Document

EXHIBIT 99.1

WESTLAKE CORPORATION

Contact—(713) 960-9111

Investors—Steve Bender

Media—L. Benjamin Ederington

Westlake Corporation Reports Third Quarter 2025 Results

HOUSTON--(BUSINESS WIRE)--Westlake Corporation (NYSE: WLK) (the "Company" or "Westlake") today announced third quarter 2025 results.

SUMMARY FINANCIAL HIGHLIGHTS (in millions of dollars, except per share data and percentages)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, 2025 |

|

Three Months Ended June 30, 2025 |

|

Three Months Ended September 30, 2024 |

|

|

|

|

|

|

|

| Westlake Corporation |

|

|

|

|

|

|

| Net sales |

|

$ |

2,838 |

|

$ |

2,953 |

|

$ |

3,117 |

Income (loss) from operations |

|

$ |

(766) |

|

$ |

(109) |

|

$ |

180 |

|

|

|

|

|

|

|

| Net income (loss) attributable to Westlake Corporation |

|

$ |

(782) |

|

$ |

(142) |

|

$ |

108 |

Diluted earnings (loss) per common share |

|

$ |

(6.06) |

|

$ |

(1.11) |

|

$ |

0.83 |

Identified Items (1) |

|

$ |

744 |

|

$ |

130 |

|

$ |

75 |

Net income (loss) attributable to Westlake Corporation excl. Identified Items |

|

$ |

(38) |

|

$ |

(12) |

|

$ |

183 |

Diluted earnings (loss) per common share excl. Identified Items |

|

$ |

(0.29) |

|

$ |

(0.09) |

|

$ |

1.41 |

| EBITDA |

|

$ |

(431) |

|

$ |

210 |

|

$ |

505 |

|

|

|

|

|

|

|

EBITDA excl. Identified Items |

|

$ |

313 |

|

$ |

340 |

|

$ |

580 |

EBITDA margin (2) |

|

11% |

|

12% |

|

19% |

|

|

|

|

|

|

|

Housing and Infrastructure Products ("HIP") Segment |

|

|

|

|

|

|

| Net sales |

|

$ |

1,091 |

|

$ |

1,160 |

|

$ |

1,098 |

| Income from operations |

|

$ |

151 |

|

$ |

222 |

|

$ |

202 |

|

|

|

|

|

|

|

| EBITDA |

|

$ |

215 |

|

$ |

275 |

|

$ |

262 |

| EBITDA margin |

|

20% |

|

24% |

|

24% |

|

|

|

|

|

|

|

Performance and Essential Materials ("PEM") Segment |

|

|

|

|

|

|

| Net sales |

|

$ |

1,747 |

|

$ |

1,793 |

|

$ |

2,019 |

Income (loss) from operations |

|

$ |

(902) |

|

$ |

(318) |

|

$ |

(9) |

|

|

|

|

|

|

|

| EBITDA |

|

$ |

(654) |

|

$ |

(78) |

|

$ |

222 |

Identified Items (1) |

|

$ |

744 |

|

$ |

130 |

|

$ |

75 |

EBITDA excl. Identified Items |

|

$ |

90 |

|

$ |

52 |

|

$ |

297 |

EBITDA margin (2) |

|

5% |

|

3% |

|

15% |

______________________________

(1)For the three months ended September 2025, Identified Items include a non-cash impairment charge of $727 million representing all of the goodwill associated with the North American Chlorovinyls reporting unit, and $17 million of accrued expenses related to previously announced shutdowns. For the three months ended June 2025, Identified Items represent $115 million of accrued expenses and $15 million inventory write-off related to previously announced shutdowns. For the three months ended September 2024, Identified Items represent $75 million of accrued expenses related to previously announced shutdowns.

(2)Excludes Identified Items

BUSINESS HIGHLIGHTS

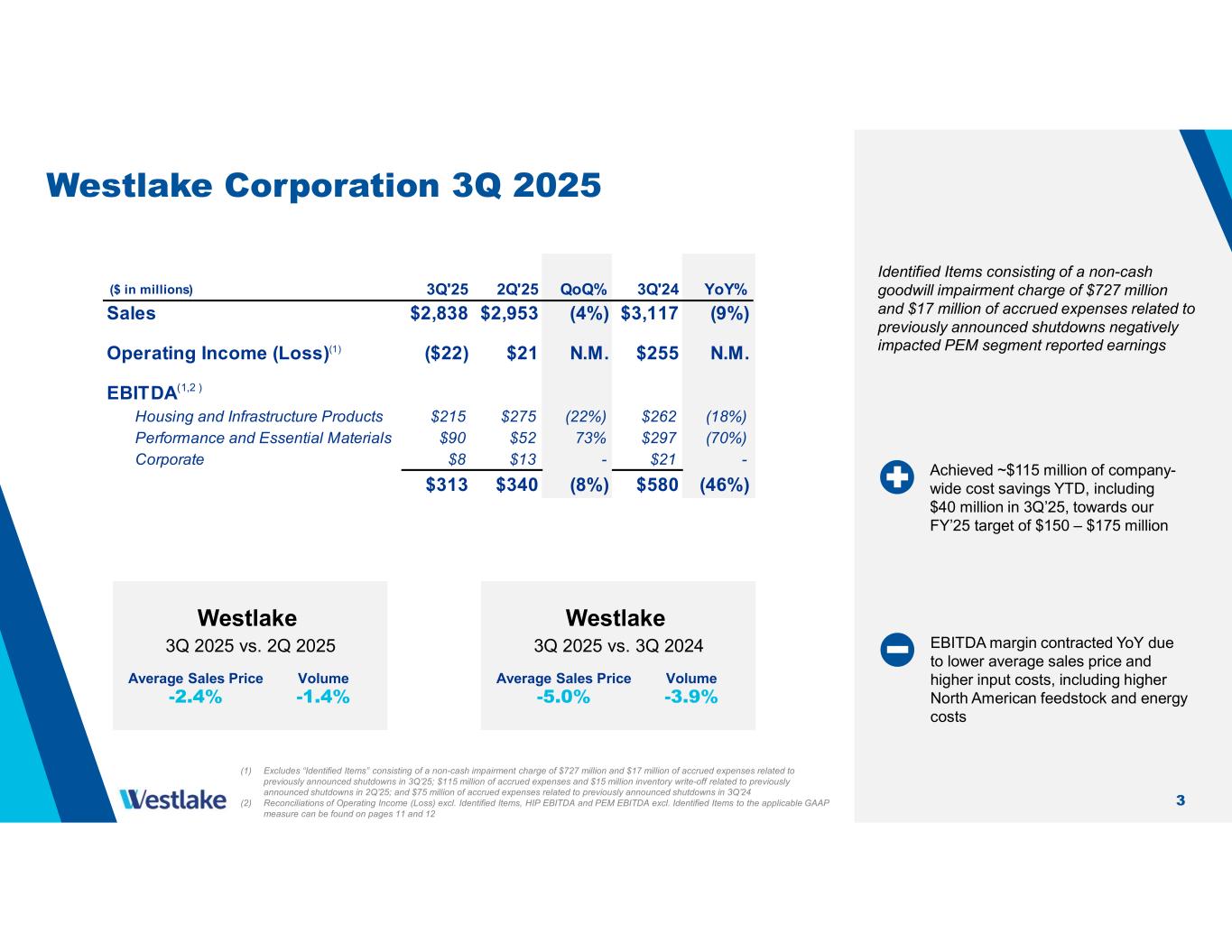

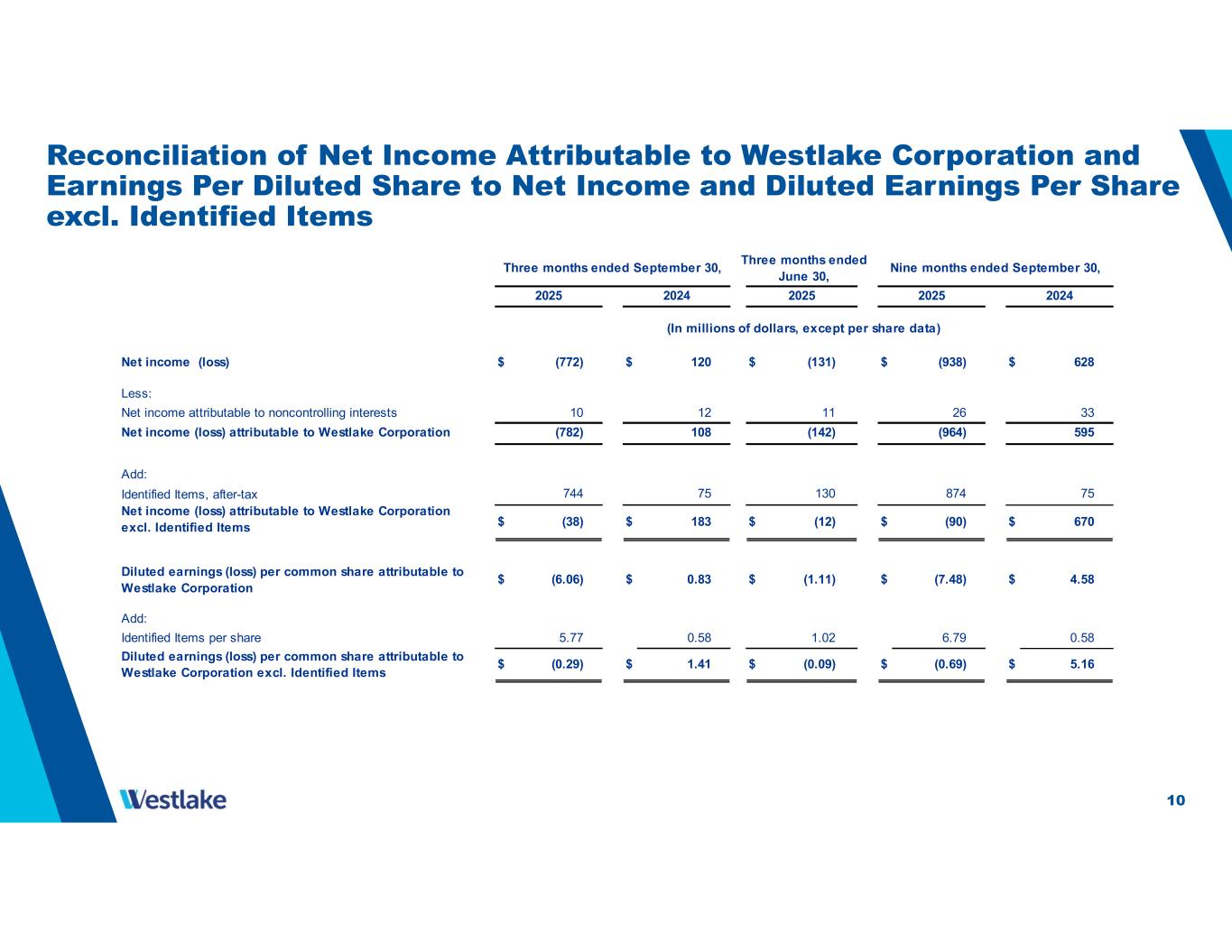

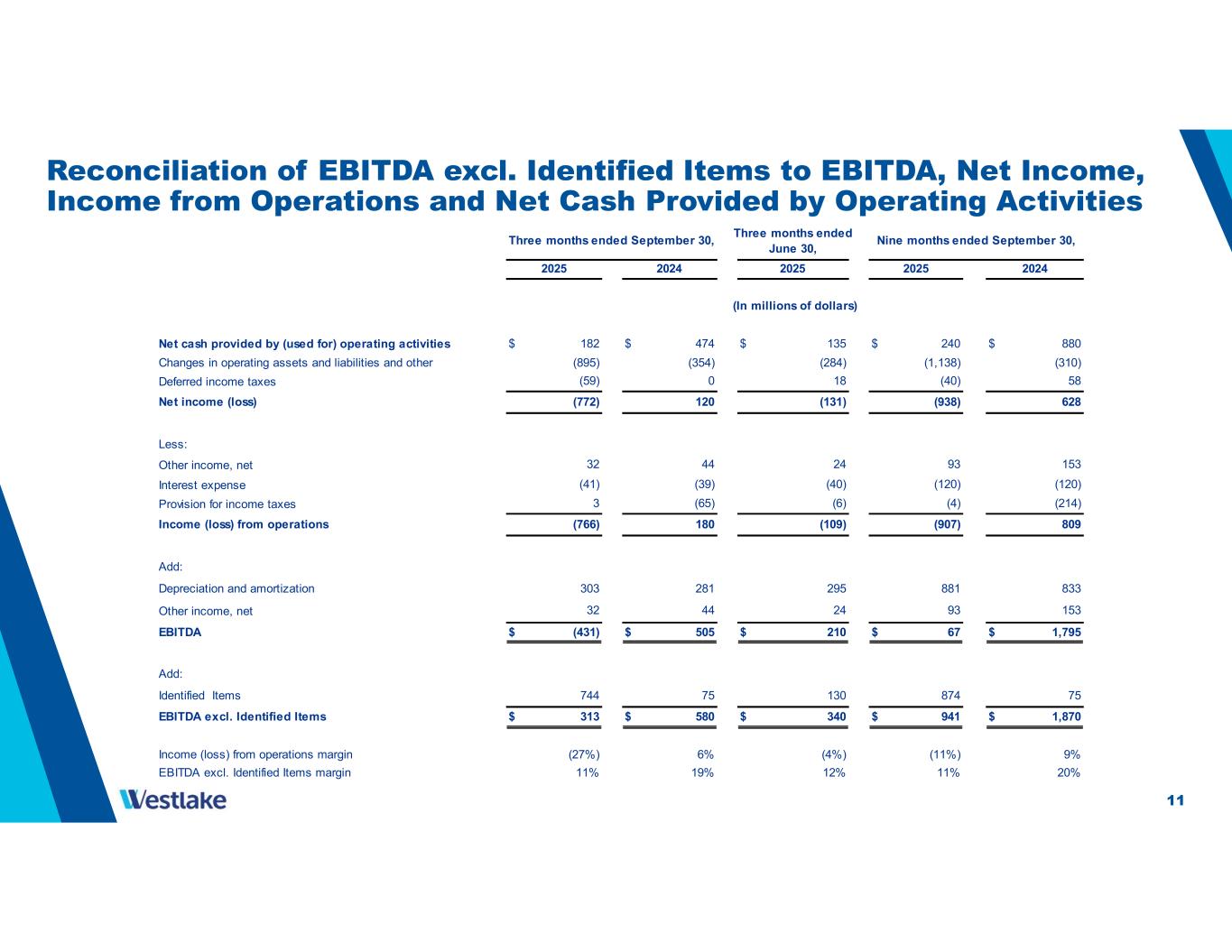

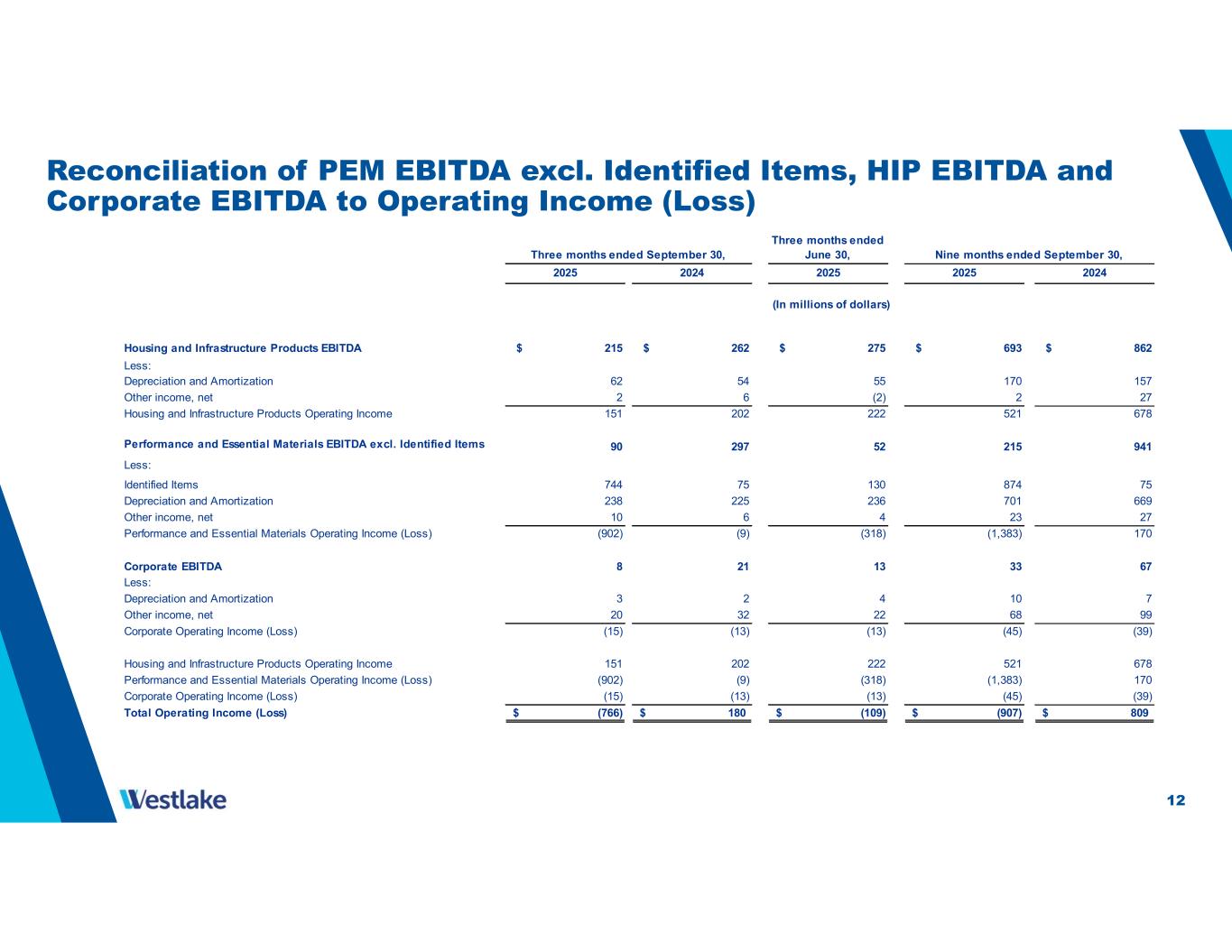

In the third quarter of 2025, Westlake reported net sales of $2.8 billion, a net loss of $782 million, or $6.06 per share, and EBITDA (earnings before interest expense, income taxes, depreciation and amortization) of ($431) million. Earnings in the third quarter were impacted by a non-cash charge of $727 million to fully impair the goodwill associated with our North American chlorovinyls business ("Chlorovinyls Impairment") as well as $17 million of accrued expenses for previously announced asset shutdowns (the "Identified Items"), which are included in the Performance and Essential Materials segment financial results. Excluding the Identified Items, the net loss in the third quarter of 2025 was $38 million, or $0.29 per share, and EBITDA was $313 million.

Compared to the second quarter of 2025, EBITDA excluding Identified Items of $313 million decreased by $27 million primarily due to lower average sales price in our PEM segment and lower sales volume in our HIP segment.

Westlake's third quarter of 2025 sales volume decreased 1% and average sales price decreased by 2% as compared to the second quarter of 2025. Housing and Infrastructure Products sales decreased 6% sequentially, driven by a 6% decrease in sales volume and unchanged average sales price. Performance and Essential Materials sales decreased 3% over the same period of time as a higher sales volume was more than offset by a 4% decline in average sales price.

EBITDA excluding Identified Items of $313 million was lower than the third quarter of 2024 EBITDA excluding Identified Items of $580 million primarily due to lower average sales price and margin as well as lower sales volume in our PEM segment. Additionally, lower average sales price and several period-related administrative, restructuring and integration expenses in our HIP segment also contributed to the lower year-over-year EBITDA excluding Identified Items.

EXECUTIVE COMMENTARY

"Global macroeconomic conditions remained challenging throughout the third quarter of 2025 with continued weakness in industrial and manufacturing activity putting pressure on sales prices and margins in our PEM segment, particularly for chlorovinyls. As a result, during the third quarter we recorded a non-cash impairment charge of $727 million for all of the goodwill associated with PEM's North American Chlorovinyls business. We remain committed to this business as the global need for its products, which are critical to industries ranging from building materials to water to manufacturing, remains intact. We have taken actions to reduce costs to deliver the earnings it is capable of generating and we will assess opportunities to optimize its footprint to return it to levels of profitability that provide an appropriate return on investment," said Jean-Marc Gilson, President and Chief Executive Officer.

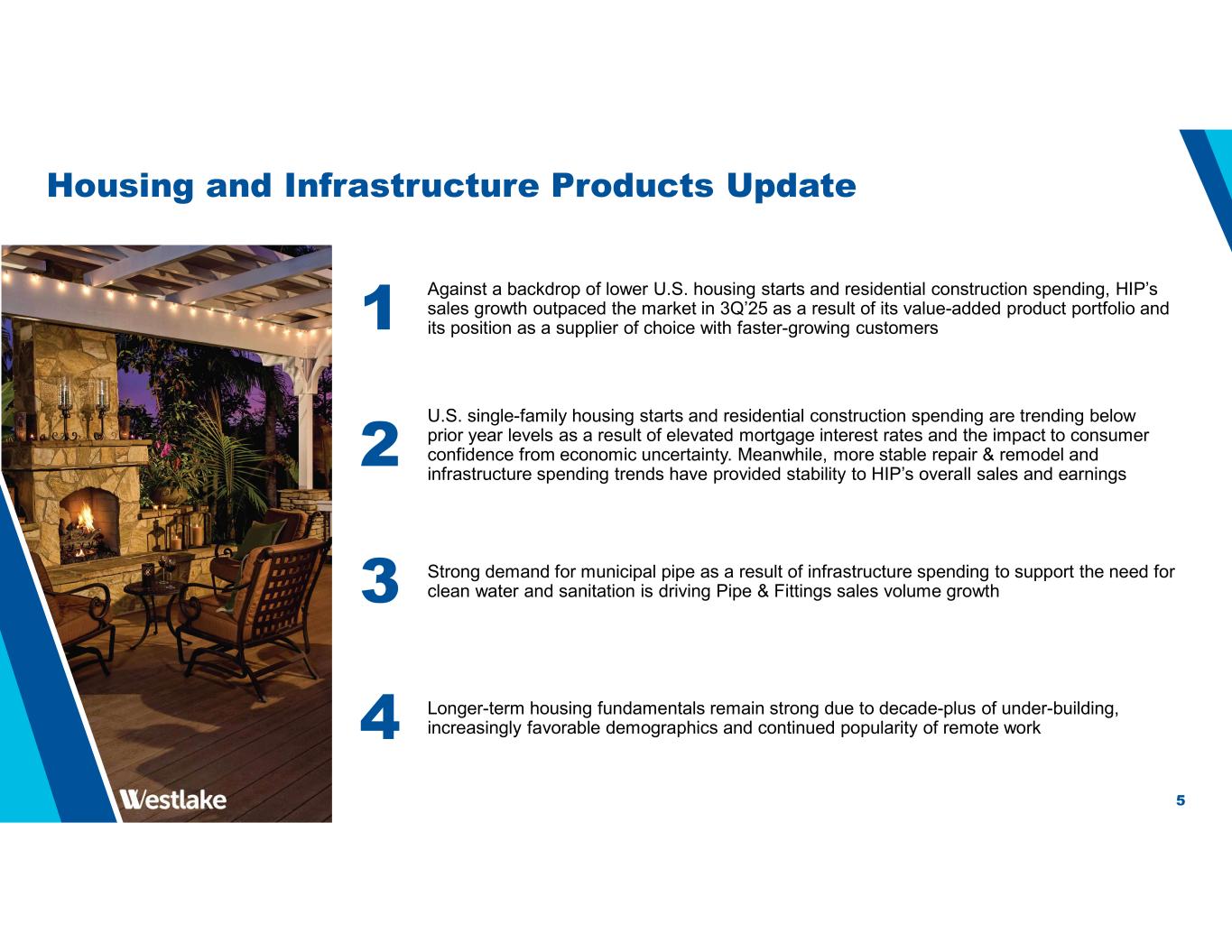

"Our HIP segment performed very well, holding sales in line with the prior-year period against a backdrop of slowing North American residential construction activity. HIP remains well positioned to continue to outgrow the market by 'winning with the winners' through product innovation and our solid position as a preferred supplier to large, national homebuilders and distributors," continued Mr. Gilson.

"Looking ahead to next year, we expect our margins and earnings to be supported by actions that we are taking to improve our profitability. First, better plant reliability should improve EBITDA. Second, we have identified $200 million of cost savings that we expect to achieve in 2026. Third, footprint optimization actions that we have already taken, including the Pernis Shutdown, will remove approximately $100 million of annual losses starting in 2026. We believe that these actions will contribute to margins and earnings next year and for years to come," concluded Mr. Gilson.

RESULTS

Consolidated Results

(Unless otherwise noted the financial numbers below exclude the Identified Items)

For the three months ended September 30, 2025, the Company reported a quarterly net loss of $38 million, or $0.29 per share, on net sales of $2.8 billion compared to the net loss of $12 million reported in the second quarter of 2025. Sequentially, earnings were impacted by lower average sales price in our PEM segment and lower sales volume in our HIP segment, which were partially offset by higher sales volume in our PEM segment.

The third quarter of 2025 net loss of $38 million was $221 million below the third quarter of 2024 primarily due to lower average sales price and margin, particularly in our PEM segment as a result of unfavorable changes in the global supply-demand balance for many of PEM's products as a result of weaker global industrial and manufacturing demand.

EBITDA of $313 million for the third quarter of 2025 decreased by $27 million compared to second quarter 2025 as a result of lower average sales price and margin in our PEM segment and lower sales volume in our HIP segment, which were partially offset by a lower impact from planned turnarounds and unplanned outages in our PEM segment.

A reconciliation of EBITDA and net income to EBITDA excluding Identified Items and net income excluding Identified Items, as well as a reconciliation of EBITDA to net income, income from operations (including and excluding Identified Items) and net cash provided by operating activities, as well as a reconciliation of free cash flow to net cash flow provided by operating activities, can be found in the financial schedules at the end of this press release.

Expenses Regarding the Chlorovinyls Impairment and Facility Closures ("Identified Items")

During the third quarter of 2025, the Company recorded a non-cash impairment charge of $727 million representing all of the goodwill associated with the North American Chlorovinyls reporting unit. Additionally, during the third quarter of 2025, the Company accrued $17 million of expenses related to previously- announced asset shutdowns.

Cash, Investments and Debt

Net cash provided by operating activities was $182 million for the third quarter of 2025 and capital expenditures were $239 million. As of September 30, 2025, cash, cash equivalents and fixed-income investments were $2.1 billion and total debt was $4.7 billion.

Housing and Infrastructure Products Segment

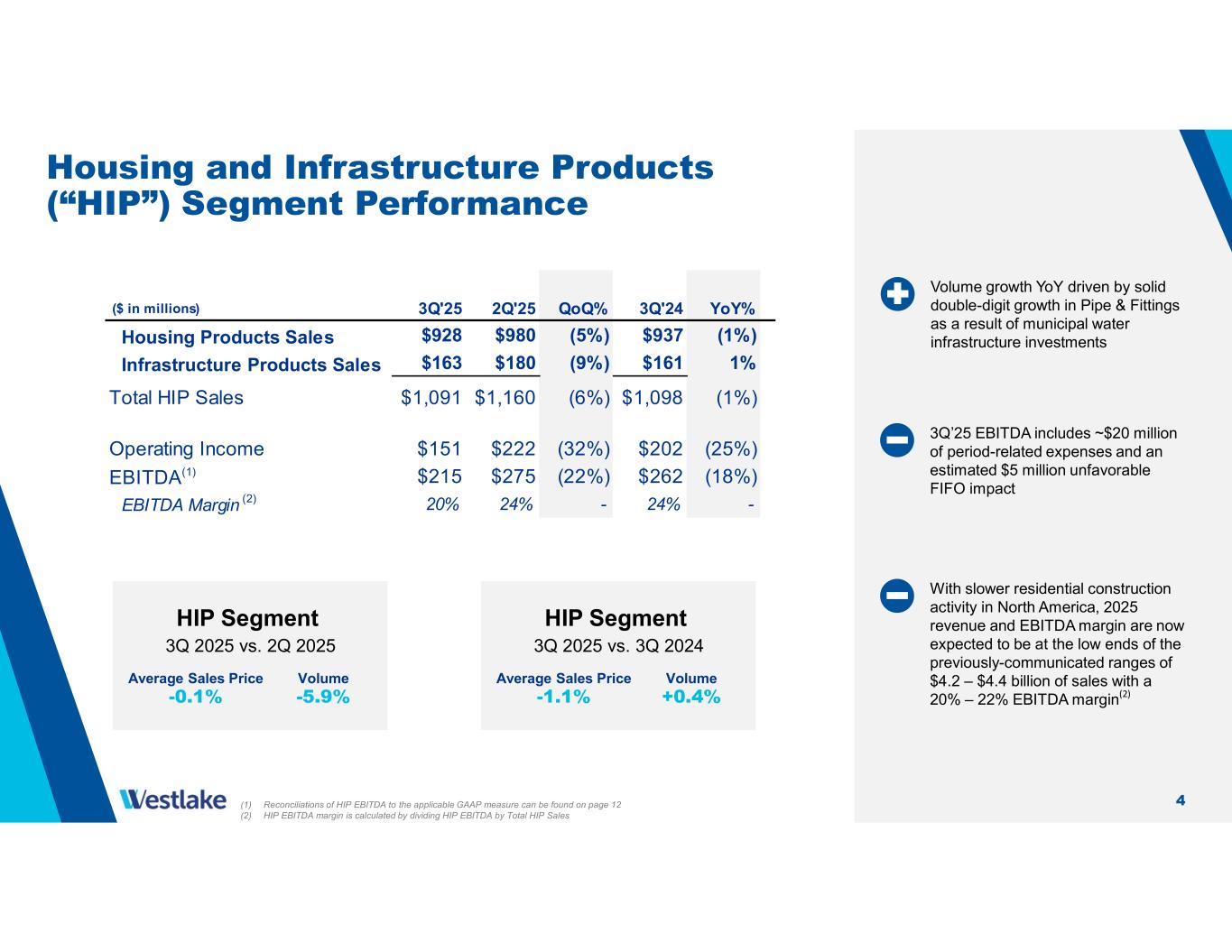

For the third quarter of 2025, Housing and Infrastructure Products income from operations of $151 million decreased by $71 million as compared to the second quarter of 2025. This decrease in income from operations versus the prior quarter was primarily due to lower sales volume in Pipe & Fittings and Building Products due to the timing of customer orders between the second and third quarters.

Compared to the third quarter of 2024, Housing and Infrastructure Products income from operations decreased by $51 million. The year-over-year decrease was the result of lower average sales price and margins, particularly in Pipe & Fittings, and several period-related expenses.

Performance and Essential Materials Segment

(Unless otherwise noted the financial numbers below exclude the Identified Items)

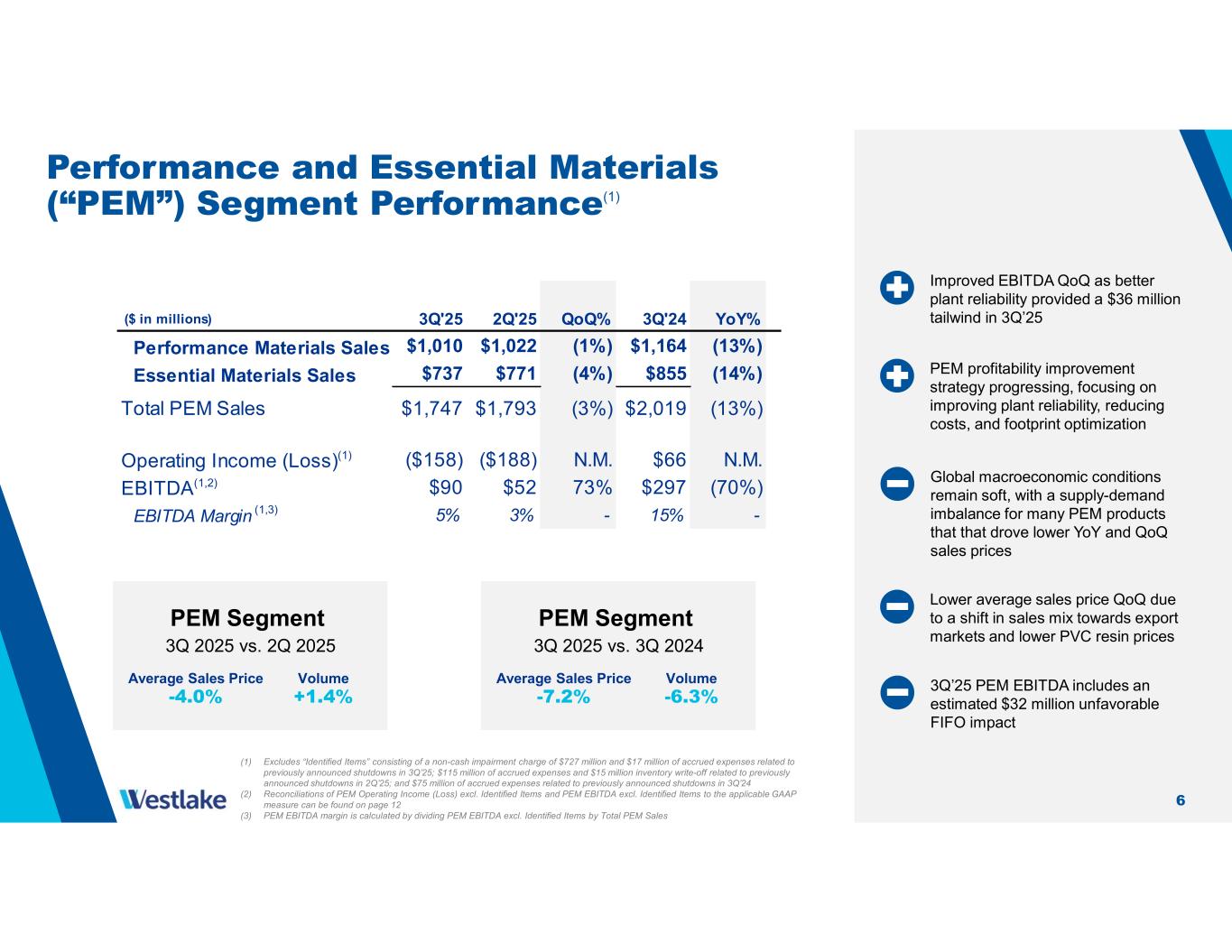

For the third quarter of 2025, Performance and Essential Materials loss from operations of $158 million decreased by $30 million as compared to the second quarter of 2025. This decrease in loss from operations versus the prior quarter was primarily driven by a lower impact from planned turnarounds and unplanned outages, which contributed to an increase in sales volume, particularly for caustic soda. Average sales price declined 4% from the second quarter of 2025, primarily driven by lower prices for PVC resin and unfavorable sales mix with higher sales in the export markets where pricing is typically lower.

Performance and Essential Materials loss from operations was $158 million in the third quarter of 2025 as compared to income from operations of $66 million in the third quarter of 2024. The year-over-year decrease was primarily due to a 7% decline in average sales price, particularly for PVC resin, and a 6% decline in sales volume, particularly for chlorine.

Forward-Looking Statements

The statements in this release and the related teleconference relating to matters that are not historical facts, including statements regarding our outlook for the performance of our business segments, global macroeconomic conditions and their effects on us and our customers, the operational reliability of our plants, the scope and duration of disruptions at our facilities, the results of the closure of the Pernis facility and our ability to remove projected annual losses, the success of our cost-reduction efforts and the timing and extent of savings therefrom, our ability to achieve our projected cost savings (including the results of our 2025 cost savings program and our goal of an additional cost savings of $200 million by the end of 2026), our ability to improve margins and earnings in 2026, industrial and manufacturing activity in our target markets, growth in our customers' businesses and their dependence on our products, our ability to weather economic volatility, home affordability and residential construction activity, product innovations, raw material costs, higher energy prices, our market position and the strength of our brands, our commitment to PEM's North American Chlorovinyls business and the results of optimization efforts, the benefits of a diversified and integrated business model, our relationships with our customers, our ability to maintain cost advantages and global demand for our products are forward-looking statements.

These forward-looking statements are subject to significant risks and uncertainties. Actual results could differ materially, based on factors including, but not limited to: general economic and business conditions; the cyclical nature of the chemical and building products industries; the availability, cost and volatility of raw materials and energy; uncertainties associated with the United States, European and worldwide economies, including those due to political tensions and conflict in the Middle East, Russia and Ukraine and elsewhere; uncertainties associated with pandemic infectious diseases; uncertainties associated with climate change; the potential impact on demand for ethylene, polyethylene and polyvinyl chloride due to initiatives such as recycling and customers seeking alternatives to polymers; current and potential governmental regulatory actions in the United States and other countries; industry production capacity and operating rates; the supply/demand balance for Westlake's products; competitive products and pricing pressures; instability in the credit and financial markets; access to capital markets; terrorist acts; operating interruptions; changes in laws and regulations, including trade policies and tariffs imposed on or by foreign jurisdictions; disruptions in global trade and the effect on trading relationships between the United States and other countries; technological developments; information systems failures and cyberattacks; foreign currency exchange risks; our ability to implement our business strategies; and creditworthiness of our customers and other risk factors. For more detailed information about the factors that could cause actual results to differ materially, please refer to Westlake's Annual Report on Form 10-K for the year ended December 31, 2024, which was filed with the Securities and Exchange Commission (SEC) in February 2025.

Use of Non-GAAP Financial Measures

This release makes reference to certain "non-GAAP" financial measures, such as EBITDA, free cash flow and other measures that exclude the effects of Identified Items, as defined in Regulation G of the U.S. Securities Exchange Act of 1934, as amended. For this purpose, a non-GAAP financial measure is generally defined by the SEC as a numerical measure of a registrant's historical or future financial performance, financial position or cash flows that (1) excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of operations, balance sheet or statement of cash flows (or equivalent statements) of the registrant; or (2) includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. We report our financial results in accordance with U.S. generally accepted accounting principles (U.S. GAAP), but believe that certain non-GAAP financial measures, such as EBITDA, free cash flow and other measures that exclude the effects of Identified Items, provide useful supplemental information to investors regarding the underlying business trends and performance of the Company's ongoing operations and are useful for period-over-period comparisons of such operations. These non-GAAP financial measures should be considered as a supplement to, and not as a substitute for or superior to, the financial measures prepared in accordance with U.S. GAAP. A reconciliation of (i) EBITDA to net income, income from operations and net cash provided by operating activities, (ii) free cash flow to net cash provided by operating activities and (iii) other measures reflecting adjustments for the effects of Identified Items can be found in the financial schedules at the end of this press release.

About Westlake

Westlake is a global manufacturer and supplier of materials and innovative products that enhance life every day. Headquartered in Houston, with operations in Asia, Europe and North America, we provide the building blocks for vital solutions — from housing and construction, to packaging and healthcare, to automotive and consumer goods. For more information, visit the Company's web site at www.westlake.com.

Westlake Corporation Conference Call Information:

A conference call to discuss Westlake Corporation's third quarter 2025 results will be held Thursday, October 30, 2025 at 11:00 AM Eastern Time (10:00 AM Central Time). To access the conference call, it is necessary to pre-register at https://register-conf.media-server.com/register/BI407a290bfbf04abdbdcf5bdeb7f15366. Once registered, you will receive a phone number and unique PIN number.

A replay of the conference call will be available beginning two hours after its conclusion. The conference call and replay will be available via webcast at https://edge.media-server.com/mmc/p/eex75wdd.

WESTLAKE CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

|

|

|

|

|

|

|

|

|

|

(in millions of dollars, except per share data and share amounts) |

| Net sales |

|

$ |

2,838 |

|

|

$ |

3,117 |

|

|

$ |

8,637 |

|

|

$ |

9,299 |

|

| Cost of sales |

|

2,602 |

|

|

2,618 |

|

|

7,911 |

|

|

7,670 |

|

| Gross profit |

|

236 |

|

|

499 |

|

|

726 |

|

|

1,629 |

|

| Selling, general and administrative expenses |

|

228 |

|

|

215 |

|

|

676 |

|

|

648 |

|

| Amortization of intangibles |

|

30 |

|

|

29 |

|

|

91 |

|

|

89 |

|

Impairment of goodwill |

|

727 |

|

|

— |

|

|

727 |

|

|

— |

|

| Restructuring, transaction and integration-related costs |

|

17 |

|

|

75 |

|

|

139 |

|

|

83 |

|

Income (loss) from operations |

|

(766) |

|

|

180 |

|

|

(907) |

|

|

809 |

|

| Interest expense |

|

(41) |

|

|

(39) |

|

|

(120) |

|

|

(120) |

|

| Other income, net |

|

32 |

|

|

44 |

|

|

93 |

|

|

153 |

|

Income (loss) before income taxes |

|

(775) |

|

|

185 |

|

|

(934) |

|

|

842 |

|

Provision for (benefit from) income taxes |

|

(3) |

|

|

65 |

|

|

4 |

|

|

214 |

|

| Net income (loss) |

|

(772) |

|

|

120 |

|

|

(938) |

|

|

628 |

|

| Net income attributable to noncontrolling interests |

|

10 |

|

|

12 |

|

|

26 |

|

|

33 |

|

Net income (loss) attributable to Westlake Corporation |

|

$ |

(782) |

|

|

$ |

108 |

|

|

$ |

(964) |

|

|

$ |

595 |

|

Earnings (loss) per common share attributable to Westlake Corporation: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(6.06) |

|

|

$ |

0.84 |

|

|

$ |

(7.48) |

|

|

$ |

4.61 |

|

| Diluted |

|

$ |

(6.06) |

|

|

$ |

0.83 |

|

|

$ |

(7.48) |

|

|

$ |

4.58 |

|

| Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

| Basic |

|

128,251,427 |

|

|

128,638,632 |

|

|

128,265,950 |

|

|

128,525,531 |

|

| Diluted |

|

128,251,427 |

|

|

129,340,461 |

|

|

128,265,950 |

|

|

129,237,560 |

|

WESTLAKE CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

2025 |

|

December 31,

2024 |

|

|

|

|

|

|

|

(in millions of dollars) |

| ASSETS |

|

|

|

|

| Current assets |

|

|

|

|

| Cash and cash equivalents |

|

$ |

1,927 |

|

|

$ |

2,919 |

|

Available-for-sale securities |

|

198 |

|

|

— |

|

| Accounts receivable, net |

|

1,763 |

|

|

1,483 |

|

| Inventories |

|

1,727 |

|

|

1,697 |

|

| Prepaid expenses and other current assets |

|

136 |

|

|

115 |

|

|

|

|

|

|

| Total current assets |

|

5,751 |

|

|

6,214 |

|

| Property, plant and equipment, net |

|

8,825 |

|

|

8,633 |

|

|

|

|

|

|

| Other assets, net |

|

5,238 |

|

|

5,903 |

|

| Total assets |

|

$ |

19,814 |

|

|

$ |

20,750 |

|

|

|

|

|

|

| LIABILITIES AND EQUITY |

|

|

|

|

| Current liabilities (accounts payable and accrued and other liabilities) |

|

$ |

2,147 |

|

|

$ |

2,213 |

|

Current portion of long-term debt, net |

|

750 |

|

|

6 |

|

| Long-term debt, net |

|

3,906 |

|

|

4,556 |

|

|

|

|

|

|

| Other liabilities |

|

3,073 |

|

|

2,932 |

|

| Total liabilities |

|

9,876 |

|

|

9,707 |

|

| Total Westlake Corporation stockholders' equity |

|

9,426 |

|

|

10,527 |

|

| Noncontrolling interests |

|

512 |

|

|

516 |

|

| Total equity |

|

9,938 |

|

|

11,043 |

|

| Total liabilities and equity |

|

$ |

19,814 |

|

|

$ |

20,750 |

|

WESTLAKE CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

2025 |

|

2024 |

|

|

|

|

|

|

|

(in millions of dollars) |

| Cash flows from operating activities |

|

|

|

|

Net income (loss) |

|

$ |

(938) |

|

|

$ |

628 |

|

| Adjustments to reconcile net income to net cash provided by operating activities |

|

|

|

|

| Depreciation and amortization |

|

881 |

|

|

833 |

|

| Deferred income taxes |

|

40 |

|

|

(58) |

|

| Net loss on disposition and others |

|

76 |

|

|

51 |

|

Impairment of goodwill |

|

727 |

|

|

— |

|

| Other balance sheet changes |

|

(546) |

|

|

(574) |

|

| Net cash provided by operating activities |

|

240 |

|

|

880 |

|

| Cash flows from investing activities |

|

|

|

|

|

|

|

|

|

| Additions to investments in unconsolidated subsidiaries |

|

(23) |

|

|

(24) |

|

| Additions to property, plant and equipment |

|

(754) |

|

|

(723) |

|

|

|

|

|

|

Purchase of available-for-sale securities |

|

(198) |

|

|

— |

|

| Other, net |

|

7 |

|

|

11 |

|

| Net cash used for investing activities |

|

(968) |

|

|

(736) |

|

| Cash flows from financing activities |

|

|

|

|

|

|

|

|

|

| Distributions to noncontrolling interests |

|

(33) |

|

|

(31) |

|

| Dividends paid |

|

(204) |

|

|

(197) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Repayment of senior notes |

|

— |

|

|

(300) |

|

| Repurchase of common stock for treasury |

|

(30) |

|

|

— |

|

| Other, net |

|

(18) |

|

|

11 |

|

| Net cash used for financing activities |

|

(285) |

|

|

(517) |

|

| Effect of exchange rate changes on cash, cash equivalents and restricted cash |

|

21 |

|

|

(15) |

|

Net decrease in cash, cash equivalents and restricted cash |

|

(992) |

|

|

(388) |

|

| Cash, cash equivalents and restricted cash at beginning of period |

|

2,935 |

|

|

3,319 |

|

| Cash, cash equivalents and restricted cash at end of period |

|

$ |

1,943 |

|

|

$ |

2,931 |

|

|

|

|

|

|

WESTLAKE CORPORATION

SEGMENT INFORMATION

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

|

|

|

|

|

|

|

|

|

|

(in millions of dollars) |

| Net external sales |

|

|

|

|

|

|

|

|

| Housing and Infrastructure Products |

|

|

|

|

|

|

|

|

| Housing Products |

|

$ |

928 |

|

|

$ |

937 |

|

|

$ |

2,746 |

|

|

$ |

2,826 |

|

| Infrastructure Products |

|

163 |

|

|

161 |

|

|

501 |

|

|

510 |

|

| Total Housing and Infrastructure Products |

|

1,091 |

|

|

1,098 |

|

|

3,247 |

|

|

3,336 |

|

| Performance and Essential Materials |

|

|

|

|

|

|

|

|

| Performance Materials |

|

1,010 |

|

|

1,164 |

|

|

3,088 |

|

|

3,505 |

|

| Essential Materials |

|

737 |

|

|

855 |

|

|

2,302 |

|

|

2,458 |

|

| Total Performance and Essential Materials |

|

1,747 |

|

|

2,019 |

|

|

5,390 |

|

|

5,963 |

|

Total reportable segments and consolidated |

|

$ |

2,838 |

|

|

$ |

3,117 |

|

|

$ |

8,637 |

|

|

$ |

9,299 |

|

|

|

|

|

|

|

|

|

|

| Income (loss) from operations |

|

|

|

|

|

|

|

|

| Housing and Infrastructure Products |

|

$ |

151 |

|

|

$ |

202 |

|

|

$ |

521 |

|

|

$ |

678 |

|

| Performance and Essential Materials |

|

(902) |

|

|

(9) |

|

|

(1,383) |

|

|

170 |

|

| Total reportable segments |

|

(751) |

|

|

193 |

|

|

(862) |

|

|

848 |

|

| Corporate and other |

|

(15) |

|

|

(13) |

|

|

(45) |

|

|

(39) |

|

| Consolidated |

|

$ |

(766) |

|

|

$ |

180 |

|

|

$ |

(907) |

|

|

$ |

809 |

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

|

|

|

|

|

|

| Housing and Infrastructure Products |

|

$ |

62 |

|

|

$ |

54 |

|

|

$ |

170 |

|

|

$ |

157 |

|

| Performance and Essential Materials |

|

238 |

|

|

225 |

|

|

701 |

|

|

669 |

|

| Total reportable segments |

|

300 |

|

|

279 |

|

|

871 |

|

|

826 |

|

| Corporate and other |

|

3 |

|

|

2 |

|

|

10 |

|

|

7 |

|

| Consolidated |

|

$ |

303 |

|

|

$ |

281 |

|

|

$ |

881 |

|

|

$ |

833 |

|

|

|

|

|

|

|

|

|

|

| Other income, net |

|

|

|

|

|

|

|

|

| Housing and Infrastructure Products |

|

$ |

2 |

|

|

$ |

6 |

|

|

$ |

2 |

|

|

$ |

27 |

|

| Performance and Essential Materials |

|

10 |

|

|

6 |

|

|

23 |

|

|

27 |

|

| Total reportable segments |

|

12 |

|

|

12 |

|

|

25 |

|

|

54 |

|

| Corporate and other |

|

20 |

|

|

32 |

|

|

68 |

|

|

99 |

|

| Consolidated |

|

$ |

32 |

|

|

$ |

44 |

|

|

$ |

93 |

|

|

$ |

153 |

|

WESTLAKE CORPORATION

RECONCILIATION OF EBITDA TO NET INCOME (LOSS), INCOME (LOSS) FROM OPERATIONS AND

NET CASH PROVIDED BY OPERATING ACTIVITIES

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

2025 |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of dollars, except percentages) |

Net cash provided by operating activities |

|

$ |

135 |

|

|

$ |

182 |

|

|

$ |

474 |

|

|

$ |

240 |

|

|

$ |

880 |

|

| Changes in operating assets and liabilities and other |

|

(284) |

|

|

(895) |

|

|

(354) |

|

|

(1,138) |

|

|

(310) |

|

| Deferred income taxes |

|

18 |

|

|

(59) |

|

|

— |

|

|

(40) |

|

|

58 |

|

| Net income (loss) |

|

(131) |

|

|

(772) |

|

|

120 |

|

|

(938) |

|

|

628 |

|

| Add: |

|

|

|

|

|

|

|

|

|

|

Identified Items |

|

130 |

|

|

744 |

|

|

75 |

|

|

874 |

|

|

75 |

|

| Net income (loss) excl. Identified Items |

|

$ |

(1) |

|

|

$ |

(28) |

|

|

$ |

195 |

|

|

$ |

(64) |

|

|

$ |

703 |

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

(131) |

|

|

(772) |

|

|

120 |

|

|

(938) |

|

|

628 |

|

| Less: |

|

|

|

|

|

|

|

|

|

|

Other income, net |

|

24 |

|

|

32 |

|

|

44 |

|

|

93 |

|

|

153 |

|

| Interest expense |

|

(40) |

|

|

(41) |

|

|

(39) |

|

|

(120) |

|

|

(120) |

|

Provision for (benefit from) income taxes |

|

(6) |

|

|

3 |

|

|

(65) |

|

|

(4) |

|

|

(214) |

|

Income (loss) from operations |

|

(109) |

|

|

(766) |

|

|

180 |

|

|

(907) |

|

|

809 |

|

| Add: |

|

|

|

|

|

|

|

|

|

|

Identified Items |

|

130 |

|

|

744 |

|

|

75 |

|

|

874 |

|

|

75 |

|

Income (loss) from operations excl. Identified Items |

|

21 |

|

|

(22) |

|

|

255 |

|

|

(33) |

|

|

884 |

|

| Add: |

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

295 |

|

|

303 |

|

|

281 |

|

|

881 |

|

|

833 |

|

| Other income, net |

|

24 |

|

|

32 |

|

|

44 |

|

|

93 |

|

|

153 |

|

EBITDA excl. Identified Items |

|

340 |

|

|

313 |

|

|

580 |

|

|

941 |

|

|

1,870 |

|

| Less: |

|

|

|

|

|

|

|

|

|

|

Identified Items |

|

130 |

|

|

744 |

|

|

75 |

|

|

874 |

|

|

75 |

|

| EBITDA |

|

$ |

210 |

|

|

$ |

(431) |

|

|

$ |

505 |

|

|

$ |

67 |

|

|

$ |

1,795 |

|

| Net external sales |

|

$ |

2,953 |

|

|

$ |

2,838 |

|

|

$ |

3,117 |

|

|

$ |

8,637 |

|

|

$ |

9,299 |

|

| Operating Income Margin |

|

(4)% |

|

(27)% |

|

6% |

|

(11)% |

|

9% |

Operating income margin excl. Identified Items |

|

1% |

|

(1)% |

|

8% |

|

—% |

|

10% |

| EBITDA Margin |

|

7% |

|

(15)% |

|

16% |

|

1% |

|

19% |

EBITDA margin excl. Identified Items |

|

12% |

|

11% |

|

19% |

|

11% |

|

20% |

WESTLAKE CORPORATION

RECONCILIATION OF DILUTED EARNINGS (LOSS) PER COMMON SHARE TO DILUTED EARNINGS (LOSS) PER COMMON SHARE EXCLUDING IDENTIFIED ITEM

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

2025 |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(per share data) |

Diluted earnings (loss) per common share attributable to Westlake Corporation |

|

$ |

(1.11) |

|

|

$ |

(6.06) |

|

|

$ |

0.83 |

|

|

$ |

(7.48) |

|

|

$ |

4.58 |

|

| Add: |

|

|

|

|

|

|

|

|

|

|

Loss per common share relating to Identified Items |

|

1.02 |

|

|

5.77 |

|

|

0.58 |

|

|

6.79 |

|

|

0.58 |

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings (loss) per common share attributable to Westlake Corporation excl. Identified Items |

|

$ |

(0.09) |

|

|

$ |

(0.29) |

|

|

$ |

1.41 |

|

|

$ |

(0.69) |

|

|

$ |

5.16 |

|

WESTLAKE CORPORATION

RECONCILIATION OF FREE CASH FLOW TO NET CASH PROVIDED BY OPERATING ACTIVITIES

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

2025 |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of dollars) |

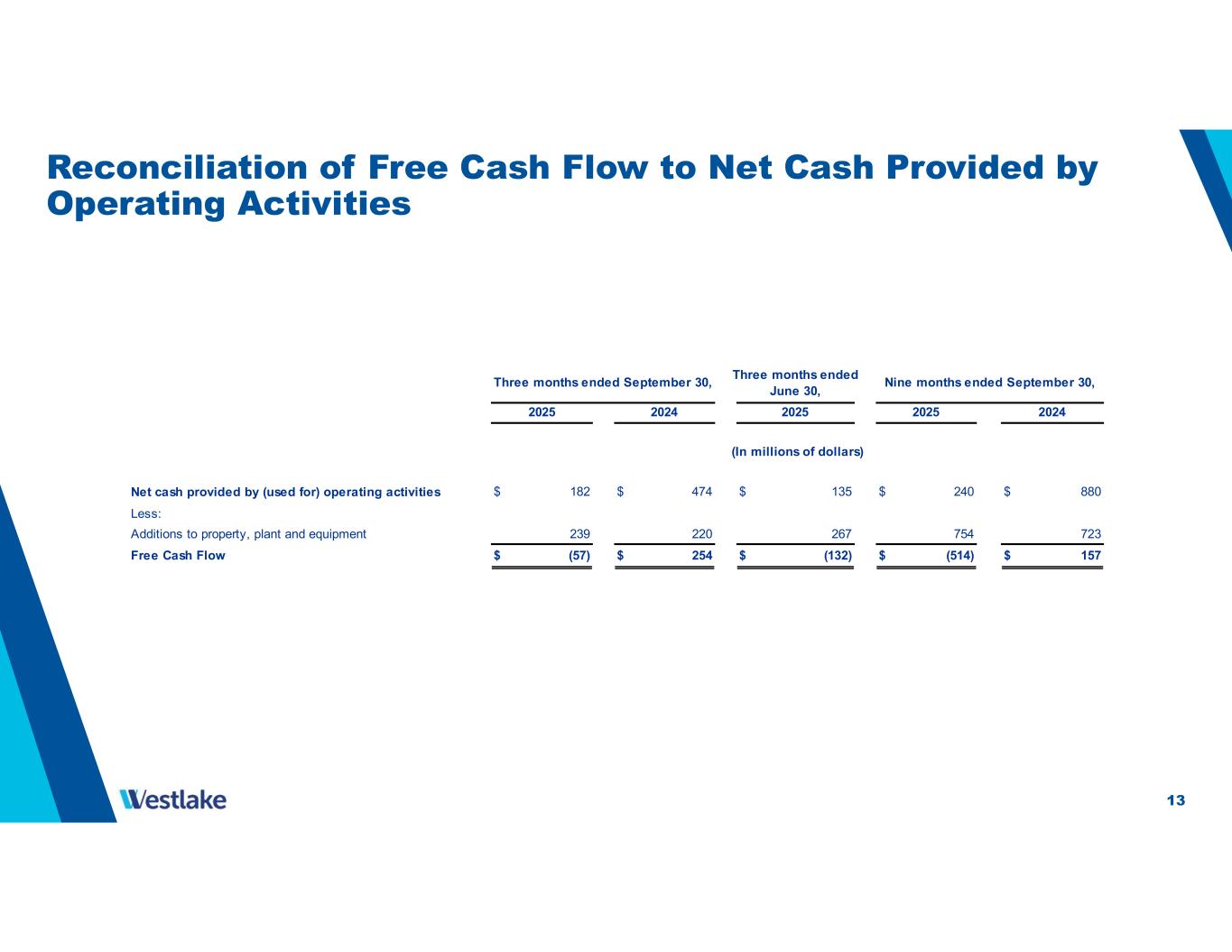

Net cash provided by operating activities |

|

$ |

135 |

|

|

$ |

182 |

|

|

$ |

474 |

|

|

$ |

240 |

|

|

$ |

880 |

|

| Less: |

|

|

|

|

|

|

|

|

|

|

| Additions to property, plant and equipment |

|

267 |

|

|

239 |

|

|

220 |

|

|

754 |

|

|

723 |

|

| Free cash flow |

|

$ |

(132) |

|

|

$ |

(57) |

|

|

$ |

254 |

|

|

$ |

(514) |

|

|

$ |

157 |

|

WESTLAKE CORPORATION

RECONCILIATION OF HIP SEGMENT EBITDA TO INCOME FROM OPERATIONS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

2025 |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of dollars, except percentages) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Housing and Infrastructure Products Segment |

|

|

|

|

|

|

|

|

|

|

Income from operations |

|

$ |

222 |

|

|

$ |

151 |

|

|

$ |

202 |

|

|

$ |

521 |

|

|

$ |

678 |

|

| Add: |

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

55 |

|

|

62 |

|

|

54 |

|

|

170 |

|

|

157 |

|

| Other income, net |

|

(2) |

|

|

2 |

|

|

6 |

|

|

2 |

|

|

27 |

|

| EBITDA |

|

$ |

275 |

|

|

$ |

215 |

|

|

$ |

262 |

|

|

$ |

693 |

|

|

$ |

862 |

|

| Net external sales |

|

$ |

1,160 |

|

|

$ |

1,091 |

|

|

$ |

1,098 |

|

|

$ |

3,247 |

|

|

$ |

3,336 |

|

| Operating Income Margin |

|

19% |

|

14% |

|

18% |

|

16% |

|

20% |

| EBITDA Margin |

|

24% |

|

20% |

|

24% |

|

21% |

|

26% |

WESTLAKE CORPORATION

RECONCILIATION OF PEM SEGMENT EBITDA TO INCOME (LOSS) FROM OPERATIONS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

2025 |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of dollars, except percentages) |

| Performance and Essential Materials Segment |

|

|

|

|

|

|

|

|

|

|

Income (loss) from operations |

|

$ |

(318) |

|

|

$ |

(902) |

|

|

$ |

(9) |

|

|

$ |

(1,383) |

|

|

$ |

170 |

|

| Add: |

|

|

|

|

|

|

|

|

|

|

Identified Items |

|

130 |

|

|

744 |

|

|

75 |

|

|

874 |

|

|

75 |

|

Income (loss) from operations excl. Identified Items |

|

(188) |

|

|

(158) |

|

|

66 |

|

|

(509) |

|

|

245 |

|

| Add: |

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

236 |

|

|

238 |

|

|

225 |

|

|

701 |

|

|

669 |

|

| Other income, net |

|

4 |

|

|

10 |

|

|

6 |

|

|

23 |

|

|

27 |

|

EBITDA excl. Identified Items |

|

52 |

|

|

90 |

|

|

297 |

|

|

215 |

|

|

941 |

|

| Less: |

|

|

|

|

|

|

|

|

|

|

Identified Items |

|

130 |

|

|

744 |

|

|

75 |

|

|

874 |

|

|

75 |

|

EBITDA |

|

$ |

(78) |

|

|

$ |

(654) |

|

|

$ |

222 |

|

|

$ |

(659) |

|

|

$ |

866 |

|

| Net external sales |

|

$ |

1,793 |

|

|

$ |

1,747 |

|

|

$ |

2,019 |

|

|

$ |

5,390 |

|

|

$ |

5,963 |

|

Operating Income Margin |

|

(18)% |

|

(52)% |

|

—% |

|

(26)% |

|

3% |

Operating income margin excl. Identified Items |

|

(10)% |

|

(9)% |

|

3% |

|

(9)% |

|

4% |

| EBITDA Margin |

|

(4)% |

|

(37)% |

|

11% |

|

(12)% |

|

15% |

EBITDA margin excl. Identified Items |

|

3% |

|

5% |

|

15% |

|

4% |

|

16% |

WESTLAKE CORPORATION

SUPPLEMENTAL INFORMATION

PRODUCT SALES PRICE AND VOLUME VARIANCE BY OPERATING SEGMENTS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third Quarter 2025 vs. Third Quarter 2024 |

|

Third Quarter 2025 vs. Second Quarter 2025 |

|

|

Average

Sales Price |

|

Volume |

|

Average

Sales Price |

|

Volume |

| Housing and Infrastructure Products |

|

-1 |

% |

|

— |

% |

|

— |

% |

|

-6 |

% |

| Performance and Essential Materials |

|

-7 |

% |

|

-6 |

% |

|

-4 |

% |

|

+1 |

% |

| Company |

|

-5 |

% |

|

-4 |

% |

|

-2 |

% |

|

-1 |

% |