UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2024.

Commission File Number 001-31722

New Gold Inc.

Suite 3320 – 181 Bay Street

Toronto, Ontario M5J 2T3

Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒ Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

DOCUMENTS FILED AS PART OF THIS FORM 6-K

| Exhibit | Description | |

| 99.1 | Notice of Meeting | |

| 99.2 | Management Information Circular dated March 28, 2024 | |

| 99.3 | Form of Proxy | |

| 99.4 | Notice and Access Notification | |

| 99.5 | Virtual Meeting User Guide |

SIGNATURES

| NEW GOLD INC. | |||

| By: | /s/ Sean Keating | ||

| Date: April 4, 2024 | Sean Keating | ||

| Vice President, General Counsel and Corporate Secretary | |||

Exhibit 99.1

|

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

Notice is hereby given that the annual general meeting of shareholders (“Meeting”) of New Gold Inc. (“New

Gold” or the “Company”) will be held virtually at https://web.lumiagm.com/426295035

on Tuesday, May 14, 2024 at 4:00 p.m. (Eastern time) for the following purposes:

| 1. | receiving the audited consolidated financial statements of the Company for the year ended December 31, 2023 and the auditor’s report on those statements; |

| 2. | electing the directors of the Company; |

| 3. | appointing Deloitte LLP as auditor of the Company and authorizing the directors to fix its remuneration; |

| 4. | considering and, if deemed appropriate, passing, with or without variation, a non-binding advisory resolution on executive compensation; and |

| 5. | conducting such other business properly brought before the Meeting or any adjournment or postponement thereof. |

Given New Gold’s desire to maximize the accessibility of the Meeting for its shareholders, New Gold will be conducting the Meeting virtually. A virtual Meeting affords all shareholders an equal ability to attend and participate in the Meeting, regardless of geographic location. At the virtual Meeting, registered shareholders, non-registered (or beneficial) shareholders and their duly appointed proxyholders will be able to participate, ask questions and vote in “real time” through an online portal. Non-registered shareholders must carefully follow the procedures set out in the management information circular (the “Circular”) that accompanies this notice if they wish to appoint themselves as a proxyholder to vote at the virtual Meeting and ask questions through the live webcast. Non-registered shareholders who do not follow the procedures set out in the Circular, along with other stakeholders who do not own common shares, will nonetheless be able to view a live webcast of the Meeting but will not be able to ask questions or vote. New Gold firmly believes that a virtual Meeting gives all shareholders an equal opportunity to participate. New Gold hopes that hosting a virtual Meeting will increase participation by its shareholders, as it will enable shareholders to more easily attend the Meeting regardless of their geographic location or the particular constraints or circumstances they may be facing.

It should be noted that the vast majority of our shareholders vote in advance of the Meeting by proxy and are encouraged to continue to do so via the various channels outlined in the Circular. The virtual Meeting does not change shareholders’ ability to vote by proxy. However, those that wish to participate in the virtual Meeting or to appoint a proxy to participate, are encouraged to carefully read the instructions in the Circular and in particular the procedure for appointing yourself or a proxy.

The record date for the Meeting is March 15, 2024. The record date is the date for the determination of the registered holders of common shares entitled to receive notice of, and to vote at, the Meeting and any adjournment or postponement thereof.

| |

This notice is accompanied by the Circular and either a proxy form or a voting instruction form. If previously requested, a copy of the audited consolidated financial statements and management’s discussion and analysis (“MD&A”) of New Gold for the year ended December 31, 2023 will also accompany this notice. Copies of New Gold’s annual and interim financial statements and MD&A are also available under New Gold’s profile on SEDAR+ at www.sedarplus.ca, on EDGAR at www.sec.gov and on New Gold’s website at www.newgold.com. As described in the notice and access notification mailed to shareholders, New Gold is using the notice and access method for delivering this notice and the Circular to shareholders. This notice and the Circular are also available on New Gold’s website at https://newgold.com/news-events/annual-meeting-of-shareholders/default.aspx and under New Gold’s profile on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov.

We value your opinion and participation in the Meeting as a shareholder of New Gold. For your information, the Meeting is not expected to include a formal presentation by management, but there will be an opportunity for shareholders to ask questions. Please review the accompanying Circular before voting, as it contains important information about the Meeting. It is important that you exercise your vote, either virtually at the Meeting or by proxy. Any questions regarding voting your common shares should be directed to New Gold’s advisor and proxy solicitation agent, Kingsdale Advisors, which can be reached by toll-free telephone in North America at 1-866-581-1477, at 1-437-561-5022 (text and call enabled collect outside North America), or by email at contactus@kingsdaleadvisors.com. For easy access to voting links and all information surrounding the Meeting, go to www.newgoldAGM.com or scan the QR code on the back page of the Circular. Any proxies to be used or acted on at the Meeting must be deposited with New Gold’s transfer agent, Computershare Investor Services, by 4:00 p.m. (Eastern time) on May 10, 2024, or no later than 48 hours (excluding Saturdays, Sundays and holidays) before the time of any adjourned or postponed Meeting. Non-registered (or beneficial) holders must provide their voting instructions to their intermediaries sufficiently in advance of this deadline to allow the intermediary sufficient time to forward this information to Computershare Investor Services.

DATED at Toronto, Ontario this 28th day of March 2024.

By Order of the Board of Directors

Ian Pearce

Chair of the Board

| |

Exhibit 99.2

|

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

Notice is hereby given that the annual general meeting of shareholders (“Meeting”) of New Gold Inc. (“New

Gold” or the “Company”) will be held virtually at https://web.lumiagm.com/426295035

on Tuesday, May 14, 2024 at 4:00 p.m. (Eastern time) for the following purposes:

| 1. | receiving the audited consolidated financial statements of the Company for the year ended December 31, 2023 and the auditor’s report on those statements; |

| 2. | electing the directors of the Company; |

| 3. | appointing Deloitte LLP as auditor of the Company and authorizing the directors to fix its remuneration; |

| 4. | considering and, if deemed appropriate, passing, with or without variation, a non-binding advisory resolution on executive compensation; and |

| 5. | conducting such other business properly brought before the Meeting or any adjournment or postponement thereof. |

Given New Gold’s desire to maximize the accessibility of the Meeting for its shareholders, New Gold will be conducting the Meeting virtually. A virtual Meeting affords all shareholders an equal ability to attend and participate in the Meeting, regardless of geographic location. At the virtual Meeting, registered shareholders, non-registered (or beneficial) shareholders and their duly appointed proxyholders will be able to participate, ask questions and vote in “real time” through an online portal. Non-registered shareholders must carefully follow the procedures set out in the management information circular (the “Circular”) that accompanies this notice if they wish to appoint themselves as a proxyholder to vote at the virtual Meeting and ask questions through the live webcast. Non-registered shareholders who do not follow the procedures set out in the Circular, along with other stakeholders who do not own common shares, will nonetheless be able to view a live webcast of the Meeting but will not be able to ask questions or vote. New Gold firmly believes that a virtual Meeting gives all shareholders an equal opportunity to participate. New Gold hopes that hosting a virtual Meeting will increase participation by its shareholders, as it will enable shareholders to more easily attend the Meeting regardless of their geographic location or the particular constraints or circumstances they may be facing.

It should be noted that the vast majority of our shareholders vote in advance of the Meeting by proxy and are encouraged to continue to do so via the various channels outlined in the Circular. The virtual Meeting does not change shareholders’ ability to vote by proxy. However, those that wish to participate in the virtual Meeting or to appoint a proxy to participate, are encouraged to carefully read the instructions in the Circular and in particular the procedure for appointing yourself or a proxy.

The record date for the Meeting is March 15, 2024. The record date is the date for the determination of the registered holders of common shares entitled to receive notice of, and to vote at, the Meeting and any adjournment or postponement thereof.

| |

|

This notice is accompanied by the Circular and either a proxy form or a voting instruction form. If previously requested, a copy of the audited consolidated financial statements and management’s discussion and analysis (“MD&A”) of New Gold for the year ended December 31, 2023 will also accompany this notice. Copies of New Gold’s annual and interim financial statements and MD&A are also available under New Gold’s profile on SEDAR+ at www.sedarplus.ca, on EDGAR at www.sec.gov and on New Gold’s website at www.newgold.com. As described in the notice and access notification mailed to shareholders, New Gold is using the notice and access method for delivering this notice and the Circular to shareholders. This notice and the Circular are also available on New Gold’s website at https://newgold.com/news-events/annual-meeting-of-shareholders/default.aspx and under New Gold’s profile on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov.

We value your opinion and participation in the Meeting as a shareholder of New Gold. For your information, the Meeting is not expected to include a formal presentation by management, but there will be an opportunity for shareholders to ask questions. Please review the accompanying Circular before voting, as it contains important information about the Meeting. It is important that you exercise your vote, either virtually at the Meeting or by proxy. Any questions regarding voting your common shares should be directed to New Gold’s advisor and proxy solicitation agent, Kingsdale Advisors, which can be reached by toll-free telephone in North America at 1-866-581-1477, at 1-437-561-5022 (text and call enabled collect outside North America), or by email at contactus@kingsdaleadvisors.com. For easy access to voting links and all information surrounding the Meeting, go to www.newgoldAGM.com or scan the QR code on the back page of the Circular. Any proxies to be used or acted on at the Meeting must be deposited with New Gold’s transfer agent, Computershare Investor Services, by 4:00 p.m. (Eastern time) on May 10, 2024, or no later than 48 hours (excluding Saturdays, Sundays and holidays) before the time of any adjourned or postponed Meeting. Non-registered (or beneficial) holders must provide their voting instructions to their intermediaries sufficiently in advance of this deadline to allow the intermediary sufficient time to forward this information to Computershare Investor Services.

DATED at Toronto, Ontario this 28th day of March 2024.

By Order of the Board of Directors

Ian Pearce

Chair of the Board

| |

TABLE OF CONTENTS

| GENERAL INFORMATION | 5 | |

| MEETING AND VOTING INFORMATION | 5 | |

| VOTING INFORMATION | 6 | |

| OTHER IMPORTANT INFORMATION | 13 | |

| BUSINESS OF THE MEETING | 14 | |

| 1. | RECEIVING THE AUDITED CONSOLIDATED FINANCIAL STATEMENTS | 14 |

| 2. | ELECTION OF DIRECTORS | 14 |

| 3. | APPOINTMENT OF AUDITOR | 25 |

| 4. | SAY ON PAY ADVISORY VOTE | 26 |

| GOVERNANCE AT A GLANCE | 28 | |

| STATEMENT OF EXECUTIVE COMPENSATION | 29 | |

| STATEMENT OF DIRECTOR COMPENSATION | 62 | |

| SUSTAINABILITY | 68 | |

| CORPORATE GOVERNANCE PRACTICES | 73 | |

| OTHER INFORMATION | 89 | |

| SCHEDULE A - EQUITY COMPENSATION PLANS | 91 | |

| SCHEDULE B - BOARD OF DIRECTORS MANDATE | 101 | |

| If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477, 1-437-561-5022 (text and call enabled) or email contactus@kingsdaleadvisors.com. |

| |

GENERAL INFORMATION

Unless otherwise stated, the information contained in this Circular is as of March 28, 2024, and all dollar amounts in this Circular refer to Canadian dollars. United States dollars are referred to as “US$”.

MEETING AND VOTING INFORMATION

WHO IS SOLICITING MY PROXY?

You have received this management information circular (the “Circular”) because you owned common shares (“Shares”) of New Gold Inc. (“New Gold” or the “Company”) as of the close of business on the record date of March 15, 2024, and are entitled to receive notice of, and vote at, our annual general meeting of shareholders (“Meeting”).

Management is soliciting your proxy for the Meeting. While it is expected that the solicitation will be made by mail, proxies may be solicited personally or by telephone by directors, officers and employees of New Gold. The Company has also retained the services of Kingsdale Advisors (“Kingsdale”) to act as strategic shareholder advisor and proxy solicitation agent. Fees for Kingsdale’s solicitation services are anticipated to be $67,140 plus disbursements. The costs of preparing and distributing Meeting materials and the cost of soliciting proxies will be borne by New Gold.

Shareholders with questions about voting their Shares may contact Kingsdale by toll-free telephone in North America at 1-866-581-1477, at 1-437-561-5022 (text and call enabled collect outside North America) or by email at contactus@kingsdaleadvisors.com.

References in this Circular to the Meeting include any adjournment(s) or postponement(s) thereof.

HOW ARE MEETING MATERIALS BEING DELIVERED TO SHAREHOLDERS?

New Gold is using the notice and access regime (“Notice and Access”) adopted by the Canadian securities regulators for the delivery of the notice of meeting (the “Notice of Meeting”), the Circular and the proxy form or voting instruction form (collectively, the “Meeting Materials”), as applicable, to registered and beneficial shareholders for the Meeting. Under Notice and Access, instead of receiving printed copies of the Meeting Materials, shareholders received a copy of the Notice of Meeting with instructions for accessing the Circular online. New Gold has adopted the Notice and Access delivery process to further its commitment to environmental sustainability and to reduce its printing and mailing costs.

New Gold has sent the Notice of Meeting and proxy form directly to registered shareholders and has distributed copies of the Notice of Meeting and voting instruction form to non-registered shareholders through their intermediaries and clearing agencies. Management of New Gold does not intend to pay for intermediaries to forward the Meeting Materials to objecting beneficial owners under National Instrument 54-101 - Communication with Beneficial Owners of Securities of a Reporting Issuer. An objecting beneficial owner will not receive the materials unless the objecting beneficial owner’s intermediary assumes the cost of delivery. New Gold does not intend to send proxy-related materials directly to non-objecting beneficial owners.

| If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477, 1-437-561-5022 (text and call enabled) or email contactus@kingsdaleadvisors.com. |

| |

Shareholders may request that printed copies of the Meeting Materials be sent to them by postal delivery at no cost to them up to one year from the date this Circular is filed on SEDAR+. Requests may be made through New Gold’s website, www.newgold.com, or by calling 1-833-324-6018. To receive the Meeting Materials in advance of the proxy cut-off deadline (as defined below) and Meeting date, New Gold must receive requests for printed copies of the Meeting Materials at least seven business days in advance of the proxy cut-off deadline.

WHEN AND WHERE IS THE MEETING BEING HELD?

The Meeting is being held virtually at https://web.lumiagm.com/426295035 at 4:00 p.m. (Eastern time) on May 14, 2024 for the purposes set out in the Notice of Meeting.

WHY IS NEW GOLD HOLDING THE MEETING VIRTUALLY?

In order to provide shareholders with an equal opportunity to attend and participate at the Meeting, regardless of the particular constraints, circumstances or difficulties they may be facing as a result of geographic location or otherwise, New Gold’s board of directors (the “Board”) and management have again decided to conduct the Meeting virtually. Registered shareholders and duly appointed proxyholders will be able to vote in real time and ask questions at the Meeting. Non-registered shareholders who have not duly appointed themselves as proxyholders may attend the Meeting as guests. Guests may listen but cannot vote at the Meeting or ask questions. New Gold firmly believes that a virtual Meeting gives all shareholders an equal opportunity to participate, regardless of their geographic location or the particular constraints or circumstances they may be facing.

HOW MANY SHAREHOLDERS ARE NEEDED TO REACH A QUORUM?

The Company must have at least two people present at the Meeting who hold, or represent by proxy, in aggregate, at least 5% of the issued and outstanding Shares of New Gold entitled to be voted at the Meeting. Shareholders who participate in and/or vote at the Meeting virtually are deemed to be present at the Meeting for all purposes, including quorum.

DOES ANY SHAREHOLDER BENEFICIALLY OWN 10% OR MORE OF THE OUTSTANDING NEW GOLD SHARES?

To the knowledge of the directors and executive officers of New Gold, as of the date of this Circular, no person or company beneficially owns, directly or indirectly, or exercises control or direction over, voting securities carrying 10% or more of the voting rights attached to any class of voting securities of New Gold.

VOTING INFORMATION

WHO CAN VOTE?

You are entitled to receive notice of, and to vote at, the Meeting if you held Shares of New Gold at the close of business on the record date for the Meeting, being March 15, 2024. As of the record date, New Gold had 687,390,679 Shares issued and outstanding. Each Share entitles the holder to one vote on the items to be voted on at the Meeting.

| If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477, 1-437-561-5022 (text and call enabled) or email contactus@kingsdaleadvisors.com. |

| |

HOW DO I VOTE MY SHARES?

The manner in which you vote your Shares depends on whether you are a registered shareholder or a non-registered (or beneficial) shareholder. You are a registered shareholder if you have a Share certificate or Direct Registration System (DRS) advice issued in your name and appear as the registered shareholder on the books of Company. You are a non-registered shareholder if your New Gold Shares are registered in the name of an intermediary, such as a bank, trust company, investment dealer, clearing agency or other institution.

If you are not sure whether you are a registered or non-registered shareholder, please contact Kingsdale by toll-free telephone in North America at 1-866-581-1477, 1-437-561-5022 (text and call enabled collect outside North America)or by email at contactus@kingsdaleadvisors.com. For easy access to voting links and all information surrounding the Meeting, go to www.newgoldAGM.com or scan the QR code on the back page of the Circular.

How do I vote if I am a registered shareholder?

Voting by Proxy

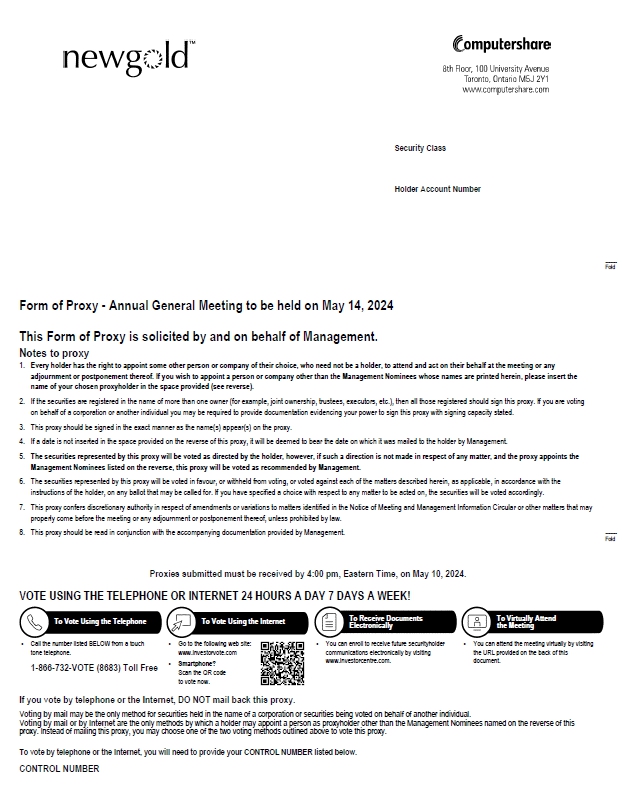

Voting by proxy is the easiest way for registered shareholders to cast their vote. You can vote by proxy in any of the following ways:

| By Telephone: |

Call Computershare toll-free in North America 1-866-732-8683 or outside North America 1-312-588-4290. You will need your 15-digit control number, which can be found on your proxy form. Please note that you cannot appoint anyone other than the directors and officers named on your proxy form as your proxyholder if you vote by telephone. See below under the heading “How will my Shares be voted if I return a proxy?” for more information. |

|

By Internet: |

Go to Computershare’s website at www.investorvote.com and follow the instructions on the screen. You will need your 15-digit control number, which can be found on your proxy form. See below under the heading “How will my Shares be voted if I return a proxy?” for more information. |

| By Mail or Fax: | Complete, sign and date your proxy form and return it to Computershare Trust Company of Canada, Attention: Proxy Department, 8th Floor, 100 University Avenue, Toronto, ON, M5J 2Y1 in the envelope provided or fax a copy of the completed, signed and dated proxy form to Computershare at 1-866-249-7775. See below under the heading “How will my Shares be voted if I return a proxy?” for more information. |

You may appoint a person other than the directors and officers designated by the Company on your proxy form, who need not be a shareholder, to represent you and vote on your behalf at the Meeting. This person does not have to be a shareholder. To do so, strike out the names of our directors and officers that are printed on the proxy form and write the name of the person you are appointing in the space provided. Complete your voting instructions, sign and date the proxy form, and return it to Computershare as instructed. In addition, for your proxyholder to attend and participate in the virtual Meeting, you must also register the appointment of your proxyholder at www.computershare.com/newgold and provide Computershare with your proxyholder’s contact information so that Computershare may provide the proxyholder with a Username via email to vote at the Meeting. Registering your proxyholder is an additional step which must be completed by no later than 4:00 p.m. (Eastern time) on May 10, 2024 (or no later than 48 hours, excluding Saturdays, Sundays and holidays, before the time of any adjourned or postponed Meeting). Failure to register the proxyholder will result in the proxyholder not receiving a Username to participate in the Meeting. Please ensure that the person you appoint is aware that he or she has been appointed to attend the virtual Meeting on your behalf.

| If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477, 1-437-561-5022 (text and call enabled) or email contactus@kingsdaleadvisors.com. |

| |

If you have complied with the steps described above, prior to the Meeting, Computershare will contact your proxyholder via email with a unique Username/control number which, along with the password “newgold2024”(case sensitive), will allow your proxyholder to log in to the live webcast and vote at the Meeting using the LUMI meeting platform. Without a control number, you or your proxyholder will not be able to ask questions or vote at the Meeting. Please see below, under the headings “How can I log in to the virtual Meeting” and “How will my Shares be voted if I return a proxy?” for more information.

Shareholders requiring assistance or experiencing difficulties during the registration, authentication or voting processes with Computershare may contact 1-800-564-6253 for additional information or technical support or alternatively email service@computershare.com. International holders can contact 514-982-7555. It is recommended shareholders include the company name, their proxyholder’s contact information, if applicable, and their 15-digit control number when contacting support or having such information available so that technical support and assistance can more quickly be provided.

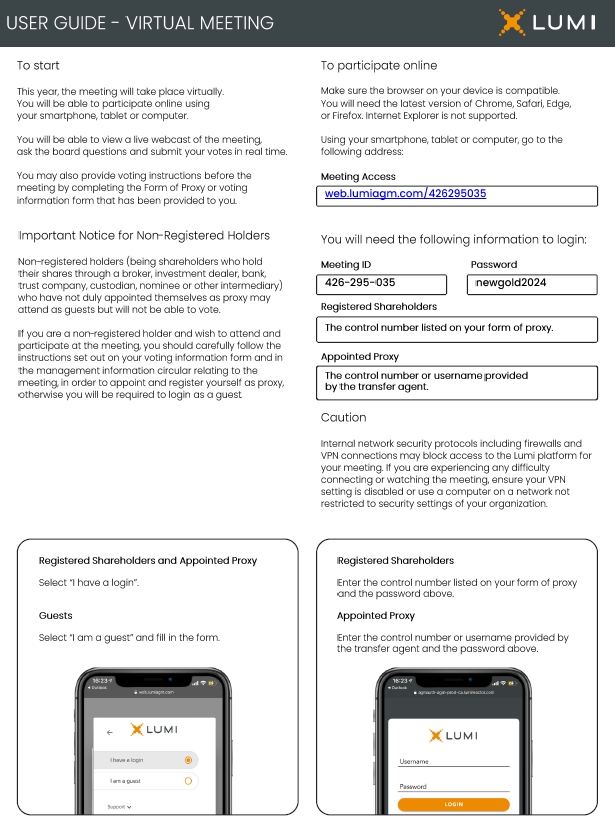

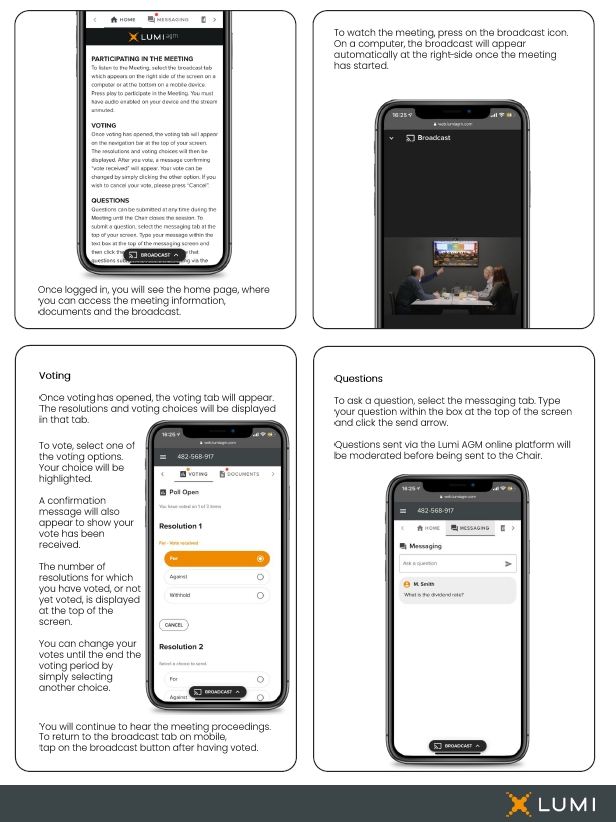

Voting in Person via Internet Webcast

Registered shareholders have the ability to participate, ask questions and vote at the Meeting using the LUMI meeting platform. Eligible registered shareholders may log in at https://web.lumiagm.com/426295035, click on “I have a login”, enter the 15-digit control number found on the proxy, and the password “newgold2024” (case sensitive), then click on the “Login” button. During the Meeting, you must ensure you are connected to the Internet at all times in order to vote when polling is commenced on the resolutions put before the Meeting. It is your responsibility to ensure Internet connectivity. You will also need to have the latest version of Chrome, Safari, Edge or Firefox. Please do not use Internet Explorer. As internal network security protocols (such as firewalls or VPN connections) may block access to the LUMI meeting platform, please ensure that you use a network that is not restricted by the security settings of your organization or that you have disabled your VPN settings. It is recommended that you log in at least an hour before the start of the Meeting. Non-registered shareholders must follow the procedures outlined below to participate in the Meeting using the LUMI meeting platform. Non-registered shareholders who fail to comply with the procedures outlined below may nonetheless view a live webcast of the Meeting by going to the same URL as above and clicking on “I am a guest”.

How do I vote if I am a non-registered (or beneficial) shareholder?

Submitting Voting Instructions

You will receive a voting instruction form that allows you to vote on the Internet, by telephone or by mail. To vote, you should follow the instructions provided on your voting instruction form. Your intermediary is required to ask for your voting instructions before the Meeting. Please contact your intermediary if you did not receive a voting instruction form. Alternatively, you may receive from your intermediary a pre-authorized proxy form indicating the number of Shares to be voted, which you should complete, sign, date, and return as directed on the form. Each intermediary has its own procedures which should be carefully followed by non-registered shareholders to ensure that their Shares are voted by their intermediary on their behalf at the Meeting.

| If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477, 1-437-561-5022 (text and call enabled) or email contactus@kingsdaleadvisors.com. |

| |

New Gold may utilize the Broadridge QuickVote™ service to assist non-registered shareholders with voting their Shares over the telephone. Alternatively, Kingsdale may contact non-registered shareholders who do not object to their names being known to the Company to assist them with conveniently voting their Shares directly over the phone. If you have any questions about the Meeting, please contact Kingsdale by telephone at 1-866-581-1477 (toll-free in North America), 1-437-561-5022 (text and call enabled outside North America) or by email at contactus@kingsdaleadvisors.com.

Voting in Person Via Internet Webcast

New Gold does not have access to the names or holdings of non-registered shareholders. This means that you can only vote your Shares virtually at the Meeting if: (a) you have previously appointed yourself as the proxyholder for your Shares by printing your name in the space provided on your voting instruction form and submitting it as directed on the form; and (b) by no later than 4:00 p.m. (Eastern time) on May 10, 2024 (or no later than 48 hours, excluding Saturdays, Sundays and holidays, before the time of any adjourned or postponed Meeting), you have registered your appointment at www.computershare.com/newgold. If you have completed these two steps within the required timeframe, then, prior to the Meeting, Computershare will contact you via email with your unique Username/control number which, along with the password “newgold2024” (case sensitive), will allow you to log in to the live webcast and vote at the Meeting using the LUMI meeting platform. Without a control number, you will not be able to ask questions or vote at the Meeting.

You may also appoint a person other than the directors and officers designated by the Company as the proxyholder for your Shares by printing their name in the space provided on your voting instruction form and submitting it as directed on the form. If your proxyholder intends to participate in the virtual Meeting, you will need to register the appointment of your proxyholder at www.computershare.com/newgold by no later than 4:00 p.m. (Eastern time) on May 10, 2024 (or no later than 48 hours, excluding Saturdays, Sundays and holidays, before the time of any adjourned or postponed Meeting). If your proxyholder has been properly appointed, Computershare will contact your proxyholder via email prior to the Meeting with a Username/control number which, along with the password “newgold2024” (case sensitive), will allow your proxyholder to participate in, and vote at, the Meeting using the LUMI meeting platform.

Your voting instructions must be received in sufficient time to allow your voting instruction form to be forwarded by your intermediary to Computershare before 4:00 p.m. (Eastern time) on May 10, 2024. If you plan to participate in the virtual Meeting (or to have your proxyholder attend the virtual Meeting), you or your proxyholder will not be entitled to vote or ask questions online unless the proper documentation is completed and received by your intermediary well in advance of the Meeting to allow them to forward the necessary information to Computershare before 4:00 p.m. (Eastern time) on May 10, 2024. You should contact your intermediary well in advance of the Meeting and follow its instructions if you want to participate in the virtual Meeting.

Please see below under the heading “How can I log in to the virtual Meeting?” for more information.

Notice for US beneficial holders

To attend and vote at the virtual Meeting, you must first obtain a valid legal proxy from your intermediary and then register in advance to attend the Meeting. Follow the instructions from your intermediary included with the proxy materials or contact your intermediary to request a legal proxy form. After first obtaining a valid legal proxy form from your intermediary, to then register to attend the virtual Meeting, you must submit a copy of your legal proxy form to Computershare. Requests for registration should be directed to:

| If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477, 1-437-561-5022 (text and call enabled) or email contactus@kingsdaleadvisors.com. |

| |

Computershare Trust Company of Canada

100 University Avenue

8th Floor

Toronto, Ontario

M5J 2Y1

OR

Email at uslegalproxy@computershare.com

Requests for registration must be labeled as “Legal Proxy” and be received no later than May 10, 2024 at 4:00 p.m. (Eastern time). You will receive a confirmation of your registration by email after Computershare receives your registration materials. Please note that you are also required to register your appointment at www.computershare.com/newgold. Once you have complied with those two steps, Computershare will contact you prior to the Meeting via email with your unique Username/control number which, along with the password “newgold2024” (case sensitive), will allow you to log in to the live webcast and vote at the Meeting at https://web.lumiagm.com/426295035 using the LUMI meeting platform. Without a control number, you will not be able to ask questions or vote at the Meeting.

IS THERE A DEADLINE FOR MY PROXY TO BE RECEIVED?

Yes. New Gold must receive your voting instructions by 4:00 p.m. (Eastern Time) on Friday, May 10, 2024 (the “proxy cut-off deadline”) to ensure that your Shares are voted at the Meeting. If the Meeting is adjourned or postponed, your proxy must be received by 4:00 p.m. (Eastern Time) on the second-last business day before the reconvened meeting. The time limit for deposit of proxies may be waived or extended by the Chair of the Meeting at his or her discretion, without notice.

As noted above, if you are a non-registered shareholder, all required voting instructions must be submitted to your intermediary sufficiently in advance of the proxy cut-off deadline to allow your intermediary time to forward this information to Computershare by the proxy cut-off deadline. New Gold reserves the right to accept late proxies and to waive the proxy cut-off deadline, with or without notice, but New Gold is under no obligation to accept or reject any particular late proxy.

ELECTRONIC DELIVERY

Beneficial shareholders are asked to consider signing up for electronic delivery (“E-delivery”) of the Meeting materials. E-delivery has become a convenient way to make distribution of materials more efficient and is an environmentally responsible alternative by eliminating the use of printed paper and the carbon footprint of the associated mail delivery process. Signing up is quick and easy, go to www.proxyvote.com and sign in with your control number. Once you’ve submitted your vote in respect of the resolutions at the meeting and received your vote confirmation, you will be able to select the electronic delivery box and provide an email address for e-delivery moving forward. Having registered for E-delivery, going forward you will receive your Meeting materials by email and will be able to vote on your device by simply following a link in the email sent by your financial intermediary, provided your intermediary supports this service.

| If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477, 1-437-561-5022 (text and call enabled) or email contactus@kingsdaleadvisors.com. |

| |

HOW CAN I LOG IN TO THE VIRTUAL MEETING?

Only shareholders of record at the close of business on March 15, 2024 and other permitted attendees may virtually attend the Meeting. Attending the Meeting virtually allows registered shareholders and duly appointed proxyholders, including non-registered shareholders who have duly appointed themselves as proxy or their duly appointed third party proxyholders, to participate, ask questions and vote at the Meeting using the LUMI meeting platform. Guests, including non-registered shareholders who have not duly appointed themselves as proxyholder, can log in to the virtual Meeting as a guest. Guests may view a live webcast of the Meeting but will not be entitled to vote or ask questions.

| (i) | Registered shareholders and duly appointed proxyholders may log in online at https://web.lumiagm.com/426295035, click on “I have a login”, enter the 15-digit control number found on the proxy or provided to a duly appointed proxyholder, as applicable, and the password “newgold2024” (case sensitive), then click on the “Login” button. New Gold recommends that you log in at least one hour before the Meeting begins. For registered shareholders, the control number is located on your proxy form. For duly appointed proxyholders (including non-registered shareholders who have appointed themselves), your control number will be provided by Computershare, provided that you or your proxyholder has been duly appointed in accordance with the procedures outlined in this Circular. |

| (ii) | Non-registered shareholders may view a live webcast of the Meeting by going to the same URL noted above and clicking on “I am a guest”. |

During the Meeting, you must ensure that you are connected to the Internet at all times in order to vote when polling is commenced on the resolutions put before the Meeting. It is your responsibility to ensure Internet connectivity. You will also need to have the latest version of Chrome, Safari, Edge or Firefox. Please do not use Internet Explorer. As internal network security protocols (such as firewalls or VPN connections) may block access to the LUMI meeting platform, please ensure that you use a network that is not restricted by the security settings of your organization or that you have disabled your VPN settings. It is recommended that you log in at least an hour before the start of the Meeting. Note that if you lose connectivity once the Meeting has commenced, there may be insufficient time to resolve your issue before polling is completed. Therefore, even if you currently plan to vote during the Meeting, you should consider voting your Shares in advance or by proxy, so that your vote will be counted in the event you experience any technical difficulties or are otherwise unable to access the Meeting. In an effort to mitigate any potential issues relating to logging into or participating during the Meeting, the Company has posted a Virtual AGM User Guide on its website at https://newgold.com/news-events/annual-meeting-of-shareholders/default.aspx, and filed it on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov, and shareholders are encouraged to review it prior to the Meeting. Shareholders with questions regarding the virtual meeting portal or requiring assistance accessing the Meeting website may visit the website https://www.lumiglobal.com/faq for additional information. Shareholders experiencing technical difficulties or otherwise requiring assistance with the Meeting website an hour before the Meeting or during the Meeting can contact technical support at support-ca@lumiglobal.com. It is recommended shareholders include the event name, meeting ID, Username and issue when contacting support or having such information available so that technical support can more quickly provide assistance.

| If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477, 1-437-561-5022 (text and call enabled) or email contactus@kingsdaleadvisors.com. |

| |

New Gold believes that the ability to participate in the Meeting in a meaningful way, including asking questions, remains important despite the decision to hold this year’s Meeting virtually. Registered shareholders, non-registered shareholders who have appointed themselves as proxyholders, and third party-proxyholders accessing the Meeting will have an opportunity to ask questions and otherwise participate in the Meeting in writing by sending a message to the Chair of the Meeting online through the LUMI platform. It is anticipated that shareholders will have substantially the same opportunity to engage on matters of business at the Meeting in the same manner as in prior years when the annual shareholders meeting was held in person. Matters properly brought before the Meeting will pertain to the formal business of the Meeting. Following the conclusion of the formal business to be conducted at the Meeting, we will invite questions and comments from shareholders and proxyholders participating through the LUMI meeting platform. To ensure fairness for all, the Chair of the Meeting will decide and announce the order of questions to be responded to, and the amount of time to be allocated to each question. The Chair can edit or reject questions considered inappropriate. Following the Meeting, the Company will post appropriate questions received during the meeting and the Company’s answers (including questions for which there was insufficient time at the Meeting to respond to) on the investor page of the website as soon as is practical.

HOW WILL MY SHARES BE VOTED IF I RETURN A PROXY?

By completing and returning a proxy form, you are authorizing the person named in the proxy to attend the Meeting and vote your Shares or withhold your Shares from voting on each item of business according to your instructions. If you sign and return your proxy form without designating a proxyholder and do not give voting instructions or specify that you want your Shares withheld from voting, the New Gold representatives will vote your Shares as follows:

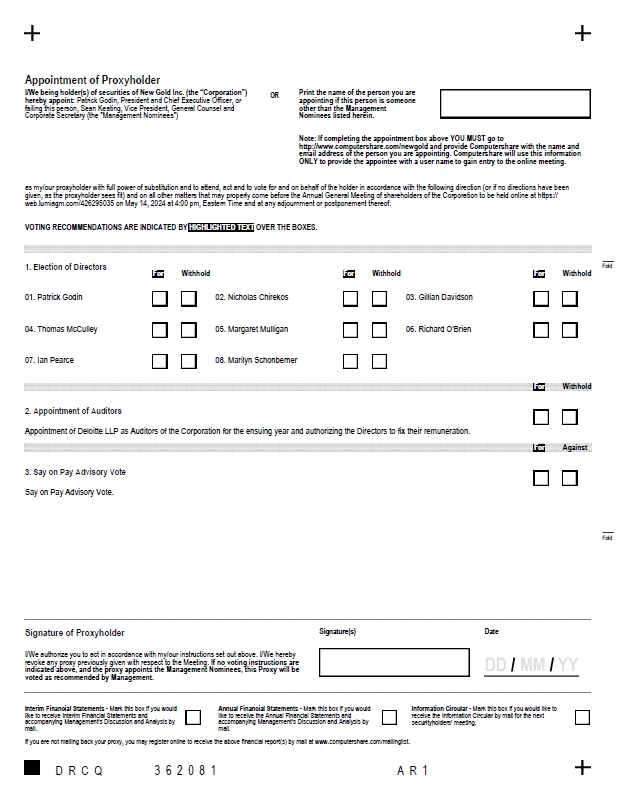

| • | FOR the election of the nominee directors to the Board; |

| • | FOR the appointment of Deloitte LLP as the Company’s auditor and the authorization of the directors to fix the auditor’s remuneration; and |

| • | FOR the non-binding advisory resolution approving the Company’s approach to executive compensation. |

WHAT HAPPENS IF THERE ARE AMENDMENTS, VARIATIONS OR OTHER MATTERS BROUGHT BEFORE THE MEETING?

Your proxy authorizes your proxyholder to act and vote for you on any amendment or variation of any of the business of the Meeting and on any other matter that properly comes before the Meeting. Your proxy is effective at any continuation following an adjournment of the Meeting. As of March 28, 2024, no director or officer of the Company is aware of any variation, amendment or other matter to be presented for a vote at the Meeting.

HOW DO I REVOKE MY PROXY?

If you change your mind about how you wish to vote your Shares, you can revoke your proxy in one of the following ways:

| (i) | voting again on the Internet or by phone before 4:00 p.m. (Eastern time) on May 10, 2024; |

| (ii) | completing a proxy form or voting instruction form that is dated later than the proxy form or voting instruction form that you are changing, and mailing it or faxing it as instructed on your proxy form or voting instruction form, as the case may be, so that it is received before 4:00 p.m. (Eastern time) on May 10, 2024; |

| (iii) | a shareholder could also revoke their proxy by attending the meeting online and casting their vote personally, which would automatically revoke any previously submitted proxy; or |

| (iv) | any other means permitted by law. |

| If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477, 1-437-561-5022 (text and call enabled) or email contactus@kingsdaleadvisors.com. |

| |

If you are a registered shareholder, you can also revoke a vote you made by sending a notice in writing from you or your authorized attorney to our Corporate Secretary so that it is received before 4:00 p.m. (Eastern time) on May 10, 2024, or giving notice in writing from you or your authorized attorney to the Chair of the Meeting, at the Meeting or at any adjournment. The revocation of a proxy does not affect any matter on which a vote has been taken before the revocation.

OTHER IMPORTANT INFORMATION

WHAT IS THE DEADLINE FOR MAKING A SHAREHOLDER PROPOSAL AT THE NEXT ANNUAL MEETING OF SHAREHOLDERS?

The final date for submission of proposals to shareholders for inclusion in the information circular in connection with next year’s annual meeting of shareholders is February 14, 2025.

ARE THERE ANY SHAREHOLDER PROPOSALS BEING CONSIDERED AT THE MEETING?

There are no shareholder proposals being considered at the Meeting.

WHERE CAN I FIND FINANCIAL INFORMATION RELATING TO THE COMPANY?

New Gold’s financial information is contained in our comparative audited annual financial statements for the year ended December 31, 2023, and related MD&A, both of which can be found on the Company’s SEDAR+ profile at www.sedarplus.ca, on EDGAR at www.sec.gov and in the news and events section of the Company’s website.

HOW DO I NOMINATE A CANDIDATE FOR ELECTION TO THE BOARD?

The Company adopted an Advance Notice Policy in 2015. Shareholders are required to comply with the Advance Notice Policy in connection with director nominations other than pursuant to a meeting requisition or shareholder proposal. Among other things, the Advance Notice Policy requires the nominating shareholder to provide to New Gold certain information regarding the shareholder and the shareholder’s proposed nominees and sets out specific timelines for providing such information. A copy of the Advance Notice Policy is available on the Company’s profile on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. The Corporate Governance and Nominating Committee (the “CGNC”) will consider candidates submitted by shareholders on the same basis as any other candidate. As of the date of this Circular, the Company has not received any notice of a shareholder’s intention to nominate directors at the Meeting pursuant to the Advance Notice Policy.

| If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477, 1-437-561-5022 (text and call enabled) or email contactus@kingsdaleadvisors.com. |

| |

BUSINESS OF THE MEETING

New Gold’s consolidated financial statements, including the auditor’s report thereon, for the year ended December 31, 2023 will be placed before the Meeting. The audited consolidated financial statements are available on New Gold’s website at www.newgold.com, SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov. Printed copies will be mailed to registered shareholders and non-registered shareholders who requested them. For information on how to request a printed copy of New Gold’s audited consolidated financial statements, please see “Meeting and Voting Information - How are Meeting Materials Being Delivered to Shareholders?” on page 5 of this Circular.

At the Meeting, the eight persons named below will be proposed for election to the Board (the “Nominees”). Seven of the eight Nominees (88%) are independent.

Richard O’Brien was appointed to the Board on March 25, 2024 and he is nominated for election by shareholders for the first time at the Meeting. Ian Pearce will be standing for re-election at the Meeting, however, Mr. Pearce has informed the Company that he will retire from the Board on August 1, 2024. It is expected that Mr. O’Brien will be appointed Chair of the Board upon Mr. Pearce’s retirement. Mr. Pearce will assist Mr. O’Brien in transitioning into the role over the coming months. The Company thanks Mr. Pearce for his commitment and invaluable contributions to New Gold since joining the Board in 2016 as well as for his leadership in his role as Chair of the Board since 2017.

Geoff Chater will not be standing for re-election at the Meeting. Mr. Chater has served on the Board since 2021. The Company also thanks Mr. Chater for his commitment and invaluable contributions to New Gold during his time on the Board.

Unless authority to do so is withheld, the persons named in the form of proxy intend to vote FOR the election of each of the Nominees.

It is not contemplated that any of the Nominees will be unable to serve as a director, but if that should occur for any reason before the Meeting, the persons named in the proxy reserve the right to nominate and vote for the election of another individual at their discretion. Each director elected will hold office until the close of the first annual meeting of shareholders of New Gold following his or her election or until his or her successor is duly elected or appointed, unless his or her office is earlier vacated in accordance with the Articles of New Gold.

The Board has adopted a Majority Voting Policy which stipulates that if a Nominee receives a greater number of votes “withheld” from his or her election than votes “for” his or her election, that Nominee will promptly submit his or her resignation to the Board, which resignation will be accepted except where exceptional circumstances would warrant rejecting or delaying the acceptance of the offer of resignation, as determined by the Board in accordance with its fiduciary duties. The Board’s decision will be publicly disclosed (with full reasons for its decision in the event the Board declines to accept the resignation). The Nominee will not participate in deliberations regarding the resignation offer, except in limited circumstances where the Nominee’s participation is required for quorum. The Majority Voting Policy does not apply in circumstances involving contested director elections. A copy of the Majority Voting Policy is available on New Gold’s website at www.newgold.com.

| If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477, 1-437-561-5022 (text and call enabled) or email contactus@kingsdaleadvisors.com. |

| |

The following pages contain brief biographies for each of the Nominees. The information provided includes the following for each Nominee: their principal occupation; description of their principal occupation; business or employment within the past five years; details of residence; independence status; age; date they first became a director of New Gold; areas of expertise; and number of Shares and other securities of New Gold beneficially owned directly or indirectly, or over which control or direction is exercised by the Nominee as at March 15, 2024. The biographies have each been reviewed by the respective Nominee.

| If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477, 1-437-561-5022 (text and call enabled) or email contactus@kingsdaleadvisors.com. |

| |

|

Colorado, United States Age: 65 Director since May 27, 2019 Independent |

NICHOLAS CHIREKOS Nicholas (Nick) Chirekos has more than 25 years of experience in investment banking and capital markets, with a focus on the mining industry. He served in various investment banking roles at J.P. Morgan Securities Inc. from 1987 until his retirement in 2016. His roles included Managing Director, North American Head of Mining from 2002 to 2016, and Global Head of Mining and Metals from 2000 to 2002. He brings extensive expertise in mergers and acquisitions, equity, equity linked and fixed income transactions and was formerly a member of J.P. Morgan’s Investment Banking North American Reputational Risk Committee. Mr. Chirekos is a director on the boards of Peabody Energy Corporation, where he is chair of the Audit Committee, and Metallus Inc. He is also a member of the Executive Advisory Board at the University of Denver’s Daniels College of Business. He holds a Bachelor of Science degree from the University of Denver and a Master of Business Administration degree from New York University. At New Gold, Mr. Chirekos is Chair of the Corporate Governance and Nominating Committee and a member of the Human Resources and Compensation Committee. Mr. Chirekos’ principal occupation is as a corporate director. |

||||||||||

| Securities Held(1) | |||||||||||

| Number of DSUs | Number of Shares | ||||||||||

| March 15, 2024 | 366,452 | - | |||||||||

| March 10, 2023 | 302,960 | - | |||||||||

| Change | 63,492 | - | |||||||||

| Mr. Chirekos meets the Company’s equity ownership guidelines. | |||||||||||

| Areas of Expertise | Director Election - Voting Results(2) | ||||||||||

| Mining Industry / Operations / Geology; Capital Markets / Finance / Accounting; Public Company Boards / Corporate Governance; HS / Sustainability / Risk Management; Strategic Planning / M&A | Year | For | Withheld | ||||||||

| 2023 | 97.90% | 2.10% | |||||||||

| 2022 | 98.63% | 1.37% | |||||||||

| 2021 | 99.47% | 0.53% | |||||||||

| Board and Committee Membership and Attendance 2023(3) |

Other Public Directorships | ||||||||||

| Board | 9 of 9 | Metallus Inc. | Since 2022 | ||||||||

| Corporate Governance and Nominating Committee, Chair | 4 of 4 | Peabody Energy Corporation | Since 2017 | ||||||||

| Human Resources and Compensation Committee | 6 of 6 | ||||||||||

| If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477, 1-437-561-5022 (text and call enabled) or email contactus@kingsdaleadvisors.com. |

| |

|

Edinburgh, United Kingdom Age: 52 Director since April 25, 2018 Independent |

GILLIAN DAVIDSON Gillian Davidson has over 25 years of experience in sustainability, ESG and responsible supply chains. She is currently a senior adviser to global extractives companies and a Non-Executive Director on the Boards of Central Asia Metals, Horizonte Minerals, Lundin Gold and New Gold, and serves as Chair of Sustainability Committee on each. She served as a board director at Lydian International until March 2020. Prior, Dr. Davidson was the Head of Mining and Metals for the World Economic Forum and Director of Social Responsibility at Teck Resources Limited. Before joining Teck, Dr. Davidson held roles related to sustainability and natural resources as a consultant, in academia and in government. Dr. Davidson is the current chair of the Global Battery Alliance and the WEF Global Future Council on Responsible Resource Use, and past chair of International Women in Mining. She also acts as Chief Sustainability Officer at Regeneration, a remining start up. Dr. Davidson’s principal occupation is as a consultant. Dr. Davidson has an Honours Master of Arts in Geography from the University of Glasgow, a PhD in Development Economics and Economic Geography from the University of Liverpool and is an alumna of the Governor General of Canada’s Leadership Conference. At New Gold, Dr. Davidson is Chair of the Technical and Sustainability Committee and a member of the Corporate Governance and Nominating Committee. |

||||||||||||

| Securities Held(1) | |||||||||||||

|

Number of DSUs |

Number of Shares | ||||||||||||

| March 15, 2024 | 544,592 | - | |||||||||||

| March 10, 2023 | 481,100 | - | |||||||||||

| Change | 63,492 | - | |||||||||||

| Dr. Davidson meets the Company’s equity ownership guidelines. | |||||||||||||

| Areas of Expertise | Director Election - Voting Results(2) | ||||||||||||

| Mining Industry / Operations / Geology; Public Company Boards / Corporate Governance; HS / Sustainability / Risk Management; Government Relations / Legal Matters | Year | For | Withheld | ||||||||||

| 2023 | 98.35% | 1.65% | |||||||||||

| 2022 | 99.28% | 0.72% | |||||||||||

| 2021 | 99.42% | 0.58% | |||||||||||

| Board and Committee Membership and Attendance 2023(3) |

Other Public Directorships | ||||||||||||

| Board | 9 of 9 | Horizonte Minerals Plc. | Since 2022 | ||||||||||

| Technical and Sustainability Committee, Chair |

5 of 5 | Lundin Gold Inc. | Since 2021 | ||||||||||

| Corporate Governance and Nominating Committee |

4 of 4 | Central Asia Metal Limited | Since 2019 | ||||||||||

| If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477, 1-437-561-5022 (text and call enabled) or email contactus@kingsdaleadvisors.com. |

| |

|

Ontario, Canada Age: 55 Director since November 23, 2022 Non-Independent |

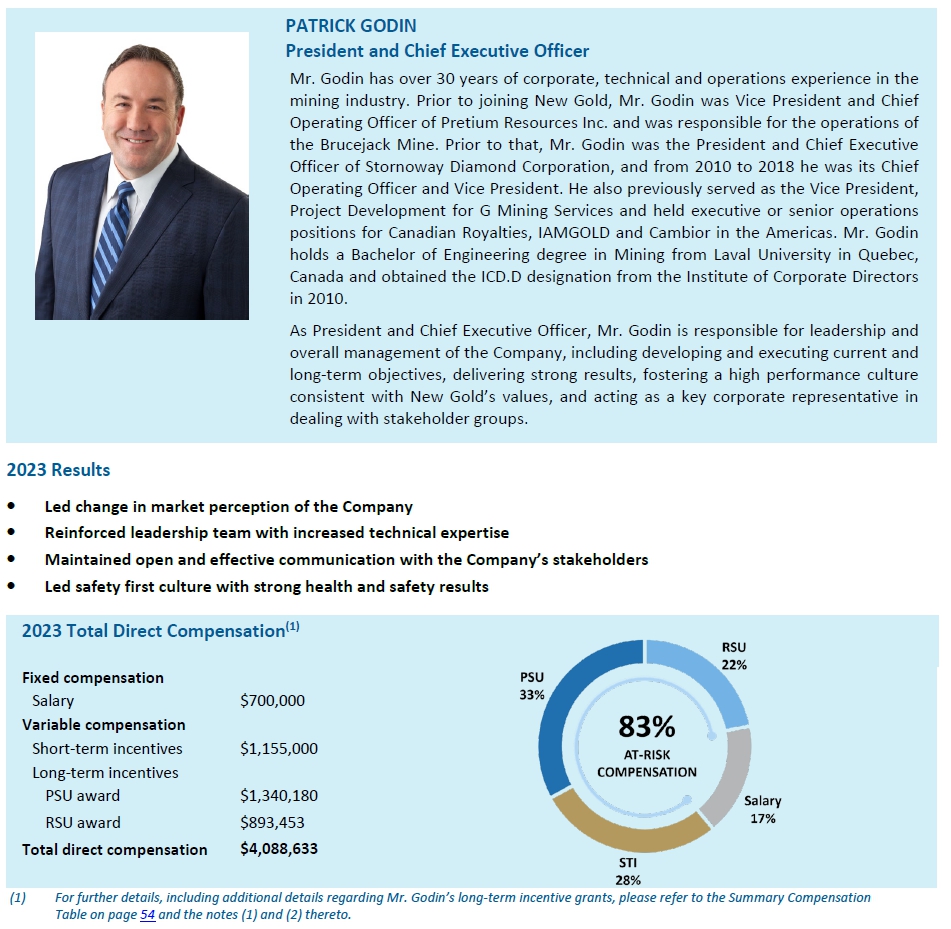

PATRICK GODIN Patrick Godin has over 30 years of corporate, technical and operations experience in the mining industry. Mr. Godin’s principal occupation is as the President and Chief Executive Officer of New Gold effective November 23, 2022. Prior to joining New Gold, Mr. Godin was Vice President and Chief Operating Officer of Pretium Resources Inc. and was responsible for the operations of the Brucejack Mine. Prior to that, Mr. Godin was the President and Chief Executive Officer of Stornoway Diamond Corporation, and from 2010 to 2018 he was its Chief Operating Officer and Vice President. He also previously served as the Vice President, Project Development for G Mining Services and held executive or senior operations positions for Canadian Royalties, lAMGOLD and Cambior in the Americas. Mr. Godin holds a Bachelor of Engineering degree in Mining from Laval University in Quebec, Canada and obtained the ICD.D designation from the Institute of Corporate Directors in 2010.

|

|||||||||||||

| Securities Held(1) | ||||||||||||||

| Number of PSUs & RSUs(4) |

Number of Shares | |||||||||||||

| March 15, 2024 | 2,993,049 | 112,600 | ||||||||||||

| March 10, 2023 | 1,861,360 | 55,000 | ||||||||||||

| Change | 1,131,689 | 57,600 | ||||||||||||

| Mr. Godin meets the Company’s equity ownership guidelines. | ||||||||||||||

| Areas of Expertise | Director Election - Voting Results(2) | |||||||||||||

| Mining Industry / Operations / Corporate Governance; HS / Sustainability / Risk Management; Talent Management; Strategic Planning / M&A; Government Relations / Legal Matters | Year | For | Withheld | |||||||||||

| 2023 | 99.40% | 0.60% | ||||||||||||

| Board and Committee Membership and Attendance 2023(3) |

Other Public Directorships | |||||||||||||

| Board | 9 of 9 | None | ||||||||||||

| If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477, 1-437-561-5022 (text and call enabled) or email contactus@kingsdaleadvisors.com. |

| |

|

London, United Kingdom Age: 55 Director since May 4, 2021 Independent |

THOMAS J. MCCULLEY Thomas (Tom) McCulley has 30 years of experience in project execution and operations leadership in the mining and construction industries, including extensive experience in the setup and leadership of industry leading global assurance programs. Mr. McCulley has experience in all phases of a mining project lifecycle, from scoping studies through commissioning and start-up and operations, including investment evaluations. Mr. McCulley is currently the Chief Executive Officer of Anglo American Crop Nutrients and Group Head of Projects for Anglo American plc, positions he has held since 2022 and 2015, respectively. Mr. McCulley previously served as Chief Executive Officer of Anglo American Peru from 2018 to 2022. From 2000 to 2015, he served in several senior roles at Newmont Mining Corporation, including as Vice President of Investment Assurance from 2011 to 2015. Mr. McCulley holds a Bachelor of Science (Accounting) from Mount Saint Mary’s University. At New Gold, Mr. McCulley is a member of the Human Resources and Compensation Committee and the Technical and Sustainability Committee. |

|||||||||||

| Securities Held(1) | ||||||||||||

|

Number of DSUs |

Number of Shares | |||||||||||

| March 15, 2024 | 209,278 | - | ||||||||||

| March 10, 2023 | 145,786 | - | ||||||||||

| Change | 63,492 | - | ||||||||||

| Mr. McCulley meets the Company’s equity ownership guidelines. | ||||||||||||

| Areas of Expertise | Director Election - Voting Results(2) | |||||||||||

| Mining Industry / Operations / Geology; Public Company Boards / Corporate Governance; HS / Sustainability / Risk Management; Talent Management; Strategic Planning / M&A; Government Relations / Legal Matters; Capital Project Management | Year | For | Withheld | |||||||||

| 2023 | 99.23% | 0.77% | ||||||||||

| 2022 | 99.47% | 0.53% | ||||||||||

| 2021 | 99.68% | 0.32% | ||||||||||

| Board and Committee Membership and Attendance 2023(3) |

Other Public Directorships | |||||||||||

| Board | 9 of 9 | None | ||||||||||

| Technical and Sustainability Committee | 5 of 5 | |||||||||||

| Human Resources and Compensation Committee | 6 of 6 | |||||||||||

| If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477, 1-437-561-5022 (text and call enabled) or email contactus@kingsdaleadvisors.com. |

| |

|

Ontario, Canada Age: 65 Director since April 25, 2018 Independent |

MARGARET MULLIGAN Margaret (Peggy) Mulligan has over 35 years of experience in audit and finance. From 2008 to 2010, Ms. Mulligan was the Executive Vice President and Chief Financial Officer of Biovail Corporation and from 2005 to 2007, she was the Executive Vice President and Chief Financial Officer of Linamar Corporation. From 1994 to 2004, Ms. Mulligan was the Senior Vice President, Audit and Chief Inspector and then the Executive Vice President, Systems and Operations of The Bank of Nova Scotia. Before joining Scotiabank, she was an Audit Partner with PricewaterhouseCoopers. She holds a Bachelor of Math (Honours) from the University of Waterloo and is a Chartered Professional Accountant, FCPA, CA. Ms. Mulligan also serves as a director on the board of Canadian Western Bank. At New Gold, Ms. Mulligan is Chair of the Human Resources and Compensation Committee and a member of the Audit Committee. Ms. Mulligan’s principal occupation is as a corporate director. |

|||||||||

| Securities Held(1) | ||||||||||

|

Number of DSUs |

Number of Shares | |||||||||

| March 15, 2024 | 644,580 | - | ||||||||

| March 10, 2023 | 525,533 | - | ||||||||

| Change | 119,047 | - | ||||||||

| Ms. Mulligan meets the Company’s equity ownership guidelines. | ||||||||||

| Areas of Expertise | Director Election - Voting Results(2) | |||||||||

| Capital Markets / Finance / Accounting; Public Company Boards / Corporate Governance; HS / Sustainability / Risk Management; Talent Management; Strategic Planning / M&A; Government Relations / Legal Matters; Capital Project Management | Year | For | Withheld | |||||||

| 2023 | 99.15% | 0.85% | ||||||||

| 2022 | 99.52% | 0.48% | ||||||||

| 2021 | 98.05% | 1.95% | ||||||||

| Board and Committee Membership and Attendance 2023(3) |

Other Public Directorships | |||||||||

| Board | 8 of 9 | Canadian Western Bank | Since 2017 | |||||||

| Audit Committee | 4 of 4 | |||||||||

| Human Resources and Compensation Committee, Chair | 6 of 6 | |||||||||

| If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477, 1-437-561-5022 (text and call enabled) or email contactus@kingsdaleadvisors.com. |

| |

|

Denver, Colorado Age: 70 Proposed New Director Independent |

RICHARD O’BRIEN Richard O’Brien has over 40 years of experience in the mining and energy sectors, including more than 20 years in chief executive officer and chief financial officer roles. Mr. O’Brien served as President and Chief Executive Officer of Newmont Mining Corporation from 2007 to 2013, Executive Vice President and Chief Financial Officer from 2006 to 2007, and Senior Vice President and Chief Financial Officer from 2005 to 2006. He also served as President and Chief Executive Officer of Boart Longyear Limited, the world’s leading provider of drilling services, drilling equipment and performance tooling for mining and drilling companies, from 2013 to 2015. He currently serves on the boards of Vulcan Materials Co., Xcel Energy Inc. and Ma’aden, The Saudi Arabian Mining Company. He was also Chair of the Board of Pretivm Resources inc. from 2019 to 2022, until its acquisition by Newcrest Mining Limited. Mr. O’Brien holds a Bachelor of Arts (Economics) from the University of Chicago and a Juris Doctor from Lewis and Clark School of Law. He also completed the Directors’ Consortium at Stanford Business School. His principal occupation is as a corporate director. |

|||||||||

| Securities Held(1) | ||||||||||

|

Number of Shares |

Number of DSUs |

Number of Shares | ||||||||

| March 15, 2024 | - | - | - | |||||||

| Mr. O’Brien, who was appointed to the Board on March 25, 2024, has until March 2027 to achieve compliance with the Company’s equity ownership guidelines. | ||||||||||

| Areas of Expertise | Director Election - Voting Results(2) | |||||||||

| Capital Markets / Finance / Accounting; Public Company Boards / Corporate Governance; HS / Sustainability / Risk Management; Talent Management; Strategic Planning / M&A; Government Relations / Legal Matters | Year | For | Withheld | |||||||

| Not applicable | ||||||||||

| Board and Committee Membership and Attendance 2023(3) |

Other Public Directorships | |||||||||

| Not applicable | Saudi Arabian Mining Co. | Since 2017 | ||||||||

| Xcel Energy Inc. | Since 2012 | |||||||||

| Vulcan Materials Co. | Since 2008 | |||||||||

| If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477, 1-437-561-5022 (text and call enabled) or email contactus@kingsdaleadvisors.com. |

| |

|

Ontario, Canada Age: 67 Director since April 27, 2016 Independent |

IAN PEARCE Ian Pearce has over 40 years of experience in the mining industry. From 1993 to 2003, Mr. Pearce held progressively more senior engineering and project management roles with Fluor Inc., including managing numerous significant development projects in the extractive sector. From 2003 to 2006, Mr. Pearce held executive roles at Falconbridge Limited, including Chief Operating Officer, and he subsequently served as Chief Executive Officer of Xstrata Nickel, a subsidiary of Xstrata plc, from 2006 to 2013. From 2013 to 2017, Mr. Pearce was a partner of X2 Resources, a private partnership focused on building a mid-tier diversified mining and metals group. Mr. Pearce currently serves as the Chair of the Board of MineSense Technologies Ltd. and as a Senior Advisor at KoBold Metals. He is a director of Metso Corporation, Northland Power Inc. and NextSource Materials Inc. In February 2022, Mr. Pearce was appointed as the CIM Incoming President Elect (2024-2025). Mr. Pearce will assume the role of CIM President in May 2024. He previously served as the Chair of the Board of Nevsun Resources Ltd. and as a director of Nexa Resources S.A. Mr. Pearce holds a Higher National Diploma in Engineering (Mineral Processing) from the University of Johannesburg and a Bachelor of Science degree from the University of the Witwatersrand in South Africa. At New Gold, Mr. Pearce is the Chair of the Board. Mr. Pearce’s principal occupation is as a corporate director. |

||||||||||

| Securities Held(1) | |||||||||||

|

Number of DSUs |

Number of Shares | ||||||||||

| March 15, 2024 | 800,779 | 27,200 | |||||||||

| March 10, 2023 | 692,843 | 27,200 | |||||||||

| Change | 107,936 | - | |||||||||

| Mr. Pearce meets the Company’s equity ownership guidelines. | |||||||||||

| Areas of Expertise | Director Election - Voting Results(2) | ||||||||||

| Mining Industry / Operations / Geology; Public Company Boards / Corporate Governance; HS / Sustainability / Risk Management; Talent Management; Strategic Planning / M&A; Capital Project Management | Year | For | Withheld | ||||||||

| 2023 | 94.97% | 5.03% | |||||||||

| 2022 | 95.52% | 4.48% | |||||||||

| 2021 | 95.05% | 4.95% | |||||||||

| Board and Committee Membership and Attendance 2023(3) |

Other Public Directorships | ||||||||||

| Board, Chair | 9 of 9 | NextSource Materials Inc. | Since 2021 | ||||||||

| Northland Power Inc. | Since 2020 | ||||||||||

| Metso Corporation | Since 2015 | ||||||||||

| If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477, 1-437-561-5022 (text and call enabled) or email contactus@kingsdaleadvisors.com. |

| |

|

Alberta, Canada Age: 64 Director since June 26, 2017 Independent |

MARILYN SCHONBERNER Marilyn Schonberner has over 35 years of international experience in the energy and mining sectors. She retired in 2018 as the Chief Financial Officer of Nexen Energy ULC. During her 21-year career with Nexen, she held various executive roles with responsibility for financial and risk management, audit, human resources, strategic planning and budgeting, supply chain, and information services. In addition to New Gold, Ms. Schonberner currently serves on the board of directors of Wheaton Precious Metals Corp. and the Advisory Board of Heritage Royalty. She holds a Bachelor of Commerce from the University of Alberta and a Master of Business Administration from the University of Calgary. She is a CPA, CMA and a Certified Internal Auditor. Ms. Schonberner completed the Senior Executive Development Programme at the London Business School and has obtained the ICD.D designation from the Institute of Corporate Directors. At New Gold, Ms. Schonberner is Chair of the Audit Committee and a member of the Corporate Governance and Nominating Committee. Her principal occupation is as a corporate director. |

||||||||||

| Securities Held(1) | |||||||||||

|

Number of DSUs |

Number of Shares | ||||||||||

| March 15, 2024 | 515,274 | - | |||||||||

| March 10, 2023 | 451,782 | - | |||||||||

| Change | 63,492 | - | |||||||||

| Ms. Schonberner meets the Company’s equity ownership guidelines. | |||||||||||

| Areas of Expertise | Director Election - Voting Results(2) | ||||||||||

| Capital Markets / Finance / Accounting; Public Company Boards / Corporate Governance; HS / Sustainability / Risk Management; Talent Management; Strategic Planning / M&A; Capital Project Management | Year | For | Withheld | ||||||||

| 2023 | 98.02% | 1.98% | |||||||||

| 2022 | 98.97% | 1.03% | |||||||||

| 2021 | 99.48% | 0.52% | |||||||||

| Board and Committee Membership and Attendance 2023(3) |

Other Public Directorships | ||||||||||

| Board | 9 of 9 | Wheaton Precious Metals Corp. | Since 2018 | ||||||||

| Audit Committee, Chair | 4 of 4 | ||||||||||

| Corporate Governance and Nominating Committee | 4 of 4 | ||||||||||

| If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477, 1-437-561-5022 (text and call enabled) or email contactus@kingsdaleadvisors.com. |

| |

| (1) | Information regarding the securities held by each Nominee, including the number of Shares beneficially owned directly or indirectly or over which control or direction is exercised, has been confirmed by the relevant Nominee. |

| (2) | Annual voting results for the last three years in which the Nominee was nominated for election to the Board. |

| (3) | Attendance by each director at Board and committee meetings is based on the number of meetings held during the period of the calendar year during which the director was a member of the Board and/or the applicable committee. |

| (4) | As of March 15, 2024, Mr. Godin held a total of 2,993,049 performance share units (“PSUs”) and restricted share units (“RSUs”) comprised of 1,944,738 PSUs and 1,048,311 RSUs. This is includes 827,922 PSUs and 551,948 RSUs granted on February 26, 2024. |

Cease Trade Orders or Bankruptcies

As at the date of this Circular, no Nominee is, or has been within the past ten years, a director, chief executive officer or chief financial officer of any company (including New Gold) that:

| (i) | was subject to a cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days (collectively, an “Order”), that was issued while the Nominee was acting in the capacity as director, chief executive officer or chief financial officer; or |

| (ii) | was subject to an Order that was issued after the Nominee ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while the Nominee was acting in the capacity as director, chief executive officer or chief financial officer. |

As at the date of this Circular, other than as stated below, no Nominee:

| (i) | is, or has been within the past ten years, a director or executive officer of any company (including New Gold) that, while the Nominee was acting in that capacity, or within a year of the Nominee ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; |

| (ii) | has, within the past ten years, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the Nominee; or |

| (iii) | has been subject to: (a) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or (b) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable shareholder in deciding whether to vote for a proposed director. |

Patrick Godin was a director and the President and Chief Executive Officer of Stornoway Diamond Corporation ("Stornoway”), a Canadian diamond exploration and production company based in Longueil, Quebec, until November 1, 2020. On September 9, 2019, Stornoway and its subsidiaries filed and obtained an initial order from the Superior Court of Quebec (Commercial Division) (“Quebec Superior Court”) for protection under the Companies’ Creditors Arrangement Act (Canada) (“CCAA”) to restructure its business and financial affairs. Under the terms of the initial order, Deloitte Restructuring Inc. was appointed as monitor to oversee the CCAA proceedings and report to the Quebec Superior Court.

| If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477, 1-437-561-5022 (text and call enabled) or email contactus@kingsdaleadvisors.com. |

| |

Stornoway received notice of delisting review by the Toronto Stock Exchange (“TSX”) on August 22, 2019, and Stornoway’s securities were delisted from the TSX effective at the close of market on October 18, 2019. The CCAA process was concluded by order of the Superior Court of Quebec in November 2019 and Stornoway’s operating subsidiary emerged from such process, continuing its operations on a going concern basis after the successful implementation of Stornoway’s restructuring transactions. In November 2019, Stornoway made a voluntary assignment into bankruptcy pursuant to the Bankruptcy and Insolvency Act (Canada).

Gillian Davidson was a director of Lydian International Limited (“Lydian”) until March 2020. Lydian and certain of its subsidiaries were granted protection under the CCAA on December 23, 2019 and entered into a plan of arrangement with its secured creditors on June 15, 2020. The plan was implemented on July 6, 2020 pursuant to a sanction and interim order. The Ontario Securities Commission issued a cease trade order against Lydian on June 9, 2020 for failing to file its periodic disclosure for the period ending March 31, 2020. The cease trade order remains in effect and will remain in effect until the dissolution and wind up of Lydian is completed.

Additional Information Regarding the Board

For additional information regarding the Board, including compensation and corporate governance practices, see “Statement of Director Compensation” and “Corporate Governance Practices”.

Shareholders will be asked to consider and, if deemed appropriate, pass an ordinary resolution to appoint Deloitte LLP as auditor of New Gold to hold office until the close of the next annual meeting of shareholders of New Gold. At the Company’s last annual general and special meeting held on May 9, 2023, 84.7% of votes cast voted in favour of the resolution. It is also proposed that shareholders authorize the directors to fix the remuneration to be paid to the auditor.

Deloitte LLP has been the auditor of New Gold (or its predecessors) since 2007. New Gold recognizes the importance of independent auditors. The Audit Committee conducts an annual formal review of the performance of the independent auditor that involves management and Audit Committee members. The review focuses on independence, objectivity, professional skepticism, quality of services and communication. The results of the formal assessment are provided to the Audit Committee and discussed with management. The formal review process and discussion serves as a way for New Gold to annually consider whether a change in auditor is appropriate.

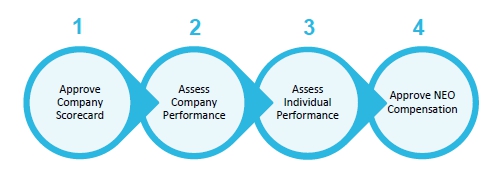

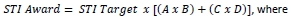

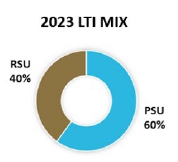

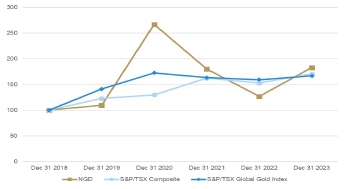

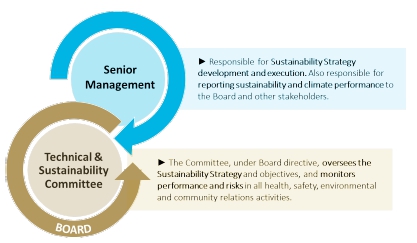

Deloitte LLP also takes steps to preserve its independence, which include the rotation of its lead audit partner and lead quality review partner at least every five years, resulting in a new audit team on a regular basis. Partners that complete a five-year term are required to observe a cooling off period of at least five years before providing any further audit or non-audit services to the Company. 2024 will be the last year for the current lead audit partner, with a new lead audit partner starting in 2025.