UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2023

Commission File Number: 001-38049

Azul S.A.

(Name of Registrant)

Edifício Jatobá, 8th floor, Castelo Branco Office Park

Avenida Marcos Penteado de Ulhôa Rodrigues, 939

Tamboré, Barueri, São Paulo, SP 06460-040, Brazil.

+55 (11) 4831 2880

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨ No x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No x

Contents

Statement of financial position |

3 |

Statement of operations |

5 |

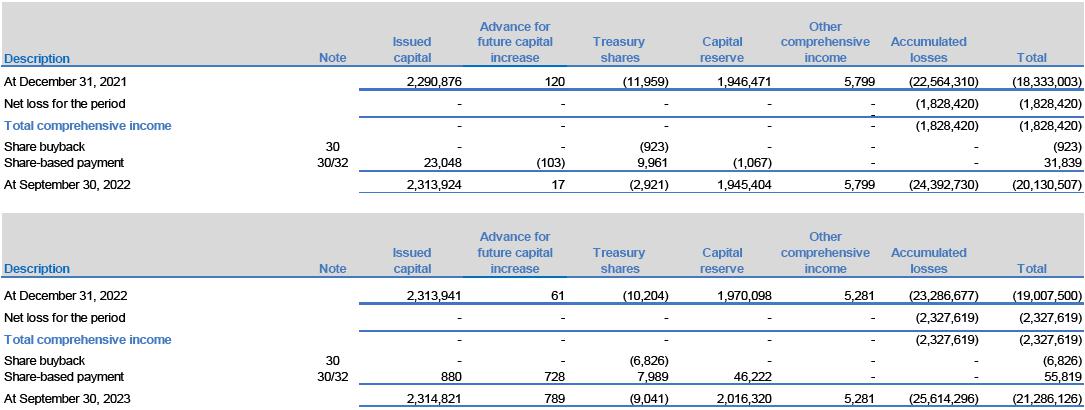

Statement of changes in equity |

8 |

Statement of cash flows |

9 |

Statement of values added |

10 |

Notes to the interim condensed individual and consolidated financial statements |

11 |

|

AZUL S.A. Statement of financial position September 30, 2023 and December 31, 2022 (In thousands of Brazilian reais – R$) |

The accompanying notes are an integral part of these interim condensed individual and consolidated financial statements.

|

|

|

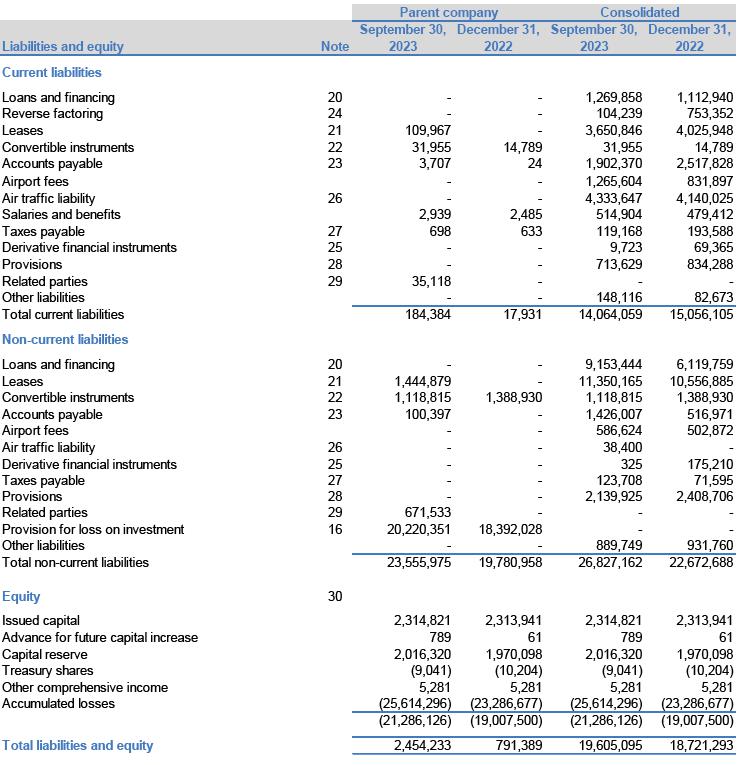

AZUL S.A. Statement of financial position September 30, 2023 and December 31, 2022 (In thousands of Brazilian reais – R$) |

The accompanying notes are an integral part of these interim condensed individual and consolidated financial statements.

|

|

|

AZUL S.A. Statement of financial position September 30, 2023 and December 31, 2022 (In thousands of Brazilian reais – R$) |

The accompanying notes are an integral part of these interim condensed individual and consolidated financial statements.

|

|

|

AZUL S.A. Statement of financial position September 30, 2023 and December 31, 2022 (In thousands of Brazilian reais – R$) |

The accompanying notes are an integral part of these interim condensed individual and consolidated financial statements.

|

|

|

AZUL S.A. Statement of financial position September 30, 2023 and December 31, 2022 (In thousands of Brazilian reais – R$) |

The accompanying notes are an integral part of these interim condensed individual and consolidated financial statements.

|

|

|

AZUL S.A. Statement of financial position September 30, 2023 and December 31, 2022 (In thousands of Brazilian reais – R$) |

The accompanying notes are an integral part of these interim condensed individual and consolidated financial statements.

|

|

|

AZUL S.A. Statement of financial position September 30, 2023 and December 31, 2022 (In thousands of Brazilian reais – R$) |

The accompanying notes are an integral part of these interim condensed individual and consolidated financial statements.

|

|

|

AZUL S.A. Statement of financial position September 30, 2023 and December 31, 2022 (In thousands of Brazilian reais – R$) |

| (a) | Not including INSS in the amount of R$229,716 in the consolidated. |

The accompanying notes are an integral part of these interim condensed individual and consolidated financial statements.

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| 1. | OPERATIONS |

Azul S.A. (“Azul”), together with its subsidiaries (“Company”) is a corporation governed by its bylaws, as per Law No. 6404/76 and by the corporate governance level 2 listing regulation of B3 S.A. – Brasil, Bolsa, Balcão (“B3”). The Azul was incorporated on January 3, 2008, and its core business comprises the operation of regular and non-regular airline passenger services, cargo or mail, passenger charter, provision of maintenance and hangarage services for aircraft, engines, parts and pieces, aircraft acquisition and lease, development of frequent-flyer programs, development of related activities and equity holding in other companies since the beginning of its operations on December 15, 2008.

The Azul carries out its activities through its subsidiaries, mainly Azul Linhas Aéreas Brasileiras S.A. (“ALAB”) and Azul Conecta Ltda. (“Conecta”), which hold authorization from government authorities to operate as airlines and ATS Viagens e Turismo Ltda (“Azul Viagens”).

The Azul shares are traded on B3 and on the New York Stock Exchange (“NYSE”) under tickers AZUL4 and AZUL, respectively.

The Azul is headquartered at Avenida Marcos Penteado de Ulhôa Rodrigues, 939, 8th floor, in the city of Barueri, state of São Paulo, Brazil.

| 1.1 | Organizational structure |

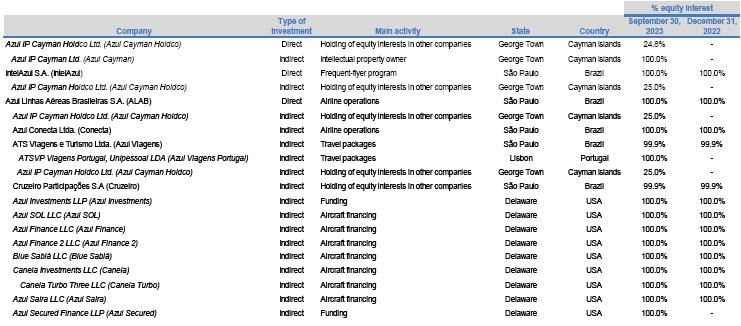

The Company organizational structure as of September 30, 2023 is as follows:

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

The table below lists the operational activities in which the Azul subsidiaries are engaged, as well as the changes in ownership that occurred in period, when applicable.

The company Azul Viagens Portugal was incorporated on March, 2023, the Azul Secured on May, 2023 and the companies Azul IP Cayman Holdco and Azul IP Cayman on June, 2023.

| 1.2 | Seasonality |

The Company’s operating revenues depend substantially on the general volume of passenger and cargo traffic, which is subject to seasonal changes. Our passenger revenues are generally higher during the summer and winter holidays, in January and July respectively, and in the last two weeks of December, which corresponds to the holiday season. Considering the distribution of fixed costs, this seasonality tends to cause variations in operating results between the quarters of the fiscal year. It should be noted that the COVID-19 pandemic impacted the behavior related to the frequency of travels of the Company’s customers, in the first quarter of 2022, thus impacting the accumulated result for nine months presented for comparative purposes.

| 2. | NET WORKING CAPITAL AND CAPITAL STRUCTURE |

2.1 Contextualization

During the quarter ended September 30, 2023, Azul's Management completed the process of restructuring its debts through several actions that will be presented in detail below, however, it is necessary to clarify the facts and conditions that led the Company to carry out such restructuring.

From the founding of the Company until the outbreak

of the COVID-19 pandemic, Azul demonstrated through its results the strengths of its economic foundations. As an airline with a differentiated

business strategy, supported by its regional routes, where there was very little or even no competition, until that moment the Company

had shown exponential growth.

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

As is generally known, on March 11, 2020, the World Health Organization (“WHO”) classified the COVID-19 disease as a “public health emergency of international concern” and declared it a pandemic. From this moment, a sharp rupture was noted in the global economic activity, unleashing an unprecedented global economic crisis.

It is worth remembering that the speed of spread and contagion of the disease has caused countries around the world, including Brazil, to adopt measures to recommend social distancing, travel restrictions and the closure of borders. As a consequence, the airline industry was one of the first and hardest hit in its operations and results.

In order to face this absolutely challenging scenario, the Company, through its Executive Committee, started to monitor and establish operational and financial strategies to go through this period of crisis until the resumption of operations. Among the main actions to achieve the established strategies, the following stand out:

2.1.1 Resizing of the airline network

One of the first and most important actions taken by Management in response to the economic crisis unleashed by the COVID-19 pandemic was the resizing of its airline network, with reductions in capacity that reached its peak in April 2020. At this moment, the volume of ASKs offered in the domestic market accounted for only 13% of the volume of the same period of 2019, represented by approximately 70 daily flights, and in turn the demand reduced to 11% of the total of the previous year. Remembering that until then the Company operated almost 1,000 daily flights. This situation severely impacted the Company's ability to generate cash and be able to honor financial commitments made in the pre-pandemic period.

2.1.2 Cost reductions

Faced with the difficulties imposed by the pandemic scenario, the Company adopted several measures to reduce its fixed and variable costs, including: (1) suspension of hiring, (2) launch of unpaid leave and voluntary dismissal programs; (3) reduction of salaries of executive committee members and directors; (4) reduction of general salary expenses by around 65%, in the period between March and August 2020, through adherence to Provisional Measure (MP) 936/20; and (5) collective agreement to reduce the working hours of pilots and flight attendants for 18 months.

2.1.3 Strengthening of liquidity cash

Throughout the period, with the evolution of the pandemic, Management endeavored to keep the cash levels necessary to face the crisis, requiring reaching new agreements with suppliers, bank creditors and lessors, within this scope the main actions taken were:

| · | Access to the capital market through the issuance of debentures; |

| · | Postponement of payment of gain and profit sharing of 2019; |

| · | Negotiation of new payment conditions with suppliers for cash preservation; |

| · | Suspension of business travels and discretionary expenses; |

| · | Negotiation to reduce aircraft parking fees; |

| · | Agreement for postponement of delivery of 59 aircraft model E2; |

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| · | Agreement with lessors with a reduction of approximately 77% of the cash outflow for the period between April and December 2020, offset by slightly higher amounts from 2023 and extension of the contractual terms; |

| · | Renegotiation of the conditions and maturities of debentures and obligations of FINAME; and |

| · | Issuance of debentures convertible into shares in the amount of R$ 1,745,900 with maturity in 5 years and interest of 7.5% in the first year and 6.0% from the second year, with semiannual settlements. |

2.1.4 Scenario after the COVID-19 pandemic

After the most critical moments due to the COVID-19 pandemic have passed, the global economy, as well as the Brazilian economy, are facing additional problems such as:

| · | abrupt increases in oil prices that directly impact jet fuel costs; |

| · | significant devaluation of the Real against the US$ until mid-2023; |

| · | growth in inflation rates in the most developed markets such as the United States and Europe; |

| · | shortage of credit, causing a significant increase in interest rates for raising funds; |

| · | crisis in the supply chain of maintenance materials that puts adverse pressure on costs for the Company. |

Given this situation, Management, in mid-December 2022, established a strategy to renegotiate all its debts, which took 9 months whose execute, due to the large number of stakeholders involved and the complexity of the topics under discussion.

Thus, in 2023, the execution of this strategy went through the following stages:

2.2 11th Issuance of simple debentures - ALAB

On June 1º, 2023, the Board of Directors approved the issuance of simple debentures,non-convertible into shares, with security interest and additional personal guarantee, in a single series, from Azul Linhas Aéreas Brasileiras respectively, in the total amount of R$600,000; with a nominal unit value of R$1, issuance costs of R$11,872, rate equivalent to CDI 6.0% p.a. and maturity on June 1, 2024. The proceeds were fully and exclusively used to pay for the supply of aviation fuels.

2.3 Issuance of notes 2028

On July, 2023, the subsidiary Azul Secured issued and priced a private offering of US$800.000 in principal amount.

Nominal interest corresponds to 11.9% p.a., and will be paid quarterly, on February, May, August and November of each year, starting on November, 2023.

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

The principal Senior Notes 2028 amount of the notes will mature on August, 2028, unless redeemed or repurchased in advance and canceled in accordance with the terms of issuance.

The costs incurred in these transactions correspond to R$192,298 and were recorded as financial expenses as required by CPC 48 – Financial Instruments, equivalent to IFRS 9.

2.4 Debt securities exchange offers (“exchange offer”) – “Senior notes – 2024 and 2026”

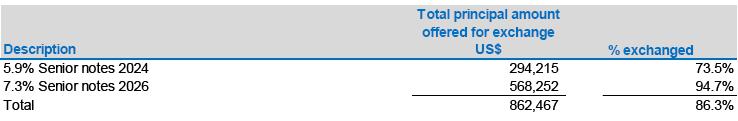

In June, 2023, the Company announced that its subsidiary Azul Investments launched:

(i) an offer to exchange 5.9% Senior Notes due in 2024 for 11.5% Senior Notes due in 2029, and

(ii) an offer to exchange 7.3% Senior Notes due in 2026 for 10.9 % Senior Notes due in 2030,

Concurrently with the exchange offers, the Company requested consent from eligible holders of existing notes for certain proposed changes to the terms of those notes.

The objective of the exchange offer was to refinance a portion of the existing notes in order to optimize the Company's debt capital structure as part of the execution of the business recapitalization strategy.

In July, 2023, the Company announced the settlement of its exchange offers and as a consequence issued:

| (i) | US$294,215 in principal amount of 11.5% Senior Notes due in 2029 (which were issued in exchange for US$294,215 in aggregate principal amount of 5.9% Senior Notes due in 2024); and |

| (ii) | US$568,219 in principal amount of 10.9% Senior Notes due in 2030 (which were issued in exchange for US$568,252 in principal amount of 7.3 % Senior Notes due in 2026). |

In total, 86,3% of the principal amount of the 2024 and 2026 notes were exchanged for 2029 notes and 2030 notes, as shown below:

The costs incurred in these transactions correspond to R$161,658 and were recorded as financial expenses as required by CPC 48 – Financial Instruments, equivalent to IFRS 9.

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

2.5 Renegotiation of convertible debentures

In July and August 2023, the Company and the debenture holders made changes to the original conditions of the convertible debenture debts. In summary, the following changes were introduced to the debt conditions:

Conversion Price: From R$32.26 to R$22.78 per preferred share, a variation that corresponds to 29.4%.

Deadline and Due Date: from October, 2025 to October , 2028, the extension period corresponds to 37.5%.

Mandatory partial early redemption: corresponded to the updated nominal unit value of the debentures that were redeemed, limited to the value in reais equivalent to US$108,900. The mandatory partial early redemption value was determined as follows:

a) the redemption value of each eligible debenture was 120% of the updated nominal unit value of the debentures, that is, the updated nominal unit value of the debentures plus a premium of 20% on the aforementioned value; and

b) the value of any and all interest and inflation adjustments due and that have not been incorporated into the updated nominal unit value, in the same form as debentures, considering a premium of 20% on said values; as well as

c) any and all interest and inflation adjustments incurred and not paid were considered;

For items (a), (b) and (c), the amounts due from the date of payment of interest or incorporation of immediately previous interest, as applicable, until the date of actual payment, were also considered.

Nominal interest rate: from 6.0% p.a. to 12.3% p.a.

The costs incurred in these transactions correspond to R$119,361 and were recorded as financial expenses as required by CPC 48 – Financial Instruments, equivalent to IFRS 9.

2.6 Renegotiation of lease obligations

In March 2023, agreements were signed (“forberance agreements”) between the Company and its main lessors, which represented more than 90% of the lease liabilities. Such contracts aimed to temporarily suspend payments related to aircraft leases, while new deadlines and methods for paying obligations were being negotiated, mainly deferrals negotiated during the Covid-19 pandemic, as well as the difference between the contractual leasing rates of Azul and current market rates.

In September 2023, the Company defined and began to sign definitive agreements with the lessors, who agreed to receive negotiable debt securities maturing in 2030 and shares priced to reflect Azul's new cash generation, its improved capital structure and the reduction of its credit risk.

By September, 2023, the Company had renegotiated 95 lease contracts under these new conditions, with approximately 40 contracts remaining for the 4th quarter. In general, the conditions agreed between the Company and lessors are as follows:

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

Notes in the equivalent amount of US$286,104, with interest to be paid quarterly from December, 2023, at a rate of 7.5% p.a., and maturity of principal on June, 2030.

Equity in the total amount of US$422,062, without interest and consecutive quarterly payments, starting on July, 2024.

The costs incurred in these transactions correspond to R$84,421 and were recorded as financial expenses as required by CPC 48 – Financial Instruments, equivalent to IFRS 9.

2.7 Renegotiation of obligations with accounts payable of aircraft services and parts

Negotiations with suppliers of aircraft services and parts mostly followed the same model as the renegotiation of lease obligations, that is, the Company issued Notes in the equivalent amount of US$84,386, with interest to be paid quarterly from December, 2023, at a rate of 7.5% p.a., and maturity of principal on June, 2030, as well as debt issuance with possibility of settlement in Azul preferred shares or cash, at the Company's discretion, in the total amount of US$27,680, without interest and consecutive quarterly payments, starting on July, 2024.

2.8 Summary of the renegotiation of the Company's financial obligations

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

After the renegotiations, the Company's working capital and its equity position are as shown below:

The variation in the balance of net working capital, which represents a reduction in the deficit of approximately 20%, is specifically due to the restructuring presented in items 2.2 to 2.7.

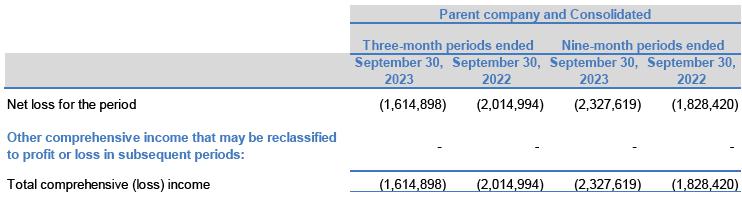

The increase in the negative position of equity is mainly due to the Company's financial result, which exceeds by R$2,327,619 the operating profit. This amount includes R$553,951 in costs and interest, resulting from the application of technical requirements for extinguishing debts (“debt extinguishment”) of IFRS – 9, equivalent to CPC 48 – Financial Instruments.

In view of the above, Management performed an evaluation and concluded that the Company is able to continue as a going concern and meet its obligations on the maturity dates. This evaluation is based on the Company's business plan approved by the Board of Directors on December 8, 2022, the entire liability restructuring process described herein. The Company's business plans include planned future actions, macroeconomic and aviation sector assumptions, such as: air transport demand level with resulting increase in traffic and fare, estimates of exchange rates and fuel prices. The Company's Management monitors and informs the Board of Directors about the performance achieved in relation to the approved plan.

Based on this conclusion, this individual and consolidated quarterly information was prepared based on the principle of going concern.

| 3. | DECLARATION OF MANAGEMENT, BASIS OF PREPARATION AND PRESENTATION OF THE INTERIM CONDENSED INDIVIDUAL AND CONSOLIDATED FINANCIAL STATEMENTS |

The Company’s interim condensed individual and consolidated financial statements have been prepared in accordance with accounting practices adopted in Brazil and the International Financial Reporting Standards (“IFRS”) issued by the International Accounting Standards Board (“IASB”), specifically IAS 34 – Interim Financial Reporting. The accounting practices adopted in Brazil include those included in the Brazilian corporation law and the technical pronouncements, guidelines and interpretations issued by the Accounting Pronouncements Committee (“CPC”), approved by the Federal Accounting Council (“CFC”) and the Brazilian Securities and Exchange Commission (“CVM”).

The Company’s interim condensed individual and consolidated financial statements have been prepared based on the real (“R$”) as a functional and presentation currency. All currencies shown are expressed in thousands unless otherwise noted..

The preparation of the Company's interim condensed individual and consolidated financial statements requires Management to make judgments, use estimates and adopt assumptions that affect the reported amounts of revenues, expenses, assets and liabilities. However, the uncertainty related to these judgments, assumptions and estimates can lead to results that require a significant adjustment to the carrying amount of assets, liabilities, income and expenses in future years.

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

When preparing these interim condensed individual and consolidated financial statements of the Company, Management used the following disclosure criteria to understand the changes observed in the equity and in its performance, since the end of the last fiscal year ended December 31, 2022, disclosed on March 6, 2023: (i) regulatory requirements; (ii) relevance and specificity of the information on the operations; (iii) informational needs of users of the interim condensed individual and consolidated financial statements; and (iv) information from other entities participating in the passenger air transport market and loads.

During the nine months ended September 30, 2023, there were no impacts related to changes in accounting estimates.

Management confirms that all relevant information specific to the interim condensed individual and consolidated financial statements, is presented and corresponds to that used by Management when carrying out its business management activities.

In order to ensure a better presentation and comparability of balances, some reclassifications were carried out in the balance sheet and statement of cash flows from the previous year.

The interim condensed individual and consolidated financial statements have been prepared based on the historical cost, except for the items significant

Fair value:

· Short-term investments classified as cash and cash equivalents;

· Short-term investments;

· Derivative financial instruments; and

· Debenture conversion right.

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

Other:

· Investments accounted for under the equity method.

| 3.1 | Approval and authorization for issue of the interim condensed individual and consolidated financial statements |

The approval and authorization for issue of these interim condensed individual and consolidated financial statements occurred at the Board of Directors’ meeting held on December 7, 2023.

| 4. | SIGNIFICANT ACCOUNTING POLICIES |

The interim condensed individual and consolidated financial statements was prepared based on the policies, practices and methods of calculating votes adopted and presented in detail in the annual financial statements of December 31, 2022 and disclosed on March 6, 2023 and, therefore, should be read together.

| 4.1 | New accounting standards and pronouncements relevant not yet adopted |

Amendment IAS 1 - Classification of liabilities as current and non-current

Aiming to promote adherence in the application of the standard's requirements, helping companies to determine whether, in the balance sheet, loans and financing and other liabilities with an uncertain settlement date should be classified as current or non-current.

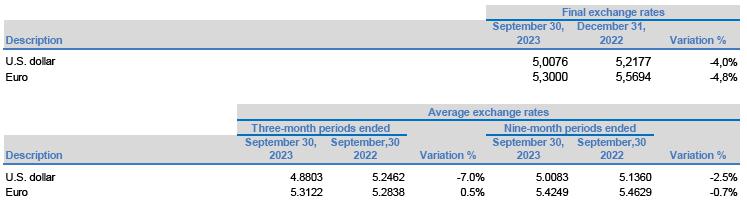

| 4.2 | Foreign currency transactions |

Foreign currency transactions are recorded at the exchange rate in effect at the date the transactions take place. Monetary assets and liabilities designated in foreign currency are translated based on the exchange rate in effect at the date this individual and consolidated quarterly information, and any difference resulting from currency translation is recorded under the line item “Foreign currency exchange, net” in the statement of operations.

The exchange rates to Brazilian reais are as follows:

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| 5. | CASH AND CASH EQUIVALENTS |

| (a) | Investment in U.S. dollar. |

| 6. | LONG-TERM INVESTMENTS |

| (b) | Investment in Euro. |

| 7. | RESTRICTED CASH |

(a) In US dollars

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

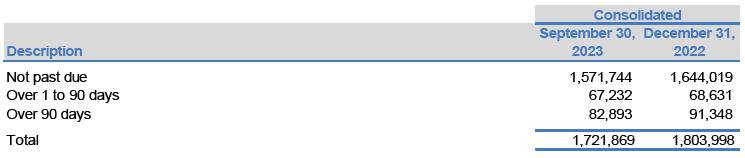

| 8. | ACCOUNTS RECEIVABLE |

In Brazil, credit card receivables are not exposed to credit risk of the cardholder. The balances can easily be converted into cash, when necessary, by discounting of these receivables with credit card companies.

During the nine months ended September 30, 2023, the Company discounted accounts receivable of R$7,614,444 from accounts receivable from credit card companies, with no right of recourse.

As of September 30, 2023, the balance of accounts receivable are net of R$2,583,710 due to such anticipations (R$1,735,432 on December 31, 2022).

The breakdown of accounts receivable by maturity, net of allowance for expected losses, is as follows:

Until December 6, 2023, out of the total amount past due within 90 days, R$42,872 had already been received.

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

Of the receivables past due for more than 90 days, approximately R$75,749 refer to receivables for lessor arranged under the headings of “reimbursement receivable for maintenance reserves” and “others” in foreign currency, and Management does not expect to incur losses on such operations as it has obligations to pay for them. The Company is negotiating to recover these amounts or offset them against lease obligations. The closing of such negotiations is scheduled for the second half of December 2023.Therefore, we conclude that the allowance for expected credit losses is adequately estimated.

The movement of the allowance for expected losses is as follows:

| 9. | AIRCRAFT SUBLEASE |

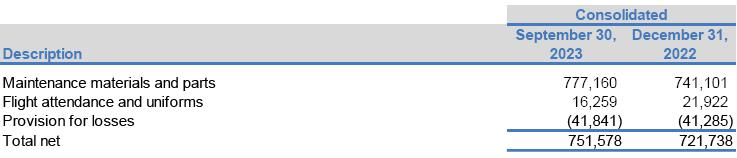

| 10. | INVENTORIES |

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

Set out below is the movement of the provision for inventory losses:

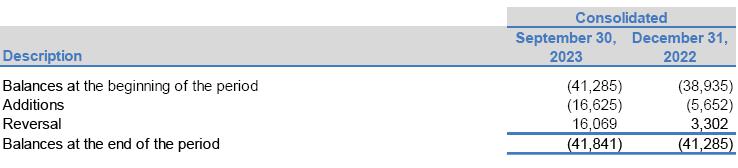

| 11. | DEPOSITS |

The movement of security deposits and maintenance reserves is as follows:

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

The movement of the allowance for maintenance reserves losses is as follows:

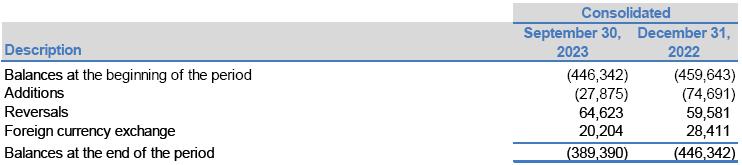

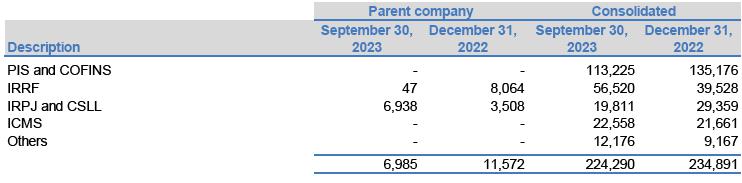

| 12. | TAXES RECOVERABLE |

| 13. | PREPAID EXPENSES |

The variation "Maintenance” mainly refers to the end of contract, the effect accounted for under “Other” in the statement of operations.

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| 14. | ADVANCE TO SUPPLIERS |

| 15. | INCOME TAX AND CONTRIBUTION |

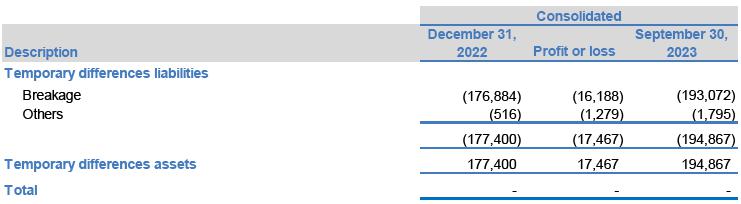

| 15.1 | Breakdown of deferred taxes |

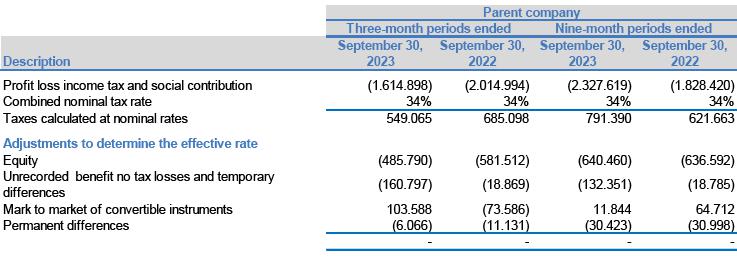

| 15.2 | Reconciliation of the effective income tax rate |

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

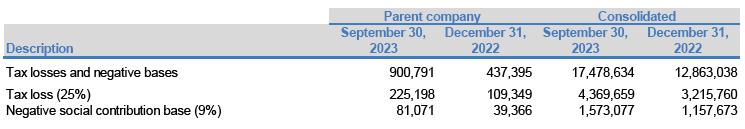

The Company has tax losses that are available indefinitely for offset against 30% of future taxable profits, as follows:

| 16. | INVESTMENTS |

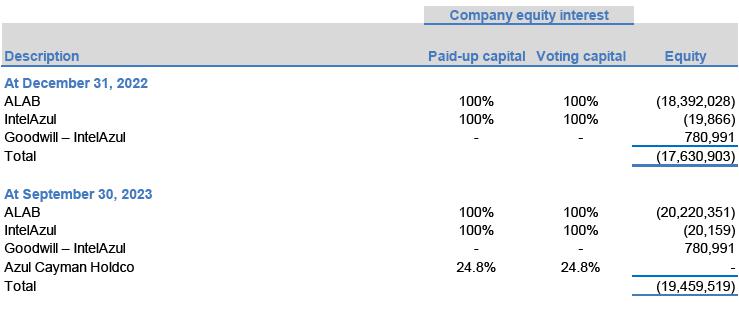

| 16.1 | Direct investments |

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| 16.2 | Movement of the investments |

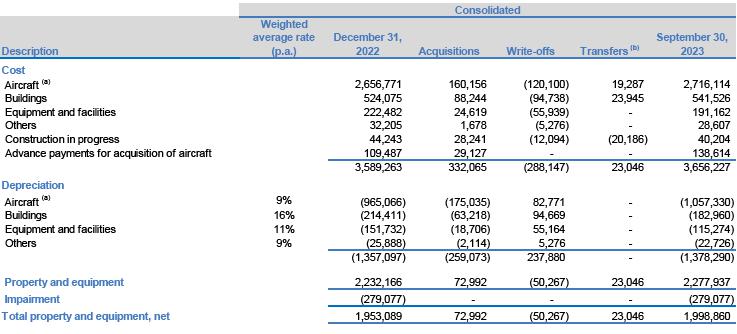

| 17. | PROPERTY AND EQUIPMENT |

(a) Includes aircraft, engines, simulators and aircraft equipment.

(b) The balances of transfers are between “Property and equipment”, “Right-of-use assets” and “Intangible” groups.

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| 18. | RIGHT-OF-USE ASSETS |

(a) Includes aircraft, engines and simulators.

(b) The balances of transfers are between “Property and equipment”, “Right-of-use assets” and "Intangible” groups.

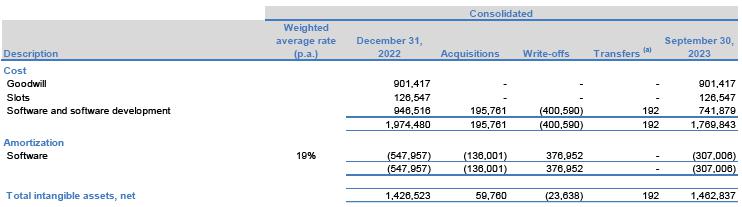

| 19. | INTANGIBLE ASSETS |

| (a) | The balances of transfers are between “Property and equipment”, “Right-of-use assets” and "Intangible” groups. |

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

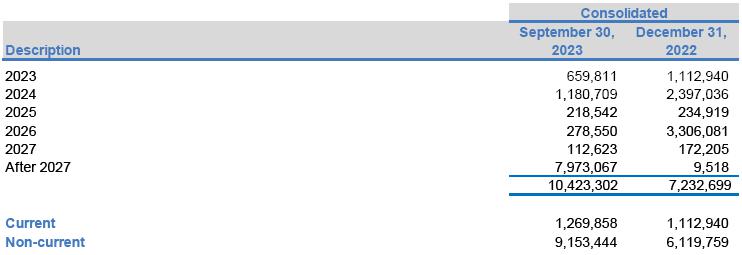

| 20. | LOANS AND FINANCING |

(a) The balance of transfers are between “Loans and financing” and “Leases” groups.

(b) Refers mainly to the acceleration of the amortization of funding costs considered extinguished in accordance with the requirements of paragraph 33.6 of CPC 48 - Financial instruments equivalent to IFRS 9, which determines that a substantial modification of the terms of a liability existing financial obligation, or a portion thereof, will be accounted for with an extinguishment of such obligation.

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

20.1 Schedule of amortization of debt

| 20.2 | New fundin |

| 20.2.1 | Working capital |

During the first quarter, the subsidiary ALAB raised R$302,252 at costs of R$1,154, a rate equivalent to CDI+6.4% p.a. and a single payment of interest and principal in June 2023. During the second quarter, there was a renegotiation that resulted in the postponement of the payment deadline to September 2023 and the interest rate to CDI+6.5% p.a. In July 2023 the balance was paid in advance.

| 20.2.2 | Debentures |

During the second quarter, the subsidiary ALAB granted the 11th issue of simple debentures, non-convertible into shares, of the type with real guarantee, with additional personal guarantee, in a single series, in the total amount of R$600,000, with unit face value of R$1, costs of R$11,872, rate equivalent to CDI+6.0% p.a. and due on June, 2024. The interest incurred will be amortized monthly. The resources were fully and exclusively used to pay for the supply of aviation fuels.

| 20.2.3 | Senior notes 2028 |

In July 2023, the subsidiary Azul Secured completed a private offering of senior debt securities in the amount of R$3,831,040 (equivalent to US$800,000), costs of R$192,298, with interest of 11.9% p.a. paid quarterly starting in November 2023 and principal due in August 2028. The net proceeds will be used to pay certain debts, obligations and other corporate purposes..

| 20.3 | Renegotiation |

| 20.3.1 | Debentures |

During the first quarter, the subsidiary ALAB renegotiated the terms of the debentures, with costs of R$2,467 in order to extend the maturity date from December, 2027 to December, 2028, there was no change in interest rates.

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| 20.3.2 | Aircraft and engines |

During the first quarter, the subsidiary ALAB renegotiated the deferral of the payment from March 31, 2023 to December 31, 2023 of an installment in the amount of R$194,330, changing the weighted average rate from 6.5% p.a. to 7.4% p.a. Linked to this renegotiation, in the second quarter, the weighted average rate of the entire contract was renegotiated, changing from 7.4% p.a. to 8.6% p.a.

| 20.3.3 | Senior notes |

On June 13, 2023, the Company announced that its subsidiary Azul Investments launched:

(i) an offer to exchange 5.9% Senior Notes due in 2024 for 11.5% Senior Notes due in 2029, and

(ii) an offer to exchange 7.3% Senior Notes due in 2026 for 10.9 % Senior Notes due in 2030,

Concurrently with the exchange offers, the Company requested consent from eligible holders of existing notes for certain proposed changes to the terms of those notes.

The objective of the exchange offer was to refinance a portion of the existing notes in order to optimize the Company's debt capital structure as part of the execution of the business recapitalization strategy.

On July 13, 2023, the Company announced the settlement of its exchange offers and as a consequence issued:

| (i) | US$294,215 in principal amount of 11.5% Senior Notes due in 2029 (which were issued in exchange for US$294,215 in aggregate principal amount of 5.9% Senior Notes due in 2024); and |

| (ii) | US$568,219 in principal amount of 10.9% Senior Notes due in 2030 (which were issued in exchange for US$568,252 in principal amount of 7.3 % Senior Notes due in 2026). |

In total, 86,3% of the principal amount of the 2024 and 2026 notes were exchanged for 2029 notes and 2030 notes, as shown below:

The costs incurred in these transactions correspond to R$161,658 and were recorded as financial expenses as required by CPC 48 – Financial Instruments, equivalent to IFRS 9.

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

Due to the debt modification, the amount of R$201,521 was recorded in the income statement, under the heading “Debt restructuring”. The amount refers to R$39,863 of the effects of extinguishing the debt and R$161,658 of new costs incurred.

| 20.4 | Covenants |

The Company has restrictive clauses covenants in some of its loan and financing agreements, as disclosed in the annual financial statements of December 31, 2022.

The Company requested a waiver from counterparties, relating to aircraft financing contracts whose measurement frequency is quarterly and thus obtained them for the quarter ended September 30, 2023. Therefore, the related debt remains classified in this quarterly information according to the flow originally established contract.

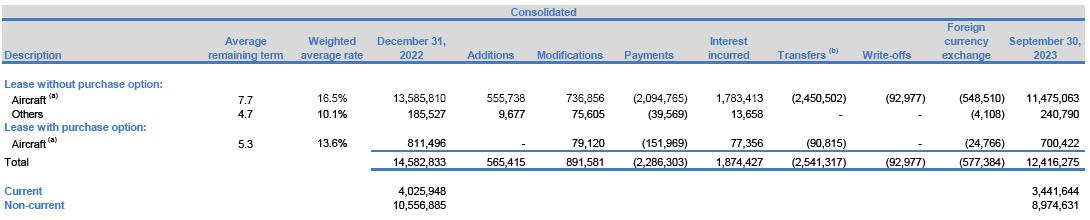

| 21. | LEASES |

In March 2023, agreements were signed (“forberance agreements”) between the Company and its main lessors, which represented more than 90% of the lease liabilities. Such contracts aimed to temporarily suspend payments related to aircraft leases, while new deadlines and methods for paying obligations were being negotiated, mainly deferrals negotiated during the Covid-19 pandemic, as well as the difference between the contractual leasing rates of Azul and current market rates.

In September 2023, the Company defined and began to sign definitive agreements with the lessors, who agreed to receive negotiable debt securities maturing in 2030 and shares priced to reflect Azul's new cash generation, its improved capital structure and the reduction of its credit risk.

By September, 2023, the Company had renegotiated 95 lease contracts under these new conditions, with approximately 40 contracts remaining for the 4th quarter. In general, the conditions agreed between the Company and lessors are as follows:

Notes in the equivalent amount of US$286,104, with interest to be paid quarterly from December, 2023, at a rate of 7.5% p.a., and maturity of principal on June, 2030.

Equity in the total amount of US$422,062, without interest and consecutive quarterly payments, starting on July, 2024.

The costs incurred in these transactions correspond to R$84,421

and were recorded as financial expenses as required by CPC 48 – Financial Instruments, equivalent to IFRS 9.

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

The costs incurred in these transactions correspond to R$86,697 and were recorded as financial expenses as required by CPC 48 – Financial Instruments, equivalent to IFRS 9.

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| 21.1 | Leases |

(a) Includes aircraft, engines and simulators.

(b) The transfer balances are between the headings “Loans and financing”, “Leases”; “Leases: Notes and Equity”; “Accounts payable” and “Other liabilities”.

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| 21.2 | Leases – Notes |

(a) The transfer balances are between the headings “Leases” and “Leases: Notes and Euity”.

| 21.3 | Leases –Equity |

(a) The transfer balances are between the headings “Leases” and “Leases: Notes and Equity”.

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

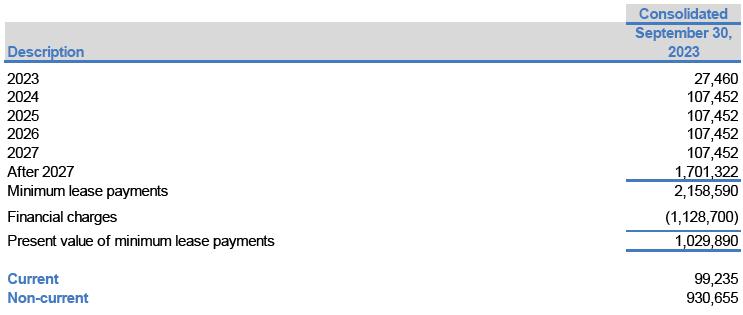

| 21.4 | Schedule of amortization of leases |

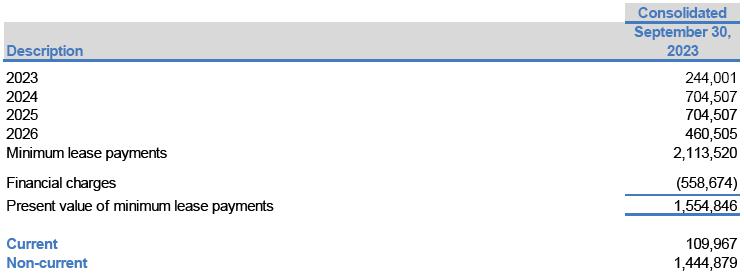

| 21.5 | Schedule of amortization of Leases – Notes |

There were no comparative balances as of December 31, 2022.

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| 21.6 | Schedule of amortization of Leases - Equity |

There were no comparative balances as of December 31, 2022.

| 21.7 | Covenants |

The Company has covenants in some of its lease agreements, as disclosed in the annual financial statements as of December 31, 2022.

These conditions will be verified only December 31, 2023, therefore, the related debt is still classified in these interim condensed individual and consolidated financial statements according to the original contractual terms.

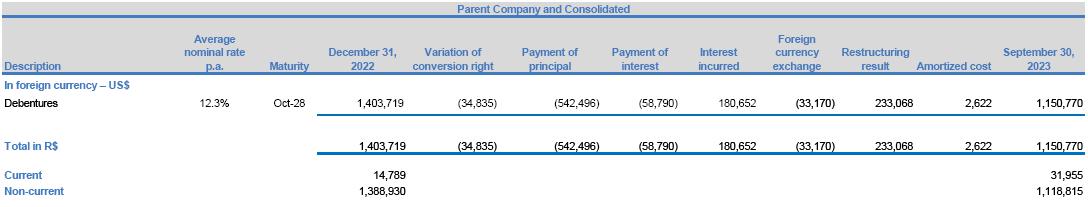

| 22. | CONVERTIBLE INSTRUMENTS |

In July 2023, the Company concluded the renegotiation of the convertible debentures, changing the maturity date from October 2025 to October 2028, the nominal rate of 6.0% p.a. to 12.3% p.a. and the conversion price from R$32.26 to R$22.78.

In accordance with CPC 48 – Financial Instruments, equivalent to IFRS 9, the Company concluded that the renegotiation of the debentures falls within the scope of debt extinguishment. Therefore, the proportional values previously recorded were extinguished and a new debt was recorded. For this reason, any costs or fees incurred were recognized in profit or loss.

Due to the modification of the debt, the amount of R$352,430 refers to R$233,068 (considers expenses of R$346,555 relating to the extinction and reconstitution of the right of conversion and revenue of R$113,487 relating to the extinguishment and reconstitution of the debt.) and R$119,362 of new costs incurred was recorded in the income statement, under the heading “Restructuring of debentures”.

The balance contains the right to convert the debt into Company shares in the amount of R$428,691 (R$116,971 as of December 31, 2022).

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

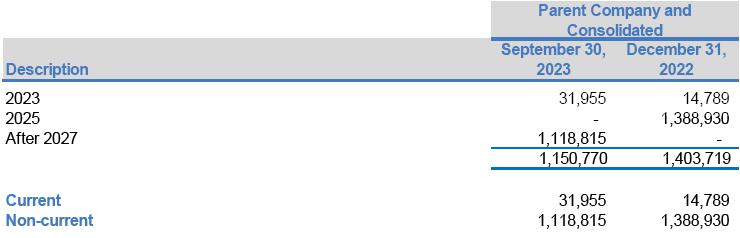

| 22.1.1 | Schedule of amortization |

| 23. | ACCOUNTS PAYABLE |

Negotiations with suppliers of aircraft services and parts mostly followed the same model as the renegotiation of lease obligations, that is, the Company issued notes in the equivalent amount of US$84,386, with interest to be paid quarterly from December, 2023, at a rate of 7.5% p.a., and maturity of principal on June, 2030, as well as Equity, in the total amount of US$27,680, without interest and consecutive quarterly payments, starting on July, 2024.

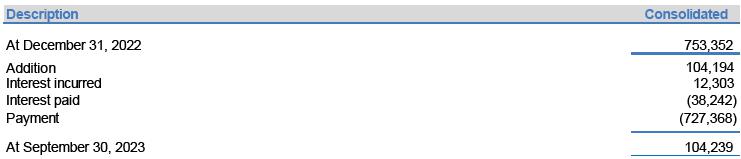

| 24. | REVERSE FACTORING |

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| 25. | DERIVATIVE FINANCIAL INSTRUMENTS |

(a) Balance recorded in the parent company.

(b) Refers to the effects of the extinction and reconstitution of the conversion right.

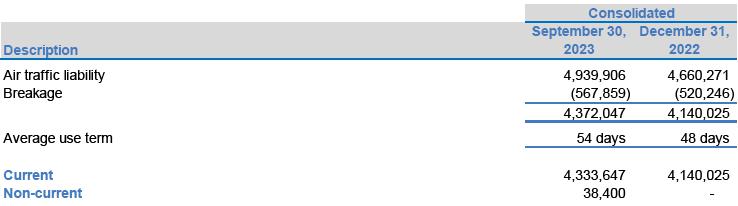

| 26. | AIR TRAFFIC LIABILITY |

The balance classified as non-current refers to the TudoAzul points program.

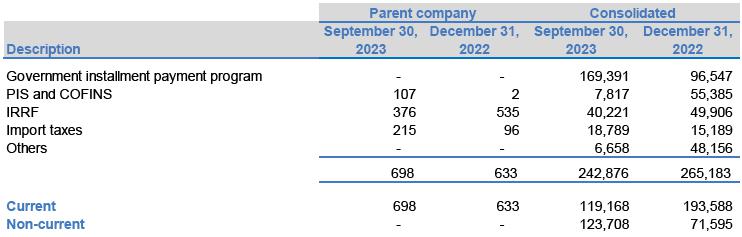

| 27. | TAXES PAYABLE |

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

In the first quarter of 2023, the Company installment federal taxes in 60 months through Government installment payment program.

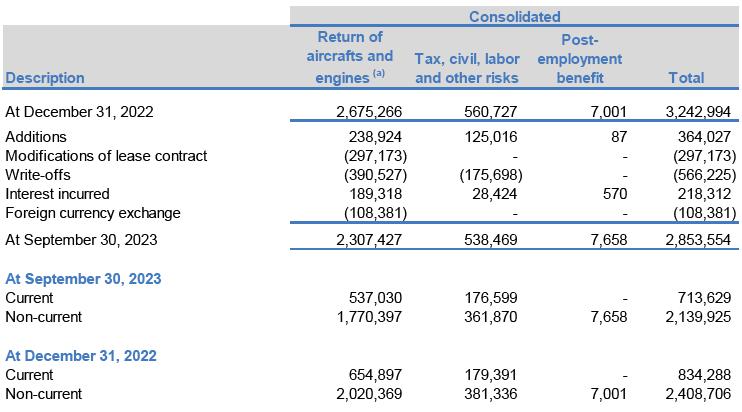

| 28. | PROVISIONS |

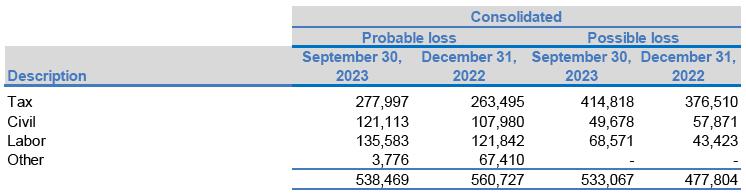

| 28.1 | Breakdown of provisions |

(a) Nominal discount rate 11.2% p.a. (11.2% p.a as of December 31, 2022).

| 28.1.1 | Tax, civil, labor and other risks |

The balances of the proceedings with estimates of probable and possible losses are shown below:

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

28.1.1.1 Relevant movement

| 28.1.1.1.1 | Labor |

| 28.1.1.1.1.1 | Possible loss |

During the first month, the Public Ministry of Labor (“MPT”) filed a lawsuit against the Company alleging non-compliance with the minor apprentice quota, intending that Azul start to consider, when calculating the quota, all functions that require professional training, as specified in the Brazilian Classification of Occupations, under penalty of a daily fine of R$5 per apprentice not hired. The MPT also requests the condenation of the Company to the payment of compensation for collective pain and suffering in the amount of R$20,000.

The lawsuit is in the initial phase, still without decision. The probability of loss is evaluated as "possible" by the Company's legal advisors

28.1.1.2 Others

28.1.1.1.2.1 Probable loss

The amounts recorded under this heading are related to the contingent liabilities assumed as a result of the business combination with Azul Conecta. During the quarter ended September 30, 2023, the process was concluded and the Company was ordered to pay R$3,776, and therefore R$63,634 were reverted to profit or loss.

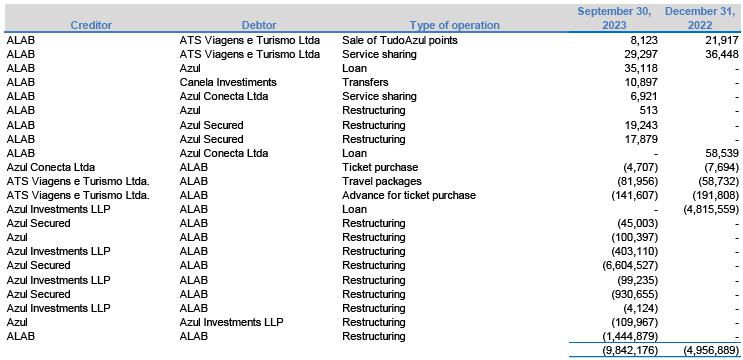

| 29. | RELATED-PARTY TRANSACTIONS |

Transactions with related parties were entered into in the ordinary course of the Company’s business, at prices, terms and financial charges according to the conditions established between the parties. Such operations include, among other aspects, shared service agreements and loan agreements.

As disclosed in explanatory note 2 of this quarterly information, the Company underwent a major process of restructuring its debts, which included the issuance of Senior Notes 2028, Exchange offer, convertible debentures, renegotiation of lease and supplier debts through the issuance of Notes and Equity. The vast majority were carried out through subsidiaries in the name of ALAB. In compliance with accounting standards, such transactions were duly eliminated for consolidation purposes, as shown below:

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

There were no comparative balances as of December 31, 2022.

The table below shows the balances of related-party transactions of the subsidiary ALAB, which were eliminated in the preparation of this consolidated interim information:

| 29.1 | Compensation of key management personnel |

The Company´s employees are entitled to profit sharing based on certain goals agreed annually. In turn, executives are entitled to bonus based on statutory provisions proposed by the Board of Directors and approved by the shareholders. The amount of profit sharing is recognized in profit or loss for the year in which the goals are achieved.

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

Key management personnel comprise the directors, officers and members of the Executive Committee. Expenses incurred with remuneration and the respective charges, paid or payable, are shown below:

Stock-based compensation plan, considers stock option plans, restricted shares and phantom shares. Such plans are expected to be settled in up to eight years and, therefore, and does not represent a cash outflow.

| 29.2 | Guarantees and pledges granted by the Parent Company |

The Company has granted guarantees on rental properties for some of its executives and the total amount involved is not significant.

| 29.3 | Technology service sharing contract |

On January, 2013, the Company entered into a contract with Águia Branca Participações S.A., one of its shareholders, for the sharing of information technology resources for an indefinite period. The total amount of services acquired during nine months ended September 30, 2023 was R$39 (R$39 as of September 30, 2022), recorded under “Other expenses, net” in the statement of operations. As of September 30, 2023, there were no amounts to be paid as a result of this transaction.

| 29.4 | Ticket sales contract |

On March, 2018, the Company entered into a ticket sales contract with Caprioli Turismo Ltda., a travel agency owned by the Caprioli family (which holds an indirect stake in the Company through TRIP former shareholders), whereby Caprioli Turismo Ltda. is granted a R$20 credit line for the purchase and resale of tickets for flights operated by the Company. This credit line is guaranteed by a non-interest bearing promissory note in the same amount payable.

| 29.5 | Aircraft sublease |

In March 2019, the Company signed a letter of intent for the sublease of aircraft to the Breeze Aviation Group (“Breeze”), an airline founded by the controlling shareholder of Azul, headquartered in the United States. The transaction was voted and approved by 97% of the Azul's shareholders at the Extraordinary General Meeting held on March 2, 2020. Following good corporate practices, the controlling shareholder did not participate in the voting.

Until September 30, 2023, the Company sub-leased three aircraft to Breeze and recorded a balance receivable of R$55,290 (R$67,056 as of December 31, 2022).

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| 29.6 | Lilium |

In August 2021, the Company announced plans to make a strategic partnership with Lilium GmbH (“Lilium”), a wholly owned subsidiary of Lilium N.V., which has ultimately become a related party as the Company’s Board of Directors’ Chairman was elected independent member of Lilium’s Board of Directors.

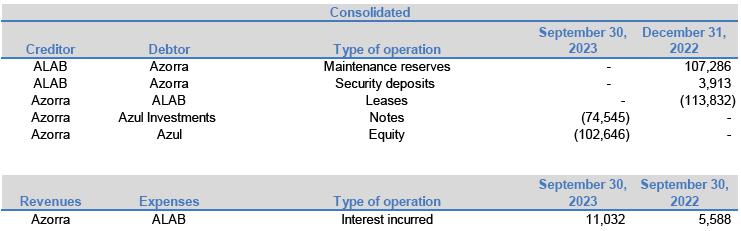

| 29.7 | Azorra |

In August 2022, the Company made agreements for purchase and sale of aircraft and engines with entities that are part of Azorra Aviation Holdings LLC. (“Azorra”) group, which has become a related party as the Company’s Board of Directors’ Chairman was elected independent member of Azorra’s Board of Directors.

The transactions between the Company and the Azorra group are shown below:

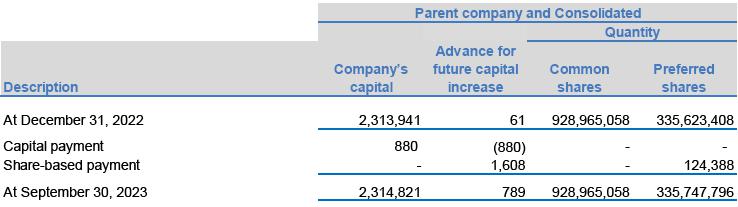

| 30. | EQUITY |

| 30.1 | Issued capital |

As established in the Company’s bylaws, each common share is entitled to 1 (one) vote. Preferred shares of any class do not have voting rights, however they do provide their holders with rights that were disclosed in detail in the annual financial statements of December 31, 2022.

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

Company shareholding structure is presented below:

| (a) | This refers to Trip Participações S.A., Trip Investimentos Ltda. and Rio Novo Locações Ltda. |

| 30.2 | Treasury shares |

As of November, 2022 approved the repurchase plan for 1,300,000 preferred shares maturing in 18 months, to keep them in treasury for a subsequent payment of the installments of the Restricted Stock Option plan. Until September 30, 2023, within the said plan, the Company reacquired 851,868 shares.

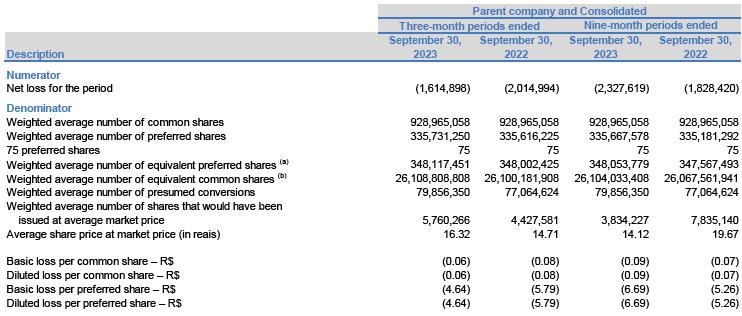

| 31. | EARNINGS (LOSS) PER SHARE |

| (a) | This refers to the participation in the value of the Company's total equity, calculated as if all 928,965,058 common shares had been converted into 12,386,201 preferred shares at the conversion ratio of 75 common shares for each preferred share. |

| (b) | This refers to the participation in the value of the Company's total equity, calculated as if the weighted average of preferred shares had been converted into common shares at the conversion ratio of 75 common shares for each one preferred share. |

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

Diluted earnings (loss) per share are calculated by adjusting the weighted average number of shares outstanding by instruments potentially convertible into shares. However, due to the loss reported in September 30, 2022 and 2023, these instruments issued by the company have a antidilutive effect and therefore were not considered in the total number of shares outstanding to determine the diluted loss per share.

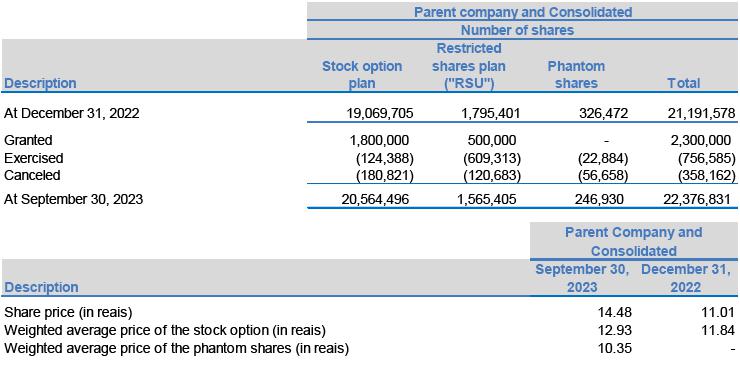

| 32. | SHARE-BASED PAYMENT |

| 32.1 | Compensation plans |

| 32.1.1 | Approved plans |

With the exception of the fifth stock option plan, which will be detailed below, the conditions of the share-based grant plans were disclosed in detail in the annual financial statements of December 31, 2022 and did not change during the nine months ended September 30, 2023.

At the EGM held on July, 2022, the fifth stock option plan was approved, which should include up to 6,000,000 preferred shares with an vesting period of up to 4 years and a maximum

exercise period up to 10 years.

The movement of the plans is as follows:

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

The amounts related to stock options and RSU are recorded under “Capital reserves” and amounts for phantom shares are recorded under “Salaries and benefits”.

On September 30, 2023, the balance of the obligation related to the phantom shares plans is R$1,428 (R$844 on December 31, 2022).

| 32.2 | Assumptions |

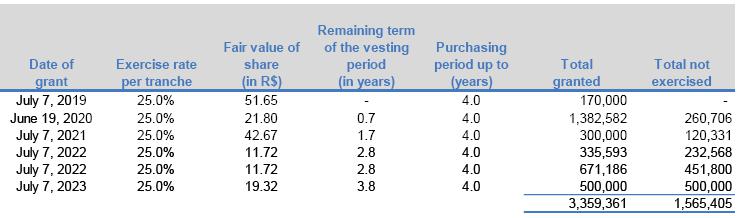

| 32.1.2 | Stock option plan |

During the third quarter, the Company granted one programs with the following conditions:

| · | vesting periods up to 4 years; |

| · | exercisable at the rate up to 25% per year; |

| · | maximum term of exercise of up to 10 years; |

| · | exercise price equivalent to the lowest price of the Company's share traded on B3 recorded |

in the 30 trading sessions prior to the grant date;

| · | historical volatility up to 75.4%; |

| · | average risk-free rate of return up to 11.6%; and |

| · | no expected dividends. |

| 32.1.3 | Restricted stock option plan |

During the third quarter, the Company granted one programs with the following conditions:

| · | vesting period of up to 4 years; and |

| · | exercisable at the rate of up to 25% per year. |

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| 32.1.4 | Phantom shares |

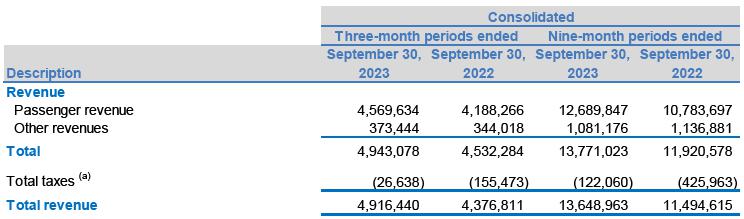

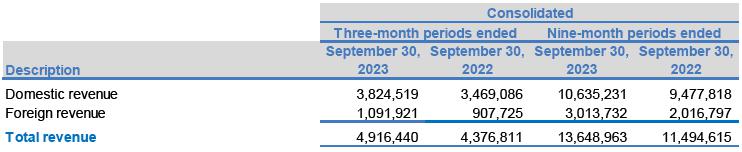

| 33. | SALES REVENUE |

| (a) | During the three and nine-month period ending on September 30, 2023, the PIS and COFINS rates on revenues arising from regular passenger air transport activities were reduced to zero, in accordance with Law 14,592/2023. |

Revenues by geographical location are as follows:

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

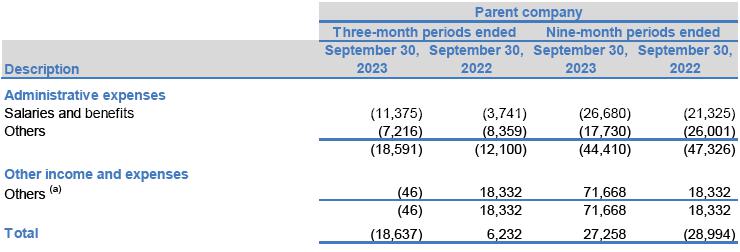

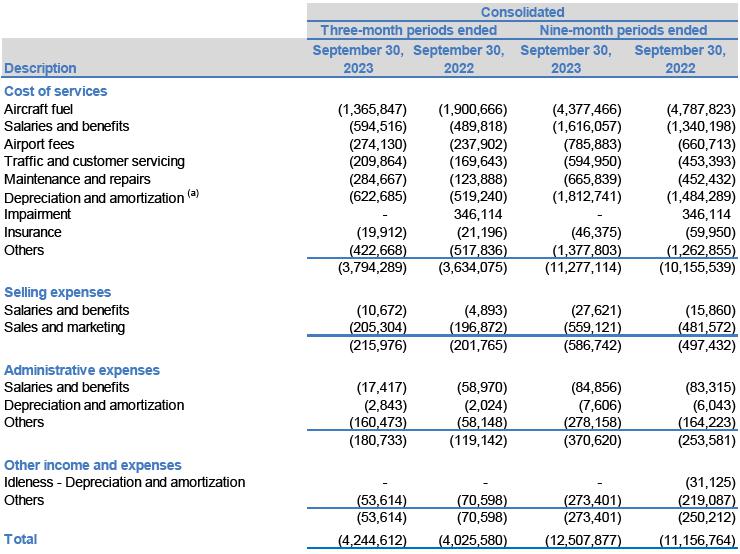

| 34. | RESULT BY NATURE |

(a) Refers to the debt forgiveness for loan operations between Azul and ALAB.

(a) Net of PIS and COFINS credits in the amount of R$404 three month and R$1,278 at the nine month.

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

In 2022, as a consequence of the reduction in the number of flights operated during the COVID-19 pandemic and by analogy to the provisions of CPC 16 (R1) - Inventories, equivalent to IAS-2, expenses with depreciation of flight equipment not directly related to the revenues generated in the quarter called idleness were reclassified from the “Cost of service” group to the “Other income and expenses, net” group.

| 35. | FINANCIAL RESULT |

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

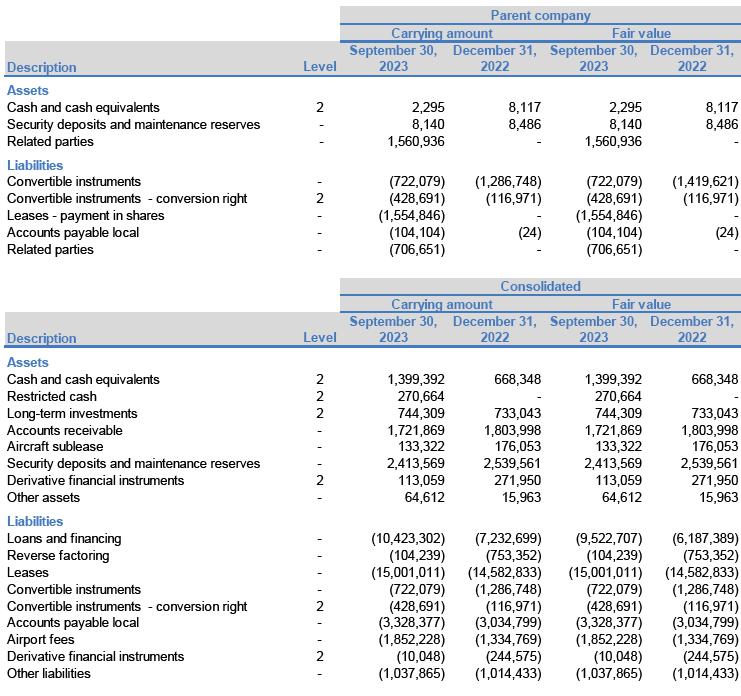

| 36. | RISK MANAGEMENT |

| 36.1 | Accounting classification and fair value hierarchy of financial instruments |

The following hierarchy is used to determine the fair value of financial instruments:

Level 1: quoted prices, without adjustment, in active markets for identical assets and liabilities;

Level 2: other techniques for which all inputs that have a significant effect on the fair value recorded are directly or indirectly observable; and

Level 3: techniques that use data that have a significant effect on the fair value recorded that are not based on observable market data.

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

The accounting classifications and the fair value hierarchy of the Company's consolidated financial instruments are shown below:

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| 36.2 | Market risks |

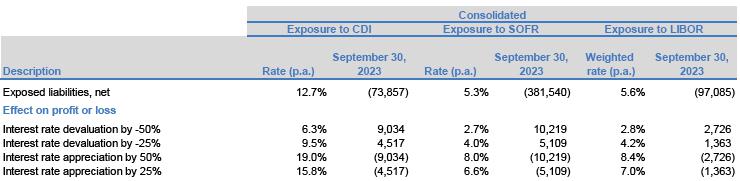

36.2.1 Interest rate risk

36.2.1.1 Sensitivity analysis

As of September 30, 2023, the Company held financial assets and liabilities linked to various types of rates. In the sensitivity analysis of non-derivative financial instruments, the impact on annual interest was only considered on positions with values exposed to such fluctuations:

Assets and liabilities linked to LIBOR are being reviewed and will be restated at the published alternative rates. The Company estimates that the updated cash flows will be economically equivalent to the original ones.

36.2.2 Fuel price risk (“QAV”)

The price of fuel may vary depending on the volatility of the price of crude oil and its derivatives. To mitigate losses linked to variations in the fuel market, the Company had, as of September 30, 2023, forward and options transactions on fuel (note 25).

36.2.2.1 Sensitivity analysis

The following table demonstrates the sensitivity analysis in US dollars of the price fluctuation of QAV liter:

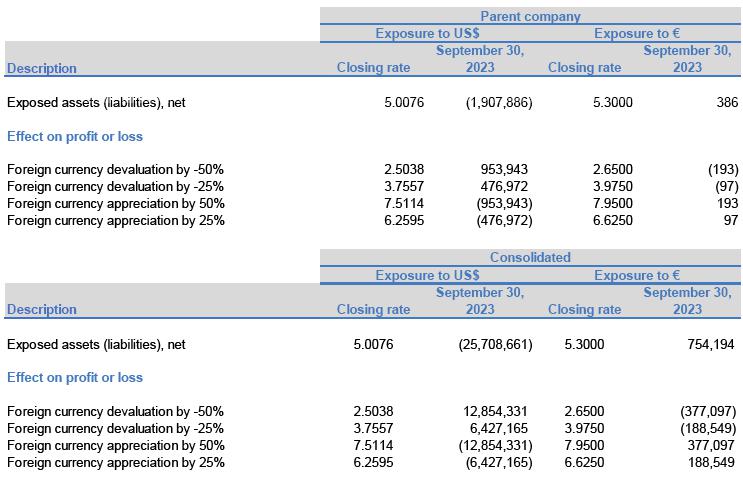

36.2.3 Foreign exchange risk

The foreign exchange risk arises from the possibility of unfavorable exchange differences to which the Company's cash flows are exposed.

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

The exposure to the main exchange differences is as follows:

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

36.2.3.1 Sensitivity analysis

| 36.3 | Credit risk |

Credit risk is inherent to the Company's operating and financial activities, mainly disclosed in cash and cash equivalents, long-term investments, accounts receivable, aircraft sublease, security deposits and maintenance reserves. Financial assets classified as cash and cash equivalents and long-term investments are deposited with counterparties that have a minimum investment grade rating in the assessment made by agencies S&P Global Ratings, Moody's or Fitch (between AAA and A+). The TAP Bond is guaranteed by intellectual property rights and credits related to the TAP mileage program.

Credit limits are established for all customers based on internal classification criteria and the carrying amounts represent the maximum credit risk exposure. Outstanding receivables from customers are frequently monitored by the Company and, when necessary, allowances for expected credit losses are recognized.

Derivative financial instruments are contracted on the over-the-counter market (OTC) from counterparties with a minimum investment grade rating, or on commodities and futures exchanges (B3 and NYMEX), which substantially mitigates the credit risk. The Company assesses the risks of counterparties in financial instruments and diversifies its exposure periodically.

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

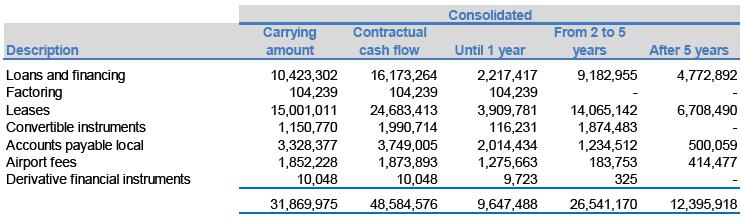

| 36.4 | Liquidity risk |

The maturity schedules of the Company’s consolidated financial liabilities as of September 30, 2023 are as follows:

| 36.5 | Capital management |

The Company seeks capital alternatives in order to satisfy its operational needs, aiming at a capital structure that it considers adequate for the financial costs and the maturity dates of funding and its guarantees. The Company's continuously monitors its net indebtedness, see note 2 with details of the Company's actions in the nine months ending September 30, 2023.

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

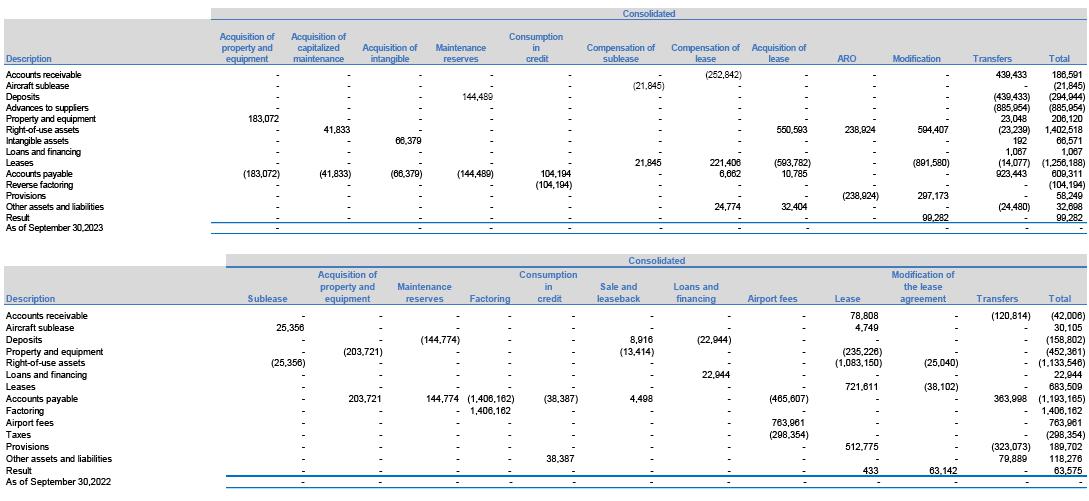

| 37. | NON-CASH TRANSACTIONS |

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| 38. | COMMITMENTS |

| 38.1 | Aircraft acquisition |

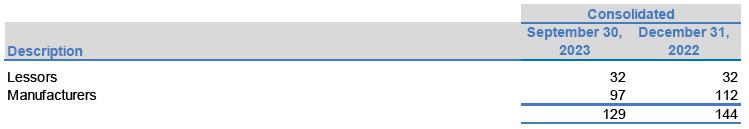

The Company contractually assumed the commitment to acquire aircraft directly from manufacturers and from lessors, according to the table below:

The amounts shown below are discounted to present value using the weighted discount rate of leasing transactions and do not necessarily characterize a cash outflow as the Company evaluates the obtainment of financing to meet these commitments.

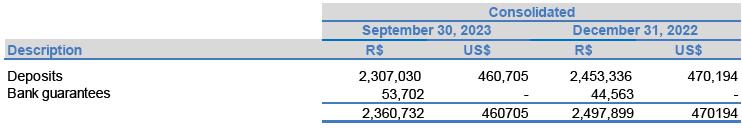

| 38.2 | Letters of credit |

The position of the letters of credit in use by the Company follows:

|

|

|

AZUL S.A. Notes to the interim condensed individual and consolidated financial statements September 30, 2023 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| 39. | SUBSEQUENT EVENTS |

39.1 Issuance of additional notes

In October 2023, the subsidiary Azul Secured issued additional notes in the amount of US$36,778 of the 2028 Senior Notes. The additional notes were issued to a professional investor in exchange for the aggregate principal amount of US$37,730 of the 2024 Senior Notes.

39.2 Installments

In November 2023, the Company signed a debt installment plan, over 60 months, relating to airport taxes and fees in the amount of R$797,275.

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 8, 2023

Azul S.A.

By: /s/ Alexandre Wagner Malfitani

Name: Alexandre Wagner Malfitani

Title: Chief Financial Officer