UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) November 13, 2025

Ondas Holdings Inc.

(Exact name of registrant as specified in its charter)

| Nevada | 001-39761 | 47-2615102 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

One Marina Park Drive, Suite 1410, Boston, MA 02210

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (888) 350-9994

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

| Common Stock par value $0.0001 | ONDS | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 13, 2025, Ondas Holdings Inc. (the “Company”), issued a press release announcing its financial and operating results for the third quarter ended September 30, 2025. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K. A slide presentation, which includes supplemental information relating to the Company’s financial results for the third quarter ended September 30, 2025, is furnished as Exhibit 99.2 to this Current Report on Form 8-K.

The information in Item 2.02 of this Current Report on Form 8-K (including Exhibit 99.1 and Exhibit 99.2) is furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. The information in Item 2.02 of this Current Report on Form 8-K (including Exhibit 99.1 and Exhibit 99.2) shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date of this Current Report on Form 8-K, regardless of any general incorporation language in the filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. | Description | |

| 99.1 | Press Release, dated November 13, 2025. | |

| 99.2 | Presentation, dated November 13, 2025. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: November 13, 2025 | ONDAS HOLDINGS INC. | |

| By: | /s/ Eric A. Brock | |

| Eric A. Brock | ||

| Chief Executive Officer | ||

Exhibit 99.1

Ondas Holdings Reports Record Third Quarter 2025 Financial Results—Robust Growth Outlook Supported by Execution at OAS, Strategic Growth Program and Strong Global Demand for Autonomous Drone Systems

Record quarterly revenue of $10.1 million in Q3; a more than 6-fold increase YoY and 60% growth QoQ

With a pro-forma cash balance of $840.4 million, we believe Ondas has one of the strongest balance sheets in the industry

Ondas is effectively deploying capital through acquisitions and investments highlighted by Sentrycs, Apeiro Motion, 4M Defense, and Rift Dynamics

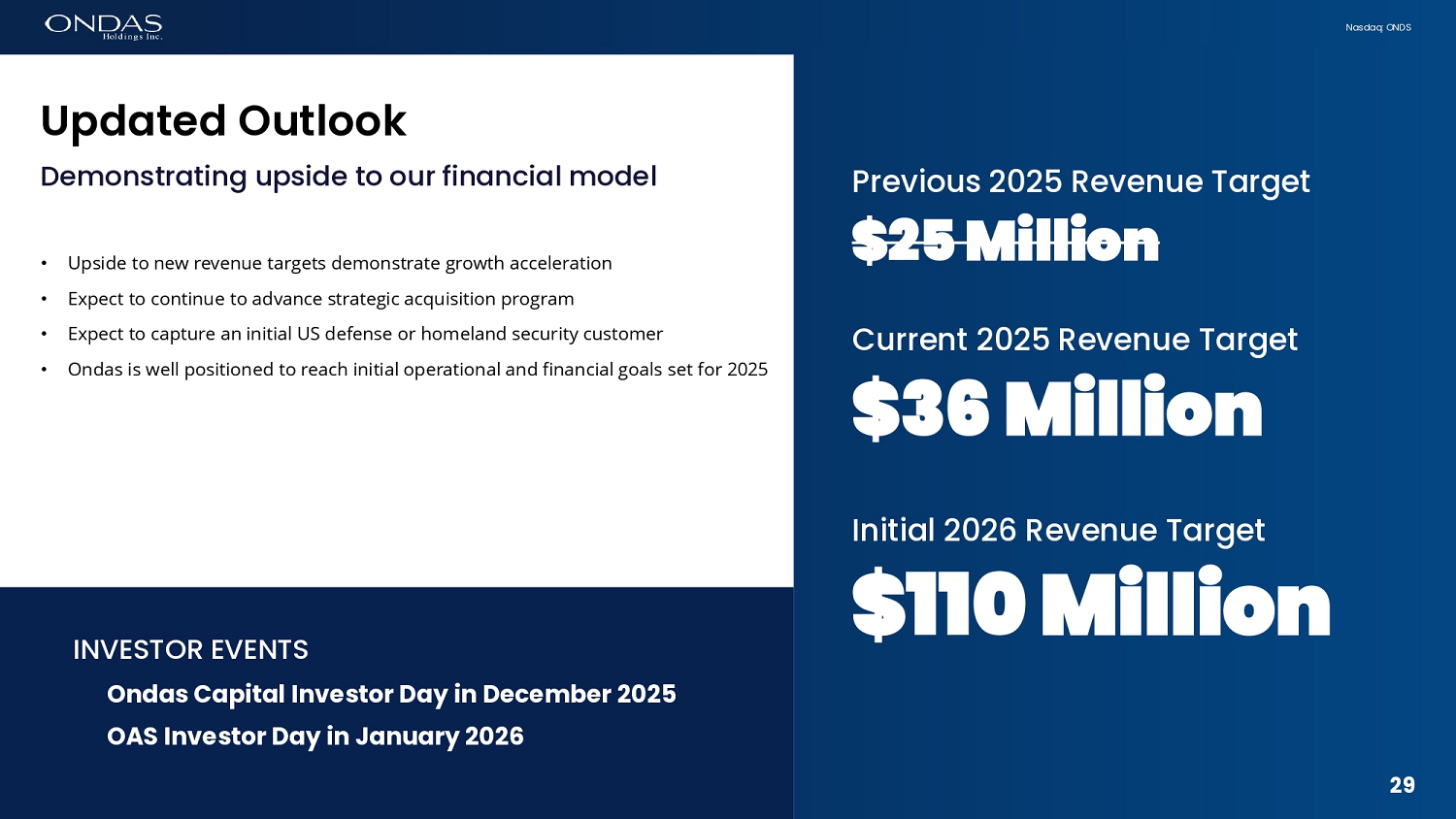

2025 revenue target increased to at least $36 million; establishing preliminary revenue target of at least $110 million for 2026

Conference Call Scheduled for Today at 8:30 a.m. ET

BOSTON, MA / November 13, 2025 / Ondas Holdings Inc. (Nasdaq: ONDS) (“Ondas” or the “Company”), a leading provider of autonomous aerial and ground robot intelligence through its Ondas Autonomous Systems (OAS) business unit and private wireless solutions through Ondas Networks, reported financial and operating results for the third quarter ended September 30, 2025.

“Ondas delivered a record quarter with $10.1 million in revenue, highlighted by sustained growth momentum at OAS amid a powerful demand cycle for our unmanned platforms,” said Eric Brock, Chairman and CEO of Ondas Holdings. “I continue to be pleased with the execution of our core growth plan, led by our Iron Drone Raider and Optimus System platforms, and supported by the expansion of our senior leadership team at OAS which is helping to ensure we have the scalable infrastructure to sustain rapid growth in the years ahead. At the same time, our strategic program continues to advance, creating a deep and maturing pipeline of opportunities for the quarters and years ahead.”

“Our strategic growth plan is advancing and is benefiting from strong investor support as evidenced by the significant capital we’ve raised since June. Our pipeline is expanding and rapidly maturing, highlighted by the acquisition of Sentrycs scheduled to close this month, which we believe will strengthen our layered counter-UAS capabilities, and the acquisition of Apeiro Motion, which establishes a strong initial position in ground robotics tailored for defense and critical infrastructure markets. Similarly, the acquisition of 4M Defense adds a multi-domain robotics and ISR capability, opening a large subsurface intelligence and demining market with significant unmet demand that is now being addressed by OAS.”

“We believe these newly acquired companies bring exceptional platforms, leadership talent, and new customer relationships that expand our capabilities and reinforce our position as a leading global provider of next-generation defense and security technologies. Together, they support the buildout of a scalable operating platform designed to deliver sustainable growth, operating leverage, and long-term profitability.”

“The establishment of Ondas Capital and our expanding partnerships in Europe and Ukraine further strengthen our strategic footprint. We believe these initiatives, together with our investment in and partnership with Rift Dynamics, will advance our localization efforts across Europe and ensure Ondas is positioned to grow in these large and strategically important markets. With what we believe to be one of the strongest balance sheets in the industry, Ondas has demonstrated its ability to deploy capital effectively to drive growth, scale operations, and build a robust financial model characterized by increasing operating leverage and a clear path toward profitability.”

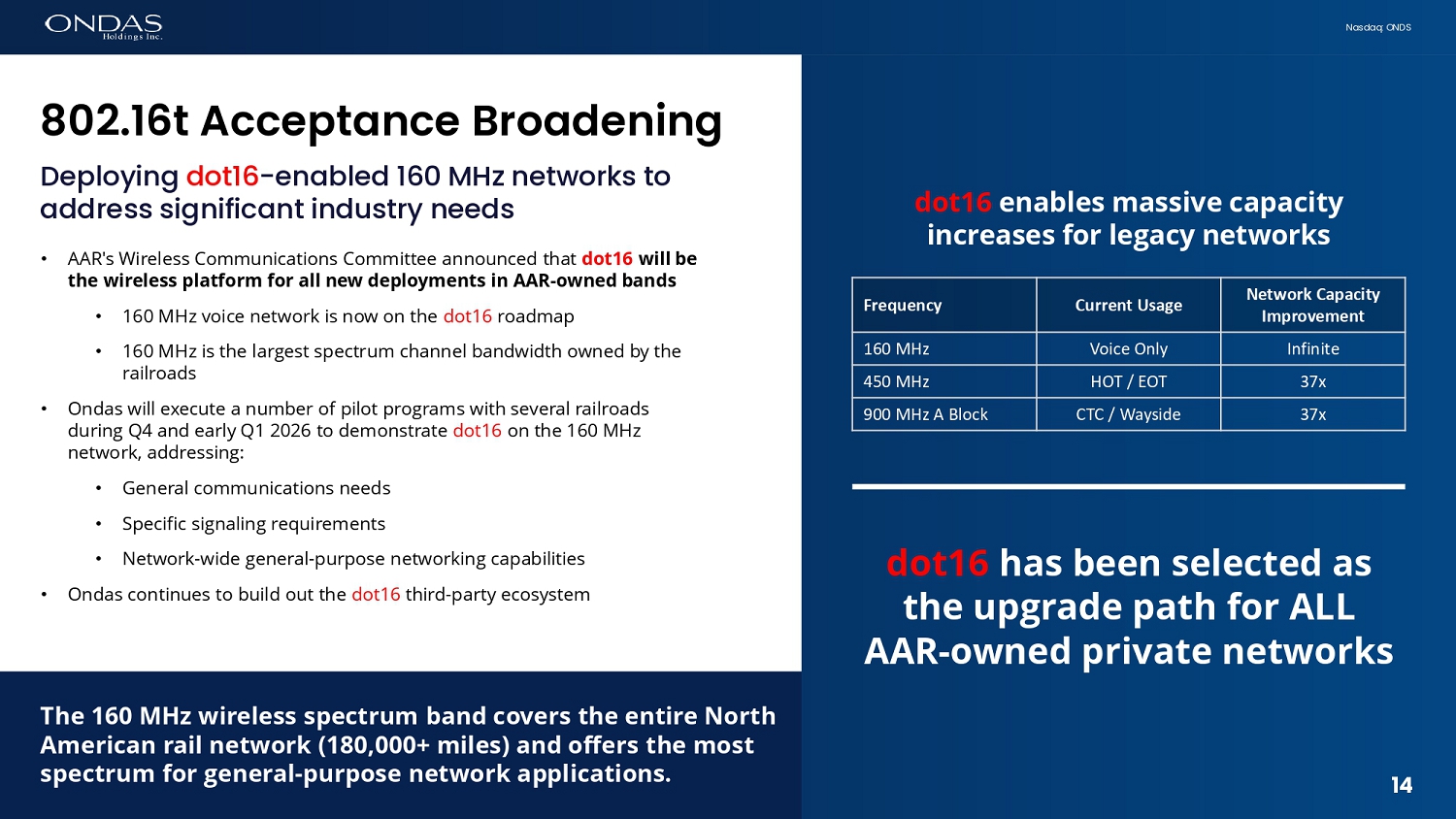

“At Ondas Networks, we continue to position our dot16 platform as the rail industry’s primary roadmap for private network modernization in North America. We were pleased to see the AAR’s Wireless Communications Committee formally declare dot16 as the upgrade path for the legacy 160 MHz network, joining the 900 MHz and 450 MHz networks where dot16 has already been adopted. In parallel, multiple Class 1 railroads have begun engaging with us to develop in-field pilots for new critical applications, reinforcing the long-term strategic value of the Ondas Networks platform.”

“We are doing what we said we would do, when we laid out our core-plus-strategic growth plan at our OAS Investor Day in July. This plan is supported by an exceptionally strong financial position and a growing institutional investor base. With record customer activity, a growing backlog, and increasing visibility, we are building a highly scalable platform at Ondas. We expect to exit 2025 with a record backlog and clear visibility on significant revenue growth into 2026 and beyond,” Brock concluded.

Third Quarter 2025 and Recent Highlights – Ondas Holdings

| ● | Raised approximately $855 million in 2025 through four equity offerings and warrant and option exercises, transforming the balance sheet and providing significant capital to support the Company’s expanded business plan. |

| ● | Launched Ondas Capital Inc. (“Ondas Capital”), a new advisory service and strategic investment management service platform established to deploy $150 million in capital to advance a Technology Bridge strategy connecting dual-use, combat-proven unmanned and autonomous technologies originating in Ukraine to the United States and Europe. The initiative aims to localize production, accelerate commercialization, and scale proven platforms, strengthening Allied industrial capacity and establishing a sustainable financial framework for integrating next-generation defense technologies across key markets. |

| ● | Appointed James Acuna, former senior CIA operations officer and founder of the Baltic Ghost Wing Center of Excellence, as Chief Operating Officer of Ondas Capital to lead the initial investment and partnership program. |

| ● | Appointed Mark Green, former Head of Technology Investment Banking at Ladenburg Thalmann, as Head of Corporate Development and M&A, supporting strategic growth initiatives across Ondas Holdings, OAS, Ondas Networks, and Ondas Capital. |

| ● | Appointed Brigadier General Patrick Huston, U.S. Army (Ret.), as General Counsel of Ondas Holdings. A former OAS advisor, General Huston brings over 35 years of military, legal, and technology leadership, including senior roles with the 101st Airborne Division, JSOC, and U.S. Central Command. His deep expertise in defense procurement, regulatory affairs, and autonomous systems strengthens Ondas’ legal and strategic capabilities as the Company expands its global defense and security operations. |

| ● | Announced a strategic investment in Rift Dynamics AS, a Norway-based defense technology company developing low-cost, attritable drone systems for Allied defense markets. |

| ● | Participated as a strategic investor in offerings by Kopin Corporation, LightPath Technologies, and Safe Pro Group, reinforcing Ondas’ engagement with the broader defense and sensing technology ecosystem. |

| ● | Hosted the inaugural Nantucket Defense Tech Summit, convening emerging technology vendors, supply chain partners, and institutional investors to advance collaboration and investment in next-generation defense and autonomous systems. |

Third Quarter 2025 and Recent Highlights – Ondas Autonomous Systems (OAS)

| ● | Generated approximately $10.0 million in revenue during the third quarter of 2025, representing a more than 8-fold increase from the same period in 2024. |

| ● | OAS backlog reached $22.2 million as of September 30, 2025, up from $20.7 million at the end of Q2, reflecting continued global demand for the Optimus and Iron Drone platforms. |

| ● | Completed multiple government-led counter-UAS pilot programs in Europe and Asia, validating the Iron Drone Raider’s superior performance in GPS-denied and complex environments and paving the way for long-term homeland security C-UAS infrastructure deployments. |

| ● | Secured a $2.7 million order from a major defense customer for Iron Drone Raider for multiple units. |

| ● | Secured a $3.5 million order from a leading defense entity for Apeiro’s rugged UGVs and modular payloads, strengthening OAS’ position in the global ground robotics market. |

| ● | Secured GreenUAS Cleared List certification for the Optimus drone, positioning the system for Department of War Blue List inclusion as a trusted, NDAA-compliant autonomous platform. |

| ● | Appointed Maj. Gen. (Ret.) Yoav Har-Even, former CEO of Rafael Advanced Defense Systems, to the OAS Advisory Board, adding exceptional global defense leadership and operational experience to guide the scaling of OAS operations and support the Company’s strategic acquisition program. |

| ● | Appointed Brig. Gen. (Res.) Yaniv Rotem to the OAS Advisory Board, formally launching an advisory board and reinforcing high-level defense R&D and innovation guidance. |

| ● | Appointed Dr. Irit Idan to the OAS Advisory Board, bringing deep expertise in AI, robotics and defense innovation to support OAS’ technology and strategic roadmap. |

| ● | Iron Drone Raider was selected by Securiton Germany, a leading integration partner to the German Armed Forces and other critical security operators, following successful system integration and demonstrations conducted in Germany by Airobotics. The joint demonstrations showcased Iron Drone’s advanced counter-UAS capabilities and seamless interoperability within Securiton’s defense and security frameworks. |

| ● | American Robotics participated in CUAS – IDICE 2025, an international counter-UAS exercise organized by UAS Norway in cooperation with INTERPOL, showcasing the combat-proven Iron Drone Raider system to global defense, homeland security, and law-enforcement leaders. |

| ● | Established strategic partnership with Rift whereby American Robotics secured exclusive U.S. distribution rights for Rift’s Wåsp attritable FPV drone platform. An initial order was placed for 500 units of the Wåsp to support its launch in the U.S. defense market. |

| ● | Expanded the Rift partnership to include Nammo Raufoss AS (“Nammo”), a leading munitions manufacturer with strong U.S. operations, enabling a fully integrated warhead solution for the Wåsp strike drone for defense customers in the U.S. |

| ● | Entered into a definitive agreement with Sentrycs, an Israeli counter-UAS company specializing in RF-based drone detection, identification, and mitigation technologies. We believe Sentrycs’ systems will provide passive, signal-intelligence-driven protection against intruder drones, complementing Iron Drone Raider and expanding OAS’ layered counter-UAS architecture across detection, interception, and electronic defense. |

| ● | Acquired Apeiro Motion (Apeiro), an Israeli robotics innovator developing advanced unmanned ground vehicles (UGVs), quadrupedal robots, and fiber-optic communication spools for radio-independent UAV and UGV operations expanding OAS’ multi-domain autonomy portfolio. |

| ● | Acquired a controlling interest in 4M Defense, a specialized land intelligence and demining company focused on autonomous robotics and AI-driven subsurface mapping for landmine, IED, and UXO detection and clearance. The acquisition extends OAS’ Continuum of Autonomy into subsurface operations, adding humanitarian and defense-grade demining capabilities. |

| ● | Acquired a controlling interest in S.P.O. Smart Precision Optics (SPO), an Israeli manufacturer of advanced precision optical components and systems. The acquisition expands OAS’ core capabilities in high-end electro-optics supporting missile defense, high-power laser, and counter-drone applications. |

| ● | Acquired a controlling interest in Insight Intelligent Sensors, adding AI-powered electro-optical and situational-awareness technologies that deliver sensor performance comparable to top tactical systems seamlessly integrated across air, ground, and maritime domains. |

| ● | Launched a new line of combat-proven, NDAA-compliant Made-in-the-USA fiber-optic spools based on Apeiro’s products for drones and ground robotics. Production will begin at American Robotics in Q4 2025, delivering secure, jam-proof connectivity for defense and homeland security missions. We believe the spools’ proven battlefield performance, U.S.-sourced materials, and proprietary packing process position them as the most reliable fiber-communications solution for multi-domain operations. |

“Business continues to strengthen at OAS, supported by the addition of exceptional talent as we invest in our leadership foundation designed for scale,” said Oshri Lugassy, Co-CEO of OAS. “We are aligning the new capabilities provided by Apeiro, SPO, Insight, Sentrycs, and 4M Defense into a single, integrated operating model that amplifies both our technological impact and market reach. This integration is unlocking meaningful cross-domain opportunities—linking air, ground, and sensing systems under one unified vision—while enhancing efficiency and accelerating innovation across the organization.”

“We are positioning OAS in front of a major demand curve for our autonomous systems. We believe the protection of critical infrastructure and borders in the U.S. and Europe is an urgent and growing priority, and OAS is exceptionally well positioned to meet that need. Our market strength will be further enhanced by the addition of Sentrycs, which we belive will enable us to offer a truly layered counter-UAS solution suite combining detection, cyber-control, and kinetic interception under one integrated architecture.”

“Across both our go-to-market and product development efforts, we are focused on execution, collaboration, and operational excellence,” Lugassy continued. “OAS is executing a disciplined growth strategy—expanding deployments, increasing manufacturing capacity, and deepening strategic engagements across key global markets. We remain on track for a record year in 2025 and are building the foundation for significant, sustained expansion in the years ahead.”

Third Quarter 2025 and Recent Highlights – Ondas Networks

| ● | The Association of American Railroads (AAR) Wireless Communications Committee (WCC) announced in September that IEEE 802.16t (“dot16”) will serve as the upgrade path for the legacy 160 MHz LMR voice network, joining the 900 MHz and 450 MHz networks where dot16 has already been formally adopted. |

| ● | The WCC decision on 160 MHz now positions Ondas Networks for a multi-year upgrade cycle across all AAR-owned frequencies, covering thousands of miles of railroad infrastructure throughout North America. |

| ● | Several railroads including two Class 1 railroads have immediately engaged with Ondas Networks to develop in-field, Proof of Concept (POC) application testing of dot16 over the 160 MHz network to address telecommunications, signaling and general operational issues. Three POCs are being prepared for deployment on three different properties in Q4 2025 and Q1 2026. |

| ● | Recent security bulletins from Cybersecurity and Infrastructure Security Agency highlighting vulnerabilities in legacy Head-of-Train/End-of-Train (HoT/EoT) technology have accelerated industry efforts to finalize the Next-Generation HoT/EoT (NGHE) Generation 4 specifications in 2026, which will incorporate Ondas’ 802.16t Direct-Peer-to-Peer protocol. |

| ● | A Class 1 railroad that had previously deployed 900 MHz equipment on a subdivision in the Chicago area to meet the Federal Communications Commission’s deadline for the move to the new A Block has now transitioned its complete installation of base stations and wayside devices to IEEE 802.16. This enables the general-purpose network capabilities of dot16 and allows connecting wayside devices such as hotbox detectors to the dot16 network. |

| ● | Ondas Networks continues to expand the ecosystem for dot16-enabled applications for all dot16-enabled networks. Third-party dot16 enabled applications enjoy end-to-end bi-directional communications over the railroads’ existing networks, including both data uploads to the back office and remotely initiated software maintenance activities, enabling the elimination of expensive cell modem connections and costly field maintenance visits. |

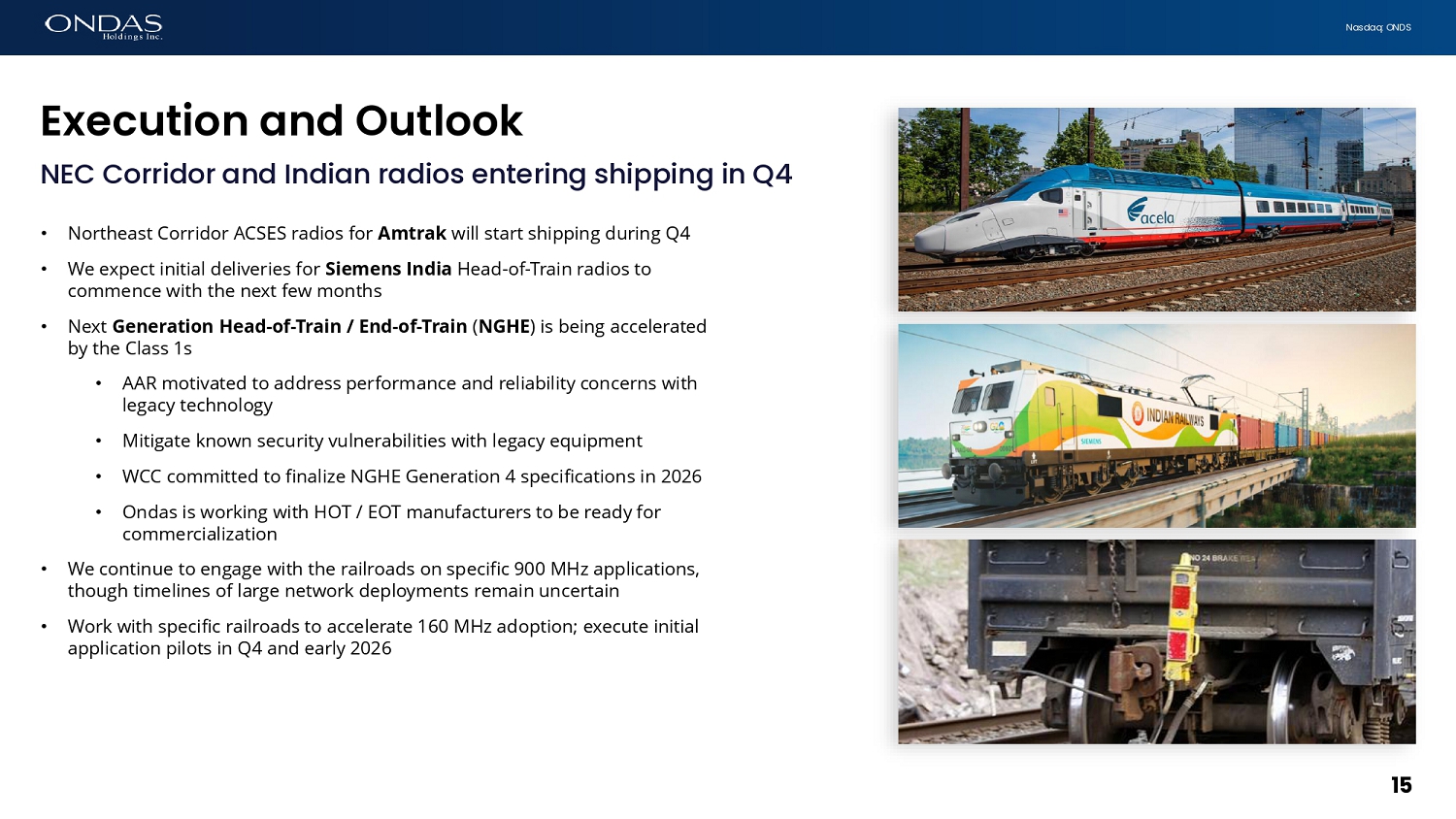

| ● | Contractual adjustments are being finalized to accommodate the current tariff environment between the United States and India. This change allows Ondas to commence the production of radio boards destined to the Indian market with first commercial deliveries in early 2026. |

Markus Nottelmann, Chief Executive Officer of Ondas Networks, commented, “We are encouraged by the broadening industry acceptance of dot16 across all AAR-owned spectrum bands, and especially by the enthusiasm from multiple Class 1 railroads for the opportunities emerging in the 160 MHz network. The Proof-of-Concept programs we have co-designed with our railroad partners—scheduled to launch on three separate properties in Q4 2025 and early 2026—represent important milestones that we expect will lead to full productization and commercialization in 2026.”

“As we continue to expand the ecosystem of dot16-enabled third-party applications, we remain focused on delivering near-term value through our existing product lines,” Nottelmann continued. “We are on track to deliver new Advanced Civil Speed Enforcement System radios for the Northeast Corridor and next-generation Head-of-Train systems for the Indian market in Q4 2025. These efforts reflect our commitment to execution and customer success while positioning Ondas Networks at the center of next-generation rail communications and safety systems.”

Third Quarter 2025 Financial Summary

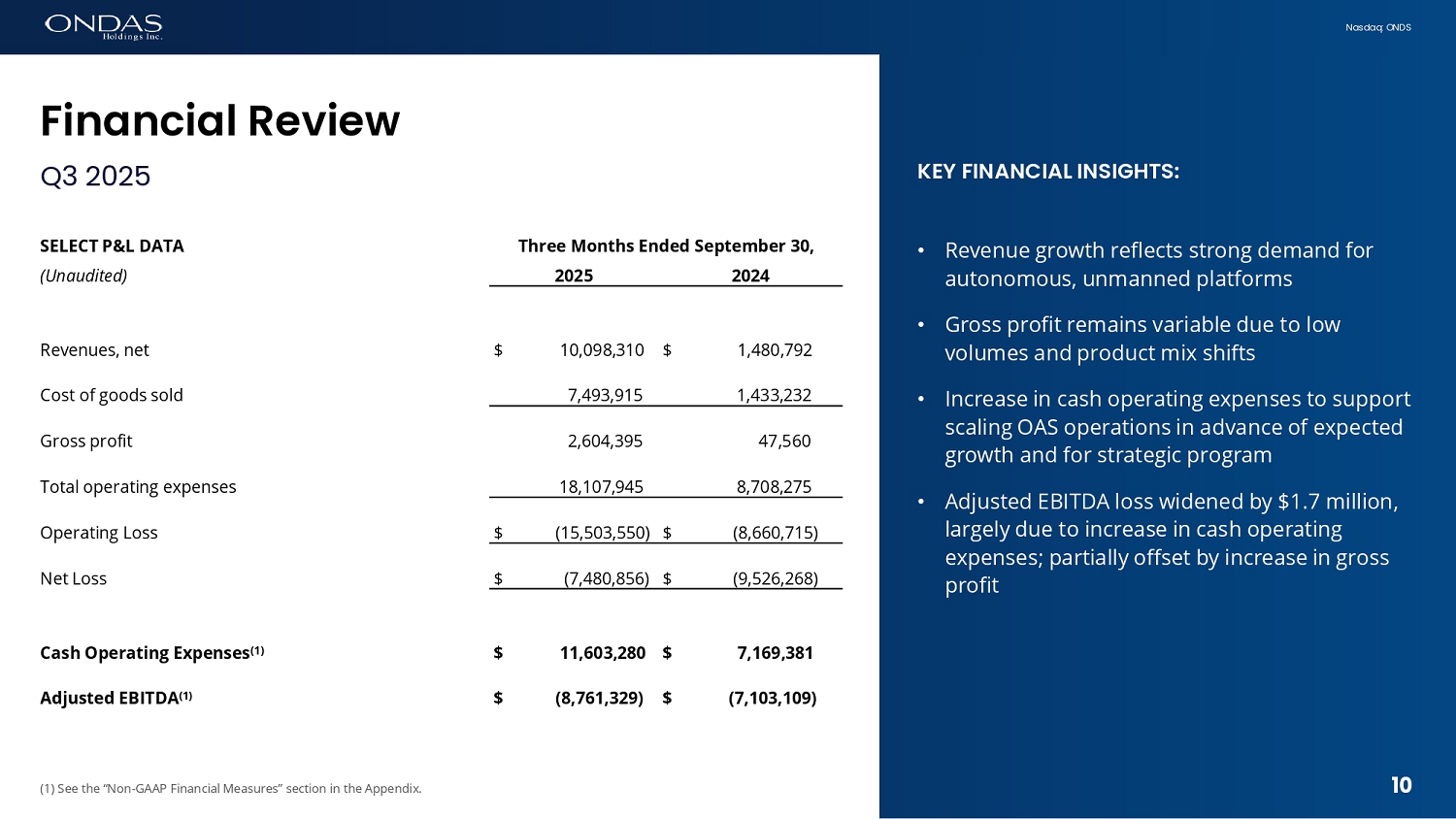

Ondas reported revenues of $10.1 million for the third quarter of 2025, a 582% increase from $1.5 million in the third quarter of 2024. This significant increase was primarily driven by ongoing deliveries of Iron Drone and Optimus systems under contracts with military and public safety customers and revenue from the recent Apeiro Motion acquisition.

Gross profit rose to $2.6 million compared to $0.05 million in the third quarter of 2024. This resulted in a gross profit margin of 26% in the third quarter of 2025 versus 3% in the third quarter of 2024. This improvement is the result of increased revenues absorbing more of the fixed operations costs. Gross margins are expected to fluctuate on a quarter-to-quarter basis depending on the mix of revenue.

Operating expenses increased by $9.4 million to $18.1 million, up from $8.7 million in the third quarter of 2024. Approximately $5.0 million of the increase relates to non-cash stock compensation expenses. Approximately $4.4 million of the increase relates to cash operating expense due to increased payroll costs to build out the OAS and corporate management teams supporting the expected continued scaling of business operations and revenue growth, as well as for legal and other professional services related to our acquisition program and other strategic initiatives.

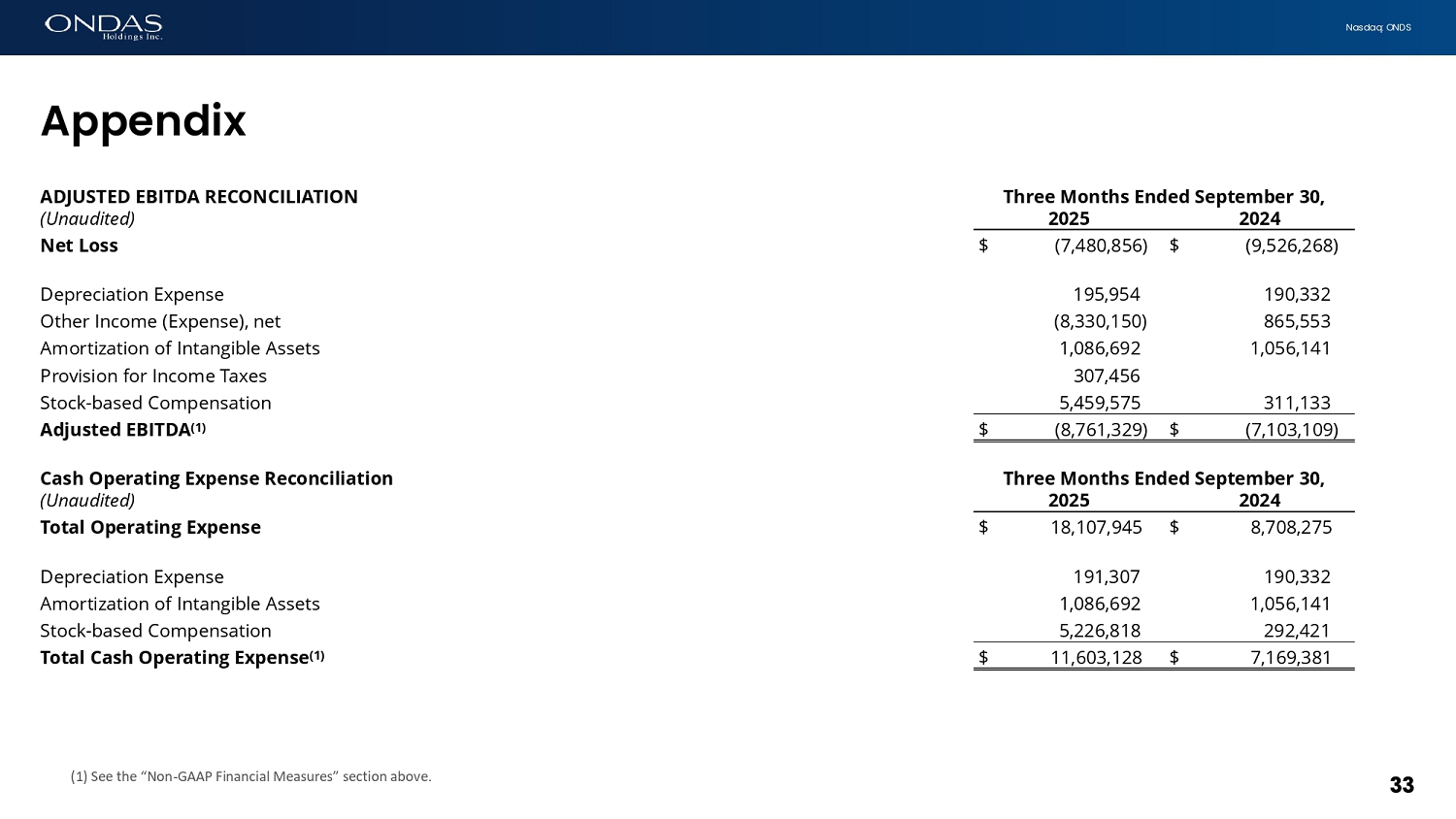

A reconciliation of cash operating expenses, a non-GAAP measure, is provided in the attached financial tables.

Operating loss was $15.5 million, compared to $8.7 million in the third quarter of 2024, primarily due to the increase in operating expenses partially offset by the increased gross profit.

Net loss was $7.5 million, compared to $9.5 million in the third quarter of 2024, which included an increase of $2.0 million in interest and dividend income from the increased cash balance, as well as a $6.9 million unrealized gain on minority equity investments made during the third quarter.

Adjusted EBITDA was a loss of $8.8 million, compared to $7.1 million in the third quarter of 2024. A reconciliation of Adjusted EBITDA, a non-GAAP measure, is provided in the attached financial tables.

Balance Sheet and Cash Flow

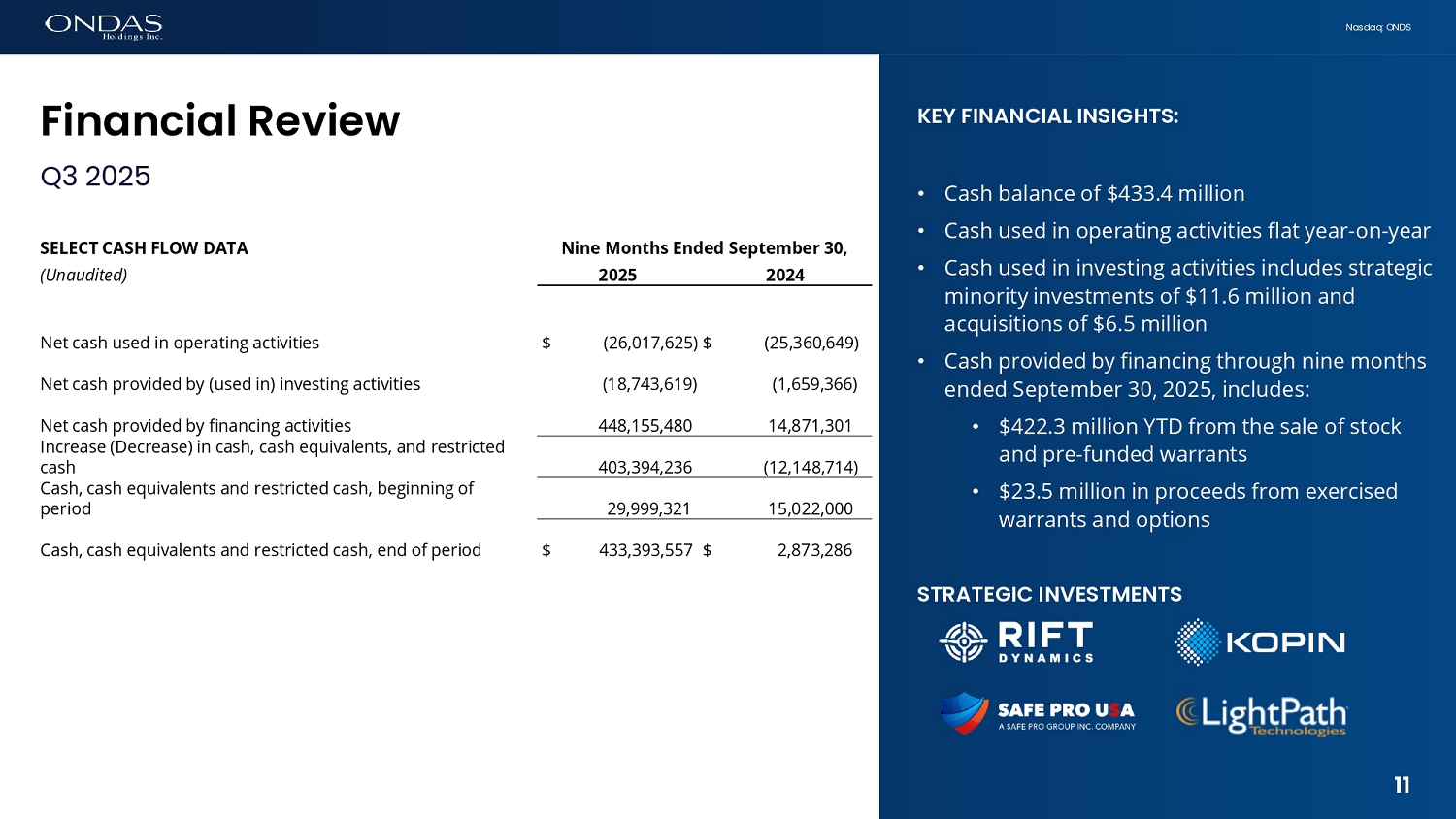

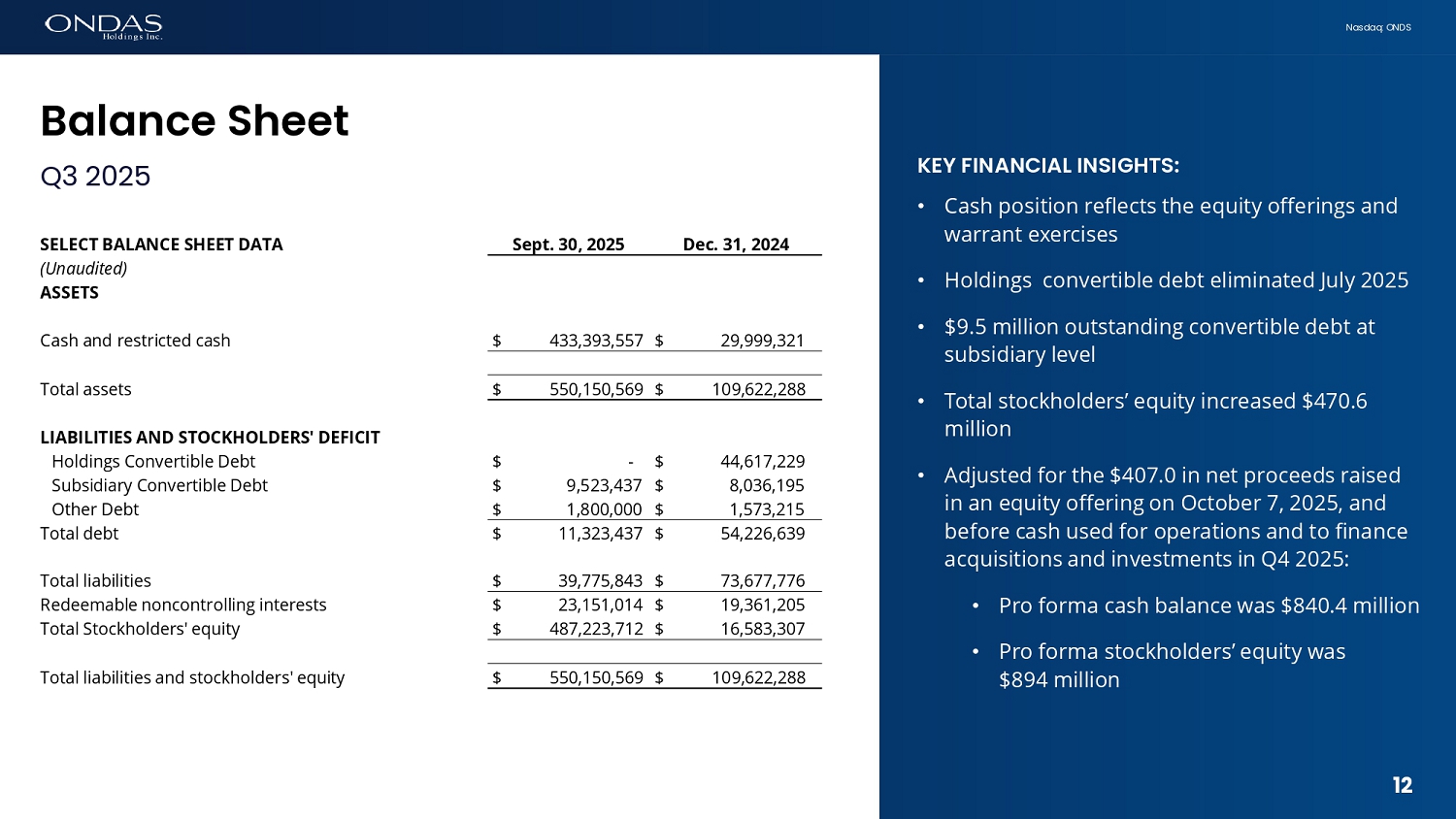

Ondas ended the third quarter of 2025 with $433.4 million in cash, cash equivalents and restricted cash, compared to $30.0 million as of December 31, 2024. Pro forma cash balances were approximately $840.4 million, adjusted for the $407.0 million in net proceeds raised in an equity offering on October 7, 2025 and before cash used for operations and to finance acquisitions and investments in Q4 2025.

Cash flows from financing activities in the nine-months ended September 30, 2025 was $448.2 million, were provided through various equity offerings, as well as through the exercise of warrants and options. Cash used in investing activities was $18.7 million. Cash used in operating activities was $26.0 million in the current period compared to $25.4 million in the first nine months of 2024.

Convertible debt outstanding, net of issuance costs, was $9.5 million as of September 30, 2025, a significant decrease from $52.7 million as of December 31, 2024. The decrease was driven by the conversion of all of the holding-company convertible debt into equity. The remaining convertible debt is convertible into shares of subsidiary companies.

As a result of the financing activities and the debt conversions, total shareholders’ equity increased to $487.2 million as of September 30, 2025, an increase of $470.6 million from $16.6 million as of December 31, 2024.

Operational and Financial Outlook

The Company continues to experience strong growth in 2025 and now expects to generate revenue of at least $36 million for the year, an increase from the prior target of at least $25 million. This new revenue target reflects continued strong performance of Ondas’ core OAS business and the addition of newly acquired businesses since the beginning of the second quarter of 2025. This outlook is supported by results to date and the $23.3 million in consolidated backlog at the end of Q3 2025, as well as visibility on expected production and delivery schedules with customers. Revenue expectations for Ondas Networks are modest given the delayed ramp in network deployments from the Class I Railroads. The Company expects to end the year with record backlog positioning Ondas for continued strong growth into 2026. The Company has established a preliminary revenue target of at least $110 million for 2026.

Bookings and revenue growth are expected to fluctuate from quarter-to-quarter given the variability around both expected orders associated with program expansion with existing customers, as well as the timing of the addition of new customers at OAS, and the timing of rail network buildouts for Ondas Networks.

Earnings Conference Call & Audio Webcast Details

An earnings conference call is scheduled for today, November 13, 2025, at 8:30 a.m. Eastern Time (5:30 a.m. Pacific Time). and via the investor relations section of the Company’s website at ir.ondas.com. A replay will be accessible from the investor relations website after completion of the event. here and via the investor relations section of the Company’s website at ir.ondas.com. A replay will be accessible from the investor relations website after completion of the event.

Date: Thursday, November 13, 2025

Time: 8:30 a.m. Eastern Time

Toll-free dial-in number: 844-883-3907

International dial-in number: 412-317-5798

Call participant pre-registration link: here

The Company encourages listeners to pre-register, which allows callers to gain immediate access and bypass the live operator. Please note that you can register at any time during the call. For those who choose not to pre-register, please call the conference telephone number 10-15 minutes prior to the start time, at which time an operator will register your name and organization.

About Ondas Holdings Inc.

Ondas Holdings Inc. (Nasdaq: ONDS) is a leading provider of autonomous systems and private wireless solutions through its business units Ondas Autonomous Systems (OAS), Ondas Capital and Ondas Networks. Ondas’ technologies offer a powerful combination of aerial intelligence and next-generation connectivity to enhance security, operational efficiency, and data-driven decision-making across essential industries.

OAS delivers a portfolio of AI-powered defense and security platforms that are deployed globally to safeguard sensitive locations, populations, and infrastructure. Through its subsidiaries American Robotics, Airobotics, and Apeiro Motion, OAS offers the Optimus System—the first U.S. FAA-certified small UAS for automated aerial security and data capture—the Iron Drone Raider—an autonomous counter-UAS platform—and Apeiro’s advanced ground robotics and tethered UAV systems, supported by innovative navigation and communications technologies.

Ondas Capital plans to combine advisory services and strategic investment management services to accelerate the rapid scaling and global deployment of unmanned and autonomous systems to Allied defense and security markets.

Ondas Networks provides software-defined wireless broadband technology through its FullMAX platform, based on the IEEE 802.16t standard. This standards-based system delivers high-performance connectivity for mission-critical IoT applications in markets such as rail, utilities, oil and gas, transportation, and government.

For additional information on Ondas Holdings: www.ondas.com, X and LinkedIn

For Ondas Autonomous Systems: LinkedIn

For Airobotics: www.airoboticsdrones.com, X and LinkedIn

For American Robotics: www.american-robotics.com, X and LinkedIn

For Apeiro Motion: www.apeiro-motion.com, LinkedIn

Non-GAAP Financial Measure

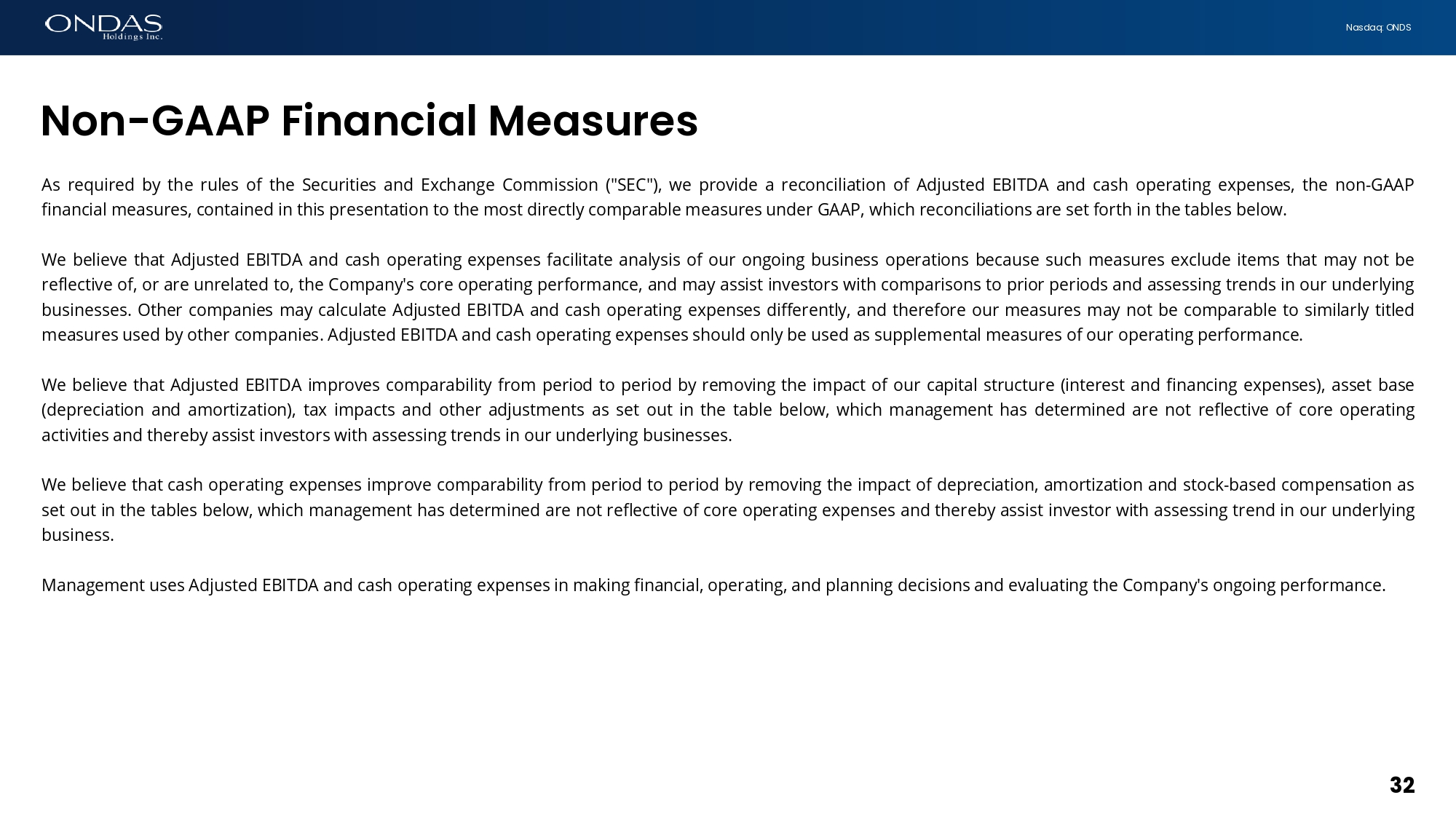

For Ondas Networks: www.ondasnetworks.com, X and LinkedIn As required by the rules of the Securities and Exchange Commission (“SEC”), we provide a reconciliation of Adjusted EBITDA and cash operating expenses, the non-GAAP financial measures, contained in this press release to the most directly comparable measures under GAAP, which reconciliations are set forth in the tables below.

We believe that Adjusted EBITDA and cash operating expenses facilitate analysis of our ongoing business operations because such measures exclude items that may not be reflective of, or are unrelated to, the Company’s core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses. Other companies may calculate Adjusted EBITDA and cash operating expenses differently, and therefore our measures may not be comparable to similarly titled measures used by other companies. Adjusted EBITDA and cash operating expenses should only be used as supplemental measures of our operating performance.

We believe that Adjusted EBITDA improves comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments as set out in the table below, which management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses.

We believe that cash operating expenses improve comparability from period to period by removing the impact of depreciation, amortization and stock-based compensation as set out in the tables below, which management has determined are not reflective of core operating expenses and thereby assist investor with assessing trend in our underlying business.

Management uses Adjusted EBITDA and cash operating expenses in making financial, operating, and planning decisions and evaluating the Company’s ongoing performance.

Forward-Looking Statements

Statements made in this release that are not statements of historical or current facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. We caution readers that forward-looking statements are predictions based on our current expectations about future events. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict. Our actual results, performance, or achievements could differ materially from those expressed or implied by the forward-looking statements as a result of a number of factors, including the risks discussed under the heading “Risk Factors” discussed under the caption “Item 1A. Risk Factors” in Part I of our most recent Annual Report on Form 10-K or any updates discussed under the caption “Item 1A. Risk Factors” in Part II of our Quarterly Reports on Form 10-Q and in our other filings with the SEC. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise that occur after that date, except as required by law.

Contacts

IR Contact for Ondas Holdings Inc.

888.350.9994

ir@ondas.com

Media Contact for Ondas

Escalate PR

ondas@escalatepr.com

Preston Grimes

Marketing Manager, Ondas Holdings Inc.

Preston.grimes@ondas.com

ONDAS HOLDINGS INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| September 30, | December 31, | |||||||

| 2025 | 2024 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash | $ | 432,816,982 | $ | 29,958,106 | ||||

| Restricted cash | 576,575 | 41,215 | ||||||

| Certificates of deposit | 917,570 | - | ||||||

| Investments in marketable equity securities | 17,893,276 | - | ||||||

| Accounts receivable, net | 5,222,547 | 5,223,182 | ||||||

| Inventory, net | 12,522,999 | 9,821,692 | ||||||

| Other current assets | 8,926,036 | 2,476,356 | ||||||

| Total current assets | 478,875,985 | 47,520,551 | ||||||

| Property and equipment, net | 2,595,499 | 2,586,691 | ||||||

| Other Assets: | ||||||||

| Goodwill, net of accumulated impairment charges | 34,773,934 | 27,751,921 | ||||||

| Intangible assets, net | 28,120,281 | 27,178,057 | ||||||

| Long-term equity investments | 587,250 | - | ||||||

| Deposits and other assets | 663,043 | 663,073 | ||||||

| Operating lease right of use assets | 4,534,577 | 3,921,995 | ||||||

| Total other assets | 68,679,085 | 59,515,046 | ||||||

| Total assets | $ | 550,150,569 | $ | 109,622,288 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current Liabilities: | ||||||||

| Accounts payable | $ | 8,377,187 | $ | 5,659,643 | ||||

| Operating lease liabilities | 1,635,116 | 1,121,565 | ||||||

| Accrued expenses and other current liabilities | 7,368,895 | 4,719,214 | ||||||

| Notes payable, net of unamortized debt discount and issuance costs of $0 and $226,785, respectively, related party | 1,500,000 | 1,273,215 | ||||||

| Convertible notes payable, net of unamortized debt discount and issuance cost of $55,439 and $362,237, respectively, related party | 5,414,561 | 5,137,763 | ||||||

| Convertible notes payable, net of unamortized debt discount and issuance cost of $121,124 and $5,236,362, respectively | 4,108,876 | 31,947,445 | ||||||

| Deferred revenue | 2,097,848 | 329,025 | ||||||

| Government grant liability | 805,390 | 388,752 | ||||||

| Total current liabilities | 31,307,873 | 50,576,622 | ||||||

| Long-Term Liabilities: | ||||||||

| Notes payable | 300,000 | 300,000 | ||||||

| Convertible notes payable, net of current, net of unamortized debt discount and issuance cost of $0 and $1,681,784, respectively | - | 15,568,216 | ||||||

| Accrued interest | 23,171 | 20,041 | ||||||

| Government grant liability, net of current | 2,165,785 | 2,168,430 | ||||||

| Operating lease liabilities, net of current | 5,011,647 | 4,961,967 | ||||||

| Deferred tax liability | 867,483 | - | ||||||

| Other liabilities | 99,884 | 82,500 | ||||||

| Total long-term liabilities | 8,467,970 | 23,101,154 | ||||||

| Total liabilities | 39,775,843 | 73,677,776 | ||||||

| Commitments and Contingencies (Note 15) | ||||||||

| Temporary Equity | ||||||||

| Redeemable noncontrolling interest | 23,151,014 | 19,361,205 | ||||||

| Stockholders’ Equity | ||||||||

| Preferred stock - par value $0.0001; 5,000,000 shares authorized and none issued or outstanding at September 30, 2025 and December 31, 2024 | - | - | ||||||

| Preferred stock, Series A - par value $0.0001; 5,000,000 shares authorized and none issued or outstanding at September 30, 2025 and December 31, 2024 | - | - | ||||||

| Common Stock - par value $0.0001; 400,000,000 and 300,000,000 shares authorized at September 30, 2025 and December 31, 2024, respectively; 329,515,817 and 93,173,191 issued and outstanding, respectively September 30, 2025 and December 31, 2024, respectively | 32,951 | 9,317 | ||||||

| Additional paid in capital | 754,767,458 | 252,941,813 | ||||||

| Accumulated deficit | (268,722,540 | ) | (236,367,823 | ) | ||||

| Total Ondas Holdings stockholders’ equity | 486,077,869 | 16,583,307 | ||||||

| Noncontrolling interest | 1,145,843 | - | ||||||

| Total stockholders’ equity | 487,223,712 | 16,583,307 | ||||||

| Total liabilities and stockholders’ equity | $ | 550,150,569 | $ | 109,622,288 | ||||

ONDAS HOLDINGS INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Revenues, net | $ | 10,098,310 | $ | 1,480,792 | $ | 20,619,880 | $ | 3,063,652 | ||||||||

| Cost of goods sold | 7,493,915 | 1,433,232 | 13,194,865 | 3,601,969 | ||||||||||||

| Gross profit (loss) | 2,604,395 | 47,560 | 7,425,015 | (538,317 | ) | |||||||||||

| Operating expenses: | ||||||||||||||||

| General and administrative | 10,595,469 | 4,114,986 | 22,583,398 | 12,177,062 | ||||||||||||

| Sales and marketing | 2,999,720 | 1,410,944 | 7,695,545 | 4,040,798 | ||||||||||||

| Research and development | 4,512,756 | 3,182,345 | 12,209,164 | 9,335,323 | ||||||||||||

| Total operating expenses | 18,107,945 | 8,708,275 | 42,488,107 | 25,553,183 | ||||||||||||

| Operating loss | (15,503,550 | ) | (8,660,715 | ) | (35,063,092 | ) | (26,091,500 | ) | ||||||||

| Other income (expense), net | ||||||||||||||||

| Other income (expense), net | 31,479 | (1,786 | ) | 13,113 | (3,853 | ) | ||||||||||

| Change in fair value of government grant liability | (87,186 | ) | (86,307 | ) | (354,560 | ) | 462,710 | |||||||||

| Interest and dividend income | 1,992,274 | 121,608 | 2,443,420 | 306,385 | ||||||||||||

| Unrealized gain on investments | 6,893,277 | - | 6,893,277 | - | ||||||||||||

| Interest expense | (444,449 | ) | (871,335 | ) | (5,872,818 | ) | (2,357,497 | ) | ||||||||

| Foreign exchange gain (loss), net | (55,245 | ) | (27,733 | ) | (119,240 | ) | 11,667 | |||||||||

| Total other income (expense), net | 8,330,150 | (865,553 | ) | 3,003,192 | (1,580,588 | ) | ||||||||||

| Loss before income taxes | (7,173,400 | ) | (9,526,268 | ) | (32,059,900 | ) | (27,672,088 | ) | ||||||||

| Provision for income taxes | 307,456 | - | 307,456 | - | ||||||||||||

| Net loss | (7,480,856 | ) | (9,526,268 | ) | (32,367,356 | ) | (27,672,088 | ) | ||||||||

| Less preferred dividends attributable to noncontrolling interest | 390,000 | 390,000 | 1,170,000 | 1,114,138 | ||||||||||||

| Less deemed dividends attributable to accretion of redemption value | 924,202 | 755,644 | 2,619,809 | 2,112,784 | ||||||||||||

| Less net loss attributable to noncontrolling interest | (12,639 | ) | - | (12,639 | ) | - | ||||||||||

| Net loss attributable to common stockholders | $ | (8,782,419 | ) | $ | (10,671,912 | ) | $ | (36,144,526 | ) | $ | (30,899,010 | ) | ||||

| Net loss per share - basic and diluted | $ | (0.03 | ) | $ | (0.15 | ) | $ | (0.21 | ) | $ | (0.46 | ) | ||||

| Weighted average number of common shares outstanding, basic and diluted | 259,909,415 | 70,741,662 | 172,423,160 | 66,732,781 | ||||||||||||

ONDAS HOLDINGS INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| Nine Months Ended | ||||||||

| September 30, | ||||||||

| 2025 | 2024 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

| Net loss | $ | (32,367,356 | ) | $ | (27,672,088 | ) | ||

| Adjustments to reconcile net loss to net cash flows used in operating activities: | ||||||||

| Investment gains | (6,893,277 | ) | - | |||||

| Depreciation | 565,643 | 424,637 | ||||||

| Amortization of debt discount and issuance costs | 4,690,079 | 1,502,657 | ||||||

| Amortization of intangible assets | 3,203,867 | 3,161,729 | ||||||

| Amortization of right of use asset | 845,168 | 902,851 | ||||||

| Retirement of assets | - | 1,578 | ||||||

| Loss on intellectual property | 15,704 | - | ||||||

| Change in fair value of government grant liability | 198,260 | (605,889 | ) | |||||

| Stock-based compensation | 9,210,913 | 988,683 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | 19,615 | 553,887 | ||||||

| Inventory | (2,641,942 | ) | (4,402,549 | ) | ||||

| Other current assets | (5,761,619 | ) | 426,879 | |||||

| Deposits and other assets | 30 | 117,125 | ||||||

| Accounts payable | 1,177,340 | (482,249 | ) | |||||

| Accrued expenses and other current liabilities | 3,964,336 | (71,933 | ) | |||||

| Deferred revenue | (1,339,559 | ) | 170,776 | |||||

| Operating lease liability | (894,519 | ) | (459,243 | ) | ||||

| Deferred tax liability | (11,356 | ) | - | |||||

| Other liabilities | 1,048 | 82,500 | ||||||

| Net cash flows used in operating activities | (26,017,625 | ) | (25,360,649 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||

| Patent costs | (44,812 | ) | (22,030 | ) | ||||

| Purchase of equipment | (437,298 | ) | (1,606,358 | ) | ||||

| Proceeds from sale of equipment | - | 1,700 | ||||||

| Purchase of software intangible | (15,615 | ) | (32,678 | ) | ||||

| Purchase of long-term equity investment | (587,250 | ) | - | |||||

| Purchases of equity securities | (10,999,999 | ) | - | |||||

| Cash paid for asset acquisition, net of cash acquired | (169,724 | ) | ||||||

| Cash paid for business acquisition, net of cash acquired | (6,488,921 | ) | - | |||||

| Net cash flows used in investing activities | (18,743,619 | ) | (1,659,366 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

| Proceeds from sale of noncontrolling interest in Ondas Networks, net of issuance costs | - | 4,375,035 | ||||||

| Proceeds from sale of common stock and warrants, net of issuance costs | 422,308,698 | 7,327,334 | ||||||

| Proceeds from exercise of options and warrants | 23,549,209 | 8,702 | ||||||

| Proceeds from exercise of warrants in OAS | 1,158,482 | - | ||||||

| Proceeds from convertible notes payable, net of issuance costs, related party | - | 1,482,868 | ||||||

| Proceeds from convertible notes payable, net of issuance costs | 923,358 | - | ||||||

| Proceeds from notes payable, net of issuance costs, related party | - | 1,377,524 | ||||||

| Proceeds from government grant | 364,683 | 299,838 | ||||||

| Payments on government grant liability | (148,950 | ) | - | |||||

| Net cash flows provided by financing activities | 448,155,480 | 14,871,301 | ||||||

| Increase (decrease) in cash, cash equivalents, and restricted cash | 403,394,236 | (12,148,714 | ) | |||||

| Cash, cash equivalents, and restricted cash, beginning of period | 29,999,321 | 15,022,000 | ||||||

| Cash, cash equivalents, and restricted cash, end of period | $ | 433,393,557 | $ | 2,873,286 | ||||

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: | ||||||||

| Cash paid for interest | $ | 8,120 | $ | 16,845 | ||||

| Cash paid for income taxes | $ | 9,662 | $ | - | ||||

| SUPPLEMENTAL SCHEDULE OF NON-CASH FINANCING ACTIVITIES: | ||||||||

| Preferred dividends attributable to redeemable noncontrolling interest | $ | 1,170,000 | $ | 1,114,138 | ||||

| Accretion of redeemable preferred stock in Ondas Networks | $ | 2,619,809 | $ | 2,112,784 | ||||

| Common stock issued in exchange for debt repayment | $ | 53,218,418 | $ | 2,079,375 | ||||

| Noncash consideration for settlement of development agreement payable | $ | - | $ | 342,428 | ||||

| Warrants in Ondas Autonomous Systems, in relation to sale of common stock | $ | - | $ | 954,737 | ||||

| Warrants in Ondas Holdings, in relation to sale of common stock | $ | - | $ | 2,198,559 | ||||

| Warrants in relation to sale of redeemable preferred stock in Ondas Networks | $ | - | $ | 1,471,194 | ||||

| Warrants in Ondas Networks, in relation to notes payable and convertible notes payable | $ | 345,403 | $ | 589,924 | ||||

| Transfer of equipment into inventory | $ | - | $ | 2,289,539 | ||||

| Operating leases right-of-use assets obtained in exchange of lease liabilities | $ | 1,457,750 | $ | - | ||||

ONDAS HOLDINGS INC.

RECONCILIATIONS OF ADJUSTED EBITDA

(Unaudited)

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Net Loss | $ | (7,480,856 | ) | $ | (9,526,268 | ) | $ | (32,367,356 | ) | $ | (27,672,088 | ) | ||||

| Depreciation | 195,954 | 190,332 | 565,643 | 424,637 | ||||||||||||

| Amortization of intangible assets | 1,086,692 | 1,056,141 | 3,203,867 | 3,161,729 | ||||||||||||

| Other (income) expense, net(1) | (8,330,150 | ) | 865,553 | (3,003,192 | ) | 1,580,588 | ||||||||||

| Provision for income taxes | 307,456 | - | 307,456 | - | ||||||||||||

| Stock-based compensation | 5,459,575 | 311,133 | 9,210,913 | 988,683 | ||||||||||||

| Adjusted EBITDA | $ | (8,761,329 | ) | $ | (7,103,109 | ) | $ | (22,082,669 | ) | $ | (21,516,451 | ) | ||||

| (1) | Other (income) expense, net includes interest and dividend income, unrealized gain on investments, interest expense, foreign exchange gain (loss), net, change in fair value of government grant liability, and other income (expense), net included on the Company’s Condensed Consolidated Statements of Operations. |

ONDAS HOLDINGS INC.

RECONCILIATIONS OF CASH OPERATING EXPENSES

(Unaudited)

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Total operating expenses | $ | 18,107,945 | $ | 8,708,275 | $ | 42,488,107 | $ | 25,553,183 | ||||||||

| Depreciation | (191,307 | ) | (190,332 | ) | (531,844 | ) | (366,978 | ) | ||||||||

| Amortization of intangible assets | (1,086,692 | ) | (1,056,141 | ) | (3,203,867 | ) | (3,161,729 | ) | ||||||||

| Stock-based compensation | (5,226,818 | ) | (292,421 | ) | (8,651,014 | ) | (932,923 | ) | ||||||||

| Cash operating expenses | $ | 16,829,946 | $ | 7,461,802 | $ | 38,752,396 | $ | 22,024,476 | ||||||||

Exhibit 99.2

Nasdaq: ONDS 1 Third Qu6rter 2025 E6rfiifigs Rele6se Copyright 2025. All rights reserved.

NASDAQ: ONDS | November 13, 2025 Nasdaq: ONDS This presentation may contain "forward - looking statements" as that term is defined under the Private Securities Litigation Reform Act of 1995 (PSLRA), which statements may be identified by words such as "expects," "projects," "will," "may," "anticipates," "believes," "should," "intends," "estimates," and other words of similar meaning . Ondas Holdings Inc . (“Ondas” or the “Company”) cautions readers that forward - looking statements are predictions based on its current expectations about future events . These forward - looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict . The Company’s actual results, performance, or achievements could differ materially from those expressed or implied by the forward - looking statements as a result of a number of factors, including, the risks discussed under the heading “Risk Factors” in the Company’s most recent Annual Report on Form 10 - K filed with the U . S . Securities and Exchange Commission (“SEC”), in the Company’s Quarterly Reports on Form 10 - Q filed with the SEC, and in the Company’s other filings with the SEC . The Company undertakes no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise that occur after that date, except as required by law . Also, this presentation contains certain non - GAAP financial measures . For a description of these non - GAAP financial measures, including reconciliations to the most comparable measure under GAAP, see the Appendix to this presentation . Information in this presentation is not an offer to sell securities or the solicitation of an offer to buy securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction .

2 Discl6imer Nasdaq: ONDS Le6dership Te6m Eric Brock CHAIRMAN, CEO Founder of Ondas with over 25 years of leadership in finance and technology, Neil L6ird CFO Veteran finance executive with 25 years of experience leading financial operations across global technology firms. Oshri Lug6ssy CO - CEO Defense and technology executive with deep military and industry experience expanding OAS’ global operations. M6rkus Nottelm6fifi CEO Technology and operations leader with extensive experience introducing advanced communications in rail and infrastructure markets.. Meir Klifier PRESIDENT Meir is an entrepreneur with over 20 years of proven track record in aerospace development and manufacturing. 3 Nasdaq: ONDS Agefid6 • Introduction • Financial Review • Business Update • Ondas Networks • Ondas Autonomous Systems (OAS) • Outlook & Closing Remarks • Q&A 4 4

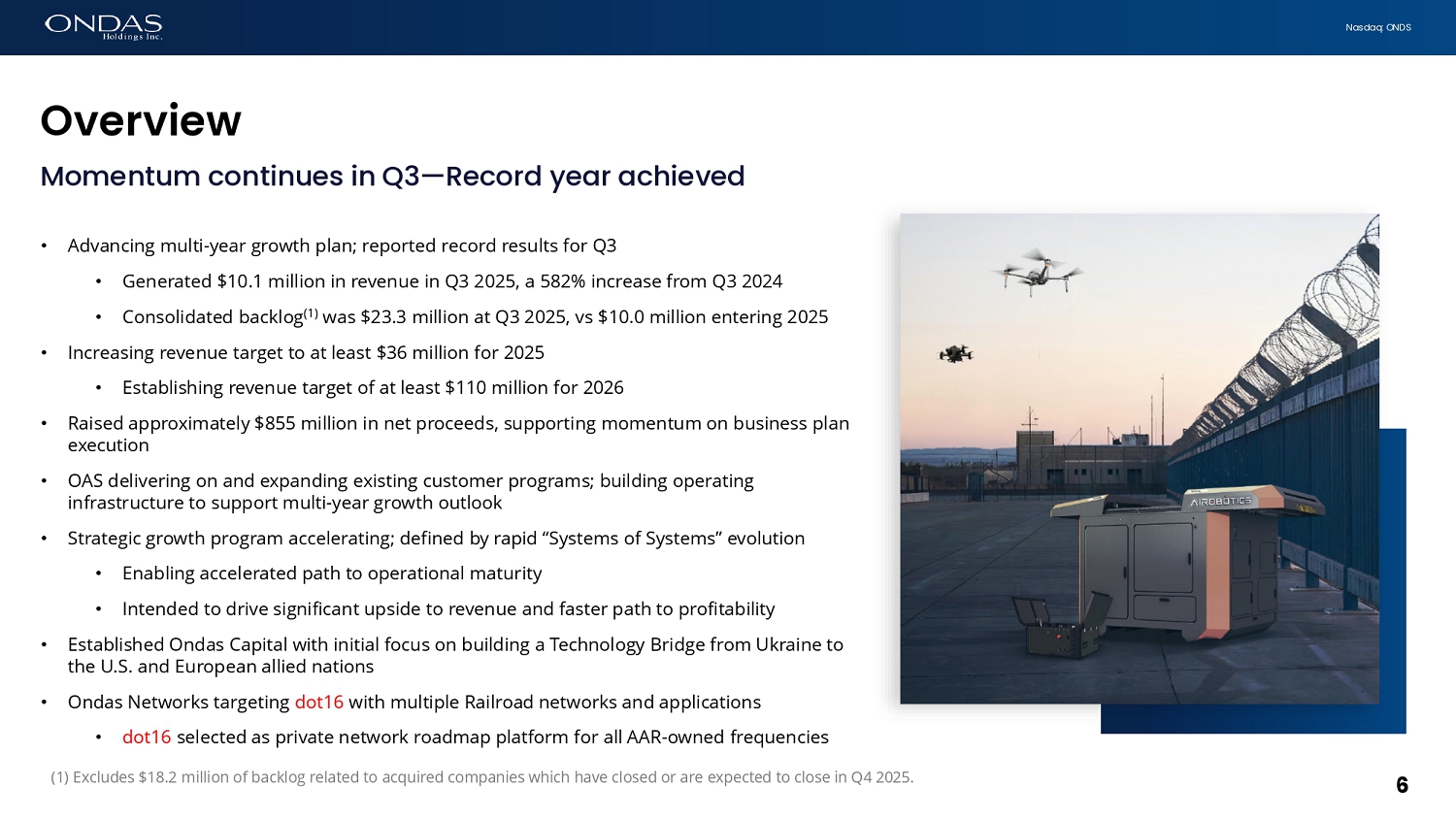

Nasdaq: ONDS Ofid6s is Positiofied for Success 4 5 Executing our growth plan • Autonomy markets at inflection point • Demonstrating platform adoption with Iron Drone and Optimus • Launched our Core + Strategic Growth Plan • Capital position supports shareholder value acceleration DELIVERING THE PLAN WE SAID WE WOULD EXECUTE 6 Nasdaq: ONDS Overview Momentum continues in Q3 — Record year achieved • Advancing multi - year growth plan; reported record results for Q3 • Generated $10.1 million in revenue in Q3 2025, a 582% increase from Q3 2024 • Consolidated backlog (1) was $23.3 million at Q3 2025, vs $10.0 million entering 2025 • Increasing revenue target to at least $36 million for 2025 • Establishing revenue target of at least $110 million for 2026 • Raised approximately $855 million in net proceeds, supporting momentum on business plan execution • OAS delivering on and expanding existing customer programs; building operating infrastructure to support multi - year growth outlook • Strategic growth program accelerating; defined by rapid “Systems of Systems” evolution • Enabling accelerated path to operational maturity • Intended to drive significant upside to revenue and faster path to profitability • Established Ondas Capital with initial focus on building a Technology Bridge from Ukraine to the U.S. and European allied nations • Ondas Networks targeting dot16 with multiple Railroad networks and applications • dot16 selected as private network roadmap platform for all AAR - owned frequencies (1) Excludes $18.2 million of backlog related to acquired companies which have closed or are expected to close in Q4 2025.

Nasdaq: ONDS Executifig Str6tegic Ro6dm6p Broadening solutions; scaling our operating platform • Expanding the core OAS operational platform • Seasoned executive leadership across disciplines • Impactful, multi - discipline Advisory Board • Advancing ecosystem partnerships across: • Technology platforms • Sales, marketing and field support • Supply chain & production • Strategic acquisition and investment pipeline maturing and expanding • Targets include larger, more mature businesses • Adding more key leadership and talent • Capturing new customers, ecosystem partners 7 7 Nasdaq: ONDS Ofid6s C6pit6l A strategic growth platform Ondas Capital is a multi - year initiative to deploy $150 million to accelerate the transition of battle - tested unmanned and dual - use technologies from Ukraine and allied nations into trusted U.S. and European production. Mission Scale proven unmanned, AI, and dual - use technologies at Technology Readiness Level 7 (TRL 7) or higher, enabling rapid production and deployment across the U.S. and Europe faster, cheaper, and at scale. Targeted Outcomes Ondas Capital aims to create and scale new businesses that expand Ondas’ total addressable markets, leveraging the Company’s global operating platform to accelerate commercialization of defense and security platforms. By integrating investment, production, and market access capabilities, Ondas Capital seeks to generate strong financial returns while strengthening the allied industrial ecosystem and advancing Ondas’ leadership across defense, security, and dual - use innovation. Global Footprint Anchored in the U.S. with forward offices in key allied innovation and financial corridors, Boston, New York, Kyiv, Tallinn, London, and Frankfurt, Ondas Capital links technology origination, investment deployment, and production integration operationalizing defense and security systems across three continents. This transatlantic network positions Ondas Capital at the center of the allied industrial ecosystem supporting Ukraine’s defense and technology innovation. 7 8 Nasdaq: ONDS 9 Third Quarter 2025 Earnings Release FINANCIAL REVIEW Copyright 2025.

All rights reserved. NASDAQ: ONDS | November 13, 2025

10 Nasdaq: ONDS KEY FINANCIAL INSIGHTS: • Revenue growth reflects strong demand for autonomous, unmanned platforms • Gross profit remains variable due to low volumes and product mix shifts • Increase in cash operating expenses to support scaling OAS operations in advance of expected growth and for strategic program • Adjusted EBITDA loss widened by $1.7 million, largely due to increase in cash operating expenses; partially offset by increase in gross profit (1) See the “Non - GAAP Financial Measures” section in the Appendix. Fifi6fici6l Review Q3 2025 10 Three Months Ended September 30, SELECT P&L DATA 2024 2025 (Unaudited) $ 1,480,792 $ 10,098,310 Revenues, net 1,433,232 7,493,915 Cost of goods sold 47,560 2,604,395 Gross profit 8,708,275 18,107,945 Total operating expenses $ (8,660,715) $ (15,503,550) Operating Loss $ (9,526,268) $ (7,480,856) Net Loss $ 7,169,381 $ 11,603,280 Cash Operating Expenses (1) $ (7,103,109) $ (8,761,329) Adjusted EBITDA (1)

Nasdaq: ONDS KEY FINANCIAL INSIGHTS: • Cash balance of $433.4 million • Cash used in operating activities flat year - on - year • Cash used in investing activities includes strategic minority investments of $11.6 million and acquisitions of $6.5 million • Cash provided by financing through nine months ended September 30, 2025, includes: • $422.3 million YTD from the sale of stock and pre - funded warrants • $23.5 million in proceeds from exercised warrants and options STRATEGIC INVESTMENTS Fifi6fici6l Review Q3 2025 Nine Months Ended September 30, SELECT CASH FLOW DATA 2024 2025 (Unaudited) $ (25,360,649) $ (26,017,625) Net cash used in operating activities (1,659,366) (18,743,619) Net cash provided by (used in) investing activities 14,871,301 448,155,480 Net cash provided by financing activities (12,148,714) 403,394,236 Increase (Decrease) in cash, cash equivalents, and restricted cash 15,022,000 29,999,321 Cash, cash equivalents and restricted cash, beginning of period $ 2,873,286 $ 433,393,557 Cash, cash equivalents and restricted cash, end of period 11 11 Nasdaq: ONDS KEY FINANCIAL INSIGHTS: 11 12 • Cash position reflects the equity offerings and warrant exercises • Holdings convertible debt eliminated July 2025 • $9.5 million outstanding convertible debt at subsidiary level • Total stockholders’ equity increased $470.6 million • Adjusted for the $407.0 in net proceeds raised in an equity offering on October 7, 2025, and before cash used for operations and to finance acquisitions and investments in Q4 2025: • Pro forma cash balance was $840.4 million • Pro forma stockholders’ equity was $894 million B6l6fice Sheet Q3 2025 Dec. 31, 2024 Sept. 30, 2025 SELECT BALANCE SHEET DATA (Unaudited) ASSETS $ 29,999,321 $ 433,393,557 Cash and restricted cash $ 109,622,288 $ 550,150,569 Total assets LIABILITIES AND STOCKHOLDERS' DEFICIT $ 44,617,229 $ - Holdings Convertible Debt $ 8,036,195 $ 9,523,437 Subsidiary Convertible Debt $ 1,573,215 $ 1,800,000 Other Debt $ 54,226,639 $ 11,323,437 Total debt $ 73,677,776 $ 39,775,843 Total liabilities $ 19,361,205 $ 23,151,014 Redeemable noncontrolling interests $ 16,583,307 $ 487,223,712 Total Stockholders' equity $ 109,622,288 $ 550,150,569 Total liabilities and stockholders' equity

14 Nasdaq: ONDS 802.16t Accept6fice Bro6defiifig The 160 MHz wireless spectrum band covers the entire North American rail network (180,000+ miles) and offers the most spectrum for general - purpose network applications. dot16 enables massive capacity increases for legacy networks Network Capacity Improvement Current Usage Frequency Infinite Voice Only 160 MHz 37x HOT / EOT 450 MHz 37x CTC / Wayside 900 MHz A Block Deploying dot16 - enabled 160 MHz networks to address significant industry needs • AAR's Wireless Communications Committee announced that dot16 will be the wireless platform for all new deployments in AAR - owned bands • 160 MHz voice network is now on the dot16 roadmap • 160 MHz is the largest spectrum channel bandwidth owned by the railroads • Ondas will execute a number of pilot programs with several railroads during Q4 and early Q1 2026 to demonstrate dot16 on the 160 MHz network, addressing: • General communications needs • Specific signaling requirements • Network - wide general - purpose networking capabilities • Ondas continues to build out the dot16 third - party ecosystem dot16 has been selected as the upgrade path for ALL AAR - owned private networks 14 Nasdaq: ONDS Executiofi 6fid Outlook NEC Corridor and Indian radios entering shipping in Q4 • Northeast Corridor ACSES radios for Amtrak will start shipping during Q4 • We expect initial deliveries for Siemens India Head - of - Train radios to commence with the next few months • Next Generation Head - of - Train / End - of - Train ( NGHE ) is being accelerated by the Class 1s • AAR motivated to address performance and reliability concerns with legacy technology • Mitigate known security vulnerabilities with legacy equipment • WCC committed to finalize NGHE Generation 4 specifications in 2026 • Ondas is working with HOT / EOT manufacturers to be ready for commercialization • We continue to engage with the railroads on specific 900 MHz applications, though timelines of large network deployments remain uncertain • Work with specific railroads to accelerate 160 MHz adoption; execute initial application pilots in Q4 and early 2026 15

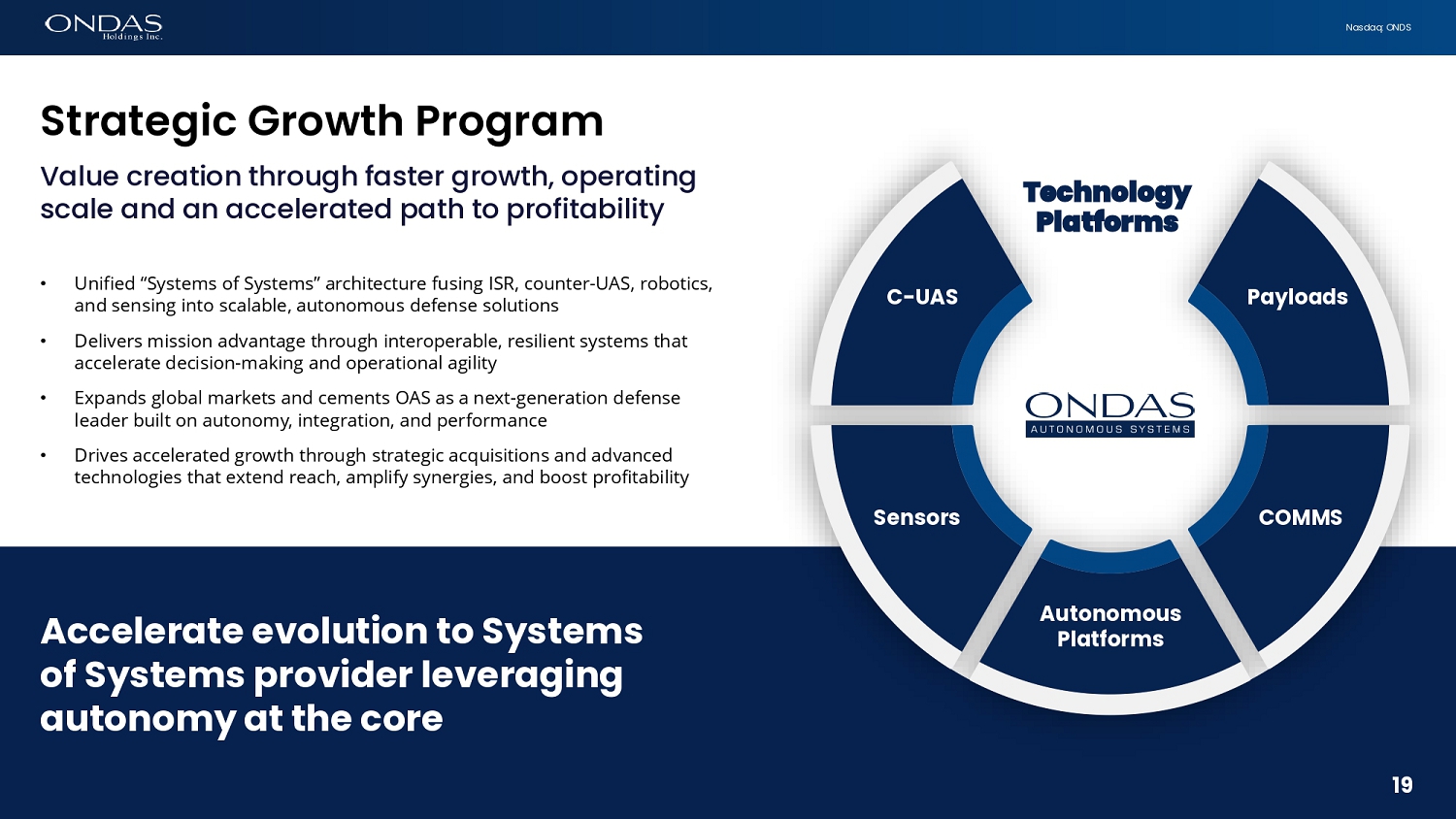

Nasdaq: ONDS VISION OAS is positioned to shape the future of defense and security - delivering autonomous, unmanned and connected systems that power mission - critical operations worldwide. We are building the infrastructure of resilience and intelligence that governments and industries trust to protect and perform. 17 Nasdaq: ONDS OAS Highlights Record - high revenue – expanding OAS as a multi - domain defense and security firm • Generated record high revenues of $10 million during Q3 2025 • OAS backlog has grown to $22.2 million at Q3 2025 • OAS backlog stands at $40.4 million including closed/pending acquisitions in Q4 2025 • Continued to expand pipeline for Iron Drone • Successfully executed counter - UAS pilots for government agencies in Europe and Asia • Showcased Iron Drone Raider at various events including INTERPOL CUAS - IDICE 2025 • Successful demonstration to German Armed Forces and others with Securiton Germany • US pipeline continues to mature in front of strong market growth • Entered strategic partnership and investment with Rift Dynamics; placed initial order for Wasp FVP drone • Launched NDAA - compliant Made - in - USA fiber - optic spools at American Robotics; preparing US production launch in Q4 for Optimus and Iron Drone • Continued to scale the operating platform with key leadership additions Optimus secures GreenUAS list BlueUAS inclusion pending Former Rafael CEO, Major General (Ret.) Yoav Har - Even, joins OAS Advisory Board 18 18 Nasdaq: ONDS Str6tegic Growth Progr6m Value creation through faster growth, operating scale and an accelerated path to profitability • Unified “Systems of Systems” architecture fusing ISR, counter - UAS, robotics, and sensing into scalable, autonomous defense solutions • Delivers mission advantage through interoperable, resilient systems that accelerate decision - making and operational agility • Expands global markets and cements OAS as a next - generation defense leader built on autonomy, integration, and performance • Drives accelerated growth through strategic acquisitions and advanced technologies that extend reach, amplify synergies, and boost profitability Autonomous Platforms Sensors Payloads COMMS C - UAS Technology Platforms 18 19 Accelerate evolution to Systems of Systems provider leveraging autonomy at the core

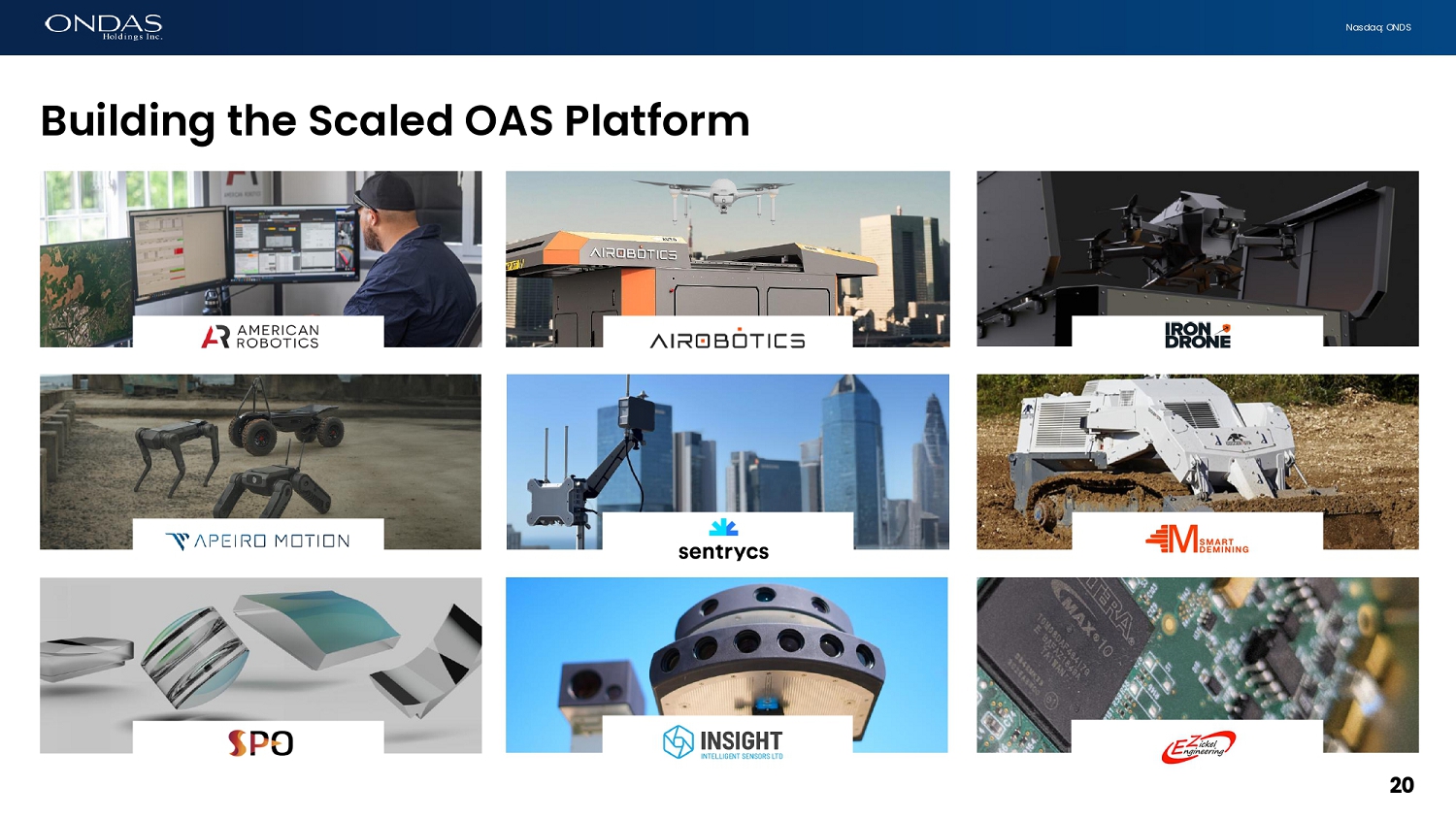

Nasdaq: ONDS Buildifig the Sc6led OAS Pl6tform 20

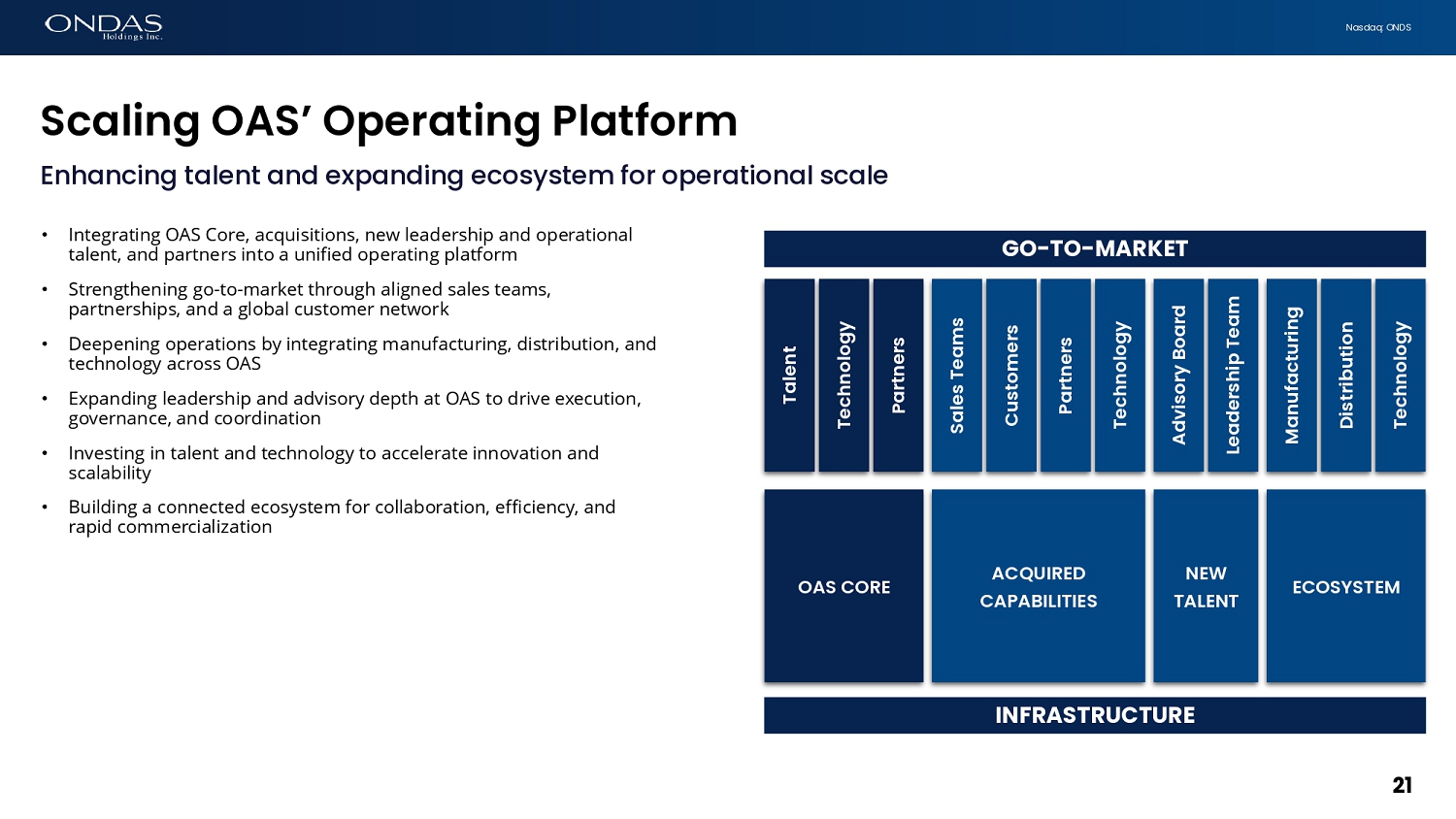

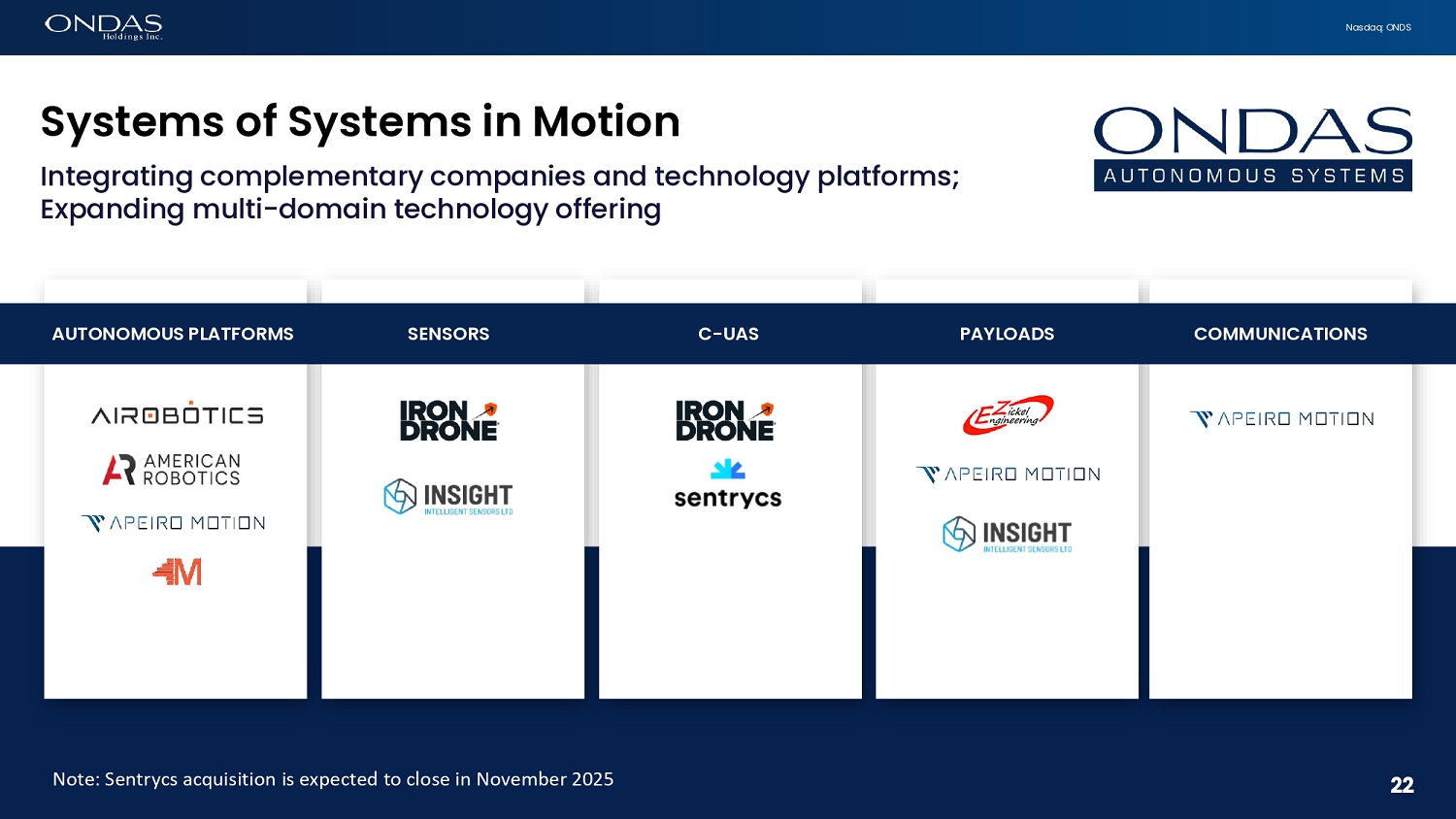

Nasdaq: ONDS Sc6lifig OAS’ Oper6tifig Pl6tform Enhancing talent and expanding ecosystem for operational scale OAS CORE T6lefi t Techfiolog y P6rtfier s ACQUIRED CAPABILITIES S6les Te6ms Customer s P6rtfier s Techfiolog y NEW TALENT Advisory Bo6rd Le6dership Te6m ECOSYSTEM M6fiuf6cturifi g Distributiof i Techfiolog y 21 INFRASTRUCTURE GO - TO - MARKET • Integrating OAS Core, acquisitions, new leadership and operational talent, and partners into a unified operating platform • Strengthening go - to - market through aligned sales teams, partnerships, and a global customer network • Deepening operations by integrating manufacturing, distribution, and technology across OAS • Expanding leadership and advisory depth at OAS to drive execution, governance, and coordination • Investing in talent and technology to accelerate innovation and scalability • Building a connected ecosystem for collaboration, efficiency, and rapid commercialization 22 Nasdaq: ONDS 22 Systems of Systems ifi Motiofi Integrating complementary companies and technology platforms; Expanding multi - domain technology offering COMMUNICATIONS AUTONOMOUS PLATFORMS SENSORS C - UAS PAYLOADS Note: Sentrycs acquisition is expected to close in November 2025

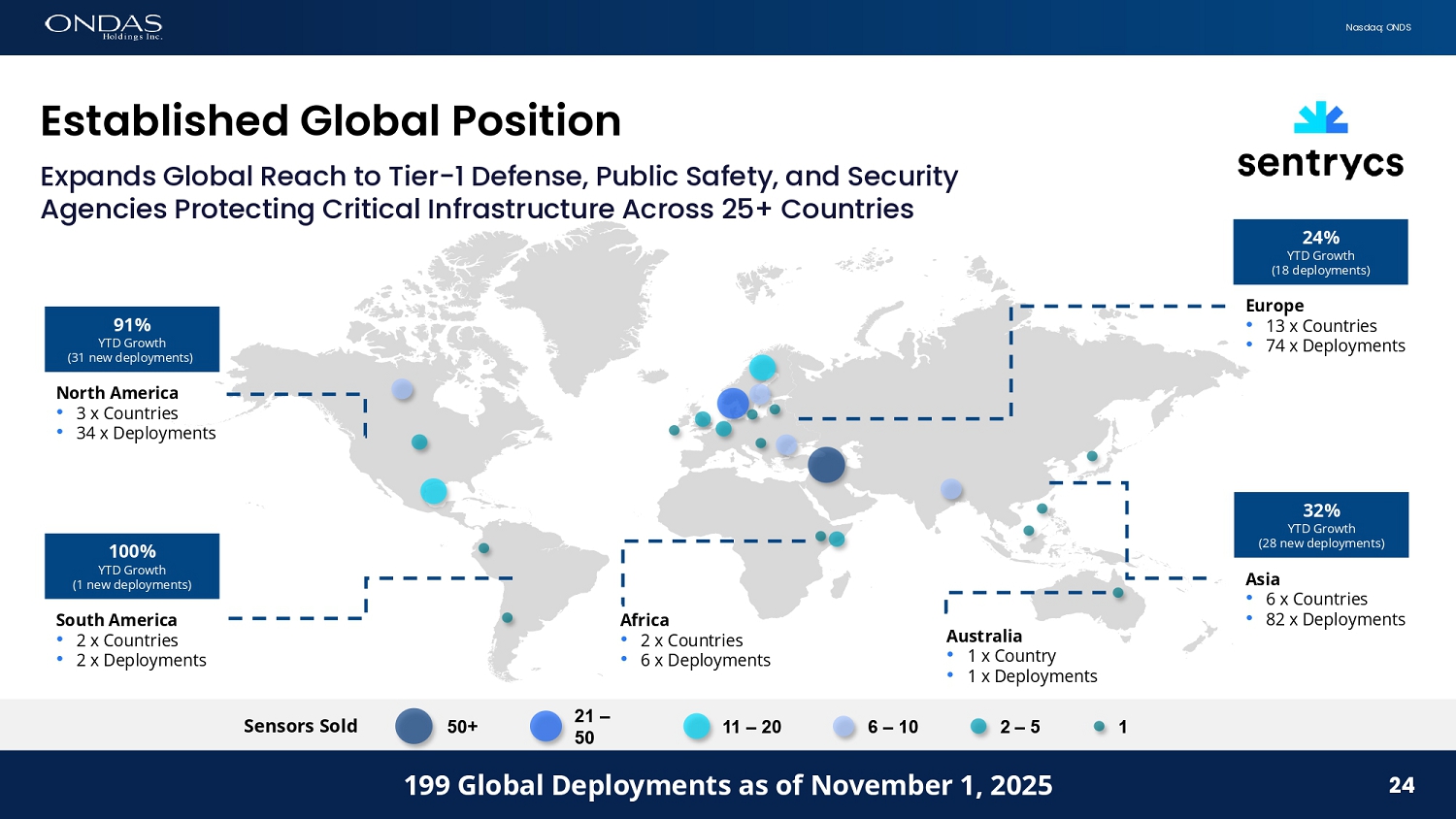

23 Nasdaq: ONDS Tr6fisformifig Airsp6ce Security through P6ssive, Ifitelligefit Drofie Cofitrol • Cyber - over - RF (CoRF) Platform – Proprietary protocol - manipulation technology that listens, decodes, and communicates directly with hostile drones — identifying both drone and operator and safely assuming control without jamming or collateral damage • Full - Spectrum Intelligence Layer – Detects, identifies, tracks, and mitigates threats using a single passive sensor with 95%+ coverage of commercial and DIY drones • Next - Generation Automation – AI - driven “Horizon” engine adapts in real time to emerging protocols and DIY builds, ensuring persistent detection and rapid updates in hours, not months • Flexible Deployment – Portable, fixed, and vehicle - mounted kits enable scalable protection for defense bases, borders, airports, prisons, and critical infrastructure 23 Tal Cohen Founder & General Manager 24 Nasdaq: ONDS 199 Global Deployments as of November 1, 2025 Sensors Sold 1 11 – 20 6 – 10 2 – 5 21 – 50 50+ North America • 3 x Countries • 34 x Deployments South America • 2 x Countries • 2 x Deployments Europe • 13 x Countries • 74 x Deployments Australia • 1 x Country • 1 x Deployments Africa • 2 x Countries • 6 x Deployments Asia • 6 x Countries • 82 x Deployments 91% YTD Growth (31 new deployments) ) 100% YTD Growth (1 new deployments) 24% YTD Growth (18 deployments) 32% YTD Growth (28 new deployments) 24 Est6blished Glob6l Positiofi Expands Global Reach to Tier - 1 Defense, Public Safety, and Security Agencies Protecting Critical Infrastructure Across 25+ Countries

25 Nasdaq: ONDS Ufiique M6rket Positiofi Securing borders, cities, and critical infrastructure with intelligent, scalable counter - UAS defense • Cyber - over - RF (CoRF) by Sentrycs – Passive, protocol - manipulation layer providing early detection, identification, and remote takeover of hostile drones without jamming or collateral damage • Iron Drone Raider Interceptor – Autonomous kinetic layer that neutralizes threats in contested or high - risk environments using on - board AI vision and GPS - independent interception Hard Kill Any drone no matter how controlled Soft Kill Radio controlled drones NO COLLATERAL DAMAGE Advancing the next generation of homeland protection — combining Cyber - over - RF control, autonomous ISR, and precision interception to defend vital infrastructure, secure borders, and ensure the safety of the airspace we all depend on. 25 26 Nasdaq: ONDS Source: Grand View Research Anti - Drome Market Analysis and Segment Forecasts – July 2025.

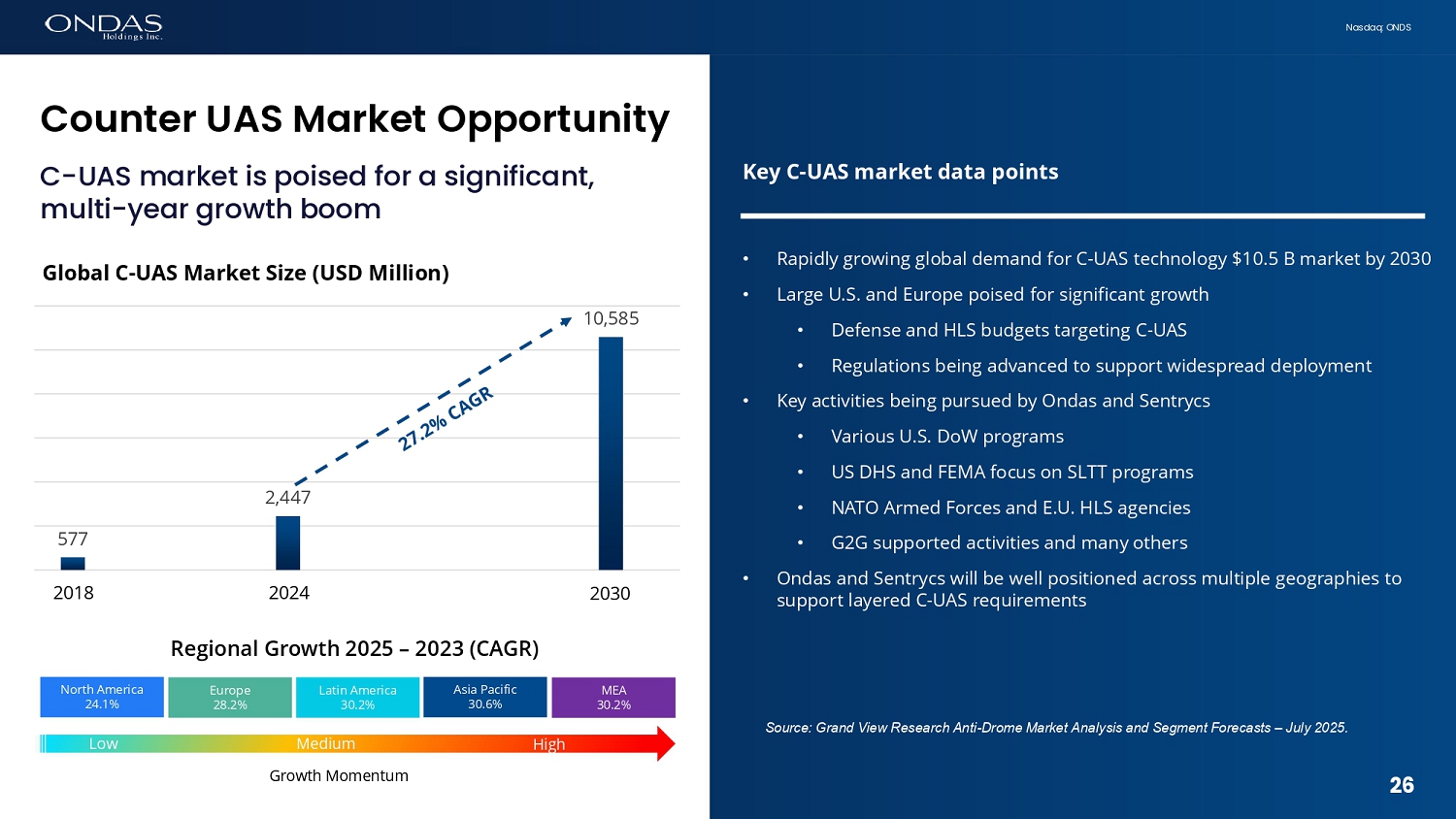

2018 2030 577 2,447 2024 MEA 30.2% Asia Pacific 30.6% Latin America 30.2% Europe 28.2% North America 24.1% Regional Growth 2025 – 2023 (CAGR) High Low Medium Growth Momentum Coufiter UAS M6rket Opportufiity C - UAS market is poised for a significant, multi - year growth boom Global C - UAS Market Size (USD Million) 10,585 • Rapidly growing global demand for C - UAS technology $10.5 B market by 2030 • Large U.S. and Europe poised for significant growth • Defense and HLS budgets targeting C - UAS • Regulations being advanced to support widespread deployment • Key activities being pursued by Ondas and Sentrycs • Various U.S. DoW programs • US DHS and FEMA focus on SLTT programs • NATO Armed Forces and E.U. HLS agencies • G2G supported activities and many others • Ondas and Sentrycs will be well positioned across multiple geographies to support layered C - UAS requirements Key C - UAS market data points 26 Nasdaq: ONDS 27 Third Quarter 2025 Earnings Release OUTLOOK Copyright 2025.

All rights reserved. NASDAQ: ONDS | November 13, 2025

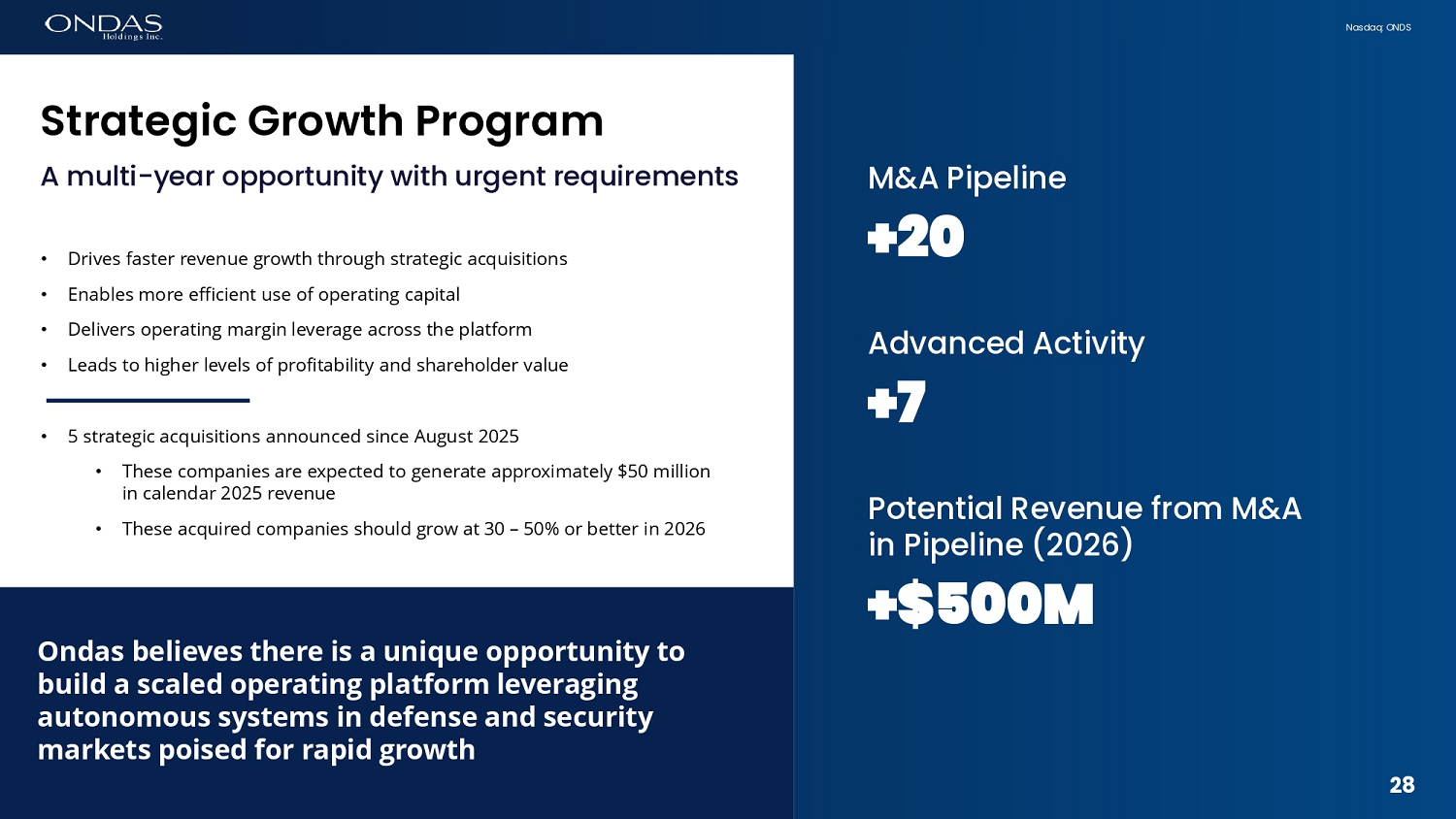

Nasdaq: ONDS Str6tegic Growth Progr6m A multi - year opportunity with urgent requirements • Drives faster revenue growth through strategic acquisitions • Enables more efficient use of operating capital • Delivers operating margin leverage across the platform • Leads to higher levels of profitability and shareholder value • 5 strategic acquisitions announced since August 2025 • These companies are expected to generate approximately $50 million in calendar 2025 revenue • These acquired companies should grow at 30 – 50% or better in 2026 M&A Pipeline +fi0 Advanced Activity +7 Potential Revenue from M&A in Pipeline (2026) +$500M Ondas believes there is a unique opportunity to build a scaled operating platform leveraging autonomous systems in defense and security markets poised for rapid growth 28 28 Nasdaq: ONDS Upd6ted Outlook Demonstrating upside to our financial model • Upside to new revenue targets demonstrate growth acceleration • Expect to continue to advance strategic acquisition program • Expect to capture an initial US defense or homeland security customer • Ondas is well positioned to reach initial operational and financial goals set for 2025 Previous 2025 Revenue Target $fi5 Million Current 2025 Revenue Target $36 Million Initial 2026 Revenue Target $110 Million INVESTOR EVENTS Ondas Capital Investor Day in December 2025 OAS Investor Day in January 2026 28 29

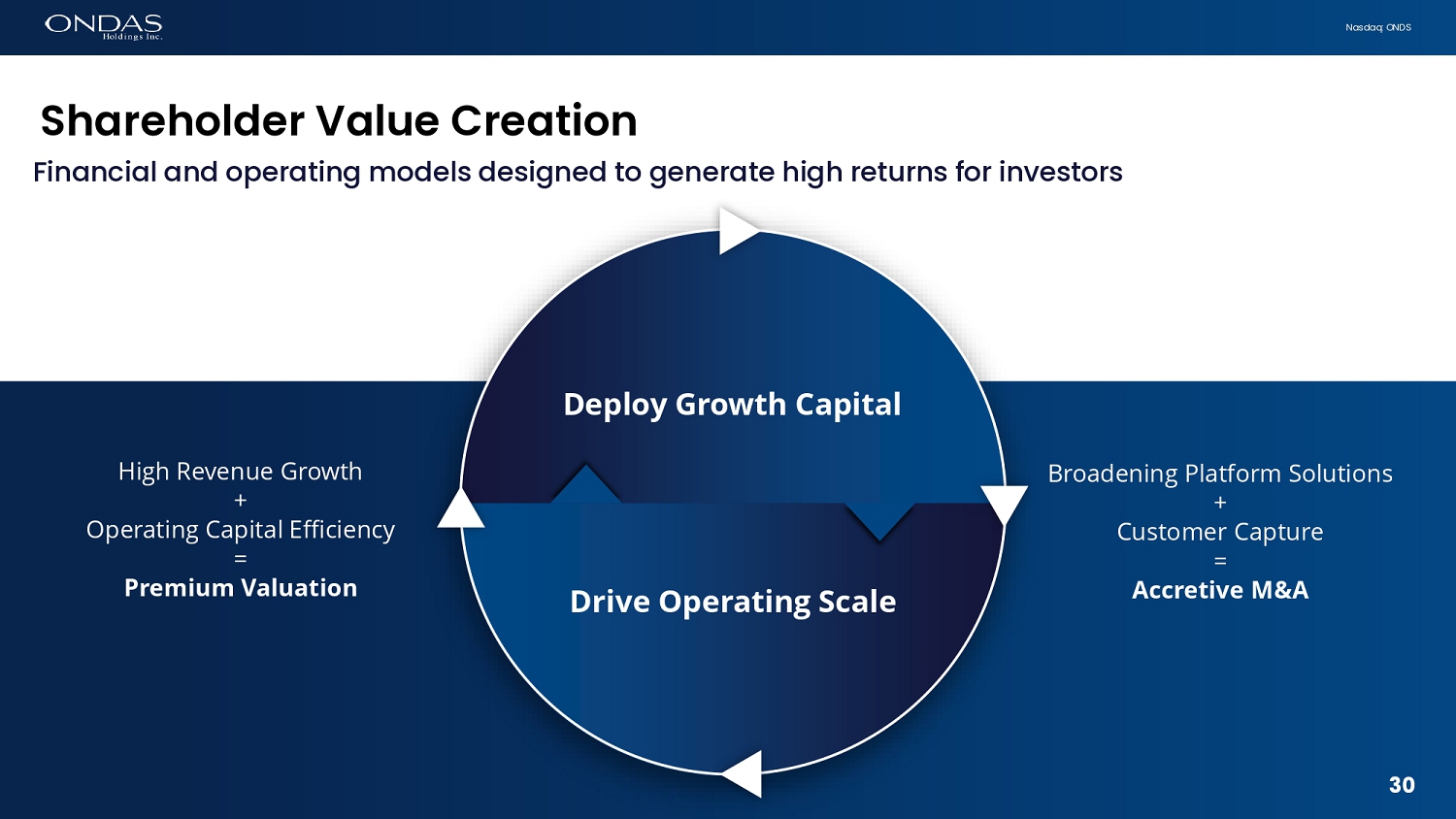

Nasdaq: ONDS Sh6reholder V6lue Cre6tiofi Financial and operating models designed to generate high returns for investors High Revenue Growth + Operating Capital Efficiency = Premium Valuation Broadening Platform Solutions + Customer Capture = Accretive M&A Deploy Growth Capital Drive Operating Scale 28 30 Q&A Third Quarter 2025 Earnings Release Copyright 2025.

All rights reserved. NASDAQ: ONDS | November 13, 2025

Nasdaq: ONDS As required by the rules of the Securities and Exchange Commission ("SEC"), we provide a reconciliation of Adjusted EBITDA and cash operating expenses, the non - GAAP financial measures, contained in this presentation to the most directly comparable measures under GAAP, which reconciliations are set forth in the tables below . We believe that Adjusted EBITDA and cash operating expenses facilitate analysis of our ongoing business operations because such measures exclude items that may not be reflective of, or are unrelated to, the Company's core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses . Other companies may calculate Adjusted EBITDA and cash operating expenses differently, and therefore our measures may not be comparable to similarly titled measures used by other companies . Adjusted EBITDA and cash operating expenses should only be used as supplemental measures of our operating performance . We believe that Adjusted EBITDA improves comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments as set out in the table below, which management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses . We believe that cash operating expenses improve comparability from period to period by removing the impact of depreciation, amortization and stock - based compensation as set out in the tables below, which management has determined are not reflective of core operating expenses and thereby assist investor with assessing trend in our underlying business . Management uses Adjusted EBITDA and cash operating expenses in making financial, operating, and planning decisions and evaluating the Company's ongoing performance . 32 Nofi - GAAP Fifi6fici6l Me6sures 33 Nasdaq: ONDS (1) See the “Non - GAAP Financial Measures” section above.

Appefidix Three Months Ended September 30, ADJUSTED EBITDA RECONCILIATION 2024 2025 (Unaudited) $ (9,526,268) $ (7,480,856) Net Loss 190,332 195,954 Depreciation Expense 865,553 (8,330,150) Other Income (Expense), net 1,056,141 1,086,692 Amortization of Intangible Assets 307,456 Provision for Income Taxes 311,133 5,459,575 Stock - based Compensation $ (7,103,109) $ (8,761,329) Adjusted EBITDA (1) Three Months Ended September 30, Cash Operating Expense Reconciliation 2024 2025 (Unaudited) $ 8,708,275 $ 18,107,945 Total Operating Expense 190,332 191,307 Depreciation Expense 1,056,141 1,086,692 Amortization of Intangible Assets 292,421 5,226,818 Stock - based Compensation $ 7,169,381 $ 11,603,128 Total Cash Operating Expense (1)

Copyright 2025. All rights reserved. THANK YOU NASDAQ: ONDS | November 13, 2025