U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the Month of April, 2025

Nexa Resources S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s Name)

37A, Avenue

J.F. Kennedy

L-1855, Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

| Form 20-F X | Form 40-F |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

| Yes | No X |

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: April 2, 2025

| NEXA RESOURCES S.A. |

| By:/s/ José Carlos del Valle |

| Name: José Carlos del Valle |

Title: Senior Vice President of Finance and Group Chief Financial Officer |

EXHIBIT INDEX

| Exhibit | Description of Exhibit |

|

|

Nexa Resources S.A. AGM EGM 2025 - Proxy Statement

|

|

|

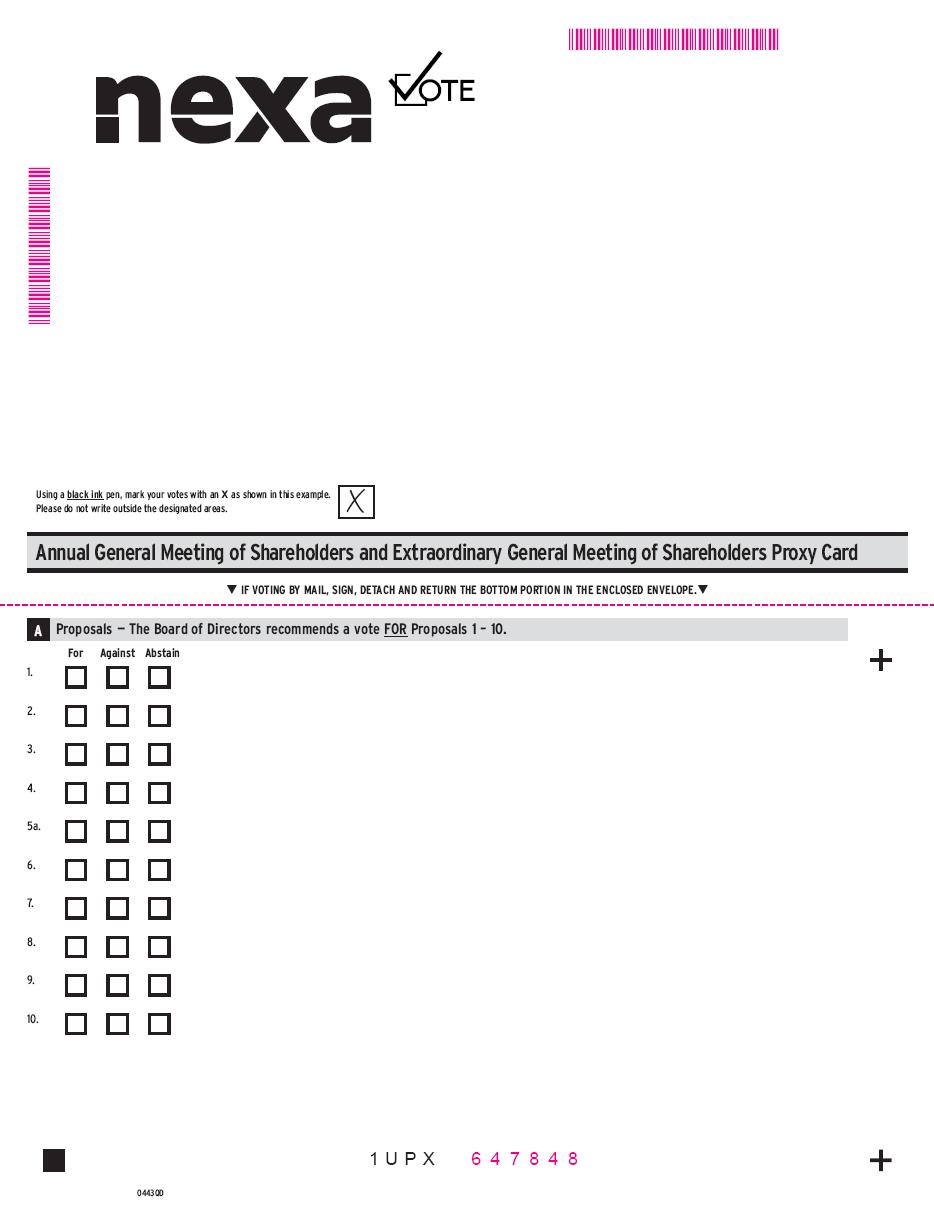

Nexa Resources S.A. AGM EGM 2025 - Proxy Card (Broker)

|

ANNUAL GENERAL MEETING OF SHAREHOLDERS

AND

EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 8, 2025, AT 3:00 P.M. LUXEMBOURG TIME AT THE REGISTERED OFFICE LOCATED AT 37A AVENUE J. F. KENNEDY, L-1855 LUXEMBOURG, GRAND DUCHY OF LUXEMBOURG 37A, Avenue J. F. Kennedy L-1855 Luxembourg, Grand Duchy of Luxembourg

Nexa Resources S.A.

R.C.S. Luxembourg B 185.489

April 2, 2025

Dear Shareholder,

You are cordially invited to attend the 2025 Annual General Meeting of Shareholders (the “Annual General Meeting”) of Nexa Resources S.A. (the “Company”) to be held at 3:00 p.m. Luxembourg time on May 8, 2025, and the Extraordinary General Meeting of Shareholders of the Company to be held immediately thereafter (the “Extraordinary General Meeting” and together with the Annual General Meeting, the “Meetings”), at the Company’s registered office located at 37A, Avenue J. F. Kennedy, L-1855 Luxembourg, Grand Duchy of Luxembourg. Information concerning the matters to be considered and voted upon at the Meetings is set out in the attached Convening Notice and Proxy Statement.

The board of directors (the “Board of Directors” or the “Board”) has fixed the close of business (EDT) on March 27, 2025, as the record date for Meetings (the “Record Date”), and only holders of record of common shares at such time will be entitled to notice of or to vote at the Meetings or any adjournment(s) or postponement(s) thereof.

If you are unable to attend the Meetings or wish to be represented, please authorize a proxy to vote your common shares in accordance with the instructions you received. This will not prevent you from voting your common shares in person if you subsequently choose to attend the Meetings (subject to compliance with the procedures set forth in the Proxy Statement and the requirements under applicable law).

Please note that powers of attorney or proxy cards must be received by the tabulation agent (Computershare), no later than 6:00 p.m. Luxembourg time, 12:00 p.m. EDT, on May 2, 2025, in order for such votes to be taken into account.

As a shareholder of the Company, it is very important that you read the accompanying materials carefully and then vote your common shares promptly.

On behalf of the Board of Directors, we thank you for your continued support.

Sincerely,

Jaime Ardila Chair of the Board of Directors 37A, Avenue J. F. Kennedy L-1855 Luxembourg,

Nexa Resources S.A.

Grand Duchy of Luxembourg

R.C.S. Luxembourg B 185.489

Convening Notice to

the Annual General Meeting of Shareholders

and

the Extraordinary General Meeting of Shareholders

to be held on May 8, 2025, at 3:00 p.m. Luxembourg time

at the Company’s registered office located at 37A, Avenue J. F. Kennedy, L-1855

Luxembourg, Grand Duchy of Luxembourg

Dear Shareholders,

The Board of Directors of Nexa Resources S.A. (the “Company”) is pleased to invite you to attend the 2025 Annual General Meeting of Shareholders, to be held on May 8, 2025, at 3:00 p.m. Luxembourg time, and the Extraordinary General Meeting of Shareholders of the Company to be held immediately thereafter, at the Company’s registered office located at 37A, Avenue J. F. Kennedy, L-1855 Luxembourg, Grand Duchy of Luxembourg with the following agenda:

Agenda of the Annual General Meeting

| 1. | Presentation of the reports of the Board of Directors of the Company and the reports of the statutory auditor (réviseur d’entreprises agréé) on the annual accounts and the consolidated financial statements of the Company for the financial year ended December 31, 2024. |

| 2. | Consider and approve the Company’s annual accounts for the financial year ended December 31, 2024. |

| 3. | Consider and approve the Company’s consolidated financial statements for the financial year ended December 31, 2024. |

| 4. | Resolve (i) to approve the share premium reimbursement recommended by the Board of Directors of the Company during the financial year ended December 31, 2024, and (ii) to carry forward the loss for the year ended December 31, 2024. |

| 5. | Grant discharge (quitus) to all members of the Board of Directors of the Company who were in office during the financial year ended December 31, 2024, for the proper performance of their duties. |

| 6. | Election of the members of the Board of Directors: |

6.1. Reelect one of the current members of the Board of Directors of the Company:

| a) | Mr. Flavio Aidar, as director until the 2026 annual general meeting of the shareholders. |

| 7. | Determine the 2025 overall remuneration of the members of the Board of Directors and ratify the 2024 overall remuneration of the members of the Board of Directors. |

| 8. | Appoint PricewaterhouseCoopers, société coopérative as statutory auditor (réviseur d’entreprises agréé) of the Company for the period ending at the 2026 annual general meeting of the shareholders. |

Agenda of the Extraordinary General Meeting

| 1. | Authorized share capital: |

1.1. Renew the authorization of the Board of Directors to increase the issued share capital of the Company on one or more occasions within the limits of the authorized share capital currently set at USD 231,924,819, during a period starting on the day of the Extraordinary General Meeting and ending on the fifth anniversary of the date of publication in the Luxembourg Legal Gazette (Recueil Electronique des Sociétés et Associations) of the minutes of the Extraordinary General Meeting, without prejudice to any further renewals;

1.2. Renew the authorization of the Board of Directors to limit or cancel the preferential subscription right of existing shareholders in the context of an issuance of new shares and instruments carried out through a public offering process; and

1.3. Amend article 5.8 of the articles of association of the Company (the “Articles”) to be read as follows:

5.8. The Board of Directors is authorized, during a period starting on the day of the general meeting of shareholders held on 8 May 2025 and ending on the fifth anniversary of the date of publication in the Luxembourg legal gazette (Recueil Electronique des Sociétés et Associations) of the minutes of such general meeting, without prejudice to any renewals, to increase the issued share capital on one or more occasions within the limits of the Authorized Capital.

Pursuant to article 13.18.1 of our Articles, the Annual General Meeting will validly deliberate on its agenda by a simple majority of the votes validly cast, regardless of the portion of the capital represented.

Pursuant to article 13.18.2 of our Articles, the Extraordinary General Meeting will validly deliberate on its agenda with a majority of two-thirds of the votes validly cast at a meeting in which holders of at least half of the Company’s issued share capital are present or represented. If the quorum is not reached at the first extraordinary general meeting for the purpose of resolving on the agenda thereof, a second extraordinary general meeting of shareholders may be convened with the same agenda at which no quorum requirement will apply. The resolutions concerning the agenda of the Extraordinary General Meeting will be adopted by a majority of two-thirds of the votes validly cast.

Any shareholder who holds common shares of the Company as of the close of business (EDT) on March 27, 2025 (the “Record Date”) will be admitted to the Meeting and may attend the Meeting, as applicable, subject to compliance with the procedures set forth in the Proxy Statement and the requirements under applicable law).

Please consult the Proxy Statement which is available on the Company’s website, on EDGAR at www.sec.gov and on SEDAR+ at www.sedarplus.ca as to the procedures for attending the Meeting or to be represented by way of proxy. Copies of the Company’s consolidated financial statements and its annual accounts for the financial year ended December 31, 2024, together with the reports of the Board of Directors and the statutory auditor are available at https://ri.nexaresources.com/corporate-governance/shareholders-meeting/. The Proxy Statement, Information Notice and Annual Report on Form 20-F are available under the Company’s profile on EDGAR at www.sec.gov and SEDAR+ at www.sedarplus.ca. The Company will prepare an Extractive Sector Transparency Measures Act (“ESTMA”) report pursuant to Canadian law requirements. The ESTMA report will be available by May 30, 2025, at https://ri.nexaresources.com/corporate-governance/shareholders-meeting/ and on Natural Resources’ Canada website at https://natural-resources.canada.ca/our-natural-resources/minerals-mining/services-for-the-mining-industry/extractive-sector-transparency-measures-act/links-estma-reports/18198, respectively, and will also be subject to fillings on EDGAR at www.sec.gov and on Luxembourg Business Registers at www.lbr.lu in accordance with the relevant laws and regulations applicable to the Company. Please note that powers of attorney or proxy cards must be received by the tabulation agent (Computershare), no later than 6:00 p.m. Luxembourg time, 12:00 p.m. EDT, on May 2, 2025, in order for such votes to be taken into account.

The Meetings will be held in person in the Grand Duchy of Luxembourg. If, for any reason, we determine that it is necessary or appropriate to take additional steps regarding how we conduct the Meetings, we will announce this decision in advance, and details will be posted on our website. Please check our website prior to the Meetings if you are planning to attend in person.

Sincerely,

Jaime Ardila

Chair

on behalf of the Board of Directors PROXY STATEMENT ANNUAL GENERAL MEETING OF SHAREHOLDERS AND EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

NEXA RESOURCES S.A.

MAY 8, 2025

GENERAL INFORMATION

This Proxy Statement is being provided to solicit proxies on behalf of the Board of Directors of Nexa Resources S.A. (the “Company”, “Nexa”, “we”, “our” or “us”) for use at the 2025 Annual General Meeting of Shareholders (the “Annual General Meeting”) to be held on May 8, 2025, at 3:00 p.m. Luxembourg time, and the Extraordinary General Meeting of Shareholders of the Company to be held immediately thereafter (the “Extraordinary General Meeting” and together with the Annual General Meeting, the “Meetings”), at the Company’s registered office located at 37A, Avenue J. F. Kennedy, L-1855 Luxembourg, Grand Duchy of Luxembourg and any adjournment or postponement thereof. This Proxy Statement is available on our website at https://ri.nexaresources.com/corporate-governance/shareholders-meeting/ and our Annual Report on Form 20-F for the year ended December 31, 2024 (the “Annual Report on Form 20-F”) is available on our website at https://ri.nexaresources.com/financial-information/annual-reports/ and all of the aforementioned documents are available under the Company’s profile on EDGAR at www.sec.gov and SEDAR+ at www.sedarplus.ca. Copies of the Company’s consolidated financial statements and annual accounts for the financial year ended December 31, 2024 are available on our website at https://ri.nexaresources.com/corporate-governance/shareholders-meeting/. The Proxy Statement will also be made available to our “street name” holders (meaning beneficial owners with their shares held through a bank, brokerage firm or other record owner) and registered shareholders as of the Record Date (as defined below) through the delivery methods described below.

This Proxy Statement, together with the Convening Notice containing the agenda and the proxy card with reply envelope, are hereinafter referred to as the “Proxy Materials.”

Status as a Foreign Private Issuer and SEC foreign Issuer

We are a “foreign private issuer” within the meaning of Rule 405 of the U.S. Securities Act of 1933, as amended, and Rule 3b-4 of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), and as a result, we are exempt from the U.S. Securities and Exchange Commission’s proxy rules under Rule 3a12-3(b) of the Exchange Act.

In accordance with applicable Canadian securities laws, as an “SEC foreign issuer” (as such term is defined in National Instrument 71-102 – Continuous Disclosure and Other Exemptions Relating to Foreign Issuers), we are exempt from certain requirements under Canadian securities laws relating to continuous disclosure obligations, proxy solicitation and certain other matters provided that we comply with appropriate requirements in the United States and our jurisdiction of incorporation, if applicable. However, recognizing that good corporate governance plays an important role in our overall success and in enhancing shareholder value, we have determined to voluntarily comply with certain best practice guidelines and to provide certain disclosures. These are discussed in further detail under the heading “Corporate Governance” below in this Proxy Statement.

|

|

How May the Meetings Materials Be Accessed?

| (a) | Street name holders (beneficial shareholders) |

We have elected to provide access to our Proxy Materials over the internet. Accordingly, we are mailing a notice (the “Information Notice”) on April 2, 2025, regarding internet availability of Proxy Materials to our street name holders (beneficial shareholders) of record as of close of business (EDT) on March 27, 2025 (the “Record Date”). You will have the ability to access the Proxy Materials, the Company’s consolidated financial statements and its annual accounts for the financial year ended December 31, 2024 and our Annual Report on Form 20-F on the websites referred to in the Information Notice (https://ri.nexaresources.com/corporate-governance/shareholders-meeting/ and https://ri.nexaresources.com/financial-information/annual-reports/) or street name holders (beneficial shareholders) may request to receive a printed set of the Proxy Materials. The Information Notice, this Proxy Statement and Annual Report on Form 20-F are, or will be, available under the Company’s profile on EDGAR at www.sec.gov and SEDAR+ at www.sedarplus.ca. Instructions on how to access the Proxy Materials either by viewing them online or by requesting a copy may be found in the Information Notice. You will not receive a printed copy of the Proxy Materials unless you have requested one when setting up your brokerage account or request one in the manner set forth in the Information Notice. This permits us to conserve resources and reduces our printing costs, while giving shareholders a convenient and efficient way to access our Proxy Materials.

| (b) | Registered shareholders |

We are mailing the Proxy Materials on April 2, 2025, to all registered shareholders of our common shares as of the Record Date.

Who May Vote?

Only registered shareholders or street name holders (beneficial shareholders) of our common shares as of the Record Date will be entitled to notice of the Meeting and to vote at the Meeting. As of the Record Date, 132,438,611 common shares were issued and outstanding, out of which 132,438,611 common shares are entitled to one vote per common share at each Meeting.

What Constitutes an Attendance Quorum?

No quorum is required for any ordinary resolutions to be considered at the Annual General Meeting. For any extraordinary resolutions to be considered at the Extraordinary General Meeting, at least one-half of our issued share capital as of the date of such meeting will constitute a quorum. If such quorum is not present, the Extraordinary General Meeting may be adjourned and convened at a later date in which no quorum is required, provided that certain notice procedures are fulfilled. Abstentions are not considered “votes” but the common shares with respect to which such abstentions are expressed do count as shares present for purposes of determining a quorum.

What Are Broker Non-Votes and Abstentions?

Broker non-votes occur when brokers holding shares in street name for beneficial owners do not receive instructions from the beneficial owners about how to vote their shares and the broker is unable to vote the shares in its discretion in the absence of an instruction. An abstention occurs when a shareholder withholds such shareholder’s vote on a particular matter by checking the “ABSTAIN” box on the proxy card.

|

|

Your broker will NOT be able to vote your shares with respect to any of the proposals or other matters considered at the Meetings, unless you have provided instructions to your broker. We strongly encourage you to provide instructions to your broker to vote your shares and exercise your right as a shareholder. A vote will not be cast in cases where a broker has not received an instruction from the beneficial owner.

With respect to all of the proposals or other matters considered at the Meetings, only those votes cast “FOR” or “AGAINST” are counted for the purposes of determining the number of votes cast with respect to each such proposal.

Broker non-votes and abstentions are not considered votes cast and have no effect on the outcome of any of the proposals.

What Is the Process for Voting?

If you are a registered shareholder, you can vote by mail by marking, dating, signing and returning the proxy card in the postage-paid envelope. Submitting your proxy by mail will not affect your ability to attend the Meeting in-person and vote at the Meeting (subject to compliance with the procedures set forth in this Proxy Statement and the requirements under applicable law).

If your shares are held in “street name” and you are a beneficial shareholder, you will receive instructions from your bank, brokerage firm or other record owner. You must follow the instructions of the bank, brokerage firm or other record owner in order for your common shares to be voted.

The Company will retain an independent tabulator to receive and tabulate the proxies.

If you submit a proxy and direct how your shares will be voted, the individuals named as proxies will vote your shares in the manner you indicate. If you submit a proxy but do not direct how your shares will be voted, the individuals named as proxies will vote your shares “FOR” the election of each of the nominees for director and “FOR” each of the other proposals identified herein.

It is not expected that any other matters will be brought before the Meetings. If, however, other matters are properly presented, the individuals named as proxies will vote in accordance with their discretion with respect to such matters.

What Is the Process for Revocation of Proxies?

A registered shareholder who has given a proxy may revoke it at any time before it is exercised at the Meetings by:

| · | attending the Meetings and voting in person; |

| · | delivering a written notice dated on or before May 2, 2025, at 6:00 p.m. Luxembourg time, 12:00 p.m. EDT at the address given below, stating that the proxy is revoked; or |

| · | signing and delivering a subsequently dated proxy card prior to the vote at the Meetings. |

If you are a registered shareholder, you may request a new proxy card by contacting our Investor Relation department by email at ir@nexaresources.com.

|

|

Registered shareholders should send any written notice or new proxy card by (i) regular mail to Nexa Resources S.A., c/o Computershare, PO Box 505000, Louisville, KY 40233-5000, or (ii) by courier or U.S. overnight mail to Nexa Resources S.A., c/o Computershare, 462 South 4th Street, Suite 1600, Louisville, KY 40233-5000 (Telephone: +1 800-368-5948).

Any street name holder (beneficial shareholder) may change or revoke previously given voting instructions by contacting the bank or brokerage firm holding the shares or by obtaining a legal proxy from such bank or brokerage firm and voting in person at the Meetings, by delivering a written notice dated on or before May 2, 2025, at 6:00 p.m. Luxembourg time, 12:00 p.m. EDT, stating that the voting instructions are revoked or changed. Your last voting instructions, prior to or at the Meetings, are the voting instructions that will be taken into account.

Who May Attend the Meetings?

Only holders of our common shares as of the Record Date or their legal proxy holders may attend the Meetings. All holders of our common shares planning to attend the Meetings in person must contact our Investor Relation department, at ir@nexaresources.com by 6:00 p.m. Luxembourg time, 12:00 p.m. EDT, on May 2, 2025, to reserve a seat. For admission, shareholders should come to the Meetings check-in area no less than 15 minutes before the Annual General Meeting is scheduled to begin.

| · | Registered shareholders |

To be admitted to the Meetings, you will need a form of photo identification. You will be admitted to the Meetings only if we are able to verify your common shareholder status by checking your name against the list of registered common shareholders as of the Record Date.

| · | Beneficial shareholders |

To be admitted to the Meetings, you will need a form of photo identification. A beneficial shareholder must also bring valid proof of ownership of your common shares as of the Record Date, in order to vote at the Meetings you must bring a valid legal proxy from the holder of record.

If you hold your common shares as a beneficial holder in street name through a bank or brokerage firm, a brokerage statement reflecting your ownership as of the Record Date or a letter from a bank or broker confirming your ownership as of the Record Date is sufficient proof of ownership to be admitted to the Meeting.

Registration will begin at 2:30 p.m. Luxembourg time and the Annual General Meeting will begin at 3:00 p.m. Luxembourg time.

No cameras, recording equipment, electronic devices (including cell phones) or large bags, briefcases or packages will be permitted in the Meetings.

Representatives of PricewaterhouseCoopers, société coopérative, the Company’s statutory auditor (réviseurs d’entreprises agréés), will attend the Annual General Meeting.

The Meetings will be held in person in the Grand Duchy of Luxembourg. If, for any reason, we determine that it is necessary or appropriate to take additional steps regarding how we conduct the Meetings, we will announce this decision in advance, and details will be posted on our website. Please check our website prior to the Meetings if you are planning to attend in person.

|

|

What Is the Process for the Solicitation of Proxies?

We will pay the cost of soliciting proxies for the Meetings. We may solicit by mail, telephone, personal contact and electronic means and arrangements are made with brokerage houses and other custodians, nominees and fiduciaries to send the Information Notice, and if requested, Proxy Materials, to beneficial owners. Upon request, we will reimburse them for their reasonable expenses. In addition, our directors, officers and employees may solicit proxies, either in-person or by telephone, facsimile or written or electronic mail (without additional compensation). Shareholders are encouraged to return their proxies promptly.

|

|

ANNUAL GENERAL MEETING

PROPOSAL WITH RESPECT TO AGENDA ITEMS NO.

1, 2 AND 3 OF THE ANNUAL GENERAL MEETING:

APPROVAL OF CONSOLIDATED FINANCIAL STATEMENTS AND ANNUAL ACCOUNTS

At the Annual General Meeting, the Board of Directors will present the management reports on the Company’s consolidated financial statements and the annual accounts for the financial year ended December 31, 2024, and the statutory auditor (réviseur d’entreprises agréé) will present its reports on the consolidated financial statements and the annual accounts for the financial year ended December 31, 2024. The management reports and the statutory auditor’s reports are available on the internet at https://ri.nexaresources.com/corporate-governance/shareholders-meeting/.

Following such presentations, the following resolutions will be put before the Annual General Meeting for approval:

Resolved: The Annual General Meeting, after having reviewed the report of the Board of Directors of the Company and the report of the statutory auditor (réviseur d’entreprises agréé) on the Company’s annual accounts for the financial year ended December 31, 2024, hereby approves the annual accounts of the Company for the financial year ended December 31, 2024, in their entirety.

Resolved: The Annual General Meeting, after having reviewed the report of the Board of Directors of the Company and the report of the statutory auditor (réviseur d’entreprises agréé) on the Company’s consolidated financial statements for the financial year ended December 31, 2024, hereby approves the consolidated financial statements of the Company for the financial year ended December 31, 2024, in their entirety.

Vote Required and Board Recommendation

Approval of these proposals requires the affirmative vote of a simple majority of votes validly cast on such resolution by shareholders entitled to vote at the Annual General Meeting.

Our Board of Directors unanimously recommends a vote “FOR” the approval of the Company’s annual accounts and consolidated financial statements for the financial year ended December 31, 2024.

|

|

PROPOSAL WITH RESPECT TO AGENDA ITEM NO.

4 OF THE ANNUAL GENERAL MEETING:

APPROVAL OF ALLOCATION OF ANNUAL RESULTS

The Board of Directors proposes that the Annual General Meeting approves:

| (i) | the reimbursement of the share premium in respect of the financial year ended December 31, 2024: |

| - | of an aggregate amount equivalent to 20% of the free cash flow pre-events, which was recommended by the Board of Directors on February 20, 2024, as a reimbursement of the share premium to each shareholder of the Company amounting to approximately US$13.4 million in total, on a pro rata basis of approximately US$ 0.1011 per common share anticipated to be paid on June 24, 2025 to shareholders who hold common shares of the Company as of the close of business (EDT) on June 10, 2025; and |

| (ii) | to carry forward the loss for the year ended December 31, 2024. |

At the Annual General Meeting, the shareholders will be asked to consider the following resolution for approval:

Resolved: The Annual General Meeting hereby resolves to:

| (i) | approve the share premium reimbursement which has been made in respect of the financial year ended December 31, 2024, of an aggregate amount equivalent to 20% of the free cash flow pre-events, which was recommended by the Board of Directors on February 20, 2024, as reimbursement of the share premium to each shareholder of the Company amounting to approximately US$13.4 million in total, on a pro rata basis of approximately US$0.1011 per common share anticipated to be paid on June 24, 2025 to shareholders who hold common shares of the Company as of the close of business (EDT) on June 10, 2025; and |

| (ii) | approve to carry forward the loss for the year ended December 31, 2024, as recommended by the Board of Directors of the Company. |

Vote Required and Board Recommendation

Approval of this proposal requires the affirmative vote of a simple majority of votes validly cast on such resolution by the shareholders entitled to vote at the Annual General Meeting.

Our Board of Directors unanimously recommends a vote “FOR” the approval of the allocation of our annual results and the confirmation of the share premium reimbursement.

|

|

PROPOSAL WITH RESPECT TO AGENDA ITEM NO.

5 OF THE ANNUAL GENERAL MEETING:

APPROVAL OF DISCHARGE TO DIRECTORS FOR PERFORMANCE OF THEIR DUTIES

Under Luxembourg law, the shareholders are asked to vote on the discharge (quitus) of the directors with respect to the performance of their duties during the completed financial year.

At the Annual General Meeting, the shareholders will be asked to approve the following resolution with respect to the discharge of our directors who served during the year ended December 31, 2024:

Resolved: The Annual General Meeting hereby grants discharge (quitus) to the members of the Board of Directors who were in office during the financial year ended December 31, 2024, for the proper performance of their duties.

Vote Required and Board Recommendation

Approval of this proposal requires the affirmative vote of a simple majority of votes validly cast on such resolution by the shareholders entitled to vote at the Annual General Meeting.

Our Board of Directors unanimously recommends a vote “FOR” the approval of discharge of the members of the Board of Directors.

|

|

PROPOSAL WITH RESPECT TO AGENDA ITEM NO.

6 OF THE ANNUAL GENERAL MEETING:

ELECTION OF DIRECTORS

Reelection of Director

Our Board of Directors currently consists of nine (9) directors. Our Articles provide that our Board of Directors will consist of no fewer than five (5) directors and no more than eleven (11) directors. Pursuant to our Articles, our directors are appointed by the general meeting of shareholders of the Company for a period not exceeding two years.

The Board of Directors has nominated Mr. Flavio Aidar, listed below, for reelection as director of the Company, with his term of office expiring at the 2026 annual general meeting of shareholders of the Company.

Nominee for Reelection to the Company’s Board of Directors

|

Name |

Age |

Principal Residence |

Position |

Elected Since |

| Flavio Aidar | 48 | São Paulo, Brazil | Director | October 1, 2024 |

Information concerning the nominee for reelection to the Board of Directors can be found under the “Management” section of this Proxy Statement.

At the Annual General Meeting, the shareholders will be asked to approve the following resolutions:

Resolved: The Annual General Meeting hereby approves the appointment of Mr. Flavio Aidar, as director of the Company for a term ending at the 2026 annual general meeting of the shareholders.

Vote Required and Board of Directors Recommendation

The reelection of the nominee for director requires the affirmative vote of a simple majority of votes validly cast on such matter by the shareholders entitled to vote at the Annual General Meeting.

Our Board of Directors unanimously recommends a vote “FOR” the reelection of the director named above to term that run until the 2026 annual general meeting of shareholders.

|

|

PROPOSAL WITH RESPECT TO AGENDA ITEM NO.

7 OF THE ANNUAL GENERAL MEETING:

DETERMINATION OF THE 2025 OVERALL REMUNERATION OF THE MEMBERS OF THE BOARD OF DIRECTORS AND RATIFICATION OF THE 2024 OVERALL REMUNERATION

OF THE BOARD OF DIRECTORS

The members of our Board of Directors are entitled to reimbursement for reasonable travel and other expenses incurred in connection with attending Board of Directors’ meetings and meetings for any committee on which he or she serves. Our directors’ compensation program is based on fixed payments.

During fiscal year 2024, our directors received cash compensation in an aggregate amount of US$2,304,278 million for services as a member of our Board of Directors (the “Overall 2024 Directors’ Remuneration”).

The Board of Directors recommends US$2,310,000 as overall directors’ remuneration for the fiscal year 2025 for services as a member of our Board of Directors (the “Overall 2025 Directors’ Remuneration”).

At the Annual General Meeting, the shareholders will be asked to approve the following resolution:

Resolved: The Annual General Meeting hereby approves and to the extent necessary, ratifies, the Overall 2024 Directors’ Remuneration and the Overall 2025 Directors’ Remuneration.

Vote Required and Board Recommendation

Approval of this proposal requires the affirmative vote of a simple majority of votes validly cast on such resolution by the shareholders entitled to vote at the Annual General Meeting.

Our Board of Directors unanimously recommends a vote “FOR” the ratification of the Overall 2024 Directors’ Remuneration and approval of the Overall 2025 Directors’ Remuneration.

|

|

PROPOSAL WITH RESPECT TO AGENDA ITEM NO.

8 OF THE ANNUAL GENERAL MEETING:

APPROVAL OF APPOINTMENT OF STATUTORY AUDITOR

The Luxembourg laws applicable to the Company do not require a mandatory rotation of the statutory auditor (réviseur d’entreprises agréé). Nevertheless, as provided by such laws, the mandate of the statutory auditor (réviseur d'entreprises agréé) shall be limited in time and the renewal of such mandate each year is submitted for approval by the Annual General Meeting. The Audit Committee and members of the Company’s management focused on Nexa’s audit each year have decided that, based on market best practices, the key audit partner carrying out the statutory audit will change every 5 years. The next rotation of such partner is expected to occur for the financial year starting January 1st, 2028.

At the Annual General Meeting, the shareholders will be asked to approve the following resolution:

Resolved: The Annual General Meeting hereby approves the appointment of PricewaterhouseCoopers, société coopérative as approved statutory auditor (réviseur d’entreprises agréé) of the Company for the period ending at the general meeting of shareholders approving the annual accounts for the financial year ending on December 31, 2025.

Vote Required and Board Recommendation

Approval of this proposal requires the affirmative vote of a simple majority of votes validly cast on such resolution by the shareholders entitled to vote at the Annual General Meeting.

Our Board of Directors unanimously recommends a vote “FOR” the appointment of PricewaterhouseCoopers, société coopérative as approved statutory auditor (réviseurs d’entreprises agréé) for the period ending at the general meeting of shareholders approving the annual accounts for the financial year ending on December 31, 2025.

|

|

EXTRAORDINARY GENERAL MEETING

PROPOSAL WITH RESPECT TO AGENDA ITEM NO. 1 EXTRAORDINARY GENERAL MEETING:

AUTHORISED SHARE CAPITAL

The Board of Directors is seeking approval by the shareholders to renew the authorization of the Board of Directors to increase the issued share capital of the Company on one or more occasions within the limits of the authorized share capital currently set at USD 231,924,819, during a period starting on the day of the Extraordinary General Meeting and ending on the fifth anniversary of the date of publication in the Luxembourg Legal Gazette (Recueil Electronique des Sociétés et Associations) of the minutes of the Extraordinary General Meeting, without prejudice to any further renewals.

The Extraordinary General Meeting is also requested to renew the authorization currently held by the Board of Directors under article 5.10 of the Articles to limit or cancel preferential subscription rights solely in the context of an issuance of new shares and instruments carried out through a public offering process in order to allow the Company to retain adequate flexibility under the portion of the authorised un-issued share capital that may be issued by the Board of Directors.

The report of the Board of Directors of the Company relating to the proposed renewal of the authorization of the Board of Directors to increase the issued share capital of the Company and the renewal of the authorization to limit or cancel the preferential subscription right of existing shareholders in the context of issuances of new shares and instruments carried out through a public offering process is available on https://ri.nexaresources.com/corporate-governance/shareholders-meeting/.

At the Extraordinary General Meeting, the shareholders will be asked to approve the following resolution:

Resolved:

(a) renew the authorization of the Board of Directors, during a period of five years starting on the date of this Extraordinary General Meeting of shareholders and ending on the fifth anniversary of the date of publication in the Luxembourg legal gazette (Recueil Electronique des Sociétés et Associations) of the minutes of the Extraordinary General Meeting, to issue additional shares in the Company within the limit of the authorized share capital;

(b) renew the authorization of the Board of Directors to limit or cancel the preferential subscription rights of existing shareholders in the event of any increase in the issued share capital up to and including the authorized share capital in the context of issuances of new shares and instruments carried out through a public offering process; and

(c) amend article 5.8 of the articles of association to be read as follows:

5.8. The Board of Directors is authorized, during a period starting on the day of the general meeting of shareholders held on 8 May 2025 and ending on the fifth anniversary of the date of publication in the Luxembourg legal gazette (Recueil Electronique des Sociétés et Associations) of the minutes of such general meeting, without prejudice to any renewals, to increase the issued share capital on one or more occasions within the limits of the authorized Capital.

|

|

The proposed amended version of the articles of association of the Company is available on https://ri.nexaresources.com/corporate-governance/shareholders-meeting/.

Vote Required and Board Recommendation

Approval of this proposal requires the affirmative vote of a two-thirds majority of the votes validly cast on such resolution, where the shares represented at the meeting represent at least half of the issued share capital.

Our Board of Directors unanimously recommends a vote “FOR” the approval of (a) the renewal of the authorization of the board of directors, during a period of five years starting on the date of this Extraordinary General Meeting of shareholders and ending on the fifth anniversary of the date of publication in the Luxembourg Legal Gazette (Recueil Electronique des Sociétés et Associations) of the minutes of the Extraordinary General Meeting, to issue additional shares in the Company within the limit of the authorized share capital; (b) the renewal of the authorization of the board of directors to limit or cancel the preferential subscription right of existing shareholders in the context of an issuance of new shares and instruments carried out through a public offering process, and (c) amendment of article 5.8 accordingly.

|

|

CORPORATE GOVERNANCE

Our corporate governance model is aimed at facilitating the flow of information between our executives and other key decision-makers on our management team, specifically, our Board of Directors, Board committees and management committee. Our corporate governance model also provides a framework for the duties of our management team, including oversight of Nexa’s performance and decision-making. Our main corporate governance activities include support for Board of Directors, Board advisory committees and executive Board meetings (management committee); contribution to the process of preparing the annual report on governance practices; and elaboration of governance documents and updating of best practices.

Our corporate governance model is designed to ensure that the proper corporate governance principles are consistently applied within our organization. We have adopted certain corporate governance policies and practices that include internal rules for the Board of Directors and key committees that have independent representation and leadership, including an audit committee and a compensation, nominating and governance committee. The charter for the compensation, nominating and governance committee includes responsibility for reviewing and assessing the size, composition and operation of the Board of Directors to ensure effective and independent decision making, advising on potential conflicts of interest situations and developing corporate governance guidelines and principles, in line with ESG standards. The disclosure set out below describes in further detail our approach to corporate governance.

Meetings of the Board of Directors and attendance

The Board of Directors ordinarily meets in person or by other means of communication as may be required. The frequency of and agenda items for Board of Directors’ meetings will vary depending on the state of affairs, requirements for approvals and opportunities available to Nexa and the risks and issues which Nexa faces. The agenda for meetings places priority and focuses on key issues for Nexa, which are identified by the Chair of our Board of Directors (the “Chair”). Routine business is dealt with after substantive discussions on the key issues.

Under the Board of Directors’ internal rules and our Articles, the Boards of Directors can validly consider any matters and make decisions provided at least a majority of the members are in attendance in person or by representation. The Board of Directors’ internal rules further provide that each member is entitled to one vote either in person or where duly represented as required by the Board of Directors internal rules. In fiscal year 2024, our Board of Directors held ten meetings, in which the rate of attendance in person or by representation was 99% of the directors. In addition, we had (i) six audit committee meetings, (ii) five finance committee meetings, (iii) seven compensation, nominating and governance committee meetings, and (iv) seven sustainability and capital projects committee meetings.

As set forth in the Board of Directors’ internal rules, the independent Directors may hold meetings in which members of the management team and the non-independent Directors are not present. In 2024, our Directors held in camera sessions without members of the management team prior and/or at the conclusion of each Board meeting.

Committees of our Board of Directors

Our Board of Directors has an audit committee, a finance committee, a compensation, nominating and governance committee and a sustainability and capital projects committee. Our Board of Directors may have other committees as it may determine from time to time. Each of the standing committees of our Board of Directors has the composition and responsibilities assigned to them by the meeting of the Board of Directors that created such committee and as set forth in their respective committee charters. These charters set out, among other things, the roles and responsibilities of the chair of each committee. As set forth in the respective charters of the committees, each of the committees may meet with or without the management,

|

|

as the case may be, at the discretion of the committee. The charter for each of the committees of our Board of Directors is available on our website.

Audit committee

Our audit committee is a standing committee established by our Board of Directors on March 28, 2017, to assist the Board of Directors in fulfilling certain of its oversight responsibilities. The audit committee may be composed of three to five members, each appointed by our Board of Directors for a term of one year. Daniella Dimitrov, Edward Ruiz and Jane Sadowsky currently serve as its members. These individuals are independent under Rule 10A-3 and applicable NYSE standards, as well as Canadian securities regulators’ National Instrument 52-110 Audit Committees. In addition, each of them satisfies the financial literacy requirement under applicable rules. Our Board of Directors has determined that Mr. Edward Ruiz qualifies as an “audit committee financial expert.”

Our audit committee’s primary responsibilities are to assist the Board of Directors’ oversight of: (i) quality and integrity of our financial reporting and related financial disclosure; (ii) the effectiveness of our internal control over financial reporting and disclosure controls and procedures; (iii) our compliance with legal and statutory requirements as they relate to financial statements and related financial disclosures; (iv) the monitoring of risk management controls and processes, according to the Enterprise Risk Management (the “ERM”) policy, and the oversight of financial reporting and related compliance, internal control over financial reporting and fraud risks; (v) the compliance and ethics program; (vi) review of all related party transactions; (vii) the qualifications, performance and independence of our independent auditors and performance of the internal audit function; (viii) the Company’s internal controls and processes to ensure ESG and cybersecurity disclosures and policies are accurate, transparent and in compliance with applicable laws, regulations or rules.

Nexa has established policies and procedures that require any engagement of our independent auditor for audit or non-audit services to be submitted to and pre-approved by the audit committee. In addition, our audit committee may delegate the authority to pre-approve non-audit services to one or more of its members. All non-audit services that are pre-approved pursuant to such delegated authority must be presented to the full audit committee at its first scheduled meeting following such pre-approval. Our audit committee shall pre-approve all audit and non-audit services to be provided to us by our independent auditor and also has the authority to recommend pre-approval policies and procedures to our Board of Directors and for the engagement of our independent auditor’s services.

Finance committee

Our finance committee is a standing committee established by our Board of Directors on March 28, 2017, to assist the Board of Directors in fulfilling certain of its oversight responsibilities. The finance committee may be composed of three to five members, each appointed by our Board of Directors for a term of one year. Gianfranco Castagnola, Paulo Macedo, Flávio Aidar and Edward Ruiz currently serve as its members. It is also the finance committee attribution to support the Board in its monitoring of the enterprise risk management in matters related to the responsibility of this committee.

Our finance committee’s primary responsibilities are to assist the Board of Directors in fulfilling its oversight responsibilities with respect to monitoring Nexa’s balance sheet and by providing recommendations on our capital management strategy and capital structure, including indebtedness, investments and returns, and support the Board of Directors in its monitoring of the enterprise risk management in matters related to the responsibilities of the committee, among others.

|

|

Compensation, nominating and governance committee (CNG committee)

Our compensation, nominating and governance committee is a standing committee established by our Board of Directors on March 28, 2017, to assist the Board of Directors in fulfilling certain of its oversight responsibilities. The compensation, nominating and governance committee may be composed of two to five members, each appointed by our Board of Directors for a term of one year. Jaime Ardila, Jane Sadowsky, Luís Ermírio de Moraes and Flavio Aidar currently serve as its members. One of the four members of the compensation, nominating and governance committee is an independent director.

Our compensation, nominating and governance committee is responsible for: (1) new compensation models and changes to compensation models currently used by us, in order to guide and influence our actions; (2) the compensation of the executive officers, of the members of the Board of Directors and of the members of the committees of the Board of Directors; (3) the administration the policy for the recovery of erroneously awarded compensation with the support of the audit and/or the finance committees where applicable, and the proposal of changes to such policy if necessary; (4) the proposal of candidates to the chair of chief executive officer, when applicable, or any serious restrictions on the candidates proposed by the chief executive officer to the other chairs of the executive officers; (5) development of corporate governance guidelines and principles; (6) the governance structure related to the Company’s ESG strategy as it applies to the Company and its value chain; (7) identification of individuals qualified to be nominated as members of the Board of Directors and suggesting nominees to fill any vacancies on the Board of Directors; (8) the structure and composition of Board of Directors’ committees; (9) evaluation of the performance and effectiveness of the Board of Directors, the chief executive officer and each of the Board’s standing committees; (10) the supervision and approval of our social responsibility plans and policies (other than community-related aspects which are overseen by the sustainability and capital projects committee), including, but not limited to our ESG strategy; (11) the supervision of Company’s people strategy; (12) the monitoring of the relationship of the Company with unions; (13) support the Board of Directors in its monitoring of the enterprise risk management in matters related to the responsibilities of the committee; and (14) any related matters required by applicable laws.

Sustainability and capital projects committee (SCP committee)

Our sustainability and capital projects committee is a standing committee established by our Board of Directors on April 29, 2019, to assist the Board of Directors in fulfilling certain of its oversight responsibilities. The sustainability and capital projects committee may be composed of at least three and no more than five members, each appointed by our Board of Directors for a term of one year. Daniella Dimitrov, Hilmar Rode, Luís Ermírio de Moraes and Jaime Ardila currently serve as its members.

Our sustainability and capital projects committee’s primary responsibilities are to assist the Board of Directors by supporting safe and sustainable business practices in the conduct of our activities in respect of environmental, health, safety and social matters, including relationships with local communities, tailings management, water, waste, biodiversity, and GHG emissions, as well as with respect to the estimation and disclosure of mineral resources and reserves at all operations and projects (collectively “Sustainability Matters”). The committee also assists the Board of Directors with the oversight of our ESG strategy, including its revision and implementation, in connection with Sustainability Matters and all related applicable laws.

The sustainability and capital projects committee is also responsible for assisting the Board of Directors with the review of technical, economic and social matters with respect to our projects, including exploration, development, permitting, construction and operation of our mining and smelting assets, which are core to our strategy and growth.

|

|

Appointment and term of members of our Board of Directors

In accordance with our Articles and the 1915 Law, the members of our Board of Directors are elected by a resolution of a general meeting of shareholders adopted with a simple majority of the votes validly cast, regardless of the portion of capital represented at such general meeting. Votes are cast for or against each nominee proposed for election to the Board of Directors and cast votes shall not include votes attaching to shares for which the shareholder has not participated in the vote, has abstained or has returned a blank or invalid vote.

Our directors are appointed for two-year terms and may be reelected. Members of our Board of Directors may be removed at any time, with or without cause, by a resolution adopted at a general meeting of our shareholders. Under Luxembourg law, in the case of a vacancy of the office of a director appointed by the general meeting of shareholders, the remaining directors may, by a simple majority vote of the directors present or represented, fill the vacancy. In these circumstances, the following general meeting of shareholders shall make the final appointment of the director.

Mandate for the Board of Directors

Our Board of Directors adopted Board of Directors internal rules, which includes the following, among other things:

| · | approve the general guidance of our business, its mission, strategic goals and guidelines; |

| · | ensure that the executive officers comply with such mission, strategic goals and guidelines; |

| · | approve the budget and a strategic plan which takes into account, among other things, the opportunities and risks of the business; |

| · | approve the annual commercial agreements strategy; |

| · | recommend the shareholders to approve mergers, spin-offs, incorporations, acquisitions, divestitures and joint venture operations related to Nexa and its subsidiaries according to our articles of association; |

| · | promote and ensure compliance with our corporate purpose; |

| · | ensure Nexa’s long-term and sustainable continuity with respect to the Company’s ESG and economic goals, including, but not limited to supporting the Board committees to oversee and revise the implementation of Company’s ESG strategy pursuant to applicable laws, when applicable; |

| · | develop our approach to corporate governance, including the creation and review, from time to time, of corporate governance principles and guidelines that are specifically applicable to us; |

| · | evaluate the performance of our CEO and executive officers; |

| · | exemplify and, together with the management committee, implement a culture of integrity throughout the organization; |

| · | approve and monitor compliance, directly and/or through its committees, with the following policies: (a) code of conduct; (b) disclosure policy; (c) insider trading policy; (d) dividend policy; (e) compliance policy; (f) antitrust/competition policy; (g) anti-corruption policy; (h) |

|

|

money laundering and terrorist financing prevention policy; (i) financial risk management policy (and complementary policies proposed by the management committee, such as the hedge, derivatives, leverage, liquidity and foreign exchange exposure policy); (j) ERM policy; (k) clawback policy; and (l) authorization policy;

| · | approve Board members’ and executive officers’ compensation, the amount of which shall not exceed the amount determined by the general meeting; |

| · | ensure appropriate succession planning for our Board of Directors, CEO and executive officers; |

| · | deliberate and approve the terms and conditions of any compensation arrangements or proposed material amendments to any terms and conditions of existing compensation arrangements entered between Nexa and any of our executive officers; |

| · | with respect to cybersecurity: (a) monitor the Audit Committee and management regarding cybersecurity matters and provide guidance as needed; (b) receive updates and reports on cybersecurity tests, incident response plans, cybersecurity incidents, and our cybersecurity policies; and (c) review with management and with the support of the Audit Committee, our cybersecurity risk management program in connection with the Enterprise Risk Management policy; and |

| · | all further tasks as required by applicable laws. |

The Board of Directors internal rules are available on our website.

The Board of Directors has at its disposal a set of provisions and practices that promotes independence in the decision-making process of the Board of Directors. In accordance with the Board of Director’s internal rules, the independent members of the Board of Directors may hold separate meetings and each director has a duty to declare, prior to any Board of Directors’ meeting, the existence of a particular reason or conflict of interest with Nexa with respect to a subject matter being discussed or considered by the Board of Directors. Accordingly, such Board of Directors member would be refrained from discussing and voting on a matter that could present a conflict of interest. Additionally, our Board of Directors members are prohibited from holding executive positions with Nexa and/or serving on more than four boards of directors of companies that do not belong to the same conglomerate. As discussed above, our audit committee is comprised entirely of independent directors and we also have independent representation on all other committees.

Chair

The Chair of our Board of Directors is not an independent director of the Company. The Board of Directors has carefully considered governance issues relating to Chair independence and believes that the Chair carries out separate responsibilities diligently and that, with the compensating practices in place, the Board of Directors operates effectively and in Nexa’s best interest.

Description of the position of Chair

Our Board of Directors has developed a written position description for the Chair of the Board of Directors. The Chair of the Board of Directors has the following responsibilities, subject to any other matters that may be set forth in our Articles or provided for under applicable law:

| · | ensure the efficiency and proper performance of the Board of Directors; |

|

|

| · | preside over the Board of Directors’ meetings; |

| · | prepare, organize, elaborate and distribute the agenda and minutes of the meetings aided by the Board of Directors secretary, including all information necessary to discuss the matters on the agenda; |

| · | coordinate the activities of other Board of Directors members; |

| · | ensure that all Board of Directors members receive comprehensive information about the items on the Board of Directors agenda in a timely manner; |

| · | propose the annual corporate calendar to the Board of Directors in coordination with Nexa’s CEO, which shall necessarily set forth the dates of corporate events; |

| · | organize the onboarding and education sessions for incoming members of the Board of Directors in coordination with Nexa’s CEO; and |

| · | periodically arrange for continuing education opportunities for all Board of Directors members, so that individuals may maintain or enhance their skills and abilities as members and ensure that their knowledge and understanding of Nexa’s business remains current. |

Orientation and continuing education

We implemented an orientation program for new directors under which each new director meets with the Chair of our Board of Directors and our executives. New directors are provided with comprehensive orientation and education as to our business, operations and corporate governance (including the role and responsibilities of the Board of Directors and each committee).

The Chair of our Board of Directors is responsible for overseeing directors’ continuing education and ensure that it is designed to maintain or enhance the skills and abilities of our directors and to ensure that their knowledge and understanding of our business remains current. The chair of each committee is responsible for coordinating orientation and continuing director development programs relating to the committee’s mandate.

Our ongoing director education programs entails site visits, presentations from outside experts and consultants, discussions on ongoing governance trends and guidelines for public companies, briefings from staff and management, and reports on issues relating to our projects and operations, sustainability and social matters, competitive factors, reserves, legal issues, economic, accounting and financial disclosure, mineral and hydrocarbon education and other initiatives intended to keep the Board of Directors abreast of new developments and challenges that we may face. As part of the education session, certain directors obtained international certifications related to the competencies necessary for their activities, such as National Association of Corporate Directors (“NACD”) Directorship Certification.

Evaluation of directors

Our compensation, nominating and governance committee established a framework for the implementation and administration of processes to assess the effectiveness of the Board of Directors and each of its members. This includes peer reviews of each director’s performance and self-assessments, as well as full Board of Directors and committee review of the Board of Directors and the respective committees, by way of questionnaires, interviews and sessions with the Chair. In addition to hiring external advisors to develop and undertake this assessment, the compensation, nominating and governance

|

|

committee is also responsible for overseeing the process and evaluating the results, with the objective of improving the performance of each director and the Board of Directors as a whole.

Considerations in evaluating director nominees

Our Board of Directors is responsible for nominating members for election to the Board of Directors and for filling vacancies on the Board of Directors that may occur between annual meetings of shareholders. The process for nominating a new director initiates with our compensation, nominating and governance committee which evaluates Nexa’s current circumstances and establishes a profile for a director candidate. Such profile is then shared with a specialized external executive search firm, who assists the compensation, nominating and governance committee in selecting candidates for interviews. Prior to the interview, the specialized external firm is responsible for a background check with former employers and colleagues of the respective candidates.

Following the interview(s), our compensation, nominating and governance committee recommends the nomination of the director candidate to our Board of Directors based upon an assessment of the independence, skills, qualifications and experience of such candidate. Specifically, the Board of Directors seeks members from diverse professional and personal backgrounds who combine a broad spectrum of experience and expertise with a reputation for integrity.

Plurality

We value diversity in our operations. We believe that having a diverse Board of directors can offer a breadth and depth of perspectives that enhance our performance. Recommendations concerning director nominees are based on merit and past performance as well as other factors, as we believe that having a diverse and inclusive organization overall is beneficial to our success.

Compensation-setting process

Our compensation, nominating and governance committee is responsible for assisting our Board of Directors in fulfilling its governance and supervisory responsibilities and advising our Board of Directors with respect to evaluation and monitoring of compensation models and policies performed every two years, which takes into account peer companies and the challenges and opportunities we face. The committee’s responsibilities also include administering and determining our compensation objectives and programs, reviewing and making recommendations to our Board of Directors concerning the level and type of the compensation payable, evaluating performance, implementing evaluation and improvement processes, and ensuring that policies and processes are consistent with our philosophy and the objectives of our compensation program.

Code of conduct

We work with all of our employees, as well as third parties who we work with, to ensure they behave in a manner consistent with our values, code of conduct and the key principles of our compliance program, particularly as these relate to the environment, human rights and labor related issues, health and safety, and anti-bribery and corruption. The Code of Conduct reflects our commitment to the principles of anti-corruption, anti-money laundering, anti-terrorist financing, integrity, ethics, human rights, social and environmental responsibilities and antitrust policies based on laws in effect in the countries where we operate. Our directors and executives have certified that they have read and that they will comply with our code of conduct. Furthermore, our Board of Directors periodically monitors compliance related topics. A conduct committee is in charge of promoting the implementation of the code and supervising the application of disciplinary measures. The last update of our Code of Conduct occurred in 2021, since then we continued

|

|

with its dissemination to current and new employees at a global level. In 2025, we expect to review our Code of Conduct and consequently issue a new version. In 2022, we also launched our Code of Conduct for Suppliers and started to disseminate it to any suppliers considered to be strategic vendors. In 2023, we launched our Code of Conduct for Customers and started disseminating it as well. In 2024, we continued to disseminate our Code of Conduct for Suppliers and Code of Conduct for Customers.

Anti-corruption, anti-money laundering and antitrust programs have been implemented, including, among other things, ethics and compliance training and an ethics hotline which enables employees and third parties to report misconduct. Information reported through our ethics hotline is investigated and following the investigation, disciplinary action may be taken, if necessary. We have not granted any implicit or explicit waivers from any provision of our code of conduct since its adoption.

Our code of conduct, code of conduct for suppliers and compliance-related policies are publicly available on our website at https://www.nexaresources.com. We will disclose future amendments to, or waivers of, our code of conduct on the same page of our corporate website. Information contained on our website is not incorporated by reference into this Proxy Statement, and you should not consider it to be part of this Proxy Statement.

Foreign private issuer and controlled company exemptions

Because we are a foreign private issuer, the NYSE rules applicable to us are considerably different from those applied to U.S. companies. Accordingly, we have been, and expect to continue, taking advantage of certain exemptions from NYSE governance requirements provided in the NYSE rules for foreign private issuers. Subject to the items listed below, as a foreign private issuer we are permitted to follow home country practice in lieu of the NYSE’s corporate governance standards. Luxembourg law does not require that a majority of our Board of Directors consist of independent directors or the implementation of a compensation committee or nominating and corporate governance committee. As a foreign private issuer, we must comply with four principal NYSE corporate governance rules: (i) we must satisfy the requirements of Exchange Act Rule 10A-3 relating to audit committees; (ii) our Chief Executive Officer must promptly notify the NYSE in writing after any executive officer becomes aware of any non-compliance with the applicable NYSE corporate governance rules; (iii) we must provide the NYSE with annual and interim written affirmations as required under the NYSE corporate governance rules; and (iv) we must provide a brief description of any significant differences between our corporate governance practices and those followed by U.S. companies under NYSE listing standards.

In addition, for purposes of the NYSE rules, as VSA beneficially owns a majority of our outstanding common shares, we are a “controlled company.” “Controlled companies” under those rules are companies of which more than 50.0% of the voting power is held by an individual, a group or another company. Accordingly, we are eligible to take advantage of certain exemptions from NYSE governance requirements provided in the NYSE rules. Specifically, as a controlled company under NYSE rules, we are not required to have a majority of independent directors or a compensation, nominating and corporate governance committee composed entirely of independent directors.

As described further above, we recognize that good corporate governance plays an important role in our overall success and in enhancing shareholder value and, accordingly, we have adopted certain corporate governance policies and practices that reflect these considerations. The following table briefly describes the significant differences between our practices and the practices of U.S. domestic issuers under NYSE corporate governance rules.

|

|

|

Section |

NYSE corporate

governance rule for |

Our approach |

| 303A.01 | A listed company must have a majority of independent directors. “Controlled companies” and “foreign private issuers” are not required to comply with this requirement. |

We are a controlled company because more than a majority of our voting power for the appointment of directors is controlled by VSA. We are a foreign private issuer because we are incorporated in Luxembourg. As a controlled company and foreign private issuer, we are not required to comply with the majority of independent director requirements. As of the date of this Proxy Statement, four of our nine directors are independent. Our Board of Directors has adopted internal rules equivalent to a charter. See “Corporate Governance, management and employees—Board of Directors” for a description of our Board of Directors and processes our Board of Directors has implemented to promote the exercise of independent judgment. |

| 303A.03 | The non-management directors of a listed company must meet at regularly scheduled executive sessions without management. | We have no management directors. |

|

|

|

Section |

NYSE corporate

governance rule for |

Our approach |

| 303A.04 |

A listed company must have a nominating/corporate governance committee composed entirely of independent directors, with a written charter that covers certain minimum specified duties. “Controlled companies” and “foreign private issuers” are not required to comply with this requirement. |

As a controlled company and foreign private issuer, we are not required to comply with the nominating/corporate governance committee requirements. However, we do have a compensation, nominating and governance committee composed of one independent director and three non-independent directors, which has adopted a committee charter. As set forth in the committee’s charter, this committee is responsible for, among other matters: · identifying individuals qualified to be nominated as members of the Board of Directors; · suggesting names to fill any vacancies on the Board of Directors; · developing corporate governance guidelines and principles; and · evaluating the performance and effectiveness of the Board of Directors, the CEO and each of committees. See “Corporate Governance, management and employees—Board of Directors—Committees of our Board of Directors.”

|

| 303A.05 |

A listed company must have a compensation committee composed entirely of independent directors, with a written charter that covers certain minimum specified duties. “Controlled companies” and “foreign private issuers” are not required to comply with this requirement. |

As a controlled company and foreign private issuer, we are not required to comply with the compensation committee requirements. However, we do have a compensation, nominating and governance committee composed of one independent director and three non-independent directors, which has adopted a committee charter. As set forth in the committee’s charter, this committee is responsible for, among other matters: · reviewing and proposing new compensation models and changes to current compensation models; and · determining compensation of executive officers, directors and committee members. See “Corporate governance, management and employees—Board of Directors—Committees of our Board of Directors.”

|

|

|

|

Section |

NYSE corporate

governance rule for |

Our approach |

|

303A.06 303A.07 |

A listed company must have an audit committee with a minimum of three independent directors who satisfy the independence requirements of Rule 10A-3 under the Exchange Act, with a written charter that covers certain minimum specified duties. |

We have an audit committee composed of three members, all of whom qualify as independent under Rule 10A-3 and applicable NYSE standards. Each member of the audit committee also satisfies the financial literacy requirement under applicable standards. The audit committee has adopted a committee charter, which was duly approved by our Board of Directors. As set forth in the committee’s charter, the committee shall assist the Board of Directors in fulfilling its oversight responsibilities with respect to, among others: · quality and integrity of our financial reporting and related financial disclosures; · the effectiveness of our internal control over financial reporting and disclosure controls and procedures; · our compliance with legal and statutory requirements as they relate to financial statements and related financial disclosures; · our risk management controls and monitoring processes, according to the ERM policy; · the qualifications, performance and independence of our independent auditors and performance of the internal audit function; · our internal controls and processes to ensure ESG and cybersecurity disclosures and policies are accurate, transparent and in compliance with applicable laws, regulations or rules.

See “Corporate governance, management and employees—Board of Directors—Committees of our Board of Directors.”

|

| 303A.08 | Shareholders must be given the opportunity to vote on all equity-compensation plans and material revisions thereto, with limited exemptions set forth in the NYSE rules. | Our articles of association require shareholder approval of overall remuneration, including any equity-compensation plans of members of the Board of Directors and members of Board of Directors committees. |

| 303A.09 | A listed company must adopt and disclose corporate governance guidelines that cover certain minimum specified subjects. | We have corporate governance policies in place as described in “Corporate governance, management and employees” in this Proxy Statement. |

| 303A.10 | A listed company must adopt and disclose a code of business conduct and ethics for directors, officers and employees, and promptly disclose any waivers of the code for directors or executive officers. | We have adopted a formal code of conduct, which applies to our directors, officers, employees and third parties who interact with the Company. Our code of conduct has a scope that is similar, but not identical, to that required for a U.S. domestic company under the NYSE rules. |

|

|

|

Section |

NYSE corporate

governance rule for |

Our approach |

| 303A.12 |

(a) Each listed company CEO must certify to the NYSE each year that he or she is not aware of any violation by the Company of NYSE corporate governance listing standards. (b) Each listed company CEO must promptly notify the NYSE in writing after any executive officer of the listed company becomes aware of any non-compliance with any applicable provisions of this Section 303A. (c) Each listed company must submit an executed Written Affirmation annually to the NYSE. In addition, each listed company must submit an interim Written Affirmation as and when required by the interim Written Affirmation form specified by the NYSE. |

As a foreign private issuer, we are subject to and comply with (b) and (c) of these requirements but are not subject to (a). |

|

|

MANAGEMENT

Board of Directors

Our Board of Directors is responsible for the general guidance of our business and affairs, including providing general guidance, governance and strategic oversight to our executives and other members of our management team. It is also responsible for ensuring that we meet our objectives, as well as for monitoring our performance and ensuring business continuity. The Board of Directors is vested with broad powers to act on behalf of Nexa and to perform or authorize all acts of administrative or ancillary nature necessary or useful to accomplish our corporate purpose. All powers not expressly reserved by law to the shareholders fall within the competence of our Board of Directors.

Our Board of Directors is comprised of a minimum of five and a maximum of eleven members and currently has nine members, of which four are independent directors and five are non-independent.