Q3 2025 Letter to Shareholders November 6, 2025 yelp-ir.com EXHIBIT 99.2

Ye lp Q 3 20 25 2 24 Note: Amounts reported in this letter, including margins, are rounded. The year-over-year percentage changes may not recalculate using the rounded amounts presented. 1 Refer to “Non-GAAP Financial Measures” and “Reconciliation of GAAP to Non-GAAP Financial Measures” below for further details, including definitions of each “non-GAAP measure” presented, and a reconciliation of the “non-GAAP measures” presented to the most directly comparable measures prepared under generally accepted accounting principles in the United States (“GAAP”). ² Yelp has not reconciled its adjusted EBITDA outlook to net income (loss) under GAAP because it does not provide an outlook for GAAP net income (loss) due to the uncertainty and potential variability of other income, net and provision for (benefit from) income taxes, which are reconciling items between adjusted EBITDA and GAAP net income (loss). Because Yelp cannot reasonably predict such items, a reconciliation of the non-GAAP financial measure outlook to the corresponding GAAP measure is not available without unreasonable effort. We caution, however, that such items could have a significant impact on the calculation of GAAP net income (loss). For more information regarding the non-GAAP financial measures discussed in this release, please see “Non-GAAP Financial Measures” and “Reconciliation of GAAP to Non-GAAP Financial Measures” below. Third Quarter 2025 Financial Highlights > Net revenue was $376 million, up 4% from the third quarter of 2024 and $6 million above the high end of our third quarter outlook range, driven primarily by growth in advertising revenue from Services businesses as we executed against our strategic initiatives. > Net income was $39 million, or $0.61 per diluted share, compared to net income of $38 million, or $0.56 per diluted share, in the third quarter of 2024. Net income margin was 10% compared to 11% in the third quarter of 2024. > Adjusted EBITDA¹ was $98 million, a decrease of $3 million, or 3%, compared to the third quarter of 2024 and $13 million above the high end of our outlook range. Adjusted EBITDA margin1 decreased two percentage points from the third quarter of 2024 to 26%. > Cash provided by operating activities was $132 million during the third quarter, and we ended the quarter with cash, cash equivalents and marketable securities of $334 million. > In the third quarter, we repurchased approximately 2.3 million shares at an aggregate cost of $75 million. > We continue to believe in the long-term opportunities ahead and our team’s ability to capture them. In 2025, we now expect net revenue will be in the range of $1.460 billion to $1.465 billion and adjusted EBITDA will be in the range of $360 million to $365 million.² 19% 17% Net Revenue +4% $360M $376M 3Q24 3Q25 Ad Clicks, y/y -11% 3Q24 3Q25 Average CPC, y/y +14% 3Q24 3Q25 Paying Advertising Locations -2% 524k 512k 3Q24 3Q25 Services RR&O Adjusted EBITDA¹ -3% $101M $98M 3Q24 3Q25 M ar gi n 28% 26%8% 7% M ar gi n Net Income +2% $38M $39M 3Q24 3Q25 10%11%

Ye lp Q 3 20 25 3 24 Dear fellow shareholders, Yelp delivered record net revenue and strong profitability in the third quarter, with Services continuing to drive our business performance amid an uncertain macroeconomic environment. Yelp’s transformation with artificial intelligence (“AI”) continues to accelerate. We are reconceiving the experience on Yelp for both consumers and businesses, recently rolling out more than 35 new features and updates that leverage the power of AI in combination with our human-generated, highly trusted content. This valuable content also underpins the continued expansion of our data licensing partnerships. Taken together, we believe our product-led strategy along with our broad reach will enable us to deliver on our ambitious product roadmap and create long-term value for our shareholders. +2 ppt 3% 4% 2Q22 2Q23 Net Income Margin 2Q24 2Q25 Net Income Margin 12%11% Adjusted EBITDA Margin 27%26% +4% We delivered record net revenue while expanding margins Net Revenue

Ye lp Q 3 20 25 4 24 Q3 Results In the third quarter, net revenue increased by 4% year over year to a record $376 million, $6 million above the high end of our outlook range. Net income increased by 2% year over year to $39 million, representing a 10% margin. Adjusted EBITDA decreased by 3% year over year to $98 million, representing a 26% margin and $13 million above the high end of our outlook range. Underlying our top line results, advertising revenue from Services businesses increased by 7% year over year to a record $244 million, driven primarily by growth in advertiser demand due to an increase in paying advertising locations and reflecting record average revenue per location1. The addition of revenue from RepairPal, Inc. (“RepairPal”) also contributed significantly to growth in Services revenue in the third quarter. At the same time, advertising revenue from Restaurants, Retail & Other (“RR&O”) businesses decreased by 2% year over year to $114 million, reflecting lower advertiser demand due to continued challenges in the operating environment for businesses in these categories and, to a lesser extent, competitive pressures from food ordering and delivery providers. Although the decline in RR&O advertiser demand was driven by a decrease in paying advertising locations, the locations that turned off their spend were generally lower-spend advertisers, which helped mitigate the overall impact on revenue. Total paying advertising locations decreased by 2% year over year, as the decline in RR&O categories offset growth in Services, while average revenue per location increased to a record level, primarily driven by the performance in Services categories. Ad clicks decreased by 11% year over year, primarily driven by macro pressures and, to a lesser extent, competitive pressures in RR&O categories and reduced spend on paid project acquisition in the current-year period. Average cost-per-click (“CPC”) increased by 14% year over year, reflecting growth in Services advertiser demand and fewer clicks overall. 1 Services advertising revenue divided by Services paying advertising locations. Services drove our business performance Services Revenue +7% $228M 3Q24 4Q24 1Q25 2Q25 3Q25 $244M $225M $232M $241M Continued challenges in RR&O RR&O Revenue -2% $116M 3Q24 4Q24 1Q25 2Q25 3Q25 $114M$121M $110M $113M

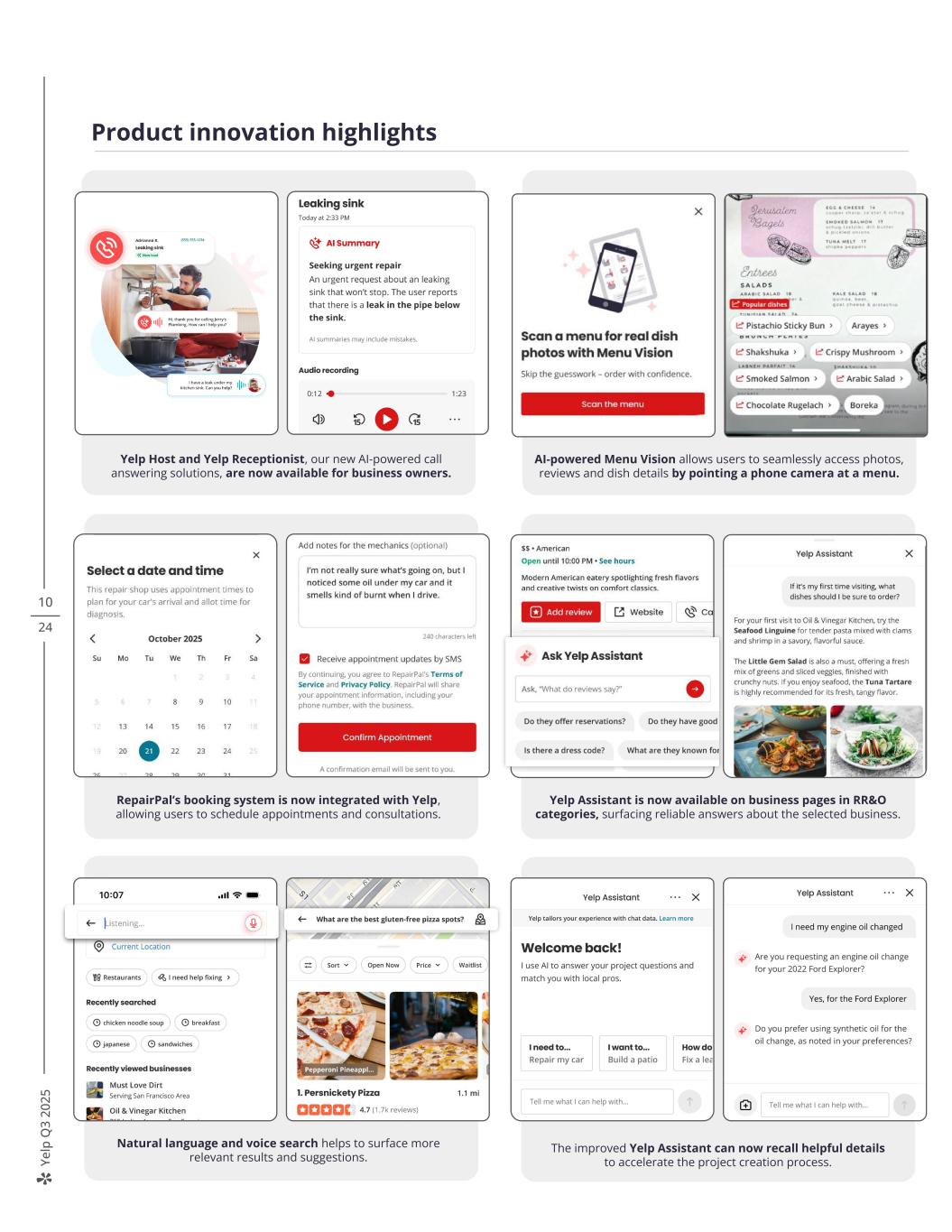

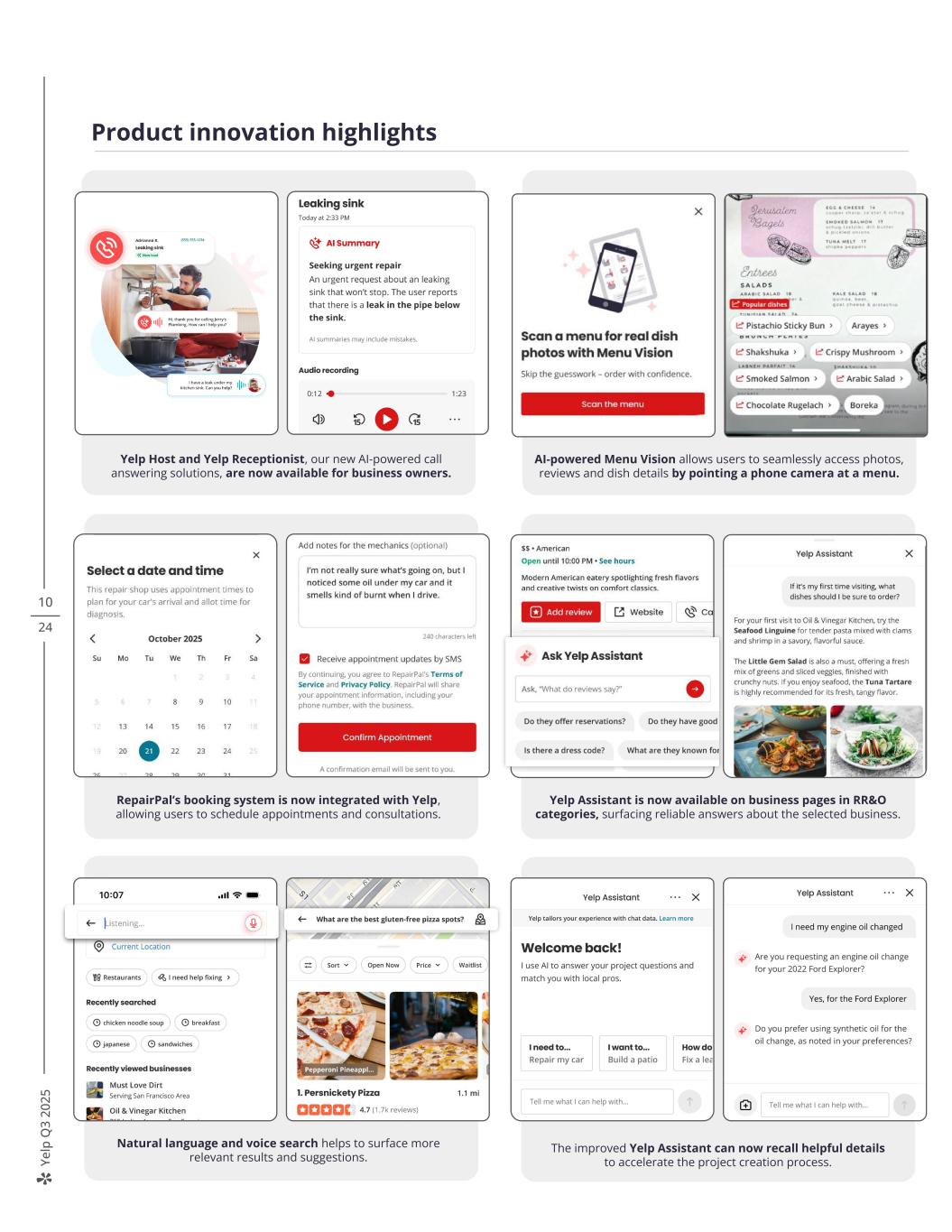

Ye lp Q 3 20 25 5 24 Initiatives to drive long-term, profitable growth In 2025, we are continuing to invest across three strategic initiatives aimed at driving profitable growth through product innovation. Underlying each investment area, we plan to continue to accelerate our strategy with AI technologies, which we believe we are well positioned to leverage based on our high-quality, trusted human-generated content. Lead in Services We are continuing to deepen our focus on Services. We plan to build on our product momentum in Home Services while expanding our roadmap to include creating a best-in-class experience across additional Services categories. In the third quarter, Services revenue increased by 7% year over year, driven by growth in the Home Services category as well as the Auto Services category, which includes revenue generated from RepairPal. Following successful testing, we recently integrated RepairPal’s booking system into Yelp to make it easier to schedule appointments with auto repair shops. Request-a-Quote projects increased by approximately 5% year over year. Excluding projects acquired through our paid search initiative, they increased by approximately 10% year over year, driven by improvements to the flow and our AI chatbot, Yelp Assistant, which maintained strong momentum. Project submissions through Yelp Assistant increased by nearly 400% year over year. Our product and engineering teams continued to improve the offering and recently rolled out an enhanced version of Yelp Assistant that remembers important details and preferences from previously submitted projects, reducing friction for future submissions. We also recently began testing Yelp Assistant for logged-out users, which we believe will drive continued growth in new projects. To simplify how consumers connect with and hire service pros, we are now using AI to group before and after project photos into a dedicated section within each business’s media gallery on desktop, with plans to expand the feature to iOS in the coming months. We also expanded our response quality badges nationwide and enabled business owners to receive real-time, AI-powered guidance to improve their replies to project requests. Additionally, we extended our Review Insights feature — which utilizes large language models (“LLMs”) to surface relevant topics and sentiment scores from reviews — to Services categories. Yelp Assistant now remembers important details and preferences from previous projects Depictions of Yelp's features are provided for illustrative purposes only and may differ from the actual product. We extended our AI-powered Review Insights to Services categories

Ye lp Q 3 20 25 6 24 Drive advertiser value Our investments in business-focused products and advertising technologies have helped us attract and retain new customers. We continue to see significant opportunities to further optimize advertisers’ budgets by prioritizing the most relevant ad content for consumers searching for local businesses. In the third quarter, ad clicks decreased by 11% year over year, primarily due to macro pressures and, to a lesser extent, competitive pressures in RR&O categories and reduced spend on paid project acquisition in the current-year period. Average CPC increased by 14% year over year, reflecting growth in Services advertiser demand and fewer clicks overall as we focused on improving the quality of our ad clicks. In addition to driving advertiser value, we continue to see opportunities to help businesses operate more efficiently by leveraging advanced AI technologies and the depth of our trusted content on local businesses. After successful testing, we recently rolled out two AI-powered call answering services — Yelp Host and Yelp Receptionist — which we expect to drive incremental subscription revenue. These solutions combine LLMs with Yelp’s high-quality data to provide smarter, more human-like AI voice answering services tailored with information specific to each individual business. Percentage Change in Ad Clicks and Average CPC, y/y Ad Clicks 2% 3Q24 4Q24 2Q25 3Q25 -11% 5% -7% 1Q25 -3% 3% Average CPC 3Q24 4Q24 1Q25 2Q25 3Q25 14% 11% 0% 9%

Ye lp Q 3 20 25 Yelp is truly the go-to platform for [the restaurant industry]. I’ve already been very satisfied with the return on ad spend, and now having the AI answering service increases the overall value. It can save a lot of money for restaurant owners by handling calls that usually distract servers and pulls them away from serving diners, especially on busy nights. It elevates the guest experience because the servers or host can pay more attention to those already on site, making Yelp Host money well spent. So just those two things are something every restaurant owner would kill to have. — Jongpil Kim, CEO of MUN Korean Steakhouse in Los Angeles, CA 7 24 Yelp Host, our offering for restaurants, is a fully autonomous AI agent that transforms how front-of-house teams handle guest calls and table management. The product is currently available for table-service restaurants starting at $149 per month, or $99 per month for Yelp Guest Manager customers. In its initial month, Yelp Host handled thousands of calls and booked hundreds of reservations, saving significant time for restaurant staff. Yelp Host Front-of-house management Business owner setup flow

Ye lp Q 3 20 25 8 24 Yelp Receptionist, our offering for service pros, handles incoming calls for eligible local businesses, asking nuanced questions to capture important project details, vetting and helping qualify new leads, and collecting information needed to provide an accurate quote or schedule a consultation or appointment. Launched in October for select Services categories, the offering is currently priced at $99 per month. Yelp Receptionist genuinely sounds human, which makes it easy for me to trust it to handle our leads while my team stays focused on the projects at hand. It exceeded my expectations because it feels like you’re talking to a real person, not a robot. — Krzysztof Jarecki, owner of FLOORecki Floors and Stairs in Chicago, IL Yelp Receptionist Yelp Receptionist landing page Business owner voice inbox

Ye lp Q 3 20 25 9 24 Transform the consumer experience Yelp’s high-quality, trusted content has made it a leading resource for consumers to search for and discover great local businesses. To strengthen our position, we are investing in a portfolio of product initiatives that we believe will make Yelp even more engaging and useful to consumers. We recently expanded Yelp Assistant to business pages in RR&O categories, leveraging our trusted content and information from businesses’ websites to give users instant, reliable answers to questions about specific businesses. This is an important step toward developing a comprehensive Yelp Assistant that works uniformly across all categories and entry points, which we plan to begin testing before the end of the year. With the recent launch of our augmented reality feature, Menu Vision, diners can now point their phones’ cameras at menus to view photos and reviews of individual dishes. We expect to roll out even more visual and engaging enhancements to this feature in early 2026. Expanding on Popular Dishes and Popular Drinks, we introduced Popular Offerings to highlight the most frequently mentioned services, items or experiences across more than 100 business categories. To make the search experience even more conversational and helpful, we rolled out several AI-powered updates. Consumers can now use voice search for natural-language questions, making it easier to find what they need hands-free. We also added a new carousel in search results that autoplays relevant user-generated videos, giving users a visual preview of local businesses. We are now partnering with DoorDash as our preferred food ordering and delivery provider, expanding our food ordering network by approximately 200,000 new restaurants to a total of more than 500,000. We expect this partnership will generate incremental revenue, which will be recorded as other revenue. We have also continued to make progress monetizing our trusted content and have seen strong demand for our data licensing products, particularly around AI search. This momentum demonstrates the expanded reach of our trusted content and reflects Yelp’s value as an essential partner in emerging AI-powered search products. We recently expanded Yelp Assistant to business pages in RR&O categories We are now partnering with DoorDash as our preferred food ordering and delivery provider

Ye lp Q 3 20 25 Product innovation highlights AI-powered Menu Vision allows users to seamlessly access photos, reviews and dish details by pointing a phone camera at a menu. Natural language and voice search helps to surface more relevant results and suggestions. Yelp Assistant is now available on business pages in RR&O categories, surfacing reliable answers about the selected business. RepairPal’s booking system is now integrated with Yelp, allowing users to schedule appointments and consultations. The improved Yelp Assistant can now recall helpful details to accelerate the project creation process. Yelp Host and Yelp Receptionist, our new AI-powered call answering solutions, are now available for business owners. 10 24

Ye lp Q 3 20 25 11 24 Delivering profitable growth Our third quarter results demonstrate our commitment to delivering profitable growth, with a net income margin of 10% and an adjusted EBITDA margin of 26%. We achieved these results through disciplined expense management and by holding overall headcount approximately flat year over year, excluding the RepairPal team that we acquired in November 2024. Stock-based compensation expense (“SBC”) as a percentage of revenue decreased by two percentage points year over year to 9% in the third quarter. We expect the combined impact of our efforts to reduce SBC and continued share repurchases to stack over time and benefit GAAP profitability in the years to come, particularly earnings per share, which was $0.61 on a diluted basis in the third quarter, an increase of 10% year over year. We remain committed to delivering value to shareholders and continue to expect our overall headcount will remain approximately flat again in 2025 as we utilize AI to deliver operational efficiencies, reflecting our commitment to drive leverage in the business through our product-led strategy. We also continue to expect that SBC will be less than 8% of revenue by the end of this year and less than 6% by the end of 2027. Total Repurchase Authorization Authorization Date Prudent Capital Allocation $2.0B Completed as of Dec. 31, 2024 Remaining Authorization $200M $250M $250M $250M $250M $250M Nov ‘22Jul ‘17 Nov ‘18 Feb ‘19 Jan ‘20 Aug ‘21 Feb ‘24 $500M End of 2025E End of 2027E Committed to reducing SBC as a percentage of revenue Stock-based Compensation Expense, % of Revenue 11% ~9% < 8% 2024 2025E < 6% Increasing adjusted EBITDA quality Adjusted EBITDA Margin 3Q24 3Q25 Stock-based compensation 26%28%

Ye lp Q 3 20 25 12 24 Prudent capital allocation Our capital allocation strategy consists of three main elements: 1) maintaining a healthy cash balance to fund our operations; 2) retaining balance sheet capacity for potential acquisitions to accelerate our strategy; and 3) returning excess capital to shareholders through share repurchases. In the third quarter, we repurchased $75 million worth of shares at an average purchase price of $32.59 per share. As of September 30, 2025, we had $127 million remaining under our existing repurchase authorization. We plan to continue repurchasing shares for the remainder of the year, subject to market and economic conditions. In summary, Yelp’s third quarter results demonstrate the profitability of our broad-based local ad platform. Despite heightened macro uncertainties, our elevated pace of product innovation and focus on Services have consistently driven business performance. We remain excited by the significant opportunities to drive profitable growth and shareholder value over the long term. Sincerely, Total Repurchase Authorization Authorization Date Prudent Capital Allocation $2.0B Completed as of June 30, 2024 Remaining Authorization $200M $250M $250M $250M $250M $250M Nov ‘22Jul ‘17 Nov ‘18 Feb ‘19 Jan ‘20 Aug ‘21 Feb ‘24 $500M Jeremy Stoppelman David Schwarzbach Total Repurchase Authorization Jul ‘17 - Aug ’21 Nov ‘22 Feb ‘24 $2.0B$500M $250M $1.2B Prudent Capital Allocation Authorization Date Completed as of Sept. 30, 2025 Remaining Authorization

Ye lp Q 3 20 25 13 24 Revenue Net revenue was $376 million in the third quarter of 2025, up 4% from the third quarter of 2024. Net revenue was $6 million above the high end of our third quarter outlook range. Advertising revenue was $357 million in the third quarter of 2025, up 4% from the third quarter of 2024, as a result of an increase in revenue from Services businesses, partially offset by a decrease in revenue from RR&O businesses. The increase in Services revenue was driven by growth in revenue from Yelp advertising products, as a result of the year-over-year increase in average CPC, which was partially offset by the year-over-year decrease in ad clicks, as well as the addition of revenue from RepairPal. Revenue from RepairPal contributed approximately two percentage points of the year-over-year growth in total advertising revenue in the third quarter. Other revenue was $19 million in the third quarter of 2025, up 17% from the third quarter of 2024. The increase was primarily driven by higher revenue from our Yelp Places API (formerly Yelp Fusion), Yelp Insights API (formerly Yelp Fusion Insights) and Yelp Guest Manager programs. Net Revenue by Product (In thousands; unaudited) Third Quarter 2025 Financial Review Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Net revenue by product: Advertising revenue by category: Services $ 243,805 $ 228,009 $ 716,183 $ 654,252 Restaurants, Retail & Other 113,547 116,397 336,867 349,130 Total advertising 357,352 344,406 1,053,050 1,003,382 Other 18,686 15,938 51,916 46,730 Total net revenue $ 376,038 $ 360,344 $ 1,104,966 $ 1,050,112 Net Revenue +4% $360M $376M 3Q24 3Q25

Ye lp Q 3 20 25 14 24 Operating expenses, net income & adjusted EBITDA Cost of revenue (exclusive of depreciation and amortization) was $36 million in the third quarter of 2025, up 12% from the third quarter of 2024. The increase was primarily driven by an increase in revenue share payments due to our acquisition of RepairPal, higher advertising fulfillment costs, largely attributable to higher costs to syndicate advertising budgets on certain third-party sites, as well as an increase in merchant credit card processing fees from an increase in advertising revenue. Sales and marketing expenses were $151 million in the third quarter of 2025, up 4% from the third quarter of 2024. The increase was primarily driven by an increase in employee-related costs primarily as a result of higher average headcount in sales and marketing roles. Product development expenses were $78 million in the third quarter of 2025, relatively consistent with the prior-year period. General and administrative expenses were $45 million in the third quarter of 2025, down 8% from the third quarter of 2024. The decrease was primarily driven by impairment charges incurred in the prior-year period related to the right-of-use assets and leasehold improvements for office space that was subleased. The decrease was partially offset by an increase in employee-related costs primarily driven by higher cost of labor, partially offset by lower average headcount in general and administrative roles. Total costs and expenses were $323 million in the third quarter of 2025, up 3% from $314 million in the third quarter of 2024. COR % of Revenue 9% 10% 3Q24 3Q25 S&M % of Revenue 40% 40% 3Q24 3Q25 PD % of Revenue 22% 21% 3Q24 3Q25 G&A % of Revenue 14%* 12% 3Q24 3Q25 *Includes impact from impairment charges.

Ye lp Q 3 20 25 15 24 Other income, net was $5 million in the third quarter of 2025, down 26% from the third quarter of 2024. The decrease was primarily driven by lower interest income due to lower cash, cash equivalents and marketable securities balances and lower federal interest rates. Provision for income taxes was $19 million in the third quarter of 2025, compared to $15 million in the third quarter of 2024. The increase was primarily due to an increase in profit before tax as well as an increase in the discrete tax expense primarily related to SBC and uncertain tax positions. Net income was $39 million in the third quarter of 2025 compared to $38 million in the third quarter of 2024. Net income margin was 10% compared to 11% in the third quarter of 2024. Diluted net income per share was $0.61 in the third quarter of 2025, up from $0.56 in the third quarter of 2024, reflecting the decrease in weighted-average diluted shares outstanding and the increase in net income. Adjusted EBITDA was $98 million in the third quarter of 2025, down 3% from $101 million in the third quarter of 2024. Adjusted EBITDA margin decreased to 26% in the third quarter of 2025 from 28% in the third quarter of 2024. Balance sheet and cash flow At the end of September 2025, we held $334 million in cash, cash equivalents and marketable securities on our condensed consolidated balance sheet, with no debt. 19% 17% 19% 17% 8% 7% M ar gi n Net Income +2% $38M $39M 3Q24 3Q25 10%11% Adjusted EBITDA -3% $101M $98M 3Q24 3Q25 M ar gi n 28% 26%

Ye lp Q 3 20 25 16 24 Business Outlook We anticipate that the heightened macroeconomic uncertainties experienced in recent quarters will persist in the fourth quarter and, together with typical seasonality in Services, will result in net revenue decreasing from the third quarter. As such, we are lowering our revenue outlook range for the full year. We now expect net revenue will be in the range of $1.460 billion to $1.465 billion, reflecting a decrease of $8 million at the midpoint. Turning to margin, we expect fourth quarter expenses to remain relatively consistent with the third quarter as we remain focused on disciplined expense management. In addition, we expect our efforts to reduce SBC will continue to act as a headwind to adjusted EBITDA, but will not impact net income. Balancing these factors with our third quarter outperformance, we are increasing our range and now expect full year adjusted EBITDA to be in the range of $360 million to $365 million, reflecting an increase of $8 million at the midpoint. $358M Adjusted EBITDA Outlook 2024 2025E $360M-$365M * Yelp has not reconciled its adjusted EBITDA outlook to net income (loss) under GAAP because it does not provide an outlook for GAAP net income (loss) due to the uncertainty and potential variability of other income, net and provision for (benefit from) income taxes, which are reconciling items between adjusted EBITDA and GAAP net income (loss). Because Yelp cannot reasonably predict such items, a reconciliation of the non-GAAP financial measure outlook to the corresponding GAAP measure is not available without unreasonable effort. We caution, however, that such items could have a significant impact on the calculation of GAAP net income (loss). For more information regarding the non-GAAP financial measures discussed in this release, please see “Non-GAAP Financial Measures” and “Reconciliation of GAAP to Non-GAAP Financial Measures” below. 2024 2025E $1.412B $1.460B-$1.465B Net Revenue Outlook Fourth Quarter 2025 Full Year 2025 Net revenue $355M to $360M $1.460B to $1.465B Adjusted EBITDA* $77M to $82M $360M to $365M Stock-based compensation expense as a % of Net revenue ~8% ~9% Depreciation and amortization as a % of Net revenue ~3% ~3%

Ye lp Q 3 20 25 17 24 Quarterly Earnings Webcast Yelp will host a live webcast today at 2:00 p.m. PST to discuss the third quarter 2025 financial results and outlook for the fourth quarter and full year 2025. The webcast can be accessed on the Yelp Investor Relations website at yelp-ir.com. A replay of the webcast will be available at the same website. About Yelp Yelp Inc. (yelp.com) is a community-driven platform that connects people with great local businesses. Millions of people rely on Yelp for useful and trusted local business information, reviews and photos to help inform their spending decisions. As a one-stop local platform, Yelp helps consumers easily discover, connect and transact with businesses across a broad range of categories by making it easy to request a quote for a service, book a table at a restaurant, and more. Yelp was founded in San Francisco in 2004.

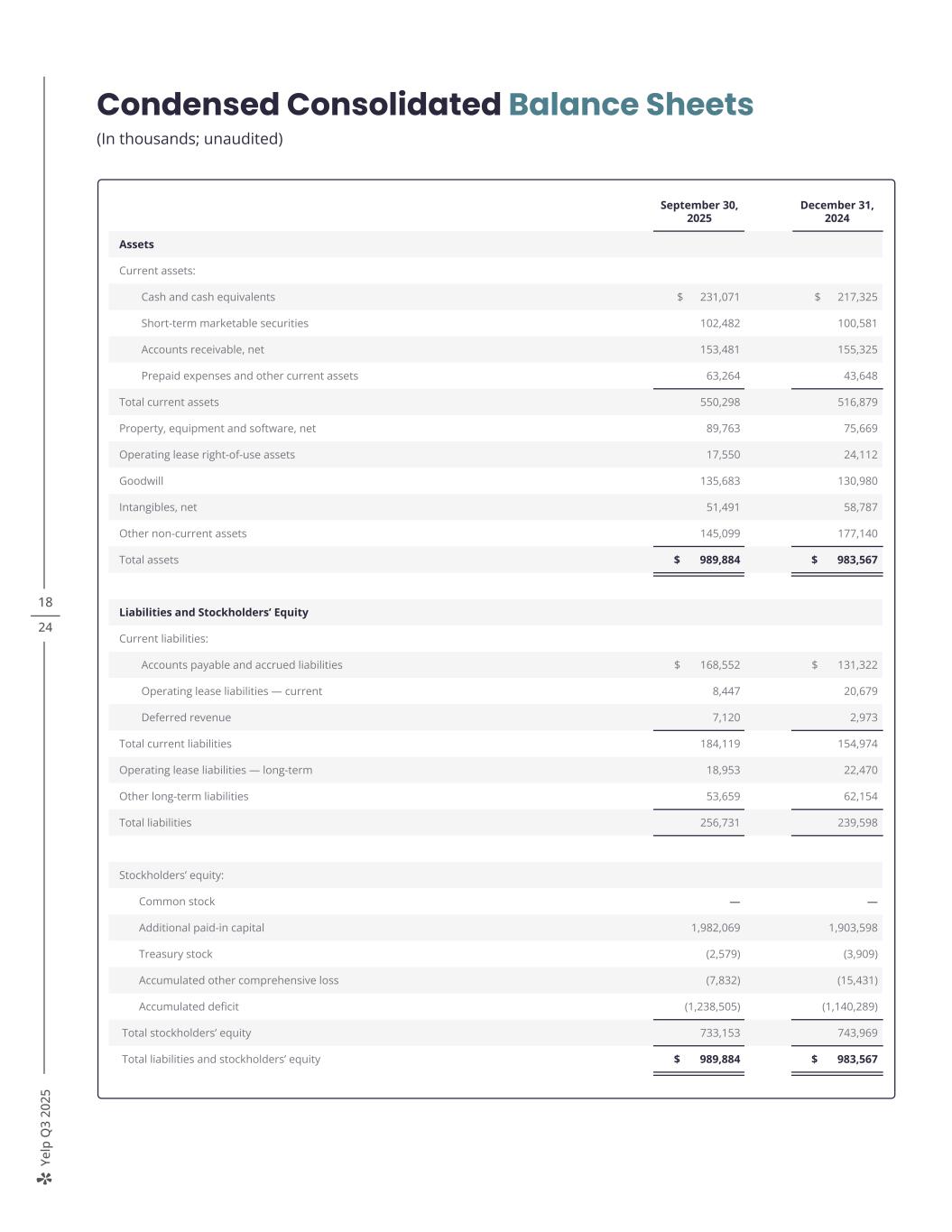

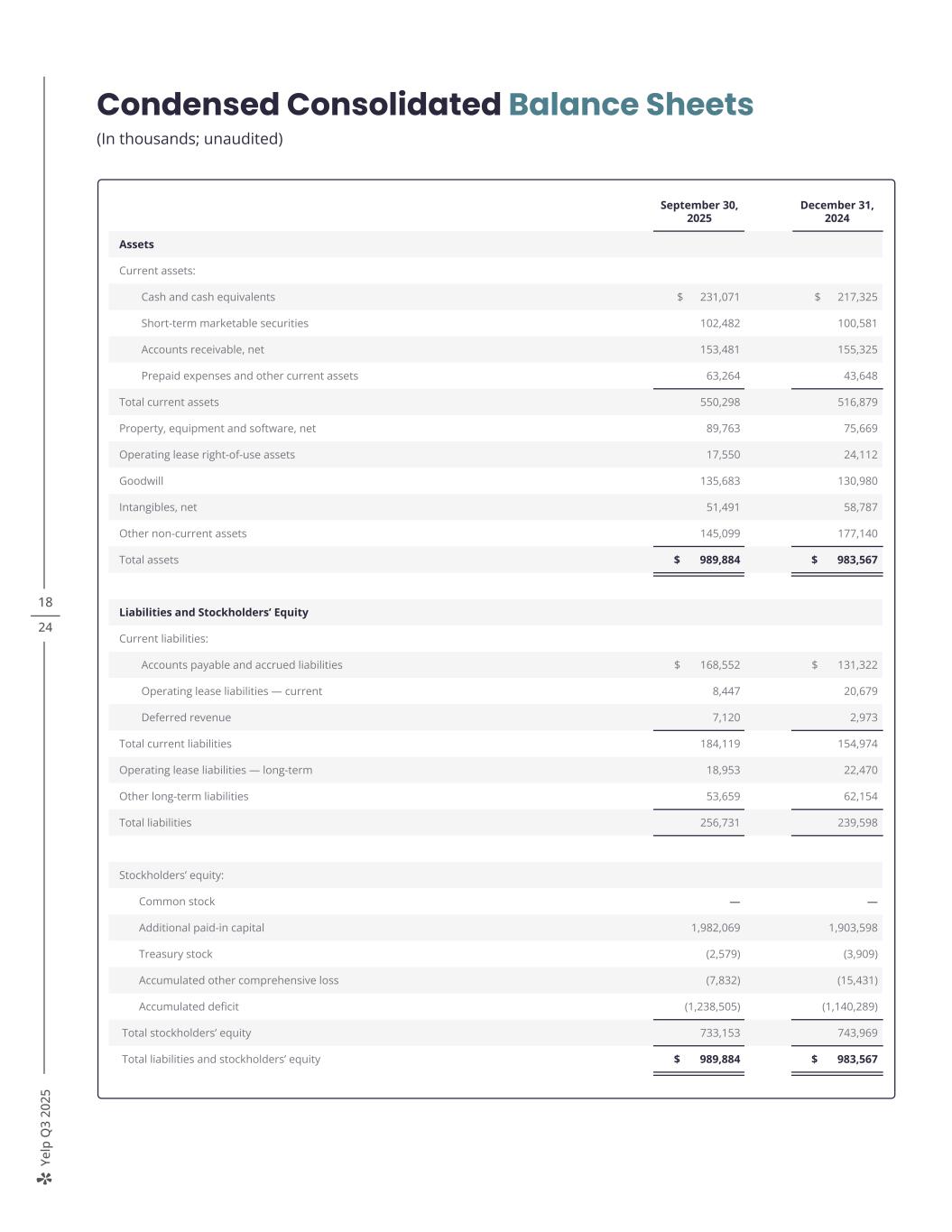

Ye lp Q 3 20 25 18 24 Condensed Consolidated Balance Sheets (In thousands; unaudited) September 30, 2025 December 31, 2024 Assets Current assets: Cash and cash equivalents $ 231,071 $ 217,325 Short-term marketable securities 102,482 100,581 Accounts receivable, net 153,481 155,325 Prepaid expenses and other current assets 63,264 43,648 Total current assets 550,298 516,879 Property, equipment and software, net 89,763 75,669 Operating lease right-of-use assets 17,550 24,112 Goodwill 135,683 130,980 Intangibles, net 51,491 58,787 Other non-current assets 145,099 177,140 Total assets $ 989,884 $ 983,567 Liabilities and Stockholders’ Equity Current liabilities: Accounts payable and accrued liabilities $ 168,552 $ 131,322 Operating lease liabilities — current 8,447 20,679 Deferred revenue 7,120 2,973 Total current liabilities 184,119 154,974 Operating lease liabilities — long-term 18,953 22,470 Other long-term liabilities 53,659 62,154 Total liabilities 256,731 239,598 Stockholders’ equity: Common stock — — Additional paid-in capital 1,982,069 1,903,598 Treasury stock (2,579) (3,909) Accumulated other comprehensive loss (7,832) (15,431) Accumulated deficit (1,238,505) (1,140,289) Total stockholders’ equity 733,153 743,969 Total liabilities and stockholders’ equity $ 989,884 $ 983,567

Ye lp Q 3 20 25 19 24 Condensed Consolidated Statements of Operations (In thousands, except per share data; unaudited) Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Net revenue $ 376,038 $ 360,344 $ 1,104,966 $ 1,050,112 Costs and expenses: Cost of revenue¹ 36,288 32,382 106,563 90,414 Sales and marketing¹ 150,740 144,631 441,636 442,715 Product development¹ 78,137 77,748 240,404 251,055 General and administrative¹ 45,462 49,605 143,487 139,471 Depreciation and amortization 12,526 9,326 37,241 28,841 Total costs and expenses 323,153 313,692 969,331 952,496 Income from operations 52,885 46,652 135,635 97,616 Other income, net 5,350 7,231 16,816 25,277 Income before income taxes 58,235 53,883 152,451 122,893 Provision for income taxes 18,911 15,443 44,647 32,263 Net income attributable to common stockholders $ 39,324 $ 38,440 $ 107,804 $ 90,630 Net income per share attributable to common stockholders: Basic $ 0.62 $ 0.57 $ 1.68 $ 1.34 Diluted $ 0.61 $ 0.56 $ 1.63 $ 1.27 Weighted-average shares used to compute net income per share attributable to common stockholders: Basic 63,025 67,219 64,136 67,862 Diluted 64,216 69,163 65,975 71,109 ¹ Includes stock-based compensation expense as follows: Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Cost of revenue $ 997 $ 1,301 $ 3,238 $ 4,099 Sales and marketing 7,052 8,588 21,986 25,905 Product development 16,607 20,887 53,862 67,074 General and administrative 8,225 8,696 26,039 26,318 Total stock-based compensation $ 32,881 $ 39,472 $ 105,125 $ 123,396

Ye lp Q 3 20 25 20 24 Condensed Consolidated Statements of Cash Flows (In thousands; unaudited) Nine Months Ended September 30, 2025 2024 Operating Activities Net income $ 107,804 $ 90,630 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 37,241 28,841 Provision for credit losses 34,155 35,111 Stock-based compensation 105,125 123,396 Amortization of right-of-use assets 8,834 11,363 Deferred income taxes 29,829 (17,408) Amortization of deferred contract cost 17,963 18,604 Asset impairment — 5,914 Other adjustments, net 2,523 (2,717) Changes in operating assets and liabilities: Accounts receivable (33,013) (44,095) Prepaid expenses and other assets (32,692) (14,302) Operating lease liabilities (18,284) (29,333) Accounts payable, accrued liabilities and other liabilities 28,062 8,838 Net cash provided by operating activities 287,547 214,842 Investing Activities Purchases of marketable securities — available-for-sale (60,987) (89,251) Sales and maturities of marketable securities — available-for-sale 59,782 83,380 Purchases of other investments (700) (2,500) Purchases of property, equipment and software (36,136) (26,337) Other investing activities 64 268 Net cash used in investing activities (37,977) (34,440) Financing Activities Proceeds from issuance of common stock for employee stock-based plans 12,295 13,436 Taxes paid related to the net share settlement of equity awards (46,624) (58,044) Repurchases of common stock (203,450) (188,399) Net cash used in financing activities (237,779) (233,007) Effect of exchange rate changes on cash, cash equivalents and restricted cash 2,016 580 Change in cash, cash equivalents and restricted cash 13,807 (52,025) Cash, cash equivalents and restricted cash — Beginning of period 217,682 314,002 Cash, cash equivalents and restricted cash — End of period $ 231,489 $ 261,977

Ye lp Q 3 20 25 21 24 Reconciliation of GAAP to Non-GAAP Financial Measures (In thousands, except percentages; unaudited) 1 Includes the release of a $3.1 million reserve related to a one-time payroll tax credit in the nine months ended September 30, 2024. 2 Recorded within general and administrative expenses on our condensed consolidated statements of operations. ³ Represents expenses recorded in connection with an indemnification obligation assumed in the RepairPal acquisition, which we do not consider to be part of our ongoing operations. Amounts reflect the reversal of certain expenses recorded in prior periods as a result of the negotiated reduction of such expenses during the three months ended September 30, 2025. We expect to be indemnified for such expenses and will also exclude any such amounts from adjusted EBITDA. Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Reconciliation of Net Income to Adjusted EBITDA: Net income $ 39,324 $ 38,440 $ 107,804 $ 90,630 Provision for income taxes 18,911 15,443 44,647 32,263 Other income, net¹ (5,350) (7,231) (16,816) (25,277) Depreciation and amortization 12,526 9,326 37,241 28,841 Stock-based compensation 32,881 39,472 105,125 123,396 Asset impairment² — 5,914 — 5,914 Expenses related to acquired indemnification obligation2,3 (226) — 4,955 — Acquisition and integration costs² — — 539 — Fees related to shareholder activism² — — — 1,168 Adjusted EBITDA $ 98,066 $ 101,364 $ 283,495 $ 256,935 Net revenue $ 376,038 $ 360,344 $ 1,104,966 $ 1,050,112 Net income margin 10 % 11 % 10 % 9 % Adjusted EBITDA margin 26 % 28 % 26 % 24 % Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow: Net cash provided by operating activities $ 131,518 $ 102,298 $ 287,547 $ 214,842 Purchases of property, equipment and software (12,581) (9,763) (36,136) (26,337) Free cash flow $ 118,937 $ 92,535 $ 251,411 $ 188,505 Net cash used in investing activities $ (11,357) $ (11,394) $ (37,977) $ (34,440) Net cash used in financing activities $ (86,197) $ (82,596) $ (237,779) $ (233,007)

Ye lp Q 3 20 25 22 24 Key Financial and Operational Metrics (In thousands, except for percentages; unaudited) 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 Advertising Revenue by Category Services1 $180,957 $178,292 $183,520 $200,274 $206,178 $203,140 $203,288 $222,955 $228,009 $224,840 $231,576 $240,802 $243,805 Restaurants, Retail & Other2 $112,707 $115,692 $113,623 $121,698 $123,854 $124,231 $114,350 $118,383 $116,397 $120,798 $110,425 $112,895 $113,547 Total Advertising Revenue $293,664 $293,984 $297,143 $321,972 $330,032 $327,371 $317,638 $341,338 $344,406 $345,638 $342,001 $353,697 $357,352 Paying Advertising Locations by Category3 Services4 238 231 238 238 235 245 252 254 252 250 261 260 258 Restaurants, Retail & Other2 334 314 316 325 326 299 278 277 272 271 256 255 254 Total Paying Advertising Locations 572 545 554 563 561 544 530 531 524 521 517 515 512 Year-over-Year Percentage Change in Ad Clicks & Average CPC Ad Clicks5 -15% -7% 1% 0% 9% 9% 8% 9% 2% 5% -3% -7% -11% Average CPC6 36% 23% 14% 14% 4% 4% -1% -1% 3% 0% 9% 11% 14% 1 Includes Home, Local, Auto, Professional, Pets, Real Estate, Financial and Event Services categories 2 Includes Restaurants, Shopping, Beauty & Fitness, Health and Other categories 3 On a monthly average basis 4 As of the first quarter of 2025, includes business locations from which RepairPal recognized revenue 5 Ad clicks represent user interactions with our pay-for-performance advertising products, including clicks on advertisements on our website and mobile app, clicks on syndicated advertisements on third-party platforms, and Request-a-Quote submissions. Ad clicks do not include user interactions with ads sold through our advertising partnerships. 6 We define Average CPC as revenue from our performance-based ad products — excluding revenue from our advertising partnerships as well as certain revenue adjustments that do not impact the outcome of an auction for an individual ad click, such as refunds — divided by the total number of ad clicks for a given period. More information about the Company, including the Company’s Key Operational and Financial Metrics definitions can be found in the Company's most recent Quarterly or Annual Report filed with the SEC, available at yelp-ir.com or the SEC’s website at sec.gov.

Ye lp Q 3 20 25 Non-GAAP Financial Measures This letter and statements made during the above referenced webcast may include information relating to Adjusted EBITDA, Adjusted EBITDA margin and Free cash flow, each of which is a “non-GAAP financial measure.” We define Adjusted EBITDA as net income (loss), adjusted to exclude: provision for (benefit from) income taxes; other income, net; depreciation and amortization; stock-based compensation expense; and, in certain periods, certain other income and expense items, such as impairment charges, expenses related to acquired indemnification obligations, acquisition and integration costs, fees related to shareholder activism and other items that we deem not to be indicative of our ongoing operating performance. We define Adjusted EBITDA margin as Adjusted EBITDA divided by net revenue. We define Free cash flow as cash flow from operating activities, less cash used for purchases of property, equipment and software. Adjusted EBITDA and Free cash flow, which are not prepared under any comprehensive set of accounting rules or principles, have limitations as analytical tools and you should not consider them in isolation or as substitutes for analysis of Yelp’s financial results as reported in accordance with GAAP. In particular, Adjusted EBITDA and Free cash flow should not be viewed as substitutes for, or superior to, net income (loss) or net cash provided by (used in) operating activities prepared in accordance with GAAP as measures of profitability or liquidity. Some of these limitations are: > although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect all cash capital expenditure requirements for such replacements or for new capital expenditure requirements; > Adjusted EBITDA does not reflect changes in, or cash requirements for, Yelp’s working capital needs; > Adjusted EBITDA does not reflect the impact of the recording or release of valuation allowances or tax payments that may represent a reduction in cash available to Yelp; > Adjusted EBITDA does not consider the potentially dilutive impact of equity-based compensation; > Adjusted EBITDA does not take into account certain income and expense items, such as impairment charges, expenses related to acquired indemnification obligations, acquisition and integration costs and fees related to shareholder activism, or other costs that management determines are not indicative of our ongoing operating performance; > Free cash flow does not represent the total residual cash flow available for discretionary purposes because it does not reflect our contractual commitments or obligations; and > other companies, including those in Yelp’s industry, may calculate Adjusted EBITDA and Free cash flow differently, which reduces their usefulness as comparative measures. Because of these limitations, you should consider Adjusted EBITDA, Adjusted EBITDA margin and Free cash flow alongside other financial performance measures, including net income (loss), net cash provided by (used in) operating activities and Yelp’s other GAAP results. Forward-Looking Statements This letter contains, and statements made during the above-referenced webcast will contain, forward-looking statements relating to, among other things, the future performance of Yelp and its consolidated subsidiaries, that are based on Yelp’s current expectations, forecasts and assumptions and involve risks and uncertainties. These statements include, but are not limited to, statements regarding: Yelp’s expected financial results; Yelp’s market opportunity; Yelp’s plans and ability to drive profitable growth and shareholder value in 2025 and the long term as well as to capture demand across advertising categories; Yelp’s plans to continue to drive growth in Services, including in Home Services and additional Services categories; Yelp’s plans for and ability to execute on its strategic initiatives as well as the expected results thereof; Yelp’s plans for and ability to deliver on its product roadmap, the expected results thereof as well as opportunities to drive growth through such product roadmap; Yelp’s plans for strategic acquisitions and partnerships, as well as the impact of such acquisitions or partnerships and their expected benefits; Yelp’s plans regarding the integration of AI and LLMs into its strategy as well as existing and new product offerings, and the expected benefits therefrom; Yelp’s expectations regarding the impact of its products on its customers; Yelp’s expectations regarding headcount; Yelp’s plans to reduce SBC expense as a percentage of revenue and the expected benefits therefrom; Yelp’s expectations regarding its share repurchase program; and Yelp’s expectations with respect to trends impacting its results of operations. 23 24

Ye lp Q 3 20 25 Yelp’s actual results could differ materially from those predicted or implied by such forward-looking statements and reported results should not be considered as an indication of future performance. Factors that could cause or contribute to such differences include, but are not limited to: > macroeconomic uncertainty — including related to labor and supply chain issues, inflation and recessionary concerns, interest rates and tariffs — and its effect on consumer behavior, user activity and advertiser spending; > Yelp’s ability to maintain and expand its base of advertisers, particularly if advertiser turnover substantially worsens, competition continues to increase and/or consumer demand significantly degrades; > Yelp’s ability to drive continued growth through its strategic initiatives; > Yelp’s ability to successfully manage acquisitions of new businesses, solutions or technologies, such as RepairPal, and to successfully integrate those businesses, solutions or technologies; > Yelp’s ability to continue to effectively operate with a primarily remote work force and attract and retain key talent; > Yelp’s limited operating history in an evolving industry; > Yelp’s ability to generate and maintain sufficient high-quality content from its users; > potential strategic opportunities and Yelp’s ability to monetize acquired products, solutions or technologies; > Yelp’s reliance on traffic to its website from search engines like Google and Bing and the quality and reliability of such traffic; > maintaining a strong brand and managing negative publicity that may arise; and > Yelp’s ability to timely upgrade and develop its systems, infrastructure and customer service capabilities. Factors that could cause or contribute to such differences also include, but are not limited to, those factors that could affect Yelp’s business, operating results and stock price included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Yelp’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q at yelp-ir.com or the SEC’s website at sec.gov. Undue reliance should not be placed on the forward-looking statements in this letter or the above-referenced webcast, which are based on information available to Yelp on the date hereof. Such forward-looking statements do not include the potential impact of any acquisitions or divestitures that may be announced and/or completed after the date hereof. Yelp assumes no obligation to update such statements. 24 24