FALSE000127790200012779022025-05-202025-05-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

|

| Date of Report (Date of earliest event reported): |

May 20, 2025 |

|

|

|

|

|

MVB Financial Corp. |

| (Exact name of registrant as specified in its charter) |

|

|

|

|

|

|

|

|

|

| West Virginia |

001-38314 |

20-0034461 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

|

|

|

301 Virginia Avenue, Fairmont, WV |

26554-2777 |

| (Address of principal executive offices) |

(Zip Code) |

|

|

|

(304) 363-4800 |

| (Registrant's telephone number, including area code) |

|

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities registered pursuant to Section 12(b) of the Act: |

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common stock, $1.00 par value |

|

MVBF |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

At the 2025 Annual Meeting of Shareholders of MVB Financial Corp. (the "Company"), to be held May 20, 2025, the Company's CEO, Larry F. Mazza, will be making a presentation to shareholders. This presentation is being furnished as

Exhibit 99.1 of this report.

The information furnished with Item 7.01 of this Current Report on Form 8-K, including

Exhibit 99.1, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

99.1 Presentation by MVB Financial Corp. to investors on or after May 20, 2025

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

MVB Financial Corp. |

|

By: |

/s/ Donald T. Robinson |

|

|

Donald T. Robinson

President and Chief Financial Officer |

Date: May 20, 2025

EX-99.1

2

a2025annualmeetingceosli.htm

EX-99.1

a2025annualmeetingceosli

1 27th ANNUAL MEETING OF SHAREHOLDERS M A Y 2 0 , 2 0 2 5

2 Message from the CEO

3 Speaker Larry F. Mazza CEO, MVBF & MVB Bank

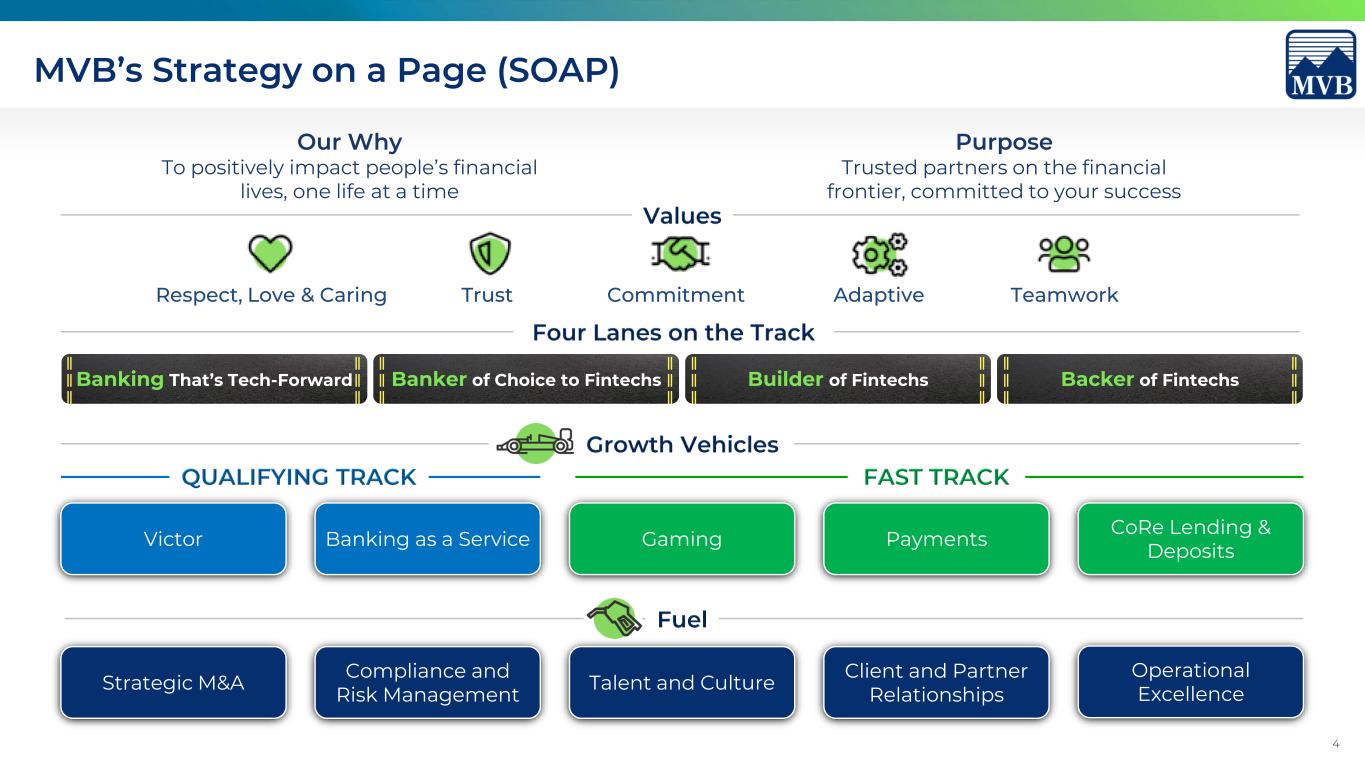

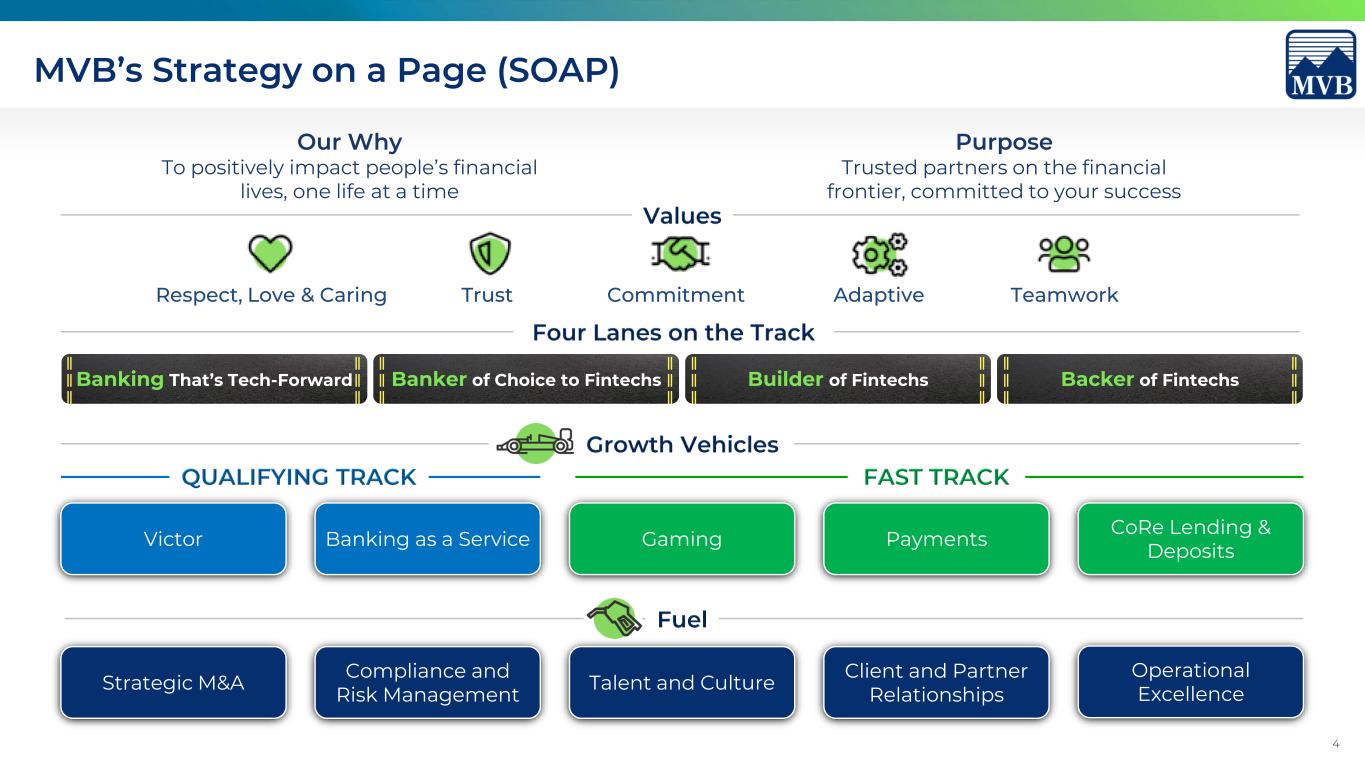

4 MVB’s Strategy on a Page (SOAP) Trust Commitment TeamworkRespect, Love & Caring Adaptive Compliance and Risk Management Talent and Culture Operational Excellence Our Why To positively impact people’s financial lives, one life at a time Purpose Trusted partners on the financial frontier, committed to your success Banking as a Service Strategic M&A Backer of FintechsBuilder of FintechsBanker of Choice to FintechsBanking That’s Tech-Forward Payments CoRe Lending & Deposits Client and Partner Relationships Victor Gaming

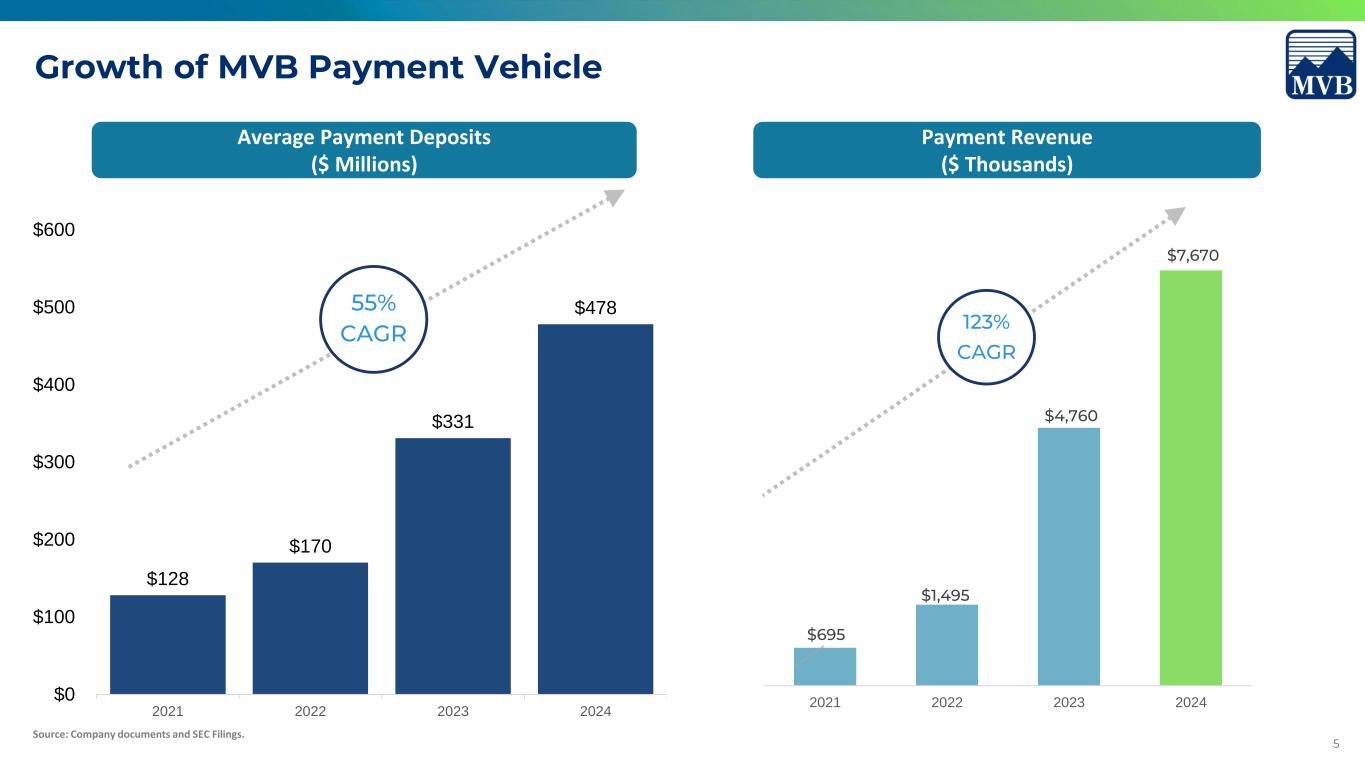

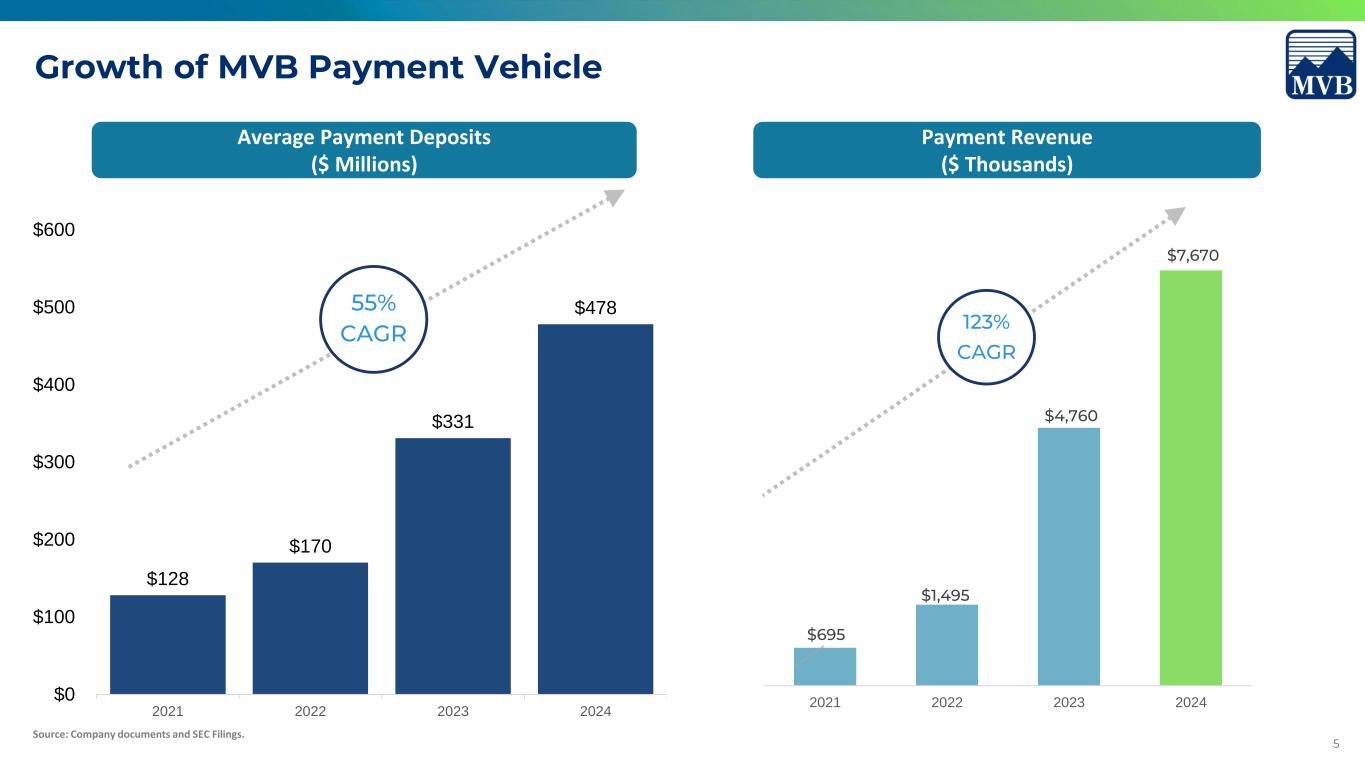

5 Growth of MVB Payment Vehicle Source: Company documents and SEC Filings. $128 $170 $331 $478 $0 $100 $200 $300 $400 $500 $600 2021 2022 2023 2024 55% CAGR Payment Revenue ($ Thousands) Average Payment Deposits ($ Millions) $695 $1,495 $4,760 $7,670 2021 2022 2023 2024 123% CAGR

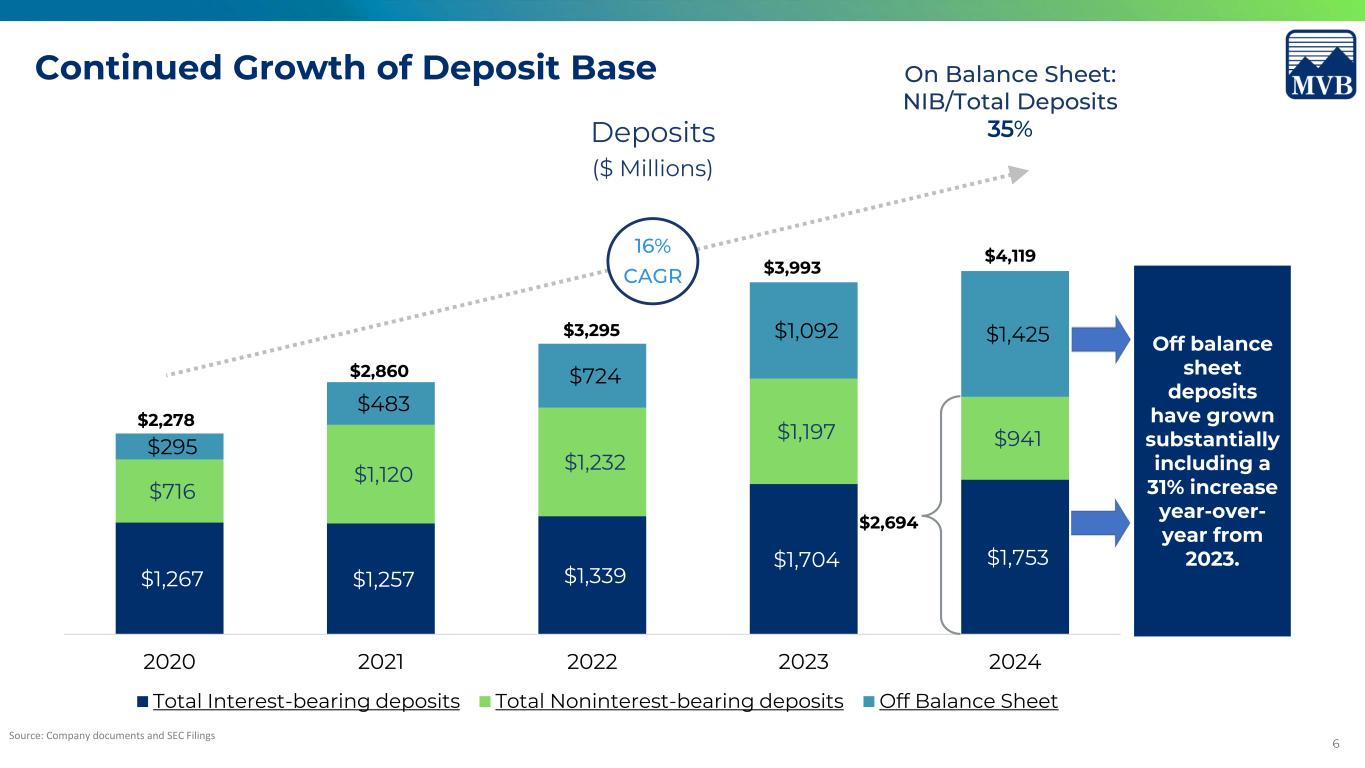

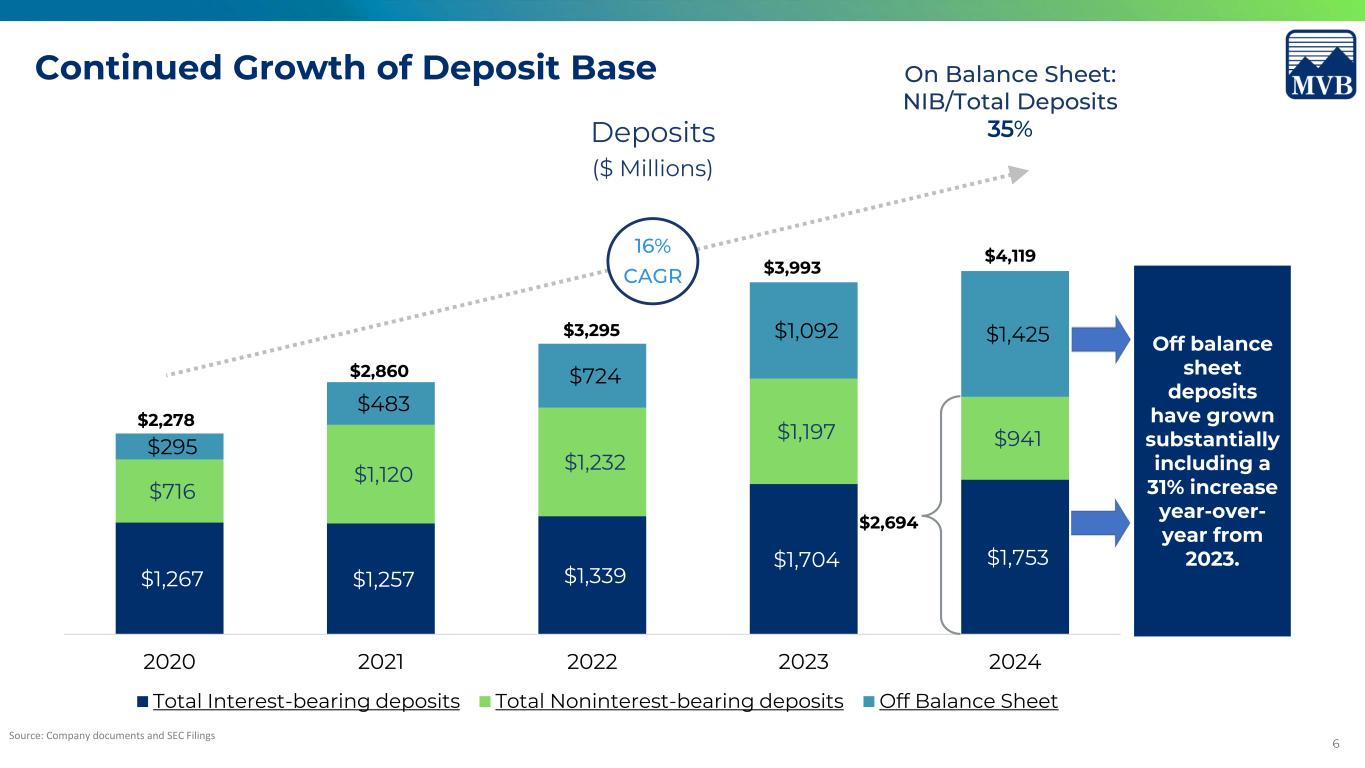

6 Source: Company documents and SEC Filings $1,267 $1,257 $1,339 $1,704 $1,753 $716 $1,120 $1,232 $1,197 $941 $295 $483 $724 $1,092 $1,425 2020 2021 2022 2023 2024 Total Interest-bearing deposits Total Noninterest-bearing deposits Off Balance Sheet $3,993 On Balance Sheet: NIB/Total Deposits 35%Deposits ($ Millions) Continued Growth of Deposit Base Off balance sheet deposits have grown substantially including a 31% increase year-over- year from 2023. $4,119 $2,694 $2,278 $2,860 $3,295 16% CAGR

7 Growth of Fintech Banking at MVB | 2020 – 2024 Source: Company documents and SEC Filings. *Commercial and Retail. (F) – Fintech deposits. (C) – CoRe deposits. $829 $1,624 $1,855 $2,038 $2,289 2020 2021 2022 2023 2024 Gross Deposits ($ Millions) 29% CAGR Gross Fee Income ($ Thousands) $1,286 $6,394 $12,330 $2,983 $2,004 $12,739 $13,260 2020 2021 2022 2023 2024 Total gross fee income Digital Asset fee income Other fee income $15,722 $15,264 86% CAGR

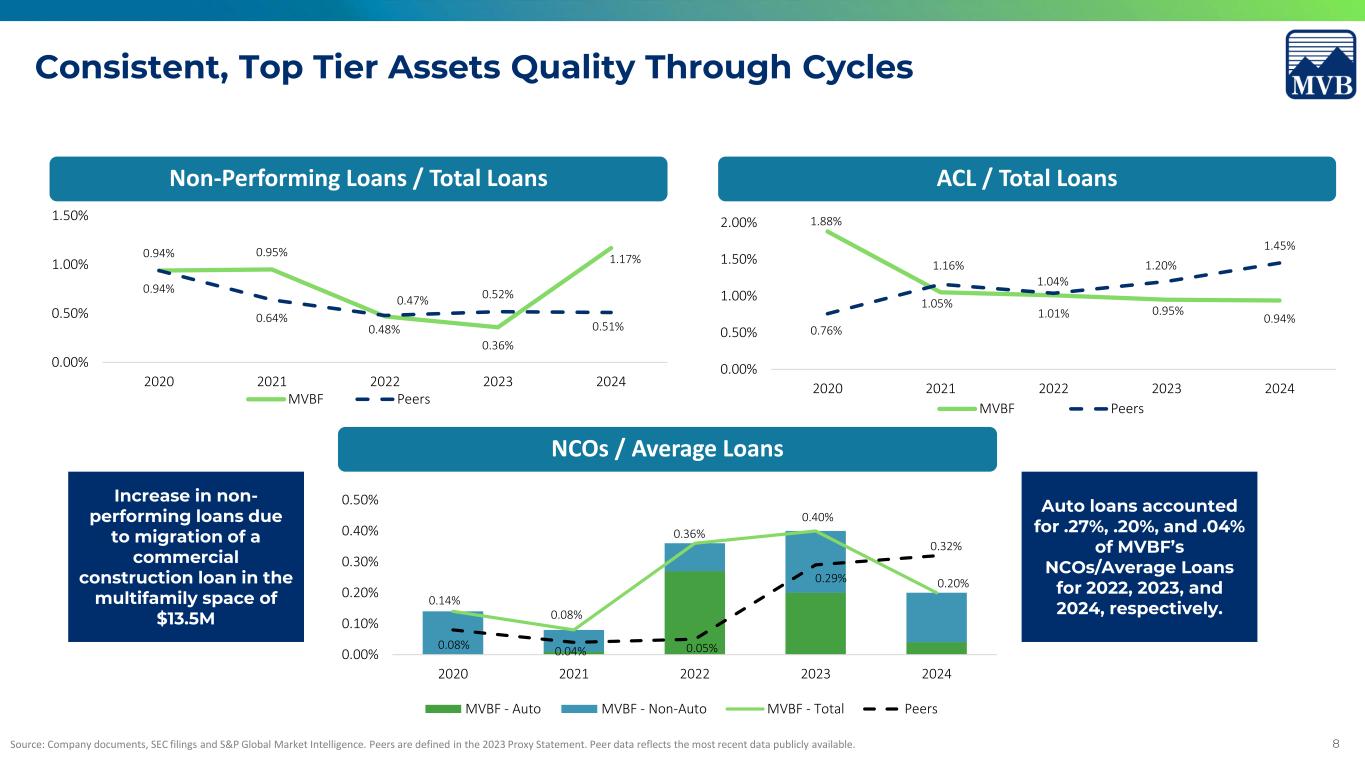

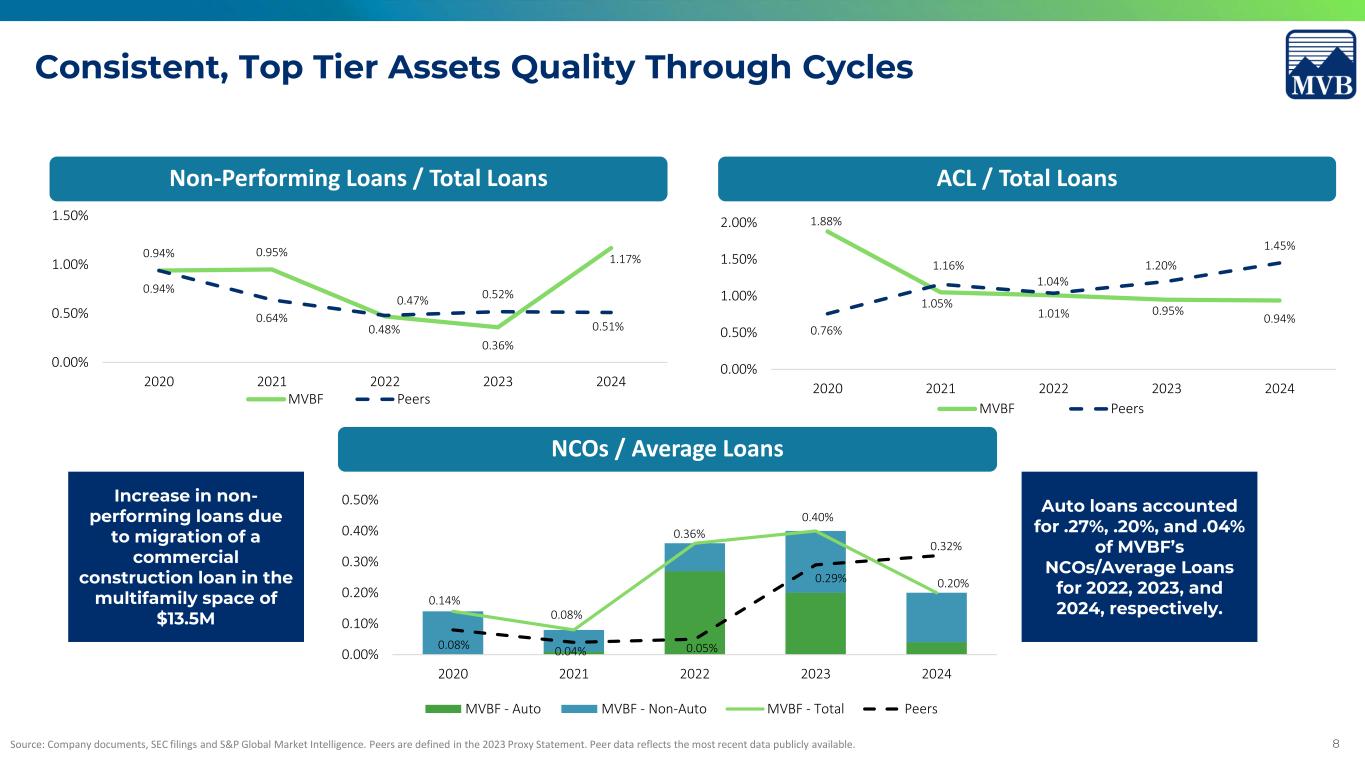

8 0.94% 0.95% 0.47% 0.36% 1.17% 0.94% 0.64% 0.48% 0.52% 0.51% 0.00% 0.50% 1.00% 1.50% 2020 2021 2022 2023 2024 MVBF Peers Non-Performing Loans / Total Loans 0.14% 0.08% 0.36% 0.40% 0.20% 0.08% 0.04% 0.05% 0.29% 0.32% 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 2020 2021 2022 2023 2024 MVBF - Auto MVBF - Non-Auto MVBF - Total Peers NCOs / Average Loans Source: Company documents, SEC filings and S&P Global Market Intelligence. Peers are defined in the 2023 Proxy Statement. Peer data reflects the most recent data publicly available. 1.88% 1.05% 1.01% 0.95% 0.94% 0.76% 1.16% 1.04% 1.20% 1.45% 0.00% 0.50% 1.00% 1.50% 2.00% 2020 2021 2022 2023 2024 MVBF Peers ACL / Total Loans Consistent, Top Tier Assets Quality Through Cycles Auto loans accounted for .27%, .20%, and .04% of MVBF’s NCOs/Average Loans for 2022, 2023, and 2024, respectively. Increase in non- performing loans due to migration of a commercial construction loan in the multifamily space of $13.5M

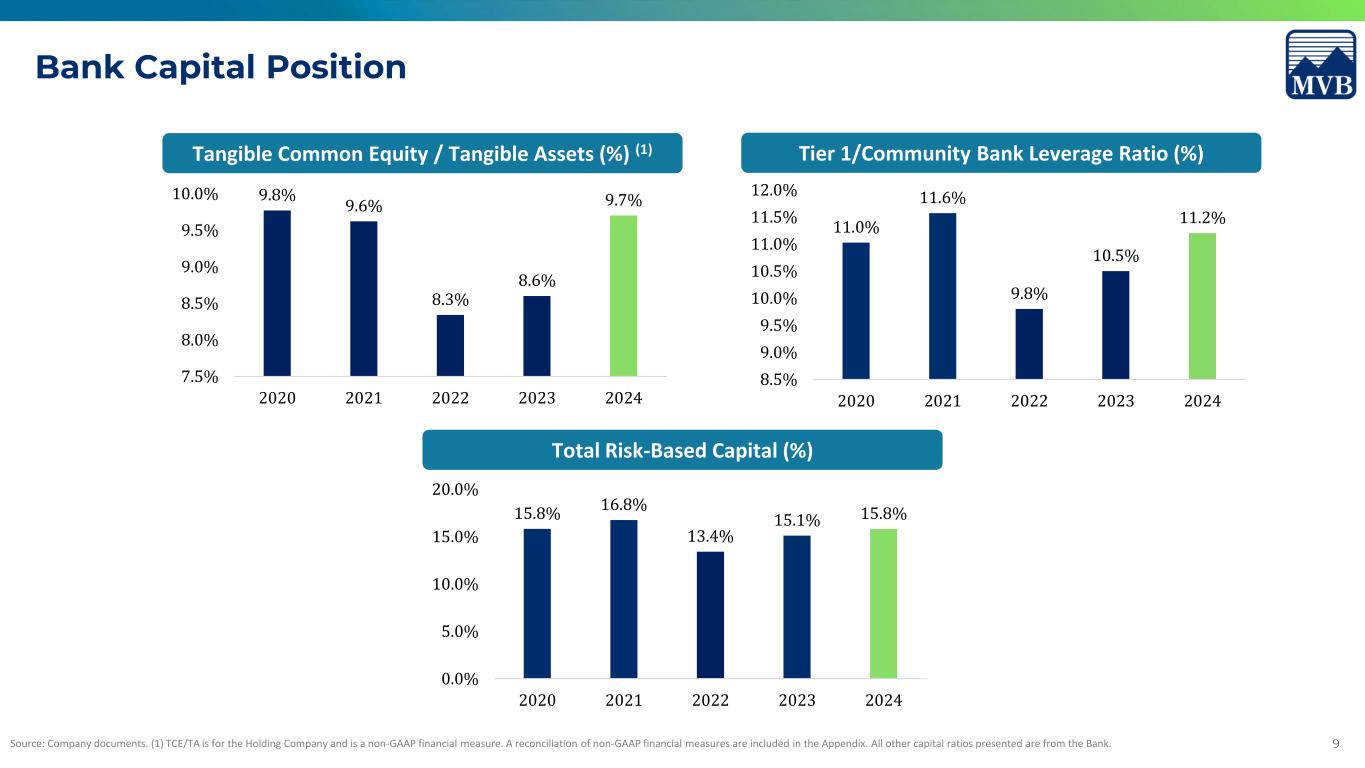

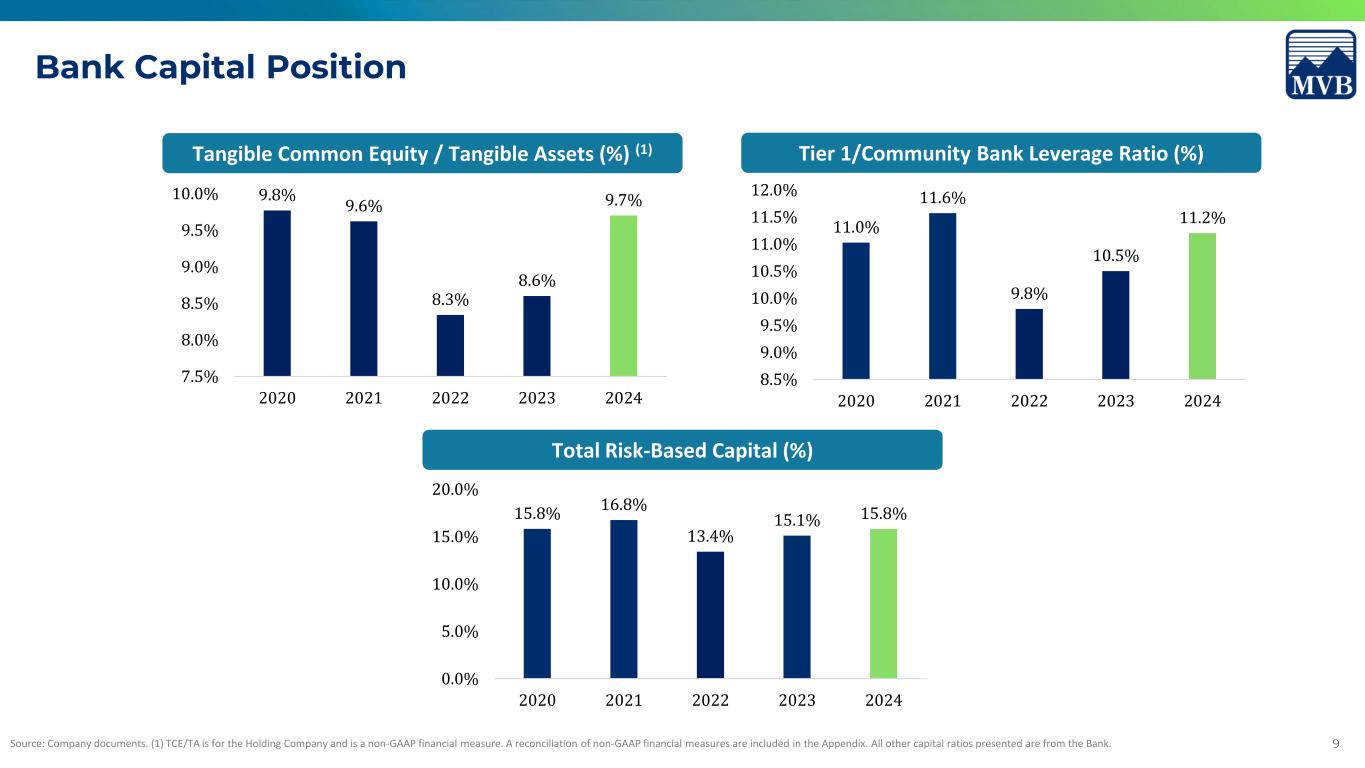

9 9.8% 9.6% 8.3% 8.6% 9.7% 7.5% 8.0% 8.5% 9.0% 9.5% 10.0% 2020 2021 2022 2023 2024 Tangible Common Equity / Tangible Assets (%) (1) 11.0% 11.6% 9.8% 10.5% 11.2% 8.5% 9.0% 9.5% 10.0% 10.5% 11.0% 11.5% 12.0% 2020 2021 2022 2023 2024 Tier 1/Community Bank Leverage Ratio (%) Source: Company documents. (1) TCE/TA is for the Holding Company and is a non-GAAP financial measure. A reconciliation of non-GAAP financial measures are included in the Appendix. All other capital ratios presented are from the Bank. Bank Capital Position 15.8% 16.8% 13.4% 15.1% 15.8% 0.0% 5.0% 10.0% 15.0% 20.0% 2020 2021 2022 2023 2024 Total Risk-Based Capital (%)

10 Awards & Accolades