U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the Month of April 2025

Nexa Resources S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s Name)

37A, Avenue J.F. Kennedy

L-1855, Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

| Form 20-F X | Form 40-F |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

| Yes | No X |

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: April 29, 2025

| NEXA RESOURCES S.A. |

| By:/s/ José Carlos del Valle |

| Name: José Carlos del Valle |

|

Title: Senior Vice President of Finance and Group Chief Financial Officer

|

EXHIBIT INDEX

| Exhibit | Description of Exhibit |

|

|

|

Nexa Reports First Quarter 2025

Financial Results including

Net Income of US$29 million and Adjusted EBITDA of US$125 million

Luxembourg, April 29, 2025 – Nexa Resources S.A. (“Nexa Resources”, “Nexa”, or the “Company”) announces today its results for the three-month period ended on March 31, 2025.

CEO Message – Ignacio Rosado

In the first quarter of 2025, we delivered resilient Adjusted EBITDA, demonstrating the strength of our integrated business model, ongoing cost discipline, and steady progress on our strategic priorities, despite operational challenges at certain of our sites that resulted in production volumes slightly below our initial estimates. These challenges were primarily driven by atypical heavy rainfall in both the Pasco region and Aripuanã, as well as production instabilities at our smelters in Brazil. We remain focused on enhancing operational stability, advancing key initiatives, such as the acquisition and installation of a fourth filter at Aripuanã in 2H25, which remains on track and is expected to ease current production constraints. We also continued to move forward with the Cerro Pasco Integration project, a central pillar of our strategy which plays a critical role in extending the operational life and value of our operating assets.

On the financial front, as part of our liability management strategy, in early April and during a volatile market we successfully executed a US$500 million bond issuance, alongside tender offers for a substantial portion of our 2027 and 2028 notes. This transaction allowed us to proactively and efficiently manage upcoming maturities, extending our debt profile, and further optimizing our capital structure. This outcome reinforces our financial flexibility, highlights our solid credit metrics and investor confidence, and aligns with our long-term commitment to capital discipline.

We are closely monitoring the evolving geopolitical landscape and ongoing discussions around tariffs. While uncertainties persist, we are encouraged by zinc’s designation as a critical mineral in several jurisdictions, given its essential role in strategic applications – a recognition that also underscores its importance to the global economy and the energy transition. With a tightening supply-demand balance and lower treatment charges, zinc market fundamentals continue to support a constructive outlook in 2025, despite potential volatility throughout the year.

We remain firmly committed to delivering the results we have planned for the year, while upholding the highest standards of safety and ESG performance across all operations. Enhancing engagement with our stakeholders – including collaborators, communities, and investors – remains a top priority as we navigate near-term challenges and pursue long-term value creation.

Summary of Financial Performance

| US$ million (except per share amounts) | 1Q25 | 4Q24 | 1Q24 |

| Net revenues | 627 | 741 | 580 |

| Gross profit | 127 | 143 | 88 |

| Net income (loss) | 29 | (111) | (12) |

| EBITDA (1) | 120 | 218 | 127 |

| Basic and diluted earnings (loss) per share ("EPS") | 0.09 | (0.74) | (0.18) |

| Adjusted net income (loss) (1) | 34 | (133) | (10) |

| Adjusted EBITDA (1) | 125 | 197 | 128 |

| Adjusted basic and diluted earnings (loss) per share (1) | 0.16 | (1.00) | (0.16) |

| Cash provided by operating activities before working capital (1) (2) | 158 | 91 | 87 |

|

| US$ million (except per share amounts) | 1Q25 | 4Q24 | 1Q24 |

| CapEx | 50 | 86 | 74 |

| Free cash flow (1) | (226) | 107 | (144) |

| Total cash (3) | 401 | 640 | 324 |

| Net debt (1) | 1,488 | 1,217 | 1,496 |

| Net Debt/LTM Adj. EBITDA | 2.1x | 1.7x | 3.7x |

(1) Refer to “Use of Non-IFRS Financial Measures” for further information. Adjusted EBITDA, adjusted net income (loss) and adjusted EPS, exclude the items presented in the “Net Income (Loss) reconciliation to Adjusted EBITDA” section of this earnings release. For details on segment definition and accounting policy, please refer to explanatory note 2 – “Information by business segment” in the “Condensed consolidated interim financial statements at and for the three-month period ended on March 31, 2025.”

(2) Working capital variations had a negative impact of US$265 million in 1Q25 and US$125 million in 1Q24, while a positive impact of US$203 million in 4Q24.

(3) Cash, cash equivalents and financial investments.

Executive Summary

Operational Performance

| § | Zinc production in 1Q25 totaled 67kt, down 23% from 1Q24, primarily due to lower output across all units except for Atacocha. Compared to 4Q24, zinc production decreased by 8%, also driven by lower output across operating units except for Cerro Lindo. |

| § | Run-of-mine mining cost in 1Q25 was US$48/t, up 7% compared to 1Q24, mainly driven by increased maintenance and personnel expenses, alongside lower treated ore volumes. Compared to 4Q24, run-of-mine mining cost rose by 8%, primarily due to higher maintenance, third-party and personnel expenses. Excluding Aripuanã, consolidated run-of-mine mining cost remained consistent across both comparative periods. |

| § | Mining cash cost net of by-products in 1Q25 improved to US$0.11/lb compared to US$0.26/lb in 1Q24. This reduction was primarily driven by higher by-products contribution, lower TCs, and favorable foreign exchange variations, partially offset by lower zinc volumes. Compared to 4Q24, cash cost increased by US$0.12/lb, impacted by lower zinc and by-products sales volume, which were partially offset by higher by-products prices (driven by increased LME prices) and lower TCs. |

| § | The smelting segment produced a total of 133kt of zinc metal and oxide in 1Q25, down 4% year-over-year and 12% quarter-over-quarter. This decrease was primarily driven by lower volumes at our Brazilian smelters, in line with our 2025 guidance, which anticipates an annual reduction of approximately 15kt compared to 2024 to accommodate a more volatile market environment and overall lower TCs. |

| § | Zinc metal and oxide sales in 1Q25 reached 130kt, down 6% and 14% from 1Q24 and 4Q24, respectively, resulting from lower production volumes at Três Marias and Juiz de Fora, as well as diminished demand for zinc oxide in the period. |

| § | Smelting conversion cost in 1Q25 was US$0.33/lb, up from US$0.30/lb in 1Q24, mainly due to higher variable costs and maintenance expenses, partially offset by favorable foreign exchange variations and reduced third-party services expenses. Compared to 4Q24, conversion cost increased by 11%, primarily driven by lower sales volume and higher variable costs and energy expenses, partially offset by lower third-party services expenses. |

| § | Smelting cash cost in 1Q25 was US$1.17/lb compared to US$0.98/lb in 1Q24. This increase was mainly attributed to higher raw material costs due to increased zinc prices, lower TCs, and higher operational costs, which were partially offset by increased by-products contribution and favorable foreign exchange variations. Compared to 4Q24, cash cost decreased by 7%, primarily driven by lower raw material costs stemming from zinc prices and operational cost reductions, which were partially offset by lower TCs and lower sales volume. |

|

|

Financial Performance

| § | Net revenues in 1Q25 were US$627 million, up 8% from US$580 million in 1Q24. This increase was primarily driven by higher LME metal prices (except for lead), partially offset by lower smelting sales volume. The LME average prices for zinc and copper rose by 16% and 11%, respectively, while lead prices declined by 5% compared to the same period in 2024. Compared to 4Q24, net revenues decreased by 15%, mainly reflecting lower smelting sales volume, along with declines in zinc and lead prices. |

| § | In 1Q25, net income amounted to US$29 million, resulting in basic and diluted earnings per share attributable to Nexa's shareholders of US$0.09. Compared to 1Q24, the increase in net income was primarily driven by foreign exchange gains from the appreciation of the Brazilian real against the U.S. dollar, as well as a slight increase in operating income. |

| § | Adjusted net income in 1Q25 was US$34 million, with an adjusted net income attributable to Nexa’s shareholders of US$21 million, resulting in an adjusted basic and diluted earnings per share of US$0.16. Refer to our “Net Income (Loss)” section for further details. |

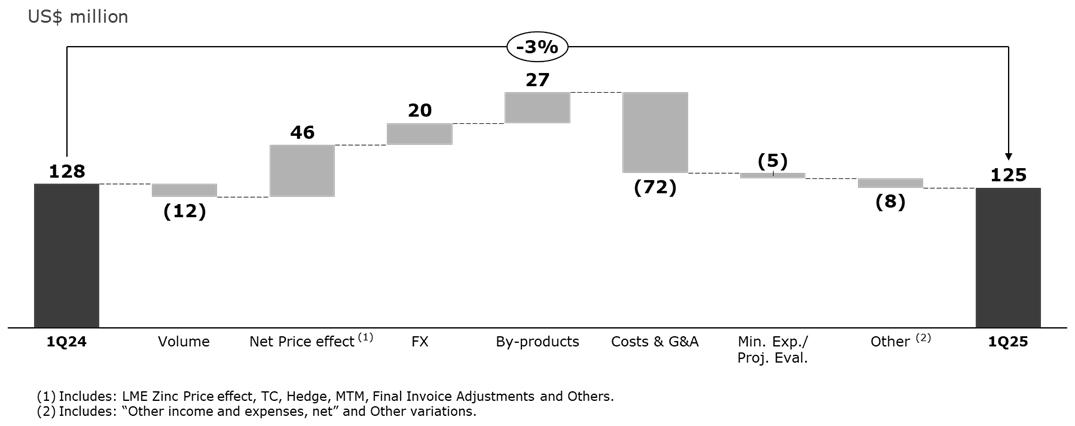

| § | Adjusted EBITDA1 in 1Q25 was US$125 million compared to US$128 million in 1Q24 and US$197 million in 4Q24. The year-over-year decrease was primarily driven by higher costs (mainly attributed to increased calcine inventory consumption at Cajamarquilla) and lower smelting sales volume, which were partially offset by higher zinc prices, increased by-products contribution, and favorable foreign exchange variations. The quarter-over-quarter decrease was mainly due to lower smelting sales volume, an increase in other variations (primarily attributed to the reversal of environmental liabilities related to the Três Marias decommissioning plan in 4Q24), higher costs resulting from increased calcine inventory consumption at Cajamarquilla and lower TCs from third-party concentrates. |

| § | Consolidated Adjusted EBITDA margin in 1Q25 was 19.9%, 6.6pp lower than in 4Q24 and 2.2pp lower than in 1Q24. |

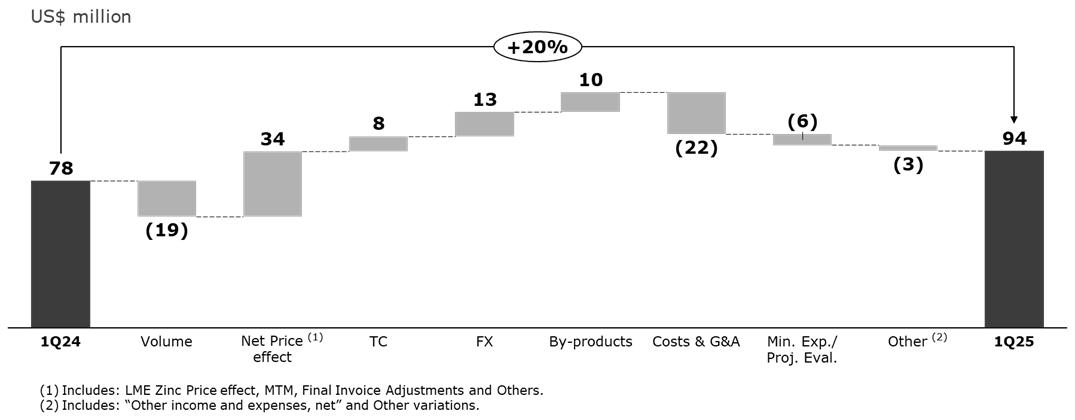

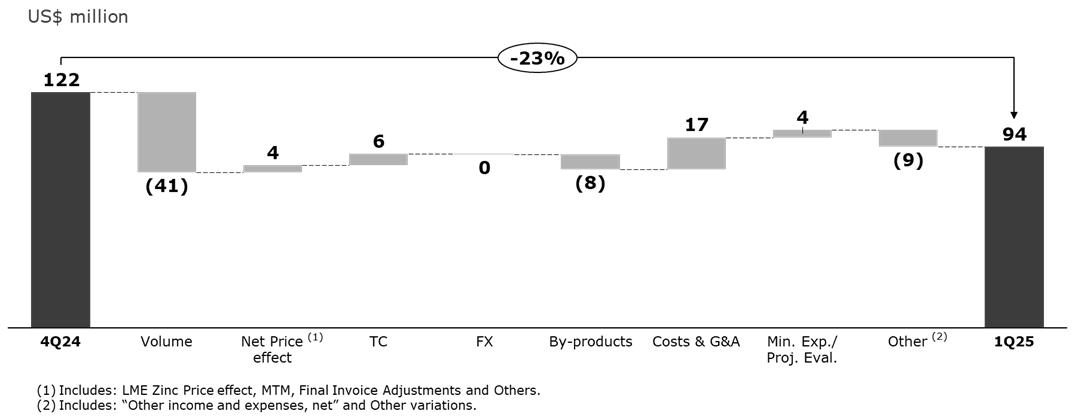

| § | Adjusted EBITDA for the mining segment in 1Q25 was US$94 million compared to US$122 million in 4Q24. This decrease was mainly driven by lower zinc sales across all units (except for Cerro Lindo), a negative impact from other variations (mainly due to lower turnover provisions, increased contingency provisions, and a reduction in cash dividend received from Enercan), and reduced by-products contribution. These effects were partially offset by cost efficiencies and lower TCs. Compared to 1Q24, Adjusted EBITDA increased by 20%, mainly due to higher zinc and copper prices, foreign exchange positive variation, increased by-products contribution and lower TCs. |

| § | Adjusted EBITDA for the smelting segment in 1Q25 was US$31 million, down from US$76 million in 4Q24. This decrease was mainly driven by lower sales volume across all units, a negative net impact in other variations (primarily attributed to the reversal of environmental liabilities related to the Três Marias decommissioning plan that benefitted 4Q24 and a reduction in cash dividend received from Enercan) and higher costs (primarily due to increased calcine inventory consumption at Cajamarquilla). These effects were partially offset by a positive zinc price effect in raw material cost and a positive impact from mark-to-market (“MTM”) variations. Compared to 1Q24, Adjusted EBITDA decreased by 38%, primarily due to higher costs (driven by increased calcine inventory consumption at Cajamarquilla), lower TCs, and reduced sales volume of both zinc metallic and oxide. These effects were partially offset by a positive MTM impact, higher zinc prices, increased by-products contribution and foreign exchange positive variation. |

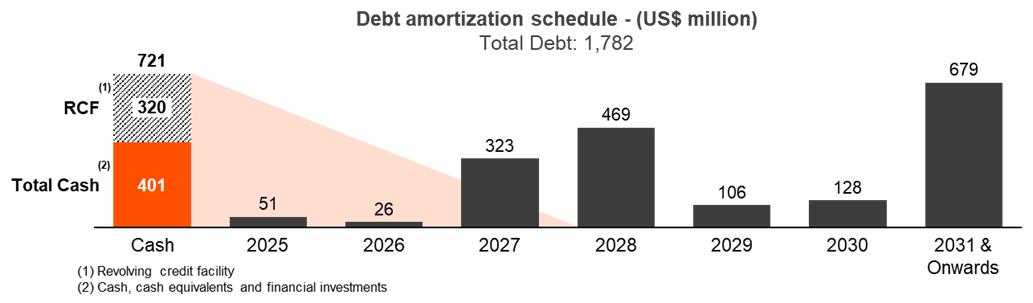

Financial Position, Investments and Financing

| § | Total cash2 at March 31, 2025, was US$401 million compared to US$640 million at December 31, 2024. Our total available liquidity in 1Q25 stood at US$721 million, including US$320 million from our undrawn sustainability-linked revolving credit facility. This liquidity is sufficient to cover all financial commitments for approximately 3 years. |

1 Adjusted EBITDA excludes the items presented in the “Net Income (Loss) reconciliation to Adjusted EBITDA” section of this earnings release – US$5 million in 1Q25, US$2 million in 1Q24 and US$(22) million in 4Q24.

2 Cash and cash equivalents, and financial investments.

|

|

| § | In 1Q25, free cash flow was negative at US$226 million, primarily due to a seasonal variation in working capital of US$265 million. This variation was mainly driven by a decrease in trade payables resulting from increased payments to suppliers. Additionally, an increase in other assets – mainly related to tax claim payments – and a decrease in other liabilities, largely due to the write-off of the commercial advance agreement in 4Q24, along with VAT payments, increased salaries and payroll charges due to bonus payments, along with higher inventory levels, also contributed to the negative cash flow. As in previous years, we remain focused on implementing initiatives to reverse this position in the following quarters. These negative effects were partially offset by strong cash flows from operations, lower CapEX investments of US$50 million and net sales of financial investments in the quarter compared to 4Q24. For further details, please refer to the “Net cash flows from operating activities excluding working capital variations and free cash flow – Reconciliation” section. |

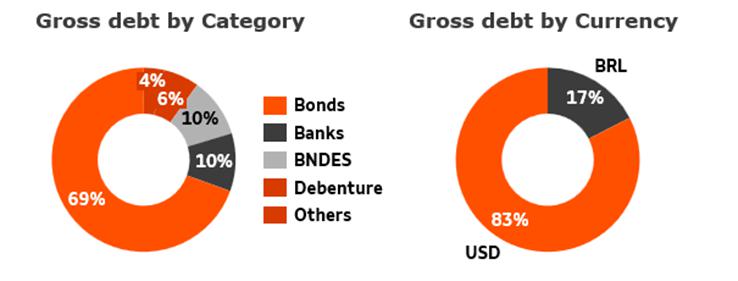

| § | Net debt to Adjusted EBITDA ratio for the last twelve months (“LTM”) increased to 2.1x at the end of 1Q25, compared to 1.7x at the end of 4Q24 and 3.7x at the end of 1Q24. The quarter-over-quarter increase was primarily driven by an increase in net debt and, to a lesser extent, a decline in LTM Adjusted EBITDA. Despite this temporary uptick, we remain committed to our deleveraging strategy and gross debt reduction. Total debt increased by US$19 million, mainly reflecting the negative effect of foreign exchange variations. |

Environmental, Social and Governance (“ESG”) and Corporate Highlights

| § | In January 2025, we introduced our first fleet of hybrid (diesel-electric) loaders for underground mining in Peru, in partnership with Ferreyros, a leading heavy machinery company. This initiative is part of our strategy to reduce fuel consumption and carbon emissions, reinforcing our commitment to sustainability and decarbonization. |

| § | In February 2025, we launched the 5th edition of the Mining Lab Beginnings, a program, which focuses on circular economy initiatives aligned with global sustainability trends. The program seeks researchers, entrepreneurs, startups, and companies with innovative solutions to address challenges in the mining and metals sector. This year’s challenge involves developing commercial and industrial applications for "Waelz Aggregate”, a slag by-product from recycling materials such as batteries and electric arc furnace (“EAF”) dust. Participants may receive R&D funding, technology scaling support, co-development opportunities and access to Nexa's supplier network. |

| § | Also in February 2025, we hosted the Safety Leadership Meeting in São Paulo, bringing together leaders from across our organization to define safety priorities for the year. The event reinforces our "Zero Harm" safety culture, with a focus on employee safety and well-being. |

| § | Additionally in February, we continued the Summer Sports Practice Program in Cajamarquilla, benefiting 80 children from the La Florida Association. Nexa assisted with soccer, volleyball, and dance classes. We also installed a new roof over the community sports court, promoting healthier habits, teamwork and discipline. |

| § | In March 2025, we inaugurated the Geotechnical Monitoring Center (“GMC”) at our Três Marias unit. The GCM enables continuous real-time monitoring of tailings dams and structural stability, strengthening our commitment to safe and responsible operations. |

| § | Also in March, we published our Responsible Mineral Sourcing Policy, which outlines clear guidelines for identifying and managing social and environmental risks in our supply chain. The policy reflects our commitment to human rights, transparency, and conflict-free sourcing, particularly in high-risk areas. The policy can be viewed here. (Note: Our Responsible Mineral Sourcing Policy and other information on our website is not incorporated by reference into this earnings release). |

| § | Throughout 1Q25, as part of Nexa’s circular economy efforts, we began commercializing bricks made from jarosite residue at our Juiz de Fora smelting unit. We also launched community training sessions to support the use of these bricks in construction and expect to extend the initiative to our Vazante unit in the upcoming months. |

|

|

| § | On April 28, 2025, we published our 2024 Annual Sustainability Report, detailing key environmental, social, and financial achievements throughout 2024. The document can be viewed here. (Note: Our Annual Sustainability Report and other information on our website is not incorporated by reference into this earnings release). |

| § | In 1Q25, Moody’s affirmed Nexa’s 'Ba2' rating and revised the Company’s outlook from 'negative' to 'stable', while S&P reaffirmed Nexa’s 'BBB-' investment grade rating, also with a 'stable' outlook. |

| § | On March 27, 2025, we published our 2024 Year-End Mineral Reserves and Mineral Resources report. As of December 31, 2024, Proven and Probable Mineral Reserves were estimated at 110.3 million tonnes, containing 4,075kt of zinc – an increase in contained metal compared to 4,031kt at the end of 2023, mainly driven by infill drilling at El Porvenir, Aripuanã, and Vazante. Additional increases resulted from Mineral Reserves conversion at Cerro Lindo, El Porvenir, Aripuanã, and Vazante. Our 2025 exploration program will continue to prioritize near-mine resource expansion and advanced-stage projects. |

| § | In April 2025, we successfully raised US$500 million through a 12-year bond issuance at a competitive 6.600% coupon. The transaction supported our proactive liability management strategy, enabling the repurchase of approximately 49% of the 2027 notes and 72% of the 2028 notes through two any-and-all tender offers. This refinancing initiative extends the Company’s debt maturity profile, enhances financial flexibility, highlights our solid credit metrics and investor confidence, and reduces near-term refinancing risk. The remaining 2027 notes are expected to be fully redeemed via a make-whole call, set to be executed on May 23, 2025, as announced on April 23, 2025. |

| § | Also in April, Mr. Gustavo Cicilini, Vice President of Human Resources and Corporate Affairs, stepped down after serving in the role since 2019. Mr. Carlos Alberto Hilario Andrade was appointed as his successor, bringing over 25 years of leadership experience as a leader in the mining industry’s Human Resources field. |

Growth, Portfolio Optimization and Strategic Investments

| § | In 1Q25, Nexa advanced on Phase I of the Cerro Pasco Integration Project – the tailings pumping and piping system – aimed at enhancing operational efficiency and extending the life of the mining complex. Engineering activities for the tailings infrastructure at El Porvenir and Atacocha proceeded on schedule. Major equipment manufacturing is underway, with electrical systems undergoing final testing, and the production of transformers and other critical components progressing as planned. Procurement of additional equipment is advancing, and the relevant construction permit is currently under review. Proposals for civil and electromechanical works have been received, with contracts expected to be awarded in May 2025. Construction is scheduled to commence in 2Q25. Preparatory work for Phase II, including technical assessments of the Picasso Shaft and the underground integration, is also progressing as planned. |

| § | We remain committed to enhancing free cash flow generation

and continuously assessing our capital allocation framework, which prioritizes sustaining capital, brownfield mineral exploration, and

ESG and Health, Safety, and Environment (“HS&E”) initiatives. Our strategy concentrates

on our most attractive assets and projects to ensure operational resilience and long-term value creation. |

|

|

2025 Outlook

Production, Sales and Cash Cost Guidance

Guidance is based on several assumptions and estimates, including but not limited to metal prices, operational performance, maintenance and input costs, and exchange rates.

| § | Nexa reaffirms its 2025 consolidated mining production guidance for all metals. Guidance and 2Q25 outlook for mining production, zinc sales, consolidated cash costs for its mining and smelting segments, capital expenditures, exploration, project evaluation and other expenses is outlined below. |

| o | Cerro Lindo: zinc production in 2Q25 is expected to be in line with or slightly higher than 1Q25 levels, while copper production is expected to increase as per the current mining plan, which includes the extraction of higher-grade stopes. |

| o | El Porvenir: zinc production in 2Q25 is expected to increase compared to 1Q25, driven by access to higher-grade zones and higher treated ore. Lead and silver production are also expected to follow a similar upward trend, supported by anticipated increases in average head grades for both metals. |

| o | Atacocha: we anticipate higher production of all metals in 2Q25 compared to 1Q25, driven by an increase in treated ore volumes and mining activities in higher-grade areas, which are currently being prepared for access in the upcoming quarters. This improvement is also supported by the end of the rainy season. |

| o | Vazante: ore throughput and zinc head grade are expected to be slightly higher in 2Q25 versus 1Q25, resulting in a modest increase in zinc production, in line with the mine sequencing plan for the period. Additionally, preparations are underway to access higher-grade zones in the subsequent quarters. |

| o | Aripuanã: We anticipate higher production of all metals in 2Q25 compared to 1Q25, supported by expected increases in average head grades, enhanced performance at the plant and tailings filters, and the seasonal benefit from the end of the rainy period. |

Mining segment – production

| Mining production | 1Q25 | Guidance 2025 | |||||

| (Metal in concentrate) | |||||||

| Zinc | kt | 67 | 311 | - | 351 | ||

| Cerro Lindo | 17 | 80 | - | 88 | |||

| El Porvenir | 12 | 56 | - | 62 | |||

| Atacocha | 2 | 10 | - | 12 | |||

| Vazante | 30 | 132 | - | 145 | |||

| Aripuanã | 6 | 35 | - | 45 | |||

| Copper | kt | 8 | 29 | - | 35 | ||

| Cerro Lindo | 6 | 24 | - | 27 | |||

| El Porvenir | 0.1 | 0.3 | - | 0.5 | |||

| Aripuanã | 1.2 | 5.1 | - | 8.2 | |||

| Lead | kt | 13 | 59 | - | 70 | ||

| Cerro Lindo | 2 | 11 | - | 12 | |||

| El Porvenir | 6 | 21 | - | 26 | |||

| Atacocha | 2 | 13 | - | 13 | |||

| Vazante | 0.2 | 1 | - | 1 | |||

| Aripuanã | 2 | 14 | - | 17 | |||

|

|

| Mining production | 1Q25 | Guidance 2025 | |||||

| (Metal in concentrate) | |||||||

| Silver | MMoz | 2 | 11 | - | 12 | ||

| Cerro Lindo | 0.9 | 3.9 | - | 4.2 | |||

| El Porvenir | 1.0 | 4.2 | - | 4.8 | |||

| Atacocha | 0.2 | 1.3 | - | 1.4 | |||

| Vazante | 0.1 | 0.4 | - | 0.6 | |||

| Aripuanã | 0.2 | 1.1 | - | 1.5 | |||

Smelting segment – sales

| § | Total sales (zinc metal and oxide) guidance also remains unchanged at 560-590kt. |

| o | Peru: we anticipate slightly higher production at Cajamarquilla in 2Q25 compared to 1Q25, driven by stable performance and consistent production levels. |

| o | Brazil: at Três Marias and Juiz de Fora, production in 2Q25 is expected to remain at similar levels to 1Q25, reflecting hydrometallurgical instability at Três Marias and the gradual recovery from the fire incident at Juiz de Fora in late December 2024. |

| Smelting sales | 1Q25 | Guidance 2025 | |||||

| Zinc metal | kt | 122 | 530 | - | 555 | ||

| Cajamarquilla | 81 | 320 | - | 330 | |||

| Três Marias | 29 | 145 | - | 155 | |||

| Juiz de Fora | 12 | 65 | - | 70 | |||

| Zinc oxide | kt | 8 | 30 | - | 35 | ||

| Três Marias | 8 | 30 | - | 35 | |||

| Total Sales | kt | 130 | 560 | - | 590 | ||

Nexa will continue to monitor risks associated with global supply chain disruptions, which could be exacerbated, among other factors, by the ongoing Russia-Ukraine war, the instability in the Middle-East, unusual weather conditions, a possible global recession and its potential impact on the demand for our products, inflationary cost pressure, metal price volatility, local community or union protests, and changes to the political situations or regulatory frameworks in the countries in which we operate that could affect our production levels and our costs. Additionally, the evolving trade policies and tariff changes globally, including recent tariff increases on imports to the U.S., could impact our cost structure, supply chain, and overall market dynamics. Nexa will continue to assess the implications of these trade policies on our operations and financial outlook. Refer to “Risks and Uncertainties” and “Cautionary Statement on Forward-Looking Statements” for further information.

Cash Costs

| § | Nexa also reaffirms its 2025 consolidated cash cost guidance for its mining and smelting segments. |

| o | Mining and smelting volumes: we anticipate a slight increase in 2Q25 compared to 1Q25, remaining within the outlined guidance ranges noted above. |

| o | We anticipate that ongoing improvements in operational efficiency and cost management will positively impact our overall performance. Several initiatives are currently being implemented across our mines and smelters to support this objective. |

| o | Commodity prices assumptions are as follows: Zinc (Zn) at US$1.29/lb, Copper (Cu) at US$4.22/lb, Lead (Pb) at US$0.94/lb, Silver (Ag) at US$31.0/oz, and Gold (Au) at US$2,600/oz. Nexa’s C1 cash cost is sensitive to by-product prices and volumes, which may affect our final cost outcomes. |

|

|

| o | Foreign Exchange Rates Assumptions: we maintain our assumptions at BRL/USD: 5.85 and PEN/USD: 3.85. |

| o | 2025 zinc treatment charges (“TCs”): while our current assumption for 2025 TCs remains at US$125/t of concentrate, recent market developments indicate a potential downward adjustment. Benchmark TCs have been agreed at US$80/t, the lowest in over 50 years. We are closely monitoring these market trends and will adjust our assumptions as necessary to align with the evolving industry landscape. |

| Mining Operating costs | Cost ROM (US$/t) |

Cash Cost (US$/lb) |

Cost ROM (US$/t) |

Cash Cost (US$/lb) |

||||||||

| 1Q25 | 1Q25 | Guidance 2025 | Guidance 2025 | |||||||||

| Mining (1) | 47.9 | 0.11 | 49.1 | - | 55.2 | 0.01 | - | 0.23 | ||||

| Cerro Lindo | 40.7 | (0.40) | 41.5 | - | 45.4 | (0.49) | - | (0.30) | ||||

| El Porvenir | 61.4 | (0.10) | 63.0 | - | 69.5 | (0.03) | - | 0.18 | ||||

| Atacocha | 39.9 | (0.41) | 34.5 | - | 38.3 | (1.16) | - | (1.07) | ||||

| Vazante | 41.1 | 0.53 | 50.4 | - | 56.1 | 0.46 | - | 0.52 | ||||

| Aripuanã | 79.3 | 0.56 | 69.0 | - | 86.6 | (0.10) | - | 0.69 | ||||

(1) C1 Weighted Cash cost net of by-products credits is measured with respect to zinc sold per mine.

| Smelting Operating costs | Conversion cost (US$/lb) |

Cash Cost (US$/lb) |

Conversion cost (US$/lb) |

Cash Cost (US$/lb) |

||||||||

| 1Q25 | 1Q25 | Guidance 2025 | Guidance 2025 | |||||||||

| Smelting (2) | 0.33 | 1.17 | 0.29 | - | 0.33 | 1.16 | - | 1.33 | ||||

| Cajamarquilla | 0.29 | 1.04 | 0.28 | - | 0.31 | 1.08 | - | 1.24 | ||||

| Três Marias | 0.33 | 1.39 | 0.24 | - | 0.29 | 1.27 | - | 1.47 | ||||

| Juiz de Fora | 0.55 | 1.39 | 0.42 | - | 0.50 | 1.22 | - | 1.40 | ||||

(2) C1 Weighted Cash cost net of by-products credits is measured with respect to zinc sold per smelter.

| § | In 1Q25, run-of-mine mining costs of US$47.9/t was slightly below our 2025 guidance, while the C1 cash cost stood at US$0.11/lb, in line with expectations. These results were achieved despite operational challenges in both Peru and Brazil, including disruptions in both the Pasco region and Aripuanã due to heavy rainfall. Our focus on cost control measures and operational improvements remains a priority to ensure the consistent execution of our mining plans. Additionally, higher by-products prices partially offset the negative impact of these challenges during the period. For further information, please see the section “Business performance – Mining segment.” |

| § | In 1Q25, smelting conversion cost was US$0.33/lb and the C1 cash cost stood at US$1.17/lb, both within our 2025 guidance ranges. These figures reflect the impact of operational instabilities at our Brazilian smelters during the quarter, while lower zinc volumes were offset by reduced operational expenses. Despite the challenges, our cost control measures remain effective, maintaining costs within the forecasted range. For further information, please see the section “Business performance – Smelting segment.” |

Capital Expenditures (“CAPEX”)

| § | In 1Q25, Nexa invested US$50 million, predominately allocated to sustaining expenditures, including mine development and maintenance of ongoing operations. Investments related to Phase I of the Cerro Pasco Integration Project – focused on the tailings pumping system – totaled approximately US$1 million during the quarter. |

|

|

| § | The appreciation of the Brazilian real against the U.S. dollar resulted in a negative impact of approximately US$0.5 million in the period. |

| § | CapEx disbursements are expected to accelerate in the upcoming quarters, and our 2025 CapEx guidance remains unchanged at US$347 million. |

| CAPEX | 1Q25 | Guidance 2025 | ||

| (US$ million) | ||||

| Non-Expansion | 52 | 344 | ||

| Sustaining (1) | 48 | 316 | ||

| HS&E | 3 | 18 | ||

| Others (2) | 0 | 11 | ||

| Expansion projects (3) | 0 | 3 | ||

| Reconciliation to Financial Statements (4) | (2) | - | ||

| TOTAL | 50 | 347 |

(1) Investments in TSF (“Tailings Storage Facility”) are included in sustaining expenses.

(2) Modernization, IT and others.

(3) Includes several projects in Vazante to improve operational performance.

(4) The amounts are mainly related to capitalization of interest net of advanced payments for imported materials and tax credits.

Exploration & Project Evaluation and Other Expenses

| § | In 1Q25, we invested US$16 million in exploration and project evaluation, reinforcing our focus on strengthening the mineral potential of our assets. Additionally, we allocated US$2 million to technology and community initiatives, supporting the continuous improvement of our operations and sustainable development of our host communities. |

| § | Our 2025 guidance for exploration and project evaluation remains unchanged at US$88 million, and US$20 million for other operating expenses. We anticipate a pickup in disbursements in the upcoming quarters, aligned with projects execution schedules. |

| § | As part of our long-term strategy, we remain committed to replacing and expanding our mineral reserves and resources. In this context, we will expect to continue advancing on our exploration programs, identifying new ore bodies and upgrading resource classifications, particularly through infill drilling campaigns. |

| Other Operating Expenses | 1Q25 | Guidance 2025 | ||

| (US$ million) | ||||

| Exploration | 14 | 70 | ||

| Mineral Exploration | 10 | 50 | ||

| Mineral rights | 2 | 10 | ||

| Exploration (mine development) | 2 | 9 | ||

| Project Evaluation | 2 | 18 | ||

| Exploration & Project Evaluation | 16 | 88 | ||

| Other | 2 | 20 | ||

| Technology | 0 | 6 | ||

| Communities | 2 | 14 |

Note: Exploration and project evaluation expenses consider several stages of development, from mineral potential definition, R&D, and subsequent scoping and pre-feasibility studies (FEL1 and FEL2).

|

|

Earnings Release 1Q25

This Earnings Release should be read in conjunction with the “Condensed consolidated interim financial statements at and for the three-month period ended on March 31, 2025.” This document contains forward-looking statements.

Table of contents

| Consolidated performance | 11 |

| Business performance – Mining | 17 |

| Business performance – Smelting | 28 |

| Liquidity and Indebtedness | 35 |

| Cash flows | 37 |

| Others | 38 |

| Market scenario | 39 |

| Risks and Uncertainties | 42 |

| Use of Non-IFRS Financial Measures | 44 |

| Cautionary Statement on Forward-Looking Statements | 45 |

| Appendix | 47 |

UPCOMING EVENT

Earnings Conference Call

Date: Wednesday, April 30, 2025 – 9:00am (EST)

Dial In

US: +1 646 931 3860

Canada: +1 780 666 0144

Brazil: +55 21 3958 7888

UK: +44 330 088 5830

Luxembourg: +352 342 080 9265

(Webinar ID: 820 0595 7999 | Passcode: 030519)

Zoom Webinar registration and slide presentation will

be available at:

https://ir.nexaresources.com

|

|

Consolidated performance

Selected financial information

| US$ million (except where otherwise indicated) |

1Q25 | 4Q24 | 1Q24 |

| Net Revenues | 627 | 741 | 580 |

| Mining | 313 | 354 | 294 |

| Smelting | 454 | 547 | 418 |

| Intersegment results | Adjustments | (140) | (160) | (133) |

| Cost of Sales | (501) | (598) | (492) |

| Mining | (215) | (256) | (251) |

| Smelting | (424) | (503) | (373) |

| Intersegment results | Adjustments | 139 | 162 | 132 |

| Selling, general and administrative | (35) | (34) | (34) |

| Mining | (18) | (19) | (17) |

| Smelting | (17) | (14) | (15) |

| Intersegment results | Adjustments | 1 | (1) | (1) |

| Depreciation and amortization | 66 | 97 | 77 |

| Mining | 42 | 69 | 56 |

| Smelting | 23 | 28 | 20 |

| Intersegment results | Adjustments | 1 | (1) | 0 |

| Adjusted EBITDA (1) | 125 | 197 | 128 |

| Mining | 94 | 122 | 78 |

| Smelting | 31 | 76 | 51 |

| Intersegment results | Adjustments | (0) | (1) | (0) |

| Adj. EBITDA margin (%) | 19.9% | 26.5% | 22.2% |

| Net income (loss) | 29 | (111) | (12) |

| Attributable to Nexa's shareholders | 12 | (99) | (24) |

| Attributable to non-controlling interests | 17 | (13) | 12 |

| Basic and diluted earnings (loss) per share | 0.09 | (0.74) | (0.18) |

| Adjusted net income (loss) (1) | 34 | (133) | (10) |

| Attributable to Nexa's shareholders | 21 | (133) | (21) |

| Attributable to non-controlling interests | 13 | (0) | 11 |

| Adjusted basic and diluted earnings (loss) per share (1) | 0.16 | (1.00) | (0.16) |

(1) Refer to “Use of Non-IFRS Financial Measures” for further information. Adjusted EBITDA, adjusted net income (loss) and adjusted EPS, exclude the items presented in the “Net Income (Loss) reconciliation to Adjusted EBITDA” section of this earnings release. For details on segment definition and accounting policy, please refer to explanatory note 2 – “Information by business segment” in the “Condensed consolidated interim financial statements at and for the three-month period ended on March 31, 2025.” This is a note about segments, and one of the explanations for the new adjustment for cash dividend at the consolidated level was to keep consistency with segment information.

|

|

Net Revenues

In 1Q25, net revenues totaled US$627 million, up 8% year-over-year, primarily driven by higher LME metal prices (except for lead). This positive impact was partially offset by lower smelting sales volume. The LME average prices for zinc and copper rose by 16% and 11%, respectively, while lead prices declined by 5% compared to the same period in 2024. For further details on metal prices, please refer to the “Market Scenario” section.

Compared to 4Q24, net revenues decreased by 15%, mainly reflecting lower smelting sales volume, along with declines in zinc and lead prices.

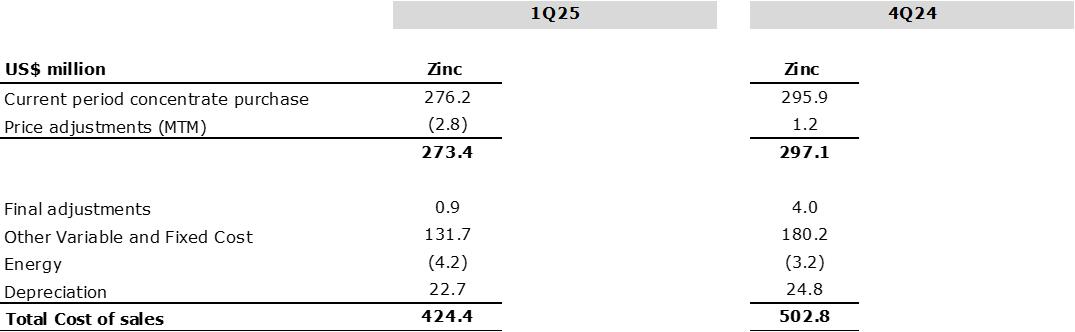

Cost of Sales

In 1Q25, cost of sales amounted to US$501 million, up 2% year-over-year. This was primarily driven by the negative impact of higher zinc prices on concentrate purchases by our smelters, as well as lower TCs from third-party concentrates. These factors were partially offset by favorable foreign exchange variations. Compared to 4Q24, cost of sales decreased by 16%, mainly due to lower sales volumes and the positive effect of lower zinc prices on concentrate purchases in our smelting segment.

Mineral exploration and Project evaluation

In 1Q25, investments in mineral exploration and project evaluation totaled US$16 million compared to US$12 million in 1Q24.

During 1Q25, we executed 10,419 meters of exploration drilling – achieving 78% of our planned activities for the period. This shortfall was primarily due to several challenges, including adverse climate conditions, operational challenges and a drilling program review as we reassessed priorities and adjusted plans. In addition, we executed 46,938 meters of mine infill drilling. Our brownfield exploration programs focus on expanding our exploration portfolio and extending the life of our mines. At Cerro Lindo, drilling has confirmed the depth and continuity of mineralization in Orebodies 8B, although economic viability was not demonstrated. At Aripuanã, drill hole BRAPD000207 intercepted 4.0 meters at 3.05% Zn, 0.90% Pb, and 4.7 meters at 2.45% Zn and 0.75% Pb. At the Cerro Pasco complex, our focus on mine development continues, and we expect to resume drilling activities in June 2025 at the Integración target.

SG&A

In 1Q25, SG&A expenses totaled US$35 million, 5% higher compared to 1Q24, primarily due to an impairment provision for trade accounts receivable, partially offset by a reduction in third-party services expenses in support areas and favorable foreign exchange variations. Compared to 4Q24, SG&A expenses increased by 3%, mainly due to increased workers’ participation expenses, partially offset by lower third-party services expenses.

Adjusted EBITDA

In 1Q25, Adjusted EBITDA was US$125 million, down 3% compared to US$128 million in 1Q24. This slight decrease was primarily driven by (i) US$72 million negative impact from higher costs – stemming from increased calcine inventory consumption (associated with higher unitary costs at Cajamarquilla), the elimination of idleness adjustments at Aripuanã (applied in 1Q24), and lower TCs from third-party concentrates; (ii) lower smelting sales volume at our Brazilian units, resulting in a US$12 million decrease (partially offset by an increase of sales volume at Cajamarquilla); (iii) an increase in other variations of US$8 million, reflecting lower turnover provisions combined with higher tax contingency provisions at Cajamarquilla; and (iv) increased mineral exploration and project evaluation expenses of US$5 million. These negative impacts were partially offset by (v) a positive net price effect of US$46 million, primarily attributed to higher zinc prices, and a favorable impact in MTM variation; (vi) higher by-products contribution of US$27 million, mainly due to increased prices across all metals (partially offset by lower mining sales volumes); and (vii) a positive impact of US$20 million from foreign exchange variations.

|

|

Compared to 4Q24, Adjusted EBITDA decreased by 36%. This decrease was mainly attributed to (i) lower smelting sales volume of US$33 million across all smelters; (ii) an increase of US$30 million in other variations, primarily attributed to the reversal of environmental liabilities related to the Três Marias decommissioning plan that benefitted 4Q24, a reduction in cash dividend received from Enercan, and increased contingency provisions at Cajamarquilla, Vazante, and Aripuanã; and (iii) higher costs amounting to US$13 million, primarily due to increased calcine inventory consumption (associated with higher unitary costs at Cajamarquilla) and lower TCs from third-party concentrates, which were partially offset by reduced severance payments and maintenance expenses at Cerro Pasco, as well as decreased maintenance and third-party service expenses in Vazante. These negative impacts were partially offset by (iv) a positive net price effect of US$6 million, mainly resulting from favorable MTM variations, partially offset by lower zinc prices.

Net Income (Loss) reconciliation to Adjusted EBITDA

| US$ million | 1Q25 | 4Q24 | 1Q24 |

| Net Income (loss) | 28.7 | (111.4) | (12.0) |

| Depreciation and amortization | 65.8 | 96.6 | 77.0 |

| Share in the results of associates | (4.9) | (4.7) | (5.7) |

| Net financial results | 0.6 | 141.6 | 67.9 |

|

|

| US$ million | 1Q25 | 4Q24 | 1Q24 |

| Income tax benefit (expense) | 29.5 | 96.2 | (0.4) |

| EBITDA | 119.8 | 218.3 | 126.8 |

| Changes in fair value of offtake agreement (2) | 10.5 | (21.4) | 1.8 |

| Impairment loss (reversal) of long-lived assets (3) | 0.3 | 7.5 | (17.2) |

| Ramp-up expenses of greenfield projects (Aripuanã) (4) | 0.0 | 0.0 | 13.8 |

| Impairment (reversal) of other assets (5) | 0.0 | 0.0 | 0.3 |

| Gain (Loss) on sale and write-off of property, plant and equipment (6) | (0.1) | 9.3 | 0.2 |

| Remeasurement in estimates of asset retirement obligations (7) | 0.8 | (27.8) | 2.6 |

| Remeasurement adjustment of streaming agreement (8) | 0.0 | 0.0 | 0.0 |

| Changes in fair value of energy forward contracts (9) | (6.2) | 11.7 | (4.4) |

| Tax voluntary disclosure – Value added tax ("VAT") matters (10) | 0.0 | 0.0 | 0.0 |

| Other restoration obligations (11) | (0.1) | (0.1) | 1.4 |

| Divestment and restructuring (12) | 0.0 | (9.9) | 3.2 |

| Dividends received in cash (13) | 0.0 | 9.0 | 0.0 |

| Adjusted EBITDA (1) | 125.0 | 196.7 | 128.4 |

(1) Adjusted EBITDA excludes the items presented above in the “Net Income (Loss) reconciliation to Adjusted EBITDA.” For details on segment definition and accounting policy, please refer to explanatory note 2 – “Information by business segment” in the “Condensed consolidated interim financial statements at and for the three-month period ended on March 31, 2025.”

(2) Non-cash adjustment: Derivative financial instrument related to the “Offtake agreement” described in the section “Others—Offtake agreement” of this earnings release.

(3) Non-cash adjustment: Cash generating unit and individual PP&E assets impairment loss (reversal). Please refer to “Others – Impairment” section in this Earnings Release for further details.

(4) Expenses related to pre-operating and ramp-up expenses incurred during the commissioning and ramp-up phases of greenfield projects which have not achieved their expected production capacity. Commencing in July 2024, these effects were no longer included since, at the end of June 2024 it reached the final stage of its ramp-up phase, transitioning to an ongoing operation.

(5) Non-cash adjustment: Value-added-taxes impairment loss.

(6) Non-cash adjustment: Results from sale and disposal of certain non-current assets.

(7) Non-cash adjustment: Asset retirement obligation remeasurement of discount rate and updated studies that are not subject to capitalization.

(8) Non-cash adjustment: Remeasurement of contractual obligation related to the forward sale contract of Cerro Lindo's Silver contained in the ore.

(9) Non-cash adjustment: The fair value adjustment of the energy surplus resulting from electric energy purchase contracts of our subsidiary, Pollarix.

(10) Expenses related to the impact of accruals related to VAT matters.

(11) Non-cash adjustment: Expenses related to the remeasurement of provision related to estimated costs of anticipated additional obligations in relation to certain inactive industrial waste containment structures in Brazil that have been closed for more than 20 years and that do not contain mining tailings, water or liquid waste.

(12) Expenses related to the effects of obligations of restructuring and divestment related to assets held for sale.

(13) Amount in cash dividend received from associates (currently, Enercan is our only associate), as our management considers this dividend part of the analysis of our energy costs.

Net financial results

Net financial results for 1Q25 were a loss of US$0.6 million, a significant improvement from the US$142 million loss in 4Q24. This was primarily driven by foreign exchange gains stemming from the 7% appreciation of the Brazilian real against the U.S. dollar3, along with higher financial income resulting from the positive variation impact from interest update in the commercial advance agreement (related to lead concentrate) in 4Q24, and lower in financial expenses, particularly due to reduced interest on lease liabilities.

Foreign exchange variations had a positive impact of US$44 million in 1Q25 compared to a negative impact of US$76 million in 4Q24.

3 In 1Q25, the Brazilian real / U.S. dollar (end of period) exchange rate was R$5.742/US$1.00 compared to R$6.192/US$1.00 in 4Q24.

|

|

Excluding foreign exchange variations, net financial expenses totaled US$45 million in 1Q25, down from US$66 million in the previous quarter.

| US$ thousand | 1Q25 | 4Q24 | 1Q24 |

| Financial income | 8,856 | 6,034 | 5,013 |

| Financial expenses | (54,711) | (70,909) | (50,904) |

| Other financial items, net | 45,255 | (76,727) | (22,042) |

| Foreign exchange gain (loss) | 44,372 | (75,900) | (21,902) |

| Net financial result | (600) | (141,602) | (67,933) |

| Net financial result excluding FX | (44,972) | (65,702) | (46,031) |

Net Income (Loss)

In 1Q25, net income amounted to US$29 million compared to a net loss of US$12 million in 1Q24 and US$111 million in 4Q24. The improvement versus 4Q24 was primarily driven by foreign exchange gains, supported by the 7% appreciation of the Brazilian real against the U.S. dollar, as well as lower financial expenses, mainly related to reduced interest on lease liabilities. Additionally, higher financial income, primarily due to the positive variation impact from interest update in the commercial advance agreement in 4Q24, and lower income tax expenses contributed to the positive result. These effects were partially offset by lower operating income, which reflected changes in the fair value of our offtake agreement and an increase in provisions for legal claims.

Net Income attributable to Nexa’s shareholders totaled US$12 million in 1Q25, resulting in basic and diluted earnings per share of US$0.09.

Excluding miscellaneous adjustments, as detailed in the Net Income (Loss) reconciliation to Adjusted EBITDA section, adjusted net income in the quarter was US$34 million.

Adjusted Net Income attributable to Nexa’s shareholders totaled US$21 million in 1Q25, with adjusted basic and diluted earnings per share of US$0.16.

| US$ million (except where otherwise indicated) |

1Q25 | 4Q24 | 1Q24 |

| Net Income (loss) | 28.7 | (111.4) | (12.0) |

| Attributable to Nexa's shareholders | 11.8 | (98.5) | (24.4) |

| Attributable to non-controlling interests | 16.9 | (12.9) | 12.4 |

| Basic and diluted earnings (loss) per share | 0.09 | (0.74) | (0.18) |

| Miscellaneous adjustments (1) | 5.2 | (21.7) | 1.7 |

| Attributable to Nexa's shareholders | 9.4 | (34.1) | 3.5 |

| Attributable to non-controlling interests | (4.1) | 12.4 | (1.8) |

| Basic and diluted miscellaneous adjustments per share | 0.07 | (0.26) | 0.03 |

| Adjusted net income (loss) | 34.0 | (133.1) | (10.4) |

| Attributable to Nexa's shareholders | 21.2 | (132.6) | (20.9) |

|

|

| US$ million (except where otherwise indicated) |

1Q25 | 4Q24 | 1Q24 |

| Attributable to non-controlling interests | 12.8 | (0.5) | 10.5 |

| Weighted average number of outstanding shares - in thousand | 132,439 | 132,439 | 132,439 |

| Adjusted basic and diluted earnings (loss) per share | 0.16 | (1.00) | (0.16) |

(1) Miscellaneous adjustments include: (i) Changes in

fair value of the offtake agreement; (ii) Impairment loss (reversal) of long-lived assets; (iii) Ramp-up expenses of greenfield projects

(Aripuanã); (iv) Impairment (reversal) of other assets; (v) Gain (loss) on sale and write-off of property, plant and equipment;

(vi) Remeasurement in estimates of asset retirement obligations; (vii) Remeasurement adjustment of streaming agreement; (viii) Changes

in fair value of energy forward contracts; (ix) Tax voluntary disclosure – VAT matters; (x) Other restoration obligations; (xi)

Divestment and restructuring; and (xii) Dividends received in cash.

|

|

Business Performance

Mining segment

| Consolidated | 1Q25 | 4Q24 | 1Q24 | 1Q25 vs. 1Q24 | 1Q25 vs. 4Q24 | |

| Ore Mined | kt | 2,983 | 3,180 | 3,263 | (8.6%) | (6.2%) |

| Treated Ore | kt | 3,048 | 3,366 | 3,393 | (10.2%) | (9.4%) |

| Grade | ||||||

| Zinc | % | 2.62 | 2.68 | 3.02 | (40 bps) | (6 bps) |

| Copper | % | 0.34 | 0.35 | 0.31 | 2 bps | (1 bps) |

| Lead | % | 0.54 | 0.67 | 0.69 | (16 bps) | (13 bps) |

| Silver | oz/t | 1.05 | 1.23 | 1.14 | (8.5%) | (14.8%) |

| Gold | oz/t | 0.005 | 0.006 | 0.006 | (16.6%) | (11.2%) |

| Production | metal contained | ||||||

| Zinc | kt | 67.3 | 73.5 | 87.5 | (23.0%) | (8.4%) |

| Copper | kt | 7.6 | 9.1 | 7.5 | 1.6% | (16.8%) |

| Lead | kt | 12.7 | 17.3 | 18.2 | (30.5%) | (27.0%) |

| Silver | MMoz | 2.4 | 3.0 | 3.0 | (19.4%) | (18.9%) |

| Gold | koz | 8.3 | 9.5 | 8.7 | (3.9%) | (11.9%) |

| Zinc Equivalent (1) | kt | 133.4 | 154.7 | 163.8 | (18.6%) | (13.8%) |

(1) Consolidated mining production in kt of zinc equivalent is calculated by converting copper, lead, silver, and gold contents to a zinc equivalent grade, assuming 2024 LME average prices: Zn: US$1.26/lb; Cu: US$4.15/lb; Pb: US$0.94/lb; Ag: US$28.3/oz; Au: US$2,386/oz.

In 1Q25, treated ore volume reached 3,048kt, down 10% year-over-year and 9% quarter-over-quarter. This decline was primarily due to operational challenges across some of our mines. In the Pasco region (El Porvenir and Atacocha), we faced atypical heavy rainfall, while Aripuanã recorded water volumes over 30% higher than the average of the past two years. Additionally, Vazante experienced restricted access areas to higher-grade areas in the period.

Ore throughput increased year-over-year at Cerro Lindo (+2%) and Vazante (+1%). Conversely, throughput decreased at Atacocha (-10%), Aripuanã (-7%), and El Porvenir (-4%).

Zinc equivalent production reached 133kt in 1Q25, down 19% compared to 1Q24 and 14% compared to 4Q24.

The average zinc head grade declined to 2.62%, down 40bps from 1Q24 and 6bps from 4Q24. Copper head grade was 0.34%, up 2bps year-over-year and down 1bps quarter-over-quarter. Lead head grade decreased by 16bps and 13bps from 1Q24 and 4Q24 to 0.54%, respectively, while silver head grade dropped by 9% year-over-year and 15% quarter-over-quarter to 1.05oz/t.

Zinc production totaled 67kt in the quarter, down 23% from 1Q24, mainly due to lower output across all units except for Atacocha, as well as the cessation of mining activities at Morro Agudo. Compared to 4Q24, production decreased by 8%, with only Cerro Lindo contributing positively.

Copper production in 1Q25 was 8kt, up 2% compared to 1Q24 due to improved plant recovery at Cerro Lindo, and down 17% compared to 4Q24, primarily driven by lower output from the same unit.

Lead production decreased by 31% year-over-year and 27% quarter-over-quarter, mainly driven by lower contributions from El Porvenir and Aripuanã.

|

|

Cerro Lindo, Peru

| Cerro Lindo (100% basis) |

1Q25 | 4Q24 | 3Q24 | 2Q24 | 1Q24 | 2024 | |

| Ore Mined | kt | 1,487 | 1,537 | 1,593 | 1,484 | 1,457 | 6,070 |

| Treated Ore | kt | 1,498 | 1,577 | 1,560 | 1,472 | 1,471 | 6,080 |

| Grade | |||||||

| Zinc | % | 1.31 | 1.11 | 1.67 | 1.86 | 1.87 | 1.62 |

| Copper | % | 0.51 | 0.60 | 0.56 | 0.66 | 0.51 | 0.58 |

| Lead | % | 0.20 | 0.19 | 0.30 | 0.31 | 0.44 | 0.31 |

| Silver | oz/t | 0.78 | 0.80 | 0.89 | 0.92 | 1.14 | 0.93 |

| Gold | oz/t | 0.002 | 0.002 | 0.003 | 0.002 | 0.003 | 0.003 |

| Production | metal contained | |||||||

| Zinc | kt | 17.0 | 14.7 | 23.1 | 24.1 | 24.3 | 86.2 |

| Copper | kt | 6.4 | 8.1 | 7.5 | 8.4 | 5.9 | 29.9 |

| Lead | kt | 2.0 | 2.0 | 3.7 | 3.3 | 4.9 | 13.9 |

| Silver | MMoz | 0.9 | 0.9 | 1.1 | 1.0 | 1.3 | 4.3 |

| Gold | koz | 1.1 | 1.4 | 1.3 | 1.0 | 1.2 | 4.9 |

| Zinc sales | kt | 16.9 | 14.6 | 24.1 | 24.4 | 22.8 | 85.9 |

| Costs | |||||||

| Cost of sales | US$ mm | 81.2 | 82.6 | 88.5 | 92.9 | 84.9 | 348.9 |

| Cost ROM (2) | US$/t | 40.7 | 35.8 | 40.6 | 45.8 | 41.6 | 40.8 |

| Cash cost (1) | US$/lb | (0.40) | (0.77) | (0.36) | (0.58) | (0.23) | (0.46) |

| Sustaining cash cost (1) | US$/lb | (0.09) | (0.22) | (0.15) | (0.36) | (0.06) | (0.20) |

| CAPEX | US$ mm | ||||||

| Sustaining | 11.5 | 16.1 | 11.0 | 11.5 | 8.5 | 47.1 | |

| Other | 0.0 | 1.7 | 0.2 | 0.1 | 0.0 | 1.9 | |

(1) Our cash cost and sustaining cash cost are net of by-products credits, measured with respect to zinc sold per mine. For a cash cost reconciliation to COGS, please refer to Appendix – All in Sustaining Cash Cost | Mining.

(2) Our cost per ROM is measured with respect to treated ore volume. Refer to “Use of Non-IFRS Financial Measures” for further information.

In 1Q25, treated ore volume totaled 1,498kt, up 2% year-over-year and down 5% quarter-over-quarter.

Zinc production of 17kt decreased by 30% year-over-year, primarily due to the current mine sequencing plan in lower grade areas. On a quarter-over-quarter basis, zinc production increased by 15%, mainly driven by mining activities in higher-grade zones during the period.

The average zinc head grade was 1.31%, down 56bps compared to 1Q24 and up 20bps compared to 4Q24.

|

|

Copper production reached 6.4kt, up 7% from 1Q24, supported by higher ROM. Compared to 4Q24, production declined by 22%, reflecting the mine reserve plan. The average copper grade was 0.51% in 1Q25, compared to 0.60% in 4Q24 and 0.51% in 1Q24.

Lead production was 2kt, flat versus 4Q24 and down from 4.9kt in 1Q24, mainly due to a decline in the average lead grade, which decreased by 23bps year-over-year.

Cost

Cost of sales totaled US$81 million in 1Q25, a decrease from US$85 million in the same period of last year. This reduction was primarily driven by lower sales volume, reduced maintenance costs and lower depreciation and amortization expenses. Compared to 4Q24, cost of sales decreased by 2%, mainly due to lower workers’ participation and depreciation and amortization, partially offset by increased drilling costs.

Run-of-mine mining cost was US$41/t in the quarter, decreased by 2% year-over-year. This improvement was primarily attributed to higher treated ore volumes, along with lower maintenance and personnel expenses. Compared to 4Q24, run-of-mine mining cost increased by 13%, primarily due to lower treated ore volumes, higher maintenance expenses, and increased fixed and variables costs.

Cash cost net of by-products in 1Q25 decreased to US$(0.40)/lb compared with US$(0.23)/lb in 1Q24. This improvement was mainly due to higher by-products contribution, supported by higher LME metal prices, partially offset by lower zinc volumes. Compared to 4Q24 cash cost increased by US$0.37/lb, mainly attributed to lower by-products contribution, higher operational costs related to maintenance and variable expenses, partially offset by higher zinc volumes.

CAPEX

In 1Q25, sustaining capital expenditures amounted to US$12 million, primarily allocated to mine development activities.

El Porvenir, Peru

| El Porvenir (100% basis) |

1Q25 | 4Q24 | 3Q24 | 2Q24 | 1Q24 | 2024 | |

| Ore Mined | kt | 512 | 548 | 571 | 538 | 530 | 2,187 |

| Treated Ore | kt | 508 | 574 | 564 | 538 | 530 | 2,205 |

| Grade | |||||||

| Zinc | % | 2.64 | 2.54 | 2.58 | 2.56 | 2.76 | 2.61 |

| Copper | % | 0.16 | 0.13 | 0.14 | 0.14 | 0.16 | 0.14 |

| Lead | % | 1.33 | 1.53 | 1.35 | 1.41 | 1.48 | 1.44 |

| Silver | oz/t | 2.36 | 2.73 | 2.34 | 2.42 | 2.47 | 2.50 |

| Gold | oz/t | 0.009 | 0.011 | 0.009 | 0.009 | 0.011 | 0.010 |

| Production | metal contained | |||||||

| Zinc | kt | 11.9 | 12.9 | 12.8 | 12.1 | 12.9 | 50.6 |

| Copper | kt | 0.1 | 0.1 | 0.1 | 0.1 | 0.1 | 0.3 |

| Lead | kt | 5.8 | 7.5 | 6.4 | 6.4 | 6.6 | 26.8 |

| Silver | MMoz | 1.0 | 1.3 | 1.1 | 1.1 | 1.1 | 4.6 |

| Gold | koz | 1.8 | 2.3 | 1.8 | 1.7 | 2.2 | 8.0 |

| Zinc sales | kt | 12.0 | 12.9 | 12.6 | 12.0 | 12.7 | 50.3 |

|

|

| El Porvenir (100% basis) |

1Q25 | 4Q24 | 3Q24 | 2Q24 | 1Q24 | 2024 | |

| Costs | |||||||

| Cost of sales | US$ mm | 39.1 | 60.5 | 51.2 | 50.2 | 49.0 | 210.9 |

| Cost ROM (2) | US$/t | 61.4 | 66.6 | 63.1 | 65.7 | 62.0 | 64.4 |

| Cash cost (1) | US$/lb | (0.10) | (0.04) | 0.18 | (0.05) | 0.24 | 0.08 |

| Sustaining cash cost (1) | US$/lb | 0.30 | 1.04 | 0.52 | 0.40 | 1.14 | 0.78 |

| CAPEX | US$ mm | ||||||

| Sustaining | 10.5 | 30.1 | 9.1 | 12.0 | 25.2 | 76.4 | |

| Other | 0.0 | 0.6 | 0.3 | 0.0 | 0.0 | 0.9 | |

(1) Our cash cost and sustaining cash cost are net of by-products credits, measured with respect to zinc sold per mine. For a cash cost reconciliation to COGS, please refer to Appendix – All in Sustaining Cash Cost | Mining.

(2) Our cost per ROM is measured with respect to treated ore volume. Refer to “Use of Non-IFRS Financial Measures” for further information.

In 1Q25, treated ore volume reached 508kt, down 4% from 1Q24 and 11% from 4Q24, primarily due to atypical heavy rainfall in the Pasco region in the period. The intense weather conditions led to restricted road access in certain areas of the mine and safety-related stoppages. As a result, production was temporarily reduced to stabilize operations, following scheduled maintenance on the conveyor belt, which took place over 2 days in both January and March.

Zinc production totaled 12kt in the quarter, down 8% year-over-year and quarter-over-quarter due to lower throughput and grade variations.

Lead production decreased by 12% compared to 1Q24 and 23% compared to 4Q24, while silver production was down 7% year-over-year and 23% quarter-over-quarter. These decreases were mainly driven by the temporary reduction in mining and milling activities, as well as lower grades in the period.

Cost

Cost of sales amounted to US$39 million in 1Q25 down from US$49 million in 1Q24. This decrease was mainly due to lower depreciation and amortization related to asset life reviews, and reduced drilling costs, partially offset by higher maintenance expenses. Compared to 4Q24, cost of sales decreased by 35%, primarily driven by lower depreciation and amortization, personnel and maintenance expenses, and third-party services related to drilling, blasting, and shotcrete/steel support.

Run-of-mine mining cost was US$61/t in the quarter, consistent with 1Q24. Lower treated ore volumes and higher maintenance costs were offset by reduced drilling expenses. Compared to 4Q24, run-of-mine mining cost decreased by 8%, mainly driven by lower personnel and third-party service costs, partially offset by lower treated ore volumes.

Cash cost net of by-products in 1Q25 decreased to US$(0.10)/lb compared to US$0.24/lb in 1Q24. This improvement was driven by higher by-products contribution and lower TCs, partially offset by lower zinc volumes. Compared to 4Q24, cash cost decreased by US$0.06/lb, primarily due to increased by-products contribution due to higher prices, lower TCs and reduced operational costs, partially offset by lower zinc and by-products volume.

CAPEX

In 1Q25, sustaining capital expenditures amounted to US$11 million, primarily related to mine development activities and ongoing work on tailings dam as part of Phase I of the Cerro Pasco Integration Project (enhancing underground mine infrastructure and expanding tailings storage capacity, ensuring long-term operational sustainability).

|

|

Atacocha, Peru

| Atacocha (100% basis) |

1Q25 | 4Q24 | 3Q24 | 2Q24 | 1Q24 | 2024 | |

| Ore Mined | kt | 312 | 422 | 365 | 379 | 347 | 1,512 |

| Treated Ore | kt | 312 | 389 | 398 | 379 | 347 | 1,512 |

| Grade | |||||||

| Zinc | % | 0.98 | 0.88 | 0.98 | 0.86 | 0.89 | 0.90 |

| Lead | % | 0.88 | 0.93 | 1.14 | 0.90 | 0.81 | 0.95 |

| Silver | oz/t | 0.84 | 0.92 | 1.18 | 0.98 | 1.02 | 1.03 |

| Gold | oz/t | 0.011 | 0.011 | 0.012 | 0.010 | 0.008 | 0.011 |

| Production | metal contained | |||||||

| Zinc | kt | 2.5 | 2.7 | 2.9 | 2.4 | 2.4 | 10.4 |

| Lead | kt | 2.3 | 3.1 | 3.9 | 2.9 | 2.3 | 12.3 |

| Silver | MMoz | 0.2 | 0.3 | 0.4 | 0.3 | 0.3 | 1.2 |

| Gold | koz | 2.0 | 2.7 | 2.9 | 2.1 | 1.4 | 9.1 |

| Zinc sales | kt | 2.5 | 2.7 | 3.0 | 2.4 | 2.1 | 10.2 |

| Costs | |||||||

| Cost of sales | US$ mm | 20.2 | 24.5 | 28.3 | 16.5 | 16.3 | 85.7 |

| Cost ROM (2) | US$/t | 39.9 | 41.3 | 35.2 | 32.5 | 33.7 | 35.8 |

| Cash cost (1) | US$/lb | (0.41) | (0.53) | (0.93) | (1.05) | 0.05 | (0.65) |

| Sustaining cash cost (1) | US$/lb | 0.00 | (0.10) | (0.50) | (0.40) | 0.95 | (0.07) |

| CAPEX | US$ mm | ||||||

| Sustaining | 2.2 | 2.2 | 2.9 | 3.4 | 4.2 | 12.7 | |

| Other | 0.0 | 0.4 | 0.0 | - | 0.0 | 0.4 | |

(1) Our cash cost and sustaining cash cost are net of by-products credits, measured with respect to zinc sold per mine. For a cash cost reconciliation to COGS, please refer to Appendix – All in Sustaining Cash Cost | Mining.

(2) Our cost per ROM is measured with respect to treated ore volume. Refer to “Use of Non-IFRS Financial Measures” for further information.

In 1Q25, treated ore volume totaled 312kt, down 10% year-over-year and 20% quarter-over-quarter. As part of the Pasco region, Atacocha was also impacted by the atypical heavy rainfall in the period, which slowed down the extraction rate from the pit.

Zinc production reached 2.5kt, slightly up from 2.4kt in 1Q24 and down from 2.7kt in 4Q24, reflecting the lower treated ore volumes in the quarter.

Zinc average grade was 0.98%, up by 9bps year-over-year and 10bps quarter-over-quarter.

Lead production remained flat at 2.3kt compared to 1Q24 and decreased from 3.1kt in 4Q24. Silver production totaled 206koz, down 24% from 1Q24 and 26% from 4Q24, primarily due to lower silver grades in the ore mined during the period.

|

|

Cost

Cost of sales in 1Q25 was US$20 million, up 23% year-over-year, primarily driven by higher depreciation and amortization expenses related to revaluation of assets and increased mineral transportation costs. Compared to 4Q24, cost of sales was down 18%, mainly due to reductions in personnel, maintenance, and third-party services expenses, as well as lower depreciation and amortization.

Run-of-mine mining cost was US$40/t in the quarter, up 18% from 1Q24, primarily driven by higher variable costs related to mineral transportation and lower treated ore volumes. Compared to 4Q24, run-of-mine mining cost decreased by 3% due to lower personnel and third-party services, partially offset by lower treated ore volumes.

Cash cost net of by-products was US$(0.41)/lb in 1Q25, decreased by US$0.45/lb from 1Q24. This improvement was mainly driven by increased contribution from by-products, supported by higher silver and gold prices, partially offset by higher operational costs. Compared to 4Q24, cash cost increased by US$0.12/lb, primarily driven by lower by-products and zinc sales volumes, partially offset by lower TCs.

CAPEX

In 1Q25, sustaining capital expenditures amounted to US$2 million, mainly allocated to road infrastructure investments.

Vazante, Brazil

| Vazante (100% basis) |

1Q25 | 4Q24 | 3Q24 | 2Q24 | 1Q24 | 2024 | |

| Ore Mined | kt | 361 | 398 | 384 | 381 | 374 | 1,537 |

| Treated Ore | kt | 430 | 450 | 449 | 444 | 427 | 1,770 |

| Grade | |||||||

| Zinc | % | 8.29 | 8.78 | 9.39 | 9.18 | 9.55 | 9.22 |

| Lead | % | 0.29 | 0.30 | 0.29 | 0.28 | 0.26 | 0.28 |

| Silver | oz/t | 0.66 | 0.69 | 0.62 | 0.62 | 0.58 | 0.63 |

| Production | metal contained | |||||||

| Zinc | kt | 29.8 | 34.0 | 36.4 | 35.2 | 35.2 | 140.7 |

| Lead | kt | 0.2 | 0.2 | 0.3 | 0.3 | 0.1 | 0.9 |

| Silver | MMoz | 0.1 | 0.1 | 0.1 | 0.1 | 0.1 | 0.5 |

| Zinc sales | kt | 29.8 | 34.0 | 36.4 | 35.2 | 35.2 | 140.7 |

| Costs | |||||||

| Cost of sales | US$ mm | 30.7 | 29.1 | 31.0 | 31.6 | 33.2 | 124.9 |

| Cost ROM (2) | US$/t | 41.1 | 46.8 | 51.7 | 48.6 | 46.1 | 48.3 |

| Cash cost (1) | US$/lb | 0.53 | 0.46 | 0.48 | 0.49 | 0.53 | 0.49 |

| Sustaining cash cost (1) | US$/lb | 0.61 | 0.55 | 0.54 | 0.58 | 0.61 | 0.57 |

| CAPEX | US$ mm | ||||||

| Sustaining | 5.2 | 6.6 | 4.8 | 7.3 | 5.9 | 24.7 | |

|

|

| Vazante (100% basis) |

1Q25 | 4Q24 | 3Q24 | 2Q24 | 1Q24 | 2024 | |

| Other | 0.3 | 0.9 | 0.4 | 0.9 | 0.7 | 2.9 |

(1) Our cash cost and sustaining cash cost are net of by-products credits, measured with respect to zinc sold per mine. For a cash cost reconciliation to COGS, please refer to Appendix – All in Sustaining Cash Cost | Mining.

(2) Our cost per ROM is measured with respect to treated ore volume. Refer to “Use of Non-IFRS Financial Measures” for further information.

In 1Q25, treated ore volume was 430kt, up 1% year-over-year and down 4% quarter-over-quarter.

This result came despite geotechnical constraints at the mine, which reduced ore extraction in the period. The impact was partially offset by increased tailings reprocessing and stockpile utilization, albeit with a lower overall grade.

Zinc production totaled 30kt, down 15% from 1Q24 and 12% from 4Q24, primarily due to mining activities in lower-grade areas, following geotechnical constraints that restricted access to higher-grade zones. These high-grade areas are expected to be prioritized in 2Q25.

The average zinc grade for the quarter was 8.29%, down 126bps from 1Q24 and 49bps from 4Q24.

Lead production totaled 0.2kt, up from 0.1kt in 1Q24 and relatively flat compared to 4Q24. Silver production reached 0.1MMoz, down 4% both year-over-year and quarter-over-quarter, mainly due to lower ore grades during the quarter.

Cost

Cost of sales in 1Q25 was US$31 million, down 7% year-over-year, primarily driven by lower sales volume and favorable foreign exchange variations. Compared to 4Q24, cost of sales increased by 5%, mainly due to higher freights expenses, partially offset by lower third-party and maintenance costs.

Run-of-mine mining cost was US$41/t in 1Q25, decreased by 11% compared to US$46/t in 1Q24. This improvement was mainly attributed to favorable foreign exchange variations on operational costs. Compared to 4Q24, run-of-mine mining cost was down by 12%, mainly due to lower maintenance and third-party services expenses.

Cash cost net of by-products of US$0.53/lb was consistent with 1Q24. Lower operational costs, lower TCs, and favorable foreign exchange variations offset the impact of lower zinc sales volume. Compared to 4Q24, cash cost increased by US$0.07/lb, mainly due to lower zinc sales, partially offset by lower TCs and reduced operational costs.

CAPEX

In 1Q25, sustaining capital expenditures amounted to US$5 million, primarily allocated to mine development activities aimed at supporting life of mine extension.

Aripuanã, Brazil

| Aripuanã (100% basis) |

1Q25 | 4Q24 | 3Q24 | 2Q24 | 1Q24 | 2024 | |

| Ore Mined | kt | 311 | 276 | 513 | 359 | 299 | 1,446 |

| Treated Ore | kt | 300 | 377 | 410 | 367 | 322 | 1,476 |

| Grade | |||||||

| Zinc | % | 2.70 | 4.05 | 2.77 | 2.99 | 3.11 | 3.23 |

| Copper | % | 0.58 | 0.42 | 0.59 | 0.54 | 0.70 | 0.56 |

| Lead | % | 0.86 | 1.53 | 0.92 | 1.05 | 0.97 | 1.12 |

| Silver | oz/t | 0.93 | 1.68 | 0.98 | 1.07 | 0.91 | 1.17 |

|

|

| Aripuanã (100% basis) |

1Q25 | 4Q24 | 3Q24 | 2Q24 | 1Q24 | 2024 | |

| Gold | oz/t | 0.017 | 0.016 | 0.012 | 0.018 | 0.026 | 0.017 |

| Production | metal contained | |||||||

| Zinc | kt | 6.2 | 9.3 | 7.5 | 7.7 | 7.2 | 31.6 |

| Copper | kt | 1.2 | 1.0 | 1.7 | 1.3 | 1.5 | 5.5 |

| Lead | kt | 2.3 | 4.6 | 2.7 | 3.2 | 2.6 | 13.1 |

| Silver | MMoz | 0.2 | 0.3 | 0.3 | 0.3 | 0.2 | 1.1 |

| Gold | koz | 3.4 | 3.0 | 3.4 | 3.7 | 4.0 | 14.0 |

| Zinc sales | kt | 6.2 | - | - | - | - | - |

| Costs | |||||||

| Cost of sales | US$ mm | 44.2 | - | - | - | - | - |

| Cost ROM (2) | US$/t | 79.3 | - | - | - | - | - |

| Cash cost (1) | US$/lb | 0.56 | - | - | - | - | - |

| Sustaining cash cost (1) | US$/lb | 0.95 | - | - | - | - | - |

| CAPEX | US$ mm | ||||||

| Sustaining | 5.1 | 8.6 | 5.9 | 9.6 | 14.4 | 38.6 | |

| Other (1) | 0.2 | 1.5 | 2.0 | 0.4 | 0.2 | 4.1 | |

(1) The negative amounts are mainly related to reclassifications between Aripuanã and Corporate, and capitalization of interest net of advanced payments for imported materials and tax credits.

In 1Q25, treated ore volume totaled 300kt, down 7% from 322kt in 1Q24 and 20% from 377kt in 4Q24.

Utilization capacity averaged 53% during the quarter, with peak daily rates occasionally exceeding 70-75%, reflecting the impact of current tailings filter constraints, which were aggravated by heavier-than-usual rainfall.

Zinc production reached 6.2kt, down 14% from 7.2kt in 1Q24 and 33% from 9.3kt in 4Q24. These decreases were primarily driven by intense rainfall in the region – with precipitation volumes averaging 30% higher than in previous years, which lead to a temporary reduction in production to stabilize operations and prevent overloading the dry stacking process.

Copper production totaled 1.2kt in 1Q25, down 21% year-over-year due to lower grades areas and up 18% quarter-over-quarter, supported by higher copper grades.

We remain focused on continuous operational improvement, particularly in addressing the current limitations of the tailings filter circuit. While capacity has significantly improved since the start of operations, some challenges and constraints persist. As previously announced, a fourth tailings filter has been acquired and is currently in the manufacturing phase. Delivery and installation are expected in 2H25, with commissioning scheduled for 1H26. This upgrade is expected to further enhance utilization capacity, particularly during the rainy season.

Cost

Cost of sales in 1Q25 was US$44 million and run-of-mine mining cost was US$79/t, positioning both metrics within the mid to upper range of our 2025 guidance. Cash cost net of by-products was US$0.56/lb in 1Q25, also in the mid to upper range of our guidance. We anticipate a reduction in unitary costs in the upcoming quarters as we enhance plant capacity and increase sales volume, thereby improving operational efficiency and cost-effectiveness.

|

|

CAPEX

In 1Q25, sustaining capital expenditures amounted to US$5 million, mainly related to mine development activities.

Financial performance

| US$ million | 1Q25 | 4Q24 | 1Q24 | 1Q25 vs. 1Q24 | 1Q25 vs. 4Q24 | |

| Net Revenues | 313.2 | 353.7 | 293.9 | 6.6% | (11.4%) | |

| Cost of Sales (1) | (215.0) | (256.5) | (251.4) | (14.5%) | (16.2%) | |

| Gross Profit | 98.3 | 97.2 | 42.5 | 131.0% | 1.1% | |

| Adjusted EBITDA | 93.7 | 121.8 | 78.0 | 20.1% | (23.1%) | |

| Adjusted EBITDA Mrg. | 29.9% | 34.4% | 26.5% | 3.4pp | (4.5pp) | |

Note: Financial performance pre intersegment eliminations.

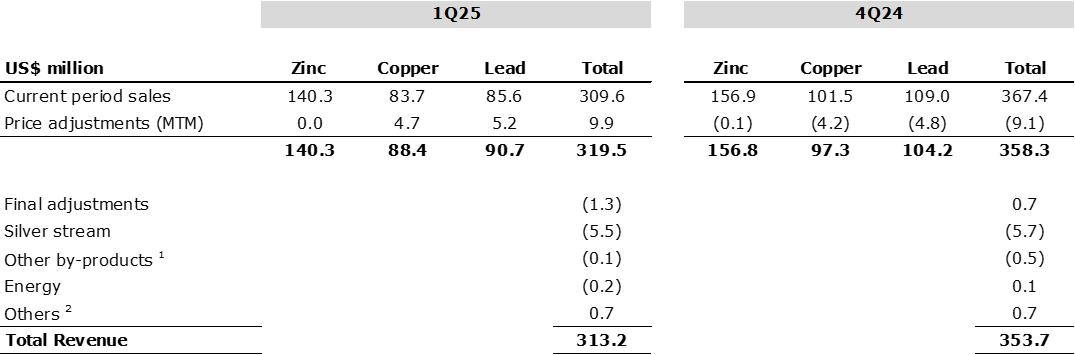

Net revenues for the mining segment totaled US$313 million in 1Q25, up 7% compared to 1Q24. This increase was mainly driven by higher LME metal prices (except for lead) and lower TCs, despite a decline in zinc sales volumes. Compared to 4Q24, net revenues decreased by 11%, mainly due to lower sales volumes across all metals and decreased zinc prices, which were partially offset by lower TCs.

Cost of sales in 1Q25 was US$215 million, down 14% compared to 1Q24. This decrease was mainly attributed to reduced mining sales volume, favorable foreign exchange variations in Brazilian mines, and lower depreciation and amortization expenses. Compared to 4Q24, cost of sales declined by 16%, primarily due to reductions in personnel, maintenance, and third-party services expenses, as well as lower drilling costs and lower depreciation and amortization.

Reconciliation of realized prices

Revenues are recorded at provisional prices and, typically, an adjustment is then made after delivery, based on the pricing terms under the relevant contract. In addition, the difference between the provisional and the final price received is recognized by adjusting the price in the period in which the sale is concluded.

Adjusted EBITDA for the mining segment in 1Q25 totaled US$94 million, up 20% compared to US$78 million in 1Q24. This increase was primarily attributed to (i) a positive net price effect of US$34 million, resulting from higher zinc and copper prices; (ii) favorable foreign exchange variations of US$13 million; (iii) higher by-products contribution of US$10 million, mainly due to higher silver and gold prices, partially offset by lower sales volumes; and (iv) lower TCs amounting to US$8 million. These gains were partially offset by (v) a negative impact of US$22 million in costs, mainly related to idleness adjustments at Aripuanã in 1Q24 (which are no longer adjusted since 3Q24); and (vi) a negative impact of US$19 million, primarily due to lower zinc sales volume at Vazante, Cerro Lindo, and El Porvenir.

|

|

Compared to 4Q24, Adjusted EBITDA decreased by 23%. This performance was primarily driven by (i) a negative impact of US$41 million due to lower zinc sales across all units (except for Cerro Lindo), along with decreased lead and copper sales at Aripuanã, reduced copper sales at Cerro Lindo, and lower lead sales at Cerro Pasco; (ii) an increase of US$9 million in other variations, mainly attributed to low turnover provisions at Vazante, Cerro Lindo and Aripuanã, and a reduction in cash dividend received from Enercan; and (iii) lower by-products contribution of US$8 million, resulting from lower sales volumes, partially offset by higher silver and gold prices. These losses were partially offset by (iv) a positive impact of US$17 million in costs, driven by lower severance payments and maintenance expenses at Cerro Pasco, as well as reduced maintenance and third-party services expenses in Vazante; (v) lower TCs amounting to US$6 million; (vi) a positive net price effect of US$4 million, mainly due to favorable MTM variations, partially offset by lower zinc prices; and (vii) a reduction of US$4 million in mineral exploration and project evaluation expenses.

Run-of-mine cost, Cash cost and AISC 4

| Consolidated cash cost | 1Q25 | 4Q24 | 1Q24 | 1Q25 vs. 1Q24 | 1Q25 vs. 4Q24 | |

| Run-of-mine mining cost | US$/t | 47.9 | 44.3 | 44.7 | 7.2% | 8.1% |

| Cash cost net of by-products | US$/t | 253 | (2) | 578 | (56.1%) | - |

4 Our cash cost and AISC are net of by-products credits, measured with respect to zinc sold.

|

|

| Consolidated cash cost | 1Q25 | 4Q24 | 1Q24 | 1Q25 vs. 1Q24 | 1Q25 vs. 4Q24 | |

| AISC net of by-products | US$/t | 1,332 | 1,382 | 1,573 | (15.3%) | (3.6%) |

| Cash cost net of by-products | US$/lb | 0.11 | (0.001) | 0.26 | (56.1%) | - |

| AISC net of by-products | US$/lb | 0.60 | 0.63 | 0.71 | (15.3%) | (3.6%) |

Note: Cash cost and AISC per ton sold does not include the impact of the cost of idleness capacity of US$1.2 million in El Porvenir in 1Q24.

Cash cost net of by-products for the mining segment in 1Q25 decreased to US$0.11/lb compared to US$0.26/lb in 1Q24. This improvement was primarily driven by higher by-products contribution, lower TCs, and favorable foreign exchange variations, partially offset by lower zinc volumes.

Compared to 4Q24, cash cost increased by US$0.12/lb, mainly due to lower zinc and by-products sales volume, which were partially offset by higher by-products prices and lower TCs.