Document

Management's discussion and analysis

February 13, 2025

This management's discussion and analysis (MD&A) contains information to help the reader make investment decisions about TC Energy Corporation (TC Energy). It discusses our business, operations, financial position, risks and other factors for the year ended December 31, 2024.

This MD&A should also be read in conjunction with our December 31, 2024 audited Consolidated financial statements and notes for the same period, which have been prepared in accordance with U.S. GAAP.

Contents

|

|

|

|

|

|

|

|

|

| ABOUT THIS DOCUMENT |

|

| ABOUT OUR BUSINESS |

|

| |

• Our core businesses |

|

| |

• Our strategy |

|

|

• 2024 Financial highlights |

|

|

•Non-GAAP measures |

|

|

•Supplementary financial measure |

|

|

• Outlook |

|

|

• Capital program |

|

| NATURAL GAS PIPELINES BUSINESS |

|

| CANADIAN NATURAL GAS PIPELINES |

|

| U.S. NATURAL GAS PIPELINES |

|

| MEXICO NATURAL GAS PIPELINES |

|

| POWER AND ENERGY SOLUTIONS |

|

| CORPORATE |

|

FOREIGN EXCHANGE |

|

FINANCIAL CONDITION |

|

DISCONTINUED OPERATIONS |

|

|

• Non-GAAP measures |

|

| OTHER INFORMATION |

|

| |

• Risk oversight and enterprise risk management |

|

| |

• Controls and procedures |

|

| |

• Critical accounting estimates |

|

| |

• Financial instruments |

|

|

• Related party transactions |

|

| |

• Accounting changes |

|

| |

• Quarterly results |

|

| GLOSSARY |

|

TC Energy Management's discussion and analysis 2024 | 9

About this document

Throughout this MD&A, the terms we, us, our and TC Energy mean TC Energy Corporation and its subsidiaries. Abbreviations and acronyms that are not defined in the document are defined in the glossary on page 138. All information is as of February 13, 2025 and all amounts are in Canadian dollars, unless noted otherwise.

On July 27, 2023, TC Energy announced plans to separate into two independent, investment-grade, publicly listed companies through the spinoff of its Liquids Pipelines business. TC Energy shareholders voted to approve the spinoff in June 2024 and, on October 1, 2024, TC Energy completed the spinoff of its Liquids Pipelines business into a new public company, South Bow Corporation (South Bow)(the Spinoff Transaction). Upon completion of the Spinoff Transaction, the Liquids Pipelines business was accounted for as a discontinued operation. To allow for a meaningful comparison, discussions throughout this MD&A are based on continuing operations unless otherwise noted. Prior year results have been recast to reflect the split between continuing and discontinued operations. Discontinued operations reflect nine months of Liquids Pipelines earnings for the year ended December 31, 2024 compared to a full year of Liquids Pipelines earnings in 2023 and 2022. Refer to Note 4, Discontinued operations, of our 2024 Consolidated financial statements for additional information.

FORWARD-LOOKING INFORMATION

We disclose forward-looking information to help the reader understand management's assessment of our future plans and financial outlook and our future prospects overall.

Statements that are forward looking are based on certain assumptions and on what we know and expect today and generally include words like anticipate, expect, believe, may, will, should, estimate or other similar words.

Forward-looking statements in this MD&A include information about the following, among other things:

•our financial and operational performance, including the performance of our subsidiaries

•expectations about strategies and goals for growth and expansion, including acquisitions

•expected cash flows and future financing options available along with portfolio management

•expectations regarding the size, structure, timing, conditions and outcome of ongoing and future transactions

•expected dividend growth

•expected access to and cost of capital

•expected energy demand levels

•expected costs and schedules for planned projects, including projects under construction and in development

•expected capital expenditures, contractual obligations, commitments and contingent liabilities, including environmental remediation costs

•expected regulatory processes and outcomes

•expected outcomes with respect to legal proceedings, including arbitration and insurance claims

•expected impact of future tax and accounting changes

•commitments and targets contained in our Report on Sustainability and GHG Emissions Reduction Plan, including statements related to our GHG emissions intensity reduction goals

•expected industry, market and economic conditions, and ongoing trade negotiations, including their impact on our customers and suppliers.

Forward-looking statements do not guarantee future performance. Actual events and results could be significantly different because of assumptions, risks or uncertainties related to our business or events that happen after the date of this MD&A.

10 | TC Energy Management's discussion and analysis 2024

Our forward-looking information is based on the following key assumptions and subject to the following risks and uncertainties:

Assumptions

•realization of expected benefits from acquisitions and divestitures, including the Spinoff Transaction

•regulatory decisions and outcomes

•planned and unplanned outages and the utilization of our pipelines, power and storage assets

•integrity and reliability of our assets

•anticipated construction costs, schedules and completion dates

•access to capital markets, including portfolio management

•expected industry, market and economic conditions, including the impact of these on our customers and suppliers

•inflation rates, commodity and labour prices

•interest, tax and foreign exchange rates

•nature and scope of hedging.

Risks and uncertainties

•realization of expected benefits from acquisitions and divestitures, including the Spinoff Transaction

•our ability to successfully implement our strategic priorities, including the Focus Project, and whether they will yield the expected benefits

•our ability to implement a capital allocation strategy aligned with maximizing shareholder value

•operating performance of our pipelines, power generation and storage assets

•amount of capacity sold and rates achieved in our pipeline businesses

•amount of capacity payments and revenues from power generation assets due to plant availability

•production levels within supply basins

•construction and completion of capital projects

•cost, availability of, and inflationary pressures on, labour, equipment and materials

•availability and market prices of commodities

•access to capital markets on competitive terms

•interest, tax and foreign exchange rates

•performance and credit risk of our counterparties

•regulatory decisions and outcomes of legal proceedings, including arbitration and insurance claims

•our ability to effectively anticipate and assess changes to government policies and regulations, including those related to the environment

•our ability to realize the value of tangible assets and contractual recoveries

•competition in the businesses in which we operate

•unexpected or unusual weather

•acts of civil disobedience

•cybersecurity and technological developments

•sustainability-related risks including climate-related risks and the impact of energy transition on our business

•economic and political conditions, and ongoing trade negotiations in North America, as well as globally

•global health crises, such as pandemics and epidemics, and the impacts related thereto.

You can read more about these factors and others in this MD&A and in other reports we have filed with Canadian securities regulators and the SEC.

As actual results could vary significantly from the forward-looking information, you should not put undue reliance on forward-looking information and should not use future-oriented information or financial outlooks for anything other than their intended purpose. We do not update our forward-looking statements due to new information or future events unless we are required to by law.

FOR MORE INFORMATION

You can find more information about TC Energy in our Annual Information Form and other disclosure documents, which are available on SEDAR+ (www.sedarplus.ca).

TC Energy Management's discussion and analysis 2024 | 11

About our business

With over 70 years of experience, TC Energy is a leader in the responsible development and reliable operation of North American energy infrastructure, including natural gas pipelines, power generation and natural gas storage facilities.

12 | TC Energy Management's discussion and analysis 2024

OUR CORE BUSINESSES

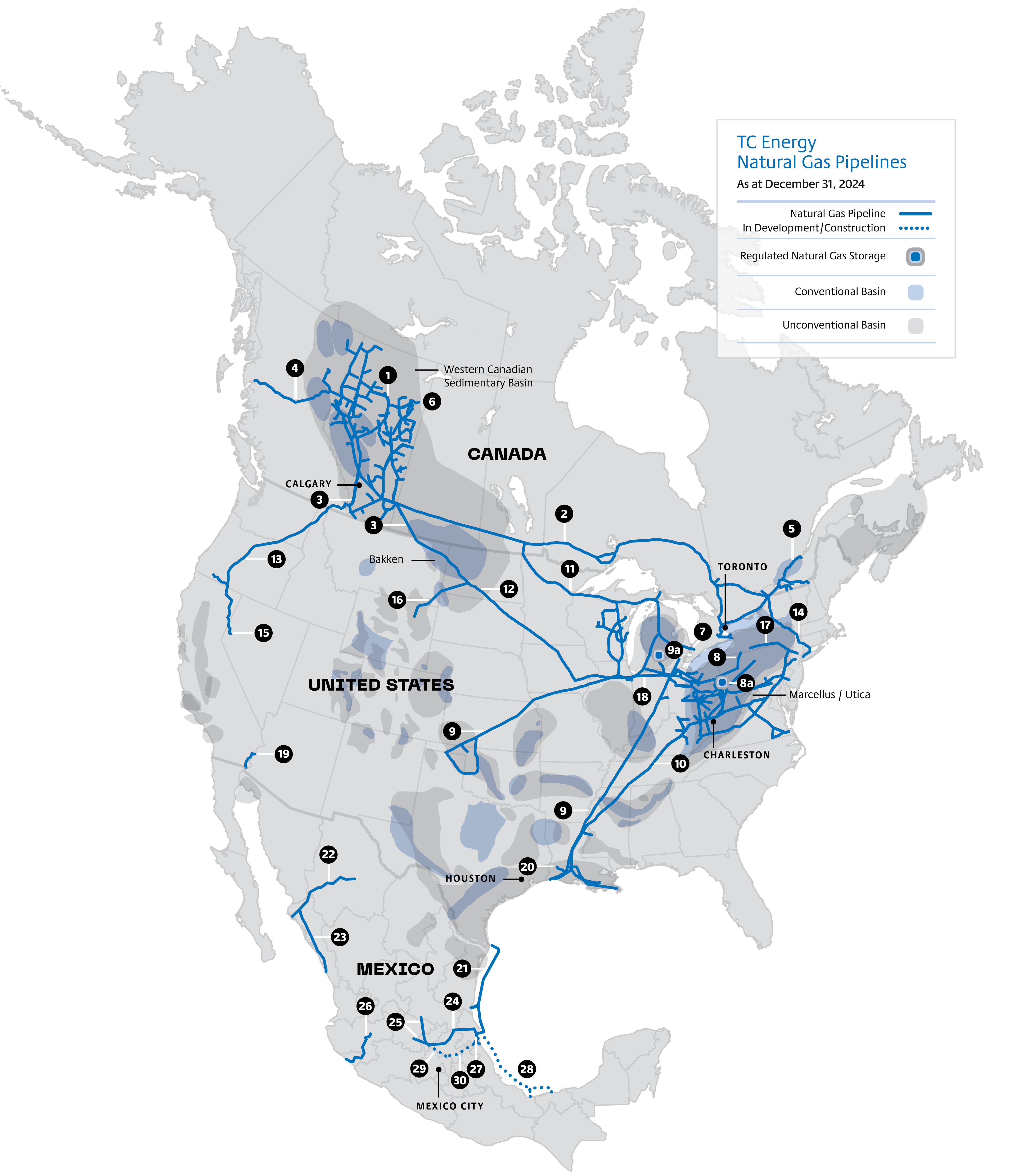

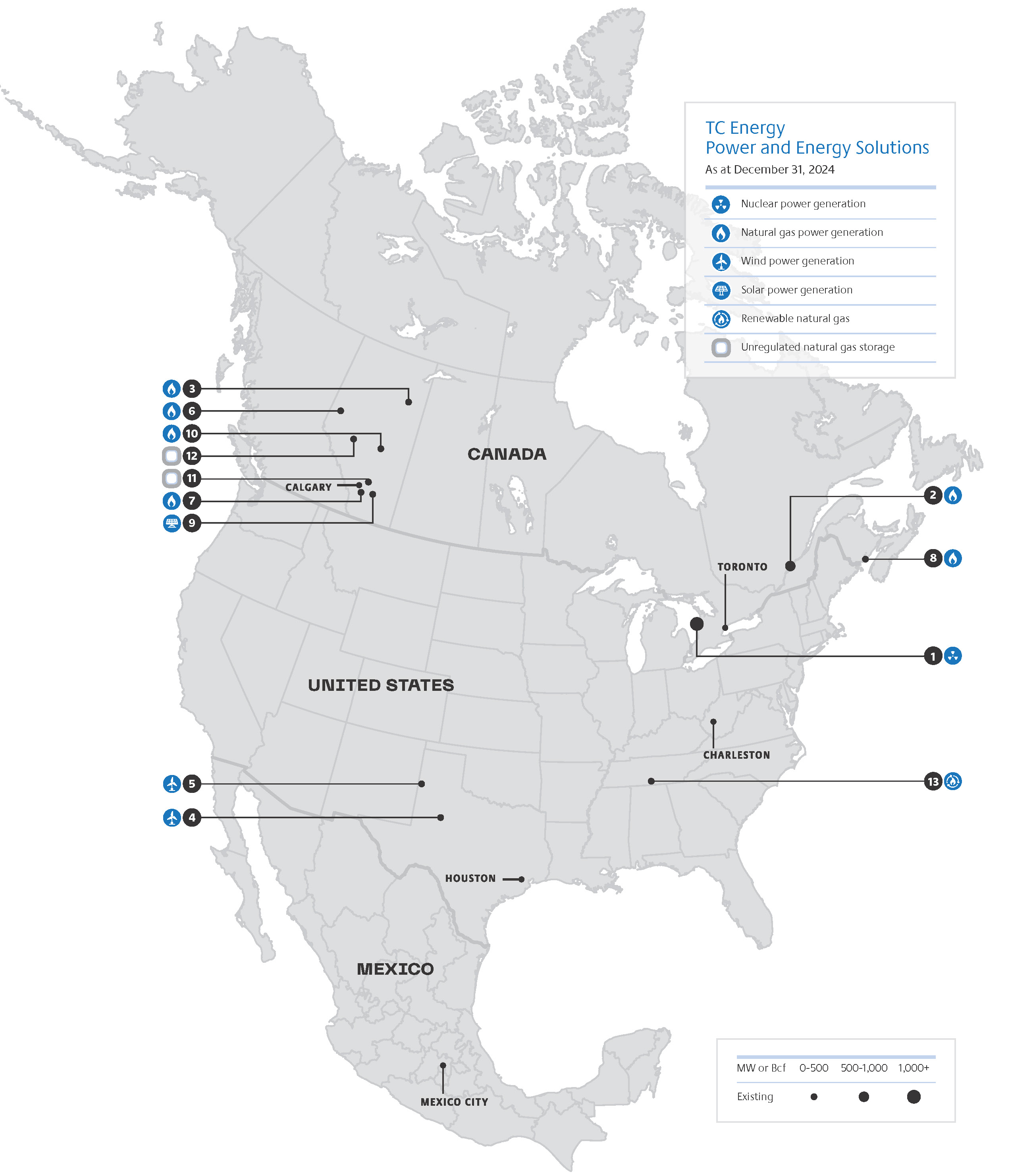

We operate in two core businesses – Natural Gas Pipelines and Power and Energy Solutions. In order to provide information that is aligned with how management decisions about our businesses are made and how performance of our businesses is assessed, our results are reflected in four operating segments: Canadian Natural Gas Pipelines, U.S. Natural Gas Pipelines, Mexico Natural Gas Pipelines and Power and Energy Solutions. We also have a Corporate segment consisting of corporate and administrative functions that provide governance, financing and other support to TC Energy's business segments.

TC Energy completed the Spinoff Transaction on October 1, 2024 and subsequently accounted for the Liquids Pipelines business as a discontinued operation. Refer to the Discontinued operations section on page 94 for additional information.

Year at-a-glance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| at December 31 |

|

|

| (millions of $) |

2024 |

|

2023¹ |

|

|

|

|

|

| Total assets by segment |

|

|

|

|

| Canadian Natural Gas Pipelines |

|

31,167 |

|

|

29,782 |

|

| U.S. Natural Gas Pipelines |

|

56,304 |

|

|

50,499 |

|

| Mexico Natural Gas Pipelines |

|

15,995 |

|

|

12,003 |

|

| Power and Energy Solutions |

|

10,217 |

|

|

9,525 |

|

| Corporate |

|

4,189 |

|

|

7,715 |

|

|

|

117,872 |

|

|

109,524 |

|

Discontinued Operations |

|

371 |

|

|

15,510 |

|

|

|

118,243 |

|

|

125,034 |

|

1 Prior year results have been recast to reflect the split between continuing and discontinued operations.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| year ended December 31 |

|

|

|

|

| (millions of $) |

2024 |

|

2023 |

|

|

|

|

|

Total revenues from continuing operations by segment1 |

|

|

|

|

| Canadian Natural Gas Pipelines |

|

5,600 |

|

|

5,173 |

|

| U.S. Natural Gas Pipelines |

|

6,339 |

|

|

6,229 |

|

Mexico Natural Gas Pipelines |

|

870 |

|

|

846 |

|

| Power and Energy Solutions |

|

954 |

|

|

1,019 |

|

Corporate |

|

8 |

|

|

— |

|

|

|

13,771 |

|

|

13,267 |

|

1 Excludes revenues of $2,217 million and $2,667 million for the years ended December 31, 2024 and 2023, respectively, related to discontinued operations, which represents nine months of Liquids Pipelines earnings in 2024 compared to a full year of Liquids Pipelines earnings in 2023.

TC Energy Management's discussion and analysis 2024 | 13

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| year ended December 31 |

|

|

|

|

| (millions of $) |

2024 |

|

2023 |

|

|

|

|

|

Comparable EBITDA from continuing operations by segment1,2 |

|

|

|

|

| Canadian Natural Gas Pipelines |

|

3,388 |

|

|

3,335 |

|

| U.S. Natural Gas Pipelines |

|

4,511 |

|

|

4,385 |

|

| Mexico Natural Gas Pipelines |

|

999 |

|

|

805 |

|

| Power and Energy Solutions |

|

1,214 |

|

|

1,020 |

|

| Corporate |

|

(63) |

|

|

(73) |

|

|

|

10,049 |

|

|

9,472 |

|

1 Comparable EBITDA is a non-GAAP measure and does not have any standardized meaning as prescribed by U.S. GAAP and therefore may not be comparable to similar measures presented by other companies. The most directly comparable GAAP measure is segmented earnings (losses). Refer to the Financial results sections for each business segment for a reconciliation to comparable EBITDA as well as the About our business - Non-GAAP measures section for additional information.

2 Excludes Comparable EBITDA from discontinued operations of $1,145 million and $1,516 million for the years ended December 31, 2024 and 2023, respectively, which represents nine months of Liquids Pipelines earnings in 2024 compared to a full year of Liquids Pipelines earnings in 2023. For further information on the reconciliation of segmented earnings to comparable EBITDA, refer to the Financial results sections for each business segment and the Discontinued operations section.

14 | TC Energy Management's discussion and analysis 2024

OUR STRATEGY

Our vision is to be the trusted leader in North America’s energy infrastructure, committed to excellence in safety, performance and stakeholder relationships. Our mission is to safely and efficiently move, generate and store the critical energy that North America and the world rely on. We are a team of energy problem solvers working to deliver energy in a safe, reliable, secure and affordable manner, while seeking to uphold our value proposition: to deliver solid growth with low risk and repeatable performance, year after year.

Our business consists of natural gas transportation and storage, as well as power generation assets:

•we deliver natural gas to Canada, the U.S. and Mexico, including to export terminals that ship LNG globally

•we generate electricity in Canada and the U.S., primarily from nuclear energy, but also from natural gas, wind and solar assets

•we store natural gas in Canada and the U.S. through regulated and non-regulated businesses.

These long-life infrastructure assets are anchored by our conservative risk preferences and are generally supported by long-term commercial arrangements and/or rate regulation. We believe that our assets will generate predictable and sustainable cash flows and earnings, providing the cornerstones of our low-risk value proposition. Our long-term strategy is driven by the following key beliefs:

•natural gas will continue to play a pivotal role in North America's energy future and support global GHG emissions reduction

•the need for reliable, on-demand energy sources will continue to grow

•energy assets will become increasingly valuable in a world with growing energy demand and existing challenges in developing new infrastructure.

Allocation of comparable EBITDA from continuing operations1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| year ended December 31 |

|

2024 |

|

2023² |

|

|

|

|

|

|

|

|

|

Comparable EBITDA from continuing operations by segment3 |

|

|

|

|

|

|

| Canadian Natural Gas Pipelines |

|

33 |

% |

|

35 |

% |

|

|

| U.S. Natural Gas Pipelines |

|

45 |

% |

|

46 |

% |

|

|

| Mexico Natural Gas Pipelines |

|

10 |

% |

|

8 |

% |

|

|

| Power and Energy Solutions |

|

12 |

% |

|

11 |

% |

|

|

|

|

100 |

% |

|

100 |

% |

|

|

1 Refer to the Financial highlights section for an allocation of segmented earnings by business segment.

2 Prior year results have been recast to reflect continuing operations only.

3 Excludes losses from Corporate comparable EBITDA from continuing operations of $63 million and $73 million for the years ended December 31, 2024 and 2023, respectively.

Our asset mix will continue to evolve with the North American energy mix. We anticipate the following trends in capital allocation over the next several years:

•Natural Gas Pipelines will continue to attract capital to meet growing customer demand, driven by coal-to-gas conversion, LNG exports and data centre buildouts

•Power and Energy Solutions' capital will primarily be allocated to extending the life and increasing the capacity of the nuclear business. We will make measured investment in emerging technologies to develop capabilities that are complementary to our core businesses, without taking significant commodity price risk, volumetric risk or utilizing unproven technologies

•additional discretionary investment will fund select high-grade opportunities in our development projects portfolio and incremental opportunities around existing assets across our businesses.

TC Energy Management's discussion and analysis 2024 | 15

Key components of our strategy

Maximize the value of our assets through safety and operational excellence

•Maintaining safe and reliable operations by maximizing availability of assets and ensuring asset integrity, while minimizing environmental impacts, continues to be the foundation of our business

•Our extensive network of natural gas pipeline assets connect long-life, low-cost supply basins with premium North American and export markets, which we believe will generate predictable and sustainable cash flows and earnings

•Our power and non-regulated storage assets are primarily under long-term contracts that provide stable cash flows and earnings

•We continually seek to enhance and protect the value of each of our assets using operational, commercial and other levers while pursuing revenue enhancements such as creating additional capacity in our systems and leveraging commercial marketing activities.

Execute our selective portfolio of growth projects

•Safety, executability, profitability and reliability are fundamental to our investments

•We develop high quality, long-life assets, largely underpinned by long-term contracts or rate regulation. We expect that these investments will contribute to incremental earnings and cash flows as they are placed in service

•We believe that our incumbent positions in regions with natural gas and power demand growth are expected to present us with a steady cadence of growth opportunities

•We strive to develop projects and manage construction risk in a disciplined manner that maximizes capital efficiency and returns to shareholders

•We seek to prudently manage development costs, minimizing capital at risk in a project's early stages

•We rely on our experience, as well as our policy, regulatory, commercial, financial, legal and operational expertise to permit, fund, build and integrate new pipelines and other energy infrastructure

•We will advance selected opportunities, including lower carbon growth initiatives, in emerging sub-sectors where we are likely to build a strong competitive position, market conditions are appropriate, technology is proven and project risks and returns are known and acceptable.

Ensure financial strength and agility

•Disciplined capital allocation supports our ability to maximize asset value over the short, medium and long term while protecting and growing our network of assets. We seek to allocate capital in a manner that improves the cost competitiveness and returns of our portfolio, while extending the life of our assets

•Our capital allocation process is designed to ensure that we remain within the annual target for net capital spend, while maximizing the expected returns of the projects that we sanction

•We assess opportunities to develop and acquire energy infrastructure that complements our existing portfolio, protects and grows our business, enhances future resilience under a changing energy mix and diversifies access to attractive supply and market regions within our risk preferences

•We monitor trends specific to energy supply and demand fundamentals, in addition to analyzing how our portfolio performs under different energy mix scenarios. This enables the identification of opportunities that we believe will contribute to our resilience, strengthen our asset base and/or improve diversification

•We believe that our high-quality, diversified portfolio of energy infrastructure assets results in predictable, low-risk cash flows and positions us well to succeed under various energy transition scenarios and across all economic cycles

•We continually seek to enhance our core competencies in safety, operational excellence, investment opportunity origination, project execution, stakeholder relations and sustainability to ensure we deliver shareholder value.

16 | TC Energy Management's discussion and analysis 2024

How we operate our business

The need for safe, reliable, secure and affordable energy solutions has become increasingly important. Decades of experience in the energy infrastructure business, a disciplined approach to project management and a proven capital allocation model result in a solid competitive position as we remain focused on our purpose – to connect the world to the energy it needs. We will do this through:

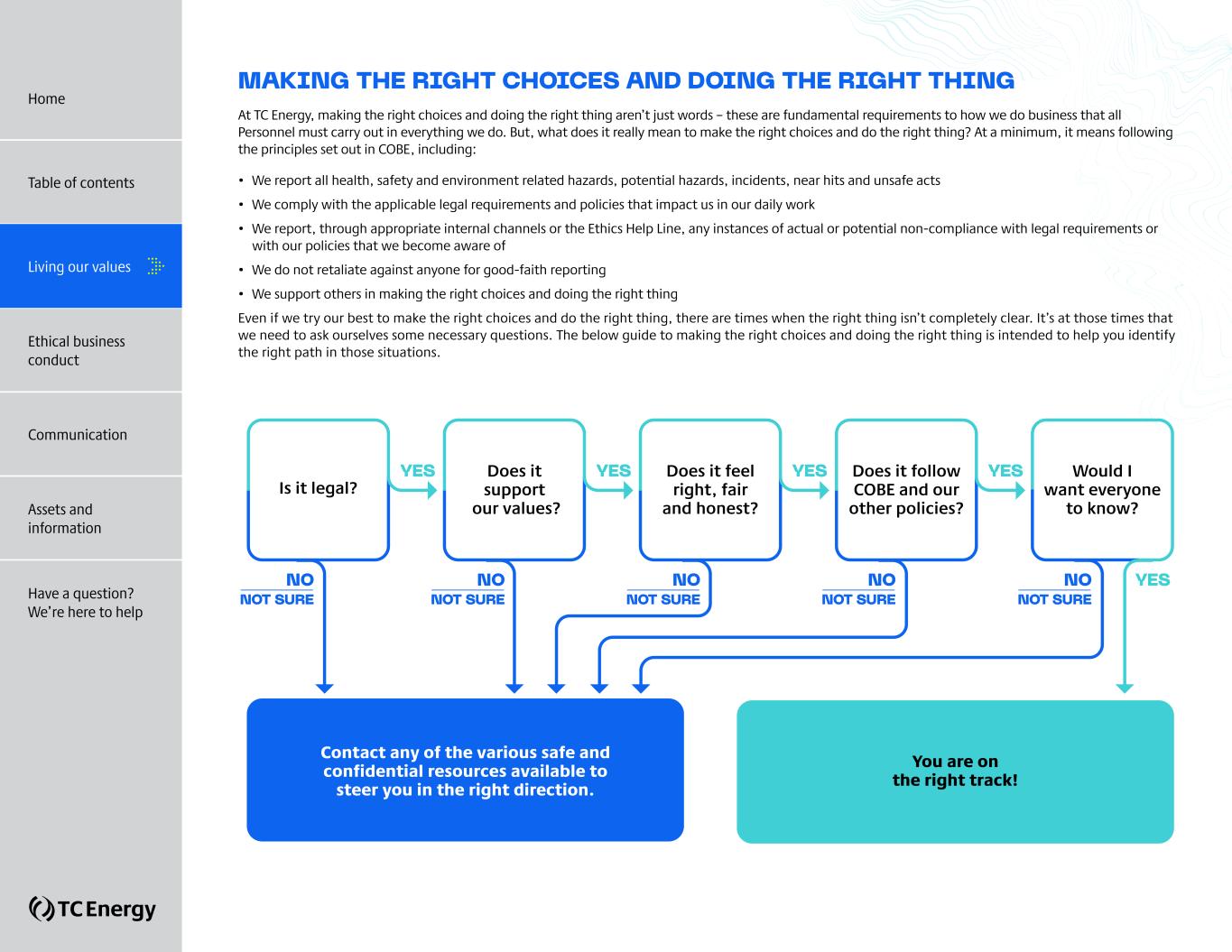

•strong leadership and governance: we maintain rigorous governance over our approach to business ethics, enterprise risk management, competitive behaviour, operating capabilities and strategy development, as well as regulatory, legal, commercial, stakeholder and financing support

•a high-quality portfolio: the strategic advantage supporting our vision is our extensive asset footprint in an industry with high barriers to entry. Our low-risk portfolio of assets offers the scale to provide essential and highly competitive infrastructure services, enabling us to maximize the full-life value of our investments throughout all points of the business cycle. Our platforms not only provide a diversified portfolio but also position TC Energy as a leader in the energy infrastructure sector. Our synergistic footprint supports both molecules and electrons, providing us flexibility to allocate capital towards natural gas, electrification or other emerging lower-carbon technologies that are complementary to our core businesses

•disciplined operations: our workforce is highly skilled in designing, building and operating energy infrastructure with a focus on safety and operational excellence and a commitment to the environment in the communities we serve that is suited to both today's environment, as well as an evolving energy industry

•financial positioning: we exhibit consistently strong financial performance, long-term stability and profitability, along with a disciplined approach to capital investment. We can access competitively-priced capital to support new investments while preserving financial flexibility, including portfolio management, to fund our operations in all market conditions. We aim to deliver a balance of dividend income and share price growth

•proven ability to adapt: we have a long track record of turning policy and technology changes into opportunities – for example, re-entering Mexico when the country shifted from fuel oil to natural gas, reversing pipeline flows in response to the shale gas revolution, installing electric compression and/or switching gas compression to electrification and currently assessing development of grid-scale, flexible and clean energy storage

•commitment to sustainability: we take a long-term view to managing our interactions with the environment, Indigenous groups, community members and landowners. We aim to communicate transparently to all rights holders and stakeholders on sustainability-related topics and publish annually our corporate GHG emissions intensity in our Report on Sustainability. We continue to focus on our sustainability commitments, which reflect the interests of our business, Indigenous rights holders and stakeholders; positioning us for long-term success. We are committed to collectively advancing a lower-emissions energy system and expect to provide an update on our interim GHG emission reduction target in 2025 to reflect the impact of the Liquids Pipelines business spinoff and projected increased utilization across our systems. We remain focused on our long-term goal of positioning to reach net-zero emissions from our operations by 2050 and acknowledge that achieving this goal requires accelerated changes in global energy policies, regulations and support for new technologies. We continue to focus on our nine sustainability commitments and associated metrics and targets that help ensure our business is well positioned for long-term success

•open communication: we carefully manage relationships with our customers, suppliers, regulators and other stakeholders and offer clear, candid communication to investors in order to build trust and support

•culture and people: our people are our most important asset and living our company values of safety, personal accountability, working as one team and active learning. These values shape how we do business and, in turn, deliver on our commitments.

TC Energy Management's discussion and analysis 2024 | 17

Our risk preferences

The following is an overview of our risk philosophy:

•financial strength and flexibility: rely on internally generated cash flows, existing debt capacity, partnerships and portfolio management to finance new initiatives

•known and acceptable project risks: select investments with known, acceptable and manageable project execution risk, including stakeholder considerations, partnership agreements, human capital and capability constraints

•business underpinned by strong fundamentals and policy support: invest in assets that are investment-grade on a stand-alone basis with stable cash flows supported by strong underlying macroeconomic fundamentals, conducive policy and regulations and/or long-term contracts with creditworthy counterparties

•manage credit metrics to ensure "top-end" sector ratings: solid investment-grade ratings are an important competitive advantage and TC Energy will seek to ensure our credit profile remains at the top end of our sector while balancing the interests of equity and fixed income investors

•prudent management of counterparty exposure: limit counterparty concentration and sovereign risk; seek diversification and solid commercial arrangements underpinned by strong fundamentals.

18 | TC Energy Management's discussion and analysis 2024

2024 FINANCIAL HIGHLIGHTS

We use certain financial measures that do not have a standardized meaning under GAAP because we believe they improve our ability to compare results between reporting periods and enhance understanding of our operating performance. Known as non-GAAP measures, they may not be comparable to similar measures provided by other companies.

Comparable EBITDA, comparable earnings and comparable earnings per common share from continuing and discontinued operations and comparable funds generated from operations are all non-GAAP measures. Refer to page 24 for more information about the non-GAAP measures we use, as well as the Financial results section in each business segment and Discontinued operations section for reconciliations to the most directly comparable GAAP measures.

As discussed on page 10 of the About this document section, results of the Liquids Pipelines business are reported as a discontinued operation. To allow for a meaningful comparison, discussions throughout this MD&A are based on continuing operations unless otherwise noted. Prior year results have been recast to reflect the split between continuing and discontinued operations. Discontinued operations reflect nine months of Liquids Pipelines earnings for the year ended December 31, 2024 compared to a full year of Liquids Pipelines earnings in 2023 and 2022. Refer to the Discontinued operations section for additional information.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| year ended December 31 |

|

|

|

|

|

|

| (millions of $, except per share amounts) |

|

2024 |

|

2023¹ |

|

2022¹ |

|

|

|

|

|

|

|

| Income |

|

|

|

|

|

|

Revenues |

|

13,771 |

|

|

13,267 |

|

|

12,309 |

|

|

|

|

|

|

|

|

| Net income (loss) attributable to common shares |

|

4,594 |

|

|

2,829 |

|

|

641 |

|

from continuing operations |

|

4,199 |

|

|

2,217 |

|

|

8 |

|

from discontinued operations2 |

|

395 |

|

|

612 |

|

|

633 |

|

|

|

|

|

|

|

|

| Net income (loss) per common share – basic |

|

$4.43 |

|

|

$2.75 |

|

|

$0.64 |

|

from continuing operations |

|

$4.05 |

|

|

$2.15 |

|

|

$0.01 |

|

from discontinued operations2 |

|

$0.38 |

|

|

$0.60 |

|

|

$0.63 |

|

|

|

|

|

|

|

|

Comparable EBITDA3 |

|

11,194 |

|

|

10,988 |

|

|

9,901 |

|

| from continuing operations |

|

10,049 |

|

|

9,472 |

|

|

8,483 |

|

from discontinued operations2 |

|

1,145 |

|

|

1,516 |

|

|

1,418 |

|

|

|

|

|

|

|

|

Comparable earnings3 |

|

4,430 |

|

|

4,652 |

|

|

4,279 |

|

from continuing operations |

|

3,865 |

|

|

3,896 |

|

|

3,618 |

|

from discontinued operations2 |

|

565 |

|

|

756 |

|

|

661 |

|

|

|

|

|

|

|

|

Comparable earnings per common share3 |

|

$4.27 |

|

|

$4.52 |

|

|

$4.30 |

|

from continuing operations |

|

$3.73 |

|

|

$3.78 |

|

|

$3.64 |

|

from discontinued operations2 |

|

$0.54 |

|

|

$0.74 |

|

|

$0.66 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1Prior year results have been recast to reflect the split between continuing and discontinued operations.

2Represents nine months of Liquids Pipelines earnings in 2024 compared to a full year of Liquids Pipelines earnings in 2023 and 2022. Refer to the Discontinued operations section for additional information.

3Additional information on the most directly comparable GAAP measure can be found on page 24.

TC Energy Management's discussion and analysis 2024 | 19

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| year ended December 31 |

|

|

|

|

|

|

(millions of $) |

|

2024 |

|

2023 |

|

2022 |

|

|

|

|

|

|

|

Cash flows1 |

|

|

|

|

|

|

Net cash provided by operations2 |

|

7,696 |

|

|

7,268 |

|

|

6,375 |

|

|

|

|

|

|

|

|

Comparable funds generated from operations2,3 |

|

7,890 |

|

|

7,980 |

|

|

7,353 |

|

|

|

|

|

|

|

|

Capital spending4 |

|

7,904 |

|

|

12,298 |

|

|

8,961 |

|

| Acquisitions, net of cash acquired |

|

— |

|

|

(307) |

|

|

— |

|

| Proceeds from sales of assets, net of transaction costs |

|

791 |

|

|

33 |

|

|

— |

|

Disposition of equity interest, net of transaction costs5 |

|

419 |

|

|

5,328 |

|

|

— |

|

1Includes continuing and discontinued operations.

2Represents nine months of Liquids Pipelines earnings in 2024 compared to a full year of Liquids Pipelines earnings in 2023 and 2022. Refer to the Discontinued operations section for additional information.

3Additional information on the most directly comparable GAAP measure can be found on page 24.

4Capital spending reflects cash flows associated with our Capital expenditures, Capital projects in development and Contributions to equity investments net of Other distributions from equity investments of $3.1 billion in 2024 in the Canadian Natural Gas Pipelines segment (2023 - nil, 2022 - $1.2 billion in the Corporate segment). Refer to Note 5, Segmented information, Note 7, Coastal GasLink and Note 12, Loans receivable from affiliates, of our 2024 Consolidated financial statements for additional information.

5Included in the Financing activities section of the Consolidated statement of cash flows, of our 2024 Consolidated financial statements.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

at December 31 (unless otherwise noted) |

|

|

|

|

|

|

| (millions of $, except per share amounts) |

|

2024 |

|

2023 |

|

2022 |

|

|

|

|

|

|

|

Balance sheet |

|

|

|

|

|

|

Total assets1 |

|

118,243 |

|

|

125,034 |

|

|

114,348 |

|

| Long-term debt, including current portion |

|

47,931 |

|

|

52,914 |

|

|

41,543 |

|

| Junior subordinated notes |

|

11,048 |

|

|

10,287 |

|

|

10,495 |

|

| Preferred shares |

|

2,499 |

|

|

2,499 |

|

|

2,499 |

|

| Non-controlling interests |

|

10,768 |

|

|

9,455 |

|

|

126 |

|

| Common shareholders' equity |

|

25,093 |

|

|

27,054 |

|

|

31,491 |

|

|

|

|

|

|

|

|

Dividends declared2 |

|

|

|

|

|

|

per common share3 |

|

$3.7025 |

|

|

$3.72 |

|

|

$3.60 |

|

|

|

|

|

|

|

|

Basic common shares (millions) |

|

|

|

|

|

|

– weighted average for the year ended |

|

1,038 |

|

|

1,030 |

|

|

995 |

|

| – issued and outstanding at end of year |

|

1,039 |

|

|

1,037 |

|

|

1,018 |

|

1At December 31, 2024, includes assets of $371 million (2023 - $15,510 million; 2022 - $15,587 million), related to discontinued operations. Refer to Note 4, Discontinued operations, of our 2024 Consolidated financial statements for additional information.

2For the year ended.

3Dividends declared in fourth quarter 2024 reflect TC Energy’s proportionate allocation following the Spinoff Transaction. Refer to the Discontinued operations section for additional information.

20 | TC Energy Management's discussion and analysis 2024

Consolidated results

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| year ended December 31 |

|

|

|

|

|

|

| (millions of $, except per share amounts) |

|

2024 |

|

2023¹ |

|

2022¹ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Canadian Natural Gas Pipelines |

|

2,016 |

|

|

(90) |

|

|

(1,440) |

|

| U.S. Natural Gas Pipelines |

|

4,053 |

|

|

3,531 |

|

|

2,617 |

|

| Mexico Natural Gas Pipelines |

|

929 |

|

|

796 |

|

|

491 |

|

| Power and Energy Solutions |

|

1,102 |

|

|

1,004 |

|

|

833 |

|

| Corporate |

|

(136) |

|

|

(144) |

|

|

(51) |

|

| Total segmented earnings (losses) |

|

7,964 |

|

|

5,097 |

|

|

2,450 |

|

Interest expense |

|

(3,019) |

|

|

(2,966) |

|

|

(2,300) |

|

| Allowance for funds used during construction |

|

784 |

|

|

575 |

|

|

369 |

|

Foreign exchange gains (losses), net |

|

(147) |

|

|

320 |

|

|

(185) |

|

| Interest income and other |

|

324 |

|

|

272 |

|

|

140 |

|

Income (loss) from continuing operations before income taxes |

|

5,906 |

|

|

3,298 |

|

|

474 |

|

Income tax (expense) recovery from continuing operations |

|

(922) |

|

|

(842) |

|

|

(322) |

|

Net income (loss) from continuing operations |

|

4,984 |

|

|

2,456 |

|

|

152 |

|

Net income (loss) from discontinued operations, net of tax2 |

|

395 |

|

|

612 |

|

|

633 |

|

Net income (loss) |

|

5,379 |

|

|

3,068 |

|

|

785 |

|

Net (income) loss attributable to non-controlling interests |

|

(681) |

|

|

(146) |

|

|

(37) |

|

Net income (loss) attributable to controlling interests |

|

4,698 |

|

|

2,922 |

|

|

748 |

|

| Preferred share dividends |

|

(104) |

|

|

(93) |

|

|

(107) |

|

Net income (loss) attributable to common shares |

|

4,594 |

|

|

2,829 |

|

|

641 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per common share – basic |

|

$4.43 |

|

|

$2.75 |

|

|

$0.64 |

|

from continuing operations |

|

$4.05 |

|

|

$2.15 |

|

|

$0.01 |

|

from discontinued operations2 |

|

$0.38 |

|

|

$0.60 |

|

|

$0.63 |

|

1Prior year results have been recast to reflect the split between continuing and discontinued operations.

2Represents nine months of Liquids Pipelines earnings in 2024 compared to a full year of Liquids Pipelines earnings in 2023 and 2022. Refer to the Discontinued operations section for additional information.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| year ended December 31 |

|

|

|

|

|

|

(millions of $) |

|

2024 |

|

2023¹ |

|

2022¹ |

|

|

|

|

|

|

|

Amounts attributable to common shares |

|

|

|

|

|

|

| Net income (loss) from continuing operations |

|

4,984 |

|

|

2,456 |

|

|

152 |

|

| Net (income) loss attributable to non-controlling interests |

|

(681) |

|

|

(146) |

|

|

(37) |

|

Net income (loss) attributable to controlling interests from continuing operations |

|

4,303 |

|

|

2,310 |

|

|

115 |

|

Preferred share dividends |

|

(104) |

|

|

(93) |

|

|

(107) |

|

Net income (loss) attributable to common shares from continuing operations |

|

4,199 |

|

|

2,217 |

|

|

8 |

|

Net income (loss) from discontinued operations, net of tax2 |

|

395 |

|

|

612 |

|

|

633 |

|

Net income (loss) attributable to common shares |

|

4,594 |

|

|

2,829 |

|

|

641 |

|

1Prior year results have been recast to reflect the split between continuing and discontinued operations.

2Represents nine months of Liquids Pipelines earnings in 2024 compared to a full year of Liquids Pipelines earnings in 2023 and 2022. Refer to the Discontinued operations section for additional information.

Net income attributable to common shares from continuing operations in 2024 was $4.2 billion or $4.05 per share (2023 – $2.2 billion or $2.15 per share; 2022 – $8 million or $0.01 per share), an increase of $2.0 billion or $1.90 per share compared to 2023 and an increase of $2.2 billion or $2.14 per share in 2023 compared to 2022. Refer to the About our business - Non-GAAP measures section for a listing of specific items included in Net income attributable to common shares from continuing operations, which have been excluded from our calculation of comparable measures.

Refer to the Discontinued operations - Non-GAAP measures section for a listing of specific items included in Net income (loss) from discontinued operations, net of tax, which have been excluded from our calculation of comparable measures.

TC Energy Management's discussion and analysis 2024 | 21

Cash flows

Net cash provided by operations of $7.7 billion in 2024 was six per cent higher than 2023 primarily due to higher funds generated from continuing operations and the amount and timing of working capital changes. Comparable funds generated from operations of $7.9 billion in 2024 were one per cent lower than 2023 primarily due to lower comparable earnings, partially offset by increased distributions from our equity investments.

Funds used in investing activities

Capital spending1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| year ended December 31 |

|

|

|

|

|

|

| (millions of $) |

|

2024 |

|

2023 |

|

2022 |

|

|

|

|

|

|

|

| Canadian Natural Gas Pipelines |

|

2,100 |

|

|

6,184 |

|

|

4,719 |

|

| U.S. Natural Gas Pipelines |

|

2,575 |

|

|

2,660 |

|

|

2,137 |

|

| Mexico Natural Gas Pipelines |

|

2,228 |

|

|

2,292 |

|

|

1,027 |

|

| Power and Energy Solutions |

|

824 |

|

|

1,080 |

|

|

894 |

|

| Corporate |

|

50 |

|

|

33 |

|

|

41 |

|

|

|

7,777 |

|

|

12,249 |

|

|

8,818 |

|

| Discontinued operations |

|

127 |

|

|

49 |

|

|

143 |

|

|

|

7,904 |

|

|

12,298 |

|

|

8,961 |

|

1Capital spending reflects cash flows associated with our Capital expenditures, Capital projects in development and Contributions to equity investments net of Other distributions from equity investments of $3.1 billion in 2024 in the Canadian Natural Gas Pipelines segment (2023 - nil, 2022 - $1.2 billion in the Corporate segment). Refer to Note 5, Segmented information, Note 7, Coastal GasLink and Note 12, Loans receivable from affiliates, of our 2024 Consolidated financial statements, for additional information.

In 2024 and 2023, we invested $7.9 billion and $12.3 billion, respectively, in capital projects to maintain and optimize the value of our existing assets and to develop new, complementary assets in high-demand areas. Our total capital spending in 2024 and 2023 included contributions of $1.5 billion (net of distributions) and $4.1 billion, respectively, to our equity investments, predominantly related to Coastal GasLink Limited Partnership (Coastal GasLink LP) and Bruce Power.

Proceeds from sales of assets

In 2024, TC Energy and its partner, Northern New England Investment Company, Inc., a subsidiary of Énergir L.P. (Énergir), completed the sale of Portland Natural Gas Transmission System (PNGTS) to a third party. Our share of the proceeds was $743 million (US$546 million), net of transaction costs.

In 2024, we also completed the sale of other non-core assets for gross proceeds of $48 million.

In 2023, we completed the sale of a 20.1 per cent equity interest in Port Neches Link LLC to its joint venture partner, Motiva Enterprises, for gross proceeds of $33 million (US$25 million). As part of the Spinoff Transaction on October 1, 2024, our remaining interest in Port Neches Link LLC was transferred to South Bow.

Acquisitions

In 2023, we acquired 100 per cent of the Class B Membership Interests in Fluvanna Wind Farm and Blue Cloud Wind Farm (Texas Wind Farms) for US$224 million, before post-closing adjustments.

Balance sheet

We continue to maintain a solid financial position while growing our total assets, excluding discontinued operations, by $8.3 billion in 2024. At December 31, 2024, common shareholders' equity and non-controlling interests, represented 37 per cent (2023 – 37 per cent) of our capital structure, while other subordinated capital, in the form of junior subordinated notes and preferred shares, represented an additional 14 per cent (2023 – 13 per cent). Refer to the Financial Condition section for additional information.

22 | TC Energy Management's discussion and analysis 2024

Dividends

Commencing with the dividends payable on January 31, 2025 to shareholders of record at the close of business on December 31, 2024, the amounts reflect TC Energy’s proportionate allocation following the Spinoff Transaction. Refer to the Discontinued operations section for additional information.

On February 14, 2025, we announced a quarterly dividend on our outstanding common shares of $0.85 per common share for the quarter ending March 31, 2025, which represents an increase of 3.3 per cent from TC Energy's proportionate allocation of the dividend following the Spinoff Transaction. This equates to an annual dividend of $3.40 per common share. This was the twenty-fifth consecutive year we have increased the dividend on our common shares and is consistent with our goal of growing our common share dividend at an average annual rate of three to five per cent.

Dividend reinvestment and share purchase plan

Under the DRP, eligible holders of common and preferred shares of TC Energy can reinvest their dividends and make optional cash payments to obtain additional TC Energy common shares. From August 31, 2022 to July 31, 2023, common shares were issued from treasury at a discount of two per cent to market prices over a specified period.

Commencing with the dividends declared on July 27, 2023, common shares purchased under TC Energy's DRP are acquired on the open market at 100 per cent of the weighted average purchase price.

Cash dividends paid

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| year ended December 31 |

|

|

|

|

|

|

| (millions of $) |

|

2024 |

|

2023 |

|

2022 |

|

|

|

|

|

|

|

| Common shares |

|

3,953 |

|

|

2,787 |

|

|

3,192 |

|

| Preferred shares |

|

99 |

|

|

92 |

|

|

106 |

|

TC Energy Management's discussion and analysis 2024 | 23

NON-GAAP MEASURES

This MD&A references non-GAAP measures, which are described in the table below. These measures do not have any standardized meaning as prescribed by GAAP and therefore may not be comparable to similar measures presented by other entities. These measures are reviewed regularly by our President and Chief Executive Officer, management and the Board of Directors in assessing our performance and making decisions regarding the ongoing operations of our business and its ability to generate cash flows. Some or all of these measures may also be used by investors and other external users of our financial statements as a supplemental measure to provide decision-useful information regarding our period-over-period performance and ability to generate earnings that are core to our ongoing operations. Discussions throughout this MD&A on the factors impacting comparable earnings before interest, taxes, depreciation and amortization (comparable EBITDA) and comparable earnings before interest and taxes (comparable EBIT) are consistent with the factors that impact segmented earnings, except where noted otherwise.

Comparable measures

We calculate comparable measures by adjusting certain GAAP measures for specific items we believe are significant but not reflective of our underlying operations in the period. Except as otherwise described herein, these comparable measures are calculated on a consistent basis from period to period and are adjusted for specific items in each period, as applicable.

Our decision to adjust for a specific item in reporting comparable measures is subjective and made after careful consideration. We maintain a consistent approach to adjustments, which generally fall into the categories described below:

•by their nature are unusual, infrequent and separately identifiable from our normal business operations and in our view are not reflective of our underlying operations in the period and generally include the following:

◦gains or losses on sales of assets or assets held for sale; impairment of goodwill, plant, property and equipment, equity investments and other assets; legal, contractual and other infrequent settlements; acquisition, integration and restructuring costs; expected credit loss provisions on net investment in leases and certain contract assets in Mexico; impacts resulting from changes in legislation and enacted tax rates and unusual tax refunds/payments and valuation allowance adjustments

•unrealized gains and losses related to fair value adjustments that do not reflect realized earnings or losses or cash impacts incurred in the current period from our underlying operations and generally include the following:

◦unrealized gains and losses from changes in the fair value of derivatives related to financial and commodity price risk management activities; unrealized fair value adjustments related to our proportionate share of Bruce Power’s risk management activities and its funds invested for post-retirement benefits; unrealized fair value adjustments on intercompany loans that impact consolidated earnings.

The following table identifies our non-GAAP measures against their most directly comparable GAAP measures. These measures are applicable to each of our continuing operations and discontinued operations. Quantitative reconciliations of our comparable measures to their GAAP measures and a discussion of specific adjustments made for 2024 and comparative periods can be found on pages 26 and 27, the Financial results section in each business segment, and the Financial condition section. Non-GAAP measures for discontinued operations are found in the Discontinued operations section on page 96.

|

|

|

|

|

|

| Non-GAAP measure |

GAAP measure |

|

|

| comparable EBITDA |

segmented earnings (losses) |

| comparable EBIT |

segmented earnings (losses) |

| comparable earnings |

net income (loss) attributable to common shares |

| comparable earnings per common share |

net income (loss) per common share |

| funds generated from operations |

net cash provided by operations |

| comparable funds generated from operations |

net cash provided by operations |

24 | TC Energy Management's discussion and analysis 2024

Comparable EBITDA and comparable EBIT

Comparable EBITDA represents segmented earnings (losses) adjusted for specific items described in the Comparable measures section, excluding charges for depreciation and amortization. We use comparable EBITDA as a measure of our earnings from ongoing operations as it is a useful indicator of our performance and is also presented on a consolidated basis. Comparable EBIT represents segmented earnings (losses) adjusted for specific items and is an effective tool for evaluating trends in each segment. Refer to each business segment and the Discontinued operations section for a reconciliation to segmented earnings (losses).

Funds generated from operations and comparable funds generated from operations

Funds generated from operations reflects net cash provided by operations before changes in operating working capital. The components of changes in working capital are disclosed in Note 29, Changes in operating working capital, of our 2024 Consolidated financial statements. Comparable funds generated from operations is adjusted for the cash impact of specific items described in the Comparable measures section. We believe funds generated from operations and comparable funds generated from operations are useful measures of our consolidated operating cash flows because they exclude fluctuations from working capital balances, which do not necessarily reflect underlying operations in the same period, and are used to provide a consistent measure of the cash-generating ability of our businesses. Refer to the Financial condition section for a reconciliation to Net cash provided by operations.

Comparable earnings and comparable earnings per common share

Comparable earnings represents earnings attributable to common shareholders on a consolidated basis, adjusted for specific items described in the Comparable measures section. Comparable earnings is comprised of segmented earnings (losses), Interest expense, AFUDC, Foreign exchange (gains) losses, net, Interest income and other, Income tax expense (recovery), Net income (loss) attributable to non-controlling interests and Preferred share dividends on our Consolidated statement of income, adjusted for specific items. We use comparable earnings as a measure of our earnings from ongoing operations as it is a useful indicator of our performance and is also presented on a consolidated basis. Refer to page 27 and the Discontinued operations section for reconciliations to Net income (loss) attributable to common shares and Net income (loss) per common share for our continuing operations and discontinued operations.

TC Energy Management's discussion and analysis 2024 | 25

Comparable earnings and comparable earnings per common share - from continuing operations

The following specific items were recognized in Net income (loss) attributable to common shares from continuing operations and were excluded from comparable earnings from continuing operations:

2024

•a pre-tax gain of $572 million (after-tax $456 million) related to the sale of PNGTS which was completed on August 15, 2024

•a pre-tax net gain on debt extinguishment of $228 million (after-tax $178 million) related to the purchase and cancellation of certain senior unsecured notes and medium term notes and the retirement of outstanding callable notes in October 2024

•pre-tax unrealized foreign exchange gains, net of $143 million (after-tax $153 million) on the peso-denominated intercompany loan between TransCanada PipeLines Limited (TCPL) and Transportadora de Gas Natural de la Huasteca (TGNH), net of non-controlling interest

•a pre-tax gain of $48 million (after-tax $63 million) related to the sale of non-core assets in U.S. Natural Gas Pipelines and Canadian Natural Gas Pipelines

•a pre-tax recovery of $22 million (after-tax $15 million) on the expected credit loss provision related to TGNH net investment in leases and certain contract assets in Mexico, net of non-controlling interest

•a deferred income tax expense of $96 million resulting from the revaluation of remaining deferred tax balances following the Spinoff Transaction

•a pre-tax impairment charge of $36 million (after-tax $27 million) related to development costs incurred on Project Tundra, a next-generation technology carbon capture and storage project, following our decision to end our collaboration on the project

•a pre-tax expense of $34 million (after-tax $26 million) related to a non-recurring third-party settlement

•a pre-tax expense of $24 million (after-tax $18 million) related to Focus Project costs

•pre-tax costs of $10 million (after-tax $42 million) related to the NGTL System Ownership Transfer.

2023

•a pre-tax impairment charge of $2.1 billion (after-tax $1.9 billion) related to our equity investment in Coastal GasLink LP. Refer to Note 7, Coastal GasLink, of our 2024 Consolidated financial statements for additional information

•a pre-tax expense of $65 million (after-tax $48 million) related to Focus Project costs

•pre-tax unrealized foreign exchange losses, net, of $44 million (after-tax $44 million) on the peso-denominated intercompany loan between TCPL and TGNH

•a pre-tax recovery of $80 million (after-tax $55 million) on the expected credit loss provision related to TGNH net investment in leases and certain contract assets in Mexico.

2022

•a pre-tax impairment charge of $3.0 billion (after-tax $2.6 billion) related to our equity investment in Coastal GasLink LP

•a pre-tax goodwill impairment charge of $571 million (after-tax $531 million) related to Great Lakes

•a $196 million expense related to the settlement of prior years' income tax assessments related to our operations in Mexico

•a pre-tax expected credit loss provision of $163 million (after-tax $114 million) related to TGNH net investment in leases and certain contract assets in Mexico.

Refer to the Financial results section in each business segment and the Financial condition section of this MD&A for additional information.

26 | TC Energy Management's discussion and analysis 2024

Reconciliation of net income (loss) attributable to common shares to comparable earnings - from continuing operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| year ended December 31 |

|

|

|

|

|

|

| (millions of $, except per share amounts) |

|

2024 |

|

2023¹ |

|

2022¹ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to common shares from continuing operations |

|

4,199 |

|

|

2,217 |

|

|

8 |

|

| Specific items (pre tax): |

|

|

|

|

|

|

| Gain on sale of PNGTS |

|

(572) |

|

|

— |

|

|

— |

|

Net gain on debt extinguishment2 |

|

(228) |

|

|

— |

|

|

— |

|

Foreign exchange (gains) losses, net – intercompany loan3 |

|

(143) |

|

|

44 |

|

|

— |

|

| Gain on sale of non-core assets |

|

(48) |

|

|

— |

|

|

— |

|

|

Expected credit loss provision on net investment in leases

and certain contract assets in Mexico4

|

|

(22) |

|

|

(80) |

|

|

163 |

|

| Project Tundra impairment charge |

|

36 |

|

|

— |

|

|

— |

|

| Third-party settlement |

|

34 |

|

|

— |

|

|

— |

|

Focus Project costs5 |

|

24 |

|

|

65 |

|

|

— |

|

| NGTL System ownership transfer costs |

|

10 |

|

|

— |

|

|

— |

|

| Coastal GasLink impairment charge |

|

— |

|

|

2,100 |

|

|

3,048 |

|

| Great Lakes goodwill impairment charge |

|

— |

|

|

— |

|

|

571 |

|

Bruce Power unrealized fair value adjustments |

|

(8) |

|

|

(7) |

|

|

17 |

|

Risk management activities6 |

|

433 |

|

|

(395) |

|

|

149 |

|

Taxes on specific items7 |

|

150 |

|

|

(48) |

|

|

(338) |

|

Comparable earnings from continuing operations |

|

3,865 |

|

|

3,896 |

|

|

3,618 |

|

Net income (loss) per common share from continuing operations |

|

$4.05 |

|

|

$2.15 |

|

|

$0.01 |

|

Specific items (net of tax) |

|

(0.32) |

|

|

1.63 |

|

|

3.63 |

|

Comparable earnings per common share from continuing operations |

|

$3.73 |

|

|

$3.78 |

|

|

$3.64 |

|

1Prior year results have been recast to reflect continuing operations only.

2In October 2024, TCPL commenced and completed our cash tender offers to purchase and cancel certain senior unsecured notes and medium term notes at a 7.73 per cent weighted average discount. In addition, we retired outstanding callable notes at par. These extinguishments of debt resulted in a pre-tax net gain of $228 million, primarily due to fair value discounts and unamortized debt issue costs. The net gain on debt extinguishment was recorded in Interest expense in the Consolidated statement of income. Refer to the Financial condition section for additional information.

3In 2023, TCPL and TGNH became party to an unsecured revolving credit facility. The loan receivable and loan payable are eliminated upon consolidation; however, due to differences in the currency that each entity reports its financial results, there is an impact to net income reflecting the revaluation and translation of the loan receivable and loan payable to TC Energy's reporting currency. As the amounts do not accurately reflect what will be realized at settlement, we exclude from comparable measures the unrealized foreign exchange gains and losses on the loan receivable, as well as the corresponding unrealized foreign exchange gains and losses on the loan payable, net of non-controlling interest.

4In 2022, TGNH and the CFE executed agreements which consolidate several natural gas pipelines under one TSA. As this TSA contains a lease, we have recognized amounts in net investment in leases on our Consolidated balance sheet. As required by U.S. GAAP, we have recognized an expected credit loss provision related to net investment in leases and certain contract assets in Mexico, which will fluctuate from period to period based on changing economic assumptions and forward-looking information. This provision is an estimate of losses that may occur over the duration of the TSA through 2055. This provision does not reflect losses or cash outflows that were incurred under this lease arrangement in the current period or from our underlying operations, and therefore, we have excluded any unrealized changes, net of non-controlling interest, from comparable measures. Refer to Note 28, Risk management and financial instruments, of our 2024 Consolidated financial statements for additional information.

5In 2022, we launched the Focus Project with benefits in the form of enhanced safety, productivity and cost-effectiveness expected to be realized in the future. Beginning in 2023, we recognized expenses in Plant operating costs and other, for external consulting and severance, some of which are not recoverable through regulatory and commercial tolling structures. Refer to the Corporate – Significant events section for additional information.

TC Energy Management's discussion and analysis 2024 | 27

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

year ended December 31 |

|

|

|

|

|

|

|

|

(millions of $) |

|

2024 |

|

2023 |

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

U.S. Natural Gas Pipelines |

|

(113) |

|

|

80 |

|

|

(15) |

|

|

|

Canadian Power |

|

84 |

|

|

(31) |

|

|

4 |

|

|

|

U.S. Power |

|

(10) |

|

|

9 |

|

|

— |

|

|

|

Natural Gas Storage |

|

(57) |

|

|

91 |

|

|

11 |

|

|

|

Interest rate |

|

(71) |

|

|

— |

|

|

— |

|

|

|

Foreign exchange |

|

(266) |

|

|

246 |

|

|

(149) |

|

|

|

|

|

(433) |

|

|

395 |

|

|

(149) |

|

|

|

Income tax attributable to risk management activities |

|

105 |

|

|

(99) |

|

|

36 |

|

|

|

Total unrealized gains (losses) from risk management activities |

|

(328) |

|

|

296 |

|

|

(113) |

|

7 |

|

Refer to the Corporate - Financial results section for additional information. |

Comparable EBITDA to comparable earnings - from continuing operations

Comparable EBITDA from continuing operations represents segmented earnings (losses) from continuing operations adjusted for the specific items described above and excludes charges for depreciation and amortization. For further information on our reconciliation to comparable EBITDA, refer to the Financial results sections for each business segment.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| year ended December 31 |

|

|

|

|

|

|

| (millions of $, except per share amounts) |

|

2024 |

|

2023¹ |

|

2022¹ |

|

|

|

|

|

|

|

| Comparable EBITDA from continuing operations |

|

|

|

|

|

|

| Canadian Natural Gas Pipelines |

|

3,388 |

|

|

3,335 |

|

|

2,806 |

|

| U.S. Natural Gas Pipelines |

|

4,511 |

|

|

4,385 |

|

|

4,089 |

|

| Mexico Natural Gas Pipelines |

|

999 |

|

|

805 |

|

|

753 |

|

| Power and Energy Solutions |

|

1,214 |

|

|

1,020 |

|

|

907 |

|

Corporate |

|

(63) |

|

|

(73) |

|

|

(72) |

|

| Comparable EBITDA from continuing operations |

|

10,049 |

|

|

9,472 |

|

|

8,483 |

|

| Depreciation and amortization |

|

(2,535) |

|

|

(2,446) |

|

|

(2,262) |

|

| Interest expense included in comparable earnings |

|

(3,176) |

|

|

(2,966) |

|

|

(2,300) |

|

| Allowance for funds used during construction |

|

784 |

|

|

575 |

|

|

369 |

|

Foreign exchange gains (losses), net included in comparable earnings |

|

(85) |

|

|

118 |

|

|

(8) |

|

Interest income and other |

|

324 |

|

|

272 |

|

|

140 |

|

Income tax (expense) recovery included in comparable earnings |

|

(772) |

|

|

(890) |

|

|

(660) |

|

|

Net (income) loss attributable to non-controlling interests included in comparable

earnings

|

|

(620) |

|

|

(146) |

|

|

(37) |

|

| Preferred share dividends |

|

(104) |

|

|

(93) |

|

|

(107) |

|

| Comparable earnings from continuing operations |

|

3,865 |

|

|

3,896 |

|

|

3,618 |

|

Comparable earnings per common share from continuing operations |

|

$3.73 |

|

|

$3.78 |

|

|

$3.64 |

|

1Prior year results have been recast to reflect continuing operations only.

28 | TC Energy Management's discussion and analysis 2024

Comparable EBITDA from continuing operations

2024 versus 2023

Comparable EBITDA from continuing operations in 2024 increased by $577 million compared to 2023 primarily due to the net result of the following:

•increased Power and Energy Solutions EBITDA primarily attributable to higher contributions from Bruce Power due to higher generation and a higher contract price, and Natural Gas Storage and other due to higher realized Alberta natural gas storage spreads, partially offset by decreased Canadian Power earnings primarily due to lower realized power prices net of lower natural gas fuel costs

•higher U.S. dollar-denominated EBITDA from Mexico Natural Gas Pipelines mainly due to increased equity earnings from Sur de Texas as a result of peso-denominated financial exposure and lower income tax expense

•increased EBITDA from Canadian Natural Gas Pipelines primarily due to higher flow-through costs and increased rate-base earnings on the NGTL System and Foothills, partially offset by lower earnings from Coastal GasLink related to the recognition of a $200 million incentive payment in 2023

•higher U.S. dollar-denominated EBITDA from U.S. Natural Gas Pipelines due to incremental earnings from growth projects placed in service and additional contract sales, partially offset by higher operational costs and decreased earnings as a result of the sale of PNGTS, which was completed on August 15, 2024

•the positive foreign exchange impact of a stronger U.S. dollar on the Canadian dollar equivalent comparable EBITDA in our U.S. dollar-denominated operations. As detailed on page 79, U.S. dollar-denominated comparable EBITDA from continuing operations increased by US$180 million compared to 2023, which was translated to Canadian dollars at an average rate of 1.37 in 2024 versus 1.35 in 2023. Refer to the Foreign exchange section for additional information.

2023 versus 2022

Comparable EBITDA from continuing operations in 2023 increased by $989 million compared to 2022 primarily due to the net result of the following:

•increased EBITDA from Canadian Natural Gas Pipelines primarily due to higher flow-through costs and increased rate-base earnings on the NGTL System and higher earnings from Coastal GasLink related to the recognition of a $200 million incentive payment upon meeting certain milestones