| Maryland | 001-32268 | 11-3715772 | ||||||

| Delaware | 333-202666-01 | 20-1453863 | ||||||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification Number) | ||||||

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||||||||

| Common Shares, $0.01 par value per share | KRG | New York Stock Exchange | ||||||||||||

| Exhibit No. | Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |||||||

| KITE REALTY GROUP TRUST | ||||||||

| Date: April 29, 2025 | By: | /s/ HEATH R. FEAR | ||||||

| Heath R. Fear | ||||||||

| Executive Vice President and | ||||||||

| Chief Financial Officer | ||||||||

| KITE REALTY GROUP, L.P. | ||||||||

| By: Kite Realty Group Trust, its sole general partner | ||||||||

| By: | /s/ HEATH R. FEAR | |||||||

| Heath R. Fear | ||||||||

| Executive Vice President and | ||||||||

| Chief Financial Officer | ||||||||

| Exhibit 99.1 | ||||||||

| Low | High | ||||||||||

| Net income | $ | 0.41 | $ | 0.47 | |||||||

| Depreciation and amortization | 1.63 | 1.63 | |||||||||

| NAREIT FFO | $ | 2.04 | $ | 2.10 | |||||||

| Non-cash items | (0.04) | (0.04) | |||||||||

| Core FFO | $ | 2.00 | $ | 2.06 | |||||||

| March 31, 2025 |

December 31, 2024 |

||||||||||

| Assets: | |||||||||||

| Investment properties, at cost | $ | 7,695,216 | $ | 7,634,191 | |||||||

| Less: accumulated depreciation | (1,639,965) | (1,587,661) | |||||||||

| Net investment properties | 6,055,251 | 6,046,530 | |||||||||

| Cash and cash equivalents | 49,061 | 128,056 | |||||||||

|

Tenant and other receivables, including accrued straight-line rent

of $69,931 and $67,377, respectively

|

124,331 | 125,768 | |||||||||

| Restricted cash and escrow deposits | 5,846 | 5,271 | |||||||||

| Deferred costs, net | 230,287 | 238,213 | |||||||||

| Short-term deposits | — | 350,000 | |||||||||

| Prepaid and other assets | 117,734 | 104,627 | |||||||||

| Investments in unconsolidated subsidiaries | 20,315 | 19,511 | |||||||||

| Assets associated with investment properties held for sale | 79,683 | 73,791 | |||||||||

| Total assets | $ | 6,682,508 | $ | 7,091,767 | |||||||

| Liabilities and Equity: | |||||||||||

| Liabilities: | |||||||||||

| Mortgage and other indebtedness, net | $ | 2,910,057 | $ | 3,226,930 | |||||||

| Accounts payable and accrued expenses | 161,438 | 202,651 | |||||||||

| Deferred revenue and other liabilities | 235,341 | 246,100 | |||||||||

| Liabilities associated with investment properties held for sale | 4,199 | 4,009 | |||||||||

| Total liabilities | 3,311,035 | 3,679,690 | |||||||||

| Commitments and contingencies | |||||||||||

| Limited Partners’ interests in the Operating Partnership | 101,619 | 98,074 | |||||||||

| Equity: | |||||||||||

|

Common shares, $0.01 par value, 490,000,000 shares authorized,

219,812,300 and 219,667,067 shares issued and outstanding at

March 31, 2025 and December 31, 2024, respectively

|

2,198 | 2,197 | |||||||||

| Additional paid-in capital | 4,864,320 | 4,868,554 | |||||||||

| Accumulated other comprehensive income | 32,307 | 36,612 | |||||||||

| Accumulated deficit | (1,630,872) | (1,595,253) | |||||||||

| Total shareholders’ equity | 3,267,953 | 3,312,110 | |||||||||

| Noncontrolling interests | 1,901 | 1,893 | |||||||||

| Total equity | 3,269,854 | 3,314,003 | |||||||||

| Total liabilities and equity | $ | 6,682,508 | $ | 7,091,767 | |||||||

| Three Months Ended March 31, | |||||||||||

| 2025 | 2024 | ||||||||||

| Revenue: | |||||||||||

| Rental income | $ | 219,172 | $ | 205,813 | |||||||

| Other property-related revenue | 2,165 | 1,311 | |||||||||

| Fee income | 425 | 315 | |||||||||

| Total revenue | 221,762 | 207,439 | |||||||||

| Expenses: | |||||||||||

| Property operating | 29,826 | 28,081 | |||||||||

| Real estate taxes | 27,761 | 26,534 | |||||||||

| General, administrative and other | 12,258 | 12,784 | |||||||||

| Depreciation and amortization | 98,231 | 100,379 | |||||||||

| Total expenses | 168,076 | 167,778 | |||||||||

| Gain (loss) on sales of operating properties, net | 91 | (236) | |||||||||

| Operating income | 53,777 | 39,425 | |||||||||

| Other (expense) income: | |||||||||||

| Interest expense | (32,954) | (30,364) | |||||||||

| Income tax expense of taxable REIT subsidiaries | (10) | (158) | |||||||||

| Equity in loss of unconsolidated subsidiaries | (607) | (420) | |||||||||

| Gain on sale of unconsolidated property, net | — | 2,325 | |||||||||

| Other income, net | 4,058 | 3,628 | |||||||||

| Net income | 24,264 | 14,436 | |||||||||

| Net income attributable to noncontrolling interests | (534) | (280) | |||||||||

| Net income attributable to common shareholders | $ | 23,730 | $ | 14,156 | |||||||

| Net income per common share – basic and diluted | $ | 0.11 | $ | 0.06 | |||||||

| Weighted average common shares outstanding – basic | 219,715,674 | 219,501,114 | |||||||||

| Weighted average common shares outstanding – diluted | 219,827,298 | 219,900,306 | |||||||||

| Three Months Ended March 31, | |||||||||||

| 2025 | 2024 | ||||||||||

| Net income | $ | 24,264 | $ | 14,436 | |||||||

| Less: net income attributable to noncontrolling interests in properties | (70) | (67) | |||||||||

| Less/add: (gain) loss on sales of operating properties, net | (91) | 236 | |||||||||

| Less: gain on sale of unconsolidated property, net | — | (2,325) | |||||||||

|

Add: depreciation and amortization of consolidated and unconsolidated entities,

net of noncontrolling interests

|

98,677 | 100,560 | |||||||||

FFO of the Operating Partnership(1) |

122,780 | 112,840 | |||||||||

| Less: Limited Partners’ interests in FFO | (2,463) | (1,822) | |||||||||

FFO attributable to common shareholders(1) |

$ | 120,317 | $ | 111,018 | |||||||

| FFO, as defined by NAREIT, per share of the Operating Partnership – basic | $ | 0.55 | $ | 0.51 | |||||||

| FFO, as defined by NAREIT, per share of the Operating Partnership – diluted | $ | 0.55 | $ | 0.50 | |||||||

| Weighted average common shares outstanding – basic | 219,715,674 | 219,501,114 | |||||||||

| Weighted average common shares outstanding – diluted | 219,827,298 | 219,900,306 | |||||||||

| Weighted average common shares and units outstanding – basic | 224,214,867 | 223,109,983 | |||||||||

| Weighted average common shares and units outstanding – diluted | 224,326,491 | 223,509,175 | |||||||||

| Reconciliation of FFO to Core FFO | |||||||||||

FFO of the Operating Partnership(1) |

$ | 122,780 | $ | 112,840 | |||||||

| Add: | |||||||||||

| Amortization of deferred financing costs | 1,644 | 929 | |||||||||

| Non-cash compensation expense and other | 2,516 | 2,722 | |||||||||

| Less: | |||||||||||

| Straight-line rent – minimum rent and common area maintenance | 2,578 | 3,125 | |||||||||

| Market rent amortization income | 3,542 | 2,267 | |||||||||

| Amortization of debt discounts, premiums and hedge instruments | 2,756 | 3,756 | |||||||||

| Core FFO of the Operating Partnership | $ | 118,064 | $ | 107,343 | |||||||

| Core FFO per share of the Operating Partnership – diluted | $ | 0.53 | $ | 0.48 | |||||||

| Three Months Ended March 31, | |||||||||||||||||

| 2025 | 2024 | Change | |||||||||||||||

Number of properties in Same Property Pool for the period(1) |

177 | 177 | |||||||||||||||

| Leased percentage at period end | 93.8 | % | 94.4 | % | |||||||||||||

| Economic occupancy percentage at period end | 91.2 | % | 91.1 | % | |||||||||||||

Economic occupancy percentage(2) |

91.9 | % | 91.2 | % | |||||||||||||

| Minimum rent | $ | 155,169 | $ | 150,209 | |||||||||||||

| Tenant recoveries | 44,642 | 42,450 | |||||||||||||||

| Bad debt reserve | (1,933) | (554) | |||||||||||||||

| Other income, net | 2,201 | 2,603 | |||||||||||||||

| Total revenue | 200,079 | 194,708 | |||||||||||||||

| Property operating | (26,111) | (25,709) | |||||||||||||||

| Real estate taxes | (26,038) | (25,475) | |||||||||||||||

| Total expenses | (52,149) | (51,184) | |||||||||||||||

| Same Property NOI | $ | 147,930 | $ | 143,524 | 3.1 | % | |||||||||||

|

Reconciliation of Same Property NOI to most

directly comparable GAAP measure:

|

|||||||||||||||||

| Net operating income – same properties | $ | 147,930 | $ | 143,524 | |||||||||||||

Net operating income – non-same activity(3) |

15,820 | 8,985 | |||||||||||||||

| Total property NOI | 163,750 | 152,509 | 7.4 | % | |||||||||||||

| Other income, net | 3,866 | 3,365 | |||||||||||||||

| General, administrative and other | (12,258) | (12,784) | |||||||||||||||

| Depreciation and amortization | (98,231) | (100,379) | |||||||||||||||

| Interest expense | (32,954) | (30,364) | |||||||||||||||

| Gain (loss) on sales of operating properties, net | 91 | (236) | |||||||||||||||

| Gain on sale of unconsolidated property, net | — | 2,325 | |||||||||||||||

| Net income attributable to noncontrolling interests | (534) | (280) | |||||||||||||||

| Net income attributable to common shareholders | $ | 23,730 | $ | 14,156 | |||||||||||||

| Three Months Ended March 31, 2025 |

|||||

| Net income | $ | 24,264 | |||

| Depreciation and amortization | 98,231 | ||||

| Interest expense | 32,954 | ||||

| Income tax expense of taxable REIT subsidiaries | 10 | ||||

| EBITDA | 155,459 | ||||

| Unconsolidated EBITDA, as adjusted | 717 | ||||

| Gain on sales of operating properties, net | (91) | ||||

| Other income and expense, net | (3,451) | ||||

| Noncontrolling interests | (198) | ||||

| Adjusted EBITDA | $ | 152,436 | |||

Annualized Adjusted EBITDA(1) |

$ | 609,744 | |||

| Company share of Net Debt: | |||||

| Mortgage and other indebtedness, net | $ | 2,910,057 | |||

| Add: Company share of unconsolidated joint venture debt | 44,575 | ||||

| Add: debt discounts, premiums and issuance costs, net | 828 | ||||

Less: Partner share of consolidated joint venture debt(2) |

(9,789) | ||||

| Company’s consolidated debt and share of unconsolidated debt | 2,945,671 | ||||

| Less: cash, cash equivalents and restricted cash | (57,205) | ||||

| Company share of Net Debt | $ | 2,888,466 | |||

| Net Debt to Adjusted EBITDA | 4.7x | ||||

| Exhibit 99.2 | ||||||||

| Earnings Press Release | |||||

| Contact Information | |||||

| Results Overview | |||||

| Consolidated Balance Sheets | |||||

| Consolidated Statements of Operations | |||||

| Same Property Net Operating Income | |||||

| Net Operating Income and Adjusted EBITDA by Quarter | |||||

| Funds From Operations | |||||

| Joint Venture Summary | |||||

| Key Debt Metrics | |||||

| Summary of Outstanding Debt | |||||

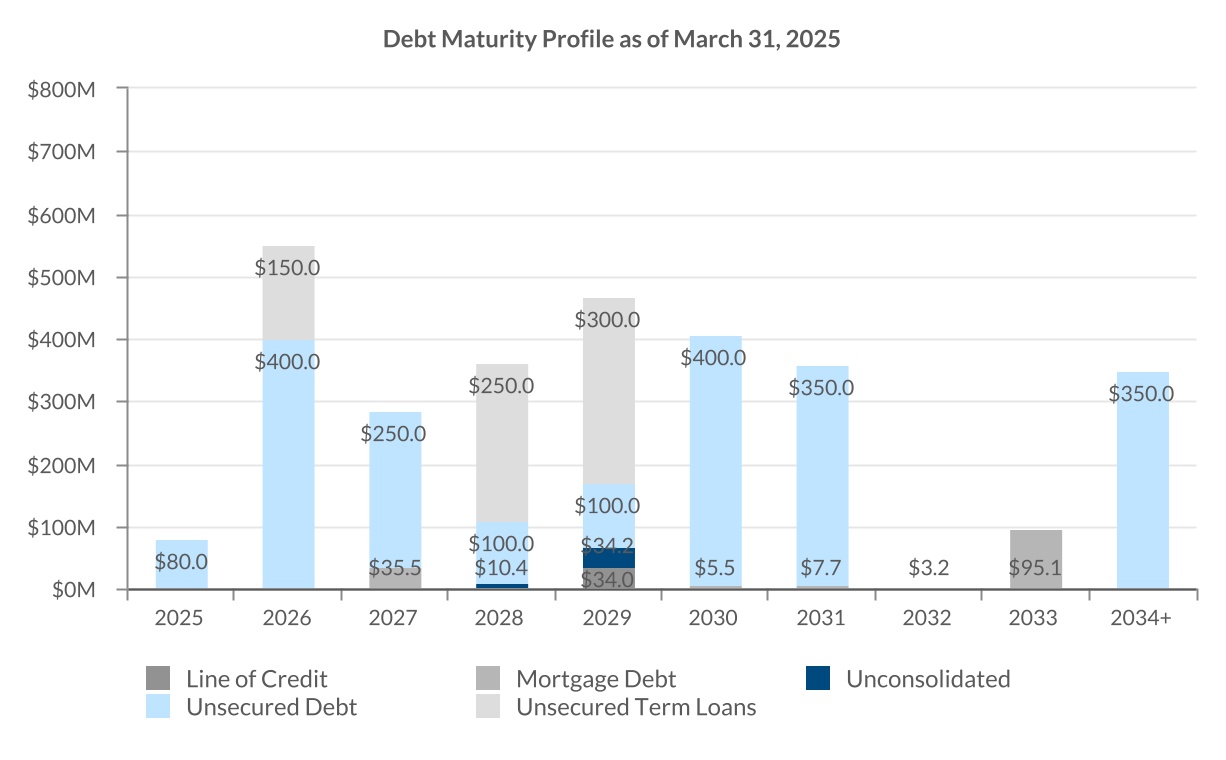

| Maturity Schedule of Outstanding Debt | |||||

| Acquisitions and Dispositions | |||||

| Development and Redevelopment Projects | |||||

| Geographic Diversification – Retail ABR by Region and State | |||||

| Top 25 Tenants by ABR | |||||

| Retail Leasing Spreads | |||||

| Lease Expirations | |||||

| Components of Net Asset Value | |||||

| Non-GAAP Financial Measures | |||||

i |

|||||

| Low | High | ||||||||||

| Net income | $ | 0.41 | $ | 0.47 | |||||||

| Depreciation and amortization | 1.63 | 1.63 | |||||||||

| NAREIT FFO | $ | 2.04 | $ | 2.10 | |||||||

| Non-cash items | (0.04) | (0.04) | |||||||||

| Core FFO | $ | 2.00 | $ | 2.06 | |||||||

ii |

|||||

iii |

|||||

| Investor Relations Contact | Analyst Coverage | Analyst Coverage | ||||||||||||

| Tyler Henshaw | Robert W. Baird & Co. | Jefferies LLC | ||||||||||||

| Senior Vice President, Capital Markets and IR | Mr. Wes Golladay | Ms. Linda Tsai | ||||||||||||

| (317) 713-7780 | (216) 737-7510 | (212) 778-8011 | ||||||||||||

| thenshaw@kiterealty.com | wgolladay@rwbaird.com | ltsai@jefferies.com | ||||||||||||

| Matt Hunt | Bank of America/Merrill Lynch | J.P. Morgan | ||||||||||||

| Senior Director, Capital Markets and IR | Mr. Jeffrey Spector | Mr. Michael W. Mueller/Mr. Hongliang Zhang | ||||||||||||

| (317) 713-7646 | (646) 855-1363 | (212) 622-6689/(212) 622-6416 | ||||||||||||

| mhunt@kiterealty.com | jeff.spector@bofa.com | michael.w.mueller@jpmorgan.com/ | ||||||||||||

| hongliang.zhang@jpmorgan.com | ||||||||||||||

| Transfer Agent | BTIG | KeyBanc Capital Markets | ||||||||||||

| Broadridge Financial Solutions | Mr. Michael Gorman | Mr. Todd Thomas | ||||||||||||

| Ms. Kristen Tartaglione | (212) 738-6138 | (917) 368-2286 | ||||||||||||

| 2 Journal Square, 7th Floor | mgorman@btig.com | tthomas@keybanccm.com | ||||||||||||

| Jersey City, NJ 07306 | ||||||||||||||

| (201) 714-8094 | Citigroup Global Markets | Piper Sandler | ||||||||||||

| Mr. Craig Mailman | Mr. Alexander Goldfarb | |||||||||||||

| (212) 816-4471 | (212) 466-7937 | |||||||||||||

| craig.mailman@citi.com | alexander.goldfarb@psc.com | |||||||||||||

| Stock Specialist | ||||||||||||||

| GTS | Compass Point Research & Trading, LLC | Raymond James | ||||||||||||

| 545 Madison Avenue, 15th Floor | Mr. Floris van Dijkum | Mr. RJ Milligan | ||||||||||||

| New York, NY 10022 | (646) 757-2621 | (727) 567-2585 | ||||||||||||

| (212) 715-2830 | fvandijkum@compasspointllc.com | rjmilligan@raymondjames.com | ||||||||||||

| Green Street | Wells Fargo | |||||||||||||

| Ms. Paulina Rojas Schmidt | Mr. James Feldman/Ms. Dori Kesten | |||||||||||||

| (949) 640-8780 | (212) 215-5328/(617) 603-4233 | |||||||||||||

| projasschmidt@greenstreet.com | james.feldman@wellsfargo.com/ | |||||||||||||

| dori.kesten@wellsfargo.com | ||||||||||||||

| 1st Quarter 2025 Supplemental Financial and Operating Statistics | 1 |

||||

| Three Months Ended March 31, | |||||||||||

| Summary Financial Results | 2025 | 2024 | |||||||||

| Total revenue (page 4) | $ | 221,762 | $ | 207,439 | |||||||

| Net income attributable to common shareholders (page 4) | $ | 23,730 | $ | 14,156 | |||||||

| Net income per diluted share (page 4) | $ | 0.11 | $ | 0.06 | |||||||

| Net operating income (NOI) (page 6) | $ | 163,750 | $ | 152,509 | |||||||

| Adjusted EBITDA (page 6) | $ | 151,917 | $ | 140,040 | |||||||

| NAREIT Funds From Operations (FFO) (page 7) | $ | 122,780 | $ | 112,840 | |||||||

| NAREIT FFO per diluted share (page 7) | $ | 0.55 | $ | 0.50 | |||||||

| Core FFO (page 7) | $ | 118,064 | $ | 107,343 | |||||||

| Core FFO per diluted share (page 7) | $ | 0.53 | $ | 0.48 | |||||||

| Dividend payout ratio (as % of NAREIT FFO) | 49 | % | 50 | % | |||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Summary Operating and Financial Ratios | March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

March 31, 2024 |

||||||||||||||||||||||||

| NOI margin (page 6) | 74.2 | % | 74.6 | % | 74.5 | % | 73.8 | % | 73.8 | % | |||||||||||||||||||

| NOI margin – retail (page 6) | 74.7 | % | 75.1 | % | 75.2 | % | 74.3 | % | 74.4 | % | |||||||||||||||||||

| Same Property NOI performance (page 5) | 3.1 | % | 4.8 | % | 3.0 | % | 1.8 | % | 1.8 | % | |||||||||||||||||||

| Total property NOI performance (page 5) | 7.4 | % | 4.9 | % | 1.2 | % | 0.1 | % | 1.3 | % | |||||||||||||||||||

| Net debt to Adjusted EBITDA, current quarter (page 9) | 4.7x | 4.7x | 4.9x | 4.8x | 5.1x | ||||||||||||||||||||||||

| Recovery ratio of retail operating properties (page 6) | 91.4 | % | 92.1 | % | 91.2 | % | 91.6 | % | 91.6 | % | |||||||||||||||||||

| Recovery ratio of consolidated portfolio (page 6) | 86.5 | % | 87.4 | % | 86.6 | % | 87.8 | % | 86.9 | % | |||||||||||||||||||

| Outstanding Classes of Stock | |||||||||||||||||||||||||||||

| Common shares and units outstanding (page 18) | 224,661,888 | 223,859,664 | 223,626,166 | 223,361,957 | 223,310,866 | ||||||||||||||||||||||||

| Summary Portfolio Statistics | |||||||||||||||||||||||||||||

| Number of properties | |||||||||||||||||||||||||||||

Operating retail (page 14)(1) |

180 | 179 | 179 | 178 | 180 | ||||||||||||||||||||||||

| Office and other components | 12 | 12 | 11 | 11 | 11 | ||||||||||||||||||||||||

| Development and redevelopment projects (page 13) | 1 | 2 | 3 | 2 | 2 | ||||||||||||||||||||||||

Owned retail operating gross leasable area (GLA)(2) (page 14) |

27.8 | M | 27.7 | M | 27.7 | M | 27.6 | M | 28.1 | M | |||||||||||||||||||

| Owned office GLA | 1.5 | M | 1.5 | M | 1.4 | M | 1.4 | M | 1.4 | M | |||||||||||||||||||

Number of multifamily units(3) |

1,405 | 1,405 | 1,405 | 1,405 | 1,405 | ||||||||||||||||||||||||

| Percent leased – total | 93.0 | % | 94.2 | % | 94.6 | % | 94.3 | % | 93.8 | % | |||||||||||||||||||

| Percent leased – retail | 93.8 | % | 95.0 | % | 95.0 | % | 94.8 | % | 94.0 | % | |||||||||||||||||||

| Anchor | 95.1 | % | 97.1 | % | 97.0 | % | 96.8 | % | 95.9 | % | |||||||||||||||||||

| Small shop | 91.3 | % | 91.2 | % | 91.2 | % | 90.8 | % | 90.5 | % | |||||||||||||||||||

| Annualized base rent (ABR) per square foot | $ | 21.49 | $ | 21.15 | $ | 21.01 | $ | 20.90 | $ | 20.84 | |||||||||||||||||||

| Total new and renewal lease GLA (page 16) | 843,829 | 1,214,390 | 1,651,986 | 1,153,766 | 968,681 | ||||||||||||||||||||||||

| New lease cash rent spread (page 16) | 15.6 | % | 23.6 | % | 24.9 | % | 34.8 | % | 48.1 | % | |||||||||||||||||||

| Non-option renewal lease cash rent spread (page 16) | 20.1 | % | 14.4 | % | 11.9 | % | 14.3 | % | 12.2 | % | |||||||||||||||||||

| Option renewal lease cash rent spread (page 16) | 7.0 | % | 6.8 | % | 7.7 | % | 6.0 | % | 5.3 | % | |||||||||||||||||||

| Total new and renewal lease cash rent spread (page 16) | 13.7 | % | 12.5 | % | 11.1 | % | 15.6 | % | 12.8 | % | |||||||||||||||||||

| 2025 Guidance | Current (as of 4/29/25) |

Previous (as of 2/11/25) |

|||||||||

| NAREIT FFO per diluted share | $2.04 to $2.10 | $2.02 to $2.08 | |||||||||

| Core FFO per diluted share | $2.00 to $2.06 | $1.98 to $2.04 | |||||||||

| 1st Quarter 2025 Supplemental Financial and Operating Statistics | 2 |

||||

| March 31, 2025 |

December 31, 2024 |

||||||||||

| Assets: | |||||||||||

| Investment properties, at cost | $ | 7,695,216 | $ | 7,634,191 | |||||||

| Less: accumulated depreciation | (1,639,965) | (1,587,661) | |||||||||

| Net investment properties | 6,055,251 | 6,046,530 | |||||||||

| Cash and cash equivalents | 49,061 | 128,056 | |||||||||

|

Tenant and other receivables, including accrued straight-line rent

of $69,931 and $67,377, respectively

|

124,331 | 125,768 | |||||||||

| Restricted cash and escrow deposits | 5,846 | 5,271 | |||||||||

| Deferred costs, net | 230,287 | 238,213 | |||||||||

| Short-term deposits | — | 350,000 | |||||||||

| Prepaid and other assets | 117,734 | 104,627 | |||||||||

| Investments in unconsolidated subsidiaries | 20,315 | 19,511 | |||||||||

| Assets associated with investment properties held for sale | 79,683 | 73,791 | |||||||||

| Total assets | $ | 6,682,508 | $ | 7,091,767 | |||||||

| Liabilities and Equity: | |||||||||||

| Liabilities: | |||||||||||

| Mortgage and other indebtedness, net | $ | 2,910,057 | $ | 3,226,930 | |||||||

| Accounts payable and accrued expenses | 161,438 | 202,651 | |||||||||

| Deferred revenue and other liabilities | 235,341 | 246,100 | |||||||||

| Liabilities associated with investment properties held for sale | 4,199 | 4,009 | |||||||||

| Total liabilities | 3,311,035 | 3,679,690 | |||||||||

| Commitments and contingencies | |||||||||||

Limited Partners’ interests in the Operating Partnership |

101,619 | 98,074 | |||||||||

| Equity: | |||||||||||

|

Common shares, $0.01 par value, 490,000,000 shares authorized,

219,812,300 and 219,667,067 shares issued and outstanding at

March 31, 2025 and December 31, 2024, respectively

|

2,198 | 2,197 | |||||||||

| Additional paid-in capital | 4,864,320 | 4,868,554 | |||||||||

| Accumulated other comprehensive income | 32,307 | 36,612 | |||||||||

| Accumulated deficit | (1,630,872) | (1,595,253) | |||||||||

| Total shareholders’ equity | 3,267,953 | 3,312,110 | |||||||||

| Noncontrolling interests | 1,901 | 1,893 | |||||||||

| Total equity | 3,269,854 | 3,314,003 | |||||||||

| Total liabilities and equity | $ | 6,682,508 | $ | 7,091,767 | |||||||

| 1st Quarter 2025 Supplemental Financial and Operating Statistics | 3 |

||||

| Three Months Ended March 31, | |||||||||||

| 2025 | 2024 | ||||||||||

| Revenue: | |||||||||||

| Rental income | $ | 219,172 | $ | 205,813 | |||||||

| Other property-related revenue | 2,165 | 1,311 | |||||||||

| Fee income | 425 | 315 | |||||||||

| Total revenue | 221,762 | 207,439 | |||||||||

| Expenses: | |||||||||||

| Property operating | 29,826 | 28,081 | |||||||||

| Real estate taxes | 27,761 | 26,534 | |||||||||

| General, administrative and other | 12,258 | 12,784 | |||||||||

| Depreciation and amortization | 98,231 | 100,379 | |||||||||

| Total expenses | 168,076 | 167,778 | |||||||||

| Gain (loss) on sales of operating properties, net | 91 | (236) | |||||||||

| Operating income | 53,777 | 39,425 | |||||||||

| Other (expense) income: | |||||||||||

| Interest expense | (32,954) | (30,364) | |||||||||

| Income tax expense of taxable REIT subsidiaries | (10) | (158) | |||||||||

| Equity in loss of unconsolidated subsidiaries | (607) | (420) | |||||||||

| Gain on sale of unconsolidated property, net | — | 2,325 | |||||||||

| Other income, net | 4,058 | 3,628 | |||||||||

| Net income | 24,264 | 14,436 | |||||||||

| Net income attributable to noncontrolling interests | (534) | (280) | |||||||||

| Net income attributable to common shareholders | $ | 23,730 | $ | 14,156 | |||||||

| Net income per common share – basic and diluted | $ | 0.11 | $ | 0.06 | |||||||

| Weighted average common shares outstanding – basic | 219,715,674 | 219,501,114 | |||||||||

| Weighted average common shares outstanding – diluted | 219,827,298 | 219,900,306 | |||||||||

| 1st Quarter 2025 Supplemental Financial and Operating Statistics | 4 |

||||

| Three Months Ended March 31, | |||||||||||||||||

| 2025 | 2024 | Change | |||||||||||||||

Number of properties in Same Property Pool for the period(1) |

177 | 177 | |||||||||||||||

| Leased percentage at period end | 93.8 | % | 94.4 | % | |||||||||||||

| Economic occupancy percentage at period end | 91.2 | % | 91.1 | % | |||||||||||||

Economic occupancy percentage(2) |

91.9 | % | 91.2 | % | |||||||||||||

| Minimum rent | $ | 155,169 | $ | 150,209 | |||||||||||||

| Tenant recoveries | 44,642 | 42,450 | |||||||||||||||

| Bad debt reserve | (1,933) | (554) | |||||||||||||||

| Other income, net | 2,201 | 2,603 | |||||||||||||||

| Total revenue | 200,079 | 194,708 | |||||||||||||||

| Property operating | (26,111) | (25,709) | |||||||||||||||

| Real estate taxes | (26,038) | (25,475) | |||||||||||||||

| Total expenses | (52,149) | (51,184) | |||||||||||||||

| Same Property NOI | $ | 147,930 | $ | 143,524 | 3.1 | % | |||||||||||

|

Reconciliation of Same Property NOI to most

directly comparable GAAP measure:

|

|||||||||||||||||

| Net operating income – same properties | $ | 147,930 | $ | 143,524 | |||||||||||||

Net operating income – non-same activity(3) |

15,820 | 8,985 | |||||||||||||||

| Total property NOI | 163,750 | 152,509 | 7.4 | % | |||||||||||||

| Other income, net | 3,866 | 3,365 | |||||||||||||||

| General, administrative and other | (12,258) | (12,784) | |||||||||||||||

| Depreciation and amortization | (98,231) | (100,379) | |||||||||||||||

| Interest expense | (32,954) | (30,364) | |||||||||||||||

| Gain (loss) on sales of operating properties, net | 91 | (236) | |||||||||||||||

| Gain on sale of unconsolidated property, net | — | 2,325 | |||||||||||||||

| Net income attributable to noncontrolling interests | (534) | (280) | |||||||||||||||

| Net income attributable to common shareholders | $ | 23,730 | $ | 14,156 | |||||||||||||

| 1st Quarter 2025 Supplemental Financial and Operating Statistics | 5 |

||||

| Three Months Ended | |||||||||||||||||||||||||||||

| March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

March 31, 2024 |

|||||||||||||||||||||||||

| Revenue: | |||||||||||||||||||||||||||||

Minimum rent(1) |

$ | 163,344 | $ | 154,233 | $ | 151,937 | $ | 151,116 | $ | 150,598 | |||||||||||||||||||

| Minimum rent – ground leases | 10,644 | 10,750 | 10,758 | 10,492 | 10,447 | ||||||||||||||||||||||||

| Tenant reimbursements | 46,213 | 44,058 | 42,453 | 44,422 | 43,577 | ||||||||||||||||||||||||

| Bad debt reserve | (2,076) | (1,755) | (1,468) | (1,544) | (589) | ||||||||||||||||||||||||

Other property-related revenue(2) |

1,640 | 3,843 | 1,402 | 2,701 | 841 | ||||||||||||||||||||||||

| Overage rent | 1,048 | 2,680 | 1,253 | 1,350 | 1,780 | ||||||||||||||||||||||||

| Total revenue | 220,813 | 213,809 | 206,335 | 208,537 | 206,654 | ||||||||||||||||||||||||

| Expenses: | |||||||||||||||||||||||||||||

Property operating – recoverable(3) |

25,798 | 24,913 | 23,961 | 24,257 | 23,763 | ||||||||||||||||||||||||

Property operating – non-recoverable(3) |

3,661 | 3,972 | 3,469 | 4,005 | 4,009 | ||||||||||||||||||||||||

| Real estate taxes | 27,604 | 25,495 | 25,083 | 26,350 | 26,373 | ||||||||||||||||||||||||

| Total expenses | 57,063 | 54,380 | 52,513 | 54,612 | 54,145 | ||||||||||||||||||||||||

| NOI | 163,750 | 159,429 | 153,822 | 153,925 | 152,509 | ||||||||||||||||||||||||

| Other (expense) income: | |||||||||||||||||||||||||||||

| General, administrative and other | (12,258) | (13,549) | (13,259) | (12,966) | (12,784) | ||||||||||||||||||||||||

| Fee income | 425 | 441 | 455 | 3,452 | 315 | ||||||||||||||||||||||||

| Total other (expense) income | (11,833) | (13,108) | (12,804) | (9,514) | (12,469) | ||||||||||||||||||||||||

| Adjusted EBITDA | 151,917 | 146,321 | 141,018 | 144,411 | 140,040 | ||||||||||||||||||||||||

| Impairment charges | — | — | — | (66,201) | — | ||||||||||||||||||||||||

| Depreciation and amortization | (98,231) | (97,009) | (96,656) | (99,291) | (100,379) | ||||||||||||||||||||||||

| Interest expense | (32,954) | (32,706) | (31,640) | (30,981) | (30,364) | ||||||||||||||||||||||||

| Equity in (loss) earnings of unconsolidated subsidiaries | (607) | 43 | (607) | (174) | (420) | ||||||||||||||||||||||||

| Gain on sale of unconsolidated property, net | — | — | — | — | 2,325 | ||||||||||||||||||||||||

| Income tax (expense) benefit of taxable REIT subsidiaries | (10) | 186 | (35) | (132) | (158) | ||||||||||||||||||||||||

| Loss on extinguishment of debt | — | (180) | — | — | — | ||||||||||||||||||||||||

| Interest income | 4,049 | 5,453 | 4,333 | 4,364 | 3,739 | ||||||||||||||||||||||||

| Other income (expense), net | 9 | 122 | 38 | (69) | (111) | ||||||||||||||||||||||||

| Gain (loss) on sales of operating properties, net | 91 | — | 602 | (1,230) | (236) | ||||||||||||||||||||||||

| Net income (loss) | 24,264 | 22,230 | 17,053 | (49,303) | 14,436 | ||||||||||||||||||||||||

Net (income) loss attributable to noncontrolling interests |

(534) | (406) | (324) | 665 | (280) | ||||||||||||||||||||||||

| Net income (loss) attributable to common shareholders | $ | 23,730 | $ | 21,824 | $ | 16,729 | $ | (48,638) | $ | 14,156 | |||||||||||||||||||

| NOI/Revenue – Retail properties | 74.7 | % | 75.1 | % | 75.2 | % | 74.3 | % | 74.4 | % | |||||||||||||||||||

| NOI/Revenue | 74.2 | % | 74.6 | % | 74.5 | % | 73.8 | % | 73.8 | % | |||||||||||||||||||

Recovery Ratios(4) |

|||||||||||||||||||||||||||||

| – Retail properties | 91.4 | % | 92.1 | % | 91.2 | % | 91.6 | % | 91.6 | % | |||||||||||||||||||

| – Consolidated | 86.5 | % | 87.4 | % | 86.6 | % | 87.8 | % | 86.9 | % | |||||||||||||||||||

| 1st Quarter 2025 Supplemental Financial and Operating Statistics | 6 |

||||

| Three Months Ended March 31, | |||||||||||

| 2025 | 2024 | ||||||||||

| Net income | $ | 24,264 | $ | 14,436 | |||||||

| Less: net income attributable to noncontrolling interests in properties | (70) | (67) | |||||||||

| Less/add: (gain) loss on sales of operating properties, net | (91) | 236 | |||||||||

| Less: gain on sale of unconsolidated property, net | — | (2,325) | |||||||||

|

Add: depreciation and amortization of consolidated and unconsolidated entities,

net of noncontrolling interests

|

98,677 | 100,560 | |||||||||

FFO of the Operating Partnership(1) |

122,780 | 112,840 | |||||||||

Less: Limited Partners’ interests in FFO |

(2,463) | (1,822) | |||||||||

FFO attributable to common shareholders(1) |

$ | 120,317 | $ | 111,018 | |||||||

| FFO, as defined by NAREIT, per share of the Operating Partnership – basic | $ | 0.55 | $ | 0.51 | |||||||

| FFO, as defined by NAREIT, per share of the Operating Partnership – diluted | $ | 0.55 | $ | 0.50 | |||||||

| Weighted average common shares outstanding – basic | 219,715,674 | 219,501,114 | |||||||||

| Weighted average common shares outstanding – diluted | 219,827,298 | 219,900,306 | |||||||||

| Weighted average common shares and units outstanding – basic | 224,214,867 | 223,109,983 | |||||||||

| Weighted average common shares and units outstanding – diluted | 224,326,491 | 223,509,175 | |||||||||

| Reconciliation of FFO to Core FFO | |||||||||||

FFO of the Operating Partnership(1) |

$ | 122,780 | $ | 112,840 | |||||||

| Add: | |||||||||||

| Amortization of deferred financing costs | 1,644 | 929 | |||||||||

| Non-cash compensation expense and other | 2,516 | 2,722 | |||||||||

| Less: | |||||||||||

| Straight-line rent – minimum rent and common area maintenance | 2,578 | 3,125 | |||||||||

| Market rent amortization income | 3,542 | 2,267 | |||||||||

| Amortization of debt discounts, premiums and hedge instruments | 2,756 | 3,756 | |||||||||

| Core FFO of the Operating Partnership | $ | 118,064 | $ | 107,343 | |||||||

| Core FFO per share of the Operating Partnership – diluted | $ | 0.53 | $ | 0.48 | |||||||

| Reconciliation of Core FFO to Adjusted Funds From Operations (“AFFO”) | |||||||||||

| Core FFO of the Operating Partnership | $ | 118,064 | $ | 107,343 | |||||||

| Less: | |||||||||||

| Maintenance capital expenditures | 6,298 | 5,738 | |||||||||

Tenant-related capital expenditures(2) |

31,322 | 18,418 | |||||||||

| Total Recurring AFFO of the Operating Partnership | $ | 80,444 | $ | 83,187 | |||||||

| 1st Quarter 2025 Supplemental Financial and Operating Statistics | 7 |

||||

| Consolidated Investments | ||||||||||||||||||||||||||

| Investments | Total Debt |

Partner Economic

Ownership Interest(1)

|

Partner Share of Debt |

Partner Share of Annual EBITDA |

||||||||||||||||||||||

| Delray Marketplace | $ | 14,000 | 2 | % | $ | 280 | $ | — | ||||||||||||||||||

| One Loudoun – Pads G&H Residential | 95,095 | 10 | % | 9,509 | 792 | |||||||||||||||||||||

| Total | $ | 109,095 | $ | 9,789 | $ | 792 | ||||||||||||||||||||

| Unconsolidated Investments | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Investments | Retail GLA | Multifamily Units |

Total Debt | KRG Economic Ownership Interest |

KRG Share of Debt |

KRG Investment |

KRG Share of Quarterly Adjusted EBITDA |

KRG Share of Quarterly Adjusted EBITDA Annualized |

||||||||||||||||||||||||||||||||||||||||||

|

Three Property Retail

Portfolio

|

415,966 | — | $ | 51,890 | 20 | % | $ | 10,378 | $ | 5,988 | $ | 290 | $ | 1,160 | ||||||||||||||||||||||||||||||||||||

|

Glendale Center

Apartments

|

— | — | — | 11.5 | % | — | 401 | 29 | 116 | |||||||||||||||||||||||||||||||||||||||||

|

Embassy Suites at Eddy

Street Commons

|

— | — | — | 35 | % | — | 9,113 | (6) | (24) | |||||||||||||||||||||||||||||||||||||||||

| The Corner – IN | 23,776 | 285 | 68,394 | 50 | % | 34,197 | 2,313 | 370 | 1,480 | |||||||||||||||||||||||||||||||||||||||||

| Other investments | — | — | — | — | % | — | 2,500 | 34 | 136 | |||||||||||||||||||||||||||||||||||||||||

| Total | 439,742 | 285 | $ | 120,284 | $ | 44,575 | $ | 20,315 | $ | 717 | $ | 2,868 | ||||||||||||||||||||||||||||||||||||||

| 1st Quarter 2025 Supplemental Financial and Operating Statistics | 8 |

||||

| Senior Unsecured Notes Covenants | |||||||||||

| March 31, 2025 |

Debt Covenant

Threshold(1)

|

||||||||||

| Total debt to undepreciated assets | 36% | <60% | |||||||||

| Secured debt to undepreciated assets | 2% | <40% | |||||||||

| Undepreciated unencumbered assets to unsecured debt | 284% | >150% | |||||||||

| Debt service coverage | 4.6x | >1.5x | |||||||||

| Unsecured Credit Facility Covenants | |||||||||||

| March 31, 2025 |

Debt Covenant

Threshold(1)

|

||||||||||

| Maximum leverage | 34% | <60% | |||||||||

| Minimum fixed charge coverage | 4.2x | >1.5x | |||||||||

| Secured indebtedness | 2.0% | <45% | |||||||||

| Unsecured debt interest coverage | 4.2x | >1.75x | |||||||||

| Unsecured leverage | 32% | <60% | |||||||||

| Senior Unsecured Debt Ratings | |||||||||||

| Fitch Ratings | BBB/Positive | ||||||||||

| Moody's Investors Service | Baa2/Stable | ||||||||||

| Standard & Poor's Rating Services | BBB/Stable | ||||||||||

| Liquidity | |||||||||||

| Cash and cash equivalents | $ | 49,061 | |||||||||

| Availability under unsecured credit facility | 1,061,500 | ||||||||||

| $ | 1,110,561 | ||||||||||

| Unencumbered NOI as a % of Total NOI | 95 | % | |||||||||

| Net Debt to Adjusted EBITDA | |||||||||||

| Mortgage and other indebtedness, net | $ | 2,910,057 | |||||||||

| Add: Company share of unconsolidated joint venture debt | 44,575 | ||||||||||

| Add: debt discounts, premiums and issuance costs, net | 828 | ||||||||||

| Less: Partner share of consolidated joint venture debt | (9,789) | ||||||||||

| Company's consolidated debt and share of unconsolidated debt | 2,945,671 | ||||||||||

| Less: cash, cash equivalents and restricted cash | (57,205) | ||||||||||

| Company share of Net Debt | $ | 2,888,466 | |||||||||

| Q1 2025 Adjusted EBITDA, Annualized: | |||||||||||

| – Consolidated Adjusted EBITDA | $ | 607,668 | |||||||||

– Unconsolidated Adjusted EBITDA(2) |

2,868 | ||||||||||

– Minority interest Adjusted EBITDA(2) |

(792) | 609,744 | |||||||||

| Ratio of Company share of Net Debt to Adjusted EBITDA | 4.7x | ||||||||||

| 1st Quarter 2025 Supplemental Financial and Operating Statistics | 9 |

||||

| Total Outstanding Debt | Amount Outstanding |

Ratio | Weighted Average Interest Rate |

Weighted Average Years to Maturity |

|||||||||||||||||||

Fixed rate debt(1) |

$ | 2,707,885 | 92 | % | 4.09 | % | 4.7 | ||||||||||||||||

Variable rate debt(2) |

203,000 | 7 | % | 7.27 | % | 2.0 | |||||||||||||||||

| Debt discounts, premiums and issuance costs, net | (828) | N/A | N/A | N/A | |||||||||||||||||||

| Total consolidated debt | 2,910,057 | 99 | % | 4.31 | % | 4.5 | |||||||||||||||||

| KRG share of unconsolidated debt | 44,575 | 1 | % | 6.45 | % | 4.4 | |||||||||||||||||

| Total | $ | 2,954,632 | 100 | % | 4.34 | % | 4.5 | ||||||||||||||||

| Schedule of Maturities by Year | |||||||||||||||||||||||||||||||||||

| Secured Debt | |||||||||||||||||||||||||||||||||||

| Scheduled Principal Payments |

Term Maturities |

Unsecured Debt |

Total Consolidated Debt |

Total Unconsolidated Debt |

Total Debt Outstanding |

||||||||||||||||||||||||||||||

| 2025 | $ | 3,948 | $ | — | $ | 80,000 | $ | 83,948 | $ | — | $ | 83,948 | |||||||||||||||||||||||

| 2026 | 4,581 | — | 550,000 | 554,581 | — | 554,581 | |||||||||||||||||||||||||||||

| 2027 | 3,120 | 10,600 | 250,000 | 263,720 | — | 263,720 | |||||||||||||||||||||||||||||

| 2028 | 3,757 | — | 350,000 | (3) |

353,757 | 10,378 | 364,135 | ||||||||||||||||||||||||||||

| 2029 | 4,324 | — | 434,000 | 438,324 | 34,197 | 472,521 | |||||||||||||||||||||||||||||

| 2030 and beyond | 23,767 | 92,788 | 1,100,000 | 1,216,555 | — | 1,216,555 | |||||||||||||||||||||||||||||

| Debt discounts, premiums and issuance costs, net | — | 876 | (1,704) | (828) | — | (828) | |||||||||||||||||||||||||||||

| Total | $ | 43,497 | $ | 104,264 | $ | 2,762,296 | $ | 2,910,057 | $ | 44,575 | $ | 2,954,632 | |||||||||||||||||||||||

| 1st Quarter 2025 Supplemental Financial and Operating Statistics | 10 |

||||

| Description | Interest Rate(1) |

Maturity Date |

Balance as of March 31, 2025 |

% of Total Outstanding |

||||||||||||||||||||||

Senior Unsecured Notes(2) |

SOFR + 365 | 9/10/2025 | $ | 80,000 | ||||||||||||||||||||||

| 2025 Debt Maturities | 7.67% | 80,000 | 3 | % | ||||||||||||||||||||||

Unsecured Term Loan(3) |

2.73% | 7/17/2026 | 150,000 | |||||||||||||||||||||||

| Senior Unsecured Notes | 4.08% | 9/30/2026 | 100,000 | |||||||||||||||||||||||

| Senior Unsecured Notes | 4.00% | 10/1/2026 | 300,000 | |||||||||||||||||||||||

| 2026 Debt Maturities | 3.67% | 550,000 | 18 | % | ||||||||||||||||||||||

| Senior Unsecured Exchangeable Notes | 0.75% | 4/1/2027 | 175,000 | |||||||||||||||||||||||

| Northgate North | 4.50% | 6/1/2027 | 21,506 | |||||||||||||||||||||||

Delray Marketplace(4) |

SOFR + 215 | 8/4/2027 | 14,000 | |||||||||||||||||||||||

Senior Unsecured Notes(2) |

SOFR + 375 | 9/10/2027 | 75,000 | |||||||||||||||||||||||

| 2027 Debt Maturities | 3.16% | 285,506 | 10 | % | ||||||||||||||||||||||

Unsecured Term Loan(5) |

3.94% | 10/24/2028 | 250,000 | |||||||||||||||||||||||

| Senior Unsecured Notes | 4.24% | 12/28/2028 | 100,000 | |||||||||||||||||||||||

| 2028 Debt Maturities | 4.03% | 350,000 | 12 | % | ||||||||||||||||||||||

| Senior Unsecured Notes | 4.82% | 6/28/2029 | 100,000 | |||||||||||||||||||||||

Unsecured Term Loan(6) |

3.72% | 7/29/2029 | 300,000 | |||||||||||||||||||||||

Unsecured Credit Facility(7) |

SOFR + 115 | 10/3/2029 | 34,000 | |||||||||||||||||||||||

| 2029 Debt Maturities | 4.12% | 434,000 | 15 | % | ||||||||||||||||||||||

| Rampart Commons | 5.73% | 6/10/2030 | 5,455 | |||||||||||||||||||||||

| Senior Unsecured Notes | 4.75% | 9/15/2030 | 400,000 | |||||||||||||||||||||||

| The Shoppes at Union Hill | 3.75% | 6/1/2031 | 7,659 | |||||||||||||||||||||||

| Senior Unsecured Notes | 4.95% | 12/15/2031 | 350,000 | |||||||||||||||||||||||

| Nora Plaza Shops | 3.80% | 2/1/2032 | 3,170 | |||||||||||||||||||||||

| One Loudoun – Pads G&H Residential | 5.36% | 5/1/2033 | 95,095 | |||||||||||||||||||||||

Senior Unsecured Notes(8) |

4.60% | 3/1/2034 | 350,000 | |||||||||||||||||||||||

| 2030 and beyond Debt Maturities | 4.81% | 1,211,379 | 41 | % | ||||||||||||||||||||||

| Debt discounts, premiums and issuance costs, net | (828) | |||||||||||||||||||||||||

| Total debt per consolidated balance sheet | 4.31% | $ | 2,910,057 | 99 | % | |||||||||||||||||||||

| KRG share of unconsolidated debt | ||||||||||||||||||||||||||

| Three Property Retail Portfolio | 4.09% | 7/1/2028 | $ | 10,378 | ||||||||||||||||||||||

The Corner – IN(9) |

SOFR + 286 | 12/15/2029 | 34,197 | |||||||||||||||||||||||

| Total KRG share of unconsolidated debt | 6.45% | 44,575 | 1 | % | ||||||||||||||||||||||

| Total consolidated and KRG share of unconsolidated debt | 4.34% | $ | 2,954,632 | |||||||||||||||||||||||

| 1st Quarter 2025 Supplemental Financial and Operating Statistics | 11 |

||||

| Property Name | Acquisition Date | Metropolitan Statistical Area (“MSA”) |

Grocery Anchor | Retail GLA |

Office GLA |

Acquisition Price – at KRG’s share |

||||||||||||||||||||||||||||||||

| Village Commons | January 15, 2025 | Miami | Publix | 170,976 | — | $ | 68,400 | |||||||||||||||||||||||||||||||

Legacy West(1) |

April 28, 2025 | Dallas/Ft. Worth | N/A | 344,076 | 443,553 | 408,200 | ||||||||||||||||||||||||||||||||

| Total acquisitions | 515,052 | 443,553 | $ | 476,600 | ||||||||||||||||||||||||||||||||||

| Property Name | Disposition Date | MSA | Grocery Anchor | GLA | Sales Price | |||||||||||||||||||||||||||

| Stoney Creek Commons | April 4, 2025 | Indianapolis | N/A | 84,094 | $ | 9,500 | ||||||||||||||||||||||||||

| 1st Quarter 2025 Supplemental Financial and Operating Statistics | 12 |

||||

| Project | MSA | KRG Ownership % |

Projected

Completion Date(1)

|

Total Commercial GLA |

Total Multifamily Units |

Total Project Costs – at KRG's Share |

KRG Equity Requirement |

KRG Remaining Spend |

Estimated Stabilized NOI to KRG |

Estimated

Remaining NOI

to Come Online(2)

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Active Projects | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

One Loudoun Expansion(3) |

Washington, D.C./Baltimore | 100% | Q4 2026– Q2 2027 |

119,000 | — | $81.0M–$91.0M | $65.0M–$75.0M | $61.0M–$71.0M | $4.7M–$6.2M | $2.2M–$3.7M | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Future Opportunities(4) |

||||||||||||||

| Project | MSA | Project Description | ||||||||||||

| Hamilton Crossing Centre – Phase II | Indianapolis, IN | Addition of mixed-use (multifamily, office and retail) components adjacent to the Republic Airways headquarters. | ||||||||||||

| Carillon | Washington, D.C./Baltimore | Potential of 1.2 million square feet of commercial GLA and 3,000 multifamily units for additional expansion. | ||||||||||||

| One Loudoun Hotel | Washington, D.C./Baltimore | Potential for 1.7 million square feet remaining following the planned approximately 170-room hotel. | ||||||||||||

| One Loudoun Residential | Washington, D.C./Baltimore | Potential for approximately 1,300 multifamily units remaining following the planned 400 additional multifamily units. | ||||||||||||

| Main Street Promenade | Chicago, IL | Potential of 16,000 square feet of commercial GLA for additional expansion. | ||||||||||||

| Downtown Crown | Washington, D.C./Baltimore | Potential of 42,000 square feet of commercial GLA for additional expansion. | ||||||||||||

| Edwards Multiplex – Ontario | Los Angeles, CA | Potential redevelopment of existing Regal Theatre. | ||||||||||||

| Glendale Town Center | Indianapolis, IN | Potential of 200 multifamily units for additional expansion. | ||||||||||||

| The Shops at Legacy East | Dallas/Ft. Worth, TX | Potential of 285 multifamily units for additional expansion. | ||||||||||||

| 1st Quarter 2025 Supplemental Financial and Operating Statistics | 13 |

||||

| Region/State |

Number of

Properties(1)

|

Owned GLA/NRA(2) |

Total

Weighted

Retail ABR(3)

|

% of

Weighted

Retail ABR(3)

|

||||||||||||||||||||||

| South | ||||||||||||||||||||||||||

| Texas | 44 | 7,493 | $ | 158,263 | 26.6 | % | ||||||||||||||||||||

| Florida | 31 | 3,676 | 73,392 | 12.4 | % | |||||||||||||||||||||

| Maryland | 8 | 1,410 | 34,257 | 5.8 | % | |||||||||||||||||||||

| North Carolina | 8 | 1,535 | 33,863 | 5.7 | % | |||||||||||||||||||||

| Virginia | 7 | 1,107 | 31,074 | 5.2 | % | |||||||||||||||||||||

| Georgia | 11 | 1,849 | 30,691 | 5.2 | % | |||||||||||||||||||||

| Tennessee | 3 | 580 | 9,047 | 1.5 | % | |||||||||||||||||||||

| Oklahoma | 3 | 506 | 8,526 | 1.4 | % | |||||||||||||||||||||

| South Carolina | 2 | 262 | 3,348 | 0.6 | % | |||||||||||||||||||||

| Total South | 117 | 18,418 | 382,461 | 64.4 | % | |||||||||||||||||||||

| West | ||||||||||||||||||||||||||

| Washington | 10 | 1,633 | 31,386 | 5.3 | % | |||||||||||||||||||||

| Nevada | 5 | 841 | 27,699 | 4.7 | % | |||||||||||||||||||||

| Arizona | 5 | 714 | 15,657 | 2.6 | % | |||||||||||||||||||||

| California | 2 | 533 | 12,480 | 2.1 | % | |||||||||||||||||||||

| Utah | 2 | 388 | 8,408 | 1.4 | % | |||||||||||||||||||||

| Total West | 24 | 4,109 | 95,630 | 16.1 | % | |||||||||||||||||||||

| Midwest | ||||||||||||||||||||||||||

| Indiana | 15 | 1,541 | 31,746 | 5.4 | % | |||||||||||||||||||||

| Illinois | 7 | 1,059 | 22,522 | 3.8 | % | |||||||||||||||||||||

| Michigan | 1 | 308 | 6,644 | 1.1 | % | |||||||||||||||||||||

| Missouri | 1 | 453 | 4,402 | 0.7 | % | |||||||||||||||||||||

| Ohio | 1 | 236 | 2,152 | 0.4 | % | |||||||||||||||||||||

| Total Midwest | 25 | 3,597 | 67,466 | 11.4 | % | |||||||||||||||||||||

| Northeast | ||||||||||||||||||||||||||

| New York | 7 | 713 | 26,051 | 4.4 | % | |||||||||||||||||||||

| New Jersey | 4 | 339 | 11,329 | 1.9 | % | |||||||||||||||||||||

| Massachusetts | 1 | 264 | 4,885 | 0.8 | % | |||||||||||||||||||||

| Connecticut | 1 | 206 | 4,071 | 0.7 | % | |||||||||||||||||||||

| Pennsylvania | 1 | 136 | 1,982 | 0.3 | % | |||||||||||||||||||||

| Total Northeast | 14 | 1,658 | 48,318 | 8.1 | % | |||||||||||||||||||||

Total(4) |

180 | 27,782 | $ | 593,875 | 100.0 | % | ||||||||||||||||||||

| 1st Quarter 2025 Supplemental Financial and Operating Statistics | 14 |

||||

| Credit Ratings | |||||||||||||||||||||||||||||||||||||||||||||||

| Tenant | Primary DBA/ Number of Stores |

Number

of Stores(1)

|

Total

Leased

GLA/NRA(2)

|

ABR(3) |

% of

Weighted ABR(4)

|

S&P | Moody’s | ||||||||||||||||||||||||||||||||||||||||

| 1 | The TJX Companies, Inc. | T.J. Maxx (18), Marshalls (13), HomeGoods (11), Homesense (4), T.J. Maxx & HomeGoods combined (2), Sierra (2) | 50 | 1,450 | $ | 16,645 | 2.8 | % | A | A2 | |||||||||||||||||||||||||||||||||||||

| 2 | Ross Stores, Inc. | Ross Dress for Less (32), dd’s DISCOUNTS (1) | 33 | 937 | 11,455 | 1.9 | % | BBB+ | A2 | ||||||||||||||||||||||||||||||||||||||

| 3 | Best Buy Co., Inc. | Best Buy (15), Pacific Sales (1) | 16 | 633 | 11,447 | 1.9 | % | BBB+ | A3 | ||||||||||||||||||||||||||||||||||||||

| 4 | PetSmart, Inc. | 32 | 657 | 10,991 | 1.9 | % | B+ | B1 | |||||||||||||||||||||||||||||||||||||||

| 5 | Michaels Stores, Inc. | Michaels | 28 | 631 | 8,458 | 1.4 | % | N/A | N/A | ||||||||||||||||||||||||||||||||||||||

| 6 | Gap Inc. | Old Navy (25), The Gap (3), Athleta (3), Banana Republic (2) | 33 | 448 | 8,107 | 1.4 | % | BB | Ba3 | ||||||||||||||||||||||||||||||||||||||

| 7 | Dick’s Sporting Goods, Inc. | Dick’s Sporting Goods (12), Golf Galaxy (1) | 13 | 625 | 8,084 | 1.4 | % | BBB | Baa2 | ||||||||||||||||||||||||||||||||||||||

| 8 | Publix Super Markets, Inc. | 15 | 720 | 7,724 | 1.3 | % | N/A | N/A | |||||||||||||||||||||||||||||||||||||||

| 9 | Ulta Beauty, Inc. | 29 | 299 | 6,649 | 1.1 | % | N/A | N/A | |||||||||||||||||||||||||||||||||||||||

| 10 | Total Wine & More | 15 | 355 | 6,266 | 1.1 | % | N/A | N/A | |||||||||||||||||||||||||||||||||||||||

| 11 | The Kroger Co. | Kroger (6), Harris Teeter (2), QFC (1), Smith’s (1) |

10 | 356 | 6,041 | 1.0 | % | BBB | Baa1 | ||||||||||||||||||||||||||||||||||||||

| 12 | BJ’s Wholesale Club, Inc. | 3 | 115 | 5,892 | 1.0 | % | BB+ | N/A | |||||||||||||||||||||||||||||||||||||||

| 13 | Lowe’s Companies, Inc. | 6 | — | 5,838 | 1.0 | % | BBB+ | Baa1 | |||||||||||||||||||||||||||||||||||||||

| 14 | Five Below, Inc. | 32 | 291 | 5,684 | 1.0 | % | N/A | N/A | |||||||||||||||||||||||||||||||||||||||

| 15 |

Petco Health and Wellness

Company, Inc.

|

19 | 274 | 5,181 | 0.9 | % | B | B3 | |||||||||||||||||||||||||||||||||||||||

| 16 | Fitness International, LLC | LA Fitness (4), XSport Fitness (1) | 5 | 206 | 5,098 | 0.9 | % | B | B2 | ||||||||||||||||||||||||||||||||||||||

| 17 | Kohl’s Corporation | 7 | 265 | 5,033 | 0.8 | % | BB- | Ba3 | |||||||||||||||||||||||||||||||||||||||

| 18 | Nordstrom, Inc. | Nordstrom Rack | 9 | 272 | 5,015 | 0.8 | % | BB | Ba2 | ||||||||||||||||||||||||||||||||||||||

| 19 | Burlington Stores, Inc. | 11 | 435 | 4,793 | 0.8 | % | BB+ | N/A | |||||||||||||||||||||||||||||||||||||||

| 20 | Designer Brands Inc. | DSW Designer Shoe Warehouse | 16 | 314 | 4,630 | 0.8 | % | N/A | N/A | ||||||||||||||||||||||||||||||||||||||

| 21 | The Container Store Group, Inc. | 7 | 151 | 4,627 | 0.8 | % | D | N/A | |||||||||||||||||||||||||||||||||||||||

| 22 | KnitWell Group | Chico’s (7), Talbots (7), LOFT (5), Soma (4), Ann Taylor (4), White House Black Market (4) | 31 | 134 | 4,625 | 0.8 | % | N/A | N/A | ||||||||||||||||||||||||||||||||||||||

| 23 | Trader Joe's | 11 | 135 | 4,521 | 0.8 | % | N/A | N/A | |||||||||||||||||||||||||||||||||||||||

| 24 | Sprouts Farmers Market, Inc. | 8 | 222 | 4,474 | 0.8 | % | N/A | N/A | |||||||||||||||||||||||||||||||||||||||

| 25 | Albertsons Companies, Inc. | Safeway (3), Tom Thumb (2), Jewel-Osco (1) | 6 | 281 | 4,198 | 0.7 | % | BB+ | Ba1 | ||||||||||||||||||||||||||||||||||||||

| Total Top Tenants | 445 | 10,206 | $ | 171,476 | 29.1 | % | |||||||||||||||||||||||||||||||||||||||||

| 1st Quarter 2025 Supplemental Financial and Operating Statistics | 15 |

||||

Comparable Space(1)(2) |

||||||||||||||||||||||||||||||||||||||||||||||||||

|

Category

|

Total

Leases(1)

|

Total

Sq. Ft.(1)

|

Leases | Sq. Ft. | Prior Rent PSF(3) |

New Rent PSF(4) |

Cash Rent Spread |

TI, LL Work,

Lease Commissions PSF(5)

|

||||||||||||||||||||||||||||||||||||||||||

| New Leases – Q1 2025 | 58 | 169,703 | 26 | 76,021 | $ | 32.89 | $ | 38.02 | 15.6 | % | ||||||||||||||||||||||||||||||||||||||||

| New Leases – Q4 2024 | 48 | 233,043 | 23 | 97,594 | 25.32 | 31.29 | 23.6 | % | ||||||||||||||||||||||||||||||||||||||||||

| New Leases – Q3 2024 | 63 | 284,580 | 35 | 136,874 | 24.11 | 30.11 | 24.9 | % | ||||||||||||||||||||||||||||||||||||||||||

| New Leases – Q2 2024 | 55 | 372,155 | 40 | 219,622 | 18.39 | 24.79 | 34.8 | % | ||||||||||||||||||||||||||||||||||||||||||

| Total | 224 | 1,059,481 | 124 | 530,111 | $ | 23.22 | $ | 29.26 | 26.0 | % | $ | 71.79 | ||||||||||||||||||||||||||||||||||||||

| Non-Option Renewals – Q1 2025 | 91 | 331,781 | 67 | 232,071 | $ | 23.57 | $ | 28.30 | 20.1 | % | ||||||||||||||||||||||||||||||||||||||||

| Non-Option Renewals – Q4 2024 | 93 | 447,352 | 69 | 323,610 | 20.67 | 23.65 | 14.4 | % | ||||||||||||||||||||||||||||||||||||||||||

| Non-Option Renewals – Q3 2024 | 81 | 477,515 | 59 | 236,747 | 23.69 | 26.50 | 11.9 | % | ||||||||||||||||||||||||||||||||||||||||||

| Non-Option Renewals – Q2 2024 | 69 | 314,899 | 60 | 216,422 | 22.17 | 25.34 | 14.3 | % | ||||||||||||||||||||||||||||||||||||||||||

| Total | 334 | 1,571,547 | 255 | 1,008,850 | $ | 22.37 | $ | 25.75 | 15.1 | % | $ | 4.22 | ||||||||||||||||||||||||||||||||||||||

| Option Renewals – Q1 2025 | 33 | 342,345 | 33 | 342,345 | $ | 17.15 | $ | 18.36 | 7.0 | % | ||||||||||||||||||||||||||||||||||||||||

| Option Renewals – Q4 2024 | 29 | 533,995 | 29 | 533,995 | 13.24 | 14.14 | 6.8 | % | ||||||||||||||||||||||||||||||||||||||||||

| Option Renewals – Q3 2024 | 61 | 889,891 | 61 | 889,891 | 16.51 | 17.79 | 7.7 | % | ||||||||||||||||||||||||||||||||||||||||||

| Option Renewals – Q2 2024 | 36 | 466,712 | 36 | 466,712 | 15.94 | 16.90 | 6.0 | % | ||||||||||||||||||||||||||||||||||||||||||

| Total | 159 | 2,232,943 | 159 | 2,232,943 | $ | 15.71 | $ | 16.82 | 7.1 | % | $ | — | ||||||||||||||||||||||||||||||||||||||

| Total – Q1 2025 | 182 | 843,829 | 126 | 650,437 | $ | 21.28 | $ | 24.20 | 13.7 | % | ||||||||||||||||||||||||||||||||||||||||

| Total – Q4 2024 | 170 | 1,214,390 | 121 | 955,199 | 16.99 | 19.11 | 12.5 | % | ||||||||||||||||||||||||||||||||||||||||||

| Total – Q3 2024 | 205 | 1,651,986 | 155 | 1,263,512 | 18.68 | 20.75 | 11.1 | % | ||||||||||||||||||||||||||||||||||||||||||

| Total – Q2 2024 | 160 | 1,153,766 | 136 | 902,756 | 18.03 | 20.84 | 15.6 | % | ||||||||||||||||||||||||||||||||||||||||||

| Total | 717 | 4,863,971 | 538 | 3,771,904 | $ | 18.54 | $ | 20.95 | 13.0 | % | $ | 11.21 | ||||||||||||||||||||||||||||||||||||||

| 1st Quarter 2025 Supplemental Financial and Operating Statistics | 16 |

||||

| Retail Operating Portfolio | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Expiring Retail GLA(2) |

Expiring ABR per Sq. Ft.(3) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Number of

Expiring

Leases(1)

|

Shop Tenants |

Anchor Tenants |

Expiring ABR (Pro rata) |

Expiring Ground Lease ABR (Pro rata) |

% of Total ABR (Pro rata) |

Shop Tenants |

Anchor Tenants |

Total | ||||||||||||||||||||||||||||||||||||||||||||||||

| 2025 | 274 | 604,711 | 745,724 | $ | 31,006 | $ | 1,741 | 5.5 | % | $ | 32.46 | $ | 15.72 | $ | 23.22 | |||||||||||||||||||||||||||||||||||||||||

| 2026 | 496 | 1,181,112 | 2,030,362 | 64,443 | 4,789 | 11.7 | % | 30.81 | 14.21 | 20.32 | ||||||||||||||||||||||||||||||||||||||||||||||

| 2027 | 543 | 1,219,778 | 2,241,364 | 71,028 | 5,556 | 12.9 | % | 32.83 | 14.00 | 20.63 | ||||||||||||||||||||||||||||||||||||||||||||||

| 2028 | 577 | 1,281,323 | 2,645,357 | 85,777 | 6,680 | 15.6 | % | 35.76 | 15.19 | 21.90 | ||||||||||||||||||||||||||||||||||||||||||||||

| 2029 | 566 | 1,253,770 | 2,982,740 | 87,422 | 3,572 | 15.3 | % | 35.82 | 15.14 | 21.26 | ||||||||||||||||||||||||||||||||||||||||||||||

| 2030 | 387 | 1,000,485 | 1,951,674 | 57,665 | 4,127 | 10.4 | % | 32.05 | 13.40 | 19.72 | ||||||||||||||||||||||||||||||||||||||||||||||

| 2031 | 190 | 491,001 | 796,345 | 28,359 | 2,131 | 5.1 | % | 34.07 | 14.74 | 22.11 | ||||||||||||||||||||||||||||||||||||||||||||||

| 2032 | 188 | 473,236 | 1,131,795 | 31,794 | 466 | 5.4 | % | 32.78 | 14.78 | 20.09 | ||||||||||||||||||||||||||||||||||||||||||||||

| 2033 | 202 | 525,427 | 709,638 | 29,566 | 4,156 | 5.7 | % | 35.41 | 15.50 | 23.97 | ||||||||||||||||||||||||||||||||||||||||||||||

| 2034 | 178 | 382,704 | 645,475 | 26,124 | 2,054 | 4.7 | % | 38.25 | 17.86 | 25.45 | ||||||||||||||||||||||||||||||||||||||||||||||

| Beyond | 224 | 507,739 | 1,247,123 | 40,656 | 4,763 | 7.7 | % | 38.29 | 17.27 | 23.35 | ||||||||||||||||||||||||||||||||||||||||||||||

| 3,825 | 8,921,286 | 17,127,597 | $ | 553,840 | $ | 40,035 | 100.0 | % | $ | 34.05 | $ | 14.95 | $ | 21.49 | ||||||||||||||||||||||||||||||||||||||||||

| 1st Quarter 2025 Supplemental Financial and Operating Statistics | 17 |

||||

| Cash Net Operating Income (“NOI”) | Page | Other Assets(1) |

Page | |||||||||||||||||

| GAAP property NOI (incl. ground lease revenue) | $ | 163,750 | 6 | Cash, cash equivalents and restricted cash | $ | 54,907 | 3 | |||||||||||||

| Lease termination income | (7,390) | 6, note 1 | Tenant and other receivables (net of SLR) | 54,400 | 3 | |||||||||||||||

| Non-cash revenue adjustments | (6,120) | Prepaid and other assets | 117,734 | 3 | ||||||||||||||||

| Other property-related revenue | (1,640) | 6 | ||||||||||||||||||

| Ground lease (“GL”) revenue | (10,644) | 6 | ||||||||||||||||||

| Consolidated Cash Property NOI (excl. GL) | $ | 137,956 | ||||||||||||||||||

|

Annualized Consolidated Cash Property NOI

(excl. ground leases)

|

$ | 551,824 | ||||||||||||||||||

| Adjustments to Normalize Annualized Cash NOI | Liabilities | |||||||||||||||||||

Remaining NOI to come online from development and redevelopment projects(2) |

$ | 2,950 | 13 | Mortgage and other indebtedness, net | $ | (2,910,885) | 10 | |||||||||||||

| Unconsolidated Adjusted EBITDA | 2,868 | 8 | Pro rata adjustment for joint venture debt | (34,786) | 8 | |||||||||||||||

| General and administrative expense allocable to property management activities included in property expenses ($3.8 million in Q1) | 15,200 | 6, note 3 | Accounts payable and accrued expenses | (161,438) | 3 | |||||||||||||||

| Total Adjustments | 21,018 | Other liabilities | (235,341) | 3 | ||||||||||||||||

Projected remaining under construction development/redevelopment(3) |

(66,000) | 13 | ||||||||||||||||||

|

Annualized Normalized Portfolio Cash NOI

(excl. ground leases)

|

$ | 572,842 | ||||||||||||||||||

| Annualized ground lease NOI | 42,576 | |||||||||||||||||||

Total Annualized Portfolio Cash NOI(4) |

$ | 615,418 | Common shares and Units outstanding | 224,661,888 | ||||||||||||||||

| 1st Quarter 2025 Supplemental Financial and Operating Statistics | 18 |

||||

| 1st Quarter 2025 Supplemental Financial and Operating Statistics | 19 |

||||

| 1st Quarter 2025 Supplemental Financial and Operating Statistics | 20 |

||||