UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2025

Commission File Number: 001-42370

MEGA MATRIX INC.

Level 21, 88 Market Street

CapitaSpring

Singapore 048948

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Explanatory Note

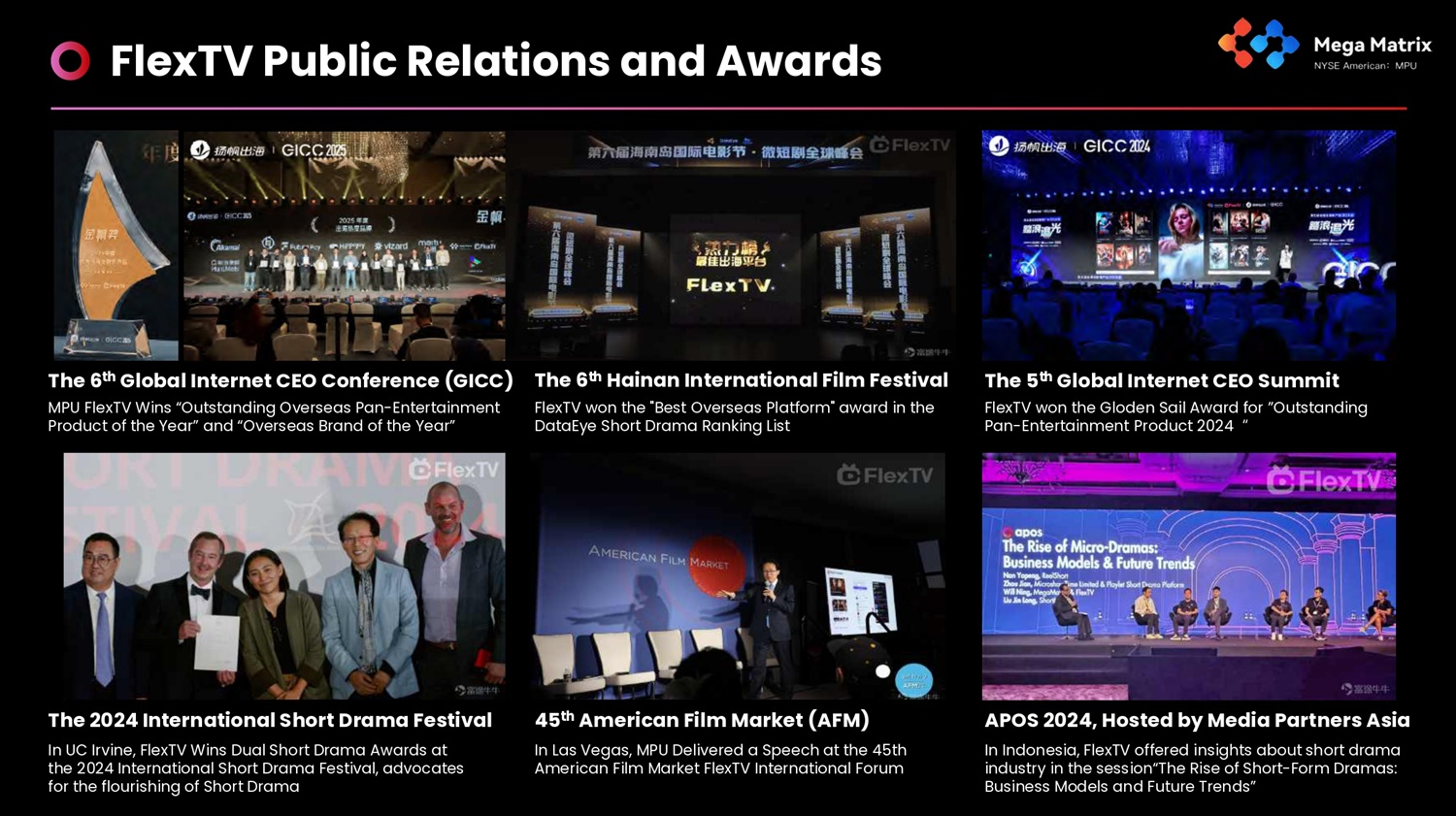

On December 5, 2025, Mega Matrix Inc. (the “Company”) reported its financial results for the quarter ended September 30, 2025. and made available an updated corporate presentation on its website. A copy of the corporate presentation is attached hereto as Exhibit 99.3.

The fact that this corporate presentation is being made available and furnished herewith should not be deemed an admission as to the materiality of any information contained in the materials. The information contained in the corporate presentation is being provided as of December 5, 2025, and the Company does not undertake any obligation to update the presentation in the future or to update forward-looking statements to reflect subsequent actual results.

Incorporation by Reference

This report on Form 6-K (other than Exhibit 99.3), including Exhibits 99.1 and 99.2, shall be deemed to be incorporated by reference in the registration statements on Form S-8 (File No. 333-277227), Form F-3 (File No. 333-283739), Form S-8 (File No. 333-289715), and Form F-3 (File No. 333-290026), each as filed with the Securities and Exchange Commission, to the extent not superseded by documents or reports subsequently filed.

Exhibit Index

| Exhibit No. | Exhibit Description | |

| 99.1 | Unaudited Interim Consolidated Financial Statements for the Three and Nine Months Ended September 30, 2025 and 2024. | |

| 99.2 | Management’s Discussion and Analysis of Financial Condition and Results of Operations in connection with the Unaudited Interim Consolidated Financial Statements for the Three and Nine Months Ended September 30, 2025 and 2024. | |

| 99.3 | Corporate Presentation dated December 5, 2025 | |

| 101.INS | Inline XBRL Instance Document | |

| 101.SCH | Inline XBRL Taxonomy Extension Schema Document | |

| 101.CAL | Inline XBRL Taxonomy Extension Calculation Linkbase Document | |

| 101.DEF | Inline XBRL Taxonomy Extension Definition Linkbase Document | |

| 101.LAB | Inline XBRL Taxonomy Extension Label Linkbase Document | |

| 101.PRE | Inline XBRL Taxonomy Extension Presentation Linkbase Document | |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Mega Matrix Inc. | ||

| By: | /s/ Yucheng Hu | |

| Yucheng Hu | ||

| Chief Executive Officer | ||

| Dated: December 5, 2025 | ||

Exhibit 99.1

MEGA MATRIX INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(Rounded to the Nearest Hundred US Dollar, except for share and per share data, unless otherwise stated)

| September 30, | December 31, | |||||||

| 2025 | 2024 | |||||||

| (Unaudited) | (Audited) | |||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash and cash equivalents | $ | 9,766,100 | $ | 8,870,800 | ||||

| Trading securities | 4,700 | 7,000 | ||||||

| Digital assets | 8,934,300 | |||||||

| Loans receivable - a related party | 767,100 | 866,000 | ||||||

| Accounts receivable | 428,800 | 422,800 | ||||||

| Prepaid expenses and other assets | 16,532,400 | 3,175,100 | ||||||

| Current content assets, net | 1,567,600 | 1,566,800 | ||||||

| Total current assets | 38,001,000 | 14,908,500 | ||||||

| Non-current Assets: | ||||||||

| Long-term investments | 1,691,700 | 1,480,800 | ||||||

| Goodwill | 2,889,200 | 2,889,200 | ||||||

| Content assets, net | 149,800 | 183,800 | ||||||

| Total non-current assets | 4,730,700 | 4,553,800 | ||||||

| Total assets | $ | 42,731,700 | $ | 19,462,300 | ||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 603,700 | $ | 1,000,500 | ||||

| Contract liabilities | 2,280,600 | 2,095,500 | ||||||

| Income taxes payable | 4,100 | 2,700 | ||||||

| Other current liabilities and accrued expenses | 2,405,000 | 2,255,300 | ||||||

| Total liabilities | 5,293,400 | 5,354,000 | ||||||

| Commitments and contingencies (Note 11) | ||||||||

| Shareholders’ Equity: | ||||||||

| Preferred stock, $0.001 par value, 2,000,000 shares authorized, no shares issued and outstanding | ||||||||

| Class A Ordinary Shares, $0.001 par value, 1,000,000,000 and 100,000,000 shares authorized, 61,789,783 and 34,536,384 shares outstanding as of September 30, 2025 and December 31, 2024, respectively | 61,800 | 34,600 | ||||||

| Class B Ordinary Shares, $0.001 par value, 50,000,000 and 10,000,000 shares authorized, 2,809,977 and 5,933,700 shares outstanding as of September 30, 2025 and December 31, 2024, respectively | 2,800 | 5,900 | ||||||

| Class C Ordinary Shares, $0.001 par value, 10,000,000 and nil shares authorized, 3,123,723 and nil shares outstanding as of September 30, 2025 and December 31, 2024, respectively | 3,100 | |||||||

| Paid-in capital | 78,494,200 | 40,405,400 | ||||||

| Accumulated deficit | (41,123,600 | ) | (26,337,600 | ) | ||||

| Total shareholder’s equity | 37,438,300 | 14,108,300 | ||||||

| Total liabilities and shareholder’s equity | $ | 42,731,700 | $ | 19,462,300 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

MEGA MATRIX INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(Rounded to the Nearest Hundred US Dollar, except for share and per share data, unless otherwise stated)

| For the Three Months Ended September 30, |

For the Nine months ended September 30, |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

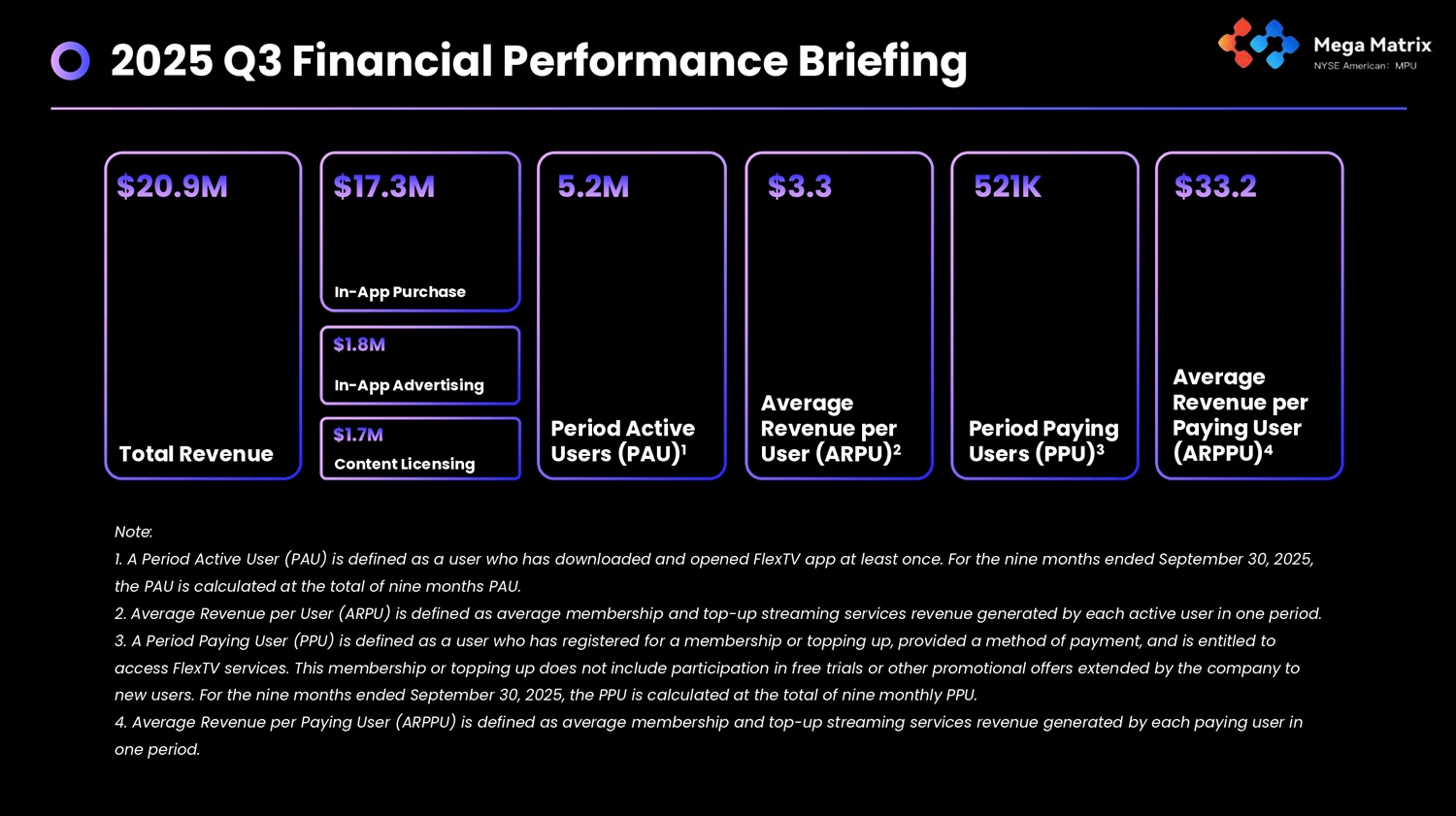

| Revenues | $ | 6,111,500 | $ | 10,345,500 | $ | 20,908,300 | $ | 25,953,200 | ||||||||

| Cost of revenues | (3,196,000 | ) | (4,293,700 | ) | (9,546,000 | ) | (10,502,800 | ) | ||||||||

| Gross profit | 2,915,500 | 6,051,800 | 11,362,300 | 15,450,400 | ||||||||||||

| Operating expenses: | ||||||||||||||||

| Selling expenses | (2,632,200 | ) | (6,437,900 | ) | (10,465,300 | ) | (18,501,000 | ) | ||||||||

| General and administrative expenses | (9,836,400 | ) | (2,301,800 | ) | (14,513,800 | ) | (7,416,300 | ) | ||||||||

| Total operating expenses | (12,468,600 | ) | (8,739,700 | ) | (24,979,100 | ) | (25,917,300 | ) | ||||||||

| Loss from operations | (9,553,100 | ) | (2,687,900 | ) | (13,616,800 | ) | (10,466,900 | ) | ||||||||

| Other income (expenses): | ||||||||||||||||

| Changes in fair value of digital assets | (1,293,700 | ) | (1,274,700 | ) | 2,238,700 | |||||||||||

| Share of equity income (loss) | 300 | (2,100 | ) | |||||||||||||

| Impairment of long-term investments | (546,000 | ) | (770,800 | ) | ||||||||||||

| Changes in fair value of trading securities | (2,600 | ) | (3,800 | ) | ||||||||||||

| Interest income, net | 2,200 | 84,800 | 96,600 | 58,200 | ||||||||||||

| Other income (expenses), net | 3,800 | (5,600 | ) | 16,200 | 1,600 | |||||||||||

| Total other (expenses) income, net | (1,290,000 | ) | (466,800 | ) | (1,167,800 | ) | 1,527,700 | |||||||||

| Loss from operations before income tax | (10,843,100 | ) | (3,154,700 | ) | (14,784,600 | ) | (8,939,200 | ) | ||||||||

| Income tax (expenses) benefits | (800 | ) | (400 | ) | (1,400 | ) | 275,800 | |||||||||

| Net loss and comprehensive loss | (10,843,900 | ) | (3,155,100 | ) | (14,786,000 | ) | (8,663,400 | ) | ||||||||

| Less: Net loss and comprehensive loss attributable to non-controlling interests | 382,300 | 1,620,300 | ||||||||||||||

| Net loss and comprehensive loss attributable to Mega Matrix Inc.’s stockholders | $ | (10,843,900 | ) | $ | (2,772,800 | ) | $ | (14,786,000 | ) | $ | (7,043,100 | ) | ||||

| Loss per share: | ||||||||||||||||

| Basic and Diluted | $ | (0.21 | ) | $ | (0.08 | ) | $ | (0.37 | ) | $ | (0.23 | ) | ||||

| Weighted average shares used in loss per share computations: | ||||||||||||||||

| Basic and Diluted | 50,955,828 | 39,207,664 | 40,349,627 | 37,176,920 | ||||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

MEGA MATRIX INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(Rounded to the Nearest Hundred US Dollar, except for share data, unless otherwise stated)

| Mega Matrix Inc.’s Shareholders’ Equity | ||||||||||||||||||||||||||||||||||||||||

| Class A Ordinary Shares |

Class B Ordinary Shares |

Class C Ordinary Shares |

Non- | |||||||||||||||||||||||||||||||||||||

| Number of Stocks |

Amount | Number of Stocks |

Amount | Number of Stocks |

Amount | Paid-in Capital |

Accumulated Deficits |

Controlling Interests |

Total | |||||||||||||||||||||||||||||||

| Balance, December 31, 2023 | 31,724,631 | $ | 31,800 | $ | $ | $ | 27,822,200 | $ | (17,454,200 | ) | $ | $ | 10,399,800 | |||||||||||||||||||||||||||

| Issuance of ordinary shares to certain investors in a private placement | 2,490,000 | 2,500 | - | - | 3,732,500 | 3,735,000 | ||||||||||||||||||||||||||||||||||

| Issuance of ordinary shares to an underwriter | 124,000 | 100 | - | - | (100 | ) | ||||||||||||||||||||||||||||||||||

| Issuance of ordinary shares to acquire a subsidiary | 1,500,000 | 1,500 | - | - | 2,263,500 | 1,510,000 | 3,775,000 | |||||||||||||||||||||||||||||||||

| Share-based compensation | 102,000 | 100 | - | - | 361,000 | 361,100 | ||||||||||||||||||||||||||||||||||

| Net loss | - | - | - | (866,800 | ) | (1,068,900 | ) | (1,935,700 | ) | |||||||||||||||||||||||||||||||

| Balance, March 31, 2024 | 35,940,631 | $ | 36,000 | $ | $ | $ | 34,179,100 | $ | (18,321,000 | ) | $ | 441,100 | $ | 16,335,200 | ||||||||||||||||||||||||||

| Issuance of common stocks to certain investors in a private placement | 1,681,817 | 1,700 | - | - | 3,698,300 | 3,700,000 | ||||||||||||||||||||||||||||||||||

| Issuance of common stocks to an underwriter | 84,091 | 100 | - | - | (100 | ) | ||||||||||||||||||||||||||||||||||

| Share-based compensation to employees | 359,950 | 400 | - | - | 701,900 | 702,300 | ||||||||||||||||||||||||||||||||||

| Share-based compensation to non-employees | 57,077 | - | - | 120,000 | 120,000 | |||||||||||||||||||||||||||||||||||

| Net loss | - | - | - | - | (3,403,500 | ) | (169,100 | ) | (3,572,600 | ) | ||||||||||||||||||||||||||||||

| Balance, June 30, 2024 | 38,123,566 | $ | 38,200 | $ | $ | $ | 38,699,200 | $ | (21,724,500 | ) | $ | 272,000 | $ | 17,284,900 | ||||||||||||||||||||||||||

| Issuance of common stocks to certain investors in a private placement | 681,818 | 700 | - | - | 1,499,300 | 1,500,000 | ||||||||||||||||||||||||||||||||||

| Share-based compensation to employees | 110,850 | 100 | - | - | 173,900 | 174,000 | ||||||||||||||||||||||||||||||||||

| Issuance of common stocks to acquire noncontrolling interest of a subsidiary (Note 4) | 1,500,000 | 1,500 | - | - | (111,800 | ) | 110,300 | |||||||||||||||||||||||||||||||||

| Net loss | - | - | - | (2,772,800 | ) | (382,300 | ) | (3,155,100 | ) | |||||||||||||||||||||||||||||||

| Balance, September 30, 2024 | 40,416,234 | $ | 40,500 | $ | $ | $ | 40,260,600 | $ | (24,497,300 | ) | $ | $ | 15,803,800 | |||||||||||||||||||||||||||

| Balance, December 31, 2024 | 34,536,384 | $ | 34,600 | 5,933,700 | $ | 5,900 | - | $ | $ | 40,405,400 | $ | (26,337,600 | ) | $ | $ | 14,108,300 | ||||||||||||||||||||||||

| Share-based compensation to employees | 132,050 | 100 | - | - | 111,000 | 111,200 | ||||||||||||||||||||||||||||||||||

| Share-based compensation to non-employees | 115,377 | 100 | - | - | 175,700 | 175,800 | ||||||||||||||||||||||||||||||||||

| Issuance of ordinary shares to Manager of ATM (Note 8) | 5,800 | * | - | - | 3,400 | 3,400 | ||||||||||||||||||||||||||||||||||

| Net loss | - | - | - | (2,477,900 | ) | (2,477,900 | ) | |||||||||||||||||||||||||||||||||

| Balance, March 31, 2025 | 34,789,611 | $ | 34,800 | 5,933,700 | $ | 5,900 | 5,933,700 | $ | 5,900 | $ | 40,695,600 | $ | (28,815,500 | ) | $ | $ | 11,920,800 | |||||||||||||||||||||||

| Share-based compensation to employees | 50,550 | 100 | - | - | 50,400 | 50,500 | ||||||||||||||||||||||||||||||||||

| Share-based compensation to non-employees | 66,000 | * | - | - | 52,500 | 52,500 | ||||||||||||||||||||||||||||||||||

| Issuance of ordinary shares to Manager of ATM (Note 8) | 392,910 | 400 | - | - | 356,600 | 357,000 | ||||||||||||||||||||||||||||||||||

| Net loss | - | - | - | (1,464,200 | ) | (1,464,200 | ) | |||||||||||||||||||||||||||||||||

| Balance, June 30, 2025 | 35,299,071 | $ | 35,300 | 5,933,700 | $ | 5,900 | - | $ | $ | 41,155,100 | $ | (30,279,700 | ) | $ | $ | 10,916,600 | ||||||||||||||||||||||||

| Reclassification of Class B Ordinary Shares to Class C Ordinary Shares | - | (3,123,723 | ) | (3,100 | ) | 3,123,723 | 3,100 | |||||||||||||||||||||||||||||||||

| Share-based compensation to employees | 3,614,150 | 3,600 | - | - | 8,453,200 | 8,456,800 | ||||||||||||||||||||||||||||||||||

| Share-based compensation to non-employees | 4,401,000 | 4,400 | - | - | 10,443,700 | 10,448,100 | ||||||||||||||||||||||||||||||||||

| Issuance of ordinary shares to Manager of ATM (Note 8) | 1,690,562 | 1,700 | - | - | 2,459,000 | 2,460,700 | ||||||||||||||||||||||||||||||||||

| Issuance of ordinary shares pursuant to a private placement | 16,000,000 | 16,000 | - | - | 15,984,000 | 16,000,000 | ||||||||||||||||||||||||||||||||||

| Issuance of ordinary shares to an underwriter of a private placement | 785,000 | 800 | - | - | (800 | ) | ||||||||||||||||||||||||||||||||||

| Net loss | - | - | - | (10,843,900 | ) | (10,843,900 | ) | |||||||||||||||||||||||||||||||||

| Balance, September 30, 2025 | 61,789,783 | $ | 61,800 | 2,809,977 | $ | 2,800 | 3,123,723 | 3,100 | $ | 78,494,200 | $ | (41,123,600 | ) | $ | $ | 37,438,300 | ||||||||||||||||||||||||

| * | The amount of Class A Ordinary Shares issued for share-based compensation to non-employees was below 100. |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

MEGA MATRIX INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Rounded to the Nearest Hundred US Dollar, unless otherwise stated)

| For the Nine months ended September 30, |

||||||||

| 2025 | 2024 | |||||||

| Net cash (used in) provided by operating activities | $ | (7,475,300 | ) | $ | 4,915,100 | |||

| Investing activities: | ||||||||

| Purchases of digital assets | (1,448,200 | ) | (610,000 | ) | ||||

| Investment in trading securities | (19,100 | ) | ||||||

| Redemption of trading securities | 17,600 | |||||||

| Investment in equity investees | (213,100 | ) | (500,000 | ) | ||||

| Loans made to a related party | (610,000 | ) | ||||||

| Repayment of loans from a related party | 111,900 | |||||||

| Acquisition of cash of a subsidiary | 118,300 | |||||||

| Net cash used in investing activities | (1,550,900 | ) | (1,601,700 | ) | ||||

| Financing activities: | ||||||||

| Subscription fees from investors | 9,921,500 | 3,504,900 | ||||||

| Net cash provided by financing activities | 9,921,500 | 3,504,900 | ||||||

| Net changes in cash and cash equivalents | 895,300 | 6,818,300 | ||||||

| Cash, cash equivalents, beginning of period | 8,870,800 | 3,129,800 | ||||||

| Cash, cash equivalents, end of period | $ | 9,766,100 | $ | 9,948,100 | ||||

| Supplemental Cash Flow Information | ||||||||

| Payment of interest expenses | $ | $ | ||||||

| Payment of income tax expenses | $ | $ | 1,600 | |||||

| Non-cash Investing and Financing activities | ||||||||

| Purchase of digital assets in the form of USDT | $ | 7,398,200 | $ | |||||

| Subscription fee from investors in the form of USDT | $ | 8,900,000 | $ | 2,675,000 | ||||

| Issuance of common stocks to settle advance from subscription fee from investors | $ | $ | 2,755,100 | |||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

MEGA MATRIX INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Rounded to the Nearest Hundred US Dollar, except for share data, unless otherwise stated)

1. ORGANIZATION AND PRINCIPAL ACTIVITIES

Reorganization and reclassification of Class A, Class B and Class C ordinary shares

On October 8, 2024, Mega Matrix Inc. (“MPU Cayman” or the “Company”), Mega Matrix Corp. (“MPU DE”, formerly “AeroCentury Corp.” and “ACY”), a Delaware corporation, and MPU Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of MPU Cayman (“MPU Merger Sub”) effected a redomicile merger (the “Redomicile Merger”). As a result, MPU Merger Sub merged with and into MPU DE, with MPU DE surviving as a wholly-owned subsidiary of MPU Cayman, pursuant to the Third Amended and Restated Agreement and Plan of Merger, dated May 31, 2024 (the “Merger Agreement”), which Merger Agreement was approved by MPU DE stockholders on September 25, 2024. Pursuant to the Redomicile Merger (as defined below) and as approved by the NYSE American, MPU Cayman’s Class A Shares are now listed on the NYSE American under the symbol “MPU.” The CUSIP/ISIN number relating to the Class A Shares of MPU Cayman is G6005C 108/ KYG6005C1087. Prior to the Redomicile Merger, shares of MPU DE’s common stock were registered pursuant to Section 12(b) of the Exchange Act, and listed on the NYSE American under the symbol “MPU.” As a result of the Redomicile Merger, each issued and outstanding share of MPU DE’s common stock acquired prior to October 8, 2024 has been exchanged for one MPU Cayman Class A Share.

MPU Cayman is authorized to issue shares totaling US$120,000, divided into (i) 100,000,000 Class A Shares of par value US$0.001 each, (ii) 10,000,000 Class B Shares of par value US$0.001 each and (iii) 10,000,000 Preferred Shares of par value US$0.001 each. The board of directors of MPU Cayman is authorized to issue the Preferred Shares in different classes and series and, with respect to each class or series, to determine the designations, powers, preferences, privileges and other rights, including dividend rights, conversion rights, terms of redemption and liquidation preferences, any or all of which may be greater than the powers and rights associated with the Ordinary Shares, at such times and on such other terms as they think proper.

Upon the completion of the Redomicile Merger, MPU Cayman issued approximately 40,470,084 Class A Shares in the Redomicile Merger and the one Class A Share issued and outstanding prior to the Redomicile Merger has been cancelled. There are no Class B Share or Preferred Shares outstanding. The Company believed that it was appropriate to reflect the above transactions on a retroactive basis pursuant to ASC 260, Earnings Per Share. The Company has retroactively adjusted all share and per share data for all periods presented. The consolidated financial statements are prepared on the basis as if the reorganization became effective as of the beginning of the first year presented in the consolidated financial statements.

On August 15, 2025, the Company’s shareholders approved an increase of the share capital to US$1,110,000, divided into: (i) 1,000,000,000 class A ordinary shares of par value US$0.001 each, (ii) 50,000,000 class B ordinary shares of par value US$0.001 each, (iii) 50,000,000 class C ordinary shares of par value US$0.001 each, and (iv) 10,000,000 preferred shares of par value US$0.001 each, by an addition of 900,000,000 class A ordinary shares of par value US$0.001 each, and 40,000,000 class B ordinary shares of par value US$0.001 each, and the creation of a new share class comprising of 50,000,000 class C ordinary shares of par value US$0.001 each.

On September 2, 2025, Mr. Yucheng Hu, Chairman of the Board of Directors and a shareholder of the Company, submitted a notice of conversion pursuant to the Company’s Third Amended and Restated Memorandum and Articles of Association (“MAA”), requesting to convert 3,123,723 Class B ordinary shares, par value $0.001 per share (“Class B Shares”), into 3,123,723 Class C ordinary shares, par value $0.001 per share (“Class C Shares”) (the “Conversion”). Each Class B Share is convertible into one (1) Class A ordinary share, par value$0.001 (“Class A Share”), or one (1) Class C Share, at the option of the holder. Each Class C Share is convertible into one (1) Class A Share at the option of the holder. Each Class A Share shall be entitled to one (1) vote, each Class B Share shall be entitled to one hundred (100) votes, and each Class C Share shall be entitled to fifty (50) votes. On September 3, 2025, Mr. Hu entered into a share transfer agreement, pursuant to which he agreed to transfer 2,290,390 Class C Shares to Mr. Yaman Demir, a director of the Company, at par value and as permitted under the MAA (the “Transfer”). The Conversion and the Transfer closed on September 22, 2025.

MEGA MATRIX INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Rounded to the Nearest Hundred US Dollar, except for share data, unless otherwise stated)

1. ORGANIZATION AND PRINCIPAL ACTIVITIES (CONTINUED)

Repurchase of Class A ordinary shares and issuance of Class B ordinary shares

On December 10, 2024, the Company entered into a share repurchase agreement (“Repurchase Agreement”) and a share subscription agreement (“Subscription Agreement”) with Mr. Yucheng Hu, the Company’s Chairman and Chief Executive Officer, pursuant to which the Company effected a reclassification (“Reclassification”) through an issuance of 5,933,700 Class B ordinary shares, par value $0.001 (“Class B Shares”) to Mr. Hu at par value concurrent with the repurchase of 5,933,700 Class A ordinary shares, par value $0.001 (“Class A Shares”) held by Mr. Hu at par value in accordance with the Companies Act (As Revised) of the Cayman Islands and the applicable memorandum and articles of association. The repurchased Class A Shares shall be cancelled and available for future issuance, without affecting the Company’s authorized share capital. The closing of the Repurchase occurred on December 10, 2024.

Setup of subsidiaries

On September 24, 2024, the Company set up Bona Box FZ LLC, a wholly owned subsidiary in Abu Dhabi. Bona Box FZ LLC is aiming to produce short dramas to customers based in Arabian area.

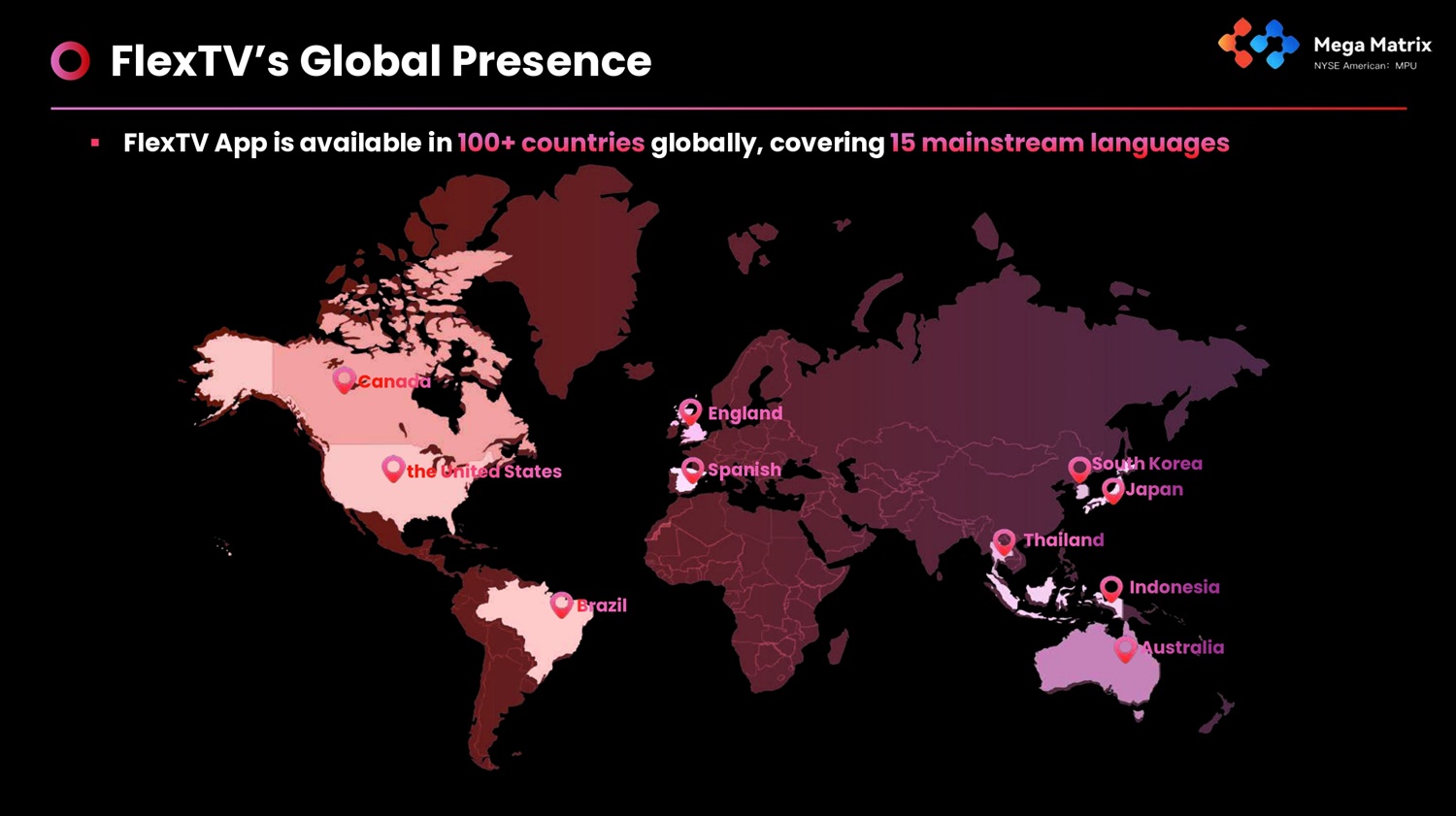

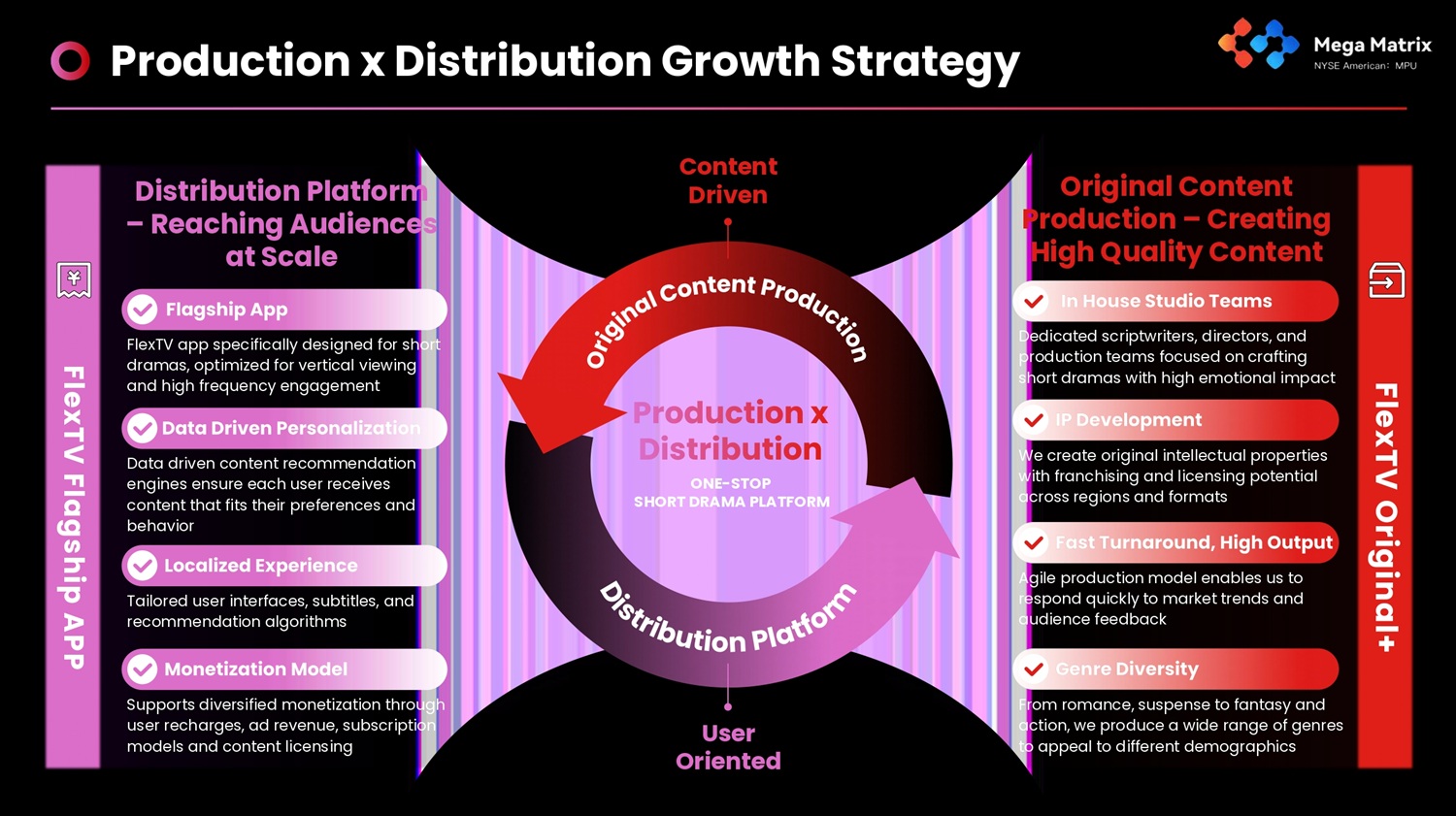

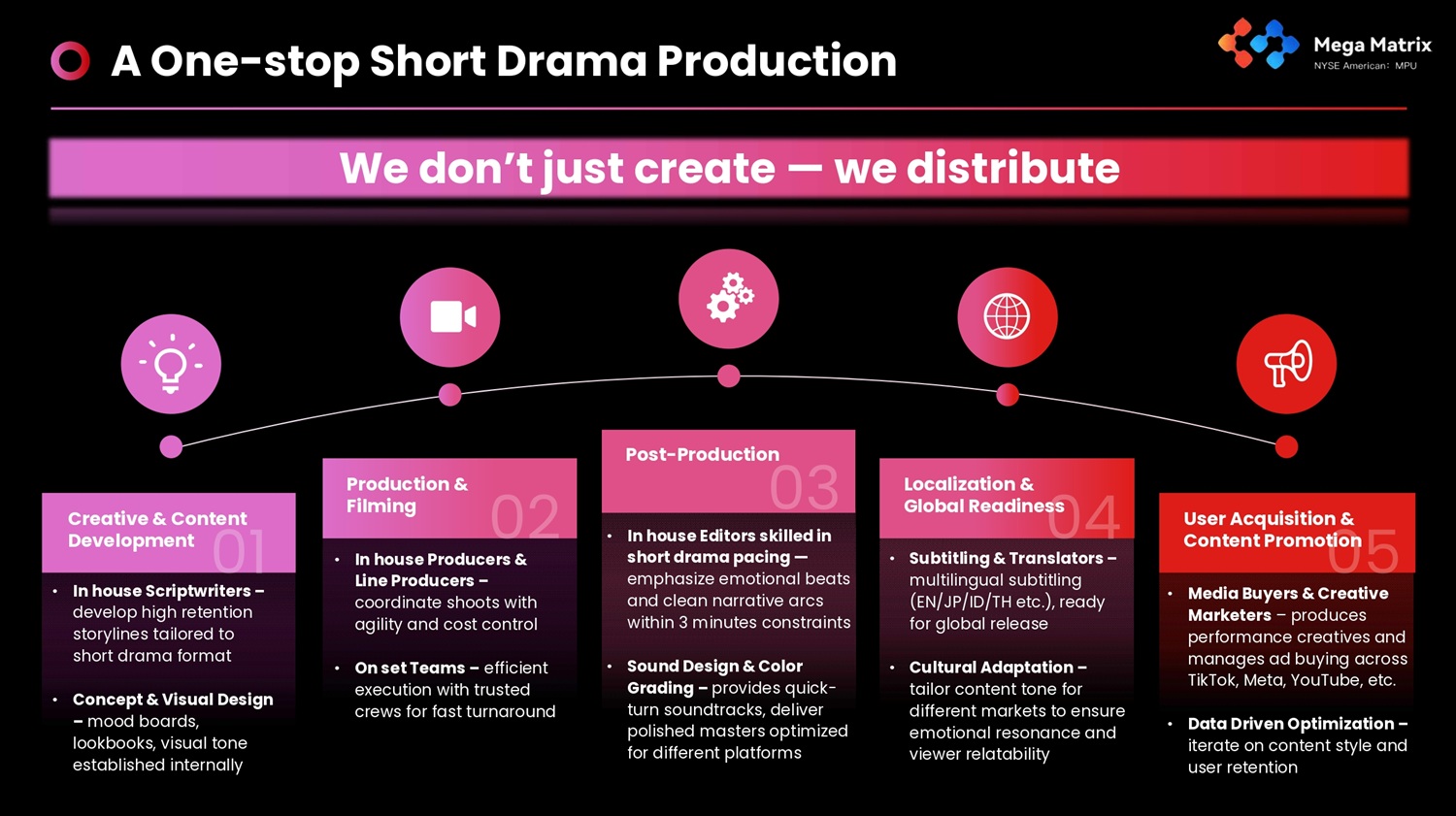

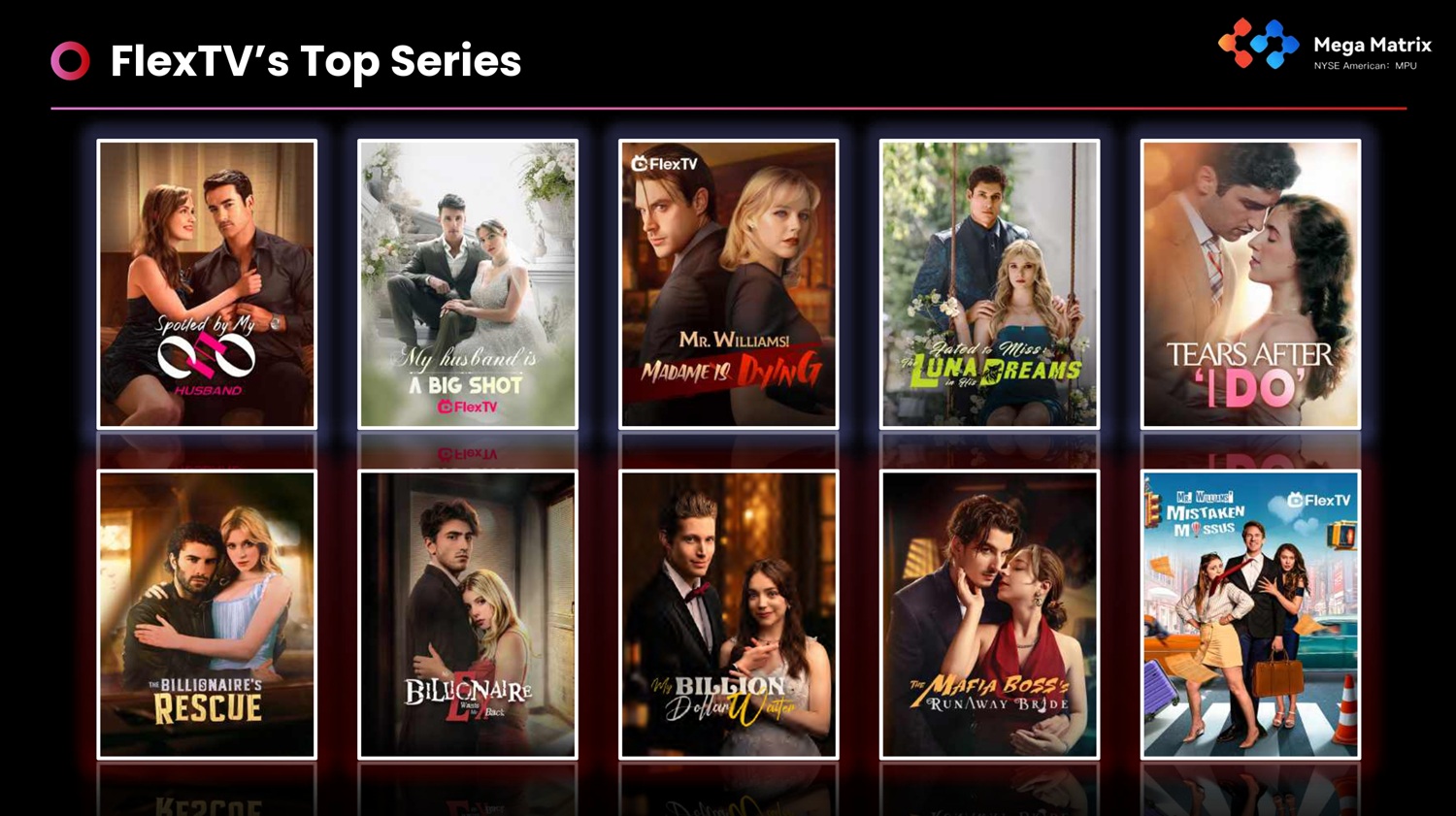

The Company is engaged in operation of FlexTV, a short drama streaming platform based in Singapore that produces English and Thai dramas through Yuder Pte. Ltd. and Bona Box FZ LLC, indirect and direct wholly owned subsidiaries of the Company, respectively.

On September 24, 2025, the Company set up FunVerse Holding Inc, a wholly owned subsidiary in Cayman Islands. FunVerse Holding Inc is a holding company.

Digital asset treasury (“DAT”) reserve strategies

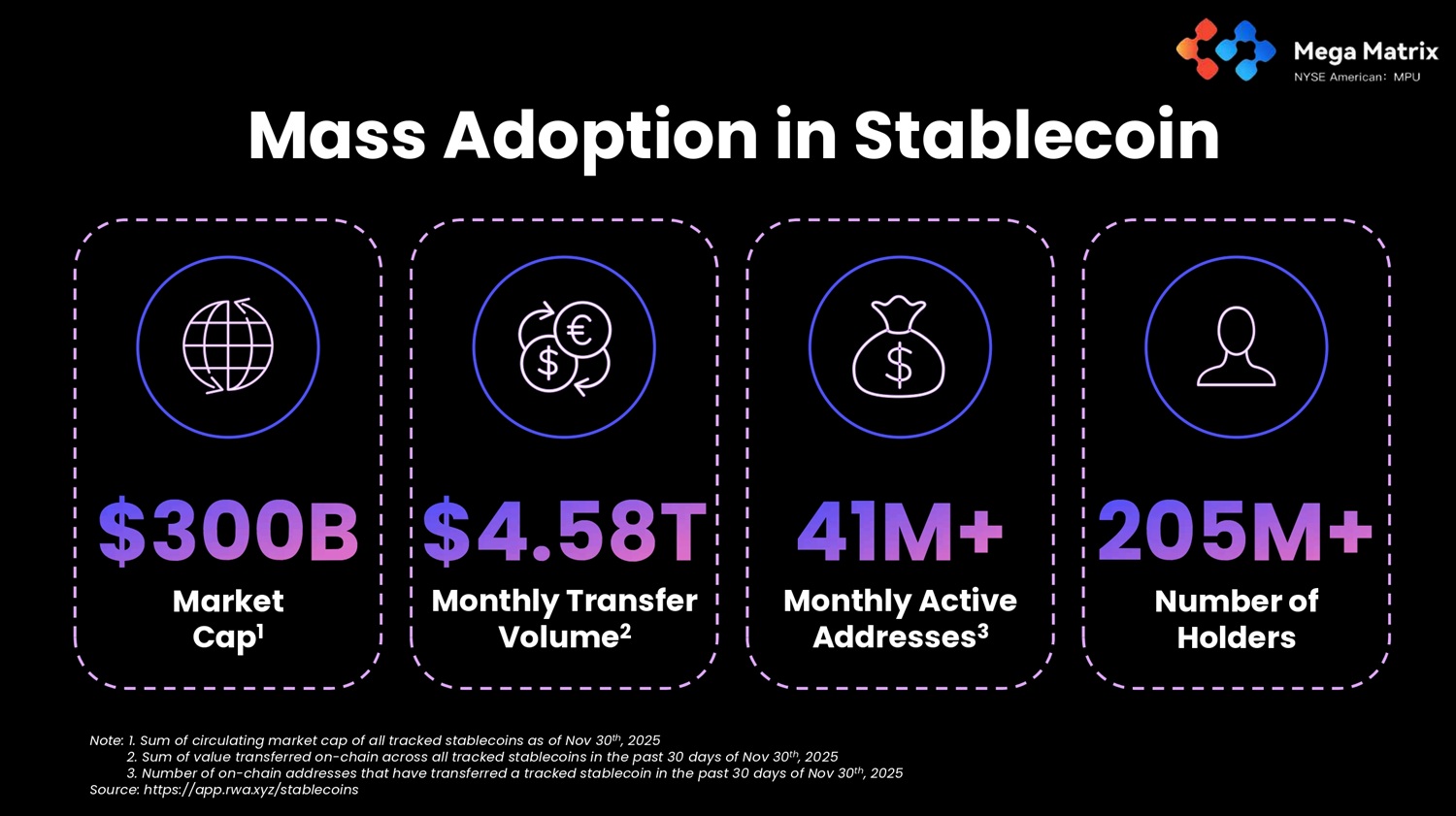

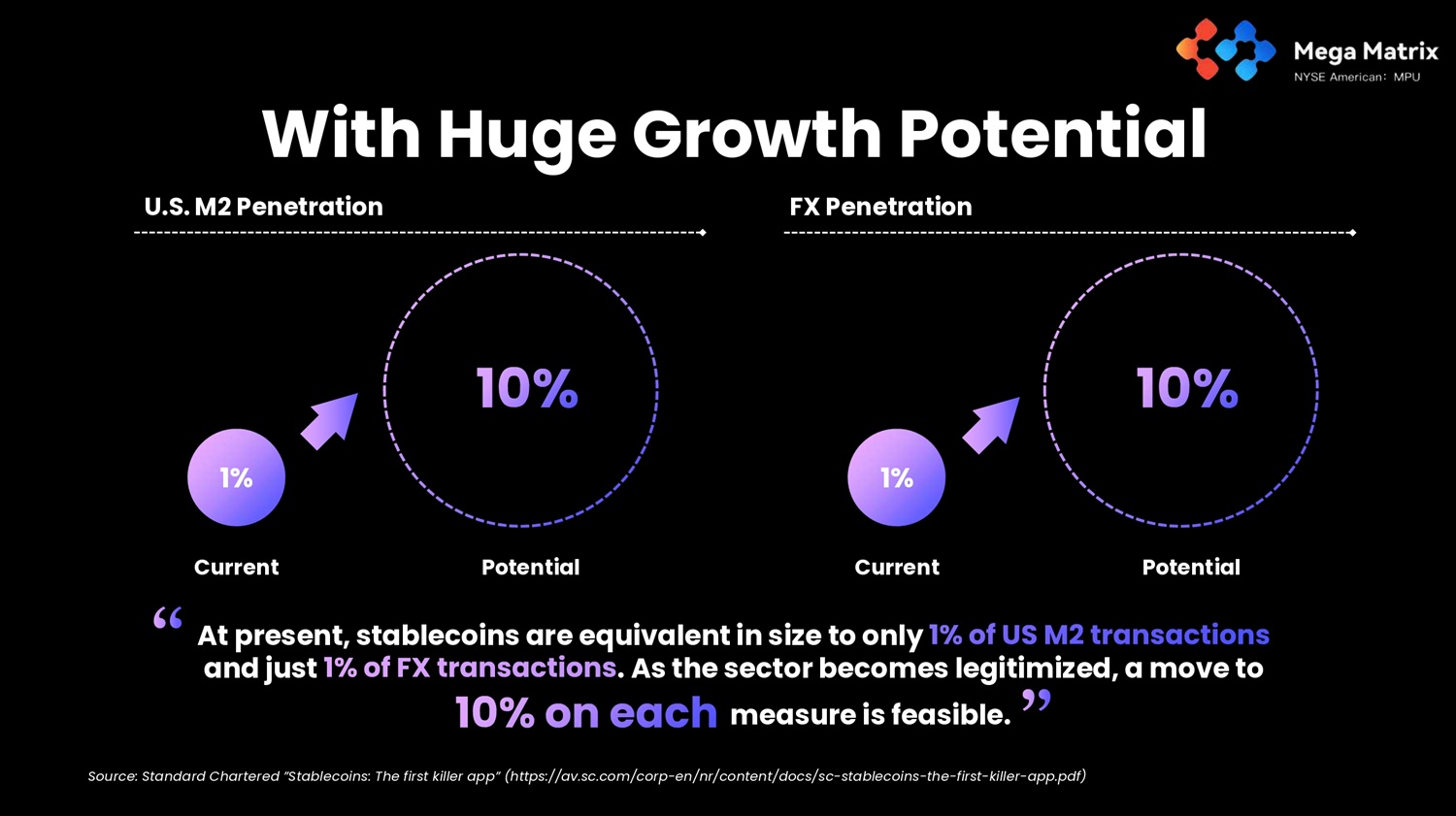

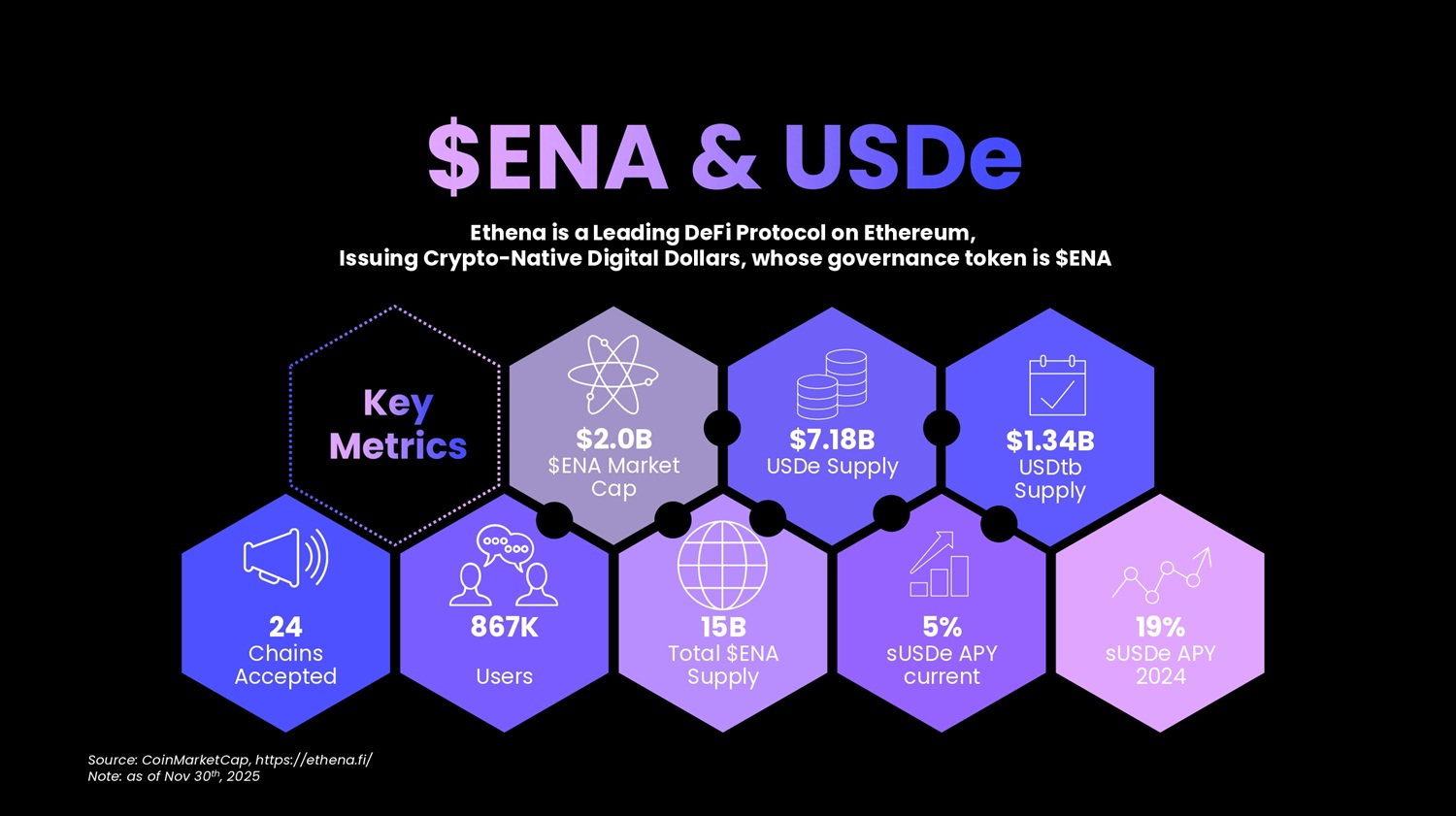

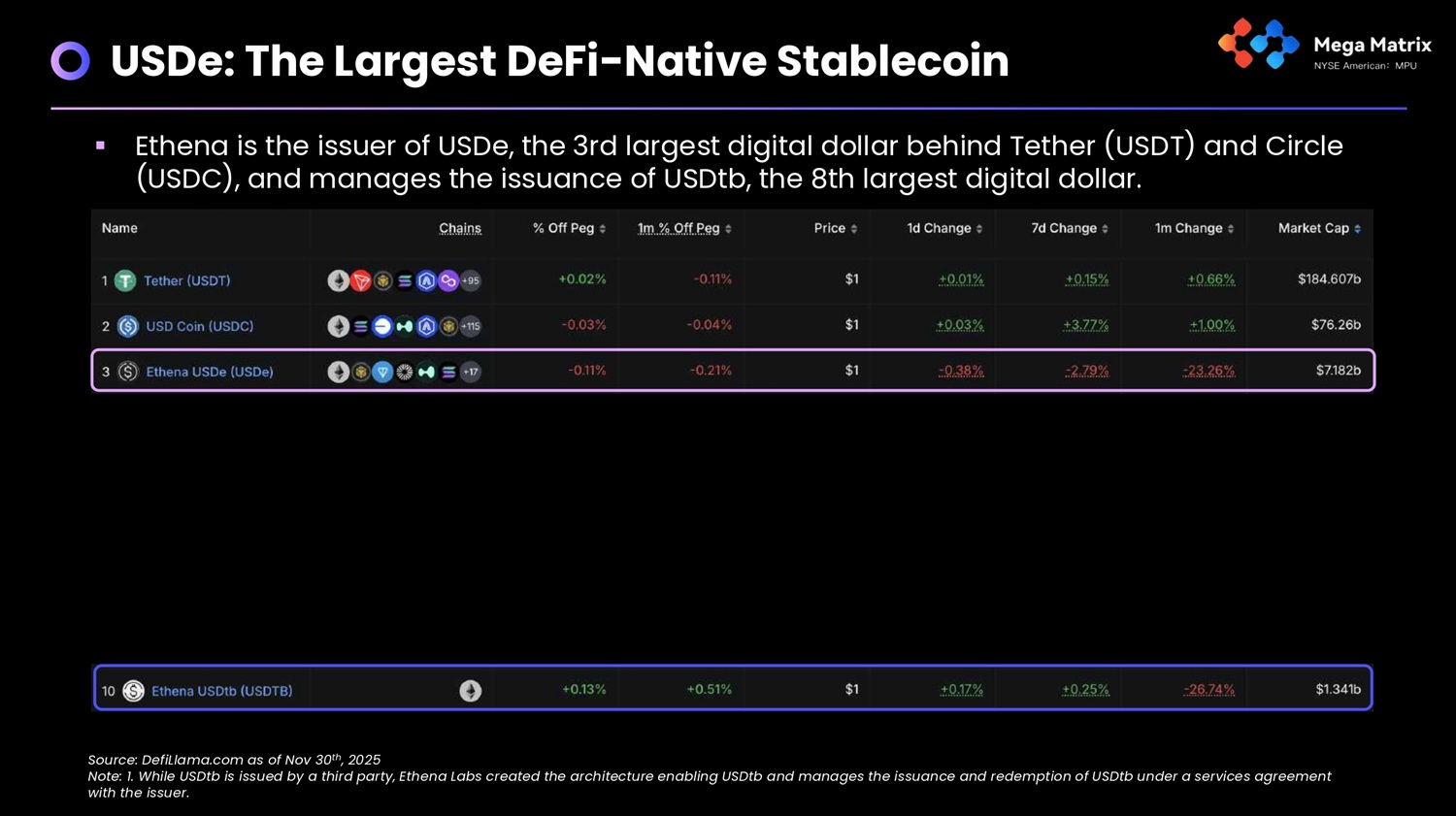

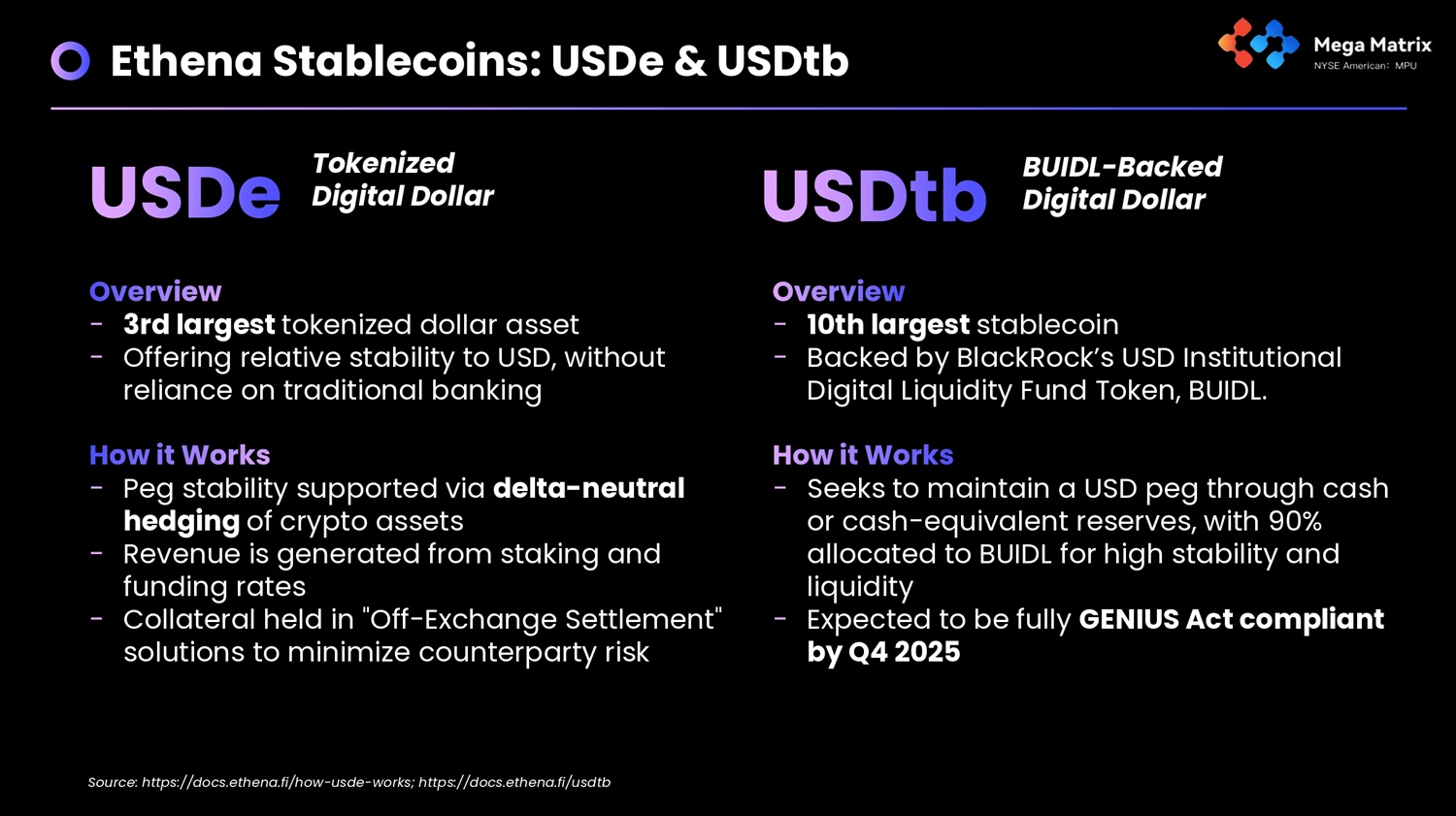

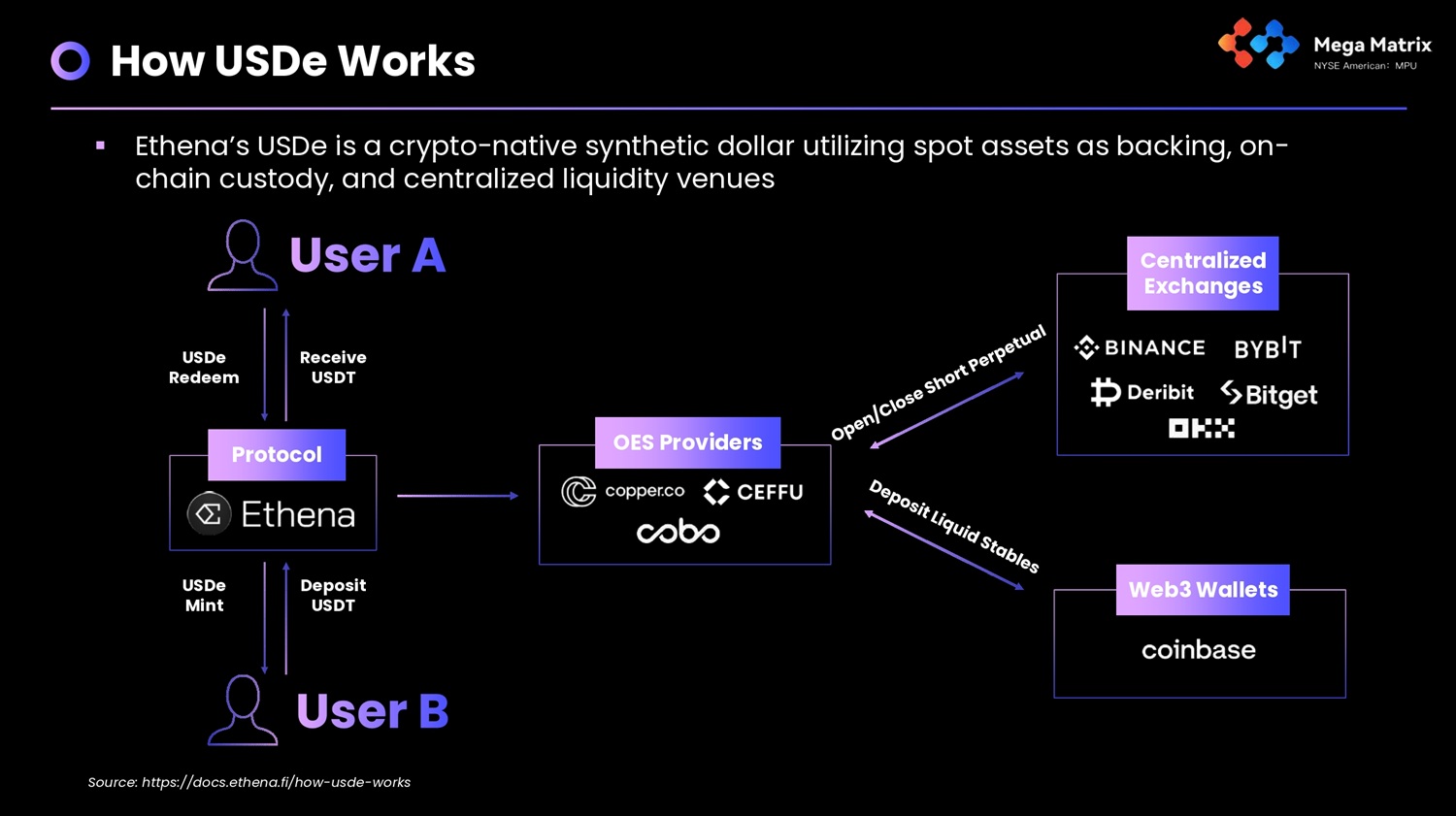

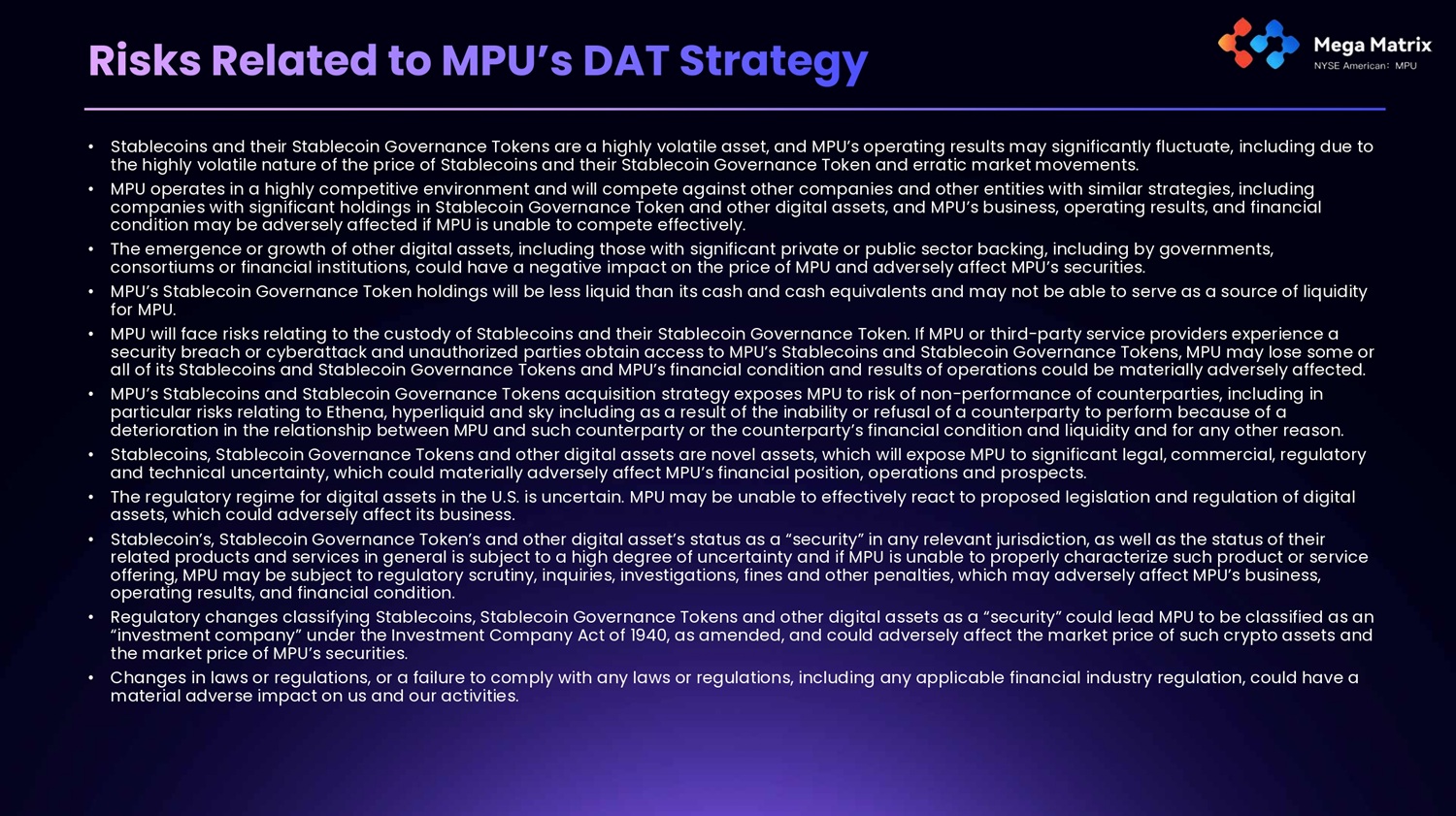

In May 2025, the Company’s Board of Directors approved the purchase of Bitcoin and/or Ethereum to hold as a treasury reserve asset. This business strategy was updated on July 2, 2025, in which the Company’s Board of Directors approved to restart its Ethereum (“ETH”) staking business and the exploration of a broader Web3-focused strategy. Through staking, the Company earns rewards that can be reinvested into ETH or used for general corporate purposes. The Company believes that its strategy to reinstate its ETH staking business will enhance long-term shareholder value. On August 21, 2025, the Company further updated its DAT reserve strategies and focus on stablecoin governance token its primary treasury asset.

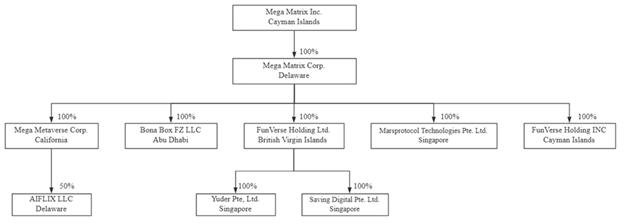

The major subsidiaries of the Company as of September 30, 2025 are summarized as below:

| Later of date of | ||||||||||

| incorporation or | Place of | % of | Principal | |||||||

| Name of Subsidiaries | Acquisition | Incorporation | Ownership | Activities | ||||||

| Major subsidiaries: | ||||||||||

| FunVerse Holding Limited | January 7, 2024 | BVI | 100 | % | Investment holding | |||||

| Yuder Pte. Ltd. | January 7, 2024 | Singapore | 100 | % | Short drama streaming platform | |||||

| Bona Box FZ LLC | September 24, 2024 | Abu Dhabi | 100 | % | Short drama streaming platform | |||||

| Saving Digital Pte. Ltd. | August 31, 2022 | Singapore | 100 | % | ETH staking | |||||

| Marsprotocol Technologies Pte. Ltd. | March 1, 2023 | Singapore | 100 | % | Investment holding | |||||

| FunVerse Holding Inc | September 24, 2025 | Cayman | 100 | % | Investment holding | |||||

MEGA MATRIX INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Rounded to the Nearest Hundred US Dollar, except for share data, unless otherwise stated)

1. ORGANIZATION AND PRINCIPAL ACTIVITIES (CONTINUED)

Acquisition of FunVerse Holding Limited (“FunVerse”) and its subsidiary

On January 7, 2024, MPU DE entered into and closed a definitive Share Exchange Agreement with FunVerse, a company incorporated under the laws of the British Virgin Islands and the sole parent company of Yuder Pte. Ltd. (“Yuder”), and the shareholders of FunVerse. Following the transaction, MPU DE owns sixty percent (60%) of equity interest of FunVerse. FunVerse, through Yuder, operates FlexTV, a short drama streaming platform based in Singapore that produces English and Thai dramas that are also translated into different languages for the users that are spread across various parts of the world. In addition to creating original dramas, Yuder also acquires third party content copyrights which it then translates and distributes on its FlexTV platform.

On August 15, 2024, MPU DE closed its acquisition of 40% equity interest in FunVerse Holding Limited (“FunVerse”) and its wholly owned subsidiary, Yuder Pte. Ltd. (“Yuder”), at share consideration of 1,500,000 Class A Ordinary Shares of the Company. Upon the acquisition, the Company, through MPU DE, indirectly owns 100% equity interest in FunVerse and Yuder.

Deconsolidation of staking business and leasing of regional aircraft business

On August 31, 2022, MPU DE acquired all of the equity interest in Saving Digital Pte, Ltd., a Singapore corporation (“SDP”) from Mr. Yucheng Hu for a nominal consideration of $10,000. SDP was intended to operate solo-staking business.

On March 1, 2023, SDP and Bit Digital Singapore Pte. Ltd. (“Bit Digital”), entered into a shareholders’ agreement (the “Shareholders Agreement”) with Marsprotocol Technologies Pte. Ltd. (“MTP”), to provide proof-of-stake technology tools for digital assets through the staking platform “MarsProtocol”, an institutional grade non-custodial staking technology. Pursuant to the Shareholders Agreement, SDP invested $300,000 and owned 60% equity inteterest of MTP. Through the MarsProtocol platform, MTP planned to provide non-custodial staking tools. In June 2023, the Company ceased provision of non-custodial staking tools to third party customers. In August 2023, Bit Digital exited its investment in MTP and withdrew its capital contribution of SGD$120,000 from MTP. As a result of the transaction, SDP owns all outstanding ordinary shares of MTP.

In March 2024, the Company ceased solo-staking business. SDP was intended to operate solo-staking business.

In August 2023, per the recommendation of board of JetFleet Management Corp. (“JMC”), MPU DE, as a holder of a majority of the voting stock of JMC, elected to approve the winding up and dissolution of JMC. JMC ceased providing aircraft advisory and management services upon winding up and the Company deconsolidated JMC and its subsidiaries in December 2023.

Upon the Company’s deconsolidation of its staking business operated by SDP and leasing of regional aircraft business operated by JMC, the Company focused on its short drama streaming platform business.

The management believed the deconsolidation does not represent a strategic shift, in both operating and financing aspects, because it is not changing the way it is running its business. The Company has not shifted the nature of its operations or the major geographic market area. The management believed the deconsolidation of does not represent a strategic shift that has (or will have) a major effect on the Company’s operations and financial results. The deconsolidation is not accounted as discontinued operations in accordance with ASC 205-20.

MEGA MATRIX INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Rounded to the Nearest Hundred US Dollar, except for share data, unless otherwise stated)

2. SUMMARY OF PRINCIPAL ACCOUNTING POLICIES

Basis of presentation

The accompanying unaudited condensed consolidated financial statements are presented on a consolidated basis in accordance with accounting principles generally accepted in the United States of America (“US GAAP”) for interim financial information, the instructions to Form 10-Q and Article 8 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by US GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. Operating results for the three and nine months ended September 30, 2025 are not necessarily indicative of the results that may be expected for the year ending December 31, 2025 or for any other period. All intercompany balances and transactions have been eliminated on consolidation.

Fair value Measurement

The Company applies ASC Topic 820, Fair Value Measurements and Disclosures which defines fair value, establishes a framework for measuring fair value and expands financial statement disclosure requirements for fair value measurements.

ASC Topic 820 defines fair value as the price that would be received from the sale of an asset or paid to transfer a liability (an exit price) on the measurement date in an orderly transaction between market participants in the principal or most advantageous market for the asset or liability.

ASC Topic 820 specifies a hierarchy of valuation techniques, which is based on whether the inputs into the valuation technique are observable or unobservable. The hierarchy is as follows:

Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets.

Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the assets or liability, either directly or indirectly, for substantially the full term of the financial instruments.

Level 3 inputs to the valuation methodology are unobservable and significant to the fair value. Unobservable inputs are valuation technique inputs that reflect the Company’s own assumptions about the assumptions that market participants would use in pricing an asset or liability.

Fair value of digital assets is based on Level 1 inputs as these were based on observable quoted prices in the Company’s principal market for identical assets. Management of the Company considers the carrying amount of cash and cash equivalents, accounts receivable, loans receivable due from a related party, other receivables, accounts payable, other payables and income taxes payable based on the short-term maturity of these instruments to approximate their fair values because of their short-term nature. Warrants were measured at fair value using unobservable inputs and categorized in Level 3 of the fair value hierarchy (Note 8).

MEGA MATRIX INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Rounded to the Nearest Hundred US Dollar, except for share data, unless otherwise stated)

2. SUMMARY OF PRINCIPAL ACCOUNTING POLICIES (CONTINUED)

Accounts receivable

Accounts receivable are recorded at the gross billing amount less an allowance for expected credit losses. Accounts receivable do not bear interest.

The Company adopted Accounting Standards Update (“ASU”) No. 2016-13, Financial Instruments-Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments (“ASU 2016-13”) to measure expected credit losses of accounts receivable.

The Company maintains an allowance for credit losses and records the allowance for credit losses as an offset to accounts receivable and the estimated credit losses charged to the allowance is classified as “General and administrative expenses” in the unaudited condensed consolidated statements of income and comprehensive income. The Company assesses collectability by reviewing accounts receivable on aging schedules because the accounts receivable were primarily consisted of online advertising service fees from certain customers. In determining the amount of the allowance for credit losses, the Company considers historical collectability based on past due status, the age of the balances, current economic conditions, reasonable and supportable forecasts of future economic conditions, and other factors that may affect the Company’s ability to collect from customers. Delinquent account balances are written-off against the allowance for expected credit loss after management has determined that the likelihood of collection is not probable.

As of September 30, 2025 and December 31, 2024, the Company did not provide expected credit losses against accounts receivable.

Digital assets

For the nine months ended September 30, 2025, the Company purchased bitcoin from open market. As of September 30, 2025, digital assets (primarily include bitcoin (“BTC”) and Ethena (“ENA”)) are initially recorded at cost in current assets in the accompanying unaudited condensed consolidated balance sheets.

The Company adopted ASU 2023-08, which requires entities to measure certain cryptocurrencies at fair value, with changes in fair value recorded in net income in each reporting period. The Company’s digital assets are within the scope of ASU 2023-08.

ASC 820 defines “principal market” as the market with the greatest volume and level of activity for the asset or liability. The determination of the principal market (and, as a result, the market participants in the principal market) is made from the perspective of the reporting entity. The digital assets held by the Company are traded on a number of active markets globally. The Company considered CoinMarketCap to be its principal market as it provides reliable and great volume and level of activity for bitcoin for which the Company can access.

Purchases of digital assets by the Company are included within investing activities on the accompanying unaudited condensed consolidated statements of cash flows. The changes of digital assets are included within investing activities in the accompanying unaudited condensed consolidated statements of cash flows. Changes in fair value are reported as “changes in fair value on digital assets” and realized gains or losses are reported as “realized gains (loss) on digital assets” in the consolidated statements of operations. The Company accounts for its gains or losses in accordance with the first-in first-out method of accounting.

MEGA MATRIX INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Rounded to the Nearest Hundred US Dollar, except for share data, unless otherwise stated)

2. SUMMARY OF PRINCIPAL ACCOUNTING POLICIES (CONTINUED)

Content assets, net

Content assets are classified as current content assets and non-current content assets, based on their estimated useful lives. Content assets are stated at cost less accumulated amortization and impairment if any. Content assets are amortized in a way which reflect the pattern in which the economic benefits of the content assets are expected to be consumed or otherwise used up. When assets are retired or disposed of, the costs and accumulated amortization are removed from the accounts, and any resulting gains or losses are included in income/loss in the year of disposition. Estimated useful lives are as follows:

| Estimated Useful Life |

||

| Software | 12 months | |

| Produced contents | 6 – 12 months | |

| Copyrights | 12 – 36 months |

Revenue Recognition

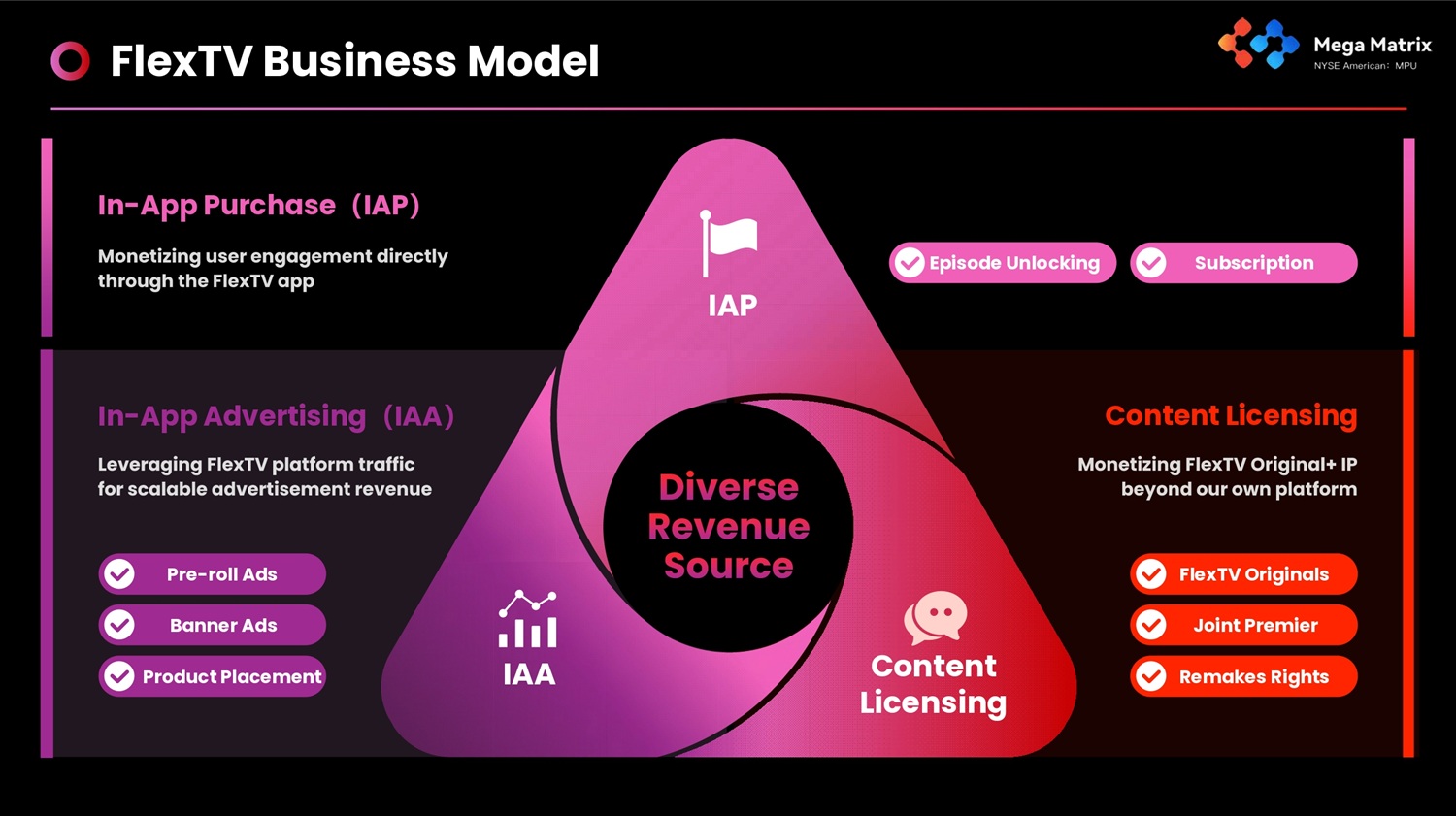

Membership and top-up streaming services (“IAP”)

Membership and top-up streaming services are referred to as In-App Purchases (“IAP”). The Company offers membership streaming services to subscribing members from various countries and the features of the plan, which primarily include access to exclusive and ad-free streaming of short dramas, and accelerated downloads and others. It’s optional for users to subscribe for weekly, monthly or annual membership on the short drama streaming platform. Users can also top up their accounts to acquire in-app coins on our platform, which are then used to continue viewing the short dramas. Users can also earn in-app coins to watch short dramas by completing daily and new user tasks.

Full membership and top-up charges are prepaid before provision of membership and top-up streaming services. The collection of membership and top-up charges are initially recorded as “contract liabilities” on the unaudited condensed consolidated balance sheets and revenue is recognized ratably over the membership period and consumption of in-app coins as services are rendered.

Online advertising services (“IAA”)

Online advertising services are referred to as In-App Advertising (“IAA”). The Company sells advertising services by delivering brand advertising primarily to third-party advertising agencies. The Company provides advertisement placements on its short drama streaming platform in different formats, including but not limited to video, banners, links, logos, brand placement and buttons. The transaction prices are varied according to the scale of impressions and types of the advertisements in the contracts with customers. The contracts have one performance obligation. Revenues are recognized over time. The Company has a right to consideration from the customers in an amount that corresponds directly with the value the Company’s performance obligations completed to date. The Company adopted practical expedient under ASC 606-10-55-18, and recognizes revenues from provision of online advertising services based on amounts invoiced to the customers.

MEGA MATRIX INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Rounded to the Nearest Hundred US Dollar, except for share data, unless otherwise stated)

2. SUMMARY OF PRINCIPAL ACCOUNTING POLICIES (CONTINUED)

Revenue Recognition (continued)

Content licensing business

The Company launched its content licensing business for its self-produced short dramas to certain online media platform in the year ended December 31, 2024. The Company entered into license agreements with third party platform customers, pursuant to which the Company grants license of its self-produced short-dramas to the platforms and allow them to distribute the short dramas for an agreed period of time. The transaction price is comprised of a fixed price and variable price which is calculated at a percentage of the revenues generated by the customers. The Company recognized revenues at fixed price upon granting license to the customers, and will recognize the variable price once the fees are collected. For the three months ended September 30, 2025 and 2024, the Company generated revenues of $509,500 and $20,000, respectively, from its content licensing business. For the nine months ended September 30, 2025 and 2024, the Company generated revenues of $1,700,500 and $20,000, respectively, from its content licensing business.

Contract balances

Contract liabilities are recognized if the Company receives consideration prior to satisfying the performance obligations, which include customer advances and deferred revenue under service arrangements.

As of December 31, 2024, the Company had contract liabilities of $2,095,500, which were recognized as revenues in the nine months ended September 30, 2025

Disaggregation of revenue

For the three and nine months ended September 30, 2025 and 2024, the Company disaggregate revenue into three revenue streams, consisting of In-App Purchases services, In-App Advertising services and content licensing business, as follows:

| For the Three Months Ended September 30, |

For the Nine months ended September 30, |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| In-App Purchase services | $ | 4,876,400 | $ | 9,294,400 | $ | 17,331,900 | $ | 23,614,200 | ||||||||

| In-App Advertising services | 725,600 | 1,031,100 | 1,875,900 | 2,319,000 | ||||||||||||

| Content licensing business | 509,500 | 20,000 | 1,700,500 | 20,000 | ||||||||||||

| $ | 6,111,500 | $ | 10,345,500 | $ | 20,908,300 | $ | 25,953,200 | |||||||||

MEGA MATRIX INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Rounded to the Nearest Hundred US Dollar, except for share data, unless otherwise stated)

2. SUMMARY OF PRINCIPAL ACCOUNTING POLICIES (CONTINUED)

Segment reporting

The Company uses the management approach to determine operating segment. The management approach considers the internal organization and reporting used by the Company’s chief operating decision maker (“CODM”) for making decisions, allocation of resource and assessing performance.

The Company operates and manages its business as a single operating and reportable segment. The Company’s CODM has been identified as the Chief Executive Officer who reviews the consolidated net income (loss) when making decisions about allocating resources and assessing performances of the Company. Significant segment expenses are the same as these presented under the operating costs and expenses in the consolidated statements of operations, and the difference between net revenue less the significant segment expenses and consolidated net income are the other segment items. The CODM reviews and utilizes these financial metrics together with non-financial metrics to make operation decisions, such as the determination of the fee rate at which the Company charges for its services and the allocation of budget between operating costs and expense.

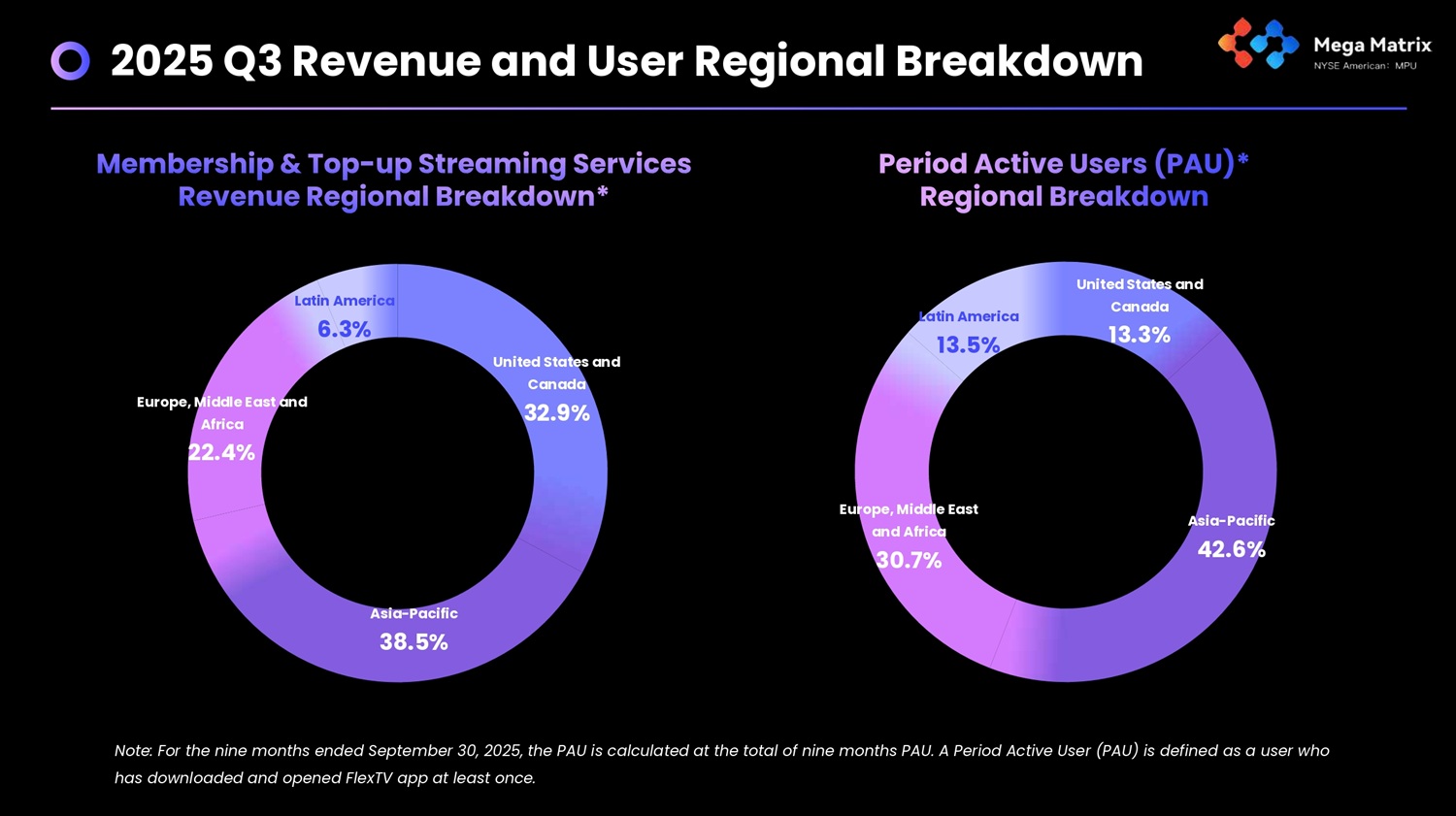

The following table disaggregates the Company’s revenues by primary geographical markets based on the location of customers for the three months ended September 30, 2025 and 2024.

| For the three months ended September 30, 2025 | ||||||||||||||||||||

| United States and |

Asia- | Europe, Middle East | Latin | |||||||||||||||||

| Canada | Pacific | and Africa | America | Total | ||||||||||||||||

| Membership and top-up streaming services revenue | $ | 1,053,000 | $ | 2,179,700 | $ | 1,360,000 | $ | 283,700 | $ | 4,876,400 | ||||||||||

| Online advertising services | 725,600 | 725,600 | ||||||||||||||||||

| Content licensing | 509,500 | 509,500 | ||||||||||||||||||

| Total | $ | 1,053,000 | $ | 3,414,800 | $ | 1,360,000 | $ | 283,700 | $ | 6,111,500 | ||||||||||

| For the three months ended September 30, 2024 | ||||||||||||||||||||

| United States and |

Asia- | Europe, Middle East | Latin | |||||||||||||||||

| Canada | Pacific | and Africa | America | Total | ||||||||||||||||

| Membership and top-up streaming services revenue | $ | 2,840,500 | $ | 4,580,200 | $ | 1,177,400 | $ | 696,300 | $ | 9,294,400 | ||||||||||

| Online advertising services | 1,031,100 | 1,031,100 | ||||||||||||||||||

| Content licensing | 20,000 | 20,000 | ||||||||||||||||||

| Total | $ | 2,840,500 | $ | 5,631,300 | $ | 1,177,400 | $ | 696,300 | $ | 10,345,500 | ||||||||||

MEGA MATRIX INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Rounded to the Nearest Hundred US Dollar, except for share data, unless otherwise stated)

2. SUMMARY OF PRINCIPAL ACCOUNTING POLICIES (CONTINUED)

Segment reporting (continued)

The following table disaggregates the Company’s revenues by primary geographical markets based on the location of customers for the nine months ended September 30, 2025 and 2024.

| For the nine months ended September 30, 2025 | ||||||||||||||||||||

| United States and |

Asia- | Europe, Middle East | Latin | |||||||||||||||||

| Canada | Pacific | and Africa | America | Total | ||||||||||||||||

| Membership and top-up streaming services revenue | $ | 5,719,800 | $ | 6,696,500 | $ | 3,896,000 | $ | 1,091,600 | $ | 17,331,900 | ||||||||||

| Online advertising services | 1,875,900 | 1,875,900 | ||||||||||||||||||

| Content licensing | 1,700,500 | 1,700,500 | ||||||||||||||||||

| Total | $ | 5,719,800 | $ | 10,272,900 | $ | 3,896,000 | $ | 1,091,600 | $ | 20,908,300 | ||||||||||

| For the nine months ended September 30, 2024 | ||||||||||||||||||||

| United States and |

Asia- | Europe, Middle East | Latin | |||||||||||||||||

| Canada | Pacific | and Africa | America | Total | ||||||||||||||||

| Membership and top-up streaming services revenue | $ | 10,691,000 | $ | 8,107,900 | $ | 3,133,800 | $ | 1,681,500 | $ | 23,614,200 | ||||||||||

| Online advertising services | 2,319,000 | 2,319,000 | ||||||||||||||||||

| Content licensing | 20,000 | 20,000 | ||||||||||||||||||

| Total | $ | 10,691,000 | $ | 10,446,900 | $ | 3,133,800 | $ | 1,681,500 | $ | 25,953,200 | ||||||||||

Going concern

For the three months ended September 30, 2025 and 2024, the Company reported net losses of approximately $10.8 million and $3.2 million, respectively. For the nine months ended September 30, 2025 and 2024, the Company reported net losses of approximately $14.8 million and $8.7 million, respectively. In addition, the Company had accumulated deficits of approximately $41.1 million and $26.3 million as of September 30, 2025 and December 31, 2024, respectively, but the Company had working capital of approximately $32.7 million among which the Company held cash of approximately $9.8 million as of September 30, 2025, which is expected to support our operating and investing activities for the next 12 months.

The Company’s liquidity is based on its ability to generate cash from operating activities and obtain financing from investors to fund its general operations and capital expansion needs. The Company’s ability to continue as a going concern is dependent on management’s ability to successfully execute its business plan, which includes increasing revenue while controlling operating cost and expenses to generate positive operating cash flows and obtain financing from outside sources.

Given the financial condition of the Company and its operating performance, the Company assesses current working capital is sufficient to meet its obligations for the next 12 months from the issuance date of this report. Accordingly, management continues to prepare the Company’s unaudited condensed consolidated financial statements on going concern basis.

MEGA MATRIX INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Rounded to the Nearest Hundred US Dollar, except for share data, unless otherwise stated)

2. SUMMARY OF PRINCIPAL ACCOUNTING POLICIES (CONTINUED)

Concentration and credit risks

1) Credit risk

Assets that potentially subject the Company to significant concentration of credit risk primarily consist of cash and cash equivalents. The maximum exposure of such assets to credit risk is their carrying amount as at the balance sheet dates. As of September 30, 2025, approximately $9.8 million were deposited in financial institutions in Singapore, and each bank accounts is insured by the government authority with the maximum limit of S$100,000. To limit exposure to credit risk relating to deposits, the Company primarily place cash and cash equivalent deposits with large financial institutions in Singapore which management believes are of high credit quality and the Company also continually monitors their credit worthiness.

The risk with respect to accounts receivable and amounts due from related parties is mitigated by credit evaluations the Company performs on its customers and its ongoing monitoring processes of outstanding balances.

The Company’s operations are carried out in Singapore. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic and legal environments in Singapore as well as by the general state of the Singapore’s economy. In addition, the Company’s business may be influenced by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, interest rates and methods of taxation among other factors.

2) Foreign currency risk

Substantially all of the Company’s operating activities that were conducted through the subsidiaries in Singapore and related assets and liabilities are denominated in SGD, which is not freely convertible into foreign currencies. All foreign exchange transactions take place either through the Monetary Authority of Singapore (“MAS”) or other authorized financial institutions at exchange rates quoted by PBOC. Approval of foreign currency payments by the MAS or other regulatory institutions requires submitting a payment application form together with suppliers’ invoices and signed contracts. The value of SGD is subject to changes in central government policies and to international economic and political developments affecting supply and demand in the MAS market.

3) Concentration risks

Accounts receivable are typically unsecured and derived from goods sold and services rendered to customers, thereby exposed to credit risk. The risk is mitigated by the Company’s assessment of customers’ creditworthiness and its ongoing monitoring of outstanding balances. The Company has a concentration of its receivables and revenues with specific customers. For the three and nine months ended September 30, 2025 and 2024, the Company had no customers which accounted for more than 10% of revenues.

As of September 30, 2025, two customers accounted for 48.7% and 12.0% of accounts receivable, respectively. As of December 31, 2024, two customers accounted for 38.3% and 15.7% of accounts receivable, respectively.

MEGA MATRIX INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Rounded to the Nearest Hundred US Dollar, except for share data, unless otherwise stated)

2. SUMMARY OF PRINCIPAL ACCOUNTING POLICIES (CONTINUED)

Recent accounting pronouncements

On July 30, 2025, the FASB issued ASU 2025-05, which amends ASC 326-20 to provide a practical expedient for all entities which elect a practical expedient that assumes that current conditions as of the balance sheet date do not change for the remaining life of the asset in developing reasonable and supportable forecasts as part of estimating expected credit losses, and an accounting policy election for all entities, other than a public business entity, that elect the practical expedient related to the estimation of expected credit losses for current accounts receivable and current contract assets that arise from transactions accounted for under ASC 606. Under ASU 2025-05, an entity is required to disclose whether it has elected to use the practical expedient and, if so, whether it has also applied the accounting policy election. An entity that makes the accounting policy election is required to disclose the date through which subsequent cash collections are evaluated. ASU 2025-05 is effective for annual reporting periods beginning after December 15, 2025, and interim reporting periods within those annual reporting periods, with early adoption permitted. Entities should apply the new guidance prospectively. The Company is currently evaluating these new disclosure requirements and does not expect the adoption to have a material impact.

In January 2025, the FASB issued ASU 2025-01, “Income Statement – Comprehensive Income – Expense Disaggregation Disclosure (Subtopic 220-40): Clarifying the Effective Date.” This pronouncement revises the effective date of ASU 2024-03 and clarifies that all public business entities are required to adopt the guidance in annual reporting periods beginning after December 15, 2026, and interim periods within annual reporting periods beginning after December 15, 2027. Entities within the ASU’s scope are permitted to early adopt the accounting standard update. The Company is currently evaluating these new disclosure requirements and does not expect the adoption to have a material impact.

In November 2024, the FASB issued ASU 2024-03, “Income Statement—Reporting Comprehensive Income (Subtopic 220-40): Disaggregation of Income Statement Expenses.” This pronouncement introduces new disclosure requirements aimed at enhancing transparency in financial reporting by requiring disaggregation of specific income statement expense captions. Under the new guidance, entities are required to disclose a breakdown of certain expense categories, such as employee compensation; depreciation; amortization, and other material components. The disaggregated information can be presented either on the face of the income statement or in the notes to the financial statements, often using a tabular format. The ASU is effective for fiscal years beginning after December 15, 2025, and interim periods within those fiscal years. Early adoption is permitted. The Company is currently evaluating these new disclosure requirements and does not expect the adoption to have a material impact.

In October 2023, the FASB issued ASU 2023-06, Disclosure Improvements — codification amendments in response to SEC’s disclosure Update and Simplification initiative which amend the disclosure or presentation requirements of codification subtopic 230-10 Statement of Cash Flows — Overall, 250-10 Accounting Changes and Error Corrections — Overall, 260-10 Earnings Per Share — Overall, 270-10 Interim Reporting — Overall, 440-10 Commitments — Overall, 470-10 Debt — Overall, 505-10 Equity — Overall, 815-10 Derivatives and Hedging — Overall, 860-30 Transfers and Servicing — Secured Borrowing and Collateral, 932-235 Extractive Activities — Oil and Gas — Notes to Financial Statements, 946-20 Financial Services — Investment Companies — Investment Company Activities, and 974-10 Real Estate — Real Estate Investment Trusts — Overall. The amendments represent changes to clarify or improve disclosure and presentation requirements of above subtopics. Many of the amendments allow users to more easily compare entities subject to the SEC’s existing disclosures with those entities that were not previously subject to the SEC’s requirements. Also, the amendments align the requirements in the Codification with the SEC’s regulations. For entities subject to existing SEC disclosure requirements or those that must provide financial statements to the SEC for securities purposes without contractual transfer restrictions, the effective date aligns with the date when the SEC removes the related disclosure from Regulation S-X or Regulation S-K. Early adoption is not allowed. For all other entities, the amendments will be effective two years later from the date of the SEC’s removal.

Recently issued ASUs by the FASB, except for the ones mentioned above, have no material impact on the Company’s unaudited condensed consolidated statements of operations and comprehensive loss or unaudited condensed consolidated balance sheets.

MEGA MATRIX INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Rounded to the Nearest Hundred US Dollar, except for share data, unless otherwise stated)

3. ACQUISITION OF FUNVERSE

On January 7, 2024, the Company acquired 60% of the equity interest of FunVerse at the cost of issuance of 1,500,000 ordinary shares. The fair value of the share consideration was $2,265,000 by reference to the closing price on January 7, 2024.

The Company has allocated the purchase price of FunVerse based upon the fair value of the identifiable assets acquired and liabilities assumed on the acquisition date. The Company estimated the fair values of the assets acquired and liabilities assumed at the acquisition date in accordance with the business combination standard issued by FASB. The Company used carrying amount of assets and liabilities as fair value, which approximate the fair value, and used cost approach to estimate the fair value of content assets which was primarily comprised software and copyrights. The Company engaged an independent appraiser firm to estimate the fair value of assets acquired, liabilities assumed and content assets identified as of the acquisition date. Acquisition-related costs incurred for the acquisitions are not material and have been expensed as incurred in other operating expenses. The following table summarizes the estimated fair values of the identifiable assets acquired at the acquisition date, which represents the net purchase price allocation at the date of the acquisition of FunVerse based on a valuation performed by an independent valuation firm engaged by the Company.

| January 7, | ||||

| 2024 | ||||

| ASSETS | ||||

| Net tangible liabilities (1) | $ | (466,400 | ) | |

| Copyrights (2) | 581,000 | |||

| Software (2) | 1,048,200 | |||

| Goodwill | 2,889,200 | |||

| Deferred tax liabilities | (277,000 | ) | ||

| Non-controlling interest | (1,510,000 | ) | ||

| Total purchase consideration | $ | 2,265,000 | ||

| (1) | The following is a reconciliation of the fair value of major classes of assets acquired and liabilities assumed which comprised of net tangible liabilities on January 7, 2024. |

| (2) | The copyrights and software, collectively known as content assets, are both applied to produce short dramas. The useful lives of these content assets ranged between 6 and 12 months. |

| January 7, | ||||

| 2024 | ||||

| ASSETS | ||||

| Cash and cash equivalents | $ | 118,300 | ||

| Accounts receivable | 323,500 | |||

| Prepayments | 25,200 | |||

| Prepaid expenses and other assets | 359,400 | |||

| Content assets | 165,300 | |||

| Total assets | $ | 991,700 | ||

| LIABILITIES | ||||

| Accounts payable | $ | 43,400 | ||

| Contract liabilities | 395,000 | |||

| Other current liabilities and accrued expenses | 1,019,700 | |||

| Total liabilities | $ | 1,458,100 | ||

| Net tangible liabilities | $ | (466,400 | ) | |

MEGA MATRIX INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Rounded to the Nearest Hundred US Dollar, except for share data, unless otherwise stated)

3. ACQUISITION OF FUNVERSE (CONTINUED)

On August 15, 2024, the Company closed its acquisition of 40% equity interest in FunVerse and Yuder, at share consideration of 1,500,000 Class A Ordinary Shares of the Company, at per share price of $1.51. Upon the acquisition, the Company owned 100% equity interest in FunVerse and Yuder. The acquisition of 40% equity interest in FunVerse does not result in a change in control of FunVerse and Yuder, which was accounted for as equity transactions. The difference between the carrying amount of the non-controlling interest as of August 15, 2024 and the fair value of 1,500,000 share consideration was recognized in additional paid-in capital.

4. DIGITAL ASSETS

Digital asset holdings were comprised of the following:

| September 30, | December 31, | |||||||

| 2025 | 2024 | |||||||

| BTC | $ | 1,368,600 | $ | |||||

| ENA | 4,983,200 | |||||||

| USDT | 2,082,500 | |||||||

| USDe | 500,000 | |||||||

| $ | 8,934,300 | $ | ||||||

For the three months ended September 30, 2025, the Company purchased one BTC from open market. For the three months ended September 30, 2025, the Company exchanged 1 BTC into ENA and realized exchange loss of $400. For the three months ended September 30, 2025, the Company recognized an increase in fair value of BTC of $86,800. For the nine ended September 30, 2025, the Company purchased 13 BTC from open market. For the nine months ended September 30, 2025, the Company exchanged one BTC into ENA and realized exchange loss of $400. For the nine months ended September 30, 2025, the Company recognized an increase in fair value of BTC of $105,800. As of September 30, 2025, the Company held 12 BTC with fair value of $1,368,600.

For the three and nine months ended September 30, 2025, the Company purchased 8,916,805 ENA from open market. For the three and nine months ended September 30, 2025, the Company did not sell ENA or exchange ENA into other digital assets. For the three and nine months ended September 30, 2025, the Company recognized a decrease in fair value of ENA of $1,454,400. As of September 30, 2025, the Company held 8,916,805 ENA with fair value of $4,983,200.

For the three and nine months ended September 30, 2025, the Company purchased 40 ETH from open market and exchanged 40 ETH into ENA. For the three and nine months ended September 30, 2025, the Company recognized an increase in fair value of $73,900. As of September 30, 2025, the Company did not hold ETH.

As of September 30, 2025, the Company held 2,082,500 USDT and 500,000 USDe, respectively. The fair value of USDT and USDe was both kept at $1.00 because one USDT/USDe is pegged to one U.S. dollar.

MEGA MATRIX INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Rounded to the Nearest Hundred US Dollar, except for share data, unless otherwise stated)

4. DIGITAL ASSETS (CONTINUED)

Additional information about digital assets

The following table presents additional information about BTC for the nine months ended September 30, 2025:

| For the Nine months ended September 30, |

||||

| 2025 | ||||

| Opening balance | $ | - | ||

| Purchases of BTC | 630,300 | |||

| Purchases of BTC from exchange of USDT | 748,200 | |||

| Exchange of BTC into ENA | (115,300 | ) | ||

| Exchange loss | (400 | ) | ||

| Changes in fair value of BTC | 105,800 | |||

| $ | 1,368,600 | |||

The following table presents additional information about ENA for the nine months ended September 30, 2025:

| For the Nine months ended September 30, |

||||

| 2025 | ||||

| Opening balance | $ | - | ||

| Purchases of ENA from exchange of USDT | 6,149,900 | |||

| Purchases of ENA from exchange of BTC | 115,300 | |||

| Purchases of ENA from exchange of ETH | 172,400 | |||

| Changes in fair value of ENA | (1,454,400 | ) | ||

| $ | 4,983,200 | |||

The following table presents additional information about ETH for the nine months ended September 30, 2025:

| For the Nine months ended September 30, |

||||

| 2025 | ||||

| Opening balance | $ | - | ||

| Purchases of ETH | 98,500 | |||

| Purchases of ENA from exchange of ETH | (172,400 | ) | ||

| Changes in fair value of ETH | 73,900 | |||

| $ | - | |||

MEGA MATRIX INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Rounded to the Nearest Hundred US Dollar, except for share data, unless otherwise stated)

4. DIGITAL ASSETS (CONTINUED)

The following table presents additional information about USDT for the nine months ended September 30, 2025:

| For the Nine months ended September 30, |

||||

| 2025 | ||||

| Opening balance | $ | - | ||

| Purchases of USDT | 719,400 | |||

| Addition of USDT from private placement | 8,900,000 | |||

| Exchange of USDT into BTC | (748,200 | ) | ||

| Exchange of USDT into ENA | (6,149,900 | ) | ||

| Exchange of USDT into USDe | (500,000 | ) | ||

| Payment of operating expenses | (138,800 | ) | ||

| $ | 2,082,500 | |||

The following table presents additional information about USDe for the nine months ended September 30, 2025:

| For the Nine months ended September 30, |

||||

| 2025 | ||||

| Opening balance | $ | |||

| Purchases of USDe from exchange of USDT | 500,000 | |||

| $ | 500,000 | |||

5. LONG-TERM INVESTMENTS

As of September 30, 2025 and December 31, 2024, long-term investments were comprised of the following:

| September 30, | December 31, | |||||||

| 2025 | 2024 | |||||||

| Investment in Quleduo | $ | 1,500,000 | $ | 1,500,000 | ||||

| Investment in AIFLIX LLC (“AIFlix”) | 213,000 | |||||||

| Less: share of equity loss in Quleduo | (21,300 | ) | (19,200 | ) | ||||

| $ | 1,691,700 | $ | 1,480,800 | |||||

MEGA MATRIX INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Rounded to the Nearest Hundred US Dollar, except for share data, unless otherwise stated)

5. LONG-TERM INVESTMENTS (CONTINUED)

Quleduo is a privately held company which is engaged in software design and development. In May and September 2023 and January 2024, the Company made a total cash consideration of $1,500,000 in three instalments to acquire 25% of equity interest in Quleduo. The Company used equity method to measure the investment in Quleduo. For the three months ended September 30, 2025, Quleduo reported net income of approximately $1,300 and the Company recorded share of equity loss of $300. For the nine months ended September 30, 2025, Quleduo incurred net loss of approximately $8,100 and the Company recorded share of equity loss of $2,100. The Company assessed indicators reflecting an other-than-temporary decline in fair value below the carrying value and did not provide impairment against the investment in Quleduo.

On March 17, 2025, the Company setup AIFlix with Wardour Studios Inc. (“Wardour Studios”), a leading Hollywood production and digital-effects studio specializing in next-generation content creation, for AI-generated short drama production. The Company and Wardour Studios owned equity interest of 50% and 50% in AIFlix, respectively. For the nine months ended September 30, 2025, the Company made investment of $213,000 to AIFlix, and AIFLIX has not generated revenue or net income. The Company assessed indicators reflecting an other-than-temporary decline in fair value below the carrying value and did not provide impairment against the investment in AIFlix.

As of September 30, 2025 and December 31, 204, the Company owned 30% equity interest in MarsLand Global Limited (“MarsLand”), over which the Company exercised significant influence. The Company used equity method to measure the investment in MarsLand. During the year ended December 31, 2024, Marsland reported an underperformance and a majority of the employees resigned from Marsland. The Company assessed indicators reflecting an other-than-temporary decline in fair value below the carrying value. As of December 31, 2024, the Company provided full impairment against the investment in Marsland. As of September 30, 2025 and December 31, 2024, the Company had investment of $nil in Marsland.

The Company owned 7.6% equity interest in DaoMax Technology Co., Ltd, (“DaoMax”), over which the Company neither had control nor significant influence through investment in ordinary shares. The Company accounted for the investment in DaoMax using the measurement alternative at cost, less impairment, with subsequent adjustments for observable price changes resulting from orderly transactions for identical or similar investments of the same issuer. In September 2024, DaoMax was closed as DaoMax assessed that it could generate profits from operations. For the year ended December 31, 2024, the Company provided full impairment of $546,000 against investment in DaoMax. As of September 30, 2025 and December 31, 2024, the Company had investment of $nil in DaoMax.

MEGA MATRIX INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Rounded to the Nearest Hundred US Dollar, except for share data, unless otherwise stated)

6. CONTENT ASSETS, NET

Content assets were comprised of current content assets and non-current content assets. The useful lives of current content assets were below 12 months, while the useful lives of non-current content assets were ranged between 18 months and 36 months.

Current content assets were comprised of the following:

| September 30, | December 31, | |||||||

| 2025 | 2024 | |||||||

| Produced contents | ||||||||

| - in development and production | $ | 238,000 | $ | 321,600 | ||||

| - released | 5,971,500 | 3,449,400 | ||||||

| Copyrights | 3,131,700 | 1,691,700 | ||||||

| 9,341,200 | 5,462,700 | |||||||

| Less: accumulated amortization | (7,770,600 | ) | (3,892,900 | ) | ||||

| Less: accumulated impairment | (3,000 | ) | (3,000 | ) | ||||

| Total | $ | 1,567,600 | $ | 1,566,800 | ||||

Non-current content assets were comprised of the following:

| September 30, | December 31, | |||||||

| 2025 | 2024 | |||||||

| Produced contents | $ | 581,000 | $ | 581,000 | ||||

| Copyrights | 425,900 | 313,000 | ||||||

| 1,006,900 | 894,000 | |||||||

| Less: accumulated amortization | (857,100 | ) | (710,200 | ) | ||||

| Total | $ | 149,800 | $ | 183,800 | ||||

The following is a schedule, by fiscal years, of amortization amount of content asset as of September 30:

| For the three months ending December 31, 2025 | $ | 1,168,900 | ||

| For the year ending December 31, 2026 | 536,200 | |||

| For the year ending December 31, 2027 | 12,300 | |||

| Total | $ | 1,717,400 |

For the three months ended September 30, 2025 and 2024, the Company recorded amortization expenses of $1,369,300 and $1,351,000 on content assets, respectively. For the nine months ended September 30, 2025 and 2024, the Company recorded amortization expenses of $4,024,700 and $2,590,900 on content assets, respectively.

MEGA MATRIX INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Rounded to the Nearest Hundred US Dollar, except for share data, unless otherwise stated)

7. OPERATING LEASES

As of September 30, 2025 and December 31, 2024, the Company leases office spaces in the United States and Singapore under non-cancelable operating leases, with terms ranging within 12 months. The Company considers those renewal or termination options that are reasonably certain to be exercised in the determination of the lease term and initial measurement of right of use assets and lease liabilities. Lease expense for lease payment is recognized on a straight-line basis over the lease term.

The Company determines whether a contract is or contains a lease at inception of the contract and whether that lease meets the classification criteria of a finance or operating lease. For operating leases that include rent holidays and rent escalation clauses, the Company recognizes lease expense on a straight-line basis over the lease term from the date it takes possession of the leased property. The Company records the straight-line lease expense and any contingent rent, if applicable, in the account of “general and administrative expenses” on the consolidated statements of operations and comprehensive loss.

The lease agreements do not contain any material residual value guarantees or material restrictive covenants.

The Company applied practical expedient to account for short-term leases with a lease term within 12 months. The Company records operating lease expense in its consolidated statements of operations and comprehensive loss on a straight-line basis over the lease term and record variable lease payments as incurred.

For the three months ended September 30, 2025 and 2024, the Company recorded rent expenses of $7,600 and $46,800, respectively. For the nine months ended September 30, 2025 and 2024, the Company recorded rent expenses of $23,500 and $56,600, respectively.

8. EQUITY

Ordinary Shares

As of December 31, 2024, the Company has been authorized to issue 100,000,000 shares of Class A Ordinary Shares and 10,000,000 Class B Ordinary Shares. As of December 31, 2024, the Company had 34,536,384 shares of Class A Ordinary Shares and 5,933,700 shares of Class B Ordinary Shares issued and outstanding.

On August 15, 2025, the Company’s shareholders approved an increase of the share capital to US$1,110,000, divided into: (i) 1,000,000,000 class A ordinary shares of par value US$0.001 each, (ii) 50,000,000 class B ordinary shares of par value US$0.001 each, (iii) 50,000,000 class C ordinary shares of par value US$0.001 each, and (iv) 10,000,000 preferred shares of par value US$0.001 each, by an addition of 900,000,000 class A ordinary shares of par value US$0.001 each, and 40,000,000 class B ordinary shares of par value US$0.001 each, and the creation of a new share class comprising of 50,000,000 class C ordinary shares of par value US$0.001 each.

On September 2, 2025, Mr. Yucheng Hu, Chairman of the Board of Directors and a shareholder of the Company, submitted a notice of conversion pursuant to the Company’s Third Amended and Restated Memorandum and Articles of Association (“MAA”), requesting to convert 3,123,723 Class B ordinary shares, par value $0.001 per share (“Class B Shares”), into 3,123,723 Class C ordinary shares, par value $0.001 per share (“Class C Shares”) (the “Conversion”). Each Class B Share is convertible into one (1) Class A ordinary share, par value$0.001 (“Class A Share”), or one (1) Class C Share, at the option of the holder. Each Class C Share is convertible into one (1) Class A Share at the option of the holder. Each Class A Share shall be entitled to one (1) vote, each Class B Share shall be entitled to one hundred (100) votes, and each Class C Share shall be entitled to fifty (50) votes. On September 3, 2025, Mr. Hu entered into a share transfer agreement, pursuant to which he agreed to transfer 2,290,390 Class C Shares to Mr. Yaman Demir, a director of the Company, at par value and as permitted under the MAA (the “Transfer”). The Conversion and the Transfer closed on September 22, 2025.

MEGA MATRIX INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Rounded to the Nearest Hundred US Dollar, except for share data, unless otherwise stated)

8. EQUITY (CONTINUED)

Ordinary Shares (continued)

On February 18, 2025, the Company entered into an At The Market Offering Agreement (the “Agreement”) with H.C. Wainwright& Co., LLC (the “Manager”) pursuant to which the Company may offer and sell, from time to time, through the Manager, Class A Ordinary Shares, par value $0.001 per share (the “Shares”), having an aggregate offering price of up to $20,000,000. For the three months ended September 30, 2025, the Company sold 1,690,562 shares of Class A Ordinary Share and raised net proceeds of $2,460,700. For the nine months ended September 30, 2025, the Company sold 2,089,272 shares of Class A Ordinary Share and raised net proceeds of $2,821,100. On March 10, 2025, the Company sold 5,800 shares of Class A Ordinary Share to the Manager as reimbursement for Manager’s counsel’s fees in connection with each due diligence update session.

On July 24, 2025, the Company signed a Securities Purchase Agreement (the “Agreement”) with certain accredited investors (collectively, the “Investors”), pursuant to which the Investors, severally and not jointly, agreed, subject to certain terms and conditions of the Agreement, to purchase an aggregate of 16,000,000 Class A ordinary shares, par value $0.001 (the “Class A Shares”), for an aggregate purchase price of $16,000,000, or $1.00 per Class A Share (the “Offering Purchase Price”, the transactions contemplated under the Agreement, the “Offering”). The Offering closed on the same day and the proceeds therefrom will provide a solid capital foundation for the Company’s proposed strategic expansion into the stable coin sector. In connection with preparation of the Offering, on July 17, 2025, the Company entered into a Finder’s Agreement with Web3 Capital Limited, a company formed under the laws of Cayman Islands (the “Finder”). The Company has agreed to a fee, to be paid in Class A Shares, equal to 5% of the Class A Shares subscribed by the investors introduced by the Finder. Upon the closing of the Offering, the Company issued 785,000 Class A Shares to the Finder under the Finder’s Agreement.

In addition, pursuant to a prior engagement letter with H.C. Wainwright & Co. (“Wainwright”), the Company agreed to pay Wainwright a cash fee equal to 3% of the aggregate gross proceeds raised in the Offering that is in excess of $5,000,000. Wainwright acted as financial advisor to the Company and has not been engaged in the solicitation or distribution of the Offering.