UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| OR |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2023 |

| OR |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| OR |

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-39570

TIM S.A.

(Exact name of Registrant as specified in its charter)

TIM, Inc.

(Translation of Registrant’s name into English)

FEDERATIVE REPUBLIC OF BRAZIL

João

Cabral de Melo Neto Avenue, 850 – South Tower – 12th floor

22775-057, Rio

de Janeiro, RJ, Brazil

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

Alberto

Mario Griselli

Chief Executive Officer and Investor Relations Officer

TIM S.A.

João

Cabral de Melo Neto Avenue, 850 – South Tower – 12th floor

22775-057,

Rio

de Janeiro, RJ, Brazil

Tel: 55

21 4109-4167

ri@timbrasil.com.br

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Shares, without par value* | New York Stock Exchange | |

| American Depositary Shares, as evidenced by American Depositary Receipts, each representing five Common Shares | TIMB | New York Stock Exchange |

| * | Not for trading, but only in connection with the listing of American Depositary Shares on the New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

| Title of Class | Number of Shares Outstanding |

| Common Shares, without par value | 2,420,804,398 |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☒ No ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐ No ☒

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ☒ Accelerated Filer ☐ Non-accelerated Filer ☐ Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

☐ U.S. GAAP

☒ International Financial Reporting Standards as issued by the International Accounting Standards Board

☐ Other

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☐

TABLE OF CONTENTS

Page

|

|

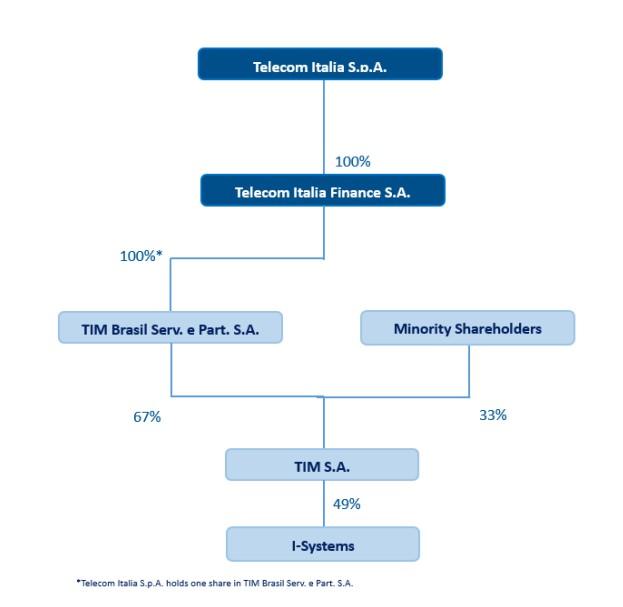

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

In this annual report, TIM S.A. (formerly known as Intelig Telecomunicações Ltda., or “Intelig”), a publicly-held company (sociedade anônima) organized under the laws of the Federative Republic of Brazil, is referred to as “TIM” or the “Company”. References to “we,” “us” and “our” are to TIM together with, where the context so requires and as explained more fully below, Cozani RJ Infraestrutura e Rede de Telecomunicações S.A. (“SPE Cozani” or “Cozani”) which was merged into the Company on April 1, 2023, TIM Participações S.A. (“TIM Participações”), our prior parent holding company, which was merged into the Company in September 2020, TIM Celular S.A. (“TIM Celular”), which was merged into the Company in October 2018, TIM Sul S.A. (“TIM Sul”) and TIM Nordeste Telecomunicações S.A. (“TIM Nordeste”), both of which merged into the Company in May 2005. Collectively, these transactions are referred to herein as the (“Reorganization”).

References in this annual report to the “common shares” are to the common shares of TIM. References to the “American Depositary Shares” or “ADSs” are to TIM’s American Depositary Shares, each representing five common shares. The ADSs are evidenced by “American Depositary Receipts,” or “ADRs,” which are listed on the New York Stock Exchange, or the “NYSE”, under the symbol “TIMB.”

Market Share Data

We calculate market share information based on information provided by Brazil’s National Telecommunications Agency (Agência Nacional de Telecomunicações) (“ANATEL”). We calculate penetration data based on information provided by the Brazilian Institute of Geography and Statistics (Instituto Brasileiro de Geografia e Estatística) (“IBGE”).

Presentation of Financial Information

We maintain our books and records in reais. The consolidated financial statements included in this annual report were prepared in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”) (“consolidated financial statements”). As a complement to the IFRS principles, the Company also applies accounting practices established under Brazilian corporate law and rules issued by the Securities and Exchange Commission of Brazil (Comissão de Valores Mobiliários) (“CVM”), for the Brazilian Stock Market Exchange and ANATEL to comply with the regulatory requirements.

The Merger, which occurred in 2020, as defined below, was accounted using the predecessor method of accounting, through which the historical operations of TIM Participações are deemed to be those of the Company. See “Item 4. Information on the Company—A. History and Development of the Company—Historical Background.” Accordingly, the consolidated financial statements included in this report reflect:

| · | the historical operating results and financial position of TIM Participações prior to the Merger; |

| · | the consolidated results of the Company and TIM Participações following the Merger; |

| · | on November 16, 2021, we sold 51% of the share capital of our subsidiary, I-Systems Soluções de Infraestrutura S.A. (formerly FiberCo Soluções de Infraestrutura S.A. (“FiberCo”)), company created by TIM to segregate network assets and provision of infrastructure services, to IHS and thereafter we no longer had any subsidiaries; and |

| · | On March 30, 2023, TIM’s annual general and extraordinary meeting approved the full incorporation of Cozani into TIM, with the incorporation and consequent extinction of Cozani becoming effective, for all intents and purposes, on April 1, 2023. The merger of Cozani had no impact in the consolidated financial statements, since this entity was a wholly owned subsidiary of TIM. |

The preparation of financial statements in accordance with IFRS requires the use of certain critical accounting estimates. It also requires management to exercise its judgment in the process of applying our accounting policies. Those areas involving a higher degree of judgment or complexity, or areas where assumptions and estimates are significant to the consolidated financial statements, are disclosed in Note 3 to our consolidated financial statements.

|

|

All references herein to the “real,” “reais” or “R$” are to the Brazilian real, the official currency of Brazil. All references to “U.S. dollars,” “dollars” or “U.S.$” are to United States dollars.

Solely for the convenience of the reader, we have translated some amounts included elsewhere in this annual report from reais into U.S. dollars using the commercial selling exchange rate as reported by the Central Bank of Brazil (Banco Central do Brasil) (“Central Bank”), on December 31, 2023, of R$4.8413 to U.S.$1.00. These translations should not be considered representations that any such amounts have been, could have been or could be converted into U.S. dollars at that or at any other exchange rate. Such translations should not be construed as representations that the real amounts represent or have been or could be converted into U.S. dollars as of that or any other date. See “Item 5. Brazilian Political and Economic Overview—A. Operating Results—Brazilian Political and Economic Overview” for information regarding exchange rates for the Brazilian currency.

Certain figures included in this annual report have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be an arithmetic aggregation of the figures that precede them.

The “Technical Glossary” at the end of this annual report provides definitions of certain technical terms used in this annual report and in the documents incorporated in this annual report by reference.

As part of our continuous process to improve the overall quality of the Company’s financial statements, and to promote greater comparability and consistency with other companies within the industry, we changed our accounting policy related to the presentation of purchases and sales of marketable securities in the statements of cash flows. Previously, the Company reported such transactions as an investing activity on a net basis (R$2.4 billion in 2022 and R$2.5 billion in 2021), in accordance with IAS 7 paragraph 22(b) and 23A(b). In connection with the new accounting policy, the Company reported such transactions as an investing activity on a gross basis, in accordance with IAS 7 paragraph 21.The Company also changed the presentation of interest income from marketable securities, that were previously reported as an investing activity (R$266.8 million in 2022 and R$173 million in 2021) to operating activity, in accordance with IAS 7 paragraph 33. The Company applied the change in accounting policy retrospectively, in accordance with IAS 8 paragraph 19(b).

Special Note Regarding Non-GAAP Financial Measures

This annual report presents certain non-GAAP financial measures, which are not recognized under IFRS, specifically Net Debt, EBITDA and Adjusted EBITDA. A non-GAAP financial measure is generally defined as one that purports to measure financial performance but excludes or includes amounts that would not be so adjusted in the most comparable GAAP or IFRS measure. Non-GAAP financial measures do not have standardized meanings and may not be directly comparable to similarly titled measures adopted by other companies. These non-GAAP financial measures are used by our management for decision-making purposes and to assess our financial and operating performance, financial position, liquidity and to make strategic decisions regarding the allocation of capital. We also believe that the disclosure of our non-GAAP financial measures provides useful supplemental information to investors and financial analysts and other interested parties in their review of our operating performance, in particular, we believe that using Adjusted EBITDA as a non-GAAP measure is useful to management, investors and other users of our financial information in evaluating operating profitability on a more variable cost basis as it excludes the depreciation and amortization expense related primarily to capital expenditures and non-recurring revenue/expenses, such as the gain from the transaction price adjustment related to the acquisition of certain assets of Oi Móvel in 2023, in 2022, the line was impacted as a result of the post-closing price adjustment from the sale of control of I-Systems and, in 2021 the impact was from the sale of part of our stake in I-Systems to IHS, as well as in evaluating operating performance in relation to TIM’s competitors.

Potential investors should not rely on information not recognized under IFRS as a substitute for the IFRS measures of earnings, financial position, cash flows or profit (loss) in making an investment decision.

We use Net Debt, EBITDA and Adjusted EBITDA, collectively, to evaluate our ongoing operations and for internal financial planning and forecasting purposes. We believe that non-GAAP financial measures, when taken collectively, may be helpful to investors because it provides consistency and comparability with past financial performance and facilitates period-to-period comparisons of results of operations.

|

|

Net Debt

We calculate Net Debt as total loans and derivatives plus lease liabilities minus lease assets minus cash and cash equivalents minus FIC (Investment Fund). For a reconciliation of Net Debt to the most directly comparable IFRS measure, see “Item 5. Operating and Financial Review and Prospects—Reconciliation of Non-GAAP Financial Measures—Reconciliation of Net Debt.”

EBITDA and Adjusted EBITDA

We calculate EBITDA as net profit for the year plus net financial income (expense), income tax and social contribution and depreciation and amortization costs and expenses. For a reconciliation of EBITDA to the most directly comparable IFRS measure, see “Item 5. Operating and Financial Review and Prospects—Reconciliation of Non-GAAP Financial Measures—Reconciliation of EBITDA and Adjusted EBITDA.”

We calculate Adjusted EBITDA as EBITDA adjusted for (i) equity in earnings and (ii) Non-recurring Revenue/Expense. For a reconciliation of Adjusted EBITDA to the most directly comparable IFRS measure, see “Operating and Financial Review and Prospects—Reconciliation of Non-GAAP Financial Measures—Reconciliation of EBITDA and Adjusted EBITDA.”

FORWARD-LOOKING INFORMATION

This annual report contains statements in relation to our plans, forecasts, expectations regarding future events, strategies and projections, which are forward-looking statements and involve risks and uncertainties and are therefore, not guarantees of future results. Forward-looking statements speak only as of the date they were made, and we undertake no obligation to update publicly or revise any forward-looking statements after we file this annual report because of new information, future events and other factors. We and our representatives may also make forward-looking statements in press releases and oral statements. Statements that are not statements of historical fact, including statements about the beliefs and expectations of our management, are forward-looking statements. Words such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “intend,” “plan,” “predict,” “project” and “target” and similar words are intended to identify forward-looking statements, which necessarily involve known and unknown risks and uncertainties. Our actual results and performance could differ substantially from those anticipated in our forward-looking statements. These statements appear in several places in this annual report, principally in “Item 4. Information on the Company” and “Item 5. Operating and Financial Review and Prospects,” and include, but are not limited to, statements regarding our intent, belief or current expectations with respect to:

| · | general economic, political, social and business conditions in Brazil and abroad, including the impact of the current international economic environment and the macroeconomic conditions in Brazil such as (i) developments and the perception of risks in connection with the administration of President Luiz Inácio Lula da Silva and the policies his government may adopt or change during his term in office, particularly economic and fiscal reforms, (ii) the ongoing war between Russia and Ukraine and (iii) the conflict involving Hamas and Israel, any of which may negatively affect growth prospects in the Brazilian economy as a whole; |

| · | Brazilian telecommunications industry conditions, size and trends; |

| · | characteristics of competing networks’ products and services; |

| · | estimated demand forecasts; |

| · | actual or threatened health epidemics, pandemics, outbreaks, or other public health crisis, could have an adverse impact on our business; |

|

|

| · | the size of our subscriber base, particularly any increase in our postpaid subscribers; |

| · | development of additional sources of revenue; |

| · | strategy for marketing and operational expansion; |

| · | achieving and maintaining customer satisfaction; |

| · | development of higher profit margin activities, attaining higher margins, and controlling customer acquisition and other costs; and |

| · | capital expenditures forecasts, funding needs and financing resources. |

Because forward-looking statements are subject to risks and uncertainties, our actual results and performance could differ significantly from those anticipated in such statements and the anticipated events or circumstances might not occur. The risks and uncertainties include, but are not limited to:

| · | our ability to successfully implement our business strategy; |

| · | increasing competition from other providers and services in the telecommunications industry, particularly global and local Over The Top (“OTT”), competitors providing communication services like Voice over Internet Protocol, (“VoIP”), calls and messages; |

| · | the trend towards consolidation in the Brazilian telecommunications market; |

| · | our ability to respond to new telecommunications technologies that are received favorably by the market; |

| · | our ability to efficiently operate our systems and controls that are subject to failure or to cyber-security risks; |

| · | our ability to expand our services while maintaining the quality of the services provided and a positive customer experience; |

| · | our ability to operate efficiently and to refinance our debt as it comes due, particularly in consideration of political and economic conditions in Brazil and uncertainties in credit and capital markets; |

| · | performance of third-party service providers and key suppliers on which we depend, as well as credit risk with respect to our customers; |

| · | government policy and changes in the regulatory environment or in the legal framework in Brazil, particularly as an economic group classified as having significant market power in some markets subject to increased regulation; |

| · | our dependence on authorizations granted and renewed by the Brazilian government; |

| · | the effect of economic and political conditions, such as inflation and exchange rate fluctuations; |

| · | the growing requirements and new regulations and standards regarding Environmental, Social and Governance (“ESG”) disclosure could generate yet to be identified obligations and expenditures; and |

| · | other factors identified or discussed under “Item 3. Key Information—D. Risk Factors” and elsewhere in this annual report. |

|

|

PART I

| Item 1. | Identity of Directors, Senior Management and Advisers |

Not applicable.

| Item 2. | Offer Statistics and Expected Timetable |

Not applicable.

| Item 3. | Key Information |

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Summary of Risk Factors

This section is intended to be a summary of more detailed discussions contained elsewhere in this annual report. The risks described below are not the only ones we face. Our business, results of operations or financial condition could be harmed if any of these risks materializes and, as a result, the trading price of our shares and our ADSs could decline.

Summary of Risks Relating to our Business

| · | We may be unable to successfully implement our business strategy. |

| · | Future partnerships or joint ventures that we enter into may not bring the expected financial results and could cause harm to our image as well as financial costs. |

| · | Any acquisitions or investments in other companies, products, or technologies could require significant management attention, disrupt our business, dilute stockholder value, and adversely affect our operating results. |

| · | We face various risks related to health epidemics, pandemics and outbreaks, which may have material adverse effects on our business, financial condition, results of operations and cash flows. |

| · | Goodwill impairments may be required in relation to acquired businesses. |

| · | We face increasing competition from other providers and services, which may adversely affect our results of operations. |

| · | We may be unable to respond to the trend towards consolidation in the Brazilian telecommunications market. |

| · | We may face difficulties responding to new telecommunications technologies. |

|

|

| · | Our operations depend on our ability to efficiently operate our systems and controls that are subject to failure that could affect our business and our reputation. |

| · | Our business is dependent on our ability to expand our services while maintaining the quality of the services provided and a positive customer experience. |

| · | We face various cyber-security risks that, if not adequately addressed, could have an adverse effect on our business. |

| · | We depend on data centers operated by third parties and third-party cloud computing platforms, and any disruption in the operation of these facilities or platforms or access to the Internet would adversely affect our business. |

| · | Certain debt agreements contain financial covenants and any default under such debt agreements may have a material adverse effect on our financial condition and cash flows. |

| · | Due to the nature of our business, we are exposed to numerous lawsuits, administrative proceedings, consumer claims and tax-related proceedings. |

| · | Any modification or termination of our ability to use the “TIM” trade name may adversely affect our business and operating results. |

| · | We are subject to credit risk with respect to our customers. |

| · | We may be subject to liability related to outsourcing certain functions to third-party service providers. |

| · | We depend on key suppliers, certain inputs and contractual relationships with other telecommunications providers which are critical to our ability to provide telecommunications services to our customers or may have a material adverse effect on our operations. |

| · | Our operations could be suspended or interrupted as a result of natural or man-made disasters or other unexpected events, such as those related to climate change. |

| · | We use demand forecasts to make investments, however such forecasts may ultimately be inaccurate due to economic volatility and result in lower revenues than expected. |

| · | Our governance and compliance processes may fail to prevent regulatory penalties and reputational harm. |

| · | Improper use of our networks could adversely affect our costs and results of operations. |

| · | We may be unable to implement our plans to expand and enhance our existing networks in Brazil in a timely manner or without unanticipated costs, which could hinder or prevent the successful implementation of our business plan and adversely affect our results of operations. |

Summary of Risks Relating to the Brazilian Telecommunications Industry

| · | ANATEL classified us as an economic group with significant market power in some markets and we are now subject to increased regulation. |

| · | As a telecommunications provider and a publicly traded company in Brazil, we are subject to extensive legal and regulatory obligations in the performance of our activities which may limit our flexibility in responding to market conditions, competition and changes in our cost structure or with which we may be unable to comply. |

| · | The Brazilian government under certain circumstances may terminate our authorizations or we may not receive renewals of our authorizations. |

|

|

| · | Actual or perceived health risks or other problems relating to mobile telecommunications technology could lead to litigation or decreased mobile communications usage, which could harm us and the mobile industry as a whole. |

Summary of Risks Relating to Brazil

| · | Risks related to Brazilian economic and political conditions may negatively affect our business. |

| · | The Brazilian government has exerted significant influence over the Brazilian economy and continues to do so. This involvement may have an adverse effect on our activities, our business and on the market prices of our shares and ADSs. |

| · | Changes in Brazilian tax laws may have an adverse impact on the taxes applicable to our business and over our prices. |

| · | Inflation, and government measures to curb inflation, may adversely affect the Brazilian economy and capital market, our business and operations and the market prices of our common shares or the ADSs. |

| · | Exchange rate movements and interest rate fluctuation may have an adverse effect on our business and the market prices of our shares or the ADSs. |

| · | The effects of the weak domestic economy could reduce purchases of our products and services and adversely affect our results of operations, cash flows and financial condition. |

| · | We may be impacted by volatility in the global financial markets. |

| · | Developments and the perception of risk in other countries may adversely affect the Brazilian economy and market price of Brazilian issuers’ securities. |

Summary of Risks Relating to our Common Shares and the ADSs

| · | Our controlling shareholder has power over the direction of our business. |

| · | Holders of our ADSs are not entitled to attend shareholders’ meetings and may only vote through the depositary. |

| · | Holders of our ADSs or common shares in the United States may not be entitled to participate in future preemptive rights offerings. |

| · | Cash dividends, interest on shareholders’ equity and other cash distributions, as well as judgments seeking to enforce our obligations in respect of our shares or ADSs in Brazil will be payable only in reais. |

| · | Holders of ADSs or common shares could be subject to Brazilian income tax on capital gains from sales of ADSs or common shares. |

| · | An exchange of ADSs for common shares risks loss of certain foreign currency remittance and Brazilian tax advantages. |

Risks Relating to our Business

We may be unable to successfully implement our business strategy.

Our business will be adversely affected if we are unable to successfully implement our strategic objectives and factors beyond our control may prevent us from doing so.

Our business strategy aims to increase cash-flow generation to support new avenues of growth and increase shareholder returns and can be divided into four key focuses: (1) “MOBILE,” becoming the most preferred mobile operator in Brazil (seeking to provide a best value proposition in a value driven market delivering superior services, the strongest network, and the most compelling offer to customers); (2) “B2B,” shaping a new market with significant growth potential, using IoT connectivity as a stepping-stone to expand towards solutions and services; (3) “BROADBAND,” growing profitably operations, with the go-to-market strategy being optimized and becoming more efficient and flexible (the Company transitioned from being a traditional broadband provider to adopting an asset-light model, enabling a mobile-like go-to-market strategy); (4) “EFFICIENCY,” establishing strict discipline in the allocation of capital and resources.

|

|

Strengthening our core business, as it is the Company’s main business, requires managing and expanding our infrastructure, including with the deployment of new technologies. Additionally, our Core strategy requires successfully monetizing our mobile customer base and expanding our fixed broadband business, while maintaining financial discipline.

In respect of our strategic efforts regarding broadband, we are seeking to increase our presence in the residential broadband market by expanding our footprint and the density of our fiber optic broadband service (“FTTH”) through Neutral Networks deals (which consist in the provision of network infrastructure so that the Company can focus on offering last mile services to our customers), such as I-Systems and VTal, an end-to-end digital infrastructure solutions company and holder of the largest neutral fiber optic network in Brazil, serving telecom operators, internet providers and OTTs, providing a higher-speed fixed connection closer to the customer residence, branded as TIM Live. As our fiber optic broadband service now relies on business partners that provide fiber expansion and customer connection, our long-return investments, growth strategy and business are exposed to risks related to the quality, pace and location of the services these business partners provide to our customers.

Additionally, TIM has launched its commercial 5G Standalone (5G SA) network infrastructure in 2022, covering all 26 state capitals in Brazil and the Federal District (Brasilia), with a special focus on certain cities where 100% of the neighborhoods are covered, such as São Paulo, Rio de Janeiro, Curitiba, Brasília, Belo Horizonte, Fortaleza, Salvador, and Recife. The number of TIM’s 5G sites is almost equal to the sum of equivalent sites operated by our competitors, placing TIM ahead of other operators. We believe that 5G SA also enables new B2B businesses through functionalities such as Network Slicing and the implementation of private networks. However, the increase of 5G traffic could impact network resources and infrastructure in the coming years, requiring us to make continued investments in infrastructure to meet the increasing 5G network capacity demand. In addition, implementing new functionalities using 5G SA carries with it the inherent risks that come with implementing any new technology, such as our ability to develop and introduce these new and innovative functionalities that need to be received favorably by the market, and which enable us to provide value-added services that encourage the use of our network.

Alongside Core, we implement a strategy of Beyond Connectivity, where our principal goal is to attract and expand partnerships that can offer significant growth opportunities in both mobile operations, with a partnership portfolio of services to generate value for TIM, and in B2B, to shape a new market leveraging our pioneering position through partnerships, while we are taking digitalization to the next level by expanding Machine Learning (ML) and AI/GenAI across the organization.

Our ability to implement our strategy is influenced by many factors partially or completely outside our control, including:

| · | an increase in the number of competitors due to the entrance of new market participants and/or the improvement in financial strength of existing players in the telecommunication sector that could reduce our market share; |

| · | increased competition from mobile virtual network operators which offer telecommunication services to customers by leasing network capacity from traditional network providers, without their own network infrastructure; |

| · | increased competition in our main markets that could force us to reduce the prices we charge for our services in order to compete effectively; |

|

|

| · | our ability to strengthen our competitive position in the Brazilian mobile telecommunications market; |

| · | increased competition from global and local OTT (Over The Top), providers who offer content and services using the internet, including voice calls and messaging, without owning network infrastructure; |

| · | increased competition in our main markets that could reduce the prices we charge for our services and could have an unintended adverse effect on our results; |

| · | our ability to efficiently operate and grow our broadband business alongside our original business as a mobile network operator (MNO); |

| · | we may be unsuccessful migrating our FTTC (Fiber to the Curb) broadband legacy customers to FTTH (Fiber to the Home) technology in an efficient manner and within the planned time frame, including due to technical or competitive issues; |

| · | pursuant to our fixed broadband asset-light strategy, we may be unable to reach our FTTH coverage rollout plan since we are dependent on the network infrastructure capacity available to us, and if the network infrastructure is not deployed as currently expected, our rollout plan will be affected; |

| · | our ability to successfully capture the economic value of investments and partnerships in IoT, particularly in B2B settings, including our ability to successfully transition from pilot programs to developing products and services that can generate profit at scale; |

| · | our ability to find and partner with IoT providers, given the fragmented IoT market and the limited number of established providers, as well as the complexity of integrating multi-vendor solutions, including data privacy risks; |

| · | our ability to select the right business partners for undertaking our strategy; |

| · | our ability to develop and introduce new and innovative technologies that are received favorably by the market, and which enable us to provide value-added services that encourage the use of our network; |

| · | controls and system technology failures, which could negatively affect our revenues and reputation; |

| · | the introduction of transformative technologies that could be difficult for us to keep pace with and which could cause significant decreases in our revenue; |

| · | the increasing network capacity demand and therefore our ability to manage the continuous growth of mobile data traffic, which in turn requires further investments in infrastructure or the acquisition of additional radio frequencies in order to maintain network quality, especially in large cities, where population density is higher and the costs of network expansion are considerably high; |

| · | controls and system technology failures, which could negatively affect our revenues and reputation; |

| · | the development and expansion of NGSO satellite internet (Non-Geostationary-Satellite Orbit), which may offer significant market and product opportunities in the telecommunications sector by offering broad wide-range coverage at high speed while also disrupting the business of existing providers; |

| · | our ability to operate efficiently and to pay or refinance our debt as it comes due, particularly in light of political and economic conditions in Brazil and uncertainties in credit and capital markets; |

| · | our ability to most efficiently scale our structure; |

| · | our ability to attract and retain qualified personnel; |

|

|

| · | performance of third-party service providers and key suppliers on which we depend, such as any difficulties we may encounter in our supply and procurement processes, including as a result of the insolvency or financial weakness of our suppliers; |

| · | government policy and changes in the regulatory environment or legal framework in Brazil; |

| · | the effect of exchange rate and inflation fluctuations; |

| · | the outcome of litigation, disputes and investigations in which we are involved or may become involved; |

| · | the costs we may incur due to unexpected events, including in situations where our insurance is not sufficient to cover such costs; |

| · | large scale adverse events that could cause negative effects, requiring a long recovery period, or which may permanently impact the socioeconomic environment, such as natural disasters, political instability, or pandemics; |

| · | the real possibility of an increase in taxes by state governments and the Brazilian Federal Government in order to balance their financial deficits or to respond to climate change and changes in energy generation; and |

| · | our ability to maintain strict discipline in the allocation of capital and resources. |

As a result of these uncertainties, there can be no assurance that our strategic objectives can effectively be attained in the manner and within the time frame described.

Future partnerships or joint ventures that we enter into may not bring the expected financial results and could cause harm to our image as well as financial costs

We may enter into relationships with other businesses in order to expand our platform, which could involve preferred or exclusive licenses, additional channels of distribution, or discount pricing or investments in other companies. Negotiating these transactions can be time-consuming, difficult, and expensive, and our ability to close these transactions may be subject to third-party approvals, such as government regulatory approvals, which are beyond our control. Consequently, we can make no assurance that these transactions, once undertaken and announced, will close.

Furthermore, our established partnerships are subject to common litigation risks and we can make no assurance that these established partnerships or future partnerships will not become involved in any type of dispute. We may also need to litigate to protect our interests, preserve our intellectual property rights, and obtain information related to products or technology developed in association with our partners, particularly when the relevant partner invests in such products and technologies. This can hinder further research and development, as well as slow down the commercialization of new technologies. Additionally, if the patents are overly broad or not clearly defined, it can lead to legal disputes and can be costly to enforce. It’s important for researchers and companies to carefully consider the potential risks and benefits before filing for patents related to technology research partnerships.

Any acquisitions or investments in other companies, products, or technologies could require significant management attention, disrupt our business, dilute stockholder value, and adversely affect our operating results.

Our business strategy has included, and may in the future include, acquiring other complementary products, technologies, or businesses. We evaluate and expect in the future to evaluate potential strategic acquisitions of, and partnerships or joint ventures with, complementary businesses, services or technologies. However, we cannot assure you that any benefits will materialize, and we may suffer losses in connection to the used funds and to the opportunity costs related to such transactions.

|

|

Acquisitions or investments may result in unforeseen operating difficulties and expenditures, and we may not achieve the anticipated benefits from certain acquisition, partnership and joint venture due to a number of factors, including:

| · | inability to integrate or benefit from businesses, services, customers or technologies that we acquire or with which we form a partnership or joint venture in a profitable manner; |

| · | unanticipated costs or liabilities associated with the acquisition; |

| · | inability to finance any businesses, services or technologies that we acquire or with which we form a partnership or joint venture; |

| · | difficulty integrating the accounting systems, operations, and personnel of the acquired business; |

| · | difficulties and additional expenses associated with supporting legacy products and hosting infrastructure of the acquired business; |

| · | diversion of management’s time and resources from other core business concerns; |

| · | adverse effects to our existing business relationships with business partners and customers as a result of the acquisition; |

| · | the potential loss of key employees; and |

| · | use of resources that are needed in other parts of our business. |

In addition, we may not be successful in identifying acquisition, partnership and joint venture targets or our competitors may be willing or able to pay more than us for acquisitions, which may cause us to lose certain acquisitions that we would otherwise desire to complete.

Also, to the extent we pay the purchase price of any acquisition in cash, it would reduce our cash reserves, and to the extent the purchase price is paid with our common shares, it could be dilutive to our shareholders. To the extent we pay the purchase price with proceeds from the incurrence of debt, it would increase our level of indebtedness and could negatively affect our liquidity and restrict our operations.

Furthermore, even if any such transaction is consummated, we may be unable to successfully integrate the new operation, business or partnership contemplated thereunder or to realize expected benefits and synergies in a timely and effective manner due to difficulties in negotiating or aligning interests with potential partners or counterparties.

We face various risks related to health epidemics, pandemics and outbreaks, which may have material adverse effects on our business, financial condition, results of operations and cash flows.

We face various risks related to health crisis such as epidemics, pandemics or outbreaks. These events can trigger changes in consumer behavior related to illness, death, fear and market downturns.

Additionally, restrictions intended to slow the spread of a health epidemic, pandemic or outbreak, such as quarantines, government-mandated actions, stay-at-home orders and other restrictions, may lead to: (i) a reduction in demand for our services, (ii) hinder our ability to provide services, (iii) disrupt supply chains; (iv) reduce international trade and business activity; and (v) create volatility in the global and Brazilian capital markets and have a negative impact on the local economy.

If significant portions of the workforce are not able to work effectively because of a health crisis, such as in the case of epidemics, pandemics and other outbreaks, including due to illness, quarantine, facility closures, ineffective remote work agreements or technology failures or limits, our operations could be significantly disrupted. Network availability, performance, maintenance, condition, repair and our ability to setup or install new connections may be affected by the effects of increased absenteeism in the field workforce, or by the imposition of restrictions such as the type implemented during the COVID-19 outbreak, for example, by hindering the movement and access of our field maintenance teams to equipment stations. The supply chain for technology products, and their underlying components (such as spare parts, transmission and switching equipment, appliances and modems) can be impacted by any delay in the manufacturing processes of suppliers in their countries of origin.

|

|

As a result of health epidemics, pandemics and outbreaks, our business can be adversely affected in many ways, potentially for an extended or unpredictable period of time. For example, as a result of impacts on the global economy, market declines and increased market volatility, which could also adversely affect our ability to refinance debt or raise capital on favorable terms.

To the extent any health crisis, epidemic, pandemic or outbreak (such as COVID-19), adversely affects our business and financial results, it could also have the effect of heightening many of the other risks described in this “Risk Factors” section, such as those relating to our ability to successfully implement our business strategy (see “—We may be unable to successfully implement our business strategy”) the credit risk of our customers (see “—We are subject to credit risk with respect to our customers”), our dependence on key suppliers and contractual relationships with other telecommunications providers (“—We depend on key suppliers, certain inputs and contractual relationships with other telecommunications providers which are critical to our ability to provide telecommunications services to our customers”) the Brazilian government’s influence over the Brazilian economy (see “—Risks Relating to Brazil—Risks related to Brazilian economic and political conditions may negatively affect our business”) and volatility in global and domestic financial markets. See “—Risks Relating to Brazil— We may be impacted by volatility in the global financial markets” and “—Risks Relating to Brazil—Developments and the perception of risk in other countries may adversely affect the Brazilian economy and market price of Brazilian issuers’ securities.”

Goodwill impairments may be required in relation to acquired businesses.

We have made business acquisitions in the past and may make further acquisitions in the future. It is possible that the goodwill which has been attributed, or may be attributed, to these businesses may have to be written down if our valuation assumptions are required to be reassessed as a result of any deterioration in the underlying profitability, asset quality and other relevant matters of the businesses. According to the relevant IFRS accounting standard, impairment testing in respect of goodwill is performed annually, or more frequently if there are impairment indicators present, and comprises a comparison of the carrying amount of the cash-generating unit with its recoverable amount. There can be no assurances that we will not have to write down the value attributed to goodwill in the future, which would adversely affect our results and net assets.

We face increasing competition from other providers and services, which may adversely affect our results of operations.

We face competition throughout Brazil from many providers in the personal communications service (“PCS”), market. We compete with providers of mobile telecommunication, VoIP services (“Voice over Internet Protocol”), and landline telecommunications services – including by bundling voice and data to customers in a single offer. Due to this increasing competition, we may incur higher advertising and commercial costs as we attempt to maintain or expand our market share. Other than TIM, the following main competitors also hold authorizations to provide PCS with national coverage: Claro S.A., under the brand name Claro and Telefônica Brasil S.A., under the brand name Vivo (“Vivo”). Moreover, all PCS providers with national coverage offer third generation, or 3G, and fourth generation, or 4G, fifth generation, or 5G mobile telecommunications network technology, reducing differentiation. With the recent acquisition of certain assets of Oi Móvel by TIM, Vivo and Claro (the “Oi Transaction”), we believe that the likelihood of further consolidations in the Brazilian telecom market among the main competitors is remote, but if further consolidations driven by our main competitors were to occur, those consolidations may favor their strategic advantage with increased market power and access to greater financial resources, thereby weakening our market position.

We also expect to face increased competition from other services outside the telecommunications industry. Technological changes, such as the development, roll-out, and improvement of 4G and 5G mobile networks, may create new revenue streams but also hinder traditional services, introducing additional sources of competition, as is already the case with services like VoLTE calls, messages and SMS. These OTT communication apps are often free of charge (i.e., no subscription fee), accessible by smartphones, and usually allow their users to have access to potentially unlimited messaging and voice services over the Internet, bypassing traditional and more profitable voice and messaging services. As a result, voice traffic is migrating to data and offers from almost all competitors have started to include unlimited voice, thereby accelerating commoditization. These and other factors, including the regulatory and tax asymmetry, are responsible for the increase in the competitive pressure we are facing in the mobile market.

|

|

OTT application service providers also leverage existing infrastructures and generally do not operate capital-intensive business models associated with traditional mobile network operators like TIM. Technological developments have led to significant improvements in the services provided by OTT applications – particularly in speech quality delivered by data communications apps, strengthening their positioning and relevance as competitors. In addition, providers with strong brand capability and financial strengths have turned their attention to the provision of OTT application services. In the long term, if non-traditional mobile voice and data services or similar services continue to increase in popularity, as they are expected to do, and if we and other mobile network operators are not able to address this competition, this could contribute to further declines in mobile monthly average revenue per user (“ARPU”), and lower margins across many of our products and services, thereby having a material adverse effect on our business, results of operations, financial condition and prospects.

OTT service providers hold most of the content, the means to create it and the distribution channel. Together with these resources they dedicate themselves to creating new ways for their customers to interact with and consume content. As a result, it can be challenging for network operators, such as ourselves, to design value-added services that are beneficial to our customers. In addition to technological, we may face other hurdles to offering value-added services, such as regulation.

Moreover, considering our fixed broadband business, we observe rising competition from smaller players aiming to attract customers towards fiber optics. This may intensify market competitiveness, elevating our churn rates.

Additionally, we expect that the 3.5GHz rights that were acquired by regional providers may provide them with an opportunity to become mobile network operators (“MNOs”).

We expect that new products and technologies will be developed frequently and that those already established will be in continuous evolution, implying a variety of potential consequences for us. These new outcomes may, in the best scenario, reduce the price of our services by providing lower-cost alternatives or, in the worst scenario, render our products and services obsolete, requiring significant investments in new technologies. If such changes occur, our main competitors in the future may be new participants in the market without the burden of an installed older infrastructure. The amount of investment needed to upgrade our premises and to stay effectively competitive could be significant.

Rising competition may increase our churn rate and could continue to adversely affect our market share and margins. Our ability to compete successfully will depend on the effectiveness of our marketing efforts and our ability to anticipate and adapt in a timely manner to developments in the industry, including the technological changes and new services that may be introduced, changes in consumer preferences, demographic trends, economic conditions and discount pricing strategies by competitors. It is difficult to predict which of many possible factors will be important in maintaining our competitive position or what expenditures will be required to develop and provide new technologies, products or services to our customers. If we are unable to compete successfully, our business, financial condition and results of operations will be materially adversely affected.

We may be unable to respond to the trend towards consolidation in the Brazilian telecommunications market.

The Brazilian telecommunications market has been subject to several movements towards market consolidation since its privatization in 1998. For detailed information on transactions we have undertaken see “Item 4. Information on the Company—A. History and Development of the Company—Historical Background.”

More recently, the economic and regulatory environment faced by telecommunications companies in Brazil could be understood as having played an important role in encouraging a trend towards market consolidation.

|

|

In 2018, via a new resolution, ANATEL reduced one of the main regulatory barriers to consolidation in the mobile market. Resolution No. 703/2018 changed the spectrum cap regulation by increasing the amount of spectrum bandwidth an operator is allowed to retain, depending on frequency range and applicable antitrust measures. On November 5, 2020, ANATEL Resolution No. 736/2020 amended Resolution No. 703/2018 by establishing new maximum limits for the spectrum for SMP licenses. These changes together with financial distress of two major participants in the mobile market, Nextel and Oi Group, led to a new wave of mergers and acquisitions activity.

In the fixed broadband market, consolidation movements have been frequent among regional internet service providers, as well as spinoff transactions which separate formerly integrated operations between client focused companies and network infrastructure focused companies. Movements like those may result in increased competition within our market. We may be unable to adequately respond to pricing pressures resulting from consolidation in our market, adversely affecting our business, financial condition, and results of operations.

We may also consider engaging in mergers and acquisitions activity, as we did by participating in the acquisition of certain assets of Oi Móvel, in response to changes in the competitive environment, which could divert resources away from other aspects of our business.

In this regard, potential acquisitions have inherent risks such as increasing leverage and debt service requirements, combining company cultures and facilities, potential exposure to successor liability, and the need to raise additional capital, which may not be possible at that time. Any of these and other factors could adversely affect our ability to achieve the anticipated cash flows at acquired operations or realize other anticipated benefits of acquisitions, which could negatively affect our reputation or operations.

We may face difficulties responding to new telecommunications technologies.

The Brazilian wireless telecommunications market is experiencing significant technological changes, as evidenced by the following, among other factors:

| · | ongoing improvements in the capacity and quality of digital technology available in Brazil; |

| · | shorter time periods between the introduction of new telecommunication technologies and subsequent upgrades or replacements; |

| · | the development of user interface, or UI, and user experience, or UX, technology, and also the development of applications that will be responsible for collecting information regarding UX associated with network and device information, and will be used as one of the inputs for the network planning, optimization, and troubleshooting activities; |

| · | the development of cloud solutions to provide platform as a service (PaaS), software as a service (SaaS), or infrastructure as a service (IaaS), in order to drive down costs; |

| · | the deployment of the Voice over LTE or NR, known as VoLTE or VoNR, which increases significantly the quality of voice calls and allows companies to traffic voice as data through their 4G and 5G networks; |

| · | the deployment of the Radio Access Network (RAN) sharing agreements among TIM and other companies (see “Item 4. Information on the Company—B. Business Overview—Site-Sharing and Other Agreements”); the acquisition of the 100 MHz frequency nationally in the 3.5 GHz band, in addition to 40 MHz blocks in the 2.3 GHz band in the South and Southeast regions of Brazil (excluding São Paulo); |

| · | the deployment of 5G standalone (known as 5G SA), which requires unprecedented levels of automation across an end-to-end network to fulfill the needs of new services and applications. The 5G SA network needs to be flexible, programmable and distributable in nature, so that it can provide the necessary flexibility to reduce time-to-market and provide the greatest performance and efficiency gains. As a result of the development of 5G SA, products and services supplied by different providers can be more greatly differentiated as between competitors, as 5G SA better enables the provision of custom services; |

|

|

| · | the widespread implementation, in the near future, of Embedded Subscriber Identity Module, or eSIM, technology, which is a small microchip built into phones as an alternative to the conventional physical SIM card, and which will enable our customers to switch faster to other providers, thereby increasing competition; |

| · | an increase in market competition in respect of residential fixed ultra-broadband, requiring operators (including former fixed internet providers which had provided services using copper and coaxial technologies) to accelerate investments in fiber capillarity deployments. This factor becomes more significant when considering the country’s continental dimensions, new market opportunities and the need to provide comparable service in capacity and quality to locations far from large centers, thus boosting investments in IP backbone and datacenters; |

| · | the expansion of the Internet of Things, or IoT, technology in all of its forms and applications, requiring the creation of new platforms enabling its operation in new areas of the value chain. We are strengthening the IoT ecosystem with new partnerships, using connectivity as an enabler to increase productivity and expand the monetization of our customer base. It is estimated that over a million NB-IoT devices will be connected by the end of 2024; and |

| · | the acceleration in the use of artificial intelligence, or AI, and machine learning, in order to use resources more efficiently, reduce spending and increase agility. |

| · | We may be unable to keep pace with these technological changes, which could affect our ability to compete effectively, and the investment required to adopt these new technologies will be significant, both of which could have a material adverse effect on our business, financial condition and results of operations. |

| · | Additionally, emerging technological advancements may have a significant impact on the telecommunications industry. Our future success depends on our ability to adjust to these technological changes. |

Our operations depend on our ability to efficiently operate our systems and controls that are subject to failure that could affect our business and our reputation.

Our success largely depends on the continued and uninterrupted performance of our controls, network technology systems and of certain hardware. Our technical infrastructure (including our network infrastructure and information technology, or IT, systems for mobile telecommunications services) is vulnerable to damage or interruption from information and telecommunication technology failures, power loss, floods, windstorms, fires, terrorism, intentional wrongdoing, human error and similar events. An unexpected increase in volume on our network and systems could cause them to malfunction, such as in periods of increased demand or unexpected circumstances that may reduce our ability to service our infrastructure, such as in a health crisis similar to the COVID-19 pandemic. Our controls are dependent, not exclusively, on these technological systems and are also subject to the interruptions and failures. Unanticipated problems with our controls, or at our facilities, system failures, hardware or software failures, computer viruses or hacker attacks could affect the quality of our services and cause service interruptions. Any of these occurrences could result in reduced user traffic and reduced revenue and could harm our levels of customer satisfaction, our reputation and compliance with certain of our regulatory obligations.

Our supply chain for technological product inputs (like spare parts, transmission and commutation equipment, handsets and modems) may be impacted by any delay in the manufacturing process of vendors in their countries of origin, including as a result of a health crisis or military conflicts that could impact logistics and global supply chain.

Our operations and reputation could be materially negatively affected by cyber-security threats or our failure to comply with new data protection laws, mainly the Brazilian General Data Protection Law (Law No. 13,709/2018), or the LGPD, which came into effect on September 18, 2020. However, the administrative sanctions provisions of LGPD only became enforceable as of August 1, 2021, pursuant to Law No. 14,010/2020. Any proceeding or action and related damages could be harmful to our reputation, force us to incur significant expenses, divert the attention of our management, increase our costs of doing business or result in the imposition of financial penalties.

|

|

In addition, Decree No. 10,474/2020 created the regulatory agency of the National Data Protection Authority, or ANPD. The ANPD must ensure the protection of personal data and will deal with cases regarding commercial and industrial secrets in Brazil.

ANPD is also responsible for developing guidelines for the Protection of Personal Data and Privacy National Policy and for inspecting and applying sanctions in the event of data breaches according to resolution CD/ANPD No. 1, of October 28, 2021. Moreover, ANPD can issue regulations and procedures to protect personal data and privacy, as well as responsible for assessing the impact of personal data protection in scenarios that may be deemed as a high risk to personal data protection principles. As a result of ANPD’s new regulations and procedures, we may be required to change our business practices and implement additional measures to adapt our personal data processing activities. This could adversely affect our business, financial condition, or results of operations. We cannot assure you that our LGPD compliance efforts will be deemed appropriate or sufficient by regulatory authorities or by courts.

We carry out continuous assessments to identify any problems related to LGPD compliance and based on the results identified, we have implemented controls in order to achieve full compliance with the requirements of the LGPD. However, deficiencies in the full adoption of data security measures, implementing personal data processing and retention requirements and reporting data measures within a narrow mandatory time frame could lead to disputes with data protection authorities, fines or harm to our reputation.

Sophisticated information and processing systems are vital to our growth and our ability to monitor costs, render monthly invoices, process customer orders, provide customer service and achieve operating efficiencies. We cannot assure that we will be able to successfully operate and upgrade our information and processing systems or that they will continue to perform as expected without any failure. A severe failure in our accounting, information and processing systems could impair our ability to collect payments from customers and respond satisfactorily to customer needs, which could adversely affect our business, financial condition and results of operations.

Our business is dependent on our ability to expand our services while maintaining the quality of the services provided and a positive customer experience.

Our business as a telecommunications services provider depends on our ability to maintain and expand our telecommunications services network. We believe that our expected growth will require, among other aspects:

| · | continuous development of our controls and operational and administrative systems; |

| · | efficiently allocate our capital; |

| · | increasing marketing activities; |

| · | improving our understanding of customer wants and needs; |

| · | continuous attention to service quality; |

| · | a positive customer experience; |

| · | attracting, training and retaining qualified management, technical, customer relations, and sales personnel; |

| · | increased network capacity through the new spectrum that we recently acquired and/or more investment in network assets such as 4G and 5G technologies; |

| · | increasing network efficiency through infrastructure projects such as the deployment of the Radio Access Network (RAN) sharing agreements among TIM and other companies (see “Item 4. Information on the Company—B. Business Overview—Site-Sharing and Other Agreements”), maintaining the customer experience; and |

|

|

| · | expansion of our optical fiber footprint, not only as a main asset for our 5G backhaul, but also as new long distance routes for backbone resilience and performance. |

We believe that these requirements will place significant demand on our managerial, operational and financial resources. Failure to manage successfully our expected growth could reduce the quality of our services and result in an inadequate customer experience, with adverse effects on our business, financial condition and results of operations.

Our operations are also dependent upon our ability to maintain and protect our network. Damage to our network and backup systems could result in service delays or interruptions and limit our ability to provide customers with reliable service over our network. The occurrence of an event that damages our network may adversely affect our business, financial condition and results of operations.

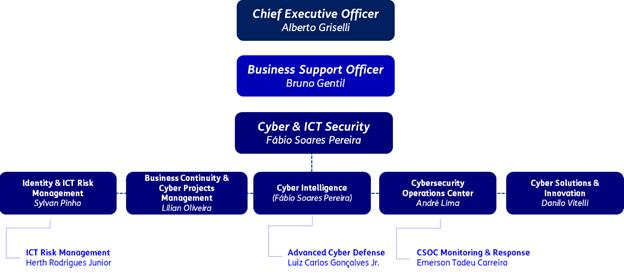

We face various cyber-security risks that, if not adequately addressed, could have an adverse effect on our business.

We face various cyber-security risks that could result in business losses, including, but not limited to, contamination (whether intentional or accidental) of our networks and systems by third parties with whom we exchange data, equipment failures, unauthorized access to and loss of confidential customer, employee and/or proprietary data by persons inside or outside our organization. We are also exposed to cyber-attacks causing systems degradation or service unavailability, the penetration of our information technology systems and platforms by malicious third parties, and infiltration of malware (such as computer viruses) into our systems.

Cyber-attacks against companies have increased in frequency, scope and potential harm in recent years. Further, the perpetrators of cyber-attacks are not restricted to particular groups or persons. These attacks may be committed by our employees or third parties operating in any region, including jurisdictions where law enforcement measures to address such attacks are unavailable or ineffective. We may not be able to successfully protect our operational and information technology systems and platforms against such threats. There can be no assurance that we will be successful in preventing cyber-attacks or successfully mitigating their effects. Similarly, there can be no assurance that we or our third-party providers and other contractors will be successful in protecting our customers’ personal data and other data that is stored on our and their systems. Further, as cyber-attacks continue to evolve, we may incur significant costs in the attempt to modify or enhance our protective measures or investigate or remediate any vulnerability.

The inability to operate our networks and systems as a result of cyber-attacks, even for a limited period of time, may result in significant expenses to us and/or a loss of market share to other communications providers. The costs associated with a major cyber-attack could include expensive incentives offered to existing customers and business partners to retain their business, increased expenditures on cyber-security measures and the use of alternate resources, lost revenues from business interruption and litigation. If we are unable to adequately address these cyber-security risks, our operating network and information systems could be compromised, which would have an adverse effect on our business, financial condition, reputation and results of operations. In order to mitigate such risks, we are currently adopting ISO 27001 standard best practices and obtained the certification in November 2022. Additionally, due to the Russia-Ukraine conflict, there have been publicized threats to increase hacking activity against the critical infrastructure of any nation or organization that retaliates against Russia for its invasion of Ukraine. Any such increase in such attacks on our third-party service providers or other systems could adversely affect our network systems or other operations. We have measures in place that are designed to detect and respond to such cyber-attacks and data security incidents, but there can be no assurance that our efforts will prevent or detect such cyber-attacks and data security incidents.

|

|

We depend on data centers operated by third parties and third-party cloud computing platforms, and any disruption in the operation of these facilities or platforms or access to the Internet would adversely affect our business.

Our business requires the ongoing availability and uninterrupted operation of internal and external systems and services. We have adopted new technology infrastructure solutions, which carries with it some risk to business continuity. With the adoption of cloud computing technology, key IT systems are being migrated to the public cloud. Despite cloud computing reducing some risks, such as delays in the supply of equipment by suppliers (like spare parts, servers, etc.), the adoption of cloud computing means that the control and responsibilities for the proper functioning of the systems are shared between ourselves and the third parties. In all cases, the third parties will be responsible for the physical infrastructure, connectivity, energy supply, cooling and all the capabilities related to infrastructure availability. Depending of the cloud service type involved for any specific system (e.g., for IaaS, PaaS, SaaS), other capabilities will be the responsibility of the third party, according to the principles of the Shared Responsibility Model defined by the Cloud Security Alliance, and incorporated into our contracts with the third-party providers

These third-party providers may experience connectivity disruption, outages and other performance problems, which may be caused by a variety of factors, including infrastructure changes, human or software errors, viruses, security attacks, fraud, spikes in customer usage and denial of service issues. As such, our success also depends directly on the continuity of the provision of computing capacity and the availability of connectivity between the cloud computing provider’s datacenters, including the connectivity with our datacenters and internal networks. An intermittent failure or complete lack of connectivity or system availability, may cause interruption to our services, affecting our availability indicators as well as our revenue and reputation.

Having data hosted on a public cloud also poses a risk to our ability to comply with data protection principles or law (such as the LGPD). As such, our success depends on our ability to certify that cloud providers are adopting security best practices, as well as complying with the terms of data protection laws in accordance with our contractually agreed terms.

Certain debt agreements contain financial covenants and any default under such debt agreements may have a material adverse effect on our financial condition and cash flows.

Certain of our existing debt agreements contain restrictions and covenants and require the maintenance or satisfaction of specified financial ratios and tests. See “Item 5. Operating and Financial Review and Prospects.” The ability to meet these financial ratios and tests can be affected by events beyond our control, and we cannot assure that we will meet those tests. Failure to meet or satisfy any of these covenants, financial ratios or financial tests could result in an event of default under these agreements.

Our ability to meet these financial ratios and tests can be affected by events beyond our control, and we cannot assure you that we will meet those requirements. Failure to meet or satisfy any of these requirements may have a material adverse effect on our financial condition and cash flows.

If we are unable to meet these debt service obligations, or comply with these debt covenants, we could be forced to restructure or refinance this indebtedness, seek additional equity capital or sell assets.

Due to the nature of our business, we are exposed to numerous lawsuits, administrative proceedings, consumer claims and tax-related proceedings.

Our business exposes us to a variety of lawsuits and other proceedings brought by or on behalf of consumers in the ordinary course of business as a mobile telecommunications provider in Brazil. We are subject to a number of public civil actions and class actions that have been brought against mobile telecommunications providers in Brazil mainly related to network quality, minimum term clauses and the use of land to install our network sites. These suits include claims contesting certain aspects of the fee structure of our prepaid plans, hybrid (monthly billed fixed price), or so-called control plans and postpaid plans, which are commonplace in the Brazilian telecommunications industry.

|

|

In addition, federal, state and municipal tax authorities have questioned some tax procedures we have adopted, and have raised questions regarding the calculation of the basis for certain sector-specific contributions (FUST and FUNTTEL, as each are defined in “Item 4. Information on the Company—B. Business Overview—Taxes on Telecommunications Goods and Services”). As of December 31, 2023, we are subject to approximately 3,715 tax-related lawsuits and administrative proceedings with an aggregate value of approximately R$19,903 million classified as “probable loss” and “possible loss” by our legal advisors. In addition, there are tax proceedings arising from the acquisition of the former Intelig business (currently TIM S.A.) by the former parent company of the TIM Participações group, relating to the purchase price.

An adverse outcome in, or any settlement of, these or other lawsuits could result in losses and costs to us, with an adverse effect on our business practices and results of operations. For some of these lawsuits, we were not required to and have not established any provision on our statement of financial position or have established provisions only for part of the amounts in controversy, based on our judgments or opinions of our legal counsel as to the likelihood of winning these lawsuits. In addition, our senior management may be required to devote substantial time to these lawsuits, which they could otherwise devote to our business. See Note 25 to our consolidated financial statements.

Any modification or termination of our ability to use the “TIM” trade name may adversely affect our business and operating results.