Document

eHealth, Inc. Announces Third Quarter 2024 Results

Third quarter performance driven by strong Medicare segment execution YoY

Entered AEP on solid financial and operational foundation

Completed extension of term loan at improved interest rate terms

AUSTIN, Texas — November 6, 2024 — eHealth, Inc. (Nasdaq: EHTH), a leading private online health insurance marketplace, today announced its financial results for the third quarter ended September 30, 2024.

|

|

|

|

|

|

|

|

|

| CEO Comments |

|

|

|

|

|

“In the third quarter, eHealth achieved our revenue and profitability targets, delivered significant growth in Medicare application volume, and completed our final preparations for the Annual Enrollment Period (“AEP”). We maintained this strong momentum in the first weeks of the AEP, with call volume, online visits to our platform and conversion rates across enrollment channels, up meaningfully year-over-year and exceeding our expectations. We have also implemented a multi-faceted plan to serve eHealth's existing members, including dedicated advisor support and plan monitor tools available on our online platform, to ensure customers continue to be enrolled in coverage that best fits their needs.” – Fran Soistman, Chief Executive Officer |

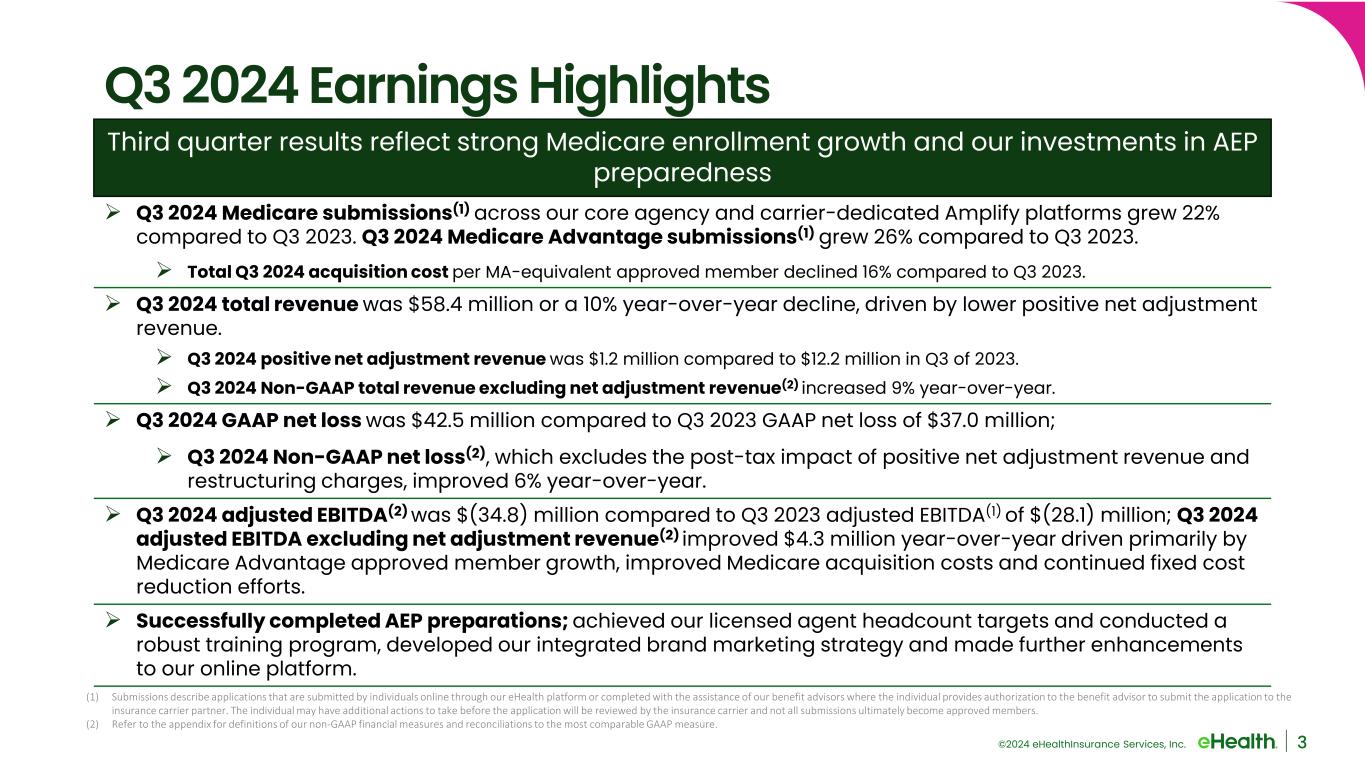

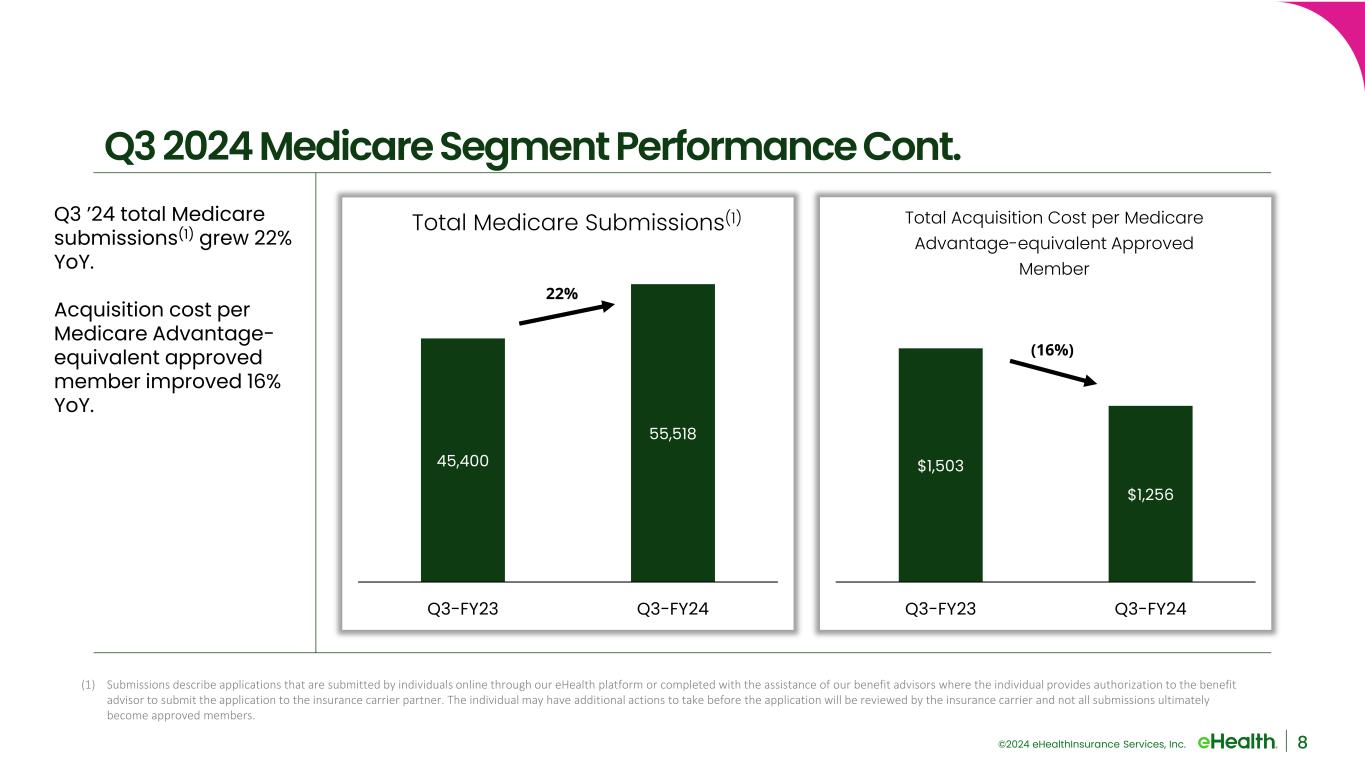

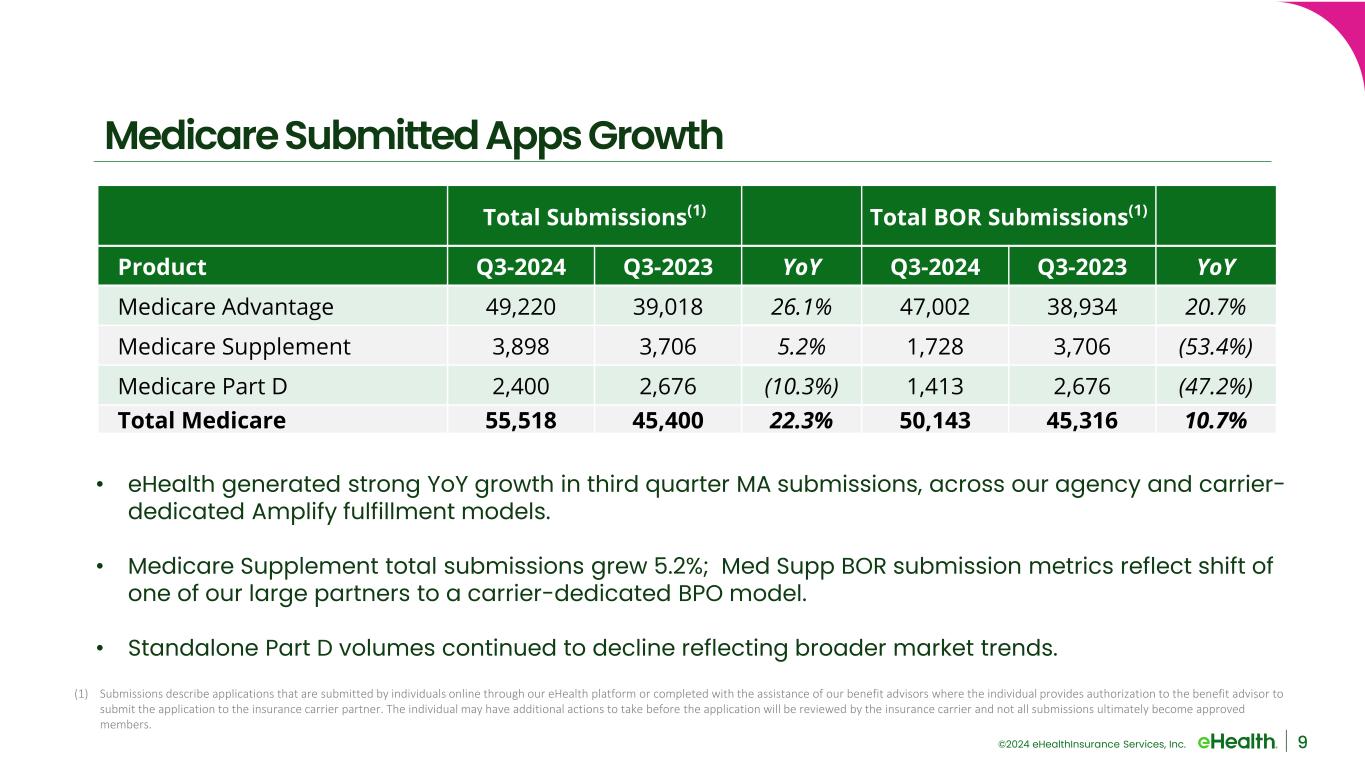

■Q3 2024 Medicare submissions(a) across our core agency and carrier-dedicated Amplify platforms grew 22% compared to Q3 2023, driven primarily by Medicare Advantage (“MA”) submissions growth of 26% year-over-year.

■Q3 2024 total Medicare approved members increased 6% year-over-year, driven mostly by a 14% increase in Q3 2024 MA approved members year-over-year.

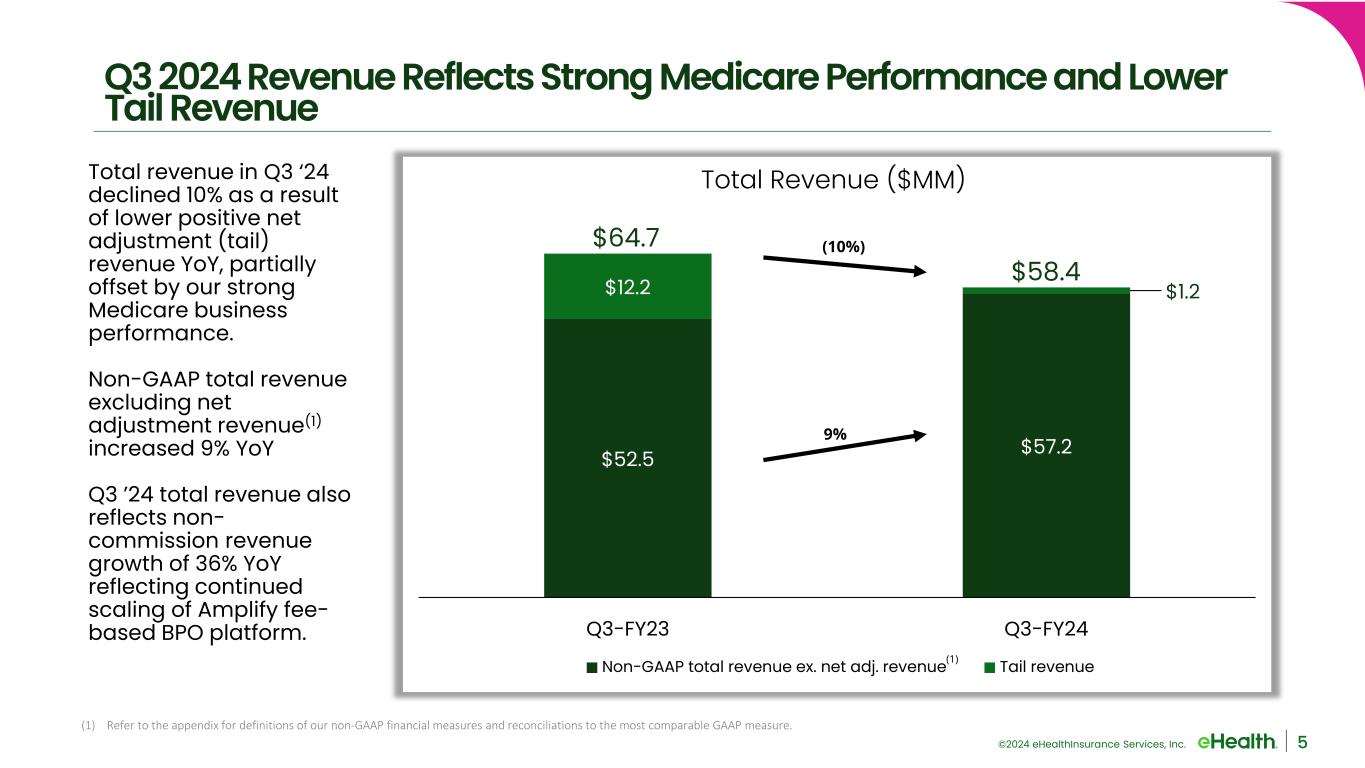

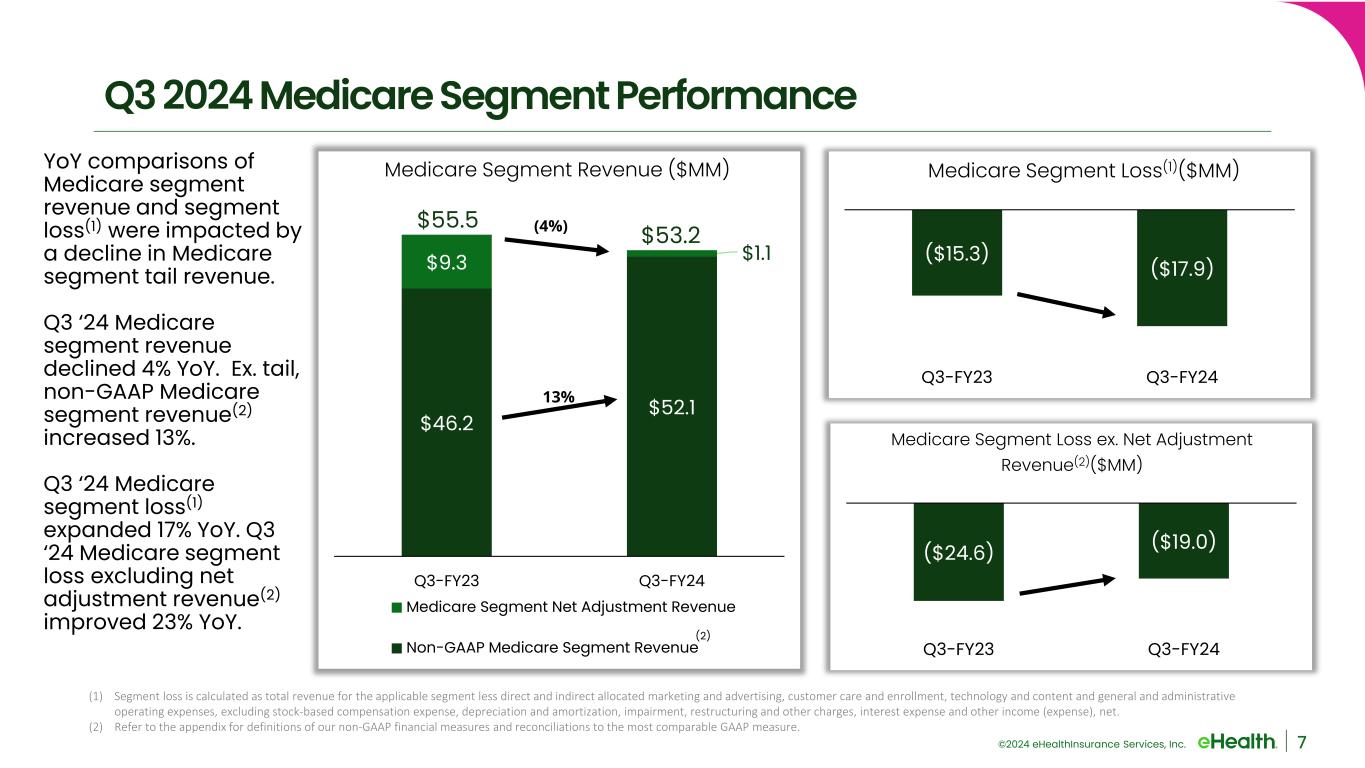

■Q3 2024 total revenue of $58.4 million decreased 10% year-over-year, driven primarily by lower positive net adjustment revenue, as compared to Q3 2023 total revenue of $64.7 million.

■Q3 2024 positive net adjustment revenue of $1.2 million compared to $12.2 million in Q3 2023.

■Q3 2024 Non-GAAP total revenue excluding net adjustment revenue(1) increased 9% year-over-year.

■Q3 2024 total acquisition cost per MA-equivalent approved member declined 16% compared to Q3 2023.

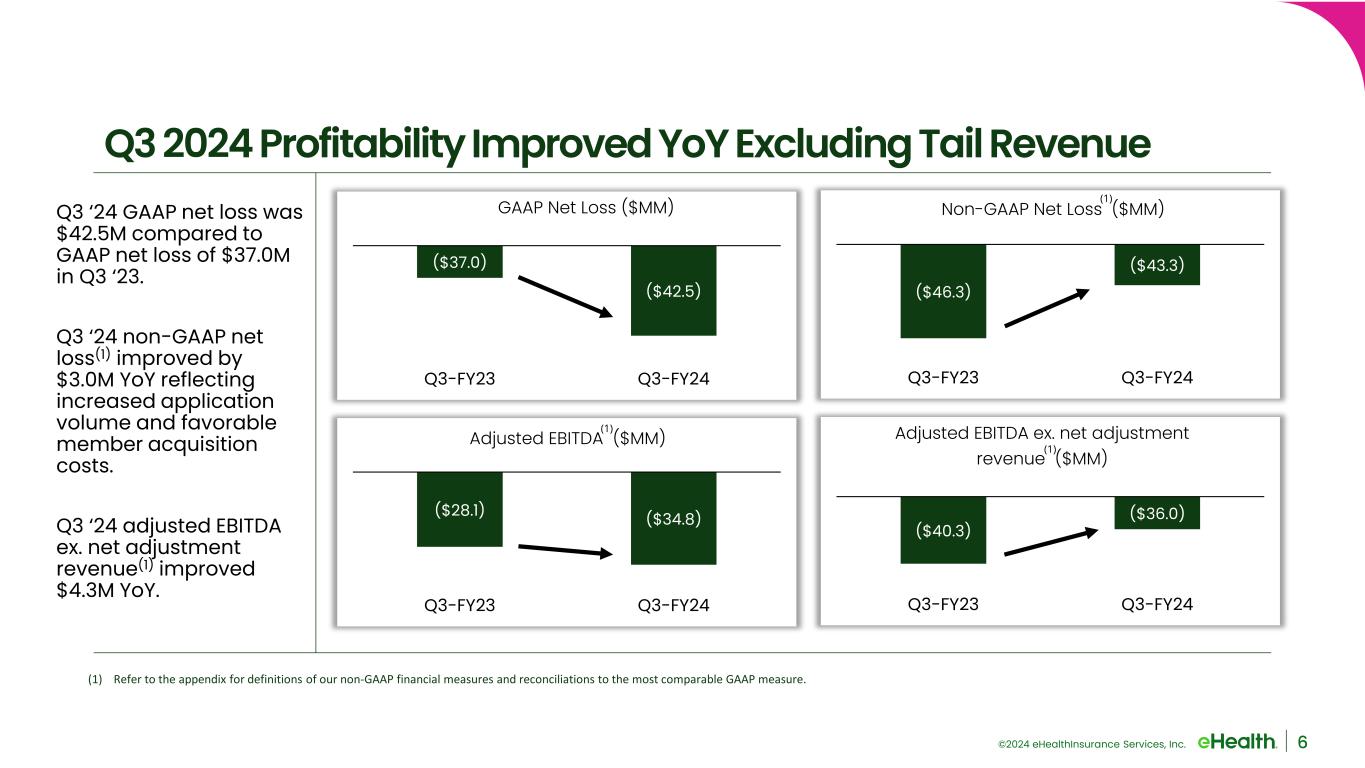

■Q3 2024 GAAP net loss of $42.5 million increased 15%, compared to Q3 2023 GAAP net loss of $37.0 million.

■Q3 2024 Non-GAAP net loss(1) of $43.3 million, which excludes the post-tax impact of positive net adjustment revenue and restructuring charges, improved 6% year-over-year.

■Q3 2024 adjusted EBITDA(1) of $(34.8) million compared to Q3 2023 adjusted EBITDA(1) of $(28.1) million; Q3 2024 adjusted EBITDA excluding net adjustment revenue(1) improved $4.3 million year-over-year, driven primarily by MA approved member growth, improved Medicare acquisition costs and continued fixed cost reduction efforts.

■Successfully completed our AEP preparations; achieved our licensed agent headcount targets and conducted a robust training program, developed our integrated brand marketing strategy and made further enhancements to our online platform.

■Amended term loan credit agreement to extend maturity date to February 2026 with improved interest rate terms.

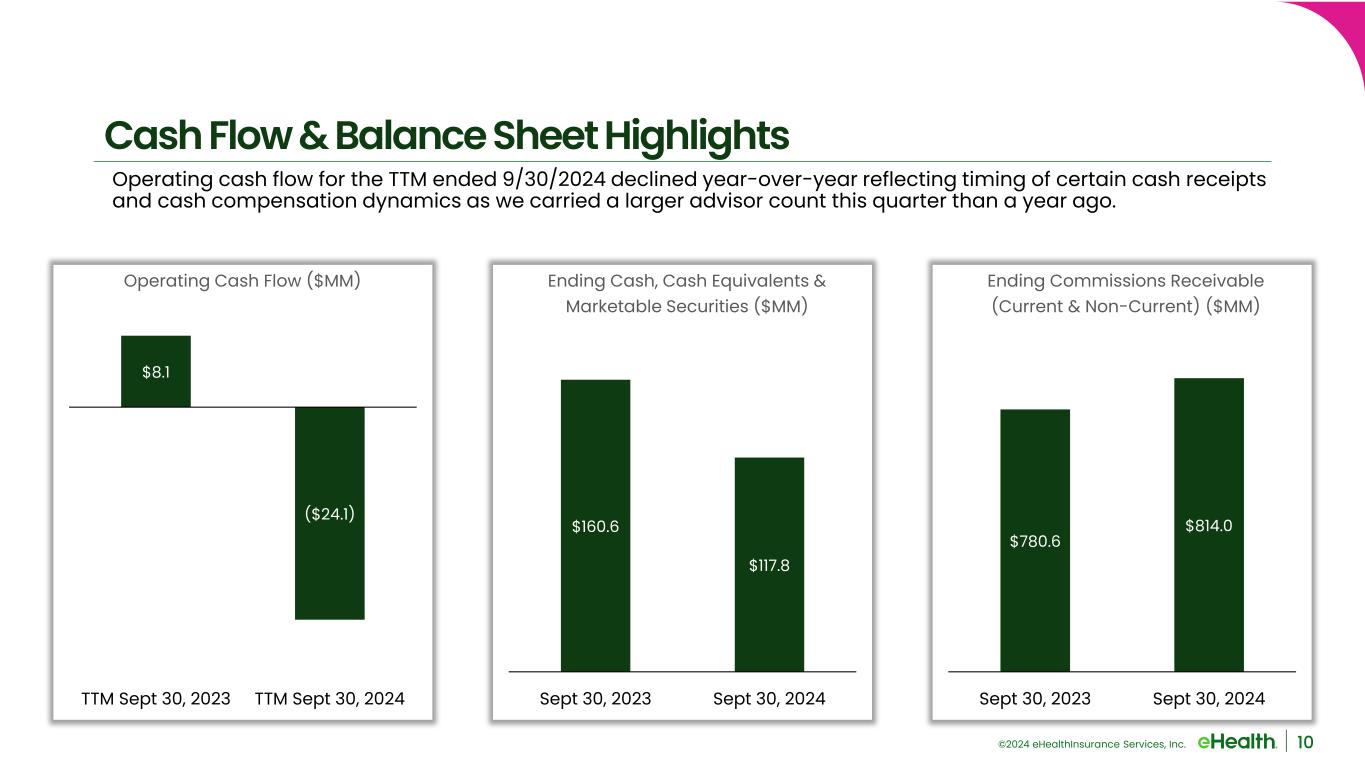

■Cash, cash equivalents and marketable securities of $117.8 million as of September 30, 2024.

■Commissions receivable balance of $814.0 million as of September 30, 2024.

__________

Note: See the tables at the end of this press release for a reconciliation of our GAAP financial measures to our non-GAAP financial measures for the relevant periods and footnote (1) on page

15 at the end of this press release for definitions of our non-GAAP financial measures.

(a) Submissions describe applications that are submitted by individuals online through our eHealth platform or completed with the assistance of our benefit advisors where the individual provides authorization to the benefit advisor to submit the application to the insurance carrier partner. The individual may have additional actions to take before the application will be reviewed by the insurance carrier and not all submissions ultimately become approved members.

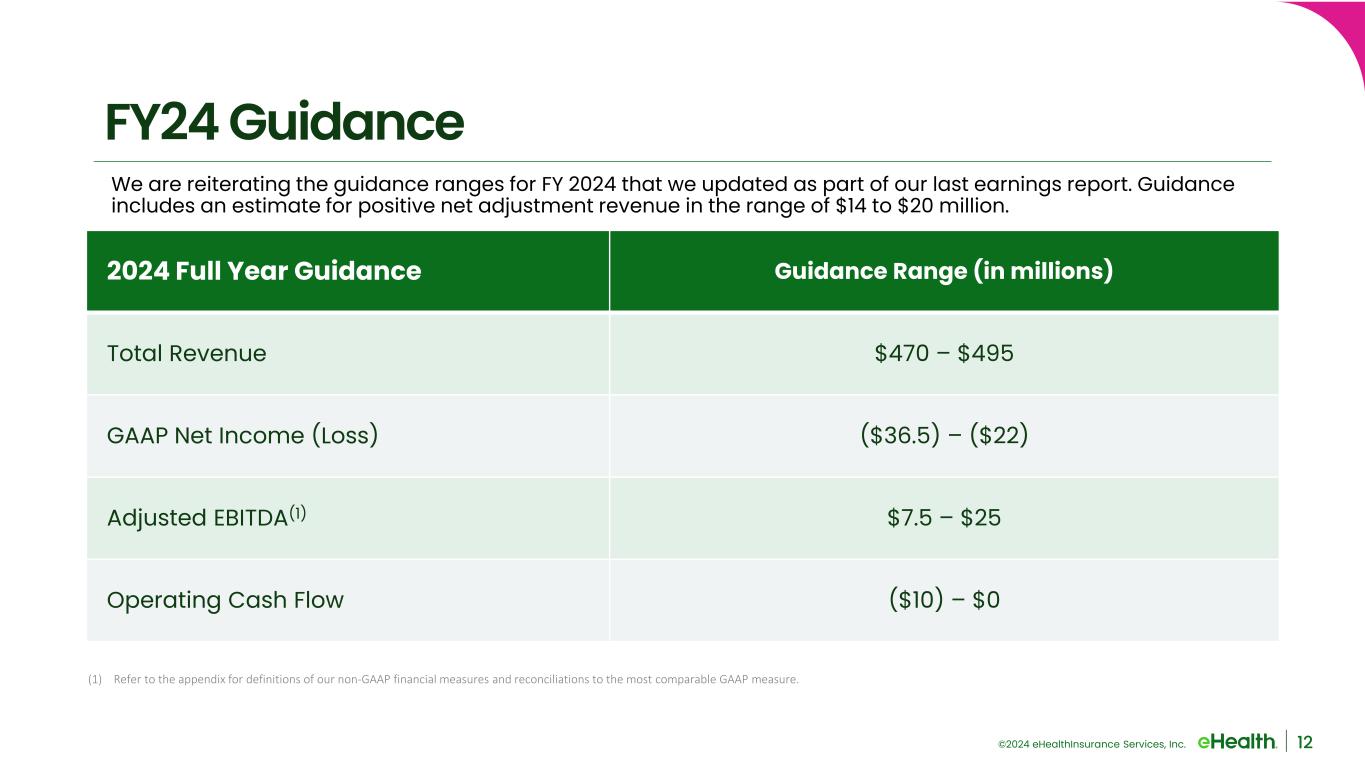

2024 Guidance

Based on information available as of November 6, 2024, we are reiterating our guidance for the full year ending December 31, 2024. These expectations are forward-looking statements and we assume no obligation to update these statements. Actual results may be materially different and are affected by the risk factors and uncertainties identified in this press release and in eHealth’s annual and quarterly reports filed with the Securities and Exchange Commission.

The following guidance is for the full year ending December 31, 2024:

•Total revenue is expected to be in the range of $470.0 million to $495.0 million.

•GAAP net income (loss) is expected to be in the range of $(36.5) million to $(22.0) million.

•Adjusted EBITDA(1) is expected to be in the range of $7.5 million to $25.0 million.

•Operating cash flow is expected to be in the range of $(10.0) million to $0.0 million.

The above guidance includes the expected impact of positive net adjustment revenue in the range of $14 to $20 million. Excluding the impact of positive net adjustment revenue in both years, the mid-point of our 2024 guidance reflects approximately 15% growth in Non-GAAP total revenue excluding net adjustment revenue(1) and a substantial improvement in Non-GAAP net income (loss)(1) and adjusted EBITDA excluding net adjustment revenue(1) year-over-year.

__________

Note: See accompanying footnotes on page

15.

Webcast and Conference Call Information

A webcast and conference call will be held today, Wednesday, November 6, 2024 at 8:30 a.m. Eastern Time / 7:30 a.m. Central Time. Individuals interested in listening to the conference call may do so by dialing (800) 343-5172. The participant passcode is 1401106. The live and archived webcast of the call will also be available under “Events & Presentations” on the Investor Relations page of our website at https://ir.ehealthinsurance.com.

About eHealth, Inc.

We’re Matchmakers. For over 25 years, eHealth has helped millions of Americans find the healthcare coverage that fits their needs at a price they can afford. As a leading independent licensed insurance agency and advisor, eHealth offers access to over 180 health insurers, including national and regional companies.

For more information, visit eHealth.com or follow us on LinkedIn, Facebook, Instagram, and X. Open positions can be found on our career page.

Forward-Looking Statements

This press release contains statements that are forward-looking statements as defined within the Private Securities Litigation Reform Act of 1995. These include statements regarding our expectations regarding our business, operations and strategy; our estimates regarding total membership, Medicare, individual and family plan, ancillary products and small business memberships; our estimates regarding constrained lifetime values of commissions per approved member by product category; our estimates regarding costs per approved member; our 2024 annual guidance for total revenue, GAAP net income (loss), adjusted EBITDA and operating cash flow; our estimates for positive net adjustment revenue and its expected impact on our 2024 annual guidance; the impact of our efforts to prepare for the annual enrollment period, and other statements regarding our future operations, financial condition, prospects and business strategies.

These forward-looking statements are inherently subject to various risks and uncertainties that could cause actual results to differ materially from the statements made. In particular, we are required by Accounting Standards Codification 606 — Revenue from Contracts with Customers to make numerous assumptions that are based on historical trends and our management’s judgment.

These assumptions may change over time and have a material impact on our revenue recognition, guidance, and results of operations. Please review the assumptions stated in this press release carefully.

The risks and uncertainties that could cause our results to differ materially from those expressed or implied by such forward-looking statements include, but are not limited to, our ability to retain existing members and enroll new members during the annual healthcare open enrollment period, the Medicare annual enrollment period, the Medicare Advantage annual open enrollment period and other special enrollment periods; changes in laws, regulations and guidelines, including in connection with healthcare reform or with respect to the marketing and sale of Medicare plans, such as the Policy and Technical Changes to Medicare Advantage for Contract Year 2025 released by CMS on April 4, 2024; competition, including competition from government-run health insurance exchanges and other sources; the seasonality of our business and the fluctuation of our operating results; our ability to accurately estimate membership, lifetime value of commissions and commissions receivable; changes in product offerings among carriers on our ecommerce platform and changes in our estimated conversion rate of an approved member to a paying member and the resulting impact of each on our commission revenue; the concentration of our revenue with a small number of health insurance carriers; our ability to execute on our growth strategy and other business initiatives; changes in our management or other key employees; our ability to hire, train, retain and ensure the productivity of licensed insurance agents, or benefit advisors, and other personnel; exposure to security risks and our ability to safeguard the security and privacy of confidential data; our relationships with health insurance carriers; the success of our carrier advertising and sponsorship program; our success in marketing and selling health insurance plans and our unit cost of acquisition; our ability to effectively manage our operations as our business evolves and execute on our business plan and other strategic initiatives; the need for health insurance carrier and regulatory approvals in connection with the marketing of Medicare-related insurance products; changes in the market for private health insurance; consumer satisfaction of our service and actions we take to improve the quality of enrollments; changes in member conversion rates; changes in commission rates; our ability to sell qualified health insurance plans to subsidy-eligible individuals and to enroll subsidy-eligible individuals through government-run health insurance exchanges; our ability to derive desired benefits from investments in our business, including membership growth and retention initiatives; our reliance on marketing partners; the success and cost of our marketing efforts, including branding, online advertising, direct-to-consumer mail, email, social media, telephone, television, radio and other marketing efforts; timing of receipt and accuracy of commission reports; payment practices of health insurance carriers; dependence on our operations in China; the restrictions in our debt obligations; the restrictions in our investment agreement with our convertible preferred stock investor; our ability to raise additional capital; compliance with insurance, privacy, cybersecurity and other laws and regulations; the outcome of litigation in which we may from time to time be involved; the performance, reliability and availability of our information technology systems, ecommerce platform and underlying network infrastructure, including any new systems we may implement; public health crises, pandemics, natural disasters, changing climate conditions and other extreme events; general economic conditions, including inflation, recession, financial, banking and credit market disruptions; and our ability to effectively administer our self-insurance program. Other factors that could cause operating, financial and other results to differ are described in our most recent Quarterly Report on Form 10-Q or Annual Report on Form 10-K filed with the Securities and Exchange Commission and available on the Investor Relations page of our website at https://ir.ehealthinsurance.com and on the Securities and Exchange Commission’s website at www.sec.gov.

All forward-looking statements in this press release are based on information available to us as of the date hereof, and we do not assume any obligation to update the forward-looking statements provided to reflect events that occur or circumstances that exist after the date on which they were made, except as required by law.

Investor Relations Contact

Kate Sidorovich, CFA

Senior Vice President, Investor Relations & Strategy

investors@ehealth.com

https://ir.ehealthinsurance.com

EHEALTH, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024 |

|

December 31, 2023 |

| Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

64,032 |

|

|

$ |

115,722 |

|

| Short-term marketable securities |

53,750 |

|

|

5,930 |

|

| Accounts receivable |

5,864 |

|

|

3,993 |

|

| Contract assets – commissions receivable – current |

197,591 |

|

|

244,663 |

|

| Prepaid expenses and other current assets |

19,630 |

|

|

12,044 |

|

| Total current assets |

340,867 |

|

|

382,352 |

|

| Contract assets – commissions receivable – non-current |

616,445 |

|

|

673,514 |

|

| Property and equipment, net |

4,770 |

|

|

4,864 |

|

|

|

|

|

| Operating lease right-of-use assets |

12,442 |

|

|

22,767 |

|

| Restricted cash |

3,090 |

|

|

3,090 |

|

| Other assets |

24,377 |

|

|

26,758 |

|

|

|

|

|

|

|

|

|

| Total assets |

$ |

1,001,991 |

|

|

$ |

1,113,345 |

|

|

|

|

|

| Liabilities, convertible preferred stock and stockholders’ equity |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

5,407 |

|

|

$ |

7,197 |

|

| Accrued compensation and benefits |

26,207 |

|

|

40,800 |

|

| Accrued marketing expenses |

9,208 |

|

|

20,340 |

|

|

|

|

|

|

|

|

|

| Lease liabilities – current |

7,429 |

|

|

7,070 |

|

|

|

|

|

| Other current liabilities |

5,597 |

|

|

3,131 |

|

| Total current liabilities |

53,848 |

|

|

78,538 |

|

| Long-term debt |

69,155 |

|

|

67,754 |

|

|

|

|

|

| Deferred income taxes – non-current |

25,347 |

|

|

29,687 |

|

| Lease liabilities – non-current |

22,349 |

|

|

28,333 |

|

| Other non-current liabilities |

4,821 |

|

|

4,949 |

|

| Total liabilities |

175,520 |

|

|

209,261 |

|

| Convertible preferred stock |

327,125 |

|

|

298,053 |

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

| Common stock |

43 |

|

|

41 |

|

| Additional paid-in capital |

812,538 |

|

|

798,786 |

|

| Treasury stock, at cost |

(199,998) |

|

|

(199,998) |

|

| Retained earnings (accumulated deficit) |

(113,363) |

|

|

7,284 |

|

| Accumulated other comprehensive income (loss) |

126 |

|

|

(82) |

|

| Total stockholders’ equity |

499,346 |

|

|

606,031 |

|

| Total liabilities, convertible preferred stock and stockholders’ equity |

$ |

1,001,991 |

|

|

$ |

1,113,345 |

|

EHEALTH, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

|

Nine Months Ended

September 30, |

|

|

|

2024 |

|

2023 |

|

% Change |

|

2024 |

|

2023 |

|

% Change |

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

| Commission |

$ |

48,222 |

|

$ |

57,239 |

|

(16) |

% |

|

$ |

185,996 |

|

$ |

185,428 |

|

— |

% |

| Other |

10,187 |

|

7,479 |

|

36 |

% |

|

31,233 |

|

19,781 |

|

58 |

% |

| Total revenue |

58,409 |

|

64,718 |

|

(10) |

% |

|

217,229 |

|

205,209 |

|

6 |

% |

Operating costs and expenses(a): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marketing and advertising(8) |

29,665 |

|

29,035 |

|

2 |

% |

|

95,185 |

|

85,343 |

|

12 |

% |

Customer care and enrollment(8) |

39,321 |

|

38,901 |

|

1 |

% |

|

100,773 |

|

93,951 |

|

7 |

% |

Technology and content(8) |

12,264 |

|

13,241 |

|

(7) |

% |

|

38,613 |

|

42,047 |

|

(8) |

% |

General and administrative(8) |

20,297 |

|

22,937 |

|

(12) |

% |

|

62,318 |

|

72,310 |

|

(14) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Impairment, restructuring and other charges |

61 |

|

— |

|

* |

|

9,409 |

|

— |

|

* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating costs and expenses |

101,608 |

|

104,114 |

|

(2) |

% |

|

306,298 |

|

293,651 |

|

4 |

% |

| Loss from operations |

(43,199) |

|

(39,396) |

|

(10) |

% |

|

(89,069) |

|

(88,442) |

|

(1) |

% |

| Interest expense |

(2,859) |

|

(2,822) |

|

(1) |

% |

|

(8,517) |

|

(8,122) |

|

(5) |

% |

| Other income, net |

1,699 |

|

2,684 |

|

(37) |

% |

|

6,425 |

|

7,500 |

|

(14) |

% |

| Loss before income taxes |

(44,359) |

|

(39,534) |

|

(12) |

% |

|

(91,161) |

|

(89,064) |

|

(2) |

% |

| Benefit from income taxes |

(1,886) |

|

(2,509) |

|

|

|

(3,736) |

|

(8,660) |

|

|

| Net loss |

(42,473) |

|

(37,025) |

|

(15) |

% |

|

(87,425) |

|

(80,404) |

|

(9) |

% |

| Preferred stock dividends |

(5,643) |

|

(5,320) |

|

|

|

(16,603) |

|

(15,644) |

|

|

| Change in preferred stock redemption value |

(5,832) |

|

(4,898) |

|

|

|

(16,619) |

|

(12,158) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss attributable to common stockholders |

$ |

(53,948) |

|

$ |

(47,243) |

|

(14) |

% |

|

$ |

(120,647) |

|

$ |

(108,206) |

|

(11) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share attributable to common stockholders: |

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

$ |

(1.83) |

|

$ |

(1.68) |

|

(9) |

% |

|

$ |

(4.13) |

|

$ |

(3.88) |

|

(6) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average number of shares used in per share: |

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

29,485 |

|

28,114 |

|

5 |

% |

|

29,211 |

|

27,863 |

|

5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

_____________________________

(a) Includes stock-based compensation expense as follows:

|

| Marketing and advertising |

$ |

437 |

|

$ |

605 |

|

|

|

$ |

1,792 |

|

$ |

1,598 |

|

|

| Customer care and enrollment |

452 |

|

836 |

|

|

|

1,487 |

|

2,229 |

|

|

| Technology and content |

845 |

|

1,306 |

|

|

|

2,598 |

|

3,384 |

|

|

| General and administrative |

2,745 |

|

3,807 |

|

|

|

9,248 |

|

10,530 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total stock-based compensation expense |

$ |

4,479 |

|

$ |

6,554 |

|

(32) |

% |

|

$ |

15,125 |

|

$ |

17,741 |

|

(15) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Results(1): |

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA(1) |

$ |

(34,832) |

|

$ |

(28,097) |

|

(24) |

% |

|

$ |

(52,024) |

|

$ |

(55,560) |

|

6 |

% |

Adjusted EBITDA margin(1) |

(60) |

% |

|

(43) |

% |

|

|

|

(24) |

% |

|

(27) |

% |

|

|

__________

* Percentage calculated is not meaningful.

Note: See accompanying footnotes on page

15.

EHEALTH, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

|

|

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

|

| Operating activities: |

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

$ |

(42,473) |

|

|

$ |

(37,025) |

|

|

$ |

(87,425) |

|

|

$ |

(80,404) |

|

|

|

|

|

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

473 |

|

|

614 |

|

|

1,481 |

|

|

1,908 |

|

|

|

|

|

| Amortization of internally developed software |

3,354 |

|

|

4,131 |

|

|

11,030 |

|

|

13,233 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation expense |

4,479 |

|

|

6,554 |

|

|

15,125 |

|

|

17,741 |

|

|

|

|

|

| Deferred income taxes |

(1,709) |

|

|

(2,611) |

|

|

(4,340) |

|

|

(9,311) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Impairment charges |

— |

|

|

— |

|

|

7,413 |

|

|

— |

|

|

|

|

|

| Other non-cash items |

74 |

|

|

106 |

|

|

(43) |

|

|

5 |

|

|

|

|

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

| Accounts receivable |

(4,681) |

|

|

121 |

|

|

(1,871) |

|

|

2,110 |

|

|

|

|

|

| Contract assets – commissions receivable |

17,885 |

|

|

9,148 |

|

|

104,582 |

|

|

104,160 |

|

|

|

|

|

| Prepaid expenses and other assets |

(11,327) |

|

|

(12,473) |

|

|

(9,896) |

|

|

(12,597) |

|

|

|

|

|

| Accounts payable |

509 |

|

|

802 |

|

|

(1,965) |

|

|

181 |

|

|

|

|

|

| Accrued compensation and benefits |

6,195 |

|

|

5,823 |

|

|

(14,593) |

|

|

6,102 |

|

|

|

|

|

| Accrued marketing expenses |

1,366 |

|

|

989 |

|

|

(11,132) |

|

|

(16,347) |

|

|

|

|

|

| Deferred revenue |

(1,173) |

|

|

1,040 |

|

|

861 |

|

|

1,323 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accrued expenses and other liabilities |

(2,255) |

|

|

(1,900) |

|

|

69 |

|

|

(1,410) |

|

|

|

|

|

| Net cash provided by (used in) operating activities |

(29,283) |

|

|

(24,681) |

|

|

9,296 |

|

|

26,694 |

|

|

|

|

|

| Investing activities: |

|

|

|

|

|

|

|

|

|

|

|

| Capitalized internal-use software and website development costs |

(3,191) |

|

|

(2,826) |

|

|

(8,070) |

|

|

(7,028) |

|

|

|

|

|

| Purchases of property and equipment and other assets |

(998) |

|

|

(1,386) |

|

|

(1,463) |

|

|

(1,759) |

|

|

|

|

|

| Purchases of marketable securities |

(48,489) |

|

|

— |

|

|

(85,880) |

|

|

(48,602) |

|

|

|

|

|

| Proceeds from redemption and maturities of marketable securities |

20,000 |

|

|

28,500 |

|

|

39,000 |

|

|

40,900 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by (used in) investing activities |

(32,678) |

|

|

24,288 |

|

|

(56,413) |

|

|

(16,489) |

|

|

|

|

|

| Financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net proceeds from exercise of common stock options and employee stock purchases |

— |

|

|

— |

|

|

354 |

|

|

262 |

|

|

|

|

|

| Repurchase of shares to satisfy employee tax withholding obligations |

(450) |

|

|

(884) |

|

|

(2,301) |

|

|

(1,935) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Principal payments in connection with leases |

— |

|

|

(8) |

|

|

(4) |

|

|

(33) |

|

|

|

|

|

| Payments of preferred stock dividends |

— |

|

|

— |

|

|

(2,740) |

|

|

(873) |

|

|

|

|

|

Net cash used in financing activities |

(450) |

|

|

(892) |

|

|

(4,691) |

|

|

(2,579) |

|

|

|

|

|

| Effect of exchange rate changes on cash, cash equivalents and restricted cash |

99 |

|

|

69 |

|

|

118 |

|

|

(58) |

|

|

|

|

|

Net increase (decrease) in cash, cash equivalents and restricted cash |

(62,312) |

|

|

(1,216) |

|

|

(51,690) |

|

|

7,568 |

|

|

|

|

|

| Cash, cash equivalents and restricted cash at beginning of period |

129,434 |

|

|

156,424 |

|

|

118,812 |

|

|

147,640 |

|

|

|

|

|

| Cash, cash equivalents and restricted cash at end of period |

$ |

67,122 |

|

|

$ |

155,208 |

|

|

$ |

67,122 |

|

|

$ |

155,208 |

|

|

|

|

|

EHEALTH, INC.

SEGMENT INFORMATION

(in thousands, unaudited)

We evaluate our business performance and manage our operations as two distinct reporting segments: Medicare and Employer and Individual (“E&I”). In the fourth quarter of 2023, the Individual, Family and Small Business segment was renamed “Employer and Individual”. The E&I segment name change was to the name only and had no impact on our historical financial position, results of operations, cash flow or segment level results previously reported. This identification of reportable segments is consistent with how the segments report to and are managed by our chief executive officer, who is our chief operating decision maker (“CODM”). The Medicare segment consists primarily of amounts earned from our sale of Medicare-related health insurance plans, including Medicare Advantage, Medicare Supplement and Medicare Part D prescription drug plans (collectively, the “Medicare Plans”), fees earned for the performance of administrative services, amounts earned from our non-broker of record arrangements, our performance of various post-enrollment services for members and to a lesser extent, amounts earned from our sale of ancillary products sold to our Medicare-eligible customers, including but not limited to, dental and vision plans, as well as amounts we are paid in connection with our advertising program for marketing and other services. The E&I segment consists primarily of amounts earned from our sale of individual, family and small business health insurance plans, including both qualified and non-qualified plans, and ancillary products sold to our non-Medicare-eligible customers, including but not limited to, dental, vision, and short-term insurance. To a lesser extent, the E&I segment consists of amounts earned from our online sponsorship and advertising program that allows carriers to purchase advertising space in specific markets in a sponsorship area on our website and our technology licensing and lead referral activities.

Marketing and advertising, customer care and enrollment, technology and content and general and administrative operating expenses that are directly attributable to a segment are reported within the applicable segment. Indirect marketing and advertising, customer care and enrollment and technology and content operating expenses are allocated to each segment based on usage. Corporate consists of other general and administrative operating expenses, excluding stock-based compensation expense, depreciation and amortization, which are managed in a corporate shared services environment and, since they are not the responsibility of segment operating management, are not allocated to the reportable segments and are instead reported within Corporate. Our results below reflect our updated methodology used in allocating certain expenses beginning in the first quarter of fiscal 2024, and results from the prior period presented have been recast to conform with the current period presentation. See accompanying footnotes on page

15 for further information.

The performance of each reportable segment is evaluated based on several factors, including revenue and segment profit (loss), which is calculated as total revenue for the applicable segment less direct and indirect allocated marketing and advertising, customer care and enrollment, technology and content and general and administrative operating expenses, excluding stock-based compensation expense, depreciation and amortization, impairment, restructuring and other charges, interest expense and other income (expense), net. Senior management uses segment profit (loss) to evaluate segment performance because they believe this measure is indicative of performance trends and the overall earnings potential of each segment.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

% Change |

|

Nine Months Ended

September 30, |

|

% Change |

| |

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

| Medicare |

$ |

53,221 |

|

|

$ |

55,523 |

|

|

(4) |

% |

|

$ |

194,857 |

|

|

$ |

172,787 |

|

|

13 |

% |

Employer and Individual |

5,188 |

|

|

9,195 |

|

|

(44) |

% |

|

22,372 |

|

|

32,422 |

|

|

(31) |

% |

| Total revenue |

$ |

58,409 |

|

|

$ |

64,718 |

|

|

(10) |

% |

|

$ |

217,229 |

|

|

$ |

205,209 |

|

|

6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Segment profit (loss)(8): |

|

|

|

|

|

|

|

|

|

|

|

| Medicare |

$ |

(17,933) |

|

|

$ |

(15,331) |

|

|

(17) |

% |

|

$ |

(8,350) |

|

|

$ |

(17,979) |

|

|

54 |

% |

Employer and Individual |

(799) |

|

|

4,810 |

|

|

(117) |

% |

|

4,743 |

|

|

19,372 |

|

|

(76) |

% |

Segment profit (loss) |

(18,732) |

|

|

(10,521) |

|

|

(78) |

% |

|

(3,607) |

|

|

1,393 |

|

|

(359) |

% |

Corporate(8) |

(16,100) |

|

|

(17,576) |

|

|

|

|

(48,417) |

|

|

(56,953) |

|

|

|

| Stock-based compensation expense |

(4,479) |

|

|

(6,554) |

|

|

|

|

(15,125) |

|

|

(17,741) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

(3,827) |

|

|

(4,745) |

|

|

|

|

(12,511) |

|

|

(15,141) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Impairment, restructuring and other charges |

(61) |

|

|

— |

|

|

|

|

(9,409) |

|

|

— |

|

|

|

| Interest expense |

(2,859) |

|

|

(2,822) |

|

|

|

|

(8,517) |

|

|

(8,122) |

|

|

|

| Other income, net |

1,699 |

|

|

2,684 |

|

|

|

|

6,425 |

|

|

7,500 |

|

|

|

Loss before income taxes |

$ |

(44,359) |

|

|

$ |

(39,534) |

|

|

(12) |

% |

|

$ |

(91,161) |

|

|

$ |

(89,064) |

|

|

(2) |

% |

__________

Note: See accompanying footnotes on page

15.

EHEALTH, INC.

COMMISSION REVENUE

(in thousands, unaudited)

Our commission revenue results from approval of an application from health insurance carriers, which we define as our customers under Accounting Standards Codification 606 — Revenue from Contracts with Customers (“ASC 606”). Our commission revenue is primarily comprised of commissions from health insurance carriers which is computed using the estimated constrained lifetime values of commission payments that we expect to receive. Our commissions may include certain bonus payments, which are generally based on our attaining predetermined target sales levels or other objectives, as determined by the health insurance carriers. For Medicare Advantage and Medicare Part D prescription drug plans, our commissions also include regular payments related to administrative services we perform.

The following table presents commission revenue by product for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

% Change |

|

Nine Months Ended

September 30, |

|

% Change |

|

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

| Medicare |

|

|

|

|

|

|

|

|

|

|

|

| Medicare Advantage |

$ |

39,463 |

|

|

$ |

43,721 |

|

|

(10) |

% |

|

$ |

143,627 |

|

|

$ |

143,231 |

|

|

— |

% |

| Medicare Supplement |

2,312 |

|

|

2,630 |

|

|

(12) |

% |

|

11,835 |

|

|

7,786 |

|

|

52 |

% |

| Medicare Part D |

843 |

|

|

2,046 |

|

|

(59) |

% |

|

6,238 |

|

|

4,686 |

|

|

33 |

% |

| Total Medicare |

42,618 |

|

|

48,397 |

|

|

(12) |

% |

|

161,700 |

|

|

155,703 |

|

|

4 |

% |

Individual and Family |

|

|

|

|

|

|

|

|

|

|

|

| Non-Qualified Health Plans |

(199) |

|

|

1,560 |

|

|

(113) |

% |

|

1,834 |

|

|

6,904 |

|

|

(73) |

% |

| Qualified Health Plans |

602 |

|

|

681 |

|

|

(12) |

% |

|

3,358 |

|

|

4,084 |

|

|

(18) |

% |

Total Individual and Family |

403 |

|

|

2,241 |

|

|

(82) |

% |

|

5,192 |

|

|

10,988 |

|

|

(53) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ancillary |

2,036 |

|

|

2,560 |

|

|

(20) |

% |

|

7,279 |

|

|

7,503 |

|

|

(3) |

% |

| Small Business |

2,268 |

|

|

3,884 |

|

|

(42) |

% |

|

8,447 |

|

|

12,557 |

|

|

(33) |

% |

| Commission Bonus and Other |

897 |

|

|

157 |

|

|

471 |

% |

|

3,378 |

|

|

(1,323) |

|

|

355 |

% |

| Total Commission Revenue |

$ |

48,222 |

|

|

$ |

57,239 |

|

|

(16) |

% |

|

$ |

185,996 |

|

|

$ |

185,428 |

|

|

— |

% |

The following table presents a summary of commission revenue by segment for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

|

|

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

| Medicare |

|

|

|

|

|

|

|

|

|

Commission revenue from members approved during the period |

$ |

42,324 |

|

|

$ |

39,169 |

|

|

$ |

152,017 |

|

|

$ |

131,792 |

|

|

|

Net commission revenue from members approved in prior periods(a) |

1,090 |

|

|

9,291 |

|

|

12,773 |

|

|

22,746 |

|

|

|

Total Medicare segment commission revenue |

43,414 |

|

|

48,460 |

|

|

164,790 |

|

|

154,538 |

|

|

|

Employer and Individual |

|

|

|

|

|

|

|

|

|

Commission revenue from members approved during the period |

2,848 |

|

|

3,829 |

|

|

11,790 |

|

|

13,835 |

|

|

|

Commission revenue from renewals of small business members during the period |

1,852 |

|

|

2,028 |

|

|

7,022 |

|

|

7,299 |

|

|

|

Net commission revenue from members approved in prior periods(a) |

108 |

|

|

2,922 |

|

|

2,394 |

|

|

9,756 |

|

|

|

Total Employer and Individual segment commission revenue |

4,808 |

|

|

8,779 |

|

|

21,206 |

|

|

30,890 |

|

|

|

Total commission revenue |

$ |

48,222 |

|

|

$ |

57,239 |

|

|

$ |

185,996 |

|

|

$ |

185,428 |

|

|

|

_____________

(a) These amounts reflect our revised estimates of cash collections for certain members approved prior to the relevant reporting period that are recognized as adjustments to revenue within the relevant reporting period. The net commission revenue from members approved in prior periods, or net adjustment revenue, includes both increases in revenue for certain prior period cohorts as well as reductions in revenue for certain prior period cohorts. The total reductions to revenue from members approved in prior periods were $0.9 million and $0.8 million for the three months ended September 30, 2024 and 2023, respectively, and $4.5 million and $3.7 million for the nine months ended September 30, 2024 and 2023, respectively. These reductions to revenue primarily relate to the Medicare segment.

EHEALTH, INC.

SUMMARY OF SELECTED METRICS

(in thousands, except member and per member data, unaudited)

Selected Metrics — Third Quarter of 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

% Change |

|

2024 |

|

2023 |

|

Approved Members(2)(a) |

|

|

|

|

|

| Medicare |

|

|

|

|

|

| Medicare Advantage |

40,141 |

|

35,069 |

|

14 |

% |

| Medicare Supplement |

1,438 |

|

3,010 |

|

(52) |

% |

| Medicare Part D |

1,292 |

|

2,480 |

|

(48) |

% |

| Total Medicare |

42,871 |

|

40,559 |

|

6 |

% |

| Individual and Family |

2,872 |

|

3,727 |

|

(23) |

% |

| Ancillary |

11,382 |

|

12,877 |

|

(12) |

% |

| Small Business |

1,141 |

|

1,304 |

|

(13) |

% |

| Total Approved Members |

58,266 |

|

58,467 |

|

— |

% |

(a) The shift of some carrier arrangements from broker of record to fee-based BPO during 2024 impacted the growth in approved members as only broker of record arrangements are reflected in approved members. |

|

|

|

|

|

|

Constrained Lifetime Value of Commissions per Approved Member(3) |

|

|

|

|

|

Medicare(b) |

|

|

|

|

|

| Medicare Advantage |

$ |

990 |

|

$ |

997 |

|

(1) |

% |

| Medicare Supplement |

1,105 |

|

833 |

|

33 |

% |

| Medicare Part D |

222 |

|

235 |

|

(6) |

% |

| Individual and Family |

|

|

|

|

|

| Non-Qualified Health Plans |

314 |

|

325 |

|

(3) |

% |

| Qualified Health Plans |

311 |

|

322 |

|

(3) |

% |

| Ancillary |

|

|

|

|

|

| Short-term |

144 |

|

151 |

|

(5) |

% |

| Dental |

118 |

|

108 |

|

9 |

% |

| Vision |

78 |

|

72 |

|

8 |

% |

| Small Business |

249 |

|

226 |

|

10 |

% |

(b) Constraint for Medicare Advantage was 5.5% and 7% for the three months ended September 30, 2024 and 2023, respectively. Constraints for all other Medicare products remained the same for the periods presented. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expense Metrics per Approved Member(4) |

|

|

|

|

|

| Medicare |

|

|

|

|

|

Customer care and enrollment cost per Medicare Advantage (“MA”)-equivalent approved member(8) |

$ |

719 |

|

$ |

946 |

|

(24) |

% |

| Variable marketing cost per MA-equivalent approved member |

537 |

|

557 |

|

(4) |

% |

| Total acquisition cost per MA-equivalent approved member |

$ |

1,256 |

|

$ |

1,503 |

|

(16) |

% |

Individual and Family Plan (“IFP”) |

|

|

|

|

|

Customer care and enrollment cost per IFP-equivalent approved member(8) |

$ |

359 |

|

$ |

256 |

|

40 |

% |

| Variable marketing cost per IFP-equivalent approved member |

118 |

|

68 |

|

74 |

% |

| Total acquisition cost per IFP-equivalent approved member |

$ |

477 |

|

$ |

324 |

|

47 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

__________

Note: See accompanying footnotes on page

15.

EHEALTH, INC.

SUMMARY OF SELECTED METRICS

(in thousands, except member and per member data, unaudited)

Selected Metrics — Nine Months Ended September 30, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended

September 30, |

|

% Change |

|

2024 |

|

2023 |

|

Approved Members(2)(a) |

|

|

|

|

|

| Medicare |

|

|

|

|

|

| Medicare Advantage |

143,529 |

|

|

131,117 |

|

|

9 |

% |

| Medicare Supplement |

9,574 |

|

|

10,518 |

|

|

(9) |

% |

| Medicare Part D |

6,335 |

|

|

9,274 |

|

|

(32) |

% |

| Total Medicare |

159,438 |

|

|

150,909 |

|

|

6 |

% |

| Individual and Family |

13,540 |

|

|

18,111 |

|

|

(25) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ancillary |

36,410 |

|

|

42,584 |

|

|

(14) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Small Business |

3,705 |

|

|

5,207 |

|

|

(29) |

% |

| Total Approved Members |

213,093 |

|

|

216,811 |

|

|

(2) |

% |

(a) The shift of some carrier arrangements from broker of record to fee-based BPO during 2024 impacted the growth in approved members as only broker of record arrangements are reflected in approved members. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of September 30, |

|

% Change |

|

2024 |

|

2023 |

|

Estimated Membership(5)(b) |

|

|

|

|

|

Medicare(6) |

|

|

|

|

|

| Medicare Advantage |

583,970 |

|

|

565,126 |

|

|

3 |

% |

| Medicare Supplement |

95,153 |

|

|

93,732 |

|

|

2 |

% |

| Medicare Part D |

194,303 |

|

|

209,475 |

|

|

(7) |

% |

| Total Medicare |

873,426 |

|

|

868,333 |

|

|

1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Individual and Family(6) |

75,871 |

|

|

85,118 |

|

|

(11) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ancillary(6) |

168,953 |

|

|

184,248 |

|

|

(8) |

% |

Small Business(7) |

41,172 |

|

|

46,316 |

|

|

(11) |

% |

| Total Estimated Membership |

1,159,422 |

|

|

1,184,015 |

|

|

(2) |

% |

(b) The shift of some carrier arrangements from broker of record to fee-based BPO during 2024 impacted the growth in estimated membership as only broker of record arrangements are reflected in estimated membership. |

______________

Note: See accompanying footnotes on page

15.

EHEALTH, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(unaudited)

Reconciliation of GAAP Operating Costs and Expenses to Non-GAAP Operating Costs and Expenses(1) (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

GAAP marketing and advertising expense(8) |

$ |

29,665 |

|

|

$ |

29,035 |

|

|

$ |

95,185 |

|

|

$ |

85,343 |

|

Stock-based compensation expense |

(437) |

|

|

(605) |

|

|

(1,792) |

|

|

(1,598) |

|

Non-GAAP marketing and advertising expense(1) |

$ |

29,228 |

|

|

$ |

28,430 |

|

|

$ |

93,393 |

|

|

$ |

83,745 |

|

|

|

|

|

|

|

|

|

GAAP customer care and enrollment expense(8) |

$ |

39,321 |

|

|

$ |

38,901 |

|

|

$ |

100,773 |

|

|

$ |

93,951 |

|

| Stock-based compensation expense |

(452) |

|

|

(836) |

|

|

(1,487) |

|

|

(2,229) |

|

Non-GAAP customer care and enrollment expense(1) |

$ |

38,869 |

|

|

$ |

38,065 |

|

|

$ |

99,286 |

|

|

$ |

91,722 |

|

|

|

|

|

|

|

|

|

GAAP technology and content expense(8) |

$ |

12,264 |

|

|

$ |

13,241 |

|

|

$ |

38,613 |

|

|

$ |

42,047 |

|

| Stock-based compensation expense |

(845) |

|

|

(1,306) |

|

|

(2,598) |

|

|

(3,384) |

|

Non-GAAP technology and content expense(1) |

$ |

11,419 |

|

|

$ |

11,935 |

|

|

$ |

36,015 |

|

|

$ |

38,663 |

|

|

|

|

|

|

|

|

|

GAAP general and administrative expense(8) |

$ |

20,297 |

|

|

$ |

22,937 |

|

|

$ |

62,318 |

|

|

$ |

72,310 |

|

| Stock-based compensation expense |

(2,745) |

|

|

(3,807) |

|

|

(9,248) |

|

|

(10,530) |

|

Non-GAAP general and administrative expense(1) |

$ |

17,552 |

|

|

$ |

19,130 |

|

|

$ |

53,070 |

|

|

$ |

61,780 |

|

|

|

|

|

|

|

|

|

| GAAP operating costs and expenses |

$ |

101,608 |

|

|

$ |

104,114 |

|

|

$ |

306,298 |

|

|

$ |

293,651 |

|

| Stock-based compensation expense |

(4,479) |

|

|

(6,554) |

|

|

(15,125) |

|

|

(17,741) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Impairment, restructuring and other charges |

(61) |

|

|

— |

|

|

(9,409) |

|

|

— |

|

|

|

|

|

|

|

|

|

Non-GAAP operating costs and expenses(1) |

$ |

97,068 |

|

|

$ |

97,560 |

|

|

$ |

281,764 |

|

|

$ |

275,910 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

__________

Note: See accompanying footnotes on page

15.

EHEALTH, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(unaudited)

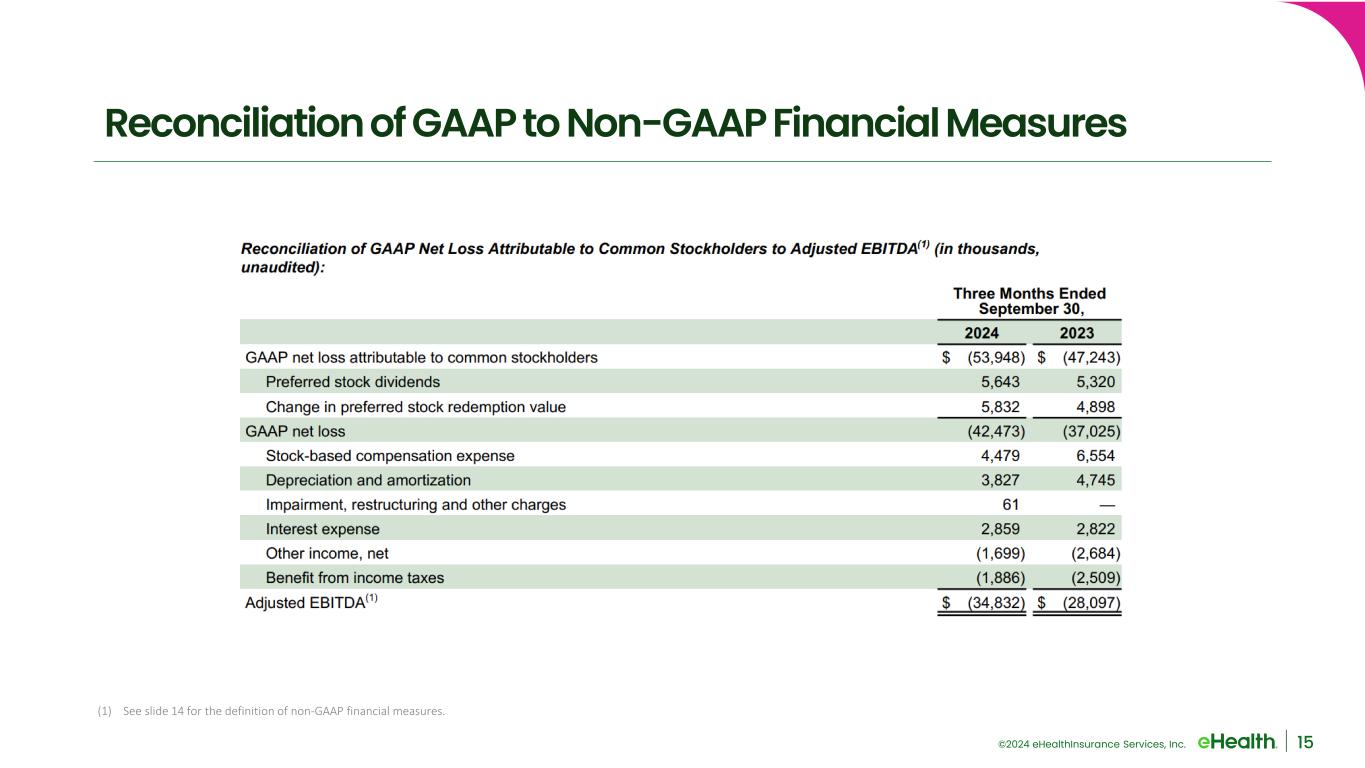

Reconciliation of GAAP Net Loss Attributable to Common Stockholders to Adjusted EBITDA(1) (in thousands) and Adjusted EBITDA Margin(1):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net loss attributable to common stockholders |

$ |

(53,948) |

|

$ |

(47,243) |

|

$ |

(120,647) |

|

$ |

(108,206) |

| Preferred stock dividends |

5,643 |

|

5,320 |

|

16,603 |

|

15,644 |

| Change in preferred stock redemption value |

5,832 |

|

4,898 |

|

16,619 |

|

12,158 |

| GAAP net loss |

(42,473) |

|

(37,025) |

|

(87,425) |

|

(80,404) |

| Stock-based compensation expense |

4,479 |

|

6,554 |

|

15,125 |

|

17,741 |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

3,827 |

|

4,745 |

|

12,511 |

|

15,141 |

|

|

|

|

|

|

|

|

| Impairment, restructuring and other charges |

61 |

|

— |

|

9,409 |

|

— |

|

|

|

|

|

|

|

|

| Interest expense |

2,859 |

|

2,822 |

|

8,517 |

|

8,122 |

| Other income, net |

(1,699) |

|

(2,684) |

|

(6,425) |

|

(7,500) |

Benefit from income taxes |

(1,886) |

|

(2,509) |

|

(3,736) |

|

(8,660) |

Adjusted EBITDA(1) |

$ |

(34,832) |

|

$ |

(28,097) |

|

$ |

(52,024) |

|

$ |

(55,560) |

Net loss margin |

(73) |

% |

|

(57) |

% |

|

(40) |

% |

|

(39) |

% |

Adjusted EBITDA margin(1) |

(60) |

% |

|

(43) |

% |

|

(24) |

% |

|

(27) |

% |

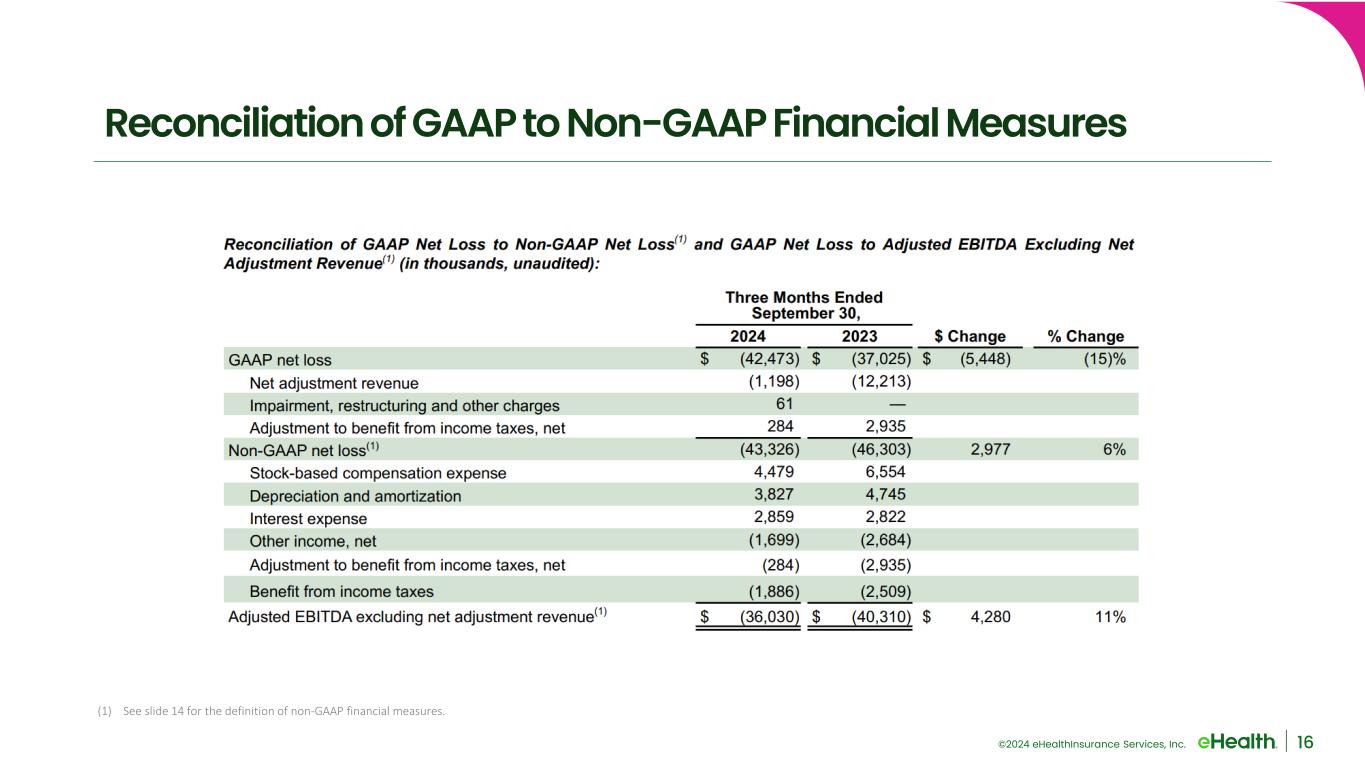

Reconciliation of GAAP Net Loss to Non-GAAP Net Loss(1) and GAAP Net Loss to Adjusted EBITDA Excluding Net Adjustment Revenue(1) (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

$ Change |

|

% Change |

|

2024 |

|

2023 |

|

|

GAAP net loss |

$ |

(42,473) |

|

|

$ |

(37,025) |

|

|

$ |

(5,448) |

|

(15)% |

Net adjustment revenue |

(1,198) |

|

|

(12,213) |

|

|

|

|

|

Impairment, restructuring and other charges |

61 |

|

|

— |

|

|

|

|

|

Adjustment to benefit from income taxes, net |

284 |

|

|

2,935 |

|

|

|

|

|

Non-GAAP net loss(1) |

(43,326) |

|

|

(46,303) |

|

|

2,977 |

|

6% |

| Stock-based compensation expense |

4,479 |

|

|

6,554 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

3,827 |

|

|

4,745 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

2,859 |

|

|

2,822 |

|

|

|

|

|

| Other income, net |

(1,699) |

|

|

(2,684) |

|

|

|

|

|

| Adjustment to benefit from income taxes, net |

(284) |

|

|

(2,935) |

|

|

|

|

|

| Benefit from income taxes |

(1,886) |

|

|

(2,509) |

|

|

|

|

|

Adjusted EBITDA excluding net adjustment revenue(1) |

$ |

(36,030) |

|

|

$ |

(40,310) |

|

|

$ |

4,280 |

|

11% |

__________

Note: See accompanying footnotes on page

15.

EHEALTH, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(unaudited)

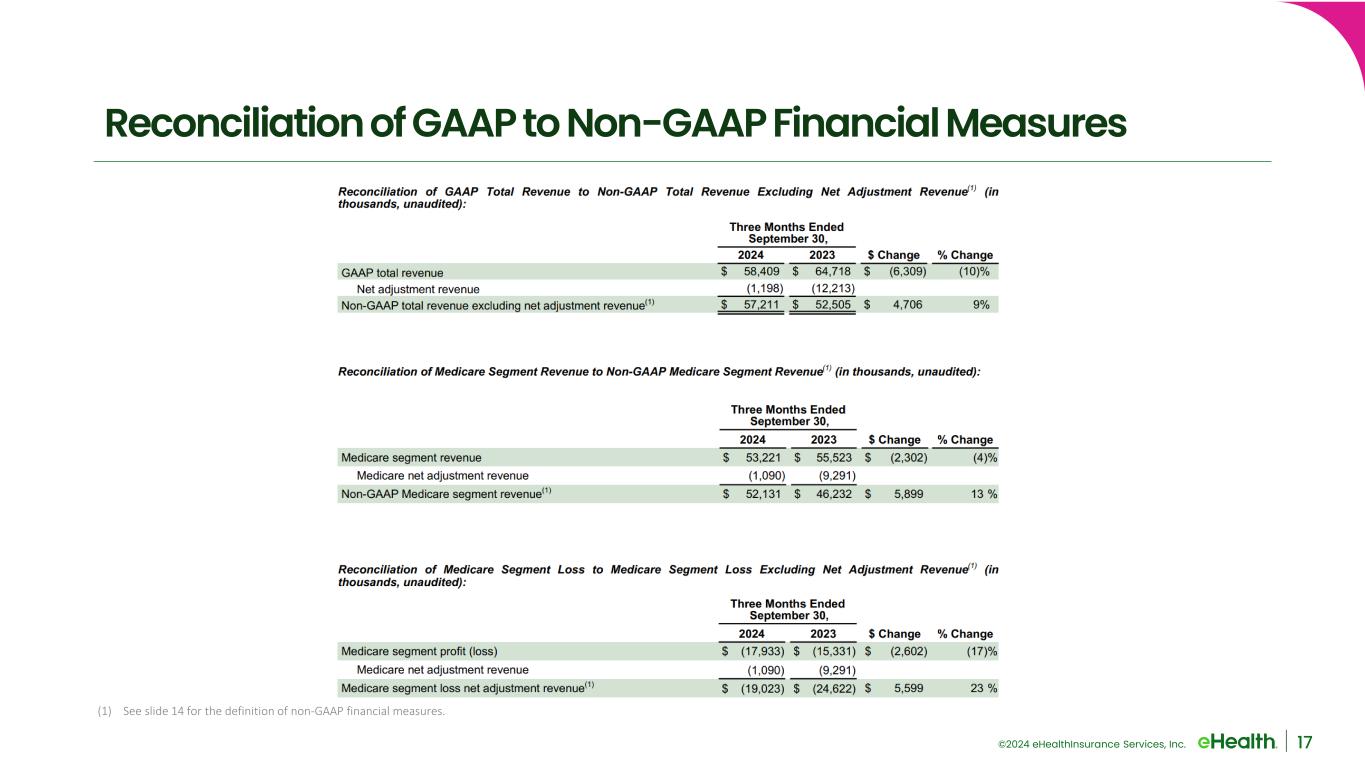

Reconciliation of GAAP Total Revenue to Non-GAAP Total Revenue Excluding Net Adjustment Revenue(1) (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

$ Change |

|

% Change |

|

2024 |

|

2023 |

|

|

GAAP total revenue |

$ |

58,409 |

|

|

$ |

64,718 |

|

|

$ |

(6,309) |

|

|

(10)% |

Net adjustment revenue |

(1,198) |

|

|

(12,213) |

|

|

|

|

|

Non-GAAP total revenue excluding net adjustment revenue(1) |

$ |

57,211 |

|

|

$ |

52,505 |

|

|

$ |

4,706 |

|

|

9% |

Reconciliation of Medicare Segment Revenue to Non-GAAP Medicare Segment Revenue(1) (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

$ Change |

|

% Change |

| |

2024 |

|

2023 |

|

|

Medicare segment revenue |

$ |

53,221 |

|

|

$ |

55,523 |

|

|

$ |

(2,302) |

|

|

(4) |

% |

Medicare net adjustment revenue |

(1,090) |

|

|

(9,291) |

|

|

|

|

|

Non-GAAP Medicare segment revenue(1) |

$ |

52,131 |

|

|

$ |

46,232 |

|

|

$ |

5,899 |

|

|

13 |

% |

Reconciliation of E&I Segment Revenue to Non-GAAP E&I Segment Revenue(1) (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

$ Change |

|

% Change |

| |

2024 |

|

2023 |

|

|

E&I segment revenue |

$ |

5,188 |

|

|

$ |

9,195 |

|

|

$ |

(4,007) |

|

|

(44) |

% |

E&I net adjustment revenue |

(108) |

|

|

(2,922) |

|

|

|

|

|

Non-GAAP E&I segment revenue(1) |

$ |

5,080 |

|

|

$ |

6,273 |

|

|

$ |

(1,193) |

|

|

(19) |

% |

Reconciliation of Segment Loss to Segment Loss Excluding Net Adjustment Revenue(1), Medicare Segment Loss to Medicare Segment Loss Excluding Net Adjustment Revenue(1) and E&I Segment Profit (Loss) to E&I Segment Profit (Loss) Excluding Net Adjustment Revenue(1) (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

$ Change |

|

% Change |

| |

2024 |

|

2023 |

|

|

Segment loss(8) |

$ |

(18,732) |

|

|

$ |

(10,521) |

|

|

$ |

(8,211) |

|

|

(78) |

% |

Net adjustment revenue |

(1,198) |

|

|

(12,213) |

|

|

|

|

|

Segment loss excluding net adjustment revenue(1) |

$ |

(19,930) |

|

|

$ |

(22,734) |

|

|

$ |

2,804 |

|

|

12 |

% |

|

|

|

|

|

|

|

|

Medicare segment loss(8) |

$ |

(17,933) |

|

|

$ |

(15,331) |

|

|

$ |

(2,602) |

|

|

(17) |

% |

Medicare net adjustment revenue |

(1,090) |

|

|

(9,291) |

|

|

|

|

|

Medicare segment loss excluding net adjustment revenue(1) |

$ |

(19,023) |

|

|

$ |

(24,622) |

|

|

$ |

5,599 |

|

|

23 |

% |

|

|

|

|

|

|

|

|

E&I segment profit (loss)(8) |

$ |

(799) |

|

|

$ |

4,810 |

|

|

$ |

(5,609) |

|

|

(117) |

% |

E&I net adjustment revenue |

(108) |

|

|

(2,922) |

|

|

|

|

|

E&I segment profit (loss) excluding net adjustment revenue(1) |

$ |

(907) |

|

|

$ |

1,888 |

|

|

$ |

(2,795) |

|

|

(148) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

__________

Note: See accompanying footnotes on page

15.

EHEALTH, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(unaudited)

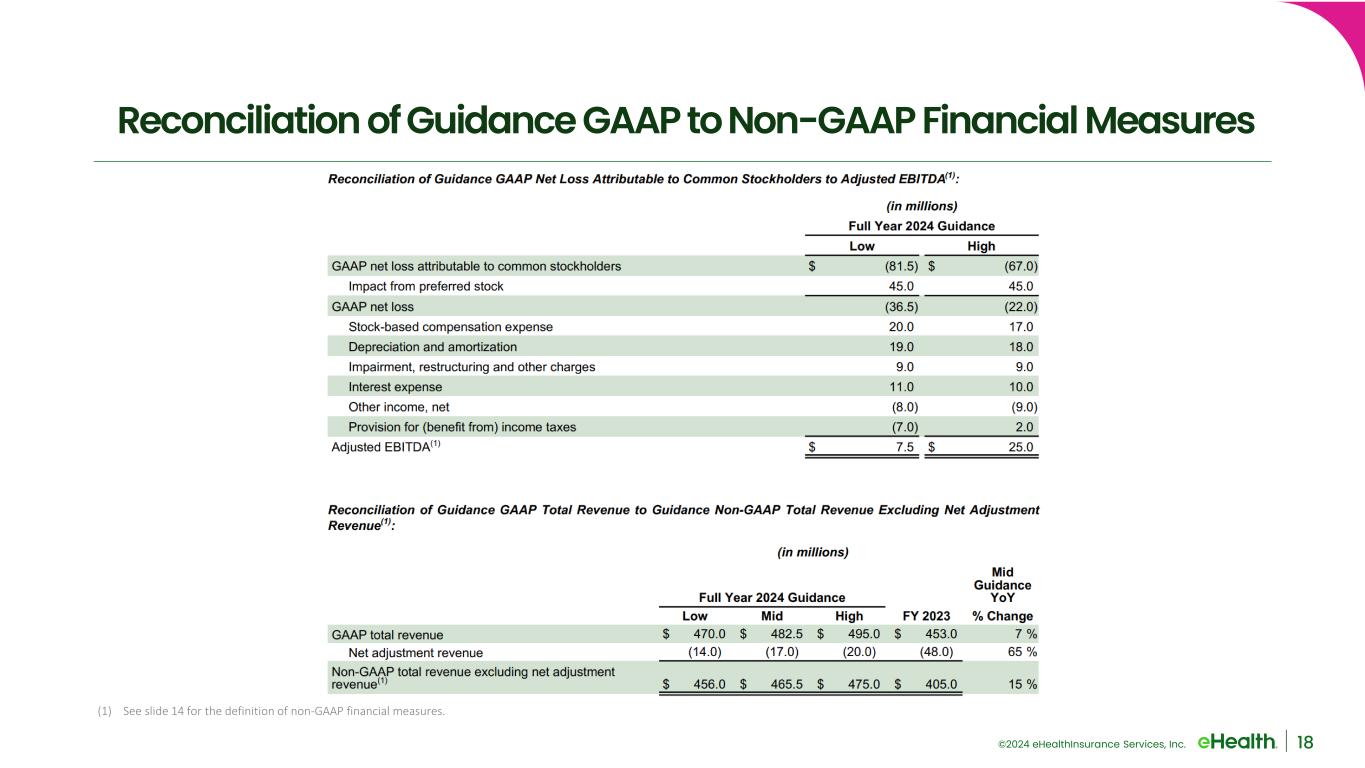

Reconciliation of Guidance GAAP Net Loss Attributable to Common Stockholders to Adjusted EBITDA(1) (in millions):

|

|

|

|

|

|

|

|

|

|

|

|

|

Full Year 2024 Guidance |

|

Low |

|

High |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP net loss attributable to common stockholders |

$ |

(81.5) |

|

|

$ |

(67.0) |

|

| Impact from preferred stock |

45.0 |

|

|

45.0 |

|

| GAAP net loss |

(36.5) |

|

|

(22.0) |

|

| Stock-based compensation expense |

20.0 |

|

|

17.0 |

|

| Depreciation and amortization |

19.0 |

|

|

18.0 |

|

| Impairment, restructuring and other charges |

9.0 |

|

|

9.0 |

|

|

|

|

|

| Interest expense |

11.0 |

|

|

10.0 |

|