2025 Annual Meeting of Shareholders June 4, 2025

Safe Harbor 2 This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements reflect the current views of First Western Financial, Inc.’s (“First Western”) management with respect to, among other things, future events and First Western’s financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “position,” “project,” “future” “forecast,” “goal,” “target,” “would” and “outlook,” or the negative variations of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about First Western’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond First Western’s control. Accordingly, First Western cautions you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although First Western believes that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. The following risks and uncertainties, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: the risk of geographic concentration in Colorado, Arizona, Wyoming, California, and Montana; the risk of changes in the economy affecting real estate values and liquidity; the risk in our ability to continue to originate residential real estate loans and sell such loans; risks specific to commercial loans and borrowers; the risk of claims and litigation pertaining to our fiduciary responsibilities; the risk of changes in interest rates could reduce our net interest margins and net interest income; increased credit risk, including as a result of deterioration in economic conditions, could require us to increase our allowance for credit losses and could have a material adverse effect on our results of operations and financial condition; the risk in our ability to maintain a strong core deposit base or other low-cost funding sources. Additional information regarding these and other risks and uncertainties to which our business and future financial performance are subject is contained in our Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (“SEC”) on March 7, 2025 and other documents we file with the SEC from time to time. All subsequent written and oral forward-looking statements attributable to First Western or persons acting on First Western’s behalf are expressly qualified in their entirety by this paragraph. Forward-looking statements speak only as of the date of this presentation. First Western undertakes no obligation to publicly update or otherwise revise any forward-looking statements, whether as a result of new information, future events or otherwise (except as required by law). Certain of the information contained herein may be derived from information provided by industry sources. The Company believes that such information is accurate and the sources from which it has been obtained are reliable; however, the Company cannot guaranty the accuracy of such information and has not independently verified such information. This presentation contains certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided at the end of this presentation. Numbers in the presentation may not sum due to rounding. Our common stock is not a deposit or savings account. Our common stock is not insured by the Federal Deposit Insurance Corporation or any governmental agency or instrumentality. Except as otherwise indicated, this presentation speaks as of the date hereof. The delivery of this presentation shall not, under any circumstances, create any implication that there has been no change in the affairs of the Company after the date hereof.

3 2024 Review and Highlights ▪ While economic conditions and interest rates created a challenging operating environment, our strong execution resulted in the achievement of key objectives ➢ Increasing our liquidity by reducing our loan-to-deposit ratio ➢ Expanding our net interest margin ➢ Improving our asset quality by reducing our level of non-performing loans ➢ Maintaining relatively stable expense levels while continuing to invest in talent and technology that will contribute to our long-term profitable growth ▪ Due to our financial performance and prudent balance sheet management, we increased our tangible book value per share(1) by 3.7% in 2024 and increased all of our capital ratios from the end of the prior year ▪ Due to the addition of banking talent and changes made throughout the organization, we had a strong year of business development ➢ Deposit gathering efforts resulted in many new deposit accounts opened in 2024 ➢ A strong year of loan production while maintaining our disciplined pricing and underwriting criteria, with most of the loan production coming from clients that also bring deposits to the bank ➢ Strong growth in our AUM in our wealth management business ▪ Strong balance sheet and increasing presence in attractive markets positions us well to continue growing our franchise and creating shareholder value (1) See Non-GAAP reconciliation

4 Strong Franchise Fundamentals ▪ Well diversified client base with no significant industry or asset class concentrations in deposit base or loan portfolio ▪ Loyal clients who value the level of service and expertise we provide that results in a sticky deposit base ▪ Well diversified business model with strong sources of non-interest income ▪ Conservatively underwritten, well diversified loan portfolio with minimal exposure to office CRE loans and multifamily loans ▪ Strength of client base and conservative underwriting standards requiring multiple sources of repayment has resulted in exceptionally low credit losses throughout First Western’s history ➢ NPAs declining as the sale of OREO properties is resulting in proceeds that cover outstanding balances and resulting in minimal loss

5 Strong Operational and Financial Momentum ▪ Robust organic balance sheet growth ▪ Accretive acquisitions ▪ Market expansion ▪ Highly leverageable operating platform driving improved efficiencies ▪ Minimal credit losses Drivers of Improved Performance

6 Consistent Value Creation TBV/Share(1) Up ~166% Since December 2017 Consistent increases in tangible book value per share driven by: • Organic growth that has increased operating leverage • Accretive acquisitions that have been well priced and smoothly integrated to realize all projected cost savings • Conservative underwriting criteria that has resulted in extremely low level of losses in the portfolio throughout the history of the company • Prudent asset/liability management including not investing excess liquidity accumulated during the pandemic in low-yielding bonds (1) See Non-GAAP reconciliation.

Driving Profitable Growth 7

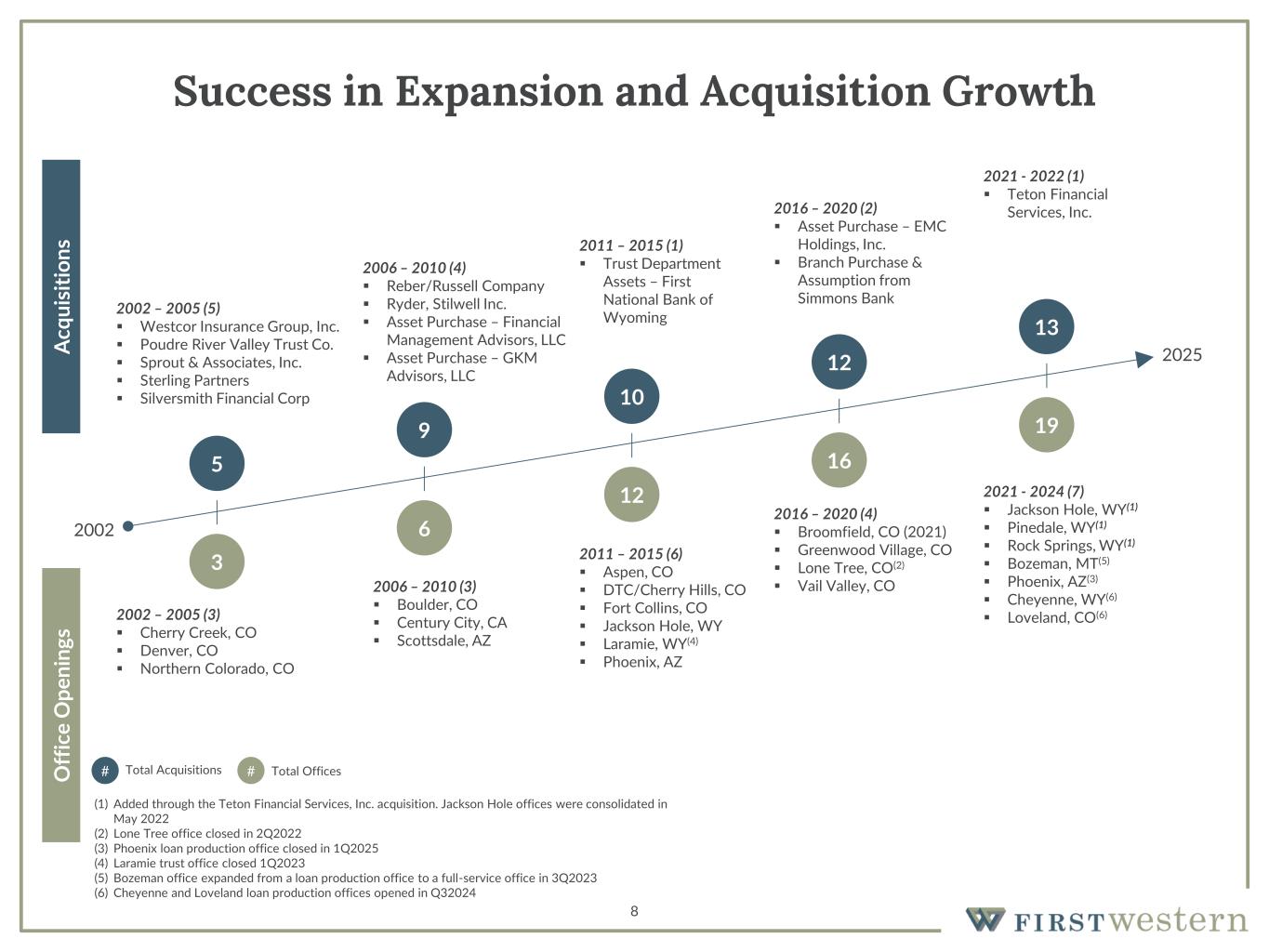

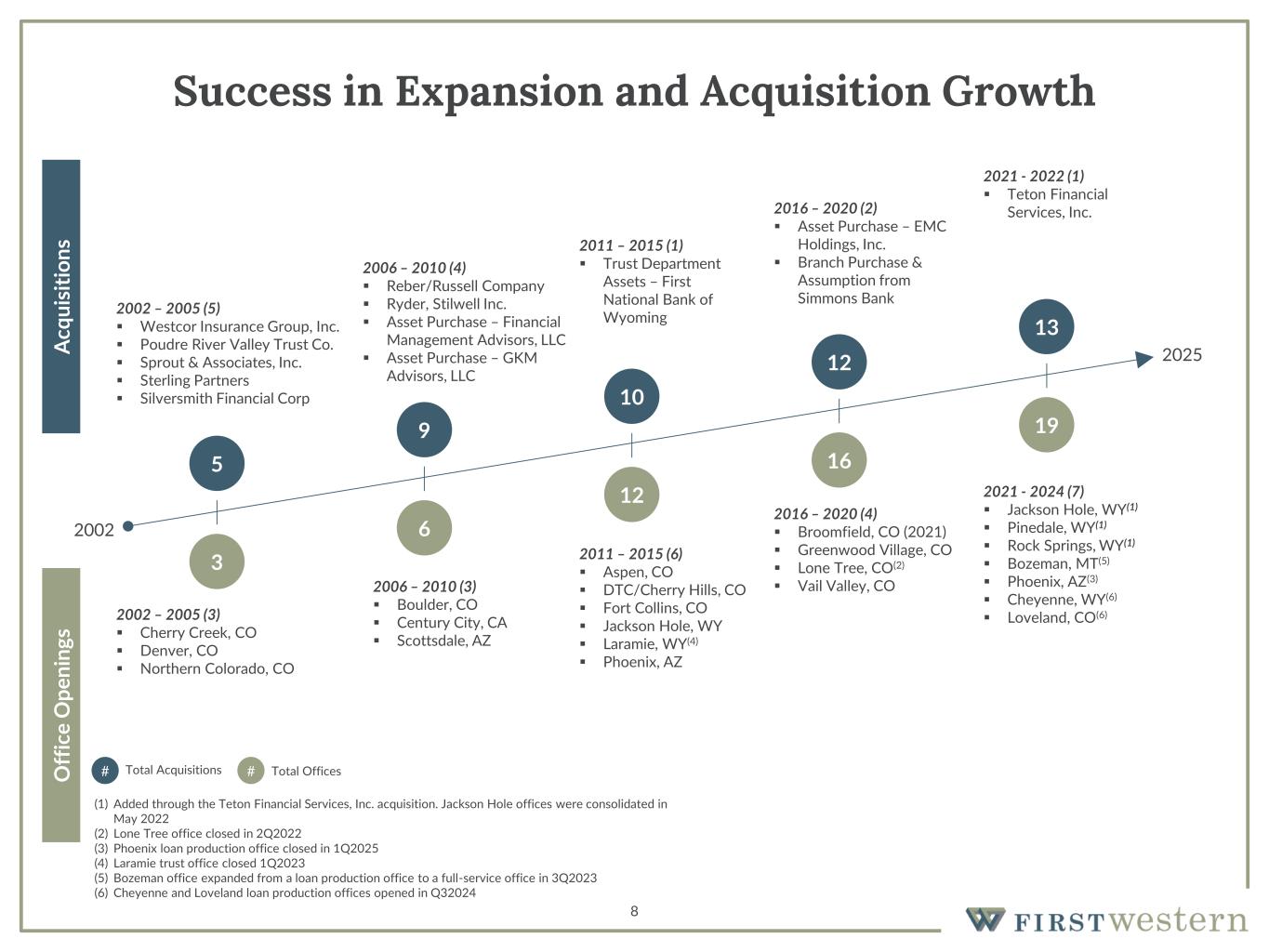

8 Success in Expansion and Acquisition Growth 2006 – 2010 (3) ▪ Boulder, CO ▪ Century City, CA ▪ Scottsdale, AZ 2011 – 2015 (6) ▪ Aspen, CO ▪ DTC/Cherry Hills, CO ▪ Fort Collins, CO ▪ Jackson Hole, WY ▪ Laramie, WY(4) ▪ Phoenix, AZ 2016 – 2020 (4) ▪ Broomfield, CO (2021) ▪ Greenwood Village, CO ▪ Lone Tree, CO(2) ▪ Vail Valley, CO 2002 – 2005 (3) ▪ Cherry Creek, CO ▪ Denver, CO ▪ Northern Colorado, CO 2002 – 2005 (5) ▪ Westcor Insurance Group, Inc. ▪ Poudre River Valley Trust Co. ▪ Sprout & Associates, Inc. ▪ Sterling Partners ▪ Silversmith Financial Corp 2006 – 2010 (4) ▪ Reber/Russell Company ▪ Ryder, Stilwell Inc. ▪ Asset Purchase – Financial Management Advisors, LLC ▪ Asset Purchase – GKM Advisors, LLC 2011 – 2015 (1) ▪ Trust Department Assets – First National Bank of Wyoming 2016 – 2020 (2) ▪ Asset Purchase – EMC Holdings, Inc. ▪ Branch Purchase & Assumption from Simmons Bank O ff ic e O pe ni ng s A cq ui si ti on s 2002 2025 3 5 6 9 12 10 16 12 # #Total Acquisitions Total Offices 19 13 2021 - 2022 (1) ▪ Teton Financial Services, Inc. 2021 - 2024 (7) ▪ Jackson Hole, WY(1) ▪ Pinedale, WY(1) ▪ Rock Springs, WY(1) ▪ Bozeman, MT(5) ▪ Phoenix, AZ(3) ▪ Cheyenne, WY(6) ▪ Loveland, CO(6) (1) Added through the Teton Financial Services, Inc. acquisition. Jackson Hole offices were consolidated in May 2022 (2) Lone Tree office closed in 2Q2022 (3) Phoenix loan production office closed in 1Q2025 (4) Laramie trust office closed 1Q2023 (5) Bozeman office expanded from a loan production office to a full-service office in 3Q2023 (6) Cheyenne and Loveland loan production offices opened in Q32024

9 Revenue Growth Strategies Expand commercial loan production platform ▪ Upgraded C&I product and service capabilities ▪ Building expertise in specific vertical markets ▪ Capitalize on growing reputation to attract additional experienced commercial banking talent Expand into new markets with attractive demographics ▪ Add infill and adjacent market locations ▪ Built team and revenue base to open office in Broomfield, CO in 2021 ▪ Full-service Bozeman, MT office opened in 2023 Execute on revenue initiatives in existing markets ▪ Differentiate with local, expert, trusted teams ▪ Cross-sell MYFW’s larger offering of planning, insurance, retirement, insurance, and investment products ▪ Continue adding banking and B2B talent to further accelerate market share gains Execute on low- risk strategic transactions that add value to the MYFW franchise ▪ Execute on minimally dilutive acquisitions ▪ Leverage infrastructure through branch acquisition transactions ▪ Proactive expansion, acquisition team

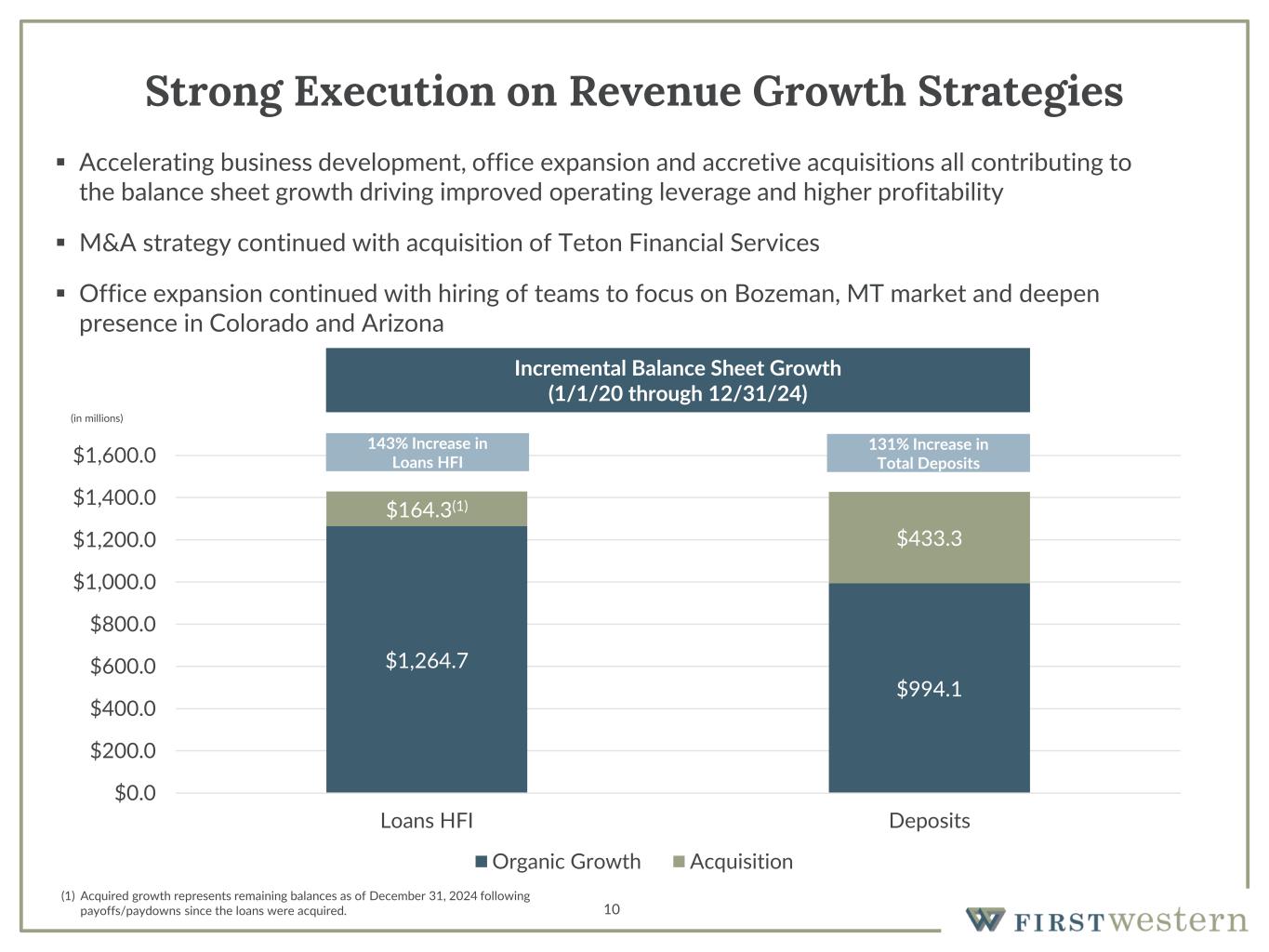

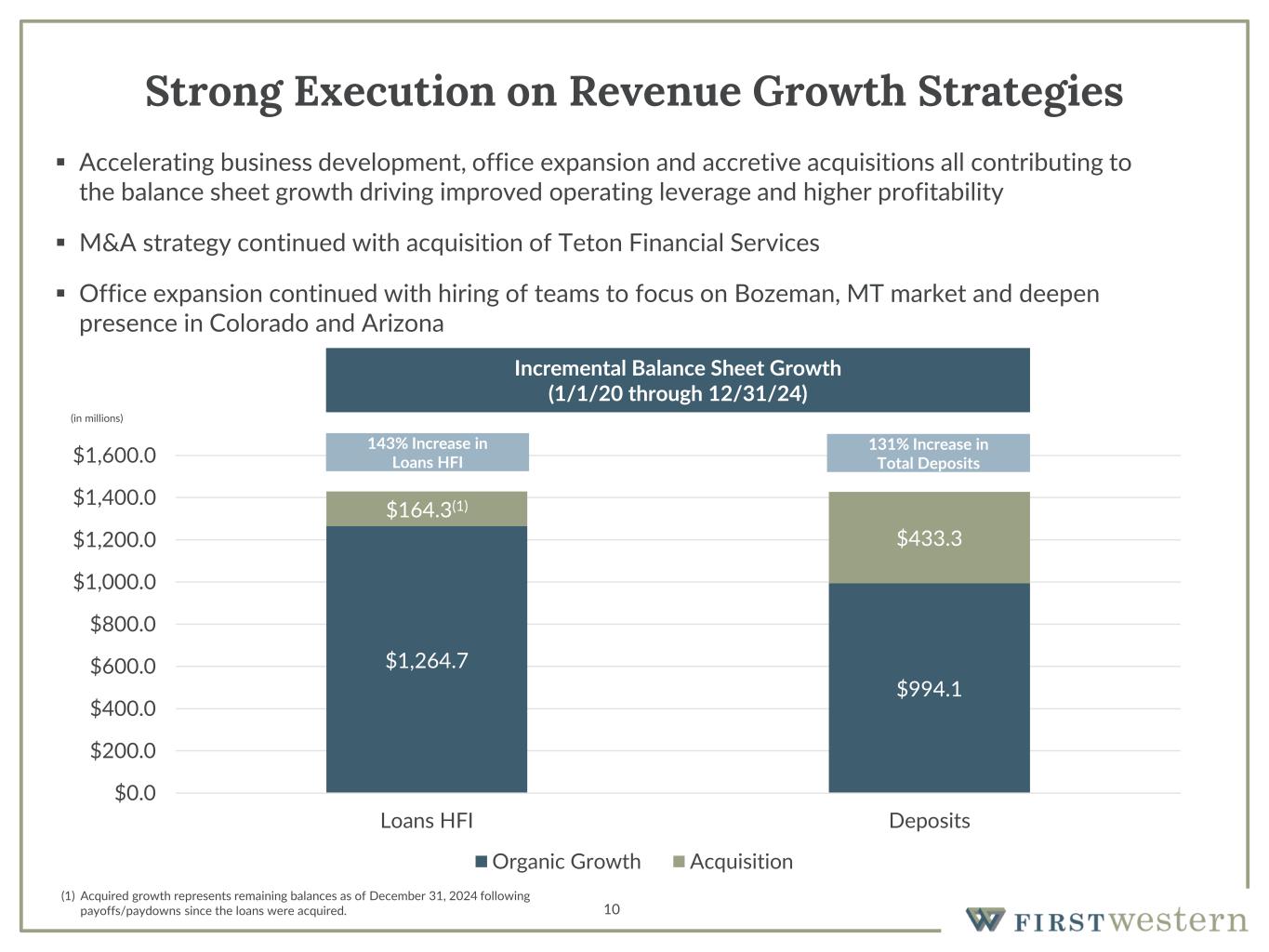

10 Strong Execution on Revenue Growth Strategies ▪ Accelerating business development, office expansion and accretive acquisitions all contributing to the balance sheet growth driving improved operating leverage and higher profitability ▪ M&A strategy continued with acquisition of Teton Financial Services ▪ Office expansion continued with hiring of teams to focus on Bozeman, MT market and deepen presence in Colorado and Arizona (in millions) Incremental Balance Sheet Growth (1/1/20 through 12/31/24) $1,264.7 $994.1 $164.3(1) $433.3 $0.0 $200.0 $400.0 $600.0 $800.0 $1,000.0 $1,200.0 $1,400.0 $1,600.0 Loans HFI Deposits Organic Growth Acquisition 143% Increase in Loans HFI 131% Increase in Total Deposits (1) Acquired growth represents remaining balances as of December 31, 2024 following payoffs/paydowns since the loans were acquired.

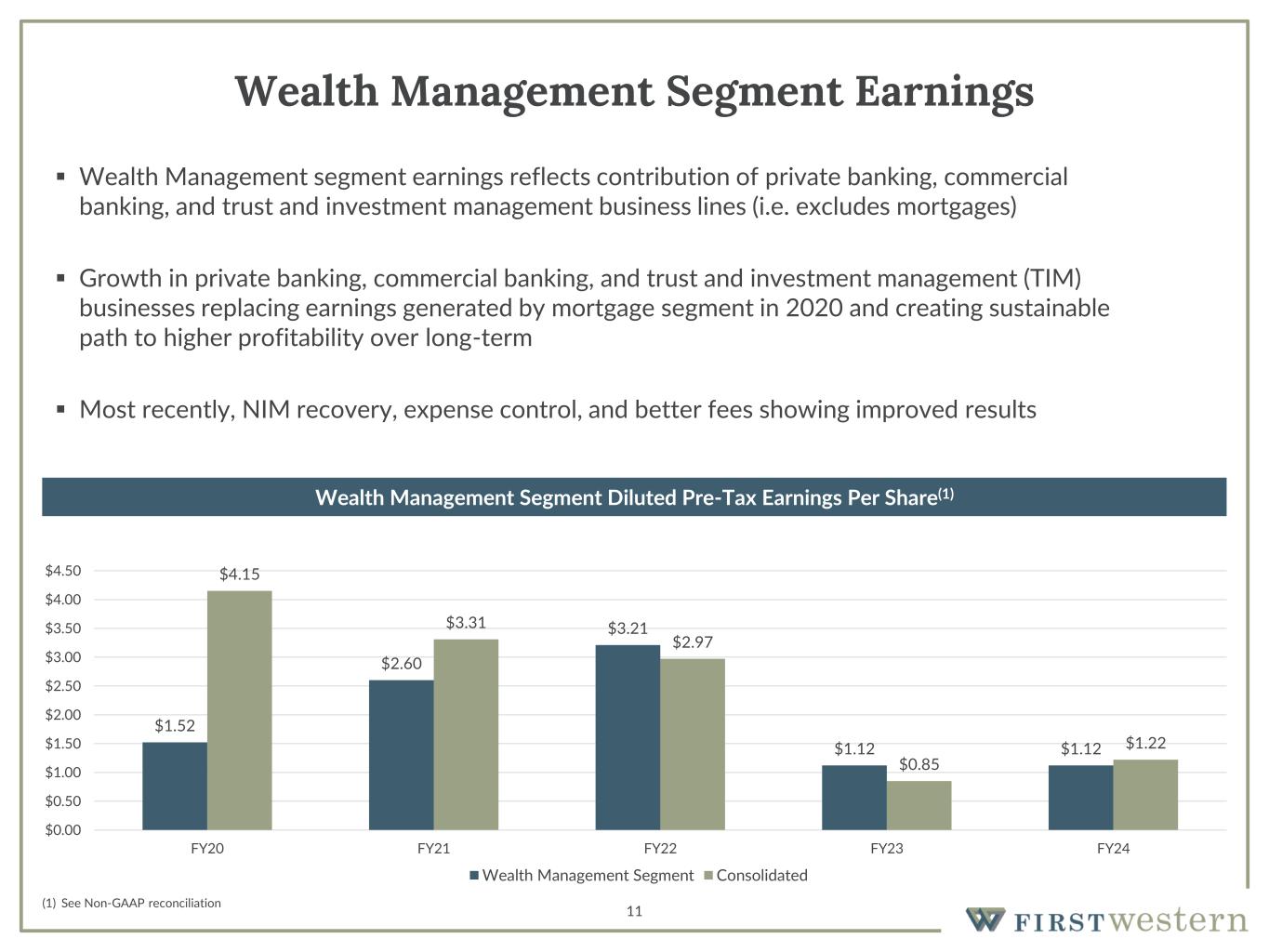

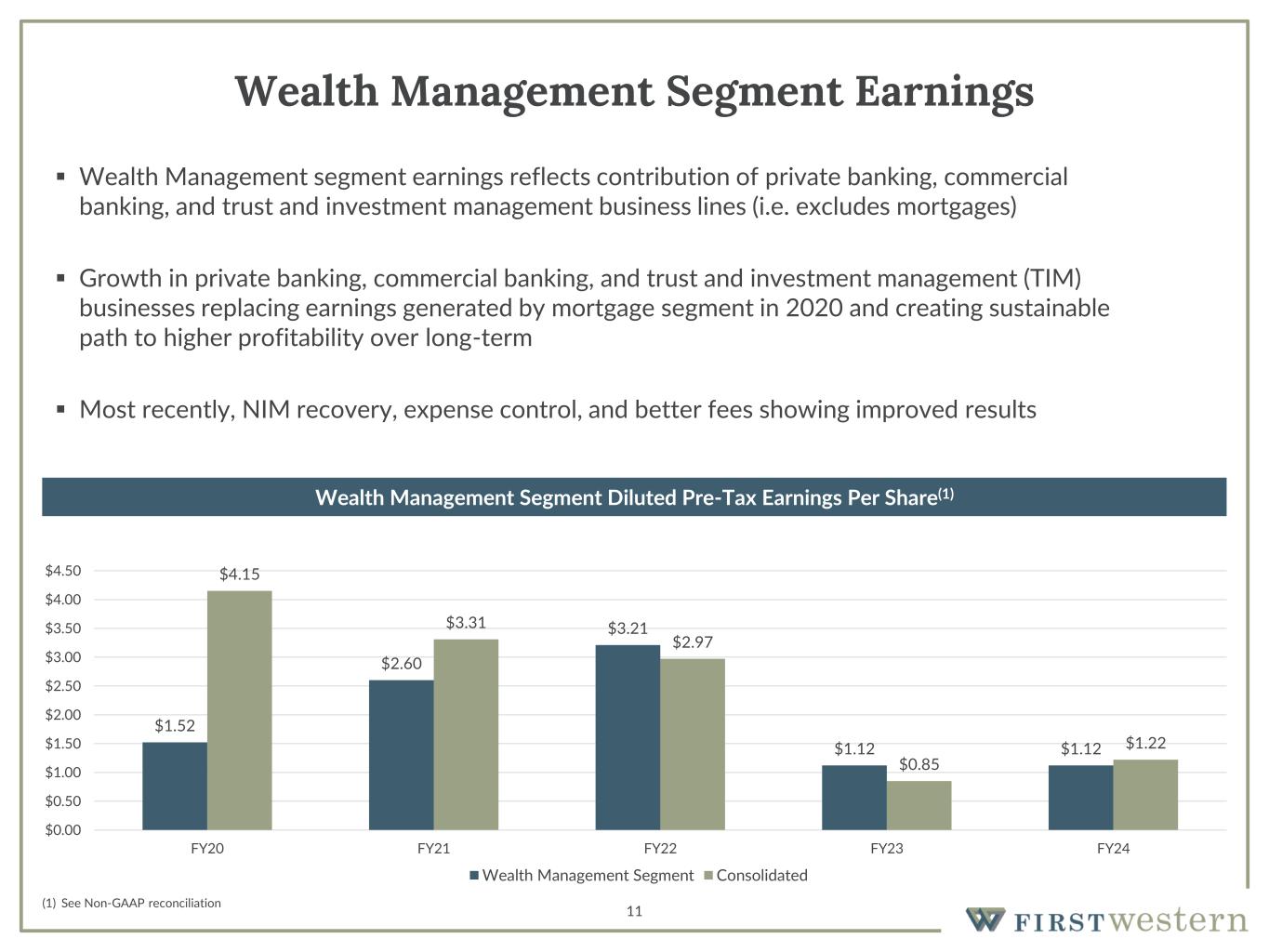

11 Wealth Management Segment Earnings (1) See Non-GAAP reconciliation $1.52 $2.60 $3.21 $1.12 $1.12 $4.15 $3.31 $2.97 $0.85 $1.22 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 $4.50 FY20 FY21 FY22 FY23 FY24 Wealth Management Segment Consolidated ▪ Wealth Management segment earnings reflects contribution of private banking, commercial banking, and trust and investment management business lines (i.e. excludes mortgages) ▪ Growth in private banking, commercial banking, and trust and investment management (TIM) businesses replacing earnings generated by mortgage segment in 2020 and creating sustainable path to higher profitability over long-term ▪ Most recently, NIM recovery, expense control, and better fees showing improved results Wealth Management Segment Diluted Pre-Tax Earnings Per Share(1)

Creating Additional Shareholder Value 12

13 2025 Outlook and Priorities • First Western's markets continue to perform well and the strength of our balance sheet and franchise provides opportunities to capitalize on market disruption and challenges being faced by competing banks to add new clients and banking talent • Addition of banking talent over past several quarters should lead to higher level of loan growth in 2025 while still maintaining disciplined underwriting and pricing criteria • Deposit gathering will remain a top priority throughout the organization • Expected drivers of improved financial performance in 2025 ◦ Increased loan growth ◦ Continued expansion in net interest margin ◦ Redeployment of cash generated from sale of OREO properties into interest-earning assets ◦ More robust business development activities in Wealth Management business ◦ More operating leverage resulting from disciplined expense control • Addition of MLOs will positively impact mortgage banking fees if environment is favorable for loan demand in 2025 • Positive trends in key areas expected to continue, which should result in steady improvement in financial performance and further value being created for shareholders

14 Drivers of Long-Term Improved Financial Performance Efficiency Ratio Asset Quality ROA and ROE ▪ Net interest margin expanding due to increase in average yield on loans and improving deposit mix ▪ Disciplined balance sheet management and effective business development efforts expected to result in growth in high quality loans, lower cost of deposits, and fee income ▪ Increased operating leverage through disciplined expense management ▪ Realization of more operational efficiencies through streamlining of back-office support and process improvements throughout the organization ▪ Organization shifting more towards revenue producers without adding to headcount ▪ Investments in technology resulting in improved efficiencies, enhanced client service, and additional revenue generation opportunities ▪ Continued resolution of non-performing loans with minimal loss content ▪ Disciplined underwriting criteria continues to result in strong overall asset quality with low level of losses

15 Long-Term Goals to Drive Shareholder Value Since our pre-2018 IPO status as of year end 2017, we have tripled total loans and total deposits, more than doubled TBV per share, had substantial increases in annual revenue, and demonstrated significant operating leverage. Looking forward we can drive shareholder value by: ▪ Continuing to execute well, creating more operating leverage to drive high performing ROAA and ROAE results ▪ Emphasizing our differentiation in marketplace ▪ Growing through $5 billion in total assets, $25 billion TIM assets through both organic growth and acquisitions, ideally: ▪ ~50 offices – infill and adjacent ▪ Maturing at $8 million in revenue per office through growing 20% ▪ 75% contribution margin per office at maturity, then growing ▪ Building footprint, scale and operating leverage with M&A ▪ Disciplined approach to be significantly earnings accretive with minimal TBV dilution ▪ Enhancing wealth management platform ▪ Upgrade omnichannel client experience ▪ Create new digital distribution channel Our mission is to be the BPBFWWMC – Best Private Bank for the Western Wealth Management Client We believe First Western can be a unique, niche focused regional powerhouse with high fee income and consistent strong earnings from our scalable wealth management platform

Non-GAAP Reconciliations 16

17 Non-GAAP Reconciliation Consolidated Gross Revenue For the Years Ended, (Dollars in thousands) 2018 2019 2020 2021 2022 2023 2024 Total income before non-interest expense 57,602$ 63,997$ 92,615$ 95,408$ 107,934$ 82,698$ 90,071$ Less: Unrealized (loss) gain recognized on equity securities (15) 21 15 (21) 342 (22) (33) Less: Net loss on loans accounted for under the fair value option - - - - (891) (2,010) (999) Less: Net gain on equity interests - 119 - 489 7 - - Less: Net gain on sale of assets - 183 - - - - - Less: Net loss on loans held for sale - - - - (12) (178) (105) Plus: Provision for credit losses 180 662 4,682 1,230 3,682 10,355 1,933 Gross revenue 57,797$ 64,336$ 97,282$ 96,170$ 112,170$ 95,263$ 93,141$ Consolidated Adjusted Pre-tax, Pre-provision Income For the Years Ended, (Dollars in thousands) 2018 2019 2020 2021 2022 2023 2024 Net income before income tax, as reported 7,422$ 10,192$ 33,063$ 27,280$ 28,828$ 7,061$ 11,579$ Plus: Provision for credit losses 180 662 4,682 1,230 3,682 10,355 1,933 Pre-tax, Pre-provision Income 7,602$ 10,854$ 37,745$ 28,510$ 32,510$ 17,416$ 13,512$ Adjusted Diluted Pre-Tax Earnings Per Share (Dollars in thousands) 2018 2019 2020 2021 2022 2023 2024 Wealth Management income before income tax 8,664$ 6,152$ 12,086$ 21,378$ 31,139$ 9,660$ 10,629$ Mortgage (loss) income before income tax (1,242) 4,040 20,978 5,902 (2,311) (2,599) 950 Plus: Impairment of contingent consideration assets - - - - - 1,249 338 Less: Income tax expense 1,775 2,183 8,529 6,670 7,130 1,836 3,106 Adjusted net income available to common shareholders 5,647$ 8,009$ 24,535$ 20,610$ 21,698$ 6,474$ 8,811$ Adjusted diluted weighted average shares 5,586,620 7,914,961 7,961,904 8,235,178 9,713,623 9,725,910 9,755,804 Wealth Management Segment Adjusted Diluted Pre-Tax Earnings Per Share 1.55$ 0.78$ 1.52$ 2.60$ 3.21$ 1.12$ 1.12$ Consolidated Adjusted Diluted Pre-Tax Earnings Per Share 1.33$ 1.29$ 4.15$ 3.31$ 2.97$ 0.85$ 1.22$ For the Years Ended,

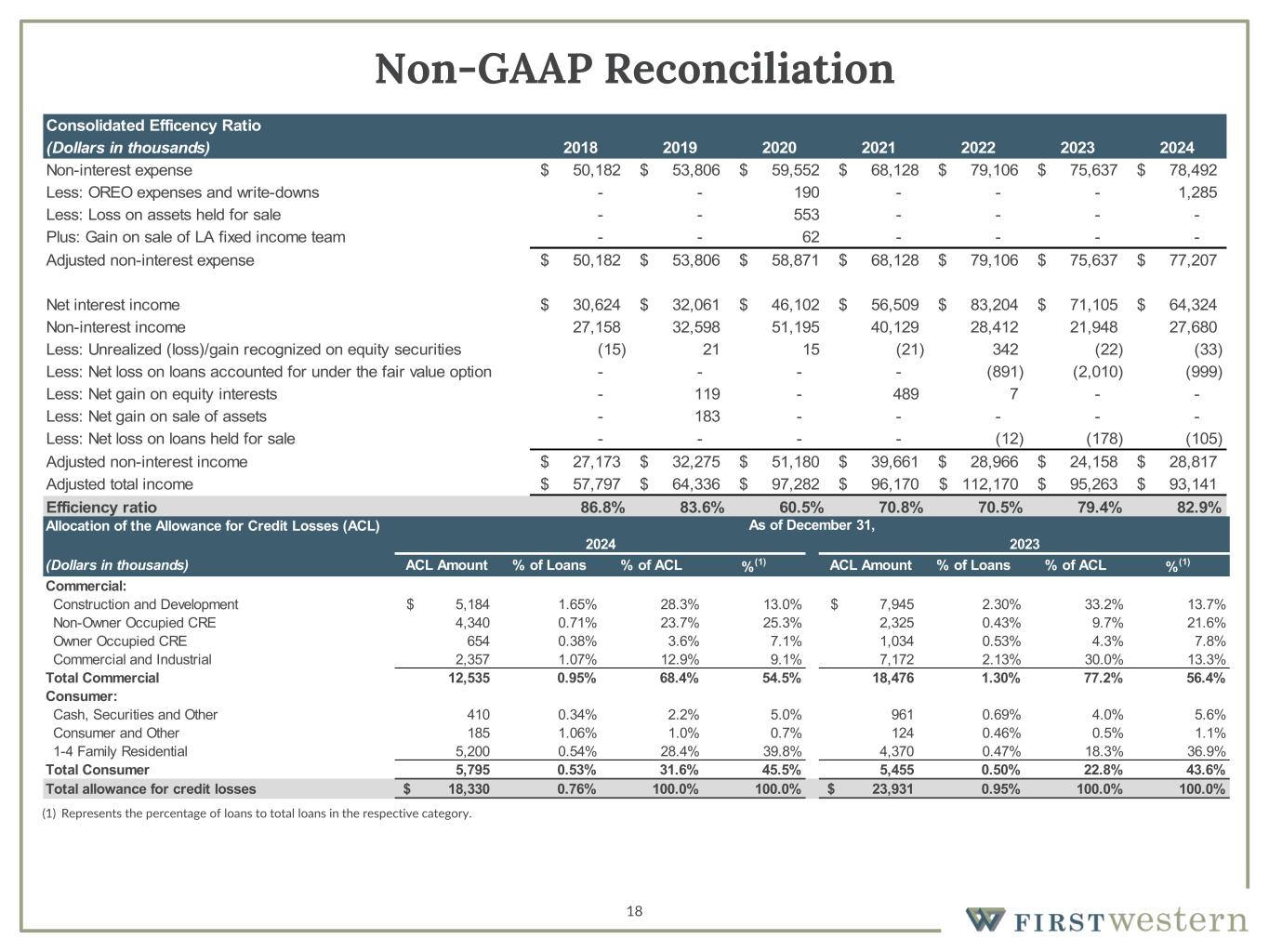

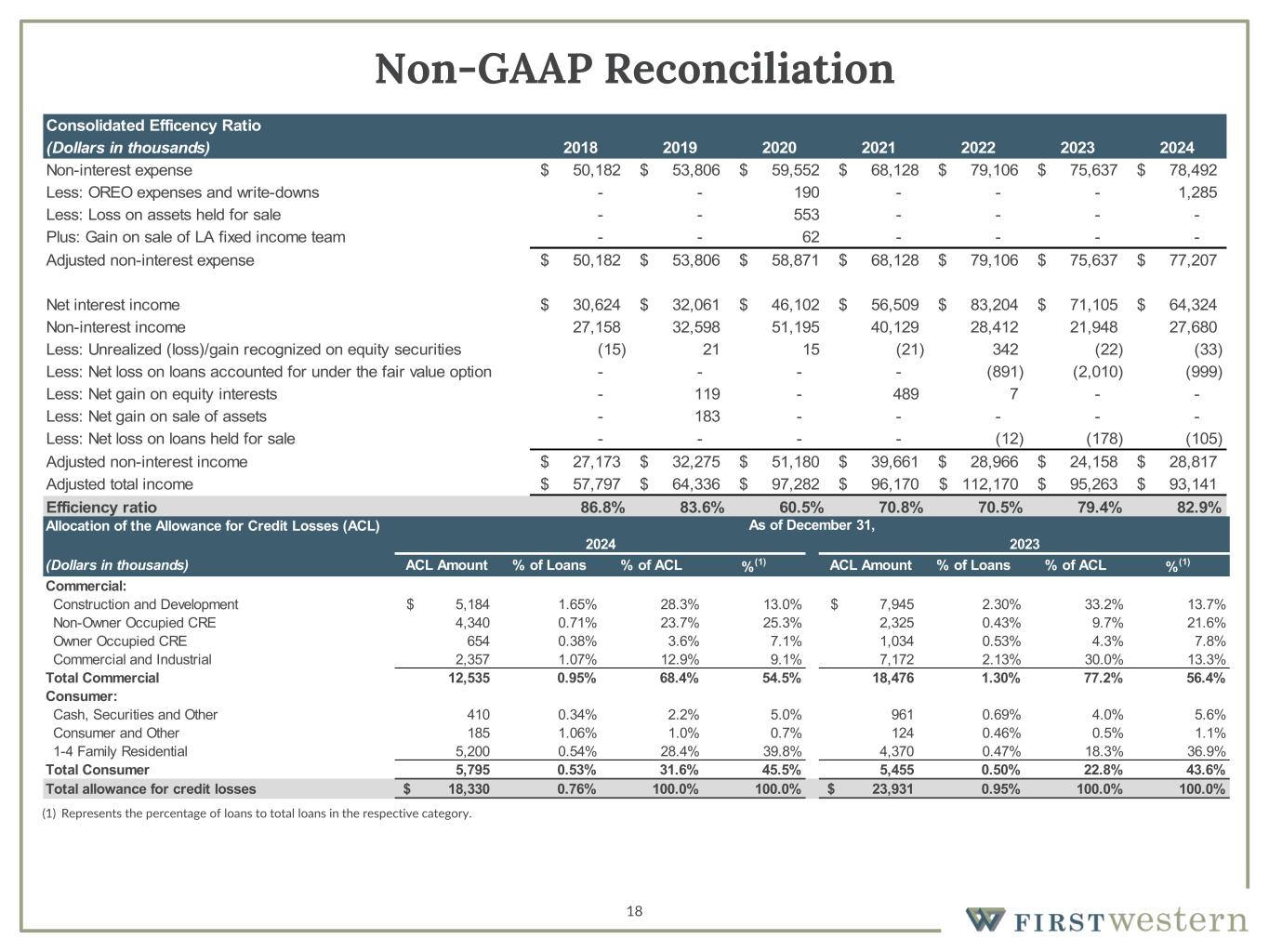

18 Non-GAAP Reconciliation Consolidated Efficency Ratio (Dollars in thousands) 2018 2019 2020 2021 2022 2023 2024 Non-interest expense 50,182$ 53,806$ 59,552$ 68,128$ 79,106$ 75,637$ 78,492$ Less: OREO expenses and write-downs - - 190 - - - 1,285 Less: Loss on assets held for sale - - 553 - - - - Plus: Gain on sale of LA fixed income team - - 62 - - - - Adjusted non-interest expense 50,182$ 53,806$ 58,871$ 68,128$ 79,106$ 75,637$ 77,207$ Net interest income 30,624$ 32,061$ 46,102$ 56,509$ 83,204$ 71,105$ 64,324$ Non-interest income 27,158 32,598 51,195 40,129 28,412 21,948 27,680 Less: Unrealized (loss)/gain recognized on equity securities (15) 21 15 (21) 342 (22) (33) Less: Net loss on loans accounted for under the fair value option - - - - (891) (2,010) (999) Less: Net gain on equity interests - 119 - 489 7 - - Less: Net gain on sale of assets - 183 - - - - - Less: Net loss on loans held for sale - - - - (12) (178) (105) Adjusted non-interest income 27,173$ 32,275$ 51,180$ 39,661$ 28,966$ 24,158$ 28,817$ Adjusted total income 57,797$ 64,336$ 97,282$ 96,170$ 112,170$ 95,263$ 93,141$ Efficiency ratio 86.8% 83.6% 60.5% 70.8% 70.5% 79.4% 82.9% (1) Represents the percentage of loans to total loans in the respective category. Allocation of the Allowance for Credit Losses (ACL) (Dollars in thousands) ACL Amount % of Loans % of ACL % (1) ACL Amount % of Loans % of ACL % (1) Commercial: Construction and Development 5,184$ 1.65% 28.3% 13.0% 7,945$ 2.30% 33.2% 13.7% Non-Owner Occupied CRE 4,340 0.71% 23.7% 25.3% 2,325 0.43% 9.7% 21.6% Owner Occupied CRE 654 0.38% 3.6% 7.1% 1,034 0.53% 4.3% 7.8% Commercial and Industrial 2,357 1.07% 12.9% 9.1% 7,172 2.13% 30.0% 13.3% Total Commercial 12,535 0.95% 68.4% 54.5% 18,476 1.30% 77.2% 56.4% Consumer: Cash, Securities and Other 410 0.34% 2.2% 5.0% 961 0.69% 4.0% 5.6% Consumer and Other 185 1.06% 1.0% 0.7% 124 0.46% 0.5% 1.1% 1-4 Family Residential 5,200 0.54% 28.4% 39.8% 4,370 0.47% 18.3% 36.9% Total Consumer 5,795 0.53% 31.6% 45.5% 5,455 0.50% 22.8% 43.6% Total allowance for credit losses 18,330$ 0.76% 100.0% 100.0% 23,931$ 0.95% 100.0% 100.0% As of December 31, 2024 2023

19 Non-GAAP Reconciliation (Dollars in thousands) 31-Dec-23 31-Mar-24 30-Jun-24 30-Sep-24 31-Dec-24 Wealth Management (loss) income before income tax (3,626)$ 3,397$ 645$ 2,218$ 4,369$ Mortgage (loss) income before income tax (731) 182 770 453 (455) Plus: Impairment of contingent consideration assets - 143 97 - 98 Less: Income tax (benefit) expense (1,138) 1,064 339 537 1,166 Adjusted net income available to common shareholders (3,219)$ 2,658$ 1,173$ 2,134$ 2,846$ Adjusted diluted weighted average shares 9,572,582 9,710,764 9,750,667 9,766,656 9,794,797 Wealth Management Segment Adjusted Diluted Pre-Tax Earnings Per Share (0.38)$ 0.36$ 0.08$ 0.23$ 0.46$ Consolidated Adjusted Diluted Pre-Tax Earnings Per Share (0.46)$ 0.38$ 0.16$ 0.27$ 0.41$

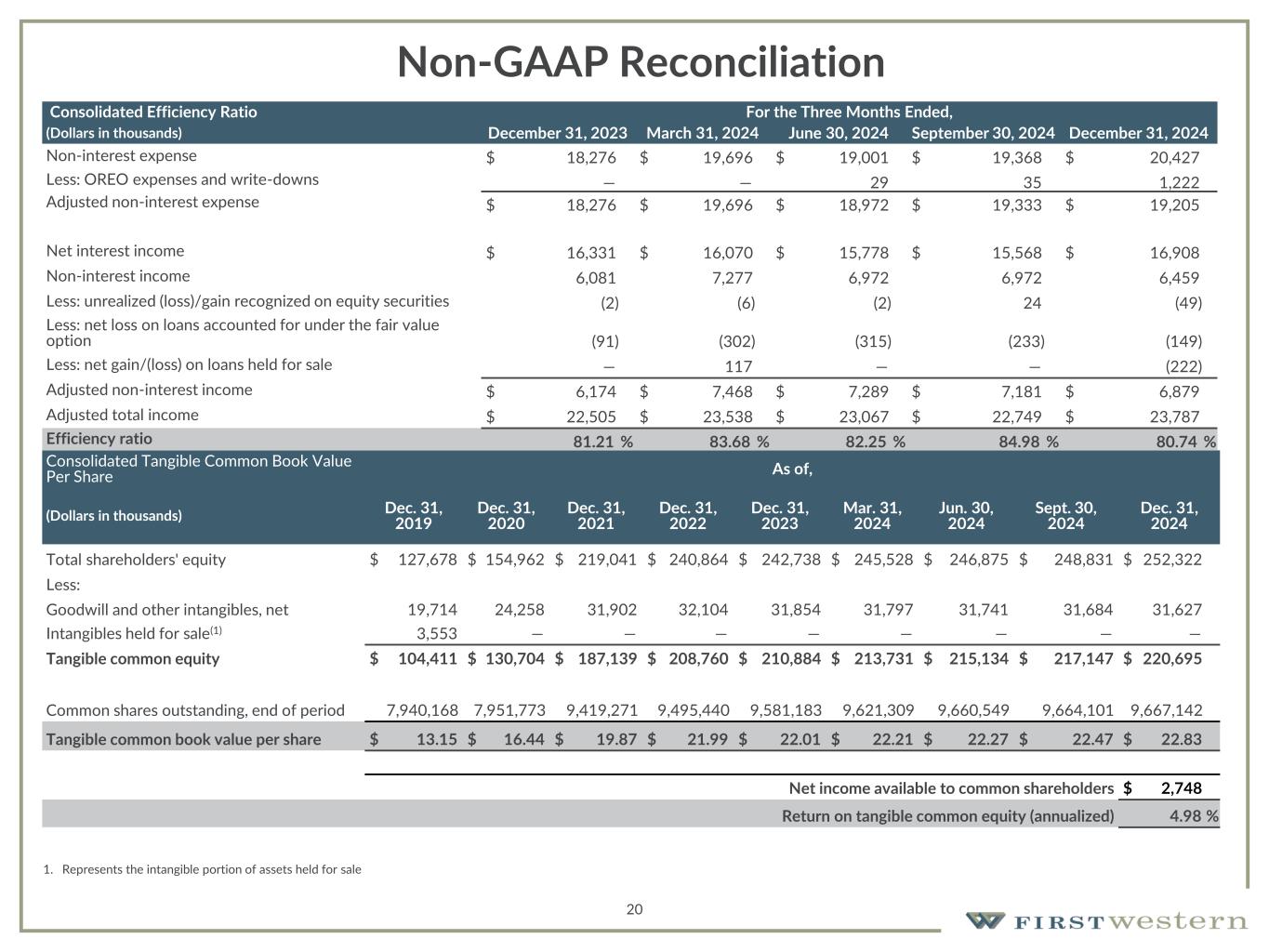

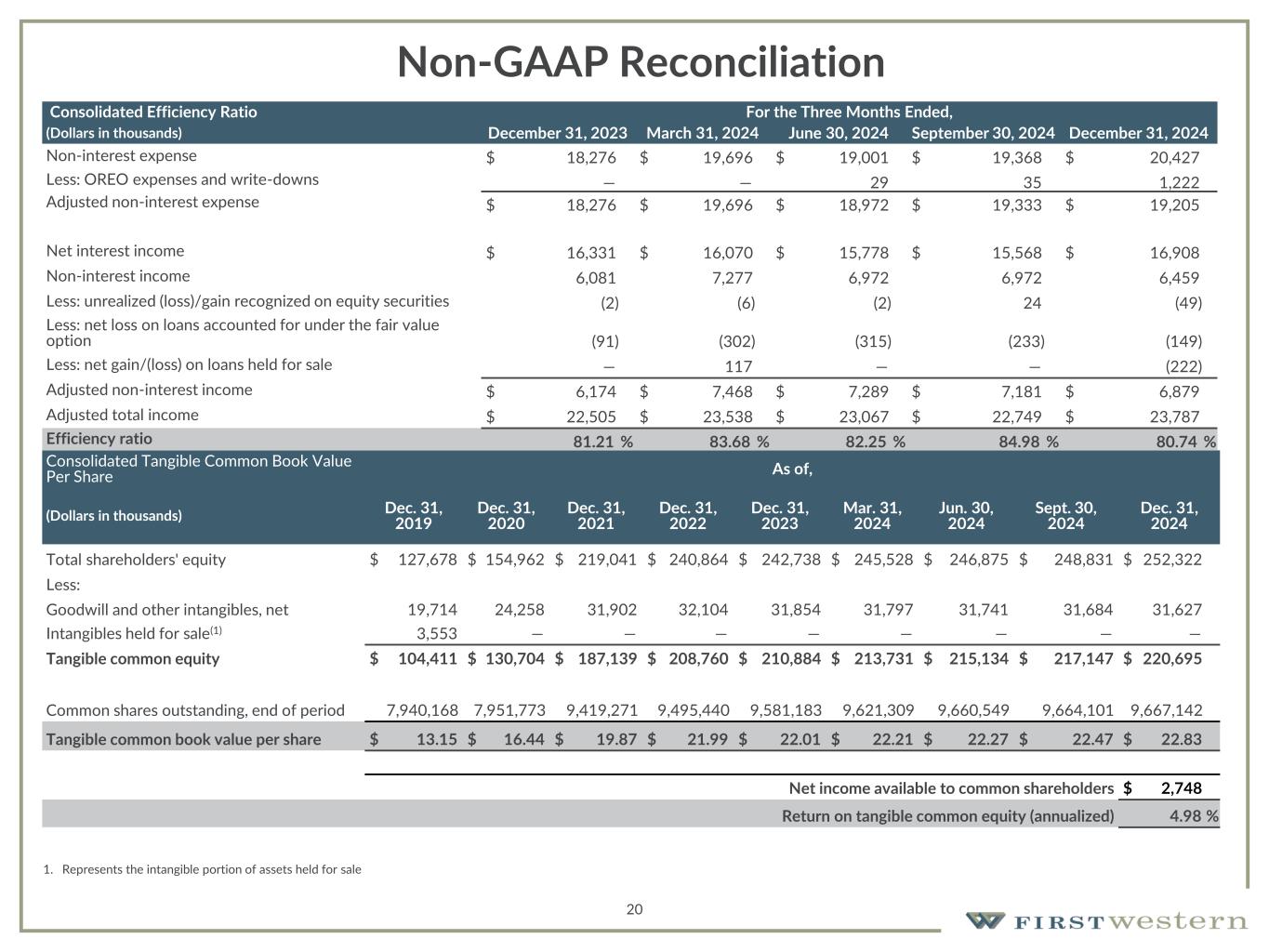

20 Non-GAAP Reconciliation Consolidated Tangible Common Book Value Per Share As of, (Dollars in thousands) Dec. 31, 2019 Dec. 31, 2020 Dec. 31, 2021 Dec. 31, 2022 Dec. 31, 2023 Mar. 31, 2024 Jun. 30, 2024 Sept. 30, 2024 Dec. 31, 2024 Total shareholders' equity $ 127,678 $ 154,962 $ 219,041 $ 240,864 $ 242,738 $ 245,528 $ 246,875 $ 248,831 $ 252,322 Less: Goodwill and other intangibles, net 19,714 24,258 31,902 32,104 31,854 31,797 31,741 31,684 31,627 Intangibles held for sale(1) 3,553 — — — — — — — — Tangible common equity $ 104,411 $ 130,704 $ 187,139 $ 208,760 $ 210,884 $ 213,731 $ 215,134 $ 217,147 $ 220,695 Common shares outstanding, end of period 7,940,168 7,951,773 9,419,271 9,495,440 9,581,183 9,621,309 9,660,549 9,664,101 9,667,142 Tangible common book value per share $ 13.15 $ 16.44 $ 19.87 $ 21.99 $ 22.01 $ 22.21 $ 22.27 $ 22.47 $ 22.83 Net income available to common shareholders $ 2,748 Return on tangible common equity (annualized) 4.98 % 1. Represents the intangible portion of assets held for sale Consolidated Efficiency Ratio For the Three Months Ended, (Dollars in thousands) December 31, 2023 March 31, 2024 June 30, 2024 September 30, 2024 December 31, 2024 Non-interest expense $ 18,276 $ 19,696 $ 19,001 $ 19,368 $ 20,427 Less: OREO expenses and write-downs — — 29 35 1,222 Adjusted non-interest expense $ 18,276 $ 19,696 $ 18,972 $ 19,333 $ 19,205 Net interest income $ 16,331 $ 16,070 $ 15,778 $ 15,568 $ 16,908 Non-interest income 6,081 7,277 6,972 6,972 6,459 Less: unrealized (loss)/gain recognized on equity securities (2) (6) (2) 24 (49) Less: net loss on loans accounted for under the fair value option (91) (302) (315) (233) (149) Less: net gain/(loss) on loans held for sale — 117 — — (222) Adjusted non-interest income $ 6,174 $ 7,468 $ 7,289 $ 7,181 $ 6,879 Adjusted total income $ 22,505 $ 23,538 $ 23,067 $ 22,749 $ 23,787 Efficiency ratio 81.21 % 83.68 % 82.25 % 84.98 % 80.74 %

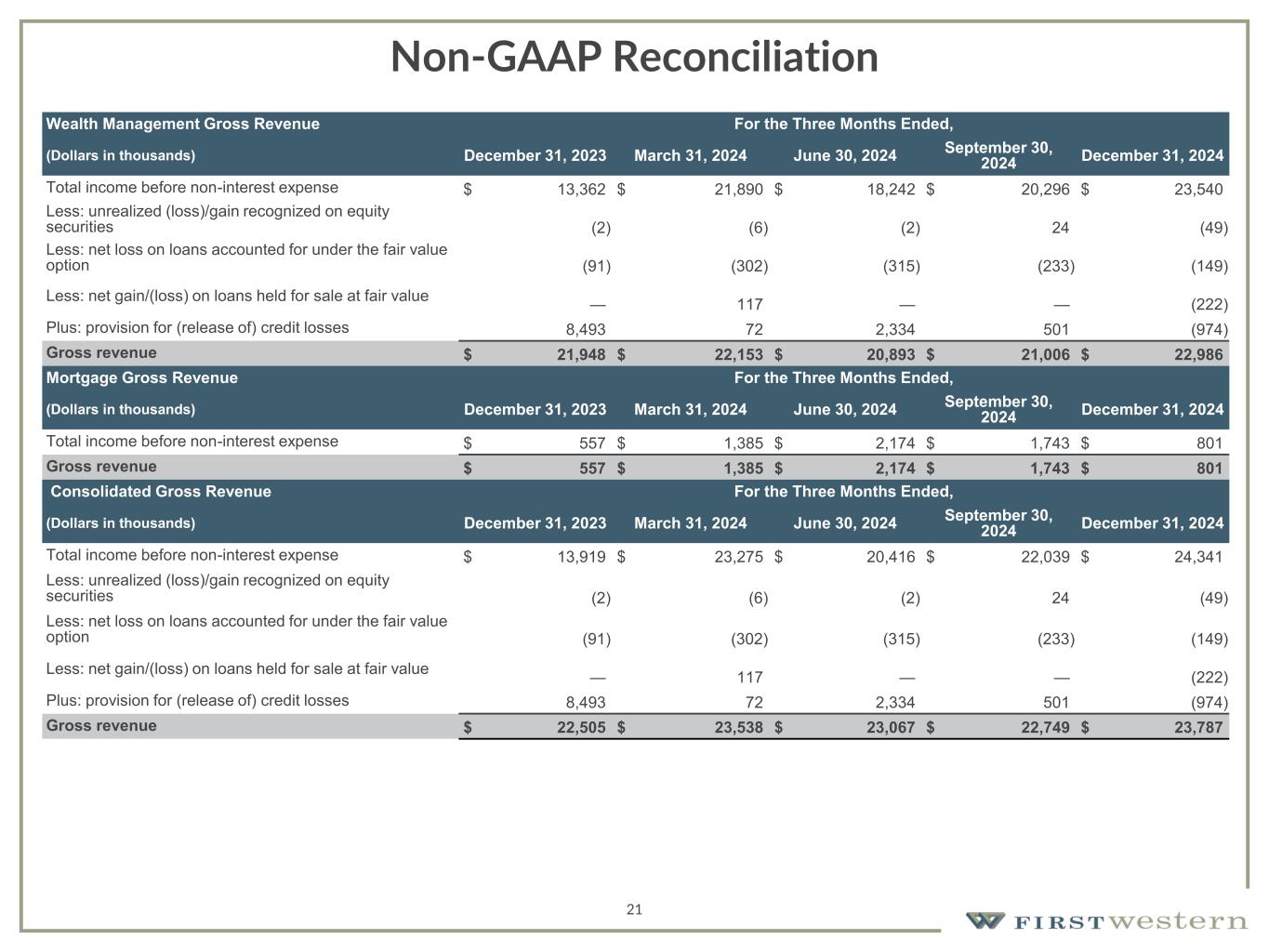

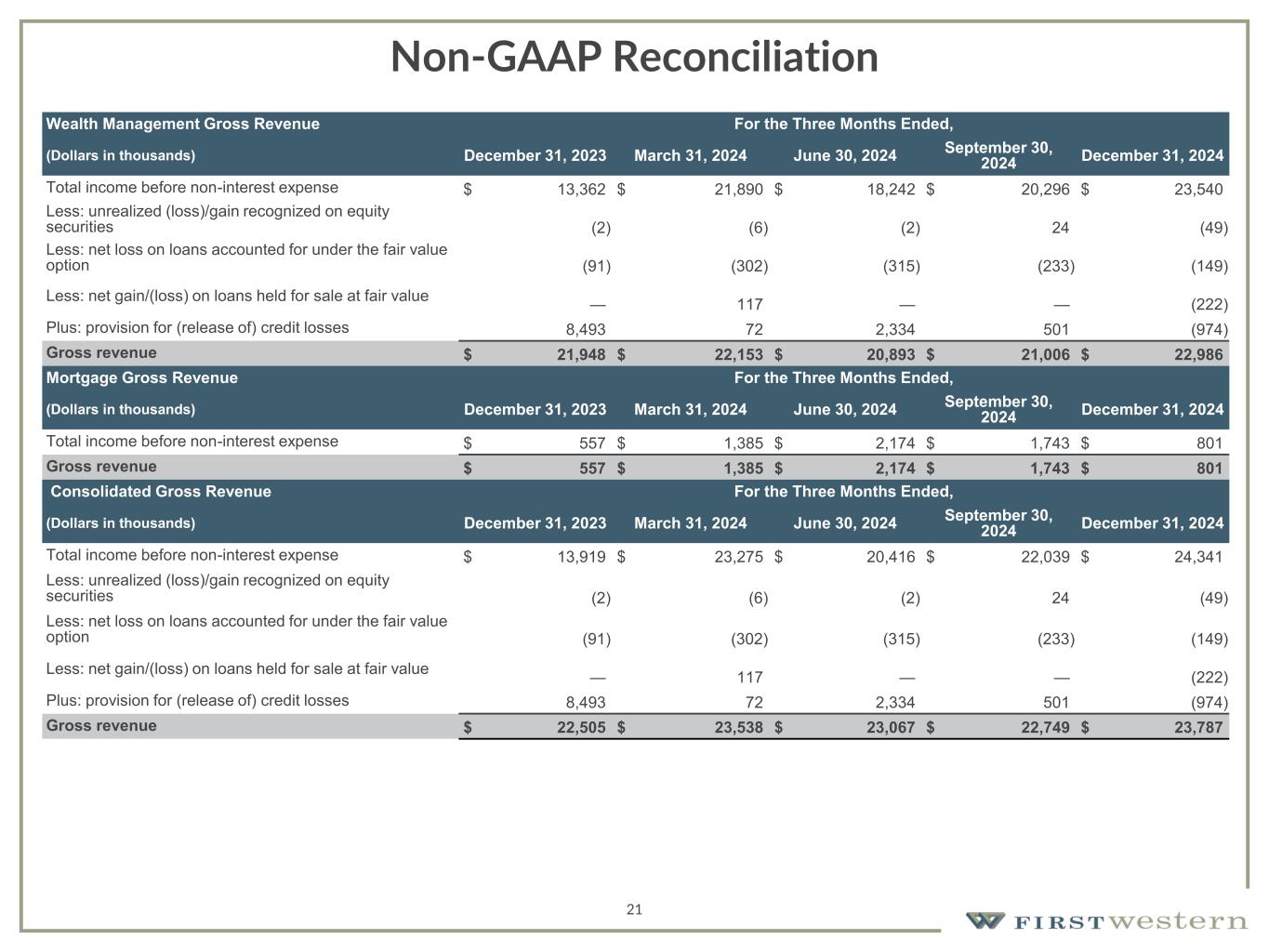

21 Non-GAAP Reconciliation Wealth Management Gross Revenue For the Three Months Ended, (Dollars in thousands) December 31, 2023 March 31, 2024 June 30, 2024 September 30, 2024 December 31, 2024 Total income before non-interest expense $ 13,362 $ 21,890 $ 18,242 $ 20,296 $ 23,540 Less: unrealized (loss)/gain recognized on equity securities (2) (6) (2) 24 (49) Less: net loss on loans accounted for under the fair value option (91) (302) (315) (233) (149) Less: net gain/(loss) on loans held for sale at fair value — 117 — — (222) Plus: provision for (release of) credit losses 8,493 72 2,334 501 (974) Gross revenue $ 21,948 $ 22,153 $ 20,893 $ 21,006 $ 22,986 Mortgage Gross Revenue For the Three Months Ended, (Dollars in thousands) December 31, 2023 March 31, 2024 June 30, 2024 September 30, 2024 December 31, 2024 Total income before non-interest expense $ 557 $ 1,385 $ 2,174 $ 1,743 $ 801 Gross revenue $ 557 $ 1,385 $ 2,174 $ 1,743 $ 801 Consolidated Gross Revenue For the Three Months Ended, (Dollars in thousands) December 31, 2023 March 31, 2024 June 30, 2024 September 30, 2024 December 31, 2024 Total income before non-interest expense $ 13,919 $ 23,275 $ 20,416 $ 22,039 $ 24,341 Less: unrealized (loss)/gain recognized on equity securities (2) (6) (2) 24 (49) Less: net loss on loans accounted for under the fair value option (91) (302) (315) (233) (149) Less: net gain/(loss) on loans held for sale at fair value — 117 — — (222) Plus: provision for (release of) credit losses 8,493 72 2,334 501 (974) Gross revenue $ 22,505 $ 23,538 $ 23,067 $ 22,749 $ 23,787

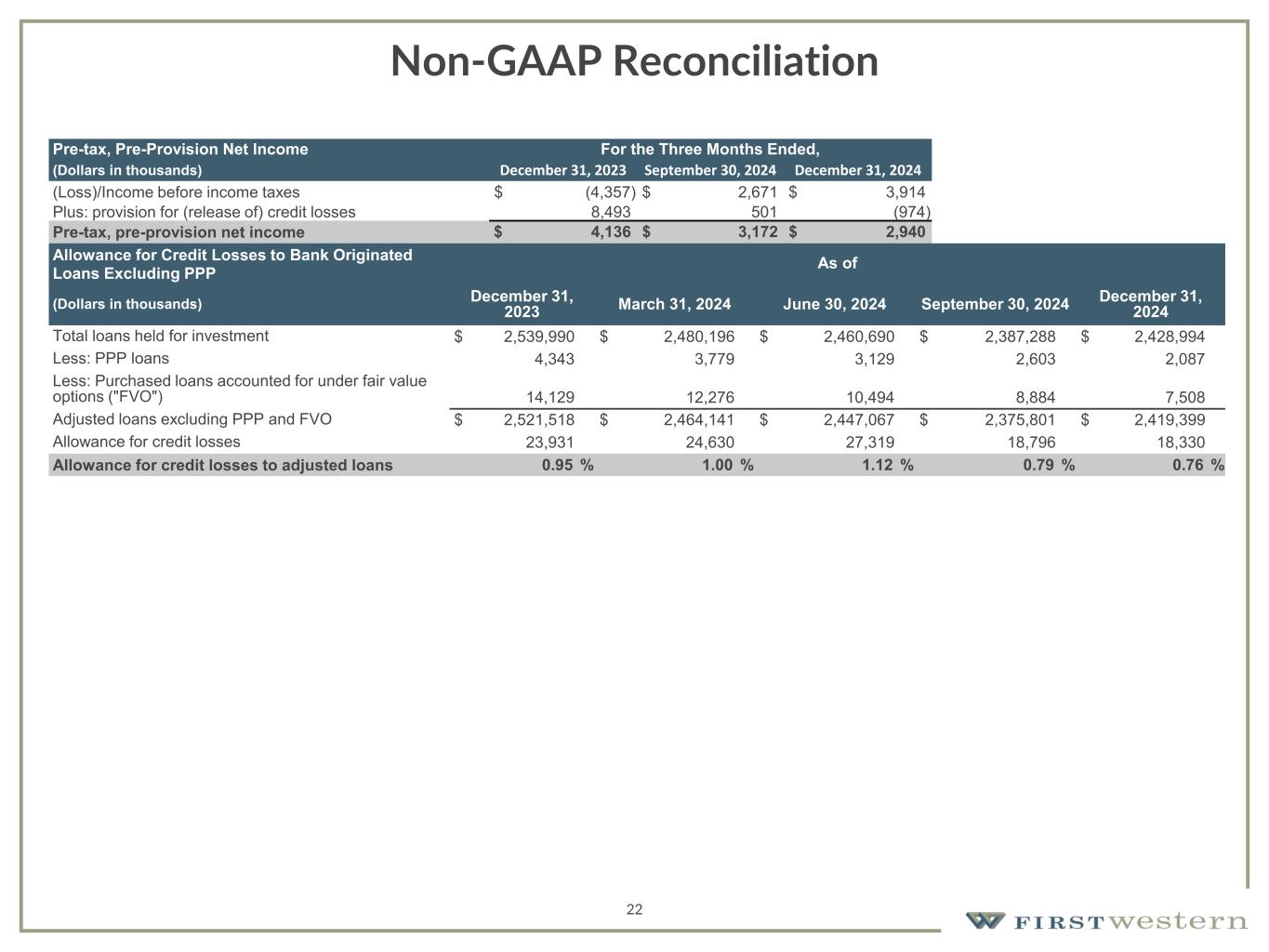

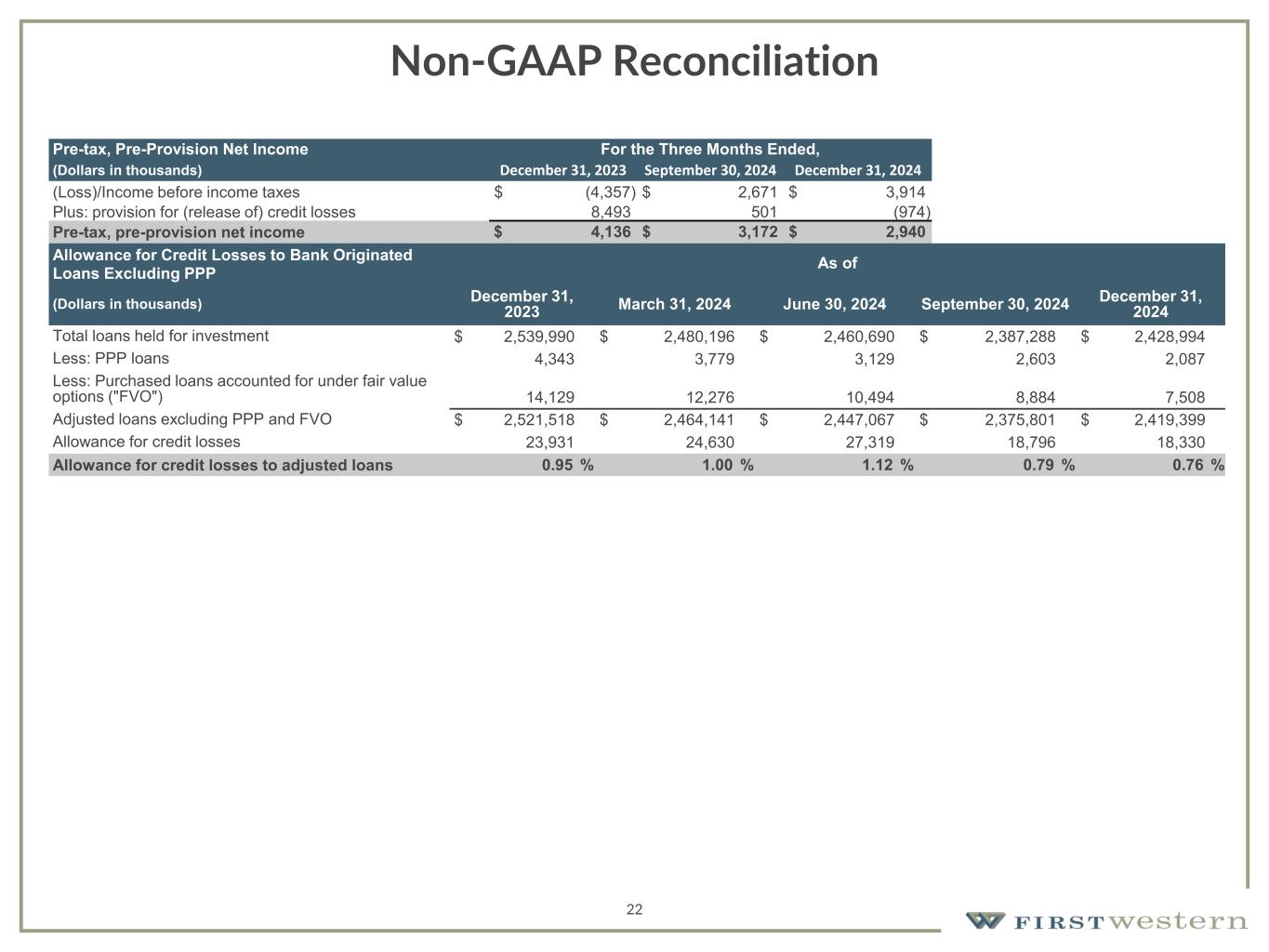

22 Non-GAAP Reconciliation Allowance for Credit Losses to Bank Originated Loans Excluding PPP As of (Dollars in thousands) December 31, 2023 March 31, 2024 June 30, 2024 September 30, 2024 December 31, 2024 Total loans held for investment $ 2,539,990 $ 2,480,196 $ 2,460,690 $ 2,387,288 $ 2,428,994 Less: PPP loans 4,343 3,779 3,129 2,603 2,087 Less: Purchased loans accounted for under fair value options ("FVO") 14,129 12,276 10,494 8,884 7,508 Adjusted loans excluding PPP and FVO $ 2,521,518 $ 2,464,141 $ 2,447,067 $ 2,375,801 $ 2,419,399 Allowance for credit losses 23,931 24,630 27,319 18,796 18,330 Allowance for credit losses to adjusted loans 0.95 % 1.00 % 1.12 % 0.79 % 0.76 % Pre-tax, Pre-Provision Net Income For the Three Months Ended, (Dollars in thousands) December 31, 2023 September 30, 2024 December 31, 2024 (Loss)/Income before income taxes $ (4,357) $ 2,671 $ 3,914 Plus: provision for (release of) credit losses 8,493 501 (974) Pre-tax, pre-provision net income $ 4,136 $ 3,172 $ 2,940