Q2 2023 Letter to Shareholders August 3, 2023 | yelp-ir.com

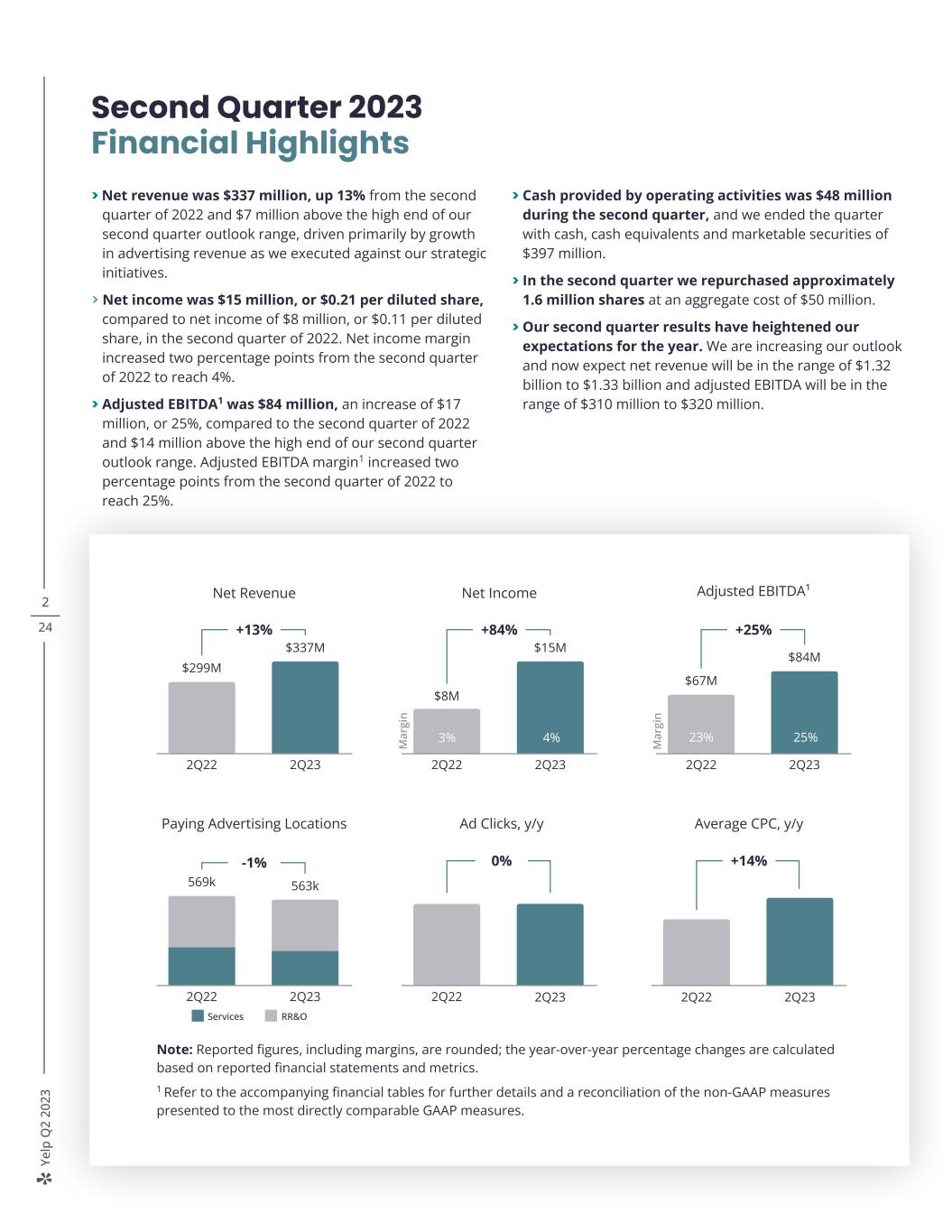

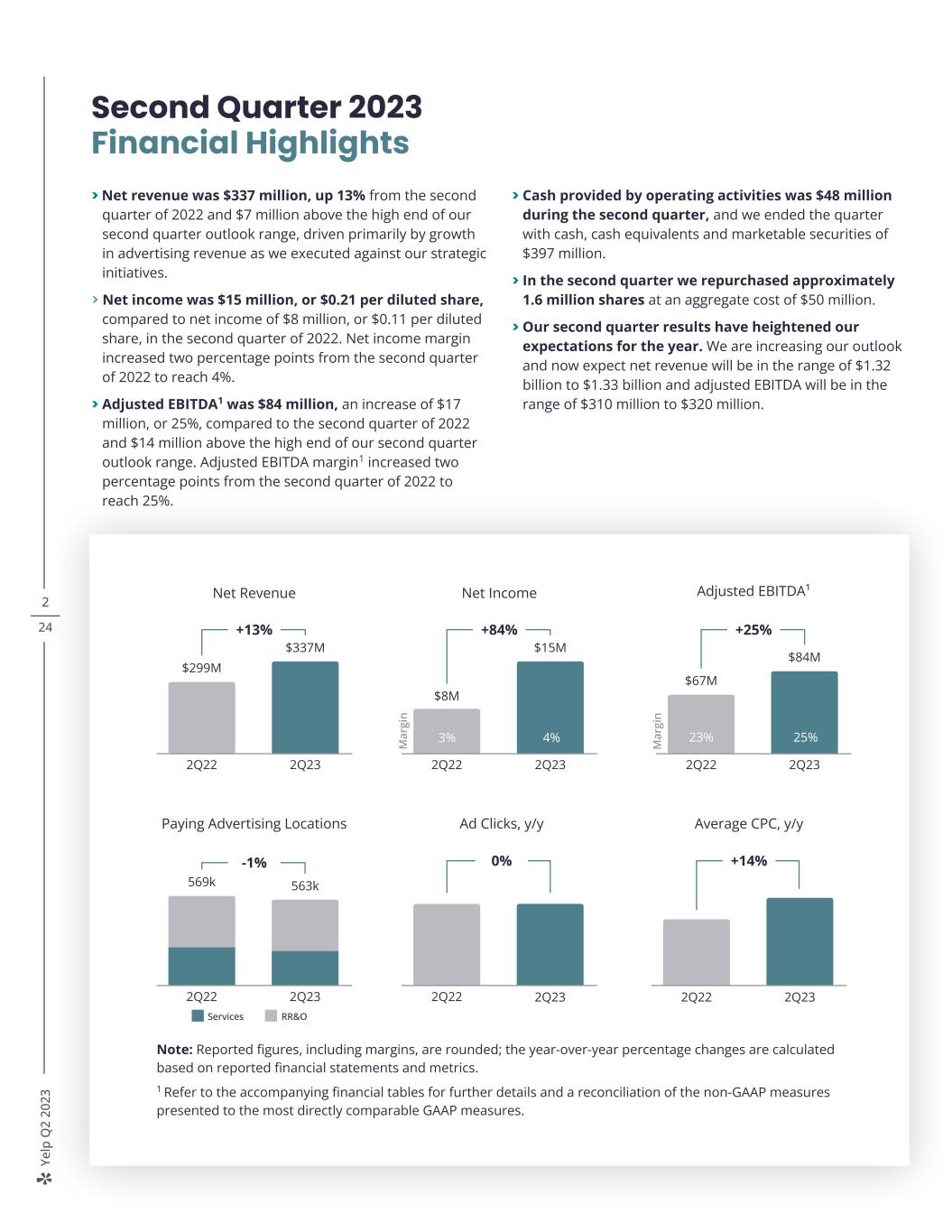

Ye lp Q 2 20 23 2 24 Note: Reported figures, including margins, are rounded; the year-over-year percentage changes are calculated based on reported financial statements and metrics. 1 Refer to the accompanying financial tables for further details and a reconciliation of the non-GAAP measures presented to the most directly comparable GAAP measures. Second Quarter 2023 Financial Highlights > Net revenue was $337 million, up 13% from the second quarter of 2022 and $7 million above the high end of our second quarter outlook range, driven primarily by growth in advertising revenue as we executed against our strategic initiatives. > Net income was $15 million, or $0.21 per diluted share, compared to net income of $8 million, or $0.11 per diluted share, in the second quarter of 2022. Net income margin increased two percentage points from the second quarter of 2022 to reach 4%. > Adjusted EBITDA1 was $84 million, an increase of $17 million, or 25%, compared to the second quarter of 2022 and $14 million above the high end of our second quarter outlook range. Adjusted EBITDA margin1 increased two percentage points from the second quarter of 2022 to reach 25%. > Cash provided by operating activities was $48 million during the second quarter, and we ended the quarter with cash, cash equivalents and marketable securities of $397 million. > In the second quarter we repurchased approximately 1.6 million shares at an aggregate cost of $50 million. > Our second quarter results have heightened our expectations for the year. We are increasing our outlook and now expect net revenue will be in the range of $1.32 billion to $1.33 billion and adjusted EBITDA will be in the range of $310 million to $320 million. 19% 17% Net Revenue +13% $299M $337M 2Q22 2Q23 Ad Clicks, y/y 0% 2Q22 2Q23 Average CPC, y/y +14% 2Q22 2Q23 Paying Advertising Locations -1% 569k 563k 2Q22 2Q23 Services RR&O Adjusted EBITDA¹ +25% $67M $84M 2Q22 2Q23 M ar gi n 23% 25%8% 7% Net Income +84% $8M $15M 2Q22 2Q23 M ar gi n 3 4

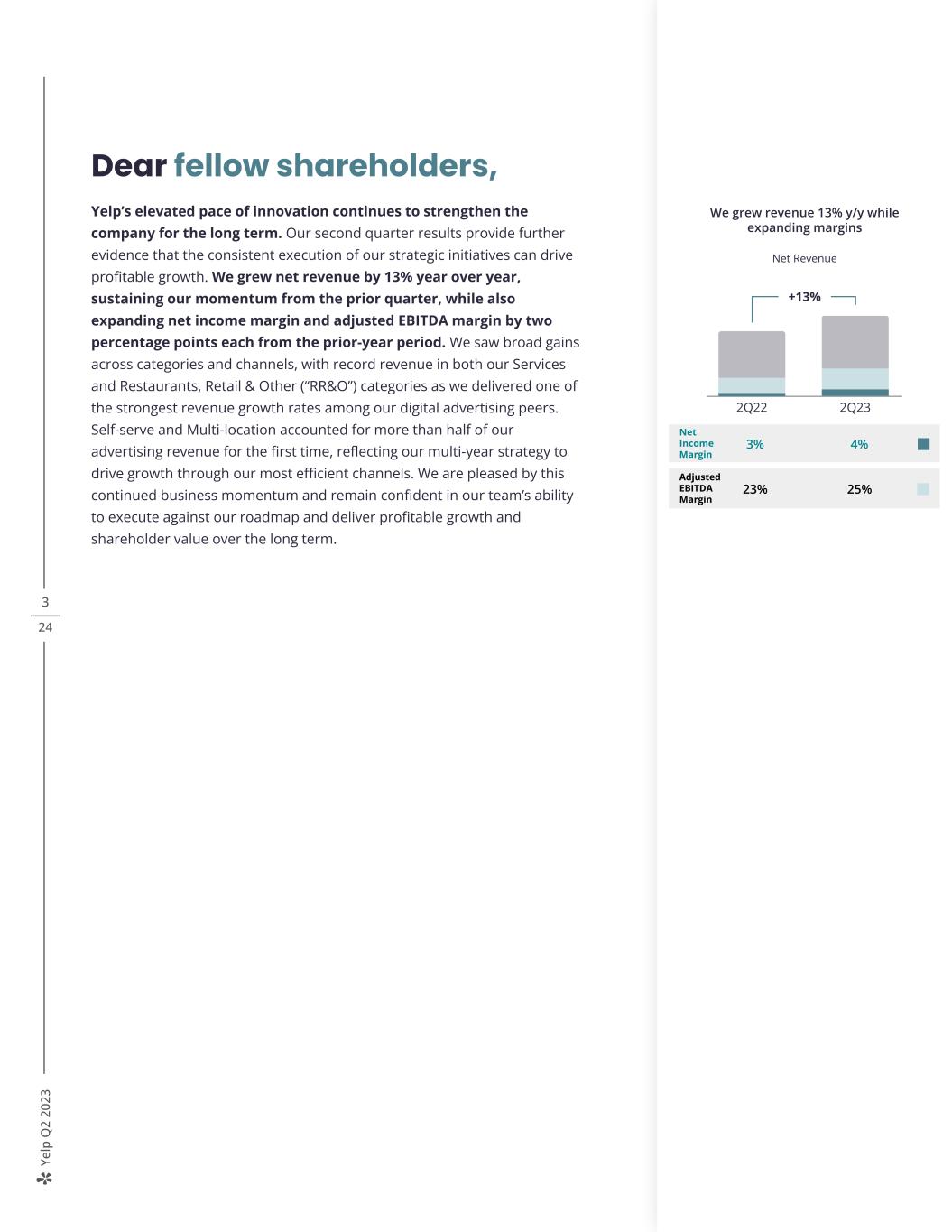

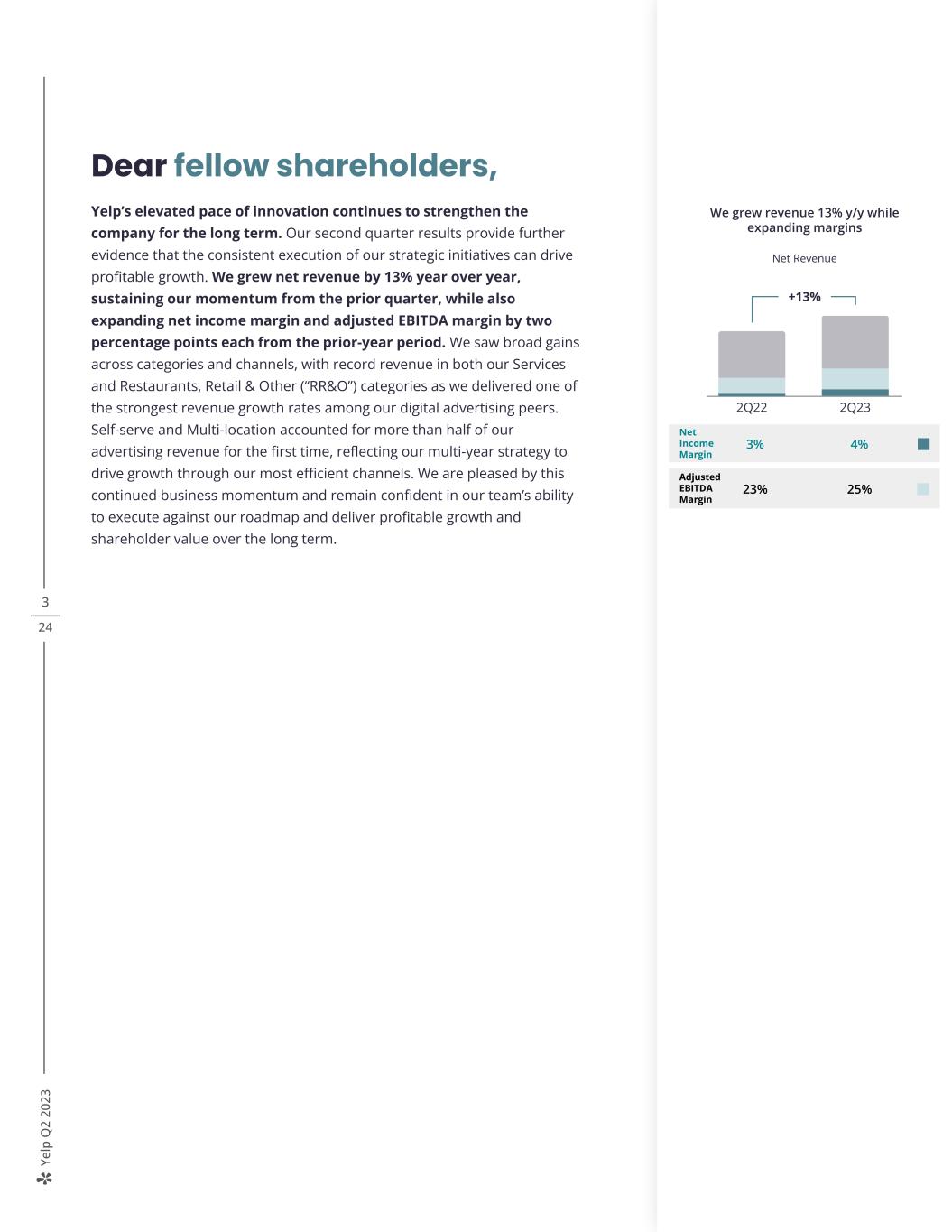

Ye lp Q 2 20 23 3 24 Dear fellow shareholders, Yelp’s elevated pace of innovation continues to strengthen the company for the long term. Our second quarter results provide further evidence that the consistent execution of our strategic initiatives can drive profitable growth. We grew net revenue by 13% year over year, sustaining our momentum from the prior quarter, while also expanding net income margin and adjusted EBITDA margin by two percentage points each from the prior-year period. We saw broad gains across categories and channels, with record revenue in both our Services and Restaurants, Retail & Other (“RR&O”) categories as we delivered one of the strongest revenue growth rates among our digital advertising peers. Self-serve and Multi-location accounted for more than half of our advertising revenue for the first time, reflecting our multi-year strategy to drive growth through our most efficient channels. We are pleased by this continued business momentum and remain confident in our team’s ability to execute against our roadmap and deliver profitable growth and shareholder value over the long term. Advertiser demand drove strong results in the first quarter Net Revenue +2 ppt 3% 4% 2Q22 2Q23 Net Income Margin +2 ppt 23% 25% 2Q22 2Q23 Adjusted EBITDA Margin +13% 2Q22 2Q23 +13% 2Q22 2Q23 +2 ppt y/y 23% 25% +2 ppt y/y 3% 4% +13% 2Q22 2Q23 We grew revenue 13% y/y while expanding margins Adjusted EBITDA Net Income 2Q22 2Q23 We grew revenue 13% y/y while expanding margins Net Income Margin 4%3% Adjusted EBITDA Margin 25%23% Net Income +13% Adjusted EBITDA 2Q22 2Q23 Net Income Margin 4%3% Adjusted EBITDA Margin 25%23% +13% We grew revenue 13% y/y while expanding margins Net Revenue

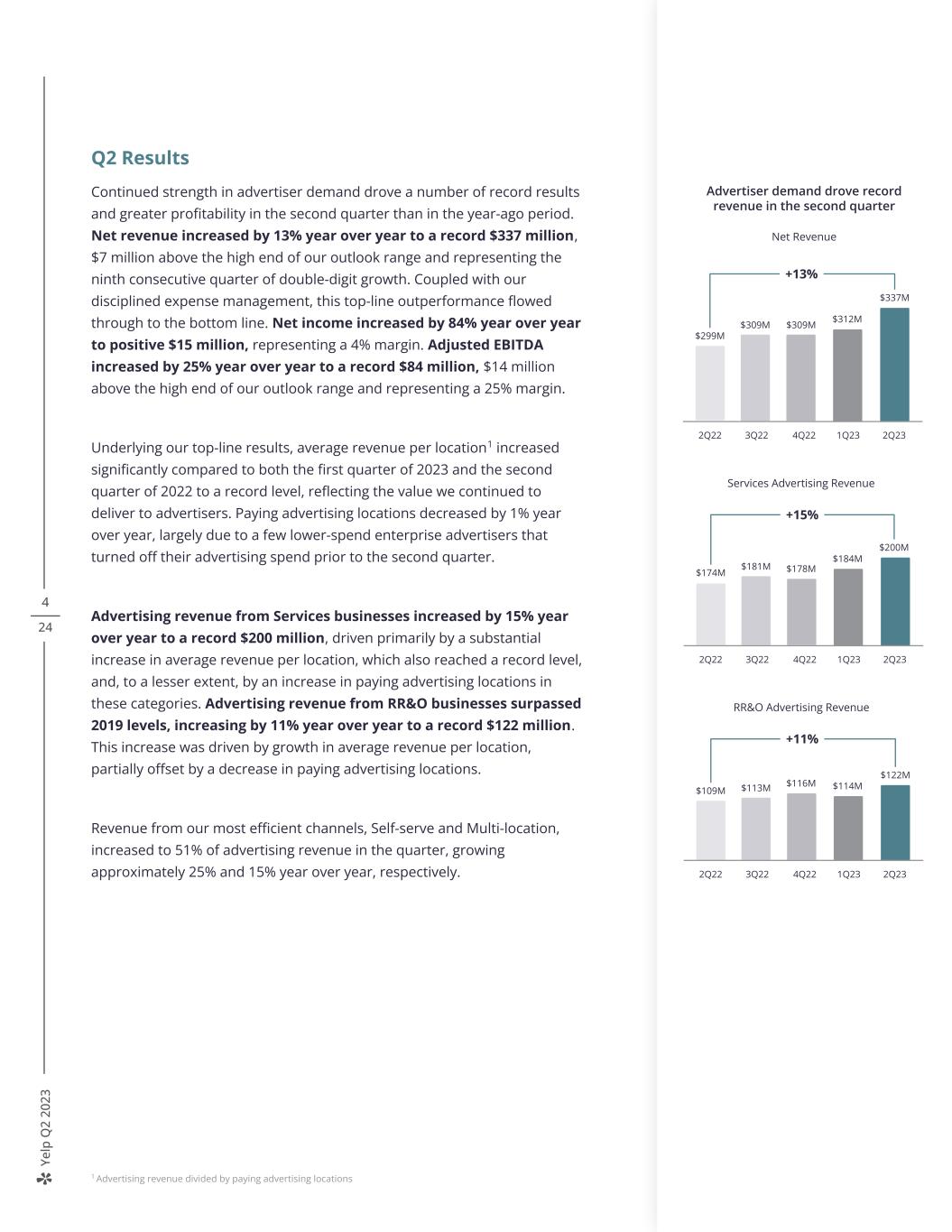

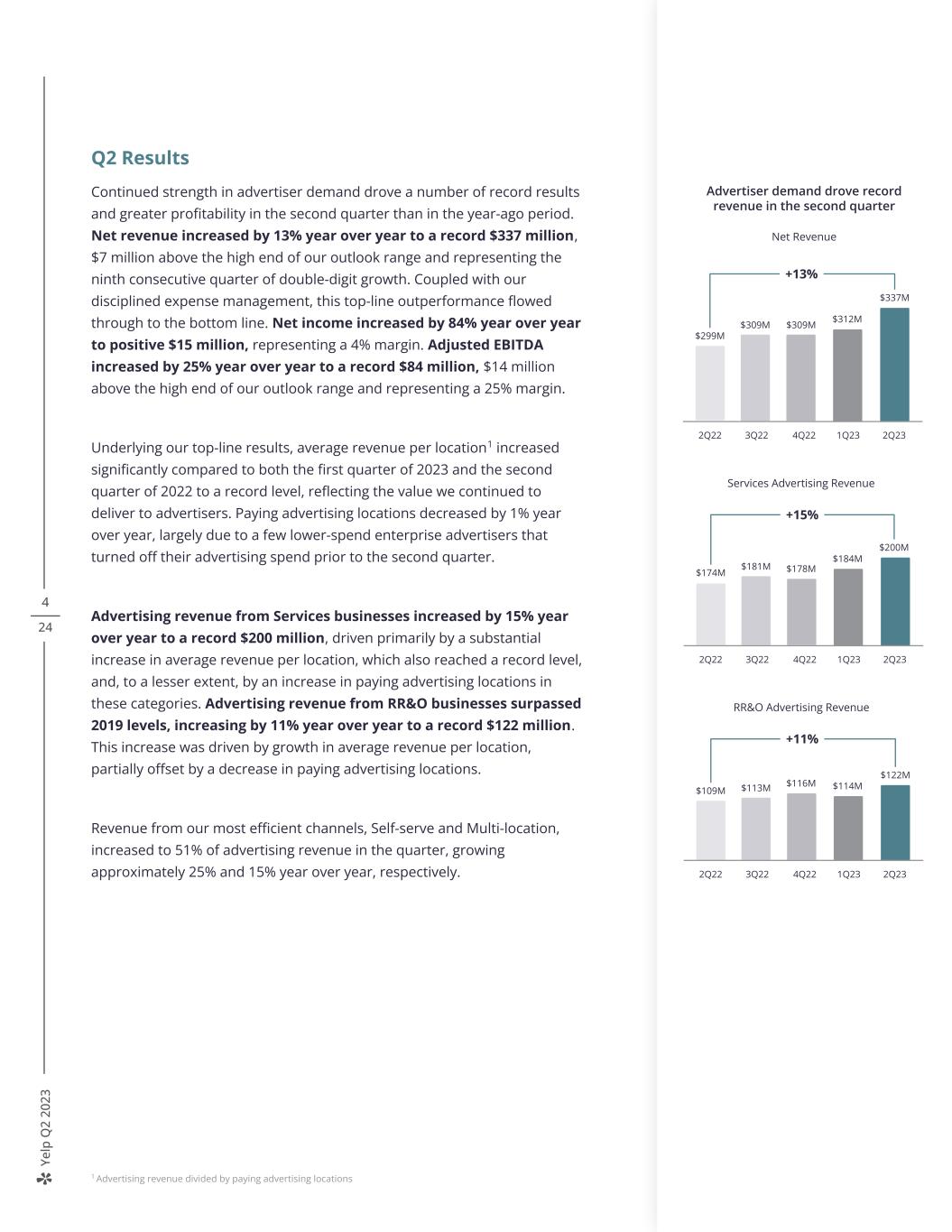

Ye lp Q 2 20 23 4 24 Q2 Results Continued strength in advertiser demand drove a number of record results and greater profitability in the second quarter than in the year-ago period. Net revenue increased by 13% year over year to a record $337 million, $7 million above the high end of our outlook range and representing the ninth consecutive quarter of double-digit growth. Coupled with our disciplined expense management, this top-line outperformance flowed through to the bottom line. Net income increased by 84% year over year to positive $15 million, representing a 4% margin. Adjusted EBITDA increased by 25% year over year to a record $84 million, $14 million above the high end of our outlook range and representing a 25% margin. Underlying our top-line results, average revenue per location1 increased significantly compared to both the first quarter of 2023 and the second quarter of 2022 to a record level, reflecting the value we continued to deliver to advertisers. Paying advertising locations decreased by 1% year over year, largely due to a few lower-spend enterprise advertisers that turned off their advertising spend prior to the second quarter. Advertising revenue from Services businesses increased by 15% year over year to a record $200 million, driven primarily by a substantial increase in average revenue per location, which also reached a record level, and, to a lesser extent, by an increase in paying advertising locations in these categories. Advertising revenue from RR&O businesses surpassed 2019 levels, increasing by 11% year over year to a record $122 million. This increase was driven by growth in average revenue per location, partially offset by a decrease in paying advertising locations. Revenue from our most efficient channels, Self-serve and Multi-location, increased to 51% of advertising revenue in the quarter, growing approximately 25% and 15% year over year, respectively. Services Advertising Revenue +15% $174M 2Q22 3Q22 4Q22 1Q23 2Q23 $200M $181M $178M $184M RR&O Advertising Revenue +11% $109M 2Q22 3Q22 4Q22 1Q23 2Q23 $122M $113M $116M $114M Advertiser demand drove record revenue in the second quarter Net Revenue +13% $299M 2Q22 3Q22 4Q22 1Q23 2Q23 $337M $309M $309M $312M 1 Advertising revenue divided by paying advertising locations

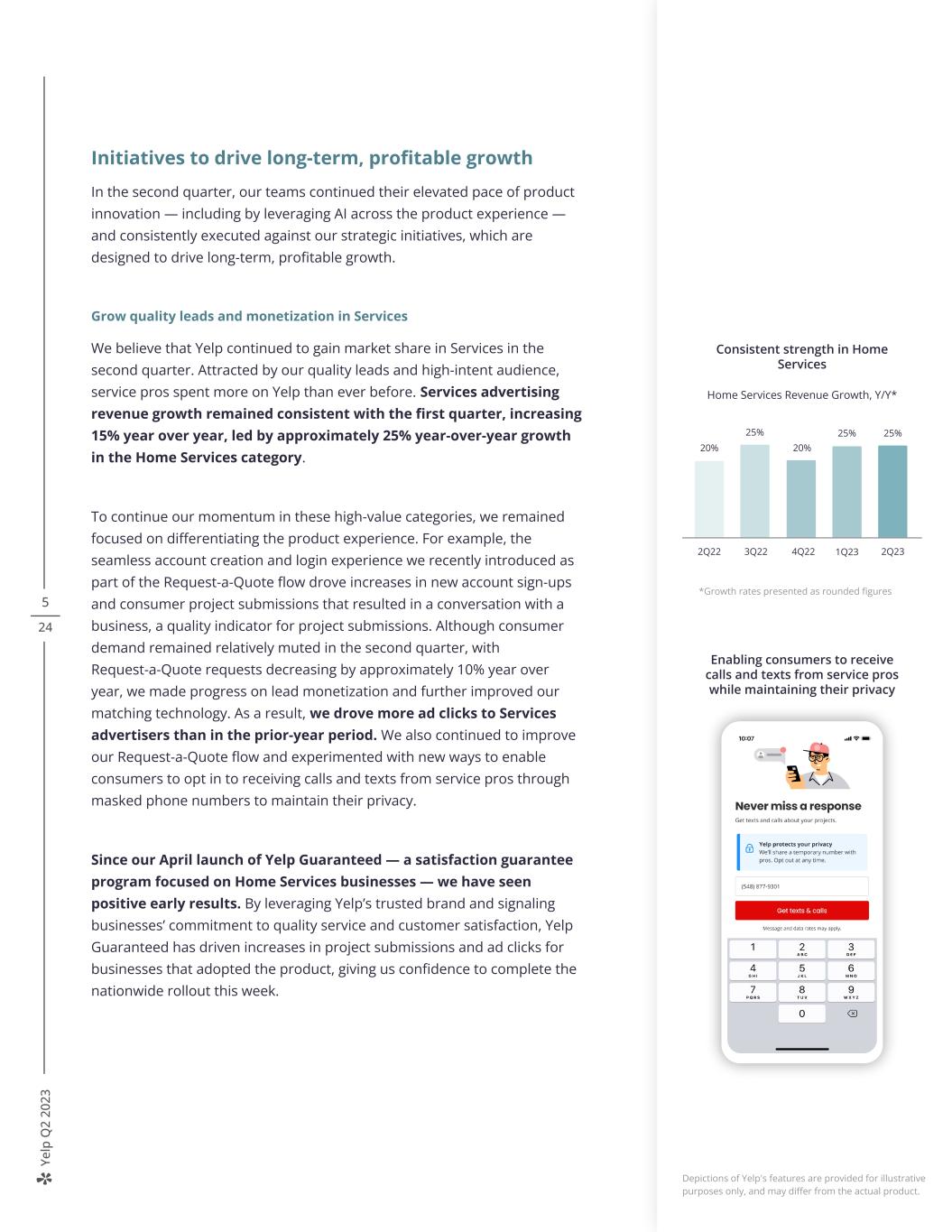

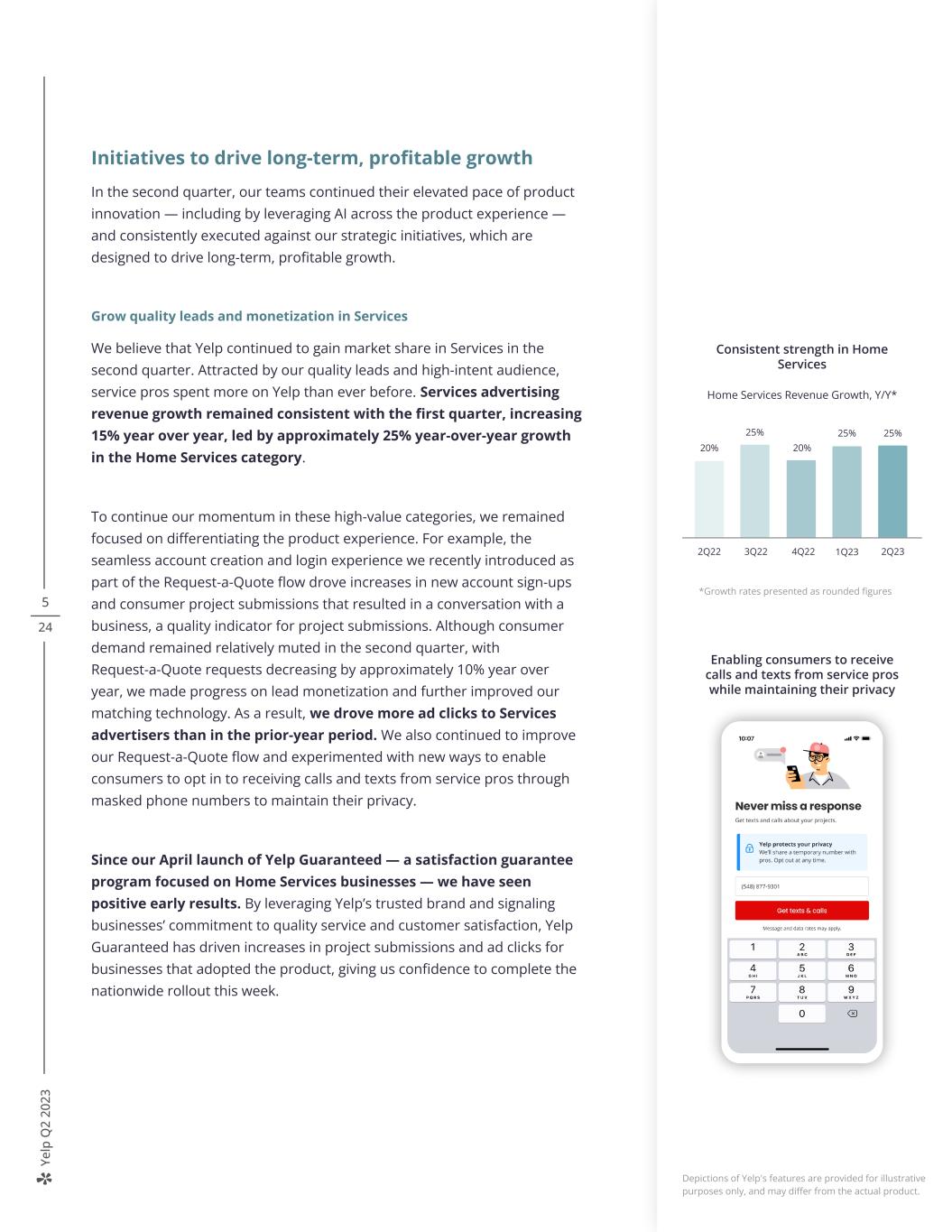

Ye lp Q 2 20 23 5 24 Initiatives to drive long-term, profitable growth In the second quarter, our teams continued their elevated pace of product innovation — including by leveraging AI across the product experience — and consistently executed against our strategic initiatives, which are designed to drive long-term, profitable growth. Grow quality leads and monetization in Services We believe that Yelp continued to gain market share in Services in the second quarter. Attracted by our quality leads and high-intent audience, service pros spent more on Yelp than ever before. Services advertising revenue growth remained consistent with the first quarter, increasing 15% year over year, led by approximately 25% year-over-year growth in the Home Services category. To continue our momentum in these high-value categories, we remained focused on differentiating the product experience. For example, the seamless account creation and login experience we recently introduced as part of the Request-a-Quote flow drove increases in new account sign-ups and consumer project submissions that resulted in a conversation with a business, a quality indicator for project submissions. Although consumer demand remained relatively muted in the second quarter, with Request-a-Quote requests decreasing by approximately 10% year over year, we made progress on lead monetization and further improved our matching technology. As a result, we drove more ad clicks to Services advertisers than in the prior-year period. We also continued to improve our Request-a-Quote flow and experimented with new ways to enable consumers to opt in to receiving calls and texts from service pros through masked phone numbers to maintain their privacy. Since our April launch of Yelp Guaranteed — a satisfaction guarantee program focused on Home Services businesses — we have seen positive early results. By leveraging Yelp’s trusted brand and signaling businesses’ commitment to quality service and customer satisfaction, Yelp Guaranteed has driven increases in project submissions and ad clicks for businesses that adopted the product, giving us confidence to complete the nationwide rollout this week. Consistent strength in Home Services Home Services Revenue Growth, Y/Y* 2Q22 3Q22 4Q22 2Q231Q23 20% 25% 20% 25% 25% Enabling consumers to receive calls and texts from service pros while maintaining their privacy *Growth rates presented as rounded figures Depictions of Yelp's features are provided for illustrative purposes only, and may differ from the actual product.

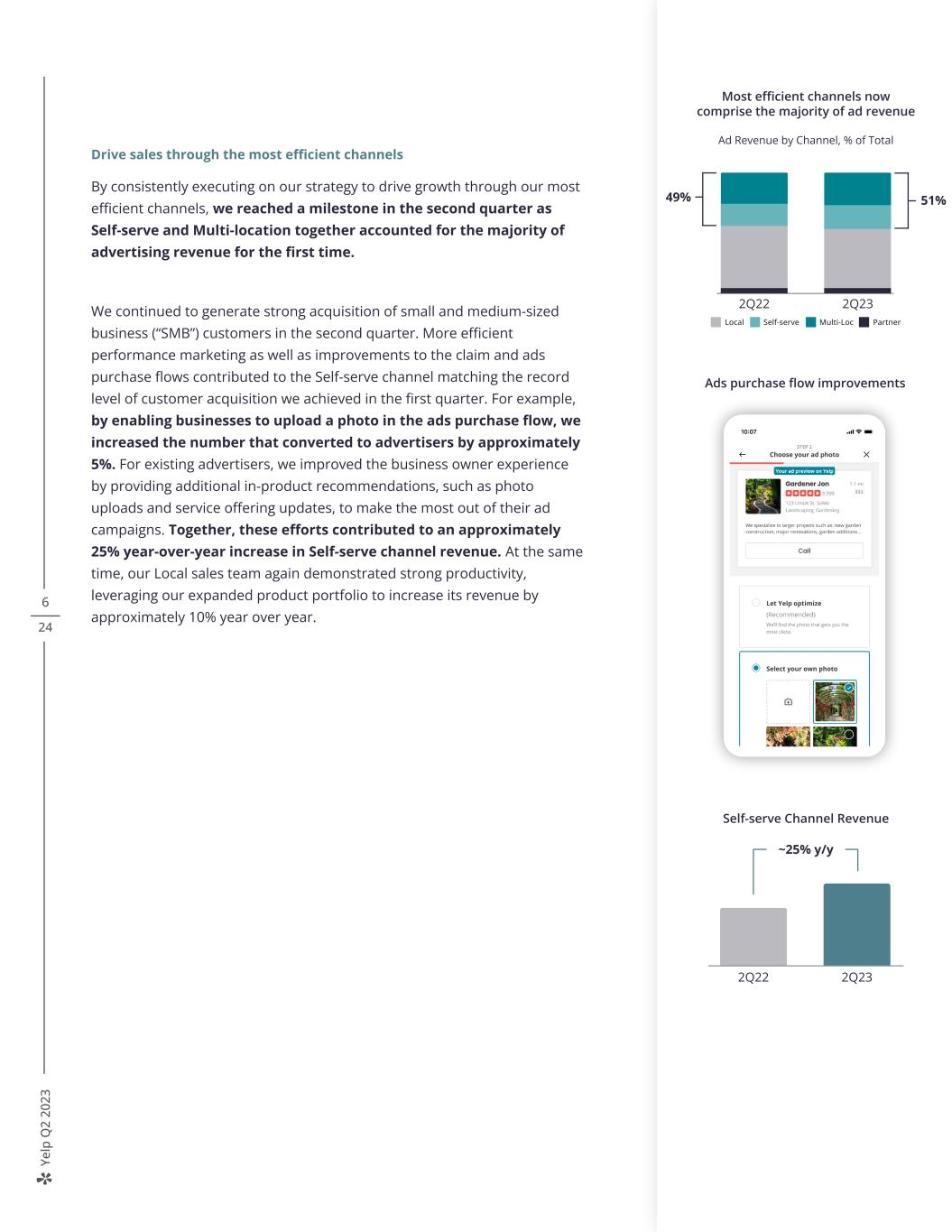

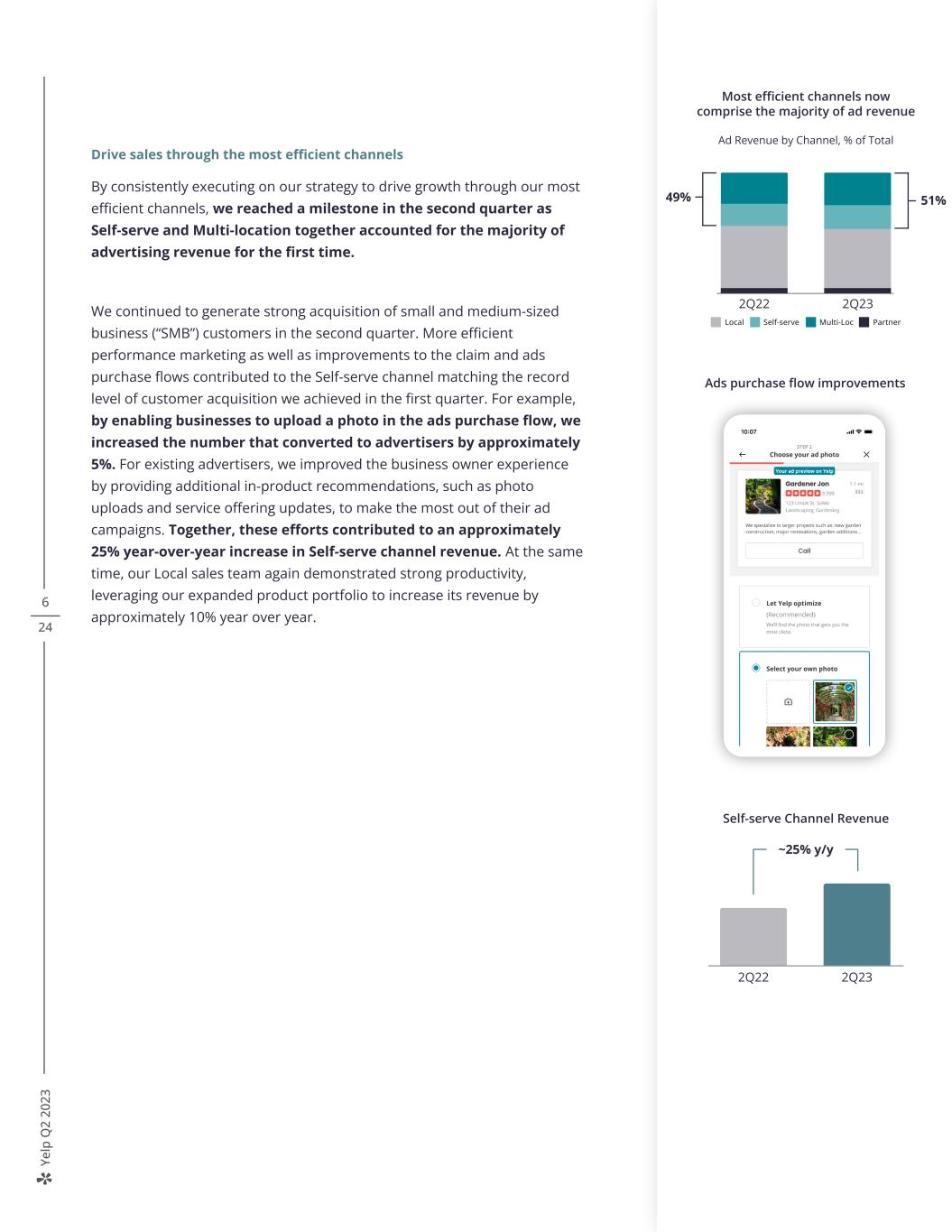

Ye lp Q 2 20 23 6 24 Drive sales through the most efficient channels By consistently executing on our strategy to drive growth through our most efficient channels, we reached a milestone in the second quarter as Self-serve and Multi-location together accounted for the majority of advertising revenue for the first time. We continued to generate strong acquisition of small and medium-sized business (“SMB”) customers in the second quarter. More efficient performance marketing as well as improvements to the claim and ads purchase flows contributed to the Self-serve channel matching the record level of customer acquisition we achieved in the first quarter. For example, by enabling businesses to upload a photo in the ads purchase flow, we increased the number that converted to advertisers by approximately 5%. For existing advertisers, we improved the business owner experience by providing additional in-product recommendations, such as photo uploads and service offering updates, to make the most out of their ad campaigns. Together, these efforts contributed to an approximately 25% year-over-year increase in Self-serve channel revenue. At the same time, our Local sales team again demonstrated strong productivity, leveraging our expanded product portfolio to increase its revenue by approximately 10% year over year. 2Q22 2Q23 Self-serveLocal Multi-Loc Partner 28%49% 51% Most efficient channels now comprise the majority of ad revenue Ad Revenue by Channel, % of Total Ads purchase flow improvements Self-serve Channel Revenue ~25% y/y 2Q22 2Q23

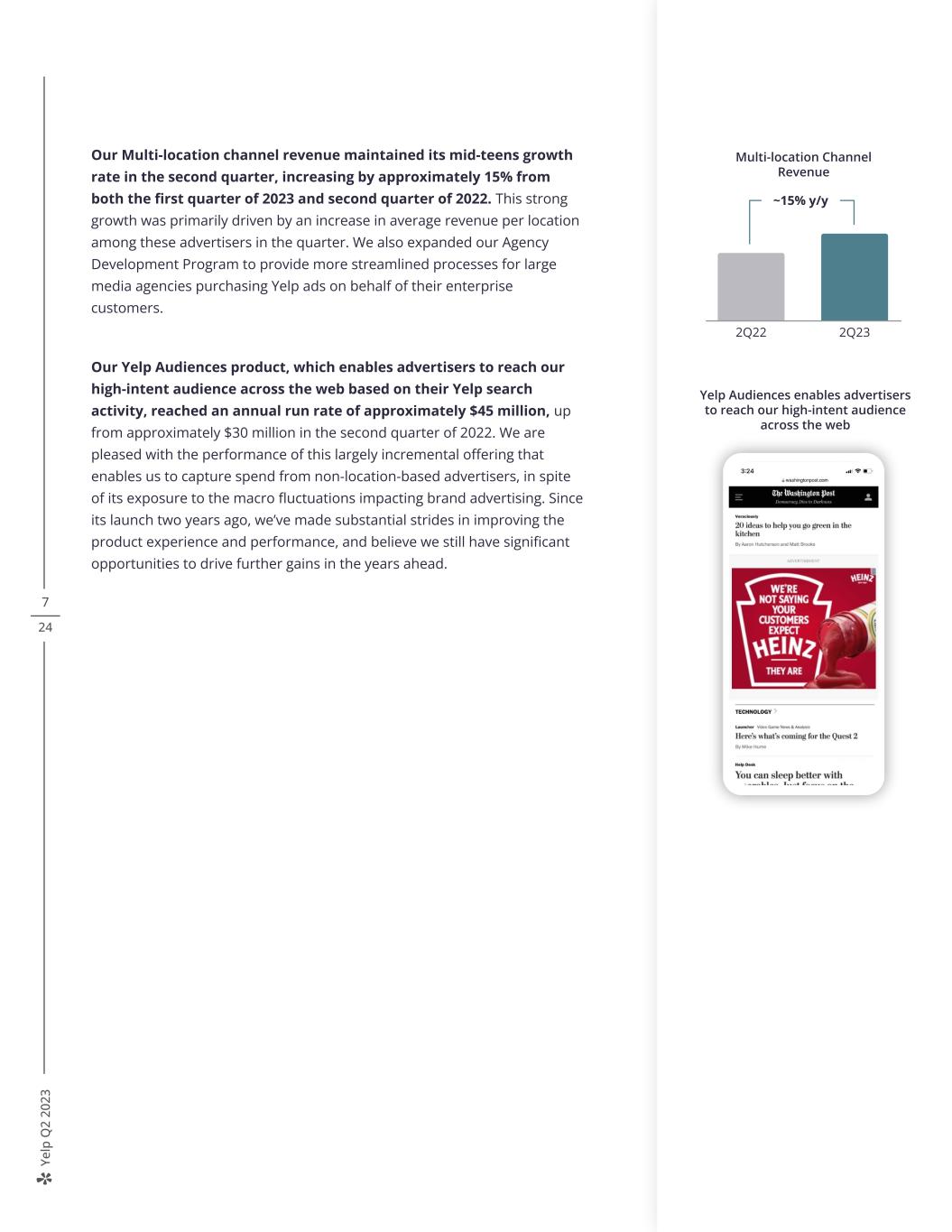

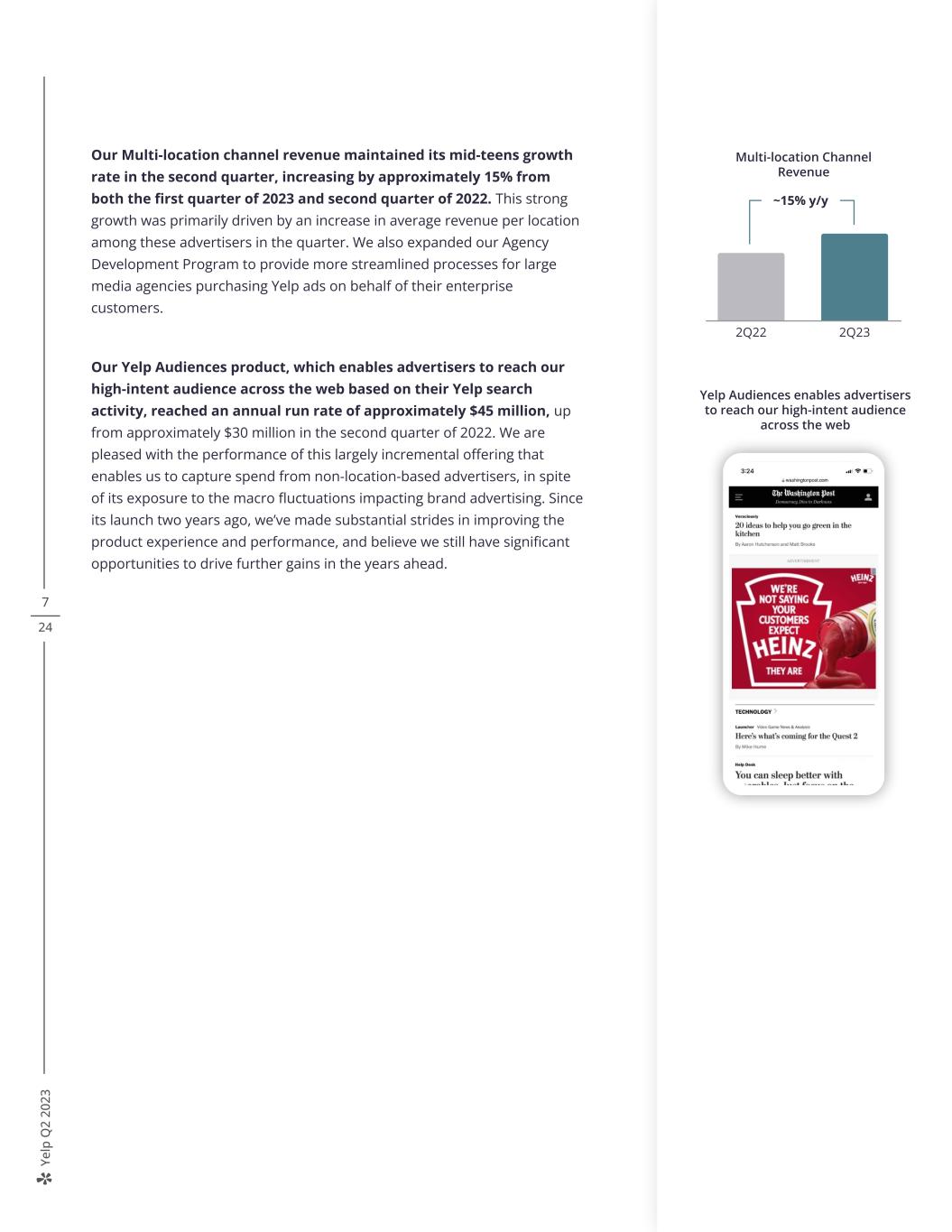

Ye lp Q 2 20 23 7 24 Our Multi-location channel revenue maintained its mid-teens growth rate in the second quarter, increasing by approximately 15% from both the first quarter of 2023 and second quarter of 2022. This strong growth was primarily driven by an increase in average revenue per location among these advertisers in the quarter. We also expanded our Agency Development Program to provide more streamlined processes for large media agencies purchasing Yelp ads on behalf of their enterprise customers. Our Yelp Audiences product, which enables advertisers to reach our high-intent audience across the web based on their Yelp search activity, reached an annual run rate of approximately $45 million, up from approximately $30 million in the second quarter of 2022. We are pleased with the performance of this largely incremental offering that enables us to capture spend from non-location-based advertisers, in spite of its exposure to the macro fluctuations impacting brand advertising. Since its launch two years ago, we’ve made substantial strides in improving the product experience and performance, and believe we still have significant opportunities to drive further gains in the years ahead. Multi-location Channel Revenue ~15% y/y 2Q22 2Q23 Yelp Audiences enables advertisers to reach our high-intent audience across the web

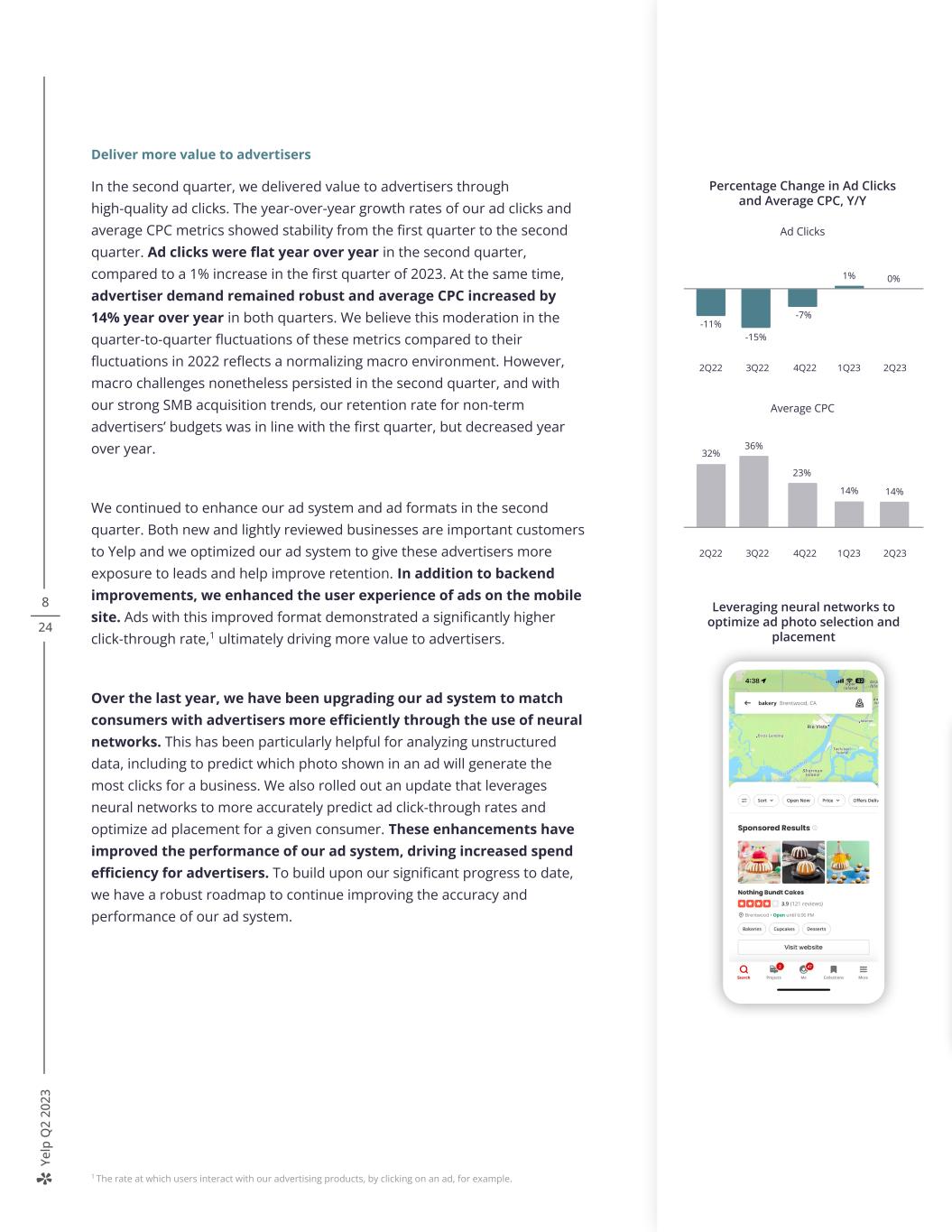

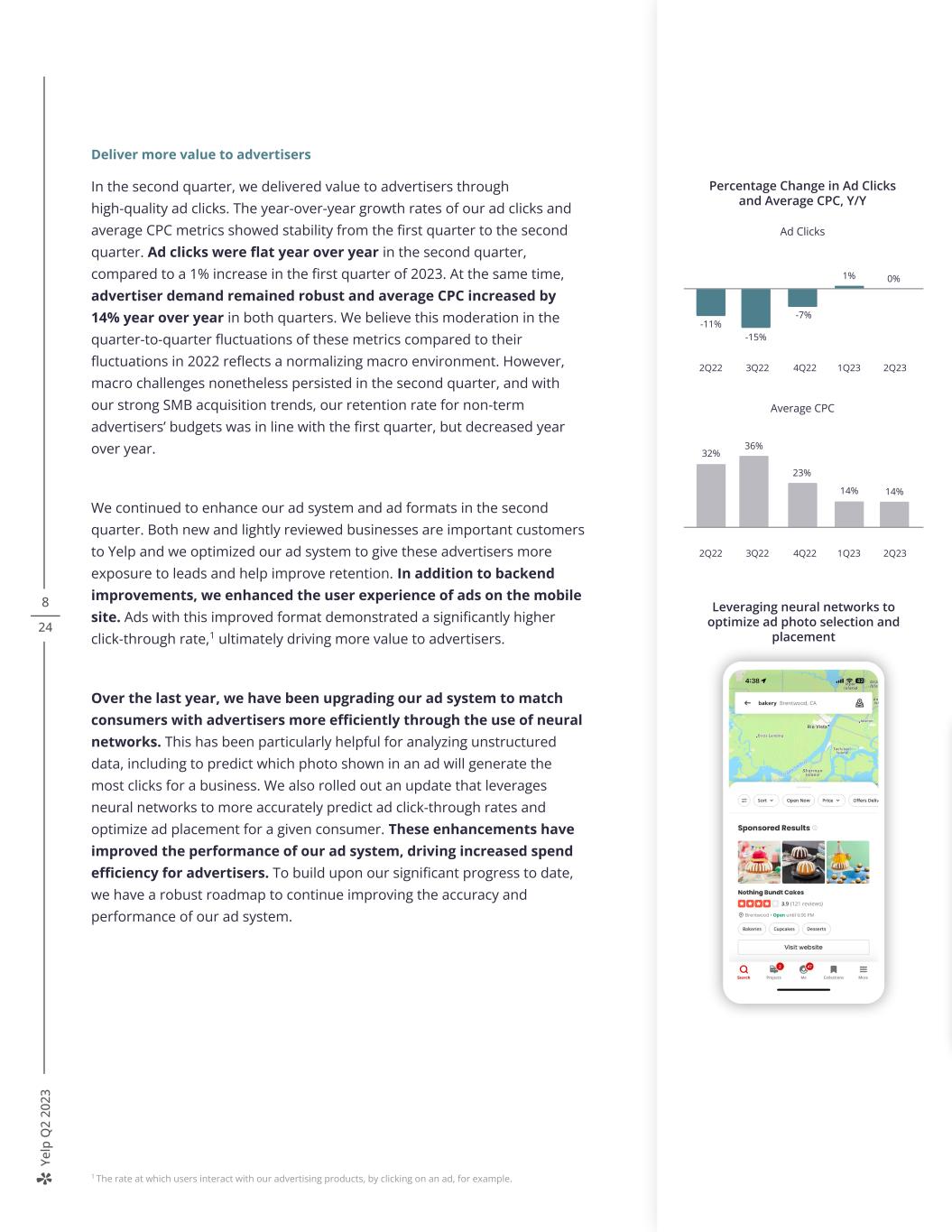

Ye lp Q 2 20 23 8 24 Deliver more value to advertisers In the second quarter, we delivered value to advertisers through high-quality ad clicks. The year-over-year growth rates of our ad clicks and average CPC metrics showed stability from the first quarter to the second quarter. Ad clicks were flat year over year in the second quarter, compared to a 1% increase in the first quarter of 2023. At the same time, advertiser demand remained robust and average CPC increased by 14% year over year in both quarters. We believe this moderation in the quarter-to-quarter fluctuations of these metrics compared to their fluctuations in 2022 reflects a normalizing macro environment. However, macro challenges nonetheless persisted in the second quarter, and with our strong SMB acquisition trends, our retention rate for non-term advertisers’ budgets was in line with the first quarter, but decreased year over year. We continued to enhance our ad system and ad formats in the second quarter. Both new and lightly reviewed businesses are important customers to Yelp and we optimized our ad system to give these advertisers more exposure to leads and help improve retention. In addition to backend improvements, we enhanced the user experience of ads on the mobile site. Ads with this improved format demonstrated a significantly higher click-through rate,1 ultimately driving more value to advertisers. Over the last year, we have been upgrading our ad system to match consumers with advertisers more efficiently through the use of neural networks. This has been particularly helpful for analyzing unstructured data, including to predict which photo shown in an ad will generate the most clicks for a business. We also rolled out an update that leverages neural networks to more accurately predict ad click-through rates and optimize ad placement for a given consumer. These enhancements have improved the performance of our ad system, driving increased spend efficiency for advertisers. To build upon our significant progress to date, we have a robust roadmap to continue improving the accuracy and performance of our ad system. Percentage Change in Ad Clicks and Average CPC, Y/Y Ad Clicks -11% 2Q22 3Q22 4Q22 1Q23 2Q23 0% -15% -7% 1% Average CPC 32% 2Q22 3Q22 4Q22 1Q23 2Q23 14% 36% 14% 23% New & lightly reviewed businesses are important Improved mobile web experience Neural nets - predicting which photo shown in an ad will generate the most clicks Leveraging neural networks to optimize ad photo selection and placement 1 The rate at which users interact with our advertising products, by clicking on an ad, for example.

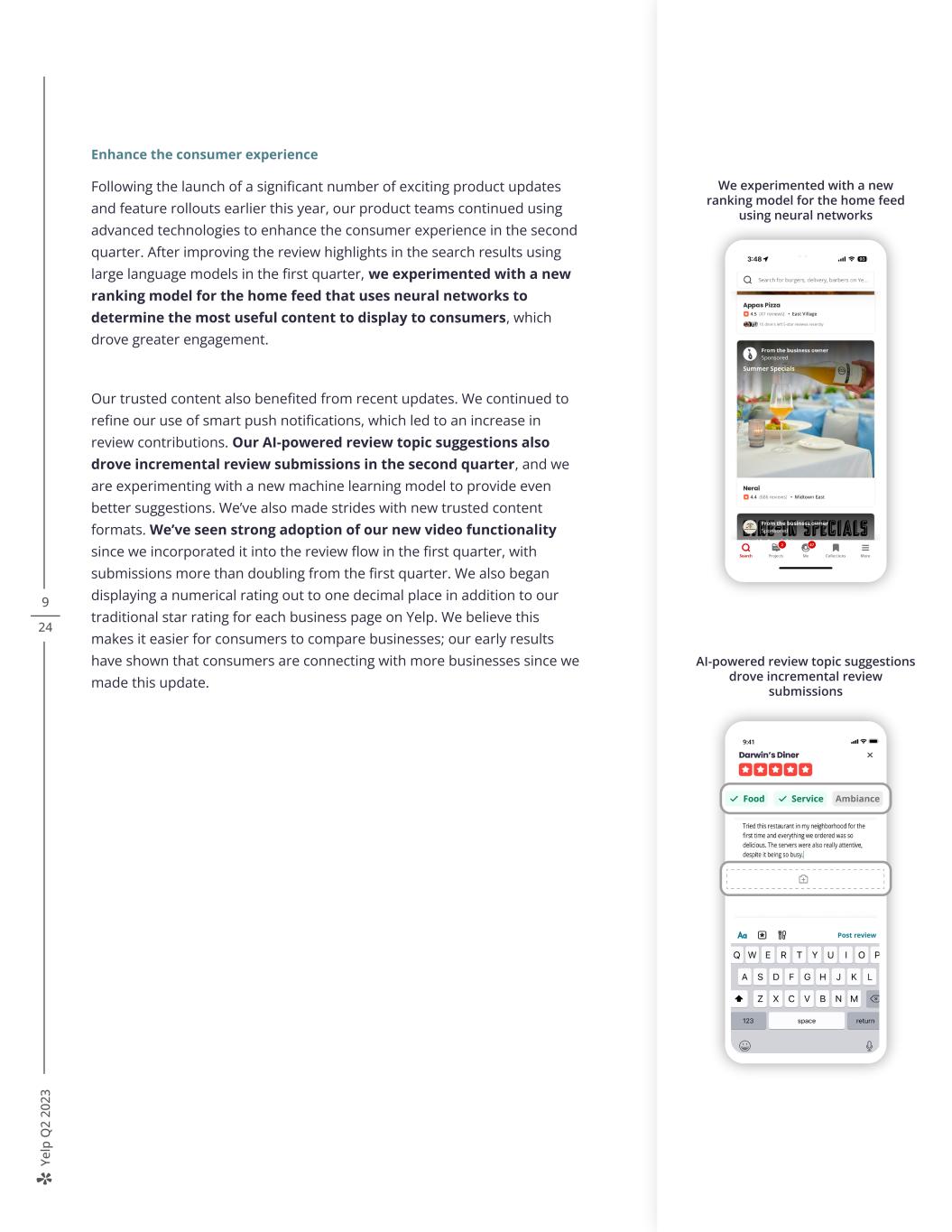

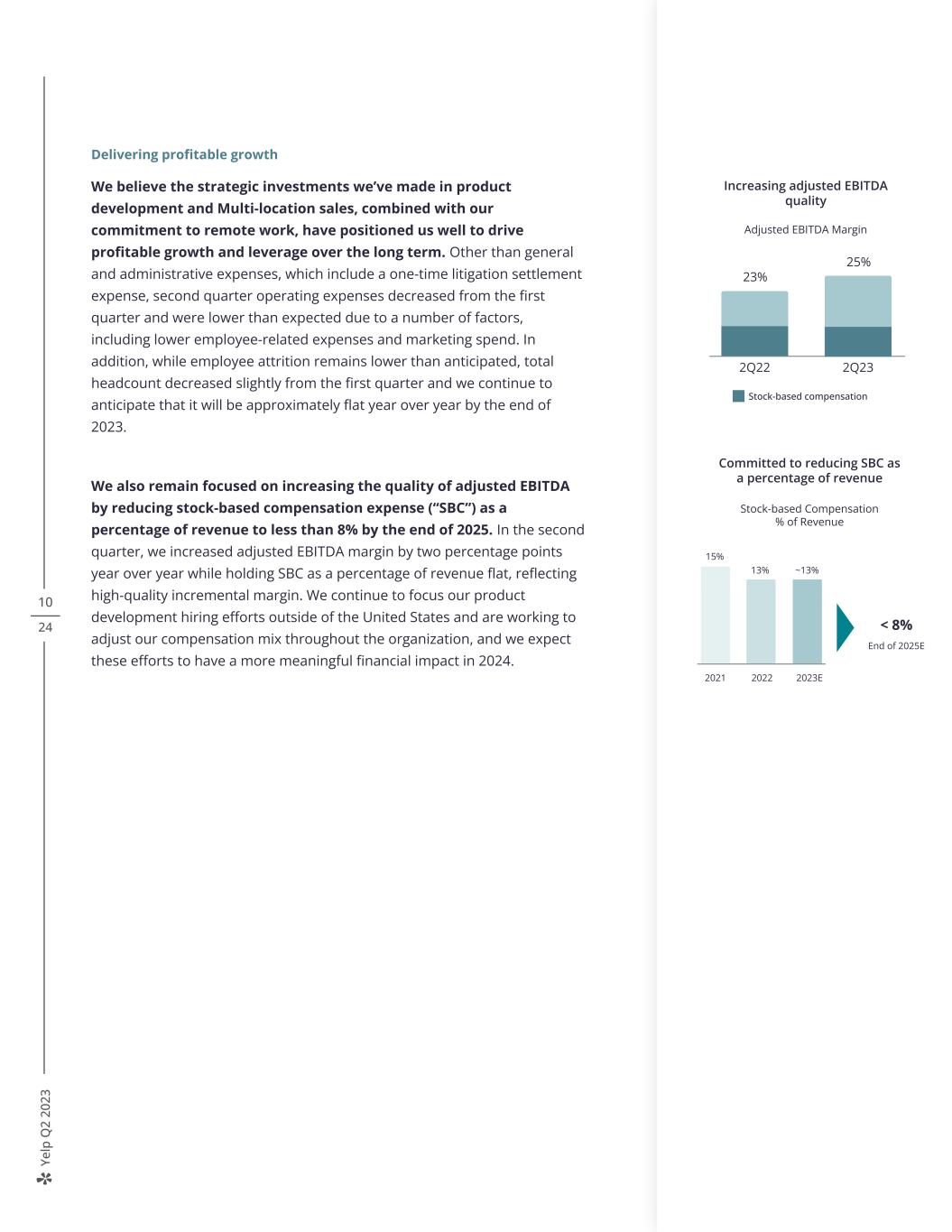

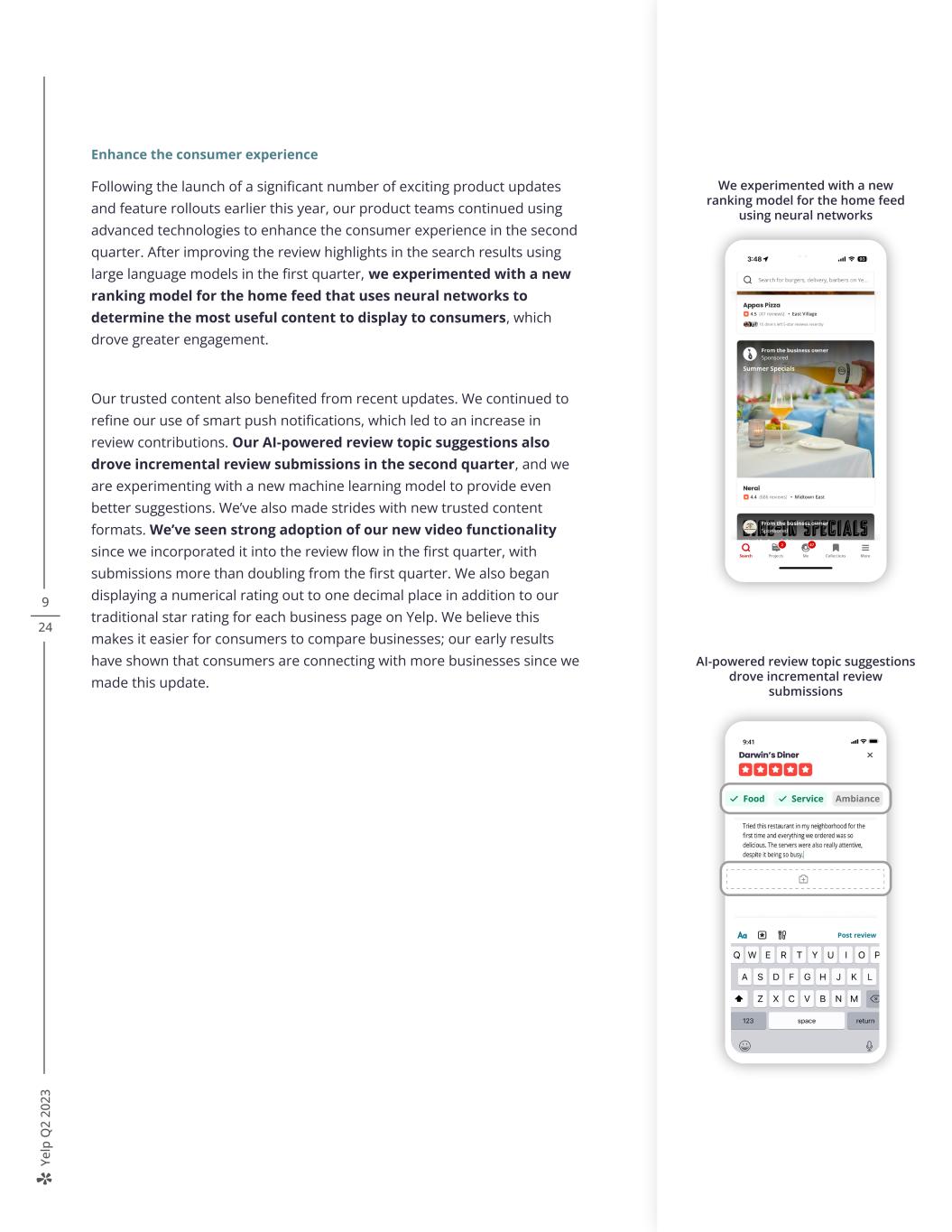

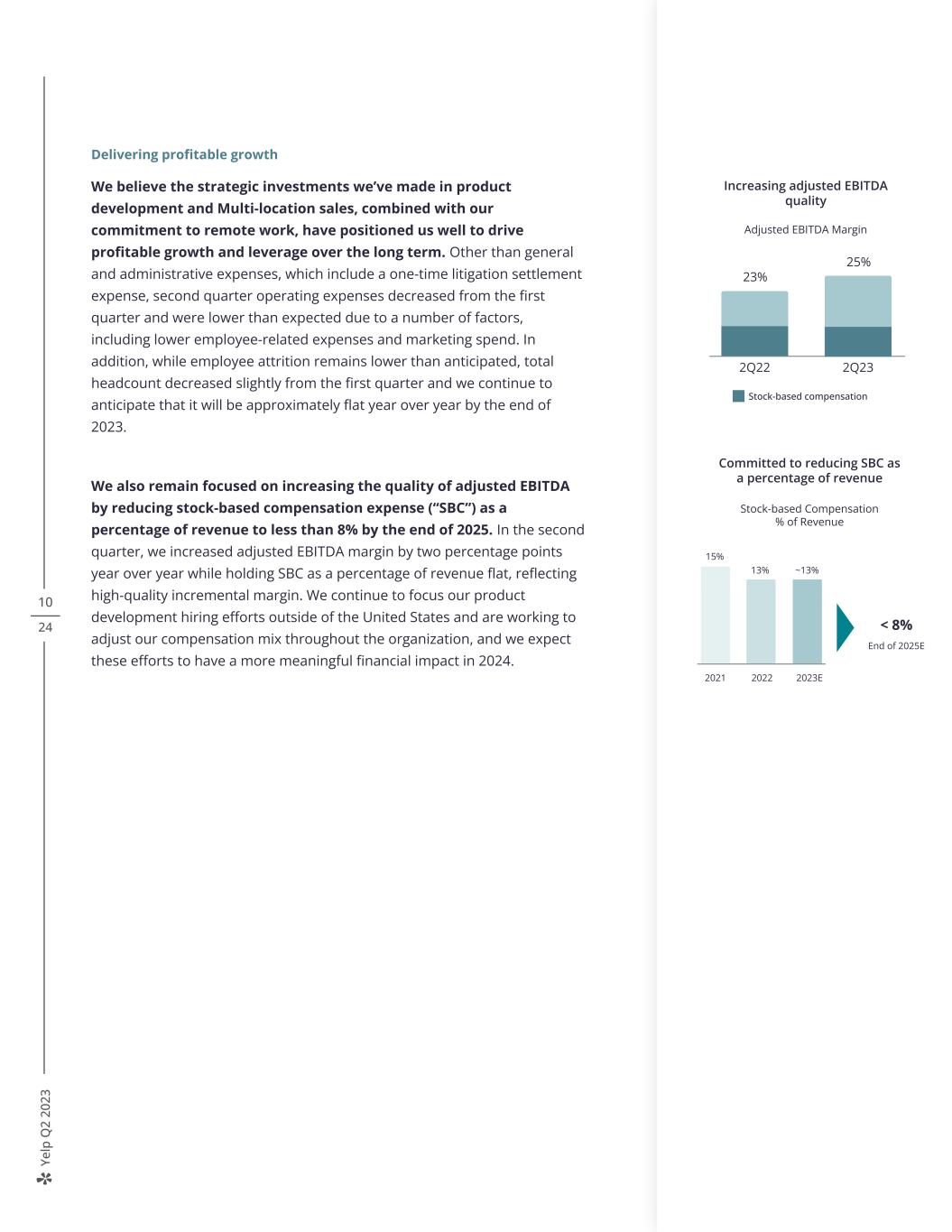

Ye lp Q 2 20 23 9 24 Enhance the consumer experience Following the launch of a significant number of exciting product updates and feature rollouts earlier this year, our product teams continued using advanced technologies to enhance the consumer experience in the second quarter. After improving the review highlights in the search results using large language models in the first quarter, we experimented with a new ranking model for the home feed that uses neural networks to determine the most useful content to display to consumers, which drove greater engagement. Our trusted content also benefited from recent updates. We continued to refine our use of smart push notifications, which led to an increase in review contributions. Our AI-powered review topic suggestions also drove incremental review submissions in the second quarter, and we are experimenting with a new machine learning model to provide even better suggestions. We’ve also made strides with new trusted content formats. We’ve seen strong adoption of our new video functionality since we incorporated it into the review flow in the first quarter, with submissions more than doubling from the first quarter. We also began displaying a numerical rating out to one decimal place in addition to our traditional star rating for each business page on Yelp. We believe this makes it easier for consumers to compare businesses; our early results have shown that consumers are connecting with more businesses since we made this update. We experimented with a new ranking model for the home feed using neural networks AI-powered review topic suggestions drove incremental review submissions

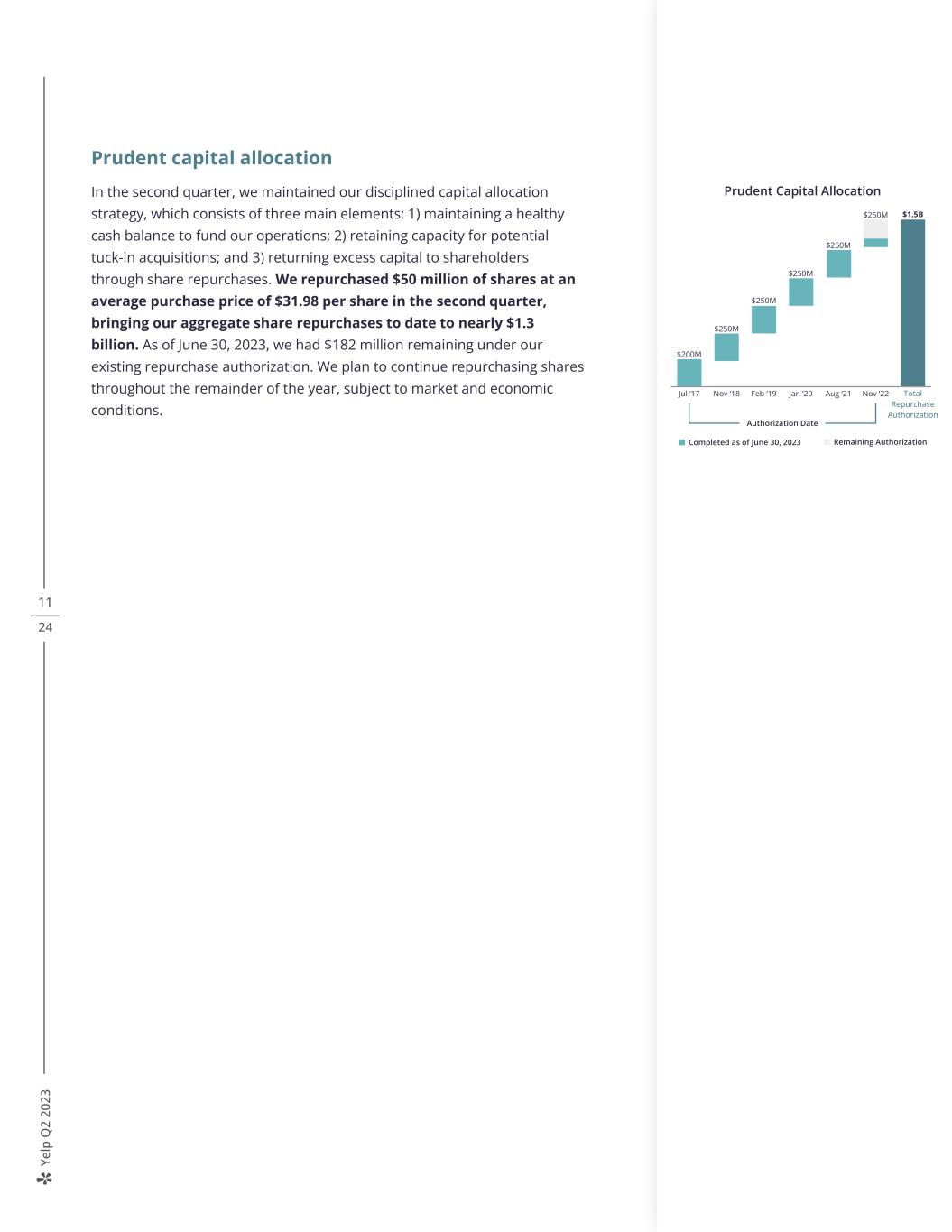

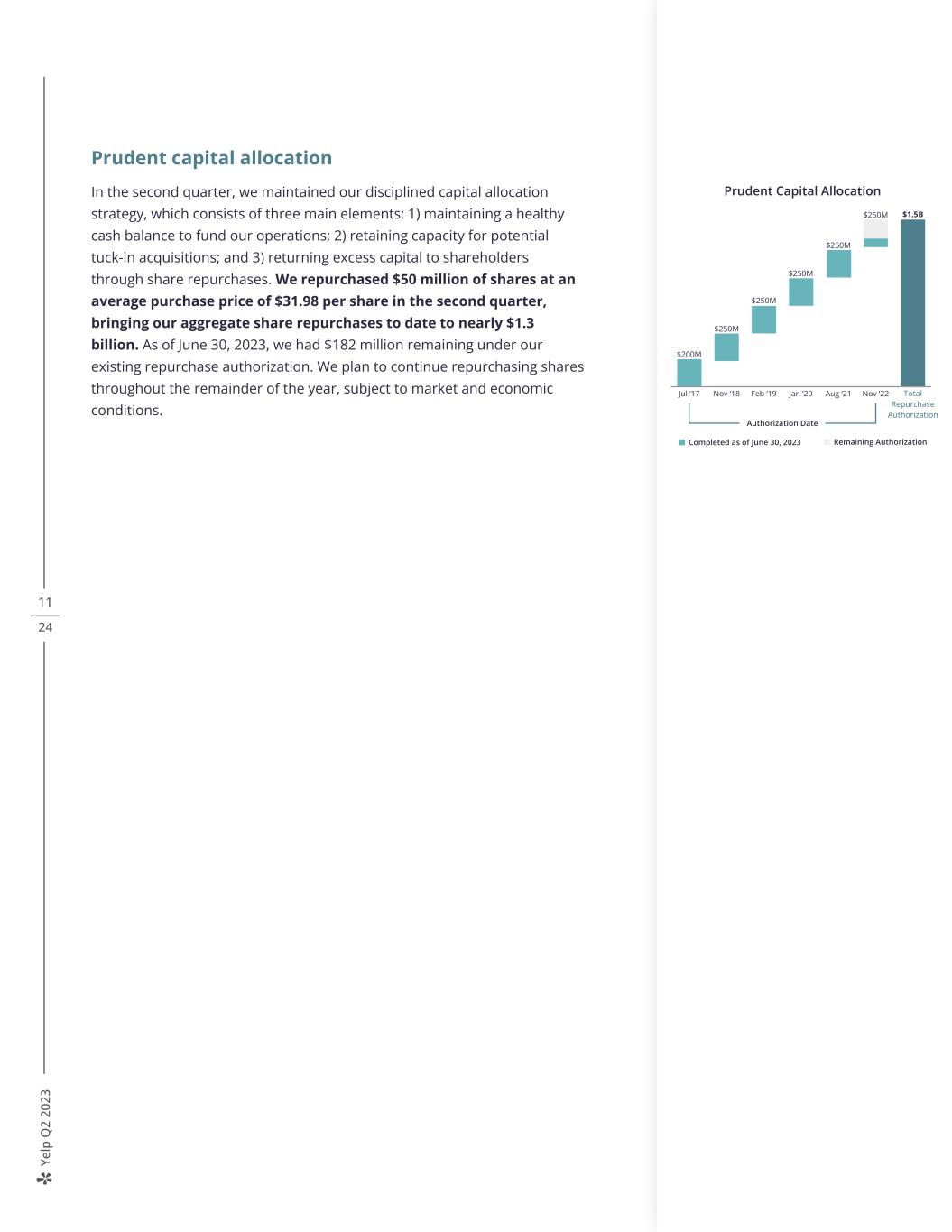

Ye lp Q 2 20 23 10 24 Delivering profitable growth We believe the strategic investments we’ve made in product development and Multi-location sales, combined with our commitment to remote work, have positioned us well to drive profitable growth and leverage over the long term. Other than general and administrative expenses, which include a one-time litigation settlement expense, second quarter operating expenses decreased from the first quarter and were lower than expected due to a number of factors, including lower employee-related expenses and marketing spend. In addition, while employee attrition remains lower than anticipated, total headcount decreased slightly from the first quarter and we continue to anticipate that it will be approximately flat year over year by the end of 2023. We also remain focused on increasing the quality of adjusted EBITDA by reducing stock-based compensation expense (“SBC”) as a percentage of revenue to less than 8% by the end of 2025. In the second quarter, we increased adjusted EBITDA margin by two percentage points year over year while holding SBC as a percentage of revenue flat, reflecting high-quality incremental margin. We continue to focus our product development hiring efforts outside of the United States and are working to adjust our compensation mix throughout the organization, and we expect these efforts to have a more meaningful financial impact in 2024. Home feed captions Numerical ratings to one decimal point Exhibit 9 2021 2022 2023E End of 2025E 15% 13% ~13% < 8% Committed to reducing SBC as a percentage of revenue Stock-based Compensation % of Revenue 2Q22 2Q23 Stock-based compensation 23% 25% Increasing adjusted EBITDA quality Adjusted EBITDA Margin

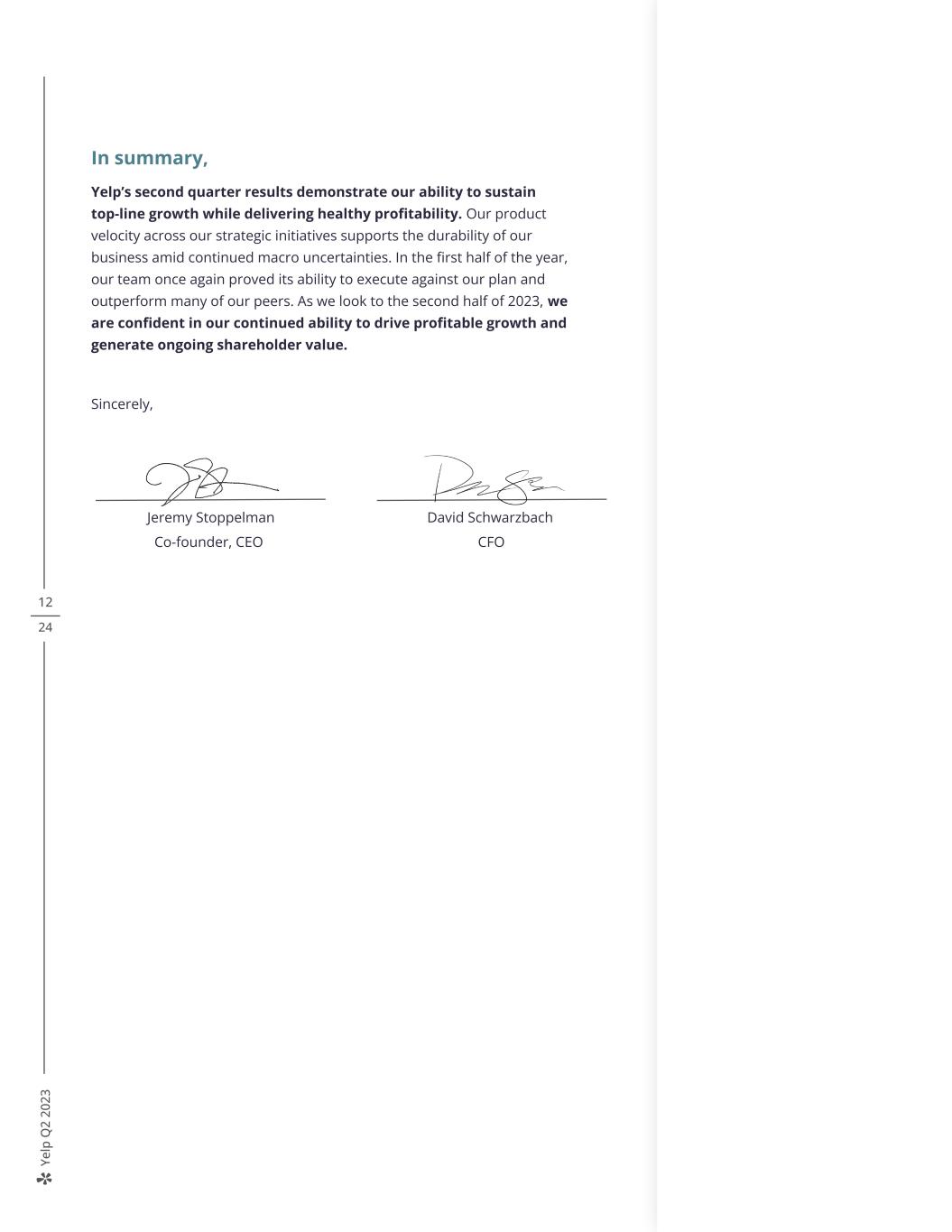

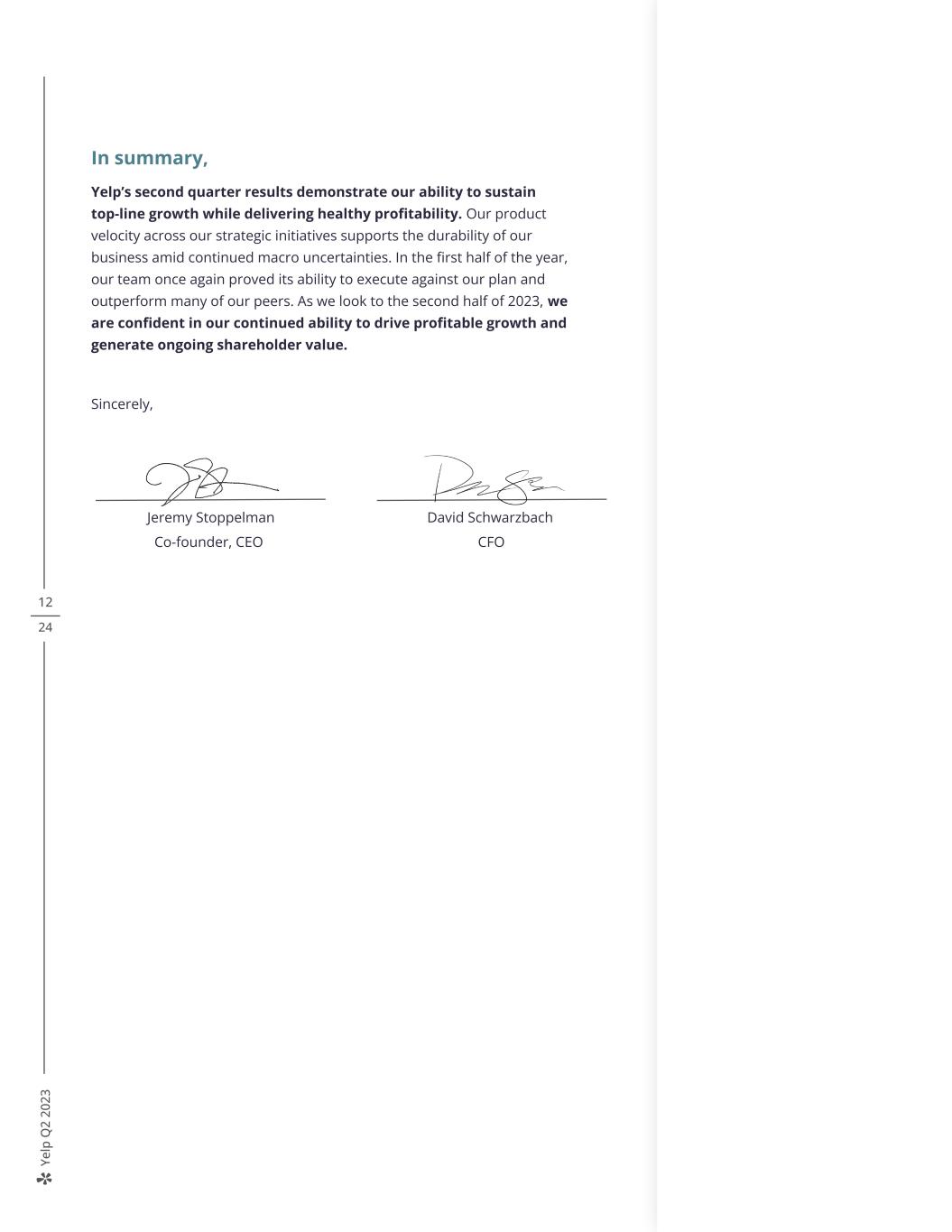

Ye lp Q 2 20 23 11 24 Prudent capital allocation In the second quarter, we maintained our disciplined capital allocation strategy, which consists of three main elements: 1) maintaining a healthy cash balance to fund our operations; 2) retaining capacity for potential tuck-in acquisitions; and 3) returning excess capital to shareholders through share repurchases. We repurchased $50 million of shares at an average purchase price of $31.98 per share in the second quarter, bringing our aggregate share repurchases to date to nearly $1.3 billion. As of June 30, 2023, we had $182 million remaining under our existing repurchase authorization. We plan to continue repurchasing shares throughout the remainder of the year, subject to market and economic conditions. Total Repurchase Authorization Nov ‘22 Authorization Date Prudent Capital Allocation $1.5B Completed as of June 30, 2023 Remaining Authorization $200M Jul ‘17 Nov ‘18 Feb ‘19 Jan ‘20 $250M $250M $250M $250M Aug ‘21 $250M

Ye lp Q 2 20 23 In summary, Yelp’s second quarter results demonstrate our ability to sustain top-line growth while delivering healthy profitability. Our product velocity across our strategic initiatives supports the durability of our business amid continued macro uncertainties. In the first half of the year, our team once again proved its ability to execute against our plan and outperform many of our peers. As we look to the second half of 2023, we are confident in our continued ability to drive profitable growth and generate ongoing shareholder value. Sincerely, Jeremy Stoppelman David Schwarzbach Co-founder, CEO CFO 12 24

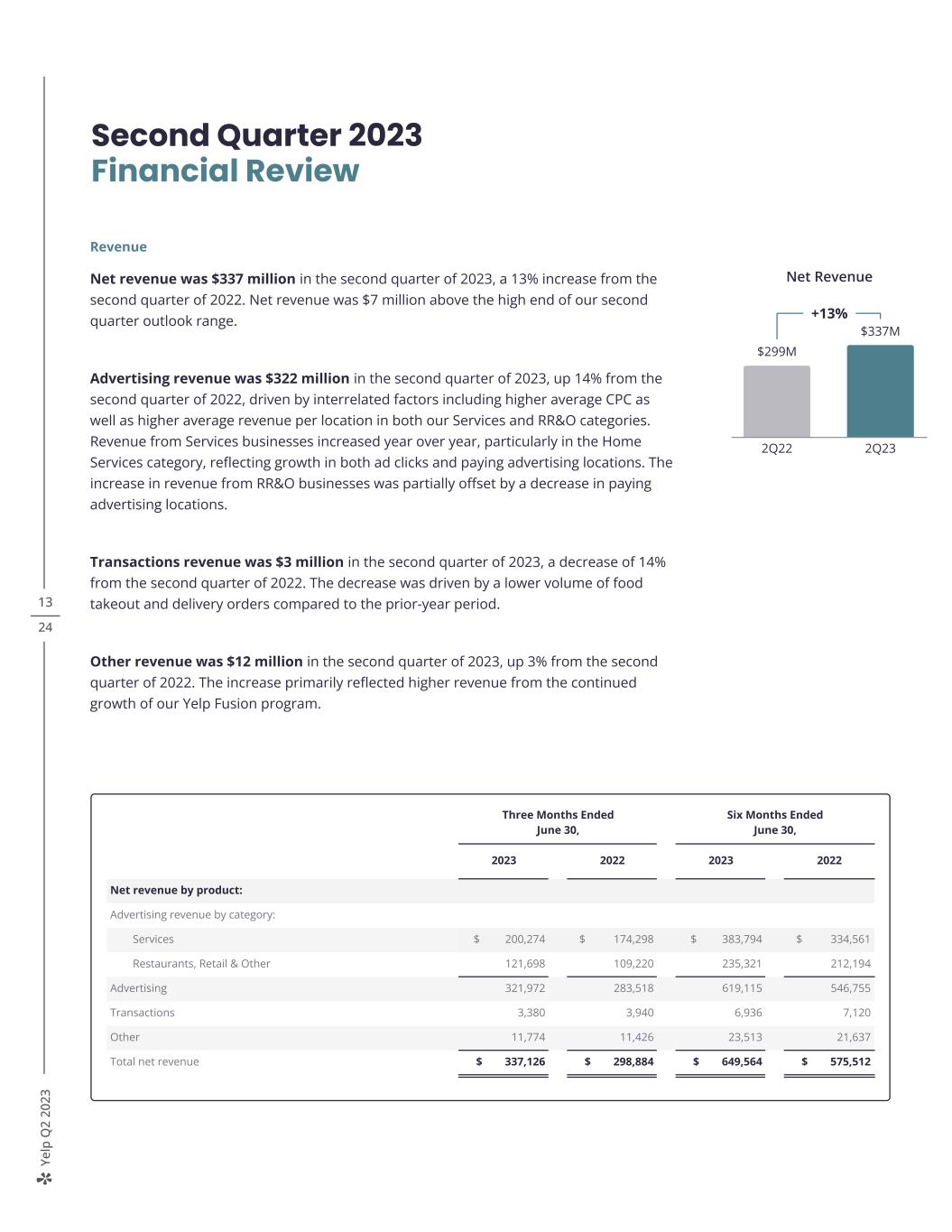

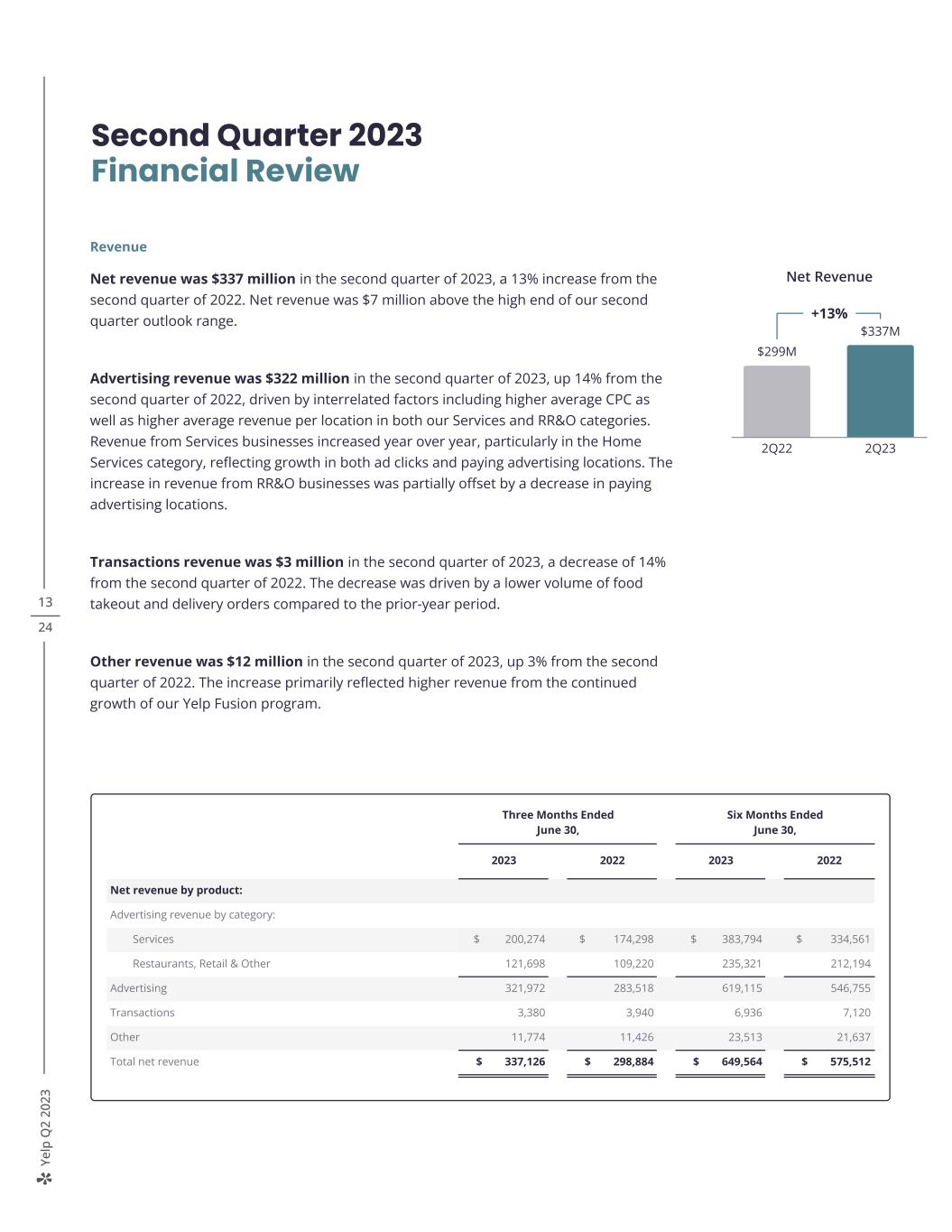

Ye lp Q 2 20 23 13 24 Revenue Net revenue was $337 million in the second quarter of 2023, a 13% increase from the second quarter of 2022. Net revenue was $7 million above the high end of our second quarter outlook range. Advertising revenue was $322 million in the second quarter of 2023, up 14% from the second quarter of 2022, driven by interrelated factors including higher average CPC as well as higher average revenue per location in both our Services and RR&O categories. Revenue from Services businesses increased year over year, particularly in the Home Services category, reflecting growth in both ad clicks and paying advertising locations. The increase in revenue from RR&O businesses was partially offset by a decrease in paying advertising locations. Transactions revenue was $3 million in the second quarter of 2023, a decrease of 14% from the second quarter of 2022. The decrease was driven by a lower volume of food takeout and delivery orders compared to the prior-year period. Other revenue was $12 million in the second quarter of 2023, up 3% from the second quarter of 2022. The increase primarily reflected higher revenue from the continued growth of our Yelp Fusion program. Second Quarter 2023 Financial Review Three Months Ended June 30, Six Months Ended June 30, 2023 2022 2023 2022 Net revenue by product: Advertising revenue by category: Services $ 200,274 $ 174,298 $ 383,794 $ 334,561 Restaurants, Retail & Other 121,698 109,220 235,321 212,194 Advertising 321,972 283,518 619,115 546,755 Transactions 3,380 3,940 6,936 7,120 Other 11,774 11,426 23,513 21,637 Total net revenue $ 337,126 $ 298,884 $ 649,564 $ 575,512 Net Revenue +13% $299M $337M 2Q22 2Q23

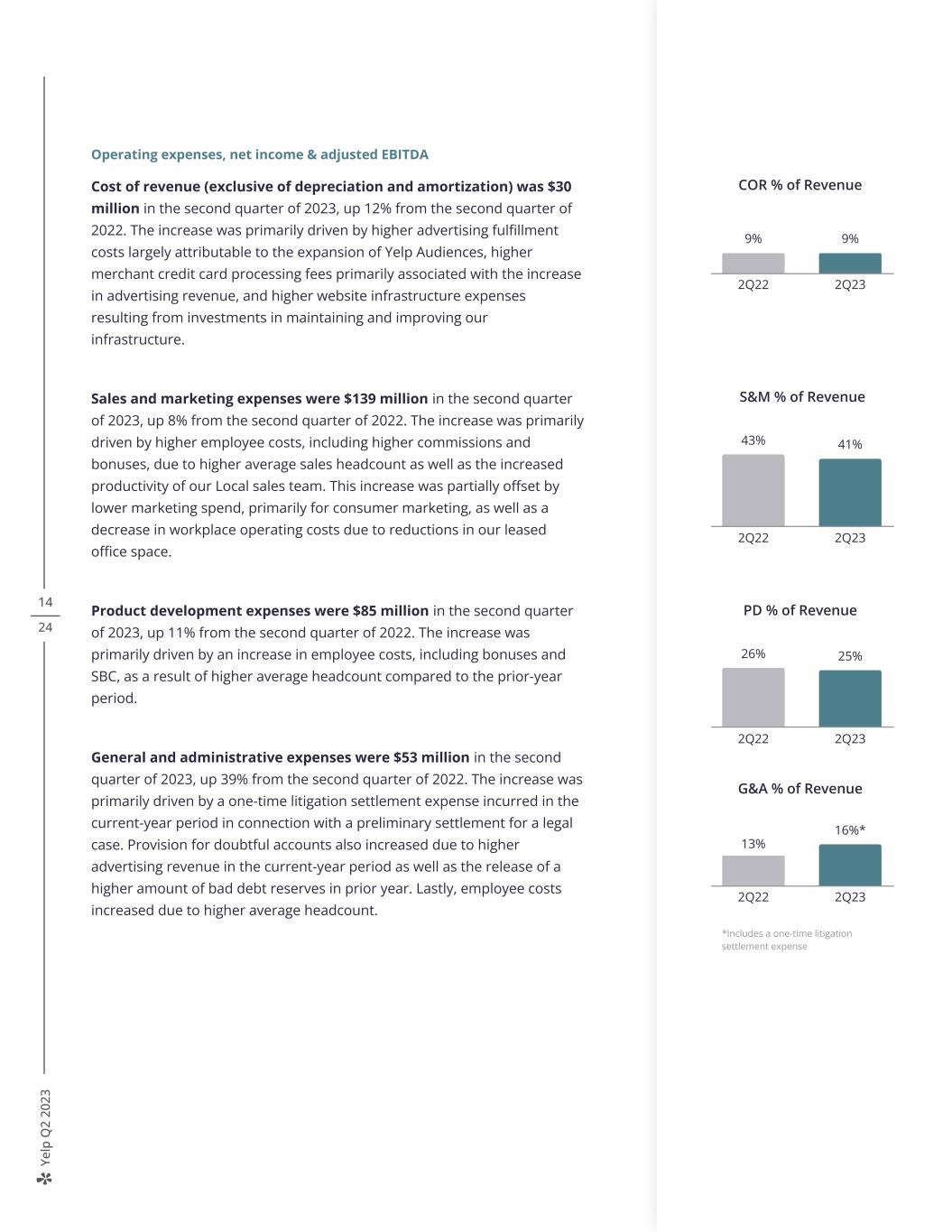

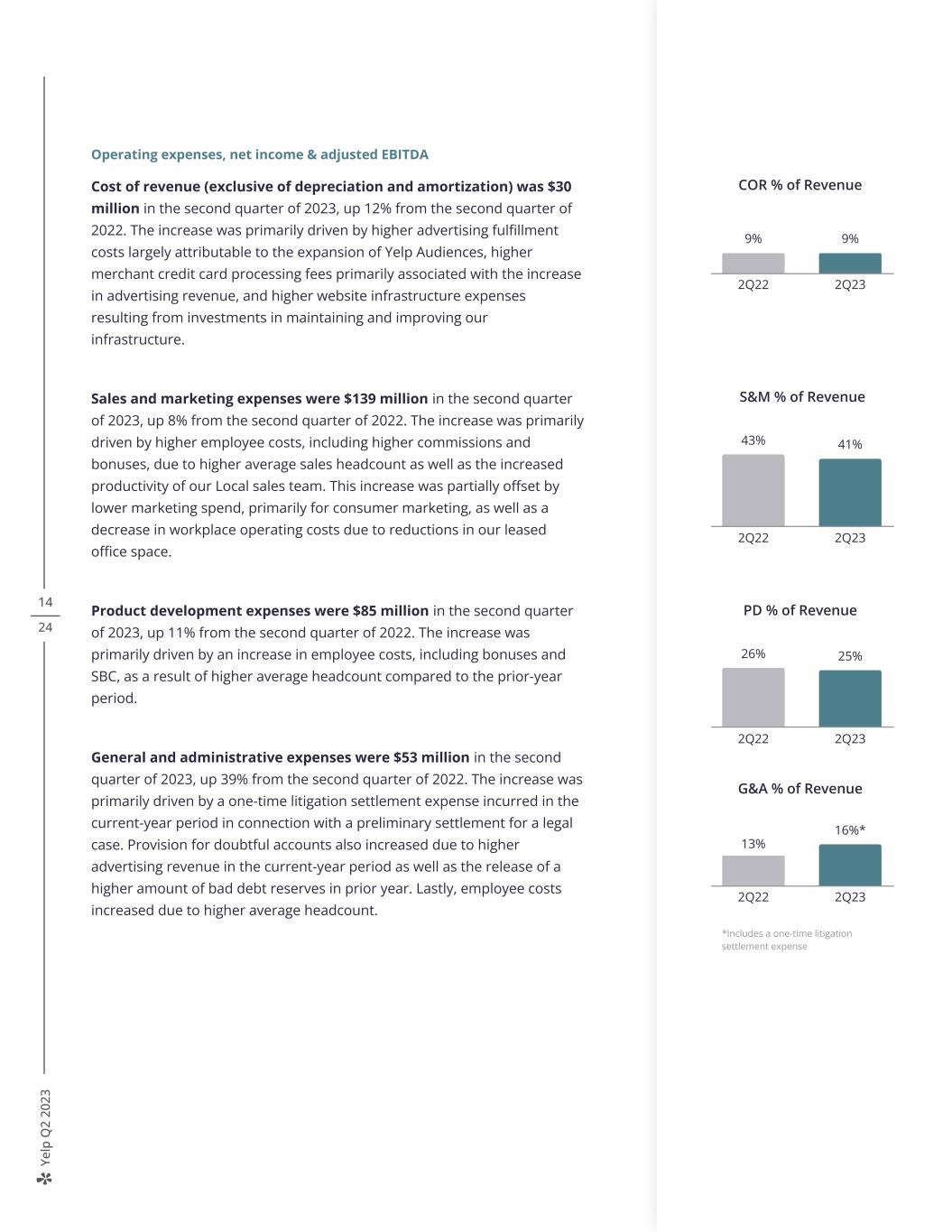

Ye lp Q 2 20 23 14 24 Operating expenses, net income & adjusted EBITDA Cost of revenue (exclusive of depreciation and amortization) was $30 million in the second quarter of 2023, up 12% from the second quarter of 2022. The increase was primarily driven by higher advertising fulfillment costs largely attributable to the expansion of Yelp Audiences, higher merchant credit card processing fees primarily associated with the increase in advertising revenue, and higher website infrastructure expenses resulting from investments in maintaining and improving our infrastructure. Sales and marketing expenses were $139 million in the second quarter of 2023, up 8% from the second quarter of 2022. The increase was primarily driven by higher employee costs, including higher commissions and bonuses, due to higher average sales headcount as well as the increased productivity of our Local sales team. This increase was partially offset by lower marketing spend, primarily for consumer marketing, as well as a decrease in workplace operating costs due to reductions in our leased office space. Product development expenses were $85 million in the second quarter of 2023, up 11% from the second quarter of 2022. The increase was primarily driven by an increase in employee costs, including bonuses and SBC, as a result of higher average headcount compared to the prior-year period. General and administrative expenses were $53 million in the second quarter of 2023, up 39% from the second quarter of 2022. The increase was primarily driven by a one-time litigation settlement expense incurred in the current-year period in connection with a preliminary settlement for a legal case. Provision for doubtful accounts also increased due to higher advertising revenue in the current-year period as well as the release of a higher amount of bad debt reserves in prior year. Lastly, employee costs increased due to higher average headcount. COR % of Revenue 9% 9% 2Q22 2Q23 S&M % of Revenue 43% 41% 2Q22 2Q23 PD % of Revenue 26% 25% 2Q22 2Q23 G&A % of Revenue 13% 16%* 2Q22 2Q23 *Includes a one-time litigation settlement expense

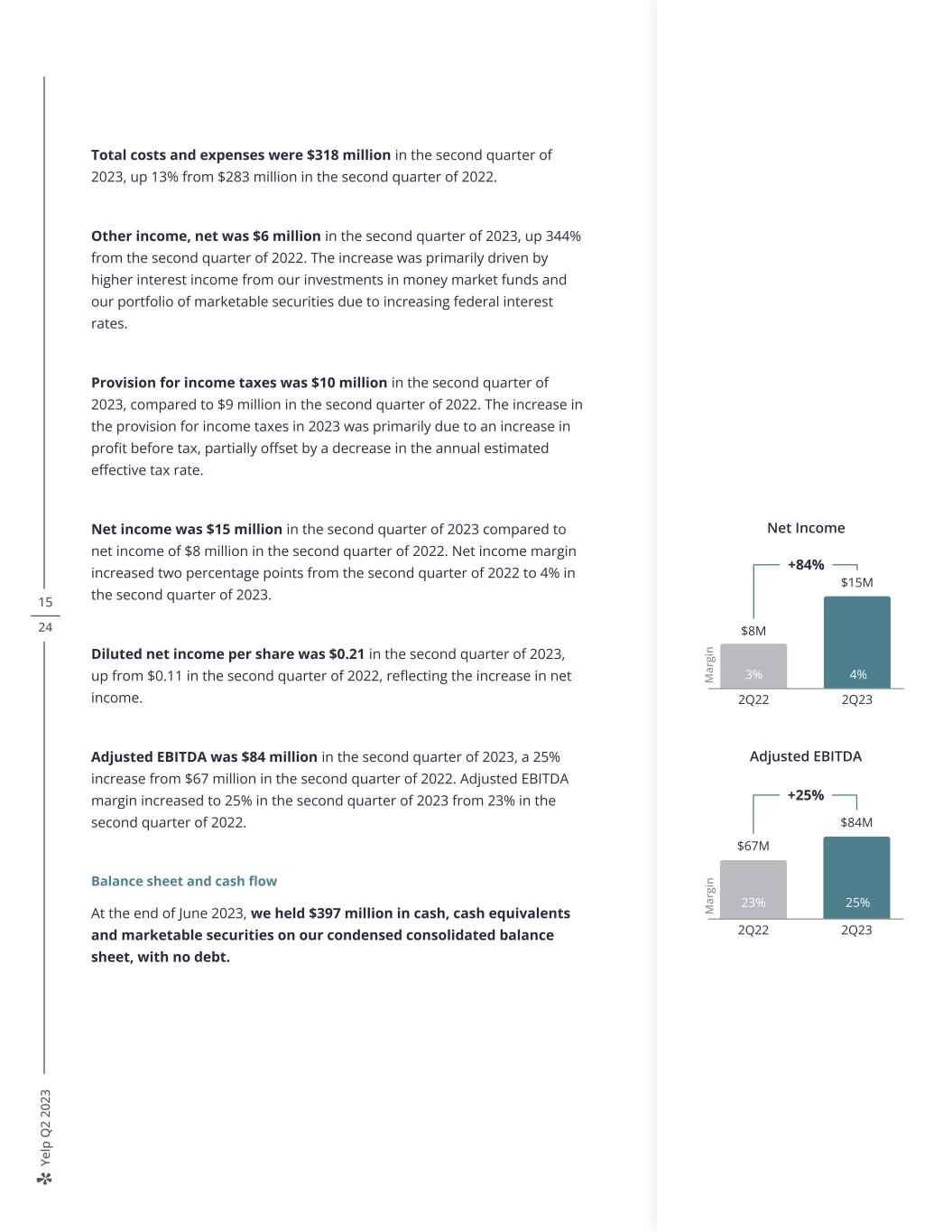

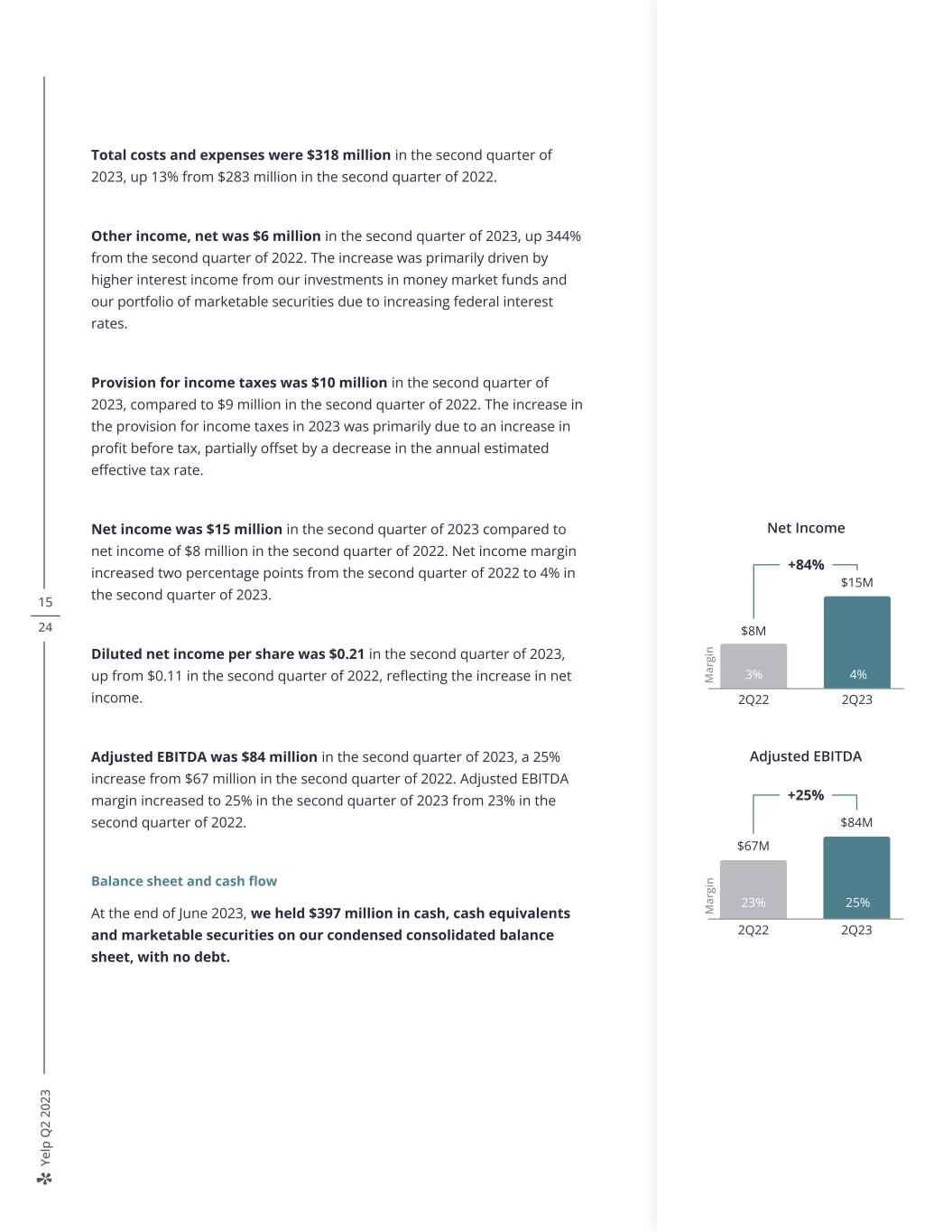

Ye lp Q 2 20 23 15 24 Total costs and expenses were $318 million in the second quarter of 2023, up 13% from $283 million in the second quarter of 2022. Other income, net was $6 million in the second quarter of 2023, up 344% from the second quarter of 2022. The increase was primarily driven by higher interest income from our investments in money market funds and our portfolio of marketable securities due to increasing federal interest rates. Provision for income taxes was $10 million in the second quarter of 2023, compared to $9 million in the second quarter of 2022. The increase in the provision for income taxes in 2023 was primarily due to an increase in profit before tax, partially offset by a decrease in the annual estimated effective tax rate. Net income was $15 million in the second quarter of 2023 compared to net income of $8 million in the second quarter of 2022. Net income margin increased two percentage points from the second quarter of 2022 to 4% in the second quarter of 2023. Diluted net income per share was $0.21 in the second quarter of 2023, up from $0.11 in the second quarter of 2022, reflecting the increase in net income. Adjusted EBITDA was $84 million in the second quarter of 2023, a 25% increase from $67 million in the second quarter of 2022. Adjusted EBITDA margin increased to 25% in the second quarter of 2023 from 23% in the second quarter of 2022. Balance sheet and cash flow At the end of June 2023, we held $397 million in cash, cash equivalents and marketable securities on our condensed consolidated balance sheet, with no debt. 19% 17% Adjusted EBITDA +25% $67M $84M 2Q22 2Q23 M ar gi n 23% 25% Net Income +84% $8M $15M 2Q22 2Q23 M ar gi n 3% 4%

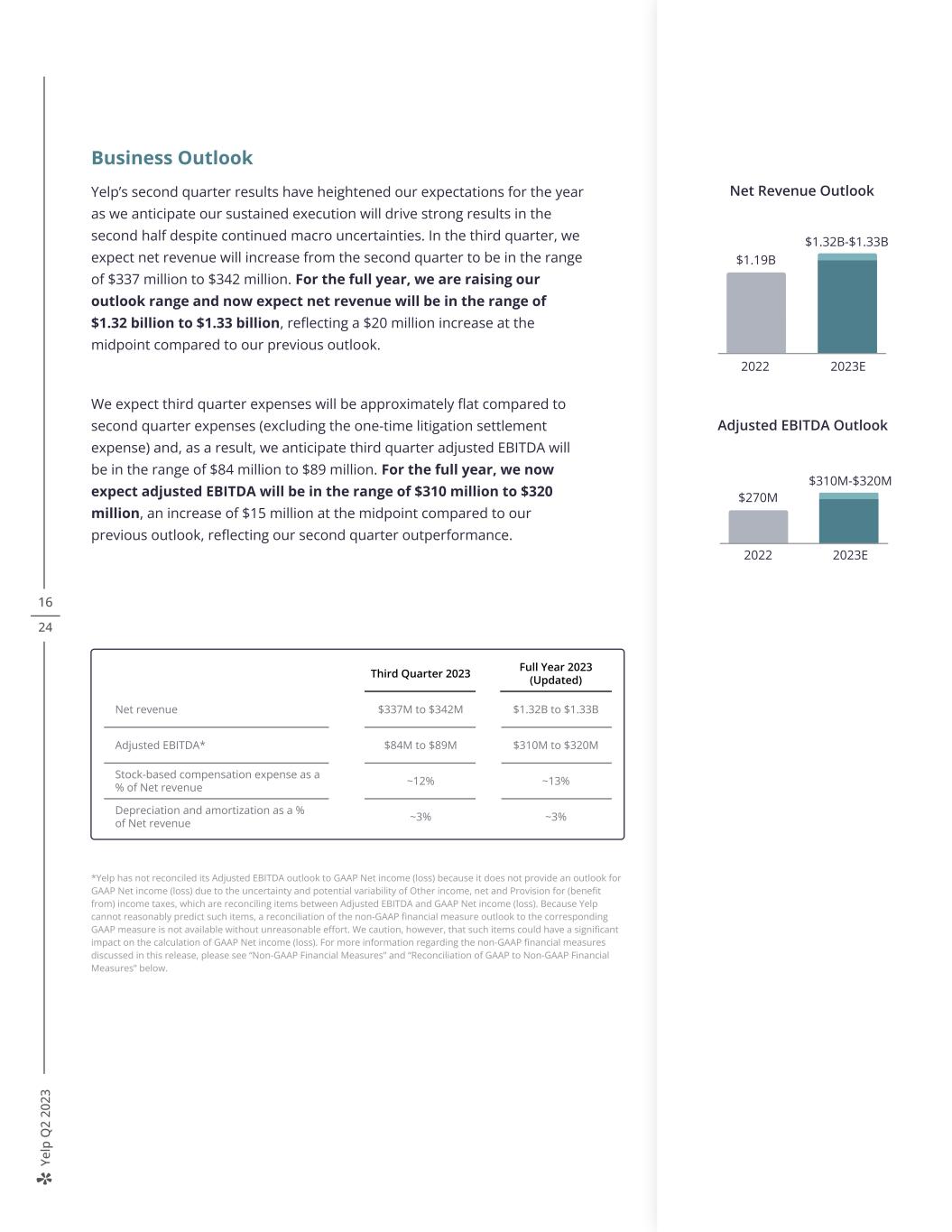

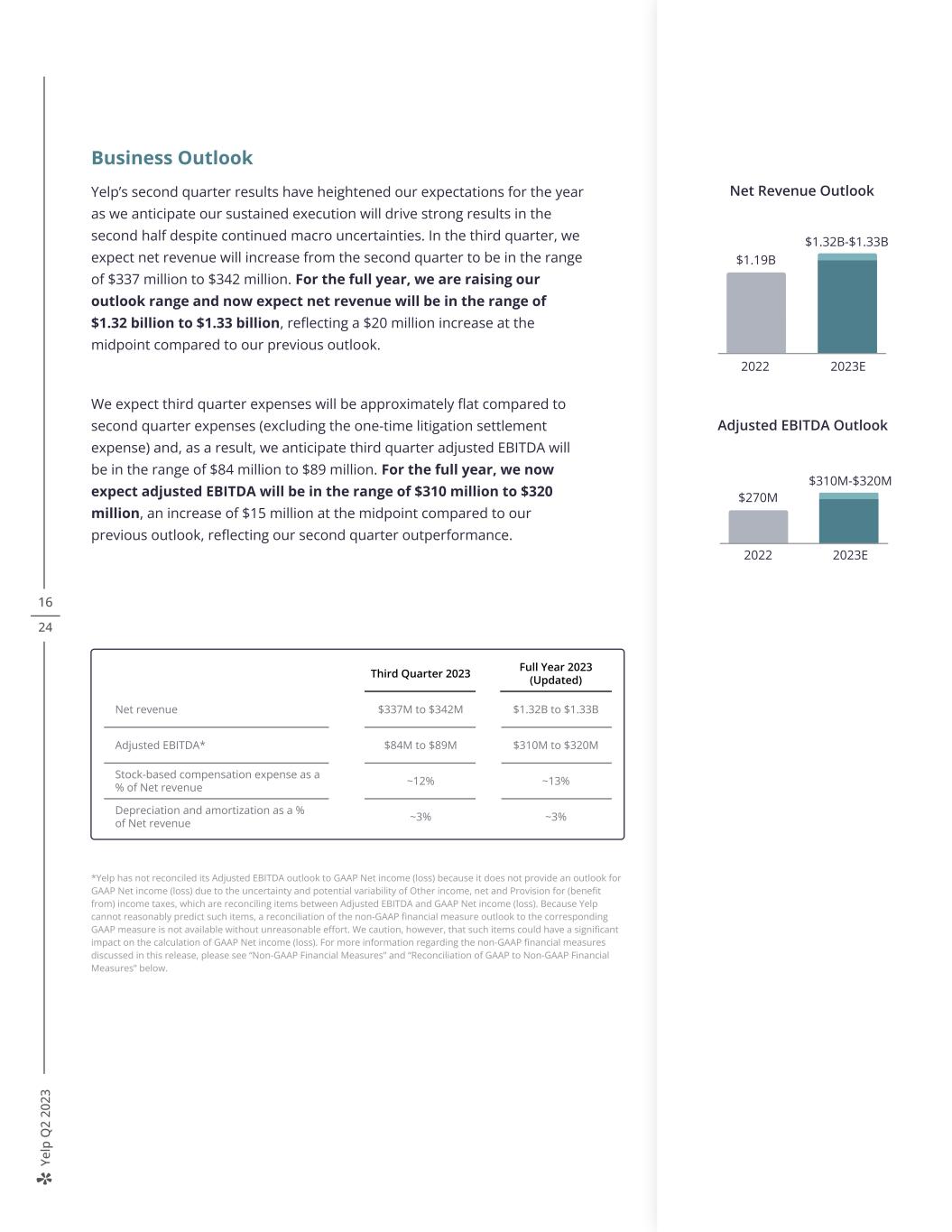

Ye lp Q 2 20 23 16 24 Business Outlook Yelp’s second quarter results have heightened our expectations for the year as we anticipate our sustained execution will drive strong results in the second half despite continued macro uncertainties. In the third quarter, we expect net revenue will increase from the second quarter to be in the range of $337 million to $342 million. For the full year, we are raising our outlook range and now expect net revenue will be in the range of $1.32 billion to $1.33 billion, reflecting a $20 million increase at the midpoint compared to our previous outlook. We expect third quarter expenses will be approximately flat compared to second quarter expenses (excluding the one-time litigation settlement expense) and, as a result, we anticipate third quarter adjusted EBITDA will be in the range of $84 million to $89 million. For the full year, we now expect adjusted EBITDA will be in the range of $310 million to $320 million, an increase of $15 million at the midpoint compared to our previous outlook, reflecting our second quarter outperformance. $270M Adjusted EBITDA Outlook 2022 2023E $310M-$320M Third Quarter 2023 Full Year 2023 (Updated) Net revenue $337M to $342M $1.32B to $1.33B Adjusted EBITDA* $84M to $89M $310M to $320M Stock-based compensation expense as a % of Net revenue ~12% ~13% Depreciation and amortization as a % of Net revenue ~3% ~3% *Yelp has not reconciled its Adjusted EBITDA outlook to GAAP Net income (loss) because it does not provide an outlook for GAAP Net income (loss) due to the uncertainty and potential variability of Other income, net and Provision for (benefit from) income taxes, which are reconciling items between Adjusted EBITDA and GAAP Net income (loss). Because Yelp cannot reasonably predict such items, a reconciliation of the non-GAAP financial measure outlook to the corresponding GAAP measure is not available without unreasonable effort. We caution, however, that such items could have a significant impact on the calculation of GAAP Net income (loss). For more information regarding the non-GAAP financial measures discussed in this release, please see “Non-GAAP Financial Measures” and “Reconciliation of GAAP to Non-GAAP Financial Measures” below. 2022 2023E $1.19B $1.32B-$1.33B Net Revenue Outlook

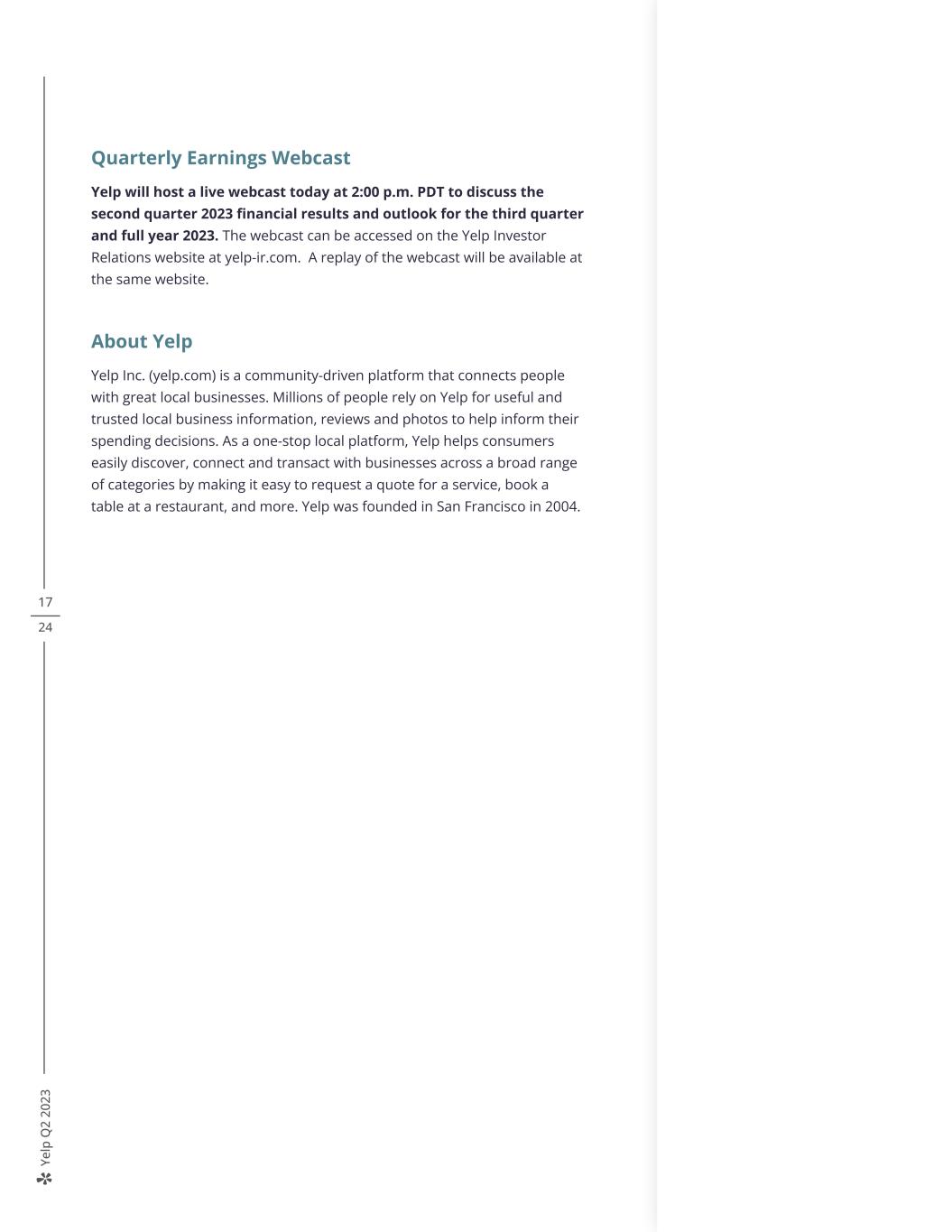

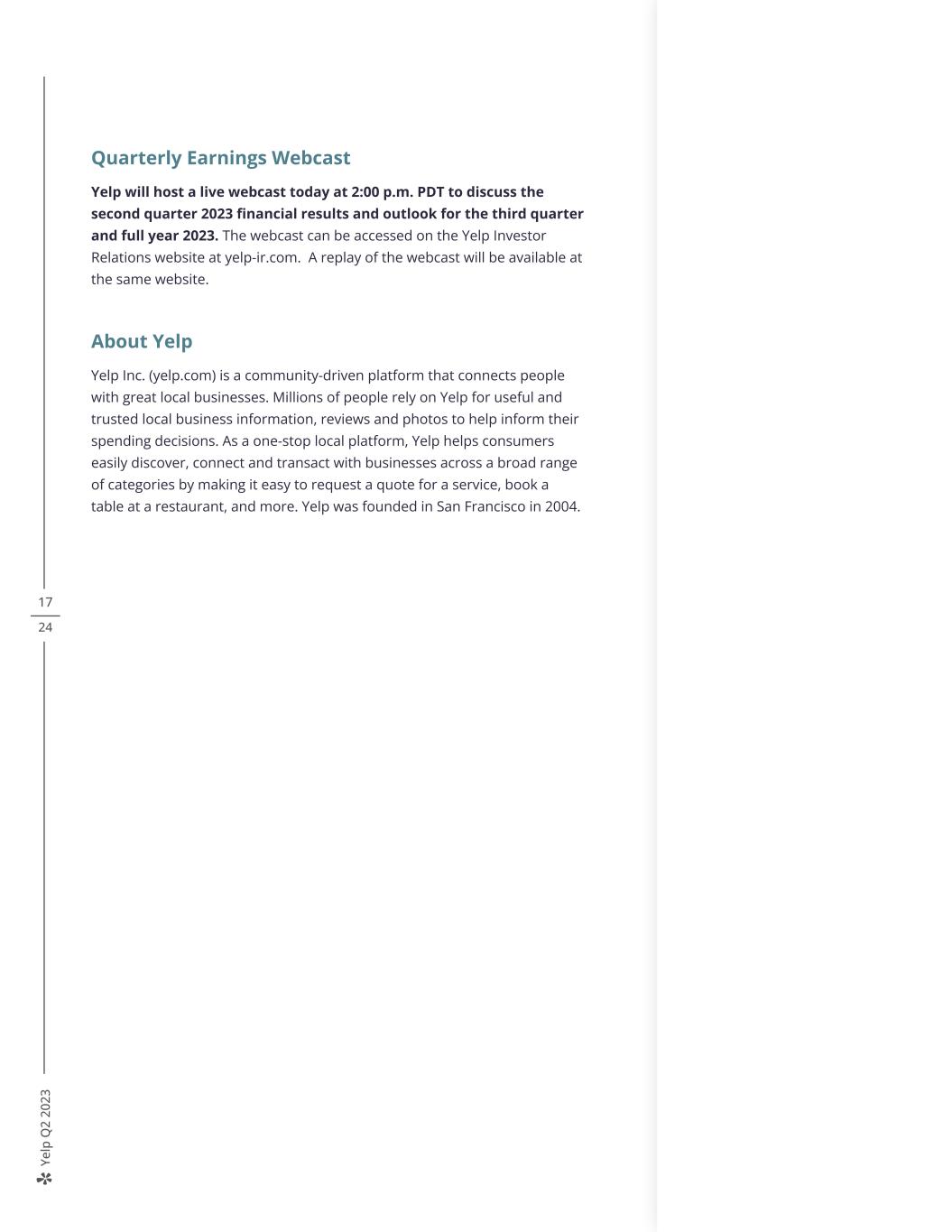

Ye lp Q 2 20 23 17 24 Quarterly Earnings Webcast Yelp will host a live webcast today at 2:00 p.m. PDT to discuss the second quarter 2023 financial results and outlook for the third quarter and full year 2023. The webcast can be accessed on the Yelp Investor Relations website at yelp-ir.com. A replay of the webcast will be available at the same website. About Yelp Yelp Inc. (yelp.com) is a community-driven platform that connects people with great local businesses. Millions of people rely on Yelp for useful and trusted local business information, reviews and photos to help inform their spending decisions. As a one-stop local platform, Yelp helps consumers easily discover, connect and transact with businesses across a broad range of categories by making it easy to request a quote for a service, book a table at a restaurant, and more. Yelp was founded in San Francisco in 2004.

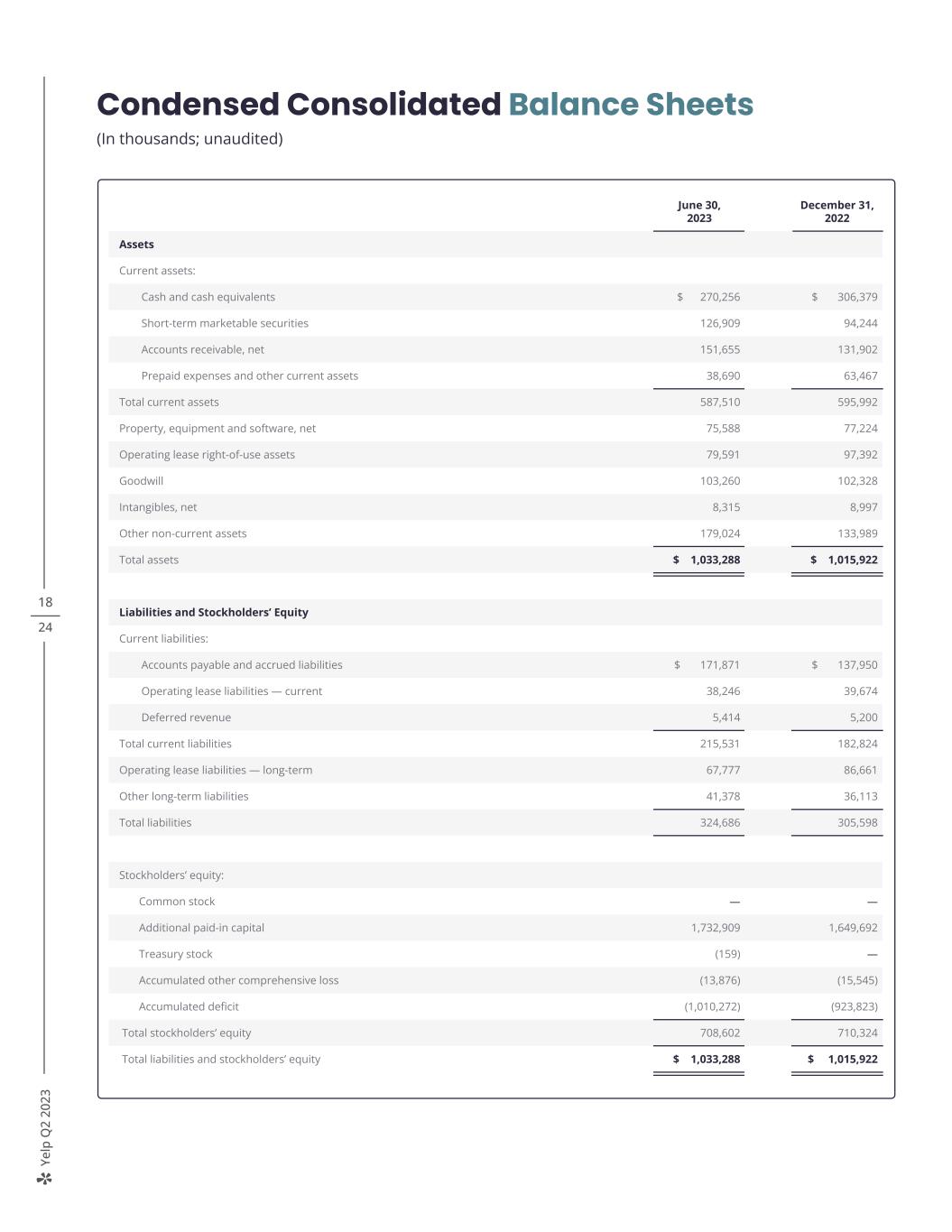

Ye lp Q 2 20 23 18 24 Condensed Consolidated Balance Sheets (In thousands; unaudited) June 30, 2023 December 31, 2022 Assets Current assets: Cash and cash equivalents $ 270,256 $ 306,379 Short-term marketable securities 126,909 94,244 Accounts receivable, net 151,655 131,902 Prepaid expenses and other current assets 38,690 63,467 Total current assets 587,510 595,992 Property, equipment and software, net 75,588 77,224 Operating lease right-of-use assets 79,591 97,392 Goodwill 103,260 102,328 Intangibles, net 8,315 8,997 Other non-current assets 179,024 133,989 Total assets $ 1,033,288 $ 1,015,922 Liabilities and Stockholders’ Equity Current liabilities: Accounts payable and accrued liabilities $ 171,871 $ 137,950 Operating lease liabilities — current 38,246 39,674 Deferred revenue 5,414 5,200 Total current liabilities 215,531 182,824 Operating lease liabilities — long-term 67,777 86,661 Other long-term liabilities 41,378 36,113 Total liabilities 324,686 305,598 Stockholders’ equity: Common stock — — Additional paid-in capital 1,732,909 1,649,692 Treasury stock (159) — Accumulated other comprehensive loss (13,876) (15,545) Accumulated deficit (1,010,272) (923,823) Total stockholders’ equity 708,602 710,324 Total liabilities and stockholders’ equity $ 1,033,288 $ 1,015,922

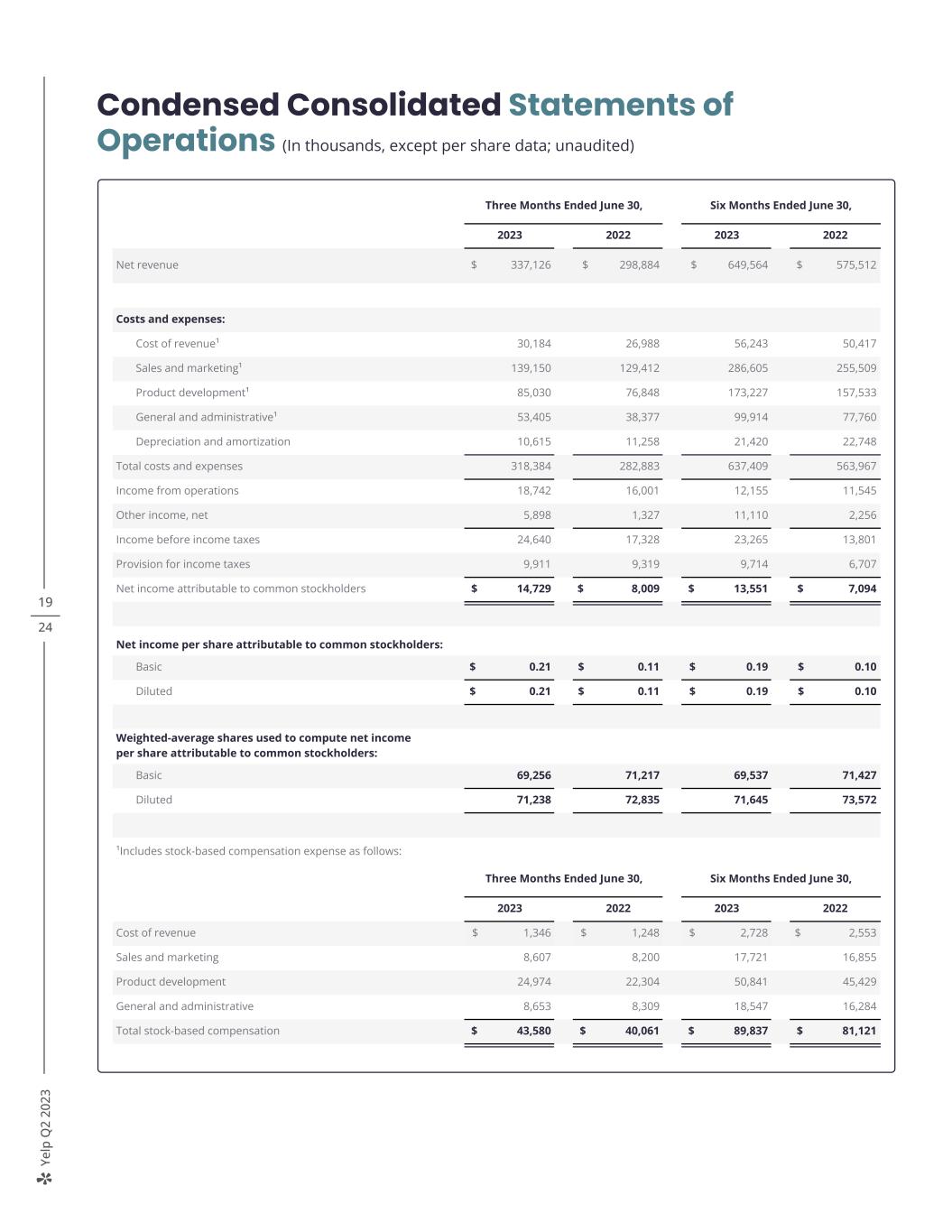

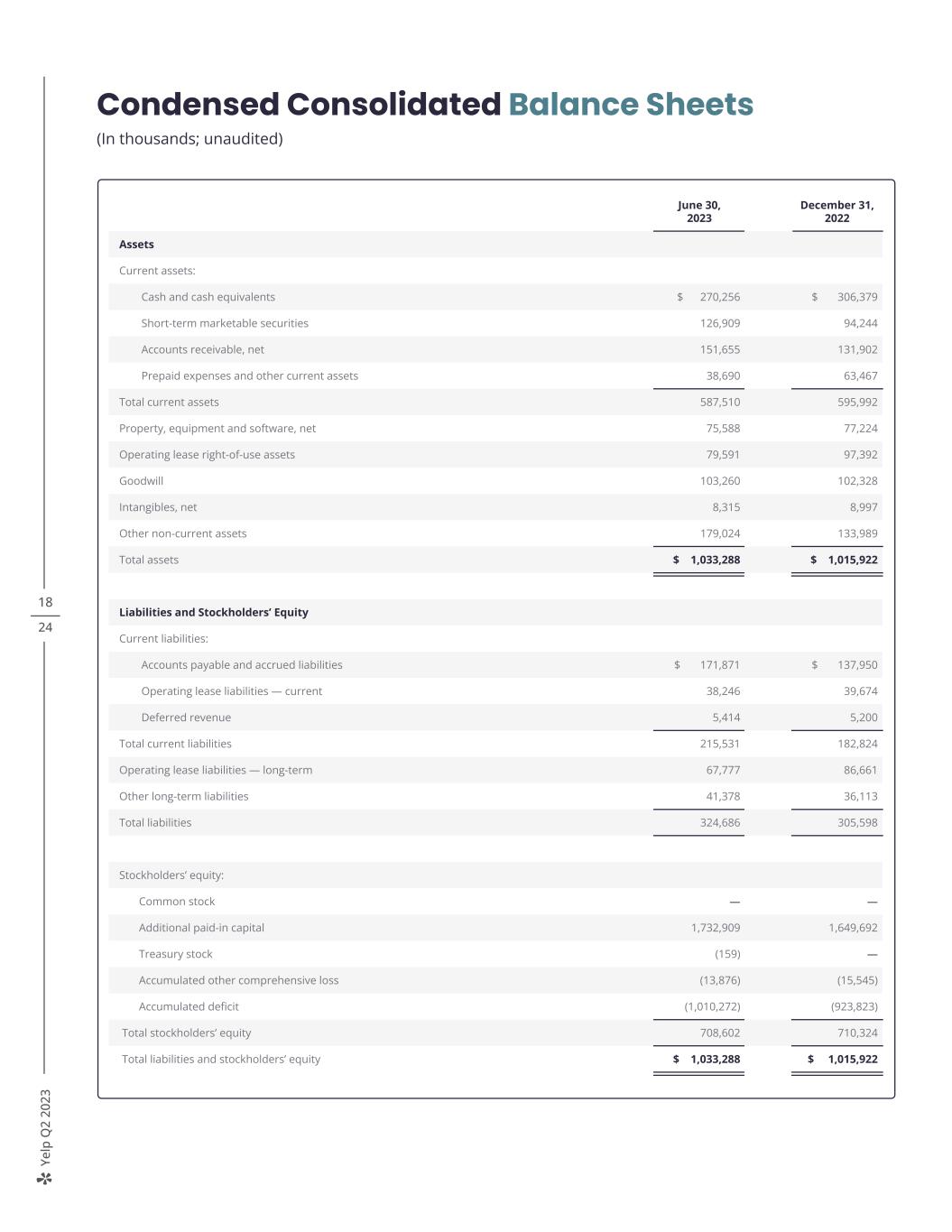

Ye lp Q 2 20 23 19 24 Condensed Consolidated Statements of Operations (In thousands, except per share data; unaudited) Three Months Ended June 30, Six Months Ended June 30, 2023 2022 2023 2022 Net revenue $ 337,126 $ 298,884 $ 649,564 $ 575,512 Costs and expenses: Cost of revenue¹ 30,184 26,988 56,243 50,417 Sales and marketing¹ 139,150 129,412 286,605 255,509 Product development¹ 85,030 76,848 173,227 157,533 General and administrative¹ 53,405 38,377 99,914 77,760 Depreciation and amortization 10,615 11,258 21,420 22,748 Total costs and expenses 318,384 282,883 637,409 563,967 Income from operations 18,742 16,001 12,155 11,545 Other income, net 5,898 1,327 11,110 2,256 Income before income taxes 24,640 17,328 23,265 13,801 Provision for income taxes 9,911 9,319 9,714 6,707 Net income attributable to common stockholders $ 14,729 $ 8,009 $ 13,551 $ 7,094 Net income per share attributable to common stockholders: Basic $ 0.21 $ 0.11 $ 0.19 $ 0.10 Diluted $ 0.21 $ 0.11 $ 0.19 $ 0.10 Weighted-average shares used to compute net income per share attributable to common stockholders: Basic 69,256 71,217 69,537 71,427 Diluted 71,238 72,835 71,645 73,572 ¹Includes stock-based compensation expense as follows: Three Months Ended June 30, Six Months Ended June 30, 2023 2022 2023 2022 Cost of revenue $ 1,346 $ 1,248 $ 2,728 $ 2,553 Sales and marketing 8,607 8,200 17,721 16,855 Product development 24,974 22,304 50,841 45,429 General and administrative 8,653 8,309 18,547 16,284 Total stock-based compensation $ 43,580 $ 40,061 $ 89,837 $ 81,121

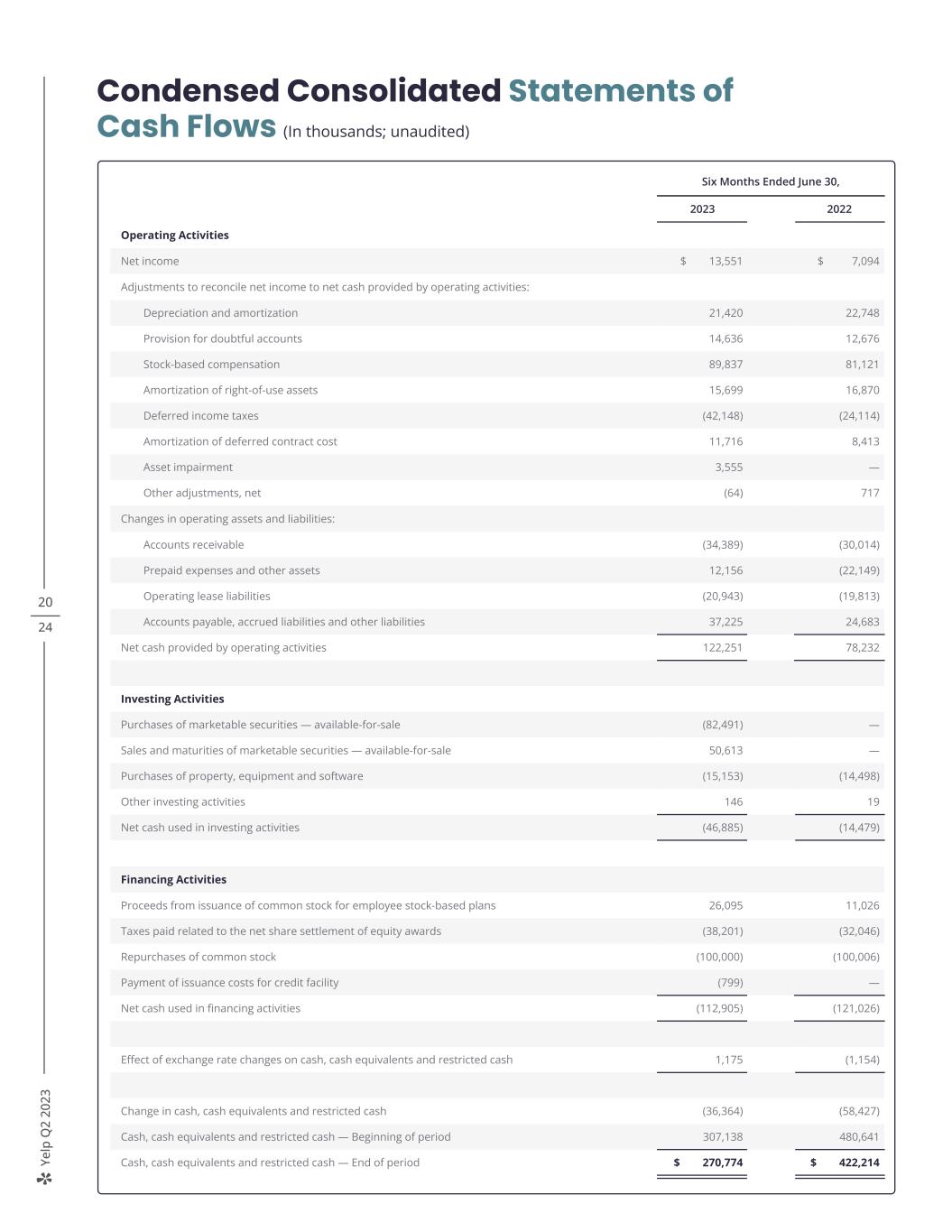

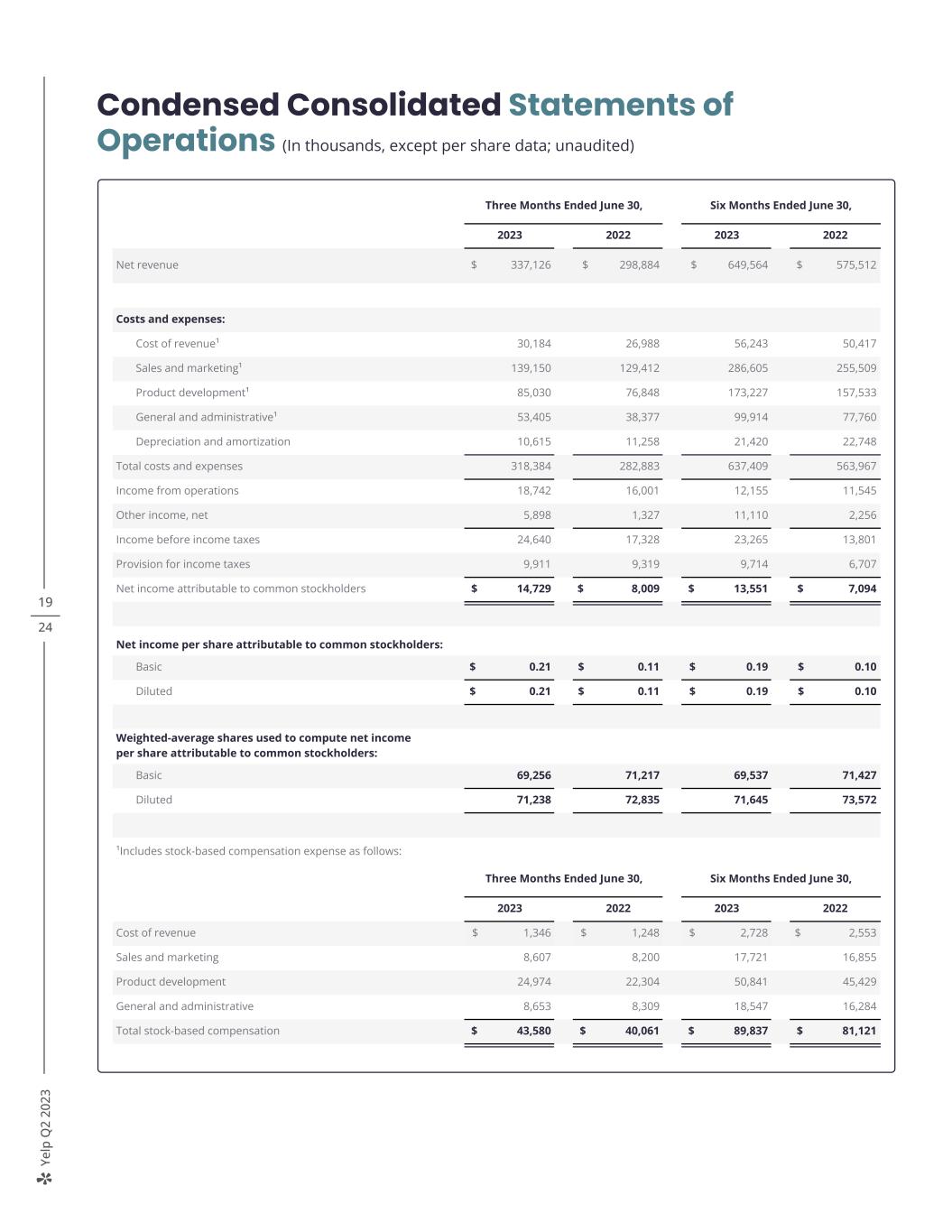

Ye lp Q 2 20 23 20 24 Condensed Consolidated Statements of Cash Flows (In thousands; unaudited) Six Months Ended June 30, 2023 2022 Operating Activities Net income $ 13,551 $ 7,094 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 21,420 22,748 Provision for doubtful accounts 14,636 12,676 Stock-based compensation 89,837 81,121 Amortization of right-of-use assets 15,699 16,870 Deferred income taxes (42,148) (24,114) Amortization of deferred contract cost 11,716 8,413 Asset impairment 3,555 — Other adjustments, net (64) 717 Changes in operating assets and liabilities: Accounts receivable (34,389) (30,014) Prepaid expenses and other assets 12,156 (22,149) Operating lease liabilities (20,943) (19,813) Accounts payable, accrued liabilities and other liabilities 37,225 24,683 Net cash provided by operating activities 122,251 78,232 Investing Activities Purchases of marketable securities — available-for-sale (82,491) — Sales and maturities of marketable securities — available-for-sale 50,613 — Purchases of property, equipment and software (15,153) (14,498) Other investing activities 146 19 Net cash used in investing activities (46,885) (14,479) Financing Activities Proceeds from issuance of common stock for employee stock-based plans 26,095 11,026 Taxes paid related to the net share settlement of equity awards (38,201) (32,046) Repurchases of common stock (100,000) (100,006) Payment of issuance costs for credit facility (799) — Net cash used in financing activities (112,905) (121,026) Effect of exchange rate changes on cash, cash equivalents and restricted cash 1,175 (1,154) Change in cash, cash equivalents and restricted cash (36,364) (58,427) Cash, cash equivalents and restricted cash — Beginning of period 307,138 480,641 Cash, cash equivalents and restricted cash — End of period $ 270,774 $ 422,214

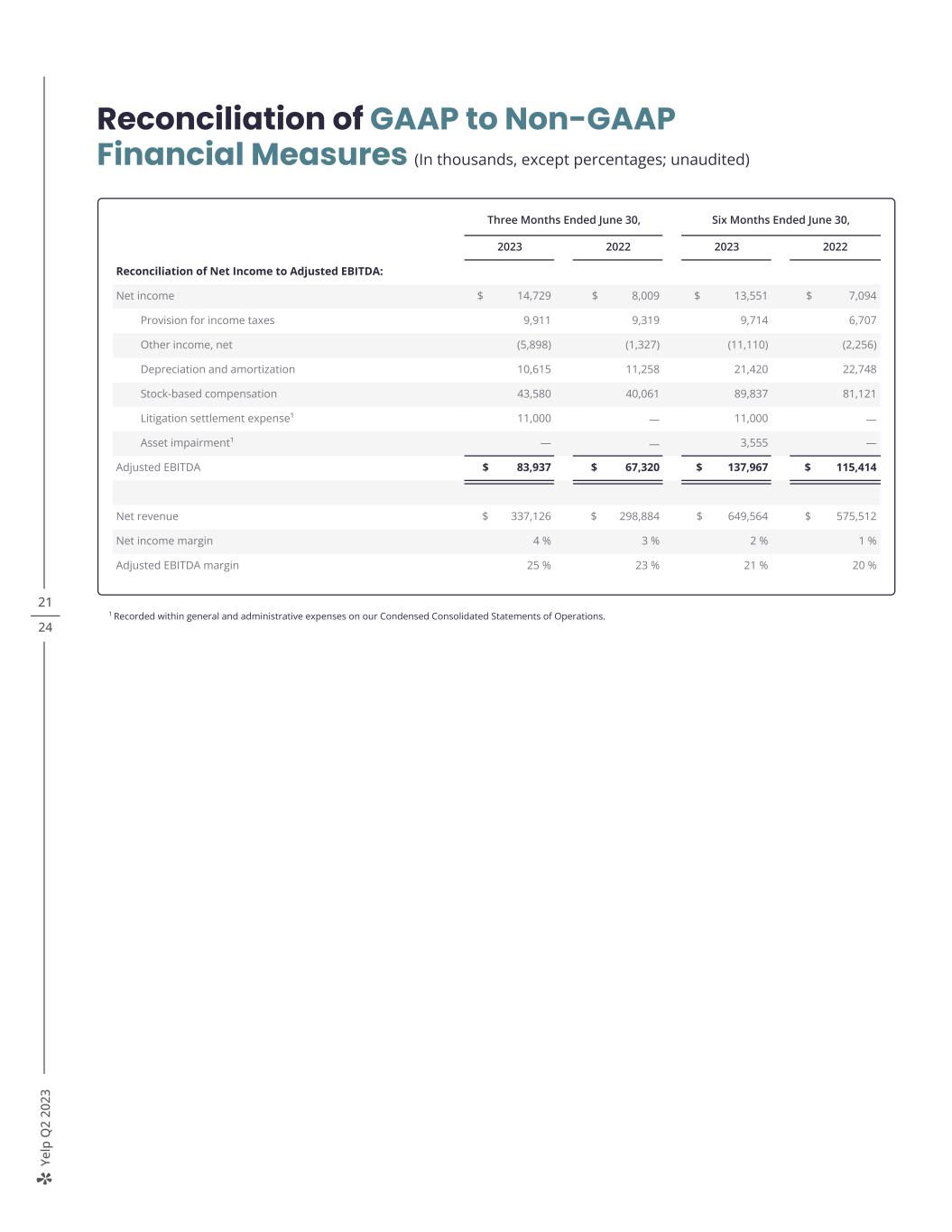

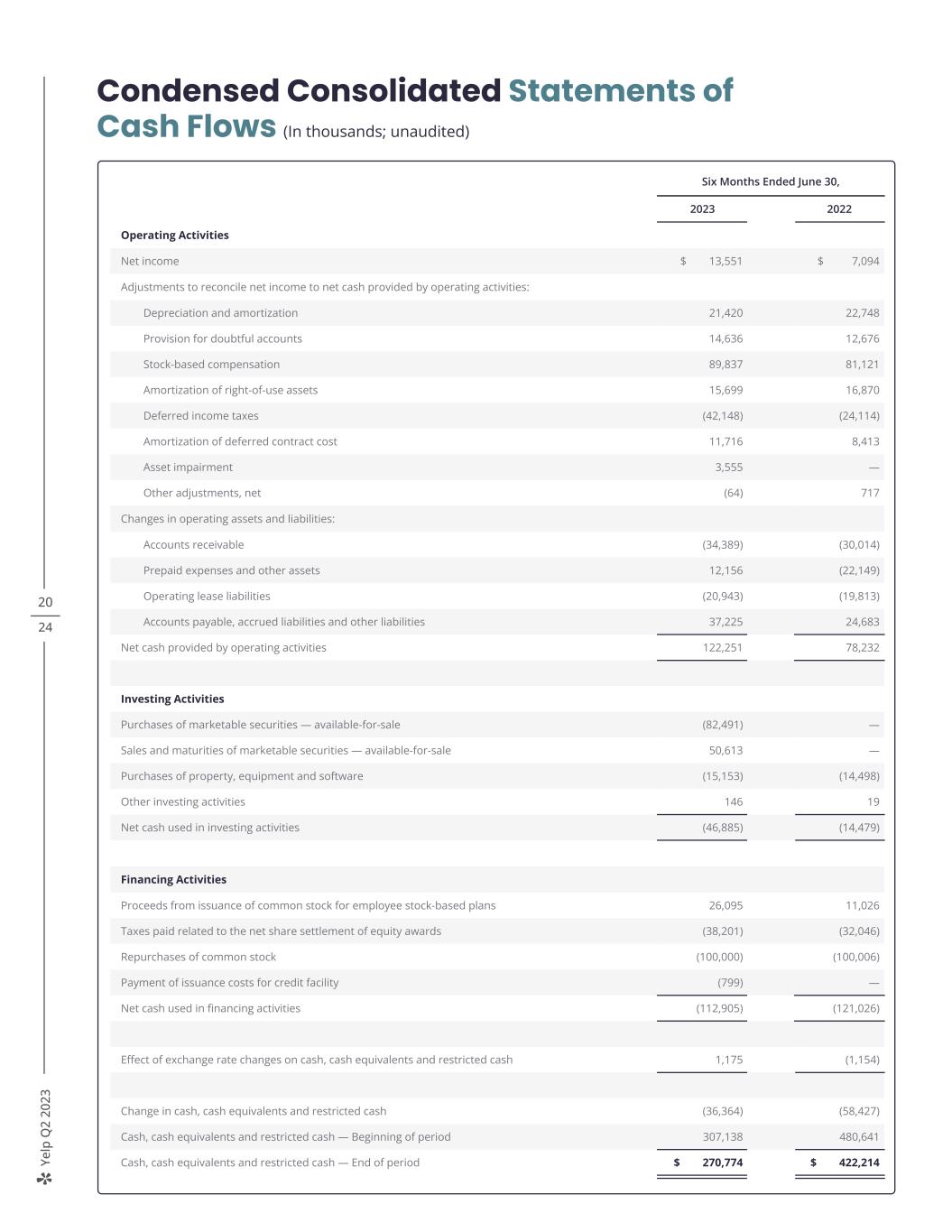

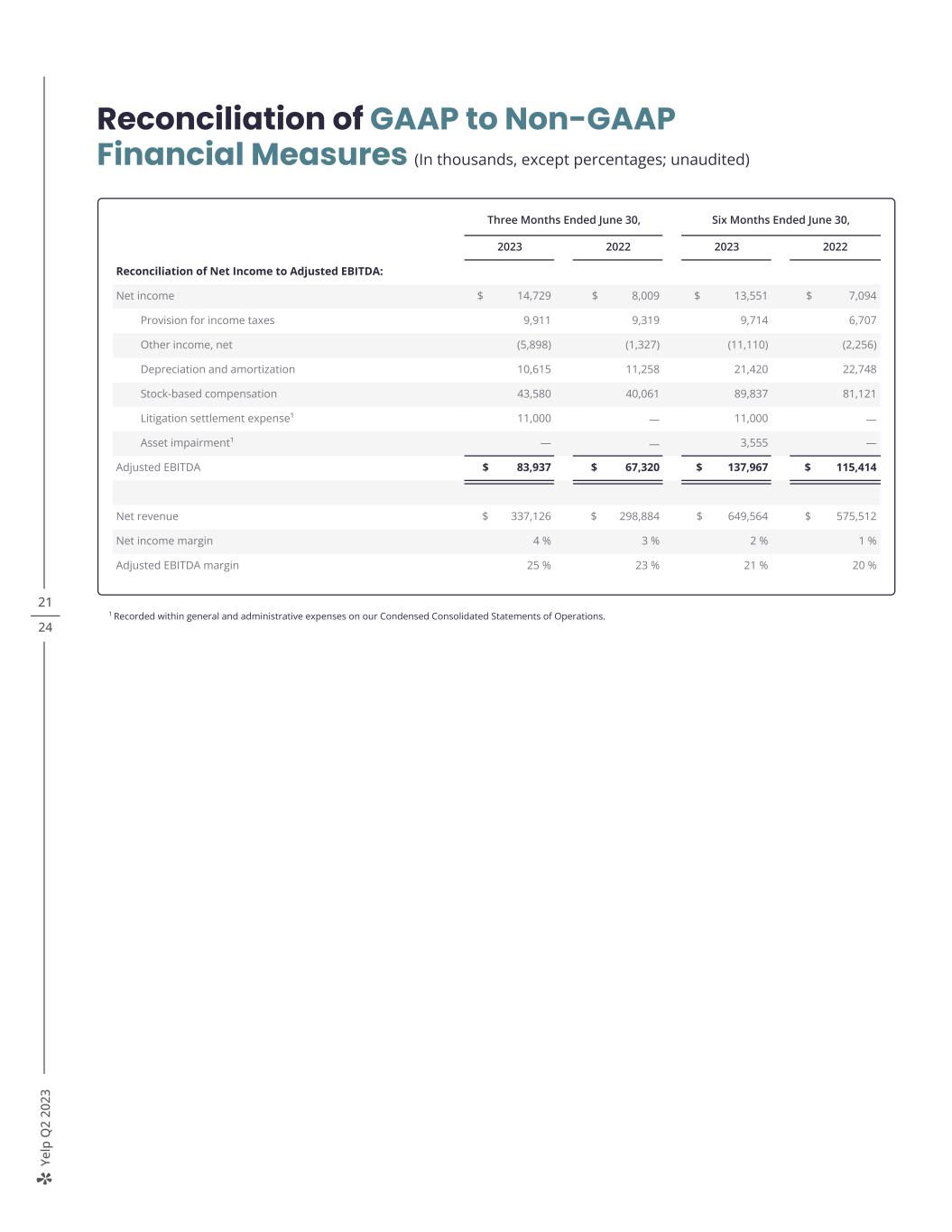

Ye lp Q 2 20 23 21 24 Reconciliation of GAAP to Non-GAAP Financial Measures (In thousands, except percentages; unaudited) 1 Recorded within general and administrative expenses on our Condensed Consolidated Statements of Operations. Three Months Ended June 30, Six Months Ended June 30, 2023 2022 2023 2022 Reconciliation of Net Income to Adjusted EBITDA: Net income $ 14,729 $ 8,009 $ 13,551 $ 7,094 Provision for income taxes 9,911 9,319 9,714 6,707 Other income, net (5,898) (1,327) (11,110) (2,256) Depreciation and amortization 10,615 11,258 21,420 22,748 Stock-based compensation 43,580 40,061 89,837 81,121 Litigation settlement expense¹ 11,000 — 11,000 — Asset impairment¹ — — 3,555 — Adjusted EBITDA $ 83,937 $ 67,320 $ 137,967 $ 115,414 Net revenue $ 337,126 $ 298,884 $ 649,564 $ 575,512 Net income margin 4 % 3 % 2 % 1 % Adjusted EBITDA margin 25 % 23 % 21 % 20 %

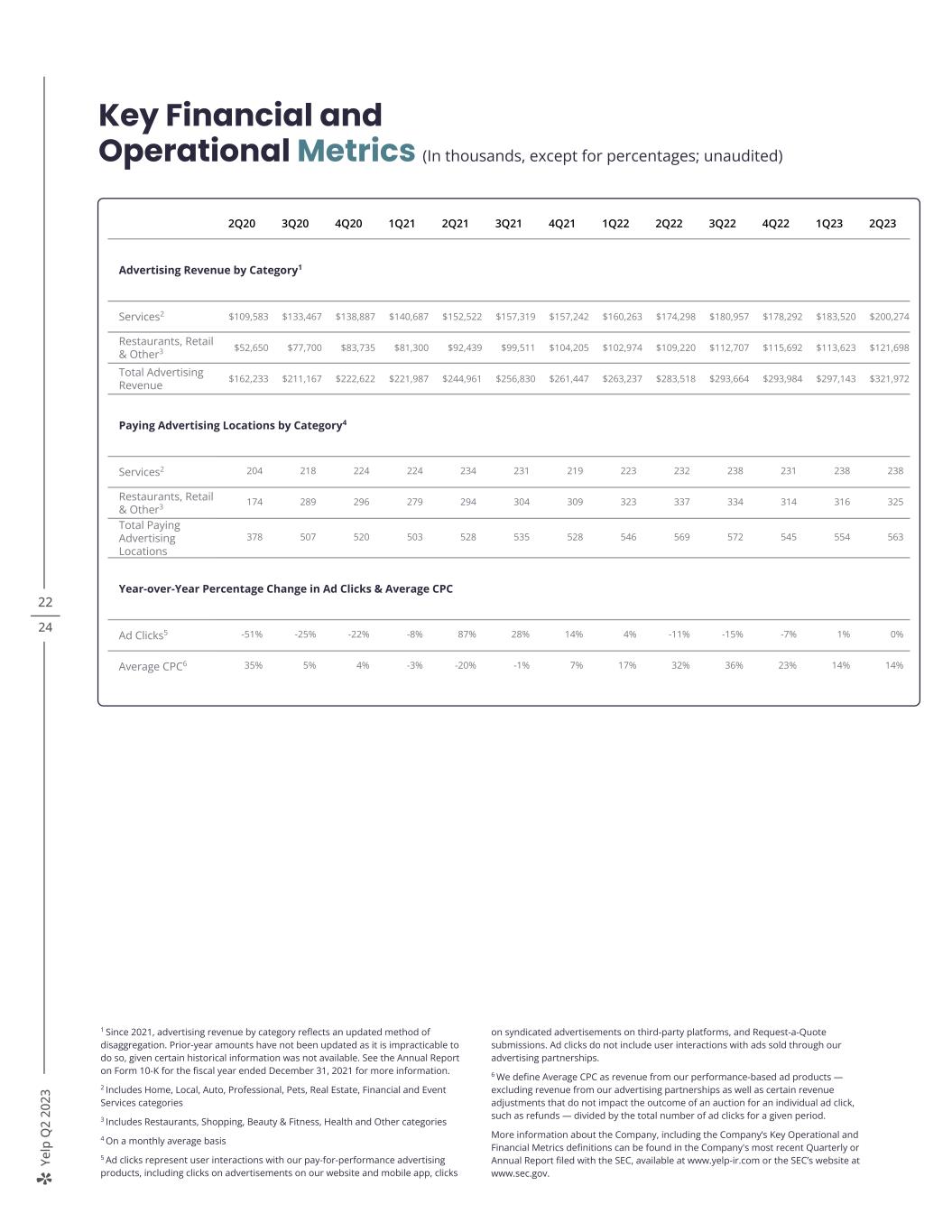

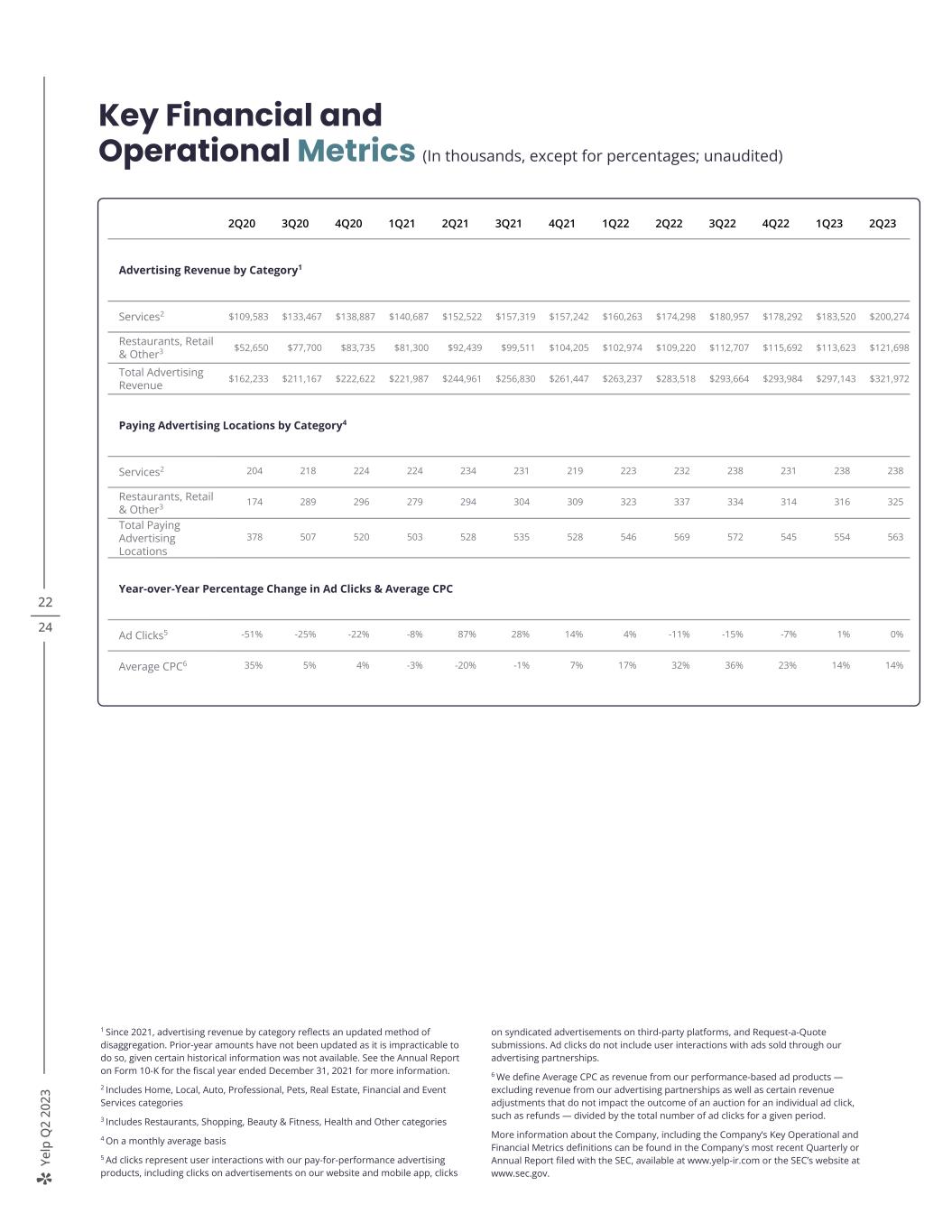

Ye lp Q 2 20 23 22 24 Key Financial and Operational Metrics (In thousands, except for percentages; unaudited) 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 Advertising Revenue by Category1 Services2 $109,583 $133,467 $138,887 $140,687 $152,522 $157,319 $157,242 $160,263 $174,298 $180,957 $178,292 $183,520 $200,274 Restaurants, Retail & Other3 $52,650 $77,700 $83,735 $81,300 $92,439 $99,511 $104,205 $102,974 $109,220 $112,707 $115,692 $113,623 $121,698 Total Advertising Revenue $162,233 $211,167 $222,622 $221,987 $244,961 $256,830 $261,447 $263,237 $283,518 $293,664 $293,984 $297,143 $321,972 Paying Advertising Locations by Category4 Services2 204 218 224 224 234 231 219 223 232 238 231 238 238 Restaurants, Retail & Other3 174 289 296 279 294 304 309 323 337 334 314 316 325 Total Paying Advertising Locations 378 507 520 503 528 535 528 546 569 572 545 554 563 Year-over-Year Percentage Change in Ad Clicks & Average CPC Ad Clicks5 -51% -25% -22% -8% 87% 28% 14% 4% -11% -15% -7% 1% 0% Average CPC6 35% 5% 4% -3% -20% -1% 7% 17% 32% 36% 23% 14% 14% 1 Since 2021, advertising revenue by category reflects an updated method of disaggregation. Prior-year amounts have not been updated as it is impracticable to do so, given certain historical information was not available. See the Annual Report on Form 10-K for the fiscal year ended December 31, 2021 for more information. 2 Includes Home, Local, Auto, Professional, Pets, Real Estate, Financial and Event Services categories 3 Includes Restaurants, Shopping, Beauty & Fitness, Health and Other categories 4 On a monthly average basis 5 Ad clicks represent user interactions with our pay-for-performance advertising products, including clicks on advertisements on our website and mobile app, clicks on syndicated advertisements on third-party platforms, and Request-a-Quote submissions. Ad clicks do not include user interactions with ads sold through our advertising partnerships. 6 We define Average CPC as revenue from our performance-based ad products — excluding revenue from our advertising partnerships as well as certain revenue adjustments that do not impact the outcome of an auction for an individual ad click, such as refunds — divided by the total number of ad clicks for a given period. More information about the Company, including the Company’s Key Operational and Financial Metrics definitions can be found in the Company's most recent Quarterly or Annual Report filed with the SEC, available at www.yelp-ir.com or the SEC’s website at www.sec.gov.

Ye lp Q 2 20 23 Non-GAAP Financial Measures This letter and statements made during the above referenced webcast may include information relating to Adjusted EBITDA and Adjusted EBITDA margin, each of which is a "non-GAAP financial measure." We define Adjusted EBITDA as net income (loss), adjusted to exclude: provision for (benefit from) income taxes; other income, net; depreciation and amortization; stock-based compensation expense; and, in certain periods, certain other income and expense items, such as litigation settlement expenses and impairment charges. We define Adjusted EBITDA margin as Adjusted EBITDA divided by net revenue. Adjusted EBITDA, which is not prepared under any comprehensive set of accounting rules or principles, has limitations as an analytical tool and you should not consider it in isolation or as a substitute for analysis of Yelp’s financial results as reported in accordance with generally accepted accounting principles in the United States (“GAAP”). In particular, Adjusted EBITDA should not be viewed as a substitute for, or superior to, net income (loss) prepared in accordance with GAAP as a measure of profitability or liquidity. Some of these limitations are: > although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect all cash capital expenditure requirements for such replacements or for new capital expenditure requirements; > Adjusted EBITDA does not reflect changes in, or cash requirements for, Yelp's working capital needs; > Adjusted EBITDA does not reflect the impact of the recording or release of valuation allowances or tax payments that may represent a reduction in cash available to Yelp > Adjusted EBITDA does not consider the potentially dilutive impact of equity-based compensation; > Adjusted EBITDA does not take into account any income or costs that management determines are not indicative of ongoing operating performance, such as litigation settlement expenses and impairment charges; and > other companies, including those in Yelp’s industry, may calculate Adjusted EBITDA differently, which reduces its usefulness as a comparative measure. Because of these limitations, you should consider Adjusted EBITDA and Adjusted EBITDA margin alongside other financial performance measures, net income (loss) and Yelp’s other GAAP results. Forward-Looking Statements This letter contains, and statements made during the above-referenced webcast will contain, forward-looking statements relating to, among other things, the future performance of Yelp and its consolidated subsidiaries that are based on Yelp’s current expectations, forecasts and assumptions and involve risks and uncertainties. These statements include, but are not limited to, statements regarding: > Yelp’s expected financial results for the third quarter and full year 2023; > Yelp’s pipeline of projects for the remainder of 2023 and beyond; > Yelp’s belief that its strategic initiatives continue to provide opportunities for growth and in its ability to execute against those initiatives in 2023; > Yelp’s belief in its ability to execute against its roadmap and deliver profitable growth and shareholder value over the long term; > Yelp’s confidence that Yelp Guaranteed will drive increases in project submissions and ad clicks for businesses that adopt the product; > Yelp’s belief that the Yelp Audiences product presents significant opportunities to drive further gains in the years ahead; > Yelp’s belief that the moderation in the quarter-to-quarter fluctuations of ad clicks and average CPC compared to their fluctuations in 2022 reflects a normalizing macro environment; > Yelp’s roadmap to continue improving the accuracy and performance of its ad system; > Yelp’s belief that its strategic investments in product development and Multi-location sales, together with its commitment to remote work, have positioned it well to drive profitable growth and leverage over the long term; > Yelp’s expectation that its headcount will be approximately flat year over year by the end of 2023; 23 24

Ye lp Q 2 20 23 > Yelp’s expectations regarding its reduction of SBC as a percentage of revenue over time, its ability to achieve those expectations by focusing on product development hiring efforts outside of the United States and adjusting the compensation mix throughout the organization, and the anticipated timing of the impact of such efforts; > Yelp’s plans to continue share repurchases under its stock repurchase program; > Yelp’s belief that its product velocity across its strategic initiatives supports the durability of its business amid continued macro uncertainties; > Yelp’s confidence in its continued ability to drive profitable growth and generate ongoing shareholder value; and > Yelp’s expectation that its sustained execution will drive profitable growth and strong results in the second half of 2023 despite continued macro uncertainties. Yelp’s actual results could differ materially from those predicted or implied by such forward-looking statements and reported results should not be considered as an indication of future performance. Factors that could cause or contribute to such differences include, but are not limited to: > macroeconomic uncertainty — including related to inflation, rising interest rates, supply chain issues, and the lingering impact of the COVID-19 pandemic and efforts to contain it — and its effect on consumer behavior, user activity and advertiser spending; > the impact of fears or actual outbreaks of disease and any resulting changes in consumer behavior, economic conditions or governmental actions; > maintaining and expanding Yelp’s base of advertisers, particularly if advertiser turnover substantially worsens and/or consumer demand significantly degrades; > the default by any subtenants on their rental payment obligations under the subleases entered into in connection with Yelp’s reduction of its office space; > Yelp’s ability to continue to effectively operate with a primarily remote work force and attract and retain key talent; > Yelp’s limited operating history in an evolving industry; > Yelp’s ability to generate and maintain sufficient high-quality content from its users; > potential strategic opportunities and Yelp’s ability to successfully manage the acquisition and integration of new businesses, solutions or technologies, as well as its ability to monetize such acquired products, solutions or technologies; > Yelp’s reliance on traffic to its website from search engines like Google and Bing and the quality and reliability of such traffic; > maintaining a strong brand and managing negative publicity that may arise; and > Yelp’s ability to timely upgrade and develop its systems, infrastructure and customer service capabilities. Factors that could cause or contribute to such differences also include, but are not limited to, those factors that could affect Yelp’s business, operating results and stock price included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Yelp’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q at www.yelp-ir.com or the SEC’s website at www.sec.gov. Undue reliance should not be placed on the forward-looking statements in this letter or the above-referenced webcast, which are based on information available to Yelp on the date hereof. Such forward-looking statements do not include the potential impact of any acquisitions or divestitures that may be announced and/or completed after the date hereof. Yelp assumes no obligation to update such statements. 24 24