SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of March, 2025

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS

(Exact name of registrant as specified in its charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Table of Contents

| Message from the Chairman of the Board of Directors | 3 |

| Participation Manual | 6 |

| 1. Exclusively digital assembly | 6 |

| 1.1. Entirely remote OEGM | 6 |

| 1.2. Distance Voting Ballot (BVD) | 7 |

| 1.3. Required documents | 9 |

| 1.4. Registration and accreditation | 10 |

| 1.5. Declaration of Membership in a Group of Shareholders | 12 |

| 1.6. Conciliation Agreement | 13 |

| 2. Management Proposal | 20 |

| 2.1. Procedural Rules: | 20 |

| 2.4.1. Merger of Eletropar into Eletrobras | 23 |

| 2.4.2. Bylaws Amendment Details: | 27 |

| First Block: Amendment to the Tie-Breaking Criteria for Matters Resolved by the Board of Directors: | 27 |

| Second Block: New Independence Criteria for Board Members and Reduction of the Minimum Number of Independent Directors: | 27 |

| Third Block: Transformation of the Fiscal Council into a Permanent Body Composed of Five (5) Members: | 28 |

| 2.5.1. Review the accounts of the Managers, examine, discuss, and vote on the Management Report and the Company's Complete Annual Financial Statements for the fiscal year ended December 31, 2024. | 29 |

| 2.5.2. Resolve on the management proposal for the allocation of results for the fiscal year ended December 31, 2024, and the distribution of dividends | 33 |

| 2.5.4. Elect the members of the Board of Directors for a unified term of two (2) years and deliberate on the characterization of their independent status: | 35 |

| 2.5.6. Set the annual aggregate compensation of the managers, external members of advisory committees, and members of the Fiscal Council (if installed) for the 2025 fiscal year: | 64 |

| SCHEDULES LIST | 67 |

| Page |

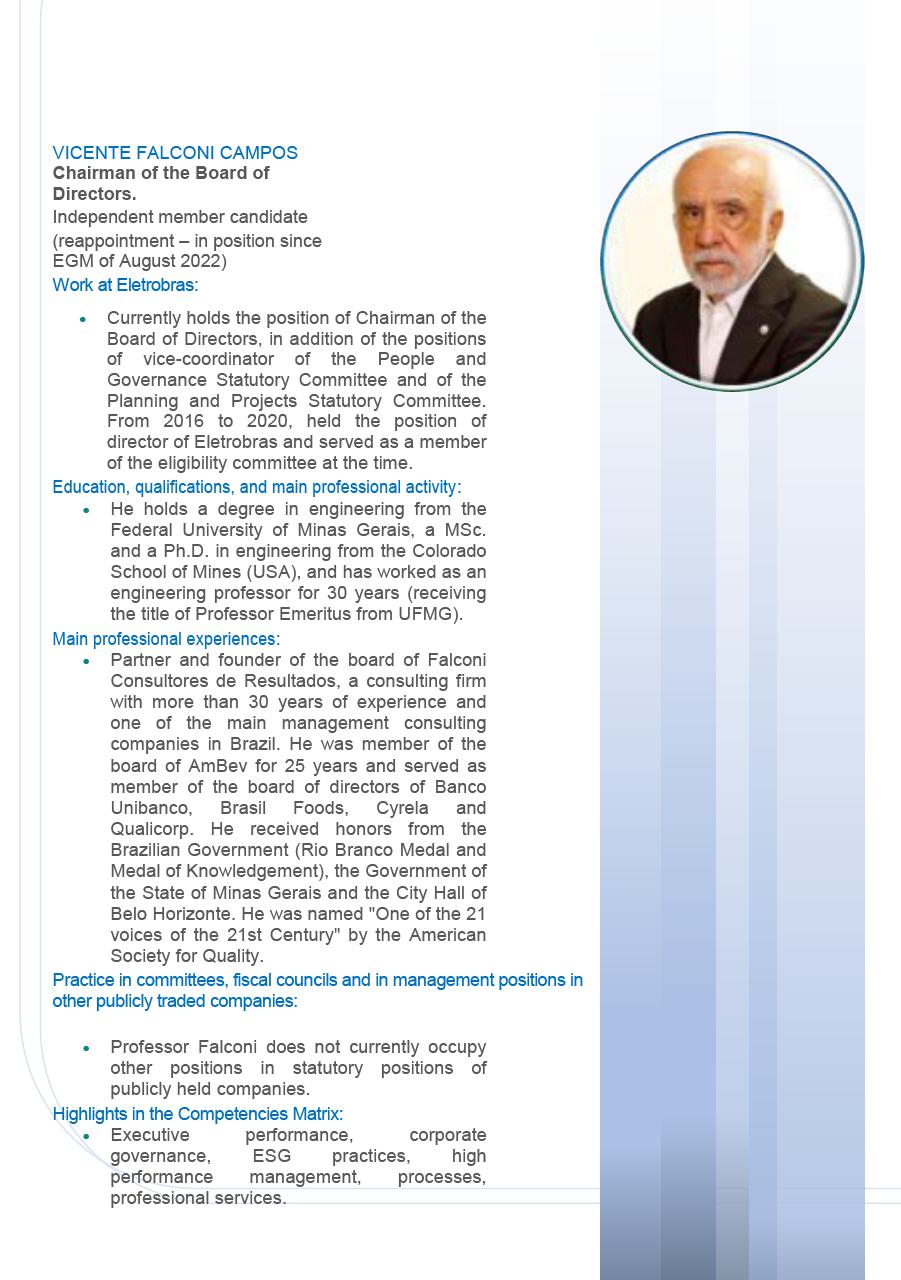

Message from the Chairman of the Board of Directors

|

Dear Shareholders, It is with great honor and enthusiasm that, on behalf of the Board of Directors, I invite you to attend the Extraordinary General Meeting for Conciliation (“Conciliation EGM”) and the Ordinary and Extraordinary General Meetings (“OEGM”) of Centrais Elétricas Brasileiras S.A. (“Eletrobras” or the “Company”), to be held on April 29, 2025, at 1:00 p.m. and 2:30 p.m. (Brasília time), respectively, in an exclusively digital format. This is a significant milestone for all of us, and I would like to take this opportunity to share some reflections on the profound transformational journey we are undertaking and experiencing. |

Since the historic privatization of Eletrobras in June 2022, we have made an unwavering commitment to building a true corporation, anchored in strong governance, operational efficiency, and performance. Our path is clearly defined: to achieve global leadership in generating sustainable value, positioning ourselves as a platform of energy intelligence and a business enabler for our clients. We strive for excellence in innovative solutions in clean and renewable energy, with high performance and market intelligence. Our goal is to consolidate Eletrobras as a benchmark organization in capital allocation, capable of attracting, developing, and retaining talent, while enhancing our natural vocation to secure a strategic position in the global renewable energy landscape.

Today, as we look back, we can already see not only profound structural changes but also a cultural transformation that is redefining and reshaping the very essence of the Company.

Our journey has been marked by formidable challenges, but it is precisely in the midst of storms that the most skilled sailors are forged. It has been no different at Eletrobras: great challenges, coupled with meritocracy, have shaped the construction of highly qualified teams within our Company. We are working to build a team of true champions—not only ready to win but especially willing to keep learning and evolving. Always with humility.

Humility is the key to breaking boundaries; it is the courage to acknowledge that there is always more to discover. If we want to grow, we must be willing to learn—and learning requires humility. It allows us to listen, to question, to test, to make mistakes, and to adjust course with agility.

The challenges we face on a daily basis push us into the unknown. And the only way to overcome the unknown is through knowledge. Only those with the humility to admit they do not know everything – and that there is always more to learn – can truly navigate the unknown. We believe that sustainable success is built upon an unquestionable foundation: the relentless pursuit of knowledge.

| Page |

That is why we have been fostering a culture at Eletrobras where the pursuit of learning is constant. We want professionals who not only accept challenges but pursue them with curiosity and determination. We are cultivating a team that not only wears the Company’s jersey but embraces it with the intensity and passion needed for a relentless quest for knowledge, continuous learning, and excellence in everything they do. We believe that the Company's growth and shareholder return depend directly on the personal and professional growth of each individual.

Human beings learn throughout their lives, and at Eletrobras it must be no different. There is no growth without challenge, and no challenge without the courage to face the unknown. Pursuing goals means venturing into new frontiers, finding solutions to complex problems, and, above all, evolving constantly. It is through our goal-setting and cascading methodology, applied across all levels of the Company, that we ensure each individual effort contributes directly to the Company’s strategic outcomes.

For this reason, we are working to consolidate a robust model for people management and development, ensuring that each employee has clarity about their role and their contribution to the Company’s future. We have created structures dedicated to continuous training and innovation, transparent communication, and the strengthening of our organizational culture. Because having goals is not enough; everyone must know how to achieve them ethically, consistently, and effectively.

We believe that ethics and governance, combined with a culture of safety, are the cornerstone of the Company’s long-term sustainability. In this regard, the Board of Directors has once again demonstrated integrity, assertiveness, and firmness. A company’s reputation takes years to build but can be lost in moments. Trust, once earned, becomes one of the most valuable assets of any organization—and its foundation is uncompromising ethics. That is why we have been consolidating a governance model that prioritizes data-driven decision-making, transparency, and accountability. True leadership is not measured solely by the ability to achieve goals, but by how those goals are achieved.

We know that what sets average companies apart from extraordinary ones is the culture they build. Our mission is to form a team deeply committed to ethics, continuous learning, and results—to embed a culture of high performance and innovation. We want professionals who are dissatisfied with mediocrity, hungry for challenges, and driven by the desire to deliver innovative solutions in clean and renewable energy, positioning Eletrobras as a benchmark in innovation, performance, and market intelligence.

Eletrobras is undergoing the greatest transformation in its history. But transformation does not happen by decree—it requires engaged, committed, and prepared people to lead it. People find purpose and fulfillment when they feel part of something greater. Our challenge is to create this environment—one in which each employee not only understands but also takes pride in the impact of their work in shaping the future.

| Page |

The results we have achieved so far are the reflection of a clear vision and a team dedicated to executing it with discipline, care, and ethics. But the future we envision—and will build—is even more ambitious and bold. Small dreams generate small challenges and limited learning. Dreaming big will take us further!

Our commitment is to move forward together on this journey of growth, innovation, and excellence as we pave the road toward Eletrobras’ admirable future. Dreaming big, working with method, strategy, and determination to break through the unknown.

Wishing us all an excellent shareholders’ meeting!

Vicente Falconi Campos

Chairman of the Board of Directors

| Page |

| Page |

| PARTICIPATION MANUAL |

|

The guidelines for the participation and manifestation of the Admitted Shareholders through the Digital Platform will be transmitted by the OEGM Board and detailed in an instruction guide sent by the Company. Matters not on the agenda must be dealt with through the usual Investor Relations channels, and will only be attached to the minutes upon express request. The Company is not responsible for factors that are not under the Company´s control. Manifestations sent to the OEGM board by e-mail to assembleiavirtual@eletrobras.com, before the end of the Meeting, such as instability in the internet connection or incompatibility between the Digital Platform and the equipment used by the OEGM participant. It is recommended that Admitted Shareholders access the platform at least 30 minutes before the start of the Meeting. Any questions or explanations may be clarified by the Financial and Investor Relations Vice President through the e-mail assembleiavirtual@eletrobras.com. 1.2. Distance Voting Ballot (BVD) Shareholders may participate in the Meeting through BVD. Guidelines on the documentation required for remote voting are contained in the BVD, available on the websites: https://ri.eletrobras.com/, https://sistemas.cvm.gov.br/ and https://www.b3.com.br/pt_br/. To participate in the Meeting through the BVD, the Company's shareholders must fill in the appropriate fields, sign the BVD and send it up to 4 days in advance of the date of the Meeting to the following recipients: |

| Page |

| Bookkeeping agent | Shareholders with book-entry shareholding positions may vote remotely through Itaú Corretora de Valores S.A. (“Bookkeeping Agent”). In this case, the submission of the Distance Voting Ballot (BVD) must be made via the Itaú Assembleia Digital website. To do so, registration and a digital certificate will be required. Information on registration and step-by-step instructions for issuing the digital certificate are available at https://assembleiadigital.certificadodigital.com/itausecuritiesservices/artigo/home/assembleia-digital |

| Custody Agent | Shareholders must verify with the custody agent if they will provide the service of receiving the BVD (“Custody Agent”). If so, Shareholders may, at their sole discretion, forward the BVD to the Custody Agent, following the appropriate procedures, which may incur potential costs. |

| Central depository | Shareholders may, at their sole discretion, submit the BVD through “Investor Area” of B3 (“Central Depositary”) in the “Services” section, under the option “Open Shareholders’ Meetings.”. |

| Company |

Shareholders may forward the BVD directly to the Company, provided that the BVD: § Only will be received when forwarded solely and exclusively through the https://qicentral.com.br/m/agoe-eletrobras-2025 website https://qicentral.com.br/m/agoe-eletrobras-2025. To access the system (i) the shareholder who is already registered on the platform must use the same access credentials, entering his e-mail and password; and (ii) the shareholder who has not yet accessed the platform must click on “Sign up now” and enter their e-mail address. The system will then forward a verification code to the email address provided, so that the shareholder can complete their registration. § It must contain the place, date and signature of the signatory shareholder. If the shareholder is considered a legal entity under the terms of the Brazilian law, the signature must be from its legal representatives or its attorneys with powers to perform this act. § It must be accompanied by documentation proving the status of shareholder or legal representative of the signatory shareholder, according to the requirements and formalities indicated in this Management Proposal. |

|

The BVD will be considered invalid and will not be processed by the Company if it is not supported with the documentation required to prove the shareholder’s status or representation and/or if it is submitted after the deadline of 4 days before the Meeting. Until the end of the submission period, the BVD may be corrected and resubmitted by the shareholder to the Company, in compliance with the procedures and other deadlines set out in RCVM 81, and no BVD will be accepted after the end of such deadline. If there are any unfilled items after the 4-day period prior to the Meeting, the Company will consider them as an instruction equivalent to abstention from voting. The Shareholder who has already sent the BVD may also register and be accredited to participate in the Meeting through the Digital Platform, provided that it does so in the manner and within the period established in item 1.4 of this Manual. In this case, such Shareholder will be allowed to: |

| Page |

| § | participate in the Meeting, in which case the voting instructions received through BVD will be computed by the Meeting's board; or |

| § | participate and vote at the Meeting, in which case the corresponding voting instructions, received through BVD, will be discarded by the Meeting's board. |

|

Important: Holders of ADRs (American Depositary Receipts) usually vote through instructions sent to the ADR depositary bank, following the deadlines and procedures defined by their intermediaries, such as brokers or custodians. The votes will be consolidated and presented at the Meeting by the local representative of the ADR depositary bank. Unlike the distance voting process in Brazil, the voting materials for ADR holders (such as the voting instruction form) cannot be updated after issuance. Thus, if new candidates for the Board of Directors or Fiscal Council are included after the finalization of these materials, ADR holders may not be able to vote for these candidates. Eletrobras will seek to minimize any differences between the voting materials in Brazil and abroad, but emphasizes that it is not possible to eliminate them entirely, due to the rules and deadlines applicable to ADRs in the United States. 1.3. Required documents These are the documents required to qualify and attend or vote in the Meeting via the Digital Platform: i. If a natural person: § copy of the identification document legally recognized as such, with a recent photo and national validity, in addition to being within the validity period (if applicable); or § in the case of being represented by an attorney-in-fact, a copy of the power of attorney signed less than 1 year old, together with the official identity document with photo of the attorney-in-fact, and such attorney-in-fact must be another Shareholder, a director of the Company or a lawyer duly registered with the Brazilian Bar Association (OAB). ii. If a legal entity: § updated articles of incorporation of the Shareholder and of the corporate document that elects the representative(s) with sufficient powers to represent it at the Meeting, duly registered with the competent authorities, together with an official identity document with photo of the said representative(s); and § if applicable, power of attorney duly granted in accordance with the law and/or the shareholder's articles of association, together with the official identity document with photo of the attorney-in-fact. |

| Page |

|

iii. If an investment fund: § a copy of the current and consolidated fund regulations, bylaws or articles of association of the administrator or manager, as the case may be, in compliance with the investment fund's voting policy; § documents that provide representative powers (corporate documents of election, term(s) of investiture, and/or power of attorney); § identification document of the legal representative(s) with a recent photo and national validity; § if applicable, a copy of the power of attorney granted under the terms of its articles of association and in accordance with the rules of Law No. 10,406, of January 10, 2002, as amended, along with the attorney's official identity document with photo. It is not necessary to send the hard copies of the shareholder representation documents to the Company's office, nor to notarize, authenticate, consularize, apostille, or provide sworn translations of documents from foreign shareholders. Only a simple copy of the original documents required should be submitted via the website https://qicentral.com.br/m/agoe-eletrobras-2025. Powers of attorney granted by Shareholders by electronic means will be admitted only if they contain digital certification within the standards of the Brazilian Public Key Infrastructure (ICP-Brasil) system or by other means of proving the authorship e and integrity of the document in electronic form. 1.4. Registration and accreditation – Shareholder Shareholders who intend to participate in the Meeting, via the Digital Platform, must fill in all registration data on the website https://qicentral.com.br/m/agoe-eletrobras-2025 and attach all documents proving qualification by 11:59 p.m. on April 27, 2025. To access the system, the shareholder who: § is already registered on the platform must access the link and use the same access credentials, entering their email and password; and § has not yet registered on the platform must access the link and click on “Register now” and then enter your email address. Afterwards, the system will forward the verification code to the e-mail informed for the shareholder to complete their registration. – Attorney-in-fact The attorney-in-fact must register with their details on the website https://qicentral.com.br/m/agoe-eletrobras-2025 and, through this platform, inform each shareholder they will represent and attach the respective documents proving their status of the shareholder and representation. |

| Page |

|

After this personal registration, the attorney-in-fact is automatically directed to the registration of his or her grantor, but if he or she leave this page and wants to add more grantors, the attorney-in-fact will need to access the website https://qicentral.com.br/m/agoe-eletrobras-2025 and log in with the password created at the time of registration to continue registering them. The attorney-in-fact will receive individual confirmation of the qualification status of each shareholder registered in his or her register and will arrange, if necessary, for documents to be completed. If the attorney-in-fact represents more than one shareholder, the attorney-in-fact: § will only be able to vote at the Meeting on behalf of shareholders whose eligibility has been confirmed by the Company; and § should beware of paragraph 2 of Article 8 of the Bylaws, which establishes that shareholders represented by the same attorney-in-fact, officer or representative under any title will be considered as belonging to the same shareholder group for the purposes of the voting limitation set forth in Articles 6 and 7 of the Bylaws, with the exception of holders of securities issued under the Company’s Depositary Receipts program, when represented by the respective depositary bank, provided they do not fall into any of the other situations outlined in the main section or §1 of Article 8 of the Bylaws. The Company will verify the documents and, if there are no pending issues, the shareholder or his attorney-in-fact, as the case may be, will be admitted (“Admitted Shareholder”) and will receive, via the Digital Platform, confirmation of his or her admission to attend the Meeting. In case of insufficient documentation, the shareholder must complete it on the same website https://qicentral.com.br/m/agoe-eletrobras-2025, until 11:59 p.m. on April 27, 2025. There will be no additional deadline to correct insufficient documentation. If an Admitted Shareholder does not receive confirmation for virtual access to the OEGM up to eight (8) hours before the start time of the Meeting, he/she must contact the Company's Investor Relations area through e-mail assembleiavirtual@eletrobras.com up to four (4) hours before the start time of the Meeting. Access to the Meeting via Digital Platform will be restricted to Admitted Shareholders (shareholders or their attorneys-in-fact, as the case may be). The Company warns that shareholders who do not submit the request and the necessary participation documents within the deadline will not be able to participate in the Meeting. The Admitted Shareholders (shareholders or their attorneys-in-fact, as the case may be) undertake to use the individual registration exclusively to follow the Meeting remotely, without transferring it or disclosing it to third parties, as well as not to record, reproduce or share any content or information transmitted during the Meeting. |

| Page |

|

1.5. Declaration of Membership in a Group of Shareholders Due to the limitation on the exercise of voting rights pursuant to Articles 6 and 7 of the Company's Bylaws, the Company requests, for the purposes of the timely examination of the matter, that the Shareholders included in the legal situations contemplated in Article 8 of the Bylaws inform, up to two (2) days prior to the date designated for the Meeting, that is, up to 11:59 p.m. on April 27, 2025, which are the members of a potential group of shareholders. In the case of investment funds with the same administrator or manager, only those whose investment and voting policies at shareholders' meetings, under the terms of the respective regulations, is the responsibility of the administrator or manager, will be considered members of a shareholder group. The information must be provided by sending the Declaration of Membership in a Group of Shareholders, exclusively to the following website address https://qicentral.com.br/m/agoe-eletrobras-2025, mentioning whether: § are part of a voting agreement and whether there are other members of the agreement and their respective corporate interests; § are part of an economic group of companies or group of entities with common administration or management or under the same authority; and § are represented by the same agent, administrator or representative in any capacity whatsoever. The form of the Declaration of Membership in a Group of Shareholders template is available on the website https://ri.eletrobras.com/informacoes/convocacoes-e-atas/. The chairman and secretary of the Meeting may, if deemed necessary, if they deem necessary, request documents and information from shareholders in order to verify whether a shareholder is a member of a Shareholder group that may hold 10% or more of the Company's voting capital. 1.6. Conciliation Agreement Eletrobras executed the Conciliation Agreement with the Federal Government (“Federal Government”) on March 26, 2025 with the aim of terminating, with a decision on the merits, the Direct Action for the Declaration of Unconstitutionality No. 7,385 (“ADI”), pending before the Supreme Federal Court (“STF”). For reference to the information disclosed by the Company on this matter, see the material facts published on February 28, 2025 and March 26, 2025. The Conciliation Agreement and the resulting amendment to the bylaws shall be submitted for approval by the common shareholders at the Extraordinary General Meeting, convened for April 29, 2025, at 1:00 p.m. (“Conciliation EGM”), prior to the OEGM hereby convened. |

| Page |

|

Accordingly, in the event of the following scenario: · Approval of the agenda of the Conciliation EGM (“Conciliation Scenario”), the Federal Government shall have the right to elect, separately, three (3) members to the Board of Directors and one (1) member, along with a respective alternate, to the Fiscal Council (see items 1.7 and 1.8 below). In this scenario, the number of seats available for election by common shareholders shall be reduced from nine (9) to six (6), such that: a. the two (2) candidates nominated by the Federal Government and included in the list proposed by the management, as identified in item 2.5.4 below, shall be withdrawn from the general election for common shareholders, and the votes attributed to them shall not be considered, as they will be elected by the Federal Government through the separate election mechanism set forth in the Term of Conciliation; b. One (1) additional candidate included in the list proposed by the management, as expressly identified in item 2.5.4 below, shall also be withdrawn from the general election for common shareholders and the corresponding votes shall not be considered, so that the list of candidates is consistent with the new number of available seats; c. the candidate for regular member of the Fiscal Council and his/her respective alternate, nominated by the Federal Government and indicated in item 2.5.5 below, shall be withdrawn from the general election for common shareholders, and the votes attributed to them shall not be considered, as they will be elected by the Federal Government through the separate election mechanism set forth in the Term of Conciliation. Accordingly, the management recommends that the Fiscal Council be installed with five (5) regular members and their respective alternates. · Rejection of the agenda of the Conciliation EGM (“Non-Conciliation Scenario”), all nine (9) seats on the Board of Directors and four (4) seats on the Fiscal Council (if installed with five (5) members) shall be subject to general election by the common shareholders, with no reduction in the number of seats. In this scenario, all candidates included in the list recommended by the management shall run in the general election under the candidate-based voting system. Likewise, the Federal Government’s nomination for a member of the Fiscal Council shall run under the candidate-based voting system of the common shareholders. Important: In either of the above scenarios, the Federal Government, under the scope of the Term of Conciliation, has undertaken the commitment to (i) not request the adoption of cumulative voting; and (ii) if a valid request for cumulative voting is submitted by other shareholders, to support only two (2) of its nominees. |

| Page |

|

The nominations made by the Federal Government are deemed to have been submitted by all shareholders that are part of its group (the “Federal Government Shareholders Group”)[1] and were reviewed by the People and Governance Committee, having been validated from the standpoint of integrity and legal eligibility requirements. Considering the dual scenarios outlined above, and aiming to provide maximum transparency to shareholders, the Board of Directors has included in its Competency Matrix both the Conciliation Scenario (six (6) recommendations by the management and three (3) nominations by the Federal Government) and the Non-Conciliation Scenario (seven (7) recommendations by the management and two (2) recommendations by the Federal Government), so that shareholders may clearly visualize the balance and diversity of profiles and skills in the final composition of the board (see item 2.5.4 below). 1.7. Installation of the Fiscal Council The Company is proposing to the Shareholders, through an amendment to the Bylaws, to establish the Fiscal Council of Eletrobras as a permanent body (see item 2.4.2 below). As of this date, the body is not permanent and its installation is subject to the request of shareholders representing at least two percent (2%) of the common shares or one percent (1%) of class “A” or “B” preferred shares issued by the Company, and it may be composed of three (3) to five (5) regular members and an equal number of alternates. The Company informs that the installation quorum has been met, following a request submitted by the Federal Government, and proposes that the Fiscal Council be composed of five (5) regular members and their respective alternates, to be elected under the candidate-based voting system, subject to the scenarios described in item 1.6 above. Requests for the installation of the Fiscal Council may be submitted by any shareholder, through the Voting Ballot or via the email assembleiavirtual@eletrobras.com. Prior to resolving on the election of the members of the Fiscal Council, the Meeting shall determine the number of seats to be filled by the candidates. For the rules to be observed in nominating candidates to the Fiscal Council, see item 1.9 below. 1.8. Election of the Board of Directors As of the date of the convening of this Shareholders’ Meeting, the Board of Directors of Eletrobras is composed of ten (10) seats, and the election shall be held under the candidate-based voting system (list), subject to the scenarios described in item 1.6 above. Additionally, common shareholders holding at least five percent (5%) of the voting shares may request the adoption of cumulative voting for the election process. The request must be submitted up to 48 hours before the Meeting (i.e., by 2:30 p.m. on April 27, 2025) and may be withdrawn until the time of the election. |

[1] In accordance with the terms of the Settlement Agreement, Article 8 of the Company's Bylaws, and the decision of the CVM Panel in Process CVM RJ/19957.000800/2024-35.

| Page |

|

§ General Election (with or without the adoption of cumulative voting): Nine (9) seats hall be subject to election by common shareholders, which will be carried out under the candidate-based voting system, subject to a valid request for the adoption of cumulative voting, as explained above. § Separate Election by Preferred Shareholders: One (1) seat shall be subject to separate election by preferred shareholders, according to the Bylaws. The Board of Directors is submitting to the shareholders nine (9) candidates for the general election by the common shareholders, of which two (2) candidates were nominated by the Federal Government (Messrs. Mauricio Tolmasquim e Silas Rondeau, as per item 2.5.4 below), and seven (7) candidates were nominated by the Board of Directors itself, along with one (1) candidate indicated by the Board of Directors for the separate election by the preferred shareholders, in accordance with the Company’s Nomination Policy, its Competency Matrix (see item 2.5.4 below), and the transitional rules set forth in the Term of Conciliation. Important: Should the matters on the agenda of the Conciliation EGM be approved, the number of seats on the Board of Directors and the Fiscal Council shall be automatically reduced, as described in item 1.6 above. Shareholders are advised to carefully read this Management Proposal to properly complete the Voting Ballot and participate in the election process for said bodies. Management Recommendations | Election process through BVD The BVD was structured to allow the process of electing the members of the Board of Directors to take into account and reflect the potential effects and developments of the deliberation on the Settlement Agreement that will take place at the Conciliation EGM — scheduled for the same date as the OEGM now called, but to be held earlier. To ensure the best use of shareholder votes, even in the face of alternative scenarios, management clarifies below how the calculation process will be conducted in each situation: |

| § General election (without multiple voting): The general election by shareholders holding common shares will take place by voting for candidates (list), and the shareholder may vote for up to nine (9) candidates. In the Scenario with Conciliation, the number of vacancies will be reduced to 6 (six). However, considering the possibility of the shareholder voting for up to nine (9) candidates in the Scenario without Conciliation, the structure of the BVD will include a specific question for each candidate ("Specific Questions") – with the exception of the three (3) candidates nominated by management and who already have a provision for automatic withdrawal of candidacy in the Scenario with Conciliation – so that the common shareholder can signal, among the candidates for whom he has voted for the list system in the Scenario without Conciliation, the 6 (six) candidates who should be considered in the list system in the Scenario with Conciliation. |

| Page |

|

If the shareholder(s) mark more than six (6) candidates in the Specific Questions and the general election at the OEGM takes place observing the Scenario with Conciliation without the adoption of multiple voting, their votes will be disregarded. For the impact of the Specific Questions on the general election scenario with the adoption of multiple voting, see the section "General election (with multiple voting)" below. ü Recommendation: Common shareholders who choose to use the BVD and still ensure both the right to elect nine (9) members of the Board of Directors in the Scenario without Conciliation and the right to elect six (6) members in the Scenario with Conciliation, are recommended to properly fill in the specific questions of each of their candidates, in order to signal the six (6) candidates who should participate in the electoral process in the last mentioned scenario. General election (with multiple voting): The BVD, in order to anticipate the dynamics of the multiple voting process, presents a mandatory question in the following terms ("BVD Question"): “In case of adopting the election process by multiple vote, should the votes corresponding to your shares be distributed in equal percentages among the candidates you have chosen? [The shareholder must be aware that the equal distribution will consider the division of the percentage of 100% among the candidates chosen up to the first two decimal places, without rounding, and that the fractions of shares calculated from the application of the resulting percentage will not be allocated to any candidate, being disregarded in the multiple voting procedure, in which case the shareholder may not vote with all of his shares.]” In the Scenario with the adoption of multiple voting for the general election at the OEGM, the Company will adopt the following interpretation in relation to the "yes" or "no" options that the shareholder indicates for the mandatory question above, in order to make the best use of the votes via BVD: Scenario without Conciliation: The votes submitted in response to this question will be fully considered for the candidates listed in the candidate list included in the Voting Ballot (“Candidate List”), in strict accordance with the instructions originally received. Scenario with Conciliation: Considering that candidates will be removed from the list of candidates and will no longer run for election (see items 1.6 and 2.5.4 and section "Recommendations of the Administration | Election process through the BVD"), the Company will take advantage of the votes as follows: |

| Page |

|

§ In the event that the shareholder(s) vote for more than six (6) candidates on the Candidate List and the Scenario with Conciliation materializes, their votes will be: (i) redistributed equally to the remaining candidates identified in the Specific Questions, if "yes" was the option to answer the BVD Question, respecting the maximum number of votes available; or (ii) maintained in the specific proportion to the candidates originally selected, if "no" was the option to answer the question or, even if it was "yes", if there was the condition "pass" marked for specific candidates in any way different from those marked in the List of Candidates available in the BVD. ü Recommendation to Shareholders: To common shareholders who wish to support the list of candidates presented by management in item 2.5.4 of this Management Proposal, the Company recommends: (a) that they ratify in the specific questions the remaining six (6) candidates proposed by management for the Conciliation Scenario; and (b) the choice of the "yes" answer to the question of the BVD Question, which will allow shareholders to take advantage of all their votes in the remaining six (6) candidates proposed by management in the Conciliation Scenario, if the multiple voting system is triggered. 1.9. Nomination of candidates Shareholders may submit alternative nominations to the Board of Directors and the Fiscal Council to run in the general election and/or in the separate election, as applicable, subject to the rules and guidelines set forth below and to the possibility of a reduction in the number of seats allocated to common shareholders, as provided in item 1.6 above. Shareholders holding at least 0.5% (zero point five percent) of the shares of a given class issued by the Company may request the inclusion of such nominations in the Voting Ballot by submitting a request to the e-mail address assembleiavirtual@eletrobras.com no later than twenty-five (25) days prior to the date of the Shareholders’ Meeting (i.e., by 14:29 p.m. on April 4, 2025). Nominations to be included in the Voting Ballot must: § be accompanied by: (i) the candidate’s résumé containing, at a minimum, their qualifications, education, professional experience, current principal activity, and identification of positions held on boards of directors, fiscal councils or advisory boards of other companies, if applicable; (ii) the information required under items 7.3 to 7.6 of the Company’s Reference Form; (iii) an indication as to whether the candidate requires the waiver referred to in Article 147, §3 of the Brazilian Corporation Law, together with a statement explaining the reasons why the Shareholders’ Meeting should grant such waiver; and (iv) an indication as to whether the nomination is intended for the general election or the separate election by preferred shareholders. |

| Page |

|

In the case of nominations to the Board of Directors, the submission must also include a declaration of absence of legal impediments and compliance with the eligibility requirements, as well as a statement on whether or not the candidate qualifies as an independent member. § Comply with the eligibility requirements set forth in Articles 147, §§1 to 3 of the Brazilian Corporation Law and Article 22 of the Company's Bylaws. In the case of nominations for the Fiscal Council, the criteria established in Article 162, caput and §2, of the Brazilian Corporation Law, as well as in §§1 to 4 of Article 22 of the Bylaws, must also be met. Additionally, the name of the respective alternate must be provided along with the name of the effective candidate. These requirements also apply to nominations made after the deadline for inclusion in the Voting Ballot, and all nominations will be subject to integrity and legal compliance review by the People and Governance Committee. The Company warns of the existence of overboarding rules, which limit the number of positions that candidates for the Board of Directors of Eletrobras may concurrently hold. In this regard, candidates who meet any of the following criteria shall not be eligible to join the Board of Directors of Eletrobras: (i) those who already hold four (4) or more positions on the boards of directors of publicly held companies not controlled by Eletrobras; (ii) those who already hold two (2) or more positions on the boards of directors of publicly held companies not controlled by Eletrobras, if one of these positions is as chair of the board; (iii) those who already hold one (1) or more positions on the boards of directors of publicly held companies not controlled by Eletrobras, if the nominee is also an executive officer of another publicly held company not controlled by Eletrobras. The Company may, after receiving the request for inclusion of candidates in the Voting Ballot and conducting an initial review of the submitted documentation, request additional information within the deadlines established in RCVM 81/2022. Important: Shareholders may nominate candidates for the Board of Directors or the Fiscal Council until the start of voting at the Meeting. To ensure that all shareholders have prior access to information about the candidates and that the Meeting proceeds in an orderly manner, the Company recommends that such nominations be made as early as possible. Nominations submitted during the Meeting will also be reviewed for integrity and compliance with legal requirements, which may prolong the session or even require a recess. |

| Page |

2. Management Proposal

2.1. Procedural Rules:

| Page |

2.2. AGENDA – EGM:

1. About the Merger of Eletropar by Eletrobras (“Merger”):

1.1. Ratify the appointment of Pricewaterhousecoopers Auditores Independentes Ltda. (“PwC”) as the valuation firm responsible for preparing the Eletrobras Participações S.A. accounting valuation report (“Eletropar Accounting Valuation Report” and “Eletropar”, respectively);

1.2. Approve the Eletropar Accounting Valuation Report;

1.3. Ratify the appointment of Ernst & Young Assessoria Empresarial Ltda. (“EY”) as the valuation firm responsible for preparing the Company’s valuation report, for the purposes of Article 264 of Brazilian Corporation Law, (“Eletrobras Article 264 Valuation Report”) and of Eletropar (“Eletropar Article 264 Valuation Report”);

1.4. Approve the Eletrobras Article 264 Valuation Report and the Eletropar Article 264 Valuation Report;

1.5. Approve the Merger Protocol and Justification, entered into by the officers of the Company and the officers of Eletropar, which establishes the terms and conditions for the Merger of Eletropar into the Company (“Merger” and “Protocol and Justification”, respectively);

1.6. Approve the Merger, pursuant to the Protocol and Justification;

1.7. Approve the amendment to the Bylaws of the Company to modify the caput of Article 4 of the Bylaws, due to the capital increase resulting from the Merger; and

1.8. Authorize the managers of Eletrobras to take all necessary actions to implement the Merger.

2. Approve, with effectiveness conditioned upon the consent of the competent authority, the following amendments to the Bylaws of the Company: Amendment to paragraph 5 of the current Article 25 of the Bylaws, to establish a new tie-breaking rule within the scope of the Board of Directors.

3. Approve, with effectiveness conditioned upon the consent of the competent authority, the following amendments to the Company’s Bylaws: Amendment to (i) paragraph 2 of the current Article 28 of the Bylaws, to reduce the minimum number of independent directors from six (6) to five (5); and (ii) paragraph 4 of the current Article 28 of the Bylaws, to include criteria for assessing the independence of members of the Board of Directors.

4. Approve, with effectiveness conditioned upon the consent of the competent authority, the following amendment to the Company’s Bylaws: Amendment to the current Article 43 of the Bylaws to make the Fiscal Council a permanent body and set its composition at five (5) full members and their respective alternates.

| Page |

5. If any of the resolutions set forth in items 1, 2, 3 and/or 4 above are approved, approve: (i) the consolidation of the Bylaws of the Company, considering all amendments approved by the shareholders at the General Meeting, including any adjustments to numbering, the use of defined terms, and cross-references applicable to the provisions of the Bylaws, due to the inclusion or exclusion of provisions, as approved by the competent authority; and (ii) if necessary, authorize the Board of Directors to take the administrative measures to reflect in the consolidated version of the Bylaws the amendments approved by the shareholders at the General Meeting and by the competent authority, including for the purposes of filing, publication, and compliance with other applicable legal and regulatory provisions.

Specific Clarifications on the Agenda of the EGM:

(a) The approval of item 1 does not depend on the approval of the competent authority;

(b) All bylaw amendments in items 2 to 4 depend on the approval of the competent authority to become effective; and

(c) Item 5 will only be submitted for voting if any of items 1, 2, 3 or 4 are approved.

2.3. AGENDA - OGM:

1. Review the accounts of the Managers, examine, discuss, and vote on the Management Report and the Company’s Complete Annual Financial Statements for the fiscal year ended December 31, 2024;

2. Resolve on the Company's management proposal for the allocation of results for the fiscal year ended December 31, 2024, and the distribution of dividends;

3. Elect the members of the Board of Directors for a unified term of office of two (2) years, as well as resolve on (i) the classification of its members as independent; and (ii) pursuant to Article 147, paragraph 3, of the Brazilian Corporation Law, the waiver of the requirements set forth in items I and II of said provision, as applicable;

4. Set the number of Fiscal Council members at five (5), along with their respective alternates, if installed;

5. Elect the members of the Fiscal Council, if installed, to serve until the next Annual General Meeting; and

6. Set the total annual compensation for the Managers, external members of advisory committees, and Fiscal Council members (if installed) for the fiscal year of 2025.

| Page |

2.4. CLARIFICATIONS ON THE AGENDA OF THE EGM:

2.4.1. Merger of Eletropar into Eletrobras

Eletropar is a subsidiary of Eletrobras, which holds 83,71% of its capital stock. Upon completion of the Merger, Eletropar will be dissolved and fully absorbed by Eletrobras, which will succeed it in all its rights and obligations (“Merger”).

Purpose

The Merger will enable Eletrobras to execute its strategic plan and unlock value drivers associated with the streamlining of its corporate and governance structures, the implementation of an efficient integrated management, the development of its core businesses, and, consequently, the divestment of non-core assets and businesses.

From the perspective of minority shareholders of Eletropar, migrating to the shareholder base of Eletrobras is beneficial, as the Acquiring Company is currently structured as a publicly held company with dispersed capital, following a true corporation model.

In this regard, by becoming shareholders of Eletrobras as a result of the Merger, these investors will benefit from greater liquidity and increased political rights, as they will no longer be minority shareholders of a controlled company whose shares have a low trading volume on B3.

Increase of Capital Stock

With the Merger, the capital stock of Eletrobras will be increased due to the absorption of the book value of shareholders' equity of Eletropar. As determined in the Eletropar Accounting Valuation Report, this increase will amount to BRL 35,375,784.48 (thirty-five million, three hundred seventy-five thousand, seven hundred eighty-four reais and forty-eight cents).

Consequently, 1,532,788 (one million, five hundred thirty-two thousand, seven hundred eighty-eight) new common shares will be issued by Eletrobras, all book-entry and without par value, with the same rights and obligations currently assigned to Eletrobras’ common shares.

The amendment to the Bylaws to reflect the update of the capital stock, as described above, will not require prior approval from the specific competent authority.

Exchange Ratio (Share Substitution)

Pursuant to applicable law and CVM guidelines, the Independent Committee of Eletropar, was formed, consisting of three members: (i) Mr. Renan dos Santos Antunes, Eletropar board member appointed by a majority of the Board of Directors in a meeting held on August 11, 2023; (ii) Mr. Carlos Alberto Policaro, a board member elected by minority shareholders at the General Meeting of Eletropar held on September 11, 2023, during which Eletrobras, in its capacity as the controlling shareholder, abstained from voting; and (iii) Ms. Lucia Maria Martins Casasanta, jointly selected by the two previous board members.

| Page |

The Independent Committee had sufficient time and access to information to independently evaluate and discuss the exchange ratio resulting from the Merger. In its analysis and discussions, the Independent Committee considered and assessed, among other aspects:

a) the strategic, commercial, and financial justifications presented by Eletropar;

b) the assumption that the Merger must be structured under commutative conditions for its shareholders;

c) the nature of the Merger transaction, which is highly common and widely tested in the market; and

d) the legal structure of the Merger.

The Independent Committee concluded that the exchange ratio, ensuring the commutativity of the Merger, is one (1) common share issued by Eletropar for zero point eight (0.8) common share issued by Eletrobras, and this recommendation was approved by the Board of Directors of Eletropar on March 27, 2025.

According to the Protocol and Justification, the Executive Board of Eletrobras and Eletropar decided to accept the exchange ratio recommendation proposed by the Independent Committee.

Withdrawal Rights

Shareholders of Eletropar who vote against, abstain, or do not attend the meeting resolving on the Merger shall be entitled to withdrawal rights (“Dissenting Shareholders Eletropar”), meaning they may exit the company by receiving reimbursement for the value of their shares (“Withdrawal Rights”).

Reimbursement Amount: BRL18.4635 per common share issued by Eletropar, based on the book value determined in the consolidated financial statements as of December 31, 2023. This amount will not be adjusted for inflation (“Reimbursement Amount”).

| Page |

The Exchange Ratio calculated based on the valuation reports prepared in accordance with Article 264 of the Brazilian Corporation Law is less favorable to the shareholders of Eletropar than the proposal set forth in the Protocol and Justification, as recommended by the Independent Committee. Therefore, the criterion under Article 264 of the Brazilian Corporation Law does not apply in this case for the purposes of calculating the Reimbursement Amount.

Term: Dissenting Shareholders may exercise their Withdrawal Rights within a 30-day period, starting from the publication date of the minutes of the EGM that approves the Merger.

Right of Reconsideration: Once the period for exercising the Withdrawal Rights has ended, Eletropar will have up to 10 days to assess whether the payment of the Reimbursement Amount would compromise its financial stability. If so, the management of Eletropar may call a new general meeting to ratify or reconsider the Merger decision (“Right of Reconsideration”).

Payment Date: The payment date will be informed in due course through a shareholder notice, on the date when the management of Eletropar decides not to exercise the Right of Reconsideration, or after the ratification of the Merger by the shareholders of Eletrobras, if a general meeting is convened to deliberate on the Right of Reconsideration, as applicable.

Shareholders of Eletrobras will not be entitled to Withdrawal Rights, in accordance with applicable law.

Procedure

The approval of the Merger is subject to:

(a) At Eletrobras:

• Approval by the Executive Board, pursuant to Article 39, items I and VIII of the Bylaws, granted on March 27, 2025;

• Opinion by the Audit and Risk Committee to the Board of Directors of Eletrobras, pursuant to its Internal Regulations, issued on March 27, 2025;

• Approval by the Board of Directors, pursuant to Article 31, items VII and XIII of the Bylaws, granted on March 27, 2025;

| Page |

• Opinion by the Fiscal Council to the General Meeting, pursuant to Article 45, item III of the Bylaws, issued on March 27, 2025; and

• Approval by the general meeting, pursuant to article 122, items I and VIII of Brazilian Corporation Law and Article 18 of the Bylaws.

(b) At Eletropar:

• Approval by the Executive Board, granted on March 26, 2025, pursuant to Article 12 of the Internal Regulations of the Executive Board of Eletropar;

• Opinion by the Audit and Risk Committee to the Board of Directors of Eletropar, pursuant to its Internal Regulations, issued on March 27, 2025;

• Approval by the Board of Directors, granted on March 27, 2025;

• Opinion by the Fiscal Council to the General Meeting, issued on March 27, 2025, pursuant to Article 39, item VI of the Bylaws of Eletropar; and

• Approval by the General Meeting, pursuant to Article 122, item VIII of the Brazilian Corporation Law and Article 10, item II of the Bylaws of Eletropar.

The approval documents referred to above may be consulted by the Shareholders on the websites of Eletropar (https://eletrobraspar.com/Paginas/Relacoes-Com-Investidores.aspx), of the Company (https://ri.eletrobras.com/), of the CVM (https://sistemas.cvm.gov.br/), and of B3 (https://www.b3.com.br/pt_br/).

| Page |

2.4.2. Bylaws Amendment Details:

First Block: Amendment to the Tie-Breaking Criteria for Matters Resolved by the Board of Directors:

To safeguard the premises of Eletrobras’ privatization and the corporation model, the Board of Directors deemed it appropriate to adjust the tie-breaking criterion for matters under its purview, granting the Chair of the Board the second and final tie-breaking vote.

Thus, the first tie-breaking criterion will now reflect the will of the group of board members that includes the highest number of independent directors, in line with corporate governance best practices.

Second Block: New Independence Criteria for Board Members and Reduction of the Minimum Number of Independent Directors:

In line with corporate governance best practices and considering the statutory and legal limits on political rights, the Company proposes the introduction of two new statutory criteria for the loss of independence of a Board Member, as follows:

| · | holding more than ten percent (10%) of the voting shares of Eletrobras; or |

| · | having a material relationship, management role, employment relationship, or equivalent link with a shareholder or group of shareholders holding more than ten percent (10%) of the voting shares of Eletrobras. |

Additionally, the management proposes reducing the minimum number of independent members from six (6) (equivalent to 60%) to five (5) (equivalent to 50%), as this new threshold, while remaining compliant with corporate governance guidelines and best practices, is more reasonably suited to the Company's needs in light of the stricter independence criteria mentioned above, and is also more aligned with the new electoral structure expected if the EGM of the Conciliation agenda is approved.

Considering the potential approval of the EGM of the Conciliation, the three (3) Board members elected separately by the Federal Government will automatically be classified as non-independent members. Furthermore, since the election process for the Board of Directors includes separate elections by preferred shareholders, if either the common or preferred shareholder groups elect a non-independent member, the other group would automatically be prevented from doing so, which is deemed unreasonable.

| Page |

Third Block: Transformation of the Fiscal Council into a Permanent Body Composed of Five (5) Members:

The Company also proposes that the Fiscal Council be formally established as a permanent body, necessarily composed of five (5) members.

This measure is justified by the following factors:

| (i) | since privatization, shareholders have broadly supported the installation of the Fiscal Council, making it reasonable to simplify the voting process and ensure predictability regarding the number of members; |

| (ii) | Setting the number of members at five (5) is justified, as in addition to the separate elections by common and preferred shareholders, the Conciliation Agreement also provides for the separate election of one (1) Fiscal Council member by the Federal Government. Thus, a five-member structure would provide a more proportional representation for common shareholders. |

| Page |

2.5. CLARIFICATIONS ON THE AGENDA OF THE OGM:

2.5.1. Review the accounts of the Managers, examine, discuss, and vote on the Management Report and the Company's Complete Annual Financial Statements for the fiscal year ended December 31, 2024

The Management proposes that the shareholders approve the managers' accounts, the Management Report, and the Company’s Complete Annual Financial Statements, accompanied by the report issued by PriceWaterhouseCoopers Auditores Independentes (“Independent Auditor”), the Fiscal Council’s opinion and the summary annual report of the Audit Committee, all related to the fiscal year ended December 31, 2024 (“Financial Statements”).

Key Highlights:

The key highlights of the year can be summarized as follows:

| § | Financial and operational optimization: |

| ü | +5.6% revenue in the power generation segment, reaching BRL 28.1 billion; |

| ü | +10.7% revenue in the transmission segment, reaching BRL19.3 billion; |

| ü | -7.2% in PMSO, totaling BRL7.6 billion; |

| ü | +51.2% consolidated EBITDA of Eletrobras, reaching BRL 26.2 billion; |

| ü | +136.2 % increase in consolidated net income, reaching BRL10.4 billion; |

| ü | BRL 37.7 billion in net debt, with a net debt/adjusted EBITDA ratio of 1.5x. |

| § | Recovery of Investment Capacity with a Focus on Resilience and Operational Efficiency: |

| ü | Investments of BRL 7.7 billion in 2024, including BRL 1.1 billion in the Coxilha Negra wind farm, which will have a 302 MW capacity; |

| ü | Acquisition of four (4) lots in the Transmission Auction held by ANEEL in March 2024, with a 30-year concession term and estimated investments of BRL 5.6 billion; |

| ü | Revitalization works on the Itaipu high-voltage direct current (HVDC) transmission system, with estimated investments of BRL1.9 billion; |

| Page |

| ü | Construction of the 500 kV transmission line through SPE Transnorte Energia (TNE), integrating Manaus with Boa Vista and connecting the State of Roraima to the National Interconnected System (SIN), with projected investments of BRL 3.3 billion. |

| ü | Robust investments in the modernization of hydroelectric plants and reinforcement and improvement of transmission lines, enhancing resilience and strengthening assets while contributing to the country's energy security. |

| § | Innovation and Technology: |

| ü | We are also investing in innovation in the management of our assets. We created the ATMOS meteorological intelligence center, which uses artificial intelligence in extreme weather forecasting models, helping to improve readiness and operational safety. |

| ü | Another innovation is the new asset monitoring center, which uses IoT sensors and digital applications (digital twin, BIM, and virtual reality) to monitor over 87,000 assets. |

| § | People Management: |

| ü | Launch of the Voluntary Termination Program, promoting a responsible career transition approach and constructive dialogue with employees and labor unions; |

| ü | Linking employee compensation to company performance, with market-aligned salaries; |

| ü | Completion of collective labor agreement negotiations (2024-2026 cycle), achieving significant advancements aligned with private sector labor practices; |

| § | Conflict Resolution: |

| ü | Conclusion of negotiations and execution of the Conciliation Agreement between Eletrobras and the Federal Government, and submission to the General Meeting of a proposal for a consensual and amicable solution to terminate, with a decision on the merits, the ADI before the STF; |

| ü | Progress in compulsory loan settlements, with a provision reversal of approximately BRL 441 million; |

| Page |

| § | Rationalization of Corporate Holdings: |

| ü | Completion of the sale of a 49% minority stake in 15 Special Purpose Entities (SPEs), including Chapada do Piauí I Holding S.A. and Chapada do Piauí II Holding S.A., in June 2024; |

| ü | Completion of the Merger of Eletrobras Furnas in 2024, which allowed for corporate and governance structure simplification and efficiency gains; |

| ü | Success in divesting its thermal power portfolio and transferring the credit risk of the respective energy agreements; |

| § | ESG Aspects and Corporate Sustainability: |

| ü | Creation of the Sustainability Committee in May 2024, which was transformed into a statutory body through the bylaws reform approved at the EGM on February 26, 2025, reflecting Eletrobras' commitment to promoting its corporate sustainability; |

| ü | Approval of the Science-Based Net Zero Target by SBTi Services; |

| ü | Execution of Eletrobras' first-ever ESG Roadshow; |

| ü | Approval of Eletrobras’ Human Rights Policy; |

| ü | For the second consecutive year, Eletrobras was included in B3’s IDIVERSA index portfolio, one of the leading diversity and inclusion indicators in the Brazilian capital markets. |

| § | Liability Management and Capital Structure Optimization: |

| ü | Secondary public offering of 93 million preferred shares of ISA Energia Brasil, totaling BRL 2.154 billion in July 2024; |

| ü | Funding of BRL 29 billion, including approximately BRL19 billion in the domestic capital markets, in addition to access to international markets, with highlights including the settlement of bond issuances, totaling US$750 million, maturing in 2035, and the execution of a US$400 million financing agreement, backed by the Italian Export Credit Agency – Servizi Assicurativi Del Commercio Estero SPA (SACE); |

| ü | Proposed dividend distribution of BRL 4,000 million related to 2024 results, of which BRL 2,202 million was paid as interim dividends in January 2025. The total shareholder remuneration, including share buybacks, amounted to BRL 4,115 million in 2024. |

| Page |

The key events and highlights of the 2024 fiscal year are detailed in the Management Report, which is part of the Financial Statements, and in the Managers' Comments on the Company's Financial Condition, referring to the fiscal year ended December 31, 2024, available in Schedule 9 of this Management Proposal.

The Financial Statements and the accompanying documents are available on the Company’s website (https://ri.eletrobras.com/), the CVM website (https://sistemas.cvm.gov.br/) and the B3 website (https://www.b3.com.br/pt_br/), and were published in the Valor Econômico (National Edition) newspaper on April 16, 2025.

| Page |

2.5.2. Resolve on the management proposal for the allocation of results for the fiscal year ended December 31, 2024, and the distribution of dividends

Eletrobras reported consolidated net income of BRL10,378 million for the fiscal year ended December 31, 2024, which represents a 136.2% increase compared to the BRL4,395 million recorded in 2023.

The Management Report and Schedule 9 to this Proposal detail the variation in the main accounts that comprise the 2024 results, highlighting the key events that occurred during the year and help clarify the result in question.

On December 19, 2024, the Board of Directors approved the payment of interim dividends in the amount of BRL2,201,690,036.65, based on the net income recorded as of September 30, 2024, as an anticipation of the allocation of the 2024 fiscal year results. Thus, the proposed dividend distribution is based on the difference between the amount already advanced and the remaining balance.

In this context, considering the favorable opinions of the Fiscal Council and the Audit and Risk Committee, as well as the Independent Auditor’s Report, the Company’s Management proposes that the net income of the parent company in the amount of BRL10,378 million be recorded, as set forth in the Financial Statements.

Allocation of Results and Distribution of Dividends

The Company’s Management proposes the following allocation of the results for the fiscal year ended December 31, 2024 (without prejudice to the Capital Budget and Retention proposal, detailed below):

| § | As provided for in the main section of Article 193 of the Brazilian Corporation Law, 5% of the net income for the year, amounting to BRL519 million, shall be allocated to the Legal Reserve; |

| § | As provided for in Article 49, Paragraph 1, of the Bylaws, the portion corresponding to 25% of the adjusted net income for the fiscal year ended December 31, 2024, amounting to BRL2,465 million, shall be distributed to the Company’s shareholders as mandatory dividends. Management also proposes the distribution of an additional 5% of the adjusted net income, as additional dividends, corresponding to BRL1,535 million. Thus, the total proposed dividend distribution corresponds to 30% of the adjusted net income for the fiscal year ended December 31, 2024, totaling BRL4,000 million, including the portion to be allocated to the holders of class “A”, class “B” preferred shares and the special class share (golden share). If approved, dividends will be paid on May 13, 2025; |

| Page |

| § | As provided for in Article 50, II, of the Company’s current Bylaws, up to 75% of the net income for the fiscal year may be allocated to the Statutory Investment Reserve. Therefore, Management proposes that the amount of BRL5,850 million, corresponding to 56% of the net income for the year, be allocated to the Statutory Investment Reserve. |

Pursuant to Article 10, II, and Annex A of RCVM 81, detailed information regarding Management’s proposal for the allocation of net income for the fiscal year ended December 31, 2024 is included in Schedule 10 to this Management Proposal.

| Page |

2.5.4. Elect the members of the Board of Directors for a unified term of two (2) years and deliberate on the characterization of their independent status:

The general election system for the Board of Directors and the rules and requirements for shareholder nominations of alternative candidates are detailed in items 1.6 to 1.9 of the Participation Manual – OEGM Eletrobras 2025 (“Participation Manual”).

Management Proposal

The Board of Directors of the Company, in accordance with the recommendation formulated by its People and Governance Committee, and for the purposes of the election of the Board of Directors for the 2025-2027 term, proposes: (a) to the common shareholders, a bundle of 9 (nine) candidates, of which 2 (two) are nominated by the Federal Government, in line with the provisions of the Conciliation Agreement, and as clarified in item 1.8 of the Participation Manual; e (b) to the preferred shareholders, one (1) candidate for separate election.

The composition proposed by the management complies with the eligibility criteria set forth in the law, Bylaws, and Nomination Policy, the independence and time availability criteria, aligns with the desired diversification of profiles, competencies, and experiences, as outlined in the Competency Matrix, and also meets other relevant premises that guided the succession planning, including two cycles of performance evaluation, collective and individual of the Board of Directors and the conciliation process with the Federal Government, which culminated in the execution of the Conciliation Agreement.

Below is the summarized list of candidates recommended by the Board of Directors of Eletrobras:

| Ø | Candidates in the Bundle for Election by Common Shareholders: |

| 1. | Vicente Falconi Campos |

Independent Member: YES

Reappointment: YES

Nomination Source: Board of Directors

| 2. | Ana Silvia Corso Matte |

Independent Member: YES

| Page |

Reappointment: YES

Nomination Source: Board of Directors

| 3. | Daniel Alves Ferreira |

Independent Member: YES

Reappointment: YES

Nomination Source: Board of Directors

| 4. | Felipe Villela Dias |

Independent Member: YES

Reappointment: YES

Nomination Source: Board of Directors

| 5. | Marisete Fátima Dadald Pereira |

Independent Member: YES

Reappointment: YES

Nomination Source: Board of Directors

| 6. | Carlos Márcio Ferreira |

Independent Member: YES

Reappointment: NO

Nomination Source: Board of Directors and Ordinary Shareholders

| 7. | Vanessa Claro Lopes |

Independent Member: YES

Reappointment: NO

Nomination Source: Board of Directors

| Page |

Attention: Candidacy for the election by the ordinary shareholders' group subject to exclusion in the event of approval of the agenda of the Conciliation OEGM (see item 1.8 of the Participation Manual).

| 8. | Mauricio Tolmasquim |

Independent Member: NO

Reappointment: NO

Nomination Source: Federal Government.

Attention: Candidacy for the election by the ordinary shareholders' group subject to exclusion in the event of approval of the agenda of the Conciliation OEGM (see item 1.8 of the Participation Manual).

| 9. | Silas Rondeau |

Independent Member: NO

Reappointment: NO

Nomination Source: Federal Government.

Attention: Candidacy for the election by the ordinary shareholders' group subject to exclusion in the event of approval of the agenda of the Conciliation OEGM (see item 1.8 of the Participation Manual).

| Ø | Individual Candidate for Election by Preferred Shareholders: |

| 10. | Pedro Batista de Lima Filho |

Independent Member: YES

Reappointment: YES

Nomination Source: Board of Directors and Preferred Shareholders

Context of the Succession Process:

Since the privatization of Eletrobras in June 2022, the Board of Directors has progressively evolved its corporate governance to align with private sector practices and the specific characteristics of its new, diversified capital structure.

| Page |

Corporate governance is regarded by management as a core asset for the preservation and sustainable generation of long-term value.

In light of this fundamental value, the Board diligently oversaw the conciliation process with the Federal Government at the CCAF, seeking a consensual resolution to the dispute raised by the ADI before the STF that would safeguard the key premises of Eletrobras’ privatization while also creating value for the Company and all its shareholders.

Within this context, the proposed list of candidates aims to address the Company’s needs, uphold best governance practices, and present a balanced solution for all shareholders, enabling a transparent and secure succession process.

General Premises of the Succession Planning

The succession planning for the Board of Directors of Eletrobras was based on the following general premises:

| · | Performance evaluation of the Board of Directors (individual and collective) and its Committees (2023–2025), with support from the independent external consultancy Spencer Stuart, to assess the adequacy and diversity of the desired profiles. |

| · | Development of the Competency Matrix to verify the alignment of Board members with the required competencies, in line with the strategic planning. |

| · | Adjustment of the composition of the People and Governance Committee to ensure it is composed exclusively of independent members of the Board of Directors. |

| · | Engagement of the independent external consultancy Korn Ferry to support the identification and assessment of candidates for the 2025 election process. |

| · | Balance in the renewal of the Board, preserving key competencies, enhancing the diversity of profiles, and ensuring legal certainty for an orderly succession process. |

Evolution of the Company’s Strategic Planning

Since 2022, Eletrobras has undergone three strategic planning cycles, focusing on stabilization as a private company and on achieving excellence and innovation in management. The Board of Directors, together with the management team, engaged in the conciliation process within the CCAF, which resulted in an agreement that preserves the premises of the privatization and unlocks value for all parties involved. Additionally, the Board discussed and shaped the Company’s future vision and strategic planning, aligned with its core values and purpose. The list of candidates proposed by the management reflects the appropriate composition to lead Eletrobras in this new phase of its business development.

| Page |

Performance Evaluation of the Board of Directors:

Since its election in August 2022, the Board of Directors of Eletrobras has conducted two performance evaluation cycles (2023-2024 and 2024-2025). In each cycle, the process, in general terms, considered:

| (i) | self-assessment questionnaire completed by board members; |

| (ii) | peer evaluation questionnaire assessing each board member; |

| (iii) | specific evaluation questionnaire for the chairman position; |

| (iv) | individual interviews with board members and executives to gather qualitative inputs on the performance of the board as a whole and the behavioral and technical aspects of its members. |

Additionally, the performance of the advisory committees and the Governance Secretariat was evaluated.

In 2024, already in possession of the results from the first performance evaluation cycle and having gone through two strategic planning cycles, the Board, with the support of Spencer Stuart, structured the first version of the Competency Matrix and identified opportunities for improvement in its composition, based on the competency assessment of the members at that time.

In this context, the Board of Directors made its first nomination to the Board during the 2024 Ordinary General Meeting, aiming to replace the professional occupying the employee representative seat, which was eliminated through a bylaw’s amendment in 2023.

In 2025, the Board completed its second performance evaluation cycle, the inputs from which, along with the challenges and objectives of the new strategic plan, were considered in forming the nominations submitted to shareholders.

Implications of the ADI and the Conciliation Agreement on the Succession Planning of the Board of Directors:

The term of the outgoing Board of Directors was marked by the filing of the ADI before the STF, which aimed to challenge the rules that structured the privatization process, particularly the voting rights limitation of up to 10% of the voting capital stock, imposed by law and bylaws amendments, which represents one of the pillars of the corporation model established by the privatization.

| Page |

Since December 27, 2023, the Company has been engaged in a conciliation process before the CCAF, as previously disclosed.

On February 28, 2025, the Company published a Material Fact, sharing with the market the general premises agreed upon with the Federal Government within the scope of the conciliation process, for the purposes of drafting the respective Conciliation Agreement.

On March 26, 2025, after approval by the Executive Board and the Board of Directors, Eletrobras executed the Conciliation Agreement with the Federal Government, which sets forth a series of conditions necessary for its full effectiveness, including its approval at the Conciliation EGM, which will also involve a specific bylaws amendment to ensure compliance with the agreed terms and conditions, as well as its ratification by STF.

The Company has called the Conciliation EGM to take place on the same day as the OEGM, but in advance. It is important to note that the Federal Government and the other entities that make up the Federal Government Shareholders Group are in a conflict of interest regarding the voting on the agenda of the Conciliation EGM and must record an abstention although present.

The Conciliation Agreement also establishes a transitional rule, with immediate effect, consisting of the inclusion of two (2) out of the three (3) nominations made by the Federal Government in the list of nine (9) candidates to be proposed by the management for election by the common shareholders.

If the Conciliation Agreement is approved at the Conciliation EGM, the two (2) Federal Government nominees included in the management’s list of candidates, in addition to the nominee Vanessa Lopes (appointed by the management), will be automatically excluded from the list of candidates submitted for vote by the common shareholders, with the corresponding votes being disregarded.

In this case, the Federal Government will elect, separately, at the OEGM, the three (3) candidates to the Board of Directors:

The Company received on March 27, 2025, the list of nominations from the Federal Government, as described below:

| Ø | Federal Government Candidate 1: Mauricio Tolmasquim |

Independent Member: NO (as provided for in the Conciliation Agreement)

| Page |

Reappointment: NO

Nomination Source: Federal Government – included in the list of candidates recommended by the management.

| Ø | Federal Government Candidate 2: Silas Rondeau |

Independent Member: NO (as provided for in the Conciliation Agreement)

Reappointment: NO

Nomination Source: Federal Government Federal Government – included in the list of candidates recommended by the management.

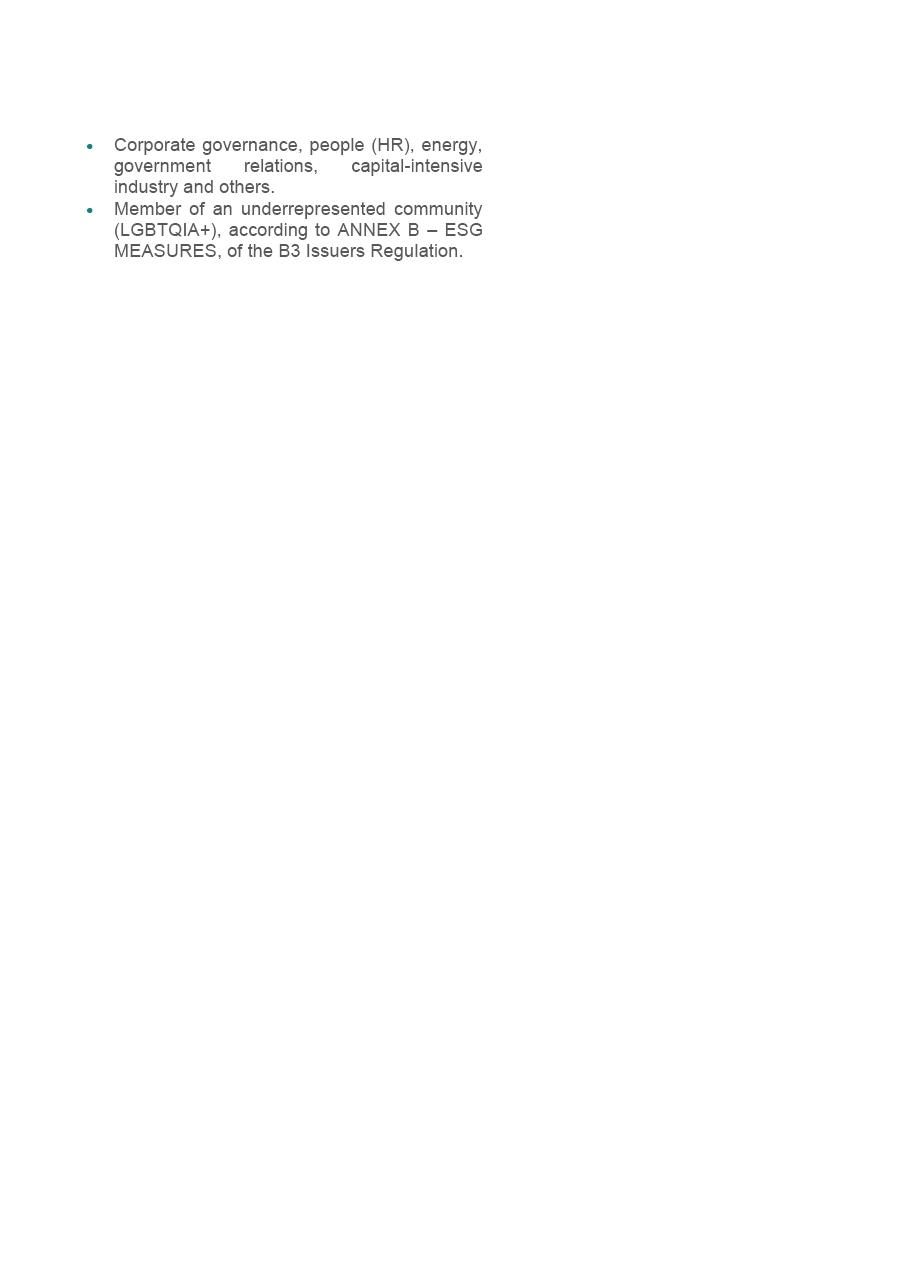

| Ø | Federal Government Candidate 3: Nelson Hubner |

Independent Member: NO (as provided for in the Conciliation Agreement)

Reappointment: NO

Nomination Source: Federal Government.

Additionally, if the ratification of the Conciliation Agreement by the STF does not occur in a timely manner, the term of office of Federal Government Candidate 3 shall be immediately terminated.