with our primary markets being the United States and Canada. The worldwide market for leak detection and pipe condition assessment is highly fragmented with numerous competitors. Our more significant competitors are Pure Technologies Ltd., Gutermann AG and Syrinix Ltd. Additionally, we sell gas repair products which are primarily used on distribution lines. Our primary competitors for these products are Smith Blair, T.D. Williamson, and A.Y. McDonald.

Research and Development

Our primary research and development (“R&D”) facilities are located in Chattanooga, Tennessee; Ariel, Israel; Atlanta, Georgia; Toronto, Ontario; and Southampton, United Kingdom. The primary focus of these operations is to develop new products, improve and refine existing products and obtain and assure compliance with industry approval certifications or standards, such as AWWA, UL, FM, NSF and The Public Health and Safety Company. R&D expenses were $25.9 million, $24.5 million and $17.1 million during 2023, 2022 and 2021, respectively.

Regulatory and Environmental Matters

Our operations are subject to numerous federal, state and local laws and regulations, both within and outside the United States, in areas such as: competition, government contracts, international trade, labor and employment, tax, licensing, consumer protection, environmental protection, workplace health and safety, and others. These and other laws and regulations impact the manner in which we conduct our business, and changes in legislation or government policies can affect our operations, both favorably and unfavorably. For example, the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”) and similar state laws affect our operations by, among other things, imposing investigation and cleanup requirements for threatened or actual releases of hazardous substances. Under CERCLA, joint and several liability may be imposed on operators, generators, site owners, lessees and others regardless of fault or the legality of the original activity that caused or resulted in the release of the hazardous substances. Thus, we may be subject to liability under CERCLA and similar state laws for properties that: (1) we currently own, lease or operate; (2) we, our predecessors, or former subsidiaries previously owned, leased or operated; (3) sites to which we, our predecessors or former subsidiaries sent waste materials; and (4) sites at which hazardous substances from our facilities’ operations have otherwise come to be located. The purchaser of U.S. Pipe has been identified as a “potentially responsible party” (“PRP”) under CERCLA in connection with a former manufacturing facility operated by U.S. Pipe that was in the vicinity of a Superfund site located in North Birmingham, Alabama. Under the terms of the acquisition agreement relating to our sale of U.S. Pipe, we agreed to indemnify the purchaser for certain environmental liabilities, including those arising out of the former manufacturing site in North Birmingham. Accordingly, the purchaser tendered the matter to us for indemnification, which we accepted. Ultimate liability for the site will depend on many factors that have not yet been determined, including the determination of the Environmental Protection Agency’s (“EPA”) remediation costs, the number and financial viability of the other PRPs (there are three other PRPs currently) and the determination of the final allocation of the costs among the PRPs. For more information regarding this matter as well as others that may affect our business, including our capital expenditures, earnings and competitive position, see “Item 1A. RISK FACTORS,” “Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS - Contingencies” and Note 15. of the Notes to Consolidated Financial Statements.

Our operations are subject to federal, state and local laws, regulations and ordinances relating to various environmental, health and safety matters. We believe our operations are in compliance with, or we are taking actions designed to reinforce compliance with, these laws, regulations and ordinances. However, the nature of our operations exposes us to the risk of claims concerning non-compliance with environmental, health and safety laws or standards, and there can be no assurance that material costs or liabilities will not be incurred in connection with those claims. Except for certain orders issued by environmental, health and safety regulatory agencies, with which we believe we are in compliance and which we believe are immaterial to our financial condition, results of operations and liquidity, we are not currently named as a party in any judicial or administrative proceeding relating to environmental, health and safety matters.

Greenhouse gas ("GHG") emissions have increasingly become the subject of political and regulatory focus. Concern over potential climate change, including global warming, has led to legislative and regulatory initiatives directed at limiting GHG emissions. In addition to certain federal proposals in the United States to regulate GHG emissions, many states and countries are considering and are enacting GHG legislation, regulations or international accords, either individually and/or as part of regional initiatives.

It is likely that additional climate change related mandates will be forthcoming, and it is expected that they may adversely impact our costs by increasing energy costs and raw material prices, requiring operational or equipment modifications to reduce emissions and creating costs to comply with regulations or to mitigate the financial consequences of such compliance.

Our environmental strategy focuses on responsible sourcing and manufacturing sustainable products that address numerous water infrastructure challenges. We have established reduction targets for key environmental performance indicators such as GHG emissions, internal water withdrawal intensity and waste to landfill, as well as targets for increased use of recycled materials in our products. In connection with these efforts, we work to minimize the amount of water we use at our manufacturing facilities and maintain stringent water quality standards. Our processes are designed to return the water used in manufacturing at a quality level that does not negatively impact the receiving environment.

Future events, such as changes in existing laws and regulations, new legislation to limit GHG emissions or contamination of sites owned, operated or used for waste disposal by us, including currently unknown contamination and contamination caused by prior owners and operators of such sites or other waste generators, may give rise to additional costs which could have a material effect on our financial condition, results of operations or liquidity.

Our anticipated capital expenditures for environmental projects are not expected to have a material effect on our financial condition, results of operations or liquidity.

Human Capital

We believe our employees are our greatest asset and we strive to provide a safe, inclusive, high-performance culture where our people can thrive. We strive to recruit, develop, engage, train and protect our workforce. The following are key human capital measures and objectives on which the Company currently focuses.

Core Values. Our core values of respect, integrity, trust, safety and inclusion shape our culture and define who we are. We are committed to upholding fundamental human rights and believe that all human beings should be treated with dignity, fairness, and respect.

Employee Total Compensation and Benefits Philosophy. We pay at or above a living wage at each of our locations. Living wage is defined as the minimum necessary income for a worker to meet the worker’s basic needs, which can fluctuate based on physical location and other local factors. We base our calculations on a single worker with no children. We are dedicated to our employees’ health and well-being. We provide access to benefits and offer programs that support work-life balance and overall well-being, including financial, physical and mental health resources, such as those listed below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financial |

|

Health and Wellness |

|

Work-Life Balance |

Competitive Base Pay |

|

Medical, Dental and Vision Benefits (including telemedicine) |

|

Paid time off, paid holidays and jury duty pay |

| Employee Incentive Plan (Annual Bonus) |

|

Flexible Spending Accounts and Health Savings Accounts |

|

Paid Parental Leave (maternity, paternity, adoption) |

| Supplemental Pay (Overtime) |

|

Supplemental Health Benefits |

|

Healthcare navigation/concierge program |

| Employee Stock Purchase Plan |

|

Wellness Rewards Program |

|

Employee Assistance Program (mental health, legal, financial services) |

| Recognition Pay and Service Awards |

|

Health Plan Incentives |

|

Associate Discount Programs and Services |

| 401(k) Retirement Savings Plan with Company Match (Traditional and Roth) |

|

On-site and complimentary Vaccinations |

|

Flexible Work Arrangements |

| Life Insurance (employee and dependents) |

|

Dependent Care Accounts |

|

Tuition Reimbursement |

| Short-term and Long-term Disability Insurance |

|

Voluntary Benefits Offering |

|

No Deductible Medical Mental Health Benefits |

Commitment to Diversity and Inclusion. We strive to promote inclusion in the workplace, to build on our understanding of potential human rights issues by engaging with appropriate communities, and to interact with our employees and all communities in a manner that respects human rights. We encourage our suppliers to follow these practices as well. As of September 30, 2023, women represented 36% and minorities also represented 36% of our Board of Directors.

We condemn human rights abuses and do not condone the use of slave or forced labor, human trafficking, child labor, the degrading treatment of individuals, physical punishment, or unsafe working conditions.

All employees are required to understand and obey local laws, to report any suspected violations, and to act in accordance with our Core Values and Code of Conduct.

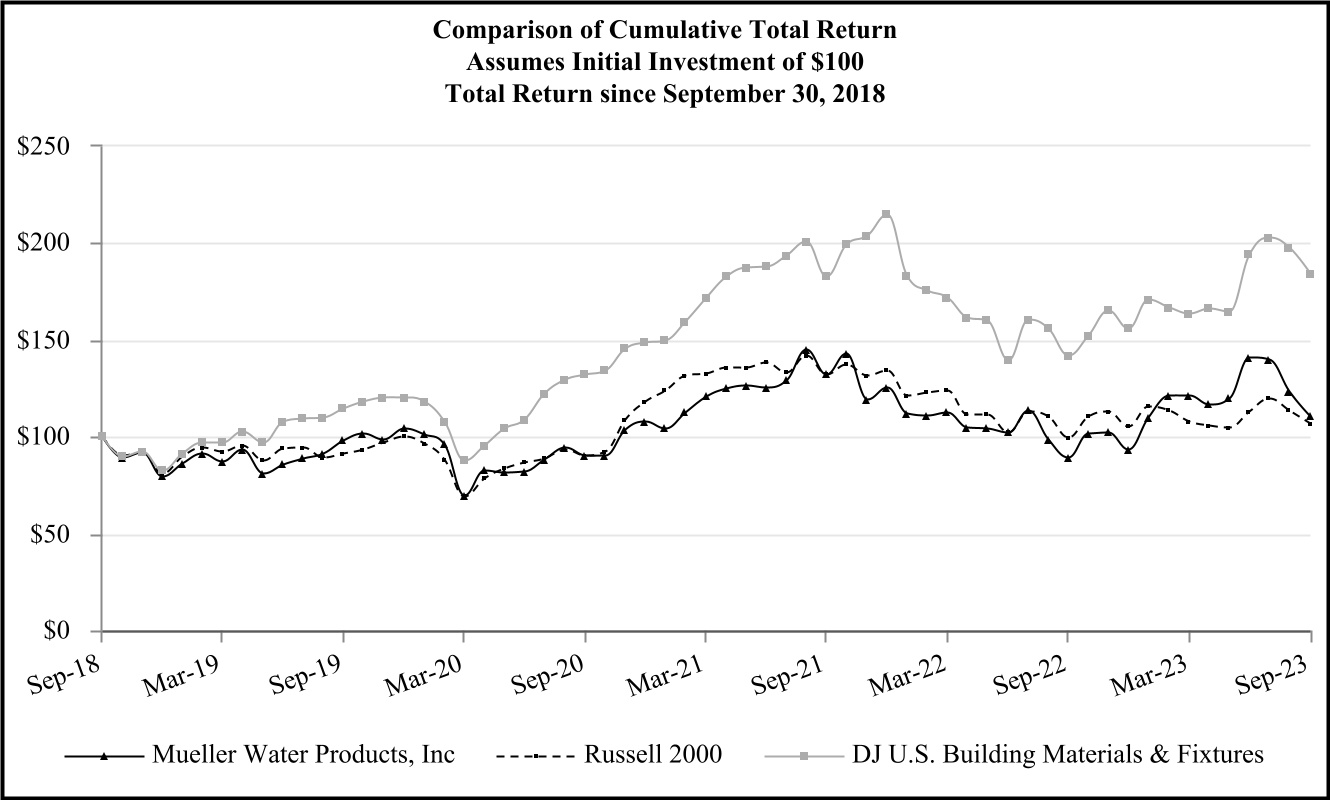

We concluded a comprehensive pay equity analysis in 2021 encompassing all staff members and job levels in addition to considering gender and race. We believe we have made compensation adjustments to rectify compensation disparities. We also implemented hiring and promotional practices to support our goal of ensuring offers to new employees or to employees being promoted internally are aligned with the market and equitable on an internal basis. We plan to conduct another comprehensive pay equity analysis in the near future and at appropriate intervals going forward.