UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (date of earliest event reported): November 21, 2025

reAlpha Tech Corp.

(Exact name of registrant as specified in its charter)

| Delaware | 001-41839 | 86-3425507 | ||

| (State or other jurisdiction of incorporation or organization) |

(Commission File Number) | (I.R.S. Employer Identification Number) |

6515 Longshore Loop, Suite 100, Dublin, OH 43017

(Address of principal executive offices and zip code)

(707) 732-5742

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0.001 per share | AIRE | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

Agreement and Plan of Merger

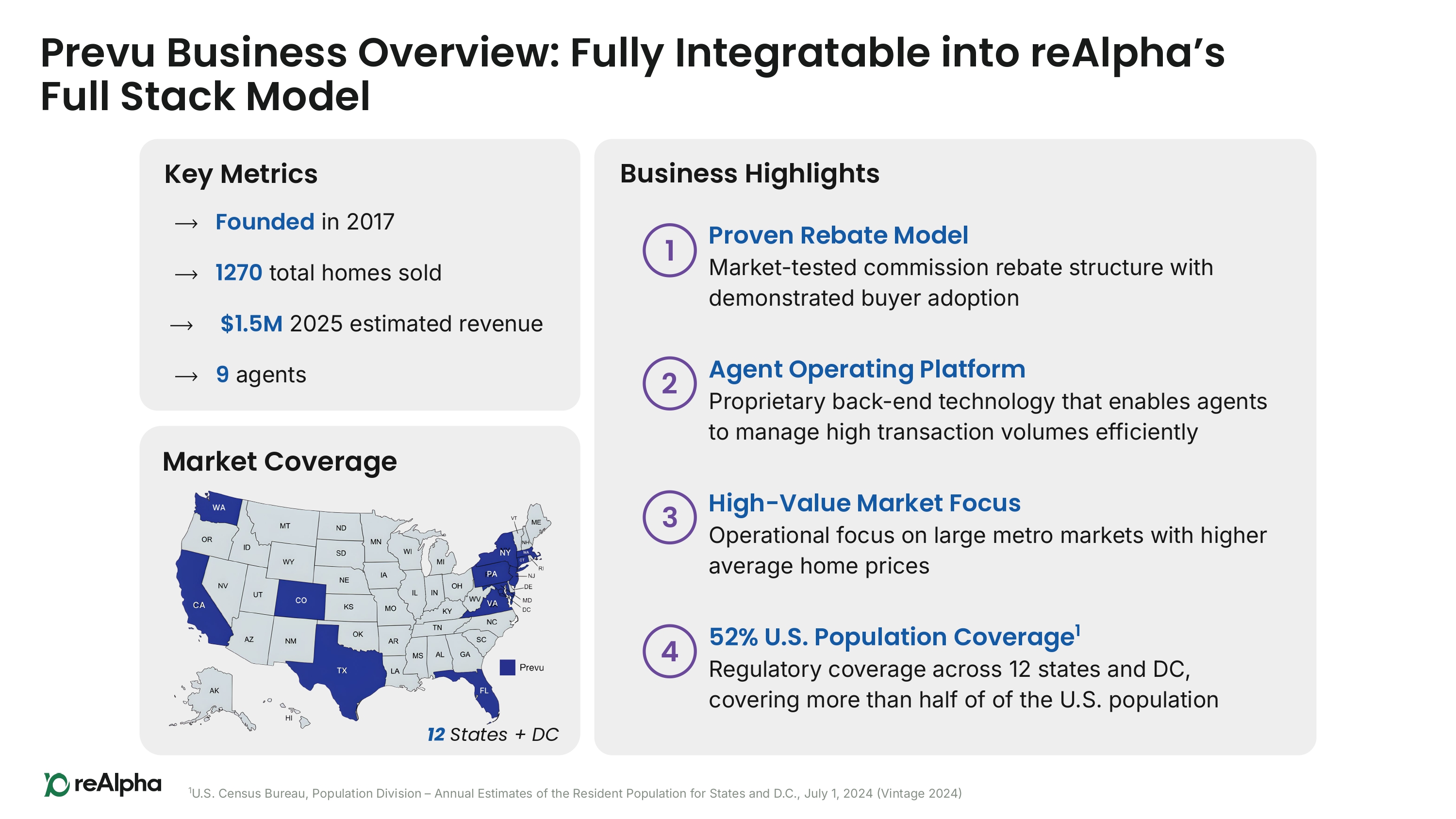

On November 21, 2025 (the “Closing Date”), reAlpha Tech Corp. (the “Company”) entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Prevu, Inc., a Delaware corporation (“Prevu”), reAlpha Merger Sub, Inc., a Delaware corporation and a newly formed wholly-owned subsidiary of the Company (the “Merger Sub”) and Thomas Kutzman, as the stockholder representative.

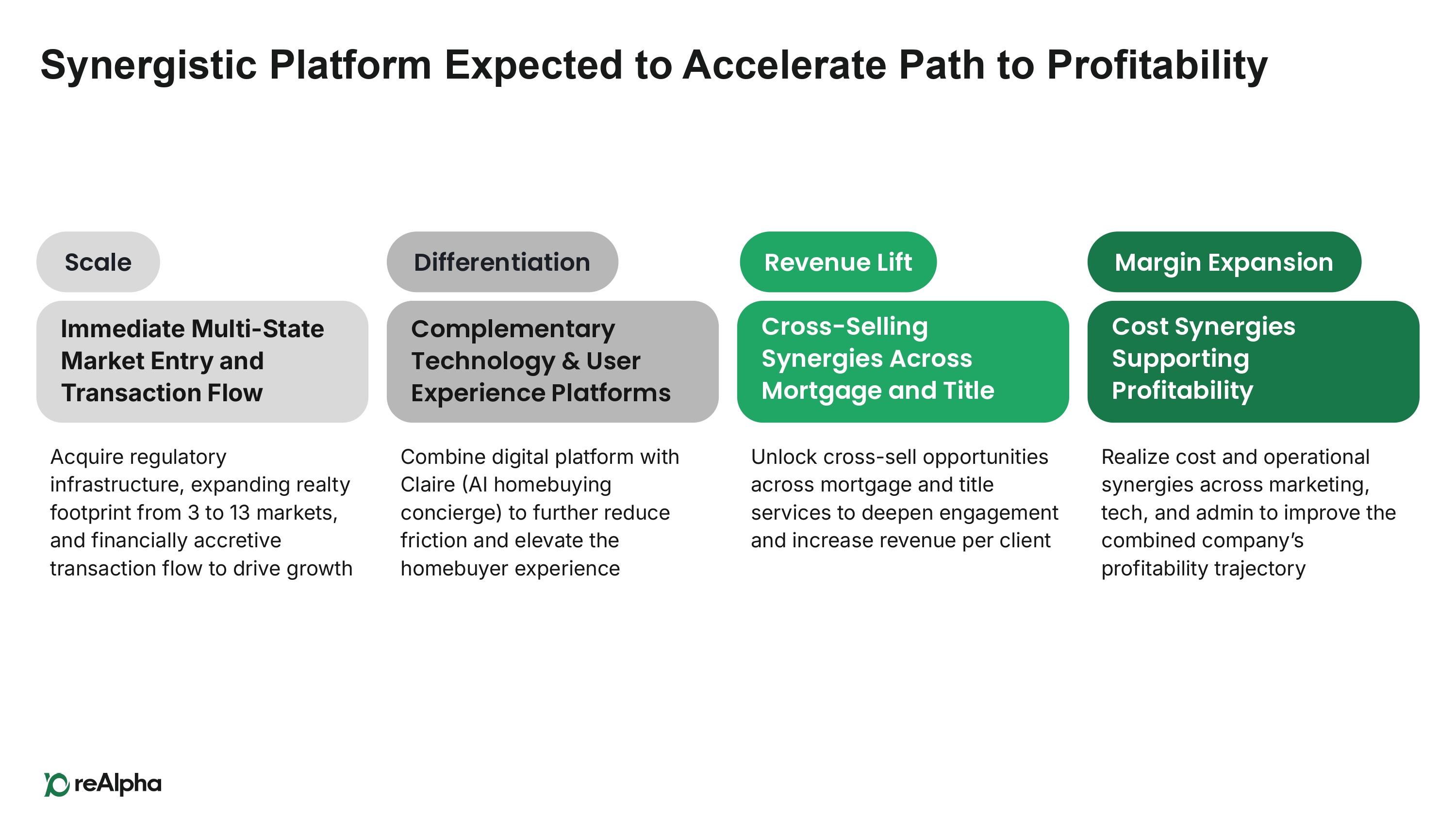

The Merger Agreement provides that, among other things and on the terms and subject to the conditions set forth therein, Merger Sub will merge with and into Prevu (the “Merger”), with Prevu surviving the Merger as a wholly-owned subsidiary of the Company. Pursuant to and subject to the terms and conditions of the Merger Agreement, the Merger became effective on November 21, 2025, upon the filing and acceptance of the Certificate of Merger by the Secretary of State of Delaware (the “Effective Time”).

Pursuant to and subject to the terms and conditions of the Merger Agreement, at the Effective Time, by virtue of the Merger and without any action on the part of Purchaser, Merger Sub, the Company or any Equityholder (as defined in the Merger Agreement): (i) all shares of Prevu common stock, par value $0.001 per share, issued and outstanding immediately prior to the Effective Time, including any shares held by Prevu as treasury stock immediately prior to the Effective Time, other than any Dissenting Shares (as defined in the Merger Agreement), were cancelled and ceased to exist, and as a result were no longer deemed outstanding as of such time, for no consideration or payment in exchange therefor or in respect thereof; (ii) all shares of Prevu’s series seed preferred stock, par value $0.001 per share, issued and outstanding immediately prior to the Effective Time, other than any Dissenting Shares, were cancelled and extinguished, and as a result were no longer deemed outstanding as of such time and represented only the right to receive a portion of the Aggregate Merger Consideration (as defined below), and converted automatically into the right to receive a portion of the Aggregate Merger Consideration in accordance with the terms and conditions of the Merger Agreement at the Effective Time; (iii) all SAFEs (as defined in the Merger Agreement) outstanding immediately prior to the Effective Time were cancelled, and as a result were no longer deemed outstanding as of such time and represented only the right to receive a portion of the Aggregate Merger Consideration, and exchanged for the right to receive a portion of the Aggregate Merger Consideration in accordance with the terms and conditions of the Merger Agreement at the Effective Time; and (iv) each Promissory Note (as defined in the Merger Agreement) outstanding immediately prior to the Effective Time was cancelled and extinguished, and each holder thereof ceased to have any rights with respect thereto, other than the right to receive a portion of the Aggregate Merger Consideration in accordance with the terms and conditions of the Merger Agreement.

In consideration thereof, the Company will pay to the Participating Securityholders (as defined in the Merger Agreement) an aggregate amount of $4,500,000 (the “Aggregate Merger Consideration”), consisting of: (i) $750,000 in cash paid on the Closing Date, less any applicable withholding tax payable by the Participating Securityholder in accordance with the terms of the Merger Agreement; (ii) $1,250,000 in shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”), or 2,501,000 shares of Common Stock at a price per share of $0.4998, issued on the Closing Date and valued based on the arithmetic average of the closing price of the Common Stock for the 10 consecutive trading day period ending on and including the trading day that is two (2) trading days prior to the date of the Merger Agreement (the “Closing Payment Purchaser Stock”); and (iii) $2,500,000 payable in four equal tranches of $625,000 over an 18-month period following the Closing Date, either in cash or shares of Common Stock (the “Additional Payment Purchaser Stock”), at the Company’s sole discretion, with such Additional Payment Purchaser Stock, if any, valued based on the volume weighted average price (“VWAP”) of the Common Stock as reported on the Nasdaq Capital Market for the ten (10) consecutive trading days ending on and including the date on which such issuance is to be made (such payments, the “Additional Payments”). The first Additional Payment is due on March 16, 2026, with subsequent payments due on August 1, 2026, December 16, 2026, and the date that is eighteen (18) months following the Closing Date.

The shares of Common Stock issued or issuable pursuant to the Merger Agreement, including any Additional Payment Purchaser Stock issuable thereunder, will be subject to a restrictive period of one hundred and eighty (180) days following the date of their respective issuances, during which period each Participating Securityholder will not be able to dispose, assign, sell and/or transfer such shares. The aggregate amount of shares of Common Stock issued or issuable under the Merger Agreement and the transactions contemplated thereby, for purposes of complying with Nasdaq Listing Rule 5635, may in no case exceed 19.99% of the Company’s issued and outstanding shares of Common Stock immediately prior to the execution of the Merger Agreement, or 25,599,604 shares of Common Stock (the “Cap Amount”), without stockholder approval of any shares exceeding such amount. In the event the shares issuable pursuant to the Merger Agreement and the transactions contemplated thereby exceed the Cap Amount, the Company will pay the Participating Securityholders cash in lieu of such excess shares of Common Stock, based on a formula set forth in the Merger Agreement.

From and after the Closing Date, the Indemnifying Securityholders (as defined in the Merger Agreement) are required to indemnify the Purchaser Indemnified Parties (as defined in the Merger Agreement) and hold each of them harmless against any Losses (as defined in the Merger Agreement) incurred by Purchaser Indemnified Parties to the extent such Losses arise out of or result from inaccuracies, errors, omissions or breaches of any representations, covenants, agreements or warranties of Prevu set forth in the Merger Agreement and certain other matters specified in the Merger Agreement, subject to certain limitations and exclusions as identified therein. Further, from and after the Closing Date, the Purchaser is required to indemnify each of the Seller Indemnified Parties (as defined in the Merger Agreement) and hold each of them harmless against any Losses incurred by a Seller Indemnified Party to the extent such losses arise out of or result from any inaccuracies or breach of any representations, covenants, agreements or warranties of the Company or Merger Sub set forth in the Merger Agreement, subject to certain limitations and exclusions as identified therein.

The Merger Agreement also contains representations and warranties of the parties to the Merger Agreement relating to their respective businesses, financial statements and public filings, as applicable, in each case generally subject to customary materiality and knowledge qualifiers and customary for transactions of this type. The Merger Agreement has been included to provide investors with information regarding its terms. The Merger Agreement is not intended to provide any other factual information about the Company. The representations, warranties and covenants contained in the Merger Agreement were made only for purposes of the Merger Agreement as of the specific dates therein, were solely for the benefit of the parties to the Merger Agreement, may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Merger Agreement instead of establishing these matters as facts, and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Investors should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the Company or any of its respective subsidiaries or affiliates. Information concerning the subject matter of representations, warranties and covenants may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in the Company’s public disclosures. The Merger Agreement should not be read alone, but should instead be read in conjunction with the other information regarding the Company that is or will be contained in, or incorporated by reference into, the Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and other documents that the Company filed, or will file from time to time, with the Securities and Exchange Commission (the “SEC”).

The foregoing description of the Merger Agreement and the transactions contemplated thereby, including the Merger, in this Current Report on Form 8-K (this “Form 8-K”) is only a summary and does not purport to be a complete description of the rights and obligations of the parties thereunder and is qualified in its entirety by reference to the full text of the Merger Agreement, a copy of which is filed hereto as Exhibit 2.1 and is incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities.

The information included in Item 1.01 of this Form 8-K is incorporated by reference into this Item 3.02 to the extent required.

In connection with the transactions contemplated by the Merger Agreement, the Company also entered into certain ancillary agreements, including a transition agreement (the “Co-Founder Transition Agreement”), between the Company and a co-founder of Prevu (the “Co-Founder”), pursuant to which the Co-Founder, among other consideration, received $100,000 in shares of Common Stock, or 200,080 shares of Common Stock, at a price per share of $0.4998 (the “Co-Founder Shares,” and together with the Closing Payment Purchaser Stock and the Additional Payment Purchaser Stock, the “Shares”) on the Closing Date as consideration for certain transition services to be rendered to the Company.

The Shares issued or issuable pursuant to the Merger Agreement and the Co-Founder Transition Agreement will be issued pursuant to an exemption from registration provided by Section 4(a)(2) and/or Rule 506 of Regulation D of the Securities Act of 1933, as amended (the “Securities Act”), because such issuances will not involve a public offering, each of the recipients will take the Shares for investment and not resale, the Company took appropriate measures to restrict transfer of the Shares, and each recipient is a sophisticated investor. The Shares are subject to transfer restrictions, and the book-entry records evidencing the Shares contain an appropriate legend stating that such securities have not been registered under the Securities Act and may not be offered or sold absent registration or pursuant to an exemption therefrom. Such Shares were not registered under the Securities Act and may not be offered or sold in the United States absent registration or an exemption from registration under the Securities Act and any applicable state securities laws.

Item 7.01. Regulation FD Disclosure.

On November 25, 2025, the Company issued a press release announcing the consummation of the Merger. A copy of the press release is being furnished as Exhibit 99.1 to this Form 8-K.

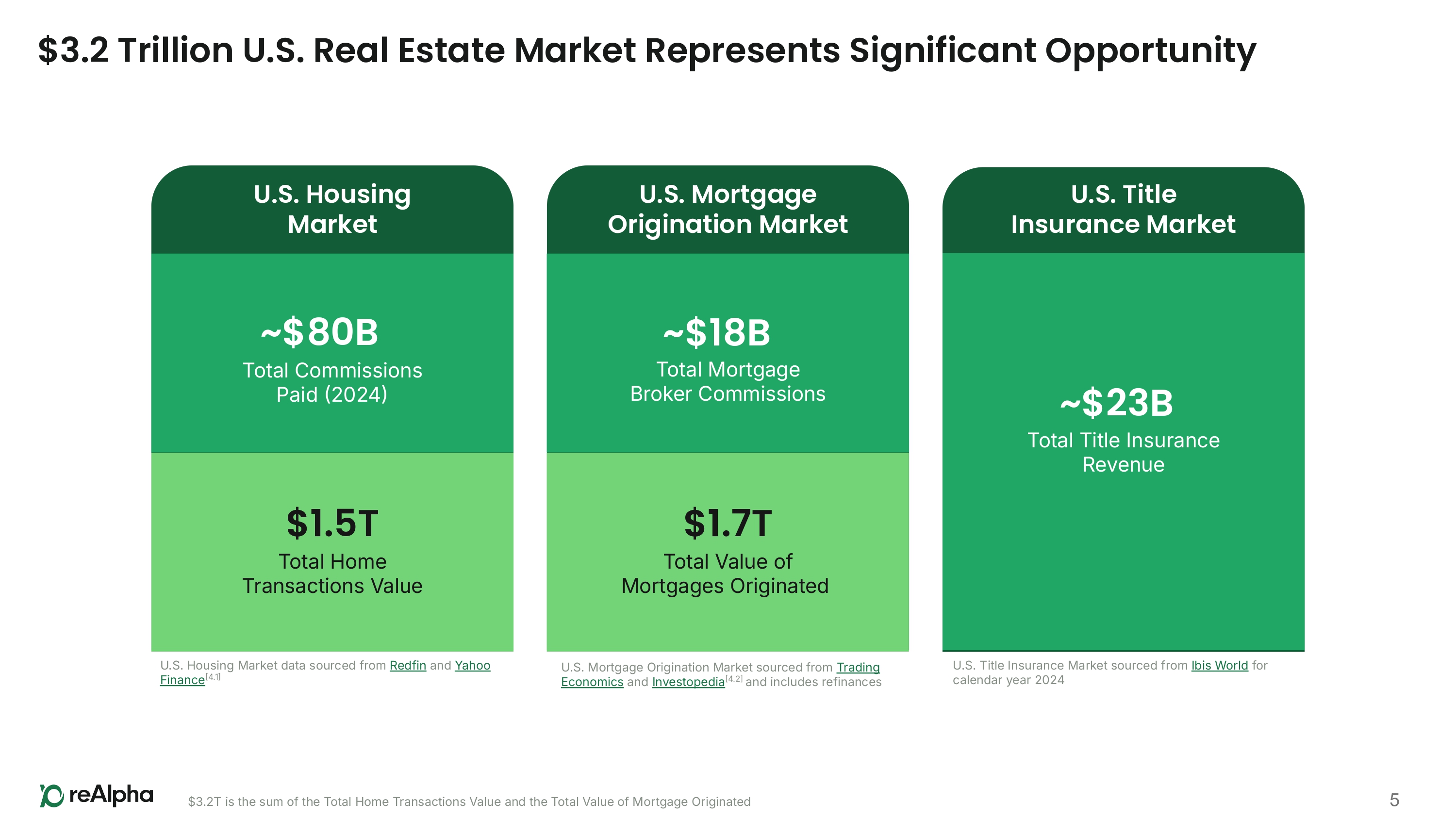

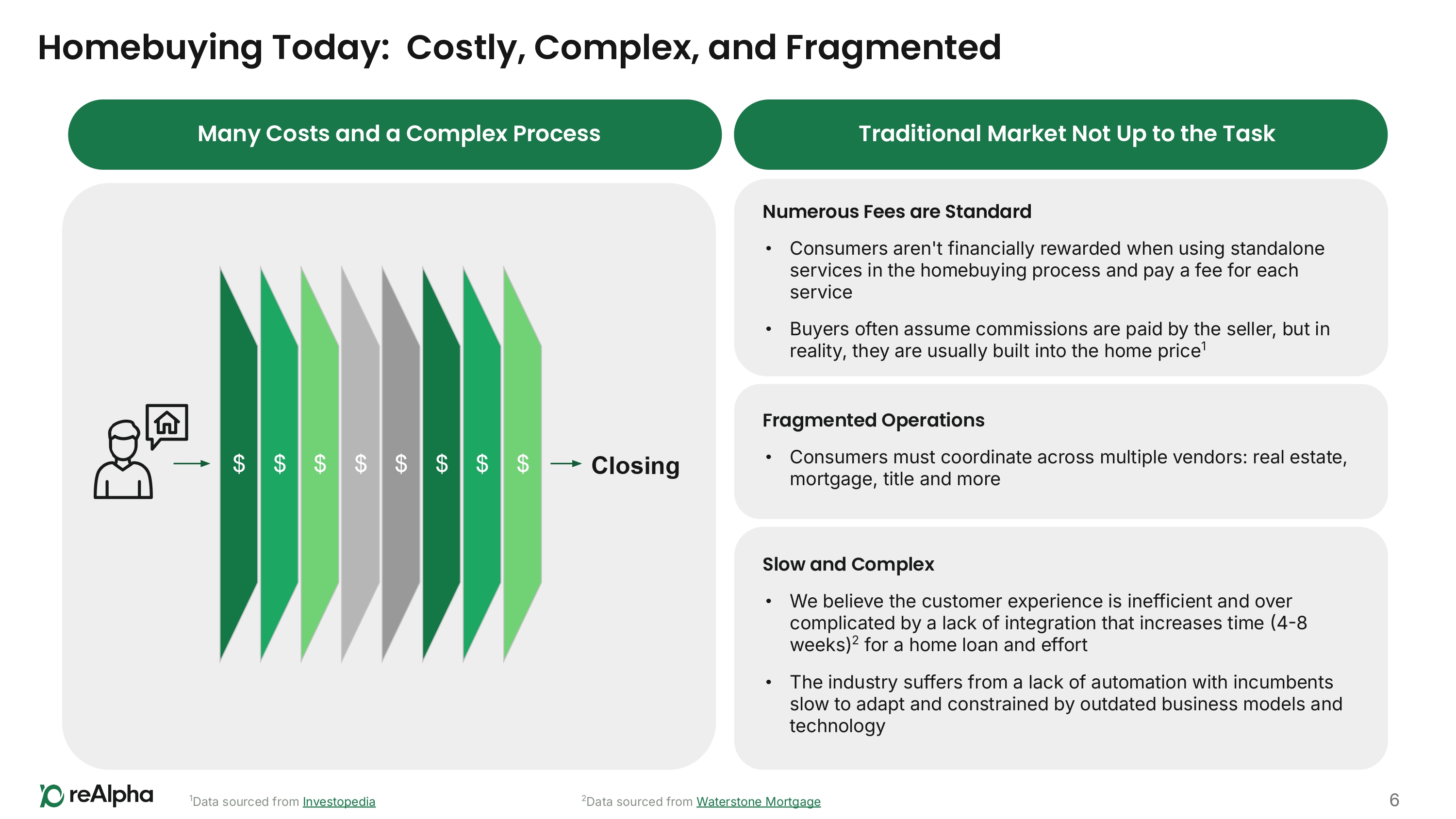

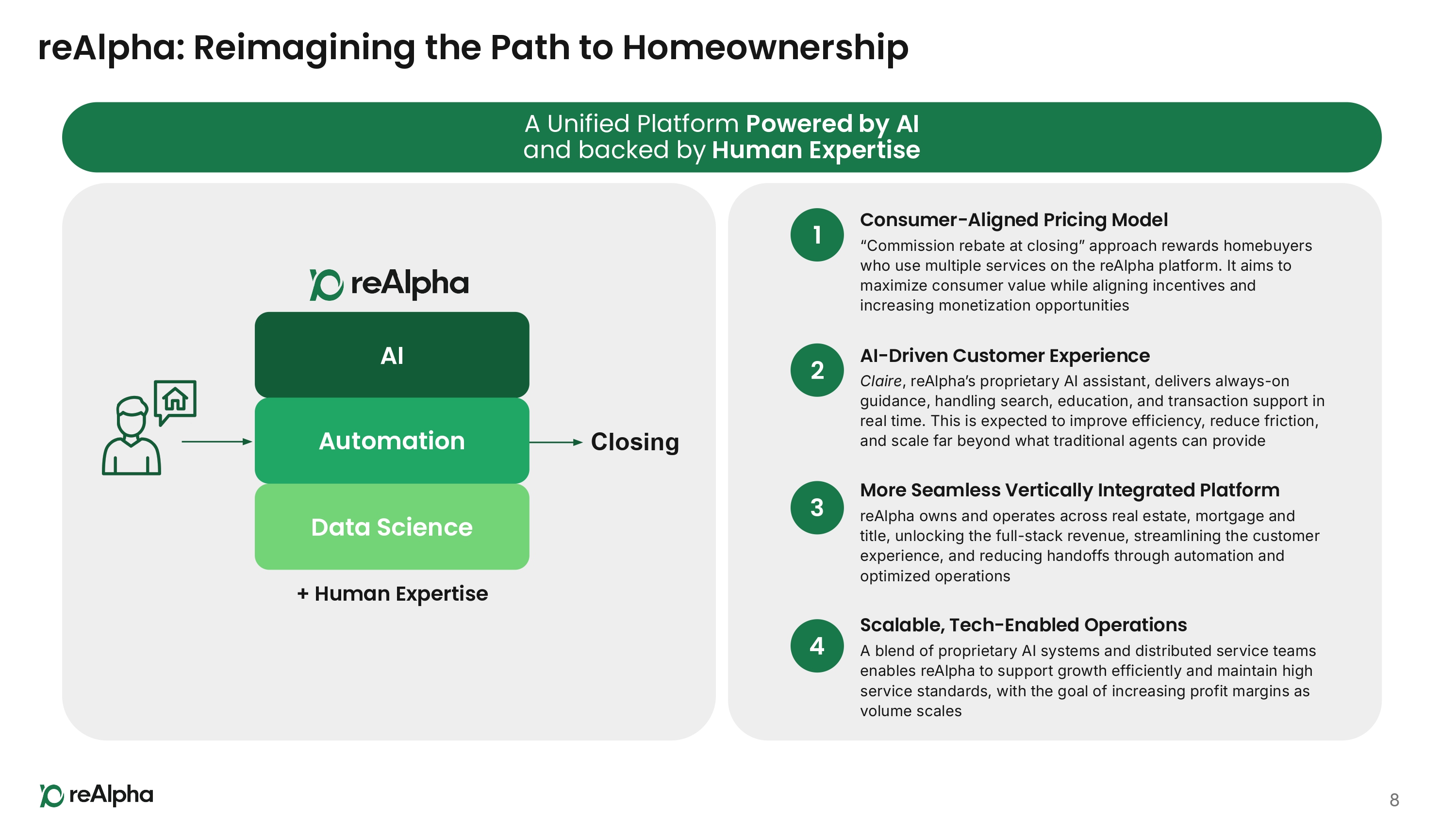

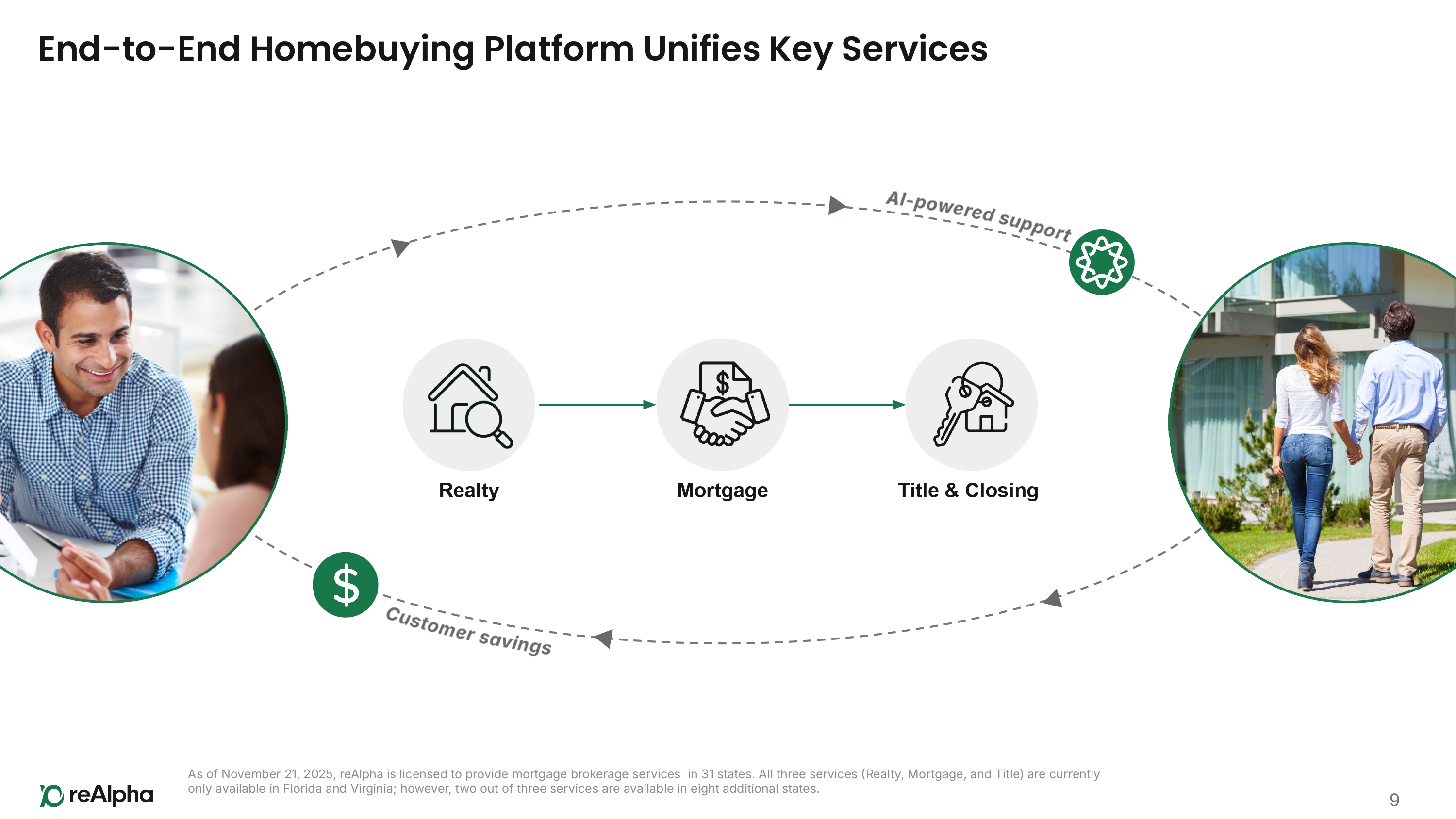

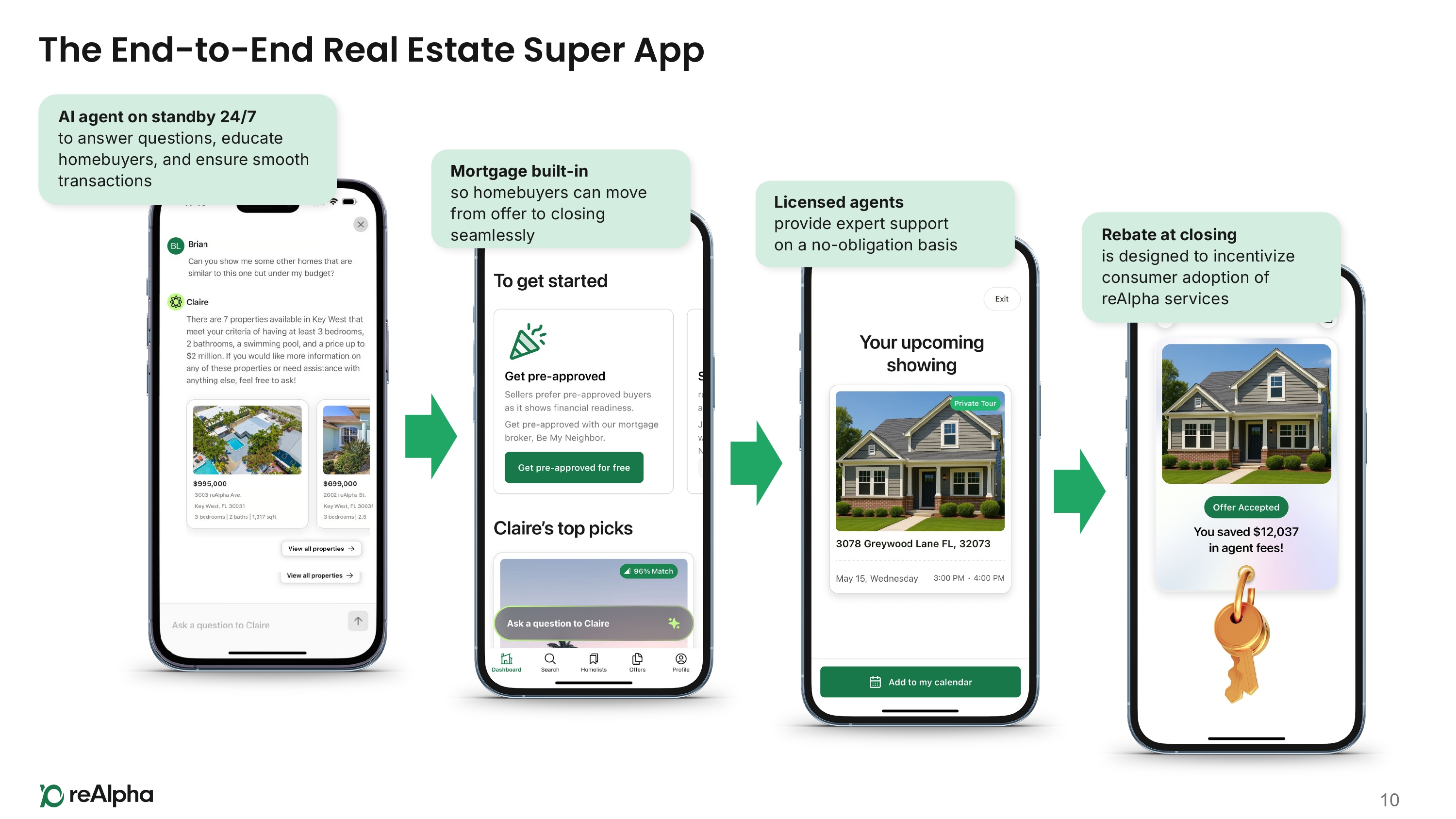

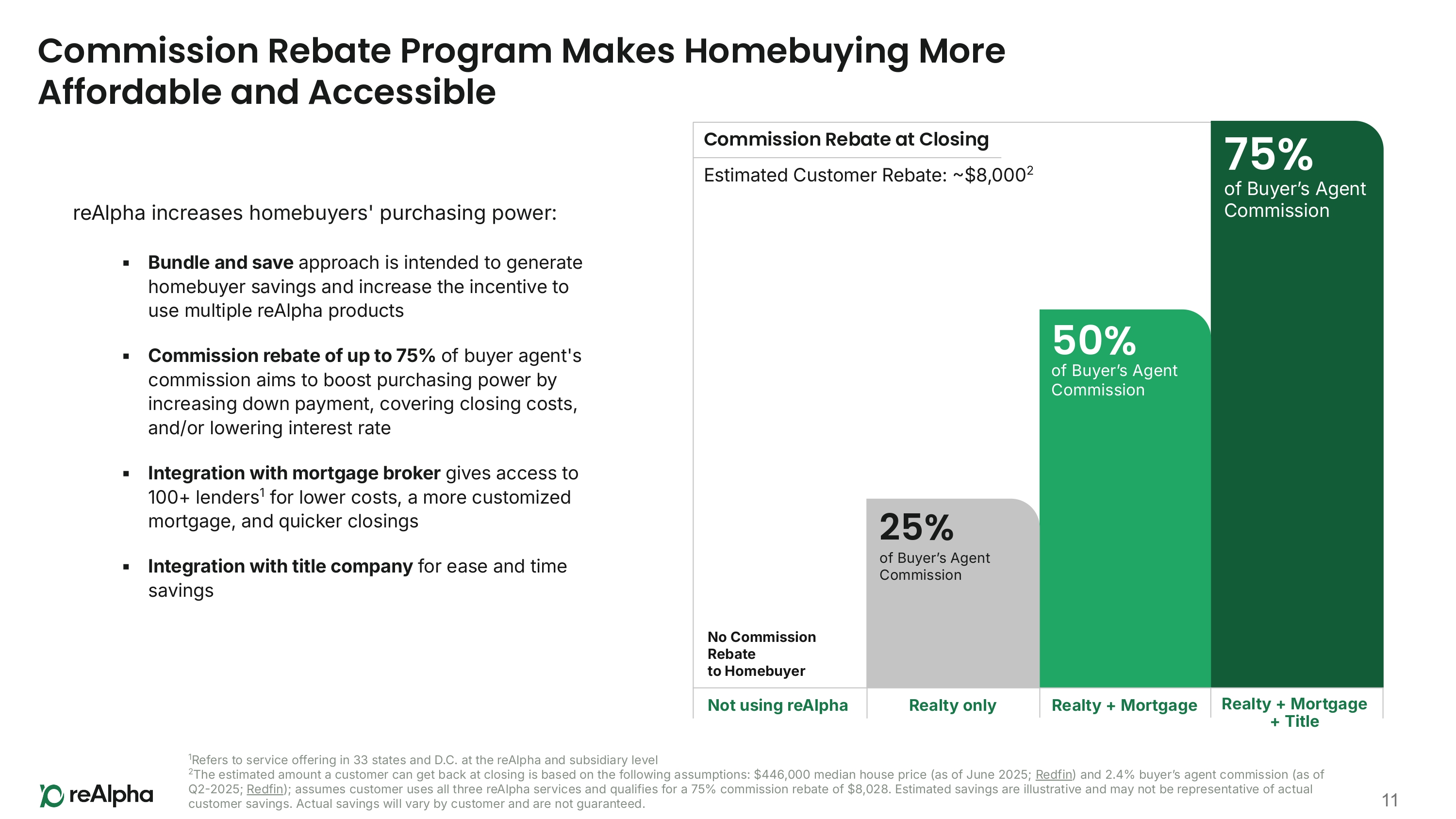

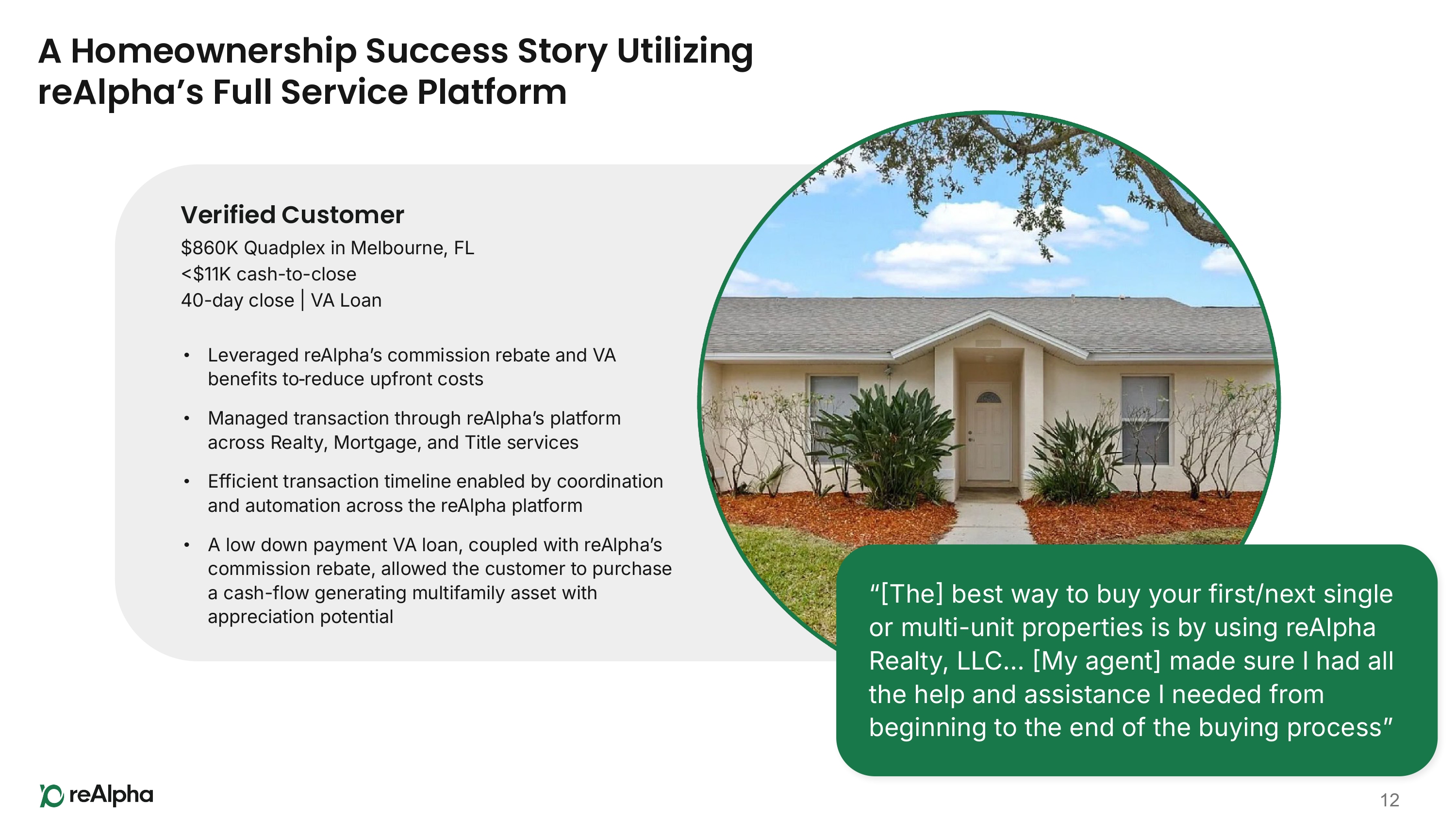

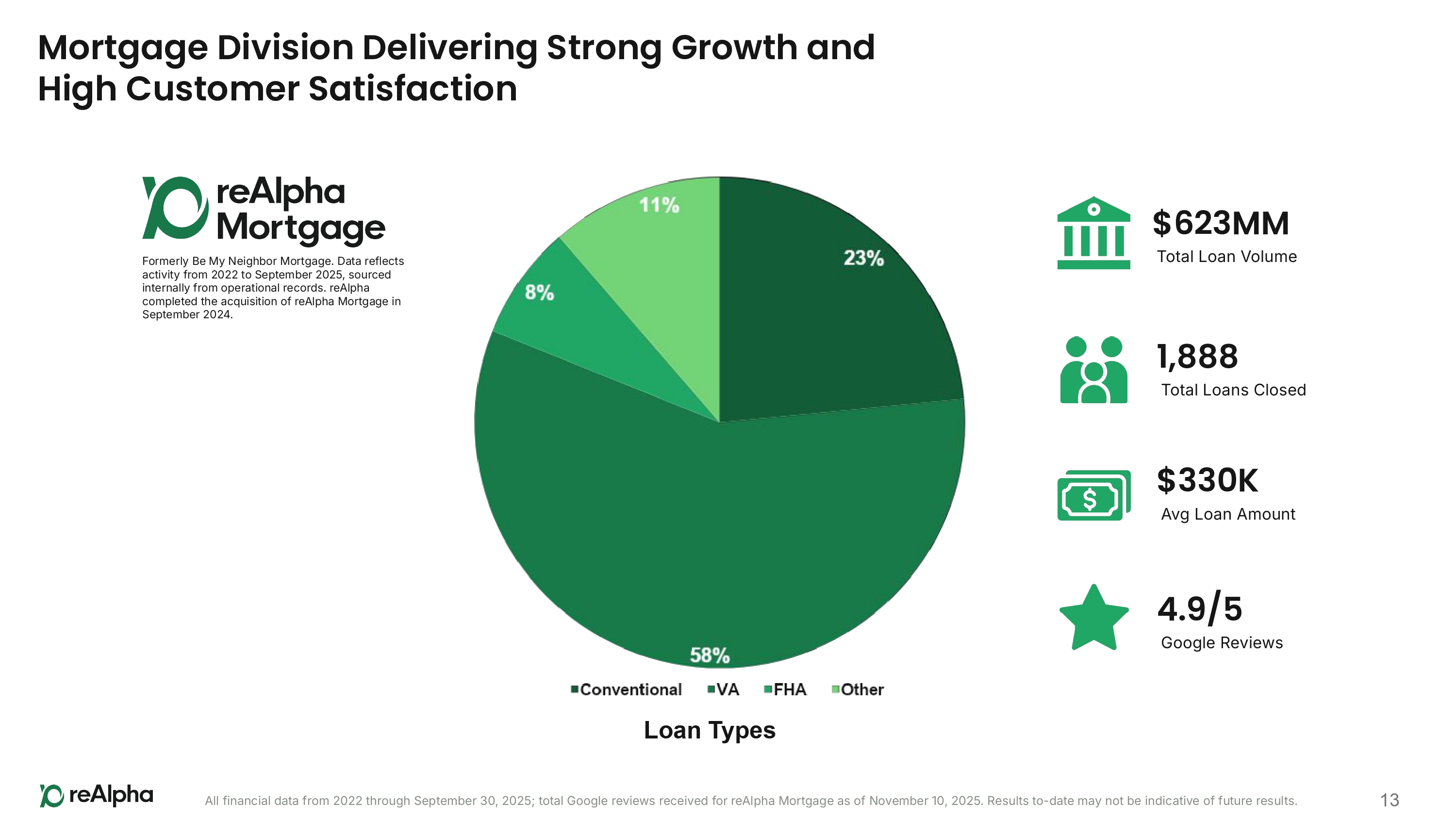

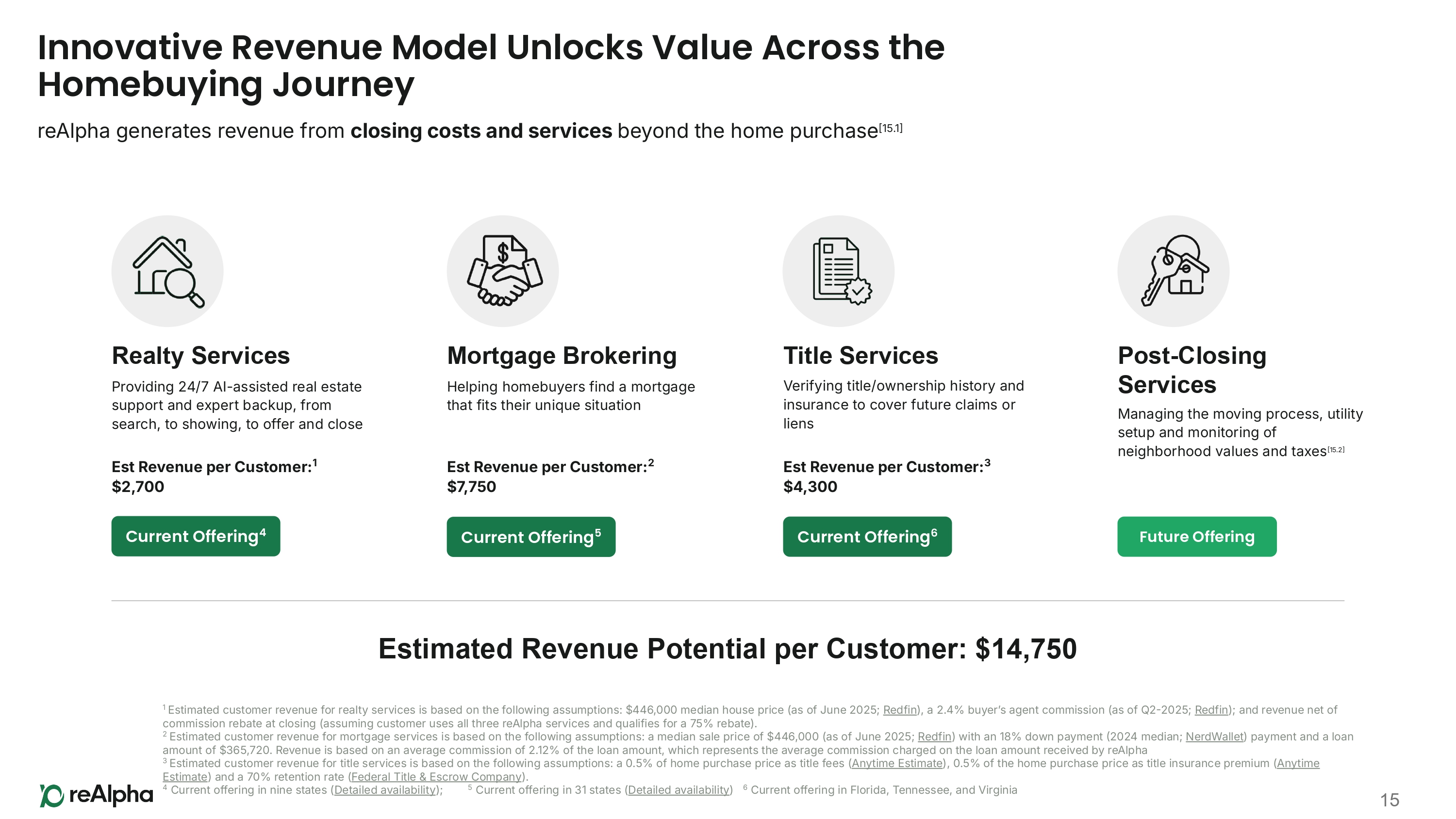

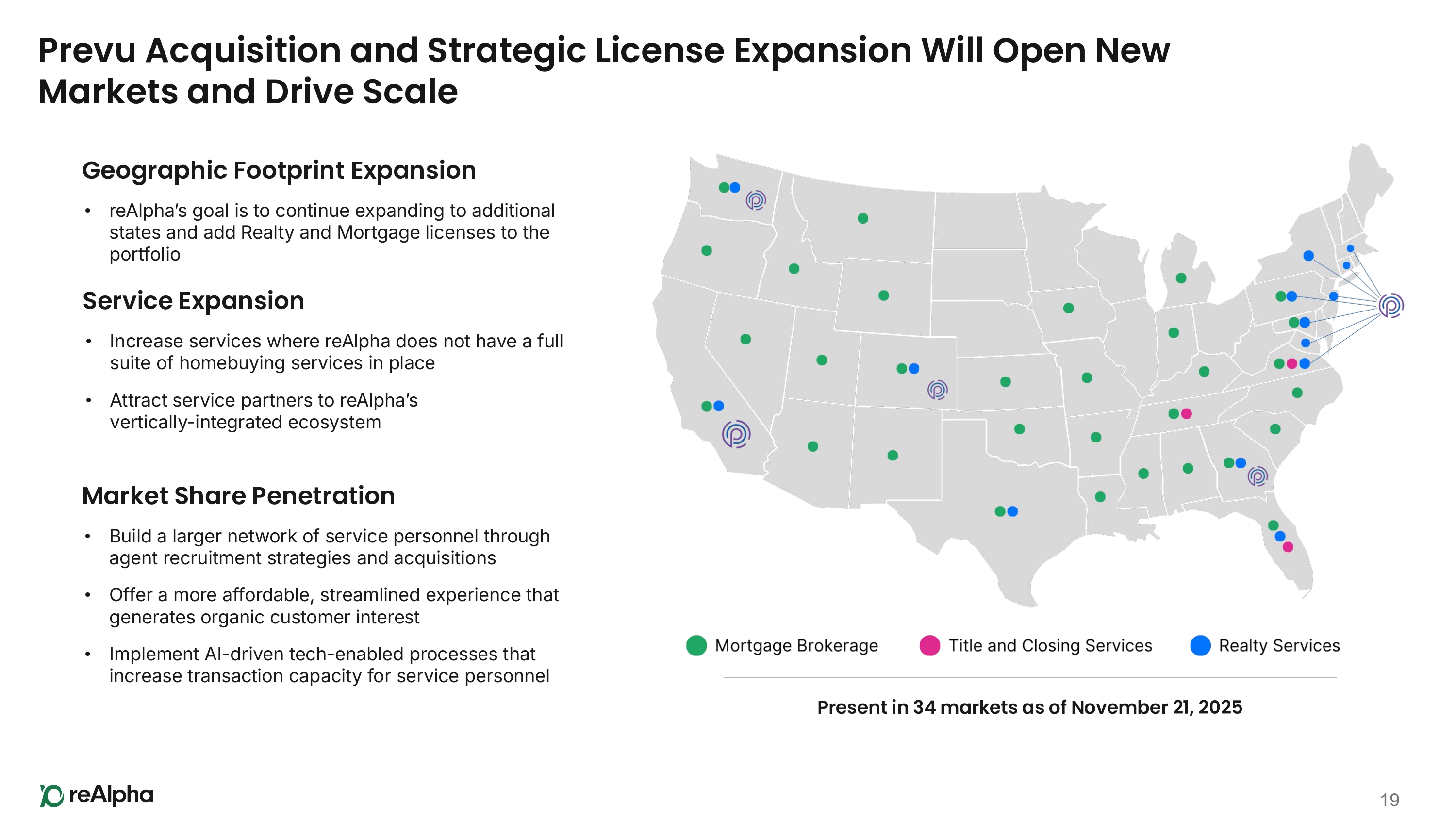

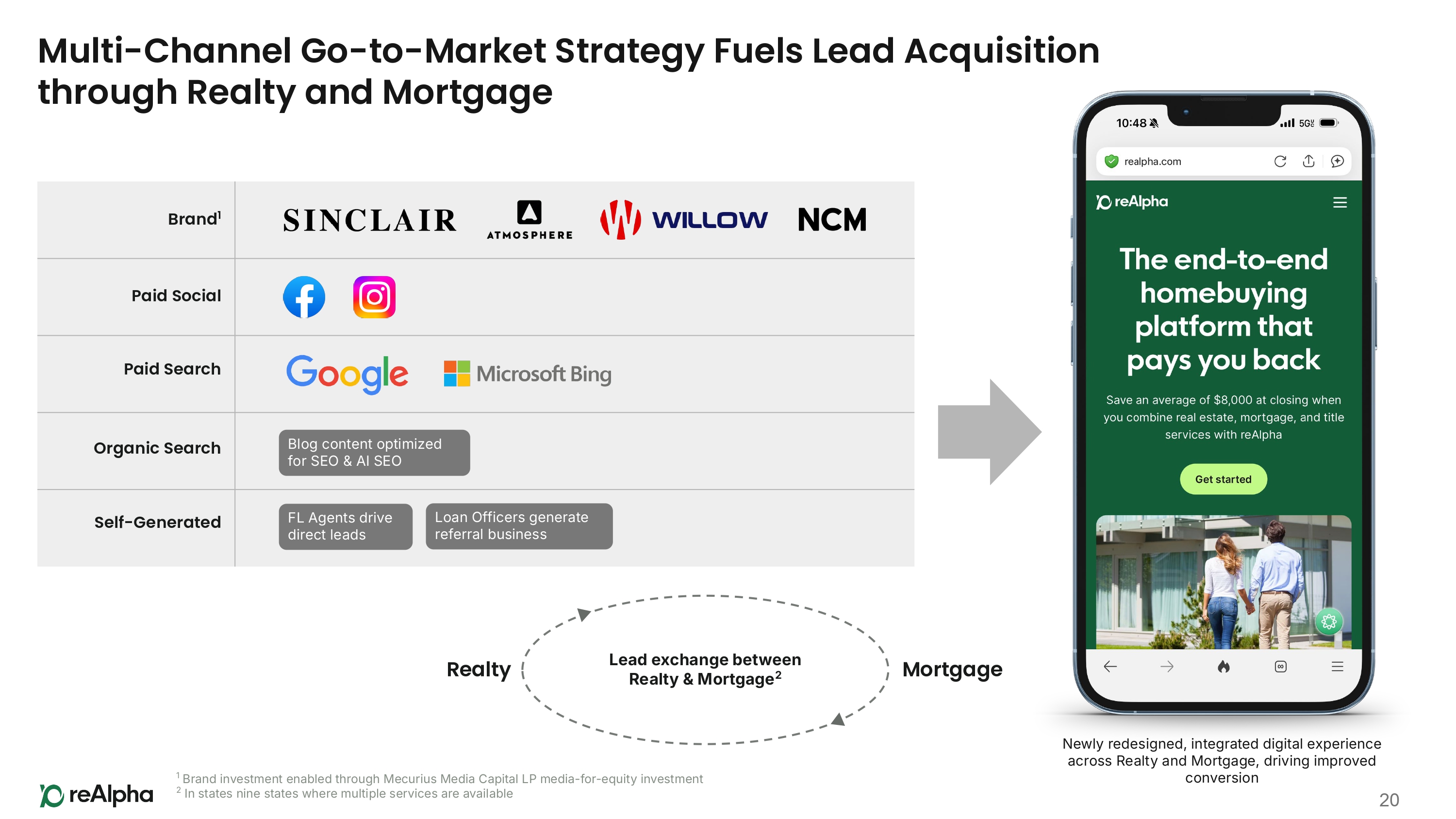

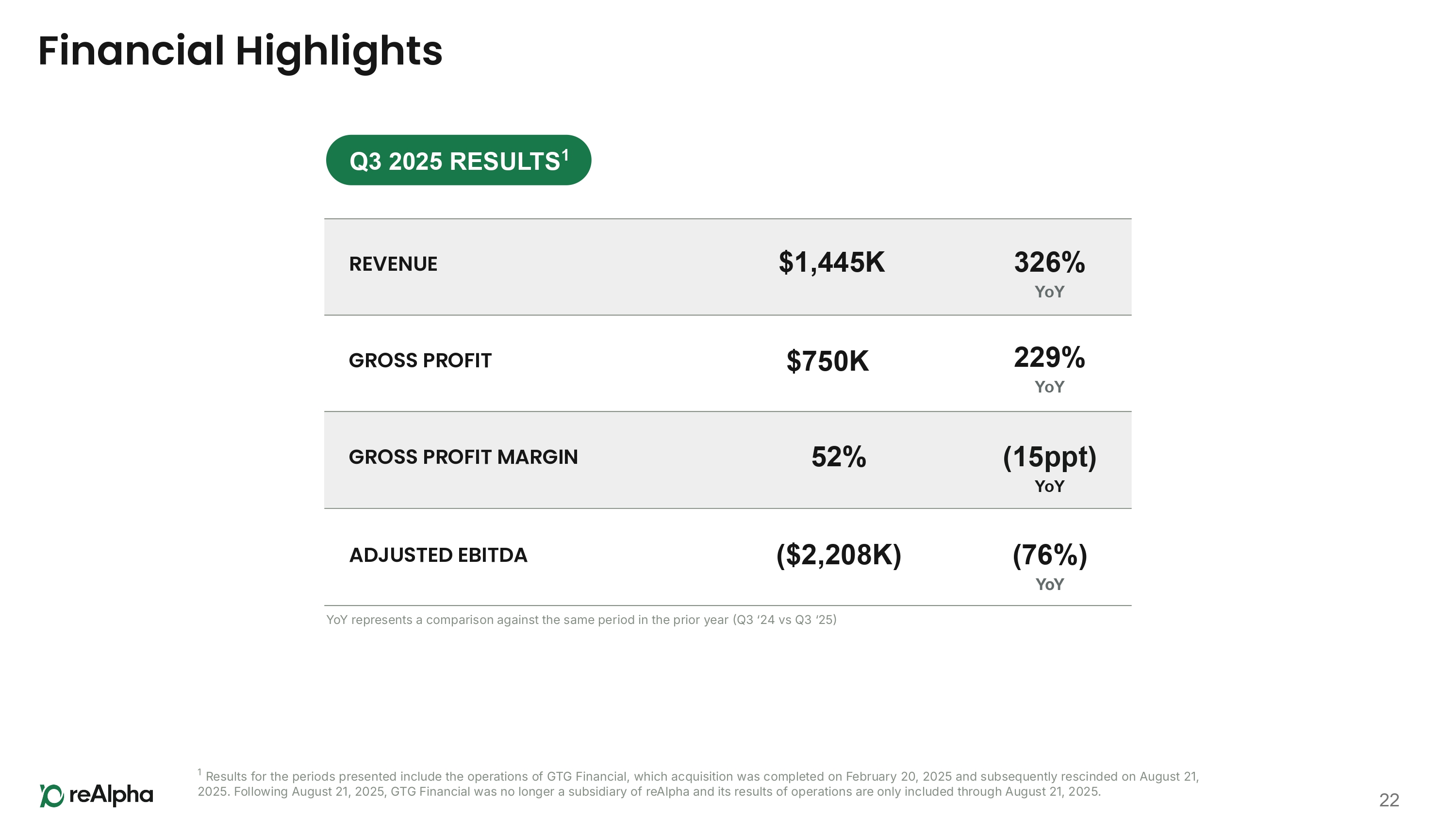

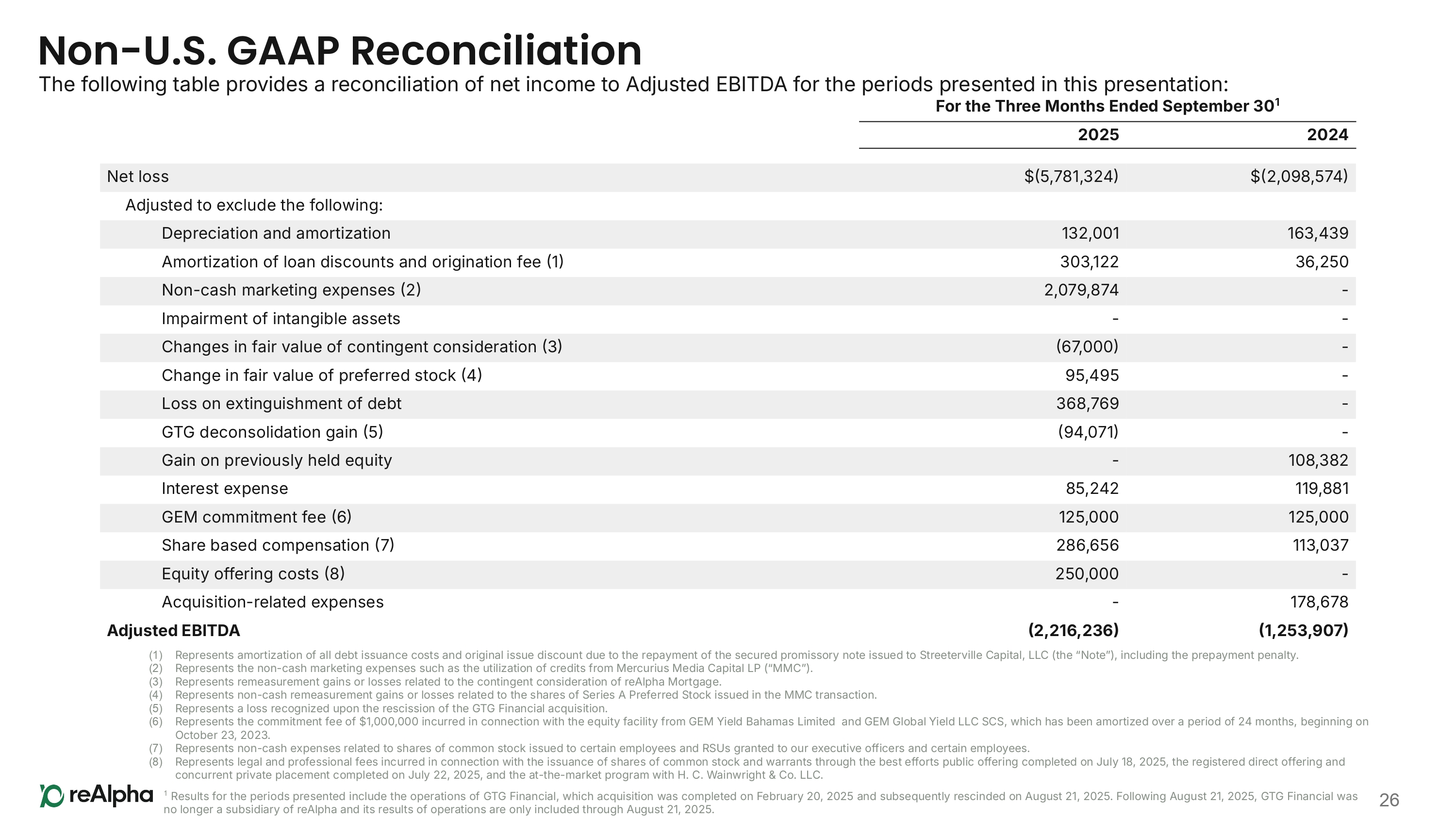

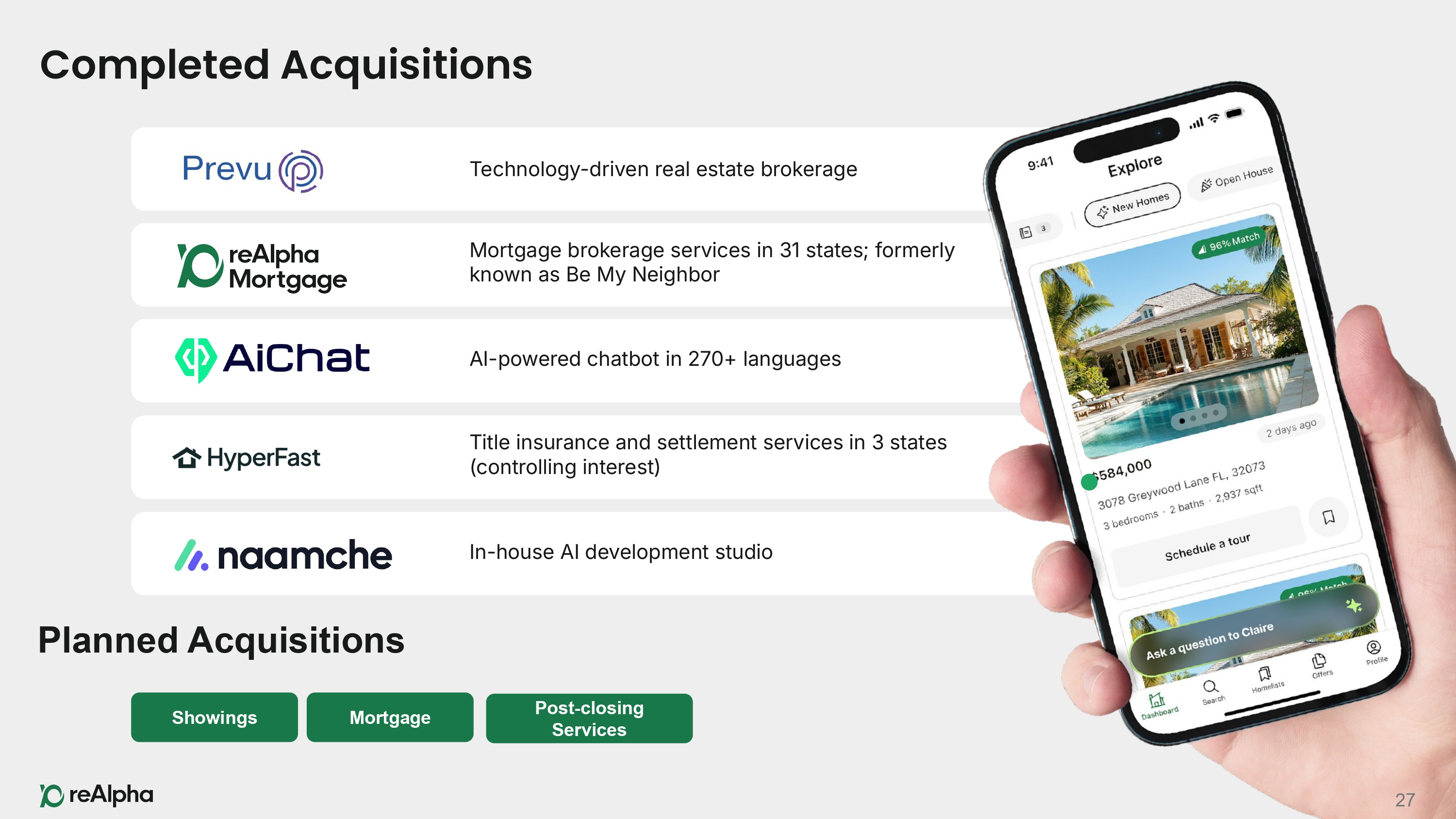

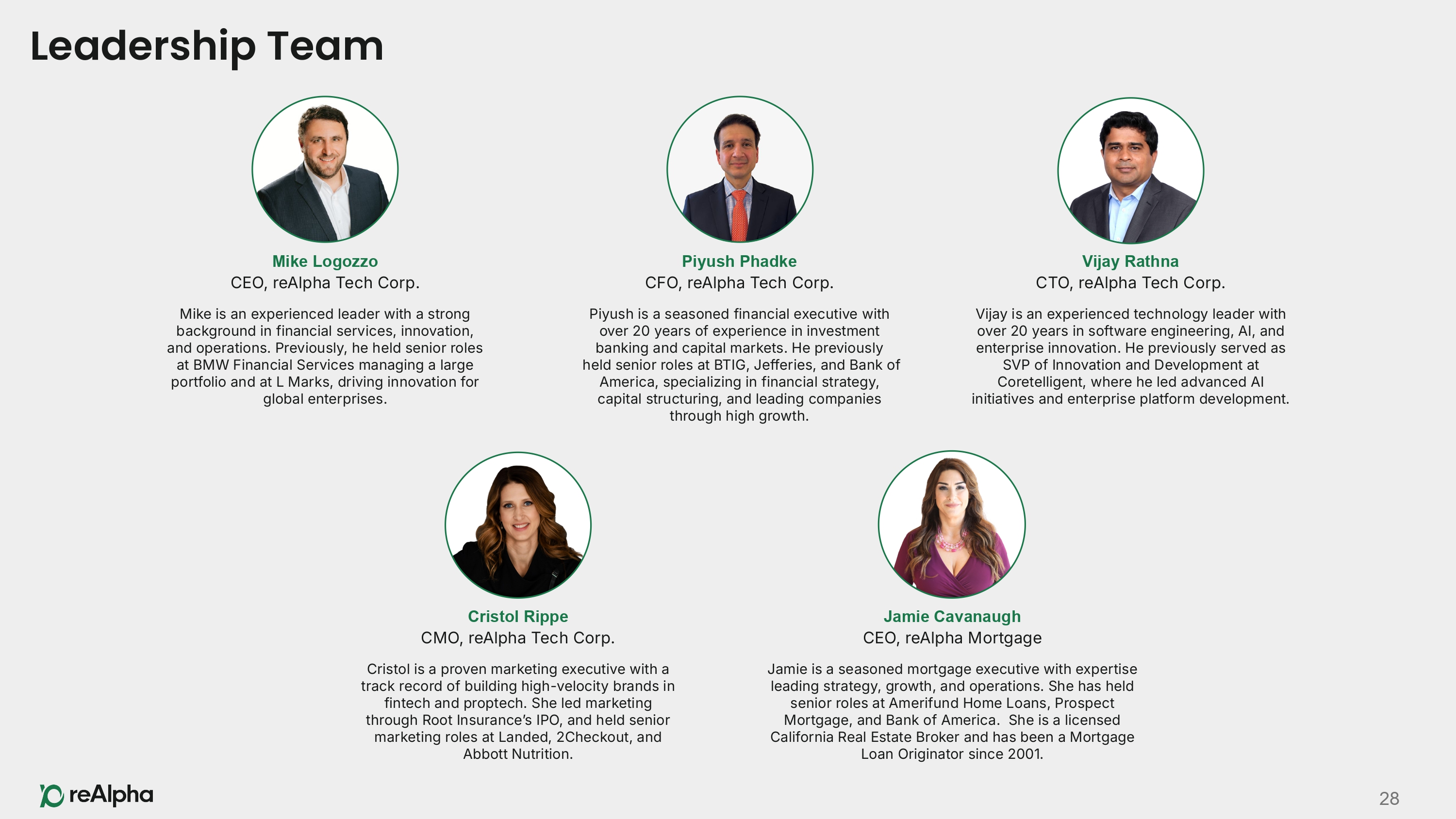

On the same date, the Company made available a corporate presentation on its website at ir.realpha.com containing information related to the Company’s strategic focus, business developments, including the consummation of the Merger, and recent trends. Representatives of the Company intend to present some of or all of this presentation to investors at various conferences and meetings beginning on the date hereof. A copy of the presentation is furnished as Exhibit 99.2 to this Form 8-K. These materials should be read together with the information included in the Company’s other filings with the SEC, including, but not limited to, the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, as amended on May 13, 2025, Quarterly Report on Form 10-Q for the quarter ended March 31, 2025, Quarterly Report on Form 10-Q for the quarter ended June 30, 2025, as amended on August 15, 2025, and Quarterly Report on Form 10-Q for the quarter ended September 30, 2025.

The information in this Item 7.01 of this Form 8-K, including Exhibits 99.1 and 99.2, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall they be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation language in such filings, except to the extent expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit Number |

Description | |

| 2.1*+ | Agreement and Plan of Merger, dated as of November 21, 2025, among reAlpha Tech Corp., Prevu, Inc., reAlpha Merger Sub, Inc. and Thomas Kutzman, as stockholder representative. | |

| 99.1** | Press Release, dated November 25, 2025. | |

| 99.2** | Investor Presentation, dated November 2025. | |

| 104* | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| * | Filed herewith. |

| ** | Furnished herewith. |

| + | Certain schedules and exhibits to this agreement have been omitted pursuant to Item 601(a)(5) of Regulation S-K. A copy of any omitted schedule and/or exhibit will be furnished to the Securities and Exchange Commission upon request. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: November 25, 2025 | reAlpha Tech Corp. | |

| By: | /s/ Michael J. Logozzo | |

| Michael J. Logozzo | ||

| Chief Executive Officer | ||

Exhibit 2.1

AGREEMENT AND PLAN OF MERGER

DATED AS OF NOVEMBER 21, 2025

BY AND AMONG

REALPHA TECH CORP.,

REALPHA MERGER SUB, INC.,

PREVU, INC.,

AND

THOMAS KUTZMAN, AS THE STOCKHOLDER REPRESENTATIVE

TABLE OF CONTENTS

| Page | |||

| ARTICLE I Merger | 2 | ||

| 1.1 | Merger | 2 | |

| 1.2 | Effective Time | 2 | |

| 1.3 | Effective Time | 2 | |

| ARTICLE II Treatment of Equity Interests | 3 | ||

| 2.1 | Treatment of Capital Stock and Other Securities in the Merger | 3 | |

| 2.2 | Payment for Securities | 4 | |

| 2.3 | Dissenting Shares | 4 | |

| 2.4 | Treatment of Equity Awards and Company Stock Plan | 5 | |

| 2.5 | Additional Payments | 5 | |

| 2.6 | Allocation Schedule | 5 | |

| 2.7 | Fractional Shares; Payments | 5 | |

| 2.8 | Nasdaq Cap Amount | 5 | |

| ARTICLE III Closing; Payments | 6 | ||

| 3.1 | The Closing | 6 | |

| 3.2 | Aggregate Merger Consideration; Closing Date Actions | 6 | |

| 3.3 | Withholding | 7 | |

| ARTICLE IV Representations and Warranties Regarding the Company and its Subsidiaries | 8 | ||

| 4.1 | Organization; Power; Authority; Good Standing | 8 | |

| 4.2 | Capitalization | 8 | |

| 4.3 | Authorization; Execution & Enforceability; No Breach | 9 | |

| 4.4 | Financial Statements; Absence of Undisclosed Liabilities | 10 | |

| 4.5 | Absence of Adverse Changes and Extraordinary Events | 11 | |

| 4.6 | Insurance | 11 | |

| 4.7 | Title to Assets | 11 | |

| 4.8 | Credit Lines, Loans, Guarantees, Banks | 12 | |

| 4.9 | Labor Matters | 12 | |

| 4.10 | Employees; Employee Benefit Arrangements | 12 | |

-

TABLE OF CONTENTS

| 4.11 | Contracts; Customers | 14 | |

| 4.12 | Data and Privacy Laws | 14 | |

| 4.13 | Legal Proceedings, Etc | 16 | |

| 4.14 | Taxes | 16 | |

| 4.15 | Compliance with law | 17 | |

| 4.16 | Broker’s or Finder’s Fees | 17 | |

| 4.17 | Related Party Transactions; Guarantees | 17 | |

| 4.18 | Intellectual Property | 18 | |

| 4.19 | No Conflict with OFAC Laws | 19 | |

| 4.20 | Anti-Corruption Laws | 19 | |

| ARTICLE V Representations and Warranties of Purchaser and Merger Sub | 20 | ||

| 5.1 | Organization; Authorization; Execution & Enforceability; No Breach | 20 | |

| 5.2 | Valid Issuance of Purchaser Common Stock; Cash Resources. | 21 | |

| 5.3 | Purchaser SEC Reports. | 21 | |

| 5.4 | Litigation. | 21 | |

| 5.5 | Brokerage. | 22 | |

| 5.6 | No Other Representations | 22 | |

| AGREEMENTS RELATING TO PURCHASER COMMON STOCK | 22 | ||

| 6.1 | Private Placement. | 22 | |

| 6.2 | Restrictions on Transfer. | 22 | |

| 6.3 | Legends. | 23 | |

| 6.4 | Rule 144 Reporting; Legend Removal | 23 | |

| ARTICLE VII Survival; Indemnification | 24 | ||

| 7.1 | Survival | 24 | |

| 7.2 | General Indemnification | 24 | |

| 7.3 | Limitations on Indemnification | 25 | |

| 7.4 | Manner of Calculation | 26 | |

| 7.5 | Exclusive Remedy | 27 | |

| 7.6 | Third Party Claims | 27 | |

| 7.7 | Claims Resolution Process. | 28 | |

| 7.8 | Satisfaction of Authorized Loss | 29 | |

| 7.9 | Adjustment Treatment | 29 | |

-

TABLE OF CONTENTS

| ARTICLE VIII Covenants | 29 | ||

| 8.1 | Tail Policy; D&O Indemnification | 29 | |

| 8.2 | Public Announcements | 30 | |

| 8.3 | Certain Tax Matters | 30 | |

| 8.4 | Appointment of Stockholder Representative | 34 | |

| 8.5 | Employee Benefit Arrangements | 36 | |

| 8.6 | Assistance with Purchaser SEC Filings | 37 | |

| ARTICLE IX Definitions | 37 | ||

| ARTICLE X Miscellaneous | 49 | ||

| 10.1 | Fees and Expenses | 49 | |

| 10.2 | Remedies | 50 | |

| 10.3 | Consent to Amendments; Waivers | 50 | |

| 10.4 | Successors and Assigns | 50 | |

| 10.5 | Severability | 50 | |

| 10.6 | Counterparts; Facsimile Signatures | 50 | |

| 10.7 | Descriptive Headings; Interpretation | 51 | |

| 10.8 | Entire Agreement | 51 | |

| 10.9 | No Third Party Beneficiaries | 51 | |

| 10.10 | Schedules and Exhibits | 51 | |

| 10.11 | Governing Law | 51 | |

| 10.12 | Notices | 52 | |

| 10.13 | Waiver of Jury Trial | 52 | |

| 10.14 | No Strict Construction | 53 | |

| 10.15 | Jurisdiction | 53 | |

| 10.16 | No Additional Representations. | 53 | |

| 10.17 | Privileged Communications | 54 | |

| 10.18 | Specific Performance | 54 | |

| 10.19 | Further Assurances | 54 | |

| 10.20 | Independence of Agreements, Covenants, Representations and Warranties | 54 | |

-

TABLE OF CONTENTS

EXHIBITS

| Exhibit A | Continuing Employees |

| Exhibit B | Form of Consent Agreement |

| Exhibit C | Form of Stockholder Consent |

| Exhibit D | Form of Certificate of Merger |

| Exhibit E-1 | Allocation Schedule |

| Exhibit E-2 | Closing Statement |

| Exhibit F-1 | Additional Deliveries by the Company and the Equityholders |

| Exhibit F-2 | Additional Deliveries by Purchaser |

| Exhibit G | Form of Letter of Transmittal |

| Exhibit H | Form of Paying Agent Agreement |

-

AGREEMENT AND PLAN OF MERGER

THIS AGREEMENT AND PLAN OF MERGER (this “Agreement”), dated as of November 21, 2025, is made by and among (a) Prevu, Inc., a Delaware corporation (the “Company”), (b) Thomas Kutzman, as the representative of the Indemnifying Securityholders (in such capacity, the “Stockholder Representative”), (c) reAlpha Merger Sub, Inc., a Delaware corporation (“Merger Sub”), and (d) reAlpha Tech Corp., a Delaware corporation and the parent of Merger Sub (“Purchaser”). The Company, the Stockholder Representative, Merger Sub and Purchaser are collectively referred to herein as the “Parties” and each individually as a “Party.” Certain capitalized terms used herein have the meanings ascribed to such terms in ARTICLE IX.

WHEREAS, the parties hereto desire to effect the acquisition of the Company by Purchaser through the merger of Merger Sub with and into the Company, with the Company continuing as the surviving corporation in the merger (the “Merger”), upon the terms and subject to the conditions set forth in this Agreement and in accordance with the General Corporation Law of the State of Delaware (the “DGCL”);

WHEREAS, the respective Boards of Directors of Merger Sub and Purchaser, the sole stockholder of Merger Sub, have (i) determined that it is in the best interests of Merger Sub and Purchaser, and declared it advisable, to enter into this Agreement, and (ii) approved the execution, delivery and performance of this Agreement and the consummation of the transactions contemplated hereby;

WHEREAS, the Board of Directors of the Company has (i) determined that it is in the best interests of the Company and the Stockholders, and declared it advisable, to enter into this Agreement, (ii) approved the execution, delivery and performance of this Agreement and the consummation of the transactions contemplated hereby, and (iii) resolved to recommend that the Stockholders adopt this Agreement and approve the Merger;

WHEREAS, each holder of a Simple Agreement for Future Equity (each, a “SAFE”, and each holder of such SAFE, a “SAFE Holder”) to which the Company was a party as of such time simultaneously with entering into this Agreement is agreeing to cancel of all such SAFEs held by such SAFE Holder in exchange for a right to such SAFE Holder’s portion of the Aggregate Merger Consideration (as hereafter defined);

WHEREAS, contemporaneously with the execution and delivery of this Agreement, certain Preferred Stockholders, SAFE Holders and Noteholders (i) are executing and delivering to the Company and Purchaser, and the Company and Purchaser are executing and delivering to such Preferred Stockholders, SAFE Holders and Noteholders, a Consent Agreement substantially in the form attached hereto as Exhibit B (each, a “Consent Agreement”), and (ii) effective immediately after the execution and delivery of this Agreement and immediately prior to the Effective Time, certain Stockholders constituting the Requisite Stockholders are executing and delivering to the Company the Action by Written Consent of the Stockholders in the form attached hereto as Exhibit C (the “Stockholder Consent”); and

WHEREAS, contemporaneously with the execution and delivery of this Agreement, and as a condition and inducement to Purchaser’s willingness to enter into this Agreement, each of the Continuing Employees identified on Exhibit A is executing and delivering to Purchaser (a) an employment offer letter that describes, among other matters, the terms of such Continuing Employee’s employment with Purchaser following Closing (each, an “Offer Letter”), and (b) a proprietary information and invention assignment agreement (a “PIIA”, collectively and together with the Offer Letters, the “Employment Agreements”).

-

NOW, THEREFORE, in consideration of the mutual covenants, agreements and understandings herein contained, the receipt and sufficiency of which is hereby acknowledged, the parties hereto hereby agree as follows:

ARTICLE I

Merger

1.1 Merger. Pursuant to the terms and subject to the conditions set forth in this Agreement and in accordance with the DGCL, at the Effective Time, Merger Sub shall be merged with and into the Company, the separate corporate existence of Merger Sub shall thereupon cease and the Company will continue as the surviving corporation in the Merger. The corporation surviving the Merger is sometimes hereinafter referred to as the “Surviving Corporation”.

1.2 Effective Time. Contemporaneously with, or as promptly as practicable after the Closing on the Closing Date, Purchaser, Merger Sub and the Company shall cause a certificate of merger in the form attached hereto as Exhibit D (the “Certificate of Merger”) to be filed with the Secretary of State of the State of Delaware in accordance with the relevant provisions of the DGCL and shall make all other filings required under the DGCL. The Merger shall become effective upon the filing and acceptance by the Secretary of State of the State of Delaware of the Certificate of Merger or at such later time as is agreed to by the parties hereto and specified in the Certificate of Merger (the time at which the Merger becomes effective is herein referred to as the “Effective Time”).

1.3 Effective Time. At the Effective Time, and without any further action on the part of the Company or Merger Sub:

(a) the certificate of incorporation of the Company, as in effect immediately prior to the Effective Time, shall be amended and restated in its entirety in the form of the certificate of incorporation of Merger Sub, as in effect immediately prior to the Effective Time, as set forth in the Certificate of Merger, and as so amended shall be the certificate of incorporation of the Surviving Corporation, except that the name of the Surviving Corporation shall be the name of the Company as of immediately prior to the Effective Time;

(b) the bylaws of the Company, as in effect immediately prior to the Effective Time, shall be amended and restated in their entirety in the form of the bylaws of Merger Sub, as in effect immediately prior to the Effective Time, and as so amended shall be the bylaws of the Surviving Corporation, except that the name of the Surviving Corporation shall be the name of the Company as of immediately prior to the Effective Time; (c) the directors and officers of Merger Sub immediately prior to the Effective Time shall, from and after the Effective Time, be the directors and officers of the Surviving Corporation; and

-

(d) the Merger shall, from and after the Effective Time, have the effects set forth in this Agreement and the applicable provisions of the DGCL. Without limiting the generality of the foregoing, and subject thereto, at the Effective Time, all the properties, rights, privileges and powers of the Company and Merger Sub shall vest in the Surviving Corporation, and all debts, liabilities and duties of the Company and Merger Sub shall become the debts, liabilities and duties of the Surviving Corporation.

ARTICLE II

Treatment of Equity Interests

2.1 Treatment of Capital Stock and Other Securities in the Merger. At the Effective Time, by virtue of the Merger and without any action on the part of Purchaser, Merger Sub, the Company or any Equityholder:

(a) Effect on Company Common Stock. All shares of Company Common Stock issued and outstanding immediately prior to the Effective Time, other than shares of Company Common Stock to be cancelled pursuant to the last sentence of this Section 2.1(a) and any Dissenting Shares, shall be cancelled and extinguished for no consideration. As of the Effective Time, all shares of Company Common Stock shall no longer be outstanding and shall automatically be cancelled and shall cease to exist. Each issued and outstanding share of Company Common Stock held by the Company as treasury stock immediately prior to the Effective Time shall automatically be cancelled and shall cease to exist, and no consideration or payment shall be delivered in exchange therefor or in respect thereof.

(b) Effect on Company Preferred Stock. All shares of Company Preferred Stock issued and outstanding immediately prior to the Effective Time, other than any Dissenting Shares, shall be cancelled and extinguished and converted automatically into the right to receive at the Effective Time the portion of the Aggregate Merger Consideration issuable to such Stockholder in respect of such shares of Company Preferred Stock as set forth opposite such Stockholder’s name on the Allocation Schedule. As of the Effective Time, all shares of Company Preferred Stock shall no longer be outstanding and shall automatically be cancelled and shall cease to exist and shall thereafter represent only the right to receive the consideration issuable in accordance with Section 2.1.

(c) Effect on Outstanding SAFEs. All SAFEs outstanding immediately prior to the Effective Time shall be cancelled and exchanged for the right to receive at the Effective Time the portion of the Aggregate Merger Consideration issuable to such SAFE Holder in respect of such SAFE as set forth opposite such SAFE Holder’s name on the Allocation Schedule at the Effective Time. As of the Effective Time, all SAFEs outstanding shall be cancelled and shall cease to exist and shall thereafter represent only the right to receive the consideration issuable in accordance with Section 2.1.

-

(d) Effect on Promissory Notes. Each Promissory Note outstanding immediately prior to the Effective Time shall be cancelled and extinguished, and each holder thereof shall cease to have any rights with respect thereto, other than the right to receive a portion of the Aggregate Merger Consideration equal to the Promissory Note Payment Amount, as set forth opposite such Noteholder’s name on the Allocation Schedule.

(e) Effect on Management Incentive Plan. At the Closing, each Covered Participant shall have the right to receive a portion of the Aggregate Merger Consideration pursuant to the terms of the Management Incentive Plan, as set forth opposite such Covered Participant’s name on the Allocation Schedule.

(f) Effect on Merger Sub Common Stock. At the Effective Time, each share of the common stock, par value $0.01 per share, of Merger Sub issued and outstanding immediately prior to the Effective Time shall automatically be converted into and become one (1) fully paid and nonassessable share of common stock of the Surviving Corporation and shall constitute the only outstanding share of capital stock of the Surviving Corporation.

(g) No Interest. No interest will be paid or accrued, and no Equityholder shall be entitled to receive, any interest upon surrender of any Company Equity.

2.2 Payment for Securities. As soon as reasonably practicable after the delivery of (to the extent not previously delivered to Purchaser) duly executed copies of the (i) Consent Agreement, (ii) Stockholder Consent, if applicable, and (iii) a Letter of Transmittal in substantially the form attached hereto as Exhibit G (such the deliveries contemplated in (i)-(iii) of this Section 2.2, the “Payment Condition”), each Participating Securityholder shall be entitled to receive in exchange therefor the applicable consideration set forth in Section 2.1. Issuance of the applicable consideration shall only be made to the Person in whose name the applicable shares of Company Preferred Stock, SAFEs or Promissory Notes are registered. No shares of Purchaser Common Stock shall be issued to any Participating Securityholder pursuant to Section 2.1 unless and until such Participating Securityholder has satisfied the Payment Condition.

2.3 Dissenting Shares. Notwithstanding anything in this Agreement to the contrary (but subject to the provisions of this Section 2.3), shares of Company Capital Stock issued and outstanding immediately prior to the Effective Time and held by a Stockholder who is entitled to demand and has properly demanded appraisal for such shares of Company Capital Stock in accordance with, and who complies in all respects with, Section 262 of the DGCL or other similar rights (if any) under applicable Law (such shares of Company Capital Stock, the “Dissenting Shares”) shall not be converted into or represent a right to receive a portion of the applicable consideration set forth in Section 2.1. Effective as of the Effective Time, all Dissenting Shares shall be cancelled and cease to exist, and the holders of Dissenting Shares shall only be entitled to the rights granted to them under Section 262 of the DGCL or other applicable Law (if any). If any such holder fails to perfect or otherwise waives, withdraws or loses such holder’s right to appraisal under Section 262 of the DGCL or such other applicable Law, then such Dissenting Shares shall be deemed to have been converted, effective as of the Effective Time, into, and shall represent only, the right to receive (upon surrender in accordance with Section 2.2) the applicable consideration, if any, set forth in Section 2.1, without interest. To the extent that Purchaser, the Surviving Corporation or the Company makes any payment or payments in respect of any Dissenting Shares in excess of the consideration that otherwise would have been payable or issuable in respect of such shares in accordance with Section 2.1 (“Excess Dissenting Share Payments”), Purchaser shall be entitled to recover the amount of such Excess Dissenting Share Payments in accordance with the terms of ARTICLE VII.

-

2.4 Treatment of Equity Awards and Company Stock Plan. At the Effective Time, each award granted under the Company Stock Plan and outstanding immediately prior to the Effective Time shall be surrendered, cancelled and terminated for no consideration. The Company shall, prior to the Effective Time, take or cause to be taken such actions, and shall obtain all such consents, as may be required to effect the foregoing provisions of this Section 2.4 and terminate the Company Stock Plan as of immediately prior to the Effective Time.

2.5 Additional Payments. As additional consideration for the Merger, Purchaser shall pay to the Preferred Stockholders, the SAFE Holders and the Covered Participants the Aggregate Additional Payments on the terms set forth in this Section 2.5 (each such payment is referred to herein as an “Additional Payment”), in each case in an amount set forth opposite the name of each such Preferred Stockholder, SAFE Holder and Covered Participant on the Allocation Schedule. Each Additional Payment shall be in the form of cash or shares of Purchaser Common Stock (valued at the Additional Payment Reference Price), at the discretion of Purchaser. Purchaser shall make four (4) equal Additional Payments of $625,000, with the first such payment due on March 16, 2026 and the other Additional Payments due on August 1, 2026, December 16, 2026 and the date that is eighteen (18) months following the Closing Date.

2.6 Allocation Schedule. Exhibit E-1 sets forth the following, in each case, calculated in accordance with this Agreement (the “Allocation Schedule”), with respect to each Participating Securityholder: (A) the name and email address of such Person; (B) in the case of a Preferred Stockholder, the number of shares of Company Preferred Stock held by such Preferred Stockholder; (C) in the case of a SAFE Holder, the Purchase Amount of each SAFE (as defined therein) held by such SAFE Holder, (D), in the case of a Noteholder, the principal amount of each Promissory Note held by such Noteholder and the amount of accrued interest thereunder through the Closing, (E) the amount of cash payable and the number of shares of Purchaser Common Stock issuable to such Person pursuant to Sections 2.1 and 2.5; (F) the Pro Rata Percentage of each such Person; and (G) such Person’s Pro Rata Percentage of the Maximum Liability Cap.

2.7 Fractional Shares; Payments. No fraction of a share of Purchaser Common Stock will be issued by virtue of the Merger. Any Participating Securityholder who would otherwise be entitled to receive a fraction of a share of Purchaser Common Stock shall instead be entitled to receive an amount of cash equal to the product obtained by multiplying (i) such fraction by (ii) the Closing Reference Price (as relating to shares of Purchaser Common Stock issued in respect of the Closing Payment Purchaser Stock) or the Additional Payment Reference Price (as relating to shares of Purchaser Common Stock issued in respect of any Additional Payment), as applicable, rounded to the nearest whole cent.

2.8 Nasdaq Cap Amount. Notwithstanding anything to the contrary contained in this Agreement, under no circumstances shall the aggregate number of shares of Purchaser Common Stock issuable under this Agreement in connection with the Merger and the transactions contemplated herein, and any other shares of Purchaser Common Stock to be issued by Purchaser, if any, which could be aggregated with the shares of Purchaser Common Stock in connection with the Merger and the transactions contemplated herein under Nasdaq Listing Rule 5635, exceed 19.99% of Purchaser’s issued and outstanding shares of common stock immediately before consummation of this Agreement and any other transactions being consummated by Purchaser in connection with the Merger and the transactions contemplated herein (the “Cap Amount”), unless Purchaser has obtained either (i) its stockholders’ approval of the issuance of more shares of Purchaser Common Stock than the Cap Amount as required by the applicable Nasdaq rules, including Nasdaq Listing Rule 5635; or (ii) a waiver from Nasdaq of Purchaser’s compliance with the applicable Nasdaq rules, including Nasdaq Listing Rule 5635. To the extent that the issuance of shares of Purchaser Common Stock under this Agreement would cause the shares of Purchaser Common Stock issuable herein to exceed the Cap Amount, Purchaser, in lieu of issuing such shares of Purchaser Common Stock, shall pay each Participating Securityholder an amount in cash equal to (x) the aggregate number of shares of Purchaser Common Stock that exceed the Cap Amount times (y) the Additional Payment Reference Price.

-

ARTICLE III

Closing; Payments

3.1 The Closing.

(a) The closing of the transactions contemplated by this Agreement (the “Closing”) shall take place remotely by electronic delivery of documents on the date hereof, effective immediately after the execution and delivery of this Agreement upon the execution and delivery of the Stockholder Consent (the “Closing Date”). Upon the Closing, the transactions contemplated by this Agreement shall become and be deemed effective as of the time that the Certificate of Merger is filed and accepted by the Secretary of State of the State of Delaware.

(b) At the Closing, the Company and the Equityholders, as applicable, shall execute or deliver or cause to be executed or delivered, as applicable, to Purchaser the items listed on Exhibit F-1.

(c) At the Closing, Purchaser shall execute or deliver or cause to be executed or delivered, as applicable, to the Company and the Equityholders, as applicable, the items listed on Exhibit F-2.

3.2 Aggregate Merger Consideration; Closing Date Actions.

(a) Prior to the Closing, the Company has delivered to Purchaser a written statement in the form attached hereto as Exhibit E-2 (the “Closing Statement”) setting forth: (i) in reasonable detail its good faith estimate of (A) the Closing Indebtedness, (B) the Unpaid Selling Expenses, (C) the Cash and Cash Equivalents, and (D) the Base Cash Consideration and the Closing Remaining Consideration, each as determined by reference to the relevant provisions of this Agreement, and (ii) the aggregate amount of cash and number of shares of Purchaser Common Stock payable and issuable to the Participating Securityholders at Closing and for each Additional Payment.

(b) At the Closing:

(i) Subject to Section 2.2, Purchaser shall, in respect of the Promissory Note Payment Amounts and the Closing Remaining Consideration, (i) pay, or cause the Paying Agent to pay, to each Participating Securityholder an amount of cash (by wire transfer of immediately available funds to the applicable accounts set forth on the Closing Statement in accordance with the wire instructions set forth in the Closing Statement) and (ii) issue, or cause the Transfer Agent to issue, to each Participating Securityholder the number of shares of Purchaser Common Stock, in each case as set forth opposite such to each Participating Securityholder’s name on the Allocation Schedule; and (ii) Purchaser shall pay or cause to be paid (on behalf of the Company) all Unpaid Selling Expenses included in the estimate of Unpaid Selling Expenses on the Closing Statement that are to be paid in connection with the Closing, by wire transfer of immediately available funds to the applicable accounts set forth on the Closing Statement in accordance with the wire instructions set forth in the Closing Statement.

-

For the avoidance of doubt, Purchaser shall use any Cash and Cash Equivalents to pay or cause to be paid any Unpaid Selling Expenses, and to the extent no Cash and Cash Equivalents are available at the time of payment, Purchaser shall use the Purchaser Cash Consideration (prior to the application of any other Closing Adjustment Amounts).

In the event of a conflict between the Closing Statement and the Allocation Schedule, on the one hand, and the provisions of this Agreement, on the other hand, the Closing Statement and the Allocation Schedule (each as may be adjusted upon the mutual agreement of the Stockholder Representative and Purchaser to correct any manifest errors) shall control. Notwithstanding anything to the contrary herein or in the Company’s Organizational Documents, Purchaser shall be entitled to rely on the Closing Statement and the Allocation Schedule as conclusive evidence of the amount of cash and the number of shares of Purchaser Common Stock payable or issuable to the Participating Securityholders and the amount of payments payable to other payment recipients pursuant to this Agreement.

3.3 Withholding. Each of Purchaser and the Company (and their respective agents, including the Paying Agent) shall be entitled to deduct and withhold from the amounts payable or otherwise deliverable pursuant to this Agreement such amounts as are required to be deducted or withheld therefrom under the Code or under any provision of state, local or non-U.S. Tax Law. Other than with respect to any amounts treated as compensation for U.S. federal and applicable state and local income tax purposes or withholding required as a result of the failure of the Company to deliver the FIRPTA Certificate, Purchaser shall use commercially reasonable efforts to provide the Stockholder Representative with at least ten (10) days’ written notice of any withholding it believes is applicable to amounts payable by or at the direction of Purchaser hereunder and a reasonably detailed statement describing the basis for such withholding and Purchaser shall use commercially reasonable efforts to cooperate with the Stockholder Representative to reduce or eliminate any such withholding. To the extent such amounts are so deducted or withheld, such amounts shall be treated for all purposes under this Agreement as having been paid to the Person to whom such amounts would otherwise have been paid. The applicable withholding agent will promptly pay or cause to be paid any amounts withheld pursuant to this Section 3.3 for applicable Taxes to the appropriate Tax Authority.

-

ARTICLE IV

Representations and Warranties Regarding the Company and its Subsidiaries

Subject to such exceptions as are set forth in the disclosure schedule delivered herewith by the Company and its Subsidiaries to Purchaser concurrently with the Parties’ execution of this Agreement (the “Disclosure Schedules”) (which disclosures will qualify the section or subsection they specifically reference and will also be deemed to qualify other sections or subsections in this ARTICLE IV to the extent that it would be reasonably apparent on the face of such disclosure that such disclosure is applicable to such other section or subsection), as a material inducement to Purchaser and Merger Sub to enter into this Agreement and to consummate the transactions contemplated hereby, the Company hereby represents and warrants to Purchaser and Merger Sub that the representations in this ARTICLE IV are true and correct as of the Closing and as of the date of this Agreement (except in the case of any individual representation and warranty which by its terms speaks only as of a specific date or dates, in which case as though made as of such specific date or dates):

4.1 Organization; Power; Authority; Good Standing. The Company is duly organized, validly existing and in good standing under the Laws of the State of Delaware. The Company possesses full power and authority necessary to own, lease and operate its properties, and to carry on its business as now conducted and as proposed to be conducted as of the Closing Date. The Company is duly licensed or qualified to transact business and is in good standing as a foreign entity in those jurisdictions set forth on Section 4.1 of the Disclosure Schedules, which constitute all of the jurisdictions in which the character of the assets owned or leased, or the business conducted by it requires such licensing or qualification, other than failures to be so qualified, licensed or in good standing that, individually or in the aggregate, would not reasonably be expected to result in a material Liability to the Company. Purchaser has been furnished with true, correct and complete copies of the Organizational Documents of the Company, as amended and in effect on the date of this Agreement.

4.2 Capitalization.

(a) The authorized capital stock of the Company consists of 18,000,000 shares of Company Common Stock, of which 9,710,000 are issued and outstanding, and 5,471,871 shares of Company Preferred Stock, of which 5,471,864 are issued and outstanding. Section 4.2(a) of the Disclosure Schedules sets forth (i) a true and complete list of the Stockholders, including the number of Shares owned by each such Stockholder and (ii) a true and complete list of the SAFE Holders, including the Purchase Amount (as defined in such SAFE) and the issuance date of the SAFE held by such SAFE Holder. All of the Shares are duly authorized, validly issued, fully paid and non-assessable and are held beneficially and of record by the Stockholders thereof as set forth on Section 4.2(a) of the Disclosure Schedules. Except for the Shares and the SAFEs set forth on Section 4.2(a) of the Disclosure Schedules and as set forth on Section 4.2(b) of the Disclosure Schedules, the Company does not have any outstanding or authorized (i) Equity Interests or other securities convertible into, or exchangeable or exercisable for, any of its Equity Interests or any rights or options to subscribe for or to purchase its Equity Interests or (ii) any equity appreciation rights, profit participation rights, phantom equity or similar plans or rights. Except as set forth on Section 4.2(a) or Section 4.2(b) of the Disclosure Schedules, there are no (A) outstanding obligations of the Company (contingent or otherwise) to repurchase or otherwise acquire or retire any of its Equity Interests or (B) voting trusts, proxies or other agreements among the Equityholders or any other Person with respect to the voting or transfer of the Company’s Equity Interests.

-

(b) Except for the Company Stock Plan, the Company has never adopted, sponsored or maintained any option plan or any other plan or Contract providing for equity or equity-based compensation to any Person. The Company Stock Plan has been duly authorized, approved and adopted by the board of directors of the Company and the Stockholders and is in full force and effect. Other than as set forth on Section 4.2(b) of the Disclosure Schedules, the Company has not issued any options, restricted stock, restricted stock unit, “phantom” stock or any similar security or right pursuant to the Company Stock Plan or otherwise.

(c) Other than as set forth on Section 4.2(c) of the Disclosure Schedules, the Company does not have and never has had any Subsidiaries, and the Company does not own and has never owned any Equity Interest in any other Person. Section 4.2(c) of the Disclosure Schedules contains a complete and accurate list of each of the Company’s Subsidiaries containing its name, its jurisdiction of organization, and other jurisdictions in which it is qualified to do business, and its capitalization (including the identity of each equity holder and the amount of equity interests held by each such holder). Each Subsidiary of the Company is an entity duly organized, validly existing and in good standing under the laws of its jurisdiction of organization and has full corporate or other power and authority necessary to own, lease and operate its properties, and to carry on its business as now conducted and as proposed to be conducted as of the Closing Date. Except as set forth on Schedule 4.2(c) of the Disclosure Schedules, each Subsidiary of the Company is duly licensed or qualified to transact business and, where the concept or a similar concept is recognized, is in good standing as a foreign entity in each jurisdiction in which the character of the assets owned or leased, or the business conducted by it requires such licensing or qualification, other than failures to be so qualified, licensed or in good standing that, individually or in the aggregate, would not reasonably be expected to result in a material Liability to such Subsidiary or to the Company. The Company is the sole holder of all outstanding equity interests in each Subsidiary of the Company and has not granted to any Person any preemptive or other similar rights with respect to any equity interests of any Subsidiary of the Company and there are no offers, options, warrants, rights, agreements or commitments of any kind (contingent or otherwise) entered into or granted by the Company relating to the issuance, conversion, exchange, registration, voting, sale or transfer of any equity interests or other equity securities of any such Subsidiary or obligating any such Subsidiary or any other Person to purchase or redeem any of such equity interests or other equity securities.

4.3 Authorization; Execution & Enforceability; No Breach.

(a) The Company has all requisite power and authority to execute and deliver each Transaction Document to which it is a party and any and all instruments necessary or appropriate in order to fully effectuate the terms and conditions of each such Transaction Document and to perform and consummate the transactions contemplated hereby and thereby. The Company’s execution, delivery and performance of each Transaction Document to which it is a party has been duly and validly authorized by all necessary action on the part of the Company or its Stockholders.

-

(b) Each Transaction Document to which the Company is a party has been duly and validly executed and delivered by the Company and constitutes, or upon its execution and delivery will constitute, a valid and legally binding obligation of the Company, enforceable against the Company in accordance with its terms and conditions, except as such enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or similar Laws affecting creditors’ rights generally and by general principles of equity (regardless of whether enforcement is sought in a proceeding at law or in equity).

(c) The execution, delivery and performance by the Company of each Transaction Document to which it is a party, and the consummation of the transactions contemplated hereby and thereby, does not and will not conflict with any provision or result in any breach or violation of the Organizational Documents of the Company.

(d) Except as set forth on Section 4.3(d) of the Disclosure Schedules, the execution, delivery and performance by the Company of each Transaction Document to which it is a party, and the consummation of the transactions contemplated hereby and thereby, does not and will not (i) result in the creation of any Lien upon any assets of the Company pursuant to, (ii) conflict with any provision or result in any breach or violation of, (iii) constitute (whether with or without the passage of time, the giving of notice or both) a default under, (iv) trigger any “change in control” or other similar provision contained in, or (v) give rise to any right of termination, cancellation, acceleration, payment or other material right under, in each case, (A) any Law applicable to the Company, (B) any Permit, or (C) any other Contracts to which the Company is a party or by which the Company is otherwise bound, except, in the case of (B) and (C), as would not, individually or in the aggregate, reasonably be expected to result in a material Liability to the Company. Except as set forth on Section 4.3(d) of the Disclosure Schedules, the Company is not required to provide any notice to, or make any filing with, any Governmental Authority or any other Person, or obtain any Permit or consent, in each case, for the valid execution, delivery and performance by the Company of the Transaction Documents to which it is a party.

4.4 Financial Statements; Absence of Undisclosed Liabilities.

(a) The Company has delivered to Purchaser true, correct and complete copies of its consolidated unaudited financial statements consisting of the consolidated balance sheet of the Company and its Subsidiaries as at December 31 in each of the years 2023 and 2024 and the related consolidated statements of income, stockholders’ equity and cash flows for the 12-month periods then ended (collectively, the “Year-End Financial Statements”) and the consolidated balance sheet of the Company and its Subsidiaries as at June 30, 2025 (the “Latest Balance Sheet Date”), and the related consolidated statements of income, stockholders’ equity and cash flows for the six-month period then ended (collectively, the “Interim Financial Statements,” and, together with the Year-End Financial Statements, the “Financial Statements”).

-

(b) The Financial Statements, including the related notes and schedules thereto, (i) have been prepared in accordance with the books and records of the Company, which are true and complete in all material respects and which have been maintained in a manner consistent with historical practice, (ii) present fairly, in accordance with GAAP, the financial condition and results of operations of the Company, including, but not limited to, all reserves for potential loan buybacks, indemnifications, or warranties, which such Financial Statements purport to present as of the dates thereof and for the periods indicated therein and (iii) have been prepared on the consistent basis and in accordance with consistent policies, principles, and practices throughout the periods covered thereby (except as may be indicated therein, in the notes thereto or as summarized in Section 4.4 of the Disclosure Schedules, and except, in the case of the Interim Financial Statements, for the absence of footnotes and to standard year-end adjustments, none of which will be material).

(c) Since the date of the Interim Financial Statements, there has been no change in (i) any accounting principle, procedure, or practice followed by the Company or (ii) the method of applying any such principle, procedure, or practice.

(d) Except as set forth in Section 4.4(d) of the Disclosure Schedules, the Company and its Subsidiaries have no Liabilities that in the aggregate exceed $1,000, whether known or unknown, absolute or contingent, accrued or unaccrued, asserted or unasserted, choate or inchoate, matured or unmatured, determined or determinable, except for: (i) Liabilities reflected or reserved against in the Financial Statements; (ii) Liabilities that have been incurred since the Latest Balance Sheet Date in the ordinary course of business consistent with past practice (none of which are material or relate to breach of contract, breach of warranty, tort, infringement, violation of Law, or litigation); and (iii) Liabilities incurred pursuant to this Agreement or the transactions contemplated hereby which shall be disclosed as Unpaid Selling Expenses on the Closing Statement.

4.5 Absence of Adverse Changes and Extraordinary Events. Except as otherwise contemplated by this Agreement, from the Latest Balance Sheet Date through the date hereof, (a) neither the Company nor any of its Subsidiaries have entered into any transactions other than in the ordinary course of business consistent with past practice, (b) there has not been any event that has had or would reasonably be expected to have a Material Adverse Effect, (c) the Company’s and its Subsidiaries’ business has been operated only in the ordinary course and substantially in the manner that such business was heretofore conducted, (d) all vendors and contractors of the Company and each of its Subsidiaries have been promptly paid, and (e) the Company and each of its Subsidiaries have used their commercially reasonable efforts to preserve the goodwill of the Company, its Subsidiaries and their respective relationships with their employees, customers, and suppliers.

4.6 Insurance. The Company and its Subsidiaries maintain insurance for their properties against loss or damage by fire or other casualty or any other such other insurance, including liability insurance, as would usually be maintained by prudent companies similar in size and credit standing to the Company and its Subsidiaries and engaged in the same or similar business.

4.7 Title to Assets. The Company and each of its Subsidiaries have good and marketable title to, or a valid leasehold or license interest in, all of its assets, properties, and interests in properties, real, personal or mixed (a) reflected on the balance sheets included in the Interim Financial Statements, (b) acquired since the Latest Balance Sheet Date, or (c) required for or used in the conduct of its business as currently conducted, except for inventory sold in the ordinary course of business since the date of that balance sheet and accounts receivable and notes to the extent that they have been paid (collectively, the “Assets”). All of the equipment, furniture, fixtures, and other personal property included in the Assets are in good operating condition and are adequate for use in the ordinary course of the Company’s business consistent with past practice with no defects that could interfere with the conduct of normal operations of such equipment, furniture, fixtures, and other personal property, except for damaged, worn, or defective items that have been written off or written down to fair market value or for which adequate reserves have been established in the Interim Financial Statements. All of the Assets are owned by the Company or its Subsidiaries, free and clear of any encumbrances, and no Assets are held on a consignment or lease basis.

-

4.8 Credit Lines, Loans, Guarantees, Banks. Section 4.8 of the Disclosure Schedules describes all the loans and credit lines of the Company and its Subsidiaries, including the identity of the lender, the loan amount and balance, terms, related security interests, and the identity of any guarantors. Except as set out on Section 4.8 of the Disclosure Schedules, (a) the Company and its Subsidiaries have no indebtedness for borrowed money or other debt obligation, other than trade credit extended in the ordinary course of business by the suppliers and vendors of the Company or any of its Subsidiaries, (b) neither the Company nor any of its Subsidiaries has guaranteed the Liabilities of any third party, and (c) neither the Company nor any of its Subsidiaries has repurchase obligations or demands from lenders due to underwriting or fraud issues. The full details of the bank accounts of the Company and its Subsidiaries, including the names of all Persons authorized to draw thereon or make withdrawals therefrom and the balance of each such account as of the most recent statement date, are set forth on Section 4.8 of the Disclosure Schedules.

4.9 Labor Matters. Except as set forth in Section 4.9 of the Disclosure Schedules: (a) the Company and its Subsidiaries are in compliance in all material respects with all applicable Laws concerning employment and employment practices, terms, and conditions of employment and wages and hours, and is not engaged in any unfair labor practice; (b) there is no unfair labor practice complaint against the Company or any of its Subsidiaries pending or, to the Knowledge of the Company, threatened before any Governmental Authority; (c) there is no labor strike, dispute, slowdown, or stoppage actually pending or, to the Knowledge of the Company, threatened against or affecting the Company or its Subsidiaries; (d) no grievance nor any arbitration proceeding arising out of or under any collective bargaining or other agreement is pending against the Company or its Subsidiaries; and (e) neither the Company nor its Subsidiaries have experienced any strike or work stoppage or other industrial dispute involving its employees in the past five (5) years.

4.10 Employees; Employee Benefit Arrangements.

(a) Section 4.10(a) of the Disclosure Schedules is a true and complete list of the names and positions of current employees of the Company and its Subsidiaries (the “Employees”) and the following compensation information for fiscal year 2024 for each Employee (as applicable): (i) annual base salary; (ii) annual bonus; (iii) commissions; (iv) benefits; (v) severance; and (vi) all other items of compensation that are in fact paid, provided, or made available to that Employee or that the Company or any of its Subsidiaries are required to pay, provide, or make available to that Employee under any Contract. Neither the Company nor any of its Subsidiaries have outstanding Liabilities (including any commission payments due) with respect to any Employee (or any dependent or beneficiary of any such Employee) that are not accrued for in the Interim Financial Statements. Except as set out on Section 4.10(a) of the Disclosure Schedules, the employment of all Employees is “at will,” and the Company or the applicable Subsidiary may terminate the employment of each Employee at any time, for any reason or for no reason. Except as set out on Section 4.10(a) of the Disclosure Schedules, neither the Company nor any of its Subsidiaries have offered employment to any individual who is not an Employee. The Company has made available to Purchaser true and complete copies of employment agreements with the Employees listed on Section 4.10(a) of the Disclosure Schedules.

-

(b) “Benefit Arrangement” means any employee benefit plans, as defined in Section 3(3) of the United States Employee Retirement Income Security Act of 1974, as amended (“ERISA”) or other applicable Law, or other pension, savings, retirement, benefit, fringe benefit, compensation, deferred compensation, incentive, bonus, commission, profit-sharing, health and welfare insurance, welfare, severance, change of control, parachute, stock option, stock purchase, or other employee benefit plan, program or arrangement, whether or not subject to any of the provisions of ERISA, whether or not funded and whether written or oral.

(c) Section 4.10(c) of the Disclosure Schedules lists the Benefit Arrangements covering former or current employees of the Company or any of its Subsidiaries, or under which the Company or any of its Subsidiaries have any Liability (each such Benefit Arrangement, a “Company Employee Plan”). Except as referred to in Section 4.10(c) of the Disclosure Schedules, neither the Company nor any of its Subsidiaries have a commitment or an obligation to create any additional Benefit Arrangements or to increase benefit levels, provide any new benefits under, or otherwise change any Company Employee Plan, and no such creation, increase, or change has been proposed, made the subject of written or oral representations to employees, or requested or demanded by employees under circumstances that make it reasonable to expect that it will occur. Correct and complete copies of all material Company Employee Plans have been made available to Purchaser.

(d) Neither the execution and delivery of this Agreement, the shareholder approval of this Agreement, nor the consummation of the transactions contemplated hereby could (either alone or in conjunction with any other event) result in any “parachute payment” as defined in Section 280G(b)(2) of the Code.

(e) Each Company Employee Plan is and has been administered in compliance with its terms and with the requirements of applicable Law in all material respects and for the exclusive benefit of the participants and beneficiaries of that Company Employee Plan. There is no pending or, to the Knowledge of the Company, threatened legal action, arbitration, or other proceeding against the Company or any of its Subsidiaries with respect to any Company Employee Plan, other than routine claims for benefits, that would reasonably be expected to result in a material Liability to the Company or to Purchaser.

-

4.11 Contracts; Customers.

(a) Section 4.11(a) of the Disclosure Schedules sets out a list of all the Contracts (including any (i) real property leases, (ii) customer contracts and customer orders (including customer contact lists) and (iii) partner and supplier contracts, (A) to which the Company is a party and (B) by which the Company or any of its Subsidiaries are bound (collectively, the “Company Contracts”) that are material to the Company or any of its Subsidiaries (“Material Contracts”), including the following:

(i) each Company Contract involving aggregate consideration in excess of $50,000 per year including, but not limited to, Contracts with mortgage lenders and vendors, and which, in each case, cannot be cancelled by the Company or its Subsidiary, as applicable, without penalty or without more than thirty (30) days’ notice;

(ii) all Company Contracts relating to Intellectual Property (as defined in Section 4.18(a)), including all licenses, sublicenses, settlements, coexistence agreements, covenants not to sue, and permissions;

(iii) except for Company Contracts relating to trade receivables, all Company Contracts relating to Indebtedness (including, without limitation, guarantees) of the Company; and

(iv) all Company Contracts that limit or purport to limit in any material respect the ability of the Company or any of its Subsidiaries, as applicable, to compete in any line of business or with any Person or in any geographic area or during any period of time.

(b) Each Material Contract is valid and binding on the Company or one of its Subsidiaries, as applicable, in accordance with its terms and is in full force and effect. Neither the Company nor any of its Subsidiaries, nor, to the Knowledge of the Company, any other party thereto is in breach of or default under (or is alleged to be in breach of or default under) any Material Contract. Complete and correct copies of each Material Contract (including all modifications, amendments, and supplements thereto and waivers thereunder) have been made available to Purchaser.

4.12 Data and Privacy Laws.

(a) Except as disclosed in Section 4.12 of the Disclosure Schedules:

(i) The Company and its Subsidiaries have complied in all material respects, and are currently in compliance in all material respects with, (1) all applicable Information Privacy and Security Laws, (2) any contractual obligations to which the Company or the Subsidiary, as applicable, is a party or by which it is bound relating to Personal Information, in each case, as applicable to the conduct of the Company’s or the Subsidiary’s business as currently conducted, and (3) all of the Company’s (and each Subsidiary’s) internal privacy policies to the extent relating to any Personal Information collected, used, maintained, disclosed, or transmitted by the Company, its Subsidiaries or by third parties having access to the records of the Company or any of its Subsidiaries. The Company and its Subsidiaries have adopted privacy notices and policies that accurately describe the Company’s (and each Subsidiary’s) privacy practices (as applicable), to any website, mobile application, or other electronic platform and complied with those notices and policies in all material respects. Neither the Company nor any of its Subsidiaries have received any written complaints regarding the collection, maintenance, use, disclosure, or transmission of Personal Information by the Company, its Subsidiaries or by third parties to whom the Company or any of its Subsidiaries have provided Personal Information.

-

(ii) No Person (including any Governmental Authority) has threatened to assert any Proceeding pursuant to any written notice, or commenced any Action with respect to any alleged violation of any Information Privacy and Security Laws or the Company’s or any of its Subsidiary’s privacy or data protection practices, or any contractual obligations to which the Company or any Subsidiary is a party or by which it is bound relating to Personal Information, including any loss, damage, or unauthorized access, use, disclosure, modification, or other misuse of any Personal Information collected or used by, or on behalf of, the Company and its Subsidiaries. The execution, delivery, and performance of this Agreement, the Transaction Documents, and the other agreements and instruments contemplated hereby and the consummation of the transactions comply in all material respects with all applicable Information Privacy and Security Laws and any contractual obligation to which the Company or any of its Subsidiaries is a party or by which it is bound relating to Personal Information.

(iii) The Company and each of its Subsidiaries have taken reasonable steps to obtain all necessary authority, consents, and authorizations to collect, use, maintain, disclose, or transmit any Personal Information collected or used by or on behalf of the Company or any of its Subsidiaries in connection with the operation of its business as currently conducted, including the use of Personal Information to send personal electronic messages. To the Knowledge of the Company, none of the Personal Information collected, stored, used, maintained, modified, disclosed, transmitted, in the possession, custody, or control of the Company or any of its Subsidiaries have been provided to the Company or any of its Subsidiaries by a third party in violation of applicable Law, including applicable Information Privacy and Security Laws or in a manner inconsistent with such third party’s own privacy policies.

(iv) The Company and each of its Subsidiaries have implemented, maintained, and executed, as necessary, commercially reasonable security controls that are designed to identify, mitigate, and resolve internal and external risks to the security of any Personal Information and implement and monitor adequate and effective administrative, technical and physical safeguards to control those risks. Neither the Company nor any of its Subsidiaries have experienced any material breach of security or safeguards relating to Personal Information, or other loss, unauthorized access, use, or disclosure of Personal Information in the possession, custody, or control of the Company or any of its Subsidiaries.

(b) For purposes of this Agreement, the following terms shall have the meaning below:

(i) “Governmental Order” means any order, writ, judgment, injunction, decree, stipulation, determination, or award, in each case having the force of Law, entered by or with any Governmental Authority.

-

(ii) “Information Privacy and Security Laws” means all applicable Laws and Governmental Orders concerning the privacy, security, or processing of Personal Information (including any Laws of jurisdictions where the Personal Information was collected or used by or on behalf of the Company), and all regulations promulgated and guidance issued by Governmental Authorities (including staff reports) thereunder concerning data breach notification, consumer protection, requirements for website and mobile application privacy policies and practices, data or web-scraping, Social Security number protection, data security, and e-mail, text message, or telephone communications. Without limiting the foregoing, Information Privacy and Security Laws include: the Federal Trade Commission Act, the Privacy Act of 1974, the CAN–SPAM Act, the Telephone Consumer Protection Act, the Telemarketing and Consumer Fraud and Abuse Prevention Act, the California Consumer Privacy Act of 2018, the Electronic Communications Privacy Act, the Computer Fraud and Abuse Act, the Gramm–Leach–Bliley Act, the Fair Credit Reporting Act, the Fair and Accurate Credit Transaction Act, all policies and procedures established to comply with the privacy and security rules of the Health Insurance Portability and Accountability Act of 1996, and all other similar federal, state, and local laws and regulations.

(iii) “Personal Information” means any information (A) the collection, maintenance, use, disclosure, or transmission of which by or on behalf of the Company is regulated or governed by one or more Information Privacy and Security Laws that apply to the Company, (B) that identifies or, alone or in combination with any other information, could reasonably be used to identify, locate, or contact a natural Person or device, including (1) name, address, e-mail address, telephone number, health information, social security number, driver’s license number, government issued identification number, or any other data that can be used to identify, contact, or precisely locate an individual, (2) any non-public personally identifiable financial information, such as financial account numbers or log-in information, (3) Internet Protocol addresses or other persistent device identifiers, or (4) any other information that is considered “personally identifiable information,” “personal information,” or “personal data” under applicable Law, and (C) all data associated with any of the foregoing that are or could reasonably be used to develop a profile or record of the activities of a natural person or device across multiple websites or online services, to predict or infer the preferences, interests, or other characteristics of a natural person, or to target advertisements or other content to a natural person.

4.13 Legal Proceedings, Etc. There is no Proceeding pending, or to the Knowledge of the Company, threatened, in each case against the Company, any of its properties or assets, or any of its officers, directors or employees in their capacities as such, before any Governmental Authority acting in an investigative or adjudicative capacity. Neither the Company nor any of its properties or assets is subject to any Governmental Order that would reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect.

4.14 Taxes. (i) All income and other material Tax Returns required to be filed by the Company and any of its Subsidiaries on or before the date hereof have been filed by or on behalf of the Company and its Subsidiaries and all such Tax Returns are true, correct, and complete in all material respects. (ii) The Company and each of its Subsidiaries have paid in full, or provided for in the Interim Financial Statements, all Taxes required to be paid by it through the date hereof, whether or not shown to be due on any Tax Returns. (iii) There are no liens or other encumbrances for Taxes upon the assets of the Company or the assets of any of its Subsidiaries except liens for Taxes not yet due. (iv) Neither the Company nor any of its Subsidiaries are party to or bound by any Tax allocation or sharing agreement, nor does it have any Liability for the Taxes of any Person other than itself under Treas. Reg. §1.1502-6 (or any similar provision of state, local, or non-U.S. Law), as a transferee or successor, by contract or otherwise. Notwithstanding anything to the contrary in this Agreement, the Company makes no representation or warranty regarding the amount, value or condition of, or any limitation on, any net operating losses, capital loss, Tax credit, Tax basis or other similar Tax attribute or the ability of Purchaser or any of its Affiliates to utilize such Tax attributes after the Closing.

-