2023Q3FALSE--12-310001280776P3Yhttp://fasb.org/us-gaap/2023#NonoperatingIncomeExpensehttp://fasb.org/us-gaap/2023#NonoperatingIncomeExpenseP3Y00012807762023-01-012023-09-3000012807762023-10-31xbrli:shares00012807762023-09-30iso4217:USD00012807762022-12-31iso4217:USDxbrli:shares00012807762023-07-012023-09-3000012807762022-07-012022-09-3000012807762022-01-012022-09-300001280776us-gaap:CommonStockMember2022-12-310001280776us-gaap:AdditionalPaidInCapitalMember2022-12-310001280776us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001280776us-gaap:RetainedEarningsMember2022-12-310001280776us-gaap:RetainedEarningsMember2023-01-012023-03-3100012807762023-01-012023-03-310001280776us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001280776us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001280776us-gaap:CommonStockMember2023-01-012023-03-310001280776us-gaap:CommonStockMember2023-03-310001280776us-gaap:AdditionalPaidInCapitalMember2023-03-310001280776us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001280776us-gaap:RetainedEarningsMember2023-03-3100012807762023-03-310001280776us-gaap:RetainedEarningsMember2023-04-012023-06-3000012807762023-04-012023-06-300001280776us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001280776us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001280776us-gaap:CommonStockMember2023-04-012023-06-300001280776us-gaap:CommonStockMember2023-06-300001280776us-gaap:AdditionalPaidInCapitalMember2023-06-300001280776us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001280776us-gaap:RetainedEarningsMember2023-06-3000012807762023-06-300001280776us-gaap:RetainedEarningsMember2023-07-012023-09-300001280776us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001280776us-gaap:CommonStockMember2023-07-012023-09-300001280776us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300001280776us-gaap:CommonStockMember2023-09-300001280776us-gaap:AdditionalPaidInCapitalMember2023-09-300001280776us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001280776us-gaap:RetainedEarningsMember2023-09-300001280776us-gaap:CommonStockMember2021-12-310001280776us-gaap:AdditionalPaidInCapitalMember2021-12-310001280776us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001280776us-gaap:RetainedEarningsMember2021-12-3100012807762021-12-310001280776us-gaap:RetainedEarningsMember2022-01-012022-03-3100012807762022-01-012022-03-310001280776us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310001280776us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310001280776us-gaap:CommonStockMember2022-01-012022-03-310001280776us-gaap:CommonStockMember2022-03-310001280776us-gaap:AdditionalPaidInCapitalMember2022-03-310001280776us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001280776us-gaap:RetainedEarningsMember2022-03-3100012807762022-03-310001280776us-gaap:RetainedEarningsMember2022-04-012022-06-3000012807762022-04-012022-06-300001280776us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001280776us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300001280776us-gaap:CommonStockMember2022-04-012022-06-300001280776us-gaap:CommonStockMember2022-06-300001280776us-gaap:AdditionalPaidInCapitalMember2022-06-300001280776us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001280776us-gaap:RetainedEarningsMember2022-06-3000012807762022-06-300001280776us-gaap:RetainedEarningsMember2022-07-012022-09-300001280776us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-300001280776us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-300001280776us-gaap:CommonStockMember2022-09-300001280776us-gaap:AdditionalPaidInCapitalMember2022-09-300001280776us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-300001280776us-gaap:RetainedEarningsMember2022-09-3000012807762022-09-30vtl:employeevtl:lease0001280776us-gaap:SubsequentEventMember2014-04-172023-10-310001280776country:US2023-09-300001280776country:DE2023-09-300001280776country:AU2023-09-30vtl:financialInstitution0001280776country:USus-gaap:MoneyMarketFundsMember2023-09-30xbrli:pure0001280776vtl:AustraliaAndGermanyMembersrt:MinimumMember2023-09-300001280776srt:MaximumMembervtl:AustraliaAndGermanyMember2023-09-300001280776us-gaap:BankTimeDepositsMember2023-09-300001280776us-gaap:BankTimeDepositsMember2022-12-310001280776srt:MinimumMember2023-09-300001280776srt:MaximumMember2023-09-3000012807762022-10-012022-12-310001280776country:DEsrt:MaximumMember2023-01-012023-09-30iso4217:EUR0001280776vtl:PreFundedWarrantsMember2023-01-310001280776us-gaap:StockOptionMember2023-01-012023-09-300001280776us-gaap:StockOptionMember2022-01-012022-09-300001280776vtl:NewYorkCityMember2023-09-300001280776vtl:GrafelfingGermanyMember2020-04-070001280776vtl:NewYorkCityMember2023-01-012023-09-300001280776vtl:PlaneggGermanyMember2023-02-012023-02-280001280776us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001280776us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001280776us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001280776us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001280776us-gaap:FairValueMeasurementsRecurringMember2023-09-300001280776us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001280776us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001280776us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001280776us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001280776us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001280776us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001280776us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001280776us-gaap:FairValueMeasurementsRecurringMember2022-12-310001280776us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001280776us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001280776us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-3100012807762020-11-3000012807762022-10-310001280776vtl:December2020ATMMember2020-12-310001280776vtl:December2020ATMMember2023-09-30utr:D0001280776vtl:December2020ATMMemberus-gaap:SubsequentEventMember2023-10-310001280776vtl:May2022ATMMember2022-05-100001280776vtl:May2022ATMMember2023-09-300001280776us-gaap:SubsequentEventMembervtl:May2022ATMMember2023-10-310001280776vtl:December2020ATMMember2023-07-012023-09-300001280776vtl:December2020ATMMember2023-01-012023-09-300001280776vtl:December2020ATMMember2022-01-012022-09-300001280776us-gaap:CommonStockMember2022-10-102022-10-100001280776us-gaap:CommonStockMember2022-10-100001280776vtl:PreFundedWarrantsMember2022-10-102022-10-100001280776vtl:PreFundedWarrantsMember2022-10-10vtl:vote0001280776vtl:A2021EmployeeStockPurchasePlanMemberus-gaap:EmployeeStockOptionMember2023-09-300001280776us-gaap:EmployeeStockOptionMember2023-09-300001280776vtl:TwoThousandFourteenEquityIncentivePlanMembervtl:EmployeeStockOptionsforFutureGrantMember2023-09-300001280776vtl:A2017InducementEquityIncentivePlanMembervtl:EmployeeStockOptionsforFutureGrantMember2023-09-300001280776vtl:TwoThousandNineteenOmnibusEquityIncentivePlanMembervtl:EmployeeStockOptionsforFutureGrantMember2023-09-300001280776vtl:A2021EmployeeStockPurchasePlanMember2021-04-252021-04-250001280776vtl:A2021EmployeeStockPurchasePlanMember2021-04-250001280776srt:MaximumMembervtl:A2021EmployeeStockPurchasePlanMember2023-09-012023-09-300001280776vtl:A2021EmployeeStockPurchasePlanMember2021-08-012021-08-010001280776vtl:A2021EmployeeStockPurchasePlanMember2023-07-012023-09-300001280776vtl:A2021EmployeeStockPurchasePlanMember2023-01-012023-09-300001280776vtl:A2021EmployeeStockPurchasePlanMember2022-07-012022-09-300001280776vtl:A2021EmployeeStockPurchasePlanMember2022-01-012022-09-300001280776vtl:A2019OmnibusEquityIncentivePlanMember2019-07-310001280776vtl:TwoThousandNineteenOmnibusEquityIncentivePlanEvergreenProvisionMember2019-07-012019-07-310001280776vtl:TwoThousandNineteenOmnibusEquityIncentivePlanEvergreenProvisionMember2020-01-012023-09-300001280776vtl:TwoThousandNineteenOmnibusEquityIncentivePlanEvergreenProvisionMember2023-06-282023-06-280001280776vtl:A2019OmnibusEquityIncentivePlanMembersrt:MaximumMember2023-01-012023-09-300001280776vtl:A2019OmnibusEquityIncentivePlanMembervtl:IncentiveEmployeeStockOptionMember2023-01-012023-09-300001280776vtl:NonStatutoryEmployeeStockOptionMembervtl:A2019OmnibusEquityIncentivePlanMembersrt:MinimumMember2023-01-012023-09-300001280776vtl:NonStatutoryEmployeeStockOptionMembervtl:A2019OmnibusEquityIncentivePlanMembersrt:MaximumMember2023-01-012023-09-300001280776vtl:TwoThousandNineteenOmnibusEquityIncentivePlanMemberus-gaap:EmployeeStockOptionMember2022-12-310001280776vtl:TwoThousandNineteenOmnibusEquityIncentivePlanMemberus-gaap:EmployeeStockOptionMember2023-01-012023-09-300001280776vtl:TwoThousandNineteenOmnibusEquityIncentivePlanMemberus-gaap:EmployeeStockOptionMember2023-09-300001280776vtl:TwoThousandNineteenOmnibusEquityIncentivePlanMemberus-gaap:EmployeeStockOptionMember2021-12-310001280776vtl:TwoThousandNineteenOmnibusEquityIncentivePlanMemberus-gaap:EmployeeStockOptionMember2022-01-012022-09-300001280776vtl:TwoThousandNineteenOmnibusEquityIncentivePlanMemberus-gaap:EmployeeStockOptionMember2022-09-300001280776vtl:A2019OmnibusEquityIncentivePlanMember2023-01-012023-09-300001280776vtl:A2019OmnibusEquityIncentivePlanMember2022-01-012022-09-300001280776us-gaap:ResearchAndDevelopmentExpenseMembervtl:EmployeeMember2023-07-012023-09-300001280776us-gaap:ResearchAndDevelopmentExpenseMembervtl:EmployeeMember2022-07-012022-09-300001280776us-gaap:ResearchAndDevelopmentExpenseMembervtl:EmployeeMember2023-01-012023-09-300001280776us-gaap:ResearchAndDevelopmentExpenseMembervtl:EmployeeMember2022-01-012022-09-300001280776us-gaap:GeneralAndAdministrativeExpenseMembervtl:EmployeeMember2023-07-012023-09-300001280776us-gaap:GeneralAndAdministrativeExpenseMembervtl:EmployeeMember2022-07-012022-09-300001280776us-gaap:GeneralAndAdministrativeExpenseMembervtl:EmployeeMember2023-01-012023-09-300001280776us-gaap:GeneralAndAdministrativeExpenseMembervtl:EmployeeMember2022-01-012022-09-300001280776vtl:EmployeeMember2023-07-012023-09-300001280776vtl:EmployeeMember2022-07-012022-09-300001280776vtl:EmployeeMember2023-01-012023-09-300001280776vtl:EmployeeMember2022-01-012022-09-300001280776vtl:TwoThousandFourteenEquityIncentivePlanMember2023-09-300001280776vtl:A2017InducementEquityIncentivePlanMember2017-09-300001280776vtl:A2017InducementEquityIncentivePlanMember2022-01-012022-09-300001280776vtl:A2017InducementEquityIncentivePlanMember2021-07-012021-09-300001280776vtl:A2017InducementEquityIncentivePlanMember2021-01-012021-09-300001280776vtl:A2017InducementEquityIncentivePlanMember2022-07-012022-09-300001280776srt:DirectorMember2023-04-272023-04-270001280776srt:ScenarioForecastMembervtl:DuaneNashMDJDMBAMembersrt:BoardOfDirectorsChairmanMembervtl:ExecutiveChairmanAgreementMembersrt:AffiliatedEntityMember2022-12-282023-12-310001280776srt:ScenarioForecastMembervtl:DuaneNashMDJDMBAMembersrt:BoardOfDirectorsChairmanMembervtl:ExecutiveChairmanAgreementMembersrt:AffiliatedEntityMember2024-01-012024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

|

|

|

|

|

| ☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2023

or

|

|

|

|

|

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-36201

Immunic, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

| Delaware |

|

56-2358443 |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

| 1200 Avenue of the Americas |

|

|

| Suite 200 |

|

|

| New York, |

NY |

10036 |

| (Address of principal executive offices) |

|

(Zip Code) |

(332) 255-9818

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.0001 par value |

IMUX |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

|

|

|

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

|

|

|

|

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

On October 31, 2023, 45,145,383 shares of common stock, $0.0001 par value, were outstanding.

IMMUNIC, INC.

INDEX

|

|

|

|

|

|

|

|

|

| |

|

Page No. |

|

|

| Item 1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Item 2. |

|

|

| Item 3. |

|

|

| Item 4. |

|

|

|

|

|

|

|

| Item 1. |

|

|

| Item 1A. |

|

|

| Item 2. |

|

|

| Item 3. |

|

|

| Item 4. |

|

|

| Item 5. |

|

|

| Item 6. |

|

|

IMMUNIC, INC.

Condensed Consolidated Balance Sheets

(In thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2023 |

|

December 31, 2022 |

|

(Unaudited) |

|

|

| Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

59,689 |

|

|

$ |

106,745 |

|

| Investments - other |

— |

|

|

9,629 |

|

| Other current assets and prepaid expenses |

5,545 |

|

|

9,490 |

|

| Total current assets |

65,234 |

|

|

125,864 |

|

| Property and equipment, net |

288 |

|

|

294 |

|

| Right-of-use assets, net |

1,412 |

|

|

1,552 |

|

| Other long-term assets |

43 |

|

|

43 |

|

| Total assets |

$ |

66,977 |

|

|

$ |

127,753 |

|

| Liabilities and Stockholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

3,199 |

|

|

$ |

4,281 |

|

| Accrued expenses |

13,659 |

|

|

7,986 |

|

| Other current liabilities |

923 |

|

|

810 |

|

| Total current liabilities |

17,781 |

|

|

13,077 |

|

| Long term liabilities |

|

|

|

| Operating lease liabilities |

789 |

|

|

992 |

|

| Total long-term liabilities |

789 |

|

|

992 |

|

| Total liabilities |

18,570 |

|

|

14,069 |

|

| Commitments and contingencies (Note 4) |

|

|

|

| Stockholders’ equity: |

|

|

|

Preferred stock, $0.0001 par value; 20,000,000 authorized and no shares issued or outstanding at September 30, 2023 and December 31, 2022 |

— |

|

|

— |

|

Common stock, $0.0001 par value; 130,000,000 shares authorized and 44,595,383 and 39,307,286 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively |

4 |

|

|

4 |

|

| Additional paid-in capital |

433,818 |

|

|

427,925 |

|

| Accumulated other comprehensive income |

3,905 |

|

|

3,035 |

|

| Accumulated deficit |

(389,320) |

|

|

(317,280) |

|

| Total stockholders’ equity |

48,407 |

|

|

113,684 |

|

| Total liabilities and stockholders’ equity |

$ |

66,977 |

|

|

$ |

127,753 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

IMMUNIC, INC.

Condensed Consolidated Statements of Operations

(In thousands, except share and per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months

Ended September 30, |

|

Nine Months

Ended September 30, |

| |

|

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

|

|

|

$ |

19,796 |

|

|

$ |

16,537 |

|

|

$ |

63,931 |

|

|

$ |

50,520 |

|

| General and administrative |

|

|

|

|

3,774 |

|

|

3,579 |

|

|

11,911 |

|

|

11,641 |

|

| Total operating expenses |

|

|

|

|

23,570 |

|

|

20,116 |

|

|

75,842 |

|

|

62,161 |

|

| Loss from operations |

|

|

|

|

(23,570) |

|

|

(20,116) |

|

|

(75,842) |

|

|

(62,161) |

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

|

|

766 |

|

|

230 |

|

|

2,534 |

|

|

343 |

|

| Other income (expense), net |

|

|

|

|

35 |

|

|

(1,338) |

|

|

1,268 |

|

|

(2,115) |

|

| Total other income (expense) |

|

|

|

|

801 |

|

|

(1,108) |

|

|

3,802 |

|

|

(1,772) |

|

| Net loss |

|

|

|

|

$ |

(22,769) |

|

|

$ |

(21,224) |

|

|

$ |

(72,040) |

|

|

$ |

(63,933) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share, basic and diluted |

|

|

|

|

$ |

(0.51) |

|

|

$ |

(0.69) |

|

|

$ |

(1.63) |

|

|

$ |

(2.16) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average common shares outstanding, basic and diluted |

|

|

|

|

44,574,377 |

|

|

30,564,995 |

|

|

44,227,264 |

|

|

29,655,946 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

IMMUNIC, INC.

Condensed Consolidated Statements of Comprehensive Loss

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months

Ended September 30, |

|

Nine Months

Ended September 30, |

| |

|

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Net loss |

|

|

|

|

$ |

(22,769) |

|

|

$ |

(21,224) |

|

|

$ |

(72,040) |

|

|

$ |

(63,933) |

|

| Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation |

|

|

|

|

(77) |

|

|

274 |

|

|

870 |

|

|

(134) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total comprehensive loss |

|

|

|

|

$ |

(22,846) |

|

|

$ |

(20,950) |

|

|

$ |

(71,170) |

|

|

$ |

(64,067) |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

IMMUNIC, INC.

Condensed Consolidated Statements of Stockholders’ Equity

(In thousands, except share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nine Months Ended September 30, 2023 |

| |

Common Stock |

|

Additional

Paid-In

Capital |

|

Accumulated

Other

Comprehensive

Income (Loss) |

|

Accumulated

Deficit |

|

Total

Stockholders’

Equity |

| |

Shares |

|

Amount |

|

| Balance at January 1, 2023 |

39,307,286 |

|

|

$ |

4 |

|

|

$ |

427,925 |

|

|

$ |

3,035 |

|

|

$ |

(317,280) |

|

|

$ |

113,684 |

|

| Net loss |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(25,272) |

|

|

(25,272) |

|

| Stock-based compensation |

— |

|

|

— |

|

|

1,979 |

|

|

— |

|

|

— |

|

|

1,979 |

|

| Foreign exchange translation adjustment |

— |

|

|

— |

|

|

— |

|

|

776 |

|

|

— |

|

|

776 |

|

| Shares issued from exercise of pre-funded warrants |

5,096,552 |

|

|

— |

|

|

51 |

|

|

— |

|

|

— |

|

|

51 |

|

| Balance at March 31, 2023 |

44,403,838 |

|

|

$ |

4 |

|

|

$ |

429,955 |

|

|

$ |

3,811 |

|

|

$ |

(342,552) |

|

|

$ |

91,218 |

|

| Net loss |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(23,999) |

|

|

(23,999) |

|

| Stock-based compensation |

— |

|

|

— |

|

|

1,798 |

|

|

— |

|

|

— |

|

|

1,798 |

|

| Foreign exchange translation adjustment |

— |

|

|

— |

|

|

— |

|

|

171 |

|

|

— |

|

|

171 |

|

| Shares issued in connection with the Company's Employee stock purchase plan |

84,533 |

|

|

$ |

— |

|

|

96 |

|

|

$ |

— |

|

|

$ |

— |

|

|

96 |

|

| Balance at June 30, 2023 |

44,488,371 |

|

|

$ |

4 |

|

|

$ |

431,849 |

|

|

$ |

3,982 |

|

|

$ |

(366,551) |

|

|

$ |

69,284 |

|

| Net loss |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(22,769) |

|

|

(22,769) |

|

| Stock-based compensation |

— |

|

|

— |

|

|

1,687 |

|

|

— |

|

|

— |

|

|

1,687 |

|

Issuance of common stock - at the market Sales Agreement net of issuance costs of $9 |

107,012 |

|

|

— |

|

|

282 |

|

|

— |

|

|

— |

|

|

282 |

|

| Foreign exchange translation adjustment |

— |

|

|

— |

|

|

— |

|

|

(77) |

|

|

— |

|

|

(77) |

|

| Balance at September 30, 2023 |

44,595,383 |

|

|

$ |

4 |

|

|

$ |

433,818 |

|

|

$ |

3,905 |

|

|

$ |

(389,320) |

|

|

48,407 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nine Months Ended September 30, 2022 |

|

Common Stock |

|

Additional

Paid-In

Capital |

|

Accumulated

Other

Comprehensive

Income (Loss) |

|

Accumulated

Deficit |

|

Total

Stockholders’

Equity |

|

Shares |

|

Amount |

|

| Balance at January 1, 2022 |

26,335,418 |

|

|

3 |

|

|

324,237 |

|

|

(252) |

|

|

(196,873) |

|

|

127,115 |

|

| Net loss |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(20,808) |

|

|

(20,808) |

|

| Stock-based compensation |

— |

|

|

— |

|

|

2,069 |

|

|

— |

|

|

— |

|

|

2,069 |

|

| Foreign exchange translation adjustment |

— |

|

|

— |

|

|

— |

|

|

(58) |

|

|

— |

|

|

(58) |

|

| Shares issued in connection with the Company's stock option plan |

852 |

|

|

— |

|

|

5 |

|

|

— |

|

|

— |

|

|

5 |

|

Issuance of common stock - at the market Sales Agreement net of issuance costs of $918 |

2,904,113 |

|

|

— |

|

|

29,638 |

|

|

— |

|

|

— |

|

|

29,638 |

|

| Balance at March 31, 2022 |

29,240,383 |

|

|

3 |

|

|

$ |

355,949 |

|

|

$ |

(310) |

|

|

$ |

(217,681) |

|

|

$ |

137,961 |

|

| Net loss |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(21,901) |

|

|

(21,901) |

|

| Stock-based compensation |

— |

|

|

— |

|

|

2,062 |

|

|

— |

|

|

— |

|

|

2,062 |

|

| Foreign exchange translation adjustment |

— |

|

|

— |

|

|

— |

|

|

(350) |

|

|

— |

|

|

(350) |

|

| Shares issued in connection with the Company's Employee stock purchase plan |

24,612 |

|

|

$ |

— |

|

|

130 |

|

|

$ |

— |

|

|

$ |

— |

|

|

130 |

|

Issuance of common stock - at the market Sales Agreement net of issuance costs of $308 |

1,300,000 |

|

|

$ |

— |

|

|

9,946 |

|

|

$ |

— |

|

|

$ |

— |

|

|

9,946 |

|

| Balance at June 30, 2022 |

30,564,995 |

|

|

$ |

3 |

|

|

$ |

368,087 |

|

|

$ |

(660) |

|

|

$ |

(239,582) |

|

|

$ |

127,848 |

|

| Net loss |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(21,224) |

|

|

(21,224) |

|

| Stock-based compensation |

— |

|

|

— |

|

|

1,912 |

|

|

— |

|

|

— |

|

|

1,912 |

|

| Foreign exchange translation adjustment |

— |

|

|

— |

|

|

— |

|

|

274 |

|

|

— |

|

|

274 |

|

| Balance at September 30, 2022 |

30,564,995 |

|

|

$ |

3 |

|

|

$ |

369,999 |

|

|

$ |

(386) |

|

|

$ |

(260,806) |

|

|

108,810 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

IMMUNIC, INC.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

| |

Nine Months

Ended September 30, |

| |

2023 |

|

2022 |

| Cash flows from operating activities: |

|

|

|

| Net loss |

$ |

(72,040) |

|

|

$ |

(63,933) |

|

| Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

| Depreciation and amortization |

88 |

|

|

58 |

|

| Unrealized foreign currency loss |

712 |

|

|

4,217 |

|

|

|

|

|

| Stock-based compensation |

5,464 |

|

|

6,043 |

|

|

|

|

|

| Changes in operating assets and liabilities: |

|

|

|

| Other current assets and prepaid expenses |

3,881 |

|

|

2,061 |

|

| Accounts payable |

(951) |

|

|

1,151 |

|

| Accrued expenses |

5,961 |

|

|

465 |

|

| Other liabilities |

84 |

|

|

(102) |

|

| Net cash used in operating activities |

(56,801) |

|

|

(50,040) |

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchases of property and equipment |

(169) |

|

|

(113) |

|

| Sale of investments - Other |

9,796 |

|

|

— |

|

| Net cash provided by (used in) investing activities |

9,627 |

|

|

(113) |

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

Proceeds from public offering of common stock through At The Market offering, net of issuance costs of $9 and $1,226, respectively |

282 |

|

|

39,584 |

|

| Proceeds from exercise of stock options |

— |

|

|

5 |

|

| Proceeds from the exercise of pre-funded warrants |

51 |

|

|

— |

|

| Proceeds from shares issued in connection with the Company's employee stock purchase plan |

96 |

|

|

130 |

|

|

|

|

|

| Net cash provided by financing activities |

429 |

|

|

39,719 |

|

| Effect of exchange rate changes on cash and cash equivalents |

(311) |

|

|

(3,658) |

|

| Net change in cash and cash equivalents |

(47,056) |

|

|

(14,092) |

|

| Cash and cash equivalents, beginning of period |

106,745 |

|

|

86,863 |

|

| Cash and cash equivalents, end of period |

$ |

59,689 |

|

|

$ |

72,771 |

|

|

|

|

|

|

|

|

|

| Supplemental disclosure of noncash investing and financing activities: |

|

|

|

|

|

|

|

|

|

|

|

| Operating lease right-of use asset obtained in exchange for lease obligation |

$ |

544 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

IMMUNIC, INC.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

1. Description of Business and Basis of Financial Statements

Description of Business

Immunic, Inc. ("Immunic" or the "Company") is a biotechnology company developing a clinical pipeline of selective oral immunology therapies focused on treating chronic inflammatory and autoimmune diseases. The Company is headquartered in New York City with its main operations in Gräfelfing near Munich, Germany. The Company currently has approximately 80 employees.

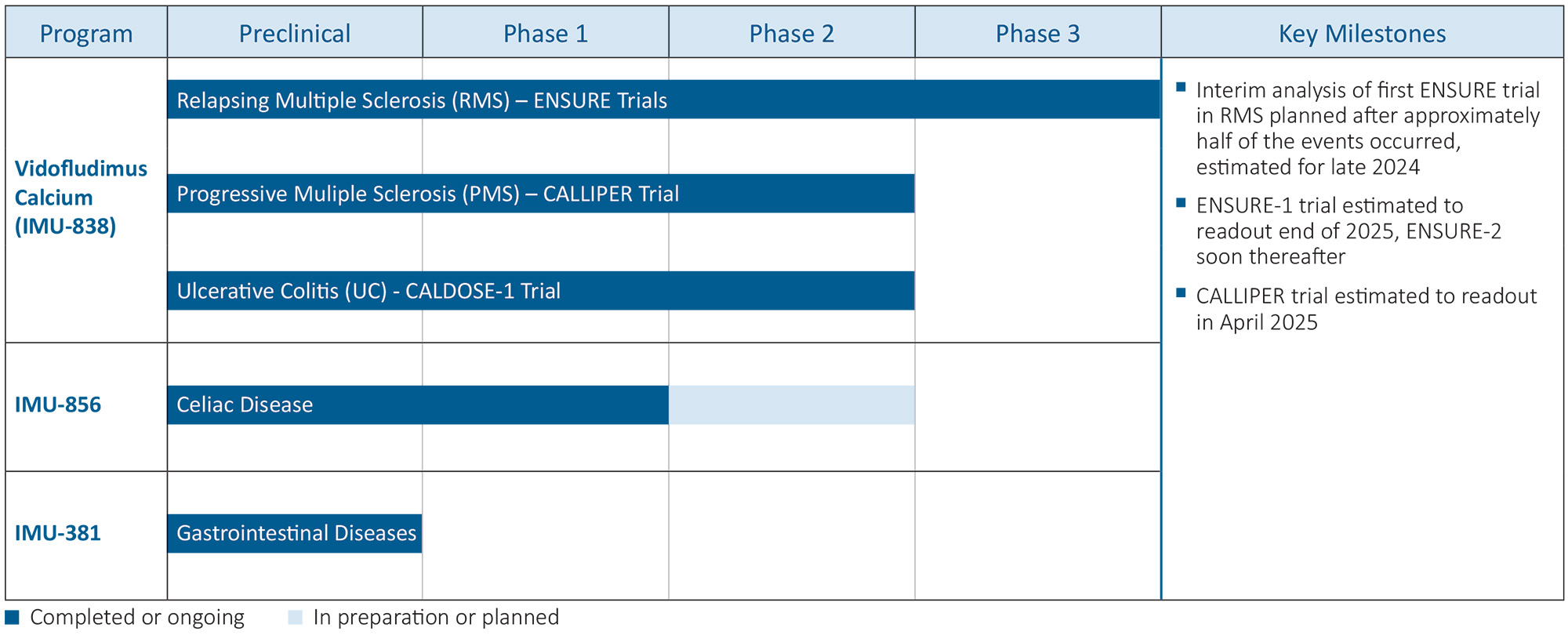

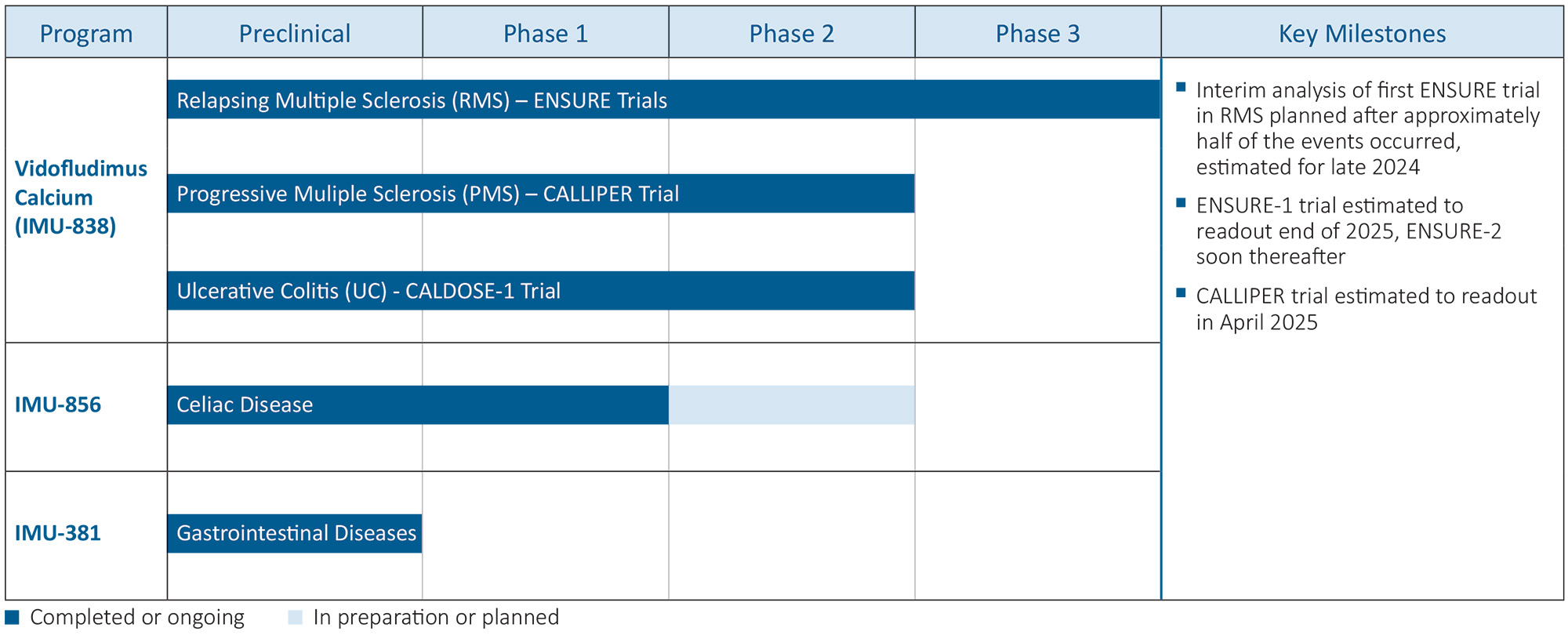

Immunic is pursuing clinical development of orally administered, small molecule programs, each of which has unique features intended to directly address the unmet needs of patients with serious chronic inflammatory and autoimmune diseases. These include the vidofludimus calcium (IMU-838) program, which is in Phase 3 clinical development for patients with multiple sclerosis (“MS”) and which has shown therapeutic activity in Phase 2 clinical trials in patients suffering from relapsing-remitting MS, progressive MS and moderate-to-severe ulcerative colitis (“UC”); the IMU-856 program, which is targeted to regenerate bowel epithelium and restore intestinal barrier function, which could potentially be applicable in numerous gastrointestinal diseases, such as celiac disease, UC, Crohn’s disease or irritable bowel syndrome with diarrhea; and the IMU-381 program, which is a next generation molecule being developed to specifically address the needs of gastrointestinal diseases.

The Company’s business, operating results, financial condition and growth prospects are subject to significant risks and uncertainties, including the failure of its clinical trials to meet their endpoints, failure to obtain regulatory approval and needing additional funding to complete the development and commercialization of the Company's three development programs.

Liquidity and Financial Condition

Immunic has no products approved for commercial sale and has not generated any revenue from product sales. It has never been profitable and has incurred operating losses in each year since inception in 2016. The Company has an accumulated deficit of approximately $389.3 million as of September 30, 2023 and $317.3 million as of December 31, 2022. Substantially all of Immunic's operating losses resulted from expenses incurred in connection with its research and development programs and from general and administrative costs associated with its operations.

Immunic expects to incur significant expenses and increasing operating losses for the foreseeable future as it initiates and continues the development of its product candidates and adds personnel necessary to advance its pipeline of product candidates. Immunic expects that its operating losses will fluctuate significantly from quarter-to-quarter and year-to-year due to timing of development programs.

From inception through October 31, 2023, Immunic has raised net cash of approximately $355.9 million from private and public offerings of preferred and common stock. As of September 30, 2023, the Company had cash and cash equivalents of approximately $59.7 million. With these funds, the Company does not have adequate liquidity to fund its operations for at least twelve months from the issuance of these financial statements without raising additional capital and such actions are not solely within the control of the Company. If the Company is unable to obtain additional capital, it would have a material adverse effect on the operations of the Company, its clinical development program, and the Company may have to cease operations altogether. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

Basis of Presentation and Consolidation

The accompanying consolidated financial statements have been prepared in conformity with United States generally accepted accounting principles, ("U.S. GAAP") and include the accounts of Immunic and its wholly-owned subsidiaries, Immunic AG and Immunic Australia Pty Ltd. All intercompany accounts and transactions have been eliminated in consolidation. Immunic manages its operations as a single reportable segment for the purposes of assessing performance and making operating decisions.

Unaudited Interim Financial Information

Immunic has prepared the accompanying interim unaudited condensed consolidated financial statements in accordance with United States generally accepted accounting principles, (“US GAAP”), for interim financial information and with the instructions to Form 10-Q and Regulation S-X of the SEC. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. These interim unaudited condensed consolidated financial statements reflect all adjustments consisting of normal recurring accruals which, in the opinion of management, are necessary to present fairly Immunic’s consolidated financial position, consolidated results of operations, consolidated statement of stockholders’ equity and consolidated cash flows for the periods and as of the dates presented. The Company’s fiscal year ends on December 31. The condensed consolidated balance sheet as of December 31, 2022 was derived from audited consolidated financial statements but does not include all disclosures required by U.S. GAAP. These condensed consolidated financial statements should be read in conjunction with the annual consolidated financial statements and the notes thereto included on the Company's Annual Report on Form 10-K filed on February 23, 2023. The nature of Immunic’s business is such that the results of any interim period may not be indicative of the results to be expected for the entire year.

2. Summary of Significant Accounting Policies

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires the Company to make certain estimates and assumptions that affect the reported amounts of assets, liabilities, expenses and the disclosure of contingent assets and liabilities in the Company’s consolidated financial statements. The most significant estimates in the Company’s financial statements and accompanying notes relate to clinical trial expenses and share-based compensation. Management believes its estimates to be reasonable under the circumstances. Actual results could differ materially from those estimates and assumptions.

Foreign Currency Translation and Presentation

The Company’s reporting currency is United States (“U.S.”) dollars. Immunic AG is located in Germany with the euro being its functional currency. Immunic Australia Pty Ltd.’s functional currency is the Australian dollar. All amounts in the financial statements where the functional currency is not the U.S. dollar are translated into U.S. dollar equivalents at exchange rates as follows:

• assets and liabilities at reporting period-end rates;

• income statement accounts at average exchange rates for the reporting period; and

• components of equity at historical rates.

Gains and losses from translation of the financial statements into U.S. dollars are recorded in stockholders’ equity as a component of accumulated other comprehensive income (loss). Realized and unrealized gains and losses resulting from foreign currency transactions denominated in currencies other than the functional currency are reflected as general and administrative expenses in the Consolidated Statements of Operations. Foreign currency transaction gains and losses related to long-term intercompany loans that are payable in the foreseeable future are recorded in Other Income (Expense). The Consolidated Statements of Cash Flows were prepared by using the average exchange rate in effect during the reporting period which reasonably approximates the timing of the cash flows.

Cash and Cash Equivalents and Investments - other

The Company considers all highly liquid investments with an original maturity of three months or less to be cash equivalents. Time Deposits with an original maturity greater than three months are classified as Investments - other.

Cash and cash equivalents and investments - other consist of cash on hand and deposits in banks located in the U.S. of approximately $35.4 million, Germany of approximately $22.4 million and Australia of approximately $1.9 million as of September 30, 2023. The Company maintains cash and cash equivalent balances denominated in Euro and U.S. dollars with major financial institutions in the U.S. and Germany in excess of the deposit limits insured by the government. Management periodically reviews the credit standing of these financial institutions. The Company currently deposits its cash and cash equivalents with two large financial institutions. Cash and Cash equivalents in the U.S. are held at J.P. Morgan and as of September 30, 2023 are primarily held in a U.S. Government money market fund account earning interest at a rate of 5.0%. Cash and cash equivalents in Germany were earning interest at a rate of 2.00% to 3.25% during the period ended September 30, 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2023 |

|

December 31, 2022 |

| Time Deposits |

$0 |

|

$9,629 |

|

$0 |

|

$9,629 |

Fair Value Measurement

Fair value is defined as the price that would be received to sell an asset or be paid to transfer a liability in an orderly transaction between market participants on the measurement date. Accounting guidance establishes a fair value hierarchy that requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The standard describes three levels of inputs that may be used to measure fair value:

Level 1—Quoted prices in active markets for identical assets or liabilities. Level 1 assets consisted of money market funds for the periods presented. The Company had no Level 1 liabilities for the periods presented.

Level 2—Inputs other than observable quoted prices for the asset or liability, either directly or indirectly; these include quoted prices for similar assets or liabilities in active markets and quoted prices for identical or similar assets or liabilities in markets that are not active. The Company had no Level 2 assets or liabilities for the periods presented.

Level 3—Unobservable inputs to the valuation methodology that are significant to the measurement of the fair value of assets or liabilities. The Company had no Level 3 assets or liabilities for the periods presented.

The carrying value of cash and cash equivalents, other current assets and prepaid expenses, accounts payable, accrued expenses, and other current liabilities approximates fair value due to the short period of time to maturity.

Property and Equipment

Property and equipment is stated at cost. Depreciation is computed using the straight-line method based on the estimated service lives of the assets, which range from three to thirteen years. Depreciation expense was $34,000 and $17,000 for the three months ended September 30, 2023 and 2022, respectively. Depreciation expense was $88,000 and $58,000 for the nine months ended September 30, 2023 and 2022, respectively.

Impairment of Long-Lived Assets

The Company records impairment losses on long-lived assets used in operations when indicators of impairment are present and the undiscounted cash flows estimated to be generated by those assets are less than the assets’ carrying amount. Impaired assets are then recorded at their estimated fair value. There were no impairment losses during the three and nine months ended September 30, 2023 and 2022.

Goodwill

Business combinations are accounted for under the acquisition method. The total purchase price of an acquisition is allocated to the underlying identifiable net assets, based on their respective estimated fair values as of the acquisition date. Determining the fair value of assets acquired and liabilities assumed requires management’s judgment and often involves the use of significant estimates and assumptions, including assumptions with respect to future cash inflows and outflows, probabilities of success, discount rates, and asset lives, among other items. Assets acquired and liabilities assumed are recorded at their estimated fair values. The excess of the purchase price over the estimated fair values of the net assets acquired is recorded as goodwill.

Goodwill is tested for impairment at the reporting unit level annually in the fourth quarter, or more frequently when events or changes in circumstances indicate that the asset might be impaired. Examples of such events or circumstances include, but are not limited to, an unfavorable clinical trial result, a significant adverse change in legal or business climate, industry market conditions, an adverse regulatory action, sustained decrease in stock price or unanticipated competition.

On October 20, 2022, the Company announced the outcome of a significant interim analysis of its Phase 1b clinical trial of izumerogant (IMU-935) in patients with moderate-to-severe psoriasis that were not deemed positive progress. On October 21, 2022, the Company experienced a significant decrease in the Company's market capitalization. The Company considered this to be a triggering event indicating that it is more likely than not that goodwill was impaired.

The Company performed an analysis of the fair value compared to the Company's book value, utilizing the Company's traded stock price (a level 1 fair value input). As a result of that analysis, the Company recorded an approximately $33.0 million non-cash goodwill impairment charge in the fourth quarter of 2022, which represents a full write down of its previous goodwill balance.

Research and Development Expenses

These costs primarily include external development expenses and internal personnel expenses for its development programs, vidofludimus calcium, izumerogant and IMU-856. Immunic has spent the majority of its research and development resources on vidofludimus calcium, the Company's lead development program, for clinical trials in MS and UC.

Research and development expenses consist of expenses incurred in research and development activities, which include clinical trials, contract research services, certain milestone payments, salaries and related employee benefits, allocated facility costs and other outsourced services. Research and development expenses are charged to operations as incurred.

The Company enters into agreements with contract research organizations (“CROs”) to provide clinical trial services for individual studies and projects by executing individual work orders governed by a Master Service Arrangement (“MSA”). The MSAs and associated work orders provide for regular recurrent payments and payments upon the completion of certain milestones. The Company regularly assesses the timing of payments against actual costs incurred to ensure a proper accrual of related expenses in the appropriate accounting period.

Collaboration Arrangements

Certain collaboration and license agreements may include payments to or from the Company of one or more of the following: non-refundable or partially refundable upfront or license fees; development, regulatory and commercial milestone payments; payment for manufacturing supply services; partial or complete reimbursement of research and development costs; and royalties on net sales of licensed products. The Company assesses whether such contracts are within the scope of Financial Accounting Standards Board (FASB) Accounting Standards Update (“ASU”) 2014-09 “Revenue from Contracts with Customers” and ASU No. 2018-18, “Collaborative Arrangements” ("ASU 2018-18"). ASU 2018-18, clarifies that certain elements of collaborative arrangements could qualify as transactions with customers in the scope of ASC 606.

In October 2018, the Company entered into an option and license agreement (the "Daiichi Sankyo Agreement") with Daiichi Sankyo Co., Ltd. ("Daiichi Sankyo") which granted the Company the right to license a group of compounds, designated by the Company as IMU-856, as a potential new oral treatment option for gastrointestinal diseases such as celiac disease, inflammatory bowel disease, irritable bowel syndrome with diarrhea and other barrier function associated diseases. During the option period, the Company performed agreed upon research and development activities for which it was reimbursed by Daiichi Sankyo up to a maximum agreed-upon limit. Such reimbursement was recorded as other income. There are no additional research and development reimbursements expected under this agreement.

On January 5, 2020, the Company exercised its option to obtain the exclusive worldwide right to commercialization of IMU-856. Among other things, the option exercise grants Immunic AG the rights to Daiichi Sankyo’s patent application related to IMU-856, for which the Company received a notice of allowance from the U.S. Patent & Trademark Office in August 2022. In connection with the option exercise, the Company paid a one-time upfront licensing fee to Daiichi Sankyo. Under the Daiichi Sankyo Agreement, Daiichi Sankyo is also eligible to receive future development, regulatory and sales milestone payments, as well as royalties related to IMU-856.

Government assistance

Government assistance relating to research and development performed by Immunic Australia is recorded as a component of other (income) expense. This government assistance is recognized at a rate of 43.5% of the qualified research and development expenditures which are incurred. We also receive government assistance from the German Government for reimbursement of research and development expenses up to one million Euros per year. We recognized $0.2 million and $2.3 million of other income related to research activities performed during the three and nine months ended September 30, 2023, respectively and $0.6 million and $2.0 million related to research activities performed during the three and nine months ended September 30, 2022, respectively.

General and Administrative Expenses

General and administrative expenses consist primarily of salaries and related costs for personnel in executive, finance, business development and other support functions. Other general and administrative expenses include, but are not limited to, stock-based compensation, insurance costs, professional fees for legal, accounting and tax services, consulting, related facility costs and travel.

Stock-Based Compensation

The Company measures the cost of employee and non-employee services received in exchange for equity awards based on the grant-date fair value of the award recognized generally as an expense (i) on a straight-line basis over the requisite service period for those awards whose vesting is based upon a service condition, and (ii) on an accelerated method for awards whose vesting is based upon a performance condition, but only to the extent it is probable that the performance condition will be met. Stock-based compensation is (i) estimated at the date of grant based on the award’s fair value for equity classified awards and (ii) final measurement date for liability classified awards. Forfeitures are recorded in the period in which they occur.

The Company estimates the fair value of stock options using the Black-Scholes-Merton option-pricing model ("BSM"), which requires the use of estimates and subjective assumptions, including the risk-free interest rate, the fair value of the underlying common stock, the expected dividend yield of the Company’s common stock, the expected volatility of the price of the Company’s common stock, and the expected term of the option. These estimates involve inherent uncertainties and the application of management’s judgment. If factors change and different assumptions are used, the Company’s stock-based compensation expense could be materially different in the future.

Leases

The Company leases office space and office equipment. The underlying lease agreements have lease terms of less than 12 months and up to 60 months. Leases with terms of 12 months or less at inception are not included in the operating lease right of use asset and operating lease liability.

The Company has three existing leases for office and laboratory space. At inception of a lease agreement, the Company determines whether an agreement represents a lease and at commencement each lease agreement is assessed as to classification as an operating or financing lease. The Company's leases have been classified as operating leases and an operating lease right-of-use asset and an operating lease liability have been recorded on the Company’s balance sheet. A right-of-use lease asset represents the Company’s right to use the underlying asset for the lease term and the lease obligation represents its commitment to make the lease payments arising from the lease. Right-of-use lease assets and obligations are recognized at the commencement date based on the present value of remaining lease payments over the lease term. As the Company’s leases do not provide an implicit rate, the Company has used an estimated incremental borrowing rate based on the information available at the commencement date in determining the present value of lease payments. The right-of-use lease asset includes any lease payments made prior to commencement and excludes any lease incentives. The lease term used in estimating future lease payments may include options to extend when it is reasonably certain that the Company will exercise that option. Operating lease expense is recognized on a straight-line basis over the lease term, subject to any changes in the lease or changes in expectations regarding the lease term. Variable lease costs such as common area costs and property taxes are expensed as incurred. Leases with an initial term of twelve months or less are not recorded on the balance sheet.

Comprehensive Income (Loss)

Comprehensive income (loss) is defined as the change in equity during a period from transactions and other events and circumstances from non-owner sources. Accumulated other comprehensive income (loss) has been reflected as a separate component of stockholders’ equity in the accompanying Consolidated Balance Sheets and consists of foreign currency translation adjustments (net of tax).

Income Taxes

The Company is subject to corporate income tax laws and regulations in the U.S., Germany and Australia. Tax regulations within each jurisdiction are subject to the interpretation of the related tax laws and regulations and require significant judgment in their application.

The Company utilizes the asset and liability method of accounting for income taxes which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the audited consolidated financial statements. Deferred income tax assets and liabilities are determined based on the differences between the financial statement and tax basis of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. The effect of changes in tax rates on deferred tax assets and liabilities is recognized in operations in the period that includes the enactment date. Deferred taxes are reduced by a valuation allowance when, in the opinion of management, it is more likely than not some portion or the entire deferred tax asset will not be realized. As of September 30, 2023 and 2022, respectively, the Company maintained a full valuation allowance against the balance of deferred tax assets.

It is the Company’s policy to provide for uncertain tax positions and the related interest and penalties based upon management’s assessment of whether a tax benefit is more likely than not to be sustained upon examination by tax authorities. The Company recognizes interest and penalties accrued on any unrecognized tax benefits as a component of income tax expense. The Company is subject to U.S. federal, New York, California, Texas, German and Australian income taxes. The Company is subject to U.S. federal or state income tax examination by tax authorities for tax returns filed for the years 2003 and forward due to the carryforward of NOLs. Tax years 2016 through 2022 are subject to audit by German and Australian tax authorities. The Company is not currently under examination by any tax jurisdictions.

Warrants

The Company accounts for issued warrants either as a liability or equity in accordance with ASC 480-10, Accounting for Certain Financial Instruments with Characteristics of both Liabilities and Equity (“ASC 480-10”) or ASC 815-40, Accounting for Derivative Financial Instruments Indexed to, and Potentially Settled in, a Company’s Own Stock (“ASC 815-40”). Under ASC 480-10, warrants are considered a liability if they are mandatorily redeemable and they require settlement in cash, other assets, or a variable number of shares. If warrants do not meet liability classification under ASC 480-10, the Company considers the requirements of ASC 815-40 to determine whether the warrants should be classified as a liability or as equity. Under ASC 815-40, contracts that may require settlement for cash are liabilities, regardless of the probability of the occurrence of the triggering event. Liability-classified warrants are measured at fair value on the issuance date and at the end of each reporting period. Any change in the fair value of the warrants after the issuance date is recorded in the consolidated statements of operations as a gain or loss. If warrants do not require liability classification under ASC 815-40, in order to conclude warrants should be classified as equity, the Company assesses whether the warrants are indexed to its common stock and whether the warrants are classified as equity under ASC 815-40 or other applicable U.S. GAAP standard. Equity-classified warrants are accounted for at fair value on the issuance date with no changes in fair value recognized after the issuance date. All of the Company's 5,096,552 pre-funded warrants were exercised in January 2023.

Net Loss Per Share

Basic net loss per share attributable to common stockholders is calculated by dividing the net loss by the weighted-average number of common shares outstanding for the period, without consideration for common stock equivalents. Diluted net loss per share attributable to common stockholders is computed by dividing the net loss by the weighted-average number of common shares and, if dilutive, common stock equivalents outstanding for the period determined using the treasury-stock method. For all periods presented, there is no difference in the number of shares used to calculate basic and diluted shares outstanding due to the Company’s net loss position.

Potentially dilutive securities, not included in the calculation of diluted net loss per share attributable to common stockholders because to do so would be anti-dilutive, are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

As of September 30, |

|

2023 |

|

2022 |

| Options to purchase common stock |

6,263,910 |

|

|

3,799,573 |

|

|

|

|

|

Recently Issued and/or Adopted Accounting Standards

There are no recently issued accounting standards that would have a significant impact on the company's consolidated financial statements.

3. Balance Sheet Details

Other Current Assets and Prepaid Expenses

Other Current Assets and Prepaid Expenses consist of (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2023 |

|

December 31, 2022 |

| Prepaid clinical and related costs |

$ |

2,304 |

|

|

$ |

5,608 |

|

| VAT receivable |

1,187 |

|

|

296 |

|

| Australian research and development tax incentive |

607 |

|

|

2,361 |

|

| Other |

1,447 |

|

|

1,225 |

|

| Total |

$ |

5,545 |

|

|

$ |

9,490 |

|

Accounts Payable

Accounts Payable consist of (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2023 |

|

December 31, 2022 |

| Clinical costs |

$ |

2,846 |

|

|

$ |

3,749 |

|

| Legal and audit costs |

71 |

|

|

288 |

|

|

|

|

|

| Other |

282 |

|

|

244 |

|

| Total |

$ |

3,199 |

|

|

$ |

4,281 |

|

Accrued Expenses

Accrued expenses consist of (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2023 |

|

December 31, 2022 |

| Accrued clinical and related costs |

$ |

12,415 |

|

|

$ |

6,807 |

|

| Accrued legal and audit costs |

78 |

|

|

169 |

|

| Accrued compensation |

1,049 |

|

|

890 |

|

| Accrued other |

117 |

|

|

120 |

|

| Total |

$ |

13,659 |

|

|

$ |

7,986 |

|

Other Current Liabilities

Other Current Liabilities consist of (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2023 |

|

December 31, 2022 |

|

| Lease liabilities |

$ |

662 |

|

|

$ |

571 |

|

|

| Other |

261 |

|

|

239 |

|

|

| Total |

923 |

|

|

810 |

|

|

4. Commitments and Contingencies

Operating Leases

The Company leases certain office space under non-cancelable operating leases. The leases terminate on July 31, 2025 for the New York City office, June 30, 2025 for the Gräfelfing, Germany office and November 30, 2028 related to the new lease of a research laboratory in Planegg, Germany. These agreements include both lease (e.g., fixed rent) and non-lease components (e.g., common-area and other maintenance costs). The non-lease components are deemed to be executory costs and are therefore excluded from the minimum lease payments used to determine the present value of the operating lease obligation and related right-of-use asset. The New York City lease was extended on December 22, 2022 for an additional 27 months resulting in the new lease termination date of July 31, 2025. The New York City lease has a renewal option, but this was not included in calculating the right of use asset and liabilities. On April 7, 2020, the Company signed a five year lease for its facility in Gräfelfing, Germany. On March 1, 2021 and August 1, 2022 the Company added additional lease space at the Gräfelfing, Germany office. Renewal options were not included in calculating the right of use asset and liabilities for this facility. In February 2023, the Company leased space in Germany for a research laboratory. The leases do not have concessions, leasehold improvement incentives or other build-out clauses. Further, the leases do not contain contingent rent provisions. The New York City lease had a six month rent holiday at the beginning of the lease as well as a three month rent holiday upon the 27 month extension starting May 2023. There were net additions of $544,000 related to the addition of new laboratory space in Planegg, Germany in February 2023.

The leases do not provide an implicit rate and, due to the lack of a commercially salable product, the Company is generally considered unable to obtain commercial credit. Therefore, the Company estimated its incremental interest rate to be 6% for the original leases and 8% for the New York City extension and German laboratory, considering the quoted rates for the lowest investment-grade debt and the interest rates implicit in recent financing leases. Immunic used its estimated incremental borrowing rate and other information available at the lease commencement date in determining the present value of the lease payments.

Immunic’s operating lease costs and variable lease costs were $209,000 and $232,000 for the three months ended September 30, 2023 and 2022, respectively and $642,000 and $498,000 for the nine months ended September 30, 2023 and 2022, respectively. Variable lease costs consist primarily of common area maintenance costs, insurance and taxes which are paid based upon actual costs incurred by the lessor.

Maturities of the operating lease obligation are as follows as of September 30, 2023 (in thousands):

|

|

|

|

|

|

|

|

|

| 2023 |

$ |

189 |

|

| 2024 |

|

758 |

|

| 2025 |

|

433 |

|

| 2026 |

|

78 |

|

| 2027 |

|

82 |

|

| Thereafter |

|

55 |

|

| Total |

|

1,595 |

|

| Interest |

|

144 |

|

| PV of obligation |

$ |

1,451 |

|

Contractual Obligations

As of September 30, 2023, the Company has non-cancelable contractual obligations under certain agreements related to its development programs for vidofludimus calcium and IMU-856 totaling approximately $5.1 million, all of which is expected to be paid in the next twelve months.

Other Commitments and Obligations

Daiichi Sankyo Agreement

On January 5, 2020, the Company exercised its option to obtain the exclusive worldwide right to commercialization of IMU-856. Among other things, the option exercise grants Immunic AG the rights to Daiichi Sankyo’s patent application related to IMU-856, for which the Company received a notice of allowance from the U.S. Patent & Trademark Office in August 2022. In connection with the option exercise, the Company paid a one-time upfront licensing fee to Daiichi Sankyo. Under the Daiichi Sankyo Agreement, Daiichi Sankyo is also eligible to receive future development, regulatory and sales milestone payments, as well as royalties related to IMU-856.

Legal Proceedings

The Company is not currently a party to any litigation, nor is it aware of any pending or threatened litigation, that it believes would materially affect its business, operating results, financial condition or cash flows. However, its industry is characterized by frequent claims and litigation including securities litigation, claims regarding patent and other intellectual property rights and claims for product liability. As a result, in the future, the Company may be involved in various legal proceedings from time to time.

5. Fair Value

The following fair value hierarchy tables present information about each major category of the Company’s financial assets and liabilities measured at fair value on a recurring basis (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Fair Value Measurement at September 30, 2023 |

| |

Fair Value |

|

Level 1 |

|

Level 2 |

|

Level 3 |

| Assets |

|

|

|

|

|

|

|

| Money market funds |

$ |

35,031 |

|

|

$ |

35,031 |

|

|

$ |

— |

|

|

$ |

— |

|

| Total assets at fair value |

$ |

35,031 |

|

|

$ |

35,031 |

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Measurement at December 31, 2022 |

|

Fair Value |

|

Level 1 |

|

Level 2 |

|

Level 3 |

| Assets |

|

|

|

|

|

|

|

| Money market funds |

$ |

85,521 |

|

|

$ |

85,521 |

|

|

$ |

— |

|

|

$ |

— |

|

| Total assets |

$ |

85,521 |

|

|

$ |

85,521 |

|

|

$ |

— |

|

|

$ |

— |

|

There were no transfers between Level 1, Level 2 or Level 3 assets during the periods presented.

For the Company’s money market funds which are included as a component of cash and cash equivalents on the consolidated balance sheet, realized gains and losses are included in interest income (expense) on the consolidated statements of operations.

Our money market fund account is held in our bank in the U.S. and was earning interest at a rate of 5.0% in a U.S. Government money market fund.

The Company has cash balances in banks in excess of the maximum amount insured by the FDIC and other international agencies as of September 30, 2023. The Company has not historically experienced any credit losses with balances in excess of FDIC limits.

The carrying amounts of other current assets and prepaid expenses, accounts payable, accrued expenses, and other current liabilities approximate their fair values due to their short-term nature. The fair value and book value of the money market funds presented in the table above are the same.

6. Common Stock

In November 2020, Immunic filed a shelf registration statement on Form S-3. The 2020 Shelf Registration Statement permits the offering, issuance and sale of up to $250.0 million of common stock, preferred stock, warrants, debt securities, and/or units in one or more offerings and in any combination of the foregoing. As of October 31, 2023, there is $75.0 million remaining on this shelf registration statement. This 2020 Shelf Registration Statement will expire on November 24, 2023. The Company plans to file prior to that expiration date, a new shelf registration statement to replace the expiring Form S-3, which would permit the Company to: (i) continue to sell, subject to applicable SEC requirements, unsold securities remaining on the expiring Form S-3; and (ii) offer and sell additional securities to be registered on the new Form S-3.

In December 2020, the Company filed a Prospectus Supplement for the offering, issuance and sale of up to a maximum aggregate offering price of $50.0 million of common stock that may be issued and sold under an at-the-market sales agreement ("December 2020 ATM") with SVB Leerink LLC (now Leerink Partners LLC) as agent. The Company has used, and intends to continue to use the net proceeds from the offering to continue to fund the ongoing clinical development of its product candidates and for other general corporate purposes, including funding existing and potential new clinical programs and product candidates. The December 2020 ATM will terminate upon the earlier of (i) the issuance and sale of all of the shares through Leerink Partners LLC on the terms and subject to the conditions set forth in the December 2020 ATM or (ii) termination of the December 2020 ATM as otherwise permitted thereby. The December 2020 ATM may be terminated at any time by either party upon ten days’ prior notice, or by Leerink Prtners LLC at any time in certain circumstances, including the occurrence of a material adverse effect on the Company. As of October 31, 2023, $8.1 million in capacity remains under the December 2020 ATM.

In May 2022, the Company filed a Prospectus Supplement for the offering, issuance and sale of up to a maximum aggregate offering price of $80.0 million of common stock that may be issued and sold under another at-the-market sales agreement ("May 2022 ATM") with SVB Leerink LLC (now Leerink Partners LLC) as agent. The Company intends to use the net proceeds from the offering to continue to fund the ongoing clinical development of its product candidates and for other general corporate purposes, including funding existing and potential new clinical programs and product candidates. The May 2022 ATM will terminate upon the earlier of (i) the issuance and sale of all of the shares through Leerink Partners LLC on the terms and subject to the conditions set forth in the May 2022 ATM or (ii) termination of the May 2022 ATM as otherwise permitted thereby. The May 2022 ATM may be terminated at any time by either party upon ten days’ prior notice, or by Leerink Partners LLC at any time in certain circumstances, including the occurrence of a material adverse effect on the Company. As of October 31, 2023, $80.0 million in capacity remains under the May 2022 ATM.