UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

Form 10-Q

______________________

(Mark One)

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2025

or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from____to____.

Commission File Number 001-10932

________________________

WisdomTree, Inc.

(Exact name of registrant as specified in its charter)

________________________

| Delaware | 13-3487784 |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

| 250 West 34th Street 3rd Floor New York, New York | 10119 |

| (Address of principal executive offices) | (Zip Code) |

212-801-2080

(Registrant’s telephone number, including area code)

________________________

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | WT | The New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of November 4, 2025, there were 140,715,080 shares of the registrant’s Common Stock, $0.01 par value per share, outstanding.

WISDOMTREE, INC.

Form 10-Q

For the Quarterly Period Ended September 30, 2025

TABLE OF CONTENTS

| PART I: FINANCIAL INFORMATION | 4 | |

| ITEM 1. | FINANCIAL STATEMENTS | 4 |

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 31 |

| ITEM 3. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 51 |

| ITEM 4. | CONTROLS AND PROCEDURES | 52 |

| PART II: OTHER INFORMATION | 52 | |

| ITEM 1. | LEGAL PROCEEDINGS | 52 |

| ITEM 1A. | RISK FACTORS | 52 |

| ITEM 2. | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | 53 |

| ITEM 3. | DEFAULTS UPON SENIOR SECURITIES | 53 |

| ITEM 4. | MINE SAFETY DISCLOSURES | 53 |

| ITEM 5. | OTHER INFORMATION | 53 |

| ITEM 6. | EXHIBITS | 54 |

Unless otherwise indicated, references to “the Company,” “we,” “us,” “our” and “WisdomTree” mean WisdomTree, Inc. and its subsidiaries.

WisdomTree®, WisdomTree Connect™, WisdomTree Prime® and Modern Alpha® are trademarks of WisdomTree, Inc. in the United States and in other countries. All other trademarks are the property of their respective owners.

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q, or Report, contains forward-looking statements that are based on our management’s beliefs and assumptions and on information currently available to our management. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect our results. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed in the section entitled “Risk Factors” included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2024 and in subsequent reports filed with or furnished to the Securities and Exchange Commission, or the SEC. If one or more of these or other risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected by the forward-looking statements. No forward-looking statement is a guarantee of future performance. You should read this Report and the documents that we reference in this Report and have filed with the SEC as exhibits to this Report, completely and with the understanding that our actual future results may be materially different from any future results expressed or implied by these forward-looking statements.

In particular, forward-looking statements in this Report may include statements about:

| ● | anticipated trends, conditions and investor sentiment in the global markets and exchange-traded products, or ETPs; |

| ● | anticipated levels of inflows into and outflows out of our ETPs; |

| ● | our ability to deliver favorable rates of return to investors; |

| ● | competition in our business; |

| ● | whether we will experience future growth; |

| ● | our ability to develop new products and services and their potential for success; |

| ● | our ability to maintain current vendors or find new vendors to provide services to us at favorable costs; |

| ● | our ability to successfully implement our strategy relating to digital assets and blockchain-enabled financial services, including WisdomTree Connect and WisdomTree Prime, and achieve its objectives; |

| ● | our ability to successfully operate and expand our business in non-U.S. markets; |

| ● | the effect of laws and regulations that apply to our business; |

| ● | the potential benefits arising from our acquisition of Ceres Partners, LLC, including financial or strategic outcomes; and |

| ● | our ability to successfully implement our strategic goals relating to the acquisition and integrate the acquired business. |

The forward-looking statements in this Report represent our views as of the date of this Report. We anticipate that subsequent events and developments may cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. Therefore, these forward-looking statements do not represent our views as of any date other than the date of this Report.

|

|

PART I: FINANCIAL INFORMATION

| ITEM 1. | FINANCIAL STATEMENTS |

WisdomTree, Inc. and Subsidiaries

Consolidated Balance Sheets

(In Thousands, Except Per Share Amounts)

|

September 30, 2025 |

December 31, 2024 |

|||||||

| Assets | (unaudited) | |||||||

| Current assets: | ||||||||

| Cash, cash equivalents and restricted cash (including $78,222 and $11,282 invested in the WisdomTree Government Money Market Digital Fund at September 30, 2025 and December 31, 2024, respectively) (Note 3) | $ | 555,851 | $ | 181,191 | ||||

| Financial instruments owned, at fair value (including $97,632 and $78,540 invested in WisdomTree products at September 30, 2025 and December 31, 2024, respectively) (Note 5) | 104,283 | 85,439 | ||||||

| Accounts receivable (including $40,684 and $34,959 due from related parties at September 30, 2025 and December 31, 2024, respectively) | 46,630 | 44,866 | ||||||

| Prepaid expenses | 7,799 | 5,340 | ||||||

| Other current assets | 1,844 | 1,542 | ||||||

| Total current assets | 716,407 | 318,378 | ||||||

| Fixed assets, net | 307 | 336 | ||||||

| Deferred tax assets, net (Note 17) | 8,010 | 11,656 | ||||||

| Investments (Note 6) | 26,476 | 8,922 | ||||||

| Right of use assets—operating leases (Note 10) | 1,768 | 880 | ||||||

| Goodwill (Note 19) | 86,841 | 86,841 | ||||||

| Intangible assets, net (Note 19) | 606,452 | 605,896 | ||||||

| Other noncurrent assets | 750 | 631 | ||||||

| Total assets | $ | 1,447,011 | $ | 1,033,540 | ||||

| Liabilities and stockholders’ equity | ||||||||

| Liabilities | ||||||||

| Current liabilities: | ||||||||

| Convertible notes—current (Note 8) | $ | 149,386 | $ | |||||

| Compensation and benefits payable | 34,287 | 39,701 | ||||||

| Fund management and administration payable | 30,991 | 31,135 | ||||||

| Payable to Gold Bullion Holdings (Jersey) Limited (“GBH”) (Note 9) | 14,804 | 14,804 | ||||||

| Operating lease liabilities (Note 10) | 1,258 | 709 | ||||||

| Income taxes payable | 701 | 724 | ||||||

| Accounts payable and other liabilities | 23,014 | 22,124 | ||||||

| Total current liabilities | 254,441 | 109,197 | ||||||

| Convertible notes (Note 8) | 805,064 | 512,033 | ||||||

| Payable to GBH (Note 9) | 13,564 | 12,159 | ||||||

| Operating lease liabilities (Note 10) | 524 | 171 | ||||||

| Total liabilities | 1,073,593 | 633,560 | ||||||

| Contingencies (Note 11) | ||||||||

| Stockholders’ equity | ||||||||

| Preferred stock, par value $0.01; 2,000 shares authorized | ||||||||

| Common stock, par value $0.01; 400,000 shares authorized; issued and outstanding: 140,278 and 146,102 at September 30, 2025 and December 31, 2024, respectively | 1,403 | 1,461 | ||||||

| Additional paid-in capital | 184,274 | 270,303 | ||||||

| Accumulated other comprehensive income/(loss) | 2,755 | (1,607 | ) | |||||

| Retained earnings | 184,986 | 129,823 | ||||||

| Total stockholders’ equity | 373,418 | 399,980 | ||||||

| Total liabilities and stockholders’ equity | $ | 1,447,011 | $ | 1,033,540 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

|

|

WisdomTree, Inc. and Subsidiaries

Consolidated Statements of Operations

(In Thousands, Except Per Share Amounts)

(Unaudited)

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Operating Revenues: | ||||||||||||||||

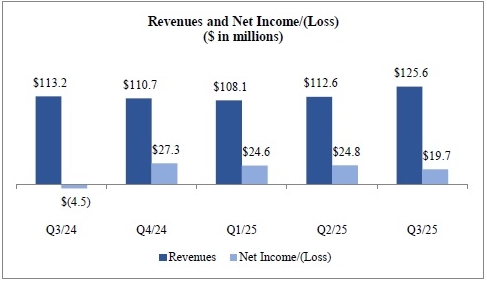

| Advisory fees | $ | 114,485 | $ | 101,659 | $ | 317,275 | $ | 293,098 | ||||||||

| Other revenues | 11,131 | 11,509 | 29,044 | 23,942 | ||||||||||||

| Total revenues | 125,616 | 113,168 | 346,319 | 317,040 | ||||||||||||

| Operating Expenses: | ||||||||||||||||

| Compensation and benefits | 33,791 | 29,405 | 100,406 | 91,249 | ||||||||||||

| Fund management and administration | 22,353 | 21,004 | 64,319 | 61,105 | ||||||||||||

| Marketing and advertising | 4,788 | 4,897 | 14,931 | 14,415 | ||||||||||||

| Sales and business development | 3,943 | 3,465 | 12,312 | 10,716 | ||||||||||||

| Professional fees | 3,505 | 6,315 | 9,464 | 16,539 | ||||||||||||

| Occupancy, communications and equipment | 1,601 | 1,397 | 4,642 | 3,921 | ||||||||||||

| Depreciation and amortization | 615 | 447 | 1,735 | 1,248 | ||||||||||||

| Third-party distribution fees | 3,977 | 2,983 | 11,172 | 7,977 | ||||||||||||

| Acquisition-related costs | 2,409 | 4,376 | ||||||||||||||

| Other | 2,980 | 2,463 | 8,514 | 7,617 | ||||||||||||

| Total operating expenses | 79,962 | 72,376 | 231,871 | 214,787 | ||||||||||||

| Operating income | 45,654 | 40,792 | 114,448 | 102,253 | ||||||||||||

| Other Income/(Expenses): | ||||||||||||||||

| Interest expense | (8,466 | ) | (5,027 | ) | (19,397 | ) | (13,295 | ) | ||||||||

| Interest income | 4,015 | 1,795 | 8,002 | 4,631 | ||||||||||||

| Loss on extinguishment of convertible notes | (13,011 | ) | (30,632 | ) | (13,011 | ) | (30,632 | ) | ||||||||

| Other gains and losses, net | 1,325 | (3,062 | ) | 1,713 | (1,753 | ) | ||||||||||

| Income before income taxes | 29,517 | 3,866 | 91,755 | 61,204 | ||||||||||||

| Income tax expense | 9,816 | 8,351 | 22,648 | 21,819 | ||||||||||||

| Net income/(loss) | $ | 19,701 | $ | (4,485 | ) | $ | 69,107 | $ | 39,385 | |||||||

| Earnings/(loss) per share—basic | $ | 0.14 | $ | (0.13 | ) | $ | 0.48 | $ | 0.16 | |||||||

| Earnings/(loss) per share—diluted | $ | 0.13 | $ | (0.13 | ) | $ | 0.47 | $ | 0.16 | |||||||

| Weighted-average common shares—basic | 139,584 | 143,929 | 141,736 | 145,756 | ||||||||||||

| Weighted-average common shares—diluted | 150,675 | 143,929 | 146,360 | 162,691 | ||||||||||||

| Cash dividends declared per common share | $ | 0.03 | $ | 0.03 | $ | 0.09 | $ | 0.09 | ||||||||

The accompanying notes are an integral part of these consolidated financial statements.

|

|

WisdomTree, Inc. and Subsidiaries

Consolidated Statements of Comprehensive Income/(Loss)

(In Thousands)

(Unaudited)

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Net income/(loss) | $ | 19,701 | $ | (4,485 | ) | $ | 69,107 | $ | 39,385 | |||||||

| Other comprehensive (loss)/income | ||||||||||||||||

| Foreign currency translation adjustment, net of income taxes | (1,105 | ) | 1,926 | 4,362 | 1,543 | |||||||||||

| Other comprehensive (loss)/income | (1,105 | ) | 1,926 | 4,362 | 1,543 | |||||||||||

| Comprehensive income/(loss) | $ | 18,596 | $ | (2,559 | ) | $ | 73,469 | $ | 40,928 | |||||||

The accompanying notes are an integral part of these consolidated financial statements.

|

|

WisdomTree, Inc. and Subsidiaries

Consolidated Statements of Changes in Stockholders’ Equity

(In Thousands)

(Unaudited)

| Three Months Ended September 30, 2025 | ||||||||||||||||||||||||

|

Common Stock |

Additional |

Accumulated Other |

|

|||||||||||||||||||||

| Shares Issued |

Par Value |

Paid-In Capital |

Comprehensive Income/(Loss) |

Retained Earnings |

Total | |||||||||||||||||||

| Balance—July 1, 2025 | 147,061 | $ | 1,471 | $ | 269,344 | $ | 3,860 | $ | 170,412 | $ | 445,087 | |||||||||||||

| Restricted stock issued and vesting of restricted stock units, net | 32 | |||||||||||||||||||||||

| Shares repurchased | (6,815 | ) | (68 | ) | (89,950 | ) | (90,018 | ) | ||||||||||||||||

| Excise taxes – stock repurchases | — | (717 | ) | (717 | ) | |||||||||||||||||||

| Stock-based compensation | — | 4,880 | 4,880 | |||||||||||||||||||||

| Other comprehensive loss | — | (1,105 | ) | (1,105 | ) | |||||||||||||||||||

| Dividends | — | (4,410 | ) | (4,410 | ) | |||||||||||||||||||

| Net income | — | 19,701 | 19,701 | |||||||||||||||||||||

| Balance—September 30, 2025 | 140,278 | $ | 1,403 | $ | 184,274 | $ | 2,755 | $ | 184,986 | $ | 373,418 | |||||||||||||

| Three Months Ended September 30, 2024 | ||||||||||||||||||||||||

|

Common Stock |

Additional |

Accumulated Other |

|

|||||||||||||||||||||

| Shares Issued |

Par Value |

Paid-In Capital |

Comprehensive (Loss)/Income |

Retained Earnings |

Total | |||||||||||||||||||

| Balance—July 1, 2024 | 151,857 | $ | 1,519 | $ | 315,359 | $ | (931 | ) | $ | 129,617 | $ | 445,564 | ||||||||||||

| Shares repurchased | (5,704 | ) | (57 | ) | (54,993 | ) | (55,050 | ) | ||||||||||||||||

| Restricted stock issued and vesting of restricted stock units, net | (49 | ) | (1 | ) | 1 | |||||||||||||||||||

| Stock-based compensation | — | 5,197 | 5,197 | |||||||||||||||||||||

| Repurchase of Series A Non-Voting Convertible Preferred Stock (Note 11) | — | (11,375 | ) | (11,375 | ) | |||||||||||||||||||

| Excise taxes – stock repurchases | — | (1,868 | ) | (1,868 | ) | |||||||||||||||||||

| Other comprehensive income | — | 1,926 | 1,926 | |||||||||||||||||||||

| Dividends | — | (4,991 | ) | (4,991 | ) | |||||||||||||||||||

| Net loss | — | (4,485 | ) | (4,485 | ) | |||||||||||||||||||

| Balance—September 30, 2024 | 146,104 | $ | 1,461 | $ | 265,564 | $ | 995 | $ | 106,898 | $ | 374,918 | |||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

|

|

WisdomTree, Inc. and Subsidiaries

Consolidated Statements of Changes in Stockholders’ Equity

(In Thousands)

(Unaudited)

Nine Months Ended September 30, 2025 |

||||||||||||||||||||||||

|

Common Stock |

Additional |

Accumulated Other |

|

|||||||||||||||||||||

| Shares Issued |

Par Value |

Paid-In Capital |

Comprehensive (Loss)/Income |

Retained Earnings |

Total | |||||||||||||||||||

| Balance—January 1, 2025 | 146,102 | $ | 1,461 | $ | 270,303 | $ | (1,607 | ) | $ | 129,823 | $ | 399,980 | ||||||||||||

| Restricted stock issued and vesting of restricted stock units, net | 2,273 | 23 | (23 | ) | ||||||||||||||||||||

| Shares repurchased | (8,097 | ) | (81 | ) | (102,651 | ) | (102,732 | ) | ||||||||||||||||

| Excise taxes – stock repurchases | — | (717 | ) | (717 | ) | |||||||||||||||||||

| Stock-based compensation | — | 16,645 | 16,645 | |||||||||||||||||||||

| Other comprehensive income | — | 4,362 | 4,362 | |||||||||||||||||||||

| Dividends | — | (13,227 | ) | (13,227 | ) | |||||||||||||||||||

| Net income | — | 69,107 | 69,107 | |||||||||||||||||||||

| Balance—September 30, 2025 | 140,278 | $ | 1,403 | $ | 184,274 | $ | 2,755 | $ | 184,986 | $ | 373,418 | |||||||||||||

Nine Months Ended September 30, 2024 |

||||||||||||||||||||||||

|

Common Stock |

Additional |

Accumulated Other |

|

|||||||||||||||||||||

| Shares Issued |

Par Value |

Paid-In Capital |

Comprehensive (Loss)/Income |

Retained Earnings |

Total | |||||||||||||||||||

| Balance—January 1, 2024 | 150,330 | $ | 1,503 | $ | 312,440 | $ | (548 | ) | $ | 95,741 | $ | 409,136 | ||||||||||||

| Restricted stock issued and vesting of restricted stock units, net | 2,574 | 26 | (26 | ) | ||||||||||||||||||||

| Shares repurchased | (6,800 | ) | (68 | ) | (62,802 | ) | (62,870 | ) | ||||||||||||||||

| Stock-based compensation | — | 15,952 | 15,952 | |||||||||||||||||||||

| Repurchase of Series A Non-Voting Convertible Preferred Stock (Note 11) | — | (11,375 | ) | (11,375 | ) | |||||||||||||||||||

| Excise taxes – stock repurchases | — | (1,868 | ) | (1,868 | ) | |||||||||||||||||||

| Other comprehensive income | — | 1,543 | 1,543 | |||||||||||||||||||||

| Dividends | — | (14,985 | ) | (14,985 | ) | |||||||||||||||||||

| Net income | — | 39,385 | 39,385 | |||||||||||||||||||||

| Balance—September 30, 2024 | 146,104 | $ | 1,461 | $ | 265,564 | $ | 995 | $ | 106,898 | $ | 374,918 | |||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

|

|

WisdomTree, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(In Thousands)

(Unaudited)

|

Nine Months Ended September 30, |

||||||||

| 2025 | 2024 | |||||||

| Cash flows from operating activities: | ||||||||

| Net income | $ | 69,107 | $ | 39,385 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Advisory and license fees paid in gold, other precious metals and cryptocurrency | (51,354 | ) | (39,028 | ) | ||||

| Stock-based compensation | 16,645 | 15,952 | ||||||

| Loss on extinguishment of convertible notes | 13,011 | 30,632 | ||||||

| Deferred income taxes | 2,628 | 2,103 | ||||||

| Amortization of issuance costs—convertible notes | 2,151 | 1,266 | ||||||

| Gains on financial instruments owned, at fair value | (1,914 | ) | (2,575 | ) | ||||

| Depreciation and amortization | 1,735 | 1,248 | ||||||

| Imputed interest on payable to GBH | 1,405 | 2,039 | ||||||

| Amortization of right of use asset | 1,003 | 976 | ||||||

| Net losses on investments | 49 | 619 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | 582 | (9,344 | ) | |||||

| Prepaid expenses | (2,351 | ) | (1,635 | ) | ||||

| Gold, other precious metals and cryptocurrency | 49,686 | 38,603 | ||||||

| Other assets | (482 | ) | (150 | ) | ||||

| Fund management and administration payable | (749 | ) | (6 | ) | ||||

| Compensation and benefits payable | (6,328 | ) | (8,251 | ) | ||||

| Income taxes payable | (40 | ) | 1,919 | |||||

| Operating lease liabilities | (987 | ) | (991 | ) | ||||

| Accounts payable and other liabilities | (540 | ) | 6,124 | |||||

| Net cash provided by operating activities | 93,257 | 78,886 | ||||||

| Cash flows from investing activities: | ||||||||

| Purchase of financial instruments owned, at fair value | (25,314 | ) | (57,855 | ) | ||||

| Purchase of investments | (17,553 | ) | ||||||

| Cash paid—software development | (2,015 | ) | (1,790 | ) | ||||

| Purchase of fixed assets | (154 | ) | (128 | ) | ||||

| Proceeds from the sale of financial instruments owned, at fair value | 8,860 | 42,388 | ||||||

| Proceeds from the exit from investment in Securrency, Inc. | 465 | |||||||

| Proceeds from held-to-maturity securities maturing or called prior to maturity | 18 | |||||||

| Net cash used in investing activities | (36,176 | ) | (16,902 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Common stock repurchased | (102,732 | ) | (62,870 | ) | ||||

| Repurchase and maturity of convertible notes | (36,681 | ) | (132,713 | ) | ||||

| Dividends paid | (13,218 | ) | (14,745 | ) | ||||

| Issuance costs—convertible notes | (11,064 | ) | (7,667 | ) | ||||

| Repurchase of Series A Non-Voting Convertible Preferred Stock | (143,812 | ) | ||||||

| Repurchase costs—Series A Non-Voting Convertible Preferred Stock | (132 | ) | ||||||

| Proceeds from the issuance of convertible notes | 475,000 | 345,000 | ||||||

| Net cash provided by/(used in) financing activities | 311,305 | (16,939 | ) | |||||

| Increase in cash flow due to changes in foreign exchange rate | 6,274 | 2,133 | ||||||

| Net increase in cash, cash equivalents and restricted cash | 374,660 | 47,178 | ||||||

| Cash, cash equivalents and restricted cash—beginning of year | 181,191 | 129,305 | ||||||

| Cash, cash equivalents and restricted cash—end of period | $ | 555,851 | $ | 176,483 | ||||

| Supplemental disclosure of cash flow information: | ||||||||

| Cash paid for income taxes | $ | 19,999 | $ | 17,807 | ||||

| Cash paid for interest | $ | 15,198 | $ | 9,913 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

|

|

WisdomTree, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

(In Thousands, Except Share and Per Share Amounts)

1. Organization and Description of Business

WisdomTree, Inc., through its subsidiaries in the U.S. and Europe (collectively, “WisdomTree” or the “Company”), is a global financial innovator, offering a diverse suite of exchange-traded products (“ETPs”), models, solutions, as well as digital asset-related products. Building on its heritage of innovation, the Company offers next-generation digital products and services related to tokenized real world assets and stablecoins, including blockchain-enabled mutual funds (“Digital Funds”), as well as its institutional platform, WisdomTree Connect, and blockchain-native digital wallet, WisdomTree Prime. The Company has the following wholly-owned operating subsidiaries:

| ● | WisdomTree Asset Management, Inc. is a New York based investment adviser registered with the SEC, providing investment advisory and other management services to the WisdomTree Trust (“WTT”) and WisdomTree exchange-traded funds (“ETFs”). The WisdomTree ETFs are issued in the U.S. by WTT. WTT is a non-consolidated Delaware statutory trust registered with the SEC as an open-end management investment company. The Company has licensed to WTT the use of certain of its own indexes on an exclusive basis for the WisdomTree ETFs in the U.S. |

| ● | WisdomTree Management Jersey Limited (“ManJer”) is a Jersey based management company providing management services to seven issuers (the “ManJer Issuers”) in respect of the ETPs issued and listed by the ManJer Issuers covering commodity, currency, cryptocurrency and leveraged-and-inverse strategies. |

| ● | WisdomTree Multi Asset Management Limited (“WTMAML”) is a Jersey based management company providing management services to WisdomTree Multi Asset Issuer PLC (“WMAI”) in respect of the ETPs issued by WMAI. WMAI is a non-consolidated public limited company domiciled in Ireland. |

| ● | WisdomTree Management Limited (“WML”) is an Ireland based management company providing management services to WisdomTree Issuer ICAV (“WTICAV”) in respect of the WisdomTree UCITS ETFs issued by WTICAV. WTICAV is a non-consolidated public limited company domiciled in Ireland. |

| ● | WisdomTree UK Limited (“WTUK”) is a U.K. based company registered with the Financial Conduct Authority currently providing distribution and support services to ManJer, WTMAML and WML. |

| ● | WisdomTree Europe Limited is a U.K. based company which is the legacy distributor of the WMAI ETPs and WisdomTree UCITS ETFs. These services are now provided directly by WTUK. WisdomTree Europe Limited is no longer regulated and does not provide any regulated services. |

| ● | WisdomTree Ireland Limited (“WT Ireland”) is an Ireland based company authorized by the Central Bank of Ireland providing distribution services to ManJer, WTMAML and WML. |

| ● | WisdomTree Digital Commodity Services, LLC is a New York based company that serves as the sponsor of the WisdomTree Bitcoin Fund, which is currently effective with the SEC. The WisdomTree Bitcoin Fund is an exchange-traded fund that issues common shares of beneficial interest and is listed on the Cboe BZX Exchange, Inc. The WisdomTree Bitcoin Fund provides exposure to the spot price of bitcoin. |

| ● | WisdomTree Digital Management, Inc. (“WT Digital Management”) is a New York based investment adviser registered with the SEC, providing investment advisory and other management services to the WisdomTree Digital Trust (“WTDT”) and WisdomTree Digital Funds. The WisdomTree Digital Funds are issued in the U.S. by WTDT. WTDT is a non-consolidated Delaware statutory trust registered with the SEC as an open-end management investment company. Each Digital Fund uses a blockchain-integrated recordkeeping system to maintain a record of its shares on one or more blockchains (e.g., Stellar or Ethereum), but does not directly or indirectly invest in any assets that rely on blockchain technology, such as cryptocurrencies. |

| ● | WisdomTree Digital Movement, Inc. (“WT Digital Movement”) is a New York based company operating as a money services business registered with the Financial Crimes Enforcement Network. WT Digital Movement has obtained and is seeking additional state money transmitter licenses to operate a platform for the purchase, sale and exchange of tokenized assets, while also providing blockchain-native digital wallet services through WisdomTree Prime to facilitate such activity. |

| ● | WisdomTree Securities, Inc. is a New York based limited purpose broker-dealer (i.e., mutual fund retailer) registered with the SEC and FINRA, facilitating transactions in WisdomTree Digital Funds. |

|

|

| ● | WisdomTree Transfers, Inc. is a New York based transfer agent registered with the SEC, providing transfer agency and registrar services for the Digital Funds. The transfer agent uses a blockchain-integrated recordkeeping system for the ownership of WisdomTree Digital Fund shares. |

| ● | WisdomTree Digital Trust Company, LLC is a New York based limited liability trust company that has been formed to operate as a limited purpose trust company under New York Banking Law and is licensed to engage in virtual currency business activity by the New York State Department of Financial Services. |

| ● | Ceres Partners, LLC is an Indiana based investment adviser registered with the SEC, providing investment advisory and other management services to Ceres Farms, LLC (“Ceres Farms”), an open-ended investment fund whose objective is to generate attractive total return through the acquisition and management of farmland primarily in the Midwestern United States. |

| ● | Ceres Securities, LLC is an Indiana based limited purpose broker-dealer registered with the SEC and FINRA, facilitating transactions in Ceres Farms. |

Acquisition of Ceres Partners, LLC

On July 31, 2025, the Company and WisdomTree Farmland Holdings, Inc., a wholly-owned subsidiary of the Company (the “Purchaser”), entered into an Equity Purchase Agreement (the “Ceres Purchase Agreement”) with Ceres Partners, LLC, an Indiana limited liability company (“Ceres”), the members of Ceres (together, the “Sellers”), and an individual acting as the Sellers’ representative, pursuant to which the Purchaser agreed to acquire from the Sellers all of the issued and outstanding equity interests of Ceres (the “Ceres Acquisition”), subject to the terms and conditions set forth therein.

On October 1, 2025, the Purchaser completed the Ceres Acquisition for aggregate consideration consisting of (i) $275,000 in cash subject to customary post-closing adjustments, including adjustments to cash, indebtedness and working capital, and (ii) earnout consideration of up to $225,000, payable in 2030, contingent upon Ceres achieving a compound annual growth rate (“CAGR”) in revenue of 12% to 22% during the earnout measurement period of January 1, 2025 through December 31, 2029. See Note 21 for additional information.

2. Significant Accounting Policies

Basis of Presentation

These consolidated financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“GAAP”) and in the opinion of management reflect all adjustments, consisting of only normal recurring adjustments, necessary for a fair presentation of the financial statements. The consolidated financial statements include the accounts of the Company’s wholly-owned subsidiaries. All intercompany accounts and transactions have been eliminated in consolidation.

Consolidation

The Company consolidates entities in which it has a controlling financial interest. The Company determines whether it has a controlling financial interest in an entity by first evaluating whether the entity is a voting interest entity (“VOE”) or a variable interest entity (“VIE”). The usual condition for a controlling financial interest in a VOE is ownership of a majority voting interest. If the Company has a majority voting interest in a VOE, the entity is consolidated. The Company has a controlling financial interest in a VIE when the Company has a variable interest that provides it with (i) the power to direct the activities of the VIE that most significantly impact the VIE’s economic performance and (ii) the obligation to absorb losses of the VIE or the right to receive benefits from the VIE that could potentially be significant to the VIE.

The Company reassesses its evaluation of whether an entity is a VOE or VIE when certain reconsideration events occur.

Segment and Geographic Information

The Company, through its subsidiaries in the U.S. and Europe, is a global financial innovator, offering a diverse suite of ETPs, models, solutions, as well as digital asset-related products. The Company conducts business as a single operating segment as an ETP sponsor and asset manager, which is based upon the Company’s current organizational and management structure, as well as information used by the Company’s Chief Executive Officer (the chief operating decision maker, or CODM) to allocate resources and other factors.

Foreign Currency Translation

Assets and liabilities of subsidiaries whose functional currency is not the U.S. dollar are translated based on the end of period exchange rates from local currency to U.S. dollars. Results of operations are translated at the average exchange rates in effect during the period. The impact of the foreign currency translation adjustment is included in the Consolidated Statements of Comprehensive Income as a component of other comprehensive (loss)/income.

|

|

Use of Estimates

The preparation of the Company’s consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the balance sheet dates and the reported amounts of revenues and expenses for the periods presented. Actual results could differ materially from those estimates.

Revenue Recognition

The Company earns a significant portion of its revenues in the form of advisory fees from its ETPs and recognizes this revenue over time, as the performance obligation is satisfied. Advisory fees are based on a percentage of the ETPs’ average daily net assets. Progress is measured using the practical expedient under the output method resulting in the recognition of revenue in the amount for which the Company has a right to invoice.

Other revenues are earned from swap providers associated with certain of the Company’s European listed ETPs, the nature of which are based on a percentage of the ETPs’ average daily net assets. The Company also earns transaction-based income on flows associated with certain European listed ETPs. There is no significant judgment in calculating amounts due, which are invoiced monthly or quarterly in arrears and are not subject to any potential reversal. Progress is measured using the practical expedient under the output method resulting in the recognition of revenue in the amount for which the Company has a right to invoice.

Marketing and Advertising

Marketing and advertising costs, including media advertising and production costs, are expensed when incurred.

Depreciation and Amortization

Depreciation and amortization is provided for using the straight-line method over the estimated useful lives of the related assets as follows:

| Equipment | 3 to 5 years | |

| Internally-developed software | 3 years |

The assets listed above are recorded at cost, less accumulated depreciation and amortization.

Stock-Based Awards

Accounting for stock-based compensation requires the measurement and recognition of compensation expense for all equity awards based on estimated fair values. Stock-based compensation is measured based on the grant-date fair value of the award and is amortized over the relevant service period. Forfeitures are recognized when they occur.

Third-Party Distribution Fees

The Company pays a percentage of its advisory fee revenues based on incremental growth in assets under management (“AUM”), subject to caps or minimums, to marketing agents to sell WisdomTree ETPs and for including WisdomTree ETPs on third-party customer platforms and recognizes these expenses as incurred.

Cash, Cash Equivalents and Restricted Cash

The Company considers all highly liquid investments with an original maturity of 90 days or less at the time of purchase to be classified as cash equivalents. The Company maintains deposits with financial institutions in an amount that is in excess of federally insured limits. Restricted cash is required to be maintained in a separate account with withdrawal and usage restrictions.

Accounts Receivable

Accounts receivable are customer and other obligations due under normal trade terms. The Company measures credit losses, if any, by applying historical loss rates (adjusted for current conditions and reasonable and supportable forecasts) to amounts outstanding using the aging method.

Financial Instruments Owned

Financial instruments owned are financial instruments classified as either trading or available-for-sale (“AFS”). These financial instruments are recorded on their trade date and are measured at fair value. All equity instruments that have readily determinable fair values are classified by the Company as trading. Debt instruments are classified based primarily on the Company’s intent to hold or sell the instrument. Changes in the fair value of debt instruments classified as trading and AFS are reported in other income/(expenses) and other comprehensive income, respectively, in the period the change occurs. Debt instruments classified as AFS are assessed for impairment on a quarterly basis and an estimate for credit loss is provided when the fair value of the AFS debt instrument is below its amortized cost basis. Credit-related impairments are recognized in earnings with a corresponding adjustment to the instrument’s amortized cost basis if the Company intends to sell the impaired AFS debt instrument or it is more likely than not the Company will be required to sell the instrument before recovering its amortized cost basis. Other credit-related impairments are recognized as an allowance with a corresponding adjustment to earnings. Impairments resulting from noncredit-related factors are recognized in other comprehensive income. Amounts recorded in other comprehensive income are reclassified into earnings upon sale of the AFS debt instrument using the specific identification method.

|

|

Investments

The Company accounts for equity investments that do not have a readily determinable fair value under the measurement alternative prescribed in Accounting Standards Codification (“ASC”) Topic 321, Investments – Equity Securities (“ASC 321”), to the extent such investments are not subject to consolidation or the equity method. Under the measurement alternative, these financial instruments are carried at cost, less any impairment (assessed quarterly), plus or minus changes resulting from observable price changes in orderly transactions for an identical or similar investment of the same issuer. In addition, income is recognized when dividends are received only to the extent they are distributed from net accumulated earnings of the investee. Otherwise, such distributions are considered returns of investment and are recorded as a reduction of the cost of the investment.

Investments in debt instruments are accounted for at fair value, with changes in fair value reported in other income/(expenses).

Goodwill

Goodwill is the excess of the purchase price over the fair values of the identifiable net assets at the acquisition date. The Company tests goodwill for impairment at least annually and at the time of a triggering event requiring re-evaluation, if one were to occur. Goodwill is considered impaired when the estimated fair value of the reporting unit that was allocated the goodwill is less than its carrying value. If the estimated fair value of such reporting unit is less than its carrying value, goodwill impairment is recognized based on that difference, not to exceed the carrying amount of goodwill. A reporting unit is an operating segment or a component of an operating segment provided that the component constitutes a business for which discrete financial information is available and management regularly reviews the operating results of that component.

Goodwill is allocated to the Company’s U.S. and European components. For impairment testing purposes, these components are aggregated as a single reporting unit as they fall under the same operating segment and have similar economic characteristics.

Goodwill is assessed for impairment annually on November 30th. When performing its goodwill impairment test, the Company considers a qualitative assessment, when appropriate, and a quantitative assessment using the market approach and its market capitalization when determining the fair value of the reporting unit.

Intangible Assets

Indefinite-lived intangible assets are tested for impairment at least annually and are also reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Indefinite-lived intangible assets are impaired if their estimated fair values are less than their carrying values.

Finite-lived intangible assets, if any, are amortized over their estimated useful life, which is the period over which the assets are expected to contribute directly or indirectly to the future cash flows of the Company. These intangible assets are tested for impairment at the time of a triggering event, if one were to occur. Finite-lived intangible assets may be impaired when the estimated undiscounted future cash flows generated from the assets are less than their carrying amounts.

The Company may rely on a qualitative assessment when performing its intangible asset impairment test. Otherwise, the impairment evaluation is performed at the lowest level of reasonably identifiable cash flows independent of other assets. The annual impairment testing date for all of the Company’s intangible assets is November 30th.

Software Development Costs

Software development costs incurred after the preliminary project stage is complete are capitalized if it is probable that the project will be completed and the software will be used as intended. Capitalized costs consist of employee compensation costs and fees paid to third parties who are directly involved in the application development efforts and are included in intangible assets, net in the Consolidated Balance Sheets. Such costs are amortized over the estimated useful life of the software on a straight-line basis and are included in depreciation and amortization in the Consolidated Statements of Operations. Once the application development stage is complete, additional costs are expensed as incurred.

Leases

The Company accounts for its lease obligations in accordance with ASC Topic 842, Leases (“ASC 842”), which requires the recognition of both (i) a lease liability equal to the present value of the remaining lease payments and (ii) an offsetting right-of-use asset. The remaining lease payments are discounted using the rate implicit in the lease, if known, or otherwise the Company’s incremental borrowing rate. After lease commencement, right-of-use assets are assessed for impairment and otherwise are amortized over the remaining lease term on a straight-line basis. These recognition requirements are not applied to short-term leases, which are those with a lease term of 12 months or less. Instead, lease payments associated with short-term leases are recognized as an expense on a straight-line basis over the lease term.

|

|

ASC 842 also provides a practical expedient which allows for consideration in a contract to be accounted for as a single lease component rather than allocated between lease and non-lease components. The Company has elected to apply this practical expedient to all lease contracts, where applicable.

Convertible Notes

Convertible notes are carried at amortized cost, net of issuance costs. The Company accounts for convertible instruments as a single liability (applicable to the convertible notes) or equity with no separate accounting for embedded conversion features unless the conversion feature meets the criteria for accounting under the substantial premium model or does not qualify for a derivative scope exception. Interest expense is recognized using the effective interest method and includes amortization of issuance costs over the life of the debt.

Acquisition-related Costs

The Company accounts for business combinations in accordance with ASC Topic 805, Business Combinations (“ASC 805”), with acquisitions recorded using the acquisition method. Transaction costs associated with acquisitions are expensed as incurred.

Contingencies

The Company may be subject to reviews, inspections and investigations by regulatory authorities as well as legal proceedings arising in the ordinary course of business. The Company evaluates the likelihood of an unfavorable outcome of all legal or regulatory proceedings to which it is a party and accrues a loss contingency when the loss is probable and reasonably estimable.

Contingent Payments

The Company recognizes a gain on contingent payments when the contingency is resolved and the gain is realized.

Earnings per Share

Basic earnings per share (“EPS”) is computed by dividing net income available to common stockholders by the weighted-average number of common shares outstanding for the period. Net income available to common stockholders represents net income of the Company reduced by an allocation of earnings to participating securities, as well as excise tax on stock repurchases. Unvested share-based payment awards that contain non-forfeitable rights to dividends or dividend equivalents (whether paid or unpaid) are participating securities and are included in the computation of EPS pursuant to the two-class method. Share-based payment awards that do not contain such rights are not deemed participating securities and are included in diluted shares outstanding (if dilutive).

Diluted EPS is calculated under the treasury stock method and the two-class method. The calculation that results in the lowest diluted EPS amount for the common stock is reported in the Company’s consolidated financial statements. The treasury stock method includes the dilutive effect of potential common shares including unvested stock-based awards and the convertible notes, if any. Potential common shares associated with the convertible notes are computed under the if-converted method. Potential common shares associated with the conversion option embedded in the convertible notes are dilutive when the Company’s average stock price exceeds the conversion price.

Income Taxes

The Company accounts for income taxes using the liability method, which requires the determination of deferred tax assets and liabilities based on the differences between the financial and tax bases of assets and liabilities using the enacted tax rates in effect for the year in which differences are expected to reverse. Deferred tax assets are reduced by a valuation allowance if, based on the weight of available evidence, it is more-likely-than-not that some portion or all the deferred tax assets will not be realized.

Tax positions are evaluated utilizing a two-step process. The Company first determines whether any of its tax positions are more-likely-than-not to be sustained upon examination, based solely on the technical merits of the position. Once it is determined that a position meets this recognition threshold, the position is measured as the largest amount of benefit that is greater than 50% likely of being realized upon ultimate settlement. The Company records interest expense and penalties related to tax expenses as income tax expense.

The Global Intangible Low-Taxed Income (“GILTI”) provisions of current tax law requires the Company to include in its U.S. income tax return foreign subsidiary earnings in excess of an allowable return on the foreign subsidiary’s tangible assets. An accounting policy election is available to either account for the tax effects of GILTI in the period that is subject to such taxes or to provide deferred taxes for book and tax basis differences that upon reversal may be subject to such taxes. The Company accounts for the tax effects of these provisions in the period that is subject to such tax.

Non-income based taxes are recorded as part of other liabilities and other expenses. Excise taxes on stock repurchases are accounted for as a direct component of the share repurchase transaction and reported as a reduction of stockholder’s equity.

|

|

Recently Issued Accounting Pronouncements

On September 18, 2025, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2025-06, Intangibles—Goodwill and Other—Internal-Use Software (Subtopic 350-40): Targeted Improvements to the Accounting for Internal-Use Software, which clarifies and modernizes the accounting for costs related to internal-use software. The guidance removes all references to project stages in prior guidance, clarifies the threshold entities apply to begin capitalizing costs and adds more detail to disclosure requirements. The guidance is effective for annual reporting periods beginning after December 15, 2027, and interim reporting periods within those annual reporting periods. The Company does not anticipate this standard to have a material impact on its financial statements.

On November 4, 2024, the FASB issued ASU 2024-03, Reporting Comprehensive Income—Expense Disaggregation Disclosures, which requires additional information about specific expense categories in the notes to financial statements at interim and annual reporting periods. The guidance is effective for annual reporting periods beginning after December 15, 2026, and interim reporting periods beginning after December 15, 2027. The Company does not anticipate this standard to have a material impact on its financial statements.

Recently Adopted Accounting Pronouncements

On December 14, 2023, the FASB issued ASU 2023-09, Improvements to Income Tax Disclosures, which establishes new income tax disclosure requirements in addition to modifying and eliminating certain existing requirements. Under the new guidance, entities must consistently categorize and provide greater disaggregation of information in the rate reconciliation. They must also further disaggregate income taxes paid. The standard is intended to benefit stockholders by providing more detailed income tax disclosures that would be useful in making capital allocation decisions. The guidance applies to all entities subject to income taxes and is effective for annual periods beginning after December 15, 2024. The guidance will be applied on a prospective basis with the option to apply the standard retrospectively. Early adoption is permitted. The Company adopted this standard on a prospective basis for the year ended December 31, 2024. See Note 17 for additional information.

3. Cash, Cash Equivalents and Restricted Cash

Of the total cash, cash equivalents and restricted cash of $555,851 and $181,191 at September 30, 2025 and December 31, 2024, respectively, $540,874 and $155,871 were held at three financial institutions. At September 30, 2025 and December 31, 2024, cash equivalents were approximately $199,576 and $48,336, respectively.

Certain of the Company’s subsidiaries are required to maintain a minimum level of regulatory capital, generally satisfied by cash on hand, which was $35,881 and $39,423 at September 30, 2025 and December 31, 2024, respectively. Of these amounts, $11,689 and $13,403 at September 30, 2025 and December 31, 2024, respectively, was restricted cash, which is required to be maintained in a separate account with withdrawal and usage restrictions in compliance with regulatory obligations.

4. Fair Value Measurements

The fair value of financial instruments is defined as the price that would be received to sell an asset or paid to transfer a liability (i.e., “the exit price”) in an orderly transaction between market participants at the measurement date. ASC 820, Fair Value Measurement, establishes a hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs are inputs that market participants would use in pricing the asset or liability developed based on market data obtained from independent sources. Unobservable inputs reflect assumptions that market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The hierarchy is broken down into three levels based on the transparency of inputs as follows:

Level 1 – Quoted prices for identical instruments in active markets.

Level 2 – Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations whose inputs are observable or whose significant value drivers are observable.

Level 3 – Instruments whose significant drivers are unobservable.

The availability of observable inputs can vary from product to product and is affected by a wide variety of factors, including, for example, the type of product, whether the product is new and not yet established in the marketplace, and other characteristics particular to the transaction. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised by management in determining fair value is greatest for instruments categorized in Level 3. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement in its entirety falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

|

|

The tables below summarize the categorization of the Company’s assets and liabilities measured at fair value. During the three and nine months ended September 30, 2025 and 2024, there were no transfers between Levels 2 and 3.

| September 30, 2025 | ||||||||||||||||

| Total | Level 1 | Level 2 | Level 3 | |||||||||||||

| Assets: | ||||||||||||||||

| Recurring fair value measurements: | ||||||||||||||||

| Cash equivalents | $ | 199,576 | $ | 199,576 | $ | $ | ||||||||||

| Financial instruments owned, at fair value: | ||||||||||||||||

| ETFs | 79,862 | 79,862 | ||||||||||||||

| Pass-through GSEs | 6,205 | 6,205 | ||||||||||||||

| Other assets—seed capital (WisdomTree Digital Funds): | ||||||||||||||||

| U.S. treasuries | 5,510 | 5,510 | ||||||||||||||

| Equities | 10,030 | 10,030 | ||||||||||||||

| Fixed income | 2,676 | 1,071 | 1,605 | |||||||||||||

| Total | $ | 303,859 | $ | 290,539 | $ | 13,320 | $ | |||||||||

| Non-recurring fair value measurements: | ||||||||||||||||

| Fnality International Limited—Series B-1 Preference Shares(1) | $ | 8,035 | $ | $ | $ | 8,035 | ||||||||||

_____________________________

| (1) | Fair value determined on September 10, 2025. Not included in the table above are prospective changes in value due to fluctuations in the British pound to U.S. dollar exchange rate. |

| December 31, 2024 | ||||||||||||||||

| Total | Level 1 | Level 2 | Level 3 | |||||||||||||

| Assets: | ||||||||||||||||

| Recurring fair value measurements: | ||||||||||||||||

| Cash equivalents | $ | 48,336 | $ | 48,336 | $ | $ | ||||||||||

| Financial instruments owned, at fair value: | ||||||||||||||||

| ETFs | 62,907 | 62,907 | ||||||||||||||

| Pass-through GSEs | 6,898 | 6,898 | ||||||||||||||

| Other assets—seed capital (WisdomTree Digital Funds): | ||||||||||||||||

| U.S. treasuries | 5,251 | 5,251 | ||||||||||||||

| Equities | 8,478 | 8,478 | ||||||||||||||

| Fixed income | 1,905 | 1,019 | 886 | |||||||||||||

| Other investments | 687 | 687 | ||||||||||||||

| Total | $ | 134,462 | $ | 120,740 | $ | 13,035 | $ | 687 | ||||||||

| Non-recurring fair value measurements: | ||||||||||||||||

| Fnality International Limited—Series B-1 Preference Shares(1) | $ | 8,288 | $ | $ | $ | 8,288 | ||||||||||

_____________________________

| (1) | Fair value determined on June 17, 2024. Not included in the table above are prospective changes in value due to fluctuations in the British pound to U.S. dollar exchange rate. |

Recurring Fair Value Measurements – Methodology

Cash Equivalents (Note 3) – These financial assets represent cash invested in highly liquid investments with original maturities of less than 90 days, as well as institutional money market funds that invest in short-term, high-quality U.S. Treasury and government agency securities and aim to maintain a stable $1.00 net asset value per share. These investments are valued at par, which approximates fair value, and are classified as Level 1 in the fair value hierarchy.

Financial instruments owned (Note 5) – Financial instruments owned are investments in ETFs, pass-through GSEs, equities and fixed income. ETFs and equities are generally traded in active, quoted and highly liquid markets and are therefore classified as Level 1 in the fair value hierarchy. Pricing of pass-through GSEs and fixed income includes consideration given to date of issuance, collateral characteristics and market assumptions related to yields, credit risk and timing of prepayments and may be classified as either Level 1 or Level 2.

|

|

Fair Value Measurements classified as Level 3 – The following table presents a reconciliation of beginning and ending balances of recurring fair value measurements classified as Level 3. These instruments consist of the following:

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Investments in Convertible Notes (Note 6) | ||||||||||||||||

| Beginning balance | $ | 850 | $ | $ | 687 | $ | ||||||||||

| Net unrealized gains(1) | 121 | 284 | ||||||||||||||

| Conversion | (971 | ) | (971 | ) | ||||||||||||

| Ending balance | $ | $ | $ | $ | ||||||||||||

_____________________________

| (1) | Recorded in other gains and losses, net in the Consolidated Statements of Operations. |

5. Financial instruments owned

These instruments consist of the following:

|

September 30, |

December 31, |

|||||||

| Financial instruments owned | ||||||||

| Trading securities | $ | 86,067 | $ | 69,805 | ||||

| Other assets—seed capital (WisdomTree Digital Funds) | 18,216 | 15,634 | ||||||

| Total | $ | 104,283 | $ | 85,439 | ||||

The Company recognized net trading gains on financial instruments owned that were still held at the reporting dates of $680 and $1,195, respectively, during the three and nine months ended September 30, 2025, and $680 and $3,023, respectively, during the comparable periods in 2024, which were recorded in other gains and losses, net, in the Consolidated Statements of Operations.

6. Investments

The following is a summary of the Company’s investments:

| September 30, 2025 | December 31, 2024 | |||||||||||||||

| Carrying Value | Cost | Carrying Value | Cost | |||||||||||||

| Fnality International Limited—Series B-1 Preference Shares | $ | 8,080 | $ | 8,091 | $ | 8,235 | $ | 8,091 | ||||||||

| Fnality International Limited—Series C-1 Preference Shares | 14,396 | 14,227 | ||||||||||||||

| Quorus Inc.—Series Seed-1 Preferred Stock | 4,000 | 4,000 | ||||||||||||||

| Other investments | 687 | 674 | ||||||||||||||

| Total | $ | 26,476 | $ | 26,318 | $ | 8,922 | $ | 8,765 | ||||||||

Fnality International Limited

The Company owns approximately 7.3% (or 6.2% on a fully-diluted basis) of capital stock of Fnality International Limited (“Fnality”), a company incorporated in England and Wales and focused on creating a peer-to-peer digital wholesale settlement ecosystem comprised of a consortium of financial institutions, offering real time cross-border payments from a single pool of liquidity. The Company’s ownership interest is represented by 2,340,378 Series B-1 Preference Shares (“Fnality B-1 Shares”) and 3,029,294 Series C-1 Preference Shares (“Fnality C-1 Shares”). The Fnality B-1 Shares resulted from the conversion of the Company’s investment of £6,000 ($8,091) in convertible notes upon Fnality’s qualified equity financing which occurred in October 2023. The Fnality C-1 Shares resulted from (i) a new investment made by the Company in the amount of £10,000 ($13,553) as part of a qualified equity financing that occurred in September 2025, and (ii) the conversion of a previously outstanding convertible note issued by Fnality with a cost of $674 (previously listed as “other investments” in the table above). The Fnality B-1 Shares and the Fnality C-1 Shares are convertible into ordinary shares at the option of the Company and contain various rights and protections. The Fnality B-1 Shares carry a 1.0x liquidation preference, while the Fnality C-1 Shares carry a 1.5x liquidation preference, which may be reduced to 1.0x upon the occurrence of certain conditions, such as receipt of specified regulatory approvals or a subsequent qualified equity financing.

|

|

This investment is accounted for under the measurement alternative prescribed in ASC 321, as it does not have a readily determinable fair value and is otherwise not subject to the equity method of accounting. The investment is assessed for impairment and similar observable transactions on a quarterly basis. The (losses)/gains recognized by the Company on its investment in Fnality were ($969) and ($49), respectively, during the three and nine months ended September 30, 2025 and $476 and ($920), respectively, during the comparable periods in 2024. These (losses)/gains are recorded in other gains and losses, net on the Consolidated Statements of Operations and are inclusive of changes in the British pound to U.S. dollar exchange rate.

The Company’s investment in Fnality Series B-1 Shares was re-measured to fair value upon the occurrence of the Fnality C-1 Shares qualified equity financing in September 2025. Fair value was determined using the backsolve method, a valuation approach that determines the value of shares for companies with complex capital structures based upon the price paid for shares recently issued. Fair value was allocated across the capital structure using the Black-Scholes option pricing model. The table below presents the inputs used in the backsolve valuation approach (classified as Level 3 in the fair value hierarchy):

| Inputs | ||||

|

September 10, 2025 |

||||

| Expected volatility | 55% | |||

| Time to exit (in years) | 5.00 | |||

| Probability of regulatory approval or qualified financing before time to exit | 100% | |||

There was no impairment recognized on this investment during the three and nine months ended September 30, 2025 based upon a qualitative assessment.

Quorus Inc.

In June 2025, the Company made a $4,000 strategic investment in Quorus Inc. (“Quorus”), a company focused on empowering asset managers and financial advisors with innovative solutions for custom portfolio management. In consideration of its investment, the Company received 3,798,562 shares of Series Seed-1 Preferred Stock representing approximately 23.8% ownership of Quorus (or 20.4% on a fully diluted basis). The shares of Series Seed-1 Preferred Stock are convertible into common stock at the option of the Company and contain various rights and protections, including non-cumulative dividend rights that participate on an as-converted, pari passu basis with the common stock, only payable if and when declared by the board of directors of Quorus, and a 1.0x non-participating liquidation preference that is senior to all other holders of capital stock of Quorus.

This investment is accounted for under the measurement alternative prescribed in ASC 321, as it does not have a readily determinable fair value and is otherwise not subject to the equity method of accounting. The investment is assessed for impairment and similar observable transactions on a quarterly basis. There was no impairment recognized on this investment during the three and nine months ended September 30, 2025 based upon a qualitative assessment.

7. Fixed Assets, Net

The following table summarizes fixed assets:

|

September 30, 2025 |

December 31, 2024 |

|||||||

| Equipment | $ | 1,223 | $ | 1,069 | ||||

| Less: accumulated depreciation | (916 | ) | (733 | ) | ||||

| Fixed Assets, Net | $ | 307 | $ | 336 | ||||

8. Convertible Notes

The Company has the following convertible notes outstanding as of September 30, 2025:

| ● | $150,000 in aggregate principal amount of 3.25% Convertible Senior Notes due 2026 (the “2026 Notes”); |

| ● | $1,815 in aggregate principal amount of 5.75% Convertible Senior Notes due 2028 (the “2028 Notes”); |

| ● | $345,000 in aggregate principal amount of 3.25% Convertible Senior Notes due 2029 (the “2029 Notes”); and |

| ● | $475,000 in aggregate principal amount of 4.625% Convertible Senior Notes due 2030 (the “2030 Notes”). |

Each class of notes was issued pursuant to indentures dated as of the issuance dates between the Company and U.S. Bank Trust Company, National Association, as trustee (either initially or as successor to U.S. Bank National Association, the “Trustee”), in private offerings to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended.

In connection with the issuance of the 2030 Notes, the Company repurchased $24,030 in aggregate principal amount of the 2028 Notes. As a result of this repurchase, the Company recognized a loss on extinguishment of $13,011 during the three and nine months ended September 30, 2025.

As of September 30, 2025, the Company had an aggregate principal amount of $971,815 outstanding of the 2026 Notes, the 2028 Notes, the 2029 Notes and the 2030 Notes (collectively, the “Convertible Notes”).

|

|

Key terms of the Convertible Notes are as follows:

| 2026 Notes | 2028 Notes | 2029 Notes | 2030 Notes | |||||||||

| Principal outstanding | $150,000 | $1,815 | $345,000 | $475,000 | ||||||||

| Issuance date | June 14, 2021 | February 14, 2023 | August 13, 2024 | August 14, 2025 | ||||||||

| Maturity date (unless earlier converted, repurchased or redeemed) | June 15, 2026 | August 15, 2028 | August 15, 2029 | August 15, 2030 | ||||||||

| Interest rate | 3.25% | 5.75% | 3.25% | 4.625% | ||||||||

| Initial conversion price | $11.04 | $9.54 | $11.82 | $19.15 | ||||||||

| Initial conversion rate | 90.5797 | 104.8658 | 84.5934 | 52.2071 | ||||||||

| Redemption price | $14.35 | $12.40 | $15.37 | $24.90 | ||||||||

| ● | Interest rate: Payable semiannually in arrears on February 15 and August 15 of each year for the 2030 Notes, the 2029 Notes and the 2028 Notes and on June 15 and December 15 of each year for the 2026 Notes. |

| ● | Conversion price: Convertible at an initial conversion rate into shares of the Company’s common stock, per $1,000 principal amount of notes (equivalent to an initial conversion price set forth in the table above), subject to adjustment. |

| ● | Conversion: Holders may convert at their option at any time prior to the close of business on the business day immediately preceding May 15, 2030, May 15, 2029, May 15, 2028 and March 15, 2026 for the 2030 Notes, the 2029 Notes, the 2028 Notes and the 2026 Notes, respectively, only under the following circumstances: (i) if the last reported sale price of the Company’s common stock for at least 20 trading days during a period of 30 consecutive trading days ending on the last trading day of the immediately preceding calendar quarter is greater than or equal to 130% of the conversion price for the respective Convertible Notes on each applicable trading day; (ii) during the five business day period after any ten consecutive trading day period (the “measurement period”) in which the trading price per $1,000 principal amount of the Convertible Notes for each trading day of the measurement period was less than 98% of the product of the last reported sales price of the Company’s common stock and the conversion rate on each such trading day; (iii) upon a notice of redemption delivered by the Company in accordance with the terms of the indentures but only with respect to the Convertible Notes called (or deemed called) for redemption; or (iv) upon the occurrence of specified corporate events. On or after May 15, 2030, May 15, 2029, May 15, 2028 and March 15, 2026 in respect of the 2030 Notes, the 2029 Notes, the 2028 Notes and the 2026 Notes, respectively, until the close of business on the second scheduled trading day immediately preceding the maturity date, holders may convert their Convertible Notes at any time, regardless of the foregoing circumstances. |

| ● | Cash settlement of principal amount: Upon conversion, the Company will pay cash up to the aggregate principal amount of the Convertible Notes to be converted. At its election, the Company will also settle the conversion obligation in excess of the aggregate principal amount of the Convertible Notes being converted in either cash, shares of its common stock or a combination of cash and shares of its common stock. |

| ● | Redemption price: The Company may redeem for cash all or any portion of the Convertible Notes, at its option, on or after August 20, 2027, August 20, 2026, August 20, 2025 and June 20, 2023 in respect of the 2030 Notes, the 2029 Notes, the 2028 Notes and the 2026 Notes, respectively, and on or prior to the 45th scheduled trading day with respect to the 2030 Notes and the 55th scheduled trading day with respect to the 2029 Notes, the 2028 Notes and the 2026 Notes immediately preceding the maturity date, if the last reported sale price of the Company’s common stock has been at least 130% of the conversion price for the respective Convertible Notes then in effect for at least 20 trading days, including the trading day immediately preceding the date on which the Company provides notice of redemption, during any 30 consecutive trading day period ending on, and including, the trading day immediately preceding the date on which the Company provides notice of redemption, at a redemption price equal to 100% of the principal amount of the notes to be redeemed, plus accrued and unpaid interest to, but excluding the redemption date. No sinking fund is provided for the Convertible Notes. |

| ● | Limited investor put rights: Holders of the Convertible Notes have the right to require the Company to repurchase for cash all or a portion of their notes at 100% of their principal amount, plus any accrued and unpaid interest, upon the occurrence of certain change of control transactions or liquidation, dissolution or common stock delisting events. |

| ● | Conversion rate increase in certain customary circumstances: In certain circumstances, conversions in connection with a “make-whole fundamental change” (as defined in the indentures) or conversions of Convertible Notes called (or deemed called) for redemption may result in an increase to the conversion rate, provided that the conversion rate will not exceed 75.7003 shares, 103.6269 shares, 167.7853 shares and 144.9275 shares of the Company’s common stock per $1,000 principal amount of the 2030 Notes, the 2029 Notes, the 2028 Notes and the 2026 Notes, respectively (the equivalent of 93,752,578 shares of the Company’s common stock based on the aggregate principal amount of Convertible Notes outstanding), subject to adjustment. |

| ● | Seniority and Security: The Convertible Notes rank equal in right of payment and are the Company’s senior unsecured obligations. |

|

|

The indentures contain customary terms and covenants, including that upon certain events of default occurring and continuing, either the Trustee or the respective holders of not less than 25% in aggregate principal amount of the respective series of Convertible Notes outstanding may declare the entire principal amount of all such respective Convertible Notes to be repurchased, plus any accrued special interest, if any, to be immediately due and payable.

The following table provides a summary of the Convertible Notes at September 30, 2025 and December 31, 2024:

| September 30, 2025 | December 31, 2024 | |||||||||||||||||||||||||||||||||||

| 2026 Notes |

2028 Notes |

2029 Notes |

2030 Notes |

Total |

2026 Notes |

2028 Notes |

2029 Notes |

Total | ||||||||||||||||||||||||||||

| Principal amount | $ | 150,000 | $ | 1,815 | $ | 345,000 | $ | 475,000 | $ | 971,815 | $ | 150,000 | $ | 25,845 | $ | 345,000 | $ | 520,845 | ||||||||||||||||||

| Less: Unamortized issuance costs | (614 | ) | (26 | ) | (5,946 | ) | (10,779 | ) | (17,365 | ) | (1,263 | ) | (466 | ) | (7,083 | ) | (8,812 | ) | ||||||||||||||||||

| Carrying amount | $ | 149,386 | $ | 1,789 | $ | 339,054 | $ | 464,221 | $ | 954,450 | $ | 148,737 | $ | 25,379 | $ | 337,917 | $ | 512,033 | ||||||||||||||||||

| Effective interest rate(1) | 3.83% | 6.25% | 3.70% | 5.10% | 4.45% | 3.83% | 6.25% | 3.70% | 3.86% | |||||||||||||||||||||||||||

_____________________________

| (1) | Includes amortization of the issuance costs and premium. |

Interest expense on the Convertible Notes was $7,984 and $17,992, respectively, during the three and nine months ended September 30, 2025 and $4,330 and $11,256, respectively, during the comparable periods in 2024. Interest payable of $5,750 and $5,107 at September 30, 2025 and December 31, 2024, respectively, is included in accounts payable and other liabilities on the Consolidated Balance Sheets.

The fair value of the Convertible Notes (classified as Level 2 in the fair value hierarchy) was $1,155,127 and $571,031, respectively, at September 30, 2025 and December 31, 2024. The if-converted value of the 2026 Notes, the 2028 Notes and the 2029 Notes was $188,859, $2,644 and $405,711, respectively, at September 30, 2025. The if-converted value of the 2030 Notes did not exceed the principal amount at September 30, 2025. The if-converted value of the 2028 Notes was $28,446 at December 31, 2024. The if-converted value of the 2026 Notes and the 2029 Notes did not exceed the principal amount at December 31, 2024.

9. Payable to Gold Bullion Holdings (Jersey) Limited (“GBH”)

On November 20, 2023, the Company repurchased all of its then-outstanding Series C Non-Voting Convertible Preferred Stock, par value $0.01 per share (the “Series C Preferred Stock”) which was convertible into 13,087,000 shares of the Company’s common stock, from GBH, a subsidiary of the World Gold Council, for aggregate cash consideration of approximately $84,411. Under the terms of the transaction, the Company has paid GBH $54.8 million to date, with the remainder of the purchase price payable in equal, interest-free installments on the second and third anniversaries of the closing date. The implied price per share was $6.02 when considering the interest-free financing element of the transaction. The investor rights agreement that the Company and GBH entered into in May 2023 in connection with the issuance of the Series C Preferred Stock, which provided GBH with certain rights and obligations with respect to the shares, including registration rights, was terminated in this transaction.

Under U.S. GAAP, the obligation was recorded at its present value utilizing a market rate of interest on the closing date of 7.0% and the corresponding discount is being amortized as interest expense pursuant to the effective interest method of accounting over the life of the obligation. The aggregate consideration payable was valued at $38,835 on the closing date and the carrying value of this obligation is as follows:

|

September 30, 2025 |

December 31, 2024 |

||||||||

| Current: | $ | 14,804 | $ | 14,804 | |||||

| Long-term | 13,564 | 12,159 | |||||||

| Total | $ | 28,368 | $ | 26,963 | |||||

Interest expense recognized was $482 and $1,405, respectively, during the three and nine months ended September 30, 2025 and $697 and $2,039, respectively, during the comparable periods in 2024 and is included as a component of total interest expense recognized on the Consolidated Statements of Operations.

10. Leases

The Company has entered into operating leases for its office facilities (including its corporate headquarters) and equipment. The Company has no finance leases.

|

|

The following table provides additional information regarding the Company’s leases:

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

|

2025 |

2024 |

2025 |

2024 |

|||||||||||||

| Lease cost: | ||||||||||||||||

| Operating lease cost | $ | 341 | $ | 328 | $ | 1,003 | $ | 976 | ||||||||

| Short-term lease cost | 47 | 65 | 142 | 205 | ||||||||||||