| Delaware | 1-33409 | 20-0836269 | ||||||||||||

| (State or other jurisdiction | (Commission File Number) | (I.R.S. Employer | ||||||||||||

of incorporation) |

Identification No.) | |||||||||||||

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common Stock, par value $0.00001 per share | TMUS | The NASDAQ Stock Market LLC | ||||||||||||

| 3.550% Senior Notes due 2029 | TMUS29 | The NASDAQ Stock Market LLC | ||||||||||||

| 3.700% Senior Notes due 2032 | TMUS32 | The NASDAQ Stock Market LLC | ||||||||||||

| 3.150% Senior Notes due 2032 | TMUS32A | The NASDAQ Stock Market LLC | ||||||||||||

| 3.850% Senior Notes due 2036 | TMUS36 | The NASDAQ Stock Market LLC | ||||||||||||

| 3.500% Senior Notes due 2037 | TMUS37 | The NASDAQ Stock Market LLC | ||||||||||||

| 3.800% Senior Notes due 2045 | TMUS45 | The NASDAQ Stock Market LLC | ||||||||||||

| 6.250% Senior Notes due 2069 | TMUSL | The NASDAQ Stock Market LLC | ||||||||||||

| 5.500% Senior Notes due March 2070 | TMUSZ | The NASDAQ Stock Market LLC | ||||||||||||

| 5.500% Senior Notes due June 2070 | TMUSI | The NASDAQ Stock Market LLC | ||||||||||||

| Exhibit | Description | |||||||

| 104 | Cover Page Interactive Data File (formatted as inline XBRL and contained in Exhibit 101) | |||||||

| SIGNATURES | |||||||||||

T-MOBILE US, INC. |

|||||||||||

| October 23, 2025 | /s/ Peter Osvaldik | ||||||||||

| Peter Osvaldik Executive Vice President and Chief Financial Officer |

|||||||||||

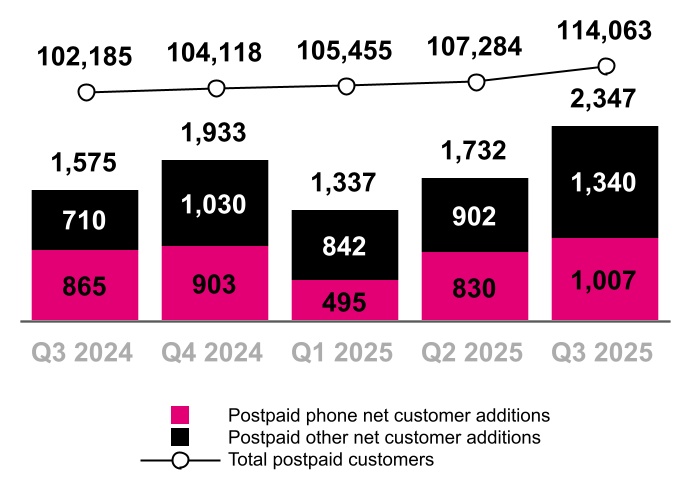

| Quarter | Nine Months Ended September 30, | ||||||||||||||||||||||||||||

| (in thousands, except churn) | Q3 2025 | Q2 2025 | Q3 2024 | 2025 | 2024 | ||||||||||||||||||||||||

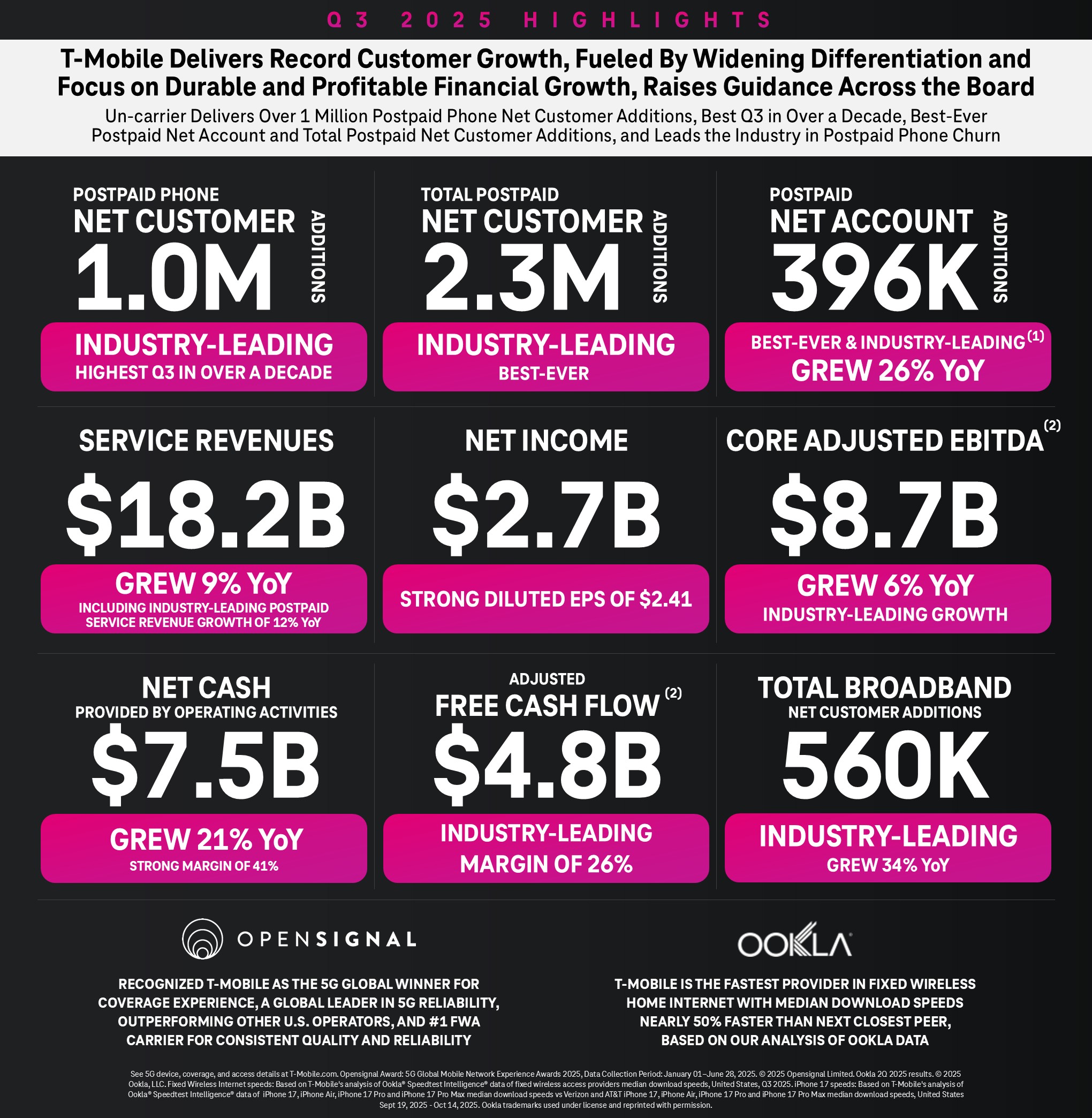

| Postpaid net account additions | 396 | 318 | 315 | 919 | 834 | ||||||||||||||||||||||||

| Total net customer additions | 2,390 | 1,771 | 1,599 | 5,543 | 4,288 | ||||||||||||||||||||||||

Postpaid net customer additions (2) |

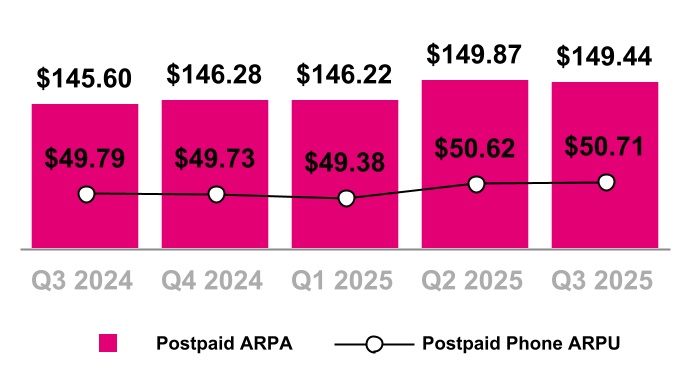

2,347 | 1,732 | 1,575 | 5,416 | 4,133 | ||||||||||||||||||||||||

Postpaid phone net customer additions (3) |

1,007 | 830 | 865 | 2,332 | 2,174 | ||||||||||||||||||||||||

Postpaid other net customer additions (2) (3) (4) (5) |

1,340 | 902 | 710 | 3,084 | 1,959 | ||||||||||||||||||||||||

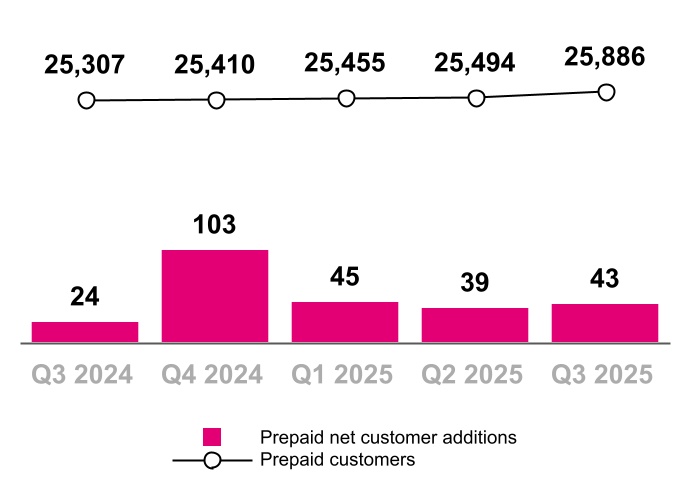

Prepaid net customer additions (2) (3) (6) |

43 | 39 | 24 | 127 | 155 | ||||||||||||||||||||||||

Total customers, end of period (2) |

139,949 | 132,778 | 127,492 | 139,949 | 127,492 | ||||||||||||||||||||||||

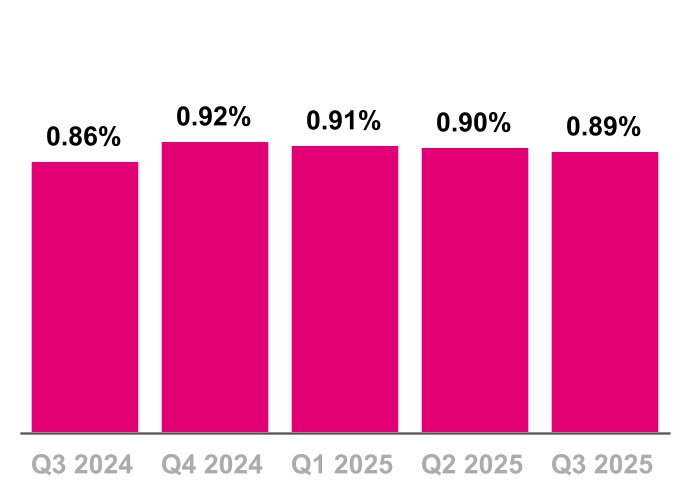

| Postpaid phone churn | 0.89 | % | 0.90 | % | 0.86 | % | 0.90 | % | 0.84 | % | |||||||||||||||||||

| Prepaid churn | 2.77 | % | 2.65 | % | 2.78 | % | 2.70 | % | 2.69 | % | |||||||||||||||||||

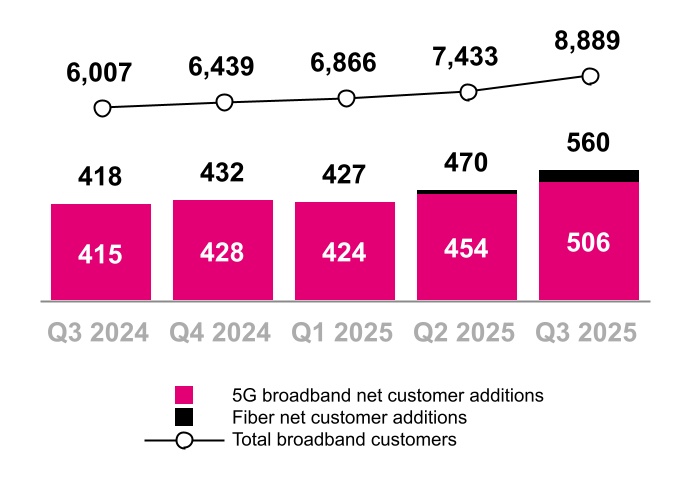

| Total broadband net customer additions | 560 | 470 | 418 | 1,457 | 1,230 | ||||||||||||||||||||||||

| 5G broadband net customer additions | 506 | 454 | 415 | 1,384 | 1,226 | ||||||||||||||||||||||||

| Total broadband customers, end of period | 8,889 | 7,433 | 6,007 | 8,889 | 6,007 | ||||||||||||||||||||||||

| Total 5G broadband customers, end of period | 7,955 | 7,308 | 6,002 | 7,955 | 6,002 | ||||||||||||||||||||||||

| Quarter | Nine Months Ended September 30, |

Q3 2025

vs.

Q2 2025

|

Q3 2025

vs.

Q3 2024

|

YTD 2025

vs.

YTD 2024

|

|||||||||||||||||||||||||||||||||||||||||||

| (in millions, except EPS) | Q3 2025 | Q2 2025 | Q3 2024 | 2025 | 2024 | ||||||||||||||||||||||||||||||||||||||||||

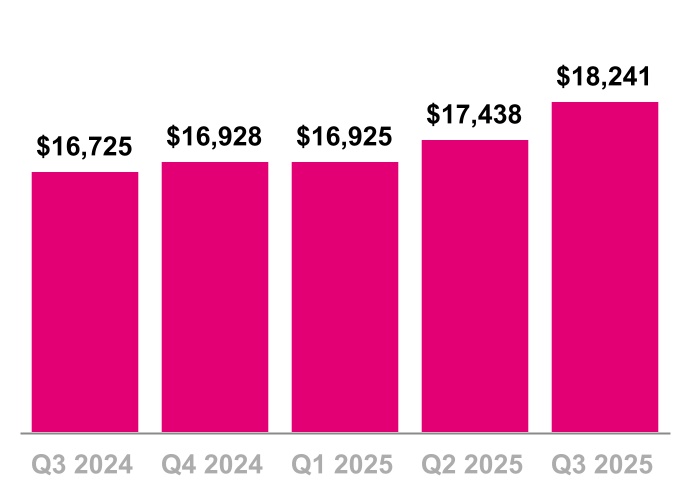

| Total service revenues | $ | 18,241 | $ | 17,438 | $ | 16,725 | $ | 52,604 | $ | 49,250 | 4.6 | % | 9.1 | % | 6.8 | % | |||||||||||||||||||||||||||||||

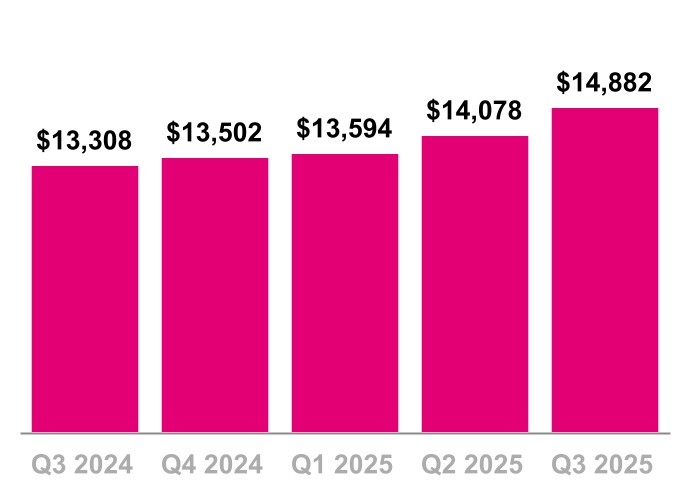

| Postpaid service revenues | 14,882 | 14,078 | 13,308 | 42,554 | 38,838 | 5.7 | % | 11.8 | % | 9.6 | % | ||||||||||||||||||||||||||||||||||||

| Total revenues | 21,957 | 21,132 | 20,162 | 63,975 | 59,528 | 3.9 | % | 8.9 | % | 7.5 | % | ||||||||||||||||||||||||||||||||||||

| Net income | 2,714 | 3,222 | 3,059 | 8,889 | 8,358 | (15.8) | % | (11.3) | % | 6.4 | % | ||||||||||||||||||||||||||||||||||||

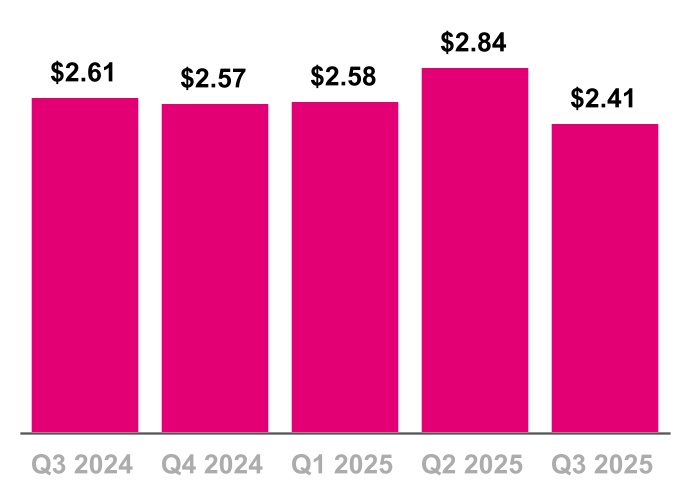

| Diluted EPS | 2.41 | 2.84 | 2.61 | 7.82 | 7.10 | (15.1) | % | (7.7) | % | 10.1 | % | ||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA | 8,684 | 8,547 | 8,243 | 25,490 | 23,948 | 1.6 | % | 5.3 | % | 6.4 | % | ||||||||||||||||||||||||||||||||||||

| Core Adjusted EBITDA | 8,680 | 8,541 | 8,222 | 25,479 | 23,866 | 1.6 | % | 5.6 | % | 6.8 | % | ||||||||||||||||||||||||||||||||||||

Net cash provided by operating activities (2) |

7,457 | 6,992 | 6,139 | 21,296 | 16,744 | 6.7 | % | 21.5 | % | 27.2 | % | ||||||||||||||||||||||||||||||||||||

| Cash purchases of property and equipment, including capitalized interest | 2,639 | 2,396 | 1,961 | 7,486 | 6,628 | 10.1 | % | 34.6 | % | 12.9 | % | ||||||||||||||||||||||||||||||||||||

Adjusted Free Cash Flow |

4,818 | 4,596 | 5,162 | 13,810 | 12,948 | 4.8 | % | (6.7) | % | 6.7 | % | ||||||||||||||||||||||||||||||||||||

| (in millions, except Postpaid net customer additions and Effective tax rate) | Previous | Current | Change (Mid-point) | ||||||||||||||||||||||||||

| Postpaid net customer additions (thousands) | 6,100 | 6,400 | 7,200 | 7,400 | 1,050 | ||||||||||||||||||||||||

Net income (1) |

N/A | N/A | N/A | N/A | N/A | ||||||||||||||||||||||||

| Effective tax rate | 24% | 26% | 23% | 24% | (150) bps | ||||||||||||||||||||||||

Core Adjusted EBITDA (2) |

$33,300 | $33,700 | $33,700 | $33,900 | $300 | ||||||||||||||||||||||||

| Net cash provided by operating activities | 27,100 | 27,500 | 27,800 | 28,000 | 600 | ||||||||||||||||||||||||

Capital expenditures (3) |

~9,500 | ~10,000 | 500 | ||||||||||||||||||||||||||

| Adjusted Free Cash Flow | 17,600 | 18,000 | 17,800 | 18,000 | 100 | ||||||||||||||||||||||||

| Quarter | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in millions) | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | 2024 | 2025 | ||||||||||||||||||||||||||||||||||||||||||||

| Net income | $ | 2,374 | $ | 2,925 | $ | 3,059 | $ | 2,981 | $ | 2,953 | $ | 3,222 | $ | 2,714 | $ | 8,358 | $ | 8,889 | |||||||||||||||||||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest expense, net | 880 | 854 | 836 | 841 | 916 | 922 | 924 | 2,570 | 2,762 | ||||||||||||||||||||||||||||||||||||||||||||

| Other (income) expense, net | (20) | 8 | (7) | (94) | 46 | 11 | 78 | (19) | 135 | ||||||||||||||||||||||||||||||||||||||||||||

| Income tax expense | 764 | 843 | 908 | 858 | 885 | 1,058 | 814 | 2,515 | 2,757 | ||||||||||||||||||||||||||||||||||||||||||||

| Operating income | 3,998 | 4,630 | 4,796 | 4,586 | 4,800 | 5,213 | 4,530 | 13,424 | 14,543 | ||||||||||||||||||||||||||||||||||||||||||||

| Depreciation and amortization | 3,371 | 3,248 | 3,151 | 3,149 | 3,198 | 3,146 | 3,408 | 9,770 | 9,752 | ||||||||||||||||||||||||||||||||||||||||||||

Stock-based compensation (1) |

140 | 147 | 143 | 156 | 168 | 178 | 217 | 430 | 563 | ||||||||||||||||||||||||||||||||||||||||||||

Merger-related costs (gain), net (2) (3) |

130 | (9) | 16 | 10 | 14 | 33 | 73 | 137 | 120 | ||||||||||||||||||||||||||||||||||||||||||||

Legal-related expenses (recoveries), net (4) |

— | 15 | 1 | (105) | 6 | (4) | 8 | 16 | 10 | ||||||||||||||||||||||||||||||||||||||||||||

| Impairment expense | — | — | — | — | — | — | 278 | — | 278 | ||||||||||||||||||||||||||||||||||||||||||||

Other, net (5) |

13 | 22 | 136 | 120 | 73 | (19) | 170 | 171 | 224 | ||||||||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA | 7,652 | 8,053 | 8,243 | 7,916 | 8,259 | 8,547 | 8,684 | 23,948 | 25,490 | ||||||||||||||||||||||||||||||||||||||||||||

Lease revenues |

(35) | (26) | (21) | (11) | (1) | (6) | (4) | (82) | (11) | ||||||||||||||||||||||||||||||||||||||||||||

| Core Adjusted EBITDA | $ | 7,617 | $ | 8,027 | $ | 8,222 | $ | 7,905 | $ | 8,258 | $ | 8,541 | $ | 8,680 | $ | 23,866 | $ | 25,479 | |||||||||||||||||||||||||||||||||||

| Quarter | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in millions, except percentages) | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | 2024 | 2025 | ||||||||||||||||||||||||||||||||||||||||||||

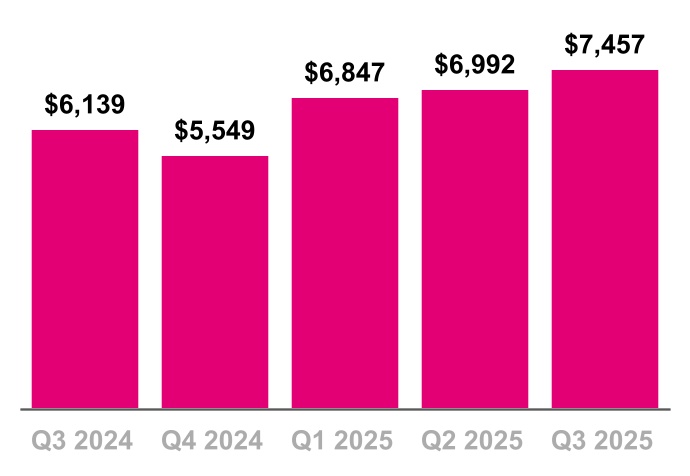

| Net cash provided by operating activities | $ | 5,084 | $ | 5,521 | $ | 6,139 | $ | 5,549 | $ | 6,847 | $ | 6,992 | $ | 7,457 | $ | 16,744 | $ | 21,296 | |||||||||||||||||||||||||||||||||||

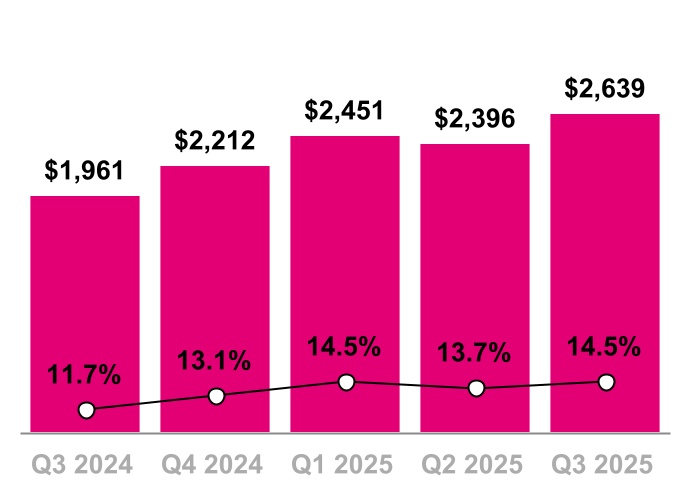

| Cash purchases of property and equipment, including capitalized interest | (2,627) | (2,040) | (1,961) | (2,212) | (2,451) | (2,396) | (2,639) | (6,628) | (7,486) | ||||||||||||||||||||||||||||||||||||||||||||

| Proceeds related to beneficial interests in securitization transactions | 890 | 958 | 984 | 747 | — | — | — | 2,832 | — | ||||||||||||||||||||||||||||||||||||||||||||

Adjusted Free Cash Flow |

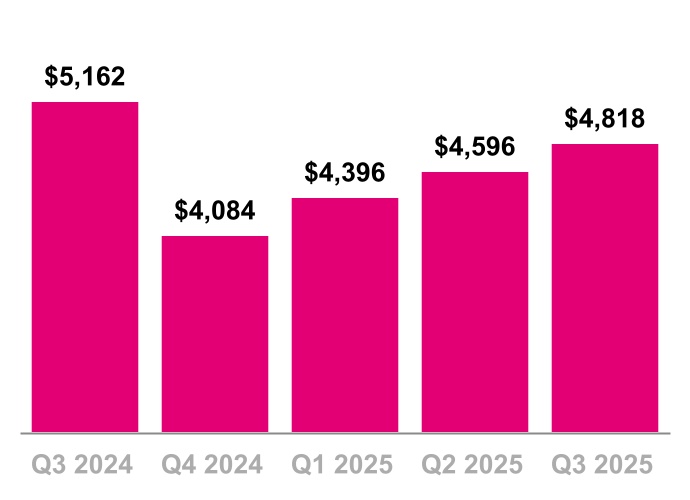

$ | 3,347 | $ | 4,439 | $ | 5,162 | $ | 4,084 | $ | 4,396 | $ | 4,596 | $ | 4,818 | $ | 12,948 | $ | 13,810 | |||||||||||||||||||||||||||||||||||

| Net cash provided by operating activities margin (Net cash provided by operating activities divided by Service revenues) | 31.6 | % | 33.6 | % | 36.7 | % | 32.8 | % | 40.5 | % | 40.1 | % | 40.9 | % | 34.0 | % | 40.5 | % | |||||||||||||||||||||||||||||||||||

| Adjusted Free Cash Flow margin (Adjusted Free Cash Flow divided by Service revenues) | 20.8 | % | 27.0 | % | 30.9 | % | 24.1 | % | 26.0 | % | 26.4 | % | 26.4 | % | 26.3 | % | 26.3 | % | |||||||||||||||||||||||||||||||||||

| FY 2025 | |||||||||||

| (in millions) | Guidance Range | ||||||||||

| Net cash provided by operating activities | $ | 27,800 | $ | 28,000 | |||||||

| Cash purchases of property and equipment, including capitalized interest | (10,000) | (10,000) | |||||||||

| Adjusted Free Cash Flow | $ | 17,800 | $ | 18,000 | |||||||

| FY 2025 | |||||||||||

| (in millions) | Guidance Range | ||||||||||

| Net cash provided by operating activities | $ | 27,100 | $ | 27,500 | |||||||

| Cash purchases of property and equipment, including capitalized interest | (9,500) | (9,500) | |||||||||

| Adjusted Free Cash Flow | $ | 17,600 | $ | 18,000 | |||||||

| Quarter | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

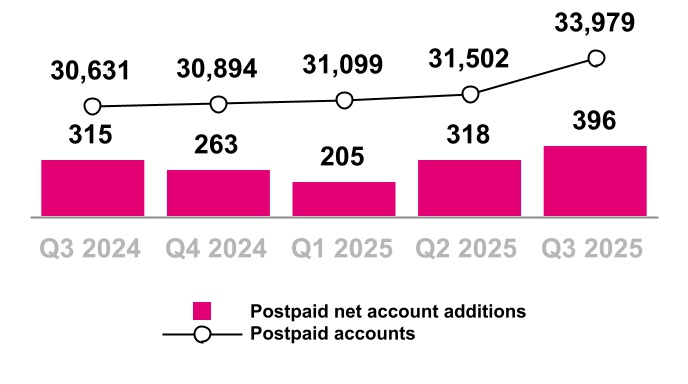

| (in dollars) | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | 2024 | 2025 | ||||||||||||||||||||||||||||||||||||||||||||

| Postpaid ARPA | $ | 140.88 | $ | 142.54 | $ | 145.60 | $ | 146.28 | $ | 146.22 | $ | 149.87 | $ | 149.44 | $ | 143.02 | $ | 148.54 | |||||||||||||||||||||||||||||||||||

| Postpaid phone ARPU | 48.79 | 49.07 | 49.79 | 49.73 | 49.38 | 50.62 | 50.71 | 49.22 | 50.25 | ||||||||||||||||||||||||||||||||||||||||||||

| Prepaid ARPU | 37.18 | 35.94 | 35.81 | 35.49 | 34.67 | 34.63 | 33.93 | 36.27 | 34.41 | ||||||||||||||||||||||||||||||||||||||||||||

|

2 |

||||

| Highlights | ||||||||

| Customer Metrics | ||||||||

| Financial Metrics | ||||||||

| Capital Structure | ||||||||

| Guidance | ||||||||

| Contacts | ||||||||

| Financial and Operational Tables | ||||||||

| ||

|

3 |

||||

| ||||||||

| ||

|

4 |

||||

|

Postpaid Accounts

(in thousands)

|

|||||

| Year-Over-Year | ||

| Sequential | ||

| Year-Over-Year | ||

| Sequential | ||

| Postpaid ARPA & Postpaid Phone ARPU | |||||

| ||

|

5 |

||||

|

Postpaid Customers

(in thousands)

|

|||||

| Year-Over-Year | ||

| Sequential | ||

| Year-Over-Year | ||

| Sequential | ||

| Postpaid Phone Churn | |||||

| ||

|

6 |

||||

|

Prepaid Customers

(in thousands)

|

|||||

| Year-Over-Year | ||

| Sequential | ||

| Year-Over-Year | ||

| Sequential | ||

|

Broadband Customers

(in thousands)

|

|||||

| ||

|

7 |

||||

|

Service Revenues

($ in millions)

|

|||||

| Year-Over-Year | ||

| Sequential | ||

| Year-Over-Year | ||

| Sequential | ||

|

Postpaid Service Revenues

($ in millions)

|

|||||

| ||

|

8 |

||||

|

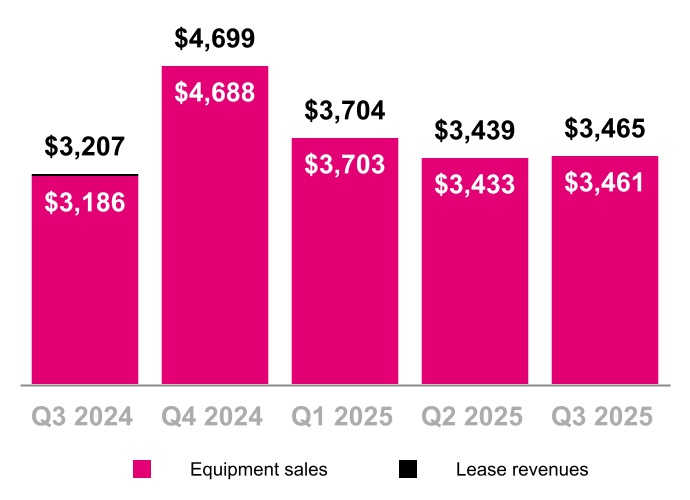

Equipment Revenues

($ in millions)

|

|||||

| Year-Over-Year | ||

| Sequential | ||

| Year-Over-Year | ||

| Sequential | ||

|

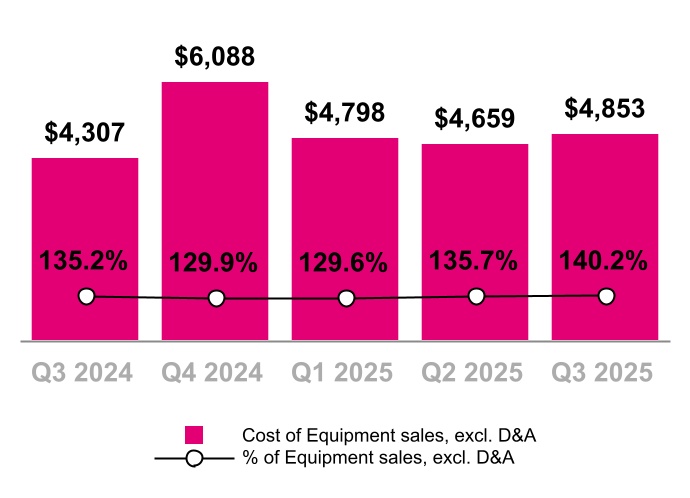

Cost of Equipment Sales, exclusive of D&A

($ in millions, % of Equipment sales)

|

|||||

| ||

|

9 |

||||

|

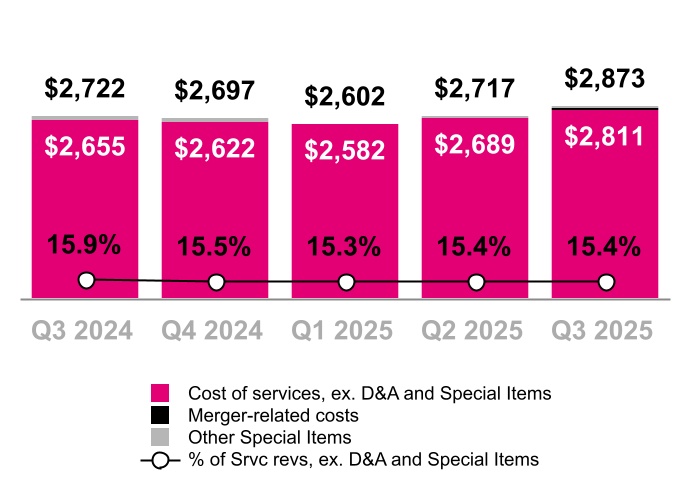

Cost of Services, exclusive of D&A

($ in millions, % of Service revenues)

|

|||||

| Year-Over-Year | ||

| Sequential | ||

| Year-Over-Year | ||

| Sequential | ||

|

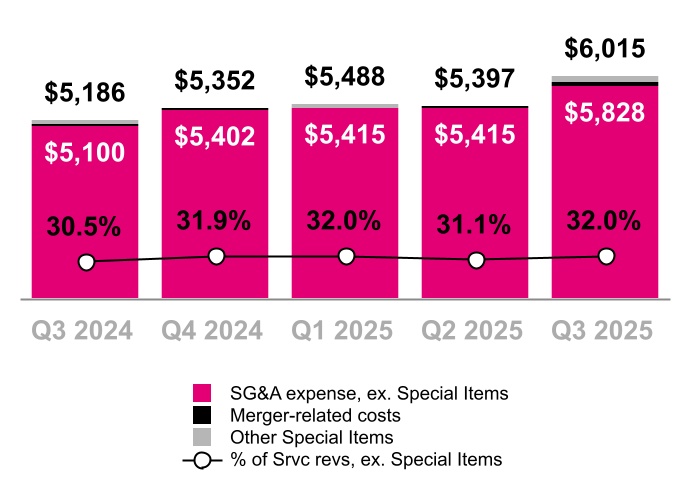

Selling, General and Administrative (SG&A) Expense

($ in millions, % of Service revenues)

|

|||||

| ||

|

10 |

||||

|

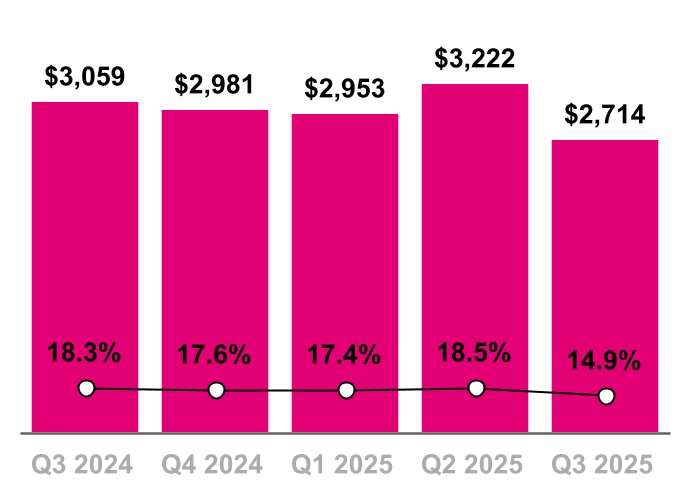

Net Income

($ in millions, % of Service revenues)

|

|||||

|

Diluted Earnings Per Share

(Diluted EPS)

|

|||||

| Year-Over-Year | ||

| Sequential | ||

| ||

|

11 |

||||

|

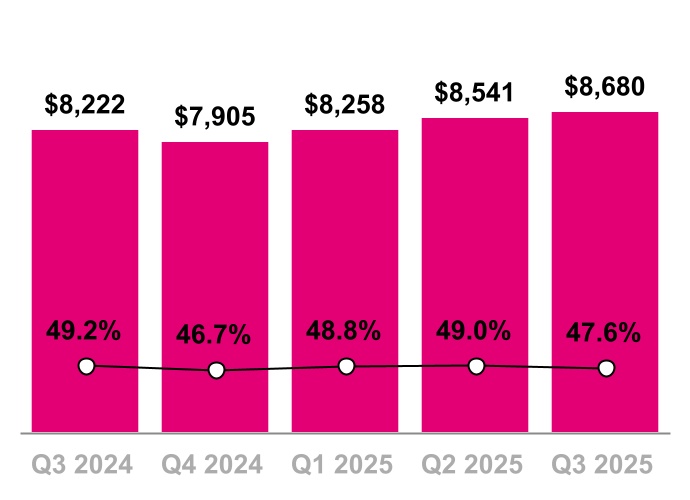

Core Adjusted EBITDA*

($ in millions, % of Service revenues)

|

|||||

| Year-Over-Year | ||

| Sequential | ||

| Year-Over-Year | ||

| Sequential | ||

|

Net Cash Provided by Operating Activities

($ in millions)

|

|||||

| ||

|

12 |

||||

|

Cash Purchases of Property and Equipment, incl. Capitalized Interest

($ in millions, % of Service revenues)

|

|||||

| Year-Over-Year | ||

| Sequential | ||

| Year-Over-Year | ||

| Sequential | ||

|

Adjusted Free Cash Flow

($ in millions)

|

|||||

| ||

|

13 |

||||

|

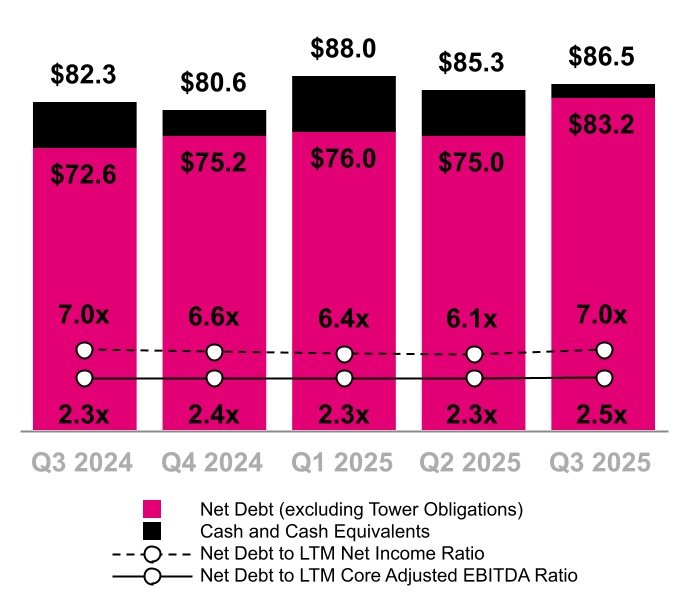

Total Debt (Excluding Tower Obligations),

Net Debt (Excluding Tower Obligations), and

Net Debt to LTM Net Income and Core Adj. EBITDA Ratios

($ in billions)

|

|||||

|

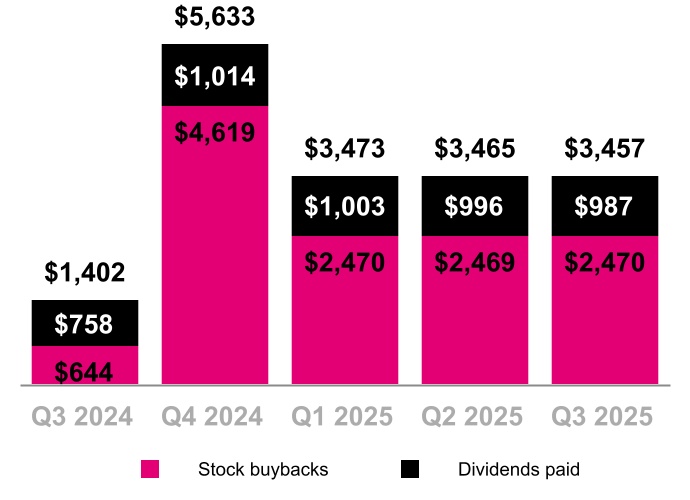

Stockholder Returns

($ in millions)

|

|||||

| ||

|

14 |

||||

| Metric | Previous | Revised | Change at Midpoint | ||||||||

| Postpaid net customer additions | 6.1 to 6.4 million |

7.2 to 7.4 million |

1.05 million |

||||||||

Net income (1) |

N/A | N/A | N/A | ||||||||

| Effective tax rate | 24% to 26% |

23% to 24% |

(150) bps | ||||||||

Core Adjusted EBITDA (2) |

$33.3 to $33.7 billion |

$33.7 to $33.9 billion |

$300 million |

||||||||

| Net cash provided by operating activities | $27.1 to $27.5 billion |

$27.8 to $28.0 billion |

$600 million |

||||||||

Capital expenditures (3) |

~$9.5 billion |

~$10.0 billion |

$500 million |

||||||||

| Adjusted Free Cash Flow | $17.6 to $18.0 billion |

$17.8 to $18.0 billion |

$100 million |

||||||||

| ||

|

15 |

||||

|

|

|

||||||||||||||||||

| Cathy Yao | Matthew Hale | Jon Lanterman | ||||||||||||||||||

| Senior Vice President | Senior Director | Senior Director | ||||||||||||||||||

| Investor Relations | Investor Relations | Investor Relations | ||||||||||||||||||

|

|

|

|

|||||||||||||||||||||||

| Chris Lo | Rose Kopecky | Charles Buffum | Danna Tao | |||||||||||||||||||||||

| Investor Relations | Investor Relations | Investor Relations | Investor Relations | |||||||||||||||||||||||

| Manager | Manager | Manager | Manager | |||||||||||||||||||||||

| ||

|

16 |

||||

| (in millions, except share and per share amounts) | September 30, 2025 |

December 31, 2024 |

|||||||||

| Assets | |||||||||||

| Current assets | |||||||||||

| Cash and cash equivalents | $ | 3,310 | $ | 5,409 | |||||||

| Accounts receivable, net of allowance for credit losses of $206 and $176 | 5,084 | 4,276 | |||||||||

Equipment installment plan receivables, net of allowance for credit losses and imputed discount of $646 and $656 |

4,599 | 4,379 | |||||||||

| Inventory | 2,370 | 1,607 | |||||||||

| Prepaid expenses | 1,128 | 880 | |||||||||

| Other current assets | 5,212 | 1,853 | |||||||||

| Total current assets | 21,703 | 18,404 | |||||||||

| Property and equipment, net | 38,718 | 38,533 | |||||||||

| Operating lease right-of-use assets | 26,070 | 25,398 | |||||||||

| Financing lease right-of-use assets | 2,955 | 3,091 | |||||||||

| Goodwill | 13,690 | 13,005 | |||||||||

| Spectrum licenses | 97,749 | 100,558 | |||||||||

| Other intangible assets, net | 4,117 | 2,512 | |||||||||

Equipment installment plan receivables due after one year, net of allowance for credit losses and imputed discount of $186 and $158 |

2,316 | 2,209 | |||||||||

| Other assets | 9,862 | 4,325 | |||||||||

| Total assets | $ | 217,180 | $ | 208,035 | |||||||

| Liabilities and Stockholders' Equity | |||||||||||

| Current liabilities | |||||||||||

| Accounts payable and accrued liabilities | $ | 9,193 | $ | 8,463 | |||||||

| Short-term debt | 6,333 | 4,068 | |||||||||

| Deferred revenue | 1,487 | 1,222 | |||||||||

| Short-term operating lease liabilities | 3,550 | 3,281 | |||||||||

| Short-term financing lease liabilities | 1,157 | 1,175 | |||||||||

| Other current liabilities | 2,581 | 1,965 | |||||||||

| Total current liabilities | 24,301 | 20,174 | |||||||||

| Long-term debt | 76,365 | 72,700 | |||||||||

| Long-term debt to affiliates | 1,498 | 1,497 | |||||||||

| Tower obligations | 3,568 | 3,664 | |||||||||

| Deferred tax liabilities | 19,222 | 16,700 | |||||||||

| Operating lease liabilities | 26,780 | 26,408 | |||||||||

| Financing lease liabilities | 1,186 | 1,151 | |||||||||

| Other long-term liabilities | 3,783 | 4,000 | |||||||||

| Total long-term liabilities | 132,402 | 126,120 | |||||||||

| Commitments and contingencies | |||||||||||

| Stockholders' equity | |||||||||||

| Common stock, par value $0.00001 per share, 2,000,000,000 shares authorized; 1,275,435,436 and 1,271,074,364 shares issued, 1,118,506,240 and 1,144,579,681 shares outstanding | — | — | |||||||||

| Additional paid-in capital | 69,267 | 68,798 | |||||||||

| Treasury stock, at cost, 156,929,196 and 126,494,683 shares issued | (28,064) | (20,584) | |||||||||

| Accumulated other comprehensive loss | (881) | (857) | |||||||||

| Retained earnings | 20,155 | 14,384 | |||||||||

| Total stockholders' equity | 60,477 | 61,741 | |||||||||

| Total liabilities and stockholders' equity | $ | 217,180 | $ | 208,035 | |||||||

| ||

|

17 |

||||

| Three Months Ended | Nine Months Ended September 30, | ||||||||||||||||||||||||||||

| (in millions, except share and per share amounts) | September 30, 2025 |

June 30, 2025 |

September 30, 2024 |

2025 | 2024 | ||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||

| Postpaid revenues | $ | 14,882 | $ | 14,078 | $ | 13,308 | $ | 42,554 | $ | 38,838 | |||||||||||||||||||

| Prepaid revenues | 2,625 | 2,643 | 2,716 | 7,911 | 7,711 | ||||||||||||||||||||||||

| Wholesale and other service revenues | 734 | 717 | 701 | 2,139 | 2,701 | ||||||||||||||||||||||||

| Total service revenues | 18,241 | 17,438 | 16,725 | 52,604 | 49,250 | ||||||||||||||||||||||||

| Equipment revenues | 3,465 | 3,439 | 3,207 | 10,608 | 9,564 | ||||||||||||||||||||||||

| Other revenues | 251 | 255 | 230 | 763 | 714 | ||||||||||||||||||||||||

| Total revenues | 21,957 | 21,132 | 20,162 | 63,975 | 59,528 | ||||||||||||||||||||||||

| Operating expenses | |||||||||||||||||||||||||||||

| Cost of services, exclusive of depreciation and amortization shown separately below | 2,873 | 2,717 | 2,722 | 8,192 | 8,074 | ||||||||||||||||||||||||

| Cost of equipment sales, exclusive of depreciation and amortization shown separately below | 4,853 | 4,659 | 4,307 | 14,310 | 12,794 | ||||||||||||||||||||||||

| Selling, general and administrative | 6,015 | 5,397 | 5,186 | 16,900 | 15,466 | ||||||||||||||||||||||||

| Impairment expense | 278 | — | — | 278 | — | ||||||||||||||||||||||||

| Depreciation and amortization | 3,408 | 3,146 | 3,151 | 9,752 | 9,770 | ||||||||||||||||||||||||

| Total operating expenses | 17,427 | 15,919 | 15,366 | 49,432 | 46,104 | ||||||||||||||||||||||||

| Operating income | 4,530 | 5,213 | 4,796 | 14,543 | 13,424 | ||||||||||||||||||||||||

| Other expense, net | |||||||||||||||||||||||||||||

| Interest expense, net | (924) | (922) | (836) | (2,762) | (2,570) | ||||||||||||||||||||||||

| Other (expense) income, net | (78) | (11) | 7 | (135) | 19 | ||||||||||||||||||||||||

| Total other expense, net | (1,002) | (933) | (829) | (2,897) | (2,551) | ||||||||||||||||||||||||

| Income before income taxes | 3,528 | 4,280 | 3,967 | 11,646 | 10,873 | ||||||||||||||||||||||||

| Income tax expense | (814) | (1,058) | (908) | (2,757) | (2,515) | ||||||||||||||||||||||||

| Net income | $ | 2,714 | $ | 3,222 | $ | 3,059 | $ | 8,889 | $ | 8,358 | |||||||||||||||||||

| Net income | $ | 2,714 | $ | 3,222 | $ | 3,059 | $ | 8,889 | $ | 8,358 | |||||||||||||||||||

| Other comprehensive income (loss), net of tax | |||||||||||||||||||||||||||||

Reclassification of loss from cash flow hedges, net of tax effect of $16, $16, $15, $48 and $45 |

48 | 47 | 44 | 141 | 130 | ||||||||||||||||||||||||

(Losses) gains on fair value hedges, net of tax effect of $(7), $13, $(5), $(55) and $(15) |

(20) | 37 | (12) | (160) | (42) | ||||||||||||||||||||||||

Unrealized loss on foreign currency translation adjustment, net of tax effect of $0, $0, $0, $0 and $0 |

— | (1) | — | (1) | — | ||||||||||||||||||||||||

Amortization of actuarial gain, net of tax effect of $0, $(1), $(2), $(1) and $(5) |

(1) | (2) | (4) | (4) | (13) | ||||||||||||||||||||||||

| Other comprehensive income (loss) | 27 | 81 | 28 | (24) | 75 | ||||||||||||||||||||||||

| Total comprehensive income | $ | 2,741 | $ | 3,303 | $ | 3,087 | $ | 8,865 | $ | 8,433 | |||||||||||||||||||

| Earnings per share | |||||||||||||||||||||||||||||

| Basic | $ | 2.42 | $ | 2.84 | $ | 2.62 | $ | 7.84 | $ | 7.12 | |||||||||||||||||||

| Diluted | $ | 2.41 | $ | 2.84 | $ | 2.61 | $ | 7.82 | $ | 7.10 | |||||||||||||||||||

| Weighted-average shares outstanding | |||||||||||||||||||||||||||||

| Basic | 1,123,754,096 | 1,132,760,465 | 1,166,961,755 | 1,133,743,367 | 1,174,069,336 | ||||||||||||||||||||||||

| Diluted | 1,126,627,708 | 1,134,846,966 | 1,170,649,561 | 1,136,920,521 | 1,177,637,145 | ||||||||||||||||||||||||

| ||

|

18 |

||||

| Three Months Ended | Nine Months Ended September 30, | ||||||||||||||||||||||||||||

| (in millions) | September 30, 2025 |

June 30, 2025 |

September 30, 2024 |

2025 | 2024 | ||||||||||||||||||||||||

| Operating activities | |||||||||||||||||||||||||||||

| Net income | $ | 2,714 | $ | 3,222 | $ | 3,059 | $ | 8,889 | $ | 8,358 | |||||||||||||||||||

| Adjustments to reconcile net income to net cash provided by operating activities | |||||||||||||||||||||||||||||

| Depreciation and amortization | 3,408 | 3,146 | 3,151 | 9,752 | 9,770 | ||||||||||||||||||||||||

| Stock-based compensation expense | 227 | 200 | 170 | 613 | 474 | ||||||||||||||||||||||||

| Deferred income tax expense | 797 | 937 | 817 | 2,505 | 2,279 | ||||||||||||||||||||||||

| Bad debt expense | 337 | 265 | 299 | 925 | 836 | ||||||||||||||||||||||||

| Losses from sales of receivables | 17 | 19 | 23 | 58 | 69 | ||||||||||||||||||||||||

| Impairment expense | 278 | — | — | 278 | — | ||||||||||||||||||||||||

| Changes in operating assets and liabilities | |||||||||||||||||||||||||||||

| Accounts receivable | (366) | (338) | (734) | (797) | (2,436) | ||||||||||||||||||||||||

| Equipment installment plan receivables | 44 | 65 | (72) | 133 | 360 | ||||||||||||||||||||||||

| Inventory | (537) | 264 | (448) | (591) | (57) | ||||||||||||||||||||||||

| Operating lease right-of-use assets | 929 | 883 | 877 | 2,667 | 2,605 | ||||||||||||||||||||||||

| Other current and long-term assets | (322) | (671) | (19) | (983) | (275) | ||||||||||||||||||||||||

| Accounts payable and accrued liabilities | 890 | 107 | (165) | 729 | (1,861) | ||||||||||||||||||||||||

| Short- and long-term operating lease liabilities | (936) | (886) | (805) | (2,720) | (2,970) | ||||||||||||||||||||||||

| Other current and long-term liabilities | (239) | (82) | (125) | (409) | (657) | ||||||||||||||||||||||||

| Other, net | 216 | (139) | 111 | 247 | 249 | ||||||||||||||||||||||||

| Net cash provided by operating activities | 7,457 | 6,992 | 6,139 | 21,296 | 16,744 | ||||||||||||||||||||||||

| Investing activities | |||||||||||||||||||||||||||||

Purchases of property and equipment, including capitalized interest of $(13), $(10), $(9), $(33) and $(26) |

(2,639) | (2,396) | (1,961) | (7,486) | (6,628) | ||||||||||||||||||||||||

| Purchases of spectrum licenses and other intangible assets, including deposits | (1,590) | (842) | (2,419) | (2,505) | (2,636) | ||||||||||||||||||||||||

| Proceeds from the sale of property, equipment and intangible assets | 18 | 2,066 | 15 | 2,091 | 38 | ||||||||||||||||||||||||

| Proceeds related to beneficial interests in securitization transactions | — | — | 984 | — | 2,832 | ||||||||||||||||||||||||

| Acquisition of companies, net of cash acquired | (2,797) | 1 | — | (3,523) | (390) | ||||||||||||||||||||||||

| Investments in unconsolidated affiliates, net | (3,072) | (908) | — | (4,055) | — | ||||||||||||||||||||||||

| Other, net | (59) | 520 | 74 | 371 | 12 | ||||||||||||||||||||||||

| Net cash used in investing activities | (10,139) | (1,559) | (3,307) | (15,107) | (6,772) | ||||||||||||||||||||||||

| Financing activities | |||||||||||||||||||||||||||||

| Proceeds from issuance of long-term debt, net | 498 | (6) | 2,480 | 8,266 | 8,089 | ||||||||||||||||||||||||

| Repayments of financing lease obligations | (318) | (331) | (347) | (964) | (1,025) | ||||||||||||||||||||||||

| Repayments of long-term debt | (828) | (3,257) | (223) | (4,564) | (3,169) | ||||||||||||||||||||||||

| Repurchases of common stock | (2,479) | (2,555) | (560) | (7,528) | (6,541) | ||||||||||||||||||||||||

| Dividends on common stock | (987) | (996) | (758) | (2,986) | (2,286) | ||||||||||||||||||||||||

| Tax withholdings on share-based awards | (92) | (30) | (36) | (394) | (244) | ||||||||||||||||||||||||

| Other, net | (32) | (30) | (49) | (80) | (117) | ||||||||||||||||||||||||

| Net cash (used in) provided by financing activities | (4,238) | (7,205) | 507 | (8,250) | (5,293) | ||||||||||||||||||||||||

| Effect of exchange rate changes on cash and cash equivalents, including restricted cash | — | 13 | — | 13 | — | ||||||||||||||||||||||||

| Change in cash and cash equivalents, including restricted cash | (6,920) | (1,759) | 3,339 | (2,048) | 4,679 | ||||||||||||||||||||||||

| Cash and cash equivalents, including restricted cash | |||||||||||||||||||||||||||||

| Beginning of period | 10,585 | 12,344 | 6,647 | 5,713 | 5,307 | ||||||||||||||||||||||||

| End of period | $ | 3,665 | $ | 10,585 | $ | 9,986 | $ | 3,665 | $ | 9,986 | |||||||||||||||||||

| ||

|

19 |

||||

| Three Months Ended | Nine Months Ended September 30, | ||||||||||||||||||||||||||||

| (in millions) | September 30, 2025 |

June 30, 2025 |

September 30, 2024 |

2025 | 2024 | ||||||||||||||||||||||||

| Supplemental disclosure of cash flow information | |||||||||||||||||||||||||||||

| Interest payments, net of amounts capitalized | $ | 997 | $ | 992 | $ | 947 | $ | 2,923 | $ | 2,778 | |||||||||||||||||||

| Operating lease payments | 1,269 | 1,202 | 1,127 | 3,685 | 3,928 | ||||||||||||||||||||||||

| Income tax payments | 65 | 347 | 50 | 427 | 164 | ||||||||||||||||||||||||

| Non-cash investing and financing activities | |||||||||||||||||||||||||||||

| Non-cash beneficial interest obtained in exchange for securitized receivables | $ | — | $ | — | $ | 789 | $ | — | $ | 2,283 | |||||||||||||||||||

| Change in accounts payable and accrued liabilities for purchases of property and equipment | 136 | (131) | 41 | (458) | (1,085) | ||||||||||||||||||||||||

| Operating lease right-of-use assets obtained in exchange for lease obligations | 1,064 | 593 | 469 | 2,138 | 1,300 | ||||||||||||||||||||||||

| Financing lease right-of-use assets obtained in exchange for lease obligations | 324 | 430 | 409 | 1,002 | 983 | ||||||||||||||||||||||||

| Deferred consideration related to the Ka’ena Acquisition | — | — | — | — | 210 | ||||||||||||||||||||||||

| Debt assumed in the UScellular Acquisition | 1,653 | — | — | 1,653 | — | ||||||||||||||||||||||||

| ||

|

20 |

||||

| Quarter | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in thousands) | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | 2024 | 2025 | ||||||||||||||||||||||||||||||||||||||||||||

| Customers, end of period | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Postpaid phone customers (1) |

76,468 | 77,245 | 78,110 | 79,013 | 79,508 | 80,338 | 84,632 | 78,110 | 84,632 | ||||||||||||||||||||||||||||||||||||||||||||

Postpaid other customers (1) (2) (3) |

22,804 | 23,365 | 24,075 | 25,105 | 25,947 | 26,946 | 29,431 | 24,075 | 29,431 | ||||||||||||||||||||||||||||||||||||||||||||

| Total postpaid customers | 99,272 | 100,610 | 102,185 | 104,118 | 105,455 | 107,284 | 114,063 | 102,185 | 114,063 | ||||||||||||||||||||||||||||||||||||||||||||

Prepaid customers (1) (4) |

21,600 | 25,283 | 25,307 | 25,410 | 25,455 | 25,494 | 25,886 | 25,307 | 25,886 | ||||||||||||||||||||||||||||||||||||||||||||

| Total customers | 120,872 | 125,893 | 127,492 | 129,528 | 130,910 | 132,778 | 139,949 | 127,492 | 139,949 | ||||||||||||||||||||||||||||||||||||||||||||

Adjustments to customers (1) (2) (3) (4) |

— | 3,504 | — | — | — | 97 | 4,781 | 3,504 | 4,878 | ||||||||||||||||||||||||||||||||||||||||||||

| Quarter | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in thousands) | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | 2024 | 2025 | ||||||||||||||||||||||||||||||||||||||||||||

| Net customer additions (losses) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Postpaid phone customers | 532 | 777 | 865 | 903 | 495 | 830 | 1,007 | 2,174 | 2,332 | ||||||||||||||||||||||||||||||||||||||||||||

| Postpaid other customers | 688 | 561 | 710 | 1,030 | 842 | 902 | 1,340 | 1,959 | 3,084 | ||||||||||||||||||||||||||||||||||||||||||||

| Total postpaid customers | 1,220 | 1,338 | 1,575 | 1,933 | 1,337 | 1,732 | 2,347 | 4,133 | 5,416 | ||||||||||||||||||||||||||||||||||||||||||||

| Prepaid customers | (48) | 179 | 24 | 103 | 45 | 39 | 43 | 155 | 127 | ||||||||||||||||||||||||||||||||||||||||||||

| Total net customer additions | 1,172 | 1,517 | 1,599 | 2,036 | 1,382 | 1,771 | 2,390 | 4,288 | 5,543 | ||||||||||||||||||||||||||||||||||||||||||||

| Migrations from prepaid to postpaid plans | 145 | 140 | 175 | 160 | 115 | 205 | 215 | 460 | 535 | ||||||||||||||||||||||||||||||||||||||||||||

| Quarter | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | 2024 | 2025 | |||||||||||||||||||||||||||||||||||||||||||||

| Churn | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Postpaid phone churn | 0.86 | % | 0.80 | % | 0.86 | % | 0.92 | % | 0.91 | % | 0.90 | % | 0.89 | % | 0.84 | % | 0.90 | % | |||||||||||||||||||||||||||||||||||

| Prepaid churn | 2.75 | % | 2.54 | % | 2.78 | % | 2.85 | % | 2.68 | % | 2.65 | % | 2.77 | % | 2.69 | % | 2.70 | % | |||||||||||||||||||||||||||||||||||

| Quarter | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | 2024 | 2025 | |||||||||||||||||||||||||||||||||||||||||||||

| Postpaid upgrade rate | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Postpaid device upgrade rate | 2.4 | % | 2.3 | % | 2.6 | % | 3.6 | % | 2.8 | % | 2.5 | % | 2.7 | % | 7.5 | % | 8.0 | % | |||||||||||||||||||||||||||||||||||

| ||

|

21 |

||||

| Quarter | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in thousands) | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | 2024 | 2025 | ||||||||||||||||||||||||||||||||||||||||||||

| Accounts, end of period | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Total postpaid accounts (1) (2) (3) |

30,015 | 30,316 | 30,631 | 30,894 | 31,099 | 31,502 | 33,979 | 30,631 | 33,979 | ||||||||||||||||||||||||||||||||||||||||||||

| Quarter | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in thousands) | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | 2024 | 2025 | ||||||||||||||||||||||||||||||||||||||||||||

| Net account additions | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Postpaid net account additions | 218 | 301 | 315 | 263 | 205 | 318 | 396 | 834 | 919 | ||||||||||||||||||||||||||||||||||||||||||||

| Quarter | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in thousands) | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | 2024 | 2025 | ||||||||||||||||||||||||||||||||||||||||||||

| Broadband customers, end of period | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Postpaid 5G broadband customers (1) |

4,634 | 4,992 | 5,377 | 5,742 | 6,129 | 6,556 | 7,163 | 5,377 | 7,163 | ||||||||||||||||||||||||||||||||||||||||||||

| Prepaid 5G broadband customers | 547 | 595 | 625 | 688 | 725 | 752 | 792 | 625 | 792 | ||||||||||||||||||||||||||||||||||||||||||||

| Total 5G broadband customers, end of period | 5,181 | 5,587 | 6,002 | 6,430 | 6,854 | 7,308 | 7,955 | 6,002 | 7,955 | ||||||||||||||||||||||||||||||||||||||||||||

Fiber customers (2) (3) |

1 | 2 | 5 | 9 | 12 | 125 | 934 | 5 | 934 | ||||||||||||||||||||||||||||||||||||||||||||

| Total broadband customers, end of period | 5,182 | 5,589 | 6,007 | 6,439 | 6,866 | 7,433 | 8,889 | 6,007 | 8,889 | ||||||||||||||||||||||||||||||||||||||||||||

Adjustments to customers (1) (2) (3) |

— | — | — | — | — | 97 | 896 | — | 993 | ||||||||||||||||||||||||||||||||||||||||||||

| Quarter | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in thousands) | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | 2024 | 2025 | ||||||||||||||||||||||||||||||||||||||||||||

| Broadband - net customer additions | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Postpaid 5G broadband customers | 346 | 358 | 385 | 365 | 387 | 427 | 466 | 1,089 | 1,280 | ||||||||||||||||||||||||||||||||||||||||||||

| Prepaid 5G broadband customers | 59 | 48 | 30 | 63 | 37 | 27 | 40 | 137 | 104 | ||||||||||||||||||||||||||||||||||||||||||||

| Total 5G broadband net customer additions | 405 | 406 | 415 | 428 | 424 | 454 | 506 | 1,226 | 1,384 | ||||||||||||||||||||||||||||||||||||||||||||

| Fiber customers | — | 1 | 3 | 4 | 3 | 16 | 54 | 4 | 73 | ||||||||||||||||||||||||||||||||||||||||||||

| Total broadband net customer additions | 405 | 407 | 418 | 432 | 427 | 470 | 560 | 1,230 | 1,457 | ||||||||||||||||||||||||||||||||||||||||||||

| ||

|

22 |

||||

| Quarter | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in millions) | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | 2024 | 2025 | ||||||||||||||||||||||||||||||||||||||||||||

| Device financing - equipment installment plans | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gross EIP financed | $ | 3,218 | $ | 3,037 | $ | 3,304 | $ | 4,689 | $ | 3,565 | $ | 3,503 | $ | 3,871 | $ | 9,559 | $ | 10,939 | |||||||||||||||||||||||||||||||||||

| EIP billings | 3,880 | 3,604 | 3,423 | 3,509 | 3,551 | 3,553 | 3,766 | 10,907 | 10,870 | ||||||||||||||||||||||||||||||||||||||||||||

| EIP receivables, net | 5,967 | 5,556 | 5,347 | 6,588 | 6,405 | 6,201 | 6,915 | 5,347 | 6,915 | ||||||||||||||||||||||||||||||||||||||||||||

| Device financing - leased devices | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lease revenues | $ | 35 | $ | 26 | $ | 21 | $ | 11 | $ | 1 | $ | 6 | $ | 4 | $ | 82 | $ | 11 | |||||||||||||||||||||||||||||||||||

| Leased device depreciation | 22 | 15 | 11 | 6 | 4 | 1 | — | 48 | 5 | ||||||||||||||||||||||||||||||||||||||||||||

| Quarter | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in dollars) | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | 2024 | 2025 | ||||||||||||||||||||||||||||||||||||||||||||

| Operating measures | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Postpaid ARPA | $ | 140.88 | $ | 142.54 | $ | 145.60 | $ | 146.28 | $ | 146.22 | $ | 149.87 | $ | 149.44 | $ | 143.02 | $ | 148.54 | |||||||||||||||||||||||||||||||||||

| Postpaid phone ARPU | 48.79 | 49.07 | 49.79 | 49.73 | 49.38 | 50.62 | 50.71 | 49.22 | 50.25 | ||||||||||||||||||||||||||||||||||||||||||||

| Prepaid ARPU | 37.18 | 35.94 | 35.81 | 35.49 | 34.67 | 34.63 | 33.93 | 36.27 | 34.41 | ||||||||||||||||||||||||||||||||||||||||||||

| ||

|

23 |

||||

| Quarter | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in millions, except percentages) | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | 2024 | 2025 | ||||||||||||||||||||||||||||||||||||||||||||

| Financial measures | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Service revenues | $ | 16,096 | $ | 16,429 | $ | 16,725 | $ | 16,928 | $ | 16,925 | $ | 17,438 | $ | 18,241 | $ | 49,250 | $ | 52,604 | |||||||||||||||||||||||||||||||||||

| Equipment revenues | $ | 3,251 | $ | 3,106 | $ | 3,207 | $ | 4,699 | $ | 3,704 | $ | 3,439 | $ | 3,465 | $ | 9,564 | $ | 10,608 | |||||||||||||||||||||||||||||||||||

| Lease revenues | 35 | 26 | 21 | 11 | 1 | 6 | 4 | 82 | 11 | ||||||||||||||||||||||||||||||||||||||||||||

| Equipment sales | $ | 3,216 | $ | 3,080 | $ | 3,186 | $ | 4,688 | $ | 3,703 | $ | 3,433 | $ | 3,461 | $ | 9,482 | $ | 10,597 | |||||||||||||||||||||||||||||||||||

| Total revenues | $ | 19,594 | $ | 19,772 | $ | 20,162 | $ | 21,872 | $ | 20,886 | $ | 21,132 | $ | 21,957 | $ | 59,528 | $ | 63,975 | |||||||||||||||||||||||||||||||||||

| Net income | $ | 2,374 | $ | 2,925 | $ | 3,059 | $ | 2,981 | $ | 2,953 | $ | 3,222 | $ | 2,714 | $ | 8,358 | $ | 8,889 | |||||||||||||||||||||||||||||||||||

| Net income margin | 14.7 | % | 17.8 | % | 18.3 | % | 17.6 | % | 17.4 | % | 18.5 | % | 14.9 | % | 17.0 | % | 16.9 | % | |||||||||||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 7,652 | $ | 8,053 | $ | 8,243 | $ | 7,916 | $ | 8,259 | $ | 8,547 | $ | 8,684 | $ | 23,948 | $ | 25,490 | |||||||||||||||||||||||||||||||||||

| Adjusted EBITDA margin | 47.5 | % | 49.0 | % | 49.3 | % | 46.8 | % | 48.8 | % | 49.0 | % | 47.6 | % | 48.6 | % | 48.5 | % | |||||||||||||||||||||||||||||||||||

| Core Adjusted EBITDA | $ | 7,617 | $ | 8,027 | $ | 8,222 | $ | 7,905 | $ | 8,258 | $ | 8,541 | $ | 8,680 | $ | 23,866 | $ | 25,479 | |||||||||||||||||||||||||||||||||||

| Core Adjusted EBITDA margin | 47.3 | % | 48.9 | % | 49.2 | % | 46.7 | % | 48.8 | % | 49.0 | % | 47.6 | % | 48.5 | % | 48.4 | % | |||||||||||||||||||||||||||||||||||

| Cost of services, exclusive of depreciation and amortization | $ | 2,688 | $ | 2,664 | $ | 2,722 | $ | 2,697 | $ | 2,602 | $ | 2,717 | $ | 2,873 | $ | 8,074 | $ | 8,192 | |||||||||||||||||||||||||||||||||||

| Merger-related costs | 107 | 73 | — | — | — | — | 7 | 180 | 7 | ||||||||||||||||||||||||||||||||||||||||||||

| Other Special Items | 1 | — | 67 | 75 | 20 | 28 | 55 | 68 | 103 | ||||||||||||||||||||||||||||||||||||||||||||

| Cost of services, excluding depreciation and amortization and Special Items | $ | 2,580 | $ | 2,591 | $ | 2,655 | $ | 2,622 | $ | 2,582 | $ | 2,689 | $ | 2,811 | $ | 7,826 | $ | 8,082 | |||||||||||||||||||||||||||||||||||

| Cost of equipment sales, exclusive of depreciation and amortization | $ | 4,399 | $ | 4,088 | $ | 4,307 | $ | 6,088 | $ | 4,798 | $ | 4,659 | $ | 4,853 | $ | 12,794 | $ | 14,310 | |||||||||||||||||||||||||||||||||||

| Merger-related costs | — | — | — | — | — | — | 2 | — | 2 | ||||||||||||||||||||||||||||||||||||||||||||

| Cost of equipment sales, exclusive of depreciation and amortization and Special Items | $ | 4,399 | $ | 4,088 | $ | 4,307 | $ | 6,088 | $ | 4,798 | $ | 4,659 | $ | 4,851 | $ | 12,794 | $ | 14,308 | |||||||||||||||||||||||||||||||||||

| Selling, general and administrative | $ | 5,138 | $ | 5,142 | $ | 5,186 | $ | 5,352 | $ | 5,488 | $ | 5,397 | $ | 6,015 | $ | 15,466 | $ | 16,900 | |||||||||||||||||||||||||||||||||||

| Merger-related costs (gain), net | 23 | (82) | 16 | 10 | 14 | 33 | 64 | (43) | 111 | ||||||||||||||||||||||||||||||||||||||||||||

| Other Special Items | 12 | 37 | 70 | (60) | 59 | (51) | 123 | 119 | 131 | ||||||||||||||||||||||||||||||||||||||||||||

| Selling, general and administrative, excluding Special Items | $ | 5,103 | $ | 5,187 | $ | 5,100 | $ | 5,402 | $ | 5,415 | $ | 5,415 | $ | 5,828 | $ | 15,390 | $ | 16,658 | |||||||||||||||||||||||||||||||||||

| Total bad debt expense and losses from sales of receivables | $ | 303 | $ | 280 | $ | 322 | $ | 349 | $ | 345 | $ | 284 | $ | 354 | $ | 905 | $ | 983 | |||||||||||||||||||||||||||||||||||

| Bad debt and losses from sales of receivables as a percentage of Total revenues | 1.5 | % | 1.4 | % | 1.6 | % | 1.6 | % | 1.7 | % | 1.3 | % | 1.6 | % | 1.5 | % | 1.5 | % | |||||||||||||||||||||||||||||||||||

| Cash purchases of property and equipment including capitalized interest | $ | 2,627 | $ | 2,040 | $ | 1,961 | $ | 2,212 | $ | 2,451 | $ | 2,396 | $ | 2,639 | $ | 6,628 | $ | 7,486 | |||||||||||||||||||||||||||||||||||

| Capitalized interest | 9 | 8 | 9 | 8 | 10 | 10 | 13 | 26 | 33 | ||||||||||||||||||||||||||||||||||||||||||||

| Net cash proceeds from securitization | $ | (29) | $ | (30) | $ | (29) | $ | (27) | $ | (26) | $ | (23) | $ | (25) | $ | (88) | $ | (74) | |||||||||||||||||||||||||||||||||||

| Net cash payments for Merger-related costs | $ | 293 | $ | 241 | $ | 132 | $ | 123 | $ | 70 | $ | 92 | $ | 96 | $ | 666 | $ | 258 | |||||||||||||||||||||||||||||||||||

| ||

|

24 |

||||

| Quarter | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in millions, except share and per share amounts) | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | 2024 | 2025 | ||||||||||||||||||||||||||||||||||||||||||||

| Stockholder returns | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total repurchases | $ | 3,568 | $ | 2,277 | $ | 644 | $ | 4,619 | $ | 2,470 | $ | 2,469 | $ | 2,470 | $ | 6,489 | $ | 7,409 | |||||||||||||||||||||||||||||||||||

| Total shares repurchased | 21,933,790 | 13,979,843 | 3,179,707 | 20,283,582 | 10,091,227 | 10,148,791 | 10,204,072 | 39,093,340 | 30,444,090 | ||||||||||||||||||||||||||||||||||||||||||||

| Average purchase price per share | $ | 162.69 | $ | 162.85 | $ | 202.45 | $ | 227.72 | $ | 244.77 | $ | 243.32 | $ | 242.01 | $ | 165.98 | $ | 243.36 | |||||||||||||||||||||||||||||||||||

| Total dividends paid | $ | 769 | $ | 759 | $ | 758 | $ | 1,014 | $ | 1,003 | $ | 996 | $ | 987 | $ | 2,286 | $ | 2,986 | |||||||||||||||||||||||||||||||||||

| Dividends per share | $ | 0.65 | $ | 0.65 | $ | 0.65 | $ | 0.88 | $ | 0.88 | $ | 0.88 | $ | 0.88 | $ | 1.95 | $ | 2.64 | |||||||||||||||||||||||||||||||||||

| Total stockholder returns | $ | 4,337 | $ | 3,036 | $ | 1,402 | $ | 5,633 | $ | 3,473 | $ | 3,465 | $ | 3,457 | $ | 8,775 | $ | 10,395 | |||||||||||||||||||||||||||||||||||

| Cumulative total repurchases | $ | 19,775 | $ | 22,052 | $ | 22,696 | $ | 27,315 | $ | 29,785 | $ | 32,254 | $ | 34,724 | $ | 22,696 | $ | 34,724 | |||||||||||||||||||||||||||||||||||

| Cumulative shares repurchased | 136,220,243 | 150,200,086 | 153,379,793 | 173,663,375 | 183,754,602 | 193,903,393 | 204,107,465 | 153,379,793 | 204,107,465 | ||||||||||||||||||||||||||||||||||||||||||||

| Cumulative stockholder returns | $ | 21,291 | $ | 24,327 | $ | 25,729 | $ | 31,362 | $ | 34,835 | $ | 38,300 | $ | 41,757 | $ | 25,729 | $ | 41,757 | |||||||||||||||||||||||||||||||||||

| ||

|

25 |

||||

| Quarter | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in millions, except percentages) | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | 2024 | 2025 | ||||||||||||||||||||||||||||||||||||||||||||

| Net income | $ | 2,374 | $ | 2,925 | $ | 3,059 | $ | 2,981 | $ | 2,953 | $ | 3,222 | $ | 2,714 | $ | 8,358 | $ | 8,889 | |||||||||||||||||||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest expense, net | 880 | 854 | 836 | 841 | 916 | 922 | 924 | 2,570 | 2,762 | ||||||||||||||||||||||||||||||||||||||||||||

| Other (income) expense, net | (20) | 8 | (7) | (94) | 46 | 11 | 78 | (19) | 135 | ||||||||||||||||||||||||||||||||||||||||||||

| Income tax expense | 764 | 843 | 908 | 858 | 885 | 1,058 | 814 | 2,515 | 2,757 | ||||||||||||||||||||||||||||||||||||||||||||

| Operating income | 3,998 | 4,630 | 4,796 | 4,586 | 4,800 | 5,213 | 4,530 | 13,424 | 14,543 | ||||||||||||||||||||||||||||||||||||||||||||

| Depreciation and amortization | 3,371 | 3,248 | 3,151 | 3,149 | 3,198 | 3,146 | 3,408 | 9,770 | 9,752 | ||||||||||||||||||||||||||||||||||||||||||||

Stock-based compensation (1) |

140 | 147 | 143 | 156 | 168 | 178 | 217 | 430 | 563 | ||||||||||||||||||||||||||||||||||||||||||||

Merger-related costs (gain), net (2) |

130 | (9) | 16 | 10 | 14 | 33 | 73 | 137 | 120 | ||||||||||||||||||||||||||||||||||||||||||||

Legal-related expenses (recoveries), net (3) |

— | 15 | 1 | (105) | 6 | (4) | 8 | 16 | 10 | ||||||||||||||||||||||||||||||||||||||||||||

| Impairment expense | — | — | — | — | — | — | 278 | — | 278 | ||||||||||||||||||||||||||||||||||||||||||||

Other, net (4) |

13 | 22 | 136 | 120 | 73 | (19) | 170 | 171 | 224 | ||||||||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA | 7,652 | 8,053 | 8,243 | 7,916 | 8,259 | 8,547 | 8,684 | 23,948 | 25,490 | ||||||||||||||||||||||||||||||||||||||||||||

| Lease revenues | (35) | (26) | (21) | (11) | (1) | (6) | (4) | (82) | (11) | ||||||||||||||||||||||||||||||||||||||||||||

| Core Adjusted EBITDA | $ | 7,617 | $ | 8,027 | $ | 8,222 | $ | 7,905 | $ | 8,258 | $ | 8,541 | $ | 8,680 | $ | 23,866 | $ | 25,479 | |||||||||||||||||||||||||||||||||||

| Net income margin (Net income divided by Service revenues) | 14.7 | % | 17.8 | % | 18.3 | % | 17.6 | % | 17.4 | % | 18.5 | % | 14.9 | % | 17.0 | % | 16.9 | % | |||||||||||||||||||||||||||||||||||

| Adjusted EBITDA margin (Adjusted EBITDA divided by Service revenues) | 47.5 | % | 49.0 | % | 49.3 | % | 46.8 | % | 48.8 | % | 49.0 | % | 47.6 | % | 48.6 | % | 48.5 | % | |||||||||||||||||||||||||||||||||||

| Core Adjusted EBITDA margin (Core Adjusted EBITDA divided by Service revenues) | 47.3 | % | 48.9 | % | 49.2 | % | 46.7 | % | 48.8 | % | 49.0 | % | 47.6 | % | 48.5 | % | 48.4 | % | |||||||||||||||||||||||||||||||||||

| ||

|

26 |

||||

| (in millions, except net debt ratios) | Mar 31, 2024 | Jun 30, 2024 | Sep 30, 2024 | Dec 31, 2024 | Mar 31, 2025 | Jun 30, 2025 | Sep 30, 2025 |

||||||||||||||||||||||||||||||||||

| Short-term debt | $ | 5,356 | $ | 5,867 | $ | 5,851 | $ | 4,068 | $ | 8,214 | $ | 6,408 | $ | 6,333 | |||||||||||||||||||||||||||

| Short-term financing lease liabilities | 1,265 | 1,252 | 1,252 | 1,175 | 1,136 | 1,157 | 1,157 | ||||||||||||||||||||||||||||||||||

| Long-term debt | 71,361 | 70,203 | 72,522 | 72,700 | 76,033 | 75,018 | 76,365 | ||||||||||||||||||||||||||||||||||

| Long-term debt to affiliates | 1,496 | 1,496 | 1,497 | 1,497 | 1,497 | 1,497 | 1,498 | ||||||||||||||||||||||||||||||||||

| Financing lease liabilities | 1,163 | 1,133 | 1,185 | 1,151 | 1,117 | 1,188 | 1,186 | ||||||||||||||||||||||||||||||||||

| Total debt (excluding tower obligations) | $ | 80,641 | $ | 79,951 | $ | 82,307 | $ | 80,591 | $ | 87,997 | $ | 85,268 | $ | 86,539 | |||||||||||||||||||||||||||

| Less: Cash and cash equivalents | (6,708) | (6,417) | (9,754) | (5,409) | (12,003) | (10,259) | (3,310) | ||||||||||||||||||||||||||||||||||

| Net debt (excluding tower obligations) | $ | 73,933 | $ | 73,534 | $ | 72,553 | $ | 75,182 | $ | 75,994 | $ | 75,009 | $ | 83,229 | |||||||||||||||||||||||||||

| Divided by: Last twelve months Net income | $ | 8,751 | $ | 9,455 | $ | 10,372 | $ | 11,339 | $ | 11,918 | $ | 12,215 | $ | 11,870 | |||||||||||||||||||||||||||

| Net debt (excluding tower obligations) to LTM Net income Ratio | 8.4 | 7.8 | 7.0 | 6.6 | 6.4 | 6.1 | 7.0 | ||||||||||||||||||||||||||||||||||

| Divided by: Last twelve months Adjusted EBITDA | $ | 29,881 | $ | 30,529 | $ | 31,172 | $ | 31,864 | $ | 32,471 | $ | 32,965 | $ | 33,406 | |||||||||||||||||||||||||||

| Net debt (excluding tower obligations) to LTM Adjusted EBITDA Ratio | 2.5 | 2.4 | 2.3 | 2.4 | 2.3 | 2.3 | 2.5 | ||||||||||||||||||||||||||||||||||

| Divided by: Last twelve months Core Adjusted EBITDA | $ | 29,681 | $ | 30,372 | $ | 31,047 | $ | 31,771 | $ | 32,412 | $ | 32,926 | $ | 33,384 | |||||||||||||||||||||||||||

| Net debt (excluding tower obligations) to LTM Core Adjusted EBITDA Ratio | 2.5 | 2.4 | 2.3 | 2.4 | 2.3 | 2.3 | 2.5 | ||||||||||||||||||||||||||||||||||

| Quarter | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in millions, except percentages) | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | 2024 | 2025 | ||||||||||||||||||||||||||||||||||||||||||||

Net cash provided by operating activities (1) |

$ | 5,084 | $ | 5,521 | $ | 6,139 | $ | 5,549 | $ | 6,847 | $ | 6,992 | $ | 7,457 | $ | 16,744 | $ | 21,296 | |||||||||||||||||||||||||||||||||||

| Cash purchases of property and equipment, including capitalized interest | (2,627) | (2,040) | (1,961) | (2,212) | (2,451) | (2,396) | (2,639) | (6,628) | (7,486) | ||||||||||||||||||||||||||||||||||||||||||||

Proceeds related to beneficial interests in securitization transactions (1) |

890 | 958 | 984 | 747 | — | — | — | 2,832 | — | ||||||||||||||||||||||||||||||||||||||||||||

| Adjusted Free Cash Flow | $ | 3,347 | $ | 4,439 | $ | 5,162 | $ | 4,084 | $ | 4,396 | $ | 4,596 | $ | 4,818 | $ | 12,948 | $ | 13,810 | |||||||||||||||||||||||||||||||||||

Net cash provided by operating activities margin |

31.6 | % | 33.6 | % | 36.7 | % | 32.8 | % | 40.5 | % | 40.1 | % | 40.9 | % | 34.0 | % | 40.5 | % | |||||||||||||||||||||||||||||||||||

Adjusted Free Cash Flow margin |

20.8 | % | 27.0 | % | 30.9 | % | 24.1 | % | 26.0 | % | 26.4 | % | 26.4 | % | 26.3 | % | 26.3 | % | |||||||||||||||||||||||||||||||||||

| ||

|

27 |

||||

| FY 2025 | |||||||||||

| (in millions) | Guidance Range | ||||||||||

| Net cash provided by operating activities | $ | 27,800 | $ | 28,000 | |||||||

| Cash purchases of property and equipment, including capitalized interest | (10,000) | (10,000) | |||||||||

| Adjusted Free Cash Flow | $ | 17,800 | $ | 18,000 | |||||||

| FY 2025 | |||||||||||

| (in millions) | Guidance Range | ||||||||||

| Net cash provided by operating activities | $ | 27,100 | $ | 27,500 | |||||||

| Cash purchases of property and equipment, including capitalized interest | (9,500) | (9,500) | |||||||||

| Adjusted Free Cash Flow | $ | 17,600 | $ | 18,000 | |||||||

| ||

|

28 |

||||

| ||

|

29 |

||||

| ||

|

30 |

||||

| ||