UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 3, 2025

Andretti Acquisition Corp. II

(Exact name of registrant as specified in its charter)

| Cayman Islands | 001-42268 | 98-1792547 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

| 100 Kimball Place, Suite 550, Alpharetta, GA | 30009 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (770) 299-2201

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

||

| Units, each consisting of one Class A Ordinary Share and one-half of one Redeemable Warrant | POLEU | The Nasdaq Stock Market LLC | ||

| Class A Ordinary Shares, par value $0.0001 per share | POLE | The Nasdaq Stock Market LLC | ||

| Redeemable Warrants, each whole warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50 per share | POLEW | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

Attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated into this Item 7.01 by reference is the investor presentation (the “Investor Presentation”) of StoreDot Ltd., an Israeli company limited by shares (“StoreDot” or the “Company”), and Andretti Acquisition Corp. II, a Cayman Islands exempted company (“Andretti” or “SPAC”) that may be used by StoreDot and Andretti in connection with the transactions contemplated by the Business Combination Agreement described below.

The Investor Presentation is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), except as expressly set forth by specific reference in such filing.

Item 8.01 Other Events.

On December 3, 2025, Andretti and StoreDot issued a joint press release announcing the execution of a definitive Business Combination Agreement (the “Business Combination Agreement”), dated as of December 3, 2025, by and among, Andretti, StoreDot, XFC Battery Ltd., a newly-formed Israeli company limited by shares (“Pubco”) that is owned by a person affiliated with StoreDot, XFC Israel Merger Sub Ltd., an Israeli company limited by shares and a wholly-owned subsidiary of Pubco (“Company Merger Sub”), and XFC Cayman Merger Sub, a Cayman Islands exempted company with limited liability (“SPAC Merger Sub”) and a wholly-owned subsidiary of Pubco.

Pursuant to the Business Combination Agreement, and subject to the terms and conditions set forth therein, upon the consummation of the transactions contemplated thereby (the “Closing”) (i) Company Merger Sub will merge with and into StoreDot, with StoreDot continuing as the surviving entity (the “Company Merger”), and as a result of which each issued and outstanding security of StoreDot immediately prior to the effective time of the Company Merger will no longer be outstanding and will automatically be cancelled in exchange for substantially equivalent securities of Pubco, and (ii) SPAC Merger Sub will merge with and into Andretti, with Andretti continuing as the surviving entity (the “SPAC Merger”, and together with the Company Merger, the “Mergers” and, collectively with the other transactions contemplated by the Business Combination Agreement and the ancillary documents, the “Business Combination”), and as a result of which each issued and outstanding security of Andretti immediately prior to the effective time of the SPAC Merger will no longer be outstanding and will automatically be cancelled in exchange for substantially equivalent securities of Pubco. As a result of the Mergers, Andretti and StoreDot will become wholly-owned subsidiaries of Pubco, all upon the terms and subject to the conditions set forth in the Business Combination Agreement and applicable law, and Pubco will become a publicly traded company. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Forward-Looking Statements

Certain statements contained in this communication regarding matters that are not historical facts are forward-looking statements. These statements are based on various assumptions and on the current expectations of StoreDot’s and Andretti’s management and are not predictions of actual performance. These include statements regarding the potential of StoreDot’s battery solutions, the rate of adoption of electric vehicle technology in general and specific battery technology in particular, the size and growth of StoreDot’s addressable markets, StoreDot’s pathway to embedded commercialization, and the ability of the parties to complete the Business Combination on the timing and terms indicated or at all; therefore, you are cautioned not to place undue reliance on them. The outcome of any forward-looking statement cannot be guaranteed, and actual results may differ materially from those projected. None of Pubco, Andretti, and StoreDot undertakes any obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise, except to the extent required by law. Pubco, Andretti and StoreDot use words such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “potential,” “positioned,” “seek,” “should,” “target,” “will,” “would,” and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology. Such forward-looking statements are based on the expectations of Pubco, Andretti, or StoreDot, and involve risks and uncertainties; consequently, actual results may differ materially from those expressed or implied in the statements due to a number of factors, including, but not limited to: scientific and technological developments in the battery, electric vehicles and drone industries; StoreDot’s financial condition, including StoreDot’s ability to obtain the funding necessary to advance the development of its products and StoreDot’s cash runway; the size of the market opportunity for StoreDot’s products; StoreDot’s competitive position and the success of competing technologies that are or may become available; StoreDot’s anticipated research and development activities and projected expenditures; existing regulations and regulatory developments in applicable jurisdictions; the effect of global economic and political developments, including geopolitical tensions with China, Russia, and in the Middle East, on StoreDot’s business operations and financial condition; and StoreDot’s intellectual property position, including the scope of protection StoreDot is able to establish and maintain for its products. In addition, it is possible that Pubco, Andretti and StoreDot may not be able to consummate the Business Combination on the terms indicated herein or at all. If StoreDot and Andretti are not able to raise sufficient capital for the Business Combination to meet the minimum cash conditions in the Business Combination Agreement or if Andretti’s investors redeem an excess amount of capital held in trust, the Business Combination may not be consummated, or if consummated, StoreDot could have a capital deficit, which may require it to raise additional capital following the Business Combination, which in turn could cause dilution to existing investors. New factors emerge from time to time, and it is not possible for Pubco, Andretti, or StoreDot to predict all such factors, nor can Andretti, StoreDot, or Pubco assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. None of Pubco, Andretti, and StoreDot undertakes any obligation to update such forward-looking statements to reflect events or circumstances after the date of this Current Report on Form 8-K, except as required by law.

Additional Information

Pubco and StoreDot intend to file with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form F-4 (as may be amended, the “Registration Statement”), which will include a preliminary proxy statement of Andretti and a prospectus in connection with the proposed Business Combination among Andretti, Pubco, StoreDot, and the other parties thereto pursuant to the Business Combination Agreement. The definitive proxy statement and other relevant documents will be mailed to shareholders of Andretti as of a record date to be established for voting on Andretti’s proposed Business Combination with StoreDot. SHAREHOLDERS OF ANDRETTI AND OTHER INTERESTED PARTIES ARE URGED TO READ, WHEN AVAILABLE, THE PRELIMINARY PROXY STATEMENT, AND AMENDMENTS THERETO, AND THE DEFINITIVE PROXY STATEMENT IN CONNECTION WITH ANDRETTI’S SOLICITATION OF PROXIES FOR THE SPECIAL MEETING OF ITS SHAREHOLDERS TO BE HELD TO APPROVE THE BUSINESS COMBINATION BECAUSE THESE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT ANDRETTI, STOREDOT, PUBCO AND THE BUSINESS COMBINATION. Shareholders will also be able to obtain copies of the Registration Statement and the proxy statement/prospectus, without charge, once available, on the SEC’s website at www.sec.gov or by directing a request to: Andretti Acquisition Corp. II, 100 Kimball Place, Suite 550, Alpharetta, GA.

Participants in The Solicitation

Pubco, Andretti, StoreDot, and their respective directors, executive officers and members, as applicable, may be deemed to be participants in the solicitation of proxies from the shareholders of Andretti in connection with the Business Combination. Andretti’s shareholders and other interested persons may obtain more detailed information regarding the names, affiliations, and interests of certain of Andretti executive officers and directors in the solicitation by reading Andretti’s final prospectus filed with the SEC on September 5, 2024 in connection with Andretti’s initial public offering (“IPO”), Andretti’s Annual Report on Form 10-K for the year ended December 31, 2024, as filed with the SEC on March 25, 2025 and Andretti’s other filings with the SEC. A list of the names of such directors and executive officers and information regarding their interests in the Business Combination, which may, in some cases, be different from those of shareholders generally, will be set forth in the Registration Statement relating to the Business Combination when it becomes available. These documents can be obtained free of charge from the source indicated above.

No Offer Or Solicitation

This communication is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit No. |

Description | |

| 99.1 | Investor Presentation, dated December 2025 | |

| 99.2 | Press Release, dated December 3, 2025 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Andretti Acquisition Corp. II | ||

| By: | /s/ William M. Brown | |

| Name: | William M. Brown | |

| Title: | Chief Executive Officer | |

Dated: December 3, 2025

4

Exhibit 99.1

Confidential 1 Private & Confidential Unlocking Mass EV Adoption with Extreme Fast Charging Batteries Management Presentation December 2025 Confidential 2 Confidential This presentation is being furnished solely for informational purposes in connection with the proposed business combination (the “de - SPAC” or the “Business Combination”) between StoreDot Ltd . (the “Company” or “StoreDot”) and Andretti Acquisition Corp . II (the “SPAC” or “Andretti”) . No Representation or Warranty None of the Company, the SPAC, or their respective representatives makes, and each hereby expressly disclaims, any representation or warranty, express or implied, as to the reasonableness of the assumptions made in this presentation or the accuracy or completeness or the information contained in or incorporated by reference herein . None of the Company, the SPAC, or their respective representatives will have any liability for any representations or warranties, express or implied, contained in, or omissions from, this presentation . The data contained herein is derived from various internal and external sources . None of the Company, the SPAC, or their respective representatives assumes any obligation to provide the recipient with access to any additional information or to update the information in this presentation . No Offer or Solicitation This presentation is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any offer, sale or solicitation of securities in any jurisdiction in which such offer, sale or solicitation would be unlawful . Any offering of securities will be made only by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 , as amended, and applicable regulations Industry and Market Data The information contained in this presentation also includes information provided by third parties . None of the Company, the SPAC or any third parties that provide information to the Company guarantee the accuracy, completeness, timeliness or availability of any information . Neither the Company nor the SPAC is responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or the results obtained from the use of such content . Neither the Company nor the SPAC gives any express or implied warranties, and each of them expressly disclaims any responsibility or liability for direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees or losses (including lost income or profits and opportunity costs) in connection with the use of the information herein . Forward - Looking Statements Certain statements contained in this communication regarding matters that are not historical facts are forward - looking statements . These include statements regarding the potential of StoreDot’s product candidates, the rate of adoption of electric vehicle technology in general and specific battery technology in particular, the size and growth of StoreDot’s addressable markets, StoreDot’s pathway to embedded commercialization, the number of vehicles anticipated to adopt StoreDot’s technology and the licensing fees to StoreDot therefor, StoreDot’s cash runway and anticipated use of net proceeds from and the prospects for the Business Combination ; therefore, you are cautioned not to place undue reliance on them . The outcome of any forward - looking statement cannot be guaranteed, and actual results may differ materially from those projected . None of Pubco, Andretti, and StoreDot undertakes any obligation to publicly update any forward - looking statement, whether as a result of new information, future events or otherwise, except to the extent required by law . Pubco, Andretti and StoreDot use words such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “potential,” “positioned,” “seek,” “should,” “target,” “will,” “would,” and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology . Such forward - looking statements are based on the expectations of Pubco, Andretti, or StoreDot, and involve risks and uncertainties ; consequently, actual results may differ materially from those expressed or implied in the statements due to a number of factors, including, but not limited to : scientific and technological developments in the battery, electric vehicles and drone industries ; StoreDot’s financial condition, including StoreDot’s ability to obtain the funding necessary to advance the development of its products and StoreDot’s cash runway ; the size of the market opportunity for StoreDot’s products ; StoreDot’s competitive position and the success of competing technologies that are or may become available ; StoreDot’s anticipated research and development activities and projected expenditures ; existing regulations and regulatory developments in applicable jurisdictions ; the effect of global economic and political developments, including geopolitical tensions with China and Russia, on StoreDot’s business operations and financial condition ; and StoreDot’s intellectual property position, including the scope of protection StoreDot is able to establish and maintain for its products . In addition, it is possible that Pubco, Andretti and StoreDot may not be able to consummate the Business Combination on the terms indicated herein or at all . If StoreDot is not able to raise sufficient capital or if Andretti’s investors redeem an excess amount of capital held in trust, StoreDot could have a capital deficit, which may require it to raise additional capital following the Business Combination, which in turn could cause dilution to investors . New factors emerge from time to time, and it is not possible for Pubco, Andretti, or StoreDot to predict all such factors, nor can Andretti, StoreDot, or Pubco assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward - looking statements . None of Pubco, Andretti, and StoreDot undertakes any obligation to update such forward - looking statements to reflect events or circumstances after the date of this communication, except as required by law . Additional Information Pubco, Andretti, and StoreDot intend to file with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form F - 4 (as may be amended, the “Registration Statement”), which will include a preliminary proxy statement of Andretti and a prospectus in connection with the proposed Business Combination among Andretti, Pubco, Andretti Merger Sub, StoreDot Merger Sub, and StoreDot pursuant to the Business Combination Agreement. The definitive proxy statement and other relevant documents will be mailed to shareholders of Andretti as of a record date to be established for voting on Andretti’s proposed Business Combination with StoreDot. SHAREHOLDERS OF ANDRETTI AND OTHER INTERESTED PARTIES ARE URGED TO READ, WHEN AVAILABLE, THE PRELIMINARY PROXY STATEMENT, AND AMENDMENTS THERETO, AND THE DEFINITIVE PROXY STATEMENT IN CONNECTION WITH ANDRETTI’S SOLICITATION OF PROXIES FOR THE SPECIAL MEETING OF ITS SHAREHOLDERS TO BE HELD TO APPROVE THE BUSINESS COMBINATION BECAUSE THESE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT ANDRETTI, STOREDOT, PUBCO AND THE BUSINESS COMBINATION. Shareholders will also be able to obtain copies of the Registration Statement and the proxy statement/prospectus, without charge, once available, on the SEC’s website at www . sec . gov or by directing a request to : Andretti Acquisition Corp . II, 100 Kimball Place, Suite 550 , Alpharetta, GA . Participants in the Solicitation Pubco, Andretti, StoreDot, and their respective directors, executive officers and members, as applicable, may be deemed to be participants in the solicitation of proxies from the shareholders of Andretti in connection with the Business Combination. Andretti’s shareholders and other interested persons may obtain more detailed information regarding the names, affiliations, and interests of certain of Andretti executive officers and directors in the solicitation by reading Andretti’s final prospectus filed with the SEC on September 5, 2024 in connection with Andretti’s initial public offering (“IPO”), Andretti’s Annual Report on Form 10 - K for the year ended December 31, 2024, as filed with the SEC on March 25, 2025 and Andretti’s other filings with the SEC. A list of the names of such directors and executive officers and information regarding their interests in the Business Combination, which may, in some cases, be different from those of shareholders generally, will be set forth in the Registration Statement relating to the Business Combination when it becomes available. These documents can be obtained free of charge from the source indicated above. Trademarks The Company has proprietary rights to trademarks used in this presentation that are important to its business, many of which are registered under applicable intellectual property laws. This presentation also contains trademarks, trade names and service marks of other companies, which are the property of their respective owners. Solely for convenience, trademarks, trade names and service marks referred to in this presentation may appear without the ®, or SM symbols, but such references are not intended to indicate, in any way, that the Company will not assert, to the fullest extent permitted under applicable law, its rights or the right of the applicable licensor to these trademarks, trade names and service marks. The Company does not intend that the use or display of other parties' trademarks, trade names or service marks imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by the Company, or any other parties.

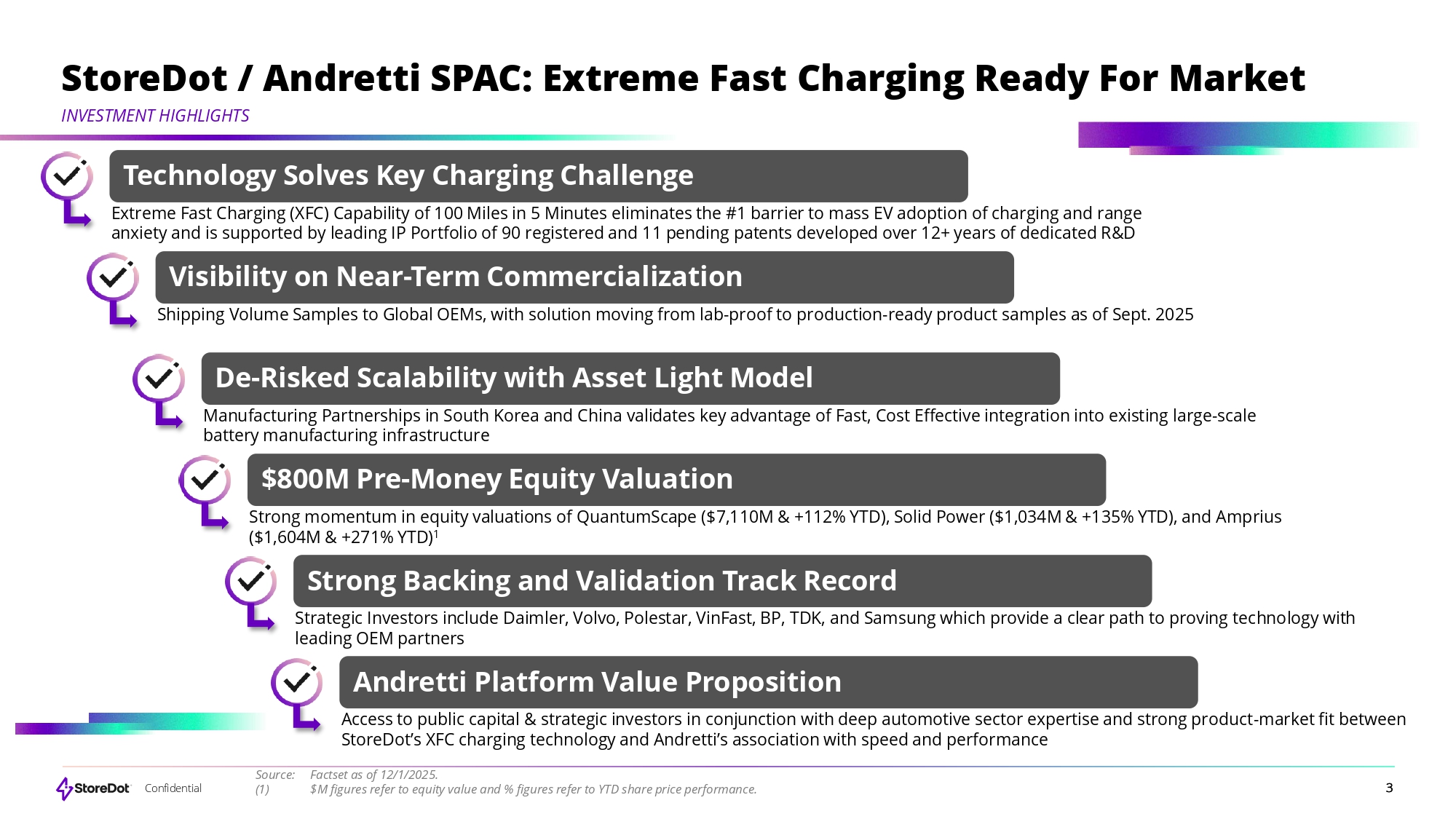

Disclaimer Confidential StoreDot / Andretti SPAC: Extreme Fast Charging Ready For Market INVESTMENT HIGHLIGHTS Technology Solves Key Charging Challenge Extreme Fast Charging (XFC) Capability of 100 Miles in 5 Minutes eliminates the #1 barrier to mass EV adoption of charging and range anxiety and is supported by leading IP Portfolio of 90 registered and 11 pending patents developed over 12+ years of dedicated R&D Visibility on Near - Term Commercialization Shipping Volume Samples to Global OEMs, with solution moving from lab - proof to production - ready product samples as of Sept. 2025 De - Risked Scalability with Asset Light Model Manufacturing Partnerships in South Korea and China validates key advantage of Fast, Cost Effective integration into existing large - scale battery manufacturing infrastructure $800M Pre - Money Equity Valuation Strong momentum in equity valuations of QuantumScape ($7,110M & +112% YTD), Solid Power ($1,034M & +135% YTD), and Amprius ($1,604M & +271% YTD) 1 Strong Backing and Validation Track Record Strategic Investors include Daimler, Volvo, Polestar, VinFast, BP, TDK, and Samsung which provide a clear path to proving technology with leading OEM partners Andretti Platform Value Proposition Access to public capital & strategic investors in conjunction with deep automotive sector expertise and strong product - market fit between StoreDot’s XFC charging technology and Andretti’s association with speed and performance Source: Factset as of 12/1/2025. (1) $M figures refer to equity value and % figures refer to YTD share price performance. 3 4 Confidential StoreDot & Andretti Introductions

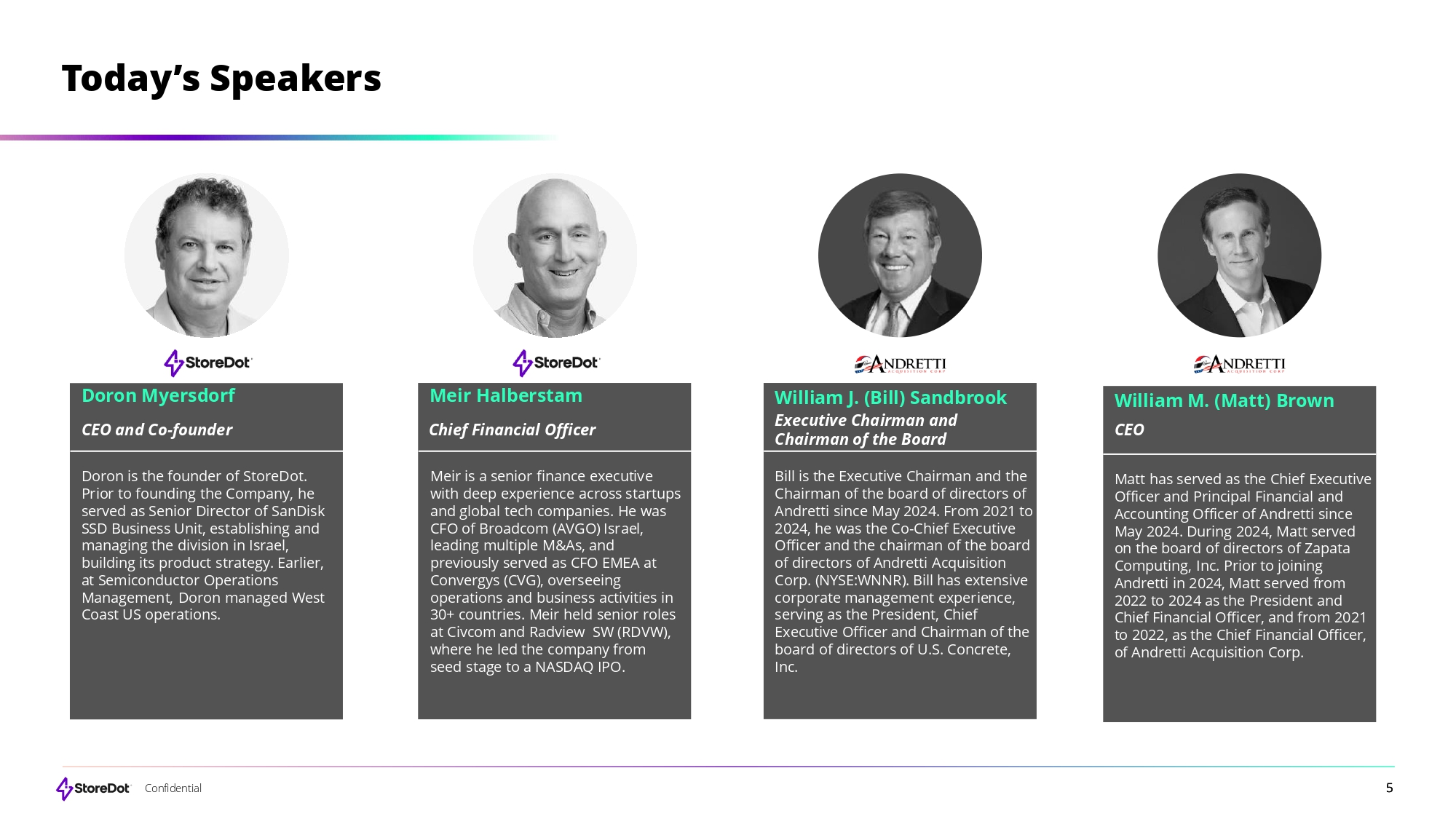

5 Confidential Today’s Speakers Doron is the founder of StoreDot. Prior to founding the Company, he served as Senior Director of SanDisk SSD Business Unit, establishing and managing the division in Israel, building its product strategy. Earlier, at Semiconductor Operations Management, Doron managed West Coast US operations. Doron Myersdorf CEO and Co - founder Meir is a senior finance executive with deep experience across startups and global tech companies. He was CFO of Broadcom (AVGO) Israel, leading multiple M&As, and previously served as CFO EMEA at Convergys (CVG), overseeing operations and business activities in 30+ countries. Meir held senior roles at Civcom and Radview SW (RDVW), where he led the company from seed stage to a NASDAQ IPO. Meir Halberstam Chief Financial Officer Matt has served as the Chief Executive Officer and Principal Financial and Accounting Officer of Andretti since May 2024. During 2024, Matt served on the board of directors of Zapata Computing, Inc. Prior to joining Andretti in 2024, Matt served from 2022 to 2024 as the President and Chief Financial Officer, and from 2021 to 2022, as the Chief Financial Officer, of Andretti Acquisition Corp. William M. (Matt) Brown CEO Bill is the Executive Chairman and the Chairman of the board of directors of Andretti since May 2024. From 2021 to 2024, he was the Co - Chief Executive Officer and the chairman of the board of directors of Andretti Acquisition Corp. (NYSE:WNNR). Bill has extensive corporate management experience, serving as the President, Chief Executive Officer and Chairman of the board of directors of U.S. Concrete, Inc. William J.

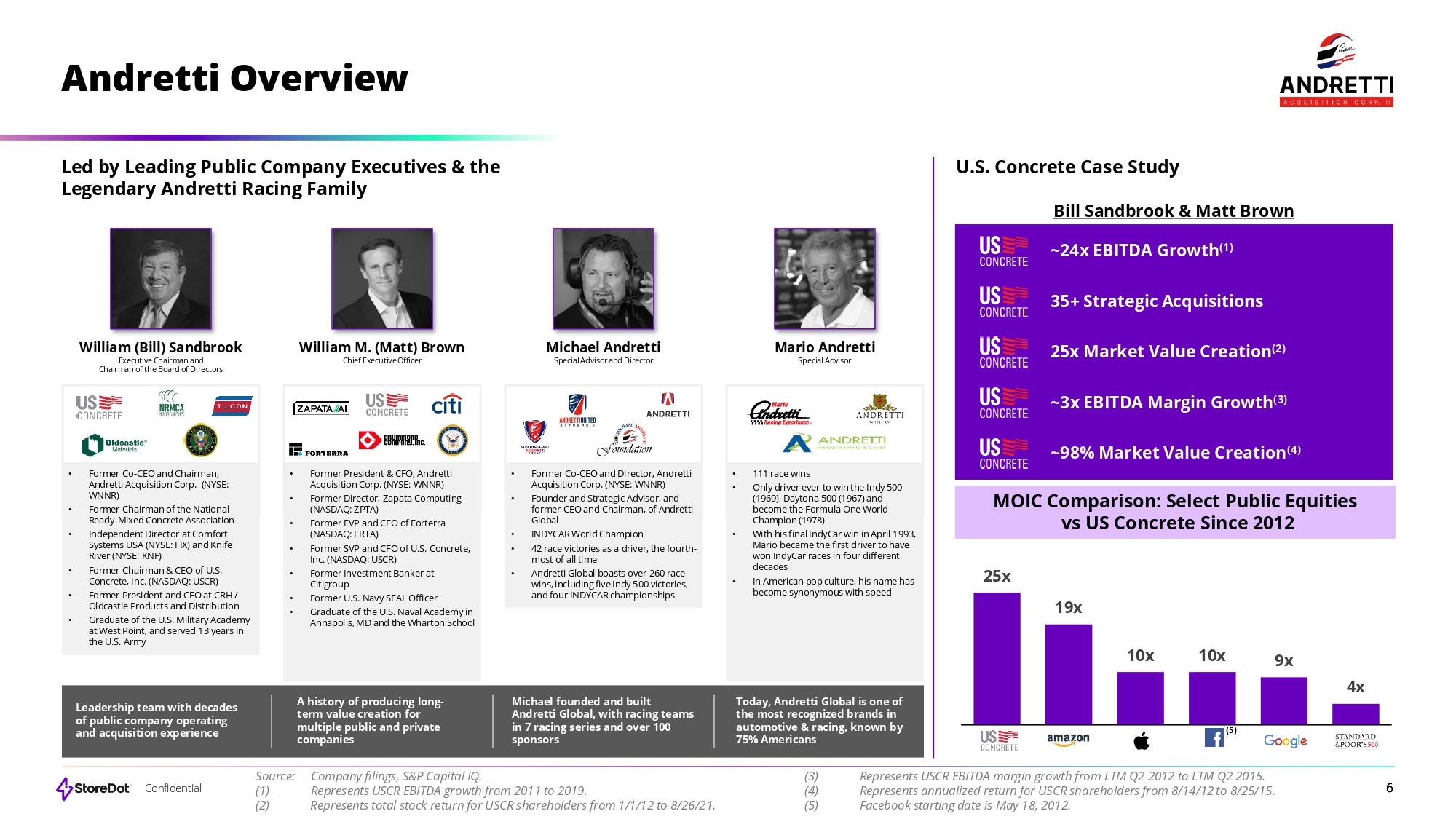

(Bill) Sandbrook Executive Chairman and Chairman of the Board 6 Confidential 25x 19x 10x 10x 9x 4x MOIC Comparison: Select Public Equities vs US Concrete Since 2012 Andretti Overview Led by Leading Public Company Executives & the Legendary Andretti Racing Family U.S. Concrete Case Study Bill Sandbrook & Matt Brown ~24x EBITDA Growth (1) 35+ Strategic Acquisitions 25x Market Value Creation (2) ~3x EBITDA Margin Growth (3) ~98% Market Value Creation (4) (5) Source: Company filings, S&P Capital IQ. (1) Represents USCR EBITDA growth from 2011 to 2019. (2) Represents total stock return for USCR shareholders from 1/1/12 to 8/26/21. (3) (4) (5) Represents USCR EBITDA margin growth from LTM Q2 2012 to LTM Q2 2015. Represents annualized return for USCR shareholders from 8/14/12 to 8/25/15. Facebook starting date is May 18, 2012. Leadership team with decades of public company operating and acquisition experience A history of producing long - term value creation for multiple public and private companies Michael founded and built Andretti Global, with racing teams in 7 racing series and over 100 sponsors Today, Andretti Global is one of the most recognized brands in automotive & racing, known by 75% Americans Mario Andretti Special Advisor Michael Andretti Special Advisor and Director William M. (Matt) Brown Chief Executive Officer William (Bill) Sandbrook Executive Chairman and Chairman of the Board of Directors • Former Co - CEO and Chairman, Andretti Acquisition Corp. (NYSE: WNNR) • Former Chairman of the National Ready - Mixed Concrete Association • Independent Director at Comfort Systems USA (NYSE: FIX) and Knife River (NYSE: KNF) • Former Chairman & CEO of U.S. Concrete, Inc. (NASDAQ: USCR) • Former President and CEO at CRH / Oldcastle Products and Distribution • Graduate of the U.S. Military Academy at West Point, and served 13 years in the U.S. Army • Former President & CFO, Andretti Acquisition Corp. (NYSE: WNNR) • Former Director, Zapata Computing (NASDAQ: ZPTA) • Former EVP and CFO of Forterra (NASDAQ: FRTA) • Former SVP and CFO of U.S. Concrete, Inc. (NASDAQ: USCR) • Former Investment Banker at Citigroup • Former U.S. Navy SEAL Officer • Graduate of the U.S. Naval Academy in Annapolis, MD and the Wharton School • Former Co - CEO and Director, Andretti Acquisition Corp.

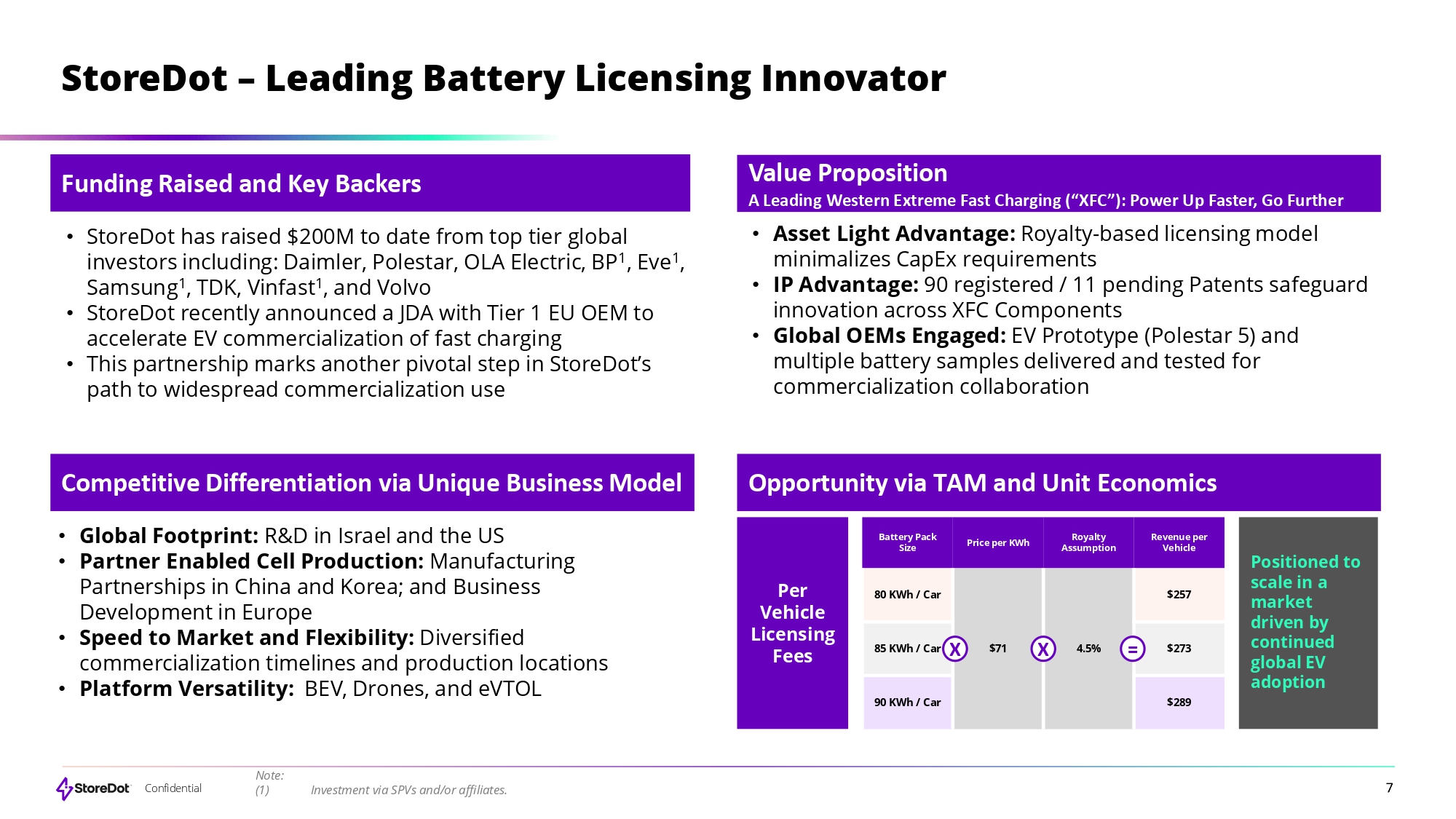

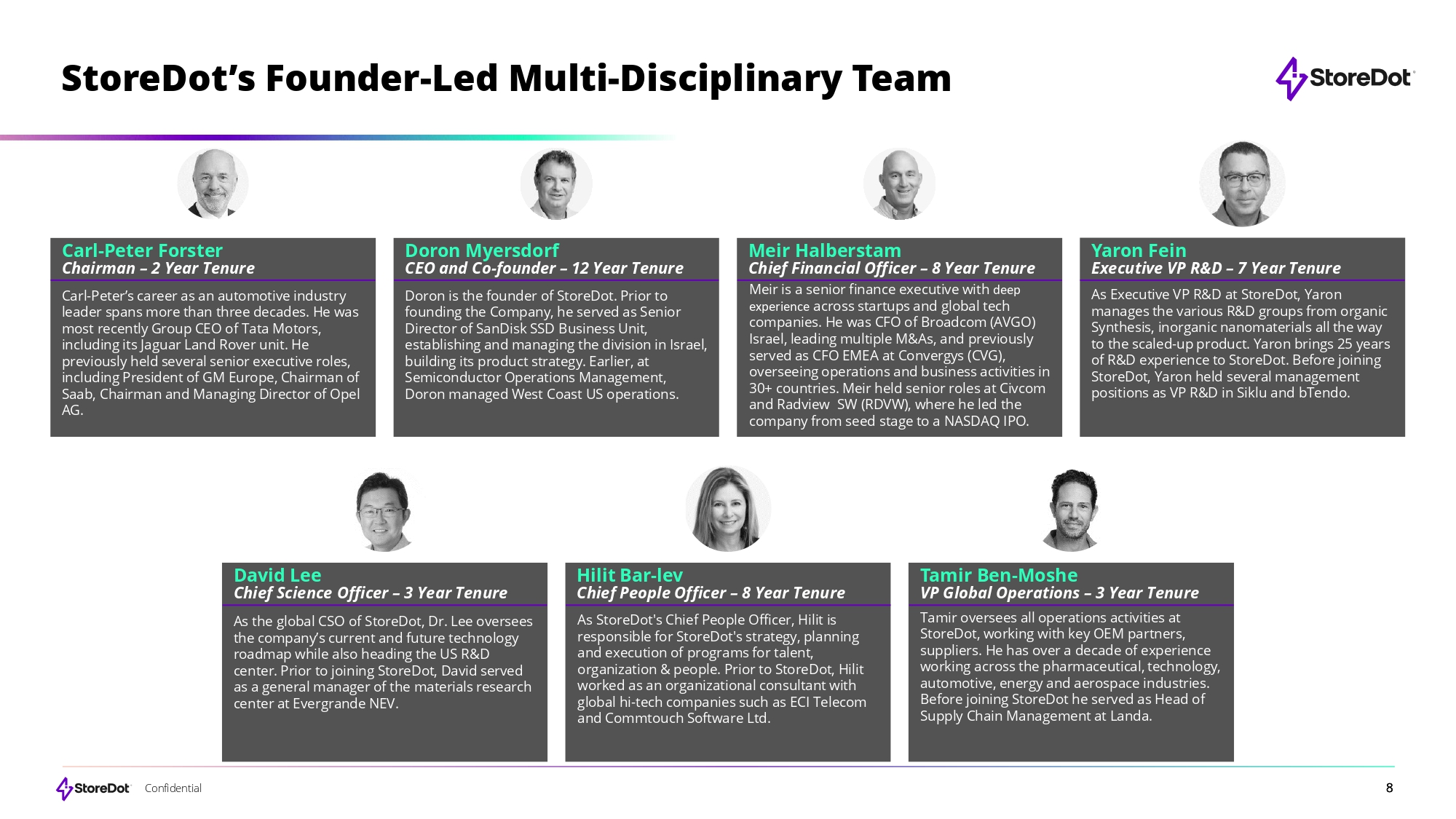

(NYSE: WNNR) • Founder and Strategic Advisor, and former CEO and Chairman, of Andretti Global • INDYCAR World Champion • 42 race victories as a driver, the fourth - most of all time • Andretti Global boasts over 260 race wins, including five Indy 500 victories, and four INDYCAR championships • 111 race wins • Only driver ever to win the Indy 500 (1969), Daytona 500 (1967) and become the Formula One World Champion (1978) • With his final IndyCar win in April 1993, Mario became the first driver to have won IndyCar races in four different decades • In American pop culture, his name has become synonymous with speed 7 Confidential Funding Raised and Backing Acquired • StoreDot has raised $200M to date from top tier global investors including: Daimler, Polestar, OLA Electric, BP 1 , Eve 1 , Samsung 1 , TDK, Vinfast 1 , and Volvo • StoreDot recently announced a JDA with Tier 1 EU OEM to accelerate EV commercialization of fast charging • This partnership marks another pivotal step in StoreDot’s path to widespread commercialization use StoreDot – Leading Battery Licensing Innovator Per Vehicle Licensing Fees Battery Pack Size Price per KWh Royalty Assumption Revenue per Vehicle 80 KWh / Car 4.5% $257 $273 90 KWh / Car $289 • Global Footprint: R&D in Israel and the US • Partner Enabled Cell Production: Manufacturing Partnerships in China and Korea; and Business Development in Europe • Speed to Market and Flexibility: Diversified commercialization timelines and production locations • Platform Versatility: BEV, Drones, and eVTOL Value Proposition • Asset Light Advantage: Royalty - based licensing model minimalizes CapEx requirements • IP Advantage: 90 registered / 11 pending Patents safeguard innovation across XFC Components • Global OEMs Engaged: EV Prototype (Polestar 5) and multiple battery samples delivered and tested for commercialization collaboration TAM and Unit Economics Funding Raised and Key Backers Competitive Differentiation via Unique Business Model Value Proposition A Leading Western Extreme Fast Charging (“XFC”): Power Up Faster, Go Further Opportunity via TAM and Unit Economics 85 KWh / Car X $71 X Positioned to scale in a market driven by continued global EV adoption Note: (1) Investment via SPVs and/or affiliates. = 8 Confidential StoreDot’s Founder - Led Multi - Disciplinary Team Carl - Peter’s career as an automotive industry leader spans more than three decades.

He was most recently Group CEO of Tata Motors, including its Jaguar Land Rover unit. He previously held several senior executive roles, including President of GM Europe, Chairman of Saab, Chairman and Managing Director of Opel AG. Carl - Peter Forster Chairman – 2 Year Tenure Doron is the founder of StoreDot. Prior to founding the Company, he served as Senior Director of SanDisk SSD Business Unit, establishing and managing the division in Israel, building its product strategy. Earlier, at Semiconductor Operations Management, Doron managed West Coast US operations. Doron Myersdorf CEO and Co - founder – 12 Year Tenure Meir is a senior finance executive with deep experience across startups and global tech companies. He was CFO of Broadcom (AVGO) Israel, leading multiple M&As, and previously served as CFO EMEA at Convergys (CVG), overseeing operations and business activities in 30+ countries. Meir held senior roles at Civcom and Radview SW (RDVW), where he led the company from seed stage to a NASDAQ IPO. Meir Halberstam Chief Financial Officer – 8 Year Tenure Yaron Fein Executive VP R&D – 7 Year Tenure As Executive VP R&D at StoreDot, Yaron manages the various R&D groups from organic Synthesis, inorganic nanomaterials all the way to the scaled - up product. Yaron brings 25 years of R&D experience to StoreDot. Before joining StoreDot, Yaron held several management positions as VP R&D in Siklu and bTendo. David Lee Chief Science Officer – 3 Year Tenure Hilit Bar - lev Chief People Officer – 8 Year Tenure Tamir Ben - Moshe VP Global Operations – 3 Year Tenure As StoreDot's Chief People Officer, Hilit is responsible for StoreDot's strategy, planning and execution of programs for talent, organization & people. Prior to StoreDot, Hilit worked as an organizational consultant with global hi - tech companies such as ECI Telecom and Commtouch Software Ltd. Tamir oversees all operations activities at StoreDot, working with key OEM partners, suppliers. He has over a decade of experience working across the pharmaceutical, technology, automotive, energy and aerospace industries. Before joining StoreDot he served as Head of Supply Chain Management at Landa. As the global CSO of StoreDot, Dr. Lee oversees the company’s current and future technology roadmap while also heading the US R&D center. Prior to joining StoreDot, David served as a general manager of the materials research center at Evergrande NEV.

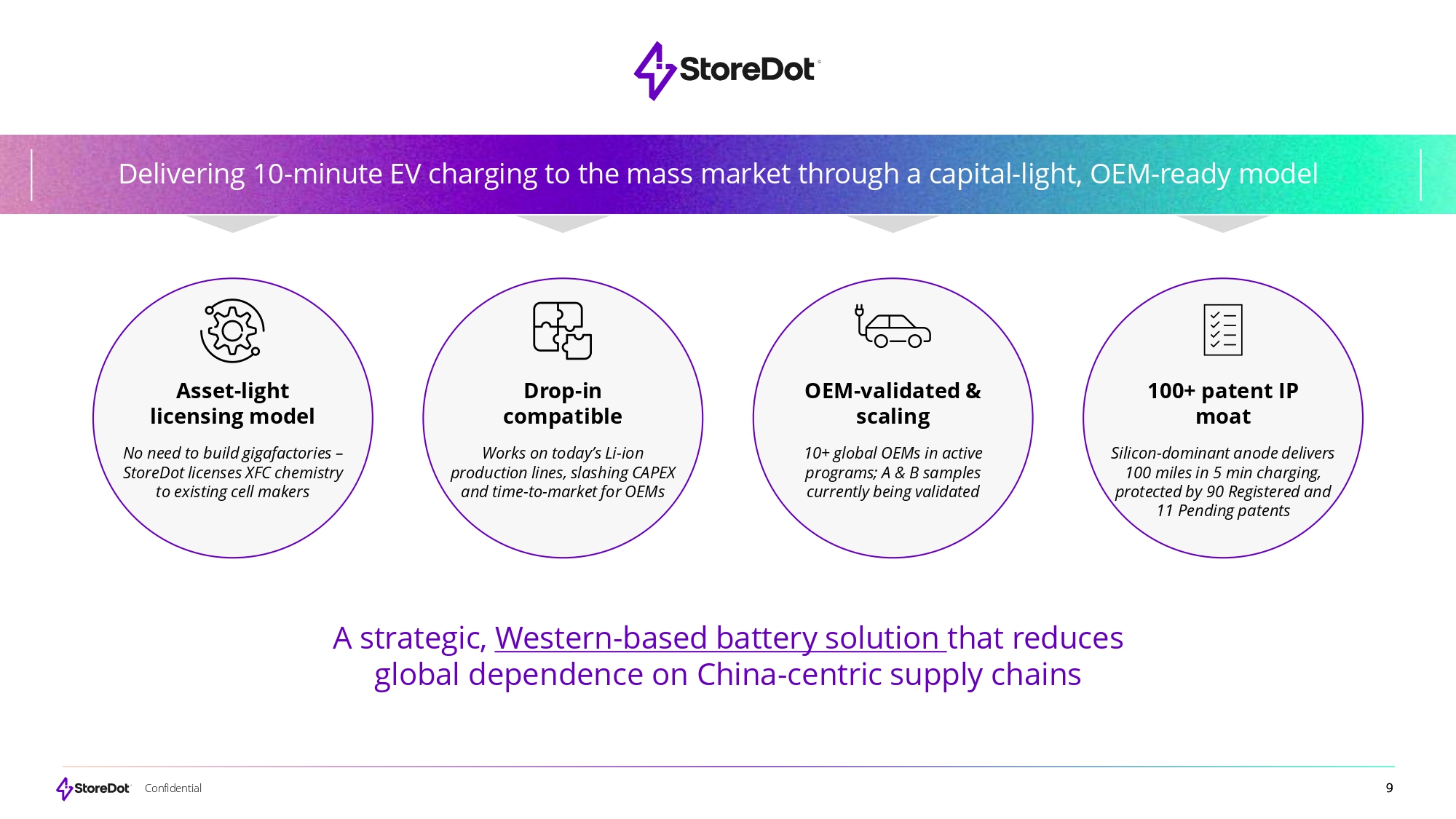

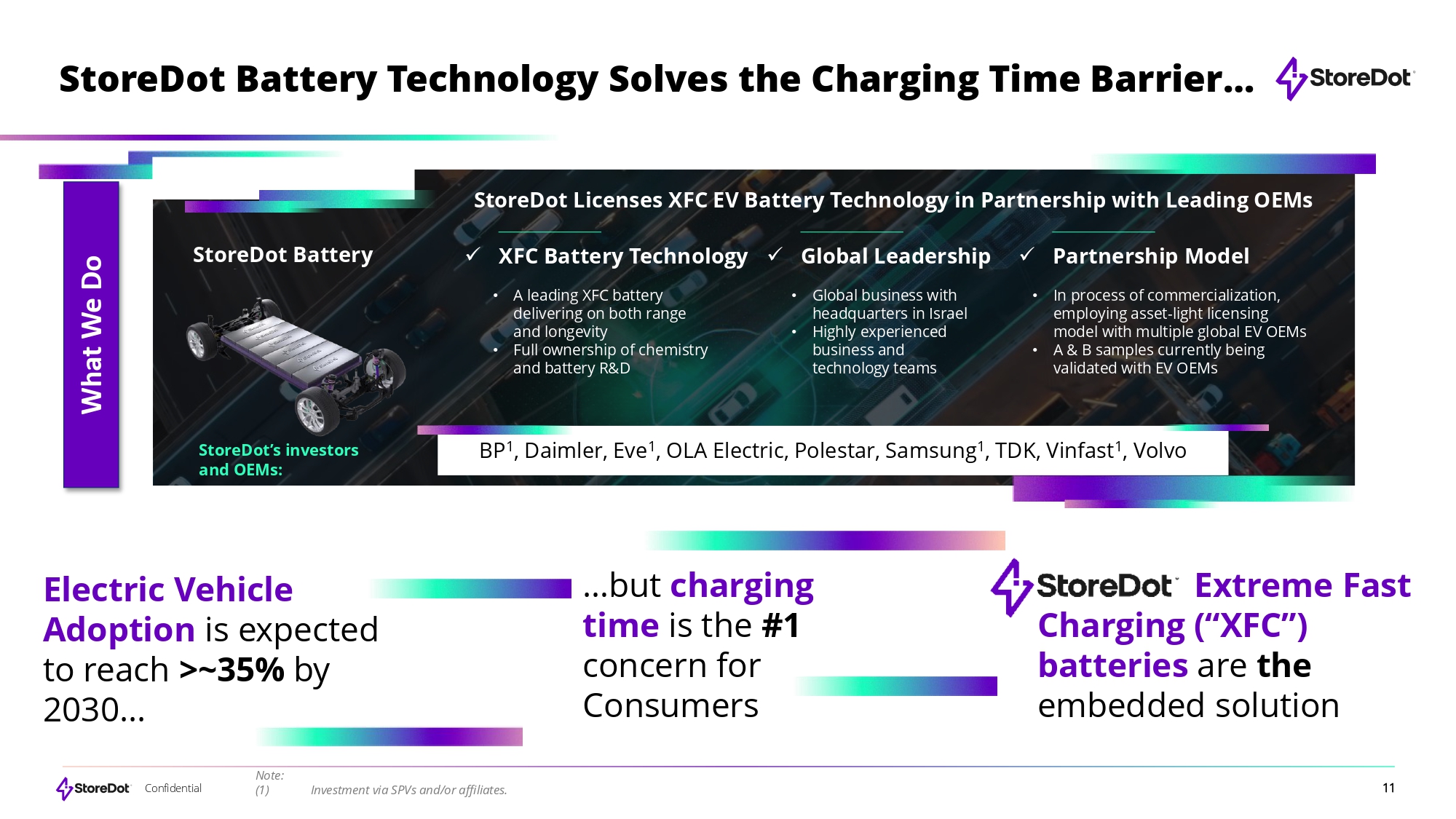

9 Confidential Delivering 10 - minute EV charging to the mass market through a capital - light, OEM - ready model Asset - light licensing model No need to build gigafactories – StoreDot licenses XFC chemistry to existing cell makers Drop - in compatible Works on today’s Li - ion production lines, slashing CAPEX and time - to - market for OEMs OEM - validated & scaling 10 + global OEMs in active programs ; A & B samples currently being validated 100+ patent IP moat Silicon - dominant anode delivers 100 miles in 5 min charging, protected by 90 Registered and 11 Pending patents A strategic, Western - based battery solution that reduces global dependence on China - centric supply chains 11 Confidential StoreDot Battery Technology Solves the Charging Time Barrier… What We Do x Partnership Model • In process of commercialization, employing asset - light licensing model with multiple global EV OEMs • A & B samples currently being validated with EV OEMs x Global Leadership • Global business with headquarters in Israel • Highly experienced business and technology teams x XFC Battery Technology • A leading XFC battery delivering on both range and longevity • Full ownership of chemistry and battery R&D StoreDot Licenses XFC EV Battery Technology in Partnership with Leading OEMs StoreDot Battery StoreDot’s investors and OEMs: Electric Vehicle Adoption is expected to reach >~35% by 2030...

10 Confidential Company Overview

…but charging time is the #1 concern for Consumers Extreme Fast Charging (“XFC”) batteries are the embedded solution BP 1 , Daimler, Eve 1 , OLA Electric, Polestar, Samsung 1 , TDK, Vinfast 1 , Volvo Note: (1) Investment via SPVs and/or affiliates.

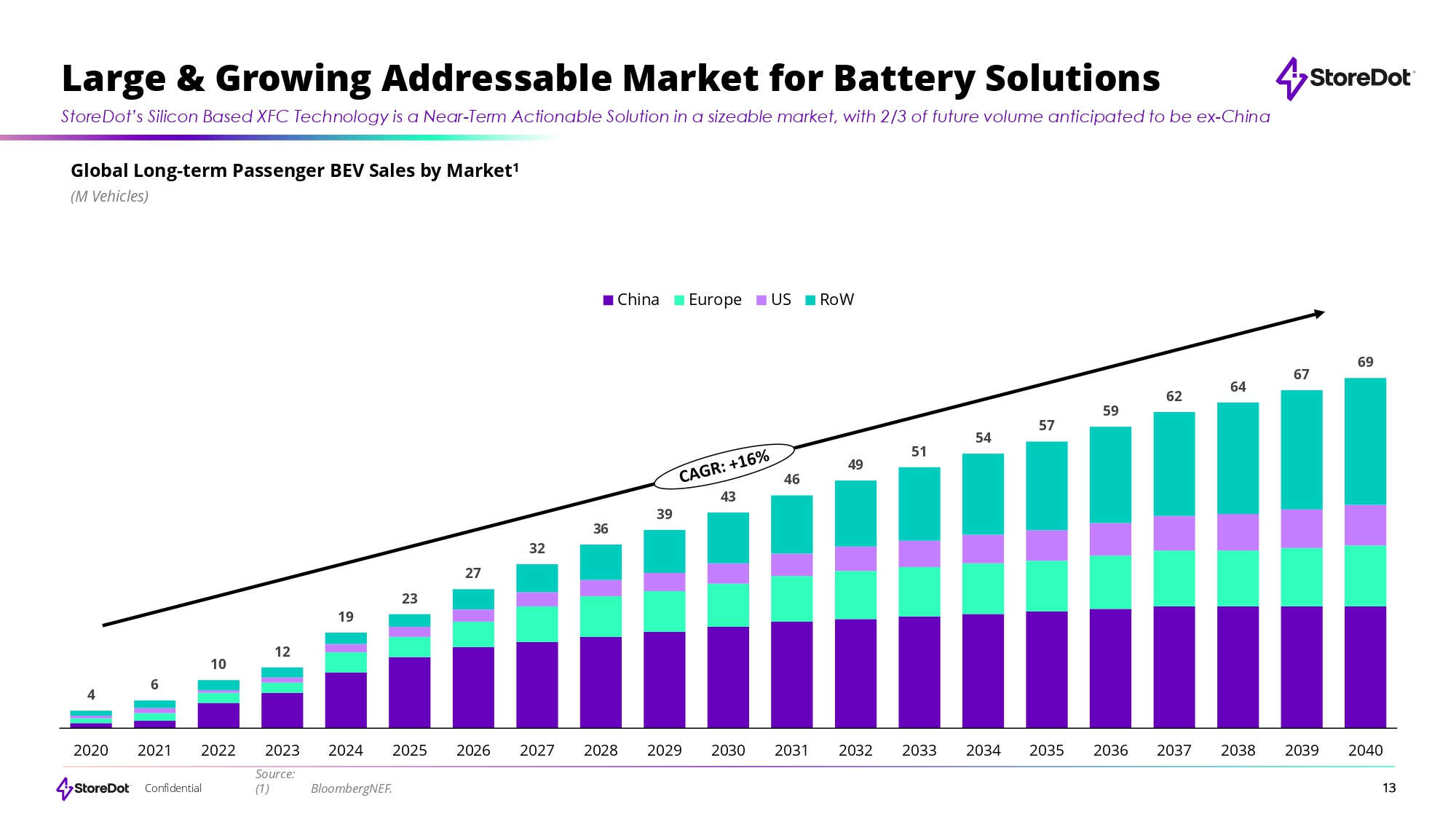

12 Confidential Skills Style Strategy System Staff Structure …Supported by a Strategic Go - to - Market Business Model A Shared Vision of Commercial Effectiveness Partnership Driven, Embedded Battery Strategy • Iterative Development with OEMs • Bespoke, Custom Solutions for OEMs Lean Organizational Structure • Business Development driven by C - Suite • Dedicated R&D team works to develop battery solutions Agile, OEM Adjacent Commercial Capabilities • Pragmatic, commercialization approach in tandem with OEMs • Emphasis on leveraging tech and business relationships Asset - Light, Licensing Business System • Contract manufacturing model with OEMs reduces CapEx needs • In - house R&D team supports OEM battery development initiatives Paradigm Changing Technological R&D Capabilities • Own and develop fast charging technology with the OEMs protected by 100 patents • Work with partner OEMs to push solution envelope for XFC batteries Leading Edge Technical and Commercial Human Capital • 15+ PHDs • Veteran management team with strong OEM relationships 13 Confidential 4 6 59 54 57 51 49 46 43 39 36 32 27 23 19 12 10 62 64 67 69 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039 2040 China Europe US RoW Global Long - term Passenger BEV Sales by Market 1 (M Vehicles) Large & Growing Addressable Market for Battery Solutions StoreDot’s Silicon Based XFC Technology is a Near - Term Actionable Solution in a sizeable market, with 2/3 of future volume anticipated to be ex - China Source: (1) BloombergNEF.

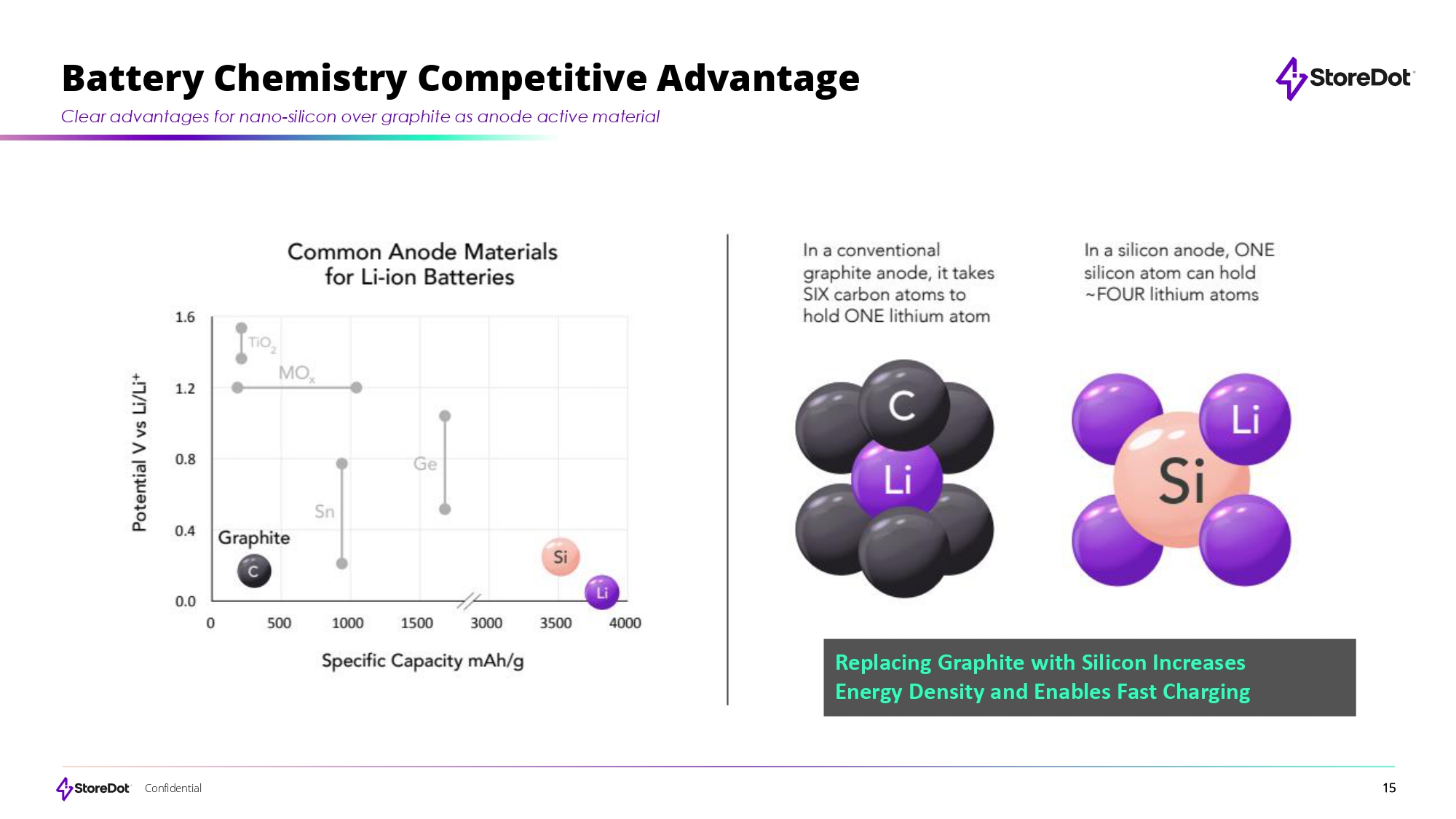

14 Confidential Anode • Nanostructuring • Composite materials • Binders • Conductive additives Electrolyte & Separator • Low viscosity co - solvents and organic additives • Ceramic coated, optimized porosity Cathode • High - capacity stable active material • Conductive additives • Binder Extreme charging rate >50% reduction in charging time with same price trajectory High energy density >330 Wh/kg and >860 Wh/L, silicon dominant anode with minimal compromise on the energy density and cycle life due to XFC Long cycle life Controlled swelling / expansion; no battery degradation for >2,000 consecutive cycles Standard production process Utilizing existing Li - ion manufacturing lines (drop - in); no CAPEX needed Environmentally sustainable Circular carbon footprint and battery tracking system Standard cooling compatibility Proven in a Polestar 5, StoreDot’s technology requires no modifications to the vehicle's cooling system StoreDot’s Unique XFC Technology Holistic approach to fast charging lithium - ion batteries 15 Confidential Battery Chemistry Competitive Advantage Clear advantages for nano - silicon over graphite as anode active material Replacing Graphite with Silicon Increases Energy Density and Enables Fast Charging

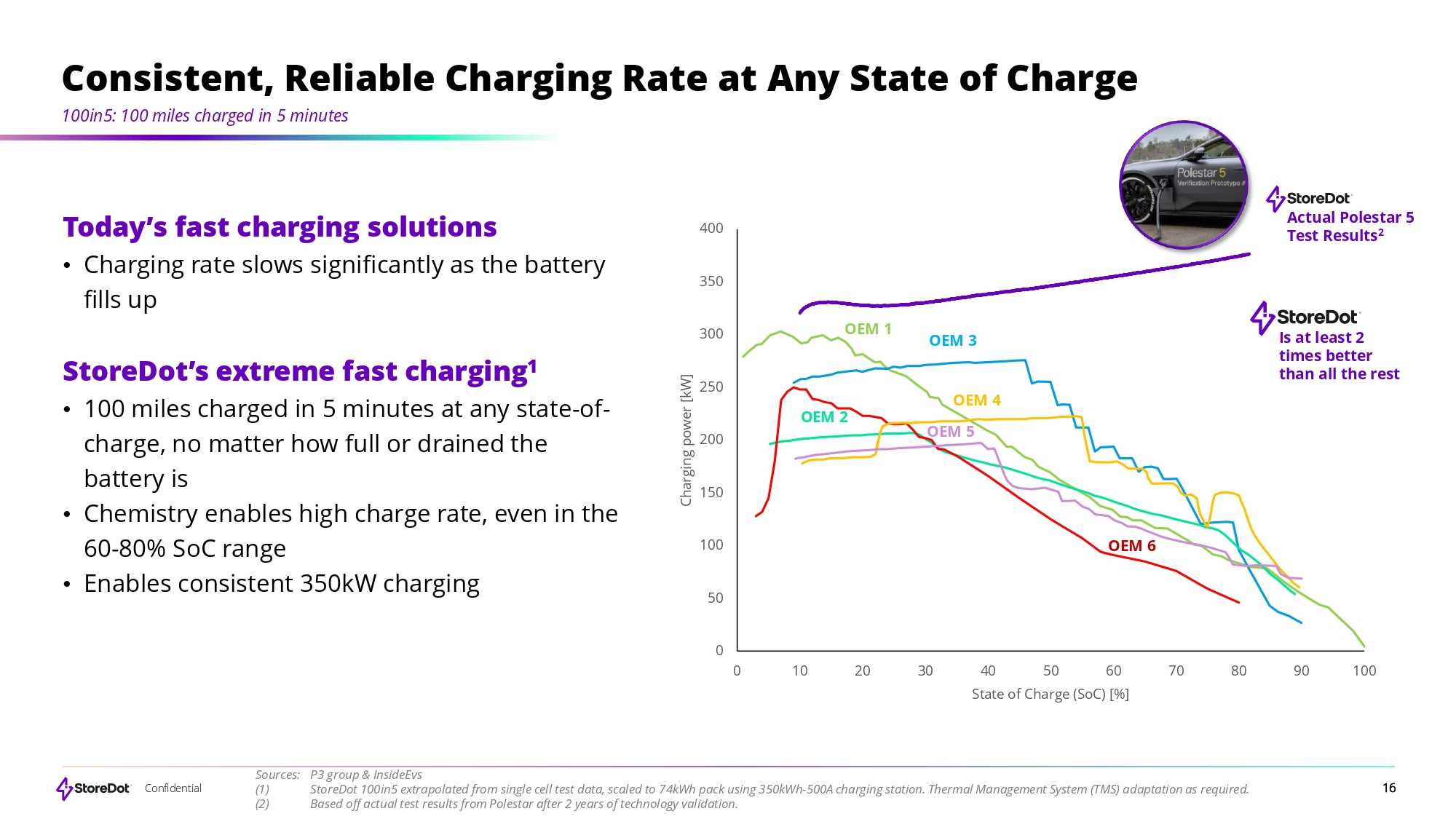

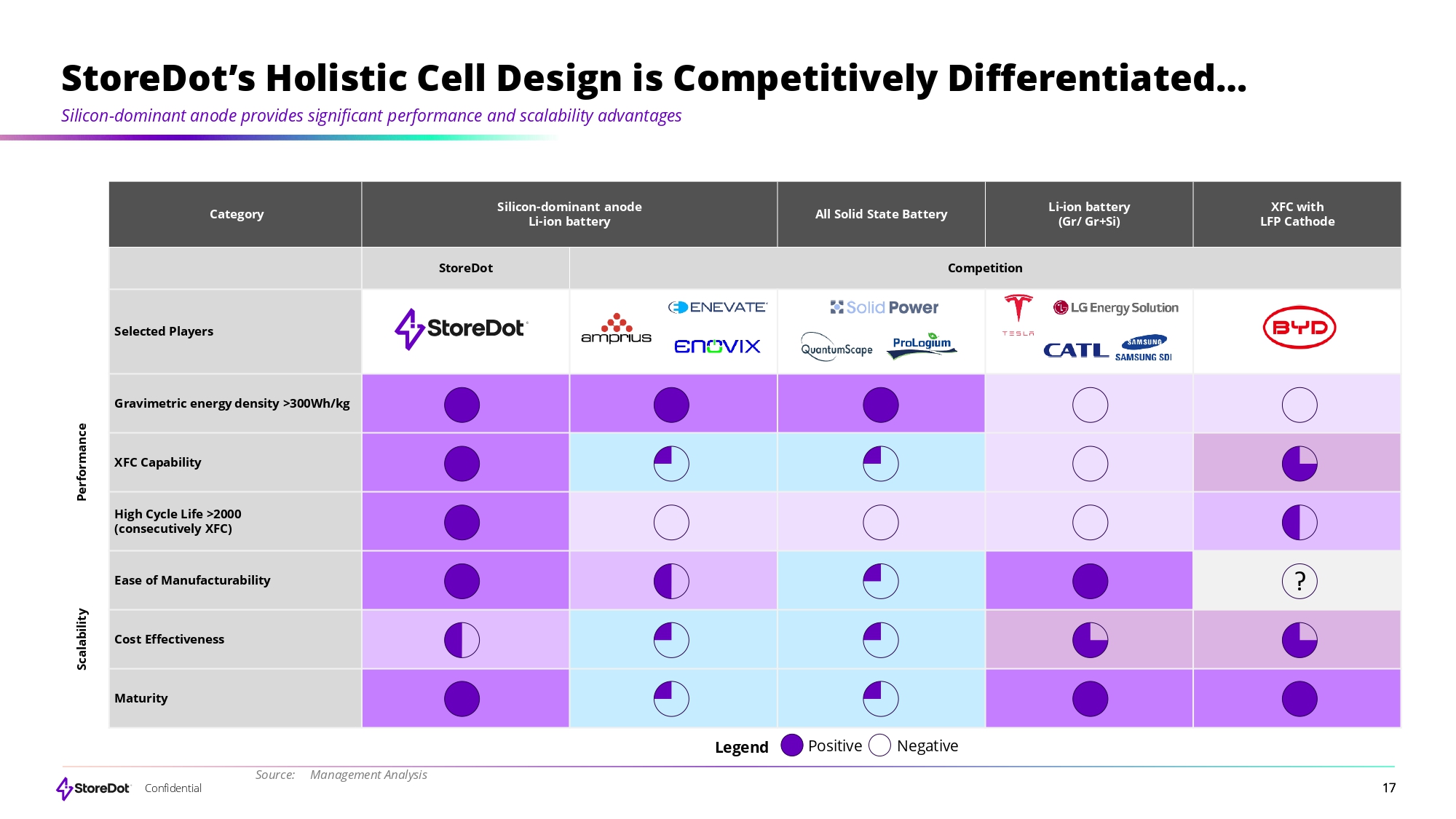

16 Confidential Sources: P3 group & InsideEvs (1) (2) StoreDot 100in5 extrapolated from single cell test data, scaled to 74kWh pack using 350kWh - 500A charging station. Thermal Management System (TMS) adaptation as required. Based off actual test results from Polestar after 2 years of technology validation. 0 50 100 150 200 250 300 350 400 0 10 20 30 40 50 60 State of Charge (SoC) [%] 70 80 90 100 Charging power [kW] OEM 1 OEM 3 OEM 6 OEM 2 OEM 4 OEM 5 Consistent, Reliable Charging Rate at Any State of Charge 100in5: 100 miles charged in 5 minutes Today’s fast charging solutions • Charging rate slows significantly as the battery fills up StoreDot’s extreme fast charging 1 • 100 miles charged in 5 minutes at any state - of - charge, no matter how full or drained the battery is • Chemistry enables high charge rate, even in the 60 - 80% SoC range • Enables consistent 350kW charging Actual Polestar 5 Test Results 2 Is at least 2 times better than all the rest 17 Confidential StoreDot’s Holistic Cell Design is Competitively Differentiated… Silicon - dominant anode provides significant performance and scalability advantages XFC with LFP Cathode Li - ion battery (Gr/ Gr+Si) All Solid State Battery Silicon - dominant anode Li - ion battery Category Competition StoreDot Selected Players Gravimetric energy density >300Wh/kg Performance XFC Capability High Cycle Life >2000 (consecutively XFC) ? Ease of Manufacturability Cost Effectiveness Scalabilit y Maturity Legend Positive Negative Source: Management Analysis

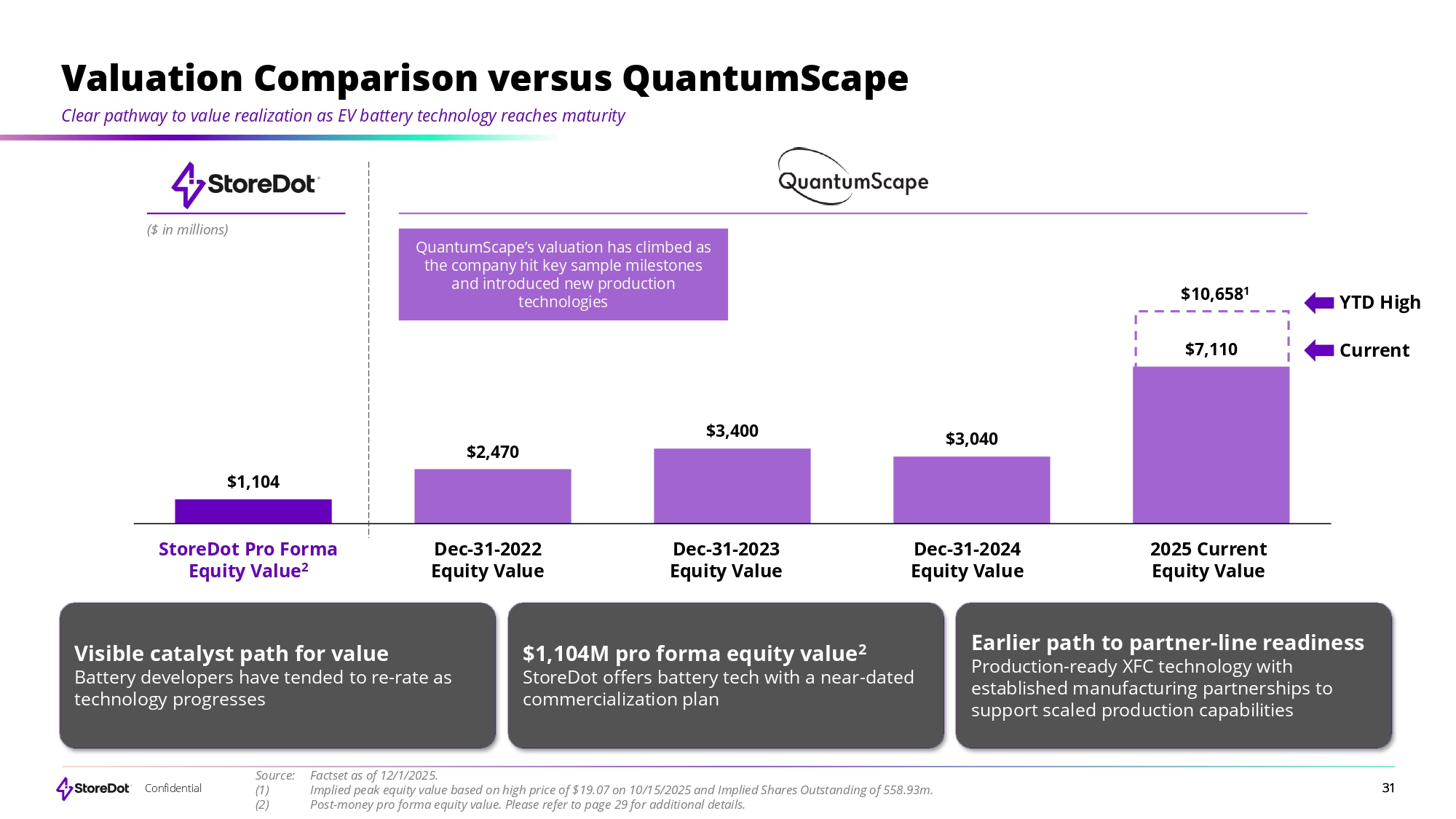

18 Confidential Company Solid - State (Anode Free), Li - Metal Silicon Anode XFC Core Technology New Factories Required Drop in for Existing Manufacturing Infrastructure Manufacturing 12 - 15 Minutes (Planned) 10 Minutes (Proven) Fast Charging (10% - 80%) High (Planned) High (Proven) Energy Density 400 (Planned) 2500 (Proven) XFC Life - Cycle VW VW, Polestar, VinFast, Renault Key Partners Ducati Scooter Polestar 5 Vehicle Prototyping Premium Standard Cell Cost Unknown with Risk UN 38.3 Regulations (Proven) 1 Safety $7,110M Public 2 $1,104M Pro Forma 2 Valuation Select Public Company Analysis StoreDot is strongly differentiated versus QuantumScape Sources: Company Website and Factset as of 12/1/2025. (1) (2) Spec validated by 7 OEMs. $1,104M StoreDot pro forma equity value and $7,110M QuantumScape equity value as of 12/1/2025.

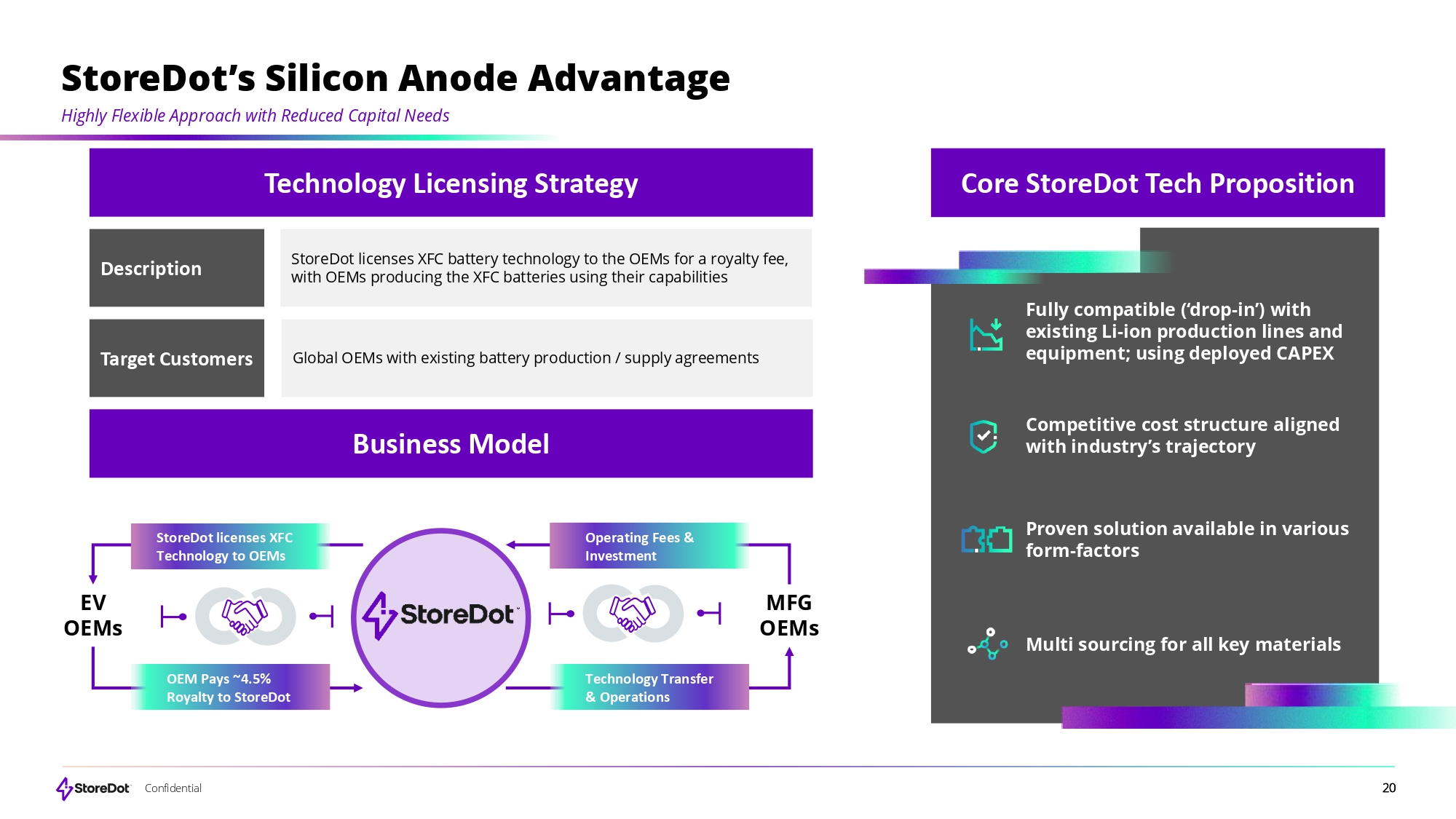

19 Confidential Defensible IP Moat – Patent Dominance in Silicon Dominant Anode Fast Charging Segment for BEVs StoreDot’s patent portfolio 90 Granted patents 11 Pending patents Active materials Organic binders Electrode composition Organic electrolyte Formation process System and cell design XFC Chemistry XFC Cell Design XFC System Designed for Safety Enables both XFC with high energy density Improves mechanical stability through optimizing independence to current flow Reduces mechanical strain and prevents undesired side reactions between the electrodes and electrolyte Reduces resistance and improves cycling, shelf, and calendar life Prevents irreversible electrolyte reactions and optimizes XFC cycle life Optimize charging and energy density via CTP, while improving cost, cycle life, and safety 20 Confidential Technology Licensing Strategy Global OEMs with existing battery production / supply agreements Target Customers StoreDot licenses XFC battery technology to the OEMs for a royalty fee, with OEMs producing the XFC batteries using their capabilities Description Fully compatible (‘drop - in’) with existing Li - ion production lines and equipment; using deployed CAPEX Competitive cost structure aligned with industry’s trajectory Proven solution available in various form - factors Multi sourcing for all key materials EV OEMs MFG OEMs OEM Pays ~4.5% Royalty to StoreDot StoreDot licenses XFC Technology to OEMs Technology Transfer & Operations Operating Fees & Investment Core StoreDot Tech Proposition Business Model StoreDot’s Silicon Anode Advantage Highly Flexible Approach with Reduced Capital Needs

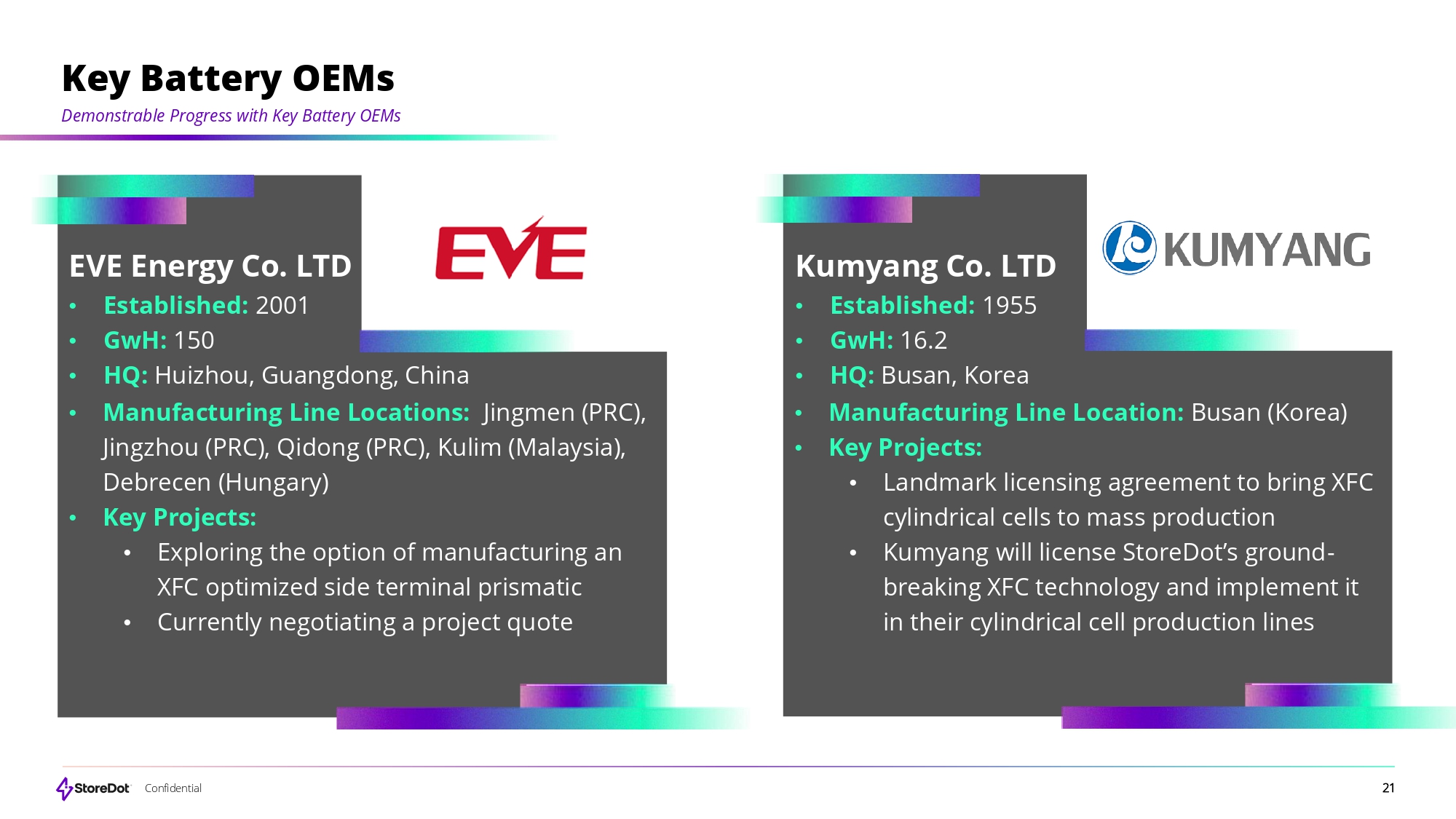

21 Confidential Key Battery OEMs Demonstrable Progress with Key Battery OEMs Kumyang Co. LTD • Established: 1955 • GwH: 16.2 • HQ: Busan, Korea • Manufacturing Line Location: Busan (Korea) • Key Projects: • Landmark licensing agreement to bring XFC cylindrical cells to mass production • Kumyang will license StoreDot’s ground - breaking XFC technology and implement it in their cylindrical cell production lines EVE Energy Co.

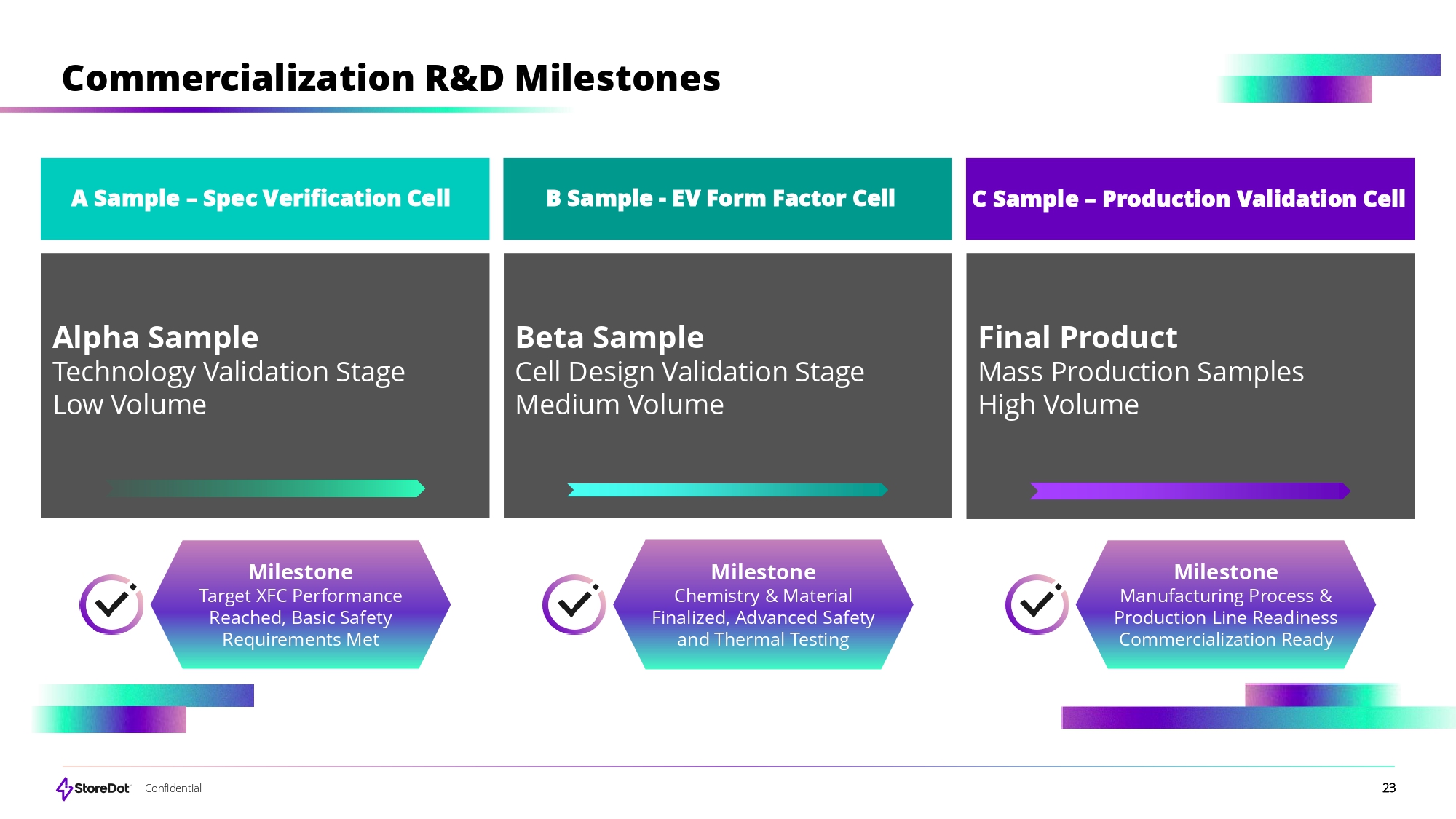

LTD • Established: 2001 • GwH: 150 • HQ: Huizhou, Guangdong, China • Manufacturing Line Locations: Jingmen (PRC), Jingzhou (PRC), Qidong (PRC), Kulim (Malaysia), Debrecen (Hungary) • Key Projects: • Exploring the option of manufacturing an XFC optimized side terminal prismatic • Currently negotiating a project quote 22 Confidential OEM OEM OEM OEM OEM OEM OEM OEM OEM OEM StoreDot R&D Center Israel – HQ and R&D Hub • Majority of personnel based outside of Tel Aviv • Global production footprint and customer base The US – R&D Center & Sample Production • R&D presence in the US to support North American OEMs • First prismatic sample cell produced in Partnership with Flex|N|Gate Europe – Business Development • Business development based out of Europe • Local coverage of European based OEMs Korea – Sample Cell Production • Sample cell production with ETS • Delivers samples for OEM testing China – Cell Production • Cell production Partnership with EVE Energy in Huizhou, Guangdong, China • Flexibility in production location depending on customer preference Business Development Office StoreDot HQ Joint Venture Manufacturing Partnerships Multiple Global Partnerships • Leading Global OEMs • Diversified Commercialization timelines Platform Partnerships StoreDot’s Integrated Global Network Ongoing programs with OEMs worldwide complemented by strategically located sales, R&D, and manufacturing centers Manufacturing 23 Confidential Commercialization R&D Milestones B Sample - EV Form Factor Cell C Sample – Production Validation Cell A Sample – Spec Verification Cell Alpha Sample Technology Validation Stage Low Volume Beta Sample Cell Design Validation Stage Medium Volume Final Product Mass Production Samples High Volume Milestone Chemistry & Material Finalized, Advanced Safety and Thermal Testing Milestone Manufacturing Process & Production Line Readiness Commercialization Ready Milestone Target XFC Performance Reached, Basic Safety Requirements Met

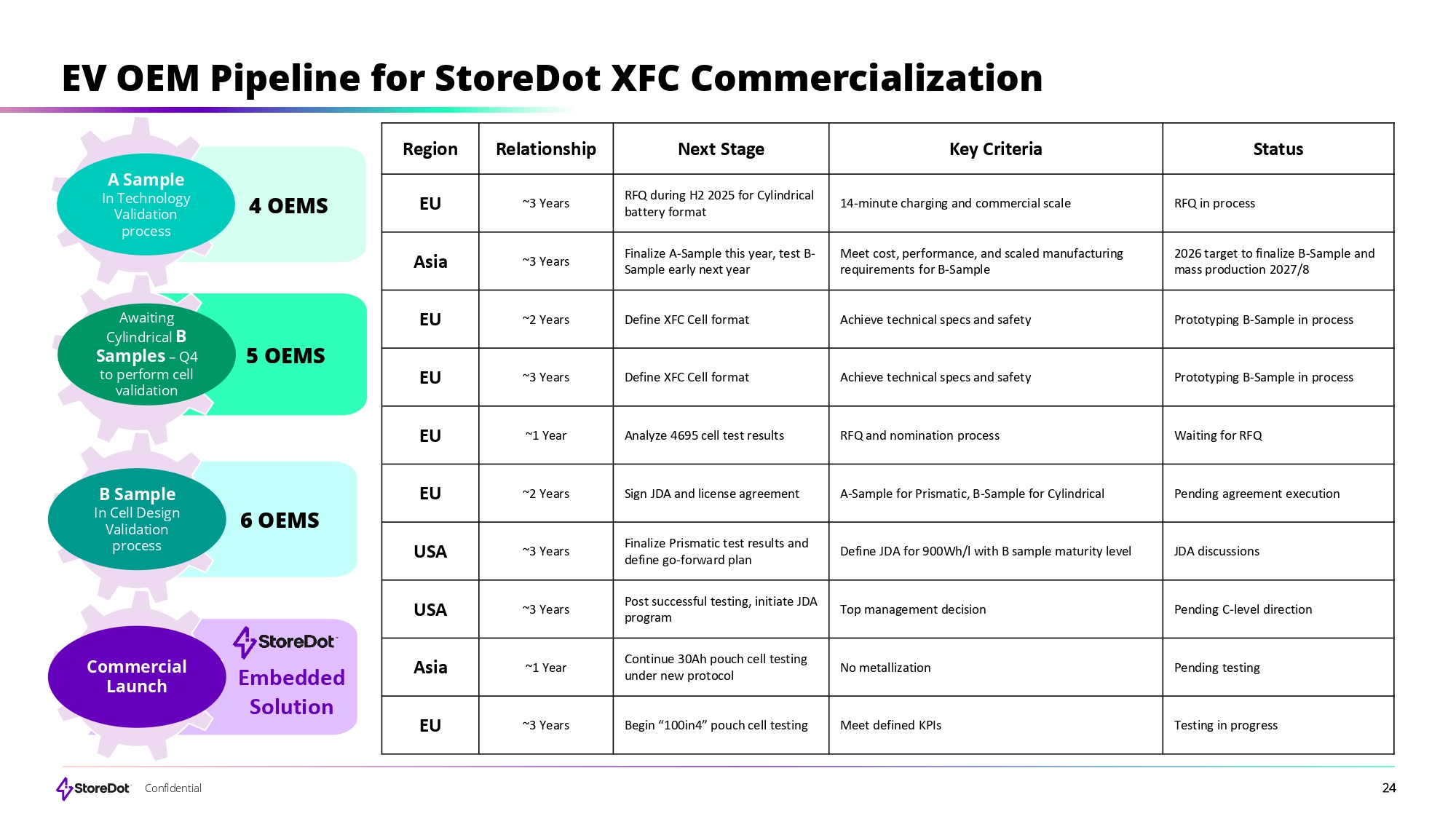

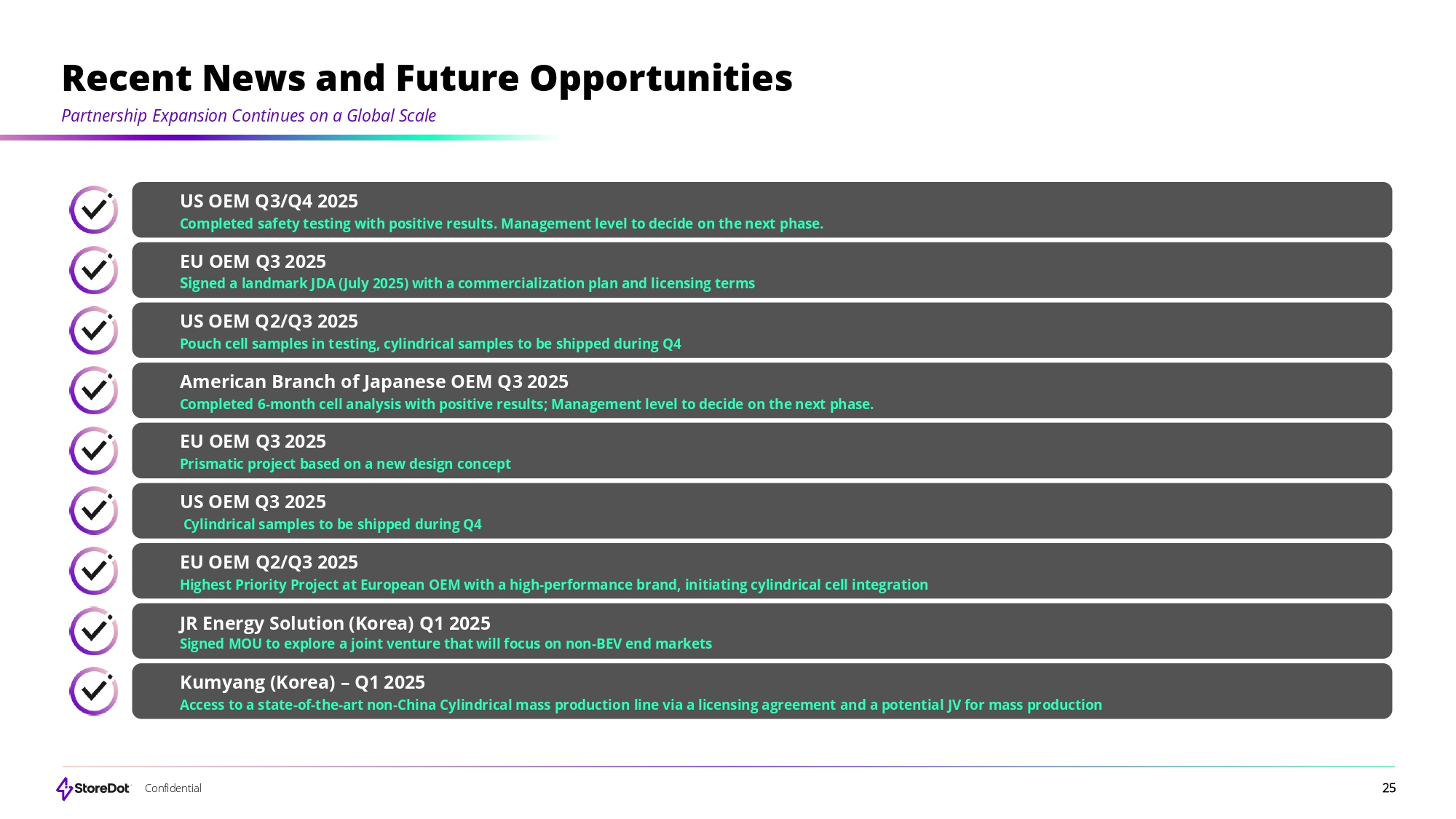

24 Confidential EV OEM Pipeline for StoreDot XFC Commercialization Awaiting Cylindrical B Samples – Q4 to perform cell validation A Sample In Technology Validation process B Sample In Cell Design Validation process Commercial Launch Embedded Solution 4 OEMS 6 OEMS 5 OEMS Status Key Criteria Next Stage Relationship Region RFQ in process 14 - minute charging and commercial scale RFQ during H2 2025 for Cylindrical battery format ~3 Years EU 2026 target to finalize B - Sample and mass production 2027/8 Meet cost, performance, and scaled manufacturing requirements for B - Sample Finalize A - Sample this year, test B - Sample early next year ~3 Years Asia Prototyping B - Sample in process Achieve technical specs and safety Define XFC Cell format ~2 Years EU Prototyping B - Sample in process Achieve technical specs and safety Define XFC Cell format ~3 Years EU Waiting for RFQ RFQ and nomination process Analyze 4695 cell test results ~1 Year EU Pending agreement execution A - Sample for Prismatic, B - Sample for Cylindrical Sign JDA and license agreement ~2 Years EU JDA discussions Define JDA for 900Wh/l with B sample maturity level Finalize Prismatic test results and define go - forward plan ~3 Years USA Pending C - level direction Top management decision Post successful testing, initiate JDA program ~3 Years USA Pending testing No metallization Continue 30Ah pouch cell testing under new protocol ~1 Year Asia Testing in progress Meet defined KPIs Begin “100in4” pouch cell testing ~3 Years EU 25 Confidential Recent News and Future Opportunities Partnership Expansion Continues on a Global Scale US OEM Q3/Q4 2025 Completed safety testing with positive results.

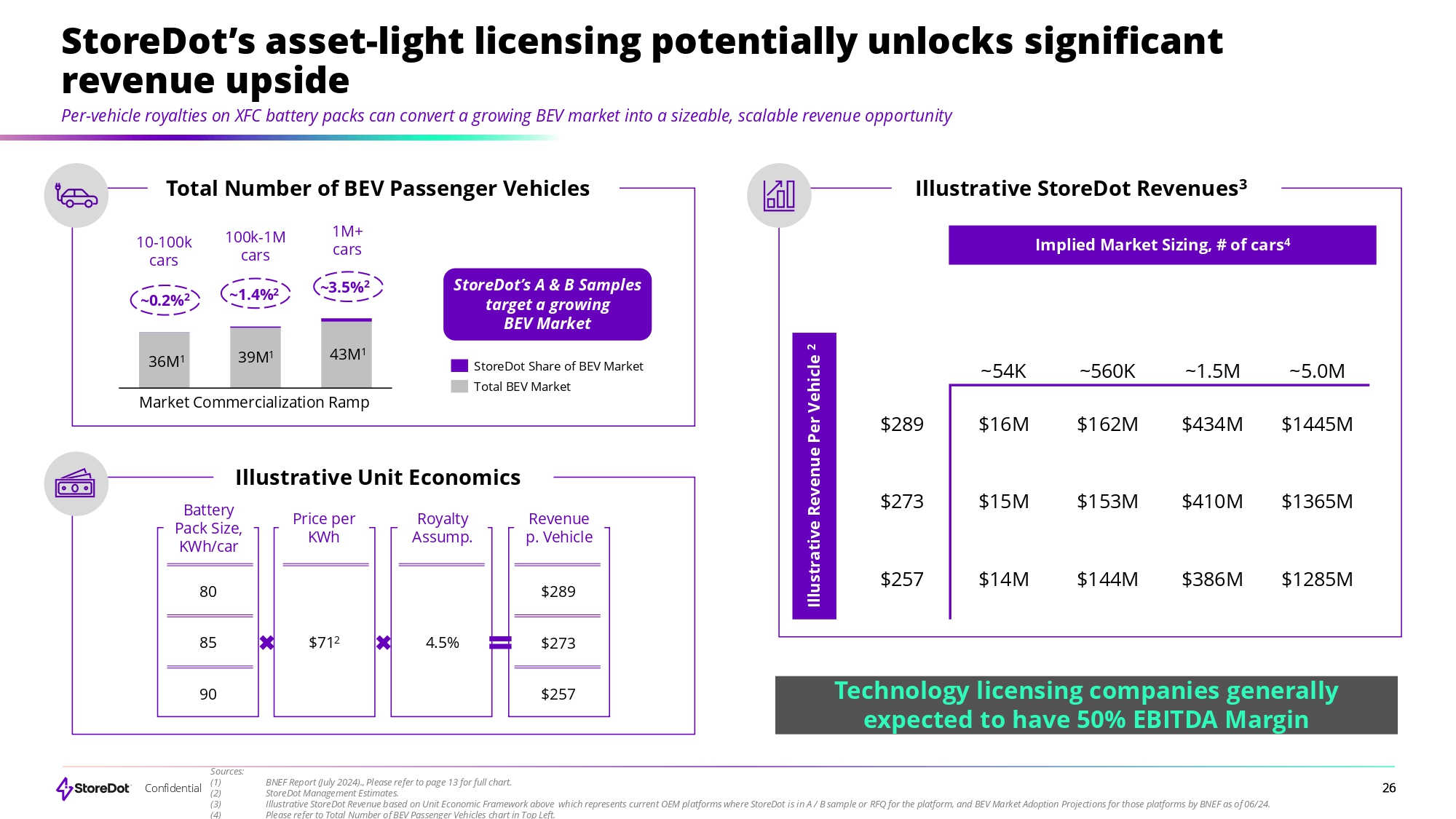

Management level to decide on the next phase. EU OEM Q3 2025 Si gned a landmark JDA (July 2025) with a commercialization plan and licensing terms US OEM Q2/Q3 2025 Pouch cell samples in testing, cylindrical samples to be shipped during Q4 American Branch of Japanese OEM Q3 2025 Completed 6 - month cell analysis with positive results; Management level to decide on the next phase. EU OEM Q3 2025 Prismatic project based on a new design concept US OEM Q3 2025 Cylindrical samples to be shipped during Q4 EU OEM Q2/Q3 2025 Highest Priority Project at European OEM with a high - performance brand, initiating cylindrical cell integration JR Energy Solution (Korea) Q1 2025 Signed MOU to explore a joint venture that will focus on non - BEV end markets Kumyang (Korea) – Q1 2025 Access to a state - of - the - art non - China Cylindrical mass production line via a licensing agreement and a potential JV for mass production 26 Confidential (1) StoreDot’s asset - light licensing potentially unlocks significant revenue upside Per - vehicle royalties on XFC battery packs can convert a growing BEV market into a sizeable, scalable revenue opportunity Illustrative StoreDot Revenues 3 Illustrative Revenue Per Vehicle 2 Implied Market Sizing, # of cars 4 Total Number of BEV Passenger Vehicles Market Commercialization Ramp StoreDot Share of BEV Market Total BEV Market Illustrative Unit Economics 36M 1 39M 1 43M 1 ~0.2% 2 ~1.4% 2 StoreDot’s A & B Samples target a growing BEV Market Battery Pack Size, KWh/car Price per Royalty KWh Assump.

Revenue p. Vehicle 80 85 90 $71 2 4.5% $289 $273 $257 Sources: BNEF Report (July 2024)., Please refer to page 13 for full chart. StoreDot Management Estimates. Illustrative StoreDot Revenue based on Unit Economic Framework above which represents current OEM platforms where StoreDot is in A / B sample or RFQ for the platform, and BEV Market Adoption Projections for those platforms by BNEF as of 06/24. Please refer to Total Number of BEV Passenger Vehicles chart in Top Left.

27 Confidential Transaction Overview

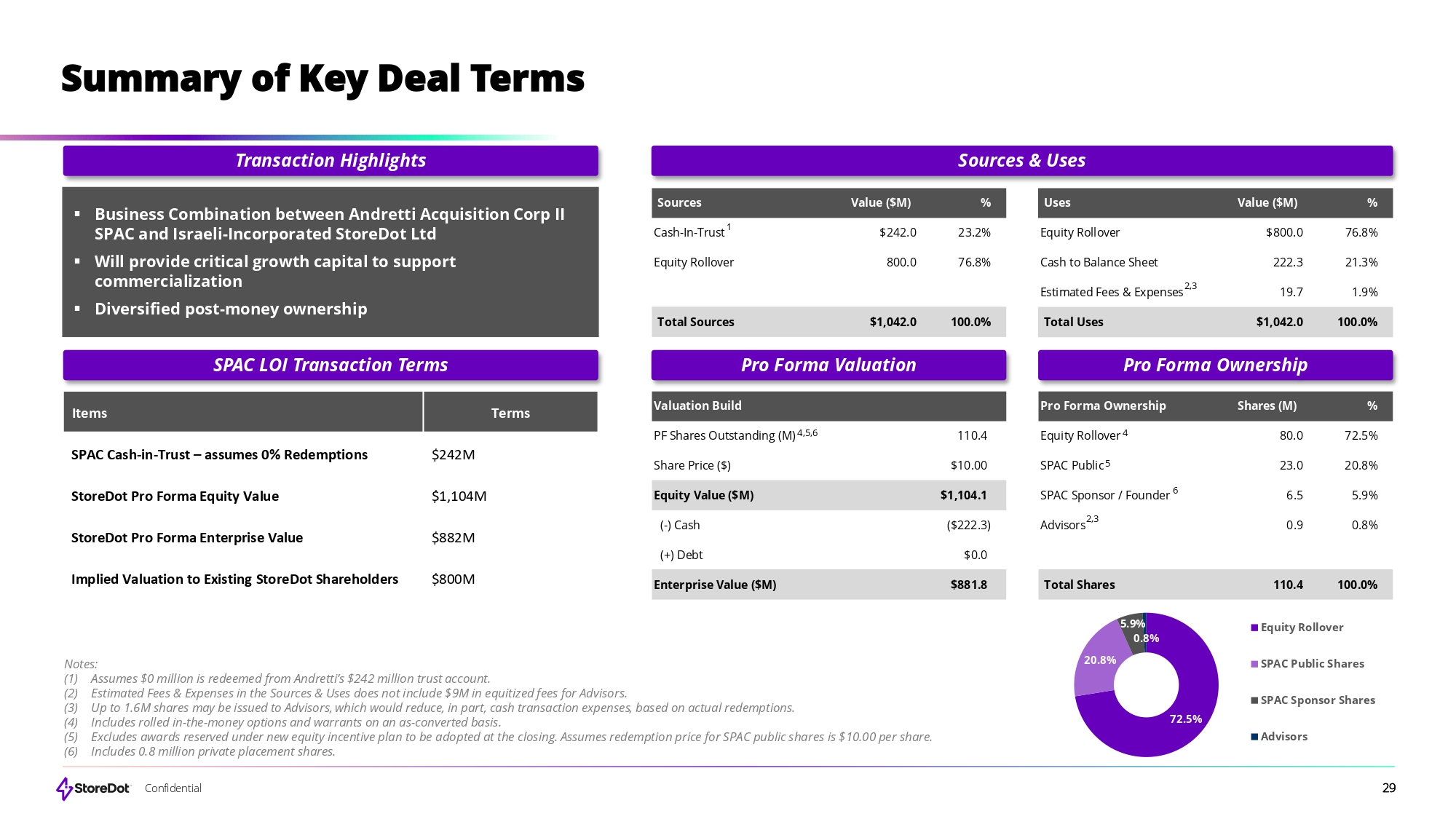

(2) (3) (4) 10 - 100k cars 100k - 1M cars 1M+ cars ~3.5% 2 Technology licensing companies generally expected to have 50% EBITDA Margin ~54K ~560K ~1.5M ~5.0M $1445M $434M $162M $16M $289 $1365M $410M $153M $15M $273 $1285M $386M $144M $14M $257 28 Confidential Transaction Summary Andretti (Nasdaq: POLE) intends to combine with StoreDot at a $1,104M pro forma equity value 1 StoreDot extreme fast charging battery solution solves the key barrier for EV adoption – range and charging anxiety StoreDot is currently working with 10+ automotive OEMs in testing and validation, with mass commercialization in the near - term StoreDot’s low - Capex licensing business model is positioned to scale, driven by surging EV adoption globally Note: (1) Post - money pro forma equity value. Please refer to page 29 for additional details.

29 Confidential Pro Forma Ownership Shares (M) % Equity Rollover 4 SPAC Public 5 SPAC Sponsor / Founder 6 Advisors 2,3 80.0 72.5% 23.0 20.8% 6.5 5.9% 0.9 0.8% Total Shares 110.4 100.0% Summary of Key Deal Terms Transaction Highlights Sources & Uses SPAC LOI Transaction Terms 2 Terms Items $242M SPAC Cash - in - Trust – assumes 0% Redemptions $1,104M StoreDot Pro Forma Equity Value $882M StoreDot Pro Forma Enterprise Value $800M Implied Valuation to Existing StoreDot Shareholders ▪ Business Combination between Andretti Acquisition Corp II SPAC and Israeli - Incorporated StoreDot Ltd ▪ Will provide critical growth capital to support commercialization ▪ Diversified post - money ownership Notes: (1) Assumes $0 million is redeemed from Andretti’s $242 million trust account. (2) Estimated Fees & Expenses in the Sources & Uses does not include $9M in equitized fees for Advisors. (3) Up to 1.6M shares may be issued to Advisors, which would reduce, in part, cash transaction expenses, based on actual redemptions. (4) Includes rolled in - the - money options and warrants on an as - converted basis. (5) Excludes awards reserved under new equity incentive plan to be adopted at the closing. Assumes redemption price for SPAC public shares is $10.00 per share. (6) Includes 0.8 million private placement shares. Cash - In - Trust 1 $242.0 23.2% Equity Rollover 800.0 76.8% PF Shares Outstanding (M) 4,5,6 Pro Forma Valuation Cash to Balance Sheet Estimated Fees & Expenses 2,3 Pro Forma Ownership Sources Value ($M) % Total Sources $1,042.0 100.0% Uses Value ($M) % Equity Rollover $800.0 76.8% 222.3 19.7 21.3% 1.9% Total Uses $1,042.0 100.0% Valuation Build 110.4 Share Price ($) $10.00 Equity Value ($M) $1,104.1 ( - ) Cash (+) Debt ($222.3) $0.0 Enterprise Value ($M) $881.8 72.5% 20.8% 5.9% 0.8% Equity Rollover SPAC Public Shares SPAC Sponsor Shares Advisors 30 Confidential 7.4x 31.8x NA 17.3x 10.3x NA $6,179 $1,587 $791 $882 $7,110 $1,604 $1,034 $1,104 $140,106 $21,119 $12,457 $9,787 $21,815 $13,241 $10,434 $1,104 $882 Select Public Company Analysis Sources: Factset as of 12/1/2025; NA indicates not available.

(1) StoreDot uses a different licensing business model than traditional, capital intensive battery manufacturing comps. Technology Licensing Businesses 1 2 Traditional, Capital Intensive Battery Manufacturers ($ in millions) ($ in millions) Enterprise Value / Forward (2 - Year) Revenue Multiple 20.7x 9.4x 59.1x /8.6x 3 Enterprise Value Equity Value Enterprise Value Equity Value (2) (3) Reflects pro - forma LOI valuation; assumes no redemptions. Given the early stage of QuantumScape, this represents a 2 - year and 4 - year forward estimate. available from Factset as of 12/1/2025.

2 $143,246 31 Confidential $1,104 $2,470 $3,400 $3,040 $7,110 Valuation Comparison versus QuantumScape Clear pathway to value realization as EV battery technology reaches maturity Dec - 31 - 2023 Equity Value Dec - 31 - 2024 Equity Value Dec - 31 - 2022 Equity Value StoreDot Pro Forma Equity Value 2 2025 Current Equity Value QuantumScape’s valuation has climbed as the company hit key sample milestones and introduced new production technologies Earlier path to partner - line readiness Production - ready XFC technology with established manufacturing partnerships to support scaled production capabilities ($ in millions) YTD High Current $1,104M pro forma equity value 2 StoreDot offers battery tech with a near - dated commercialization plan Visible catalyst path for value Battery developers have tended to re - rate as technology progresses $10,658 1 Source: Factset as of 12/1/2025. (1) (2) Implied peak equity value based on high price of $19.07 on 10/15/2025 and Implied Shares Outstanding of 558.93m. Post - money pro forma equity value. Please refer to page 29 for additional details.

32 Confidential

Exhibit 99.2

StoreDot Ltd. and Andretti Acquisition Corp. II Announce Signing of Definitive Agreement for Business Combination to Accelerate the EV Revolution with Extreme Fast Charging Battery Technology

| ● | Eliminating Charging Anxiety: The combined entity will focus on commercializing StoreDot's XFC batteries to solve the #1 consumer pain point in the electric vehicle space: long charging times. The combined entity intends to eliminate range and charging anxiety, leveraging StoreDot's proven Extreme Fast Charging - XFC - technology. |

| ● | Significant Market Opportunity: The combined entity targets the rapidly expanding EV battery market. StoreDot believes that it is positioned to capture significant market share by addressing the primary barrier to EV adoption: charging speed. |

| ● | Scalable, Asset-Light Business Model: StoreDot employs a capital-efficient licensing model designed to be a "drop-in" solution compatible with existing Lithium-ion production lines. This accelerates the path to mass-market adoption and commercial deployment, eliminating the need for new manufacturing infrastructure. |

| ● | The combined company will be led by Dr. Doron Myersdorf as Chief Executive Officer and StoreDot’s highly experienced management team. |

| ● | The transaction values StoreDot at a $800 million pre-money equity value, with existing StoreDot shareholders, optionholders and warrantholders rolling over 100% of their equity, and the pro forma enterprise value is currently expected to be $882 million (assuming no redemptions by Andretti’s public shareholders). |

Herzliya, Israel and Alpharetta, Georgia, USA, Dec. 03, 2025 (GLOBE NEWSWIRE) -- StoreDot Ltd., an Israeli company (“StoreDot”), a pioneer and leader in Extreme Fast Charging (XFC) battery technology for electric vehicles (EVs), and Andretti Acquisition Corp. II (NASDAQ: POLE), a Cayman Islands publicly traded special purpose acquisition company (“Andretti”), today announced they have entered into a definitive business combination agreement (the “Business Combination Agreement”) for a business combination between Andretti and StoreDot under a newly formed holding company (the “Business Combination”). The holding company will be named “XFC Battery” (“Pubco”) and its shares are expected to be listed for trading on the Nasdaq Stock Market LLC. StoreDot’s patented XFC technology is a proven, production-ready solution capable of delivering 100 miles of charge in just 5 minutes, with a clear plan and roadmap to 100 miles of charge in 3 minutes. This groundbreaking capability is essential for making the EV experience as convenient as refueling a gasoline car. StoreDot has built significant commercial traction, actively engaged in B-sample development and validation programs with leading global OEMs. This deep-seated industry validation and collaboration underscore the technology's readiness for mass production, utilizing existing battery manufacturing infrastructure.

Dr. Doron Myersdorf, CEO of StoreDot, commented, “Partnering with Andretti II SPAC and its iconic team provides us with the ideal platform and resources to dramatically scale our production and commercialization efforts. Our mission is to eliminate range and charging anxiety, and we believe this transaction fuels our ability to deliver XFC to EV drivers globally. The strong momentum we have with leading OEMs, who are in the process of validating and integrating our cells, proves that the industry is ready for minutes-long charging. Together with the Andretti team, we are set to transform the EV landscape.”

“We believe this business combination marks a pivotal moment in the future of electric mobility,” said Michael Andretti, a director of and Special Advisor to Andretti Acquisition Corp. II. “The Andretti name is synonymous with speed, innovation, and winning, and we see all of that in StoreDot’s XFC technology. They have established incredible momentum, securing strategic partnerships and investment from global automotive and technology giants. Our partnership is about more than capital; it's about accelerating the deployment of this critical technology to consumers worldwide and cementing the combined company as a market leader.”

Transaction Overview

The Business Combination transaction values StoreDot at an implied pre-money equity value of $800 million, with existing StoreDot shareholders, optionholders and warrantholders set to roll over 100% of their equity into Pubco, or 80.0 million shares (including rolled over options and warrants on a net exercise basis) valued at $10.00 per share.

Andretti Acquisition Corp. II currently holds approximately $242 million in cash in trust, all of which is subject to redemption.

The pro forma enterprise value of the combined business is expected to be $882 million (assuming no redemptions by Andretti’s public shareholders).

The Boards of Directors of both Andretti Acquisition Corp. II and StoreDot have each unanimously approved the Business Combination Agreement and the proposed Business Combination.

The Business Combination transaction will require the approval of the stockholders of Andretti and StoreDot and is subject to satisfaction or waiver of the conditions stated in the Business Combination Agreement and other customary closing conditions, including obtaining certain financing commitments and the receipt of certain regulatory approvals.

The transaction is expected to close in the second quarter of 2026, subject to specified closing conditions.Additional information about the proposed Business Combination transaction, including a copy of the Business Combination Agreement and investor presentation, will be provided in a Current Report on Form 8-K to be filed by Andretti with the Securities and Exchange Commission (“SEC”) and available at www.sec.gov.

Advisors

Cohen & Company Capital Markets, a division of Cohen & Company Securities, LLC, is serving as the financial and capital markets advisor to Andretti Acquisition Corp. II.

Ellenoff Grossman & Schole LLP is serving as legal counsel to Andretti Acquisition Corp. II.

Cantor is serving as the exclusive financial advisor to StoreDot. King & Spalding LLP is serving as legal counsel to Cantor.

DLA Piper LLP (US) is serving as legal counsel to StoreDot.

About Andretti Acquisition Corp. II (NASDAQ: POLE)

Andretti Acquisition Corp. II is a special purpose acquisition company formed for the purpose of effecting a business combination with one or more businesses or entities.

Two key members of the sponsor team are racing legends Mario and Michael Andretti. To learn more, visit: https://www.andrettiacquisition.com.

About StoreDot

StoreDot is a pioneer and leader in extreme fast charging (XFC) battery technology for electric vehicles.

The company is revolutionizing the conventional Lithium-ion battery by designing and synthesizing proprietary compounds that enable an EV to be charged in minutes.

StoreDot's investors include major automotive manufacturers such as Daimler, Volvo Cars, Polestar, Ola Electric, and VinFast, as well as technology companies such as BP Ventures, Samsung, and TDK.

To learn more, visit: https://www.store-dot.com.

Contacts

For Andretti Acquisition Corp. II

Investors: ir@andrettiacquisition.com

Media: pr@andrettiacquistion.com

For StoreDot

Investors: ir@store-dot.com

Media: media@store-dot.com

Forward-Looking Statements

Certain statements contained in this communication regarding matters that are not historical facts are forward-looking statements. These statements are based on various assumptions and on the current expectations of StoreDot’s and Andretti’s management and are not predictions of actual performance. These include statements regarding the potential of StoreDot’s battery solutions, the rate of adoption of electric vehicle technology in general and specific battery technology in particular, the size and growth of StoreDot’s addressable markets, StoreDot’s pathway to embedded commercialization, and the ability of the parties to complete the Business Combination on the timing and terms indicated or at all; therefore, you are cautioned not to place undue reliance on them. The outcome of any forward-looking statement cannot be guaranteed, and actual results may differ materially from those projected. None of Pubco, Andretti, and StoreDot undertakes any obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise, except to the extent required by law. Pubco, Andretti and StoreDot use words such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “potential,” “positioned,” “seek,” “should,” “target,” “will,” “would,” and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology. Such forward-looking statements are based on the expectations of Pubco, Andretti, or StoreDot, and involve risks and uncertainties; consequently, actual results may differ materially from those expressed or implied in the statements due to a number of factors, including, but not limited to: scientific and technological developments in the battery, electric vehicles and drone industries; StoreDot’s financial condition, including StoreDot’s ability to obtain the funding necessary to advance the development of its products and StoreDot’s cash runway; the size of the market opportunity for StoreDot’s products; StoreDot’s competitive position and the success of competing technologies that are or may become available; StoreDot’s anticipated research and development activities and projected expenditures; existing regulations and regulatory developments in applicable jurisdictions; the effect of global economic and political developments, including geopolitical tensions with China, Russia, and in the Middle East, on StoreDot’s business operations and financial condition; and StoreDot’s intellectual property position, including the scope of protection StoreDot is able to establish and maintain for its products. In addition, it is possible that Pubco, Andretti and StoreDot may not be able to consummate the Business Combination on the terms indicated herein or at all. If StoreDot and Andretti are not able to raise sufficient capital for the Business Combination to meet the minimum cash conditions in the Business Combination Agreement or if Andretti’s investors redeem an excess amount of capital held in trust, the Business Combination may not be consummated, or if consummated, StoreDot could have a capital deficit, which may require it to raise additional capital following the Business Combination, which in turn could cause dilution to existing investors. New factors emerge from time to time, and it is not possible for Pubco, Andretti, or StoreDot to predict all such factors, nor can Andretti, StoreDot, or Pubco assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. None of Pubco, Andretti, and StoreDot undertakes any obligation to update such forward-looking statements to reflect events or circumstances after the date of this 8-K, except as required by law.

Additional Information

Pubco and StoreDot intend to file with the SEC a Registration Statement on Form F-4 (as may be amended, the “Registration Statement”), which will include a preliminary proxy statement of Andretti and a prospectus in connection with the proposed Business Combination among Andretti, Pubco, StoreDot, and the other parties thereto pursuant to the Business Combination Agreement. The definitive proxy statement and other relevant documents will be mailed to shareholders of Andretti as of a record date to be established for voting on Andretti’s proposed Business Combination with StoreDot. SHAREHOLDERS OF ANDRETTI AND OTHER INTERESTED PARTIES ARE URGED TO READ, WHEN AVAILABLE, THE PRELIMINARY PROXY STATEMENT, AND AMENDMENTS THERETO, AND THE DEFINITIVE PROXY STATEMENT IN CONNECTION WITH ANDRETTI’S SOLICITATION OF PROXIES FOR THE SPECIAL MEETING OF ITS SHAREHOLDERS TO BE HELD TO APPROVE THE BUSINESS COMBINATION BECAUSE THESE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT ANDRETTI, STOREDOT, PUBCO AND THE BUSINESS COMBINATION. Shareholders will also be able to obtain copies of the Registration Statement and the proxy statement/prospectus, without charge, once available, on the SEC’s website at www.sec.gov or by directing a request to: Andretti Acquisition Corp. II, 100 Kimball Place, Suite 550, Alpharetta, GA.

Participants in The Solicitation

Pubco, Andretti, StoreDot, and their respective directors, executive officers and members, as applicable, may be deemed to be participants in the solicitation of proxies from the shareholders of Andretti in connection with the Business Combination. Andretti’s shareholders and other interested persons may obtain more detailed information regarding the names, affiliations, and interests of certain of Andretti executive officers and directors in the solicitation by reading Andretti’s final prospectus filed with the SEC on September 5, 2024 in connection with Andretti’s initial public offering (“IPO”), Andretti’s Annual Report on Form 10-K for the year ended December 31, 2024, as filed with the SEC on March 25, 2025 and Andretti’s other filings with the SEC. A list of the names of such directors and executive officers and information regarding their interests in the Business Combination, which may, in some cases, be different from those of shareholders generally, will be set forth in the Registration Statement relating to the Business Combination when it becomes available. These documents can be obtained free of charge from the source indicated above.

No Offer Or Solicitation

This communication is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.