UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark one)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2025.

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report ____________

For the transition period from ____________to ____________

Commission file number 001-40280

EpicQuest Education Group International Limited

(Exact name of Registrant as specified in its charter)

British Virgin Islands

(Jurisdiction of incorporation or organization)

200 N. St. Clair St., Suite 100, Toledo OH, 43604

Telephone: +1(513)649-8350

(Address of principal executive offices)

Jianbo Zhang, CEO

200 N. St. Clair St., Suite 100, Toledo OH, 43604

Telephone: +1(513)649-8350

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||

| Common Shares, $0.0016 par value per share | EEIQ | The Nasdaq Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None.

On September 30, 2025, the issuer had 23,396,667 shares outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☐ Large Accelerated filer | ☐ Accelerated filer | ☒ Non-accelerated filer |

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| ☒ US GAAP | ☐ International Financial Reporting Standards as issued by the International Accounting Standards Board | ☐ Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

TABLE OF CONTENTS

| Page | ||

| PART I | 1 | |

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | 1 |

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE | 1 |

| ITEM 3. | KEY INFORMATION | 1 |

| ITEM 4. | INFORMATION ON THE COMPANY | 19 |

| ITEM 4A. | UNRESOLVED STAFF COMMENTS | 32 |

| ITEM 5. | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 32 |

| ITEM 6. | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 41 |

| ITEM 7. | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | 50 |

| ITEM 8. | FINANCIAL INFORMATION | 52 |

| ITEM 9. | THE OFFER AND LISTING | 53 |

| ITEM 10. | ADDITIONAL INFORMATION | 53 |

| ITEM 11. | QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK | 61 |

| ITEM 12. | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 61 |

| PART II | 62 | |

| ITEM 13. | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | 62 |

| ITEM 14. | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 62 |

| ITEM 15. | CONTROLS AND PROCEDURES | 62 |

| ITEM 16. | RESERVED | 63 |

| ITEM 16A. | AUDIT COMMITTEE FINANCIAL EXPERT | 63 |

| ITEM 16B. | CODE OF ETHICS | 63 |

| ITEM 16C. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 63 |

| ITEM 16D. | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES. | 63 |

| ITEM 16E. | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 63 |

| ITEM 16F. | CHANGES IN REGISTRANT’S CERTIFYING ACCOUNTANT | 63 |

| ITEM 16G. | CORPORATE GOVERNANCE | 64 |

| ITEM 16H | MINE SAFETY DISCLOSURE | 64 |

| ITEM 16I | DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS. | 64 |

| PART III | 65 | |

| ITEM 17. | FINANCIAL STATEMENTS | 65 |

| ITEM 18. | FINANCIAL STATEMENTS | 65 |

| ITEM 19. | EXHIBITS | 65 |

CERTAIN INFORMATION

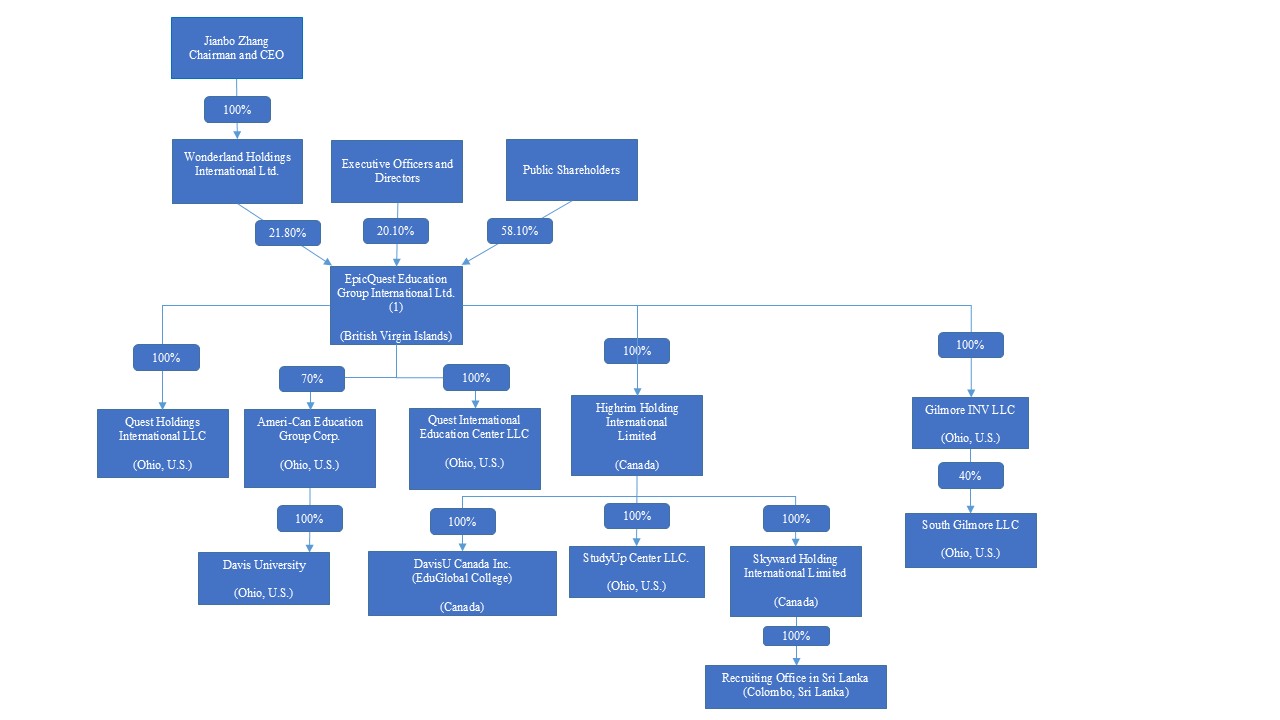

In this Annual Report on Form 20-F (the “Annual Report”), unless otherwise indicated, “we,” “us,” “our,” “EpicQuest Education,” “EpicQuest,” and “Company” refers to EpicQuest Education Group International Limited, a British Virgin Islands (“BVI”) company, and its subsidiaries, including Quest Holdings International LLC, an Ohio limited liability company (“QHI”); Quest International Education Center LLC, an Ohio limited liability company (“QIE”); Ameri-Can Education Group Corp., an Ohio corporation (“Ameri-Can”); Davis College Inc. (d.b.a. Davis University), an Ohio limited liability company (“Davis University,” “Davis,” or “DU”); Study Up Center LLC, an Ohio limited liability company (“SUPC”); Gilmore INV LLC, an Ohio limited liability company (“Gilmore”); SouthGilmore LLC, an Ohio limited liability company (“SouthGilmore”); DavisU Canada Inc., a Canadian company, d.b.a. EduGlobal College (“DC” or “EduGlobal College”); Highrim Holding International Limited, a Canadian company (“HHI”); and Skyward Holding International Limited, a Canadian company (“Skyward”).

Unless the context indicates otherwise, all references to “China” or “PRC” refer to the People’s Republic of China. All references to “provincial-level regions” or “regions” include provinces as well as autonomous regions and directly controlled municipalities in China, which have an administrative status equal to provinces, including Beijing.

All references to “Renminbi,” “RMB” or “yuan” are to the legal currency of the People’s Republic of China, and all references to “U.S. dollars,” “dollars,” “$” are to the legal currency of the United States. This Report contains translations of Renminbi amounts into U.S. dollars at specified rates solely for the convenience of the reader. We make no representation that the Renminbi or U.S. dollar amounts referred to in this Report could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all. On September 30, 2025, the buying rate announced by the Federal Reserve Statistical Release was RMB 7.119 to $1.00.

FORWARD-LOOKING STATEMENTS

This Report contains “forward-looking statements” that represent our beliefs, projections and predictions about future events. All statements other than statements of historical fact are “forward-looking statements” including any projections of earnings, revenue or other financial items, any statements of the plans, strategies and objectives of management for future operations, any statements concerning proposed new projects or other developments, any statements regarding future economic conditions or performance, any statements of management’s beliefs, goals, strategies, intentions and objectives, and any statements of assumptions underlying any of the foregoing. Words such as “may”, “will”, “should”, “could”, “would”, “predicts”, “potential”, “continue”, “expects”, “anticipates”, “future”, “intends”, “plans”, “believes”, “estimates” and similar expressions, as well as statements in the future tense, identify forward-looking statements.

These statements are necessarily subjective and involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from any future results, performance or achievements described in or implied by such statements. Actual results may differ materially from expected results described in our forward-looking statements, including with respect to correct measurement and identification of factors affecting our business or the extent of their likely impact, the accuracy and completeness of the publicly available information with respect to the factors upon which our business strategy is based on the success of our business.

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of whether, or the times by which, our performance or results may be achieved. Forward-looking statements are based on information available at the time those statements are made and management’s belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to, those factors discussed under the headings “Risk Factors”, “Operating and Financial Review and Prospects,” “Information on the Company” and elsewhere in this Annual Report.

This Annual Report should be read in conjunction with our audited financial statements and the accompanying notes thereto, which are included in Item 18 of this Annual Report.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not required.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not required.

ITEM 3. KEY INFORMATION

A. [Reserved]

B. Capitalization and Indebtedness

Not required.

C. Reasons for the Offer and Use of Proceeds

Not required.

D. Risk factors

You should carefully consider the following risk factors, together with all of the other information included in this Annual Report.

Risks Related to Our Business

There is uncertainty regarding our ability to continue as a going concern.

As of September 30, 2025, we have incurred recurring net losses and negative cash flows from operations, which raise substantial doubt about our ability to continue as a going concern within one year after the date that the consolidated financial statements included in this Annual Report are issued. As of September 30, 2025, the Company had an accumulated deficit of $17,387,799, negative operating cash flow of $2,946,315.

While we believe that our plans to address these concerns are feasible, there is no assurance that our actions will be successful in mitigating the substantial doubt about the our ability to continue as a going concern. If we are unable to obtain sufficient financing or generate adequate cash flows from operations, we may be required to curtail or cease operations, seek protection under applicable bankruptcy laws, or pursue other strategic alternatives.

As a result of the foregoing, the report of our independent registered public accounting firm contains an explanatory paragraph relating to our ability to continue as a going concern. This uncertainty may materially and adversely affect the market price of our ordinary shares and our ability to raise new capital.

Although historically we have generated net income, we cannot assure you that we will continue on the profitability path going forward.

We have generated revenues of $8,939,989 and $8,153,546 and had net (loss) of $(2,526,613) and $(6,571,184) for the years ended September 30, 2025 and 2024, respectively. We expect that both our revenues and our operating expenses will increase as we expand our business. If we are not able to increase revenue and/or manage operating expenses in line with revenue forecasts, we may not be able to achieve profitability. Any significant failure to realize anticipated revenue growth from our new and existing lines of business and/or manage operating expenses in line with revenue forecasts, could result in continued operating losses. As such, we cannot assure you that we will maintain profitability.

If we are not able to continue to attract students to retain our services, our business and prospects will be materially and adversely affected.

The success of our business depends primarily on the number of student members enrolled. Therefore, our ability to continue to attract students is critical to the continued success and growth of our business. This in turn will depend on several factors, including our ability to develop new services and enhance existing ones to respond to changes in market trends and student demands, manage our growth while maintaining consistent and high education quality, broaden our relationships with strategic partners and market our services effectively to a broader base of prospective students. If we are unable to continue to attract students, our net revenues may decline, which may have a material adverse effect on our business, financial condition and results of operations.

Our results of operations may fluctuate significantly and may not fully reflect the underlying performance of our business.

Our results of operations, including our operating revenue, expenses and other key metrics, may vary significantly in the future and period-to-period comparisons of our operating results may not be meaningful. Accordingly, the results for any one quarter are not necessarily an indication of future performance. Our financial results may fluctuate due to a variety of factors, some of which are outside of our control and, as a result, may not fully reflect the underlying performance of our business. Fluctuation in our operating results may adversely affect the price of our common shares. Factors that may cause fluctuations in our quarterly results include:

| ● | our ability to attract new customers, maintain relationships with existing customers, and expand into new markets; | |

| ● | the amount and timing of operating expenses related to the maintenance and expansion of our business, operations and infrastructure; |

| ● | general economic, industry and market conditions in China; and | |

| ● | our emphasis on customer experience instead of near-term growth. |

If we fail to attract more students to participate in our activities, our operations and financial condition will be materially adversely affected.

The success of our business depends primarily on the number of students who participate each year. Therefore, our ability to continue to attract students is critical to our continued success and growth. We rely heavily on our relationships with provincial and local governments, schools, principals and teachers to promote and encourage participation in our programs to parents, teachers and students. We must create an innovative theme to attract the interest of the participants. In addition, parental support is critical for student participation. If we are unable to continue to attract parents and students to participate, not only will our revenues decline in this business line, but our brand will be harmed, which may have a material adverse effect on our business, financial condition and results of operations.

Parents’ and students’ interest in such travel and education abroad opportunities may be adversely affected by the COVID-19 pandemic and future pandemics. Our business, operations and financial performance have been, and may continue to be, affected by the macroeconomic impacts resulting from pandemics, and as a result, our revenue growth rate and expenses as a percentage of our revenues in future periods may differ significantly from our historical rates, and our future operating results may fall below expectations. The extent to which our business will continue to be affected will depend on a variety of factors, many of which are outside of our control, including the persistence of the pandemic, impacts on economic activity, and the possibility of recession or continued financial market instability. We currently believe that our financial resources will be adequate to sustain the Company’s operations through the outbreak. However, in the event that we do need to raise capital in the future, the outbreak-related instability in the securities markets could adversely affect our ability to raise additional capital.

China regulates education services extensively and we may be subject to government actions if our programs do not comply with PRC laws.

Violation of PRC laws, rules or regulations pertaining to education and related activities may result in penalties, including fines. We endeavor to comply with such requirements by requesting relevant documents from our program participants. However, we cannot assure you that violations or alleged violations of such requirements will not occur with respect to our operations. If the relevant PRC governmental agencies determine that our programs violate any applicable laws, rules or regulations, we could be subject to penalties. While we have and continue to engage in strategies to mitigate this risk by diversifying our marketing efforts and focusing on Southeast Asian markets, there is no assurance that such efforts will be successful in mitigating such risks faced by the Company.

Recent regulatory developments in China may subject us to additional regulatory review and disclosure requirement, or expose us to government interference, all of which could materially and adversely affect our business and the value of our securities.

We may need to adjust our business operations in the future to comply with PRC laws regulating our industry and our business operations. However, such efforts may not be completed in a liability-free manner or at all. We cannot guarantee that we will not be subject to PRC regulatory inspection and/or review relating to cybersecurity, especially when there remains significant uncertainty as to the scope and manner of the regulatory enforcement. If we become subject to regulatory inspection and/or review by PRC authorities, or are required by them to take any specific actions, it could cause disruptions to our operations, result in negative publicity regarding our company, and divert our managerial and financial resources. We may also be subject to fines or other penalties, which could materially and adversely affect our business, financial condition, and results of operations.

The Chinese government may intervene or influence the operations at any time or may exert more control over offerings conducted overseas and foreign investment in China-based issuers, which could result in a material change in the operations and/or the value of the securities we are registering for sale. Additionally, the PRC government has recently indicated an intent to exert more oversight over offerings that are conducted overseas and/or foreign investment in China-based issuers, which could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless.

Substantially all of our revenue is currently derived in China through Davis University and, historically, a portion of our operations have been conducted in China by QHI and Davis through their business partners in China, Renda Financial Education Technology Co., Ltd. and Wenfeng Shenghe Study Abroad Co. Ltd. Accordingly, our results of operations, financial condition and prospects are influenced by economic, political and legal developments in China, especially the government policies of PRC government. The PRC government has significant oversight and authority to exert influence on the ability of a China-based company to conduct the business. It regulates and may intervene or influence the operations at any time, which could result in a material adverse change in the operations and/or the value of the securities we are registering for sale. Implementation of any industry-wide regulations directly targeting our business operations could cause our securities to significantly decline in value or become worthless. Also, the PRC government has recently indicated an intent to exert more oversight over offerings that are conducted overseas and/or foreign investment in China-based issuers. Any such action could significantly limit or completely hinder our ability to offer or continue to offer securities to investors, and any uncertainties or negative publicity regarding such actions could also materially and adversely affect the business, prospects, financial condition, reputation, and the trading price of our common shares, which may cause our securities to significantly decline in value or be worthless. Therefore, investors in our company face potential uncertainty from the actions taken by the PRC government.

Moreover, the significant oversight of the PRC government could also be reflected from the uncertainties arising from the legal system in China. The laws and regulations of the PRC can change quickly without sufficient notice in advance, which makes it difficult for us to predict which kind of laws and regulations will come into force in the future and how it will influence our company and operations. Any actions by the Chinese government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or become worthless.

The PRC government has significant influence over companies with operations in China by enforcing existing rules and regulation, adopting new ones, or changing relevant industrial policies in a manner that may materially increase our compliance cost, change relevant industry landscape or otherwise cause significant changes to our business operations in China, which could result in material and adverse changes in our operations and cause the value of our securities to significantly decline or be worthless.

Our customers have historically been located within China. The PRC government has significant influence over operations in China by any company by allocating resources, providing preferential treatment to particular industries or companies, or imposing industry-wide policies on certain industries. The PRC government may also amend or enforce existing rules and regulation, or adopt ones, which could materially increase our compliance cost, change the relevant industry landscape, or cause significant changes to our business operations in China. In addition, the PRC regulatory system is based in part on government policies and internal guidance, some of which are not published on a timely basis, or at all, and some of which may even have a retroactive effect. We may not be aware of all non-compliance incidents at all times, and we may face regulatory investigation, fines and other penalties as a consequence. As a result of the changes in the industrial policies of the PRC government, including the amendment to and/or enforcement of the related laws and regulations, companies with operations in China, including us, and the industries in which we operate, face significant compliance and operational risks and uncertainties. For example, on July 24, 2021, Chinese state media, including Xinhua News Agency and China Central Television, announced a broad set of reforms targeting private education companies providing after-school tutoring services and prohibiting foreign investments in institutions providing such after-school tutoring services. As a result, the market value of certain U.S. listed companies with China-based operations in the affected sectors declined substantially. As of the date of this Report, we are not aware of any similar regulations that may be adopted to significantly curtail our business operations in China. However, if such other adverse regulations or policies are adopted in China, our operations in China will be materially and adversely affected, which may significantly disrupt our operations and adversely affect our business.

We may be subject to anti-monopoly concerns as a result of our doing business in China.

Article 3 of Anti-Monopoly Law of the People’s Republic of China (the “Anti-Monopoly Law”) prohibits “monopolistic practices,” which include: a) the conclusion of monopoly agreements between operators; b) the abuse of dominant market position by operators; and c) concentration of undertakings which has or may have the effect of eliminating or restricting market competition. Also, according to Article 19 of the Anti-Monopoly Law, the operator(s) will be assumed to have a dominant market position if it has following situation: a) an operator has 50% or higher market share in a relevant market; b) two operators have 66% or higher market share in a relevant market; or c) three operators have 75% or higher market share in a relevant market. We do not believe we have engaged in any monopolistic practices in China, and that recent statements and regulatory actions by the Chinese government do not impact our ability to conduct business, accept foreign investments, or list on an U.S. or other foreign stock exchange. However, there can be no assurance that regulators in China will not promulgate new laws and regulations or adopt new series of regulatory actions which may require us to meet new requirements on the issues mentioned above.

Rules and regulations in China can change quickly with little advance notice, creating substantial uncertainty. Changes in the PRC legal system may adversely affect our business and operations.

Our customers have historically been located in the PRC and therefore we are subject to the laws and regulations of the PRC. The PRC legal system is based on the written statutes and involves a unified, multilevel legislative system. The National People’s Congress (the “NPC”) and its Standing Committee exercise the state power to make laws. The NPC enacts and amends basic laws pertaining to criminal offences, civil affairs, state organs and other matters. The Standing Committee enacts and amends all laws except for basic laws that should be enacted by the NPC. When the NPC is not in session, its Standing Committee may partially supplement and revise laws enacted by the NPC, provided that the changes do not contravene the laws’ basic principles. Generally, the PRC laws will go through specific legislative procedures before being promulgated. The legislative authority may propose a bill and then the bill shall be deliberated three times before being voted. However, administrative regulations are formulated by the State Council which reports them to the NPC. The administration regulations are often promulgated with little advance notice, which results in a lack of predictability, and substantial uncertainty. Moreover, the uncertainties may fundamentally impact the development of one or more specific industries and in extreme cases result in the termination of certain businesses. For example, the Opinions on Further Easing the Burden of Excessive Homework and After-School Tutoring for Students Undergoing Compulsory Education, known as “double reduction” education policy, was promulgated by General Office of the CPC Central Committee and General Office of the State Council on July 24, 2021. The “double reduction” education policy comes into effective immediately and has posed a significant impact on the education and training industries, as well as those China-based companies listed in the United States. The resulting unpredictable could materially and adversely affects the market value and the operation of the businesses affected.

Furthermore, the PRC administrative authorities and courts have the power to interpret and implement or enforce statutory rules and contractual terms at their reasonable discretion which makes the business environment much more complicated and unpredictable. It is difficult to predict the outcome of the administrative and court proceedings. The uncertainties may affect our assessments of the relevance of legal requirements, and our business decisions. Such uncertainties may result in substantial operating expenses and costs. Should there be any investigations, arbitrations or litigation with respect to our alleged non-compliance with statutory rules and contractual terms, the management team could be distracted from our primary business considerations, and therefore such a circumstance could materially and adversely affect our business and results of operations. We cannot predict future developments relating to the laws, regulations and rules in the PRC. We may be required to procure additional permits, authorizations and approvals for our operations, which we may not be able to obtain. Our failure to obtain such permits, authorizations and approvals may materially and adversely affect our business, financial condition and the results of operations.

Neither we, nor our subsidiaries, have received any permits, authorizations and approvals from any governmental agency, as we do not believe our operations require any such permissions or approvals. There can be no assurance, however, that regulators in China will not take a contrary view or will not subsequently require us to undergo the approval procedures and subject us to penalties for non-compliance. The foregoing statements are based on our management’s belief and we have determined not to seek an opinion of local counsel to verify our management’s belief. We made this decision based on the types of activities we conduct in China, which do not believe raises any issues under Chinese law. Notwithstanding the foregoing, we, our subsidiaries, and investors in our securities would be materially harmed if (i) we do not receive or maintain such permissions or approvals, (ii) we inadvertently conclude that such permissions or approvals are not required, or (iii) applicable laws, regulations, or interpretations change and we are required to obtain such permissions or approvals in the future.

To the extent cash in the business is in the PRC or a PRC entity, the funds may not be available to fund operations or for other use outside of the PRC due to interventions in or the imposition of restrictions and limitations on the ability of our Company, or our subsidiaries, by the PRC government to transfer cash.

The PRC government imposes controls on the convertibility of Renminbi into foreign currencies and, in certain cases, the remittance of currency out of the PRC. If, in the future, we maintain cash in the PRC, shortages in foreign currencies may restrict our ability to pay dividends or other payments, or otherwise satisfy any foreign currency denominated obligations, if any. Approval from appropriate government authorities is required if Renminbi is converted into foreign currency and remitted out of the PRC to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC government may, at its discretion, impose restrictions on access to foreign currencies for current account transactions and if this occurs in the future, we may not be able to pay dividends in foreign currencies to our shareholders.

As a result of the above, to the extent cash in the business is in the PRC or a PRC entity, such funds or assets may not be available to fund operations or for other use outside of the PRC, due to interventions in or the imposition of restrictions and limitations on the ability of us, or our subsidiaries, by the government to the transfer of cash.

Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our business and operations.

Our business, financial condition, results of operations and prospects may be influenced to a significant degree by political, economic and social conditions in China generally and by continued economic growth in China as a whole. China’s economy differs from the economies of most developed countries in many respects, including the level of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. The PRC government has implemented measures since the late 1970’s emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets, and the establishment of improved corporate governance in business enterprises, which are generally viewed as a positive development for foreign business investment. In addition, the PRC government continues to play a significant role in regulating industry development by imposing industrial policies. The PRC government also exercises significant control over the PRC economic growth through allocating resources, controlling payments of foreign currency-denominated obligations, setting monetary policy, and providing preferential treatment to particular industries or companies. For example, as a result of China’s current nationwide anti-corruption campaign, public school spending has become strictly regulated. To comply with the expenditure control policies of the Chinese government, many public universities temporarily reduced their self-taught education spending in 2017. This caused the demand for our courses in 2017 to decrease. If our clients continue to reduce their demand for our services due to the policies of the Chinese government, this could adversely impact our business, financial condition and operating results.

While China’s economy has experienced significant growth over the past decades, growth has been uneven, both geographically and among various sectors of the economy, and the rate of growth has been slowing. Some of the governmental measures may benefit the overall Chinese economy but may have a negative effect on us. For example, our financial condition and results of operations may be adversely affected by government control over capital investments or changes in tax regulations. Any stimulus measures designed to boost the Chinese economy may contribute to higher inflation, which could adversely affect our results of operations and financial condition. For example, certain operating costs and expenses, such as employee compensation and office operating expenses, may increase as a result of higher inflation. In addition, the PRC government has implemented in the past certain measures to control the pace of economic growth. These measures may cause decreased economic activity, which in turn could lead to a reduction in demand for our services and consequently have a material adverse effect on our businesses, financial condition and results of operations.

Our business, financial condition and results of operations may be adversely affected by a downturn in the global or Chinese economy.

Because our student enrollment may depend on our students’ and potential students’ and their parents’ levels of disposable income, perceived job prospects and willingness to spend, our business and prospects may be affected by economic conditions in China or globally. The global financial markets experienced significant disruptions in 2008 and the United States, Europe and other economies went into recession; and since 2020 the world economy has been facing the challenges related to the global COVID-19 pandemic, including supply chain challenges and inflationary pressures. The recovery from the lows of 2008 and 2009 was uneven and is continuously facing new challenges, including the escalation of the European sovereign debt crisis since 2011 and the slowdown of the Chinese economy in 2012. In addition, the global recovery from the lows in 2020 and the COVID-19 pandemic remain slow and inconsistent. Economic conditions in China are sensitive to global economic conditions, as well as changes in domestic economic and political policies and the expected or perceived overall economic growth rate in China. A decline in the economic prospects in the mechanics and other industries could alter current or prospective students’ spending priorities and the recruiting demand from workers in these areas. We cannot assure you that education spending in general or with respect to our course offerings in particular will increase, or not decrease, from current levels. Therefore, a slowdown in China’s economy or the global economy may lead to a reduction in demand for mechanics or other training covered by our courses, which could materially and adversely affect our financial condition and results of operations.

The Company’s operations and performance depend significantly on global and regional economic and geopolitical conditions. Changes in U.S.-China trade policies, and a number of other economic and geopolitical factors both in China and abroad could have a material adverse effect on the Company’s business, financial condition, results of operations or cash flows. Such factors may include, without limitation:

| ● | instability in political or economic conditions, including but not limited to inflation, recession, foreign currency exchange restrictions and devaluations, restrictive governmental controls on transportation, visas issued to citizens of other countries, the movement and repatriation of earnings and capital, and actual or anticipated military or political conflicts, particularly in emerging markets; | |

| ● | intergovernmental conflicts or actions, including but not limited to armed conflict, trade wars, retaliatory tariffs, and acts of terrorism or war; and | |

| ● | interruptions to the Company’s business with its largest customers, distributors and suppliers resulting from but not limited to, strikes, financial instabilities, computer malfunctions or cybersecurity incidents, inventory excesses, natural disasters or other disasters such as fires, floods, earthquakes, hurricanes or explosions. |

We could be adversely affected by political tensions between the United States and China.

Political tensions between the United States and China have escalated due to, among other things, the COVID-19 outbreak, the PRC National People’s Congress’ passage of the Hong Kong National Security Law, sanctions imposed by the U.S. Department of Treasury on certain officials of the Hong Kong Special Administrative Region and the central government of the PRC, as well as the executive orders could have adverse effect on our operations. Rising political tensions could reduce levels of trade, investments, technological exchanges and other economic activities between the two major economies, which would have a material adverse effect on global economic conditions and the stability of global financial markets. Any of these factors could have a material adverse effect on our business, prospects, financial condition and results of operations. Furthermore, there have been recent media reports on deliberations within the U.S. government regarding potentially limiting or restricting China-based companies from accessing U.S. capital markets. If any such deliberations were to materialize, the resulting legislation may have a material and adverse impact on the stock performance of China-based issuers listed in the United States. We cannot assure you that, if the political tension between the United States and China intensifies and further regulations affecting our business are passed, our business will not be materially and adversely affected.

Our business is highly dependent on the ability of international students to obtain admission to, and maintain enrollment in, U.S. colleges and universities. This process is fundamentally reliant on the U.S. government’s immigration policies, including the issuance and maintenance of student visas, as well as the regulatory environment governing international student presence in the United States. Recent and ongoing changes in U.S. government rules and restrictions present significant risks that could materially and adversely affect our operations, financial condition, and results of operations.

The U.S. government has recently implemented, and may continue to implement, policies that increase scrutiny of international student visa applicants and holders. These include, but are not limited to: (i) suspension and delay of visa processing, (ii) expanded social media and background checks, and (iii) revocation of existing visas and SEVIS records.

Recent policy announcements have indicated a willingness to target students from specific countries, including China, or those studying in so-called “critical fields.” Such targeted restrictions may include aggressive revocation of visas, heightened vetting, or outright bans on enrollment for certain populations. These actions could significantly reduce the pool of eligible students and disrupt established partnerships with foreign institutions.

The U.S. government has also demonstrated a willingness to impose sanctions on specific universities, including revoking their ability to enroll international students or cutting federal research funding. Such actions may be based on alleged non-compliance with information requests, perceived ties to foreign governments, or other policy considerations. If universities lose their certification to host international students, our clients may be unable to enroll or continue their studies, and our company may lose key institutional partners.

The legal landscape for international students is currently in flux. This uncertainty complicates our ability to provide reliable guidance to students and institutions, increases the risk of non-compliance, and may expose our company to legal liability or reputational harm if students are unable to complete their studies as planned.

The evolving and often unpredictable nature of U.S. government rules and restrictions on international students presents significant risks to our business model. We may be unable to anticipate or mitigate the full impact of these changes, which could materially and adversely affect our ability to assist international students with enrollment in U.S. institutions, as well as our overall financial performance and strategic objectives. We continue to monitor regulatory developments closely and adapt our operations as necessary, but there can be no assurance that future changes will not have a material adverse effect on our company.

Some students may decide not to continue engaging our courses for a number of reasons, including a perceived lack of improvement in their performance in specific courses, a change in requirements or general dissatisfaction with our programs, which may adversely affect our business, financial condition, results of operations and reputation.

The success of our business depends in large part on our ability to retain our students by delivering a satisfactory learning experience and improving their performance. If students feel that we are not providing them the experience they are seeking, they may choose not to renew. Student satisfaction with our programs may decline for a number of reasons, many of which may not reflect the effectiveness and efficiency of our services. If students’ performances decline as a result of their own study habits, they may not refer other students to us, which could materially adversely affect our business.

Failure to protect the confidential information of our customers against security breaches could damage our reputation and brand and substantially harm our business and results of operations.

Maintaining security for the storage and transmission of confidential information on our system, such as student names, personal information and billing addresses, is essential to maintaining student confidence. We have adopted security policies and measures to protect our proprietary data and student information. However, advances in technology, the expertise of hackers, new discoveries in the field of cryptography or other events or developments could result in a compromise or breach of the technology that we use to protect confidential information. We may not be able to prevent third parties, especially hackers or other individuals or entities engaging in similar activities, from illegally obtaining such confidential or private information. Such individuals or entities obtaining our clients’ confidential or private information may further engage in various other illegal activities using such information. Any negative publicity regarding our safety or privacy protection mechanisms and policies, and any claims asserted against us or fines imposed upon us as a result of actual or perceived failures, could have a material and adverse effect on our public image, reputation, financial condition and results of operations.

If we fail to strengthen and protect our brands, our operations and the financial situation will be materially affected.

We believe that our brand is synonymous with achievement, creativity, self-esteem and accomplishment throughout the PRC. It is critical that we maintain and protect our brand and our image, as we continue to launch new programs, projects and acquire new businesses. As we launch new business lines, and seek to increase visibility in our current business lines, the use of several marketing tools, sponsorship and support from traditional advertisers, schools and government officials will be important to our success. A number of factors could prevent us from successfully promoting our brand, including student and parent dissatisfaction with our services, the failure of our marketing tools and strategies to attract new students. If we are unable to maintain and enhance the brand or utilize marketing tools in a cost-effective manner, our revenues and profitability may suffer. If we are unable to further enhance our brand recognition and increase awareness of our services, or if we incur excessive sales and marketing expenses, our business and results of operations may be materially and adversely affected.

We may not be able to implement our growth strategy and future plans successfully.

Our growth strategy includes increasing sales, leveraging our brand, and acquiring companies that have services, products or technologies that extend or complement our existing business. While we currently have not identified any specific target companies, the process to undertake a growth strategy like ours, is time-consuming and costly. We expect to expend significant resources and there is no guarantee that we will successfully execute our plans. Failure to manage expansion effectively may affect our success in executing our business plan and may adversely affect our business, financial condition and results of operations. We may not realize the anticipated benefits of any or all of our strategies, or may not realize them in the time frame expected. In addition, future acquisitions may require us to issue additional equity securities, spend our cash, or incur debt, and amortization expenses related to intangible assets or write-offs of goodwill, any of which could adversely affect our results of operations.

We face significant competition and if we fail to compete effectively, we may lose our market share and our profitability may be adversely affected.

The education sector in China is rapidly evolving, highly fragmented and competitive, and we expect competition in this sector to persist and intensify. We face competition and competition is particularly intense in some of the key geographic markets in which we operate. We also face competition from companies that focus on one area of our business and are able to devote all of their resources to that business line. These companies may be able to more quickly adapt to changing technology, student preferences and market conditions in these markets than we can. These companies may, therefore, have a competitive advantage over us with respect to these business areas. The increasing use of the Internet and advances in Internet and computer-related technologies are eliminating geographic and cost-entry barriers to providing educational services and products. As a result, many international companies that offer online test preparation and language training courses may decide to expand their presence in China or to try to penetrate the Chinese market. Many of these international companies have strong education brands, and students and parents in China may be attracted to the offerings based in the country that the student wishes to study in or in which the selected language is widely spoken. In addition, many Chinese and smaller companies are able to use the Internet to quickly and cost-effectively offer their services and products to a large number of students with less capital expenditure than previously required. Competition could result in loss of market share and revenues, lower profit margins and limit our future growth. A number of our current and potential future competitors may have greater financial and other resources than we have. In addition, many US universities and colleges marketing in China also represent our competition. These competitors may be able to devote greater resources than we can to the development, promotion and sale of their services and products, and respond more quickly than we can to changes in student needs, market needs or new technologies. As a result, our net revenues and profitability may decrease. We cannot assure you that we will be able to compete successfully against current or future competitors. If we are unable to maintain our competitive position or otherwise respond to competitive pressures effectively, we may lose our market share and our profitability may be materially adversely affected.

Our success depends, to a large extent, on the skill and experience of our management in the education business. If any member of our senior management leaves, or if we fail to recruit suitable replacements, our operation and financial situation will be adversely affected.

Our success depends in large part on the continued employment of our senior management and key personnel who can effectively identify, build and expand relationships that are critical for us, operate our business, as well as our ability to attract and retain skilled employees. Competition for highly skilled management, technical, research and development and other employees is intense in the education industry in the PRC and we may not be able to attract or retain highly qualified personnel in the future. If any of our employees leave, and we fail to effectively manage a transition to new personnel, or if we fail to attract and retain qualified and experienced professionals on acceptable terms, our business, financial conditions and results of operations could be adversely affected. Our success also depends on our having highly trained sales and marketing personnel to support and promote our current products as well as new service and product launches. We will need to continue to hire additional personnel as our business grows. A shortage in the number of people with these skills or our failure to attract them to our company could impede our ability to increase revenues from our existing products and services, ensure full compliance with applicable federal and state regulations, launch new product offerings and would have an adverse effect on our business and financial results.

We may not be able to adequately protect our intellectual property, which could cause us to be less competitive.

Our trademarks, trade names, and other intellectual property rights are important to our success. In connection with our business, we have registered one domain name in the PRC. We maintain confidentiality of applicant information by encrypting all such information and storing it on third-party servers, with controlled access to any such confidential information by our personnel. Unauthorized use of any of our intellectual property may adversely affect our business and reputation. We rely on trade secrets and confidentiality agreements with our employees, consultants and others to protect our intellectual property rights. Nevertheless, it may be possible for third parties to obtain and use our intellectual property without authorization, or use logos or trade names similar to ours. The unauthorized use of intellectual property is widespread in China, and enforcement of intellectual property rights by Chinese regulatory agencies is inconsistent. Moreover, litigation may be necessary in the future to enforce our intellectual property rights. Future litigation could result in substantial costs and diversion of our management’s attention and resources and could disrupt our business. If we are unable to enforce our intellectual property rights, it could have a material adverse effect on our financial condition and results of operations. Given the relative unpredictability of China’s legal system and potential difficulties enforcing a court judgment in China, we may be unable to halt the unauthorized use of our intellectual property through litigation. Failure to adequately protect our intellectual property could materially adversely affect our competitive position, our ability to attract students and our results of operations.

Our operations are subject to seasonality.

Our programs, which are our primary source of revenues, are seasonal. We tend to experience an increase in revenue from these lines in the second half of the year. As a result, we generally record higher revenue in the second half as compared to the first half of each calendar year. Any adverse change in the trends in spending patterns and other factors, conditions or events in the PRC, may affect our operational results.

We may need additional capital, and financing may not be available on terms acceptable to us, or at all.

Although our current cash and cash equivalents, anticipated cash flows from operating activities will be sufficient to meet our anticipated working capital requirements and capital expenditures in the common course of business for at least 12 months, there is a risk that we may need additional cash resources in the future to fund our growth plans or if we experience adverse changes in business conditions or other developments. We may also need additional cash resources in the future if we find and wish to pursue opportunities for new investments, acquisitions, capital expenditures or similar actions. If we determine that our cash requirements exceed the amount of cash and cash equivalents we have on hand at the time, we may seek to issue equity or debt securities or obtain credit facilities. We cannot assure you that financing will be available in amounts or on terms acceptable to us, if at all. The issuance and sale of additional equity would result in further dilution to our shareholders.

| ● | default and foreclosure on our assets if our operating revenue is insufficient to repay debt obligations; |

| ● | acceleration of obligations to repay the indebtedness (or other outstanding indebtedness), even if we make all principal and interest payments when due, if we breach any covenants that require the maintenance of certain financial ratios or reserves without a waiver or renegotiation of that covenant; | |

| ● | our inability to obtain necessary additional financing if the debt security contains covenants restricting our ability to obtain such financing while the debt security is outstanding; |

| ● | diverting a substantial portion of cash flow to pay principal and interest on such debt, which would reduce the funds available for expenses, capital expenditures, acquisitions and other general corporate purposes; and | |

| ● | creating potential limitations on our flexibility in planning for and reacting to changes in our business and in the industry in which we operate. |

The occurrence of any of these risks could adversely affect our operations or financial condition.

We are subject to changing laws, rules and regulations in the U.S. and other jurisdictions regarding regulatory matters, corporate governance and public disclosure that will increase both our costs and the risks associated with non-compliance.

We are subject to rules and regulations by various governing bodies, including, for example, the Securities and Exchange Commission, which are charged with the protection of investors and the oversight of companies whose securities are publicly traded, and to new and evolving regulatory measures under applicable law. Our efforts to comply with new and changing laws and regulations have resulted in and are likely to continue to result in increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities. Moreover, because these laws, regulations and standards are subject to varying interpretations, their application in practice may evolve over time as new guidance becomes available. This evolution may result in continuing uncertainty regarding compliance matters and additional costs necessitated by ongoing revisions to our disclosure and governance practices. If we fail to address and comply with these regulations and any subsequent changes, we may be subject to penalty and our business may be harmed.

Our business is subject to risks related to lawsuits and other claims brought by our clients or business partners. If the outcomes of these proceedings are adverse to us, it could have a material adverse effect on our business, results of operations and financial condition.

We are subject to lawsuits and other claims in the common course of our business. We are currently not involved in any lawsuits with our customers. However, claims arising out of actual or alleged violations of law could be asserted against us by individuals, companies, governmental or other entities in civil, administrative or criminal investigations and proceedings. These claims could be asserted under a variety of laws and regulations, including but not limited to contract laws, consumer protection laws or regulations, intellectual property laws, environmental laws, and labor and employment laws. These actions could expose us to adverse publicity and to monetary damages, fines and penalties, as well as suspension or revocation of licenses or permits to conduct business. Even if we eventually prevail in these matters, we could incur significant legal fees or suffer reputational harm, which could have a material adverse effect on our business and results of operations as well as our future growth and prospects. While all of students enrolled in university academic programs are required to maintain health insurance coverage, we may be subject to claims by students and/or their parents if and to the extent they decide to assert claims against us relating to, among other things, their stay at our dorms and use of our catering services. If such claims are asserted and successfully litigated, our operations and financial condition may be materially affected by the adverse outcome of any such litigation.

Our management team members, individually and together, own a large percentage of our outstanding stock and could significantly influence the outcome of our corporate matters.

As of January 28, 2026, including common shares underlying stock options exercisable within 60 days of that date, Messrs. Zhang and Wu hold approximately 38.93% and 11.58% of our outstanding shares, respectively. As a result, together, and individually they will be able to exercise significant influence over all matters that require us to obtain shareholder approval, including the election of directors to our board and approval of significant corporate transactions that we may consider, such as a merger or other sale of our company or its assets. This concentration of ownership in our shares by such individual or their affiliates will limit the other shareholders’ ability to influence corporate matters and may have the effect of delaying or preventing a third party from acquiring control over us.

If we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, cause investors to lose confidence in our reported financial information and have a negative effect on the market price of our common shares.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. We maintain a system of internal control over financial reporting, which is defined as a process designed by, or under the supervision of, our principal executive officer and principal financial officer, or persons performing similar functions, and effected by our board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with U.S. GAAP.

As a public company, we have significant additional requirements for enhanced financial reporting and internal controls. We are required to document and test our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002. In addition, an independent registered public accounting firm will be required to attest to the effectiveness of our internal control over financial reporting beginning with our annual report on Form 20-F following the date on which we cease to qualify as an emerging growth company if we become an accelerated filer or large accelerated filer. The process of designing and implementing effective internal controls is a continuous effort that requires us to anticipate and react to changes in our business and the economic and regulatory environments and to expend significant resources to maintain a system of internal controls that is adequate to satisfy our reporting obligations as a public company.

If we are unable to maintain adequate internal controls or fail to correct deficiencies in our controls noted by our management or our independent registered public accounting firm, our business and operating results could be adversely affected, we could fail to meet our obligations to report our operating results accurately and completely.

We cannot assure you that we will not, in the future, identify areas requiring improvement in our internal control over financial reporting. We cannot assure you that the measures we will take to remediate any areas in need of improvement will be successful or that we will implement and maintain adequate controls over our financial processes and reporting in the future as we continue our growth. If we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, cause investors to lose confidence in our reported financial information and have a material adverse effect on the market price of our common shares.

Lack of experience of our management team as officers of a publicly traded company may hinder our ability to comply with the Sarbanes-Oxley Act.

It may be time-consuming, difficult and costly for us to develop and implement the internal controls and reporting procedures required by the Sarbanes-Oxley Act. We need to hire additional financial reporting, internal controls and other finance staff or consultants in order to develop and implement appropriate internal controls and reporting procedures. If we are unable to comply with the Sarbanes-Oxley Act’s internal controls requirements, we may not be able to obtain the independent registered public accounting firm certifications that the Sarbanes-Oxley Act requires publicly traded companies to obtain.

The Company faces cybersecurity risks.

The Company’s information systems (including those of its subsidiaries and counterparties) are increasingly susceptible to the threat of continuously evolving cybersecurity risks. Unauthorized individuals may seek to gain access to these systems or information through fraudulent activities or other forms of deception. The Company’s operations rely, in part, on how effectively it and its counterparties safeguard networks, equipment, technology systems, and software from potential threats and damages. Failures in information systems or their components, depending on their nature and scope, could adversely impact the Company’s reputation, results of operations, and financial condition. There is no guarantee that the Company, its subsidiaries, or its counterparties will avoid such losses in the future. The Company’s exposure to these risks cannot be fully mitigated due to, among other factors, the dynamic and evolving nature of these threats. Consequently, the Company continues to prioritize the development and enhancement of controls, processes, and practices designed to protect systems, software, data, computers, and networks from unauthorized access, attacks, or damage. Despite these efforts, cybersecurity remains a critical area of focus.

Risks Related to Our Corporate Structure

We will likely not pay dividends in the foreseeable future.

Dividend policy is subject to the discretion of our Board of Directors and will depend on, among other things, our earnings, financial condition, capital requirements and other factors. There is no assurance that our Board of Directors will declare dividends even if we are profitable. Under BVI law, we may only pay dividends if we are solvent before and after the dividend payment in the sense that we will be able to satisfy our liabilities as they become due in the common course of business; and the value of assets of our Company will not be less than the sum of our total liabilities.

As the rights of shareholders under British Virgin Islands law differ from those under U.S. law, you may have fewer protections as a shareholder.

Our corporate affairs is governed by our memorandum and articles of association, the BVI Business Companies Act, 2004 (as amended), referred to below as the “BVI Act”, and the common law of the British Virgin Islands. The rights of shareholders to take legal action against our directors, actions by minority shareholders and the fiduciary responsibilities of our directors under British Virgin Islands law are governed by the BVI Act and the common law of the British Virgin Islands. The common law of the British Virgin Islands is derived in part from comparatively limited judicial precedent in the British Virgin Islands as well as from the common law of England and the wider Commonwealth, which has persuasive, but not binding, authority on a court in the British Virgin Islands. The rights of our shareholders and the fiduciary responsibilities of our directors under British Virgin Islands law are largely codified in the BVI Act, but are potentially not as clearly established as they would be under statutes or judicial precedents in some jurisdictions in the United States. In particular, the British Virgin Islands has a less developed body of securities laws as compared to the United States, and some states (such as Delaware) have more fully developed and judicially interpreted bodies of corporate law. As a result of all of the above, holders of our shares may have more difficulty in protecting their interests through actions against our management, directors or major shareholders than they would as shareholders of a U.S. company.

British Virgin Islands companies may not be able to initiate shareholder derivative actions, thereby depriving shareholders of the ability to protect their interests.

Shareholders of British Virgin Islands companies may not have standing to initiate a shareholder derivative action in a federal court of the United States Shareholders of a British Virgin Islands company could, however, bring a derivative action in the British Virgin Islands courts, and there is a clear statutory right to commence such derivative claims under Section 184C of the BVI Act. The circumstances in which any such action may be brought, and the procedures and defenses that may be available in respect to any such action, may result in the rights of shareholders of a British Virgin Islands company being more limited than those of shareholders of a company organized in the United States. Accordingly, shareholders may have fewer alternatives available to them if they believe that corporate wrongdoing has occurred. The British Virgin Islands courts are also unlikely to recognize or enforce against us judgments of courts in the United States based on certain liability provisions of U.S. securities law; and to impose liabilities against us, in original actions brought in the British Virgin Islands, based on certain liability provisions of U.S. securities laws that are penal in nature. There is no statutory recognition in the British Virgin Islands of judgments obtained in the United States, although the courts of the British Virgin Islands will generally recognize and enforce the non-penal judgment of a foreign court of competent jurisdiction without retrial on the merits. This means that even if shareholders were to sue us successfully, they may not be able to recover anything to make up for the losses suffered.

The laws of the British Virgin Islands may provide less protection for minority shareholders than those under U.S. law, so minority shareholders may have less recourse than they would under U.S. law if the shareholders are dissatisfied with the conduct of our affairs.

Under the laws of the British Virgin Islands, the rights of minority shareholders are protected by provisions of the BVI Act dealing with shareholder remedies and other remedies available under common law (in tort or contractual remedies). The principal protection under statutory law is that shareholders may bring an action to enforce the constitutional documents of the company (i.e. the memorandum and articles of association) as shareholders are entitled to have the affairs of the company conducted in accordance with the BVI Act and the memorandum and articles of association of the company. A shareholder may also bring an action under statute if he feels that the affairs of the company have been or will be carried out in a manner that is unfairly prejudicial or discriminating or oppressive to him. The BVI Act also provides for certain other protections for minority shareholders, including in respect of investigation of the company and inspection of the company books and records. There are also common law rights for the protection of shareholders that may be invoked, largely dependent on English common law, since the common law of the British Virgin Islands for business companies is limited.

Risks Related to Our Securities

Our common shares are listed on the Nasdaq Capital Market; if our financial condition deteriorates, we may not meet continued listing standards on the Nasdaq Capital Market.

The Nasdaq Capital Market also requires companies to fulfill specific requirements in order for their shares to continue to be listed. If our common shares are delisted from the Nasdaq Capital Market at some later date, our shareholders could find it difficult to sell our common shares. In addition, if our common shares are delisted from the Nasdaq Capital Market at some later date, we may apply to have our common shares quoted on the Bulletin Board or in the “pink sheets” maintained by the National Quotation Bureau, Inc. The Bulletin Board and the “pink sheets” are generally considered to be less efficient markets than the Nasdaq Capital Market. In addition, if our common shares are not so listed or are delisted at some later date, our common shares may be subject to the “penny stock” regulations. These rules impose additional sales practice requirements on broker-dealers that sell low-priced securities to persons other than established customers and institutional accredited investors and require the delivery of a disclosure schedule explaining the nature and risks of the penny stock market. As a result, the ability or willingness of broker-dealers to sell or make a market in our common shares might decline. If our common shares are delisted from the Nasdaq Capital Market at some later date or become subject to the penny stock regulations, it is likely that the price of our common shares would decline and that our shareholders would find it difficult to sell their shares.

We are currently not in compliance with the continued listing requirements of the Nasdaq Capital Market in order to maintain the listing of our common shares.

On March 7, 2025, the Company received a delinquency notification letter (the “Letter”) from the Listing Qualifications Department of The Nasdaq Stock Market LLC (“Nasdaq”) indicating that the Company was not currently in compliance with the minimum bid price requirement set forth in Nasdaq’s Listing Rules for continued listing on the Nasdaq Capital Market, as the closing bid price for the Company’s common shares listed on the Nasdaq Capital Market was below $1.00 per share for 30 consecutive business days. Nasdaq Listing Rule 5550(a)(2) requires listed securities to maintain a minimum bid price of $1.00 per share, and Nasdaq Listing Rule 5810(c)(3)(A) provides that a failure to meet the minimum bid price requirement exists if the deficiency continues for a period of 30 consecutive business days. The Letter provided that the Company had a period of 180 calendar days from the date of the Letter, or until September 1, 2025, to regain compliance with the minimum bid price requirement. On September 2, 2025, Nasdaq granted a 180-day extension, or until March 2, 2026, to regain compliance. As of the date this report, we were not in compliance with the listing rule and we will likely be required to effect a reverse share split of our common shares prior to the above date in order to regain compliance with the listing rule.

If we fail to satisfy any of Nasdaq’s continued listing requirements, Nasdaq may take steps to delist our common shares, which could have a materially adverse effect on our ability to raise additional funds as well as the price and liquidity of our common shares.

We could be delisted if it is determined that the Public Company Accounting Oversight Board is unable to inspect or investigate our auditor completely.

Our independent registered public accounting firm that issues the audit report included in this Report on Form 20-F, as an auditor of companies that are traded publicly in the United States and a firm registered with the Public Company Accounting Oversight Board, or the PCAOB, is required by the laws of the United States to undergo regular inspections by the PCAOB to assess its compliance with the laws of the United States and applicable professional standards. Our independent registered public accounting firm is currently subject to PCAOB inspections on a regular basis. However, if it is determined in the future that the PCAOB is unable to inspect or investigate our auditor completely, or if our future audit reports are prepared by auditors that are not completely inspected by the PCAOB, our common shares may be delisted or trading in our ordinary shares may be prohibited under the Holding Foreign Companies Accountable Act, or HFCAA.

The lack of PCAOB inspections of audit work in foreign countries prevents the PCAOB from regularly evaluating auditors’ audits and their quality control procedures. As a result, investors would be deprived of the benefits of PCAOB inspections. The Holding Foreign Companies Accountable Act (“HFCAA”) was enacted on December 18, 2020, to address concerns over lack of access to audit records of foreign companies. The HFCAA requires the SEC to prohibit trading of securities of any foreign issuer if the PCAOB is unable to inspect or investigate the company’s auditor for three consecutive years. This prohibition applies to both exchanges and over-the-counter markets. Beginning in 2021, foreign issuers may be designated as “Commission-Identified Issuers” if they retain such an auditor, and if identified for three consecutive years, may be subject to delisting. We could face such consequences if either we or our auditor are designated accordingly.