Q1 2023 Letter to Shareholders May 4, 2023 | yelp-ir.com

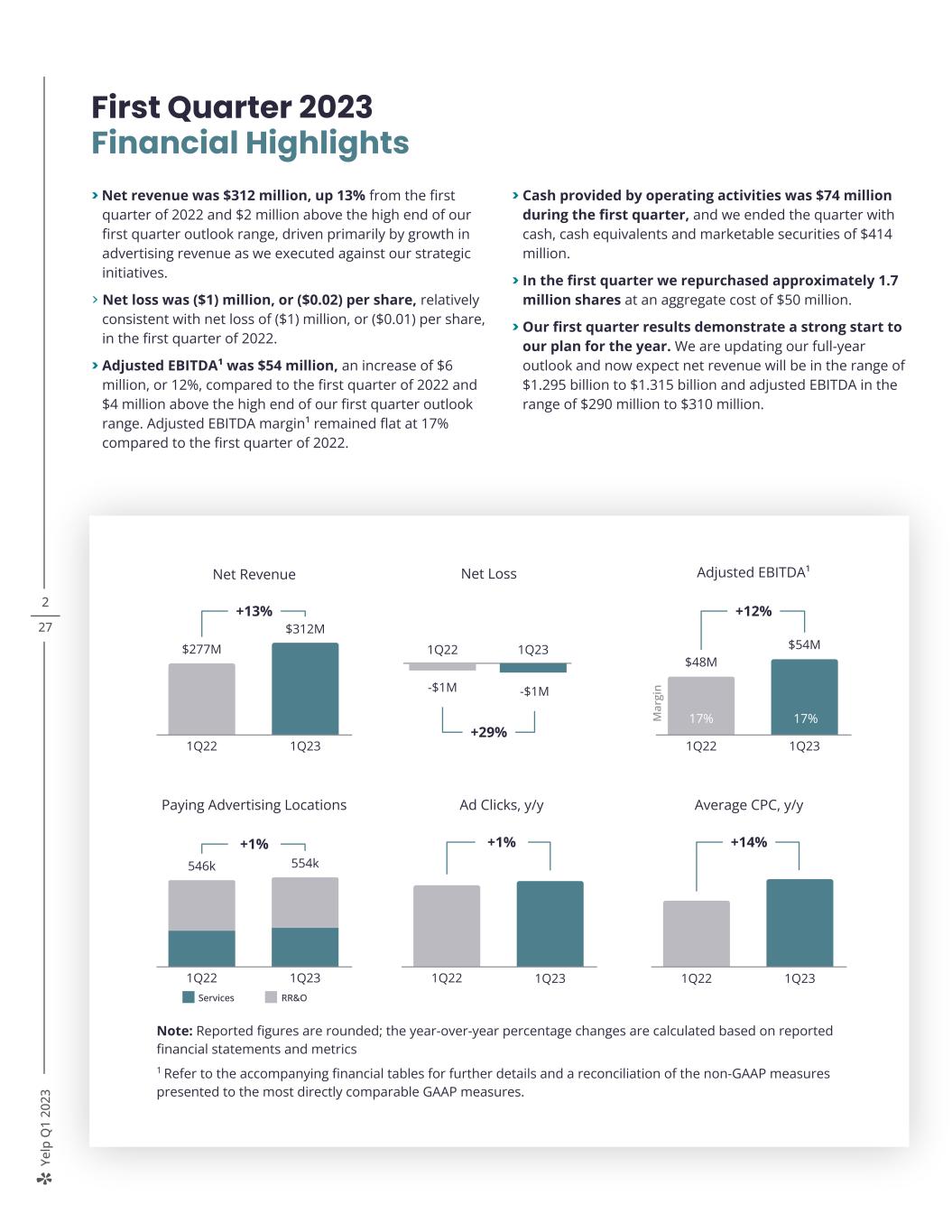

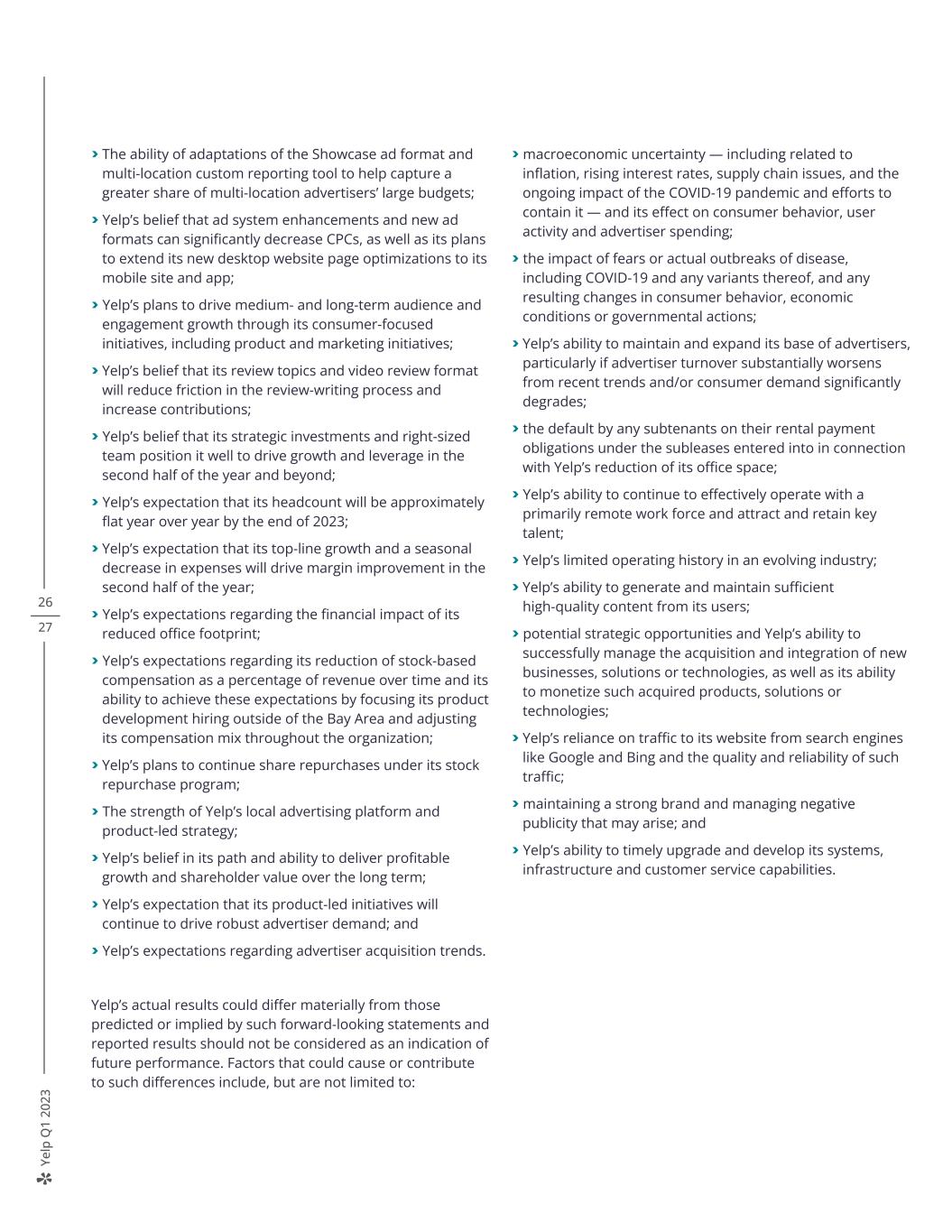

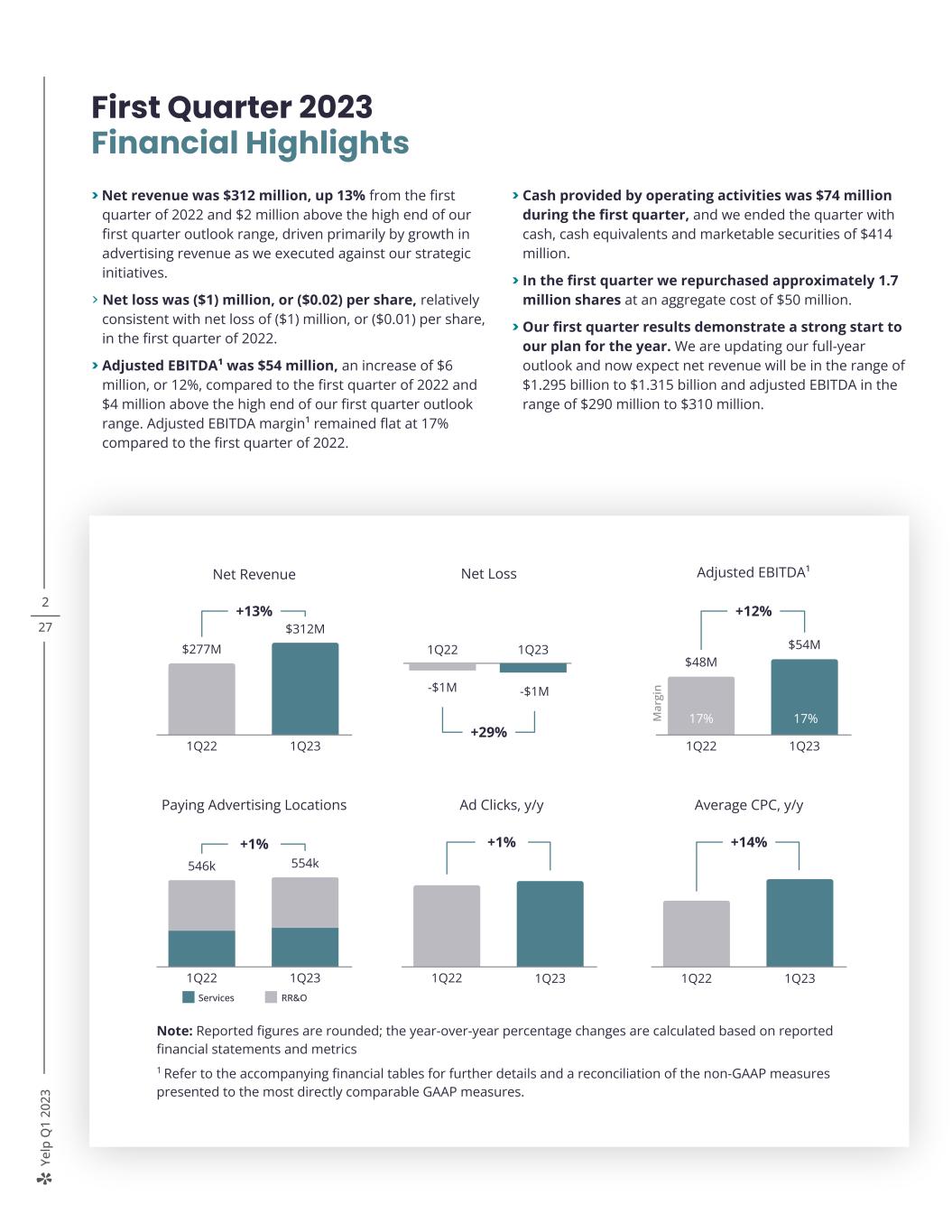

Ye lp Q 1 20 23 2 27 Note: Reported figures are rounded; the year-over-year percentage changes are calculated based on reported financial statements and metrics 1 Refer to the accompanying financial tables for further details and a reconciliation of the non-GAAP measures presented to the most directly comparable GAAP measures. First Quarter 2023 Financial Highlights > Net revenue was $312 million, up 13% from the first quarter of 2022 and $2 million above the high end of our first quarter outlook range, driven primarily by growth in advertising revenue as we executed against our strategic initiatives. > Net loss was ($1) million, or ($0.02) per share, relatively consistent with net loss of ($1) million, or ($0.01) per share, in the first quarter of 2022. > Adjusted EBITDA¹ was $54 million, an increase of $6 million, or 12%, compared to the first quarter of 2022 and $4 million above the high end of our first quarter outlook range. Adjusted EBITDA margin¹ remained flat at 17% compared to the first quarter of 2022. > Cash provided by operating activities was $74 million during the first quarter, and we ended the quarter with cash, cash equivalents and marketable securities of $414 million. > In the first quarter we repurchased approximately 1.7 million shares at an aggregate cost of $50 million. > Our first quarter results demonstrate a strong start to our plan for the year. We are updating our full-year outlook and now expect net revenue will be in the range of $1.295 billion to $1.315 billion and adjusted EBITDA in the range of $290 million to $310 million. 19% 17% Net Revenue +13% $277M $312M 1Q22 1Q23 Ad Clicks, y/y +1% 1Q22 1Q23 Average CPC, y/y +14% 1Q22 1Q23 Paying Advertising Locations +1% 546k 554k 1Q22 1Q23 Services RR&O Adjusted EBITDA¹ +12% $48M $54M 1Q22 1Q23 M ar gi n 17% 17%8% 7% Net Loss +29% 1Q22 1Q23 -$1M -$1M

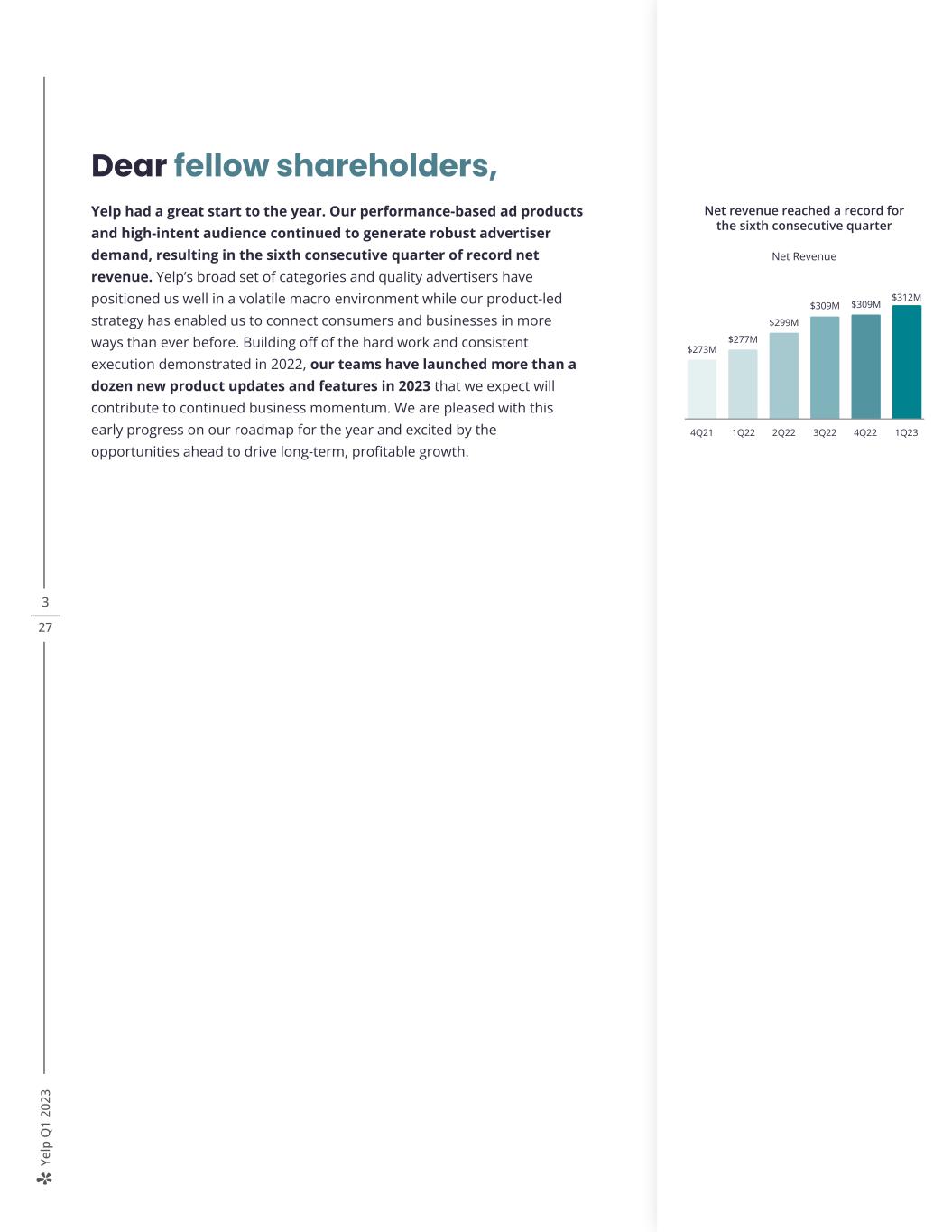

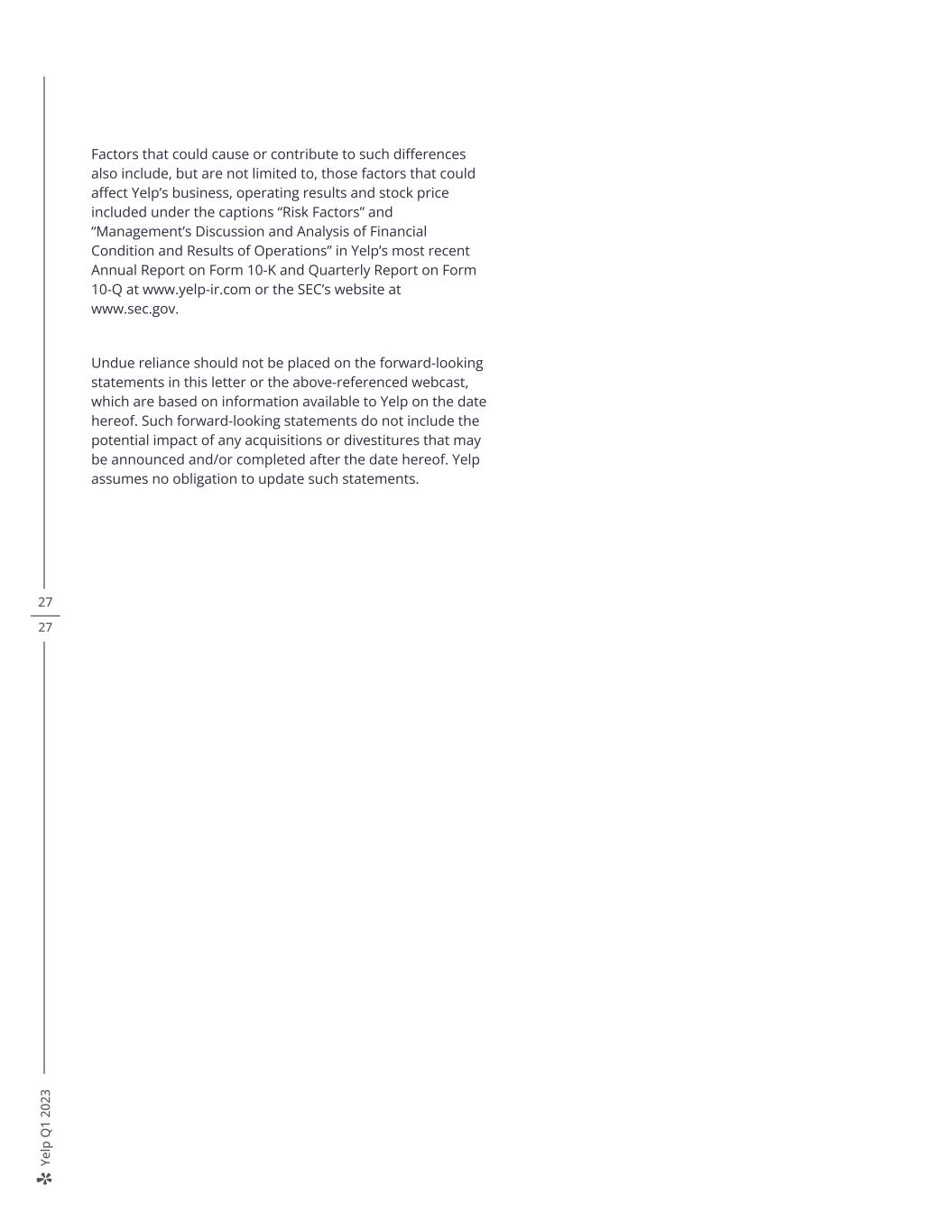

Ye lp Q 1 20 23 3 27 Dear fellow shareholders, Yelp had a great start to the year. Our performance-based ad products and high-intent audience continued to generate robust advertiser demand, resulting in the sixth consecutive quarter of record net revenue. Yelp’s broad set of categories and quality advertisers have positioned us well in a volatile macro environment while our product-led strategy has enabled us to connect consumers and businesses in more ways than ever before. Building off of the hard work and consistent execution demonstrated in 2022, our teams have launched more than a dozen new product updates and features in 2023 that we expect will contribute to continued business momentum. We are pleased with this early progress on our roadmap for the year and excited by the opportunities ahead to drive long-term, profitable growth. Net revenue reached a record for the sixth consecutive quarter Net Revenue 4Q21 1Q22 2Q22 4Q223Q22 1Q23 $312M $309M$309M $299M $277M $273M

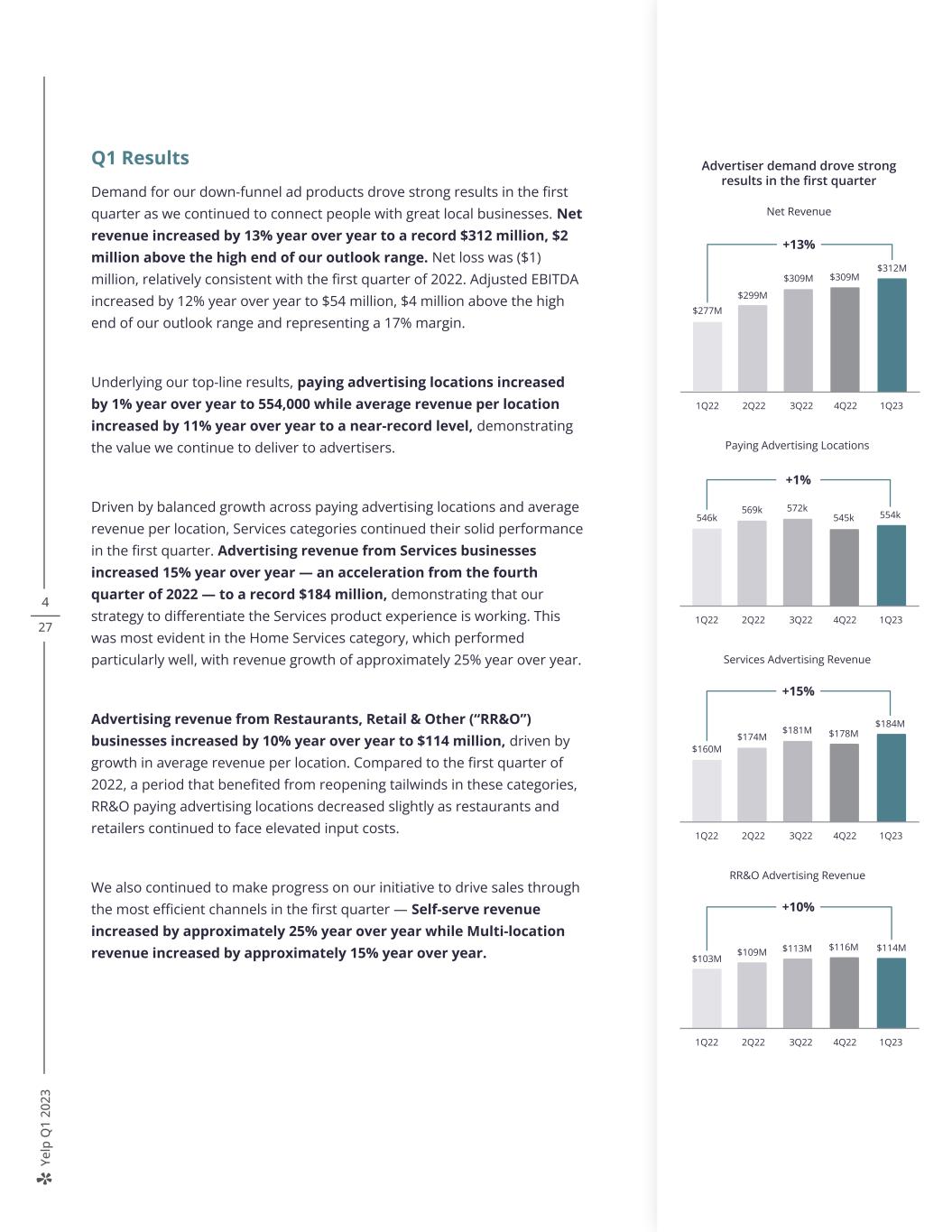

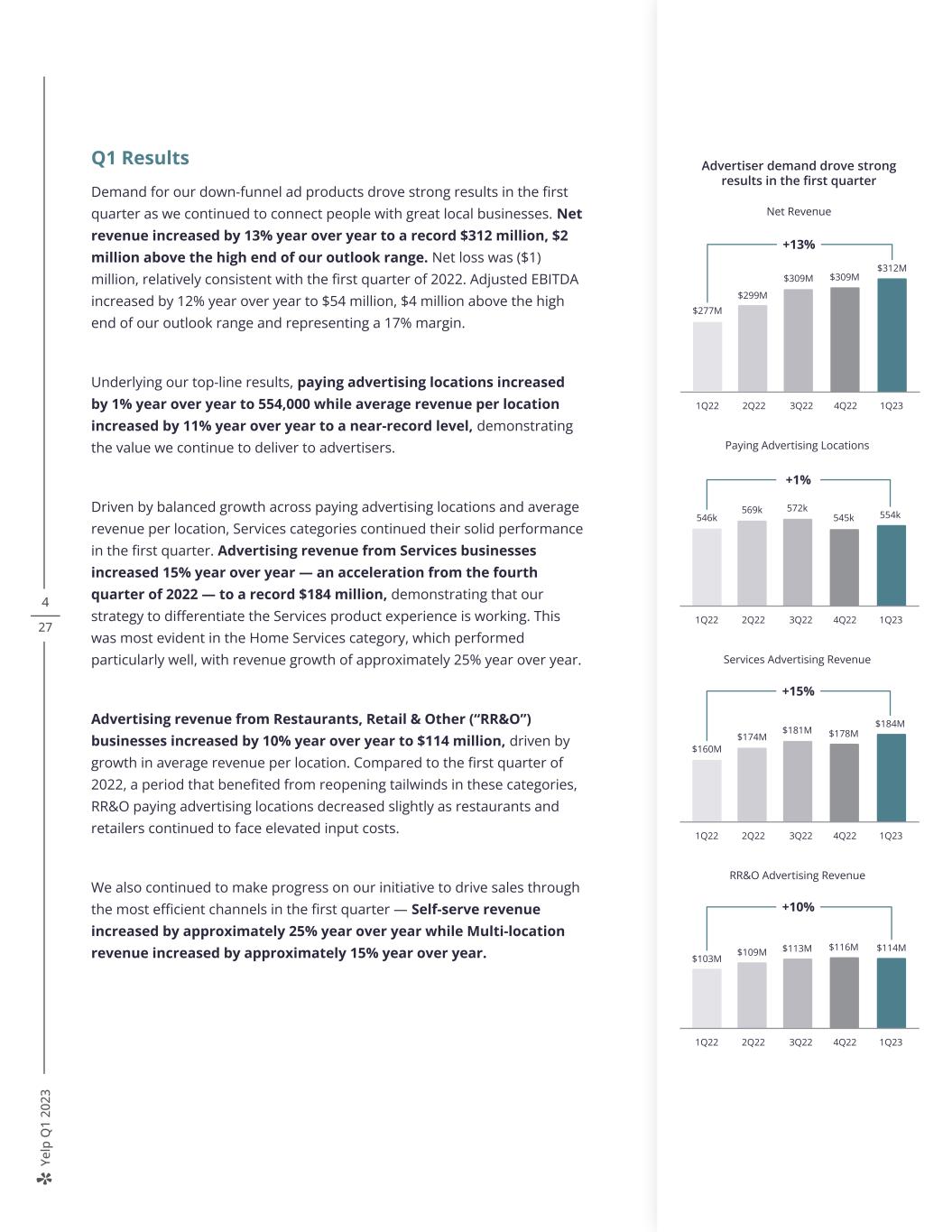

Ye lp Q 1 20 23 4 27 Q1 Results Demand for our down-funnel ad products drove strong results in the first quarter as we continued to connect people with great local businesses. Net revenue increased by 13% year over year to a record $312 million, $2 million above the high end of our outlook range. Net loss was ($1) million, relatively consistent with the first quarter of 2022. Adjusted EBITDA increased by 12% year over year to $54 million, $4 million above the high end of our outlook range and representing a 17% margin. Underlying our top-line results, paying advertising locations increased by 1% year over year to 554,000 while average revenue per location increased by 11% year over year to a near-record level, demonstrating the value we continue to deliver to advertisers. Driven by balanced growth across paying advertising locations and average revenue per location, Services categories continued their solid performance in the first quarter. Advertising revenue from Services businesses increased 15% year over year — an acceleration from the fourth quarter of 2022 — to a record $184 million, demonstrating that our strategy to differentiate the Services product experience is working. This was most evident in the Home Services category, which performed particularly well, with revenue growth of approximately 25% year over year. Advertising revenue from Restaurants, Retail & Other (“RR&O”) businesses increased by 10% year over year to $114 million, driven by growth in average revenue per location. Compared to the first quarter of 2022, a period that benefited from reopening tailwinds in these categories, RR&O paying advertising locations decreased slightly as restaurants and retailers continued to face elevated input costs. We also continued to make progress on our initiative to drive sales through the most efficient channels in the first quarter — Self-serve revenue increased by approximately 25% year over year while Multi-location revenue increased by approximately 15% year over year. Paying Advertising Locations +1% 546k 1Q22 2Q22 3Q22 4Q22 1Q23 554k569k 572k 545k Services Advertising Revenue +15% $160M 1Q22 2Q22 3Q22 4Q22 1Q23 $184M $174M $181M $178M RR&O Advertising Revenue +10% $103M 1Q22 2Q22 3Q22 4Q22 1Q23 $114M$109M $113M $116M Advertiser demand drove strong results in the first quarter Net Revenue +13% $277M 1Q22 2Q22 3Q22 4Q22 1Q23 $312M $299M $309M $309M

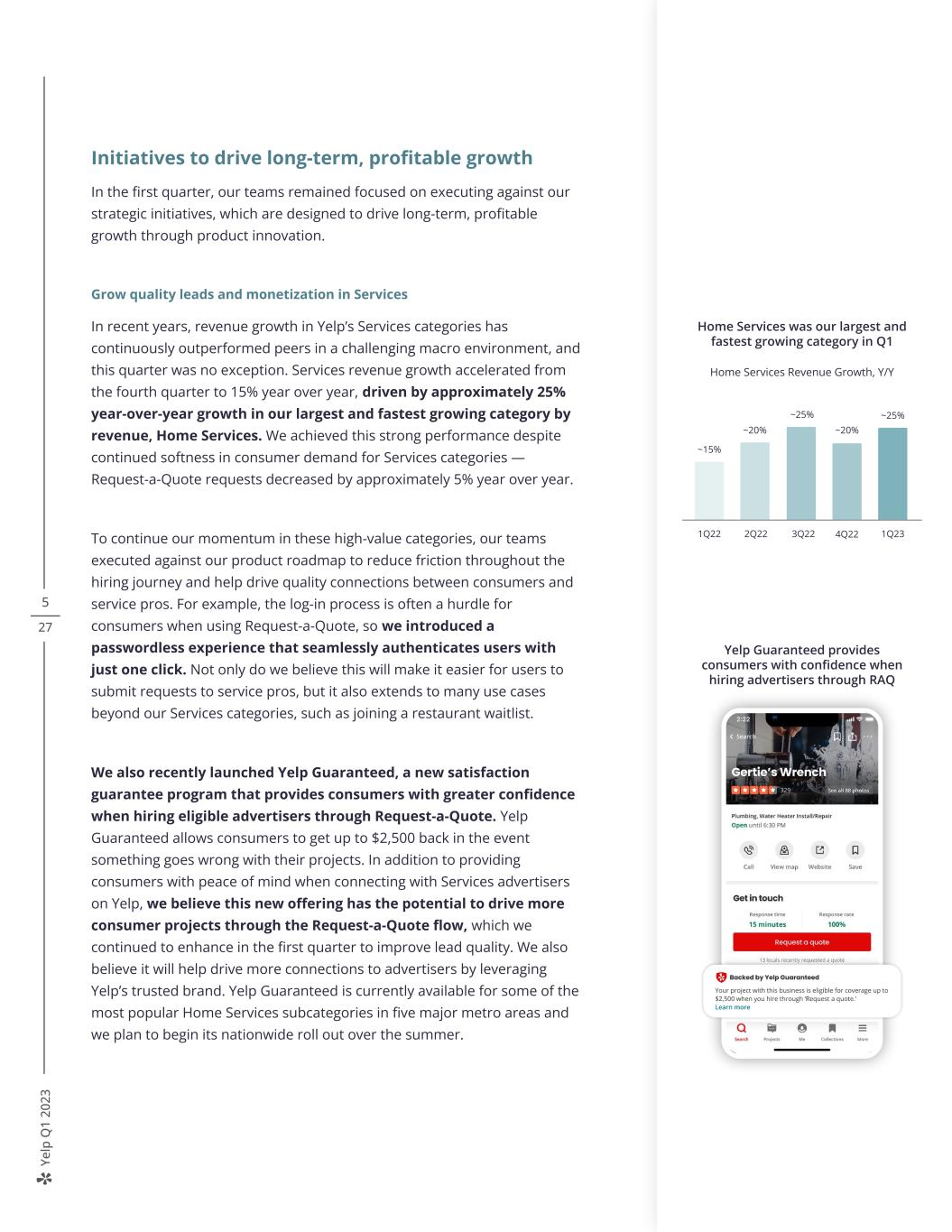

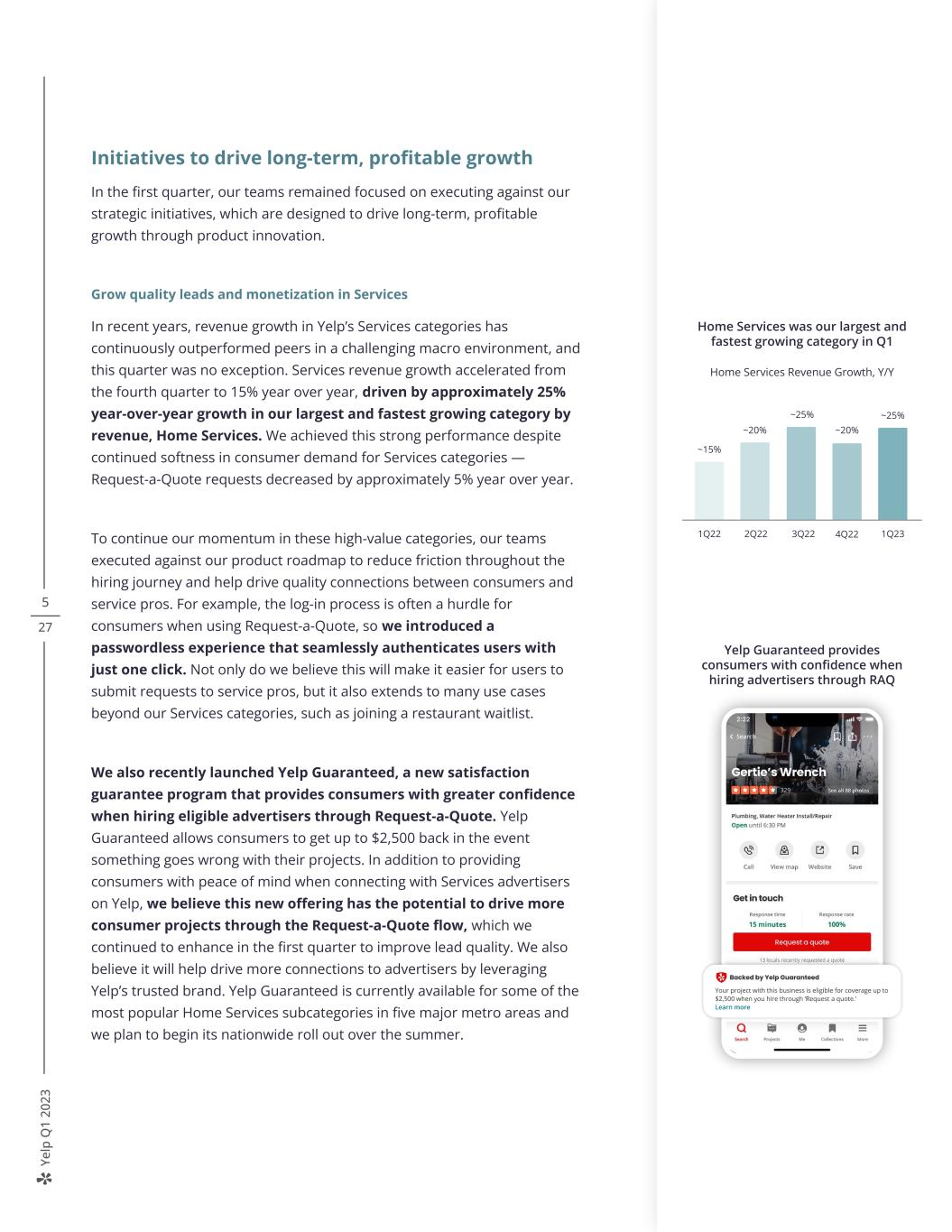

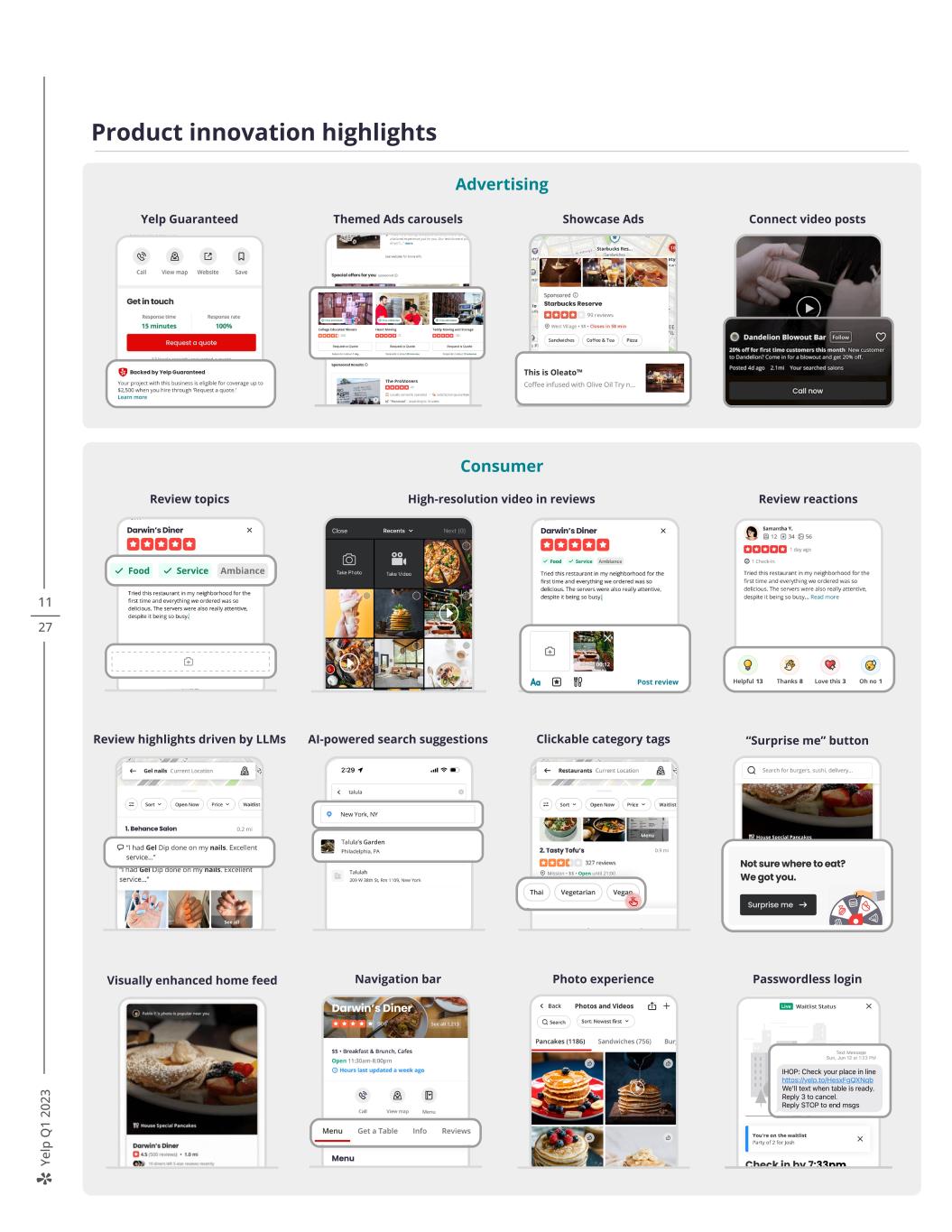

Ye lp Q 1 20 23 5 27 Initiatives to drive long-term, profitable growth In the first quarter, our teams remained focused on executing against our strategic initiatives, which are designed to drive long-term, profitable growth through product innovation. Grow quality leads and monetization in Services In recent years, revenue growth in Yelp’s Services categories has continuously outperformed peers in a challenging macro environment, and this quarter was no exception. Services revenue growth accelerated from the fourth quarter to 15% year over year, driven by approximately 25% year-over-year growth in our largest and fastest growing category by revenue, Home Services. We achieved this strong performance despite continued softness in consumer demand for Services categories — Request-a-Quote requests decreased by approximately 5% year over year. To continue our momentum in these high-value categories, our teams executed against our product roadmap to reduce friction throughout the hiring journey and help drive quality connections between consumers and service pros. For example, the log-in process is often a hurdle for consumers when using Request-a-Quote, so we introduced a passwordless experience that seamlessly authenticates users with just one click. Not only do we believe this will make it easier for users to submit requests to service pros, but it also extends to many use cases beyond our Services categories, such as joining a restaurant waitlist. We also recently launched Yelp Guaranteed, a new satisfaction guarantee program that provides consumers with greater confidence when hiring eligible advertisers through Request-a-Quote. Yelp Guaranteed allows consumers to get up to $2,500 back in the event something goes wrong with their projects. In addition to providing consumers with peace of mind when connecting with Services advertisers on Yelp, we believe this new offering has the potential to drive more consumer projects through the Request-a-Quote flow, which we continued to enhance in the first quarter to improve lead quality. We also believe it will help drive more connections to advertisers by leveraging Yelp’s trusted brand. Yelp Guaranteed is currently available for some of the most popular Home Services subcategories in five major metro areas and we plan to begin its nationwide roll out over the summer. Home Services was our largest and fastest growing category in Q1 Home Services Revenue Growth, Y/Y 1Q22 2Q22 3Q22 1Q234Q22 ~15% ~20% ~25% ~20% ~25% Yelp Guaranteed provides consumers with confidence when hiring advertisers through RAQ ~25% 3Q21 3Q22 +15% Local, Auto, Professional, Pets, Real Estate, Financial and Event Services Home Services Home Services revenue growth accelerated to approximately 25% y/y Services Revenue Strength in Home Services drove revenue growth of 25% y/y Home Services Revenue +25% 1Q22 1Q23

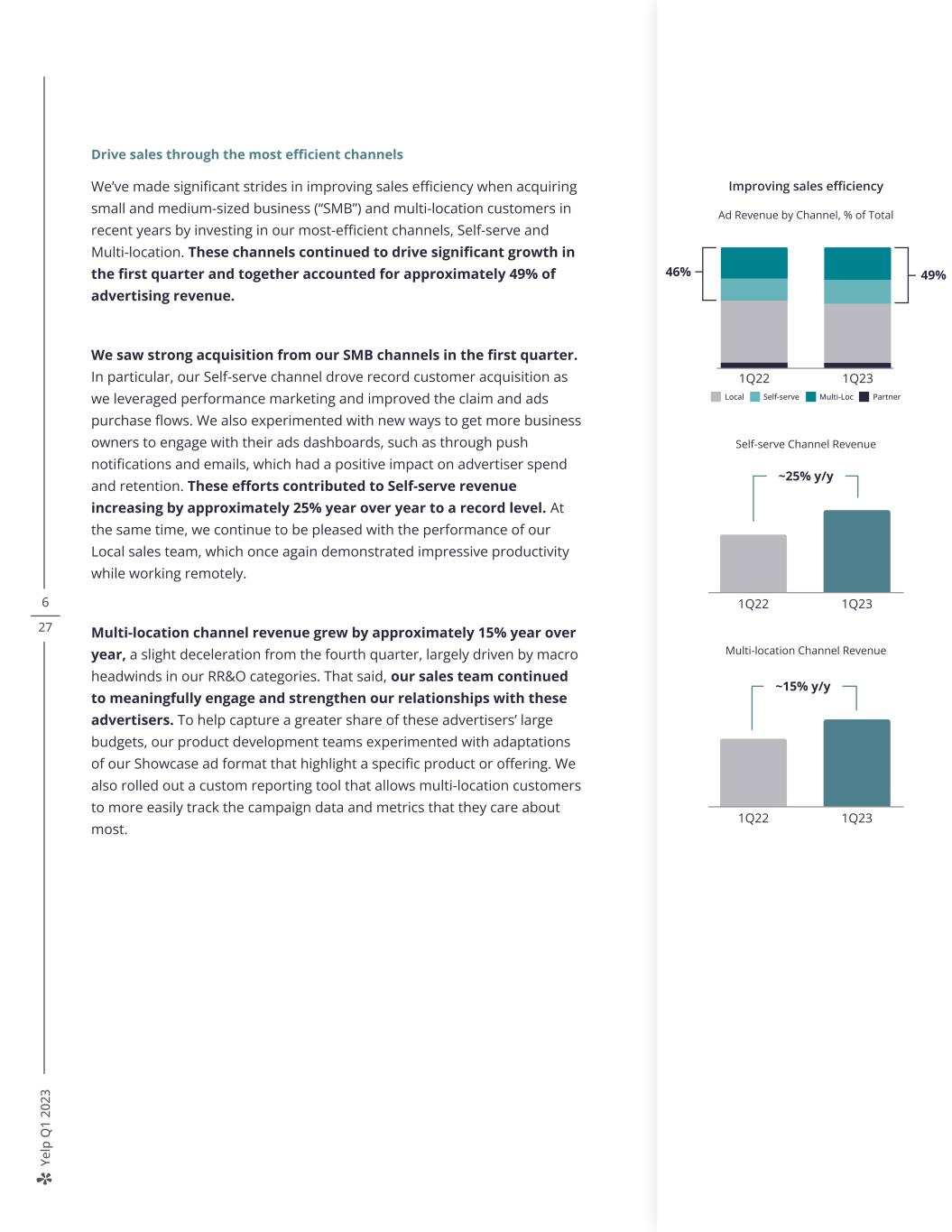

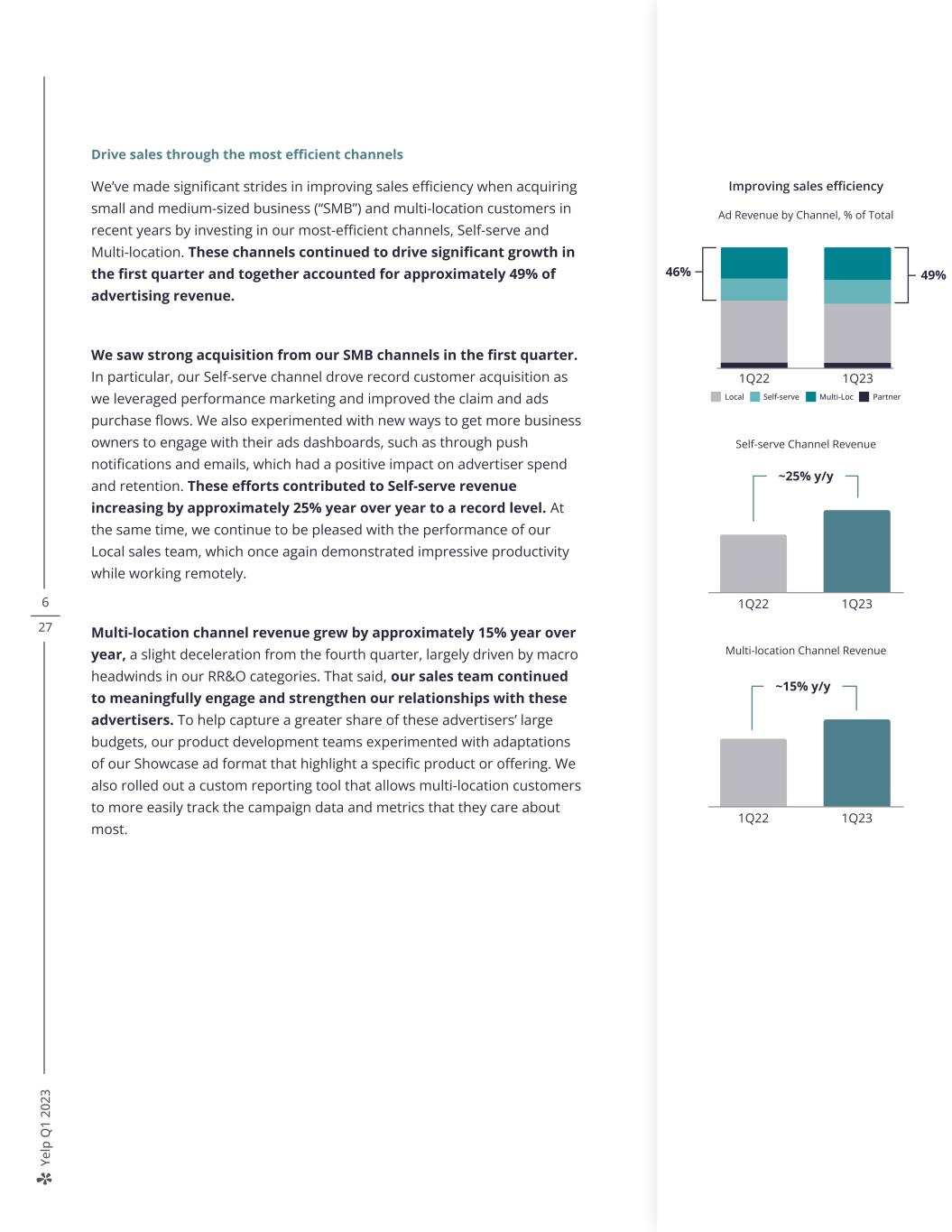

Ye lp Q 1 20 23 6 27 Drive sales through the most efficient channels We’ve made significant strides in improving sales efficiency when acquiring small and medium-sized business (“SMB”) and multi-location customers in recent years by investing in our most-efficient channels, Self-serve and Multi-location. These channels continued to drive significant growth in the first quarter and together accounted for approximately 49% of advertising revenue. We saw strong acquisition from our SMB channels in the first quarter. In particular, our Self-serve channel drove record customer acquisition as we leveraged performance marketing and improved the claim and ads purchase flows. We also experimented with new ways to get more business owners to engage with their ads dashboards, such as through push notifications and emails, which had a positive impact on advertiser spend and retention. These efforts contributed to Self-serve revenue increasing by approximately 25% year over year to a record level. At the same time, we continue to be pleased with the performance of our Local sales team, which once again demonstrated impressive productivity while working remotely. Multi-location channel revenue grew by approximately 15% year over year, a slight deceleration from the fourth quarter, largely driven by macro headwinds in our RR&O categories. That said, our sales team continued to meaningfully engage and strengthen our relationships with these advertisers. To help capture a greater share of these advertisers’ large budgets, our product development teams experimented with adaptations of our Showcase ad format that highlight a specific product or offering. We also rolled out a custom reporting tool that allows multi-location customers to more easily track the campaign data and metrics that they care about most. Self-serve Channel Revenue ~25% y/y 1Q22 1Q23 1Q22 1Q23 Self-serveLocal Multi-Loc Partner 28%46% 49% Improving sales efficiency Ad Revenue by Channel, % of Total Multi-location Channel Revenue ~15% y/y 1Q22 1Q23

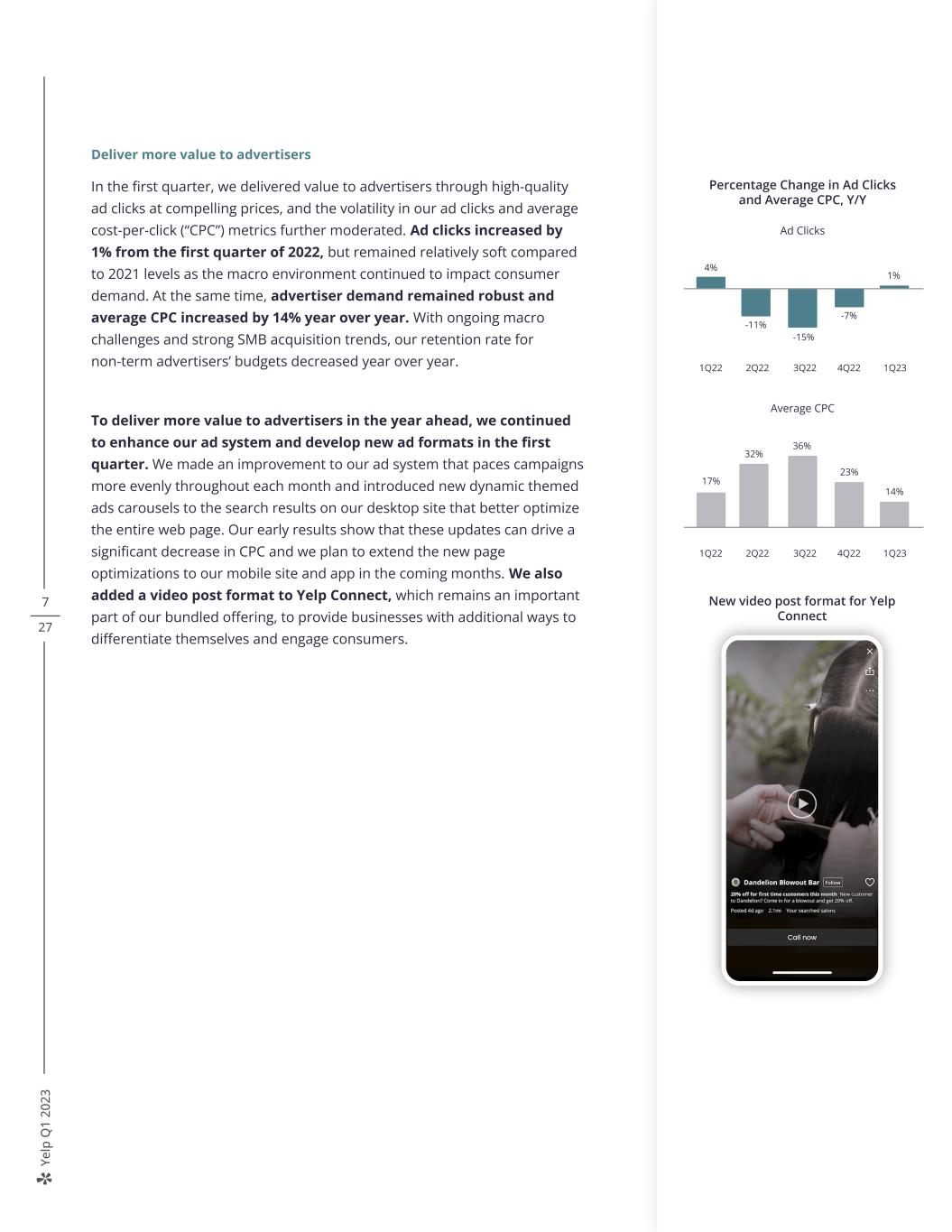

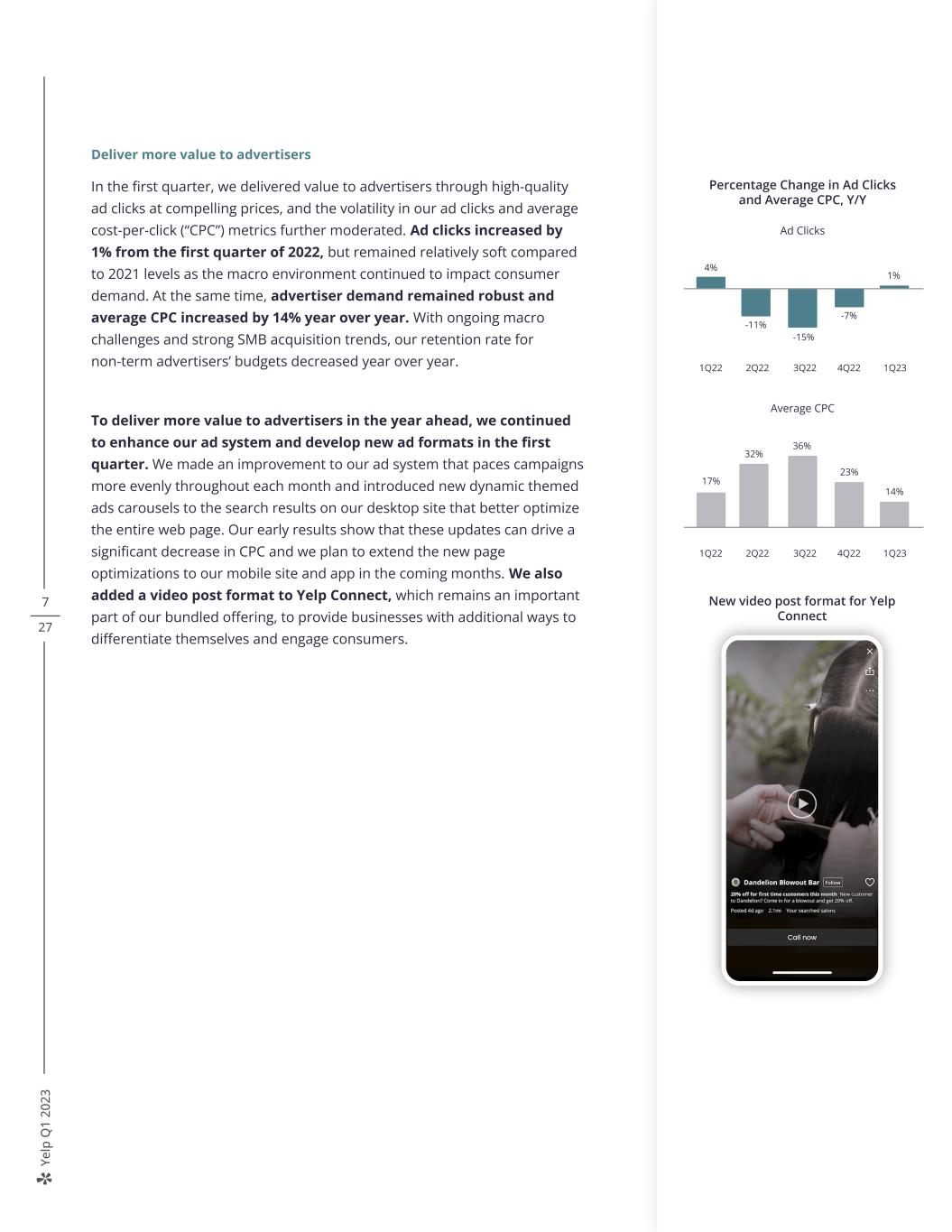

Ye lp Q 1 20 23 7 27 Deliver more value to advertisers In the first quarter, we delivered value to advertisers through high-quality ad clicks at compelling prices, and the volatility in our ad clicks and average cost-per-click (“CPC”) metrics further moderated. Ad clicks increased by 1% from the first quarter of 2022, but remained relatively soft compared to 2021 levels as the macro environment continued to impact consumer demand. At the same time, advertiser demand remained robust and average CPC increased by 14% year over year. With ongoing macro challenges and strong SMB acquisition trends, our retention rate for non-term advertisers’ budgets decreased year over year. To deliver more value to advertisers in the year ahead, we continued to enhance our ad system and develop new ad formats in the first quarter. We made an improvement to our ad system that paces campaigns more evenly throughout each month and introduced new dynamic themed ads carousels to the search results on our desktop site that better optimize the entire web page. Our early results show that these updates can drive a significant decrease in CPC and we plan to extend the new page optimizations to our mobile site and app in the coming months. We also added a video post format to Yelp Connect, which remains an important part of our bundled offering, to provide businesses with additional ways to differentiate themselves and engage consumers. Percentage Change in Ad Clicks and Average CPC, Y/Y Ad Clicks 4% 1Q22 2Q22 3Q22 4Q22 1Q23 1% -11% -15% -7% Average CPC 17% 1Q22 2Q22 3Q22 4Q22 1Q23 23% 32% 14% 36% New video post format for Yelp Connect

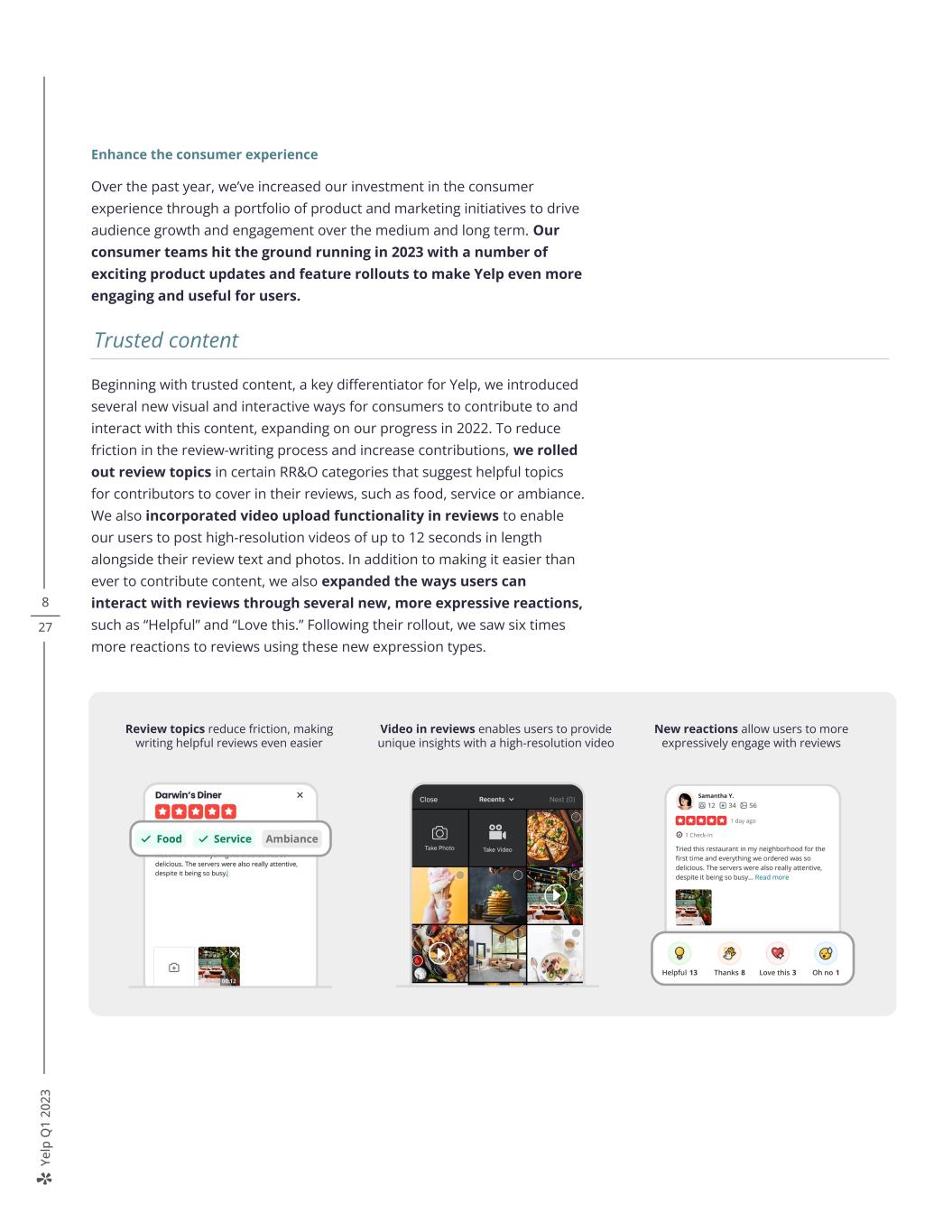

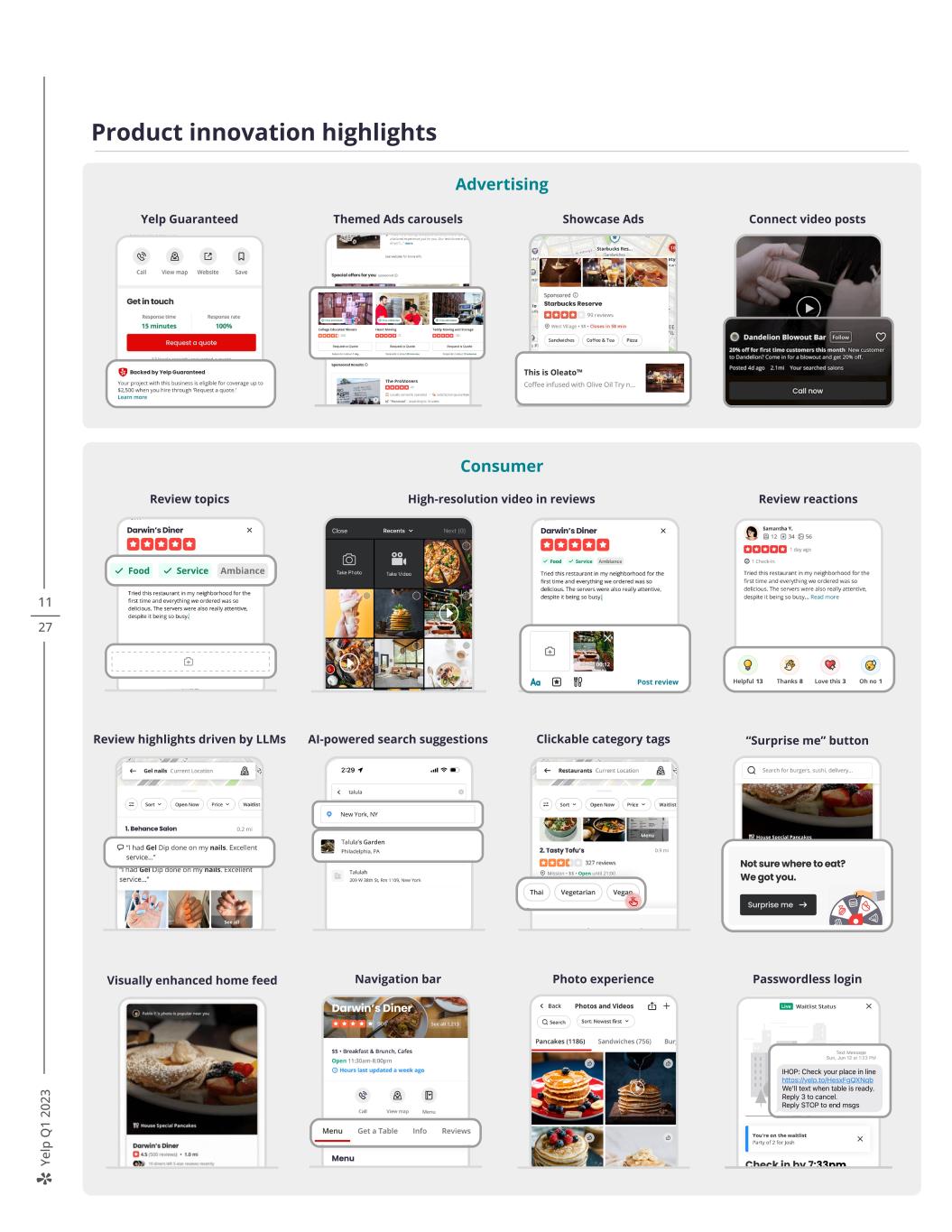

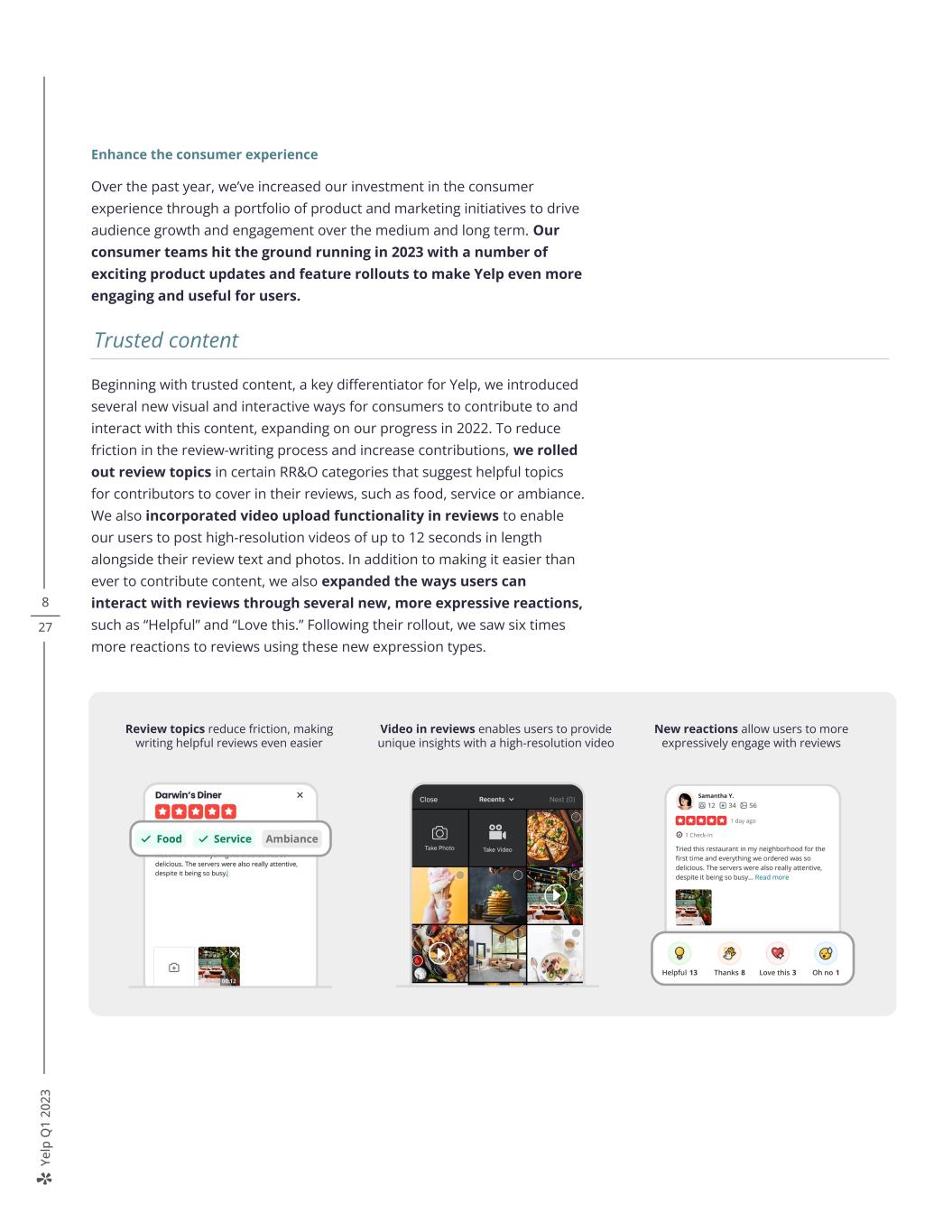

Ye lp Q 1 20 23 8 27 Enhance the consumer experience Over the past year, we’ve increased our investment in the consumer experience through a portfolio of product and marketing initiatives to drive audience growth and engagement over the medium and long term. Our consumer teams hit the ground running in 2023 with a number of exciting product updates and feature rollouts to make Yelp even more engaging and useful for users. Beginning with trusted content, a key differentiator for Yelp, we introduced several new visual and interactive ways for consumers to contribute to and interact with this content, expanding on our progress in 2022. To reduce friction in the review-writing process and increase contributions, we rolled out review topics in certain RR&O categories that suggest helpful topics for contributors to cover in their reviews, such as food, service or ambiance. We also incorporated video upload functionality in reviews to enable our users to post high-resolution videos of up to 12 seconds in length alongside their review text and photos. In addition to making it easier than ever to contribute content, we also expanded the ways users can interact with reviews through several new, more expressive reactions, such as “Helpful” and “Love this.” Following their rollout, we saw six times more reactions to reviews using these new expression types. Review topics reduce friction, making writing helpful reviews even easier Video in reviews enables users to provide unique insights with a high-resolution video New reactions allow users to more expressively engage with reviews Trusted content

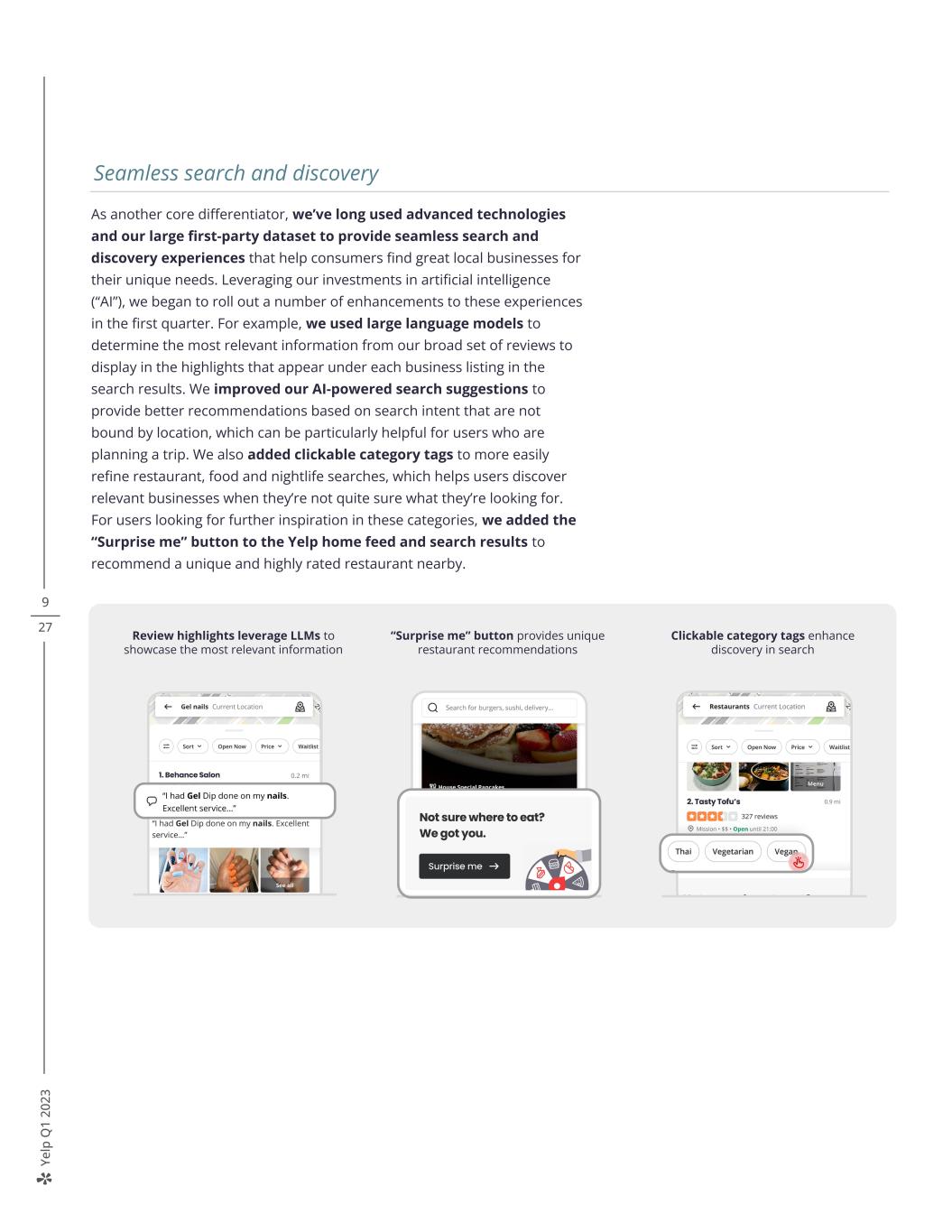

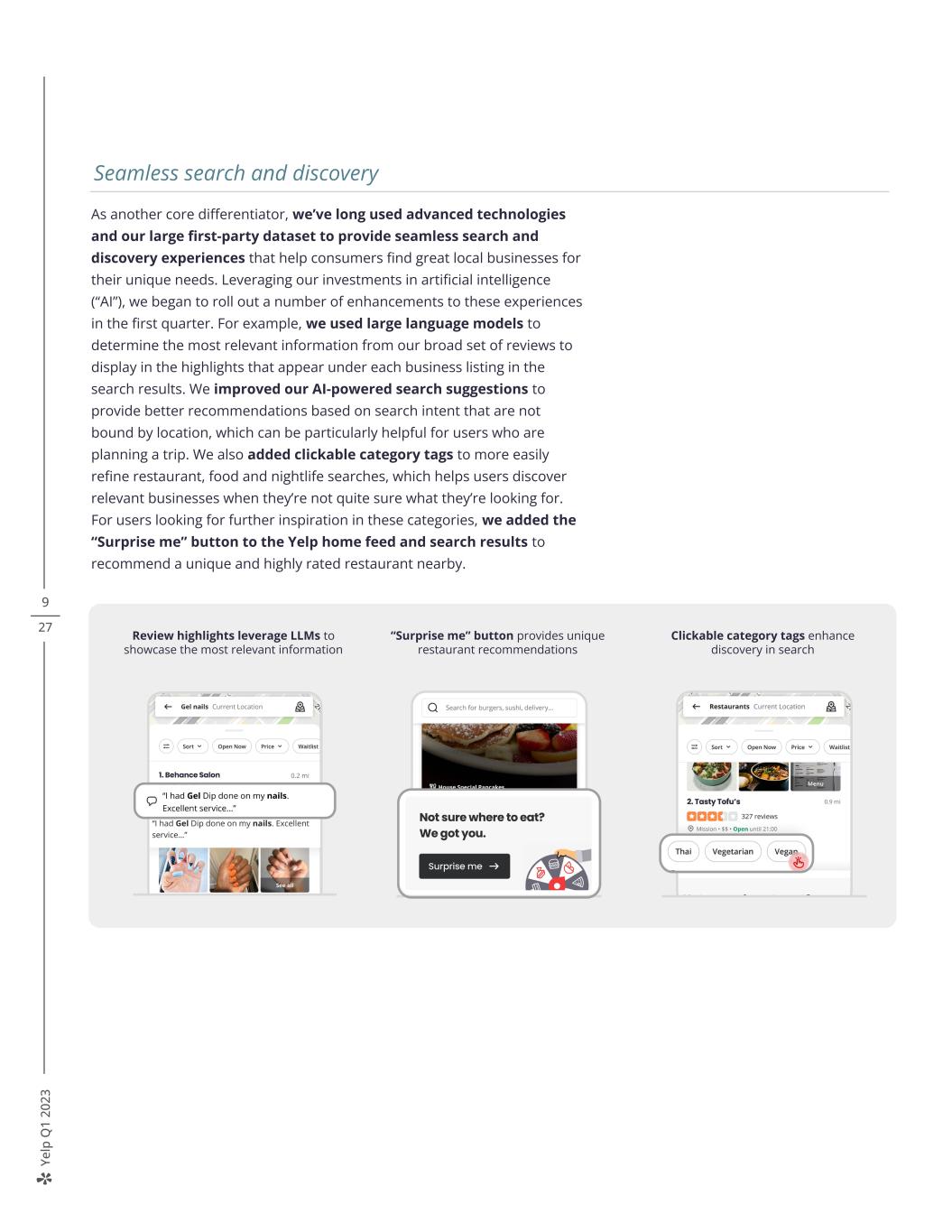

Ye lp Q 1 20 23 9 27 As another core differentiator, we’ve long used advanced technologies and our large first-party dataset to provide seamless search and discovery experiences that help consumers find great local businesses for their unique needs. Leveraging our investments in artificial intelligence (“AI”), we began to roll out a number of enhancements to these experiences in the first quarter. For example, we used large language models to determine the most relevant information from our broad set of reviews to display in the highlights that appear under each business listing in the search results. We improved our AI-powered search suggestions to provide better recommendations based on search intent that are not bound by location, which can be particularly helpful for users who are planning a trip. We also added clickable category tags to more easily refine restaurant, food and nightlife searches, which helps users discover relevant businesses when they’re not quite sure what they’re looking for. For users looking for further inspiration in these categories, we added the “Surprise me” button to the Yelp home feed and search results to recommend a unique and highly rated restaurant nearby. “Surprise me” button provides unique restaurant recommendations Clickable category tags enhance discovery in search Review highlights leverage LLMs to showcase the most relevant information Seamless search and discovery

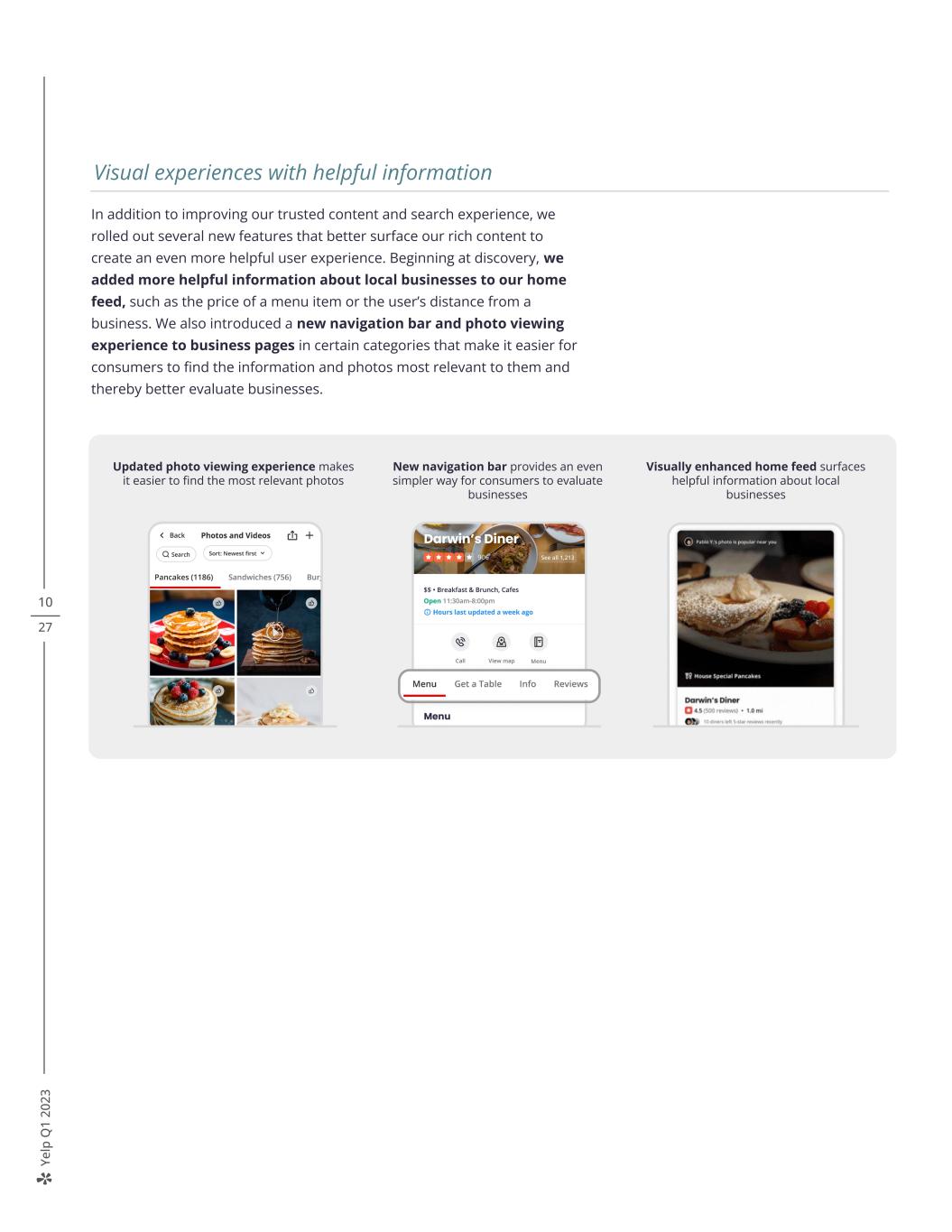

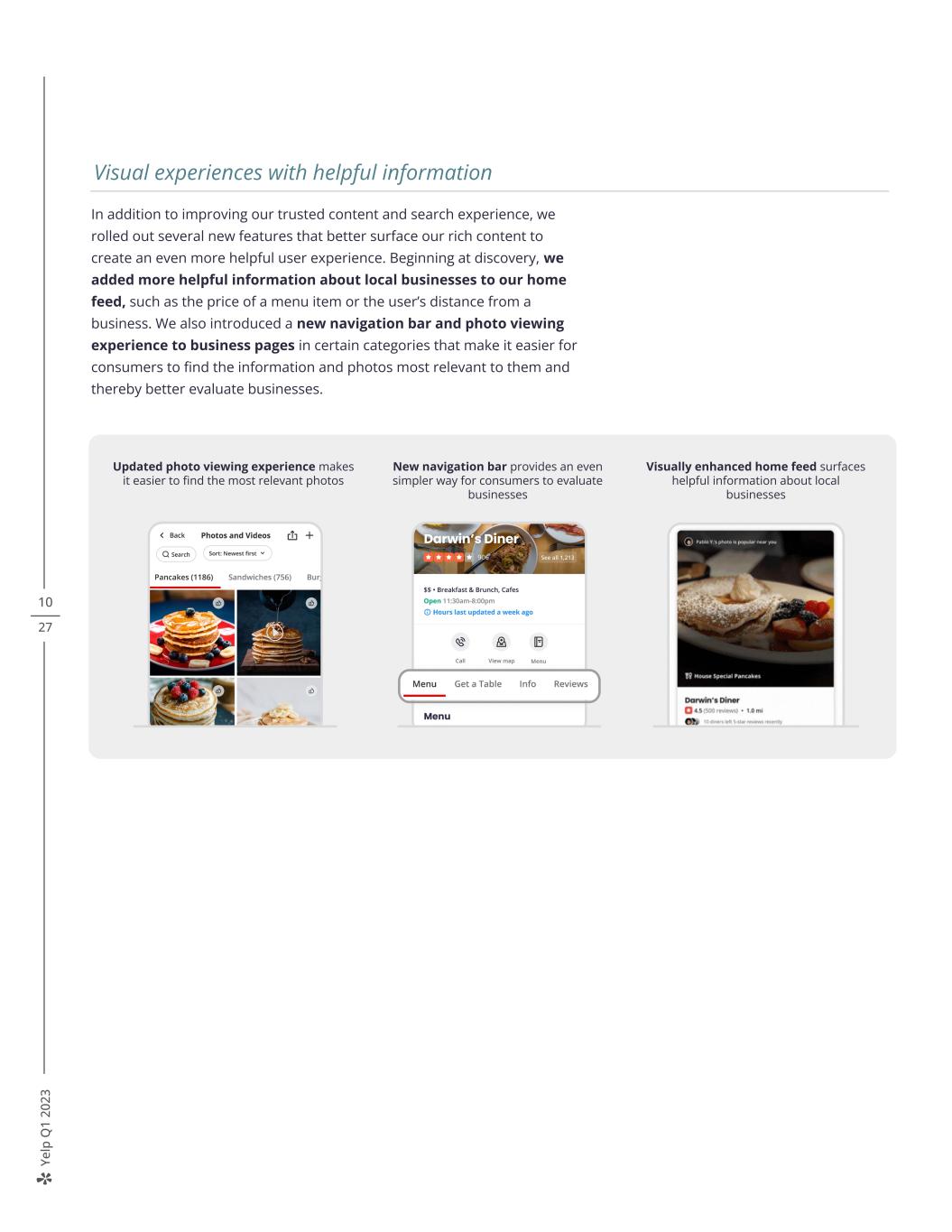

Ye lp Q 1 20 23 10 27 In addition to improving our trusted content and search experience, we rolled out several new features that better surface our rich content to create an even more helpful user experience. Beginning at discovery, we added more helpful information about local businesses to our home feed, such as the price of a menu item or the user’s distance from a business. We also introduced a new navigation bar and photo viewing experience to business pages in certain categories that make it easier for consumers to find the information and photos most relevant to them and thereby better evaluate businesses. Visual experiences with helpful information New navigation bar provides an even simpler way for consumers to evaluate businesses Visually enhanced home feed surfaces helpful information about local businesses Updated photo viewing experience makes it easier to find the most relevant photos

Ye lp Q 1 20 23 11 27 Product innovation highlights Yelp Guaranteed High-resolution video in reviews Passwordless login Connect video posts Review highlights driven by LLMs AI-powered search suggestions Clickable category tags “Surprise me” button Photo experience Navigation barVisually enhanced home feed Themed Ads carousels Advertising Consumer Showcase Ads Review topics Review reactions

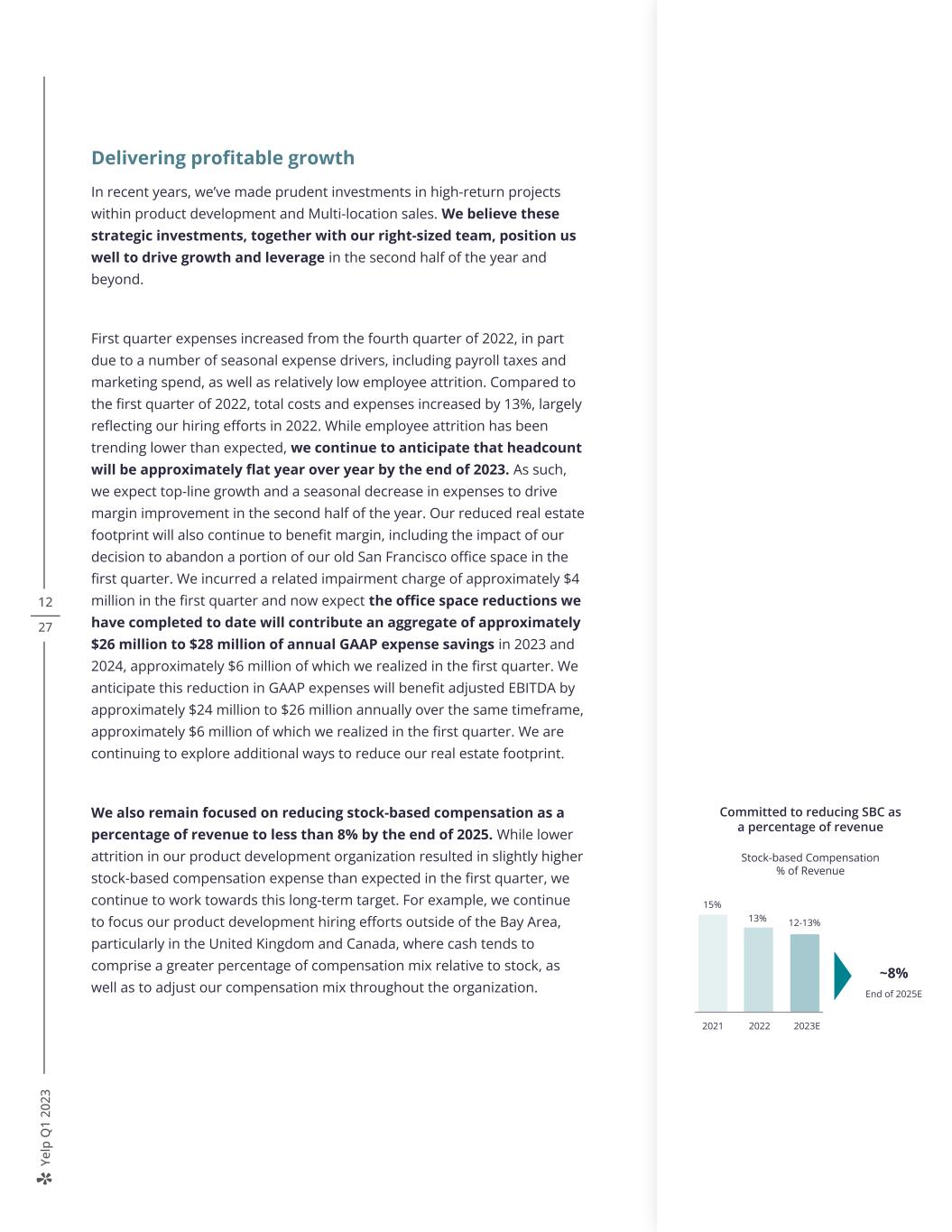

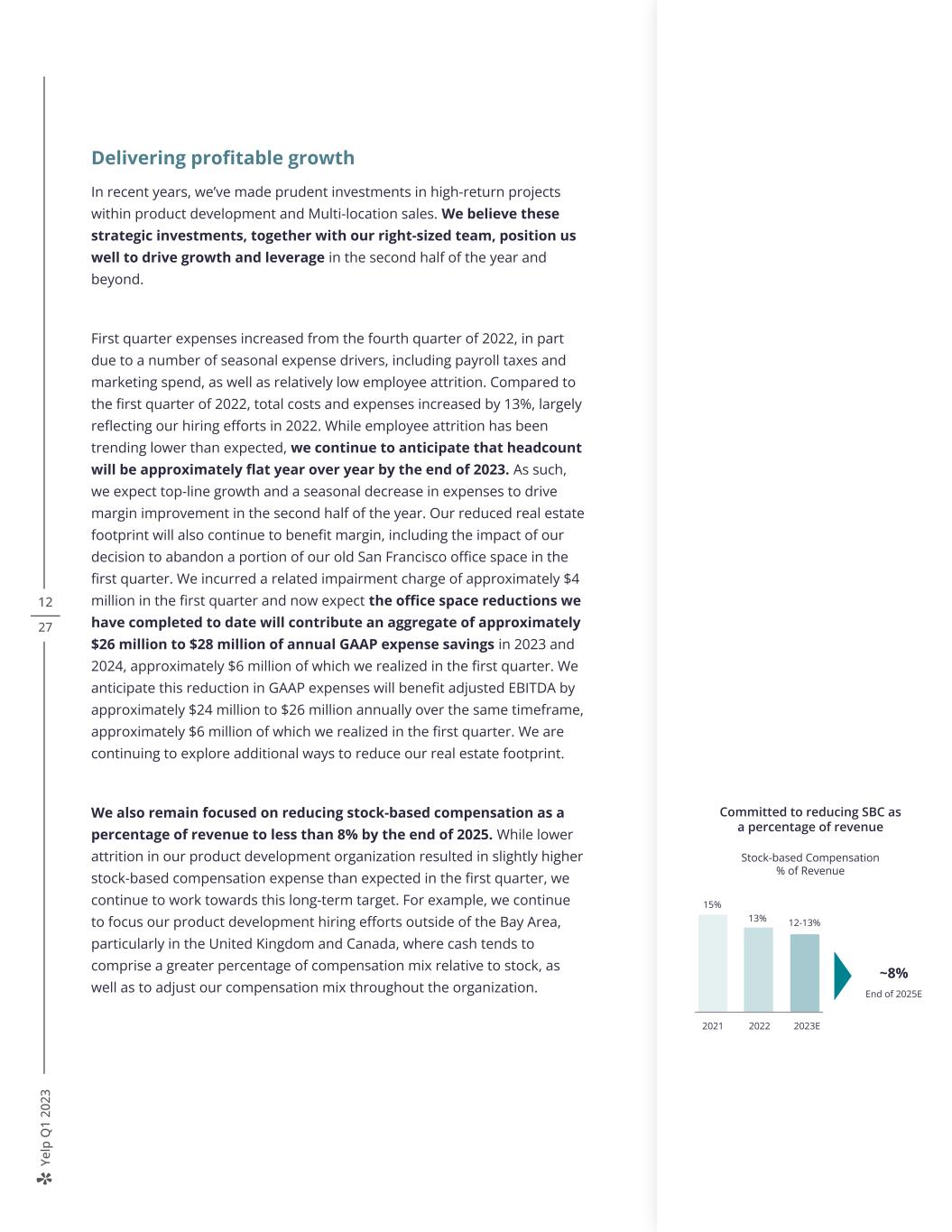

Ye lp Q 1 20 23 12 27 Delivering profitable growth In recent years, we’ve made prudent investments in high-return projects within product development and Multi-location sales. We believe these strategic investments, together with our right-sized team, position us well to drive growth and leverage in the second half of the year and beyond. First quarter expenses increased from the fourth quarter of 2022, in part due to a number of seasonal expense drivers, including payroll taxes and marketing spend, as well as relatively low employee attrition. Compared to the first quarter of 2022, total costs and expenses increased by 13%, largely reflecting our hiring efforts in 2022. While employee attrition has been trending lower than expected, we continue to anticipate that headcount will be approximately flat year over year by the end of 2023. As such, we expect top-line growth and a seasonal decrease in expenses to drive margin improvement in the second half of the year. Our reduced real estate footprint will also continue to benefit margin, including the impact of our decision to abandon a portion of our old San Francisco office space in the first quarter. We incurred a related impairment charge of approximately $4 million in the first quarter and now expect the office space reductions we have completed to date will contribute an aggregate of approximately $26 million to $28 million of annual GAAP expense savings in 2023 and 2024, approximately $6 million of which we realized in the first quarter. We anticipate this reduction in GAAP expenses will benefit adjusted EBITDA by approximately $24 million to $26 million annually over the same timeframe, approximately $6 million of which we realized in the first quarter. We are continuing to explore additional ways to reduce our real estate footprint. We also remain focused on reducing stock-based compensation as a percentage of revenue to less than 8% by the end of 2025. While lower attrition in our product development organization resulted in slightly higher stock-based compensation expense than expected in the first quarter, we continue to work towards this long-term target. For example, we continue to focus our product development hiring efforts outside of the Bay Area, particularly in the United Kingdom and Canada, where cash tends to comprise a greater percentage of compensation mix relative to stock, as well as to adjust our compensation mix throughout the organization. 8% Exhibit 9 2021 2022 2023E End of 2025E 15% 13% 12-13% ~8% Committed to reducing SBC as a percentage of revenue Stock-based Compensation % of Revenue

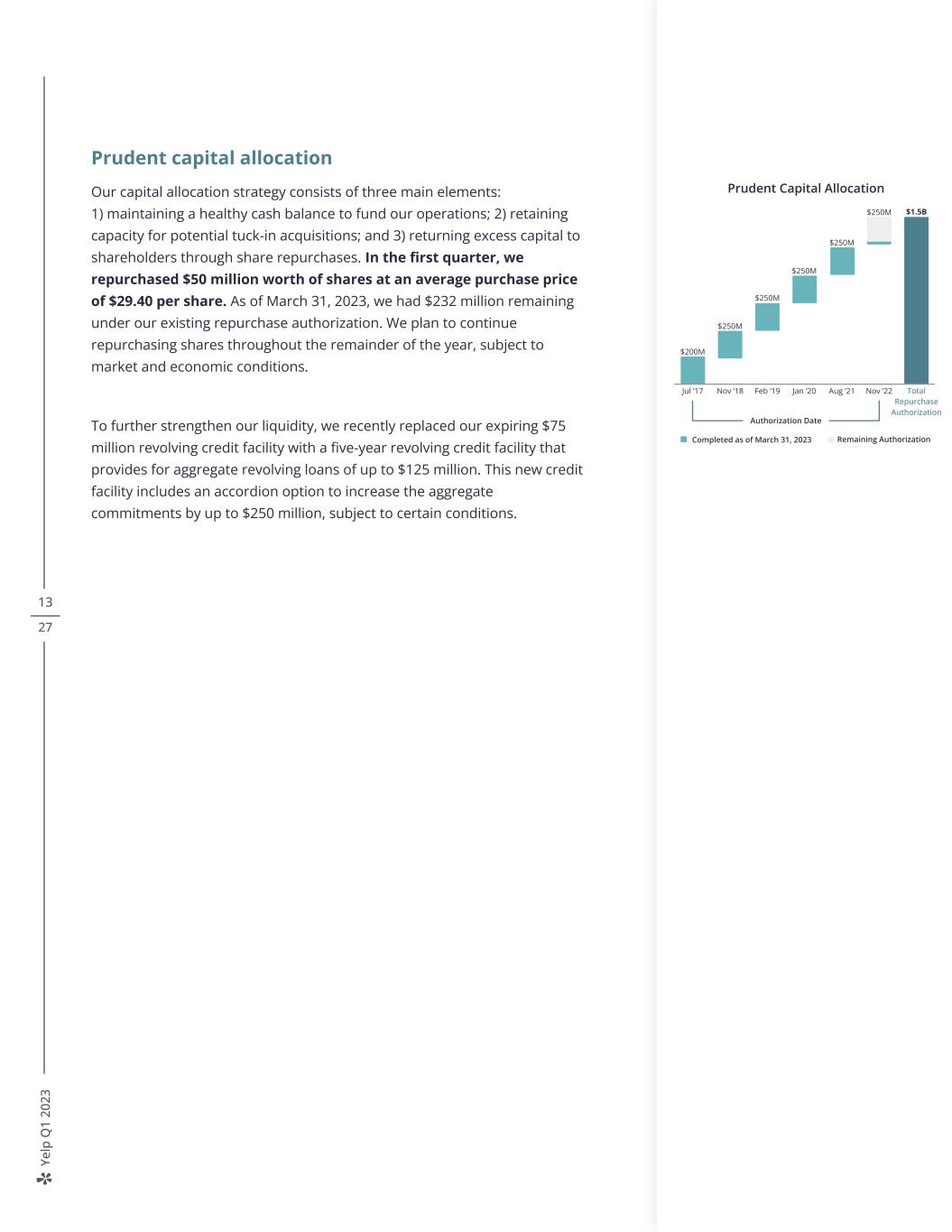

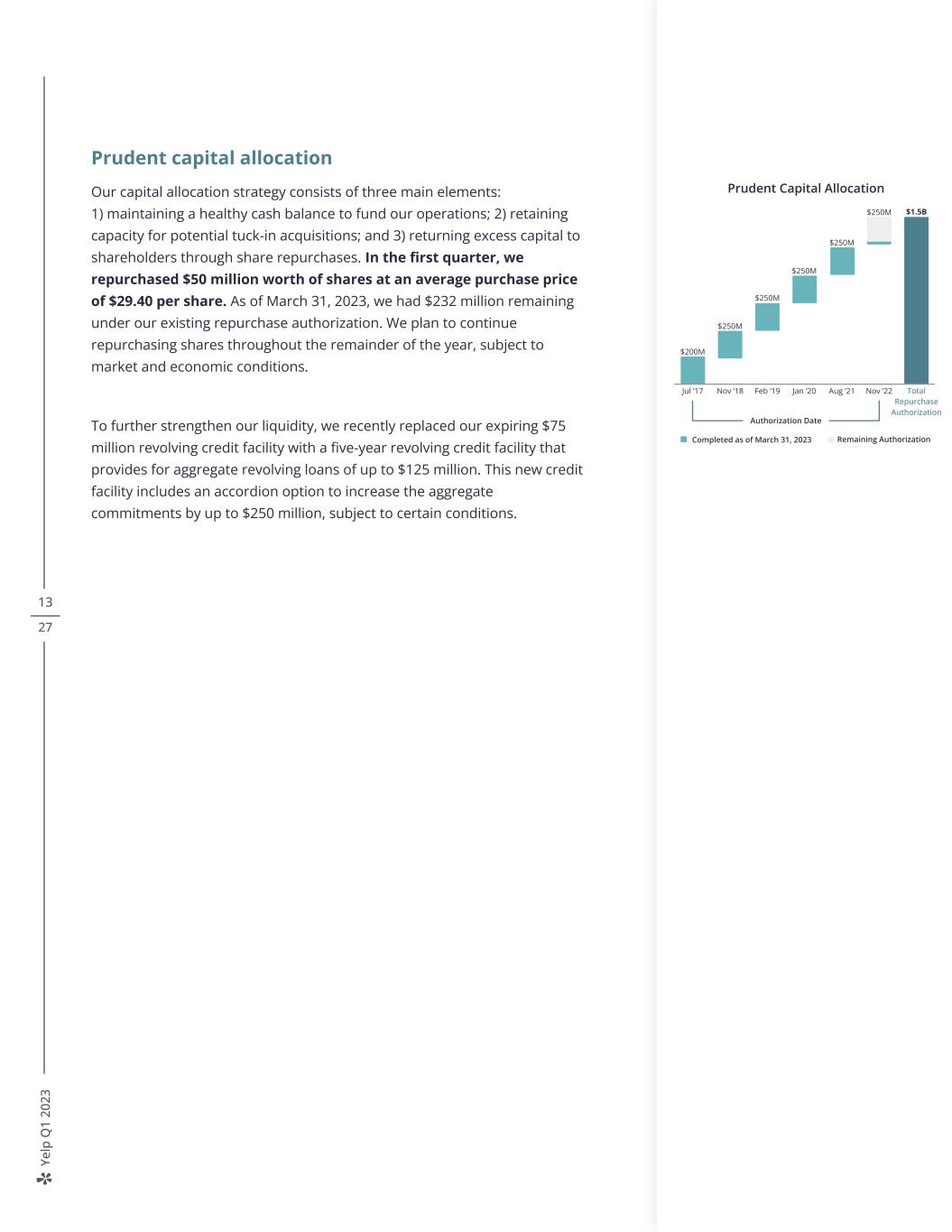

Ye lp Q 1 20 23 Total Repurchase Authorization Nov ‘22 13 27 Prudent capital allocation Our capital allocation strategy consists of three main elements: 1) maintaining a healthy cash balance to fund our operations; 2) retaining capacity for potential tuck-in acquisitions; and 3) returning excess capital to shareholders through share repurchases. In the first quarter, we repurchased $50 million worth of shares at an average purchase price of $29.40 per share. As of March 31, 2023, we had $232 million remaining under our existing repurchase authorization. We plan to continue repurchasing shares throughout the remainder of the year, subject to market and economic conditions. To further strengthen our liquidity, we recently replaced our expiring $75 million revolving credit facility with a five-year revolving credit facility that provides for aggregate revolving loans of up to $125 million. This new credit facility includes an accordion option to increase the aggregate commitments by up to $250 million, subject to certain conditions. Authorization Date Prudent Capital Allocation $1.5B Completed as of March 31, 2023 Remaining Authorization $200M Jul ‘17 Nov ‘18 Feb ‘19 Jan ‘20 $250M $250M $250M $250M Aug ‘21 $250M

Ye lp Q 1 20 23 In summary, Yelp’s first quarter results demonstrate the strength of our broad-based local advertising platform and product-led strategy. We continue to be pleased by the execution of our teams, which has enabled us to deliver consistently strong financial performance in the face of persistent macro uncertainties. We are excited by the opportunities ahead and are confident in Yelp’s ability to drive profitable growth and shareholder value over the long term. Sincerely, Jeremy Stoppelman David Schwarzbach 14 27

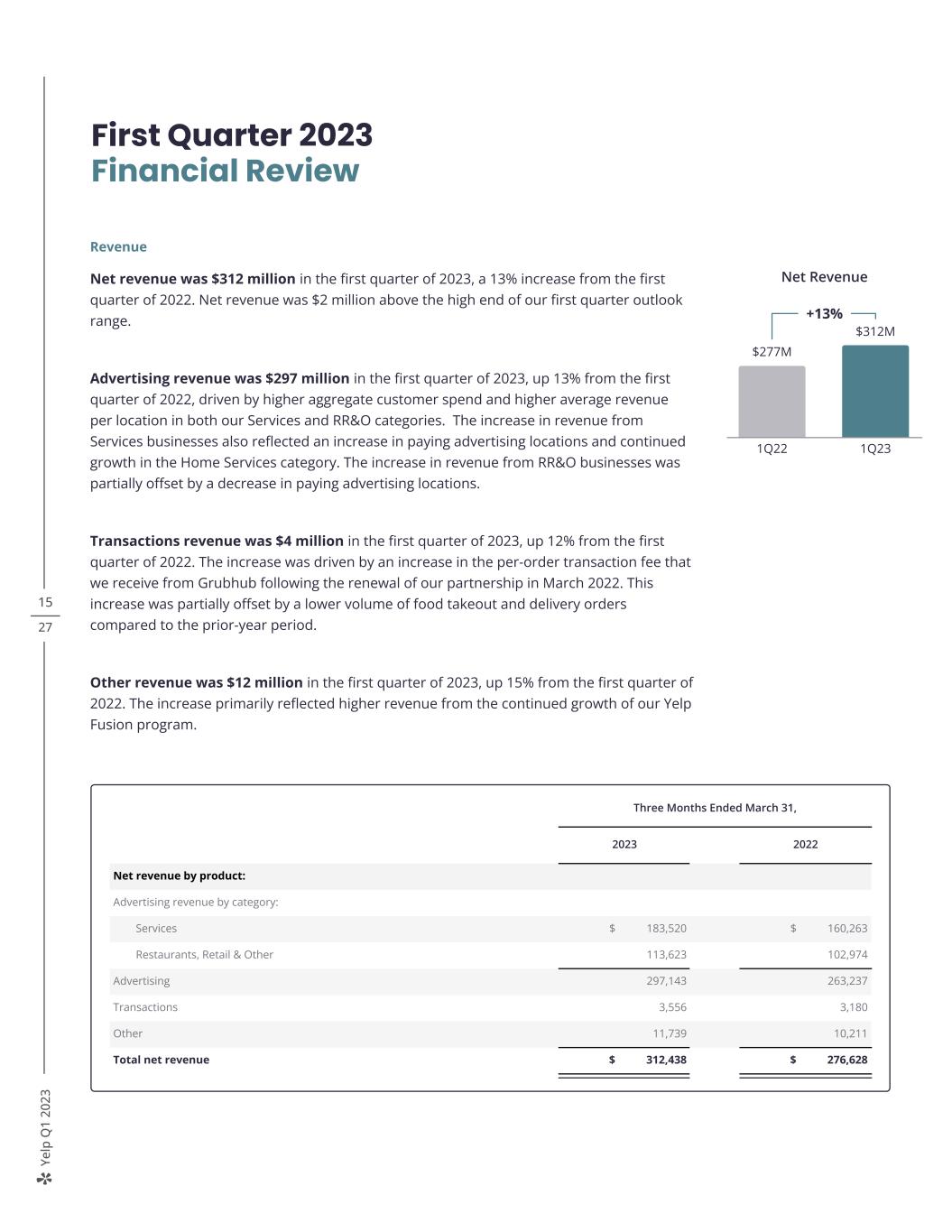

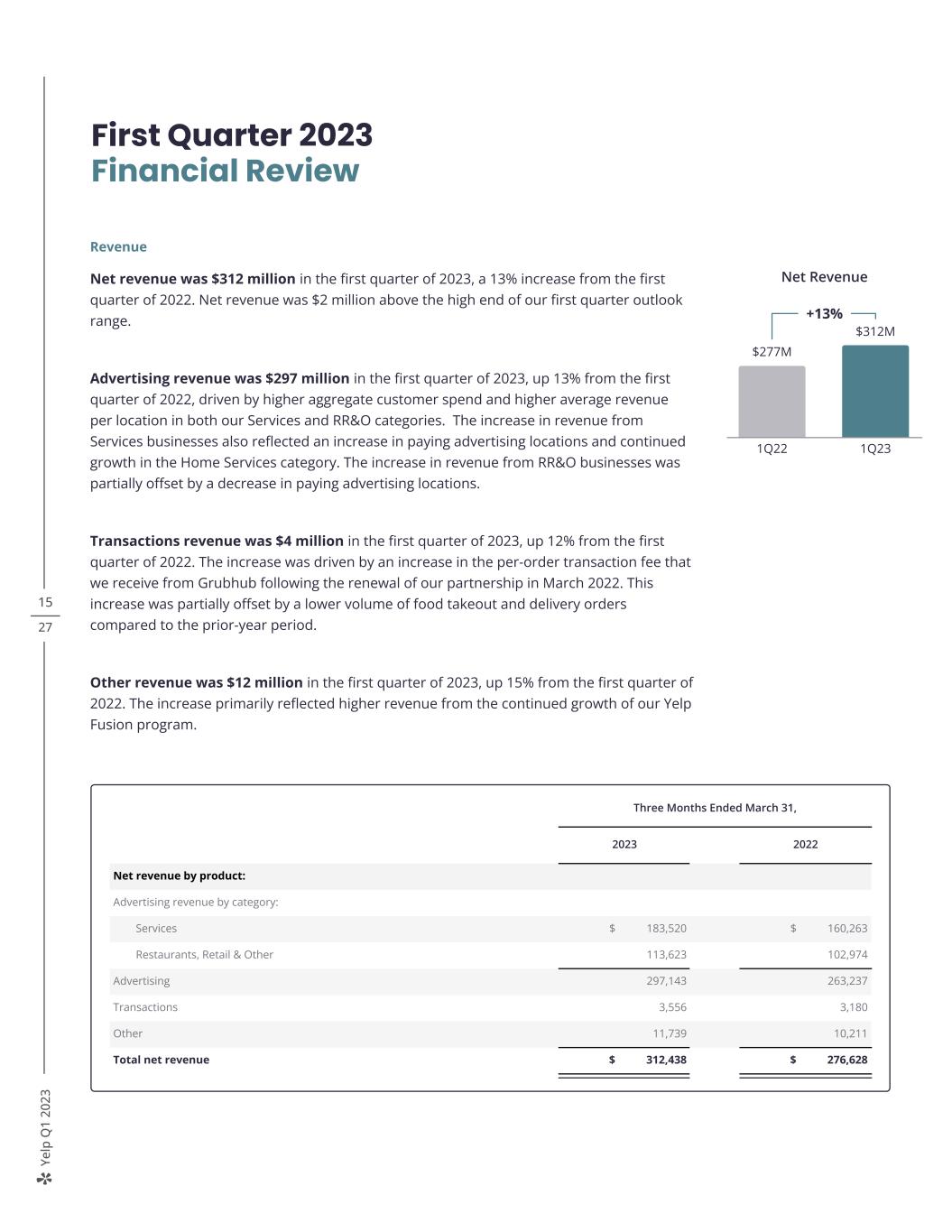

Ye lp Q 1 20 23 15 27 Revenue Net revenue was $312 million in the first quarter of 2023, a 13% increase from the first quarter of 2022. Net revenue was $2 million above the high end of our first quarter outlook range. Advertising revenue was $297 million in the first quarter of 2023, up 13% from the first quarter of 2022, driven by higher aggregate customer spend and higher average revenue per location in both our Services and RR&O categories. The increase in revenue from Services businesses also reflected an increase in paying advertising locations and continued growth in the Home Services category. The increase in revenue from RR&O businesses was partially offset by a decrease in paying advertising locations. Transactions revenue was $4 million in the first quarter of 2023, up 12% from the first quarter of 2022. The increase was driven by an increase in the per-order transaction fee that we receive from Grubhub following the renewal of our partnership in March 2022. This increase was partially offset by a lower volume of food takeout and delivery orders compared to the prior-year period. Other revenue was $12 million in the first quarter of 2023, up 15% from the first quarter of 2022. The increase primarily reflected higher revenue from the continued growth of our Yelp Fusion program. First Quarter 2023 Financial Review Three Months Ended March 31, 2023 2022 Net revenue by product: Advertising revenue by category: Services $ 183,520 $ 160,263 Restaurants, Retail & Other 113,623 102,974 Advertising 297,143 263,237 Transactions 3,556 3,180 Other 11,739 10,211 Total net revenue $ 312,438 $ 276,628 Net Revenue +13% $277M $312M 1Q22 1Q23

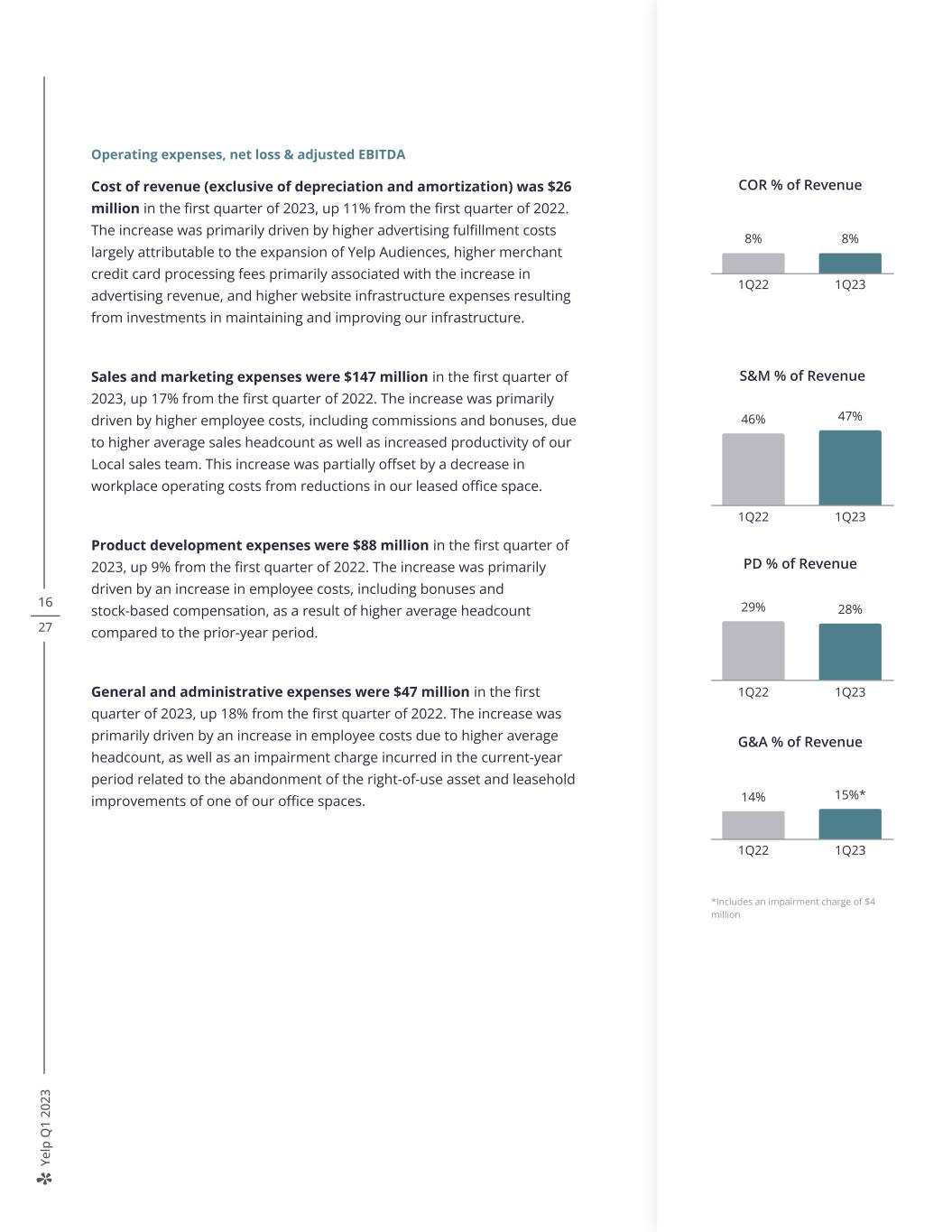

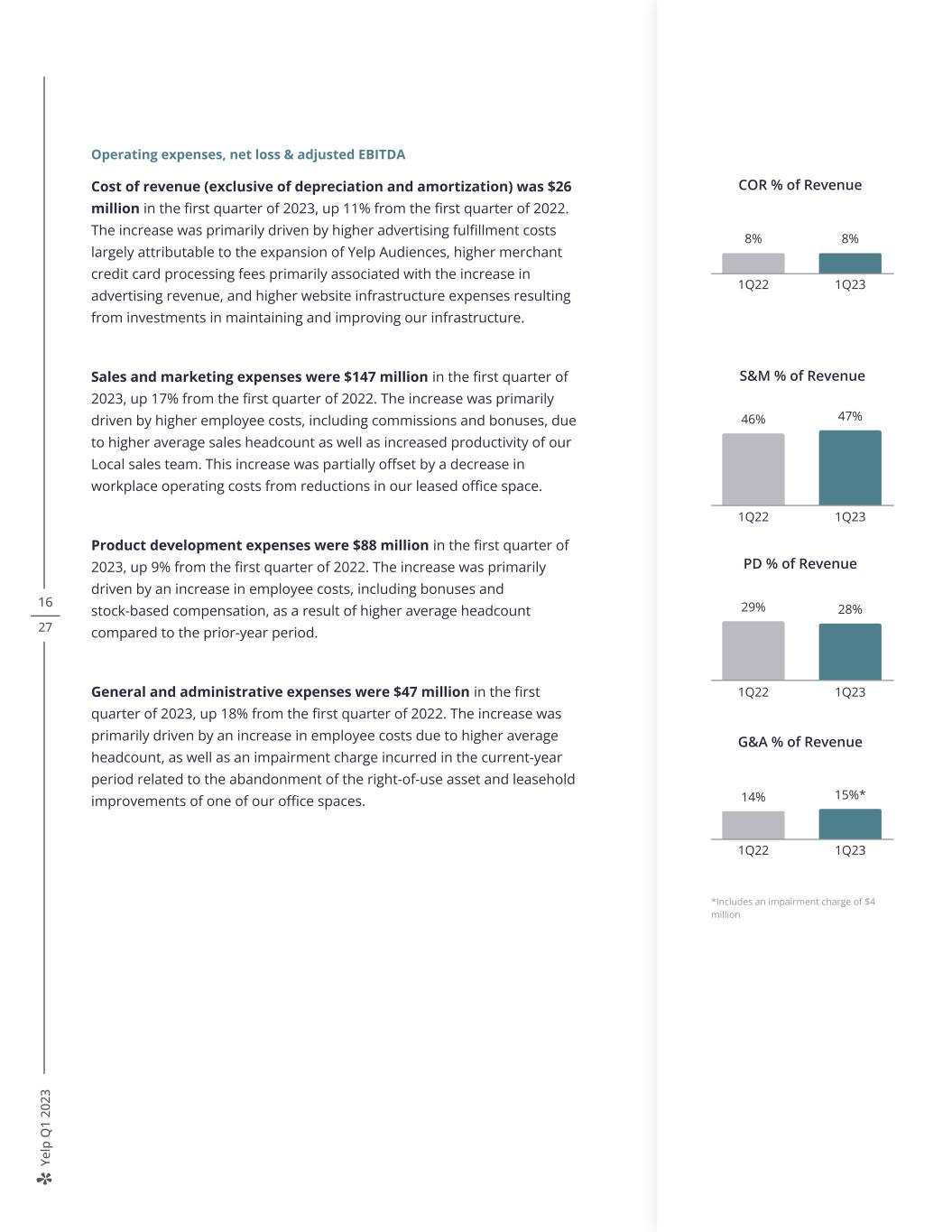

Ye lp Q 1 20 23 16 27 Operating expenses, net loss & adjusted EBITDA Cost of revenue (exclusive of depreciation and amortization) was $26 million in the first quarter of 2023, up 11% from the first quarter of 2022. The increase was primarily driven by higher advertising fulfillment costs largely attributable to the expansion of Yelp Audiences, higher merchant credit card processing fees primarily associated with the increase in advertising revenue, and higher website infrastructure expenses resulting from investments in maintaining and improving our infrastructure. Sales and marketing expenses were $147 million in the first quarter of 2023, up 17% from the first quarter of 2022. The increase was primarily driven by higher employee costs, including commissions and bonuses, due to higher average sales headcount as well as increased productivity of our Local sales team. This increase was partially offset by a decrease in workplace operating costs from reductions in our leased office space. Product development expenses were $88 million in the first quarter of 2023, up 9% from the first quarter of 2022. The increase was primarily driven by an increase in employee costs, including bonuses and stock-based compensation, as a result of higher average headcount compared to the prior-year period. General and administrative expenses were $47 million in the first quarter of 2023, up 18% from the first quarter of 2022. The increase was primarily driven by an increase in employee costs due to higher average headcount, as well as an impairment charge incurred in the current-year period related to the abandonment of the right-of-use asset and leasehold improvements of one of our office spaces. COR % of Revenue 8% 8% 1Q22 1Q23 S&M % of Revenue 46% 47% 1Q22 1Q23 PD % of Revenue 29% 28% 1Q22 1Q23 G&A % of Revenue 14% 15%* 1Q22 1Q23 *Includes an impairment charge of $4 million

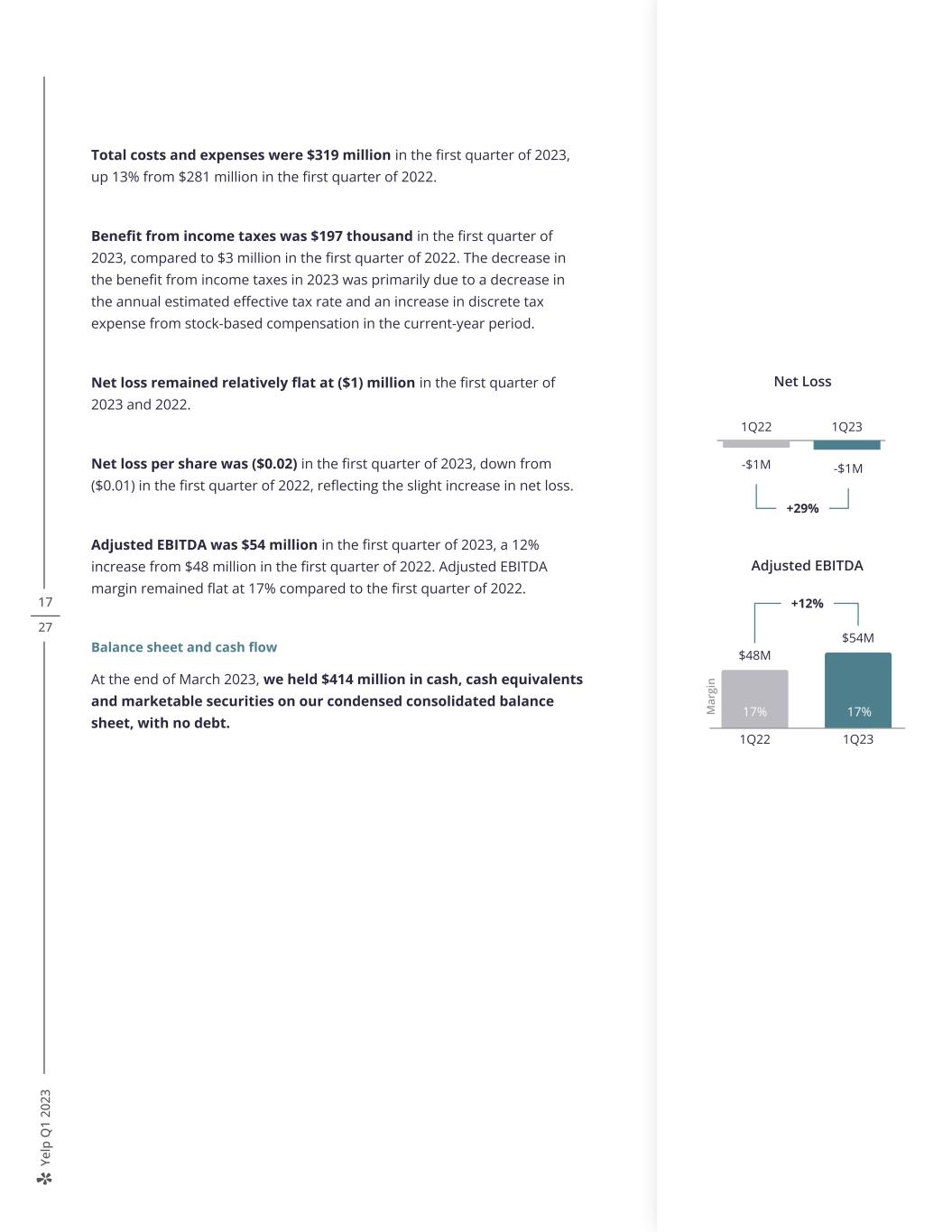

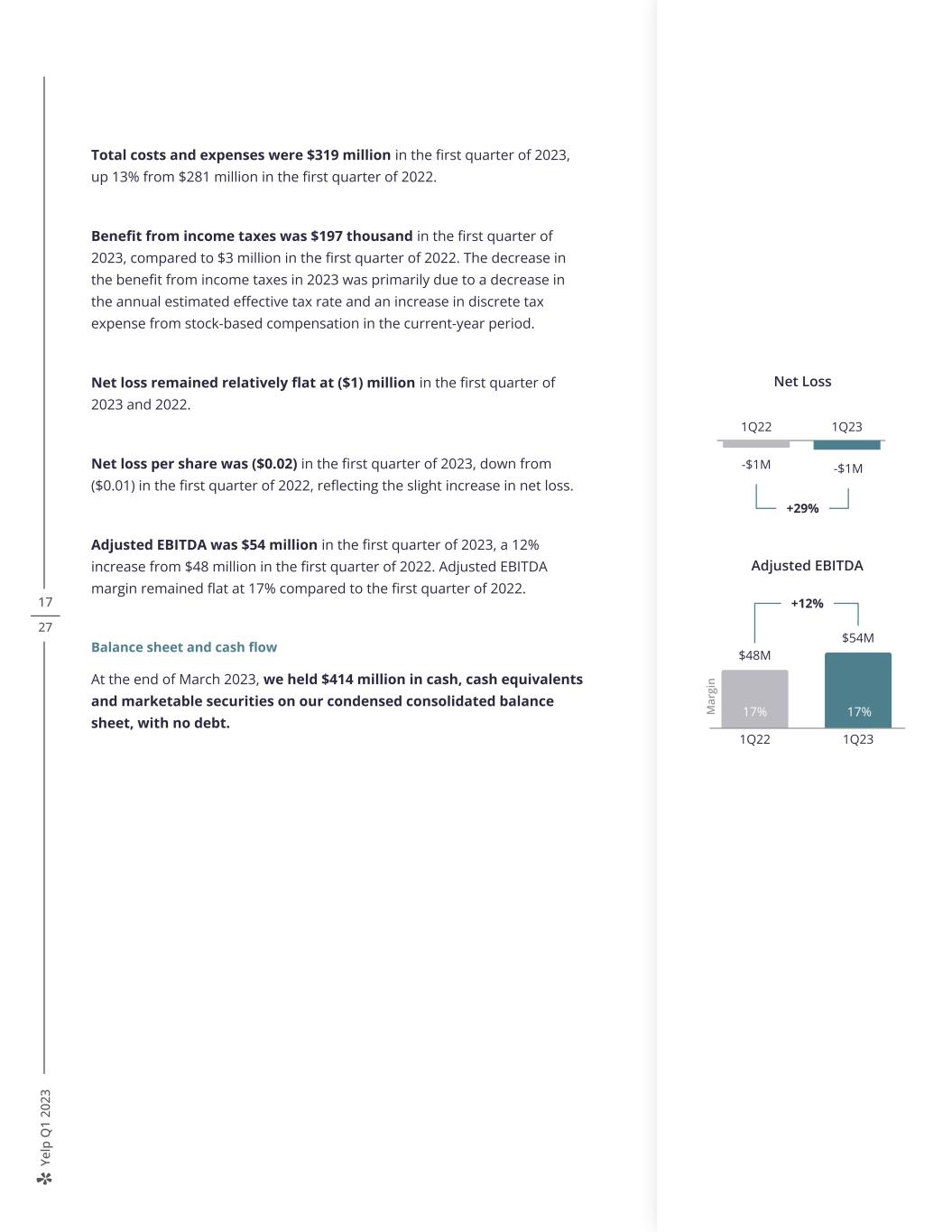

Ye lp Q 1 20 23 17 27 Total costs and expenses were $319 million in the first quarter of 2023, up 13% from $281 million in the first quarter of 2022. Benefit from income taxes was $197 thousand in the first quarter of 2023, compared to $3 million in the first quarter of 2022. The decrease in the benefit from income taxes in 2023 was primarily due to a decrease in the annual estimated effective tax rate and an increase in discrete tax expense from stock-based compensation in the current-year period. Net loss remained relatively flat at ($1) million in the first quarter of 2023 and 2022. Net loss per share was ($0.02) in the first quarter of 2023, down from ($0.01) in the first quarter of 2022, reflecting the slight increase in net loss. Adjusted EBITDA was $54 million in the first quarter of 2023, a 12% increase from $48 million in the first quarter of 2022. Adjusted EBITDA margin remained flat at 17% compared to the first quarter of 2022. Balance sheet and cash flow At the end of March 2023, we held $414 million in cash, cash equivalents and marketable securities on our condensed consolidated balance sheet, with no debt. 19% 17% Net Loss +29% 1Q22 1Q23 -$1M -$1M Adjusted EBITDA +12% $48M $54M 1Q22 1Q23 M ar gi n 17% 17%

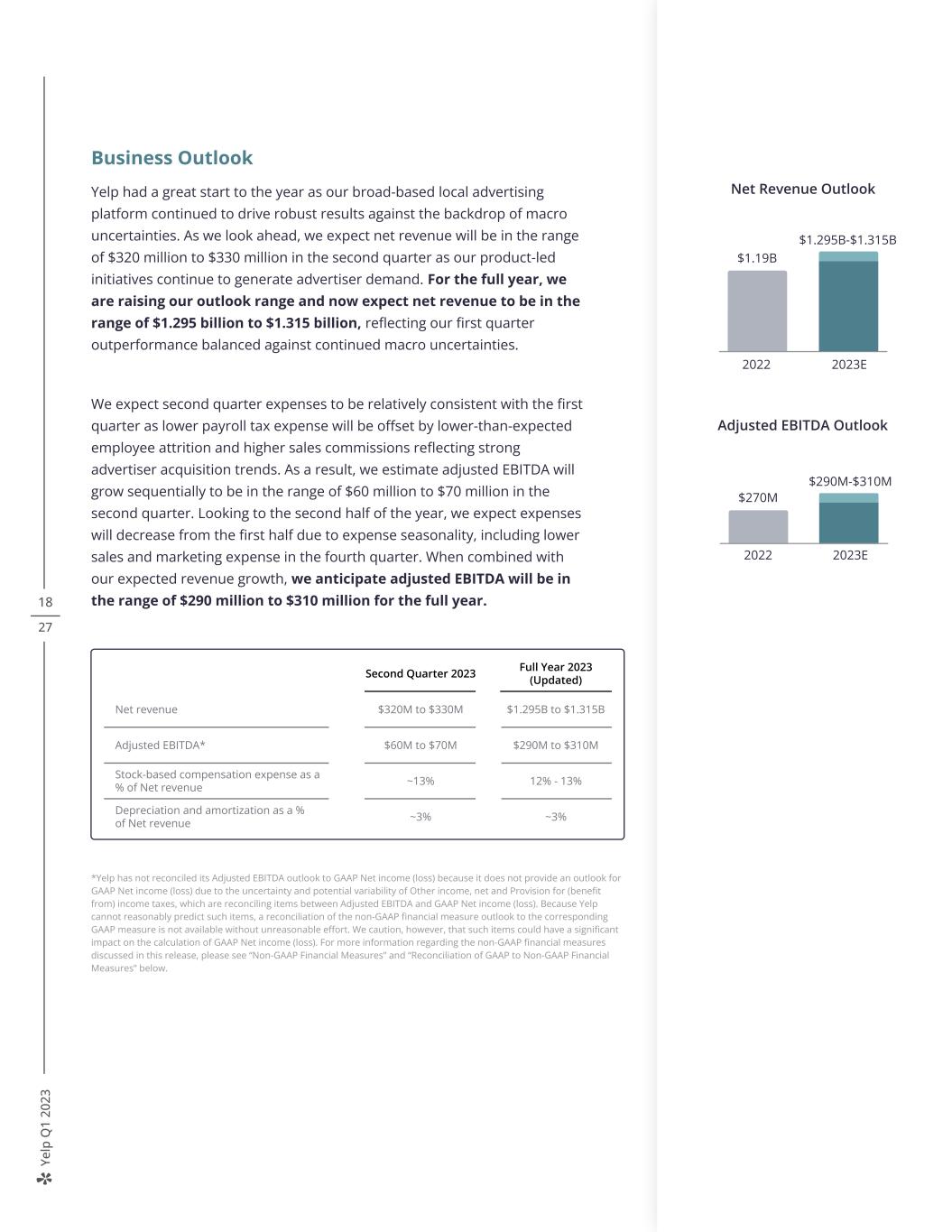

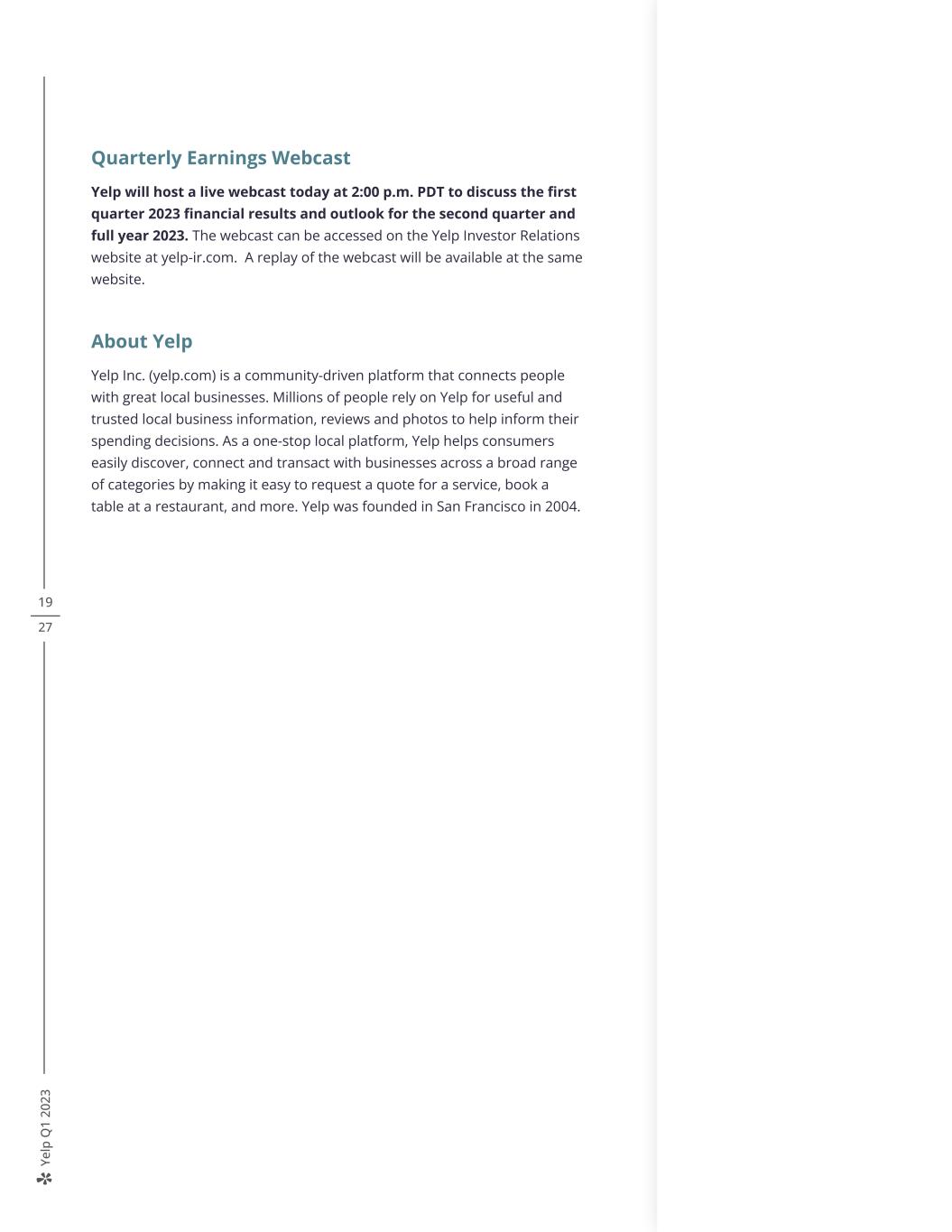

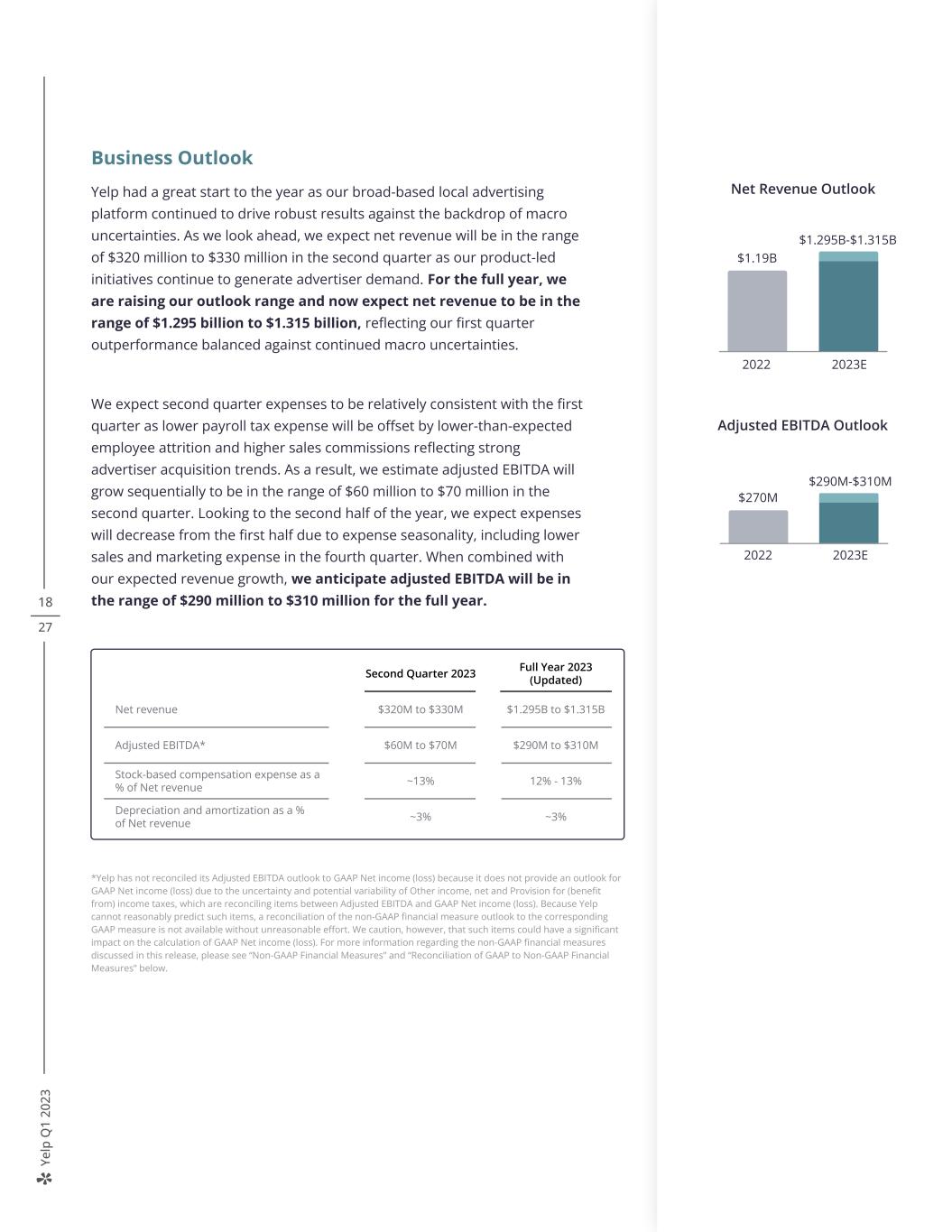

Ye lp Q 1 20 23 18 27 Business Outlook Yelp had a great start to the year as our broad-based local advertising platform continued to drive robust results against the backdrop of macro uncertainties. As we look ahead, we expect net revenue will be in the range of $320 million to $330 million in the second quarter as our product-led initiatives continue to generate advertiser demand. For the full year, we are raising our outlook range and now expect net revenue to be in the range of $1.295 billion to $1.315 billion, reflecting our first quarter outperformance balanced against continued macro uncertainties. We expect second quarter expenses to be relatively consistent with the first quarter as lower payroll tax expense will be offset by lower-than-expected employee attrition and higher sales commissions reflecting strong advertiser acquisition trends. As a result, we estimate adjusted EBITDA will grow sequentially to be in the range of $60 million to $70 million in the second quarter. Looking to the second half of the year, we expect expenses will decrease from the first half due to expense seasonality, including lower sales and marketing expense in the fourth quarter. When combined with our expected revenue growth, we anticipate adjusted EBITDA will be in the range of $290 million to $310 million for the full year. $270M Adjusted EBITDA Outlook 2022 2023E $290M-$310M 2022 2023E $1.19B $1.295B-$1.315B Net Revenue Outlook Second Quarter 2023 Full Year 2023 (Updated) Net revenue $320M to $330M $1.295B to $1.315B Adjusted EBITDA* $60M to $70M $290M to $310M Stock-based compensation expense as a % of Net revenue ~13% 12% - 13% Depreciation and amortization as a % of Net revenue ~3% ~3% *Yelp has not reconciled its Adjusted EBITDA outlook to GAAP Net income (loss) because it does not provide an outlook for GAAP Net income (loss) due to the uncertainty and potential variability of Other income, net and Provision for (benefit from) income taxes, which are reconciling items between Adjusted EBITDA and GAAP Net income (loss). Because Yelp cannot reasonably predict such items, a reconciliation of the non-GAAP financial measure outlook to the corresponding GAAP measure is not available without unreasonable effort. We caution, however, that such items could have a significant impact on the calculation of GAAP Net income (loss). For more information regarding the non-GAAP financial measures discussed in this release, please see “Non-GAAP Financial Measures” and “Reconciliation of GAAP to Non-GAAP Financial Measures” below.

Ye lp Q 1 20 23 19 27 Quarterly Earnings Webcast Yelp will host a live webcast today at 2:00 p.m. PDT to discuss the first quarter 2023 financial results and outlook for the second quarter and full year 2023. The webcast can be accessed on the Yelp Investor Relations website at yelp-ir.com. A replay of the webcast will be available at the same website. About Yelp Yelp Inc. (yelp.com) is a community-driven platform that connects people with great local businesses. Millions of people rely on Yelp for useful and trusted local business information, reviews and photos to help inform their spending decisions. As a one-stop local platform, Yelp helps consumers easily discover, connect and transact with businesses across a broad range of categories by making it easy to request a quote for a service, book a table at a restaurant, and more. Yelp was founded in San Francisco in 2004.

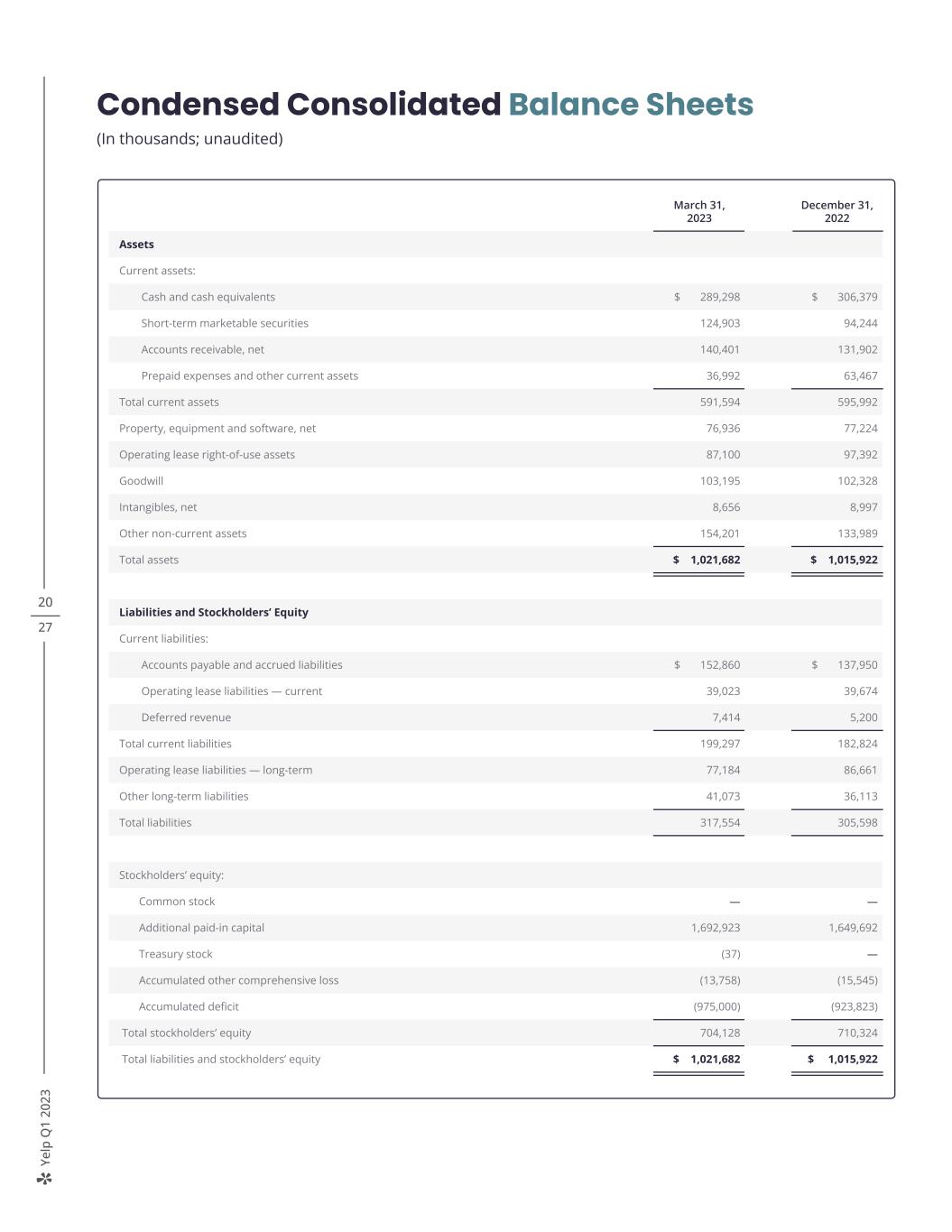

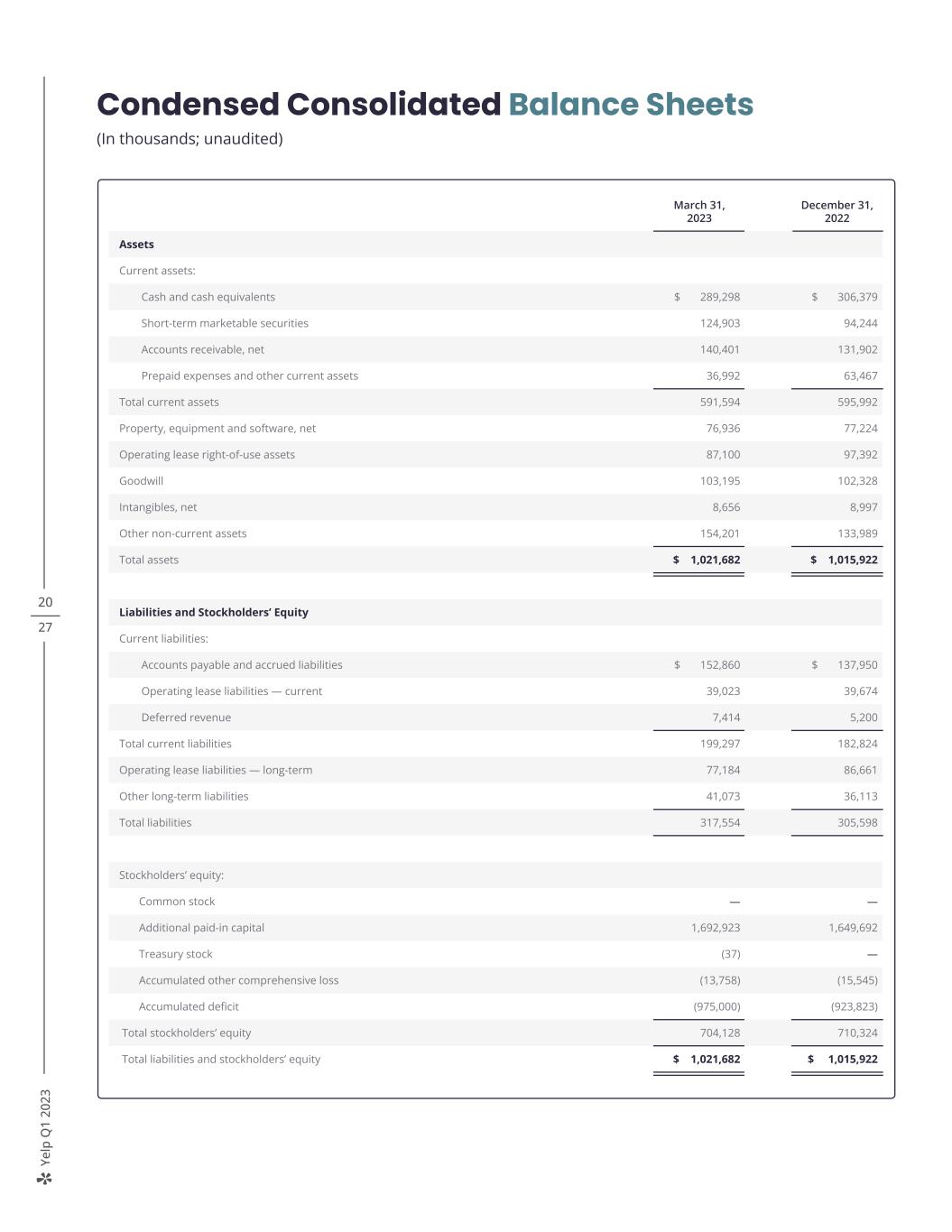

Ye lp Q 1 20 23 20 27 Condensed Consolidated Balance Sheets (In thousands; unaudited) March 31, 2023 December 31, 2022 Assets Current assets: Cash and cash equivalents $ 289,298 $ 306,379 Short-term marketable securities 124,903 94,244 Accounts receivable, net 140,401 131,902 Prepaid expenses and other current assets 36,992 63,467 Total current assets 591,594 595,992 Property, equipment and software, net 76,936 77,224 Operating lease right-of-use assets 87,100 97,392 Goodwill 103,195 102,328 Intangibles, net 8,656 8,997 Other non-current assets 154,201 133,989 Total assets $ 1,021,682 $ 1,015,922 Liabilities and Stockholders’ Equity Current liabilities: Accounts payable and accrued liabilities $ 152,860 $ 137,950 Operating lease liabilities — current 39,023 39,674 Deferred revenue 7,414 5,200 Total current liabilities 199,297 182,824 Operating lease liabilities — long-term 77,184 86,661 Other long-term liabilities 41,073 36,113 Total liabilities 317,554 305,598 Stockholders’ equity: Common stock — — Additional paid-in capital 1,692,923 1,649,692 Treasury stock (37) — Accumulated other comprehensive loss (13,758) (15,545) Accumulated deficit (975,000) (923,823) Total stockholders’ equity 704,128 710,324 Total liabilities and stockholders’ equity $ 1,021,682 $ 1,015,922

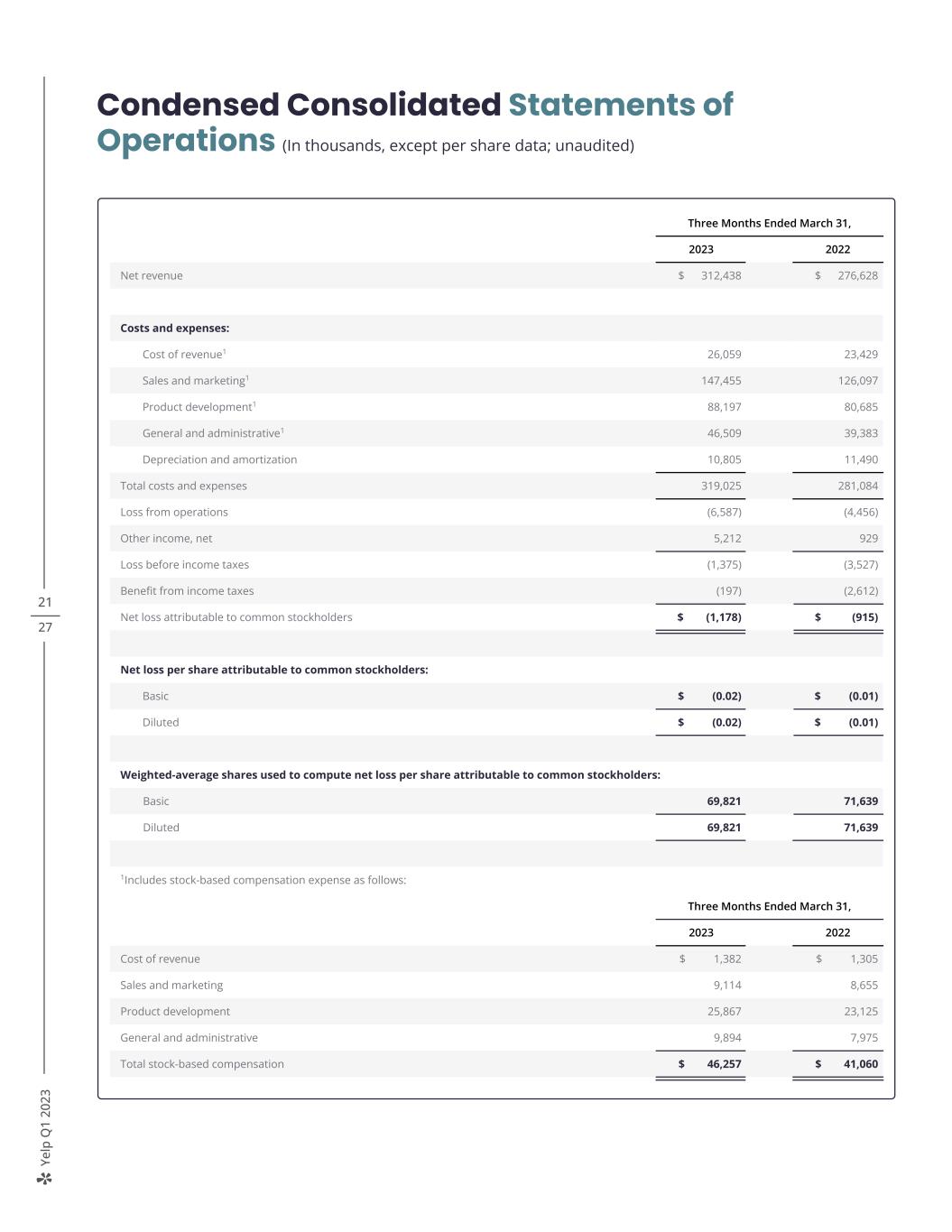

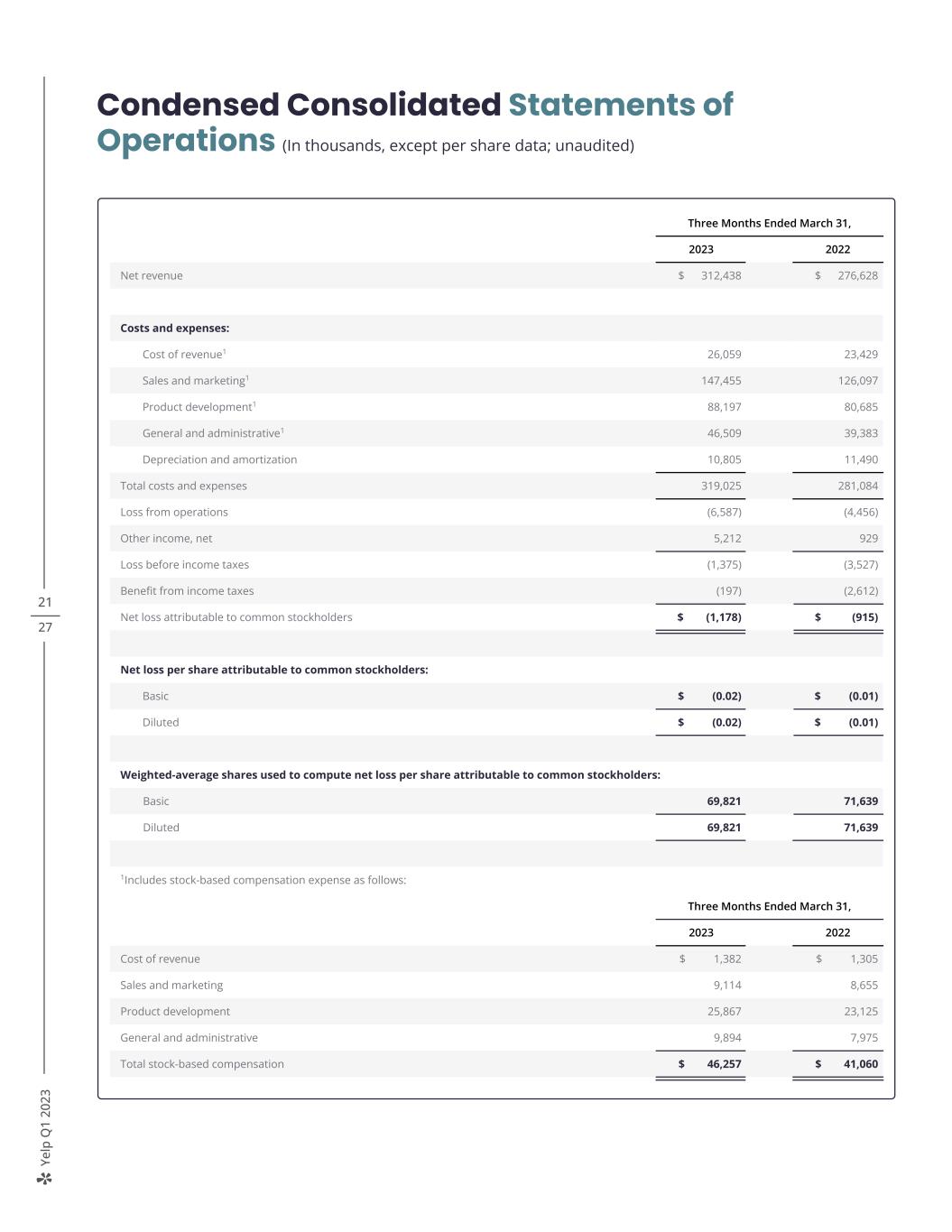

Ye lp Q 1 20 23 21 27 Condensed Consolidated Statements of Operations (In thousands, except per share data; unaudited) Three Months Ended March 31, 2023 2022 Net revenue $ 312,438 $ 276,628 Costs and expenses: Cost of revenue1 26,059 23,429 Sales and marketing1 147,455 126,097 Product development1 88,197 80,685 General and administrative1 46,509 39,383 Depreciation and amortization 10,805 11,490 Total costs and expenses 319,025 281,084 Loss from operations (6,587) (4,456) Other income, net 5,212 929 Loss before income taxes (1,375) (3,527) Benefit from income taxes (197) (2,612) Net loss attributable to common stockholders $ (1,178) $ (915) Net loss per share attributable to common stockholders: Basic $ (0.02) $ (0.01) Diluted $ (0.02) $ (0.01) Weighted-average shares used to compute net loss per share attributable to common stockholders: Basic 69,821 71,639 Diluted 69,821 71,639 1Includes stock-based compensation expense as follows: Three Months Ended March 31, 2023 2022 Cost of revenue $ 1,382 $ 1,305 Sales and marketing 9,114 8,655 Product development 25,867 23,125 General and administrative 9,894 7,975 Total stock-based compensation $ 46,257 $ 41,060

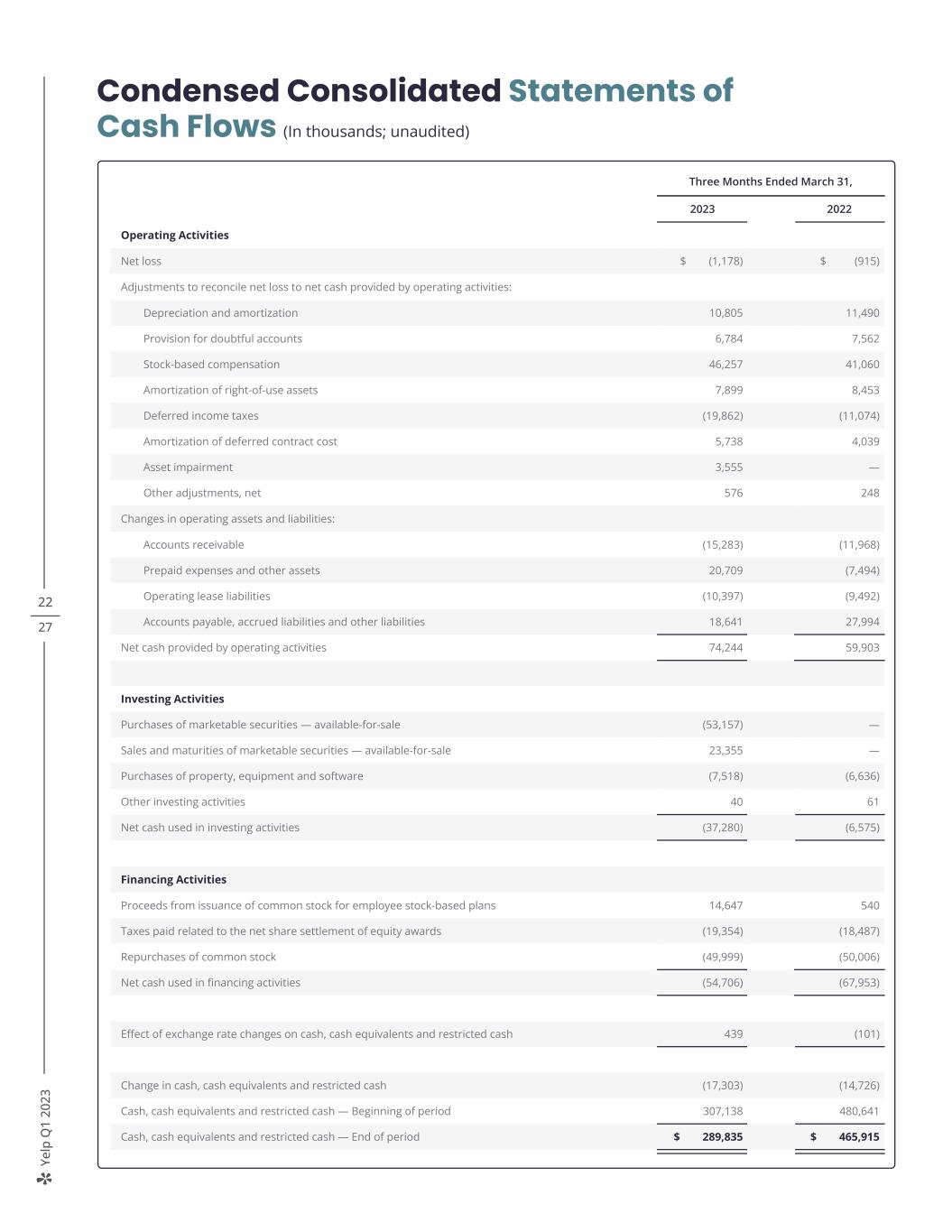

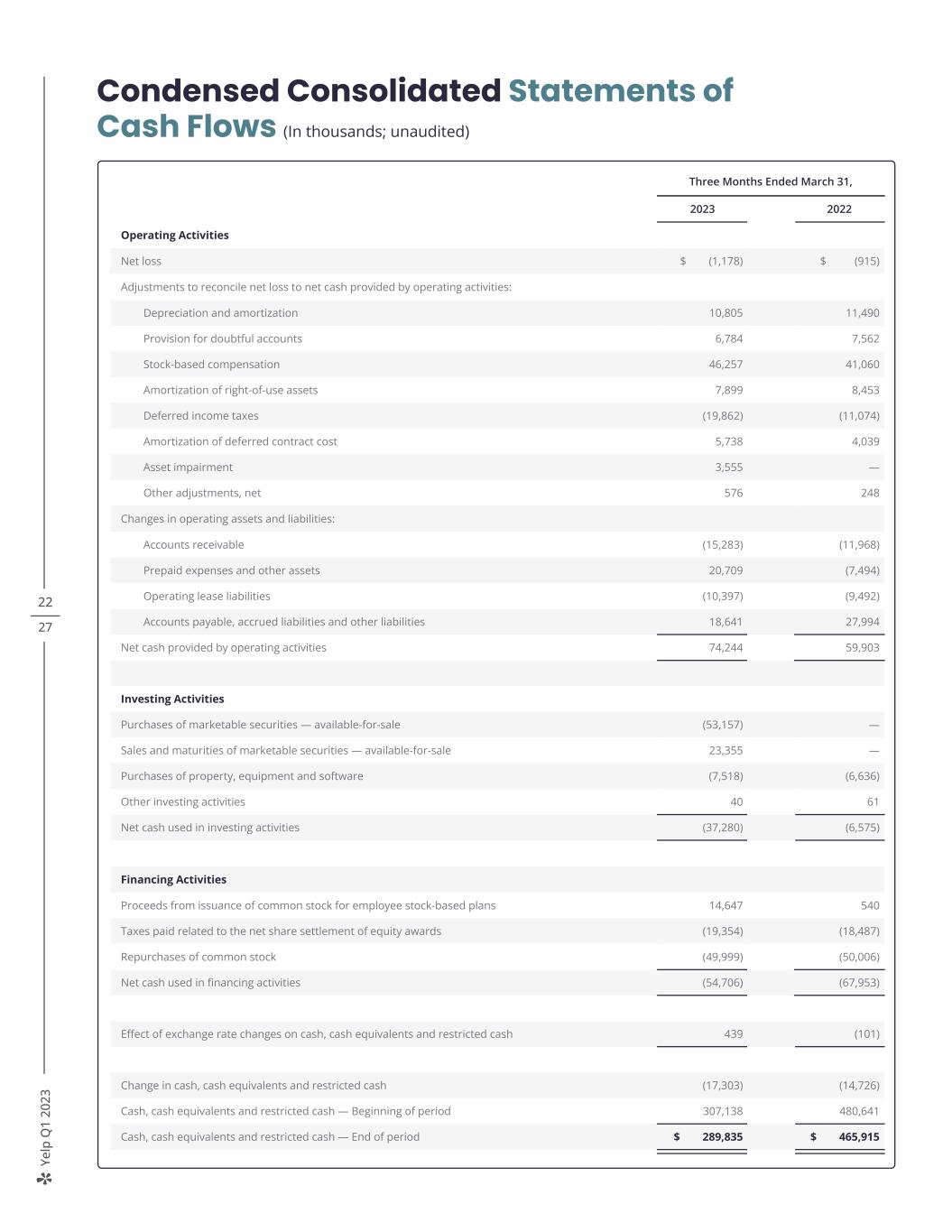

Ye lp Q 1 20 23 22 27 Condensed Consolidated Statements of Cash Flows (In thousands; unaudited) Three Months Ended March 31, 2023 2022 Operating Activities Net loss $ (1,178) $ (915) Adjustments to reconcile net loss to net cash provided by operating activities: Depreciation and amortization 10,805 11,490 Provision for doubtful accounts 6,784 7,562 Stock-based compensation 46,257 41,060 Amortization of right-of-use assets 7,899 8,453 Deferred income taxes (19,862) (11,074) Amortization of deferred contract cost 5,738 4,039 Asset impairment 3,555 — Other adjustments, net 576 248 Changes in operating assets and liabilities: Accounts receivable (15,283) (11,968) Prepaid expenses and other assets 20,709 (7,494) Operating lease liabilities (10,397) (9,492) Accounts payable, accrued liabilities and other liabilities 18,641 27,994 Net cash provided by operating activities 74,244 59,903 Investing Activities Purchases of marketable securities — available-for-sale (53,157) — Sales and maturities of marketable securities — available-for-sale 23,355 — Purchases of property, equipment and software (7,518) (6,636) Other investing activities 40 61 Net cash used in investing activities (37,280) (6,575) Financing Activities Proceeds from issuance of common stock for employee stock-based plans 14,647 540 Taxes paid related to the net share settlement of equity awards (19,354) (18,487) Repurchases of common stock (49,999) (50,006) Net cash used in financing activities (54,706) (67,953) Effect of exchange rate changes on cash, cash equivalents and restricted cash 439 (101) Change in cash, cash equivalents and restricted cash (17,303) (14,726) Cash, cash equivalents and restricted cash — Beginning of period 307,138 480,641 Cash, cash equivalents and restricted cash — End of period $ 289,835 $ 465,915

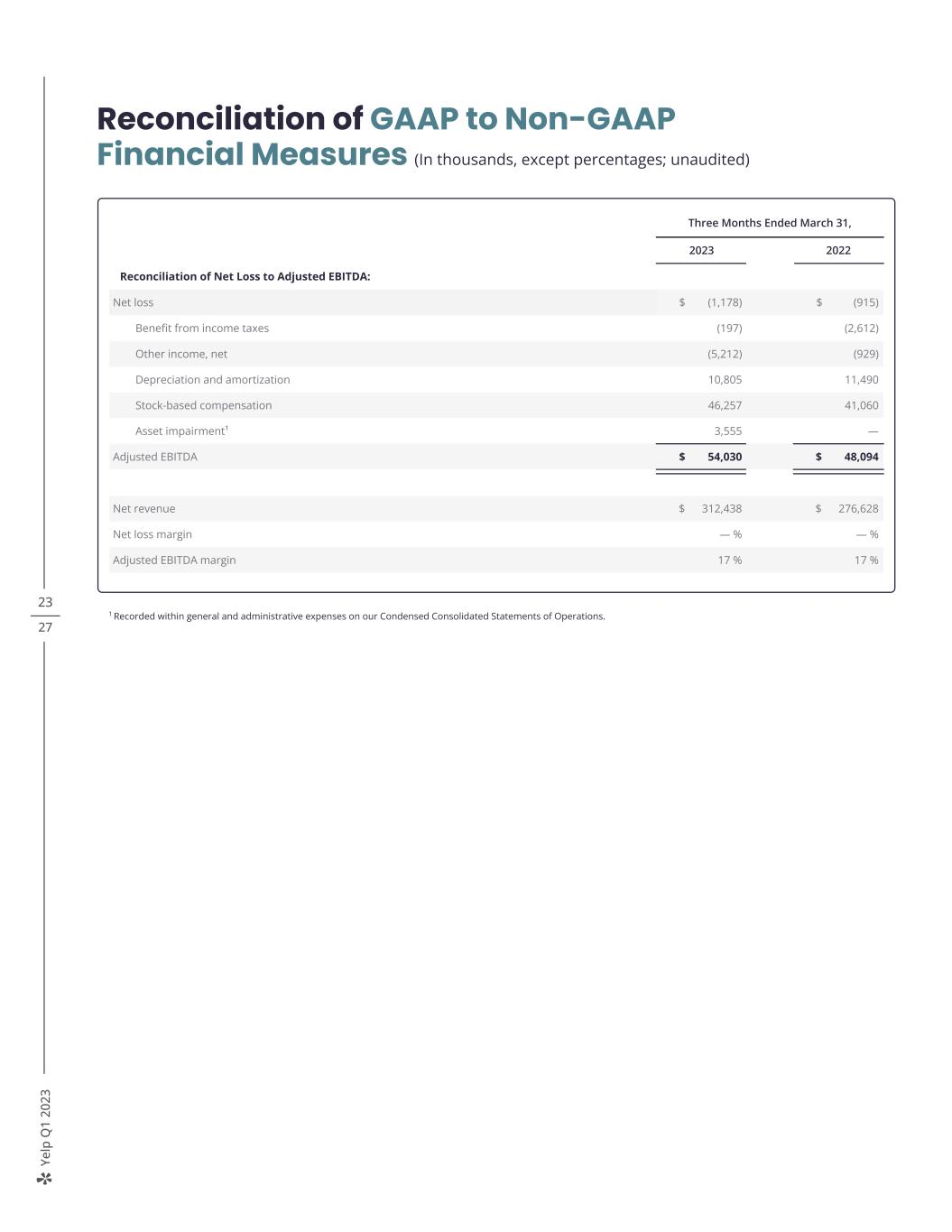

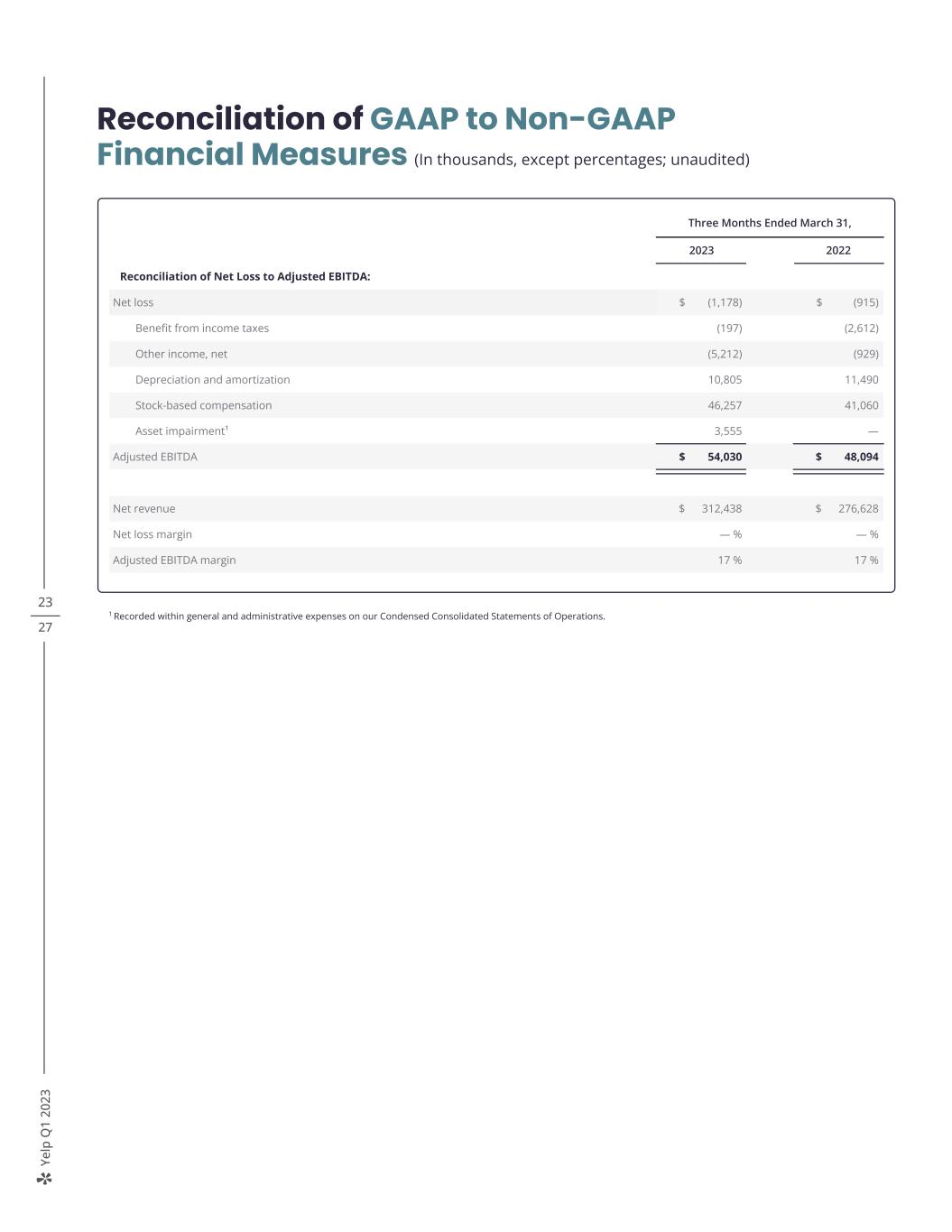

Ye lp Q 1 20 23 23 27 Reconciliation of GAAP to Non-GAAP Financial Measures (In thousands, except percentages; unaudited) 1 Recorded within general and administrative expenses on our Condensed Consolidated Statements of Operations. Three Months Ended March 31, 2023 2022 Reconciliation of Net Loss to Adjusted EBITDA: Net loss $ (1,178) $ (915) Benefit from income taxes (197) (2,612) Other income, net (5,212) (929) Depreciation and amortization 10,805 11,490 Stock-based compensation 46,257 41,060 Asset impairment¹ 3,555 — Adjusted EBITDA $ 54,030 $ 48,094 Net revenue $ 312,438 $ 276,628 Net loss margin — % — % Adjusted EBITDA margin 17 % 17 %

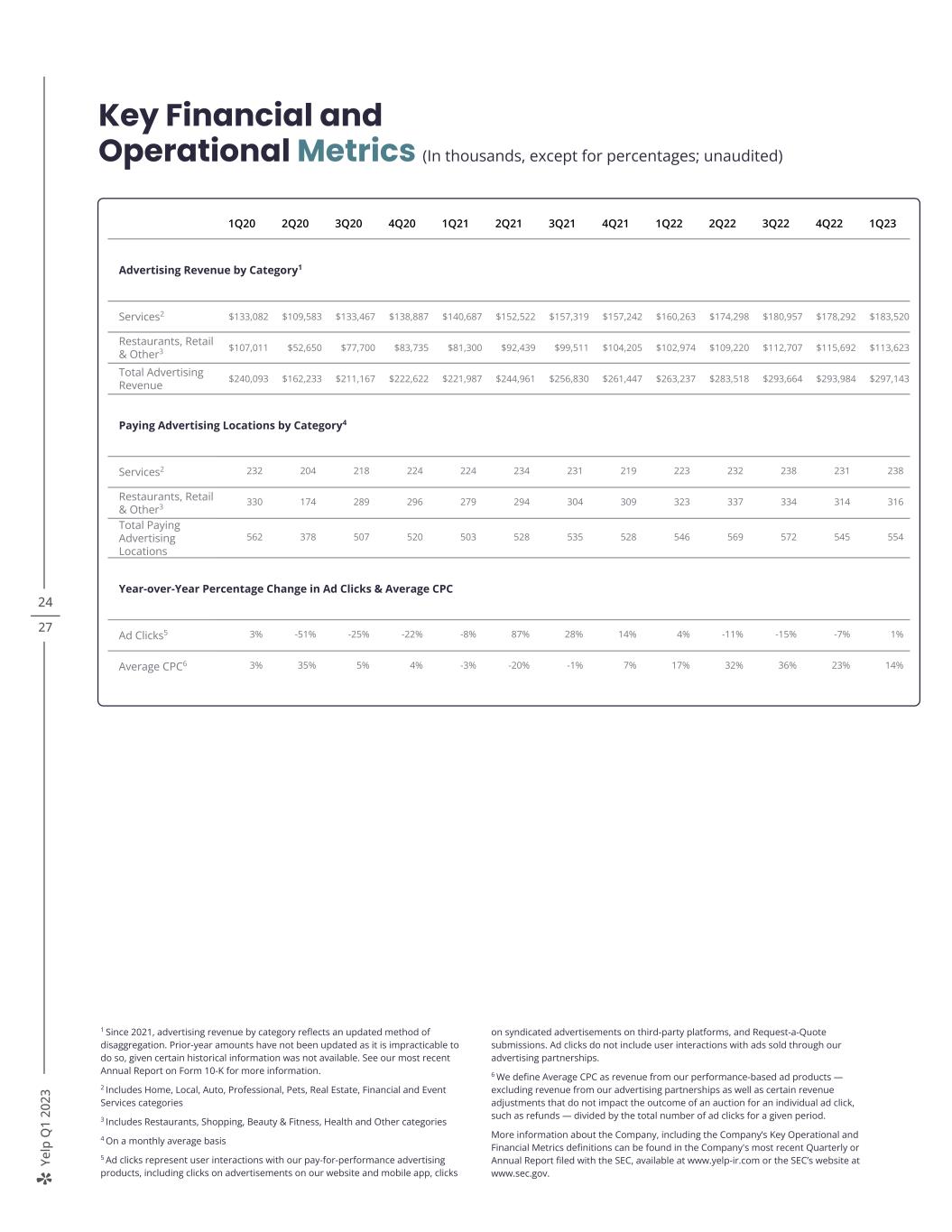

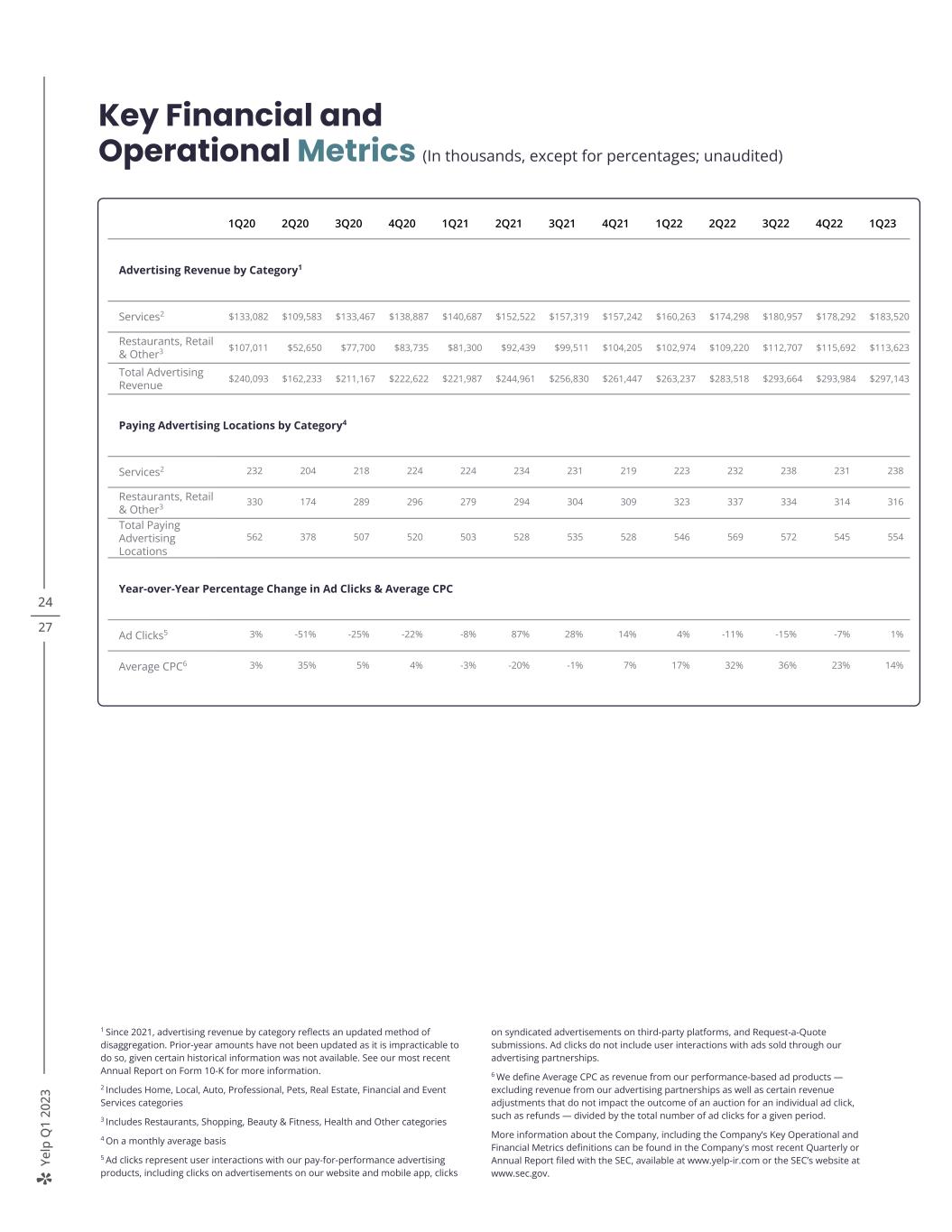

Ye lp Q 1 20 23 24 27 Key Financial and Operational Metrics (In thousands, except for percentages; unaudited) 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 Advertising Revenue by Category1 Services2 $133,082 $109,583 $133,467 $138,887 $140,687 $152,522 $157,319 $157,242 $160,263 $174,298 $180,957 $178,292 $183,520 Restaurants, Retail & Other3 $107,011 $52,650 $77,700 $83,735 $81,300 $92,439 $99,511 $104,205 $102,974 $109,220 $112,707 $115,692 $113,623 Total Advertising Revenue $240,093 $162,233 $211,167 $222,622 $221,987 $244,961 $256,830 $261,447 $263,237 $283,518 $293,664 $293,984 $297,143 Paying Advertising Locations by Category4 Services2 232 204 218 224 224 234 231 219 223 232 238 231 238 Restaurants, Retail & Other3 330 174 289 296 279 294 304 309 323 337 334 314 316 Total Paying Advertising Locations 562 378 507 520 503 528 535 528 546 569 572 545 554 Year-over-Year Percentage Change in Ad Clicks & Average CPC Ad Clicks5 3% -51% -25% -22% -8% 87% 28% 14% 4% -11% -15% -7% 1% Average CPC6 3% 35% 5% 4% -3% -20% -1% 7% 17% 32% 36% 23% 14% 1 Since 2021, advertising revenue by category reflects an updated method of disaggregation. Prior-year amounts have not been updated as it is impracticable to do so, given certain historical information was not available. See our most recent Annual Report on Form 10-K for more information. 2 Includes Home, Local, Auto, Professional, Pets, Real Estate, Financial and Event Services categories 3 Includes Restaurants, Shopping, Beauty & Fitness, Health and Other categories 4 On a monthly average basis 5 Ad clicks represent user interactions with our pay-for-performance advertising products, including clicks on advertisements on our website and mobile app, clicks on syndicated advertisements on third-party platforms, and Request-a-Quote submissions. Ad clicks do not include user interactions with ads sold through our advertising partnerships. 6 We define Average CPC as revenue from our performance-based ad products — excluding revenue from our advertising partnerships as well as certain revenue adjustments that do not impact the outcome of an auction for an individual ad click, such as refunds — divided by the total number of ad clicks for a given period. More information about the Company, including the Company’s Key Operational and Financial Metrics definitions can be found in the Company's most recent Quarterly or Annual Report filed with the SEC, available at www.yelp-ir.com or the SEC’s website at www.sec.gov.

Ye lp Q 1 20 23 Non-GAAP Financial Measures This letter and statements made during the above referenced webcast may include information relating to Adjusted EBITDA and Adjusted EBITDA margin, each of which is a "non-GAAP financial measure." We define Adjusted EBITDA as net income (loss), adjusted to exclude: provision for (benefit from) income taxes; other income, net; depreciation and amortization; stock-based compensation expense; and, in certain periods, certain other income and expense items, such as impairment charges. We define Adjusted EBITDA margin as Adjusted EBITDA divided by net revenue. Adjusted EBITDA, which is not prepared under any comprehensive set of accounting rules or principles, has limitations as an analytical tool and you should not consider it in isolation or as a substitute for analysis of Yelp’s financial results as reported in accordance with generally accepted accounting principles in the United States (“GAAP”). In particular, Adjusted EBITDA should not be viewed as a substitute for, or superior to, net income (loss) prepared in accordance with GAAP as a measure of profitability or liquidity. Some of these limitations are: > although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect all cash capital expenditure requirements for such replacements or for new capital expenditure requirements; > Adjusted EBITDA does not reflect changes in, or cash requirements for, Yelp's working capital needs; > Adjusted EBITDA does not reflect the impact of the recording or release of valuation allowances or tax payments that may represent a reduction in cash available to Yelp; > Adjusted EBITDA does not consider the potentially dilutive impact of equity-based compensation; > Adjusted EBITDA does not take into account any income or costs that management determines are not indicative of ongoing operating performance, such as impairment charges; and > other companies, including those in Yelp’s industry, may calculate Adjusted EBITDA differently, which reduces its usefulness as a comparative measure. Because of these limitations, you should consider Adjusted EBITDA and Adjusted EBITDA margin alongside other financial performance measures, net income (loss) and Yelp’s other GAAP results. Forward-Looking Statements This letter contains, and statements made during the above-referenced webcast will contain, forward-looking statements relating to, among other things, the future performance of Yelp and its consolidated subsidiaries that are based on Yelp’s current expectations, forecasts and assumptions and involve risks and uncertainties. These statements include, but are not limited to, statements regarding: > Yelp’s expected financial results for the second quarter and full year 2023; > Yelp’s pipeline of projects for the remainder of 2023 and beyond; > Yelp’s belief that its broad set of categories and quality advertisers position it well to drive long-term, profitable growth; > Yelp’s expectation that its new 2023 product updates and features will contribute to continued business momentum; > Yelp’s belief that its strategic initiatives continue to provide opportunities for growth and its ability to execute against those initiatives in 2023; > Yelp’s assessment of its opportunities and its ability to drive profitable growth and shareholder value over the long term; > Yelp’s expectations regarding the ability of its product roadmap to reduce friction throughout the hiring journey and help drive quality connections between consumers and business pros; > Yelp’s belief that its passwordless Request-a-Quote experience will make it easier for users to submit requests to service pros and extend to other use cases; > Yelp’s belief that Yelp Guaranteed will provide consumers with peace of mind when connecting with Services advertisers on Yelp as well as drive more consumer projects through the Request-a-Quote flow and more connections to advertisers; > Yelp’s belief that its enhancements the Request-a-Quote flow will improve lead quality; > Yelp’s plans to roll out Yelp Guaranteed nationwide; 25 27

Ye lp Q 1 20 23 > The ability of adaptations of the Showcase ad format and multi-location custom reporting tool to help capture a greater share of multi-location advertisers’ large budgets; > Yelp’s belief that ad system enhancements and new ad formats can significantly decrease CPCs, as well as its plans to extend its new desktop website page optimizations to its mobile site and app; > Yelp’s plans to drive medium- and long-term audience and engagement growth through its consumer-focused initiatives, including product and marketing initiatives; > Yelp’s belief that its review topics and video review format will reduce friction in the review-writing process and increase contributions; > Yelp’s belief that its strategic investments and right-sized team position it well to drive growth and leverage in the second half of the year and beyond; > Yelp’s expectation that its headcount will be approximately flat year over year by the end of 2023; > Yelp’s expectation that its top-line growth and a seasonal decrease in expenses will drive margin improvement in the second half of the year; > Yelp’s expectations regarding the financial impact of its reduced office footprint; > Yelp’s expectations regarding its reduction of stock-based compensation as a percentage of revenue over time and its ability to achieve these expectations by focusing its product development hiring outside of the Bay Area and adjusting its compensation mix throughout the organization; > Yelp’s plans to continue share repurchases under its stock repurchase program; > The strength of Yelp’s local advertising platform and product-led strategy; > Yelp’s belief in its path and ability to deliver profitable growth and shareholder value over the long term; > Yelp’s expectation that its product-led initiatives will continue to drive robust advertiser demand; and > Yelp’s expectations regarding advertiser acquisition trends. Yelp’s actual results could differ materially from those predicted or implied by such forward-looking statements and reported results should not be considered as an indication of future performance. Factors that could cause or contribute to such differences include, but are not limited to: > macroeconomic uncertainty — including related to inflation, rising interest rates, supply chain issues, and the ongoing impact of the COVID-19 pandemic and efforts to contain it — and its effect on consumer behavior, user activity and advertiser spending; > the impact of fears or actual outbreaks of disease, including COVID-19 and any variants thereof, and any resulting changes in consumer behavior, economic conditions or governmental actions; > Yelp’s ability to maintain and expand its base of advertisers, particularly if advertiser turnover substantially worsens from recent trends and/or consumer demand significantly degrades; > the default by any subtenants on their rental payment obligations under the subleases entered into in connection with Yelp’s reduction of its office space; > Yelp’s ability to continue to effectively operate with a primarily remote work force and attract and retain key talent; > Yelp’s limited operating history in an evolving industry; > Yelp’s ability to generate and maintain sufficient high-quality content from its users; > potential strategic opportunities and Yelp’s ability to successfully manage the acquisition and integration of new businesses, solutions or technologies, as well as its ability to monetize such acquired products, solutions or technologies; > Yelp’s reliance on traffic to its website from search engines like Google and Bing and the quality and reliability of such traffic; > maintaining a strong brand and managing negative publicity that may arise; and > Yelp’s ability to timely upgrade and develop its systems, infrastructure and customer service capabilities. 26 27

Ye lp Q 1 20 23 Factors that could cause or contribute to such differences also include, but are not limited to, those factors that could affect Yelp’s business, operating results and stock price included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Yelp’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q at www.yelp-ir.com or the SEC’s website at www.sec.gov. Undue reliance should not be placed on the forward-looking statements in this letter or the above-referenced webcast, which are based on information available to Yelp on the date hereof. Such forward-looking statements do not include the potential impact of any acquisitions or divestitures that may be announced and/or completed after the date hereof. Yelp assumes no obligation to update such statements. 27 27