Analyst and Investor Day Michael Carrel, CEO © 2025 AtriCure, Inc. All rights reserved. March 2025 Exhibit 99.1

© 2025 AtriCure, Inc. All rights reserved. 2 Forward Looking Statements and Non-GAAP Financial Measures This presentation and oral statements made in connection with this presentation contain “forward-looking statements,” which are statements related to future events that by their nature address matters that are uncertain. Forward-looking statements address, among other things, AtriCure’s expected market opportunity, future business, financial performance, financial condition, and results of operations, and often contain words such as “intends,” “estimates,” “anticipates,” “hopes,” “projects,” “plans,” “expects,” “drives,” “seek,” “believes,” "see," “focus,” “should,” “will,” “would,” “can,” “opportunity,” “target,” “outlook,” and similar expressions and the negative versions thereof. Such statements are based only upon current expectations of AtriCure. All forward-looking information is inherently uncertain and actual results may differ materially from assumptions, estimates, projections or expectations reflected or contained in the forward-looking statements as a result of various risk factors. These risks and uncertainties include, but are not limited to, the following: our estimate of the market for our products; the rate and degree of market acceptance of our products; negative clinical data; competition from existing and new products and procedures, including the development of drugs or catheter-based technologies; our reliance on independent distributors to sell our products; inventory related charges; the timing of and ability to obtain and maintain regulatory clearances and approvals for our products; impacts of rising healthcare costs; our ability to comply with extensive FDA regulations; the timing of and ability to obtain third party payor reimbursement of procedures utilizing our products; unfavorable publicity; the potential impact of any acquisitions, mergers, dispositions, joint ventures or investments we may make; disruptions to our manufacturing operations; our failure to properly manage growth; disruptions of critical information systems or material breaches in the security of our systems; our ability to manage our intellectual property rights to provide meaningful protection; fluctuation of quarterly financial results; fluctuations in foreign currency exchange rates; reliance on third party manufacturers and suppliers; and litigation, administrative or other proceedings. These risks and uncertainties, as well as others, are discussed in greater detail in our filings with the Securities and Exchange Commission ("SEC"), including our Annual Report on Form 10-K for the year ended December 31, 2024 filed with the SEC on February 14, 2025. There may be additional risks of which we are not presently aware or that we currently believe are immaterial which could have an adverse impact on our business. Any forward-looking statements are based on our current expectations, estimates and assumptions regarding future events and are applicable only as of the dates of such statements. We make no commitment to revise or update any forward-looking statements in order to reflect events or circumstances that may change unless required by law. To supplement AtriCure’s consolidated financial statements prepared in accordance with accounting principles generally accepted in the United States of America, or GAAP, AtriCure provides certain non-GAAP financial measures as supplemental financial metrics in this presentation. Adjusted EBITDA is calculated as net loss before other income/expense (including interest), income tax expense, depreciation and amortization expense, share-based compensation expense, and non-recurring charges that are not reflective of the operational results of the Company’s core business and may affect comparability of results period-over-period. Non-recurring charges include acquisition costs, acquired in-process research and development (IPR&D) and related milestone payments arising from asset acquisitions, legal settlement costs, impairment of intangible assets and change in fair value of contingent consideration liabilities. Management believes in order to properly understand short-term and long-term financial trends, investors may wish to consider the impact of these excluded items in addition to GAAP measures. The excluded items vary in frequency and/or impact on our continuing results of operations and management believes that the excluded items are typically not reflective of our ongoing core business operations and financial condition. Further, management uses adjusted EBITDA for both strategic and annual operating planning. Adjusted loss per share is a non-GAAP measure which calculates the net loss per share before non-cash adjustments in fair value of contingent consideration liabilities, acquired IPR&D and related milestone payments arising from asset acquisitions, legal settlement costs, impairment of intangible assets and debt extinguishment. The non-GAAP financial measures used by AtriCure may not be the same or calculated in the same manner as those used and calculated by other companies. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as a substitute for AtriCure’s financial results prepared and reported in accordance with GAAP. We urge investors to review the reconciliation of these non-GAAP financial measures to the comparable GAAP financials measures, and not to rely on any single financial measure to evaluate our business.

© 2025 AtriCure, Inc. All rights reserved. creating standards of care for a world of unmet needs Welcome! 2025 Analyst & Investor Day 3

Large and Growing Markets Addressing an underserved and growing patient population representing a $10B opportunity Strong Portfolio Existing products and solutions and continuous innovation driving consistent growth A Bright Future Novel therapies supported by growing body of clinical evidence: creating standards of care for a world of unmet needs We are passionately focused on healing the lives of those affected by Afib and pain after surgery Our Vision © 2025 AtriCure, Inc. All rights reserved. Global Leader with Local Roots Leader in our markets, reaching 58 countries, dedicated to our roots in the United States 4

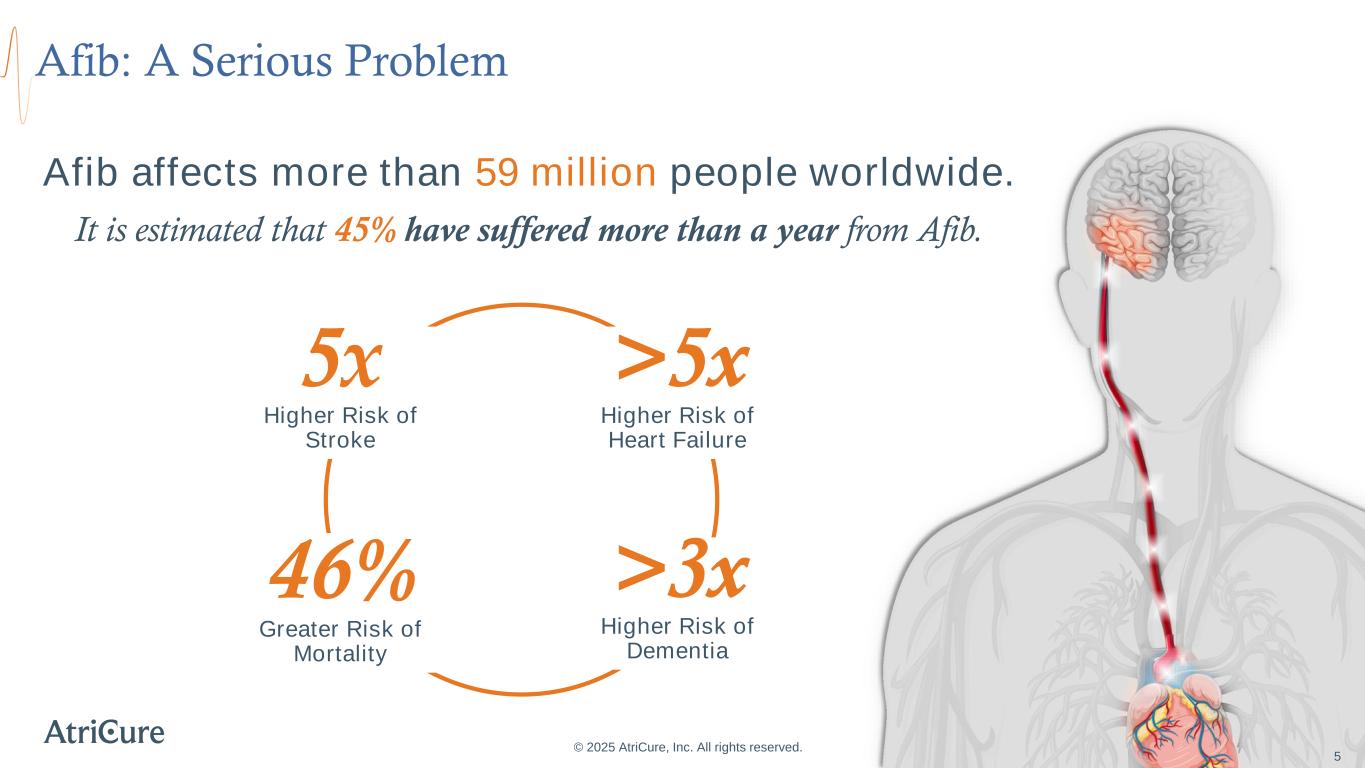

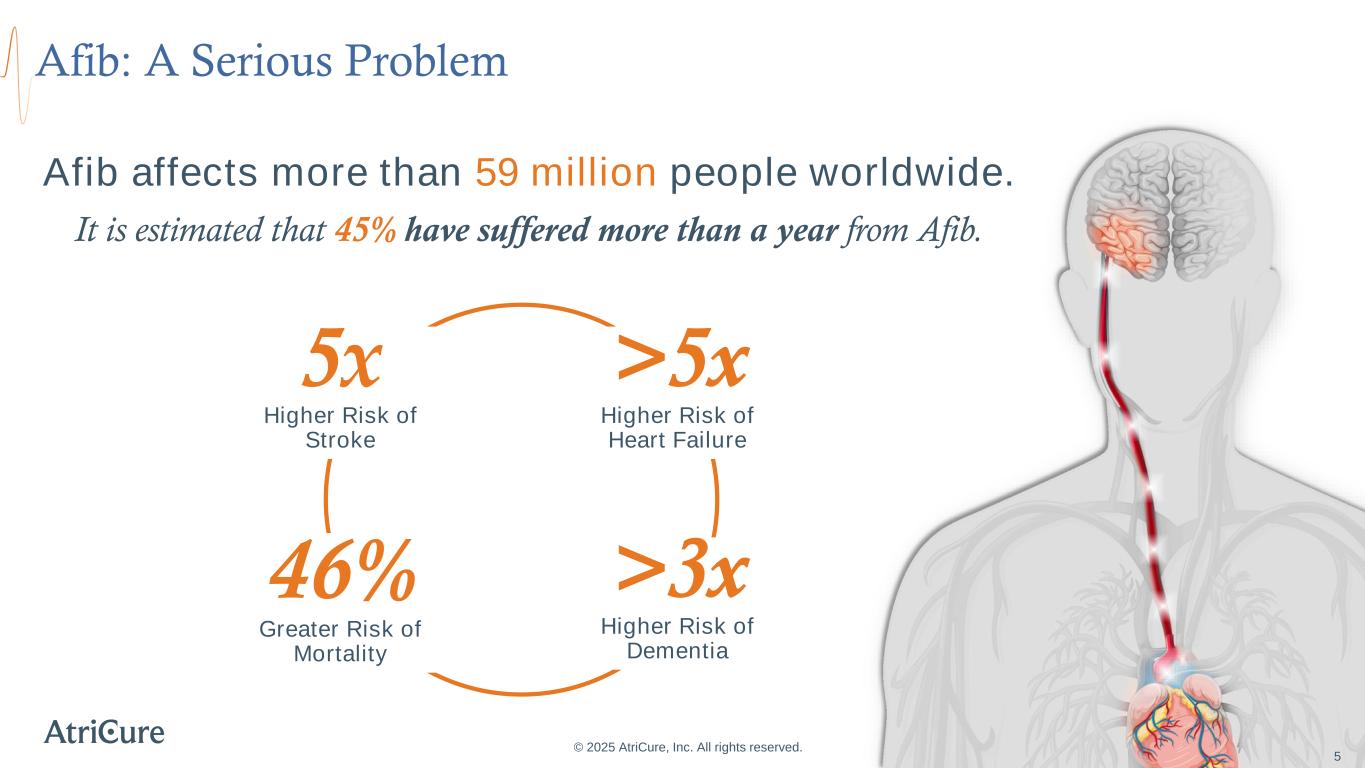

Afib: A Serious Problem © 2025 AtriCure, Inc. All rights reserved. 5 5x Higher Risk of Stroke 46% Greater Risk of Mortality >5x Higher Risk of Heart Failure >3x Higher Risk of Dementia Afib affects more than 59 million people worldwide. It is estimated that 45% have suffered more than a year from Afib. 5

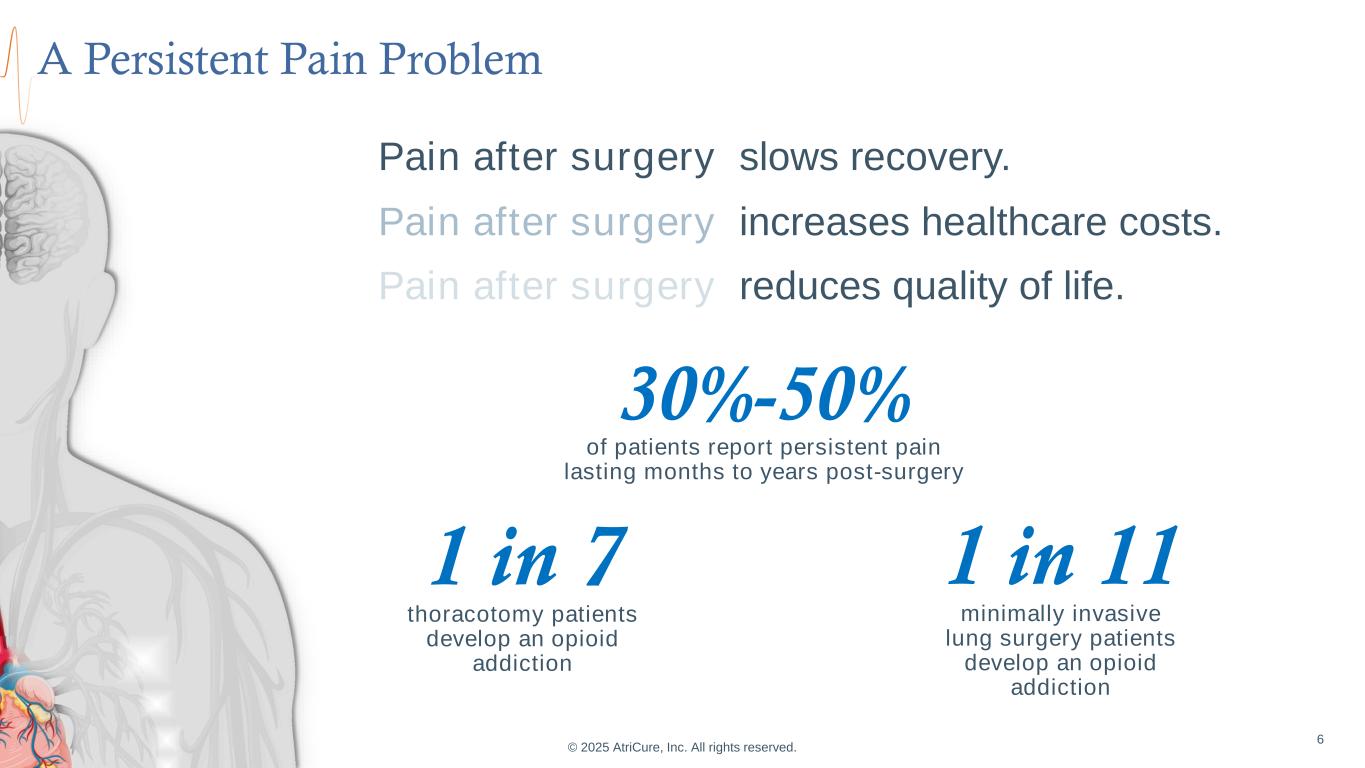

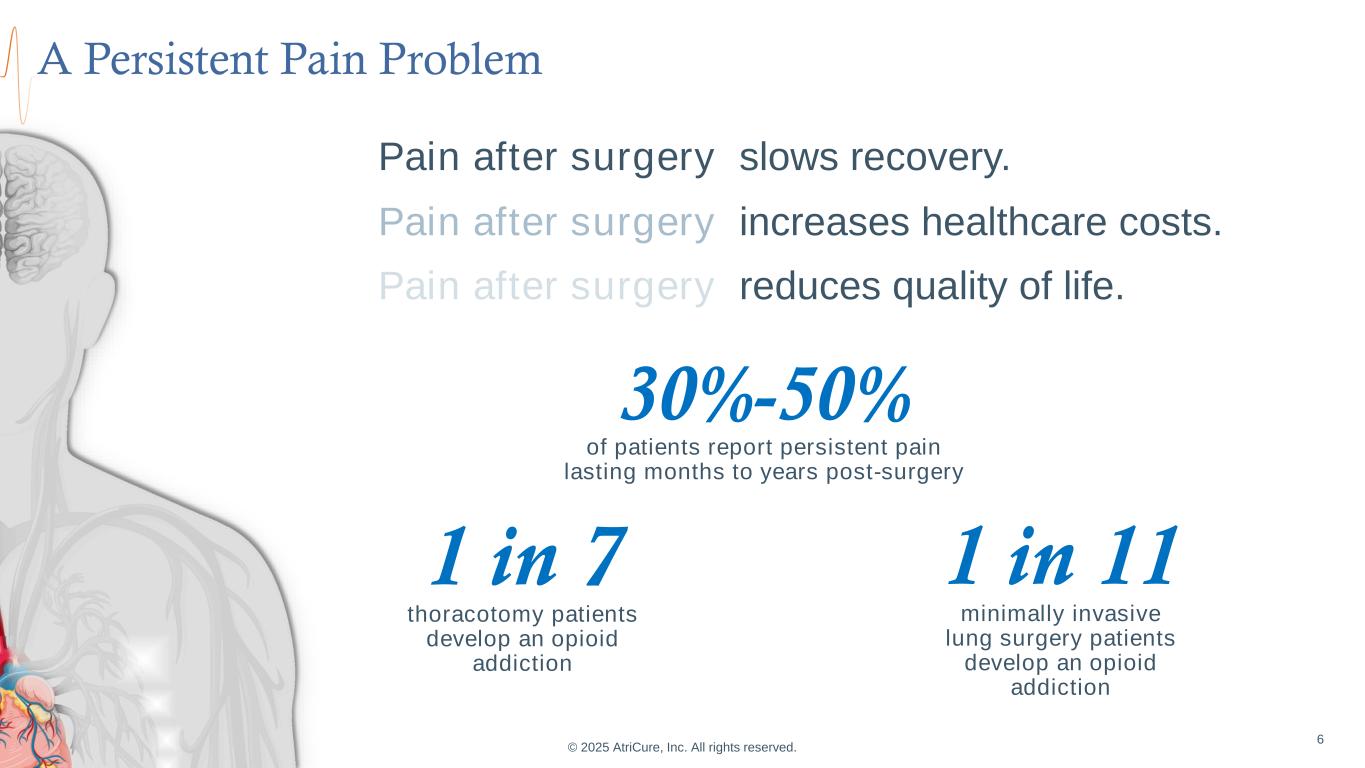

© 2025 AtriCure, Inc. All rights reserved. 6 30%-50% of patients report persistent pain lasting months to years post-surgery 1 in 7 thoracotomy patients develop an opioid addiction 1 in 11 minimally invasive lung surgery patients develop an opioid addiction Pain after surgery slows recovery. A Persistent Pain Problem Pain after surgery increases healthcare costs. Pain after surgery reduces quality of life.

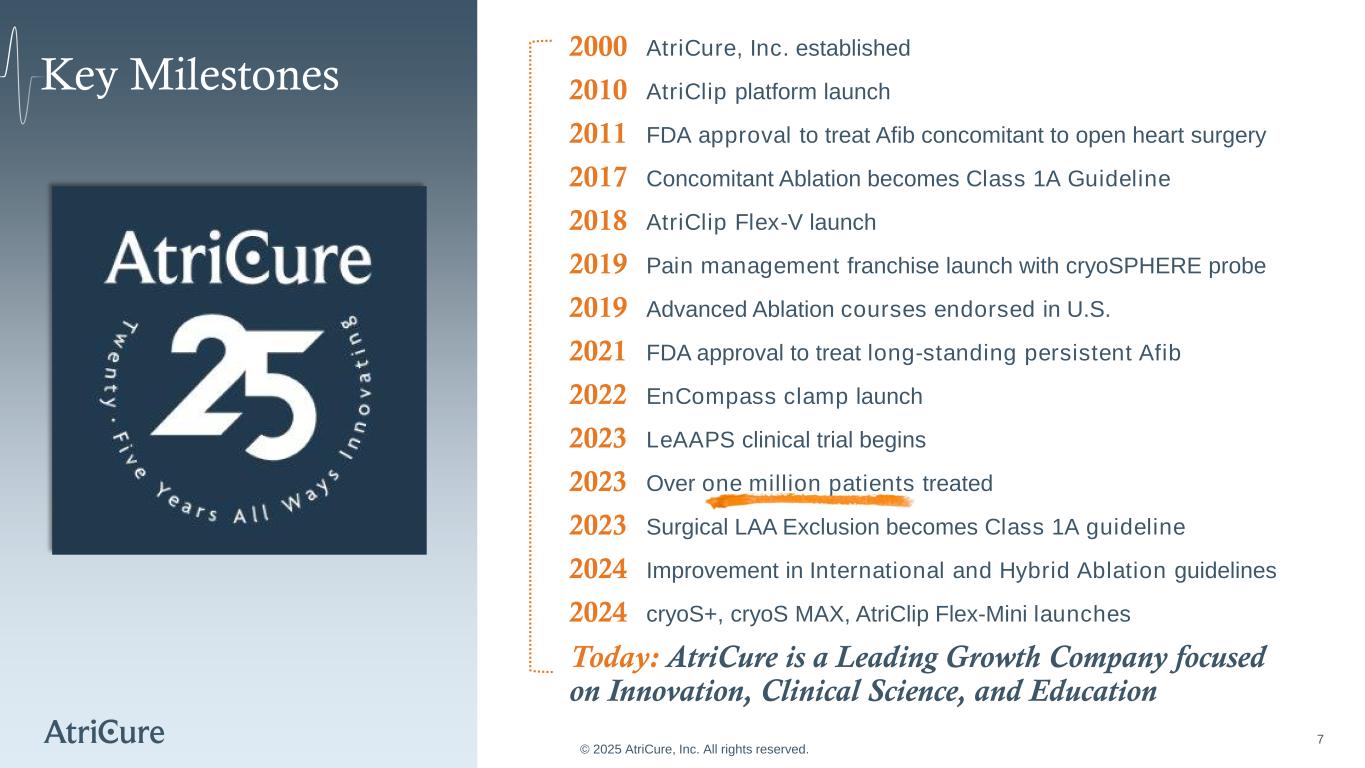

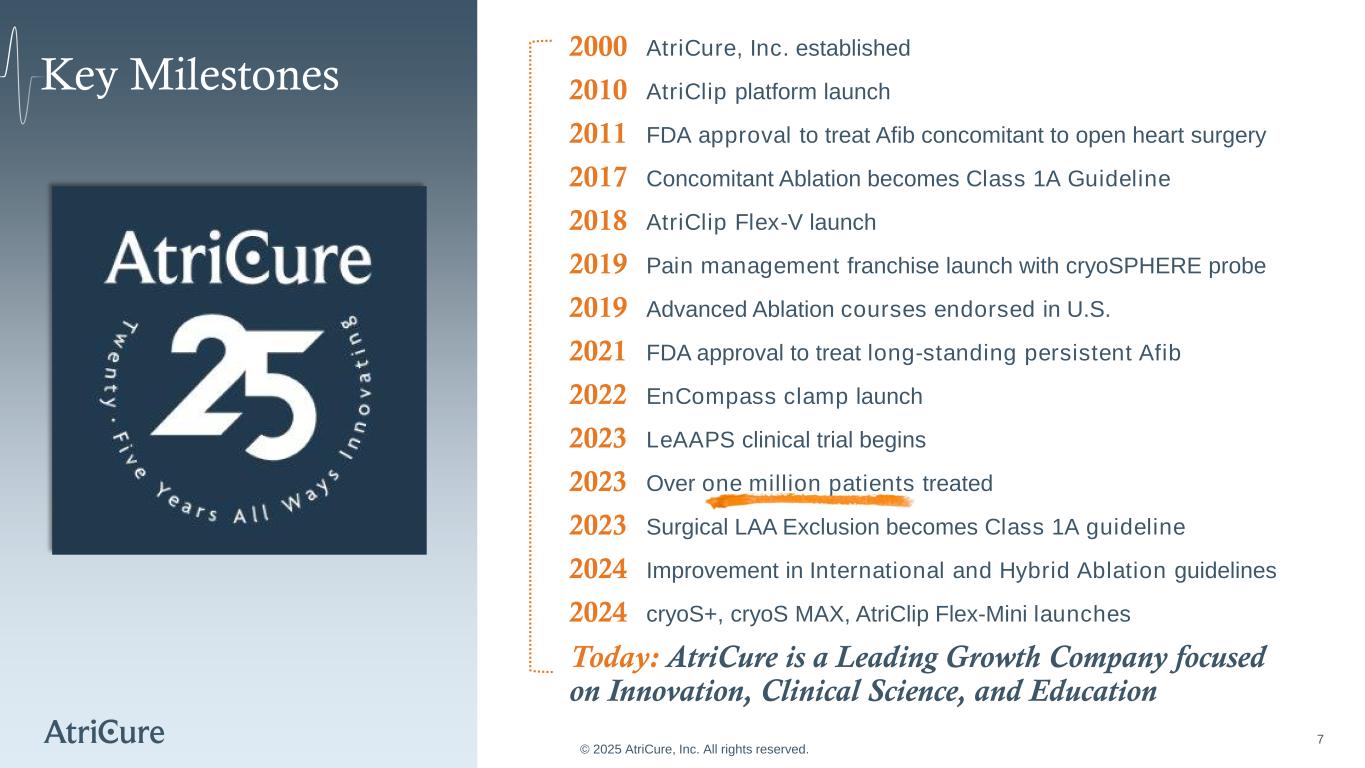

7 Key Milestones © 2025 AtriCure, Inc. All rights reserved. 2000 AtriCure, Inc. established 2010 AtriClip platform launch 2011 FDA approval to treat Afib concomitant to open heart surgery 2017 Concomitant Ablation becomes Class 1A Guideline 2018 AtriClip Flex-V launch 2019 Pain management franchise launch with cryoSPHERE probe 2019 Advanced Ablation courses endorsed in U.S. 2021 FDA approval to treat long-standing persistent Afib 2022 EnCompass clamp launch 2023 LeAAPS clinical trial begins 2023 Over one million patients treated 2023 Surgical LAA Exclusion becomes Class 1A guideline 2024 Improvement in International and Hybrid Ablation guidelines 2024 cryoS+, cryoS MAX, AtriClip Flex-Mini launches Today: AtriCure is a Leading Growth Company focused on Innovation, Clinical Science, and Education

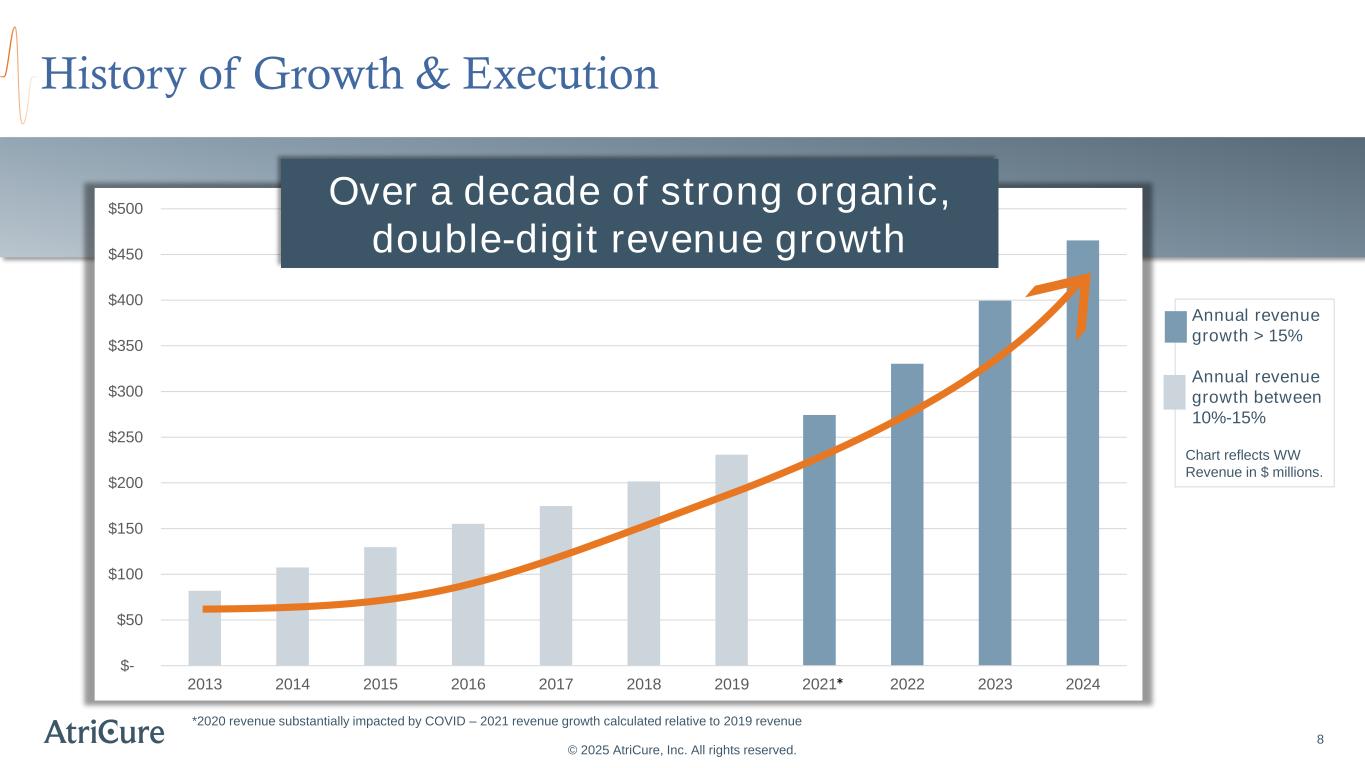

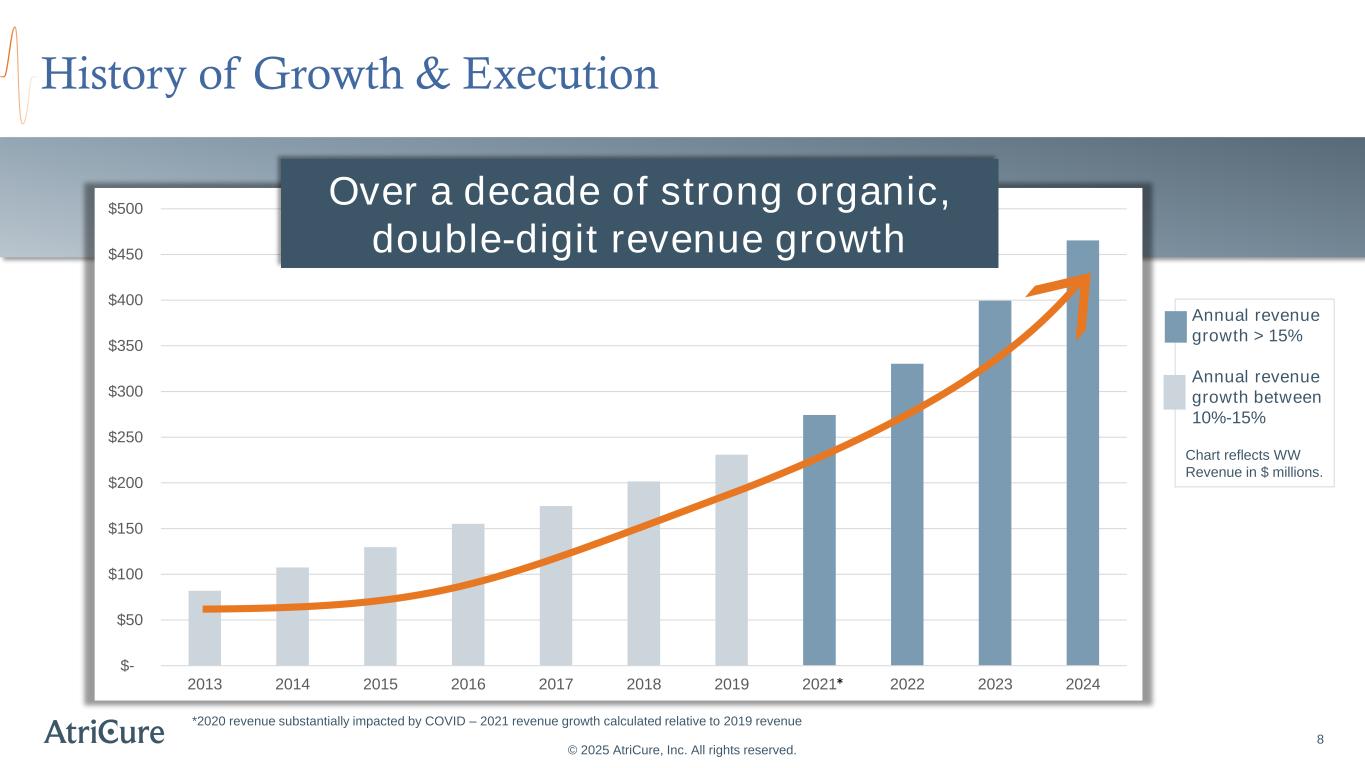

Annual revenue growth > 15% Annual revenue growth between 10%-15% Chart reflects WW Revenue in $ millions. $- $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 2013 2014 2015 2016 2017 2018 2019 2021 2022 2023 2024 8 History of Growth & Execution © 2025 AtriCure, Inc. All rights reserved. *2020 revenue substantially impacted by COVID – 2021 revenue growth calculated relative to 2019 revenue Over a decade of strong organic, double-digit revenue growth *

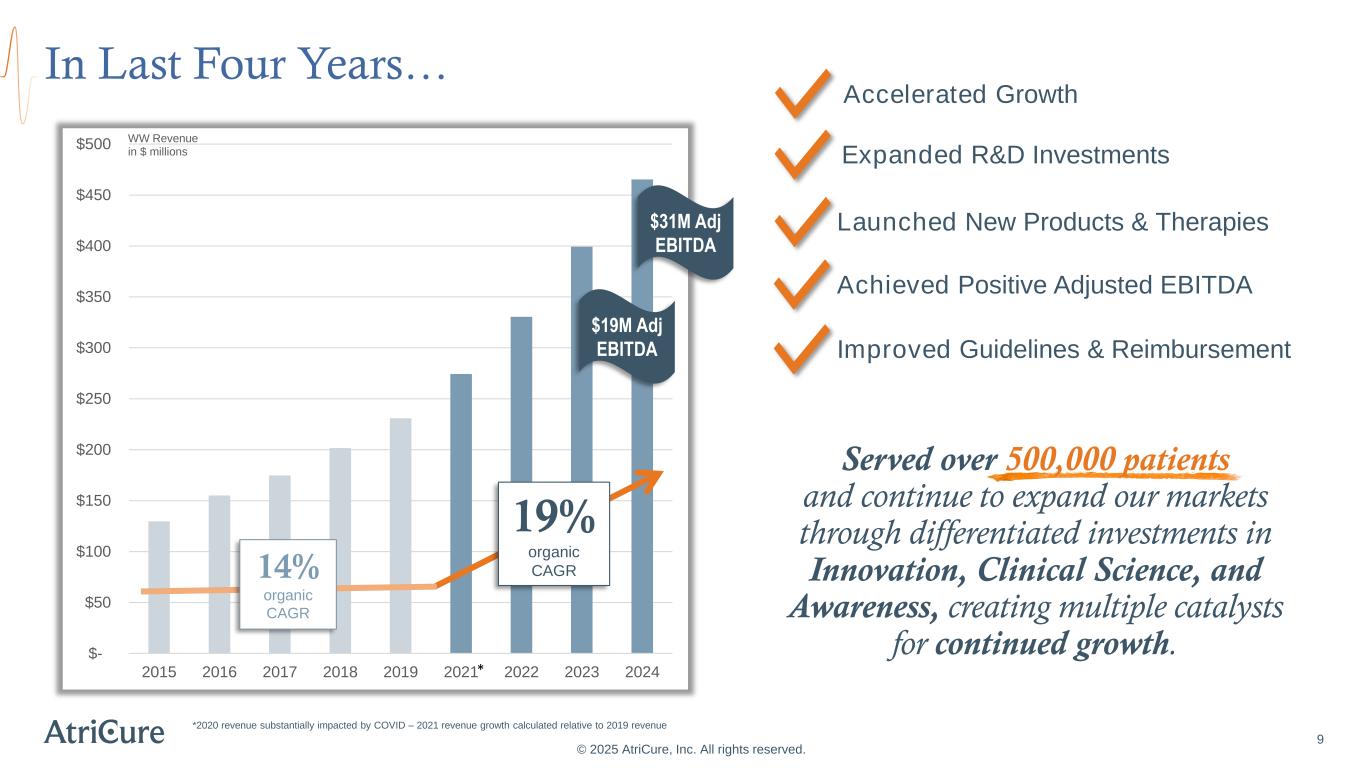

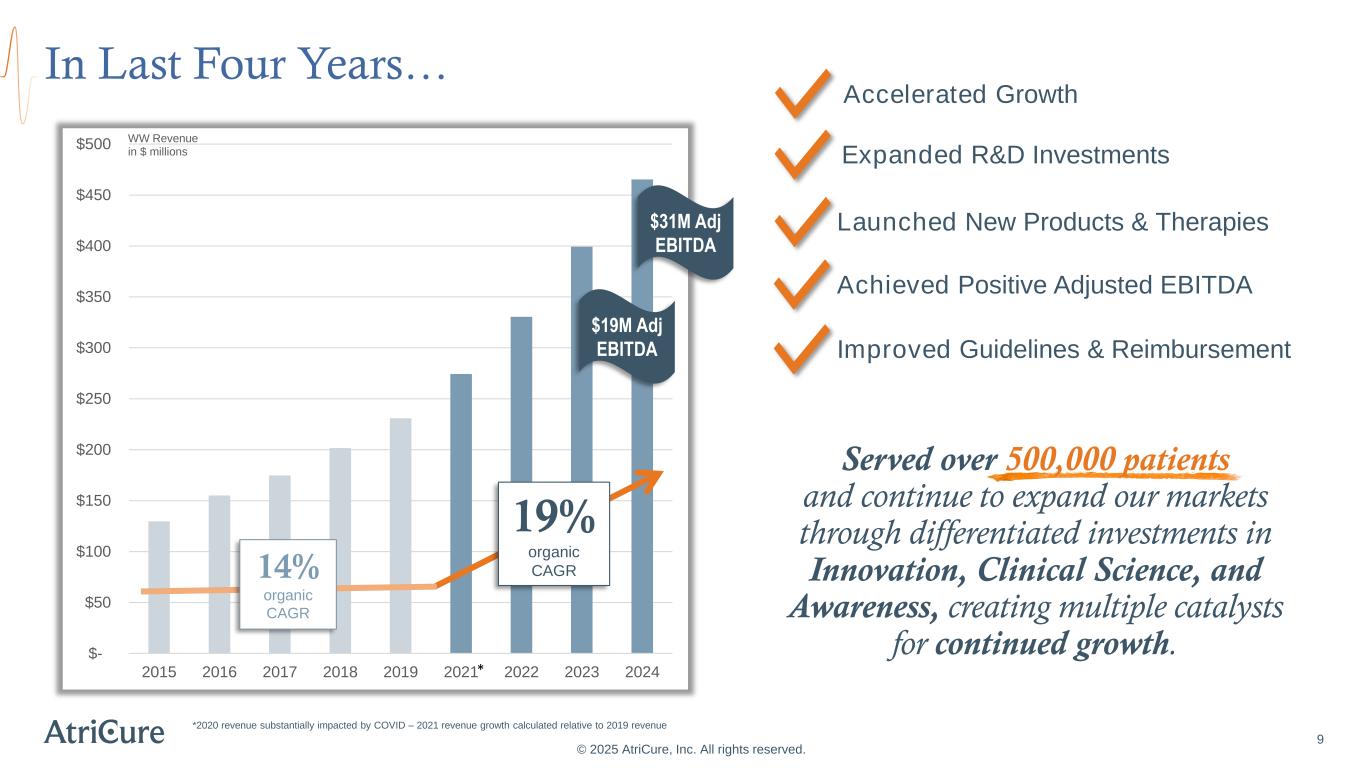

In Last Four Years… $- $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 2015 2016 2017 2018 2019 2021 2022 2023 2024 19% organic CAGR *2020 revenue substantially impacted by COVID – 2021 revenue growth calculated relative to 2019 revenue © 2025 AtriCure, Inc. All rights reserved. $19M Adj EBITDA $31M Adj EBITDA 14% organic CAGR Accelerated Growth Achieved Positive Adjusted EBITDA Expanded R&D Investments Launched New Products & Therapies Improved Guidelines & Reimbursement * WW Revenue in $ millions 9 Served over 500,000 patients and continue to expand our markets through differentiated investments in Innovation, Clinical Science, and Awareness, creating multiple catalysts for continued growth.

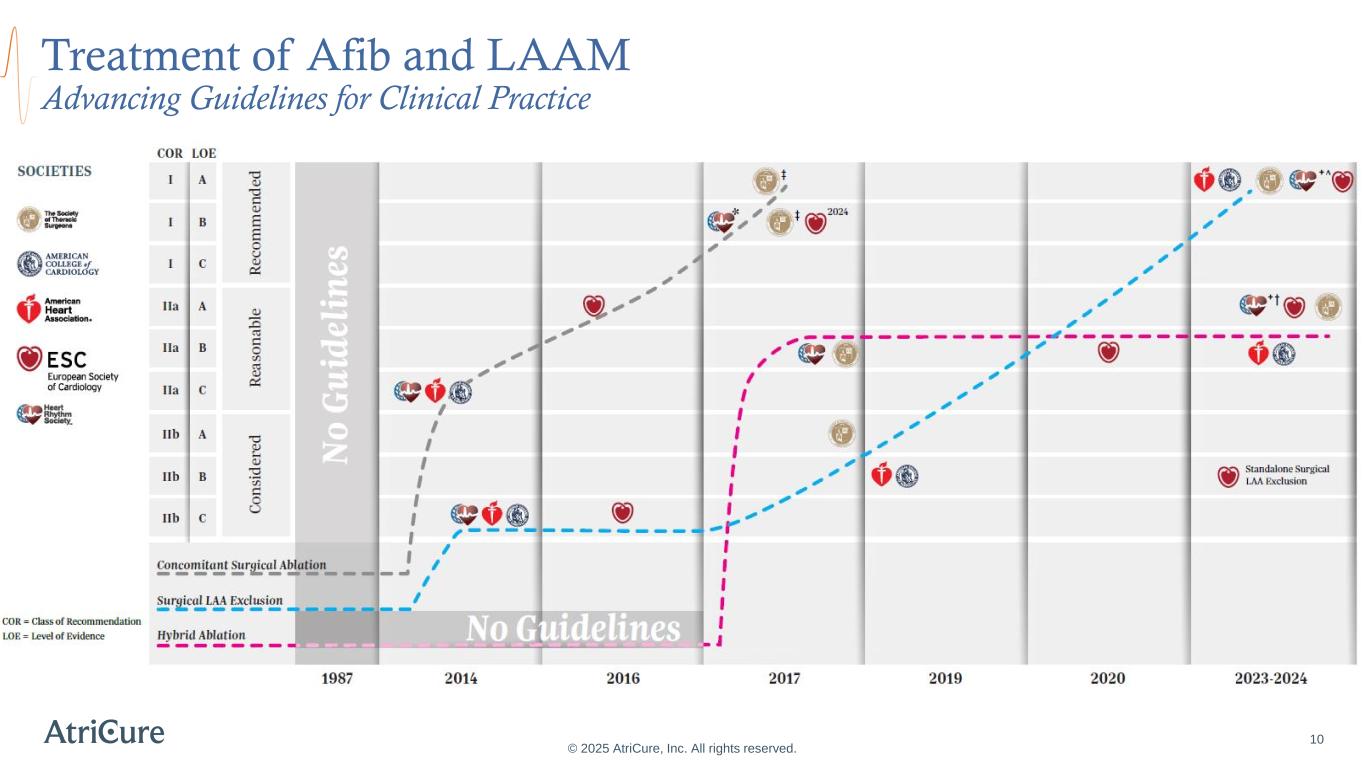

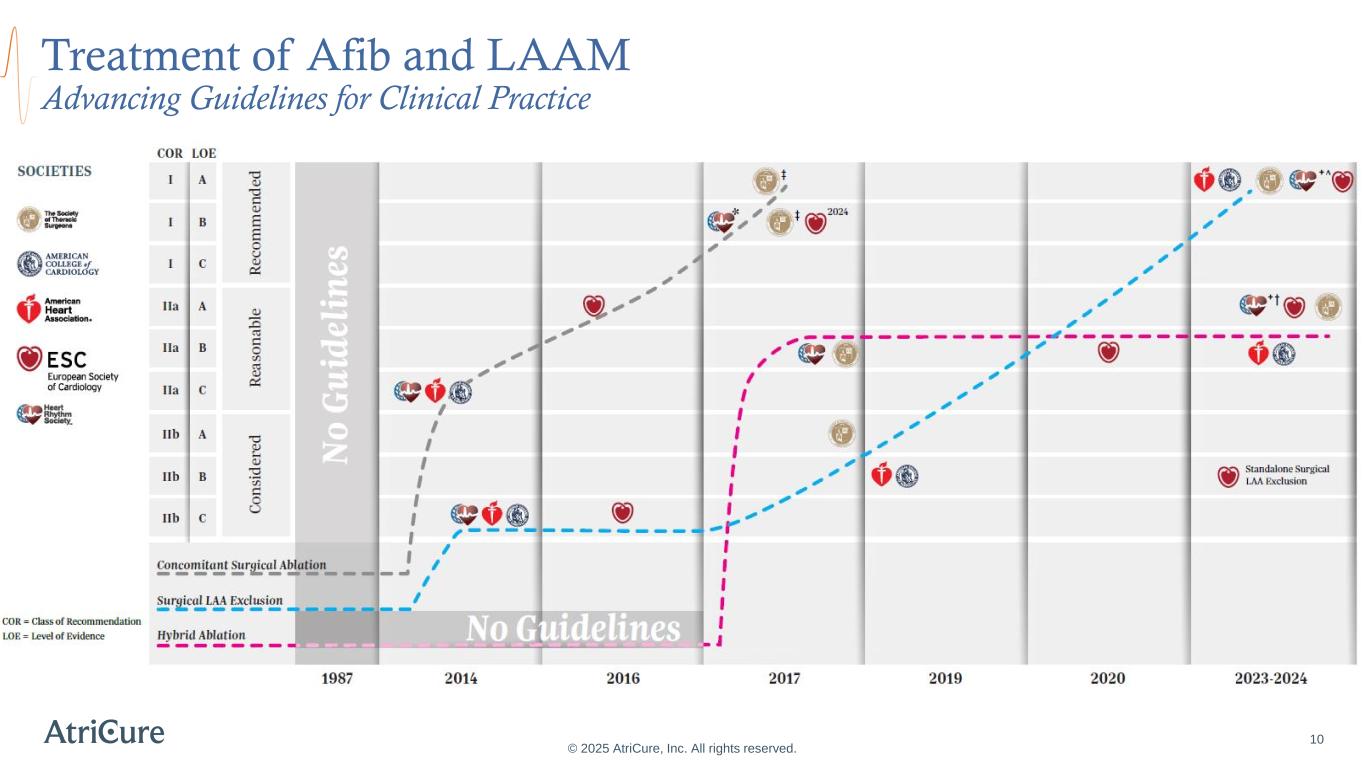

Treatment of Afib and LAAM Advancing Guidelines for Clinical Practice © 2025 AtriCure, Inc. All rights reserved. 10 Lasts beyond 7 days and as long as 1 year Lasts longer than 1 year without stopping

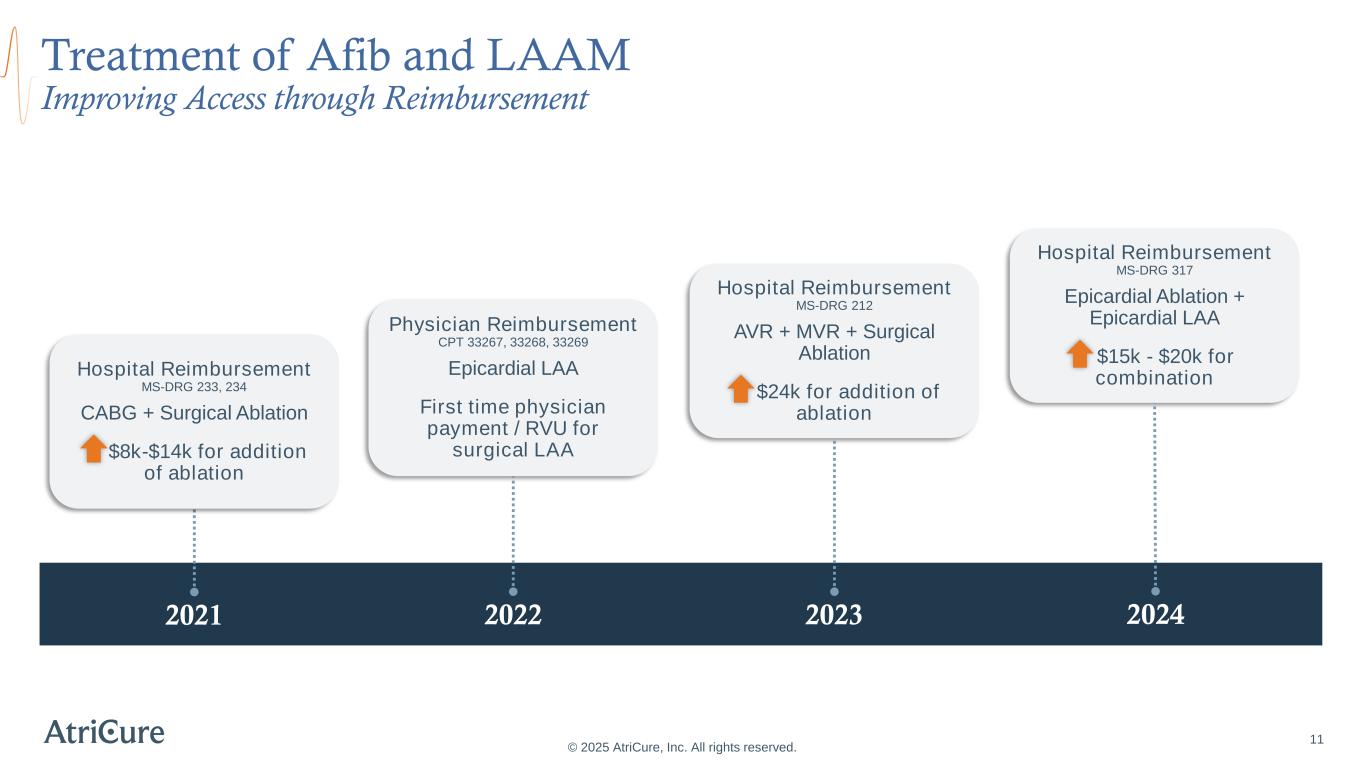

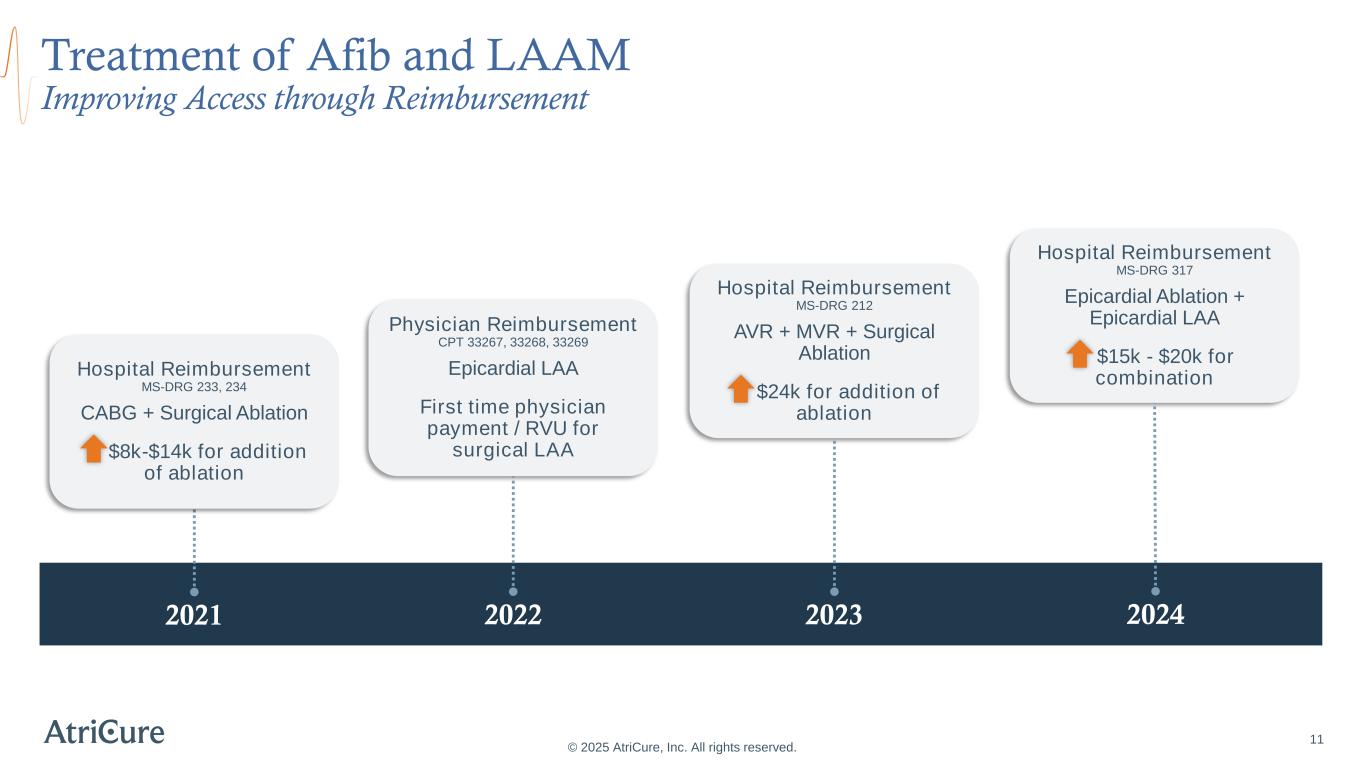

© 2025 AtriCure, Inc. All rights reserved. 11 Lasts longer than 1 year without stopping Treatment of Afib and LAAM Improving Access through Reimbursement 2021 2022 2023 2024 Hospital Reimbursement MS-DRG 233, 234 CABG + Surgical Ablation $8k-$14k for addition of ablation Physician Reimbursement CPT 33267, 33268, 33269 Epicardial LAA First time physician payment / RVU for surgical LAA Hospital Reimbursement MS-DRG 212 AVR + MVR + Surgical Ablation $24k for addition of ablation Hospital Reimbursement MS-DRG 317 Epicardial Ablation + Epicardial LAA $15k - $20k for combination

Creating and delivering Standards of Care to improve the lives of patients with the most complex arrythmias and reduce pain after surgery. We will help millions of patients as we drive continued strong revenue growth and market expansion. VISION FOR 2030 12 © 2025 AtriCure, Inc. All rights reserved.

By 2030 . . . Our Vision Expanding Patient Impact Increasing Profitability and Cash Flow Advancing Science through Clinical Trials Cultivating Markets as a Leader in each Innovating New Products and Therapies Valuing our Patients, People and Partners Growing Revenue to $1 Billion+ Creating Standards of Care for a world of unmet needs. 13 © 2025 AtriCure, Inc. All rights reserved.

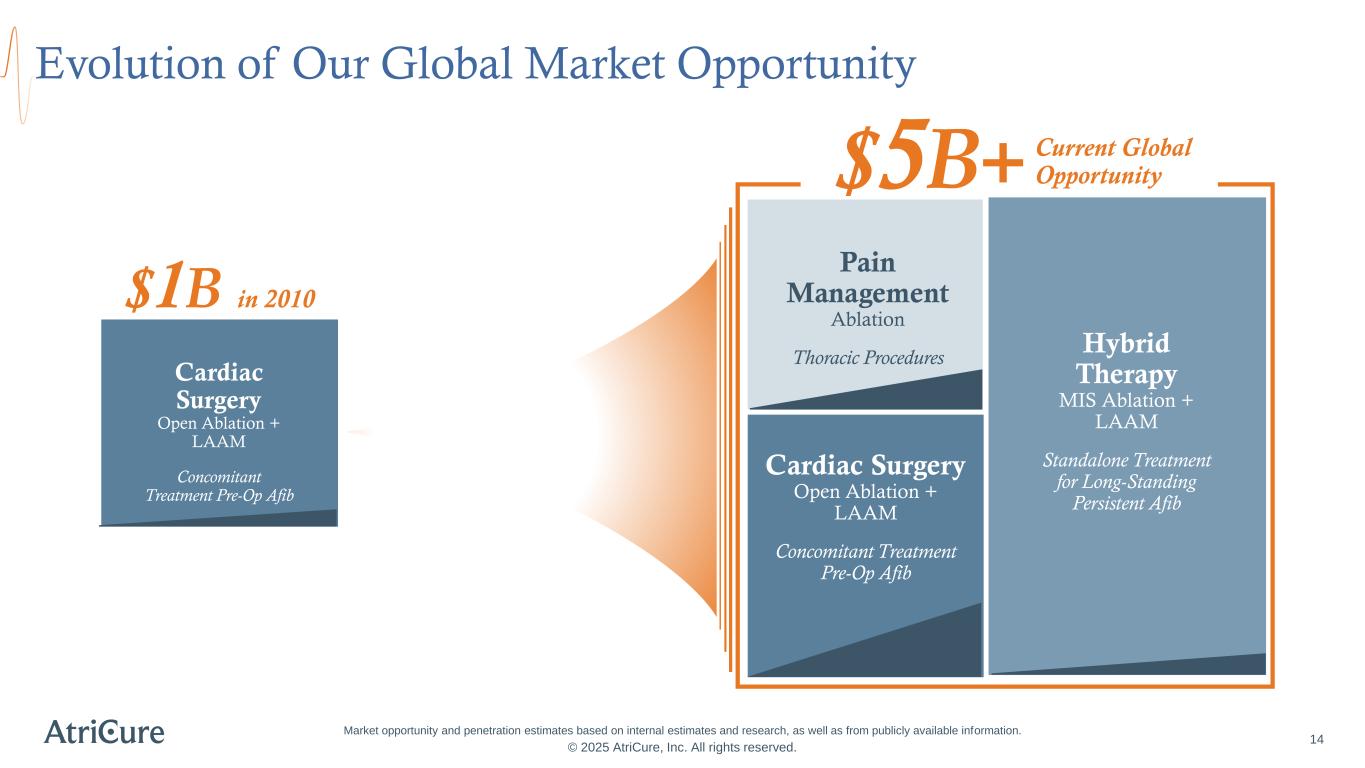

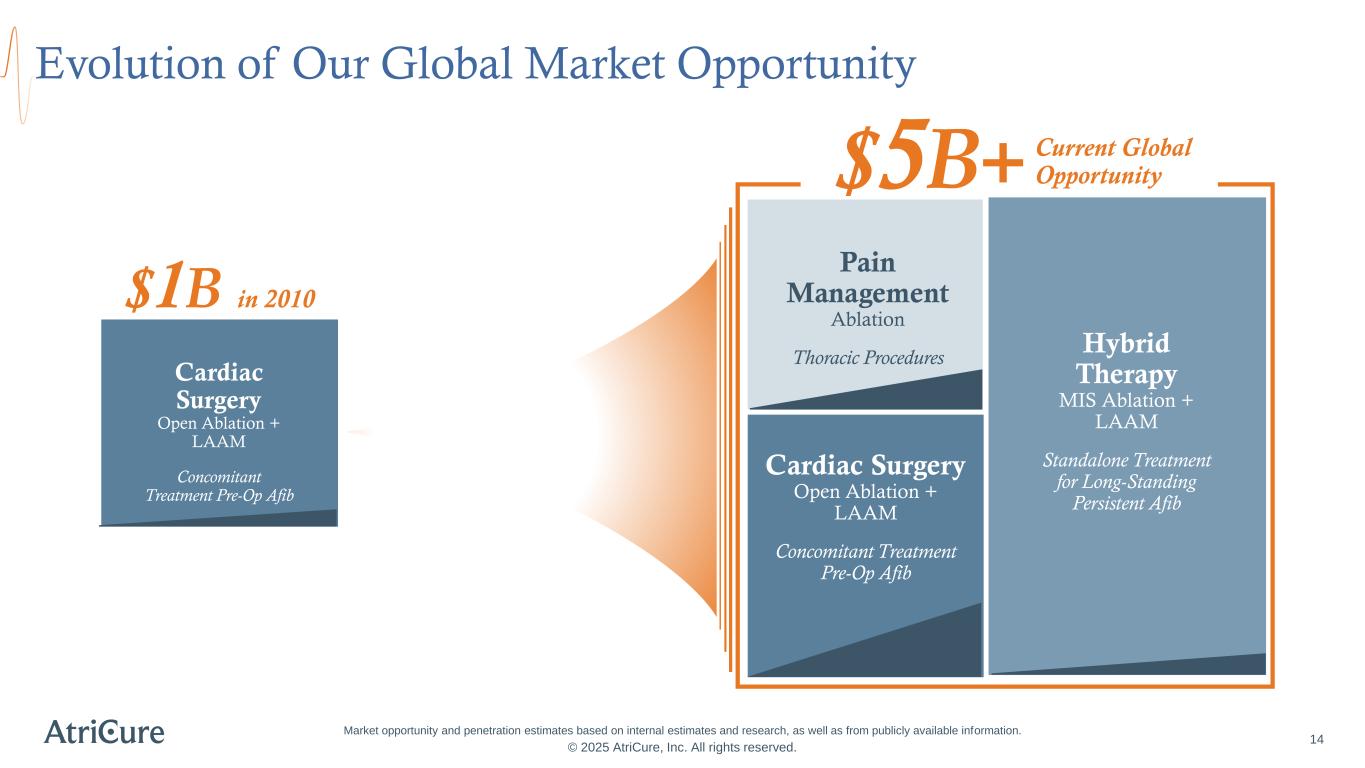

14 Evolution of Our Global Market Opportunity Pain Management Ablation Thoracic Procedures Hybrid Therapy MIS Ablation + LAAM Standalone Treatment for Long-Standing Persistent Afib Cardiac Surgery Open Ablation + LAAM Concomitant Treatment Pre-Op Afib Cardiac Surgery Open Ablation + LAAM Concomitant Treatment Pre-Op Afib Current Global Opportunity$5B+ $1B in 2010 © 2025 AtriCure, Inc. All rights reserved. Market opportunity and penetration estimates based on internal estimates and research, as well as from publicly available information.

Opportunity Will Grow to More Than $10B by 2030! © 2025 AtriCure, Inc. All rights reserved. 15 Market opportunity and penetration estimates based on internal estimates and research, as well as from publicly available information. Leading with innovation, clinical science and awareness to establish and grow our markets $10B+ Pain Management Ablation Thoracic Procedures Cardiac Surgery Open Ablation + LAAM Concomitant Treatment Pre-Op Afib Hybrid Therapy MIS Ablation + LAAM Standalone Treatment for Long-Standing Persistent Afib Cardiac Surgery LAAM Concomitant Treatment PMA study underway for Non-Afib LAAM Pain Management Ablation Sternotomy Procedures Hybrid Therapy MIS Ablation PMA study underway for IST Pain Management Ablation Extremities Cardiac Surgery Ablation Concomitant Treatment PMA study underway for Non-Afib Ablation Global Opportunity +

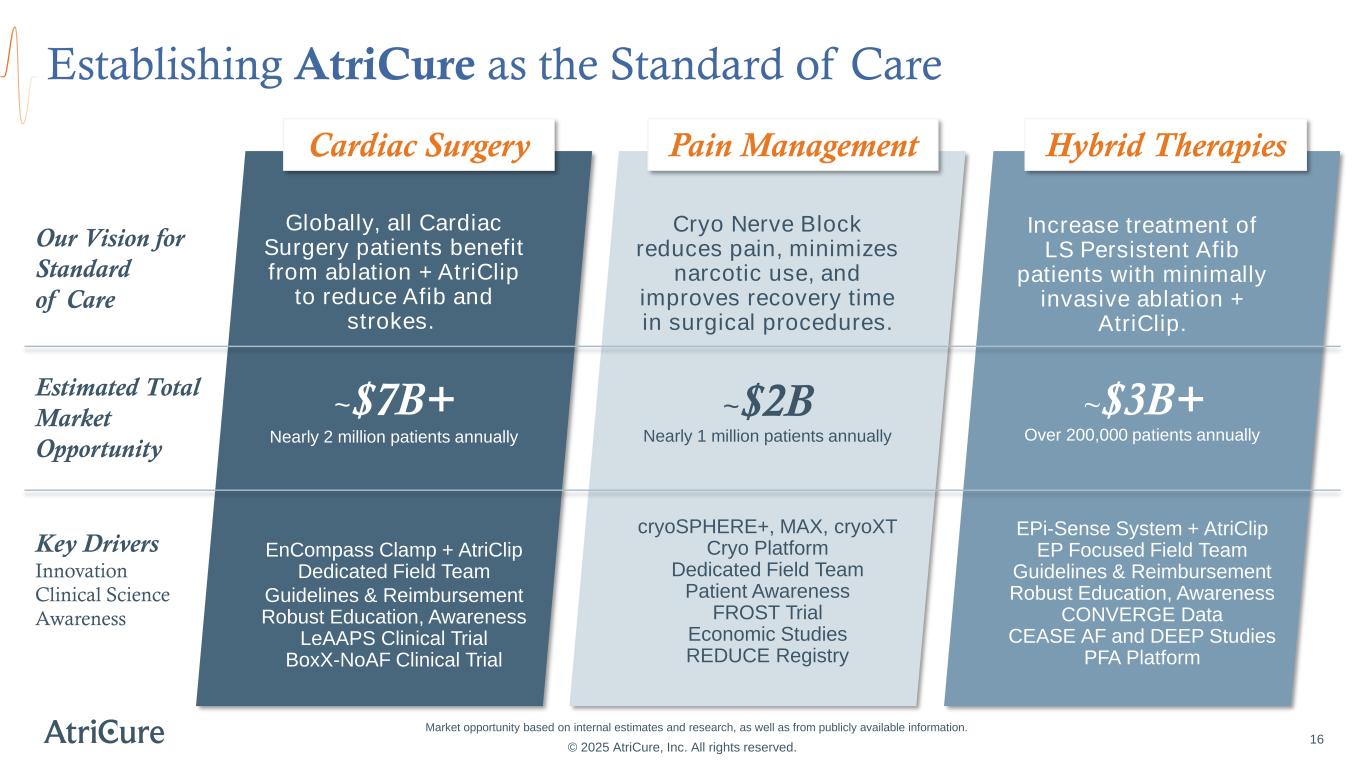

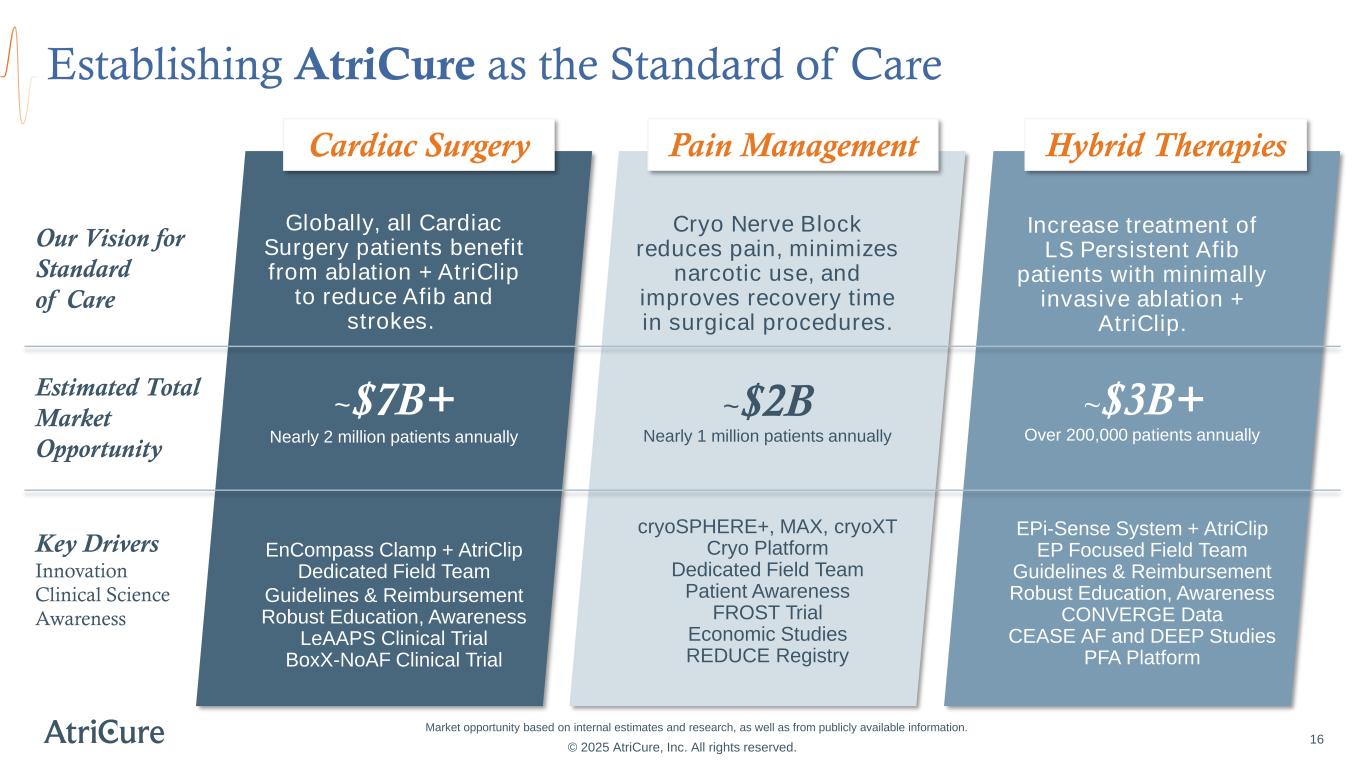

Establishing AtriCure as the Standard of Care Estimated Total Market Opportunity Our Vision for Standard of Care Key Drivers Innovation Clinical Science Awareness Globally, all Cardiac Surgery patients benefit from ablation + AtriClip to reduce Afib and strokes. ~$7B+ Nearly 2 million patients annually EnCompass Clamp + AtriClip Dedicated Field Team Guidelines & Reimbursement Robust Education, Awareness LeAAPS Clinical Trial BoxX-NoAF Clinical Trial Cardiac Surgery Increase treatment of LS Persistent Afib patients with minimally invasive ablation + AtriClip. ~$3B+ Over 200,000 patients annually EPi-Sense System + AtriClip EP Focused Field Team Guidelines & Reimbursement Robust Education, Awareness CONVERGE Data CEASE AF and DEEP Studies PFA Platform Hybrid Therapies Cryo Nerve Block reduces pain, minimizes narcotic use, and improves recovery time in surgical procedures. ~$2B Nearly 1 million patients annually cryoSPHERE+, MAX, cryoXT Cryo Platform Dedicated Field Team Patient Awareness FROST Trial Economic Studies REDUCE Registry Pain Management 16 © 2025 AtriCure, Inc. All rights reserved. Market opportunity based on internal estimates and research, as well as from publicly available information.

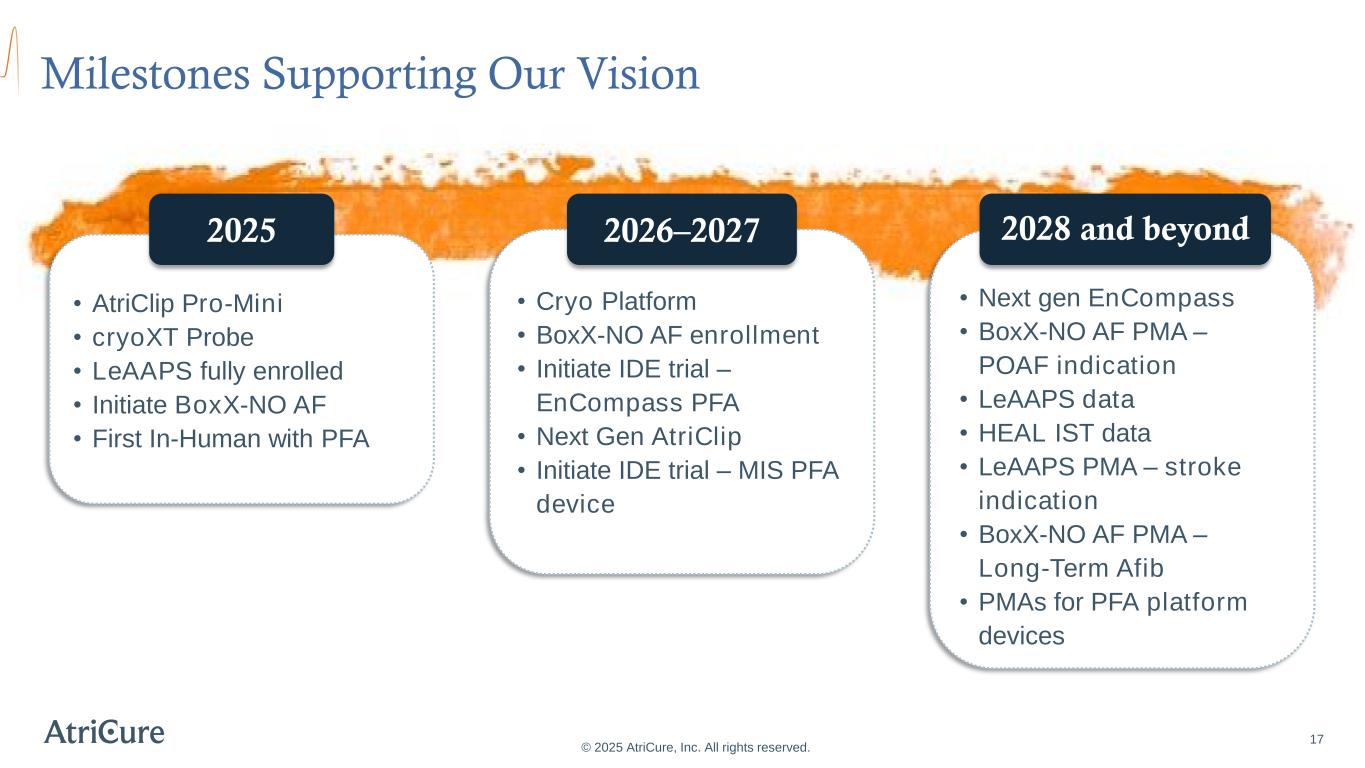

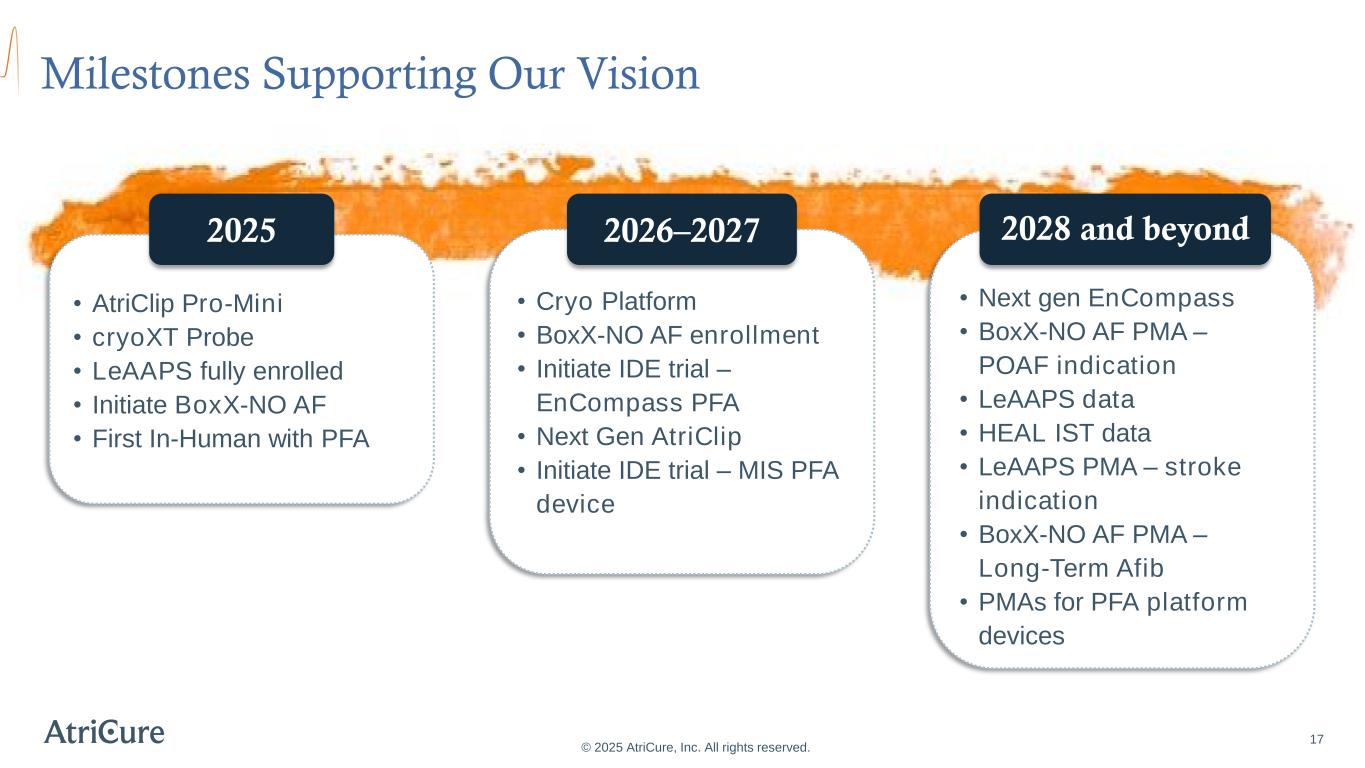

Milestones Supporting Our Vision 17 © 2025 AtriCure, Inc. All rights reserved. • AtriClip Pro-Mini • cryoXT Probe • LeAAPS fully enrolled • Initiate BoxX-NO AF • First In-Human with PFA 2025 • Cryo Platform • BoxX-NO AF enrollment • Initiate IDE trial – EnCompass PFA • Next Gen AtriClip • Initiate IDE trial – MIS PFA device 2026–2027 • Next gen EnCompass • BoxX-NO AF PMA – POAF indication • LeAAPS data • HEAL IST data • LeAAPS PMA – stroke indication • BoxX-NO AF PMA – Long-Term Afib • PMAs for PFA platform devices 2028 and beyond

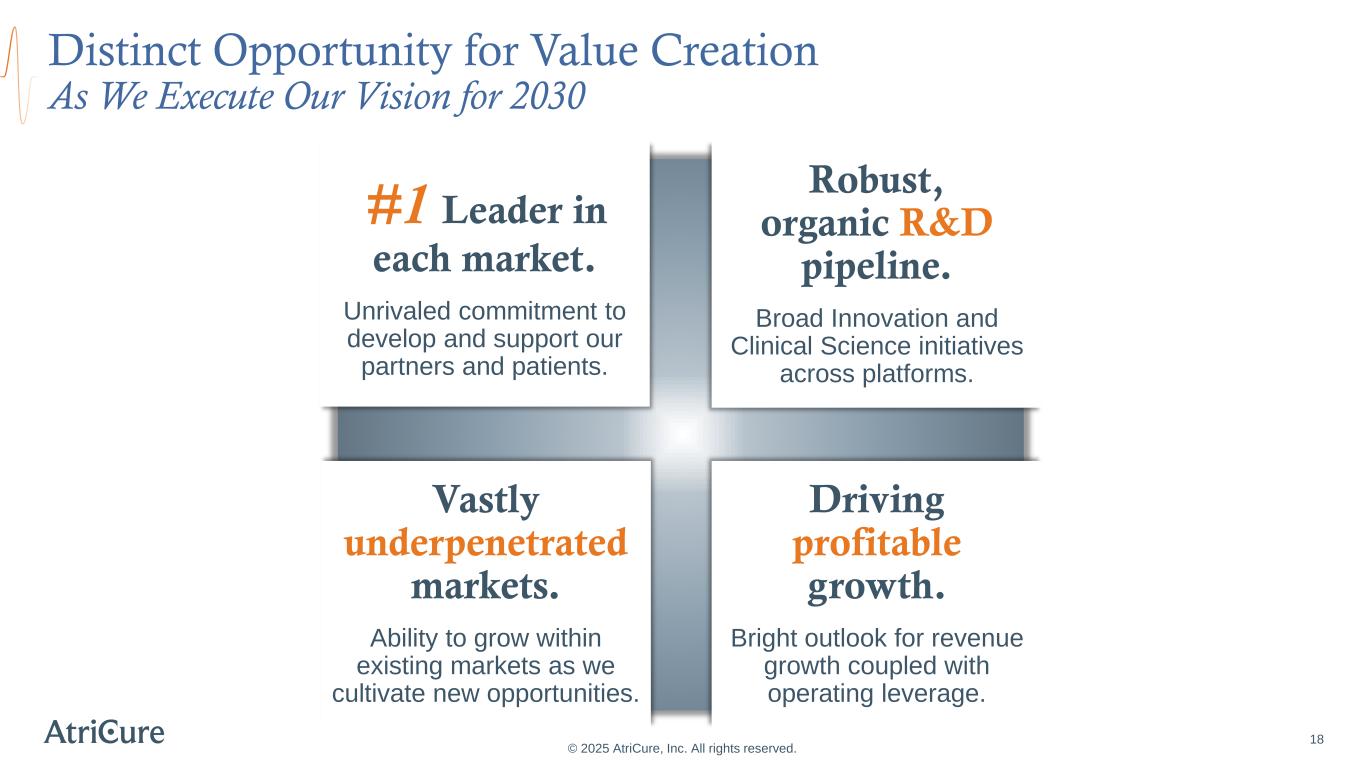

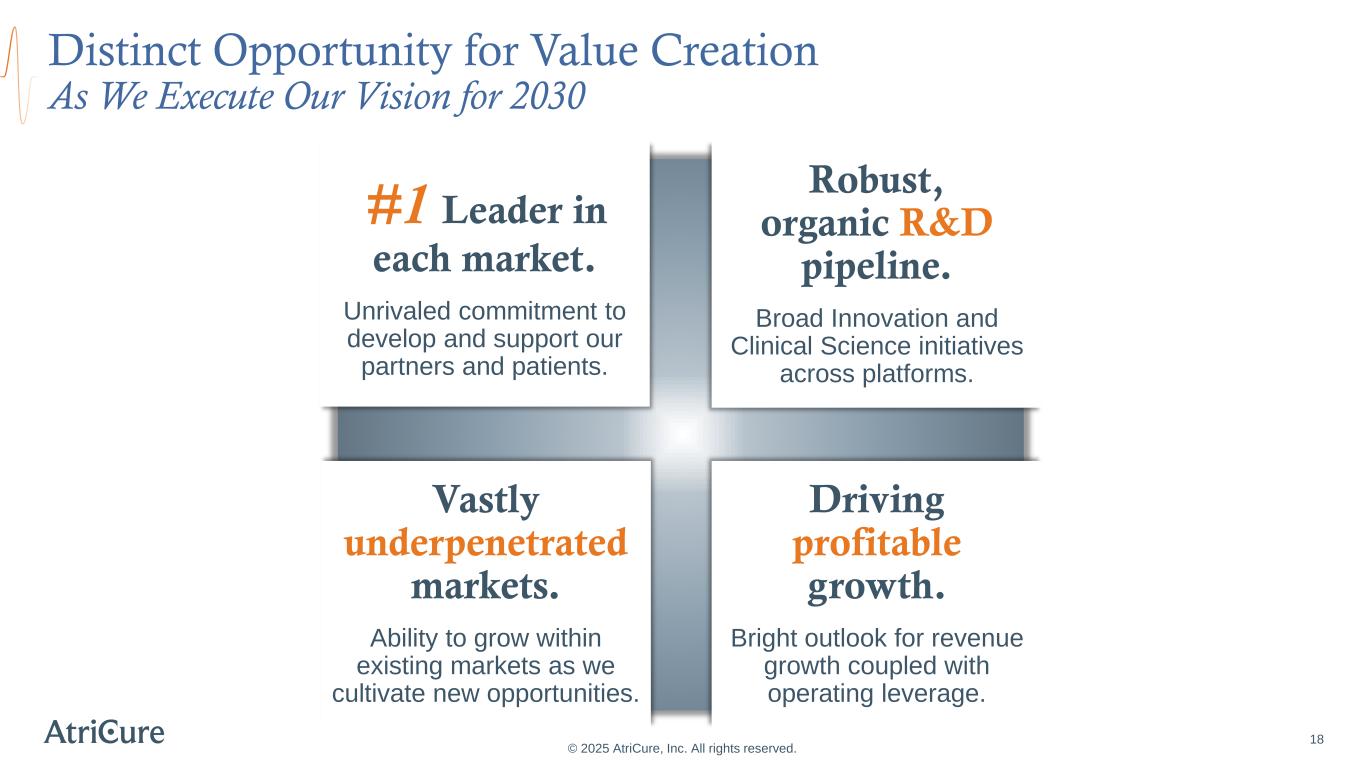

Distinct Opportunity for Value Creation As We Execute Our Vision for 2030 #1 Leader in each market. Unrivaled commitment to develop and support our partners and patients. Driving profitable growth. Bright outlook for revenue growth coupled with operating leverage. Robust, organic R&D pipeline. Broad Innovation and Clinical Science initiatives across platforms. Vastly underpenetrated markets. Ability to grow within existing markets as we cultivate new opportunities. © 2025 AtriCure, Inc. All rights reserved. 18

© 2025 AtriCure, Inc. All rights reserved. Analyst & Investor Day Program Market Expansion through Key Cardiac Surgery Trials: LeAAPS and BoxX-NO AF Featuring Dr. Richard Whitlock and Dr. Ed Soltesz CONVERGE and Catheter-based PFA Awareness Featuring Dr. Kevin Makati and Dr. Nitesh Sood Overview of AtriCure’s PFA Platform Strategy for Pain Management Opportunity with Cryo Nerve Block Justin Noznesky, Chief Marketing & Strategy Officer Sam Privitera, Chief Technology Officer AtriCure’s Financial Profile and Goals Angie Wirick, Chief Financial Officer Creating Standards of Care for a world of unmet needs. 19

© 2025 AtriCure, Inc. All rights reserved. creating standards of care for a world of unmet needs

© 2025 AtriCure, Inc. All rights reserved. Analyst & Investor Day: Financial Overview Angie Wirick, CFO

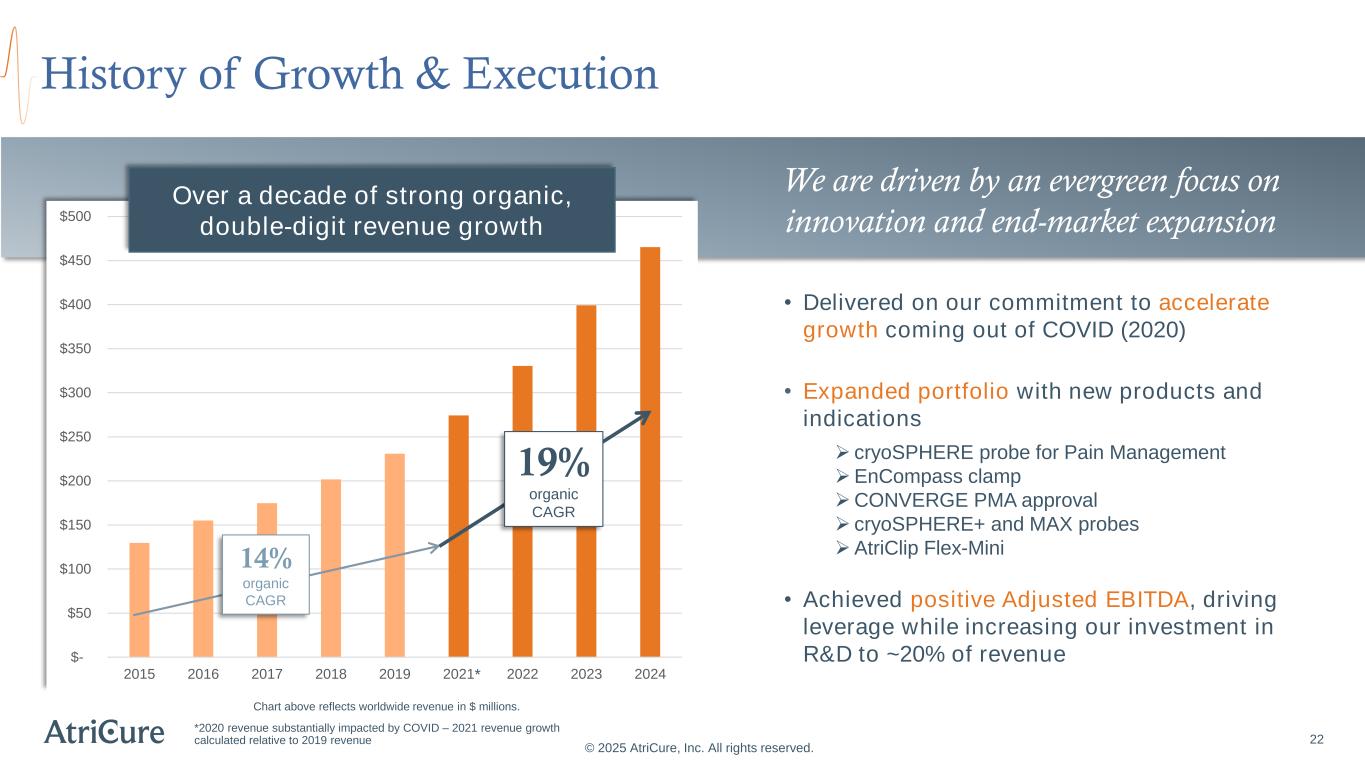

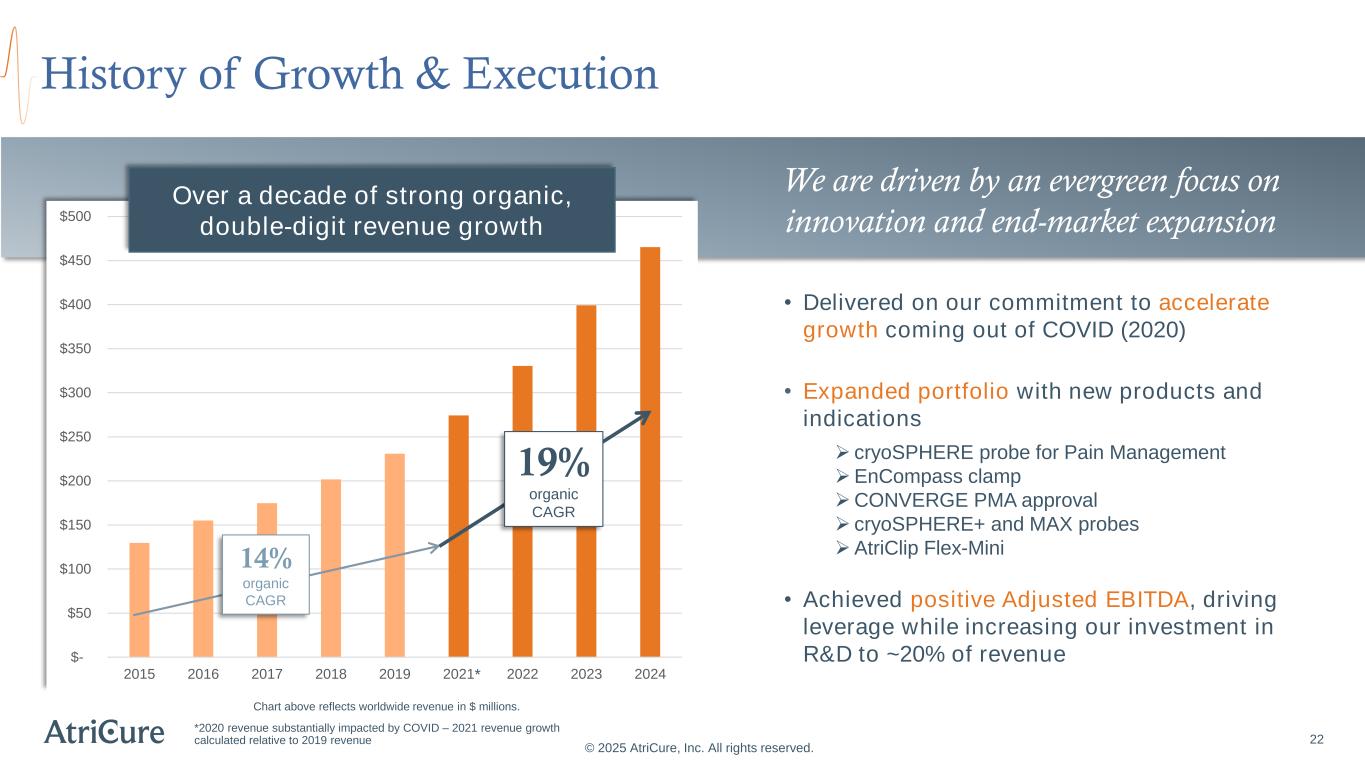

22 History of Growth & Execution © 2025 AtriCure, Inc. All rights reserved. We are driven by an evergreen focus on innovation and end-market expansion *2020 revenue substantially impacted by COVID – 2021 revenue growth calculated relative to 2019 revenue • Delivered on our commitment to accelerate growth coming out of COVID (2020) • Expanded portfolio with new products and indications ➢ cryoSPHERE probe for Pain Management ➢EnCompass clamp ➢CONVERGE PMA approval ➢ cryoSPHERE+ and MAX probes ➢AtriClip Flex-Mini • Achieved positive Adjusted EBITDA, driving leverage while increasing our investment in R&D to ~20% of revenue $- $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 2015 2016 2017 2018 2019 2021 2022 2023 2024 Over a decade of strong organic, double-digit revenue growth 14% organic CAGR 19% organic CAGR * Chart above reflects worldwide revenue in $ millions.

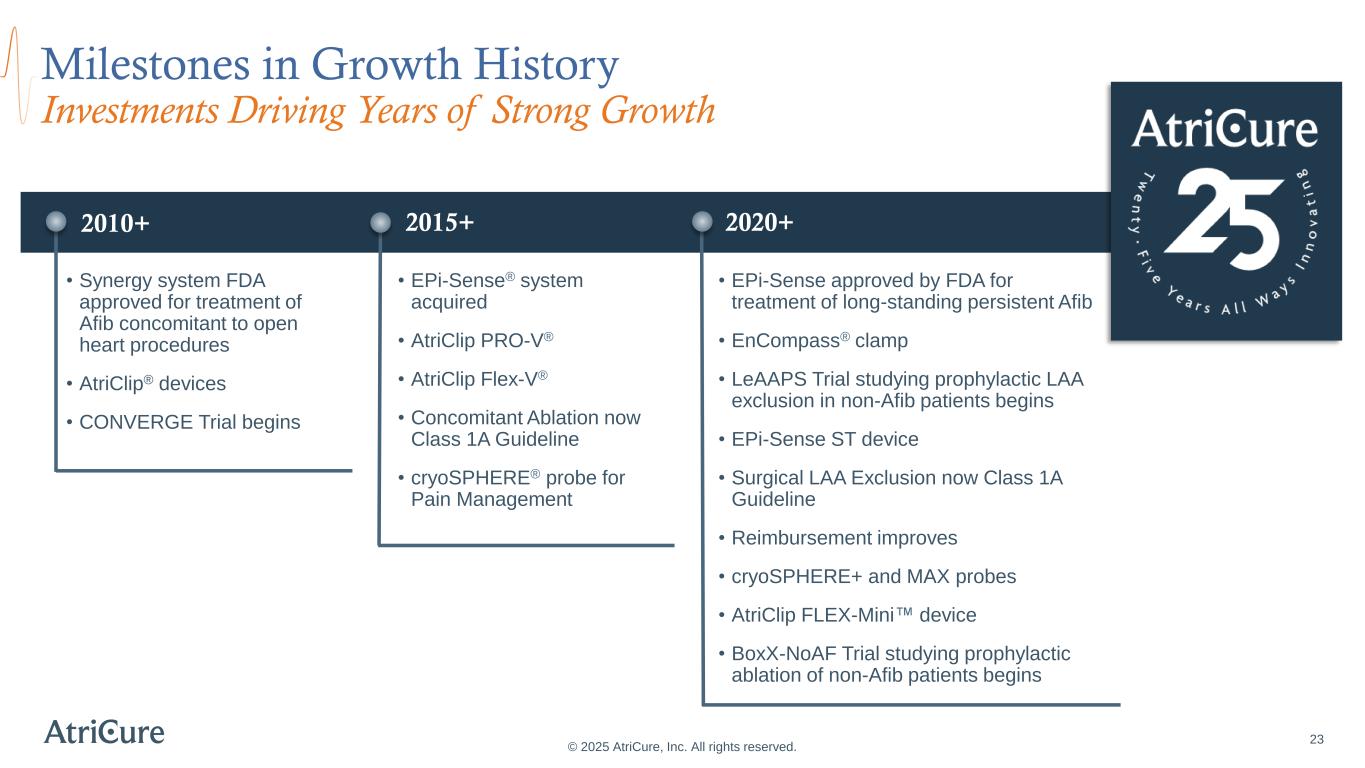

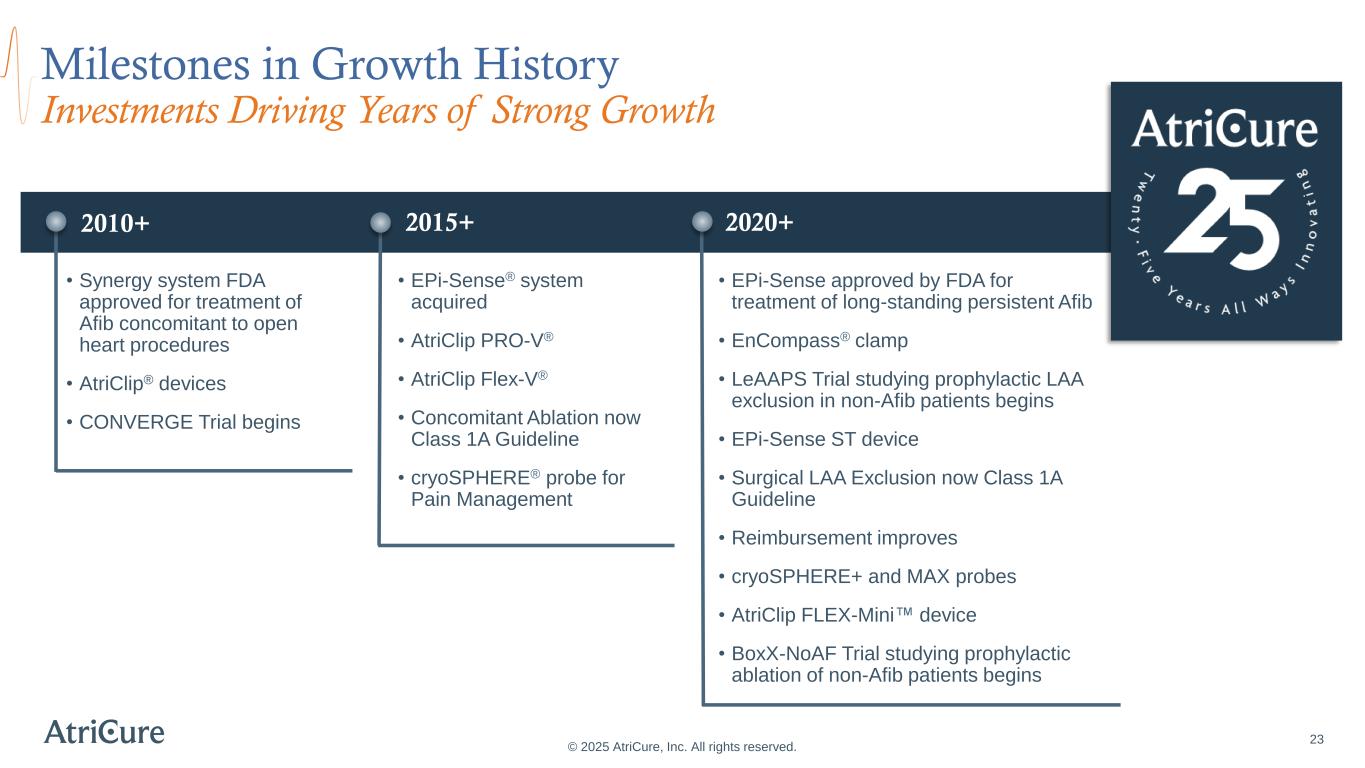

2010+ 23 Milestones in Growth History Investments Driving Years of Strong Growth © 2025 AtriCure, Inc. All rights reserved. • Synergy system FDA approved for treatment of Afib concomitant to open heart procedures • AtriClip® devices • CONVERGE Trial begins • EPi-Sense® system acquired • AtriClip PRO-V® • AtriClip Flex-V® • Concomitant Ablation now Class 1A Guideline • cryoSPHERE® probe for Pain Management • EPi-Sense approved by FDA for treatment of long-standing persistent Afib • EnCompass® clamp • LeAAPS Trial studying prophylactic LAA exclusion in non-Afib patients begins • EPi-Sense ST device • Surgical LAA Exclusion now Class 1A Guideline • Reimbursement improves • cryoSPHERE+ and MAX probes • AtriClip FLEX-Mini device • BoxX-NoAF Trial studying prophylactic ablation of non-Afib patients begins 2015+ 2020+

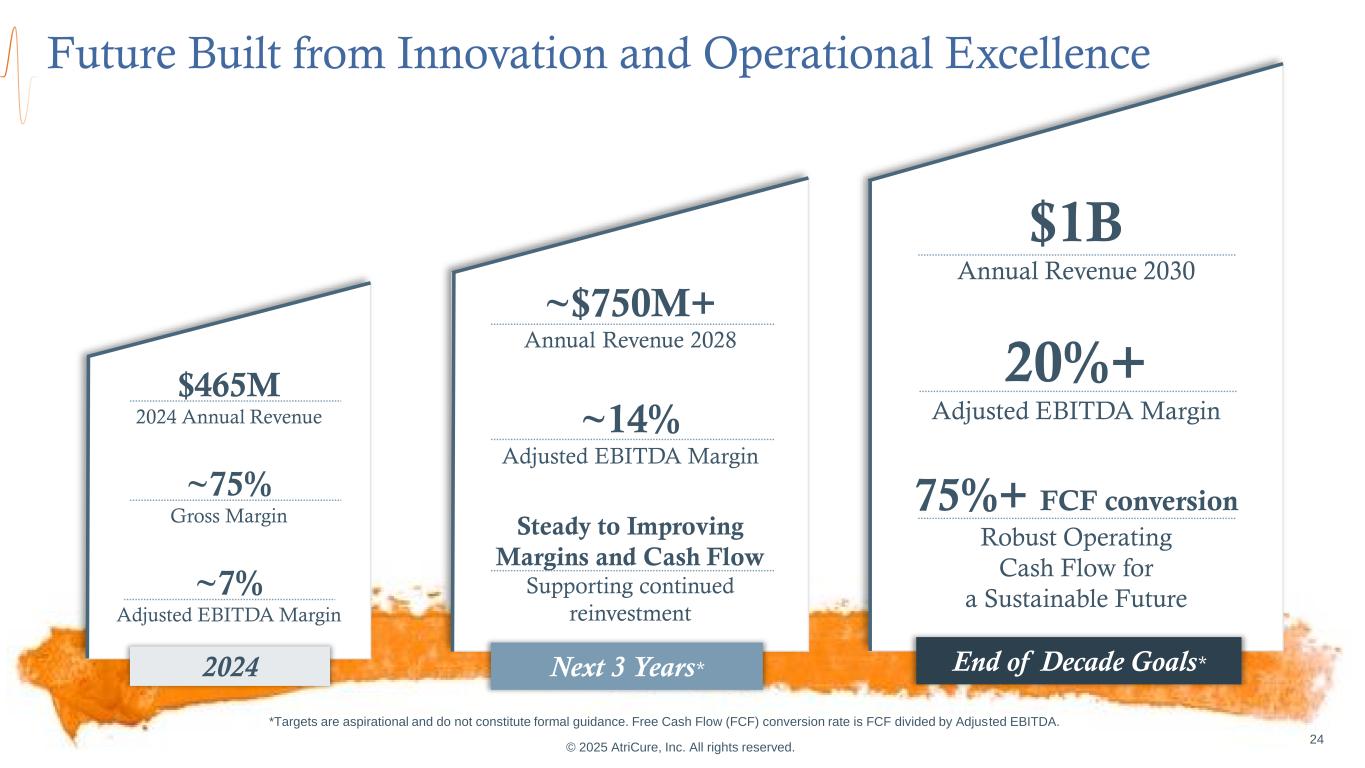

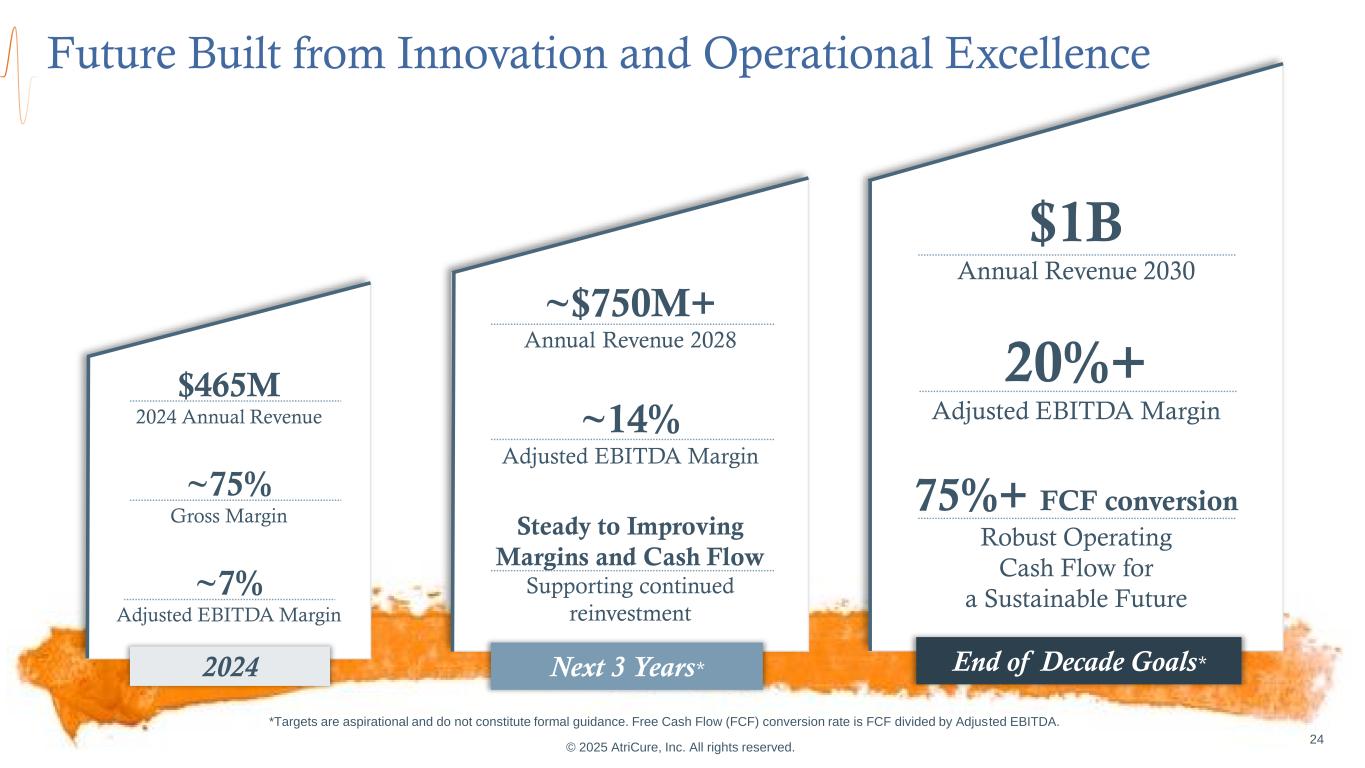

$1B Annual Revenue 2030 20%+ Adjusted EBITDA Margin 75%+ FCF conversion Robust Operating Cash Flow for a Sustainable Future ~$750M+ Annual Revenue 2028 ~14% Adjusted EBITDA Margin Steady to Improving Margins and Cash Flow Supporting continued reinvestment © 2025 AtriCure, Inc. All rights reserved. 24 $465M 2024 Annual Revenue ~75% Gross Margin ~7% Adjusted EBITDA Margin Future Built from Innovation and Operational Excellence End of Decade Goals*Next 3 Years*2024 *Targets are aspirational and do not constitute formal guidance. Free Cash Flow (FCF) conversion rate is FCF divided by Adjusted EBITDA.

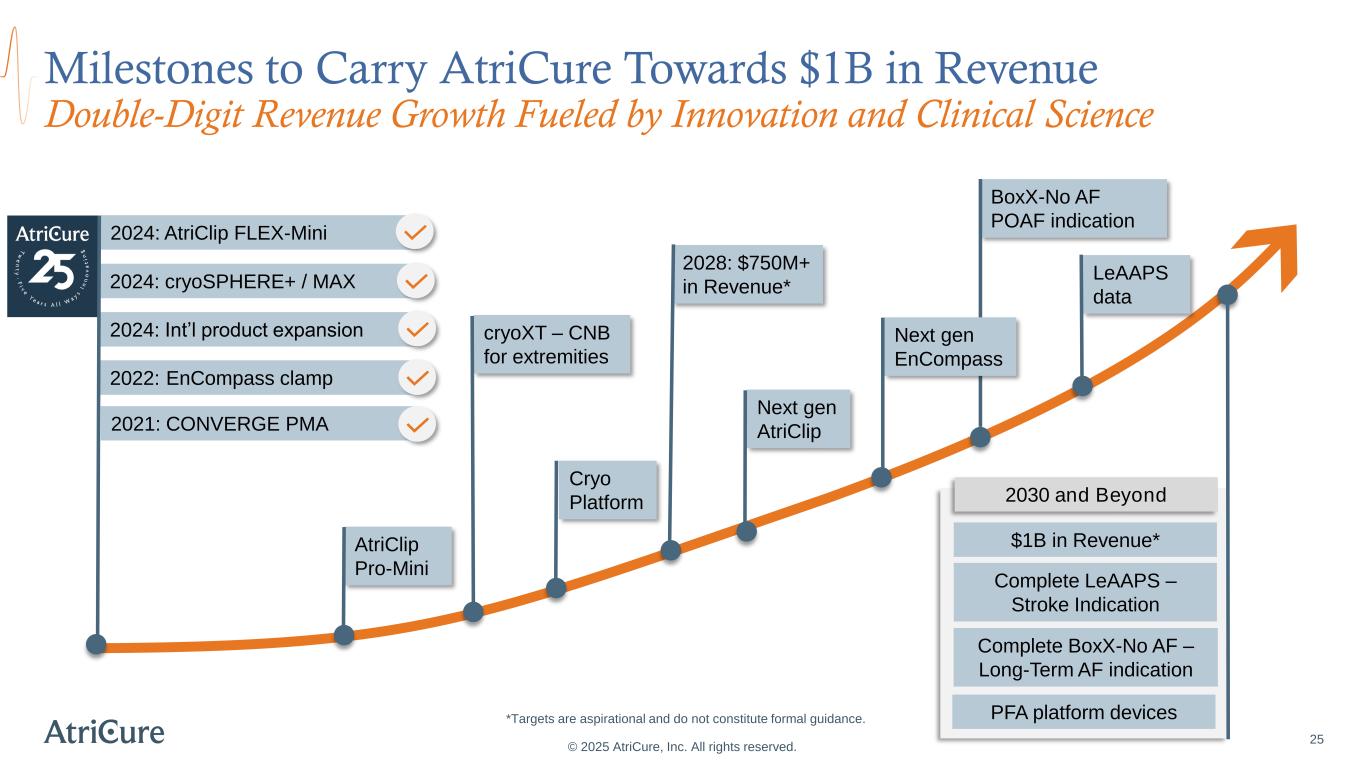

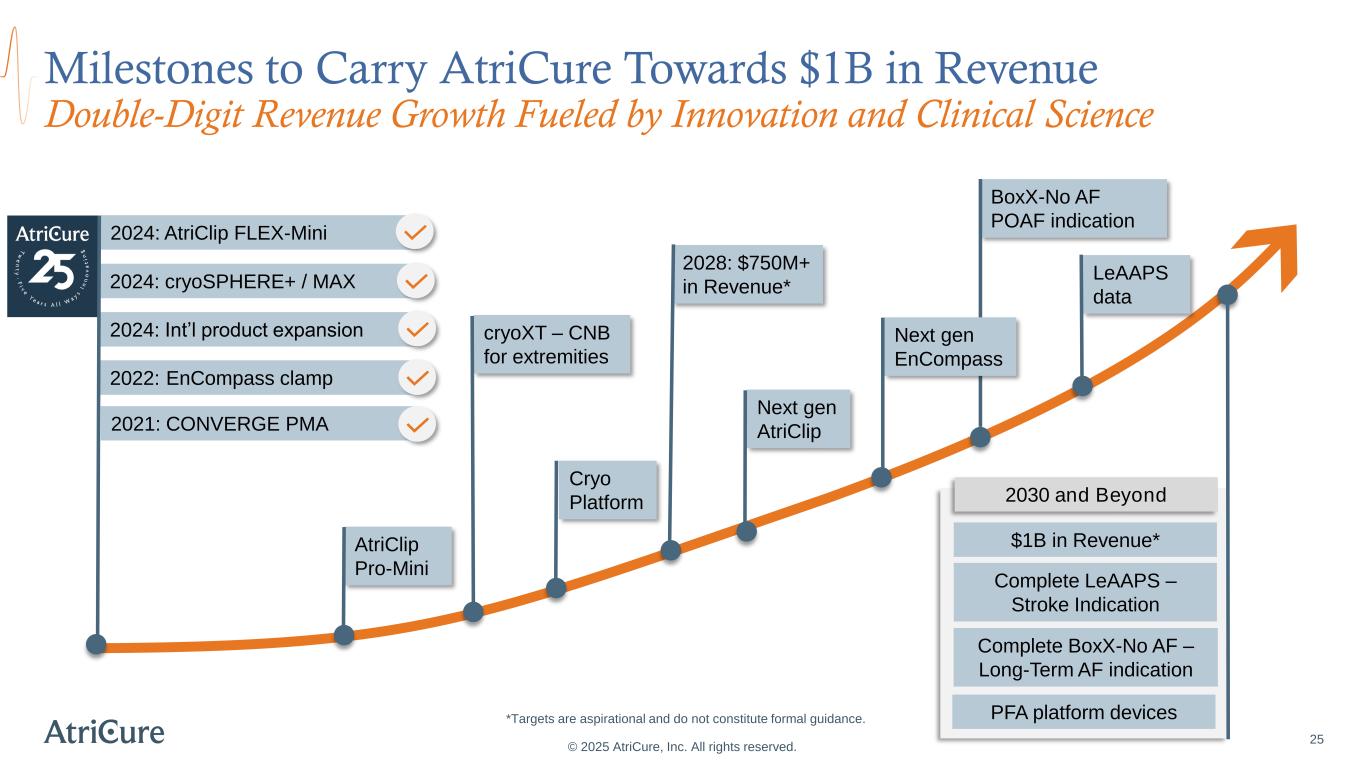

2024: Int’l product expansion 2022: EnCompass clamp 2024: cryoSPHERE+ / MAX 2028: $750M+ in Revenue* 25 Milestones to Carry AtriCure Towards $1B in Revenue Double-Digit Revenue Growth Fueled by Innovation and Clinical Science © 2025 AtriCure, Inc. All rights reserved. 2030 and Beyond $1B in Revenue* Complete LeAAPS – Stroke Indication Complete BoxX-No AF – Long-Term AF indication cryoXT – CNB for extremities 2024: AtriClip FLEX-Mini BoxX-No AF POAF indication PFA platform devices*Targets are aspirational and do not constitute formal guidance. Next gen AtriClip AtriClip Pro-Mini Cryo Platform 2021: CONVERGE PMA LeAAPS data Next gen EnCompass

26 Key Takeaways © 2025 AtriCure, Inc. All rights reserved. • Building standards of care in existing large, underpenetrated markets • Innovating to reach new, expanded patient populations • Focusing on organic R&D initiatives to deliver differentiated therapies for patients and providers • Supporting clinical efforts for therapy adoption and expanded indications • Delivering durable, double-digit revenue growth • Driving improved profitability while investing in growth opportunities • Creating a diversified portfolio to propel strong, profitable growth

© 2025 AtriCure, Inc. All rights reserved. Questions? Thank You creating standards of care for a world of unmet needs

© 2025 AtriCure, Inc. All rights reserved. References and Abbreviations

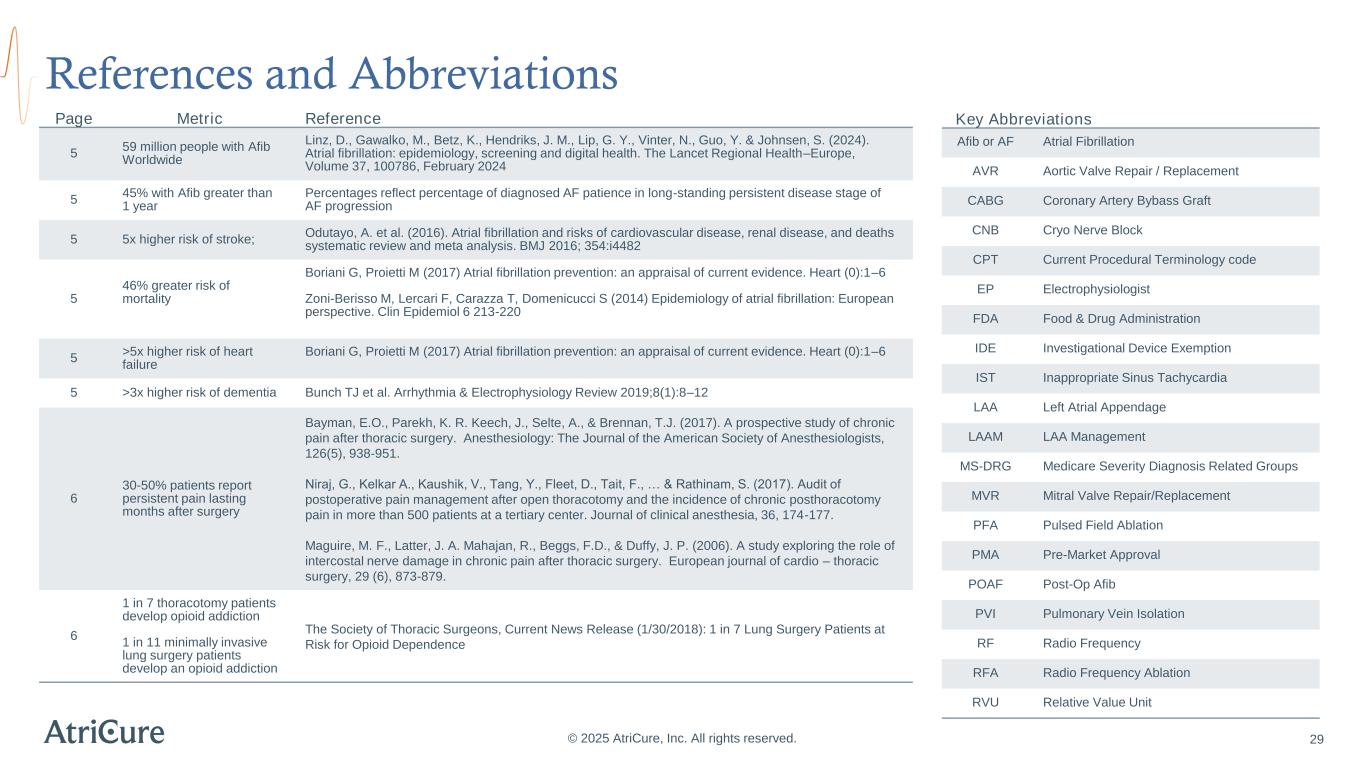

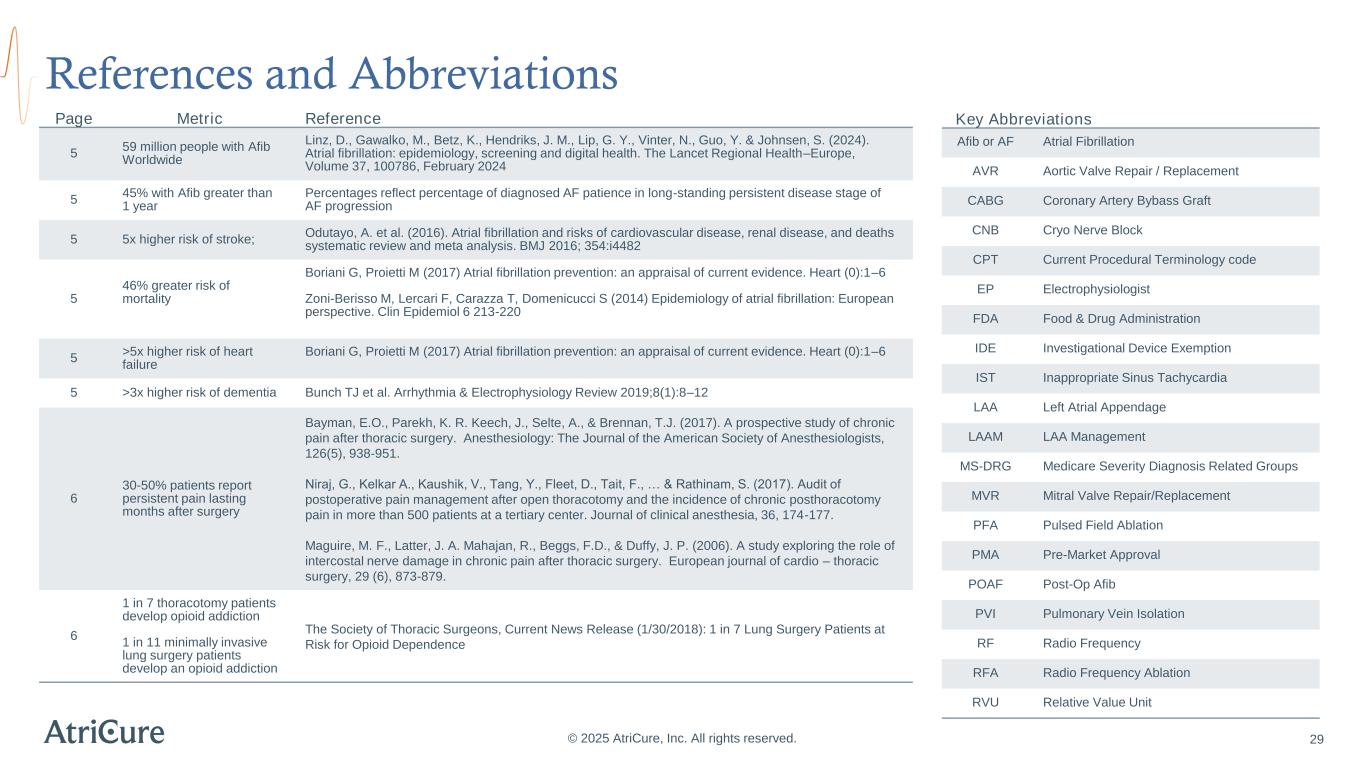

References and Abbreviations © 2025 AtriCure, Inc. All rights reserved. Page Metric Reference 5 59 million people with Afib Worldwide Linz, D., Gawalko, M., Betz, K., Hendriks, J. M., Lip, G. Y., Vinter, N., Guo, Y. & Johnsen, S. (2024). Atrial fibrillation: epidemiology, screening and digital health. The Lancet Regional Health–Europe, Volume 37, 100786, February 2024 5 45% with Afib greater than 1 year Percentages reflect percentage of diagnosed AF patience in long-standing persistent disease stage of AF progression 5 5x higher risk of stroke; Odutayo, A. et al. (2016). Atrial fibrillation and risks of cardiovascular disease, renal disease, and deaths systematic review and meta analysis. BMJ 2016; 354:i4482 5 46% greater risk of mortality Boriani G, Proietti M (2017) Atrial fibrillation prevention: an appraisal of current evidence. Heart (0):1–6 Zoni-Berisso M, Lercari F, Carazza T, Domenicucci S (2014) Epidemiology of atrial fibrillation: European perspective. Clin Epidemiol 6 213-220 5 >5x higher risk of heart failure Boriani G, Proietti M (2017) Atrial fibrillation prevention: an appraisal of current evidence. Heart (0):1–6 5 >3x higher risk of dementia Bunch TJ et al. Arrhythmia & Electrophysiology Review 2019;8(1):8–12 6 30-50% patients report persistent pain lasting months after surgery Bayman, E.O., Parekh, K. R. Keech, J., Selte, A., & Brennan, T.J. (2017). A prospective study of chronic pain after thoracic surgery. Anesthesiology: The Journal of the American Society of Anesthesiologists, 126(5), 938-951. Niraj, G., Kelkar A., Kaushik, V., Tang, Y., Fleet, D., Tait, F., … & Rathinam, S. (2017). Audit of postoperative pain management after open thoracotomy and the incidence of chronic posthoracotomy pain in more than 500 patients at a tertiary center. Journal of clinical anesthesia, 36, 174-177. Maguire, M. F., Latter, J. A. Mahajan, R., Beggs, F.D., & Duffy, J. P. (2006). A study exploring the role of intercostal nerve damage in chronic pain after thoracic surgery. European journal of cardio – thoracic surgery, 29 (6), 873-879. 6 1 in 7 thoracotomy patients develop opioid addiction 1 in 11 minimally invasive lung surgery patients develop an opioid addiction The Society of Thoracic Surgeons, Current News Release (1/30/2018): 1 in 7 Lung Surgery Patients at Risk for Opioid Dependence Key Abbreviations Afib or AF Atrial Fibrillation AVR Aortic Valve Repair / Replacement CABG Coronary Artery Bybass Graft CNB Cryo Nerve Block CPT Current Procedural Terminology code EP Electrophysiologist FDA Food & Drug Administration IDE Investigational Device Exemption IST Inappropriate Sinus Tachycardia LAA Left Atrial Appendage LAAM LAA Management MS-DRG Medicare Severity Diagnosis Related Groups MVR Mitral Valve Repair/Replacement PFA Pulsed Field Ablation PMA Pre-Market Approval POAF Post-Op Afib PVI Pulmonary Vein Isolation RF Radio Frequency RFA Radio Frequency Ablation RVU Relative Value Unit 29

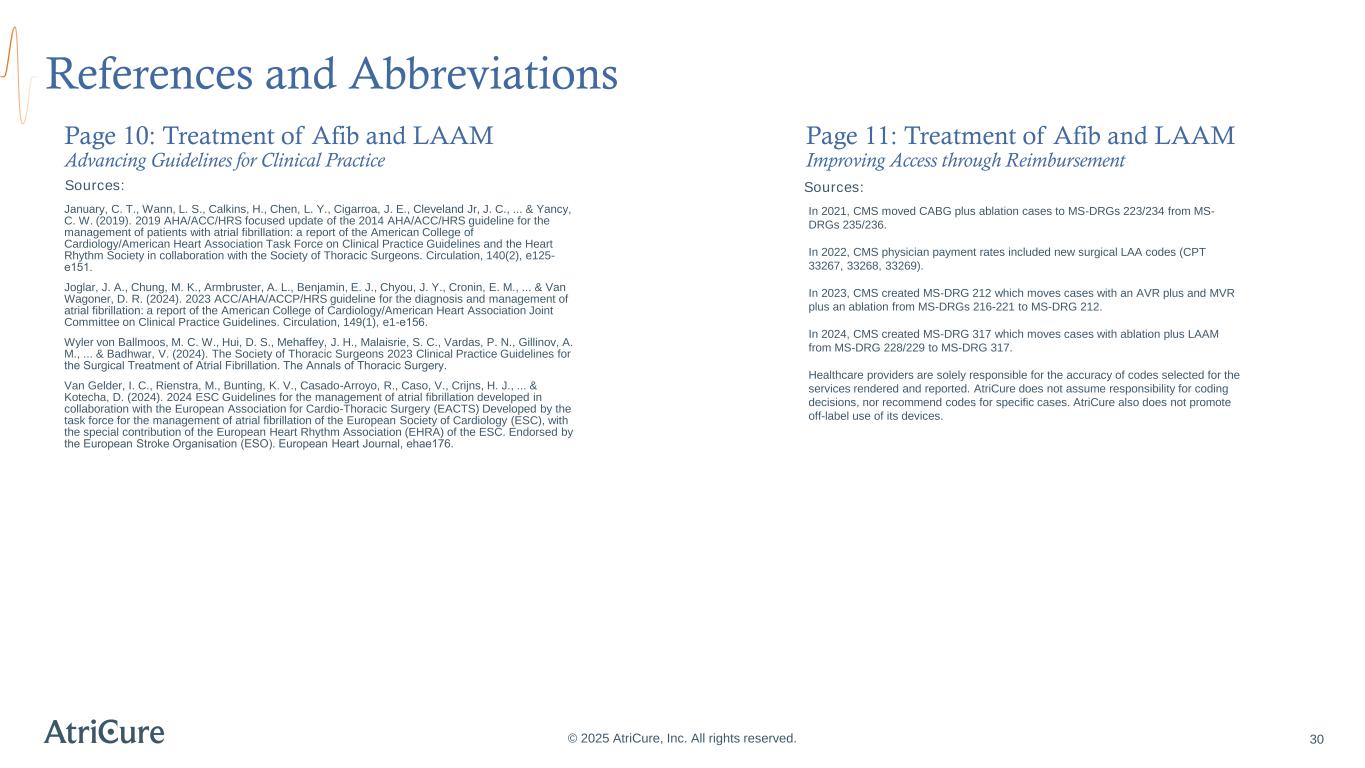

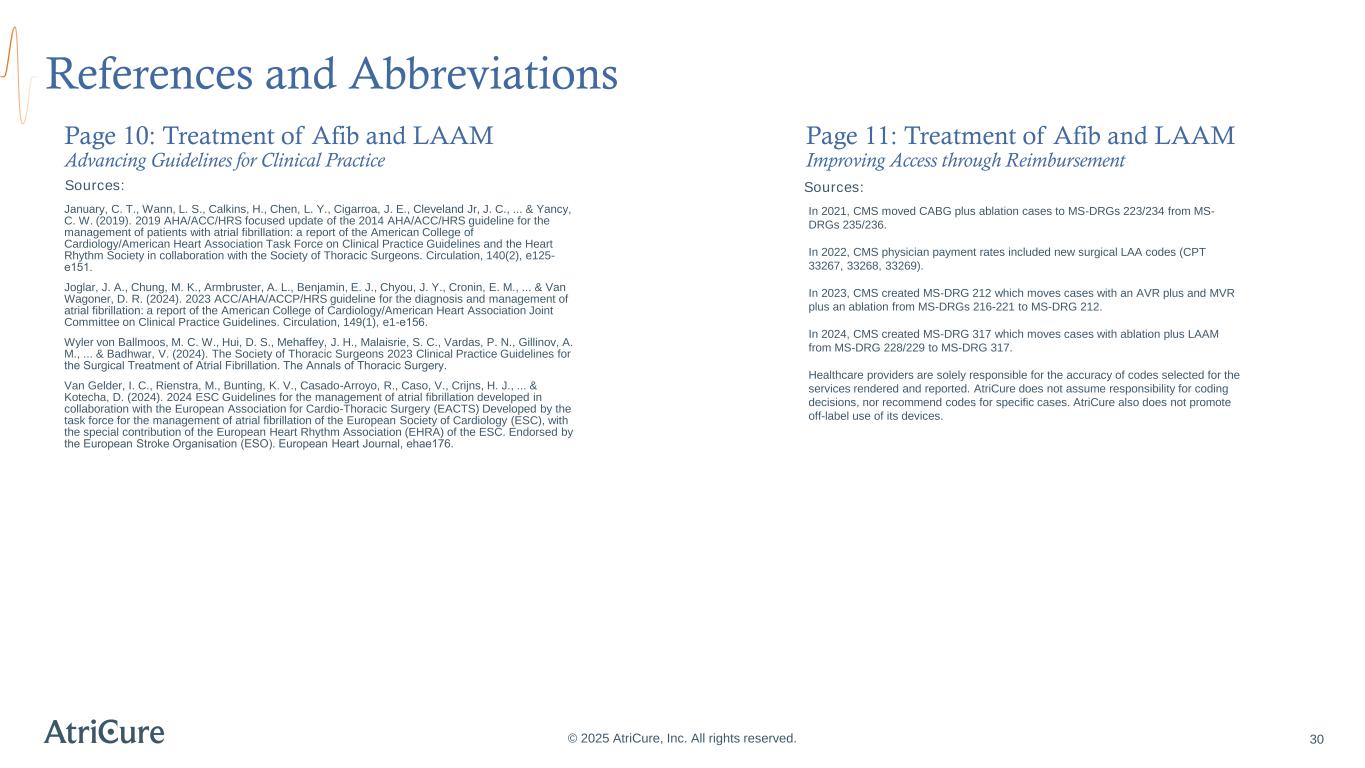

References and Abbreviations © 2025 AtriCure, Inc. All rights reserved. January, C. T., Wann, L. S., Calkins, H., Chen, L. Y., Cigarroa, J. E., Cleveland Jr, J. C., ... & Yancy, C. W. (2019). 2019 AHA/ACC/HRS focused update of the 2014 AHA/ACC/HRS guideline for the management of patients with atrial fibrillation: a report of the American College of Cardiology/American Heart Association Task Force on Clinical Practice Guidelines and the Heart Rhythm Society in collaboration with the Society of Thoracic Surgeons. Circulation, 140(2), e125- e151. Joglar, J. A., Chung, M. K., Armbruster, A. L., Benjamin, E. J., Chyou, J. Y., Cronin, E. M., ... & Van Wagoner, D. R. (2024). 2023 ACC/AHA/ACCP/HRS guideline for the diagnosis and management of atrial fibrillation: a report of the American College of Cardiology/American Heart Association Joint Committee on Clinical Practice Guidelines. Circulation, 149(1), e1-e156. Wyler von Ballmoos, M. C. W., Hui, D. S., Mehaffey, J. H., Malaisrie, S. C., Vardas, P. N., Gillinov, A. M., ... & Badhwar, V. (2024). The Society of Thoracic Surgeons 2023 Clinical Practice Guidelines for the Surgical Treatment of Atrial Fibrillation. The Annals of Thoracic Surgery. Van Gelder, I. C., Rienstra, M., Bunting, K. V., Casado-Arroyo, R., Caso, V., Crijns, H. J., ... & Kotecha, D. (2024). 2024 ESC Guidelines for the management of atrial fibrillation developed in collaboration with the European Association for Cardio-Thoracic Surgery (EACTS) Developed by the task force for the management of atrial fibrillation of the European Society of Cardiology (ESC), with the special contribution of the European Heart Rhythm Association (EHRA) of the ESC. Endorsed by the European Stroke Organisation (ESO). European Heart Journal, ehae176. Sources: Page 10: Treatment of Afib and LAAM Advancing Guidelines for Clinical Practice Page 11: Treatment of Afib and LAAM Improving Access through Reimbursement In 2021, CMS moved CABG plus ablation cases to MS-DRGs 223/234 from MS- DRGs 235/236. In 2022, CMS physician payment rates included new surgical LAA codes (CPT 33267, 33268, 33269). In 2023, CMS created MS-DRG 212 which moves cases with an AVR plus and MVR plus an ablation from MS-DRGs 216-221 to MS-DRG 212. In 2024, CMS created MS-DRG 317 which moves cases with ablation plus LAAM from MS-DRG 228/229 to MS-DRG 317. Healthcare providers are solely responsible for the accuracy of codes selected for the services rendered and reported. AtriCure does not assume responsibility for coding decisions, nor recommend codes for specific cases. AtriCure also does not promote off-label use of its devices. Sources: 30