UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) November 23, 2025

Ondas Holdings Inc.

(Exact name of registrant as specified in its charter)

| Nevada | 001-39761 | 47-2615102 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

One Marina Park Drive, Suite 1410, Boston, MA 02210

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (888) 350-9994

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

| Common Stock par value $0.0001 | ONDS | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On November 23, 2025, Ondas Holdings Inc. (the “Company” or “Ondas”) entered into a Share Purchase Agreement (the "Agreement"), by and among the Company, Robo-Team Holdings Ltd, a company organized under the laws of the State of Israel (the “Robo-Team”), the Robo-Team shareholders (the “Company Shareholders”), and Mr. Yossi Wolf, of 10 Hankin St., Tel Aviv, solely in his capacity as the representative, agent and attorney-in-fact of the Indemnifying Parties (the “Shareholders’ Agent”).

The Agreement provides that, upon the terms and subject to the conditions set forth in the Agreement, the Company will acquire 100% of the issued and outstanding share capital ("Robo-Team Shares") of Robo-Team (the "Acquisition"). At the closing of the Acquisition, upon the terms and subject to the conditions set forth in the Agreement, the Company shall pay an aggregate amount of $80,000,000 in cash, subject to certain adjustments as set forth in the Agreement, in exchange for the Robo-Team Shares.

Each of the Company, Robo-Team, and the Company Shareholders has provided customary representations, warranties and covenants in the Agreement. The completion of the Acquisition is subject to various closing conditions, including (a) the requisite shareholder consent of Robo-Team being obtained, (b) the requisite Governmental Entity (as defined in the Agreement) approvals, consents and/or waivers being obtained, (c) the absence of any applicable order (whether temporary, preliminary or permanent) in effect which prohibits the consummation of the Acquisition, (d) the absence of any threatened, instituted or pending lawsuit, litigation, claims, investigations or other proceedings by any third party challenging or seeking the recovery of a material amount of damages in connection with Acquisition or seeking to prohibit or limit the exercise by the Company of any material right pertaining to ownership of the Robo-Team Shares, and (e) the absence of any Material Adverse Effect (as defined in the Agreement) with respect to Robo-Team or its subsidiaries.

The Agreement may be terminated upon (i) the written agreement of the Company and the Shareholders' Agent, (ii) the written notice by the Company or the Shareholders’ Agent if the closing of the Acquisition has not occur on or before December 31, 2025, provided however, that to the extent that the only conditions not fulfilled are the approval(s) of any Governmental Entities, then an additional 45-day period, or such other date that Acquirer and the Shareholder's Agent may agree upon in writing, or (iii) the written notice by the Company or the Shareholders' Agent if any Order of a Governmental Entity of competent authority preventing the consummation of the Acquisition shall have become final and non-appealable.

The foregoing description of the Agreement does not purport to be complete and is qualified in its entirety by the full text of the Agreement, a copy of which is attached hereto as Exhibit 2.1, and is incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

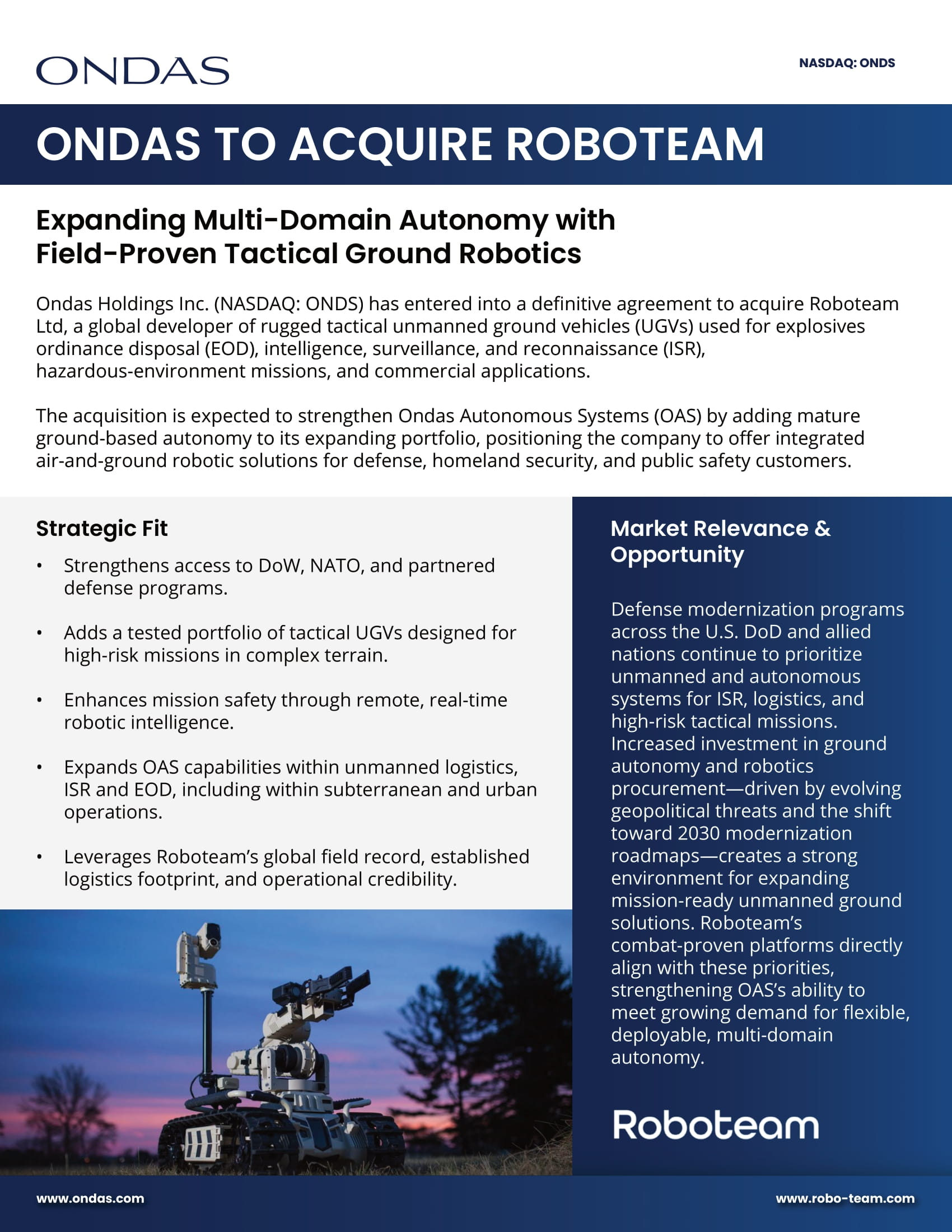

On November 25, 2025, the Company issued an investor fact sheet regarding the Acquisition. A copy of the fact sheet is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Also, on November 25, 2025, the Company issued a press release announcing the Acquisition. A copy of the press release is furnished as Exhibit 99.2 to this Current Report on Form 8-K.

The information furnished pursuant to this Item 7.01, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. | Description | |

| 2.1* | Share Purchase Agreement, by and amount the Company, Robo-Team Holdings Ltd, the Robo-Team shareholders, and Mr. Yossi Wolf, solely in his capacity as the representative, agent and attorney-in-fact of the Indemnifying Partie, dated November 23, 2025. | |

| 99.1 | Fact Sheet, dated November 25, 2025. | |

| 99.2 | Press Release, dated November 25, 2025. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| * | Schedules and Exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company agrees to furnish supplementally to the Securities and Exchange Commission a copy of any omitted schedule upon request. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: November 25, 2025 | ONDAS HOLDINGS INC. | |

| By: | /s/ Eric A. Brock | |

| Eric A. Brock | ||

| Chief Executive Officer | ||

2

Exhibit 2.1

Execution Copy

SHARE PURCHASE AGREEMENT

by and among

Ondas Holdings, Inc.

a Nevada corporation,

Robo-Team Holdings Ltd.,

a company organized under the laws of the State of Israel,

the Company Shareholders

and

Mr. Yossi Wolf,

as the Shareholders’ Agent

Dated as of November 23, 2025

Share Purchase Agreement

This Share Purchase Agreement (this “Agreement”) is made and entered into as of November 23, 2025 (the “Agreement Date”), by and among Ondas Holdings, Inc., a Nevada corporation (“Acquirer”), Robo-Team Holdings Ltd, a company organized under the laws of the State of Israel (the “Company”), the Company, the shareholders (the “Company Shareholders”), and Mr. Yossi Wolf, of 10 Hankin St., Tel Aviv, solely in his capacity as the representative, agent and attorney-in-fact of the Indemnifying Parties (the “Shareholders’ Agent”). Certain other capitalized terms used herein are defined in Exhibit A.

RECITALS

| A. | The Company Shareholders collectively are the holders and the legal and beneficial owners of all of the Company Shares. |

| B. | Acquirer desires to, subject to the terms and conditions set forth in this Agreement, purchase from the Company Shareholders, and each Company Shareholder will sell to Acquirer, all of the Company Shares owned by such Company Shareholder free from any Encumbrances and subject to the terms and conditions set forth in this Agreement (the “Share Purchase”). |

| C. | The Company, the Company Shareholders, and Acquirer desire to make certain representations, warranties, covenants and other agreements in connection with the Share Purchase as set forth herein. |

| D. | The board of directors of the Company (the “Board”) has carefully considered the terms of this Agreement and has unanimously determined that this Agreement and the transactions contemplated by this Agreement and the documents referenced herein (collectively, the “Transactions”), are in the best interests of, and are advisable to, the Company and the Company Shareholders and recommended that all of the Company Shareholders enter into this Agreement. |

| E. | Concurrently with the execution and delivery of this Agreement, the Company Shareholders representing holders of 100% of the issued and outstanding share capital of the Company as of the date hereof have delivered a duly executed counterpart to a unanimous written consent in the form attached hereto as Exhibit E (the “Shareholder Consent”), pursuant to which all of the Company Shareholders irrevocably (i) approved this Agreement, the other Transaction Documents, the Share Purchase and the Transactions, and (ii) waived all of their respective Acquisition Rights (if any). |

Now, Therefore, in consideration of the representations, warranties, covenants, agreements and obligations contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

ARTICLE I

The Share Purchases

1.1 The Share Purchase.

(a) Company Shares. On the terms and subject to the conditions of this Agreement, each Company Shareholder shall sell, transfer and deliver to Acquirer at the Closing, and Acquirer shall, at the Closing, purchase from each Company Shareholder, all of the Company Shares owned by such Company Shareholder as of immediately prior to the Closing (as set forth on the Spreadsheet) free and clear of all Encumbrances, in exchange for the right to receive (in each case, without interest and subject to withholding in accordance with the provisions of Section 1.1(d)) at the Closing,

(i) for each Company Share owned by such Company Shareholder:

(1) an amount in cash equal to the Closing Cash Consideration payable per each Company Share (as calculated in the Spreadsheet), minus such Company Shareholder’s Pro Rata Share of (x) the Escrow Amount and (y) the Shareholders’ Agent Expense Amount; payable per such Company Share (as calculated in the Spreadsheet);

(2) the right to receive, subject to the terms and provisions hereof, upon release, such Company Shareholder’s portion of (x) the Final Adjustment, (y) the Escrow Amount, and (z) the Shareholders’ Agent Expense Amount (all per each Company Share and as calculated in the Spreadsheet).

(ii) Notwithstanding anything to the contrary herein, any portion of the consideration payable or otherwise deliverable pursuant to this Agreement in respect of Company 102 Shares, shall be deposited with the Paying Agent, and shall be delivered by the Paying Agent to the 102 Trustee, which will hold and release such payment in accordance with the provisions of Sections 102 and 3(i) of the Israeli Income Tax Ordinance and in accordance with the provisions of the 102 Tax Ruling (or the 102 Interim Ruling).

(b) Company Options.

(i) No Out-of-the-Money Company Options or Unvested Company Options shall be assumed by, continued in effect or replaced by Acquirer in the Share Purchase. At the Closing, each Out-of-the-Money Company Option and each Unvested Company Option shall, by virtue of the Share Purchase, and without any further action on the part of Acquirer, the Company or any holder thereof, be cancelled and extinguished without the payment of any consideration therefore, and each holder thereof shall cease to have any rights with respect thereto, including any present or future right to receive any portion of the Closing Cash Consideration. The Company shall, prior to the Closing, take all actions (including executing necessary resolutions of the board of directors of the Company or a committee thereof) necessary in order to effectuate the actions contemplated by this Section 1.1(b)(i) and to ensure that no holder of Out-of-the-Money Company Options or Unvested Company Option shall have any rights from and after the Closing with respect to any Out-of-the-Money Company Option or Unvested Company Option.

(ii) At the Closing, each In-the-Money Vested Company Option shall, by virtue of the Share Purchase, and without any further action on the part of Acquirer, the Company or any holder thereof, be cancelled and extinguished in exchange for the right of the holder of such In-the-Money Vested Company Option to receive (in each case, without interest and subject to withholding in accordance with the provisions of Section 1.1(d)):

(1) at the Closing, for each In-the-Money Vested Company Option

(A) an amount in cash equal to the (1) Closing Cash Consideration payable per each Company Share (as calculated in the Spreadsheet), minus (2) the per share exercise price of such In-the-Money Vested Company Option and minus such Company Optionholder’s Pro Rata Share of (x) the Escrow Amount and (y) the Shareholders’ Agent Expense Amount; payable per each Company Share (as calculated in the Spreadsheet); and

(B) the right to receive, subject to the terms and provisions hereof, upon release, such Company Optionholder’s portion of (x) the Final Adjustment, (y) the Escrow Amount, and (z) the Shareholders’ Agent Expense Amount (all per each Company Share and as calculated in the Spreadsheet).

(iii) The payments to each holder of an In-the-Money Vested Company Option described in this Section 1.1(b) shall be subject to such holder executing and delivering to Acquirer an Option Surrender Agreement. Notwithstanding anything to the contrary herein, any portion of the consideration payable or otherwise deliverable pursuant to this Agreement in respect of In-the-Money Vested Company Options that are Company 102 Options or Company 3(i) Options, shall be deposited with the Paying Agent, and shall be delivered by the Paying Agent to the 102 Trustee which will hold and release such payment in accordance with the provisions of Sections 102 and 3(i) of the Israeli Income Tax Ordinance and in accordance with the provisions of the 102 Tax Ruling (or the 102 Interim Ruling).

(iv) Prior to the Closing, the Company shall take or cause to be taken such actions and obtain all such consents as may be required to effect the foregoing provisions of this Section 1.1(b) and to terminate the Company Option Plan, in each case after consultation with, and subject to the reasonable approval of, Acquirer.

(c) Withholding; Certain Tax Matters.

(i) Each of Acquirer, the Paying Agent, the 102 Trustee and the Company (each, a “Payor”) shall be entitled to deduct and withhold (without duplication) from any consideration in cash payable or otherwise deliverable to any Person pursuant to this Agreement (each, a “Payee”) such amounts as Payor determines are required to be deducted or withheld therefrom in connection therewith under the Code or any provision of state, local or foreign Tax law or under any other Applicable Law, including Israeli Income Tax Ordinance (New Version) 1961 and any regulations promulgated thereunder (as amended) (the “Israeli Income Tax Ordinance”), provided, however, that in respect of non-Israeli Tax deduction or withholding, the Payor shall provide the applicable Payees with written notice of its intent to deduct or withhold at least five (5) Business Days prior to deducting or withholding, as applicable, and the parties shall cooperate in good faith to mitigate or eliminate any such deduction and withholding (including through the request and provision of any statements, forms or other documents to reduce or eliminate any such deduction or withholding) to the maximum extent permitted by applicable Tax Law. To the extent such amounts were so deducted or withheld and timely remitted to the applicable Tax Authority, such amounts shall be treated for all purposes under this Agreement as having been paid to the Person to whom such amounts would otherwise have been paid. To the extent such amounts are deducted and withheld, the Payor shall timely furnish the payee with documentation evidencing such Tax withholding.

(ii) Notwithstanding the provisions of Section 1.1(c)(i) above, the Paying Agent shall provide Acquirer, prior to the Closing Date, with an undertaking as required under Section 6.2.4.3 of the Income Tax Circular 19/2018 (Transaction for Sale of Rights in a Corporation that includes Consideration that will be transferred to the Seller at Future Dates), with respect to Israeli Tax, any payments payable or otherwise deliverable in cash to any Payee (other than consideration payable in respect of Company 102 Securities and Company 3(i) Options) pursuant to this Agreement shall be retained by the Paying Agent for the benefit of each such Payee for a period of up to 180 days from the Closing (or, with respect to any amounts payable or otherwise deliverable in cash after the Closing, 90 days from the date of such payment) or an earlier date required in writing by such Payee or as otherwise requested by the ITA (the “Withholding Drop Date”) (during which time, unless otherwise required by the ITA, no amount shall be paid by the Paying Agent to such Payee and no amounts for Israeli Taxes shall be withheld from amounts paid to the Paying Agent), and during which time each Payee may obtain a valid certification or ruling, issued by the ITA and applicable to the payments to be made to the Payee pursuant to this Agreement, in form and substance reasonably acceptable to Paying Agent (x) exempting the Payor from the duty to withhold Israeli Taxes with respect to payment to such Payee, (y) determining the applicable rate of Israeli Tax to be withheld from the payment to such Payee, or (z) providing any other written instructions with respect to withholding of Israeli Taxes (the “Valid Tax Certificate”). For the avoidance of doubt, a Valid Tax Certificate shall include a valid certification pursuant to Israeli Income Tax Regulations (Withholding from Payments for Services or Assets), 5737-1977. In the event that no later than five (5) Business Days before the Withholding Drop Date, a Payee submits a Valid Tax Certificate to the Paying Agent, the Paying Agent shall act in accordance with the provisions of such Valid Tax Certificate, and subject to any deduction and withholding as may be required under any provision of foreign Tax Law (other than Israeli Law), the balance of the payment that is not withheld shall be promptly paid to such Payee. If any Payee (A) does not provide the Paying Agent with a Valid Tax Certificate, no later than five (5) Business Days before the Withholding Drop Date, or (B) submits a written request with the Paying Agent to release its portion of the applicable payment payable in cash prior to the Withholding Drop Date and fails to submit a Valid Tax Certificate at or before such time, then Israeli Taxes will be withheld from such Payee’s portion of the applicable payment under this Agreement as determined by the Paying Agent, in consultation with Acquirer and/or its advisors at its reasonable discretion, according to the applicable withholding rate in accordance with the Israeli Income Tax Ordinance (calculated in NIS based on the published US$:NIS exchange rate of the Bank of Israel on the actual payment date to such Payee), which amount shall be delivered, or caused to be delivered, to the ITA by the Paying Agent, and the Paying Agent shall deliver to such Payee the balance of the applicable payment due to such Payee that is not so withheld. Any currency conversion commissions will be borne by the applicable Payee and deducted from payments to be made to such Payee. For the avoidance of doubt, any Valid Tax Certificate delivered to the Paying Agent by any Payee with respect to any amount payable or otherwise deliverable pursuant to this Agreement at a certain date shall apply only to the amount payable or otherwise deliverable at such certain date and will not apply to any amounts payable or otherwise deliverable to the Acquirer at any later dates thereafter, unless, with respect to each later date, such Valid Tax Certificate is in force during such later date and covers the full amount payable or otherwise deliverable to the Acquirer on such later date. For the avoidance of doubt, a Payee shall be required to provide Payor a Valid Tax Certificate with respect to such Payee’s portion of the Escrow Amount and the Shareholders’ Agent Expense Amount, by no later than five (5) Business Days before the actual release date of such amount or any portions thereof to such Payee. For the avoidance of doubt, the transfer of funds from Acquirer to the Paying Agent or the Escrow Agent will not be subject to any withholding deduction.

(iii) Notwithstanding anything to the contrary herein, any payments made in cash to holders of Company 102 Shares and holders of In-the-Money Vested Company Options will be subject to deduction or withholding of Israeli Tax under the Israeli Income Tax Ordinance on the sixteenth (16th) day of the calendar month following the month during which the Closing occurs unless: (A) with respect to holders of Company 102 Securities or Company 3(i) Options, the 102 Tax Ruling (or the 102 Interim Ruling) providing for no Tax withholding shall have been obtained prior to such date and (B) with respect to non-Israeli resident holders of In-the-Money Vested Company Options, which holders were granted such awards in consideration for work or services performed exclusively outside of Israel to a non-Israeli Affiliate of the Company, a validly executed declaration, in a form attached hereto as Schedule 1.1(c)(iii), regarding their non-Israeli Tax residence and confirmation that they were granted such awards in consideration for work or services performed exclusively outside of Israel to a non-Israeli Affiliate of the Company shall have been provided to Acquirer, prior to the Closing. Such payments to non-Israeli resident holders of In-the-Money Vested Company Options shall be made through the employing entity’s payroll processing service or system.

(iv) In the event that the Payor receives a demand from the ITA to withhold any amount and transfer it to the ITA, the Payor (i) shall notify the applicable Payee of such matter reasonably promptly after receipt of such demand, and provide such Payee with reasonable time to attempt to delay such requirement or extend the period for complying with such requirement as evidenced by a written certificate, ruling or confirmation from the ITA and (ii) to the extent that any such certificate, ruling or confirmation is not timely provided by such Payee to the Payor, transfer to the ITA any amount so demanded, including any interest, indexation and fines required by the ITA in respect thereof, and such amounts shall be treated for all purposes of this Agreement as having been delivered and paid to the applicable Payee.

(d) Closing. Upon the terms and subject to the conditions set forth herein, the closing of the Transactions, including the consummation of the Share Purchase (the “Closing”), shall take place remotely via the exchange of documents and electronic signatures, or at such other location, date and time to be agreed by Acquirer and the Company in writing, subject to satisfaction or waiver all of the conditions set forth in Article VII of this Agreement (other than those conditions that, by their terms, are intended to be satisfied at the Closing, but subject to the satisfaction or waiver of those conditions). The date on which the Closing occurs is referred to herein as the “Closing Date”.

1.2 Closing Deliveries.

(a) Acquirer Deliveries. Acquirer shall take the following actions and deliver the following documents to the Company at or prior to the Closing, except as otherwise indicated:

(i) A certificate, dated as of the Closing Date, executed on behalf of Acquirer by a duly authorized officer of Acquirer to the effect that each of the conditions set forth in Section 7.2(a) has been satisfied;

(ii) the Escrow Agreement (as attached hereto as Schedule 1.2(a)(ii)) (the “Escrow Agreement”), duly executed by the Acquirer; and

(iii) the Paying Agent Agreement, duly executed by the Acquirer.

(b) Company Deliveries. The Company or the Company Securityholders, as applicable, shall deliver, or cause the Company to deliver, to Acquirer, at or prior to the Closing:

(i) duly executed share transfer deeds signed by all Company Shareholders with respect to all of the Company Shares held by each such Company Shareholder as of the Closing Date;

(ii) a certificate dated as of the Closing Date and executed on behalf of the Company by its Chief Executive Officer, to the effect that each of the conditions set forth in clauses (a), (c), (d), (f) and (i) of Section 7.3 has been satisfied (the “Company Closing Certificate”);

(iii) a certificate, dated as of the Closing Date and executed on behalf of the Company by its Chief Executive Officer, certifying the (A) Company’s Amended and Restated Articles of Association as in effect immediately prior to the Closing (the “Charter Documents”) and (B) the Board Action and the Shareholder Consent (including a certification that, as of the Closing Date, such resolutions remain in full force and effect and have not been amended, rescinded or modified), and (C) the incumbency and signatures of the officers of the Company executing this Agreement or any other Transaction Document (the “Company Officer’s Certificate” and together with the Acquirer Officer’s Certificate, the “Officer’s Certificates”);

(iv) an invoice (including Tax Forms) from each advisor or other service provider to any of the Acquired Companies (other than any Employee, director or officer of any of the Acquired Companies), in each case dated no more than three (3) Business Days prior to the Closing Date, with respect to all their respective Transaction Expenses set forth in the Spreadsheet, and written acknowledgments pursuant to which each such advisor or other service provider states the total amount of Transaction Expenses owed to such Person and that, upon payment of such amount at the Closing (or when otherwise due), such Person shall be paid in full and shall not be owed any other amount by any of Acquirer, the Company or their respective Affiliates (each, an “Invoice”);

(v) a resignation letter in the form attached hereto as Schedule 1.2(b)(vi), executed by each director and statutory officer of the Company and each of its Subsidiaries in office immediately prior to the Closing, in each case, effective immediately prior to the Closing (the “Company D&O Resignation Letter”);

(vi) (A) a certificate from the Israeli Registrar of Companies certifying that the Company is registered under Israeli Law since its date of incorporation and dated as of not earlier than seven (7) Business Days prior to the Closing Date, and (B) a certificate from any applicable jurisdiction dated as of not earlier than seven (7) Business Days prior to the Closing Date, certifying that any applicable Subsidiary is in good standing in its place of incorporation and in any jurisdiction where it is qualified to do business;

(vii) evidence reasonably satisfactory to Acquirer of the termination or waiver of any rights of first refusal, redemption rights, conversion rights and rights of notice of any Company Securityholder with respect to any of the Transactions, effective as of, and contingent upon the Closing;

(viii) the Spreadsheet, completed to include all of the information specified in Section 6.5 in a form similar to the Signing Spreadsheet and satisfactory to Acquirer, and a certificate executed by the Chief Executive Officer of the Company, dated as of the Closing Date, certifying on behalf of the Company that the Spreadsheet is true, correct and complete; (ix) evidence reasonably satisfactory to Acquirer of (A) the Company’s and its Subsidiary’s receipt of all consents, waivers and approvals listed on Schedule 1.3(b)(xiii)(A) and (B) the amendment or termination, as applicable, of each of the Contracts listed on Schedule 1.2(b)(x)(B), as described therein;

(x) a USB, CD or DVD-ROM, or URL link containing a complete copy of the contents of data room as of immediately prior to the Closing; subject at all times to the confidentiality obligation of the Acquirer under the MNDA;

(xi) evidence that the Company has purchased the D&O Tail Policy;

(xii) the (A) Escrow Agreement and (B) Paying Agent Agreement, duly executed by Shareholders’ Agent and the Escrow Agent and Paying Agent, as applicable;

(xiii) an Option Surrender Agreement, in the form attached hereto as Schedule 1.2(b)(xiii) (an “Option Surrender Agreement”), in respect of each In-the-Money Vested Company Option, duly executed by all holders of In-the-Money Vested Company Options and the Company;

(xiv) evidence that (i) a vote of the shareholders was solicited in conformance with Section 280G of the Code and the requisite shareholder approval was obtained with respect to any Waived Section 280G Payments (the “280G Shareholder Approval”), or (ii) the 280G Shareholder Approval was not obtained and as a consequence, such Waived Section 280G Payments shall not be made or provided to the extent they would cause any amounts to constitute “parachute payments” ;

(xv) The Company Securityholders shall have received the 102 Tax Ruling (or the 102 Interim Ruling), in the form and format acceptable to them; and

(xvi) the shareholders registry of the Company, duly executed by an authorized officer or director of the Company, evidencing the transfer and ownership of all of the Company Shares to Acquirer, as well as a share certificate registered in the name of the Acquirer, representing ownership of one hundred percent (100%) of the Company Shares, and, as soon as reasonably practicable after Closing, evidence from the Israeli Registrar of Companies confirming the Acquirer's ownership of 100% of the Company Shares and the effectiveness of the Director Resignations (as defined below).

(xvii) Evidence reasonably satisfactory to Acquirer that the credit line facility with Bank Leumi has been fully terminated and that there are no outstanding obligations, liabilities, or indebtedness of the Company and its Subsidiaries.

(xviii) Evidence that all the liens and/or the pledges of the Company and its Subsidiaries have been released.

Receipt by Acquirer of any of the agreements, instruments, certificates or documents delivered pursuant to this Section 1.2(b) shall not be deemed to be an agreement by Acquirer that the information or statements contained therein are true, correct or complete, and shall not diminish Acquirer’s remedies hereunder if any of the foregoing agreements, instruments, certificates or documents are not true, correct or complete.

(c) Rights Not Transferable. The rights of the Company Securityholders under this Agreement as of immediately prior to the Closing are personal to each such Company Securityholder and shall not be transferable for any reason, other than by operation of law, will or the laws of descent. Any attempted transfer of such right by any holder thereof (other than as permitted by the immediately preceding sentence) shall be null and void.

1.3 Surrender of Certificates.

(a) Certificate Exchange Procedures.

(i) At the Closing, Acquirer shall cause to be deposited with ESOP Management and Trust Services Ltd. (the “Paying Agent”) an amount of cash sufficient to pay the Closing Cash Consideration, Escrow Amount, Shareholders’ Agent Expense Amount, the Estimated Transaction Expenses (and shall instruct the Paying Agent to pay the Transaction Expenses to such account or accounts as are designated in the applicable Invoices by the Company in the Spreadsheet, in each case, subject to the withholding provisions of Section 1.1(d)), the Estimated Company Debt (and shall instruct the Paying Agent to pay such Company Debt in accordance with the terms of the applicable Payoff Letter delivered by the Company to Acquirer (or if no such instructions have been provided by such creditor or recipient thereof, the instructions provided by the Company in the Spreadsheet)).

(ii) At the Closing and upon the effectiveness of the Share Purchase, Acquirer, and the Shareholders’ Agent shall enter with the Paying Agent into a Paying Agent Agreement in the form attached hereto as Schedule 1.3(a)(ii) (the “Paying Agent Agreement”), which shall provide for the payment specified under clause (i) above to the Company Securityholders subject to the withholding provisions of Section 1.1(c), all as set forth in the Spreadsheet and in accordance with Section 1.1. To the extent not previously delivered, as soon as reasonably practicable after the Closing, Paying Agent shall deliver to each such Company Securityholder receiving a portion of the Closing Cash Consideration, a transmittal letter in the Paying Agent’s standard form (the “Letter of Transmittal”), and each such Company Securityholder shall fill in its applicable Letter of Transmittal and shall return such document to the Paying Agent signed, and shall surrender to the Paying Agent all of the certificates or instruments required to be so delivered (the “Converting Instruments”). Notwithstanding anything to the contrary herein, any portion of the Closing Cash Consideration is payable or otherwise deliverable pursuant to this Agreement in respect of any Company 102 Shares or In-the-Money Vested Company Options that are Company 102 Options or Company 3(i) Options, shall be delivered by the Paying Agent to the 102 Trustee, which will hold and release such payment in accordance with the provisions of Sections 102 and 3(i) of the Israeli Income Tax Ordinance and in accordance with the provisions of the 102 Tax Ruling (or the 102 Interim Ruling).

(iii) If any certificates representing Company Shares shall have been lost, stolen or destroyed, upon the making of an affidavit of that fact by the Person claiming such certificate to be lost, stolen, or destroyed and upon delivery of such affidavit, the Paying Agent will pay in respect of such Person’s Company Shares represented by such lost, stolen or destroyed certificate the applicable portion of the Closing Cash Consideration due at Closing pursuant to Section 1.1.

(b) Escrow. Notwithstanding anything to the contrary in the other provisions of this Article I, at the Closing, a portion of the Closing Cash Consideration due at Closing equal to the Escrow Amount shall not be paid to the Company Securityholders, but shall instead be deposited by the Paying Agent with the Escrow Agent to be further deposited into a separate escrow account (the “Escrow Account”) for the purpose of securing the obligations of the Indemnifying Parties under Article IX of this Agreement. The Escrow Amount in the Escrow Account shall be distributed in accordance with the terms of this Agreement and the Escrow Agreement..

(c) Shareholders’ Agent Expense Amount. A portion of the Closing Cash Consideration otherwise payable to the Indemnifying Parties equal to the Shareholders’ Agent Expense Amount, shall not be paid at the Closing Date to the Indemnifying Parties, but shall instead be deposited by Acquirer with the Paying Agent to be used for the direct payment, of, or reimbursement of the Shareholders’ Agent for, third party expenses incurred by the Shareholders’ Agent (or on his behalf) in connection with this Agreement and the agreements ancillary hereto. As soon as practicable following the completion of the Shareholders’ Agent’s responsibilities, the Paying Agent shall, as instructed by the Shareholders’ Agent, release any remaining balance of the Shareholders’ Agent Expense Account to the Indemnifying Parties in accordance with each such Indemnifying Party’s Pro Rata Share of such amount.

1.4 Company Net Working Capital Adjustment.

(a) Concurrently with the execution of this Agreement by the Company, the Company shall deliver to the Acquirer a schedule certified by the Chief Financial Officer of the Company on behalf of the Company setting forth such items required to be included in the Spreadsheet, as of such date (the “Signing Spreadsheet”). Pursuant to Section 6.5, the Company shall deliver the Spreadsheet to Acquirer not later than five (5) Business Days prior to the Closing Date, certified by the Chief Financial Officer of the Company on behalf of the Company, dated as of the Closing Date.

(b) Within 90 days after the Closing, Acquirer shall deliver to the Shareholders’ Agent a notice (the “Acquirer NWC Notice”) setting forth Acquirer’s calculation of Company Cash, Company Debt, Transaction Expenses and the Closing Net Working Capital Adjustment and the amount by which Company Cash, Company Debt, Transaction Expenses or Company Net Working Capital as calculated by Acquirer is more or less than Estimated Company Cash, Estimated Company Debt, Estimated Transaction Expenses or the Estimated Closing Net Working Capital Adjustment, in each case together with supporting documentation, information and calculations (including without limitation a consolidated balance sheet of the Company as of the Closing). Any matters not expressly set forth in the Acquirer NWC Notice shall be deemed to have been accepted by the Acquirer.

(c) The Shareholders’ Agent, after receiving any relevant information which it may reasonably request, may object to the calculation of Company Cash, Company Debt, Transaction Expenses or Closing Net Working Capital Adjustment set forth in the Acquirer NWC Notice by providing written notice of such objection to Acquirer within 30 days after Acquirer’s delivery of the Acquirer NWC Notice (the “Notice of Objection”), together with supporting documentation, information and calculations. Any matters not expressly set forth in the Notice of Objection shall be deemed to have been accepted by the Shareholders’ Agent on behalf of the Indemnifying Parties.

(d) If the Shareholders’ Agent timely provides the Notice of Objection, then Acquirer and the Shareholders’ Agent shall confer in good faith for a period of up to 15 Business Days following delivery of the Notice of Objection in an attempt to resolve any disputed matter set forth in the Notice of Objection, and any resolution by them shall be in writing and shall be final and binding on the parties hereto and the Indemnifying Parties.

(e) If, after the 15 Business Day period set forth in Section 1.4(d), Acquirer and the Shareholders’ Agent cannot resolve any matter set forth in the Notice of Objection, then Acquirer and the Shareholders’ Agent shall engage EY Israel or, if such firm is not able or willing to so act, another internationally recognized auditing firm acceptable to both Acquirer and the Shareholders’ Agent and independent of both the Company and Acquirer (the “Reviewing Accountant”) to review only the matters in the Notice of Objection that are still disputed by Acquirer and the Shareholders’ Agent. The Reviewing Accountant shall base its review solely on the presentations and supporting material provided by the parties and not on an independent review. After its review, the Reviewing Accountant shall promptly (and in any event within 60 days following its engagement) determine the resolution of such remaining disputed matters, which determination shall be final and binding on the parties hereto and the Indemnifying Parties, and the Reviewing Accountant shall provide Acquirer and the Shareholders’ Agent with a calculation of Company Cash, Company Debt, Transaction Expenses and Closing Net Working Capital Adjustment in accordance with such determination.

(f) If the sum of (such sum, the “Final Amount”), without duplication, (i) Closing Net Working Capital Adjustment as finally determined pursuant to Section 1.4(c), Section 1.4(d) and/or Section 1.4(e), as the case may be, plus (ii) the Company Cash as finally determined pursuant to Section 1.4(c), Section 1.4(d) and/or Section 1.4(e), as the case may be, less (iii) the Company Debt as finally determined pursuant to Section 1.4(c), Section 1.4(d) and/or Section 1.4(e), less (iv) the Transaction Expenses as finally determined pursuant to Section 1.4(c), Section 1.4(d) and/or Section 1.4(e), as the case may be, is less than the sum of (such sum, the “Closing Amount”) (A) the Closing Net Working Capital Adjustment as set forth in the Spreadsheet (the “Estimated Closing Net Working Capital Adjustment”), plus (B) the Company Cash as set forth in the Spreadsheet (the “Estimated Company Cash”), less (C) the Company Debt as set forth in the Spreadsheet (the “Estimated Company Debt”) less (D) the Transaction Expenses (expressed as a positive number) as set forth in the Spreadsheet (the “Estimated Transaction Expenses” and the Final Amount less the Closing Amount, the “Final Adjustment”), then within two (2) Business Days of final determination of the Final Adjustment and without any dispute by the parties hereto, the Escrow Agent shall, upon Acquirer’s direction, immediately deliver from the Escrow Amount to Acquirer the amount of the Final Adjustment; provided, that if the funds in the Escrow Account are insufficient to pay the full Final Adjustment to Acquirer, Acquirer shall be indemnified for the full amount of such shortfall by the Indemnifying Parties in accordance with each such Indemnifying Party’s Pro Rata Share, in any such case by wire transfer of immediately available funds and without any dispute by the Shareholders’ Agent or Indemnifying Parties; provided that, for the avoidance of doubt, such indemnification shall not exceed the Closing Cash Consideration actually paid to such Indemnifying Party other than in the event of fraud committed by a certain Indemnifying Party or fraud such Indemnifying Party had actual knowledge of, in which case the aforesaid limitation shall not apply.

(g) If the Final Amount shall be greater than the Closing Amount, then within two (2) Business Days of final determination of the Final Adjustment and without any dispute by the parties hereto, Acquirer shall pay the amount of such difference, if any, between the Final Amount and the Closing Amount to the Paying Agent for further payment to the Company Securityholders in accordance with each such Company Securityholder's Pro Rata Share of such amount.

(h) If the Final Amount is neither greater than nor less than the Closing Amount, then there will be no additional adjustments, and the Final Adjustment will be deemed to be $0, including, for the avoidance of doubt, in respect of the Company Securityholders’ rights to receive their Pro Rata Share of the Final Adjustment pursuant to Section 1.1.

(i) The fees, costs and expenses, if any, of the Reviewing Accountant shall be paid pro rata by Acquirer on the one hand and by the Shareholders’ Agent on the other hand on behalf of the Company Securityholders from the Shareholders’ Agent Expense Account based on the inverse of the percentage that the Reviewing Accountant’s determination (before such allocation) bears to the total amount of the total items in dispute as originally submitted to the Reviewing Accountant.

(j) The Final Adjustment amount shall be treated as an adjustment to the Closing Cash Consideration payable at Closing for Tax purposes, unless otherwise required by Applicable Law.

1.5 Transfer Taxes. All transfer, documentary, sales, use, stamp, registration and other Taxes and fees (including any penalties and interest) that become payable in connection with the transactions contemplated by this Agreement, except, for avoidance of doubt, any income taxes applicable to the Company Securityholders with respect to the sale and/or cancellation of their Securities hereunder, which shall be their sole responsibility.(“Transfer Taxes”) shall be borne by the party responsible and required by Applicable Law to file any Tax Return with respect to Transfer Taxes in the time and manner prescribed by Applicable Law.

1.6 Taking of Necessary Action; Further Action. Prior to the Closing, Acquirer, the Company and each Company Securityholder, as applicable, shall sign and deliver any documents and instruments and take any further action that is reasonable necessary to effect the Closing and to carry out the purposes of this Agreement and to vest Acquirer, with full right, title and interest in and to the Company Shares. If, at any time after the Closing, any further action is necessary or desirable to carry out the purposes of this Agreement and to vest the Company or Acquirer, with full right, title and interest in, to and under, and/or possession of, all assets, property, rights, privileges, powers and franchises of the Company and its Subsidiaries, the officers and directors of the Company and Acquirer are fully authorized, in the name and on behalf of the Company and its Subsidiaries or otherwise, to take all lawful action necessary or desirable to accomplish such purpose or acts, so long as such action is not inconsistent with this Agreement.

1.7 Waiver and Release of Claims.

(a) Effective for all purposes as of and subject to the Closing, each Company Securityholder, severally and not jointly with any other Company Securityholder, acknowledges and agrees on behalf of itself and each of its agents, trustees, beneficiaries, directors, officers, Affiliates, estate, successors and assigns (each, a “Releasing Party”) that each hereby releases and forever discharges, to the fullest extent permitted by Law, the Company, each Company Securityholder and Acquirer (each a “Beneficiary”) and each of such Beneficiary’s respective subsidiaries, affiliates, directors, officers, employees, representatives, agents, members, stockholders, successors, predecessors and assigns (each, a “Released Party” and collectively, the “Released Parties”) from any and all Shareholder Claims such Releasing Party may have or assert against any of the Released Parties, in each case whether known or unknown, or whether or not the facts that could give rise to or support a Shareholder Claim are known or should have been known; except with regard to (i) its rights pursuant to this Agreement, the other Transaction Documents and the Transactions; (ii) rights to indemnification of directors and officers under or related to any indemnification or exculpation obligations set forth in the Company’s existing organizational documents; (ii) rights or claims under the D&O Tail Policy; or (iii) with respect to Elbit Systems C4I And Cyber Ltd. (“ESLC”) only, (1) the Commercial Agreement dated October 2, 2019, as amended by that certain Amendment to Commercial Agreement dated May 18, 2021, between (a) Robo-Team Defense Ltd. and Robo-Team NA, Inc.; and (b) ESLC as amended and terminated as of Closing; and (2) the Teaming and Business Development Agreement dated May 15, 2022, by and between Flying Production Ltd. (an Affiliate of ESLC), Robo-Team Defense Ltd. and Mistral Inc as amended and terminated as of Closing. In this Agreement a “Shareholder Claim” shall mean any claims, suits, demands, causes of action, cross-claims, counter claims, compensatory damages, liquidated damages, punitive or exemplary damages, other damages, contracts, covenants, obligations, debts, costs, expenses, attorneys’ fees and liabilities claim or other rights, of whatever kind or nature, in law or in equity, by statute or otherwise, related to the Company, in each case, arising out of anything done, omitted, suffered or to be done by the Released Parties prior to the Closing, including without limitation: (i) with regard to any Company Securities other than the Company Securities set forth in the Spreadsheet with respect to such Person, (ii) to receive any portion of the Closing Cash Consideration or any other form, amount or value of consideration payable to any Company Securityholder pursuant to the terms of this Agreement, other than as specifically set forth in the Spreadsheet (subject to any adjustments contemplated in this Agreement), or (iii) with respect to the authority or enforceability to enter into this Agreement, the Share Purchase or any of the Transactions, but (B) specifically excluding (i) Acquirer’s failure to pay the Closing Cash Consideration in accordance with and subject to the provisions of this Agreement (subject to any adjustments contemplated in this Agreement) or other breach by Acquirer of this Agreement or any of the other Transaction Documents, and (ii) rights relating to any employment payment, including salary, bonuses, accrued vacation, any other employee compensation and/or benefits, any amounts set forth in this Agreement to be paid to such Releasing Party and unreimbursed expenses (provided all such salary payments shall be only in the ordinary course of business or otherwise specified in the Company Disclosure Schedule).

(b) Each Company Securityholder hereby confirms, acknowledges, represents and warrants that he, she or it: (A) (i) examined the Spreadsheet and is entitled only to the distribution set forth in the Spreadsheet (subject to any changes and adjustments contemplated in this Agreement); and (ii) waives, subject to Closing, any right to receive consideration other than as set forth in the Spreadsheet (subject to any adjustments contemplated in this Agreement) (including for any interest payments, the method of determination or calculation of any of the values or allocations pursuant to this Agreement, any preferential or other amount resulting from its investment in the Company or the purchase of Company Securities (e.g. in the form of indemnification), the conversion of Company Shares, any other rights of any nature under the Charter Documents, or any Shareholders Agreement, which the Company Shareholders and/or its successors and assignees ever had, now have or hereafter can, shall or may have, at any time, due to actions or events that occurred prior to Closing which do not conform or are not consistent with the terms of this Agreement and the consideration attributed to such Company Shareholders in the Spreadsheet); (B) hereby, subject to Closing, terminates and waives any rights, powers and privileges such Company Securityholder has or may have pursuant to any “Shareholders Agreement” (which for purposes of this Agreement will be defined as any investors rights agreement, registration rights agreement or shareholders agreement entered into by such Company Securityholders with respect to the Company) or any right to make a claim or demand for any discrepancy between any Shareholders Agreement, share purchase agreement or convertible loan agreement entered into by such Company Shareholder and the provisions of this Agreement and his, her or its entitlement pursuant to such agreements.

(c) Notwithstanding anything to the contrary, should any portion or provision of this release (including, without limitation, any portion or provision of any section of this release) be found, held, declared, determined, or deemed by any court of competent jurisdiction to be void, illegal, invalid or unenforceable under any Applicable Law, (a) the legality, validity, and enforceability of the remaining portions and provisions will not be affected and (b) the parties hereto shall use all reasonable efforts to replace such void, illegal, invalid or unenforceable portion or provision with a valid and enforceable portion or provision that shall achieve, to the greatest extent possible, the economic, business and other purposes of such void, illegal, invalid or unenforceable portion or provision (and if not possible, the illegal, invalid, or unenforceable portion or provision will be deemed not to be a part of this release).

ARTICLE II

Representations and Warranties of the Company

Subject to the disclosures set forth in the disclosure letter of the Company delivered to Acquirer concurrently with the execution of this Agreement (the “Company Disclosure Letter”) (each of which disclosures, in order to be effective, shall clearly indicate the Section and, if applicable, the Subsection of this Article II to which it relates (unless and only to the extent the relevance to other representations and warranties is readily apparent from the actual text of the disclosures without any reference to extrinsic documentation or any independent knowledge on the part of the reader regarding the matter disclosed), and each of which disclosures shall also be deemed to be representations and warranties made by the Company to Acquirer under this Article II), the Company represents and warrants to Acquirer as follows (and any reference to the Company shall be deemed reference to each of the Company’s Subsidiaries as well, unless specifically stated otherwise or unless the context of the representation expressly implies otherwise):

2.1 Organization, Standing, Power and Subsidiary.

(a) The Company and its Subsidiary is a corporation duly organized, validly existing and in good standing under the laws of its jurisdiction of organization, and the Company is not registered by the Israeli Registrar of Companies as a “violating company” as such term is defined under Section 362a of the Israeli Companies Law, and it has not received any notice or warning concerning any intention of the Israeli Registrar of Companies to declare that the Company is a “violating company”. Each of the Company and its Subsidiary has the corporate power to own, operate, use, distribute and lease its properties and to conduct the Business and is duly licensed or qualified to do business and is in good standing in each jurisdiction where the failure to be so qualified or in good standing, individually or in the aggregate with any such other failures, would reasonably be expected to have a Material Adverse Effect with respect to the Company and its Subsidiary taken as a whole. The Company and its Subsidiary, since their applicable inception, have had no Equity Interest, whether direct or indirect, in, any corporation, partnership, limited liability company, joint venture or other business entity (other than with respect to the Company’s holding of Equity Interests in the Subsidiary). Except as set forth in Schedule 2.1(a) of the Company Disclosure Letter, there are no outstanding and currently effective powers of attorneys executed by or on behalf of the Company or its Subsidiary (except, in the case of the Subsidiary, in favor of the Company). The Company has made available to Acquirer accurate and complete copies of the Charter Documents of the Company and the organizational documents of its Subsidiary, as amended to date and currently in effect, which documents are in full force and effect, and neither the Company nor its Subsidiary is, in any material respect, in default under or in violation of any provisions thereof.

(b) Neither the Company nor any of its shareholders has ever approved or commenced any proceeding or made any election contemplating the dissolution or liquidation of the Company or the Subsidiary or the winding up or cessation of the business or affairs of the Company or the Subsidiary.

(c) Schedule 2.1(c) of the Company Disclosure Letter sets forth a true, correct and complete list of: (i) the names of the members of the Board and the board of directors (or similar body) of the Subsidiary, (ii) the names of the members of each committee of the Board and the board of directors (or similar body) of the Subsidiary and (iii) the names and titles of the officers of each of the Company and its Subsidiary.

(d) The Company has not conducted any business under or otherwise used, for any purpose or in any jurisdiction, any fictitious name, assumed name, or other name, other than (1) its corporate name as set forth in this Agreement or (ii) any of its trademarks.

(e) Neither the Company nor the Subsidiary is, or has ever been, bankrupt or insolvent, and has not proposed a voluntary arrangement or made or proposed any arrangement or composition with such Company’s or Subsidiary’s creditors or any class of such creditors, and no petition in respect of any such arrangement or composition has been presented. The consummation of the Share Purchase and the other Transactions shall not constitute a fraudulent transfer by the Company or the Subsidiary under applicable bankruptcy and other similar laws relating to bankruptcy and insolvency.

2.2 Capital Structure.

(a) The authorized share capital of the Company consists solely of: (i) 871,812 Company Ordinary Shares, (ii) 102,000 Preferred A Shares; (iii) 94,714 Preferred B Shares ; (iv) 131,592 Preferred C Shares ; (v) 220,325 Preferred D Shares; (vi) 164,936 Preferred E Shares and (vii) 73,043 Preferred E-1 Shares, of which 778,938 , are issued and outstanding as of the Agreement Date and there are no other issued and outstanding shares of Company Shares and no commitments or Contracts to issue any shares of Company Shares other than pursuant to the exercise of Company Options under the Company Option Plans that are outstanding as of the Agreement Date. Neither the Company nor its Subsidiary hold any treasury shares. Schedule 2.2(a) of the Company Disclosure Letter sets forth, as of the Agreement Date, (i) a true, correct and complete list of the Company Shareholders that are the registered owners of any Company Shares and the number and type of such shares so owned by such Company Shareholder and any beneficial holders thereof, if applicable, (ii) the number of Company Ordinary Shares that would be owned by such Company Shareholder assuming conversion of all Company Preferred Shares so owned by such Person after giving effect to all anti-dilution and similar adjustments in accordance with the Charter Documents or any Contract to which the Company is a party or by which the Company is bound, and (iii) the number of such Company Ordinary Shares that are not vested under the terms of any Contract with the Company (including any share option agreement, share option exercise agreement or restricted share purchase agreement) as of the Agreement Date (the “Unvested Company Shares”), including, as applicable, the number and type of such Unvested Company Shares, the per share purchase price paid for such Unvested Company Shares, the vesting schedule in effect for such Unvested Company Shares (and the terms of any acceleration thereof), the per share repurchase price payable for such Unvested Company Shares and the length of the repurchase period following the termination of service of the holder of such Unvested Company Shares. All issued and outstanding shares of Company Shares are duly authorized, validly issued, fully paid and non-assessable and are free of any Encumbrances other than restrictions on transfer under applicable securities Laws and/or under the Charter Documents.

(b) None of the Company nor its Subsidiary has ever declared or paid any dividends on any shares of Company Shares. There is no Liability for dividends accrued and unpaid by the Company or its Subsidiary. All issued and outstanding shares of Company Shares and Company Options were issued, in compliance with Applicable Law and all requirements set forth in the Charter Documents, the Company Option Plans (if applicable) and any applicable Contracts to which the Company or its Subsidiary is a party or by which the Company or its Subsidiary or any of their respective assets are bound.

(c) The Company has reserved 256,421 Company Ordinary Shares for issuance to employees, non-employee directors and consultants pursuant to the Company Option Plan, of which 206,000 Company Ordinary Shares are subject to outstanding and unexercised Company Options, and 14,769 Company Ordinary Shares remain available for issuance thereunder. Schedule 2.2(c) of the Company Disclosure Letter sets forth, as of the Agreement Date, a true, correct and complete list of all holders of outstanding Company Options, whether or not granted under the Company Option Plans, including the number of Company Ordinary Shares subject to each Company Option, the number of such shares that are vested or unvested, the date of grant of such Company Option, the vesting commencement date, the vesting schedule (and the terms of any acceleration thereof), the exercise price per share, , the term of each Company Option, the Company Option Plan under which such Company Option was granted (if any), the country and state, if applicable, of residence of such holder, whether each such Company Option was granted and is subject to Tax pursuant to Section 3(i) of the Israeli Income Tax Ordinance or Section 102 of the Israeli Income Tax Ordinance and the applicable sub-section of Section 102 of the Israeli Income Tax Ordinance, and for Company Options subject to Section 102(b)(2) of the Israeli Income Tax Ordinance the date of deposit of such Company Option with the 102 Trustee.

(d) Schedule 2.2(d) of the Company Disclosure Letter indicates which holders of outstanding Company Options are not employees of the Company or the Subsidiary (including non-employee directors, consultants, vendors, service providers or other similar Persons), including a description of the relationship between each such Person and the Company or the Subsidiary, as applicable. True, correct and complete copies of each Company Option Plan and all forms of agreements and instruments relating to or issued under each Company Option Plan (including, except as set forth under Schedule 2.2(d)(i) of the Company Disclosure Letter, executed copies of all Contracts relating to each Company Option and the Company Ordinary Shares purchased under such Company Option) have been provided to Acquirer, and such Company Option Plans and forms and terms have not been amended, modified or supplemented since being provided to Acquirer, and there are no agreements, understandings or commitments to amend, modify or supplement such Company Option Plans or forms and terms in any case from those provided to Acquirer . The terms of the Company Option Plans permit the treatment of Company Options as provided herein and other than as set forth in Schedule 2.2(d) of the Company Disclosure Letter, there will be no acceleration of the exercise schedule or vesting provisions in effect for any outstanding Company Options whether under the Company Options Plans or otherwise.

(e) Except as set forth in Schedule 2.2(e) of the Company Disclosure Letter, all Company 102 Options currently outstanding and granted by the Company to its officers and employees in Israel were granted under employee option plans approved by the ITA under the capital gains route of Section 102 of the Israeli Income Tax Ordinance. The Company has complied with all of the requirements under such Section 102 and the regulations promulgated thereunder in all respects.

(f) Except as set forth on Schedule 2.2(f) of the Company Disclosure Letter, the Company has never repurchased, redeemed or otherwise reacquired any of its Company Shares or Company Options, or other Equity Interests.

(g) As of the Closing, (i) the number of Company Shares set forth in the Spreadsheet as being owned by a Person, or subject to Company Options owned by such Person, will constitute the entire interest of such Person in the issued and outstanding Company Shares or any other Equity Interests of the Company, (ii) no Person not disclosed in the Spreadsheet owns or will have a right to acquire from the Company or its Subsidiary any shares of Company Shares, Company Options, or any other Equity Interests of the Company or its Subsidiary and (iii) the shares of Company Shares, Company Options and/or disclosed in the Spreadsheet will be free and clear of any Encumbrances.

(h) Except for the equity interests identified in Schedule 2.2(a) of the Company Disclosure Letter, neither the Company not its Subsidiary owns, beneficially or otherwise, any units or other securities of, or any direct or indirect equity, voting, beneficial ownership interest in, any other Person and neither the Company nor its Subsidiary has agreed or is obligated to make any future investment in or capital contribution to any Person (other than with respect to the Company’s holding of Equity Interests in the Subsidiary).

2.3 Authority; Non-Contravention.

(a) Authority. The Company has all requisite corporate power and authority to enter into this Agreement and the other Transaction Documents to which it is a party and to consummate the Transactions. The execution and delivery of this Agreement and the other Transaction Documents to which the Company is a party and the consummation of the Transactions have been duly authorized by all necessary corporate action on the part of the Company. Each Transaction Document to which the Company is a party has been duly executed and delivered by the Company and, assuming the due execution and delivery of such Transaction Document by the other parties hereto, constitutes the valid and binding obligation of the Company enforceable against the Company in accordance with its terms subject only to the effect, if any, of (i) applicable bankruptcy and other similar Applicable Law affecting the rights of creditors generally and (ii) rules of law governing specific performance, injunctive relief and other equitable remedies. The Board, by resolutions duly adopted (and not thereafter modified or rescinded) by the unanimous vote of the Board, has (x) approved this Agreement and approved the Share Purchase and the other Transactions and determined that this Agreement and the Transactions, including the Share Purchase, upon the terms and subject to the conditions set forth herein, are advisable, and in the best interests of the Company and the Company Shareholders, (y) approved this Agreement in accordance with the provisions of Israeli Law and the Charter Documents and (z) recommended that all of the Company Shareholders approve and execute this Agreement (the “Board Action”). The Shareholder Consent constitutes the only vote or approval of, or waiver by, any holder of any class or series of Company Shares necessary to adopt and approve this Agreement, the other Transaction Documents, and the Transactions under Applicable Laws, the Charter Documents, any Contracts by which the Company is bound and/or a party, or otherwise. The Company and its Subsidiary and the Transactions are not, and by the passage of time or notice or both will not be, subject to, and no Person has Acquisition Rights or, to the Company Knowledge, other rights that could affect or threaten the Company or any Company Securityholder’s compliance with any of the obligations under this Agreement, or any of the other Transaction Documents.

(b) The execution and delivery of this Agreement and the other Transaction Documents to which the Company is a party by the Company does not, and the consummation of the Transactions will not, (i) result in the creation of any Encumbrance, on any of the material assets of the Company or its Subsidiary or any of the shares of Company Shares, (ii) conflict with, or result in any violation of or default under (with or without notice or lapse of time, or both), or give rise to a right of termination, cancellation or acceleration of any obligation or loss of any benefit under, or require any consent, approval or waiver from any Person pursuant to, (A) any provision of the Charter Documents of the Company or its Subsidiary, in each case as amended to date, or any resolution adopted by the Company Shareholders or Board, (B) any Contract of the Company or its Subsidiary or any Contract applicable to any of the material properties or assets of the Company or its Subsidiary, or (C) any Applicable Law, or (iii) to the Company’s Knowledge, contravene, conflict with or result in a violation of, or give any Governmental Entity or other Person the right to challenge any of the transactions contemplated by this Agreement or to exercise any remedy or obtain any relief under, Israeli Law or any Order to which the Company or its Subsidiary or any of the assets owned or used by the Company or its Subsidiary, is subject.

(c) Except as set forth in Schedule 2.3(c), no consent, approval, Order or authorization of, or registration, declaration or filing with, or notice to, any Governmental Entity or any other Person is required by or with respect to the Company or the Subsidiary in connection with the execution and delivery of this Agreement or any other Transaction Document to which the Company is a party or the consummation of the Transactions, (including any filings and notifications as may be required to be made by the Company in connection with the Share Purchase under the Israeli Economic Competition Law, 5748-1988, antitrust laws and other Applicable Law), except for such consents, approvals, Orders, authorizations, registrations, declarations, filings and notices that, if not obtained or made, would not adversely affect, and would not reasonably be expected to adversely affect, the Company’s or the Subsidiary’s ability to perform or comply with the covenants, agreements or obligations of the Company herein or in any other Transaction Document to which the Company is a party or to consummate the Transactions in accordance with this Agreement or any other such Transaction Document and Applicable Law.

(d) Assuming the consents set forth in Schedule 2.3(c) above are obtained, the execution and delivery of this Agreement by the Company does not, and the consummation of the Transactions will not contravene, conflict with or result in a violation of any of the terms or requirements of, or give any Governmental Entity the right to revoke, withdraw, suspend, cancel, terminate or modify, any authorization from a Governmental Entity that is held by the Company or its Subsidiary that otherwise relates to the Company’s or the Subsidiary’s Business or to any of the assets owned or used by the Company.

2.4 Financial Statements; No Undisclosed Liabilities.

(a) The Company has delivered to Acquirer its audited, consolidated financial statements for the fiscal year ended December 31, 2024 and its unaudited, consolidated financial statements for September 30, 2025 and the nine month period ended September 30, 2025, and the trial balance and ledgers for September 30, 2025 and the nine months period ended September 30, 2025 (including, in each case, balance sheets, statements of operations and statements of cash flows and notes) (collectively, the “Financial Statements”), which are included as Schedule 2.4(a) of the Company Disclosure Letter. The Financial Statements (i) are derived from and in accordance with the books and records of the Company and its Subsidiary, (ii) are complied as to form with applicable accounting requirements with respect thereto as of their respective dates, (iii) fairly and accurately present the consolidated financial condition of the Company and its Subsidiary at the dates therein indicated and the consolidated results of operations and cash flows of the Company and its Subsidiary for the periods therein specified (subject, in the case of unaudited interim period financial statements, to normal recurring year-end audit adjustments, none of which individually or in the aggregate will be material in amount), (iv) are true, correct and complete, (v) were prepared in accordance with GAAP, except for the absence of footnotes in the unaudited Financial Statements (which would not be material individually or in the aggregate if disclosed or recorded and which are expected to be consistent with past practice), applied on a consistent basis throughout the periods involved, and (vi) have been kept accurately in the ordinary course of business consistent in all material respects with Israeli Law. No basis exists that would require, and no circumstance exists that would reasonably be expected to require, the Company to restate any of the Financial Statements.

(b) Except as set forth in Schedule 2.4(b), neither the Company nor the Subsidiary has any Liabilities of any nature other than (i) those set forth or adequately provided for in the balance sheet included in the Financial Statements (such date, the “Company Balance Sheet Date” and such balance sheet, the “Company Balance Sheet”), (ii) those incurred in the conduct of the Company’s and its Subsidiary’s business since the Company Balance Sheet Date in the ordinary course consistent with past practice that are of the type that ordinarily recur and, individually or in the aggregate, are not material in nature or amount and do not result from any breach of Contract, warranty, infringement, tort or violation of Applicable Law, and (iii) those incurred by the Company and its Subsidiary in connection with the execution of this Agreement or the Transactions, including, for the avoidance of doubt, the Transaction Expenses. Except (i) as set forth in Schedule 2.4(b) and (ii) for Liabilities reflected in the Financial Statements, neither the Company nor the Subsidiary has any off-balance sheet Liability of any nature to, or any financial interest in, any third parties or entities, the purpose or effect of which is to defer, postpone, reduce or otherwise avoid or adjust the recording of expenses incurred by the Company and its Subsidiary. All reserves that are set forth in or reflected in the Company Balance Sheet have been established in accordance with GAAP consistently applied and are adequate. Without limiting the generality of the foregoing, neither the Company nor the Subsidiary has ever guaranteed any debt or other obligation of any other Person.

(c) Schedule 2.4(d) of the Company Disclosure Letter sets forth the names and locations of all banks and other financial institutions at which the Company and its Subsidiary maintain an account (whether checking, savings or otherwise), lock box or safe deposit box, and the account numbers thereof and the names of all Persons authorized to make withdrawals therefrom.

2.5 Absence of Changes. Except as set forth in Schedule 2.5 of the Company Disclosure Letter, since the Company Balance Sheet Date, (i) the Company and its Subsidiary have conducted the Business only in the ordinary course of business consistent with past practice, (ii) there has not occurred any Material Adverse Effect with respect to the Company and Subsidiary and (iii) neither the Company nor the Subsidiary has done, caused or permitted any action that would constitute a breach of Section 5.2 if such action were taken by the Company or its Subsidiary, as applicable, without the written consent of Acquirer, between the Agreement Date and the earlier of the termination of this Agreement and the Closing.

2.6 Litigation. Except as set forth in Schedule 2.6, there is no, and has not been during the period commencing on January 1, 2022, a Legal Proceeding to which the Company or its Subsidiary is a party pending before any Governmental Entity, or threatened against the Company or its Subsidiary or, in each case, any of its assets or any of its directors, officers or employees (in their capacities as such or relating to their employment, services or relationship with the Company or its Subsidiary), and to the knowledge of the Company, there is not any reasonable basis for any such Legal Proceeding. There is no Order against the Company, or its Subsidiary, or any of their respective assets, any of the Company’s or its Subsidiary’s directors, officers or, to the knowledge of the Company, their employees (in their capacities as such or relating to their employment, services or relationship with the Company or its Subsidiary). To the knowledge of the Company, there is no reasonable basis for any Person to assert a claim against the Company or its Subsidiary or any of their respective assets or any of the Company’s or its Subsidiary’s directors, officers or employees (in their capacities as such or relating to their employment, services or relationship with the Company or its Subsidiary) based upon: (i) the Company or its Subsidiary entering into this Agreement, any of the Transactions or the agreements contemplated by this Agreement, including a claim that such director, officer or employee breached a fiduciary duty in connection therewith, (ii) any confidentiality or similar agreement entered into by the Company or its Subsidiary regarding its assets or (iii) any claim that the Company or its Subsidiary has agreed to sell or dispose of any of its assets to any party other than Acquirer, whether by way of merger, consolidation, sale of assets or otherwise. Neither the Company nor its Subsidiary has any Legal Proceeding pending against any other Person.

2.7 Restrictions on Business Activities. Except as set forth in Schedule 2.7 of the Company Disclosure Letter, there is no Contract or Order binding upon the Company or its Subsidiary that restricts or prohibits the conduct or operation of the Business or, excluding restrictions on the use of Third-Party Intellectual Property contained in the applicable written license agreement therefor, limiting the freedom of the Company or its Subsidiary to (i) engage or participate, or compete with any other Person, in any line of business, market or geographic area with respect to the Company Products or the Company Intellectual Property, or to make use of any Company Intellectual Property, such as any grants by the Company of exclusive rights or licenses thereto, or any Contract granting most favored nation pricing, exclusive sales, distribution, marketing or other exclusive rights, rights of refusal, rights of first negotiation or similar rights and/or terms to any Person, or (ii) sell, distribute or manufacture any products or services or to purchase or otherwise obtain any software, components, parts or services.

2.8 Compliance with Laws; Governmental Permits.

(a) The Company and its Subsidiary have complied in all material respects with, are not in violation in any material respect of, and have not received any notices of violation with respect to, Applicable Law.