000127344112/312025Q2falsehttp://grantierra.com/20250630#OilSalesMemberhttp://fasb.org/us-gaap/2025#LongTermDebthttp://fasb.org/us-gaap/2025#LongTermDebt33.3333.3333.33xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesgte:segmentgte:leaseutr:Boexbrli:pureiso4217:CADutr:bbliso4217:USDutr:bbliso4217:CADgte:dollarsPerBarreliso4217:CADutr:GJiso4217:CADutr:MWhiso4217:COPiso4217:COPgte:collar00012734412025-01-012025-06-3000012734412025-07-2800012734412025-04-012025-06-3000012734412024-04-012024-06-3000012734412024-01-012024-06-3000012734412025-06-3000012734412024-12-310001273441us-gaap:CommonStockMember2024-12-3100012734412023-12-3100012734412024-06-300001273441us-gaap:CommonStockMember2025-03-310001273441us-gaap:CommonStockMember2024-03-310001273441us-gaap:CommonStockMember2023-12-310001273441us-gaap:CommonStockMember2025-04-012025-06-300001273441us-gaap:CommonStockMember2024-04-012024-06-300001273441us-gaap:CommonStockMember2025-01-012025-06-300001273441us-gaap:CommonStockMember2024-01-012024-06-300001273441us-gaap:CommonStockMember2025-06-300001273441us-gaap:CommonStockMember2024-06-300001273441us-gaap:AdditionalPaidInCapitalMember2025-03-310001273441us-gaap:AdditionalPaidInCapitalMember2024-03-310001273441us-gaap:AdditionalPaidInCapitalMember2024-12-310001273441us-gaap:AdditionalPaidInCapitalMember2023-12-310001273441us-gaap:AdditionalPaidInCapitalMember2025-04-012025-06-300001273441us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001273441us-gaap:AdditionalPaidInCapitalMember2025-01-012025-06-300001273441us-gaap:AdditionalPaidInCapitalMember2024-01-012024-06-300001273441us-gaap:AdditionalPaidInCapitalMember2025-06-300001273441us-gaap:AdditionalPaidInCapitalMember2024-06-300001273441us-gaap:TreasuryStockCommonMember2025-03-310001273441us-gaap:TreasuryStockCommonMember2024-03-310001273441us-gaap:TreasuryStockCommonMember2024-12-310001273441us-gaap:TreasuryStockCommonMember2023-12-310001273441us-gaap:TreasuryStockCommonMember2025-04-012025-06-300001273441us-gaap:TreasuryStockCommonMember2024-04-012024-06-300001273441us-gaap:TreasuryStockCommonMember2025-01-012025-06-300001273441us-gaap:TreasuryStockCommonMember2024-01-012024-06-300001273441us-gaap:TreasuryStockCommonMember2025-06-300001273441us-gaap:TreasuryStockCommonMember2024-06-300001273441us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-03-310001273441us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001273441us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310001273441us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001273441us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-04-012025-06-300001273441us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001273441us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-01-012025-06-300001273441us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-06-300001273441us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-06-300001273441us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001273441us-gaap:RetainedEarningsMember2025-03-310001273441us-gaap:RetainedEarningsMember2024-03-310001273441us-gaap:RetainedEarningsMember2024-12-310001273441us-gaap:RetainedEarningsMember2023-12-310001273441us-gaap:RetainedEarningsMember2025-04-012025-06-300001273441us-gaap:RetainedEarningsMember2024-04-012024-06-300001273441us-gaap:RetainedEarningsMember2025-01-012025-06-300001273441us-gaap:RetainedEarningsMember2024-01-012024-06-300001273441us-gaap:RetainedEarningsMember2025-06-300001273441us-gaap:RetainedEarningsMember2024-06-300001273441gte:I3EnergyMember2024-10-312024-10-310001273441gte:I3EnergyMember2024-10-310001273441gte:I3EnergyMember2024-04-012024-06-300001273441gte:I3EnergyMember2024-01-012024-06-300001273441us-gaap:OperatingSegmentsMembergte:ColombiaSegmentMember2025-04-012025-06-300001273441us-gaap:OperatingSegmentsMembergte:EcuadorSegmentMember2025-04-012025-06-300001273441us-gaap:OperatingSegmentsMembergte:CanadaSegmentMember2025-04-012025-06-300001273441us-gaap:CorporateNonSegmentMember2025-04-012025-06-300001273441gte:OperatingSegmentsAndCorporateNonSegmentMember2025-04-012025-06-300001273441us-gaap:MaterialReconcilingItemsMember2025-04-012025-06-300001273441us-gaap:OperatingSegmentsMembergte:ColombiaSegmentMember2025-01-012025-06-300001273441us-gaap:OperatingSegmentsMembergte:EcuadorSegmentMember2025-01-012025-06-300001273441us-gaap:OperatingSegmentsMembergte:CanadaSegmentMember2025-01-012025-06-300001273441us-gaap:CorporateNonSegmentMember2025-01-012025-06-300001273441gte:OperatingSegmentsAndCorporateNonSegmentMember2025-01-012025-06-300001273441us-gaap:MaterialReconcilingItemsMember2025-01-012025-06-300001273441us-gaap:OperatingSegmentsMembergte:ColombiaSegmentMember2024-04-012024-06-300001273441us-gaap:OperatingSegmentsMembergte:EcuadorSegmentMember2024-04-012024-06-300001273441us-gaap:OperatingSegmentsMembergte:CanadaSegmentMember2024-04-012024-06-300001273441us-gaap:CorporateNonSegmentMember2024-04-012024-06-300001273441gte:OperatingSegmentsAndCorporateNonSegmentMember2024-04-012024-06-300001273441us-gaap:MaterialReconcilingItemsMember2024-04-012024-06-300001273441us-gaap:OperatingSegmentsMembergte:ColombiaSegmentMember2024-01-012024-06-300001273441us-gaap:OperatingSegmentsMembergte:EcuadorSegmentMember2024-01-012024-06-300001273441us-gaap:OperatingSegmentsMembergte:CanadaSegmentMember2024-01-012024-06-300001273441us-gaap:CorporateNonSegmentMember2024-01-012024-06-300001273441gte:OperatingSegmentsAndCorporateNonSegmentMember2024-01-012024-06-300001273441us-gaap:MaterialReconcilingItemsMember2024-01-012024-06-300001273441us-gaap:OperatingSegmentsMembergte:ColombiaSegmentMember2025-06-300001273441us-gaap:OperatingSegmentsMembergte:EcuadorSegmentMember2025-06-300001273441us-gaap:OperatingSegmentsMembergte:CanadaSegmentMember2025-06-300001273441us-gaap:CorporateNonSegmentMember2025-06-300001273441us-gaap:OperatingSegmentsMembergte:ColombiaSegmentMember2024-12-310001273441us-gaap:OperatingSegmentsMembergte:EcuadorSegmentMember2024-12-310001273441us-gaap:OperatingSegmentsMembergte:CanadaSegmentMember2024-12-310001273441us-gaap:CorporateNonSegmentMember2024-12-310001273441gte:ProvedOilandGasPropertiesMember2025-06-300001273441gte:ProvedOilandGasPropertiesMember2024-12-310001273441gte:UnprovedOilAndGasPropertiesMember2025-06-300001273441gte:UnprovedOilAndGasPropertiesMember2024-12-310001273441us-gaap:OilAndGasPropertiesMember2025-06-300001273441us-gaap:OilAndGasPropertiesMember2024-12-310001273441us-gaap:PropertyPlantAndEquipmentOtherTypesMember2025-06-300001273441us-gaap:PropertyPlantAndEquipmentOtherTypesMember2024-12-310001273441gte:NewLeaseContractsForPowerGeneratingEquipmentMember2025-01-012025-06-300001273441gte:BrentCrudeMember2025-01-012025-06-300001273441gte:EdmontonLightCrudeMember2025-01-012025-06-300001273441gte:AlbertaAECOMember2025-01-012025-06-300001273441gte:EdmontonPropaneMember2025-01-012025-06-300001273441gte:EdmontonButaneMember2025-01-012025-06-300001273441gte:EdmontonCondensateMember2025-01-012025-06-300001273441gte:BrentCrudeMember2024-01-012024-06-300001273441gte:SixPointTwoFivePercentSeniorNotesdue2025Member2025-06-300001273441gte:SixPointTwoFivePercentSeniorNotesdue2025Memberus-gaap:SeniorNotesMember2025-06-300001273441gte:SixPointTwoFivePercentSeniorNotesdue2025Memberus-gaap:SeniorNotesMember2024-12-310001273441gte:CreditFacilityCanadaMemberus-gaap:LineOfCreditMember2025-06-300001273441gte:CreditFacilityCanadaMemberus-gaap:LineOfCreditMember2024-12-310001273441gte:CreditFacilityColombiaMemberus-gaap:LineOfCreditMember2025-06-300001273441gte:CreditFacilityColombiaMemberus-gaap:LineOfCreditMember2024-12-310001273441gte:SevenPointSevenFivePercentSeniorNotesdue2027Member2025-06-300001273441gte:SevenPointSevenFivePercentSeniorNotesdue2027Memberus-gaap:SeniorNotesMember2025-06-300001273441gte:SevenPointSevenFivePercentSeniorNotesdue2027Memberus-gaap:SeniorNotesMember2024-12-310001273441gte:NinePointFiveZeroPercentSeniorNotesDue2029Member2025-06-300001273441gte:NinePointFiveZeroPercentSeniorNotesDue2029Memberus-gaap:SeniorNotesMember2025-06-300001273441gte:NinePointFiveZeroPercentSeniorNotesDue2029Memberus-gaap:SeniorNotesMember2024-12-310001273441us-gaap:RevolvingCreditFacilityMember2024-10-310001273441us-gaap:RevolvingCreditFacilityMember2025-06-300001273441us-gaap:RevolvingCreditFacilityMembergte:SyndicatedFacilityMember2024-10-310001273441us-gaap:RevolvingCreditFacilityMembergte:SyndicatedFacilityMember2025-06-300001273441us-gaap:RevolvingCreditFacilityMembergte:OperatingFacilityMember2024-10-310001273441us-gaap:RevolvingCreditFacilityMembergte:OperatingFacilityMember2025-06-300001273441us-gaap:RevolvingCreditFacilityMembergte:CORRAMembersrt:MinimumMember2024-10-312024-10-310001273441us-gaap:RevolvingCreditFacilityMembergte:CORRAMembersrt:MaximumMember2024-10-312024-10-310001273441us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrMembersrt:MinimumMember2024-10-312024-10-310001273441us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrMembersrt:MaximumMember2024-10-312024-10-310001273441us-gaap:RevolvingCreditFacilityMembersrt:MinimumMember2024-10-312024-10-310001273441us-gaap:RevolvingCreditFacilityMembersrt:MaximumMember2024-10-312024-10-310001273441us-gaap:RevolvingCreditFacilityMembergte:CreditFacilityCanadaMemberus-gaap:LineOfCreditMember2025-06-300001273441us-gaap:RevolvingCreditFacilityMember2024-10-312024-10-310001273441gte:ReserveBasedLendingFacilityMemberus-gaap:LineOfCreditMember2025-04-160001273441gte:BaseRateFloorMembergte:ReserveBasedLendingFacilityMemberus-gaap:LineOfCreditMember2025-04-162025-04-160001273441gte:BaseRateFloorMemberus-gaap:BaseRateMemberus-gaap:LineOfCreditMember2025-04-162025-04-160001273441us-gaap:SecuredOvernightFinancingRateSofrMemberus-gaap:BaseRateMemberus-gaap:LineOfCreditMember2025-04-162025-04-160001273441gte:ReserveBasedLendingFacilityMemberus-gaap:LineOfCreditMember2025-04-162025-04-160001273441gte:CreditFacilityColombiaMemberus-gaap:LineOfCreditMember2025-04-012025-06-300001273441gte:ReserveBasedLendingFacilityMemberus-gaap:LineOfCreditMember2025-06-300001273441gte:SixPointTwoFivePercentSeniorNotesDueFebruary2025Memberus-gaap:SeniorNotesMember2025-01-012025-06-300001273441gte:SixPointTwoFivePercentSeniorNotesDueFebruary2025Memberus-gaap:SeniorNotesMember2025-06-300001273441gte:NinePointFiveZeroPercentSeniorNotesDueInFebruary2025Memberus-gaap:SeniorNotesMember2025-06-300001273441gte:NinePointFiveZeroPercentSeniorNotesDue2029Memberus-gaap:SeniorNotesMember2025-01-012025-06-300001273441gte:NinePointFiveZeroPercentSeniorNotesDue2029Memberus-gaap:DebtInstrumentRedemptionPeriodOneMemberus-gaap:SeniorNotesMember2025-06-300001273441gte:NinePointFiveZeroPercentSeniorNotesDue2029Memberus-gaap:DebtInstrumentRedemptionPeriodTwoMemberus-gaap:SeniorNotesMember2025-06-300001273441gte:NinePointFiveZeroPercentSeniorNotesDue2029Memberus-gaap:DebtInstrumentRedemptionPeriodThreeMemberus-gaap:SeniorNotesMember2025-06-300001273441gte:A2024ProgramMember2024-12-310001273441srt:MaximumMember2024-10-310001273441gte:A2024ProgramMember2024-01-012024-12-310001273441srt:MaximumMember2024-12-310001273441gte:A2024ProgramMember2025-04-012025-06-300001273441gte:A2024ProgramMember2025-01-012025-06-300001273441gte:A2023ProgramMember2024-04-012024-06-300001273441gte:A2023ProgramMember2024-01-012024-06-300001273441gte:A2024ProgramMember2025-06-300001273441gte:A2024ProgramMemberus-gaap:SubsequentEventMember2024-11-062025-07-280001273441gte:A2024ProgramMemberus-gaap:SubsequentEventMember2025-07-280001273441gte:PerformanceShareUnitsMember2024-12-310001273441gte:DeferredShareUnitsMember2024-12-310001273441us-gaap:RestrictedStockUnitsRSUMember2024-12-310001273441gte:PerformanceShareUnitsMember2025-01-012025-06-300001273441gte:DeferredShareUnitsMember2025-01-012025-06-300001273441us-gaap:RestrictedStockUnitsRSUMember2025-01-012025-06-300001273441gte:PerformanceShareUnitsMember2025-06-300001273441gte:DeferredShareUnitsMember2025-06-300001273441us-gaap:RestrictedStockUnitsRSUMember2025-06-300001273441us-gaap:EmployeeStockOptionMember2024-05-010001273441us-gaap:EmployeeStockOptionMember2024-05-012024-05-010001273441us-gaap:EmployeeStockOptionMember2025-06-300001273441srt:MinimumMemberus-gaap:EmployeeStockOptionMember2025-01-012025-06-300001273441srt:MaximumMemberus-gaap:EmployeeStockOptionMember2025-01-012025-06-300001273441gte:PerformanceShareUnitsMembergte:VestedOnDecember312023Member2025-01-012025-06-300001273441gte:PerformanceShareUnitsMembergte:VestedOnDecember312022Member2024-01-012024-06-300001273441gte:A2007EquityIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2025-04-012025-06-300001273441gte:A2007EquityIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2025-01-012025-06-300001273441us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheOneMembergte:A2007EquityIncentivePlanMember2025-01-012025-06-300001273441us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMembergte:A2007EquityIncentivePlanMember2025-01-012025-06-300001273441us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMembergte:A2007EquityIncentivePlanMember2025-01-012025-06-300001273441country:COsrt:CrudeOilMember2025-04-012025-06-300001273441country:COsrt:NaturalGasReservesMember2025-04-012025-06-300001273441country:COsrt:NaturalGasLiquidsReservesMember2025-04-012025-06-300001273441country:CO2025-04-012025-06-300001273441country:COsrt:CrudeOilMember2025-01-012025-06-300001273441country:COsrt:NaturalGasReservesMember2025-01-012025-06-300001273441country:COsrt:NaturalGasLiquidsReservesMember2025-01-012025-06-300001273441country:CO2025-01-012025-06-300001273441country:ECsrt:CrudeOilMember2025-04-012025-06-300001273441country:ECsrt:NaturalGasReservesMember2025-04-012025-06-300001273441country:ECsrt:NaturalGasLiquidsReservesMember2025-04-012025-06-300001273441country:EC2025-04-012025-06-300001273441country:ECsrt:CrudeOilMember2025-01-012025-06-300001273441country:ECsrt:NaturalGasReservesMember2025-01-012025-06-300001273441country:ECsrt:NaturalGasLiquidsReservesMember2025-01-012025-06-300001273441country:EC2025-01-012025-06-300001273441country:CAsrt:CrudeOilMember2025-04-012025-06-300001273441country:CAsrt:NaturalGasReservesMember2025-04-012025-06-300001273441country:CAsrt:NaturalGasLiquidsReservesMember2025-04-012025-06-300001273441country:CA2025-04-012025-06-300001273441country:CAsrt:CrudeOilMember2025-01-012025-06-300001273441country:CAsrt:NaturalGasReservesMember2025-01-012025-06-300001273441country:CAsrt:NaturalGasLiquidsReservesMember2025-01-012025-06-300001273441country:CA2025-01-012025-06-300001273441srt:CrudeOilMember2025-04-012025-06-300001273441srt:NaturalGasReservesMember2025-04-012025-06-300001273441srt:NaturalGasLiquidsReservesMember2025-04-012025-06-300001273441srt:CrudeOilMember2025-01-012025-06-300001273441srt:NaturalGasReservesMember2025-01-012025-06-300001273441srt:NaturalGasLiquidsReservesMember2025-01-012025-06-300001273441country:COsrt:CrudeOilMember2024-04-012024-06-300001273441country:COsrt:NaturalGasReservesMember2024-04-012024-06-300001273441country:COsrt:NaturalGasLiquidsReservesMember2024-04-012024-06-300001273441country:CO2024-04-012024-06-300001273441country:COsrt:CrudeOilMember2024-01-012024-06-300001273441country:COsrt:NaturalGasReservesMember2024-01-012024-06-300001273441country:COsrt:NaturalGasLiquidsReservesMember2024-01-012024-06-300001273441country:CO2024-01-012024-06-300001273441country:ECsrt:CrudeOilMember2024-04-012024-06-300001273441country:ECsrt:NaturalGasReservesMember2024-04-012024-06-300001273441country:ECsrt:NaturalGasLiquidsReservesMember2024-04-012024-06-300001273441country:EC2024-04-012024-06-300001273441country:ECsrt:CrudeOilMember2024-01-012024-06-300001273441country:ECsrt:NaturalGasReservesMember2024-01-012024-06-300001273441country:ECsrt:NaturalGasLiquidsReservesMember2024-01-012024-06-300001273441country:EC2024-01-012024-06-300001273441country:CAsrt:CrudeOilMember2024-04-012024-06-300001273441country:CAsrt:NaturalGasReservesMember2024-04-012024-06-300001273441country:CAsrt:NaturalGasLiquidsReservesMember2024-04-012024-06-300001273441country:CA2024-04-012024-06-300001273441country:CAsrt:CrudeOilMember2024-01-012024-06-300001273441country:CAsrt:NaturalGasReservesMember2024-01-012024-06-300001273441country:CAsrt:NaturalGasLiquidsReservesMember2024-01-012024-06-300001273441country:CA2024-01-012024-06-300001273441srt:CrudeOilMember2024-04-012024-06-300001273441srt:NaturalGasReservesMember2024-04-012024-06-300001273441srt:NaturalGasLiquidsReservesMember2024-04-012024-06-300001273441srt:CrudeOilMember2024-01-012024-06-300001273441srt:NaturalGasReservesMember2024-01-012024-06-300001273441srt:NaturalGasLiquidsReservesMember2024-01-012024-06-300001273441gte:Customer1Memberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2025-01-012025-06-300001273441gte:Customer1Memberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2025-04-012025-06-300001273441gte:Customer2Memberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2025-04-012025-06-300001273441gte:Customer2Memberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2025-01-012025-06-300001273441country:COgte:Customer1Memberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2025-01-012025-06-300001273441country:COgte:Customer1Memberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2025-04-012025-06-300001273441country:ECgte:Customer1Memberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2025-01-012025-06-300001273441country:ECgte:Customer1Memberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2025-04-012025-06-300001273441country:CAgte:Customer1Memberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2025-04-012025-06-300001273441country:CAgte:Customer1Memberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2025-01-012025-06-300001273441country:COgte:Customer1Memberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2024-01-012024-06-300001273441country:COgte:Customer1Memberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2024-04-012024-06-300001273441us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Membergte:SixPointTwoFivePercentSeniorNotesdue2025Member2025-06-300001273441us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Membergte:SixPointTwoFivePercentSeniorNotesdue2025Member2024-12-310001273441us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Membergte:SevenPointSevenFivePercentSeniorNotesdue2027Member2025-06-300001273441us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Membergte:SevenPointSevenFivePercentSeniorNotesdue2027Member2024-12-310001273441us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Membergte:NinePointFiveZeroPercentSeniorNotesDue2029Member2025-06-300001273441us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Membergte:NinePointFiveZeroPercentSeniorNotesDue2029Member2024-12-310001273441us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2025-06-300001273441us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2024-12-310001273441us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2025-06-300001273441us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2024-12-310001273441us-gaap:CarryingReportedAmountFairValueDisclosureMembergte:SevenPointSevenFivePercentSeniorNotesdue2027Memberus-gaap:SeniorNotesMember2025-06-300001273441us-gaap:CarryingReportedAmountFairValueDisclosureMembergte:NinePointFiveZeroPercentSeniorNotesDue2029Memberus-gaap:SeniorNotesMember2025-06-300001273441us-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMembergte:SevenPointSevenFivePercentSeniorNotesdue2027Memberus-gaap:SeniorNotesMember2025-06-300001273441us-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMembergte:NinePointFiveZeroPercentSeniorNotesDue2029Memberus-gaap:SeniorNotesMember2025-06-300001273441us-gaap:CommodityContractMember2025-04-012025-06-300001273441us-gaap:CommodityContractMember2024-04-012024-06-300001273441us-gaap:CommodityContractMember2025-01-012025-06-300001273441us-gaap:CommodityContractMember2024-01-012024-06-300001273441us-gaap:ForeignExchangeContractMember2025-04-012025-06-300001273441us-gaap:ForeignExchangeContractMember2024-04-012024-06-300001273441us-gaap:ForeignExchangeContractMember2025-01-012025-06-300001273441us-gaap:ForeignExchangeContractMember2024-01-012024-06-300001273441country:CAgte:WTICMASwapSeptember2025Member2025-01-012025-06-300001273441country:CAgte:WTICMASwapSeptember2025Member2025-06-300001273441country:CAgte:WTICMACollarDecember2025Member2025-01-012025-06-300001273441country:CAgte:WTICMACollarDecember2025Memberus-gaap:DesignatedAsHedgingInstrumentMember2025-06-300001273441country:CAgte:WTICMACollarDecember2025Memberus-gaap:NondesignatedMember2025-06-300001273441country:CAgte:WTICMACallOptionDecember2025Member2025-01-012025-06-300001273441country:CAgte:WTICMACallOptionDecember2025Memberus-gaap:NondesignatedMember2025-06-300001273441country:CAgte:WTICMACollarMarch2026Member2025-01-012025-06-300001273441country:CAgte:WTICMACollarMarch2026Memberus-gaap:DesignatedAsHedgingInstrumentMember2025-06-300001273441country:CAgte:WTICMACollarMarch2026Memberus-gaap:NondesignatedMember2025-06-300001273441country:CAgte:AECO5ASwapSeptember2025Member2025-01-012025-06-300001273441country:CAgte:AECO5ASwapSeptember2025Member2025-06-300001273441country:CAgte:AECO7APutOptionSeptember2025Member2025-01-012025-06-300001273441country:CAgte:AECO7APutOptionSeptember2025Member2025-06-300001273441country:CAgte:AECO7APutOptionSeptember2025Memberus-gaap:DesignatedAsHedgingInstrumentMember2025-06-300001273441country:CAgte:AECO5ASwapDecember2025Member2025-01-012025-06-300001273441country:CAgte:AECO5ASwapDecember2025Member2025-06-300001273441country:CAgte:AESOSwapSeptember2025Member2025-01-012025-06-300001273441country:CAgte:AESOSwapSeptember2025Member2025-06-300001273441country:CAgte:AESOSwapDecember2025Member2025-01-012025-06-300001273441country:CAgte:AESOSwapDecember2025Member2025-06-300001273441country:COgte:BrentCollarSeptember2025Member2025-01-012025-06-300001273441country:COgte:BrentCollarSeptember2025Memberus-gaap:DesignatedAsHedgingInstrumentMember2025-06-300001273441country:COgte:BrentCollarSeptember2025Memberus-gaap:NondesignatedMember2025-06-300001273441country:COgte:BrentPutOptionDecember2025Member2025-01-012025-06-300001273441country:COgte:BrentPutOptionDecember2025Memberus-gaap:DesignatedAsHedgingInstrumentMember2025-06-300001273441country:COgte:BrentPutOptionDecember2025Member2025-06-300001273441country:COgte:Brent3WaySeptember2025Member2025-01-012025-06-300001273441country:COgte:Brent3WaySeptember2025Memberus-gaap:DesignatedAsHedgingInstrumentMember2025-06-300001273441country:COgte:Brent3WaySeptember2025Memberus-gaap:NondesignatedMember2025-06-300001273441country:COgte:BrentCollarDecember2025Member2025-01-012025-06-300001273441country:COgte:BrentCollarDecember2025Memberus-gaap:DesignatedAsHedgingInstrumentMember2025-06-300001273441country:COgte:BrentCollarDecember2025Memberus-gaap:NondesignatedMember2025-06-300001273441country:COgte:Brent3WayDecember20251Member2025-01-012025-06-300001273441country:COgte:Brent3WayDecember20251Memberus-gaap:DesignatedAsHedgingInstrumentMember2025-06-300001273441country:COgte:Brent3WayDecember20251Memberus-gaap:NondesignatedMember2025-06-300001273441country:COgte:BrentCollarMarch2026Member2025-01-012025-06-300001273441country:COgte:BrentCollarMarch2026Memberus-gaap:DesignatedAsHedgingInstrumentMember2025-06-300001273441country:COgte:BrentCollarMarch2026Memberus-gaap:NondesignatedMember2025-06-300001273441country:COgte:Brent3WayMarch2026Member2025-01-012025-06-300001273441country:COgte:Brent3WayMarch2026Memberus-gaap:DesignatedAsHedgingInstrumentMember2025-06-300001273441country:COgte:Brent3WayMarch2026Memberus-gaap:NondesignatedMember2025-06-300001273441country:CAgte:WTICMA3WayMarch2026Member2025-01-012025-06-300001273441country:CAgte:WTICMA3WayMarch2026Memberus-gaap:DesignatedAsHedgingInstrumentMember2025-06-300001273441country:CAgte:WTICMA3WayMarch2026Memberus-gaap:NondesignatedMember2025-06-300001273441country:CAgte:WTICMA3WayMarch2026Member2025-06-300001273441country:CAgte:WTICMACollarSeptember2026Member2025-01-012025-06-300001273441country:CAgte:WTICMACollarSeptember2026Memberus-gaap:DesignatedAsHedgingInstrumentMember2025-06-300001273441country:CAgte:WTICMACollarSeptember2026Memberus-gaap:NondesignatedMember2025-06-300001273441country:CAgte:WTICMA3WaySeptember2026Member2025-01-012025-06-300001273441country:CAgte:WTICMA3WaySeptember2026Memberus-gaap:DesignatedAsHedgingInstrumentMember2025-06-300001273441country:CAgte:WTICMA3WaySeptember2026Memberus-gaap:NondesignatedMember2025-06-300001273441country:CAgte:WTICMA3WayDecember2026Member2025-01-012025-06-300001273441country:CAgte:WTICMA3WayDecember2026Memberus-gaap:DesignatedAsHedgingInstrumentMember2025-06-300001273441country:CAgte:WTICMA3WayDecember2026Memberus-gaap:NondesignatedMember2025-06-300001273441country:CAgte:WTICMA3WayDecember2026Member2025-06-300001273441country:COgte:Brent3WayDecember20252Member2025-01-012025-06-300001273441country:COgte:Brent3WayDecember20252Memberus-gaap:DesignatedAsHedgingInstrumentMember2025-06-300001273441country:COgte:Brent3WayDecember20252Memberus-gaap:NondesignatedMember2025-06-300001273441country:COgte:BrentPutOptionJune2026Member2025-01-012025-06-300001273441country:COgte:BrentPutOptionJune2026Memberus-gaap:DesignatedAsHedgingInstrumentMember2025-06-300001273441country:COgte:BrentPutOptionJune2026Member2025-06-300001273441country:COgte:Brent3WayJune2026Member2025-01-012025-06-300001273441country:COgte:Brent3WayJune2026Memberus-gaap:DesignatedAsHedgingInstrumentMember2025-06-300001273441country:COgte:Brent3WayJune2026Memberus-gaap:NondesignatedMember2025-06-300001273441country:COgte:BrentCollarJune2026Member2025-01-012025-06-300001273441country:COgte:BrentCollarJune2026Memberus-gaap:DesignatedAsHedgingInstrumentMember2025-06-300001273441country:COgte:BrentCollarJune2026Memberus-gaap:NondesignatedMember2025-06-300001273441country:COgte:Brent3WaySeptember2026Member2025-01-012025-06-300001273441country:COgte:Brent3WaySeptember2026Memberus-gaap:DesignatedAsHedgingInstrumentMember2025-06-300001273441country:COgte:Brent3WaySeptember2026Memberus-gaap:NondesignatedMember2025-06-300001273441gte:COPCollarsApril2026Member2025-06-300001273441us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembergte:GranTierraNorthSeaLimitedMembersrt:ScenarioForecastMembergte:GranTierraUKLimitedMember2025-12-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

|

|

|

|

|

|

|

|

| ☒ |

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2025

or

|

|

|

|

|

|

|

|

|

| ☐ |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission file number 001-34018

GRAN TIERRA ENERGY INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Delaware |

|

98-0479924 |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

| 500 Centre Street S.E. |

|

Calgary, |

Alberta |

Canada |

T2G 1A6 |

|

| (Address of principal executive offices, including zip code) |

(403) 265-3221

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, par value $0.001 per share |

GTE |

NYSE American |

Toronto Stock Exchange |

London Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of large accelerated filer, accelerated filer, smaller reporting company, and emerging growth company in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☐ |

Accelerated filer |

☒ |

| Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

On July 28, 2025, 35,290,955 shares of the registrant’s Common Stock, $0.001 par value, were issued and outstanding.

Gran Tierra Energy Inc.

Quarterly Report on Form 10-Q

Quarterly Period Ended June 30, 2025

Table of contents

|

|

|

|

|

|

|

|

|

| |

|

Page |

| PART I |

Financial Information |

|

| Item 1. |

Financial Statements |

|

| Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

| Item 3. |

Quantitative and Qualitative Disclosures About Market Risk |

|

| Item 4. |

Controls and Procedures |

|

|

|

|

| PART II |

Other Information |

|

| Item 1. |

Legal Proceedings |

|

| Item 1A. |

Risk Factors |

|

|

|

|

| Item 2. |

Unregistered Sales of Equity Securities and Use of Proceeds |

|

| Item 5. |

Other information |

|

| Item 6. |

Exhibits |

|

| SIGNATURES |

|

|

|

CAUTIONARY LANGUAGE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical facts included in this Quarterly Report on Form 10-Q regarding our financial position, estimated quantities and net present values of reserves, business strategy, plans and objectives of our management for future operations, covenant compliance, capital spending plans and benefits of the changes in our capital program or expenditures, our liquidity and financial condition and those statements preceded by, followed by or that otherwise include the words “believe”, “expect”, “anticipate”, “intend”, “estimate”, “project”, “target”, “goal”, “plan”, “budget”, “objective”, “should”, “outlook” or similar expressions or variations on these expressions are forward-looking statements. We can give no assurances that the assumptions upon which the forward-looking statements are based will prove to be correct or that, even if correct, intervening circumstances will not occur to cause actual results to be different than expected. Because forward-looking statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by the forward-looking statements. There are a number of risks, uncertainties and other important factors that could cause our actual results to differ materially from the forward-looking statements, including, but not limited to, our ability to successfully integrate the assets and operations of i3 Energy Plc (“i3Energy”) and realize the anticipated benefits and operating synergies expected from the 2024 acquisition of i3 Energy; certain of our operations are located in South America and unexpected problems can arise due to guerilla activity, strikes, local blockades or protests; technical difficulties and operational difficulties may arise which impact the production, transport or sale of our products; other disruptions to local operations; global health events; global and regional changes in the demand, supply, prices, differentials or other market conditions affecting oil and natural gas, including inflation and changes resulting from actual or anticipated tariffs and trade policies, a global health crises, geopolitical events, including the ongoing conflicts in Ukraine and the Middle East, or from the imposition or lifting of crude oil production quotas or other actions that might be imposed by OPEC and other producing countries and the resulting company or third-party actions in response to such changes; changes in commodity prices, including volatility or a prolonged decline in these prices relative to historical or future expected levels; the risk that current global economic and credit conditions may impact oil prices and oil consumption more than we currently predict, which could cause further modification of our strategy and capital spending program; prices and markets for oil and natural gas are unpredictable and volatile; the effect of hedges; the accuracy of productive capacity of any particular field; geographic, political and weather conditions can impact the production, transport or sale of our products; our ability to execute our business plan, which may include acquisitions and realize expected benefits from current or future initiatives; the risk that unexpected delays and difficulties in developing currently owned properties may occur; the ability to replace reserves and production and develop and manage reserves on an economically viable basis; the accuracy of testing and production results and seismic data, pricing and cost estimates (including with respect to commodity pricing and exchange rates); the risk profile of planned exploration activities; the effects of drilling down-dip; the effects of waterflood and multi-stage fracture stimulation operations; the extent and effect of delivery disruptions, equipment performance and costs; actions by third parties; the timely receipt of regulatory or other required approvals for our operating activities; the failure of exploratory drilling to result in commercial wells; unexpected delays due to the limited availability of drilling equipment and personnel; volatility or declines in the trading price of our common stock or bonds; the risk that we do not receive the anticipated benefits of government programs, including government tax refunds; our ability to access debt or equity capital markets from time to time to raise additional capital, increase liquidity, fund acquisitions or refinance debt; our ability to comply with financial covenants in our indentures and make borrowings under our credit agreement; and those factors set out in Part II, Item 1A “Risk Factors” in this Quarterly Report on Form 10-Q and Part I, Item 1A “Risk Factors” in our 2024 Annual Report on Form 10-K (the “2024 Annual Report on Form 10-K”). This information included herein is given as of the filing date of this Quarterly Report on Form 10-Q with the Securities and Exchange Commission (“SEC”) and, except as otherwise required by the securities laws, we disclaim any obligation or undertaking to publicly release any updates or revisions to or to withdraw, any forward-looking statement contained in this Quarterly Report on Form 10-Q to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any forward-looking statement is based.

GLOSSARY OF OIL AND GAS TERMS

In this document, the abbreviations set forth below have the following meanings:

|

|

|

|

|

|

|

|

|

|

|

|

| bbl |

barrel |

BOEPD |

barrels of oil equivalent per day |

| BOPD |

barrels of oil per day |

NGL |

natural gas liquids |

| NAR |

net after royalty |

boe |

barrels of oil equivalent |

Sales volumes represent production NAR adjusted for inventory changes. Our oil and gas reserves are reported as NAR. Our production is also reported NAR, except as otherwise specifically noted as “working interest production before royalties”.

PART I - Financial Information

Item 1. Financial Statements

Gran Tierra Energy Inc.

Condensed Consolidated Statements of Operations (Unaudited)

(Thousands of U.S. Dollars, Except for Share and Per Share Amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2025 |

|

2024 |

|

2025 |

|

2024 |

OIL, NATURAL GAS AND NGL SALES (Note 9) |

$ |

152,481 |

|

|

$ |

165,609 |

|

|

$ |

323,014 |

|

|

$ |

323,186 |

|

| |

|

|

|

|

|

|

|

| EXPENSES |

|

|

|

|

|

|

|

| Operating |

55,855 |

|

|

47,035 |

|

|

123,209 |

|

|

95,501 |

|

| Transportation |

7,618 |

|

|

5,690 |

|

|

14,529 |

|

|

10,274 |

|

Depletion, depreciation and accretion (Note 6) |

68,635 |

|

|

55,490 |

|

|

140,837 |

|

|

111,640 |

|

| General and administrative |

15,006 |

|

|

17,127 |

|

|

26,632 |

|

|

31,270 |

|

|

|

|

|

|

|

|

|

| Foreign exchange loss (gain) |

3,716 |

|

|

(4,413) |

|

|

7,554 |

|

|

(5,228) |

|

Derivative instruments gain (Note 12) |

(14,032) |

|

|

— |

|

|

(12,565) |

|

|

— |

|

Interest expense (Note 7) |

24,366 |

|

|

18,398 |

|

|

47,601 |

|

|

36,822 |

|

| |

161,164 |

|

|

139,327 |

|

|

347,797 |

|

|

280,279 |

|

|

|

|

|

|

|

|

|

| INTEREST INCOME |

251 |

|

|

1,017 |

|

|

676 |

|

|

1,709 |

|

| OTHER INCOME |

339 |

|

|

— |

|

|

287 |

|

|

— |

|

| (LOSS) INCOME BEFORE INCOME TAXES |

(8,093) |

|

|

27,299 |

|

|

(23,820) |

|

|

44,616 |

|

|

|

|

|

|

|

|

|

| INCOME TAX EXPENSE (RECOVERY) |

|

|

|

|

|

|

|

Current (Note 10) |

2,195 |

|

|

42,289 |

|

|

10,460 |

|

|

46,205 |

|

Deferred (Note 10) |

2,453 |

|

|

(51,361) |

|

|

(2,259) |

|

|

(37,882) |

|

|

4,648 |

|

|

(9,072) |

|

|

8,201 |

|

|

8,323 |

|

| NET (LOSS) INCOME |

$ |

(12,741) |

|

|

$ |

36,371 |

|

|

$ |

(32,021) |

|

|

$ |

36,293 |

|

|

|

|

|

|

|

|

|

| OTHER COMPREHENSIVE INCOME |

|

|

|

|

|

|

|

| Foreign currency translation adjustment |

9,583 |

|

|

— |

|

|

9,774 |

|

|

— |

|

| NET AND COMPREHENSIVE (LOSS) INCOME |

$ |

(3,158) |

|

|

$ |

36,371 |

|

|

$ |

(22,247) |

|

|

$ |

36,293 |

|

|

|

|

|

|

|

|

|

| NET(LOSS) INCOME PER SHARE |

|

|

|

|

|

|

|

| - BASIC and DILUTED |

$ |

(0.36) |

|

|

$ |

1.16 |

|

|

$ |

(0.90) |

|

|

$ |

1.15 |

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE SHARES OUTSTANDING - BASIC and DILUTED (Note 8) |

35,334,692 |

|

|

31,281,651 |

|

|

35,554,806 |

|

|

31,547,362 |

|

|

|

|

|

|

|

|

|

(See notes to the condensed consolidated financial statements)

Gran Tierra Energy Inc.

Condensed Consolidated Balance Sheets (Unaudited)

(Thousands of U.S. Dollars, Except for Share Amounts)

|

|

|

|

|

|

|

|

|

|

|

|

| |

As at June 30, 2025 |

|

As at December 31, 2024 |

|

|

|

|

| ASSETS |

|

|

|

| Current Assets |

|

|

|

Cash and cash equivalents (Note 13) |

$ |

61,028 |

|

|

$ |

103,379 |

|

| Accounts receivable |

37,952 |

|

|

35,480 |

|

| Inventory |

40,987 |

|

|

43,116 |

|

Taxes receivable (Note 5) |

29,047 |

|

|

18,095 |

|

Other current assets (Note 12 and 13) |

33,470 |

|

|

11,201 |

|

| Total Current Assets |

202,484 |

|

|

211,271 |

|

|

|

|

|

| Oil and Gas Properties |

|

|

|

| Proved |

1,297,745 |

|

|

1,260,578 |

|

| Unproved |

116,000 |

|

|

119,520 |

|

| Total Oil and Gas Properties |

1,413,745 |

|

|

1,380,098 |

|

| Other capital assets |

42,541 |

|

|

43,033 |

|

Total Property, Plant and Equipment (Note 6) |

1,456,286 |

|

|

1,423,131 |

|

|

|

|

|

| Other Long-Term Assets |

|

|

|

| Deferred tax assets |

27,671 |

|

|

11,718 |

|

Taxes receivable long-term (Note 5) |

1,765 |

|

|

1,629 |

|

Other long-term assets (Note 12 and 13) |

8,750 |

|

|

7,038 |

|

| Total Other Long-Term Assets |

38,186 |

|

|

20,385 |

|

| Total Assets |

$ |

1,696,956 |

|

|

$ |

1,654,787 |

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

| Current Liabilities |

|

|

|

| Accounts payable and accrued liabilities |

$ |

302,897 |

|

|

$ |

273,103 |

|

|

|

|

|

Current portion of long-term debt (Note 7 and 12) |

— |

|

|

24,807 |

|

Taxes payable (Note 5) |

10,603 |

|

|

13,970 |

|

Equity compensation award liability (Note 8) |

7,402 |

|

|

10,568 |

|

| Total Current Liabilities |

320,902 |

|

|

322,448 |

|

|

|

|

|

| Long-Term Liabilities |

|

|

|

Long-term debt (Note 7 and 12) |

772,616 |

|

|

722,123 |

|

| Deferred tax liabilities |

81,471 |

|

|

64,114 |

|

| Asset retirement obligation |

111,156 |

|

|

105,936 |

|

Equity compensation award liability (Note 8) |

11,003 |

|

|

17,456 |

|

|

|

|

|

| Other long-term liabilities |

10,012 |

|

|

9,142 |

|

| Total Long-Term Liabilities |

986,258 |

|

|

918,771 |

|

|

|

|

|

Contingencies (Note 11) |

|

|

|

|

|

|

|

| Shareholders' Equity |

|

|

|

Common Stock (35,288,985 and 36,460,141 issued shares and 35,288,985 and 35,972,193 outstanding shares of Common Stock as at June 30, 2025 and December 31, 2024, respectively, par value $0.001 per share), (Note 8) |

9,939 |

|

|

9,940 |

|

| Additional paid-in capital |

1,268,654 |

|

|

1,273,343 |

|

Treasury Stock (Note 8) |

— |

|

|

(3,165) |

|

| Accumulated other comprehensive gain (loss) |

3,038 |

|

|

(6,736) |

|

| Deficit |

(891,835) |

|

|

(859,814) |

|

| Total Shareholders’ Equity |

389,796 |

|

|

413,568 |

|

| Total Liabilities and Shareholders’ Equity |

$ |

1,696,956 |

|

|

$ |

1,654,787 |

|

(See notes to the condensed consolidated financial statements)

Gran Tierra Energy Inc.

Condensed Consolidated Statements of Cash Flows (Unaudited)

(Thousands of U.S. Dollars)

|

|

|

|

|

|

|

|

|

|

|

|

| |

Six Months Ended June 30, |

| |

2025 |

|

2024 |

| Operating Activities |

|

|

|

| Net (loss) income |

$ |

(32,021) |

|

|

$ |

36,293 |

|

| Adjustments to reconcile net loss to net cash provided by operating activities: |

|

|

|

Depletion, depreciation and accretion (Note 6) |

140,837 |

|

|

111,640 |

|

|

|

|

|

Deferred tax recovery (Note 10) |

(2,259) |

|

|

(37,882) |

|

Stock-based compensation expense (Note 8) |

29 |

|

|

9,521 |

|

Amortization of debt issuance costs (Note 7) |

7,915 |

|

|

6,066 |

|

| Unrealized foreign exchange loss (gain) |

4,801 |

|

|

(5,589) |

|

| Loss on bond purchased |

90 |

|

|

— |

|

| Unrealized derivative instruments gain |

(10,491) |

|

|

— |

|

| Cash settlement of asset retirement obligation |

(3,045) |

|

|

(223) |

|

| Non-cash lease expenses |

3,461 |

|

|

2,794 |

|

| Lease payments |

(3,112) |

|

|

(2,369) |

|

Net change in assets and liabilities from operating activities (Note 13) |

1,702 |

|

|

13,809 |

|

| Net cash provided by operating activities |

107,907 |

|

|

134,060 |

|

|

|

|

|

| Investing Activities |

|

|

|

Additions to property, plant and equipment (Note 6 and 13) |

(153,971) |

|

|

(114,044) |

|

|

|

|

|

| Net cash used in investing activities |

(153,971) |

|

|

(114,044) |

|

|

|

|

|

| Financing Activities |

|

|

|

Proceeds from issuance of Senior Notes, net of issuance costs (Note 7) |

— |

|

|

85,615 |

|

Proceeds from long-term debt, net of issuance costs (Note 7) |

44,781 |

|

|

— |

|

Repayment of long-term debt (Note 7) |

(1,894) |

|

|

— |

|

Repayment of Senior Notes (Note 7) |

(24,828) |

|

|

(36,364) |

|

| Purchase of Senior Notes |

(1,712) |

|

|

— |

|

Re-purchase of shares of Common Stock (Note 8) |

(3,466) |

|

|

(8,667) |

|

| Proceeds from exercise of stock options |

22 |

|

|

367 |

|

| Lease payments |

(7,849) |

|

|

(7,078) |

|

| Net cash provided by financing activities |

5,054 |

|

|

33,873 |

|

|

|

|

|

| Foreign exchange loss on cash, cash equivalents and restricted cash and cash equivalents |

(766) |

|

|

(1,513) |

|

|

|

|

|

| Net (decrease) increase in cash, cash equivalents and restricted cash and cash equivalents |

(41,776) |

|

|

52,376 |

|

|

Cash and cash equivalents and restricted cash and cash equivalents,

beginning of period (Note 13)

|

111,337 |

|

|

71,038 |

|

|

Cash and cash equivalents and restricted cash and cash equivalents,

end of period (Note 13)

|

$ |

69,561 |

|

|

$ |

123,414 |

|

|

|

|

|

Supplemental cash flow disclosures (Note 13) |

|

|

|

(See notes to the condensed consolidated financial statements)

Gran Tierra Energy Inc.

Condensed Consolidated Statements of Shareholders’ Equity (Unaudited)

(Thousands of U.S. Dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2025 |

|

2024 |

|

2025 |

|

2024 |

| Share Capital |

|

|

|

|

|

|

|

| Balance, beginning of period |

$ |

9,939 |

|

|

$ |

9,935 |

|

|

$ |

9,940 |

|

|

$ |

9,936 |

|

|

|

|

|

|

|

|

|

Cancellation of shares of Common Stock (Note 8) |

— |

|

|

— |

|

|

(1) |

|

|

(1) |

|

| Balance, end of period |

$ |

9,939 |

|

|

$ |

9,935 |

|

|

$ |

9,939 |

|

|

$ |

9,935 |

|

|

|

|

|

|

|

|

|

| Additional Paid-in Capital |

|

|

|

|

|

|

|

| Balance, beginning of period |

$ |

1,269,557 |

|

|

$ |

1,245,387 |

|

|

$ |

1,273,343 |

|

|

$ |

1,249,651 |

|

| Exercise of stock options |

22 |

|

|

206 |

|

|

22 |

|

|

367 |

|

Stock-based compensation (Note 8) |

175 |

|

|

89 |

|

|

1,918 |

|

|

571 |

|

Modification of stock options (Note 8) |

— |

|

|

(4,057) |

|

|

— |

|

|

(4,057) |

|

Cancellation of shares of Common Stock (Note 8) |

(1,100) |

|

|

(3,781) |

|

|

(6,629) |

|

|

(8,688) |

|

| Balance, end of period |

$ |

1,268,654 |

|

|

$ |

1,237,844 |

|

|

$ |

1,268,654 |

|

|

$ |

1,237,844 |

|

|

|

|

|

|

|

|

|

| Treasury Stock |

|

|

|

|

|

|

|

| Balance, beginning of period |

$ |

(49) |

|

|

$ |

(203) |

|

|

$ |

(3,165) |

|

|

$ |

(163) |

|

Re-purchase of shares of Common Stock (Note 8) |

(1,051) |

|

|

(3,719) |

|

|

(3,465) |

|

|

(8,667) |

|

Cancellation of shares of Common Stock (Note 8) |

1,100 |

|

|

3,781 |

|

|

6,630 |

|

|

8,689 |

|

| Balance, end of period |

$ |

— |

|

|

$ |

(141) |

|

|

$ |

— |

|

|

$ |

(141) |

|

|

|

|

|

|

|

|

|

| Accumulated and other comprehensive income (loss) |

|

|

|

|

|

|

|

| Balance, beginning of period |

$ |

(6,545) |

|

|

$ |

— |

|

|

$ |

(6,736) |

|

|

$ |

— |

|

| Other comprehensive income |

9,583 |

|

|

— |

|

|

9,774 |

|

|

— |

|

| Balance, end of period |

$ |

3,038 |

|

|

$ |

— |

|

|

$ |

3,038 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

| Deficit |

|

|

|

|

|

|

|

| Balance, beginning of period |

$ |

(879,094) |

|

|

$ |

(863,108) |

|

|

$ |

(859,814) |

|

|

$ |

(863,030) |

|

| Net (loss) income |

(12,741) |

|

|

36,371 |

|

|

(32,021) |

|

|

36,293 |

|

| Balance, end of period |

$ |

(891,835) |

|

|

$ |

(826,737) |

|

|

$ |

(891,835) |

|

|

$ |

(826,737) |

|

|

|

|

|

|

|

|

|

| Total Shareholders’ Equity |

$ |

389,796 |

|

|

$ |

420,901 |

|

|

$ |

389,796 |

|

|

$ |

420,901 |

|

(See notes to the condensed consolidated financial statements)

Gran Tierra Energy Inc.

Notes to the Condensed Consolidated Financial Statements (Unaudited)

(Expressed in U.S. Dollars, unless otherwise indicated)

1. Description of Business

Gran Tierra Energy Inc. a Delaware corporation (the “Company” or “Gran Tierra”), is a publicly traded company focused on oil and natural gas exploration and production with assets currently in Colombia, Ecuador and Canada.

2. Significant Accounting Policies

These interim unaudited condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”). The information furnished herein reflects all normal recurring adjustments that are, in the opinion of management, necessary for the fair presentation of results for the interim periods.

The note disclosure requirements of annual audited consolidated financial statements provide additional disclosures required for interim unaudited condensed consolidated financial statements. Accordingly, these interim unaudited condensed consolidated financial statements should be read in conjunction with the Company’s consolidated financial statements as at and for the year ended December 31, 2024, included in the Company’s 2024 Annual Report on Form 10-K.

The Company’s significant accounting policies are described in Note 2 of the consolidated financial statements, which are included in the Company’s 2024 Annual Report on Form 10-K and are the same policies followed in these interim unaudited condensed consolidated financial statements. The Company has evaluated all subsequent events to the date these interim unaudited condensed consolidated financial statements were issued.

Recently Issued Accounting Pronouncements

In November 2024 and January 2025 FASB issued ASU 2024-03 and ASU 2025-01, “Income Statement - Reporting Comprehensive Income - Expense Disaggregation Disclosures”. The amendments in ASU 2024-03 require disclosure, in the notes to financial statements, of specified information about certain costs and expenses recognized as part of oil-and natural gas-producing activities included in each relevant expense caption on the face of statement of operations. In addition, this ASU requires the presentation of specific expense captions of comprehensive income on the face of the statements of operations. ASU 2025-01 clarifies the effective date of ASU 2024-03 to be effective for annual reporting periods beginning after December 15, 2026, and interim reporting periods within annual periods beginning after December 15, 2027. The Company is currently assessing the impact of this update will have on its financial statements.

Recently Adopted Accounting Pronouncements

In December 2023, FASB issued ASU 2023-09, “Improvements to Income Tax Disclosures”. ASU 2023-09 enhances the income tax disclosures to enable investors to better understand entity’s exposure to potential changes in jurisdictional tax legislation and associated risks and opportunities, income tax information that effects cash flow forecasts and potential opportunities to increase future cash flows. This ASU is effective for annual reporting periods beginning after December 15, 2024 and should be applied prospectively, with retrospective application permitted. The Company adopted ASU 2023-09 effective January 1, 2025. The implementation of this update did not have a material impact on income tax disclosures.

3. Business Combination

On October 31, 2024, the Company acquired all of the issued and outstanding common shares of i3 Energy Plc (“i3 Energy”), subsequently renamed as Gran Tierra UK Limited (“Gran Tierra UK”) for $204.5 million, consisting of cash consideration of $161.8 million, cash dividend of $4.0 million, cash settlement of stock options of $2.0 million and 5,808,925 shares of the Company’s Common Stock, the fair value of which was determined to be $36.7 million based on the closing price of the Company’s shares on the acquisition date. The acquisition was accounted for as a business combination using the acquisition method with Gran Tierra being the acquirer, whereby the assets acquired and liabilities assumed were recognized at their fair values as at the i3 Energy acquisition date, and the results of i3 Energy were included with those of Gran Tierra from that date. Fair value estimates were made based on significant unobservable (Level 3) inputs and based on the best information available at the time.

Determining the fair values of the assets and liabilities of i3 Energy and the consideration paid required significant judgment and certain assumptions to be made. The most significant fair value estimates related to the valuation of i3 Energy's proved and unproved oil and natural gas properties.

The fair value of proved oil and natural gas properties acquired is based on cash flows associated with estimated acquired proved oil and natural gas reserves and the discount rate. Factors that impact these reserves cash flows include forecasted production, forecasted commodity prices, and forecasted operating, royalty and capital costs. Management is continuing to review and assess information to accurately determine the acquisition date fair value of the proved oil and natural gas properties and deferred tax assets and liabilities acquired.

Due to the timing of acquisition, management is continuing to review and assess information to accurately determine the acquisition date fair value of the proved oil and natural gas properties and deferred tax assets and liabilities acquired. As at June 30, 2025, there were no changes to initial measurement of fair value of the proved oil and natural gas properties and deferred tax assets and liabilities acquired.

Pro Forma Results (unaudited)

Pro forma for the three and six months ended June 30, 2024 are shown below, as if the i3 Energy acquisition had occurred on January 1, 2024. Pro forma results are not indicative of actual results or future performance:

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

(Unaudited, thousands of U.S. Dollars) |

2024 |

|

2024 |

Oil, natural gas and NGL sales |

$ |

202,089 |

|

|

$ |

399,501 |

|

| Net income |

$ |

54,822 |

|

|

$ |

47,059 |

|

|

|

|

|

|

|

|

|

4. Segment and Geographic Reporting

The Company is primarily engaged in the exploration and production of oil and natural gas. The Company reports segmented information based on internal management reporting used by our Chief Operational Decision Makers (“CODM”), which are the Company’s Chief Executive Officer, Chief Financial Officer, Chief Operating Officer and Vice Presidents across various business functions. CODM allocates resources and assesses performance of each reportable segment based on segmented earnings. The Company determined three reportable segments based on the geographic organization: Colombia, Ecuador and Canada. The “Other” category represents the Company’s corporate activities.

The following tables present information on the Company’s reportable segments and other activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, 2025 |

| (Thousands of U.S. Dollars) |

Colombia |

Ecuador |

Canada |

Other |

Total |

| Oil, natural gas and NGL sales |

$ |

109,692 |

|

$ |

8,495 |

|

$ |

34,294 |

|

$ |

— |

|

$ |

152,481 |

|

| Operating expenses |

38,432 |

|

4,122 |

|

13,301 |

|

— |

|

55,855 |

|

| Transportation expenses |

3,735 |

|

441 |

|

3,442 |

|

— |

|

7,618 |

|

| Segmented earnings |

$ |

67,525 |

|

$ |

3,932 |

|

$ |

17,551 |

|

$ |

— |

|

$ |

89,008 |

|

|

|

|

|

|

|

| DD&A expenses |

|

|

|

|

68,635 |

|

| General and administrative expenses |

|

|

|

|

15,006 |

|

| Foreign exchange loss |

|

|

|

|

3,716 |

|

| Derivative instruments gain |

|

|

|

|

(14,032) |

|

| Interest expense |

|

|

|

|

24,366 |

|

| Non-segmented expenses |

|

|

|

|

97,691 |

|

|

|

|

|

|

|

| Other income |

|

|

|

|

339 |

|

| Interest income |

|

|

|

|

251 |

|

| Loss before income taxes |

|

|

|

|

(8,093) |

|

| Income tax expense |

|

|

|

|

4,648 |

|

| Net loss |

|

|

|

|

$ |

(12,741) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment capital expenditures |

$ |

37,749 |

|

$ |

24,800 |

|

$ |

23,871 |

|

$ |

47 |

|

$ |

86,467 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, 2025 |

| (Thousands of U.S. Dollars) |

Colombia |

Ecuador |

Canada |

Other |

Total |

| Oil, natural gas and NGL sales |

$ |

227,340 |

|

$ |

29,518 |

|

$ |

66,156 |

|

$ |

— |

|

$ |

323,014 |

|

| Operating expenses |

81,186 |

|

12,195 |

|

29,828 |

|

— |

|

123,209 |

|

| Transportation expenses |

6,946 |

|

1,534 |

|

6,049 |

|

— |

|

14,529 |

|

| Segmented earnings |

$ |

139,208 |

|

$ |

15,789 |

|

$ |

30,279 |

|

$ |

— |

|

$ |

185,276 |

|

|

|

|

|

|

|

| DD&A expenses |

|

|

|

|

140,837 |

|

| General and administrative expenses |

|

|

|

|

26,632 |

|

| Foreign exchange loss |

|

|

|

|

7,554 |

|

| Derivative instruments loss |

|

|

|

|

(12,565) |

|

| Interest expense |

|

|

|

|

47,601 |

|

| Non-segmented expenses |

|

|

|

|

210,059 |

|

|

|

|

|

|

|

| Other income |

|

|

|

|

287 |

|

| Interest income |

|

|

|

|

676 |

|

| Loss before income taxes |

|

|

|

|

(23,820) |

|

| Income tax expense |

|

|

|

|

8,201 |

|

| Net loss |

|

|

|

|

$ |

(32,021) |

|

|

|

|

|

|

|

| Segment capital expenditures |

$ |

60,418 |

|

$ |

45,587 |

|

$ |

47,536 |

|

$ |

430 |

|

$ |

153,971 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, 2024 |

| (Thousands of U.S. Dollars) |

Colombia |

Ecuador |

Canada |

Other |

Total |

| Oil, natural gas and NGL sales |

$ |

162,573 |

|

$ |

3,036 |

|

$ |

— |

|

$ |

— |

|

$ |

165,609 |

|

| Operating expenses |

45,267 |

|

1,768 |

|

— |

|

— |

|

47,035 |

|

| Transportation expenses |

5,516 |

|

174 |

|

— |

|

— |

|

5,690 |

|

| Segmented earnings |

$ |

111,790 |

|

$ |

1,094 |

|

$ |

— |

|

$ |

— |

|

$ |

112,884 |

|

|

|

|

|

|

|

| DD&A expenses |

|

|

|

|

55,490 |

|

| General and administrative expenses |

|

|

|

|

17,127 |

|

| Severance |

|

|

|

|

— |

|

| Foreign exchange gain |

|

|

|

|

(4,413) |

|

| Interest expense |

|

|

|

|

18,398 |

|

| Non-segmented expenses |

|

|

|

|

86,602 |

|

|

|

|

|

|

|

| Interest income |

|

|

|

|

1,017 |

|

| Income before income taxes |

|

|

|

|

27,299 |

|

| Income tax expense |

|

|

|

|

(9,072) |

|

| Net income |

|

|

|

|

$ |

36,371 |

|

|

|

|

|

|

|

| Segment capital expenditures |

$ |

31,163 |

|

$ |

43,614 |

|

$ |

— |

|

$ |

467 |

|

$ |

75,244 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, 2024 |

| (Thousands of U.S. Dollars) |

Colombia |

Ecuador |

Canada |

Other |

Total |

| Oil, natural gas and NGL sales |

$ |

313,044 |

|

$ |

10,142 |

|

$ |

— |

|

$ |

— |

|

$ |

323,186 |

|

| Operating expenses |

90,393 |

|

5,108 |

|

— |

|

— |

|

95,501 |

|

| Transportation expenses |

9,742 |

|

532 |

|

— |

|

— |

|

10,274 |

|

| Segmented earnings |

$ |

212,909 |

|

$ |

4,502 |

|

$ |

— |

|

$ |

— |

|

$ |

217,411 |

|

|

|

|

|

|

|

| DD&A expenses |

|

|

|

|

111,640 |

|

| General and administrative expenses |

|

|

|

|

31,270 |

|

|

|

|

|

|

|

| Foreign exchange gain |

|

|

|

|

(5,228) |

|

| Interest expense |

|

|

|

|

36,822 |

|

| Non-segmented expenses |

|

|

|

|

174,504 |

|

|

|

|

|

|

|

| Interest income |

|

|

|

|

1,709 |

|

| Income before income taxes |

|

|

|

|

44,616 |

|

| Income tax expense |

|

|

|

|

8,323 |

|

| Net income |

|

|

|

|

$ |

36,293 |

|

|

|

|

|

|

|

| Segment capital expenditures |

$ |

64,876 |

|

$ |

48,701 |

|

$ |

— |

|

$ |

467 |

|

$ |

114,044 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As at June 30, 2025 |

| (Thousands of U.S. Dollars) |

Colombia |

Ecuador |

Canada |

Other |

Total |

| Property, plant and equipment |

$ |

1,012,354 |

|

$ |

161,893 |

|

$ |

269,636 |

|

$ |

12,403 |

|

$ |

1,456,286 |

|

| All other assets |

131,347 |

|

39,445 |

|

32,009 |

|

37,869 |

|

240,670 |

|

| Total Assets |

$ |

1,143,701 |

|

$ |

201,338 |

|

$ |

301,645 |

|

$ |

50,272 |

|

$ |

1,696,956 |

|

|

|

|

|

|

|

|

As at December 31, 2024 |

| (Thousands of U.S. Dollars) |

Colombia |

Ecuador |

Canada |

Other |

Total |

| Property, plant and equipment |

$ |

1,022,808 |

|

$ |

143,034 |

|

$ |

247,512 |

|

$ |

9,777 |

|

$ |

1,423,131 |

|

| All other assets |

99,100 |

|

27,942 |

|

62,541 |

|

42,073 |

|

231,656 |

|

| Total Assets |

$ |

1,121,908 |

|

$ |

170,976 |

|

$ |

310,053 |

|

$ |

51,850 |

|

$ |

1,654,787 |

|

5. Taxes Receivable and Payable

The table below shows the break-down of taxes receivable, which are comprised of value added tax (“VAT”) and income tax receivables and payables:

|

|

|

|

|

|

|

|

|

|

|

|

| (Thousands of U.S. Dollars) |

As at June 30, 2025 |

|

As at December 31, 2024 |

Taxes Receivable |

|

|

|

| Current |

|

|

|

VAT Receivable |

$ |

2,217 |

|

|

$ |

657 |

|

| Income Tax Receivable |

26,830 |

|

|

17,438 |

|

|

$ |

29,047 |

|

|

$ |

18,095 |

|

| Long-Term |

|

|

|

Income Tax Receivable |

$ |

1,765 |

|

|

$ |

1,629 |

|

|

|

|

|

Taxes Payable |

|

|

|

Current |

|

|

|

VAT Payable |

$ |

(6,175) |

|

|

$ |

(7,640) |

|

| Income Tax Payable |

(4,428) |

|

|

(6,330) |

|

|

$ |

(10,603) |

|

|

$ |

(13,970) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Net Taxes Receivable |

$ |

20,209 |

|

|

$ |

5,754 |

|

The following table shows the movement of VAT and income tax receivables and payables for the period:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Thousands of U.S. Dollars) |

VAT Receivable/(Payable(1)) |

|

Income Tax Receivable |

|

Total Net Taxes Receivable |

Balance, as at December 31, 2024 |

$ |

(6,983) |

|

|

$ |

12,737 |

|

|

$ |

5,754 |

|

Collected through direct government refunds |

(367) |

|

|

— |

|

|

(367) |

|

Collected through sales contracts |

(48,067) |

|

|

— |

|

|

(48,067) |

|

| Taxes paid |

51,417 |

|

|

3,816 |

|

|

55,233 |

|

Withholding taxes paid |

— |

|

|

15,654 |

|

|

15,654 |

|

Current tax expense |

— |

|

|

(10,460) |

|

|

(10,460) |

|

| Foreign exchange loss |

42 |

|

|

2,420 |

|

|

2,462 |

|

Balance, as at June 30, 2025 |

$ |

(3,958) |

|

|

$ |

24,167 |

|

|

$ |

20,209 |

|

(1) VAT is paid on certain goods and services and collected on sales in Colombia at a rate of 19%

6. Property, Plant and Equipment

|

|

|

|

|

|

|

|

|

|

|

|

| (Thousands of U.S. Dollars) |

As at June 30, 2025 |

|

As at December 31, 2024 |

| Oil and natural gas properties |

|

|

|

| Proved |

$ |

5,462,507 |

|

|

$ |

5,298,085 |

|

| Unproved |

116,000 |

|

|

119,520 |

|

| |

5,578,507 |

|

|

5,417,605 |

|

Other (1) |

74,824 |

|

|

97,795 |

|

|

5,653,331 |

|

|

5,515,400 |

|

| Accumulated depletion, depreciation and impairment |

(4,197,045) |

|

|

(4,092,269) |

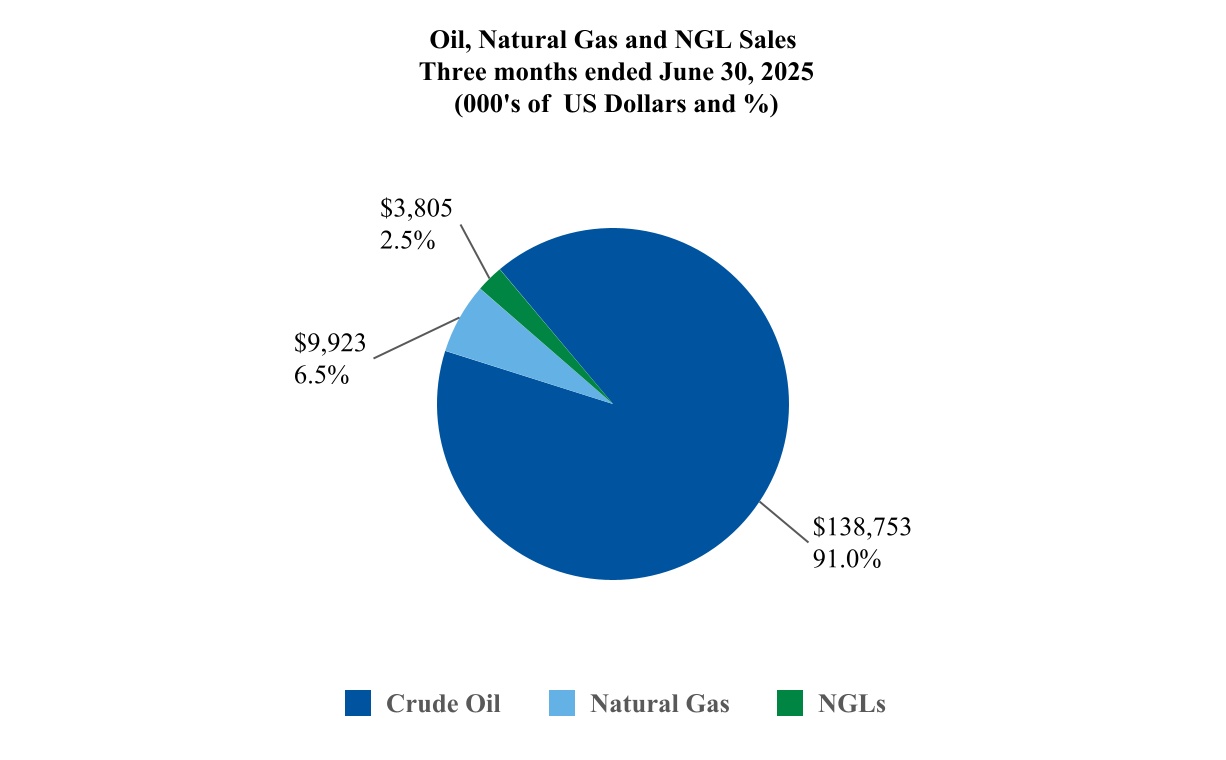

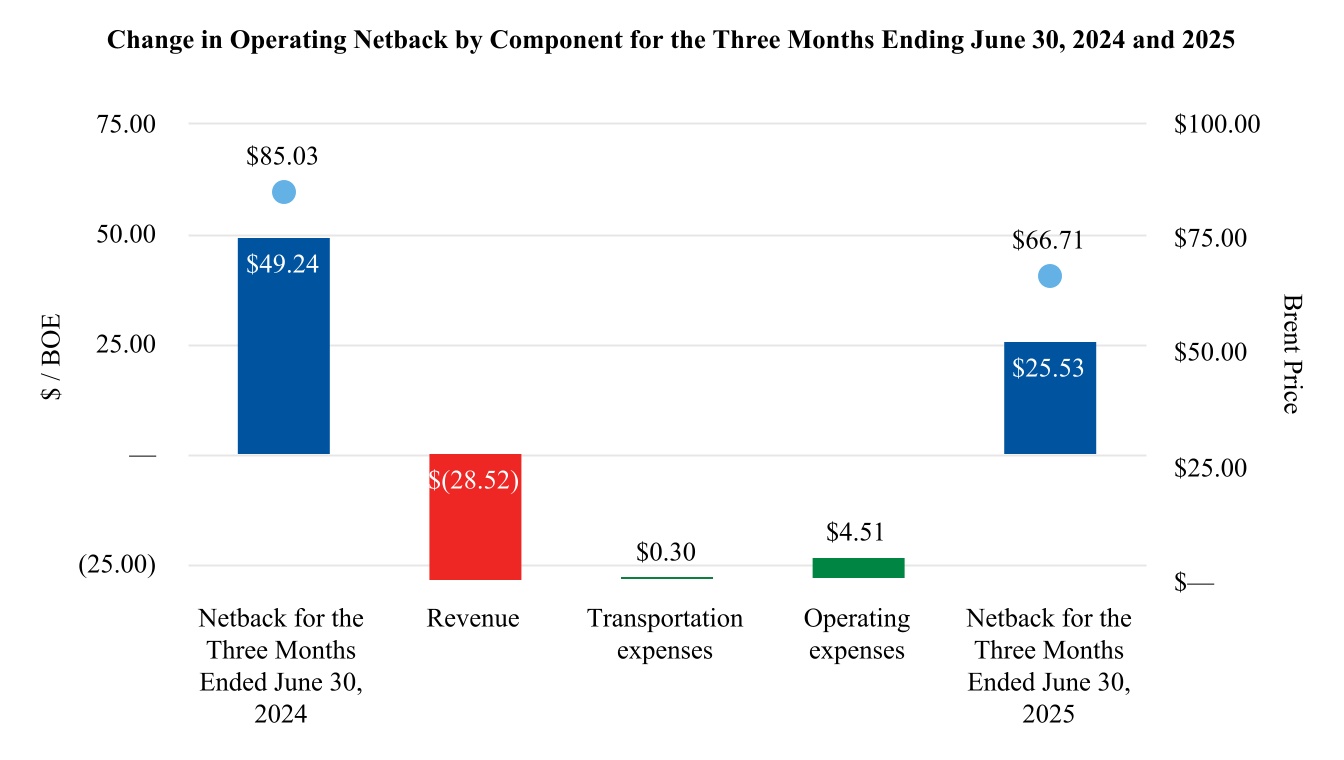

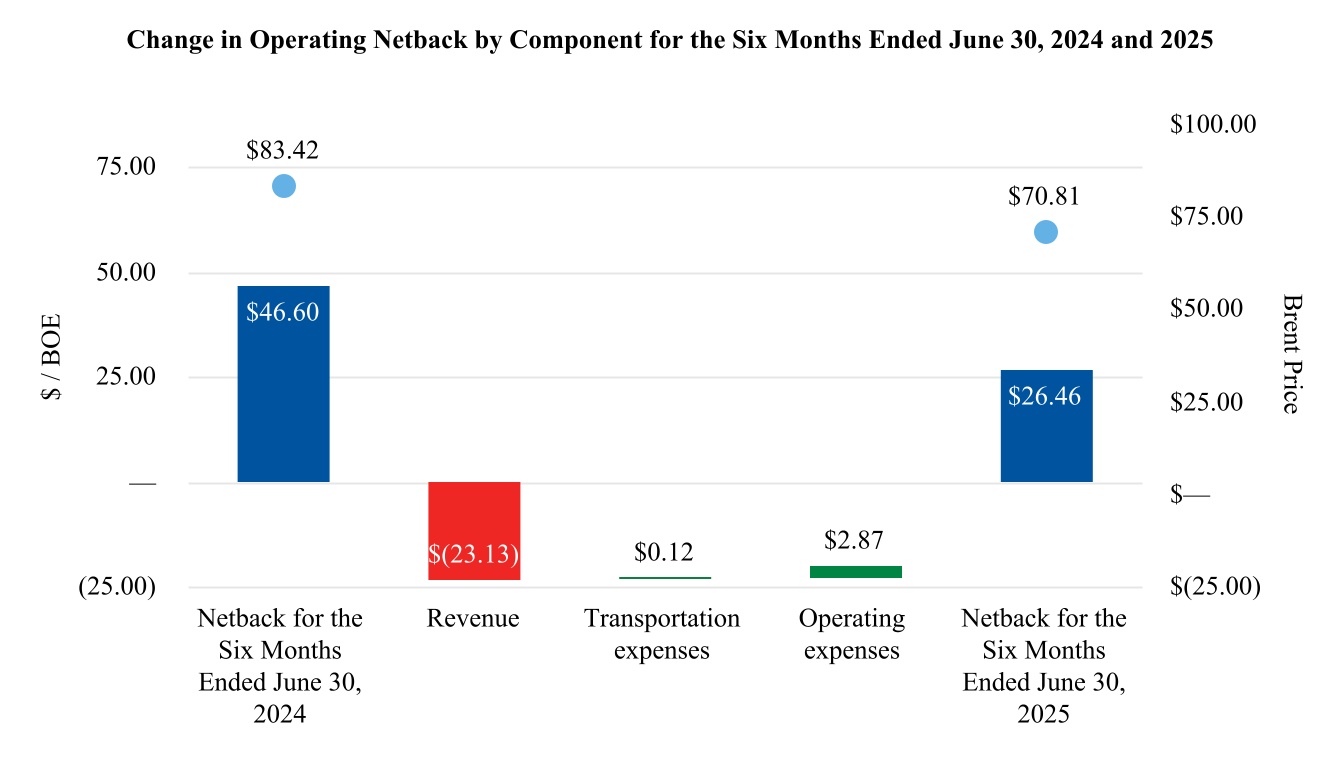

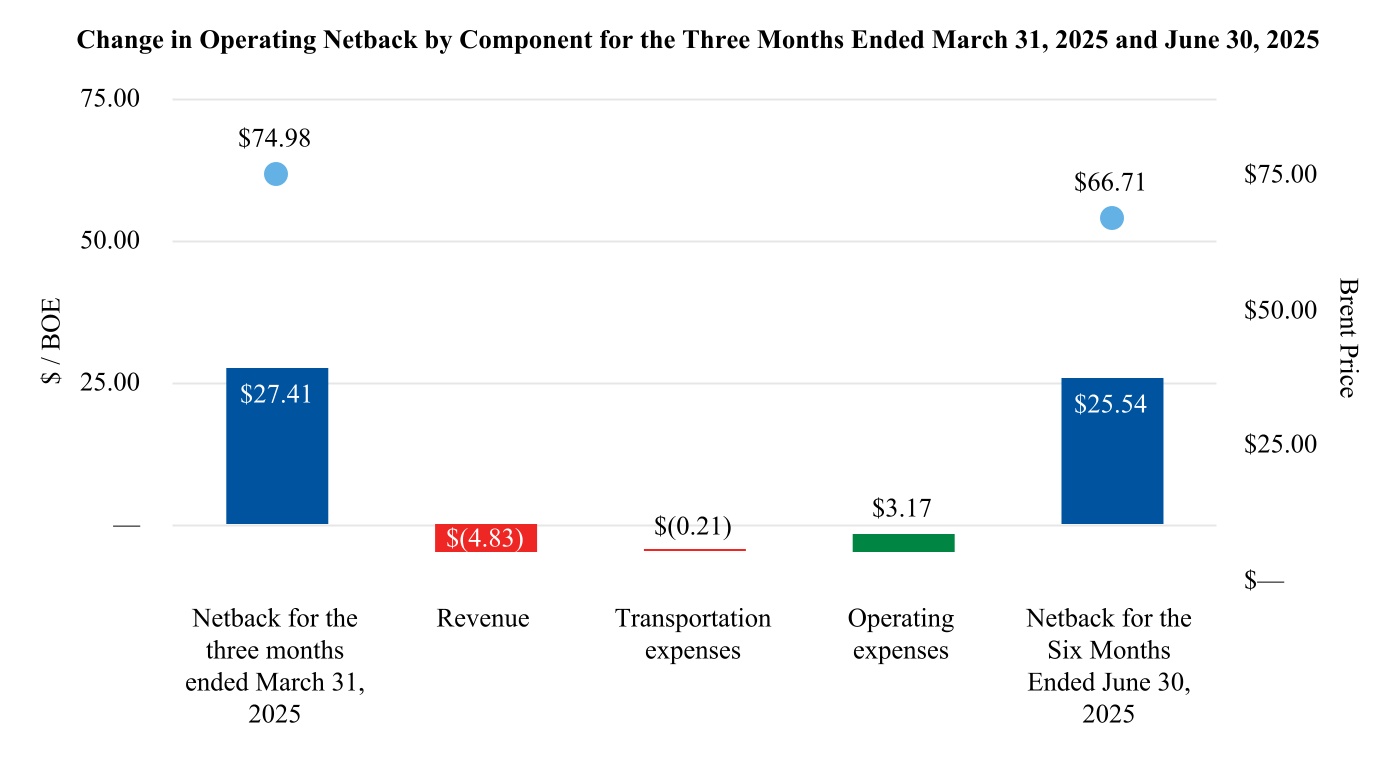

|