UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16 or

15d-16 of the Securities Exchange Act of 1934

For the month of July 2023

Commission File Number: 001-39928

_____________________

Sendas Distribuidora S.A.

(Exact Name as Specified in its Charter)

Sendas Distributor S.A.

(Translation of registrant’s name into English)

Avenida Ayrton Senna, No. 6,000, Lote 2, Pal 48959, Anexo A

Jacarepaguá

22775-005 Rio de Janeiro, RJ, Brazil

(Address of principal executive offices)

(Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F: ý

Form 40-F: o

São Paulo, July 26, 2023 – Assaí Atacadista announces its results for the 2nd quarter of 2023.All comments on adjusted EBITDA exclude other operating expenses and income in the periods. Figures also include the effects of IFRS 16/CPC 06 (R2) – Leases, which eliminates the distinction between operating and financial leases, except where stated otherwise.

|

RESILIENT RESULT: EBITDA MG OF 7% SHOWS SUCCESSFUL EXPANSION AND ACCELERATED CONVESIONS MATURATION CUSTOMERS FLOW INCREASES 25%, REACHING 70 MILLION TICKETS AND RECORD MARKET SHARE WITH 3.6 p.p. GAINS LEVERAGE RATIO REDUCED TO 2.6x (-0.2x vs. 1Q23)

|

|

|

“The highlight of the second quarter was the conclusion of around 90% of the hypermarket conversion project. Our business model and the exceptional location of the conversions are key factors in the success of these stores, which delivered growth above the Company’s average, with sales uplift 2.5x higher than the hypermarket format. Our performance is connected to the strong involvement of Our People. This year, we rose 10 points in the GPTW engagement survey, beating the industry average and consolidating Assaí as one of the 10 Best Companies to Work for in the Retail Sector. Results like these make us an industry reference, with continuous market share gains and sustainable growth. Additionally, in this quarter, the new Board of Directors took office and we consolidate our position as a True Corporation, with 100% of stock widely disseminated.”

Belmiro Gomes, CEO of Assaí

SALES GROWTH WITH SIGNIFICANT CONTRIBUTION FROM EXPANSION

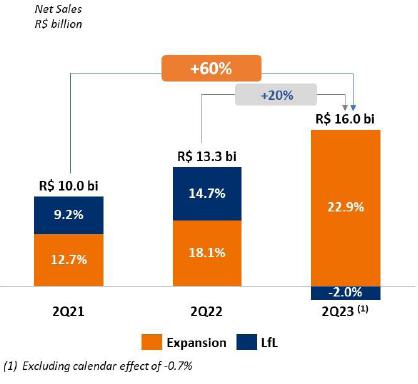

Net sales in the quarter came to R$ 16.0 billion, increasing R$ 2.7 billion, which represents a growth of 20.3% compared to 2Q22 and 59.7% to 2Q21. The performance is mainly explained by:

| (i) | the solid contribution from the expansion project, with 60 stores opened in the last 12 months (+22.9%), with the highlight to the conversions performance; |

| (ii) | the efficient commercial strategy that, throughout successful commercial campaigns, resulted in record customer traffic, reaching over 70 million tickets, representing growth of 25%; |

| (iii) | continuous improvement in the shopping experience, with rapid adaptation of assortment and services to meet the needs of each region; |

| (iv) | same-store sales performance (-2.0%), which improved gradually over the quarter to turn positive in June. The period also was marked by deflation in certain categories and the strong comparison base (+14.7% in 2Q22) due to the large number of hypermarkets closed in 2022. |

Additionally, even with the strong growth in the Cash & Carry segment, the Company registered significant improvements of market share in June (+3.6 p.p.), reaching its highest market share ever, supported by the success of Assaí’s commercial strategy and business model.

In 1H23, net sales totaled R$ 31.1 billion (+25.7% vs. 1H22), reflecting the strong contribution from expansion, driven mainly by the performance of converted stores, the successful business model and the same-store sales growth of +2.3%, despite the strong comparison base (+10.8% in 1H22).

|

|

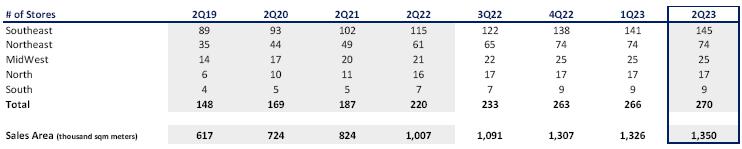

CONTINUED EXPANSION WITH ADVANCES IN CONVERSION PROJECT

|

The expansion schedule remains in line with expectations, with around 30 stores to be inaugurated in 2023. In addition to the 10 conversions inaugurated in 2023, of which 8 in the 1st semester, currently, more than 20 stores are under construction. Assaí ended 1H23 with 270 stores in operation and total sales area of 1.4 million square meters, representing expansion of +34% in the last 12 months. |

|

In 2Q23, 5 converted stores were inaugurated in 3 states, 2 of which in the state of São Paulo, 2 in Rio de Janeiro and 1 in Minas

Gerais. Considering the 2 conversions inaugurated in July, 57 converted stores were opened to date, which represents a conclusion of ~90%

of the project.

The excellent locations of the converted stores in densely populated regions and highly recognized by the public, together with the strong attractiveness of this business model, already enable conversions, that are operating on average for 8 months, to achieve monthly sales above the average of stores operating for more than 12 months, which represents an uplift of 2.5x (vs. 2.2x in 1Q23), and present an improvement in EBITDA margin of around 6%.

COMMERCIAL GALLERIES WILL CONTRIBUTE TO CONVERSIONS MATURATION

In addition to expanding the sales area, the hypermarket conversions will add, at the end of the project, more than 220,000 sqm of gross leasable area (GLA) of commercial galleries and around 1,300 tenants. The galleries will contribute to the maturation of conversions, with an increase in the customers traffic, dilution of rent and occupancy costs, such as IPTU (urban property tax).

In 1H23, revenue from the galleries reached R$ 44 million, even with 50% of the galleries available for lease.

“MEU ASSAÍ” APP CUSTOMER BASE GROWTH

Launched in April 2023 and available nationwide, the new app “Meu Assaí” registered growth of 1.2 million users in only 2 months, reaching 8.2 million customers, which represents an increase of 17% from its launch.

|

The app is an important tool for broadening knowledge of consumer habits and to improve their shopping experience by uniting the physical world with the online universe. The app reinforces the Company’s Phygital strategy through its exclusive and segmented campaigns for Assaí customers, generating customer loyalty and recurring purchases. Also, the online sales operation in partnership with last mile operators continues to present significant growth and break sales records, with growth of 58% in comparison with 2Q22 and 15% vs. 1Q23. |

|

|

|

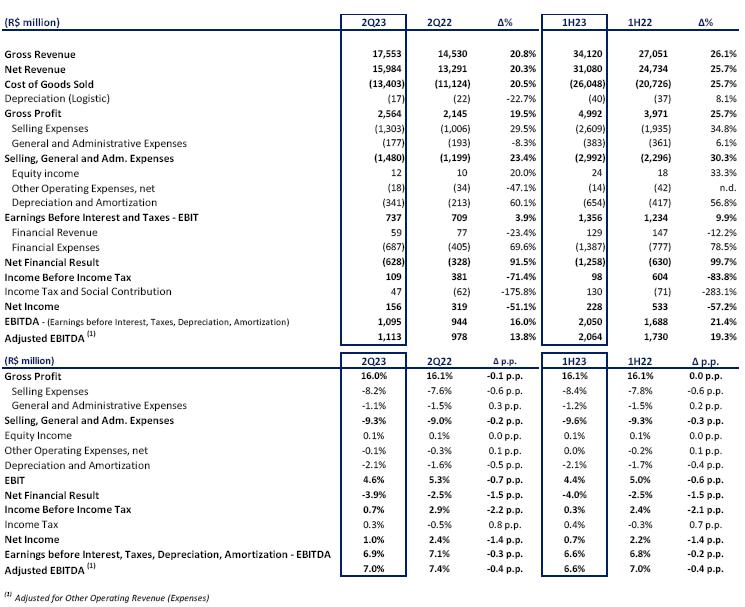

RESILIENT OPERATING RESULTS

Gross income amounted to R$ 2.6 billion, with margin virtually stable at 16.0%, with this performance mainly reflecting:

| (i) | the resilient performance of the conversions, which, due to their exceptional location and proximity to higher-income consumers, present accelerated maturation and margins above the organic stores; |

| (ii) | the effective Company’s commercial dynamics, which carried out successful promotional campaigns that supported an increase in customer traffic. |

This result demonstrates the adequate level of Assaí’s competitiveness combined with the investments in modernizing the stores base and improving the shopping experience.

|

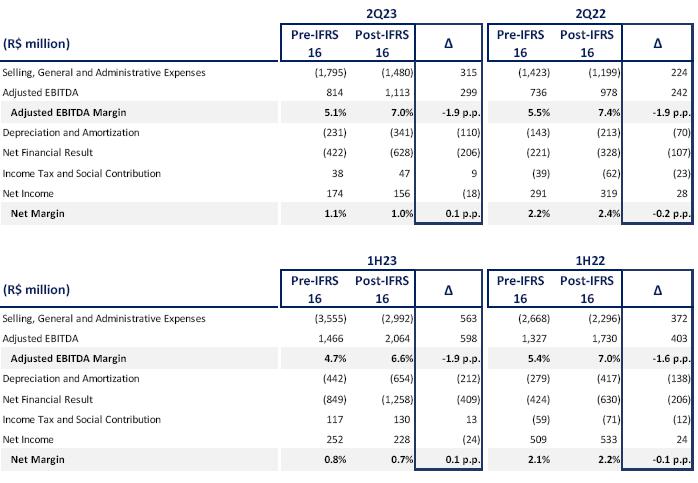

Selling, general and administrative expenses corresponded to 9.3% of net sales in 2Q23 (vs. 9.0% in 2Q22), mainly reflecting the effect from the maturation of new stores.

Equity income from Assaí's interest of approximately 18% in the capital of FIC came to R$ 12 million in the quarter (+20.0% vs. 2Q22). Passaí cards issued exceeded 2.4 million and accounts for over 4% of sales. |

Adjusted EBITDA reached R$ 1.1 billion in 2Q23, up R$ 135 million on 2Q22. Adjusted EBITDA margin reached 7.0%, expanding in relation to 1Q23 (6.3%), despite 35% of stores in the maturation process and the pre-operating expenses related to the expansion project. Excluding the conversions effect, the EBITDA margin remained stable compared to 2Q22.

In the year to date, Adjusted EBITDA totaled R$ 2.1 billion with margin of 6.6%, representing growth of +19.3% or R$ 334 million. This result reflects the resilience of the business model and the successful performance of conversions, which presents accelerated maturation.

|

|

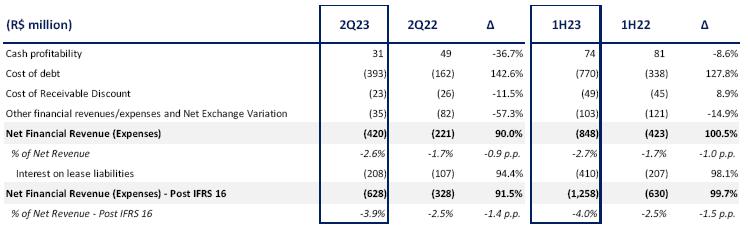

HIGH INTEREST RATE AFFECTS FINANCIAL RESULT

At the end of 2Q23, net financial (post-IFRS16) result was R$ 628 million, equivalent to 3.9% of net sales. Excluding the effect from interest on lease liabilities, the net financial expense reached R$ 420 million, or 2.6% of net sales. The high interest rate scenario and the higher level of gross debt to support the Company’s expansion contributed to the financial result level.

NET INCOME INCREASED COMPARED TO 1Q23

Net income reached R$ 156 million in the quarter and margin of 1.0%, which is 2 times higher than in 1Q23. In 1H23, net income was R$ 228 million, with 0.7% margin. Net income in both periods continued to be directly affected by the high interest rate scenario, which significantly affected the financial result, and by the large number of stores in the maturation phase.

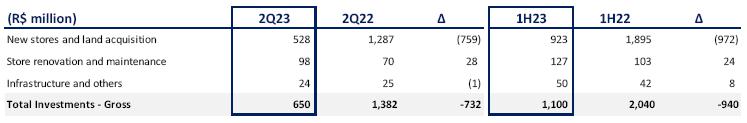

INVESTMENTS RESULTS IN SALES AREA EXPANSION OF 34%

Investments amounted to R$ 650 million in the quarter, explained by the opening of 5 converted stores in the period and the ongoing expansion process, with more than 20 stores under construction. In 1H23, investments totaled R$ 1.1 billion, during which 8 converted stores were inaugurated.

|

|

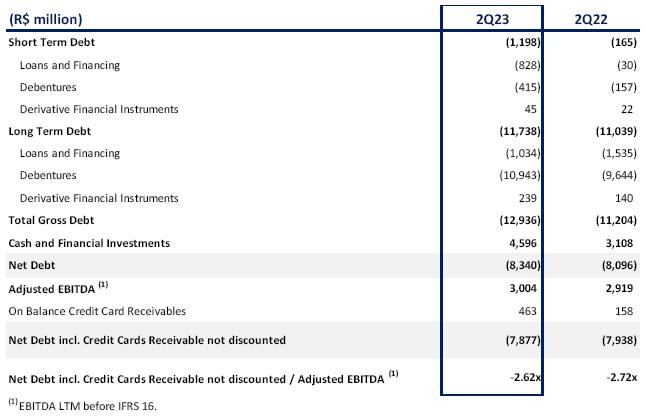

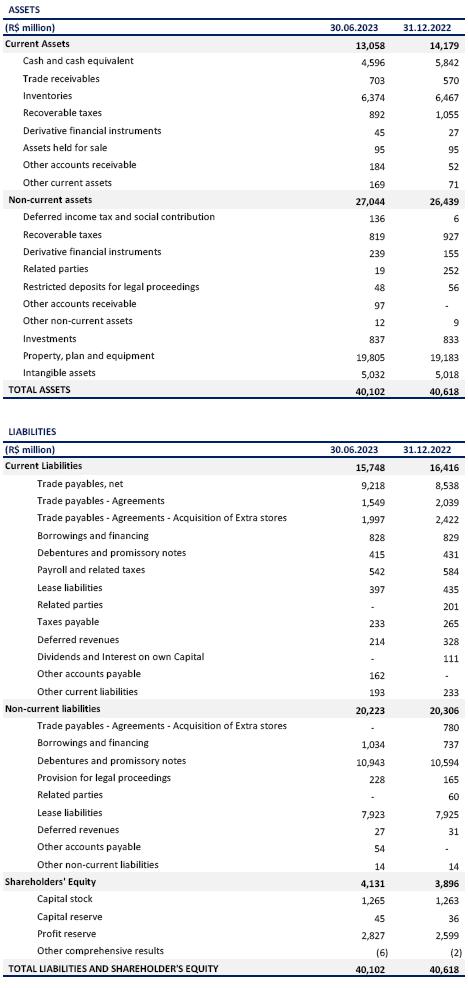

WORKING CAPITAL MANAGEMENT SUPPORTS DELEVERAGE

The leverage ratio (net debt/Adjusted EBITDA) ended the 2Q23 at 2.62x, declining around 0.2x from 1Q23 (2.78x), despite the high investment cycle. The leverage level reflects (i) the cash generation as a result of improvements in Working Capital; (ii) payments related to the acquisition of hypermarket commercial points; (iii) the investments in expansion over the last 12 months, with 60 stores opened; and (iv) the ongoing expansion project, with over 20 stores under construction to be inaugurated in 2023.

Note that the leverage shown in the table above considers EBITDA pre-IFRS 16 (including rental expenses), which differs from the contractual definition of covenants, which considers an EBITDA based on post-IFRS 16 EBITDA (excluding rental expenses).

The following chart clearly shows that the contractual ratios are well below the limit of the covenants of 3x, especially if we consider the advances in the maturation of converted stores.

|

Ratios Release: Net Debt = Gross Debt (-) Cash and Financial Investments (-) Credit Card Receivables EBITDA (LTM) = EBITDA Before IFRS 16 Ratios Contracts: Net Debt = Gross Debt (-) Cash and Financial Investments (-) Credit Card Receivables (-) Other Receivables as tickets and invoices, with a discount of 1.5% EBITDA (LTM) = Gross Profit (-) Selling, General and Administrative Expenses (-) Depreciation and Amortization (+) Other Operating Revenue

|

|

|

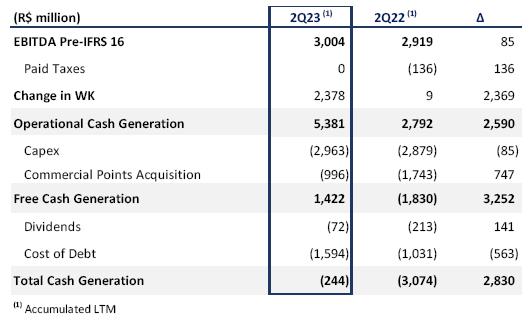

OPERATING CASH FLOW OF R$ 5.4 BILLION

Operating cash flow reached R$ 5.4 billion in the last 12 months, an increase of R$ 2.6 billion from 2Q22. The result mainly reflects improvements in the Company’s working capital management and the operational performance consistency within a context of strong expansion.

IFRS-16 IMPACTS

With the adoption of IFRS 16 in January 2019, some income statement accounts are affected. The table below presents the main effects:

|

|

CONSTANT ESG ADVANCES

Assaí, as an inherent part of its business model, implements initiatives to foster a more responsible and inclusive society based on five strategic pillars:

| 1. | Combating Climate Change: innovating and enhancing environmental management; |

| 2. | Integrated Management and Transparency: improving ESG practices through ethical and transparent relationships; |

| 3. | Transforming the Value Chain: co-building value chains committed to the environment and people; |

| 4. | Engaging with Society: acting as an agent of change to promote fair and inclusive opportunities; and |

| 5. | Valuing Our People: being a reference in fostering diversity, inclusion and sustainability through our employees. |

The main highlights in 2Q23 include:

| · | More than 20,000 submissions to the Assaí Academia Award 2023. The initiative aims to recognize and financially support the businesses of small entrepreneurs in the food segment; |

| · | +75% in volume collected and donated through the campaign “Winter Clothes We Share”: over 42 tons of clothing, coats and blankets will be delivered to 20 partner institutions in Brazil; |

| · | Reduction of 5.5% in scope 1(1) and 2(2) emissions from the same period of 2022, in line with the Company's strategy of combating climate change and its target to reduce emissions by 38% by 2030 (base year 2015); |

| · | Through recycling, composting and reduction of product waste, Assaí reused 44% of the waste, reducing disposal in landfills Highlighting the Right Destination program, with donations of 174 tons of fresh produce; |

| · | Commitment to create a diverse company with equal opportunities for everyone: |

| o | Increased participation of women on the Board of Directors with the election of 2 members; |

| o | 24.6% of Women in leadership positions (managers and above); |

| o | 42.8% of leadership positions are occupied by black people. |

(1) Direct emissions from the company.

(2) Emissions from electricity consumption.

AWARDS AND RECOGNITIONS

For the second straight year, Assaí was certified as an excellent place to work in Brazil, according to GPTW (Great Place to Work). With an increase of 10 p.p. in the score from last year, our employees indicated how satisfied they are with our practices of management, care, respect, development incentives and valuing contributions.

In addition, during the quarter, according to the Best Companies in Diversity Practices and Actions Award, the Company placed first in the “Value Chain Engagement” category and second in the “Promotion of Blacks” category. The award aims to recognize practices to combat racism and foster diversity in companies nationwide.

Assaí also won first place in the “Retail – Supermarkets, Proximity, Cash and Carry” category of the 24th edition of the Modern Consumer of Excellence in Customer Service Award and second place in the 23rd edition of the Broadcast Companies Award, which highlights the ten publicly-held companies with the best results for shareholders.

|

|

ABOUT SENDAS DISTRIBUIDORA S.A.

Assaí is a Cash & Carry wholesaler serving small and midsized merchants as well as consumers in general on unit items as well as large volumes. With gross sales of around R$ 60 billion in 2022, Assaí is Brazil’s second largest retailer and one of the country’s 10 best companies to work for in the segment (“Super Large” category, based on GPTW 2022). Serving all five regions of the country, Assaí has over 270 stores in 23 states (plus the Federal District) and more than 70,000 employees.

Since 2021, Assaí shares have been traded both on the São Paulo Stock Exchange (B3), under the ticker ASAI3, and on the New York Stock Exchange (NYSE), making it the only company in the industry to be listed on both. In 2022, the Company was considered Top of Mind in the “Wholesale” category in a survey carried out by the Datafolha Institute; and elected the best company in the “Retail Trade” branch by the Valor 1000 Award. In 2023, Assaí was considered the most valuable food retail brand by annual rankings promoted by Interbrand (20th overall) and by Brand Finance (13th overall).

CONTACTS – INVESTOR RELATIONS DEPARTMENT

Gabrielle Castelo Branco Helú

Investor Relations Officer

Ana Carolina Silva

Beatris Atilio

Daniel Magalhães

E-mail: ri.assai@assai.com.br

Website: www.ri.assai.com.br

|

|

OPERATIONAL INFORMATION

I – Number of stores and sales area

In the last 12 months, 5 stores were closed, 1 of which in 3Q22, 3 in 4Q22 and 1 in 2Q23. The number of stores operating at the end of 4Q22 includes 5 existing stores whose sales area was expanded under the conversion project.

|

|

FINANCIAL INFORMATION

II - Income Statement

|

|

III - Balance Sheet

|

|

IV – Cash Flow

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: July 26, 2023

Sendas Distribuidora S.A.

By: /s/ Daniela Sabbag Papa

Name: Daniela Sabbag Papa

Title: Chief Financial Officer

By: /s/ Gabrielle Helú

Name: Gabrielle Helú

Title: Investor Relations Officer

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.