1 INVESTOR PRESENTATION Q 3 2 0 2 5 M V B – F 1 : S U C C E S S L O V E S S P E E D

2 MVB Financial Corp. (“MVB” or the “Company”) has made forward-looking statements, within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, in this earnings release that are intended to be covered by the protections provided under the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on current expectations about the future and subject to risks and uncertainties. Forward-looking statements include, without limitation, information concerning possible or assumed future results of operations of the Company and its subsidiaries. Forward-looking statements can be identified by the use of words such as “may,” “could,” “should,”, “would,” “will,” “plans,” “believes,” “estimates,” “expects,” “anticipates,” “intends,” “continues,” or the negative of those terms or similar expressions. Note that many factors could affect the future financial results of the Company and its subsidiaries, both individually and collectively, and could cause those results to differ materially from those expressed in forward-looking statements. Therefore, undue reliance should not be placed upon any forward-looking statements. Those factors include but are not limited to: market, economic, operational, liquidity, and credit risk; changes in market interest rates; inability to successfully execute business plans, including strategies related to investments in financial technology companies; competition; unforeseen events, such as pandemics or natural disasters, and any governmental or societal responses thereto, changes in economic, business, and political conditions; changes in demand for loan products and deposit flow; changes in deposit classifications, operational risks and risk management failures; and government regulation and supervision. Further, we urge you to carefully review and consider the cautionary statements and disclosures, specifically those made in Part I, Item 1A, Risk Factors, of our Annual Report on Form 10-K for the year ended December 31, 2024 (the “2024 Form 10-K”), filed with the Securities and Exchange Commission ("SEC") on March 13, 2025, and from time to time, in our other filings with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of the stated report. Except to the extent required by law, we undertake no obligation to update any forward-looking statements in order to reflect any event or circumstance occurring after the date of this report or currently unknown facts or conditions or the occurrence of unanticipated events. All forward-looking statements are qualified in their entirety by this cautionary statement. Accounting standards require the consideration of subsequent events occurring after the balance sheet date for matters that require adjustment to, or disclosure in, the consolidated financial statements. The review period for subsequent events extends up to and including the filing date of a public company’s financial statements when filed with the SEC. Accordingly, the consolidated financial information in this announcement is subject to change. The Company uses certain non-GAAP financial measures, such as tangible book value per share and tangible common equity to tangible assets, to provide information useful to investors in understanding the Company’s operating performance and trends and to facilitate comparisons with the performance of the Company’s peers. The non-GAAP financial measures used may differ from the non-GAAP financial measures other financial institutions use to measure their results of operations. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, the Company’s reported results prepared in accordance with U.S. GAAP. Reconciliations of these non-GAAP financial measures to the most directly comparable U.S. GAAP financial measures are provided in the Appendix to this Presentation. Forward-Looking Statements

3 New Horizons: Driving Forward with Optimism

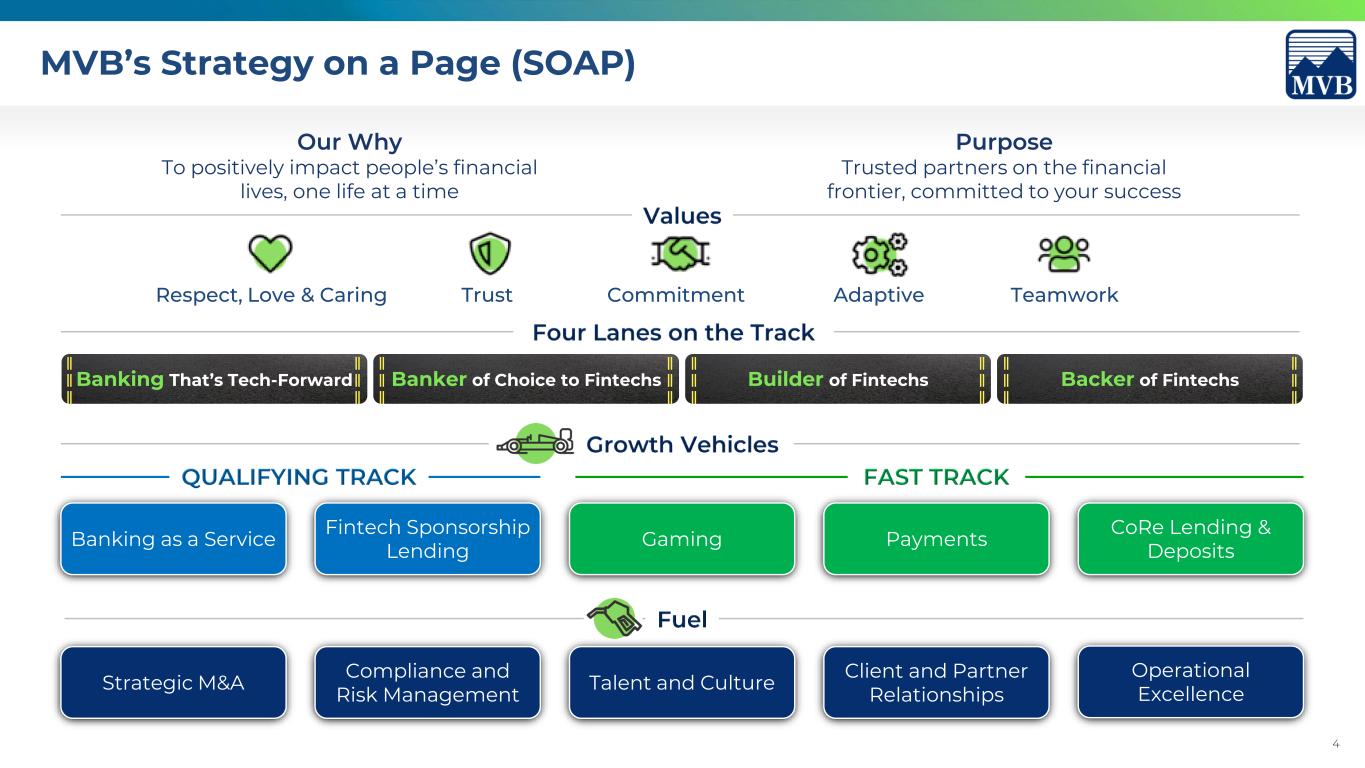

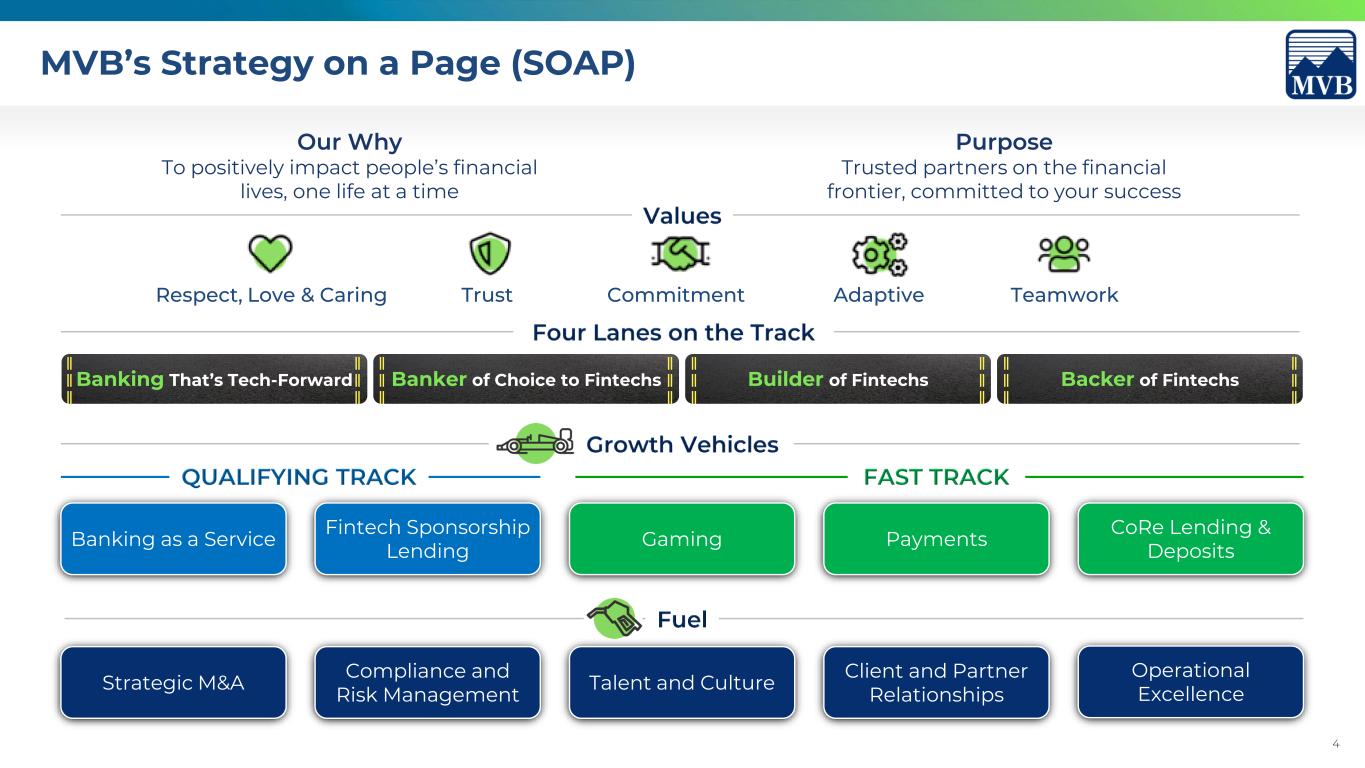

4 Trust Commitment TeamworkRespect, Love & Caring Adaptive Compliance and Risk Management Talent and Culture Operational Excellence Our Why To positively impact people’s financial lives, one life at a time Purpose Trusted partners on the financial frontier, committed to your success MVB’s Strategy on a Page (SOAP) Fintech Sponsorship Lending Strategic M&A Backer of FintechsBuilder of FintechsBanker of Choice to FintechsBanking That’s Tech-Forward Payments CoRe Lending & Deposits Client and Partner Relationships Banking as a Service Gaming

5 Source: Company documents and SEC Filings Q3 2025 Key Highlights • Completed strategic sale of Victor Technologies, Inc. (“Victor”), generating a pre-tax gain of $34.1 million • Completed securities repositioning, which, when combined with expense efficiencies from Victor sale, is expected to add $0.30 to $0.35 to annualized EPS • Tangible book value per share increased to $25.98, a 9.7% increase from Q2 2025 • Quarter-over-quarter loan growth of 4.9% • Net interest income growth of 3.1% in the quarter • Completed previously announced $10 million share repurchase program that included total repurchases of 473,584 shares at an average price of $21.15 per share • Authorized new $10 million share repurchase program in October 2025

6 Strong Insider Support and Opportunistically Repurchasing Shares $10M 473,584 shares, or ~4% of outstanding shares, repurchased in 2025 $502K 28,698 shares purchased YTD 9/30/2025 YTD Insider Stock Purchases $6.5M 41 consecutive quarters of dividends paid YTD Common Dividends Paid Source: Company documents and SEC Filings Share Repurchase Activity (Year-to-date through 9/30/2025) Authorized new $10M share repurchase plan in October 2025

7 Payments: A Modern Platform of Capabilities Money Movement of Any Kind

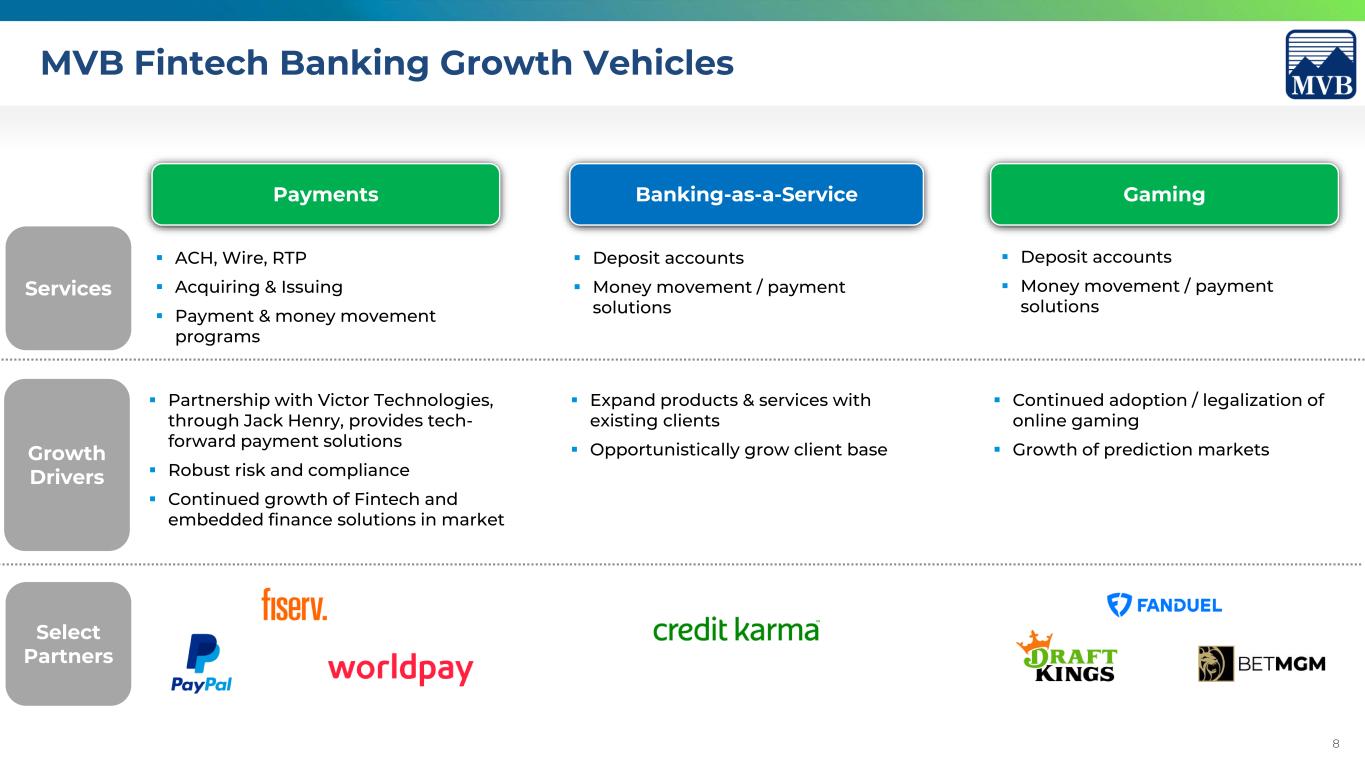

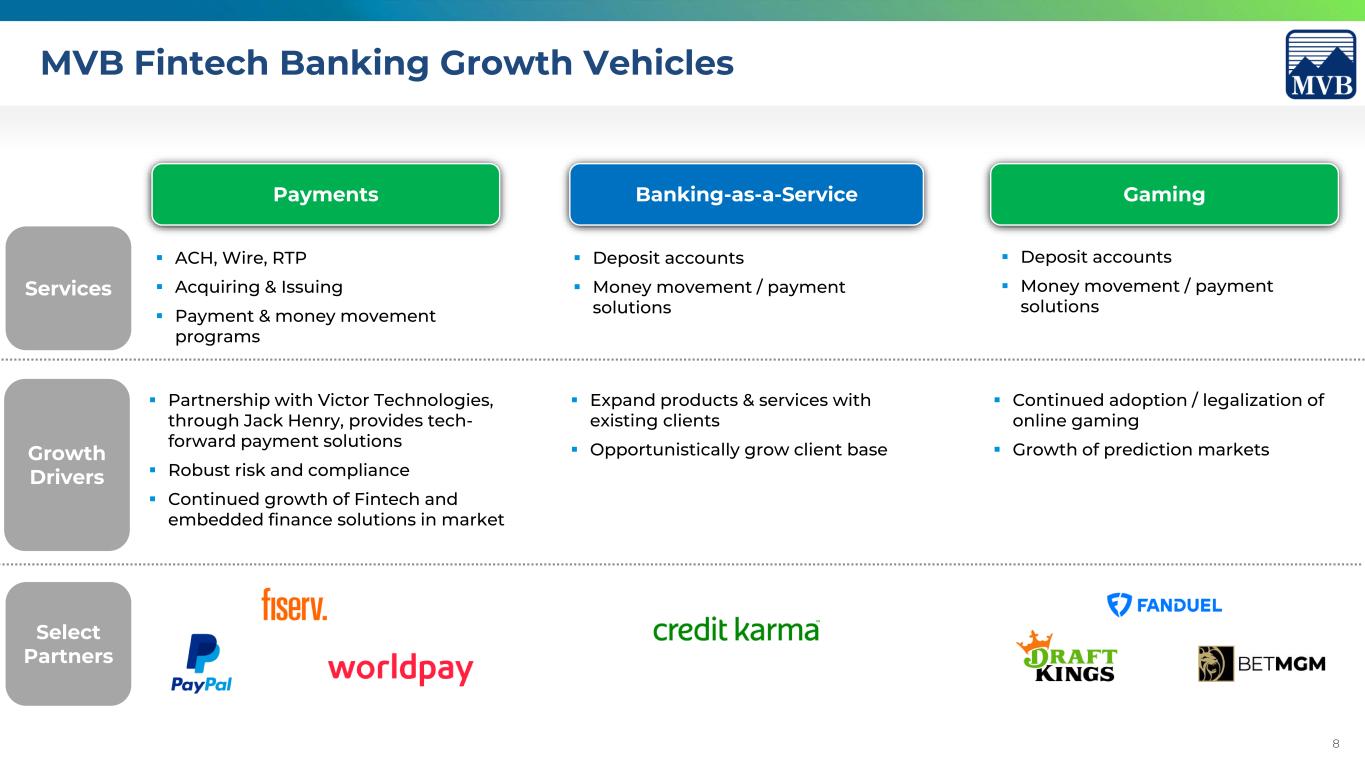

8 MVB Fintech Banking Growth Vehicles Banking-as-a-Service GamingPayments ▪ ACH, Wire, RTP ▪ Acquiring & Issuing ▪ Payment & money movement programs ▪ Deposit accounts ▪ Money movement / payment solutions ▪ Deposit accounts ▪ Money movement / payment solutions ▪ Partnership with Victor Technologies, through Jack Henry, provides tech- forward payment solutions ▪ Robust risk and compliance ▪ Continued growth of Fintech and embedded finance solutions in market ▪ Expand products & services with existing clients ▪ Opportunistically grow client base ▪ Continued adoption / legalization of online gaming ▪ Growth of prediction markets Services Select Partners Growth Drivers

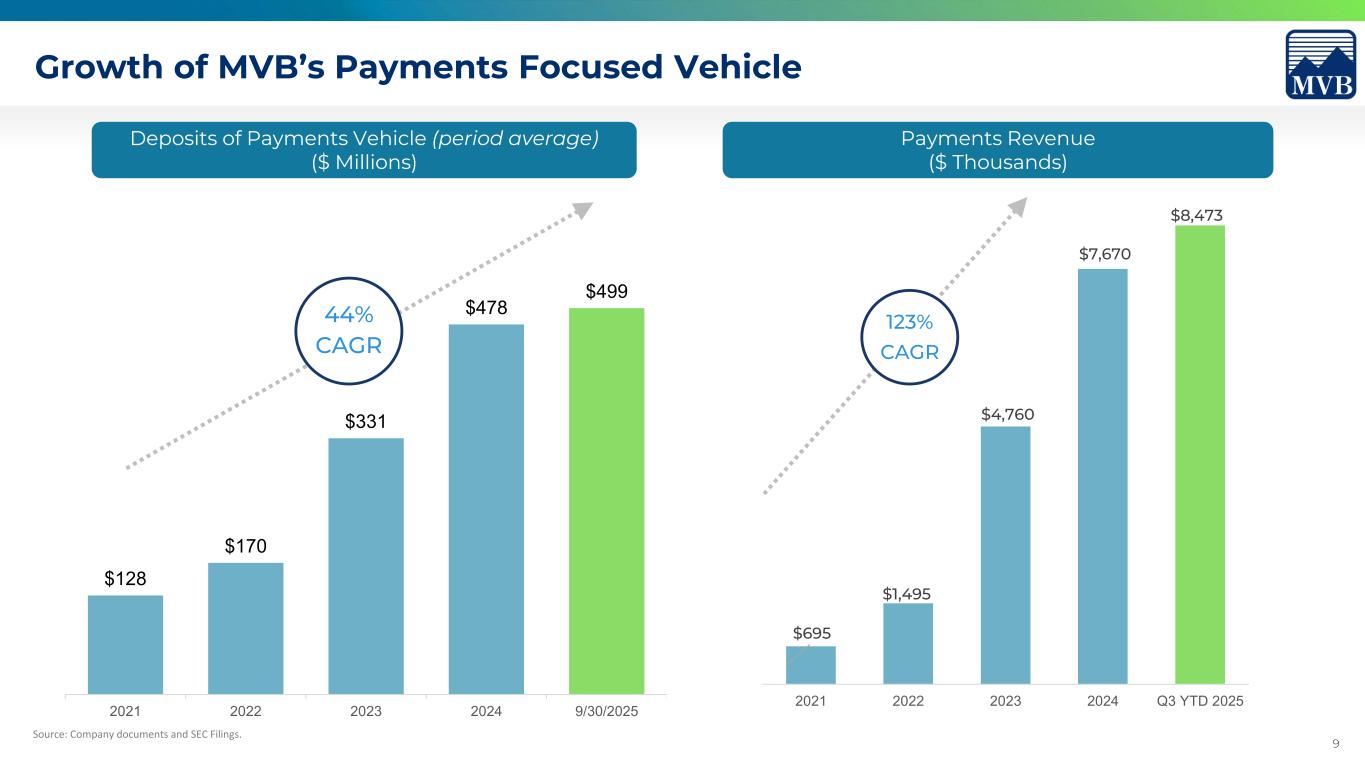

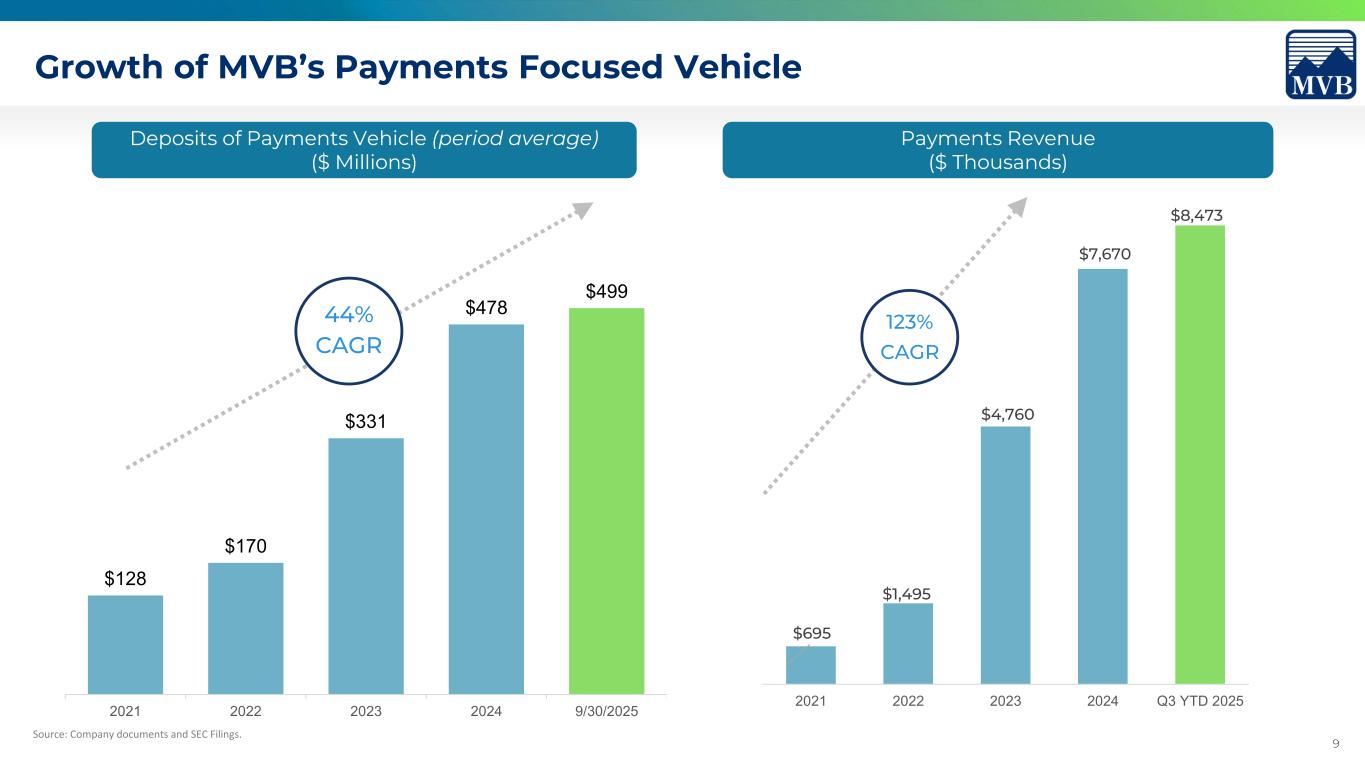

9 Growth of MVB’s Payments Focused Vehicle Source: Company documents and SEC Filings. $128 $170 $331 $478 $499 2021 2022 2023 2024 9/30/2025 44% CAGR Payments Revenue ($ Thousands) Deposits of Payments Vehicle (period average) ($ Millions) $695 $1,495 $4,760 $7,670 $8,473 2021 2022 2023 2024 Q3 YTD 2025 123% CAGR

10 Fintech Pipeline Summary Finalizing Terms 6 Implementation (Signed MSA or LOI) 14 Testing 4 Launched* 2 Partner Service Launch Testing Phase: 1. Loyalty Award Incentive Issuing Q4 2025 2. Pay by Bank Network Money Movement Q4 2025 3. Global Payments Provider (Fortune 200) Acquiring Q4 2025 4. Leading Neo-Bank Earned Wage Access Q4 2025 Launched: 1. Pay by Bank Network Money Movement Q4 2025 2. Global Payments Provider (Fortune 500) Acquiring Q2 2025 Strong pipeline of 52 Fintech partnership opportunities across Issuing, Acquiring, Money Movement, Gaming and Digital Assets Summary of Advanced-Stage Fintech Pipeline (# of Opportunities) Data as of October 31, 2025 * Represents partners launched since June 30, 2025 Recent / Anticipated Launches (New Partners or Products)

11 Deposits

12 Source: Company documents and SEC Filings $1,749 $1,027 $912 Off Balance Sheet Total Noninterest-bearing Deposits Total Interest-bearing Deposits $3,688 Deposits ($ Millions) Strong Funding and Liquidity Position $300 $55 $912 $580 $150 $67 Liquidity Sources ($ Millions) Cash and Cash Equivalents Unpledged Investment Securities Off Balance Sheet Custodial Deposits FHLB Borrowing Capacity Fed Discount Window Funds Unsecured Funding and Other Wholesale Funding Options $2,064 $2,776 On-Balance Sheet Deposits 7% CAGR in Total Deposits Since 2021 37% Noninterest-bearing Deposits / Total Deposits Data as of September 30, 2025

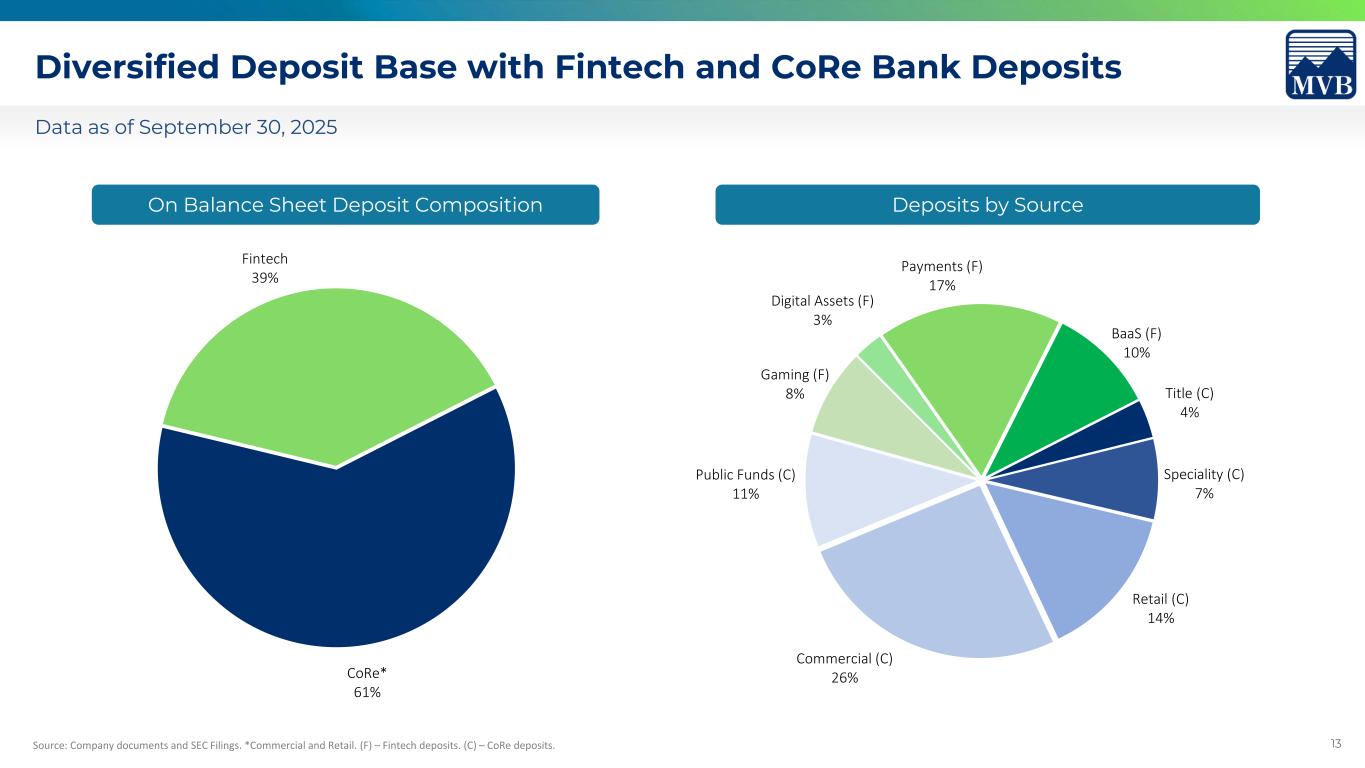

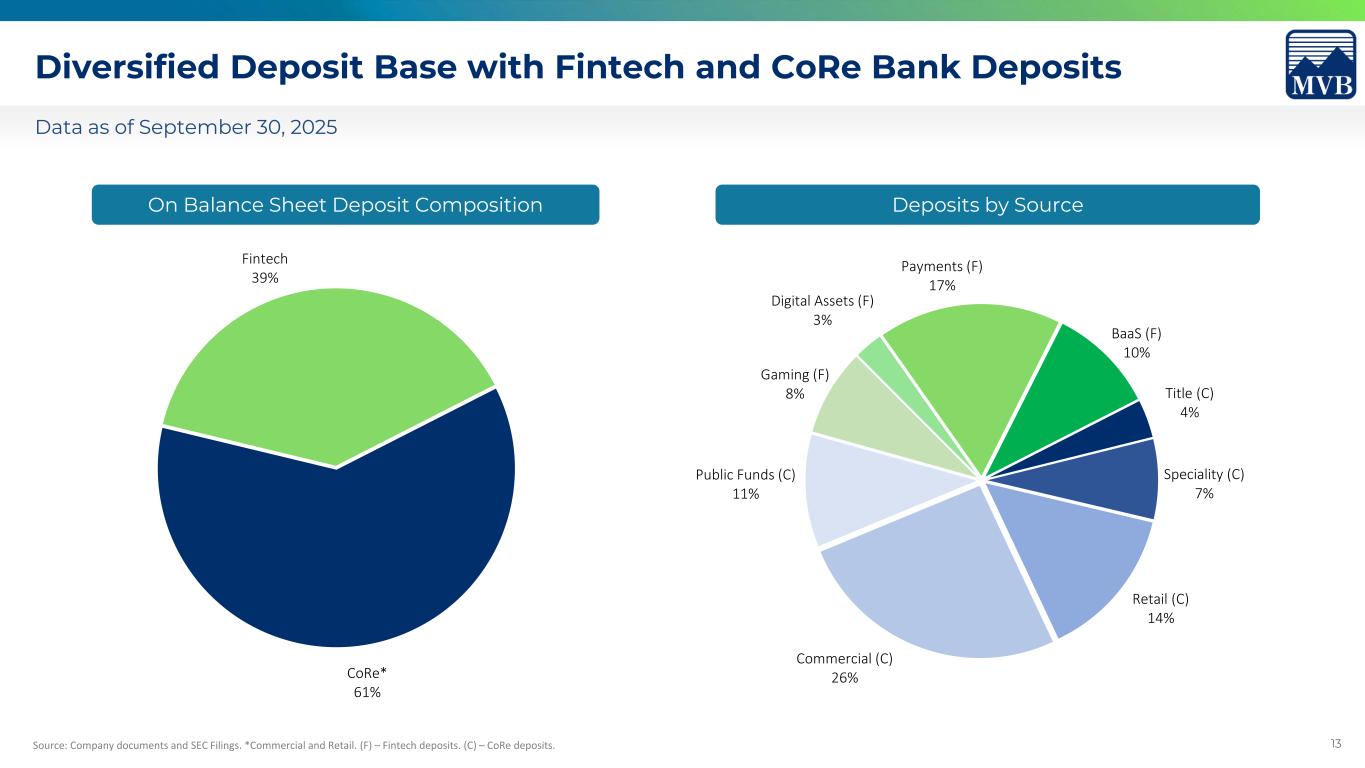

13 On Balance Sheet Deposit Composition Deposits by Source CoRe* 61% Fintech 39% Title (C) 4% Speciality (C) 7% Retail (C) 14% Commercial (C) 26% Public Funds (C) 11% Gaming (F) 8% Digital Assets (F) 3% Payments (F) 17% BaaS (F) 10% Diversified Deposit Base with Fintech and CoRe Bank Deposits Source: Company documents and SEC Filings. *Commercial and Retail. (F) – Fintech deposits. (C) – CoRe deposits. Data as of September 30, 2025

14 Continued Remix of Deposit Portfolio with Future Repricing Opportunities Source: Company documents and SEC Filings $46 $158 $63 $20 $66 $4 $13 Q4 2025 Q1 2026 Q2 2026 Q3 2026 Retail CDs Brokered Deposits 3.98% 4.51% 4.24% 4.28% Wtd. Avg. Rate ▪ $286 million of CDs repricing over the next 4 quarters with a weighted average rate of 4.05% ▪ $66 million of brokered CDs maturing in Q1 2026 with a weighted average rate of 4.78% $339 $328 $315 $287 $496 $405 $305 $305 2024 Q1 2025 Q2 2025 Q3 2025 Retail CDs Brokered Deposits Upcoming CD Maturities ($ Millions) CD Balances ($ Millions)

15 Loan Portfolio & Asset Quality

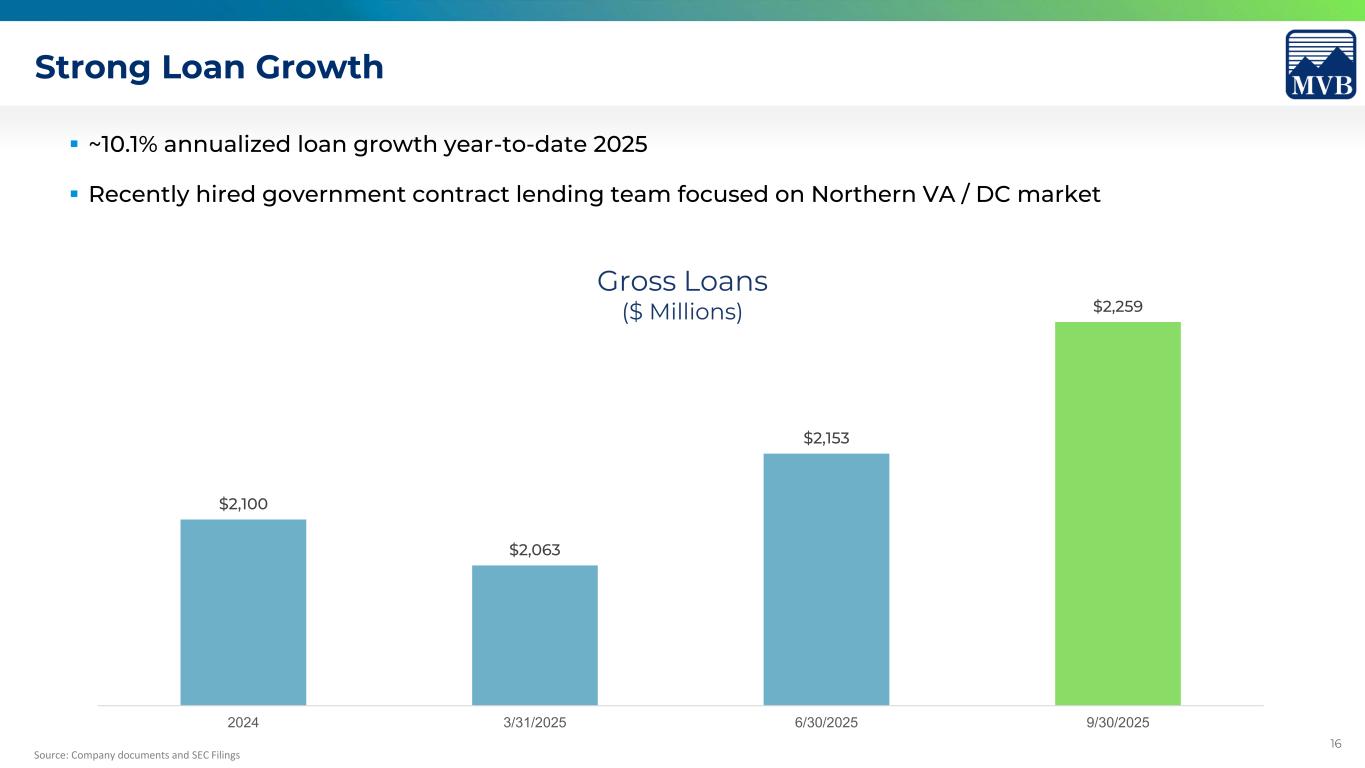

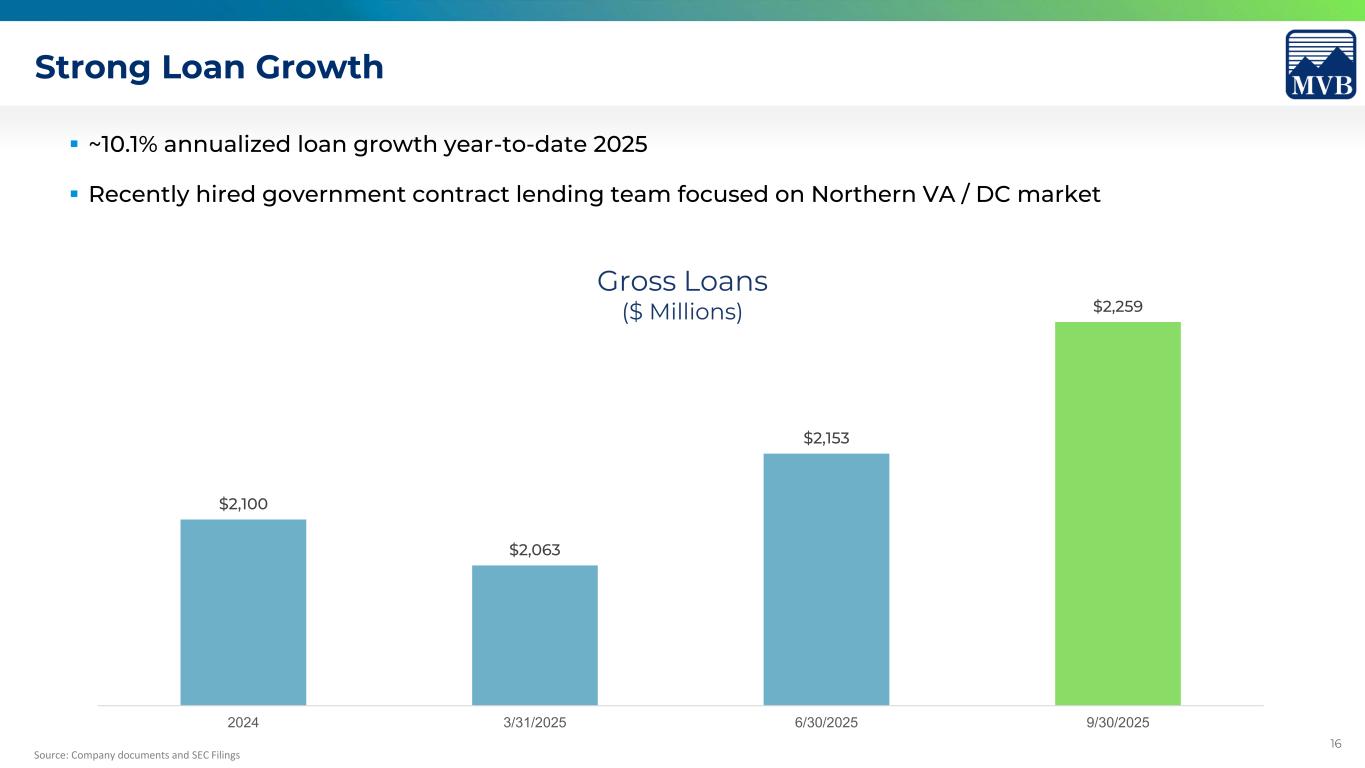

16 Strong Loan Growth Source: Company documents and SEC Filings $2,100 $2,063 $2,153 $2,259 2024 3/31/2025 6/30/2025 9/30/2025 Gross Loans ($ Millions) ▪ ~10.1% annualized loan growth year-to-date 2025 ▪ Recently hired government contract lending team focused on Northern VA / DC market

17 Loan Portfolio Composition Loan Portfolio by Industry Source: Company Documents. Commercial Business 20.9% Home Equity 0.5% Commercial Real Estate 36.2% Owner Occupied Real Estate 9.0% Acquisition & Development 4.3% Residential 28.2% Consumer 0.9% Other 18.9% Office Space 4.2% Commercial Construction 2.0% Healthcare 24.5% Auto 2.7% Multifamily 3.6% Residential 29.4% Government 0.9% Energy 2.7% Financial 3.7% Retail Space 7.4% Diversified Loan Portfolio – 9/30/2025 268% CRE Concentration Ratio 2.5% Percentage of Non-OO Office to Total Loans

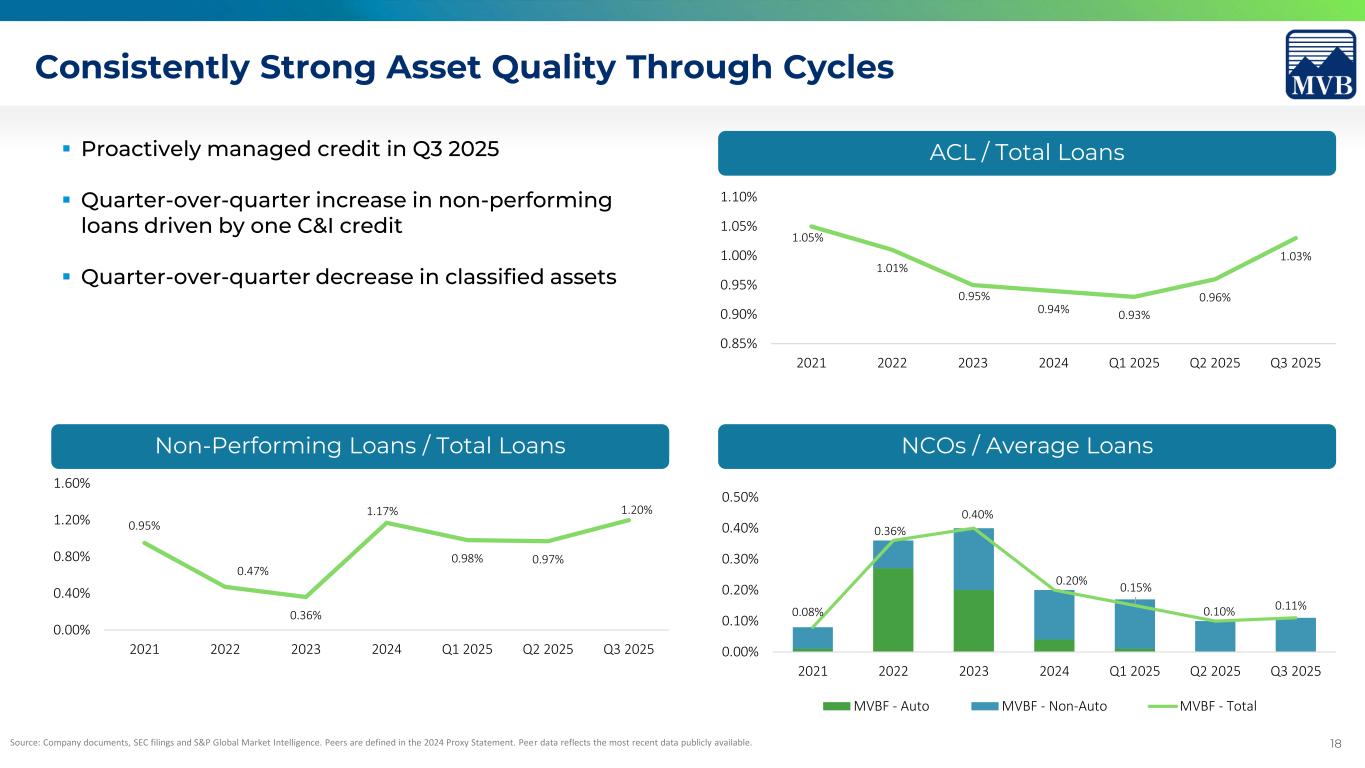

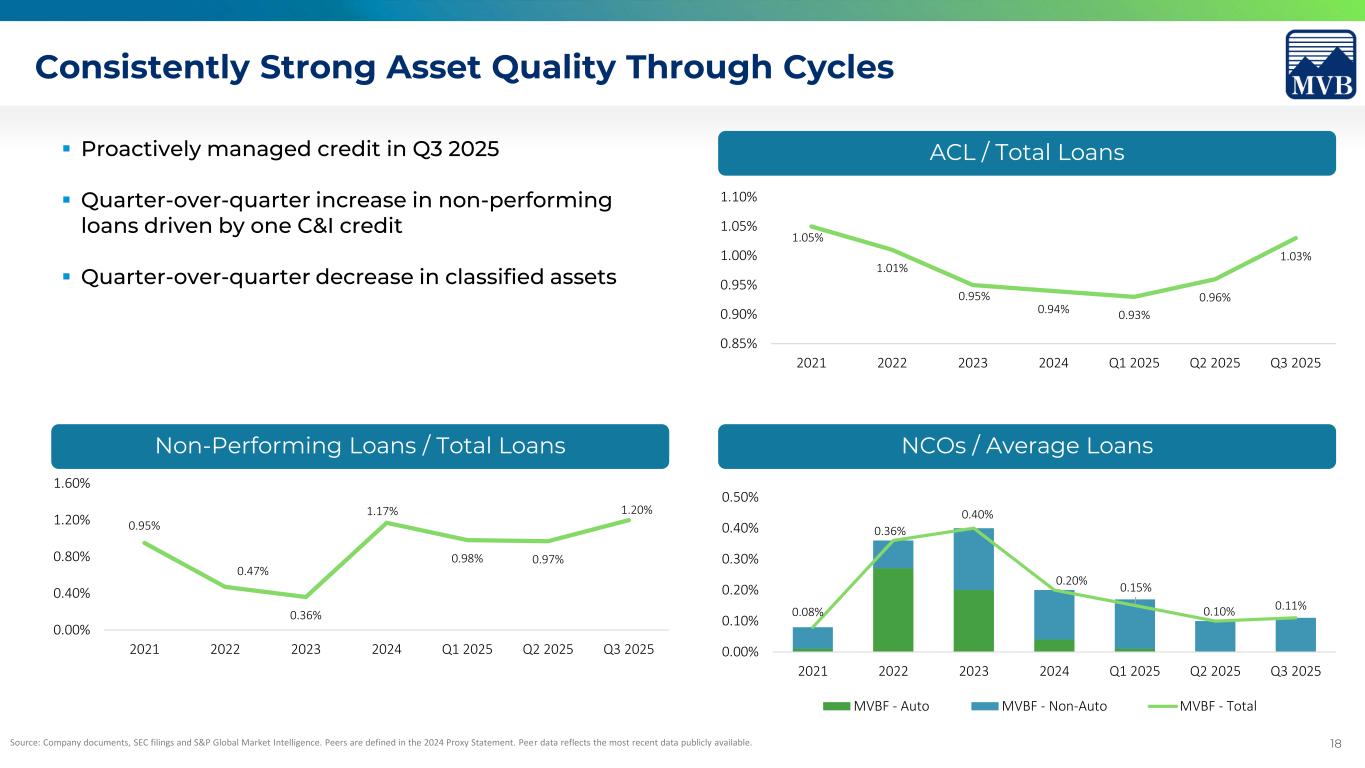

18 0.95% 0.47% 0.36% 1.17% 0.98% 0.97% 1.20% 0.00% 0.40% 0.80% 1.20% 1.60% 2021 2022 2023 2024 Q1 2025 Q2 2025 Q3 2025 Non-Performing Loans / Total Loans 0.08% 0.36% 0.40% 0.20% 0.15% 0.10% 0.11% 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 2021 2022 2023 2024 Q1 2025 Q2 2025 Q3 2025 MVBF - Auto MVBF - Non-Auto MVBF - Total NCOs / Average Loans Source: Company documents, SEC filings and S&P Global Market Intelligence. Peers are defined in the 2024 Proxy Statement. Peer data reflects the most recent data publicly available. 1.05% 1.01% 0.95% 0.94% 0.93% 0.96% 1.03% 0.85% 0.90% 0.95% 1.00% 1.05% 1.10% 2021 2022 2023 2024 Q1 2025 Q2 2025 Q3 2025 ACL / Total Loans Consistently Strong Asset Quality Through Cycles ▪ Proactively managed credit in Q3 2025 ▪ Quarter-over-quarter increase in non-performing loans driven by one C&I credit ▪ Quarter-over-quarter decrease in classified assets

19 Capital Strength

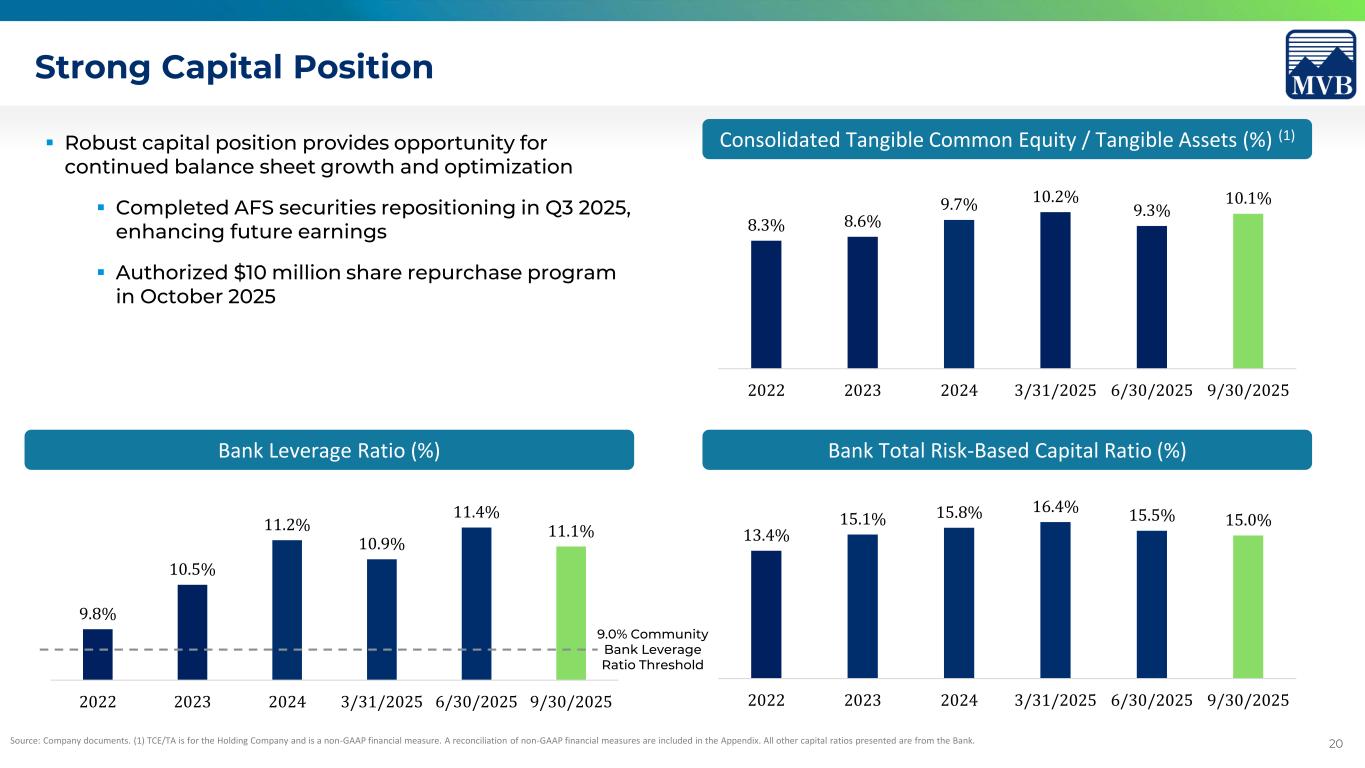

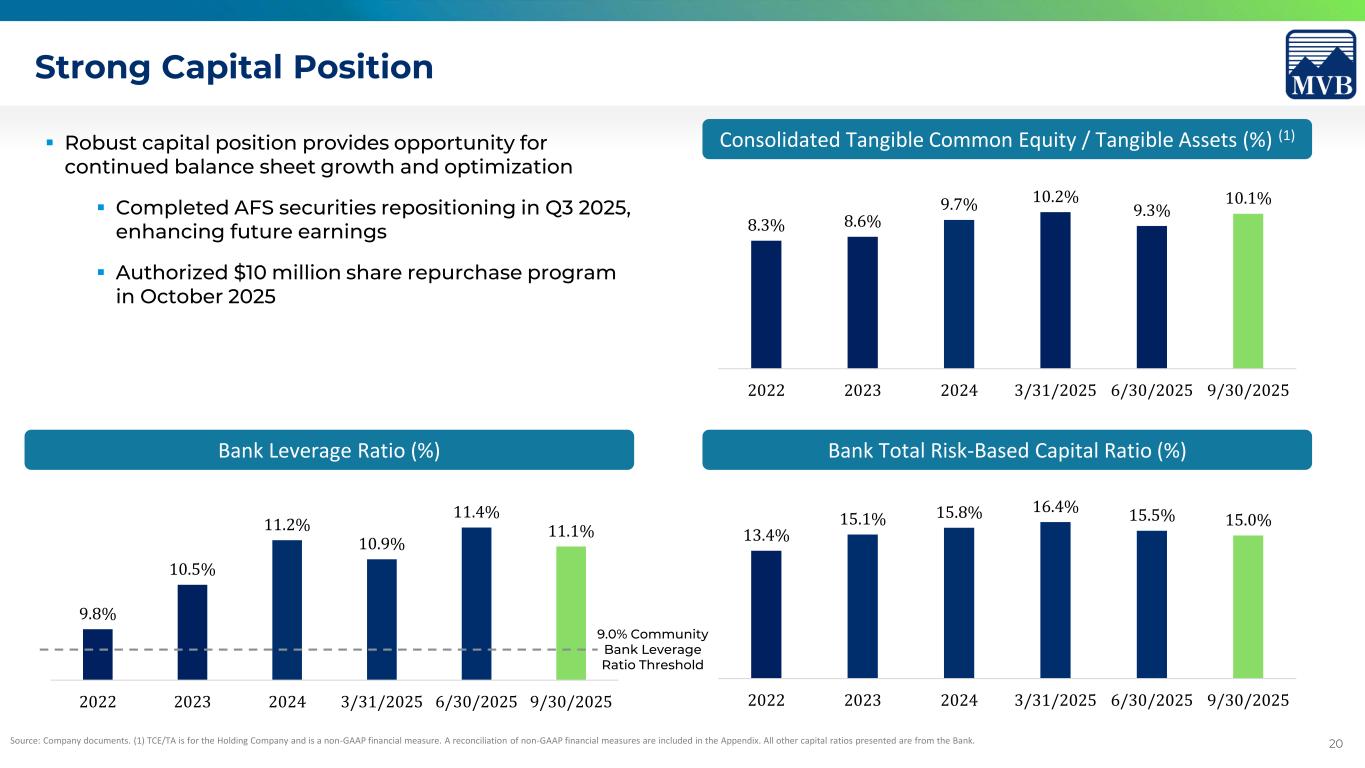

20 8.3% 8.6% 9.7% 10.2% 9.3% 10.1% 2022 2023 2024 3/31/2025 6/30/2025 9/30/2025 Consolidated Tangible Common Equity / Tangible Assets (%) (1) 9.8% 10.5% 11.2% 10.9% 11.4% 11.1% 2022 2023 2024 3/31/2025 6/30/2025 9/30/2025 Bank Leverage Ratio (%) Source: Company documents. (1) TCE/TA is for the Holding Company and is a non-GAAP financial measure. A reconciliation of non-GAAP financial measures are included in the Appendix. All other capital ratios presented are from the Bank. Strong Capital Position 13.4% 15.1% 15.8% 16.4% 15.5% 15.0% 2022 2023 2024 3/31/2025 6/30/2025 9/30/2025 Bank Total Risk-Based Capital Ratio (%) ▪ Robust capital position provides opportunity for continued balance sheet growth and optimization ▪ Completed AFS securities repositioning in Q3 2025, enhancing future earnings ▪ Authorized $10 million share repurchase program in October 2025 9.0% Community Bank Leverage Ratio Threshold

21 Tangible Book Value per Share Growth Source: Company documents and SEC Filings $15.20 $19.73 $22.17 $20.25 $22.43 $23.37 $23.85 $23.68 $25.98 $14.00 $16.00 $18.00 $20.00 $22.00 $24.00 $26.00 $28.00 2019 2020 2021 2022 2023 2024 3/31/2025 6/30/2025 9/30/2025 Tangible Book Value per Share 9.8% CAGR Dividend paid per share $0.26 $0.36 $0.51 $0.68 $0.68 $0.68 $0.17 $0.17 $0.17 $3.68 per share paid in common dividends since 2019

22 AI Implementation Operational Excellence

23 Implementing AI and Automation to Drive Efficiency Built Data Foundation: Implemented Snowflake and Data Transformation tools to build clean data lake Upgraded Transaction Monitoring: Implemented AI-driven Risk Canvas for transaction monitoring Established Data & AI Center of Operational Excellence: Hired Head of Automation and AI; Formed dedicated AI and Business Transformation team; AI University Digital Worker Pilot: Partnering with The Lab and WorkFusion to build and begin deploying digital workers Expansion Phase: Expand digital workers across HR, Accounting, Operations, Risk, Compliance, and Lending; Onboard Enterprise AI model(s) 2H 2025 2026 & Beyond 1H 2025 1H 2025 FY 2024 Data & AI Partners: ✓ ✓ ✓ We are here Next Step

24 Risk Management Strength and Capabilities Teams 2021 2022 2023 2024* 2025 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Risk Management 10 12 11 14 16 22 23 24 24 24 30 27 32 35 30 25 25 27 27 BSA/AML (MVB) 17 19 18 18 18 18 18 18 23 31 50 59 50 60 62 60 56 61 59 BSA/AML (Co-sourced FTEs) 5 12 15 17 19 23 22 21 16 17 17 17 41 60 34 27 33 27 24 Consumer Compliance 3 3 3 3 3 4 5 5 6 6 7 7 7 8 8 8 9 9 7 Total Risk Staffing: 35 46 47 52 56 67 68 68 69 78 104 110 130 160 134 120 123 124 117 0 20 40 60 80 100 120 140 160 180 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Risk Management BSA/AML (MVB) BSA/AML (Co-sourced FTEs) Consumer Compliance 35 117 * Included various short-term initiatives and projects implemented throughout the year

25 Appendix Non-GAAP Reconciliations

26 Source: Company documents. Tangible Book Value per Common Share and Tangible Common Equity Ratio (%) (Dollars in thousands) 2019 2020 2021 2022 2023 2024 9/30/2025 Goodwill $ 19,630 $ 2,350 $ 3,988 $ 3,988 $ 2,838 $ 2,838 $ 1,200 Intangibles 3,473 2,400 2,316 1,631 352 262 -- Total intangible assets $ 23,103 $ 4,750 $ 6,304 $ 5,619 $ 3,190 $ 3,100 $ 1,200 Total equity attributable to parent $ 211,936 $ 239,483 $ 274,328 $ 261,084 $ 289,342 $ 305,679 $ 327,752 Less: Preferred stock (7,334) (7,334) -- -- -- -- -- Less: Total intangible assets (23,103) (4,750) (6,304) (5,619) (3,190) (3,100) (1,200) Total tangible common equity $ 181,499 $ 227,399 $ 268,024 $ 255,465 $ 286,152 $ 302,579 $ 326,552 Total assets $ 1,944,114 $ 2,331,476 $ 2,792,449 $ 3,068,860 $ 3,313,882 $ 3,128,704 $ 3,232,953 Less: Total intangible assets (23,103) (4,750) (6,304) (5,619) (3,190) (3,100) (1,200) Total tangible assets $ 1,921,011 $ 2,326,726 $ 2,786,145 $ 3,063,241 $ 3,310,692 $ 3,125,604 $ 3,231,753 Tangible common equity to tangible assets 9.5% 9.8% 9.6% 8.3% 8.6% 9.7% 10.1% Tangible common equity $ 181,499 $ 227,399 $ 268,024 $ 255,465 $ 286,152 $ 302,579 $ 326,552 Common shares outstanding (000s) 11,944 11,526 12,087 12,618 12,758 12,945 12,570 Tangible book value per common share $ 15.20 $ 19.73 $ 22.17 $ 20.25 $ 22.43 $ 23.37 $ 25.98 Appendix: Non-GAAP Reconciliation