Comstock Reports Fourth Quarter and Fiscal Year 2024 Results Consistent revenue growth and positive operating cash flows continue CHCI’s successful track record Q4 2024 • Q4 revenue of $16.9 million up 54% vs. prior year, including 38% increase in recurring fee-based revenue ◦ $3.2 million of supplemental fee revenue earned in Q4 alone • Q4 net income of $10.3 million, including 162% increase in operating income • Q4 Adjusted EBITDA increased 45% to $3.1 million • Generated $7.8 million of operating cash in Q4 Fiscal Year 2024 • YTD revenue increased 15% to $51.3 million, including 25% increase in recurring fee-based revenue • YTD net income of $14.6 million, up 87% vs. prior year • YTD Adjusted EBITDA increased 11% to $11.6 million • Year-end cash holdings of $28.8 million Managed Portfolio • Strong AUM growth continued throughout 2024, major assets on track for late 2025 delivery ◦ 23 additional AUM vs. prior year, primarily driven by rapid ParkX expansion ◦ Commercial and Residential portfolio assets in high demand and leased well-above industry average ◦ The Row at Reston Station nears delivery of two Trophy office towers, luxury residential tower, Virginia’s first JW Marriott hotel and branded residential condominiums, and mixed-use retail RESTON, Va. — March 21, 2025 — Comstock Holding Companies, Inc. (Nasdaq: CHCI) (“Comstock” or the “Company”), a leading asset manager, developer, and operator of mixed-use and transit-oriented properties in the Washington, D.C. region, announced its financial results for the fourth quarter and fiscal year ended December 31, 2024. “Our fiscal year 2024 results are the latest data point in what is now a seven-year track record of producing positive net earnings and consistent growth in revenue and Adjusted EBITDA,” said Christopher Clemente, Comstock’s Chairman and Chief Executive Officer. “Dating back to our transition to the asset-light, debt free business model we now deploy, our top-line CAGR is an industry-defying 25%. We have earned our reputation as a best-in-class provider of real estate services in the Washington, D.C. region, fostering consistent AUM growth that has produced stable revenue streams through our fee-based services. Our streamlined balance sheet and our ability to consistently generate operating cash provides us with significant working capital that will allows us to supplement our growth through additional investment opportunities in 2025 and beyond.” Key Performance Metrics ($ in thousands, except per share and portfolio data) Q4 2024 Q4 2023 YTD 2024 YTD 2023 Revenue $ 16,908 $ 11,016 $ 51,294 $ 44,721 Net income $ 10,327 $ 1,870 $ 14,560 $ 7,784 Adjusted EBITDA 3,133 2,165 11,597 10,423 Net income per share — diluted $ 0.99 $ 0.18 $ 1.41 $ 0.77 Managed Portfolio - # of assets 72 49 72 49 Please see the included financial tables for a reconciliation of Adjusted EBITDA to the most directly comparable GAAP financial measure. 1

Mr. Clemente continued, “In a time when companies are returning to work and individuals are seeking quality, convenient places to live, the assets in our managed portfolio continue to deliver. The stabilized commercial and residential properties that anchor the transit-oriented, mixed-use neighborhoods we serve are more than 90% leased. We recently announced a new 87,000 square foot lease with Carfax to relocate their headquarters to Reston Station’s Metro Plaza District. Over the past 3 years, our dedicated team has been working hard to finalize construction and leasing for The Row at Reston Station, the second phase of the five-phase Reston Station development. This premier 1.5 million square foot development will include Virginia’s first and only JW Marriott hotel and branded residential tower, the luxury BLVD Haley residential tower, and two Trophy-class office towers. Supplementing these world-class buildings are premium retail offerings that include a flagship 50,000 square foot VIDA health and wellness facility, the D.C. area’s first Puttshack location that will provide an upscale, tech-themed mini-golf experience with a full bar and restaurant, and Ebbitt House, the first ever expansion of D.C.’s famous Old Ebbitt Grill. A 2,500 space parking garage will easily accommodate all tenants and guests at Northern Virginia’s newest must-visit destination that is set to deliver later this fall.” Mr. Clemente concluded, “Finally, I would like to sincerely thank every member of the Comstock team, as well as our loyal shareholders, customers, and partners for contributing to our success in 2024. Our primary focus is on delivering exceptional results for our customers and providing exceptional experiences to all those that live, work, and play in the communities that we serve. We are well-positioned and remain committed to delivering value to all stakeholders for many years to come.” Additional Information • Stabilized Commercial managed portfolio leased percentage of 93%; 8 new commercial leases executed in Q4, representing 104,000 sqft. of office and retail spaces; 28 new leases executed YTD, representing over 245,000 square feet. • Residential managed portfolio leased percentage of 96%; average in-place rents increased 4% vs. prior year and more than 600 units leased YTD. • ParkX-related AUM expansion led to QTD and YTD increases in total revenue of 56% and 69%, respectively, for ParkX Management subsidiary. • The Row at Reston Station construction progress on track for late 2025 delivery; JW Marriott condominium pre-sales continue to exceed expectations. • In 2024, managed portfolio assets generated well over $100 million in gross revenue for the asset owners. Cautionary Statement Regarding Forward-Looking Statements This release may include "forward-looking" statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by use of words such as "anticipate," "believe," "estimate," "may," "intend," "expect," "will," "should," "seeks" or other similar expressions. Forward-looking statements are based largely on our expectations and involve inherent risks and uncertainties, many of which are beyond our control. You should not place any undue reliance on any forward-looking statement, which speaks only as of the date made. Any number of important factors could cause actual results to differ materially from those projected or suggested by the forward-looking statements. Comstock specifically disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, future developments, or otherwise. 2

About Comstock Founded in 1985, Comstock is a leading asset manager, developer, and operator of mixed-use and transit- oriented properties in the Washington, D.C. region. With a managed portfolio that includes approximately 10 million square feet of stabilized, under construction, and planned assets that are strategically located at key Metro stations, Comstock is at the forefront of the urban transformation taking place in one of the nation’s best real estate markets. Comstock’s developments include some of the largest and most prominent mixed-use and transit-oriented projects in the mid-Atlantic region, as well as multiple large-scale public-private partnership developments. For more information, please visit Comstock.com. Investor Contact Media Contact investorrelations@comstock.com publicrelations@comstock.com 3

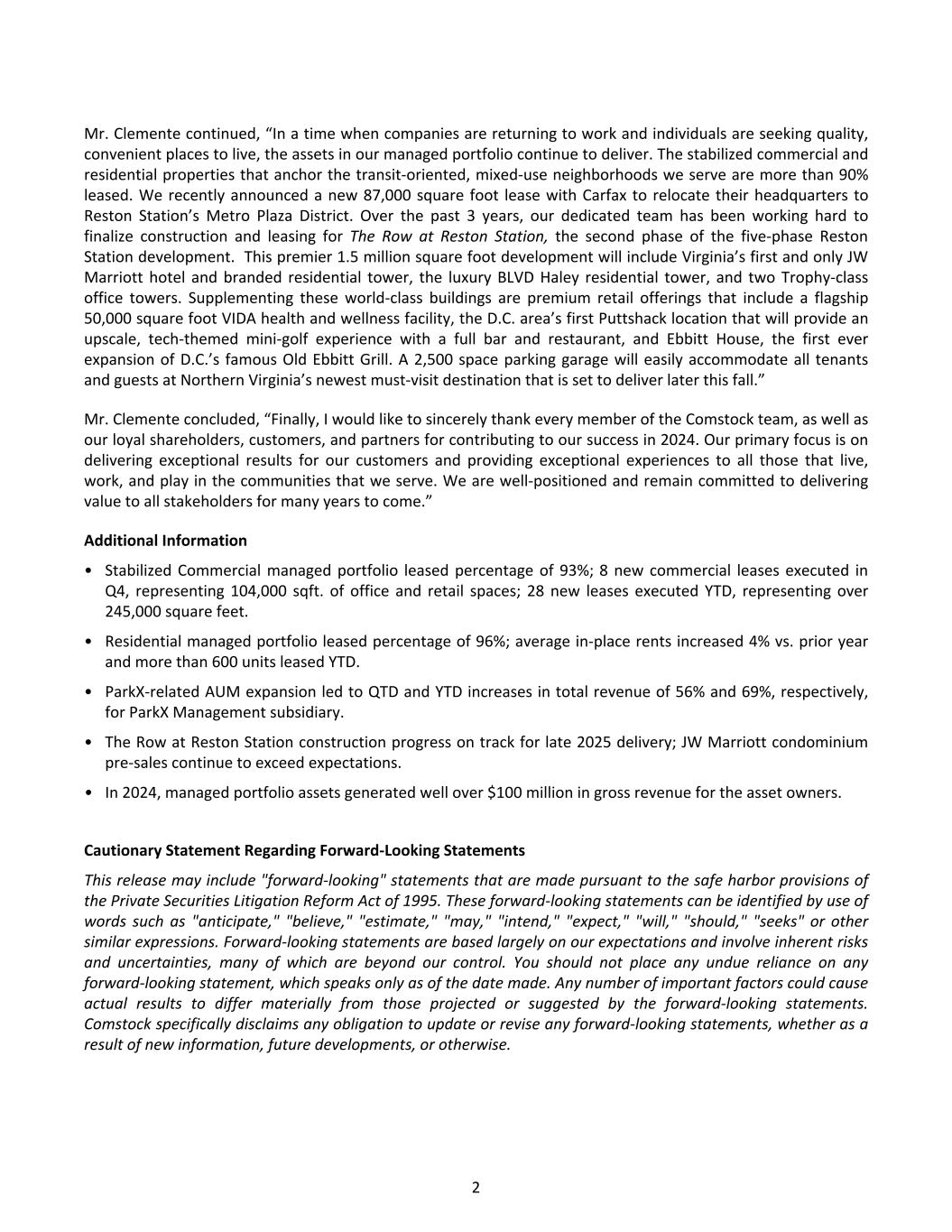

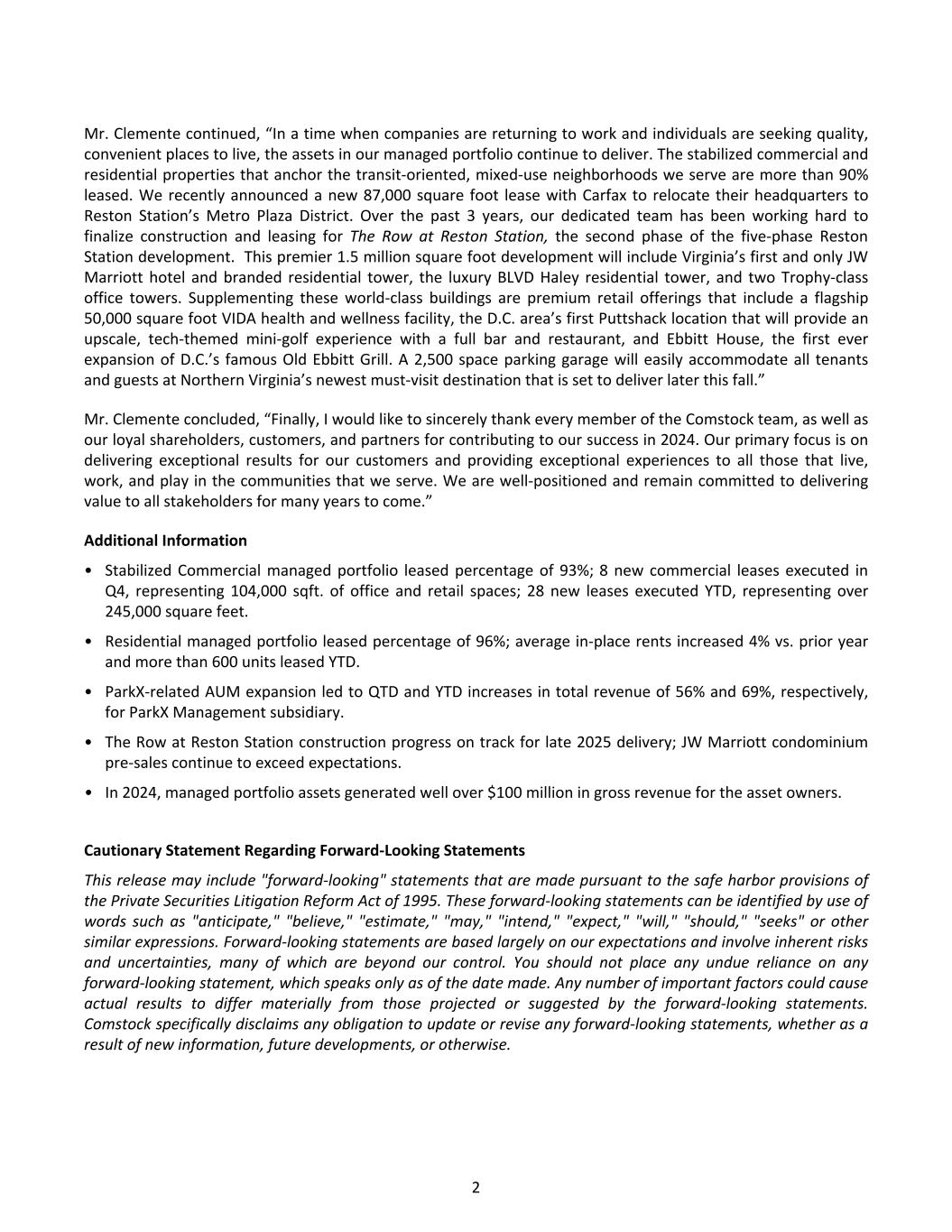

December 31, 2024 2023 Assets Current assets: Cash and cash equivalents $ 28,761 $ 18,788 Accounts receivable, net 282 496 Accounts receivable - related parties 7,254 4,749 Prepaid expenses and other current assets 430 353 Total current assets 36,727 24,386 Fixed assets, net 574 478 Intangible assets 144 144 Leasehold improvements, net 60 89 Investments in real estate ventures 6,228 7,077 Operating lease assets 5,916 6,790 Deferred income taxes, net 14,720 10,885 Deferred compensation plan assets 438 53 Other assets 60 37 Total assets $ 64,867 $ 49,939 Liabilities and Stockholders' Equity Current liabilities: Accrued personnel costs $ 4,952 $ 4,681 Accounts payable and accrued liabilities 781 838 Current operating lease liabilities 922 854 Total current liabilities 6,655 6,373 Deferred compensation plan liabilities 492 77 Operating lease liabilities 5,351 6,273 Total liabilities 12,498 12,723 Stockholders' equity: Class A common stock 97 94 Class B common stock 2 2 Additional paid-in capital 202,702 202,112 Treasury stock (2,662) (2,662) Accumulated deficit (147,770) (162,330) Total stockholders' equity 52,369 37,216 Total liabilities and stockholders' equity $ 64,867 $ 49,939 COMSTOCK HOLDING COMPANIES, INC. Consolidated Balance Sheets (Unaudited; In thousands) 4

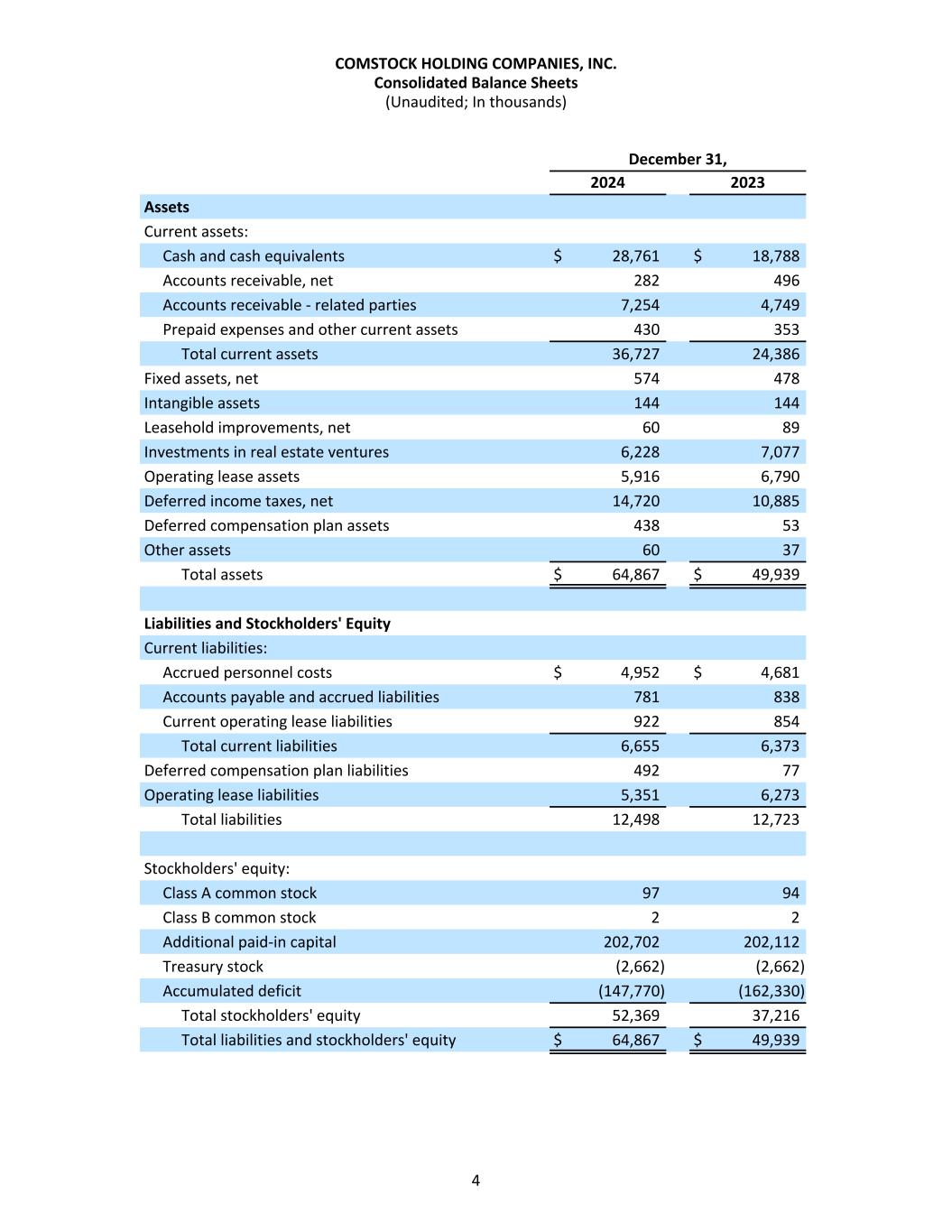

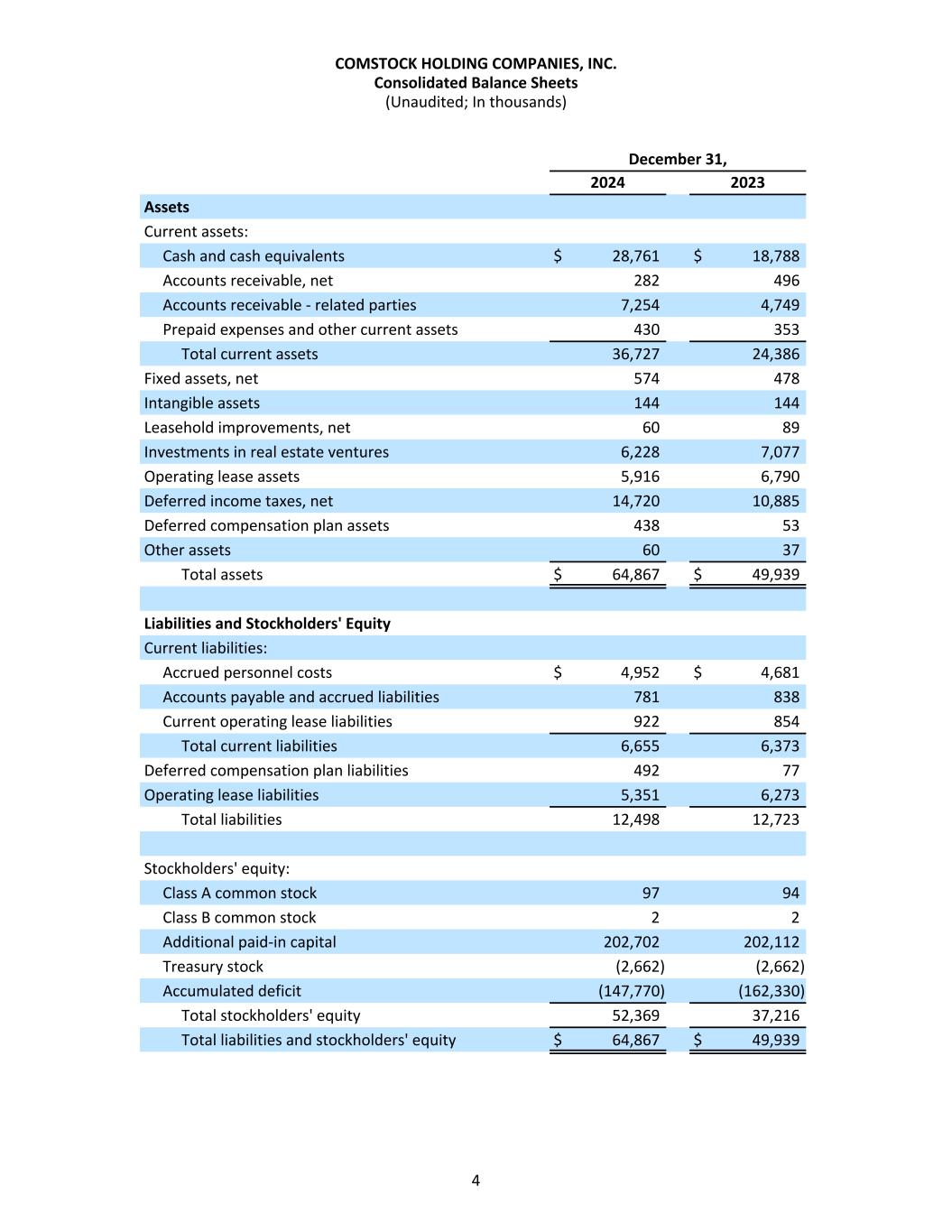

Three Months Ended December 31, Year Ended December 31, 2024 2023 2024 2023 Revenue $ 16,908 $ 11,016 $ 51,294 $ 44,721 Operating costs and expenses: Cost of revenue 11,255 8,479 38,630 33,040 Selling, general, and administrative 487 594 2,075 2,305 Depreciation and amortization 84 — 302 212 Total operating costs and expenses 11,826 9,073 41,007 35,557 Income (loss) from operations 5,082 1,943 10,287 9,164 Other income (expense): Interest income 196 96 672 96 Gain (loss) on real estate ventures 72 (467) (297) (1,187) Other income (expense), net 7 31 63 79 Income (loss) from operations before income tax 5,357 1,603 10,725 8,152 Provision for (benefit from) income tax (4,970) (267) (3,835) 368 Net income (loss) $ 10,327 $ 1,870 $ 14,560 $ 7,784 Weighted-average common stock outstanding: Basic 9,895 9,653 9,846 9,629 Diluted 10,418 10,169 10,327 10,108 Net income (loss) per share: Basic $ 1.04 $ 0.19 $ 1.48 $ 0.81 Diluted $ 0.99 $ 0.18 $ 1.41 $ 0.77 COMSTOCK HOLDING COMPANIES, INC. Consolidated Statements of Operations (Unaudited; In thousands, except per share data) 5

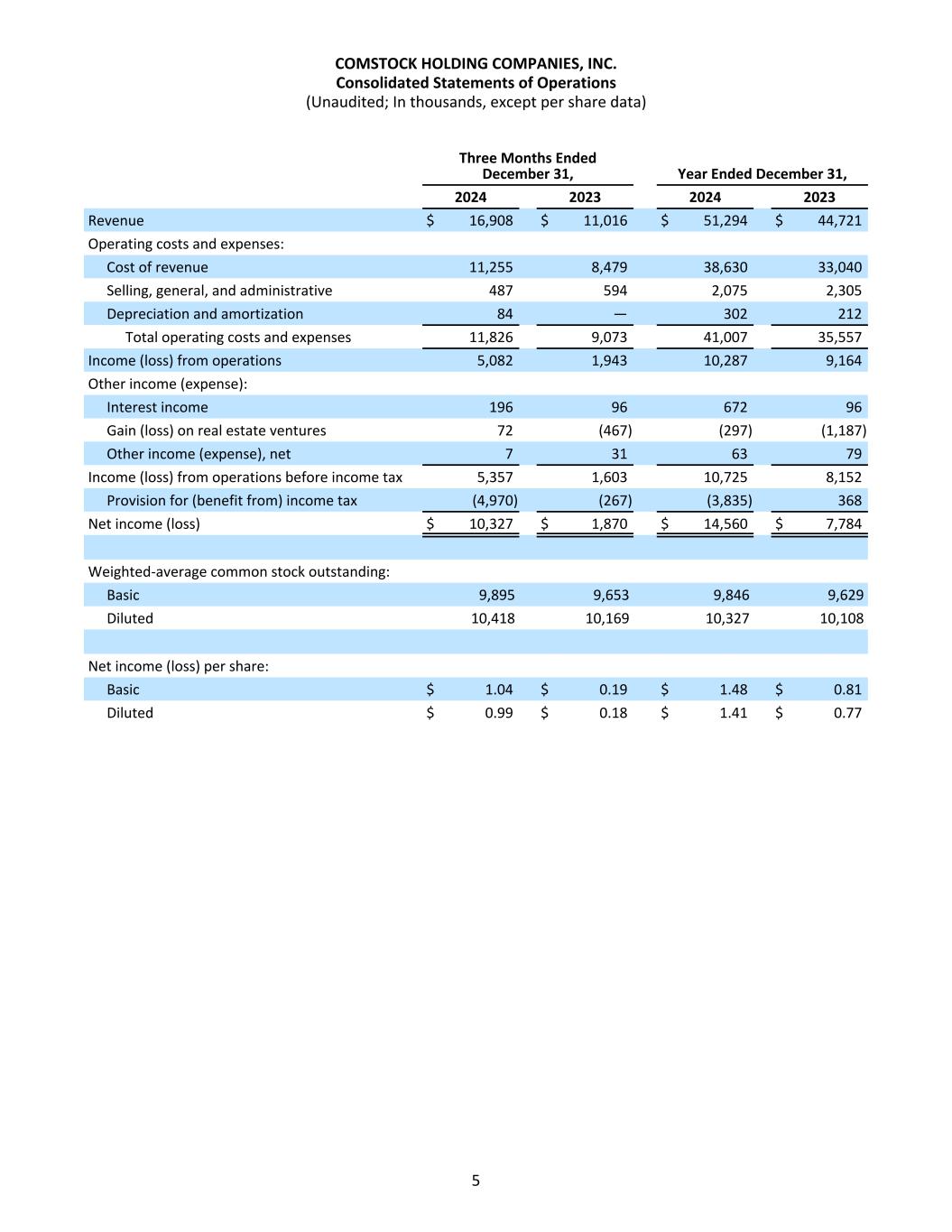

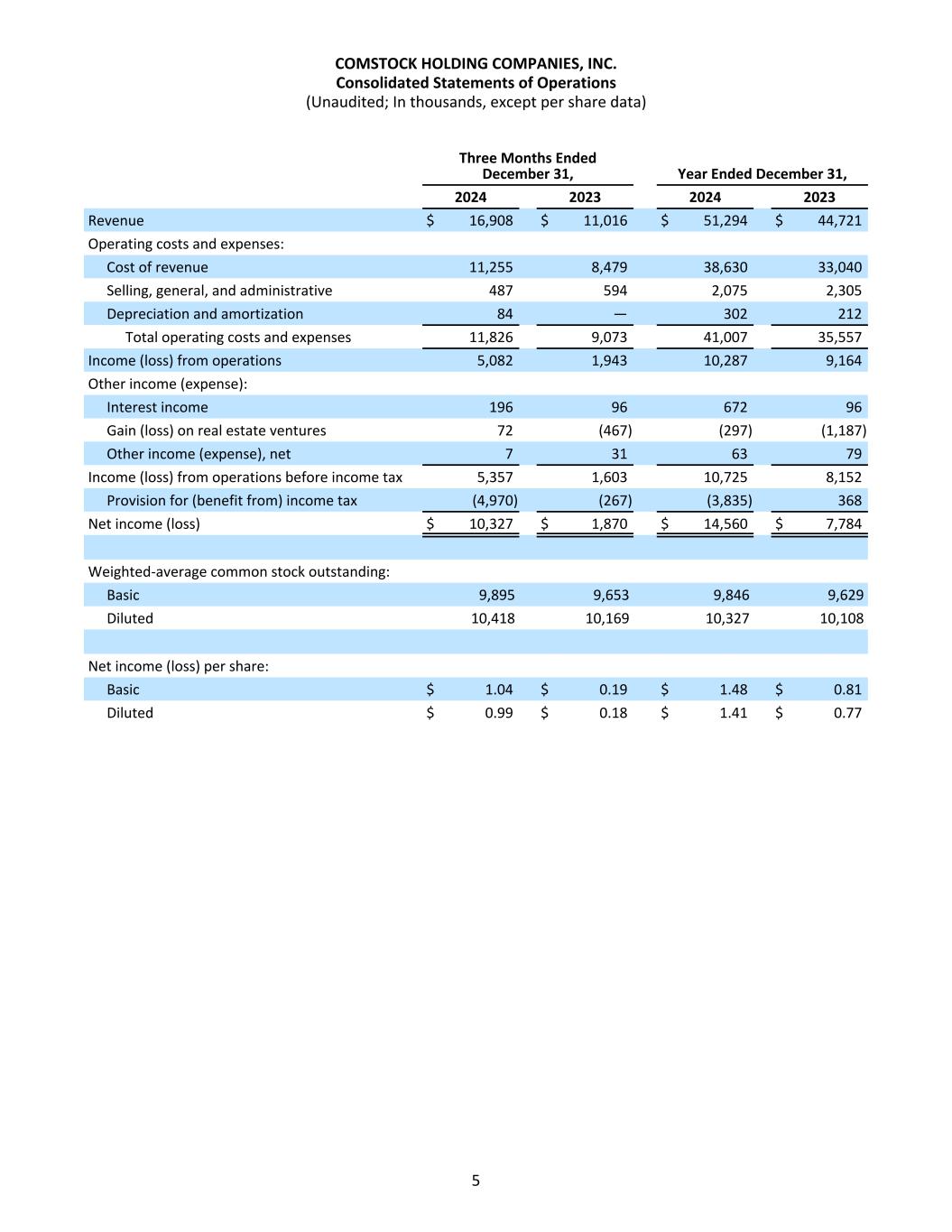

Adjusted EBITDA The following table presents a reconciliation of net income (loss) from continuing operations, the most directly comparable financial measure as measured in accordance with GAAP, to Adjusted EBITDA: Three Months Ended December 31, Year Ended December 31, 2024 2023 2024 2023 Net income (loss) $ 2,377 $ 1,870 $ 14,560 $ 7,784 Interest income (169) (96) (672) (96) Income taxes 568 (267) (3,835) 368 Depreciation and amortization 77 — 302 212 Stock-based compensation 205 191 945 968 (Gain) loss on real estate ventures 75 467 297 1,187 Adjusted EBITDA $ 3,133 $ 2,165 $ 11,597 $ 10,423 The increases in Adjusted EBITDA for the three months and year ended December 31, 2024 are primarily driven by significant increases in recurring fee-based property and parking management revenue and supplemental asset management fee revenue. We define Adjusted EBITDA as net income (loss) from continuing operations, excluding the impact of interest expense (net of interest income), income taxes, depreciation and amortization, stock-based compensation, and gain or loss on equity method investments in real estate ventures. We use Adjusted EBITDA to evaluate financial performance, analyze the underlying trends in our business and establish operational goals and forecasts that are used when allocating resources. We expect to compute Adjusted EBITDA consistently using the same methods each period. We believe Adjusted EBITDA is a useful measure because it permits investors to better understand changes over comparative periods by providing financial results that are unaffected by certain non-cash items that are not considered by management to be indicative of our operational performance. While we believe that Adjusted EBITDA is useful to investors when evaluating our business, it is not prepared and presented in accordance with GAAP, and therefore should be considered supplemental in nature. Adjusted EBITDA should not be considered in isolation, or as a substitute, for other financial performance measures presented in accordance with GAAP. Adjusted EBITDA may differ from similarly titled measures presented by other companies. COMSTOCK HOLDING COMPANIES, INC. Non-GAAP Financial Measures (Unaudited; In thousands) 6