UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

| Date of Report (Date of earliest event reported): | August 13, 2025 |

VerifyMe, Inc.

(Exact name of registrant as specified in its charter)

| Nevada | 001-39332 | 23-3023677 | ||||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||||

| 801 International Parkway, Fifth Floor, Lake Mary, Florida | 32746 | |||||

| (Address of principal executive offices) | (Zip Code) | |||||

| Registrant’s telephone number, including area code: | (585) 736-9400 | |||||

_____________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) |

Name of each exchange on which registered | ||

| Common Stock, par value $0.001 per share | VRME | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition. |

On August 13, 2025, VerifyMe, Inc. (the “Company”) issued a press release announcing its financial results for its three and six months ended June 30, 2025. A copy of the Company’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information furnished pursuant to this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under such section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act or the Exchange Act.

| Item 7.01 | Regulation FD Disclosure. |

The disclosure contained in Item 2.02 is incorporated herein by reference. Also on August 13, 2025, the Company posted slides to the Investor section of its website that will accompany the Company’s earnings conference call and webcast at 11:00 a.m. Eastern Time on August 13, 2025. The slides are attached to this Form 8-K as Exhibit 99.2.

The information furnished pursuant to this Item 7.01, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities under such section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act, or the Exchange Act.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit No. | Description | |

|

99.1 |

||

| 99.2 | Slides for the August 13, 2025, Earnings Conference Call and Webcast. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| VerifyMe, Inc. | |||

| Date: August 13, 2025 |

/s/ Adam Stedham |

||

| Name: | Adam Stedham | ||

| Title: | Chief Executive Officer and President | ||

Exhibit 99.1

VerifyMe Reports Second Quarter 2025 Financial Results

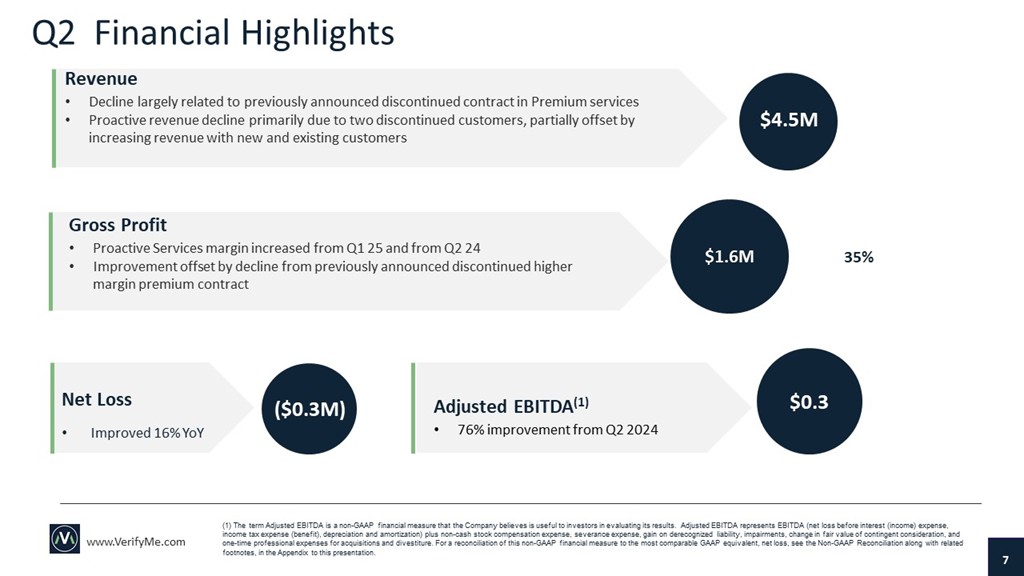

| · | Cash of $6.1 million as of June 30, 2025, with cash provided by operations of $0.7 million in Q2 2025, compared to $0.4 million in Q2 2024 |

| · | Quarterly revenue of $4.5 million in Q2 2025, compared to $5.4 million in Q2 2024(1) |

| · | Quarterly gross profit of $1.6 million or 35% in Q2 2025, compared to $2.1 million or 39% in Q2 2024 |

| · | Net loss of ($0.29) million in Q2 2025, compared to ($0.34) million in Q2 2024(1) |

| · | Adjusted EBITDA(2) of $0.3 million in Q2 2025, compared to $0.2 million in Q2 2024(1) |

Lake Mary, FL – August 13, 2025 – PRNewswire — VerifyMe, Inc. (NASDAQ: VRME) (“VerifyMe,” “we,” “our,” or the “Company”) provides brand owners time and temperature sensitive logistics, and brand protection and enhancement solutions, announced today the Company’s financial results for its second quarter ended June 30, 2025 (“Q2 2025”).

Adam Stedham, VerifyMe’s CEO and President stated “We are pleased with our year-to-date adjusted EBITDA growth over 2024, our positive cash generation in Q2 2025, and our new partnership with the other major parcel carrier in the US. We continue to look for strategic acquisitions to complement our services. In the meantime, we are setting the stage for organic revenue growth in 2026, accompanied by a higher margin profile and continued cash generation”.

__________

(1) Including $0.6 million from loss of previously disclosed Premium services customer

(2) Adjusted EBITDA is a non-GAAP financial measure. See "Use of Non-GAAP Financial Measures" below for information about this non-GAAP measure. A reconciliation to the most directly comparable GAAP measure, net loss, is included as a schedule to this release.

|

|

Key Financial Highlights for Q2 2025:

| · | Quarterly consolidated revenue of $4.5 million in Q2 2025, compared to $5.4 million for the three months ended June 30, 2024 (“Q2 2024”), approximately 70% of reduction is attributable to a $0.6 million decrease from a discontinued contract with one customer in our Premium services. |

| · | Gross profit of $1.6 million or 35% in Q2 2025, compared to $2.1 million or 39% in Q2 2024 |

| · | Net loss of ($0.29) million or ($0.02) per basic and diluted share in Q2 2025, compared to a net loss of ($0.34) million or ($0.03) per basic and diluted share in Q2 2024(1) |

| · | Adjusted EBITDA(2) of $0.3 million in Q2 2025, compared to Adjusted EBITDA of $0.2 million in Q2 2024(1) |

| · | Cash of $6.1 million as of June 30, 2025, with $0.7 million provided by operations during Q2 2025 compared to $0.4 million in Q2 2024. |

Financial Results for the Three Months Ended June 30, 2025:

Revenue in Q2 2025 was $4.5 million, compared to $5.4 million in Q2 2024. Revenue for the quarter decreased by $0.9 million. The decrease is primarily due to a $0.6 million decrease from a discontinued contract with one customer in our Premium services, a $0.5 million decrease related to discontinued services to two customers in our Proactive services, partially offset by increased revenues from new and existing customers in the Precision Logistics segment. The decrease in revenue in our Authentication segment is primarily due to the divestiture of our Trust Codes Global business in December 2024.

Gross profit in Q2 2025 was $1.6 million, compared to $2.1 million in Q2 2024. The resulting gross margin percentage was 35% for the three months ended June 30, 2025, compared to 39% for the three months ended June 30, 2024. The decrease in gross margin was principally due to the discontinued contract in Premium services in the Precision Logistics segment which has higher margins. The Proactive services gross margin percentage improved in Q2 2025 compared to Q2 2024.

Operating loss was ($0.3) million in Q2 2025, compared to ($0.5) million in Q2 2024. The decrease in gross profit was more than offset by the decrease in operating expenses in the quarter. In addition to the reduction in operating costs with the divestiture of Trust Codes, the Company also implemented cost cutting measures in Precision Logistics.

Our net loss was ($0.29) million in Q2 2025and ($0.34) million in Q2 2024(1). The resulting loss per basic and diluted share was ($0.02) in Q2 2025, compared to loss per basic and diluted share of ($0.03) in Q2 2024.

Adjusted EBITDA(2) in Q2 2025 was $0.3 million, compared to $0.2 million in Q2 2024. Adjusted EBITDA is a non-GAAP financial measure. Please see “Use of Non-GAAP Financial Measures” for a discussion of this non-GAAP measure. A reconciliation to the most directly comparable GAAP measure, net loss is included as a schedule to this release.

At June 30, 2025, we had a $6.1 million cash balance and $6.0 million in working capital.

__________

(1) Including $0.6 million from loss of previously disclosed Premium services customer

(2) Adjusted EBITDA is a non-GAAP financial measure. See "Use of Non-GAAP Financial Measures" below for information about this non-GAAP measure. A reconciliation to the most directly comparable GAAP measure, net loss, is included as a schedule to this release.

|

|

Earnings Call

The Company has scheduled an earnings conference call and webcast for 11:00 a.m. ET on Wednesday, August 13, 2025. Prepared remarks regarding the company's financial and operational results will be followed by a question and answer period with VerifyMe's executive team. The conference call may be accessed via webcast at: https://event.choruscall.com/mediaframe/webcast.html?webcastid=YmPT1jph or by calling +1 (844) 763-8274 within the US, or +1 (412) 717-9224 internationally, and requesting the “VerifyMe Call.” The presentation slides broadcast via the webcast will also be available on the Investors section of the VerifyMe website the morning of the call. Participants must be logged in via telephone to submit a question to management during the call. Participants may optionally pre-register for the conference call and webcast at: https://dpregister.com/sreg/10201806/ffaa27b28a.

The webcast and presentation will be archived on the Investors section of VerifyMe’s website and will remain available for 90 days.

About VerifyMe, Inc.

VerifyMe, Inc. (NASDAQ: VRME), provides specialized logistics for time and temperature sensitive products, as well as brand protection and enhancement solutions. To learn more, visit www.verifyme.com.

Cautionary Note Regarding Forward-Looking Statements

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “continue,” “may,” “should,” "will," and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. Important factors that could cause actual results to differ from those in the forward-looking statements include our engagement in future acquisitions or strategic partnerships that increase our capital requirements or cause us to incur debt or assume contingent liabilities, our reliance on one key strategic partner for shipping services in our Precision Logistics segment, competition including by our key strategic partner, seasonal trends in our business, severe climate conditions, the highly competitive nature of the industry in which we operate, our brand image and corporate reputation, impairments related to our goodwill and other intangible assets, economic and other factors such as recessions, downturns in the economy, inflation, global uncertainty and instability, the effects of pandemics, changes in United States social, political, and regulatory conditions and/or a disruption of financial markets, reduced freight volumes due to economic conditions, reduced discretionary spending in a recessionary environment, global supply-chain delays or shortages, fluctuations in labor costs, raw materials, and changes in the availability of key suppliers, our history of losses, our ability to use our net operating losses to offset future taxable income, the confusion of our name brand with other brands, the ability of our technology to work as anticipated and to successfully provide analytics logistics management, our ability to continue to invest in the development and commercialization of our Authentication segment, the ability of our strategic partners to integrate our solutions into their product offerings, our ability to manage our growth effectively, our ability to successfully develop and expand our sales and marketing capabilities, risks related to doing business outside of the U.S., intellectual property litigation, our ability to successfully develop, implement, maintain, upgrade, enhance, and protect our information technology systems, our reliance on third-party information technology service providers, our ability to respond to evolving laws related to information technology such as privacy laws, our ability to attract, retain and develop successors for management, our ability to work with partners in selling our technologies to businesses, production difficulties, our inability to enter into contracts and arrangements with future partners, our ability to acquire new customers, issues which may affect the reluctance of large companies to change their purchasing of products, acceptance of our technologies and the efficiency of our authenticators in the field, our ability to comply with the continued listing standards of the Nasdaq Capital Market, and our ability to timely pay amounts due and comply with the covenants under our debt facilities. These risk factors and uncertainties include those more fully described in VerifyMe’s Annual Report and Quarterly Reports filed with the Securities and Exchange Commission, including under the heading entitled “Risk Factors.” Should one or more of these risks or uncertainties materialize, or should any of our underlying assumptions prove incorrect, actual results may vary materially from those currently anticipated. Any forward-looking statement made by us herein speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

|

|

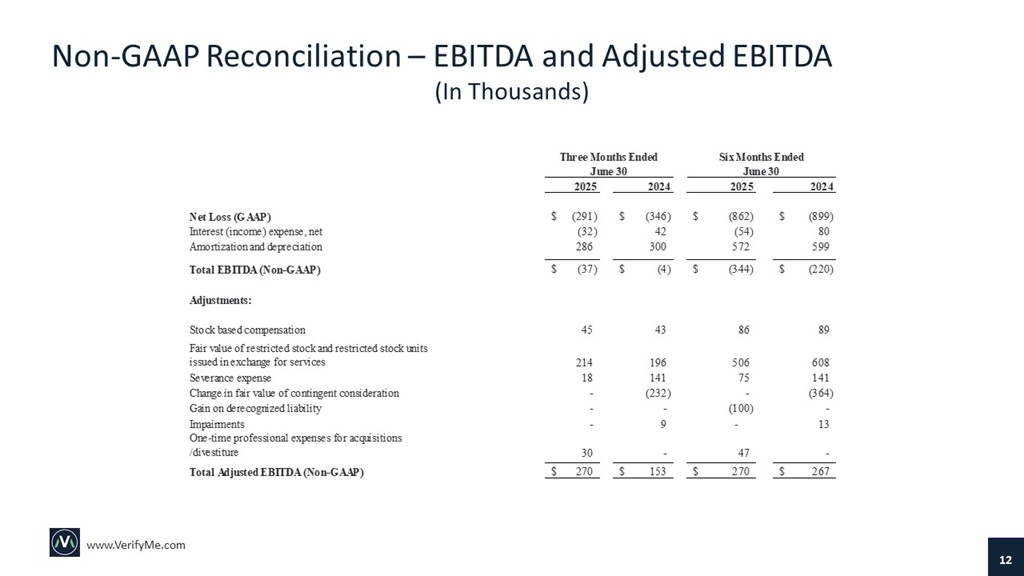

Use of Non-GAAP Financial Measures

This press release includes both financial measures in accordance with U.S. generally accepted accounting principles (“GAAP”), as well as non-GAAP financial measures. Generally, a non-GAAP financial measure is a numerical measure of a company’s performance, financial position or cash flows that either excludes or includes amounts that are not normally included or excluded in the most directly comparable measure calculated and presented in accordance with GAAP. Non-GAAP financial measures should be viewed as supplemental to and should not be considered as alternatives to any other GAAP financial measures. They may not be indicative of the historical operating results of VerifyMe nor are they intended to be predictive of potential future results. Investors should not consider non-GAAP financial measures in isolation or as substitutes for performance measures calculated in accordance with GAAP.

VerifyMe’s management uses and relies on EBITDA and Adjusted EBITDA, which are non-GAAP financial measures. The Company believes that both management and shareholders benefit from referring to EBITDA and Adjusted EBITDA in planning, forecasting and analyzing future periods. Additionally, the Company believes Adjusted EBITDA is useful to investors to evaluate its results because it excludes certain items that are not directly related to the Company’s core operating performance. In particular, with regard to our comparison of Adjusted EBITDA for the three and six months ended June 30, 2025, to the three and six months ended June 30, 2024, we believe is useful to investors in understanding the results of operations. The Company’s management uses these non-GAAP financial measures in evaluating its financial and operational decision making and as a means to evaluate period-to-period comparison. The Company’s management recognizes that EBITDA and Adjusted EBITDA, as non-GAAP financial measures, have inherent limitations because of the described excluded items.

The Company defines EBITDA as net loss before interest (income) expense, income tax expense (benefit), and depreciation and amortization. Adjusted EBITDA represents EBITDA plus non-cash stock compensation expense, severance expense, gain on derecognized liability, impairments, change in fair value of contingent consideration, and one-time professional expenses for acquisitions and divestiture. VerifyMe believes EBITDA and Adjusted EBITDA are important measures of VerifyMe’s operating performance because they allow management, investors and analysts to evaluate and assess VerifyMe’s core operating results from period-to-period after removing the impact of items of a non-operational nature that affect comparability.

A reconciliation of EBITDA and Adjusted EBITDA to the most comparable financial measure, net loss, calculated in accordance with GAAP is included in a schedule to this press release. The Company believes that providing the non-GAAP financial measure, together with the reconciliation to GAAP, helps investors make comparisons between VerifyMe and other companies. In making any comparisons to other companies, investors need to be aware that companies use different non-GAAP measures to evaluate their financial performance. Investors should pay close attention to the specific definition being used and to the reconciliation between such measure and the corresponding GAAP measure provided by each company under applicable SEC rules as the presentation here may not be comparable to other similarly titled measures of other companies.

For Other Information Contact:

Company: VerifyMe, Inc.

Email: IR@verifyme.com

|

|

VerifyMe, Inc.

Consolidated Balance Sheets

(In thousands, except share data)

| June 30, 2025 | December 31, 2024 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| CURRENT ASSETS | ||||||||

| Cash and cash equivalents | $ | 6,067 | $ | 2,823 | ||||

| Accounts receivable, net of allowance for credit loss reserve, $8 and $71 as of June 30, 2025 and December 31, 2024, respectively | 1,100 | 2,636 | ||||||

| Unbilled revenue | 324 | 733 | ||||||

| Prepaid expenses and other current assets | 335 | 131 | ||||||

| Inventory | 41 | 39 | ||||||

| TOTAL CURRENT ASSETS | 7,867 | 6,362 | ||||||

| PROPERTY AND EQUIPMENT, NET | $ | 80 | $ | 116 | ||||

| RIGHT OF USE ASSET | 89 | 236 | ||||||

| INTANGIBLE ASSETS, NET | 5,142 | 5,365 | ||||||

| GOODWILL | 3,988 | 3,988 | ||||||

| TOTAL ASSETS | $ | 17,166 | $ | 16,067 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| CURRENT LIABILITIES | ||||||||

| Term note, current | $ | - | $ | 500 | ||||

| Accounts payable | 1,559 | 2,971 | ||||||

| Other accrued expense | 327 | 660 | ||||||

| Lease liability- current | 51 | 108 | ||||||

| TOTAL CURRENT LIABILITIES | 1,937 | 4,239 | ||||||

| LONG-TERM LIABILITIES | ||||||||

| Long-term lease liability | 43 | 139 | ||||||

| Term note | - | 375 | ||||||

| Convertible note – related party | 450 | 450 | ||||||

| Convertible note | 300 | 650 | ||||||

| TOTAL LIABILITIES | $ | 2,730 | $ | 5,853 | ||||

| STOCKHOLDERS' EQUITY | ||||||||

| Series A Convertible Preferred Stock, $0.001 par value, 37,564,767 shares authorized; 0 shares issued and outstanding as of June 30, 2025 and December 31, 2024, respectively | - | - | ||||||

| Series B Convertible Preferred Stock, $0.001 par value; 85 shares authorized; 0.85 shares issued and outstanding as of June 30, 2025 and December 31, 2024, respectively | - | - | ||||||

| Common stock, $0.001 par value; 675,000,000 shares authorized;12,734,425 and 10,829,908 shares issued, 12,323,668 and 10,539,441 shares outstanding as of June 30, 2025 and December 31, 2024, respectively | 13 | 11 | ||||||

| Additional paid in capital | 101,392 | 96,344 | ||||||

| Treasury stock as cost; 410,757 and 290,467 shares at June 30, 2025 and December 31, 2024, respectively | (434 | ) | (480 | ) | ||||

| Accumulated deficit | (86,535 | ) | (85,673 | ) | ||||

| Accumulated other comprehensive loss | - | 12 | ||||||

| STOCKHOLDERS' EQUITY | 14,436 | 10,214 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 17,166 | $ | 16,067 | ||||

|

|

VerifyMe, Inc.

Consolidated Statements of Operations

(Unaudited)

(In thousands, except share data)

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, 2025 | June 30, 2024 | June 30, 2025 | June 30, 2024 | |||||||||||||

| NET REVENUE | $ | 4,520 | $ | 5,352 | $ | 8,975 | $ | 11,111 | ||||||||

| COST OF REVENUE | 2,929 | 3,262 | 5,894 | 6,761 | ||||||||||||

| GROSS PROFIT | 1,591 | 2,090 | 3,081 | 4,350 | ||||||||||||

| OPERATING EXPENSES | ||||||||||||||||

| Segment management and Technology(a) | 920 | 1,517 | 1,846 | 2,860 | ||||||||||||

| General and administrative (a) | 716 | 894 | 1,572 | 2,015 | ||||||||||||

| Research and development | 5 | 5 | 10 | 60 | ||||||||||||

| Sales and marketing (a) | 272 | 210 | 568 | 598 | ||||||||||||

| Total Operating expenses | 1,913 | 2,626 | 3,996 | 5,533 | ||||||||||||

| LOSS BEFORE OTHER INCOME (EXPENSE) | (322 | ) | (536 | ) | (915 | ) | (1,183 | ) | ||||||||

| OTHER (EXPENSE) INCOME | ||||||||||||||||

| Interest income (expenses), net | 32 | (42 | ) | 54 | (80 | ) | ||||||||||

| Other (expense) income, net | (1 | ) | (1 | ) | ||||||||||||

| Change in fair value of contingent consideration | 232 | 364 | ||||||||||||||

| TOTAL OTHER INCOME (EXPENSE), NET | 31 | 190 | 53 | 284 | ||||||||||||

| NET LOSS | ||||||||||||||||

| $ | (291 | ) | $ | (346 | ) | $ | (862 | ) | $ | (899 | ) | |||||

| LOSS PER SHARE | ||||||||||||||||

| BASIC | (0.02 | ) | (0.03 | ) | (0.07 | ) | (0.09 | ) | ||||||||

| DILUTED | (0.02 | ) | (0.03 | ) | (0.07 | ) | (0.09 | ) | ||||||||

| WEIGHTED AVERAGE COMMON SHARE OUTSTANDING | ||||||||||||||||

| BASIC | 12,643,791 | 10,238,717 | 12,469,118 | 10,156,081 | ||||||||||||

| DILUTED | 12,643,791 | 10,238,717 | 12,469,118 | 10,156,081 | ||||||||||||

| (a) | Includes share-based compensation of $259 thousand and $592 thousand for the three and six months ended June 30, 2025, respectively, and $239 thousand and $697 thousand for the three and six months ended June 30, 2024 respectively. |

|

|

VerifyMe, Inc.

Consolidated EBITDA and Adjusted EBITDA Reconciliation

Table (Unaudited)

(In thousands)

| Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Net Loss (GAAP) | $ | (291 | ) | $ | (346 | ) | $ | (862 | ) | $ | (899 | ) | ||||

| Interest (income) expense, net | (32 | ) | 42 | (54 | ) | 80 | ||||||||||

| Amortization and depreciation | 286 | 300 | 572 | 599 | ||||||||||||

| Total EBITDA (Non-GAAP) | (37 | ) | (4 | ) | (344 | ) | (220 | ) | ||||||||

| Adjustments: | ||||||||||||||||

| Stock based compensation | 45 | 43 | 86 | 89 | ||||||||||||

| Fair value of restricted stock and restricted stock units issued in exchange for services | 214 | 196 | 506 | 608 | ||||||||||||

| Severance | 18 | 141 | 75 | 141 | ||||||||||||

| Change in fair value of contingent consideration | - | (232 | ) | - | (364 | ) | ||||||||||

| Gain on derecognized liability | - | - | (100 | ) | - | |||||||||||

| Impairments | - | 9 | - | 13 | ||||||||||||

| One-time professional expenses for acquisitions/divestiture | 30 | - | 47 | - | ||||||||||||

| Total Adjusted EBITDA (Non-GAAP) | $ | 270 | $ | 153 | $ | 270 | $ | 267 | ||||||||

7

Exhibit 99.2

Protect your brand. Grow your business. Second Quarter 2025 Investor Conference Call August 13, 2025 www.VerifyMe.com NASDAQ:VRME 1

Agenda NASDAQ:VRME 01 Welcome & Introductions Operations and Strategic Update Financial Review Q&A Closing Remarks 02 03 www.VerifyMe.com 04 05 2

Forward Looking Statements In addition to historical information, this presentation contains statements relating to revenue opportunities, anticipated revenue, profitability of the combined company, future business, financial performance, future catalysts and future events or developments, strategy, projected costs, prospects, plans, objectives of management and future operations, future revenue, and expected market growth of VerifyMe, Inc . together with its wholly owned subsidiary PeriShip Global LLC, (“VerifyMe,” the “Company,” “we,” or “us”) that may constitute “forward - looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 . The words “believe,” “continue,” “may,” “should,” "will," and similar expressions, as they relate to us, are intended to identify forward - looking statements . We have based these forward - looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs . Important factors that could cause actual results to differ from those in the forward - looking statements include our ability to regain compliance with the Nasdaq Listing Standards and maintain the listing of our securities on Nasdaq, our engagement in future acquisitions or strategic partnerships that increase our capital requirements or cause us to incur debt or assume contingent liabilities, our reliance on one key strategic partner for shipping services in our Precision Logistics segment, competition including by our key strategic partner, seasonal trends in our business, severe climate conditions, the highly competitive nature of the industry in which we operate, our brand image and corporate reputation, impairments related to our goodwill and other intangible assets, economic and other factors such as recessions, downturns in the economy, inflation, global uncertainty and instability, the effects of pandemics, changes in United States social, political, and regulatory conditions and/or a disruption of financial markets, reduced freight volumes due to economic conditions, reduced discretionary spending in a recessionary environment, global supply - chain delays or shortages, fluctuations in labor costs, raw materials, and changes in the availability of key suppliers, our history of losses, our ability to use our net operating losses to offset future taxable income, the confusion of our name brand with other brands, the ability of our technology to work as anticipated and to successfully provide analytics logistics management, the ability of our strategic partners to integrate our solutions into their product offerings, our ability to manage our growth effectively, our ability to successfully develop and expand our sales and marketing capabilities, risks related to doing business outside of the U . S . , intellectual property litigation, our ability to successfully develop, implement, maintain, upgrade, enhance, and protect our information technology systems, our reliance on third - party information technology service providers, our ability to respond to evolving laws related to information technology such as privacy laws, our ability to retain key management personnel, our ability to work with partners in selling our technologies to businesses, production difficulties, our inability to enter into contracts and arrangements with future partners, our ability to acquire new customers, issues which may affect the reluctance of large companies to change their purchasing of products, acceptance of our technologies and the efficiency of our authenticators in the field, our ability to comply with the continued listing standards of the Nasdaq Capital Market, and our ability to timely pay amounts due and comply with the covenants under our debt facilities . More detailed information about these factors may be found in the Company’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10 - K for the year ended December 31 , 2024 , and subsequent Quarterly Reports on Form 10 - Q . The statements made herein speak only as of the date of this presentation . The Company’s actual results, performance or achievements could differ materially from the results expressed in, or implied by, these forward - looking statements . The Company undertakes no obligation to update or revise its forward - looking statements to reflect events or circumstances after the date of this presentation, except as required by law . Market data and industry information used herein are based on our management's knowledge of the industry and the good faith estimates of management . We also relied, to the extent available, upon managements review of independent industry surveys, forecasts and publications and other publicly available information prepared by a number of third - party sources . All of the market data and industry information used herein involves a number of assumptions and limitations which we believe to be reasonable, and you are cautioned not to give undue weight to such estimates . Although we believe that these sources are reliable, we cannot guarantee the accuracy or completeness of this information, and we have not independently verified this information . Projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are subject to a high degree of uncertainty and risk due to a variety of factors, including those described, above . These and other factors could cause results to differ materially from those expressed in our estimates and beliefs and in the estimates prepared by independent parties . Non - GAAP Financial Measures This presentation includes non - GAAP financial information . This non - GAAP information is in addition to, not a substitute for or superior to, measures of financial performance or liquidity determined in accordance with GAAP . The Securities and Exchange Commission‘s Regulation G applies to any public disclosure or release of material information that includes a non - GAAP financial measure and requires : (i) the presentation of the most directly comparable financial measure calculated and presented in accordance with GAAP and (ii) a reconciliation of the differences between the non - GAAP financial measure presented and the most directly comparable financial measure calculated and presented in accordance with GAAP . The required presentations and reconciliations are contained in this presentation and can also be found at our website at www . verifyme . com 3 NASDAQ:VRME www.VerifyMe.com

Welcome Adam Stedham Chief Executive Officer and President www.VerifyMe.com NASDAQ:VRME 4

Overall Performance 1 • Precision Logistics Q2 2025 Revenue decreased by 14% compared to Q2 2024 • VerifyMe Q2 2025 operating costs reduced by 27% compared to Q2 2024 • Q2 2025 Adjusted EBITDA exceeded Q2 2024 Adjusted EBITDA • Marketing and Business Development continue to generate new customers Capital & Strategic Initiatives • Cash $6.1M at end of Q2 2025 • Continue to evaluate tuck - in and transformative acquisitions • Improved treasury interest through 9 - month promissory note Growth Initiatives • Added additional freight carrier relationship • Completed integration with e - commerce shopping carts 3 2 Strategic Snapshot 5 www.VerifyMe.com

Financials www.VerifyMe.com NASDAQ:VRME – Q2 2025 Financial Highlights – Balance Sheet 6

Q2 Financial Highlights Revenue • Decline largely related to previously announced discontinued contract in Premium services • Proactive revenue decline primarily due to two discontinued customers, partially offset by increasing revenue with new and existing customers $4.5M Net Loss • Improved 16% YoY ($0.4M) $3.1M Gross Profit • Proactive Services margin increased from Q1 25 and from Q2 24 • Improvement offset by decline from previously announced discontinued higher margin premium contract $1.6M 35% (1) The term Adjusted EBITDA is a non - GAAP financial measure that the Company believes is useful to investors in evaluating its results. Adjusted EBITDA represents EBITDA (net loss before interest (income) expense, income tax expense (benefit), depreciation and amortization) plus non - cash stock compensation expense, severance expense, gain o n derecognized liability, impairments, change in fair value of contingent consideration, and one - time professional expenses for acquisitions and divestiture. For a reconciliation of this non - GAAP financial measure to the most comparable GAAP equivalent, net loss, see the Non - GAAP Reconciliation along with related footnotes, in the Appendix to this presentation. 7 ($0.3M) $0.3 Adjusted EBITDA (1) • 76% improvement from Q2 2024 www.VerifyMe.com

Balance Sheet ($ in thousan ds ) 8 www.VerifyMe.com June 30, 2025 (Unaudited) December 31, 2024 Assets Cash and cash equivalents $6,067 $2,823 Accounts receivable and unbilled revenue Intangible assets & Goodwill 1,424 9,130 3,369 9,353 Other assets 545 522 Total Assets $17,166 $16,067 Current Liabilities Accounts payable, accrued exp, current lease exp and contingent consideration Current portion of debt $1,937 - $3,739 500 Non - Current Liabilities Long term portion of debt & Convertible Note Other long - term liabilities 750 43 1,475 139 Total Liabilities $2,730 $5,853 Total Stockholders’ Equity $14,436 $10,214 Total Liabilities and Stockholders’ $17,166 $16,067

9 Q & A 9 NASDAQ:VRME www.VerifyMe.com

10 Appendix www.VerifyMe.com

11 Non - GAAP Reconciliation This presentation includes both financial measures in accordance with U . S . generally accepted accounting principles (“GAAP”), as well as non - GAAP financial measures . Generally, a non - GAAP financial measure is a numerical measure of a company’s performance, financial position or cash flows that either excludes or includes amounts that are not normally included or excluded in the most directly comparable measure calculated and presented in accordance with GAAP . Non - GAAP financial measures should be viewed as supplemental to and should not be considered as alternatives to any other GAAP financial measures . They may not be indicative of the historical operating results of VerifyMe nor are they intended to be predictive of potential future results . Investors should not consider non - GAAP financial measures in isolation or as substitutes for performance measures calculated in accordance with GAAP . VerifyMe’s management uses and relies on EBITDA and Adjusted EBITDA, which are non - GAAP financial measures . The Company believes that both management and shareholders benefit from referring to EBITDA and Adjusted EBITDA in planning, forecasting and analyzing future periods . Additionally, the Company believes Adjusted EBIDTA is useful to investors to evaluate its results because it excludes certain items that are not directly related to the Company’s core operating performance . In particular, with regard to our comparison of Adjusted EBITDA for the three and six months ended June 30 , 2025 , to the three and six months ended June 30 , 2024 , we believe that certain charges make a comparison of net loss less useful to investors than a comparison of Adjusted EBITDA in understanding the results of operations . The Company’s management uses these non - GAAP financial measures in evaluating its financial and operational decision making and as a means to evaluate period - to - period comparison . The Company’s management recognizes that EBITDA and Adjusted EBITDA, as non - GAAP financial measures, have inherent limitations because of the described excluded items . The Company defines EBITDA as net loss before interest (income) expense, income tax expense (benefit), and depreciation and amortization . Adjusted EBITDA represents EBITDA plus non - cash stock compensation expense, severance expense, gain on derecognized liability, impairments, change in fair value of contingent consideration, and one - time professional expenses for acquisitions and divestiture . VerifyMe believes EBITDA and Adjusted EBITDA are important measures of VerifyMe’s operating performance because they allow management, investors and analysts to evaluate and assess VerifyMe’s core operating results from period - to - period after removing the impact of items of a non - operational nature that affect comparability . A reconciliation of EBITDA and Adjusted EBITDA to the most comparable financial measure, net loss, calculated in accordance with GAAP is included in the table on the next slide . The Company believes that providing the non - GAAP financial measure, together with the reconciliation to GAAP, helps investors make comparisons between VerifyMe and other companies . In making any comparisons to other companies, investors need to be aware that companies use different non - GAAP measures to evaluate their financial performance . Investors should pay close attention to the specific definition being used and to the reconciliation between such measure and the corresponding GAAP measure provided by each company under applicable SEC rules as the presentation here may not be comparable to other similarly titled measures of other companies . www.VerifyMe.com

12 Non - GAAP Reconciliation – EBITDA and Adjusted EBITDA (In Thousands) www.VerifyMe.com 2025 2024 2025 2024 Net Loss (GAAP) (291)$ (346)$ (862)$ (899)$ Interest (income) expense, net (32) 42 (54) 80 Amortization and depreciation 286 300 572 599 Total EBITDA (Non-GAAP) (37)$ (4)$ (344)$ (220)$ Adjustments: Stock based compensation 45 43 86 89 Fair value of restricted stock and restricted stock units issued in exchange for services 214 196 506 608 Severance expense 18 141 75 141 Change in fair value of contingent consideration - (232) - (364) Gain on derecognized liability - - (100) - Impairments - 9 - 13 One-time professional expenses for acquisitions /divestiture 30 - 47 - Total Adjusted EBITDA (Non-GAAP) 270$ 153$ 270$ 267$ Three Months Ended June 30 Six Months Ended June 30

Protect your brand. Grow your business. US Headquarters 801 International Parkway Fifth Floor Lake Mary, FL 32746 +1 585 736 9400 info@ verifyme.com 13